(Mark One)

| ☒ | Quarterly Report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 | |

2019

| ☐ | Transition Report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 | |

For the transition period fromto

| Massachusetts | 04-2787865 | |||||||

(State or other jurisdiction of incorporation or organization) | (IRS Employer Identification No.) | |||||||

| ||||||||

| One Rogers Street | , | Cambridge | , | MA | 02142-1209 | |||

| (Address of principal executive offices) | (Zip Code) | |||||||

(617)

| Title of each class | Trading symbol(s) | Name of each exchange on which registered |

| Common Stock, $.01 par value per share | PEGA | NASDAQ Global Select Market |

| Large accelerated filer | x | Accelerated filer | ☐ | ||||||

| Non-accelerated filer | ☐ | Smaller reporting company | ☐ | ||||||

| Emerging growth company | ☐ | ||||||||

Index to Form

| Page | ||||

| ||||

Item 1. Unaudited Condensed Consolidated Financial Statements | ||||

Unaudited Condensed Consolidated Balance Sheets as of September 30, | ||||

| 2018 | ||||

| 2018 | ||||

Unaudited Condensed Consolidated Statements of Stockholders’ Equity for the nine months ended September 30, 2019 and 2018 | ||||

| Unaudited Condensed Consolidated Statements of Cash Flows for the nine months ended September 30, | ||||

Notes to Unaudited Condensed Consolidated Financial Statements | ||||

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations | ||||

Item 3. Quantitative and Qualitative Disclosures About Market Risk | ||||

| PART II - OTHER INFORMATION | ||||

| ||||

Item 2. Unregistered Sales of Equity Securities and Use of Proceeds | ||||

| Item 5. Other Information | ||||

| Item 6. Exhibits | ||||

| Signature | ||||

| September 30, 2017 | December 31, 2016 | |||||||

Assets | ||||||||

Current assets: | ||||||||

Cash and cash equivalents | $ | 130,568 | $ | 70,594 | ||||

Marketable securities | 63,812 | 63,167 | ||||||

|

|

|

| |||||

Total cash, cash equivalents, and marketable securities | 194,380 | 133,761 | ||||||

Trade accounts receivable, net of allowance of $6,189 and $4,126 | 191,161 | 265,028 | ||||||

Income taxes receivable | 34,864 | 14,155 | ||||||

Other current assets | 17,679 | 12,188 | ||||||

|

|

|

| |||||

Total current assets | 438,084 | 425,132 | ||||||

Property and equipment, net | 39,849 | 38,281 | ||||||

Deferred income taxes | 73,459 | 69,898 | ||||||

Long-term other assets | 5,982 | 3,990 | ||||||

Intangible assets, net | 34,755 | 44,191 | ||||||

Goodwill | 72,941 | 73,164 | ||||||

|

|

|

| |||||

Total assets | $ | 665,070 | $ | 654,656 | ||||

|

|

|

| |||||

Liabilities and Stockholders’ Equity | ||||||||

Current liabilities: | ||||||||

Accounts payable | $ | 12,535 | $ | 14,414 | ||||

Accrued expenses | 39,681 | 36,751 | ||||||

Accrued compensation and related expenses | 53,869 | 60,660 | ||||||

Deferred revenue | 160,931 | 175,647 | ||||||

|

|

|

| |||||

Total current liabilities | 267,016 | 287,472 | ||||||

Income taxes payable | 4,774 | 4,263 | ||||||

Long-term deferred revenue | 6,130 | 10,989 | ||||||

Other long-term liabilities | 15,449 | 16,043 | ||||||

|

|

|

| |||||

Total liabilities | 293,369 | 318,767 | ||||||

|

|

|

| |||||

Stockholders’ equity: | ||||||||

Preferred stock, 1,000 shares authorized; no shares issued and outstanding | — | — | ||||||

Common stock, 200,000 shares authorized; 77,839 shares and 76,591 shares issued and outstanding | 778 | 766 | ||||||

Additionalpaid-in capital | 146,728 | 143,903 | ||||||

Retained earnings | 227,953 | 198,315 | ||||||

Accumulated other comprehensive loss | (3,758 | ) | (7,095 | ) | ||||

|

|

|

| |||||

Total stockholders’ equity | 371,701 | 335,889 | ||||||

|

|

|

| |||||

Total liabilities and stockholders’ equity | $ | 665,070 | $ | 654,656 | ||||

|

|

|

| |||||

| September 30, 2019 | December 31, 2018 | ||||||

| Assets | |||||||

| Current assets: | |||||||

| Cash and cash equivalents | $ | 92,104 | $ | 114,422 | |||

| Marketable securities | 20,465 | 93,001 | |||||

| Total cash, cash equivalents, and marketable securities | 112,569 | 207,423 | |||||

| Accounts receivable | 123,268 | 180,872 | |||||

| Unbilled receivables | 172,090 | 172,656 | |||||

| Other current assets | 58,204 | 49,684 | |||||

| Total current assets | 466,131 | 610,635 | |||||

| Long-term unbilled receivables | 123,962 | 151,237 | |||||

| Goodwill | 78,862 | 72,858 | |||||

| Other long-term assets | 248,069 | 147,823 | |||||

| Total assets | $ | 917,024 | $ | 982,553 | |||

| Liabilities and stockholders’ equity | |||||||

| Current liabilities: | |||||||

| Accounts payable | $ | 15,435 | $ | 16,487 | |||

| Accrued expenses | 41,520 | 45,506 | |||||

| Accrued compensation and related expenses | 88,349 | 84,671 | |||||

| Deferred revenue | 159,849 | 185,145 | |||||

| Other current liabilities | 15,742 | — | |||||

| Total current liabilities | 320,895 | 331,809 | |||||

| Operating lease liabilities | 56,904 | — | |||||

| Other long-term liabilities | 10,393 | 29,213 | |||||

| Total liabilities | 388,192 | 361,022 | |||||

| Stockholders’ equity: | |||||||

| Preferred stock, 1,000 shares authorized; none issued | — | — | |||||

Common stock, 200,000 shares authorized; 79,324 and 78,526 shares issued and outstanding at September 30, 2019 and December 31, 2018, respectively | 793 | 785 | |||||

| Additional paid-in capital | 129,559 | 123,205 | |||||

| Retained earnings | 412,389 | 510,863 | |||||

| Accumulated other comprehensive (loss) | (13,909 | ) | (13,322 | ) | |||

| Total stockholders’ equity | 528,832 | 621,531 | |||||

| Total liabilities and stockholders’ equity | $ | 917,024 | $ | 982,553 | |||

| Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||

| 2017 | 2016 | 2017 | 2016 | |||||||||||||

Revenue: | ||||||||||||||||

Software license | $ | 41,793 | $ | 68,833 | $ | 195,220 | $ | 207,849 | ||||||||

Maintenance | 62,204 | 55,038 | 180,759 | 163,174 | ||||||||||||

Services | 75,818 | 58,931 | 225,063 | 179,633 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

Total revenue | 179,815 | 182,802 | 601,042 | 550,656 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

Cost of revenue: | ||||||||||||||||

Software license | 1,276 | 1,313 | 3,826 | 3,646 | ||||||||||||

Maintenance | 6,716 | 6,659 | 20,945 | 18,889 | ||||||||||||

Services | 61,739 | 52,465 | 180,925 | 154,512 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

Total cost of revenue | 69,731 | 60,437 | 205,696 | 177,047 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

Gross profit | 110,084 | 122,365 | 395,346 | 373,609 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

Operating expenses: | ||||||||||||||||

Selling and marketing | 70,209 | 67,032 | 217,384 | 202,126 | ||||||||||||

Research and development | 41,031 | 38,036 | 121,089 | 108,530 | ||||||||||||

General and administrative | 13,133 | 11,725 | 38,174 | 34,067 | ||||||||||||

Acquisition-related | — | 74 | — | 2,903 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

Total operating expenses | 124,373 | 116,867 | 376,647 | 347,626 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

(Loss)/income from operations | (14,289 | ) | 5,498 | 18,699 | 25,983 | |||||||||||

Foreign currency transaction (loss)/gain | (552 | ) | 1,082 | (793 | ) | 2,764 | ||||||||||

Interest income, net | 144 | 172 | 470 | 650 | ||||||||||||

Other income/(expense), net | — | (1,237 | ) | 287 | (4,891 | ) | ||||||||||

|

|

|

|

|

|

|

| |||||||||

(Loss)/income before (benefit)/provision for income taxes | (14,697 | ) | 5,515 | 18,663 | 24,506 | |||||||||||

(Benefit)/provision for income taxes | (12,885 | ) | 2,214 | (17,952 | ) | 6,269 | ||||||||||

|

|

|

|

|

|

|

| |||||||||

Net (loss)/income | $ | (1,812 | ) | $ | 3,301 | $ | 36,615 | $ | 18,237 | |||||||

|

|

|

|

|

|

|

| |||||||||

(Loss)/earnings per share: | ||||||||||||||||

Basic | (0.03 | ) | 0.04 | 0.47 | 0.24 | |||||||||||

Diluted | (0.03 | ) | 0.04 | 0.44 | 0.23 | |||||||||||

Weighted-average number of common shares outstanding: | ||||||||||||||||

Basic | 77,691 | 76,278 | 77,258 | 76,323 | ||||||||||||

Diluted | 77,691 | 79,548 | 82,717 | 79,401 | ||||||||||||

Cash dividends declared per share | $ | 0.03 | $ | 0.03 | $ | 0.09 | $ | 0.09 | ||||||||

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||

| 2019 | 2018 | 2019 | 2018 | ||||||||||||

| Revenue | |||||||||||||||

| Software license | $ | 58,005 | $ | 52,342 | $ | 165,543 | $ | 184,899 | |||||||

| Maintenance | 70,371 | 66,017 | 207,406 | 196,448 | |||||||||||

| Services | 88,327 | 84,904 | 261,892 | 253,877 | |||||||||||

| Total revenue | 216,703 | 203,263 | 634,841 | 635,224 | |||||||||||

| Cost of revenue | |||||||||||||||

| Software license | 676 | 1,255 | 2,982 | 3,772 | |||||||||||

| Maintenance | 6,688 | 6,079 | 19,315 | 18,035 | |||||||||||

| Services | 73,534 | 67,089 | 210,118 | 202,047 | |||||||||||

| Total cost of revenue | 80,898 | 74,423 | 232,415 | 223,854 | |||||||||||

| Gross profit | 135,805 | 128,840 | 402,426 | 411,370 | |||||||||||

| Operating expenses | |||||||||||||||

| Selling and marketing | 115,237 | 87,490 | 341,064 | 269,845 | |||||||||||

| Research and development | 52,492 | 46,504 | 152,802 | 135,261 | |||||||||||

| General and administrative | 14,843 | 12,104 | 41,693 | 38,749 | |||||||||||

| Total operating expenses | 182,572 | 146,098 | 535,559 | 443,855 | |||||||||||

| (Loss) from operations | (46,767 | ) | (17,258 | ) | (133,133 | ) | (32,485 | ) | |||||||

| Foreign currency transaction (loss) gain | (1,970 | ) | 399 | (3,577 | ) | 558 | |||||||||

| Interest income, net | 556 | 683 | 1,823 | 2,076 | |||||||||||

| Other income, net | 323 | — | 378 | 363 | |||||||||||

| (Loss) before (benefit from) income taxes | (47,858 | ) | (16,176 | ) | (134,509 | ) | (29,488 | ) | |||||||

| (Benefit from) income taxes | (17,520 | ) | (8,589 | ) | (43,158 | ) | (23,692 | ) | |||||||

| Net (loss) | $ | (30,338 | ) | $ | (7,587 | ) | $ | (91,351 | ) | $ | (5,796 | ) | |||

| (Loss) per share | |||||||||||||||

| Basic | $ | (0.38 | ) | $ | (0.10 | ) | $ | (1.16 | ) | $ | (0.07 | ) | |||

| Diluted | $ | (0.38 | ) | $ | (0.10 | ) | $ | (1.16 | ) | $ | (0.07 | ) | |||

| Weighted-average number of common shares outstanding | |||||||||||||||

| Basic | 79,200 | 78,700 | 78,928 | 78,525 | |||||||||||

| Diluted | 79,200 | 78,700 | 78,928 | 78,525 | |||||||||||

(LOSS)

| Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||

| 2017 | 2016 | 2017 | 2016 | |||||||||||||

Net (loss)/income | $ | (1,812 | ) | $ | 3,301 | $ | 36,615 | $ | 18,237 | |||||||

Other comprehensive income/(loss), net of tax | ||||||||||||||||

Unrealized gain/(loss) onavailable-for-sale marketable securities, net of tax | 22 | (174 | ) | 148 | 168 | |||||||||||

Foreign currency translation adjustments | 549 | (169 | ) | 3,189 | (1,400 | ) | ||||||||||

|

|

|

|

|

|

|

| |||||||||

Total other comprehensive income/(loss), net of tax | 571 | (343 | ) | 3,337 | (1,232 | ) | ||||||||||

|

|

|

|

|

|

|

| |||||||||

Comprehensive (loss)/income | $ | (1,241 | ) | $ | 2,958 | $ | 39,952 | $ | 17,005 | |||||||

|

|

|

|

|

|

|

| |||||||||

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||

| 2019 | 2018 | 2019 | 2018 | ||||||||||||

| Net (loss) | $ | (30,338 | ) | $ | (7,587 | ) | $ | (91,351 | ) | $ | (5,796 | ) | |||

| Other comprehensive (loss), net of tax | |||||||||||||||

| Unrealized (loss) gain on available-for-sale marketable securities | (216 | ) | (162 | ) | 396 | (277 | ) | ||||||||

| Foreign currency translation adjustments | (2,201 | ) | (1,934 | ) | (983 | ) | (4,898 | ) | |||||||

| Total other comprehensive (loss), net of tax | (2,417 | ) | (2,096 | ) | (587 | ) | (5,175 | ) | |||||||

| Comprehensive (loss) | $ | (32,755 | ) | $ | (9,683 | ) | $ | (91,938 | ) | $ | (10,971 | ) | |||

PEGASYSTEMS INC.

(in thousands)

| Nine Months Ended September 30, | ||||||||

| 2017 | 2016 | |||||||

Operating activities: | ||||||||

Net income | $ | 36,615 | $ | 18,237 | ||||

Adjustments to reconcile net income to cash provided by operating activities: | ||||||||

Deferred income taxes | (2,607 | ) | (2,841 | ) | ||||

Depreciation and amortization | 18,703 | 17,896 | ||||||

Stock-based compensation expense | 39,929 | 30,634 | ||||||

Foreign currency transaction loss/(gain) | 793 | (2,764 | ) | |||||

Othernon-cash | (89 | ) | 153 | |||||

Change in operating assets and liabilities: | ||||||||

Trade accounts receivable | 80,580 | 3,940 | ||||||

Income taxes receivable and other current assets | (25,943 | ) | (11,904 | ) | ||||

Accounts payable and accrued expenses | (8,546 | ) | (16,678 | ) | ||||

Deferred revenue | (25,639 | ) | (17,698 | ) | ||||

Other long-term assets and liabilities | 130 | 1,581 | ||||||

|

|

|

| |||||

Cash provided by operating activities | 113,926 | 20,556 | ||||||

Investing activities: | ||||||||

Purchases of marketable securities | (25,687 | ) | (22,614 | ) | ||||

Proceeds from maturities and called marketable securities | 23,124 | 21,838 | ||||||

Sales of marketable securities | — | 62,283 | ||||||

Payments for acquisitions, net of cash acquired | (297 | ) | (49,113 | ) | ||||

Investment in property and equipment | (9,106 | ) | (15,253 | ) | ||||

|

|

|

| |||||

Cash used in investing activities | (11,966 | ) | (2,859 | ) | ||||

Financing activities: | ||||||||

Dividend payments to shareholders | (6,941 | ) | (6,883 | ) | ||||

Common stock repurchases for tax withholdings for net settlement of equity awards | (34,113 | ) | (10,398 | ) | ||||

Common stock repurchases under share repurchase programs | (2,986 | ) | (25,750 | ) | ||||

|

|

|

| |||||

Cash used in financing activities | (44,040 | ) | (43,031 | ) | ||||

Effect of exchange rates on cash and cash equivalents | 2,054 | (1,309 | ) | |||||

|

|

|

| |||||

Net increase/(decrease) in cash and cash equivalents | 59,974 | (26,643 | ) | |||||

Cash and cash equivalents, beginning of period | 70,594 | 93,026 | ||||||

|

|

|

| |||||

Cash and cash equivalents, end of period | $ | 130,568 | $ | 66,383 | ||||

|

|

|

| |||||

PEGASYSTEMS INC. UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY (in thousands, except per share amounts) | ||||||||||||||||||||||

| Common Stock | Additional Paid-In Capital | Retained Earnings | Accumulated Other Comprehensive (Loss) Income | Total Stockholders’ Equity | ||||||||||||||||||

| Number of Shares | Amount | |||||||||||||||||||||

| December 31, 2017 | 78,081 | $ | 781 | $ | 152,097 | $ | 509,697 | $ | (6,705 | ) | $ | 655,870 | ||||||||||

| Repurchase of common stock | (101 | ) | (1 | ) | (5,688 | ) | — | — | (5,689 | ) | ||||||||||||

| Issuance of common stock for share-based compensation plans | 566 | 5 | (15,556 | ) | — | — | (15,551 | ) | ||||||||||||||

| Stock-based compensation | — | — | 15,109 | — | — | 15,109 | ||||||||||||||||

| Cash dividends declared ($0.12 per share) | — | — | — | (2,355 | ) | — | (2,355 | ) | ||||||||||||||

| Other comprehensive income | — | — | — | — | 4,262 | 4,262 | ||||||||||||||||

| Net income | — | — | — | 12,200 | — | 12,200 | ||||||||||||||||

| March 31, 2018 | 78,546 | 785 | 145,962 | 519,542 | (2,443 | ) | 663,846 | |||||||||||||||

| Repurchase of common stock | (171 | ) | (2 | ) | (10,179 | ) | — | — | (10,181 | ) | ||||||||||||

| Issuance of common stock for share-based compensation plans | 358 | 4 | (11,395 | ) | — | — | (11,391 | ) | ||||||||||||||

| Issuance of common stock under Employee Stock Purchase Plan | 15 | — | 849 | — | — | 849 | ||||||||||||||||

| Stock-based compensation | — | — | 16,163 | — | — | 16,163 | ||||||||||||||||

| Cash dividends declared ($0.12 per share) | — | — | — | (2,364 | ) | — | (2,364 | ) | ||||||||||||||

| Other comprehensive (loss) | — | — | — | — | (7,341 | ) | (7,341 | ) | ||||||||||||||

| Net (loss) | — | — | — | (10,409 | ) | — | (10,409 | ) | ||||||||||||||

| June 30, 2018 | 78,748 | 787 | 141,400 | 506,769 | (9,784 | ) | 639,172 | |||||||||||||||

| Repurchase of common stock | (242 | ) | (2 | ) | (14,277 | ) | — | — | (14,279 | ) | ||||||||||||

| Issuance of common stock for share-based compensation plans | 310 | 3 | (8,399 | ) | — | — | (8,396 | ) | ||||||||||||||

| Stock-based compensation | — | — | 16,408 | — | 16,408 | |||||||||||||||||

| Cash dividends declared ($0.12 per share) | — | — | — | (2,367 | ) | — | (2,367 | ) | ||||||||||||||

| Other comprehensive (loss) | — | — | — | — | (2,096 | ) | (2,096 | ) | ||||||||||||||

| Net (loss) | — | — | — | (7,587 | ) | — | (7,587 | ) | ||||||||||||||

| September 30, 2018 | 78,816 | $ | 788 | $ | 135,132 | $ | 496,815 | $ | (11,880 | ) | $ | 620,855 | ||||||||||

| See notes to unaudited condensed consolidated financial statements. | ||||||||||||||||||||||

PEGASYSTEMS INC. UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY (in thousands, except per share amounts) | ||||||||||||||||||||||

| Common Stock | Additional Paid-In Capital | Retained Earnings | Accumulated Other Comprehensive (Loss) Income | Total Stockholders’ Equity | ||||||||||||||||||

| Number of Shares | Amount | |||||||||||||||||||||

| December 31, 2018 | 78,526 | $ | 785 | $ | 123,205 | $ | 510,863 | $ | (13,322 | ) | $ | 621,531 | ||||||||||

| Repurchase of common stock | (144 | ) | (1 | ) | (7,586 | ) | — | — | (7,587 | ) | ||||||||||||

| Issuance of common stock for share-based compensation plans | 514 | 5 | (14,843 | ) | — | — | (14,838 | ) | ||||||||||||||

| Stock-based compensation | — | — | 18,406 | — | — | 18,406 | ||||||||||||||||

| Cash dividends declared ($0.12 per share) | — | — | — | (2,367 | ) | — | (2,367 | ) | ||||||||||||||

| Other comprehensive income | — | — | — | — | 2,001 | 2,001 | ||||||||||||||||

| Net (loss) | — | — | — | (28,717 | ) | — | (28,717 | ) | ||||||||||||||

| March 31, 2019 | 78,896 | 789 | 119,182 | 479,779 | (11,321 | ) | 588,429 | |||||||||||||||

| Repurchase of common stock | (88 | ) | (1 | ) | (6,301 | ) | — | — | (6,302 | ) | ||||||||||||

| Issuance of common stock for share-based compensation plans | 320 | 3 | (11,217 | ) | — | — | (11,214 | ) | ||||||||||||||

| Issuance of common stock under Employee Stock Purchase Plan | 16 | — | 1,103 | — | — | 1,103 | ||||||||||||||||

| Stock-based compensation | — | — | 20,113 | — | — | 20,113 | ||||||||||||||||

| Cash dividends declared ($0.12 per share) | — | — | — | (2,375 | ) | — | (2,375 | ) | ||||||||||||||

| Other comprehensive (loss) | — | — | — | — | (171 | ) | (171 | ) | ||||||||||||||

| Net (loss) | — | — | — | (32,296 | ) | — | (32,296 | ) | ||||||||||||||

| June 30, 2019 | 79,144 | 791 | 122,880 | 445,108 | (11,492 | ) | 557,287 | |||||||||||||||

| Repurchase of common stock | (88 | ) | (1 | ) | (6,396 | ) | — | — | (6,397 | ) | ||||||||||||

| Issuance of common stock for share-based compensation plans | 268 | 3 | (8,804 | ) | — | — | (8,801 | ) | ||||||||||||||

| Stock-based compensation | — | — | 21,879 | — | — | 21,879 | ||||||||||||||||

| Cash dividends declared ($0.12 per share) | — | — | — | (2,381 | ) | — | (2,381 | ) | ||||||||||||||

| Other comprehensive (loss) | — | — | — | — | (2,417 | ) | (2,417 | ) | ||||||||||||||

| Net (loss) | — | — | — | (30,338 | ) | — | (30,338 | ) | ||||||||||||||

| September 30, 2019 | 79,324 | $ | 793 | $ | 129,559 | $ | 412,389 | $ | (13,909 | ) | $ | 528,832 | ||||||||||

| Nine Months Ended September 30, | |||||||

| 2019 | 2018 | ||||||

| Operating activities | |||||||

| Net (loss) | $ | (91,351 | ) | $ | (5,796 | ) | |

| Adjustments to reconcile net (loss) to cash (used in) provided by operating activities | |||||||

| Stock-based compensation | 60,242 | 47,573 | |||||

| Amortization and depreciation | 50,622 | 31,742 | |||||

| Deferred income taxes | (40,531 | ) | (1,388 | ) | |||

| Foreign currency transaction loss (gain) | 3,577 | (558 | ) | ||||

| Other non-cash | (363 | ) | (1,377 | ) | |||

| Change in operating assets and liabilities, net | 4,342 | (3,108 | ) | ||||

| Cash (used in) provided by operating activities | (13,462 | ) | 67,088 | ||||

| Investing activities | |||||||

| Purchases of investments | (11,182 | ) | (68,177 | ) | |||

| Proceeds from maturities and called investments | 13,066 | 26,456 | |||||

| Sales of investments | 68,937 | — | |||||

| Payments for acquisitions, net of cash acquired | (10,934 | ) | — | ||||

| Investment in property and equipment | (6,439 | ) | (7,874 | ) | |||

| Cash provided by (used in) investing activities | 53,448 | (49,595 | ) | ||||

| Financing activities | |||||||

| Dividend payments to shareholders | (7,105 | ) | (7,067 | ) | |||

| Common stock repurchases | (54,836 | ) | (64,597 | ) | |||

| Cash (used in) financing activities | (61,941 | ) | (71,664 | ) | |||

| Effect of exchange rate changes on cash and cash equivalents | (363 | ) | (1,913 | ) | |||

| Net (decrease) in cash and cash equivalents | (22,318 | ) | (56,084 | ) | |||

| Cash and cash equivalents, beginning of period | 114,422 | 162,279 | |||||

| Cash and cash equivalents, end of period | $ | 92,104 | $ | 106,195 | |||

2018.

2019.

Stock-Based Compensation

Financial Instruments

In June 2016, the FASB issued ASUNo. 2016-13, “Financial Instruments—Instruments - Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments,” which requires measurement and recognition of expected credit losses for financial assets measured at amortized cost, including trade accounts receivable, upon initial recognition of that financial asset using a forward-looking expected loss model, rather than an incurred loss model for credit losses.model. Credit losses relating toavailable-for-sale debt securities should be recorded through an allowance for credit losses when the fair value is below the amortized cost of the asset, removing the concept of “other-than-temporary” impairments. The effective date for the Company will be January 1, 2020, with early adoption permitted. The Company is currently evaluatingdoes not expect the effectadoption of this ASUstandard will have a material effect on its consolidated financial statements and related disclosures.

Leases

In February 2016, the FASB issued ASUNo. 2016-02, “Leases (Topic 842),” which requires lessees to record most leases on their balance sheets, recognizing a lease liability for the obligation to make lease payments and aright-of-use asset for the right to use the underlying asset for the lease term. The effective date for the Company will be January 1, 2019, with early adoption permitted. The Company expects that most of its operating lease commitments will be subject to this ASU and recognized as operating lease liabilities andright-of-use assets upon adoption with no material impact to itsposition or results of operations and cash flows.

Revenue

Inoperations.

| September 30, 2019 | |||||||||||||||

| (in thousands) | Amortized Cost | Unrealized Gains | Unrealized Losses | Fair Value | |||||||||||

| Municipal bonds | $ | 10,680 | $ | 69 | $ | — | $ | 10,749 | |||||||

| Corporate bonds | 9,611 | 105 | — | 9,716 | |||||||||||

| $ | 20,291 | $ | 174 | $ | — | $ | 20,465 | ||||||||

| December 31, 2018 | |||||||||||||||

| (in thousands) | Amortized Cost | Unrealized Gains | Unrealized Losses | Fair Value | |||||||||||

| Municipal bonds | $ | 44,802 | $ | 13 | $ | (110 | ) | $ | 44,705 | ||||||

| Corporate bonds | 48,499 | 23 | (226 | ) | 48,296 | ||||||||||

| $ | 93,301 | $ | 36 | $ | (336 | ) | $ | 93,001 | |||||||

The Company has elected the full retrospective adoption model, effective January 1, 2018. The Company’s quarterly results beginning with the quarter ending March 31, 2018 and comparative prior periods will be compliant with ASC 606. The Company’s Annual Report on Form10-K for the year ended December 31, 2018 will be the Company’s first Annual Report that will be issued in compliance with ASC 606.

approximately 1.5 years.

The Company has made significant progress on quantifying the impact of its adoption and identifying necessary changes to our policies, processes, systems, and controls.

The Company expects the following impacts:

| (in thousands) | September 30, 2019 | December 31, 2018 | |||||

| Accounts receivable | $ | 123,268 | $ | 180,872 | |||

| Unbilled receivables | 172,090 | 172,656 | |||||

| Long-term unbilled receivables | 123,962 | 151,237 | |||||

| $ | 419,320 | $ | 504,765 | ||||

| (Dollars in thousands) | September 30, 2019 | ||||

| 1 year or less | $ | 172,090 | 59 | % | |

| 1-2 years | 84,045 | 28 | % | ||

| 2-5 years | 39,917 | 13 | % | ||

| $ | 296,052 | 100 | % | ||

| (in thousands) | September 30, 2019 | December 31, 2018 | |||||

Contract assets (1) | $ | 5,046 | $ | 3,711 | |||

Long-term contract assets (2) | 2,381 | 2,543 | |||||

| $ | 7,427 | $ | 6,254 | ||||

| (in thousands) | September 30, 2019 | December 31, 2018 | |||||

| Deferred revenue | $ | 159,849 | $ | 185,145 | |||

Long-term deferred revenue (1) | 4,029 | 5,344 | |||||

| $ | 163,878 | $ | 190,489 | ||||

| (in thousands) | September 30, 2019 | December 31, 2018 | |||||

Deferred contract costs (1) | $ | 67,182 | $ | 64,367 | |||

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||

| (in thousands) | 2019 | 2018 | 2019 | 2018 | |||||||||||

Amortization of deferred contract costs (1) | $ | 8,193 | $ | 4,208 | $ | 22,372 | $ | 11,806 | |||||||

PEGASYSTEMS INC.

3. MARKETABLE SECURITIES

| (in thousands) | Nine Months Ended September 30, 2019 | ||

| Balance as of January 1, | $ | 72,858 | |

Acquisition (1) | 6,179 | ||

| Currency translation adjustments | (175 | ) | |

| Balance as of September 30, | $ | 78,862 | |

| (in thousands) | Amortized Cost | Unrealized Gains | Unrealized Losses | Fair Value | ||||||||||||

September 30, 2017 | ||||||||||||||||

Municipal bonds | $ | 32,764 | $ | 12 | �� | $ | (17 | ) | $ | 32,759 | ||||||

Corporate bonds | 31,079 | 12 | (38 | ) | 31,053 | |||||||||||

|

|

|

|

|

|

|

| |||||||||

| $ | 63,843 | $ | 24 | $ | (55 | ) | $ | 63,812 | ||||||||

|

|

|

|

|

|

|

| |||||||||

December 31, 2016 | ||||||||||||||||

Municipal bonds | $ | 36,746 | $ | — | $ | (139 | ) | $ | 36,607 | |||||||

Corporate bonds | 26,610 | 1 | (51 | ) | 26,560 | |||||||||||

|

|

|

|

|

|

|

| |||||||||

| $ | 63,356 | $ | 1 | $ | (190 | ) | $ | 63,167 | ||||||||

|

|

|

|

|

|

|

| |||||||||

As

| September 30, 2019 | |||||||||||||

| (in thousands) | Useful Lives | Cost | Accumulated Amortization | Net Book Value (1) | |||||||||

| Client-related | 4-10 years | $ | 63,089 | $ | (53,960 | ) | $ | 9,129 | |||||

| Technology | 2-10 years | 64,843 | (53,252 | ) | 11,591 | ||||||||

| Other | 1 - 5 years | 5,361 | (5,361 | ) | — | ||||||||

| $ | 133,293 | $ | (112,573 | ) | $ | 20,720 | |||||||

| December 31, 2018 | |||||||||||||

| (in thousands) | Useful Lives | Cost | Accumulated Amortization | Net Book Value (1) | |||||||||

| Client-related | 4-10 years | $ | 63,115 | $ | (51,224 | ) | $ | 11,891 | |||||

| Technology | 2-10 years | 59,742 | (50,398 | ) | 9,344 | ||||||||

| Other | 1 - 5 years | 5,361 | (5,361 | ) | — | ||||||||

| $ | 128,218 | $ | (106,983 | ) | $ | 21,235 | |||||||

As of September 30, 2017, remaining maturities of marketable debt securities ranged from October 2017 to September 2020, with a weighted-average remaining maturity of approximately 14 months.

4. DERIVATIVE INSTRUMENTS

In May 2017, the Company discontinued its forward contracts program; however, it will continue to evaluate periodically its foreign exchange exposures and mayre-initiate this program if it is deemed necessary.

The Company has historically used foreign currency forward contracts (“forward contracts”) to hedge its exposure to fluctuations in foreign currency exchange rates associated with its foreign currency denominated cash, accounts receivable, and intercompany receivables and payables held primarily by the U.S. parent company and its United Kingdom (“U.K.”) subsidiary.

At December 31, 2016, the total notional value of the Company’s outstanding forward contracts was $128.4 million.

The fair value of the Company’s outstanding forward contracts was as follows:

| December 31, 2016 | ||||||||

| (in thousands) | Recorded In: | Fair Value | ||||||

Asset Derivatives | ||||||||

Foreign currency forward contracts | Other current assets | $ | 628 | |||||

Liability Derivatives | ||||||||

Foreign currency forward contracts | Accrued expenses | $ | 883 | |||||

As of September 30, 2017, the Company did not have any forward contracts outstanding.

The Company had forward contracts outstanding with total notional values as of September 30, 2016 as follows:

| (in thousands) | ||||

Euro | € | 21,810 | ||

British pound | £ | 5,919 | ||

Australian dollar | A$ | 19,515 | ||

United States dollar | $ | 59,450 | ||

intangible assets was:

| (in thousands) | Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||

| 2019 | 2018 | 2019 | 2018 | ||||||||||||

| Cost of revenue | $ | 647 | $ | 1,232 | $ | 2,854 | $ | 3,695 | |||||||

| Selling and marketing | 370 | 1,603 | 2,754 | 4,813 | |||||||||||

| $ | 1,017 | $ | 2,835 | $ | 5,608 | $ | 8,508 | ||||||||

| (in thousands) | September 30, 2019 | December 31, 2018 | |||||

| Outside professional services expenses | $ | 8,568 | $ | 10,367 | |||

| Income and other taxes | 5,418 | 10,387 | |||||

| Marketing and sales program expenses | 5,969 | 5,860 | |||||

| Dividends payable | 2,381 | 2,363 | |||||

| Employee-related expenses | 4,785 | 3,536 | |||||

| Cloud hosting expenses | 10,158 | 4,604 | |||||

| Other | 4,241 | 8,389 | |||||

| $ | 41,520 | $ | 45,506 | ||||

The income statement impact of the Company’s outstanding forward contracts and foreign currency transactions was as follows:

| Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||

| (in thousands) | 2017 | 2016 | 2017 | 2016 | ||||||||||||

Gain (loss) from the change in the fair value of forward contracts included in other income (expense), net | $ | — | $ | (1,237 | ) | $ | 286 | $ | (4,955 | ) | ||||||

Foreign currency transaction (loss) gain from the remeasurement of foreign currency assets and liabilities | (552 | ) | 1,082 | (793 | ) | 2,764 | ||||||||||

|

|

|

|

|

|

|

| |||||||||

| $ | (552 | ) | $ | (155 | ) | $ | (507 | ) | $ | (2,191 | ) | |||||

|

|

|

|

|

|

|

| |||||||||

5.

recurring basis

PEGASYSTEMS INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (continued)

2019.

| Fair Value Measurements at Reporting Date Using | Total | |||||||||||||||||||

| (in thousands) | Level 1 | Level 2 | ||||||||||||||||||

September 30, 2017 | ||||||||||||||||||||

Fair Value Assets: | ||||||||||||||||||||

Money market funds | $ | 655 | $ | — | $ | 655 | ||||||||||||||

Marketable securities: | ||||||||||||||||||||

Municipal bonds | $ | — | $ | 32,759 | 32,759 | |||||||||||||||

Corporate bonds | — | 31,053 | 31,053 | |||||||||||||||||

|

|

|

|

|

| |||||||||||||||

| $ | — | $ | 63,812 | $ | 63,812 | |||||||||||||||

December 31, 2016 | ||||||||||||||||||||

Fair Value Assets: | ||||||||||||||||||||

Money market funds | $ | 458 | $ | — | $ | 458 | ||||||||||||||

Marketable securities: | ||||||||||||||||||||

Municipal bonds | $ | — | $ | 36,607 | $ | 36,607 | ||||||||||||||

Corporate bonds | — | 26,560 | 26,560 | |||||||||||||||||

|

|

|

|

|

| |||||||||||||||

| $ | — | $ | 63,167 | $ | 63,167 | |||||||||||||||

Foreign currency forward contracts | — | 628 | 628 | |||||||||||||||||

Fair Value Liabilities: | ||||||||||||||||||||

Foreign currency forward contracts | $ | — | $ | 883 | $ | 883 | ||||||||||||||

were:

| September 30, 2019 | |||||||||||||||

| (in thousands) | Level 1 | Level 2 | Level 3 | Total | |||||||||||

| Cash equivalents | $ | 88 | $ | — | $ | — | $ | 88 | |||||||

| Marketable securities: | |||||||||||||||

| Municipal bonds | $ | — | $ | 10,749 | $ | — | $ | 10,749 | |||||||

| Corporate bonds | — | 9,716 | — | 9,716 | |||||||||||

| Total marketable securities | $ | — | $ | 20,465 | $ | — | $ | 20,465 | |||||||

Investments in privately-held companies (1) | $ | — | $ | — | $ | 4,583 | $ | 4,583 | |||||||

| December 31, 2018 | |||||||||||||||

| (in thousands) | Level 1 | Level 2 | Level 3 | Total | |||||||||||

| Cash equivalents | $ | 10,155 | $ | 10,000 | $ | — | $ | 20,155 | |||||||

| Marketable securities: | |||||||||||||||

| Municipal bonds | $ | — | $ | 44,705 | $ | — | $ | 44,705 | |||||||

| Corporate bonds | — | 48,296 | — | 48,296 | |||||||||||

| Total marketable securities | $ | — | $ | 93,001 | $ | — | $ | 93,001 | |||||||

Investments in privately-held companies (1) | $ | — | $ | — | $ | 3,390 | $ | 3,390 | |||||||

Assets Measured

Assets recorded at fair value on a nonrecurringstraight-line basis such as property and equipment and intangible assets,over the term of the lease. Variable lease costs are recognized at fair value when they are impaired. Duringin the nine months ended September 30, 2017period in which the obligation for those payments is incurred. The Company combines lease and 2016,non-lease components in the determination of lease costs for its office space leases. The lease liability includes lease payments related to options to extend or renew the lease term if the Company did not recognize any impairments of its assets recorded at fair value on a nonrecurring basis.

6. TRADE ACCOUNTS RECEIVABLE, NET OF ALLOWANCE

| (in thousands) | September 30, 2017 | December 31, 2016 | ||||||

Trade accounts receivable | $ | 164,530 | $ | 234,473 | ||||

Unbilled trade accounts receivable | 32,820 | 34,681 | ||||||

|

|

|

| |||||

Total trade accounts receivable | 197,350 | 269,154 | ||||||

Allowance for sales credit memos | (6,189 | ) | (4,126 | ) | ||||

|

|

|

| |||||

| $ | 191,161 | $ | 265,028 | |||||

|

|

|

| |||||

Unbilled trade accounts receivable primarily relate to services earned under time and materials arrangements and to license, maintenance, and cloud arrangements that have commenced or been delivered in excess of scheduled invoicing.

7. GOODWILL AND OTHER INTANGIBLE ASSETS

The changes in the carrying amount of goodwill for the nine months ended September 30, 2017 as follows:

| (in thousands) | ||||

Balance as of January 1, | $ | 73,164 | ||

Purchase price adjustments to goodwill | (354 | ) | ||

Currency translation adjustments | 131 | |||

|

| |||

Balance as of September 30, | $ | 72,941 | ||

|

| |||

is

Intangible

| (in thousands) | Three Months Ended September 30, 2019 | Nine Months Ended September 30, 2019 | |||||

| Fixed lease costs | $ | 4,763 | $ | 13,344 | |||

| Variable lease costs | 1,470 | 4,153 | |||||

| $ | 6,233 | $ | 17,497 | ||||

| (in thousands) | Range of Remaining Useful Lives | Cost | Accumulated Amortization | Net Book Value | ||||||||||||

September 30, 2017 | ||||||||||||||||

Customer related intangibles | 4-10 years | $ | 63,158 | $ | (43,205 | ) | $ | 19,953 | ||||||||

Technology | 7-10 years | 58,942 | (44,140 | ) | 14,802 | |||||||||||

Other intangibles | — | 5,361 | (5,361 | ) | — | |||||||||||

|

|

|

|

|

| |||||||||||

| $ | 127,461 | $ | (92,706 | ) | $ | 34,755 | ||||||||||

|

|

|

|

|

| |||||||||||

December 31, 2016 | ||||||||||||||||

Customer related intangibles | 4-10 years | $ | 63,091 | $ | (37,573 | ) | $ | 25,518 | ||||||||

Technology | 3-10 years | 58,942 | (40,269 | ) | 18,673 | |||||||||||

Other intangibles | — | 5,361 | (5,361 | ) | — | |||||||||||

|

|

|

|

|

| |||||||||||

| $ | 127,394 | $ | (83,203 | ) | $ | 44,191 | ||||||||||

|

|

|

|

|

| |||||||||||

Amortization expense of intangibles assets is reflected inlease liabilities

| (in thousands) | September 30, 2019 | ||

Right of use assets (1) | $ | 62,296 | |

Lease liabilities (2) | $ | 15,742 | |

| Long-term lease liabilities | $ | 56,904 | |

| September 30, 2019 | ||

| Weighted-average remaining lease term | 4.2 years | |

Weighted-average discount rate (1) | 5.8 | % |

| Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||

| (in thousands) | 2017 | 2016 | 2017 | 2016 | ||||||||||||

Cost of revenue | $ | 1,232 | $ | 1,642 | $ | 3,871 | $ | 4,626 | ||||||||

Selling and marketing | 1,873 | 1,867 | 5,608 | 5,274 | ||||||||||||

General and administrative | — | 90 | — | 268 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

| $ | 3,105 | $ | 3,599 | $ | 9,479 | $ | 10,168 | |||||||||

|

|

|

|

|

|

|

| |||||||||

Futurethe discount rate when measuring operating lease liabilities. The incremental borrowing rate represents an estimate of the interest rate the Company would incur to borrow an amount equal to the lease payments on a collateralized basis over the term of the lease.

| (in thousands) | September 30, 2019 | ||

| Remainder of 2019 | $ | 3,402 | |

| 2020 | 21,061 | ||

| 2021 | 18,800 | ||

| 2022 | 17,642 | ||

| 2023 and thereafter | 21,375 | ||

| Total lease payments | 82,280 | ||

Less: imputed interest (1) | (9,634 | ) | |

| Total short and long-term lease liabilities | $ | 72,646 | |

| (in thousands) | Operating Leases (1) | ||

| 2019 | $ | 15,993 | |

| 2020 | 14,807 | ||

| 2021 | 13,262 | ||

| 2022 | 12,279 | ||

| 2023 | 11,084 | ||

| $ | 67,425 | ||

| (in thousands) | ||||

Remainder of 2017 | $ | 2,846 | ||

2018 | 11,347 | |||

2019 | 5,555 | |||

2020 | 2,659 | |||

2021 | 2,637 | |||

2022 and thereafter | 9,711 | |||

|

| |||

| $ | 34,755 | |||

|

| |||

8. ACCRUED EXPENSES

| (in thousands) | September 30, 2017 | December 31, 2016 | ||||||

Outside professional services | $ | 13,447 | $ | 10,204 | ||||

Income and other taxes | 5,947 | 10,422 | ||||||

Marketing and sales program expenses | 4,679 | 3,707 | ||||||

Dividends payable | 2,336 | 2,298 | ||||||

Employee related expenses | 4,715 | 3,806 | ||||||

Other | 8,557 | 6,314 | ||||||

|

|

|

| |||||

| $ | 39,681 | $ | 36,751 | |||||

|

|

|

| |||||

its restructuring activities.

| (in thousands) | Nine Months Ended September 30, 2019 | |

| Cash paid for leases | 14,586 | |

| Right of use assets recognized for new leases and amendments (non-cash) | 31,126 | |

9. DEFERRED

| (in thousands) | September 30, 2017 | December 31, 2016 | ||||||

Term license | $ | 5,636 | $ | 15,843 | ||||

Perpetual license | 20,844 | 23,189 | ||||||

Maintenance | 105,588 | 112,397 | ||||||

Cloud | 18,805 | 13,604 | ||||||

Professional Services | 10,058 | 10,614 | ||||||

|

|

|

| |||||

Current deferred revenue | 160,931 | 175,647 | ||||||

Perpetual license | 4,085 | 7,909 | ||||||

Maintenance | 828 | 1,802 | ||||||

Cloud | 1,217 | 1,278 | ||||||

|

|

|

| |||||

Long-term deferred revenue | 6,130 | 10,989 | ||||||

|

|

|

| |||||

| $ | 167,061 | $ | 186,636 | |||||

|

|

|

| |||||

10.

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||||||||||

| (Dollars in thousands) | 2019 | 2018 | 2019 | 2018 | |||||||||||||||||||

| U.S. | $ | 123,447 | 57 | % | $ | 103,075 | 51 | % | $ | 347,120 | 55 | % | $ | 327,409 | 51 | % | |||||||

| Other Americas | 11,748 | 5 | % | 10,424 | 5 | % | 49,450 | 8 | % | 37,766 | 6 | % | |||||||||||

| United Kingdom (“U.K.”) | 23,034 | 11 | % | 19,277 | 9 | % | 64,269 | 10 | % | 68,450 | 11 | % | |||||||||||

| Europe (excluding U.K.), Middle East, and Africa | 34,761 | 16 | % | 42,254 | 21 | % | 102,342 | 16 | % | 101,150 | 16 | % | |||||||||||

| Asia-Pacific | 23,713 | 11 | % | 28,233 | 14 | % | 71,660 | 11 | % | 100,449 | 16 | % | |||||||||||

| $ | 216,703 | 100 | % | $ | 203,263 | 100 | % | $ | 634,841 | 100 | % | $ | 635,224 | 100 | % | ||||||||

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||

| (in thousands) | 2019 | 2018 | 2019 | 2018 | |||||||||||

| Perpetual license | $ | 9,016 | $ | 20,276 | $ | 43,286 | $ | 56,829 | |||||||

| Term license | 48,989 | 32,066 | 122,257 | 128,070 | |||||||||||

| Revenue recognized at a point in time | 58,005 | 52,342 | 165,543 | 184,899 | |||||||||||

| Maintenance | 70,371 | 66,017 | 207,406 | 196,448 | |||||||||||

| Cloud | 35,153 | 22,184 | 94,610 | 57,967 | |||||||||||

| Consulting | 53,174 | 62,720 | 167,282 | 195,910 | |||||||||||

| Revenue recognized over time | 158,698 | 150,921 | 469,298 | 450,325 | |||||||||||

| $ | 216,703 | $ | 203,263 | $ | 634,841 | $ | 635,224 | ||||||||

| (in thousands) | Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||

| 2019 | 2018 | 2019 | 2018 | ||||||||||||

| Term license | $ | 48,989 | $ | 32,066 | $ | 122,257 | $ | 128,070 | |||||||

| Cloud | 35,153 | 22,184 | 94,610 | 57,967 | |||||||||||

| Maintenance | 70,371 | 66,017 | 207,406 | 196,448 | |||||||||||

Subscription (1) | 154,513 | 120,267 | 424,273 | 382,485 | |||||||||||

| Perpetual license | 9,016 | 20,276 | 43,286 | 56,829 | |||||||||||

| Consulting | 53,174 | 62,720 | 167,282 | 195,910 | |||||||||||

| $ | 216,703 | $ | 203,263 | $ | 634,841 | $ | 635,224 | ||||||||

| September 30, 2019 | |||||||||||||||||||||||||

| (Dollars in thousands) | Perpetual license | Term license | Maintenance | Cloud | Consulting | Total | |||||||||||||||||||

| 1 year or less | $ | 7,689 | $ | 25,948 | $ | 158,220 | $ | 133,785 | $ | 13,145 | $ | 338,787 | 56 | % | |||||||||||

| 1-2 years | 853 | 3,798 | 18,590 | 105,081 | 863 | 129,185 | 21 | % | |||||||||||||||||

| 2-3 years | 1,306 | 591 | 8,323 | 72,915 | 841 | 83,976 | 14 | % | |||||||||||||||||

| Greater than 3 years | — | 85 | 4,959 | 51,591 | — | 56,635 | 9 | % | |||||||||||||||||

| $ | 9,848 | $ | 30,422 | $ | 190,092 | $ | 363,372 | $ | 14,849 | $ | 608,583 | 100 | % | ||||||||||||

| September 30, 2018 | |||||||||||||||||||||||||

| (Dollars in thousands) | Perpetual license | Term License | Maintenance | Cloud | Consulting | Total | |||||||||||||||||||

| 1 year or less | $ | 25,343 | $ | 44,283 | $ | 140,591 | $ | 88,529 | $ | 14,107 | $ | 312,853 | 60 | % | |||||||||||

| 1-2 years | 6,490 | 10,063 | 8,877 | 70,815 | 1,830 | 98,075 | 19 | % | |||||||||||||||||

| 2-3 years | 360 | 1,598 | 2,586 | 54,646 | 449 | 59,639 | 11 | % | |||||||||||||||||

| Greater than 3 years | 1,306 | 218 | 1,079 | 49,110 | 50 | 51,763 | 10 | % | |||||||||||||||||

| $ | 33,499 | $ | 56,162 | $ | 153,133 | $ | 263,100 | $ | 16,436 | $ | 522,330 | 100 | % | ||||||||||||

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||

| (in thousands) | 2019 | 2018 | 2019 | 2018 | |||||||||||

| Total revenue | $ | 216,703 | $ | 203,263 | $ | 634,841 | $ | 635,224 | |||||||

| Client A | * | 10 | % | * | * | ||||||||||

Stock-based compensation expense is reflected in the Company’s unaudited condensed consolidated statements of operations as follows:

| Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||

| (in thousands) | 2017 | 2016 | 2017 | 2016 | ||||||||||||

Cost of revenues | $ | 3,613 | $ | 3,117 | $ | 10,913 | $ | 8,711 | ||||||||

Selling and marketing | 3,976 | 3,468 | 11,482 | 9,395 | ||||||||||||

Research and development | 3,420 | 2,260 | 10,306 | 7,480 | ||||||||||||

General and administrative | 2,480 | 1,983 | 7,228 | 4,706 | ||||||||||||

Acquisition-related | — | (10 | ) | — | 342 | |||||||||||

|

|

|

|

|

|

|

| |||||||||

Total stock-based compensation before tax | $ | 13,489 | $ | 10,818 | $ | 39,929 | $ | 30,634 | ||||||||

|

|

|

|

|

|

|

| |||||||||

Income tax benefit | $ | (4,129 | ) | $ | (3,227 | ) | $ | (12,231 | ) | $ | (8,917 | ) | ||||

During the nine months ended September 30, 2017, the Company issued approximately 1,299,000 shares of common stock to its employees and 18,000 shares of common stock to itsnon-employee directors under the Company’s stock-based compensation plans.

During the nine months ended September 30, 2017, the Company granted approximately 1,052,000 restricted stock units (“RSUs”) and 1,520,000non-qualified stock options to its employees with total fair values of approximately $47.5 million and $20.6 million, respectively. This includes approximately 175,000 RSUs which were granted in connection with the election by employees to receive 50% of their 2017 target incentive compensation under the Company’s Corporate Incentive Compensation Plan in the form of RSUs instead of cash. Stock-based compensation of approximately $7.7 million associated with this RSU grant will be recognized over aone-year period beginning on the grant date.

The Company recognizes stock based compensation on the accelerated recognition method, treating each vesting tranche as if it were an individual grant.

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||

| (in thousands) | 2019 | 2018 | 2019 | 2018 | |||||||||||

| Cost of revenues | $ | 4,787 | $ | 4,319 | $ | 14,216 | $ | 12,277 | |||||||

| Selling and marketing | 8,317 | 6,198 | 24,055 | 16,895 | |||||||||||

| Research and development | 4,858 | 3,917 | 13,990 | 11,356 | |||||||||||

| General and administrative | 3,884 | 1,974 | 7,981 | 7,045 | |||||||||||

| $ | 21,846 | $ | 16,408 | $ | 60,242 | $ | 47,573 | ||||||||

| Income tax benefit | $ | (4,430 | ) | $ | (3,555 | ) | $ | (12,226 | ) | $ | (10,037 | ) | |||

11.

| Nine Months Ended September 30, 2019 | ||||||

| (in thousands) | Shares | Total Fair Value | ||||

| RSUs | 1,153 | $ | 75,510 | |||

| Non-qualified stock options | 2,165 | $ | 41,260 | |||

| Common stock | 11 | $ | 800 | |||

| Nine Months Ended September 30, | |||||||

| (Dollars in thousands) | 2019 | 2018 | |||||

| (Benefit from) income taxes | $ | (43,158 | ) | $ | (23,692 | ) | |

| Effective income tax rate | 32 | % | 80 | % | |||

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||

| (in thousands, except per share amounts) | 2019 | 2018 | 2019 | 2018 | |||||||||||

| Basic | |||||||||||||||

| Net (loss) | $ | (30,338 | ) | $ | (7,587 | ) | $ | (91,351 | ) | $ | (5,796 | ) | |||

| Weighted-average common shares outstanding | 79,200 | 78,700 | 78,928 | 78,525 | |||||||||||

| (Loss) per share, basic | $ | (0.38 | ) | $ | (0.10 | ) | $ | (1.16 | ) | $ | (0.07 | ) | |||

| Diluted | |||||||||||||||

| Net (loss) | $ | (30,338 | ) | $ | (7,587 | ) | $ | (91,351 | ) | $ | (5,796 | ) | |||

| Weighted-average effect of dilutive securities: | |||||||||||||||

| Stock options | — | — | — | — | |||||||||||

| RSUs | — | — | — | — | |||||||||||

| Effect of dilutive securities | — | — | — | — | |||||||||||

| Weighted-average common shares outstanding, assuming dilution | 79,200 | 78,700 | 78,928 | 78,525 | |||||||||||

| (Loss) per share, diluted | $ | (0.38 | ) | $ | (0.10 | ) | $ | (1.16 | ) | $ | (0.07 | ) | |||

Outstanding anti-dilutive stock options and RSUs (1) | 5,953 | 6,119 | 5,923 | 6,380 | |||||||||||

The calculation of

| Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||

| (in thousands, except per share amounts) | 2017 | 2016 | 2017 | 2016 | ||||||||||||

Basic | ||||||||||||||||

Net (loss)/income | $ | (1,812 | ) | $ | 3,301 | $ | 36,615 | $ | 18,237 | |||||||

|

|

|

|

|

|

|

| |||||||||

Weighted-average common shares outstanding | 77,691 | 76,278 | 77,258 | 76,323 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

(Loss)/earnings per share, basic | $ | (0.03 | ) | $ | 0.04 | $ | 0.47 | $ | 0.24 | |||||||

|

|

|

|

|

|

|

| |||||||||

Diluted | ||||||||||||||||

Net (loss)/income | $ | (1,812 | ) | $ | 3,301 | $ | 36,615 | $ | 18,237 | |||||||

|

|

|

|

|

|

|

| |||||||||

Weighted-average effect of dilutive securities: | ||||||||||||||||

Stock options | — | 1,933 | 3,519 | 1,851 | ||||||||||||

RSUs | — | 1,337 | 1,940 | 1,227 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

Effect of assumed exercise of stock options and RSUs | — | 3,270 | 5,459 | 3,078 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

Weighted-average common shares outstanding, assuming dilution | 77,691 | 79,548 | 82,717 | 79,401 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

(Loss)/earnings per share, diluted | $ | (0.03 | ) | $ | 0.04 | $ | 0.44 | $ | 0.23 | |||||||

|

|

|

|

|

|

|

| |||||||||

Outstanding stock options and RSUs excluded as impact would be anti-dilutive | 7,232 | 296 | 219 | 368 | ||||||||||||

In periods of loss, all equity awards are excluded, as the inclusion of any equity awards would be anti-dilutive.

12. GEOGRAPHIC INFORMATION AND MAJOR CLIENTS

Geographic Information

Operating segments are defined as components of an enterprise, about which separate financial information is available that is evaluated regularly by the chief operating decision makerCompany entered into a five-year $100 million, senior secured revolving credit agreement (the “Credit Agreement”) with PNC Bank, National Association (“CODM”PNC”) in deciding how to allocate resources and in assessing performance.

. The Company developsmay use borrowings to finance working capital needs and licenses software applications for customer engagementgeneral corporate purposes. Subject to specific circumstances, the Credit Agreement allows the Company to increase the aggregate commitment up to $200 million.

The Company’s international revenue, based upon the clients’ location, is as follows:

| Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||||||||||||||||||

| (Dollars in thousands) | 2017 | 2016 | 2017 | 2016 | ||||||||||||||||||||||||||||

U.S. | $ | 95,087 | 53 | % | $ | 111,274 | 61 | % | $ | 351,330 | 59 | % | $ | 308,049 | 56 | % | ||||||||||||||||

Other Americas | 8,722 | 5 | % | 7,952 | 4 | % | 30,243 | 5 | % | 49,494 | 9 | % | ||||||||||||||||||||

U.K. | 18,485 | 10 | % | 21,490 | 12 | % | 68,003 | 11 | % | 77,181 | 14 | % | ||||||||||||||||||||

Other EMEA(1) | 28,100 | 16 | % | 23,656 | 13 | % | 76,958 | 13 | % | 67,314 | 12 | % | ||||||||||||||||||||

Asia Pacific | 29,421 | 16 | % | 18,430 | 10 | % | 74,508 | 12 | % | 48,618 | 9 | % | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||

| $ | 179,815 | 100 | % | $ | 182,802 | 100 | % | $ | 601,042 | 100 | % | $ | 550,656 | 100 | % | |||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||

PEGASYSTEMS INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (continued)

Major Clients

Clients accounting for 10% or more of the Company’s total revenue were as follows:

| Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||

| (in thousands) | 2017 | 2016 | 2017 | 2016 | ||||||||||||

Total revenue | $ | 179,815 | $ | 182,802 | $ | 601,042 | $ | 550,656 | ||||||||

Client A | 10.6 | % | * | * | * | |||||||||||

Clients accounting for 10% or more of the Company’s total trade accounts receivable were as follows:

| (in thousands) | September 30, 2017 | December 31, 2016 | ||||||

Total trade accounts receivable | 197,350 | 269,154 | ||||||

Client A | 12.4 | % | * | |||||

any outstanding loans will be payable on such date.

Forward-Looking Statements

2018.

These statements are not guarantees of future performance and involve certain risks, uncertainties, and assumptions that are difficult to predict.

We have (“SEC”).

Business overview

otherwise.

Ourtarget clients includeare Global 3000 companiesorganizations and government agencies that seekrequire applications to manage complex enterprise systemsdifferentiate themselves in the markets they serve. Our applications achieve and customer service issues with greaterfacilitate differentiation by increasing business agility, driving growth, improving productivity, attracting and cost-effectiveness. Our strategy isretaining customers, and reducing risk. We deliver applications tailored to sell a client a series of licenses, each focused on aour clients’ specific purpose or area of operations in support of longer term enterprise-wide digital transformation initiatives.

Our license revenue is primarily derived from sales of our applications and our Pega Platform. Our cloud revenue is derived from the licensing of our hosted Pega Platform and software application environments. Our consulting services revenue is primarily related to new license implementations.

Financial and industry needs.

Management evaluates our financial performance, based a number of select financial and performance metrics. Themetrics

(Dollars in thousands, except per share amounts) | Three Months Ended September 30, | Change | Nine Months Ended September 30, | Change | |||||||||||||||||||||||

| 2019 | 2018 | 2019 | 2018 | ||||||||||||||||||||||||

| Total revenue | $ | 216,703 | $ | 203,263 | $ | 13,440 | 7 | % | $ | 634,841 | $ | 635,224 | $ | (383 | ) | — | % | ||||||||||

Subscription revenue (1) | $ | 154,513 | $ | 120,267 | $ | 34,246 | 28 | % | $ | 424,273 | $ | 382,485 | $ | 41,788 | 11 | % | |||||||||||

| Net (loss) | $ | (30,338 | ) | $ | (7,587 | ) | $ | (22,751 | ) | (300 | )% | $ | (91,351 | ) | $ | (5,796 | ) | $ | (85,555 | ) | (1,476 | )% | |||||

| (Loss) per share, diluted | $ | (0.38 | ) | $ | (0.10 | ) | $ | (0.28 | ) | (280 | )% | $ | (1.16 | ) | $ | (0.07 | ) | $ | (1.09 | ) | (1,557 | )% | |||||

Select Financial Metrics

(Dollars in thousands, except per share amounts) | Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||||||||||||||||||

| 2017 | 2016 | Change | 2017 | 2016 | Change | |||||||||||||||||||||||||||

Total revenue | $ | 179,815 | $ | 182,802 | (2,987 | ) | (2 | )% | $ | 601,042 | $ | 550,656 | $ | 50,386 | 9 | % | ||||||||||||||||

Operating margin | (8 | )% | 3 | % | 3 | % | 5 | % | ||||||||||||||||||||||||

Diluted (loss)/earnings per share | $ | (0.03 | ) | $ | 0.04 | $ | (0.07 | ) | (175 | )% | $ | 0.44 | $ | 0.23 | $ | 0.21 | 91 | % | ||||||||||||||

Cash flow provided by operating activities | 113,926 | 20,556 | 93,370 | 454 | % | |||||||||||||||||||||||||||

Select Performance Metrics

Annual Contract Value (“ACV”)

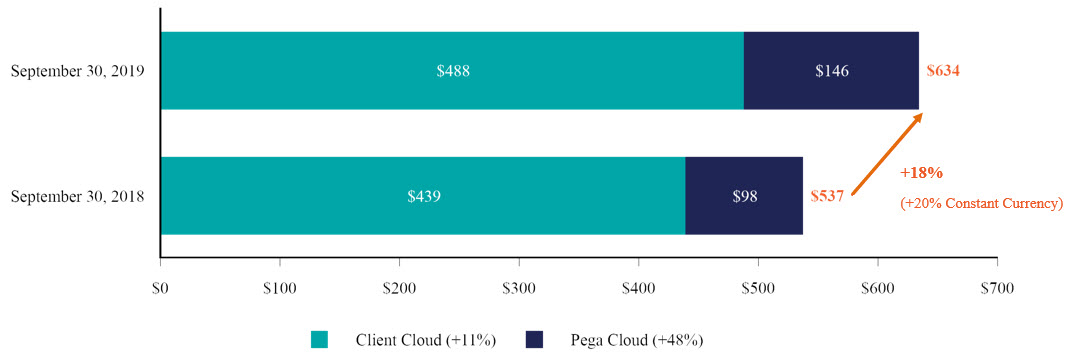

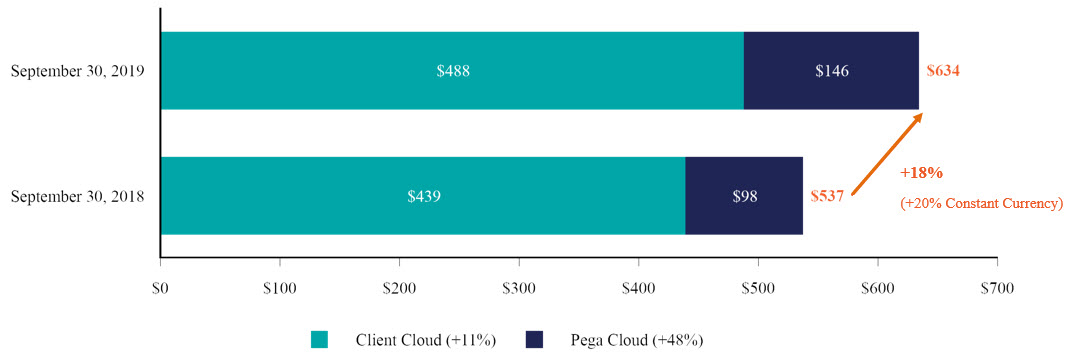

| September 30, | Change | Constant Currency Change | ||||||||||||||

| (Dollars in thousands) | 2019 | 2018 | ||||||||||||||

| Maintenance | $ | 281,484 | $ | 264,068 | $ | 17,416 | 7 | % | 9 | % | ||||||

| Term | 207,317 | 174,320 | $ | 32,997 | 19 | % | 20 | % | ||||||||

| Client Cloud | 488,801 | 438,388 | $ | 50,413 | 11 | % | 13 | % | ||||||||

| Pega Cloud | 145,549 | 98,373 | 47,176 | 48 | % | 51 | % | |||||||||

| Total ACV | $ | 634,350 | $ | 536,761 | $ | 97,589 | 18 | % | 20 | % | ||||||

| • | Client Cloud: the sum of (1) the annual value of each term license contract in effect on such date, which is equal to its total license value divided by the total number of years and (2) maintenance revenue reported for the quarter ended on such date, multiplied by four. We do not provide hosting services for Client Cloud arrangements. |

| • | Pega Cloud: the sum of the annual value of each cloud contract in effect on such date, which is equal to its total value divided by the total number of years. |

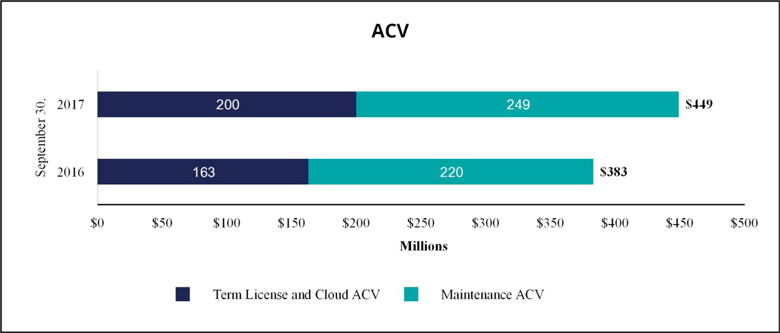

| September 30, | ||||||||||||||||

| (in thousands) | 2017 | 2016 | Change | |||||||||||||

Term License and Cloud ACV | $ | 200,180 | $ | 163,408 | $ | 36,772 | 23 | % | ||||||||

Maintenance ACV | 248,816 | 220,152 | $ | 28,664 | 13 | % | ||||||||||

|

|

|

| |||||||||||||

Term License, Cloud and Maintenance ACV | $ | 448,996 | $ | 383,560 | $ | 65,436 | 17 | % | ||||||||

|

|

|

| |||||||||||||

Recurring Revenue

A measure of the predictability and repeatabilityunderstanding of our revenue.

| Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||||||||||||||||||

| (Dollars in thousands) | 2017 | 2016 | Change | 2017 | 2016 | Change | ||||||||||||||||||||||||||

Recurring revenue | ||||||||||||||||||||||||||||||||

Term license | $ | 21,678 | $ | 28,919 | $ | (7,241 | ) | (25 | )% | $ | 106,170 | $ | 102,115 | $ | 4,055 | 4 | % | |||||||||||||||

Maintenance | 62,204 | 55,038 | $ | 7,166 | 13 | % | 180,759 | 163,174 | $ | 17,585 | 11 | % | ||||||||||||||||||||

Cloud | 13,354 | 10,873 | $ | 2,481 | 23 | % | 36,914 | 30,640 | $ | 6,274 | 20 | % | ||||||||||||||||||||

|

|

|

|

|

|

|

| |||||||||||||||||||||||||

Total recurring revenue | $ | 97,236 | $ | 94,830 | $ | 2,406 | 3 | % | $ | 323,843 | $ | 295,929 | $ | 27,914 | 9 | % | ||||||||||||||||

|

|

|

|

|

|

|

| |||||||||||||||||||||||||

Recurring revenue as a percent of total revenue | 54 | % | 52 | % | 54 | % | 54 | % | ||||||||||||||||||||||||

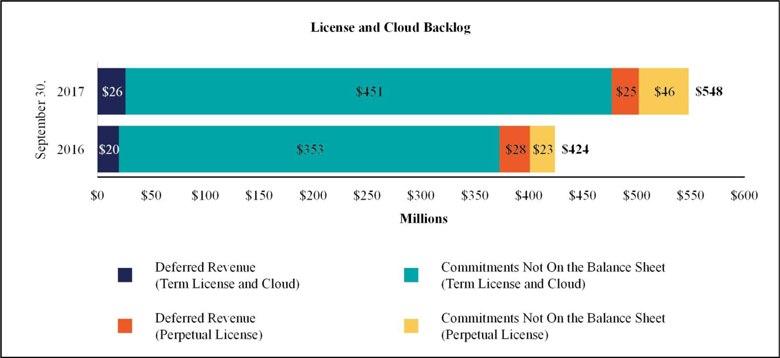

Licenseresults and Cloud Backlog

A measure of the continued growthevaluation of our business as a result ofperformance in comparison to prior periods.

License and Cloud Backlog is the sum of the following two components:

| September 30, 2019 | |||||||||||||||||||||||||

| (Dollars in thousands) | Perpetual license | Term license | Maintenance | Cloud | Consulting | Total | |||||||||||||||||||

| 1 year or less | $ | 7,689 | $ | 25,948 | $ | 158,220 | $ | 133,785 | $ | 13,145 | $ | 338,787 | 56 | % | |||||||||||

| 1-2 years | 853 | 3,798 | 18,590 | 105,081 | 863 | 129,185 | 21 | % | |||||||||||||||||

| 2-3 years | 1,306 | 591 | 8,323 | 72,915 | 841 | 83,976 | 14 | % | |||||||||||||||||

| Greater than 3 years | — | 85 | 4,959 | 51,591 | — | 56,635 | 9 | % | |||||||||||||||||

| $ | 9,848 | $ | 30,422 | $ | 190,092 | $ | 363,372 | $ | 14,849 | $ | 608,583 | 100 | % | ||||||||||||

| Change in RPO Since September 30, 2018 | |||||||||||||||||||||||||

| $ | (23,651 | ) | $ | (25,740 | ) | $ | 36,959 | $ | 100,272 | $ | (1,587 | ) | $ | 86,253 | |||||||||||

| (71 | )% | (46 | )% | 24 | % | 38 | % | (10 | )% | 17 | % | ||||||||||||||

| September 30, 2018 | |||||||||||||||||||||||||

| (Dollars in thousands) | Perpetual license | Term license | Maintenance | Cloud | Consulting | Total | |||||||||||||||||||

| 1 year or less | $ | 25,343 | $ | 44,283 | $ | 140,591 | $ | 88,529 | $ | 14,107 | $ | 312,853 | 60 | % | |||||||||||

| 1-2 years | 6,490 | 10,063 | 8,877 | 70,815 | 1,830 | 98,075 | 19 | % | |||||||||||||||||

| 2-3 years | 360 | 1,598 | 2,586 | 54,646 | 449 | 59,639 | 11 | % | |||||||||||||||||

| Greater than 3 years | 1,306 | 218 | 1,079 | 49,110 | 50 | 51,763 | 10 | % | |||||||||||||||||

| $ | 33,499 | $ | 56,162 | $ | 153,133 | $ | 263,100 | $ | 16,436 | $ | 522,330 | 100 | % | ||||||||||||

License and cloud backlog may vary in any given period depending on the amount and timing of when the arrangements are executed, as well as the mix between perpetual, term, and cloud license arrangements, which may depend on our clients’ deployment preferences. A change in the mix may cause our revenues to vary materially from period to period. A higher proportion of term and cloud license arrangements executed will generally result in revenue being recognized over longer periods.

| September 30, | Change | |||||||||||||||||||

| (Dollars in thousands) | 2017 | 2016 | ||||||||||||||||||

Deferred license and cloud revenue on the balance sheet | ||||||||||||||||||||

Term license and cloud | $ | 25,658 | 51 | % | $ | 19,627 | 42 | % | 31 | % | ||||||||||

Perpetual license | 24,929 | 49 | % | 27,653 | 58 | % | (10 | )% | ||||||||||||

|

|

|

| |||||||||||||||||

Total deferred license and cloud revenue | 50,587 | 100 | % | 47,280 | 100 | % | 7 | % | ||||||||||||

|

|

|

| |||||||||||||||||

License and cloud contractual commitments not on the balance sheet | ||||||||||||||||||||

Term license and cloud | 450,535 | 91 | % | 352,804 | 94 | % | 28 | % | ||||||||||||

Perpetual license | 46,459 | 9 | % | 23,483 | 6 | % | 98 | % | ||||||||||||

|

|

|

| |||||||||||||||||

Total license and cloud commitments | 496,994 | 100 | % | 376,287 | 100 | % | 32 | % | ||||||||||||

|

|

|

| |||||||||||||||||

Total license (term and perpetual) and cloud backlog | $ | 547,581 | $ | 423,567 | 29 | % | ||||||||||||||

|

|

|

| |||||||||||||||||

Total term license and cloud backlog | 476,193 | 87 | % | 372,431 | 88 | % | 28 | % | ||||||||||||

|

|

|

| |||||||||||||||||

Critical accounting policies

There have been no changes in our critical accounting policies as disclosed in our Annual Report on Form10-K for the year ended December 31, 2016.

2018:

| Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||||||||||||||||||

| (Dollars in thousands) | 2017 | 2016 | Change | 2017 | 2016 | Change | ||||||||||||||||||||||||||

Total revenue | $ | 179,815 | $ | 182,802 | $ | (2,987 | ) | (2 | )% | $ | 601,042 | $ | 550,656 | $ | 50,386 | 9 | % | |||||||||||||||

Gross profit | $ | 110,084 | $ | 122,365 | $ | (12,281 | ) | (10 | )% | $ | 395,346 | $ | 373,609 | $ | 21,737 | 6 | % | |||||||||||||||

Total operating expenses | $ | 124,373 | $ | 116,867 | $ | 7,506 | 6 | % | $ | 376,647 | $ | 347,626 | $ | 29,021 | 8 | % | ||||||||||||||||

(Loss)/income from operations | $ | (14,289 | ) | $ | 5,498 | $ | (19,787 | ) | (360 | )% | $ | 18,699 | $ | 25,983 | $ | (7,284 | ) | (28 | )% | |||||||||||||

Operating margin | (8 | )% | 3 | % | 3 | % | 5 | % | ||||||||||||||||||||||||

(Loss)/income before (benefit)/provision for income taxes | $ | (14,697 | ) | $ | 5,515 | $ | (20,212 | ) | (366 | )% | $ | 18,663 | $ | 24,506 | $ | (5,843 | ) | (24 | )% | |||||||||||||

Operations”; and

Software

| (Dollars in thousands) | Three Months Ended September 30, | Change | Nine Months Ended September 30, | Change | |||||||||||||||||||||||||||||||

| 2019 | 2018 | 2019 | 2018 | ||||||||||||||||||||||||||||||||

| Cloud | $ | 35,153 | 16 | % | $ | 22,184 | 11 | % | $ | 12,969 | 58 | % | $ | 94,610 | 15 | % | $ | 57,967 | 9 | % | $ | 36,643 | 63 | % | |||||||||||

| Term license | 48,989 | 23 | % | 32,066 | 16 | % | 16,923 | 53 | % | 122,257 | 19 | % | 128,070 | 20 | % | (5,813 | ) | (5 | )% | ||||||||||||||||

| Maintenance | 70,371 | 32 | % | 66,017 | 32 | % | 4,354 | 7 | % | 207,406 | 33 | % | 196,448 | 31 | % | 10,958 | 6 | % | |||||||||||||||||

Subscription (1) | 154,513 | 71 | % | 120,267 | 59 | % | 34,246 | 28 | % | 424,273 | 67 | % | 382,485 | 60 | % | 41,788 | 11 | % | |||||||||||||||||

| Perpetual license | 9,016 | 4 | % | 20,276 | 10 | % | (11,260 | ) | (56 | )% | 43,286 | 7 | % | 56,829 | 9 | % | (13,543 | ) | (24 | )% | |||||||||||||||

| Consulting | 53,174 | 25 | % | 62,720 | 31 | % | (9,546 | ) | (15 | )% | 167,282 | 26 | % | 195,910 | 31 | % | (28,628 | ) | (15 | )% | |||||||||||||||

| $ | 216,703 | 100 | % | $ | 203,263 | 100 | % | $ | 13,440 | 7 | % | $ | 634,841 | 100 | % | $ | 635,224 | 100 | % | $ | (383 | ) | — | % | |||||||||||

| (Dollars in thousands) | Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||||||||||||||||||||||||||||||||||

| 2017 | 2016 | Change | 2017 | 2016 | Change | |||||||||||||||||||||||||||||||||||||||||||

Perpetual license | $ | 20,115 | 48 | % | $ | 39,914 | 58 | % | $ | (19,799 | ) | (50 | )% | $ | 89,050 | 46 | % | $ | 105,734 | 51 | % | ($ | 16,684 | ) | (16 | )% | ||||||||||||||||||||||

Term license | 21,678 | 52 | % | 28,919 | 42 | % | (7,241 | ) | (25 | )% | 106,170 | 54 | % | 102,115 | 49 | % | 4,055 | 4 | % | |||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||||||||||

Total license revenue | $ | 41,793 | 100 | % | $ | 68,833 | 100 | % | $ | (27,040 | ) | (39 | )% | $ | 195,220 | 100 | % | $ | 207,849 | 100 | % | ($ | 12,629 | ) | (6 | )% | ||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||||||||||

The is derived from sales of our applications and Pega Platform. Our cloud revenue is derived from our hosted Pega Platform and software applications.

The decrease in perpetual licensecloud revenue in the three months ended September 30, 2017 was primarily due to a decrease in the average value of perpetual arrangements executed and a lower percentage of perpetual arrangements executed and recognized in revenue in the current period. The decrease in perpetual license revenue in the nine months ended September 30, 2017 was primarily due2019 reflect the shift in client preferences to a lower percentagecloud arrangements from other types of perpetual arrangements executed and recognized in revenue.

arrangements. The decreaseincrease in term license revenue in the three months ended September 30, 20172019 was primarily due to arevenue recognized from several large, multi-year term license renewal for which the second year of the term was recognized as revenuecontracts in the three months ended September 30, 2016. If the second year of this term license arrangement was not paid in advance in the three months ended September 30, 2016, term license revenue would have decreased 2%.2019. The increasedecrease in term license revenue in the nine months ended September 30, 20172019 was primarily dueattributable to broad based growth amongst new and existing customers offset by a largerevenue recognized from term license arrangementcontracts in the nine months ended September 30, 2019 with multi-year committed maintenance periods, which was prepaid and recognizedresulted in a greater portion of the contract value being allocated to maintenance. The increases in maintenance revenue in the three and nine months ended March 31, 2016. If this term license arrangement was not prepaid and recognized in revenue in the three months ended March 31, 2016 term license revenue would have increased 26%.

The aggregate value of future revenue expected to be recognized during the remainder of the year under existing noncancellable perpetual arrangements not reflected in deferred revenue was $13.3 million as of September 30, 2017 compared to $3.9 million as of September 30, 2016.

The aggregate value of future revenue expected to be recognized during the remainder of the year under existing noncancellable term and cloud arrangements not reflected in deferred revenue was $37.7 million as of September 30, 2017 compared to $26.7 million as of September 30, 2016. For additional information see “Future Cash Receipts from Committed License and Cloud Arrangements” which can be found in “Liquidity and Capital Resources.”

Maintenance revenue

| Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||||||||||||||||||

| (Dollars in thousands) | 2017 | 2016 | Change | 2017 | 2016 | Change | ||||||||||||||||||||||||||

Maintenance | $ | 62,204 | $ | 55,038 | $ | 7,166 | 13 | % | $ | 180,759 | $ | 163,174 | $ | 17,585 | 11 | % | ||||||||||||||||

The increases2019 were primarily due to the continued growth in the aggregate value of the installed base of our software and strong renewal rates significantly in excess of 90%.

Services

| Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||||||||||||||||||||||||||||||||||

| (Dollars in thousands) | 2017 | 2016 | Change | 2017 | 2016 | Change | ||||||||||||||||||||||||||||||||||||||||||

Consulting services | $ | 61,535 | 81 | % | $ | 46,829 | 80 | % | $ | 14,706 | 31 | % | $ | 183,447 | 82 | % | $ | 144,263 | 80 | % | $ | 39,184 | 27 | % | ||||||||||||||||||||||||

Cloud | 13,354 | 18 | % | 10,873 | 18 | % | 2,481 | 23 | % | 36,914 | 16 | % | 30,640 | 17 | % | 6,274 | 20 | % | ||||||||||||||||||||||||||||||

Training | 929 | 1 | % | 1,229 | 2 | % | (300 | ) | (24 | )% | 4,702 | 2 | % | 4,730 | 3 | % | (28 | ) | (1 | )% | ||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||||||||||

Total services | $ | 75,818 | 100 | % | $ | 58,931 | 100 | % | $ | 16,887 | 29 | % | $ | 225,063 | 100 | % | $ | 179,633 | 100 | % | $ | 45,430 | 25 | % | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||||||||||

Consulting services revenue is primarily generated from new in the three and nine months ended September 30, 2019 reflects the shift in client preferences in favor of our cloud offerings instead of our perpetual license implementations. arrangements.

The increasesdecreases in consulting services revenue were primarily due to higher billable hours duringin the three and nine months ended September 30, 2017 driven by a large project which began in the second half of 2016.

Cloud revenue represents revenue from our Pega Cloud offerings. The increases in cloud revenue2019 were primarily due to continueddecreases in billable hours.

| Three Months Ended September 30, | Change | Nine Months Ended September 30, | Change | ||||||||||||||||||||||||||||||||

| (Dollars in thousands) | 2019 | 2018 | 2019 | 2018 | |||||||||||||||||||||||||||||||

| Software license | $ | 57,329 | 99 | % | $ | 51,087 | 98 | % | $ | 6,242 | 12 | % | $ | 162,561 | 98 | % | $ | 181,127 | 98 | % | $ | (18,566 | ) | (10 | )% | ||||||||||

| Maintenance | 63,683 | 90 | % | 59,938 | 91 | % | 3,745 | 6 | % | 188,091 | 91 | % | 178,413 | 91 | % | 9,678 | 5 | % | |||||||||||||||||

| Cloud | 17,329 | 49 | % | 12,569 | 57 | % | 4,760 | 38 | % | 46,841 | 50 | % | 31,853 | 55 | % | 14,988 | 47 | % | |||||||||||||||||

| Consulting | (2,536 | ) | (5 | )% | 5,246 | 8 | % | (7,782 | ) | * | 4,933 | 3 | % | 19,977 | 10 | % | (15,044 | ) | (75 | )% | |||||||||||||||

| $ | 135,805 | 63 | % | $ | 128,840 | 63 | % | $ | 6,965 | 5 | % | $ | 402,426 | 63 | % | $ | 411,370 | 65 | % | $ | (8,944 | ) | (2 | )% | |||||||||||

Gross profit

| Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||||||||||||||||||

| (Dollars in thousands) | 2017 | 2016 | Change | 2017 | 2016 | Change | ||||||||||||||||||||||||||

Software license | $ | 40,517 | $ | 67,520 | $ | (27,003 | ) | (40 | )% | $ | 191,394 | $ | 204,203 | $ | (12,809 | ) | (6 | )% | ||||||||||||||

Maintenance | 55,488 | 48,379 | 7,109 | 15 | % | 159,814 | 144,285 | 15,529 | 11 | % | ||||||||||||||||||||||

Services | 14,079 | 6,466 | 7,613 | 118 | % | 44,138 | 25,121 | 19,017 | 76 | % | ||||||||||||||||||||||

|

|

|

|

|

|

|

| |||||||||||||||||||||||||

Total gross profit | $ | 110,084 | $ | 122,365 | $ | (12,281 | ) | (10 | )% | $ | 395,346 | $ | 373,609 | $ | 21,737 | 6 | % | |||||||||||||||

Software license gross profit % | 97 | % | 98 | % | 98 | % | 98 | % | ||||||||||||||||||||||||

Maintenance gross profit % | 89 | % | 88 | % | 88 | % | 88 | % | ||||||||||||||||||||||||

Services gross profit % | 19 | % | 11 | % | 20 | % | 14 | % | ||||||||||||||||||||||||

|

|

|

|

|

|

|

| |||||||||||||||||||||||||

Total gross profit % | 61 | % | 67 | % | 66 | % | 68 | % | ||||||||||||||||||||||||

business continues to grow and scale. Revenue from cloud arrangements is generally recognized over the service period, while revenue from term and perpetual license arrangements is generally recognized upfront when the license rights become effective.

term revenue recognized from several large, multi-year term license contracts in the three months ended September 30, 2019. It was also due to an increase in cloud revenue reflecting the shift in client preferences to cloud arrangements from other types of arrangements, an increase in maintenance revenue due to the continued growth in the aggregate value of the installed base of our software and strong renewal rates in excess of 90%.

gross profit percent in the nine months ended September 30, 2019 was driven by the shift in client preferences in favor of cloud arrangements, which are lower margin than our term and perpetual license revenue streams and decreases in cloud and consulting gross profit percent.

leveraging our partner network.

| Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||||||||||||||||||

| (Dollars in thousands) | 2017 | 2016 | Change | 2017 | 2016 | Change | ||||||||||||||||||||||||||

Selling and marketing | $ | 70,209 | $ | 67,032 | $ | 3,177 | 5 | % | $ | 217,384 | $ | 202,126 | $ | 15,258 | 8 | % | ||||||||||||||||

As a percent of total revenue | 39 | % | 37 | % | 36 | % | 37 | % | ||||||||||||||||||||||||

Selling and marketing headcount, end of period | 934 | 875 | 59 | 7 | % | |||||||||||||||||||||||||||

Selling and marketing expenses include

| Three Months Ended September 30, | Change | Nine Months Ended September 30, | Change | ||||||||||||||||||||||||