UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON,Washington, D.C. 20549

FORM 10-Q

(Mark One)

☒QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended ended: September 30, 20172023

ORor

☐TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ________________ to ________________

Commission File No. file number: 000-12536

China Recycling Energy CorporationSMART POWERR CORP.

(Exact Namename of Registrantregistrant as Specifiedspecified in Its Charter)its charter)

| Nevada | 90-0093373 | |

(State or other jurisdiction of

| ( Identification No.) |

12/4/F, Tower AC

ChangRong Cheng Yun Gu Building Keji 3rd Road, Yanta District

Xi An International Building

No. 88 Nan Guan Zheng Jie

Xi’an City, ShaanxiShaan Xi Province,

China 710075

(Address of Principal Executive Offices, Zip Code)principal executive offices)

(011) 86-29-8765-1098

(Registrant’s Telephone Number, Including Area Code: + 86-29-8765-1098telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| Common Stock, $0.001 par value | CREG | Nasdaq Capital Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark whether the registrant:registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the precedingpast 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” accelerated filer”“accelerated filer,” “smaller reporting company,”company” and “emerging growth company” in Rule 12b-2 of the Exchange Act:Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | ||

| Non-accelerated filer | ☐ | Smaller reporting company | ☒ | ||

| Emerging | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Sectionsection 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ☐ No ☒

The numberAs of November 13, 2023, there were 7,963,444 shares outstanding of the registrant’s Common Stock, as of November 10, 2017 was 8,310,198.common stock outstanding.

INDEXSMART POWERR CORP.

FORM 10-Q

TABLE OF CONTENTS

| PART I - FINANCIAL INFORMATION | ||

| Item 1. | Consolidated Financial Statements | 1 |

| Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | |

| Item 3. | Quantitative and Qualitative Disclosures About Market Risk | |

| Item 4. | Controls and Procedures | |

| PART II - OTHER INFORMATION | ||

| Item 1. | Legal Proceedings | |

| Item 1A. | Risk Factors | |

| Item 2. | Unregistered Sales of Equity Securities and Use of Proceeds | |

| Item 3. | Defaults Upon Senior Securities | |

| Item 4. | Mine Safety Disclosures | |

| Item 5. | Other Information | |

| Item 6. | Exhibits | |

| SIGNATURES | 41 | |

i

PART I –- FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

Item 1.Financial Statements

SMART POWERR CORP.

CHINA RECYCLING ENERGY CORPORATION AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

AS OF SEPTEMBER 30, 2017 (UNAUDITED) AND DECEMBER 31, 2016

| SEPTEMBER 30 | DECEMBER 31 | |||||||

| 2017 | 2016 | |||||||

| ASSETS | ||||||||

| CURRENT ASSETS | ||||||||

| Cash and equivalents | $ | 48,307,948 | $ | 47,752,353 | ||||

| Notes receivable | 1,717,669 | - | ||||||

| Accounts receivable | 13,162,772 | 12,593,340 | ||||||

| Current portion of investment in sales-type leases, net | 13,404,978 | 9,385,453 | ||||||

| Interest receivable on sales type leases | 8,049,073 | 4,621,491 | ||||||

| Prepaid expenses | 223,025 | 682,781 | ||||||

| Other receivables | 3,894,231 | 560,468 | ||||||

| Total current assets | 88,759,696 | 75,595,886 | ||||||

| NON-CURRENT ASSETS | ||||||||

| Investment in sales-type leases, net | 100,783,320 | 101,706,978 | ||||||

| Long term investment | 789,500 | 641,897 | ||||||

| Long term deposit | - | 61,564 | ||||||

| Property and equipment, net | 12,006 | 12,558 | ||||||

| Construction in progress | 92,864,300 | 86,493,182 | ||||||

| Total non-current assets | 194,449,126 | 188,916,179 | ||||||

| TOTAL ASSETS | $ | 283,208,821 | $ | 264,512,065 | ||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY | ||||||||

| CURRENT LIABILITIES | ||||||||

| Accounts payable | $ | 2,736,594 | $ | 1,506,924 | ||||

| Taxes payable | 1,503,831 | 1,202,677 | ||||||

| Accrued liabilities and other payables | 1,567,381 | 1,596,580 | ||||||

| Due to related parties | 41,775 | 44,059 | ||||||

| Loans payable - current | - | 720,773 | ||||||

| Interest payable on entrusted loans | 6,046,477 | 224,090 | ||||||

| Current portion of entrusted loan payable | 50,023,354 | 47,570,996 | ||||||

| Total current liabilities | 61,919,412 | 52,866,099 | ||||||

| NONCURRENT LIABILITIES | ||||||||

| Deferred tax liability, net | 9,436,882 | 8,900,979 | ||||||

| Refundable deposit from customers for systems leasing | 1,069,777 | 1,023,497 | ||||||

| Entrusted loan payable | - | 288,309 | ||||||

| Total noncurrent liabilities | 10,506,659 | 10,212,785 | ||||||

| Total liabilities | 72,426,071 | 63,078,884 | ||||||

| CONTINGENCIES AND COMMITMENTS | ||||||||

| STOCKHOLDERS’ EQUITY | ||||||||

| Common stock, $0.001 par value; 100,000,000 shares authorized, 8,310,198 shares issued and outstanding as of September 30, 2017 and December 31, 2016, respectively | 8,310 | 8,310 | ||||||

| Additional paid in capital | 111,796,813 | 111,789,166 | ||||||

| Statutory reserve | 14,838,561 | 14,473,924 | ||||||

| Accumulated other comprehensive income | (1,621,265 | ) | (10,544,426 | ) | ||||

| Retained earnings | 86,177,041 | 85,838,638 | ||||||

| Total Company stockholders’ equity | 211,199,460 | 201,565,612 | ||||||

| Noncontrolling interest | (416,709 | ) | (132,431 | ) | ||||

| Total equity | 210,782,751 | 201,433,181 | ||||||

| TOTAL LIABILITIES AND EQUITY | $ | 283,208,821 | $ | 264,512,065 | ||||

| SEPTEMBER 30, 2023 | DECEMBER 31, 2022 | |||||||

| (UNAUDITED) | ||||||||

| ASSETS | ||||||||

| CURRENT ASSETS | ||||||||

| Cash | $ | 67,950,506 | $ | 138,813,673 | ||||

| VAT receivable | 168,386 | 173,589 | ||||||

| Advance to supplier | 66,537,792 | 31,923 | ||||||

| Right-of-use assets, net | 15,266 | 62,177 | ||||||

| Other receivables | 50,229 | 49,690 | ||||||

| Total current assets | 134,722,179 | 139,131,052 | ||||||

| NON-CURRENT ASSET | ||||||||

| Fixed assets, net | 4,514 | 4,653 | ||||||

| Total non-current asset | 4,514 | 4,653 | ||||||

| TOTAL ASSETS | $ | 134,726,693 | $ | 139,135,705 | ||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY | ||||||||

| CURRENT LIABILITIES | ||||||||

| Accounts payable | $ | 69,134 | $ | 71,271 | ||||

| Taxes payable | 3,683,369 | 3,681,352 | ||||||

| Accrued interest on notes | 58,190 | 261,035 | ||||||

| Notes payable, net of unamortized OID of $0 and $31,250, respectively | 5,309,812 | 5,697,727 | ||||||

| Accrued liabilities and other payables | 2,666,492 | 2,776,414 | ||||||

| Lease liabilities | - | 62,178 | ||||||

| Payable for purchase of 10% equity interest of Zhonghong | 417,839 | 430,750 | ||||||

| Interest payable on entrusted loans | 336,841 | 347,249 | ||||||

| Entrusted loan payable | 10,724,533 | 11,055,911 | ||||||

| Total current liabilities | 23,266,210 | 24,383,887 | ||||||

| NONCURRENT LIABILITY | ||||||||

| Income tax payable | 3,958,625 | 3,958,625 | ||||||

| Total noncurrent liability | 3,958,625 | 3,958,625 | ||||||

| Total liabilities | 27,224,835 | 28,342,512 | ||||||

| CONTINGENCIES AND COMMITMENTS | ||||||||

| STOCKHOLDERS’ EQUITY | ||||||||

| Common stock, $0.001 par value; 100,000,000 shares authorized, 7,963,444 and 7,391,996 shares issued and outstanding | 7,963 | 7,392 | ||||||

| Additional paid in capital | 164,614,149 | 163,663,305 | ||||||

| Statutory reserve | 15,191,337 | 15,168,003 | ||||||

| Accumulated other comprehensive loss | (12,043,245 | ) | (8,318,564 | ) | ||||

| Accumulated deficit | (60,268,346 | ) | (59,726,943 | ) | ||||

| Total Company stockholders’ equity | 107,501,858 | 110,793,193 | ||||||

| TOTAL LIABILITIES AND EQUITY | $ | 134,726,693 | $ | 139,135,705 | ||||

The accompanying notes are an integral part of these unaudited consolidated financial statements. statements

CHINA RECYCLING ENERGY CORPORATION AND SUBSIDIARIESSMART POWERR CORP.

CONSOLIDATED STATEMENTS OF INCOMEOPERATIONS AND COMPREHENSIVE (LOSS)/INCOME (LOSS)

(UNAUDITED)

| NINE MONTHS ENDED SEPTEMBER 30, | THREE MONTHS ENDED SEPTEMBER 30, | |||||||||||||||

| 2017 | 2016 | 2017 | 2016 | |||||||||||||

| Revenue | ||||||||||||||||

| Sales of systems | $ | - | $ | - | $ | - | $ | - | ||||||||

| Contingent rental income | - | - | - | - | ||||||||||||

| Total revenue | - | - | - | - | ||||||||||||

| Cost of sales | ||||||||||||||||

| Cost of systems and contingent rental income | - | - | - | - | ||||||||||||

| Gross profit | - | - | - | - | ||||||||||||

| Interest income on sales-type leases | 6,062,347 | 10,945,411 | 1,731,336 | 2,286,948 | ||||||||||||

| Total operating income | 6,062,347 | 10,945,411 | 1,731,336 | 2,286,948 | ||||||||||||

| Operating expenses | ||||||||||||||||

| General and administrative | 581,308 | 1,153,894 | 242,007 | 299,110 | ||||||||||||

| Total operating expenses | 581,308 | 1,153,894 | 242,007 | 299,110 | ||||||||||||

| Income from operations | 5,481,039 | 9,791,517 | 1,489,329 | 1,987,838 | ||||||||||||

| Non-operating income (expenses) | ||||||||||||||||

| Interest income | 106,764 | 98,790 | 35,887 | 35,288 | ||||||||||||

| Interest expense | (3,986,233 | ) | (5,040,022 | ) | (1,263,491 | ) | (1,658,033 | ) | ||||||||

| Loss on sale of construction in progress of Xuzhou Zhongtai | - | (2,822,679 | ) | - | - | |||||||||||

| Loss on systems repurchase from Yida | - | (417,952 | ) | - | - | |||||||||||

| Other income | 9,389 | 279,200 | 1,591 | 202,782 | ||||||||||||

| Total non-operating expenses, net | (3,870,080 | ) | (7,902,663 | ) | (1,226,013 | ) | (1,419,963 | ) | ||||||||

| Income before income tax | 1,610,959 | 1,888,854 | 263,316 | 567,875 | ||||||||||||

| Income tax expense (benefit) | 1,179,602 | (861,811 | ) | 397,636 | 110,957 | |||||||||||

| Income (loss) before noncontrolling interest | 431,357 | 2,750,665 | (134,320 | ) | 456,918 | |||||||||||

| Less: loss attributable to noncontrolling interest | (271,683 | ) | (227,126 | ) | (93,428 | ) | (79,921 | ) | ||||||||

| Net income (loss) attributable to China Recycling Energy Corporation | 703,040 | 2,977,791 | (40,892 | ) | 536,839 | |||||||||||

| Other comprehensive items | ||||||||||||||||

| Foreign currency translation gain (loss) attributable to China Recycling Energy Corporation | 8,923,161 | (5,899,631 | ) | 4,290,726 | (1,400,319 | ) | ||||||||||

| Foreign currency translation gain (loss) attributable to noncontrolling interest | (12,595 | ) | (5,450 | ) | (6,909 | ) | (27,005 | ) | ||||||||

| Comprehensive income (loss) attributable to China Recycling Energy Corporation | $ | 9,626,201 | $ | (2,921,840 | ) | $ | 4,249,834 | $ | (863,480 | ) | ||||||

| Comprehensive loss attributable to noncontrolling interest | $ | (284,278 | ) | $ | (232,576 | ) | $ | (100,337 | ) | $ | (106,926 | ) | ||||

| Basic and diluted weighted average shares outstanding | 8,310,198 | 8,310,198 | 8,310,198 | 8,310,198 | ||||||||||||

| Basic and diluted earnings per share | $ | 0.08 | $ | 0.36 | $ | 0.00 | $ | 0.06 | ||||||||

| NINE MONTHS ENDED SEPTEMBER 30, | THREE MONTHS ENDED SEPTEMBER 30, | |||||||||||||||

| 2023 | 2022 | 2023 | 2022 | |||||||||||||

| Revenue | ||||||||||||||||

| Contingent rental income | $ | - | $ | - | $ | - | $ | - | ||||||||

| Interest income on sales-type leases | - | - | - | - | ||||||||||||

| Total operating income | - | - | - | - | ||||||||||||

| Operating expenses | ||||||||||||||||

| General and administrative | 606,105 | 552,264 | 146,870 | 168,758 | ||||||||||||

| Total operating expenses | 606,105 | 552,264 | 146,870 | 168,758 | ||||||||||||

| Loss from operations | (606,105 | ) | (552,264 | ) | (146,870 | ) | (168,758 | ) | ||||||||

| Non-operating income (expenses) | ||||||||||||||||

| Loss on note conversion | (1,415 | ) | (121,121 | ) | (7,017 | ) | - | |||||||||

| Interest income | 218,242 | 329,576 | 47,801 | 105,661 | ||||||||||||

| Interest expense | (328,200 | ) | (571,050 | ) | (107,920 | ) | (340,732 | ) | ||||||||

| Other income (expenses), net | 296,549 | (162,536 | ) | 67,931 | (30,854 | ) | ||||||||||

| Total non-operating income (expenses), net | 185,176 | (525,131 | ) | 795 | (265,925 | ) | ||||||||||

| Loss before income tax | (420,929 | ) | (1,077,395 | ) | (146,075 | ) | (434,683 | ) | ||||||||

| Income tax expense | 97,140 | 36,511 | 34,648 | 12,954 | ||||||||||||

| Net loss | (518,069 | ) | (1,113,906 | ) | (180,723 | ) | (447,637 | ) | ||||||||

| Other comprehensive items | ||||||||||||||||

| Foreign currency translation gain (loss) | (3,724,681 | ) | (14,129,752 | ) | 767,367 | (7,199,437 | ) | |||||||||

| Comprehensive income (loss) | $ | (4,242,750 | ) | $ | (15,243,658 | ) | $ | 586,644 | $ | (7,647,074 | ) | |||||

| Weighted average shares used for computing basic and diluted loss per share | 7,724,688 | 7,320,355 | 7,969,912 | 7,358,052 | ||||||||||||

| Basic and diluted net loss per share | $ | (0.07 | ) | $ | (0.15 | ) | $ | (0.02 | ) | $ | (0.06 | ) | ||||

The accompanying notes are an integral part of these unaudited consolidated financial statements.statements

SMART POWERR CORP.

CHINA RECYCLING ENERGY CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWSSTOCKHOLDERS’ EQUITY

NINE MONTHS ENDED SEPTEMBER 30, 2023 AND 2022

(UNAUDITED)

| NINE MONTHS ENDED SEPTEMBER 30, | ||||||||

| 2017 | 2016 | |||||||

| CASH FLOWS FROM OPERATING ACTIVITIES: | ||||||||

| Income including noncontrolling interest | $ | 431,357 | $ | 2,750,665 | ||||

| Adjustments to reconcile income including noncontrolling interest to net cash provided by (used in) operating activities: | ||||||||

| Changes in bad debt allowance | 61,779 | - | ||||||

| Depreciation and amortization | 1,093 | 3,667 | ||||||

| Stock option expense | 7,647 | - | ||||||

| Investment income (loss) | (115,763 | ) | 300,957 | |||||

| Changes in deferred tax | 130,260 | (2,073,235 | ) | |||||

| Loss on sales of construction in progress of Xuzhou Zhongtai | - | 2,765,716 | ||||||

| Changes in assets and liabilities: | ||||||||

| Interest receivable on sales type leases | (3,142,199 | ) | (2,785,713 | ) | ||||

| Collection of principal on sales type leases | 1,819,850 | 19,264,234 | ||||||

| Prepaid expenses | 478,981 | (68,773 | ) | |||||

| Accounts receivable | - | (10,106,830 | ) | |||||

| Other receivables | (3,167,054 | ) | (344,004 | ) | ||||

| Notes receivable | (1,676,890 | ) | - | |||||

| Construction in progress | (2,401,757 | ) | 20,612,058 | |||||

| Accounts payable | 1,133,988 | 1,066,424 | ||||||

| Taxes payable | 240,914 | (175,134 | ) | |||||

| Interest payable on entrusted loan | 5,674,264 | (49,858 | ) | |||||

| Accrued liabilities and other payables | (364,368 | ) | (727,410 | ) | ||||

| Net cash provided by (used in) operating activities | (887,898 | ) | 30,432,764 | |||||

| CASH FLOWS FROM INVESTING ACTIVITIES: | ||||||||

| Changes of restricted cash | - | 1,101,308 | ||||||

| Net cash provided by investing activities | - | 1,101,308 | ||||||

| CASH FLOWS FROM FINANCING ACTIVITIES: | ||||||||

| Repayment of loans | (735,478 | ) | (30,473,533 | ) | ||||

| Repayment of notes payable | - | (990,277 | ) | |||||

| Net cash used in financing activities | (735,478 | ) | (31,463,810 | ) | ||||

| EFFECT OF EXCHANGE RATE CHANGE ON CASH AND EQUIVALENTS | 2,178,971 | (1,139,134 | ) | |||||

| NET INCREASE (DECREASE) IN CASH AND EQUIVALENTS | 555,595 | (1,068,872 | ) | |||||

| CASH AND EQUIVALENTS, BEGINNING OF PERIOD | 47,752,353 | 41,749,388 | ||||||

| CASH AND EQUIVALENTS, END OF PERIOD | $ | 48,307,948 | $ | 40,680,516 | ||||

| Supplemental cash flow data: | ||||||||

| Income tax paid | $ | 1,433,497 | $ | 1,148,757 | ||||

| Interest paid | $ | 14,363 | $ | 7,888,466 | ||||

| Common Stock | Paid in | Statutory | Other Comprehensive | Accumulated | ||||||||||||||||||||||||

| Shares | Amount | Capital | Reserves | Loss | Deficit | Total | ||||||||||||||||||||||

| Balance at December 31, 2022 | 7,391,996 | $ | 7,392 | $ | 163,663,305 | $ | 15,168,003 | $ | (8,318,564 | ) | $ | (59,726,943 | ) | $ | 110,793,193 | |||||||||||||

| Net loss for the period | - | - | - | - | - | (89,504 | ) | (89,504 | ) | |||||||||||||||||||

| Conversion of long-term notes into common shares | 241,537 | 242 | 489,276 | - | - | - | 489,518 | |||||||||||||||||||||

| Transfer to statutory reserves | - | - | - | 2,590 | - | (2,590 | ) | - | ||||||||||||||||||||

| Foreign currency translation gain | - | - | - | - | 1,681,720 | - | 1,681,720 | |||||||||||||||||||||

| Balance at March 31, 2023 | 7,633,533 | 7,634 | 164,152,581 | 15,170,593 | (6,636,844 | ) | (59,819,037 | ) | 112,874,927 | |||||||||||||||||||

| Net loss for the period | - | - | - | - | - | (247,842 | ) | (247,842 | ) | |||||||||||||||||||

| Conversion of long-term notes into common shares | 154,473 | 154 | 254,727 | - | - | - | 254,881 | |||||||||||||||||||||

| Transfer to statutory reserves | - | - | - | 15,296 | - | (15,296 | ) | - | ||||||||||||||||||||

| Foreign currency translation loss | - | - | - | - | (6,173,768 | ) | - | (6,173,768 | ) | |||||||||||||||||||

| Balance at June 30, 2023 | 7,788,006 | 7,788 | 164,407,308 | 15,185,889 | (12,810,612 | ) | (60,082,175 | ) | 106,708,198 | |||||||||||||||||||

| Net loss for the period | - | - | - | - | - | (180,723 | ) | (180,723 | ) | |||||||||||||||||||

| Conversion of long-term notes into common shares | 175,438 | 175 | 206,841 | - | - | - | 207,016 | |||||||||||||||||||||

| Transfer to statutory reserves | - | - | - | 5,448 | - | (5,448 | ) | - | ||||||||||||||||||||

| Foreign currency translation loss | - | - | - | - | 767,367 | - | 767,367 | |||||||||||||||||||||

| Balance at September 30, 2023 | 7,963,444 | $ | 7,963 | $ | 164,614,149 | $ | 15,191,337 | $ | (12,043,245 | ) | $ | (60,268,346 | ) | $ | 107,501,858 | |||||||||||||

| Common Stock | Paid in | Statutory | Other Comprehensive | Accumulated | ||||||||||||||||||||||||

| Shares | Amount | Capital | Reserves | (Loss) / Income | Deficit | Total | ||||||||||||||||||||||

| Balance at December 31, 2021 | 7,044,408 | $ | 7,044 | $ | 161,531,565 | $ | 15,180,067 | $ | 3,321,189.0 | $ | (55,281,680 | ) | $ | 124,758,185 | ||||||||||||||

| Net loss for the period | - | - | - | - | - | (441,459 | ) | (441,459 | ) | |||||||||||||||||||

| Conversion of long-term notes into common shares | 313,644 | 314 | 2,017,793 | - | - | - | 2,018,107 | |||||||||||||||||||||

| Transfer to statutory reserves | - | - | - | (22,277 | ) | - | 22,277 | - | ||||||||||||||||||||

| Foreign currency translation gain | - | - | - | - | 600,181 | - | 600,181 | |||||||||||||||||||||

| Balance at March 31, 2022 | 7,358,052 | 7,358 | 163,549,358 | 15,157,790 | 3,921,370 | (55,700,862 | ) | 126,935,014 | ||||||||||||||||||||

| Net loss for the period | - | - | - | - | - | (224,810 | ) | (224,810 | ) | |||||||||||||||||||

| Transfer to statutory reserves | - | - | - | 4,443 | - | (4,443 | ) | - | ||||||||||||||||||||

| Foreign currency translation loss | - | - | - | - | (7,530,496 | ) | - | (7,530,496 | ) | |||||||||||||||||||

| Balance at June 30, 2022 | 7,358,052 | 7,358 | 163,549,358 | 15,162,233 | (3,609,126 | ) | (55,930,115 | ) | 119,179,708 | |||||||||||||||||||

| Net loss for the period | - | - | - | - | - | (447,637 | ) | (447,637 | ) | |||||||||||||||||||

| Transfer to statutory reserves | - | - | - | 4,351 | - | (4,351 | ) | - | ||||||||||||||||||||

| Foreign currency translation loss | - | - | - | - | (7,199,437 | ) | - | (7,199,437 | ) | |||||||||||||||||||

| Balance at September 30, 2022 | 7,358,052 | $ | 7,358 | $ | 163,549,358 | $ | 15,166,584 | $ | (10,808,563 | ) | $ | (56,382,103 | ) | $ | 111,532,634 | |||||||||||||

The accompanying notes are an integral part of these unaudited consolidated financial statements.statements

SMART POWERR CORP.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(UNAUDITED)

| NINE MONTHS ENDED SEPTEMBER 30, | ||||||||

| 2023 | 2022 | |||||||

| CASH FLOWS FROM OPERATING ACTIVITIES: | ||||||||

| Net loss | $ | (518,069 | ) | $ | (1,113,906 | ) | ||

| Adjustments to reconcile net loss to net cash used in operating activities: | ||||||||

| Amortization of OID and debt issuing costs of notes | 31,250 | 163,105 | ||||||

| Operating lease expenses | 46,876 | 49,771 | ||||||

| Loss on note conversion | 1,415 | 121,121 | ||||||

| Interest expense | - | 229,015 | ||||||

| Changes in assets and liabilities: | ||||||||

| Advance to supplier | (68,063,624 | ) | (5,215 | ) | ||||

| Other receivables | (293 | ) | 2,376 | |||||

| Taxes payable | 3,069 | (19,901 | ) | |||||

| Payment of lease liabilities | (62,502 | ) | (66,362 | ) | ||||

| Accrued liabilities and other payables | 297,135 | 330,871 | ||||||

| Net cash used in operating activities | (68,264,743 | ) | (309,125 | ) | ||||

| EFFECT OF EXCHANGE RATE CHANGE ON CASH | (2,598,424 | ) | (15,486,470 | ) | ||||

| NET DECREASE IN CASH | (70,863,167 | ) | (15,795,595 | ) | ||||

| CASH, BEGINNING OF PERIOD | 138,813,673 | 152,011,887 | ||||||

| CASH, END OF PERIOD | $ | 67,950,506 | $ | 136,216,292 | ||||

| Supplemental cash flow data: | ||||||||

| Income tax paid | $ | 94,126 | $ | 56,495 | ||||

| Interest paid | $ | - | $ | - | ||||

| Supplemental disclosure of non-cash financing activities | ||||||||

| Conversion of notes into common shares | $ | 950,000 | $ | 1,896,986 | ||||

The accompanying notes are an integral part of these consolidated financial statements

CHINA RECYCLING ENERGY CORPORATION

SMART POWERR CORP. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 20172023 (UNAUDITED) AND DECEMBER 31, 20162022

1. ORGANIZATION AND DESCRIPTION OF BUSINESS

China Recycling Energy CorporationSmart Powerr Corp. (the “Company” or “CREG”“SPC”) was incorporated on May 8, 1980in Nevada, and was formerly known as Boulder Brewing Company under the laws of the State of Colorado. On September 6, 2001, the Company changed its state of incorporation to the Nevada. In 2004, the Company changed its name from Boulder Brewing Company to China Digital Wireless, Inc. and on March 8, 2007, again changed its name from China Digital Wireless, Inc. to its current name, China Recycling EnergyEntergy Corporation. The Company, through its subsidiaries, provides energy saving solutions and services, including selling and leasing energy saving systems and equipment to customers, and project investment investment management, economic information consulting, technical services, financial leasing, purchase of financial leasing assets, disposal and repair of financial leasing assets, consulting and ensuring of financial leasing transactions in the Peoples Republic of China (“PRC”).

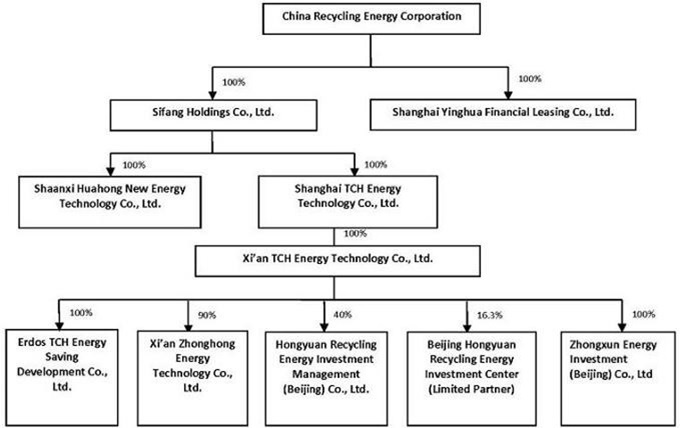

The Company’s organizational chart as of September 30, 2023 is as follows:

Erdos TCH – Joint Venture

On April 14, 2009, the Company formed a joint venture (the “JV”) with Erdos Metallurgy Co., Ltd. (“Erdos”) to recycle waste heat from Erdos’ metal refining plants to generate power and steam to be sold back to Erdos. The name of the JV was Inner Mongolia Erdos TCH Energy Saving Development Co., Ltd. (“Erdos TCH”) with a term of 20 years. Total investment for the project was estimated at $79 million (RMB 500 million) with an initial investment of $17.55 million (RMB 120 million). Erdos contributed 7% of the total investment of the project, and Xi’an TCH Energy Technology Co., Ltd. (“Xi’an TCH”) contributed 93%. According to the parties’ agreement on profit distribution, Xi’an TCH and Erdos will receive 80% and 20%, respectively, of the profit from the JV until Xi’an TCH receives the complete return of its investment. Xi’an TCH and Erdos will then receive 60% and 40%, respectively, of the profit from the JV. On June 15, 2013, Xi’an TCH and Erdos entered into a share transfer agreement, pursuant to which Erdos sold its 7% ownership interest in the JV to Xi’an TCH for $1.29 million (RMB 8 million), plus certain accumulated profits as described below.profits. Xi’an TCH paid the $1.29 million in July 2013 and, as a result, became the sole stockholder of the JV. In addition, Xi’an TCH paid Erdos accumulated profits from inception up to June 30, 2013 in accordance with a supplementary agreement entered on August 6, 2013. In August 2013, Xi’an TCH paid 20% of the accumulated profit (calculated under PRC GAAP) of $226,000 to Erdos. Erdos TCH currently has two power generation systems in Phase I with a total of 18 MW power capacity, and three power generation systems in Phase II with a total of 27 MW power capacity. On April 28, 2016, Erdos TCH and Erdos entered into a supplemental agreement, effective on May 1, 2016, whereby Erdos TCH cancelled monthly minimum lease payments from Erdos, and chargesstarted to charge Erdos based on actual electricity sold at RMB 0.30 / KWH. The selling price of each KWH will beis determined annually based on prevailing market conditions.

Pucheng Biomass Power Generation Projects

On June 29, 2010, Xi’an In May 2019, Erdos TCH entered intoceased operations due to renovations and furnace safety upgrades of Erdos, and the Company initially expected the resumption of operations in July 2020, but the resumption of operations was further delayed due to the government’s mandate for Erdos to significantly lower its energy consumption per unit of GDP by implementing a Biomass Power Generation (“BMPG”) Project Lease Agreement with PuchengXinHeng Yuan Biomass Power Generationcomprehensive technical upgrade of its ferrosilicon production line to meet the City’s energy-saving targets. Erdos is currently researching the technical rectification scheme. Once the scheme is determined, Erdos TCH will carry out technical transformation for its waste heat power station project. During this period, Erdos will compensate Erdos TCH RMB 1 million ($145,524) per month, until operations resume. The Company has not recognized any income due to the uncertainty of collection. In addition, Erdos TCH has 30% ownership in DaTangShiDai (BinZhou) Energy Savings Technology Co., Ltd. (“Pucheng”BinZhou Energy Savings”), a limited liability company incorporated30% ownership in China. Under this lease agreement, Xi’an TCH leased a set of 12 MW BMPG systems to Pucheng at a minimum of $279,400 (RMB 1,900,000) per month for 15 years.

On September 11, 2013, Xi’an TCH entered into a BMPG Asset Transfer Agreement (the “Pucheng Transfer Agreement”) with Pucheng. The Pucheng Transfer Agreement provided for the sale by Pucheng to Xi’an TCH of a set of 12 MW BMPG systems with completion of system transformation for RMB 100 million ($16.48 million) in the form of 8,766,547 shares of common stock of the Company at $1.87 per share. These shares were issued to Pucheng on October 29, 2013. Also on September 11, 2013, Xi’an TCH entered into a BMPG Project Lease Agreement with Pucheng (the “Pucheng Lease”). Under the Pucheng Lease, Xi’an TCH leases this same set of 12 MW BMPG system to Pucheng, and combined this lease with the lease for the 12 MW BMPG station of Pucheng Phase I project, under a single lease to Pucheng for RMB 3.8 million ($0.63 million) per month (the “Pucheng Phase II Project”). The term for the combined lease is from September 2013 to June 2025. The lease agreement for the 12 MW station from Pucheng Phase I project terminated upon the effective date of the Pucheng Lease. The ownership of two 12 MW BMPG systems will transfer to Pucheng at no additional charge when the Pucheng Lease expires.

Shenqiu Yuneng Biomass Power Generation Projects

On May 25, 2011, Xi’an TCH entered into a Letter of Intent with ShenqiuYuNeng Thermal Power Co., Ltd. (“Shenqiu”) to reconstruct and transform a Thermal Power Generation System owned by Shenqiu into a 75T/H BMPG System for $3.57 million (RMB 22.5 million). The project commenced in June 2011 and was completed in the third quarter of 2011. On September 28, 2011, Xi’an TCH entered into a BMPG Asset Transfer Agreement with Shenqiu (the “Shenqiu Transfer Agreement”). Pursuant to the Shenqiu Transfer Agreement, Shenqiu sold Xi’an TCH a set of 12 MW BMPG systems (after Xi’an TCH converted the system for BMPG purposes). As consideration for the BMPG systems, Xi’an TCH agreed to pay Shenqiu $10,937,500 (RMB 70 million) in cash in three installments within six months upon the transfer of ownership of the systems. By the end of 2012, all the consideration was paid. On September 28, 2011, Xi’an TCH and Shenqiu also entered into a BMPG Project Lease Agreement (the “2011 Shenqiu Lease”). Under the 2011 Shenqiu Lease, Xi’an TCH agreed to lease a set of 12 MW BMPG systems to Shenqiu at a monthly rental rate of $286,000 (RMB 1,800,000) for 11 years. Upon expiration of the 2011 Shenqiu Lease, ownership of this system will transfer from Xi’an TCH to Shenqiu at no additional cost. In connection with the 2011 Shenqiu Lease, Shenqiu paid one month’s rent as a security deposit to Xi’an TCH, in addition to providing personal guarantees.

On October 8, 2012, Xi’an TCH entered into a Letter of Intent for technical reformation of Shenqiu Project Phase II with Shenqiu for technical reformation to enlarge the capacity of the Shenqiu Project Phase I (the “Shenqiu Phase II Project”). The technical reformation involved the construction of another 12 MW BMPG system. After the reformation, the generation capacity of the power plant increased to 24 MW. The project commenced on October 25, 2012 and was completed during the first quarter of 2013. The total cost of the project was $11.1 million (RMB 68 million). On March 30, 2013, Xi’an TCH and Shenqiu entered into a BMPG Project Lease Agreement (the “2013 Shenqiu Lease”). Under the 2013 Shenqiu Lease, Xi’an TCH agreed to lease the second set of 12 MW BMPG systems to Shenqiu for $239,000 (RMB 1.5 million) per month for 9.5 years. When the 2013 Shenqiu Lease expires, ownership of this system will transfer from Xi’an TCH to Shenqiu at no additional cost.

Yida Coke Oven Gas Power Generation Projects

On June 28, 2014, Xi’an TCH entered into an Asset Transfer Agreement (the “Transfer Agreement”) with Qitaihe City Boli Yida Coal Selection Co., Ltd. (“Yida”), a limited liability company incorporated in China. The Transfer Agreement provided for the sale to Xi’an TCH of a 15 MW coke oven gas power generation station, which had been converted from a 15 MW coal gangue power generation station from Yida. As consideration for the Transfer Asset, Xi’an TCH was to pay to Yida RMB 115 million ($18.69 million) in the form of the common stock shares of the Company at the average closing price per share of the Stock for the 10 trading days prior to the closing date of the transaction ($2.27 per share). The exchange rate between the US Dollar and Chinese RMB in connection with the stock issuance is the rate equal to the middle rate published by the People’s Bank of China on the closing date of the assets transfer. Accordingly, the Company issued 8,233,779 shares (the “Shares”) for the Yida 15 MW coke oven gas power generation station, the fair value of 8,233,779 shares was $14.49 million based on the stock price at the agreement date ($1.76 per share), and was the cost of the power generation station.

On June 28, 2014, Xi’an TCH also entered into a Coke Oven Gas Power Generation Project Lease Agreement (the “Lease Agreement”) with Yida. Under the Lease Agreement, Xi’an TCH leased the Transfer Asset to Yida for RMB 3 million ($0.49 million) per month, and the term of the lease is from June 28, 2014 to June 27, 2029. Yida provided an RMB 3 million ($0.49 million) security deposit (without interest) for the lease. Xi’an TCH will transfer the Transfer Asset back to Yida at no cost at the end of the lease term.

On June 22, 2016, Xi’an TCH entered into a Coal Oven Gas Power Generation Project Repurchase Agreement (the “Repurchase Agreement”) with Yida. Under the Repurchase Agreement, Xi’an TCH agreed to transfer to Yida all the project assets for RMB 112,000,000 ($16.89 million) (the “Transfer Price”) with Yida’s retention of ownership of the Shares. Yida agreed to make the following payments: (i) the outstanding monthly leasing fees for April and May 2016 in total of RMB 6,000,000 ($0.90 million) to Xi’an TCH within 5 business days from the execution of the Repurchase Agreement; (ii) a payment of RMB 50,000,000 ($7.54 million) of the Transfer Price to Xi’an TCH within 5 business days from the execution of the Repurchase Agreement; and (iii) a payment of the remaining RMB 62,000,000 ($9.35 million) of the Transfer Price to Xi’an TCH within 15 business days from the execution of the Repurchase Agreement. Under the Repurchase Agreement, ownership of the project assets will transfer from Xi’an TCH to Yida within 3 business days after Xi’an TCH receives the full Transfer Price and the outstanding monthly leasing fees. In July 2016, the Company received the full payment of the Transfer Price and title to the system was transferred at that time. The Company recorded a $0.42 million loss from this transaction in 2016.

The Fund Management Company

On June 25, 2013, Xi’an TCH and HongyuanHuifu Venture Capital Co. Ltd. (“HongyuanHuifu”) jointly established HongyuanDaTangShiDai DaTong Recycling Energy Investment Management Beijing Co., Ltd. (the “Fund Management Company”) with registered capital of RMB 10 million ($1.45 million). Xi’an TCH made an initial capital contribution of RMB 4 million ($650,000) and has a 40% ownership interest in the Fund Management Company. With respect to the Fund Management Company, voting rights and dividend rights are allocated 80% and 20% between HongyuanHuifu and Xi’an TCH, respectively.

The Fund Management Company is the general partner of Beijing Hongyuan Recycling Energy Investment Center, LLP (the “HYREF Fund”), a limited liability partnership established on July 18, 2013 in Beijing. The Fund Management Company made an initial capital contribution of RMB 5 million ($830,000) to the HYREF Fund. An initial total of RMB 460 million ($77 million) was fully subscribed by all partners for the HYREF Fund. The HYREF Fund has three limited partners: (1) China Orient Asset Management Co., Ltd., which made an initial capital contribution of RMB 280 million ($46.67 million) to the HYREF Fund and is a preferred limited partner; (2) HongyuanHuifu, which made an initial capital contribution of RMB 100 million ($16.67 million) to the HYREF Fund and is an ordinary limited partner; and (3) the Company’s wholly-owned subsidiary, Xi’an TCH, which made an initial capital contribution of RMB 75 million ($12.5 million) to the HYREF Fund and is a secondary limited partner. The term of the HYREF Fund’s partnership is six years from the date of its establishment, expiring July 18, 2019. The term is four years from the date of contribution for the preferred limited partner, and four years from the date of contribution for the ordinary limited partner. The total size of the HYREF Fund is RMB 460 million ($76.66 million). The HYREF Fund was formed for the purpose of investing in Xi’an Zhonghong New Energy Technology Co., Ltd., a 90% owned subsidiary of Xi’an TCH, for the construction of two coke dry quenching (“CDQ”) WHPG stations with Jiangsu Tianyu Energy and Chemical Group Co., Ltd. (“Tianyu”) and one CDQ WHPG station with Boxing County Chengli Gas Supply Co., Ltd. (“Chengli”).

Chengli Waste Heat Power Generation Projects

On July 19, 2013, Xi’an TCH formed a new company, “Xi’an Zhonghong New Energy Technology Co., Ltd.” (“Zhonghong”), with registered capital of RMB 30 million ($4.85 million). Xi’an TCH paid RMB 27 million ($4.37 million) and owns 90% of Zhonghong. Zhonghong is engaged to provide energy saving solution and services, including constructing, selling and leasing energy saving systems and equipment to customers.

On July 24, 2013, Zhonghong entered into a Cooperative Agreement of CDQ and CDQ WHPG Project with Boxing County Chengli Gas Supply Co., Ltd. (“Chengli”). The parties entered into a supplement agreement on July 26, 2013. Pursuant to these agreements, Zhonghong will design, build and maintain a 25 MW CDQ system and a CDQ WHPG system to supply power to Chengli, and Chengli will pay energy saving fees (the “Chengli Project”). Chengli will contract the operation of the system to a third-party contractor that is mutually agreed to by Zhonghong. In addition, Chengli will provide the land for the CDQ system and CDQ WHPG system at no cost to Zhonghong. The term of the Agreements is for 20 years. The first 800 million watt hours generated by the Chengli Project will be charged at RMB 0.42 ($0.068) per kilowatt hour (excluding tax); thereafter, the energy saving fee will be RMB 0.20 ($0.036) per kilowatt hour (excluding tax). The operating time shall be based upon an average 8,000 hours annually. If the operating time is less than 8,000 hours per year due to a reason attributable to Chengli, then time charged shall be 8,000 hours a year, and if it is less than 8,000 hours due to a reason attributable to Zhonghong, then it shall be charged at actual operating hours. The construction of the Chengli Project was completed in the second quarter of 2015 and the project successfully completed commissioning tests in the first quarter of 2017. The Chengli Project is now operational, but will not begin operations until the Company receives the required power generating license, which the Company anticipates receiving in the fourth quarter of 2017. When operations begin, Chengli shall ensure its coking production line works properly and that working hours for the CDQ system are at least 8,000 hours per year, and Zhonghong shall ensure that working hours for the CDQ WHPG system are at least 7,200 hours per year.

On July 22, 2013, Zhonghong entered into an Engineering, Procurement and Construction (“EPC”) General Contractor Agreement for the Boxing County Chengli Gas Supply Co., Ltd. CDQ Power Generation Project (the “Chengli Project”) with Xi’an Huaxin New Energy Co., Ltd. (“Huaxin”). Zhonghong, as the owner of the Chengli Project, contracted EPC services for a CDQ system and a 25 MW CDQ WHPG system for Chengli from Huaxin. Huaxin shall provide construction, equipment procurement, transportation, installation and adjustment, test run, construction engineering management and other necessary services to complete the Huaxin Project and ensure the CDQ system and CDQ WHPG system for Chengli meet the inspection and acceptance requirements and work normally. The Chengli Project is a turn-key project where Huaxin is responsible for monitoring the quality, safety, duration and cost of the Chengli Project. The total contract price is RMB 200 million ($33.34 million), which includes all the materials, equipment, labor, transportation, electricity, water, waste disposal, machinery and safety costs.

Tianyu Waste Heat Power Generation Project

On July 19, 2013, Zhonghong entered into a Cooperative Agreement (the “Tianyu Agreement”) for Energy Management of CDQ and CDQ WHPG Project with Jiangsu Tianyu Energy and Chemical Group Co., Ltd. (“Tianyu”). Pursuant to the Tianyu Agreement, Zhonghong will design, build, operate and maintain two sets of 25 MW CDQ systems and CDQ WHPG systems for two subsidiaries of Tianyu – Xuzhou Tian’an Chemical Co., Ltd. (“Xuzhou Tian’an”) and Xuzhou Huayu Coking Co., Ltd. (“Xuzhou Huayu”) – to be located at Xuzhou Tian’an and Xuzhou Huayu’s respective locations (the “Tianyu Project”). Upon completion of the Tianyu Project, Zhonghong will charge Tianyu an energy saving fee of RMB 0.534 ($0.087) per kilowatt hour (excluding tax). The operating time will be based upon an average 8,000 hours annually for each of Xuzhou Tian’an and Xuzhou Huayu. If the operating time is less than 8,000 hours per year due to a reason attributable to Tianyu, then time charged will be 8,000 hours a year. The term of the Tianyu Agreement is 20 years. The construction of the Xuzhou Tian’an Project is anticipated to be completed by the second quarter of 2018. Xuzhou Tian’an will provide the land for the CDQ and CDQ WHPG systems for free. Xuzhou Tian’an also guarantees that it will purchase all the power generated by the CDQ WHPG systems. The Xuzhou Huayu Project is currently on hold due to a conflict between Xuzhou Huayu Coking Co., Ltd. and local residents on certain pollution-related issues. The local government has acted in its capacity to coordinate the resolution of this issue. The local residents were requested to move from the hygienic buffer zone of the project location with compensatory payments from the government. Xuzhou Huayu was required to stop production and implement technical innovations to mitigate pollution discharge including sewage treatment, dust collection, noise control, and recycling of coal gas. Currently, some local residents have moved. Xuzhou Huayu has completed the implementation of the technical innovations of sewage treatment, dust collection, and noise control, and the Company is waiting for local governmental agencies to approve these technical innovations so that we can resume construction. We expect to complete the recycling of coal gas in the second quarter of 2018. Once Huayu obtains the government’s acceptance and approval of the technical innovations, the project will resume.

On July 22, 2013, Zhonghong entered into an EPC General Contractor Agreement for the Tianyu Project with Xi’an Huaxin New Energy Co., Ltd. (“Huaxin”). Zhonghong, as the owner of the Tianyu Project, contracted EPC services for two CDQ systems and two 25 MW CDQ WHPG systems for Tianyu to Huaxin. Huaxin shall provide construction, equipment procurement, transportation, installation and adjustment, test run, construction engineering management and other necessary services to complete the Tianyu Project and ensure the CDQ and CDQ WHPG systems for Tianyu meet the inspection and acceptance requirements and work normally. The Tianyu Project is a turn-key project where Huaxin is responsible for monitoring the quality, safety, duration and cost of the project. The total contract price is RMB 400 million ($66.68 million), which includes all the materials, equipment, labor, transportation, electricity, water, waste disposal, machinery and safety costs.

Zhongtai Waste Heat Power Generation Energy Management Cooperative Agreement

On December 6, 2013, Xi’an entered into a CDQ and WHPG Energy Management Cooperative Agreement (the “Zhongtai Agreement”) with Xuzhou Zhongtai Energy Technology Co., Ltd. (“Zhongtai”DaTong Recycling Energy”), a limited liability companyand 40% ownership in DaTang ShiDai TianYu XuZhou Recycling Energy Technology Co, Ltd. (“TianYu XuZhou Recycling Energy”). These companies were incorporated in Jiangsu Province, China.2012 but had no operations since then nor has any registered capital contribution been made.

Pursuant to the Zhongtai Agreement, Xi’an TCH will design, build and maintain a 150 ton per hour CDQ system and a 25 MW CDQ WHPG system and sell the power to Zhongtai, and Xi’an TCH will also build a furnace to generate steam from the waste heat of the smoke pipeline and sell the steam to Zhongtai.

The construction period of the Project is expected to be 18 months from the date when conditions are ready for construction to begin. Zhongtai will start to pay an energy saving service fee from the date when the WHPG station passes the required 72-hour test run. The payment term is 20 years. For the first 10 years, Zhongtai shall pay an energy saving fee at RMB 0.534 ($0.089) per kilowatt hour (KWH) (including value added tax) for the power generated from the system. For the second 10 years, Zhongtai shall pay an energy saving fee at RMB 0.402 ($0.067) per KWH (including value added tax). During the term of the contract the energy saving fee shall be adjusted at the same percentage as the change of local grid electricity price. Zhongtai shall also pay an energy saving fee for the steam supplied by Xi’an TCH at RMB 100 ($16.67) per ton (including value added tax). Zhongtai and its parent company will provide guarantees to ensure Zhongtai will fulfill its obligations under the Agreement. Upon the completion of the term, Xi’an TCH will transfer the systems to Zhongtai at RMB 1 ($0.16). Zhongtai shall provide waste heat to the systems for no less than 8,000 hours per year and waste gas volume no less than 150,000 Normal Meter Cubed (Nm3) per hour with a temperature no less than 950°C. If these requirements are not met, the term of the Agreement will be extended accordingly. If Zhongtai wants to terminate the Zhongtai Agreement early, it shall provide Xi’an TCH a 60 day notice and pay the termination fee and compensation for the damages to Xi’an TCH according to the following formula: (1) if it is less than five years into the term when Zhongtai requests termination, Zhongtai shall pay: Xi’an TCH’s total investment amount plus Xi’an TCH’s annual investment return times five years minus the years in which the system has already operated; or 2) if it is more than five years into the term when Zhongtai requests the termination, Zhongtai shall pay: Xi’an TCH’s total investment amount minus total amortization cost (the amortization period is 10 years).

In March 2016, Xi’an TCH entered into a Transfer Agreement of CDQ and a CDQ WHPG system with Zhongtai and Xi’an Huaxin (the “Transfer Agreement”). Under the Transfer Agreement, Xi’an TCH agreed to transfer to Zhongtai all of the assets associated with the CDQ Waste Heat Power Generation Project (the “Project”), which is under construction pursuant to the Zhongtai Agreement. Additionally, Xi’an TCH agreed to transfer to Zhongtai the Engineering, Procurement and Construction (“EPC”) Contract for the CDQ Waste Heat Power Generation Project which Xi’an TCH had entered into with Xi’an Huaxin in connection with the Project. Xi’an Huaxin will continue to construct and complete the Project and Xi’an TCH agreed to transfer all its rights and obligation under the EPC Contract to Zhongtai. As consideration for the transfer of the Project, Zhongtai agreed to pay to Xi’an TCH an aggregate transfer price of RMB 167,360,000 ($25.77 million) including payments of: (i) RMB 152,360,000 ($23.46 million) for the construction of the Project; and (ii) RMB 15,000,000 ($2.31 million) as payment for partial loan interest accrued during the construction period. Those amounts have been, or will be, paid by Zhongtai to Xi’an TCH according to the following schedule: (a) RMB 50,000,000 ($7.70 million) was paid within 20 business days after the Transfer Agreement was signed; (b) RMB 30,000,000 ($4.32 million) was paid within 20 business days after the Project is completed, but no later than July 30, 2016; and (c) RMB 87,360,000 ($13.45 million) will be paid no later than July 30, 2017. Xuzhou Taifa Special Steel Technology Co., Ltd. (“Xuzhou Taifa”) guaranteed the payments from Zhongtai to Xi’an TCH. The ownership of the Project was conditionally transferred to Zhongtai following the initial payment of RMB 50,000,000 ($7.70 million) by Zhongtai to Xi’an TCH and the full ownership of the Project will be officially transferred to Zhongtai after it completes all payments pursuant to the Transfer Agreement. As of September 30, 2017, Xi’an TCH had received the first payment of $7.70 million and the second payment of $4.32 million. The Company recorded a $2.82 million loss from this transaction in 2016. As of the date of this report, the Company has not yet received the remaining payment of RMB 87,360,000 ($13.45 million). The Company expects to collect part of the remaining balance during the fourth quarter of 2017.

Rongfeng CDQ Power Generation Energy Management Cooperative Agreement

On December 12, 2013, Xi’an TCH entered into a CDQ Power Generation Energy Management Cooperative Agreement with Tangshan Rongfeng Iron & Steel Co., Ltd. (the “Rongfeng Agreement”), a limited liability company incorporated in Hebei Province, China.

Pursuant to the Rongfeng Agreement, Xi’an TCH will design, build and maintain a CDQ and a CDQ WHPG system and sell the power to Rongfeng. The construction period of the Project is expected to be 18 months after the Agreement takes effect and from the date when conditions are ready for construction to begin.

Rongfeng will pay an energy saving fee from the date when the WHPG station passes the required 72-hour test run. The payment term is 20 years. For the first 10 years, Rongfeng shall pay an energy saving fee at RMB 0.582 ($0.095) per KWH (including tax) for the power generated from the system. For the second 10 years, Rongfeng shall pay an energy saving fee at RMB 0.432 ($0.071) per KWH (including tax). During the term of the contract the energy saving fee shall be adjusted at the same percentage as the change of local grid electricity price. Rongfeng and its parent company will provide guarantees to ensure Rongfeng will fulfill its obligations under the Rongfeng Agreement. Upon the completion of the term, Xi’an TCH will transfer the systems to Rongfeng at RMB 1. Rongfeng shall provide waste heat to the systems for no less than 8,000 hours per year with a temperature no less than 950°C. If these requirements are not met, the term of the Agreement will be extended accordingly. If Rongfeng wants to terminate the Agreement early, it shall provide Xi’an TCH a 60 day notice and pay the termination fee and compensation for the damages to Xi’an TCH according to the following formula: 1) if it is less than five years (including five years) into the term when Rongfeng requests termination, Rongfeng shall pay: Xi’an TCH’s total investment amount plus Xi’an TCH’s average annual investment return times (five years minus the years of which the system has already operated); 2) if it is more than five years into the term when Rongfeng requests the termination, Rongfeng shall pay: Xi’an TCH’s total investment amount minus total amortization cost (the amortization period is 10 years). On November 16, 2015, Xi’an TCH entered into a Transfer Agreement of CDQ and a CDQ WHPG system with Rongfeng and Xi’an Huaxin New Energy Co., Ltd., a limited liability company incorporated in China (“Xi’an Huaxin”). The Transfer Agreement provided for the sale to Rongfeng of the CDQ Waste Heat Power Generation Project (the “Project”) from Xi’an TCH. Additionally, Xi’an TCH would transfer to Rongfeng the Engineering, Procurement and Construction (“EPC”) Contract for the CDQ Waste Heat Power Generation Project which Xi’an TCH had entered into with Xi’an Huaxin in connection with the Project. As consideration for the transfer of the Project, Rongfeng is to pay to Xi’an TCH an aggregate purchase price of RMB 165,200, 000 ($25.45 million), whereby (a) RMB 65,200,000 ($10.05 million) was to be paid by Rongfeng to Xi’an TCH within 20 business days after signing the Transfer Agreement, (b) RMB 50,000,000 ($7.70 million) was paid by Rongfeng to Xi’an TCH within 20 business days after the Project is completed, but no later than March 31, 2016 and (c) RMB 50,000,000 ($7.70 million) was to be paid by Rongfeng to Xi’an TCH no later than September 30, 2016. Mr. Cheng Li, the largest stockholder of Rongfeng, has personally guaranteed the payments. The ownership of the Project was conditionally transferred to Rongfeng within 3 business days following the initial payment of RMB 65,200,000 ($10.05 million) by Rongfeng to Xi’an TCH and the full ownership of the Project will be officially transferred to Rongfeng after it completes the entire payment pursuant to the Transfer Agreement. The Company recorded a $3.78 million loss from this transaction in 2015. As of December 31, 2016, the Company had received full payment of $25.45 million.

Formation of Zhongxun

On March 24, 2014, Xi’an TCH incorporated a new subsidiary, Zhongxun Energy Investment (Beijing) Co., LtdLtd. (“Zhongxun”) with registered capital of $5,695,502 (RMB 35,000,000), which must be contributed before October 1, 2028. Zhongxun is 100% owned by Xi’an TCH and will be mainly engaged in project investment, investment management, economic information consulting, and technical services. Zhongxun has not yet commenced operations nor has any capital contribution been made as of the date of this report.

Formation of Yinghua

On February 11, 2015, the Company incorporated a new subsidiary, Shanghai Yinghua Financial Leasing Co., LtdLtd. (“Yinghua”) with registered capital of $30,000,000, to be paid within 10 years from the date the business license is issued. Yinghua is 100% owned by the Company and will be mainly engaged in financial leasing, purchase of financial leasing assets, disposal and repair of financial leasing assets, consulting and ensuring of financial leasing transactions, and related factoring business. Yinghua has not yet commenced operations nor has any capital contribution been made as of the date of this report.

Summary of Sales-Type Lease at September 30, 2017Other Events

Status at September 30, 2017

As of September 30, 2017, Xi’an TCH leases the following systems: (i) BMPG systems to Pucheng Phase I and II (15 and 11 year terms, respectively); (ii) BMPG systems to Shenqiu Phase I (11-year term); and (iii) Shenqiu Phase II (9.5-year term). In addition, as of September 30, 2017, Erdos TCH leased power and steam generating systems for recycling waste heat from metal refining to Erdos (five systems) for a term of 20 years.

Asset Repurchase Agreement

During the nine months ended September 30, 2017 and the year ended December 31, 2016,On March 3, 2022, the Company entered into the following Asset Repurchase Agreements:

In March 2016, Xi’an TCH entered into a Transfer Agreement of CDQ and a CDQ WHPG system with Zhongtai and Xi’an Huaxin (the “Transfer Agreement”). Under the Transfer Agreement, Xi’an TCH agreed to transfer to Zhongtai all of the assets associated with the CDQ Waste Heat Power Generation Project (the “Project”), which is under construction pursuant to the Zhongtai Agreement. Additionally, Xi’an TCH agreed to transfer to Zhongtai the Engineering, Procurement and Construction (“EPC”) Contract for the CDQ Waste Heat Power Generation Project which Xi’an TCH had entered into with Xi’an Huaxin in connection with the Project. Xi’an Huaxin will continue to construct and complete the Project and Xi’an TCH agreed to transfer all its rights and obligation under the “EPC” Contract to Zhongtai. As consideration for the transfer of the Project, Zhongtai agreed to pay to Xi’an TCH an aggregate transfer price of RMB 167,360,000 ($25.77 million) including payments of: (i) RMB 152,360,000 ($23.46 million) for the construction of the Project; and (ii) RMB 15,000,000 ($2.31 million) as payment for partial loan interest accrued during the construction period. Those amounts have been, or will be, paid by Zhongtai to Xi’an TCH according to the following schedule: (a) RMB 50,000,000 ($7.70 million) was paid within 20 business days after the Transfer Agreement was signed; (b) RMB 30,000,000 ($4.32 million) was paid within 20 business days after the Project is completed, but no later than July 30, 2016; and (c) RMB 87,360,000 ($13.45 million) will be paid no later than July 30, 2017. Xuzhou Taifa Special Steel Technology Co., Ltd. (“Xuzhou Taifa”) has guaranteed the payments from Zhongtai to Xi’an TCH. The ownership of the Project was conditionally transferred to Zhongtai following the initial payment of RMB 50,000,000 ($7.70 million) by Zhongtai to Xi’an TCH and the full ownership of the Project will be officially transferred to Zhongtai after it completes all payments pursuant to the Transfer Agreement. As of September 30, 2017, Xi’an TCH had received the first payment of $7.70 million and the second payment of $4.32 million. The Company recorded a $2.82 million loss from this transaction in 2016. As of this report date, the Company has not yet received the remaining payment of RMB 87,360,000 ($13.45 million) due to the tight cash flow of Zhongtai, the Company expects to collect part of the remaining balance during the fourth quarter of 2017.

On June 22, 2016, Xi’an TCH entered into a Coal Oven Gas Power Generation Project Repurchase Agreement (the “Repurchase Agreement”) with Yida. Under the Repurchase Agreement, Xi’an TCH agreed to transfer to Yida all the project assets for RMB 112,000,000 ($16.89 million) (the “Transfer Price”) with Yida’s retention of ownership of the Shares. Yida agreed to make the following payments: (i) the outstanding monthly leasing fees for April and May 2016 in total of RMB 6,000,000 ($0.90 million) to Xi’an TCH within 5 business days from the execution of the Repurchase Agreement; (ii) a payment of RMB 50,000,000 ($7.54 million) of the Transfer Price to Xi’an TCH within 5 business days from the execution of the Repurchase Agreement; and (iii) a payment of the remaining RMB 62,000,000 ($9.35 million) of the Transfer Price to Xi’an TCH within 15 business days from the execution of the Repurchase Agreement. Under the Repurchase Agreement, ownership of the project assets will be transferred from Xi’an TCH to Yida within 3 business days after Xi’an TCH receives the full Transfer Price and the outstanding monthly leasing fees. In July 2016, the Company had received the full payment of the Transfer Price and title to the system was transferred at that time. The Company recorded a $0.42 million loss from this transaction in 2016.

Reverse Stock Split

On May 24, 2016, the Company filed a Certificate of Change with the Secretary of State of the State of Nevada with an effective datea Certificate of May 25, 2016 (the “Effective Date”), at which time the Company effected a 1-for-10 reverse stock split ofAmendment to the Company’s authorized sharesAmended and Restated Certificate of common stock, par value $0.001 (the “Common Stock”), accompanied by a corresponding decrease in the Company’s issued and outstanding shares of Common Stock (the “Reverse Stock Split”).

The Company rounded upIncorporation to the next full share of the Company’s Common Stock any fractional shares resultingchange our corporate name from the Reverse Stock Split. The Reverse Stock Split was retroactively stated for the periods covered by the financial statements included herein.

China Recycling Energy Corporation to Smart Powerr Corp, effective March 3, 2022.

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation

The accompanying unaudited financial statements included herein were prepared by the Company, pursuant to the rulesinformation as of and regulations of the Securities and Exchange Commission (“SEC”). The information furnished herein reflects all adjustments (consisting of normal recurring accruals and adjustments) that are, in the opinion of management, necessary to fairly present the operating results for the respective periods. Certain informationnine and footnote disclosures normally present in annual financial statementsthree months ended September 30, 2023 and 2022 was prepared in accordance with accounting principles generally accepted in the United States of AmericaU.S. (“US GAAP”) were omitted pursuantfor interim financial information and with the instructions to Quarterly Report on Form 10-Q and Article 10 of Regulation S-X. In the opinion of management, such rulesfinancial information includes all adjustments (consisting only of normal recurring adjustments, unless otherwise indicated) considered necessary for a fair presentation of our financial position at such date and regulations. Thesethe operating results and cash flows for such periods. Operating results for the nine months ended September 30, 2023 are not necessarily indicative of the results that may be expected for the entire year or for any other subsequent interim period. The interim consolidated financial statementsinformation should be read in conjunction with the audited financial statementsFinancial Statements and footnotes included in the Company’s 2016 audited financial statementsnotes thereto, included in the Company’s Annual Report on Form 10-K. The results10-K for the nine and three monthsfiscal year ended September 30, 2017 are not necessarily indicative of the results expected for the full year ending December 31, 2017. 2022, previously filed with the Securities Exchange Commission (“SEC”) on May 8, 2023.

BasisPrinciple of Consolidation

The consolidated financial statementsConsolidated Financial Statements (“CFS”) include the accounts of CREGSPC and its subsidiaries, Shanghai Yinghua Financial Leasing Co., Ltd. (“Yinghua”) and Sifang Holdings, itsHoldings; Sifang Holdings’ wholly owned subsidiaries, Huahong New Energy Technology Co., Ltd. (“Huahong”) and Shanghai TCH Energy Tech Co., Ltd. (“Shanghai TCH”); Shanghai TCH’s wholly-owned subsidiary, Xi’an TCH Energy Tech Co., Ltd. (“Xi’an TCH”); and Xi’an TCH’s subsidiaries, 1) Erdos TCH Energy Saving Development Co., Ltd (“Erdos TCH”), 100% owned by Xi’an TCH, (See note 1),2) Zhonghong, 90% owned by Xi’an TCH and 10% owned by Shanghai TCH, and 3) Zhongxun, 100% owned by Xi’an TCH. Substantially all the Company’s revenues are derived from the operations of Shanghai TCH and its subsidiaries, which represent substantially all the Company’s consolidated assets and liabilities as of September 30, 20172023. However, there was no revenue for the Company for the nine and December 31, 2016, respectively.three months ended September 30, 2023 or 2022. All significant inter-company accounts and transactions were eliminated in consolidation.

Uses and Sources of Liquidity

For the nine months ended September 30, 2023 and 2022, the Company had a net loss of $518,069 and $1,113,906, respectively. For the three months ended September 30, 2023 and 2022, the Company had a net loss of $180,723 and $447,637, respectively. The Company had an accumulated deficit of $60.27 million as of September 30, 2023. The Company disposed all of its systems and currently holds five power generating systems through Erdos TCH, the five power generating systems are currently not producing any electricity. The Company is in the process of transforming and expanding into an energy storage integrated solution provider business. The Company plans to pursue disciplined and targeted expansion strategies for market areas the Company currently does not serve. The Company actively seeks and explores opportunities to apply energy storage technologies to new industries or segments with high growth potential, including industrial and commercial complexes, large scale photovoltaic (PV) and wind power stations, remote islands without electricity, and smart energy cities with multi-energy supplies. The Company’s cash flow forecast indicates it will have sufficient cash to fund its operations for the next 12 months from the date of issuance of these CFS.

Use of Estimates

In preparing these CFS in accordance with US GAAP, management makes estimates and assumptions that affect the reported amounts of assets and liabilities in the balance sheets as well as revenues and expenses during the period reported. Actual results may differ from these estimates. On an on-going basis, management evaluates its estimates, including those allowances for bad debt, impairment loss on fixed assets and construction in progress, income taxes, and contingencies and litigation. Management bases its estimates on historical experience and on various other assumptions that are believed to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities that are not readily apparent from other resources.

Revenue Recognition

A)Sales-type Leasing and Related Revenue Recognition

The Company follows Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 842. The Company’s sales type lease contracts for revenue recognition fall under ASC 842. During the nine and three months ended September 30, 2023 and 2022, the Company did not sell any new power generating projects.

The Company constructs and leases waste energy recycling power generating projects to its customers. The Company typically transfers legal ownership of the waste energy recycling power generating projects to its customers at the end of the lease. The investment in these projects is recorded as investment in sales-type leases in accordance with Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 840, “Leases,” and its various amendments and interpretations.

The Company finances construction of waste energy recycling power generating projects. The sales and cost of sales are recognized at the inception of the lease.lease, which is when control is transferred to the lessee. The Company accounts for the transfer of control as a sales type lease in accordance with ASC 842-10-25-2. The underlying asset is derecognized, and revenue is recorded when collection of payments is probable. This is in accordance with the revenue recognition principle in ASC 606 - Revenue from contracts with customers. The investment in sales-type leases consists of the sum of the minimum lease payments receivable less unearned interest income and estimated executory cost. Minimum lease payments are part of the lease agreement between the Company (as the lessor) and the customer (as the lessee). The discount rate implicit in the lease is used to calculate the present value of minimum lease payments. The minimum lease payments consist of the gross lease payments net of executory costs and contingent rentals, if any. Unearned interest income is amortized to income over the lease term to produce a constant periodic rate of return on net investment in the lease. While revenue is recognized at the inception of the lease, the cash flow from the sales-type lease occurs over the course of the lease, which results in interest income and reduction of receivables. Revenue is recognized net of salesvalue-added tax.

B)Contingent Rental Income

The Company records income from actual electricity usage in addition to minimum lease paymentsgenerated of each project as contingent rental income in the period contingent rentalthe income is earned.earned, which is when the electricity is generated. Contingent rent is not part of minimum lease payments.

Operating Leases

The Company determines if an arrangement is a lease or contains a lease at inception. Operating lease liabilities are recognized based on the present value of the remaining lease payments, discounted using the discount rate for the lease at the commencement date. As the rate implicit in the lease is not readily determinable for an operating lease, the Company generally uses an incremental borrowing rate based on information available at the commencement date to determine the present value of future lease payments. Operating lease right-of-use (“ROU assets”) assets represent the Company’s right to control the use of an identified asset for the lease term and lease liabilities represent the Company’s obligation to make lease payments arising from the lease. ROU assets are generally recognized based on the amount of the initial measurement of the lease liability. Lease expense is recognized on a straight-line basis over the lease term.

ROU assets are reviewed for impairment when indicators of impairment are present. ROU assets from operating and finance leases are subject to the impairment guidance in ASC 360, Property, Plant, and Equipment, as ROU assets are long-lived nonfinancial assets.

ROU assets are tested for impairment individually or as part of an asset group if the cash flows related to the ROU asset are not independent from the cash flows of other assets and liabilities. An asset group is the unit of accounting for long-lived assets to be held and used, which represents the lowest level for which identifiable cash flows are largely independent of the cash flows of other groups of assets and liabilities. The Company recognized no impairment of ROU assets as of September 30, 2023 or December 31, 2022.

Operating leases are included in operating lease ROU and operating lease liabilities (current and non-current), on the consolidated balance sheets.

Cash

Cash and Equivalents

Cash and equivalents includes cash on hand, demand deposits placed with banks or other financial institutions and all highly liquid investments with an original maturity of three months or less as of the purchase date of such investments.date.

Accounts Receivable

As of September 30, 2017, the Company had accounts receivable of $13,162,772 (from the sales of CDQ and a CDQ WHPG systemThe Company’s policy is to Zhongtai). As of December 31, 2016, the Company had accounts receivable of $12,593,340 (from the sales of CDQ and a CDQ WHPG system to Zhongtai).

Interest Receivable on Sales Type Leases

As of September 30, 2017, the interest receivable on sales type leases was $8,049,073, mainly from recognized but not yet collected interest income for the Pucheng and Shenqiu systems. As of December 31, 2016, the interest receivable on sales type leases was $4,621,491.

The Company maintains reservesmaintain an allowance for potential credit losses on receivables.accounts receivable. Management reviews the composition of receivablesaccounts receivable and analyzes historical bad debts, customer concentrations, customer credit worthiness, current economic trends and changes in customer payment patterns to evaluate the adequacy of these reserves. During the nine months endedAs of September 30, 2017,2023 and December 31, 2022, the Company had bad debtno accounts receivable.

Advance to suppliers

Advance to suppliers consist of balances paid to suppliers for materials that have not been received. The Company reviews its advances to suppliers on a periodic basis and makes general and specific allowances when there is doubt as to the ability of a supplier to provide supplies to the Company or refund an advance.

Short term loan receivables

The Company provided loans to certain third parties for the purpose of making use of its cash.

The Company monitors all loans receivable for delinquency and provides for estimated losses for specific receivables that are not likely to be collected. Management periodically assesses the collectability of these loans receivable. Delinquent account balances are written-off against the allowance for net investment receivabledoubtful accounts after management has determined that the likelihood of $61,800.collection is not probable. As of September 30, 2023 and 2022, the Company did not accrue allowance against short term loan receivables.

Concentration of Credit Risk

Cash includes cash on hand and demand deposits in accounts maintained within China. Balances at financial institutions and state-owned banks within the PRC are covered by insurance up to RMB 500,000 ($71,792) per bank. Any balance over RMB 500,000 ($71,792) per bank in PRC is not covered. The Company has not experienced any losses in such accounts.

Certain other financial instruments, which subject the Company to concentration of credit risk, consist of accounts and other receivables. The Company does not require collateral or other security to support these receivables. The Company conducts periodic reviews of its customers’ financial condition and customer payment practices to minimize collection risk on accounts receivable.

The operations of the Company are in the PRC. Accordingly, the Company’s business, financial condition and results of operations may be influenced by the political, economic and legal environments in the PRC.

Property and Equipment

Property and equipment are stated at cost, net of accumulated depreciation. Expenditures for maintenance and repairs are expensed as incurred; additions, renewals and betterments are capitalized. When property and equipment are retired or otherwise disposed of, the related cost and accumulated depreciation are removed from the respective accounts, and any gain or loss is included in operations. Depreciation of property and equipment is provided using the straight-line method over the estimated lives as follows:

| Vehicles | 2 - 5 years | |

| Office and Other Equipment | 2 - 5 years | |

Impairment of Long-lived Assets

In accordance with FASB ASC Topic 360, “Property, Plant, and Equipment,” the Company reviews its long-lived assets, including property and equipment, for impairment whenever events or changes in circumstances indicate that the carrying amounts of the assets may not be fully recoverable. If the total expected undiscounted future net cash flows isare less than the carrying amount of the asset, a loss is recognized for the difference between the fair value (“FV”) and carrying amount of the asset. The total undiscounted future net cash flow (total future payment receivable) is less than net investment in sales-type leases for Erdos Phase II, the 2nd system at December 31, 2016; accordingly, the Company recorded an assetdid not record any impairment loss of $242,305 for the year ended December 31, 2016. There was no impairment loss for the nine and three months ended September 30, 2017.2023 and 2022.

Notes Payable – Banker’s Acceptances

The

Accounts and other payables

Accounts and other payables represent liabilities for goods and services provided to the Company endorses banker’s acceptances that are issued from a bankprior to vendors as payment for its obligations. Mostthe end of the banker’s acceptances have maturity datesfinancial year which are unpaid. They are classified as current liabilities if payment is due within one year or less (or in the normal operating cycle of less than sixthe business if longer). Otherwise, they are presented as non-current liabilities.

Accounts and other payables are initially recognized as fair value, and subsequently carried at amortized cost using the effective interest method.

Borrowings

Borrowings are presented as current liabilities unless the Company has an unconditional right to defer settlement for at least 12 months following their issuance.after the financial year end date, in which case they are presented as non-current liabilities.

Borrowings are initially recognized at fair value (net of transaction costs) and subsequently carried at amortized cost. Any difference between the proceeds (net of transaction costs) and the redemption value is recognized in profit or loss over the period of the borrowings using an effective interest method.

Borrowing costs are recognized in profit or loss using the effective interest method.

Cost of Sales

Cost of sales consists primarily of the direct material of the power generating system and expenses incurred directly for project construction for sales-type leasing and sales tax and additions for contingent rental income.

Income Taxes

Noncontrolling Interests

Income taxes are accounted for using an asset and liability method. Under this method, deferred income taxes are recognized for the tax consequences in future years of differences between the tax bases of assets and liabilities and their financial reporting amounts at each period end based on enacted tax laws and statutory tax rates, applicable to the periods in which the differences are expected to affect taxable income. Valuation allowances are established, when necessary, to reduce deferred tax assets to the amount expected to be realized.

The Company follows FASB ASC Topic 810, “Consolidation,”740, which established new standards governing theprescribes a more-likely-than-not threshold for financial statement recognition and measurement of a tax position taken or expected to be taken in a tax return. ASC Topic 740 also provides guidance on recognition of income tax assets and liabilities, classification of current and deferred income tax assets and liabilities, accounting for interest and reportingpenalties associated with tax positions, accounting for income taxes in interim periods, and income tax disclosures.