UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

FORM 10-Q

(Mark One)

|

| |

| ý | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended JuneSeptember 30, 2017

OR

|

| |

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number: 001-31719

MOLINA HEALTHCARE, INC.

(Exact name of registrant as specified in its charter)

|

| | |

| Delaware | | 13-4204626 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | |

200 Oceangate, Suite 100 Long Beach, California | | 90802 |

| (Address of principal executive offices) | | (Zip Code) |

(562) 435-3666

(Registrant’s telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

| | | |

| Large accelerated filer | ý | Accelerated filer | ¨ |

| | | | |

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | ¨ |

| | | Emerging growth company | ¨ |

|

| |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section13(a) of the Exchange Act. | |

| ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ¨ No ý

The number of shares of the issuer’s Common Stock, $0.001 par value, outstanding as of July 28,October 27, 2017, was approximately 57,118,000.57,094,000.

MOLINA HEALTHCARE, INC. FORM 10-Q

FOR THE QUARTERLY PERIOD ENDED JuneSeptember 30, 2017

TABLE OF CONTENTS

CROSS-REFERENCE INDEX

| | | ITEM NUMBER | ITEM NUMBER | Page | ITEM NUMBER | Page |

| | | |

| PART I - Financial Information | PART I - Financial Information | | PART I - Financial Information | |

| | | |

| 1. | | | | |

| | | |

| 2. | | | | |

| | | |

| 3. | |

| |

|

| | | |

| 4. | | | | |

| | | |

| | | | |

| | | |

| 1. | | | | |

| | | |

| 1A. | | | | |

| | | |

| 2. | | | | |

| | | |

| 3. | Defaults Upon Senior Securities | Not Applicable. | Defaults Upon Senior Securities | Not Applicable. |

| | | |

| 4. | Mine Safety Disclosures | Not Applicable. | Mine Safety Disclosures | Not Applicable. |

| | | |

| 5. | Other Information | Not Applicable. | Other Information | Not Applicable. |

| | | |

| 6. | | | | |

| | | |

| | | | | |

| | | |

| | | |

FINANCIAL STATEMENTS

MOLINA HEALTHCARE, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS | | | | Three Months Ended June 30, | | Six Months Ended June 30, | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2017 | | 2016 | | 2017 | | 2016 | 2017 | | 2016 | | 2017 | | 2016 |

| | (In millions, except per-share data) (Unaudited) | (In millions, except per-share data) (Unaudited) |

| Revenue: | | | | | | | | | | | | | | |

| Premium revenue | $ | 4,740 |

| | $ | 4,029 |

| | $ | 9,388 |

| | $ | 8,024 |

| $ | 4,777 |

| | $ | 4,191 |

| | $ | 14,165 |

| | $ | 12,215 |

|

| Service revenue | 129 |

| | 135 |

| | 260 |

| | 275 |

| 130 |

| | 133 |

| | 390 |

| | 408 |

|

| Premium tax revenue | 114 |

| | 109 |

| | 225 |

| | 218 |

| 106 |

| | 127 |

| | 331 |

| | 345 |

|

| Health insurer fee revenue | — |

| | 76 |

| | — |

| | 166 |

| — |

| | 85 |

| | — |

| | 251 |

|

| Investment income and other revenue | 16 |

| | 10 |

| | 30 |

| | 19 |

| 18 |

| | 10 |

| | 48 |

| | 29 |

|

| Total revenue | 4,999 |

| | 4,359 |

| | 9,903 |

| | 8,702 |

| 5,031 |

| | 4,546 |

| | 14,934 |

| | 13,248 |

|

| Operating expenses: | | | | | | | | | | | | | | |

| Medical care costs | 4,491 |

| | 3,594 |

| | 8,602 |

| | 7,182 |

| 4,220 |

| | 3,748 |

| | 12,822 |

| | 10,930 |

|

| Cost of service revenue | 124 |

| | 116 |

| | 246 |

| | 243 |

| 123 |

| | 119 |

| | 369 |

| | 362 |

|

| General and administrative expenses | 405 |

| | 351 |

| | 844 |

| | 691 |

| 383 |

| | 343 |

| | 1,227 |

| | 1,034 |

|

| Premium tax expenses | 114 |

| | 109 |

| | 225 |

| | 218 |

| 106 |

| | 127 |

| | 331 |

| | 345 |

|

| Health insurer fee expenses | — |

| | 50 |

| | — |

| | 108 |

| — |

| | 55 |

| | — |

| | 163 |

|

| Depreciation and amortization | 37 |

| | 34 |

| | 76 |

| | 66 |

| 33 |

| | 36 |

| | 109 |

| | 102 |

|

| Impairment losses | 72 |

| | — |

| | 72 |

| | — |

| 129 |

| | — |

| | 201 |

| | — |

|

| Restructuring and separation costs | 43 |

| | — |

| | 43 |

| | — |

| 118 |

| | — |

| | 161 |

| | — |

|

| Total operating expenses | 5,286 |

| | 4,254 |

| | 10,108 |

| | 8,508 |

| 5,112 |

| | 4,428 |

| | 15,220 |

| | 12,936 |

|

| Operating (loss) income | (287 | ) | | 105 |

| | (205 | ) | | 194 |

| (81 | ) | | 118 |

| | (286 | ) | | 312 |

|

| Other expenses (income), net: | | | | | | | | |

| Other expenses, net: | | | | | | | | |

| Interest expense | 27 |

| | 25 |

| | 53 |

| | 50 |

| 32 |

| | 26 |

| | 85 |

| | 76 |

|

| Other income, net | — |

| | — |

| | (75 | ) | | — |

| — |

| | — |

| | (75 | ) | | — |

|

| Total other expenses (income), net | 27 |

| | 25 |

| | (22 | ) | | 50 |

| |

| Total other expenses, net | | 32 |

| | 26 |

| | 10 |

| | 76 |

|

| (Loss) income before income tax (benefit) expense | (314 | ) | | 80 |

| | (183 | ) | | 144 |

| (113 | ) | | 92 |

| | (296 | ) | | 236 |

|

| Income tax (benefit) expense | (84 | ) | | 47 |

| | (30 | ) | | 87 |

| (16 | ) | | 50 |

| | (46 | ) | | 137 |

|

| Net (loss) income | $ | (230 | ) | | $ | 33 |

| | $ | (153 | ) | | $ | 57 |

| $ | (97 | ) | | $ | 42 |

| | $ | (250 | ) | | $ | 99 |

|

| | | | | | | | | | | | | | | |

| Net (loss) income per share: | | | | | | | | | | | | | | |

| Basic | $ | (4.10 | ) | | $ | 0.58 |

| | $ | (2.74 | ) | | $ | 1.02 |

| $ | (1.70 | ) | | $ | 0.77 |

| | $ | (4.44 | ) | | $ | 1.79 |

|

| Diluted | $ | (4.10 | ) | | $ | 0.58 |

| | $ | (2.74 | ) | | $ | 1.01 |

| $ | (1.70 | ) | | $ | 0.76 |

| | $ | (4.44 | ) | | $ | 1.77 |

|

CONSOLIDATED STATEMENTS OF COMPREHENSIVE (LOSS) INCOME

| | | | Three Months Ended June 30, | | Six Months Ended June 30, | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2017 | | 2016 | | 2017 | | 2016 | 2017 | | 2016 | | 2017 | | 2016 |

| | (Amounts in millions) (Unaudited) | (Amounts in millions) (Unaudited) |

| Net (loss) income | $ | (230 | ) | | $ | 33 |

| | $ | (153 | ) | | $ | 57 |

| $ | (97 | ) | | $ | 42 |

| | $ | (250 | ) | | $ | 99 |

|

| Other comprehensive income: | | | | | | | | | | | | | | |

| Unrealized investment gain | — |

| | 4 |

| | 1 |

| | 13 |

| |

| Unrealized investment gain (loss) | | 1 |

| | (3 | ) | | 2 |

| | 10 |

|

| Less: effect of income taxes | — |

| | 2 |

| | — |

| | 5 |

| 1 |

| | (2 | ) | | 1 |

| | 3 |

|

| Other comprehensive income, net of tax | — |

| | 2 |

| | 1 |

| | 8 |

| |

| Other comprehensive (loss) income, net of tax | | — |

| | (1 | ) | | 1 |

| | 7 |

|

| Comprehensive (loss) income | $ | (230 | ) | | $ | 35 |

| | $ | (152 | ) | | $ | 65 |

| $ | (97 | ) | | $ | 41 |

| | $ | (249 | ) | | $ | 106 |

|

See accompanying notes.

MOLINA HEALTHCARE, INC.

CONSOLIDATED BALANCE SHEETS | | | | June 30,

2017 | | December 31,

2016 | September 30,

2017 | | December 31,

2016 |

| | (Amounts in millions, except per-share data) | (Amounts in millions, except per-share data) |

| | (Unaudited) | | | (Unaudited) | | |

ASSETS | | Current assets: | | | | | | |

| Cash and cash equivalents | $ | 2,979 |

| | $ | 2,819 |

| $ | 3,934 |

| | $ | 2,819 |

|

| Investments | 2,192 |

| | 1,758 |

| 1,787 |

| | 1,758 |

|

| Restricted investments | 325 |

| | — |

| 326 |

| | — |

|

| Receivables | 1,006 |

| | 974 |

| 1,002 |

| | 974 |

|

| Income taxes refundable | 68 |

| | 39 |

| 60 |

| | 39 |

|

| Prepaid expenses and other current assets | 159 |

| | 131 |

| 174 |

| | 131 |

|

| Derivative asset | 440 |

| | 267 |

| 425 |

| | 267 |

|

| Total current assets | 7,169 |

| | 5,988 |

| 7,708 |

| | 5,988 |

|

| Property, equipment, and capitalized software, net | 449 |

| | 454 |

| 397 |

| | 454 |

|

| Deferred contract costs | 93 |

| | 86 |

| 97 |

| | 86 |

|

| Intangible assets, net | 112 |

| | 140 |

| 101 |

| | 140 |

|

| Goodwill | 559 |

| | 620 |

| 430 |

| | 620 |

|

| Restricted investments | 118 |

| | 110 |

| 117 |

| | 110 |

|

| Deferred income taxes | 36 |

| | 10 |

| 62 |

| | 10 |

|

| Other assets | 47 |

| | 41 |

| 42 |

| | 41 |

|

| | $ | 8,583 |

| | $ | 7,449 |

| $ | 8,954 |

| | $ | 7,449 |

|

| | | | | | | |

LIABILITIES AND STOCKHOLDERS’ EQUITY | | Current liabilities: | | | | | | |

| Medical claims and benefits payable | $ | 2,077 |

| | $ | 1,929 |

| $ | 2,478 |

| | $ | 1,929 |

|

| Amounts due government agencies | 1,844 |

| | 1,202 |

| 1,324 |

| | 1,202 |

|

| Accounts payable and accrued liabilities | 375 |

| | 385 |

| 485 |

| | 385 |

|

| Deferred revenue | 284 |

| | 315 |

| 468 |

| | 315 |

|

| Current portion of long-term debt | 773 |

| | 472 |

| 782 |

| | 472 |

|

| Derivative liability | 440 |

| | 267 |

| 425 |

| | 267 |

|

| Total current liabilities | 5,793 |

| | 4,570 |

| 5,962 |

| | 4,570 |

|

| Senior notes | 1,017 |

| | 975 |

| |

| Long-term debt | | 1,317 |

| | 975 |

|

| Lease financing obligations | 198 |

| | 198 |

| 198 |

| | 198 |

|

| Deferred income taxes | — |

| | 15 |

| — |

| | 15 |

|

| Other long-term liabilities | 54 |

| | 42 |

| 48 |

| | 42 |

|

| Total liabilities | 7,062 |

| | 5,800 |

| 7,525 |

| | 5,800 |

|

| | | | | | | |

| Stockholders’ equity: | | | | | | |

| Common stock, $0.001 par value; 150 shares authorized; outstanding: 57 shares at June 30, 2017 and at December 31, 2016 | — |

| | — |

| |

| Common stock, $0.001 par value; 150 shares authorized; outstanding: 57 shares at September 30, 2017 and at December 31, 2016 | | — |

| | — |

|

| Preferred stock, $0.001 par value; 20 shares authorized, no shares issued and outstanding | — |

| | — |

| — |

| | — |

|

| Additional paid-in capital | 865 |

| | 841 |

| 870 |

| | 841 |

|

| Accumulated other comprehensive loss | (1 | ) | | (2 | ) | (1 | ) | | (2 | ) |

| Retained earnings | 657 |

| | 810 |

| 560 |

| | 810 |

|

| Total stockholders’ equity | 1,521 |

| | 1,649 |

| 1,429 |

| | 1,649 |

|

| | $ | 8,583 |

| | $ | 7,449 |

| $ | 8,954 |

| | $ | 7,449 |

|

See accompanying notes.

MOLINA HEALTHCARE, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

| | | | Six Months Ended June 30, | Nine Months Ended September 30, |

| | 2017 | | 2016 | 2017 | | 2016 |

| | (Amounts in millions)

(Unaudited) | (Amounts in millions)

(Unaudited) |

| Operating activities: | | | | | | |

| Net (loss) income | $ | (153 | ) | | $ | 57 |

| $ | (250 | ) | | $ | 99 |

|

| Adjustments to reconcile net (loss) income to net cash provided by operating activities: | | | | | | |

| Depreciation and amortization | 96 |

| | 89 |

| 139 |

| | 135 |

|

| Impairment losses | 72 |

| | — |

| 201 |

| | — |

|

| Deferred income taxes | (41 | ) | | 39 |

| (68 | ) | | 20 |

|

| Share-based compensation, including accelerated share-based compensation | 35 |

| | 16 |

| 38 |

| | 24 |

|

| Non-cash restructuring charges | | 49 |

| | — |

|

| Amortization of convertible senior notes and lease financing obligations | 16 |

| | 15 |

| 24 |

| | 23 |

|

| Other, net | 7 |

| | 11 |

| 13 |

| | 14 |

|

| Changes in operating assets and liabilities: | | | | | | |

| Receivables | (32 | ) | | (415 | ) | (28 | ) | | (427 | ) |

| Prepaid expenses and other assets | (38 | ) | | (143 | ) | (53 | ) | | (116 | ) |

| Medical claims and benefits payable | 148 |

| | 82 |

| 549 |

| | 168 |

|

| Amounts due government agencies | 642 |

| | 509 |

| 122 |

| | 503 |

|

| Accounts payable and accrued liabilities | (18 | ) | | 147 |

| 90 |

| | 1 |

|

| Deferred revenue | (32 | ) | | (119 | ) | 153 |

| | 157 |

|

| Income taxes | (30 | ) | | (10 | ) | (22 | ) | | 32 |

|

| Net cash provided by operating activities | 672 |

| | 278 |

| 957 |

| | 633 |

|

| Investing activities: | | | | | | |

| Purchases of investments | (1,636 | ) | | (974 | ) | (1,896 | ) | | (1,444 | ) |

| Proceeds from sales and maturities of investments | 874 |

| | 812 |

| 1,538 |

| | 1,512 |

|

| Purchases of property, equipment and capitalized software | (60 | ) | | (102 | ) | (85 | ) | | (143 | ) |

| (Increase) decrease in restricted investments held-to-maturity | (10 | ) | | 5 |

| (10 | ) | | 4 |

|

| Net cash paid in business combinations | — |

| | (8 | ) | — |

| | (48 | ) |

| Other, net | (13 | ) | | (6 | ) | (21 | ) | | (12 | ) |

| Net cash used in investing activities | (845 | ) | | (273 | ) | (474 | ) | | (131 | ) |

| Financing activities: | | | | | | |

| Proceeds from senior notes offering, net of issuance costs | 325 |

| | — |

| 325 |

| | — |

|

| Proceeds from borrowings under credit facility | | 300 |

| | — |

|

| Proceeds from employee stock plans | 11 |

| | 10 |

| 11 |

| | 10 |

|

| Other, net | (3 | ) | | 1 |

| (4 | ) | | 1 |

|

| Net cash provided by financing activities | 333 |

| | 11 |

| 632 |

| | 11 |

|

| Net increase in cash and cash equivalents | 160 |

| | 16 |

| 1,115 |

| | 513 |

|

| Cash and cash equivalents at beginning of period | 2,819 |

| | 2,329 |

| 2,819 |

| | 2,329 |

|

| Cash and cash equivalents at end of period | $ | 2,979 |

| | $ | 2,345 |

| $ | 3,934 |

| | $ | 2,842 |

|

MOLINA HEALTHCARE, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(continued)

| | | | Six Months Ended June 30, | Nine Months Ended September 30, |

| | 2017 | | 2016 | 2017 | | 2016 |

| | (Amounts in millions)

(Unaudited) | (Amounts in millions)

(Unaudited) |

| Supplemental cash flow information: | | | | | | |

| | | | | | | |

| Schedule of non-cash investing and financing activities: | | | | | | |

| Common stock used for share-based compensation | $ | (21 | ) | | $ | (7 | ) | $ | (21 | ) | | $ | (8 | ) |

| | | | | | | |

| Details of change in fair value of derivatives, net: | | | | | | |

| Gain (loss) on 1.125% Call Option | $ | 173 |

| | $ | (148 | ) | $ | 158 |

| | $ | (60 | ) |

| (Loss) gain on 1.125% Conversion Option | (173 | ) | | 148 |

| (158 | ) | | 60 |

|

| Change in fair value of derivatives, net | $ | — |

| | $ | — |

| $ | — |

| | $ | — |

|

| | | | | | | |

| Details of business combinations: | | | | | | |

| Fair value of assets acquired | $ | — |

| | $ | (131 | ) | $ | — |

| | $ | (186 | ) |

| Fair value of liabilities assumed | | — |

| | 28 |

|

| Purchase price amounts accrued/received | — |

| | 21 |

| — |

| | 8 |

|

| Reversal of amounts advanced to sellers in prior year | — |

| | 102 |

| — |

| | 102 |

|

| Net cash paid in business combinations | $ | — |

| | $ | (8 | ) | $ | — |

| | $ | (48 | ) |

See accompanying notes.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

JuneSeptember 30, 2017

1. Basis of Presentation

Organization and Operations

Molina Healthcare, Inc. provides quality managed health care to people receiving government assistance. We offer cost-effective Medicaid-related solutions to meet the health care needs of low-income families and individuals, and to assist government agencies in their administration of the Medicaid program. We have three reportable segments. These segments consist of our Health Plans segment, which constitutes the vast majority of our operations; our Molina Medicaid Solutions segment; and our Other segment.

The Health Plans segment consists of health plans operating in 12 states and the Commonwealth of Puerto Rico, and includes our direct delivery business.Rico. As of JuneSeptember 30, 2017, these health plans served approximately 4.74.5 million members eligible for Medicaid, Medicare, and other government-sponsored health care programs for low-income families and individuals. This membership includes Affordable Care Act Marketplace (Marketplace) members, most of whom receive government premium subsidies. The health plans are operated by our respective wholly owned subsidiaries in those states, each of which is licensed as a health maintenance organization (HMO). Our direct delivery business consists primarily of the operation of primary care clinics in several states in which we operate.

Our health plans’ state Medicaid contracts generally have terms of three to four years. These contracts typically contain renewal options exercisable by the state Medicaid agency, and allow either the state or the health plan to terminate the contract with or without cause. Our health plan subsidiaries have generally been successful in retaining their contracts, but such contracts are subject to risk of loss when a state issues a new request for proposal (RFP) open to competitive bidding by other health plans. If one of our health plans is not a successful responsive bidder to a state RFP, its contract may be subject to non-renewal.

In addition to contract renewal, our state Medicaid contracts may be periodically amended to include or exclude certain health benefits (such as pharmacy services, behavioral health services, or long-term care services); populations such as the aged, blind or disabled (ABD); and regions or service areas.

The Molina Medicaid Solutions segment provides support to state government agencies in the administration of their Medicaid programs, including business processing, information technology development and administrative services.

The Other segment includes primarily our Pathways behavioral health and social services provider, and corporate amounts not allocated to other reportable segments.

Restructuring Plan

We recorded $43 million in restructuring and separation costs in the second quarter of 2017 related primarily to contractually required termination benefits paid to our former chief executive officer (CEO) and chief financial officer (CFO). Also included in these costs are consulting fees incurred for the development and implementation of our corporate restructuring initiatives. See Note 11, “Restructuring and Separation Costs.”

Recent Developments — Health Plans Segment

Direct Delivery.Illinois Health Plan. OnIn August 2, 2017, we announced plansMolina Healthcare of Illinois, Inc. was awarded a statewide Medicaid managed care contract by the Illinois Department of Healthcare and Family Services. This Medicaid contract further integrates behavioral health and physical health by combining the State’s three current managed care programs into one program. The contract begins January 1, 2018, for four years with options to restructure our direct delivery operations.renew annually for up to four additional years.

Mississippi Health Plan. In June 2017, Molina Healthcare of Mississippi, Inc. was awarded a Medicaid Coordinated Care Contract for the statewide administration of the Mississippi Coordinated Access Network (MississippiCAN). The operational start date for the program is currently scheduled for October 1, 2018, pending the completion of a readiness review. The initial term of the contract begins July 1, 2017, for three yearsis through June 2020, with options to renew annually for up to two additional years. The operational start date for the program is currently scheduled for July 1, 2018, pending the completion of a readiness review.

Washington Health Plan. In May 2017, Molina Healthcare of Washington, Inc. was selected by the Washington State Health Care Authority to negotiate and enter into managed care contracts for the North Central region of the state’s Apple Health Integrated Managed Care Program. The start date for the new contract is scheduled for January 1, 2018.

Terminated Medicare Acquisition. In August 2016, we entered into agreements with each of Aetna Inc. and Humana Inc. to acquire certain assets related to their Medicare Advantage business. The transaction was subject to closing

conditions including the completion of the proposed acquisition of Humana by Aetna (the Aetna-Humana Merger). In January 2017, the U.S. District Court for the District of Columbia granted the request for relief made by the U.S. Department of Justice in its civil antitrust lawsuit against Aetna and Humana, to prohibit the Aetna-Humana Merger. In February 2017, our agreements with each of Aetna and Humana were terminated by the parties pursuant to the terms of the agreements. Under the termination agreements, we received an aggregate termination fee of $75 million from Aetna and Humana in the first quarter of 2017, which is reported in “Other income, net.” net” in the accompanying consolidated statements of operations.

New York Health Plan. In August 2016, we closed on our acquisition of the outstanding equity interests of Today’s Options of New York, Inc., which now operates as Molina Healthcare of New York, Inc. The purchase price allocation was completed, and the final purchase price adjustments were recorded, in the first quarter of 2017. Such adjustments were insignificant, and the final cash purchase price was $38 million.

Recent Developments — Other SegmentImpairment Losses

Molina Medicaid Solutions segment. In the third quarter of 2017, we recorded a non-cash goodwill impairment loss of $28 million.See Note 10, “Impairment Losses.”

Other segment. In the third quarter of 2017, we recorded a non-cash goodwill impairment loss of $101 million for our Pathways subsidiary. In the second quarter of 2017, we recorded non-cash goodwill and intangible assets impairment losses of $72 million, related primarily tofor our Pathways subsidiary. See Note 10, “Impairment Losses.”

Consolidation and Interim Financial Information

The consolidated financial statements include the accounts of Molina Healthcare, Inc., its subsidiaries, and variable interest entities (VIEs) in which Molina Healthcare, Inc. is considered to be the primary beneficiary. Such VIEs are insignificant to our consolidated financial position and results of operations. In the opinion of management, all adjustments considered necessary for a fair presentation of the results as of the date and for the interim periods presented have been included; such adjustments consist of normal recurring adjustments. All significant intercompany balances and transactions have been eliminated. The consolidated results of operations for the current interim period are not necessarily indicative of the results for the entire year ending December 31, 2017.

The unaudited consolidated interim financial statements have been prepared under the assumption that users of the interim financial data have either read or have access to our audited consolidated financial statements for the fiscal year ended December 31, 2016. Accordingly, certain disclosures that would substantially duplicate the disclosures contained in the December 31, 2016 audited consolidated financial statements have been omitted. These unaudited consolidated interim financial statements should be read in conjunction with our December 31, 2016 audited consolidated financial statements.

2. Significant Accounting Policies

Certain of our significant accounting policies are discussed within the note to which they specifically relate.

Revenue Recognition – Health Plans Segment

Premium revenue is fixed in advance of the periods covered and, except as described below, is not generally subject to significant accounting estimates. Premium revenues are recognized in the month that members are entitled to receive health care services, and premiums collected in advance are deferred. Certain components of premium revenue are subject to accounting estimates and fall into two broad categories discussed in further detail below: 1) “Contractual Provisions That May Adjust or Limit Revenue or Profit;” and 2) “Quality Incentives.”

Contractual Provisions That May Adjust or Limit Revenue or Profit

Medicaid

Medical Cost Floors (Minimums), and Medical Cost Corridors: A portion of our premium revenue may be returned if certain minimum amounts are not spent on defined medical care costs. In the aggregate, we recorded a liability under the terms of such contract provisions of $136$119 million and $272 million at JuneSeptember 30, 2017 and December 31, 2016, respectively, to “Amounts due government agencies.” Approximately $114$82 million and $244 million of the liability accrued at JuneSeptember 30, 2017 and December 31, 2016, respectively, relates to our participation in Medicaid Expansion programs.

In certain circumstances, our health plans may receive additional premiums if amounts spent on medical care costs exceed a defined maximum threshold. Receivables relating to such provisions were insignificant at JuneSeptember 30, 2017 and December 31, 2016.

Profit Sharing and Profit Ceiling: Our contracts with certain states contain profit-sharing or profit ceiling provisions under which we refund amounts to the states if our health plans generate profit above a certain specified percentage. In some cases, we are limited in the amount of administrative costs that we may deduct in calculating the refund, if any. Liabilities for profits in excess of the amount we are allowed to retain under these provisions were insignificant at JuneSeptember 30, 2017 and December 31, 2016.

Retroactive Premium Adjustments: State Medicaid programs periodically adjust premium rates on a retroactive basis. In these cases, we must adjust our premium revenue in the period in which we learn of the adjustment, rather than in the months of service to which the retroactive adjustment applies.

Medicare

Risk Adjustment: Our Medicare premiums are subject to retroactive increase or decrease based on the health status of our Medicare members (measured as a member risk score). We estimate our members’ risk scores and the related amount of Medicare revenue that will ultimately be realized for the periods presented based on our knowledge of our members’ health status, risk scores and the Centers for Medicare & Medicaid Services (CMS) practices. Consolidated balance sheet amounts related to anticipated Medicare risk adjustment premiums and Medicare Part D settlements were insignificant at JuneSeptember 30, 2017 and December 31, 2016.

Minimum MLR: Additionally, federal regulations have established a minimum annual medical loss ratio (Minimum MLR) of 85% for Medicare. The medical loss ratio represents medical costs as a percentage of premium revenue. Federal regulations define what constitutes medical costs and premium revenue. If the Minimum MLR is not met, we may be required to pay rebates to the federal government. We recognize estimated rebates under the Minimum MLR as an adjustment to premium revenue in our consolidated statements of operations.

Marketplace

Premium Stabilization Programs: The Affordable Care Act (ACA) established Marketplace premium stabilization programs effective January 1, 2014. These programs, commonly referred to as the “3R’s,” include a permanent risk adjustment program, a transitional reinsurance program, and a temporary risk corridor program. We record receivables or payables related to the 3R programs and the Minimum MLR when the amounts are reasonably estimable as described below, and, for receivables, when collection is reasonably assured. Our receivables (payables) for each of these programs, as of the dates indicated, were as follows:

| | | | June 30, 2017 | | December 31,

2016 | September 30, 2017 | | December 31,

2016 |

| | Current Benefit Year | | Prior Benefit Years | | Total | | Current Benefit Year | | Prior Benefit Years | | Total | |

| | | | | | | | | | | | | | | |

| | (In millions) | (In millions) |

| Risk adjustment | $ | (502 | ) | | $ | (546 | ) | | $ | (1,048 | ) | | $ | (522 | ) | $ | (655 | ) | | $ | — |

| | $ | (655 | ) | | $ | (522 | ) |

| Reinsurance | — |

| | 57 |

| | 57 |

| | 55 |

| — |

| | 10 |

| | 10 |

| | 55 |

|

| Risk corridor | — |

| | (1 | ) | | (1 | ) | | (1 | ) | — |

| | — |

| | — |

| | (1 | ) |

| Minimum MLR | (3 | ) | | (2 | ) | | (5 | ) | | (1 | ) | (27 | ) | | — |

| | (27 | ) | | (1 | ) |

Risk adjustment: Under this permanent program, our health plans’ composite risk scores are compared with the overall average risk score for the relevant state and market pool. Generally, our health plans will make a risk transfer payment into the pool if their composite risk scores are below the average risk score, and will receive a risk transfer payment from the pool if their composite risk scores are above the average risk score. We estimate our ultimate premium based on insurance policy year-to-date experience, and recognize estimated premiums relating to the risk adjustment program as an adjustment to premium revenue in our consolidated statements of operations.

Reinsurance: This program was designed to provide reimbursement to insurers for high cost members and ended December 31, 2016; we expect to settle the outstanding receivable balance in 2017.

Risk corridor: This program was intended to limit gains and losses of insurers by comparing allowable costs to a target amount as defined by CMS, and ended December 31, 2016; we expect to settle theall outstanding payable balance inbalances were settled as of September 30, 2017.

Additionally, the ACA established a Minimum MLR of 80% for the Marketplace. The medical loss ratio represents medical costs as a percentage of premium revenue. Federal regulations define what constitutes medical costs and premium revenue. If the Minimum MLR is not met, we may be required to pay rebates to our Marketplace policyholders. Each of the 3R programs is taken into consideration when computing the Minimum MLR. We

recognize estimated rebates under the Minimum MLR as an adjustment to premium revenue in our consolidated statements of operations.

Quality Incentives

At several of our health plans, revenue ranging from approximately 1% to 3% of certain health plan premiums is earned only if certain performance measures are met.

The following table quantifies the quality incentive premium revenue recognized for the periods presented, including the amounts earned in the periods presented and prior periods. Although the reasonably possible effects of a change in estimate related to quality incentive premium revenue as of JuneSeptember 30, 2017 are not known, we have no reason to believe that the adjustments to prior years noted below are not indicative of the potential future changes in our estimates as of JuneSeptember 30, 2017.

| | | | Three Months Ended June 30, | | Six Months Ended June 30, | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2017 | | 2016 | | 2017 | | 2016 | 2017 | | 2016 | | 2017 | | 2016 |

| | (Dollars in millions) | (Dollars in millions) |

| Maximum available quality incentive premium - current period | $ | 39 |

| | $ | 41 |

| | $ | 77 |

| | $ | 81 |

| $ | 36 |

| | $ | 33 |

| | $ | 113 |

| | $ | 114 |

|

| Quality incentive premium revenue recognized in current period: | | | | | | | | | | | | | | |

| Earned current period | $ | 29 |

| | $ | 36 |

| | $ | 48 |

| | $ | 54 |

| $ | 24 |

| | $ | 26 |

| | $ | 72 |

| | $ | 80 |

|

| Earned prior periods | 1 |

| | 49 |

| | 6 |

| | 54 |

| 3 |

| | — |

| | 9 |

| | 54 |

|

| Total | $ | 30 |

| | $ | 85 |

| | $ | 54 |

| | 108 |

| $ | 27 |

| | $ | 26 |

| | $ | 81 |

| | 134 |

|

| | | | | | | | | | | | | | | |

| Quality incentive premium revenue recognized as a percentage of total premium revenue | 0.6 | % | | 2.1 | % | | 0.6 | % | | 1.3 | % | 0.6 | % | | 0.6 | % | | 0.6 | % | | 1.1 | % |

Income Taxes

The provision for income taxes is determined using an estimated annual effective tax rate, which generally differs from the U.S. federal statutory rate primarily because of state taxes, nondeductible expenses such as the Health Insurer Fee (HIF), goodwill impairment, certain compensation, and other general and administrative expenses. The effective tax rate was not impacted by HIF in 2017 given the 2017 HIF moratorium.

The effective tax rate may be subject to fluctuations during the year, particularly as a result of the level of pretax earnings, and also as new information is obtained. Such information may affect the assumptions used to estimate the annual effective tax rate, including factors such as the mix of pretax earnings in the various tax jurisdictions in which we operate, valuation allowances against deferred tax assets, the recognition or the reversal of the recognition of tax benefits related to uncertain tax positions, and changes in or the interpretation of tax laws in jurisdictions where we conduct business. We recognize deferred tax assets and liabilities for temporary differences between the financial reporting basis and the tax basis of our assets and liabilities, along with net operating loss and tax credit carryovers.

Premium Deficiency Reserves on Loss Contracts

We assess the profitability of our medical care policies to identify groups of contracts where current operating results or forecasts indicate probable future losses. If anticipated future variable costs exceed anticipated future premiums and investment income, a premium deficiency reserve is recognized. We assume a full-year CSR reconciliation (see further information below) in the premium deficiency reserve calculation for the Marketplace program. We recorded a premium deficiency reserve to “Medical claims and benefits payable” on our accompanying consolidated balance sheets relating to our Marketplace program of $30 million as of December 31, 2016, which increased to $100 million as of June 30, 2017, and then decreased to $70 million as of September 30, 2017. If a nine-month CSR reconciliation had been included in the computation rather than a full year, the premium deficiency reserve would have increased by $55 million, to $125 million as of September 30, 2017. The theoretical $55 million increase to the premium deficiency reserve is less than the potential fourth quarter 2017 impact described below, or $85 million, because such adjustment only recognizes the potential CSR impact to the extent it would have created a deficiency in premiums at September 30, 2017.

Marketplace Cost Share Reduction (CSR) Update

Our third quarter results do not include any potential impact from the October 12, 2017, direction to Centers for Medicare and Medicaid Services (CMS) from Acting Department of Health and Human Services Secretary Hargan to cease payment of Marketplace CSR subsidies. At September 30, 2017, we had a total of approximately $220 million in excess CSR subsidies, recorded as a payable to CMS. This payable represents the extent to which payments received by us from CMS exceeded our estimate of the actual cost of member subsidies incurred by us through September 30, 2017.

We expect to incur approximately $85 million in unreimbursed expense associated with the cessation of CSR subsidies in the fourth quarter of 2017. It has been the practice of CMS to perform a reconciliation on an annual basis of CSR subsidies paid to all health plans against the actual costs incurred by the health plans. Were such a reconciliation to be performed for the full calendar year of 2017—consistent with past practice—we would be able to offset nearly all of the $85 million expense incurred in the fourth quarter against the excess amounts received prior to September 30, 2017. However, should CMS transition to a nine month reconciliation period ending September 30, 2017—the last month for which CSR subsidies have been paid—the absence of CSR subsidy reimbursement would reduce income before income tax expense by approximately $85 million in the fourth quarter of 2017.

Recent Accounting Pronouncements

Goodwill Impairment. In January 2017, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) 2017-04, Simplifying the Test for Goodwill Impairment, which eliminates the requirement to calculate the implied fair value of goodwill to measure a goodwill impairment loss. Instead, an impairment loss is measured as the excess of the carrying amount of the reporting unit, including goodwill, over the fair value of the reporting unit. ASU 2017-04 is effective beginning January 1, 2020; we have early adopted ASU 2017-04 as of June 30, 2017, in connection with the interim assessment of our Pathways subsidiary. See further discussion at Note 10, “Impairment Losses.”

Restricted Cash. In November 2016, the FASB issued ASU 2016-18, Restricted Cash, which will require us to include in our consolidated statements of cash flows the balances of cash, cash equivalents, restricted cash and

restricted cash equivalents. When these items are presented in more than one line item on the balance sheet, the new guidance requires a reconciliation of the totals in the statement of cash flows to the related captions in the balance sheet. Transfers between cash and cash equivalents and restricted cash and restricted cash equivalents will no longer be presented in the statement of cash flows. ASU 2016-18 is effective beginning January 1, 2018; early adoption is permitted. We intend to early adopt ASU 2016-18 as of December 31, 2017, and are currently evaluating the effect tochanges that will be required in our consolidated statements of cash flows.

Stock Compensation. In March 2016, the FASB issued ASU 2016-09, Improvements to Employee Share-Based Payment Accounting, which amends ASC Topic 718, Compensation – Stock Compensation. ASU 2016-09 simplifies several aspects of accounting for employee share-based payment transactions, including the accounting for income taxes, forfeitures, statutory tax and classification in the statement of cash flows. We adopted ASU 2016-09 in the first quarter of 2017; such adoption did not significantly impact our consolidated financial statements. In addition, the prior period presentation in the statement of cash flows was not adjusted because such adjustments were insignificant.

Leases. In February 2016, the FASB issued ASU 2016-02, Leases (Topic 842), as modified by ASU 2017-03, Transition and Open Effective Date Information. Under ASU 2016-02, an entity will be required to recognize assets and liabilities for the rights and obligations created by leases on the entity’s balance sheet for both finance and operating leases. For leases with a term of 12 months or less, an entity can elect to not recognize lease assets and lease liabilities and expense the lease over a straight-line basis for the term of the lease. ASU 2016-02 will require new disclosures that depict the amount, timing, and uncertainty of cash flows pertaining to an entity’s leases. ASU 2016-02 is effective for us beginning January 1, 2019, and must be adopted using a modified retrospective approach for annual and interim periods beginning after December 15, 2018. Early adoption is permitted. Under this guidance, we will record assets and liabilities relating primarily to our long-term office leases, andleases. We are currently evaluating the effect to our consolidated financial statements.

Revenue Recognition. In May 2014, the FASB issued ASU 2014-09, Revenue from Contracts with Customers (Topic 606). We intend to adopt this standard and the related modifications on January 1, 2018, using the modified retrospective approach. Under this approach, the cumulative effect of initially applying the guidance will be reflected as an adjustment to beginning retained earnings.

We have determined that the insurance contracts of our Health Plans segment, which comprisessegment constitutes the vast majority of our operations, are excluded from the scope of ASU 2014-09Topic 606 because the recognition of revenue under these contracts is dictated by other accounting standards governing insurance contracts.

For our Molina Medicaid Solutions segment, we have reevaluated our earlier assessment and determined that certainrevenue for contracts that include design, development and implementation of Medicaid managed care systems shall be deferred until the system ‘go-live’ date, and then generally recognized on a straight-line basis over the hosting period. This approach is consistent with the FASB/IASB Joint Transition Resource Group for Revenue Recognition view for entities that provide software as a service solution, and similar to our historical revenue recognition methodology. We are continuing to evaluate the existence of customers’ rights with regard to renewal options and whether such rights may constitute separate performance obligations. We expect that cost of service revenue will no longer be deferred and recognized over the service delivery period. Rather, service revenue willgenerally be recognized based onin a manner consistent with the expected cost plus gross margin method, and cost of servicecorresponding revenue will be recognized as incurred. As of June 30, 2017, we expectrecognition.

We believe the cumulative adjustment for historical periods through June 30, 2017 to increase retained earnings by no more than $50 million. This estimateassociated with the adoption of Topic 606 effective January 1, 2018, will be updated in each quarterlyinsignificant for both our Molina Medicaid Solutions and annual report until adoption. We expect the cumulative adjustment, if any, relating to our Other segment to be insignificant.segments.

Other recent accounting pronouncements issued by the FASB (including its Emerging Issues Task Force), the American Institute of Certified Public Accountants, and the Securities and Exchange Commission (SEC) did not have, or are not believed by management to have, a significant impact on our present or future consolidated financial statements.

3. Net (Loss) Income per Share

The following table sets forth the calculation of basic and diluted net (loss) income per share: | | | | Three Months Ended June 30, | | Six Months Ended June 30, | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2017 | | 2016 | | 2017 | | 2016 | 2017 | | 2016 | | 2017 | | 2016 |

| | (In millions, except net income per share) | (In millions, except net income per share) |

| Numerator: | | | | | | | | | | | | | | |

| Net (loss) income | $ | (230 | ) | | $ | 33 |

| | $ | (153 | ) | | $ | 57 |

| $ | (97 | ) | | $ | 42 |

| | $ | (250 | ) | | $ | 99 |

|

| Denominator: | | | | | | | | | | | | | | |

| Denominator for basic net (loss) income per share | 56 |

| | 55 |

| | 56 |

| | 55 |

| 57 |

| | 56 |

| | 56 |

| | 55 |

|

| Effect of dilutive securities: | | | | | | | | | | | | | | |

1.125% Warrants (1) | — |

| | — |

| | — |

| | 1 |

| — |

| | — |

| | — |

| | 1 |

|

| Denominator for diluted net (loss) income per share | 56 |

| | 55 |

| | 56 |

| | 56 |

| 57 |

| | 56 |

| | 56 |

| | 56 |

|

| | | | | | | | | | | | | | | |

Net (loss) income per share: (2) | | | | | | | | | | | | | | |

| Basic | $ | (4.10 | ) | | $ | 0.58 |

| | $ | (2.74 | ) | | $ | 1.02 |

| $ | (1.70 | ) | | $ | 0.77 |

| | $ | (4.44 | ) | | $ | 1.79 |

|

| Diluted | $ | (4.10 | ) | | $ | 0.58 |

| | $ | (2.74 | ) | | $ | 1.01 |

| $ | (1.70 | ) | | $ | 0.76 |

| | $ | (4.44 | ) | | $ | 1.77 |

|

| | | | | | | | | | | | | | | |

| Potentially dilutive common shares excluded from calculations: | | | | | | | | | | | | | | |

1.125% Warrants (1) | 2 |

| | — |

| | 1 |

| | — |

| 2 |

| | — |

| | 2 |

| | — |

|

1.625% Notes (1) | | 1 |

| | — |

| | — |

| | — |

|

| |

| (1) | For more information regarding the 1.125% Warrants, refer to Note 9, “Stockholders' Equity.” For more information regarding the 1.625% Notes, refer to Note 7, “Debt.” The dilutive effect of all potentially dilutive common shares is calculated using the treasury-stocktreasury stock method. Certain potentiallyPotentially dilutive common shares issuable arewere not included in the computation of diluted net (loss) incomeloss per share because to do so would be anti-dilutive. Forin the three and sixnine months ended JuneSeptember 30, 2017, the 1.125% Warrants were excluded from diluted shares outstanding because to do so would have been anti-dilutive. |

| |

| (2) | Source data for calculations in thousands. |

4. Fair Value Measurements

We consider the carrying amounts of cash, and cash equivalents and other current assets and current liabilities (not including derivatives and the current portion of long-term debt) to approximate their fair values because of the

relatively short period of time between the origination of these instruments and their expected realization or payment. For our financial instruments measured at fair value on a recurring basis, we prioritize the inputs used in measuring fair value according to athe three-tier fair value hierarchy defined by GAAP.hierarchy. For a description of the methods and assumptions that we use to a) estimate the fair value; and b) determine the classification according to the fair value hierarchy for each financial instrument, see Note 5, “Fair Value Measurements,” in our 2016 Annual Report on Form 10-K.

Derivative financial instruments include the 1.125% Call Option derivative asset and the 1.125% Conversion Option derivative liability. These derivatives are not actively traded and are valued based on an option pricing model that uses observable and unobservable market data for inputs. Significant market data inputs used to determine fair value as of JuneSeptember 30, 2017, included the price of our common stock, the time to maturity of the derivative instruments, the risk-free interest rate, and the implied volatility of our common stock. As described further in Note 8, “Derivatives,” the 1.125% Call Option asset and the 1.125% Conversion Option liability were designed such that changes in their fair values would offset, with minimal impact to the consolidated statements of operations. Therefore, the sensitivity of changes in the unobservable inputs to the option pricing model for such instruments is mitigated.

The net changes in fair value of Level 3 financial instruments were insignificant to our results of operations for the sixnine months ended JuneSeptember 30, 2017.

Our financial instruments measured at fair value on a recurring basis at JuneSeptember 30, 2017, were as follows: | | | | Total | | Quoted Market Prices (Level 1) | | Significant Other Observable Inputs (Level 2) | | Significant Unobservable Inputs (Level 3) | Total | | Quoted Market Prices (Level 1) | | Significant Other Observable Inputs (Level 2) | | Significant Unobservable Inputs (Level 3) |

| | (In millions) | (In millions) |

| Corporate debt securities | $ | 1,386 |

| | $ | — |

| | $ | 1,386 |

| | $ | — |

| $ | 1,162 |

| | $ | — |

| | $ | 1,162 |

| | $ | — |

|

| U.S. treasury notes | 263 |

| | 263 |

| | — |

| | — |

| |

| Government-sponsored enterprise securities (GSEs) | 241 |

| | 241 |

| | — |

| | — |

| 220 |

| | 220 |

| | — |

| | — |

|

| Municipal securities | 140 |

| | — |

| | 140 |

| | — |

| 131 |

| | — |

| | 131 |

| | — |

|

| Asset-backed securities | 128 |

| | — |

| | 128 |

| | — |

| 125 |

| | — |

| | 125 |

| | — |

|

| U.S. treasury notes | | 121 |

| | 121 |

| | — |

| | — |

|

| Certificates of deposit | 34 |

| | — |

| | 34 |

| | — |

| 28 |

| | — |

| | 28 |

| | — |

|

| Subtotal - current investments | 2,192 |

| | 504 |

| | 1,688 |

| | — |

| 1,787 |

| | 341 |

| | 1,446 |

| | — |

|

| Corporate debt securities | 228 |

| | — |

| | 228 |

| | — |

| 229 |

| | — |

| | 229 |

| | — |

|

| U.S. treasury notes | 97 |

| | 97 |

| | — |

| | — |

| 97 |

| | 97 |

| | — |

| | — |

|

| Subtotal - current restricted investments | 325 |

| | 97 |

| | 228 |

| | — |

| 326 |

| | 97 |

| | 229 |

| | — |

|

| 1.125% Call Option derivative asset | 440 |

| | — |

| | — |

| | 440 |

| 425 |

| | — |

| | — |

| | 425 |

|

| Total assets | $ | 2,957 |

| | $ | 601 |

| | $ | 1,916 |

| | $ | 440 |

| $ | 2,538 |

| | $ | 438 |

| | $ | 1,675 |

| | $ | 425 |

|

| | | | | | | | | | | | | | | |

| 1.125% Conversion Option derivative liability | $ | 440 |

| | $ | — |

| | $ | — |

| | $ | 440 |

| $ | 425 |

| | $ | — |

| | $ | — |

| | $ | 425 |

|

| Total liabilities | $ | 440 |

| | $ | — |

| | $ | — |

| | $ | 440 |

| $ | 425 |

| | $ | — |

| | $ | — |

| | $ | 425 |

|

Our financial instruments measured at fair value on a recurring basis at December 31, 2016, were as follows: | | | | Total | | Quoted Market Prices (Level 1) | | Significant Other Observable Inputs (Level 2) | | Significant Unobservable Inputs (Level 3) | Total | | Quoted Market Prices (Level 1) | | Significant Other Observable Inputs (Level 2) | | Significant Unobservable Inputs (Level 3) |

| | (In millions) | (In millions) |

| Corporate debt securities | $ | 1,179 |

| | $ | — |

| | $ | 1,179 |

| | $ | — |

| $ | 1,179 |

| | $ | — |

| | $ | 1,179 |

| | $ | — |

|

| U.S. treasury notes | 84 |

| | 84 |

| | — |

| | — |

| |

| GSEs | 231 |

| | 231 |

| | — |

| | — |

| 231 |

| | 231 |

| | — |

| | — |

|

| Municipal securities | 142 |

| | — |

| | 142 |

| | — |

| 142 |

| | — |

| | 142 |

| | — |

|

| Asset-backed securities | 69 |

| | — |

| | 69 |

| | — |

| 69 |

| | — |

| | 69 |

| | — |

|

| U.S. treasury notes | | 84 |

| | 84 |

| | — |

| | — |

|

| Certificates of deposit | 53 |

| | — |

| | 53 |

| | — |

| 53 |

| | — |

| | 53 |

| | — |

|

| Subtotal - current investments | 1,758 |

| | 315 |

| | 1,443 |

| | — |

| 1,758 |

| | 315 |

| | 1,443 |

| | — |

|

| 1.125% Call Option derivative asset | 267 |

| | — |

| | — |

| | 267 |

| 267 |

| | — |

| | — |

| | 267 |

|

| Total assets | $ | 2,025 |

| | $ | 315 |

| | $ | 1,443 |

| | $ | 267 |

| $ | 2,025 |

| | $ | 315 |

| | $ | 1,443 |

| | $ | 267 |

|

| | | | | | | | | | | | | | | |

| 1.125% Conversion Option derivative liability | $ | 267 |

| | $ | — |

| | $ | — |

| | $ | 267 |

| $ | 267 |

| | $ | — |

| | $ | — |

| | $ | 267 |

|

| Total liabilities | $ | 267 |

| | $ | — |

| | $ | — |

| | $ | 267 |

| $ | 267 |

| | $ | — |

| | $ | — |

| | $ | 267 |

|

There were no current restricted investments as of December 31, 2016.

Fair Value Measurements – Disclosure Only

The carrying amounts and estimated fair values of our senior notes which are classified as Level 2 financial instruments,instruments. Fair value for these securities is determined using a market approach based on quoted market prices for similar securities in active markets or quoted prices for identical securities in inactive markets. The carrying amount and estimated fair value of the amount due under our Credit Facility is classified as a Level 3 financial instrument, because certain inputs used to determine its fair value are indicated innot observable. As of September 30, 2017, the following table.carrying value of the amount due under the Credit Facility approximates it fair value because of the recency of this borrowing during the third quarter of 2017.

| | | | June 30, 2017 | | December 31, 2016 | September 30, 2017 | | December 31, 2016 |

| | Carrying Value | |

Fair Value | | Carrying Value | |

Fair Value | Carrying Value | |

Fair Value | | Carrying Value | |

Fair Value |

| | (In millions) | (In millions) |

| 5.375% Notes | $ | 692 |

| | $ | 745 |

| | $ | 691 |

| | $ | 714 |

| $ | 692 |

| | $ | 726 |

| | $ | 691 |

| | $ | 714 |

|

| 1.125% Convertible Notes | 483 |

| | 976 |

| | 471 |

| | 792 |

| 489 |

| | 927 |

| | 471 |

| | 792 |

|

| 4.875% Notes | 325 |

| | 333 |

| | — |

| | — |

| 325 |

| | 324 |

| | — |

| | — |

|

| Credit Facility | | 300 |

| | 300 |

| | — |

| | — |

|

| 1.625% Convertible Notes | 289 |

| | 386 |

| | 284 |

| | 344 |

| 292 |

| | 373 |

| | 284 |

| | 344 |

|

| | $ | 1,789 |

| | $ | 2,440 |

| | $ | 1,446 |

| | $ | 1,850 |

| $ | 2,098 |

| | $ | 2,650 |

| | $ | 1,446 |

| | $ | 1,850 |

|

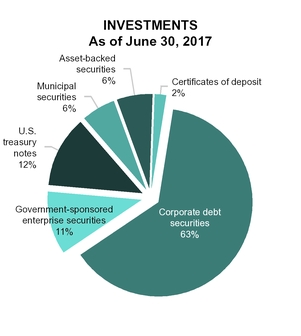

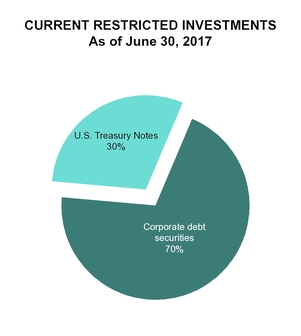

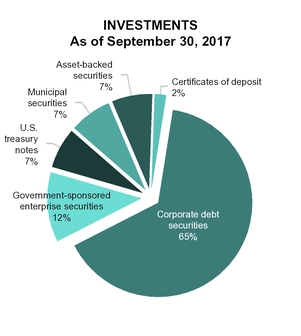

5. Investments

Available-for-Sale Investments

We consider all of our investments classified as current assets (including restricted investments) to be available-for-sale. Certain of our senior notes, as further discussed in Note 7, “Debt,” contain a limitation on the use of proceeds which required us to deposit the net proceeds from their issuance into a segregated deposit account, a current asset reported as “Restricted investments” in the accompanying consolidated balance sheets. Such proceeds, while restricted as to their use and held in a segregated deposit account, are available-for-sale based upon our contractual liquidity requirements.

The following tables summarize our investments as of the dates indicated: | | | | June 30, 2017 | September 30, 2017 |

| | Amortized | | Gross Unrealized | | Estimated Fair | Amortized | | Gross Unrealized | | Estimated Fair |

| | Cost | | Gains | | Losses | | Value | Cost | | Gains | | Losses | | Value |

| | (In millions) | (In millions) |

| Corporate debt securities | $ | 1,387 |

| | $ | 1 |

| | $ | 2 |

| | $ | 1,386 |

| $ | 1,162 |

| | $ | 1 |

| | $ | 1 |

| | $ | 1,162 |

|

| U.S. treasury notes | 263 |

| | — |

| | — |

| | 263 |

| |

| GSEs | 242 |

| | — |

| | 1 |

| | 241 |

| 221 |

| | — |

| | 1 |

| | 220 |

|

| Municipal securities | 140 |

| | — |

| | — |

| | 140 |

| 132 |

| | — |

| | 1 |

| | 131 |

|

| Asset-backed securities | 128 |

| | — |

| | — |

| | 128 |

| 125 |

| | — |

| | — |

| | 125 |

|

| U.S. treasury notes | | 121 |

| | — |

| | — |

| | 121 |

|

| Certificates of deposit | 34 |

| | — |

| | — |

| | 34 |

| 28 |

| | — |

| | — |

| | 28 |

|

| Subtotal - current investments | 2,194 |

| | 1 |

| | 3 |

| | 2,192 |

| 1,789 |

| | 1 |

| | 3 |

| | 1,787 |

|

| Corporate debt securities | 227 |

| | 1 |

| | — |

| | 228 |

| 229 |

| | — |

| | — |

| | 229 |

|

| U.S. treasury notes | 97 |

| | — |

| | — |

| | 97 |

| 97 |

| | — |

| | — |

| | 97 |

|

| Subtotal - current restricted investments | 324 |

| | 1 |

| | — |

| | 325 |

| 326 |

| | — |

| | — |

| | 326 |

|

| Total | $ | 2,518 |

| | $ | 2 |

| | $ | 3 |

| | $ | 2,517 |

| |

| | | $ | 2,115 |

| | $ | 1 |

| | $ | 3 |

| | $ | 2,113 |

|

| | | | December 31, 2016 | December 31, 2016 |

| | Amortized | | Gross Unrealized | | Estimated Fair | Amortized | | Gross Unrealized | | Estimated Fair |

| | Cost | | Gains | | Losses | | Value | Cost | | Gains | | Losses | | Value |

| | (In millions) | (In millions) |

| Corporate debt securities | $ | 1,180 |

| | $ | 1 |

| | $ | 2 |

| | $ | 1,179 |

| $ | 1,180 |

| | $ | 1 |

| | $ | 2 |

| | $ | 1,179 |

|

| U.S. treasury notes | 84 |

| | — |

| | — |

| | 84 |

| |

| GSEs | 232 |

| | — |

| | 1 |

| | 231 |

| 232 |

| | — |

| | 1 |

| | 231 |

|

| Municipal securities | 143 |

| | — |

| | 1 |

| | 142 |

| 143 |

| | — |

| | 1 |

| | 142 |

|

| Asset-backed securities | 69 |

| | — |

| | — |

| | 69 |

| 69 |

| | — |

| | — |

| | 69 |

|

| U.S. treasury notes | | 84 |

| | — |

| | — |

| | 84 |

|

| Certificates of deposit | 53 |

| | — |

| | — |

| | 53 |

| 53 |

| | — |

| | — |

| | 53 |

|

| Total - current investments | $ | 1,761 |

| | $ | 1 |

| | $ | 4 |

| | $ | 1,758 |

| |

| | | $ | 1,761 |

| | $ | 1 |

| | $ | 4 |

| | $ | 1,758 |

|

There were no current restricted investments as of December 31, 2016.

The contractual maturities of our available-for-sale investments as of JuneSeptember 30, 2017 are summarized below: | | | | Amortized Cost | | Estimated Fair Value | Amortized Cost | | Estimated Fair Value |

| | (In millions) | (In millions) |

| Due in one year or less | $ | 1,301 |

| | $ | 1,301 |

| $ | 1,154 |

| | $ | 1,153 |

|

| Due after one year through five years | 1,194 |

| | 1,193 |

| 944 |

| | 943 |

|

| Due after five years through ten years | 23 |

| | 23 |

| 17 |

| | 17 |

|

| Total | $ | 2,518 |

| | $ | 2,517 |

| |

| | | $ | 2,115 |

| | $ | 2,113 |

|

Gross realized gains and losses from sales of available-for-sale securities are calculated under the specific identification method and are included in investment income. Gross realized investment gains and losses for the three and sixnine months ended JuneSeptember 30, 2017 and 2016 were insignificant.

We have determined that unrealized losses at JuneSeptember 30, 2017 and December 31, 2016, are temporary in nature, because the change in market value for these securities has resulted from fluctuating interest rates, rather than a deterioration of the credit worthinesscreditworthiness of the issuers. So long as we maintain the intent and ability to hold these securities to maturity, we are unlikely to experience losses. In the event that we dispose of these securities before maturity, we expect that realized losses, if any, will be insignificant.

The following table segregates those available-for-sale investments that have been in a continuous loss position for less than 12 months, and those that have been in a loss position for 12 months or more as of June 30, 2017:

|

| | | | | | | | | | | | | | | | | | | | | |

| | In a Continuous Loss Position for Less than 12 Months | | In a Continuous Loss Position for 12 Months or More |

| | Estimated Fair Value | | Unrealized Losses | | Total Number of Positions | | Estimated Fair Value | | Unrealized Losses | | Total Number of Positions |

| | (Dollars in millions) |

| Corporate debt securities | $ | 913 |

| | $ | 2 |

| | 418 |

| | $ | — |

| | $ | — |

| | — |

|

| GSEs | 247 |

| | 1 |

| | 101 |

| | — |

| | — |

| | — |

|

| Total - current investments | $ | 1,160 |

| | $ | 3 |

| | 519 |

| | $ | — |

| | $ | — |

| | — |

|

The following table segregates those available-for-sale investments that have been in a continuous loss position for less than 12 months, and those that have been in a continuous loss position for 12 months or more as of September 30, 2017:

|

| | | | | | | | | | | | | | | | | | | | | |

| | In a Continuous Loss Position for Less than 12 Months | | In a Continuous Loss Position for 12 Months or More |

| | Estimated Fair Value | | Unrealized Losses | | Total Number of Positions | | Estimated Fair Value | | Unrealized Losses | | Total Number of Positions |

| | (Dollars in millions) |

| Corporate debt securities | $ | 783 |

| | $ | 1 |

| | 314 |

| | $ | — |

| | $ | — |

| | — |

|

| GSEs | — |

| | — |

| | — |

| | 58 |

| | 1 |

| | 20 |

|

| Municipal securities | 97 |

| | 1 |

| | 116 |

| | — |

| | — |

| | — |

|

| | $ | 880 |

| | $ | 2 |

| | 430 |

| | $ | 58 |

| | $ | 1 |

| | 20 |

|

The following table segregates those available-for-sale investments that have been in a continuous loss position for less than 12 months, and those that have been in a continuous loss position for 12 months or more as of December 31, 2016:

| | | | In a Continuous Loss Position for Less than 12 Months | | In a Continuous Loss Position for 12 Months or More | In a Continuous Loss Position for Less than 12 Months | | In a Continuous Loss Position for 12 Months or More |

| | Estimated Fair Value | | Unrealized Losses | | Total Number of Positions | | Estimated Fair Value | | Unrealized Losses | | Total Number of Positions | Estimated Fair Value | | Unrealized Losses | | Total Number of Positions | | Estimated Fair Value | | Unrealized Losses | | Total Number of Positions |

| | (Dollars in millions) | (Dollars in millions) |

| Corporate debt securities | $ | 542 |

| | $ | 2 |

| | 378 |

| | $ | — |

| | $ | — |

| | — |

| $ | 542 |

| | $ | 2 |

| | 378 |

| | $ | — |

| | $ | — |

| | — |

|

| GSEs | 198 |

| | 1 |

| | 73 |

| | — |

| | — |

| | — |

| 198 |

| | 1 |

| | 73 |

| | — |

| | — |

| | — |

|

| Municipal securities | 101 |

| | 1 |

| | 129 |

| | — |

| | — |

| | — |

| 101 |

| | 1 |

| | 129 |

| | — |

| | — |

| | — |

|

| Total - current investments | $ | 841 |

| | $ | 4 |

| | 580 |

| | $ | — |

| | $ | — |

| | — |

| |

| | | $ | 841 |

| | $ | 4 |

| | 580 |

| | $ | — |

| | $ | — |

| | — |

|

Held-to-Maturity Investments

Pursuant to the regulations governing our Health Plans segment subsidiaries, we maintain statutory deposits and deposits required by government authorities primarily in certificates of deposit and U.S. treasury securities. We also maintain restricted investments as protection against the insolvency of certain capitated providers. The use of these funds is limited as required by regulation in the various states in which we operate, or as needed in the event of insolvency of capitated providers. Therefore, such investments are reported as non-current “Restricted investments” in the accompanying consolidated balance sheet.sheets. We have the ability to hold these restricted investments until maturity, and as a result, we would not expect the value of these investments to decline significantly due to a sudden change in market interest rates.

The contractual maturities of our held-to-maturity restricted investments, which are carried at amortized cost, which approximates fair value, as of JuneSeptember 30, 2017 are summarized below: | | | | Amortized Cost | | Estimated Fair Value | Amortized Cost | | Estimated Fair Value |

| | (In millions) | (In millions) |

| Due in one year or less | $ | 100 |

| | $ | 100 |

| $ | 100 |

| | $ | 100 |

|

| Due after one year through five years | 18 |

| | 17 |

| 17 |

| | 17 |

|

| | $ | 118 |

| | $ | 117 |

| $ | 117 |

| | $ | 117 |

|

6. Medical Claims and Benefits Payable

The following table provides the details of our medical claims and benefits payable (including amounts payable for the provision of long-term services and supports, or LTSS) as of the dates indicated.indicated:

| | | | June 30,

2017 | | December 31,

2016 | September 30,

2017 | | December 31,

2016 |

| | (In millions) | (In millions) |

| Fee-for-service claims incurred but not paid (IBNP) | $ | 1,478 |

| | $ | 1,352 |

| $ | 1,681 |

| | $ | 1,352 |

|

| Pharmacy payable | 121 |

| | 112 |

| 125 |

| | 112 |

|

| Capitation payable | 45 |

| | 37 |

| 57 |

| | 37 |

|

| Other | 433 |

| | 428 |

| 615 |

| | 428 |

|

| | $ | 2,077 |

| | $ | 1,929 |

| $ | 2,478 |

| | $ | 1,929 |

|

“Other” medical claims and benefits payable include amounts payable to certain providers for which we act as an intermediary on behalf of various government agencies without assuming financial risk. Such receipts and payments do not impact our consolidated statements of operations. Non-risk provider payables amounted to $111$403 million and $225 million as of JuneSeptember 30, 2017 and December 31, 2016, respectively.

Reinsurance recoverables of $65$16 million and $83$72 million as of JuneSeptember 30, 2017 and 2016, respectively, are included in “Receivables” in the accompanying consolidated balance sheets.

The following table presents the components of the change in our medical claims and benefits payable for the periods indicated. The amounts presented for “Components of medical care costs related to: Prior periods” represent the amountamounts by which our original estimate of medical claims and benefits payable at the beginning of the period were moreless (more) than the actual amount of the liability based on information (principally the payment of claims) developed since that liability was first reported.

| | | | Six Months Ended June 30, | Nine Months Ended September 30, |

| | 2017 | | 2016 | 2017 | | 2016 |

| | (Dollars in millions) | (Dollars in millions) |

| Medical claims and benefits payable, beginning balance | $ | 1,929 |

| | $ | 1,685 |

| $ | 1,929 |

| | $ | 1,685 |

|

| Components of medical care costs related to: | | | | | | |

| Current period | 8,633 |

| | 7,371 |

| 12,813 |

| | 11,120 |

|

| Prior periods | (31 | ) | | (189 | ) | 9 |

| | (190 | ) |

| Total medical care costs | 8,602 |

| | 7,182 |

| 12,822 |

| | 10,930 |

|

| | | | | | | |

| Change in non-risk provider payables | (114 | ) | | 24 |

| 172 |

| | 70 |

|

| | | | | | | |

| Payments for medical care costs related to: | | | | | | |

| Current period | 6,883 |

| | 5,885 |

| 10,944 |

| | 9,536 |

|

| Prior periods | 1,457 |

| | 1,240 |

| 1,501 |

| | 1,278 |

|

| Total paid | 8,340 |

| | 7,125 |

| 12,445 |

| | 10,814 |

|

| Medical claims and benefits payable, ending balance | $ | 2,077 |

| | $ | 1,766 |

| $ | 2,478 |

| | $ | 1,871 |

|

| Benefit from prior period as a percentage of: | | | | | | |

| Balance at beginning of period | 1.6 | % | | 11.3 | % | (0.5 | )% | | 11.3 | % |

| Premium revenue, trailing twelve months | 0.2 | % | | 1.3 | % | — | % | | 1.2 | % |

| Medical care costs, trailing twelve months | 0.2 | % | | 1.4 | % | (0.1 | )% | | 1.3 | % |

Assuming that our initial estimate of IBNP is accurate, we believe that amounts ultimately paid would generally be between 8% and 10% less than the IBNP liability recorded at the end of the period as a result of the inclusion in that liability of the provision for adverse claims deviation and the accrued cost of settling those claims. Because the amount of our initial liability is merely an estimate (and therefore not perfectly accurate), we will always experience variability in that estimate as new information becomes available with the passage of time. Therefore, there can be no assurance that amounts ultimately paid out will fall within the range of 8% to 10% lower than the liability that was initially recorded. Furthermore, because our initial estimate of IBNP is derived from many factors, some of which are qualitative in nature rather than quantitative, we are seldom able to assign specific values to the reasons for a change in estimate—we only know when the circumstances for any one or more factors are out of the ordinary.

As indicated in the table above, the amounts ultimately paid out on our medical claims and benefits payable liabilities in fiscal years 2017 and 2016 were less than what we had expected when we had established those liabilities. The differences between our original estimates and the amounts ultimately paid out (or now expected to be ultimately paid out) for the most part related to IBNP. While many related factors working in conjunction with one another serve to determine the accuracy of our estimates, we are seldom able to quantify the impact that any single

factor has on a change in estimate. In addition, given the variability inherent in the reserving process, we will only be able to identify specific factors if they represent a significant departure from expectations. As a result, we do not expect to be able to fully quantify the impact of individual factors on changes in estimates.

While priorPrior period development of our estimate as of December 31, 2016, through JuneSeptember 30, 2017, was favorableunfavorable by $31$9 million, that amountwhich is substantially less than the favorable prior period development of $189$190 million we recognized for the same period in the prior year. Further, favorablethe unfavorable development through JuneSeptember 30, 2017, was less than the 8% to 10% favorable development we typically expect.

We believe that the most significant uncertainties surrounding our IBNP estimates at JuneSeptember 30, 2017 are as follows:

In the first half of 2017, our Marketplace enrollment across all health plans increased by over 400,000 members. Due to limited insight into the cost patterns associated with this large number of new Marketplace members, our liability estimates for these members are subject to more than the usual amount of uncertainty.

At our Florida health plan, the inventory of unpaid claims receipts increased significantly overduring the last few months due to an increasefirst two quarters of 2017, and then dropped in the receipt of secondary claims, many of which are not our liability. These claims will either be denied or will have very small paid amounts.third quarter. For this reason, the timing between the dates of service and the dates claims denial rates, amountsare paid per claim and other claims indicators will be impacted, making our liability estimates subject to more than the usual amount of uncertainty.

At our Illinois health plan, in 2017 we paid a large number of claims in the first half of 2017 that had previously been denied and were subsequently disputed by providers. We have also established a liability for additional expected claims resulting from provider disputes. This has created some distortion in the claims payment patterns, making our liability estimates subject to more than the usual amount of uncertainty.

At our California health plan, we adjusted our inpatient authorization process. As a result, due to the expected increase in authorized inpatient stays, our liability estimates are subject to more than the usual amount of uncertainty.

At our Illinois and New MexicoYork health plan,plans, we implemented a fee schedule reductionnew process for increased quality review of claims payments. While we do not anticipate this new process will impact the percentage of claims paid within the timely turnaround requirements, we believe it will have a large provider has createdminor impact on the timing of some distortion in the claims payment patterns, makingpaid claims. For this reason, our liability estimates in these two health plans are subject to more than the usual amount of uncertainty.

At our Puerto Rico health plan, Hurricane Maria had a significant impact on both utilization of services and our ability to process claims payments in Puerto Rico. For these reasons, we believe our liability estimates are subject to more than the usual amount of uncertainty.

7. Debt

Substantially all of our debt is held at the parent, which is reported in the Other segment. The following table summarizes our outstanding debt obligations and their classification in the accompanying consolidated balance sheets (in millions):

| | | | June 30,

2017 | | December 31,

2016 | September 30,

2017 | | December 31,

2016 |