UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

FORM 10-Q

(Mark One)

|

| |

| ý | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 2018March 31, 2019

OR

|

| |

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number: 001-31719

MOLINA HEALTHCARE, INC.

(Exact name of registrant as specified in its charter)

|

| | |

| Delaware | | 13-4204626 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | |

200 Oceangate, Suite 100 Long Beach, California | | 90802 |

| (Address of principal executive offices) | | (Zip Code) |

(562) 435-3666

(Registrant’s telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ý Accelerated filer ¨ Non-accelerated filer ¨ (do not check if a smaller reporting company) |

| | | |

Large accelerated filer | ý | Accelerated filer | ¨ |

Non-accelerated filer | Smaller reporting company ¨ Emerging growth company ¨ If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section13(a) of the Exchange Act. ¨ ¨ (Do not check if a smaller reporting company)

| Smaller reporting company | ¨ |

| | Emerging growth company | ¨ |

|

| |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section13(a) of the Exchange Act. | |

¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ¨ No ý

The number of shares of the issuer’s Common Stock, $0.001 par value, outstanding as of OctoberApril 26, 2018,2019, was approximately 62,389,000.62,619,000.

MOLINA HEALTHCARE, INC. FORM 10-Q

FOR THE QUARTERLY PERIOD ENDED September 30, 2018March 31, 2019

TABLE OF CONTENTS

| | | ITEM NUMBER | ITEM NUMBER | Page | ITEM NUMBER | Page |

| | | |

| PART I - Financial Information | PART I - Financial Information | | PART I - Financial Information | |

| | | |

| 1. | | | | |

| | | |

| 2. | | | | |

| | | |

| 3. | | | | |

| | | |

| 4. | | | | |

| | | |

| | | | |

| | | |

| 1. | | | | |

| | | |

| 1A. | | | | |

| | | |

| 2. | | | | |

| | | |

| 3. | Defaults Upon Senior Securities | Not Applicable. | Defaults Upon Senior Securities | Not Applicable. |

| | | |

| 4. | Mine Safety Disclosures | Not Applicable. | Mine Safety Disclosures | Not Applicable. |

| | | |

| 5. | Other Information | Not Applicable. | Other Information | Not Applicable. |

| | | |

| 6. | | | | |

| | | |

| | | | | |

| | | |

| | | |

CONSOLIDATED STATEMENTS OF OPERATIONSINCOME | | | | Three Months Ended September 30, | | Nine Months Ended September 30, | Three Months Ended March 31, |

| | 2018 | | 2017 | | 2018 | | 2017 | 2019 | | 2018 |

| | (In millions, except per-share data) (Unaudited) | (In millions, except per-share amounts) (Unaudited) |

| Revenue: | | | | | | | | | | |

| Premium revenue | $ | 4,337 |

| | $ | 4,777 |

| | $ | 13,174 |

| | $ | 14,165 |

| $ | 3,952 |

| | $ | 4,323 |

|

| Service revenue | 130 |

| | 130 |

| | 391 |

| | 390 |

| |

| Premium tax revenue | 110 |

| | 106 |

| | 320 |

| | 331 |

| 138 |

| | 104 |

|

| Health insurer fees reimbursed | 83 |

| | — |

| | 248 |

| | — |

| — |

| | 61 |

|

| Service revenue | | — |

| | 134 |

|

| Investment income and other revenue | 37 |

| | 18 |

| | 93 |

| | 48 |

| 29 |

| | 24 |

|

| Total revenue | 4,697 |

| | 5,031 |

| | 14,226 |

| | 14,934 |

| 4,119 |

| | 4,646 |

|

| Operating expenses: | | | | | | | | | | |

| Medical care costs | 3,790 |

| | 4,220 |

| | 11,362 |

| | 12,822 |

| 3,371 |

| | 3,722 |

|

| Cost of service revenue | 111 |

| | 123 |

| | 349 |

| | 369 |

| |

| General and administrative expenses | 311 |

| | 383 |

| | 998 |

| | 1,227 |

| 302 |

| | 352 |

|

| Premium tax expenses | 110 |

| | 106 |

| | 320 |

| | 331 |

| 138 |

| | 104 |

|

| Health insurer fees | 87 |

| | — |

| | 261 |

| | — |

| — |

| | 75 |

|

| Depreciation and amortization | 25 |

| | 33 |

| | 76 |

| | 109 |

| 25 |

| | 26 |

|

| Restructuring and separation costs | 5 |

| | 118 |

| | 38 |

| | 161 |

| |

| Impairment losses | — |

| | 129 |

| | — |

| | 201 |

| |

| Restructuring costs | | 3 |

| | 25 |

|

| Cost of service revenue | | — |

| | 120 |

|

| Total operating expenses | 4,439 |

| | 5,112 |

| | 13,404 |

| | 15,220 |

| 3,839 |

| | 4,424 |

|

| Gain on sale of subsidiary | 37 |

| | — |

| | 37 |

| | — |

| |

| Operating income (loss) | 295 |

| | (81 | ) | | 859 |

| | (286 | ) | |

| Operating income | | 280 |

| | 222 |

|

| Other expenses, net: | | | | | | | | | | |

| Interest expense | 26 |

| | 32 |

| | 91 |

| | 85 |

| 23 |

| | 33 |

|

| Other expenses (income), net | 10 |

| | — |

| | 25 |

| | (75 | ) | |

| Other (income) expenses, net | | (3 | ) | | 10 |

|

| Total other expenses, net | 36 |

| | 32 |

| | 116 |

| | 10 |

| 20 |

| | 43 |

|

| Income (loss) before income tax expense (benefit) | 259 |

| | (113 | ) | | 743 |

| | (296 | ) | |

| Income tax expense (benefit) | 62 |

| | (16 | ) | | 237 |

| | (46 | ) | |

| Net income (loss) | $ | 197 |

| | $ | (97 | ) | | $ | 506 |

| | $ | (250 | ) | |

| Income before income tax expense | | 260 |

| | 179 |

|

| Income tax expense | | 62 |

| | 72 |

|

| Net income | | $ | 198 |

| | $ | 107 |

|

| | | | | | | | | | | |

| Net income (loss) per share: | | | | | | | | |

| Net income per share: | | | | |

| Basic | $ | 3.22 |

| | $ | (1.70 | ) | | $ | 8.32 |

| | $ | (4.44 | ) | $ | 3.19 |

| | $ | 1.79 |

|

| Diluted | $ | 2.90 |

| | $ | (1.70 | ) | | $ | 7.60 |

| | $ | (4.44 | ) | $ | 2.99 |

| | $ | 1.64 |

|

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS)

| | | | Three Months Ended September 30, | | Nine Months Ended September 30, | Three Months Ended March 31, |

| | 2018 | | 2017 | | 2018 | | 2017 | 2019 | | 2018 |

| | (In millions) (Unaudited) | (In millions) (Unaudited) |

| Net income (loss) | $ | 197 |

| | $ | (97 | ) | | $ | 506 |

| | $ | (250 | ) | |

| Net income | | $ | 198 |

| | $ | 107 |

|

| Other comprehensive income (loss): | | | | | | | | | | |

| Unrealized investment gain (loss) | 1 |

| | 1 |

| | (5 | ) | | 2 |

| 7 |

| | (7 | ) |

| Less: effect of income taxes | — |

| | 1 |

| | (1 | ) | | 1 |

| 2 |

| | (1 | ) |

| Other comprehensive income (loss), net of tax | 1 |

| | — |

| | (4 | ) | | 1 |

| 5 |

| | (6 | ) |

| Comprehensive income (loss) | $ | 198 |

| | $ | (97 | ) | | $ | 502 |

| | $ | (249 | ) | |

| Comprehensive income | | $ | 203 |

| | $ | 101 |

|

See accompanying notes.

CONSOLIDATED BALANCE SHEETS | | | | September 30,

2018 | | December 31,

2017 | March 31,

2019 | | December 31,

2018 |

| | (In millions, except per-share data) | (Dollars in millions, except per-share amounts) |

| | (Unaudited) | | | (Unaudited) | | |

ASSETS | | Current assets: | | | | | | |

| Cash and cash equivalents | $ | 2,814 |

| | $ | 3,186 |

| $ | 3,224 |

| | $ | 2,826 |

|

| Investments | 1,812 |

| | 2,524 |

| 1,508 |

| | 1,681 |

|

| Restricted investments | — |

| | 169 |

| |

| Receivables | 1,346 |

| | 871 |

| 1,359 |

| | 1,330 |

|

| Prepaid expenses and other current assets | 486 |

| | 239 |

| 124 |

| | 149 |

|

| Derivative asset | 843 |

| | 522 |

| 516 |

| | 476 |

|

| Total current assets | 7,301 |

| | 7,511 |

| 6,731 |

| | 6,462 |

|

| Property, equipment, and capitalized software, net | 264 |

| | 342 |

| 376 |

| | 241 |

|

| Goodwill and intangible assets, net | 195 |

| | 255 |

| 185 |

| | 190 |

|

| Restricted investments | 118 |

| | 119 |

| 100 |

| | 120 |

|

| Deferred income taxes | 143 |

| | 103 |

| 76 |

| | 117 |

|

| Other assets | 30 |

| | 141 |

| 111 |

| | 24 |

|

| | $ | 8,051 |

| | $ | 8,471 |

| $ | 7,579 |

| | $ | 7,154 |

|

| | | | | | | |

LIABILITIES AND STOCKHOLDERS’ EQUITY | | Current liabilities: | | | | | | |

| Medical claims and benefits payable | $ | 2,042 |

| | $ | 2,192 |

| $ | 1,995 |

| | $ | 1,961 |

|

| Amounts due government agencies | 1,030 |

| | 1,542 |

| 932 |

| | 967 |

|

| Accounts payable and accrued liabilities | 824 |

| | 366 |

| 444 |

| | 390 |

|

| Deferred revenue | 178 |

| | 282 |

| 207 |

| | 211 |

|

| Current portion of long-term debt | 296 |

| | 653 |

| 198 |

| | 241 |

|

| Derivative liability | 843 |

| | 522 |

| 516 |

| | 476 |

|

| Total current liabilities | 5,213 |

| | 5,557 |

| 4,292 |

| | 4,246 |

|

| Long-term debt | 1,019 |

| | 1,318 |

| 1,121 |

| | 1,020 |

|

| Lease financing obligations | 198 |

| | 198 |

| |

| Finance lease liabilities | | 234 |

| | 197 |

|

| Other long-term liabilities | 60 |

| | 61 |

| 97 |

| | 44 |

|

| Total liabilities | 6,490 |

| | 7,134 |

| 5,744 |

| | 5,507 |

|

| | | | | | | |

| Stockholders’ equity: | | | | | | |

| Common stock, $0.001 par value, 150 shares authorized; outstanding: 62 shares at September 30, 2018 and 60 shares at December 31, 2017 | — |

| | — |

| |

| Preferred stock, $0.001 par value; 20 shares authorized, no shares issued and outstanding | — |

| | — |

| |

| Common stock, $0.001 par value, 150 million shares authorized; outstanding: 63 million shares at March 31, 2019 and 62 million shares at December 31, 2018 | | — |

| | — |

|

| Preferred stock, $0.001 par value; 20 million shares authorized, no shares issued and outstanding | | — |

| | — |

|

| Additional paid-in capital | 760 |

| | 1,044 |

| 543 |

| | 643 |

|

| Accumulated other comprehensive loss | (10 | ) | | (5 | ) | (3 | ) | | (8 | ) |

| Retained earnings | 811 |

| | 298 |

| 1,295 |

| | 1,012 |

|

| Total stockholders’ equity | 1,561 |

| | 1,337 |

| 1,835 |

| | 1,647 |

|

| | $ | 8,051 |

| | $ | 8,471 |

| $ | 7,579 |

| | $ | 7,154 |

|

See accompanying notes.

CONSOLIDATED STATEMENTSTATEMENTS OF STOCKHOLDERS’ EQUITY

|

| | | | | | | | | | | | | | | | | | | | | | |

| | Common Stock | | Additional Paid-in Capital | | Accumulated Other Comprehensive Loss | | Retained Earnings | | Total |

| | Outstanding | | Amount | | | | |

| | (In millions) |

| | (Unaudited) |

| Balance at January 1, 2018 | 60 |

| | $ | — |

| | $ | 1,044 |

| | $ | (5 | ) | | $ | 298 |

| | $ | 1,337 |

|

| Net income | — |

| | — |

| | — |

| | — |

| | 107 |

| | 107 |

|

| Adoption of Topic 606 | — |

| | — |

| | — |

| | — |

| | 6 |

| | 6 |

|

| Adoption of ASU 2018-02 | — |

| | — |

| | — |

| | (1 | ) | | 1 |

| | — |

|

| Exchange of 1.625% Notes | 2 |

| | — |

| | 108 |

| | — |

| | — |

| | 108 |

|

| Other comprehensive loss, net | — |

| | — |

| | — |

| | (6 | ) | | — |

| | (6 | ) |

| Share-based compensation | — |

| | — |

| | 1 |

| | — |

| | — |

| | 1 |

|

| Balance at March 31, 2018 | 62 |

| | — |

| | 1,153 |

| | (12 | ) | | 412 |

| | 1,553 |

|

| Net income | — |

| | — |

| | — |

| | — |

| | 202 |

| | 202 |

|

| Partial termination of 1.125% Warrants | — |

| | — |

| | (113 | ) | | — |

| | — |

| | (113 | ) |

| Other comprehensive income, net | — |

| | — |

| | — |

| | 1 |

| | — |

| | 1 |

|

| Share-based compensation | — |

| | — |

| | 15 |

| | — |

| | — |

| | 15 |

|

| Balance at June 30, 2018 | 62 |

| | — |

| | 1,055 |

| | (11 | ) | | 614 |

| | 1,658 |

|

| Net income | — |

| | — |

| | — |

| | — |

| | 197 |

| | 197 |

|

| Partial termination of 1.125% Warrants | — |

| | — |

| | (306 | ) | | — |

| | — |

| | (306 | ) |

| Conversion of 1.625% Notes | — |

| | — |

| | 4 |

| | — |

| | — |

| | 4 |

|

| Other comprehensive income, net | — |

| | — |

| | — |

| | 1 |

| | — |

| | 1 |

|

| Share-based compensation | — |

| |

|

| | 7 |

| | — |

| | — |

| | 7 |

|

| Balance at September 30, 2018 | 62 |

| | $ | — |

| | $ | 760 |

| | $ | (10 | ) | | $ | 811 |

| | $ | 1,561 |

|

|

| | | | | | | | | | | | | | | | | | | | | | |

| | Common Stock | | Additional Paid-in Capital | | Accumulated Other Comprehensive Loss | | Retained Earnings | | Total |

| | Outstanding | | Amount | | | | |

| | (In millions) |

| | (Unaudited) |

| Balance at December 31, 2018 | 62 |

| | $ | — |

| | $ | 643 |

| | $ | (8 | ) | | $ | 1,012 |

| | $ | 1,647 |

|

| Net income | — |

| | — |

| | — |

| | — |

| | 198 |

| | 198 |

|

| Adoption of new accounting standard | — |

| | — |

| | — |

| | — |

| | 85 |

| | 85 |

|

| Partial termination of 1.125% Warrants | — |

| | — |

| | (103 | ) | | — |

| | — |

| | (103 | ) |

| Other comprehensive gain, net | — |

| | — |

| | — |

| | 5 |

| | — |

| | 5 |

|

| Share-based compensation | 1 |

| | — |

| | 3 |

| | — |

| | — |

| | 3 |

|

| Balance at March 31, 2019 | 63 |

| | $ | — |

| | $ | 543 |

| | $ | (3 | ) | | $ | 1,295 |

| | $ | 1,835 |

|

|

| | | | | | | | | | | | | | | | | | | | | | |

| | Common Stock | | Additional Paid-in Capital | | Accumulated Other Comprehensive Loss | | Retained Earnings | | Total |

| | Outstanding | | Amount | | | | |

| | (In millions) |

| | (Unaudited) |

| Balance at January 1, 2017 | 57 |

| | $ | — |

| | $ | 841 |

| | $ | (2 | ) | | $ | 810 |

| | $ | 1,649 |

|

| Net income | — |

| | — |

| | — |

| | — |

| | 77 |

| | 77 |

|

| Other comprehensive income, net | — |

| | — |

| | — |

| | 1 |

| | — |

| | 1 |

|

| Balance at March 31, 2017 | 57 |

| | — |

| | 841 |

| | (1 | ) | | 887 |

| | 1,727 |

|

| Net loss | — |

| | — |

| | — |

| | — |

| | (230 | ) | | (230 | ) |

| Share-based compensation | — |

| | — |

| | 24 |

| | — |

| | — |

| | 24 |

|

| Balance at June 30, 2017 | 57 |

| | — |

| | 865 |

| | (1 | ) | | 657 |

| | 1,521 |

|

| Net loss | — |

| | — |

| | — |

| | — |

| | (97 | ) | | (97 | ) |

| Share-based compensation | — |

| | — |

| | 5 |

| | — |

| | — |

| | 5 |

|

| Balance at September 30, 2017 | 57 |

| | $ | — |

| | $ | 870 |

| | $ | (1 | ) | | $ | 560 |

| | $ | 1,429 |

|

|

| | | | | | | | | | | | | | | | | | | | | | |

| | Common Stock | | Additional Paid-in Capital | | Accumulated Other Comprehensive Loss | | Retained Earnings | | Total |

| | Outstanding | | Amount | | | | |

| | (In millions) |

| | (Unaudited) |

| Balance at December 31, 2017 | 60 |

| | $ | — |

| | $ | 1,044 |

| | $ | (5 | ) | | $ | 298 |

| | $ | 1,337 |

|

| Net income | — |

| | — |

| | — |

| | — |

| | 107 |

| | 107 |

|

| Adoption of new accounting standards | — |

| | — |

| | — |

| | (1 | ) | | 7 |

| | 6 |

|

| Exchange of 1.625% Convertible Notes | 2 |

| | — |

| | 108 |

| | — |

| | — |

| | 108 |

|

| Other comprehensive loss, net | — |

| | — |

| | — |

| | (6 | ) | | — |

| | (6 | ) |

| Share-based compensation | — |

| | — |

| | 1 |

| | — |

| | — |

| | 1 |

|

| Balance at March 31, 2018 | 62 |

| | $ | — |

| | $ | 1,153 |

| | $ | (12 | ) | | $ | 412 |

| | $ | 1,553 |

|

See accompanying notes.

CONSOLIDATED STATEMENTS OF CASH FLOWS

| | | | Nine Months Ended September 30, | Three Months Ended March 31, |

| | 2018 | | 2017 | 2019 | | 2018 |

| | (In millions)

(Unaudited) | (In millions)

(Unaudited) |

| Operating activities: | | | | | | |

| Net income (loss) | $ | 506 |

| | $ | (250 | ) | |

| Adjustments to reconcile net income (loss) to net cash (used in) provided by operating activities: | | | | |

| Net income | | $ | 198 |

| | $ | 107 |

|

| Adjustments to reconcile net income to net cash provided by operating activities: | | | | |

| Depreciation and amortization | 104 |

| | 139 |

| 25 |

| | 37 |

|

| Deferred income taxes | (32 | ) | | (68 | ) | 15 |

| | (6 | ) |

| Share-based compensation | 20 |

| | 38 |

| 9 |

| | 6 |

|

| Amortization of convertible senior notes and finance lease liabilities | | 3 |

| | 7 |

|

| (Gain) loss on debt extinguishment | | (3 | ) | | 10 |

|

| Non-cash restructuring costs | 17 |

| | 49 |

| — |

| | 17 |

|

| Amortization of convertible senior notes and lease financing obligations | 18 |

| | 24 |

| |

| Gain on sale of subsidiary | (37 | ) | | — |

| |

| Loss on debt extinguishment | 25 |

| | — |

| |

| Impairment losses | — |

| | 201 |

| |

| Other, net | 6 |

| | 13 |

| 3 |

| | 2 |

|

| Changes in operating assets and liabilities: | | | | | | |

| Receivables | (507 | ) | | (28 | ) | (29 | ) | | (83 | ) |

| Prepaid expenses and other current assets | (117 | ) | | (53 | ) | 20 |

| | (239 | ) |

| Medical claims and benefits payable | (144 | ) | | 549 |

| 34 |

| | (163 | ) |

| Amounts due government agencies | (511 | ) | | 122 |

| (35 | ) | | 172 |

|

| Accounts payable and accrued liabilities | 398 |

| | 90 |

| (30 | ) | | 319 |

|

| Deferred revenue | (55 | ) | | 153 |

| (4 | ) | | 130 |

|

| Income taxes | 118 |

| | (22 | ) | 43 |

| | 78 |

|

| Net cash (used in) provided by operating activities | (191 | ) | | 957 |

| |

| Net cash provided by operating activities | | 249 |

| | 394 |

|

| Investing activities: | | | | | | |

| Purchases of investments | (1,202 | ) | | (1,894 | ) | (185 | ) | | (389 | ) |

| Proceeds from sales and maturities of investments | 2,070 |

| | 1,536 |

| 366 |

| | 543 |

|

| Purchases of property, equipment and capitalized software | (24 | ) | | (85 | ) | (6 | ) | | (4 | ) |

| Other, net | (23 | ) | | (33 | ) | (4 | ) | | (5 | ) |

| Net cash provided by (used in) investing activities | 821 |

| | (476 | ) | |

| Net cash provided by investing activities | | 171 |

| | 145 |

|

| Financing activities: | | | | | | |

| Repayment of credit facility | (300 | ) | | — |

| |

| Repayment of principal amount of 1.125% Notes | (236 | ) | | — |

| |

| Repayment of principal amount of 1.125% Convertible Notes | | (46 | ) | | — |

|

| Cash paid for partial settlement of 1.125% Conversion Option | (477 | ) | | — |

| (115 | ) | | — |

|

| Cash received for partial termination of 1.125% Call Option | 477 |

| | — |

| 115 |

| | — |

|

| Cash paid for partial termination of 1.125% Warrants | (419 | ) | | — |

| (103 | ) | | — |

|

| Repayment of principal amount of 1.625% Notes | (64 | ) | | — |

| |

| Proceeds from senior notes offerings, net of issuance costs | — |

| | 325 |

| |

| Proceeds from borrowings under credit facility | — |

| | 300 |

| |

| Proceeds from borrowings under Term Loan | | 100 |

| | — |

|

| Other, net | 7 |

| | 7 |

| 1 |

| | (5 | ) |

| Net cash (used in) provided by financing activities | (1,012 | ) | | 632 |

| |

| Net (decrease) increase in cash, cash equivalents, and restricted cash and cash equivalents | (382 | ) | | 1,113 |

| |

| Net cash used in financing activities | | (48 | ) | | (5 | ) |

| Net increase in cash, cash equivalents, and restricted cash and cash equivalents | | 372 |

| | 534 |

|

| Cash, cash equivalents, and restricted cash and cash equivalents at beginning of period | 3,290 |

| | 2,912 |

| 2,926 |

| | 3,290 |

|

| Cash, cash equivalents, and restricted cash and cash equivalents at end of period | $ | 2,908 |

| | $ | 4,025 |

| $ | 3,298 |

| | $ | 3,824 |

|

CONSOLIDATED STATEMENTS OF CASH FLOWS

(continued)

|

| | | | | | | |

| | Nine Months Ended September 30, |

| | 2018 | | 2017 |

| | (In millions)

(Unaudited) |

| Supplemental cash flow information: | | | |

| | | | |

| Schedule of non-cash investing and financing activities: | | | |

| Common stock used for share-based compensation | $ | (6 | ) | | $ | (21 | ) |

| | | | |

| Details of sale of subsidiary: | | | |

| Decrease in carrying amount of assets | $ | (243 | ) | | $ | — |

|

| Decrease in carrying amount of liabilities | 59 |

| | — |

|

| Transaction costs | (12 | ) | | — |

|

| Receivable from buyer - recorded in prepaid expenses and other current assets | 233 |

| | — |

|

| Gain on sale of subsidiary | $ | 37 |

| | $ | — |

|

| | | | |

| Details of change in fair value of derivatives, net: | | | |

| Gain on 1.125% Call Option | $ | 321 |

| | $ | 158 |

|

| Loss on 1.125% Conversion Option | (321 | ) | | (158 | ) |

| Change in fair value of derivatives, net | $ | — |

| | $ | — |

|

| | | | |

| 1.625% Notes exchange transaction: | | | |

| Common stock issued in exchange for 1.625% Notes | $ | 131 |

| | $ | — |

|

| Component of 1.625% Notes allocated to additional paid-in capital, net of income taxes | (23 | ) | | — |

|

| Net increase to additional paid-in capital | $ | 108 |

| | $ | — |

|

|

| | | | | | | |

| | Three Months Ended March 31, |

| | 2019 | | 2018 |

| | (In millions)

(Unaudited) |

| Supplemental cash flow information: | | | |

| | | | |

| Schedule of non-cash investing and financing activities: | | | |

| Common stock used for share-based compensation | $ | (7 | ) | | $ | (5 | ) |

| | | | |

| Details of change in fair value of derivatives, net: | | | |

| Gain on 1.125% Call Option | $ | 155 |

| | $ | 63 |

|

| Loss on 1.125% Conversion Option | (155 | ) | | (63 | ) |

| Change in fair value of derivatives, net | $ | — |

| | $ | — |

|

| | | | |

| 1.625% Convertible Notes exchange transaction: | | | |

| Common stock issued in exchange for 1.625% Convertible Notes | $ | — |

| | $ | 131 |

|

| Component allocated to additional paid-in capital, net of income taxes | — |

| | (23 | ) |

| Net increase to additional paid-in capital | $ | — |

| | $ | 108 |

|

See accompanying notes.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

September 30, 2018March 31, 2019

1. Organization and Basis of Presentation

Organization and Operations

Molina Healthcare, Inc. provides quality managed health care to people receiving government assistance. We offer cost-effective Medicaid-related solutions to meet the health care needs of low-income families and individuals, and to assist government agencies in their administration ofservices under the Medicaid program.and Medicare programs and through the insurance marketplaces (the “Marketplace”). We currently have threetwo reportable segments, consisting ofsegments: our Health Plans segment which constitutesand our Other segment. We manage the vast majority of our operations;operations through our MolinaHealth Plans segment. The Other segment includes the historical results of the Medicaid Solutions segment;management information systems (“MMIS”) and our Otherbehavioral health subsidiaries that were sold in the fourth quarter of 2018, as well as certain corporate amounts not allocated to the Health Plans segment. Prior to the fourth quarter of 2018, the MMIS subsidiary was reported as a stand-alone segment.

The Health Plans segment consists of health plans operating in 1314 states and the Commonwealth of Puerto Rico. As of September 30, 2018,March 31, 2019, these health plans served approximately 4.03.4 million members eligible for Medicaid, Medicare, and other government-sponsored health care programs for low-income families and individuals. This membership includes Affordable Care Actindividuals including Marketplace (Marketplace) members, most of whom receive government premium subsidies.subsidies for premiums. The health plans are generally operated by our respective wholly owned subsidiaries in those states, each of which is licensed as a health maintenance organization (HMO)(“HMO”).

Our health plans’ state Medicaid contracts generally have terms of three to five years. These contracts typically contain renewal options exercisable by the state Medicaid agency, and allow either the state or the health plan to terminate the contract with or without cause. Such contracts are subject to risk of loss in states that issue requests for proposal (RFP)(“RFPs”) open to competitive bidding by other health plans. If one of our health plans is not a successful responsive bidder to a state RFP, its contract may not be renewed.

In addition to contract renewal, our state Medicaid contracts may be periodically amended to include or exclude certain health benefits (such as pharmacy services, behavioral health services, or long-term care services); populations such as the aged, blind or disabled (ABD);disabled; and regions or service areas.

The Molina Medicaid Solutions segment provides support to state government agencies’ administration of their Medicaid programs, including business processing, information technology development and administrative services. The Other segment includes primarily our behavioral health and social services provider subsidiary (Pathways), and corporate amounts not allocated to other reportable segments.

Recent Developments – Health Plans Segment

New Mexico Health Plan. In our Annual Report on Form 10-K for 2017, we reported that we were notified by the New Mexico Medicaid agency that we had not been selected for a tentative award of a 2019 Medicaid contract. A hearing was held on our judicial protest on October 17, 2018, with a decision expected in the fourth quarter of 2018. Regardless of the court’s decision on our protest, we would have further rights of appeal. We are continuing to manage the business in run-off until such time as a different outcome is determined. As of September 30, 2018, we served approximately 206,000 Medicaid members in New Mexico, which represented premium revenue of $891 million for the nine months ended September 30, 2018.

Puerto Rico Health Plan. In July 2018, our Puerto Rico health plan was selected by the Puerto Rico Health Insurance Administration to be one of the organizations to administer the Commonwealth’s new Medicaid Managed Care contract. We expect to serve approximately 290,000 members under the new contract. The base contract runs for a period of three years with an optional one-year extension. As of September 30, 2018, we served approximately 320,000 Medicaid members in the East and Southwest regions of Puerto Rico, which represented premium revenue of $549 million for the nine months ended September 30, 2018.

Florida Health Plan. In June 2018, our Florida health plan was awarded comprehensive Medicaid Managed Care contracts by the Florida Agency for Health Care Administration (AHCA) in Regions 8 and 11 of the Florida Statewide Medicaid Managed Care Invitation to Negotiate. As of September 30, 2018, we served approximately 96,000 Medicaid members in those regions, which represented premium revenue of approximately $346 million for the nine months ended September 30, 2018. Services under the new contract are expected to begin on January 1, 2019. We will be serving both the Medicaid and long-term care populations in the two regions.

Washington Health Plan. In May 2018, our Washington health plan was selected by the Washington State Health Care Authority (HCA) to enter into a managed care contract for the eight remaining regions of the state’s Apple Health Integrated Managed Care program, in addition to the two regions previously awarded to us. We were

selected by HCA for the following regions: Greater Columbia, King, North Sound, Pierce, and Spokane beginning January 1, 2019; and Salish, Thurston-Mason, and Great Rivers beginning January 1, 2020. As of September 30, 2018, we served approximately 738,000 Medicaid members in Washington, which represented premium revenue of $1,558 million for the nine months ended September 30, 2018.

Recent Developments – Molina Medicaid Solutions Segment

We closed on the sale of Molina Medicaid Solutions (MMS) to DXC Technology Company on September 30, 2018. The net cash selling price for the equity interests of MMS was $233 million, which we received on October 1, 2018. As a result of this transaction, we recognized a pretax gain, net of transaction costs, of $37 million. Refer to Note 11, “Segments,” for further information.

Subsequent Event – Other Segment

On October 19, 2018, we sold our Pathways subsidiary to Pyramid Health Holdings, LLC for a nominal purchase price. We expect to record a loss on sale of subsidiary amounting to approximately $40 million, net of income tax benefits.

Presentation and Reclassification

We have reclassified certain amounts in the 2017 consolidated statement of cash flows to conform to the 2018 presentation, relating to the presentation of restricted cash and cash equivalents. The reclassification is a result of our adoption of Accounting Standards Update (ASU) 2016-18, Restricted Cash effective January 1, 2018. See Note 2, “Significant Accounting Policies,” for further information, including the amount reclassified.

We have combined certain line items in the accompanying consolidated balance sheets. For all periods presented, we have combined the presentation of:

Income taxes refundable with “Prepaid expenses and other current assets;”

Income taxes payable with “Accounts payable and accrued liabilities;”

Goodwill, and intangible assets, net to a single line; and

Deferred contract costs with “Other assets.”

Consolidation and Interim Financial Information

The consolidated financial statements include the accounts of Molina Healthcare, Inc., and its subsidiaries, and variable interest entities (VIEs) in which Molina Healthcare, Inc. is considered to be the primary beneficiary. Such VIEs are insignificant to our consolidated financial position and results of operations.subsidiaries. In the opinion of management, all adjustments considered necessary for a fair presentation of the results as of the date and for the interim periods presented have been included; such adjustments consist of normal recurring adjustments. All significant intercompany balances and transactions have been eliminated. The consolidated results of operations for the ninethree months ended September 30, 2018March 31, 2019, are not necessarily indicative of the results for the entire year ending December 31, 2018.2019.

The unaudited consolidated interim financial statements have been prepared under the assumption that users of the interim financial data have either read or have access to our audited consolidated financial statements for the fiscal year ended December 31, 2017.2018. Accordingly, certain disclosures that would substantially duplicate the disclosures contained in our December 31, 20172018, audited consolidated financial statements have been omitted. These unaudited consolidated interim financial statements should be read in conjunction with our audited consolidated financial statements for the fiscal year ended December 31, 2017.2018.

Use of Estimates

The preparation of consolidated financial statements in conformity with generally accepted accounting principles (“GAAP”) requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities. Estimates also affect the reported amounts of revenues and expenses during the reporting period. Actual results could differ from these estimates. Principal areas requiring the use of estimates include:

The determination of medical claims and benefits payable of our Health Plans segment;

Health plans’ contractual provisions that may limit revenue recognition based upon the costs incurred or the profits realized under a specific contract;

Health plans’ quality incentives that allow us to recognize incremental revenue if certain quality standards are met;

Settlements under risk or savings sharing programs;

The assessment of long-lived and intangible assets, and goodwill for impairment;

The determination of reserves for potential absorption of claims unpaid by insolvent providers;

The determination of reserves for litigation outcomes;

The determination of valuation allowances for deferred tax assets; and

The determination of unrecognized tax benefits.

2. Significant Accounting Policies

Cash and Cash Equivalents

Cash and cash equivalents consist of cash and short-term, highly liquid investments that are both readily convertible into known amounts of cash and have a maturity of three months or less on the date of purchase. The following table provides a reconciliation of cash, cash equivalents, and restricted cash and cash equivalents reported within the accompanying consolidated balance sheets that sum to the total of the same such amounts presented in the accompanying consolidated statements of cash flows. The restricted cash and cash equivalents presented below are included in non-current “Restricted investments” in the accompanying consolidated balance sheets.

| | | | Nine Months Ended September 30, | March 31, |

| | 2018 | | 2017 | 2019 | | 2018 |

| | (In millions) | (In millions) |

| Cash and cash equivalents | $ | 2,814 |

| | $ | 3,934 |

| $ | 3,224 |

| | $ | 3,729 |

|

| Restricted cash and cash equivalents | 94 |

| | 91 |

| 74 |

| | 95 |

|

| Total cash, cash equivalents, and restricted cash and cash equivalents presented in the statements of cash flows | $ | 2,908 |

| | $ | 4,025 |

| $ | 3,298 |

| | $ | 3,824 |

|

Premium Revenue Recognition

We adopted ASU 2014-09, Revenue from Contracts with Customers (Topic 606) effective January 1, 2018, using the modified retrospective approach. The insurance contracts of our Health Plans segment, which segment constitutes the vast majority of our operations, are excluded from the scope of Topic 606 because the recognition of revenue under these contracts is dictated by other accounting standards governing insurance contracts. The cumulative effect of initially applying the guidance, relating entirely to our Molina Medicaid Solutions segment contracts, resulted in an immaterial impact to beginning retained earnings, as presented in the accompanying consolidated statement of stockholders’ equity. Topic 606 was only applied to service contracts that were not completed as of December 31, 2017. Refer to “Other segment” below for further information.

Health Plans segment

Premium revenue is fixed in advance of the periods covered and, except as described below, is not generally subject to significant accounting estimates. Premium revenues are recognized in the month that members are entitled to receive health care services, and premiums collected in advance are deferred. Certain components of premium revenue are subject to accounting estimates and fall into two broad categories discussed in further detail below: 1) “Contractualthe following categories:

Contractual Provisions That May Adjust or Limit Revenue or Profit;” and 2) “Quality Incentives.” Liabilities recorded for such provisions are included in “Amounts due government agencies” in the accompanying consolidated balance sheets.Profit

| |

1) | Contractual Provisions That May Adjust or Limit Revenue or Profit: |

Medicaid Program

Medical Cost Floors (Minimums), and Medical Cost Corridors:Corridors. Pursuant to certain contract provisions, aA portion of our premium revenue may be returned if certain minimum amounts are not spent on defined medical care costs. In the aggregate, we recorded a liability under the terms of such contract provisions of $198$98 million and $135$103 million at September 30, 2018March 31, 2019 and December 31, 2017,2018, respectively. Approximately $144 million and $96$87 million of thisthe liability accrued at September 30, 2018both March 31, 2019 and December 31, 2017, respectively,2018, relates to our participation in Medicaid Expansion programs. Refer

In certain circumstances, the health plans may receive additional premiums if amounts spent on medical care costs exceed a defined maximum threshold. Receivables relating to Note 12, “such provisions were insignificant at March 31, 2019 and December 31, 2018.

Profit Sharing and Profit Ceiling. CommitmentsOur contracts with certain states contain profit-sharing or profit ceiling provisions under which we refund amounts to the states if our health plans generate profit above a certain specified percentage. In some cases, we are limited in the amount of administrative costs that we may deduct in calculating the refund, if any. Liabilities for profits in excess of the amount we are allowed to retain under these provisions were insignificant at March 31, 2019 and Contingencies,” for further information regarding the California Medicaid Expansion program.December 31, 2018.

Retroactive Premium Adjustments:Adjustments. State Medicaid programs periodically adjust premium rates on a retroactive basis. In these cases, we must adjust our premium revenue in the period in which we learn of the adjustment, rather than in the months of service to which the retroactive adjustment applies.

Medicare Program

Risk Adjusted Premiums: Our Medicare premiums are subject to retroactive increase or decrease based on the health status of our Medicare members (as measured by member risk score). We estimate our members’ risk scores and the related amount of Medicare revenue that will ultimately be realized for the periods presented based on our knowledge of our members’ health status, risk scores and CMS practices. Consolidated balance sheet

amounts related to anticipated Medicare risk adjusted premiums and Medicare Part D settlements were insignificant at March 31, 2019 and December 31, 2018.

Minimum MLR:MLR. The Affordable Care Act (ACA)(“ACA”) has established a minimum annual medical loss ratio (Minimum MLR) of 85% for Medicare. The medical loss ratio represents medical costs as a percentage of premium revenue. Federal regulations define what constitutes medical costs and premium revenue. If the Minimum MLR is not met, we may be required to pay rebates to the federal government. We recognize estimated rebates under the Minimum MLR as an adjustment to premium revenue in our consolidated statements of operations.income. The amounts payable for the Medicare Minimum MLR was not significant at September 30, 2018March 31, 2019 and December 31, 2017.2018.

Marketplace Program

Risk adjustment:adjustment. Under this program, our health plans’ composite risk scores are compared with the overall average risk score for the relevant state and market pool. Generally, our health plans will make a risk adjustment payment into the pool if their composite risk scores are below the average risk score (risk adjustment payable), and will receive a risk adjustment payment from the pool if their composite risk scores are above the average risk score.score (risk adjustment receivable). We estimate our ultimate premium based on insurance policy year-to-date experience, and recognize estimated premiums relating to the risk adjustment program as an adjustment to premium

revenue in our consolidated statements of operations.income. As of September 30, 2018,March 31, 2019, and December 31, 2017,2018, the Marketplace risk adjustment payable amounted to $390$568 million and $912$466 million, respectively. As of March 31, 2019, and December 31, 2018, the Marketplace risk adjustment receivable amounted to $51 million and $34 million, respectively.

Minimum MLR:MLR. The ACA has established a Minimum MLR of 80% for the Marketplace. If the Minimum MLR is not met, we may be required to pay rebates to our Marketplace policyholders. The Marketplace risk adjustment program is taken into consideration when computing the Minimum MLR. We recognize estimated rebates under the Minimum MLR as an adjustment to premium revenue in our consolidated statements of operations. The payable forincome. Aggregate balance sheet amounts related to the Marketplace Minimum MLR was not significantwere insignificant at September 30, 2018March 31, 2019 and December 31, 2017.2018.

Quality Incentives

At many of our health plans, revenue ranging from approximately 1% to 3%4% of certain health plan premiums is earned only if certain performance measures are met.

The following table quantifies the quality incentive premium revenue recognized for the periods presented, including the amounts earned in the periods presented and prior periods. Although the reasonably possible effects of a change in estimate related to quality incentive premium revenue as of September 30, 2018March 31, 2019, are not known, we have no reason to believe that the adjustments to prior years noted below are not indicative of the potential future changes in our estimates as of September 30, 2018.March 31, 2019.

| | | | Three Months Ended September 30, | | Nine Months Ended September 30, | Three Months Ended March 31, |

| | 2018 | | 2017 | | 2018 | | 2017 | 2019 | | 2018 |

| | (Dollars in millions) | (In millions) |

| Maximum available quality incentive premium - current period | $ | 48 |

| | $ | 36 |

| | $ | 135 |

| | $ | 113 |

| $ | 45 |

| | $ | 40 |

|

| | | | | |

| Quality incentive premium revenue recognized in current period: | | | | | | | | | | |

| Earned current period | $ | 39 |

| | $ | 24 |

| | $ | 97 |

| | $ | 72 |

| $ | 26 |

| | $ | 24 |

|

| Earned prior periods | 9 |

| | 3 |

| | 32 |

| | 9 |

| 20 |

| | 11 |

|

| Total | $ | 48 |

| | $ | 27 |

| | $ | 129 |

| | 81 |

| $ | 46 |

| | $ | 35 |

|

| | | | | | | | | | | |

| Quality incentive premium revenue recognized as a percentage of total premium revenue | 1.1 | % | | 0.6 | % | | 1.0 | % | | 0.6 | % | 1.2 | % | | 0.8 | % |

Other segment

Our Pathways subsidiary’s revenueA summary of the categories of amounts due government agencies is all variable, and generally invoiced after services are rendered; customer payment follows invoicing. We concluded that there is no change to revenue recognition under Topic 606 for Pathways, and therefore no impact to retained earnings effective January 1, 2018. As discussed in Note 1, “Organization and Basis of Presentation,” we sold Pathways on October 19, 2018.as follows:

|

| | | | | | | |

| | March 31,

2019 | | December 31,

2018 |

| | (In millions) |

| Medicaid program: | | | |

| Medical cost floors and corridors | $ | 98 |

| | $ | 103 |

|

| Other amounts due to states | 90 |

| | 81 |

|

| Marketplace program: | | | |

| Risk adjustment | 568 |

| | 466 |

|

| Cost sharing reduction | — |

| | 183 |

|

| Other | 176 |

| | 134 |

|

| | $ | 932 |

| | $ | 967 |

|

Medical Care Costs -

Marketplace Cost Share Reduction (CSR) UpdateProgram

In the nine months ended September 30,first quarter of 2018, we recognized a benefit of approximately $81$70 million in reduced medical expensecare costs related to 2017 dates of service including $5 million in the third quarter of 2018, as a result of the federal government’s confirmation that the reconciliation of 2017 Marketplace CSRcost sharing reduction (“CSR”) subsidies would be performed on an annual basis. In the fourth quarter of 2017, we had assumed a nine-month reconciliation of this item pending confirmation of the time period to which the 2017 reconciliation would be applied.

Leases

Right-of-use (“ROU”) assets represent our right to use the underlying assets over the lease term, and lease liabilities represent our obligation to make lease payments arising from the related leases. ROU assets and lease liabilities are recognized at the lease commencement date based on the present value of lease payments over the lease term. Lease terms may include options to extend or terminate the lease when we believe it is reasonably certain that we will exercise such options. Operating lease ROU assets are reported in other assets, and operating lease liabilities are reported in accounts payable and accrued liabilities (current), and other long-term liabilities (non-current) in our consolidated balance sheets. Finance lease ROU assets are reported in property, equipment, and capitalized software, and finance lease liabilities are reported in accounts payable and accrued liabilities (current), and finance lease liabilities (non-current) in our consolidated balance sheets.

Because most of our leases do not provide an implicit interest rate, we generally use our incremental borrowing rate to determine the present value of lease payments. Lease expenses for operating lease payments are recognized on a straight-line basis over the lease term, and the related ROU assets and liabilities are reduced to the present value of the remaining lease payments at the end of each period. Finance lease payments reduce finance lease liabilities, the related ROU assets are amortized on a straight-line basis over the lease term, and interest expense is recognized using the effective interest method.

Short-term leases (with a term of 12 months or less) are not recorded as ROU assets or liabilities in the consolidated balance sheets. We account for lease and non-lease components as a single lease component. For certain leases that represent a portfolio of similar assets, such as a fleet of vehicles, we apply a portfolio approach to account for the related operating lease ROU assets and liabilities, rather than account for such assets and liabilities on an individual basis. A nominal number of our lease agreements include rental payments that adjust periodically for inflation. Our lease agreements do not contain any material residual value guarantees or material restrictive covenants.

For further information regarding our adoption of Accounting Standards Update (“ASU”) 2016-02, Leases (Topic 842), see Recent Accounting Pronouncements Adopted, below.

Concentrations of Credit Risk

Financial instruments that potentially subject us to concentrations of credit risk consist primarily of cash and cash equivalents, investments, receivables, and restricted investments. Our investments and a portion of our cash equivalents are managed by professional portfolio managers operating under documented investment guidelines. Our portfolio managers must obtain our prior approval before selling investments where the loss position of those investments exceeds certain levels. Our investments consist primarily of investment-grade debt securities with a

maximum maturity of 10 years and an average duration of three years or less.years. Restricted investments are invested principally in certificates of deposit and U.S. treasuryTreasury securities. Concentration of credit risk with respect to accounts receivable is generally limited because our payors consist principally of the governments of each state in which our health plan subsidiaries operate.

Income Taxes

The provision for income taxes is determined using an estimated annual effective tax rate, which generally differs from the U.S. federal statutory rate primarily because of state taxes, nondeductible expenses such as the Health Insurer Fee (HIF)(“HIF”), certain compensation, and other general and administrative expenses. The effective tax rate waswill not be impacted by HIF in 20172019 given the 20172019 HIF moratorium.

The effective tax rate may be subject to fluctuations during the year as new information is obtained. Such information may affect the assumptions used to estimate the annual effective tax rate, including projected pretax earnings, the mix of pretax earnings in the various tax jurisdictions in which we operate, valuation allowances against deferred tax assets, the recognition or the reversal of the recognition of tax benefits related to uncertain tax positions, and changes in or the interpretation of tax laws in jurisdictions where we conduct business. We recognize deferred tax assets and liabilities for temporary differences between the financial reporting basis and the tax basis of our assets and liabilities, along with net operating loss and tax credit carryovers.

The Tax Cuts and Jobs Act (TCJA) was enacted on December 22, 2017. The TCJA, in part, reduced the U.S. federal statutory corporate income tax rate from 35% to 21% effective January 1, 2018. Accounting guidance allows filers a measurement period of one year from the enactment date to finalize the provisional valuation of deferred tax assets and liabilities. During the third quarter of 2018, we recognized approximately $4 million in adjustments to our provisional valuation of our deferred tax assets and liabilities recorded at December 31, 2017, and included these adjustments as a component of income tax expense from continuing operations, which decreased our effective tax rate by 150 basis points in the quarter. At September 30, 2018, we had not completed our accounting for the tax effects resulting from enactment of TCJA with respect to valuation of our deferred tax assets and liabilities. We will continue to refine our calculations as additional analysis is completed. In addition, our estimates may also be affected by expected future guidance on the tax law from the Internal Revenue Service and U.S. Treasury.

Recent Accounting Pronouncements Adopted

Revenue Recognition (Topic 606). See discussion above, in “Revenue Recognition.”

Comprehensive Income.Leases. In February 2018,2016, the Financial Accounting Standards Board (FASB)(“FASB”) issued ASU 2018-02, ReclassificationTopic 842, which was subsequently modified by several ASUs issued in 2017 and 2018. Topic 842 was issued to increase transparency and comparability among organizations by requiring the recognition of Certain Tax EffectsROU assets and lease liabilities on the balance sheet. Most prominent among the changes in Topic 842 is the recognition of ROU assets and lease liabilities by lessees for those leases classified as operating leases. In addition, Topic 842’s disclosures are required to meet the objective of enabling users of financial statements to assess the amount, timing and uncertainty of cash flows arising from Accumulated Other Comprehensive Income,leases. Topic 842’s transition provisions are applied using a modified retrospective approach under which allows a reclassification from accumulated other comprehensive incomeentities may not retrospectively adjust any periods prior to retained earnings for stranded tax effects resulting from the TCJA. ASU 2018-02earliest comparative period presented, or at the beginning of the period of adoption, whichever is effectivelater. Entities may elect whether to apply the transition provisions, including disclosure requirements, at the beginning January 1, 2019; we earlyof the earliest comparative period presented or on the adoption date.

We adopted this ASUTopic 842 effective January 1, 2018. The2019, and have elected to apply the transition provisions as of January 1, 2019. Accordingly, we recognized the cumulative effect of initially applying the guidance resulted instandard as an immaterial impactadjustment to beginningthe opening balance of retained earnings as presentedon January 1, 2019. In addition, we elected the available practical expedients and implemented internal controls and key system functionality to enable the preparation of financial information on adoption.

As indicated in the accompanying consolidated statementstatements of stockholders’ equity.

Restricted Cash. In November 2016,equity, the FASB issued ASU 2016-18, Restricted Cash, which requires uscumulative effect adjustment was an increase of $85 million to includeretained earnings, relating primarily to the transition provisions for sale-leaseback arrangements that did not qualify for sale treatment. Accordingly, such arrangements for certain office buildings were de-recognized and recorded as finance lease ROU assets and lease liabilities. The difference between the de-recognized assets and lease financing obligations resulted in an increase to retained earnings. The recognition of these arrangements as finance lease ROU assets and lease liabilities will not materially impact our consolidated statementsresults of cash flowsoperations throughout the changes interms of the balances of cash, cash equivalents, restricted cash and restricted cash equivalents. We adopted ASU 2016-18 on January 1, 2018. We have applied the guidance retrospectively to all periods presented. Such retrospective adoption resulted in a $91 million reclassification of restricted cash and cash equivalents from “Investing activities,leases.

See Note 13, “Leases,” to the beginning and ending balances of cash and cash equivalents in our consolidated statements of cash flows for the nine months ended September 30, 2017. There was no impact to our consolidated statementsrequired disclosures under Topic 842, including the amount and location of operations, balance sheets, or stockholders’ equity. The reconciliation of cashthe ROU assets and cash equivalents to cash, cash equivalents, and restricted cash and cash equivalents is presented at the beginning of this note.

Recent Accounting Pronouncements Not Yet Adoptedlease liabilities recognized.

Software Licenses. In August 2018, the FASB issued ASU 2018-15, Customer’s Accounting for Implementation Costs Incurred in a Cloud Computing Arrangement That Is a Service Contract, which aligns the requirements for capitalizing implementation costs incurred in a hosting arrangement that is a service contract with the requirements for capitalizing implementation costs incurred to develop or obtain internal-use software. We early adopted ASU 2018-15 is effective beginning January 1, 2020, and can be applied either retrospectively or prospectively to all implementation costs incurred after the date of adoption; early adoption is permitted. We are evaluating the effect of this guidance.

Callable Debt Securities. In March 2017, the FASB issued ASU 2017-08, Premium Amortization on Purchased Callable Debt Securities, which shortens the amortization period for certain callable debt securities held at a premium. Specifically, the amendments require the premium to be amortized to the earliest call date. ASU 2017-08 is effective beginning January 1, 2019, and must be adopted as a cumulative effect adjustmentusing the prospective method, with no material impact to retained earnings; early adoption is permitted. We are evaluating the effectour financial condition, results of operations or cash flows. Adoption of this guidance.guidance may be significant to us in the future depending on the extent to which we use cloud computing arrangements that qualify as service contracts.

Recent Accounting Pronouncements Not Yet Adopted

Credit Losses. In June 2016, the FASB issued ASU 2016-13, Measurement of Credit Losses on Financial Instruments. Rather than generally recognizing credit losses when it is probable that the loss has been incurred, the

revised guidance requires companies to recognize an allowance for credit losses for the difference between the amortized cost basis of a financial instrument and the amount of amortized cost that the company expectscompanies expect to collect over the instrument’s

contractual life. ASU 2016-13 is effective beginning January 1, 2020, and must be adopted as a cumulative effect adjustment to retained earnings; early adoption is permitted. We are in the early stages of evaluating the effect of this guidance.

Leases. In February 2016,Other recent accounting pronouncements issued by the FASB issued ASU 2016-02, Leases (Topic 842)(including its Emerging Issues Task Force), as modified by:

ASU 2017-03, Transitionthe American Institute of Certified Public Accountants, and Open Effective Date Information;

ASU 2018-01, Leases (Topic 842): Land Easement Practical Expedient for Transition to Topic 842;

ASU 2018-10, Codification Improvements to Topic 842, Leases;the Securities and

ASU 2018-11, Leases (Topic 842): Targeted Improvements.

Under Topic 842, an entity will be required to recognize assets and liabilities for the rights and obligations created by leases on the entity’s balance sheet for both financing and operating leases. Topic 842 also requires new disclosures that depict the amount, timing, and uncertainty of cash flows pertaining to an entity’s leases. We will adopt Topic 842 effective January 1, 2019, using the modified retrospective method. Under this method, we will recognize the cumulative effect of initially applying the standard as an adjustment to the opening balance of retained earnings on January 1, 2019. In addition, we Exchange Commission (“SEC”) did not have, elected the transition option provided under ASU 2018-11, which allows entities to continue to apply the legacy guidance in Topic 840, Leases, including its disclosure requirements, in the comparative periods presented in the year of adoption.

Under Topic 842, we will record right-of-use assets and liabilities relating primarily to our long-term office operating leases. We have substantially completed the configuration of our lease databasenor does management system for the adoption of Topic 842. We do not currently expect the adoption of this guidancesuch pronouncements to have, a material effectsignificant impact on our present or future consolidated results of operations, financial condition or cash flows.statements.

3. Net Income (Loss) per Share

The following table sets forth the calculation of basic and diluted net income (loss) per share: | | | | Three Months Ended September 30, | | Nine Months Ended September 30, | Three Months Ended March 31, |

| | 2018 | | 2017 | | 2018 | | 2017 | 2019 | | 2018 |

| | (In millions, except net income per share) | (In millions, except net income per share) |

| Numerator: | | | | | | | | | | |

| Net income (loss) | $ | 197 |

| | $ | (97 | ) | | $ | 506 |

| | $ | (250 | ) | |

| Net income | | $ | 198 |

| | $ | 107 |

|

| Denominator: | | | | | | | | | | |

| Shares outstanding at the beginning of the period | 61.3 |

| | 56.5 |

| | 59.3 |

| | 55.8 |

| 62.1 |

| | 59.3 |

|

| Weighted-average number of shares issued: | | | | | | | | | | |

Exchange of 1.625% Notes (1) | — |

| | — |

| | 1.3 |

| | — |

| |

| Stock-based compensation | — |

| | — |

| | 0.2 |

| | 0.4 |

| |

| Exchange of 1.625% Convertible Notes | | — |

| | 0.5 |

|

| Denominator for basic net income per share | 61.3 |

| | 56.5 |

| | 60.8 |

| | 56.2 |

| 62.1 |

| | 59.8 |

|

| Effect of dilutive securities: | | | | | | | | | | |

1.125% Warrants (1) | 5.6 |

| | — |

| | 5.0 |

| | — |

| 3.5 |

| | 4.4 |

|

1.625% Notes (1) | 0.6 |

| | — |

| | 0.5 |

| | — |

| |

| 1.625% Convertible Notes | | — |

| | 0.7 |

|

| Stock-based compensation | 0.4 |

| | — |

| | 0.3 |

| | — |

| 0.6 |

| | 0.3 |

|

| Denominator for diluted net income per share | 67.9 |

| | 56.5 |

| | 66.6 |

| | 56.2 |

| 66.2 |

| | 65.2 |

|

| | | | | | | | | | | |

Net income (loss) per share: (2) | | | | | | | | |

Net income per share: (2) | | | | |

| Basic | $ | 3.22 |

| | $ | (1.70 | ) | | $ | 8.32 |

| | $ | (4.44 | ) | $ | 3.19 |

| | $ | 1.79 |

|

| Diluted | $ | 2.90 |

| | $ | (1.70 | ) | | $ | 7.60 |

| | $ | (4.44 | ) | $ | 2.99 |

| | $ | 1.64 |

|

| | | | | | | | | | | |

| Potentially dilutive common shares excluded from calculations: | | | | | | | | |

1.125% Warrants (1) | — |

| | 2.3 |

| | — |

| | 1.3 |

| |

1.625% Notes (1) | — |

| | 0.6 |

| | — |

| | 0.3 |

| |

Potentially dilutive common shares excluded from calculations: (1) | | | | |

| Stock-based compensation | — |

| | 0.2 |

| | — |

| | 0.3 |

| 0.1 |

| | 0.4 |

|

| |

| (1) | For more information and definitions regarding the 1.625% Notes, refer to Note 7, “Debt.” For more information and definitions regarding the 1.125% Warrants, including partial termination transactions, refer to Note 9, “Stockholders' Equity.” The dilutive effect of all potentially dilutive common shares is calculated using the treasury stock method. Certain potentially dilutive common shares issuable arewere not included in the computation of diluted net income (loss) per share because to do so would behave been anti-dilutive. |

| |

| (2) | Source data for calculations in thousands. |

4. Fair Value Measurements

We consider the carrying amounts of cash, cash equivalents and other current assets and current liabilities (not including derivatives and the current portion of long-term debt) to approximate their fair values because of the relatively short period of time between the origination of these instruments and their expected realization or payment. For our financial instruments measured at fair value on a recurring basis, we prioritize the inputs used in measuring fair value according to the three-tier fair value hierarchy. For a description of the methods and assumptions that we use to a) estimate the fair value; and b) determine the classification according to the fair value hierarchy for each financial instrument, see Note 4, “Fair Value Measurements,” in our 20172018 Annual Report on Form 10-K.

Derivative financial instruments include the 1.125% Call Option derivative asset and the 1.125% Conversion Option derivative liability (see Note 8 “Derivatives,” for definitions and further information). These derivatives are not

actively traded and are valued based on an option pricing model that uses observable and unobservable market data for inputs. Significant market data inputs used to determine fair value as of September 30, 2018,March 31, 2019, included the price of our common stock, the time to maturity of the derivative instruments, the risk-free interest rate, and the implied volatility of our common stock. The 1.125% Call Option derivative asset and the 1.125% Conversion Option

derivative liability were designed such that changes in their fair values would offset, with minimal impact to the consolidated statements of operations.income. Therefore, the sensitivity of changes in the unobservable inputs to the option pricing model for such derivative instruments is mitigated.

The net changes in fair value of Level 3 financial instruments were insignificant to our results of operationsincome for the ninethree months ended September 30, 2018.March 31, 2019.

Our financial instruments measured at fair value on a recurring basis at September 30, 2018,March 31, 2019, were as follows: | | | | Total | | Quoted Market Prices (Level 1) | | Significant Other Observable Inputs (Level 2) | | Significant Unobservable Inputs (Level 3) | Total | | Observable Inputs (Level 1) | | Directly or Indirectly Observable Inputs (Level 2) | | Unobservable Inputs (Level 3) |

| | (In millions) | (In millions) |

| Corporate debt securities | $ | 1,191 |

| | $ | — |

| | $ | 1,191 |

| | $ | — |

| $ | 947 |

| | $ | — |

| | $ | 947 |

| | $ | — |

|

| U.S. treasury notes | 221 |

| | 221 |

| | — |

| | — |

| |

| Government-sponsored enterprise securities (GSEs) | 170 |

| | 170 |

| | — |

| | — |

| |

| U.S. Treasury notes | | 168 |

| | — |

| | 168 |

| | — |

|

| Government-sponsored enterprise securities (“GSEs”) | | 166 |

| | — |

| | 166 |

| | — |

|

| Municipal securities | 119 |

| | — |

| | 119 |

| | — |

| 112 |

| | — |

| | 112 |

| | — |

|

| Asset-backed securities | 92 |

| | — |

| | 92 |

| | — |

| 75 |

| | — |

| | 75 |

| | — |

|

| Mortgage-backed securities | | 23 |

| | — |

| | 23 |

| | — |

|

| Certificate of deposit | 15 |

| | — |

| | 15 |

| | — |

| 14 |

| | — |

| | 14 |

| | — |

|

| Other | 4 |

| | — |

| | 4 |

| | — |

| 3 |

| | — |

| | 3 |

| | — |

|

| Subtotal - current investments | 1,812 |

| | 391 |

| | 1,421 |

| | — |

| 1,508 |

| | — |

| | 1,508 |

| | — |

|

| 1.125% Call Option derivative asset | 843 |

| | — |

| | — |

| | 843 |

| 516 |

| | — |

| | — |

| | 516 |

|

| Total assets | $ | 2,655 |

| | $ | 391 |

| | $ | 1,421 |

| | $ | 843 |

| $ | 2,024 |

| | $ | — |

| | $ | 1,508 |

| | $ | 516 |

|

| | | | | | | | | | | | | | | |

| 1.125% Conversion Option derivative liability | $ | 843 |

| | $ | — |

| | $ | — |

| | $ | 843 |

| $ | 516 |

| | $ | — |

| | $ | — |

| | $ | 516 |

|

| Total liabilities | $ | 843 |

| | $ | — |

| | $ | — |

| | $ | 843 |

| $ | 516 |

| | $ | — |

| | $ | — |

| | $ | 516 |

|

Our financial instruments measured at fair value on a recurring basis at December 31, 2017,2018, were as follows: | | | | Total | | Quoted Market Prices (Level 1) | | Significant Other Observable Inputs (Level 2) | | Significant Unobservable Inputs (Level 3) | Total | | Observable Inputs (Level 1) | | Directly or Indirectly Observable Inputs (Level 2) | | Unobservable Inputs (Level 3) |

| | (In millions) | (In millions) |

| Corporate debt securities | $ | 1,588 |

| | $ | — |

| | $ | 1,588 |

| | $ | — |

| $ | 1,123 |

| | $ | — |

| | $ | 1,123 |

| | $ | — |

|

| U.S. treasury notes | 388 |

| | 388 |

| | — |

| | — |

| |

| U.S. Treasury notes | | 181 |

| | — |

| | 181 |

| | — |

|

| GSEs | 253 |

| | 253 |

| | — |

| | — |

| 163 |

| | — |

| | 163 |

| | — |

|

| Municipal securities | 141 |

| | — |

| | 141 |

| | — |

| 114 |

| | — |

| | 114 |

| | — |

|

| Asset-backed securities | 117 |

| | — |

| | 117 |

| | — |

| 82 |

| | — |

| | 82 |

| | — |

|

| Certificates of deposit | 37 |

| | — |

| | 37 |

| | — |

| 14 |

| | — |

| | 14 |

| | — |

|

| Other | | 4 |

| | — |

| | 4 |

| | — |

|

| Subtotal - current investments | 2,524 |

| | 641 |

| | 1,883 |

| | — |

| 1,681 |

| | — |

| | 1,681 |

| | — |

|

| Corporate debt securities | 101 |

| | — |

| | 101 |

| | — |

| |

| U.S. treasury notes | 68 |

| | 68 |

| | — |

| | — |

| |

| Subtotal - current restricted investments | 169 |

| | 68 |

| | 101 |

| | — |

| |

| 1.125% Call Option derivative asset | 522 |

| | — |

| | — |

| | 522 |

| 476 |

| | — |

| | — |

| | 476 |

|

| Total assets | $ | 3,215 |

| | $ | 709 |

| | $ | 1,984 |

| | $ | 522 |

| $ | 2,157 |

| | $ | — |

| | $ | 1,681 |

| | $ | 476 |

|

| | | | | | | | | | | | | | | |

| 1.125% Conversion Option derivative liability | $ | 522 |

| | $ | — |

| | $ | — |

| | $ | 522 |

| $ | 476 |

| | $ | — |

| | $ | — |

| | $ | 476 |

|

| Total liabilities | $ | 522 |

| | $ | — |

| | $ | — |

| | $ | 522 |

| $ | 476 |

| | $ | — |

| | $ | — |

| | $ | 476 |

|

Fair Value Measurements – Disclosure Only

The carrying amounts and estimated fair values of our senior notes payable are classified as Level 2 financial instruments. Fair value for these securities is determined using a market approach based on quoted market prices for similar securities in active markets or quoted prices for identical securities in inactive markets. The carrying amount and estimated fair value of the Term Loan is classified as a Level 3 financial instrument, because certain inputs used to determine its fair value are not observable. As of March 31, 2019, the carrying amount of the Term Loan approximates fair value because its interest rate is a variable rate that approximates rates currently available to us.

|

| | | | | | | | | | | | | | | |

| | September 30, 2018 | | December 31, 2017 |

| | Carrying Amount | |

Fair Value | | Carrying Amount | |

Fair Value |

| | (In millions) |

| 5.375% Notes | $ | 693 |

| | $ | 711 |

| | $ | 692 |

| | $ | 730 |

|

1.125% Notes (1) | 295 |

| | 1,142 |

| | 496 |

| | 1,052 |

|

| 4.875% Notes | 326 |

| | 325 |

| | 325 |

| | 329 |

|

1.625% Notes (2) | — |

| | — |

| | 157 |

| | 220 |

|

Credit Facility (2) | — |

| | — |

| | 300 |

| | 300 |

|

| | $ | 1,314 |

| | $ | 2,178 |

| | $ | 1,970 |

| | $ | 2,631 |

|

|

| | | | | | | | | | | | | | | |

| | March 31, 2019 | | December 31, 2018 |

| | Carrying Amount | |

Fair Value | | Carrying Amount | |

Fair Value |

| | (In millions) |

| 5.375% Notes | $ | 695 |

| | $ | 725 |

| | $ | 694 |

| | $ | 674 |

|

| 4.875% Notes | 326 |

| | 327 |

| | 326 |

| | 301 |

|

1.125% Convertible Notes (1),(2) | 198 |

| | 716 |

| | 240 |

| | 732 |

|

| Term Loan | 100 |

| | 100 |

| | — |

| | — |

|

| | $ | 1,319 |

| | $ | 1,868 |

| | $ | 1,260 |

| | $ | 1,707 |

|

______________________

| |

| (1) | The fair value of the 1.125% Conversion Option (the embedded cash conversion option), which is includedreflected in the fair value amounts presented above, amounted to $843$516 million and $522$476 million as of September 30, 2018,March 31, 2019, and December 31, 2017,2018, respectively. See further discussion at Note 7, “Debt,” and Note 8, “Derivatives.” |

| |

| (2) | For more information on debt repayments in the nine months ended September 30, 2018,first quarter of 2019, refer to Note 7, “Debt.” |

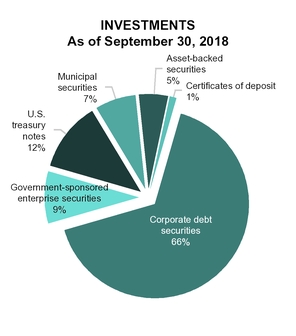

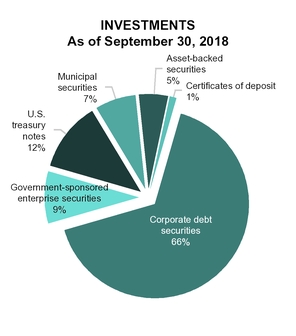

5. Investments

Available-for-Sale Investments

We consider all of our investments classified as current assets to be available-for-sale. The following tables summarize our investments as of the dates indicated: | | | | September 30, 2018 | March 31, 2019 |

| | Amortized | | Gross Unrealized | | Estimated Fair | Amortized | | Gross Unrealized | | Estimated Fair |

| | Cost | | Gains | | Losses | | Value | Cost | | Gains | | Losses | | Value |

| | (In millions) | (In millions) |

| Corporate debt securities | $ | 1,197 |

| | $ | 1 |

| | $ | 7 |

| | $ | 1,191 |

| $ | 949 |

| | $ | 1 |

| | $ | 3 |

| | $ | 947 |

|

| U.S. treasury notes | 222 |

| | — |

| | 1 |

| | 221 |

| |

| U.S. Treasury notes | | 168 |

| | — |

| | — |

| | 168 |

|

| GSEs | 172 |

| | — |

| | 2 |

| | 170 |

| 167 |

| | — |

| | 1 |

| | 166 |

|

| Municipal securities | 121 |

| | — |

| | 2 |

| | 119 |

| 113 |

| | — |

| | 1 |

| | 112 |

|

| Asset backed securities | 93 |

| | — |

| | 1 |

| | 92 |

| |

| Asset-backed securities | | 75 |

| | — |

| | — |

| | 75 |

|

| Mortgage-backed securities | | 23 |

| | — |

| | — |

| | 23 |

|

| Certificates of deposit | 15 |

| | — |

| | — |

| | 15 |

| 14 |

| | — |

| | — |

| | 14 |

|

| Other | 4 |

| | — |

| | — |

| | 4 |

| 3 |

| | — |

| | — |

| | 3 |

|

| | $ | 1,824 |

| | $ | 1 |

| | $ | 13 |

| | $ | 1,812 |

| $ | 1,512 |

| | $ | 1 |

| | $ | 5 |

| | $ | 1,508 |

|

| | | | December 31, 2017 | December 31, 2018 |

| | Amortized | | Gross Unrealized | | Estimated Fair | Amortized | | Gross Unrealized | | Estimated Fair |

| | Cost | | Gains | | Losses | | Value | Cost | | Gains | | Losses | | Value |

| | (In millions) | (In millions) |