Notable Transactions

On April 9, 2018,10, 2019, Blackstone concluded its investmentissuedsub-advisory€ relationship with FS Investments’ funds600 million aggregate principal amount of 1.500% Senior Notes maturing on April 10, 2029.

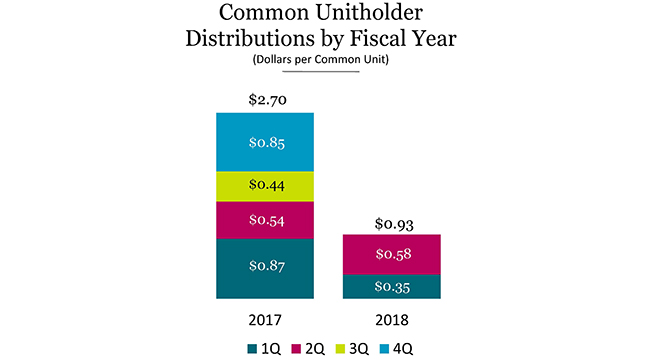

On April 18, 2019, we announced our decision to convert (the “FS Funds”“Conversion”), as previously announced. At March 31, 2018, the FS Funds represented $20.0 billion of Total Assets Under Management. Over time, we believe we will replace and ultimately overtake the prior level of revenue and earnings associated with oursub-advisory relationship with FS Investments. As part of the transaction, The Blackstone received proceedsGroup L.P. (the “Partnership”) from FS Investments of $580.9 million which is recorded as Other Revenues within the Condensed Consolidated Statement of Operations for the three months ended June 30, 2018. This amount is characterized as a Transaction-Related Charge and therefore is not included in Economic Income, Fee Related Earnings, or Distributable Earnings for the three months ended June 30, 2018.Delaware limited partnership to a Delaware corporation named The Blackstone intendsGroup Inc. (the “Corporation”). See “– Conversion to distribute a portion of theafter-tax proceeds to unitholders resulting in an anticipated incremental $0.30 per common unit and per Blackstone Holdings Partnership unit over the second, third and fourth quarters of 2018, of which $0.10 per common unit was distributed on August 6, 2018.Corporation.”

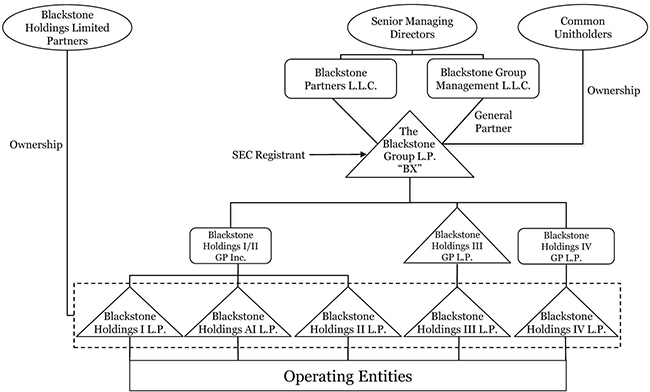

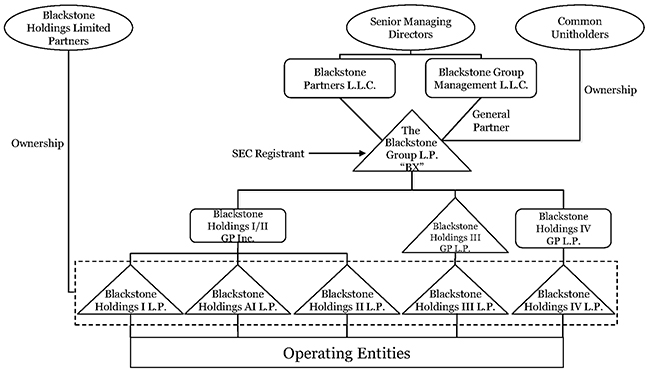

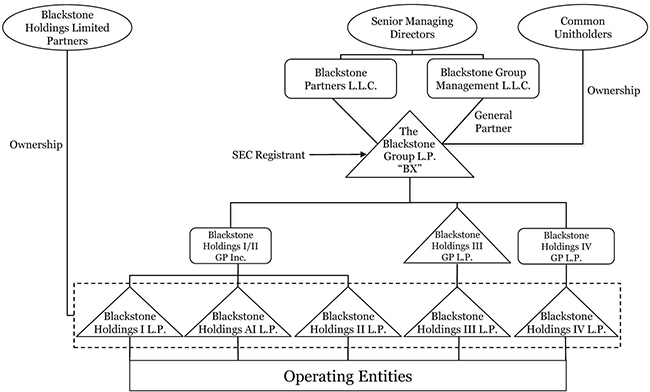

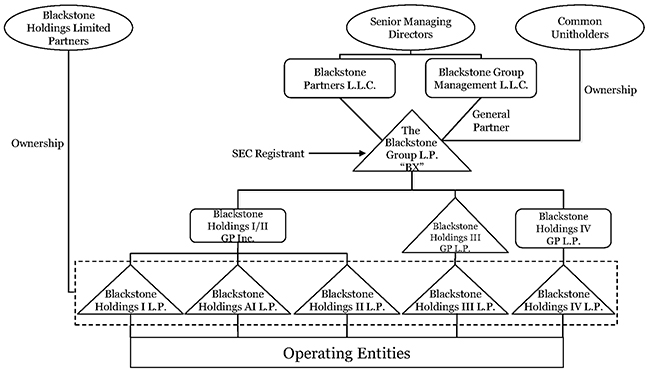

Organizational Structure

The simplified diagram below depicts our current organizational structure. The diagram does not depict all of our subsidiaries, including intermediate holding companies through which certain of the subsidiaries depicted are held.

On April 18, 2019, we announced our decision to convert The Blackstone Group L.P. from a Delaware limited partnership to a Delaware corporation named The Blackstone Group Inc. We expect the Conversion to become effective on July 1, 2019 (such date and time at which the Conversion becomes effective, the “Effective Time”). The Conversion was unanimously approved by the board of directors of our general partner, Blackstone Group Management L.L.C., following our receipt of special approval of the Conversion from the conflicts committee of the board of directors of our general partner pursuant to our limited partnership agreement. Under Section 14.3(d) of our limited partnership agreement, no vote of the unitholders is required or will be sought for the Conversion.

We believe that the Conversion will make it significantly easier for both domestic and international investors to own our stock. We expect that simplifying the tax reporting of our owners by eliminatingSchedule K-1s will make our equity eligible for investment by a broader universe of institutional investors that today are restricted from owning it. Following the Conversion, we also anticipate that our Class A common stock

will be eligible for inclusion in benchmark stock indices underlying a meaningful portion of the total exchange-traded and index fund market by assets under management, including CRSP, MSCI and Total Market indices. Further, simplifying our tax structure should increase the appeal of our equity tonon-U.S. investors for whom certain kinds of pass through income can be problematic. As a result, we believe the Conversion will meaningfully expand our global investor base and drive greater value for our shareholders over time.

The Conversion is expected to qualify for thenon-recognition of gain or loss to our unitholders for U.S. federal income tax purposes. The application of thenon-recognition rules tonon-U.S. unitholders in the context of the Conversion is dependent on local tax requirements. All unitholders should consult their own advisors as to the consequences of the Conversion to them. Final ScheduleK-1s will be issued in respect of our final taxable period as a limited partnership ending June 30, 2019, which we anticipate will become available in March, 2020. Following the Conversion, dividends will be reported to stockholders onForm 1099-DIV. We believe this change will simplify our stockholders’ tax reporting obligations. For U.S. federal income tax purposes, any dividends we pay following the Conversion generally will be treated as qualified dividend income (generally taxable to U.S. individual stockholders at capital gain rates) paid by a domestic corporation to the extent paid out of our current or accumulated earnings and profits, as determined for U.S. federal income tax purposes.

Following the Conversion, all of the net income attributable to the Corporation will be subject to U.S. federal (and state and local) corporate income taxes. See “Part II. Item 1A. Risk Factors — Following the Conversion, we expect to pay more corporate income taxes than we would have as a limited partnership.”

Conversion Steps

In order to implement the Conversion, Blackstone Group Management L.L.C., in its capacity as the Partnership’s general partner, will file with the Secretary of State of the State of Delaware a Certificate of Conversion (the “Certificate of Conversion”) and, in its capacity as sole incorporator of the Corporation, will file with the Secretary of State of the State of Delaware a Certificate of Incorporation (the “Certificate of Incorporation”). As a result, at the Effective Time, the Partnership will convert to the Corporation.

As a result of the Conversion, the business and affairs of the Corporation will be overseen by a board of directors of the Corporation, rather than by the board of directors of our general partner. At the Effective Time, the directors of our general partner immediately prior to the Effective Time will become the directors of the Corporation and cease to be directors of our general partner. In addition, the audit committee and executive committee of our general partner’s board, and the membership thereof, immediately prior to the Effective Time, will be replicated at the Corporation at the Effective Time. The board of directors of the Corporation will also have a compensation committee, the members of which will be appointed by Blackstone Group Management L.L.C., as the sole holder of Class C Common Stock. Mr. Schwarzman will initially be the sole member of the compensation committee. Following the Conversion, when the provisions of our existing partnership agreement that contemplate a standing conflicts committee will no longer apply, disinterested members of our board of directors will continue to address conflicts, including by referral of such matters to the audit committee or such other committee of disinterested directors as the board deems appropriate. In addition, at the Effective Time, the executive officers of our general partner will become the executive officers of the Corporation.

Reorganization and Amendments to Material Agreements

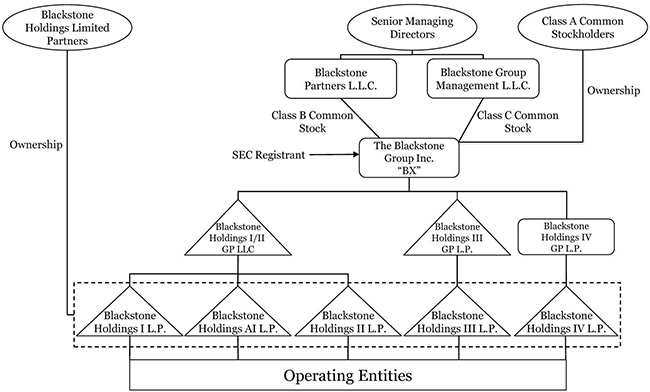

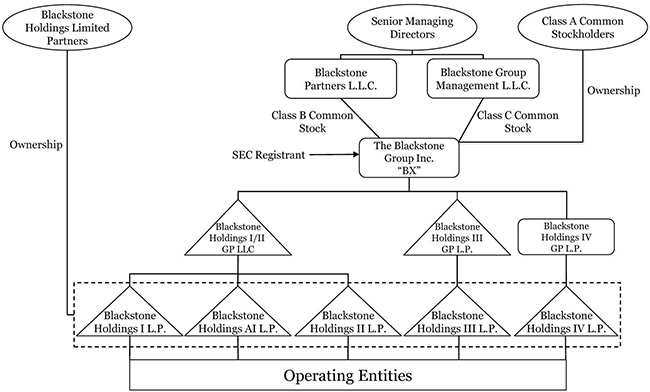

In connection with the Conversion, at or prior to the Effective Time, Blackstone Holdings I/II GP Inc., a wholly owned subsidiary of the Partnership, will convert from a Delaware corporation to a Delaware limited liability company and we will effect certain other ancillary restructuring steps (such restructuring steps, together with the Conversion, the “Transactions”). At or prior to the Effective Time, we will also amend certain of Blackstone’s existing agreements to give effect to and reflect the Transactions. These changes are generally clarifying and conforming in nature and intended to preserve the status quo.

Capital Stock of the Corporation

At the Effective Time, (a) each common unit of the Partnership (“Common Unit”) outstanding immediately prior to the Effective Time will be converted into one issued and outstanding, fully paid and nonassessable share of Class A common stock, $0.00001 par value per share, of the Corporation (“Class A Common Stock”), (b) the special voting unit (“Special Voting Unit”) of the Partnership outstanding immediately prior to the Effective Time will be converted into one issued and outstanding, fully paid and nonassessable share of Class B common stock, $0.00001 par value per share, of the Corporation (“Class B Common Stock”) and (c) the general partner units of the Partnership outstanding immediately prior to the Effective Time will be converted into one issued and outstanding, fully paid and nonassessable share of Class C common stock, $0.00001 par value per share, of the Corporation (“Class C Common Stock”).

As a result of the Conversion, holders of Common Units will become holders of Class A Common Stock, which will continue to be listed on the NYSE under the symbol “BX” at the opening of trading immediately following the Effective Time. Blackstone Partners L.L.C., an entity owned by senior managing directors of Blackstone and controlled by Mr. Schwarzman and the current holder of the Special Voting Unit, will be the sole holder of the Class B Common Stock. Blackstone Group Management L.L.C., a separate entity owned by senior managing directors of Blackstone and controlled by Mr. Schwarzman and the current general partner of the Partnership, will be the sole holder of the Class C Common Stock.

Prior to the Effective Time, we will notify the NYSE that the Certificate of Conversion will be filed with the Secretary of State of Delaware and request that, as of the open of business on July 2, 2019, the NYSE cease trading of the Common Units on the NYSE and commence trading of the Class A Common Stock on the NYSE under the existing ticker symbol “BX.” It is expected that the Class A Common Stock will have the same CUSIP number as the existing Common Units.

The Certificate of Incorporation and Bylaws of the Corporation will provide our Class A common stockholders following the Conversion with substantially the same rights and obligations that our common unitholders have under the Partnership’s limited partnership agreement. Accordingly, the Class A Common Stock generally will benon-voting like the existing Common Units. More specifically, the Certificate of Incorporation will provide that, holders of the Class A Common Stock will not have any voting rights or powers except as required by the Delaware General Corporation Law or as expressly provided in the Certificate of Incorporation. Similarly, the Class B Common Stock generally will benon-voting like the existing Special Voting Unit. The holder of the Class B Common Stock generally will vote together with the Class A Common Stock as a single class on those few matters that may be submitted for a vote of the Class A Common Stock. The Class C Common Stock that will be held by the entity that has served as the Partnership’s general partner will be the only class of the Corporation’s common stock entitled to vote at a meeting of stockholders (or to take similar action by written consent) in the election of directors and generally with respect to all other matters submitted to a vote of stockholders. As a result, the Corporation will be a “controlled company” within the meaning of the corporate governance standards of the NYSE and, like the Partnership, will qualify for exceptions from certain corporate governance rules of the NYSE.

Under the existing partnership agreement of the Partnership, our general partner may, upon the approval of the holders of at leasttwo-thirds of the voting power of our outstanding Common Units and Special Voting Units voting together as a single class, be replaced with a successor general partner designated by a majority of the voting power of such classes voting together as a single class. Similarly, under the Certificate of Incorporation, the holder of the Class C Common Stock may, upon the approval of the stockholders holding at leasttwo-thirds of the voting power of our outstanding shares of Class A Common Stock and Class B Common Stock voting together as a single class, be required to transfer its shares of Class C Common Stock to a successor holder of Class C Common Stock designated by the stockholders holding a majority of the voting power of such classes voting together as a single class.

The simplified diagram below depicts our organizational structure following the Conversion. The diagram does not depict all of our subsidiaries, including intermediate holding companies through which certain of the subsidiaries depicted are held.

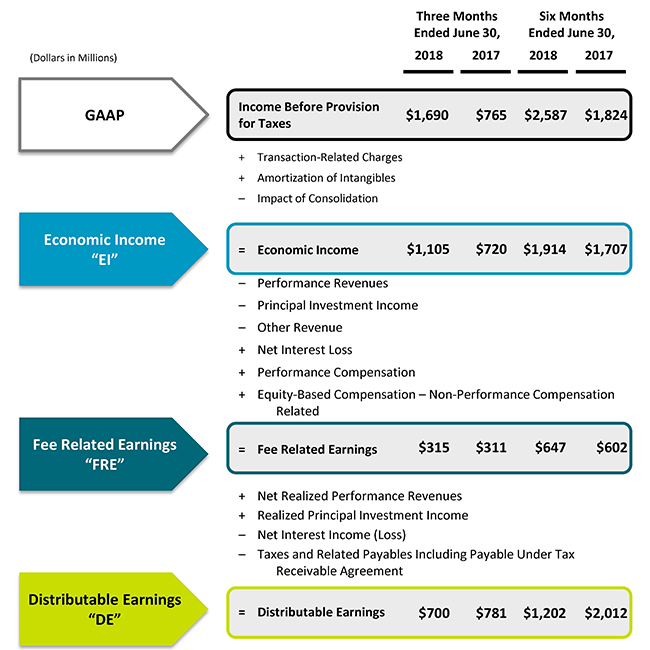

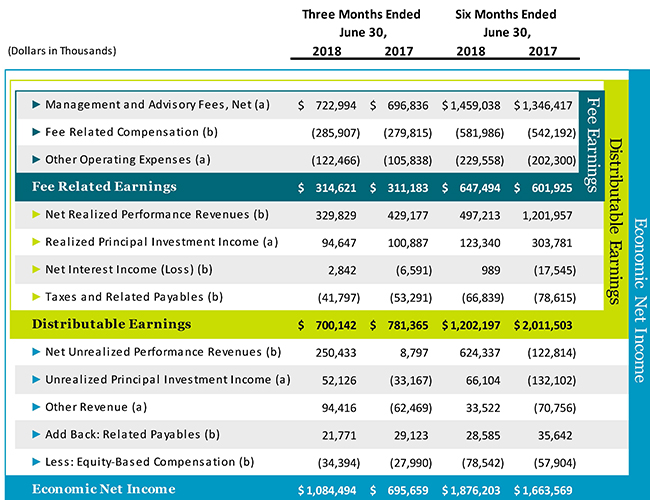

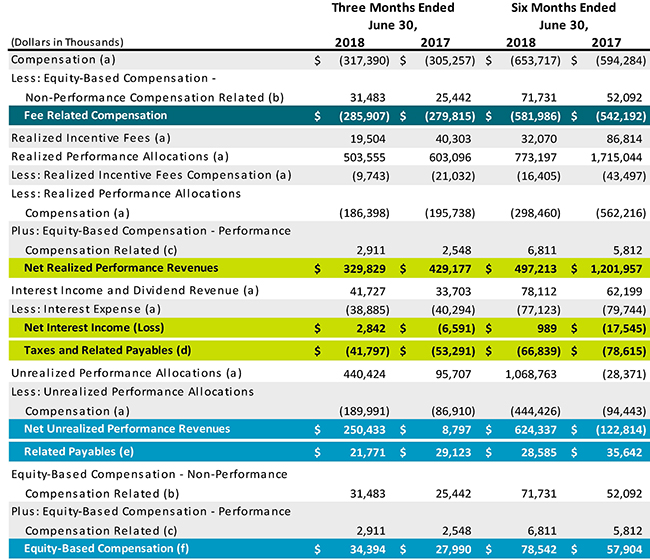

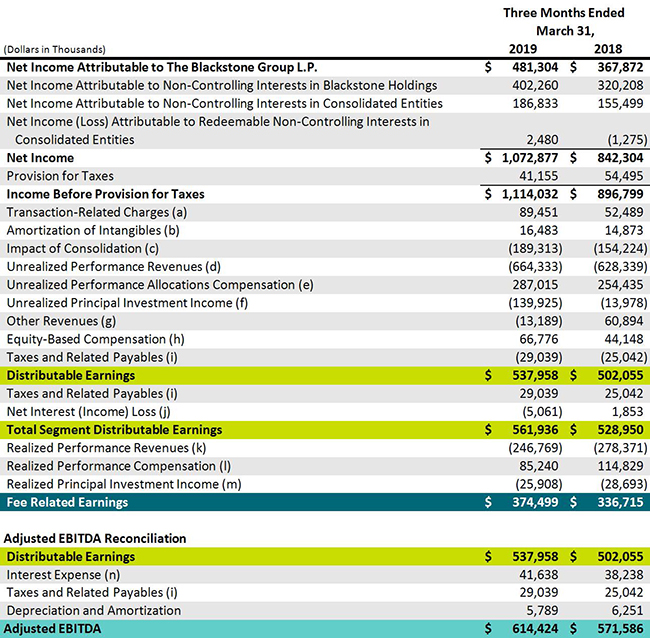

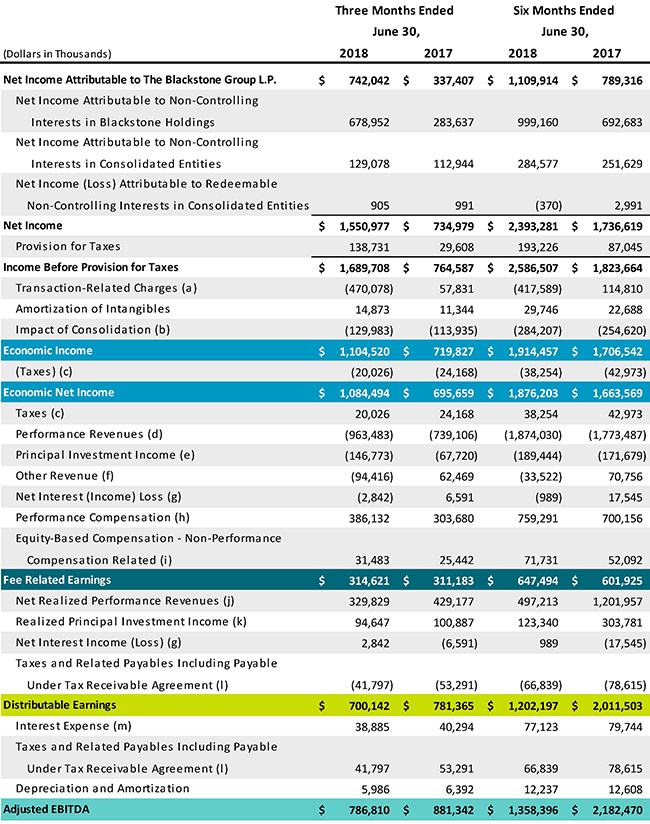

Key Financial Measures and Indicators

We manage our business using keytraditional financial measures and indicatorskey operating metrics since we believe theythese metrics measure the productivity of our investment activities. Our key financial measures and indicators are discussed below.

Revenues

Revenues primarily consist of management and advisory fees, incentive fees, investment income, interest and dividend revenue and other. Please refer to “Part I. Item 1. Business — Incentive Arrangements / Fee Structure”We prepare our Condensed Consolidated Financial Statements in our Annual Report onForm 10-K for the year ended December 31, 2017 and “— Critical Accounting Policies — Revenue Recognition” for additional information regarding the manner in which Base Management Fees and Incentive Fees are generated.