CONDENSED CONSOLIDATED BALANCE SHEETS

U.S. Dollars in thousands (except share and per share data)

(UNAUDITED)

| November 30, | August 31, | November 30, | August 31, | |||||||||||||

| 2017 | 2017 | 2019 | 2019 | |||||||||||||

| Assets | ||||||||||||||||

| CURRENT ASSETS: | ||||||||||||||||

| Cash and cash equivalents | $ | 1,258 | $ | 3,969 | 3,171 | 3,329 | ||||||||||

| Short-term deposits | 14,992 | 13,293 | 23,755 | 25,252 | ||||||||||||

| Marketable securities | 2,722 | 2,860 | 3,207 | 3,701 | ||||||||||||

| Restricted cash | - | 16 | ||||||||||||||

| Prepaid expenses and other current assets | 163 | 159 | 609 | 1,042 | ||||||||||||

| Total current assets | 19,135 | 20,297 | 30,742 | 33,324 | ||||||||||||

| LONG-TERM ASSETS: | ||||||||||||||||

| Long-term deposits and investment | 17,780 | 16,232 | ||||||||||||||

| Long-term deposits | 1 | 1 | ||||||||||||||

| Marketable securities | 4,598 | 2,151 | 250 | 1,295 | ||||||||||||

| Amounts funded in respect of employee rights upon retirement | 14 | 14 | 16 | 19 | ||||||||||||

| Property and equipment, net | 17 | 18 | 27 | 24 | ||||||||||||

| Operating lease right of use assets | 106 | - | ||||||||||||||

| Total long-term assets | 22,409 | 18,415 | 400 | 1,339 | ||||||||||||

| Total assets | $ | 41,544 | $ | 38,712 | 31,142 | 34,663 | ||||||||||

| Liabilities and stockholders’ equity | ||||||||||||||||

| Liabilities and stockholders' equity | ||||||||||||||||

| CURRENT LIABILITIES: | ||||||||||||||||

| Accounts payable and accrued expenses | $ | 2,599 | $ | 2,716 | 1,796 | 2,541 | ||||||||||

| Deferred revenues | 2,449 | 2,449 | 2,703 | 2,703 | ||||||||||||

| Payable to related parties | 76 | - | 96 | 64 | ||||||||||||

| Operating lease liabilities | 46 | - | ||||||||||||||

| Total current liabilities | 5,124 | 5,165 | 4,641 | 5,308 | ||||||||||||

| LONG-TERM LIABILITIES: | ||||||||||||||||

| Deferred revenues | 13,226 | 13,837 | 8,983 | 9,658 | ||||||||||||

| Employee rights upon retirement | 19 | 18 | 17 | 22 | ||||||||||||

| Provision for uncertain tax position | 11 | 11 | 11 | 11 | ||||||||||||

| Operating lease liabilities | 60 | - | ||||||||||||||

| Other liabilities | 423 | 443 | 270 | 271 | ||||||||||||

| Total long-term liabilities | 13,679 | 14,309 | 9,341 | 9,962 | ||||||||||||

| COMMITMENTS (note 2) | ||||||||||||||||

| STOCKHOLDERS’ EQUITY: | ||||||||||||||||

| Common stock, $0.012 par value (30,000,000 authorized shares; 14,307,890 and 13,668,530 shares issued and outstanding as of November 30, 2017 and August 31, 2017, respectively) | 170 | 163 | ||||||||||||||

| STOCKHOLDERS' EQUITY: | ||||||||||||||||

| Common stock, $0.012 par value (30,000,000 authorized shares; 17,400,612 and 17,383,359 shares issued and outstanding as of November 30, 2019 and August 31, 2019, respectively) | 209 | 208 | ||||||||||||||

| Additional paid-in capital | 80,871 | 75,170 | 100,597 | 100,288 | ||||||||||||

| Accumulated other comprehensive income | 727 | 401 | ||||||||||||||

| Accumulated loss | (59,027 | ) | (56,496 | ) | ||||||||||||

| Total stockholders’ equity | 22,741 | 19,238 | ||||||||||||||

| Total liabilities and stockholders’ equity | $ | 41,544 | $ | 38,712 | ||||||||||||

| Accumulated deficit | (83,646 | ) | (81,103 | ) | ||||||||||||

| Total stockholders' equity | 17,160 | 19,393 | ||||||||||||||

| Total liabilities and stockholders' equity | 31,142 | 34,663 | ||||||||||||||

The accompanying notes are an integral part of the condensed consolidated financial statements.

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE LOSS

U.S. Dollars in thousands (except share and per share data)

(UNAUDITED)

| Three months ended | ||||||||

| November 30, | November 30, | |||||||

| 2017 | 2016 | |||||||

| REVENUES | $ | 611 | $ | 610 | ||||

| COST OF REVENUES | - | 187 | ||||||

| RESEARCH AND DEVELOPMENT EXPENSES, NET | 2,327 | 2,353 | ||||||

| GENERAL AND ADMINISTRATIVE EXPENSES | 1,016 | 468 | ||||||

| OPERATING LOSS | 2,732 | 2,398 | ||||||

| FINANCIAL INCOME | 222 | 186 | ||||||

| FINANCIAL EXPENSES | 21 | 24 | ||||||

| LOSS BEFORE TAXES ON INCOME | 2,531 | 2,236 | ||||||

| TAXES ON INCOME | - | 400 | ||||||

| NET LOSS FOR THE PERIOD | $ | 2,531 | $ | 2,636 | ||||

| UNREALIZED LOSS (GAIN) ON AVAILABLE FOR SALE SECURITIES | (326 | ) | 63 | |||||

| TOTAL OTHER COMPREHENSIVE LOSS (GAIN) | (326 | ) | 63 | |||||

| TOTAL COMPREHENSIVE LOSS FOR THE PERIOD | $ | 2,205 | $ | 2,699 | ||||

| LOSS PER SHARE OF COMMON STOCK: | ||||||||

| BASIC AND DILUTED LOSS PER SHARE OF COMMON STOCK | $ | 0.18 | $ | 0.20 | ||||

| WEIGHTED AVERAGE NUMBER OF SHARES OF COMMON STOCK USED IN COMPUTING BASIC AND DILUTED LOSS PER SHARE OF COMMON STOCK | 14,239,346 | 13,205,971 | ||||||

| Three months ended | ||||||||

| November 30, | November 30, | |||||||

| 2019 | 2018 | |||||||

| REVENUES | $ | 674 | $ | 674 | ||||

| COST OF REVENUES | 35 | |||||||

| RESEARCH AND DEVELOPMENT EXPENSES | 2,022 | 4,347 | ||||||

| GENERAL AND ADMINISTRATIVE EXPENSES | 1,081 | 932 | ||||||

| OPERATING LOSS | 2,429 | 4,640 | ||||||

| FINANCIAL INCOME | 209 | 286 | ||||||

| FINANCIAL EXPENSES | 20 | 8 | ||||||

| INCOME (LOSS) FROM CHANGES IN FAIR VALUE OF INVESTMENTS | (303 | ) | 60 | |||||

| NET LOSS FOR THE PERIOD | $ | 2,543 | $ | 4,302 | ||||

| LOSS PER SHARE OF COMMON STOCK: | ||||||||

| BASIC AND DILUTED LOSS PER SHARE OF COMMON STOCK | $ | 0.15 | $ | 0.25 | ||||

| WEIGHTED AVERAGE NUMBER OF SHARES OF COMMON STOCK USED IN COMPUTING BASIC AND DILUTED LOSS PER SHARE OF COMMON STOCK | 17,472,315 | 17,448,744 | ||||||

The accompanying notes are an integral part of the condensed consolidated financial statements.

3

CONDENSED CONSOLIDATED STATEMENTSTATEMENTS OF CHANGES IN STOCKHOLDERS’STOCKHOLDERS' EQUITY

U.S. Dollars in thousands (except share data)

(UNAUDITED)

| Accumulated | ||||||||||||||||||||||||

| Additional | other | Total | ||||||||||||||||||||||

| Common Stock | paid-in | comprehensive | Accumulated | stockholders’ | ||||||||||||||||||||

| Shares | $ | capital | income | loss | equity | |||||||||||||||||||

| In thousands | ||||||||||||||||||||||||

| BALANCE AS OF AUGUST 31, 2017 | 13,668 | $ | 163 | $ | 75,170 | $ | 401 | $ | (56,496 | ) | $ | 19,238 | ||||||||||||

| CHANGES DURING THE THREE-MONTH PERIOD ENDED NOVEMBER 30, 2017: | ||||||||||||||||||||||||

| SHARES ISSUED FOR SERVICES | 3 | * | 24 | - | - | 24 | ||||||||||||||||||

| ISSUANCE OF COMMON STOCK, NET | 454 | 5 | 4,225 | - | - | 4,230 | ||||||||||||||||||

| EXERCISE OF WARRANTS AND OPTIONS | 178 | 2 | 928 | - | - | 930 | ||||||||||||||||||

| STOCK-BASED COMPENSATION | 5 | * | 524 | - | - | 524 | ||||||||||||||||||

| NET LOSS | - | - | - | - | (2,531 | ) | (2,531 | ) | ||||||||||||||||

| OTHER COMPREHENSIVE INCOME | - | - | - | 326 | - | 326 | ||||||||||||||||||

| BALANCE AS OF NOVEMBER 30, 2017 | 14,308 | $ | 170 | $ | 80,871 | $ | 727 | $ | (59,027 | ) | $ | 22,741 | ||||||||||||

| Accumulated | ||||||||||||||||||||||||

| Additional | other | Total | ||||||||||||||||||||||

| Common Stock | paid-in | comprehensive | Accumulated | stockholders' | ||||||||||||||||||||

| Shares | $ | capital | income | deficit | equity | |||||||||||||||||||

| In thousands | ||||||||||||||||||||||||

| BALANCE AS OF AUGUST 31, 2019 | 17,383 | $ | 208 | $ | 100,288 | - | $ | (81,103 | ) | $ | 19,393 | |||||||||||||

| CHANGES DURING THE THREE MONTH PERIOD ENDED NOVEMBER 30, 2019: | ||||||||||||||||||||||||

| SHARES ISSUED FOR SERVICES | 5 | * | 17 | - | - | 17 | ||||||||||||||||||

| EXERCISE OF WARRANTS AND OPTIONS | 12 | 1 | 12 | - | - | 13 | ||||||||||||||||||

| STOCK-BASED COMPENSATION | - | * | 280 | - | - | 280 | ||||||||||||||||||

| NET LOSS | - | - | - | - | (2,543 | ) | (2,543 | ) | ||||||||||||||||

| BALANCE AS OF NOVEMBER 30, 2019 | 17,400 | $ | 209 | $ | 100,597 | - | $ | (83,646 | ) | $ | 17,160 | |||||||||||||

| Accumulated | ||||||||||||||||||||||||

| Additional | other | Total | ||||||||||||||||||||||

| Common Stock | paid-in | comprehensive | Accumulated | stockholders' | ||||||||||||||||||||

| Shares | $ | capital | income | deficit | equity | |||||||||||||||||||

| In thousands | ||||||||||||||||||||||||

| BALANCE AS OF AUGUST 31, 2018 | 17,369 | $ | 207 | $ | 99,426 | $ | 702 | $ | (69,223 | ) | $ | 31,112 | ||||||||||||

| INITIAL ADOPTION OF ASC 606 | 1,773 | 1,773 | ||||||||||||||||||||||

| INITIAL ADOPTION OF ASU 2016-01 | (702 | ) | 702 | - | ||||||||||||||||||||

| CHANGES DURING THE THREE MONTH PERIOD ENDED NOVEMBER 30, 2018: | ||||||||||||||||||||||||

| SHARES ISSUED FOR SERVICES | 8 | * | 36 | - | - | 36 | ||||||||||||||||||

| STOCK-BASED COMPENSATION | - | * | 239 | - | - | 239 | ||||||||||||||||||

| NET LOSS | - | - | - | - | (4,302 | ) | (4,302 | ) | ||||||||||||||||

| BALANCE AS OF NOVEMBER 30, 2018 | 17,377 | $ | 207 | $ | 99,701 | - | $ | (71,050 | ) | $ | 28,858 | |||||||||||||

| * | Represents an amount of less than $1. |

* Represents an amount of less than $1.

The accompanying notes are an integral part of the condensed consolidated financial statements.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

U.S. dollars in thousands

(UNAUDITED)

| Three months ended | Three months ended | |||||||||||||||

| November 30, | November 30, | |||||||||||||||

| 2017 | 2016 | 2019 | 2018 | |||||||||||||

| CASH FLOWS FROM OPERATING ACTIVITIES: | ||||||||||||||||

| Net loss | $ | (2,531 | ) | $ | (2,636 | ) | $ | (2,543 | ) | $ | (4,302 | ) | ||||

| Adjustments required to reconcile net loss to net cash provided by (used in) operating activities: | ||||||||||||||||

| Adjustments required to reconcile net loss to net cash used in operating activities: | ||||||||||||||||

| Depreciation | 1 | 1 | - | 2 | ||||||||||||

| Exchange differences and interest on deposits and held to maturity bonds | (71 | ) | (112 | ) | (92 | ) | (116 | ) | ||||||||

| Changes in fair value of investments | 303 | (60 | ) | |||||||||||||

| Stock-based compensation | 524 | 158 | 280 | 239 | ||||||||||||

| Shares issued for services | 24 | 17 | 17 | 36 | ||||||||||||

| Changes in operating assets and liabilities: | ||||||||||||||||

| Prepaid expenses and other current assets | (4 | ) | (232 | ) | 433 | (153 | ) | |||||||||

| Accounts payable, accrued expenses and related parties | (41 | ) | 825 | (714 | ) | 929 | ||||||||||

| Deferred revenues | (611 | ) | 3,366 | |||||||||||||

| Contract liabilities | (675 | ) | (674 | ) | ||||||||||||

| Liability for employee rights upon retirement | 1 | - | (5 | ) | - | |||||||||||

| Other liabilities | (20 | ) | 111 | - | (32 | ) | ||||||||||

| Total net cash provided by (used in) operating activities | (2,728 | ) | 1,498 | |||||||||||||

| Total net cash used in operating activities | (2,996 | ) | (4,131 | ) | ||||||||||||

| CASH FLOWS FROM INVESTING ACTIVITIES: | ||||||||||||||||

| Purchase of short-term deposits | (2,039 | ) | (1,000 | ) | (3,000 | ) | - | |||||||||

| Purchase of long-term deposits | (3,540 | ) | (3,000 | ) | ||||||||||||

| Purchase of held to maturity securities | (2,879 | ) | (1,056 | ) | - | (397 | ) | |||||||||

| Proceeds from sale of short-term deposits | 2,455 | 1,320 | 4,600 | 3,000 | ||||||||||||

| Proceeds from maturity of held to maturity securities | 857 | 300 | 1,225 | 400 | ||||||||||||

| Total net cash used in investing activities | (5,146 | ) | (3,436 | ) | ||||||||||||

| Funds in respect of employee rights upon retirement | 3 | - | ||||||||||||||

| Purchase of property and equipment | (3 | ) | (8 | ) | ||||||||||||

| Total net cash provided by investing activities | 2,825 | 2,995 | ||||||||||||||

| CASH FLOWS FROM FINANCING ACTIVITIES: | ||||||||||||||||

| Proceeds from issuance of common stock, net of issuance costs | 4,230 | - | 1 | - | ||||||||||||

| Proceeds from exercise of warrants and options | 930 | 320 | ||||||||||||||

| Proceeds from exercise of options | 12 | - | ||||||||||||||

| Total net cash provided by financing activities | 5,160 | 320 | 13 | - | ||||||||||||

| EFFECT OF EXCHANGE RATE CHANGES ON CASH | 3 | 1 | 0 | 1 | ||||||||||||

| DECREASE IN CASH AND CASH EQUIVALENTS | (2,711 | ) | (1,617 | ) | (158 | ) | (1,135 | ) | ||||||||

| CASH AND CASH EQUIVALENTS AT BEGINNING OF PERIOD | 3,969 | 3,907 | 3,329 | 4,996 | ||||||||||||

| CASH AND CASH EQUIVALENTS AT END OF PERIOD | $ | 1,258 | $ | 2,290 | $ | 3,171 | $ | 3,861 | ||||||||

| SUPPLEMENTARY DISCLOSURE ON CASH FLOWS - | ||||||||||||||||

| Interest received | $ | 133 | $ | 56 | $ | 112 | $ | 159 | ||||||||

The accompanying notes are an integral part of the condensed consolidated financial statements.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

U.S. Dollars in thousands (except share and per share data)

(UNAUDITED)

NOTE 1 - SIGNIFICANT ACCOUNTING POLICIES:

| a. | General: |

| 1) | Incorporation and operations |

Oramed Pharmaceuticals Inc. (collectively with its subsidiary, the “Company”, unless the context indicates otherwise) was incorporated on April 12, 2002, under the laws of the State of Nevada. From incorporation until March 3, 2006, the Company was an exploration stage company engaged in the acquisition and exploration of mineral properties. On February 17, 2006, the Company entered into an agreement with Hadasit Medical Services and Development Ltd. (“Hadasit”) to acquire the provisional patent related to an orally ingestible insulin capsule to be used for the treatment of individuals with diabetes.

On May 14, 2007, the Company incorporated a wholly-owned subsidiary in Israel, Oramed Ltd. (the “Subsidiary”), which is engaged in research and development.

On March 11, 2011, the Company was reincorporated from the State of Nevada to the State of Delaware.

On July 30, 2019, the Subsidiary incorporated a wholly-owned subsidiary in Hong Kong, Oramed HK Limited. As of November 30, 2019, Oramed HK Limited has no operations.

On November 30,2015, the Company entered into a Technology License Agreement with Hefei Tianhui IncubationIncubator of Technologies Co. Ltd. (“HTIT”) and on December 21, 2015, the parties entered into an Amended and Restated Technology License Agreement that was further amended by the parties on June 3, 2016 and July 24, 2016 (the “License Agreement”). According to the License Agreement, the Company granted HTIT an exclusive commercialization license in the territory of the People’sPeople's Republic of China, Macau and Hong Kong (the “Territory”), related to the Company’s oral insulin capsule, ORMD-0801 (the “Product”"Product"). Pursuant to the License Agreement, HTIT willHTITwill conduct, at its own expense, certain pre-commercialization and regulatory activities with respect to the Subsidiary’s technology and ORMD-0801 capsule, and will pay to the Subsidiary (i) royalties of 10% on net sales of the related commercialized products to be sold by HTIT in the Territory (“Royalties”), and (ii) an aggregate of $37,500, of which $3,000 was payable immediately, $8,000 will be paid subject to the Company entering into certain agreements with certain third parties, and $26,500will be paid upon achievement of certain milestones and conditions. In the event that the Company does not meet certain conditions, the Royalties rate may be reduced to a minimum of 8%. Following the final expiration of the Company’sCompany's patents covering the technology in the Territory in 2033, the Royalties rate may be reduced, under certain circumstances, to 5%.

The royalty payment obligation shall apply during the period of time beginning upon the first commercial sale of the Product in the Territory, and ending upon the later of (i) the expiration of the last-to-expire licensed patents in the Territory; and (ii) 15 years after the first commercial sale of the Product in the Territory (the “Royalty Term”"Royalty Term").

The License Agreement shall remain in effect until the expiration of the Royalty Term. The License Agreement contains customary termination provisions.

ORAMED PHARMACEUTICALS INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

U.S. Dollars in thousands (except share and per share data)

(UNAUDITED)

NOTE 1 - SIGNIFICANT ACCOUNTING POLICIES(continued):

Among others, the Company’sCompany's involvement through the product submission date will include consultancy for the pre-commercialization activities in the Territory, as well as advisory services to HTIT on an ongoing basis.

TheAs of November 30, 2019, the Company has received milestone payments in an aggregate amount of $20,500 as follows: the initial payment of $3,000 was received in January 2016. Following the achievement of certain milestones, the second and third payments of $6,500 and $4,000, respectively, were received in July 2016, and the fourth milestone payment of $4,000 was received in October 2016.2016 and the fifth milestone payment of $3,000 was received in January 2019.

In addition, on November 30, 2015, the Company entered into a Stock Purchase Agreement with HTIT (the “SPA”). According to the SPA, the Company issued 1,155,367 shares of common stock to HTIT for $12,000. The transaction closed on December 28, 2015.

The License Agreement and the SPA were considered a single arrangement with multiple deliverables. The Company allocated the total consideration of $49,500 between the License Agreement and the SPA according to their fair value, as follows: $10,617 was allocated to the issuance of common stock (less issuance expenses of $23), based on the quoted price of the Company’s shares on the closing date of the SPA on December 28, 2015, and $38,883 was allocated to the License Agreement. Given the Company’s continuing involvement through the expected product submission (June 2023), amounts received relating to the License Agreement are recognized over the period from which the Company is entitled to the respective payment, and the expected product submission date using a time-based model approach over the periods that the fees are earned.

In July 2015, according to the letter of intent signed between the parties or their affiliates, HTIT’sHTIT's affiliate paid the Subsidiary a non-refundable amount of $500 as a no-shop fee. The no-shop fee was deferred and the related revenue is recognized over the estimated term of the License Agreement.

Amounts that were allocated to the License Agreement as of November 30, 2017 aggregated $19,383, all of which were received through the balance sheet date. Through November 30, 2017, the Company recognizedFor revenue in the amount of $3,708, and deferred the remaining amount of $15,675.recognition policy see note 1c.

ORAMED PHARMACEUTICALS INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

U.S. Dollars in thousands (except share and per share data)

(UNAUDITED)

NOTE 1 - SIGNIFICANT ACCOUNTING POLICIES(continued):

The following table summarizes the movement in deferred revenues balances for the three-month period ended November 30, 2017 and the year ended August 31, 2017:

| Three months ended November 30, | Year ended August 31, | ||||||||

| 2017 | 2017 | ||||||||

| Deferred revenue at the beginning of period | $ | 16,286 | $ | 14,766 | |||||

| Amounts received | - | 4,000 | |||||||

| Amounts due to the Company | - | (24 | ) | ||||||

| Revenue recognized | (611 | ) | (2,456 | ) | |||||

| Deferred revenue at the end of period | 15,675 | 16,286 | |||||||

| Less – current deferred revenue portion | (2,449 | ) | (2,449 | ) | |||||

| Non-current deferred revenue portion | $ | 13,226 | $ | 13,837 | |||||

| 2) | Development and liquidity risks |

The Company is engaged in research and development in the biotechnology field for innovative pharmaceutical solutions, including an orally ingestible insulin capsule to be used for the treatment of individuals with diabetes, and the use of orally ingestible capsules for delivery of other polypeptides, and has not generated significant revenues from its operations. Continued operation ofBased on the Company’s current cash resources and commitments, the Company is contingent upon obtaining sufficient funding untilbelieves it becomes profitable.will be able to maintain its current planned development activities and the corresponding level of expenditures for at least the next 12 months and beyond, although no assurance can be given that the Company will not need additional funds prior to such time. If there are unexpected increases in its operating expenses, the Company may need to seek additional financing during the next 12 months. Successful completion of the Company’s development programs and its transition to normal operations is dependent upon obtaining necessary regulatory approvals from theU.S. Food and Drug Administration prior to selling its products within the United States, obtaining foreign regulatory approvals to sell its products internationally, or entering into licensing agreements with third parties. There can be no assurance that the Company will receive regulatory approval of any of its product candidates, and a substantial amount of time may pass before the Company achieves a level of revenues adequate to support its operations, if at all. The Company also expects to incur substantial expenditures in connection with the regulatory approval process for each of its product candidates during their respective developmental periods. Obtaining marketing approval will be directly dependent on the Company’s ability to implement the necessary regulatory steps required to obtain marketing approval in the United States and in other countries. The Company cannot predict the outcome of these activities.

ORAMED PHARMACEUTICALS INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

U.S. Dollars in thousands (except share and per share data)

(UNAUDITED)

NOTE 1 - SIGNIFICANT ACCOUNTING POLICIES(continued):

| b. | Loss per common share |

Basic and diluted net loss per common share are computed by dividing the net loss for the period by the weighted average number of shares of common stock outstanding for each period. Outstanding stock options, warrants and restricted stock units (“RSUs”) have been excluded from the calculation of the diluted loss per share because all such securities are anti-dilutive for all periods presented. The totalweighted average number of common stock options, warrants and RSUs excluded from the calculation of diluted net loss was 1,424,0294,366,806 and 2,470,4944,352,798 for the three-monththree month periods ended November 30, 20172019 and 2016,2018, respectively.

| Revenue recognition |

The License Agreement and the SPA were considered a single arrangement with multiple deliverables. The Company allocated the total consideration of $49,500 between the License Agreement and the SPA according to their fair value, as follows: $10,617 was allocated to the issuance of common stock (less issuance expenses of $23), based on the quoted price of the Company's shares on the closing date of the SPA on December 28, 2015, and $38,883 was allocated to the License Agreement.

Under Accounting Standards Codification ("ASC") 605 (which was the authoritative revenue recognition guidance applied for all periods prior to September 1, 2018) given the Company's continuing involvement through the expected product submission in June 2023, amounts received relating to the License Agreement were recognized over the period from which the Company was entitled to the respective payment, and the expected product submission date using a time-based model approach over the periods that the fees were earned.

On September 1, 2018, the Company adopted Accounting Standards Update ("ASU") 2014-09 “Revenue from Contracts with Customers (Topic 606)” (“ASC 606”), using the modified retrospective method of adoption. Under this method, the Company applied ASC 606 to the License Agreement at the adoption date and was required to make an adjustment to the September 1, 2018 opening accumulated deficit balance and all prior periods continue to be presented under ASC 605. The most significant impact from adopting ASC 606 was the impact of the timing of recognition of revenue associated with the milestone payment. Under ASC 605 (which was the authoritative revenue recognition guidance applied for all periods prior to September 1, 2018) given the Company's continuing involvement through the expected product submission in June 2023, amounts received relating to the License Agreement were recognized over the period from which the Company was entitled to the respective payment, and the expected product submission date using a time-based model approach over the periods that the fees were earned. However, under ASC 606, the Company is required to recognize the total transaction price (which includes consideration related to milestones once the criteria for recognition have been satisfied) using the input method over the period the performance obligation is fulfilled. Accordingly, once the consideration associated with a milestone is included in the transaction price, incremental revenue is recognized immediately based on the period of time that has elapsed towards complete satisfaction of the performance obligation. This method results in the recognition of revenue earlier than under ASC 605 and the resulting impact was recorded as a reduction of the opening balance of accumulated deficit at September 1, 2018 as further described below.

ORAMED PHARMACEUTICALS INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

U.S. Dollars in thousands (except share and per share data)

(UNAUDITED)

NOTE 1 - SIGNIFICANT ACCOUNTING POLICIES(continued):

Under ASC 606, the Company identified a single performance obligation in the agreement and determined that the license and services are not distinct as the license and services are highly dependent on each other. In other words, HTIT cannot benefit from the license without the related services, and vice versa.

Since the customer benefits from the services as the entity performs, revenue is recognized over time through the expected product submission date in June 2023, using the input method. The Company used the input method to measure the process for the purpose of recognizing revenue, which approximates the straight line attribution. The Company used significant judgment when it determined the product submission date.

Under ASC 606, the consideration that the Company would be entitled to upon the achievement of contractual milestones, which are contingent upon the occurrence of future events, are a form of variable consideration. When assessing the portion, if any, of such milestones-related consideration to be included in the transaction price, the Company first assesses the most likely outcome for each milestone and excludes the consideration related to milestones of which the occurrence is not considered the most likely outcome.

The Company then evaluates if any of the variable consideration determined in the first step is constrained by including in the transaction price variable consideration to the extent that it is probable that a significant reversal in the amount of cumulative revenue recognized will not occur when the uncertainty associated with the variable consideration is subsequently resolved. The Company used significant judgment when it determined the first step of variable consideration.

The potential future royalty consideration is also considered a form of variable consideration under ASC 606 as it is based on a percentage of potential future sales of the Company's products. However, the Company applies the sales-based royalty exception and accordingly will recognize the sales-based royalty amounts when the related sale has occurred. To date, the Company has not recognized any royalty-related revenue.

As of the adoption date, the Company adjusted its accumulated deficit by $1,773 against contract liabilities due to the effect of variable consideration.

Amounts that were allocated to the License Agreement as of November 30, 2019 aggregated $22,382, all of which were received through the balance sheet date. Through November 30, 2019, the Company has recognized revenue associated with this agreement in the aggregate amount of $10,696 (of which $674 was recognized in the quarter ended November 30, 2019, and deferred the remaining amount of $11,686 which is presented as deferred revenues on the condensed consolidated balance sheet.

ORAMED PHARMACEUTICALS INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

U.S. Dollars in thousands (except share and per share data)

(UNAUDITED)

NOTE 1 - SIGNIFICANT ACCOUNTING POLICIES(continued):

| Financial instruments |

In January 2016, the Financial Accounting Standards Board (“FASB”) issued guidance which updates certain aspects of recognition, measurement, presentation and disclosure of financial assets and financial liabilities (“ASU 2016-01”). The guidance requires entities to recognize changes in fair value in net income rather than in accumulated other comprehensive income. The Company adopted the provisions of this update in the first quarter of fiscal year 2019. Following the adoption, as of September 1, 2018, the Company classified the available for sale securities to financial assets measured in fair value through profit or loss. The impact of this adoption on the Company's accumulated losses as of the adoption date was $702.

| e. | Condensed Consolidated Financial Statements Preparation |

The condensed consolidated financial statements included herein have been prepared in accordance with United States generally accepted accounting principles (“U.S. GAAPGAAP”) and, except as described in note 1f, on the same basis as the audited consolidated financial statements included in the Company’s Annual Report on Form 10-K for the fiscal year ended August 31, 20172019 (the “2017“2019 Form 10-K”). These condensed consolidated financial statements reflect all adjustments that are of a normal recurring nature and that are considered necessary for a fair statement of the results of the periods presented. Certain information and disclosures normally included in annual consolidated financial statements have been omitted in this interim period report pursuant to the rules and regulations of the Securities and Exchange Commission. Because the condensed consolidated interim financial statements do not include all of the information and disclosures required by U.S. GAAP for annual financial statements, they should be read in conjunction with the audited consolidated financial statements and notes included in the 20172019 Form 10-K. The results for interim periods are not necessarily indicative of a full fiscal year’s results.

In May 2014,February 2016, the Financial Accounting Standards Board (“FASB”)FASB issued Accounting Standards Update (“ASU”)ASU No. 2014-092016-02, “Leases (Topic 606) “Revenue from Contracts842)”, which supersedes the existing guidance for lease accounting, Leases (Topic 840). The new standard requires a lessee to record assets and liabilities on its balance sheet for all leases with Customers” thatterms longer than 12 months. Leases will supersede most current revenuebe classified as either finance or operating, with classification affecting the pattern of expense recognition in the lessee’s income statement. The Company adopted this standard as of September 1, 2019 on a modified retrospective basis and will not restate comparative periods. The Company elected the package of practical expedients permitted under the transition guidance including industry-specific guidance.within the new standard which, among other things, allows the Company to carryforward the historical lease classification. The underlying principleCompany made an accounting policy election to keep leases with an initial term of this ASU is that an entity will recognize revenue upon12 months or less off of its balance sheet. The Company recognized those lease payments in its statements of operations on a straight-line basis over the transfer of goods or services to customers in an amount that the entity expects to be entitled to in exchange for those goods or services. The guidance provides a five-step analysis of transactions to determine when and how revenue is recognized. Other major provisions include capitalization of certain contract costs, considerationlease period.

As of the time valueadoption date, the Company recognized an operating lease asset and liability of money in the transaction price,$113 and allowing estimates$113, respectively, as of variable consideration to be recognized before contingencies are resolved in certain circumstances. The guidance also requires enhanced disclosures regarding the nature, amount, timing and uncertainty of revenue and cash flows arising from an entity’s contracts with customers. The guidance is effective in annual reporting periods beginning after December 15, 2017, including interim reporting periods within that reporting period. The Company will implement the guidance for the annual period ending on August 31, 2019. The Company is currently evaluating the impact of the guidanceSeptember 1, 2019 on its consolidated financial statements.balance sheet.

ORAMED PHARMACEUTICALS INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

U.S. Dollars in thousands (except share and per share data)

(UNAUDITED)

NOTE 2 - COMMITMENTS:

As part of this agreement, the Subsidiary entered into a patent transfer agreement (the “Patent Transfer Agreement”) according to which the Subsidiary assigned to Entera all of its right, title and interest in and to thea certain patent application related to the oral administration of proteins that it has licensed to Entera since August 2010. Under this agreement, the Subsidiary is entitled to receive from Entera royalties of 3% of Entera’s net revenues (as defined in the agreement) and a license back of that patent application for use in respect of diabetes and influenza. As of November 30, 2017,2019, Entera had not yet realized any revenues and had not paid any royalties to the Subsidiary. On December 11, 2018, Entera announced that it had entered into a research collaboration and license agreement (the “Amgen License”) with Amgen related to research of inflammatory disease and other serious illnesses. As reported by Entera, under the terms of the Amgen License, Entera will receive a modest initial technology access fee from Amgen and will be responsible for preclinical development at Amgen’s expense. Entera will be eligible to receive up to $270,000 in aggregate payments, as well as tiered royalties up to mid-single digits, upon achievement of various clinical and commercial milestones if Amgen decides to move all of these programs forward. Amgen is responsible for clinical development, manufacturing and commercialization of any of the resulting programs. To the extent the Amgen License results in net revenues as defined in the Patent Transfer Agreement, the Subsidiary will be entitled to the aforementioned royalties.

In addition, as part of a consulting agreement with a third party, dated February 15, 2011, the Subsidiary is obliged to pay this third party royalties of 8% of the net royalties received in respect of the patent that was sold to Entera in March 2011.

| b. | On January 3, 2017, the Subsidiary entered into a lease agreement for its office facilities in Israel. The lease agreement is for a period of 60 months commencing October 1, 2016. |

The annual lease payment iswas New Israeli Shekel (“NIS”) 119,000 ($34)32) from October 2016 through September 2018 and NIS 132,000 ($38) from October 2018 through September 2021, and is linked to the increase in the Israeli consumer price index (“CPI”) (as of November 30, 2017,2019, the aggregate future lease payments will be $70 until the expiration of the lease agreement, will be $142, based on the exchange rate as of November 30, 2017)2019).

As security for its obligation under this lease agreement, the Company provided a bank guarantee in an amount equal to three monthly lease payments.

ORAMED PHARMACEUTICALS INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

U.S. Dollars in thousands (except share and per share data)

(UNAUDITED)

NOTE 2 - COMMITMENTS(continued):

| On |

| On February |

| On May |

The Subsidiary is committed to pay royalties to Bio-Jerusalem on proceeds from future sales at a rate of 4% and up to 100% of the amount of the grant received (Israeli CPI linked) at the total amount of $65. The Company received no grants from Bio-Jerusalem since fiscal year 2013.

Through November 30, 2017, total milestone payments received which are related to the funded project aggregated $17,500 and all related royalty expenses were recognized in cost of revenues in prior periods.

| Grants from the Israel Innovation Authority |

Under the terms of the Company’s funding from the IIA, royalties of 3.5%3% are payable on sales of products developed from a project so funded, up to a maximum amount equaling 100%-150% of the grants received (dollar linked) with the addition of interest at an annual rate based on LIBOR.

At the time the grants were received, successful development of the related projects was not assured.

The total amount that was received through November 30, 20172019 was $2,194.$2,207.

Through November 30, 2017, total milestone payments receivedThe royalty expenses which are related to the funded project aggregated $17,500. The royalty expenses were recognized in cost of revenues in the quarter ended November 30, 2019 and in prior periods and will be paid overperiods.

| h. | Grants from the European Commission (“EC”) |

On November 26, 2019 the termCompany received an initial payment of €17.50 from the EC under the SME Instrument of the License Agreement in accordance withEuropean Innovation Programme Horizon 2020.

As part of the revenue recognizedgrant terms, the Company is required to use the proceeds from the related project.grant in Europe. The Company intends on using the grant to explore the possibility of running clinical trials in Europe.

ORAMED PHARMACEUTICALS INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

U.S. Dollars in thousands (except share and per share data)

(UNAUDITED)

NOTE 3 - FAIR VALUE:

The Company measures fair value and discloses fair value measurements for financial assets and liabilities.assets. Fair value is based on the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. In order to increase consistency and comparability in fair value measurements, the guidance establishes a fair value hierarchy that prioritizes observable and unobservable inputs used to measure fair value into three broad levels, which are described as follows:

| Level 1: | Quoted prices (unadjusted) in active markets that are accessible at the measurement date for assets or liabilities. The fair value hierarchy gives the highest priority to Level 1 inputs. | |

| Level 2: | Observable prices that are based on inputs other than quoted prices included within Level 1 that are observable for the asset or liability, either directly or indirectly. | |

| Level 3: | Unobservable inputs are used when little or no market data is available. The fair value hierarchy gives the lowest priority to Level 3 inputs. |

As of November 30, 2017,2019, the assets or liabilities measured at fair value are comprised of available for sale equity securities (Level 1).

In determining The fair value the Company utilizes valuation techniques that maximize the use of observable inputs and minimize the use of unobservable inputsheld to the extent possible.maturity bonds as presented in note 4 was based on a Level 2 measurement.

As of November 30, 2017,2019, the carrying amountamounts of cash and cash equivalents, short-term deposits and other current assets, accounts payable and accrued expenses approximate their fair values due to the short-term maturities of these instruments.

As of November 30, 2017,2019, the carrying amountamounts of long-term deposits approximatesapproximate their fair values due to the stated interest rates which approximate market rates.

The fair value of held to maturity bonds as presented in note 4 was based on a Level 1 measurement.

The amounts funded in respect of employee rights are stated at cash surrender value which approximates its fair value.

There were no Level 3 items for the three-monththree month periods ended November 30, 20172019 and 2016.

2018.

13

ORAMED PHARMACEUTICALS INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

U.S. Dollars in thousands (except share and per share data)

(UNAUDITED)

NOTE 4 - MARKETABLE SECURITIES:

The Company’sCompany's marketable securities include investments in equity securities of D.N.A and Entera, and in held to maturity bonds.

| a. | Composition: |

| November 30, 2017 | August 31, 2017 | ||||||||

| Short-term: | |||||||||

| D.N.A (see b below) | $ | 1,322 | $ | 996 | |||||

| Held to maturity bonds (see c below) | 1,400 | 1,864 | |||||||

| $ | 2,722 | $ | 2,860 | ||||||

| Long-term: | |||||||||

| Held to maturity bonds (see c below) | $ | 4,598 | $ | 2,151 | |||||

November 30, 2019 | August 31, 2019 | |||||||

| Short-term: | ||||||||

| D.N.A (see b below) | $ | 296 | $ | 557 | ||||

| Entera (see c below) | 263 | 304 | ||||||

| Held to maturity bonds (see d below) | 2,648 | 2,840 | ||||||

| $ | 3,207 | $ | 3,701 | |||||

| Long-term: | ||||||||

| Held to maturity bonds (see d below) | $ | 250 | $ | 1,295 | ||||

| b. | D.N.A |

The investment in D.N.A is reported at fair value, with unrealized gains and losses, recorded as a separate component of other comprehensive income in equity until realized. Unrealized losses that are considered to be other-than-temporary are charged to statement of operations as an impairment charge and are included in the consolidated statement of operations under impairment of available-for-sale securities.

The D.N.A ordinary shares are traded on the Tel Aviv Stock Exchange. The fair value of those securities is measured at the quoted prices of the securities on the measurement date.

As of November 30, 2017,2019, the Company owns approximately 6.9% of D.N.A’s outstanding ordinary shares.

The cost of the securities as of November 30, 20172019 and August 31, 20172019 is $595.

| Entera |

Entera ordinary shares have been traded on The Nasdaq Capital Market since June 28, 2018. The Company measures the investment at fair value from such date, since it has a readily determinable fair value (prior to such date the investment was accounted for as a cost method investment (amounting to $1)).

14

ORAMED PHARMACEUTICALS INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

U.S. Dollars in thousands (except share and per share data)

(UNAUDITED)

NOTE 4 - MARKETABLE SECURITIES (continued):

| Held to maturity securities |

The amortized cost and estimated fair value of held-to-maturity securities as of November 30, 2017,2019, are as follows:

| November 30, 2017 | |||||||||||||

| Amortized cost | Gross unrealized losses |

Estimated fair value | |||||||||||

| Short-term: | |||||||||||||

| Commercial bonds | $ | 1,359 | $ | (2 | ) | $ | 1,357 | ||||||

| Accrued interest | 41 | - | 41 | ||||||||||

| Long-term | 4,598 | (27 | ) | 4,571 | |||||||||

| $ | 5,998 | $ | (29 | ) | $ | 5,969 | |||||||

| November 30, 2019 | ||||||||||||

| Amortized cost | Gross unrealized losses | Estimated fair value | ||||||||||

| Short-term: | ||||||||||||

| Commercial bonds | $ | 2,624 | $ | (16 | ) | $ | 2,608 | |||||

| Accrued interest | 24 | - | 24 | |||||||||

| Long-term | 250 | - | 250 | |||||||||

| $ | 2,898 | $ | (16 | ) | $ | 2,882 | ||||||

As of November 30, 2017,2019, the contractual maturities of debt securities classified as held-to-maturity are as follows: after one year through two years, $4,598,$250, and the yield to maturity rates vary between 1.40% to 1.90%rate is 2.77%.

The amortized cost and estimated fair value of held-to-maturity securities as of August 31, 2017,2019, are as follows:

| August 31, 2017 | |||||||||||||

| Amortized cost | Gross unrealized losses |

Estimated fair value | |||||||||||

| Short-term: | |||||||||||||

| Commercial bonds | $ | 1,823 | $ | (1 | ) | $ | 1,822 | ||||||

| Accrued interest | 41 | - | 41 | ||||||||||

| Long-term | 2,151 | - | 2,151 | ||||||||||

| $ | 4,015 | $ | (1 | ) | $ | 4,014 | |||||||

| August 31, 2019 | ||||||||||||

| Amortized cost | Gross unrealized losses | Estimated fair value | ||||||||||

| Short-term: | ||||||||||||

| Commercial bonds | $ | 2,808 | $ | 6 | $ | 2,814 | ||||||

| Accrued interest | 32 | - | 32 | |||||||||

| Long-term | 1,295 | 4 | 1,299 | |||||||||

| $ | 4,135 | $ | 10 | $ | 4,145 | |||||||

As of August 31, 2017,2019, the contractual maturities of debt securities classified as held-to-maturity are as follows: after one year through two years, $2,151$1,295 and the yield to maturity rates vary between 1.30%2.55% to 1.87%3.20%.

Held to maturity securities which will mature during the 12 months from the balance sheet date are included in short-term marketable securities. Held to maturity securities with maturity dates of more than one year are considered long-term marketable securities.

15

ORAMED PHARMACEUTICALS INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

U.S. Dollars in thousands (except share and per share data)

(UNAUDITED)

NOTE 5 - LONG-TERM DEPOSITS AND INVESTMENTS:STOCKHOLDERS’ EQUITY:

Composition:

| November 30, | August 31, | ||||||||

| 2017 | 2017 | ||||||||

| Bank deposits (1) | $ | 17,778 | $ | 16,230 | |||||

| Lease car deposits | 1 | 1 | |||||||

| Investment | 1 | 1 | |||||||

| $ | 17,780 | $ | 16,232 | ||||||

NOTE 6 - ACCOUNTS PAYABLE AND ACCRUED EXPENSES:

Composition:

| November 30, | August 31, | ||||||||

| 2017 | 2017 | ||||||||

| Accounts payable | $ | 1,582 | $ | 571 | |||||

| Payroll and related accruals | 54 | 97 | |||||||

| Institutions | 24 | 228 | |||||||

| Accrued liabilities | 645 | 1,593 | |||||||

| Other | 294 | 227 | |||||||

| $ | 2,599 | $ | 2,716 | ||||||

NOTE 7 - STOCKHOLDERS’ EQUITY:

On April 2, 2015,September 5, 2019, the Company entered into an At The Market Issuance SalesEquity Distribution Agreement (the “Sales Agreement”) with B. Riley FBR, Inc., as successor to FBR Capital Markets & Co. (“FBR”), as amended, pursuant to which the Company may, from time to time and at itsthe Company's option, issue and sell shares of itsCompany common stock having an aggregate offering price of up to $25,000$15,000, through FBR as itsa sales agent, subject to certain terms and conditions. Any shares sold will be sold pursuant to the Company’sCompany's effective shelf registration statement on Form S-3 including a prospectus dated February 2, 2017, as supplemented by a prospectus supplement dated AprilSeptember 5, 2017.2019. The Company will pay FBRthe sales agent a cash commission of 3.0% of the gross proceeds of the sale of any shares sold through FBR.the sales agent under the Sales Agreement. As of November 30, 2017, 456,8892019, no shares were sold under the Sales Agreement. As of January 9, 2020, 335,163 shares were issued under the Sales Agreement for aggregate net proceeds of $4,256 and an additional 50,000 shares were subsequently sold during December 2017 for aggregate net proceeds of $441.$1,785.

ORAMED PHARMACEUTICALS INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

U.S. Dollars in thousands (except share and per share data)

(UNAUDITED)

NOTE 86 - RELATED PARTIES - TRANSACTIONS:

On July 1, 2008, the Subsidiary entered into two consulting agreements with KNRY Ltd. (“KNRY”), an Israeli company owned by the Chief Scientific Officer (the “CSO”"CSO"), whereby the Chief Executive Officer (the “CEO”"CEO") and the CSO, through KNRY, provide services to the Company (the “Consulting Agreements”). The Consulting Agreements are both terminable by either party upon 140 days prior written notice. The Consulting Agreements, as amended, provide that KNRY will be reimbursed for reasonable expenses incurred in connection with performance of the Consulting Agreements and that the monthly consulting fee paid to the CEO and the CSO is NIS 127,570 ($35)37) and NIS 80,454 ($22)23), respectively.

In addition to the Consulting Agreement,Agreements, based on a relocation cost analysis prepared by consulting company ORI - Organizational Resources International Ltd., the Company pays for certain direct costs, related taxes and expenses incurred in connection with the relocation of the CEO to New York, upYork. During the three months ended November 30, 2019, such relocation expenses totaled $86 compared to an aggregate yearly amount of $332.

NOTE 9 - SUBSEQUENT EVENT:

$131 for the three months ended November 30, 2018.

ITEM 2 - MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion and analysis of our financial condition and results of operations should be read in conjunction with the condensed consolidated financial statements and the related notes included elsewhere herein and in our consolidated financial statements, accompanying notes and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” contained in our Annual Report (as defined below).

Forward-Looking Statements

The statements contained in this Quarterly Report on Form 10-Q that are not historical facts are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 and other federal securities laws. Words such as “expects,” “anticipates,” “intends,” “plans,” “planned expenditures,” “believes,” “seeks,” “estimates” and similar expressions or variations of such words are intended to identify forward-looking statements, but are not deemed to represent an all-inclusive means of identifying forward-looking statements as denoted in this Quarterly Report on Form 10-Q. Additionally, statements concerning future matters are forward-looking statements. We remind readers that forward-looking statements are merely predictions and therefore inherently subject to uncertainties and other factors and involve known and unknown risks that could cause the actual results, performance, levels of activity, or our achievements, or industry results, to be materially different from any future results, performance, levels of activity, or our achievements, or industry results, expressed or implied by such forward-looking statements. Such forward-looking statements include, among other statements, statements regarding the following:

| ● | the expected development and potential benefits from our products in treating diabetes; |

| ● | the prospects of entering into additional license agreements, or other partnerships or forms of cooperation with other companies or medical institutions; |

| ● | future milestones, conditions and royalties under the license agreement with Hefei Tianhui | |

| ● | our research and development plans, including pre-clinical and clinical trials plans and the timing of enrollment, obtaining results and conclusion of trials, including without limitation, our expectation that we will initiate | |

| ● | our belief that our technology has the potential to deliver medications and vaccines orally that today can only be delivered via injection; | |

| ● | the competitive ability of our technology based product efficacy, safety, patient convenience, reliability, value and patent position; | |

| ● | the potential market demand for our products; | |

| ● | our expectation that in the upcoming |

| ● | our expectations regarding our short- and long-term capital requirements; | |

| ● | our outlook for the coming months and future periods, including but not limited to our expectations regarding future revenue and expenses; and |

| ● | information with respect to any other plans and strategies for our business. |

Although forward-looking statements in this Quarterly Report on Form 10-Q reflect the good faith judgment of our management, such statements can only be based on facts and factors currently known by us. Consequently, forward-looking statements are inherently subject to risks and uncertainties and actual results and outcomes may differ materially from the results and outcomes discussed in or anticipated by the forward-looking statements. Factors that could cause or contribute to such differences in results and outcomes include, without limitation, those specifically addressed under the heading “Item 1A. Risk Factors” in our Annual Report on Form 10-K for the fiscal year ended August 31, 2017,2019, or our Annual Report, as filed with the Securities and Exchange Commission, or the SEC, on November 29, 2017,27, 2019, as well as those discussed elsewhere in our Annual Report and this QuarterlyReport on Form 10-Q and expressed from time to time in our other filings with the SEC. In addition, historic results of scientific research, clinical and preclinical trials do not guarantee that the conclusions of future research or trials would not suggest different conclusions. Also, historic results referred to in this Quarterly Report on Form 10-Q could be interpreted differently in light of additional research, clinical and preclinical trials results. Readers are urged not to place undue reliance on these forward-looking statements, which speak only as of the date of this Quarterly Report on Form 10-Q. Except as required by law, we undertake no obligation to revise or update any forward-looking statements in order to reflect any event or circumstance that may arise after the date of this Quarterly Report on Form 10-Q. Readers are urged to carefully review and consider the various disclosures made throughout the entirety of this Quarterly Report on Form 10-Q which attempt to advise interested parties of the risks and factors that may affect our business, financial condition, results of operations and prospects.

Overview of Operations

We are a pharmaceutical company currently engaged in the research and development of innovative pharmaceutical solutions, including an oral insulin capsule to be used for the treatment of individuals with diabetes, and the use of orally ingestible capsules or pills for delivery of other polypeptides. We utilize clinical research organizations, or CROs, to conduct our clinical studies.

Recent business developments

Product Candidates

Oral insulin: We are seeking to transform the treatment of diabetes through our proprietary flagship product, an orally ingestible insulin capsule, or ORMD-0801. Our technology allows insulin to travel from the gastrointestinal tract via the portal vein to the bloodstream, revolutionizing the manner in which insulin is delivered. It enables the passage in a more physiological manner than current delivery methods of insulin. Our technology is a platform that has the potential to deliver medications and vaccines orally that today can only be delivered via injection.

Product CandidatesFDA Guidance:

Orally Ingestible Insulin

In August 2017, we hadduring a call with the U.S. Food and Drug Administration, or FDA, regarding our proprietary flagship product, an orally ingestible insulin capsule, or ORMD-0801. During the call, the FDAwe were advised that the regulatory pathway for the submission of ORMD-0801 would be a Biologics License Application.Application, or BLA. If approved such athe BLA pathway would grant us 12 years of marketing exclusivity for ORMD-0801, from the approval date, and an additional six months of exclusivity may be granted to us if the product also receives approval for use in pediatric patients. The FDA confirmed that the approach to nonclinical toxicology, chemistry manufacturing controls and qualification of excipients would be driven by their published guidance documents. We plan to initiate in the first quarter of calendar year

Phase IIb Study: In May 2018, we initiated a three-month dose-ranging Phase IIb clinical trial of ORMD-0801. This placebo controlled, randomized, 90-day treatment clinical trial was conducted on approximately 240269 type 2 diabetic patients in multiple centers throughout the United States pursuant to an Investigational New Drug application, or IND, with the FDA. The primary endpoints of the trial were to assess the safety and evaluate the effect of ORMD-0801 on HbA1c the main FDA registrational endpoint andlevels over a clamp study on six type 1 diabetic patients.

In February 2017, we completed a Phase IIa dose finding clinical trial which was initiated in October 2016. This randomized, double-blind trial was conducted on 32 type 2 adult diabetic patients in order to better define the optimal dosing of ORMD-0801 moving forward. The results90-day treatment period. Secondary endpoints of the trial indicatedincluded measurements of fasting plasma glucose, or FPG, post-prandial glucose, or PPG levels, during a positive safety profilemixed-meal tolerance test, or MMTT, and potentially meaningful efficacyweight. In May 2019, we began an extension of ORMD-0801, as the efficacy data suggest ORMD-0801 improves glucose control.

In March 2017, we initiated a six month toxicology study to allowthis protocol for the use of our oral insulin capsule for a longer period than previously performed, in preparation for our proposed upcoming three-month clinical trial forapproximately 75 type 2 diabetes. diabetic patients, who were dosed using a lower dosage. We anticipate receivingexpect to receive the final report of this study in the first quarter of calendar year 2018.2020.

In April 2016,November 2019, we completed aannounced positive results from the initial cohort of the Phase IIb clinical trial on 180 type 2 adult diabetic patients that was initiated in June 2015 and conducted in 33 sitestrial. Patients randomized in the United States.trial to once-daily ORMD-0801 achieved a reduction in mean HbA1c of 0.60% from baseline, or a reduction of 0.54% adjusted for placebo (p value = 0.036). This double-blind, randomized, 28-day dosing clinical trial was conducted under0.54% reduction in HbA1c is considered clinically meaningful. Treatment with ORMD-0801 demonstrated an Investigational New Drug application, or IND, with the FDA. The clinical trial, designed to assess theexcellent safety and efficacy of our ORMD-0801, investigated ORMD-0801 over a 28 day treatment period and had statistical power to give us greater insight into the drug’s efficacy. The trial indicated a statistically significant lowering of blood glucose levels versus placebo across several endpoints,profile, with no serious or severedrug-related adverse issues relatedevents and with no increased frequency of hypoglycemic episodes when compared to placebo. In addition, during this 90-day trial, no weight gain was observed. In the initial cohort, 269 U.S.-based patients were enrolled and treated with a dose-increasing approach: 16 mg initial dose, titrated to 24 mg per dose, and then titrated to 32 mg per dose. Patients were randomized into three groups to assess dosing frequency: once-daily (32 mg per day), twice-daily (64 mg per day), thrice daily (96 mg per day). There was a corresponding placebo for each treatment arm. Two hundred nine (209) patients completed treatment to the drug. The trial successfully met all12-week endpoint and were included in the data analysis (24 subjects did not complete the full 12 weeks of its primary and mosttreatment). In addition, due to evidence of its secondary and exploratory endpoints for both safety and efficacy.treatment-by-center interaction, two sites (36 patients (13.4% of enrolled subjects)) were excluded from the statistical analysis as they showed results opposite from the rest of the statistically significant results. We are still investigating the cause of this discrepancy.

The once-daily and twice-daily arms achieved statistically significant (p-value 0.036 and 0.042, respectively) reductions from baseline in A1C of 0.60% (0.54% with placebo adjustment) and 0.59% (0.53% with placebo adjustment), respectively. The thrice-daily arm did not meet statistical significance (p-value 0.093).

Should ourThe FDA agreed to hold an initial end of Phase IIb three-month dose-ranging2 meeting to review Chemistry Manufacturing and Control (CMC) aspects which is to take place on February 4, 2020. A second end of phase 2 meeting, which will focus on clinical trial successfully meet its primary endpoints, wefacets, is expected following the release of data from the low dose cohort of the Phase 2b trial.

We anticipate initiating two six-month Phase III clinical trials on both type 1 and type 2 diabetic patients, following which we expect to initiate in the second half of calendar year 2020. Following these trials we expect to file a New Drug ApplicationBLA with a potential FDA approval by the third quarterend of calendar year 2023.2024.

GLP-1 AnalogClamp Study:

In September 2013,June 2018, we submittedinitiated a pre-IND packageglucose clamp study which should quantify insulin absorption in diabetic patients treated with ORMD-0801. The glucose clamp is a method for quantifying insulin absorption in order to measure a patient’s insulin sensitivity and how well a patient metabolizes glucose. This exploratory, randomized, double-blind glucose clamp study is evaluating exposure-response profiles of type 1 diabetic patients treated with ORMD-0801. Six patients with A1C levels of 10% or below, aged 18-50, are enrolled in the FDA for ORMD-0901, our oral exenatide capsule, for a Phase II clinical trial on healthy volunteers and type 2 diabetic patients. In August 2015, we began a non-FDA clinical trial outside of the United States on type 2 diabetic patients. The trial was completed during the second quarter of calendar year 2016 and indicated positive results as it showed ORMD-0901study.We expect to be safe and well tolerated and demonstrated encouraging efficacy data. We completed a three-month pre-clinical toxicology study in March 2017 andreceive the final report will be submitted to the FDA with our IND. We expect to file an IND duringof this study in the first quarter of calendar year 2020.

Food Effect Study:In June 2018, we initiated a food effect trial for ORMD-0801. This single-blind, five period, randomized, placebo-controlled crossover trial is evaluating the pharmacokinetics, or PK, and move directly into a small pharmacokinetics study onpharmacodynamics, of ORMD-0801 taken at different times in relation to meals in healthy volunteers and patients with type 1 diabetes. Forty-eight (48) patients are enrolled, including 24 healthy volunteers and 24 patients with type 1 diabetes.We expect to receive the final report of this study in the first quarter of calendar year 2020.

NASH Study:In October 2018, we initiated an exploratory clinical study of ORMD-0801 in type 2 patients with nonalcoholic steatohepatitis, or NASH. The three-month treatment study, which was approved by Israel’s Ministry of Health, will assess the effectiveness of ORMD-0801 in reducing liver fat content, inflammation and fibrosis in 30 patients with NASH. As requested by Israel’s Ministry of Health, the first part of the study will be conducted on 10 participants and is expected to be completed during first quarter of calendar year 2020.

Toxicology Study (6 Months): In March 2019, we completed a six-month dosing toxicology study of ORMD-0801, which was initiated in September 2018 following the FDA’s request.We expect to receive the final report of this study in the first quarter of calendar year 2020.

Type 1 Study:In November 2019 we initiated a crossover study of type 1 diabetic patients to compare the effects of ORMD-0801 given once daily versus the effects of ORMD-0801 given three times daily. The study is anticipated to include 26 subjects and is expected to be completed in the first quarter of calendar year 2020.

Oral Glucagon-Like Peptide-1: Glucagon-like peptide-1, or GLP-1, is an incretin hormone, which stimulates the secretion of insulin from the pancreas. In addition, GLP-1 was found to suppress glucagon release (a hormone involved in the regulation of glucose) from the pancreas, slow gastric emptying to reduce the rate of absorption of nutrients into the blood stream and increase satiety. Other important beneficial attributes of GLP-1 are its effects of increasing the number of beta cells (cells that manufacture and release insulin) in the pancreas and, possibly, protection of the heart. In addition to our flagship product, the ORMD-0801 insulin capsule, we are using our technology for an orally ingestible GLP-1 capsule, or ORMD-0901.

In February 2019, we completeda Phase I PK trial to evaluate the safety and the pharmacokinetics of ORMD-0901 compared to placebo. We expect to receive the final report of this study in thefirst quarter of calendar year 2020. This study was conducted pursuant to an IND, which we expect to befollowed by further bioavailability studies (results expected in calendar year 2020) and a large Phase II trial on type 2 diabetic patients which will likely be conducted in the United States under an IND.

Other products

During the first quarter of calendar 2017, weWe recently began developing a new drug candidate, a weight loss treatment in the form of an oral leptin capsule, and in April 2017, Israel’s Ministry of Health approved our commencement ofcapsule. We anticipate initiating a proof of concept single dose study for our oral leptin drug candidate to evaluate its pharmacokinetic and pharmacodynamics (glucagon reduction) in 10 type 1 adult diabetic patients. The study is projected to initiatepatients in the first quarter of calendar year 2018 and be completed during2020. We anticipate receiving the final report of this study in the first half of calendar year 2019.

In November 2017, Israel’s Ministry of Health approved us to initiate an exploratory clinical study of our oral insulin capsule, ORMD-0801, in patients with nonalcoholic steatohepatitis (NASH). The proposed three-month treatment study will assess the effectiveness of ORMD-0801 in reducing liver fat content, inflammation and fibrosis in patients with NASH. We expect to initiate the study in calendar year 2018 and complete it during calendar year 2019.2020.

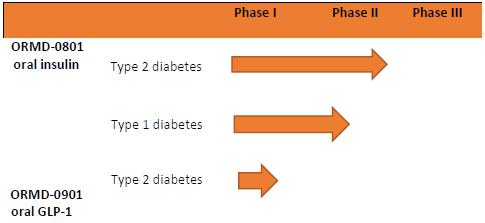

The table below gives an overview of our primary product pipeline (calendar quarters):pipeline:

|  |

| ||||

|

| |||||

|  |

| ||||

Out-Licensed Technology

On November 30, 2015, we, our Israeli subsidiary and HTIT entered into a Technology License Agreement, and on December 21, 2015 these parties entered into an Amended and Restated Technology License Agreement that was further amended by the parties on June 3, 2016 and July 24, 2016, or the License Agreement. According to the License Agreement, we granted HTIT an exclusive commercialization license in the territory of the People’sPeople's Republic of China, Macau and Hong Kong, or the Territory, related to our oral insulin capsule, ORMD-0801, or the Product. Pursuant to the License Agreement, HTIT will conduct, at its own expense, certain pre-commercialization and regulatory activities with respect to our subsidiary’s technology and ORMD-0801 capsule, and will pay (i) royalties of 10% on net sales of the related commercialized products to be sold by HTIT in the Territory, or Royalties, and (ii) an aggregate of $37.5 million, of which $3 million iswas payable immediately, $8 million will be paid subject to our entry into certain agreements with certain third parties, and $26.5 million will be payablepaid upon achievement of certain milestones and conditions. In the event that we will not meet certain conditions, the Royalties rate may be reduced to a minimum of 8%. Following the final expiration of our patents covering the technology in the Territory in 2033, the Royalties rate may be reduced, under certain circumstances, to 5%. The royalty payment obligation shall apply during the period of time beginning upon the first commercial sale of the Product in the Territory, and ending upon the later of (i) the final expiration of the last-to-expire licensed patentpatents in the TerritoryTerritory; and (ii) 15 years after the first commercial sale of the Product in the Territory, or the Royalty Term. The License Agreement shall remain in effect until the expiration of the Royalty Term. The License Agreement contains customary termination provisions. The initial payment of $3 million wasThrough November 30, 2019, we received in January 2016. Following the achievement of certain milestones, the second and thirdaggregate milestone payments of $6.5$20.5 million and $4 million, respectively, were received in July 2016, andout of the fourth milestone paymentaggregate amount of $4 million was received in October 2016.$37.5 million.

On November 30, 2015, we also entered into a separate Securities Purchase Agreement with HTIT, or the SPA, pursuant to which, in December 2015, we issued to HTIT 1,155,367 shares of our common stock for total consideration of $12 million. In connection with the License Agreement and the SPA, we received a non-refundable payment of $500,000 as a no-shop fee.

Results of Operations

Comparison of three month periods ended November 30, 20172019 and 20162018

The following table summarizes certain statements of operations data of the Company for the three month periods ended November 30, 20172019 and 20162018 (in thousands of dollars except share and per share data):

| Three months ended | Three months ended | |||||||||||||||

| November 30, | November 30, | |||||||||||||||

| 2017 | 2016 | 2019 | 2018 | |||||||||||||

| Revenues | $ | 611 | $ | 610 | $ | 674 | $ | 674 | ||||||||

| Cost of revenues | - | 187 | - | 35 | ||||||||||||

| Research and development expenses | 2,327 | 2,353 | 2,022 | 4,347 | ||||||||||||

| General and administrative expenses | 1,016 | 468 | 1,081 | 932 | ||||||||||||

| Financial income, net | 201 | 162 | 114 | 338 | ||||||||||||

| Taxes on income | - | 400 | ||||||||||||||

| Net loss for the period | $ | 2,531 | $ | 2,636 | $ | 2,543 | $ | 4,302 | ||||||||

| Loss per common share - basic and diluted | $ | 0.18 | $ | 0.20 | $ | 0.15 | $ | 0.25 | ||||||||

| Weighted average common shares outstanding | 14,239,346 | 13,205,971 | 17,472,315 | 17,448,744 | ||||||||||||

Revenues

Revenues consist of proceeds related to the License Agreement that are recognized overon a cumulative basis when it is probable that a significant reversal in the termamount of cumulative revenue recognized will not occur, through the License Agreement throughexpected product submission date of June 2023.2023 using the input method.

Revenues for each of the three month periodperiods ended November 30, 2017 totaled $611,000, consistent with $610,000 for the three month period ended November 30, 2016.2019 and 2018 were $674,000.

Cost of revenues

Cost of revenues consists of royalties related to the License Agreement that will be paid over the term of the License Agreement in accordance with revenue recognition accounting and the Law for the Encouragement of Industrial Research, Development and Technological Innovation, 1984, as amended, including any regulations or tracks promulgated thereunder.

NoThere was no cost of revenues was recognized during the three month period ended November 30, 2017 compared to cost of revenues of $187,000 for the three month period ended November 30, 2016. The decrease is due2019 compared to no additional milestone payments having been received during$35,000 for the three month period ended November 30, 2017.2018. The decrease is attributable to the inclusion of additional milestone payments under the License Agreement in the transaction price as part of the implementation of ASC 606 in the three months ended November 30, 2018.

21

Research and development expenses

Research and development expenses include costs directly attributable to the conduct of research and development programs, including the cost of salaries, employee benefits, costs of materials, supplies, the cost of services provided by outside contractors, including services related to our clinical trials, clinical trial expenses, the full cost of manufacturing drugs for use in research and preclinical development. All costs associated with research and development are expensed as incurred.

Clinical trial costs are a significant component of research and development expenses and include costs associated with third-party contractors. We outsource a substantial portion of our clinical trial activities, utilizing external entities such as contract research organizations, or CROs, independent clinical investigators and other third-party service providers to assist us with the execution of our clinical studies.

Clinical activities which relate principally to clinical sites and other administrative functions to manage our clinical trials are performed primarily by CROs. CROs typically perform most of the start-up activities for our trials, including document preparation, site identification, screening and preparation, pre-study visits, training, and program management.

Clinical trial and pre-clinical trial expenses include regulatory and scientific consultants’ compensation and fees, research expenses, purchase of materials, cost of capsule manufacturing, of the oral insulin and exenatide capsules, payments for patient recruitment and treatment, as well as salaries and related expenses of research and development staff.

Research and development expenses for the three month period ended November 30, 20172019 decreased by 1%53% to $2,327,000,$2,022,000, from $2,353,000$4,347,000 for the three month period ended November 30, 2016.2018. The decrease is mainlyprimarily due to completion ofa decrease in expenses related to our dose findingPhase IIb three-month treatment clinical trial and is partially offset by an increase in expenses related to progress in toxicology studies and preparations for our Phase IIb three-month clinical trial.regulatory consulting. Stock-based compensation costs for the three month period ended November 30, 20172019 totaled $171,000,$95,000, as compared to $136,000$39,000 during the three month period ended November 30, 2016.2018. The increase is mainly attributable to awards granted to employees and a consultant during fiscal year 2017.new grants in the three months ended November 30, 2019.

Government grants

In the three month periods ended November 30, 20172019 and 2016,2018, we did not recognize any research and development grants. As of November 30, 2017,2019, we incurred liabilities to pay royalties to the Israel Innovation Authority of the Israeli Ministry of Economy & Industry of $533,000.$354,000.

General and administrative expenses

General and administrative expenses include the salaries and related expenses of our management, consulting costs, legal and professional fees, travel expenses, business development costs, insurance expenses and other general costs.

General and administrative expenses for the three month period ended November 30, 20172019 increased by 117%16% to $1,016,000$1,081,000 from $468,000$932,000 for the three month period ended November 30, 2016.2018. The increase in costs related to general and administrative activities during the three month period ended November 30, 2017 is mainlyprimarily attributable to an increase in stock-based compensation costs, consulting and travel expenses related to the relocation of our Chief Executive Officer to New York, where the Company has leased an office since September 2017.legal expenses. Stock-based compensation costs for the three month period ended November 30, 20172019 totaled $352,000,$184,000, as compared to $23,000$199,000 during the three month period ended November 30, 2016.2018. The increasedecrease is mainlyprimarily attributable to the progress in amortization of awards granted to employees and a consultantdirectors during fiscal year 2017.2020 and is partially offset by an increase due to awards granted during fiscal year 2019.

22

Financial income, net

Net financial income increaseddecreased by 24%66% from net income of $162,000$338,000 for the three month period ended November 30, 20162018 to net income of $201,000$114,000 for the three month period ended November 30, 2017.2019. The increasedecrease is mainlyprimarily attributable to an increasea decrease in income from bank deposits and held to maturity bonds as a result of an increase in interest rates.

Taxes on income

No taxes on income were recognized for the three month period ended November 30, 2017 as compared to $400,000 for the three month period ended November 30, 2016. The decrease is due to a decrease in withholding tax deducted from milestone payments received related to the License Agreement that resulted fromcash invested, as well as a decrease in such proceeds. The Company estimates that withholding tax will not be utilized in the next five years, and therefore it was deducted.

Other comprehensive income

Unrealized gains on available for sale securities for the three month period ended November 30, 2017 of $326,000, compared to losses of $63,000 for the three month period ended November 30, 2016, resulted from the increase in fair value of the ordinary shares of D.N.A Biomedical Solutions Ltd. that we hold.and Entera Bio Ltd.