UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended September 30, 2017March 31, 2024

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ____________ to ____________

Commission file number: 001-36055

China Commercial Credit, Inc.BAIYU HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 45-4077653 | |

(State or other jurisdiction of

| (I.R.S. Employer

|

No.1 Zhongying Commercial Plaza,

Zhong Ying Road,

Wujiang, Suzhou,

Jiangsu Province, China

(Address of principal executive offices)

| 139, Xinzhou 11th Street, Futian District Shenzhen, Guangdong, PRC | 518000 | |

| (Address of principal executive offices) | (Zip Code) |

+86-512 6396-002286 (0755) 82792111

(Registrant’s(Registrant’s telephone number, including area code)

25th Floor, Block C, Tairan Building

No. 31 Tairan 8th Road, Futian District, Shenzhen, Guangdong, PRC

(Former name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| Common Stock, par value $0.001 | BYU | Nasdaq Capital Market |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | Smaller reporting company | ☒ | |

| Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of NovemberMay 10, 2017, 19,030,9152024, 19,935,688 shares of the Company’s Common Stock, $0.001 par value per share, were issued and outstanding.

PART I.1. FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

CHINA COMMERCIAL CREDIT,BAIYU HOLDINGS, INC.

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS

As of March 31, 2024 and December 31, 2023

| September 30, | ||||||||

2017 (Unaudited) | December 31, 2016 | |||||||

| ASSETS | ||||||||

| Cash and cash equivalent | $ | 3,030,468 | $ | 768,501 | ||||

| Restricted cash | 9,596 | 9,163 | ||||||

| Notes receivable | 279,493 | 107,995 | ||||||

| Loans receivable, net of allowance for loan losses of $54,821,187 and $51,708,062 for September 30, 2017 and December 31, 2016, respectively | 3,445,533 | 6,814,919 | ||||||

| Investment in direct financing lease, net of allowance for direct financing lease losses of $2,615,635 and $2,441,663 for September 30, 2017 and December 31, 2016, respectively | 450,795 | 871,159 | ||||||

| Interest receivable | 77,329 | 11,408 | ||||||

| Due from a related party | - | 469,418 | ||||||

| Property and equipment, net | 15,727 | 19,969 | ||||||

| Guarantee paid on behalf of guarantee service customers, net of allowance for repayment on behalf of guarantee service customers losses of $12,089,724 and $11,543,868 for September 30, 2017 and December 31, 2016, respectively | 54 | 98,887 | ||||||

| Guarantee paid on behalf of a related party, net of allowance for repayment on behalf of a related party losses of $102,270 and $98,000 for September 30, 2017 and December 31, 2016, respectively | 102,270 | 98,000 | ||||||

| Other assets | 302,748 | 301,324 | ||||||

| Total Assets | $ | 7,714,013 | $ | 9,570,743 | ||||

| LIABILITIES AND SHAREHOLDERS’ (DEFICIT) /EQUITY | ||||||||

| Liabilities | ||||||||

| Deposits payable | $ | 781,379 | $ | 748,765 | ||||

| Unearned income from financial guarantee services and finance lease services | 1,878 | 20,819 | ||||||

| Accrual for financial guarantee services | 7,058,187 | 6,005,608 | ||||||

| Other current liabilities | 324,180 | 273,447 | ||||||

| Income tax payable | 240,739 | 169,226 | ||||||

| Deferred tax liability | 81,901 | 139,947 | ||||||

| Total Liabilities | 8,488,264 | 7,357,812 | ||||||

| Shareholders' (Deficit)/ Equity | ||||||||

| Series A Preferred Stock (par value $0.001 per share, 1,000,000 shares authorized at September 30, 2017 and December 31, 2016, respectively; nil and nil shares issued and outstanding at September 30, 2017 and December 31, 2016, respectively) | $ | - | $ | - | ||||

| Series B Preferred Stock (par value $0.001 per share, 5,000,000 shares authorized at September 30, 2017 and December 31, 2016, respectively; nil and nil shares issued and outstanding at September 30, 2017 and December 31, 2016, respectively) | - | - | ||||||

| Common stock (par value $0.001 per share, 100,000,000 shares authorized; 19,030,915 and 16,637,679 shares issued and outstanding at September 30, 2017 and December 31, 2016, respectively) | 19,030 | 16,638 | ||||||

| Subscription receivable | (1,062 | ) | (1,062 | ) | ||||

| Additional paid-in capital | 68,664,627 | 63,124,040 | ||||||

| Statutory reserve | 5,442,150 | 5,442,150 | ||||||

| Due from a non-controlling shareholder | (1,051,857 | ) | (1,007,953 | ) | ||||

| Accumulated deficit | (78,764,900 | ) | (70,234,656 | ) | ||||

| Accumulated other comprehensive income | 4,917,761 | 4,873,774 | ||||||

| Total Shareholders’ (Deficit)/ Equity | (774,251 | ) | 2,212,931 | |||||

| Total Liabilities and Shareholders’ (Deficit)/Equity | $ | 7,714,013 | $ | 9,570,743 | ||||

(Expressed in U.S. dollars, except for the number of shares)

| March 31, | December 31, | |||||||

| 2024 | 2023 | |||||||

| ASSETS | ||||||||

| Current Assets | ||||||||

| Cash and cash equivalents | $ | 557,451 | $ | 1,516,358 | ||||

| Loans receivable from third parties | 247,049,634 | 240,430,865 | ||||||

| Inventories, net | - | 259,806 | ||||||

| Other current asset | 11,727,715 | 10,134,829 | ||||||

| Total current assets | 259,334,800 | 252,341,858 | ||||||

| Non-Current Assets | ||||||||

| Plant and equipment, net | 28,921 | 32,090 | ||||||

| Goodwill | 157,268,963 | 157,542,081 | ||||||

| Intangible assets, net | 43,228,852 | 45,285,617 | ||||||

| Right-of-use assets, net | 60,532 | 83,375 | ||||||

| Total non-current assets | 200,587,268 | 202,943,163 | ||||||

| Total Assets | $ | 459,922,068 | $ | 455,285,021 | ||||

| LIABILITIES AND EQUITY | ||||||||

| Current Liabilities | ||||||||

| Bank borrowings | 1,055,814 | 1,057,648 | ||||||

| Third party loans payable | 481,704 | 476,627 | ||||||

| Contract liabilities | 4,477,564 | 3,090,201 | ||||||

| Income tax payable | 17,671,662 | 16,187,826 | ||||||

| Lease liabilities | 63,303 | 86,691 | ||||||

| Other current liabilities | 7,018,000 | 6,578,349 | ||||||

| Convertible promissory notes | 4,107,742 | 4,284,622 | ||||||

| Total current liabilities | 34,875,789 | 31,761,964 | ||||||

| Non-Current Liabilities | ||||||||

| Deferred tax liabilities | 2,065,053 | 2,256,696 | ||||||

| Due to related parties | 38,054,968 | 38,121,056 | ||||||

| Total non-current liabilities | 40,120,021 | 40,377,752 | ||||||

| Total liabilities | 74,995,810 | 72,139,716 | ||||||

| Commitments and Contingencies (Note 16) | ||||||||

| Equity | ||||||||

| Common stock (par value $0.001 per share, 600,000,000 shares authorized; 19,785,688 and 19,335,220 shares issued and outstanding as of March 31, 2024 and December 31, 2023, respectively)* | 19,786 | 19,335 | ||||||

| Additional paid-in capital | 439,430,236 | 438,980,687 | ||||||

| Statutory surplus reserve | 2,602,667 | 2,602,667 | ||||||

| Accumulated deficit | (37,140,024 | ) | (39,520,164 | ) | ||||

| Accumulated other comprehensive income | (16,812,601 | ) | (16,144,752 | ) | ||||

| Total BAIYU Shareholders’ Equity | 388,100,064 | 385,937,773 | ||||||

| Non-controlling interest | (3,173,806 | ) | (2,792,468 | ) | ||||

| Total Equity | 384,926,258 | 383,145,305 | ||||||

| Total Liabilities and Equity | $ | 459,922,068 | $ | 455,285,021 | ||||

| * | On October 30, 2023, the Company completed a 50:1 reverse stock split of our common stock issued and outstanding. All shares and associated amounts have been retroactively restated to reflect the reverse stock split. See Note 13 - Reverse stock split of |

SeeThe accompanying notes toare an integral part of the unaudited condensed consolidated financial statements

statements.

CHINA COMMERCIAL CREDIT,

BAIYU HOLDINGS, INC.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND

COMPREHENSIVE LOSSINCOME (LOSS)

For the Three Months Ended March 31, 2024 and 2023

(Expressed in U.S. dollars, except for the number of shares)

For the Three Months Ended September 30, | For the Nine Months Ended September 30, | |||||||||||||||

2017 (Unaudited) | 2016 (Unaudited) | 2017 (Unaudited) | 2016 (Unaudited) | |||||||||||||

| Interest income | ||||||||||||||||

| Interests and fees on loans and direct financing lease | $ | 128,460 | $ | 722,117 | $ | 290,566 | $ | 1,203,663 | ||||||||

| Interests on deposits with banks | 4,042 | 263 | 4,728 | 3,526 | ||||||||||||

| Total interest and fee income | 132,502 | 722,380 | 295,294 | 1,207,189 | ||||||||||||

| Interest expense | ||||||||||||||||

| Interest expense on short-term bank loans | - | - | - | (30,057 | ) | |||||||||||

| Net interest income | 132,502 | 722,380 | 295,294 | 1,177,132 | ||||||||||||

| Reversal of provision/(Provision) for loan losses | 452,786 | 226,694 | (2,420,698 | ) | 133,177 | |||||||||||

| (Provision)/Reversal of provision for direct financing lease losses | (18,616 | ) | 242,180 | (66,113 | ) | 242,180 | ||||||||||

| Net interest income/(loss) after provision for loan losses and financing lease losses | 566,672 | 1,191,254 | (2,191,517 | ) | 1,552,489 | |||||||||||

| Commissions and fees on financial guarantee services | - | 9,117 | 2,843 | 26,308 | ||||||||||||

| (Provision)/Reversal of provision for financial guarantee services | (1,142,807 | ) | (599,808 | ) | (830,140 | ) | 385,352 | |||||||||

| Commission and fee (loss)/income on guarantee services, net | (1,142,807 | ) | (590,691 | ) | (827,297 | ) | 411,660 | |||||||||

| Net (Loss)/Revenue | (576,135 | ) | 600,563 | (3,018,814 | ) | 1,964,149 | ||||||||||

| Non-interest income | ||||||||||||||||

| Other non-interest income | - | - | - | 48,945 | ||||||||||||

| Total non-interest income | - | - | - | 48,945 | ||||||||||||

| Non-interest expense | ||||||||||||||||

| Salaries and employee surcharge | (180,461 | ) | (120,130 | ) | (707,012 | ) | (548,978 | ) | ||||||||

| Rental expenses | (13,975 | ) | (28,132 | ) | (41,242 | ) | (64,850 | ) | ||||||||

| Business taxes and surcharge | (1,376 | ) | 9,617 | (3,221 | ) | (21,798 | ) | |||||||||

| Transaction costs relating to acquisition | (1,356,285 | ) | - | (2,136,285 | ) | - | ||||||||||

| Litigation and settlement cost for the shareholders’ lawsuit | - | - | (1,838,500 | ) | (690,000 | ) | ||||||||||

| Other operating expenses | (387,003 | ) | (1,086,092 | ) | (784,815 | ) | (1,893,027 | ) | ||||||||

| Total non-interest expense | (1,939,100 | ) | (1,224,737 | ) | (5,511,075 | ) | (3,218,653 | ) | ||||||||

| Foreign exchange loss | (57 | ) | (271 | ) | (355 | ) | (557 | ) | ||||||||

| Loss Before Income Taxes | (2,515,292 | ) | (624,445 | ) | (8,530,244 | ) | (1,206,116 | ) | ||||||||

| Income tax expense | - | - | - | - | ||||||||||||

| Net Loss | $ | (2,515,292 | ) | $ | (624,445 | ) | $ | (8,530,244 | ) | $ | (1,206,116 | ) | ||||

| Loss per Share- Basic and Diluted | (0.139 | ) | (0.039 | ) | (0.491 | ) | (0.086 | ) | ||||||||

| Weighted Average Shares Outstanding-Basic and Diluted | 18,092,369 | 15,889,853 | 17,371,183 | 14,026,815 | ||||||||||||

| Net Loss | (2,515,292 | ) | (624,445 | ) | (8,530,244 | ) | (1,206,116 | ) | ||||||||

| Other comprehensive income | ||||||||||||||||

| Foreign currency translation adjustment | 14,699 | 260,803 | 43,987 | 205,546 | ||||||||||||

| Comprehensive Loss | $ | (2,500,593 | ) | $ | (363,642 | ) | $ | (8,486,257 | ) | $ | (1,000,570 | ) | ||||

| For the Three Months Ended March 31, | ||||||||

| 2024 | 2023 | |||||||

| Revenues | ||||||||

| - Sales of commodity products – third parties | $ | 28,089,681 | $ | 34,571,288 | ||||

| - Supply chain management services – third parties | 2,466 | 6,350 | ||||||

| Total revenue | 28,092,147 | 34,577,638 | ||||||

| Cost of revenues | ||||||||

| - Commodity product sales-third parties | (28,144,823 | ) | (34,653,239 | ) | ||||

| - Supply chain management services-third parties | (16 | ) | (40 | ) | ||||

| Total operating costs | (28,144,839 | ) | (34,653,279 | ) | ||||

| Gross loss | (52,692 | ) | (75,641 | ) | ||||

| Operating expenses | ||||||||

| Selling, general, and administrative expenses | (2,707,183 | ) | (2,743,061 | ) | ||||

| Total operating expenses | (2,707,183 | ) | (2,743,061 | ) | ||||

| Net Operating Loss | (2,759,875 | ) | (2,818,702 | ) | ||||

| Other income (expenses), net | ||||||||

| Interest income | 6,269,463 | 4,449,000 | ||||||

| Interest expenses | (121,438 | ) | (109,987 | ) | ||||

| Amortization of beneficial conversion feature relating to issuance of convertible promissory notes | (92,552 | ) | (220,652 | ) | ||||

| Other income, net | 25,918 | 4,523 | ||||||

| Total other income, net | 6,081,391 | 4,122,884 | ||||||

| Net income before income taxes | 3,321,516 | 1,304,182 | ||||||

| Income tax expenses | (1,322,714 | ) | (852,905 | ) | ||||

| Net income | 1,998,802 | 451,277 | ||||||

| Less: Net loss attributable to non-controlling interests | (381,338 | ) | (398,966 | ) | ||||

| Net income attributable to BAIYU Holdings, Inc.’s Stockholders | 2,380,140 | 850,243 | ||||||

| Comprehensive Income | ||||||||

| Net income | 1, 998,802 | 451,277 | ||||||

| Foreign currency translation adjustments | (667,849 | ) | 3,045,818 | |||||

| Comprehensive Income | $ | 1,330,953 | $ | 3,497,095 | ||||

| Less: Total comprehensive loss attributable to non-controlling interests | (381,338 | ) | (398,966 | ) | ||||

| Comprehensive income attributable to BAIYU Holdings, Inc.’s Stockholders | $ | 1,712,291 | $ | 3,896,061 | ||||

| Income per share - basic and diluted | ||||||||

| Continuing Operation- income per share – basic* | $ | 0.26 | $ | 0.16 | ||||

| Continuing Operation- income per share –diluted* | $ | 0.17 | $ | 0.04 | ||||

| Weighted Average Shares Outstanding-Basic* | 7,624,124 | 2,800,903 | ||||||

| Weighted Average Shares Outstanding- Diluted* | 11,723,885 | 10,877,671 | ||||||

| * | On October 30, 2023, the Company completed a 50:1 reverse stock split of our common stock issued and outstanding. All shares and associated amounts have been retroactively restated to reflect the reverse stock split. See Note 13 - Reverse stock split of common stock. |

See

The accompanying notes toare an integral part of the unaudited condensed consolidated financial statementsstatements.

CHINA COMMERCIAL CREDIT,

BAIYU HOLDINGS, INC.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY

For the Three Months Ended March 31, 2024 and 2023

(Expressed in U.S. dollars, except for the number of shares)

| Common Stock | Additional paid-in | Accumulated | Surplus | Accumulated other comprehensive | Non-controlling | Total | ||||||||||||||||||||||||||

| Shares | Amount | capital | Deficit | Reserve | income(loss) | interests | Equity | |||||||||||||||||||||||||

| Balance as of December 31, 2022 | 106,742,117 | $ | 106,742 | $ | 344,295,992 | $ | (38,800,375 | ) | 2,602,667 | $ | (8,984,925 | ) | $ | (1,245,932 | ) | $ | 297,974,169 | |||||||||||||||

| Issuance of common stocks in connection with private placements | 35,000,000 | 35,000 | 42,315,000 | - | - | - | - | 42,350,000 | ||||||||||||||||||||||||

| Issuance of common stocks pursuant to exercise of convertible promissory notes | 2,409,900 | 2,410 | 2,072,590 | - | - | - | - | 2,075,000 | ||||||||||||||||||||||||

| Issuance of common stocks pursuant to ATM transaction | 689,306 | 689 | 558,384 | - | - | - | - | 559,073 | ||||||||||||||||||||||||

| Beneficial conversion feature relating to issuance of convertible promissory notes | - | - | 913,000 | - | - | - | - | 913,000 | ||||||||||||||||||||||||

| Net income (loss) | - | - | - | 850,243 | - | - | (398,966 | ) | 451,277 | |||||||||||||||||||||||

| Foreign currency translation adjustments | - | - | - | - | - | 3,045,818 | 3,045,818 | |||||||||||||||||||||||||

| Balance as of March 31, 2023 | 144,841,323 | $ | 144,841 | $ | 390,154,966 | $ | (37,950,132 | ) | 2,602,667 | $ | (5,939,107 | ) | $ | (1,644,898 | ) | $ | 347,368,337 | |||||||||||||||

| Balance as of December 31, 2023 | 19,335,220 | $ | 19,335 | $ | 438,980,687 | $ | (39,520,164 | ) | 2,602,667 | $ | (16,144,752 | ) | $ | (2,792,468 | ) | $ | 383,145,305 | |||||||||||||||

| Issuance of common stocks pursuant to exercise of convertible promissory notes | 450,438 | 451 | 449,549 | - | - | - | - | 450,000 | ||||||||||||||||||||||||

| Net income (loss) | - | - | - | 2,380,140 | - | - | (381,338 | ) | 1,998,802 | |||||||||||||||||||||||

| Foreign currency translation adjustments | - | - | - | - | - | (667,849 | ) | - | (667,849 | ) | ||||||||||||||||||||||

| Balance as of March 31, 2024 | 19,785,658 | $ | 19,786 | $ | 439,430,236 | $ | (37,140,024 | ) | 2,602,667 | $ | (16,812,601 | ) | $ | (3,173,806 | ) | $ | 384,926,258 | |||||||||||||||

| * | On October 30, 2023, the Company completed a 50:1 reverse stock split of our common stock issued and outstanding. All shares and associated amounts have been retroactively restated to reflect the reverse stock split. See Note 13 - Reverse stock split of common stock. |

The accompanying notes are an integral part of the unaudited condensed consolidated financial statements.

BAIYU HOLDINGS, INC.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

For the Three Months Ended March 31, 2024 and 2023

(Expressed in U.S. dollar)

For The Nine Months Ended September 30, | ||||||||

2017 (Unaudited) | 2016 (Unaudited) | |||||||

| Cash Flows from Operating Activities: | ||||||||

| Net loss | $ | (8,530,244 | ) | $ | (1,206,116 | ) | ||

| Adjustments to reconcile net loss to net cash used in operating activities: | ||||||||

| Depreciation and amortization | 4,999 | 46,455 | ||||||

| Provision/(Reversal of provision) for loan losses | 2,420,698 | (133,177 | ) | |||||

| Provision/(Reversal of provision) for direct financing lease losses | 66,113 | (242,180 | ) | |||||

| Provision/(Reversal of provision) of provision for financial guarantee services | 830,140 | (385,352 | ) | |||||

| Deferred tax credit | - | (40,364 | ) | |||||

| Income from disposal of property and equipment | - | (48,945 | ) | |||||

| Shares issued to executive officers and professional services | 2,159,480 | 1,354,424 | ||||||

| Provision for settlement expenses against legal proceedings | 1,843,500 | 465,000 | ||||||

| Changes in operating assets and liabilities: | ||||||||

| Restricted cash | (34 | ) | - | |||||

| Interest receivable | (63,967 | ) | - | |||||

| Other assets | 11,439 | 8,060 | ||||||

| Unearned income from guarantee services and finance lease services | (19,406 | ) | (23,572 | ) | ||||

| Other current liabilities | 28,653 | 118,255 | ||||||

| Income tax payable | - | 39,641 | ||||||

| Net Cash Used in Operating Activities | (1,248,629 | ) | (47,871 | ) | ||||

| Cash Flows from Investing Activities: | ||||||||

| Loans collection from third parties | 1,155,055 | 2,147,593 | ||||||

| Payment of loans on behalf of guarantees | - | (127,886 | ) | |||||

| Collection from guarantees for loan paid on behalf of customers | 44,075 | 1,825,730 | ||||||

| Collection of principal of finance lease, in installments | 227,723 | 484,361 | ||||||

| Deposit released from banks for financial guarantee services | - | 801,530 | ||||||

| Deposit paid to banks for financial guarantee services | - | (694,403 | ) | |||||

| Purchases of property and equipment and intangible asset | - | (48,342 | ) | |||||

| Disposal of property and equipment | - | 56,557 | ||||||

| Short-term loan paid to a related party | - | (1,945,224 | ) | |||||

| Short-term loan collected from a related party | 478,954 | - | ||||||

| Net Cash Provided by Investing Activities | 1,905,807 | 2,499,916 | ||||||

| Cash Flows From Financing Activities: | ||||||||

| Cash raised in private placement | 1,560,000 | 1,000,000 | ||||||

| Repayment of short-term bank borrowings | - | (2,600,832 | ) | |||||

| Net Cash Provided by/ (Used in) Financing Activities | 1,560,000 | (1,600,832 | ) | |||||

| Effect of Exchange Rate Changes on Cash and Cash Equivalents | 44,789 | 9,747 | ||||||

| Net Increase In Cash and Cash Equivalents | 2,261,967 | 860,960 | ||||||

| Cash and Cash Equivalents at Beginning of Period | 768,501 | 306,401 | ||||||

| Cash and Cash Equivalents at End of Period | $ | 3,030,468 | $ | 1,167,361 | ||||

| Supplemental Cash Flow Information | ||||||||

| Cash paid for interest expense | $ | - | $ | 30,057 | ||||

| Cash paid for income tax | $ | - | $ | - | ||||

| For the Three Months Ended March 31, | ||||||||

| 2024 | 2023 | |||||||

| Cash Flows from Operating Activities: | ||||||||

| Net income | $ | 1,998,802 | $ | 451,277 | ||||

| Adjustments to reconcile net income to net cash used in operating activities: | ||||||||

| Depreciation of plant and equipment | 3,110 | 1,215 | ||||||

| Amortization of intangible assets | 1,976,086 | 2,049,732 | ||||||

| Amortization of right of use assets | 22,674 | 30,846 | ||||||

| Amortization of discount on convertible promissory notes | 66,667 | 93,333 | ||||||

| Interest expense for convertible promissory notes | 113,901 | 101,330 | ||||||

| Amortization of beneficial conversion feature of convertible promissory notes | 92,552 | 220,652 | ||||||

| Deferred tax liabilities | (187,526 | ) | (194,515 | ) | ||||

| Inventories impairment | - | (17,229 | ) | |||||

| Inventories | 259,071 | 66,033 | ||||||

| Other current assets | 407,897 | (24,222 | ) | |||||

| Prepayments | (800,396 | ) | 447,960 | |||||

| Contract liabilities | 1,391,191 | (426,158 | ) | |||||

| Due from third parties | (1,165,090 | ) | (628,474 | ) | ||||

| Due from related parties | - | (685,488 | ) | |||||

| Accounts payable | - | (1,291 | ) | |||||

| Income tax payable | 1,510,240 | 1,047,382 | ||||||

| Other current liabilities | 447,472 | 259,083 | ||||||

| Lease liabilities | (23,213 | ) | (30,476 | ) | ||||

| Due to third party loans payable | 5,897 | 6,050 | ||||||

| Net cash provided by operating activities | 6,119,335 | 2,767,040 | ||||||

| Cash Flows from Investing Activities: | ||||||||

| Loans made to third parties | (32,073,939 | ) | (46,678,620 | ) | ||||

| Collection of loans from related parties | 25,046,081 | - | ||||||

| Investments in other investing activities | (49,282 | ) | (10,707 | ) | ||||

| Net cash used in investing activities | (7,077,140 | ) | (46,689,327 | ) | ||||

| Cash Flows from Financing Activities: | ||||||||

| Proceeds from issuance of common stock under ATM transaction | - | 559,073 | ||||||

| Proceeds from issuance of common stock under private placement transactions | - | 42,350,000 | ||||||

| Proceeds from convertible promissory notes | - | 3,000,000 | ||||||

| Net cash provided by financing activities | - | 45,909,073 | ||||||

| Effect of exchange rate changes on cash and cash equivalents | (1,102 | ) | (898,831 | ) | ||||

| Net increase/(decrease) in cash and cash equivalents | (958,907 | ) | 1,087,955 | |||||

| Cash and cash equivalents at beginning of period | 1,516,358 | 893,057 | ||||||

| Cash and cash equivalents at end of period | $ | 557,451 | $ | 1,981,012 | ||||

| Supplemental Cash Flow Information | ||||||||

| Cash paid for interest expenses | $ | 19,218 | $ | 19,934 | ||||

| Supplemental disclosure of Non-cash investing and financing activities | ||||||||

| Issuance of common stocks in connection with conversion of convertible promissory notes | $ | 450,000 | $ | 2,988,000 | ||||

SeeThe accompanying notes toare an integral part of the unaudited condensed consolidated financial statementsstatements.

1. ORGANIZATION AND BUSINESS DESCRIPTION

CHINA COMMERCIAL CREDIT, INC.

NOTES TO THE UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

China Commercial Credit,BAIYU Holding, Inc. (“CCC” or “the Company”) is a holding company that wasDelaware corporation, incorporated under the laws of the Statestate of Delaware on December 19, 2011.

VIE AGREEMENTS WITH WUJIANG LUXIANG

On September 26, 2012, the Company through its indirectly wholly owned subsidiary, Wujiang Luxiang Information Technology Consulting Co. Ltd. (“WFOE”), entered into a series of VIE Agreements with Wujiang Luxiang and the Wujiang Luxiang Shareholders. The purpose of the VIE Agreements is solely to give WFOE the exclusive control over Wujiang Luxiang’s management and operations.Delaware.

The significant termsCompany primarily conducts business through Shenzhen Baiyu Jucheng Data Technology Co., Ltd., Shenzhen Qianhai Baiyu Supply Chain Co., Ltd., Hainan Jianchi Import and Export Co., Ltd., and Shenzhen Tongdow Internet Technology Co., Ltd. to offer the commodity trading business and supply chain management services to customers in the PRC. Supply chain management services consist of the VIE Agreements are summarized below:loan recommendation services and commodity product distribution services.

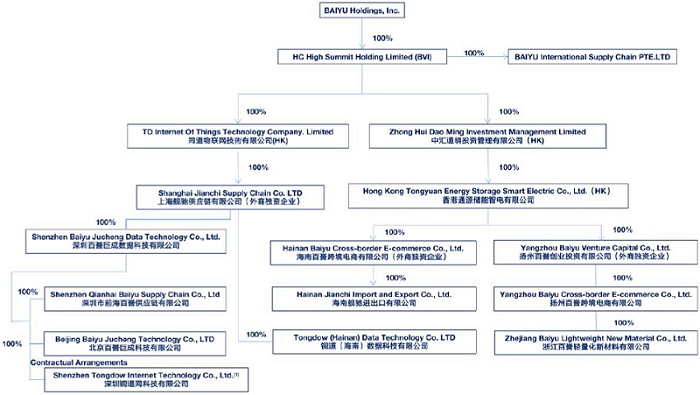

| Name | Background | Ownership | ||

| HC High Summit Holding Limited (“HC High BVI”) | A BVI company Incorporated on March 22, 2018 A holding company | 100% owned by the Company | ||

| TD Internet of Things Technology Company Limited (“TD Internet Technology”) (Formerly Named: Tongdow Block Chain Information Technology Company Limited) | A Hong Kong company Incorporated on February 14, 2020 A holding company | 100% owned by HC High BVI | ||

| Hainan Baiyu Cross-border E-commerce Co., Ltd. (“Hainan Baiyu”) | A Hong Kong company Incorporated on June 19, 2002 A holding company | WFOE, 100% owned by Tongdow HK | ||

| Zhong Hui Dao Ming Investment Management Limited (“ZHDM HK”) | A Hong Kong company Incorporated on June 19, 2002 A holding company | 100% owned by HC High BVI | ||

| Hong Kong Tongyuan Energy Storage Smart Electric Co., Ltd (“Tongdow HK”) (Formerly Named: Tongdow E-trade Limited) | A Hong Kong company Incorporated on November 25, 2010 A holding company | 100% owned by HC High BVI | ||

| Shanghai Jianchi Supply Chain Co., Ltd. (“Shanghai Jianchi”) | A PRC company and deemed a wholly foreign owned enterprise (“WFOE”) Incorporated on April 2, 2020 Registered capital of $10 million A holding company | WFOE, 100% owned by TD Internet Technology | ||

| Tongdow (Hainan) Data Technology Co., Ltd. (“Tondow Hainan”) | A PRC limited liability company Incorporated on July 16, 2020 Registered capital of $1,417,736 (RMB10 million) | A wholly owned subsidiary of Shanghai Jianchi | ||

| Hainan Jianchi Import and Export Co., Ltd. (“Hainan Jianchi”) | A PRC limited liability company Incorporated on December 21, 2020 Registered capital of $7,632,772 (RMB50 million) with registered capital of $0 (RMB0) paid-up | A wholly owned subsidiary of Shanghai Jianchi |

Exclusive Business Cooperation Agreement

| Shenzhen Baiyu Jucheng Data Techonology Co., Ltd. (“Shenzhen Baiyu Jucheng”) | A PRC limited liability company Incorporated on December 30, 2013 Registered capital of $1,417,736 (RMB10 million) with registered capital fully paid-up | VIE of Hao Limo Technology (Beijing) Co., Ltd. before June 25, 2020, and a wholly owned subsidiary of Shanghai Jianchi | ||

| Shenzhen Qianhai Baiyu Supply Chain Co., Ltd. (“Qianhai Baiyu”) | A PRC limited liability company Incorporated on August 17, 2016 Registered capital of $4,523,857 (RMB30 million) with registered capital of $736,506 (RMB5 million) paid-up | A wholly owned subsidiary of Shenzhen Baiyu Jucheng | ||

| Shenzhen Tongdow Internet Technology Co., Ltd. (“Shenzhen Tongdow”) | A PRC limited liability company Incorporated on November 11, 2014 Registered capital of $1,628,320 (RMB10 million) with registered capital of $1,628,320 (RMB10 million) paid-up | VIE of Shenzhen Baiyu Jucheng | ||

| Yangzhou Baiyu Venture Capital Co. Ltd. (“Yangzhou Baiyu Venture”) | A PRC limited liability company Incorporated on April 19, 2021 Registered capital of $30 million with registered capital of $7 million paid-up | WFOE, 100% owned by Tongdow HK | ||

| Yangzhou Baiyu Cross-broder E-commerce Co., Ltd. (“Yangzhou Baiyu E-commerce”) | A PRC limited liability company Incorporated on May 14, 2021 Registered capital of $30 million (RMB200 million) with registered capital of $7 million (RMB48 million) paid-up | 100% owned by Yangzhou Baiyu Venture | ||

| Zhejiang Baiyu Lightweight New Material Co., Ltd. (“Zhejiang Baiyu”) | A PRC limited liability company Incorporated on August 5, 2022 Registered capital of $1,483,569 (RMB10 million) | 100% owned by Yangzhou Baiyu E-commerce | ||

| Baiyu International Supply Chain PTE.LTD | A Singapore company Incorporated on Jun 28, 2023 | 100% owned by HC High BVI | ||

| Beijing Baiyu Jucheng Technology Co., LTD | A PRC limited liability company Incorporated on January 19, 2024 | 100% owned by Qianhai Baiyu |

The following diagram illustrates our corporate structure as of March 31, 2024.

Pursuant to the Exclusive Business Cooperation Agreement between Wujiang Luxiang and WFOE, WFOE provides Wujiang Luxiang with technical support, consulting services and other management services relating to its day-to-day business operations and management, on an exclusive basis, utilizing its advantages in technology, human resources, and information. Additionally, Wujiang Luxiang grants an irrevocable and exclusive option to WFOE to purchase from Wujiang Luxiang any or all

| (1) | A variable interest entity. |

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

(a) Basis of its assets at the lowest purchase price permitted under PRC laws. For services rendered to Wujiang Luxiang by WFOE under the Agreement, the service fee Wujiang Luxiang is obligated to pay shall be calculated based on the time of services rendered multiplied by the corresponding rate, which is approximately equal to the net income of Wujiang Luxiang.presentation

The Exclusive Business Cooperation Agreement shall remain in effect for ten years unless it is terminated by WFOE with 30-day prior notice. Wujiang Luxiang does not have the right to terminate the agreement unilaterally. WFOE may unilaterally extend the term of this agreement with prior written notice.

Share Pledge Agreement

Under the Share Pledge Agreement between the Wujiang Luxiang Shareholders and WFOE, the 12 Wujiang Luxiang Shareholders pledged all of their equity interests in Wujiang Luxiang to WFOE to guarantee the performance of Wujiang Luxiang’s obligations under the Exclusive Business Cooperation Agreement. Under the terms of the agreement, in the event that Wujiang Luxiang or its shareholders breach their respective contractual obligations under the Exclusive Business Cooperation Agreement, WFOE, as pledgee, will be entitled to certain rights, including, but not limited to, the right to collect dividends generated by the pledged equity interests. The Wujiang Luxiang Shareholders also agreed that upon occurrence of any event of default, as set forth in the Share Pledge Agreement, WFOE is entitled to dispose of the pledged equity interest in accordance with applicable PRC laws. The Wujiang Luxiang Shareholders further agree not to dispose of the pledged equity interests or take any actions that would prejudice WFOE’s interest.

Exclusive Option Agreement

Under the Exclusive Option Agreement, the Wujiang Luxiang Shareholders irrevocably granted WFOE (or its designee) an exclusive option to purchase, to the extent permitted under PRC law, once or at multiple times, at any time, part or all of their equity interests in Wujiang Luxiang. The option price is equal to the capital paid in by the Wujiang Luxiang Shareholders subject to any appraisal or restrictions required by applicable PRC laws and regulations.

Power of Attorney

Under the Power of Attorney, the Wujiang Luxiang Shareholders authorize WFOE to act on their behalf as their exclusive agent and attorney with respect to all rights as shareholders, including but not limited to: (a) attending shareholders’ meetings; (b) exercising all the shareholder’s rights, including voting, that shareholders are entitled to under the laws of China and the Articles of Association, including but not limited to the sale or transfer or pledge or disposition of shares in part or in whole; and (c) designating and appointing on behalf of shareholders the legal representative, the executive director, supervisor, the chief executive officer and other senior management members of Wujiang Luxiang. The Power of Attorney is coupled with an interest and shall be irrevocable and continuously valid from the date of execution, so long as the Wujiang Shareholder is a shareholder of the Company.

CHINA COMMERCIAL CREDIT, INC.

NOTES TO THE UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

Timely Reporting Agreement

To ensure Wujiang Luxiang promptly provides all of the information that WFOE and the Company need to file various reports with the SEC, a Timely Reporting Agreement was entered between Wujiang Luxiang and the Company.

Under the Timely Reporting Agreement, Wujiang Luxiang agrees that it is obligated to make its officers and directors available to the Company and promptly provide all information required by the Company so that the Company can file all necessary SEC and other regulatory reports as required.

INCORPORATION OF PFL

On September 5, 2013, our wholly owned subsidiary, CCC International Investment Holding Ltd. (“CCC HK”), established Pride Financial Leasing (Suzhou) Co. Ltd. (“PFL”) in Jiangsu Province, China. PFL was expected to offer financial leasing of machinery and equipment, transportation vehicles, and medical devices to municipal government agencies, hospitals and SMEs in Jiangsu Province and beyond. As of September 30, 2017, PFL had one finance lease transaction.

Theaccompanying unaudited condensed interim consolidated financial statements have been prepared on a going concern basis, which contemplates the realization of assets and the satisfaction of liabilities in the normal course of business. The realization of assets and the satisfaction of liabilities in the normal course of business are dependent on, among other things, the Company’s ability to operate profitably, to generate cash flows from operations, and to pursue financing arrangements to support its working capital requirements. The conditions described below raises substantial doubt about the Company’s ability to continue as a going concern within one year from the date of this filing.

The Company had an accumulated deficit of US$78,764,900 as of September 30, 2017. In addition, the Company had a negative net asset of US$774,251 as of September 30, 2017. As of September 30, 2017, the Company had cash and cash equivalents of US$3,030,468, and total short-term borrowings of nil. Caused by the limited funds, the management assessed that the Company was not able to keep the size of lending business within one year from the filing of Form 10-Q.

The Company is actively seeking other strategic investors with experience in lending business. If necessary, the shareholders of Wujiang Luxiang will contribute more capital into Wujiang Luxiang.

During the nine months ended September 30, 2017, the Company incurred operating loss of US$8,530,244. Affected by the reduction of lending business and guarantee business and increased loss loans, the management was in the opinion that recurring operating losses would be made within one year from the issuance of the filing.

The Company continues to use its best effort to improve collection of loan receivable and interest receivable. Management engaged two PRC law firms to represent the Company in the legal proceedings against the borrowers and their counter guarantors.

During the nine months ended September 30, 2017, the Company incurred negative operating cash flow of US$1,248,629. Affected by significant balance of charged-off interest receivable, the management assessed the Company would continue to have negative operating cash flow within one year from the issuance of the filing.

The Company continues to reduce the redundant headcount and entered into a new office lease with lower rent commitment since January 1, 2017 to improve operating cash flow.

CHINA COMMERCIAL CREDIT, INC.

NOTES TO THE UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

Most loan customers are from textile industry which has been facing downward pressure. Additionally adversely affected by emergence of internet finance entities, the Company was facing fierce competition. Considering the high risks from both customers and competitors, management assessed the Company would further reduced the loan business without strong financial support.

Considering the above factors, the Company, on August 9, 2017, entered into Certain Share Exchange Agreement (“Exchange Agreement”) with the parent company of Sorghum Investment Holdings Limited (“Sorghum”). Pursuant to the terms of the Exchange Agreement, CCCR will acquire 100% of the outstanding shares of Sorghum through issuance of 152,587,000 of its common shares. This transaction will be accounted for as a “reverse acquisition” since, immediately following completion of the transaction, the shareholders of Sorghum immediately prior to the transaction will effectuate control of the Company, through its 87.9% ownership interest in the post-merger entity.

While management believes that the measures in the liquidity plan will be adequate to satisfy its liquidity and cash flow requirements for the twelve months after the financial statements are available to be issued, there is no assurance that the liquidity plan will be successfully implemented. Failure to successfully implement the liquidity plan will have a material adverse effect on the Company’s business, results of operations and financial position, and may materially adversely affect its ability to continue as a going concern.

The unaudited condensed interim consolidated financial statements are prepared and presented in accordanceconformity with accounting principles generally accepted in the United States of America (“U.S. GAAP”GAAP”). All transactions and balances among the Company and its subsidiaries have been eliminated upon consolidation.

The unaudited interim condensed interimconsolidated financial information as of September 30, 2017March 31, 2024 and for the three and nine months ended September 30, 2017March 31, 2024 and 20162023 have been prepared, without audit, pursuant to the rules and regulations of the Securities and Exchange Commission (the “SEC”“SEC”) and pursuant to Regulation S-X.. Certain information and footnote disclosures, which are normally included in annual condensed consolidated financial statements prepared in accordance with U.S. GAAP, have been omitted pursuant to those rules and regulations. The unaudited interim condensed interimconsolidated financial information should be read in conjunction with the auditedconsolidated financial statements and the notes thereto, included in the Company’s Form 10-K for the fiscal year ended December 31, 20162023 previously filed with the SEC on April 6, 2017.March 22, 2024.

In the opinion of management, all adjustments (which include normal recurring adjustments) necessary to present a fair statement of the Company’s unaudited condensed consolidated financial position as of September 30, 2017,March 31, 2024 and its unaudited condensed consolidated results of operations for the three and nine months ended September 30March 31, 2024 and 2016,2023, and its unaudited condensed consolidated cash flows for the ninethree months ended September 30, 2017March 31, 2024 and 2016,2023, as applicable, have been made. The unaudited interim results of operations are not necessarily indicative of the operating results for the full fiscal year or any future periods.

All significant inter-company accounts and transactions have been eliminated in consolidation.

CHINA COMMERCIAL CREDIT, INC.

NOTES TO THE UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

Interest on loans receivable is accrued and credited to income as earned. The Company determines a loan past due status by the number(b) Use of days that have elapsed since a borrower has failed to make a contractual loan payment. Accrual of interest is generally discontinued when either (i) reasonable doubt exists as to the full, timely collection of interest or principal or (ii) when a loan becomes past due by more than 90 days. Additionally, any previously accrued but uncollected interest is reversed. Subsequent recognition of income occurs only to the extent payment is received, subject to management’s assessment of the collectability of the remaining interest and principal. Loans are generally restored to an accrual status when it is no longer delinquent and collectability of interest and principal is no longer in doubt and past due interest is recognized at that time.estimates

The interest reversed duepreparation of consolidated financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the above reason was US$2,604,172reported amounts of assets and US$2,604,172 asliabilities, disclosure of September 30, 2017contingent assets and December 31, 2016, respectively.

Certain itemsliabilities at the date of the financial statements, and the reported amounts of revenue and expenses during the reporting period. Actual results could differ from those estimates. On an ongoing basis, management reviews these estimates using the currently available information. Changes in facts and circumstances may cause the Company to revise its estimates. Significant accounting estimates reflected in the financial statements include: (i) useful lives and residual value of comparative period have been reclassified to conform tolong-lived assets; (ii) the financial statementsimpairment of long-lived assets and investments; (iii) the valuation allowance of deferred tax assets; (iv) estimates of allowance for the current period.doubtful accounts, including loans receivable from third parties and related parties, (v) valuation of Inventory, and (vi) contingencies and litigation.

(c) Foreign currency translation

The reportingCompany’s financial information is presented in U.S. dollars (“USD”). The functional currency of the Company is United States Dollarsthe Chinese Yuan Renminbi (“US$RMB”), which is also the Company’s functional currency. The PRC subsidiaries and VIEs maintain their books and records in its local currency, the Renminbi Yuan (“RMB”), which is their functional currencies as being the primary currency of PRC. Any transactions which are denominated in currencies other than RMB are translated into RMB at the economic environmentexchange rate quoted by the People’s Bank of China prevailing at the dates of the transactions, and exchange gains and losses are included in which these entities operate.

For financial reporting purposes, the statements of operations as foreign currency transaction gain or loss. The consolidated financial statements of the Company have been translated into U.S. dollars in accordance with ASC 830, Foreign Currency Matters. The financial information is first prepared usingin RMB and then translated into U.S. dollars at period-end exchange rates for assets and liabilities and average exchange rates for revenue and expenses. Capital accounts are translated into the Company’s reporting currency, United States Dollars, at thetheir historical exchange rates quoted by www.oanda.com. Assets and liabilitieswhen the capital transactions occurred. The effects of foreign currency translation adjustments are translated using the exchange rate at each balance sheet date. Revenue and expenses are translated using average rates prevailing during each reporting period, and shareholders’ equity is translated at historical exchange rates. Adjustments resulting from the translation are recordedincluded as a separate component of accumulated other comprehensive income (loss) in shareholders’stockholders’ equity.

| September 30, 2017 | December 31, 2016 | |||||||

| Balance sheet items, except for equity accounts | 6.6549 | 6.9448 | ||||||

| For the nine months ended September 30, | ||||||||

| 2017 | 2016 | |||||||

| Items in the statements of operations and comprehensive loss, and statements of cash flows | 6.8065 | 6.5802 | ||||||

Transactions denominated in Cash flows from the Company’s operations are calculated based upon the local currencies other thanusing the functional currency are translated into prevailing functional currency ataverage translation rate. As a result, amounts related to assets and liabilities reported on the exchange rates prevailing at the datesstatements of the transactions. The resulting exchange differences are includedcash flows will not necessarily agree with changes in the condensed consolidated statements of comprehensive loss.

corresponding balances on the balance sheets.

CHINA COMMERCIAL CREDIT, INC.

NOTES TO THE UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

Financial guarantee service contracts provides guarantee which protects the holder of a debt obligation against default. Pursuant to such guarantee, the Company makes payments if the obligor responsible for making payments fails to do so as scheduled.(d) Convertible promissory notes

The contract amounts reflectConvertible promissory notes are recognized initially at fair value, net of upfront fees, debt discounts or premiums, debt issuance costs and other incidental fees. Upfront fees, debt discounts or premiums, debt issuance costs and other incidental fees are recorded as a reduction of the extent of involvementproceeds received and the Company hasrelated accretion is recorded as interest expense in the guarantee transaction and also representconsolidated income statements over the Company’s maximum exposure to credit loss in its guarantee business.estimated term of the facilities using the effective interest method.

(e) Beneficial conversion feature

The Company evaluates the conversion feature to determine whether it was beneficial as described in ASC 470-20. The intrinsic value of a beneficial conversion feature inherent to a convertible note payable, which is not bifurcated and accounted for separately from the convertible notes payable and may not be settled in cash upon conversion, is treated as a partydiscount to financial instruments with off-balance-sheet riskthe convertible notes payable. This discount is amortized over the period from the date of issuance to the date the notes are due using the effective interest method. If the notes payable are retired prior to the end of their contractual term, the unamortized discount is expensed in the normal courseperiod of businessretirement to meetinterest expense. In general, the financing needs of its customers. Financial instruments representing credit risk are as follows:

| September 30, 2017 (Unaudited) | December 31, 2016 | |||||||

| Guarantee | $ | 11,367,564 | $ | 10,893,089 | ||||

A provision for possible loss to be absorbedbeneficial conversion feature is measured by comparing the Company foreffective conversion price, after considering the financial guarantee it provides is recorded as an accrued liability when the guarantees are made and recorded as “Accrual for financial guarantee services” on the condensed consolidated balance sheets. This liability represents probable losses and is increased or decreased by accruing a “(Provision)/ Reversal of provision for financial guarantee services” against the income of commissions and fees on guarantee services.

This is done throughout the life of the guarantee, as necessary when additional relevant information becomes available. The methodology used to estimate the liability for possible guarantee loss considers the guarantee contract amount and a variety of factors, which include, depending on the counterparty, latest financial position and performance of the borrowers, actual defaults, estimated future defaults, historical loss experience, estimated value of collaterals or guarantees the customers or third parties offered, and other economic conditions such as the economy trend of the area and the country. The estimates are based upon currently available information.

Based on the past experience and expected customer default status of financial guarantee services, the Company estimates the probable loss for immature financial guarantee services to be approximately 62% and 55% of contract amount as of September 30, 2017 and December 31, 2016, respectively, for possible credit risk of its guarantees. In addition, the Company accrued specific provisions for repayment on behalf of guarantee customers who defaulted on their loans. The Company reviews the provision on a quarterly basis. The allowance are detailed in following table:

| September 30, 2017 (Unaudited) | December 31, 2016 | |||||||

| Allowance for immature financial guarantee services | $ | 7,058,187 | $ | 6,005,608 | ||||

| Allowance for repayment on behalf of guarantee service customers losses | 12,089,724 | 11,543,868 | ||||||

| Allowance for repayment on behalf of a related party losses | 102,270 | 98,000 | ||||||

| Total allowance for repayment on behalf of guarantee customers losses | $ | 12,191,994 | $ | 11,641,868 | ||||

The Company recorded a provision of US$1,142,807 and US$599,808 for the three months ended September 30, 2017 and 2016, respectively, and recorded a provision of US$830,140 and reversed a provision of US$385,352 for the nine months ended September 30, 2017 and 2016, respectively. As the Company collected from guarantee customers for payments on behalf of in the amount of US$44,075 and US$1,825,730, for the nine month ended September 30, 2017 and 2016, respectively. Among the collection, US$44,075 and US$1,825,730 were accrued of 100% allowance as of pervious year end.

As of September 30, 2017 and December 31, 2016, the management charged off specific provision for three and two customers in the amount of US$164,220 and US$142,966, considering remote collectability from the customers.

CHINA COMMERCIAL CREDIT, INC.

NOTES TO THE UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

Non-interest expenses primarily consist of salary and benefits for employees, traveling cost, entertainment expenses, depreciation of equipment, office rental expenses, professional service fee, office supplies, etc.

Current income tax expenses are provided for in accordance with the laws of the relevant taxing authorities. As part of the process of preparing financial statements, the Company is required to estimate its income taxes in each of the jurisdictions in which it operates. The Company accounts for income taxes using the liability approach. Under this method, deferred income taxes are recognized for tax consequences in future years of differences between the tax bases of assets and liabilities and their reported amounts in the financial statements at each year-end and tax loss carry forwards. Deferred tax assets and liabilities are measured using enacted tax rates applicable for the differences that are expected to affect taxable income.

Comprehensive loss includes net loss and foreign currency adjustments. Comprehensive loss is reported in the statements of operations and comprehensive loss.

Accumulated other comprehensive income, as presented on the balance sheets are the cumulative foreign currency translation adjustments.

Share-based awards granted to the Company’s employees are measured at fair value on grant date and share-based compensation expense is recognized (i) immediately at the grant date if no vesting conditions are required, or (ii) using the accelerated attribution method, net of estimated forfeitures, over the requisite service period. Therelative fair value of restricted shares is determined with referencedetachable instruments included in the financing transaction, if any, to the fair value of the underlying shares.shares of common stock at the commitment date to be received upon conversion.

(f) Recent accounting pronouncement

AtIn November 2023, the FASB issued guidance to enhance disclosure of expenses of a public entity’s reportable segments. The new guidance requires a public entity to disclose: (1) on an annual and interim basis, significant segment expenses that are regularly provided to the chief operating decision maker (CODM) and included within each reported measure of segment profit or loss, (2) on an annual and interim basis, an amount for other segment items (the difference between segment revenue less the significant expenses disclosed under the significant expense principle and each reported measure of segment profit or loss), including a description of its composition, (3) on an annual and interim basis, information about a reportable segment’s profit or loss and assets previously required to be disclosed only on an annual basis, and (4) the title and position of the CODM and an explanation of how the CODM uses the reported measure(s) of segment profit or loss in assessing segment performance and how to allocate resources. The new guidance also clarifies that if the CODM uses more than one measure of a segment’s profit or loss, one or more of those measures may be reported and requires that a public entity that has a single reportable segment provide all the disclosures required by the amendments in this update and all existing segment disclosures. The guidance is effective for the current fiscal year 2024 annual reporting, and in the first quarter of 2025 for interim period reporting, with early adoption permitted. Upon adoption, this guidance should be applied retrospectively to all prior periods presented. We do not expect the adoption of this accounting standard to have an impact on our Consolidated Financial Statements.

In December 2023, the FASB issued guidance to enhance transparency of income tax disclosures. On an annual basis, the new guidance requires a public entity to disclose: (1) specific categories in the rate reconciliation, (2) additional information for reconciling items that are equal to or greater than 5% of the amount computed by multiplying income (or loss) from continuing operations before income tax expense (or benefit) by the applicable statutory income tax rate, (3) income taxes paid (net of refunds received) disaggregated by federal (national), state, and foreign taxes, with foreign taxes disaggregated by individual jurisdictions in which income taxes paid is equal to or greater than 5% of total income taxes paid, (4) income (or loss) from continuing operations before income tax expense (or benefit) disaggregated between domestic and foreign, and (5) income tax expense (or benefit) from continuing operations disaggregated between federal (national), state and foreign. The guidance is effective for fiscal year 2025 annual reporting, with early adoption permitted, to be applied on a prospective basis, with retrospective application permitted. We do not expect the adoption of this accounting standard to have an impact on our Consolidated Financial Statements but will require certain additional disclosures.

Other accounting standards that have been issued or proposed by FASB that do not require adoption until a future date are not expected to have a material impact on the consolidated financial statements upon adoption. The Company does not discuss recent pronouncements that are not anticipated to have an impact on or are unrelated to its consolidated financial condition, results of measurement,operations, cash flows or disclosures.

3. LOANS RECEIVABLE FROM THIRD PARTIES

| March 31, 2024 | December 31, 2023 | |||||||

| Loans receivable from third parties | $ | 247,049,634 | $ | 240,430,865 | ||||

As of March 31, 2024, the Company reviews internalhas thirteen loan agreements compared with thirteen loan agreements on December 31, 2023. The Company provided loans aggregating $32,073,939 for the purpose of making use of idle cash and external sourcesmaintaining long-term customer relationship and collected $25,046,081 during the three months ended March 31, 2024. These loans will mature from May 2024 through February 2025, and charge an interest rate of information10.95% per annum on these customers. The company has the right to assistpledge account receivable or inventory.

Interest income of $6,269,380 and $4,448,860 was accrued for the three months ended March 31, 2024 and 2023, respectively. As of March 31, 2024 and December 31, 2023, the Company recorded an interest receivable of $6,652,850 and $5,931,541 as reflected under “other current assets” in the estimationcondensed consolidated balance sheets.

As of various attributesMarch 31, 2024 and December 31,2023, there was no allowance recorded as the Company considers all of the loans receivable fully collectible.

4. INVENTORIES, NET

The Company’s inventories consist of aluminum ingots, etc., that were purchased from third parties for resale to determinethird parties. Inventories consisted of the following:

| March 31, 2024 | December 31, 2023 | |||||||

| Aluminum ingots | $ | - | $ | 259,806 | ||||

| Inventories, net | $ | - | $ | 259,806 | ||||

For the three months ended March 31, 2024, the Company did not accrue or charge back any impairment as the impaired inventories have been sold.

5. OTHER CURRENT ASSETS

| March 31, 2024 | December 31, 2023 | |||||||

| Other current assets: | ||||||||

| Deposit | $ | 42,632 | $ | 35,888 | ||||

| Interest receivables | 6,652,849 | 5,931,541 | ||||||

| Prepayments | 4,885,130 | 4,089,210 | ||||||

| Others | 147,104 | 78,190 | ||||||

| Total | $ | 11,727,715 | $ | 10,134,829 | ||||

6. PLANT AND EQUIPMENT, NET

| March 31, 2024 | December 31, 2023 | |||||||

| Cost: | ||||||||

| Office equipment | $ | 43,924 | $ | 43,999 | ||||

| Accumulated depreciation: | ||||||||

| Office equipment | $ | (15,003 | ) | $ | (11,909 | ) | ||

| Plant and equipment, net | $ | 28,921 | $ | 32,090 | ||||

Depreciation expense was $3,110, and currency translation difference was $16 for the three months ended March 31, 2024. Depreciation expense was $1,215, and currency translation difference was $36 for the year ended March 31, 2023.

7. GOODWILL

Changes in the carrying amount of goodwill by segment for the years ended March 31, 2024, and December 31, 2023 were as follows:

| Acquisition of Qianhai Baiyu | Contractual arrangement with Tongdow Internet Technology | Total | ||||||||||

| Balance as of December 31, 2022 | $ | 65,022,402 | $ | 95,191,148 | $ | 160,213,550 | ||||||

| Foreign currency translation adjustments | (1,084,211 | ) | (1,587,258 | ) | (2,671,469 | ) | ||||||

| Balance as of December 31, 2023 | 63,938,191 | 93,603,890 | 157,542,081 | |||||||||

| Foreign currency translation adjustments | $ | (110,845 | ) | $ | (162,273 | ) | $ | (273,118 | ) | |||

| Balance as of March 31, 2024 | 63,827,346 | 93,441,617 | 157,268,963 | |||||||||

Based on an assessment of the qualitative factors, management determined that it is more-likely-than-not that the fair value of the share-based awards granted byreporting unit is in excess of its carrying amount. Therefore, management concluded that it was not necessary to proceed with the Company, including but not limited totwo-step goodwill impairment test. No impairment loss or other changes were recorded, except for the influence of foreign currency translation for the three months ended March 31, 2024 and the year ended December 31, 2023.

8. INTANGIBLE ASSETS

| March 31, 2024 | December 31, 2023 | |||||||

| Customer relationships | $ | 18,522,903 | $ | 18,555,071 | ||||

| Software copyright | 46,934,462 | 47,015,968 | ||||||

| Total | 65,457,365 | 65,571,039 | ||||||

| Less: accumulative amortization | (22,228,513 | ) | (20,285,422 | ) | ||||

| Intangible assets, net | $ | 43,228,852 | $ | 45,285,617 | ||||

The Company’s intangible assets consist of customer relationships and software copyrights. Customer relationships are generally recorded in connection with acquisitions at their fair value, one kind of software copyright was purchased in March 2021 and the other kind of software copyright was recorded in connection with the contractual arrangement with Shenzhen Tongdow Internet Technology Co., Ltd. in October 2022. Intangible assets with estimable lives are amortized, generally on a straight-line basis, over their respective estimated useful lives: 6.2 years for customer relationships, 6.83 years for one kind of software copyright purchased in March 2021 and 10 years for the other kind of software copyright recorded in connection with the contractual arrangement with Shenzhen Tongdow Internet Technology Co., Ltd, to their estimated residual values and reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount may not be recoverable.

Amortization expense for the three months ended March 31, 2024 and the year ended December 31, 2023 was $1,976,068 and $7,967,272, respectively. The currency translation difference was $32,994 for the three months ended March 31, 2024.

No impairment loss was made against the intangible assets during the three months ended March 31, 2024.

The estimated amortization expense for these intangible assets in the next five years and thereafter is as follows:

| Period ending March 31, 2024: | Amount | |||

| current year | $ | 5,934,776 | ||

| 2025 | 7,913,034 | |||

| 2026 | 7,913,034 | |||

| 2027 | 4,907,049 | |||

| 2028 | 4,228,330 | |||

| Thereafter | 12,332,629 | |||

| Total: | $ | 43,228,852 | ||

9. BANK BORROWINGS

Bank borrowings represent the amounts due to Baosheng County Bank that are due within one year. As of March 31, 2024 and December 31, 2023, bank loans consisted of the underlying shares, expected life, expected volatility and expected forfeiture rates. The Company is required to consider many factors and make certain assumptions during this assessment. If any of the assumptions used to determine the fair value of the share-based awards changes significantly, share-based compensation expense may differ materially in the future from that recorded in the current reporting period.following:

| March 31, 2024 | December 31, 2023 | |||||||

| Short-term bank loans: | ||||||||

| Loan from Baosheng County Bank | $ | 986,610 | $ | 988,324 | ||||

| Loan from Bank of Communications | 69,204 | 69,324 | ||||||

| Total | $ | 1,055,814 | $ | 1,057,648 | ||||

In August 2022, Qianhai Baiyu entered into another five loan agreements with Baosheng County Bank to borrow a total amount of RMB7.0 million as working capital for one year, with the maturity date of August 2023. In August 2023, the company and the bank renewed the contract, extending the borrowing time to August 2024. The five loans bear a fixed interest rate of 7.8% per annum and are guaranteed by Shenzhen Herun Investment Co., Ltd, Li Hongbin and Wang Shuang.

In August 2023, Qianhai Baiyu entered into a loan agreement with the Bank of Communications, borrowing a total of RMB 0.49 million yuan as a one-year working capital, with the maturity date of August 2024.The loan bears a fixed interest rate of 4.15% per annum.

10. LEASES

The Company leases its principalan office space under non-cancelable operating leases, with terms of 24 months. The Company considers those renewal or termination options that are reasonably certain to be exercised in the determination of the lease term and initial measurement of right of use assets and lease liabilities. The amortization of right of use assets for lease payment is recognized on a straight-line basis over the lease term. Leases with an initial term of 12 months or less are not recorded on the balance sheet.

The Company determines whether a contract is or contains a lease agreementat inception of the contract and whether that qualifies as anlease meets the classification criteria of a finance or operating lease. TheWhen available, the Company recordsuses the rental underrate implicit in the lease agreement into discount lease payments to present value; however, most of the Company’s leases do not provide a readily determinable implicit rate. Therefore, the Company discounts lease payments based on an estimate of its incremental borrowing rate.

The Company’s lease agreements do not contain any material residual value guarantees or material restrictive covenants.

Supplemental consolidated balance sheet information related to the operating expense when incurred.lease was as follows:

| March 31, 2024 | December 31, 2023 | |||||||

| Right-of-use lease assets, net | $ | 60,532 | $ | 83,375 | ||||

| Lease Liabilities-current | $ | 63,303 | $ | 86,691 | ||||

| Lease liabilities-non current | - | - | ||||||

| Total | $ | 63,303 | $ | 86,691 | ||||

The weighted average remaining lease terms and discount rates for the operating lease were as follows as of March 31, 2024:

| Weighted average remaining lease term (years) | ||||

| Weighted average discount rate | 4.75 | % | ||

InFor the normal coursethree months ended March 31, 2024 and 2023, the Company charged total amortization of right-of-use assets of $121,063 and $30,846 respectively.

The following is a schedule, by fiscal quarter, of maturities of lease liabilities as of March 31, 2024:

| Period ended March 31, 2024: | Amount | |||

| current year | $ | 64,412 | ||

| Total lease payments | 64,412 | |||

| Less: imputed interest | 1,109 | |||

| Present value of lease liabilities | 63,303 | |||

11. OTHER CURRENT LIABILITIES

| March 31, 2024 | December 31, 2023 | |||||||

| Accrued payroll and benefit | $ | 1,830,702 | $ | 3,210,615 | ||||

| Other tax payable | 5,185,305 | 3,352,643 | ||||||

| Others | 1,993 | 15,091 | ||||||

| Total | $ | 7,018,000 | $ | 6,578,349 | ||||

12. CONVERTIBLE PROMISSORY NOTES

| March 31, 2024 | December 31, 2023 | |||||||

| Convertible promissory notes – principal | $ | 2,539,358 | $ | 3,043,358 | ||||

| Convertible promissory notes – discount | - | (159,219 | ) | |||||

| Convertible promissory notes – interest | 1,514,384 | 1,400,483 | ||||||

| Convertible promissory notes, net | $ | 4,107,742 | $ | 4,284,622 | ||||

On May 6, 2022, the Company entered into a securities purchase agreement with Streeterville Capital, LLC, a Utah limited liability company, pursuant to which the Company issued the investor a convertible promissory note in the original principal amount of $3,320,000, convertible into shares of Common Stock, $0.001 par value per share, of the Company, for $3,000,000 in gross proceeds. By written consent dated May 10, 2022, as permitted by Section 228 of the Delaware General Corporation Law and Section 8 of Article II of our bylaws, the stockholders who have the authority to vote a majority of the outstanding shares of Common Stock approved the following corporate actions: (i) the entry into a purchase agreement dated as of May 6, 2022 by and between the Company and Investor, pursuant to which the Company issued the note dated as of May 6, 2022 to the investor; and (ii) the issuance of shares of Common Stock in excess of 19.99% of the currently issued and outstanding shares of Common Stock of the Company upon the conversion of the note. The Company settled a convertible promissory note of $375,000 on November 16, 2022, and issued 445,749 shares of the Company’s Common Stock on November 17, 2022. The Company settled convertible promissory notes of $200,000 on January 18, 2023, $200,000 on February 3, 2023, $175,000 on February 8, 2023, $250,000 on February 15, 2023, $250,000 on March 8, 2023, $125,000 on March 24, 2023,$150,000 on September 14,2023,$200,000 on October 7,2023 and $175,000 on November 8, 2023, respectively, and issued 4,719, 4,688, 4,102, 5,860, 5,591, 2,913, 3,496, 131,585 and 115,137 shares of the Company’s common stock on January 19, 2023, February 6, 2023, February 8, 2023, February 15, 2023, March 15, 2023, March 29, 2023, March 29, 2023, September 14,2023, October 7,2023 and November 8, 2023, respectively for the year ended December 31, 2023.

On March 13, 2023, the Company entered into a securities purchase agreement with Streeterville Capital, LLC, a Utah limited liability company, pursuant to which the Company issued the investor a convertible promissory note in the original principal amount of $3,320,000, convertible into shares of Common Stock, $0.001 par value per share, of the Company, for $3,000,000 in gross proceeds. By written consent dated March 6, 2023, as permitted by Section 228 of the Delaware General Corporation Law and Section 8 of Article II of our bylaws, the stockholders who have the authority to vote a majority of the outstanding shares of Common Stock approved the following corporate actions: (i) the entry into a purchase agreement, with terms substantially the same as the agreement attached in the aforesaid purchase agreement, by and between the Company and Investor, pursuant to which the Company issued an unsecured convertible promissory to the investor; and (ii) the issuance of shares of Common Stock in excess of 19.99% of the currently issued and outstanding shares of Common Stock of the Company upon the conversion of the note. The Company settled convertible promissory notes of $300,000 on September 7, 2023, $200,000 on October 10, 2023, $175,000 on October 13, 2023, $150,000 on November 16, 2023, $150,000 on December 5, 2023, and $150,000 on December 29, 2023, respectively, and issued 41,829, 41,736, 36,920, 109,075, 109,075, and 137,644, shares of the Company’s common stock on September 12, 2023, October 11, 2023, October 13, 2023, November 20, 2023, December 7, 2023, and December 29, 2023, respectively, for the year ended December 31, 2023. The Company settled convertible promissory notes of $150,000 on February 1, 2024 and $150,000 on February 15, 2024 respectively, and issued 160,174 and 152,620 shares of the Company’s common stock on February 1, 2024 and February 10, 2024, respectively, for the three months ended March 31, 2024.

The above two unsettled convertible promissory notes, issued on May 6, 2022 and March 13, 2023, have a maturity date of 12 months with an interest rate of 10% per annum. The Company retains the right to prepay the note at any time prior to conversion with an amount in cash equal to 125% of the principal that the Company elects to prepay at any time six months after the issue date, subject to maximum monthly redemption amount of $375,000 and $375,000, respectively. On or before the close of business on the third trading day of redemption, the Company should deliver conversion shares via “DWAC” (DTC’s Deposit/Withdrawal at Custodian system). The Company will be required to pay the redemption amount in cash, or chooses to satisfy a redemption in registered stock or unregistered stock, such stock shall be issued at 80% of the average of the lowest “VWAP” (the volume-weighted average price of the Common Stock on the principal market for a particular Trading Day or set of Trading Days) during the fifteen trading days immediately preceding the redemption notice is delivered.

For the above two unsettled convertible promissory notes, upon evaluation, the Company determined that the Agreements contained embedded beneficial conversion features which met the definition of Debt with Conversion and Other Options covered under the Accounting Standards Codification topic 470 (“ASC 470”). According to ASC 470, an embedded beneficial conversion feature present in a convertible instrument shall be recognized separately at issuance by allocating a portion of the proceeds equal to the intrinsic value of that feature to additional paid-in capital. Pursuant to the agreements, the Company shall recognize embedded beneficial conversion features three months after commitment date of $913,000 and $913,000 respectively. Beneficial conversion features have been recognized into discount on convertible promissory notes and additional paid-in capital and such discount will be amortized in 12 months until the notes will be settled. For the year ended December 31, 2023, the Company has recognized the amortization of beneficial conversion feature $218,750 and $820,448 to profit with respect to these two unsettled convertible promissory notes. For the three months ended March 31, 2024, the Company has recognized the amortization of beneficial conversion feature of $nil and $92,552 to profit for the above two unsettled convertible promissory notes.

13. EQUITY

Common stock issued in private placements

On January 9, 2023, the Company entered into a certain securities purchase agreement with Ms. Huiwen Hu, an affiliate of the Company, and certain other purchasers who are non-U.S. Persons (as defined in Regulation S under the Securities Act of 1933, as amended), pursuant to which the Company agreed to sell an aggregate of 700,000 shares of its common stock, at a purchase price of $60.5 per share (“January 2023 PIPE”). The gross proceeds to the Company from the January 2023 PIPE were $42.35 million. Since Ms. Huiwen Hu is an affiliate of the Company, the January 2023 PIPE has been approved by the Audit Committee as well as the Board of Directors of the Company.

On July 31, 2023, the Company entered into a certain securities purchase agreement with Mr. Wenhao Cui, an affiliate of the Company, and certain other purchasers who are non-U.S. Persons (as defined in Regulation S under the Securities Act of 1933, as amended), pursuant to which the Company agreed to sell an aggregate of 560,000 shares of its common stock, at a purchase price of $17.50 per share (“August 2023 PIPE”). The gross proceeds to the Company from the January 2023 PIPE were $9.8 million.

On November 16, 2023, the Company entered into a certain securities purchase agreement with certain purchasers who are non-U.S. Persons (as defined in Regulation S under the Securities Act of 1933, as amended), pursuant to which the Company agreed to sell an aggregate of 15,000,000 shares of its common stock, at a purchase price of $2.09 per share (“November 2023 PIPE”). The gross proceeds to the Company from the November 2023 PIPE were $31.35 million.

Solely for accounting purposes, the number of shares and the purchase price per share have been retroactively restated to reflect the reverse stock split. Please refer to “Note 13 - Reverse Stock Split of Common Stock” for further details.

Settlement and Restated Common Stock Purchase Agreement