UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10−Q

(Mark One)

☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended: SeptemberJune 30, 20172021

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ____________ to _____________

Commission File Number: 333-192093000-55925

AERKOMM INC.

(Exact name of registrant as specified in its charter)

| Nevada | | 46-3424568 |

(State or other jurisdiction of

incorporation or organization) | | (I.R.S. Employer

Identification No.) |

923 Incline Way, #39, Incline Village, NV 8945144043 Fremont Blvd., Fremont, CA 94538

(Address of principal executive offices, Zip Code)

(877) 742-3094

(Registrant’s telephone number, including area code)

(Former name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which

registered |

| None | | N/A | | N/A |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | | Accelerated filer ☐ |

| Non-accelerated filer ☐ (Do not check if a smaller reporting company) | | Smaller reporting company ☒ |

| | | Emerging growth company ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for comply with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of November 13, 2017,August 19, 2021, there were 41,076,3309,637,051 shares of the registrant’s common stock of the registrant issued and outstanding.

AERKOMM INC.

Quarterly Report on Form 10-Q

Period Ended SeptemberJune 30, 20172021

TABLE OF CONTENTS

PART I

FINANCIAL INFORMATION

| ITEM 1. | FINANCIAL STATEMENTS. |

ITEM 1. FINANCIAL STATEMENTS.

AERKOMM INC.

CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

AERKOMM INC. AND SUBSIDIARIES

Condensed Consolidated Balance Sheets

June 30, 2021 and December 31, 2020

| | | September 30, 2017

(unaudited) | | | December 31, 2016 | |

| Assets | | | | | | |

| Current Assets | | | | | | |

| Cash | | $ | 6,566 | | | $ | 312,173 | |

| Inventories | | | 208,674 | | | | 209,729 | |

| Prepaid expenses | | | 482,390 | | | | 11,784 | |

| Other receivable | | | 440,223 | | | | 891 | |

| Total Current Assets | | | 1,137,853 | | | | 534,577 | |

| Prepaid investment | | | 460,000 | | | | - | |

| Property and Equipment, Net | | | 3,572,422 | | | | 3,745,092 | |

| Intangible asset, net | | | 4,001,250 | | | | 4,372,500 | |

| Goodwill | | | 1,105,942 | | | | 1,105,942 | |

| Other assets | | | 126,497 | | | | 806,371 | |

| Total Assets | | $ | 10,403,964 | | | $ | 10,564,482 | |

| Liabilities and Equity | | | | | | | | |

| Current Liabilities | | | | | | | | |

| Short-term bank loan | | $ | 10,000 | | | $ | - | |

| Accrued expenses | | | 498,106 | | | | 71,978 | |

| Other payable - related parties | | | 899,268 | | | | 2,955,575 | |

| Other payable - others | | | 2,286,068 | | | | 1,671,269 | |

| Total Current Liabilities | | | 3,693,442 | | | | 4,698,822 | |

| Restricted stock deposit liability | | | 453 | | | | 3,342 | |

| Total Liabilities | | | 3,693,895 | | | | 4,702,164 | |

| Commitments and Contingency | | | | | | | | |

| Stockholders’ Equity | | | | | | | | |

| Preferred stock, $0.001 par value Authorized - 50,000,000 shares Issued and outstanding - none | | | - | | | | - | |

| Common stock, $0.001 par value Authorized - 450,000,000 shares Issued and outstanding – 40,758,328 (excluding unvested restricted stock of 337,683) shares as of September 30, 2017 | | | 40,758 | | | | - | |

| Common stock, no par value Authorized – 210,000,000 shares Issued and outstanding - 98,720,060 (excluding unvested restricted stock of 6,683,340 shares) shares as of December 31, 2016 (See Note 1) | | | - | | | | 4,470,839 | |

| Additional paid in capital | | | 10,860,030 | | | | 80,000 | |

| Subscribed capital | | | 544,913 | | | | 1,862,643 | |

| Accumulated deficits | | | (4,732,026 | ) | | | (551,204 | ) |

| Accumulated other comprehensive loss | | | (3,606 | ) | | | (10 | ) |

| Total Stockholders' Equity | | | 6,710,069 | | | | 5,862,268 | |

| Non-controlling interest in subsidiary | | | - | | | | 50 | |

| Total Equity | | | 6,710,069 | | | | 5,862,318 | |

| Total Liabilities and Equity | | $ | 10,403,964 | | | $ | 10,564,482 | |

| | | June 30,

2021 | | | December 31,

2020 | |

| | | (Unaudited) | | | | |

| Assets | | | | | | |

| Current Assets | | | | | | |

| Cash | | $ | 40,487 | | | $ | 584,591 | |

| Short-term investment | | | 60,493 | | | | 87,154 | |

| Inventories, net | | | 6,807,797 | | | | 5,211,427 | |

| Prepaid expenses and other current assets | | | 1,992,959 | | | | 1,637,195 | |

| Total Current Assets | | | 8,901,736 | | | | 7,520,367 | |

| Long-term Investment | | | 3,709,042 | | | | 4,305,556 | |

| Property and Equipment | | | | | | | | |

| Cost | | | 2,787,510 | | | | 2,806,420 | |

| Accumulated depreciation | | | (1,681,178 | ) | | | (1,414,191 | ) |

| | | | 1,106,332 | | | | 1,392,229 | |

| Prepayment for land | | | 35,861,589 | | | | 35,861,589 | |

| Prepayment for equipment | | | 86,617 | | | | 86,617 | |

| Net Property and Equipment | | | 37,054,538 | | | | 37,340,435 | |

| Other Assets | | | | | | | | |

| Restricted cash | | | 3,210,000 | | | | 3,210,000 | |

| Intangible asset, net | | | 2,145,000 | | | | 2,392,500 | |

| Goodwill | | | 1,475,334 | | | | 1,475,334 | |

| Right-of-use assets, net | | | 279,414 | | | | 353,442 | |

| Deposits | | | 117,914 | | | | 119,436 | |

| Total Other Assets | | | 7,227,662 | | | | 7,550,712 | |

| Total Assets | | $ | 56,892,978 | | | $ | 56,717,070 | |

| | | | | | | | | |

| Liabilities and Stockholders’ Equity | | | | | | | | |

| Current Liabilities | | | | | | | | |

| Short-term loans | | $ | 1,544,759 | | | $ | 527,066 | |

| Accounts payable | | | 1,874,339 | | | | 1,874,339 | |

| Accrued expenses and other current liabilities | | | 6,621,781 | | | | 4,695,000 | |

| Prepayment from customer - current | | | 1,611,357 | | | | - | |

| Long-term loan - current | | | 10,732 | | | | 10,171 | |

| Lease liability – current | | | 417,437 | | | | 357,880 | |

| Total Current Liabilities | | | 12,080,405 | | | | 7,464,456 | |

| Long-term Liabilities | | | | | | | | |

| Long-term bonds payable | | | 9,313,753 | | | | 9,218,094 | |

| Long-term loan – non-current | | | 23,713 | | | | 29,034 | |

| Lease liability – non-current | | | 112,409 | | | | 210,443 | |

| Prepayment from customer – non-current | | | 762,000 | | | | 762,000 | |

| Restricted stock deposit liability | | | 1,000 | | | | 1,000 | |

| Total Long-Term Liabilities | | | 10,212,875 | | | | 10,220,571 | |

| Total Liabilities | | | 22,293,280 | | | | 17,685,027 | |

| Commitments | | | | | | | | |

| Stockholders’ Equity | | | | | | | | |

| Preferred stock, $0.001 par value, 50,000,000 shares authorized, none issued and outstanding as of June 30, 2021 and December 31, 2020 | | | - | | | | - | |

| Common stock, $0.001 par value, 90,000,000 shares authorized, 9,487,889 shares (excluding 149,162 unvested restricted shares) issued and outstanding as of June 30, 2021 and December 31, 2020 | | | 9,488 | | | | 9,488 | |

| Additional paid in capital | | | 74,622,712 | | | | 73,160,616 | |

| Accumulated deficits | | | (38,147,860 | ) | | | (32,383,833 | ) |

| Accumulated other comprehensive loss | | | (1,884,642 | ) | | | (1,754,228 | ) |

| Total Stockholders’ Equity | | | 34,599,698 | | | | 39,032,043 | |

| Total Liabilities and Stockholders’ Equity | | $ | 56,892,978 | | | $ | 56,717,070 | |

See accompanying notes to the condensed consolidated financial statements.

AERKOMM INC. AND SUBSIDIARIES

Condensed Consolidated Statements of Operations and Comprehensive Loss

(Unaudited)For the Three-Month and Six-Month Periods ended June 30, 2021 and 2020

| | | Three-Month Period

Ended June 30, | | | Six-Month Period

Ended June 30, | |

| | | 2021 | | | 2020 | | | 2021 | | | 2020 | |

| | | (Unaudited) | | | (Unaudited) | | | (Unaudited) | | | (Unaudited) | |

| | | | | | | | | | | | | |

| Net Sales | | $ | 72,000 | | | $ | - | | | $ | 72,000 | | | $ | - | |

| | | | | | | | | | | | | | | | | |

| Cost of Sales | | | 43,878 | | | | - | | | | 43,878 | | | | - | |

| | | | | | | | | | | | | | | | | |

| Gross Profit | | | 28,122 | | | | - | | | | 28,122 | | | | - | |

| | | | | | | | | | | | | | | | | |

| Operating Expenses | | | 1,996,515 | | | | 2,686,549 | | | | 5,167,514 | | | | 4,642,594 | |

| | | | | | | | | | | | | | | | | |

| Loss from Operations | | | (1,968,393 | ) | | | (2,686,549 | ) | | | (5,139,392 | ) | | | (4,642,594 | ) |

| | | | | | | | | | | | | | | | | |

| Non-Operating Income (Loss) | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Foreign currency exchange gain | | | 512,418 | | | | 536,461 | | | | 141,914 | | | | 215,760 | |

| Unrealized investment income (loss) | | | (18,742 | ) | | | 20,514 | | | | (643,480 | ) | | | (60,170 | ) |

| Other income (loss), net | | | (61,210 | ) | | | 8,379 | | | | (119,800 | ) | | | 2,567 | |

| | | | | | | | | | | | | | | | | |

| Net Non-Operating Income (Loss) | | | 432,466 | | | | 565,354 | | | | (621,366 | ) | | | 158,157 | |

| | | | | | | | | | | | | | | | | |

| Loss before Income Taxes | | | (1,535,927 | ) | | | (2,121,195 | ) | | | (5,760,758 | ) | | | (4,484,437 | ) |

| | | | | | | | | | | | | | | | | |

| Income Tax Expense | | | (26 | ) | | | 11 | | | | 3,269 | | | | 3,263 | |

| | | | | | | | | | | | | | | | | |

| Net Loss | | | (1,535,901 | ) | | | (2,121,206 | ) | | | (5,764,027 | ) | | | (4,487,700 | ) |

| | | | | | | | | | | | | | | | | |

| Other Comprehensive Income (Loss) | | | | | | | | | | | | | | | | |

| Change in foreign currency translation adjustments | | | (524,181 | ) | | | (571,592 | ) | | | (130,414 | ) | | | (227,817 | ) |

| | | | | | | | | | | | | | | | | |

| Total Comprehensive Loss | | $ | (2,060,082 | ) | | $ | (2,692,798 | ) | | $ | (5,894,441 | ) | | $ | (4,715,517 | ) |

| | | | | | | | | | | | | | | | | |

| Net Loss Per Common Share: | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Basic | | $ | (0.1594 | ) | | $ | (0.2223 | ) | | $ | (0.5981 | ) | | $ | (0.4704 | ) |

| Diluted | | $ | (0.1594 | ) | | $ | (0.2223 | ) | | $ | (0.5981 | ) | | $ | (0.4704 | ) |

| | | | | | | | | | | | | | | | | |

| Weighted Average Shares Outstanding - Basic | | | 9,637,051 | | | | 9,540,891 | | | | 9,637,051 | | | | 9,540,891 | |

| Weighted Average Shares Outstanding - Diluted | | | 9,637,051 | | | | 9,540,891 | | | | 9,637,051 | | | | 9,540,891 | |

| | | Three-Month Period Ended September 30, | | | Nine-Month Period Ended September 30, | |

| | | 2017 | | | 2016 | | | 2017 | | | 2016 | |

| Net Sales | | $ | - | | | $ | - | | | $ | - | | | $ | - | |

| Operating expenses | | | 1,398,590 | | | | 680,836 | | | | 4,735,979 | | | | 3,255,855 | |

| Loss from Operations | | | (1,398,590 | ) | | | (680,836 | ) | | | (4,735,979 | ) | | | (3,255,855 | ) |

| Net Non-Operating Income (Loss) | | | (998 | ) | | | - | | | | 25,166 | | | | (89,557 | ) |

| Loss before Income Taxes | | | (1,399,588 | ) | | | (680,836 | ) | | | (4,710,813 | ) | | | (3,345,412 | ) |

| Income Tax Expense (Benefit) | | | 4,453 | | | | (249,000 | ) | | | 9,889 | | | | (816,000 | ) |

| Net Loss | | | (1,404,041 | ) | | | (431,836 | ) | | | (4,720,702 | ) | | | (2,529,412 | ) |

| Less: Loss Attributed to Non-Controlling Interest | | | - | | | | - | | | | - | | | | - | |

| Net Loss Attributable to the Company | | | (1,404,041 | ) | | | (431,836 | ) | | | (4,720,702 | ) | | | (2,529,412 | ) |

| Other Comprehensive Loss | | | - | | | | - | | | | - | | | | - | |

| Change in foreign currency translation adjustments | | | (242 | ) | | | - | | | | (3,596 | ) | | | - | |

| Total Comprehensive Loss | | $ | (1,404,283 | ) | | $ | (431,836 | ) | | $ | (4,724,298 | ) | | $ | (2,529,412 | ) |

| Net Loss Per Common Share: | | | | | | | | | | | | | | | | |

| Basic | | $ | (0.0342 | ) | | $ | (0.0110 | ) | | $ | (0.1167 | ) | | $ | (0.0644 | ) |

| Diluted | | $ | (0.0342 | ) | | $ | (0.0110 | ) | | $ | (0.1167 | ) | | $ | (0.0644 | ) |

| Weighted Average Shares Outstanding - Basic | | | 41,096,011 | | | | 39,335,796 | | | | 40,439,237 | | | | 39,305,412 | |

| Weighted Average Shares Outstanding - Diluted | | | 41,096,011 | | | | 39,335,796 | | | | 40,439,237 | | | | 39,305,412 | |

See accompanying notes to the condensed consolidated financial statements.

AERKOMM INC. AND SUBSIDIARIES

Condensed Consolidated Statements of Changes in Stockholders’ Equity

For the Three-Month and Six-Month Periods ended June 30, 2021 and 2020

| | | Common Stock | | | Additional

Paid in | | | Accumulated | | | Accumulated Other Comprehensive | | | Total Stockholders’ | |

| | | Shares | | | Amount | | | Capital | | | Deficits | | | Income | | | Equity | |

| Balance as of January 1, 2020 | | | 9,391,729 | | | $ | 9,392 | | | $ | 69,560,529 | | | $ | (23,271,687 | ) | | $ | (482,639 | ) | | $ | 45,815,595 | |

| Stock compensation expense | | | - | | | | - | | | | 464,827 | | | | - | | | | - | | | | 464,827 | |

| Revaluation of stock warrant | | | - | | | | - | | | | (66,200 | ) | | | - | | | | - | | | | (66,200 | ) |

| Other comprehensive income | | | - | | | | - | | | | - | | | | - | | | | 343,775 | | | | 343,775 | |

| Net loss for the period | | | - | | | | - | | | | - | | | | (2,366,494 | ) | | | - | | | | (2,366,494 | ) |

| Balance as of March 31, 2020 (Unaudited) | | | 9,391,729 | | | $ | 9,392 | | | $ | 69,959,156 | | | $ | (25,638,181 | ) | | $ | (138,864 | ) | | $ | 44,191,503 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Stock compensation expense | | | - | | | | - | | | | 448,987 | | | | - | | | | - | | | | 448,987 | |

| Revaluation of stock warrant | | | - | | | | - | | | | 455,500 | | | | - | | | | - | | | | 455,500 | |

| Other comprehensive loss | | | - | | | | - | | | | - | | | | - | | | | (571,592 | ) | | | (571,592 | ) |

| Net loss for the period | | | - | | | | - | | | | - | | | | (2,121,206 | ) | | | - | | | | (2,121,206 | ) |

| Balance as of June 30, 2020 (unaudited) | | | 9,391,729 | | | $ | 9,392 | | | $ | 70,863,643 | | | $ | (27,759,387 | ) | | $ | (710,456 | ) | | $ | 42,403,192 | |

| | | Common Stock | | | Additional

Paid in | | | Accumulated | | | Accumulated Other Comprehensive | | | Total Stockholders’ | |

| | | Shares | | | Amount | | | Capital | | | Deficits | | | Income (Loss) | | | Equity | |

| Balance as of January 1, 2021 | | | 9,487,889 | | | $ | 9,488 | | | $ | 73,160,616 | | | $ | (32,383,833 | ) | | $ | (1,754,228 | ) | | $ | 39,032,043 | |

| Stock compensation expense | | | - | | | | - | | | | 1,680,365 | | | | - | | | | - | | | | 1,680,365 | |

| Revaluation of stock warrant | | | - | | | | - | | | | (355,600 | ) | | | - | | | | - | | | | (355,600 | ) |

| Other comprehensive income | | | - | | | | - | | | | - | | | | - | | | | 393,767 | | | | 393,767 | |

| Net loss for the period | | | - | | | | - | | | | - | | | | (4,228,126 | ) | | | - | | | | (4,228,126 | ) |

| Balance as of March 31, 2021 (Unaudited) | | | 9,487,889 | | | $ | 9,488 | | | $ | 74,485,381 | | | $ | (36,611,959 | ) | | $ | (1,360,461 | ) | | $ | 36,522,449 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Stock compensation expense | | | - | | | | - | | | | 179,331 | | | | - | | | | - | | | | 179,331 | |

| Revaluation of stock warrant | | | - | | | | - | | | | (42,000 | ) | | | - | | | | - | | | | (42,000 | ) |

| Other comprehensive loss | | | - | | | | - | | | | - | | | | - | | | | (524,181 | ) | | | (524,181 | ) |

| Net loss for the period | | | - | | | | - | | | | - | | | | (1,535,901 | ) | | | - | | | | (1,535,901 | ) |

| Balance as of June 30, 2021 (Unaudited) | | | 9,487,889 | | | $ | 9,488 | | | $ | 74,622,712 | | | $ | (38,147,860 | ) | | $ | (1,884,642 | ) | | $ | 34,599,698 | |

See accompanying notes to the consolidated financial statements.

AERKOMM INC. AND SUBSIDIARIES

Condensed Consolidated Statements of Cash Flows

(Unaudited)For the Six-Month Period ended June 30, 2021 and 2020

| | | Nine-Month Period Ended September 30, | |

| | | 2017 | | | 2016 | |

| Cash Flows from Operating Activities | | | | | | |

| Net loss | | $ | (4,720,702 | ) | | $ | (2,529,412 | ) |

| Adjustments to reconcile net loss to net cash provided by (used for) operating activities: | | | | | | | | |

| Depreciation and amortization | | | 413,888 | | | | 387,666 | |

| Stock-based compensation | | | 1,136,835 | | | | 22,600 | |

| Issuance of stock warrant | | | 60,000 | | | | 20,000 | |

| Changes in operating assets and liabilities: | | | | | | | | |

| Accounts receivable – related parties | | | - | | | | 3,478,900 | |

| Inventories | | | 1,055 | | | | (97,674 | ) |

| Prepaid expenses | | | (470,606 | ) | | | 116,327 | |

| Prepaid investment | | | (460,000 | ) | | | - | |

| Other receivable – related parties | | | - | | | | (425 | ) |

| Other receivable – others | | | (29,332 | ) | | | 66,180 | |

| Deposits | | | 679,874 | | | | (387,500 | ) |

| Accrued expenses | | | 439,606 | | | | (25,888 | ) |

| Other payable - related parties | | | (42,385 | ) | | | (2,382,397 | ) |

| Other payable - others | | | 614,799 | | | | 664,092 | |

| Net Cash Used for Operating Activities | | | (2,376,968 | ) | | | (667,531 | ) |

| Cash Flows from Investing Activity | | | | | | | | |

| Purchase of property and equipment | | | (279,968 | ) | | | (3,677,337 | ) |

| Net Cash Used for Investing Activity | | | (279,968 | ) | | | (3,677,337 | ) |

| Cash Flows from Financing Activity | | | | | | | | |

| Proceed from short-term bank loan | | | 10,000 | | | | - | |

| Proceeds from issuance of common stock | | | 1,800,022 | | | | 3,599,729 | |

| Proceeds from subscribed capital | | | 544,913 | | | | 750,000 | |

| Net Cash Provided by Financing Activity | | | 2,354,935 | | | | 4,349,729 | |

| Net Increase (Decrease) in Cash | | | (302,001 | ) | | | 4,861 | |

| Cash, Beginning of Period | | | 312,173 | | | | 19,498 | |

| Foreign currency translation effect on cash | | | (3,606 | ) | | | - | |

| Cash, End of Period | | $ | 6,566 | | | $ | 24,359 | |

| Supplemental Disclosures of Cash Flow Information: | | | | | | | | |

| Non-cash operating and financing activities: | | | | | | | | |

| Restricted stock deposit liability transferred to common stock | | $ | 2,890 | | | $ | 3,979 | |

| Other payable to related parties transferred to common stock | | $ | 2,027,400 | | | $ | - | |

| | | Six Months Ended

June 30, | |

| | | 2021 | | | 2020 | |

| | | (Unaudited) | | | (Unaudited) | |

| Cash Flows from Operating Activities | | | | | | |

| Net loss | | $ | (5,764,027 | ) | | $ | (4,487,700 | ) |

| Adjustments to reconcile net loss to net cash used for operating activities: | | | | | | | | |

| Depreciation and amortization | | | 515,984 | | | | 521,126 | |

| Stock-based compensation | | | 1,859,696 | | | | 913,814 | |

| Consulting expense adjustment from change in fair value of warrants | | | (397,600 | ) | | | 389,300 | |

| Unrealized losses on trading security | | | 643,480 | | | | 60,170 | |

| Amortization of bonds issuance costs | | | 95,659 | | | | - | |

| Changes in operating assets and liabilities: | | | | | | | | |

| Accounts receivable | | | - | | | | 451,130 | |

| Inventories | | | (1,575,436 | ) | | | (1,811,443 | ) |

| Prepaid expenses and other current assets | | | (355,764 | ) | | | 90,401 | |

| Deposits | | | 1,522 | | | | (200 | ) |

| Accounts payable | | | - | | | | 961,610 | |

| Accrued expenses and other current liabilities | | | 1,908,033 | | | | 1,280,837 | |

| Prepayment from customer | | | 1,611,357 | | | | - | |

| Operating lease liability | | | 38,715 | | | | 107,020 | |

| Net Cash Used for Operating Activities | | | (1,418,381 | ) | | | (1,523,935 | ) |

| | | | | | | | | |

| Cash Flows from Investing Activities | | | | | | | | |

| Purchase of trading security | | | (877 | ) | | | (157,756 | ) |

| Purchase of property and equipment | | | (3,521 | ) | | | (28,924 | ) |

| Purchase of long-term investment | | | (680 | ) | | | - | |

| Net Cash Used for Investing Activities | | | (5,078 | ) | | | (186,680 | ) |

| | | | | | | | | |

| Cash Flows from Financing Activities | | | | | | | | |

| Proceeds from short-term loans | | | 1,017,693 | | | | 1,385,411 | |

| Payment on long-term loan | | | (4,760 | ) | | | (3,568 | ) |

| Payment on finance lease liability | | | (3,164 | ) | | | (5,926 | ) |

| Net Cash Provided by Financing Activities | | | 1,009,769 | | | | 1,375,917 | |

| | | | | | | | | |

| Net Decrease in Cash and Restricted Cash | | | (413,690 | ) | | | (334,698 | ) |

| | | | | | | | | |

| Cash and Restricted Cash, Beginning of Period | | | 3,794,591 | | | | 976,829 | |

| | | | | | | | | |

| Foreign Currency Translation Effect on Cash | | | (130,414 | ) | | | (227,817 | ) |

| | | | | | | | | |

| Cash and Restricted Cash, End of Period | | $ | 3,250,487 | | | $ | 414,314 | |

| | | | | | | | | |

| Supplemental disclosures of cash flow information: | | | | | | | | |

| Cash paid during the period for income taxes | | $ | 3,269 | | | $ | 1,651 | |

| Cash paid during the period for interest | | $ | 18,679 | | | $ | 3,373 | |

| | | | | | | | | |

| Cash and Restricted Cash: | | | | | | | | |

| Cash | | $ | 40,487 | | | $ | 346,570 | |

| Restricted cash | | | 3,210,000 | | | | 67,744 | |

| Total | | $ | 3,250,487 | | | $ | 414,314 | |

See accompanying notes to the condensed consolidated financial statements.

AERCOMMAERKOMM INC. AND SUBSIDIARIES

Notes to Condensed Consolidated Financial Statements

NOTE 1 - Organization

(Unaudited)

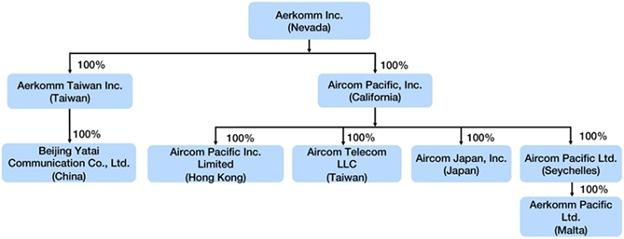

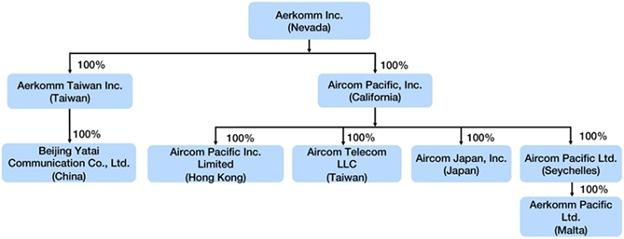

Aerkomm Inc. (formerly Maple Tree Kids Inc.) (“Aerkomm”) was incorporated on August 14, 2013 in the State of Nevada. Aerkomm was a retail distribution company selling all of its products over the internet in the United States, operating in the infant and toddler products business market.

On December 28, 2016, Aircom Pacific IncInc. (“Aircom”) purchased 700,000 shares of Aerkomm’s common stock, representing approximately 86.3% of Aerkomm’s issued and outstanding common stock as of the closing.closing date of purchase. As a result of the transaction, Aircom became the controlling shareholder of Aerkomm. Aircom was incorporated on September 29, 2014 under the laws of the State of California.

On February 13, 2017, Aerkomm entered into a share exchange agreement (“Exchange Agreement”) with Aircom and its shareholders, pursuant to which Aerkomm acquired 100% of the issued and outstanding capital stock of Aircom in exchange for approximately 99.7% of the issued and outstanding capital stock of Aerkomm (or 87.81% on a fully-diluted basis).Aerkomm. As a result of the share exchange, Aircom became a wholly-owned subsidiary of Aerkomm, and the former shareholders of Aircom became the holders of approximately 99.7% of Aerkomm’s issued and outstanding capital stock.

Aircom was incorporated on September 29, 2014 under the laws of the State of California.

On December 31, 2014, Aircom acquired a newly incorporated subsidiary, Aircom Pacific Ltd. (“Aircom Seychelles”), a corporation formed under the laws of the Republic of Seychelles. Aircom Seychelles was formed to facilitate Aircom’s global corporate structure for both business operations and tax planning. Presently, Aircom Seychelles has no operation.operations. Aircom is working with corporate and tax advisers in finalizing its global corporate structure and has not yet concluded its final plan.

On October 17, 2016, Aircom acquired a wholly owned subsidiary, Aircom Pacific Inc. Limited (“Aircom HK”), a corporation formed under the laws of Hong Kong. The purpose of Aircom HK is to conduct Aircom’s business and operations in Hong Kong and China.Kong. Presently, its primary function is business development, both with respect to airlines as well as content providers and advertisement partners based in Hong Kong and China.Kong. Aircom HK is also actively seeking strategic partnerships whom Aircom may leverage in order to provide more and better services to its customers. Aircom also plans to provide local supports to Hong Kong-based airlines via Aircom HK and teleports located in the Hong Kong and China regions.Kong.

On December 15, 2016, Aircom acquired a wholly owned subsidiary, Aircom Japan, Inc. (“Aircom Japan”), a corporation formed under the laws of Japan. The purpose of Aircom Japan is to conduct business development and operations located within Japan. Aircom Japan is in the process of applying for, and will be the holder of, Satellite Communication Blanket License in Japan, which is necessary for Aircom to provide services within Japan. Aircom Japan will also provide local supports to airlines operateoperating within the territory of Japan.

Aircom Telecom LLC (“Aircom Taiwan”), which became a wholly owned subsidiary of Aircom in December 2017, was organized under the laws of Taiwan on June 29, 2016. Aircom Taiwan is responsible for Aircom’s business development efforts and general operations within Taiwan.

On June 13, 2018, Aerkomm established a new wholly owned subsidiary, Aerkomm Taiwan Inc. (“Aerkomm Taiwan”), a corporation formed under the laws of Taiwan. The purpose of Aerkomm Taiwan is to purchase a parcel of land and raise sufficient fund for ground station building and operate the ground station for data processing (although that cannot be guaranteed).

On November 15, 2018, Aircom Taiwan acquired a wholly owned subsidiary, Beijing Yatai Communication Co., Ltd. (“Beijing Yatai”), a corporation formed under the laws of China. The purpose of Beijing Yatai is to conduct Aircom’s business and operations in China. Presently, its primary function is business development, both with respect to airlines as well as content providers and advertisement partners based in China as most business conducted in China requires a local registered company. Beijing Yatai is also actively seeking strategic partnerships whom Aircom may leverage in order to provide more and better services to its customers. Aircom also plans to provide local supports to China-based airlines via Beijing Yatai and teleports located in China. On November 6, 2020, 100% ownership of Beijing Yatai was transferred from Aircom Taiwan to Aerkomm Taiwan.

AERKOMM INC. AND SUBSIDIARIES

Notes to Condensed Consolidated Financial Statements

NOTE 1 - Organization - Continued

On October 31, 2019, Aircom Seychelles established a new a wholly owned subsidiary, Aerkomm Pacific Limited (“Aerkomm Malta”), a corporation formed under the laws of Malta. The purpose of Aerkomm Malta is to conduct Aircom’s business and operations and to engage with suppliers and potential airlines customers in the European Union.

The Company’s organization structure is as following:

Aerkomm and its subsidiaries (the “Company”) are full servicefull-service, development stage providers of in-flight entertainment and connectivity solutions with their initial market in the Asian Pacific region.

Aerkomm and its subsidiaries (“the Company”) haveThe Company has not generated significant revenues, excluding non-recurring revenues, from affiliates in 2015, and will incur additional expenses as a result of being a public reporting company. If the Company is unable to obtain additional working capital, the Company’s business may fail. As of September 30, 2017, the Company generated a net loss of $4,724,298 and had working capital deficiency of $2,555,589, which raises substantial doubt about its ability to continue as a going concern. Currently, the Company has taken measures that management believes will improve its financial position by financing activities, including through ongoing public offerings, short-term borrowings and equity contributions. Two of the Company’s current shareholders (the “Lenders”) each committed to provide to the Company a $10 million bridge loan (together, the “Loans”) for an aggregate principal amount of $20 million, to bridge the Company’s cash flow needs prior to its obtaining a mortgage loan to be secured by a parcel of land (the “Land”) the Company purchased in Taiwan. The Lenders also agreed to an earlier closing of up to 25% of the principal amounts of the Loans upon the Company’s request prior to the time that title to the Land is vested in the Company’s subsidiary, Aerkomm Taiwan, to pay the outstanding payable to the Company’s vendors.

On July 29, 2020, the Company filed an amendment to the Registration Statement on Form S-1, originally filed on April 30, 2020, with the Securities and Exchange Commission, or the SEC, pursuant to Section 5 of the Securities Act of 1933 to issue and sell up to 1,951,219 shares (approximately $47,276,000) of the Company’s common stock, at a per share price of €20.50 (approximately $24.23). The Form S-1 is subsequently amended on July 29, 2020, October 21, 2020 and November 5, 2020, and was declared effective on November 6, 2020. As of December 31, 2020, the Company closed a public offering with net proceeds of $1,667,080.

With the $20 million in Loans committed by the Lenders and the remaining amount of €38 million (not including the 15% over-subscription) to be raised from the effective S-1 and future fund raising, the Company believes its working capital will be adequate to sustain its operations for the next twelve months. However, there is no assurance that management will be successful in furthering the Company’s business plan, especially if the Company is not able to raise additional capital in its registered public offering or from other sources. There are a number of additional factors that could potentially arise that could result in shortfalls in the Company’s business plan, such as general worldwide economic conditions, competitive pricing in the connectivity industry, the continuing impact of the COVID 19 pandemic, the Company’s operating results continuing to deteriorate and the Company’s banks and shareholders not being able to provide continued financial support.

AERKOMM INC. AND SUBSIDIARIES

Notes to Condensed Consolidated Financial Statements - Continued

(Unaudited)

NOTE 2 – | Summary of Significant Accounting Policies |

NOTE 2 - Summary of Significant Accounting Policies

Unaudited Interim Financial Information

The accompanying condensed consolidated balance sheet as of SeptemberJune 30, 2017,2021, and the condensed consolidated statements of operations and comprehensive loss and cash flows for the nine-month periodssix months ended SeptemberJune 30, 20162021 and 2017 and the consolidated statement of changes in equity for the nine-month periods ended September 30, 20172020 are unaudited. The unaudited interim condensed consolidated financial statements have been prepared on the same basis as the annual consolidated financial statements and, in the opinion of management, reflect all adjustments, which include only normal recurring adjustments, necessary to present fairly the Company’s financial position as of SeptemberJune 30, 20172021 and the results of operations and cash flows for the nine-month periodssix months ended SeptemberJune 30, 20162021 and 2017.2020. The financial data and the other information disclosed in these notes to the condensed consolidated financial statements related to these nine-monththree-month periods are unaudited. The results of operations for the nine-month periodssix months ended SeptemberJune 30, 2016 and 20172021 are not necessarily indicative of the results to be expected for the fiscal year ending December 31, 20172021 or for any other interim period or other future year.

Reverse Acquisition

On February 13, 2017, Aerkomm completed the reverse acquisition of Aircom pursuant to the Exchange Agreement. As a result of the reverse acquisition, Aircom became Aerkomm’s wholly-owned subsidiary. For accounting purposes, the share exchange transaction with Aircom was treated as a reverse acquisition, with Aircom as the acquirer and Aerkomm as the acquired party. Unless the context suggests otherwise, “the Company” referred to for the periods prior to the consummation of the reverse acquisition is Aircom and its consolidated subsidiaries.

Principle of Consolidation

Aerkomm consolidates the accounts of its subsidiaries, Aircom, Aircom Seychelles, Aircom HK, Aircom Japan, Aircom Taiwan, Aerkomm Taiwan, Beijing Yatai and Aircom Japan.Aerkomm Malta. All significant intercompany accounts and transactions have been eliminated in consolidation.

All of the entities in these condensed consolidated financial statements have adopted fiscal year end of December 31.

Reclassifications of Prior Year Presentation

Certain prior year balance sheet amounts have been reclassified for consistency with the current period presentation. These reclassifications had no effect on the reported results of operations.

Use of Estimates

The preparation of condensed consolidated financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the amounts reported in the condensed consolidated financial statements and accompanying notes. Actual results may differ from these estimates.

Concentrations of Credit Risk

Financial instruments that potentially subject the Company to significant concentrations of credit risk consist primarily of cash in banks and accounts receivable.banks. As of SeptemberJune 30, 20172021 and December 31, 2016,2020, the total balancesbalance of cash in banks werebank was fully insured by the Federal Deposit Insurance Corporation (FDIC) and. The balance of cash deposited in foreign financial institution deposits insurance.institutions exceeding the amount insured by local insurance is approximately $3,107,000 and $3,514,000 as of June 30, 2021 and December 31, 2020, respectively.

Short-term investment

Inventories

The Company’s short-term investment securities are classified as trading security. The securities are stated at fair value within current assets on the Company’s condensed balance sheets. Fair value is calculated based on publicly available market information or other estimates determined by the Company. Changes in fair value are recorded in current income.

Inventories

Inventories are recorded at the lower of weighted-average cost or market.net realizable value. The Company assesses the impact of changing technology on its inventory on hand and writes off inventories that are considered obsolete. Estimated losses on scrap and slow-moving items are recognized in the allowance for losses.

Long-term Investment

Long-term investment includes holdings of marketable equity securities with less than 20% of ownership of the investee. Marketable equity securities include equity securities which are initially recognized at fair value plus transaction costs that are directly attributable to the acquisition. Changes in fair value from subsequent remeasurement are reported under non-operating income in the Company’s statement of income. The cost of the securities sold is based on the weighted average cost method. Stock dividends from the investment are included to recalculate the cost basis of the investment based on the total number of shares.

Investments are considered to be impaired when a decline in fair value is judged to be other than temporary. If the cost of an investment exceeds its fair value, the Company evaluates, among other factors, general market conditions, the duration and extent to which the fair value is less than cost, as well as its intent and ability to hold the investment, for recording an impairment loss.

AERKOMM INC. AND SUBSIDIARIES

Notes to Condensed Consolidated Financial Statements – Continued

(Unaudited)

NOTE 2 – | Summary of Significant Accounting Policies - Continued |

NOTE 2 - Summary of Significant Accounting Policies - Continued

Property and Equipment

Property and equipment are stated at cost less accumulated depreciation. When value impairment is determined, the related assets are stated at the lower of fair value or book value. Significant additions, renewals and betterments are capitalized. Maintenance and repairs are expensed as incurred.

Depreciation is computed by using the straight-line and double declining methodmethods over the following estimated service lives: ground station equipment – 5 years, computer equipment –- 3 to 5 years, furniture and fixtures - 5 years, satellite equipment – 5 years, vehicles – 5 years and satellite equipmentlease improvement – 5 years.

Construction costs for on-flight entertainment equipment not yet in service are recorded under construction in progress.

Upon sale or disposal of property and equipment, the related cost and accumulated depreciation are removed from the corresponding accounts, with any gain or loss credited or charged to non-operating income in the period of sale or disposal.

The Company reviews the carrying amount of property and equipment for impairment when events or changes in circumstances indicate that the carrying amount of such assets may not be recoverable. It determined that there was no impairment loss for the nine-month periodssix-month period ended SeptemberJune 30, 20172021 and 2016.2020.

Right-of-Use Asset and Lease Liability

In February 2016, the FASB issued ASU No. 2016-02, “Leases” (Topic 842) (“ASU 2016-02”), which modifies lease accounting for both lessees and lessors to increase transparency and comparability by recognizing lease assets and lease liabilities by lessees for those leases classified as operating leases and finance leases under previous accounting standards and disclosing key information about leasing arrangements.

A lessee should recognize the lease liability to make lease payments and the right-of-use asset representing its right to use the underlying asset for the lease term. For operating leases and finance leases, a right-of-use asset and a lease liability are initially measured at the present value of the lease payments by discount rates. The Company’s lease discount rates are generally based on its incremental borrowing rate, as the discount rates implicit in the Company’s leases is readily determinable. Operating leases are included in operating lease right-of-use assets and lease liabilities in the consolidated balance sheets. Finance leases are included in property and equipment and lease liability in our consolidated balance sheets. Lease expense for operating expense payments is recognized on a straight-line basis over the lease term. Interest and amortization expenses are recognized for finance leases on a straight-line basis over the lease term.

For the leases with a term of twelve months or less, a lessee is permitted to make an accounting policy election by class of underlying asset not to recognize lease assets and lease liabilities. If a lessee makes this election, it should recognize lease expense for such leases generally on a straight-line basis over the lease term. The Company adopted ASU 2016-02 effective January 1, 2019.

Goodwill and Purchased Intangible Assets

The Company’s goodwill represents the amount by which the total purchase price paid exceeded the estimated fair value of net assets acquired from acquisition of subsidiaries. The Company tests goodwill for impairment on an annual basis, or more often if events or circumstances indicate that there may be impairment.

Purchased intangible assets with finite life are amortized on the straight-line basis over the estimated useful lives of respective assets. Purchased intangible assets with indefinite life are evaluated for impairment when events or changes in circumstances indicate that the carrying amount of such assets may not be recoverable. As of September 30, 2017 and December 31, 2016, purchasedPurchased intangible asset consists of satellite system software and is amortized over 10 years.

Fair Value of Financial Instruments

The Company utilizes the three-level valuation hierarchy for the recognition and disclosure of fair value measurements. The categorization of assets and liabilities within this hierarchy is based upon the lowest level of input that is significant to the measurement of fair value. The three levels of the hierarchy consist of the following:

Level 1 –- Inputs to the valuation methodology are unadjusted quoted prices in active markets for identical assets or liabilities that the Company has the ability to access at the measurement date.

AERKOMM INC. AND SUBSIDIARIES

Notes to Condensed Consolidated Financial Statements

NOTE 2 - Summary of Significant Accounting Policies - Continued

Fair Value of Financial Instruments-Continued

Level 2 –- Inputs to the valuation methodology are quoted prices for similar assets and liabilities in active markets, quoted prices in markets that are not active or inputs that are observable for the asset or liability, either directly or indirectly, for substantially the full term of the instrument.

Level 3 –- Inputs to the valuation methodology are unobservable inputs based upon management’s best estimate of inputs market participants could use in pricing the asset or liability at the measurement date, including assumptions.

The carrying amounts of the Company’s cash other receivable,and restricted cash, accounts payable, short-term bank loan and other payable approximated their fair value due to the short-term nature of these financial instruments. The Company’s short-term investment and long-term investment are classified within Level 1 of the fair value hierarchy on June 30, 2021. The Company’s long-term bonds payable, long-term loan and lease payable approximated the carrying amount as its interest rate is considered as approximate to the current rate for comparable loans and leases, respectively. There were no outstanding derivative financial instruments as of June 30, 2021.

Revenue Recognition

AERKOMM INC. AND SUBSIDIARIES

Notes to Condensed Consolidated Financial Statements – Continued

(Unaudited)

NOTE 2 – | Summary of Significant Accounting Policies - Continued |

ResearchThe Company adopted the provisions of ASU 2014-09 Revenue from Contract with Customers (Topic 606) and Development Costs

Research and development costs are charged to operating expenses as incurred. For the nine-month periods ended September 30, 2017 and 2016,principal versus agent guidance within the new revenue standard. As such, the Company incurred approximately $0identifies a contract with a customer, identifies the performance obligations in the contract, determines the transaction price, allocates the transaction price to each performance obligation in the contract and $1,579,000 in research and development costs, respectively.recognizes revenue when (or as) the Company satisfies a performance obligation.

Income Taxes

Income taxes are accounted for under the asset and liability method. Deferred tax assets and liabilities are computed for differences between the financial statement and tax bases of assets and liabilities that will result in taxable or deductible amounts in the future based on enacted tax laws and rates applicable to the periods in which the differences are expected to affect taxable income.

Valuation allowances are established when necessary to reduce deferred tax assets to the amount expected to be realized. Income tax expense is the tax payable or refundable for the period plus or minus the change during the period in deferred tax assets and liabilities. Adjustments to prior period’s income tax liabilities are added to or deducted from the current period’s tax provision.

The Company follows FASB guidance on uncertain tax positions and has analyzed its filing positions in all the federal, state and foreign jurisdictions where it is required to file income tax returns, as well as all open tax years in those jurisdictions. The Company files income tax returns in the US federal, state and foreign jurisdictions where it conducts business. It is not subject to income tax examinations by US federal, state and local tax authorities for years before 2016. The Company believes that its income tax filing positions and deductions will be sustained on audit and does not anticipate any adjustments that will result in a material adverse effect on its consolidated financial position, results of operations, or cash flows. Therefore, no reserves for uncertain tax positions have been recorded. The Company does not expect its unrecognized tax benefits to change significantly over the next twelve months.

The Company’s policy for recording interest and penalties associated with any uncertain tax positions is to record such items as a component of income before taxes. Penalties and interest paid or received, if any, are recorded as part of other operating expenses in the consolidated statement of operations.

Foreign Currency Transactions

Foreign currency transactions are recorded in U.S. dollars at the exchange rates in effect when the transactions occur. Exchange gains or losses derived from foreign currency transactions or monetary assets and liabilities denominated in foreign currencies are recognized in current income. At the end of each period, assets and liabilities denominated in foreign currencies are revalued at the prevailing exchange rates with the resulting gains or losses recognized in income for the period.

Translation Adjustments

If a foreign subsidiary’s functional currency is the local currency, translation adjustments will result from the process of translating the subsidiary’s condensed financial statements into the reporting currency of the Company. Such adjustments are accumulated and reported under other comprehensive income (loss) as a separate component of stockholder’sstockholders’ equity.

AERKOMM INC. AND SUBSIDIARIES

Notes to Condensed Consolidated Financial Statements

NOTE 2 - Summary of Significant Accounting Policies - Continued

Earnings (Loss) Per Share

Basic and diluted earnings (loss) per share (EPS) areis computed by dividing income available to common shareholders by the weighted-averageweighted average number of shares of common stock outstanding during the period. Diluted earnings (loss) per share is computed by dividing income available to common shareholders by the weighted-average number of shares of common stock outstanding during the period increased to include the number of additional shares of common stock that would have been outstanding if the potentially dilutive securities had been issued. Potentially dilutive securities include stock warrants and outstanding stock options, shares to be purchased by employees under the Company’s employee stock purchase plan. Basic

Subsequent Events

The Company has evaluated events and diluted earnings (loss) per common share presented fortransactions after the nine-monthreported period ended Septemberup to August [*], 2021, the date on which these consolidated financial statements were available to be issued. All subsequent events requiring recognition as of June 30, 2016 has taken into account the stock split2021 have been included in June 2016 and share exchange for reverse acquisition on February 13, 2017 (see Note 1).

these consolidated financial statements.

AERKOMM INC. AND SUBSIDIARIES

Notes to Condensed Consolidated Financial Statements - Continued

(Unaudited)

NOTE 3 – | Recent Accounting Pronouncements |

NOTE 3 - Recent Accounting Pronouncements

Financial Instruments

Simplifying the Accounting for Debt with Conversion and Other Options.

In January 2016,June 2020, the FASB issued ASU No. 2016-01, “Financial Instruments – Overall (Subtopic 825-10): Recognition2020-06 to simplify the accounting in ASC 470, Debt with Conversion and Measurement of Financial AssetsOther Options and Financial Liabilities” (“ASU 2016-01”), which updates certain aspects of recognition, measurement, presentationASC 815, Contracts in Equity’s Own Entity. The guidance simplifies the current guidance for convertible instruments and disclosure of financialthe derivatives scope exception for contracts in an entity’s own equity. Additionally, the amendments affect the diluted EPS calculation for instruments that may be settled in cash or shares and for convertible instruments. This ASU 2016-01 will be effective for fiscal years beginning after March 15, 2017, including interim periods within those fiscal years and forin the Company in its first quarter of 2018.the Company’s fiscal year 2022. Early adoption is permitted. The amendments in this update must be applied on either full retrospective basis or modified retrospective basis through a cumulative-effect adjustment to retained earnings/(deficit) in the period of adoption. The Company is currently evaluating the impact of adopting ASU 2016-012020-06 on its consolidated financial statements.statements and related disclosures, as well as the timing of adoption.

Financial Instruments

In June 2016, the FASB issued ASU No. 2016-13, “Financial Instruments –- Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments” (“ASU 2016-13”), which modifies the measurement of expected credit losses of certain financial instruments. In February 2020, the FASB issued ASU 2020-02 and delayed the effective date of ASU 2016-13 until fiscal year beginning after December 15, 2022. The Company is currently evaluating the impact of adopting ASU 2016-13 on its consolidated financial statements.

Simplifying the Accounting for Income Taxes

In December 2019, the FASB issued ASU 2019-12 to simplify the accounting in ASC 740, “Income Taxes.” This guidance removes certain exceptions related to the approach for intra-period tax allocation, the methodology for calculating income taxes in an interim period, and the recognition of deferred tax liabilities for outside basis differences. This guidance also clarifies and simplifies other areas of ASC 740. This ASU will be effective beginning in the first quarter of the Company’s fiscal year 2021. Early adoption is permitted. Certain amendments in this update must be applied on a prospective basis, certain amendments must be applied on a retrospective basis, and certain amendments must be applied on a modified retrospective basis through a cumulative-effect adjustment to retained earnings/(deficit) in the period of adoption. The adoption of ASU 2019-12 does not have a significant impact on the Company’s consolidated financial statements as of and for the six-month period ended June 30, 2021.

Earnings Per Share

In April 2021, the FASB issued ASU 2021-04, which included Topic 260 “Earnings Per Share”. This guidance clarifies and reduces diversity in an issuer’s accounting for modifications or exchanges of freestanding equity-classified written call options due to a lack of explicit guidance in the FASB Codification. The ASU 2021-04 is effective for all entities for fiscal years beginning after MarchDecember 15, 2020, including interim periods within those fiscal years and for the Company in its first quarter of 2021, and early2021. Early adoption is permitted. The Company is currently evaluating the impact of adopting ASU 2016-13on its consolidated financial statements.

Intangibles

In January 2017, the FASB issued ASU No. 2017-04, “Intangibles – Goodwill and Other” (Topic 350): Simplifying the Test for Goodwill Impairment, which goodwill shall be tested at least annually for impairment at a level of reporting referred to as a reporting unit. ASU 2017-04 will be effective for annual periods beginning after March 15, 2019, and interim periods within annual periods beginning after March 15, 2020, and early adoption is permitted. The Company is currently evaluating the impact of adopting ASU 2017-042021-04 on its consolidated financial statements.

Stock Compensation

In March 2016, the FASB issued ASU No. 2016-09, “Compensation – Stock Compensation” (Topic 718): Improvements to Employee Share-Based Payment Accounting (“ASU 2016-09”), which simplifies certain aspects of the accounting for share-based payment transactions, including income taxes, classification of awards and classification on the statement of cash flows. ASU 2016-09 will be effective for annual periods beginning after March 15, 2017, and interim periods within annual periods beginning after March 15, 2018 and for the Company in its first quarter of 2019, and early adoption is permitted. The Company is currently evaluating the impact of adopting ASU 2016-09 on its consolidated financial statements.

Revenue Recognition

In May 2014, the FASB issued ASU No. 2014-09, “Revenue from Contracts with Customers” (Topic 606) (“ASU 2014-09”), which amends the existing accounting standards for revenue recognition. ASU 2014-09 is based on principles that govern the recognition of revenue at an amount an entity expects to be entitled when products are transferred to customers. ASU 2014-09 will be effective for annual periods beginning after March 15, 2017, and interim periods within annual periods beginning after March 15, 2018 and for the Company in its first quarter of 2019, and early adoption is permitted.

Subsequently, the FASB issued the following standards related to ASU 2014-09: ASU No. 2016-08, “Revenue from Contracts with Customers (Topic 606): Principal versus Agent Considerations” (“ASU 2016-08”); ASU No. 2016-10, “Revenue from Contracts with Customers” (Topic 606): Identifying “Performance Obligations and Licensing” (“ASU 2016-10”); and ASU No. 2016-12, “Revenue from Contracts with Customers” (Topic 606): “Narrow-Scope Improvements and Practical Expedients” (“ASU 2016-12”). The Company must adopt ASU 2016-08, ASU 2016-10 and ASU 2016-12 with ASU 2014-09 (collectively, the “new revenue standards”).

The new revenue standards may be applied retrospectively to each prior period presented or retrospectively with the cumulative effect recognized as of the date of adoption. The Company currently expects to adopt the new revenue standards in its first quarter of 2019 utilizing the full retrospective transition method. The Company is currently evaluating the impact of adopting the new revenue standards on its consolidated financial statements.

AERKOMM INC. AND SUBSIDIARIES

Notes to Condensed Consolidated Financial Statements - Continued

NOTE 4 – Short-term Investment

(Unaudited)

NOTE 3 – | Recent Accounting Pronouncements – Continued |

Leases

In February 2016, the FASB issued ASU No. 2016-02, “Leases” (Topic 842) (“ASU 2016-02”), which modifies lease accounting for both lessees and lessors to increase transparency and comparability by recognizing lease assets and lease liabilities by lessees for those leases classified as operating leases under previous accounting standards and disclosing key information about leasing arrangements. ASU 2016-02 will be effective for fiscal years beginning after March 15, 2018, including interim periods within those fiscal years and forOn September 9, 2019, the Company entered into a liquidity agreement with a security company (“the Liquidity Provider”) in its first quarterFrance, which is consistent with customary practice in the French securities market. The liquidity agreement complies with applicable laws and regulations in France and authorizes the Liquidity Provider to carry out market purchases and sales of 2019,shares of the Company’s common stock on the Euronext Paris market. To enable the Liquidity Provider to carry out the interventions provided for in the contract, the Company contributed approximately $225,500 (200,000 euros) into the account. The transaction was initiated in the beginning of 2020, and early adoptionthe Company pays annual compensation of 20,000 euros to the Liquidity Provider in advance by semi-annual installments at the beginning of each semi-annual period under the agreement. The liquidity agreement had an initial term of one year and is permitted. Thebeing renewed automatically unless otherwise terminated by either party. As of June 30, 2021, the Company is currently evaluating the timinghad purchased 11,604 shares (unaudited) of its adoption andcommon stock with the impactfair value of adopting ASU 2016-02 on its consolidated financial statements.$60,493 (unaudited). The securities were recorded as short-term investment with an accumulated unrealized loss of $168,767.

NOTE 5 - Inventories

Income Taxes

In October 2016, FASB issued ASU 2016-16, “Income Taxes (Topic 740): Intra-Entity Transfer of Assets Other than Inventory” (“ASU 2016-16”), which requires the recognition of the income tax consequences of an intra-entity transfer of an asset, other than inventory, when the transfer occurs. ASU 2016-06 will be effective for annual reporting periods beginning after March 15, 2017 and for the Company in its first quarter of 2018. The Company is currently evaluating the impact of adopting ASU 2016-16 on its consolidated financial statements.

Business Combinations

In January 2017, the FASB issued ASU No. 2017-01, “Business Combinations” (Topic 805): Clarifying the Definition of a Business, which a business is an integrated set of activities and assets that is capable of being conducted and managed for the purpose of providing a return in the form of dividends, lower costs, or other economic benefits directly to investors or other owners, members, or participants. ASU 2017-01 will be effective for annual periods beginning after March 15, 2017, and interim periods within annual periods beginning after March 15, 2018, and early adoption is permitted. The Company is currently evaluating the impact of adopting ASU 2017-01 on its consolidated financial statements.

As of SeptemberJune 30, 20172021 and December 31, 2016,2020, inventories consisted of the following:

| | | | September 30, 2017 | | | December 31, 2016 | |

| | Satellite equipment for sale under construction | | $ | 197,645 | | | $ | 197,645 | |

| | Parts | | | 15,953 | | | | 11,029 | |

| | Supplies | | | 722 | | | | 6,437 | |

| | | | | 214,320 | | | | 215,111 | |

| | Allowance for inventory loss | | | (5,646 | ) | | | (5,382 | ) |

| | Net | | $ | 208,674 | | | $ | 209,729 | |

| | | June 30,

2021 | | | December 31,

2020 | |

| | | (Unaudited) | | | | |

| Satellite equipment for sale under construction | | $ | 6,476,397 | | | $ | 4,669,297 | |

| Supplies | | | 5,192 | | | | 5,317 | |

| | | | 6,481,589 | | | | 4,674,614 | |

| Allowance for inventory loss | | | (5,192 | ) | | | (5,317 | ) |

| Net | | | 6,476,397 | | | | 4,669,297 | |

| Prepayment for inventory | | | 331,400 | | | | 542,130 | |

| Total | | $ | 6,807,797 | | | $ | 5,211,427 | |

NOTE 5 – | Prepaid Investment |

NOTE 6 - Property and Equipment

As of SeptemberJune 30, 2017, the Company had paid $460,000 to Aircom Telecom, LLC (Aircom Taiwan), a Taiwan company not affiliated with the Company, as the pre-payment of subscribed capital. As of November 10, 2017, the investment transaction has not been finalized as it is subject to the approval of Taiwan government, which approval may not be granted.

AERKOMM INC. AND SUBSIDIARIES

Notes to Condensed Consolidated Financial Statements - Continued

(Unaudited)

NOTE 6 – | Property and Equipment, Net |

As of September 30, 20172021 and December 31, 2016,2020, the balances of property and equipment were as follows:

| | | | September 30, 2017 | | | December 31, 2016 | |

| | Computer software and equipment | | $ | 123,667 | | | $ | 125,524 | |

| | Furniture and fixture | | | 10,001 | | | | 3,393 | |

| | Satellite equipment | | | 275,410 | | | | - | |

| | | | | 409,078 | | | | 128,917 | |

| | Accumulated depreciation | | | (86,656 | ) | | | (43,825 | ) |

| | Net | | | 322,422 | | | | 85,092 | |

| | Construction in progress | | | 3,250,000 | | | | 3,660,000 | |

| | Net | | $ | 3,572,422 | | | $ | 3,745,092 | |

| | | June 30,

2021 | | | December 31,

2020 | |

| | | (Unaudited) | | | | | |

| Ground station equipment | | $ | 1,854,027 | | | $ | 1,876,458 | |

| Computer software and equipment | | | 339,229 | | | | 335,708 | |

| Satellite equipment | | | 275,410 | | | | 275,410 | |

| Vehicle | | | 198,741 | | | | 198,741 | |

| Leasehold improvement | | | 83,721 | | | | 83,721 | |

| Furniture and fixture | | | 36,382 | | | | 36,382 | |

| | | | 2,787,510 | | | | 2,806,420 | |

| Accumulated depreciation | | | (1,681,178 | ) | | | (1,414,191 | ) |

| Net | | | 1,106,332 | | | | 1,392,229 | |

| Prepayments - land | | | 35,861,589 | | | | 35,861,589 | |

| Prepaid equipment | | | 86,617 | | | | 86,617 | |

| Net | | $ | 37,054,538 | | | $ | 37,340,435 | |

NOTE 7 – | Intangible Asset, Net |

On July 10, 2018, the Company and Aerkomm Taiwan entered into a real estate sale contract (the “Land Purchase Contract”) with Tsai Ming-Yin (the “Seller”) with respect to the acquisition by Aerkomm Taiwan of a parcel of land located in Taiwan. The land is expected to be used to build a satellite ground station and data center. Pursuant to the terms of the Land Purchase Contract, and subsequent amendments on July 30, 2018, September 4, 2018, November 2, 2018 and January 3, 2019, the Company paid to the seller in installments refundable prepayments of $34,474,462 in total. As of SeptemberJune 30, 20172021 and December 31, 2016,2020, the estimated commission payable for the land purchase in the amount of $1,387,127 was recorded to the cost of land and the payment to be paid after the full payment of the Land acquisition price no later than December 31, 2021. According to the amended Land Purchase Contract dated on November 10, 2020, the transaction may be terminated at any time by both the buyer and the seller and agreed by all parties if the Company is unable to obtain the qualified satellite license issued by Taiwan authority before July 31, 2021. As of August 20, 2021, the license applications are still in progress.

Depreciation expense was $133,919 (unaudited) and $136,587 (unaudited) for the three-month periods ended June 30, 2021 and 2020, respectively, and $268,484 (unaudited) and $273,626 (unaudited) for the six-month periods ended June 30, 2021 and 2020, respectively.

AERKOMM INC. AND SUBSIDIARIES

Notes to Condensed Consolidated Financial Statements

NOTE 7 – Long-term Investment

On December 3, 2020, the Company entered into three separate stock purchase agreements (or “Stock Purchase Agreement”) from three individuals to purchase an aggregate of 6,000,000 restricted shares of one of the Company’s related parties, YuanJiu Inc. (YuanJiu) in a total amount of NT$141,175,000. YuanJiu is a listed company in Taiwan Stock Exchange and the stock title transfer is subject to certain restrictions. Albert Hsu, a member of the Company’s board of directors, is the Chairman of YuanJiu. On July 19, 2021, YuanJiu Inc. changed its name to “EJECTT INC.”

In the Stock Purchase Agreement, there was a restriction on the stock title transfer until May 13, 2021. As of August 12, 2021, this restriction on the stock transfer was released and the stock title transfer process has been completed. As of June 30, 2021 and December 31, 2020, this investment totaled approximately a 10% ownership of YuanJiu. The Company intends to hold this investment for long-term purposes.

On March 24, 2021, the Company purchased additional 1,000 shares of YuanJiu’s common stock for a total amount of $694 (unaudited) from a related party.

As of June 30, 2021 and December 31, 2020, the fair value of the investment was as follows:

| | | June 30,

2021 | | | December 31,

2020 | |

| | | (Unaudited) | | | | | |

| Investment cost | | $ | 5,058,917 | | | $ | 5,027,600 | |

| Less: Allowance for value decline | | | (1,349,875 | ) | | | (722,044 | ) |

| Net | | $ | 3,709,042 | | | $ | 4,305,556 | |

NOTE 8 - Intangible Asset, Net

As of June 30, 2021 and December 31, 2020, the cost and accumulated amortization for intangible asset were as follows:

| | | June 30,

2021 | | | December 31,

2020 | |

| | | (Unaudited) | | | | | |

| Satellite system software | | $ | 4,950,000 | | | $ | 4,950,000 | |

| Accumulated amortization | | | (2,805,000 | ) | | | (2,557,500 | ) |

| Net | | $ | 2,145,000 | | | $ | 2,392,500 | |

Amortization expense was $123,750 (unaudited) and $123,750 (unaudited) for the three-month periods ended June 30, 2021 and 2020, respectively, and $247,500 (unaudited) and $247,500 (unaudited) for the six-month periods ended June 30, 2021 and 2020, respectively.

NOTE 9 - Operating and Finance Leases

| A. | Lease term and discount rate: |

The weighted-average remaining lease term and discount rate related to the leases were as follows:

| | | 2021 | | | 2020 | |

| Weighted-average remaining lease term | | (Unaudited) | | | | | |

| Operating lease | | | 1.03 Years | | | | 2.01 Years | |

| Finance lease | | | 3.35 Years | | | | 3.84 Years | |

| Weighted-average discount rate | | | | | | | | |

| Operating lease | | | 6.00 | % | | | 6.00 | % |

| Finance lease | | | 3.82 | % | | | 3.82 | % |

AERKOMM INC. AND SUBSIDIARIES

Notes to Condensed Consolidated Financial Statements

NOTE 9 - Operating and Finance Leases - Continued

| B. | The balances for the operating and finance leases are presented as follows within the consolidated balance sheets as of June 30, 2021 and December 31, 2020: |

Operating Leases

| | | June 30,

2021 | | | December 31,

2020 | |

| | | (Unaudited) | | | | |

| Right-of-use assets | | $ | 279,414 | | | $ | 353,442 | |

| | | | | | | | | |

| Lease liability – current | | $ | 406,146 | | | $ | 346,870 | |

| Lease liability – non-current | | | 80,746 | | | | 173,308 | |

| Total operating lease liabilities | | $ | 486,892 | | | $ | 520,178 | |

Finance Leases

| | | | September 30, 2017 | | | December 31, 2016 | |

| | Satellite system software | | $ | 4,950,000 | | | $ | 4,950,000 | |

| | Accumulated amortization | | | (948,750 | ) | | | (577,500 | ) |

| | Net | | $ | 4,001,250 | | | $ | 4,372,500 | |

| | | June 30,

2021 | | | December 31,

2020 | |

| | | (Unaudited) | | | | | |

| Property and equipment, at cost | | $ | 56,770 | | | $ | 56,770 | |

| Accumulated depreciation | | | (19,156 | ) | | | (13,098 | ) |

| Property and equipment, net | | $ | 37,615 | | | $ | 43,672 | |

| | | | | | | | | |

| Lease liability - current | | $ | 11,291 | | | $ | 11,010 | |

| Lease liability – non-current | | | 31,663 | | | | 37,135 | |

| Total finance lease liabilities | | $ | 42,954 | | | $ | 48,145 | |

The components of lease expense are as follows within the consolidated statements of operations and comprehensive loss for the six-month periods ended June 30, 2021 and 2020:

Operating Leases

| | | Three Months Ended | | | Six Months Ended | |

| | | June 30,

2021 | | | June 30,

2020 | | | June 30,

2021 | | | June 30,

2020 | |

| | | (Unaudited) | | | (Unaudited) | | | (Unaudited) | | | (Unaudited) | |

| Lease expense | | $ | 54,658 | | | $ | 108,348 | | | $ | 112,590 | | | $ | 220,345 | |

| Sublease rental income | | | (2,737 | ) | | | (2,791 | ) | | | (5,563 | ) | | | (5,545 | ) |

| Net lease expense | | $ | 51,921 | | | $ | 105,557 | | | $ | 107,027 | | | $ | 214,800 | |

Finance Leases

| | | Three Months Ended | | | Six Months Ended | |

| | | June 30,

2021 | | | June 30,

2020 | | | June 30,

2021 | | | June 30,

2020 | |

| | | (Unaudited) | | | (Unaudited) | | | (Unaudited) | | | (Unaudited) | |

| Amortization of right-of-use asset | | $ | 3,034 | | | $ | 2,841 | | | $ | 6,057 | | | $ | 5,932 | |

| Interest on lease liabilities | | | 429 | | | | 496 | | | | 880 | | | | 1,012 | |

| Total finance lease cost | | $ | 3,463 | | | $ | 3,337 | | | $ | 6,937 | | | $ | 6,944 | |

NOTE 8 – | Short-term Bank Loan |

AERKOMM INC. AND SUBSIDIARIES

Notes to Condensed Consolidated Financial Statements

NOTE 9 - Operating and Finance Leases - Continued

Supplemental cash flow information related to leases for the six-month periods ended June 30, 2021 and 2020 is as follows:

| | | June 30,

2021 | | | June 30,

2020 | |

| | | (Unaudited) | | | (Unaudited) | |

| Cash paid for amounts included in the measurement of lease liabilities: | | | | | | | | |

| Operating cash outflows from operating leases | | $ | 64,517 | | | $ | 93,689 | |

| Operating cash outflows from finance lease | | $ | 5,462 | | | $ | 5,926 | |

| Financing cash outflows from finance lease | | $ | 878 | | | $ | 1,012 | |

| Leased assets obtained in exchange for lease liabilities: | | | | | | | | |

| Operating leases | | $ | 28,197 | | | $ | 261,781 | |

Maturity of lease liabilities:

Operating Leases

| | | Related

Party | | | Others | | | Total | |

| | | (Unaudited) | | | (Unaudited) | | | (Unaudited) | |

| July 1, 2021 – June 30, 2022 | | $ | 55,757 | | | $ | 361,327 | | | $ | 417,084 | |

| July 1, 2022 – June 30, 2023 | | | - | | | | 83,155 | | | | 83,155 | |

| July 1, 2023 – June 30, 2024 | | | - | | | | - | | | | - | |

| Total lease payments | | $ | 55,757 | | | $ | 444,482 | | | $ | 500,239 | |

| Less: Imputed interest | | | (1,521 | ) | | | (11,826 | ) | | | (13,347 | ) |

| Present value of lease liabilities | | $ | 54,236 | | | $ | 432,656 | | | $ | 486,892 | |

| Current portion | | | (54,236 | ) | | | (351,910 | ) | | | (406,146 | ) |

| Non-current portion | | $ | - | | | $ | 80,746 | | | $ | 80,746 | |

Finance Leases

| | | Total | |

| | | (Unaudited) | |

| July 1, 2021 – June 30, 2022 | | $ | 12,735 | |

| July 1, 2022 – June 30, 2023 | | | 12,735 | |

| July 1, 2023 – June 30, 2024 | | | 12,735 | |

| July 1, 2024 – June 30, 2025 | | | 7,828 | |

| Total lease payments | | $ | 46,033 | |

| Less: Imputed interest | | | (3,079 | ) |

| Present value of lease liabilities | | $ | 42,954 | |

| Current portion | | | (11,291 | ) |

| Non-current portion | | $ | 31,663 | |

NOTE 10 - Short-term Loans

In 2020, the Company entered into a loan agreement in the amount of $423,225 with the Company’s insurance service provider in order to pay the Company’s insurance premium. The Company has an unsecured short-term bank credit line of $10,000 from a local bankloan matures on September 25, 2021 with an annual interest rate of 4.25%3.3%. Under this loan agreement, the Company is required to make the installment payment monthly. The installment liability as of SeptemberJune 30, 2017.

2021 was $111,582.

Additionally, in June 2021, the Company entered into a loan agreement in the amount of $1,433,177 (NT $40,000,000) (unaudited) with a non-related party. This loan, which carries no interest, originally matured on July 16, 2021 and the Company agreed to put 4,000,000 shares of Yuanjiu stocks as collateral. As of August 20, 2021, the Company has repaid $179,147 (NT $5,000,000) (unaudited) of the outstanding loan and the two parties signed the amendment agreement to extend the loan repayment date to September 16, 2021.

AERKOMM INC. AND SUBSIDIARIES

Notes to Condensed Consolidated Financial Statements

NOTE 11 - Long-term Loan

The Company has a car loan credit line of NT$1,500,000 (approximately US$48,371), which matures on May 21, 2024, from a Taiwan financing company with annual interest rate of 9.7%. The installment payment plan is 60 months to pay off the balance on the 21st of each month. Future installment payments as of June 30, 2021 are as follows:

| Twelve months ending June 30, | | (Unaudited) | |

| 2022 | | $ | 13,608 | |

| 2023 | | | 13,608 | |

| 2024 | | | 12,474 | |

| Total installment payments | | | 39,690 | |

| Less: Imputed interest | | | (5,244 | ) |

| Present value of long-term loan | | | 34,446 | |

| Current portion | | | (10,732 | ) |

| Non-current portion | | $ | 23,714 | |

NOTE 12 – Long-term Bonds Payable and Restricted Cash

On December 3, 2020, the Company closed a private placement offering consisting of US$10,000,000 in aggregate principal amount of its Credit Enhanced Zero Coupon Convertible Bonds (the “Zero Coupon Bonds”) and US$200,000 in aggregate principal amount of its 7.5% convertible bonds (the “Coupon Bonds”), both due on December 2, 2025 (collectively the “Bonds”). Unless previously redeemed, converted or repurchased and cancelled, the Zero-Coupon Bonds will be redeemed on December 2, 2025 at 105.11% of their principal amount and the Coupon Bonds will be redeemed on December 2, 2025 at 100% of their principal amount plus any accrued and unpaid interest. The Coupon Bonds will bear interest from and including December 2, 2020 at the rate of 7.5% per annum. Interest on the Coupon Bonds is payable semi-annually in arrears on June 1 and December 1 each year, commencing on June 1, 2021.

The Company has the option to redeem the Bonds at a redemption amount equal to the Early Redemption Amount, as defined in the Offering Memorandum, at any time on or after December 2, 2023 and prior to the Maturity Date, if the Closing Price of the Company’s Common Stock listed on the Euronext Paris for 20 trading days in any period of 30 consecutive trading days, the last day of which occurs not more than fifteen trading days prior to the date on which notice of such redemption is given, is greater than 130% of the Conversion Price on each applicable trading day or (ii) in whole or in part of the Bonds on the second anniversary of the issue date or (iii) where 90% or more in principal amount of the Bonds issued have been redeemed, converted or repurchased and cancelled.

Unless previously redeemed, converted or repurchased and cancelled, the Bonds may be converted at any time on or after December 3, 2020 up to November 20, 2025 into shares of Common Stock of the Company with a par value of $0.001 each. The initial conversion price for the Bonds is $13.30 per share and is subject to adjustment in specified circumstances.

Holders of the Bonds may also require the Company to repurchase all or part of the Bonds on the third anniversary of the Issue Date, at the Early Redemption Amount. Unless the Bonds have been previously redeemed, converted or repurchased and cancelled, Holders of the Bonds will also have the right to require the Company to repurchase the Bonds for cash at the Early Redemption Amount if an event of delisting or a change of control occurs.