UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM10-Q

| ☒ | Quarterly Report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the quarterly period ended March 31,June 30, 2018

OR

| ☐ | Transition Report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

Commission File Number:1-11859

PEGASYSTEMS INC.

(Exact name of Registrant as specified in its charter)

| Massachusetts | 04-2787865 | |

| (State or other jurisdiction of incorporation or organization) | (IRS Employer Identification No.) | |

| One Rogers Street, Cambridge, MA | 02142-1209 | |

| (Address of principal executive offices) | (Zip Code) | |

(617)374-9600

(Registrant’s telephone number, including area code)

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the Registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of RegulationS-T during the preceding 12 months (or for such shorter period that the Registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, anon-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” inRule 12b-2 of the Exchange Act.

| Large accelerated filer ☒ | Accelerated filer ☐ | Non-accelerated filer ☐ (Do not check if smaller reporting company) | Smaller reporting company ☐ | Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the Registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the Registrant is a shell company (as defined inRule 12b-2 of the Exchange Act). Yes ☐ No ☒

There were 78,575,80378,645,411 shares of the Registrant’s common stock, $0.01 par value per share, outstanding on MayAugust 1, 2018.

PEGASYSTEMS INC.

QUARTERLY REPORT ON FORM10-Q

PART I - FINANCIAL INFORMATION

| ITEM 1. | UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS |

PEGASYSTEMS INC.

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS (1)

(in thousands)

| March 31, 2018 | December 31, 2017 | |||||||||||||||

| As Adjusted(1) | June 30, 2018 | December 31, 2017 | |||||||||||||

Assets | ||||||||||||||||

Current assets: | ||||||||||||||||

Cash and cash equivalents | $ | 165,790 | $ | 162,279 | $ | 144,291 | $ | 162,279 | ||||||||

Marketable securities | 89,047 | 61,469 | 99,292 | 61,469 | ||||||||||||

|

|

|

| |||||||||||||

Total cash, cash equivalents, and marketable securities | 254,837 | 223,748 | 243,583 | 223,748 | ||||||||||||

Accounts receivable | 164,981 | 222,735 | 141,384 | 222,735 | ||||||||||||

Unbilled receivables | 153,657 | 158,898 | 151,354 | 158,898 | ||||||||||||

Other current assets | 50,692 | 41,135 | 63,864 | 41,135 | ||||||||||||

|

|

|

| |||||||||||||

Total current assets | 624,167 | 646,516 | 600,185 | 646,516 | ||||||||||||

Long-term unbilled receivables | 180,077 | 160,708 | 169,330 | 160,708 | ||||||||||||

Goodwill | 73,017 | 72,952 | 72,911 | 72,952 | ||||||||||||

Other long-term assets | 128,694 | 131,391 | 130,614 | 131,391 | ||||||||||||

|

|

|

| |||||||||||||

Total assets | $ | 1,005,955 | $ | 1,011,567 | $ | 973,040 | $ | 1,011,567 | ||||||||

|

|

|

| |||||||||||||

Liabilities and stockholders’ equity | ||||||||||||||||

Current liabilities: | ||||||||||||||||

Accounts payable | $ | 12,175 | $ | 17,370 | $ | 14,411 | $ | 17,370 | ||||||||

Accrued expenses | 48,278 | 45,508 | 44,882 | 45,508 | ||||||||||||

Accrued compensation and related expenses | 44,093 | 66,040 | 48,691 | 66,040 | ||||||||||||

Deferred revenue | 175,586 | 166,297 | 163,525 | 166,297 | ||||||||||||

|

|

|

| |||||||||||||

Total current liabilities | 280,132 | 295,215 | 271,509 | 295,215 | ||||||||||||

Deferred income tax liabilities | 39,932 | 38,463 | 38,208 | 38,463 | ||||||||||||

Other long-term liabilities | 23,768 | 23,652 | 24,151 | 23,652 | ||||||||||||

|

|

|

| |||||||||||||

Total liabilities | 343,832 | 357,330 | 333,868 | 357,330 | ||||||||||||

Stockholders’ equity: | ||||||||||||||||

Preferred stock, 1,000 shares authorized; no shares issued and outstanding | — | — | — | — | ||||||||||||

Common stock, 200,000 shares authorized; 78,546 shares and 78,081 issued and outstanding at March 31, 2018 and December 31, 2017, respectively | 785 | 781 | ||||||||||||||

Common stock, 200,000 shares authorized; 78,748 and 78,081 shares issued and outstanding at June 30, 2018 and December 31, 2017, respectively | 787 | 781 | ||||||||||||||

Additionalpaid-in capital | 145,962 | 152,097 | 141,400 | 152,097 | ||||||||||||

Retained earnings | 517,893 | 508,051 | 506,769 | 508,051 | ||||||||||||

Accumulated other comprehensive loss | (2,517) | (6,692) | (9,784) | (6,692) | ||||||||||||

|

|

|

| |||||||||||||

Total stockholders’ equity | 662,123 | 654,237 | 639,172 | 654,237 | ||||||||||||

|

|

|

| |||||||||||||

Total liabilities and stockholders’ equity | $ | 1,005,955 | $ | 1,011,567 | $ | 973,040 | $ | 1,011,567 | ||||||||

|

|

|

| |||||||||||||

| (1) | On January 1, 2018 the Company adopted the |

See notes to unaudited condensed consolidated financial statements.

PEGASYSTEMS INC.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (1)

(in thousands, except per share amounts)

| Three Months Ended March 31, | ||||||||||||||||||||||||

| 2018 | 2017 | Three Months Ended June 30, | Six Months Ended June 30, | |||||||||||||||||||||

| As Adjusted(1) | 2018 | 2017 | 2018 | 2017 | |||||||||||||||||||

Revenue | ||||||||||||||||||||||||

Software license | $ | 87,773 | $ | 127,008 | $ | 44,784 | $ | 51,150 | $ | 132,557 | $ | 178,158 | ||||||||||||

Maintenance | 64,525 | 58,713 | 65,906 | 59,424 | 130,431 | 118,137 | ||||||||||||||||||

Services | 82,884 | 70,588 | 86,089 | 76,022 | 168,973 | 146,610 | ||||||||||||||||||

|

|

|

|

|

| |||||||||||||||||||

Total revenue | 235,182 | 256,309 | 196,779 | 186,596 | 431,961 | 442,905 | ||||||||||||||||||

|

|

|

|

|

| |||||||||||||||||||

Cost of revenue | ||||||||||||||||||||||||

Software license | 1,255 | 1,300 | 1,262 | 1,250 | 2,517 | 2,550 | ||||||||||||||||||

Maintenance | 6,082 | 7,218 | 5,874 | 7,011 | 11,956 | 14,229 | ||||||||||||||||||

Services | 68,277 | 59,572 | 66,681 | 59,614 | 134,958 | 119,186 | ||||||||||||||||||

|

|

|

|

|

| |||||||||||||||||||

Total cost of revenue | 75,614 | 68,090 | 73,817 | 67,875 | 149,431 | 135,965 | ||||||||||||||||||

|

|

|

|

|

| |||||||||||||||||||

Gross profit | 159,568 | 188,219 | 122,962 | 118,721 | 282,530 | 306,940 | ||||||||||||||||||

|

|

|

|

|

| |||||||||||||||||||

Operating expenses | ||||||||||||||||||||||||

Selling and marketing | 88,383 | 69,681 | 93,972 | 75,200 | 182,355 | 144,881 | ||||||||||||||||||

Research and development | 46,785 | 40,296 | 41,972 | 39,762 | 88,757 | 80,058 | ||||||||||||||||||

General and administrative | 16,464 | 12,335 | 10,181 | 12,706 | 26,645 | 25,041 | ||||||||||||||||||

|

|

|

|

|

| |||||||||||||||||||

Total operating expenses | 151,632 | 122,312 | 146,125 | 127,668 | 297,757 | 249,980 | ||||||||||||||||||

|

|

|

|

|

| |||||||||||||||||||

Income from operations | 7,936 | 65,907 | ||||||||||||||||||||||

(Loss)/income from operations | (23,163) | (8,947) | (15,227) | 56,960 | ||||||||||||||||||||

Foreign currency transaction gain/(loss) | 1,244 | (2,242) | 159 | (1,497) | ||||||||||||||||||||

Interest income, net | 629 | 202 | 1,393 | 407 | ||||||||||||||||||||

Other income, net | — | 566 | 363 | 287 | ||||||||||||||||||||

|

|

|

|

|

| |||||||||||||||||||

Foreign currency transaction (loss)/gain | (1,085) | 745 | ||||||||||||||||||||||

Interest income, net | 764 | 205 | ||||||||||||||||||||||

Other income/(expense), net | 363 | (279) | ||||||||||||||||||||||

(Loss)/income before (benefit) from income taxes | (21,290) | (10,421) | (13,312) | 56,157 | ||||||||||||||||||||

(Benefit) from income taxes | (10,881) | (14,123) | (15,103) | (508) | ||||||||||||||||||||

|

|

|

|

|

| |||||||||||||||||||

Income before (benefit)/provision for income taxes | 7,978 | 66,578 | ||||||||||||||||||||||

(Benefit)/provision for income taxes | (4,222) | 13,615 | ||||||||||||||||||||||

Net (loss)/income | $ | (10,409) | $ | 3,702 | $ | 1,791 | $ | 56,665 | ||||||||||||||||

|

|

|

|

|

| |||||||||||||||||||

Net income | $ | 12,200 | $ | 52,963 | ||||||||||||||||||||

|

| |||||||||||||||||||||||

Earnings per share | ||||||||||||||||||||||||

(Loss)/earnings per share | ||||||||||||||||||||||||

Basic | $ | 0.16 | $ | 0.69 | $ | (0.13) | $ | 0.05 | $ | 0.02 | $ | 0.74 | ||||||||||||

Diluted | $ | 0.15 | $ | 0.65 | $ | (0.13) | $ | 0.04 | $ | 0.02 | $ | 0.69 | ||||||||||||

Weighted-average number of common shares outstanding | ||||||||||||||||||||||||

Basic | 78,236 | 76,761 | 78,635 | 77,313 | 78,436 | 77,039 | ||||||||||||||||||

Diluted | 83,102 | 81,875 | 78,635 | 82,945 | 83,247 | 82,412 | ||||||||||||||||||

Cash dividends declared per share | $ | 0.03 | $ | 0.03 | $ | 0.03 | $ | 0.03 | $ | 0.06 | $ | 0.06 | ||||||||||||

| (1) | On January 1, 2018 the Company adopted the ASC 606 |

See notes to unaudited condensed consolidated financial statements.

PEGASYSTEMS INC.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE (LOSS)/INCOME(1)

(in thousands)

| Three Months Ended March 31, | ||||||||

| 2018 | 2017 | |||||||

| As Adjusted(1) | |||||||

Net income | $ | 12,200 | $ | 52,963 | ||||

Other comprehensive income, net of tax | ||||||||

Unrealized (loss)/gain onavailable-for-sale marketable securities, net of tax | (188) | 127 | ||||||

Foreign currency translation adjustments | 4,363 | 2,229 | ||||||

|

|

|

| |||||

Total other comprehensive income, net of tax | 4,175 | 2,356 | ||||||

|

|

|

| |||||

Comprehensive income | $ | 16,375 | $ | 55,319 | ||||

|

|

|

| |||||

| Three Months Ended June 30, | Six Months Ended June 30, | |||||||||||||||

| 2018 | 2017 | 2018 | 2017 | |||||||||||||

Net (loss)/income | $ | (10,409) | $ | 3,702 | $ | 1,791 | $ | 56,665 | ||||||||

Other comprehensive (loss)/income, net of tax | ||||||||||||||||

Unrealized gain/(loss) onavailable-for-sale marketable securities, net of tax | 73 | (1) | (115) | 126 | ||||||||||||

Foreign currency translation adjustments | (7,414) | 4,043 | (2,977) | 6,272 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

Total other comprehensive (loss)/income, net of tax | (7,341) | 4,042 | (3,092) | 6,398 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

Comprehensive (loss)/income | $ | (17,750) | $ | 7,744 | $ | (1,301) | $ | 63,063 | ||||||||

|

|

|

|

|

|

|

| |||||||||

| (1) | On January 1, 2018 the Company adopted the ASC 606 |

See notes to unaudited condensed consolidated financial statements.

PEGASYSTEMS INC.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (1)

(in thousands)

| Three Months Ended March 31, | ||||||||||||||||

| 2018 | 2017 | Six Months Ended June 30, | ||||||||||||||

| As Adjusted(1) | 2018 | 2017 | |||||||||||||

Operating activities: | ||||||||||||||||

Net income | $ | 12,200 | $ | 52,963 | $ | 1,791 | $ | 56,665 | ||||||||

Adjustments to reconcile net income to cash provided by operating activities: | ||||||||||||||||

Change in operating assets and liabilities, net | 19,591 | (47,555) | 30,158 | (14,874) | ||||||||||||

Stock-based compensation expense | 15,109 | 12,508 | 31,165 | 26,440 | ||||||||||||

Depreciation and amortization of intangible assets | 6,145 | 6,088 | 12,474 | 12,356 | ||||||||||||

Othernon-cash | 2,610 | 8,440 | (156) | 5,182 | ||||||||||||

|

|

|

| |||||||||||||

Cash provided by operating activities | 55,655 | 32,444 | 75,432 | 85,769 | ||||||||||||

Investing activities: | ||||||||||||||||

Purchases of investments | (35,204) | (3,322) | (51,395) | (16,656) | ||||||||||||

Proceeds from maturities and called investments | 5,995 | 2,300 | 11,546 | 20,824 | ||||||||||||

Other | (2,069) | (2,705) | (6,520) | (5,327) | ||||||||||||

|

|

|

| |||||||||||||

Cash used in investing activities | (31,278) | (3,727) | (46,369) | (1,159) | ||||||||||||

Financing activities: | ||||||||||||||||

Dividend payments to shareholders | (2,344) | (2,298) | (4,702) | (4,613) | ||||||||||||

Common stock repurchases | (20,708) | (13,696) | (41,123) | (30,247) | ||||||||||||

|

|

|

| |||||||||||||

Cash used in financing activities | (23,052) | (15,994) | (45,825) | (34,860) | ||||||||||||

Effect of exchange rates on cash and cash equivalents | 2,186 | 521 | (1,226) | 1,282 | ||||||||||||

|

|

|

| |||||||||||||

Net increase in cash and cash equivalents | 3,511 | 13,244 | ||||||||||||||

Net (decrease)/increase in cash and cash equivalents | (17,988) | 51,032 | ||||||||||||||

Cash and cash equivalents, beginning of period | 162,279 | 70,594 | 162,279 | 70,594 | ||||||||||||

|

|

|

| |||||||||||||

Cash and cash equivalents, end of period | $ | 165,790 | $ | 83,838 | $ | 144,291 | $ | 121,626 | ||||||||

|

|

|

| |||||||||||||

| (1) | On January 1, 2018 the Company adopted the ASC 606 |

See notes to unaudited condensed consolidated financial statements.

PEGASYSTEMS INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

1. BASIS OF PRESENTATION

Pegasystems Inc. (together with its subsidiaries, “the Company”) has prepared the accompanying unaudited condensed consolidated financial statements pursuant to the rules and regulations of the U.S. Securities and Exchange Commission (“SEC”) regarding interim financial reporting. Accordingly, they do not include all of the information and footnotes required by accounting principles generally accepted in the United States of America (“U.S.”) for complete financial statements and should be read in conjunction with the Company’s audited financial statements included in the Annual Report on Form10-K for the year ended December 31, 2017.

On January 1, 2018 the Company adopted Accounting Standards Update (“ASU”) ASUNo. 2014-09, “Revenue from Contracts with Customers (Topic 606)” using the full retrospective method which required each prior reporting period presented to be adjusted to reflect the application of this ASU. See Note 2. “New Accounting Pronouncements” for additional information.

In the opinion of management, the Company has prepared the accompanying unaudited condensed consolidated financial statements on the same basis as its audited financial statements, and these financial statements include all adjustments, consisting only of normal recurring adjustments, necessary for a fair presentation of the results of the interim periods presented.

The operating results for the interim periods presented are not necessarily indicative of the results expected for the full year 2018.

2. NEW ACCOUNTING PRONOUNCEMENTS

Financial Instruments

In June 2016, the Financial Accounting Standards Board (“FASB”) issued ASUNo. 2016-13, “Financial Instruments - Instruments—Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments,” which requires measurement and recognition of expected credit losses for financial assets measured at amortized cost, including accounts receivable, upon initial recognition of that financial asset using a forward-looking expected loss model, rather than an incurred loss model for credit losses. Credit losses relating toavailable-for-sale debt securities should be recorded through an allowance for credit losses when the fair value is below the amortized cost of the asset, removing the concept of “other-than-temporary” impairments. The effective date for the Company will be January 1, 2020, with early adoption permitted. The Company is currently evaluating the effect this ASU will have on its consolidated financial statements and related disclosures.

Leases

In February 2016, the FASB issued ASUNo. 2016-02, “Leases (Topic 842),” which requires lessees to record most leases on their balance sheets, recognizing a lease liability for the obligation to make lease payments and aright-of-use asset for the right to use the underlying asset for the lease term. The effective date for the Company will be January 1, 2019, with early adoption permitted. The Company expects that most of its operating lease commitments will be subject to this ASU and recognized as operating lease liabilities andright-of-use assets upon adoption with no material impact to its results of operations and cash flows.

ASC 606 and ASC340-40

In May 2014, the FASB issued ASUNo. 2014-09, “Revenue from Contracts with Customers (Topic 606)”. The Company adopted ASC 606 and ASC340-40 onOn January 1, 2018 using the full retrospective method, which required the Company to retrospectively adjustadopted the ASC 606 revenue recognition standard and has adjusted prior periods presented.to conform.

The most significant impacts of adopting ASC 606 and ASC340-40 were as follows:

| • | Perpetual licenses with extended payment terms and term licenses- Revenue from perpetual |

| • | Allocation of future credits and significant discounts - |

PEGASYSTEMS INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (continued)

| • | Deferred contract costs - Sales incentive programs and other incremental |

PEGASYSTEMS INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (continued)

| • | Taxes - The corresponding effect on tax balances |

For additional information on the Company’s accounting policies as a result of the adoption of ASC 606 and ASC340-40 see Note 4. “Receivables, Contract Assets, and Deferred Revenue”, Note 5. “Deferred Contract Costs”, and Note 9. “Revenue”.

The impact of the adoption ASC 606 and ASC340-40 on the Company’s unaudited condensed consolidated balance sheet and unaudited condensed consolidated statement of operations is:

| December 31, 2017 | December 31, 2017 | |||||||||||||||||||||||

| (in thousands) | Previously reported | Adjustments | As adjusted | Previously reported | Adjustments | As adjusted | ||||||||||||||||||

Accounts receivable and unbilled receivables | $ | 248,331 | $ | 133,302 | $ | 381,633 | ||||||||||||||||||

Contract assets | — | 914 | 914 | |||||||||||||||||||||

Assets | ||||||||||||||||||||||||

Accounts receivable, unbilled receivables, and contract assets | $ | 248,331 | $ | 134,216 | $ | 382,547 | ||||||||||||||||||

Long-term unbilled receivables | — | 160,708 | 160,708 | — | 160,708 | 160,708 | ||||||||||||||||||

Deferred income taxes | 57,127 | (42,887) | 14,240 | 57,127 | (42,887) | 14,240 | ||||||||||||||||||

Deferred contract costs | — | 37,924 | 37,924 | — | 37,924 | 37,924 | ||||||||||||||||||

Other assets(1) | 416,148 | — | 416,148 | 416,148 | ��� | 416,148 | ||||||||||||||||||

|

|

|

|

|

| |||||||||||||||||||

Total Assets | 721,606 | 289,961 | 1,011,567 | $ | 721,606 | $ | 289,961 | $ | 1,011,567 | |||||||||||||||

|

|

|

|

|

| |||||||||||||||||||

Liabilities and stockholders’ equity | ||||||||||||||||||||||||

Deferred revenue | 195,073 | (28,776) | 166,297 | $ | 195,073 | $ | (28,776) | $ | 166,297 | |||||||||||||||

Long-term deferred revenue | 6,591 | (2,885) | 3,706 | 6,591 | (2,885) | 3,706 | ||||||||||||||||||

Deferred income tax liabilities | — | 38,463 | 38,463 | — | 38,463 | 38,463 | ||||||||||||||||||

Other liabilities(2) | 148,864 | — | 148,864 | 148,864 | — | 148,864 | ||||||||||||||||||

|

|

|

|

|

| |||||||||||||||||||

Total liabilities | 350,528 | 6,802 | 357,330 | 350,528 | 6,802 | 357,330 | ||||||||||||||||||

Foreign currency translation adjustments | (3,494) | (2,966) | (6,460) | (3,494) | (2,966) | (6,460) | ||||||||||||||||||

Retained earnings | 221,926 | 286,125 | 508,051 | 221,926 | 286,125 | 508,051 | ||||||||||||||||||

Other equity(3) | 152,646 | — | 152,646 | 152,646 | — | 152,646 | ||||||||||||||||||

|

|

|

|

|

| |||||||||||||||||||

Total stockholders’ equity | 371,078 | 283,159 | 654,237 | 371,078 | 283,159 | 654,237 | ||||||||||||||||||

|

|

|

|

|

| |||||||||||||||||||

Total liabilities and stockholders’ equity | $ | 721,606 | $ | 289,961 | $ | 1,011,567 | $ | 721,606 | $ | 289,961 | $ | 1,011,567 | ||||||||||||

|

|

|

|

|

| |||||||||||||||||||

| (1) | Includes cash, |

| (2) | Includes accounts payable, accrued expenses, accrued compensation and related expenses, income taxes payable, and other long-term liabilities (as reflected in the consolidated balance sheets in the Annual Report on Form10-K for the year ended December 31, 2017). |

| (3) | Includes common stock, additionalpaid-in capital, and net unrealized loss onavailable-for-sale marketable securities (as reflected in the consolidated balance sheets in the Annual Report on Form10-K for the year ended December 31, 2017). |

PEGASYSTEMS INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (continued)

| Three Months Ended | ||||||||||||||||||||||||||||||||||||

| March 31, 2017 | Three months ended June 30, 2017 | Six months ended June 30, 2017 | ||||||||||||||||||||||||||||||||||

| (in thousands, except per share amounts) | Previously reported | Adjustments | As adjusted | Previously Reported | Adjustments | As Adjusted | Previously Reported | Adjustments | As Adjusted | |||||||||||||||||||||||||||

Revenue: | ||||||||||||||||||||||||||||||||||||

Software license | $ | 92,390 | $ | 34,618 | $ | 127,008 | $ | 61,037 | $ | (9,887) | $ | 51,150 | $ | 153,427 | $ | 24,731 | $ | 178,158 | ||||||||||||||||||

Maintenance | 58,965 | (252) | 58,713 | 59,590 | (166) | 59,424 | 118,555 | (418) | 118,137 | |||||||||||||||||||||||||||

Services | 71,892 | (1,304) | 70,588 | 77,353 | (1,331) | 76,022 | 149,245 | (2,635) | 146,610 | |||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

| ||||||||||||||||||||||||||||

Total revenue | 223,247 | 33,062 | 256,309 | 197,980 | (11,384) | 186,596 | 421,227 | 21,678 | 442,905 | |||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

| ||||||||||||||||||||||||||||

Cost of revenue: | ||||||||||||||||||||||||||||||||||||

Software license | 1,300 | — | 1,300 | 1,250 | — | 1,250 | 2,550 | — | 2,550 | |||||||||||||||||||||||||||

Maintenance | 7,218 | — | 7,218 | 7,011 | — | 7,011 | 14,229 | — | 14,229 | |||||||||||||||||||||||||||

Services | 59,572 | — | 59,572 | 59,614 | — | 59,614 | 119,186 | — | 119,186 | |||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

| ||||||||||||||||||||||||||||

Total cost of revenue | 68,090 | — | 68,090 | 67,875 | — | 67,875 | 135,965 | — | 135,965 | |||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

| ||||||||||||||||||||||||||||

Gross profit | 155,157 | 33,062 | 188,219 | 130,105 | (11,384) | 118,721 | 285,262 | 21,678 | 306,940 | |||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

| ||||||||||||||||||||||||||||

Operating expenses: | ||||||||||||||||||||||||||||||||||||

Selling and marketing | 71,288 | (1,607 | ) | 69,681 | 75,887 | (687) | 75,200 | 147,175 | (2,294) | 144,881 | ||||||||||||||||||||||||||

Research and development | 40,296 | — | 40,296 | 39,762 | — | 39,762 | 80,058 | — | 80,058 | |||||||||||||||||||||||||||

General and administrative | 12,335 | — | 12,335 | 12,706 | — | 12,706 | 25,041 | — | 25,041 | |||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

| ||||||||||||||||||||||||||||

Total operating expenses | 123,919 | (1,607 | ) | 122,312 | 128,355 | (687) | 127,668 | 252,274 | (2,294) | 249,980 | ||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

| ||||||||||||||||||||||||||||

Income from operations | 31,238 | 34,669 | 65,907 | |||||||||||||||||||||||||||||||||

Income/(loss) from operations | 1,750 | (10,697) | (8,947) | 32,988 | 23,972 | 56,960 | ||||||||||||||||||||||||||||||

Foreign currency transaction loss | (917) | (1,325) | (2,242) | (241) | (1,256) | (1,497) | ||||||||||||||||||||||||||||||

Interest income, net | 161 | 41 | 202 | 326 | 81 | 407 | ||||||||||||||||||||||||||||||

Other income, net | 566 | — | 566 | 287 | — | 287 | ||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

| ||||||||||||||||||||||||||||

Foreign currency transaction gain | 676 | 69 | 745 | |||||||||||||||||||||||||||||||||

Interest income, net | 165 | 40 | 205 | |||||||||||||||||||||||||||||||||

Other expense, net | (279) | — | (279) | |||||||||||||||||||||||||||||||||

|

|

| ||||||||||||||||||||||||||||||||||

Income before provision for income taxes | 31,800 | 34,778 | 66,578 | |||||||||||||||||||||||||||||||||

Provision for income taxes | 4,779 | 8,836 | 13,615 | |||||||||||||||||||||||||||||||||

Income/(loss) before benefit from income taxes | 1,560 | (11,981) | (10,421) | 33,360 | 22,797 | 56,157 | ||||||||||||||||||||||||||||||

Benefit from income taxes | (9,846) | (4,277) | (14,123) | (5,067) | 4,559 | (508) | ||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

| ||||||||||||||||||||||||||||

Net income | $ | 27,021 | $ | 25,942 | $ | 52,963 | $ | 11,406 | $ | (7,704) | $ | 3,702 | $ | 38,427 | $ | 18,238 | $ | 56,665 | ||||||||||||||||||

|

|

|

|

|

|

|

|

| ||||||||||||||||||||||||||||

Earnings per share: | ||||||||||||||||||||||||||||||||||||

Basic | $ | 0.35 | $ | 0.69 | $ | 0.15 | $ | 0.05 | $ | 0.50 | $ | 0.74 | ||||||||||||||||||||||||

|

|

|

|

|

| |||||||||||||||||||||||||||||||

Diluted | $ | 0.33 | $ | 0.65 | $ | 0.14 | $ | 0.04 | $ | 0.47 | $ | 0.69 | ||||||||||||||||||||||||

|

|

|

|

|

| |||||||||||||||||||||||||||||||

Weighted-average number of common shares outstanding: | ||||||||||||||||||||||||||||||||||||

Basic | 76,761 | 76,761 | 77,313 | 77,313 | 77,039 | 77,039 | ||||||||||||||||||||||||||||||

Diluted | 81,875 | 81,875 | 82,945 | 82,945 | 82,412 | 82,412 | ||||||||||||||||||||||||||||||

Adoption of ASC 606 and ASC340-40 had no impact on total cash from or used in operating, financing, or investing activities in the Company’s unaudited condensed consolidated statements of cash flows for the threesix months ended March 31,June 30, 2017.

3. MARKETABLE SECURITIES

| March 31, 2018 | ||||||||||||||||

| (in thousands) | Amortized Cost | Unrealized Gains | Unrealized Losses | Fair Value | ||||||||||||

Municipal bonds | $ | 50,782 | $ | — | $ | (191) | $ | 50,591 | ||||||||

Corporate bonds | 38,761 | 1 | (306) | 38,456 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

| $ | 89,543 | $ | 1 | $ | (497) | $ | 89,047 | |||||||||

|

|

|

|

|

|

|

| |||||||||

| December 31, 2017 | June 30, 2018 | |||||||||||||||||||||||||||||||

| (in thousands) | Amortized Cost | Unrealized Gains | Unrealized Losses | Fair Value | Amortized Cost | Unrealized Gains | Unrealized Losses | Fair Value | ||||||||||||||||||||||||

Municipal bonds | $ | 32,996 | $ | — | $ | (148) | $ | 32,848 | $ | 55,466 | $ | 20 | $ | (112) | $ | 55,374 | ||||||||||||||||

Corporate bonds | 28,757 | 1 | (137) | 28,621 | 44,258 | 2 | (342) | 43,918 | ||||||||||||||||||||||||

|

|

|

|

|

|

|

| |||||||||||||||||||||||||

| $ | 61,753 | $ | 1 | $ | (285) | $ | 61,469 | $ | 99,724 | $ | 22 | $ | (454) | $ | 99,292 | |||||||||||||||||

|

|

|

|

|

|

|

| |||||||||||||||||||||||||

PEGASYSTEMS INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (continued)

| December 31, 2017 | ||||||||||||||||

| (in thousands) | Amortized Cost | Unrealized Gains | Unrealized Losses | Fair Value | ||||||||||||

Municipal bonds | $ | 32,996 | $ | — | $ | (148) | $ | 32,848 | ||||||||

Corporate bonds | 28,757 | 1 | (137) | 28,621 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

| $ | 61,753 | $ | 1 | $ | (285) | $ | 61,469 | |||||||||

|

|

|

|

|

|

|

| |||||||||

As of March 31,June 30, 2018, the Company did not hold any investments with unrealized losses that are considered to be other-than-temporary.

As of March 31,June 30, 2018, remaining maturities of marketable securities ranged from MayJuly 2018 to FebruaryAugust 2021, with a weighted-average remaining maturity of approximately 1.41.5 years.

4. RECEIVABLES, CONTRACT ASSETS, AND DEFERRED REVENUE

Receivables

(in thousands)

| March 31, 2018 | December 31, 2017 | June 30, 2018 | December 31, 2017 | ||||||||||||

Accounts receivable | $ | 164,981 | $ | 222,735 | $ | 141,384 | $ | 222,735 | ||||||||

Unbilled receivables | 153,657 | 158,898 | 151,354 | 158,898 | ||||||||||||

Long-term unbilled receivables | 180,077 | 160,708 | 169,330 | 160,708 | ||||||||||||

|

|

|

| |||||||||||||

Total receivables | $ | 498,715 | $ | 542,341 | ||||||||||||

|

| $ | 462,068 | $ | 542,341 | |||||||||||

|

| |||||||||||||||

Unbilled receivables is the amount due from clients where the only condition on the right of payment is the passage of time. The Company regularly reassessesassesses receivables for collectability. As of March 31,June 30, 2018 and December 31, 2017, the allowance for doubtful accounts was not material.

Long-term unbilledUnbilled receivables are expected to be billed in the future as follows:

(in thousands)

| March 31, 2018 | |||

2019 | $ | 82,518 | ||

2020 | 58,433 | |||

2021 | 31,129 | |||

2022 and thereafter | 7,997 | |||

|

| |||

| $ | 180,077 | |||

|

| |||

| (in thousands) | June 30, 2018 | |||

1 Year or Less | $ | 151,354 | ||

1-2 Years | 79,654 | |||

2-5 Years | 89,676 | |||

| $ | 320,684 | |||

Contract assets and deferred revenue

(in thousands)

| March 31, 2018 | December 31, 2017 | June 30, 2018 | December 31, 2017 | ||||||||||||

Contract assets(1) | $ | 788 | $ | 914 | $ | 2,425 | $ | 914 | ||||||||

Long-term contract assets(2) | 1,545 | — | ||||||||||||||

|

| |||||||||||||||

| $ | 3,970 | $ | 914 | |||||||||||||

|

| |||||||||||||||

Deferred revenue | 175,586 | 166,297 | $ | 163,525 | $ | 166,297 | ||||||||||

Long-term deferred revenue(2) | $ | 3,277 | $ | 3,706 | ||||||||||||

Long-term deferred revenue(3) | 6,210 | 3,706 | ||||||||||||||

|

| |||||||||||||||

| $ | 169,735 | $ | 170,003 | |||||||||||||

|

| |||||||||||||||

(1)Included in other current assets in the unaudited condensed consolidated balance sheets.

(2) Included in other long-term assets in the unaudited condensed consolidated balance sheets.

(3)Included in other long-term liabilities in the unaudited condensed consolidated balance sheets.

Contract assets and deferred revenue are presented net at the contract level for each reporting period. Contract assets are unbilled amounts resulting fromunder client contracts where revenue recognized exceeds the amount billed to the client and the right to payment is subject to conditions other than the passage of time, such as the completion of a related performance obligation. Deferred revenue consists of billings and payments received in advance of revenue recognition.

PEGASYSTEMS INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (continued)

The change in deferred revenue in the threesix months ended March 31,June 30, 2018, was primarily due to new billings in advance of revenue recognition and $168.2 million of revenue recognized, excluding the impact of the netting of contract assets and deferred revenue, was primarily due to new billings in advance of revenue recognition and $101.6 million of revenue recognizedduring the period that was included in deferred revenue at December 31, 2017.

Major clients

No client represented 10% or more of the Company’s total receivables as of March 31,June 30, 2018 or December 31, 2017.

5. DEFERRED CONTRACT COSTS

Sales incentives paid by the Company are considered incremental and recoverable costs of obtaining a contract with a client. These costs are deferred, as a long-term asset, and then amortized using the straight-line method over the period of benefit which is on average five years. The Company determined the period of benefit by taking into consideration client contracts, the Company’s technology, and other factors. The Company utilizes a practical expedient available under ASC 606 to expense costs to obtain a contract as incurred when the original

PEGASYSTEMS INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (continued)

amortization period is one year or less. During

| (in thousands) | June 30, 2018 | December 31, 2017 | ||||||

Deferred contract costs(1) | $ | 42,246 | $ | 37,924 | ||||

(1) Included in other long-term assets in the three months ended March 31, 2018 and 2017, impairmentunaudited condensed consolidated balance sheets.

Amortization of deferred contract costs was not material.as follows:

(in thousands)

| March 31, 2018 | December 31, 2017 | ||||||||||||||||||

Deferred contract costs(1) | $ 39,781 | $ 37,924 | ||||||||||||||||||

(1) Included in other long-term assets in the unaudited condensed consolidated balance sheets.

Amortization of deferred contract costs was as follows: | ||||||||||||||||||||

Three Months Ended March 31, | Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||||||

| (in thousands) | 2018 | 2017 | 2018 | 2017 | 2018 | 2017 | ||||||||||||||

Amortization of deferred contract costs(1) | $3,789 | $2,594 | $ | 3,809 | $ | 2,902 | $ | 7,598 | $ | 5,496 | ||||||||||

(1)Included in selling and marketing expenses in the unaudited condensed consolidated statement of operations.

During the six months ended June 30, 2018 and 2017, impairment of deferred contract costs was not material.

6. GOODWILL AND OTHER INTANGIBLE ASSETS

The changeschange in the carrying amount of goodwill werewas as follows:

| (in thousands) | | |||

| 2018 | ||||

Balance as of January 1, | $ | 72,952 | ||

| ||||

Currency translation adjustments | ||||

|

| |||

Balance as of | $ | |||

|

| |||

Intangible assets are recorded at cost and are amortized using the straight-line method over their estimated useful lives as follows:

March 31, 2018 | June 30, 2018 | |||||||||||||||

| (in thousands) | Useful Lives | Cost | Accumulated | Net Book Value(1) | Useful Lives | Cost | Accumulated | Net Book Value(1) | ||||||||

Client-related intangibles | 9-10 years | $ 63,197 | $ (46,456) | $ 16,741 | 9-10 years | $ 63,143 | $ (48,033) | $ 15,110 | ||||||||

Technology | 7-10 years | 58,942 | (46,603) | 12,339 | 7-10 years | 58,942 | (47,835) | 11,107 | ||||||||

Other intangibles | — | 5,361 | (5,361) | — | — | 5,361 | (5,361) | — | ||||||||

|

|

|

|

|

| |||||||||||

| $ 127,500 | $ (98,420) | $ 29,080 | $ 127,446 | $ (101,229) | $ 26,217 | |||||||||||

|

|

|

|

|

| |||||||||||

(1) Included in other long-term assets in the unaudited condensed consolidated balance sheet. | ||||||||||||||||

December 31, 2017 | ||||||||||||||||

| (in thousands) | Useful Lives | Cost | Accumulated | Net Book Value(1) | ||||||||||||

Client-related intangibles | 9-10 years | $ 63,164 | $ (44,835) | $ 18,329 | ||||||||||||

Technology | 7-10 years | 58,942 | (45,372) | 13,570 | ||||||||||||

Other intangibles | — | 5,361 | (5,361) | — | ||||||||||||

|

|

| ||||||||||||||

| $ 127,467 | $ (95,568) | $ 31,899 | ||||||||||||||

|

|

| ||||||||||||||

(1) Included in other long-term assets in the unaudited condensed consolidated balance sheets.

PEGASYSTEMS INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (continued)

| December 31, 2017 | ||||||||||||||||

| (in thousands) | Useful Lives | Cost | Accumulated Amortization | Net Book Value(1) | ||||||||||||

Client-related intangibles | 9-10 years | $ | 63,164 | $ | (44,835) | $ | 18,329 | |||||||||

Technology | 7-10 years | 58,942 | (45,372) | 13,570 | ||||||||||||

Other intangibles | — | 5,361 | (5,361) | — | ||||||||||||

|

|

|

|

|

| |||||||||||

| $ | 127,467 | $ | (95,568) | $ | 31,899 | |||||||||||

|

|

|

|

|

| |||||||||||

(1) Included in other long-term assets in the unaudited condensed consolidated balance sheets.

Amortization of intangiblesintangible assets is reflected in the Company’s unaudited condensed consolidated statements of operations as follows:

| Three Months Ended March 31, | ||||||||||||||||||||||||

| (in thousands) | Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||||||||||

| 2018 | 2017 | 2018 | 2017 | 2018 | 2017 | |||||||||||||||||||

Cost of revenue |

$ |

1,232 |

|

$ |

1,334 |

| $ | 1,231 | $ | 1,305 | $ | 2,463 | $ | 2,639 | ||||||||||

Selling and marketing | 1,605 | 1,866 | 1,605 | 1,869 | 3,210 | 3,735 | ||||||||||||||||||

|

|

|

|

|

| |||||||||||||||||||

| $ | 2,837 | $ | 3,200 | $ | 2,836 | $ | 3,174 | $ | 5,673 | $ | 6,374 | |||||||||||||

|

|

|

|

|

| |||||||||||||||||||

7. ACCRUED EXPENSES

| (in thousands) | March 31, 2018 | December 31, 2017 | June 30, 2018 | December 31, 2017 | ||||||||||||

Outside professional services |

$ |

15,152 |

|

$ |

14,468 |

| $ | 10,143 | $ | 14,468 | ||||||

Income and other taxes | 7,272 | 7,420 | 4,837 | 7,420 | ||||||||||||

Marketing and sales program expenses | 8,724 | 6,444 | 9,282 | 6,444 | ||||||||||||

Dividends payable | 2,358 | 2,344 | 2,365 | 2,344 | ||||||||||||

Employee-related expenses | 5,091 | 4,065 | 5,737 | 4,065 | ||||||||||||

Other | 9,681 | 10,767 | 12,518 | 10,767 | ||||||||||||

|

|

|

| |||||||||||||

| $ | 48,278 | $ | 45,508 | $ | 44,882 | $ | 45,508 | |||||||||

|

|

|

| |||||||||||||

8. FAIR VALUE MEASUREMENTS

Assets and Liabilities Measured at Fair Value on a Recurring Basis

The Company records its cash equivalents, marketable securities, and investments in privately-held companies at fair value on a recurring basis. Fair value is an exit price, representing the amount that would be received from the sale of an asset or paid to transfer a liability in an orderly transaction between market participants based on assumptions that market participants would use in pricing an asset or liability.

As a basis for classifying the fair value measurements, a three-tier fair value hierarchy, which classifies the fair value measurements based on the inputs used in measuring fair value, was established as follows:

Level 1 - observable inputs such as quoted prices in active markets for identical assets or liabilities;

Level 2 - significant other inputs that are observable either directly or indirectly; and

Level 3 - significant unobservable inputs on which there is little or no market data, which require the Company to develop its own assumptions. This hierarchy requires the Company to use observable market data, when available, and to minimize the use of unobservable inputs when determining fair value.

The Company’s cash equivalents are composed of money market funds and time deposits which are classified as Level 1 and Level 2, respectively, in the fair value hierarchy. The Company’s marketable securities, which are classified within Level 2 of the fair value hierarchy are valued based on a market approach using quoted prices, when available, or matrix pricing compiled by third party pricing vendors, using observable market inputs such as interest rates, yield curves, and credit risk. The Company’s investments in privately-held companies are classified within Level 3 of the fair value hierarchy and are valued using model-based techniques, including option pricing models and discounted cash flow models.

PEGASYSTEMS INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (continued)

If applicable, the Company will recognize transfers into and out of levels within the fair value hierarchy at the end of the reporting period in which the actual event or change in circumstance occurs. There were no transfers between levels during the threesix months ended March 31,June 30, 2018.

PEGASYSTEMS INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (continued)

The Company’s assets and liabilities measured at fair value on a recurring basis were as follows:

| March 31, 2018 | June 30, 2018 | |||||||||||||||||||||||||||||||

| Level 1 | Level 2 | Level 3 | Total | Level 1 | Level 2 | Level 3 | Total | |||||||||||||||||||||||||

Cash equivalents | $ | 130 | $ | 30,072 | $ | — | $ | 30,202 | $ | 28 | $ | 32,009 | $ | — | $ | 32,037 | ||||||||||||||||

Marketable securities: | ||||||||||||||||||||||||||||||||

Municipal bonds | $ | — | $ | 50,591 | $ | — | $ | 50,591 | — | 55,374 | — | 55,374 | ||||||||||||||||||||

Corporate bonds | — | 38,456 | — | 38,456 | — | 43,918 | — | 43,918 | ||||||||||||||||||||||||

|

|

|

|

|

|

|

| |||||||||||||||||||||||||

Total marketable securities | $ | — | $ | 89,047 | $ | — | $ | 89,047 | — | 99,292 | — | 99,292 | ||||||||||||||||||||

Investments in privately-held companies(1) | $ | — | $ | — | $ | 2,060 | $ | 2,060 | — | — | 2,060 | 2,060 | ||||||||||||||||||||

(1) Included in other long-term assets in the unaudited condensed consolidated balance sheets. |

(1) Included in other long-term assets in the unaudited condensed consolidated balance sheets. |

|

(1) Included in other long-term assets in the unaudited condensed consolidated balance sheets. |

| ||||||||||||||||||||||||||||

| December 31, 2017 | December 31, 2017 | |||||||||||||||||||||||||||||||

| Level 1 | Level 2 | Level 3 | Total | Level 1 | Level 2 | Level 3 | Total | |||||||||||||||||||||||||

Cash equivalents | $ | 2,720 | $ | 40,051 | $ | — | $ | 42,771 | $ | 2,720 | $ | 40,051 | $ | — | $ | 42,771 | ||||||||||||||||

Marketable securities: | ||||||||||||||||||||||||||||||||

Municipal bonds | $ | — | $ | 32,848 | $ | — | $ | 32,848 | — | 32,848 | — | 32,848 | ||||||||||||||||||||

Corporate bonds | — | 28,621 | — | 28,621 | — | 28,621 | — | 28,621 | ||||||||||||||||||||||||

|

|

|

|

|

|

|

| |||||||||||||||||||||||||

Total marketable securities | $ | — | $ | 61,469 | $ | — | $ | 61,469 | — | 61,469 | — | 61,469 | ||||||||||||||||||||

Investments in privately-held companies(1) | $ | — | $ | — | $ | 1,030 | $ | 1,030 | — | — | 1,030 | 1,030 | ||||||||||||||||||||

(1) Included in other long-term assets in the unaudited condensed consolidated balance sheets. |

| |||||||||||||||||||||||||||||||

(1) Included in other long-term assets in the unaudited condensed consolidated balance sheets.

For certain other financial instruments, including accounts receivable and accounts payable, the carrying value approximates their fair value due to the relatively short maturity of these items.

Assets Measured at Fair Value on a Nonrecurring Basis

Assets recorded at fair value on a nonrecurring basis, including property and equipment and intangible assets, are recognized at fair value when they are impaired. During the threesix months ended March 31,June 30, 2018 and 2017, the Company did not recognize any impairments of its assets recorded at fair value on a nonrecurring basis.

9. REVENUE

Revenue policy

The Company’s revenue is primarily derived from sales of software licenses, maintenance fees related to the Company’s software licenses, and services.from:

Software license revenue is primarily derived from sales of the Company’s software applications and Pega Platform.

Maintenance revenue includes revenue from client support including software upgrades, on a whenand-if available basis, telephone support, and bug fixes or patches.

Services revenue is primarily derived from cloud revenue, which is sales of the Company’s hosted Pega Platform and software application environments.

Contracts with multiple performance obligations

The Company’s license and cloud arrangements often contain multiple performance obligations, including maintenance, consulting, and training. For contracts with multiple performance obligations, the Company accounts for individual performance obligations separately if they are distinct. The transaction price is allocated to the separate performance obligations on a relative stand-alone selling price basis. If the transaction price contains discounts or the Company expects to provide a future price concession, these elements are considered when determining the transaction price prior to allocation. Variable fees within the transaction price will beare estimated and recognized in revenue as the Company satisfies itseach performance obligationsobligation to the extent it is probable that a significant reversal of cumulative revenue recognized will not occur when the uncertainty associated with the variable fee is resolved. If the contract grants the client the option to acquire additional products or services, the Company assesses whether or not any discount on the included products and services is in excess of levels normally available to similar clients and, if so, accounts for that discount as an additional performance obligation.

PEGASYSTEMS INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (continued)

Software licenses

The Company has concluded that its software licenses are distinct performance obligations as the client can benefit from the software on its own. Software license revenue is typically recognized at a point in time when control is transferred to the client, which is defined as the point in time when the client can use and benefit from the license. The software license is delivered before related services are provided and is functional without services, updates, and technical support. The Company’s license arrangements generally contain multiple performance obligations, including consulting, training, and maintenance. Stand-alone selling price for software licenses is determined using the residual approach. The Company utilizes the residual approach as license performance obligations are sold for a broad range of amounts (the selling price is highly variable) and a stand-alone selling price is not discernible from past transactions or other observable evidence. Periodically, the Company evaluates whether the residual approach is appropriate for its license and cloud performance obligations when sold with other performance obligations. As a result, if the standalonestandalone selling price analysis illustrates that the license and cloud performance obligations are no longer highly variable, the Company will utilize the relative allocation method for such arrangements.

Term license fees are usually payable in advance on a monthly, quarterly, or annual basis over the term of the license agreement, which is typically three to five years and may be renewed for additional terms at the client’s option. Perpetual license fees are usually payable when the contract is executed. The Company recognizes

Maintenance

Software maintenance contracts entitle clients to receive technical support and software license revenueupdates, on a when control is transferred, and if available basis, during the corresponding difference betweenterm of the amount invoicedmaintenance contract. Technical support and recognizedsoftware updates are considered distinct services but accounted for as a single performance obligation as they each constitute a series of distinct services that are substantially the same and have the same pattern of transfer to the client. Software maintenance revenue is recorded as unbilled receivables, as the payment of consideration is subject only to the passage of time.

Maintenance

Maintenance revenue includes revenue from client support and related professional services. Client support includes software upgradesrecognized over time on a whenand-if availablestraight-line basis telephone support, and bug fixesover the contract period. Maintenance fees are usually payable in advance on a monthly, quarterly, or patches. Maintenance isannual basis over the term of the agreement.

Each of the performance obligations included in maintenance are priced as a percentage of the selling price of the related software license, which is highly variable. The Company determined the standalone selling price of each performance obligation included in maintenance based on this pricing relationship, which has remained constant within a narrow range, and observable data from standalone sales of maintenance, along with all other observable data.

The Company has identified two separate distinct performance obligations of maintenance:

These performance obligations are distinct within the contract and, although they are not sold separately, the components are not essential to the functionality of the other components. Each of the performance obligations included in maintenance revenue is a stand-alone obligation that is recognized over the passage of the contractual term, which is typically one year. Maintenance fees are usually payable in advance on a monthly, quarterly, or annual basis over the term of the agreement.

Services

The Company’s services revenue is comprised of consulting and training, including software license implementations, training, reimbursable expenses, and cloud which is derived from sales of the Company’s hosted Pega Platform and software application environments. The Company has concluded that most services are distinct performance obligations. Consulting may be provided on a stand-alone basis or bundled with license and software maintenance services.

The stand-alone selling price for consulting in time and materials contracts is determined by observable prices in similar transactions without multiple performance obligations and recognized as revenue as the services are performed. Fees for time and materials consulting contracts are usually payable shortly after the service is provided.

The Company estimates the stand-alone selling price for fixed price services based on the estimated hours versus actual hours in similar geographies and for similar contract sizes. Revenue for fixed price services is recognized over time as the services are provided. Fees for fixed price services consulting contracts are usually payable as contract milestones are achieved.

The stand-alone selling price of cloud sales of production environments is determined based on the residual approach when sold with services and is recognized over the term of the service. The Company utilizes the residual approach as cloud performance obligations are sold for a broad range of amounts (the selling price is highly variable) and a stand-alone selling price is not discernible from past transactions or other observable evidence. The stand-alone selling price for cloud sales of development and testing environments is developed using observable prices in similar transactions without multiple performance obligations and is recognized over time over the term of the service. Cloud fees are usually payable in advance on a monthly, quarterly, or annual basis over the term of the service.

PEGASYSTEMS INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (continued)

Contract modifications

The Company sometimes enters into amendments to previously executed contracts which constitute contract modifications. The Company assesses each of these contract modifications to determine:

| 1. | If the additional products and services are distinct from the products and services in the original arrangement, and |

PEGASYSTEMS INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (continued)

| 2. | If the amount of consideration expected for the added products and services reflects the stand-alone selling price of those products and services. |

A contract modification meeting both criteria is accounted for as a separate contract. A contract modification not meeting both criteria is considered a change to the original contract and is accounted for on either:

| 1. | a prospective basis as a termination of the existing contract and the creation of a new contract; or |

| 2. | a cumulativecatch-up basis. |

Geographic revenue

| Three Months Ended March 31, | Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||||||||||||||||||||||||||||||||||

| (in thousands) | 2018 | 2017 | 2018 | 2017 | 2018 | 2017 | ||||||||||||||||||||||||||||||||||||||||||

U.S. | $ | 113,985 | 48% | $ | 169,662 | 67% | $ | 110,349 | 55% | $ | 102,098 | 55% | $ | 224,334 | 52% | $ | 271,760 | 62% | ||||||||||||||||||||||||||||||

Other Americas | 17,715 | 8% | 10,406 | 4% | 9,627 | 5% | 13,177 | 7% | 27,342 | 6% | 23,583 | 5% | ||||||||||||||||||||||||||||||||||||

United Kingdom | 26,094 | 11% | 26,342 | 10% | ||||||||||||||||||||||||||||||||||||||||||||

Europe, Middle East, and Africa excluding the United Kingdom | 31,826 | 14% | 24,211 | 9% | ||||||||||||||||||||||||||||||||||||||||||||

United Kingdom (“U.K.”) | 23,079 | 12% | 22,524 | 12% | 49,173 | 11% | 48,866 | 11% | ||||||||||||||||||||||||||||||||||||||||

Europe (excluding U.K.), Middle East, and Africa | 27,070 | 14% | 26,237 | 14% | 58,896 | 14% | 50,448 | 11% | ||||||||||||||||||||||||||||||||||||||||

Asia-Pacific | 45,562 | 19% | 25,688 | 10% | 26,654 | 14% | 22,560 | 12% | 72,216 | 17% | 48,248 | 11% | ||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||||||||||||||

Total Revenue | $ | 235,182 | 100% | $ | 256,309 | 100% | ||||||||||||||||||||||||||||||||||||||||||

Total revenue | $ | 196,779 | 100% | $ | 186,596 | 100% | $ | 431,961 | 100% | $ | 442,905 | 100% | ||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||||||||||||||

Major products and services

| Three Months Ended March 31, | Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||||||||||

| (in thousands) | 2018 | 2017 | 2018 | 2017 | 2018 | 2017 | ||||||||||||||||||

Perpetual license | $ | 23,078 | $ | 37,899 | $ | 13,475 | $ | 31,297 | $ | 36,553 | $ | 69,196 | ||||||||||||

Term license | 64,695 | 89,109 | 31,309 | 19,853 | 96,004 | 108,962 | ||||||||||||||||||

|

|

|

|

|

| |||||||||||||||||||

Performance obligations transferred at a point in time | 87,773 | 127,008 | ||||||||||||||||||||||

Revenue recognized at a point in time | 44,784 | 51,150 | 132,557 | 178,158 | ||||||||||||||||||||

Maintenance | 64,525 | 58,713 | 65,906 | 59,424 | 130,431 | 118,137 | ||||||||||||||||||

Cloud | 15,582 | 10,402 | 20,201 | 12,525 | 35,783 | 22,927 | ||||||||||||||||||

Consulting and training | 67,302 | 60,186 | 65,888 | 63,497 | 133,190 | 123,683 | ||||||||||||||||||

|

|

|

|

|

| |||||||||||||||||||

Performance obligations transferred over time | 147,409 | 129,301 | ||||||||||||||||||||||

Revenue recognized over time | 151,995 | 135,446 | 299,404 | 264,747 | ||||||||||||||||||||

|

|

|

|

|

| |||||||||||||||||||

Total Revenue | $ | 235,182 | $ | 256,309 | ||||||||||||||||||||

Total revenue | $ | 196,779 | $ | 186,596 | $ | 431,961 | $ | 442,905 | ||||||||||||||||

|

|

|

|

|

| |||||||||||||||||||

During the threesix months ended March 31,June 30, 2018 and 2017, there were no material changes in the Company’s estimate of variable fees. The amount of revenue recognized from performance obligations satisfied in prior periods was not material.

Transaction price allocated to remaining performance obligationsCommitted not yet recognized revenue

Transaction price allocated to remaining performance obligationsCommitted not recognized revenue represents contracted revenue that has not yet been recognized. Transaction price on remaining performance obligations was $291 millionrecognized in revenue. Committed not recognized revenue is expected to be recognized in the future as of March 31, 2018, of which the Company expects to recognize $198.3 million prior to January 1, 2020. These amounts do not include contracts that have an original expected duration of one year or less. follows:

| (in thousands) | June 30, 2018 | |||

Remainder of 2018 | $ | 213,244 | ||

2019 | 140,209 | |||

2020 | 63,603 | |||

2021 and thereafter | 59,604 | |||

|

| |||

| $ | 476,660 | |||

|

| |||

For reporting periods ending prior to January 1, 2018, the date of initial adoption of ASC 606, the Company has elected the practical expedient and not compiled and disclosed the amount of the transaction price allocated to the remaining performance obligations.

PEGASYSTEMS INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (continued)

Major clients

Clients accounting for 10% or more of the Company’s total revenue were as follows:

| Three Months Ended March 31, | Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||||||||||||||

| (in thousands) | 2018 | 2017 | 2018 | 2017 | 2018 | 2017 | ||||||||||||||||||||||

|

|

|

|

|

| |||||||||||||||||||||||

Total revenue | $ 235,182 | $ | 256,309 | $ | 196,779 | $ | 186,596 | $ | 431,961 | $ | 442,905 | |||||||||||||||||

Client A | * | 14% | * | 11% | * | * | ||||||||||||||||||||||

Client B | * | 11% | ||||||||||||||||||||||||||

*Client accounted for less than 10% of total revenue.

10. STOCK-BASED COMPENSATION

Expense

| Three Months Ended March 31, | Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||||||||||

| (in thousands) | 2018 | 2017 | 2018 | 2017 | 2018 | 2017 | ||||||||||||||||||

|

|

|

| |||||||||||||||||||||

Cost of revenues | $ | 3,701 | $ | 3,622 | $ | 4,257 | $ | 3,677 | $ | 7,958 | $ | 7,299 | ||||||||||||

Selling and marketing | 4,658 | 3,405 | 6,038 | 4,101 | 10,696 | 7,506 | ||||||||||||||||||

Research and development | 3,637 | 3,312 | 3,802 | 3,575 | 7,439 | 6,887 | ||||||||||||||||||

General and administrative | 3,113 | 2,169 | 1,959 | 2,579 | 5,072 | 4,748 | ||||||||||||||||||

|

|

|

|

|

| |||||||||||||||||||

| $ | 15,109 | $ | 12,508 | $ | 16,056 | $ | 13,932 | $ | 31,165 | $ | 26,440 | |||||||||||||

|

|

|

|

|

| |||||||||||||||||||

Income tax benefit | $ | (3,141) | $ | (3,815) | $ | (3,341) | $ | (4,287) | $ | (6,482) | $ | (8,102) | ||||||||||||

The Company recognizes stock-based compensation onusing the accelerated recognition method, treating each vesting tranche as if it were an individual grant. As of March 31,June 30, 2018, the Company had, net of estimated forfeitures, $92.5$79.7 million of unrecognized stock-based compensation expense, related to all unvested restricted stock units (“RSUs”) and stock options, which was expected to be recognized over a weighted-average period of 2.32.2 years.

Grants

The Company granted the following stock-based compensation awards:

| Three Months Ended March 31, | Six Months Ended June 30, | |||||||||||||||

| (in thousands) | Shares | Total Fair Value | Shares | Total Fair Value | ||||||||||||

RSUs(1) | 858 | $ | 49,600 | 931 | $ | 54,100 | ||||||||||

Non-qualified stock options | 1,377 | $ | 24,700 | 1,446 | $ | 26,000 | ||||||||||

| (1) | Includes approximately 0.1 million RSUs which were granted in connection with the election by certain employees to receive 50% of their 2018 target incentive compensation under the Company’s Corporate Incentive Compensation Plan in the form of RSUs instead of cash. Stock-based compensation of approximately $8.2 million associated with this RSU grant is expected to be recognized over aone-year period beginning on the grant date. |

RSU vestings and stock option exercises

During the threesix months ended March 31,June 30, 2018, 0.60.9 million shares of common stock were issued due to stock option exercises and RSU vestings under the Company’s stock-based compensation plans.

PEGASYSTEMS INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (continued)

11. INCOME TAXES

Effective Tax Rateincome tax rate

The Company computes its (benefit)/provision forbenefit from income taxes by applying the estimated annual effective income tax rate to year to date (loss)/income before (benefit)/provision forbenefit from income taxes and adjusts for discrete tax items recorded in the period.

| Three Months Ended March 31, | Six Months Ended June 30, | |||||||||||||||

| (Dollars in thousands) | 2018 | 2017 | 2018 | 2017 | ||||||||||||

(Benefit)/provision for income taxes | $ | (4,222) | $ | 13,615 | ||||||||||||

(Benefit) from income taxes | $ | (15,103) | $ | (508) | ||||||||||||

Effective income tax rate | (53)% | 20% | 113% | (1)% | ||||||||||||

During the threesix months ended March 31,June 30, 2018, the Company’s effective tax rate changed primarily due to the following factors:

excess tax benefits from stock-based compensation were disproportionately greater relative to the (loss)/income before (benefit)/provision forbenefit from income taxes;

a decrease in the estimated annual effective income tax rate primarily due to the reduction of the U.S. statutory federal tax rate from 35% to 21% pursuant to the Tax Reform Act; and

an increase in U.S. research and development tax credits.credits; and

a decrease in uncertain tax benefits as a result of the settlement of a foreign tax audit for 2012, 2013, 2014, and 2015.

Tax Reform Actreform act

On December 22, 2017, the Tax Cuts and Jobs Act of 2017 (“Tax Reform Act”) was enacted into law, which significantly changed U.S. tax law and included many provisions, such as a reduction of the U.S. federal statutory tax rate, imposed aone-time transition tax on deemed repatriation of deferred foreign earnings, and included a provision to tax global intangiblelow-taxed income (“GILTI”) of foreign subsidiaries, a special tax deduction for foreign derived intangible income, and a base erosion anti-abuse tax measure (“BEAT”) that may tax payments between a U.S. corporation and its foreign subsidiaries, among other tax changes.

Under the SEC Staff Accounting Bulletin No. 118 (“SAB 118”), the Company recognized the provisional tax impacts in the three months ended December 31, 2017 that included $20.4 million of income tax expense tore-measure its net deferred tax assets to the 21% enacted rate. However, the Company has revised its provisional amount to reflect the impact of the retrospective adoption of ASC 606 and has recognized a $12.6 million income tax benefit for the remeasurement of its net deferred tax liabilities on a retrospective basis in the three months ended December 31, 2017.

The final amounts may differ from those provisional amounts, possibly materially, due to, among other things, additional analysis, changes in interpretations and assumptions the Company has made, additional regulatory guidance that may be issued, and actions the Company may take as a result of the Tax Reform Act.

The Tax Reform Act also provided for aone-time deemed mandatory repatriation of post-1986 undistributed foreign subsidiary earnings and profits through December 31, 2017. However, based on the Company’s provisional analysis performed as of that date, the Company does not expect to be subject to theone-time transition tax due to the Company’s foreign subsidiaries being in a net accumulated deficit position. During the threesix months ended March 31,June 30, 2018, the Company recognized no significant adjustments to these estimates.

The Tax Reform Act provides the following new anti-abuse provisions beginning in 2018:

The GILTI provisions require the Company to include in its U.S. income tax base foreign subsidiary earnings in excess of an allowable return on the foreign subsidiary’s tangible assets. The Company expects that it will be subject to incremental U.S. tax resulting from GILTI inclusions beginning in 2018. As of March 31,June 30, 2018, the Company has included an estimate of the effect of its GILTI provisions in its estimated annual effective tax rate. The Company continues to monitor IRS guidance and will update its estimates as guidance is issued.

The BEAT provisions in the Tax Reform Act impose an alternative minimum tax on taxpayers with substantial base-erosion payments. The Company’s preliminary assessment is that the Company will not be subject to the BEAT in 2018. The Company continues to monitor IRS guidance and will update its estimates as guidance is issued.

PEGASYSTEMS INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (continued)

12. EARNINGS PER SHARE

Basic earnings per share is computed using the weighted-average number of common shares outstanding during the applicable period. Diluted earnings per share is computed using the weighted-average number of common shares outstanding during the applicable period, plus the dilutive effect of outstanding stock options and RSUs, using the treasury stock method. In periods of loss, all stock options and RSUs are excluded, as their inclusion would be anti-dilutive.

The calculation of the basic and diluted earnings per share is as follows:

Three Months Ended | Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||||||

| (in thousands, except per share amounts) | 2018 | 2017 | 2018 | 2017 | 2018 | 2017 | ||||||||||||||

Basic | ||||||||||||||||||||

Net income | $ 12,200 | $ 52,963 | ||||||||||||||||||

Net (loss)/income | $ | (10,409) | $ | 3,702 | $ | 1,791 | $ | 56,665 | ||||||||||||

Weighted-average common shares outstanding | 78,236 | 76,761 | 78,635 | 77,313 | 78,436 | 77,039 | ||||||||||||||

|

|

|

|

|

| |||||||||||||||

Earnings per share, basic | $ 0.16 | $ 0.69 | ||||||||||||||||||

(Loss)/earnings per share, basic | $ | (0.13) | $ | 0.05 | $ | 0.02 | $ | 0.74 | ||||||||||||

|

|

|

|

|

| |||||||||||||||

Diluted | ||||||||||||||||||||

Net income | $ 12,200 | $ 52,963 | ||||||||||||||||||

Net (loss)/income | $ | (10,409) | $ | 3,702 | $ | 1,791 | $ | 56,665 | ||||||||||||

Weighted-average effect of dilutive securities: | ||||||||||||||||||||

Stock options | 3,119 | 3,184 | — | 3,694 | 3,132 | 3,439 | ||||||||||||||

RSUs | 1,747 | 1,930 | — | 1,938 | 1,679 | 1,934 | ||||||||||||||

|

|

|

|

|

| |||||||||||||||

Effect of dilutive securities | 4,866 | 5,114 | — | 5,632 | 4,811 | 5,373 | ||||||||||||||

|

|

|

|

|

| |||||||||||||||

Weighted-average common shares outstanding, assuming dilution | 83,102 | 81,875 | 78,635 | 82,945 | 83,247 | 82,412 | ||||||||||||||

|

|

|

|

|

| |||||||||||||||

Earnings per share, diluted | $ 0.15 | $ 0.65 | ||||||||||||||||||

(Loss)/earnings per share, diluted | $ | (0.13) | $ | 0.04 | $ | 0.02 | $ | 0.69 | ||||||||||||

|

|

|

|

|

| |||||||||||||||

Outstanding anti-dilutive stock options and RSUs(1) | 397 | 314 | 6,500 | 237 | 242 | 276 | ||||||||||||||

| (1) | Certain outstanding stock options and RSUs were excluded from the computation of diluted earnings per share because they were anti-dilutive in the period presented. These awards may be dilutive in the future. |

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form10-Q contains or incorporates forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements include, but are not limited to, statements about our future financial performance and business plans, the adequacy of our liquidity and capital resources, the continued payment of quarterly dividends, and the timing of revenue recognition and are described more completely in Part I of our Annual Report on Form10-K for the year ended December 31, 2017.

These forward-looking statements are based on current expectations, estimates, forecasts, and projections about the industry and markets in which we operate, and management’s beliefs and assumptions. In addition, other written or oral statements that constitute forward-looking statements may be made by us or on our behalf. Words such as “expect,” “anticipate,” “intend,” “plan,” “believe,” “could,” “estimate,” “may,” “target,” “strategy,” “is intended to,” “project,” “guidance,” “likely,” “usually,” or variations of such words and similar expressions are intended to identify such forward-looking statements.

These statements are not guarantees of future performance and involve certain risks, uncertainties, and assumptions that are difficult to predict. Important factors that could cause actual future activities and results to differ materially from those expressed in such forward-looking statements include, among others, variation in demand for our products and services and the difficulty in predicting factors affecting the timing of license revenue recognition;services; reliance on third party relationships; our beliefs and the timing of the completion of our analysis regarding the impact of the Tax Cuts and Jobs Act of 2017, including its impact on income tax expense and deferred tax assets; the inherent risks associated with international operations and the continued uncertainties in the global economy; our continued effort to market and sell both domestically and internationally; foreign currency exchange rates; the financial impact of any future acquisitions; the potential legal and financial liabilities and reputation damage due to cyber-attacks and security breaches; and management of our growth. These risks and other factors that could cause actual results to differ materially from those expressed in such forward-looking statements are described more completely in Part I of our Annual Report on Form10-K for the year ended December 31, 2017 as well as other filings we make with the U.S. Securities and Exchange Commission (“SEC”).

Investors are cautioned not to place undue reliance on such forward-looking statements and there are no assurances that the mattersresults contained in such statements will be achieved. Although subsequent events may cause our view to change, except as required by applicable law, we do not undertake and specifically disclaim any obligation to publicly update or revise these forward-looking statements whether as the result of new information, future events, or otherwise.

BUSINESS OVERVIEW

We develop, market, license, and support software applications for customer engagement and digital process automation, in addition to licensing our Pega Platform application development product for clients that wish to build and extend their own applications. The Pega Platform and applications help connect enterprises to their customers in real-time across channels, streamline business operations, and adapt to meet changing requirements.

Our clients include Global 3000 companies and government agencies that seek to manage complex enterprise systems and customer service issues with greater agility and cost-effectiveness. Our strategy is to sell a client a series of licenses, each focused on a specific purpose or area of operations in support of longer term enterprise-wide digital transformation initiatives.

Our license revenue is primarily derived from sales of our applications and Pega Platform. Our cloud revenue is derived from our hosted software applicationapplications and Pega Platform environments. Our consulting revenue is primarily related to new license implementations.

Financial and Performance Metrics

We adopted the new revenue recognition standard (“ASC 606”) effective January 1, 2018 using the full retrospective method. See Note 2. “New Accounting Pronouncements” included in Item 1. “Unaudited Condensed Consolidated Financial Statements” for additional information.

| (Dollars in thousands, except per share amounts) | Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||||||||||||||||||

| 2018 | 2017 | Change | 2018 | 2017 | Change | |||||||||||||||||||||||||||

Total revenue | $ | 196,779 | $ | 186,596 | $ | 10,183 | 5% | $ | 431,961 | $ | 442,905 | $ | (10,944) | (2)% | ||||||||||||||||||

Net (loss)/income | $ | (10,409) | $ | 3,702 | $ | (14,111) | n/m | $ | 1,791 | $ | 56,665 | $ | (54,874) | (97)% | ||||||||||||||||||

Diluted (loss)/earnings per share | $ | (0.13) | $ | 0.04 | $ | (0.17) | n/m | $ | 0.02 | $ | 0.69 | $ | (0.67) | (97)% | ||||||||||||||||||

Cash provided by operating activities | $ | 75,432 | $ | 85,769 | $ | (10,337) | (12)% | |||||||||||||||||||||||||

n/m - not meaningful

| (Dollars in thousands, except per share amounts) | Three Months Ended March 31, | |||||||||||||||

| 2018 | 2017 | Change | ||||||||||||||

Total revenue | $ | 235,182 | $ | 256,309 | $ | (21,127 | ) | (8)% | ||||||||

Net income | $ | 12,200 | $ | 52,963 | $ | (40,763 | ) | (77)% | ||||||||

Diluted earnings per share | $ | 0.15 | $ | 0.65 | $ | (0.50 | ) | (77)% | ||||||||

Cash provided by operating activities | $ | 55,655 | $ | 32,444 | $ | 23,211 | 72% | |||||||||

The decrease in total revenue in the three months ended March 31, 2018 was primarily due to a large term license arrangement recognized in revenue in the three months ended March 31, 2017 and a shift in client preferences to cloud arrangements. Cloud arrangements are generally recognized in revenue over the term of the cloud contract, as compared to other arrangements, which are generally recognized in revenue on the contract effective date.

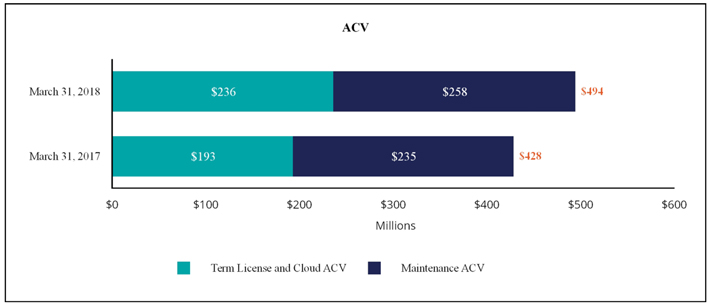

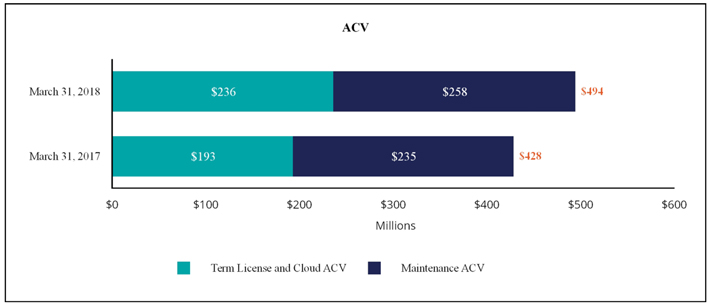

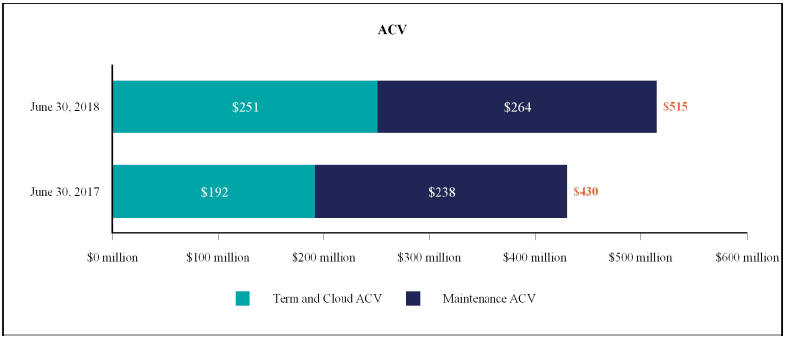

Annual Contract Value (“ACV”)(1)

The change in ACV measures the growth and predictability of future cash flows from committed term, cloud, and maintenance arrangements as of the end of the particular reporting period.

| March 31, | June 30, | |||||||||||||||||||||||||||||||

| (in thousands) | 2018 | 2017 | Change | 2018 | 2017 | Change | ||||||||||||||||||||||||||

Term and Cloud ACV | $ | 236,025 | $ | 193,004 | $ | 43,021 | 22% | $ | 250,904 | $ | 191,634 | $ | 59,270 | 31% | ||||||||||||||||||

Maintenance ACV | 258,100 | 234,852 | $ | 23,248 | 10% | 263,624 | 237,696 | 25,928 | 11% | |||||||||||||||||||||||

|

|

|

| |||||||||||||||||||||||||||||

Total ACV | $ | 494,125 | $ | 427,856 | $ | 66,269 | 15% | $ | 514,528 | $ | 429,330 | $ | 85,198 | 20% | ||||||||||||||||||

|

|

|

| |||||||||||||||||||||||||||||