UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

|

| | | | |

x☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 20172020

OR

|

| | | | |

¨☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 001-35940

CHANNELADVISOR CORPORATION

(Exact name of registrant as specified in its charter)

____________________________________________________

|

| | | | | | | |

| Delaware | | 56-2257867 |

(State or Other Jurisdiction of

Incorporation or Organization)

| | (I.R.S. Employer

Identification No.)

|

| |

| 3025 Carrington Mill Boulevard, Morrisville, NC | | 27560 |

| (Address of principal executive offices) | | (Zip Code) |

(919) 228-4700

(Registrant’sRegistrant's telephone number, including area code)

N/A

(Former name, former address and former

fiscal year, if changed since last report)

____________________________________________________

Securities registered pursuant to Section 12(b) of the Exchange Act:

| | | | | | | | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| Common Stock, $0.001 par value | ECOM | New York Stock Exchange |

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x☒ No ¨☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x☒ No ¨☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large"large accelerated filer,” “accelerated" "accelerated filer,” “smaller" "smaller reporting company”company" and "emerging growth company" in Rule 12b-2 of the Securities Exchange Act of 1934.

|

| | | | | | | | | | |

| Large accelerated filer | ¨☐ | Accelerated filer | x☒ |

| Non-accelerated filer | o (Do not check if a smaller reporting company)

☐ | Smaller reporting company | ¨☐ |

| | Emerging growth company | x☐ | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. x¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Securities Exchange Act of 1934). Yes ¨☐ No x☒

The number of outstanding shares of the registrant’sregistrant's common stock, par value $0.001 per share, as of the close of business on October 19, 201730, 2020 was 26,569,655.

29,000,150.

PART I - FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

CHANNELADVISOR CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands, except share and per share data)

| |

| September 30, 2017 |

| December 31, 2016 | | September 30, 2020 | | December 31, 2019 |

| | (unaudited) |

| | | (unaudited) | | |

| Assets |

|

|

| Assets | |

| Current assets: |

|

|

| Current assets: | |

| Cash and cash equivalents | $ | 54,178 |

|

| $ | 65,420 |

| Cash and cash equivalents | $ | 66,357 | | | $ | 51,785 | |

| Accounts receivable, net of allowance of $304 and $594 as of September 30, 2017 and December 31, 2016, respectively | 21,276 |

|

| 19,445 |

| |

| Accounts receivable, net of allowance of $410 and $733 as of September 30, 2020 and December 31, 2019, respectively | | Accounts receivable, net of allowance of $410 and $733 as of September 30, 2020 and December 31, 2019, respectively | 21,817 | | | 22,126 | |

| Prepaid expenses and other current assets | 12,249 |

|

| 10,972 |

| Prepaid expenses and other current assets | 12,840 | | | 10,452 | |

| Total current assets | 87,703 |

|

| 95,837 |

| Total current assets | 101,014 | | | 84,363 | |

| Operating lease right of use assets | | Operating lease right of use assets | 8,802 | | | 11,128 | |

| Property and equipment, net | 11,797 |

|

| 13,252 |

| Property and equipment, net | 9,184 | | | 9,597 | |

| Goodwill | 23,486 |

|

| 21,632 |

| Goodwill | 30,990 | | | 23,486 | |

| Intangible assets, net | 2,658 |

|

| 2,660 |

| Intangible assets, net | 4,439 | | | 1,285 | |

| Deferred contract costs, net of current portion | | Deferred contract costs, net of current portion | 13,370 | | | 12,810 | |

| Long-term deferred tax assets, net | 5,580 |

| | 5,244 |

| Long-term deferred tax assets, net | 3,649 | | | 3,584 | |

| Other assets | 813 |

|

| 533 |

| Other assets | 979 | | | 614 | |

| Total assets | $ | 132,037 |

|

| $ | 139,158 |

| Total assets | $ | 172,427 | | | $ | 146,867 | |

| Liabilities and stockholders’ equity |

|

|

| |

| Liabilities and stockholders' equity | | Liabilities and stockholders' equity | | | |

| Current liabilities: |

|

|

| Current liabilities: | |

| Accounts payable | $ | 3,533 |

|

| $ | 4,709 |

| Accounts payable | $ | 545 | | | $ | 409 | |

| Accrued expenses | 10,656 |

|

| 11,067 |

| Accrued expenses | 14,892 | | | 8,577 | |

| Deferred revenue | 26,316 |

|

| 23,474 |

| Deferred revenue | 21,368 | | | 21,000 | |

| Other current liabilities | 4,807 |

|

| 4,450 |

| Other current liabilities | 6,375 | | | 6,431 | |

| Total current liabilities | 45,312 |

|

| 43,700 |

| Total current liabilities | 43,180 | | | 36,417 | |

| Long-term capital leases, net of current portion | 898 |

|

| 1,262 |

| |

| Lease incentive obligation | 3,547 |

| | 4,206 |

| |

| Long-term operating leases, net of current portion | | Long-term operating leases, net of current portion | 6,436 | | | 9,767 | |

| Long-term finance leases, net of current portion | | Long-term finance leases, net of current portion | 12 | | | 27 | |

| Other long-term liabilities | 3,484 |

|

| 2,993 |

| Other long-term liabilities | 2,170 | | | 1,007 | |

| Total liabilities | 53,241 |

|

| 52,161 |

| Total liabilities | 51,798 | | | 47,218 | |

| Commitments and contingencies |

|

|

|

|

| Commitments and contingencies | |

| Stockholders’ equity: |

|

|

| |

| Preferred stock, $0.001 par value, 5,000,000 shares authorized, no shares issued and outstanding as of September 30, 2017 and December 31, 2016 | — |

| | — |

| |

| Common stock, $0.001 par value, 100,000,000 shares authorized, 26,481,401 and 25,955,759 shares issued and outstanding as of September 30, 2017 and December 31, 2016, respectively | 26 |

|

| 26 |

| |

| Stockholders' equity: | | Stockholders' equity: | |

| Preferred stock, $0.001 par value, 5,000,000 shares authorized, 0 shares issued and outstanding as of September 30, 2020 and December 31, 2019 | | Preferred stock, $0.001 par value, 5,000,000 shares authorized, 0 shares issued and outstanding as of September 30, 2020 and December 31, 2019 | 0 | | | 0 | |

| Common stock, $0.001 par value, 100,000,000 shares authorized, 28,981,204 and 28,077,469 shares issued and outstanding as of September 30, 2020 and December 31, 2019, respectively | | Common stock, $0.001 par value, 100,000,000 shares authorized, 28,981,204 and 28,077,469 shares issued and outstanding as of September 30, 2020 and December 31, 2019, respectively | 29 | | | 28 | |

| Additional paid-in capital | 259,334 |

|

| 252,158 |

| Additional paid-in capital | 286,208 | | | 278,111 | |

| Accumulated other comprehensive loss | (893 | ) |

| (1,612 | ) | Accumulated other comprehensive loss | (1,803) | | | (1,740) | |

| Accumulated deficit | (179,671 | ) |

| (163,575 | ) | Accumulated deficit | (163,805) | | | (176,750) | |

| Total stockholders’ equity | 78,796 |

|

| 86,997 |

| |

| Total liabilities and stockholders’ equity | $ | 132,037 |

|

| $ | 139,158 |

| |

| Total stockholders' equity | | Total stockholders' equity | 120,629 | | | 99,649 | |

| Total liabilities and stockholders' equity | | Total liabilities and stockholders' equity | $ | 172,427 | | | $ | 146,867 | |

The accompanying notes are an integral part of the unaudited condensed consolidated financial statements.

CHANNELADVISOR CORPORATION AND SUBSIDIARIES

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except share and per share data)

| | | | Three Months Ended September 30, | | Nine Months Ended September 30, | | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2017 | | 2016 | | 2017 | | 2016 | | 2020 | | 2019 | | 2020 | | 2019 |

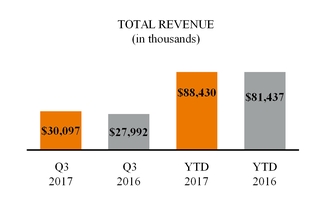

| Revenue | $ | 30,097 |

| | $ | 27,992 |

| | $ | 88,430 |

| | $ | 81,437 |

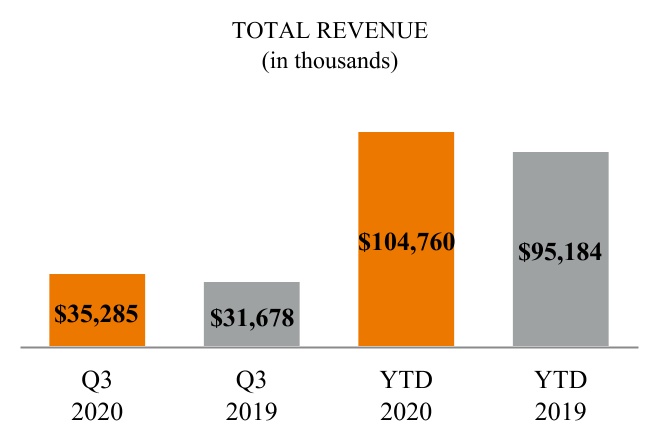

| Revenue | $ | 35,285 | | | $ | 31,678 | | | $ | 104,760 | | | $ | 95,184 | |

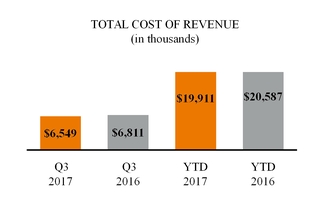

| Cost of revenue | 6,549 |

| | 6,811 |

| | 19,911 |

| | 20,587 |

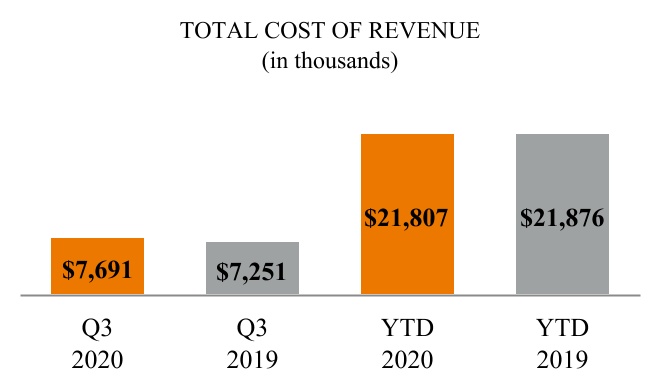

| Cost of revenue | 7,691 | | | 7,251 | | | 21,807 | | | 21,876 | |

| Gross profit | 23,548 |

| | 21,181 |

| | 68,519 |

| | 60,850 |

| Gross profit | 27,594 | | | 24,427 | | | 82,953 | | | 73,308 | |

| Operating expenses: |

| | | | | | | Operating expenses: | |

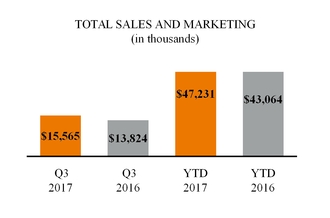

| Sales and marketing | 15,565 |

| | 13,824 |

| | 47,231 |

| | 43,064 |

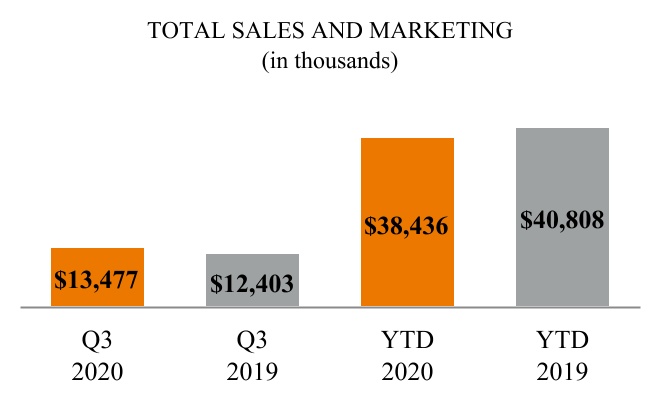

| Sales and marketing | 13,477 | | | 12,403 | | | 38,436 | | | 40,808 | |

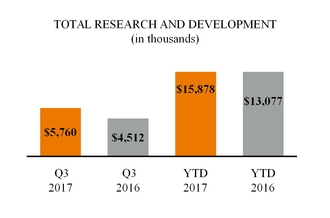

| Research and development | 5,760 |

| | 4,512 |

| | 15,878 |

| | 13,077 |

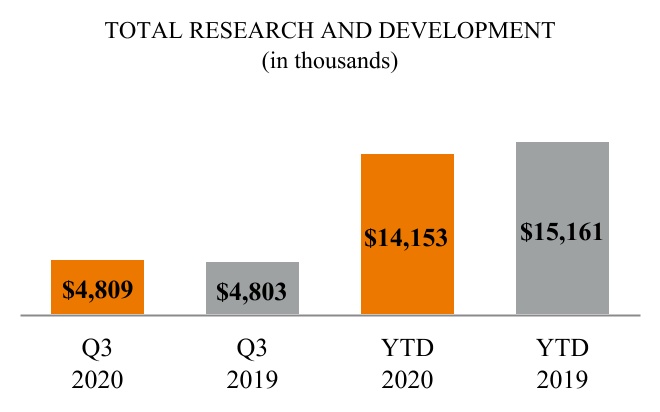

| Research and development | 4,809 | | | 4,803 | | | 14,153 | | | 15,161 | |

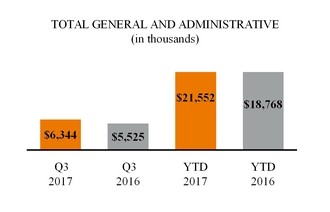

| General and administrative | 6,344 |

| | 5,525 |

| | 21,552 |

| | 18,768 |

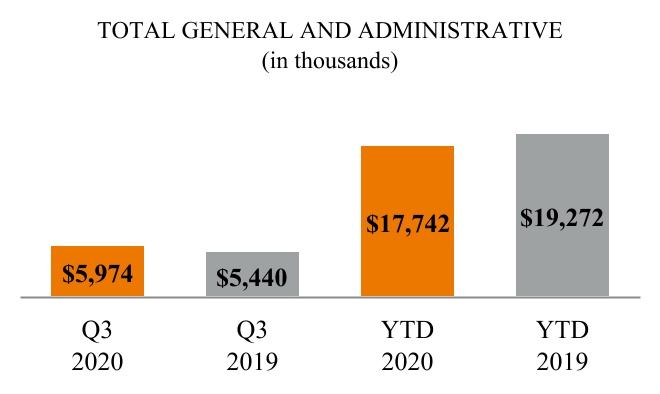

| General and administrative | 5,974 | | | 5,440 | | | 17,742 | | | 19,272 | |

| Total operating expenses | 27,669 |

| | 23,861 |

| | 84,661 |

| | 74,909 |

| Total operating expenses | 24,260 | | | 22,646 | | | 70,331 | | | 75,241 | |

| Loss from operations | (4,121 | ) | | (2,680 | ) | | (16,142 | ) | | (14,059 | ) | |

| Other income (expense): | | | | | | | | |

| Interest income (expense), net | 67 |

| | 11 |

| | 149 |

| | (11 | ) | |

| Income (loss) from operations | | Income (loss) from operations | 3,334 | | | 1,781 | | | 12,622 | | | (1,933) | |

| Other income: | | Other income: | |

| Interest (expense) income, net | | Interest (expense) income, net | (1) | | | 205 | | | 210 | | | 599 | |

| Other income (expense), net | 36 |

| | 90 |

| | 106 |

| | 137 |

| Other income (expense), net | 5 | | | (44) | | | 44 | | | (32) | |

| Total other income (expense) | 103 |

| | 101 |

| | 255 |

| | 126 |

| |

| Loss before income taxes | (4,018 | ) | | (2,579 | ) | | (15,887 | ) | | (13,933 | ) | |

| Income tax expense (benefit) | 37 |

| | (27 | ) | | 209 |

| | (91 | ) | |

| Net loss | $ | (4,055 | ) | | $ | (2,552 | ) | | $ | (16,096 | ) | | $ | (13,842 | ) | |

| Net loss per share: | | | | | | | | |

| Basic and diluted | $ | (0.15 | ) | | $ | (0.10 | ) | | $ | (0.61 | ) | | $ | (0.54 | ) | |

| Total other income | | Total other income | 4 | | | 161 | | | 254 | | | 567 | |

| Income (loss) before income taxes | | Income (loss) before income taxes | 3,338 | | | 1,942 | | | 12,876 | | | (1,366) | |

| Income tax (benefit) expense | | Income tax (benefit) expense | (374) | | | 213 | | | 171 | | | 572 | |

| Net income (loss) | | Net income (loss) | $ | 3,712 | | | $ | 1,729 | | | $ | 12,705 | | | $ | (1,938) | |

| Net income (loss) per share: | | Net income (loss) per share: | | | | | | | |

| Basic | | Basic | $ | 0.13 | | | $ | 0.06 | | | $ | 0.45 | | | $ | (0.07) | |

| Diluted | | Diluted | $ | 0.12 | | | $ | 0.06 | | | $ | 0.43 | | | $ | (0.07) | |

| Weighted average common shares outstanding: | | | | | | | | Weighted average common shares outstanding: | |

| Basic and diluted | 26,439,830 |

| | 25,723,749 |

| | 26,293,650 |

| | 25,513,105 |

| |

| Basic | | Basic | 28,802,310 | | | 28,049,199 | | | 28,485,547 | | | 27,824,696 | |

| Diluted | | Diluted | 30,436,601 | | | 28,754,679 | | | 29,815,829 | | | 27,824,696 | |

The accompanying notes are an integral part of the unaudited condensed consolidated financial statements.

CHANNELADVISOR CORPORATION AND SUBSIDIARIES

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE LOSSINCOME (LOSS)

(in thousands)

|

| | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2017 | | 2016 | | 2017 | | 2016 |

| Net loss | $ | (4,055 | ) |

| $ | (2,552 | ) |

| $ | (16,096 | ) |

| $ | (13,842 | ) |

| Other comprehensive gain (loss): | | | | | | | |

| Foreign currency translation adjustments | 184 |

| | (78 | ) | | 719 |

| | (180 | ) |

| Total comprehensive loss | $ | (3,871 | ) | | $ | (2,630 | ) | | $ | (15,377 | ) | | $ | (14,022 | ) |

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2020 | | 2019 | | 2020 | | 2019 |

| Net income (loss) | $ | 3,712 | | | $ | 1,729 | | | $ | 12,705 | | | $ | (1,938) | |

| Other comprehensive income (loss): | | | | | | | |

| Foreign currency translation adjustments | 438 | | | (530) | | | (63) | | | (595) | |

| Total comprehensive income (loss) | $ | 4,150 | | | $ | 1,199 | | | $ | 12,642 | | | $ | (2,533) | |

The accompanying notes are an integral part of the unaudited condensed consolidated financial statements.

CHANNELADVISOR CORPORATION AND SUBSIDIARIES

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

| | | | Nine Months Ended September 30, | | Nine Months Ended September 30, |

| | 2017 | | 2016 | | 2020 | | 2019 |

| Cash flows from operating activities | | | | Cash flows from operating activities | | | |

| Net loss | $ | (16,096 | ) | | $ | (13,842 | ) | |

| Adjustments to reconcile net loss to cash and cash equivalents (used in) provided by operating activities: | | | | |

| Net income (loss) | | Net income (loss) | $ | 12,705 | | | $ | (1,938) | |

| Adjustments to reconcile net income (loss) to cash and cash equivalents provided by operating activities: | | Adjustments to reconcile net income (loss) to cash and cash equivalents provided by operating activities: | |

| Depreciation and amortization | 5,041 |

| | 5,961 |

| Depreciation and amortization | 4,655 | | | 4,806 | |

| Bad debt expense | 271 |

| | 246 |

| Bad debt expense | 479 | | | 911 | |

| Stock-based compensation expense | 9,132 |

| | 10,207 |

| Stock-based compensation expense | 7,732 | | | 7,000 | |

| Deferred income taxes | | Deferred income taxes | (61) | | | 513 | |

| Other items, net | (499 | ) | | (769 | ) | Other items, net | (617) | | | 43 | |

| Changes in assets and liabilities, net of effects from acquisition: | | | | Changes in assets and liabilities, net of effects from acquisition: | |

| Accounts receivable | (1,674 | ) | | 2,820 |

| Accounts receivable | 343 | | | 1,007 | |

| Prepaid expenses and other assets | (1,370 | ) | | 1,832 |

| Prepaid expenses and other assets | (917) | | | 2,282 | |

| Deferred contract costs | | Deferred contract costs | (1,800) | | | (2,661) | |

| Accounts payable and accrued expenses | (51 | ) | | (1,251 | ) | Accounts payable and accrued expenses | 3,404 | | | (2,112) | |

| Deferred revenue | 3,042 |

| | 4,162 |

| Deferred revenue | 62 | | | (2,337) | |

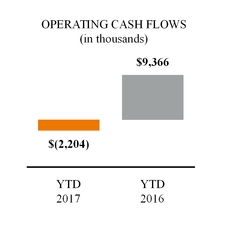

| Cash and cash equivalents (used in) provided by operating activities | (2,204 | ) | | 9,366 |

| |

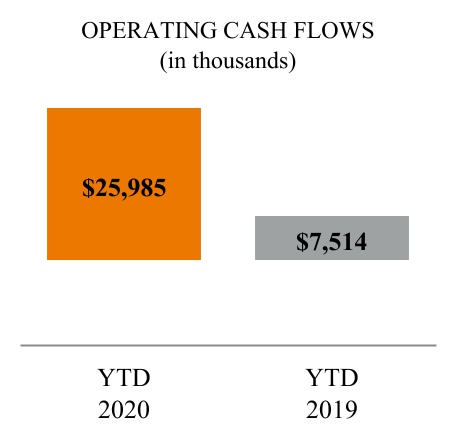

| Cash and cash equivalents provided by operating activities | | Cash and cash equivalents provided by operating activities | 25,985 | | | 7,514 | |

| Cash flows from investing activities | | | | Cash flows from investing activities | |

| Acquisition, net of cash acquired | | Acquisition, net of cash acquired | (8,787) | | | 0 | |

| Purchases of property and equipment | (2,427 | ) | | (920 | ) | Purchases of property and equipment | (1,021) | | | (755) | |

| Payment of internal-use software development costs | (224 | ) | | (195 | ) | |

| Acquisition, net of cash acquired | (2,177 | ) | | — |

| |

| Payment of software development costs | | Payment of software development costs | (2,283) | | | (1,972) | |

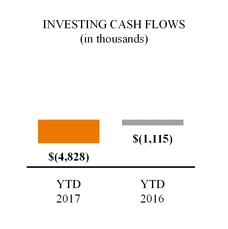

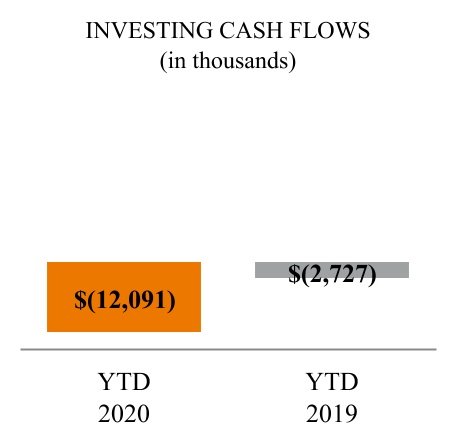

| Cash and cash equivalents used in investing activities | (4,828 | ) | | (1,115 | ) | Cash and cash equivalents used in investing activities | (12,091) | | | (2,727) | |

| Cash flows from financing activities | | | | Cash flows from financing activities | |

| Repayment of capital leases | (2,586 | ) | | (2,079 | ) | |

| Repayment of finance leases | | Repayment of finance leases | (1,418) | | | (2,357) | |

| Proceeds from exercise of stock options | 625 |

| | 821 |

| Proceeds from exercise of stock options | 3,553 | | | 968 | |

| Payment of contingent consideration | — |

| | (338 | ) | |

| Payment of statutory tax withholding related to net-share settlement of restricted stock units | (2,581 | ) | | (2,085 | ) | Payment of statutory tax withholding related to net-share settlement of restricted stock units | (1,299) | | | (2,101) | |

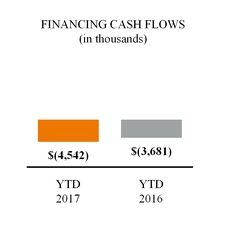

| Cash and cash equivalents used in financing activities | (4,542 | ) | | (3,681 | ) | |

| Payment of line of credit financing costs | | Payment of line of credit financing costs | (179) | | | 0 | |

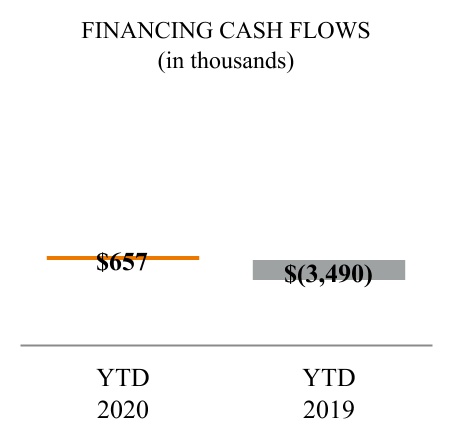

| Cash and cash equivalents provided by (used in) financing activities | | Cash and cash equivalents provided by (used in) financing activities | 657 | | | (3,490) | |

| Effect of currency exchange rate changes on cash and cash equivalents | 332 |

| | (313 | ) | Effect of currency exchange rate changes on cash and cash equivalents | 21 | | | (256) | |

| Net (decrease) increase in cash and cash equivalents | (11,242 | ) | | 4,257 |

| |

| Net increase in cash and cash equivalents | | Net increase in cash and cash equivalents | 14,572 | | | 1,041 | |

| Cash and cash equivalents, beginning of period | 65,420 |

| | 60,474 |

| Cash and cash equivalents, beginning of period | 51,785 | | | 47,185 | |

| Cash and cash equivalents, end of period | $ | 54,178 |

| | $ | 64,731 |

| Cash and cash equivalents, end of period | $ | 66,357 | | | $ | 48,226 | |

| Supplemental disclosure of cash flow information | | | | Supplemental disclosure of cash flow information | | | |

| Cash paid for interest | $ | 99 |

| | $ | 126 |

| Cash paid for interest | $ | 109 | | | $ | 215 | |

| Cash paid for income taxes, net | $ | 151 |

| | $ | 110 |

| Cash paid for income taxes, net | $ | 386 | | | $ | 64 | |

| Supplemental disclosure of noncash investing and financing activities | | | | Supplemental disclosure of noncash investing and financing activities | | | |

| Accrued statutory tax withholding related to net-share settlement of restricted stock units | | Accrued statutory tax withholding related to net-share settlement of restricted stock units | $ | 1,889 | | | $ | 1,206 | |

| Accrued capital expenditures | $ | 54 |

| | $ | 439 |

| Accrued capital expenditures | $ | 379 | | | $ | 35 | |

| Capital lease obligations entered into for the purchase of fixed assets | $ | 567 |

| | $ | 1,771 |

| |

|

The accompanying notes are an integral part of the unaudited condensed consolidated financial statements.

CHANNELADVISOR CORPORATION AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS 1. DESCRIPTION OF THE BUSINESS

ChannelAdvisor Corporation ("ChannelAdvisor" or the "Company") was incorporated in the state of Delaware and capitalized in June 2001. The Company began operations in July 2001. ChannelAdvisor is a provider of software-as-a-service, or SaaS, solutions and ourits mission is to connect and optimize the world's commerce. ChannelAdvisor's e-commerceSaaS cloud platform helps retailersbrands and branded manufacturersretailers worldwide improve their online performance by expanding sales channels, connecting with consumers around the world, optimizing their operations for peak performance and providing actionable analytics to improve competitiveness. The Company is headquartered in Morrisville, North Carolina and has internationalmaintains sales, service, support and research and development offices in England, Ireland, Germany, Australia, Brazil, Chinavarious domestic and Spain.international locations.

2. SIGNIFICANT ACCOUNTING POLICIES

Principles of Consolidation

The accompanying condensed consolidated financial statements include the accounts of the Company and its wholly-ownedwholly owned subsidiaries. All intercompany accounts and transactions have been eliminated in consolidation.

Interim Condensed Consolidated Financial Information

The accompanying condensed consolidated financial statements and footnotes have been prepared in accordance with generally accepted accounting principles in the United States of America, ("or U.S. GAAP")GAAP, as contained in the Financial Accounting Standards Board, ("FASB")or FASB, Accounting Standards Codification, ("ASC")or ASC, for interim financial information. In the opinion of management, the interim financial information includes all adjustments of a normal recurring nature necessary for a fair presentation of financial position, the results of operations, comprehensive loss and cash flows. The results of operations for the three and nine months ended September 30, 20172020 are not necessarily indicative of the results for the full year or the results for any future periods.periods, especially in light of the potential effects of the novel coronavirus, or COVID-19, pandemic on the Company’s business, operations and financial performance. These unaudited interim financial statements should be read in conjunction with the audited financial statements and related footnotes for the year ended December 31, 2016 ("2019, or fiscal 2016"),2019, which are included in the Company’sCompany's Annual Report on Form 10-K for fiscal 2016.2019. There have been no material changes to the Company’sCompany's significant accounting policies from those described in the footnotes to the audited financial statements contained in the Company’sCompany's Annual Report on Form 10-K for fiscal 2016. 2019.

Recent Accounting Pronouncements

|

| | | | | | | |

| Standard | Description | Effect on the Financial Statements or Other Significant Matters |

Standards that the Company has not yet adopted as of January 1, 2020 |

Revenue Recognition: |

|

| | Financial Instruments: |

Accounting Standards Update ("ASU") 2014-09, Revenue from Contracts with Customers (Topic 606)

The Company's adoption date:

January 1, 2018

| The standard will replace existing revenue recognition standards and provides that an entity should recognize revenue to depict the transfer of promised goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods or services. ASU 2014-09 also requires improved disclosures to help users of financial statements better understand the nature, amount, timing, and uncertainty of revenue that is recognized. Entities have the option of using either a full retrospective or modified retrospective approach for the adoption of the standard. | The Company formed a project team to evaluate and direct the implementation of the new revenue recognition standard and related amendments. The project team developed an implementation plan centered around specific functional areas that may be impacted by the standard and its amendments, including accounting and reporting, information technology ("IT"), internal audit and contracts and legal, among others. This team has recently completed certain IT updates to the Company's accounting system to support recognition and disclosure under the new standard, and is continuing to make additional updates to facilitate the standard's adoption and reporting requirements. The project team completed an initial contract assessment on a sample of contracts and analyzed the Company's contract portfolio and associated contract costs. The team is finalizing the Company's remaining accounting positions under ASU 2014-09, as amended, including certain significant judgments and estimates required, and is currently assessing the potential changes to internal controls and the tax effect implications. The project team has reported the findings and progress of the implementation plan to management and to the Audit Committee on a frequent basis over the last two years and will continue to do so as the effective date of the new standard approaches.

The Company anticipates that the adoption of the new standard will impact the timing of revenue recognition of fixed fees for its contracts, as well as the accounting for costs to obtain contracts. For managed-service contracts, the Company currently defers revenue until the completion of the implementation services, at which point the Company recognizes a cumulative catch-up adjustment equal to the revenue earned during the implementation period but previously deferred. The remaining balance of these fixed fees is recognized ratably over the remaining term of the contract. Under the new standard, the Company expects revenue recognition for the managed-service subscription and implementation fees to begin on the launch date and to be recognized over time through the contract end date, with no cumulative catch-up adjustment on the launch date. Further, the Company currently expenses sales commissions and related bonuses as incurred. Under the new standard, the Company will be required to defer and amortize a portion of these contract costs.

The Company intends to adopt the new standard using the modified retrospective transition method effective January 1, 2018. The Company continues to evaluate the provisions of the new standard to identify further potential impacts to its consolidated financial statements.

|

ASU 2016-08, Principal Versus Agent Considerations (Reporting Revenue Gross Versus Net)

The Company's adoption date:

January 1, 2018

| The standard clarifies implementation guidance on principal versus agent considerations in ASU 2014-09. |

ASU 2016-10, Identifying Performance Obligations and Licensing

The Company's adoption date:

January 1, 2018

| The standard clarifies implementation guidance on the identification of performance obligations and the licensing implementation guidance in ASU 2014-09. |

ASU 2016-12, Narrow-Scope Improvements and Practical Expedients

The Company's adoption date:

January 1, 2018

| The standard clarifies the guidance on assessing collectability, presentation of sales taxes, noncash consideration and completed contracts and contract modifications at transition. |

ASU 2016-20, Technical Corrections and Improvements to Topic 606

The Company's adoption date:

January 1, 2018

| The standard clarifies certain narrow aspects of ASU 2014-09. |

Leases: |

ASU 2016-02, Leases (Topic 842)

The Company's adoption date:

January 1, 2019

| The standard requires that lessees recognize assets and liabilities for leases with lease terms greater than twelve months in the statement of financial position. The standard also requires improved disclosures to help users of financial statements better understand the amount, timing and uncertainty of cash flows arising from leases. | The Company is currently evaluating the impact the adoption of the standard will have on its consolidated financial statements.

|

|

| | |

Financial Instruments: |

ASU 2016-13, Financial Instruments - Credit Losses (Topic 326)

The Company's adoptionEffective date:

January 1, 2020

| TheThis standard replaces the incurred loss impairment methodology in current U.S. GAAP (defined below) with a methodology that reflects expected credit losses. The update is intended to provide financial statement users with more useful information about expected credit losses. | The Company is currently evaluating the impact the adoption of the standard will have on its consolidated financial statements. |

Cash Flow: |

ASU 2016-18, Restricted Cash

The Company's adoption date:

January 1, 2018

| The standard requires that entities show the changes in the total of cash, cash equivalents and restricted cash in the statement of cash flows. Transfers between cash, cash equivalents and restricted cash should not be presented as cash flow activities on the statement of cash flows. | The Company is currently evaluating the impact the adoption of the standard will have on its consolidated financial statements. |

Standards that the Company has recently adopted |

Stock-Based Compensation: |

ASU 2016-09, Improvements to Employee Share-Based Payment Accounting (Topic 718)

The Company's adoption date:

January 1, 2017

| The standard is intended to simplify several aspects of the accounting for share-based payment transactions, including the accounting for income taxes, forfeitures, and statutory tax withholding requirements, as well as classification in the statement of cash flows. | The Company adopted this standard effective January 1, 2017. As2020. The adoption did not have a resultmaterial impact on its consolidated financial statements, although it resulted in a change in accounting policy for accounts receivable. Refer to "Accounts Receivable" below for additional information regarding the Company’s accounting policy for accounts receivable following the adoption of ASU 2016-13. |

| Intangibles: |

ASU 2018-15, Intangibles -Goodwill and Other - Internal-Use Software (Subtopic 350-40)

Effective date: January 1, 2020

| This standard aligns the requirements for capitalizing implementation costs incurred in a hosting arrangement that is a service contract with the requirements for capitalizing implementation costs incurred to develop or obtain internal-use software. | The Company adopted this standard effective January 1, 2020. The adoption did not have an impact on its consolidated financial statements.

|

| Income Taxes: |

ASU 2019-12, Income Taxes (Topic 740) Simplifying the Accounting for Income Taxes

Effective date: January 1, 2020 | This standard amends the approaches and methodologies in accounting for income taxes during interim periods and makes changes to certain income tax classifications. The new standard allows exceptions to the use of the incremental approach for intra-period tax allocation, when there is a loss from continuing operations and income or a gain from other items, and to the general methodology for calculating income taxes in an interim period, when a year-to-date loss exceeds the anticipated loss for the year. The standard also requires franchise or similar taxes partially based on income to be reported as income tax and the effects of enacted changes in tax laws or rates to be included in the annual effective tax rate computation from the date of enactment. Lastly, the Company recognized $8.2 millionwould be required to evaluate when the step-up in the tax basis of deferred tax assets attributable to accumulated excess tax benefits that undergoodwill is part of the previous guidance couldbusiness combination and when it should be considered a separate transaction. ASU 2019-12 is effective for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2020.

| The Company early adopted this standard effective January 1, 2020. The early adoption did not be recognized until the benefits were realized throughhave a reduction in income taxes payable. This adjustment was applied using a modified retrospective method with a cumulative-effect adjustment to the accumulated deficit for the excess tax benefits not previously recognized. However, given the full valuation allowance of $8.2 million placed on the additional deferred tax assets, the recognition upon adoption had nomaterial impact on the Company's accumulated deficit as of January 1, 2017. Further, the Company has elected to continue to estimate forfeitures to determine the amount of compensation cost to be recognized in each period.its consolidated financial statements or related disclosures.

|

The Company has reviewed new accounting pronouncements that were issued during the nine months ended September 30, 2020 and does not believe that these pronouncements are applicable to the Company, or that they will have a material impact on its financial position or results of operations.

Use of Estimates

The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the amounts reported in the condensed consolidated financial statements and accompanying notes. Actual results could differ from those estimates.

On an ongoing basis, the Company evaluates its estimates, including those related to the accounts receivable allowance, the useful lives of long-lived assets and other intangible assets, income taxes, and assumptions used for purposes of determining stock-based compensation, leases, including estimating lease terms and extensions, and revenue recognition, including standalone selling prices for contracts with multiple performance obligations and the expected period of benefit for deferred contract costs, among others. Estimates and assumptions are also required to value assets acquired and liabilities assumed as well as contingent consideration, where applicable, in conjunction with business combinations. The Company bases its estimates on historical experience and on various other assumptions that it believes to be reasonable, the results of which form the basis for making judgments about the carrying value of assets and liabilities.

Accounts Receivable

The Company extends credit to customers without requiring collateral. Accounts receivable are stated at amortized cost, net of an allowance for credit losses. The Company records an allowance for credit losses at the time that accounts receivable are initially recorded based on consideration of the current economic environment, expectations of future economic conditions, the Company's historical collection experience and a loss-rate approach whereby impairment is calculated by multiplying an estimated loss rate by the asset’s amortized cost at the balance sheet date. The Company reassesses the allowance at each reporting date. When it becomes apparent, based on age or customer circumstances, that such amounts will not be collected, they are charged to the allowance. Payments subsequently received are credited to the credit loss expense account included within general and administrative expense in the condensed consolidated statements of operations.

3. STOCKHOLDERS' EQUITY

The following table summarizes thequarterly stockholders' equity activity for the nine monthsnine-month periods ended September 30, 20172020 and 2019 (in thousands)thousands, except number of shares):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Quarterly Activity For The Nine Months Ended September 30, 2020 |

| Common Stock | | Additional

Paid-In

Capital | | Accumulated

Other

Comprehensive

Loss | | Accumulated

Deficit | | Total

Stockholders'

Equity |

| Shares | | Amount | | |

| Balance, December 31, 2019 | 28,077,469 | | | $ | 28 | | | $ | 278,111 | | | $ | (1,740) | | | $ | (176,750) | | | $ | 99,649 | |

Cumulative effect of accounting change (1) | — | | | — | | | — | | | — | | | 240 | | | 240 | |

| Exercise of stock options and vesting of restricted stock units | 394,998 | | | 0 | | | 87 | | | — | | | — | | | 87 | |

| Stock-based compensation expense | — | | | — | | | 2,914 | | | — | | | — | | | 2,914 | |

| Statutory tax withholding related to net-share settlement of restricted stock units | (107,398) | | | — | | | (980) | | | — | | | — | | | (980) | |

| Net income | — | | | — | | | — | | | — | | | 2,007 | | | 2,007 | |

| Foreign currency translation adjustments | — | | | — | | | — | | | (800) | | | — | | | (800) | |

| Balance, March 31, 2020 | 28,365,069 | | | 28 | | | 280,132 | | | (2,540) | | | (174,503) | | | 103,117 | |

| Exercise of stock options and vesting of restricted stock units | 330,692 | | | 1 | | | 2,046 | | | — | | | — | | | 2,047 | |

| Stock-based compensation expense | — | | | — | | | 2,556 | | | — | | | — | | | 2,556 | |

| Statutory tax withholding related to net-share settlement of restricted stock units | (48,675) | | | — | | | (659) | | | — | | | — | | | (659) | |

| Net income | — | | | — | | | — | | | — | | | 6,986 | | | 6,986 | |

| Foreign currency translation adjustments | — | | | — | | | — | | | 299 | | | — | | | 299 | |

| Balance, June 30, 2020 | 28,647,086 | | | 29 | | | 284,075 | | | (2,241) | | | (167,517) | | | 114,346 | |

| Exercise of stock options and vesting of restricted stock units | 411,651 | | | 0 | | | 1,420 | | | — | | | — | | | 1,420 | |

| Stock-based compensation expense | — | | | — | | | 2,262 | | | — | | | — | | | 2,262 | |

| Statutory tax withholding related to net-share settlement of restricted stock units | (77,533) | | | — | | | (1,549) | | | — | | | — | | | (1,549) | |

| Net income | — | | | — | | | — | | | — | | | 3,712 | | | 3,712 | |

| Foreign currency translation adjustments | — | | | — | | | — | | | 438 | | | — | | | 438 | |

| Balance, September 30, 2020 | 28,981,204 | | | $ | 29 | | | $ | 286,208 | | | $ | (1,803) | | | $ | (163,805) | | | $ | 120,629 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

(1) The Company recorded a reduction to accumulated deficit at January 1, 2020 as a result of its adoption of ASU 2016-13, Financial Instruments - Credit Losses.

| | | | | | Quarterly Activity For The Nine Months Ended September 30, 2019 |

| Balance as of December 31, 2016 | $ | 86,997 |

| |

| | | Common Stock | | Additional

Paid-In

Capital | | Accumulated

Other

Comprehensive

Loss | | Accumulated

Deficit | | Total

Stockholders'

Equity |

| | | Shares | | Amount | |

| Balance, December 31, 2018 | | Balance, December 31, 2018 | 27,347,115 | | | $ | 27 | | | $ | 271,550 | | | $ | (1,707) | | | $ | (180,232) | | | $ | 89,638 | |

| Exercise of stock options and vesting of restricted stock units | 625 |

| Exercise of stock options and vesting of restricted stock units | 681,944 | | | 1 | | | 936 | | | — | | | — | | | 937 | |

| Stock-based compensation expense | 9,132 |

| Stock-based compensation expense | — | | | — | | | 3,398 | | | — | | | — | | | 3,398 | |

| Statutory tax withholding related to net-share settlement of restricted stock units | (2,581 | ) | Statutory tax withholding related to net-share settlement of restricted stock units | (178,071) | | | — | | | (2,277) | | | — | | | — | | | (2,277) | |

| Net loss | (16,096 | ) | Net loss | — | | | — | | | — | | | — | | | (2,329) | | | (2,329) | |

| Foreign currency translation adjustments | 719 |

| Foreign currency translation adjustments | — | | | — | | | — | | | 78 | | | — | | | 78 | |

| Balance as of September 30, 2017 | $ | 78,796 |

| |

| Balance, March 31, 2019 | | Balance, March 31, 2019 | 27,850,988 | | | 28 | | | 273,607 | | | (1,629) | | | (182,561) | | | 89,445 | |

| Exercise of stock options and vesting of restricted stock units | | Exercise of stock options and vesting of restricted stock units | 290,346 | | | 0 | | | 15 | | | — | | | — | | | 15 | |

| Stock-based compensation expense | | Stock-based compensation expense | — | | | — | | | 2,801 | | | — | | | — | | | 2,801 | |

| Statutory tax withholding related to net-share settlement of restricted stock units | | Statutory tax withholding related to net-share settlement of restricted stock units | (98,975) | | | — | | | (981) | | | — | | | — | | | (981) | |

| Net loss | | Net loss | — | | | — | | | — | | | — | | | (1,338) | | | (1,338) | |

| Foreign currency translation adjustments | | Foreign currency translation adjustments | — | | | — | | | — | | | (143) | | | — | | | (143) | |

| Balance, June 30, 2019 | | Balance, June 30, 2019 | 28,042,359 | | | 28 | | | 275,442 | | | (1,772) | | | (183,899) | | | 89,799 | |

| Exercise of stock options and vesting of restricted stock units | | Exercise of stock options and vesting of restricted stock units | 21,958 | | | 0 | | | 17 | | | — | | | — | | | 17 | |

| Stock-based compensation expense | | Stock-based compensation expense | — | | | — | | | 801 | | | — | | | — | | | 801 | |

| Statutory tax withholding related to net-share settlement of restricted stock units | | Statutory tax withholding related to net-share settlement of restricted stock units | (5,510) | | | — | | | (49) | | | — | | | — | | | (49) | |

| Net income | | Net income | — | | | — | | | — | | | — | | | 1,729 | | | 1,729 | |

| Foreign currency translation adjustments | | Foreign currency translation adjustments | — | | | — | | | — | | | (530) | | | — | | | (530) | |

| Balance, September 30, 2019 | | Balance, September 30, 2019 | 28,058,807 | | | $ | 28 | | | $ | 276,211 | | | $ | (2,302) | | | $ | (182,170) | | | $ | 91,767 | |

|

4. BUSINESS COMBINATIONS,COMBINATION, GOODWILL AND INTANGIBLE ASSETS

Business CombinationsCombination

On May 26, 2017,July 23, 2020, the Company entered into ana Share Purchase Agreement and Plan of Merger (the “Merger Agreement”"Purchase Agreement") pursuant to which the Companyit acquired all of the issued and outstanding shares of HubLogix Commerce Corp.Blueboard, a private limited company organized under the laws of France ("HubLogix"BlueBoard") (now ChannelAdvisor Fulfillment, Inc.),. BlueBoard is headquartered in Paris, France and is a fulfillment and logistics platform that automates order management by connecting online storefrontsleader in e-commerce analytics. The acquisition of BlueBoard adds analytic capabilities, including actionable insights into how products are performing across thousands of retailer websites and marketplaces, to distribution and fulfillment centers. The Company acquired HubLogix to further enhance its fulfillment network offering and capabilities.the Company's existing cloud-based e-commerce solutions.

Under the MergerPurchase Agreement, the Company paid an aggregateto the shareholders of BlueBoard a cash purchase price of $2.3$9.0 million, for HubLogix, all of which was paid in cash, which amount is subject to adjustment as set forth in the MergerPurchase Agreement. TheA portion of the purchase price includes $0.4 million that has been placed into escrow to secure the indemnification obligations of HubLogix stockholdersBlueBoard’s shareholders until November 26, 2018. July 22, 2021. In addition to the purchase price paid at the closing, the Company may be obligated to pay up to $3.0 million to the BlueBoard shareholders upon the achievement of specified annual revenue targets through July 2023, as set forth in the Purchase Agreement. Pursuant to ASC Topic 805, Business Combinations, or ASC 805, this contingent consideration is deemed to be part of the purchase price and is recorded as a liability based on the estimated fair value of the consideration the Company expects to pay as of the acquisition date. As of September 30, 2020, $1.5 million of contingent consideration was recorded as a liability on the Company's condensed consolidated balance sheet.

The acquisition has been accounted for under the acquisition method of accounting in accordance with Accounting Standards Codification Topic 805, Business Combinations ("ASC 805").805. Under the acquisition method of accounting, the Company allocated the purchase price to the identifiable assets acquired and liabilities assumed based on their estimated acquisition-date fair value.values. The difference between the acquisition-date fair valueexcess of the consideration and the estimated fair value ofpurchase price over the net assets acquired is recorded as goodwill. Goodwill represents the future economic benefits expected to arise from other intangible assets acquired that do not qualify for separate recognition, including acquired workforce, as well as expected future synergies.

Based on management’smanagement's provisional assessment of the acquisition-date fair value of the assets acquired and liabilities assumed, the aggregate purchase price of $2.3$10.5 million, which is comprised of $9.0 million of cash and $1.5 million for contingent consideration noted above, has been allocated to the Company’sCompany's assets and liabilities on a preliminary basis as follows: $1.9$7.5 million to goodwill, $0.5$3.7 million to identifiable intangible assets, including acquired technology of $3.3 million and customer relationships of $0.4 million, $0.6 million to long-term deferred tax liabilities and $0.1 million to working capital as a net current liability. The purchase price allocation in conjunction with the acquisition of HubLogixBlueBoard is subject to change as additional information becomes available. Any adjustments will be made as soon as practicable, but not later than one year from the acquisition date.

The goodwill of $1.9 million arising from the acquisition of HubLogix consists largely ofBlueBoard represents the future economic benefits expected to arise from other intangible assets that do not qualify for separate recognition, including acquired workforce, theas well as expected company-specific synergies and the opportunity to expand the Company’s product offerings to customers.future synergies. The goodwill recognized is not deductible for income tax purposes.

The Company incurred transaction costs in connection with the acquisition of $0.3$0.2 million and $0.4 million for the three and nine months ended September 30, 2020, respectively, which are included in general and administrative expense in the accompanying condensed consolidated statements of operations for the nine months ended September 30, 2017.operations.

Comparative pro forma financial information for this acquisition has not been presented because the acquisition is not material to the Company’sCompany's consolidated results of operations.

Goodwill and Intangible Assets

The following table shows the changes in the carrying amount of goodwill for the nine months ended September 30, 20172020 (in thousands):

|

| | | |

| Balance as of December 31, 2016 | $ | 21,632 |

|

| Goodwill attributable to the HubLogix acquisition | 1,854 |

|

| Balance as of September 30, 2017 | $ | 23,486 |

|

| | | | | |

| Balance as of December 31, 2019 | $ | 23,486 | |

| Goodwill attributable to the BlueBoard acquisition | 7,504 | |

| Balance as of September 30, 2020 | $ | 30,990 | |

There were no0 changes to the Company's goodwill during the year ended December 31, 2016.2019.

The Company has acquired intangible assets in connection with its business acquisitions. These assets were recorded at their estimated fair values at the acquisition date and are being amortized over their respective estimated useful lives using the straight-line method. The estimated useful lives and amortization methodology used in computing amortization are as follows: |

| | | | | | | |

| Estimated Useful Life | Amortization Methodology |

| Customer relationships | 7 years | Straight-line |

| Acquired technology | 7 years | Straight-line |

Trade names | 3 years | Straight-line |

Amortization expense associated with the Company's intangible assets was $0.2$0.3 million and $0.1$0.2 million for the three months ended September 30, 20172020 and 2016,2019, respectively, and was $0.5$0.6 million and $0.4$0.5 million for the nine months ended September 30, 20172020 and 2016,2019, respectively.

5. COMMITMENTSFAIR VALUE OF MEASUREMENTS

Sales Tax

During the first quarter of 2017, theThe Company completed its analysis with regarduses a three-tier fair value hierarchy to potential unpaid sales tax obligations. Basedclassify all assets and liabilities measured at fair value on the results of this analysis, the Company made the decision to enter into voluntary disclosure agreements ("VDAs") with certain jurisdictions to reduce the Company’s potential sales tax liability. VDAs generally provide for a maximum look-back period, a waiver of penalties and, at times, interestrecurring basis, as well as assets and liabilities measured at fair value on a non-recurring basis, in periods subsequent to their initial measurement. The hierarchy requires the Company to use observable inputs when available, and to minimize the use of unobservable inputs when determining fair value. The three tiers are defined as follows:

•Level 1. Observable inputs based on unadjusted quoted prices in active markets for identical assets or liabilities.

•Level 2. Inputs, other than quoted prices in active markets, that are observable either directly or indirectly.

•Level 3. Unobservable inputs for which there is little or no market data, which require the Company to develop its own assumptions.

The carrying amounts of certain of the Company’s financial instruments, including cash and cash equivalents, accounts receivable, accounts payable and accrued expenses approximate their respective fair values due to their short-term nature.

The acquisition of BlueBoard on July 23, 2020 includes a contingent consideration arrangement, as described in Note 4 above. Contingent consideration was measured at fair value at the acquisition date and is remeasured at fair value at each reporting date until the contingency is resolved.

The fair value of the contingent consideration related to the BlueBoard acquisition was estimated based on a probability-weighted model in which the Company developed various scenarios for achievement of the financial targets. The Company discounted the expected future earn-out payment arrangements.of each scenario to its net present value using Level 3 inputs and assigned probabilities to achieving each scenario. Key assumptions used in the measurement of fair value of contingent consideration include the Company’s internal financial projections and analysis of BlueBoard's current customer base and expected customer growth, target market, sales potential, risk-free rates and discount rates. Increases or decreases in any valuation inputs in isolation may result in a significantly lower or higher fair value measurement in the future. Subsequent changes in the fair value of contingent consideration are recognized within general and administrative expenses in the Company’s condensed consolidated statements of operations. As of September 30, 2020, the fair value of the contingent consideration was $1.5 million, of which $0.9 million is recorded in "Other current liabilities" and $0.6 million is recorded in "Other long-term liabilities."

6. CAPITALIZED SOFTWARE DEVELOPMENT COSTS

Capitalized software development costs related to creating internally developed software and implementing software purchased for internal use are included in property and equipment in the accompanying condensed consolidated balance sheets. The Company's estimated aggregate VDA liabilityCompany capitalized software development costs of $2.5$0.9 million and $0.7 million during the three months ended September 30, 2020 and 2019, respectively, and $2.3 million and $2.0 million during the nine months ended September 30, 2020 and 2019, respectively. Amortization expense related to capitalized internally developed software was recorded as a one-time charge$0.5 million and $0.2 million during the three months ended September 30, 2020 and 2019, respectively, and $1.3 million and $0.5 million during the nine months ended September 30, 2020 and 2019, respectively, and is included in cost of revenue or general and administrative expense in the accompanying condensed consolidated statements of operations, depending upon the nature of the software development project. The net book value of capitalized internally developed software was $3.9 million and $2.9 million at September 30, 2020 and December 31, 2019, respectively.

7. LINE OF CREDIT

On August 5, 2020, the Company established a $25.0 million revolving credit facility with a commercial lender that is available for use until August 5, 2023. Proceeds from borrowings under the credit facility may be used for working capital and general corporate purposes, including acquisitions. Up to $10.0 million of the facility is available for letters of credit. Additionally, the Company may request increases to the facility, subject to the consent of the lender, provided that the aggregate amount of such increases during the term do not exceed $10.0 million. Amounts borrowed under the facility will bear interest equal to either a base rate plus 2.25% per annum or LIBOR plus 3.25% per annum. The Company will pay a fee on all outstanding letters of credit at a rate of 3.25% per annum. In addition, the Company will pay a quarterly fee at a rate of 0.50% per annum on the undrawn portion of the facility. As collateral for extension of credit under the facility, the Company granted security interests in substantially all of its assets and those of one of its subsidiaries. The agreement for the credit facility contains customary representations and warranties and subjects the Company to affirmative and negative covenants. As of September 30, 2020, the Company had not drawn on, or issued any letters of credit under, the credit facility.

8. REVENUE FROM CONTRACTS WITH CUSTOMERS

Revenue Recognition and Disaggregation of Revenue

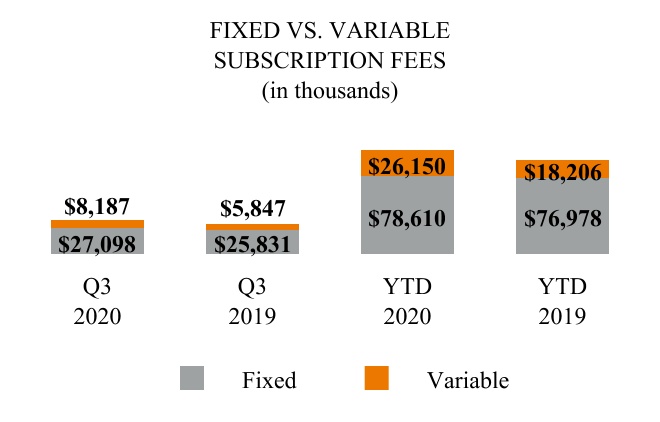

The Company derives the majority of its revenue from subscription fees paid for access to and usage of its SaaS solutions for a specified period of time. A portion of the subscription fee is typically fixed and is based on a specified minimum amount of gross merchandise value, or GMV, or advertising spend that a customer expects to process through the Company's platform over the contract term. The remaining portion of the subscription fee is variable and is based on a specified percentage of GMV or advertising spend processed through the Company's platform in excess of the customer's specified minimum GMV or advertising spend amount. In addition to subscription fees, contracts with customers may include implementation fees for launch assistance and training. Fixed subscription and implementation fees are billed in advance of the subscription term and are due in accordance with contract terms, which generally provide for payment within 30 days. Variable fees are subject to the same payment terms, although they are generally billed the month after they are incurred. The Company also generates revenue from its solutions that allow brands to direct potential consumers from their websites and digital marketing campaigns to authorized resellers. The majority of the Company's contracts have a one year term. The Company's contractual arrangements include performance, termination and cancellation provisions, but do not provide for refunds. Customers do not have the contractual right to take possession of the Company's software at any time. Sales taxes collected from customers and remitted to government authorities are excluded from revenue.

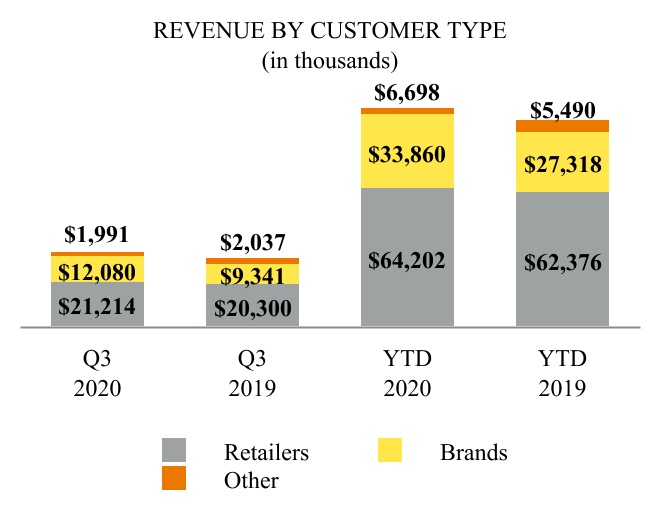

The Company's customers are categorized as follows:

Retailers. The Company generally categorizes a customer as a retailer if it primarily focuses on selling third-party products.

Brands. The Company generally categorizes a customer as a brand if it primarily focuses on selling its own proprietary products.

Other. Other is primarily comprised of strategic partnerships.

The following table summarizes revenue disaggregation by customer type for the three and nine months ended September 30, 2020 and 2019 (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2020 | | 2019 | | 2020 | | 2019 |

| Retailers | $ | 21,214 | | | $ | 20,300 | | | $ | 64,202 | | | $ | 62,376 | |

| Brands | 12,080 | | | 9,341 | | | 33,860 | | | 27,318 | |

| Other | 1,991 | | | 2,037 | | | 6,698 | | | 5,490 | |

| $ | 35,285 | | | $ | 31,678 | | | $ | 104,760 | | | $ | 95,184 | |

Contracts with Multiple Performance Obligations

Customers may elect to purchase a subscription to multiple modules, multiple modules with multiple service levels, or, for certain of the Company's solutions, multiple brands or geographies. The Company evaluates such contracts to determine whether the services to be provided are distinct and accordingly should be accounted for as separate performance obligations. If the Company determines that a contract has multiple performance obligations, the transaction price, which is the total price of the contract, is allocated to each performance obligation based on a relative standalone selling price method. The Company estimates standalone selling price based on observable prices in past transactions for which the product offering subject to the performance obligation has been sold separately. As the performance obligations are satisfied, revenue is recognized as discussed above in the product descriptions.

Transaction Price Allocated to Future Performance Obligations

As the Company typically enters into contracts with customers for a twelve-month subscription term, a substantial majority of its performance obligations that have not yet been satisfied as of September 30, 2020 are part of a contract that has an original expected duration of one year or less. For contracts with an original expected duration of greater than one year, the aggregate transaction price allocated to the unsatisfied performance obligations was $28.9 million as of September 30, 2020, of which $17.5 million is expected to be recognized as revenue over the next twelve months.

Deferred Revenue

Deferred revenue represents the unearned portion of subscription and implementation fees. Deferred revenue is recorded when cash payments are received in advance of performance. Deferred amounts are generally recognized within one year. Deferred revenue is included in the accompanying condensed consolidated balance sheets under "Total current liabilities," net

of any long-term portion that is included in "Other long-term liabilities." The following table summarizes deferred revenue activity for the nine months ended September 30, 2017. This amount represents2020 (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | |

| Balance, beginning of period | | Net additions | | Revenue recognized | | Balance, end of period |

| Deferred revenue | $ | 21,459 | | | 78,909 | | | (78,610) | | | $ | 21,758 | |

Of the Company's estimate$104.8 million of its potential unpaidrevenue recognized in the nine months ended September 30, 2020, $11.9 million was included in deferred revenue at January 1, 2020.

Costs to Obtain Contracts

The Company capitalizes sales tax liability throughcommissions and a portion of other incentive compensation costs that are directly related to obtaining customer contracts and that would not have been incurred if the anticipated look-back periods including interest, where applicable,contract had not been obtained. These costs are included in all jurisdictionsthe accompanying condensed consolidated balance sheets and are classified as "Prepaid expenses and other current assets," net of any long-term portion that is included in "Deferred contract costs, net of current portion." As of September 30, 2020, $6.8 million was included in "Prepaid expenses and other current assets." Deferred contract costs are amortized to sales and marketing expense over the expected period of benefit, which the Company has entered intodetermined to be five years based on the estimated customer relationship period. The following table summarizes deferred contract cost activity for the nine months ended September 30, 2020 (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | |

| Balance, beginning of period | | Additions | | Amortized costs (1) | | Balance, end of period |

| Deferred contract costs | $ | 18,414 | | | 6,428 | | | (4,623) | | | $ | 20,219 | |

(1) Includes contract costs amortized to sales and marketing expense during the period and the impact from foreign currency exchange rate fluctuations.

9. STOCK-BASED COMPENSATION

In February 2020, the Company’s Compensation Committee implemented changes to the equity compensation program for the Company’s executive officers. Beginning in 2020, 50% of each executive's equity awards were granted in the form of performance-based vesting restricted stock units, or intendsPSUs, that are eligible for vesting only if the Company achieves pre-defined targets set by the Compensation Committee for the Company’s combined year-over-year revenue growth and adjusted earnings before interest, tax, depreciation and amortization, or EBITDA, margin over a multi-year measurement period (a two-year measurement period for fiscal 2020 grants), subject to enter into VDAs. Ifthe executive’s continued service with the Company. For any PSUs to vest, revenue growth must be positive over the performance period. Vesting of these PSU awards is based on a sliding scale of actual performance against the pre-defined goals. The sliding scale ranges from 0 vesting and forfeiture of the tax authorities rejects the Company's VDA applications or offers terms that are other than whatawards if the Company is anticipating, ordoes not achieve the performance threshold, to an award of up to 150% of the target number of awards if the VDAs do not resolve all potential unpaid sales tax obligations, thenpre-defined maximum performance is achieved. As soon as reasonably practicable after the completion of the performance period, the Compensation Committee will determine the level of attainment of the performance goal and if the performance threshold is achieved, on the second anniversary of the grant date, subject to the executive’s continued service as of that date, 50% of the earned PSU awards will vest and, on the third anniversary of the grant date, the remaining 50% of earned PSU awards will vest, subject to the executive’s continued service as of that date. The Committee may make adjustments to the manner in which the achievement is determined as it is possible thatdeems equitable and appropriate to exclude the actual aggregate unpaid sales tax liability may be highereffect of unusual, non-recurring or lower than the Company's estimate.

Through September 30, 2017,infrequent matters, transactions or events affecting the Company has paid approximately $0.9 million under termsor its consolidated financial statements; changes in accounting principles, practices or policies or in tax laws or other laws or requirements; or other similar events, matters or changed circumstances. Each adjustment, if any, shall be made solely for the purpose of maintaining the intended economics of the VDA agreements that it has completedaward in light of changed circumstances to prevent the dilution or enlargement of the executive’s rights with certain jurisdictions. Duringrespect to the third quarterPSUs. The fair value of 2017, a jurisdiction rejected the Company's VDA applicationPSU awards is determined using the Company’s stock price on the grant date. These awards are equity classified and will be conducting a sales tax audit. The Company believesexpensed over the scoperequisite service period based on the extent to which achievement of the audit will be limited and similar in principle to the VDA program offered by that jurisdiction; as a result, the Company has determined not to revise its estimate of its potential unpaid sales tax liability. The completion date of the sales tax audit has not been determined. The Company expects to complete the remaining VDAs within the next six months following the date of filing this Quarterly Report on Form 10-Q.

6. STOCK-BASED COMPENSATIONperformance metrics is probable.

The Company recognizes stock-based compensation expense using the accelerated attribution method, net of estimated forfeitures, in which compensation cost for each vesting tranche in an award is recognized ratably from the service inception date to the vesting date for that tranche.

Stock-based compensation expense is included in the following line items in the accompanying condensed consolidated statements of operations for the three and nine months ended September 30, 20172020 and 20162019 (in thousands):

| | | | Three Months Ended September 30, | | Nine Months Ended September 30, | | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2017 | | 2016 | | 2017 | | 2016 | | 2020 | | 2019 (1) | | 2020 | | 2019 (1) |

| Cost of revenue | $ | 259 |

| | $ | 330 |

| | $ | 753 |

| | $ | 941 |

| Cost of revenue | $ | 203 | | | $ | 169 | | | $ | 760 | | | $ | 745 | |

| Sales and marketing | 970 |

| | 1,161 |

| | 2,960 |

| | 3,651 |

| Sales and marketing | 544 | | | 0 | | | 2,061 | | | 1,773 | |

| Research and development | 588 |

| | 496 |

| | 1,659 |

| | 1,485 |

| Research and development | 485 | | | 454 | | | 1,708 | | | 1,696 | |

| General and administrative | 1,023 |

| | 878 |

| | 3,760 |

| | 4,130 |

| General and administrative | 1,030 | | | 178 | | | 3,203 | | | 2,786 | |

| | $ | 2,840 |

| | $ | 2,865 |

| | $ | 9,132 |

| | $ | 10,207 |

| |

| Total stock-based compensation expense | | Total stock-based compensation expense | $ | 2,262 | | | $ | 801 | | | $ | 7,732 | | | $ | 7,000 | |

During the nine months ended September 30, 2017, the Company granted the following share-based awards: |

| | | | | | |

| | Number of Shares Underlying Grant | | Weighted Average Grant Date Fair Value |

| Stock options | 597,034 |

| | $ | 4.21 |

|

| Restricted stock units ("RSUs") | 1,325,172 |

| | 10.44 |

|

| Total share-based awards | 1,922,206 |

| | 8.50 |

|

7. NET LOSS PER SHARE

Diluted net loss per share is the same as basic net loss per share for all periods presented because the effects of potentially dilutive items were anti-dilutive given the Company’s net loss. The following securities have been excluded from the calculation of weighted average common shares outstanding because the effect is anti-dilutive(1) Stock-based compensation expense for the three and nine months ended September 30, 20172019 was impacted by forfeitures due to changes in executive management.

During the nine months ended September 30, 2020, the Company granted the following share-based awards:

| | | | | | | | | | | |

| Number of Shares Underlying Grant | | Weighted Average Grant Date Fair Value |

| Restricted stock units | 958,055 | | | $ | 11.32 | |

| Performance stock units | 142,317 | | | $ | 9.27 | |

| Total share-based awards | 1,100,372 | | | |

10. NET INCOME (LOSS) PER SHARE

Basic net income (loss) per share is calculated by dividing net income (loss) by the weighted-average number of shares of common stock outstanding for the period. Diluted net income (loss) per share is calculated giving effect to all potentially dilutive shares of common stock, including stock options and 2016:restricted stock units. The dilutive effect of outstanding awards is reflected in diluted earnings per share by application of the treasury stock method.

The following table summarizes the calculation of basic and diluted net income (loss) per share (in thousands, except share and per share data):

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2020 | | 2019 | | 2020 | | 2019 |

| Basic: | | | | | | | |

| Net income (loss) | $ | 3,712 | | | $ | 1,729 | | | $ | 12,705 | | | $ | (1,938) | |

| Weighted average common shares outstanding, basic | 28,802,310 | | | 28,049,199 | | | 28,485,547 | | | 27,824,696 | |

| Basic net income (loss) per share | $ | 0.13 | | | $ | 0.06 | | | $ | 0.45 | | | $ | (0.07) | |

| Diluted: | | | | | | | |

| Net income (loss) | $ | 3,712 | | | $ | 1,729 | | | $ | 12,705 | | | $ | (1,938) | |

| Weighted average common shares outstanding, basic | 28,802,310 | | | 28,049,199 | | | 28,485,547 | | | 27,824,696 | |

| Dilutive effect of: | | | | | | | |

| Stock options | 571,884 | | | 169,354 | | | 334,565 | | | — | |

| Unvested restricted stock units | 1,062,407 | | | 536,126 | | | 995,717 | | | — | |

| Weighted average common shares outstanding, diluted | 30,436,601 | | | 28,754,679 | | | 29,815,829 | | | 27,824,696 | |

| Diluted net income (loss) per share | $ | 0.12 | | | $ | 0.06 | | | $ | 0.43 | | | $ | (0.07) | |

The following equity instruments have been excluded from the calculation of diluted net income (loss) per share because the effect is anti-dilutive:

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2020 | | 2019 | | 2020 | | 2019 |

| Stock options | 145,279 | | | 1,923,938 | | | 528,777 | | | 2,341,209 | |

| Restricted stock units | 19,322 | | | 269,552 | | | 26,397 | | | 2,206,636 | |

|

| | | | | |

| | Three and Nine Months Ended September 30, |

| | 2017 | | 2016 |

| Stock options | 2,132,715 |

| | 1,657,549 |

|

| RSUs | 2,547,941 |

| | 2,342,444 |

|

8.11. INCOME TAXES

At the end of each interim reporting period, the Company estimates its effective income tax rate expected to be applicable for the full year. This estimate is used to determine the income tax provision or benefit on a year-to-date basis and may change in subsequent interim periods.

The Company’sCompany's effective tax rate was (0.9)(11.2)% and 1.0%11.0% for the three months ended September 30, 20172020 and 2016,2019, respectively, and (1.3)%1.3% and 0.7%(41.9)% for the nine months ended September 30, 20172020 and 2016,2019, respectively. The tax (expense) benefit(benefit) expense for each of the periods was based on U.S. federal, state, local and foreign income taxes. The Company’s effective tax rate for these periods is lower than the U.S. federal statutory rate of 34%21% primarily due to operating lossesloss carryforwards which are subject to a valuation allowance. The Company cannot recognize the tax benefit of operating loss carryforwards generated in certain jurisdictions due to uncertainties relating to future taxable income in those jurisdictions in terms of both its timing and its sufficiency, which would enable the Company to realize the benefits of those carryforwards. The Company began recognizingchange in the effective tax expense duringrate for the 2017 interim periodsthree months ended September 30, 2020 compared with the same period in the prior year was primarily due to having recognizedan increase in the UK corporate income tax benefits duringrate resulting in an increase to the 2016 interim periods. This was in part a result of releasing valuation allowances in certain foreign jurisdictions during the fourth quarter of 2016. In addition, during the interim periods in 2017, the Company no longer had sufficient deferred tax liabilities in one of its foreign subsidiaries necessary to realize the tax benefit of all of itsUK deferred tax assets and the acquisition of BlueBoard and their current year operating losses, for that same foreign subsidiary. The Company recorded a valuation allowance against the deferred tax assets of that foreign subsidiary, net of deferred tax liabilities. As a result,which the Company is not currently permitted tocan recognize the tax benefitbenefit. The change in the effective tax rate for the nine months ended September 30, 2020 compared with the same period in the prior year was primarily due to the shift from pre-tax loss for the nine-month period in 2019 to pre-tax income for the nine-month period in 2020.

The Tax Cuts and Jobs Act of that subsidiary’s losses.2017, or Tax Act, which went into effect on December 22, 2017, significantly revised the Internal Revenue Code of 1986, as amended. The Tax Act contains, among other things, significant changes to corporate taxation, including reduction of the corporate tax rate from a top marginal rate of 35% to a flat rate of 21%, limitation of the tax deduction for interest expense to 30% of adjusted earnings (except for certain small businesses), repeal of the alternative minimum tax, limitation of the deduction for net operating losses to 80% of current year taxable income, indefinite net operating loss carryforward period and elimination of net operating loss carrybacks, elimination of U.S. tax on foreign earnings (subject to certain important exceptions), immediate deductions for certain new investments instead of deductions for depreciation expense over time, creation of the base erosion anti-abuse tax, the global intangible low taxed income inclusion, which the Company accounts for as a period cost, the foreign derived intangible income deduction and modification or repeal of many business deductions and credits.

The Coronavirus, Aid, Relief and Economic Security Act, or CARES Act, was enacted on March 27, 2020. The CARES Act includes both income tax and non-income tax measures to assist companies. Some of the key income tax-related provisions of the CARES Act include the elimination of the 80% limitation on certain net operating loss carryforwards and allowing net operating loss carrybacks, an increase to the interest expense deduction limit, passage of technical corrections to the Tax Cuts and Jobs Act of 2017, and acceleration of the Alternative Minimum Tax Credit refund. In addition to the income tax provisions, the CARES Act includes non-income tax provisions, such as loan programs, penalty and interest-free deferral of certain tax payments, and payroll tax credits. The Company has decided not to apply for any of the loan programs in the CARES Act. The relevant corporate income tax changes have been incorporated into the Company's income tax provision for the three and nine months ended September 30, 2020 based on the language in the CARES Act and guidance promulgated prior to the issuance of these financial statements. These corporate tax changes had an insignificant impact on the income tax provision for the three and nine months ended September 30, 2020. The Company is also monitoring COVID-19 tax relief developments in U.S. states and foreign jurisdictions where the Company has operations. The Company is currently benefiting from penalty and interest-free tax payment deferral in a few of the jurisdictions where the Company has operations, including deferral of the employer portion of the 2020 U.S. Social Security tax payments as provided in the CARES Act.

9.12. SEGMENT AND GEOGRAPHIC INFORMATION

Operating segments are defined as components of an enterprise for which discrete financial information is available that is evaluated regularly by the chief operating decision maker, (“CODM”)or CODM, for purposes of allocating resources and evaluating financial performance. The Company’sCompany's CODM reviews financial information presented on a consolidated basis for purposes of allocating resources and evaluating financial performance. As such, the Company’sCompany's operations constitute a single operating segment and one1 reportable segment.

Substantially all assets were held in the United States during the nine months ended September 30, 20172020 and the year ended December 31, 2016.2019. The Company categorizes domestic and international revenue from customers based on their billing address. The following table below summarizes revenue by geography for the three and nine months ended September 30, 20172020 and 20162019 (in thousands). The Company categorizes domestic and international:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | | 2020 | | 2019 (1) | | 2020 | | 2019 (1) |

| Domestic | | $ | 26,135 | | | $ | 23,537 | | | $ | 78,571 | | | $ | 71,207 | |

| International | | 9,150 | | | 8,141 | | | 26,189 | | | 23,977 | |

| Total revenue | | $ | 35,285 | | | $ | 31,678 | | | $ | 104,760 | | | $ | 95,184 | |