UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

FORM 10-Q

(Mark One)

|

| |

| ý | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended JuneSeptember 30, 2018

OR

|

| |

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number: 001-31719

MOLINA HEALTHCARE, INC.

(Exact name of registrant as specified in its charter)

|

| | |

| Delaware | | 13-4204626 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | |

200 Oceangate, Suite 100 Long Beach, California | | 90802 |

| (Address of principal executive offices) | | (Zip Code) |

(562) 435-3666

(Registrant’s telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

| | | |

| Large accelerated filer | ý | Accelerated filer | ¨ |

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | ¨ |

| | | Emerging growth company | ¨ |

|

| |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section13(a) of the Exchange Act. | |

| ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ¨ No ý

The number of shares of the issuer’s Common Stock, $0.001 par value, outstanding as of July 27,October 26, 2018, was approximately 61,762,000.62,389,000.

MOLINA HEALTHCARE, INC. FORM 10-Q

FOR THE QUARTERLY PERIOD ENDED JuneSeptember 30, 2018

TABLE OF CONTENTS

| | | ITEM NUMBER | ITEM NUMBER | Page | ITEM NUMBER | Page |

| | | |

| PART I - Financial Information | PART I - Financial Information | | PART I - Financial Information | |

| | | |

| 1. | | | | |

| | | |

| 2. | | | | |

| | | |

| 3. | | | | |

| | | |

| 4. | | | | |

| | | |

| | | | |

| | | |

| 1. | | | | |

| | | |

| 1A. | | | | |

| | | |

| 2. | | | | |

| | | |

| 3. | Defaults Upon Senior Securities | Not Applicable. | Defaults Upon Senior Securities | Not Applicable. |

| | | |

| 4. | Mine Safety Disclosures | Not Applicable. | Mine Safety Disclosures | Not Applicable. |

| | | |

| 5. | Other Information | Not Applicable. | Other Information | Not Applicable. |

| | | |

| 6. | | | | |

| | | |

| | | | | |

| | | |

| | | |

CONSOLIDATED STATEMENTS OF OPERATIONS | | | | Three Months Ended June 30, | | Six Months Ended June 30, | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2018 | | 2017 | | 2018 | | 2017 | 2018 | | 2017 | | 2018 | | 2017 |

| | (In millions, except per-share data) (Unaudited) | (In millions, except per-share data) (Unaudited) |

| Revenue: | | | | | | | | | | | | | | |

| Premium revenue | $ | 4,514 |

| | $ | 4,740 |

| | $ | 8,837 |

| | $ | 9,388 |

| $ | 4,337 |

| | $ | 4,777 |

| | $ | 13,174 |

| | $ | 14,165 |

|

| Service revenue | 127 |

| | 129 |

| | 261 |

| | 260 |

| 130 |

| | 130 |

| | 391 |

| | 390 |

|

| Premium tax revenue | 106 |

| | 114 |

| | 210 |

| | 225 |

| 110 |

| | 106 |

| | 320 |

| | 331 |

|

| Health insurer fees reimbursed | 104 |

| | — |

| | 165 |

| | — |

| 83 |

| | — |

| | 248 |

| | — |

|

| Investment income and other revenue | 32 |

| | 16 |

| | 56 |

| | 30 |

| 37 |

| | 18 |

| | 93 |

| | 48 |

|

| Total revenue | 4,883 |

| | 4,999 |

| | 9,529 |

| | 9,903 |

| 4,697 |

| | 5,031 |

| | 14,226 |

| | 14,934 |

|

| Operating expenses: | | | | | | | | | | | | | | |

| Medical care costs | 3,850 |

| | 4,491 |

| | 7,572 |

| | 8,602 |

| 3,790 |

| | 4,220 |

| | 11,362 |

| | 12,822 |

|

| Cost of service revenue | 118 |

| | 124 |

| | 238 |

| | 246 |

| 111 |

| | 123 |

| | 349 |

| | 369 |

|

| General and administrative expenses | 335 |

| | 405 |

| | 687 |

| | 844 |

| 311 |

| | 383 |

| | 998 |

| | 1,227 |

|

| Premium tax expenses | 106 |

| | 114 |

| | 210 |

| | 225 |

| 110 |

| | 106 |

| | 320 |

| | 331 |

|

| Health insurer fees | 99 |

| | — |

| | 174 |

| | — |

| 87 |

| | — |

| | 261 |

| | — |

|

| Depreciation and amortization | 25 |

| | 37 |

| | 51 |

| | 76 |

| 25 |

| | 33 |

| | 76 |

| | 109 |

|

| Restructuring and separation costs | | 5 |

| | 118 |

| | 38 |

| | 161 |

|

| Impairment losses | — |

| | 72 |

| | — |

| | 72 |

| — |

| | 129 |

| | — |

| | 201 |

|

| Restructuring and separation costs | 8 |

| | 43 |

| | 33 |

| | 43 |

| |

| Total operating expenses | 4,541 |

| | 5,286 |

| | 8,965 |

| | 10,108 |

| 4,439 |

| | 5,112 |

| | 13,404 |

| | 15,220 |

|

| Gain on sale of subsidiary | | 37 |

| | — |

| | 37 |

| | — |

|

| Operating income (loss) | 342 |

| | (287 | ) | | 564 |

| | (205 | ) | 295 |

| | (81 | ) | | 859 |

| | (286 | ) |

| Other expenses (income), net: | | | | | | | | |

| Other expenses, net: | | | | | | | | |

| Interest expense | 32 |

| | 27 |

| | 65 |

| | 53 |

| 26 |

| | 32 |

| | 91 |

| | 85 |

|

| Other expense (income), net | 5 |

| | — |

| | 15 |

| | (75 | ) | |

| Total other expenses (income), net | 37 |

| | 27 |

| | 80 |

| | (22 | ) | |

| Other expenses (income), net | | 10 |

| | — |

| | 25 |

| | (75 | ) |

| Total other expenses, net | | 36 |

| | 32 |

| | 116 |

| | 10 |

|

| Income (loss) before income tax expense (benefit) | 305 |

| | (314 | ) | | 484 |

| | (183 | ) | 259 |

| | (113 | ) | | 743 |

| | (296 | ) |

| Income tax expense (benefit) | 103 |

| | (84 | ) | | 175 |

| | (30 | ) | 62 |

| | (16 | ) | | 237 |

| | (46 | ) |

| Net income (loss) | $ | 202 |

| | $ | (230 | ) | | $ | 309 |

| | $ | (153 | ) | $ | 197 |

| | $ | (97 | ) | | $ | 506 |

| | $ | (250 | ) |

| | | | | | | | | | | | | | | |

| Net income (loss) per share: | | | | | | | | | | | | | | |

| Basic | $ | 3.29 |

| | $ | (4.10 | ) | | $ | 5.10 |

| | $ | (2.74 | ) | $ | 3.22 |

| | $ | (1.70 | ) | | $ | 8.32 |

| | $ | (4.44 | ) |

| Diluted | $ | 3.02 |

| | $ | (4.10 | ) | | $ | 4.68 |

| | $ | (2.74 | ) | $ | 2.90 |

| | $ | (1.70 | ) | | $ | 7.60 |

| | $ | (4.44 | ) |

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS)

| | | | Three Months Ended June 30, | | Six Months Ended June 30, | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2018 | | 2017 | | 2018 | | 2017 | 2018 | | 2017 | | 2018 | | 2017 |

| | (Amounts in millions) (Unaudited) | (In millions) (Unaudited) |

| Net income (loss) | $ | 202 |

| | $ | (230 | ) | | $ | 309 |

| | $ | (153 | ) | $ | 197 |

| | $ | (97 | ) | | $ | 506 |

| | $ | (250 | ) |

| Other comprehensive income (loss): | | | | | | | | | | | | | | |

| Unrealized investment gain (loss) | 1 |

| | — |

| | (6 | ) | | 1 |

| 1 |

| | 1 |

| | (5 | ) | | 2 |

|

| Less: effect of income taxes | (1 | ) | | — |

| | (1 | ) | | — |

| — |

| | 1 |

| | (1 | ) | | 1 |

|

| Other comprehensive income (loss), net of tax | 2 |

| | — |

| | (5 | ) | | 1 |

| 1 |

| | — |

| | (4 | ) | | 1 |

|

| Comprehensive income (loss) | $ | 204 |

| | $ | (230 | ) | | $ | 304 |

| | $ | (152 | ) | $ | 198 |

| | $ | (97 | ) | | $ | 502 |

| | $ | (249 | ) |

See accompanying notes.

CONSOLIDATED BALANCE SHEETS | | | | June 30,

2018 | | December 31,

2017 | September 30,

2018 | | December 31,

2017 |

| | (Amounts in millions, except per-share data) | (In millions, except per-share data) |

| | (Unaudited) | | | (Unaudited) | | |

ASSETS | | Current assets: | | | | | | |

| Cash and cash equivalents | $ | 3,392 |

| | $ | 3,186 |

| $ | 2,814 |

| | $ | 3,186 |

|

| Investments | 2,176 |

| | 2,524 |

| 1,812 |

| | 2,524 |

|

| Restricted investments | 80 |

| | 169 |

| — |

| | 169 |

|

| Receivables | 1,148 |

| | 871 |

| 1,346 |

| | 871 |

|

| Prepaid expenses and other current assets | 344 |

| | 239 |

| 486 |

| | 239 |

|

| Derivative asset | 657 |

| | 522 |

| 843 |

| | 522 |

|

| Assets held for sale | 230 |

| | — |

| |

| Total current assets | 8,027 |

| | 7,511 |

| 7,301 |

| | 7,511 |

|

| Property, equipment, and capitalized software, net | 276 |

| | 342 |

| 264 |

| | 342 |

|

| Goodwill and intangible assets, net | 201 |

| | 255 |

| 195 |

| | 255 |

|

| Restricted investments | 117 |

| | 119 |

| 118 |

| | 119 |

|

| Deferred income taxes | 114 |

| | 103 |

| 143 |

| | 103 |

|

| Other assets | 28 |

| | 141 |

| 30 |

| | 141 |

|

| | $ | 8,763 |

| | $ | 8,471 |

| $ | 8,051 |

| | $ | 8,471 |

|

| | | | | | | |

LIABILITIES AND STOCKHOLDERS’ EQUITY | | Current liabilities: | | | | | | |

| Medical claims and benefits payable | $ | 1,920 |

| | $ | 2,192 |

| $ | 2,042 |

| | $ | 2,192 |

|

| Amounts due government agencies | 1,746 |

| | 1,542 |

| 1,030 |

| | 1,542 |

|

| Accounts payable and accrued liabilities | 754 |

| | 366 |

| 824 |

| | 366 |

|

| Deferred revenue | 193 |

| | 282 |

| 178 |

| | 282 |

|

| Current portion of long-term debt | 484 |

| | 653 |

| 296 |

| | 653 |

|

| Derivative liability | 657 |

| | 522 |

| 843 |

| | 522 |

|

| Liabilities held for sale | 66 |

| | — |

| |

| Total current liabilities | 5,820 |

| | 5,557 |

| 5,213 |

| | 5,557 |

|

| Long-term debt | 1,019 |

| | 1,318 |

| 1,019 |

| | 1,318 |

|

| Lease financing obligations | 198 |

| | 198 |

| 198 |

| | 198 |

|

| Other long-term liabilities | 68 |

| | 61 |

| 60 |

| | 61 |

|

| Total liabilities | 7,105 |

| | 7,134 |

| 6,490 |

| | 7,134 |

|

| | | | | | | |

| Stockholders’ equity: | | | | | | |

| Common stock, $0.001 par value, 150 shares authorized; outstanding: 62 shares at June 30, 2018 and 60 shares at December 31, 2017 | — |

| | — |

| |

| Common stock, $0.001 par value, 150 shares authorized; outstanding: 62 shares at September 30, 2018 and 60 shares at December 31, 2017 | | — |

| | — |

|

| Preferred stock, $0.001 par value; 20 shares authorized, no shares issued and outstanding | — |

| | — |

| — |

| | — |

|

| Additional paid-in capital | 1,055 |

| | 1,044 |

| 760 |

| | 1,044 |

|

| Accumulated other comprehensive loss | (11 | ) | | (5 | ) | (10 | ) | | (5 | ) |

| Retained earnings | 614 |

| | 298 |

| 811 |

| | 298 |

|

| Total stockholders’ equity | 1,658 |

| | 1,337 |

| 1,561 |

| | 1,337 |

|

| | $ | 8,763 |

| | $ | 8,471 |

| $ | 8,051 |

| | $ | 8,471 |

|

See accompanying notes.

CONSOLIDATED STATEMENT OF STOCKHOLDERS’ EQUITY

| | | | Common Stock | | Additional Paid-in Capital | | Accumulated Other Comprehensive Loss | | Retained Earnings | | Total | Common Stock | | Additional Paid-in Capital | | Accumulated Other Comprehensive Loss | | Retained Earnings | | Total |

| | Outstanding | | Amount | | Outstanding | | Amount | |

| | (In millions) | (In millions) |

| | (Unaudited) | (Unaudited) |

| Balance at January 1, 2018 | 60 |

| | $ | — |

| | $ | 1,044 |

| | $ | (5 | ) | | $ | 298 |

| | $ | 1,337 |

| 60 |

| | $ | — |

| | $ | 1,044 |

| | $ | (5 | ) | | $ | 298 |

| | $ | 1,337 |

|

| Net income | — |

| | — |

| | — |

| | — |

| | 309 |

| | 309 |

| — |

| | — |

| | — |

| | — |

| | 107 |

| | 107 |

|

| Adoption of Topic 606 | — |

| | — |

| | — |

| | — |

| | 6 |

| | 6 |

| — |

| | — |

| | — |

| | — |

| | 6 |

| | 6 |

|

| Adoption of ASU 2018-02 | — |

| | — |

| | — |

| | (1 | ) | | 1 |

| | — |

| — |

| | — |

| | — |

| | (1 | ) | | 1 |

| | — |

|

| Partial termination of 1.125% Warrants | — |

| | — |

| | (113 | ) | | — |

| | — |

| | (113 | ) | |

| 1.625% Convertible Notes exchange transaction | 2 |

| | — |

| | 108 |

| | — |

| | — |

| | 108 |

| |

| Exchange of 1.625% Notes | | 2 |

| | — |

| | 108 |

| | — |

| | — |

| | 108 |

|

| Other comprehensive loss, net | — |

| | — |

| | — |

| | (5 | ) | | — |

| | (5 | ) | — |

| | — |

| | — |

| | (6 | ) | | — |

| | (6 | ) |

| Share-based compensation | — |

| | — |

| | 16 |

| | — |

| | — |

| | 16 |

| — |

| | — |

| | 1 |

| | — |

| | — |

| | 1 |

|

| Balance at March 31, 2018 | | 62 |

| | — |

| | 1,153 |

| | (12 | ) | | 412 |

| | 1,553 |

|

| Net income | | — |

| | — |

| | — |

| | — |

| | 202 |

| | 202 |

|

| Partial termination of 1.125% Warrants | | — |

| | — |

| | (113 | ) | | — |

| | — |

| | (113 | ) |

| Other comprehensive income, net | | — |

| | — |

| | — |

| | 1 |

| | — |

| | 1 |

|

| Share-based compensation | | — |

| | — |

| | 15 |

| | — |

| | — |

| | 15 |

|

| Balance at June 30, 2018 | 62 |

| | $ | — |

| | $ | 1,055 |

| | $ | (11 | ) | | $ | 614 |

| | $ | 1,658 |

| 62 |

| | — |

| | 1,055 |

| | (11 | ) | | 614 |

| | 1,658 |

|

| Net income | | — |

| | — |

| | — |

| | — |

| | 197 |

| | 197 |

|

| Partial termination of 1.125% Warrants | | — |

| | — |

| | (306 | ) | | — |

| | — |

| | (306 | ) |

| Conversion of 1.625% Notes | | — |

| | — |

| | 4 |

| | — |

| | — |

| | 4 |

|

| Other comprehensive income, net | | — |

| | — |

| | — |

| | 1 |

| | — |

| | 1 |

|

| Share-based compensation | | — |

| |

|

| | 7 |

| | — |

| | — |

| | 7 |

|

| Balance at September 30, 2018 | | 62 |

| | $ | — |

| | $ | 760 |

| | $ | (10 | ) | | $ | 811 |

| | $ | 1,561 |

|

|

| | | | | | | | | | | | | | | | | | | | | | |

| | Common Stock | | Additional Paid-in Capital | | Accumulated Other Comprehensive Loss | | Retained Earnings | | Total |

| | Outstanding | | Amount | | | | |

| | (In millions) |

| | (Unaudited) |

| Balance at January 1, 2017 | 57 |

| | $ | — |

| | $ | 841 |

| | $ | (2 | ) | | $ | 810 |

| | $ | 1,649 |

|

| Net income | — |

| | — |

| | — |

| | — |

| | 77 |

| | 77 |

|

| Other comprehensive income, net | — |

| | — |

| | — |

| | 1 |

| | — |

| | 1 |

|

| Balance at March 31, 2017 | 57 |

| | — |

| | 841 |

| | (1 | ) | | 887 |

| | 1,727 |

|

| Net loss | — |

| | — |

| | — |

| | — |

| | (230 | ) | | (230 | ) |

| Share-based compensation | — |

| | — |

| | 24 |

| | — |

| | — |

| | 24 |

|

| Balance at June 30, 2017 | 57 |

| | — |

| | 865 |

| | (1 | ) | | 657 |

| | 1,521 |

|

| Net loss | — |

| | — |

| | — |

| | — |

| | (97 | ) | | (97 | ) |

| Share-based compensation | — |

| | — |

| | 5 |

| | — |

| | — |

| | 5 |

|

| Balance at September 30, 2017 | 57 |

| | $ | — |

| | $ | 870 |

| | $ | (1 | ) | | $ | 560 |

| | $ | 1,429 |

|

See accompanying notes.

CONSOLIDATED STATEMENTS OF CASH FLOWS

| | | | Six Months Ended June 30, | Nine Months Ended September 30, |

| | 2018 | | 2017 | 2018 | | 2017 |

| | (Amounts in millions)

(Unaudited) | (In millions)

(Unaudited) |

| Operating activities: | | | | | | |

| Net income (loss) | $ | 309 |

| | $ | (153 | ) | $ | 506 |

| | $ | (250 | ) |

| Adjustments to reconcile net income (loss) to net cash provided by operating activities: | | | | |

| Adjustments to reconcile net income (loss) to net cash (used in) provided by operating activities: | | | | |

| Depreciation and amortization | 73 |

| | 96 |

| 104 |

| | 139 |

|

| Impairment losses | — |

| | 72 |

| |

| Deferred income taxes | (6 | ) | | (41 | ) | (32 | ) | | (68 | ) |

| Share-based compensation | 13 |

| | 35 |

| 20 |

| | 38 |

|

| Non-cash restructuring costs | 17 |

| | — |

| 17 |

| | 49 |

|

| Amortization of convertible senior notes and lease financing obligations | 13 |

| | 16 |

| 18 |

| | 24 |

|

| Gain on sale of subsidiary | | (37 | ) | | — |

|

| Loss on debt extinguishment | 15 |

| | — |

| 25 |

| | — |

|

| Impairment losses | | — |

| | 201 |

|

| Other, net | 4 |

| | 7 |

| 6 |

| | 13 |

|

| Changes in operating assets and liabilities: | | | | | | |

| Receivables | (315 | ) | | (32 | ) | (507 | ) | | (28 | ) |

| Prepaid expenses and other current assets | (181 | ) | | (38 | ) | (117 | ) | | (53 | ) |

| Medical claims and benefits payable | (267 | ) | | 148 |

| (144 | ) | | 549 |

|

| Amounts due government agencies | 205 |

| | 642 |

| (511 | ) | | 122 |

|

| Accounts payable and accrued liabilities | 349 |

| | (18 | ) | 398 |

| | 90 |

|

| Deferred revenue | (42 | ) | | (32 | ) | (55 | ) | | 153 |

|

| Income taxes | 127 |

| | (30 | ) | 118 |

| | (22 | ) |

| Net cash provided by operating activities | 314 |

| | 672 |

| |

| Net cash (used in) provided by operating activities | | (191 | ) | | 957 |

|

| Investing activities: | | | | | | |

| Purchases of investments | (914 | ) | | (1,636 | ) | (1,202 | ) | | (1,894 | ) |

| Proceeds from sales and maturities of investments | 1,335 |

| | 874 |

| 2,070 |

| | 1,536 |

|

| Purchases of property, equipment and capitalized software | (14 | ) | | (60 | ) | (24 | ) | | (85 | ) |

| Other, net | (9 | ) | | (24 | ) | (23 | ) | | (33 | ) |

| Net cash provided by (used in) investing activities | 398 |

| | (846 | ) | 821 |

| | (476 | ) |

| Financing activities: | | | | | | |

| Repayment of credit facility | (300 | ) | | — |

| (300 | ) | | — |

|

| Repayment of 1.125% Convertible Notes | (89 | ) | | — |

| |

| Repayment of principal amount of 1.125% Notes | | (236 | ) | | — |

|

| Cash paid for partial settlement of 1.125% Conversion Option | (134 | ) | | — |

| (477 | ) | | — |

|

| Cash received for partial termination of 1.125% Call Option | 134 |

| | — |

| 477 |

| | — |

|

| Cash paid for partial termination of 1.125% Warrants | (113 | ) | | — |

| (419 | ) | | — |

|

| Repayment of principal amount of 1.625% Notes | | (64 | ) | | — |

|

| Proceeds from senior notes offerings, net of issuance costs | — |

| | 325 |

| — |

| | 325 |

|

| Proceeds from borrowings under credit facility | | — |

| | 300 |

|

| Other, net | (1 | ) | | 8 |

| 7 |

| | 7 |

|

| Net cash (used in) provided by financing activities | (503 | ) | | 333 |

| (1,012 | ) | | 632 |

|

| Net increase in cash, cash equivalents, and restricted cash and cash equivalents | 209 |

| | 159 |

| |

| Net (decrease) increase in cash, cash equivalents, and restricted cash and cash equivalents | | (382 | ) | | 1,113 |

|

| Cash, cash equivalents, and restricted cash and cash equivalents at beginning of period | 3,290 |

| | 2,912 |

| 3,290 |

| | 2,912 |

|

| Cash, cash equivalents, and restricted cash and cash equivalents at end of period | $ | 3,499 |

| | $ | 3,071 |

| $ | 2,908 |

| | $ | 4,025 |

|

CONSOLIDATED STATEMENTS OF CASH FLOWS

(continued)

| | | | Six Months Ended June 30, | Nine Months Ended September 30, |

| | 2018 | | 2017 | 2018 | | 2017 |

| | (Amounts in millions)

(Unaudited) | (In millions)

(Unaudited) |

| Supplemental cash flow information: | | | | | | |

| | | | | | | |

| Schedule of non-cash investing and financing activities: | | | | | | |

| Common stock used for share-based compensation | $ | (6 | ) | | $ | (21 | ) | $ | (6 | ) | | $ | (21 | ) |

| | | | | | | |

| Details of sale of subsidiary: | | | | |

| Decrease in carrying amount of assets | | $ | (243 | ) | | $ | — |

|

| Decrease in carrying amount of liabilities | | 59 |

| | — |

|

| Transaction costs | | (12 | ) | | — |

|

| Receivable from buyer - recorded in prepaid expenses and other current assets | | 233 |

| | — |

|

| Gain on sale of subsidiary | | $ | 37 |

| | $ | — |

|

| | | | | |

| Details of change in fair value of derivatives, net: | | | | | | |

| Gain on 1.125% Call Option | $ | 135 |

| | $ | 173 |

| $ | 321 |

| | $ | 158 |

|

| Loss on 1.125% Conversion Option | (135 | ) | | (173 | ) | (321 | ) | | (158 | ) |

| Change in fair value of derivatives, net | $ | — |

| | $ | — |

| $ | — |

| | $ | — |

|

| | | | | | | |

| 1.625% Convertible Notes exchange transaction: | | | | |

| Common stock issued in exchange for 1.625% Convertible Notes | $ | 131 |

| | $ | — |

| |

| Component of 1.625% Convertible Notes allocated to additional paid-in capital, net of income taxes | (23 | ) | | — |

| |

| 1.625% Notes exchange transaction: | | | | |

| Common stock issued in exchange for 1.625% Notes | | $ | 131 |

| | $ | — |

|

| Component of 1.625% Notes allocated to additional paid-in capital, net of income taxes | | (23 | ) | | — |

|

| Net increase to additional paid-in capital | $ | 108 |

| | $ | — |

| $ | 108 |

| | $ | — |

|

See accompanying notes.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

JuneSeptember 30, 2018

1. Organization and Basis of Presentation

Organization and Operations

Molina Healthcare, Inc. provides quality managed health care to people receiving government assistance. We offer cost-effective Medicaid-related solutions to meet the health care needs of low-income families and individuals, and to assist government agencies in their administration of the Medicaid program. We have three reportable segments. These segments, consistconsisting of our Health Plans segment, which constitutes the vast majority of our operations; our Molina Medicaid Solutions segment; and our Other segment.

The Health Plans segment consists of health plans operating in 13 states and the Commonwealth of Puerto Rico. As of JuneSeptember 30, 2018, these health plans served approximately 4.14.0 million members eligible for Medicaid, Medicare, and other government-sponsored health care programs for low-income families and individuals. This membership includes Affordable Care Act Marketplace (Marketplace) members, most of whom receive government premium subsidies. The health plans are operated by our respective wholly owned subsidiaries in those states, each of which is licensed as a health maintenance organization (HMO).

Our health plans’ state Medicaid contracts generally have terms of three to five years. These contracts typically contain renewal options exercisable by the state Medicaid agency, and allow either the state or the health plan to terminate the contract with or without cause. Such contracts are subject to risk of loss in states that issue requests for proposal (RFP) open to competitive bidding by other health plans. If one of our health plans is not a successful responsive bidder to a state RFP, its contract may not be renewed.

In addition to contract renewal, our state Medicaid contracts may be periodically amended to include or exclude certain health benefits (such as pharmacy services, behavioral health services, or long-term care services); populations such as the aged, blind or disabled (ABD); and regions or service areas.

The Molina Medicaid Solutions segment provides support to state government agencies’ administration of their Medicaid programs, including business processing, information technology development and administrative services. The Other segment includes primarily our Pathways behavioral health and social services provider subsidiary (Pathways), and corporate amounts not allocated to other reportable segments.

Recent Developments – Health Plans Segment

New Mexico Health Plan. In our Annual Report on Form 10-K for 2017, we reported that we were notified by the New Mexico Medicaid agency that we had not been selected for a tentative award of a 2019 Medicaid contract. A hearing was held on our judicial protest on October 17, 2018, with a decision expected in the fourth quarter of 2018. Regardless of the court’s decision on our protest, we would have further rights of appeal. We are continuing to manage the business in run-off until such time as a different outcome is determined. As of September 30, 2018, we served approximately 206,000 Medicaid members in New Mexico, which represented premium revenue of $891 million for the nine months ended September 30, 2018.

Puerto Rico Health Plan. In July 2018, our Puerto Rico health plan was selected by the Puerto Rico Health Insurance Administration to be one of the organizations to administer the Commonwealth’s new Medicaid Managed Care contract. ServicesWe expect to serve approximately 290,000 members under the new contract, currently expected to begin on November 1, 2018, would cover the entire island.contract. The base contract runs for a period of three years with an optional one yearone-year extension. As of JuneSeptember 30, 2018, we served approximately 326,000320,000 Medicaid members in the East and Southwest regions of Puerto Rico, which represented premium revenue of $370$549 million for the sixnine months ended JuneSeptember 30, 2018.

Florida Health Plan. In June 2018, our Florida health plan was awarded comprehensive Medicaid Managed Care contracts by the Florida Agency for Health Care Administration (AHCA) in Regions 8 and 11 of the Florida Statewide Medicaid Managed Care Invitation to Negotiate. As of JuneSeptember 30, 2018, we served approximately 96,000 Medicaid members in those regions, which represented premium revenue of approximately $232$346 million for the sixnine months ended JuneSeptember 30, 2018. Services under the new contract are expected to begin on January 1, 2019. We will be serving both the Medicaid and long-term care populations in the two regions.

Washington Health Plan. In May 2018, our Washington health plan was selected by the Washington State Health Care Authority (HCA) to enter into a managed care contract for the eight remaining regions of the state’s Apple Health Integrated Managed Care program, in addition to the two regions previously awarded to us. We were

selected by HCA for the following regions: Greater Columbia, King, North Sound, Pierce, and Spokane beginning January 1, 2019; and Salish, Thurston-Mason, and Great Rivers beginning January 1, 2020. As of JuneSeptember 30, 2018, we served approximately 742,000738,000 Medicaid members in Washington, which represented premium revenue of $1,083$1,558 million for the sixnine months ended JuneSeptember 30, 2018.

Recent Developments – Molina Medicaid Solutions Segment

In June 2018, we entered into a definitive agreement to sellWe closed on the sale of Molina Medicaid Solutions (MMS) to DXC Technology Company.Company on September 30, 2018. The divestiture, expected to close innet cash selling price for the third quarterequity interests of 2018, is subject to the satisfactionMMS was $233 million, which we received on October 1, 2018. As a result of customary

closing conditions and the receiptthis transaction, we recognized a pretax gain, net of certain third party consents and regulatory approvals.transaction costs, of $37 million. Refer to Note 11, “Segments,” for further information.

Subsequent Event – Other Segment

On October 19, 2018, we sold our Pathways subsidiary to Pyramid Health Holdings, LLC for a nominal purchase price. We expect to record a loss on sale of subsidiary amounting to approximately $40 million, net of income tax benefits.

Presentation and Reclassification

We have reclassified certain amounts in the 2017 consolidated statement of cash flows to conform to the 2018 presentation, relating to the presentation of restricted cash and cash equivalents. The reclassification is a result of our adoption of Accounting Standards Update (ASU) 2016-18, Restricted Cash effective January 1, 2018. See Note 2, “Significant Accounting Policies,” for further information, including the amount reclassified.

We have combined certain line items in the accompanying consolidated balance sheets. For all periods presented, we have combined the presentation of:

Income taxes refundable with “Prepaid expenses and other current assets;”

Income taxes payable with “Accounts payable and accrued liabilities;”

Goodwill, and intangible assets, net to a single line; and

Deferred contract costs with “Other assets.”

Consolidation and Interim Financial Information

The consolidated financial statements include the accounts of Molina Healthcare, Inc., its subsidiaries, and variable interest entities (VIEs) in which Molina Healthcare, Inc. is considered to be the primary beneficiary. Such VIEs are insignificant to our consolidated financial position and results of operations. In the opinion of management, all adjustments considered necessary for a fair presentation of the results as of the date and for the interim periods presented have been included; such adjustments consist of normal recurring adjustments. All significant intercompany balances and transactions have been eliminated. The consolidated results of operations for the sixnine months ended JuneSeptember 30, 2018 are not necessarily indicative of the results for the entire year ending December 31, 2018.

The unaudited consolidated interim financial statements have been prepared under the assumption that users of the interim financial data have either read or have access to our audited consolidated financial statements for the fiscal year ended December 31, 2017. Accordingly, certain disclosures that would substantially duplicate the disclosures contained in our December 31, 2017 audited consolidated financial statements have been omitted. These unaudited consolidated interim financial statements should be read in conjunction with our audited consolidated financial statements for the fiscal year ended December 31, 2017.

2. Significant Accounting Policies

Cash and Cash Equivalents

Cash and cash equivalents consist of cash and short-term, highly liquid investments that are both readily convertible into known amounts of cash and have a maturity of three months or less on the date of purchase. The following table provides a reconciliation of cash, cash equivalents, and restricted cash and cash equivalents reported within the accompanying consolidated balance sheets that sum to the total of the same such amounts presented in the accompanying consolidated statements of cash flows. The restricted cash and cash equivalents presented below are included in non-current “Restricted investments” in the accompanying consolidated balance sheets.

| | | | Six Months Ended June 30, | Nine Months Ended September 30, |

| | 2018 | | 2017 | 2018 | | 2017 |

| | (In millions) | (In millions) |

| Cash and cash equivalents | $ | 3,392 |

| | $ | 2,979 |

| $ | 2,814 |

| | $ | 3,934 |

|

| Restricted cash and cash equivalents | 98 |

| | 92 |

| 94 |

| | 91 |

|

| Cash and cash equivalents reported in assets held for sale | 9 |

| | — |

| |

| Total cash, cash equivalents, and restricted cash and cash equivalents presented in the statements of cash flows | $ | 3,499 |

| | $ | 3,071 |

| $ | 2,908 |

| | $ | 4,025 |

|

Revenue Recognition

We adopted ASU 2014-09, Revenue from Contracts with Customers (Topic 606) effective January 1, 2018, using the modified retrospective approach. The insurance contracts of our Health Plans segment, which segment constitutes the vast majority of our operations, are excluded from the scope of Topic 606 because the recognition of revenue under these contracts is dictated by other accounting standards governing insurance contracts. The cumulative effect of initially applying the guidance, relating entirely to our Molina Medicaid Solutions segment contracts, resulted in an immaterial impact to beginning retained earnings, as presented in the accompanying consolidated statement of stockholders’ equity. Topic 606 was only applied to service contracts that were not completed as of December 31, 2017. Refer to “Molina Medicaid Solutions segment” and “Other segment” below for further information.

Health Plans segment

Premium revenue is fixed in advance of the periods covered and, except as described below, is not generally subject to significant accounting estimates. Premium revenues are recognized in the month that members are entitled to receive health care services, and premiums collected in advance are deferred. Certain components of premium revenue are subject to accounting estimates and fall into two broad categories discussed in further detail below: 1) “Contractual Provisions That May Adjust or Limit Revenue or Profit;” and 2) “Quality Incentives.” Liabilities recorded for such provisions are included in “Amounts due government agencies” in the accompanying consolidated balance sheets.

| |

| 1) | Contractual Provisions That May Adjust or Limit Revenue or Profit: |

Medicaid

Medical Cost Floors (Minimums), and Medical Cost Corridors: APursuant to certain contract provisions, a portion of our premium revenue may be returned if certain minimum amounts are not spent on defined medical care costs. In the aggregate, we recorded a liability under the terms of such contract provisions of $144$198 million and $135 million at JuneSeptember 30, 2018 and December 31, 2017, respectively. Approximately $97$144 million and $96 million of thethis liability accrued at JuneSeptember 30, 2018 and December 31, 2017, respectively, relates to our participation in Medicaid Expansion programs. Refer to Note 12, “Commitments and Contingencies,” for further information regarding the California Medicaid Expansion program.

Retroactive Premium Adjustments: State Medicaid programs periodically adjust premium rates on a retroactive basis. In these cases, we must adjust our premium revenue in the period in which we learn of the adjustment, rather than in the months of service to which the retroactive adjustment applies.

Medicare

Minimum MLR: Federal regulations haveThe Affordable Care Act (ACA) has established a minimum annual medical loss ratio (Minimum MLR) of 85% for Medicare. The medical loss ratio represents medical costs as a percentage of premium revenue. Federal regulations define what constitutes medical costs and premium revenue. If the Minimum MLR is not met, we may be required to pay rebates to the federal government. We recognize estimated rebates under the Minimum MLR as an adjustment to premium revenue in our consolidated statements of operations. The payable for the Medicare Minimum MLR was not significant at September 30, 2018 and December 31, 2017.

Marketplace

Risk adjustment: Under this program, our health plans’ composite risk scores are compared with the overall average risk score for the relevant state and market pool. Generally, our health plans will make a risk adjustment payment into the pool if their composite risk scores are below the average risk score, and will receive a risk adjustment payment from the pool if their composite risk scores are above the average risk score. We estimate our ultimate premium based on insurance policy year-to-date experience, and recognize estimated premiums relating to the risk adjustment program as an adjustment to premium

revenue in our consolidated statements of operations. As of JuneSeptember 30, 2018, and December 31, 2017, the Marketplace risk adjustment payable amounted to $1,159$390 million and $912 million, respectively. Refer to Note 12, “Commitments and Contingencies,” for further information regarding recent developments in the Marketplace risk adjustment program.

Minimum MLR: The Affordable Care Act (ACA)ACA has established a Minimum MLR of 80% for the Marketplace. If the Minimum MLR is not met, we may be required to pay rebates to our Marketplace policyholders. The Marketplace risk adjustment program is taken into consideration when computing the Minimum MLR. We recognize estimated rebates under the Minimum MLR as an adjustment to premium revenue in our consolidated statements of operations. The payable for the Marketplace Minimum MLR was not significant at September 30, 2018 and December 31, 2017.

At many of our health plans, revenue ranging from approximately 1% to 3% of certain health plan premiums is earned only if certain performance measures are met.

The following table quantifies the quality incentive premium revenue recognized for the periods presented, including the amounts earned in the periods presented and prior periods. Although the reasonably possible effects of a change in estimate related to quality incentive premium revenue as of JuneSeptember 30, 2018 are not known, we have no reason to believe that the adjustments to prior years noted below are not indicative of the potential future changes in our estimates as of JuneSeptember 30, 2018.

|

| | | | | | | | | | | | | | | |

| | Three Months Ended June 30, | | Six Months Ended June 30, |

| | 2018 | | 2017 | | 2018 | | 2017 |

| | (Dollars in millions) |

| Maximum available quality incentive premium - current period | $ | 47 |

| | $ | 39 |

| | $ | 87 |

| | $ | 77 |

|

| Quality incentive premium revenue recognized in current period: | | | | | | | |

| Earned current period | $ | 34 |

| | $ | 29 |

| | $ | 58 |

| | $ | 48 |

|

| Earned prior periods | 12 |

| | 1 |

| | 23 |

| | 6 |

|

| Total | $ | 46 |

| | $ | 30 |

| | $ | 81 |

| | 54 |

|

| | | | | | | | |

| Quality incentive premium revenue recognized as a percentage of total premium revenue | 1.0 | % | | 0.6 | % | | 0.9 | % | | 0.6 | % |

Molina Medicaid Solutions segment

MMS is under contract with Medicaid agencies in six states and the U.S. Virgin Islands. Our existing contracts have terms that currently extend to 2018 through 2025, before renewal options. As of June 30, 2018, the aggregate amount of service revenue relating to unsatisfied performance obligations amounted to approximately $638 million.

Business process outsourcing services are billed immediately following the end of the month in which such services are performed, with payment received soon thereafter. Payments for the design, development and implementation (DDI) of Medicaid management information systems milestones are received following our performance, and the customer’s acceptance, of the milestone deliverable. However, recognition of DDI revenue is deferred until the system ‘go-live’ date, and is amortized over the initial contract hosting period. |

| | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2018 | | 2017 | | 2018 | | 2017 |

| | (Dollars in millions) |

| Maximum available quality incentive premium - current period | $ | 48 |

| | $ | 36 |

| | $ | 135 |

| | $ | 113 |

|

| Quality incentive premium revenue recognized in current period: | | | | | | | |

| Earned current period | $ | 39 |

| | $ | 24 |

| | $ | 97 |

| | $ | 72 |

|

| Earned prior periods | 9 |

| | 3 |

| | 32 |

| | 9 |

|

| Total | $ | 48 |

| | $ | 27 |

| | $ | 129 |

| | 81 |

|

| | | | | | | | |

| Quality incentive premium revenue recognized as a percentage of total premium revenue | 1.1 | % | | 0.6 | % | | 1.0 | % | | 0.6 | % |

Other segment

Our Pathways behavioral health subsidiary’s revenue is all variable, and generally invoiced after services are rendered; customer payment follows invoicing. We have concluded that there is no change to revenue recognition under Topic 606 for our Pathways, behavioral health subsidiary, and therefore no impact to retained earnings effective January 1, 2018.

The following table presents the opening As discussed in Note 1, “Organization and closing balancesBasis of receivables, deferred contract costs (contract assets), and deferred revenue (contract liabilities) from contracts with customers, by segment.

|

| | | | | | | |

| | June 30,

2018 | | December 31,

2017 |

| | (In millions) |

| Receivables: | | | |

| Molina Medicaid Solutions | $ | 34 |

| | $ | 30 |

|

| Other | 40 |

| | 44 |

|

| Deferred contract costs (contract assets) – Molina Medicaid Solutions | 109 |

| | 101 |

|

| Deferred revenue (contract liabilities) – Molina Medicaid Solutions | 39 |

| | 49 |

|

Medical Care Costs - Marketplace Cost Share Reduction (CSR) Update

DuringIn the first half ofnine months ended September 30, 2018, we recognized a benefit of approximately $76$81 million in reduced medical expense related to 2017 dates of service, including $5 million in the third quarter of 2018, as a result of the federal government’s confirmation that the reconciliation of 2017 Marketplace CSR subsidies would be performed on an annual basis. In the fourth quarter of 2017, we had assumed

a nine-month reconciliation of this item pending confirmation of the time period to which the 2017 reconciliation would be applied.

Concentrations of Credit Risk

Financial instruments that potentially subject us to concentrations of credit risk consist primarily of cash and cash equivalents, investments, receivables, and restricted investments. Our investments and a portion of our cash equivalents are managed by professional portfolio managers operating under documented investment guidelines. Our portfolio managers must obtain our prior approval before selling investments where the loss position of those investments exceeds certain levels. Our investments consist primarily of investment-grade debt securities with a maximum maturity of 10 years and an average duration of three years or less. Restricted investments are invested principally in certificates of deposit and U.S. treasury securities. Concentration of credit risk with respect to accounts receivable is generally limited because our payors consist principally of the governments of each state in which our health plan subsidiaries operate.

Income Taxes

The provision for income taxes is determined using an estimated annual effective tax rate, which generally differs from the U.S. federal statutory rate primarily because of state taxes, nondeductible expenses such as the Health Insurer Fee (HIF), certain compensation, and other general and administrative expenses. The effective tax rate was not impacted by HIF in 2017 given the 2017 HIF moratorium.

The effective tax rate may be subject to fluctuations during the year as new information is obtained. Such information may affect the assumptions used to estimate the annual effective tax rate, including projected pretax earnings, the mix of pretax earnings in the various tax jurisdictions in which we operate, valuation allowances against deferred tax assets, the recognition or the reversal of the recognition of tax benefits related to uncertain tax positions, and changes in or the interpretation of tax laws in jurisdictions where we conduct business. We recognize deferred tax assets and liabilities for temporary differences between the financial reporting basis and the tax basis of our assets and liabilities, along with net operating loss and tax credit carryovers.

The Tax Cuts and Jobs Act (TCJA) was enacted on December 22, 2017. The TCJA, in part, reduced the U.S. federal statutory corporate income tax rate from 35% to 21% effective January 1, 2018. Accounting guidance allows filers a measurement period of one year subsequent tofrom the end of the tax yearenactment date to finalize the provisional valuation of deferred tax assets and liabilities. During the third quarter of 2018, we recognized approximately $4 million in adjustments to our provisional valuation of our deferred tax assets and liabilities recorded at December 31, 2017, and included these adjustments as a component of income tax expense from continuing operations, which decreased our effective tax rate by 150 basis points in the quarter. At JuneSeptember 30, 2018, we had not completed our accounting for the tax effects resulting from enactment of TCJA with respect to valuation of our deferred tax assets and liabilities. We will continue to make and refine our calculations as additional analysis is completed. In addition, our estimates may also be affected as we gain a more thorough understanding ofby expected future guidance on the tax law based on expected future guidance from the Internal Revenue Service and U.S. Treasury.

Recent Accounting Pronouncements Adopted

Revenue Recognition (Topic 606). See discussion above, in “Revenue Recognition.”

Comprehensive Income. In February 2018, the Financial Accounting Standards Board (FASB) issued ASU 2018-02, Reclassification of Certain Tax Effects from Accumulated Other Comprehensive Income, which allows a reclassification from accumulated other comprehensive income to retained earnings for stranded tax effects resulting from the TCJA. ASU 2018-02 is effective beginning January 1, 2019; we early adopted this ASU effective January 1, 2018. The effect of applying the guidance resulted in an immaterial impact to beginning retained earnings, as presented in the accompanying consolidated statement of stockholders’ equity.

Restricted Cash. In November 2016, the FASB issued ASU 2016-18, Restricted Cash, which requires us to include in our consolidated statements of cash flows the changes in the balances of cash, cash equivalents, restricted cash and restricted cash equivalents. We adopted ASU 2016-18 on January 1, 2018. We have applied the guidance retrospectively to all periods presented. Such retrospective adoption resulted in a $92$91 million reclassification of restricted cash and cash equivalents from “Investing activities”activities,” to the beginning and ending balances of cash and cash equivalents in our consolidated statements of cash flows for the sixnine months ended JuneSeptember 30, 2017. There was no impact to our consolidated statements of operations, balance sheets, or stockholders’ equity. The reconciliation of cash and cash equivalents to cash, cash equivalents, and restricted cash and cash equivalents is presented at the beginning of this note.

Recent Accounting Pronouncements Not Yet Adopted

Software Licenses. In August 2018, the FASB issued ASU 2018-15, Customer’s Accounting for Implementation Costs Incurred in a Cloud Computing Arrangement That Is a Service Contract, which aligns the requirements for capitalizing implementation costs incurred in a hosting arrangement that is a service contract with the requirements for capitalizing implementation costs incurred to develop or obtain internal-use software. ASU 2018-15 is effective beginning January 1, 2020, and can be applied either retrospectively or prospectively to all implementation costs incurred after the date of adoption; early adoption is permitted. We are evaluating the effect of this guidance.

Callable Debt Securities. In March 2017, the FASB issued ASU 2017-08, Premium Amortization on Purchased Callable Debt Securities, which shortens the amortization period for certain callable debt securities held at a premium. Specifically, the amendments require the premium to be amortized to the earliest call date. ASU 2017-08 is effective beginning January 1, 2019, and must be adopted as a cumulative effect adjustment to retained earnings; early adoption is permitted. We are evaluating the effect of this guidance.

Credit Losses. In June 2016, the FASB issued ASU 2016-13, Measurement of Credit Losses on Financial Instruments. Rather than generally recognizing credit losses when it is probable that the loss has been incurred, the

revised guidance requires companies to recognize an allowance for credit losses for the difference between the amortized cost basis of a financial instrument and the amount of amortized cost that the company expects to collect over the instrument’s contractual life. ASU 2016-13 is effective beginning January 1, 2020, and must be adopted as a cumulative effect adjustment to retained earnings; early adoption is permitted. We are evaluating the effect of this guidance.

Leases. In February 2016, the FASB issued ASU 2016-02, Leases (Topic 842), as modified by by:

ASU 2017-03, Transition and Open Effective Date InformationInformation;

ASU 2018-01, and Leases (Topic 842): Land Easement Practical Expedient for Transition to Topic 842;

ASU 2018-10, Codification Improvements to Topic 842, LeasesLeases; and

ASU 2018-11, . Leases (Topic 842): Targeted Improvements.

Under ASU 2016-02,Topic 842, an entity will be required to recognize assets and liabilities for the rights and obligations created by leases on the entity’s balance sheet for both financing and operating leases. For leases with a term of 12 months or less, an entity may elect to not recognize lease assets and lease liabilities and expense the lease over a straight-line basis for the term of the lease. ASU 2016-02 will requireTopic 842 also requires new disclosures that depict the amount, timing,

and uncertainty of cash flows pertaining to an entity’s leases. ASU 2016-02 must be adoptedWe will adopt Topic 842 effective January 1, 2019, using athe modified retrospective approach for annual and interim periods beginning after December 15, 2018. Early adoption is permitted.method. Under this method, we will recognize the cumulative effect of initially applying the standard as an adjustment to the opening balance of retained earnings on January 1, 2019. In addition, we have elected the transition option provided under ASU 2018-11, which allows entities to continue to apply the legacy guidance in Topic 840, Leases, including its disclosure requirements, in the comparative periods presented in the year of adoption.

Under Topic 842, we will record right of useright-of-use assets and liabilities relating primarily to our long-term office operating leases. We are currently updatinghave substantially completed the configuration of our lease database management system for the adoption of Topic 842; we842. We do not currently expect the adoption of this guidance to have a material effect on our consolidated results of operations, financial condition or cash flows.

3. Net Income (Loss) per Share

The following table sets forth the calculation of basic and diluted net income (loss) per share: | | | | Three Months Ended June 30, | | Six Months Ended June 30, | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2018 | | 2017 | | 2018 | | 2017 | 2018 | | 2017 | | 2018 | | 2017 |

| | (In millions, except net income per share) | (In millions, except net income per share) |

| Numerator: | | | | | | | | | | | | | | |

| Net income (loss) | $ | 202 |

| | $ | (230 | ) | | $ | 309 |

| | $ | (153 | ) | $ | 197 |

| | $ | (97 | ) | | $ | 506 |

| | $ | (250 | ) |

| Denominator: | | | | | | | | | | | | | | |

| Shares outstanding at the beginning of the period | 61 |

| | 56 |

| | 59 |

| | 56 |

| 61.3 |

| | 56.5 |

| | 59.3 |

| | 55.8 |

|

| Weighted-average number of shares issued: | | | | | | | | | | | | | | |

1.625% Exchange (1) | — |

| | — |

| | 2 |

| | — |

| |

Exchange of 1.625% Notes (1) | | — |

| | — |

| | 1.3 |

| | — |

|

| Stock-based compensation | | — |

| | — |

| | 0.2 |

| | 0.4 |

|

| Denominator for basic net income per share | 61 |

| | 56 |

| | 61 |

| | 56 |

| 61.3 |

| | 56.5 |

| | 60.8 |

| | 56.2 |

|

| Effect of dilutive securities: | | | | | | | | | | | | | | |

1.625% Convertible Notes (1) | 1 |

| | — |

| | — |

| | — |

| |

1.125% Warrants (1) | 5 |

| | — |

| | 5 |

| | — |

| 5.6 |

| | — |

| | 5.0 |

| | — |

|

1.625% Notes (1) | | 0.6 |

| | — |

| | 0.5 |

| | — |

|

| Stock-based compensation | | 0.4 |

| | — |

| | 0.3 |

| | — |

|

| Denominator for diluted net income per share | 67 |

| | 56 |

| | 66 |

| | 56 |

| 67.9 |

| | 56.5 |

| | 66.6 |

| | 56.2 |

|

| | | | | | | | | | | | | | | |

Net income (loss) per share: (2) | | | | | | | | | | | | | | |

| Basic | $ | 3.29 |

| | $ | (4.10 | ) | | $ | 5.10 |

| | $ | (2.74 | ) | $ | 3.22 |

| | $ | (1.70 | ) | | $ | 8.32 |

| | $ | (4.44 | ) |

| Diluted | $ | 3.02 |

| | $ | (4.10 | ) | | $ | 4.68 |

| | $ | (2.74 | ) | $ | 2.90 |

| | $ | (1.70 | ) | | $ | 7.60 |

| | $ | (4.44 | ) |

| | | | | | | | | | | | | | | |

| Potentially dilutive common shares excluded from calculations: | | | | | | | | | | | | | | |

1.125% Warrants (1) | — |

| | 2 |

| | — |

| | 1 |

| — |

| | 2.3 |

| | — |

| | 1.3 |

|

1.625% Notes (1) | | — |

| | 0.6 |

| | — |

| | 0.3 |

|

| Stock-based compensation | | — |

| | 0.2 |

| | — |

| | 0.3 |

|

| |

| (1) | For more information and definitions regarding the 1.625% Exchange and the 1.625% Convertible Notes, refer to Note 7, “Debt.” For more information and definitions regarding the 1.125% Warrants, refer to Note 9, “Stockholders' Equity.” The dilutive effect of all potentially dilutive common shares is calculated using the treasury stock method. Certain potentially dilutive common shares issuable are not included in the computation of diluted net income (loss) per share because to do so would be anti-dilutive. For the three and six months ended June 30, 2017, the 1.125% Warrants were not included in diluted shares outstanding because to do so would have been anti-dilutive. |

| |

| (2) | Source data for calculations in thousands. |

4. Fair Value Measurements

We consider the carrying amounts of cash, cash equivalents and other current assets and current liabilities (not including derivatives and the current portion of long-term debt, and certain accounts reported in assets and liabilities held for sale)debt) to approximate their fair values because of the relatively short period of time between the origination of these instruments and their expected realization or payment. For our financial instruments measured at fair value on a recurring basis, we prioritize the inputs used in measuring fair value according to the three-tier fair value hierarchy. For a description of the methods and assumptions that we use to a) estimate the fair value; and b) determine the classification according to the fair value hierarchy for each financial instrument, see Note 4, “Fair Value Measurements,” in our 2017 Annual Report on Form 10-K.

Derivative financial instruments include the 1.125% Call Option derivative asset and the 1.125% Conversion Option derivative liability.liability (see Note 8 “Derivatives,” for definitions and further information). These derivatives are not actively traded and are valued based on an option pricing model that uses observable and unobservable market data for inputs. Significant market data inputs used to determine fair value as of JuneSeptember 30, 2018, included the price of our common stock, the time to maturity of the derivative instruments, the risk-free interest rate, and the implied volatility of our common stock. As described further in Note 8, “Derivatives,” theThe 1.125% Call Option derivative asset and the 1.125% Conversion Option

derivative liability were designed such that changes in their fair values would offset, with minimal impact to the consolidated statements of operations. Therefore, the sensitivity of changes in the unobservable inputs to the option pricing model for such derivative instruments is mitigated.

The net changes in fair value of Level 3 financial instruments were insignificant to our results of operations for the sixnine months ended JuneSeptember 30, 2018.

Our financial instruments measured at fair value on a recurring basis at JuneSeptember 30, 2018, were as follows: | | | | Total | | Quoted Market Prices (Level 1) | | Significant Other Observable Inputs (Level 2) | | Significant Unobservable Inputs (Level 3) | Total | | Quoted Market Prices (Level 1) | | Significant Other Observable Inputs (Level 2) | | Significant Unobservable Inputs (Level 3) |

| | (In millions) | (In millions) |

| Corporate debt securities | $ | 1,382 |

| | $ | — |

| | $ | 1,382 |

| | $ | — |

| $ | 1,191 |

| | $ | — |

| | $ | 1,191 |

| | $ | — |

|

| U.S. treasury notes | 330 |

| | 330 |

| | — |

| | — |

| 221 |

| | 221 |

| | — |

| | — |

|

| Government-sponsored enterprise securities (GSEs) | 207 |

| | 207 |

| | — |

| | — |

| 170 |

| | 170 |

| | — |

| | — |

|

| Municipal securities | 136 |

| | — |

| | 136 |

| | — |

| 119 |

| | — |

| | 119 |

| | — |

|

| Asset-backed securities | 99 |

| | — |

| | 99 |

| | — |

| 92 |

| | — |

| | 92 |

| | — |

|

| Certificate of deposit | 19 |

| | — |

| | 19 |

| | — |

| 15 |

| | — |

| | 15 |

| | — |

|

| Other | 3 |

| | — |

| | 3 |

| | — |

| 4 |

| | — |

| | 4 |

| | — |

|

| Subtotal - current investments | 2,176 |

| | 537 |

| | 1,639 |

| | — |

| 1,812 |

| | 391 |

| | 1,421 |

| | — |

|

| Corporate debt securities | 55 |

| | — |

| | 55 |

| | — |

| |

| U.S. treasury notes | 25 |

| | 25 |

| | — |

| | — |

| |

| Subtotal - current restricted investments | 80 |

| | 25 |

| | 55 |

| | — |

| |

| 1.125% Call Option derivative asset | 657 |

| | — |

| | — |

| | 657 |

| 843 |

| | — |

| | — |

| | 843 |

|

| Total assets | $ | 2,913 |

| | $ | 562 |

| | $ | 1,694 |

| | $ | 657 |

| $ | 2,655 |

| | $ | 391 |

| | $ | 1,421 |

| | $ | 843 |

|

| | | | | | | | | | | | | | | |

| 1.125% Conversion Option derivative liability | $ | 657 |

| | $ | — |

| | $ | — |

| | $ | 657 |

| $ | 843 |

| | $ | — |

| | $ | — |

| | $ | 843 |

|

| Total liabilities | $ | 657 |

| | $ | — |

| | $ | — |

| | $ | 657 |

| $ | 843 |

| | $ | — |

| | $ | — |

| | $ | 843 |

|

Our financial instruments measured at fair value on a recurring basis at December 31, 2017, were as follows: |

| | | | | | | | | | | | | | | |

| | Total | | Quoted Market Prices (Level 1) | | Significant Other Observable Inputs (Level 2) | | Significant Unobservable Inputs (Level 3) |

| | (In millions) |

| Corporate debt securities | $ | 1,588 |

| | $ | — |

| | $ | 1,588 |

| | $ | — |

|

| U.S. treasury notes | 388 |

| | 388 |

| | — |

| | — |

|

| GSEs | 253 |

| | 253 |

| | — |

| | — |

|

| Municipal securities | 141 |

| | — |

| | 141 |

| | — |

|

| Asset-backed securities | 117 |

| | — |

| | 117 |

| | — |

|

| Certificates of deposit | 37 |

| | — |

| | 37 |

| | — |

|

| Subtotal - current investments | 2,524 |

| | 641 |

| | 1,883 |

| | — |

|

| Corporate debt securities | 101 |

| | — |

| | 101 |

| | — |

|

| U.S. treasury notes | 68 |

| | 68 |

| | — |

| | — |

|

| Subtotal - current restricted investments | 169 |

| | 68 |

| | 101 |

| | — |

|

| 1.125% Call Option derivative asset | 522 |

| | — |

| | — |

| | 522 |

|

| Total assets | $ | 3,215 |

| | $ | 709 |

| | $ | 1,984 |

| | $ | 522 |

|

| | | | | | | | |

| 1.125% Conversion Option derivative liability | $ | 522 |

| | $ | — |

| | $ | — |

| | $ | 522 |

|

| Total liabilities | $ | 522 |

| | $ | — |

| | $ | — |

| | $ | 522 |

|

Fair Value Measurements – Disclosure Only

The carrying amounts and estimated fair values of our senior notes are classified as Level 2 financial instruments. Fair value for these securities is determined using a market approach based on quoted market prices for similar securities in active markets or quoted prices for identical securities in inactive markets. The carrying amount and estimated fair value of the amount due under our Credit Facility was classified as a Level 3 financial instrument, because certain inputs used to determine its fair value were not observable. The carrying amount of the amount due under the Credit Facility as of December 31, 2017, approximated its fair value because the Credit Facility’s interest rate is a variable rate that approximates rates currently available to us.

| | | | June 30, 2018 | | December 31, 2017 | September 30, 2018 | | December 31, 2017 |

| | Carrying Amount | |

Fair Value | | Carrying Amount | |

Fair Value | Carrying Amount | |

Fair Value | | Carrying Amount | |

Fair Value |

| | (In millions) | (In millions) |

| 5.375% Notes | $ | 693 |

| | $ | 706 |

| | $ | 692 |

| | $ | 730 |

| $ | 693 |

| | $ | 711 |

| | $ | 692 |

| | $ | 730 |

|

1.125% Convertible Notes (1) | 420 |

| | 1,099 |

| | 496 |

| | 1,052 |

| |

1.125% Notes (1) | | 295 |

| | 1,142 |

| | 496 |

| | 1,052 |

|

| 4.875% Notes | 326 |

| | 320 |

| | 325 |

| | 329 |

| 326 |

| | 325 |

| | 325 |

| | 329 |

|

| 1.625% Convertible Notes | 63 |

| | 107 |

| | 157 |

| | 220 |

| |

1.625% Notes (2) | | — |

| | — |

| | 157 |

| | 220 |

|

Credit Facility | — |

| | — |

| | 300 |

| | 300 |

| — |

| | — |

| | 300 |

| | 300 |

|

| | $ | 1,502 |

| | $ | 2,232 |

| | $ | 1,970 |

| | $ | 2,631 |

| $ | 1,314 |

| | $ | 2,178 |

| | $ | 1,970 |

| | $ | 2,631 |

|

______________________

| |

| (1) | The fair value of the 1.125% Conversion Option (the embedded cash conversion option), which is included in the fair value amounts presented above, amounted to $657$843 million and $522 million as of JuneSeptember 30, 2018, and December 31, 2017, respectively. See further discussion at Note 7, “Debt,” and Note 8, “Derivatives.” |

| |

| (2) | For more information on debt repayments in the nine months ended September 30, 2018, refer to Note 7, “Debt.” |

5. Investments

Available-for-Sale Investments

We consider all of our investments classified as current assets (including restricted investments) to be available-for-sale. Our 4.875% Notes, as further discussed in Note 7, “Debt,” contain a limitation on the use of proceeds which required us to deposit the net proceeds from their issuance into a segregated deposit account, a current asset reported as “Restricted investments” in the accompanying consolidated balance sheets. Such proceeds, while

restricted as to their use and held in a segregated deposit account, are available-for-sale based upon our contractual liquidity requirements.

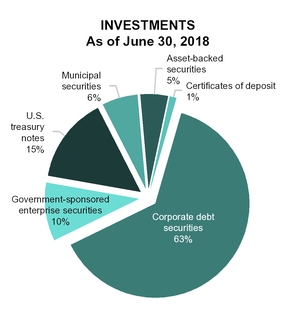

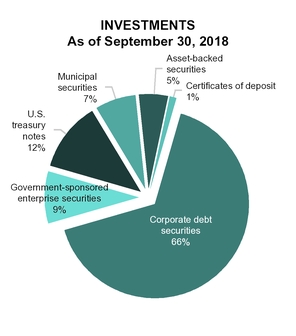

The following tables summarize our investments as of the dates indicated: | | | | June 30, 2018 | September 30, 2018 |

| | Amortized | | Gross Unrealized | | Estimated Fair | Amortized | | Gross Unrealized | | Estimated Fair |

| | Cost | | Gains | | Losses | | Value | Cost | | Gains | | Losses | | Value |

| | (In millions) | (In millions) |

| Corporate debt securities | $ | 1,390 |

| | $ | — |

| | $ | 8 |

| | $ | 1,382 |

| $ | 1,197 |

| | $ | 1 |

| | $ | 7 |

| | $ | 1,191 |

|

| U.S. treasury notes | 331 |

| | — |

| | 1 |

| | 330 |

| 222 |

| | — |

| | 1 |

| | 221 |

|

| GSEs | 209 |

| | — |

| | 2 |

| | 207 |

| 172 |

| | — |

| | 2 |

| | 170 |

|

| Municipal securities | 138 |

| | — |

| | 2 |

| | 136 |

| 121 |

| | — |

| | 2 |

| | 119 |

|

| Asset backed securities | 100 |

| | — |

| | 1 |

| | 99 |

| 93 |

| | — |

| | 1 |

| | 92 |

|

| Certificates of deposit | 19 |

| | — |

| | — |

| | 19 |

| 15 |

| | — |

| | — |

| | 15 |

|

| Other | 3 |

| | — |

| | — |

| | 3 |

| 4 |

| | — |

| | — |

| | 4 |

|

| Subtotal - current investments | 2,190 |

| | — |

| | 14 |

| | 2,176 |

| |

| Corporate debt securities | 55 |

| | — |

| | — |

| | 55 |

| |

| U.S. treasury notes | 25 |

| | — |

| | — |

| | 25 |

| |

| Subtotal - current restricted investments | 80 |

| | — |

| | — |

| | 80 |

| |

| | $ | 2,270 |

| | $ | — |

| | $ | 14 |

| | $ | 2,256 |

| $ | 1,824 |

| | $ | 1 |

| | $ | 13 |

| | $ | 1,812 |

|

|

| | | | | | | | | | | | | | | |

| | December 31, 2017 |

| | Amortized | | Gross Unrealized | | Estimated Fair |

| | Cost | | Gains | | Losses | | Value |

| | (In millions) |

| Corporate debt securities | $ | 1,591 |

| | $ | 1 |

| | $ | 4 |

| | $ | 1,588 |

|

| U.S. treasury notes | 389 |

| | — |

| | 1 |

| | 388 |

|

| GSEs | 255 |

| | — |

| | 2 |

| | 253 |

|

| Municipal securities | 142 |

| | — |

| | 1 |

| | 141 |

|

| Asset-backed securities | 117 |

| | — |

| | — |

| | 117 |

|

| Certificates of deposit | 37 |

| | — |

| | — |

| | 37 |

|

| Subtotal - current investments | 2,531 |

| | 1 |

| | 8 |

| | 2,524 |

|

| Corporate debt securities | 101 |

| | — |

| | — |

| | 101 |

|

| U.S. treasury notes | 68 |

| | — |

| | — |

| | 68 |

|

| Subtotal - current restricted investments | 169 |

| | — |

| | — |

| | 169 |

|

| | $ | 2,700 |

| | $ | 1 |

| | $ | 8 |

| | $ | 2,693 |

|

The contractual maturities of our available-for-sale investments as of JuneSeptember 30, 2018 are summarized below: | | | | Amortized Cost | | Estimated Fair Value | Amortized Cost | | Estimated Fair Value |

| | (In millions) | (In millions) |

| Due in one year or less | $ | 1,356 |

| | $ | 1,354 |

| $ | 1,025 |

| | $ | 1,023 |

|

| Due after one year through five years | 914 |

| | 902 |

| 799 |

| | 789 |

|

| | $ | 2,270 |

| | $ | 2,256 |

| $ | 1,824 |

| | $ | 1,812 |

|

As discussed further in Note 7, “Debt,” the 4.875% Notes’ indenture required us to hold a portion of the net proceeds from their issuance in a segregated account to be used to settle the conversion of the 1.625% Notes. Prior to September 30, 2018, this account was reported as a current asset, entitled “Restricted investments,” in the accompanying consolidated balance sheets. Because this account was used to settle the conversion of the 1.625% Notes in the third quarter of 2018, current restricted investments, as of September 30, 2018, was reduced to zero.

Gross realized gains and losses from sales of available-for-sale securities are calculated under the specific identification method and are included in investment income. Gross realized investment gains and losses for the three and sixnine months ended JuneSeptember 30, 2018 and 2017 were insignificant.

We have determined that unrealized losses at JuneSeptember 30, 2018 and December 31, 2017, are temporary in nature, because the change in market value for these securities has resulted from fluctuating interest rates, rather than a deterioration of the creditworthiness of the issuers. So long as we maintain the intent and ability to hold these securities to maturity, we are unlikely to experience losses. In the event that we dispose of these securities before maturity, we expect that realized losses, if any, will be insignificant.

The following table segregates those available-for-sale investments that have been in a continuous loss position for less than 12 months, and those that have been in a continuous loss position for 12 months or more as of JuneSeptember 30, 2018:

| | | | In a Continuous Loss Position for Less than 12 Months | | In a Continuous Loss Position for 12 Months or More | In a Continuous Loss Position for Less than 12 Months | | In a Continuous Loss Position for 12 Months or More |

| | Estimated Fair Value | | Unrealized Losses | | Total Number of Positions | | Estimated Fair Value | | Unrealized Losses | | Total Number of Positions | Estimated Fair Value | | Unrealized Losses | | Total Number of Positions | | Estimated Fair Value | | Unrealized Losses | | Total Number of Positions |

| | (Dollars in millions) | (Dollars in millions) |

| Corporate debt securities | $ | 959 |

| | $ | 7 |

| | 535 |

| | $ | 116 |

| | $ | 1 |

| | 72 |

| $ | 727 |

| | $ | 4 |

| | 460 |

| | $ | 186 |

| | $ | 3 |

| | 127 |

|

| U.S. Treasury notes | 224 |

| | 1 |

| | 52 |

| | — |

| | — |

| | — |

| — |

| | — |

| | — |

| | 94 |

| | 1 |

| | 31 |

|

| GSEs | — |

| | — |

| | — |

| | 113 |

| | 2 |

| | 56 |

| — |

| | — |

| | — |

| | 127 |

| | 2 |

| | 68 |

|

| Municipal securities | 81 |

| | 1 |

|

| 79 |

|

| 40 |

|

| 1 |

|

| 52 |

| 63 |

| | 1 |

|

| 63 |

|

| 55 |

|

| 1 |

|

| 57 |

|

| Asset backed securities | 90 |

| | 1 |

| | 59 |

| | — |

| | — |

| | — |

| 72 |

| | 1 |

| | 41 |

| | — |

| | — |

| | — |

|

| | $ | 1,354 |

| | $ | 10 |

| | 725 |

| | $ | 269 |

| | $ | 4 |

| | 180 |

| $ | 862 |

| | $ | 6 |

| | 564 |

| | $ | 462 |

| | $ | 7 |

| | 283 |

|

The following table segregates those available-for-sale investments that have been in a continuous loss position for less than 12 months, and those that have been in a continuous loss position for 12 months or more as of December 31, 2017:

|

| | | | | | | | | | | | | | | | | | | | | |

| | In a Continuous Loss Position for Less than 12 Months | | In a Continuous Loss Position for 12 Months or More |

| | Estimated Fair Value | | Unrealized Losses | | Total Number of Positions | | Estimated Fair Value | | Unrealized Losses | | Total Number of Positions |

| | (Dollars in millions) |

| Corporate debt securities | $ | 1,297 |

| | $ | 3 |

| | 561 |

| | $ | 94 |

| | $ | 1 |

| | 69 |

|

| U.S. Treasury Notes | 470 |

| | 1 |

| | 89 |

| | — |

| | — |

| | — |

|

| GSEs | 173 |

| | 1 |

| | 69 |

| | 95 |

| | 1 |

| | 47 |

|

| Municipal securities | — |

| | — |

| | — |

| | 38 |

| | 1 |

| | 48 |

|

| | $ | 1,940 |

| | $ | 5 |

| | 719 |

| | $ | 227 |

| | $ | 3 |

| | 164 |

|

Held-to-Maturity Investments

Pursuant to the regulations governing our Health Plans segment subsidiaries, we maintain statutory deposits and deposits required by government authorities primarily in certificates of deposit and U.S. treasury securities. We also maintain restricted investments as protection against the insolvency of certain capitated providers. The use of these funds is limited as required by regulations in the various states in which we operate, or as needed in the event of insolvency of capitated providers. Therefore, such investments are reported as non-current “Restricted investments” in the accompanying consolidated balance sheets. We have the ability to hold these restricted investments until maturity, and as a result, we would not expect the value of these investments to decline significantly due to a sudden change in market interest rates.

Our held-to-maturity restricted investments are carried at amortized cost, which approximates fair value. SuchHeld-to-maturity restricted investments amounted to $117 million at Juneas of September 30, 2018, and mature in one year or less.are summarized below:

|

| | | | | | | |

| | Amortized Cost | | Estimated Fair Value |