Hedging

The Fund may enter into currency hedging contracts, interest rate hedging agreements such as futures, options, swaps and forward contracts, and credit hedging contracts, such as credit default swaps. However, no assurance can be given that such hedging transactions will be entered into or, if they are, that they will be effective. For the three months ended March 31, 2023 and March 31, 2022, the Fund did not enter into any hedging contracts.

Financial Condition, Liquidity and Capital Resources

We expectAs of March 31, 2023, and December 31, 2022, the Fund had $65,352,472 and $48,785,985 in cash and cash equivalents, respectively. The Fund expects to generate cash primarily from (i) the net proceeds of the Private Offering, (ii) cash flows from ourthe Fund’s operations, (iii) any financing arrangements wenow existing or that the Fund may enter into in the future and (iv) any future offerings of ourthe Fund’s equity or debt securities. WeThe Fund may fund a portion of ourits investments through borrowings from banks, or other large global institutions such as insurance companies, and issuances of senior securities.

OurThe Fund’s primary use of funds from a credit facility will be investments in portfolio companies, cash distributions to holders of ourits common stock and the payment of operating expenses.

In the future, wethe Fund may also securitize or finance a portion of ourits investments with a special purpose vehicle. If we undertakethe Fund undertakes a securitization transaction, wethe Fund will consolidate ourits allocable portion of the debt of any securitization subsidiary on ourits financial statements, and include such debt in ourthe Fund’s calculation of the asset coverage test, if and to the extent required pursuant to the guidance of the staff of the SEC.

Cash and cash equivalents as of September 30, 2017,March 31, 2023, taken together with ourthe Fund’s uncalled Capital Commitments of $70,928,060,$99,216,798 and $22,000,000 undrawn amount on the 2021 HSBC Credit Facility and $8,000,000 undrawn amount on the Synovus Credit Facility, is expected to be sufficient for ourthe Fund’s investing activities and to conduct ourthe Fund’s operations for at least the next twelve months.

As of March 31, 2023, the Fund has unfunded commitments to fund future investments in the near term. Asamount of September 30, 2017, we had $25,000$171,537,939, and contractual obligations in cashthe form of Revolving Credit Facilities of $520,000,000 and cash equivalents. During the nine months ended September 30, 2017, we used no cash for operating activities, as theNotes of $245,254,335.

Equity Activity

The Fund had not yet begun investment activities.

Equity Activity

In connection with our formation, we havehas the authority to issue 200,000,000 sharesShares.

The Fund has entered into Subscription Agreements with investors providing for the private placement of common stock at a $0.01 per share par value.

On June 27, 2016, we issued 100 sharesShares. Under the terms of our common stockthe Subscription Agreements, investors are required to fund drawdowns to purchase Shares up to the Adviser, foramount of their respective Capital Commitments on an aggregate purchase priceas-needed basis upon the issuance of $1,000. On May 26, 2017, we issued 2,400 sharesa capital draw down notice. As of our common stockMarch 31, 2023, the Fund received Capital Commitments of $594,505,663. Inception to March 31, 2023, the Fund received Capital Contributions to the Adviser,Fund of $495,288,865. Proceeds from the issuances of Shares in respect of drawdown notices described below were used for an aggregate purchase price of $24,000. We have not had anyinvesting activities and for other equity transactions as of September 30, 2017 and December 31, 2016.general corporate purposes.

Contractual Obligations

As of September 30, 2017 and December 31, 2016, we have not commenced operations.

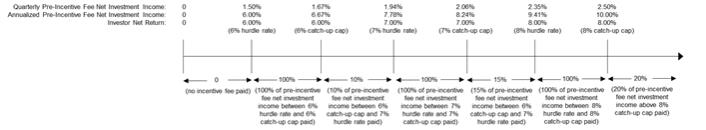

We have entered into the Advisory AgreementConsistent with the AdviserFund’s offering documents, beginning with the quarter ending March 31, 2021, the Fund was required to begin conducting quarterly General Tenders. Pursuant to the General Tender Program, at the Board’s discretion and in accordance with the requirements of Rule 13e-4 under the Exchange Act and the 1940 Act. UnderAct, each stockholder is given the Advisory Agreement,opportunity to tender Shares at a specific Purchase Price based on the AdviserFund’s net asset value as of the last date of the quarter in which the General Tender is responsible for sourcing, reviewing and structuring investment opportunities for us, underwriting and conducting diligence on our investments and monitoring our investment portfolio on an ongoing basis. For these services, we will pay (i) a base management fee equalconducted. The Fund intends to conduct each General Tender to repurchase up to a certain percentage of the weighted average

outstanding assets of the number of Shares outstanding during the three-month period prior to the quarter in which the General Tender is conducted, as determined by the Board. The General Tender Program includes numerous restrictions that limit stockholders’ ability to sell their Shares.

On February 24, 2023, the Fund (which equalscommenced the gross value of equity and debt instruments, including investments made utilizing leverage), excluding cash and cash equivalents, during such fiscal quarter and (ii) an incentive fee based on our performance.Q1 2023 Tender Offer for up to 1,215,453.85 Shares. The cost of bothPurchase Price for the base management feeQ1 2023 Tender Offer was $9.30 per Share and the incentive fee will ultimately be borne by our stockholders. We have entered intoQ1 2023 Tender Offer expired on March 31, 2023.

On February 25, 2022, the Administration Agreement withFund commenced the AdministratorQ1 2022 Tender Offer for up to 795,164.70 Shares. The Purchase Price for the Q1 2022 Tender Offer was $9.70 per Share and the Q1 2022 Tender Offer expired on March 31, 2022.

Stockholders who tendered Shares in the Q1 2023 Tender Offer and Q1 2022 Tender Offer received a separate expense reimbursement agreement withnon-interest bearing, non-transferable promissory note entitling such stockholders to an amount in cash equal to the Adviser (the “Expense Reimbursement Agreement”) under which any allocable portionnumber of the cost of our Chief Compliance Officer and Chief Financial Officer and their respective staffs will be reimbursedShares accepted for purchase multiplied by the Fund. Under the Administration Agreement, the Administrator will be responsible for providing us with clerical, bookkeeping, recordkeeping and other administrative services. We will reimburse the Adviser an amount equal to our allocable portion (subject to the review of our Board) of its overhead resulting from its obligations under the Expense Reimbursement Agreement, including the allocable portion of the cost of our Chief Compliance Officer and Chief Financial Officer and their respective staffs. Stockholder approvalapplicable Purchase Price.

65