Table of Contents

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

| | | | |

x | | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) | |

| OF THE SECURITIES EXCHANGE ACT OF 1934 | |

| For the quarterly period ended June 30, 20122013 | | |

OR

| | | | |

¨

| OR | |

| | |

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) | |

| OF THE SECURITIES EXCHANGE ACT OF 1934 | |

| For the transition period fromtofrom_____to_____ | | |

| | | | |

Commission | | Registrant; State of Incorporation; | | IRS Employer |

File Number | | Address; and Telephone Number | | Identification No. |

1-9513 | | CMS ENERGY CORPORATION | | 38-2726431 |

(A Michigan Corporation)

One Energy Plaza, Jackson, Michigan 49201

(517) 788-0550

| | | | 38-2726431 |

| | (A Michigan Corporation) | | |

| | One Energy Plaza, Jackson, Michigan 49201 | | |

| | (517) 788-0550 | | |

| | | | |

1-5611 | | CONSUMERS ENERGY COMPANY | | 38-0442310 |

| | (A Michigan Corporation) | | |

| | One Energy Plaza, Jackson, Michigan 49201 | | |

| | (517) 788-0550 | | |

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

CMS Energy Corporation: YesxT No¨o Consumers Energy Company: YesxT No¨o

Indicate by check mark whether the Registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data file required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit and post such files).

CMS Energy Corporation: YesxT No¨o Consumers Energy Company: YesxT No¨o

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

CMS Energy Corporation:

Large accelerated filerxT Accelerated filer¨o Non-Accelerated filer¨o Smaller reporting company¨o

(Do not check if a smaller reporting company)

Consumers Energy Company:

Large accelerated filer¨o Accelerated filer¨o Non-Accelerated filerxT Smaller reporting company¨o

(Do not check if a smaller reporting company)

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

CMS Energy Corporation: Yes¨o NoxTConsumers Energy Company: Yes¨o NoxT

Indicate the number of shares outstanding of each of the issuer’s classes of common stock at July 13, 2012:5, 2013:

CMS Energy Corporation:

| | |

CMS Energy Common Stock, $0.01 par value | | |

(including 1,296,406(including 1,091,320 shares owned by Consumers Energy Company) | | 264,986,880266,959,461 |

Consumers Energy Company:

| | |

Consumers Energy Common Stock, $10 par value, privately held by CMS Energy Corporation | | 84,108,789 |

Table of Contents

CMS Energy Corporation

Consumers Energy Company

Quarterly Reports on Form 10-Q to the Securities and Exchange Commission for the Period Ended

June 30, 20122013

TABLE OF CONTENTS

1

Table of Contents

GLOSSARYGLOSSARY

Certain terms used in the text and financial statements are defined below.

| | |

2008 Energy Law | | Comprehensive energy reform package enacted in Michigan in October 2008 |

| |

2011

| | |

2012 Form 10-K | | Each of CMS Energy’s and Consumers’ Annual Report on Form 10-K for the year ended December 31, 20112012 |

| | |

ABATE | | Association of Businesses Advocating Tariff Equity |

| |

ASU

| | Financial Accounting Standards Board Accounting Standards Update |

| |

Bay Harbor | | A residential/commercial real estate area located near Petoskey, Michigan, in which CMS Energy sold its interest in 2002 |

| | |

bcf | | Billion cubic feet of gas |

| | |

Big Rock | | Big Rock Point nuclear power plant, formerly owned by Consumers |

| | |

CAIR | | The Clean Air Interstate Rule |

| | |

Cantera Gas Company | | Cantera Gas Company LLC, a non-affiliated company, formerly known as CMS Field Services |

| | |

Cantera Natural Gas, Inc. | | Cantera Natural Gas, Inc., a non-affiliated company that purchased CMS Field Services |

| |

CCB

| | |

CCR | | Coal combustion by-productresidual |

| | |

CEO | | Chief Executive Officer |

| | |

CFO | | Chief Financial Officer |

| |

CKD

| | Cement kiln dust |

| |

Clean Air Act | | Federal Clean Air Act of 1963, as amended |

| | |

Clean Water Act | | Federal Water Pollution Control Act of 1972, as amended |

| | |

CMS Capital | | CMS Capital, L.L.C., a wholly owned subsidiary of CMS Energy |

| | |

CMS Energy | | CMS Energy Corporation, the parent of Consumers and CMS Enterprises |

| | |

CMS Enterprises | | CMS Enterprises Company, a wholly owned subsidiary of CMS Energy |

| | |

CMS ERM | | CMS Energy Resource Management Company, formerly CMS MST, a wholly owned subsidiary of CMS Enterprises |

| | |

| | |

CMS Field Services | | CMS Field Services, Inc., a former wholly owned subsidiary of CMS Gas Transmission |

| |

3

Table of Contents

CMS Gas Transmission | | CMS Gas Transmission Company, a wholly owned subsidiary of CMS Enterprises |

| | |

CMS Land | | CMS Land Company, a wholly owned subsidiary of CMS Capital |

| | |

CMS MST | | CMS Marketing, Services and Trading Company, a wholly owned subsidiary of CMS Enterprises, whose name was changed to CMS ERM effective Januaryin 2004 |

| | |

Consumers | | Consumers Energy Company, a wholly owned subsidiary of CMS Energy |

| | |

CSAPR | | The Cross-State Air Pollution Rule which would supersede the EPA’s proposed Clean Air Transport Rule and replace CAIR, was finalized in July 2011 and was stayed in December 2011 pending judicial review |

| | |

Customer Choice Act | | Customer Choice and Electricity Reliability Act, a Michigan statute |

| |

D.C.

| | District of Columbia |

| |

Detroit EdisonDB SERP

| | The Detroit Edison Company, a non-affiliated companyDefined Benefit Supplemental Executive Retirement Plan |

| | |

Dodd-Frank Act | | Dodd-Frank Wall Street Reform and Consumer Protection Act enacted inof 2010 |

| | |

DOE | | U.S. Department of Energy |

| | |

DOJ | | U.S. Department of Justice |

| | |

DTE Electric | | DTE Electric Company, a non-affiliated company |

| | |

EBITDA | | Earnings before interest, taxes, depreciation, and amortization |

| | |

EGWP | | Employer Group Waiver Plan |

| | |

EnerBank | | EnerBank USA, a wholly owned subsidiary of CMS Capital |

| | |

Entergy | | Entergy Corporation, a non-affiliated company |

| | |

Environmental Mitigation Projects | | Environmentally beneficial projects that a party agrees to undertake as part of the settlement of an enforcement action, but which the party is not otherwise legally required to perform |

| | |

EPA | | U.S. Environmental Protection Agency |

| | |

EPS | | Earnings per share |

| | |

Exchange Act | | Securities Exchange Act of 1934, as amended |

| | |

FDIC | | Federal Deposit Insurance Corporation |

| | |

FERC | | The Federal Energy Regulatory Commission |

| | |

fine particulate matter | | Particulate matter that is 2.5 microns or less in diameter |

4

Table of Contents

FLI Liquidating Trust | | Trust formed in Missouri bankruptcy court to accomplish the liquidation of Farmland Industries, Inc., a non-affiliated entity |

| | |

| | |

FMB | | First mortgage bond |

| | |

FOV | | Finding of Violation |

| | |

FTR | | Financial transmission right |

| | |

GAAP | | U.S. Generally Accepted Accounting Principles |

| | |

GCR | | Gas cost recovery |

| | |

Health Care Acts | | Comprehensive health care reform enacted in March 2010, comprising the Patient Protection and Affordable Care Act and the related Health Care and Education Reconciliation Act |

| | |

ISFSI | | Independent spent fuel storage installation |

| | |

kWh | | Kilowatt-hour, a unit of energy equal to one thousand watt-hours |

| |

LIBOR

| | The London Interbank Offered Rate |

| |

Ludington | | Ludington pumped-storage plant, jointly owned by Consumers and Detroit EdisonDTE Electric |

| | |

MACT | | Maximum Achievable Control Technology, which is the emission control that is achieved in practice by the best-controlled similar source; for existing sources, MACT is the average emission limitation achieved by the best performing 12 percent of existing sources or the average limitation achieved by the best performing five sources, depending on the number of sources in the categorysource |

| | |

MATS | | Mercury and Air ToxicToxics Standards, which limit mercury, acid gases, and other toxic pollution from coal-fueled and oil-fueled power plants |

| |

MCIT

| | Michigan Corporate Income Tax |

| |

MD&A | | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

| | |

MDEQ | | Michigan Department of Environmental Quality |

| | |

MDL | | A pending multi-district litigation case in Nevada |

| | |

MGP | | Manufactured gas plant |

| | |

Michigan Business Corporation Act | | Michigan Business Corporation Act of 1972, as amended |

| | |

Michigan Mercury Rule | | Michigan Air Pollution Control Rules, Part 15, Emission Limitations and Prohibitions – Mercury, addressing mercury emissions from coal-fueled electric generating units |

| | |

Midwest Energy Market | | An energy market developed by MISO to provide day-ahead and real-time market information and centralized dispatch for market participants |

| | |

MISO | | The MidwestMidcontinent Independent Transmission System Operator, Inc. |

5

Table of Contents

| | |

| |

mothball | | To place a generating unit into a state of extended reserve shutdown in which the unit is inactive and unavailable for service for a specified period, during which the unit can be brought back into service after receiving appropriate notification and completing any necessary maintenance or other work; generation owners in MISO must request approval to mothball a unit, and MISO then evaluates the request for reliability impacts |

| | |

MPSC | | Michigan Public Service Commission |

| | |

MW | | Megawatt, a unit of power equal to one million watts |

| |

MWh

| | Megawatt-hour, a unit of energy equal to one million watt-hours |

NAV | | Net asset value |

| | |

NERC | | The North American Electric Reliability Corporation, a non-affiliated company responsible for developing and enforcing reliability standards, monitoring the bulk power system, and educating and certifying industry personnel |

| | |

NOV | | Notice of Violation |

| | |

NPDES | | National Pollutant Discharge Elimination System, a permit system for regulating point sources of pollution under the Clean Water Act |

| | |

NREPA | | Part 201 of Michigan Natural Resources and Environmental Protection Act, a statute that covers environmental activities including remediation |

| | |

NSR | | New Source Review, a construction-permitting program under the Clean Air Act |

| | |

NYMEX | | The New York Mercantile Exchange |

| | |

OPEB | | Postretirement benefit plans other than pensionsOther Post-Employment Benefits |

| | |

OPEB Plan | | Defined benefit postretirement health-care and life insurance plans of CMS Energy, Consumers, and Panhandle |

| | |

Palisades | | Palisades nuclear power plant, sold by Consumers to Entergy in 2007 |

| | |

Panhandle | | Panhandle Eastern Pipe Line Company, including its wholly owned subsidiaries Trunkline Gas Company, LLC, Pan Gas Storage Company, Panhandle Storage Company, and Panhandle Holding Company, a former wholly owned subsidiary of CMS Gas Transmission |

| | |

PCB | | Polychlorinated biphenyl |

| | |

Pension Plan | | Trusteed, non-contributory, defined benefit pension plan of CMS Energy, Consumers, and Panhandle |

| | |

PSCR | | Power supply cost recovery |

| | |

PSD | | Prevention of Significant Deterioration |

| | |

REC | | Renewable energy credit established under the 2008 Energy Law |

6

Table of Contents

ReliabilityFirst Corporation | | ReliabilityFirst Corporation, a non-affiliated company responsible for the preservation and enhancement of bulk power system reliability and security |

| | |

Renewable Operating Permit | | Michigan’s Title V permitting program under the Clean Air Act |

| | |

RMRR | | Routine maintenance, repair, and replacement |

| | |

| | |

ROA | | Retail Open Access, which allows electric generation customers to choose alternative electric suppliers pursuant to the Customer Choice Act |

| | |

SEC | | U.S. Securities and Exchange Commission |

| |

SERP

| | Supplemental Executive Retirement Plan |

| |

Sherman Act | | Sherman Antitrust Act enacted inof 1890 |

| | |

Smart GridEnergy | | Consumers’ Smart Energy grid modernization project, which includes the installation of smart meters that transmit and receive data, a two-way communications network, and modifications to Consumers’ existing information technology system to manage the data and enable changes to key business processes |

| | |

Superfund | | Comprehensive Environmental Response, Compensation, and Liability Act |

| of 1980 |

Supplemental Environmental Projects

| | Environmentally beneficial projects that a party agrees to undertake as part of the settlement of an enforcement action, but which the party is not otherwise legally required to perform |

| |

Title V | | A federal program under the Clean Air Act designed to standardize air quality permits and the permitting process for major sources of emissions across the U.S. |

| |

Trust Preferred Securities

| | Securities representing an undivided beneficial interest in the assets of statutory business trusts, the interests of which have a preference with respect to certain trust distributions over the interests of either CMS Energy or Consumers, as applicable, as owner of the common beneficial interests of the trusts |

| |

U.S.Trunkline

| | United States |

| |

XBRL

| | eXtensible Business Reporting LanguageTrunkline Gas Company, LLC, a non-affiliated company and wholly owned subsidiary of Panhandle |

7

Table of Contents

FILING FORMAT

This combined Form 10-Q is separately filed by CMS Energy and Consumers. Information in this combined Form 10-Q relating to each individual registrant is filed by such registrant on its own behalf. Consumers makes no representation regarding information relating to any other companies affiliated with CMS Energy other than its own subsidiaries. None of CMS Energy, CMS Enterprises, nor any of CMS Energy’s other subsidiaries (other than Consumers) has any obligation in respect of Consumers’ debt securities and holders of such debt securities should not consider the financial resources or results of operations of CMS Energy, CMS Enterprises, nor any of CMS Energy’s other subsidiaries (other than Consumers and its own subsidiaries (in relevant circumstances)) in making a decision with respect to Consumers’ debt securities. Similarly, none of Consumers nor any other subsidiary of CMS Energy has any obligation in respect of debt securities of CMS Energy.

This report should be read in its entirety. No one section of this report deals with all aspects of the subject matter of this report. This report should be read in conjunction with the consolidated financial statements and related notes and with MD&A included in the 20112012 Form 10-K.

FORWARD-LOOKING STATEMENTS AND INFORMATION

This Form 10-Q and other written and oral statements that CMS Energy and Consumers make may contain forward-looking statements as defined by the Private Securities Litigation Reform Act of 1995. The use of “might,” “may,” “could,” “should,” “anticipates,” “believes,” “estimates,” “expects,” “intends,” “plans,” “projects,” “forecasts,” “predicts,” “assumes,” and other similar words is intended to identify forward-looking statements that involve risk and uncertainty. This discussion of potential risks and uncertainties is designed to highlight important factors that may impact CMS Energy’s and Consumers’ businesses and financial outlook. CMS Energy and Consumers have no obligation to update or revise forward-looking statements regardless of whether new information, future events, or any other factors affect the information contained in the statements. These forward-looking statements are subject to various factors that could cause CMS Energy’s and Consumers’ actual results to differ materially from the results anticipated in these statements. These factors include, but are not limited to, the following, all of which are potentially significant:

·the impact of regulation by the MPSC or FERC and other applicable governmental proceedings and regulations, including any associated impact on electric or gas rates or rate structures;

·potentially adverse regulatory treatment or failure to receive timely regulatory orders affecting Consumers that are or could come before the MPSC, FERC, MISO, or other governmental authorities, including the treatment of Consumers’ pilot gas revenue decoupling mechanism;authorities;

·the adoption of federal or state laws or regulations or changes in applicable laws, rules, regulations, principles, or practices, or in their interpretation, including those related to energy policy and ROA, the environment, regulation or deregulation, health care reforms (including the Health Care Acts), taxes, accounting matters, and other business issues that could have an impact on CMS Energy’s or Consumers’ businesses or financial results, including laws or regulations regarding climate change and air emissions and potential effects of the Dodd-Frank Act and related regulations on CMS Energy, Consumers, or any of their affiliates;

·potentially adverse regulatory or legal interpretations or decisions regarding environmental matters, or delayed regulatory treatment or permitting decisions that are or could come before the MDEQ, EPA, and/or EPA,U.S. Army Corps of Engineers, and potential environmental remediation costs associated with these interpretations or decisions, including those that may affect Bay Harbor or Consumers’ RMRR classification under NSR regulations;

8

Table of Contents

·changes in energy markets, including availability and price of electric capacity and the timing and extent of changes in commodity prices and availability of coal, natural gas, natural gas liquids, electricity, oil, and certain related products;

·the price of CMS Energy common stock, the credit ratings of CMS Energy and Consumers, capital and financial market conditions, and the effect of these market conditions on CMS Energy’s and Consumers’ interest costs and access to the capital markets, including availability of financing to CMS Energy, Consumers, or any of their affiliates;

·the investment performance of the assets of CMS Energy’s and Consumers’ pension and benefit plans and the discount rates applicable to their planused in calculating the plans’ obligations, and the resulting impact on future funding requirements;

·the impact of the economy, particularly in Michigan, and potential future volatility in the financial and credit markets on CMS Energy’s, Consumers’, or any of their affiliates’ revenues, ability to collect accounts receivable from customers, or cost and availability of capital;

·changes in the economic and financial viability of CMS Energy’s and Consumers’ suppliers, customers, and other counterparties and the continued ability of these third parties, including third parties in bankruptcy, to meet their obligations to CMS Energy and Consumers;

·population changes in the geographic areas where CMS Energy and Consumers conduct business;

·national, regional, and local economic, competitive, and regulatory policies, conditions, and developments;developments, including municipal bankruptcy filings such as the recent filing by the City of Detroit;

·loss of customer demand for electric generation supply to alternative energy suppliers;

·federal regulation of electric sales and transmission of electricity, including periodic re-examination by federal regulators of CMS Energy’s and Consumers’ market-based sales authorizations in wholesale power markets without price restrictions;

·the impact of credit markets, economic conditions, and any new banking regulations on EnerBank;

·the availability, cost, coverage, and terms of insurance, the stability of insurance providers, and the ability of Consumers to recover the costs of any insurance from customers;

·the effectiveness of CMS Energy’s and Consumers’ risk management policies, procedures, and strategies, including their strategies to hedge risk related to future prices of electricity, natural gas, and other energy-related commodities;

·factors affecting development of electric generation projects and distribution infrastructure replacement and expansion projects, including those related to project site identification, construction material pricing, availability of qualified construction personnel, permitting, and government approvals;

·factors affecting operations, such as costs and availability of personnel, equipment, and materials, unusual weather conditions, catastrophic weather-related damage, scheduled or unscheduled equipment outages, maintenance or repairs, environmental incidents, and electric transmission and distribution or gas pipeline system constraints;

9

Table of Contents

·potential disruption to, interruption of, or other impacts on facilities, utility infrastructure, or operations due to accidents, explosions, physical disasters, war, or terrorism, and the ability to obtain or maintain insurance coverage for these events;

·changes or disruption in fuel supply, including but not limited to rail or vessel transport of coal and pipeline transport of natural gas;

·potential costs, lost revenues, or other consequences resulting from misappropriation of assets or sensitive information, corruption of data, or operational disruption in connection with a cyber attack or other cyber incident;

·technological developments in energy production, storage, delivery, usage, and storage;metering, including Smart Energy and the success of its implementation;

·the impact of CMS Energy’s and Consumers’ integrated business software system and its operation on their activities, including utility customer billing and collections;

·adverse consequences resulting from any past or future assertion of indemnity or warranty claims associated with assets and businesses previously owned by CMS Energy or Consumers, including claims resulting from attempts by foreign or domestic governments to assess taxes on past operations or transactions;

·the outcome, cost, and other effects of legal or administrative proceedings, settlements, investigations, or claims;

·restrictions imposed by various financing arrangements and regulatory requirements on the ability of Consumers and other subsidiaries of CMS Energy to transfer funds to CMS Energy in the form of cash dividends, loans, or advances;

·earnings volatility resulting from the application of fair value accounting to certain energy commodity contracts such as electricity sales agreements andor interest rate and foreign currency contracts;

·changes in financial or regulatory accounting principles or policies, including a possible future requirement to comply with International Financial Reporting Standards, which differ from GAAP in various ways, including the present lack of special accounting treatment for regulated activities; and

·other matters that may be disclosed from time to time in CMS Energy’s and Consumers’ SEC filings, or in other publicly issued documents.

All forward-looking statements should be considered in the context of the risk and other factors described above and as detailed from time to time in CMS Energy’s and Consumers’ SEC filings. For additional details regarding these and other uncertainties, see Part I – Item 1. Consolidated Financial Statements (Unaudited) – Notes to the Unaudited Consolidated Financial Statements – Note 3:1, Regulatory Matters and Note 2, Contingencies and Commitments and Note 4: Regulatory Matters;Commitments; Part I – Item 2. MD&A – Outlook; and Part II – Item 1A. Risk Factors.

10

Table of Contents

CMS Energy Corporation

Consumers Energy Company

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

This MD&A is a combined report of CMS Energy and Consumers.

EXECUTIVE OVERVIEW

CMS Energy is an energy company operating primarily in Michigan. It is the parent holding company of several subsidiaries, including Consumers, an electric and gas utility, and CMS Enterprises, primarily a domestic independent power producer. Consumers’ electric utility operations include the generation, purchase, distribution, and sale of electricity, and Consumers’ gas utility operations include the purchase, transmission, storage, distribution, and sale of natural gas. Consumers’ customer base consists of a mix of residential, commercial, and diversified industrial customers. CMS Enterprises, through its subsidiaries and equity investments, owns and operates power generation facilities.

CMS Energy and Consumers manage their businesses by the nature of services each provides. CMS Energy operates principally in three business segments: electric utility; gas utility; and enterprises, its non-utility investments and operations. Consumers operates principally in two business segments: electric utility and gas utility.

CMS Energy and Consumers earn revenue and generate cash from operations by providing electric and natural gas utility services; electric distribution and generation; gas transmission, storage, and distribution; and other energy-related services. Their businesses are affected primarily by:

·regulation and regulatory matters;

·energy commodity prices;

·CMS Energy’s and Consumers’ securities’ credit ratings.

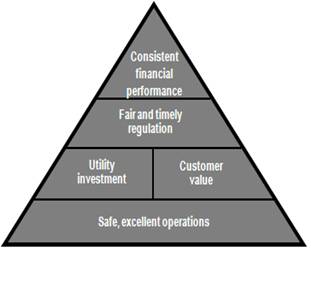

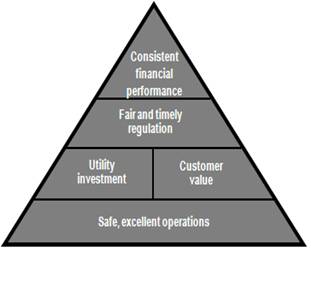

CMS Energy’s business strategy has emphasizedemphasizes the key elements depicted below:

11

Table of Contents

SAFE,, EXCELLENTOPERATIONS

The safety of employees, customers, and the general public remains a priority of CMS Energy and Consumers. Accordingly, CMS Energy and Consumers have worked to integrate a set of safety principles into their business operations and culture. These principles include complying with applicable safety, health, and security regulations and implementing programs and processes aimed at continually improving safety and security conditions. From 20072006 to 2011,2012, Consumers achieved a 7376 percent reduction in the annual number of recordable safety incidents.

CCUSTOMERVALUE

Consumers is undertaking a number of initiatives that reflect its intensified customer focus. Consumers’ planned investments in reliability are aimed at improving safety, reducing customer outage frequency, reducing repetitive outages, and increasing customer satisfaction. Also, in order to minimize increases in customer rates, Consumers considers thesehas undertaken several initiatives to reduce costs through a voluntary separation plan in 2012, accelerated pension funding, employee and other aspectsretiree health-care cost sharing, negotiated labor agreements, information system efficiencies, and productivity improvement programs. These initiatives, together with Consumers’ plans to accelerate further cost reductions, should allow Consumers to avoid increasing electric and gas base rates through 2014. Consumers’ ability to avoid base rate increases is dependent on MPSC approval of its customer value initiativecertain applications yet to be important tofiled. Consumers may also reconsider this expectation should its success.assumptions change regarding the economy or other matters.

UUTILITYINVESTMENT

Consumers expects to make capital investments of $6.6about $7 billion from 20122013 through 2016.2017. Consumers has limited its capital investment program to those investments it believes are needed to provide safe, reliable, and efficient service to its customers. Consumers’ capital investment program is expected to result in annual rate base growth of five to seven percent while allowing Consumers to maintain sustainable customer base rate increases (excluding PSCR and GCR charges) at or below the rate of inflation.

Among the key components of Consumers’ investment program are projects that will enhance customer value. Consumers’ planned distributionbase capital investments of $1.7$3.2 billion comprise $1.0$2.1 billion of electric utility projects to improve reliability and increase capacity and $0.7$1.1 billion of gas utility projects to increase capacity and deliverability and enhance pipeline integrity. Consumers also expects to spend $1.5 billion on environmental investments needed to comply with state and federal laws and regulations. An additional $1.2$1.4 billion of planned reliability investments at Consumers are aimed at reducing outages and improving customer satisfaction; these investments comprise $0.8$0.7 billion at the electric utility to strengthen circuits and substations, replace poles, and upgrade the Ludington pumped-storage plant, and $0.4$0.7 billion at the gas utility to replace mains and enhance transmission and storage systems. Consumers also expects to spend $1.1 billion on environmental investments needed to comply with state and federal laws and regulations.

In December 2012, Consumers announced plans to build a 700-MW gas-fueled electric generating plant at its Thetford complex in Genesee County, Michigan and filed an air permit application with the MDEQ for the proposed plant. In July 2013, Consumers filed for approval of a certificate of necessity with the MPSC, as allowed under the 2008 Energy Law. Construction of the plant, at an estimated cost of $750 million, is contingent upon obtaining the certificate of necessity and environmental permits. Consumers expects the plant to be operational in 2017.

Renewable energy projects are another major component of Consumers’ planned capital investments. Consumers expects to spend $0.5$0.3 billion on renewable energy investments, under an MPSC-approved renewable energy plan, from 20122013 through 2016.2017. The 2008 Energy Law requires that at least ten percent of Consumers’ electric sales volume come from renewable energy sources by 2015, and it includes requirements for specific capacity additions. Consumers has historically included renewable resources as part of its portfolio, with about fiveeight percent of its present power supply coming from such renewable sources as hydroelectric,hydropower, landfill gas, biomass, wind, anaerobic digestion, and wind.solar.

12

Table of Contents

Consumers’ Smart GridEnergy program, with an estimated total project capital cost of $750 million,$0.8 billion, also represents a major capital investment. The full-scale deployment of advanced metering infrastructure began in August 2012 and is planned to begin in the second half of 2012 and to continue through 2019. Consumers has spent $140 million$0.2 billion through 20112012 on its Smart GridEnergy program, and expects to spend an additional $260 million,$0.3 billion, following a phased approach, from 20122013 through 2016.

2017.RREGULATION

Regulatory matters are a key aspect of CMS Energy’s and Consumers’ businesses, particularly Consumers’ rate cases and regulatory proceedings before the MPSC. ImportantMichigan Governor Rick Snyder has appointed Sally Talberg to serve on the three-member MPSC for a six-year term starting July 3, 2013 replacing Orjiakor Isiogu. Talberg has served in various energy-related consulting, management, and public service roles during her career. She will represent political independents on the Commission. Her appointment is subject to the advice and consent of the Michigan Senate. Other important regulatory events and developments are summarized below.

| • | | Electric Rate Case: In June 2011, Consumers filed a general electric rate case seeking an annual rate increase of $195 million, based on a 10.7·Electric Rate Cases: Consumers filed a general electric rate case with the MPSC in September 2012, seeking an annual rate increase of $148 million, based on a 10.5 percent authorized return on equity. Consumers self-implemented an annual rate increase of $118 million in December 2011, subject to refund with interest. In June 2012, the MPSC authorized an annual rate increase of $118 million, based on a 10.3 percent return on equity. In January 2013, Consumers supplemented its electric rate case application to reflect changes to its environmental compliance and generation outage plans, which reduced its requested annual rate increase to $145 million.

|

| • | | Gas Rate Case: In September 2011, Consumers filed a general gas rate case seeking an annual rate increase of $49 million, based on a 10.7 percent authorized return on equity. Consumers self-implemented an annual rate increase of $23In March 2013, Consumers self-implemented an annual rate increase of $110 million out of its requested $145 million, subject to refund with interest. Consumers’ self-implementation required no order by the MSPC, and no intervenors in Consumers’ electric rate case opposed Consumers’ self-implementation amount. The MPSC approved a partial settlement agreement in May 2013, authorizing an annual rate increase of $89 million, based on a 10.3 percent authorized rate of return on equity. In July 2013, Consumers filed a reconciliation of total revenues collected during self-implementation to those that would have been collected under final rates. Consumers’ reconciliation indicated that no refund would be required. ·Gas Rate Case: In February 2013, Consumers filed an application with the MPSC seeking an annual rate increase of $49 million, based on a 10.5 percent authorized return on equity. The filing requested authority to recover new investments in customer reliability, deliverability, safety, and system enhancements, and sought approval of several rate adjustment mechanisms. Subsequent to this filing, Consumers’ projection of non-fuel costs decreased. As a result, in March 2012, subject to refund with interest. In June 2013, Consumers filed a petition with the MPSC to close the docket or, alternatively, to suspend and extend indefinitely the schedule in this case. The MPSC approved Consumers’ petition to suspend and indefinitely extend the schedule. ·Gas Revenue Decoupling Mechanism: The gas revenue decoupling mechanism, authorized by the MPSC in its 2009 order in Consumers’ gas rate case and extended through April 2012, allowed Consumers to adjust future gas rates to the degree that actual average weather-adjusted 13

Table of Contents sales per customer differed from the rate order. In December 2012, the MPSC approved Consumers’ settlement agreement and authorized an annual rate increase of $16 million, based on a 10.3 percent return on equity. |

| • | | Revenue Decoupling Mechanisms:Consumers has two electric revenue decoupling mechanism reconciliations pending with the MPSC, covering the period December 2009 through November 2011 and requesting, in total, recovery of $59 million.

|

In April 2012, the Michigan Court of Appeals ruled in an appeal filed by ABATE that disputed the MPSC’s decision to authorize an electric revenue decoupling mechanism for Detroit Edison. The Court concluded that the MPSC lacks statutory authority to approve or direct the use of a revenue decoupling mechanism for electric providers. Consumers cannot predict whether this decision will be appealed to the Michigan Supreme Court or the timing or outcome of any such appeal. As a result, Consumers determined that it no longer met the accounting criteria for recognition of a regulatory asset under an alternative revenue program, and wrote off its $59 million electric revenue decoupling mechanism regulatory asset at March 31, 2012. Although the case before the Court of Appeals related specifically to Detroit Edison, Consumers will continue to pursue all of its legal and regulatory avenues to recover its decoupling revenues.

As a result of the Court of Appeals decision in the Detroit Edison case, the MPSC requested all interested parties to submit comments regarding the future use of electric revenue decoupling mechanisms in Michigan. In May 2012, Consumers filed its comments with the MPSC. Consumers is unable to predict the outcome of this matter.

In September 2011, Consumers filed its first reconciliation of the gas revenue decoupling mechanism, requestingin which Consumers requested recovery of $16 million from customers for the period June 2010 through May 2011. ThisThe MPSC authorized recovery of the full amount over a three-month period that began in February 2013.

Consumers filed its final reconciliation of the gas revenue decoupling mechanism which was extendedin August 2012, requesting recovery of $17 million from customers for the period June 2011 through April 2012 and was not affected by the Court of Appeals decision on electric decoupling, allowed Consumers to adjust future gas rates to compensate for changes in sales volumes resulting from the difference between the level of average sales per customer adopted in the order and actual average weather-adjusted sales per customer, subject to certain conditions. Certain parties have filed in opposition to the reconciliation.2012. At June 30, 2012,2013, Consumers had a $33$17 million non-current regulatory asset recorded for gas revenue decoupling.

decoupling for that period. | • | | DOE Settlement: In July 2011, Consumers entered into an agreement with the DOE to settle for $120 million its claims related to the DOE’s failure to accept spent nuclear fuel. In September 2011, Consumers filed an application with the MPSC regarding the allocation of the $120 million settlement amount.

|

The 2008 Energy Law limits alternative electric supply to ten percent of Consumers’ weather-adjusted retail sales of the preceding calendar year. At June 30, 2012,2013, Consumers’ electric deliveries under the ROA program were at the ten percent limit.

In March 2012,February 2013, a bill was introduced to the Michigan Senate and House of Representatives that, upon enactment,if enacted, would revise the 2008 Energy Law and allow customers then on the ROA program waiting list to switch their service to an alternative electric supplier. Presently, the proportion of Consumers’ electric deliveries under the ROA program and on the ROA waiting list is 2325 percent. The revisionbill also proposes an increase in the cap of six percentage points per year from 20132014 through 2015.

In June 2012, a bill was introduced to the Michigan Senate and House of Representatives that would likely phase out electric choice and return the state’s electric industry to full regulation. This legislation was meant to counterpoint the bill introduced in March 2012.2016. Consumers is unable to predict the outcome of these twothis legislative proposals.proposal.

In January 2012, a ballot initiative was filed proposing to amend the Michigan Constitution to require Michigan utilities to obtain at least 25 percent of their electric energy from clean renewable energy sources such as wind, solar, biomass, and hydropower by 2025. The proposed amendment would also limit how much utilities could charge customers for the cost of complying with this requirement. If this ballot initiative is certified by the State Board of Canvassers, Michigan voters will vote on the proposal in the November 2012 general election.

Environmental regulation is another area of importance for CMS Energy and Consumers, and they are monitoring numerous legislative and regulatory initiatives, including initiatives to regulate greenhouse gases, and related litigation.

In July 2011, the EPA finalized CSAPR, which replaces CAIR. In December 2011, due to litigation surrounding CSAPR, the U.S. Court of Appeals for the D.C. Circuit issued a stay of CSAPR, stating that CAIR would remain in place while the court considers the issues.

Additionally, in FebruaryIn 2012, the EPA published its final MACT emission standards for electric generating units, based on Section 112 of the Clean Air Act, calling the final rule MATS. Although numerous parties, including the State of Michigan, have sought to extend the deadline of MATS, it is expected to take effect in 2015. Consumers has received from the MDEQ a one-year extension for MATS and the Michigan Mercury Rule for ten of its coal-fueled units, allowing them to run as presently configured until April 2016. CMS Energy and Consumers are continuing to assess the impact and cost associated with these standards.

In June 2013, President Obama directed the EPA to issue a revised proposal addressing greenhouse gas emissions of complyingnew fossil-fuel-fired steam electric generating units by September 20, 2013, and to finalize the rule in a timely fashion. The EPA was further directed to address existing, modified, and reconstructed fossil-fuel-fired steam electric generating units with CSAPRproposed standards, regulations, or guidelines to be completed by June 1, 2014, and MATS.final standards, regulations, or guidelines to be completed by June 1, 2015. Subsequent state implementation plans are due by June 30, 2016. Consumers believes that its balanced energy initiative, its present carbon reduction target, and its emphasis on supply diversity will position it favorably to deal with the impact of carbon regulation, but cannot predict the nature or outcome of these proposals. Consumers will continue to monitor regulatory activity regarding greenhouse gas emissions standards that may affect electric generating units.

FFINANCIALPERFORMANCEIN 2012AND BEYOND

For the six months ended June 30, 2012,2013, CMS Energy’s net income available to common stockholders was $167$224 million, and diluted EPS were $0.62.$0.83. This compares with net income available to common stockholders of $235$167 million and diluted EPS of $0.90$0.62 for the six months ended June 30, 2011.2012. The main factors contributing to CMS Energy’s improved performance in 2013 were increased gas deliveries and the declineabsence, in earnings in 2012 were2013, of the write-off of Consumers’ electric revenue decoupling mechanism regulatory asset as discussed above,in 2012.

Consumers’ utility operations are seasonal. The consumption of electric energy typically increases in the summer months, due primarily to the use of air conditioners and other cooling equipment, while peak

14

Table of Contents

demand for natural gas occurs in the winter due to colder temperatures and the absenceresulting use of a tax benefit recognized in 2011 related to the enactment of the MCIT.

natural gas as heating fuel. A more detailed discussion of the factors affecting CMS Energy’s and Consumers’ performance can be found in the Results of Operations section that follows this Executive Overview.

CMS Energy and Consumers believe that economic conditions in Michigan are improving. Although Michigan’s economy continuesConsumers expects its electric sales to be affectedincrease annually by about 0.5 to 1.0 percent on average through 2017, driven largely by the recession and its impact oncontinued rise in industrial production. Excluding the state’s automotive industry and by high unemployment rates, there are indications that the recession has eased in Michigan.impacts of energy efficiency programs, Consumers expects its electric sales to increase by about one1.0 to 1.5 percent annually through 2016, driven largely by the continued rise in industrial production.2017. Consumers is projecting that its gas sales will remain stable through 2016.2017. This outlook reflects growth in gas demand offset by energy efficiency and conservation.

As Consumers seeks to continue to receive fair and timely regulatory treatment, delivering customer value will remain a key strategic priority. To keep costs down for its utility customers, Consumers has set goals to achieve further annual productivity improvements. Additionally, Consumers will strive to give priority to capital investments that increase customer value or lower costs.

Consumers expects to continue to have sufficient capacity to fund its investment-based growth plans. CMS Energy also expects its sources of liquidity to remain sufficient to meet its cash requirements. CMS Energy and Consumers will continue to monitor developments in the financial and credit markets, as well as government policy responses to those developments, for potential implications for their businesses and their future financial needs.

15

Table of Contents

RESULTS OF OPERATIONS

CMS ENERGY CONSOLIDATED RESULTSOF OPERATIONS

| | | | | | | | | | | | | | | | | | | | | | | | |

| In Millions, Except Per Share Amounts | |

| | | Three Months Ended | | | Six Months Ended | |

| June 30 | | 2012 | | | 2011 | | | Change | | | 2012 | | | 2011 | | | Change | |

Net Income Available to Common Stockholders | | $ | 100 | | | $ | 100 | | | $ | - | | | $ | 167 | | | $ | 235 | | | $ | (68 | ) |

Basic Earnings Per Share | | $ | 0.38 | | | $ | 0.40 | | | $ | (0.02 | ) | | $ | 0.64 | | | $ | 0.94 | | | $ | (0.30 | ) |

Diluted Earnings Per Share | | $ | 0.37 | | | $ | 0.38 | | | $ | (0.01 | ) | | $ | 0.62 | | | $ | 0.90 | | | $ | (0.28 | ) |

| | |

|

| In Millions | |

| | | Three Months Ended | | | Six Months Ended | |

| June 30 | | 2012 | | | 2011 | | | Change | | | 2012 | | | 2011 | | | Change | |

Electric utility | | $ | 111 | | | $ | 85 | | | $ | 26 | | | $ | 132 | | | $ | 150 | | | $ | (18 | ) |

Gas utility | | | 9 | | | | 5 | | | | 4 | | | | 64 | | | | 93 | | | | (29 | ) |

Enterprises | | | (1 | ) | | | 29 | | | | (30 | ) | | | 4 | | | | 32 | | | | (28 | ) |

Corporate interest and other | | | (19 | ) | | | (19 | ) | | | - | | | | (40 | ) | | | (42 | ) | | | 2 | |

Discontinued operations | | | - | | | | - | | | | - | | | | 7 | | | | 2 | | | | 5 | |

Net Income Available to Common Stockholders | | $ | 100 | | | $ | 100 | | | $ | - | | | $ | 167 | | | $ | 235 | | | $ | (68 | ) |

| | |

CMS ENERGY CONSOLIDATED RESULTSOF OPERATIONS

| | | | In Millions, Except Per Share Amounts | |

| | Three Months Ended | | Six Months Ended |

June 30 | | 2013 | | 2012 | | Change | | 2013 | | 2012 | | Change | |

Net Income Available to Common Stockholders | | $ | 80 | | $ | 100 | | $ | (20 | ) | $ | 224 | | $ | 167 | | $ | 57 | |

Basic Earnings Per Share | | $ | 0.30 | | $ | 0.38 | | $ | (0.08 | ) | $ | 0.85 | | $ | 0.64 | | $ | 0.21 | |

Diluted Earnings Per Share | | $ | 0.29 | | $ | 0.37 | | $ | (0.08 | ) | $ | 0.83 | | $ | 0.62 | | $ | 0.21 | |

| | | | | | | | | | | | | |

| | | | | | In Millions | |

| | Three Months Ended | | Six Months Ended |

June 30 | | 2013 | | 2012 | | Change | | 2013 | | 2012 | | Change | |

Electric utility | | $ | 93 | | $ | 111 | | $ | (18 | ) | $ | 159 | | $ | 132 | | $ | 27 | |

Gas utility | | 5 | | 9 | | (4 | ) | 101 | | 64 | | 37 | |

Enterprises | | 1 | | (1 | ) | 2 | | 5 | | 4 | | 1 | |

Corporate interest and other | | (19 | ) | (19 | ) | - | | (41 | ) | (40 | ) | (1 | ) |

Discontinued operations | | - | | - | | - | | - | | 7 | | (7 | ) |

Net Income Available to Common Stockholders | | $ | 80 | | $ | 100 | | $ | (20 | ) | $ | 224 | | $ | 167 | | $ | 57 | |

Presented in the following table are specific after-tax changes to net income available to common stockholders for 20122013 versus 2011:2012:

| | | | | | | | | | | | | | | | |

| In Millions | |

| | | June 30, 2012 better/(worse) than 2011 | |

| Reasons for the change | | Three Months Ended | | | Six Months Ended | |

Gas sales | | $ | (5 | ) | | | | | | $ | (41 | ) | | | | |

Electric sales | | | 7 | | | | | | | | (13 | ) | | | | |

Electric and gas rate orders | | | 23 | | | | | | | | 50 | | | | | |

Recovery of development costs related to canceled coal-fueled plant | | | 9 | | | | | | | | 9 | | | | | |

Distribution and service restoration cost | | | 9 | | | | | | | | 9 | | | | | |

Other, including depreciation and property tax | | | (7 | ) | | $ | 36 | | | | (18 | ) | | $ | (4 | ) |

| | | | | | | | | | | | | | | | |

| | | | |

Subsidiary earnings of enterprises segment | | | | | | | (2 | ) | | | | | | | 2 | |

Lower corporate fixed charges, EnerBank earnings, and other | | | | | | | 5 | | | | | | | | 6 | |

Charge to write off electric decoupling regulatory asset | | | | | | | - | | | | | | | | (36 | ) |

Absence of MCIT enactment in 2011 | | | | | | | (32 | ) | | | | | | | (32 | ) |

Other, mainly voluntary separation program cost | | | | | | | (7 | ) | | | | | | | (4 | ) |

| | |

Total change | | | | | | $ | - | | | | | | | $ | (68 | ) |

| | |

| | | | | | In Millions | |

| | June 30, 2013 better/(worse) than 2012 | |

Reasons for the change | | Three Months Ended | | Six Months Ended | |

Gas sales | | $ | 5 | | | | $ | 46 | | | |

Electric sales | | (10) | | | | 1 | | | |

Electric and gas rate orders | | 17 | | | | 30 | | | |

Depreciation and property tax | | (10) | | | | (20) | | | |

Distribution and restoration cost | | (20) | | | | (21) | | | |

Absence of recovery of development costs related to

canceled coal-fueled plant in 2012 | | (9) | | | | (9) | | | |

Subsidiary earnings of enterprises segment | | 1 | | | | (1) | | | |

Higher corporate fixed charges and other,

offset by higher EnerBank earnings | | - | | | | (1) | | | |

Other | | (2) | | $ | (28 | ) | (6) | | $ | 19 | |

| | | | | | | | | |

Absence of 2012 charge to write off electric decoupling

regulatory asset | | | | - | | | | 36 | |

Absence of voluntary separation plan cost in 2012 | | | | 7 | | | | 7 | |

Other, including the absence of the elimination, in 2012, of

a liability associated with a prior asset sale | | | | 1 | | | | (5 | ) |

Total change | | | | $ | (20 | ) | | | $ | 57 | |

| | | | | | | | | | | | | |

16

CONSUMERS ELECTRIC UTILITY RESULTSOF OPERATIONSTable of Contents

| | | | | | | | | | | | |

| In Millions | |

| June 30 | | 2012 | | | 2011 | | | Change | |

Net Income Available to Common Stockholders | | | | | | | | | | | | |

Three months ended | | $ | 111 | | | $ | 85 | | | $ | 26 | |

Six months ended | | | 132 | | | | 150 | | | | (18 | ) |

| | |

CONSUMERS ELECTRIC UTILITY RESULTS OF OPERATIONS

| | | | | | | | | | | | | | In Millions | |

| In Millions | | |

| | | June 30, 2012 better/(worse) than 2011 | | | Three Months Ended | | Six Months Ended | |

June 30 | | | 2013 | | 2012 | | Change | | 2013 | | 2012 | | Change | |

Net Income Available to Common Stockholders | | | $ | 93 | | $ | 111 | | $ | (18 | ) | $ | 159 | | $ | 132 | | $ | 27 | |

| Reasons for the change | | Three Months Ended | | Six Months Ended | | | | | | | | | | | | | | |

Electric deliveries and rate increases | | | $ 45 | | | | $ (12 | ) | | | | | | $ | (2 | ) | | | | | $ | 78 | |

Power supply costs and related revenue | | | 2 | | | | 2 | | | | | | | (1 | ) | | | | | (1 | ) |

Other income, net of expenses | | | (2 | ) | | | (2 | ) | | | | | | (1 | ) | | | | | (2 | ) |

Maintenance and other operating expenses | | | 7 | | | | 4 | | | | | | | (17 | ) | | | | | (13 | ) |

Depreciation and amortization | | | (7 | ) | | | (13 | ) | | | | | | (8 | ) | | | | | (19 | ) |

General taxes | | | 3 | | | | 2 | | | | | | | (1 | ) | | | | | (2 | ) |

Interest charges | | | 3 | | | | 4 | | | | | | | - | | | | | | 1 | |

Income taxes | | | (25 | ) | | | (3 | ) | | | | | | 12 | | | | | | (15 | ) |

| | | |

Total change | | | $ 26 | | | | $ (18 | ) | | | | | | $ | (18 | ) | | | | | $ | 27 | |

| | | | | | | | | | | | | | | | | | | | | | |

Electric deliveries and rate increases: For the three months ended June 30, 2012,2013, electric delivery revenues increased $45decreased $2 million compared with 2011.2012. This variance wasdecrease reflected $19 million of lower deliveries, due partially to additional revenues of $25milder weather in 2013, and a $2 million resultingdecrease in other revenues. These decreases were offset largely by a $19 million benefit from a December 2011 self-implementedMay 2013 rate increase and $26 million resulting from higher deliveries, reflecting warmer weather and increased usagethat Consumers self-implemented in 2012. Additionally, other miscellaneous revenue increased $3 million. These increases were offset partially by the absence, in 2012, of $9 million of electric decoupling revenues recognized in 2011.March 2013. Deliveries to end-use customers, excluding deliveries to Consumers’ largest customer, which is on an economic development rate, were 9.58.6 billion kWh in 2012, an increase2013, a decrease of 0.60.1 billion kWh, or 6.7one percent, compared with 2011.2012.

For the six months ended June 30, 2012,2013, electric delivery revenues decreased $12increased $78 million compared with 2011.2012. This decreaseincrease reflected the absence, in 2013, of a $59 million charge to write off Consumers’ electric decoupling mechanism regulatory asset, and the absence,a $23 million benefit from a May 2013 rate increase that Consumers self-implemented in 2012, of $30 million of electric decoupling revenues recognized in 2011.March 2013. These decreasesincreases were offset largelypartially by additional revenues of $51a $4 million resulting from a December 2011 self-implemented rate increase, $11 million resulting from higher deliveriesdecrease in 2012, and a $15 million increase in surcharges and other miscellaneous revenues. Deliveries to end-use customers, excluding deliveries to Consumers’ largest customer, which is on an economic development rate, were 18.717.3 billion kWh in 2012,2013, an increase of 0.40.1 billion kWh, or 2.2one percent, compared with 2011.2012.

Maintenance and other operating expenses: For the three months ended June 30, 2012,2013, maintenance and other operating expenses decreased $7increased $17 million compared with 2011.2012. This decreaseincrease reflected the $14 millionabsence, in 2013, of the authorized recovery of costs$14 million associated with Consumers’ proposedcancelled coal-fueled plant and a $7an $11 million reductionincrease in service restoration costs.expenses. These decreasesincreases were offset partially by the absence, in 2013, of $8 million of voluntary separation program expenses, $5 million of higher energy optimization program costs, and a $1 million increase in other operatingprograms expenses.

For the six months ended June 30, 2012,2013, maintenance and other operating expenses decreased $4increased $13 million compared with 2011.2012. This decreaseincrease reflected the $14 millionabsence, in 2013, of the authorized recovery of costs$14 million associated with Consumers’ proposedcancelled coal-fueled plant, and a $9an $8 million reductionincrease in service restoration costs.expenses. These decreasesincreases were offset partially by the absence, in 2013, of $8 million of voluntary separation program expenses, $9 million of higher energy optimization program costs, and a $2$1 million increasedecrease in other operating expenses.

Depreciation and amortization: For the three months ended June 30, 2012,2013, depreciation and amortization expense increased $7$8 million compared with 2011,2012, and for the six months ended June 30, 2012,2013, depreciation and amortization expense increased $13$19 million compared with 2011.2012. These

17

Table of Contents

increases were due primarily to higher depreciation expense from increased plant in service.service during 2013 and an increase in depreciation rates that took effect in June 2012.

Income taxes: For the three months ended June 30, 2012,2013, income taxes increased $25decreased $12 million compared with 2011,2012, reflecting higherlower electric utility earnings in 2012.

CONSUMERS GAS UTILITY RESULTSOF OPERATIONS

| | | | | | | | | | | | |

| In Millions | |

| June 30 | | 2012 | | | 2011 | | | Change | |

Net Income Available to Common Stockholders | | | | | | | | | | | | |

Three months ended | | $ | 9 | | | $ | 5 | | | $ | 4 | |

Six months ended | | | 64 | | | | 93 | | | | (29 | ) |

| | |

| | | | | | | | |

| In Millions | |

| | | June 30, 2012 better/(worse) than 2011 | |

| Reasons for the change | | Three Months Ended | | | Six Months Ended | |

Gas deliveries and rate increases | | | $ 3 | | | | $ (32 | ) |

Other income, net of expenses | | | (1 | ) | | | (1 | ) |

Maintenance and other operating expenses | | | 1 | | | | (8 | ) |

Depreciation and amortization | | | - | | | | (5 | ) |

General taxes | | | - | | | | (1 | ) |

Interest charges | | | 2 | | | | 3 | |

Income taxes | | | (1 | ) | | | 15 | |

Total change | | | $ 4 | | | | $ (29 | ) |

| | |

Gas deliveries and rate increases: Forfor the three months ended June 30, 2012, gas delivery revenues increased $3 million compared with 2011. This increase reflected $5 million in additional revenues from March 2012 and May 2011 rate increases and a $5 million increase in surcharges and other miscellaneous revenues. These increases were offset partially by a $7 million reduction resulting from lower customer deliveries, due primarily to warmer weather in 2012. Gas deliveries, including transportation to end-use customers, were 40 bcf in 2012, a decrease of 6 bcf, or 13 percent, compared with 2011.2013.

For the six months ended June 30, 2013, income taxes increased $15 million compared with 2012, reflecting higher electric utility earnings for the first six months of 2013.

CONSUMERS GAS UTILITY RESULTS OF OPERATIONS

| | | | | | | | | | In Millions | |

| | Three Months Ended | | Six Months Ended | |

June 30 | | 2013 | | 2012 | | Change | | 2013 | | 2012 | | Change | |

Net Income Available to Common Stockholders | | $ | 5 | | $ | 9 | | $ | (4 | ) | $ | 101 | | $ | 64 | | $ | 37 | |

Reasons for the change | | | | | | | | | | | | | |

Gas deliveries and rate increases | | | | | | $ | 2 | | | | | | $ | 57 | |

Maintenance and other operating expenses | | | | | | (6 | ) | | | | | 1 | |

Depreciation and amortization | | | | | | - | | | | | | 3 | |

General taxes | | | | | | - | | | | | | (1 | ) |

Interest charges | | | | | | (1 | ) | | | | | - | |

Income taxes | | | | | | 1 | | | | | | (23 | ) |

Total change | | | | | | $ | (4 | ) | | | | | $ | 37 | |

| | | | | | | | | | | | | | | | | | | |

Gas deliveries and rate increases: For the three months ended June 30, 2013, gas delivery revenues decreased $32increased $2 million compared with 2011.2012. This decrease reflected a $67 million reduction resulting from lower customer deliveries,increase was due primarily to warmer weather in 2012. The decrease washigher customer deliveries, offset partially by $19 millionthe absence of additional revenues from March 2012 and May 2011 rate increases, an $8 million increase related to the energy optimization program, and an $8 million increasegas revenue decoupling mechanism in other miscellaneous revenues. Gas deliveries, including transportation2013. Deliveries to end-use customers were 14647 bcf in 2012, a decrease2013, an increase of 337 bcf, or 18 percent, compared with 2011.2012.

Maintenance and other operating expenses:

For the six months ended June 30, 2013, gas delivery revenues increased $57 million compared with 2012. This increase reflected $51 million of higher customer deliveries, due primarily to colder weather in 2013, offset partially by the absence of the gas revenue decoupling mechanism in 2013, and a $6 million benefit from a June 2012 rate increase that Consumers self-implemented in March 2012. Deliveries to end-use customers were 179 bcf in 2013, an increase of 33 bcf, or 23 percent, compared with 2012.

Maintenance and other operating expenses: For the three months ended June 30, 2013, maintenance and other operating expenses increased $8$6 million compared with 20112012. This increase was due to $8a $10 million increase in pipeline integrity and gas distribution operating expenses, offset partially by the absence, in 2013, of $4 million of higher energy optimizationvoluntary separation program costsexpenses.

For the six months ended June 30, 2013, maintenance and other operating expenses decreased $1 million compared with 2012. This decrease was due to the absence, in 2013, of $4 million of voluntary separation program expenses, offset partially by $4a $3 million of lowerincrease in gas distribution operating expenses.

Depreciation and amortization: For the six months ended June 30, 2012,2013, depreciation and amortization expense increased $5decreased $3 million compared with 2011,2012, due primarily to higherdecreased depreciation expense from increased plantrates that took effect in service.January 2013.

Income taxes: For the six months ended June 30, 2012,2013, income taxes decreased $15increased $23 million compared with 2011, reflecting lower2012, due to higher gas utility earnings in 2012.

ENTERPRISES RESULTSOF OPERATIONS2013.

| | | | | | | | | | | | |

| In Millions | |

| June 30 | | 2012 | | | 2011 | | | Change | |

Net Income (Loss) Available to Common Stockholders | | | | | | | | | | | | |

Three months ended | | $ | (1 | ) | | $ | 29 | | | $ | (30 | ) |

Six months ended | | | 4 | | | | 32 | | | | (28 | ) |

| | |

18

Table of Contents

ENTERPRISES RESULTS OF OPERATIONS

| | | | | | | | | | In Millions | |

| | Three Months Ended | | Six Months Ended |

June 30 | | 2013 | | 2012 | | Change | | 2013 | | 2012 | | Change | |

Net Income Available to Common Stockholders | | $ | 1 | | $ | (1 | ) | $ | 2 | | $ | 5 | | $ | 4 | | $ | 1 | |

| | | | | | | | | | | | | | | | | | | |

For the three months ended June 30, 2012, the enterprises segment recorded a net loss of $1 million, compared with net income of $29 million for the three months ended June 30, 2011, and for the six months ended June 30, 2012,2013, net income of the enterprises segment decreased $28increased $2 million compared with 2011. These changes were2012, due primarily to the absence, in 2012, of a $28 million income tax benefit resulting from the enactment of the MCIT in May 2011.

CORPORATE INTERESTAND OTHER RESULTSOF OPERATIONSimproved gross margins.

| | | | | | | | | | | | |

| In Millions | |

| June 30 | | 2012 | | | 2011 | | | Change | |

Net Loss Available to Common Stockholders | | | | | | | | | | | | |

Three months ended | | | $ (19 | ) | | | $ (19 | ) | | | $ - | |

Six months ended | | | (40 | ) | | | (42 | ) | | | 2 | |

| | |

For the six months ended June 30, 2013, net income of the enterprises segment increased $1 million compared with 2012, due primarily to lower expenses, offset partially by the absence of a $2 million 2012 Michigan tax benefit.

CORPORATE INTEREST AND OTHER RESULTS OF OPERATIONS

| | | | | | | | | | In Millions | |

| | Three Months Ended | | Six Months Ended |

June 30 | | 2013 | | 2012 | | Change | | 2013 | | 2012 | | Change | |

Net Income (Reduction) Available to Common Stockholders | | $ | (19 | ) | $ | (19 | ) | $ | - | | $ | (41 | ) | $ | (40 | ) | $ | (1 | ) |

| | | | | | | | | | | | | | | | | | | |

For the six months ended June 30, 2013, corporate interest and other net expenses decreased $2increased $1 million compared with 2011,2012, due primarily to higher net earnings at EnerBank.an increase in interest expense, reflecting increased borrowings.

DDISCONTINUEDOPERATIONS

For each of the three-month periodsthree months ended June 30, 2012 and 2011,2013, the net loss recorded from discontinued operations was less than $1 million.

For the six months ended June 30, 2012,2013, the net loss from discontinued operations was less than $1 million, compared with income from discontinued operations wasof $7 million in 2012, reflecting the elimination of a liability related to a prior asset sale, compared with income from discontinued operationssale.

19

Table of $2 million in 2011 as a result of a favorable legal settlement related to a previously sold business.Contents

CASH POSITION, INVESTING, AND FINANCING

At June 30, 2012,2013, CMS Energy had $215$566 million of consolidated cash and cash equivalents, which included $29 million of restricted cash and cash equivalents. At June 30, 2013, Consumers had $314 million of consolidated cash and cash equivalents, which included $28 million of restricted cash and cash equivalents. Consumers had $181 million of consolidated cash and cash equivalents, which included $27 million of restricted cash and cash equivalents.

OOPERATINGACTIVITIES

Presented in the following table are specific components of net cash provided by operating activities for the six months ended June 30, 20122013 and 2011:2012:

| | | | | | | | | | | | In Millions | |

| In Millions | | |

| Six Months Ended June 30 | | 2012 | | 2011 | | Change | | | 2013 | | 2012 | | Change | |

CMS Energy, including Consumers | | | | | | | | | | | | | |

Net income | | $ | 168 | | | $ | 236 | | | $ | (68 | ) | | $ | 225 | | $ | 168 | | $ | 57 | |

Non-cash transactions1 | | | 533 | | | | 480 | | | | 53 | | | 580 | | 533 | | 47 | |

| | | | | | 805 | | 701 | | 104 | |

| | | 701 | | | | 716 | | | | (15 | ) | |

Postretirement benefits contributions | | | (37 | ) | | | (39 | ) | | | 2 | | | (88 | ) | (37 | ) | (51 | ) |

Decrease in core working capital2 | | | 291 | | | | 453 | | | | (162 | ) | |

Other changes in assets and liabilities, net | | | (12 | ) | | | 86 | | | | (98 | ) | |

Proceeds from government grant | | | 69 | | - | | 69 | |

Changes in core working capital2 | | | 357 | | 291 | | 66 | |

Changes in other assets and liabilities, net | | | (48 | ) | (12 | ) | (36 | ) |

Net cash provided by operating activities | | $ | 943 | | | $ | 1,216 | | | $ | (273 | ) | | $ | 1,095 | | $ | 943 | | $ | 152 | |

| | | |

Consumers | | | | | | | | | | | | | |

Net income | | $ | 198 | | | $ | 245 | | | $ | (47 | ) | | $ | 262 | | $ | 198 | | $ | 64 | |

Non-cash transactions1 | | | 461 | | | | 473 | | | | (12 | ) | | 527 | | 461 | | 66 | |

| | | | | | 789 | | 659 | | 130 | |

| | | 659 | | | | 718 | | | | (59 | ) | |

Postretirement benefits contributions | | | (34 | ) | | | (37 | ) | | | 3 | | | (86 | ) | (34 | ) | (52 | ) |

Decrease in core working capital2 | | | 294 | | | | 451 | | | | (157 | ) | |

Other changes in assets and liabilities, net | | | 94 | | | | 113 | | | | (19 | ) | |

Proceeds from government grant | | | 69 | | - | | 69 | |

Changes in core working capital2 | | | 357 | | 294 | | 63 | |

Changes in other assets and liabilities, net | | | (44 | ) | 94 | | (138 | ) |

Net cash provided by operating activities | | $ | 1,013 | | | $ | 1,245 | | | $ | (232 | ) | | $ | 1,085 | | $ | 1,013 | | $ | 72 | |

| | | |

1Non-cash transactions comprise depreciation and amortization, changes in deferred income taxes, postretirement benefits

expense, and other non-cash items.

2Core working capital comprises accounts receivable and accrued revenues, inventories, and accounts payable.

For the six months ended June 30, 2012,2013, net cash provided by operating activities at CMS Energy decreased $273increased $152 million compared with 2011,2012, and net cash provided by operating activities at Consumers decreased $232increased $72 million compared with 2011.2012. The decreasesincreases were due primarily to lower gas saleshigher net income, net of non-cash transactions, the receipt of a $69 million renewable energy grant for Lake Winds® Energy Park, an increase in refunds to customers, and a smallerlarger reduction in core working capital, reflecting lowerhigher usage of gas inventory. These changes were offset partially by higher pension contributions. At Consumers, these changes were also offset partially by an increase in tax payments to CMS Energy.

20

Table of Contents

INVESTINGACTIVITIES

Presented in the following table are specific components of net cash used in investing activities for the six months ended June 30, 20122013 and 2011:2012:

| | | | | | | | | | | | In Millions | |

| In Millions | | |

| Six Months Ended June 30 | | 2012 | | 2011 | | Change | | | 2013 | | 2012 | | Change | |

CMS Energy, including Consumers | | | | | | | | | | | | | |

Capital expenditures | | $ | (575 | ) | | $ | (399 | ) | | $ | (176 | ) | | $ | (580 | ) | $ | (575 | ) | $ | (5 | ) |

Costs to retire property and other | | | (35 | ) | | | (72 | ) | | | 37 | | | (36 | ) | (35 | ) | (1 | ) |

Net cash used in investing activities | | $ | (610 | ) | | $ | (471 | ) | | $ | (139 | ) | | $ | (616 | ) | $ | (610 | ) | $ | (6 | ) |

| | | |

Consumers | | | | | | | | | | | | | |

Capital expenditures | | $ | (572 | ) | | $ | (394 | ) | | $ | (178 | ) | | $ | (579 | ) | $ | (572 | ) | $ | (7 | ) |

Costs to retire property and other | | | (29 | ) | | | (51 | ) | | | 22 | | | (34 | ) | (29 | ) | (5 | ) |

Net cash used in investing activities | | $ | (601 | ) | | $ | (445 | ) | | $ | (156 | ) | | $ | (613 | ) | $ | (601 | ) | $ | (12 | ) |

| | | |

For the six months ended June 30, 2012,2013, net cash used in investing activities at CMS Energy increased $139$6 million compared with 2011,2012, and net cash used in investing activities at Consumers increased $156$12 million compared with 2011.2012. The increases were due primarily to increasesa slight increase in capital expenditures.expenditures under Consumers’ capital investment program.

FFINANCINGACTIVITIES

Presented in the following table are specific components of net cash used in financing activities for the six months ended June 30, 20122013 and 2011:2012:

| | | | | | | | | | | | In Millions | |

| In Millions | | |

| Six Months Ended June 30 | | 2012 | | 2011 | | Change | | | 2013 | | 2012 | | Change | |

CMS Energy, including Consumers | | | | | | | | | | | | | |

Issuance of FMBs, senior notes, and other debt | | $ | 914 | | | $ | 396 | | | $ | 518 | | |

Retirement of debt and other debt maturity payments | | | (1,100 | ) | | | (292 | ) | | | (808 | ) | |

Common stock issued | | | 23 | | | | 22 | | | | 1 | | |

Payments of common stock dividends | | | (125 | ) | | | (106 | ) | | | (19 | ) | |

Issuance of debt | | | $ | 788 | | $ | 914 | | $ | (126 | ) |

Retirement of debt | | | (586 | ) | (1,100 | ) | 514 | |

Payment of common stock dividends | | | (135 | ) | (125 | ) | (10 | ) |

Decrease in notes payable | | | (110 | ) | - | | (110 | ) |

Other financing activities | | | (19 | ) | | | (20 | ) | | | 1 | | | 8 | | 4 | | 4 | |

Net cash used in financing activities | | $ | (307 | ) | | $ | - | | | $ | (307 | ) | | $ | (35 | ) | $ | (307 | ) | $ | 272 | |

| | | |

Consumers | | | | | | | | | | | | | |

Issuance of FMBs | | $ | 375 | | | $ | - | | | $ | 375 | | |

Retirement of debt and other debt maturity payments | | | (694 | ) | | | (18 | ) | | | (676 | ) | |

Payments of common stock dividends | | | (158 | ) | | | (196 | ) | | | 38 | | |

Issuance of debt | | | $ | 425 | | $ | 375 | | $ | 50 | |

Retirement of debt | | | (445 | ) | (694 | ) | 249 | |

Payment of common and preferred stock dividends | | | (195 | ) | (159 | ) | (36 | ) |

Stockholder contribution from CMS Energy | | | 150 | | | | 125 | | | | 25 | | | 150 | | 150 | | - | |

Decrease in notes payable | | | (110 | ) | - | | (110 | ) |

Other financing activities | | | (16 | ) | | | (16 | ) | | | - | | | (16 | ) | (15 | ) | (1 | ) |

Net cash used in financing activities | | $ | (343 | ) | | $ | (105 | ) | | $ | (238 | ) | | $ | (191 | ) | $ | (343 | ) | $ | 152 | |

| | | |

For the six months ended June 30, 2012,2013, net cash used in financing activities at CMS Energy increased $307decreased $272 million compared with 2011,2012 and net cash used in financing activities at Consumers increased $238decreased $152 million compared with 2011.2012. These increaseschanges were due primarily to an increasea decrease in net debt retirements.retirements, offset partially by repayments by Consumers under its revolving accounts receivable sales program.

21

Table of Contents

RETIREMENT BENEFITS

Effective July 1, 2013, CMS Energy and Consumers approved a change to the Medicare drug program provided through their OPEB Plan from an employer-sponsored prescription drug plan with a retiree drug subsidy to an EGWP, to begin on January 1, 2015. As a result of changes stemming from the Health Care Acts, the EGWP structure can result in reduced costs for employers, without impacting plan participants’ benefit coverage or costs. Also effective July 1, 2013, CMS Energy and Consumers approved certain benefit changes to the OPEB Plan, to begin on January 1, 2016. Accordingly, CMS Energy and Consumers performed a remeasurement of the OPEB Plan as of July 1, 2013. In addition, with the plan remeasurement, the discount rate used to measure the OPEB liability was increased from 4.4 percent at December 31, 2012 to 5.1 percent at July 1, 2013. Assumptions regarding the expected long-term rate of return on plan assets and the health-care cost trend rate did not change from December 31, 2012 levels.

As a result of these changes, CMS Energy’s (including Consumers’) OPEB liability decreased by $613 million and its OPEB regulatory asset decreased by $599 million as of July 1, 2013. CMS Energy’s accumulated other comprehensive loss decreased by $14 million. CMS Energy’s (including Consumers’) OPEB cost is expected to decrease by $46 million in 2013. Consumers’ OPEB liability decreased by $599 million and its OPEB regulatory asset decreased by $599 million as of July 1, 2013. Consumers’ OPEB cost is expected to decrease by $45 million in 2013.

The decrease in CMS Energy’s and Consumers’ OPEB liabilities was due primarily to the change in the discount rate used to measure the liabilities and other changes in actuarial assumptions, the benefit changes, and the change in the OPEB Plan’s Medicare drug program to the EGWP structure. Presented in the following table are the components of the decrease in CMS Energy’s and Consumers’ OPEB liabilities at July 1, 2013.

| | In Millions | |

| | OPEB Liability | |

CMS Energy, including Consumers | | | |

Discount rate and other actuarial assumptions | | $ | 250 | |

Benefit changes | | 208 | |

Medicare drug program structure | | 155 | |

Total decrease | | $ | 613 | |

Consumers | | | |

Discount rate and other actuarial assumptions | | $ | 245 | |

Benefit changes | | 203 | |

Medicare drug program structure | | 151 | |

Total decrease | | $ | 599 | |

22

Table of Contents

Presented in the following table are the most recent estimates of CMS Energy’s and Consumers’ pension cost, OPEB cost, and cash contributions through 2014:2015. These updated estimates incorporate the OPEB Plan changes that became effective July 1, 2013.

| | | | | | | | | | | | | | | | In Millions | |

| In Millions | | |

| | | Pension | | OPEB | | Pension | | OPEB | |

| | | Pension Cost | | | OPEB Cost | | | Pension

Contribution | | | OPEB

Contribution | | | Cost | | Cost (Credit | ) | Contribution | | Contribution | |

CMS Energy, including Consumers | | | | | | | | | | | | | | | | | |

2012 | | | $ 103 | | | | $ 75 | | | | $ - | | | | $ 65 | | |

2013 | | | 115 | | | | 73 | | | | - | | | | 74 | | | $ | 119 | | $ | 14 | | $ | 50 | | $ | 72 | |

2014 | | | 112 | | | | 90 | | | | 111 | | | | 73 | | | 102 | | (24 | ) | 4 | | 57 | |

| | | |

2015 | | | 104 | | (17 | ) | 145 | | 25 | |

Consumers | | | | | | | | | | | | | | | | | |

2012 | | | $ 100 | | | | $ 77 | | | | $ - | | | | $ 64 | | |

2013 | | | 112 | | | | 75 | | | | - | | | | 73 | | | $ | 116 | | $ | 17 | | $ | 49 | | $ | 71 | |

2014 | | | 109 | | | | 92 | | | | 108 | | | | 72 | | | 100 | | (20 | ) | 4 | | 56 | |

| | | |

2015 | | | 101 | | (13 | ) | 141 | | 25 | |

Contribution estimates comprise amounts required for pensionamounts and discretionary contributions for OPEB.contributions. Consumers’ pension and OPEB costs are recoverable through its general ratemaking process. Actual future costs and contributions will depend on future investment performance, changes in discount rates, and various other factors related to the Pension Plan and OPEB participants.

For additional details on retirement benefits, see Note 10: Retirement Benefits.

CAPITAL RESOURCES AND LIQUIDITY