CHINA RECYCLING ENERGY CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

(UNAUDITED)

| SIX MONTHS ENDED JUNE 30, | THREE MONTHS ENDED JUNE 30, | |||||||||||||||

| 2019 | 2018 | 2019 | 2018 | |||||||||||||

| Revenue | ||||||||||||||||

| Contingent rental income | $ | 702,973 | $ | 2,804,268 | $ | 80,924 | $ | 1,381,437 | ||||||||

| Interest income on sales-type leases | 173,360 | 2,264,481 | - | 657,866 | ||||||||||||

| Total operating income | 876,333 | 5,068,749 | 80,924 | 2,039,303 | ||||||||||||

| Operating expenses | ||||||||||||||||

| Bad debt | 2,824,903 | 835,871 | 2,716,507 | 735,992 | ||||||||||||

| General and administrative | 2,017,336 | 2,856,535 | 682,912 | 1,450,183 | ||||||||||||

| Total operating expenses | 4,842,239 | 3,692,406 | 3,399,419 | 2,186,175 | ||||||||||||

| Income (loss) from operations | (3,965,906 | ) | 1,376,343 | (3,318,495 | ) | (146,872 | ) | |||||||||

| Non-operating income (expenses) | ||||||||||||||||

| Loss on note conversion | (893,958 | ) | - | - | - | |||||||||||

| Loss on disposal of systems | (1,264,256 | ) | - | - | - | |||||||||||

| Interest income | 82,610 | 77,220 | 41,498 | 40,016 | ||||||||||||

| Interest expense | (3,793,920 | ) | (2,918,465 | ) | (1,861,815 | ) | (1,493,837 | ) | ||||||||

| Other income (expenses), net | 344,003 | (1,281 | ) | (19,450 | ) | 460 | ||||||||||

| Total non-operating expenses, net | (5,525,521 | ) | (2,842,526 | ) | (1,839,767 | ) | (1,453,361 | ) | ||||||||

| Loss before income tax | (9,491,427 | ) | (1,466,183 | ) | (5,158,262 | ) | (1,600,233 | ) | ||||||||

| Income tax expense (benefit) | (2,286,044 | ) | 267,918 | 104,827 | (71,627 | ) | ||||||||||

| Loss before noncontrolling interest | (7,205,383 | ) | (1,734,101 | ) | (5,263,089 | ) | (1,528,606 | ) | ||||||||

| Less: loss attributable to noncontrolling interest | - | (187,183 | ) | - | (95,925 | ) | ||||||||||

| Net loss attributable to China Recycling Energy Corporation | (7,205,383 | ) | (1,546,918 | ) | (5,263,089 | ) | (1,432,681 | ) | ||||||||

| Other comprehensive items | ||||||||||||||||

| Foreign currency translation loss attributable to China Recycling Energy Corporation | (96,559 | ) | (1,980,469 | ) | (1,907,185 | ) | (8,385,747 | ) | ||||||||

| Foreign currency translation gain attributable to noncontrolling interest | - | 12,626 | - | 34,548 | ||||||||||||

| Comprehensive loss attributable to China Recycling Energy Corporation | $ | (7,301,942 | ) | $ | (3,527,387 | ) | $ | (7,170,274 | ) | $ | (9,818,428 | ) | ||||

| Comprehensive loss attributable to noncontrolling interest | $ | - | $ | (174,557 | ) | $ | - | $ | (61,377 | ) | ||||||

| Basic weighted average shares outstanding | 13,914,784 | 8,310,198 | 15,743,533 | 8,310,198 | ||||||||||||

| Diluted weighted average shares outstanding | 13,914,784 | 8,310,198 | 15,743,533 | 8,310,198 | ||||||||||||

| Basic loss per share | $ | (0.52 | ) | $ | (0.19 | ) | $ | (0.33 | ) | $ | (0.17 | ) | ||||

| Diluted loss per share | $ | (0.52 | ) | $ | (0.19 | ) | $ | (0.33 | ) | $ | (0.17 | ) | ||||

| SIX MONTHS ENDED JUNE 30, | THREE MONTHS ENDED JUNE 30, | |||||||||||||||

| 2020 | 2019 | 2020 | 2019 | |||||||||||||

| Revenue | ||||||||||||||||

| Contingent rental income | $ | - | $ | 702,973 | $ | - | $ | 80,924 | ||||||||

| Interest income on sales-type leases | - | 173,360 | - | - | ||||||||||||

| Total operating income | - | 876,333 | - | 80,924 | ||||||||||||

| Operating expenses | ||||||||||||||||

| Bad debts (reversal) | (1,649,622 | ) | 2,824,903 | (1,649,622 | ) | 2,716,507 | ||||||||||

| Loss on disposal of systems | - | 1,264,256 | - | - | ||||||||||||

| General and administrative | 390,864 | 2,017,336 | 236,686 | 682,912 | ||||||||||||

| Total operating (income) expenses | (1,258,758 | ) | 6,106,495 | (1,412,936 | ) | 3,399,419 | ||||||||||

| Income (loss) from operations | 1,258,758 | (5,230,162 | ) | 1,412,936 | (3,318,495 | ) | ||||||||||

| Non-operating income (expenses) | ||||||||||||||||

| Loss on note redemption / conversion | (198,330 | ) | (893,958 | ) | (95,163 | ) | - | |||||||||

| Interest income | 72,617 | 82,610 | 45,611 | 41,498 | ||||||||||||

| Interest expense | (697,028 | ) | (3,793,920 | ) | (341,784 | ) | (1,861,815 | ) | ||||||||

| Other income (expenses), net | (40,628 | ) | 344,003 | (27,660 | ) | (19,450 | ) | |||||||||

| Total non-operating expenses, net | (863,369 | ) | (4,261,265 | ) | (418,996 | ) | (1,839,767 | ) | ||||||||

| Income (loss) before income tax | 395,389 | (9,491,427 | ) | 993,940 | (5,158,262 | ) | ||||||||||

| Income tax (benefit) expense | - | (2,286,044 | ) | - | 104,827 | |||||||||||

| Net income (loss) attributable to China Recycling Energy Corporation | 395,389 | (7,205,383 | ) | 993,940 | (5,263,089 | ) | ||||||||||

| Other comprehensive items | ||||||||||||||||

| Foreign currency translation gain (loss) | (1,282,589 | ) | (96,559 | ) | 58,688 | (1,907,185 | ) | |||||||||

| Comprehensive income (loss) attributable to China Recycling Energy Corporation | $ | (887,200 | ) | $ | (7,301,942 | ) | $ | 1,052,628 | $ | (7,170,274 | ) | |||||

| Basic and diluted weighted average shares outstanding | 2,226,282 | 13,914,784 | 2,317,223 | 15,743,533 | ||||||||||||

| Basic and diluted loss per share | $ | 0.18 | $ | (0.52 | ) | $ | 0.43 | $ | (0.33 | ) | ||||||

The accompanying notes are an integral part of these consolidated financial statements.statements

CHINA RECYCLING ENERGY CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(UNAUDITED)

| SIX MONTHS ENDED JUNE 30, | SIX MONTHS ENDED JUNE 30, | |||||||||||||||

| 2019 | 2018 | 2020 | 2019 | |||||||||||||

| CASH FLOWS FROM OPERATING ACTIVITIES: | ||||||||||||||||

| Loss including noncontrolling interest | $ | (7,205,383 | ) | $ | (1,734,101 | ) | ||||||||||

| Adjustments to reconcile loss including noncontrolling interest to net cash provided by (used in) operating activities: | ||||||||||||||||

| Depreciation | - | 2,117 | ||||||||||||||

| Amortization of OID and debt issuing costs of convertible note | 72,161 | - | ||||||||||||||

| Bad debt expense | 2,824,901 | 835,871 | ||||||||||||||

| Net income (loss) | $ | 395,389 | $ | (7,205,383 | ) | |||||||||||

| Adjustments to reconcile net income (loss) | ||||||||||||||||

| to net cash provided by (used in) operating activities: | ||||||||||||||||

| Amortization of OID and debt issuing costs of notes | 39,583 | 72,161 | ||||||||||||||

| Stock compensation expense | 10,999 | - | ||||||||||||||

| Operating lease expenses | 32,502 | - | ||||||||||||||

| Bad debts expense (reversal) | (1,649,622 | ) | 2,824,901 | |||||||||||||

| Loss on disposal of 40% ownership of Fund Management Co | 47,267 | - | - | 47,267 | ||||||||||||

| Investment loss | - | 4,815 | ||||||||||||||

| Loss on transfer of Chengli Boxing system | 634,963 | - | - | 634,963 | ||||||||||||

| Loss on transfer of Xuzhou Huayu system | 403,922 | - | - | 403,922 | ||||||||||||

| Loss on transfer of Shenqiu Phase I & II systems | 211,975 | - | - | 211,975 | ||||||||||||

| Loss on disposal of fixed assets | 293 | - | - | 293 | ||||||||||||

| Loss on note conversion | 893,958 | - | ||||||||||||||

| Loss on notes redemption / conversion | 198,330 | 893,958 | ||||||||||||||

| Changes in deferred tax | (2,364,088 | ) | (653,123 | ) | - | (2,364,088 | ) | |||||||||

| Changes in assets and liabilities: | ||||||||||||||||

| Interest receivable on sales type leases | (173,360 | ) | (358,904 | ) | - | (173,360 | ) | |||||||||

| Collection of principal on sales type leases | - | 1,716,968 | 13,879,575 | - | ||||||||||||

| Accounts receivable | 65,001 | (1,386,881 | ) | 35,552,191 | 65,001 | |||||||||||

| Prepaid expenses | - | 604,127 | 919 | - | ||||||||||||

| Other receivables | (1,074,031 | ) | (190,118 | ) | (3,589 | ) | (1,074,031 | ) | ||||||||

| Notes receivable | - | 62,686 | ||||||||||||||

| Construction in progress | - | (1,696,509 | ) | |||||||||||||

| Accounts payable | (2,888,301 | ) | 407,382 | - | (2,888,301 | ) | ||||||||||

| Taxes payable | (1,283,246 | ) | 382,467 | (2,121,622 | ) | (1,283,246 | ) | |||||||||

| Payment of lease liability | (31,174 | ) | - | |||||||||||||

| Interest payable on entrusted loan | 3,720,566 | 4,008,587 | 635,375 | 3,720,566 | ||||||||||||

| Accrued liabilities and other payables | (371,026 | ) | (253,103 | ) | 57,740 | (371,026 | ) | |||||||||

| Refundable deposit for systems leasing | (486,668 | ) | - | - | (486,668 | ) | ||||||||||

| Net cash provided by (used in) operating activities | (6,971,096 | ) | 1,752,281 | 46,996,596 | (6,971,096 | ) | ||||||||||

| CASH FLOWS FROM INVESTING ACTIVITIES: | ||||||||||||||||

| Proceeds from disposal of property & equipment | 5,162 | - | - | 5,162 | ||||||||||||

| Net cash provided by investing activities | 5,162 | - | - | 5,162 | ||||||||||||

| CASH FLOWS FROM FINANCING ACTIVITIES: | ||||||||||||||||

| Issuance of notes payable | 2,000,000 | - | - | 2,000,000 | ||||||||||||

| Issuance of common stock | 3,309,475 | - | - | 3,309,475 | ||||||||||||

| Net cash provided by financing activities | 5,309,475 | - | - | 5,309,475 | ||||||||||||

| EFFECT OF EXCHANGE RATE CHANGE ON CASH AND EQUIVALENTS | (80,341 | ) | (444,208 | ) | ||||||||||||

| EFFECT OF EXCHANGE RATE CHANGE ON CASH | (551,508 | ) | (80,341 | ) | ||||||||||||

| NET INCREASE (DECREASE) IN CASH AND EQUIVALENTS | (1,736,800 | ) | 1,308,073 | |||||||||||||

| CASH AND EQUIVALENTS, BEGINNING OF PERIOD | 53,223,142 | 49,830,243 | ||||||||||||||

| NET INCREASE (DECREASE) IN CASH | 46,445,088 | (1,736,800 | ) | |||||||||||||

| CASH, BEGINNING OF PERIOD | 16,221,297 | 53,223,142 | ||||||||||||||

| CASH AND EQUIVALENTS, END OF PERIOD | $ | 51,486,342 | $ | 51,138,316 | ||||||||||||

| CASH, END OF PERIOD | $ | 62,666,385 | $ | 51,486,342 | ||||||||||||

| Supplemental cash flow data: | ||||||||||||||||

| Income tax paid | $ | 225,784 | $ | 956,828 | $ | - | $ | 225,784 | ||||||||

| Interest paid | $ | - | $ | - | $ | - | $ | - | ||||||||

| Supplemental disclosure of non-cash financing activities: | ||||||||||||||||

| Transfer of Xuzhou Huayu Project and Shenqiu Phase I & II project to Mr. Bai | $ | 35,938,441 | $ | - | ||||||||||||

| Supplemental disclosure of non-cash operating activities | ||||||||||||||||

| Transfer of Tian’an project from construction in progress to accounts receivable | $ | 23,635,489 | $ | - | ||||||||||||

| Supplemental disclosure of non-cash financing activities | ||||||||||||||||

| Transfer of Xuzhou Huayu Project and Shenqiu Phase I & II projects to Mr. Bai | $ | - | $ | 35,938,441 | ||||||||||||

| Conversion of convertible debt into common shares | $ | 1,070,000 | $ | - | $ | - | $ | 1,070,000 | ||||||||

| Conversion of long-term notes into common shares | $ | 1,104,586 | $ | - | ||||||||||||

The accompanying notes are an integral part of these consolidated financial statements.statements

3

CHINA RECYCLING ENERGY CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

SIX AND THREE MONTHS ENDED JUNE 30, 20192020 AND 20182019

(UNAUDITED)

| Common Stock | Paid in | Statutory | Other Comprehensive | Accumulated | Noncontrolling | |||||||||||||||||||||||||||

| Shares | Amount | Capital | Reserves | Loss | Deficit | Total | Interest | |||||||||||||||||||||||||

| Balance at December 31, 2018 | 10,295,820 | $ | 10,295 | $ | 114,484,018 | $ | 14,525,712 | $ | (4,620,930 | ) | $ | (37,675,202 | ) | $ | 86,723,893 | $ | (3,544,624 | ) | ||||||||||||||

| Issuance of common stock | 1,600,000 | 1,600 | 1,619,200 | - | - | - | 1,620,800 | - | ||||||||||||||||||||||||

| Conversion of note payable into shares | 1,851,946 | 1,852 | 2,013,124 | - | - | - | 2,014,976 | - | ||||||||||||||||||||||||

| Purchase of noncontrolling interest | - | - | (3,948,242 | ) | - | - | - | (3,948,242 | ) | 3,544,624 | ||||||||||||||||||||||

| Net loss for the quarter | - | - | - | - | - | (1,942,294 | ) | (1,942,294 | ) | - | ||||||||||||||||||||||

| Transfer to statutory reserves | - | - | - | 213,360 | - | (213,360 | ) | - | - | |||||||||||||||||||||||

| Foreign currency translation gain | - | - | - | - | 1,810,626 | - | 1,810,626 | - | ||||||||||||||||||||||||

| Balance at March 31, 2019 | 13,747,766 | 13,747 | 114,168,100 | 14,739,072 | (2,810,304 | ) | (39,830,856 | ) | 86,279,759 | - | ||||||||||||||||||||||

| Issuance of common stock | 2,358,732 | 2,359 | 1,686,316 | - | - | - | 1,688,675 | - | ||||||||||||||||||||||||

| Net loss for the quarter | - | - | - | - | - | (5,263,089 | ) | (5,263,089 | ) | - | ||||||||||||||||||||||

| Transfer to statutory reserves | - | - | - | (250,321 | ) | - | 250,321 | - | - | |||||||||||||||||||||||

| Foreign currency translation loss | - | - | - | - | (1,907,185 | ) | - | (1,907,185 | ) | - | ||||||||||||||||||||||

| Balance at June 30, 2019 | 16,106,498 | $ | 16,106 | $ | 115,854,416 | $ | 14,488,751 | $ | (4,717,489 | ) | $ | (44,843,624 | ) | $ | 80,798,160 | $ | - | |||||||||||||||

| Common Stock | Paid in | Statutory | Other Comprehensive | Retained | Noncontrolling | |||||||||||||||||||||||||||

| Shares | Amount | Capital | Reserves | Income (loss) | Earning | Total | Interest | |||||||||||||||||||||||||

| Balance at December 31, 2017 | 8,310,198 | $ | 8,310 | $ | 111,796,813 | $ | 14,525,712 | $ | 860,553 | $ | 28,321,696 | $ | 155,513,084 | $ | (478,637 | ) | ||||||||||||||||

| Net loss for the quarter | - | - | - | - | - | (114,237 | ) | (114,237 | ) | (91,258 | ) | |||||||||||||||||||||

| Transfer to statutory reserves | - | - | - | 75,990 | - | (75,990 | ) | - | - | |||||||||||||||||||||||

| Foreign currency translation gain | - | - | - | - | 6,405,278 | - | 6,405,278 | (21,922 | ) | |||||||||||||||||||||||

| Balance at March 31, 2018 | 8,310,198 | 8,310 | 111,796,813 | 14,601,702 | 7,265,831 | 28,131,469 | 161,804,125 | (591,817 | ) | |||||||||||||||||||||||

| Net loss for the quarter | - | - | - | - | - | (1,432,681 | ) | (1,432,681 | ) | (95,925 | ) | |||||||||||||||||||||

| Transfer to statutory reserves | - | - | - | (39,791 | ) | - | 39,791 | - | - | |||||||||||||||||||||||

| Foreign currency translation loss | - | - | - | - | (8,385,747 | ) | - | (8,385,747 | ) | 34,548 | ||||||||||||||||||||||

| Balance at June 30, 2018 | 8,310,198 | $ | 8,310 | $ | 111,796,813 | $ | 14,561,911 | $ | (1,119,916 | ) | $ | 26,738,579 | $ | 151,985,697 | $ | (653,194 | ) | |||||||||||||||

| Common Stock | ||||||||||||||||||||||||||||

| Shares | Amount | Paid in Capital | Statutory Reserves | Other Comprehensive Loss | Accumulated Deficit | Total | ||||||||||||||||||||||

| Balance at December 31, 2019 | 2,032,721 | $ | 2,033 | $ | 116,682,374 | $ | 14,525,712 | $ | (6,132,614 | ) | $ | (46,447,959 | ) | $ | 78,629,546 | |||||||||||||

| Net loss for the quarter | - | - | - | - | - | (598,551 | ) | (598,551 | ) | |||||||||||||||||||

| Issuance of common stock for stock compensation | 3,333 | 3 | 10,996 | - | - | - | 10,999 | |||||||||||||||||||||

| Conversion of long-term notes into common shares | 143,333 | 143 | 533,024 | - | - | - | 533,167 | |||||||||||||||||||||

| Foreign currency translation loss | - | - | - | - | (1,341,276 | ) | - | (1,341,276 | ) | |||||||||||||||||||

| Balance at March 31, 2020 | 2,179,387 | 2,179 | 117,226,394 | 14,525,712 | (7,473,890 | ) | (47,046,510 | ) | 77,233,885 | |||||||||||||||||||

| Conversion of long-term notes into common shares | 304,710 | 305 | 769,444 | - | - | - | 769,749 | |||||||||||||||||||||

| Round-up of franctional shares due to reverse split | 9,100 | 9 | (9 | ) | - | - | - | - | ||||||||||||||||||||

| Net loss for the quarter | - | - | - | - | - | 993,940 | 993,940 | |||||||||||||||||||||

| Transfer to statutory reserves | - | - | - | 140,494 | - | (140,494 | ) | - | ||||||||||||||||||||

| Foreign currency translation loss | - | - | - | - | 58,688 | - | 58,688 | |||||||||||||||||||||

| Balance at June 30, 2020 | 2,493,197 | $ | 2,493 | $ | 117,995,829 | $ | 14,666,206 | $ | (7,415,203 | ) | $ | (46,193,064 | ) | $ | 79,056,262 | |||||||||||||

| Common Stock | ||||||||||||||||||||||||||||||||

| Shares | Amount | Paid in Capital | Statutory Reserves | Other Comprehensive Loss | Accumulated Deficit | Total | Noncontrolling Interest | |||||||||||||||||||||||||

| Balance at December 31, 2018 | 1,029,582 | $ | 1,030 | $ | 114,493,283 | $ | 14,525,712 | $ | (4,620,930 | ) | $ | (37,675,202 | ) | $ | 86,723,893 | $ | (3,544,624 | ) | ||||||||||||||

| Net loss for the quarter | - | - | - | - | - | (1,942,294 | ) | (1,942,294 | ) | - | ||||||||||||||||||||||

| Purchase of noncontrolling interest | - | - | (3,948,242 | ) | - | - | - | (3,948,242 | ) | 3,544,624 | ||||||||||||||||||||||

| Issuance of common stock for equity financing | 160,000 | 160 | 1,620,640 | - | - | - | 1,620,800 | - | ||||||||||||||||||||||||

| Conversion of convertible notes including accrued interest into common shares | 185,195 | 185 | 2,014,791 | - | - | - | 2,014,976 | - | ||||||||||||||||||||||||

| Transfer to statutory reserves | - | - | - | 213,360 | - | (213,360 | ) | - | - | |||||||||||||||||||||||

| Foreign currency translation gain | - | - | - | - | 1,810,626 | - | 1,810,626 | - | ||||||||||||||||||||||||

| Balance at March 31, 2019 | 1,374,777 | 1,375 | 114,180,472 | 14,739,072 | (2,810,304 | ) | (39,830,856 | ) | 86,279,759 | - | ||||||||||||||||||||||

| Issuance of common stock | 235,873 | 236 | 1,688,439 | - | - | - | 1,688,675 | - | ||||||||||||||||||||||||

| Net loss for the quarter | - | - | - | - | - | (5,263,089 | ) | (5,263,089 | ) | - | ||||||||||||||||||||||

| Transfer to statutory reserves | - | - | - | (250,321 | ) | - | 250,321 | - | - | |||||||||||||||||||||||

| Foreign currency translation loss | - | - | - | - | (1,907,185 | ) | - | (1,907,185 | ) | - | ||||||||||||||||||||||

| Balance at June 30, 2019 | 1,610,650 | $ | 1,611 | $ | 115,868,911 | $ | 14,488,751 | $ | (4,717,489 | ) | $ | (44,843,624 | ) | $ | 80,798,160 | $ | - | |||||||||||||||

The accompanying notes are an integral part of these consolidated financial statements.statements

4

CHINA RECYCLING ENERGY CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

JUNE 30, 201920, 2020 (UNAUDITED) AND DECEMBER 31, 20182019

1. ORGANIZATION AND DESCRIPTION OF BUSINESS

China Recycling Energy Corporation (the “Company” or “CREG”) wasis incorporated on May 8, 1980 as Boulder Brewing Company under the laws of the State of Colorado. On September 6, 2001, the Company changed its state of incorporation to Nevada. In 2004, the Company changed its name from Boulder Brewing Company to China Digital Wireless, Inc. and on March 8, 2007, again changed its name from China Digital Wireless, Inc. to its current name, China Recycling Energy Corporation.in Nevada state. The Company, through its subsidiaries, provides energy saving solutions and services, including selling and leasing energy saving systems and equipment to customers, and project investment in the Peoples Republic of China (“PRC”).

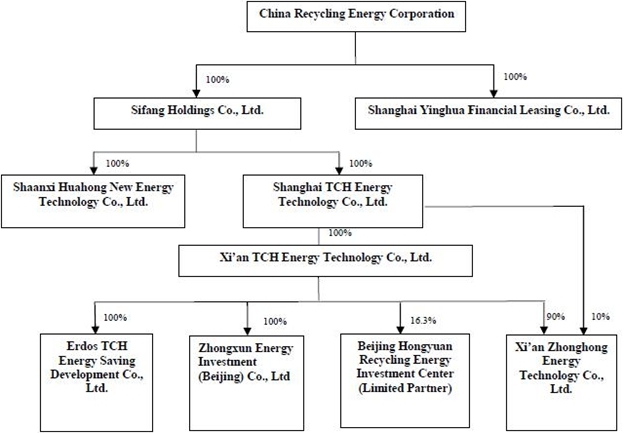

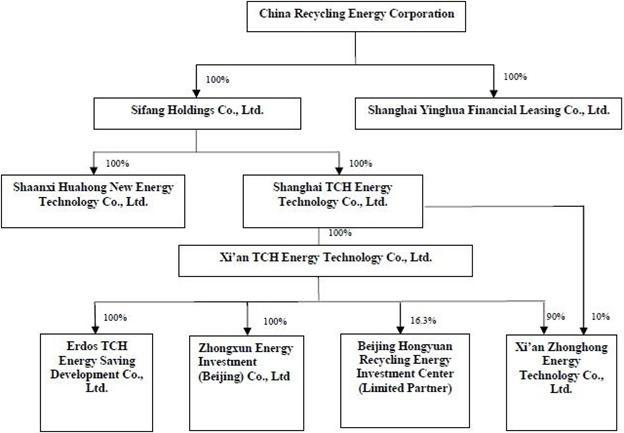

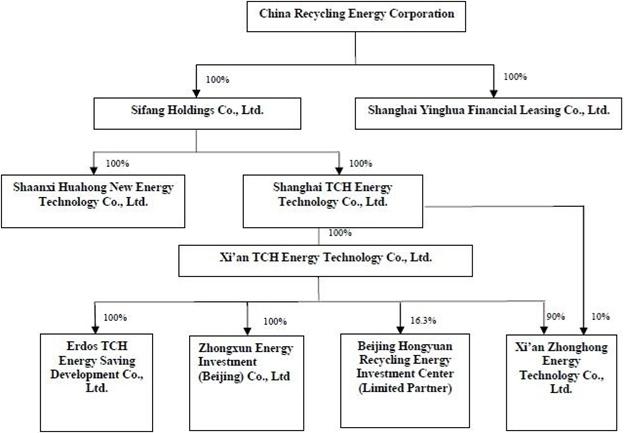

The Company’s organizational chart as of June 30, 20192020 is as follows:

Erdos TCH – Joint Venture

On April 14, 2009, the Company formed a joint venture (the “JV”) with Erdos Metallurgy Co., Ltd. (“Erdos”) to recycle waste heat from Erdos’ metal refining plants to generate power and steam to be sold back to Erdos. The name of the JV was Inner Mongolia Erdos TCH Energy Saving Development Co., Ltd. (“Erdos TCH”) with a term of 20 years. Total investment for the project was estimated at $79 million (RMB 500 million) with an initial investment of $17.55 million (RMB 120 million). Erdos contributed 7% of the total investment of the project, and Xi’an TCH Energy Technology Co., Ltd. (“Xi’an TCH”) contributed 93%. According to the parties’ agreement on profit distribution, Xi’an TCH and Erdos will receive 80% and 20%, respectively, of the profit from the JV until Xi’an TCH receives a complete return of its investment. Xi’an TCH and Erdos will then receive 60% and 40%, respectively, of the profit from the JV. On June 15, 2013, Xi’an TCH and Erdos entered into a share transfer agreement, pursuant to which Erdos sold its 7% ownership interest in the JV to Xi’an TCH for $1.29 million (RMB 8 million), plus certain accumulated profits as described below. Xi’an TCH paid the $1.29 million in July 2013 and, as a result, became the sole stockholder of the JV. In addition, Xi’an TCH paid Erdos accumulated profits from inception up to June 30, 2013 in accordance with a supplementary agreement entered into on August 6, 2013. In August 2013, Xi’an TCH paid 20% of the accumulated profit (calculated under PRC GAAP) of $226,000 to Erdos. Erdos TCH currently has two power generation systems in Phase I with a total of 18 MW power capacity, and three power generation systems in Phase II with a total of 27 MW power capacity. On April 28, 2016, Erdos TCH and Erdos entered into a supplemental agreement, effective May 1, 2016, whereby Erdos TCH cancelled monthly minimum lease payments from Erdos, and now chargesstarted to charge Erdos based on actual electricity sold at RMB 0.30 / KWH. The selling price of each KWH is determined annually based on prevailing market conditions. The Company evaluated the modified terms for payments based on actual electricity sold as minimum lease payments as defined in ASC 840-10-25-4, since lease payments that depend on a factor directly related to the future use of the leased property are contingent rentals and, accordingly, are excluded from minimum lease payments in their entirety. The Company wrote off the net investment receivables of these leases at the lease modification date. FromSince May 2019 through October 2019, Erdos TCH will ceasehas ceased its operations due to renovations and furnace safety upgrades.upgrades of Erdos, and the Company initially expected the resumption of operations in July 2020, but the resumption of operations will be delayed due to the global pandemic of Covid-19, the Company is not able to provide a resumption date as it will depend on the overall progress of the global epidemic control. During this period, Erdos will compensate Erdos TCH RMB 1 million ($145,460) per month, until operations resume.

In addition, Erdos TCH has 30% ownership in DaTangShiDai (BinZhou) Energy Savings Technology Co., Ltd. (“BinZhou Energy Savings”), 30% ownership in DaTangShiDai DaTong Recycling Energy Technology Co., Ltd. (“DaTong Recycling Energy”), and 40% ownership in DaTang ShiDai TianYu XuZhou Recycling Energy Technology Co, Ltd. (“TianYu XuZhou Recycling Energy”). These companies were incorporated in 2012 but there have not been any operations since then nor has any registered capital contribution been made.

Pucheng Biomass Power Generation Projects

On June 29, 2010, Xi’an TCH entered into a Biomass Power Generation (“BMPG”) Project Lease Agreement with Pucheng XinHengYuan Biomass Power Generation Co., Ltd. (“Pucheng”), a limited liability company incorporated in China. Under this lease agreement, Xi’an TCH leased a set of 12 MW BMPG systems to Pucheng at a minimum of $279,400 (RMB 1,900,000) per month for 15 years (“Pucheng Phase I”).

On September 11, 2013, Xi’an TCH entered into a BMPG Asset Transfer Agreement (the “Pucheng Transfer Agreement”) with Pucheng. The Pucheng Transfer Agreement provided for the sale by Pucheng to Xi’an TCH of a set of 12 MW BMPG systems with completion of system transformation for RMB 100 million ($16.48 million) in the form of 8,766,54787,666 shares (post-reverse stock split) of common stock of the Company at $1.87$187.0 per share.share (post-reverse stock price). Also on September 11, 2013, Xi’an TCH entered into a BMPG Project Lease Agreement with Pucheng (the “Pucheng Lease”). Under the Pucheng Lease, Xi’an TCH leases this same set of 12 MW BMPG systems to Pucheng, and combined this lease with the lease for the 12 MW BMPG station of Pucheng Phase I project, under a single lease to Pucheng for RMB 3.8 million ($0.63 million) per month (the “Pucheng Phase II Project”). The term for the combined lease is from September 2013 to June 2025. The lease agreement for the 12 MW station from the Pucheng Phase I project terminated upon the effective date of the Pucheng Lease. The ownership of the two 12 MW BMPG systems will transfer to Pucheng at no additional charge when the Pucheng Lease expires.

On September 29, 2019, Xi’an TCH entered into a Termination Agreement of the Lease Agreement of the Biomass Power Generation Project (the “Termination Agreement”) with Pucheng.

Pucheng failed to pay fees it owed to Xi’an TCH for leasing two biomass power generation systems from Xi’an TCH, due to its long suspension of production resulting from the significant reduction of raw material supplies for its biomass power generation operation in Pucheng County, which caused the biomass power generation project to no longer be suitable. Pursuant to the Termination Agreement, the parties agreed that: (i) Pucheng shall pay outstanding lease fees of RMB 97.6 million ($14 million) owed as of December 31, 2018 to Xi’an TCH before January 15, 2020; (ii) Xi’an TCH will waive the lease fees owed after January 1, 2019; (iii) Xi’an TCH will not return RMB 3.8 million ($542,857) in cash deposits paid by Pucheng; (iv) Xi’an TCH will transfer the Project to Pucheng at no additional cost after receiving RMB 97.6 million ($14 million) from Pucheng, and the original lease agreement between the parties will be formally terminated; and (v) if Pucheng fails to pay off RMB 97.6 million ($14 million) to Xi’an TCH before January 15, 2020, Xi’an TCH will still hold ownership of the Project and the original lease agreement shall still be valid. The Company recorded an additional $2.67 million bad debt expense for Pucheng during the year ended December 31, 2019. Xi’an TCH received RMB 97.6 million ($14 million) in full on January 14, 2020 and the ownership of the system was transferred.

Shenqiu Yuneng Biomass Power Generation Projects

On May 25, 2011, Xi’an TCH entered into a Letter of Intent with Shenqiu YuNeng Thermal Power Co., Ltd. (“Shenqiu”) to reconstruct and transform a Thermal Power Generation System owned by Shenqiu into a 75T/H BMPG System for $3.57 million (RMB 22.5 million). The project commenced in June 2011 and was completed in the third quarter of 2011. On September 28, 2011, Xi’an TCH entered into a BMPG Asset Transfer Agreement with Shenqiu (the “Shenqiu Transfer Agreement”). Pursuant to the Shenqiu Transfer Agreement, Shenqiu sold Xi’an TCH a set of 12 MW BMPG systems (after Xi’an TCH converted the system for BMPG purposes). As consideration for the BMPG systems, Xi’an TCH paid Shenqiu $10,937,500 (RMB 70 million) in cash in three installments within six months, upon the transfer of ownership of the systems. By the end of 2012, all the consideration was paid. On September 28, 2011, Xi’an TCH and Shenqiu also entered into a BMPG Project Lease Agreement (the “2011 Shenqiu Lease”). Under the 2011 Shenqiu Lease, Xi’an TCH agreed to lease a set of 12 MW BMPG systems to Shenqiu at a monthly rental of $286,000 (RMB 1,800,000) for 11 years. Upon expiration of the 2011 Shenqiu Lease, ownership of this system will transfer from Xi’an TCH to Shenqiu at no additional cost. In connection with the 2011 Shenqiu Lease, Shenqiu paid one month’s rent as a security deposit to Xi’an TCH, in addition to providing personal guarantees.

On October 8, 2012, Xi’an TCH entered into a Letter of Intent for technical reformation of Shenqiu Project Phase II with Shenqiu for technical reformation to enlarge the capacity of the Shenqiu Project Phase I (the “Shenqiu Phase II Project”). The technical reformation involved the construction of another 12 MW BMPG system. After the reformation, the generation capacity of the power plant increased to 24 MW. The project commenced on October 25, 2012 and was completed during the first quarter of 2013. The total cost of the project was $11.1 million (RMB 68 million). On March 30, 2013, Xi’an TCH and Shenqiu entered into a BMPG Project Lease Agreement (the “2013 Shenqiu Lease”). Under the 2013 Shenqiu Lease, Xi’an TCH agreed to lease the second set of 12 MW BMPG systems to Shenqiu for $239,000 (RMB 1.5 million) per month for 9.5 years. When the 2013 Shenqiu Lease expires, ownership of this system will transfer from

As repayment for a loan made by Xi’an TCHZhonghong to Shenqiu at no additional cost.

OnBeijing Hongyuan Recycling Energy Investment Center, LLP (the “HYREF”) on January 10, 2019 (see further discussion in Note 9); on January 4, 2019, Xi’an Zhonghong, Xi’an TCH, and Mr. Chonggong Bai (or “Mr. Bai”), a resident of China, entered into a Projects Transfer Agreement (the “Agreement”), pursuant to which Xi’an TCH transferred two BMGP in Shenqiu (“Shenqiu Phase I and II Projects”) to Mr. Bai for RMB 127,066,000 ($18.55 million). Mr. Bai agreed that asAs consideration for the transfer of the ShenquiShenqiu Phase I and II Projects to himMr. Bai (Note 12)9), he would transferMr. Bai transferred all the equity shares of his wholly owned company, Xi’an Hanneng Enterprises Management Consulting Co. Ltd. (“Xi’an Hanneng”) to Beijing Hongyuan Recycling Energy Investment Center, LLP (the “HYREF”) as repayment for an outstandinga loan made by Xi’an Zhonghong to HYREF.HYREF on January 10, 2019. The transfer of the projects was completed on February 15, 2019. The Company recorded $213,044$208,359 loss from the transfer during the six monthsyear ended June 30,December 31, 2019.

Xi’an Hanneng was expected to own 47,150,000 shares of Xi’an Huaxin New Energy Co., Ltd for the repayment of Shenqiu system and Huayu system. However, Xi’an Hanneng was not able to obtain all the Huaxin shares due to halted trading of Huaxin stock by NEEQ for not filing its 2018 annual report. On December 20, 2019, Mr. Bai and all the related parties therefore agreed to have Mr. Bai instead paying in cash for the transfer price of Shenqiu (see Note 9 for detail).

The Fund Management Company

On June 25, 2013, Xi’an TCH and Hongyuan Huifu Venture Capital Co. Ltd. (“Hongyuan Huifu”) established Beijing Hongyuan Recycling Energy Investment Management Company Ltd. (the “Fund Management Company”) with registered capital of RMB 10 million ($1.45 million). Xi’an TCH made an initial capital contribution of RMB 4 million ($650,000) and hadheld a 40% ownership interest in the Fund Management Company. With respect to the Fund Management Company, voting rights and dividend rights are allocated 80% and 20% between HongyuanHuifuHongyuan Huifu and Xi’an TCH, respectively.

The Fund Management Company is the general partner of Beijing Hongyuan Recycling Energy Investment Center, LLP (the “HYREF Fund”), a limited liability partnership established on July 18, 2013 in Beijing. The Fund Management Company made an initial capital contribution of RMB 5 million ($830,000) to the HYREF Fund. RMB 460 million ($77 million) was fully subscribed by all partners for the HYREF Fund. The HYREF Fund has three limited partners: (1) China Orient Asset Management Co., Ltd., which made an initial capital contribution of RMB 280 million ($46.67 million) to the HYREF Fund and is a preferred limited partner; (2) Hongyuan Huifu, which made an initial capital contribution of RMB 100 million ($16.67 million) to the HYREF Fund and is an ordinary limited partner; and (3) the Company’s wholly-owned subsidiary, Xi’an TCH, which made an initial capital contribution of RMB 75 million ($12.5 million) to the HYREF Fund and is a secondary limited partner. In addition, Xi’an TCH and Hongyuan Huifu formed Beijing Hongyuan Recycling Energy Investment Management Company Ltd. to manage this Fund, which also subscribed in the amount of RMB 5 million ($830,000) from the Fund. The term of the HYREF Fund’s partnership is six years from the date of its establishment, expiring July 18, 2019. However, the HYREF Fund’s partnership will not terminate until the HYREF loan is fully repaid and the buy-back period is over pursuant to the Buy-back Agreement entered on December 29, 2018 (see Note 12)9). The term is four years from the date of contribution for the preferred limited partner, and four years from the date of contribution for the ordinary limited partner. The total size of the HYREF Fund is RMB 460 million ($77 million). The HYREF Fund was formed to invest in Xi’an Zhonghong New Energy Technology Co., Ltd., a then 90% owned subsidiary of Xi’an TCH, for the construction of two coke dry quenching (“CDQ”) Waste Heat Power Generation (“WHPG”) stations with Jiangsu Tianyu Energy and Chemical Group Co., Ltd. (“Tianyu”) and one CDQ WHPG station with Boxing County Chengli Gas Supply Co., Ltd. (“Chengli”).

On December 29, 2018, Xi’an TCH entered into a Share Transfer Agreement with Hongyuan Huifu, pursuant to which Xi’an TCH transferred its 40% ownership in the Fund Management Company to Hongyuan Huifu for RMB 3,453,867 ($0.53 million). The transfer was completed January 22, 2019. The Company recorded approximately $47,500$46,500 loss from the sale of a 40% equity interest in Fund Management Company. The Company does not have any ownership in the Fund Management Company after this transaction.

Chengli Waste Heat Power Generation Projects

On July 19, 2013, Xi’an TCH formed a new company, “Xi’an Zhonghong New Energy Technology Co., Ltd.” (“Zhonghong”), with registered capital of RMB 30 million ($4.85 million). Xi’an TCH paid RMB 27 million ($4.37 million) and owns 90% of Zhonghong. Zhonghong is engaged to provide energy saving solution and services, including constructing, selling and leasing energy saving systems and equipment to customers. On December 29, 2018, Shanghai TCH entered into a Share Transfer Agreement with HYREF, pursuant to which HYREF transferred its 10% ownership in Xi’an Zhonghong to Shanghai TCH for RMB 3 million ($0.44 million). The transfer was completed on January 22, 2019. The Company owns 100% of Xi’an Zhonghong after the transaction.

On July 24, 2013, Zhonghong entered into a Cooperative Agreement of CDQ and CDQ WHPG Project (Coke Dry Quenching Waste Heat Power Generation Project) with Boxing County Chengli Gas Supply Co., Ltd. (“Chengli”). The parties entered into a supplement agreement on July 26, 2013. Pursuant to these agreements, Zhonghong will design, build and maintain a 25 MW CDQ system and a CDQ WHPG system to supply power to Chengli, and Chengli will pay energy saving fees (the “Chengli Project”). Chengli will contract the operation of the system to a third-party contractor, as mutually agreed upon by Zhonghong. In addition, Chengli will provide the land for the CDQ WHPG systems at no cost to Zhonghong. The term of the Agreements is 20 years. The watt hours generated by the Chengli Project will be charged at RMB 0.42 ($0.068) per kilowatt hour (excluding tax). The operating time shall be based upon an average 8,000 hours annually. If the operating time is less than 8,000 hours per year due to a reason attributable to Chengli, then time charged shall be 8,000 hours a year, and if it is less than 8,000 hours due to a reason attributable to Zhonghong, then it shall be charged at actual operating hours. Due to intensifying environmental protection, the local environmental authorities required the project owner constructing CDQ sewage treatment to complete supporting works, which were completed and passed acceptance inspection during the quarter ended September 30, 2018. However, the owner of Chengli Project changed from Chengli to Shandong Boxing Shengli Technology Company Ltd. (“Shengli”) in March 2014. This change resulted from transfer of the equity ownership of Chengli to Shengli (a private company). Chengli, as a state-owned enterprise that is 100% owned by the local Power Supply Bureau, is no longer allowed to carry out business activities, and Shengli, the new owner, is not entitled to the high on-grid prices, and thus demanded a renegotiation of the settlement terms for the project.

On July 22, 2013, Zhonghong entered into an Engineering, Procurement and Construction (“EPC”) General Contractor Agreement for the Boxing County Chengli Gas Supply Co., Ltd. CDQ Power Generation Project (the “Chengli Project”) with Xi’an Huaxin New Energy Co., Ltd. (“Huaxin”). Zhonghong, as the owner of the Chengli Project, contracted EPC services for a CDQ system and a 25 MW CDQ WHPG system for Chengli to Huaxin. Huaxin shall provide construction, equipment procurement, transportation, installation and adjustment, test run, construction engineering management and other necessary services to complete the Huaxin Project and ensure the CDQ and CDQ WHPG systems for Chengli meet the inspection and acceptance requirements and work normally. The Chengli Project is a turn-key project in which Huaxin is responsible for monitoring the quality, safety, duration and cost of the Chengli Project. The total contract price is RMB 200 million ($33.34 million), which includes all the materials, equipment, labor, transportation, electricity, water, waste disposal, machinery and safety costs.

On December 29, 2018, Xi’an Zhonghong, Xi’an TCH, the HYREF, Guohua Ku, and Mr. Chonggong Bai entered into a CDQ WHPG Station Fixed Assets Transfer Agreement, pursuant to which Xi’an Zhonghong will transfertransferred Chengli CDQ WHPG station as the repayment for the loan of RMB 188,639,400 ($27.54 million) to HYREF. Xi’an Zhonghong, Xi’an TCH, Guohua Ku and Chonggong Bai also agreed to buy back the CDQ WHPG Station when conditions under the Buy Back Agreement are met (see Note 12)9). The transfer of the Station was completed January 22, 2019, the Company recorded $638,166$624,133 loss from this transfer.

Since the original terms of Buy Back Agreement are still valid, and the Buy Back possibility could occur; therefore, the loan principal and interest and the corresponding asset of Chengli CDQ WHPG station cannot be derecognized due to the existence of Buy Back clauses (see Note 5 for detail).

Tianyu Waste Heat Power Generation Project

On July 19, 2013, Zhonghong entered into a Cooperative Agreement (the “Tianyu Agreement”) for Energy Management of CDQ and CDQ WHPG Projects with Jiangsu Tianyu Energy and Chemical Group Co., Ltd. (“Tianyu”). Pursuant to the Tianyu Agreement, Zhonghong will design, build, operate and maintain two sets of 25 MW CDQ systems and CDQ WHPG systems for two subsidiaries of Tianyu – Xuzhou Tian’an Chemical Co., Ltd. (“Xuzhou Tian’an”) and Xuzhou Huayu Coking Co., Ltd. (“Xuzhou Huayu”) – to be located at Xuzhou Tian’an and Xuzhou Huayu’s respective locations (the “Tianyu Project”). Upon completion of the Tianyu Project, Zhonghong will charge Tianyu an energy saving fee of RMB 0.534 ($0.087) per kilowatt hour (excluding tax). The operating time will be based upon an average 8,000 hours annually for each of Xuzhou Tian’an and Xuzhou Huayu. If the operating time is less than 8,000 hours per year due to a reason attributable to Tianyu, then time charged will be 8,000 hours a year. Because of overcapacity and pollution of the iron and steel and related industries, the Chinese government has imposed production limitations for the energy-intensive enterprises with heavy pollution, including Xuzhou Tian’an. Xuzhou Tian’an has slowed the construction process for its dry quenching production line which caused the delay of our project. The term of the Tianyu Agreement is 20 years. The construction of the Xuzhou Tian’an Project is anticipated to be completed by the endsecond quarter of 2019. Xuzhou Tian’an will provide the land for the CDQ and CDQ WHPG systems for free. Xuzhou Tian’an has also guaranteed that it will purchase all the power generated by the CDQ WHPG systems.2020. The Xuzhou Huayu Project is currentlyhas been on hold due to a conflict between Xuzhou Huayu Coking Co., Ltd. and local residents on certain pollution-related issues. The local government acted in its capacity to coordinate the resolution of this issue. The local residents were requested to move from the hygienic buffer zone of the project location, in exchange for compensatory payments from the government. Xuzhou Huayu was required to stop production and implement technical innovations to mitigate pollution discharge including sewage treatment, dust collection, noise control, and recycling of coal gas. Currently, some local residents have moved. Xuzhou Huayu has completed the implementation of the technical innovations of sewage treatment, dust collection, and noise control, and the Company is waiting for local governmental agencies to approve these technical innovations. Due to the stricter administration of environmental protection policies and recent increases in environmental protections for the coking industry in Xuzhou, all local coking, as well as steel iron enterprises, are facing similar situations of suspended production while they rectify technologies and procedures.

On July 22, 2013, Zhonghong entered into an EPC General Contractor Agreement for the Tianyu Project with Xi’an Huaxin New Energy Co., Ltd. (“Huaxin”). Zhonghong, as the owner of the Tianyu Project, contracted EPC services for two CDQ systems and two 25 MW CDQ WHPG systems for Tianyu to Huaxin. Huaxin will provide construction, equipment procurement, transportation, installation and adjustment, test run, construction engineering management and other necessary services to complete the Tianyu Project and ensure the CDQ and CDQ WHPG systems for Tianyu meet the inspection and acceptance requirements and work normally. The Tianyu Project is a turn-key project in which Huaxin is responsible for monitoring the quality, safety, duration and cost of the project. The total contract price is RMB 400 million ($66.68 million), which includes all the materials, equipment, labor, transportation, electricity, water, waste disposal, machinery and safety costs.

On January 4, 2019, Xi’an Zhonghong, Xi’an TCH, and Mr. Chonggong Bai entered into a Projects Transfer Agreement (the “Agreement”), pursuant to which Xi’an Zhonghong transferred a CDQ WHPG station (under construction) located in Xuzhou City for Xuzhou Huayu Coking Co., Ltd. (“Xuzhou Huayu Project”) to Mr. Bai for RMB 120,000,000 ($17.52 million). Mr. Bai agreed that as consideration for the transfer of the Xuzhou Huayu Project to him (Note 12)9), he would transfer all the equity shares of his wholly owned company, Xi’an Hanneng, to HYREF as repayment for the loan made by Xi’an Zhonghong to HYREF. The transfer of the project was completed on February 15, 2019. The Company recorded $405,959$397,033 loss from this transfer during the six monthsyear ended June 30,December 31, 2019. As of June 30,On January 10, 2019, Mr. Chonggong Bai is in the process of transferringtransferred all the equity shares of his wholly owned company, Xi’an Hanneng, to HYREF as repayment for the loan. Xi’an Hanneng willwas expected to own 47,150,000 shares of Xi’an Huaxin New Energy Co., Ltd for the repayment.repayment of Huayu system and Shenqiu system. As of JuneSeptember 30, 2019, Xi’an Hanneng already ownsowned 29,948,000 shares of Huaxin, and is in the process of obtaining the remaining 17,202,000 shares; however, Huaxin stock is halted trading by NEEQ until its 2018 annual report is filed. As of the date of this report, the partners of HYREF and the Company orally agreedbut was not able to extend the due date of the equity share transfer of Xi’an Hanneng for another few months when Xi’an Hanneng obtainsobtain the remaining 17,202,000 shares due to halted trading of Huaxin. SinceHuaxin stock by NEEQ for not filing its 2018 annual report. On December 20, 2019, Mr. Bai and all the debt settlementrelated parties agreed to have Mr. Bai instead pay in cash for the transfer price of Huayu (see Note 9 for detail).

On January 10, 2020, Zhonghong, Tianyu and Huaxin signed a transfer agreement to transfer all assets under construction and related rights and interests of Xuzhou Tian’an Project to Tianyu for RMB 170 million including VAT ($24.37 million) in three installment payments. The 1st installment payment of RMB 50 million ($7.17 million) to be paid within 20 working days after the contract is not fully implemented,signed. The 2nd installment payment of RMB 50 million ($7.17 million) is to be paid within 20 working days after completion of the loan was deemed unpaid at June 30, 2019.

project construction but no later than July 31, 2020. The final installment payment of RMB 70 million ($10.03 million) is to be paid before December 31, 2020. On March 11, 2020, the Company received the 1st installment payment. The repayment date for 2nd installment payment is delayed to fourth quarter of 2020.

Zhongtai Waste Heat Power Generation Energy Management Cooperative Agreement

On December 6, 2013, Xi’an TCH entered into a CDQ and WHPG Energy Management Cooperative Agreement (the “Zhongtai Agreement”) with Xuzhou Zhongtai Energy Technology Co., Ltd. (“Zhongtai”), a limited liability company incorporated in Jiangsu Province, China.

Pursuant to the Zhongtai Agreement, Xi’an TCH willwas to design, build and maintain a 150 ton per hour CDQ system and a 25 MW CDQ WHPG system and sell the power to Zhongtai, and Xi’an TCH willis also to build a furnace to generate steam from the smoke pipeline’s waste heat and sell the steam to Zhongtai.

The construction period of the Project iswas expected to be 18 months from the date when conditions are ready for construction to begin. Zhongtai willis to start to pay an energy saving service fee from the date when the WHPG station passes the required 72-hour test run. The payment term is 20 years. For the first 10 years, Zhongtai shall pay an energy saving fee at RMB 0.534 ($0.089) per kilowatt hour (KWH) (including value added tax) for the power generated from the system. For the second 10 years, Zhongtai shall pay an energy saving fee at RMB 0.402 ($0.067) per KWH (including value added tax). During the term of the contract the energy saving fee shall be adjusted at the same percentage as the change of local grid electricity price. Zhongtai shall also pay an energy saving fee for the steam supplied by Xi’an TCH at RMB 100 ($16.67) per ton (including value added tax). Zhongtai and its parent company will provide guarantees to ensure Zhongtai will fulfill its obligations under the Agreement. Upon the completion of the term, Xi’an TCH will transfer the systems to Zhongtai for RMB 1 ($0.16). Zhongtai shall provide waste heat to the systems for no less than 8,000 hours per year and waste gas volume no less than 150,000 Normal Meter Cubed (Nm3) per hour, with a temperature no less than 950°C. If these requirements are not met, the term of the Agreement will be extended accordingly. If Zhongtai wants to terminate the Zhongtai Agreement early, it shall provide Xi’an TCH with a 60 day notice and pay the termination fee and compensation for the damages to Xi’an TCH according to the following formula: (1) if it is less than five years into the term when Zhongtai requests termination, Zhongtai shall pay: Xi’an TCH’s total investment amount plus Xi’an TCH’s annual investment return times five years minus the years in which the system has already operated; or 2) if it is more than five years into the term when Zhongtai requests the termination, Zhongtai shall pay: Xi’an TCH’s total investment amount minus total amortization cost (the amortization period is 10 years).

In March 2016, Xi’an TCH entered into a Transfer Agreement of CDQ and a CDQ WHPG system with Zhongtai and Xi’an Huaxin (the “Transfer Agreement”). Under the Transfer Agreement, Xi’an TCH agreed to transfer to Zhongtai all of the assets associated with the CDQ Waste Heat Power Generation Project (the “Project”), which is under construction pursuant to the Zhongtai Agreement. Additionally, Xi’an TCH agreed to transfer to Zhongtai the Engineering, Procurement and Construction (“EPC”) Contract for the CDQ Waste Heat Power Generation Project which Xi’an TCH had entered into with Xi’an Huaxin in connection with the Project. Xi’an Huaxin will continue to construct and complete the Project and Xi’an TCH agreed to transfer all its rights and obligations under the EPC Contract to Zhongtai. As consideration for the transfer of the Project, Zhongtai agreed to pay to Xi’an TCH RMB 167,360,000 ($25.77 million) including payments of: (i) RMB 152,360,000 ($23.46 million) for the construction of the Project; and (ii) RMB 15,000,000 ($2.31 million) as payment for partial loan interest accrued during the construction period. Those amounts have been, or will be, paid by Zhongtai to Xi’an TCH according to the following schedule: (a) RMB 50,000,000 ($7.70 million) was to be paid within 20 business days after the Transfer Agreement was signed; (b) RMB 30,000,000 ($4.32 million) was to be paid within 20 business days after the Project was completed, but no later than July 30, 2016; and (c) RMB 87,360,000 ($13.45 million) was to be paid no later than July 30, 2017. Xuzhou Taifa Special Steel Technology Co., Ltd. (“Xuzhou Taifa”) guaranteed the payments from Zhongtai to Xi’an TCH. The ownership of the Project was conditionally transferred to Zhongtai following the initial payment of RMB 50,000,000 ($7.70 million) by Zhongtai to Xi’an TCH and the full ownership of the Project will be officially transferred to Zhongtai after it completes all payments pursuant to the Transfer Agreement. The Company recorded a $2.82 million loss from this transaction in 2016. In 2016, Xi’an TCH had received the first payment of $7.70 million and the second payment of $4.32 million. However, the Company received a repayment commitment letter from Zhongtai on February 23, 2018, in which Zhongtai committed to pay the remaining payment of RMB 87,360,000 ($13.45 million) no later than the end of July 2018; in July 2018, Zhongtai and the Company reached a further oral agreement to extend the repayment term of RMB 87,360,000 ($13.45 million) by another two to three months. In August 2018, the Company received $1,070,000 from Zhongtai; asAs of June 30, 2019,2020, the Company had gross receivable from Zhongtai for $11.64$4.24 million (with bad debt allowance of $5.82$4.24 million). In January 2020, Zhongtai paid RMB 10 million ($1.41 million); in March 2020, Zhongtai paid RMB 20 million ($2.82 million); in June 2020, Zhongtai paid RMB 10 million ($1.41 million). Zhongtai provided an acknowledgement letteris committed to the Company stating they expect to repaypay in full the remaining balance of $11.88RMB 30 million by($4.24 million) no later than the end of October 2019, once it resumes normal production.2020.

Formation of Zhongxun

On March 24, 2014, Xi’an TCH incorporated a subsidiary, Zhongxun Energy Investment (Beijing) Co., Ltd. (“Zhongxun”) with registered capital of $5,695,502 (RMB 35,000,000), which must be contributed before October 1, 2028. Zhongxun is 100% owned by Xi’an TCH and will be mainly engaged in project investment, investment management, economic information consulting, and technical services. Zhongxun has not yet commenced operations nor has any capital contribution been made as of the date of this report.

Formation of Yinghua

On February 11, 2015, the Company incorporated a subsidiary, Shanghai Yinghua Financial Leasing Co., Ltd. (“Yinghua”) with registered capital of $30,000,000, to be paid within 10 years from the date the business license is issued. Yinghua is 100% owned by the Company and will be mainly engaged in financial leasing, purchase of financial leasing assets, disposal and repair of financial leasing assets, consulting and ensuring of financial leasing transactions, and related factoring business. Yinghua has not yet commenced operations as of the date of this report.

Formation of ShengYa Energy

On July 1, 2016, Xi’an Zhonghong incorporated a subsidiary, Xi’an ShengYa Energy Co., Ltd. (“ShengYa Energy”) with registered capital of $29.42 million (RMB 200,000,000), ShengYa Energy has not yet commenced operations nor has any capital contribution been made as of the date of this report.

Summary of Sales-Type Leases at June 30, 2019Reverse Stock Split

AsOn April 13, 2020, the Company filed a certificate of change (“Certificate of Change”) with the Secretary of State of the State of Nevada, pursuant to which, on April 13, 2020, the Company effected a reverse stock split of its common stock, $0.001 per share at a rate of 1-for-10, accompanied by a corresponding decrease in the Company’s issued and outstanding shares of common stock (the “Reverse Stock Split”). The consolidated financial statements as of June 30, 2020 and December 31, 2019, and for the six and three months ended June 30, 2020 and 2019 were retroactively restated to reflect this reverse stock split.

Other Events

On September 9, 2019, the Company hadentered into a letter of intent to acquire a controlling interest in Xi’an Yineng Zhihui Technology Co., Ltd. (“YNZH”), a next generation energy storage solution provider in China. YNZH is a leading comprehensive high-tech intelligent energy service company integrated with energy efficiency improvement and storage management in China. The energy efficiency management is to fully use big data cloud computing technology, effectively adopt the following sales-type leases: BMPG systemscombination of the mature international and domestic clean energy technologies to Pucheng Phase Imake the customers’ energy management more efficient, more economical, more secure and II (15 and 11-yearmore scientific. The terms respectively).of this proposed transaction are currently being negotiated.

In December 2019, a novel strain of coronavirus (COVID-19) was reported in Wuhan, China. The World Health Organization has declared the outbreak to constitute a “Public Health Emergency of International Concern.” This pandemic, which continues to spread to additional countries, and is disrupting supply chains and affecting production and sales across a range of industries as a result of quarantines, facility closures, and travel and logistics restrictions in connection with the outbreak. However, as a result of PRC government’s effort on disease control, most cities in China were reopened, the outbreak in China is under the control. The Company disposed all of its systems and currently holds only five power generating systems through Erdos TCH, the Company initially expected to resume production of these five power generating systems in July 2020 from the renovation and furnace safety upgrade, but the resumption of operations will be delayed due to the global pandemic of Covid-19; Erdos exports ferrosilicon to 27 countries, the Company decided not to resume the production in the third quarter of 2020 as a result of decreased sales order and overstocked inventory, and the Company is not able to provide a resumption date as it will depend on the overall progress of the global epidemic control. There are some new Covid-19 cases discovered in a few provinces of China including Beijing and Liaoning province, no new case has been discovered in Xi’an province where the Company is located as of today.

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation

The consolidated financial statements (“CFS”) were prepared in accordance with accounting principles generally accepted in the United States of America (“US GAAP”).

The interim consolidated financial information as of June 30, 20192020 and for the six and three monththree-month periods ended June 30,March, 2020 and 2019 and 2018 was prepared without audit, pursuant to the rules and regulations of the Securities and Exchange Commission (“SEC”). Certain information and footnote disclosures, which are normally included in consolidated financial statementsCFS prepared in accordance with accounting principles generally accepted in the United States of America (“US GAAP”)U.S. GAAP were not included. The interim consolidated financial information should be read in conjunction with the Financial Statements and the notes thereto, included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2018,2019, previously filed with the SEC. SEC on May 14, 2020.

In the opinion of management, all adjustments (which include all significant normal and recurring adjustments) necessary to present a fair statement of the Company’s consolidated financial position as of June 30, 2019,2020, its consolidated results of operations and cash flows for the six and three months ended June 30, 20192020 and 2018, and cash flows for the six months ended June 30, 2019, and 2018, as applicable, were made. The interim results of operations are not necessarily indicative of the operating results for the full fiscal year or any future periods.

The financial statements included herein were prepared by the Company, pursuant to the rules and regulations of the SEC. The information furnished herein reflects all adjustments (consisting of normal recurring accruals and adjustments) that are, in the opinion of management, necessary to fairly present the operating results for the respective periods. Certain information and footnote disclosures normally present in annual financial statements prepared in accordance with US GAAP were omitted pursuant to such rules and regulations.

Basis of Consolidation

The consolidated financial statements (“CFS”)CFS include the accounts of CREG and its subsidiaries, Shanghai Yinghua Financial Leasing Co., Ltd. (“Yinghua”) and Sifang Holdings; Sifang Holdings’ wholly owned subsidiaries, Huahong New Energy Technology Co., Ltd. (“Huahong”) and Shanghai TCH Energy Tech Co., Ltd. (“Shanghai TCH”); Shanghai TCH’s wholly-owned subsidiary, Xi’an TCH Energy Tech Co., Ltd. (“Xi’an TCH”); and Xi’an TCH’s subsidiaries, 1) Erdos TCH Energy Saving Development Co., Ltd (“Erdos TCH”), 100% owned by Xi’an TCH (See note 1), 2) Zhonghong, 90% owned by Xi’an TCH and 10% owned by Shanghai TCH, and 3) Zhongxun, 100% owned by Xi’an TCH. Substantially all the Company’s revenues are derived from the operations of Shanghai TCH and its subsidiaries, which represent substantially all the Company’s consolidated assets and liabilities as of June 30, 2019.2020. All significant inter-company accounts and transactions were eliminated in consolidation.

Uses and Sources of Liquidity

For the six and three months ended June 30, 2020, the Company had a net income of $0.40 million and 0.99 million. For the year ended December 31, 2019, the Company had net loss of $8.78 million. The Company has an accumulated deficit of $46.19 million as of June 30, 2020. The Company is in the process of transforming and expanding into an energy storage integrated solution provider. The Company plans to pursue disciplined and targeted expansion strategies for market areas the Company currently does not serve. The Company actively seeks and explores opportunities to apply energy storage technologies to new industries or segments with high growth potential, including industrial and commercial complexes, large scale photovoltaic (PV) and wind power stations, remote islands without electricity, and smart energy cities with multi-energy supplies. Management also intends to raise additional funds by way of a private or public offering, or by obtaining loans from banks or others. The Company’s cash flow forecast indicate it will have sufficient cash to funds its operations for the next 12 months from the date of issuance of these financial statements.

The historical operating results indicate substantial doubt exists related to the Company’s ability to continue as a going concern. However, the Company had $62.67 million cash on hand at June 30, 2020. The Company believes that the actions discussed above are probable of occurring and the occurrence, mitigate the substantial doubt raised by its historical operating results.

While the Company believes in the viability of its strategy to generate sufficient revenue and in its ability to raise additional funds on reasonable terms and conditions, there can be no assurances to that effect. The ability of the Company to continue as a going concern is dependent upon the Company’s ability to further implement its business plan and generate sufficient revenue and its ability to raise additional funds by way of a public or private offering, or debt financing including bank loans. The consolidated financial statements do not include any adjustments that might result from the outcome of these uncertainties.

Use of Estimates

In preparing these CFS in accordance with US GAAP, management makes estimates and assumptions that affect the reported amounts of assets and liabilities in the balance sheets as well as revenues and expenses during the period reported. Actual results may differ from these estimates. On an on-going basis, management evaluates their estimates, including those related to allowances for bad debt and inventory obsolescence, impairment loss on fixed assets and construction in progress, income taxes, and contingencies and litigation. Management bases their estimates on historical experience and on various other assumptions that are believed to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities that are not readily apparent from other resources.

Revenue Recognition

A)Sales-type Leasing and Related Revenue Recognition

On January 1, 2019, the Company adopted Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 842 using the modified retrospective transition approach by applying the new standard to all leases existing at the date of initial application. Results and disclosure requirements for reporting periods beginning after January 1, 2019 are presented under ASC Topic 842, while prior period amounts have not been adjusted and continue to be reported in accordance with our historical accounting under Topic 840. (See Operating lease below as relates to the Company as a lessee). The Company’s sales type lease contracts for revenue recognition fall under ASC 842. During the six and three months ended June 30, 2020 and 2019, the Company did not sell any new standard establishes a right-of-use (“ROU”) model that requires a lessee to record a ROU asset and a lease liability on the balance sheet for all leases with terms longer than 12 months. Leases will be classified as either finance or operating, with classification affecting the pattern of expense recognition in the income statement. A modified retrospective transition approach is required for lessees for capital and operating leases existing at, or entered into after, the beginning of the earliest comparative period presented in the financial statements, with certain practical expedients available. power generating projects.

The Company constructs and leases waste energy recycling power generating projects to its customers. The Company typically transfers legal ownership of the waste energy recycling power generating projects to its customers at the end of the lease. Prior to January 1, 2019, the investment in these projects was recorded as investment in sales-type leases in accordance with ASC Topic 840, “Leases,” and its various amendments and interpretations.

In February 2016, the FASB issued ASU No. 2016-02, Leases (Topic 842). The new standard establishes a right-of-use (“ROU”) model that requires a lessee to record a ROU asset and a lease liability on the balance sheet for all leases with terms longer than 12 months. Leases will be classified as either finance or operating, with classification affecting the pattern of expense recognition in the income statement. The new standard is effective for fiscal years beginning after December 15, 2018, including interim periods within those fiscal years. A modified retrospective transition approach is required for lessees for capital and operating leases existing at, or entered into after, the beginning of the earliest comparative period presented in the financial statements, with certain practical expedients available. The Company adopted this ASU on CFS on January 1, 2019 and concluded the adoption of this new AUS did not have a material impact to the Company’s CFS.

The Company finances construction of waste energy recycling power generating projects. The sales and cost of sales are recognized at the inception of the lease.lease, which is when the control is transferred to the lessee. The Company accounts for the transfer of control as a sales type lease in accordance with ASC 842-10-25-2. The underlying asset is derecognized, and revenue is recorded when collection of payments is probable. This is in accordance with the revenue recognition principle in ASC 606 - Revenue from contracts with customers. The investment in sales-type leases consists of the sum of the minimum lease payments receivable less unearned interest income and estimated executory cost. Minimum lease payments are part of the lease agreement between the Company (as the lessor) and the customer (as the lessee). The discount rate implicit in the lease is used to calculate the present value of minimum lease payments. The minimum lease payments consist of the gross lease payments net of executory costs and contingent rentals, if any. Unearned interest is amortized to income over the lease term to produce a constant periodic rate of return on net investment in the lease. While revenue is recognized at the inception of the lease, the cash flow from the sales-type lease occurs over the course of the lease, which results in interest income and reduction of receivables. Revenue is recognized net of sales tax.

B)Contingent Rental Income

The Company records income from actual electricity usage in addition to minimum lease paymentsgenerated of each project as contingent rental income in the period contingent rentalthe income is earned.earned, which is when the electricity is generated. Contingent rent is not part of minimum lease payments.

Operating Leases

On January 1, 2019, the Company adopted Topic 842 using the modified retrospective transition approach by applying the new standard to all leases existing at the date of initial application. Results and disclosure requirements for reporting periods beginning after January 1, 2019 are presented under Topic 842, while prior period amounts have not been adjusted and continue to be reported in accordance with its historical accounting under Topic 840. The new standard establishes a right-of-use (“ROU”) model that requires a lessee to record a ROU asset and a lease liability on the balance sheet for all leases with terms longer than 12 months. Leases will be classified as either finance or operating, with classification affecting the pattern of expense recognition in the income statement. A modified retrospective transition approach is required for lessees for capital and operating leases existing at, or entered into after, the beginning of the earliest comparative period presented in the financial statements, with certain practical expedients available.

The Company elected the package of practical expedients permitted under the transition guidance, which allowed it to carry forward its historical lease classification, its assessment on whether a contract was or contains a lease, and its initial direct costs for any leases that existed prior to January 1, 2019. The Company also elected to combine its lease and non-lease components and to keep leases with an initial term of 12 months or less off the balance sheet and recognize the associated lease payments in the consolidated statements of income on a straight-line basis over the lease term.

The company leased an office in Xi’an, China as the Company’s headquarter; upon adoption, the Company recognized total Right of Use Asset (“ROU”) of $116,917, with corresponding liabilities of $116,917 on the consolidated balance sheets. The ROU assets include adjustments for prepayments and accrued lease payments. The adoption did not impact its beginning retained earnings, or its prior year consolidated statements of income and statements of cash flows. At June 30, 2020, the ROU was $21,655.

Under Topic 842, the Company determines if an arrangement is a lease at inception. ROU assets and liabilities are recognized at commencement date based on the present value of remaining lease payments over the lease term. For this purpose, the Company considers only payments that are fixed and determinable at the time of commencement. As most of its leases do not provide an implicit rate, it uses its incremental borrowing rate based on the information available at commencement date in determining the present value of lease payments. The Company’s incremental borrowing rate is a hypothetical rate based on its understanding of what its credit rating would be. The ROU asset also includes any lease payments made prior to commencement and is recorded net of any lease incentives received. The Company’s lease terms may include options to extend or terminate the lease when it is reasonably certain that it will exercise such options.

Operating leases are included in operating lease right-of-use assets and operating lease liabilities (current and non-current), on the consolidated balance sheets.

Cash and Equivalents

Cash and equivalents include cash on hand, demand deposits placed with banks or other financial institutions and all highly liquid investments with an original maturity of three months or less as of the purchase date of such investments.

Accounts Receivable

The Company’s policy is to maintain an allowance for potential credit losses on accounts receivable. Management reviews the composition of accounts receivable and analyzes historical bad debts, customer concentrations, customer credit worthiness, current economic trends and changes in customer payment patterns to evaluate the adequacy of these reserves.

As of June 30, 2019,2020, the Company had gross accounts receivable of $51,100,975;$36.06 million; of which, $35.94$13.71 million was for transferring the ownership of Huayu and Shenqiu Phase I and II systems to Mr. BaiBai; $4.23 million was from the sales of CDQ and a CDQ WHPG system to Zhongtai, $16.95 million was from transferring the ownership of Tian’an project to Tianyu, and $1.16 million accounts receivable of Erdos TCH for electricity sold. As of December 31, 2019, the Company had gross accounts receivable of $48.06 million; of which, is waiting$35.42 million was for completiontransferring the ownership of transferHuayu and Shenqiu Phase I and II systems to Mr. Bai’s all the equity shares of his wholly owned company, Xi’an Hanneng, to HYREF; $11.64Bai; $10.03 million was from the sales of CDQ and a CDQ WHPG system to Zhongtai, and $3.53$2.61 million accounts receivable of Erdos TCH for the electricity sold. As of December 31, 2018, the Company had accounts receivable of $15,252,162 (from the sales of CDQ and a CDQ WHPG system to Zhongtai, and accounts receivable of Erdos TCH for electricity sold). As of June 30, 2019,2020, the Company had bad debt allowance of $5,818,435$4,237,587 for Zhongtai and $352,566$31,611 for Erdos TCH due to not making the payments as scheduled. As of December 31, 2018,2019, the Company had bad debt allowance of $3,496,911$5,733,781 for Zhongtai and $261,430 for Erdos TCH due to not making the payments as scheduled. In June 2020, Xuzhou Zhongtai collected RMB 10 million ($1.41 million) accounts receivable. In June 2020, Erdos TCH collected RMB 10 million ($1.41 million) accounts receivable; on July 2020, Erdos TCH collected additional RMB 6 million ($0.86 million) accounts receivable; as a result, the Company made a reversal of bad debts allowance of $1,649,622, of which $1,422,090 was for Zhongtai and $227,532 was for Erdos TCH during the three months ended June 30, 2020.

| 2020 | 2019 | |||||||

| Xuzhou Zhongtai project | $ | 4,237,587 | $ | 10,034,116 | ||||

| Bai Chonggong (for Shenqiu and Huayu projects) | 13,710,855 | 35,415,556 | ||||||

| Xuzhou Tian’an project | 16,950,350 | - | ||||||

| Receivable of electricity sales of Erdos | 1,163,624 | 2,614,299 | ||||||

| Total accounts receivable | 36,062,416 | 48,063,971 | ||||||

| Bad debt allowance | (4,269,198 | ) | (5,995,210 | ) | ||||

| Accounts receivable, net | $ | 31,793,218 | $ | 42,068,761 | ||||

Interest Receivable on Sales Type Leases

As of June 30, 2020, the interest receivable on sales type leases was $0. As of December 31, 2019, the interest receivable on sales type leases was $5,322,686,$5,245,244, mainly from recognized but not yet collected interest income for the Pucheng systems. AsThe ownership of December 31, 2018, the interest receivable on sales type leasesPucheng systems was $9,336,140, mainly from recognized but not yet collected interest income for thetransferred to Pucheng and Shengqiu systems. Asas a result of April 1, 2018, the Company stopped accruing interest receivable on the Pucheng lease as the Pucheng lease was at least one year overduefull payment received by Xi’an TCH in its payments.January 2020.

Investment in sales-type leases, net

As of June 30, 2020 and December 31, 2019, the Company had net investment in sales-type leases of $0 and $8,287,560, respectively. The Company maintains reserves for potential credit losses on receivables. Management reviews the composition of receivables and analyzes historical bad debts, customer concentrations, customer credit worthiness, current economic trends and changes in customer payment patterns to evaluate the adequacy of these reserves. As of June 30, 2020 and December 31, 2019, the Company had bad debt allowance for net investment receivable on sales-type leases of $22,071,360$0 and $24,416,441 for the Pucheng systems. Assystem, respectively. Xi’an TCH received RMB 97.6 million ($14 million) in full which included interest of December 31, 2018,$5.3 million for Pucheng system on January 14, 2020 and the Company hadownership of the system was transferred. The bad debt allowance for net investment receivable of $29,276,658 ($7,274,872 for the Shenqiu systems and $22,071,360 for the Pucheng systems) due to lessees’ tight working capital and continuous delaywas recorded in making the payment.2019.

Concentration of Credit Risk

Cash includes cash on hand and demand deposits in accounts maintained within China. Balances at financial institutions within China are not covered by insurance. The Company has not experienced any losses in such accounts.

Certain other financial instruments, which subject the Company to concentration of credit risk, consist of accounts and other receivables. The Company does not require collateral or other security to support these receivables. The Company conducts periodic reviews of its customers’ financial condition and customer payment practices to minimize collection risk on accounts receivable.

The operations of the Company are in the PRC. Accordingly, the Company’s business, financial condition and results of operations may be influenced by the political, economic and legal environments in the PRC.

Property and Equipment

Property and equipment are stated at cost, net of accumulated depreciation. Expenditures for maintenance and repairs are expensed as incurred; additions, renewals and betterments are capitalized. When property and equipment are retired or otherwise disposed of, the related cost and accumulated depreciation are removed from the respective accounts, and any gain or loss is included in operations. Depreciation of property and equipment is provided using the straight-line method over the estimated lives as follows:

| Building | 20 years | |||

| Vehicles | 2 - 5 years | |||

| Office and Other Equipment | 2 - 5 years | |||

| Software | 2 - 3 years |

Impairment of Long-lived Assets

In accordance with FASB ASC Topic 360, “Property, Plant, and Equipment,” the Company reviews its long-lived assets, including property and equipment, for impairment whenever events or changes in circumstances indicate that the carrying amounts of the assets may not be fully recoverable. If the total expected undiscounted future net cash flows are less than the carrying amount of the asset, a loss is recognized for the difference between the fair value and carrying amount of the asset. The Company recorded no$0 asset impairment loss for the six and three months ended June 30, 2020 and 2019. The Company recorded asset impairment loss of $28,429,789 for three projectsconstruction in progress of Xuzhou Tian’an of $876,660 for the year ended December 31, 2018, as described below.

On January 4, 2019, Xi’an Zhonghong, Xi’an TCH,which is the difference between the book value and Mr. Chonggong Bai entered into a Projects Transfer Agreement for Xi’an Zhonghong to transfer the Xuzhou Huayu Project to Mr. Bai for RMB 120,000,000 ($17.52 million), which transferdisposal price was considered the fair value (“FV”) of the project. The Company compared the carrying value and FV of the Huayu project, and recorded asset impairment loss of $6,528,120 for the project for the year ended December 31, 2018.

On December 29, 2018, Xi’an Zhonghong, Xi’an TCH, the HYREF, Guohua Ku, and Mr. Chonggong Bai entered into a CDQ WHPG Station Fixed Assets Transfer Agreement for Xi’an Zhonghong to transfer Chengli CDQ WHPG station as the repayment of a loan for RMB 188,639,400 ($27.54 million) to HYREF. The transfer price was considered the FV of the system. The Company compared the carrying value and FV of the Chengli system, and recorded asset impairment loss of $8,124,968 for the system for the year ended December 31, 2018.

As of December 31, 2018, the progress of the Xuzhou Tian’an project is slow due to strict environmental protection policies. The Company estimated the FV of the Xuzhou Tian’an project to be around RMB 172,250,000.00 ($25.58 million). The Company compared the carrying value and FV of the Tian’an Project, and recorded asset impairment loss of $13,512,592 for the project for the year ended December 31, 2018.

Notes Payable – Banker’s Acceptancesasset.