UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

☒ Quarterly Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the quarterly period ended September 30, 20222023

☐ Transition Report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the transition period from ________ to ________

Commission File Number: 000-50058

PRA Group, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | | | 75-3078675 |

| (State or other jurisdiction of incorporation or organization) | | | | (I.R.S. Employer Identification No.) |

120 Corporate Boulevard

Norfolk, Virginia 23502

(Address of principal executive offices)

(888) 772-7326

(Registrant's Telephone No., including area code)

Not Applicable

(Former name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.01 par value per share | PRAA | NASDAQ Global Select Market |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes þ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer þ Accelerated filer ¨ Non-accelerated filer ¨ Smaller reporting company ☐ Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No þ

The number of shares of the registrant's common stock outstanding as of October 31, 20222023 was 38,976,910.39,244,145.

Table of Contents

| | | | | | | | |

| |

| | |

| Item 1. | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| Item 2. | | |

| Item 3. | | |

| Item 4. | | |

| | |

| |

| | |

| Item 1. | | |

| Item 1A. | | |

| Item 2. | | |

| Item 3. | | |

| Item 4. | | |

| Item 5. | | |

| Item 6. | | |

| | |

| Signatures | | |

Part I. Financial Information

Item 1. Financial Statements (Unaudited)

PRA Group, Inc.

Consolidated Balance Sheets

September 30, 20222023 and December 31, 20212022

(Amounts in thousands)

| | | (unaudited) | | | (unaudited) | |

| | September 30,

2022 | | December 31,

2021 | | September 30,

2023 | | December 31,

2022 |

| Assets | Assets | | | | Assets | | | |

| Cash and cash equivalents | Cash and cash equivalents | $ | 57,991 | | | $ | 87,584 | | Cash and cash equivalents | $ | 105,172 | | | $ | 83,376 | |

| | Investments | Investments | 76,171 | | | 92,977 | | Investments | 74,729 | | | 79,948 | |

| Finance receivables, net | Finance receivables, net | 3,037,360 | | | 3,428,285 | | Finance receivables, net | 3,460,804 | | | 3,295,008 | |

| Income taxes receivable | Income taxes receivable | 36,420 | | | 41,146 | | Income taxes receivable | 38,695 | | | 31,774 | |

| Deferred tax assets, net | Deferred tax assets, net | 53,949 | | | 67,760 | | Deferred tax assets, net | 55,493 | | | 56,908 | |

| Right-of-use assets | Right-of-use assets | 52,648 | | | 56,713 | | Right-of-use assets | 47,156 | | | 54,506 | |

| Property and equipment, net | Property and equipment, net | 52,061 | | | 54,513 | | Property and equipment, net | 38,562 | | | 51,645 | |

| Goodwill | Goodwill | 404,474 | | | 480,263 | | Goodwill | 412,513 | | | 435,921 | |

| Other assets | Other assets | 124,256 | | | 57,002 | | Other assets | 96,851 | | | 86,588 | |

| Total assets | Total assets | $ | 3,895,330 | | | $ | 4,366,243 | | Total assets | $ | 4,329,975 | | | $ | 4,175,674 | |

| Liabilities and Equity | Liabilities and Equity | | | | Liabilities and Equity | | | |

| Liabilities: | Liabilities: | | Liabilities: | |

| Accounts payable | Accounts payable | $ | 6,148 | | | $ | 3,821 | | Accounts payable | $ | 6,159 | | | $ | 7,329 | |

| Accrued expenses | Accrued expenses | 104,059 | | | 127,802 | | Accrued expenses | 106,391 | | | 111,395 | |

| Income taxes payable | Income taxes payable | 16,412 | | | 19,276 | | Income taxes payable | 15,946 | | | 25,693 | |

| Deferred tax liabilities, net | Deferred tax liabilities, net | 49,248 | | | 36,630 | | Deferred tax liabilities, net | 14,185 | | | 42,918 | |

| Lease liabilities | Lease liabilities | 57,376 | | | 61,188 | | Lease liabilities | 51,658 | | | 59,384 | |

| Interest-bearing deposits | Interest-bearing deposits | 88,155 | | | 124,623 | | Interest-bearing deposits | 100,505 | | | 112,992 | |

| Borrowings | Borrowings | 2,379,614 | | | 2,608,714 | | Borrowings | 2,832,225 | | | 2,494,858 | |

| Other liabilities | Other liabilities | 11,729 | | | 59,352 | | Other liabilities | 12,919 | | | 34,355 | |

| | Total liabilities | Total liabilities | 2,712,741 | | | 3,041,406 | | Total liabilities | 3,139,988 | | | 2,888,924 | |

| | Equity: | Equity: | | | | Equity: | | | |

| Preferred stock, $0.01 par value, 2,000 shares authorized, no shares issued and outstanding | Preferred stock, $0.01 par value, 2,000 shares authorized, no shares issued and outstanding | — | | | — | | Preferred stock, $0.01 par value, 2,000 shares authorized, no shares issued and outstanding | — | | | — | |

| Common stock, $0.01 par value, 100,000 shares authorized, 38,976 shares issued and outstanding at September 30, 2022; 100,000 shares authorized, 41,008 shares issued and outstanding at December 31, 2021 | 389 | | | 410 | | |

Common stock, $0.01 par value; 100,000 shares authorized, 39,243 shares issued and outstanding at September 30, 2023; 100,000 shares authorized, 38,980 shares issued and outstanding at December 31, 2022 | | Common stock, $0.01 par value; 100,000 shares authorized, 39,243 shares issued and outstanding at September 30, 2023; 100,000 shares authorized, 38,980 shares issued and outstanding at December 31, 2022 | 392 | | | 390 | |

| Additional paid-in capital | Additional paid-in capital | — | | | — | | Additional paid-in capital | 4,157 | | | 2,172 | |

| Retained earnings | Retained earnings | 1,557,066 | | | 1,552,845 | | Retained earnings | 1,498,330 | | | 1,573,025 | |

| Accumulated other comprehensive loss | Accumulated other comprehensive loss | (426,086) | | | (266,909) | | Accumulated other comprehensive loss | (387,289) | | | (347,926) | |

| Total stockholders' equity - PRA Group, Inc. | Total stockholders' equity - PRA Group, Inc. | 1,131,369 | | | 1,286,346 | | Total stockholders' equity - PRA Group, Inc. | 1,115,590 | | | 1,227,661 | |

| Noncontrolling interest | Noncontrolling interest | 51,220 | | | 38,491 | | Noncontrolling interest | 74,397 | | | 59,089 | |

| Total equity | Total equity | 1,182,589 | | | 1,324,837 | | Total equity | 1,189,987 | | | 1,286,750 | |

| Total liabilities and equity | Total liabilities and equity | $ | 3,895,330 | | | $ | 4,366,243 | | Total liabilities and equity | $ | 4,329,975 | | | $ | 4,175,674 | |

The accompanying notes are an integral part of these Consolidated Financial Statements.

PRA Group, Inc.

Consolidated Income Statements

For the Three and Nine Months Ended September 30, 20222023 and 20212022

(unaudited)

(Amounts in thousands, except per share amounts)

| | | Three Months Ended | | Nine Months Ended | | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2022 | | 2021 | | 2022 | | 2021 | | 2023 | | 2022 | | 2023 | | 2022 |

| Revenues: | Revenues: | | | | | | | | | Revenues: | | | | | | | | |

| Portfolio income | Portfolio income | | $ | 185,853 | | | $ | 212,905 | | | $ | 587,394 | | | $ | 663,714 | | Portfolio income | | $ | 189,960 | | | $ | 185,853 | | | $ | 562,492 | | | $ | 587,394 | |

| Changes in expected recoveries | Changes in expected recoveries | | 48,336 | | | 43,820 | | | 134,817 | | | 157,504 | | Changes in expected recoveries | | 22,156 | | | 48,336 | | | 6,380 | | | 134,817 | |

| Total portfolio revenue | Total portfolio revenue | | 234,189 | | | 256,725 | | | 722,211 | | | 821,218 | | Total portfolio revenue | | 212,116 | | | 234,189 | | | 568,872 | | | 722,211 | |

| Fee income | | 6,122 | | | 6,209 | | | 14,419 | | | 10,843 | | |

| Other revenue | Other revenue | | 4,496 | | | 764 | | | 7,044 | | | 6,735 | | Other revenue | | 4,314 | | | 10,618 | | | 12,264 | | | 21,463 | |

| Total revenues | Total revenues | | 244,807 | | | 263,698 | | | 743,674 | | | 838,796 | | Total revenues | | 216,430 | | | 244,807 | | | 581,136 | | | 743,674 | |

| | | Operating expenses: | Operating expenses: | | Operating expenses: | |

| Compensation and employee services | Compensation and employee services | | 70,382 | | | 74,584 | | | 215,615 | | | 228,200 | | Compensation and employee services | | 69,517 | | | 70,382 | | | 217,708 | | | 215,615 | |

| Legal collection fees | Legal collection fees | | 8,963 | | | 10,993 | | | 29,390 | | | 36,208 | | Legal collection fees | | 9,839 | | | 8,963 | | | 28,228 | | | 29,390 | |

| Legal collection costs | Legal collection costs | | 23,391 | | | 21,450 | | | 57,694 | | | 61,231 | | Legal collection costs | | 20,761 | | | 23,391 | | | 66,228 | | | 57,694 | |

| Agency fees | Agency fees | | 15,160 | | | 15,646 | | | 47,374 | | | 47,145 | | Agency fees | | 19,436 | | | 15,160 | | | 54,491 | | | 47,374 | |

| Outside fees and services | Outside fees and services | | 24,618 | | | 29,434 | | | 71,489 | | | 71,167 | | Outside fees and services | | 18,858 | | | 24,618 | | | 62,064 | | | 71,489 | |

| Communication | Communication | | 9,951 | | | 9,782 | | | 32,062 | | | 33,039 | | Communication | | 9,881 | | | 9,951 | | | 30,525 | | | 32,062 | |

| Rent and occupancy | Rent and occupancy | | 4,669 | | | 4,571 | | | 14,289 | | | 13,694 | | Rent and occupancy | | 4,426 | | | 4,669 | | | 13,193 | | | 14,289 | |

| Depreciation and amortization | Depreciation and amortization | | 3,741 | | | 3,724 | | | 11,384 | | | 11,520 | | Depreciation and amortization | | 3,273 | | | 3,741 | | | 10,344 | | | 11,384 | |

| Impairment of real estate | | Impairment of real estate | | 5,037 | | | — | | | 5,037 | | | — | |

| Other operating expenses | Other operating expenses | | 13,144 | | | 15,935 | | | 37,885 | | | 44,045 | | Other operating expenses | | 12,356 | | | 13,144 | | | 38,355 | | | 37,885 | |

| | Total operating expenses | Total operating expenses | | 174,019 | | | 186,119 | | | 517,182 | | | 546,249 | | Total operating expenses | | 173,384 | | | 174,019 | | | 526,173 | | | 517,182 | |

| | Income from operations | Income from operations | | 70,788 | | | 77,579 | | | 226,492 | | | 292,547 | | Income from operations | | 43,046 | | | 70,788 | | | 54,963 | | | 226,492 | |

| Other income and (expense): | Other income and (expense): | | Other income and (expense): | |

| | Interest expense, net | Interest expense, net | | (32,455) | | | (29,599) | | | (95,765) | | | (91,987) | | Interest expense, net | | (49,473) | | | (32,455) | | | (130,778) | | | (95,765) | |

| Foreign exchange gain, net | Foreign exchange gain, net | | 4 | | | 1,232 | | | 791 | | | 127 | | Foreign exchange gain, net | | 564 | | | 4 | | | 984 | | | 791 | |

| Other | Other | | (83) | | | 85 | | | (754) | | | 294 | | Other | | (500) | | | (83) | | | (1,380) | | | (754) | |

| Income before income taxes | | 38,254 | | | 49,297 | | | 130,764 | | | 200,981 | | |

| Income tax expense | | 11,072 | | | 12,627 | | | 29,828 | | | 41,870 | | |

| Net income | | 27,182 | | | 36,670 | | | 100,936 | | | 159,111 | | |

| Income/(loss) before income taxes | | Income/(loss) before income taxes | | (6,363) | | | 38,254 | | | (76,211) | | | 130,764 | |

| Income tax expense/(benefit) | | Income tax expense/(benefit) | | 1,788 | | | 11,072 | | | (15,317) | | | 29,828 | |

| Net income/(loss) | | Net income/(loss) | | (8,151) | | | 27,182 | | | (60,894) | | | 100,936 | |

| Adjustment for net income/(loss) attributable to noncontrolling interests | Adjustment for net income/(loss) attributable to noncontrolling interests | | 2,450 | | | 2,190 | | | (252) | | | 10,229 | | Adjustment for net income/(loss) attributable to noncontrolling interests | | 4,111 | | | 2,450 | | | 13,801 | | | (252) | |

| Net income attributable to PRA Group, Inc. | | $ | 24,732 | | | $ | 34,480 | | | $ | 101,188 | | | $ | 148,882 | | |

| Net income per common share attributable to PRA Group, Inc.: | | | | | | | | | |

| Net income/(loss) attributable to PRA Group, Inc. | | Net income/(loss) attributable to PRA Group, Inc. | | $ | (12,262) | | | $ | 24,732 | | | $ | (74,695) | | | $ | 101,188 | |

| | Net income/(loss) per common share attributable to PRA Group, Inc.: | | Net income/(loss) per common share attributable to PRA Group, Inc.: | |

| Basic | Basic | | $ | 0.63 | | | $ | 0.76 | | | $ | 2.54 | | | $ | 3.27 | | Basic | | $ | (0.31) | | | $ | 0.63 | | | $ | (1.91) | | | $ | 2.54 | |

| Diluted | Diluted | | $ | 0.63 | | | $ | 0.76 | | | $ | 2.52 | | | $ | 3.24 | | Diluted | | $ | (0.31) | | | $ | 0.63 | | | $ | (1.91) | | | $ | 2.52 | |

| Weighted average number of shares outstanding: | Weighted average number of shares outstanding: | | Weighted average number of shares outstanding: | |

| Basic | Basic | | 39,018 | | | 45,305 | | | 39,858 | | | 45,594 | | Basic | | 39,242 | | | 39,018 | | | 39,155 | | | 39,858 | |

| Diluted | Diluted | | 39,170 | | | 45,656 | | | 40,125 | | | 45,920 | | Diluted | | 39,242 | | | 39,170 | | | 39,155 | | | 40,125 | |

The accompanying notes are an integral part of these Consolidated Financial Statements.

PRA Group, Inc.

Consolidated Statements of Comprehensive (Loss)/Income

For the Three and Nine Months Ended September 30, 20222023 and 20212022

(unaudited)

(Amounts in thousands)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

| 2022 | | 2021 | | 2022 | | 2021 |

| Net income | $ | 27,182 | | | $ | 36,670 | | | $ | 100,936 | | | $ | 159,111 | |

| Other comprehensive (loss)/income, net of tax: | | | | | | | |

| Currency translation adjustments | (91,390) | | | (38,238) | | | (194,656) | | | (43,682) | |

| Cash flow hedges | 19,590 | | | 5,522 | | | 44,007 | | | 19,200 | |

| Debt securities available-for-sale | 133 | | | (50) | | | (269) | | | (192) | |

| Other comprehensive (loss)/income | (71,667) | | | (32,766) | | | (150,918) | | | (24,674) | |

| Total comprehensive (loss)/income | (44,485) | | | 3,904 | | | (49,982) | | | 134,437 | |

| Less comprehensive income/(loss) attributable to noncontrolling interests | 9,049 | | | (1,154) | | | 8,008 | | | 4,544 | |

| Comprehensive (loss)/income attributable to PRA Group, Inc. | $ | (53,534) | | | $ | 5,058 | | | $ | (57,990) | | | $ | 129,893 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Net income/(loss) | $ | (8,151) | | | $ | 27,182 | | | $ | (60,894) | | | $ | 100,936 | |

| Other comprehensive loss, net of tax | | | | | | | |

| Currency translation adjustments | (34,279) | | | (91,390) | | | (28,746) | | | (194,656) | |

| Cash flow hedges | (7,660) | | | 19,590 | | | (6,772) | | | 44,007 | |

| Debt securities available-for-sale | (26) | | | 133 | | | 22 | | | (269) | |

| Other comprehensive loss | (41,965) | | | (71,667) | | | (35,496) | | | (150,918) | |

| Total comprehensive loss | (50,116) | | | (44,485) | | | (96,390) | | | (49,982) | |

| Less comprehensive income attributable to noncontrolling interests | 1,436 | | | 9,049 | | | 17,668 | | | 8,008 | |

| Comprehensive loss attributable to PRA Group, Inc. | $ | (51,552) | | | $ | (53,534) | | | $ | (114,058) | | | $ | (57,990) | |

The accompanying notes are an integral part of these Consolidated Financial Statements.

PRA Group, Inc.

Consolidated Statements of Changes in Equity

For the Nine Months Ended September 30, 20222023

(unaudited)

(Amounts in thousands)

| | | Common Stock | | Additional Paid-In | | Retained | | Accumulated Other Comprehensive | | Noncontrolling | | Total | | | Common Stock | | Additional Paid-In | | Retained | | Accumulated Other Comprehensive | | Noncontrolling | | Total | |

| | Shares | | Amount | | Capital | | Earnings | | (Loss)/ Income | | Interest | | Equity | | | Shares | | Amount | | Capital | | Earnings | | Income/(Loss) | | Interest | | Equity | |

| Balance at December 31, 2021 | 41,008 | | | $ | 410 | | | $ | — | | | $ | 1,552,845 | | | $ | (266,909) | | | $ | 38,491 | | | $ | 1,324,837 | | | |

| Balance at December 31, 2022 | | Balance at December 31, 2022 | 38,980 | | | $ | 390 | | | $ | 2,172 | | | $ | 1,573,025 | | | $ | (347,926) | | | $ | 59,089 | | | $ | 1,286,750 | | |

| Components of comprehensive income, net of tax: | Components of comprehensive income, net of tax: | | | Components of comprehensive income, net of tax: | | |

| Net income | — | | | — | | | — | | | 39,972 | | | — | | | (5,354) | | | 34,618 | | | |

| Net income/(loss) | | Net income/(loss) | — | | | — | | | — | | | (58,629) | | | — | | | 4,726 | | | (53,903) | | |

| Currency translation adjustments | Currency translation adjustments | — | | | — | | | — | | | — | | | 4,780 | | | 7,490 | | | 12,270 | | | Currency translation adjustments | — | | | — | | | — | | | — | | | (4,101) | | | 2,551 | | | (1,550) | | |

| Cash flow hedges | Cash flow hedges | — | | | — | | | — | | | — | | | 18,580 | | | — | | | 18,580 | | | Cash flow hedges | — | | | — | | | — | | | — | | | (4,831) | | | — | | | (4,831) | | |

| Debt securities available-for-sale | Debt securities available-for-sale | — | | | — | | | — | | | — | | | (160) | | | — | | | (160) | | | Debt securities available-for-sale | — | | | — | | | — | | | — | | | 128 | | | — | | | 128 | | |

| Vesting of restricted stock | Vesting of restricted stock | 262 | | | 3 | | | (3) | | | — | | | — | | | — | | | — | | | Vesting of restricted stock | 190 | | | 2 | | | (2) | | | — | | | — | | | — | | | — | | |

| Repurchase and cancellation of common stock | (860) | | | (9) | | | 4,527 | | | (43,972) | | | — | | | — | | | (39,454) | | | |

| Share-based compensation expense | Share-based compensation expense | — | | | 3,891 | | | — | | | — | | | — | | | 3,891 | | | Share-based compensation expense | — | | | — | | | 3,799 | | | — | | | — | | | — | | | 3,799 | | |

| Employee stock relinquished for payment of taxes | Employee stock relinquished for payment of taxes | — | | | — | | | (8,415) | | | — | | | — | | | — | | | (8,415) | | | Employee stock relinquished for payment of taxes | — | | | — | | | (5,684) | | | — | | | — | | | — | | | (5,684) | | |

| Balance at March 31, 2022 | 40,410 | | | $ | 404 | | | $ | — | | | $ | 1,548,845 | | | $ | (243,709) | | | $ | 40,627 | | | $ | 1,346,167 | | | |

| Balance at March 31, 2023 | | Balance at March 31, 2023 | 39,170 | | | $ | 392 | | | $ | 285 | | | $ | 1,514,396 | | | $ | (356,730) | | | $ | 66,366 | | | $ | 1,224,709 | | |

| Components of comprehensive income, net of tax: | Components of comprehensive income, net of tax: | | | Components of comprehensive income, net of tax: | | | | | | | | | | | | | | |

| Net income | — | | | — | | | — | | | 36,484 | | | — | | | 2,652 | | | 39,136 | | | |

| Currency translation adjustments | — | | | — | | | — | | | — | | | (109,707) | | | (5,829) | | | (115,536) | | | |

| Cash flow hedges | — | | | — | | | — | | | — | | | 5,837 | | | — | | | 5,837 | | | |

| | Debt securities available-for-sale | — | | | — | | | — | | | — | | | (242) | | | — | | | (242) | | | |

| Distributions to noncontrolling interest | — | | | — | | | — | | | — | | | — | | | (3,494) | | | (3,494) | | | |

| Contributions from noncontrolling interest | — | | | — | | | — | | | — | | | — | | | 1,599 | | | 1,599 | | | |

| | Vesting of restricted stock | 37 | | | — | | | — | | | — | | | — | | | — | | | — | | | |

| Repurchase and cancellation of common stock | (808) | | | (8) | | | (3,835) | | | (31,092) | | | — | | | — | | | (34,935) | | | |

| Share-based compensation expense | — | | | — | | | 3,849 | | | — | | | — | | | — | | | 3,849 | | | |

| | Employee stock relinquished for payment of taxes | — | | | — | | | (14) | | | — | | | — | | | — | | | (14) | | | |

| | Balance at June 30, 2022 | 39,639 | | | $ | 396 | | | $ | — | | | $ | 1,554,237 | | | $ | (347,821) | | | $ | 35,555 | | | $ | 1,242,367 | | | |

| Components of comprehensive income, net of tax: | | | |

| Net income | — | | | — | | | — | | | 24,732 | | | — | | | 2,450 | | | 27,182 | | | |

| Net income/(loss) | | Net income/(loss) | — | | | — | | | — | | | (3,804) | | | — | | | 4,964 | | | 1,160 | | |

| Currency translation adjustments | Currency translation adjustments | — | | | — | | | — | | | — | | | (97,988) | | | 6,598 | | | (91,390) | | | Currency translation adjustments | — | | | — | | | — | | | — | | | 3,091 | | | 3,992 | | | 7,083 | | |

| Cash flow hedges | Cash flow hedges | — | | | — | | | — | | | — | | | 19,590 | | | — | | | 19,590 | | | Cash flow hedges | — | | | — | | | — | | | — | | | 5,719 | | | — | | | 5,719 | | |

| Debt securities available-for-sale | Debt securities available-for-sale | — | | | — | | | — | | | — | | | 133 | | | — | | | 133 | | | Debt securities available-for-sale | — | | | — | | | — | | | — | | | (80) | | | — | | | (80) | | |

| Distributions to noncontrolling interest | Distributions to noncontrolling interest | — | | | — | | | — | | | — | | | — | | | (1,127) | | | (1,127) | | | Distributions to noncontrolling interest | — | | | — | | | — | | | — | | | — | | | (1,173) | | | (1,173) | | |

| Contributions from noncontrolling interest | — | | | — | | | — | | | — | | | — | | | 7,744 | | | 7,744 | | | |

| | Repurchase and cancellation of common stock | (663) | | | (7) | | | (3,091) | | | (21,903) | | | — | | | — | | | (25,001) | | | |

| Vesting of restricted stock | | Vesting of restricted stock | 72 | | | — | | | — | | | — | | | — | | | — | | | — | | |

| Share-based compensation expense | Share-based compensation expense | — | | | — | | | 3,101 | | | — | | | — | | | — | | | 3,101 | | | Share-based compensation expense | — | | | — | | | 2,715 | | | — | | | — | | | — | | | 2,715 | | |

| Employee stock relinquished for payment of taxes | Employee stock relinquished for payment of taxes | — | | | — | | | (10) | | | — | | | — | | | — | | | (10) | | | Employee stock relinquished for payment of taxes | — | | | — | | | (459) | | | — | | | — | | | — | | | (459) | | |

| Balance at September 30, 2022 | 38,976 | | | $ | 389 | | | $ | — | | | $ | 1,557,066 | | | $ | (426,086) | | | $ | 51,220 | | | $ | 1,182,589 | | | |

| | Balance at June 30, 2023 | | Balance at June 30, 2023 | 39,242 | | | $ | 392 | | | $ | 2,541 | | | $ | 1,510,592 | | | $ | (348,000) | | | $ | 74,149 | | | $ | 1,239,674 | | |

| Components of comprehensive income, net of tax: | | Components of comprehensive income, net of tax: | | | | | | | | | | | | | | |

| Net income/(loss) | | Net income/(loss) | — | | | — | | | — | | | (12,262) | | | — | | | 4,111 | | | (8,151) | | |

| Currency translation adjustments | | Currency translation adjustments | — | | | — | | | — | | | — | | | (31,603) | | | (2,676) | | | (34,279) | | |

| Cash flow hedges | | Cash flow hedges | — | | | — | | | — | | | — | | | (7,660) | | | — | | | (7,660) | | |

| Debt securities available-for-sale | | Debt securities available-for-sale | — | | | — | | | — | | | — | | | (26) | | | — | | | (26) | | |

| Distributions to noncontrolling interest | | Distributions to noncontrolling interest | — | | | — | | | — | | | — | | | — | | | (1,187) | | | (1,187) | | |

| Vesting of restricted stock | | Vesting of restricted stock | 1 | | | — | | | — | | | — | | | — | | | — | | | — | | |

| Share-based compensation expense | | Share-based compensation expense | — | | | — | | | 1,629 | | | — | | | — | | | — | | | 1,629 | | |

| Employee stock relinquished for payment of taxes | | Employee stock relinquished for payment of taxes | — | | | — | | | (13) | | | — | | | — | | | — | | | (13) | | |

| Balance at September 30, 2023 | | Balance at September 30, 2023 | 39,243 | | | $ | 392 | | | $ | 4,157 | | | $ | 1,498,330 | | | $ | (387,289) | | | $ | 74,397 | | | $ | 1,189,987 | | |

The accompanying notes are an integral part of these Consolidated Financial Statements.

PRA Group, Inc.

Consolidated Statements of Changes in Equity

For the Nine Months Ended September 30, 20212022

(unaudited)

(Amounts in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Common Stock | | Additional Paid-In | | Retained | | Accumulated Other Comprehensive | | Noncontrolling | | Total | | |

| Shares | | Amount | | Capital | | Earnings | | (Loss)/ Income | | Interest | | Equity | | |

| Balance at December 31, 2020 | 45,585 | | | $ | 456 | | | $ | 75,282 | | | $ | 1,511,970 | | | $ | (245,791) | | | $ | 31,609 | | | $ | 1,373,526 | | | |

Effect of change in accounting principle (1) | — | | | — | | | (26,697) | | | 12,008 | | | — | | | — | | | (14,689) | | | |

| Balance at January 1, 2021 | 45,585 | | | $ | 456 | | | $ | 48,585 | | | $ | 1,523,978 | | | $ | (245,791) | | | $ | 31,609 | | | $ | 1,358,837 | | | |

| Components of comprehensive income, net of tax: | | | | | | | | | | | | | | | |

| Net income | — | | | — | | | — | | | 58,406 | | | — | | | 3,474 | | | 61,880 | | | |

| Currency translation adjustments | — | | | — | | | — | | | — | | | (20,108) | | | (4,423) | | | (24,531) | | | |

| Cash flow hedges | — | | | — | | | — | | | — | | | 12,323 | | | — | | | 12,323 | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Distributions to noncontrolling interest | — | | | — | | | — | | | — | | | — | | | (3,933) | | | (3,933) | | | |

| | | | | | | | | | | | | | | |

| Vesting of restricted stock | 214 | | | 2 | | | (2) | | | — | | | — | | | — | | | — | | | |

| | | | | | | | | | | | | | | |

| Share-based compensation expense | — | | | — | | | 4,113 | | | — | | | — | | | — | | | 4,113 | | | |

| | | | | | | | | | | | | | | |

| Employee stock relinquished for payment of taxes | — | | | — | | | (5,460) | | | — | | | — | | | — | | | (5,460) | | | |

| | | | | | | | | | | | | | | |

| Balance at March 31, 2021 | 45,799 | | | $ | 458 | | | $ | 47,236 | | | $ | 1,582,384 | | | $ | (253,576) | | | $ | 26,727 | | | $ | 1,403,229 | | | |

| Components of comprehensive income, net of tax: | | | | | | | | | | | | | | | |

| Net income | — | | | — | | | — | | | 55,996 | | | — | | | 4,565 | | | 60,561 | | | |

| Currency translation adjustments | — | | | — | | | — | | | — | | | 17,004 | | | 2,083 | | | 19,087 | | | |

| Cash flow hedges | — | | | — | | | — | | | — | | | 1,355 | | | — | | | 1,355 | | | |

| Debt securities available-for-sale | — | | | — | | | — | | | — | | | (142) | | | — | | | (142) | | | |

| Distributions to noncontrolling interest | — | | | — | | | — | | | — | | | — | | | (13,120) | | | (13,120) | | | |

| Vesting of restricted stock | 38 | | | — | | | — | | | — | | | — | | | — | | | — | | | |

| Share-based compensation expense | — | | | — | | | 4,040 | | | — | | | — | | | — | | | 4,040 | | | |

| Employee stock relinquished for payment of taxes | — | | | — | | | (70) | | | — | | | — | | | — | | | (70) | | | |

| Balance at June 30, 2021 | 45,837 | | | $ | 458 | | | $ | 51,206 | | | $ | 1,638,380 | | | $ | (235,359) | | | $ | 20,255 | | | $ | 1,474,940 | | | |

| Components of comprehensive income, net of tax: | | | | | | | | | | | | | | | |

| Net income | — | | | — | | | — | | | 34,480 | | | — | | | 2,190 | | | 36,670 | | | |

| Currency translation adjustments | — | | | — | | | — | | | — | | | (34,894) | | | (3,344) | | | (38,238) | | | |

| Cash flow hedges | — | | | — | | | — | | | — | | | 5,522 | | | — | | | 5,522 | | | |

| Debt securities available-for-sale | — | | | — | | | — | | | — | | | (50) | | | — | | | (50) | | | |

| Distributions to noncontrolling interest | — | | | — | | | — | | | — | | | — | | | (3,397) | | | (3,397) | | | |

| Contributions from noncontrolling interest | — | | | — | | | — | | | — | | | — | | | 22,743 | | | 22,743 | | | |

| Repurchase and cancellation of common stock | (1,797) | | | (18) | | | (55,513) | | | (18,316) | | | — | | | — | | | (73,847) | | | |

| Share-based compensation expense | — | | | — | | | 4,317 | | | — | | | — | | | — | | | 4,317 | | | |

| Employee stock relinquished for payment of taxes | — | | | — | | | (10) | | | — | | | — | | | — | | | (10) | | | |

| Balance at September 30, 2021 | 44,040 | | | $ | 440 | | | $ | — | | | $ | 1,654,544 | | | $ | (264,781) | | | $ | 38,447 | | | $ | 1,428,650 | | | |

(1) Reflects adjustments recorded for the January 1, 2021 adoption of an accounting update. Refer to the Company's 2021 Annual Report on Form 10-K for more information. | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Common Stock | | Additional Paid-In | | Retained | | Accumulated Other Comprehensive | | Noncontrolling | | Total | | |

| Shares | | Amount | | Capital | | Earnings | | Income/(Loss) | | Interest | | Equity | | |

| Balance at December 31, 2021 | 41,008 | | | $ | 410 | | | $ | — | | | $ | 1,552,845 | | | $ | (266,909) | | | $ | 38,491 | | | $ | 1,324,837 | | | |

| Components of comprehensive income, net of tax: | | | | | | | | | | | | | | | |

| Net income/(loss) | — | | | — | | | — | | | 39,972 | | | — | | | (5,354) | | | 34,618 | | | |

| Currency translation adjustments | — | | | — | | | — | | | — | | | 4,780 | | | 7,490 | | | 12,270 | | | |

| Cash flow hedges | — | | | — | | | — | | | — | | | 18,580 | | | — | | | 18,580 | | | |

| Debt securities available-for-sale | — | | | — | | | — | | | — | | | (160) | | | — | | | (160) | | | |

| Vesting of restricted stock | 262 | | | 3 | | | (3) | | | — | | | — | | | — | | | — | | | |

| Repurchase and cancellation of common stock | (860) | | | (9) | | | 4,527 | | | (43,972) | | | — | | | — | | | (39,454) | | | |

| Share-based compensation expense | — | | | | | 3,891 | | | — | | | — | | | — | | | 3,891 | | | |

| Employee stock relinquished for payment of taxes | — | | | — | | | (8,415) | | | — | | | — | | | — | | | (8,415) | | | |

| Balance at March 31, 2022 | 40,410 | | | $ | 404 | | | $ | — | | | $ | 1,548,845 | | | $ | (243,709) | | | $ | 40,627 | | | $ | 1,346,167 | | | |

| | | | | | | | | | | | | | | |

| Components of comprehensive income, net of tax: | | | | | | | | | | | | | | | |

| Net income/(loss) | — | | | — | | | — | | | 36,484 | | | — | | | 2,652 | | | 39,136 | | | |

| Currency translation adjustments | — | | | — | | | — | | | — | | | (109,707) | | | (5,829) | | | (115,536) | | | |

| Cash flow hedges | — | | | — | | | — | | | — | | | 5,837 | | | — | | | 5,837 | | | |

| Debt securities available-for-sale | — | | | — | | | — | | | — | | | (242) | | | — | | | (242) | | | |

| Distributions to noncontrolling interest | — | | | — | | | — | | | — | | | — | | | (3,494) | | | (3,494) | | | |

| Contributions from noncontrolling interest | — | | | — | | | — | | | — | | | — | | | 1,599 | | | 1,599 | | | |

| Vesting of restricted stock | 37 | | | — | | | — | | | — | | | — | | | — | | | — | | | |

| Repurchase and cancellation of common stock | (808) | | | (8) | | | (3,835) | | | (31,092) | | | — | | | — | | | (34,935) | | | |

| Share-based compensation expense | — | | | — | | | 3,849 | | | — | | | — | | | — | | | 3,849 | | | |

| Employee stock relinquished for payment of taxes | — | | | — | | | (14) | | | — | | | — | | | — | | | (14) | | | |

| Balance at June 30, 2022 | 39,639 | | | $ | 396 | | | $ | — | | | $ | 1,554,237 | | | $ | (347,821) | | | $ | 35,555 | | | $ | 1,242,367 | | | |

| Components of comprehensive income, net of tax: | | | | | | | | | | | | | | | |

| Net income/(loss) | — | | | — | | | — | | | 24,732 | | | — | | | 2,450 | | | 27,182 | | | |

| Currency translation adjustments | — | | | — | | | — | | | — | | | (97,988) | | | 6,598 | | | (91,390) | | | |

| Cash flow hedges | — | | | — | | | — | | | — | | | 19,590 | | | — | | | 19,590 | | | |

| Debt securities available-for-sale | — | | | — | | | — | | | — | | | 133 | | | — | | | 133 | | | |

| Distributions to noncontrolling interest | — | | | — | | | — | | | — | | | — | | | (1,127) | | | (1,127) | | | |

| Contributions from noncontrolling interest | — | | | — | | | — | | | — | | | — | | | 7,744 | | | 7,744 | | | |

| Repurchase and cancellation of common stock | (663) | | | (7) | | | (3,091) | | | (21,903) | | | — | | | — | | | (25,001) | | | |

| Share-based compensation expense | — | | | — | | | 3,101 | | | — | | | — | | | — | | | 3,101 | | | |

| Employee stock relinquished for payment of taxes | — | | | — | | | (10) | | | — | | | — | | | — | | | (10) | | | |

| Balance at September 30, 2022 | 38,976 | | | $ | 389 | | | $ | — | | | $ | 1,557,066 | | | $ | (426,086) | | | $ | 51,220 | | | $ | 1,182,589 | | | |

The accompanying notes are an integral part of these Consolidated Financial Statements.

PRA Group, Inc.

Consolidated Statements of Cash Flows

For the Nine Months Ended September 30, 20222023 and 20212022

(unaudited)

(Amounts in thousands)

| | | | | | | | | | | |

| Nine Months Ended |

| 2022 | | 2021 |

| Cash flows from operating activities: | | | |

| Net income | $ | 100,936 | | | $ | 159,111 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | |

| Share-based compensation expense | 10,841 | | | 12,470 | |

| Depreciation and amortization | 11,384 | | | 11,520 | |

| | | |

| | | |

| Amortization of debt discount and issuance costs | 7,653 | | | 7,053 | |

| Changes in expected recoveries | (134,817) | | | (157,504) | |

| | | |

| Deferred income taxes | 8,710 | | | (4,235) | |

| Net unrealized foreign currency transactions | 21,356 | | | 7,462 | |

| Fair value in earnings for equity securities | (175) | | | 92 | |

| Other | 159 | | | 91 | |

| | | |

| Changes in operating assets and liabilities: | | | |

| Other assets | (2,547) | | | 7,779 | |

| | | |

| Accounts payable | 3,028 | | | 201 | |

| Income taxes payable, net | (155) | | | (9,391) | |

| Accrued expenses | (7,655) | | | 3,086 | |

| Other liabilities | (22,521) | | | 531 | |

| Right of use asset/lease liability | 389 | | | 17 | |

| | | |

| Net cash (used)/provided by operating activities | (3,414) | | | 38,283 | |

| Cash flows from investing activities: | | | |

| Purchases of property and equipment, net | (10,698) | | | (6,772) | |

| | | |

| Purchases of finance receivables | (561,901) | | | (770,377) | |

| Recoveries applied to negative allowance | 765,732 | | | 934,002 | |

| Purchases of investments | (2,292) | | | (74,485) | |

| Proceeds from sales and maturities of investments | 4,565 | | | 42,110 | |

| Business acquisition, net of cash acquired | — | | | (647) | |

| | | |

| | | |

| Net cash provided by investing activities | 195,406 | | | 123,831 | |

| Cash flows from financing activities: | | | |

| Proceeds from lines of credit | 1,343,434 | | | 426,135 | |

| Principal payments on lines of credit | (1,389,371) | | | (908,215) | |

| | | |

| Proceeds from senior notes | — | | | 350,000 | |

| | | |

| Principal payments on long-term debt | (7,500) | | | (7,500) | |

| Repurchases of common stock | (111,371) | | | (73,847) | |

| Payments of origination cost and fees | (7,798) | | | (8,835) | |

| Tax withholdings related to share-based payments | (8,438) | | | (5,540) | |

| Distributions paid to noncontrolling interest | (4,621) | | | (20,450) | |

| Contributions from noncontrolling interest | 9,343 | | | 22,743 | |

| | | |

| Net (decrease)/increase in interest-bearing deposits | (13,732) | | | 8,847 | |

| | | |

| | | |

| Net cash used in financing activities | (190,054) | | | (216,662) | |

| Effect of exchange rate on cash | (31,927) | | | (5,202) | |

| Net decrease in cash and cash equivalents | (29,989) | | | (59,750) | |

| Cash and cash equivalents beginning of period | 89,072 | | | 121,047 | |

| Cash and cash equivalents, end of period | $ | 59,083 | | | $ | 61,297 | |

| | | |

| Supplemental disclosure of cash flow information: | | | |

| Cash paid for interest | $ | 87,912 | | | $ | 88,676 | |

| Cash paid for income taxes | 21,086 | | | 55,234 | |

| | | |

| Cash, cash equivalents and restricted cash reconciliation: | | | |

| Cash and cash equivalents per Consolidated Balance Sheets | $ | 57,991 | | | $ | 56,545 | |

| Restricted cash included in Other assets per Consolidated Balance Sheets | 1,092 | | | 4,752 | |

| Total cash, cash equivalents and restricted cash | $ | 59,083 | | | $ | 61,297 | |

| | | |

| | | |

| | | |

| | | |

| | | | | | | | | | | |

| Nine Months Ended September 30, |

| 2023 | | 2022 |

| Cash flows from operating activities: | | | |

| Net income/(loss) | $ | (60,894) | | | $ | 100,936 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | |

| Share-based compensation expense | 8,143 | | | 10,841 | |

| Depreciation, amortization and impairment | 15,381 | | | 11,384 | |

| Gain on extinguishment of debt | (343) | | | — | |

| | | |

| | | |

| Amortization of debt discount and issuance costs | 7,045 | | | 7,653 | |

| Changes in expected recoveries | (6,380) | | | (134,817) | |

| | | |

| Deferred income taxes | (26,276) | | | 8,710 | |

| Net unrealized foreign currency transactions | (31,783) | | | 21,356 | |

| Fair value in earnings for equity securities | 1,094 | | | (175) | |

| Other | (1,318) | | | 159 | |

| | | |

| Changes in operating assets and liabilities: | | | |

| Other assets | 1,111 | | | (2,547) | |

| | | |

| Accounts payable | (1,123) | | | 3,028 | |

| Income taxes payable, net | (18,259) | | | (155) | |

| Accrued expenses | (4,685) | | | (7,655) | |

| Other liabilities | 385 | | | (22,521) | |

| Right-of-use asset/lease liability | (370) | | | 389 | |

| | | |

| Net cash used in operating activities | (118,272) | | | (3,414) | |

| Cash flows from investing activities: | | | |

| Purchases of property and equipment, net | (2,306) | | | (10,698) | |

| | | |

| Purchases of finance receivables | (875,373) | | | (561,901) | |

| Recoveries applied to negative allowance | 695,386 | | | 765,732 | |

| Purchases of investments | (60,058) | | | (2,292) | |

| Proceeds from sales and maturities of investments | 62,762 | | | 4,565 | |

| | | |

| | | |

| | | |

| Net cash provided by/(used in) investing activities | (179,589) | | | 195,406 | |

| Cash flows from financing activities: | | | |

| Proceeds from lines of credit | 695,651 | | | 1,343,434 | |

| Principal payments on lines of credit | (389,658) | | | (1,389,371) | |

| Retirement of Convertible Senior Notes due 2023 | (345,000) | | | — | |

| | | |

| Proceeds from issuance of Senior Notes due 2028 | 400,000 | | | — | |

| Principal payments on long-term debt | (7,500) | | | (7,500) | |

| Repurchases of senior notes | (3,657) | | | — | |

| Repurchases of common stock | — | | | (111,371) | |

| Payments of origination cost and fees | (5,323) | | | (7,798) | |

| Tax withholdings related to share-based payments | (6,155) | | | (8,438) | |

| Distributions paid to noncontrolling interest | (2,360) | | | (4,621) | |

| Contributions from noncontrolling interest | — | | | 9,343 | |

| | | |

| Net decrease in interest-bearing deposits | (7,747) | | | (13,732) | |

| | | |

| | | |

| Net cash provided by/(used in) financing activities | 328,251 | | | (190,054) | |

| Effect of exchange rate on cash | 3,270 | | | (31,927) | |

| Net increase/(decrease) in cash and cash equivalents | 33,660 | | | (29,989) | |

| Cash and cash equivalents, beginning of period | 84,758 | | | 89,072 | |

| Cash and cash equivalents, end of period | $ | 118,418 | | | $ | 59,083 | |

| Supplemental disclosure of cash flow information: | | | |

| Cash paid for interest | $ | 111,344 | | | $ | 87,912 | |

| Cash paid for income taxes | 28,479 | | | 21,086 | |

| Cash, cash equivalents and restricted cash reconciliation: | | | |

| Cash and cash equivalents per Consolidated Balance Sheets | $ | 105,172 | | | $ | 57,991 | |

| Restricted cash included in Other assets per Consolidated Balance Sheets | 13,246 | | | 1,092 | |

| Total cash, cash equivalents and restricted cash | $ | 118,418 | | | $ | 59,083 | |

| | | |

| | | |

| | | |

| | | |

The accompanying notes are an integral part of these Consolidated Financial Statements.

PRA Group, Inc.

Notes to Consolidated Financial Statements

1. Organization and Business:

Nature of operations: As used herein, the terms "PRA Group," the "Company," or similar terms refer to PRA Group, Inc. and its subsidiaries.

PRA Group, Inc., a Delaware corporation, is a global financial and business services company with operations in the Americas, Europe and Australia. The Company's primary business is the purchase, collection and management of portfolios of nonperforming loans. The Company also provides fee-based services on class action claims recoveries and by servicing consumer bankruptcy accounts in the United States ("U.S.").

Basis of presentation: The Consolidated Financial Statements of the Company are prepared in accordance with U.S. generally accepted accounting principles ("GAAP"). The accompanying interim financial statements have been prepared in accordance with the instructions for Quarterly Reports on Form 10-Q and, therefore, do not include all information and Notes to the Consolidated Financial Statements necessary for a complete presentation of financial position, results of operations, comprehensive income/(loss) and cash flows in conformity with GAAP. In the opinion of management, all adjustments, consisting of normal and recurring items, necessary for the fair presentation of the Company's Consolidated Balance Sheets as of September 30, 2022,2023, its Consolidated Income Statements and Statements of Comprehensive (Loss)/Income for the three and nine months ended September 30, 20222023 and 2021,2022, and its Consolidated Statements of Changes in Equity and Statements of Cash Flows for the nine months ended September 30, 20222023 and 20212022, have been included. The Company's Consolidated Income Statements for the three and nine months ended September 30, 20222023 may not be indicative of future results.

These unaudited Consolidated Financial Statements should be read in conjunction with the audited Consolidated Financial Statements and notes thereto included in the Company's Annual Report on Form 10-K for the year ended December 31, 20212022 (the "2021"2022 Form 10-K").

Reclassification of prior year presentation: Certain prior year amounts have been reclassified for consistency with the current year presentation. Fee income is now included within Other revenue on the Consolidated Income Statements.

Consolidation: The Consolidated Financial Statements include the accounts of PRA Group and other entities in which the Company has a controlling interest. All significant intercompany accounts and transactions have been eliminated.

Entities in which the Company has a controlling financial interest, through ownership of the majority of the entities’ voting equity interests, or through other contractual rights that give the Company control, consist of entities which purchase and collect on portfolios of nonperforming loans.

Investments in companies in which the Company has significant influence over operating and financing decisions, but does not own a majority of the voting equity interests or exercise control, are accounted for in accordance with the equity method of accounting, which requires the Company to recognize its proportionate share of the entity’sentity's net earnings. TheseIncome or loss from these investments are included in Other assets, with income or lossis included in Other revenue.

The Company performs on-going reassessments of whether changes in the facts and circumstances regarding the Company’s involvement with an entity would cause the Company’s consolidation conclusionconclusions to change.

Segments: The Company has determined that it has two operating segments that meet the aggregation criteria of Accounting Standards Codification ("ASC") 280, Segment Reporting ("ASC 280") and, therefore, it has one reportable segment,segment; accounts receivable management. This conclusion is based on similarities among the operating units, including economic characteristics, the nature of the products and services, the nature of the production processes, the types or class of customer for their products and services, the methods used to distribute their products and services and the nature of the regulatory environment.

The following tables show the amount of revenue generated

PRA Group, Inc.

Notes to Consolidated Financial Statements

Revenues and long-lived assets by geographical location: Revenues for the three and nine months ended September 30, 20222023 and 2021,2022, and long-lived assets held atas of September 30, 20222023 and 2021,2022, both for the U.S., the Company's country of domicile, and outside of the U.S., were as follows (amounts in thousands):

| | | | | | | | | | | | | | | | | | | | | | | |

| As of and for the | | As of and for the |

| Three Months Ended September 30, 2022 | | Three Months Ended September 30, 2021 |

| Revenues (2) | | Long-Lived Assets | | Revenues (2) | | Long-Lived Assets |

| United States | $ | 138,398 | | | $ | 80,496 | | | $ | 157,124 | | | $ | 90,980 | |

| United Kingdom | 37,032 | | | 10,762 | | | 42,388 | | | 2,040 | |

Other (1) | 69,377 | | | 13,451 | | | 64,186 | | | 12,745 | |

| Total | $ | 244,807 | | | $ | 104,709 | | | $ | 263,698 | | | $ | 105,765 | |

PRA Group, Inc.

Notes to Consolidated Financial Statements

| | | As of and for the | | As of and for the | | As of and for the | | As of and for the |

| | Nine Months Ended September 30, 2022 | | Nine months ended September 30, 2021 | | Three Months Ended September 30, 2023 | | Three Months Ended September 30, 2022 |

| | Revenues (2) | | Long-Lived Assets | | Revenues (2) | | Long-Lived Assets | | Revenues (2) | | Long-Lived Assets | | Revenues (2) | | Long-Lived Assets |

| United States | $ | 426,675 | | | $ | 80,496 | | | $ | 503,994 | | | $ | 90,980 | | |

| U.S. | | U.S. | $ | 105,456 | | | $ | 61,788 | | | $ | 138,398 | | | $ | 80,496 | |

| United Kingdom | United Kingdom | 126,866 | | | 10,762 | | | 133,024 | | | 2,040 | | United Kingdom | 30,978 | | | 11,233 | | | 37,032 | | | 10,762 | |

| Brazil | | Brazil | 24,749 | | | 3 | | | 14,293 | | | 3 | |

Other (1) | Other (1) | 190,133 | | | 13,451 | | | 201,778 | | | 12,745 | | Other (1) | 55,247 | | | 12,694 | | | 55,084 | | | 13,448 | |

| Total | Total | $ | 743,674 | | | $ | 104,709 | | | $ | 838,796 | | | $ | 105,765 | | Total | $ | 216,430 | | | $ | 85,718 | | | $ | 244,807 | | | $ | 104,709 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| As of and for the | | As of and for the |

| Nine Months Ended September 30, 2023 | | Nine Months Ended September 30, 2022 |

| Revenues (2) | | Long-Lived Assets | | Revenues (2) | | Long-Lived Assets |

| U.S. | $ | 258,848 | | | $ | 61,788 | | | $ | 426,675 | | | $ | 80,496 | |

| United Kingdom | 99,547 | | | 11,233 | | | 126,866 | | | 10,762 | |

| Brazil | 69,383 | | | 3 | | | 22,629 | | | 3 | |

Other (1) | 153,358 | | | 12,694 | | | 167,504 | | | 13,448 | |

| Total | $ | 581,136 | | | $ | 85,718 | | | $ | 743,674 | | | $ | 104,709 | |

(1) None of the countries included in "Other" comprise greater than 10% of the Company's consolidated revenues or long-lived assets.(2) Based on the Company’s financial statement information used to produce the Company's general-purpose financial statements, it is impracticable to report further breakdowns of revenues from external customers by product or service.

Revenues are attributed to countries based on the location of the related operations. Long-lived assets consist of net property and equipment and right-of-use assets. The Company reports revenues earned from collection activities on nonperforming loans, fee-based services and investments. For additional information on the Company's investments, see Note 3.Long-lived assets consist of Property and equipment, net and Right-of-use ("ROU") assets. 2. Finance Receivables, net:

Finance receivables, net consisted of the following at September 30, 20222023 and December 31, 20212022 (amounts in thousands):

| | | | | | | | | | | |

| September 30, 2022 | | December 31, 2021 |

| Amortized cost | $ | — | | | $ | — | |

Negative allowance for expected recoveries (1) | 3,037,360 | | | 3,428,285 | |

| Balance at end of period | $ | 3,037,360 | | | $ | 3,428,285 | |

(1) The negative allowance balance includes certain portfolios of nonperforming loans for which the Company holds a beneficial interest representing approximately 0.8% of the balance. | | | | | | | | | | | |

| September 30, 2023 | | December 31, 2022 |

| Amortized cost | $ | — | | | $ | — | |

| Negative allowance for expected recoveries | 3,460,804 | | | 3,295,008 | |

| Balance at end of period | $ | 3,460,804 | | | $ | 3,295,008 | |

Three Months Ended September 30, 20222023 and 20212022

Changes in the negative allowance for expected recoveries by portfolio segment for the three months ended September 30, 20222023 and 20212022 were as follows (amounts in thousands):

| | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, 2022 |

| Core | | Insolvency | | Total |

| Balance at beginning of period | $ | 2,814,761 | | | $ | 368,871 | | | $ | 3,183,632 | |

Initial negative allowance for expected recoveries - portfolio acquisitions (1) | 160,206 | | | 22,898 | | | 183,104 | |

| Foreign currency translation adjustment | (133,263) | | | (14,254) | | | (147,517) | |

Recoveries applied to negative allowance (2) | (186,112) | | | (44,083) | | | (230,195) | |

Changes in expected recoveries (3) | 38,686 | | | 9,650 | | | 48,336 | |

| Balance at end of period | $ | 2,694,278 | | | $ | 343,082 | | | $ | 3,037,360 | |

| | | Three Months Ended September 30, 2021 | | Three Months Ended September 30, 2023 |

| | Core | | Insolvency | | Total | | Core | | Insolvency | | Total |

| Balance at beginning of period | Balance at beginning of period | $ | 2,894,963 | | | $ | 454,075 | | | $ | 3,349,038 | | Balance at beginning of period | $ | 3,086,405 | | | $ | 338,143 | | | $ | 3,424,548 | |

Initial negative allowance for expected recoveries - portfolio acquisitions (1) | Initial negative allowance for expected recoveries - portfolio acquisitions (1) | 374,645 | | | 17,302 | | | 391,947 | | Initial negative allowance for expected recoveries - portfolio acquisitions (1) | 248,181 | | | 63,002 | | | 311,183 | |

| Foreign currency translation adjustment | Foreign currency translation adjustment | (52,650) | | | (5,558) | | | (58,208) | | Foreign currency translation adjustment | (58,878) | | | (6,786) | | | (65,664) | |

Recoveries applied to negative allowance (2) | Recoveries applied to negative allowance (2) | (230,237) | | | (46,421) | | | (276,658) | | Recoveries applied to negative allowance (2) | (189,710) | | | (41,709) | | | (231,419) | |

Changes in expected recoveries (3) | Changes in expected recoveries (3) | 40,583 | | | 3,237 | | | 43,820 | | Changes in expected recoveries (3) | 15,894 | | | 6,262 | | | 22,156 | |

| Balance at end of period | Balance at end of period | $ | 3,027,304 | | | $ | 422,635 | | | $ | 3,449,939 | | Balance at end of period | $ | 3,101,892 | | | $ | 358,912 | | | $ | 3,460,804 | |

PRA Group, Inc.

Notes to Consolidated Financial Statements

| | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, 2022 |

| Core | | Insolvency | | Total |

| Balance at beginning of period | $ | 2,814,761 | | | $ | 368,871 | | | $ | 3,183,632 | |

Initial negative allowance for expected recoveries - portfolio acquisitions (1) | 160,206 | | | 22,898 | | | 183,104 | |

| Foreign currency translation adjustment | (133,263) | | | (14,254) | | | (147,517) | |

Recoveries applied to negative allowance (2) | (186,112) | | | (44,083) | | | (230,195) | |

Changes in expected recoveries (3) | 38,686 | | | 9,650 | | | 48,336 | |

| Balance at end of period | $ | 2,694,278 | | | $ | 343,082 | | | $ | 3,037,360 | |

(1) Initial negative allowance for expected recoveries - portfolio acquisitions

Portfolio acquisitions for the three months ended September 30, 20222023 and 20212022 were as follows (amounts in thousands):

| | | Three Months Ended September 30, 2022 | | Three Months Ended September 30, 2023 |

| | Core | | Insolvency | | Total | | Core | | Insolvency | | Total |

| Face value | Face value | $ | 1,482,758 | | | $ | 123,369 | | | $ | 1,606,127 | | Face value | $ | 1,992,448 | | | $ | 382,363 | | | $ | 2,374,811 | |

| Noncredit discount | Noncredit discount | (126,205) | | | (7,874) | | | (134,079) | | Noncredit discount | (209,131) | | | (23,837) | | | (232,968) | |

| Allowance for credit losses at acquisition | Allowance for credit losses at acquisition | (1,196,347) | | | (92,597) | | | (1,288,944) | | Allowance for credit losses at acquisition | (1,535,136) | | | (295,524) | | | (1,830,660) | |

| Purchase price | Purchase price | $ | 160,206 | | | $ | 22,898 | | | $ | 183,104 | | Purchase price | $ | 248,181 | | | $ | 63,002 | | | $ | 311,183 | |

| | | Three Months Ended September 30, 2021 | | Three Months Ended September 30, 2022 |

| | Core | | Insolvency | | Total | | Core | | Insolvency | | Total |

| Face value | Face value | $ | 2,499,453 | | | $ | 82,704 | | | $ | 2,582,157 | | Face value | $ | 1,482,758 | | | $ | 123,369 | | | $ | 1,606,127 | |

| Noncredit discount | Noncredit discount | (280,213) | | | (6,355) | | | (286,568) | | Noncredit discount | (126,205) | | | (7,874) | | | (134,079) | |

| Allowance for credit losses at acquisition | Allowance for credit losses at acquisition | (1,844,595) | | | (59,047) | | | (1,903,642) | | Allowance for credit losses at acquisition | (1,196,347) | | | (92,597) | | | (1,288,944) | |

| Purchase price | Purchase price | $ | 374,645 | | | $ | 17,302 | | | $ | 391,947 | | Purchase price | $ | 160,206 | | | $ | 22,898 | | | $ | 183,104 | |

The initial negative allowance recorded on portfolio acquisitions for the three months ended September 30, 20222023 and 20212022 was as follows (amounts in thousands):

| | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, 2023 |

| Core | | Insolvency | | Total |

| Allowance for credit losses at acquisition | $ | (1,535,136) | | | $ | (295,524) | | | $ | (1,830,660) | |

| Writeoffs, net | 1,535,136 | | | 295,524 | | | 1,830,660 | |

| Expected recoveries | 248,181 | | | 63,002 | | | 311,183 | |

| Initial negative allowance for expected recoveries | $ | 248,181 | | | $ | 63,002 | | | $ | 311,183 | |

| | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, 2022 |

| Core | | Insolvency | | Total |

| Allowance for credit losses at acquisition | $ | (1,196,347) | | | $ | (92,597) | | | $ | (1,288,944) | |

| Writeoffs, net | 1,196,347 | | | 92,597 | | | 1,288,944 | |

| Expected recoveries | 160,206 | | | 22,898 | | | 183,104 | |

| Initial negative allowance for expected recoveries | $ | 160,206 | | | $ | 22,898 | | | $ | 183,104 | |

| | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, 2021 |

| Core | | Insolvency | | Total |

| Allowance for credit losses at acquisition | $ | (1,844,595) | | | $ | (59,047) | | | $ | (1,903,642) | |

| Writeoffs, net | 1,844,595 | | | 59,047 | | | 1,903,642 | |

| Expected recoveries | 374,645 | | | 17,302 | | | 391,947 | |

| Initial negative allowance for expected recoveries | $ | 374,645 | | | $ | 17,302 | | | $ | 391,947 | |

(2) Recoveries applied to negative allowance

Recoveries applied to the negative allowance were calculated as follows for the three months ended September 30, 2022 and 2021 (amounts in thousands):

| | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, 2022 |

| Core | | Insolvency | | Total |

Recoveries (a) | $ | 361,089 | | | $ | 54,959 | | | $ | 416,048 | |

| Less - amounts reclassified to portfolio income | 174,977 | | | 10,876 | | | 185,853 | |

| Recoveries applied to negative allowance | $ | 186,112 | | | $ | 44,083 | | | $ | 230,195 | |

| | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, 2021 |

| Core | | Insolvency | | Total |

Recoveries (a) | $ | 429,166 | | | $ | 60,397 | | | $ | 489,563 | |

| Less - amounts reclassified to portfolio income | 198,929 | | | 13,976 | | | 212,905 | |

| Recoveries applied to negative allowance | $ | 230,237 | | | $ | 46,421 | | | $ | 276,658 | |

(a) Recoveries includes cash collections, buybacks and other cash-based adjustments.

PRA Group, Inc.

Notes to Consolidated Financial Statements

(2) Recoveries applied to negative allowance

Recoveries applied to the negative allowance for the three months ended September 30, 2023 and 2022 were as follows (amounts in thousands):

| | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, 2023 |

| Core | | Insolvency | | Total |

Recoveries (a) | $ | 369,385 | | | $ | 51,994 | | | $ | 421,379 | |

| Less - amounts reclassified to portfolio income | 179,675 | | | 10,285 | | | 189,960 | |

| Recoveries applied to negative allowance | $ | 189,710 | | | $ | 41,709 | | | $ | 231,419 | |

| | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, 2022 |

| Core | | Insolvency | | Total |

Recoveries (a) | $ | 361,089 | | | $ | 54,959 | | | $ | 416,048 | |

| Less - amounts reclassified to portfolio income | 174,977 | | | 10,876 | | | 185,853 | |

| Recoveries applied to negative allowance | $ | 186,112 | | | $ | 44,083 | | | $ | 230,195 | |

(a) Recoveries include cash collections, buybacks and other cash-based adjustments.

(3) Changes in expected recoveries

Changes in expected recoveries consisted of the following for the three months ended September 30, 2023 and 2022 and 2021were as follows (amounts in thousands):

| | | Three Months Ended September 30, 2022 | | Three Months Ended September 30, 2023 |

| | Core | | Insolvency | | Total | | Core | | Insolvency | | Total |

| Changes in expected future recoveries | Changes in expected future recoveries | $ | 17,851 | | | $ | 2,361 | | | $ | 20,212 | | Changes in expected future recoveries | $ | 4,234 | | | $ | (168) | | | $ | 4,066 | |

| Recoveries received in excess of forecast | Recoveries received in excess of forecast | 20,835 | | | 7,289 | | | 28,124 | | Recoveries received in excess of forecast | 11,660 | | | 6,430 | | | 18,090 | |

| Changes in expected recoveries | Changes in expected recoveries | $ | 38,686 | | | $ | 9,650 | | | $ | 48,336 | | Changes in expected recoveries | $ | 15,894 | | | $ | 6,262 | | | $ | 22,156 | |

| | | Three Months Ended September 30, 2021 | | Three Months Ended September 30, 2022 |

| | Core | | Insolvency | | Total | | Core | | Insolvency | | Total |

| Changes in expected future recoveries | Changes in expected future recoveries | $ | 4,114 | | | $ | (6,026) | | | $ | (1,912) | | Changes in expected future recoveries | $ | 17,851 | | | $ | 2,361 | | | $ | 20,212 | |

| Recoveries received in excess of forecast | Recoveries received in excess of forecast | 36,469 | | | 9,263 | | | 45,732 | | Recoveries received in excess of forecast | 20,835 | | | 7,289 | | | 28,124 | |

| Changes in expected recoveries | Changes in expected recoveries | $ | 40,583 | | | $ | 3,237 | | | $ | 43,820 | | Changes in expected recoveries | $ | 38,686 | | | $ | 9,650 | | | $ | 48,336 | |

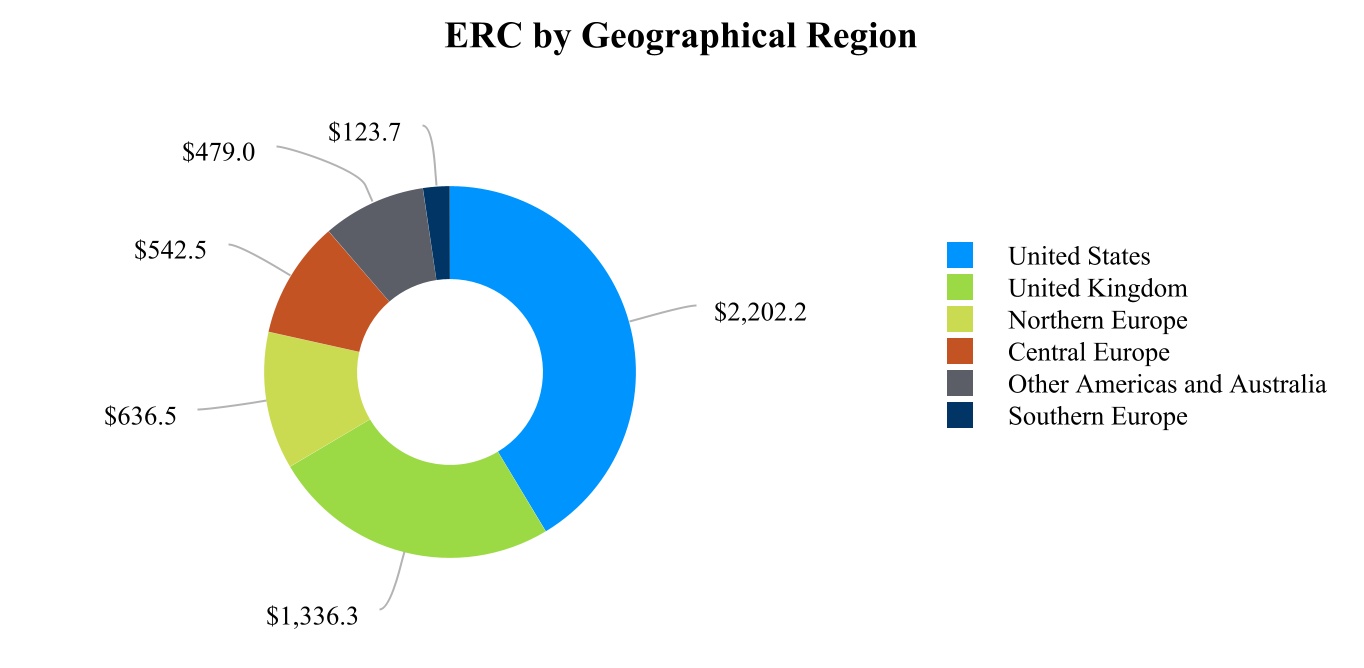

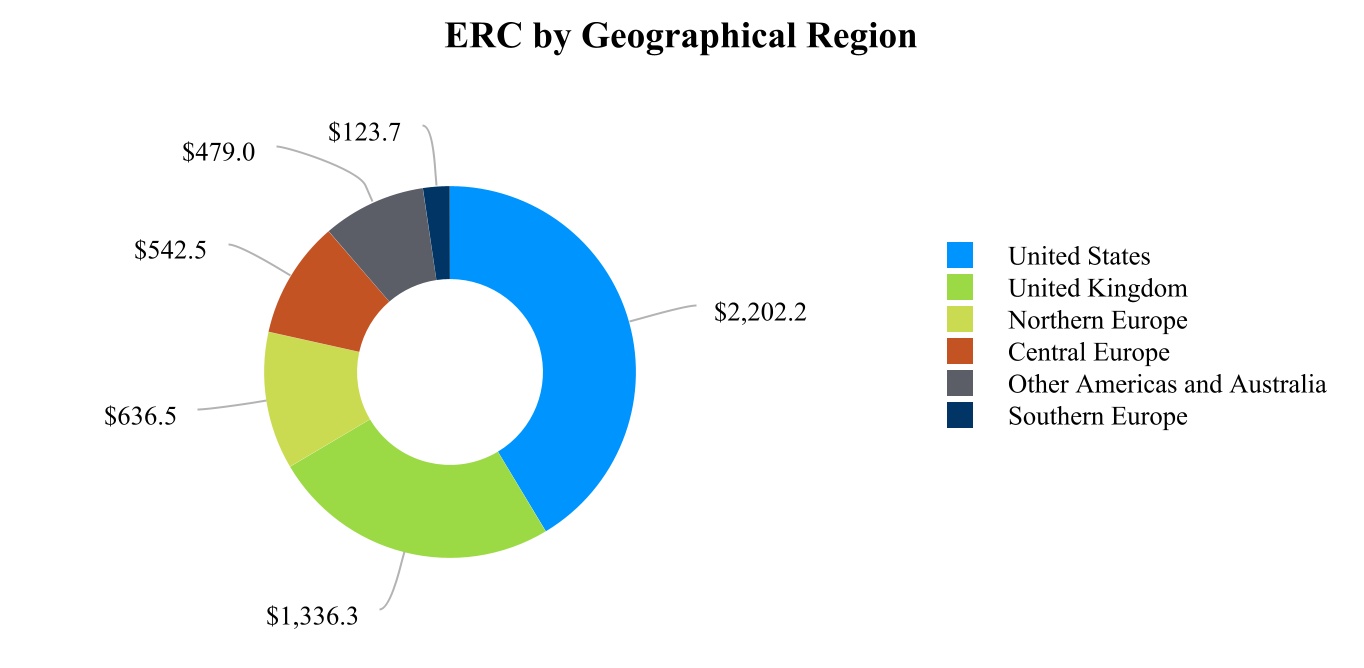

In order to estimate future cash collections, the Company consideredconsiders historical performance and current economic forecasts, as well as expectations for short-term and long-term growth and consumer habits in the various geographies in which the Company operates. The Company consideredconsiders recent collection activity in its determination to adjust assumptions related to estimated remaining collections ("ERC") for certain pools. Based on these considerations, the Company’s estimates of ERC incorporate changes in both amounts and in the timing of expected cash collections over the forecast period.

Changes in expected recoveries for the three months ended September 30, 2023 were a net positive $22.2 million. This includes $18.1 million in recoveries received in excess of forecast (cash collections overperformance) and a $4.1 million positive adjustment to changes in expected future recoveries. The $18.1 million in recoveries received in excess of forecast reflected overperformance in Europe and the Americas.

Changes in expected recoveries for the three months ended September 30, 2022 were a net positive $48.3 million. This reflectsreflected $28.1 million in recoveries received in excess of forecast reflecting cash collections overperformance and a $20.2 million positive adjustment to changes in expected future recoveries. The changes in expected future recoveries reflectsreflected the Company's assessment of certain pools, where continued strong performance has resulted in an increase to the Company's forecasted ERC.

Changes in expected recoveries for the three months ended September 30, 2021 were a net positive $43.8 million. This reflected $45.7 million in recoveries received in excess of forecast, which was largely due

PRA Group, Inc.

Notes to cash collections overperformance partially offset by a $1.9 million adjustment to changes in expected future recoveries. The changes in expected future recoveries included the Company's assumption that the majority of the overperformance was due to acceleration of future collections. The Company made adjustments in some geographies to increase near-term expected collections, bringing them in line with performance trends in collections, with corresponding reductions made later in the forecast period.Consolidated Financial Statements

Nine Months Ended September 30, 20222023 and 20212022

Changes in the negative allowance for expected recoveries by portfolio segment for the nine months ended September 30, 20222023 and 20212022 were as follows (amounts in thousands):

| | | Nine Months Ended September 30, 2022 | | Nine Months Ended September 30, 2023 |

| | Core | | Insolvency | | Total | | Core | | Insolvency | | Total |

| Balance at beginning of period | Balance at beginning of period | $ | 2,989,932 | | | $ | 438,353 | | | $ | 3,428,285 | | Balance at beginning of period | $ | 2,936,207 | | | $ | 358,801 | | | $ | 3,295,008 | |

Initial negative allowance for expected recoveries - portfolio acquisitions (1) | Initial negative allowance for expected recoveries - portfolio acquisitions (1) | 513,385 | | | 48,516 | | | 561,901 | | Initial negative allowance for expected recoveries - portfolio acquisitions (1) | 763,776 | | | 105,391 | | | 869,167 | |

| Foreign currency translation adjustment | Foreign currency translation adjustment | (287,901) | | | (34,010) | | | (321,911) | | Foreign currency translation adjustment | (15,662) | | | 1,296 | | | (14,366) | |

Recoveries applied to negative allowance (2) | Recoveries applied to negative allowance (2) | (628,293) | | | (137,439) | | | (765,732) | | Recoveries applied to negative allowance (2) | (574,993) | | | (120,392) | | | (695,385) | |

Changes in expected recoveries (3) | Changes in expected recoveries (3) | 107,155 | | | 27,662 | | | 134,817 | | Changes in expected recoveries (3) | (7,436) | | | 13,816 | | | 6,380 | |

| Balance at end of period | Balance at end of period | $ | 2,694,278 | | | $ | 343,082 | | | $ | 3,037,360 | | Balance at end of period | $ | 3,101,892 | | | $ | 358,912 | | | $ | 3,460,804 | |

PRA Group, Inc.

Notes to Consolidated Financial Statements

| | | Nine Months Ended September 30, 2021 | | Nine Months Ended September 30, 2022 |

| | Core | | Insolvency | | Total | | Core | | Insolvency | | Total |

| Balance at beginning of period | Balance at beginning of period | $ | 3,019,477 | | | $ | 495,311 | | | $ | 3,514,788 | | Balance at beginning of period | $ | 2,989,932 | | | $ | 438,353 | | | $ | 3,428,285 | |

Initial negative allowance for expected recoveries - portfolio acquisitions (1) | Initial negative allowance for expected recoveries - portfolio acquisitions (1) | 712,687 | | | 57,898 | | | 770,585 | | Initial negative allowance for expected recoveries - portfolio acquisitions (1) | 513,385 | | | 48,516 | | | 561,901 | |

| Foreign currency translation adjustment | Foreign currency translation adjustment | (56,387) | | | (2,549) | | | (58,936) | | Foreign currency translation adjustment | (287,901) | | | (34,010) | | | (321,911) | |

Recoveries applied to negative allowance (2) | Recoveries applied to negative allowance (2) | (797,648) | | | (136,354) | | | (934,002) | | Recoveries applied to negative allowance (2) | (628,293) | | | (137,439) | | | (765,732) | |

Changes in expected recoveries (3) | Changes in expected recoveries (3) | 149,175 | | | 8,329 | | | 157,504 | | Changes in expected recoveries (3) | 107,155 | | | 27,662 | | | 134,817 | |

| Balance at end of period | Balance at end of period | $ | 3,027,304 | | | $ | 422,635 | | | $ | 3,449,939 | | Balance at end of period | $ | 2,694,278 | | | $ | 343,082 | | | $ | 3,037,360 | |

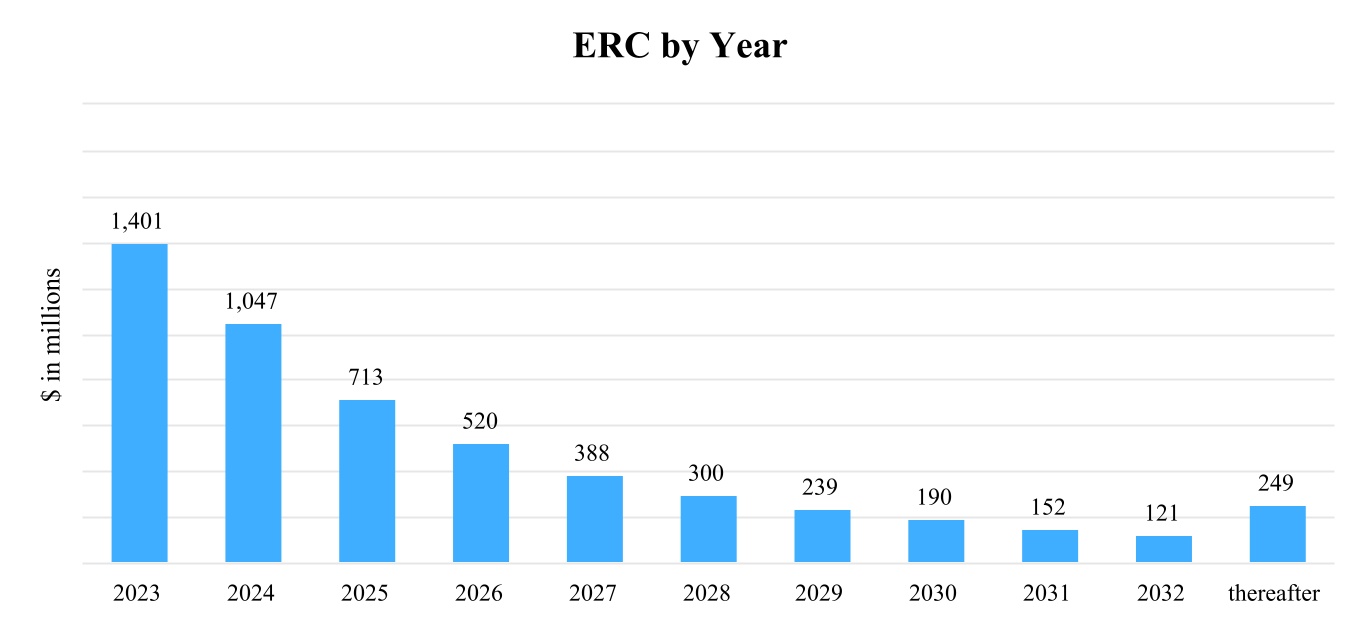

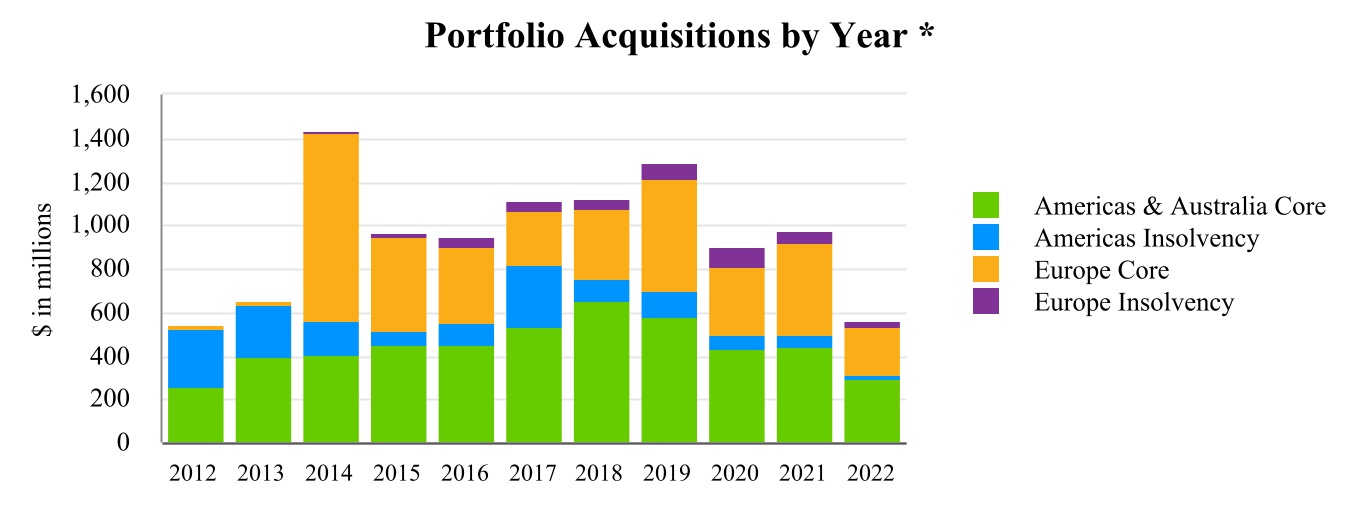

(1) Initial negative allowance for expected recoveries - portfolio acquisitions

Portfolio acquisitions for the nine months ended September 30, 20222023 and 20212022 were as follows (amounts in thousands):

| | | | | | | | | | | | | | | | | |

| Nine Months Ended September 30, 2023 |

| Core | | Insolvency | | Total |

| Face value | $ | 5,717,674 | | | $ | 579,113 | | | $ | 6,296,787 | |

| Noncredit discount | (600,174) | | | (38,621) | | | (638,795) | |

| Allowance for credit losses at acquisition | (4,353,724) | | | (435,101) | | | (4,788,825) | |

| Purchase price | $ | 763,776 | | | $ | 105,391 | | | $ | 869,167 | |

| | | | | | | | | | | | | | | | | |

| Nine Months Ended September 30, 2022 |

| Core | | Insolvency | | Total |

| Face value | $ | 3,539,705 | | | $ | 256,528 | | | $ | 3,796,233 | |

| Noncredit discount | (363,138) | | | (16,976) | | | (380,114) | |

| Allowance for credit losses at acquisition | (2,663,182) | | | (191,036) | | | (2,854,218) | |

| Purchase price | $ | 513,385 | | | $ | 48,516 | | | $ | 561,901 | |

| | | | | | | | | | | | | | | | | |

| Nine Months Ended September 30, 2021 |

| Core | | Insolvency | | Total |

| Face value | $ | 4,863,736 | | | $ | 277,831 | | | $ | 5,141,567 | |

| Noncredit discount | (585,400) | | | (19,368) | | | (604,768) | |

| Allowance for credit losses at acquisition | (3,565,649) | | | (200,565) | | | (3,766,214) | |

| Purchase price | $ | 712,687 | | | $ | 57,898 | | | $ | 770,585 | |

The initial negative allowance recorded on portfolio acquisitions for the nine months ended September 30, 2022 and 2021 was as follows (amounts in thousands):

| | | | | | | | | | | | | | | | | |

| Nine Months Ended September 30, 2022 |

| Core | | Insolvency | | Total |

| Allowance for credit losses at acquisition | $ | (2,663,182) | | | $ | (191,036) | | | $ | (2,854,218) | |

| Writeoffs, net | 2,663,182 | | | 191,036 | | | 2,854,218 | |

| Expected recoveries | 513,385 | | | 48,516 | | | 561,901 | |

| Initial negative allowance for expected recoveries | $ | 513,385 | | | $ | 48,516 | | | $ | 561,901 | |

| | | | | | | | | | | | | | | | | |

| Nine Months Ended September 30, 2021 |

| Core | | Insolvency | | Total |

| Allowance for credit losses at acquisition | $ | (3,565,649) | | | $ | (200,565) | | | $ | (3,766,214) | |

| Writeoffs, net | 3,565,649 | | | 200,565 | | | 3,766,214 | |

| Expected recoveries | 712,687 | | | 57,898 | | | 770,585 | |

| Initial negative allowance for expected recoveries | $ | 712,687 | | | $ | 57,898 | | | $ | 770,585 | |

PRA Group, Inc.

Notes to Consolidated Financial Statements

The initial negative allowance recorded on portfolio acquisitions for the nine months ended September 30, 2023 and 2022 was as follows (amounts in thousands):

| | | | | | | | | | | | | | | | | |

| Nine Months Ended September 30, 2023 |

| Core | | Insolvency | | Total |

| Allowance for credit losses at acquisition | $ | (4,353,724) | | | $ | (435,101) | | | $ | (4,788,825) | |

| Writeoffs, net | 4,353,724 | | | 435,101 | | | 4,788,825 | |

| Expected recoveries | 763,776 | | | 105,391 | | | 869,167 | |

| Initial negative allowance for expected recoveries | $ | 763,776 | | | $ | 105,391 | | | $ | 869,167 | |

| | | | | | | | | | | | | | | | | |

| Nine Months Ended September 30, 2022 |

| Core | | Insolvency | | Total |

| Allowance for credit losses at acquisition | $ | (2,663,182) | | | $ | (191,036) | | | $ | (2,854,218) | |

| Writeoffs, net | 2,663,182 | | | 191,036 | | | 2,854,218 | |

| Expected recoveries | 513,385 | | | 48,516 | | | 561,901 | |

| Initial negative allowance for expected recoveries | $ | 513,385 | | | $ | 48,516 | | | $ | 561,901 | |

(2) Recoveries applied to negative allowance

Recoveries applied to the negative allowance were calculated as follows for the nine months ended September 30, 2023 and 2022 and 2021were as follows (amounts in thousands):

| | | Nine Months Ended September 30, 2022 | | Nine Months Ended September 30, 2023 |

| | Core | | Insolvency | | Total | | Core | | Insolvency | | Total |

Recoveries (a) | Recoveries (a) | $ | 1,179,746 | | | $ | 173,380 | | | $ | 1,353,126 | | Recoveries (a) | $ | 1,106,799 | | | $ | 151,078 | | | $ | 1,257,877 | |

| Less - amounts reclassified to portfolio income | Less - amounts reclassified to portfolio income | 551,453 | | | 35,941 | | | 587,394 | | Less - amounts reclassified to portfolio income | 531,806 | | | 30,686 | | | 562,492 | |

| Recoveries applied to negative allowance | Recoveries applied to negative allowance | $ | 628,293 | | | $ | 137,439 | | | $ | 765,732 | | Recoveries applied to negative allowance | $ | 574,993 | | | $ | 120,392 | | | $ | 695,385 | |

| | | Nine Months Ended September 30, 2021 | | Nine Months Ended September 30, 2022 |

| | Core | | Insolvency | | Total | | Core | | Insolvency | | Total |

Recoveries (a) | Recoveries (a) | $ | 1,415,619 | | | $ | 182,097 | | | $ | 1,597,716 | | Recoveries (a) | $ | 1,179,746 | | | $ | 173,380 | | | $ | 1,353,126 | |

| Less - amounts reclassified to portfolio income | Less - amounts reclassified to portfolio income | 617,971 | | | 45,743 | | | 663,714 | | Less - amounts reclassified to portfolio income | 551,453 | | | 35,941 | | | 587,394 | |

| Recoveries applied to negative allowance | Recoveries applied to negative allowance | $ | 797,648 | | | $ | 136,354 | | | $ | 934,002 | | Recoveries applied to negative allowance | $ | 628,293 | | | $ | 137,439 | | | $ | 765,732 | |

(a) Recoveries includesinclude cash collections, buybacks and other cash-based adjustments.

(3) Changes in expected recoveries

Changes in expected recoveries consisted of the following for the nine months ended September 30, 2023 and 2022 and 2021were as follows (amounts in thousands):

| | | | | | | | | | | | | | | | | |

| Nine Months Ended September 30, 2023 |

| Core | | Insolvency | | Total |

| Changes in expected future recoveries | $ | (40,919) | | | $ | 23 | | | $ | (40,896) | |

| Recoveries received in excess of forecast | 33,483 | | | 13,793 | | | 47,276 | |

| Changes in expected recoveries | $ | (7,436) | | | $ | 13,816 | | | $ | 6,380 | |

| | | | | | | | | | | | | | | | | |

| Nine Months Ended September 30, 2022 |

| Core | | Insolvency | | Total |

| Changes in expected future recoveries | $ | 43,262 | | | $ | 3,894 | | | $ | 47,156 | |

| Recoveries received in excess of forecast | 63,893 | | | 23,768 | | | 87,661 | |

| Changes in expected recoveries | $ | 107,155 | | | $ | 27,662 | | | $ | 134,817 | |

| | | | | | | | | | | | | | | | | |

| Nine Months Ended September 30, 2021 |

| Core | | Insolvency | | Total |

| Changes in expected future recoveries | $ | (47,738) | | | $ | (18,871) | | | $ | (66,609) | |

| Recoveries received in excess of forecast | 196,913 | | | 27,200 | | | 224,113 | |

| Changes in expected recoveries | $ | 149,175 | | | $ | 8,329 | | | $ | 157,504 | |

PRA Group, Inc.

Notes to Consolidated Financial Statements

Changes in expected recoveries for the nine months ended September 30, 2023 were a net positive $6.4 million. This includes $47.3 million in recoveries received in excess of forecast (cash collections overperformance), primarily due to continued strong performance in Europe and South America, and a $40.9 million negative adjustment to changes in expected future recoveries. The changes in expected future recoveries reflected the Company's assessment of certain pools, which resulted in a reduction of expected cash flows due largely to collections performance in the U.S.

Changes in expected recoveries for the nine months ended September 30, 2022 were a net positive $134.8 million. This reflectsreflected $87.7 million in recoveries received in excess of forecast reflecting cash collections overperformance and a $47.2 million net positive adjustment to changes in expected future recoveries. The changes in expected future recoveries reflectsreflected the Company's assessment of certain pools, where continued strong performance has resulted in a net increase to the Company's forecasted ERC. The Company continuescontinued to believe that the majority of the overperformance in its more recent pools was due to acceleration in the timing of cash collections rather than an increase in total expected collections. The change in expected recoveries also included a $20.5 million write down during the first quarter in 2022 on one portfolio in Brazil.

Changes in expected recoveries for the nine months ended September 30, 2021 were a net positive $157.5 million. The changes were the net result of recoveries received in excess of forecast of $224.1 million from significant cash collection overperformance reduced by a $66.6 million negative adjustment to changes in expected future recoveries. The changes in expected future recoveries included the Company's assumption that the majority of the overperformance was due to acceleration of future collections. The Company made adjustments in some geographies to increase near-term expected collections, bringing them in line with performance trends in collections, with corresponding reductions made later in the forecast period.

PRA Group, Inc.

Notes to Consolidated Financial Statements

3. Investments:

Investments consisted of the following at September 30, 20222023 and December 31, 20212022 (amounts in thousands):

| | | September 30, 2022 | | December 31, 2021 | | September 30, 2023 | | December 31, 2022 |