UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

FORM 10-Q

(Mark One)

|

| |

| ý | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended SeptemberJune 30, 20162017

OR

|

| |

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number: 001-31719

MOLINA HEALTHCARE, INC.

(Exact name of registrant as specified in its charter)

|

| | |

| Delaware | | 13-4204626 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | |

200 Oceangate, Suite 100 Long Beach, California | | 90802 |

| (Address of principal executive offices) | | (Zip Code) |

(562) 435-3666

(Registrant’s telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company, or an emerging growth company. See the definitions of "large“large accelerated filer," "accelerated filer"” “accelerated filer,” “smaller reporting company,” and "smaller reporting company"“emerging growth company” in Rule 12b-2 of the Exchange Act.

|

| | | |

| Large accelerated filer | ý | Accelerated filer | ¨ |

| | | | |

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | ¨ |

| | Emerging growth company | ¨ |

|

| |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section13(a) of the Exchange Act. | |

| ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ¨ No ý

The number of shares of the issuer’s Common Stock, $0.001 par value, outstanding as of October 21, 2016,July 28, 2017, was approximately 56,821,000.57,118,000.

MOLINA HEALTHCARE, INC.

Form FORM 10-Q

FOR THE QUARTERLY PERIOD ENDED June 30, 2017

For the Quarterly Period Ended September 30, 2016

TABLE OF CONTENTS

|

| | |

| | | Page |

Item 1. | | |

Item 2. | | |

Item 3. | | |

Item 4. | | |

| | |

| | |

Item 1. | | |

Item 1A. | | |

Item 2. | | |

Item 3. | | |

Item 4. | | |

Item 5. | | |

Item 6. | | |

| | |

PART I. CROSS-REFERENCE INDEX

|

| | |

| ITEM NUMBER | Page |

| | | |

| PART I - Financial Information | |

| | | |

| 1. | | |

| | | |

| 2. | | |

| | | |

| 3. | |

|

| | | |

| 4. | | |

| | | |

| |

| | | |

| 1. | | |

| | | |

| 1A. | | |

| | | |

| 2. | | |

| | | |

| 3. | Defaults Upon Senior Securities | Not Applicable. |

| | | |

| 4. | Mine Safety Disclosures | Not Applicable. |

| | | |

| 5. | Other Information | Not Applicable. |

| | | |

| 6. | | |

| | | |

| | | |

| | | |

| | | |

FINANCIAL INFORMATION

Item 1.Financial StatementsSTATEMENTS

MOLINA HEALTHCARE, INC.

CONSOLIDATED BALANCE SHEETSSTATEMENTS OF OPERATIONS |

| | | | | | | |

| | September 30,

2016 | | December 31,

2015 |

| | (Amounts in millions, except per-share data) |

| | (Unaudited) | | |

| ASSETS |

| Current assets: | | | |

| Cash and cash equivalents | $ | 2,842 |

| | $ | 2,329 |

|

| Investments | 1,735 |

| | 1,801 |

|

| Receivables | 1,053 |

| | 597 |

|

| Income taxes refundable | — |

| | 13 |

|

| Prepaid expenses and other current assets | 169 |

| | 192 |

|

| Derivative asset | 314 |

| | 374 |

|

| Total current assets | 6,113 |

| | 5,306 |

|

| Property, equipment, and capitalized software, net | 450 |

| | 393 |

|

| Deferred contract costs | 83 |

| | 81 |

|

| Intangible assets, net | 149 |

| | 122 |

|

| Goodwill | 619 |

| | 519 |

|

| Restricted investments | 116 |

| | 109 |

|

| Deferred income taxes | — |

| | 18 |

|

| Other assets | 40 |

| | 28 |

|

| | $ | 7,570 |

| | $ | 6,576 |

|

| | | | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY |

| Current liabilities: | | | |

| Medical claims and benefits payable | $ | 1,871 |

| | $ | 1,685 |

|

| Amounts due government agencies | 1,232 |

| | 729 |

|

| Accounts payable and accrued liabilities | 383 |

| | 362 |

|

| Deferred revenue | 380 |

| | 223 |

|

| Income taxes payable | 19 |

| | — |

|

| Current portion of long-term debt | 466 |

| | 449 |

|

| Derivative liability | 314 |

| | 374 |

|

| Total current liabilities | 4,665 |

| | 3,822 |

|

| Senior notes | 971 |

| | 962 |

|

| Lease financing obligations | 198 |

| | 198 |

|

| Deferred income taxes | 6 |

| | — |

|

| Other long-term liabilities | 39 |

| | 37 |

|

| Total liabilities | 5,879 |

| | 5,019 |

|

| | | | |

| Stockholders’ equity: | | | |

| Common stock, $0.001 par value; 150 shares authorized; outstanding: 57 shares at September 30, 2016 and 56 shares at December 31, 2015 | — |

| | — |

|

| Preferred stock, $0.001 par value; 20 shares authorized, no shares issued and outstanding | — |

| | — |

|

| Additional paid-in capital | 831 |

| | 803 |

|

| Accumulated other comprehensive gain (loss) | 3 |

| | (4 | ) |

| Retained earnings | 857 |

| | 758 |

|

| Total stockholders' equity | 1,691 |

| | 1,557 |

|

| | $ | 7,570 |

| | $ | 6,576 |

|

See accompanying notes.

MOLINA HEALTHCARE, INC. |

| | | | | | | | | | | | | | | |

| | Three Months Ended June 30, | | Six Months Ended June 30, |

| | 2017 | | 2016 | | 2017 | | 2016 |

| | (In millions, except per-share data) (Unaudited) |

| Revenue: | | | | | | | |

| Premium revenue | $ | 4,740 |

| | $ | 4,029 |

| | $ | 9,388 |

| | $ | 8,024 |

|

| Service revenue | 129 |

| | 135 |

| | 260 |

| | 275 |

|

| Premium tax revenue | 114 |

| | 109 |

| | 225 |

| | 218 |

|

| Health insurer fee revenue | — |

| | 76 |

| | — |

| | 166 |

|

| Investment income and other revenue | 16 |

| | 10 |

| | 30 |

| | 19 |

|

| Total revenue | 4,999 |

| | 4,359 |

| | 9,903 |

| | 8,702 |

|

| Operating expenses: | | | | | | | |

| Medical care costs | 4,491 |

| | 3,594 |

| | 8,602 |

| | 7,182 |

|

| Cost of service revenue | 124 |

| | 116 |

| | 246 |

| | 243 |

|

| General and administrative expenses | 405 |

| | 351 |

| | 844 |

| | 691 |

|

| Premium tax expenses | 114 |

| | 109 |

| | 225 |

| | 218 |

|

| Health insurer fee expenses | — |

| | 50 |

| | — |

| | 108 |

|

| Depreciation and amortization | 37 |

| | 34 |

| | 76 |

| | 66 |

|

| Impairment losses | 72 |

| | — |

| | 72 |

| | — |

|

| Restructuring and separation costs | 43 |

| | — |

| | 43 |

| | — |

|

| Total operating expenses | 5,286 |

| | 4,254 |

| | 10,108 |

| | 8,508 |

|

| Operating (loss) income | (287 | ) | | 105 |

| | (205 | ) | | 194 |

|

| Other expenses (income), net: | | | | | | | |

| Interest expense | 27 |

| | 25 |

| | 53 |

| | 50 |

|

| Other income, net | — |

| | — |

| | (75 | ) | | — |

|

| Total other expenses (income), net | 27 |

| | 25 |

| | (22 | ) | | 50 |

|

| (Loss) income before income tax (benefit) expense | (314 | ) | | 80 |

| | (183 | ) | | 144 |

|

| Income tax (benefit) expense | (84 | ) | | 47 |

| | (30 | ) | | 87 |

|

| Net (loss) income | $ | (230 | ) | | $ | 33 |

| | $ | (153 | ) | | $ | 57 |

|

| | | | | | | | |

| Net (loss) income per share: | | | | | | | |

| Basic | $ | (4.10 | ) | | $ | 0.58 |

| | $ | (2.74 | ) | | $ | 1.02 |

|

| Diluted | $ | (4.10 | ) | | $ | 0.58 |

| | $ | (2.74 | ) | | $ | 1.01 |

|

CONSOLIDATED STATEMENTS OF COMPREHENSIVE (LOSS) INCOME

|

| | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2016 | | 2015 | | 2016 | | 2015 |

| | (In millions, except per-share data) (Unaudited) |

| Revenue: | | | | | | | |

| Premium revenue | $ | 4,191 |

| | $ | 3,377 |

| | $ | 12,215 |

| | $ | 9,652 |

|

| Service revenue | 133 |

| | 47 |

| | 408 |

| | 146 |

|

| Premium tax revenue | 127 |

| | 99 |

| | 345 |

| | 289 |

|

| Health insurer fee revenue | 85 |

| | 81 |

| | 251 |

| | 203 |

|

| Investment income | 9 |

| | 5 |

| | 25 |

| | 12 |

|

| Other revenue | 1 |

| | 2 |

| | 4 |

| | 5 |

|

| Total revenue | 4,546 |

| | 3,611 |

| | 13,248 |

| | 10,307 |

|

| Operating expenses: | | | | | | | |

| Medical care costs | 3,748 |

| | 3,016 |

| | 10,930 |

| | 8,581 |

|

| Cost of service revenue | 119 |

| | 34 |

| | 362 |

| | 103 |

|

| General and administrative expenses | 343 |

| | 287 |

| | 1,034 |

| | 830 |

|

| Premium tax expenses | 127 |

| | 99 |

| | 345 |

| | 289 |

|

| Health insurer fee expenses | 55 |

| | 36 |

| | 163 |

| | 117 |

|

| Depreciation and amortization | 36 |

| | 26 |

| | 102 |

| | 76 |

|

| Total operating expenses | 4,428 |

| | 3,498 |

| | 12,936 |

| | 9,996 |

|

| Operating income | 118 |

| | 113 |

| | 312 |

| | 311 |

|

| Interest expense | 26 |

| | 15 |

| | 76 |

| | 45 |

|

| Income before income tax expense | 92 |

| | 98 |

| | 236 |

| | 266 |

|

| Income tax expense | 50 |

| | 52 |

| | 137 |

| | 153 |

|

| Net income | $ | 42 |

| | $ | 46 |

| | $ | 99 |

| | $ | 113 |

|

| | | | | | | | |

| Net income per share: | | | | | | | |

| Basic | $ | 0.77 |

| | $ | 0.84 |

| | $ | 1.79 |

| | $ | 2.21 |

|

| Diluted | $ | 0.76 |

| | $ | 0.77 |

| | $ | 1.77 |

| | $ | 2.07 |

|

|

| | | | | | | | | | | | | | | |

| | Three Months Ended June 30, | | Six Months Ended June 30, |

| | 2017 | | 2016 | | 2017 | | 2016 |

| | (Amounts in millions) (Unaudited) |

| Net (loss) income | $ | (230 | ) | | $ | 33 |

| | $ | (153 | ) | | $ | 57 |

|

| Other comprehensive income: | | | | | | | |

| Unrealized investment gain | — |

| | 4 |

| | 1 |

| | 13 |

|

| Less: effect of income taxes | — |

| | 2 |

| | — |

| | 5 |

|

| Other comprehensive income, net of tax | — |

| | 2 |

| | 1 |

| | 8 |

|

| Comprehensive (loss) income | $ | (230 | ) | | $ | 35 |

| | $ | (152 | ) | | $ | 65 |

|

See accompanying notes.

MOLINA HEALTHCARE, INC.

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOMEBALANCE SHEETS |

| | | | | | | |

| | June 30,

2017 | | December 31,

2016 |

| | (Amounts in millions, except per-share data) |

| | (Unaudited) | | |

| ASSETS |

| Current assets: | | | |

| Cash and cash equivalents | $ | 2,979 |

| | $ | 2,819 |

|

| Investments | 2,192 |

| | 1,758 |

|

| Restricted investments | 325 |

| | — |

|

| Receivables | 1,006 |

| | 974 |

|

| Income taxes refundable | 68 |

| | 39 |

|

| Prepaid expenses and other current assets | 159 |

| | 131 |

|

| Derivative asset | 440 |

| | 267 |

|

| Total current assets | 7,169 |

| | 5,988 |

|

| Property, equipment, and capitalized software, net | 449 |

| | 454 |

|

| Deferred contract costs | 93 |

| | 86 |

|

| Intangible assets, net | 112 |

| | 140 |

|

| Goodwill | 559 |

| | 620 |

|

| Restricted investments | 118 |

| | 110 |

|

| Deferred income taxes | 36 |

| | 10 |

|

| Other assets | 47 |

| | 41 |

|

| | $ | 8,583 |

| | $ | 7,449 |

|

| | | | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY |

| Current liabilities: | | | |

| Medical claims and benefits payable | $ | 2,077 |

| | $ | 1,929 |

|

| Amounts due government agencies | 1,844 |

| | 1,202 |

|

| Accounts payable and accrued liabilities | 375 |

| | 385 |

|

| Deferred revenue | 284 |

| | 315 |

|

| Current portion of long-term debt | 773 |

| | 472 |

|

| Derivative liability | 440 |

| | 267 |

|

| Total current liabilities | 5,793 |

| | 4,570 |

|

| Senior notes | 1,017 |

| | 975 |

|

| Lease financing obligations | 198 |

| | 198 |

|

| Deferred income taxes | — |

| | 15 |

|

| Other long-term liabilities | 54 |

| | 42 |

|

| Total liabilities | 7,062 |

| | 5,800 |

|

| | | | |

| Stockholders’ equity: | | | |

| Common stock, $0.001 par value; 150 shares authorized; outstanding: 57 shares at June 30, 2017 and at December 31, 2016 | — |

| | — |

|

| Preferred stock, $0.001 par value; 20 shares authorized, no shares issued and outstanding | — |

| | — |

|

| Additional paid-in capital | 865 |

| | 841 |

|

| Accumulated other comprehensive loss | (1 | ) | | (2 | ) |

| Retained earnings | 657 |

| | 810 |

|

| Total stockholders’ equity | 1,521 |

| | 1,649 |

|

| | $ | 8,583 |

| | $ | 7,449 |

|

|

| | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2016 | | 2015 | | 2016 | | 2015 |

| | (Amounts in millions) (Unaudited) |

| Net income | $ | 42 |

| | $ | 46 |

| | $ | 99 |

| | $ | 113 |

|

| Other comprehensive (loss) income: | | | | | | | |

| Unrealized investment (loss) gain | (3 | ) | | 2 |

| | 10 |

| | 1 |

|

| Less: effect of income taxes | (2 | ) | | — |

| | 3 |

| | — |

|

| Other comprehensive (loss) income, net of tax | (1 | ) | | 2 |

| | 7 |

| | 1 |

|

| Comprehensive income | $ | 41 |

| | $ | 48 |

| | $ | 106 |

| | $ | 114 |

|

See accompanying notes.

MOLINA HEALTHCARE, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

| | | | Nine Months Ended September 30, | Six Months Ended June 30, |

| | 2016 | | 2015 | 2017 | | 2016 |

| | (Amounts in millions)

(Unaudited) | (Amounts in millions)

(Unaudited) |

| Operating activities: | | | | | | |

| Net income | $ | 99 |

| | $ | 113 |

| |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | | |

| Net (loss) income | | $ | (153 | ) | | $ | 57 |

|

| Adjustments to reconcile net (loss) income to net cash provided by operating activities: | | | | |

| Depreciation and amortization | 135 |

| | 93 |

| 96 |

| | 89 |

|

| Impairment losses | | 72 |

| | — |

|

| Deferred income taxes | 20 |

| | (12 | ) | (41 | ) | | 39 |

|

| Share-based compensation | 24 |

| | 16 |

| |

| Share-based compensation, including accelerated share-based compensation | | 35 |

| | 16 |

|

| Amortization of convertible senior notes and lease financing obligations | 23 |

| | 22 |

| 16 |

| | 15 |

|

| Other, net | 14 |

| | 13 |

| 7 |

| | 11 |

|

| Changes in operating assets and liabilities: | | | | | | |

| Receivables | (427 | ) | | (23 | ) | (32 | ) | | (415 | ) |

| Prepaid expenses and other assets | (116 | ) | | (63 | ) | (38 | ) | | (143 | ) |

| Medical claims and benefits payable | 168 |

| | 359 |

| 148 |

| | 82 |

|

| Amounts due government agencies | 503 |

| | 453 |

| 642 |

| | 509 |

|

| Accounts payable and accrued liabilities | 1 |

| | 34 |

| (18 | ) | | 147 |

|

| Deferred revenue | 157 |

| | (129 | ) | (32 | ) | | (119 | ) |

| Income taxes | 32 |

| | 30 |

| (30 | ) | | (10 | ) |

| Net cash provided by operating activities | 633 |

| | 906 |

| 672 |

| | 278 |

|

| Investing activities: | | | | | | |

| Purchases of investments | (1,444 | ) | | (1,311 | ) | (1,636 | ) | | (974 | ) |

| Proceeds from sales and maturities of investments | 1,512 |

| | 863 |

| 874 |

| | 812 |

|

| Purchases of property, equipment and capitalized software | (143 | ) | | (101 | ) | (60 | ) | | (102 | ) |

| Change in restricted investments | 4 |

| | (5 | ) | |

| (Increase) decrease in restricted investments held-to-maturity | | (10 | ) | | 5 |

|

| Net cash paid in business combinations | (48 | ) | | (77 | ) | — |

| | (8 | ) |

| Other, net | (12 | ) | | (34 | ) | (13 | ) | | (6 | ) |

| Net cash used in investing activities | (131 | ) | | (665 | ) | (845 | ) | | (273 | ) |

| Financing activities: | | | | | | |

| Proceeds from common stock offering, net of issuance costs | — |

| | 373 |

| |

| Proceeds from senior notes offering, net of issuance costs | | 325 |

| | — |

|

| Proceeds from employee stock plans | 10 |

| | 8 |

| 11 |

| | 10 |

|

| Other, net | 1 |

| | 3 |

| (3 | ) | | 1 |

|

| Net cash provided by financing activities | 11 |

| | 384 |

| 333 |

| | 11 |

|

| Net increase in cash and cash equivalents | 513 |

| | 625 |

| 160 |

| | 16 |

|

| Cash and cash equivalents at beginning of period | 2,329 |

| | 1,539 |

| 2,819 |

| | 2,329 |

|

| Cash and cash equivalents at end of period | $ | 2,842 |

| | $ | 2,164 |

| $ | 2,979 |

| | $ | 2,345 |

|

MOLINA HEALTHCARE, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(continued)

| | | | Nine Months Ended September 30, | Six Months Ended June 30, |

| | 2016 | | 2015 | 2017 | | 2016 |

| | (Amounts in millions)

(Unaudited) | (Amounts in millions)

(Unaudited) |

| Supplemental cash flow information: | | | | | | |

| | | | | | | |

| Schedule of non-cash investing and financing activities: | | | | | | |

| Common stock used for share-based compensation | $ | (8 | ) | | $ | (9 | ) | $ | (21 | ) | | $ | (7 | ) |

| | | | | | | |

| Details of change in fair value of derivatives, net: | | | | | | |

| (Loss) gain on 1.125% Call Option | $ | (60 | ) | | $ | 161 |

| |

| Gain (loss) on 1.125% Conversion Option | 60 |

| | (161 | ) | |

| Gain (loss) on 1.125% Call Option | | $ | 173 |

| | $ | (148 | ) |

| (Loss) gain on 1.125% Conversion Option | | (173 | ) | | 148 |

|

| Change in fair value of derivatives, net | $ | — |

| | $ | — |

| $ | — |

| | $ | — |

|

| | | | | | | |

| Details of business combinations: | | | | | | |

| Fair value of assets acquired | $ | (186 | ) | | $ | (69 | ) | $ | — |

| | $ | (131 | ) |

| Fair value of liabilities assumed | 28 |

| | — |

| |

| Purchase price amounts accrued/received (paid) | 8 |

| | (8 | ) | |

| Purchase price amounts accrued/received | | — |

| | 21 |

|

| Reversal of amounts advanced to sellers in prior year | 102 |

| | — |

| — |

| | 102 |

|

| Net cash paid in business combinations | $ | (48 | ) | | $ | (77 | ) | $ | — |

| | $ | (8 | ) |

See accompanying notes.

MOLINA HEALTHCARE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited) (UNAUDITED)

SeptemberJune 30, 20162017

1. Basis of Presentation

Organization and Operations

Molina Healthcare, Inc. provides quality managed health care to people receiving government assistance. We offer cost-effective Medicaid-related solutions to meet the health care needs of low-income families and individuals, and to assist government agencies in their administration of the Medicaid program. We have three reportable segments. These segments includeconsist of our Health Plans segment, which comprisesconstitutes the vast majority of our operations; our Molina Medicaid Solutions segment; and our Other segment, which includes our behavioral health and social services subsidiary, Pathways. As of December 31, 2015, we changed our reporting structure as a result of the Pathways acquisition in November 2015. All prior periods reported conform to this presentation.segment.

The Health Plans segment consists of health plans operating in 12 states and the Commonwealth of Puerto Rico, and includes our direct delivery business. As of SeptemberJune 30, 2016,2017, these health plans served 4.2 approximately 4.7 million members eligible for Medicaid, Medicare, and other government-sponsored health care programs for low-income families and individuals. This membership includes Health InsuranceAffordable Care Act Marketplace (Marketplace) members, most of whom receive government premium subsidies. The health plans are operated by our respective wholly owned subsidiaries in those states, each of which is licensed as a health maintenance organization (HMO). Our direct delivery business consists primarily of the operation of primary care clinics in several states in which we operate.

Our health plans’ state Medicaid contracts generally have terms of three to four years. These contracts typically contain renewal options exercisable by the state Medicaid agency, and allow either the state or the health plan to terminate the contract with or without cause. Our health plan subsidiaries have generally been successful in retaining their contracts, but such contracts are subject to risk of loss when a state issues a new request for proposal (RFP) open to competitive bidding by other health plans. If one of our health plans is not a successful responsive bidder to a state RFP, its contract may be subject to non-renewal.

In addition to contract renewal, our state Medicaid contracts may be periodically amended to include or exclude certain health benefits (such as pharmacy services, behavioral health services, or long-term care services); populations such as the aged, blind or disabled (ABD); and regions or service areas.

The Molina Medicaid Solutions segment provides support to state government agencies in the administration of their Medicaid programs, including business processing, information technology development and administrative services. Molina Medicaid Solutions is under contract with the Medicaid agencies in Idaho, Louisiana, Maine, New Jersey, West Virginia, and the U.S. Virgin Islands, and drug rebate administration services in Florida.

The Other segment includes businesses, such asprimarily our Pathways behavioral health and social services provider, which do not meet the quantitative thresholds for a reportable segment as defined by U.S. generally accepted accounting principles (GAAP), as well asand corporate amounts not allocated to other reportable segments.

Market Updates -Restructuring Plan

We recorded $43 million in restructuring and separation costs in the second quarter of 2017 related primarily to contractually required termination benefits paid to our former chief executive officer (CEO) and chief financial officer (CFO). Also included in these costs are consulting fees incurred for the development and implementation of our corporate restructuring initiatives. See Note 11, “Restructuring and Separation Costs.”

Recent Developments — Health Plans Segment

Proposed acquisition.Direct Delivery. On August 2, 2017, we announced plans to restructure our direct delivery operations.

Mississippi Health Plan. In June 2017, Molina Healthcare of Mississippi, Inc. was awarded a Medicaid Coordinated Care Contract for the statewide administration of the Mississippi Coordinated Access Network (MississippiCAN). The contract begins July 1, 2017, for three years with options to renew annually for up to two additional years. The operational start date for the program is currently scheduled for July 1, 2018, pending the completion of a readiness review.

Washington Health Plan. In May 2017, Molina Healthcare of Washington, Inc. was selected by the Washington State Health Care Authority to negotiate and enter into managed care contracts for the North Central region of the state’s Apple Health Integrated Managed Care Program. The start date for the new contract is scheduled for January 1, 2018.

Terminated Medicare Acquisition. In August 2016, we entered into substantially identical agreements with each of Aetna Inc. and Humana Inc. to acquire certain ofassets related to their Medicare Advantage membership and other assets relatedbusiness. The transaction was subject to such Medicare Advantage business (the Medicare Acquisition) for cash. The Medicare Acquisition is related to Aetna Inc.'sclosing conditions including the completion of the proposed acquisition of Humana Inc.by Aetna (the Aetna-Humana Merger). We expectIn January 2017, the Medicare Acquisition to close in 2017 subject toU.S. District Court for the following:

CompletionDistrict of Columbia granted the Aetna-Humana Merger;

Resolution, in a manner permitting the Medicare Acquisition, of the pending litigation broughtrequest for relief made by the United StatesU.S. Department of Justice challengingin its civil antitrust lawsuit against Aetna and Humana, to prohibit the Aetna-Humana Merger;

ApprovalMerger. In February 2017, our agreements with each of Aetna and Humana were terminated by the federal Centers for Medicare & Medicaid Services (CMS)parties pursuant to the terms of the novation to usagreements. Under the termination agreements, we received an aggregate termination fee of each$75 million from Aetna and Humana in the first quarter of the contracts to be divested under the Medicare Acquisition; and

Customary closing conditions, including approvals of state departments of insurance and other regulators.

Completed acquisitions. For all of the following transactions, see Note 4, "Business Combinations," for further information.

Illinois. On January 1, 2016, our Illinois health plan closed on its acquisitions of the Medicaid membership, and certain assets related to the Medicaid business of, Accountable Care Chicago, LLC, also known as MyCare Chicago, and Loyola Physician Partners, LLC.

On March 1, 2016, our Illinois health plan closed on its acquisition of the Medicaid membership, and certain assets related to the Medicaid business, of Better Health Network, LLC.

Michigan. On January 1, 2016, our Michigan health plan closed on its acquisition of the Medicaid and MIChild membership, and certain Medicaid and MIChild assets, of HAP Midwest Health Plan, Inc.2017, which is reported in “Other income, net.”

New York. York Health Plan.On In August 1, 2016, we closed on our acquisition to acquire allof the outstanding equity interests of Today'sToday’s Options of New York, Inc., which now operates as Molina Healthcare of New York, Inc. The purchase price allocation was completed, and the Total Care Medicaid plan.final purchase price adjustments were recorded, in the first quarter of 2017. Such adjustments were insignificant, and the final purchase price was $38 million.

Recent Developments — Other Segment

Washington.Pathways subsidiary. On January 1, 2016,In the second quarter of 2017, we recorded non-cash goodwill and intangible assets impairment losses of $72 million, related primarily to our Washington health plan closed on its acquisition of the Medicaid contracts, and certain assets related to the operation of the Medicaid business, of Columbia United Providers, Inc.Pathways subsidiary. See Note 10, “Impairment Losses.”

Consolidation and Interim Financial Information

The consolidated financial statements include the accounts of Molina Healthcare, Inc., its subsidiaries, and variable interest entities (VIEs) in which Molina Healthcare, Inc. is considered to be the primary beneficiary. Such VIEs are insignificant to our consolidated financial position and results of operations. In the opinion of management, all adjustments considered necessary for a fair presentation of the results as of the date and for the interim periods presented have been included; such adjustments consist of normal recurring adjustments. All significant intercompany balances and transactions have been eliminated. The consolidated results of operations for the current interim period are not necessarily indicative of the results for the entire year ending December 31, 2016.2017.

The unaudited consolidated interim financial statements have been prepared under the assumption that users of the interim financial data have either read or have access to our audited consolidated financial statements for the fiscal year ended December 31, 2015.2016. Accordingly, certain disclosures that would substantially duplicate the disclosures contained in the December 31, 20152016 audited consolidated financial statements have been omitted. These unaudited consolidated interim financial statements should be read in conjunction with our December 31, 20152016 audited consolidated financial statements.

2.Significant Accounting Policies

Certain of our significant accounting policies are discussed within the note to which they specifically relate.

Revenue Recognition – Health Plans Segment

Premium revenue is fixed in advance of the periods covered and, except as described below, is not generally subject to significant accounting estimates. Premium revenues are recognized in the month that members are entitled to receive health care services, and premiums collected in advance are deferred. Certain components of premium revenue are subject to accounting estimates and fall into the following categories:two broad categories discussed in further detail below: 1) “Contractual Provisions That May Adjust or Limit Revenue or Profit;” and 2) “Quality Incentives.”

Contractual Provisions That May Adjust or Limit Revenue or Profit

Medicaid

Medical Cost Floors (Minimums), and Medical Cost Corridors, and Administrative Cost Ceilings (Maximums):Corridors: A portion of our premium revenue may be returned if certain minimum amounts are not spent on defined medical care costs. In the aggregate, we recorded a liability under the terms of such contract provisions of $323$136 million and $214$272 million at SeptemberJune 30, 20162017 and December 31, 2015,2016, respectively, to amounts“Amounts due government agencies.” Approximately $298$114 million and $208$244 million of the liability accrued at SeptemberJune 30, 20162017 and December 31, 2015,2016, respectively, relates to our participation in Medicaid Expansion programs.

In certain circumstances, theour health plans may receive additional premiums if amounts spent on medical care costs exceed a defined maximum threshold. We recorded receivables of $1 million and $3 millionReceivables relating to such provisions were insignificant at SeptemberJune 30, 20162017 and December 31, 2015, respectively, relating to such provisions.2016.

Profit Sharing and Profit Ceiling: Our contracts with certain states contain profit-sharing or profit ceiling provisions under which we refund amounts to the states if our health plans generate profit above a certain specified percentage. In some cases, we are limited in the amount of administrative costs that we may deduct in calculating the refund, if any. Under these provisions, we recorded a liability of $9 million and $10 million at September 30, 2016 and December 31, 2015, respectively,Liabilities for profitprofits in excess of the amount we are allowed to retain.retain under these provisions were insignificant at June 30, 2017 and December 31, 2016.

Retroactive Premium Adjustments: The stateState Medicaid programs periodically adjust premium rates on a retroactive basis. In these cases, we must adjust our premium revenue in the period in which we learn of the adjustment, rather than in the months of service to which the retroactive adjustment applies. In the first quarter of 2016, our Florida health plan recorded a retroactive increase to Medicaid premium revenue of approximately $18 million relating to dates of service prior to 2016.

Cost Plus Retroactive Premium Adjustments: In New Mexico, when members are retroactively enrolled into our health plan, we earn revenue only to the extent of the actual medical costs incurred by us for services provided during those retroactive periods, plus a small percentage of that medical cost for administration and profit. This arrangement first became effective July 1, 2014 (retroactive to January 1, 2014). We are paid normal monthly capitation rates for the retroactive eligibility periods, and the difference between those capitation rates and the amounts due to us on a cost plus basis are periodically settled with the state. To date, no such settlement has been made. During the years ended December 31, 2014 and 2015, our New Mexico contract was not specific as to the definition of retroactive membership, and the amount we owe the state (or that the state owes us) for the difference between capitation received and amounts due to us under the cost plus arrangement during those periods varies widely depending upon the definition of retroactive membership. Although we believe that the amount we have recorded as a

liability for this matter is consistent with the state’s expectations, we cannot be certain that the state will not seek to recover an amount in excess of our recorded liability.

Medicare

Risk Adjustment: Our Medicare premiums are subject to retroactive increase or decrease based on the health status of our Medicare members (as measured by(measured as a member risk score). We estimate our members'members’ risk scores and the related amount of Medicare revenue that will ultimately be realized for the periods presented based on our knowledge of our members’ health status, risk scores and CMSCenters for Medicare & Medicaid Services (CMS) practices. Based on our estimates, we have recorded a net payable of $17 million and $4 million forConsolidated balance sheet amounts related to anticipated Medicare risk adjustment premiums and Medicare Part D settlements were insignificant at SeptemberJune 30, 20162017 and December 31, 2015, respectively.2016.

Minimum MLR: Additionally, federal regulations have established a minimum annual medical loss ratio (Minimum MLR) of 85% for Medicare. The medical loss ratio represents medical costs as a percentage of premium revenue. Federal regulations define what constitutes medical costs and premium revenue. If the Minimum MLR is not met, we may be required to pay rebates to the federal government. We recognize estimated rebates under the Minimum MLR as an adjustment to premium revenue in our consolidated statements of operations.

Marketplace

Premium Stabilization Programs: The Affordable Care Act (ACA) established Marketplace premium stabilization programs effective January 1, 2014. These programs, commonly referred to as the "3R's,"“3R’s,” include a permanent risk adjustment program, a transitional reinsurance program, and a temporary risk corridor program. We record receivables or payables related to the 3R programs and the minimum annual medical loss ratio (Minimum MLR)Minimum MLR when the amounts are reasonably estimable as described below, and, for receivables, when collection is reasonably assured. Our receivables (payables) for each of these programs, as of the dates indicated, were as follows:

| | | | | | | | | | | June 30, 2017 | | December 31,

2016 |

| | September 30, 2016 | | December 31,

2015 | Current Benefit Year | | Prior Benefit Years | | Total | |

| | Current Benefit Year | | Prior Benefit Years | | Total | | | | | | | | |

| | (In millions) | (In millions) |

| Risk adjustment | $ | (372 | ) | | $ | 2 |

| | $ | (370 | ) | | $ | (214 | ) | $ | (502 | ) | | $ | (546 | ) | | $ | (1,048 | ) | | $ | (522 | ) |

| Reinsurance | 62 |

| | 4 |

| | 66 |

| | 36 |

| — |

| | 57 |

| | 57 |

| | 55 |

|

| Risk corridor | (4 | ) | | (1 | ) | | (5 | ) | | (10 | ) | — |

| | (1 | ) | | (1 | ) | | (1 | ) |

| Minimum MLR | (11 | ) | | (4 | ) | | (15 | ) | | (3 | ) | (3 | ) | | (2 | ) | | (5 | ) | | (1 | ) |

Risk adjustment: Under this permanent program, our health plans'plans’ composite risk scores are compared with the overall average risk score for the relevant state and market pool. Generally, our health plans will make a risk transfer payment into the pool if their composite risk scores are below the average risk score, and will receive a risk transfer payment from the pool if their composite risk scores are above the average risk score. We estimate our ultimate premium based on insurance policy year-to-date experience, and recognize estimated premiums relating to the risk adjustment program as an adjustment to premium revenue in our consolidated statements of income. On June 30, 2016, CMS released the final update on risk transfer and reinsurance payments for the 2015 benefit year, and we adjusted our accruals accordingly.operations.

Reinsurance: This program iswas designed to provide reimbursement to insurers for high cost members. Our health plans pay an annual contribution on a per-member basis,members and are eligible for recoveries if claims for individual members exceed a specified threshold, up to a maximum amount. This three-year program will end onended December 31, 2016. We recognize2016; we expect to settle the assessments to fund the transitional reinsurance program as a reduction to premium revenueoutstanding receivable balance in our consolidated statements of income. We recognize recoveries under the reinsurance program as a reduction to medical care costs in our consolidated statements of income.2017.

Risk corridor: This program iswas intended to limit gains and losses of insurers by comparing allowable costs to a target amount as defined by CMS. Variances from the target amount exceeding certain thresholds may result in amounts due to or receivables due from CMS. This three-year program will end onCMS, and ended December 31, 2016. Due2016; we expect to uncertainties as tosettle the amount of federal funding available to support the risk corridor program, we do not recognize amounts receivable under this program. Our estimate of the unrecorded receivable for the Marketplace risk corridor amounted to approximately $80 million as of September 30, 2016. Of this total amount, $52 million relates to the 2015 benefit year and $28 million relates to the nine months ended September 30, 2016. All liabilities are recognized as incurred. We estimate our ultimate premium based on insurance policy year-to-date experience, and recognize estimated premiums relating to the risk corridor program as an adjustment to premium revenueoutstanding payable balance in our consolidated statements of income.2017.

Additionally, the ACA established a Minimum MLR of 80% for the Marketplace. The medical loss ratio represents medical costs as a percentage of premium revenue. WhatFederal regulations define what constitutes medical costs and premium revenue are specifically defined by federal regulations.revenue. If the Minimum MLR is not met, we may be required to pay rebates to our Marketplace policyholders. Each of the 3R programs is taken into consideration when computing the Minimum MLR. We

recognize estimated rebates under the Minimum MLR as an adjustment to premium revenue in our consolidated statements of income.operations.

Quality Incentives

At several of our health plans, revenue ranging from approximately 1% to 3% of certain health plan premiums is earned only if certain performance measures are met.

During the second quarter of 2016, we were informed by the Texas Department of Health and Human Services that it will not recoup any quality revenue for calendar years 2014, 2015, and 2016. Therefore, we recognized previously deferred quality revenue amounting to approximately $51 million in the second quarter of 2016. Of the $51 million total adjustment, $44 million related to 2015 and 2014 dates of service, and $7 million related to the first quarter of 2016.

The following table quantifies the quality incentive premium revenue recognized for the periods presented, including the amounts earned in the periods presented and prior periods. Although the reasonably possible effects of a change in estimate related to quality incentive premium revenue as of SeptemberJune 30, 20162017 are not known, we have no reason to believe that the adjustments to prior periodsyears noted below are not indicative of the potential future changes in our estimates as of SeptemberJune 30, 2016, other than the Texas quality revenue recognized in the second quarter of 2016 described above.2017.

| | | | Three Months Ended September 30, | | Nine Months Ended September 30, | Three Months Ended June 30, | | Six Months Ended June 30, |

| | 2016 | | 2015 | | 2016 | | 2015 | 2017 | | 2016 | | 2017 | | 2016 |

| | (In millions) | (Dollars in millions) |

| Maximum available quality incentive premium - current period | $ | 33 |

| | $ | 28 |

| | $ | 114 |

| | $ | 86 |

| $ | 39 |

| | $ | 41 |

| | $ | 77 |

| | $ | 81 |

|

| Amount of quality incentive premium revenue recognized in current period: | | | | | | | | |

| Quality incentive premium revenue recognized in current period: | | | | | | | | |

| Earned current period | $ | 26 |

| | $ | 17 |

| | $ | 80 |

| | $ | 38 |

| $ | 29 |

| | $ | 36 |

| | $ | 48 |

| | $ | 54 |

|

| Earned prior periods | — |

| | — |

| | 54 |

| | 11 |

| 1 |

| | 49 |

| | 6 |

| | 54 |

|

| Total | $ | 26 |

| | $ | 17 |

| | $ | 134 |

| | 49 |

| $ | 30 |

| | $ | 85 |

| | $ | 54 |

| | 108 |

|

| | | | | | | | | | | | | | | |

| Quality incentive premium revenue recognized as a percentage of total premium revenue | 0.6 | % | | 0.5 | % | | 1.1 | % | | 0.5 | % | 0.6 | % | | 2.1 | % | | 0.6 | % | | 1.3 | % |

Income Taxes

The provision for income taxes is determined using an estimated annual effective tax rate, which is generally greater thandiffers from the U.S. federal statutory rate primarily because of state taxes, nondeductible expenses such as the Health Insurer Fee (HIF), goodwill impairment, certain compensation, and other general and administrative expenses. The effective tax rate was not impacted by HIF in 2017 given the 2017 HIF moratorium.

The effective tax rate may be subject to fluctuations during the year, particularly as a result of the level of pretax earnings, and also as new information is obtained. Such information may affect the assumptions used to estimate the annual effective tax rate, including factors such as the mix of pretax earnings in the various tax jurisdictions in which we operate, valuation allowances against deferred tax assets, the recognition or the reversal of the recognition of tax benefits related to uncertain tax positions, and changes in or the interpretation of tax laws in jurisdictions where we conduct business. For example, in the third quarter of 2016 we entered into an agreement with the seller in the Pathways acquisition to change the allocation of the purchase price across certain legal entities, allowing us to recognize a $4 million tax benefit. We recognize deferred tax assets and liabilities for temporary differences between the financial reporting basis and the tax basis of our assets and liabilities, along with net operating loss and tax credit carryovers.

Premium Deficiency Reserves on Loss Contracts

We assess the profitability of our medical care policies to identify groups of contracts where current operating results or forecasts indicate probable future losses. If anticipated future variable costs exceed anticipated future premiums and investment income, a premium deficiency reserve is recognized. We recorded a premium deficiency reserve to “Medical claims and benefits payable” on our accompanying consolidated balance sheets relating to our Marketplace program of $30 million as of December 31, 2016, which increased to $100 million as of June 30, 2017.

Recent Accounting Pronouncements

Statement of Cash Flows.Goodwill Impairment. In August 2016,January 2017, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) No. 2016-15,2017-04, Classification of Certain Cash Receipts and Cash PaymentsSimplifying the Test for Goodwill Impairment, which amends Accounting Standards Codification (ASC) 230eliminates the requirement to add or clarifycalculate the implied fair value of goodwill to measure a goodwill impairment loss. Instead, an impairment loss is measured as the excess of the carrying amount of the reporting unit, including goodwill, over the fair value of the reporting unit. ASU 2017-04 is effective beginning January 1, 2020; we have early adopted ASU 2017-04 as of June 30, 2017, in connection with the assessment of our Pathways subsidiary. See further discussion at Note 10, “Impairment Losses.”

Restricted Cash. In November 2016, the FASB issued ASU 2016-18, Restricted Cash, which will require us to include in our consolidated statements of cash flows the balances of cash, cash equivalents, restricted cash and

restricted cash equivalents. When these items are presented in more than one line item on the balance sheet, the new guidance on eight classification issues related torequires a reconciliation of the totals in the statement of cash flows such as debt prepayment or debt extinguishment costs,to the related captions in the balance sheet. Transfers between cash and contingent consideration payments made after a business combination.cash equivalents and restricted cash and restricted cash equivalents will no longer be presented in the statement of cash flows. ASU 2016-152016-18 is effective for fiscal periods beginning after December 15, 2017 and must be adopted using a retrospective transition method to each period presented but may be applied prospectively if retrospective application would be impracticable. Early adoption is permitted, including adoption in an interim period. We are evaluating the potential effects of the adoption to our financial statements.

Revenue Recognition. In May 2016, the FASB issued ASU 2016-12, Revenue from Contracts with Customers (Topic 606). The amendments, which address transition, collectibility, non-cash consideration and the presentation of sales and other similar taxes, do not change the core principles of ASU 2014-09, but rather address implementation issues and are intended to result in

more consistent application. We intend to adopt this standard on January 1, 2018. We are evaluating the potential effects of the adoption to our financial statements.

In April 2016, the FASB issued ASU 2016-10, Identifying Performance Obligations and Licensing, which amends certain aspects of ASC 606, Revenue from Contracts with Customers. ASU 2016-10 amends step two of the new revenue standard’s five-step model to include guidance on immaterial promised goods or services, shipping and handling activities and identifying when promises represent performance obligations. ASU 2016-10 also provides guidance related to licensing such as, but not limited to, sales-based and usage-based royalties and renewals of licenses that provide a right to use intellectual property. We intend to adopt this standard on January 1, 2018. We are evaluating the potential effects of the adoption to our financial statements.

In March 2016, the FASB issued ASU 2016-08, Revenue from Contracts with Customers - Principal vs. Agent Considerations, which amends the principal–versus–agent implementation guidance in ASC 606. ASU 2016-08 clarifies that an entity should evaluate whether it is the principal or agent for each specified good or service promised in a contract with a customer as defined in ASC 606. The entity must first identify each specified good or service to be provided to the customer and then assess whether it controls each specified good or service. The ASU also removed two of the five indicators used in evaluating control under the old guidance and reframes the remaining three indicators. We intend to adopt this standard on January 1, 2018. We are evaluating the potential effects of the adoption to our financial statements.

Credit Losses. In June 2016, the FASB issued ASU 2016-13, Measurement of Credit Losses on Financial Instruments, which changes how companies measure credit losses on most financial instruments measured at amortized cost, such as loans, receivables and held-to-maturity debt securities. Rather than generally recognizing credit losses when it is probable that the loss has been incurred, the revised guidance requires companies to recognize an allowance for credit losses for the difference between the amortized cost basis of a financial instrument and the amount of amortized cost that the company expects to collect over the instrument's contractual life. ASU 2016-13 is effective for fiscal periods beginning after December 15, 2019 and must be adopted as a cumulative effect adjustment to retained earnings. Early2018; early adoption is permitted. We intend to early adopt ASU 2016-18 as of December 31, 2017, and are currently evaluating the potential effects of the adoptioneffect to our financial statements.consolidated statements of cash flows.

Stock Compensation. In March 2016, the FASB issued ASU 2016-09,Compensation-Stock Compensation Improvements to Employee Share-Based Payment Accounting, which amends ASC Topic 718, Compensation – Stock Compensation. ASU 2016-09 simplifies several aspects of accounting for employee share-based payment transactions, including the accounting for income taxes, forfeitures, statutory tax and classification in the statement of cash flows. We adopted ASU 2016-09 is effective for fiscal periods beginning after December 15, 2016 and must be adopted usingin the modified retrospective approach except for classificationfirst quarter of 2017; such adoption did not significantly impact our consolidated financial statements. In addition, the prior period presentation in the statement of cash flows whichwas not adjusted because such adjustments were insignificant.

Leases. In February 2016, the FASB issued ASU 2016-02, Leases (Topic 842), as modified by ASU 2017-03, Transition and Open Effective Date Information. Under ASU 2016-02, an entity will be required to recognize assets and liabilities for the rights and obligations created by leases on the entity’s balance sheet for both finance and operating leases. For leases with a term of 12 months or less, an entity can elect to not recognize lease assets and lease liabilities and expense the lease over a straight-line basis for the term of the lease. ASU 2016-02 will require new disclosures that depict the amount, timing, and uncertainty of cash flows pertaining to an entity’s leases. ASU 2016-02 is effective for us beginning January 1, 2019, and must be adopted using either the prospective ora modified retrospective approach.approach for annual and interim periods beginning after December 15, 2018. Early adoption is permitted. WeUnder this guidance, we will record assets and liabilities relating primarily to our long-term office leases, and are currently evaluating the potential effects of the adoptioneffect to our consolidated financial statements.

Revenue Recognition. In May 2014, the FASB issued ASU 2014-09, Revenue from Contracts with Customers (Topic 606). We intend to adopt this standard and the related modifications on January 1, 2018, using the modified retrospective approach. Under this approach, the cumulative effect of initially applying the guidance will be reflected as an adjustment to beginning retained earnings.

We have determined that the insurance contracts of our Health Plans segment, which comprises the majority of our operations, are excluded from the scope of ASU 2014-09 because the recognition of revenue under these contracts is dictated by other accounting standards governing insurance contracts.

For our Molina Medicaid Solutions segment, we have determined that certain service revenue and cost of service revenue will no longer be deferred and recognized over the service delivery period. Rather, service revenue will be recognized based on the expected cost plus gross margin method, and cost of service revenue will be recognized as incurred. As of June 30, 2017, we expect the cumulative adjustment for historical periods through June 30, 2017 to increase retained earnings by no more than $50 million. This estimate will be updated in each quarterly and annual report until adoption. We expect the cumulative adjustment, if any, relating to our Other segment to be insignificant.

Other recent accounting pronouncements issued by the FASB (including its Emerging Issues Task Force), the American Institute of Certified Public Accountants, and the Securities and Exchange Commission (SEC) did not have, or are not believed by management to have, a materialsignificant impact on our present or future consolidated financial statements.

3. Net (Loss) Income per Share

The following table sets forth the calculation of basic and diluted net (loss) income per share: |

| | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2016 | | 2015 | | 2016 | | 2015 |

| | (In millions, except net income per share) |

| Numerator: | | | | | | | |

| Net income | $ | 42 |

| | $ | 46 |

| | $ | 99 |

| | $ | 113 |

|

| Denominator: | | | | | | | |

| Shares outstanding at the beginning of the period | 56 |

| | 55 |

| | 55 |

| | 49 |

|

| Weighted-average number of shares: | | | | | | | |

| Issued in common stock offering | — |

| | — |

| | — |

| | 2 |

|

| Denominator for basic net income per share | 56 |

| | 55 |

| | 55 |

| | 51 |

|

| Effect of dilutive securities: | | | | | | | |

| Share-based compensation | — |

| | — |

| | — |

| | 1 |

|

| Convertible senior notes (1) | — |

| | 1 |

| | — |

| | 1 |

|

| 1.125% Warrants (1) | — |

| | 4 |

| | 1 |

| | 2 |

|

| Denominator for diluted net income per share | 56 |

| | 60 |

| | 56 |

| | 55 |

|

| | | | | | | | |

| Net income per share (2): | | | | | | | |

| Basic | $ | 0.77 |

| | $ | 0.84 |

| | $ | 1.79 |

| | $ | 2.21 |

|

| Diluted | $ | 0.76 |

| | $ | 0.77 |

| | $ | 1.77 |

| | $ | 2.07 |

|

|

| | | | | | | | | | | | | | | |

| | Three Months Ended June 30, | | Six Months Ended June 30, |

| | 2017 | | 2016 | | 2017 | | 2016 |

| | (In millions, except net income per share) |

| Numerator: | | | | | | | |

| Net (loss) income | $ | (230 | ) | | $ | 33 |

| | $ | (153 | ) | | $ | 57 |

|

| Denominator: | | | | | | | |

| Denominator for basic net (loss) income per share | 56 |

| | 55 |

| | 56 |

| | 55 |

|

| Effect of dilutive securities: | | | | | | | |

1.125% Warrants (1) | — |

| | — |

| | — |

| | 1 |

|

| Denominator for diluted net (loss) income per share | 56 |

| | 55 |

| | 56 |

| | 56 |

|

| | | | | | | | |

Net (loss) income per share: (2) | | | | | | | |

| Basic | $ | (4.10 | ) | | $ | 0.58 |

| | $ | (2.74 | ) | | $ | 1.02 |

|

| Diluted | $ | (4.10 | ) | | $ | 0.58 |

| | $ | (2.74 | ) | | $ | 1.01 |

|

| | | | | | | | |

| Potentially dilutive common shares excluded from calculations: | | | | | | | |

1.125% Warrants (1) | 2 |

| | — |

| | 1 |

| | — |

|

| |

| (1) | For more information regarding the convertible senior notes, refer to Note 10, "Debt." For more information regarding the 1.125% Warrants, refer to Note 12, "Stockholders'9, “Stockholders' Equity."” The dilutive effect of all potentially dilutive common shares is calculated using the treasury-stock method. Certain potentially dilutive common shares issuable are not included in the computation of diluted net (loss) income per share because to do so would be anti-dilutive. For the three and six months ended June 30, 2017, the 1.125% Warrants were excluded from diluted shares outstanding because to do so would have been anti-dilutive. |

| |

| (2) | Source data for calculations in thousands. |

4. Business Combinations

Health Plans Segment

In 2016, we closed on several business combinations in the Health Plans segment, consistent with our strategy to grow in our existing markets and expand into new markets. For all of these transactions, we applied the acquisition method of accounting, where the total purchase price was allocated, or preliminarily allocated, to tangible and intangible assets acquired, and liabilities assumed based on their respective fair values. For the Health Plans acquisitions described below, except New York, only intangible assets were acquired. All of these acquisitions were funded using available cash and acquisition-related costs were insignificant. The individual transactions were as follows:

Illinois. On January 1, 2016, our Illinois health plan closed on its acquisition of the Medicaid membership, and certain assets related to the Medicaid business of, Accountable Care Chicago, LLC, also known as MyCare Chicago. The final purchase price was approximately $30 million, and the Illinois health plan added approximately 50,000 Medicaid members as a result of this transaction.

On January 1, 2016, our Illinois health plan closed on its acquisition of the Medicaid membership, and certain assets related to the Medicaid business, of Loyola Physician Partners, LLC. The final purchase price was approximately $12 million, and the Illinois health plan added approximately 18,000 Medicaid members as a result of this transaction.

On March 1, 2016, our Illinois health plan closed on its acquisition of the Medicaid membership, and certain assets related to the Medicaid business, of Better Health Network, LLC. The final purchase price was approximately $15 million, and the Illinois health plan added approximately 28,000 Medicaid members as a result of this transaction.

Michigan. On January 1, 2016, our Michigan health plan closed on its acquisition of the Medicaid and MIChild membership, and certain Medicaid and MIChild assets, of HAP Midwest Health Plan, Inc. The final purchase price was approximately $31 million, and the Michigan health plan added approximately 68,000 Medicaid and MIChild members as a result of this transaction.

New York. On August 1, 2016, we closed on our acquisition to acquire all outstanding equity interests of Today's Options of New York, Inc., which operates the Total Care Medicaid plan. The initial purchase price was approximately $38 million, and we now serve approximately 37,000 Medicaid members in upstate New York as a result of the transaction. As of September 30, 2016, the purchase price allocation was preliminary, subject to final purchase price adjustments as provided in the stock purchase agreement.

Washington. On January 1, 2016, our Washington health plan closed on its acquisition of the Medicaid contracts, and certain assets related to the operation of the Medicaid business, of Columbia United Providers, Inc. The final purchase price was approximately $28 million, and the Washington health plan added approximately 57,000 Medicaid members as a result of this transaction.

For these acquisitions, we recorded goodwill to the Health Plans segment amounting to $95 million in the aggregate, which relates to future economic benefits arising from expected synergies to be achieved. Such synergies include use of our existing infrastructure to support the added membership. In general, the amount recorded as goodwill is deductible for income tax purposes. For the New York acquisition, the tax deductibility of goodwill will be determined once the purchase price is finalized.

The following table presents the intangible assets identified in the transactions described above. The weighted-average amortization period, in the aggregate, is 5.7 years. For these acquisitions in the aggregate, we expect to record amortization of approximately $6 million in 2016, $8 million per year in the years 2017 through 2020, and $3 million in 2021.

|

| | | | | |

| | Fair Value | | Life |

| | (In millions) | | (Years) |

| Intangible asset type: | | | |

| Contract rights - member list | $ | 38 |

| | 5 |

| Provider network | 7 |

| | 10 |

| | $ | 45 |

| | |

Other Segment

Pathways.On November 1, 2015, we acquired the outstanding ownership interests in Pathways Health and Community Support LLC (Pathways). In the third quarter of 2016, we recorded a pre-acquisition contingent liability and corresponding indemnification asset in the amount of $14 million in connection with the Rodriguez Litigation matter defined and described further in Note 14, "Commitments and Contingencies." Also in the third quarter of 2016, certain tax elections were made such that approximately 50% of the goodwill recorded in this transaction is deductible for income tax purposes.

5.4. Fair Value Measurements

We consider the carrying amounts of cash and cash equivalents and other current assets and current liabilities (not including derivatives and the current portion of long-term debt) to approximate their fair values because of the relatively short period of time between the origination of these instruments and their expected realization or payment. For our financial instruments measured at fair value on a recurring basis, we prioritize the inputs used in measuring fair value according to a three-tier fair value hierarchy as follows:

Level 1 — Observable Inputs. Level 1 financial instruments are actively tradeddefined by GAAP. For a description of the methods and thereforeassumptions that we use to a) estimate the fair value; and b) determine the classification according to the fair value hierarchy for these securities is based on quoted market prices on one or more securities exchanges.

Level 2 — Directly or Indirectly Observable Inputs. Level 2 financial instruments are traded frequently though not necessarily daily. Fair value for these investments is determined using a market approach based on quoted prices for similar securities in active markets or quoted prices for identical securities in inactive markets.

Level 3 — Unobservable Inputs. Level 3 financial instruments are valued using unobservable inputs that represent management's best estimate of what market participants would use in pricing theeach financial instrument, at the measurement date. Our Level 3 financial instruments include derivative financial instruments.see Note 5, “Fair Value Measurements,” in our 2016 Annual Report on Form 10-K.

Derivative financial instruments include the 1.125% Call Option derivative asset and the 1.125% Conversion Option derivative liability. These derivatives are not actively traded and are valued based on an option pricing model that uses observable and unobservable market data for inputs. Significant market data inputs used to determine fair value as of SeptemberJune 30, 20162017 included the price of our common stock, the time to maturity of the derivative instruments, the risk-free interest rate, and the implied volatility of our common stock. As described further in Note 11,8, “Derivatives,” the 1.125% Call Option asset and the 1.125% Conversion Option liability were designed such that changes in their fair values would offset, with minimal impact to the

consolidated statements of income.operations. Therefore, the sensitivity of changes in the unobservable inputs to the option pricing model for such instruments is mitigated.

The net changes in fair value of Level 3 financial instruments were insignificant to our results of operations for the ninesix months ended SeptemberJune 30, 2016.2017.

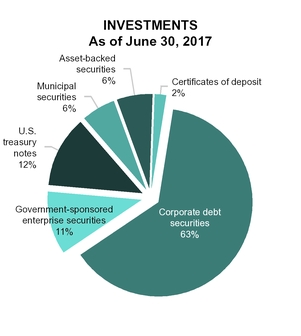

Our financial instruments measured at fair value on a recurring basis at SeptemberJune 30, 2016,2017, were as follows: | | | | Total | | Level 1 | | Level 2 | | Level 3 | Total | | Quoted Market Prices (Level 1) | | Significant Other Observable Inputs (Level 2) | | Significant Unobservable Inputs (Level 3) |

| | (In millions) | (In millions) |

| Corporate debt securities | $ | 1,127 |

| | $ | — |

| | $ | 1,127 |

| | $ | — |

| $ | 1,386 |

| | $ | — |

| | $ | 1,386 |

| | $ | — |

|

| U.S. treasury notes | | 263 |

| | 263 |

| | — |

| | — |

|

| Government-sponsored enterprise securities (GSEs) | 259 |

| | 259 |

| | — |

| | — |

| 241 |

| | 241 |

| | — |

| | — |

|

| Municipal securities | 148 |

| | — |

| | 148 |

| | — |

| 140 |

| | — |

| | 140 |

| | — |

|

| Asset-backed securities | 76 |

| | — |

| | 76 |

| | — |

| 128 |

| | — |

| | 128 |

| | — |

|

| U.S. treasury notes | 65 |

| | 65 |

| | — |

| | — |

| |

| Certificates of deposit | 60 |

| | — |

| | 60 |

| | — |

| 34 |

| | — |

| | 34 |

| | — |

|

| Subtotal - current investments | 1,735 |

| | 324 |

| | 1,411 |

| | — |

| 2,192 |

| | 504 |

| | 1,688 |

| | — |

|

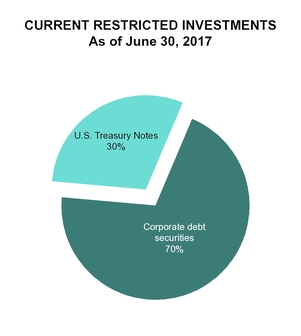

| Corporate debt securities | | 228 |

| | — |

| | 228 |

| | — |

|

| U.S. treasury notes | | 97 |

| | 97 |

| | — |

| | — |

|

| Subtotal - current restricted investments | | 325 |

| | 97 |

| | 228 |

| | — |

|

| 1.125% Call Option derivative asset | 314 |

| | — |

| | — |

| | 314 |

| 440 |

| | — |

| | — |

| | 440 |

|

| Total assets measured at fair value on a recurring basis | $ | 2,049 |

| | $ | 324 |

| | $ | 1,411 |

| | $ | 314 |

| |

| Total assets | | $ | 2,957 |

| | $ | 601 |

| | $ | 1,916 |

| | $ | 440 |

|

| | | | | | | | | | | | | | | |

| 1.125% Conversion Option derivative liability | $ | 314 |

| | $ | — |

| | $ | — |

| | $ | 314 |

| $ | 440 |

| | $ | — |

| | $ | — |

| | $ | 440 |

|

| Total liabilities measured at fair value on a recurring basis | $ | 314 |

| | $ | — |

| | $ | — |

| | $ | 314 |

| |

| Total liabilities | | $ | 440 |

| | $ | — |

| | $ | — |

| | $ | 440 |

|

Our financial instruments measured at fair value on a recurring basis at December 31, 2015,2016, were as follows: | | | | Total | | Level 1 | | Level 2 | | Level 3 | Total | | Quoted Market Prices (Level 1) | | Significant Other Observable Inputs (Level 2) | | Significant Unobservable Inputs (Level 3) |

| | (In millions) | (In millions) |

| Corporate debt securities | $ | 1,184 |

| | $ | — |

| | $ | 1,184 |

| | $ | — |

| $ | 1,179 |

| | $ | — |

| | $ | 1,179 |

| | $ | — |

|

| U.S. treasury notes | | 84 |

| | 84 |

| | — |

| | — |

|

| GSEs | 211 |

| | 211 |

| | — |

| | — |

| 231 |

| | 231 |

| | — |

| | — |

|

| Municipal securities | 185 |

| | — |

| | 185 |

| | — |

| 142 |

| | — |

| | 142 |

| | — |

|

| Asset-backed securities | 63 |

| | — |

| | 63 |

| | — |

| 69 |

| | — |

| | 69 |

| | — |

|

| U.S. treasury notes | 78 |

| | 78 |

| | — |

| | — |

| |

| Certificates of deposit | 80 |

| | — |

| | 80 |

| | — |

| 53 |

| | — |

| | 53 |

| | — |

|

| Subtotal - current investments | 1,801 |

| | 289 |

| | 1,512 |

| | — |

| 1,758 |

| | 315 |

| | 1,443 |

| | — |

|

| 1.125% Call Option derivative asset | 374 |

| | — |

| | — |

| | 374 |

| 267 |

| | — |

| | — |

| | 267 |

|

| Total assets measured at fair value on a recurring basis | $ | 2,175 |

| | $ | 289 |

| | $ | 1,512 |

| | $ | 374 |

| |

| Total assets | | $ | 2,025 |

| | $ | 315 |

| | $ | 1,443 |

| | $ | 267 |

|

| | | | | | | | | | | | | | | |

| 1.125% Conversion Option derivative liability | $ | 374 |

| | $ | — |

| | $ | — |

| | $ | 374 |

| $ | 267 |

| | $ | — |

| | $ | — |

| | $ | 267 |

|

| Total liabilities measured at fair value on a recurring basis | $ | 374 |

| | $ | — |

| | $ | — |

| | $ | 374 |

| |

| Total liabilities | | $ | 267 |

| | $ | — |

| | $ | — |

| | $ | 267 |

|

There were no current restricted investments as of December 31, 2016.

Fair Value Measurements – Disclosure Only

The carrying amounts and estimated fair values of our senior notes, which are classified as Level 2 financial instruments, are indicated in the following table. | | | | September 30, 2016 | | December 31, 2015 | June 30, 2017 | | December 31, 2016 |

| | Carrying Value | |

Fair Value | | Carrying Value | |

Fair Value | Carrying Value | |

Fair Value | | Carrying Value | |

Fair Value |

| | (In millions) | (In millions) |

| 5.375% Notes | $ | 690 |

| | $ | 725 |

| | $ | 689 |

| | $ | 700 |

| $ | 692 |

| | $ | 745 |

| | $ | 691 |

| | $ | 714 |

|

| 1.125% Convertible Notes | 466 |

| | 827 |

| | 448 |

| | 865 |

| 483 |

| | 976 |

| | 471 |

| | 792 |

|

| 4.875% Notes | | 325 |

| | 333 |

| | — |

| | — |

|

| 1.625% Convertible Notes | 281 |

| | 358 |

| | 273 |

| | 365 |

| 289 |

| | 386 |

| | 284 |

| | 344 |

|

| | $ | 1,437 |

| | $ | 1,910 |

| | $ | 1,410 |

| | $ | 1,930 |

| $ | 1,789 |

| | $ | 2,440 |

| | $ | 1,446 |

| | $ | 1,850 |

|

6.5. Investments

Available-for-Sale Investments

We consider all of our investments classified as current assets (including restricted investments) to be available-for-sale. Certain of our senior notes, as further discussed in Note 7, “Debt,” contain a limitation on the use of proceeds which required us to deposit the net proceeds from their issuance into a segregated deposit account, a current asset reported as “Restricted investments” in the accompanying consolidated balance sheets. Such proceeds, while restricted as to their use and held in a segregated deposit account, are available-for-sale based upon our contractual liquidity requirements.

The following tables summarize our investments as of the dates indicated: | | | | September 30, 2016 | June 30, 2017 |

| | Amortized | | Gross Unrealized | | Estimated Fair | Amortized | | Gross Unrealized | | Estimated Fair |

| | Cost | | Gains | | Losses | | Value | Cost | | Gains | | Losses | | Value |

| | (In millions) | (In millions) |

| Corporate debt securities | $ | 1,123 |

| | $ | 4 |

| | $ | — |

| | $ | 1,127 |

| $ | 1,387 |

| | $ | 1 |

| | $ | 2 |

| | $ | 1,386 |

|

| U.S. treasury notes | | 263 |

| | — |

| | — |

| | 263 |

|

| GSEs | 259 |

| | — |

| | — |

| | 259 |

| 242 |

| | — |

| | 1 |

| | 241 |

|

| Municipal securities | 147 |

| | 1 |

| | — |

| | 148 |

| 140 |

| | — |

| | — |

| | 140 |

|

| Asset-backed securities | 76 |

| | — |

| | — |

| | 76 |

| 128 |

| | — |

| | — |

| | 128 |

|

| Certificates of deposit | | 34 |

| | — |

| | — |

| | 34 |

|

| Subtotal - current investments | | 2,194 |

| | 1 |

| | 3 |

| | 2,192 |

|

| Corporate debt securities | | 227 |

| | 1 |

| | — |

| | 228 |

|

| U.S. treasury notes | 65 |

| | — |

| | — |

| | 65 |

| 97 |

| | — |

| | — |

| | 97 |

|

| Certificates of deposit | 60 |

| | — |

| | — |

| | 60 |

| |

| | $ | 1,730 |

| | $ | 5 |

| | $ | — |

| | $ | 1,735 |

| |

| Subtotal - current restricted investments | | 324 |

| | 1 |

| | — |

| | 325 |

|

| Total | | $ | 2,518 |

| | $ | 2 |

| | $ | 3 |

| | $ | 2,517 |

|

| | | | December 31, 2015 | December 31, 2016 |

| | Amortized | | Gross Unrealized | | Estimated Fair | Amortized | | Gross Unrealized | | Estimated Fair |

| | Cost | | Gains | | Losses | | Value | Cost | | Gains | | Losses | | Value |

| | (In millions) | (In millions) |

| Corporate debt securities | $ | 1,189 |

| | $ | — |

| | $ | 5 |

| | $ | 1,184 |

| $ | 1,180 |

| | $ | 1 |

| | $ | 2 |

| | $ | 1,179 |

|

| U.S. treasury notes | | 84 |

| | — |

| | — |

| | 84 |

|

| GSEs | 212 |

| | — |

| | 1 |

| | 211 |

| 232 |

| | — |

| | 1 |

| | 231 |

|

| Municipal securities | 186 |

| | — |

| | 1 |

| | 185 |

| 143 |

| | — |

| | 1 |

| | 142 |

|

| Asset-backed securities | 63 |

| | — |

| | — |

| | 63 |

| 69 |

| | — |

| | — |

| | 69 |

|

| U.S. treasury notes | 78 |

| | — |

| | — |

| | 78 |

| |

| Certificates of deposit | 80 |

| | — |

| | — |

| | 80 |

| 53 |

| | — |

| | — |

| | 53 |

|

| | $ | 1,808 |

| | $ | — |

| | $ | 7 |

| | $ | 1,801 |

| |

| Total - current investments | | $ | 1,761 |

| | $ | 1 |

| | $ | 4 |

| | $ | 1,758 |

|

There were no current restricted investments as of December 31, 2016.

The contractual maturities of our available-for-sale investments as of SeptemberJune 30, 20162017 are summarized below: | | | | Amortized Cost | | Estimated Fair Value | Amortized Cost | | Estimated Fair Value |

| | (In millions) | (In millions) |

| Due in one year or less | $ | 887 |

| | $ | 887 |

| $ | 1,301 |

| | $ | 1,301 |

|

| Due after one year through five years | 817 |

| | 821 |

| 1,194 |

| | 1,193 |

|

| Due after five years through ten years | 26 |

| | 27 |

| 23 |

| | 23 |

|

| | $ | 1,730 |

| | $ | 1,735 |

| |

| Total | | $ | 2,518 |

| | $ | 2,517 |

|