U.S. SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-Q

☒ Quarterly report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the period endedDecember 31, 20172021

☐ Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the transition period from _____________________ to ___________.__________.

Commission File Number 001-34024

Sino-Global Shipping America,Singularity Future Technology Ltd.

(Exact name of registrant as specified in its charter)

| Virginia | 11-3588546 | |

| (State or other jurisdiction of | (I.R.S. employer | |

| Incorporation or organization) | identification number) |

1044 Northern Boulevard, Suite 305

Roslyn, New York 11576-1514

(Address of principal executive offices and zip code)

98 Cutter Mill Road, Suite 322 Great Neck, New York | 11021 | |

| (Address of principal executive offices) | (Zip Code) |

(718) 888-1814

(Registrant’s telephone number, including area code)

Securities Registered Pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| Common Stock | SGLY | NASDAQ Capital Market |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ | |

| Non-accelerated filer | Smaller reporting company ☒ | |

| Emerging Growth Company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

IndicateAs of February 14, 2022, the number ofCompany had 21,880,333 shares outstanding of each of the issuer’s classes of common stock as of the latest practicable date. As of February 12, 2018, the Company has 10,435,535 issued and outstanding shares of common stock.outstanding.

SINO-GLOBAL SHIPPING AMERICA,SINGULARITY FUTURE TECHNOLOGY LTD.

FORM 10-Q

INDEX

i

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This document contains certain statements of a forward-looking nature. Such forward-looking statements, including but not limited to projected growth, trends and strategies, future operating and financial results, financial expectations and current business indicators are based upon current information and expectations and are subject to change based on factors beyond the control of the Company.our control. Forward-looking statements typically are identified by the use of terms such as “look,” “may,” “will,” “should,” “might,” “believe,” “plan,” “expect,” “anticipate,”“look”, “may”, “will”, “should”, “might”, “believe”, “plan”, “expect”, “anticipate”, “estimate” and similar words, although some forward-looking statements are expressed differently. The accuracy of such statements may be impacted by a number of business risks and uncertainties that could cause actual results to differ materially from those projected or anticipated, including but not limited to the following:

| ● | Our ability to timely and properly deliver our services; |

| ● | Our dependence on a limited number of major customers and related parties; |

| ● | Political and economic factors in the |

| ● | Our ability to expand and grow our lines of business; |

| ● | Unanticipated changes in general market conditions or other factors, which may result in cancellations or reductions in the need for our services; |

| ● | Economic conditions which would reduce demand for services provided by |

| ● | The effect of terrorist acts, or the threat thereof, on the demand for the shipping and logistic industry which could, adversely affect |

| ● | The acceptance in the marketplace of our new lines of business; |

| ● | Foreign currency exchange rate fluctuations; |

| ● | Hurricanes, outbreak of contagious diseases or other natural disasters; and |

| ● | Our ability to attract, retain and motivate skilled personnel. |

Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. The Company undertakesWe undertake no obligation to update this forward-looking information unless required by applicable law or regulations.

ii

PART I. FINANCIAL INFORMATION

SINO-GLOBAL SHIPPING AMERICA,SINGULARITY FUTURE TECHNOLOGY LTD. AND AFFILIATES

INDEX TO FINANCIAL STATEMENTS

SUBSIDIARIES

SINO-GLOBAL SHIPPING AMERICA, LTD. AND AFFILIATES

CONDENSED CONSOLIDATED BALANCE SHEETS

(UNAUDITED)

| December 31, | June 30, | |||||||

| 2017 | 2017 | |||||||

| Assets | ||||||||

| Current assets | ||||||||

| Cash and cash equivalents | $ | 7,219,848 | $ | 8,733,742 | ||||

| Accounts receivable, less allowance for doubtful accounts of $763,984 and $185,821 as of December 31, 2017 and June 30, 2017, respectively | 4,248,363 | 2,569,141 | ||||||

| Other receivables, less allowance for doubtful accounts of $145,279 and $145,244 as of December 31, 2017 and June 30, 2017, respectively | 318,827 | 37,811 | ||||||

| Advances to suppliers-third parties | 14,611 | 54,890 | ||||||

| Advances to suppliers-related party | 3,473,717 | 3,333,038 | ||||||

| Prepaid expenses and other current assets | 230,721 | 311,136 | ||||||

| Due from related parties, net | 2,372,996 | 1,715,130 | ||||||

| Total Current Assets | 17,879,083 | 16,754,888 | ||||||

| Property and equipment, net | 217,335 | 187,373 | ||||||

| Intangible assets, net | 184,722 | - | ||||||

| Prepaid expenses | - | 6,882 | ||||||

| Other long-term assets | 119,059 | 117,478 | ||||||

| Deferred tax assets | 1,823,100 | 749,400 | ||||||

| Total Assets | $ | 20,223,299 | $ | 17,816,021 | ||||

| Liabilities and Equity | ||||||||

| Current Liabilities | ||||||||

| Advances from customers | $ | 360,744 | $ | 369,717 | ||||

| Accounts payable | 506,989 | 206,211 | ||||||

| Taxes payable | 2,258,737 | 1,886,216 | ||||||

| Due to related parties | - | 206,323 | ||||||

| Accrued expenses and other current liabilities | 359,748 | 418,029 | ||||||

| Total Current Liabilities | 3,486,218 | 3,086,496 | ||||||

| Income tax payable - noncurrent portion | 440,219 | - | ||||||

| Total Liabilities | 3,926,437 | 3,086,496 | ||||||

| Commitments and Contingencies | ||||||||

| Equity | ||||||||

| Preferred stock, 2,000,000 shares authorized, no par value, none issued. | - | - | ||||||

| Common stock, 50,000,000 shares authorized, no par value; 10,611,032 and 10,281,032 shares issued as of December 31, 2017 and June 30, 2017, respectively; 10,435,535 and 10,105,535 outstanding as of December 31, 2017 and June 30, 2017, respectively | 20,535,379 | 20,535,379 | ||||||

| Additional paid-in capital | 1,032,016 | 688,934 | ||||||

| Treasury stock, at cost, 175,497 shares as of December 31, 2017 and June 30, 2017 | (417,538 | ) | (417,538 | ) | ||||

| Retained earnings (accumulated deficit) | 20,985 | (893,907 | ) | |||||

| Accumulated other comprehensive loss | (134,637 | ) | (414,564 | ) | ||||

| Total Sino-Global Shipping America Ltd. Stockholders' Equity | 21,036,205 | 19,498,304 | ||||||

| Non-controlling Interest | (4,739,343 | ) | (4,768,779 | ) | ||||

| Total Equity | 16,296,862 | 14,729,525 | ||||||

| Total Liabilities and Equity | $ | 20,223,299 | $ | 17,816,021 | ||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements

(UNAUDITED)

SINO-GLOBAL SHIPPING AMERICA, LTD. AND AFFILIATES

| December 31, | June 30, | |||||||

| 2021 | 2021 | |||||||

| Assets | ||||||||

| Current assets | ||||||||

| Cash | $ | 51,401,410 | $ | 44,837,317 | ||||

| Cryptocurrencies | 211,211 | 261,338 | ||||||

| Accounts receivable, net | 65,990 | 113,242 | ||||||

| Other receivables, net | 3,492,832 | 2,558 | ||||||

| Advances to suppliers - third parties | 450,239 | 880,000 | ||||||

| Prepaid expenses and other current assets | 148,878 | 341,992 | ||||||

| Due from related party, net | 1,772,677 | 430,902 | ||||||

| Total Current Assets | 57,543,237 | 46,867,349 | ||||||

| Property and equipment, net | 1,060,774 | 757,257 | ||||||

| Right-of-use assets | 1,545,550 | 417,570 | ||||||

| Other long-term assets - deposits | 133,912 | 115,971 | ||||||

| Loan receivable-related parties | 4,762,635 | 4,644,969 | ||||||

| Investment in unconsolidated entity | 210,010 | - | ||||||

| Total Assets | $ | 65,256,118 | $ | 52,803,116 | ||||

| Liabilities and Equity | ||||||||

| Current Liabilities | ||||||||

| Deferred revenue | $ | 72,095 | $ | 471,516 | ||||

| Accounts payable | 540,427 | 574,857 | ||||||

| Lease liabilities - current | 525,942 | 192,044 | ||||||

| Taxes payable | 3,638,541 | 3,572,419 | ||||||

| Accrued expenses and other current liabilities | 634,254 | 529,777 | ||||||

| Loan payable - current | - | 3,035 | ||||||

| Total current liabilities | 5,411,259 | 5,343,648 | ||||||

| Lease liabilities - noncurrent | 1,034,756 | 237,956 | ||||||

| Loan payable-noncurrent | - | 152,370 | ||||||

| Convertible notes | 10,000,000 | - | ||||||

| Total liabilities | 16,446,015 | 5,733,974 | ||||||

| Commitments and Contingencies | ||||||||

| Equity | ||||||||

| Preferred stock, 2,000,000 shares authorized, no par value, no shares issued and outstanding as of December 31, 2021 and June 30, 2021, respectively | - | - | ||||||

| Common stock, 50,000,000 shares authorized, no par value; 17,652,113 and 4,438,788 shares issued and outstanding as of December 31, 2021 and June 30,2021, respectively* | 90,424,008 | 82,555,700 | ||||||

| Additional paid-in capital | 2,334,962 | 2,334,962 | ||||||

| Accumulated deficit | (41,953,051 | ) | (30,244,937 | ) | ||||

| Accumulated other comprehensive loss | (843,226 | ) | (625,449 | ) | ||||

| Total Stockholders' Equity attributable to controlling shareholders of the Company | 49,962,693 | 54,020,276 | ||||||

| Non-controlling Interest | (1,152,590 | ) | (6,951,134 | ) | ||||

| Total Equity | 48,810,103 | 47,069,142 | ||||||

| Total Liabilities and Equity | $ | 65,256,118 | $ | 52,803,116 | ||||

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME

(UNAUDITED)

| * | Shares and per share data are presented on a retroactive basis to reflect the 1-for-5 reverse stock split on July 7, 2020. |

| For the Three Months Ended December 31, | For the Six Months Ended December 31, | |||||||||||||||

| 2017 | 2016 | 2017 | 2016 | |||||||||||||

| Net revenues - third parties | $ | 4,665,235 | $ | 1,511,624 | $ | 9,480,086 | $ | 2,606,547 | ||||||||

| Net revenues - related party | 555,246 | 616,924 | 1,120,406 | 1,466,403 | ||||||||||||

| Total revenues | 5,220,481 | 2,128,548 | 10,600,492 | 4,072,950 | ||||||||||||

| Cost of revenues | (3,375,878 | ) | (350,796 | ) | (7,041,796 | ) | (657,135 | ) | ||||||||

| Gross profit | 1,844,603 | 1,777,752 | 3,558,696 | 3,415,815 | ||||||||||||

| General and administrative expenses | (1,827,014 | ) | (776,284 | ) | (2,590,371 | ) | (1,636,198 | ) | ||||||||

| Selling expenses | (335,261 | ) | (46,875 | ) | (357,727 | ) | (112,184 | ) | ||||||||

| Total operating expenses | (2,162,275 | ) | (823,159 | ) | (2,948,098 | ) | (1,748,382 | ) | ||||||||

| Operating income (loss) | (317,672 | ) | 954,593 | 610,598 | 1,667,433 | |||||||||||

| Other income (expense) | ||||||||||||||||

| Financial income (expense), net | 137,799 | (88,470 | ) | 222,595 | (91,904 | ) | ||||||||||

| Total other income (expense) | 137,799 | (88,470 | ) | 222,595 | (91,904 | ) | ||||||||||

| Net income (loss) before provision for income taxes | (179,873 | ) | 866,123 | 833,193 | 1,575,529 | |||||||||||

| Income tax benefit (expense) | 571,121 | (73,391 | ) | 274,692 | (145,012 | ) | ||||||||||

| Net income | 391,248 | 792,732 | 1,107,885 | 1,430,517 | ||||||||||||

| Net income (loss) attributable to non-controlling interest | 93,545 | (100,169 | ) | 192,993 | (108,104 | ) | ||||||||||

| Net income attributable to Sino-Global Shipping America, Ltd. | $ | 297,703 | $ | 892,901 | $ | 914,892 | $ | 1,538,621 | ||||||||

| Comprehensive income | ||||||||||||||||

| Net income | $ | 391,248 | $ | 792,732 | $ | 1,107,885 | $ | 1,430,517 | ||||||||

| Foreign currency translation income (loss) | 97,600 | (104,312 | ) | 145,317 | (118,882 | ) | ||||||||||

| Comprehensive income | 488,848 | 688,420 | 1,253,202 | 1,311,635 | ||||||||||||

| Less: Comprehensive income attributable to non-controlling interest | 20,618 | 21,512 | 61,365 | 24,121 | ||||||||||||

| Comprehensive income attributable to Sino-Global Shipping America Ltd. | $ | 468,230 | $ | 666,908 | $ | 1,191,837 | $ | 1,287,514 | ||||||||

| Earnings per share | ||||||||||||||||

| -Basic | $ | 0.03 | $ | 0.11 | $ | 0.09 | $ | 0.19 | ||||||||

| -Diluted | $ | 0.03 | $ | 0.11 | $ | 0.09 | $ | 0.18 | ||||||||

| Weighted average number of common shares used in computation | ||||||||||||||||

| -Basic | 10,367,492 | 8,280,535 | 10,236,513 | 8,280,535 | ||||||||||||

| -Diluted | 10,415,503 | 8,342,870 | 10,286,683 | 8,318,541 | ||||||||||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statementsstatements.

SINO-GLOBAL SHIPPING AMERICASINGULARITY FUTURE TECHNOLOGY LTD. AND AFFILIATESUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWSOPERATIONS AND COMPREHENSIVE LOSS

(UNAUDITED)

| For the six months ended December 31, | ||||||||

| 2017 | 2016 | |||||||

| US$ | US$ | |||||||

| Cash flows from operating Activities | ||||||||

| Net income | $ | 1,107,885 | $ | 1,430,517 | ||||

| Adjustment to reconcile net income to net cash provided by (used in) operating activities: | ||||||||

| Stock - based compensation expense | 9,665 | 92,472 | ||||||

| Amortization of stock - based compensation to consultants | 333,417 | 529,569 | ||||||

| Depreciation and amortization | 31,742 | 25,407 | ||||||

| Provision for (recovery of) doubtful accounts | 837,431 | (108,344 | ) | |||||

| Deferred tax benefit | (1,073,700 | ) | - | |||||

| Changes in assets and liabilities | ||||||||

| Accounts receivable | (2,210,485 | ) | 615,324 | |||||

| Other receivables | (234,751 | ) | 219,860 | |||||

| Advances to suppliers - third parties | 50,465 | (1,417,731 | ) | |||||

| Prepaid expense and other current assets | 80,952 | 42,906 | ||||||

| Other long-term assets | - | 5,693 | ||||||

| Due from related parties | (921,532 | ) | (133,713 | ) | ||||

| Advances from customers | (23,001 | ) | 369,626 | |||||

| Accounts payable | 288,283 | (309,941 | ) | |||||

| Taxes payable | 731,456 | 174,432 | ||||||

| Due to related parties | (206,323 | ) | - | |||||

| Accrued expenses and other current liabilities | (61,218 | ) | 386,381 | |||||

| Net cash provided by (used in) operating activities | (1,259,714 | ) | 1,922,458 | |||||

| Cash flows from investing Activities | ||||||||

| Acquisition of property and equipment | (50,278 | ) | - | |||||

| Acquisition of intangible assets | (190,000 | ) | - | |||||

| Prepayment for acquisition of intangible assets | (10,000 | ) | - | |||||

| Net cash used in investing activities | (250,278 | ) | - | |||||

| Effect of exchange rate fluctuations on cash and cash equivalents | (3,902 | ) | (14,999 | ) | ||||

| Net (decrease) increase in cash and cash equivalents | (1,513,894 | ) | 1,907,459 | |||||

| Cash and cash equivalents at beginning of period | 8,733,742 | 1,385,994 | ||||||

| Cash and cash equivalents at end of period | $ | 7,219,848 | $ | 3,293,453 | ||||

| Supplemental information | ||||||||

| Income taxes paid | $ | 60,162 | $ | 6,446 | ||||

| For the Three Months Ended | For the Six Months Ended | |||||||||||||||

| December 31, | December 31, | |||||||||||||||

| 2021 | 2020 | 2021 | 2020 | |||||||||||||

| Net revenues (including related party revenue of $223,705 for three months ended December 31,2021 | 1,041,925 | 1,884,440 | $ | 2,838,135 | $ | 3,021,239 | ||||||||||

| Cost of revenues | (1,024,891 | ) | (1,688,464 | ) | (2,651,759 | ) | (2,783,690 | ) | ||||||||

| Gross profit | 17,034 | 195,976 | 186,376 | 237,549 | ||||||||||||

| Selling expenses | (197,225 | ) | (73,462 | ) | (271,621 | ) | (142,392 | ) | ||||||||

| General and administrative expenses | (2,151,431 | ) | (1,314,235 | ) | (4,118,000 | ) | (2,017,669 | ) | ||||||||

| Impairment loss of cryptocurrencies | (50,127 | ) | - | (50,127 | ) | - | ||||||||||

| Recovery (provision) for doubtful accounts, net | 1,876 | 15,891 | 1,931,591 | (2,462 | ) | |||||||||||

| Stock-based compensation | (377,000 | ) | - | (3,304,400 | ) | - | ||||||||||

| Total operating expenses | (2,773,907 | ) | (1,371,806 | ) | (5,812,557 | ) | (2,162,523 | ) | ||||||||

| Operating loss | (2,756,873 | ) | (1,175,830 | ) | (5,626,181 | ) | (1,924,974 | ) | ||||||||

| Loss from disposal of subsidiary and VIE | (6,131,616 | ) | - | (6,131,616 | ) | - | ||||||||||

| Other expenses, net | (29,881 | ) | 85,720 | (82,235 | ) | 86,408 | ||||||||||

| Net loss before provision for income taxes | (8,918,370 | ) | (1,090,110 | ) | (11,840,032 | ) | (1,838,566 | ) | ||||||||

| Income tax expense | - | (3,450 | ) | - | (3,450 | ) | ||||||||||

| Net loss | (8,918,370 | ) | (1,093,560 | ) | (11,840,032 | ) | (1,842,016 | ) | ||||||||

| Net loss attributable to non-controlling interest | (65,268 | ) | 9,359 | (131,918 | ) | (5,306 | ) | |||||||||

| Net loss attributable to controlling shareholders of the Company | $ | (8,853,102 | ) | (1,102,919 | ) | $ | (11,708,114 | ) | $ | (1,836,710 | ) | |||||

| Comprehensive loss | ||||||||||||||||

| Net loss | $ | (8,918,370 | ) | (1,093,560 | ) | $ | (11,840,032 | ) | $ | (1,842,016 | ) | |||||

| Other comprehensive income - foreign currency | (246,679 | ) | 31,038 | (193,197 | ) | 23,465 | ||||||||||

| Comprehensive loss | (9,165,049 | ) | (1,062,522 | ) | (12,033,229 | ) | (1,818,551 | ) | ||||||||

| Less: Comprehensive gain/(loss) attributable to non-controlling interest | 163,196 | (195,468 | ) | 87,304 | (408,957 | ) | ||||||||||

| Comprehensive loss attributable to controlling shareholders of the Company | $ | (9,328,245 | ) | (867,054 | ) | $ | (12,120,533 | ) | $ | (1,409,594 | ) | |||||

| Loss per share | ||||||||||||||||

| Basic and diluted* | $ | (0.55 | ) | (0.23 | ) | $ | (0.74 | ) | $ | (0.42 | ) | |||||

| Weighted average number of common shares used in computation | ||||||||||||||||

| Basic and diluted* | 16,201,026 | 4,828,788 | 15,836,703 | 4,328,571 | ||||||||||||

| * | Shares and per share data are presented on a retroactive basis to reflect the 1-for-5 reverse stock split on July 7, 2020. |

The accompanying notes are an integral part of these unaudited condensed consolidated financial statementsstatements.

SINO-GLOBAL SHIPPING AMERICA,SINGULARITY FUTURE TECHNOLOGY LTD. AND AFFILIATESSUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY

(UNAUDITED)

| Preferred Stock | Common Stock | Additional paid-in | Subscription | Accumulated | Accumulated other comprehensive | Noncontrolling | ||||||||||||||||||||||||||||||||||

| Shares | Amount | Shares* | Amount | capital | receivable | deficit | loss | interest | Total | |||||||||||||||||||||||||||||||

| BALANCE, June 30, 2020 | - | $ | - | 3,718,788 | $ | 28,414,992 | $ | 2,334,962 | $ | (59,869 | ) | $ | (23,421,594 | ) | $ | (1,084,030 | ) | $ | (6,542,361 | ) | $ | (357,900 | ) | |||||||||||||||||

| Issuance of common stock to private investor | - | - | 720,000 | 1,051,200 | - | 59,869 | - | - | - | 1,111,069 | ||||||||||||||||||||||||||||||

| Foreign currency translation | - | - | - | - | - | - | - | 191,251 | (198,824 | ) | (7,573 | ) | ||||||||||||||||||||||||||||

| Net income | - | - | - | - | - | - | (733,791 | ) | - | (14,665 | ) | (748,456 | ) | |||||||||||||||||||||||||||

| BALANCE, September 30, 2020 (Restated) | - | - | 4,438,788 | 29,466,192 | 2,334,962 | - | (24,155,385 | ) | (892,779 | ) | (6,755,850 | ) | (2,860 | ) | ||||||||||||||||||||||||||

| Issuance of preferred stock to private investor | 860,000 | 1,427,600 | - | - | - | - | - | - | - | 1,427,600 | ||||||||||||||||||||||||||||||

| Issuance of common stock to private investor | - | - | 1,560,000 | 4,322,330 | - | - | - | - | - | 4,322,330 | ||||||||||||||||||||||||||||||

| Foreign currency translation | - | - | - | - | - | - | - | 235,865 | (204,827 | ) | 31,038 | |||||||||||||||||||||||||||||

| Net income (loss) | - | - | - | - | - | - | (1,102,919 | ) | - | 9,359 | (1,093,560 | ) | ||||||||||||||||||||||||||||

| BALANCE, December 31, 2020 | 860,000 | $ | 1,427,600 | 5,998,788 | $ | 33,788,522 | $ | 2,334,962 | $ | - | $ | (25,258,304 | ) | $ | (656,914 | ) | $ | (6,951,318 | ) | $ | 4,684,548 | |||||||||||||||||||

| Preferred Stock | Common Stock | Additional paid-in | Subscription | Accumulated | Accumulated other comprehensive | Noncontrolling | ||||||||||||||||||||||||||||||||||

| Shares | Amount | Shares* | Amount | capital | receivable | deficit | loss | interest | Total | |||||||||||||||||||||||||||||||

| BALANCE, June 30, 2021 | - | $ | - | 15,132,113 | $ | 82,555,700 | $ | 2,334,962 | $ | - | $ | (30,244,937 | ) | $ | (625,449 | ) | $ | (6,951,134 | ) | $ | 47,069,142 | |||||||||||||||||||

| Stock compensation issue to employee | - | - | 1,020,000 | 2,927,400 | - | - | - | - | - | 2,927,400 | ||||||||||||||||||||||||||||||

| Foreign currency translation | - | - | - | - | - | - | - | 62,724 | (9,242 | ) | 53,482 | |||||||||||||||||||||||||||||

| Net loss | - | - | - | - | - | - | (2,855,012 | ) | - | (66,650 | ) | (2,921,662 | ) | |||||||||||||||||||||||||||

| BALANCE, September 30, 2021 | - | - | 16,152,113 | 85,483,100 | 2,334,962 | - | (33,099,949 | ) | (562,725 | ) | (7,027,026 | ) | 47,128,362 | |||||||||||||||||||||||||||

| Stock compensation issue to former director | - | - | 100,000 | 377,000 | - | - | - | - | - | 377,000 | ||||||||||||||||||||||||||||||

| Issuance of common stock to private investors | - | - | 1,400,000 | 4,563,908 | - | - | - | - | - | 4,563,908 | ||||||||||||||||||||||||||||||

| Foreign currency translation | - | - | - | - | - | - | - | (280,501 | ) | 87,304 | (193,197 | ) | ||||||||||||||||||||||||||||

| Disposal of VIE and subsidiaries | - | - | - | - | - | - | - | - | 5,919,050 | 5,919,050 | ||||||||||||||||||||||||||||||

| Net loss | - | - | - | - | - | - | (8,853,102 | ) | - | (131,918 | ) | (8,985,020 | ) | |||||||||||||||||||||||||||

| BALANCE, December 31, 2021 | - | $ | - | 17,652,113 | $ | 90,424,008 | $ | 2,334,962 | $ | - | $ | (41,953,051 | ) | $ | (843,226 | ) | $ | (1,152,590 | ) | $ | 48,810,103 | |||||||||||||||||||

| * | Shares and per share data are presented on a retroactive basis to reflect the 1-for-5 reverse stock split on July 7, 2020. |

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

SINGULARITY FUTURE TECHNOLOGY LTD. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

CONDENSED

| For the Six Months Ended | ||||||||

| December 31, | ||||||||

| 2021 | 2020 | |||||||

| Operating Activities | - | |||||||

| Net loss | $ | (11,840,032 | ) | $ | (1,842,016 | ) | ||

| Adjustments to reconcile net loss to net cash used in operating activities: | ||||||||

| Stock-based compensation | 3,304,400 | - | ||||||

| Depreciation and amortization | 278,517 | 165,128 | ||||||

| Non-cash lease expense | 256,218 | 76,716 | ||||||

| (Recovery) provision for doubtful accounts, net | (1,931,591 | ) | 2,462 | |||||

| Loss on disposal of fixed assets | 52,489 | - | ||||||

| Loss on disposal of subsidiaries and VIE | 6,131,616 | - | ||||||

| Impairment loss of cryptocurrencies | 50,127 | |||||||

| Changes in assets and liabilities | ||||||||

| Accounts receivable | (3,188 | ) | (190,033 | ) | ||||

| Other receivables | (1,722,529 | ) | (881,628 | ) | ||||

| Advances to suppliers - third parties | 431,581 | (28,770 | ) | |||||

| Prepaid expenses and other current assets | 192,841 | 27,277 | ||||||

| Other long-term assets - deposits | (18,712 | ) | (100,746 | ) | ||||

| Due from related parties | - | 86,000 | ||||||

| Deferred revenue | (398,800 | ) | 401,966 | |||||

| Accounts payable | (27,635 | ) | 57,265 | |||||

| Taxes payable | 104,305 | 140,633 | ||||||

| Lease liabilities | (253,500 | ) | (93,459 | ) | ||||

| Accrued expenses and other current liabilities | 154,090 | (788,780 | ) | |||||

| Net cash used in operating activities | (5,239,803 | ) | (2,967,985 | ) | ||||

| Investing Activities | ||||||||

| Acquisition of property and equipment | (624,086 | ) | - | |||||

| Loan to related party | (41,505 | ) | - | |||||

| Investment in unconsolidated entity | (210,000 | ) | - | |||||

| Advance to related parties | (1,470,922 | ) | - | |||||

| Repayment from related parties | 136,167 | - | ||||||

| Net cash used in investing activities | (2,210,346 | ) | - | |||||

| Financing Activities | ||||||||

| Proceeds from issuance of preferred stock | - | 1,427,600 | ||||||

| Proceeds from issuance of common stock | 4,563,908 | 5,433,399 | ||||||

| Proceeds from convertible notes | 10,000,000 | - | ||||||

| Repayment of loan payable | (155,405 | ) | - | |||||

| Net cash provided by financing activities | 14,408,503 | 6,860,999 | ||||||

| Effect of exchange rate fluctuations on cash | (394,261 | ) | 448,804 | |||||

| Net increase in cash | 6,564,093 | 4,341,818 | ||||||

| Cash at beginning of period | 44,837,317 | 131,182 | ||||||

| Cash at end of period | $ | 51,401,410 | $ | 4,473,000 | ||||

| Supplemental information | ||||||||

| Income taxes paid | $ | - | $ | - | ||||

| Interest paid | $ | 2,404 | $ | - | ||||

| Non-cash transactions of operating and investing activities | ||||||||

| Initial recognition of right-of-use assets and lease liabilities | $ | 1,384,721 | $ | - | ||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

SINGULARITY FUTURE TECHNOLOGY LTD. AND SUBSIDIARIES

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

(UNAUDITED)

Note 1. ORGANIZATION AND NATURE OF BUSINESS

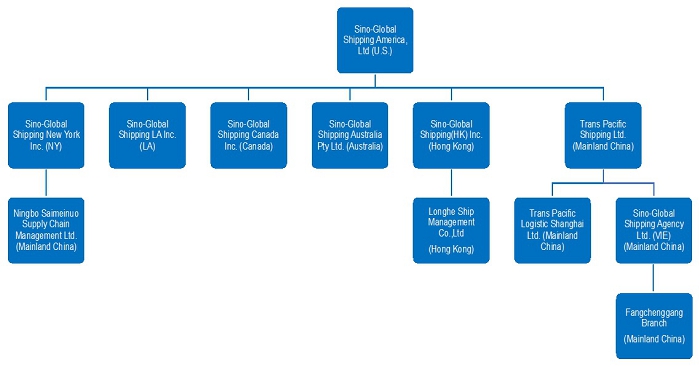

Founded in the United States (the “U.S.”) in 2001, Sino-Global Shipping America, Ltd., a Virginia corporation (“Sino-Global” or the “Company”), is a non-asset based global shipping and freight logistics integrated solutionssolution provider. The Company provides tailored solutions and value-added services forto its customers to drive effectivenessefficiency and control in related linkssteps throughout the entire shipping and freight logistics chain. The Company conducts its business primarily through its wholly-owned subsidiaries in the U.S., the People’s Republic of China including(the “PRC” or “China”) (including Hong Kong (the “PRC”), AustraliaKong) and Canada. Currently,the U.S. where a significant portionmajority of the Company’s business is generated from clients locatedare located. The Company operates in the PRC.

The Company’s Chinese subsidiary, Trans Pacific Shipping Limited, a wholly-owned foreign enterprise (“Trans Pacific Beijing”), is the 90% owner of Trans Pacific Logistics Shanghai Limited (“Trans Pacific Shanghai”). Trans Pacific Beijing and Trans Pacific Shanghai are referred to collectively as “Trans Pacific”.

Prior to fiscal year 2016, the Company’stwo operating segments including (1) shipping agency business was operated by its subsidiaries in the PRC. The Company’s shippingand management services, were operated by its subsidiary in Hong Kong. The Company’s shipping and chartering services were operated by its subsidiaries in the U.S. and subsidiary in Hong Kong. Currently, the Company’s inland transportation management serviceswhich are operated by its subsidiaries in the PRC, Hong Kong and the U.S. The Company’s; (2) freight logistics services, which are operated by its subsidiaries in the PRCPRC.

On January 3, 2022, the Company filed Articles of Amendment with the Virginia State Corporation Commission to change its corporate name from Sino-Global Shipping America, Ltd. to Singularity Future Technology Ltd. The Company plans to leverage its core expertise in logistics and shipping to accelerate its diversification and growth in cryptocurrency and other new markets. The Company plans to enter into digital assets business through its US subsidiaries.

On December 14, 2020, the U.S. The Company’s container truckingCompany incorporated a new entity named “Blumargo IT Solution Ltd.” with 80% ownership in partnership with Tianjin Anboweiye Technology Co. to build up hi-tech and information-based logistic services are currently operated by its subsidiaries into meet the PRChigher and throughcomplicate demand of customers. On June 30, 2021, the Company increased the ownership to 100%.

On April 13, 2021, the Company formed a joint venture in which the Company owned 99% equity interest of Hainan Saimeinuo Trading Co., Ltd., in the free tax zone in Hainan Province, China, with a registered capital of approximately $1.5 million. This subsidiary primarily engages in freight logistics services.

On April 21, 2021, the Company entered into a cooperation agreement with Mr. Bangpin Yu to set up a joint venture in U.S. The Company’s newly added bulk cargo container truckingnamed “Brilliant Warehouse Service Inc.” to support its freight logistics services are currently operated by its subsidiary in the U.S. The Company has increased itsa 51% equity interest in the joint venture.

In July 2021, the company registered a new company Gorgeous Trading Ltd., which is 100% owned by Sino-Global Shipping New York Inc. and which will be mainly responsible for the Company’s smart warehouse and related business in the U.S. since the launch of the short haul container truck services web-based platform in December 2016.Texas.

In January 2016,On August 31, 2021, the Company formed a subsidiary,joint venture, Phi Electric Motor, Inc. in New York, which is 51% owned by Sino-Global Shipping LANew York Inc., a California corporation (“Sino LA”), for the purpose of expanding its business to provide freight logistics services to importers who ship goods into the U.S. The Company expects to generate a majority of its revenues from providing inland transportation services and bulk cargo container services in the coming fiscal year.

In fiscal year 2016, affected by worsening market conditions in the shipping industry, the Company’s shipping agency business sector suffered a significant decrease in revenue due to a reduced number of ships served. As a result, the Company has suspended its shipping agency services business. Also There have been no operations as a result of these market condition changes, the Company has suspended its shipping management services business. In addition, in December 2015, the Company suspended its shipping and chartering services business, primarily as a result of the termination of a previously-contemplated vessel acquisition. As of December 31, 2017, the Company’s business segments consist of inland transportation management services, freight logistics services, container trucking services and bulk cargo container services.2021.

In August 2016,On September 29, 2021, the Company’s Board of Directors (the “Board”) authorized management to move forward with the development ofCompany formed a mobile application that will provide a full-service logistics platform between the U.S. and the PRC for short-haul trucking100% owned subsidiary, SG Shipping & Risk Solution Inc. in the U.S.

Sino-Global completed development of a full-service logistics platformNew York. On December 23, 2021, SG Shipping & Risk Solution Inc. formed SG Link LLC. There have been no material operations as of December 2016. Upon the completion of the platform, the Company signed two significant agreements with COSCO Beijing International Freight Co., Ltd. (“COSFRE Beijing”) and Sino-Trans Guangxi in December 2016. Pursuant to the agreement with COSFRE Beijing, the Company will receive a percentage of the total amount of each transportation fee for the arrangement of inland transportation services for COSFRE Beijing’s container shipments into U.S. ports. For the strategic cooperation framework agreement with Sino-Trans Guangxi, which is a subsidiary of Sino-Trans Limited, the Company expects to utilize both parties’ existing resources and establish an integrated logistics plan to provide an end-to-end supply chain solution for customers shipping soybeans and sulfur products from the U.S. to southern PRC via container.31, 2021.

On January 5, 2017,October 3, 2021, the Company entered into a Strategic Alliance Agreement (the “Agreement”) with Shenzhen Highsharp Electronic Ltd. (“Highsharp”) to establish a joint venture agreementfor collaborative engineering, technical development and commercialization of a proprietary cryptocurrency mining machine under the brand name Thor, with exclusive rights covering design production, intellectual property, branding, marketing and sales. On October 11, 2021, the Company formed a new joint venture, company named ACH Trucking Center Corp. (“ACH Center”) with Jetta Global LogisticsThor Miner Inc. (“Jetta Global”). Along with the establishment of ACH Center, the Company began providing short haul trucking transportation and logistics services to customers located in the New York and New Jersey areas. The Company holds aDelaware, which is 51% ownership stake in ACH Center. Although the establishment of ACH Center brought benefit forowned by the Company and Jetta Global, it could not satisfy long term development for both the Company and Jetta Global. The Company signed a termination agreement with Jetta Global to terminate the joint venture agreement on December 4, 2017. As ACH center’s operating revenue was less than 1% of the Company’s consolidated revenue and the termination did not constitute a strategic shift that will have a major effect on the Company’s operations and financial results, the results of operations for ACH Center was not reported as discontinued operations under the guidance of Accounting Standards Codification 205.49% owned by Highsharp.

On January 9, 2017,December 31, 2021, the Company entered into a strategic cooperation agreement with China Oceanseries of agreements to terminate its variable interest entity (“VIE”) structure and terminate the existence of its formerly controlled entity Sino-Global Shipping Agency Qingdao Co. Ltd. (“COSCO Qingdao”). COSCO Qingdao will utilize the Company’s full-service logistics platform to arrange the transportation of its container shipments into U.S. ports. Sino-Global will receive a percentage of the total amount of each transportation fee in exchange for the arrangement of inland transportation services for COSCO Qingdao’s container shipments into U.S. ports.

On February 18, 2017, the Company entered into a cooperative transportation agreement with a related party, Zhiyuan International Investment & Holding Group (Hong Kong) Co., Ltd. (the “Buyer” or “Zhiyuan Hong Kong”). Zhiyuan Hong Kong, jointly with China Minmetals Corporation and China Metallurgical Group Corporation, acts as the general designer, general equipment provider and general service contractor in the upgrade and renovation project of Perwaja Steel, located in Malaysia (the “Project”Sino-China”). The Company agreed to provide high-quality services, includingcontrolled Sino-China through its wholly owned subsidiary Trans Pacific Shipping Limited (“Trans Pacific Beijing”). The Company made its decision because Sino-China has no active operations and potential risks on VIE structures. In addition, the design of a detailed transportation plan as well as execution and necessary supervisionCompany dissolved its subsidiary Sino-Global Shipping LA, Inc.

The outbreak of the plan at Zhiyuan Hong Kong’s demand,novel coronavirus (COVID-19) starting from late January 2020 in considerationthe PRC has spread rapidly to many parts of the world. In March 2020, the World Health Organization declared the COVID-19 as a pandemic and has resulted in quarantines, travel restrictions, and the temporary closure of stores and business facilities in China and the U.S. Given the rapidly expanding nature of the COVID-19 pandemic, and because substantially all of the Company’s business operations and its workforce are concentrated in China and the U.S., the Company’s business, results of operations, and financial condition have been adversely affected for whichthe year ended June 30, 2021. The situation remains highly uncertain for any further outbreak or resurgence of the COVID-19. It is therefore difficult for the Company will receive a 1% to 1.25% transportation fee incurred inestimate the Project as a commission for its services rendered (see Note 3 and Note 15). On July 7, 2017, the Company signed a supplemental agreement with the Buyer, pursuant to which the Company will cooperate with Zhiyuan Hong Kong exclusivelyimpact on the entire Project’s transportation needs. Pursuant to the supplemental agreement, the Company agrees to make prepayments to Zhiyuan Hong Kong for its sharebusiness or operating results that might be adversely affected by any further outbreak or resurgence of packaging and transporting costs related to the Project; in return, the Company will receive 15% of the cost incurred in the Project from Zhiyuan Hong Kong as a service fee. The Project is expected to be completed in one to two years and the Company will collect its service fee in accordance with Project completion.COVID-19.

On September 11, 2017, the Company set up a new wholly-owned subsidiary, Ningbo Saimeinuo Supply Chain Management Ltd. (“Sino Ningbo”), via the wholly-owned entity, Sino-Global Shipping New York Inc. This subsidiary primarily engages in supply chain management and freight logistics services.

Note 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

(a) Basis of Presentation

The accompanying unaudited condensed consolidated financial statements have been prepared in accordance with generally accepted accounting principles generally accepted in the United States of America (“US GAAP”) for information pursuant to the rules and regulations of the Securities and Exchange Commission (“SEC”).

In the opinion of management, all adjustments, consisting only of normal recurring adjustments, considered necessary to give a fair presentation have been included. Interim results are not necessarily indicative of results of a full year. The information in this Form 10-Q should be read in conjunction with information included in the annual report for the fiscal year ended June 30, 2017 on Form 10-K filed with the SEC on September 27, 2017.

(b) Basis of Consolidation

The unaudited condensed consolidated financial statements include the accounts of the Company itsand include the assets, liabilities, revenues and expenses of the subsidiaries and its affiliates.VIEs. All significant intercompany transactions and balances arehave been eliminated in consolidation. A subsidiary is an entity in which the Company, directly or indirectly, controls more than one half of the voting power or has the power to: govern the financial and operating policies; appoint or remove the majority of the members of the board of directors; cast a majority of votes at the meeting of the board of directors.

U.S. GAAP provides guidance on the identification of variable interest entity (“VIE”) and financial reporting for entities over which control is achieved through means other than voting interests. The Company evaluates each of its interests in an entity to determine whether or not the investee is a VIE and, if so, whether the Company is the primary beneficiary of such VIE. In determining whether the Company is the primary beneficiary, the Company considers if the Company (1) has power to direct the activities that most significantly affects the economic performance of the VIE, and (2) receives the economic benefits of the VIE that could be significant to the VIE. If deemed the primary beneficiary, the Company consolidates the VIE. Sino-Global Shipping Agency Ltd., a PRC corporation (“Sino-China”), is considered a VIE,variable interest entity (“VIE”), with the Company as the primary beneficiary. The Company, through Trans Pacific Beijing,Shipping Ltd., entered into certain agreements with Sino-China, pursuant to which the Company receives 90% of Sino-China’s net income. The Company does not receive any payments from Sino-China unless Sino-China recognizes net income during its fiscal year.

As a VIE, Sino-China’s revenues are included in the Company’s total revenues, and any income/loss from operations is consolidated with that of the Company. Because of contractual arrangements between the Company and Sino-China, the Company has a pecuniary interest in Sino-China that requires consolidation of the financial statements of the Company and Sino-China.

The Company has consolidated Sino-China’s operating results because the entities are under common control in accordance with ASC 805-10, “Business Combinations”Accounting Standards Codification (“ASC”) 810-10, “Consolidation”. The agency relationship between the Company and Sino-China and its branches is governed by a series of contractual arrangements pursuant to which the Company has substantial control over Sino-China. Management makes ongoing reassessments of whether the Company remains the primary beneficiary of Sino-China. As mentioned elsewhere in this report, dueOn December 31, 2021, the Company entered into a series of agreements to terminate its Variable Interest Entity (“VIE”) structure and terminate the worsening market conditionsexistence of its formerly controlled entity Sino-China.

Loss from disposal of Sino-China amounted to approximately $6.1 million. Since Sino-China did not have material operation prior to disposal, the disposal did not represent a strategic change in the shipping industry, Sino-China’s shipping agencyCompany’s business, suffered a significant decrease in revenue due to a reduced number of ships served. As a result,as such the Company has temporarily suspended this business. Sino-China is also providing services in other related business segments of the Company.disposal was not presented as discontinued operations.

The carrying amount and classification of Sino-China’s assets and liabilities included in the Company’s unaudited condensed consolidated balance sheets were as follows:

| December 31, | June 30, | |||||||

| 2017 | 2017 | |||||||

| Total current assets | $ | 9,736,634 | $ | 9,327,990 | ||||

| Total assets | 9,877,880 | 9,472,651 | ||||||

| Total current liabilities | 6,279 | 4,517 | ||||||

| Total liabilities | 6,279 | 4,517 | ||||||

| December 31, | June 30, | |||||||

| 2021 | 2021 | |||||||

| Current assets: | ||||||||

| Cash | $ | - | $ | 113,779 | ||||

| Total current assets | - | 113,779 | ||||||

| Deposits | - | 56 | ||||||

| Property and equipment, net | - | - | ||||||

| Total assets | $ | - | $ | 113,835 | ||||

| Current liabilities: | ||||||||

| Other payables and accrued liabilities | $ | - | $ | 32,939 | ||||

| Total liabilities | $ | - | $ | 32,939 | ||||

(c)

As of December 31 2021, the Company also dissolved its subsidiary Sino-Global Shipping LA, Inc. The net assets of disposed VIE and subsidiaries are as follows:

| December 31, 2021 | ||||||||||||

| VIE | Subsidiary | Total | ||||||||||

| Total current assets | $ | 83,573 | $ | 20,898 | $ | 104,471 | ||||||

| Total other assets | 8,723 | - | 8,723 | |||||||||

| Total assets | 92,296 | 20,898 | 113,194 | |||||||||

| Total current liabilities | 41,608 | 1,100 | 42,708 | |||||||||

| Total net assets | 50,688 | 19,798 | 70,486 | |||||||||

| Due from noncontrolling interests | 5,919,050 | - | 5,919,050 | |||||||||

| Exchange rate effect | 142,079 | - | 142,079 | |||||||||

| Total loss on disposal | $ | 6,111,817 | $ | 19,798 | $ | 6,131,615 | ||||||

(b) Fair Value of Financial Instruments

We followThe Company follows the provisions of ASC 820, Fair Value Measurements and Disclosures, which clarifies the definition of fair value, prescribes methods for measuring fair value, and establishes a fair value hierarchy to classify the inputs used in measuring fair value as follows:

Level 1 — Observable inputs such as unadjusted quoted prices in active markets for identical assets or liabilities available at the measurement date.

Level 2 — Inputs other than quoted prices that are observable for the asset or liability in active markets, quoted prices for identical or similar assets and liabilities in markets that are not active, inputs other than quoted prices that are observable, and inputs derived from or corroborated by observable market data.

Level 3 — Unobservable inputs that reflect management’s assumptions based on the best available information.

The carrying value of accounts receivable, other receivables, other current assets, and current liabilities approximate their fair values because of the short-term nature of these instruments.

(d)(c) Use of Estimates and Assumptions

The preparation of the Company’s unaudited condensed consolidated financial statements in conformity with U.S.US GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the dates of the financial statements and the reported amounts of revenues and expenses during the reporting periods. Estimates are adjusted to reflect actual experience when necessary. Significant accounting estimates reflected in the Company’s unaudited condensed consolidated financial statements include revenue recognition, fair value of stock based compensation, cost of revenues, allowance for doubtful accounts, impairment loss, deferred income taxes, income tax expense and the useful lives of property and equipment. The inputs into the Company’s judgments and estimates consider the economic implications of COVID-19 on the Company’s critical and significant accounting estimates. Since the use of estimates is an integral component of the financial reporting process, actual results could differ from those estimates.

(e)(d) Translation of Foreign Currency

The accounts of the Company and its subsidiaries including Sino-China and each of its branches are measured using the currency of the primary economic environment in which the entity operates (the “functional currency”). The Company’s functional currency is the U.S. dollar (“USD”) while its subsidiaries in the PRC, including Sino-China, Trans Pacific Shipping Ltd. and Trans Pacific Logistic Shanghai Ltd. report their financial positions and results of operations in Renminbi (“RMB”), its subsidiary Sino-Global Shipping Australia Pty Ltd., reports its financial positions and results of operations in Australian dollar (“AUD”), its subsidiary Sino-Global Shipping Hong Kong reports its financial positions and results of operations in Hong Kong dollar (“HKD”) and its subsidiary Sino-Global Shipping Canada, Inc. reports its financial positions and results of operations in Canadian Dollar (“CAD”). The accompanying unaudited condensed consolidated financial statements are presented in USD. Foreign currency transactions are translated into USD using the fixed exchange rates in effect at the time of the transaction. Generally, foreign exchange gains and losses resulting from the settlement of such transactions are recognized in the unaudited condensed consolidated statements of operations. The Company translates the foreign currency financial statements of Sino-China, Sino-Global Shipping Australia, Sino-Global Shipping Hong Kong, Sino-Global Shipping Canada, Trans Pacific Beijing, Trans Pacific Shanghai and Sino Ningbo in accordance with ASC 830-10, “Foreign Currency Matters”. Assets and liabilities are translated at current exchange rates quoted by the People’s Bank of China at the balance sheetsheets’ dates and revenues and expenses are translated at average exchange rates in effect during the year. The resulting translation adjustments are recorded as other comprehensive income (loss)loss and accumulated other comprehensive loss as a separate component of equity of the Company, and also included in non-controlling interests.

The exchange rates as of December 31, 20172021 and June 30, 20172021 and for the three and six months ended December 31, 20172021 and 20162020 are as follows:

| December 31, | June 30, | Three months ended December 31, | Six months ended December 31, | |||||||||||||||||||||

| 2017 | 2017 | 2017 | 2016 | 2017 | 2016 | |||||||||||||||||||

| Foreign currency | Balance Sheet | Balance Sheet | Profits/Loss | Profits/Loss | Profits/Loss | Profits/Loss | ||||||||||||||||||

| RMB:1USD | 6.5060 | 6.7806 | 6.6153 | 6.8328 | 6.6428 | 6.7498 | ||||||||||||||||||

| AUD:1USD | 1.2797 | 1.3028 | 1.3007 | 1.3357 | 1.2838 | 1.3275 | ||||||||||||||||||

| HKD:1USD | 7.8118 | 7.8059 | 7.8076 | 7.7576 | 7.8112 | 7.7571 | ||||||||||||||||||

| CAD:1USD | 1.2573 | 1.2982 | 1.2702 | 1.3351 | 1.2620 | 1.3198 | ||||||||||||||||||

| December 31, 2021 | June 30, 2021 | Three months ended December 31, | Six months ended December 31, | |||||||||||||||||||||

| Foreign currency | Balance Sheet | Balance Sheet | 2021 Profit/Loss | 2020 Profit/Loss | 2021 Profit/Loss | 2020 Profit/Loss | ||||||||||||||||||

| RMB:1USD | 6.3551 | 6.4586 | 6.3952 | 6.6254 | 6.4330 | 6.7736 | ||||||||||||||||||

| AUD:1USD | 1.3759 | 1.3342 | 1.3735 | 1.3688 | 1.3669 | 1.3840 | ||||||||||||||||||

| HKD:1USD | 7.7973 | 7.7661 | 7.7897 | 7.7520 | 7.7837 | 7.7513 | ||||||||||||||||||

| CAD:1USD | 1.2656 | 1.2404 | 1.2608 | 1.3038 | 1.2600 | 1.3181 | ||||||||||||||||||

(f)(e) Cash and Cash Equivalents

Cash and cash equivalents consistconsists of cash on hand and other highly liquid investmentscash in bank which are unrestricted as to withdrawal or use, and which have an original maturity of three months or less when purchased.use. The Company maintains cash and cash equivalents with various financial institutions mainly in the PRC, Australia, Hong Kong, Canada and the U.S. As of December 31, 20172021 and June 30, 2017,2021, cash balances of $6,812,501$643,160 and $6,246,337,$628,039, respectively, were maintained at financial institutions in the PRC, which werePRC. $458,784 and $201,990 of these balances are not covered by insurance as the deposit insurance system in China only insured by anyeach depositor at one bank for a maximum of the Chinese authorities.approximately $70,000 (RMB 500,000). As of, December 31, 20172021 and June 30, 2017,2021, cash balancebalances of $364,722$50,735,018 and $2,462,792,$44,203,436, respectively, were maintained at U.S. financial institutions,institutions. $ 49,162,822 and were$ 43,507,335 of these balances are not covered by insurance, as each U.S. account was insured by the Federal Deposit Insurance Corporation or other programs subject to certain$250,000 limitations. The Hong Kong Deposit Protection Board pays compensation up to a limit of HKD 500,000 (approximately $64,000) if the bank with which an individual/a company holds its eligible deposit fails. As of December 31, 2021 and June 30, 2021, cash balances of $22,261 and $3,698, respectively, were maintained at financial institutions in Hong Kong and were insured by the Hong Kong Deposit Protection Board. As of December 31, 2021 and June 30, 2021, cash balances of $206 and $693, respectively, were maintained at Australia financial institutions, and were insured as the Australian government guarantees deposits up to AUD 250,000 (approximately $172,000). As of December 31, 2021 and June 30, 2021, amount of deposits the Company had covered by insurance amounted to $1,779,039 and $1,125,838, respectively.

(f) Cryptocurrencies

Cryptocurrencies, mainly bitcoin, are included in current assets in the accompanying consolidated balance sheets. Cryptocurrencies purchased are recorded at cost and cryptocurrencies awarded to the Company through its mining activities are accounted for as other revenue of the Company for the three and six months ended December 31, 2021. Fair value of the cryptocurrency award received is determined using the quoted price of the related cryptocurrency at the time of receipt. Cryptocurrencies awarded to the Company through its mining activities are recorded as other income and as operating activities in the Company’s unaudited condensed consolidated financial statements.

Cryptocurrencies held are accounted for as intangible assets with indefinite useful lives. An intangible asset with an indefinite useful life is not amortized but assessed for impairment annually, or more frequently, when events or changes in circumstances occur indicating that it is more likely than not that the indefinite-lived asset is impaired. Impairment exists when the carrying amount exceeds its fair value, which is measured using the quoted price of the cryptocurrency at the time its fair value is being measured. In testing for impairment, the Company has the option to first perform a qualitative assessment to determine whether it is more likely than not that an impairment exists. If it is determined that it is not more likely than not that an impairment exists, a quantitative impairment test is not necessary. If the Company concludes otherwise, it is required to perform a quantitative impairment test. The company recorded $50,127 impairment loss for the three and six months ended December 31, 2021. To the extent an impairment loss is recognized, the loss establishes the new cost basis of the asset. Subsequent reversal of impairment losses is not permitted.

(g) Accounts ReceivableReceivables and Allowance for Doubtful Accounts

Accounts receivable are presented at net realizable value. The Company maintains allowances for doubtful accounts and for estimated losses. The Company reviews the accounts receivable on a periodic basis and makes general and specific allowances when there is doubt as to the collectability of individual receivable balances. In evaluating the collectability of individual receivable balances, the Company considers many factors, including the age of the balances, customers’ historical payment history, their current credit-worthinesscreditworthiness and current economic trends. Receivables are generally considered past due after 180 days. The Company reserves 25%-50% of the customers balance aged between 181 days to 1 year, 50%-100% of the customers balance over 1 year and 100% of the customers balance over 2 years. Accounts Receivablereceivable are written off against the allowances only after exhaustive collection efforts. As the Company has focused its development in the shipping management segment, its customer base will be more from smaller privately owned companies that will pay more timely than state owned companies. The Company also considers the economic implications of COVID-19 on its estimates of the allowance and made nil and $2,609 of allowance for doubtful accounts of accounts receivable for the three months ended December 31, 2021 and 2020, nil and $33,418 of allowance for doubtful accounts of accounts receivable for the six months ended December 31, 2021 and 2020. The Company recovered nil and $2,456 of accounts receivable for the six months ended December 31, 2021 and 2020, respectively.

Other receivables represent mainly customer advances, prepaid employee insurance and welfare benefits. Management reviews its receivables on a regular basis to determine if the bad debt allowance is adequate, and adjusts the allowance when necessary. Delinquent account balances are written-off against allowance for doubtful accounts after management has determined that the likelihood of collection is not probable. Other receivables are written off against the allowances only after exhaustive collection efforts.

(h) Property and Equipment, net

Net propertyProperty and equipment are stated at historical cost less accumulated depreciation. Historical cost comprises the asset’sits purchase price and any directly attributable costs of bringing the assetassets to its working condition and location for its intended use. Depreciation is calculated on a straight-line basis over the following estimated useful lives:

| Buildings | 20 years | |

| Motor vehicles | ||

| Furniture and fixtures | 3-5 years | |

| System software | 5 years | |

| Leasehold improvements | Shorter of lease term or useful | |

| Mining equipment | 3 years |

The carrying value of a long-lived asset is considered impaired by the Company when the anticipated undiscounted cash flows from such asset areis less than the asset’sits carrying value. If impairment is identified, a loss is recognized based on the amount by which the carrying value exceeds the fair value of the long-lived asset. Fair value is determined primarily using the anticipated cash flows discounted at a rate commensurate with the risk involved or based on independent appraisals. ManagementFor the three and six months ended December 31, 2021 and 2020, no impairment were recorded, respectively.

(i) Investments in unconsolidated entity

Entities in which the Company has determined that there were no impairmentsthe ability to exercise significant influence, but does not have a controlling interest, are accounted for using the equity method. Significant influence is generally considered to exist when the Company has voting shares representing 20% to 50%, and other factors, such as representation on the board of directors, voting rights and the impact of commercial arrangements, are considered in determining whether the equity method of accounting is appropriate. Under this method of accounting, the Company records its proportionate share of the balance sheet dates.net earnings or losses of equity method investees and a corresponding increase or decrease to the investment balances. Dividends received from the equity method investments are recorded as reductions in the cost of such investments. The Company generally considers an ownership interest of 20% or higher to represent significant influence. The Company accounts for the investments in entities over which it has neither control nor significant influence, and no readily determinable fair value is available, using the investment cost minus any impairment, if necessary.

(i) Intangible Assets, net

Intangible assets

Investments are recorded at cost less accumulated amortization. Amortization is calculated on a straight-line basis over the following estimated useful lives:

The Company evaluates intangible assetsevaluated for impairment whenever eventswhen facts or changes in circumstances indicate that the assets might be impaired. There was no suchfair value of the long-term investment is less than its carrying value. An impairment as of December 31, 2017.

(j) Revenue Recognition

Revenueloss is recognized when alla decline in fair value is determined to be other-than-temporary. The Company reviews several factors to determine whether a loss is other-than-temporary. These factors include, but are not limited to, the: (i) nature of the followinginvestment; (ii) cause and duration of the impairment; (iii) extent to which fair value is less than cost; (iv) financial condition and near term prospects of the investment; and (v) ability to hold the security for a period of time sufficient to allow for any anticipated recovery in fair value. On January 10, 2020, the Company entered into a cooperation agreement with Mr. Shanming Liang, a shareholder of the Company, to set up a joint venture in New York named LSM Trading Ltd., in which the Company holds a 40% equity interest. The new joint venture will facilitate the purchase agricultural related commodities in the U.S. for customers in China and the Company will provide comprehensive supply chain and logistics solutions. For the three and six months ended December 31, 2021 the Company recorded $210,010 investment in unconsolidated entity and no events have occurred:occurred that indicated other-than-temporary for the three and six months ended December 31, 2021.

(j) Convertible notes

The Company evaluates its convertible notes to determine if those contracts or embedded components of those contracts qualify as derivatives. The result of this accounting treatment is that the fair value of the embedded derivative is recorded at fair value each reporting period and recorded as a liability. In the event that the fair value is recorded as a liability, the change in fair value is recorded in the statements of operations as other income or expense.

(k) Revenue Recognition

The Company recognizes revenue which represents the transfer of goods and services to customers in an amount that reflects the consideration to which the Company expects to be entitled in such exchange. The Company identifies contractual performance obligations and determines whether revenue should be recognized at a point in time or over time, based on when control of goods and services transfers to a customer. The Company’s revenue streams are recognized at a point in time.

The Company uses a five-step model to recognize revenue from customer contracts. The five-step model requires the Company to (i) persuasiveidentify the contract with the customer, (ii) identify the performance obligations in the contract, (iii) determine the transaction price, including variable consideration to the extent that it is probable that a significant future reversal will not occur, (iv) allocate the transaction price to the respective performance obligations in the contract, and (v) recognize revenue when (or as) the Company satisfies the performance obligation.

The Company continues to derive its revenues from sales contracts with its customers with revenues being recognized upon performance of services. Persuasive evidence of an arrangement exists, (ii) delivery has occurred or services have been rendered, (iii)is demonstrated via sales contract and invoice; and the sales price to the customer is fixed upon acceptance of the sales contract and there is no separate sales rebate, discount, or determinable, and (iv) the ability to collect is reasonably assuredother incentive. The Company’s revenues are recognized at a point in time after all performance obligations are satisfied.

Contract balances

The Company records receivables related to revenue when the Company has an unconditional right to invoice and receive payment.

Deferred revenue consists primarily of customer billings made in advance of performance obligations being satisfied and revenue being recognized.

The Company’s disaggregated revenue streams are described as follows:

| For the Three Months Ended | For the Six Months Ended | |||||||||||||||

| December 31, | December 31, | December 31, | December 31, | |||||||||||||

| 2021 | 2020 | 2021 | 2020 | |||||||||||||

| Shipping and management agency services | $ | - | $ | - | $ | $ | 206,845 | |||||||||

| Freight logistics services | 1,041,925 | 1,884,440 | 2,838,135 | 2,814,394 | ||||||||||||

| Total | $ | 1,041,925 | $ | 1,884,440 | $ | 2,838,135 | $ | 3,021,239 | ||||||||

| ● | Revenues from |

| ● | ||

Revenues from freight logistics services are recognized when the related contractual services are rendered. | ||

Bulk cargo container services included shippingDisaggregated information of products, arranging cargo container shipping from U.S. to China port, then from China port to end user. Revenue is recognized upon completion of shipping arrangements agreed with customers, either at customer’s designated port or final destination.revenues by geographic locations are as follows:

| For the Three Months Ended | For the Six Months Ended | |||||||||||||||

| December 31, | December 31, | December 31, | December 31, | |||||||||||||

| 2021 | 2020 | 2021 | 2020 | |||||||||||||

| PRC | $ | 868,255 | 1,884,440 | 1,593,332 | 2,814,394 | |||||||||||

| U.S. | 173,670 | - | 1,244,803 | 206,845 | ||||||||||||

| Total revenues | $ | 1,041,925 | $ | 1,884,440 | $ | 2,838,135 | $ | 3,021,239 | ||||||||

(k)

(l) Taxation

Because the Company and its subsidiaries and Sino-China arewere incorporated in different jurisdictions, they file separate income tax returns. The Company uses the asset and liability method of accounting for income taxes in accordance with U.S. GAAP. Deferred taxes, if any, are recognized for the future tax consequences of temporary differences between the tax basis of assets and liabilities and their reported amounts in the unaudited condensed consolidated financial statements. A valuation allowance is provided against deferred tax assets if it is more likely than not that the asset will not be utilized in the future.

The Company recognizes the tax benefit from an uncertain tax position only if it is more likely than not that the tax position will be sustained on examination by the taxing authorities, based on the technical merits of the position. The Company recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense. The Company had no uncertain tax positions as of December 31, 2021 and June 30, 2021.

Income tax returns for the years prior to 20142018 are no longer subject to examination by U.S. tax authorities.

On December 22, 2017, the “Tax Cuts and Jobs Act” (“The Act”) was enacted. Under the provisions of The Act, the U.S. corporate tax rate decreased from 35% to 21%. Since the Company has a June 30 fiscal year-end, the U.S. statutory federal blended rate will be approximately 28% for our fiscal year ending June 30, 2018, and 21% for subsequent fiscal years. Additionally, the Tax Act imposes a one-time transition tax on deemed repatriation of historical earnings of foreign subsidiaries, and future foreign earnings are subject to U.S. taxation. The change in rate has caused the Company to re-measure all U.S. deferred income tax assets and liabilities for temporary differences using the blended rate. Net operating loss (“NOL”) carryforwards are limited to 80% of taxable income and can be carried forward indefinitely.

PRC Enterprise Income Tax

PRC enterprise income tax is calculated based on taxable income determined under the PRC Generally Accepted Accounting Principles (“PRC GAAP”) at 25%. Sino-China and Trans Pacific are registered in PRC and governed by the Enterprise Income Tax Laws of the PRC.

PRC Business TaxValue Added Taxes and Surcharges

RevenuesThe Company is subject to value added tax (“VAT”). Revenue from services provided by the Company’s PRC subsidiaries and affiliates, including Sino-China and Trans Pacific are subject to VAT at rates ranging from 9% to 13%. Entities that are VAT general taxpayers are allowed to offset qualified VAT paid to suppliers against their VAT liability. Net VAT liability is recorded in taxes payable on the PRC business tax of 5%. Business tax and surcharges are paid on gross revenues generated minus the costs of services which are paid on behalf of the customers.consolidated balance sheets.

Enterprises or individuals who sell commodities, engage in services or selling of goods in the PRC are subject to a value added tax (“VAT”) in accordance with PRC laws. All of the Company’s revenue generated in the PRC are subject to a VAT on the gross sales price. The VAT rates are 6% and 11%, depending on the type of services provided. The Company is entitled to a deduction or offset for VAT paid on the services rendered by the vendors against the VAT when the Company engage in services.

In addition, under the PRC regulations, the Company’s PRC subsidiaries and affiliates are required to pay the city construction taxestax (7%) and education surcharges (3%) based on calculated business taxthe net VAT payments.

The Company’s PRC subsidiaries and affiliates report revenues net of PRC’s VAT, business tax and surcharges for all the periods presented in the consolidated statements of operations.(m) Earnings (loss) per Share

(l) Earnings per Share

Basic earnings (loss) per share is computed by dividing net income (loss) attributable to holders of common sharesstock of the Company by the weighted average number of shares of common sharesstock of the Company outstanding during the applicable period. Diluted earnings (loss) per share reflect the potential dilution that could occur if securities or other contracts to issue common sharesstock of the Company were exercised or converted into common sharesstock of the Company. Common sharestock equivalents are excluded from the computation of diluted earnings per share if their effects would be anti-dilutive.

For the three and six months ended December 31, 2017, the basic average shares outstanding2021 and diluted average shares of the Company outstanding were not the same because the2020, there was no dilutive effect of potential shares of common stock of the Company was dilutive sincebecause the exercise prices for options were lower than the average market price for the related periods. For the three and six months ended December 31, 2017, a total of 48,011 and 50,170 unexercised options were dilutive, respectively, and were included in the computation of diluted earnings per share. For the three and six months ended December 31, 2016, a total of 62,335 and 38,006 unexercised options were dilutive, respectively, and were included in the computation of diluted EPS.Company generated net loss.

(m)(n) Comprehensive Income (loss)(Loss)

The Company reports comprehensive income (loss) in accordance with the authoritative guidance issued by Financial Accounting Standards Board (“FASB”(the “FASB”) issued authoritative guidance which establishes standards for reporting comprehensive income (loss) and its component in financial statements. ComprehensiveOther comprehensive income (loss), refers to revenue, expenses, gains and losses that under US GAAP are recorded as defined, includes all changes inan element of stockholders’ equity duringbut are excluded from net income. Other comprehensive income (loss) consists of a periodforeign currency translation adjustment resulting from non-owner sources.the Company not using the U.S. dollar as its functional currencies.

(n)(o) Stock-based Compensation

Stock-basedThe Company accounts for stock-based compensation awards to employees in accordance with FASB ASC Topic 718, “Compensation – Stock Compensation”, which requires that stock-based payment transactions with employees arebe measured based on the grant-date fair value of the equity instrument issued and recognized as compensation expense over the requisite service period. The Company records stock-based compensation expense at fair value on the grant date and recognizes the expense over the employee’s requisite service period.

The Company accounts for stock-based compensation awards to non-employees in accordance with FASB ASC Topic 718 amended by ASU 2018-07. Under FASB ASC Topic 718, stock compensation granted to non-employees has been determined as the fair value of the consideration received or the fair value of equity instrument issued, whichever is more reliably measured and is recognized as an expense as the goods or services are received.

Valuations of stock based compensation are based upon highly subjective assumptions about the future, including stock price volatility and exercise patterns. The fair value of share-based payment awards was estimated using the Black-Scholes option pricing model. Expected volatilities are based on the historical volatility of the Company’s stock. The Company uses historical data to estimate option exercise and employee terminations. The expected term of options granted represents the period of time that options granted are expected to be outstanding. The risk-free rate for periods within the expected life of the option is based on the U.S. Treasury yield curve in effect at the time of the grant.

(o)(p) Risks and Uncertainties

The Company’s business, financial position and results of operations may be influenced by the political, economic, health and legal environments in the PRC, as well as by the general state of the PRC economy. The Company’s operations in the PRC are subject to special considerations and significant risks not typically associated with companies in North America and Western Europe. These include risks associated with, among others, the political, economic, health and legal environmentenvironments and foreign currency exchange. The Company’s results may be adversely affected by changes in the political, regulatory and social conditions in the PRC, and by changes in governmental policies or interpretations with respect to laws and regulations, anti-inflationary measures, currency conversion, remittances abroad, and rates and methods of taxation, among other things. Moreover,

In March 2020, the World Health Organization declared the COVID-19 as a pandemic. Given the rapidly expanding nature of the COVID-19 pandemic, and because substantially all of the Company’s ability to grow its business operations and maintain its profitability could be negatively affected by the natureworkforce are concentrated in China and extent of services provided to its major customers, Tianjin Zhiyuan Investment Group Co., Ltd. (the “Zhiyuan Investment Group”) and Tengda Northwest Ferroalloy Co., Ltd. (“Tengda Northwest”).

(p) Reclassification

Certain prior period amounts have been reclassified to conform toUnited States, the current period presentation, including reclassification of $125,755 amortization of stock-based compensation to consultants as prepaid expense and other current assets, and reclassification of $504,815 revenue and $390,719 cost of revenue from freight logistics service segment to bulk cargo container service segment. These reclassifications have no effect on theCompany’s business, results of operations, and cash flows.

(q) Recent Accounting Pronouncements

Revenue Recognition: In May 2014, the FASB issued Accounting Standards Update No. 2014-09, Revenue from Contracts with Customers: Topic 606 (ASU 2014-09), to supersede nearly all existing revenue recognition guidance under U.S. GAAP. The core principle of ASU 2014-09 is to recognize revenues when promised goods or services are transferred to customers in an amount that reflects the consideration that is expected to be receivedfinancial condition have been adversely affected for those goods or services. ASU 2014-09 defines a five step process to achieve this core principle and, in doing so, it is possible more judgment and estimates may be required within the revenue recognition process than are required under existing U.S. GAAP, including identifying performance obligations in the contract, estimating the amount of variable consideration to include in the transaction price and allocating the transaction price to each separate performance obligation. ASU 2014-09 is effective for the Company in the first quarter of fiscal year 2018 using either of two methods: (i) retrospective to each prior reporting period presented with the option to elect certain practical expedients as defined within ASU 2014-09 (full retrospective method); or (ii) retrospective with the cumulative effect of initially applying ASU 2014-09 recognized at the date of initial application and providing certain additional unaudited condensed as defined per ASU 2014-09 (modified retrospective method). The Company is currently assessing the impact to its unaudited condensed financial statements, and has not yet selected a transition approach.

Leases: In February 2016, the FASB issued ASU No. 2016-02, Leases (Topic 842) (“ASU 2016-2”), which provides guidance on lease amendments to the FASB Accounting Standard Codification. This ASU will be effective for us beginning in December 15, 2018. The Company is currently in the process of evaluating the impact of the adoption of ASU 2016-2 on unaudited condensed financial statements.