UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

☒ Quarterly Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the quarterly period ended June 30, 2020March 31, 2021

☐ Transition Report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the transition period from ________ to ________

Commission File Number: 000-50058

PRA Group, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | | | 75-3078675 |

| (State or other jurisdiction of incorporation or organization) | | | | (I.R.S. Employer Identification No.) |

120 Corporate Boulevard

Norfolk, Virginia 23502

(Address of principal executive offices)

(888) 772-7326

(Registrant's Telephone No., including area code)

Not Applicable

(Former name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.01 par value per share | PRAA | NASDAQ Global Select Market |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes þ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer þ Accelerated filer ¨ Non-accelerated filer ¨ Smaller reporting company ☐ Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No þ

The number of shares of the registrant's common stock outstanding as of August 4, 2020May 5, 2021 was 45,579,483.45,799,855.

Table of Contents

| | | | | | | | |

| | |

| | |

| Item 1. | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| Item 2. | | |

| Item 3. | | |

| Item 4. | | |

| | |

| | |

| | |

| Item 1. | | |

| Item 1A. | | |

| Item 2. | | |

| Item 3. | | |

| Item 4. | | |

| Item 5. | | |

| Item 6. | | |

| | |

| Signatures | | |

Part I. Financial Information

Item 1. Financial Statements (Unaudited)

PRA Group, Inc.

Consolidated Balance Sheets

June 30, 2020March 31, 2021 and December 31, 20192020

(Amounts in thousands)

| | | (unaudited) | | | (unaudited) | |

| | June 30,

2020 | | December 31,

2019 | | March 31,

2021 | | December 31,

2020 |

| Assets | Assets | | | | Assets | | | |

| Cash and cash equivalents | Cash and cash equivalents | $ | 115,741 | | | $ | 119,774 | | Cash and cash equivalents | $ | 92,798 | | | $ | 108,613 | |

| Restricted cash | | Restricted cash | 16,057 | | | 12,434 | |

| Investments | Investments | 18,746 | | | 56,176 | | Investments | 54,682 | | | 55,759 | |

| Finance receivables, net | Finance receivables, net | 3,351,532 | | | 3,514,165 | | Finance receivables, net | 3,372,666 | | | 3,514,788 | |

| Other receivables, net | Other receivables, net | 15,532 | | | 10,606 | | Other receivables, net | 3,223 | | | 13,194 | |

| Income taxes receivable | Income taxes receivable | 23,166 | | | 17,918 | | Income taxes receivable | 27,246 | | | 21,928 | |

| Deferred tax asset, net | 64,548 | | | 63,225 | | |

| Deferred tax assets, net | | Deferred tax assets, net | 72,523 | | | 83,205 | |

| Right-of-use assets | | Right-of-use assets | 50,839 | | | 52,951 | |

| Property and equipment, net | Property and equipment, net | 59,285 | | | 56,501 | | Property and equipment, net | 56,825 | | | 58,356 | |

| Right-of-use assets | 58,213 | | | 68,972 | | |

| Goodwill | Goodwill | 444,507 | | | 480,794 | | Goodwill | 492,751 | | | 492,989 | |

| Intangible assets, net | 3,666 | | | 4,497 | | |

| Other assets | Other assets | 42,888 | | | 31,263 | | Other assets | 38,920 | | | 38,844 | |

| | Total assets | Total assets | $ | 4,197,824 | | | $ | 4,423,891 | | Total assets | $ | 4,278,530 | | | $ | 4,453,061 | |

| Liabilities and Equity | Liabilities and Equity | | | | Liabilities and Equity | | | |

| Liabilities: | Liabilities: | | Liabilities: | |

| Accounts payable | Accounts payable | $ | 4,667 | | | $ | 4,258 | | Accounts payable | $ | 4,817 | | | $ | 5,294 | |

| Accrued expenses | Accrued expenses | 72,871 | | | 88,925 | | Accrued expenses | 76,684 | | | 97,320 | |

| Income taxes payable | Income taxes payable | 31,226 | | | 4,046 | | Income taxes payable | 31,853 | | | 29,692 | |

| Deferred tax liability, net | 59,860 | | | 85,390 | | |

| Deferred tax liabilities, net | | Deferred tax liabilities, net | 39,739 | | | 40,867 | |

| Lease liabilities | Lease liabilities | 62,706 | | | 73,377 | | Lease liabilities | 55,322 | | | 57,348 | |

| Interest-bearing deposits | Interest-bearing deposits | 120,520 | | | 106,246 | | Interest-bearing deposits | 124,998 | | | 132,739 | |

| Borrowings | Borrowings | 2,580,068 | | | 2,808,425 | | Borrowings | 2,501,133 | | | 2,661,289 | |

| Other liabilities | Other liabilities | 71,044 | | | 26,211 | | Other liabilities | 40,755 | | | 54,986 | |

| | Total liabilities | Total liabilities | 3,002,962 | | | 3,196,878 | | Total liabilities | 2,875,301 | | | 3,079,535 | |

| | Equity: | Equity: | | | | Equity: | | | |

| Preferred stock, $0.01 par value, 2,000 shares authorized, no shares issued and outstanding | Preferred stock, $0.01 par value, 2,000 shares authorized, no shares issued and outstanding | — | | | — | | Preferred stock, $0.01 par value, 2,000 shares authorized, no shares issued and outstanding | 0 | | | 0 | |

| Common stock, $0.01 par value, 100,000 shares authorized, 45,579 shares issued and outstanding at June 30, 2020; 100,000 shares authorized, 45,416 shares issued and outstanding at December 31, 2019 | 456 | | | 454 | | |

| Common stock, $0.01 par value, 100,000 shares authorized, 45,799 shares issued and outstanding at March 31, 2021; 100,000 shares authorized, 45,585 shares issued and outstanding at December 31, 2020 | | Common stock, $0.01 par value, 100,000 shares authorized, 45,799 shares issued and outstanding at March 31, 2021; 100,000 shares authorized, 45,585 shares issued and outstanding at December 31, 2020 | 458 | | | 456 | |

| Additional paid-in capital | Additional paid-in capital | 70,065 | | | 67,321 | | Additional paid-in capital | 47,236 | | | 75,282 | |

| Retained earnings | Retained earnings | 1,439,680 | | | 1,362,631 | | Retained earnings | 1,582,384 | | | 1,511,970 | |

| Accumulated other comprehensive loss | Accumulated other comprehensive loss | (347,212) | | | (261,018) | | Accumulated other comprehensive loss | (253,576) | | | (245,791) | |

| Total stockholders' equity - PRA Group, Inc. | Total stockholders' equity - PRA Group, Inc. | 1,162,989 | | | 1,169,388 | | Total stockholders' equity - PRA Group, Inc. | 1,376,502 | | | 1,341,917 | |

| Noncontrolling interest | Noncontrolling interest | 31,873 | | | 57,625 | | Noncontrolling interest | 26,727 | | | 31,609 | |

| Total equity | Total equity | 1,194,862 | | | 1,227,013 | | Total equity | 1,403,229 | | | 1,373,526 | |

| Total liabilities and equity | Total liabilities and equity | $ | 4,197,824 | | | $ | 4,423,891 | | Total liabilities and equity | $ | 4,278,530 | | | $ | 4,453,061 | |

The accompanying notes are an integral part of these consolidated financial statements.Consolidated Financial Statements.

PRA Group, Inc.

Consolidated Income Statements

For the three and six months ended June 30,March 31, 2021 and 2020 and 2019

(unaudited)

(Amounts in thousands, except per share amounts)

| | | Three Months Ended June 30, | | | Six Months Ended June 30, | | | Three Months Ended March 31, |

| | 2020 | | 2019 | | 2020 | | 2019 | | 2021 | | 2020 |

| Revenues: | Revenues: | | | | | | | | Revenues: | | | | |

| Portfolio income | Portfolio income | $ | 248,284 | | | $ | — | | | $ | 510,306 | | | $ | — | | Portfolio income | | $ | 231,672 | | | $ | 262,022 | |

| Changes in expected recoveries | Changes in expected recoveries | 19,801 | | | — | | | 6,985 | | | — | | Changes in expected recoveries | | 50,136 | | | (12,816) | |

| Income recognized on finance receivables | — | | | 249,219 | | | — | | | 488,055 | | |

| | Fee income | Fee income | 2,639 | | | 2,707 | | | 4,848 | | | 9,081 | | Fee income | | 2,181 | | | 2,209 | |

| Other revenue | Other revenue | 1,186 | | | 131 | | | 1,555 | | | 798 | | Other revenue | | 5,480 | | | 369 | |

| Total revenues | Total revenues | 271,910 | | | 252,057 | | | 523,694 | | | 497,934 | | Total revenues | | 289,469 | | | 251,784 | |

| | Net allowance charges | — | | | (1,196) | | | — | | | (7,291) | | |

| | | Operating expenses: | Operating expenses: | | Operating expenses: | |

| Compensation and employee services | Compensation and employee services | 70,472 | | | 79,808 | | | 145,643 | | | 159,453 | | Compensation and employee services | | 73,984 | | | 75,171 | |

| Legal collection fees | Legal collection fees | 13,742 | | | 14,297 | | | 28,314 | | | 27,356 | | Legal collection fees | | 12,926 | | | 14,572 | |

| Legal collection costs | Legal collection costs | 19,507 | | | 33,121 | | | 53,954 | | | 68,350 | | Legal collection costs | | 21,312 | | | 34,447 | |

| Agency fees | Agency fees | 10,343 | | | 13,013 | | | 23,719 | | | 27,045 | | Agency fees | | 15,591 | | | 13,376 | |

| Outside fees and services | Outside fees and services | 18,683 | | | 16,293 | | | 38,077 | | | 31,541 | | Outside fees and services | | 20,760 | | | 19,394 | |

| Communication | Communication | 8,812 | | | 10,824 | | | 22,323 | | | 24,025 | | Communication | | 12,663 | | | 13,511 | |

| Rent and occupancy | Rent and occupancy | 4,471 | | | 4,491 | | | 8,955 | | | 8,854 | | Rent and occupancy | | 4,480 | | | 4,484 | |

| Depreciation and amortization | Depreciation and amortization | 4,109 | | | 4,723 | | | 8,193 | | | 9,295 | | Depreciation and amortization | | 3,981 | | | 4,084 | |

| Other operating expenses | Other operating expenses | 10,491 | | | 10,926 | | | 22,696 | | | 22,511 | | Other operating expenses | | 13,018 | | | 12,205 | |

| | Total operating expenses | Total operating expenses | 160,630 | | | 187,496 | | | 351,874 | | | 378,430 | | Total operating expenses | | 178,715 | | | 191,244 | |

| | Income from operations | Income from operations | 111,280 | | | 63,365 | | | 171,820 | | | 112,213 | | Income from operations | | 110,754 | | | 60,540 | |

| Other income and (expense): | Other income and (expense): | | Other income and (expense): | |

| | Interest expense, net | Interest expense, net | (35,416) | | | (36,027) | | | (72,627) | | | (70,008) | | Interest expense, net | | (31,552) | | | (37,211) | |

| Foreign exchange gain/(loss) | 683 | | | (311) | | | 2,966 | | | 5,953 | | |

| Foreign exchange (loss)/gain | | Foreign exchange (loss)/gain | | (26) | | | 2,283 | |

| Other | Other | (1,582) | | | 248 | | | (1,658) | | | (104) | | Other | | 26 | | | (76) | |

| Income before income taxes | Income before income taxes | 74,965 | | | 27,275 | | | 100,501 | | | 48,054 | | Income before income taxes | | 79,202 | | | 25,536 | |

| Income tax expense | Income tax expense | 14,137 | | | 5,075 | | | 17,237 | | | 8,942 | | Income tax expense | | 17,322 | | | 3,100 | |

| Net income | Net income | 60,828 | | | 22,200 | | | 83,264 | | | 39,112 | | Net income | | 61,880 | | | 22,436 | |

| Adjustment for net income attributable to noncontrolling interests | Adjustment for net income attributable to noncontrolling interests | 2,914 | | | 3,581 | | | 6,215 | | | 5,266 | | Adjustment for net income attributable to noncontrolling interests | | 3,474 | | | 3,301 | |

| Net income attributable to PRA Group, Inc. | Net income attributable to PRA Group, Inc. | $ | 57,914 | | | $ | 18,619 | | | $ | 77,049 | | | $ | 33,846 | | Net income attributable to PRA Group, Inc. | | $ | 58,406 | | | $ | 19,135 | |

| Net income per common share attributable to PRA Group, Inc.: | Net income per common share attributable to PRA Group, Inc.: | | | | | | | | Net income per common share attributable to PRA Group, Inc.: | | | | |

| Basic | Basic | $ | 1.27 | | | $ | 0.41 | | | $ | 1.69 | | | $ | 0.75 | | Basic | | $ | 1.28 | | | $ | 0.42 | |

| Diluted | Diluted | $ | 1.26 | | | $ | 0.41 | | | $ | 1.68 | | | $ | 0.74 | | Diluted | | $ | 1.27 | | | $ | 0.42 | |

| Weighted average number of shares outstanding: | Weighted average number of shares outstanding: | | Weighted average number of shares outstanding: | |

| Basic | Basic | 45,548 | | | 45,387 | | | 45,500 | | | 45,363 | | Basic | | 45,669 | | | 45,452 | |

| Diluted | Diluted | 45,987 | | | 45,495 | | | 45,886 | | | 45,457 | | Diluted | | 46,045 | | | 45,784 | |

The accompanying notes are an integral part of these consolidated financial statements.Consolidated Financial Statements.

PRA Group, Inc.

Consolidated Statements of Comprehensive Income/(Loss)

For the three and six months ended June 30,March 31, 2021 and 2020 and 2019

(unaudited)

(Amounts in thousands)

| | | Three Months Ended June 30, | | | Six Months Ended June 30, | | | Three Months Ended March 31, |

| | 2020 | | 2019 | | 2020 | | 2019 | | 2021 | | 2020 |

| Net income | Net income | $ | 60,828 | | | $ | 22,200 | | | $ | 83,264 | | | $ | 39,112 | | Net income | | $ | 61,880 | | | $ | 22,436 | |

| Other comprehensive income/(loss), net of tax: | Other comprehensive income/(loss), net of tax: | | Other comprehensive income/(loss), net of tax: | |

| Currency translation adjustments | Currency translation adjustments | 28,923 | | | 4,740 | | | (79,153) | | | 3,567 | | Currency translation adjustments | | (24,531) | | | (108,076) | |

| Cash flow hedges | Cash flow hedges | (3,753) | | | (8,002) | | | (24,321) | | | (13,717) | | Cash flow hedges | | 12,323 | | | (20,568) | |

| Debt securities available-for-sale | Debt securities available-for-sale | 51 | | | 37 | | | 221 | | | 82 | | Debt securities available-for-sale | | 0 | | | 170 | |

| Other comprehensive income/(loss) | 25,221 | | | (3,225) | | | (103,253) | | | (10,068) | | |

| Other comprehensive loss | | Other comprehensive loss | | (12,208) | | | (128,474) | |

| Total comprehensive income/(loss) | Total comprehensive income/(loss) | 86,049 | | | 18,975 | | | (19,989) | | | 29,044 | | Total comprehensive income/(loss) | | 49,672 | | | (106,038) | |

| Less comprehensive (loss)/ income attributable to noncontrolling interests | (270) | | | 3,959 | | | (10,844) | | | 5,213 | | |

| Less comprehensive loss attributable to noncontrolling interests | | Less comprehensive loss attributable to noncontrolling interests | | (950) | | | (10,574) | |

| Comprehensive income/(loss) attributable to PRA Group, Inc. | Comprehensive income/(loss) attributable to PRA Group, Inc. | $ | 86,319 | | | $ | 15,016 | | | $ | (9,145) | | | $ | 23,831 | | Comprehensive income/(loss) attributable to PRA Group, Inc. | | $ | 50,622 | | | $ | (95,464) | |

The accompanying notes are an integral part of these consolidated financial statements.Consolidated Financial Statements.

PRA Group, Inc.

Consolidated Statements of Changes in Equity

For the sixthree months ended June 30,March 31, 2021 and 2020

(unaudited)

(Amounts in thousands)

| | | Common Stock | | | Additional Paid-in Capital | | Retained Earnings | | Accumulated Other Comprehensive (Loss) | | Noncontrolling Interest | | Total Equity | | | Common Stock | | Additional Paid-In | | Retained | | Accumulated Other Comprehensive | | Noncontrolling | | Total | |

| | Shares | | Amount | | | | | | | | | | | | Shares | | Amount | | Capital | | Earnings | | (Loss) | | Interest | | Equity | |

| Balance at December 31, 2019 | 45,416 | | | $ | 454 | | | $ | 67,321 | | | $ | 1,362,631 | | | $ | (261,018) | | | $ | 57,625 | | | $ | 1,227,013 | | | |

| | Balance at December 31, 2020 | | Balance at December 31, 2020 | 45,585 | | | $ | 456 | | | $ | 75,282 | | | $ | 1,511,970 | | | $ | (245,791) | | | $ | 31,609 | | | $ | 1,373,526 | | |

Effect of change in accounting principle (1) | | Effect of change in accounting principle (1) | — | | | — | | | (26,697) | | | 12,008 | | | — | | | — | | | (14,689) | | |

| Balance at January 1, 2021 | | Balance at January 1, 2021 | 45,585 | | | 456 | | | 48,585 | | | 1,523,978 | | | (245,791) | | | 31,609 | | | 1,358,837 | | |

| Components of comprehensive income, net of tax: | Components of comprehensive income, net of tax: | | | | | | | | | | | | | | | Components of comprehensive income, net of tax: | | |

| Net income | Net income | — | | | — | | | — | | | 19,135 | | | — | | | 3,301 | | | 22,436 | | | Net income | — | | | — | | | — | | | 58,406 | | | — | | | 3,474 | | | 61,880 | | |

| Currency translation adjustments | Currency translation adjustments | — | | | — | | | — | | | — | | | (94,201) | | | (13,875) | | | (108,076) | | | Currency translation adjustments | — | | | — | | | — | | | — | | | (20,108) | | | (4,423) | | | (24,531) | | |

| Cash flow hedges | Cash flow hedges | — | | | — | | | — | | | — | | | (20,568) | | | — | | | (20,568) | | | Cash flow hedges | — | | | — | | | — | | | — | | | 12,323 | | | — | | | 12,323 | | |

| | Debt securities available-for-sale | — | | | — | | | — | | | — | | | 170 | | | — | | | 170 | | | |

| | Distributions to noncontrolling interest | | Distributions to noncontrolling interest | — | | | — | | | — | | | — | | | — | | | (3,933) | | | (3,933) | | |

| | Vesting of restricted stock | Vesting of restricted stock | 124 | | | 1 | | | — | | | — | | | — | | | — | | | 1 | | | Vesting of restricted stock | 214 | | | 2 | | | (2) | | | — | | | — | | | — | | | 0 | | |

| | Share-based compensation expense | Share-based compensation expense | — | | | — | | | 2,857 | | | — | | | — | | | — | | | 2,857 | | | Share-based compensation expense | — | | | — | | | 4,113 | | | — | | | — | | | — | | | 4,113 | | |

| | Employee stock relinquished for payment of taxes | Employee stock relinquished for payment of taxes | — | | | — | | | (3,157) | | | — | | | — | | | — | | | (3,157) | | | Employee stock relinquished for payment of taxes | — | | | — | | | (5,460) | | | — | | | — | | | — | | | (5,460) | | |

| | Balance at March 31, 2020 | 45,540 | | | $ | 455 | | | $ | 67,021 | | | $ | 1,381,766 | | | $ | (375,617) | | | $ | 47,051 | | | $ | 1,120,676 | | | |

| Balance at March 31, 2021 | | Balance at March 31, 2021 | 45,799 | | | $ | 458 | | | $ | 47,236 | | | $ | 1,582,384 | | | $ | (253,576) | | | $ | 26,727 | | | $ | 1,403,229 | | |

| | | | Common Stock | | Additional Paid-In | | Retained | | Accumulated Other Comprehensive | | Noncontrolling | | Total | |

| | | Shares | | Amount | | Capital | | Earnings | | (Loss) | | Interest | | Equity | |

| Balance at December 31, 2019 | | Balance at December 31, 2019 | 45,416 | | | $ | 454 | | | $ | 67,321 | | | $ | 1,362,631 | | | $ | (261,018) | | | $ | 57,625 | | | $ | 1,227,013 | | |

| Components of comprehensive income, net of tax: | Components of comprehensive income, net of tax: | | | | | | | | | | | | | | | Components of comprehensive income, net of tax: | | |

| Net income | Net income | — | | | — | | | — | | | 57,914 | | | — | | | 2,914 | | | 60,828 | | | Net income | — | | | — | | | — | | | 19,135 | | | — | | | 3,301 | | | 22,436 | | |

| Currency translation adjustments | Currency translation adjustments | — | | | — | | | — | | | — | | | 32,107 | | | (3,184) | | | 28,923 | | | Currency translation adjustments | — | | | — | | | — | | | — | | | (94,201) | | | (13,875) | | | (108,076) | | |

| Cash flow hedges | Cash flow hedges | — | | | — | | | — | | | — | | | (3,753) | | | — | | | (3,753) | | | Cash flow hedges | — | | | — | | | — | | | — | | | (20,568) | | | — | | | (20,568) | | |

| Debt securities available-for-sale | Debt securities available-for-sale | — | | | — | | | — | | | — | | | 51 | | | — | | | 51 | | | Debt securities available-for-sale | — | | | — | | | — | | | — | | | 170 | | | — | | | 170 | | |

| Distributions to noncontrolling interest | — | | | — | | | — | | | — | | | — | | | (14,908) | | | (14,908) | | | |

| | Vesting of restricted stock | Vesting of restricted stock | 39 | | | 1 | | | (1) | | | — | | | — | | | — | | | — | | | Vesting of restricted stock | 124 | | | 1 | | | — | | | — | | | — | | | — | | | 1 | | |

| Share-based compensation expense | Share-based compensation expense | — | | | — | | | 3,063 | | | — | | | — | | | — | | | 3,063 | | | Share-based compensation expense | — | | | — | | | 2,857 | | | — | | | — | | | — | | | 2,857 | | |

| Employee stock relinquished for payment of taxes | Employee stock relinquished for payment of taxes | — | | | — | | | (18) | | | — | | | — | | | — | | | (18) | | | Employee stock relinquished for payment of taxes | — | | | — | | | (3,157) | | | — | | | — | | | — | | | (3,157) | | |

| | Balance at June 30, 2020 | 45,579 | | | $ | 456 | | | $ | 70,065 | | | $ | 1,439,680 | | | $ | (347,212) | | | $ | 31,873 | | | $ | 1,194,862 | | | |

| | Balance at March 31, 2020 | | Balance at March 31, 2020 | 45,540 | | | $ | 455 | | | $ | 67,021 | | | $ | 1,381,766 | | | $ | (375,617) | | | $ | 47,051 | | | $ | 1,120,676 | | |

PRA Group, Inc.

Consolidated Statements of Changes in Equity

For the six months ended June 30, 2019

(unaudited)

(Amounts in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Common Stock | | | | Additional Paid-in Capital | | Retained Earnings | | Accumulated Other Comprehensive (Loss) | | Noncontrolling Interest | | Total Equity | |

| Shares | | Amount | | | | | | | | | | | |

| Balance at December 31, 2018 | 45,304 | | | $ | 453 | | | $ | 60,303 | | | $ | 1,276,473 | | | $ | (242,109) | | | $ | 28,849 | | | $ | 1,123,969 | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Components of comprehensive income, net of tax: | | | | | | | | | | | | | | |

| Net income | — | | | — | | | — | | | 15,227 | | | — | | | 1,685 | | | 16,912 | | |

| Currency translation adjustments | — | | | — | | | — | | | — | | | (742) | | | (431) | | | (1,173) | | |

| Cash flow hedges | — | | | — | | | — | | | — | | | (5,715) | | | — | | | (5,715) | | |

| Debt securities available-for-sale | — | | | — | | | — | | | — | | | 45 | | | — | | | 45 | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Distributions to noncontrolling interest | — | | | — | | | — | | | — | | | — | | | (6,877) | | | (6,877) | | |

| Contributions from noncontrolling interest | — | | | — | | | — | | | — | | | — | | | 89 | | | 89 | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Vesting of restricted stock | 80 | | | 1 | | | (1) | | | — | | | — | | | — | | | — | | |

| | | | | | | | | | | | | | |

| Share-based compensation expense | — | | | — | | | 2,314 | | | — | | | — | | | — | | | 2,314 | | |

| | | | | | | | | | | | | | |

| Employee stock relinquished for payment of taxes | — | | | — | | | (1,437) | | | — | | | — | | | — | | | (1,437) | | |

| Other | — | | | — | | | (2,088) | | | — | | | — | | | — | | | (2,088) | | |

| Balance at March 31, 2019 | 45,384 | | | $ | 454 | | | $ | 59,091 | | | $ | 1,291,700 | | | $ | (248,521) | | | $ | 23,315 | | | $ | 1,126,039 | | |

| Components of comprehensive income, net of tax: | | | | | | | | | | | | | | |

| Net income | — | | | — | | | — | | | 18,619 | | | — | | | 3,581 | | | 22,200 | | |

| Currency translation adjustments | — | | | — | | | — | | | — | | | 4,362 | | | 378 | | | 4,740 | | |

| Cash flow hedges | — | | | — | | | — | | | — | | | (8,002) | | | — | | | (8,002) | | |

| Debt securities available-for-sale | — | | | — | | | — | | | — | | | 37 | | | — | | | 37 | | |

| | | | | | | | | | | | | | |

| Contributions from noncontrolling interest | — | | | — | | | — | | | — | | | — | | | 3,229 | | | 3,229 | | |

| Vesting of restricted stock | 25 | | | — | | | — | | | — | | | — | | | — | | | — | | |

| Share-based compensation expense | — | | | — | | | 2,620 | | | — | | | — | | | — | | | 2,620 | | |

| Employee stock relinquished for payment of taxes | — | | | — | | | (6) | | | — | | | — | | | — | | | (6) | | |

| | | | | | | | | | | | | | |

| Balance at June 30, 2019 | 45,409 | | | $ | 454 | | | $ | 61,705 | | | $ | 1,310,319 | | | $ | (252,124) | | | $ | 30,503 | | | $ | 1,150,857 | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

The accompanying notes are an integral part of these consolidated financial statements.Consolidated Financial Statements.

PRA Group, Inc.

Consolidated Statements of Cash Flows

For the sixthree months ended June 30,March 31, 2021 and 2020 and 2019

(unaudited)

(Amounts in thousands)

| | | Six Months Ended June 30, | | | Three Months Ended March 31, |

| | 2020 | | 2019 | | 2021 | | 2020 |

| Cash flows from operating activities: | Cash flows from operating activities: | | | | Cash flows from operating activities: | | | |

| Net income | Net income | $ | 83,264 | | | $ | 39,112 | | Net income | $ | 61,880 | | | $ | 22,436 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | Adjustments to reconcile net income to net cash provided by operating activities: | | Adjustments to reconcile net income to net cash provided by operating activities: | |

| Share-based compensation expense | Share-based compensation expense | 5,920 | | | 4,934 | | Share-based compensation expense | 4,113 | | | 2,857 | |

| Depreciation and amortization | Depreciation and amortization | 8,193 | | | 9,295 | | Depreciation and amortization | 3,981 | | | 4,084 | |

| | Amortization of debt discount and issuance costs | Amortization of debt discount and issuance costs | 11,846 | | | 11,403 | | Amortization of debt discount and issuance costs | 2,256 | | | 5,857 | |

| Changes in expected recoveries | Changes in expected recoveries | (6,985) | | | — | | Changes in expected recoveries | (50,136) | | | 12,816 | |

| | Deferred income taxes | Deferred income taxes | (21,361) | | | (25,287) | | Deferred income taxes | 10,371 | | | (12,755) | |

| Net unrealized foreign currency transactions | Net unrealized foreign currency transactions | 33,320 | | | (7,437) | | Net unrealized foreign currency transactions | 2,134 | | | 24,873 | |

| Fair value in earnings for equity securities | Fair value in earnings for equity securities | 1,412 | | | (1,448) | | Fair value in earnings for equity securities | (107) | | | (7,566) | |

| Net allowance charges | — | | | 7,291 | | |

| Other | Other | (256) | | | — | | Other | (419) | | | (135) | |

| | Changes in operating assets and liabilities: | Changes in operating assets and liabilities: | | Changes in operating assets and liabilities: | |

| Other assets | Other assets | 256 | | | 1,863 | | Other assets | 670 | | | (1,242) | |

| Other receivables, net | Other receivables, net | (4,733) | | | 2,978 | | Other receivables, net | 10,043 | | | (545) | |

| Accounts payable | Accounts payable | 507 | | | (2,956) | | Accounts payable | (431) | | | 221 | |

| Income taxes payable, net | Income taxes payable, net | 22,527 | | | (8,766) | | Income taxes payable, net | (3,669) | | | 3,835 | |

| Accrued expenses | Accrued expenses | (13,336) | | | (1,979) | | Accrued expenses | (20,227) | | | (8,990) | |

| Other liabilities | Other liabilities | 1,821 | | | 1,799 | | Other liabilities | (336) | | | 994 | |

| Right of use asset/lease liability | Right of use asset/lease liability | 105 | | | — | | Right of use asset/lease liability | 85 | | | 66 | |

| Other, net | — | | | 146 | | |

| | Net cash provided by operating activities | Net cash provided by operating activities | 122,500 | | | 30,948 | | Net cash provided by operating activities | 20,208 | | | 46,806 | |

| Cash flows from investing activities: | Cash flows from investing activities: | | | | Cash flows from investing activities: | | | |

| Net, purchases of property and equipment | (10,597) | | | (5,646) | | |

| Purchases of property and equipment, net | | Purchases of property and equipment, net | (2,366) | | | (7,639) | |

| | Purchases of finance receivables | Purchases of finance receivables | (436,097) | | | (549,377) | | Purchases of finance receivables | (159,328) | | | (271,845) | |

| Recoveries applied to negative allowance | Recoveries applied to negative allowance | 501,583 | | | — | | Recoveries applied to negative allowance | 328,559 | | | 236,656 | |

| Collections applied to principal on finance receivables | — | | | 443,390 | | |

| Purchase of investments | (8,317) | | | (82,648) | | |

| | Proceeds from sales and maturities of investments | Proceeds from sales and maturities of investments | 41,505 | | | 43,011 | | Proceeds from sales and maturities of investments | 764 | | | 648 | |

| Business acquisition, net of cash acquired | Business acquisition, net of cash acquired | — | | | (57,610) | | Business acquisition, net of cash acquired | (647) | | | 0 | |

| | Proceeds from sale of subsidiaries, net | — | | | 31,177 | | |

| | Net cash provided by/(used in) investing activities | Net cash provided by/(used in) investing activities | 88,077 | | | (177,703) | | Net cash provided by/(used in) investing activities | 166,982 | | | (42,180) | |

| Cash flows from financing activities: | Cash flows from financing activities: | | | | Cash flows from financing activities: | | | |

| Proceeds from lines of credit | Proceeds from lines of credit | 395,152 | | | 769,021 | | Proceeds from lines of credit | 45,369 | | | 315,118 | |

| Principal payments on lines of credit | Principal payments on lines of credit | (568,912) | | | (324,103) | | Principal payments on lines of credit | (226,621) | | | (227,459) | |

| Principal payments on notes payable and long-term debt | (5,000) | | | (308,165) | | |

| | Principal payments on long-term debt | | Principal payments on long-term debt | (2,500) | | | (2,500) | |

| | Payments of origination cost and fees | Payments of origination cost and fees | (9,781) | | | — | | Payments of origination cost and fees | (113) | | | (8,203) | |

| Tax withholdings related to share-based payments | Tax withholdings related to share-based payments | (3,176) | | | (1,443) | | Tax withholdings related to share-based payments | (5,460) | | | (3,156) | |

| Distributions paid to noncontrolling interest | Distributions paid to noncontrolling interest | (14,908) | | | (6,877) | | Distributions paid to noncontrolling interest | (3,933) | | | 0 | |

| | Purchase of noncontrolling interest | — | | | (1,166) | | |

| | Net increase in interest-bearing deposits | 13,675 | | | 28,429 | | |

| Other financing activities | — | | | 1,141 | | |

| | Net increase/(decrease) in interest-bearing deposits | | Net increase/(decrease) in interest-bearing deposits | 303 | | | (1,658) | |

| | | Net cash (used in)/provided by financing activities | Net cash (used in)/provided by financing activities | (192,950) | | | 156,837 | | Net cash (used in)/provided by financing activities | (192,955) | | | 72,142 | |

| Effect of exchange rate on cash | Effect of exchange rate on cash | (16,503) | | | (3,281) | | Effect of exchange rate on cash | (6,427) | | | (16,575) | |

| Net increase in cash and cash equivalents | 1,124 | | | 6,801 | | |

| Cash and cash equivalents, beginning of period | 123,807 | | | 98,695 | | |

| Cash and cash equivalents, end of period | $ | 124,931 | | | $ | 105,496 | | |

| Net (decrease)/increase in cash, cash equivalents and restricted cash | | Net (decrease)/increase in cash, cash equivalents and restricted cash | (12,192) | | | 60,193 | |

| Cash, cash equivalents and restricted cash beginning of period | | Cash, cash equivalents and restricted cash beginning of period | 121,047 | | | 123,807 | |

| Cash, cash equivalents and restricted cash, end of period | | Cash, cash equivalents and restricted cash, end of period | $ | 108,855 | | | $ | 184,000 | |

| Supplemental disclosure of cash flow information: | Supplemental disclosure of cash flow information: | | | | Supplemental disclosure of cash flow information: | | | |

| Cash paid for interest | Cash paid for interest | $ | 60,618 | | | $ | 54,973 | | Cash paid for interest | $ | 32,622 | | | $ | 30,502 | |

| Cash paid for income taxes | Cash paid for income taxes | 16,796 | | | 42,172 | | Cash paid for income taxes | 10,463 | | | 12,100 | |

| Cash, cash equivalents and restricted cash reconciliation: | | |

| Cash and cash equivalents per Consolidated Balance Sheets | $ | 115,741 | | | $ | 105,496 | | |

| Restricted cash included in Other assets per Consolidated Balance Sheets | 9,190 | | | — | | |

| Total cash, cash equivalents and restricted cash | $ | 124,931 | | | $ | 105,496 | | |

|

The accompanying notes are an integral part of these consolidated financial statements.Consolidated Financial Statements.

PRA Group, Inc.

Notes to Consolidated Financial Statements

1. Organization and Business:

As used herein, the terms "PRA Group," the "Company," or similar terms refer to PRA Group, Inc. and its subsidiaries.

PRA Group, Inc., a Delaware corporation, is a global financial and business services company with operations in the Americas, Europe and Australia. The Company's primary business is the purchase, collection and management of portfolios of nonperforming loans. The Company also provides fee-based services on class action claims recoveries and by servicing consumer bankruptcy accounts in the United States ("U.S.").

On March 11, 2020, due to the global outbreak of the novel coronavirus ("COVID-19"), the World Health Organization declared a global pandemic. Since the initial outbreak was reported, COVID-19 has continued to adversely impact all countries in which the Company operates. As a result, the Company continues to operate in business continuity mode globally. The Company's business continuity plans have allowed the Company to operate its business while minimizing disruption and complying with country-specific, federal, state and local laws, regulations and governmental actions related to the pandemic.

Basis of presentation: The consolidated financial statementsConsolidated Financial Statements of the Company are prepared in accordance with U.S. generally accepted accounting principles ("GAAP"). The accompanying interim financial statements have been prepared in accordance with the instructions for Quarterly Reports on Form 10-Q and, therefore, do not include all information and Notes to the Consolidated Financial Statements necessary for a complete presentation of financial position, results of operations, comprehensive income/(loss) and cash flows in conformity with GAAP. In the opinion of management, all adjustments, consisting of normal and recurring items, necessary for the fair presentation of the Company's Consolidated Balance Sheets as of June 30, 2020,March 31, 2021 and its Consolidated Income Statements, and its Consolidated Statements of Comprehensive Income/(Loss) for the three and six months ended June 30, 2020 and 2019, and its Consolidated, Statements of Changes in Equity and Consolidated Statements of Cash Flows for the sixthree months ended June 30,March 31, 2021 and 2020, and 2019, have been included. The Company's Consolidated Income Statements of the Company for the three and six months ended June 30, 2020March 31, 2021 may not be indicative of future results.

These unaudited consolidated financial statementsConsolidated Financial Statements should be read in conjunction with the audited consolidated financial statementsConsolidated Financial Statements and notes thereto included in the Company's Annual Report on Form 10-K for the year ended December 31, 20192020 (the "2019"2020 Form 10-K").

Consolidation: The consolidated financial statementsConsolidated Financial Statements include the accounts of PRA Group and other entities in which the Company has a controlling interest. All significant intercompany accounts and transactions have been eliminated.

Entities in which the Company has a controlling financial interest, through ownership of the majority of the entities’ voting equity interests, or through other contractual rights that give the Company control, consist of entities which purchase and collect on portfolios of nonperforming loans.

Investments in companies in which the Company has significant influence over operating and financing decisions, but does not own a majority of the voting equity interests, are accounted for in accordance with the equity method of accounting, which requires the Company to recognize its proportionate share of the entity’s net earnings. These investments are included in otherOther assets, with income or loss included in otherOther revenue.

The Company performs on-going reassessments of whether changes in the facts and circumstances regarding the Company’s involvement with an entity cause the Company’s consolidation conclusion to change.

Restricted cash: Cash that is subject to legal restrictions or is unavailable for general operating purposes is classified as restricted cash.

Segments: Under the guidance of the Financial Accounting Standards Board ("FASB") Accounting Standards Codification ("ASC") ASC Topic 280 "Segment Reporting" ("ASC 280"), the Company has determined that it has several operating segments that meet the aggregation criteria of ASC 280, and, therefore, it has 1 reportable segment, accounts receivable management. This conclusion is based on similarities among the operating units, including economic characteristics, the nature of the products and services, the nature of the production processes, the types or class of customer for their products and services, the methods used to distribute their products and services and the nature of the regulatory environment.

PRA Group, Inc.

Notes to Consolidated Financial Statements

The following table shows the amount of revenue generated for the three and six months ended June 30,March 31, 2021 and 2020, and 2019, and long-lived assets held at June 30,March 31, 2021 and 2020, and 2019, both for the U.S., the Company's country of domicile, and outside of the U.S. (amounts in thousands):

| | | As of and for the | | | As of and for the | | | As of and for the | | As of and for the |

| | Three Months Ended June 30, 2020 | | | Three Months Ended June 30, 2019 | | | Three Months Ended March 31, 2021 | | Three Months Ended March 31, 2020 |

| | Revenues | | Long-Lived Assets | | Revenues | | Long-Lived Assets | | Revenues (2) | | Long-Lived Assets | | Revenues (2) | | Long-Lived Assets |

| United States | United States | $ | 192,293 | | | $ | 105,996 | | | $ | 167,923 | | | $ | 110,323 | | United States | $ | 178,181 | | | $ | 96,630 | | | $ | 153,335 | | | $ | 115,053 | |

| United Kingdom | United Kingdom | 28,041 | | | 2,755 | | | 28,292 | | | 3,917 | | United Kingdom | 48,177 | | | 2,269 | | | 36,340 | | | 3,076 | |

Other (1) | Other (1) | 51,576 | | | 8,747 | | | 55,842 | | | 10,061 | | Other (1) | 63,111 | | | 8,765 | | | 62,109 | | | 8,408 | |

| Total | Total | $ | 271,910 | | | $ | 117,498 | | | $ | 252,057 | | | $ | 124,301 | | Total | $ | 289,469 | | | $ | 107,664 | | | $ | 251,784 | | | $ | 126,537 | |

| | As of and for the | | | As of and for the | | |

| Six Months Ended June 30, 2020 | | | Six Months Ended June 30, 2019 | | |

| Revenues | | Long-Lived Assets | | Revenues | | Long-Lived Assets | |

| United States | $ | 345,628 | | | $ | 105,996 | | | $ | 335,499 | | | $ | 110,323 | | |

| United Kingdom | 64,381 | | | 2,755 | | | 58,048 | | | 3,917 | | |

Other (1) | 113,685 | | | 8,747 | | | 104,387 | | | 10,061 | | |

| Total | $ | 523,694 | | | $ | 117,498 | | | $ | 497,934 | | | $ | 124,301 | | |

(1) None of the countries included in "Other" comprise greater than 10% of the Company's consolidated revenues or long-lived assets.

(2) Based on the Company’s financial statement information used to produce the Company's general-purpose financial statements, it is impracticable to report further breakdowns of revenues from external customers by product or service.

PRA Group, Inc.

Notes to Consolidated Financial Statements

Beginning January 1, 2020, the Company implemented Accounting Standards Update ("ASU") ASU 2016-13, "Financial Instruments - Credit Losses" ("Topic 326") ("ASU 2016-13") and ASU 2019-11, “Codification Improvements to Topic 326, Financial Instruments - Credit Losses” (“ASU 2019-11”), collectively referred to as "ASC 326", on a prospective basis. Prior to January 1, 2020, the vast majority of the Company's investment in finance receivables were accounted for under ASC 310-30 "Loans and Debt Securities Acquired with Deteriorated Credit Quality" ("ASC 310-30"). Refer to Note 2.

Finance receivables and income recognition: 4The Company accounts for its investment in finance receivables at amortized cost under the guidance of ASC Topic 310 “Receivables” (“ASC 310”) and ASC Topic 326-20 “Financial Instruments - Credit Losses - Measured at Amortized Cost” (“ASC 326-20”). ASC 326-20 requires a financial asset (or a group of financial assets) measured at amortized cost basis to be presented at the net amount expected to be collected.

Credit quality information: The Company acquires portfolios of accounts that have experienced deterioration of credit quality between origination and the Company's acquisition of the accounts. The amount paid for a portfolio reflects the Company's determination that it is probable the Company will be unable to collect all amounts due according to an account's contractual terms. The Company accounts for the portfolios in accordance with the guidance for purchased credit deteriorated ("PCD") assets. The initial allowance for credit losses is added to the purchase price rather than recorded as a credit loss expense. The Company has established a policy to writeoff the amortized cost of individual assets when it deems probable that it will not collect on an individual asset. Due to the deteriorated credit quality of the individual accounts, the Company may writeoff the unpaid principal balance of all accounts in a portfolio at the time of acquisition. However, when the Company has an expectation of collecting cash flows at the portfolio level, a negative allowance is established for expected recoveries at an amount not to exceed the amount paid for the financial portfolios.

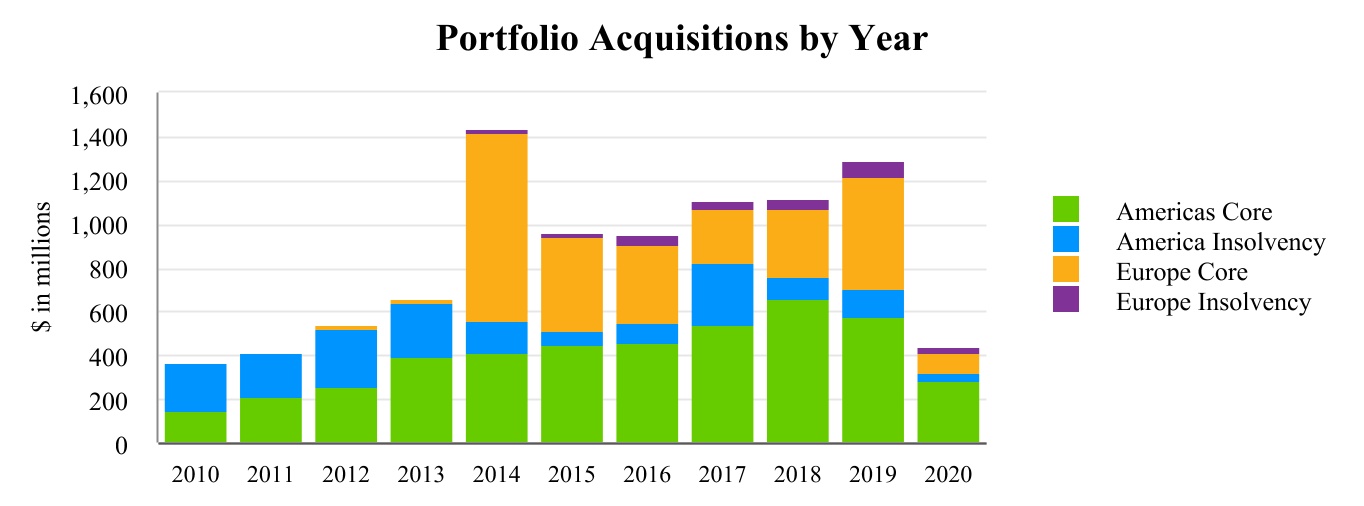

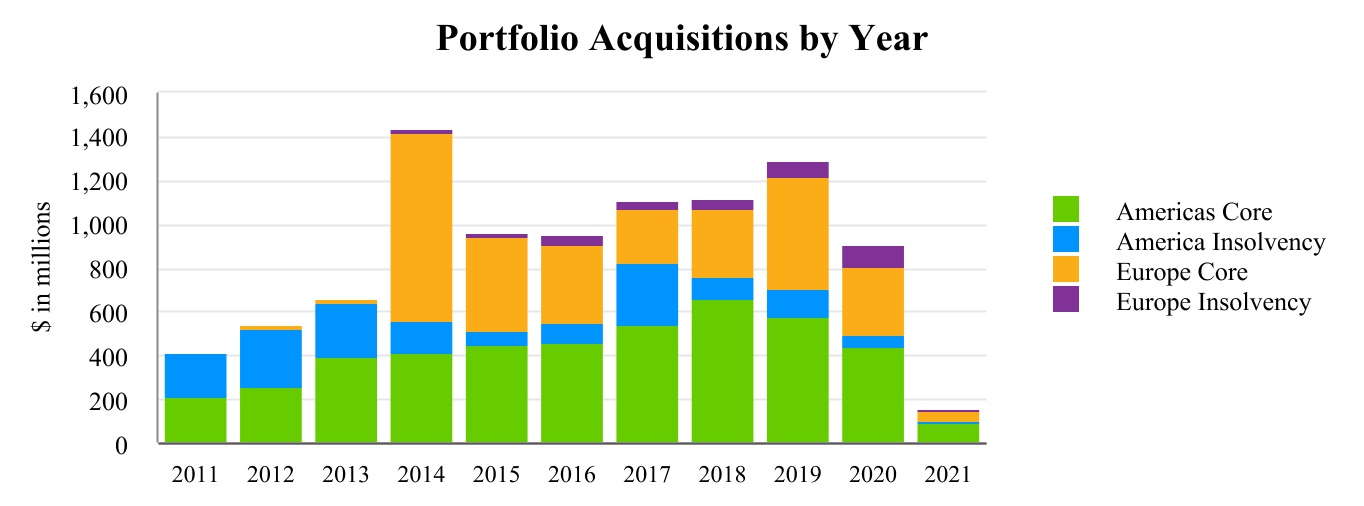

Portfolio segments: The Company develops systematic methodologies to determine its allowance for credit losses at the portfolio segment level. The Company’s nonperforming loan portfolio segments consist of two broad categories: Core and Insolvency. The Company’s Core portfolios contain loan accounts that are in default, which were purchased at a substantial discount to face value because either the credit grantor and/or other third-party collection agencies have been unsuccessful in collecting the full balance owed. The Company’s Insolvency portfolios contain loan accounts that are in default where the customer is involved in a bankruptcy or insolvency proceeding and were purchased at a substantial discount to face value. Each of the two broad portfolio segments of purchased nonperforming loan portfolios consist of large numbers of homogeneous receivables with similar risk characteristics.

PRA Group, Inc.

Notes to Consolidated Financial Statements

Effective interest rate and accounting pools: Within each portfolio segment, the Company pools accounts with similar risk characteristics that are acquired in the same year. Similar risk characteristics generally include portfolio segment and geographic region. The initial effective interest rate of the pool is established based on the purchase price and expected recoveries of each individual purchase at the purchase date. During the year of acquisition, the annual pool is aggregated, and the blended effective interest rate will change to reflect new acquisitions and new cash flow estimates until the end of the year. The effective interest rate for a pool is fixed for the remaining life of the pool once the year has ended.

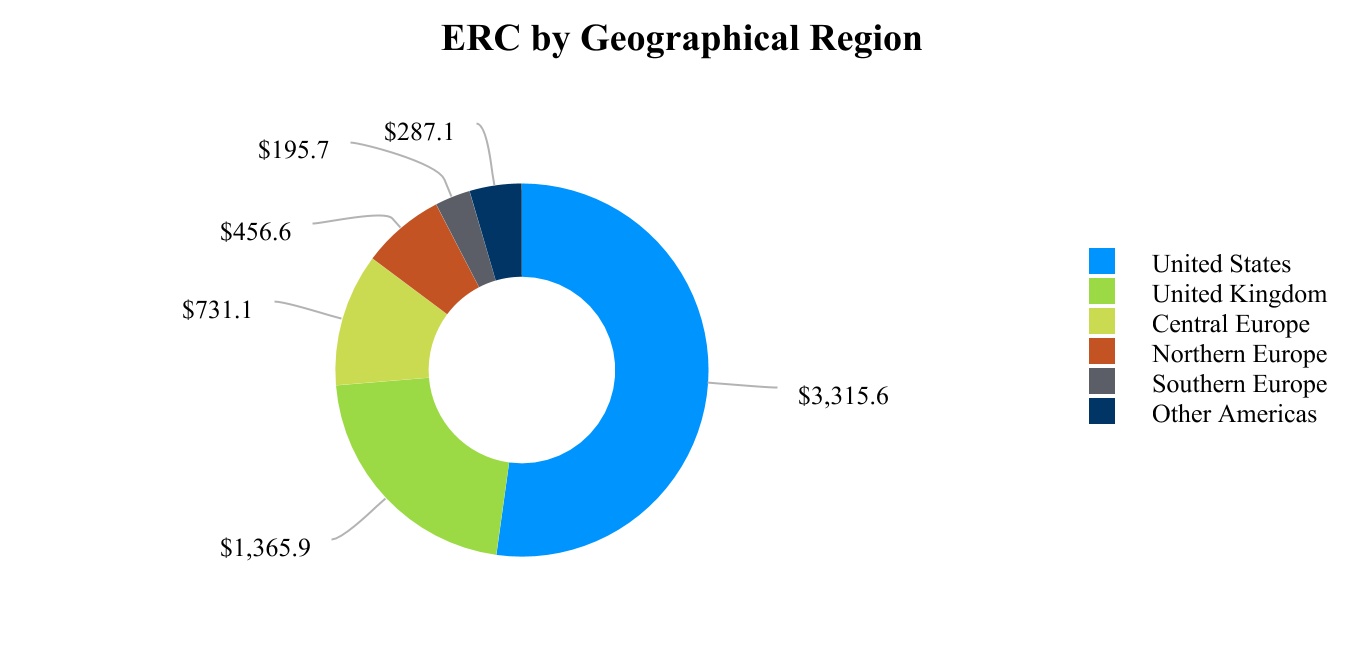

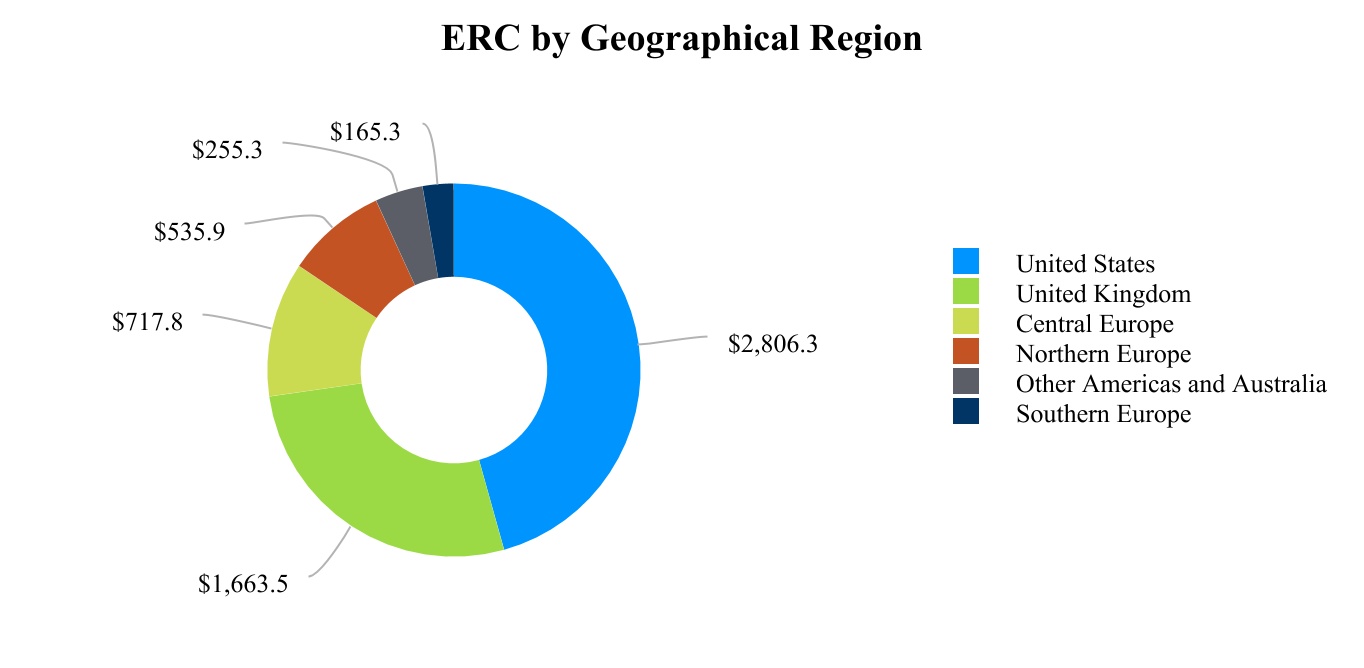

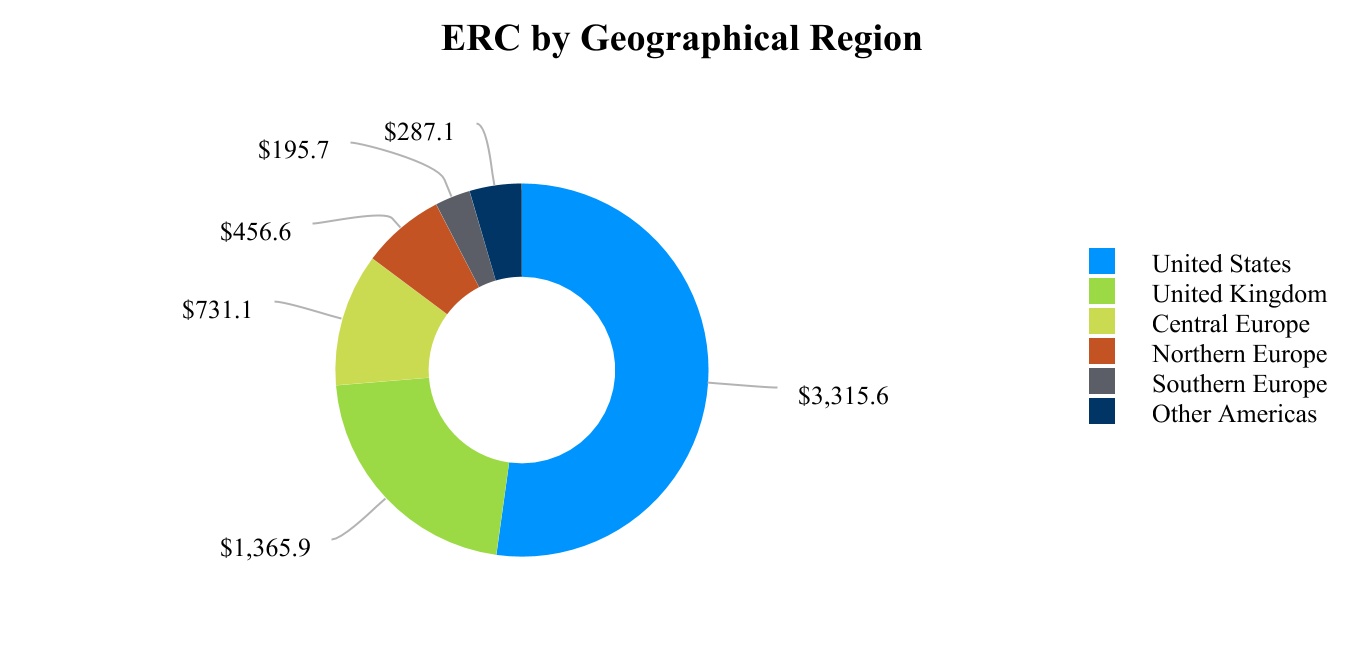

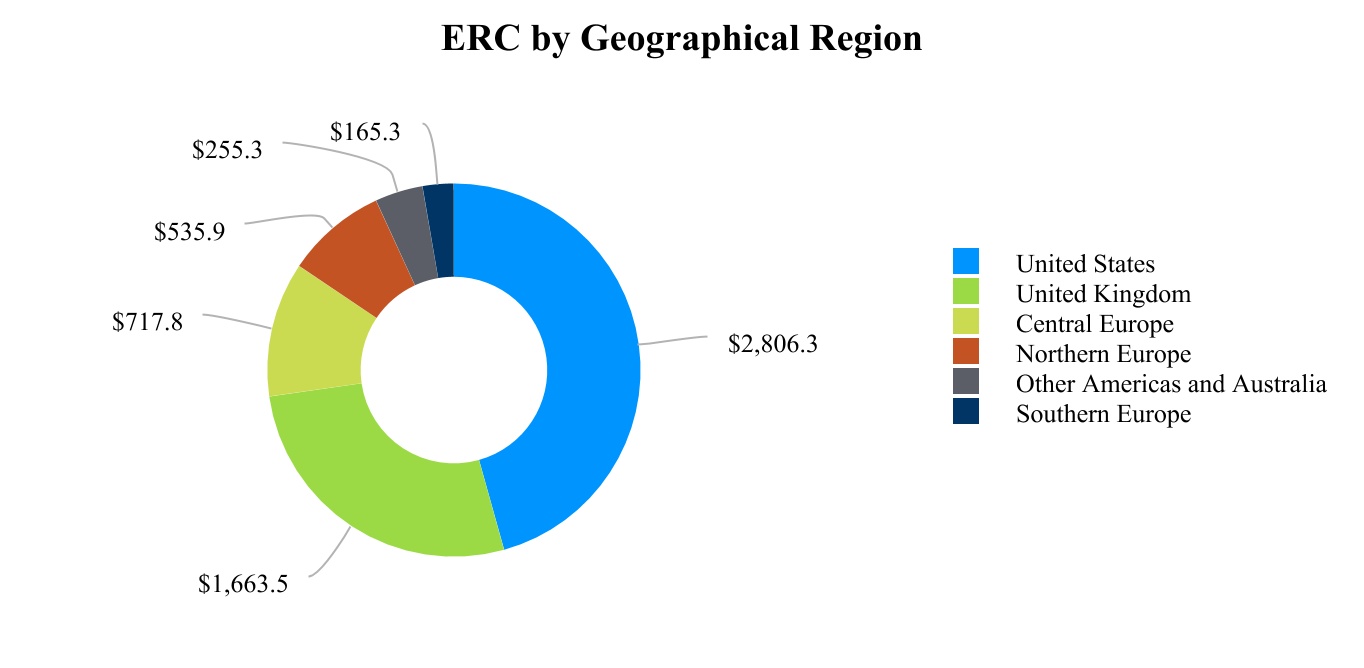

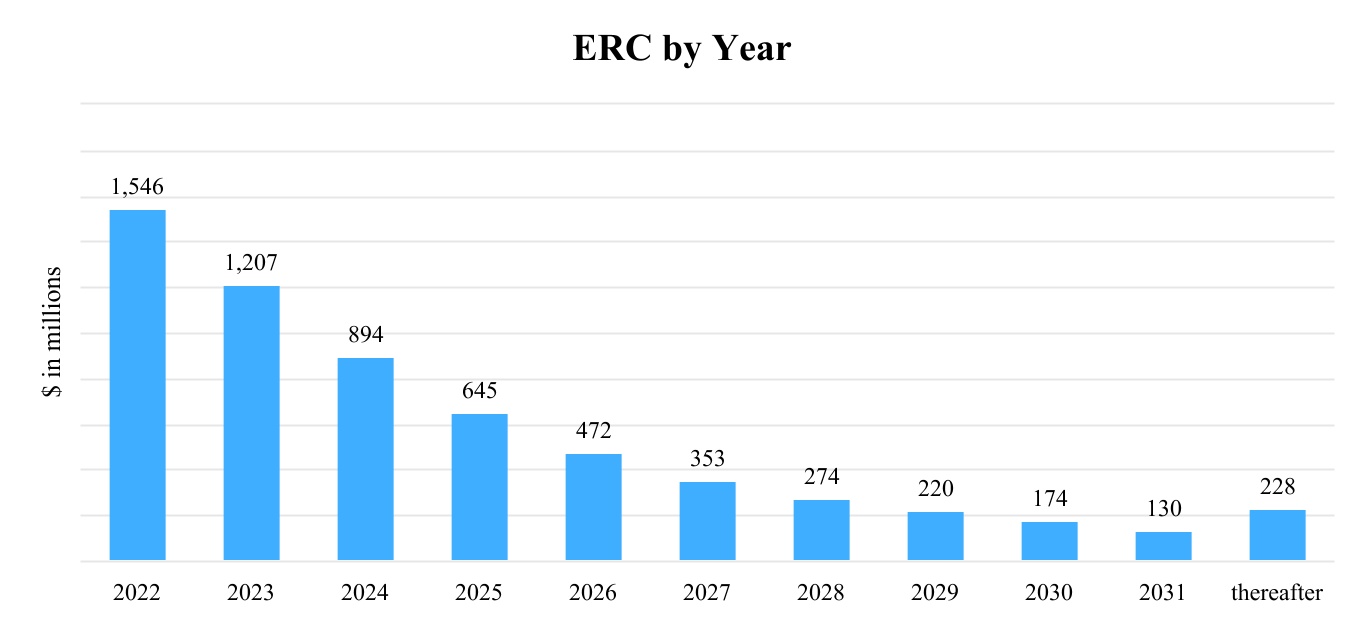

Methodology: The Company develops its estimates of expected recoveries in the Consolidated Balance Sheets by applying discounted cash flow methodologies to its estimated remaining collections (“ERC”) and recognizes income over the estimated life of the pool at the constant effective interest rate of the pool. Subsequent changes (favorable and unfavorable) in expected cash flows are recognized within changes in expected recoveries in the Consolidated Income Statements by adjusting the present value of increases or decreases in ERC at a constant effective interest rate. Amounts included in the estimate of recoveries do not exceed the aggregate amount of the amortized cost basis previously written off or expected to be written off.

The measurement of expected recoveries is based on relevant information about past events, including historical experience, current conditions, and reasonable and supportable forecasts that affect the collectability of the reported amount. Factors that may contribute to the changes in estimated cash flows include both external and internal factors. External factors that may have an impact on the collectability, and subsequently on the overall profitability of acquired pools of nonperforming loans, would include new laws or regulations relating to collections, new interpretations of existing laws or regulations, and the overall condition of the economy. Internal factors that may have an impact on the collectability, and subsequently the overall profitability of acquired pools of nonperforming loans, would include necessary revisions to initial and post-acquisition scoring and modeling estimates, operational activities, expected impact of operational strategies and changes in productivity related to turnover and tenure of the Company's collection staff.

Portfolio income: The recognition of income on expected recoveries is based on the constant effective interest rate established for a pool.

Changes in expected recoveries: The activity consists of differences between actual recoveries compared to expected recoveries for the reporting period, as well as the net present value of increases or decreases in ERC at the constant effective interest rate.

Agreements to acquire the aforementioned receivables include general representations and warranties from the sellers covering matters such as account holder death or insolvency and accounts settled or disputed prior to sale. The representation and warranty period permitting the return of these accounts from the Company to the seller is typically 90 to 180 days, with certain international agreements extending as long as 24 months. Any funds received from the seller as a return of purchase price are referred to as buybacks. Buyback funds are included in changes in expected recoveries when received.

Fees paid to third parties other than the seller related to the direct acquisition of a portfolio of accounts are expensed when incurred.

Goodwill and intangible assets: Goodwill, in accordance with ASC Topic 350, "Intangibles-Goodwill and Other" ("ASC 350"), is not amortized but rather is reviewed for impairment annually or more frequently if indicators of potential impairment exist. On January 1, 2020, the Company adopted ASU 2017-04, "Intangibles - Goodwill and Other (Topic 350): Simplifying the Test for Goodwill Impairment" ("ASU 2017-04"). The Company performs its annual assessment of goodwill as of October 1. The Company may first assess qualitative factors to determine whether it is more likely than not that the fair value of a reporting unit is less than its carrying amount, including goodwill. If management concludes that it is more likely than not that the fair value of a reporting unit is less than its carrying amount, an impairment loss is recognized. The loss will be recorded at the amount by which the carrying amount exceeds the reporting unit’s fair value, not to exceed the total amount of goodwill allocated to the respective reporting unit.

2. Change in Accounting Principle:

Financial Instruments - Credit Losses

In June 2016,August 2020, the FASB issued Accounting Standards Update ("ASU") 2020-06 Debt—Debt with Conversion and Other Options (Subtopic 470-20) and Derivatives and Hedging—Contracts in Entity’s Own Equity (Subtopic 815-40): Accounting for Convertible Instruments and Contracts in an Entity’s Own Equity ("ASU 2016-13, which introduced a new methodology requiring2020-06"). ASU 2020-06 reduces the measurementnumber of expected credit lossesaccounting models for financialconvertible debt instruments held at the reporting date based on historical experience, currentand convertible preferred stock. Additionally, ASU 2020-06 removes certain settlement conditions and reasonable and supportable forecasts. ASU 2016-13 utilizes a lifetime “expected credit loss” measurement objectivethat are required for equity contracts to qualify for the recognition of credit lossesderivative scope exception and simplifies the diluted earnings per share ("EPS") calculation in certain areas.

The Company accounts for loans, held-to-maturity debt securitiesits 3.50% Convertible Notes due 2023 (the "2023 Notes" or the "Convertible Notes") in accordance with ASC 470-20, "Debt with Conversion and other receivables measured at amortized cost. The

PRA Group, Inc.

NotesOther Options" ("ASC 470"). Under ASU 2020-06, the embedded conversion features are no longer separated from the host contract for convertible instruments with conversion features that are not required to Consolidated Financial Statements

new methodology requires an entity to present on the balance sheet the net amount expected to be collected. This methodology replaces the multiple impairment methods under prior GAAP, including for purchased credit impaired ("PCI") assets, and introduces the concept of PCD assets. The Company's PCI assets previously accounted for under ASC 310-30 are now accounted for as PCD assets upon adoption. ASU 2016-13 requires PCD assets toderivatives under ASC Topic 815 "Derivatives and Hedging" ("ASC 815"), or that do not result in substantial premiums accounted for as paid-in capital. Consequently, a convertible debt instrument will be recognizedaccounted for as a single liability measured at their purchase price plus the allowance for credit losses expected at the time of acquisition. ASU 2016-13 also requires that financial assets should be written off when they are deemed uncollectible.

In November 2019, FASB issued ASU 2019-11, which amended the PCD asset guidance in ASU 2016-13 to clarify that expected recoveries of amounts previously written off and expected to be written off should be included in the valuation account. Additionally, they should not exceed the aggregate of amounts previously written off and expected to be written off by an entity. Further, ASU 2019-11 clarifies that a negative allowance is recognized when an entity determines, after a full or partial writeoff of theits amortized cost basis, that it will recover all or a portion of the basis.

cost. The Company adopted ASC 326 on January 1, 2020 onthe standard using a prospective basis. In accordancemodified retrospective method, with adjustments which increased retained earnings by $12.0 million, reduced additional paid-in capital by $26.7 million and increased the guidance, substantially all the Company’s PCI assets were transitioned using the PCD guidance, with immediate writeoffnet carrying amount of the amortized cost basis of individual accounts and establishment of a negative allowance for expected recoveries equal to the amortized cost basis written off. Accounts previously accounted for under ASC 310-30, were aggregated into annual pools based on similar risk characteristics and an effective interest rate was established based on the estimated remaining cash flows of the annual pool. The immediate writeoff and subsequent recognition of expected recoveries had no impact on the Company’s Consolidated Income Statements or the Consolidated Balance Sheets at the date of adoption. The Company develops its estimate of expected recoveries2023 Notes by applying discounted cash flow methodologies to its ERC and recognizes income over the estimated life of the pool at the constant effective interest rate of the pool. Changes (favorable and unfavorable) in expected cash flows are recognized in current period earnings by adjusting the present value of the changes in expected recoveries.

Following the transition guidance for PCD assets, the Company grossed up the amortized cost of its net finance receivables$19.8 million at January 1, 2020 as shown below (amounts in thousands):

| | | | | |

Amortized cost2021. Additionally, the effect of adoption reduced interest expense for the three months ended March 31, 2021 by $2.0 million, increased net income by $1.6 million and increased earnings per share by $0.04 per share. For more information on the 2023 Notes, see Note 7. | $ | 3,514,165 | |

Allowance for credit losses | 125,757,689 | |

Noncredit discount | 3,240,131 | |

Face value | $ | 132,511,985 | |

| |

Allowance for credit losses | $ | 125,757,689 | |

Writeoffs, net | (125,757,689) | |

Expected recoveries | 3,514,165 | |

Initial negative allowance for expected recoveries | $ | 3,514,165 | |

3. Finance Receivables, net:

Finance Receivables, net after the adoption of ASC 326 (refer to Note 2)

Finance receivables, net consistsconsisted of the following at June 30,March 31, 2021 and December 31, 2020 (amounts in thousands):

| | | | | |

Amortized cost | $ | — | |

Negative allowance for expected recoveries (1)

| 3,351,532 | |

Balance at end of period | $ | 3,351,532 | |

| | | | | | | | | | | |

| March 31, 2021 | | December 31, 2020 |

| Amortized cost | $ | 0 | | | $ | 0 | |

Negative allowance for expected recoveries (1) | 3,372,666 | | | 3,514,788 | |

| Balance at end of period | $ | 3,372,666 | | | $ | 3,514,788 | |

(1) The negative allowance balance includes certain portfolios of nonperforming loans for which the Company holds a beneficial interest representing approximately 1% of the balance.

PRA Group, Inc.

Notes to Consolidated Financial Statements

Three Months Ended June 30, 2020

Changes in the negative allowance for expected recoveries by portfolio segment for the three months ended June 30,March 31, 2021 and 2020 were as follows (amounts in thousands):

| | | For the three months ended June 30, 2020 | | | March 31, 2021 |

| | Core | | Insolvency | | Total | | Core | | Insolvency | | Total |

| Balance at beginning of period | Balance at beginning of period | $ | 2,949,384 | | | $ | 458,690 | | | $ | 3,408,074 | | Balance at beginning of period | $ | 3,019,477 | | | $ | 495,311 | | | $ | 3,514,788 | |

Initial negative allowance for expected recoveries - portfolio acquisitions (1) | Initial negative allowance for expected recoveries - portfolio acquisitions (1) | 144,721 | | | 19,778 | | | 164,499 | | Initial negative allowance for expected recoveries - portfolio acquisitions (1) | 133,007 | | | 25,954 | | | 158,961 | |

| Foreign currency translation adjustment | Foreign currency translation adjustment | 24,215 | | | (130) | | | 24,085 | | Foreign currency translation adjustment | (24,249) | | | 1,589 | | | (22,660) | |

Recoveries applied to negative allowance (2) | Recoveries applied to negative allowance (2) | (231,435) | | | (33,492) | | | (264,927) | | Recoveries applied to negative allowance (2) | (285,171) | | | (43,388) | | | (328,559) | |

Changes in expected recoveries (3) | Changes in expected recoveries (3) | 21,251 | | | (1,450) | | | 19,801 | | Changes in expected recoveries (3) | 48,410 | | | 1,726 | | | 50,136 | |

| Balance at end of period | Balance at end of period | $ | 2,908,136 | | | $ | 443,396 | | | $ | 3,351,532 | | Balance at end of period | $ | 2,891,474 | | | $ | 481,192 | | | $ | 3,372,666 | |

PRA Group, Inc.

Notes to Consolidated Financial Statements

| | | | | | | | | | | | | | | | | |

| March 31, 2020 |

| Core | | Insolvency | | Total |

| Balance at beginning of period | $ | 3,051,426 | | | $ | 462,739 | | | $ | 3,514,165 | |

Initial negative allowance for expected recoveries - portfolio acquisitions (1) | 233,687 | | | 39,550 | | | 273,237 | |

| Foreign currency translation adjustment | (120,214) | | | (9,642) | | | (129,856) | |

Recoveries applied to negative allowance (2) | (199,038) | | | (37,618) | | | (236,656) | |

Changes in expected recoveries (3) | (16,477) | | | 3,661 | | | (12,816) | |

| Balance at end of period | $ | 2,949,384 | | | $ | 458,690 | | | $ | 3,408,074 | |

(1) Initial negative allowance for expected recoveries - portfolio acquisitions

Portfolio acquisitions for the three months ended June 30,March 31, 2021 and 2020 were as follows (amounts in thousands):

| | | For the three months ended June 30, 2020 | | | March 31, 2021 |

| | Core | | Insolvency | | Total | | Core | | Insolvency | | Total |

| Face value | Face value | $ | 1,288,243 | | | $ | 96,964 | | | $ | 1,385,207 | | Face value | $ | 1,088,655 | | | $ | 134,811 | | | $ | 1,223,466 | |

| Noncredit discount | Noncredit discount | (160,409) | | | (7,979) | | | (168,388) | | Noncredit discount | (132,532) | | | (7,498) | | | (140,030) | |

| Allowance for credit losses at acquisition | Allowance for credit losses at acquisition | (983,113) | | | (69,207) | | | (1,052,320) | | Allowance for credit losses at acquisition | (823,116) | | | (101,359) | | | (924,475) | |

| Purchase price | Purchase price | $ | 144,721 | | | $ | 19,778 | | | $ | 164,499 | | Purchase price | $ | 133,007 | | | $ | 25,954 | | | $ | 158,961 | |

| | | | | | | | | | | | | | | | | |

| March 31, 2020 |

| Core | | Insolvency | | Total |

| Face value | $ | 1,891,142 | | | $ | 177,454 | | | $ | 2,068,596 | |

| Noncredit discount | (213,289) | | | (13,032) | | | (226,321) | |

| Allowance for credit losses at acquisition | (1,444,166) | | | (124,872) | | | (1,569,038) | |

| Purchase price | $ | 233,687 | | | $ | 39,550 | | | $ | 273,237 | |

The initial negative allowance recorded on portfolio acquisitions for the three months ended June 30,March 31, 2021 and 2020 were as follows (amounts in thousands):

| | | For the three months ended June 30, 2020 | | | March 31, 2021 |

| | Core | | Insolvency | | Total | | Core | | Insolvency | | Total |

| Allowance for credit losses at acquisition | Allowance for credit losses at acquisition | $ | (983,113) | | | $ | (69,207) | | | $ | (1,052,320) | | Allowance for credit losses at acquisition | $ | (823,116) | | | $ | (101,359) | | | $ | (924,475) | |

| Writeoffs, net | Writeoffs, net | 983,113 | | | 69,207 | | | 1,052,320 | | Writeoffs, net | 823,116 | | | 101,359 | | | 924,475 | |

| Expected recoveries | Expected recoveries | 144,721 | | | 19,778 | | | 164,499 | | Expected recoveries | 133,007 | | | 25,954 | | | 158,961 | |

| Initial negative allowance for expected recoveries | Initial negative allowance for expected recoveries | $ | 144,721 | | | $ | 19,778 | | | $ | 164,499 | | Initial negative allowance for expected recoveries | $ | 133,007 | | | $ | 25,954 | | | $ | 158,961 | |

(2) Recoveries applied to negative allowance

Recoveries applied to the negative allowance were computed as follows for the three months ended June 30, 2020 (amounts in thousands):

| | | | | | | | | | | | | | | | | |

| For the three months ended June 30, 2020 | | | | |

| Core | | Insolvency | | Total |

Recoveries (a) | $ | 461,238 | | | $ | 51,973 | | | $ | 513,211 | |

Less - amounts reclassified to portfolio income (b) | 229,803 | | | 18,481 | | | 248,284 | |

| Recoveries applied to negative allowance | $ | 231,435 | | | $ | 33,492 | | | $ | 264,927 | |

(a) Recoveries includes cash collections, buybacks and other adjustments.

(b) The Company reported income on expected recoveries based on the constant effective interest rate in portfolio income on the Company's Consolidated Income Statements. | | | | | | | | | | | | | | | | | |

| March 31, 2020 |

| Core | | Insolvency | | Total |

| Allowance for credit losses at acquisition | $ | (1,444,166) | | | $ | (124,872) | | | $ | (1,569,038) | |

| Writeoffs, net | 1,444,166 | | | 124,872 | | | 1,569,038 | |

| Expected recoveries | 233,687 | | | 39,550 | | | 273,237 | |

| Initial negative allowance for expected recoveries | $ | 233,687 | | | $ | 39,550 | | | $ | 273,237 | |

PRA Group, Inc.

Notes to Consolidated Financial Statements

(3) Changes in expected recoveries

Changes in expected recoveries consists of the following for the three months ended June 30, 2020 (amounts in thousands):

| | | | | | | | | | | | | | | | | |

| For the three months ended June 30, 2020 | | | | |

| Core | | Insolvency | | Total |

| Changes in expected future recoveries | $ | (97,910) | | | $ | (1,788) | | | $ | (99,698) | |

| Recoveries received in excess of forecast | 119,161 | | | 338 | | | 119,499 | |

| Changes in expected recoveries | $ | 21,251 | | | $ | (1,450) | | | $ | 19,801 | |

Six Months Ended June 30, 2020

Changes in the negative allowance for expected recoveries by portfolio segment for the six months ended June 30, 2020 were as follows (amounts in thousands):

| | | | | | | | | | | | | | | | | |

| For the six months ended June 30, 2020 | | | | |

| Core | | Insolvency | | Total |

| Balance at beginning of period | $ | 3,051,426 | | | $ | 462,739 | | | $ | 3,514,165 | |

Initial negative allowance for expected recoveries - portfolio acquisitions (1) | 378,408 | | | 59,328 | | | 437,736 | |

| Foreign currency translation adjustment | (95,999) | | | (9,772) | | | (105,771) | |

Recoveries applied to negative allowance (2) | (430,473) | | | (71,110) | | | (501,583) | |

Changes in expected recoveries (3) | 4,774 | | | 2,211 | | | 6,985 | |

| Balance at end of period | $ | 2,908,136 | | | $ | 443,396 | | | $ | 3,351,532 | |

(1) Initial negative allowance for expected recoveries - portfolio acquisitions

Portfolio acquisitions for the six months ended June 30, 2020 were as follows (amounts in thousands):

| | | | | | | | | | | | | | | | | |

| For the six months ended June 30, 2020 | | | | |

| Core | | Insolvency | | Total |

| Face value | $ | 3,179,386 | | | $ | 274,418 | | | $ | 3,453,804 | |

| Noncredit discount | (373,699) | | | (21,011) | | | (394,710) | |

| Allowance for credit losses at acquisition | (2,427,279) | | | (194,079) | | | (2,621,358) | |

| Purchase price | $ | 378,408 | | | $ | 59,328 | | | $ | 437,736 | |

The initial negative allowance recorded on portfolio acquisitions for the six months ended was as follows June 30, 2020 (amounts in thousands):

| | | | | | | | | | | | | | | | | |

| For the six months ended June 30, 2020 | | | | |

| Core | | Insolvency | | Total |

| Allowance for credit losses at acquisition | $ | (2,427,279) | | | $ | (194,079) | | | $ | (2,621,358) | |

| Writeoffs, net | 2,427,279 | | | 194,079 | | | 2,621,358 | |

| Expected recoveries | 378,408 | | | 59,328 | | | 437,736 | |

| Initial negative allowance for expected recoveries | $ | 378,408 | | | $ | 59,328 | | | $ | 437,736 | |

PRA Group, Inc.

Notes to Consolidated Financial Statements

(2) Recoveries applied to negative allowance

Recoveries applied to the negative allowance were computed as follows for the sixthree months ended June 30,March 31, 2021 and 2020 (amounts in thousands):

| | | For the six months ended June 30, 2020 | | | March 31, 2021 |

| | Core | | Insolvency | | Total | | Core | | Insolvency | | Total |

Recoveries (a) | Recoveries (a) | $ | 901,932 | | | $ | 109,957 | | | $ | 1,011,889 | | Recoveries (a) | $ | 500,332 | | | $ | 59,899 | | | $ | 560,231 | |

Less - amounts reclassified to portfolio income (b) | Less - amounts reclassified to portfolio income (b) | 471,459 | | | 38,847 | | | 510,306 | | Less - amounts reclassified to portfolio income (b) | 215,161 | | | 16,511 | | | 231,672 | |

| Recoveries applied to negative allowance | Recoveries applied to negative allowance | $ | 430,473 | | | $ | 71,110 | | | $ | 501,583 | | Recoveries applied to negative allowance | $ | 285,171 | | | $ | 43,388 | | | $ | 328,559 | |

| | | | | | | | | | | | | | | | | |

| March 31, 2020 |

| Core | | Insolvency | | Total |

Recoveries (a) | $ | 440,694 | | | $ | 57,984 | | | $ | 498,678 | |

Less - amounts reclassified to portfolio income (b) | 241,656 | | | 20,366 | | | 262,022 | |

| Recoveries applied to negative allowance | $ | 199,038 | | | $ | 37,618 | | | $ | 236,656 | |

(a) Recoveries includes cash collections, buybacks and other cash-based adjustments.

(b) The Company reported income on expected recoveries based onFor more information, refer to the constant effective interest rate inCompany's discussion of portfolio income onwithin finance receivables and income recognition within Note 1 of the Company's Consolidated Income Statements.Financial Statements included in Item 8 of the 2020 Form 10-K.

(3) Changes in expected recoveries

Changes in expected recoveries consistsconsisted of the following for the sixthree months ended June 30,March 31, 2021 and 2020 (amounts in thousands):

| | | For the six months ended June 30, 2020 | | | March 31, 2021 |

| | Core | | Insolvency | | Total | | Core | | Insolvency | | Total |

| Changes in expected future recoveries | Changes in expected future recoveries | $ | (118,434) | | | $ | (1,890) | | | $ | (120,324) | | Changes in expected future recoveries | $ | (46,502) | | | $ | (6,350) | | | $ | (52,852) | |

| Recoveries received in excess of forecast | Recoveries received in excess of forecast | 123,208 | | | 4,101 | | | 127,309 | | Recoveries received in excess of forecast | 94,912 | | | 8,076 | | | 102,988 | |

| Changes in expected recoveries | Changes in expected recoveries | $ | 4,774 | | | $ | 2,211 | | | $ | 6,985 | | Changes in expected recoveries | $ | 48,410 | | | $ | 1,726 | | | $ | 50,136 | |

| | | | | | | | | | | | | | | | | |

| March 31, 2020 |

| Core | | Insolvency | | Total |

| Changes in expected future recoveries | $ | (20,524) | | | $ | (102) | | | $ | (20,626) | |

| Recoveries received in excess of forecast | 4,047 | | | 3,763 | | | 7,810 | |

| Changes in expected recoveries | $ | (16,477) | | | $ | 3,661 | | | $ | (12,816) | |

In order to evaluate the impact of the COVID-19 pandemic on expectationsmake estimates of future cash collections, the Company considered historical performance, current economic forecasts, regarding the duration of the impact to short-term and long-term growth in the various geographies in which the Company operates and evolving information regarding its effect on economic activity and consumer habits as reopening initiatives occur.habits. The Company also considered currentrecent collection activity in its determination to adjust theassumptions related to near-term estimated timing of near term ERCremaining collections ("ERC") for certain pools. Based on these considerations, the Company’s estimates incorporate changes in both amounts and in the timing of expected cash collections over the next 6 to 18 months.forecast period.

For the three months ended June 30, 2020,March 31, 2021, changes in expected recoveries increased $19.8were a positive $50.1 million. This reflects $119.5$103.0 million in recoveries received during the quarter in excess of forecast, partially offset by a $99.7 million decrease to the present value of expected future recoveries. The majority of the decrease reflects the Company's assumption that the overperformance was acceleration in cash collections rather than an increase to total expected collections. Additionally, the Company made forecast adjustments deemed appropriate given the current environment in which the Company operates.

For the six months ended June 30, 2020, changes in expected recoveries increased $7.0 million. This reflects $127.3 million in recoveries in excess of forecast, which was largely due to significant cash collections overperformance, during the most recent quarter. This was mostly offsetreduced by a $120.3$52.9 million decreasenegative adjustment to changes in the present value of expected future recoveries. The majority of the decrease reflectschanges in expected future recoveries reflect the Company's assumption that the majority of the current quarter overperformance was primarily due to acceleration in the timing of cash collections rather than an increase to total expected collections. Additionally,collections resulting in a present value adjustment.

For the Company madethree months ended March 31, 2020, changes in expected recoveries were a negative $12.8 million. This reflected a $20.6 million negative adjustment to the present value of expected future recoveries primarily related to an expected delay in cash collections from the impact of the novel coronavirus ("COVID-19") pandemic, partially offset by $7.8 million in recoveries received in excess of forecast adjustments in both quarters deemed appropriate given the current environment in which the Company operates.

Changes in the Company’s assumptions regarding the duration and impact of COVID-19 to cash collections could change significantly as conditions evolve.

Finance Receivables, net prior to adoption of ASC 326

The following information reflects finance receivables, net as previously disclosed in the Company's Quarterly Report on Form 10-Q for the three and six months ended June 30, 2019 which was under previous revenue recognition accounting standard ASC 310-30.quarter.

PRA Group, Inc.

Notes to Consolidated Financial Statements

Changes in finance receivables, net for the three and six months ended June 30, 2019 were as follows (amounts in thousands):

| | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended June 30, 2019 | | | | Six Months Ended June 30, 2019 |

| | | | | | | |

| Balance at beginning of period | | | $ | 3,177,229 | | | | | $ | 3,084,777 | |

Acquisitions of finance receivables (1) | | | 284,448 | | | | | 597,894 | |

| | | | | | | |

| Foreign currency translation adjustment | | | (8,477) | | | | | (1,041) | |

| Cash collections | | | (470,274) | | | | | (931,445) | |

| Income recognized on finance receivables | | | 249,219 | | | | | 488,055 | |

| Net allowance charges | | | (1,196) | | | | | (7,291) | |

| | | | | | | |

| Balance at end of period | | | $ | 3,230,949 | | | | | $ | 3,230,949 | |

(1) Includes portfolio purchases adjusted for buybacks and acquisition related costs, and portfolios from the acquisition of a business in Canada made during the first quarter of 2019.

During the three months ended June 30, 2019, the Company acquired finance receivable portfolios with a face value of $1.8 billion for $289.2 million. During the six months ended June 30, 2019, the Company acquired finance receivables portfolios with a face value of $6.6 billion for $608.0 million. At June 30, 2019, the ERC on the receivables acquired during the three and six months ended June 30, 2019 were $513.0 million and $1.02 billion, respectively.

At the time of acquisition and each quarter thereafter, the life of each quarterly accounting pool was estimated based on projected amounts and timing of future cash collections using the proprietary models of the Company. Based upon projections, cash collections expected to be applied to principal were estimated to be as follows for the twelve-month periods ending June 30, (amounts in thousands):

| | | | | |

| 2020 | $ | 845,437 | |

| 2021 | 694,169 | |

| 2023 | 531,004 | |

| 2024 | 393,087 | |

| 2025 | 281,166 | |

| 2026 | 173,283 | |

| 2027 | 101,570 | |

| 2028 | 77,943 | |

| 2029 | 51,868 | |

| 2030 | 35,070 | |

| Thereafter | 46,352 | |

| Total ERC expected to be applied to principal | $ | 3,230,949 | |

At June 30, 2019, the Company had aggregate net finance receivables balances in pools accounted for under the cost recovery method of $39.4 million.

Accretable yield represented the amount of income on finance receivables the Company expected to recognize over the remaining life of its existing portfolios based on estimated future cash flows as of the balance sheet date. Additions represented the original expected accretable yield on portfolios acquired during the period. Net reclassifications from nonaccretable difference to accretable yield primarily resulted from the increase in the Company's estimate of future cash flows. When applicable, net reclassifications to nonaccretable difference from accretable yield resulted from the decrease in the Company's estimates of future cash flows and allowance charges that together exceeded the increase in the Company's estimate of future cash flows.

PRA Group, Inc.

Notes to Consolidated Financial Statements

Changes in accretable yield for the three and six months ended June 30, 2019 were as follows (amounts in thousands):

| | | | | | | | | | | | | | | |

| Three Months Ended June 30, 2019 | | Six Months Ended June 30, 2019 | | | | |

| Balance at beginning of period | $ | 3,080,168 | | | $ | 3,058,445 | | | | | |

| Income recognized on finance receivables | (249,219) | | | (488,055) | | | | | |

| Net allowance charges | 1,196 | | | 7,291 | | | | | |

| Additions from portfolio acquisitions | 228,796 | | | 464,610 | | | | | |

| Reclassifications from nonaccretable difference | 112,901 | | | 132,062 | | | | | |

| Foreign currency translation adjustment | (829) | | | (1,340) | | | | | |

| Balance at end of period | $ | 3,173,013 | | | $ | 3,173,013 | | | | | |

The following is a summary of activity within the Company's valuation allowance account, all of which relates to acquired finance receivables, for the three and six months ended June 30, 2019 (amounts in thousands):

| | | | | | | | | | | |

| Three Months Ended June 30, 2019 | | Six Months Ended June 30, 2019 |

| Beginning balance | $ | 263,324 | | | $ | 257,148 | |

| Allowance charges | 5,532 | | | 13,509 | |

| Reversal of previously recorded allowance charges | (4,336) | | | (6,218) | |

| Net allowance charges | 1,196 | | | 7,291 | |

| Foreign currency translation adjustment | 71 | | | 152 | |

| Ending balance | $ | 264,591 | | | $ | 264,591 | |

4. Investments:

Investments consisted of the following at June 30, 2020March 31, 2021 and December 31, 20192020 (amounts in thousands):

| | | June 30, 2020 | | December 31, 2019 | | March 31, 2021 | | December 31, 2020 |

| | Debt securities | Debt securities | | | | Debt securities | | | |

| | Available-for-sale | Available-for-sale | $ | 4,767 | | | $ | 5,052 | | Available-for-sale | $ | 5,308 | | | $ | 5,368 | |

| | Equity securities | Equity securities | | Equity securities | |

| Exchange traded funds | | Exchange traded funds | 34,841 | | | 34,847 | |

| Private equity funds | Private equity funds | 5,588 | | | 7,218 | | Private equity funds | 6,155 | | | 6,123 | |

| Mutual funds | Mutual funds | 743 | | | 33,677 | | Mutual funds | 896 | | | 1,023 | |

| Equity method investments | Equity method investments | 7,648 | | | 10,229 | | Equity method investments | 7,482 | | | 8,398 | |

| | Total investments | Total investments | $ | 18,746 | | | $ | 56,176 | | Total investments | $ | 54,682 | | | $ | 55,759 | |

Debt Securities

Available-for-sale