UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

☒ Quarterly Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the quarterly period ended SeptemberJune 30, 20192020

or

☐ Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the transition period from ______to______

Commission file number 001-33997

KANDI TECHNOLOGIES GROUP, INC.

(Exact name of registrant as specified in charter)

| Delaware | 90-0363723 | |

| (State or other jurisdiction of | (I.R.S. Employer | |

| incorporation or organization) | Identification No.) | |

| Jinhua City Industrial Zone Jinhua, Zhejiang Province People’s Republic of China | 321016 | |

| (Address of principal executive offices) | (Zip Code) |

(86 - 579) 82239856

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| Common Stock | KNDI | NASDAQ Global Select Market |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files) Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☒ |

| Non-accelerated filer | ☐ | Smaller reporting company | ☒ |

| Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of NovemberAugust 5, 2019,2020, the registrant had 56,243,10256,521,702 shares of common stock issued and 52,819,44154,600,758 shares of common stock outstanding, par value $0.001 per share.

TABLE OF CONTENTS

i

PART I — FINANCIAL INFORMATION

KANDI TECHNOLOGIES GROUP, INC.

AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETSHEETS

| September 30, 2019 | December 31, 2018 | June 30, 2020 | December 31, 2019 | |||||||||||||

| (UNAUDITED) | (UNAUDITED) | |||||||||||||||

| Current assets | ||||||||||||||||

| Cash and cash equivalents | $ | 14,338,637 | $ | 15,662,201 | $ | 3,457,498 | $ | 5,490,557 | ||||||||

| Restricted cash | 11,713,004 | 6,690,870 | 3,221,053 | 11,022,078 | ||||||||||||

| Accounts receivable (net of allowance for doubtful accounts of $130,420 and $120,010 as of September 30, 2019 and December 31, 2018, respectively) | 54,859,801 | 34,274,728 | ||||||||||||||

| Accounts receivable (net of allowance for doubtful accounts of $251,012 and $254,665 as of June 30, 2020 and December 31, 2019, respectively) | 60,020,455 | 61,181,849 | ||||||||||||||

| Inventories | 35,447,383 | 21,997,868 | 28,245,267 | 27,736,566 | ||||||||||||

| Notes receivable | 41,549,888 | 72,712 | - | 42,487,225 | ||||||||||||

| Notes receivable from the Affiliate Company and related party | - | 3,861,032 | ||||||||||||||

| Other receivables | 12,859,304 | 1,264,323 | 42,661,342 | 5,019,971 | ||||||||||||

| Prepayments and prepaid expense | 9,497,459 | 11,136,408 | 10,407,572 | 10,615,063 | ||||||||||||

| Due from employees | 5,499 | 1,001 | ||||||||||||||

| Advances to suppliers | 4,474,104 | 4,705,183 | ||||||||||||||

| Amount due from the Affiliate Company, net | 25,335,894 | 67,683,462 | 20,107,347 | 31,330,763 | ||||||||||||

| Right - of - use asset | 42,974 | - | ||||||||||||||

| Other current assets | 13,283,400 | 688,364 | ||||||||||||||

| TOTAL CURRENT ASSETS | 210,123,947 | 167,349,788 | 181,403,934 | 195,572,436 | ||||||||||||

| LONG-TERM ASSETS | ||||||||||||||||

| Property, plant and equipment, net | 74,491,204 | 82,045,923 | 69,907,964 | 74,407,858 | ||||||||||||

| Intangible assets | 3,298,384 | 3,654,772 | ||||||||||||||

| Land use rights, net | 11,084,717 | 11,749,728 | 8,765,196 | 11,272,815 | ||||||||||||

| Construction in progress | 17,781 | - | ||||||||||||||

| Deferred taxes assets | - | 8,204 | ||||||||||||||

| Investment in the Affiliate Company | 53,837,011 | 128,929,893 | 42,490,448 | 47,228,614 | ||||||||||||

| Goodwill | 27,762,120 | 28,552,215 | 27,962,871 | 28,270,400 | ||||||||||||

| Intangible assets | 3,723,988 | 4,328,127 | ||||||||||||||

| Other long term assets | 4,803,349 | 5,865,386 | 10,529,348 | 10,811,501 | ||||||||||||

| TOTAL Long-Term Assets | 175,720,170 | 261,479,476 | 162,954,211 | 175,645,960 | ||||||||||||

| TOTAL ASSETS | $ | 385,844,117 | $ | 428,829,264 | $ | 344,358,145 | $ | 371,218,396 | ||||||||

| CURRENT LIABILITIES | ||||||||||||||||

| Accounts payable | $ | 79,632,036 | $ | 112,309,683 | $ | 59,656,133 | $ | 72,093,940 | ||||||||

| Other payables and accrued expenses | 4,843,001 | 4,251,487 | 4,239,760 | 6,078,041 | ||||||||||||

| Short-term loans | 30,969,731 | 30,539,236 | - | 25,980,364 | ||||||||||||

| Customer deposits | 33,535 | 94,408 | ||||||||||||||

| Notes payable | 11,463,004 | 12,787,619 | 2,971,053 | 10,765,344 | ||||||||||||

| Income tax payable | 1,519,699 | 3,471,366 | 2,901,610 | 1,796,601 | ||||||||||||

| Due to employees | 7,105 | 28,473 | ||||||||||||||

| Deferred income | 1,237,556 | 1,340,605 | ||||||||||||||

| Lease liability | 44,121 | - | ||||||||||||||

| Advance receipts | 18,497,676 | - | ||||||||||||||

| Long term loans - current portion | 16,128,576 | 13,779,641 | ||||||||||||||

| Other current liability | 1,421,364 | 1,379,808 | ||||||||||||||

| Total Current Liabilities | 129,749,788 | 164,822,877 | 105,816,172 | 131,873,739 | ||||||||||||

| LONG-TERM LIABILITIES | ||||||||||||||||

| Long term bank loans | 27,606,502 | 28,794,136 | ||||||||||||||

| Long term loans | 11,712,415 | 14,353,792 | ||||||||||||||

| Deferred taxes liability | 1,758,643 | 1,711,343 | 3,448,922 | 1,362,786 | ||||||||||||

| Contingent consideration liability | 6,562,000 | 7,256,000 | 2,334,000 | 5,197,000 | ||||||||||||

| Other long-term liability | - | 622,034 | 565,915 | 574,152 | ||||||||||||

| Total Long-Term Liabilities | 35,927,145 | 38,383,513 | 18,061,252 | 21,487,730 | ||||||||||||

| TOTAL LIABILITIES | 165,676,933 | 203,206,390 | 123,877,424 | 153,361,469 | ||||||||||||

| STOCKHOLDER’S EQUITY | ||||||||||||||||

| Common stock, $0.001 par value; 100,000,000 shares authorized; 56,263,102 and 55,992,002 shares issued and 52,839,441 and 51,484,444 outstanding at September 30, 2019 and December 31, 2018, respectively | 52,839 | 51,484 | ||||||||||||||

| Less: Treasury stock (487,155 shares with average price of $5.09 and 0 shares at September 30, 2019 and December 31, 2018, respectively ) | (2,477,965 | ) | - | |||||||||||||

| Common stock, $0.001 par value; 100,000,000 shares authorized; 56,273,102 and 56,263,102 shares issued and 54,352,158 and 52,839,441 outstanding at June 30,2020 and December 31,2019, respectively | 54,352 | 52,839 | ||||||||||||||

| Less: Treasury stock (487,155 shares with average price of $5.09 at June 30,2020 and December 31,2019, respectively ) | (2,477,965 | ) | (2,477,965 | ) | ||||||||||||

| Additional paid-in capital | 259,691,370 | 254,989,657 | 262,878,585 | 259,691,370 | ||||||||||||

| Accumulated deficit (the restricted portion is $4,422,033 and $4,422,033 at September 30, 2019 and December 31, 2018, respectively) | (9,135,198 | ) | (9,497,009 | ) | ||||||||||||

| Accumulated deficit (the restricted portion is $4,422,033 and $4,422,033 at June 30,2020 and December 31,2019, respectively) | (14,205,339 | ) | (16,685,736 | ) | ||||||||||||

| Accumulated other comprehensive loss | (27,963,862 | ) | (19,921,258 | ) | (25,768,912 | ) | (22,723,581 | ) | ||||||||

| TOTAL STOCKHOLDERS’ EQUITY | 220,167,184 | 225,622,874 | 220,480,721 | 217,856,927 | ||||||||||||

| TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY | $ | 385,844,117 | $ | 428,829,264 | $ | 344,358,145 | $ | 371,218,396 | ||||||||

See accompanying notes to condensed consolidated financial statements

1

KANDI TECHNOLOGIES GROUP, INC.

AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF INCOME (LOSS)OPERATIONS AND

COMPREHENSIVE INCOME (LOSS)

(UNAUDITED)

| Three Months Ended | Nine Months Ended | Three Months Ended | Six Months Ended | |||||||||||||||||||||||||||||

| September 30, 2019 | September 30, 2018 | September 30, 2019 | September 30, 2018 | June 30, 2020 | June 30, 2019 | June 30, 2020 | June 30, 2019 | |||||||||||||||||||||||||

| REVENUES FROM UNRELATED PARTY, NET | $ | 26,968,385 | $ | 14,860,034 | $ | 63,360,044 | $ | 32,211,352 | $ | 19,436,120 | $ | 20,056,696 | $ | 25,808,544 | $ | 36,391,659 | ||||||||||||||||

| REVENUES FROM THE AFFILIATE COMPANY AND RELATED PARTY, NET | 4,720,159 | 23,135,326 | 10,543,190 | 30,479,521 | 956 | 4,089,534 | 956 | 5,823,031 | ||||||||||||||||||||||||

| REVENUES, NET | 31,688,544 | 37,995,360 | 73,903,234 | 62,690,873 | 19,437,076 | 24,146,230 | 25,809,500 | 42,214,690 | ||||||||||||||||||||||||

| COST OF GOODS SOLD | (26,412,129 | ) | (31,753,311 | ) | (61,288,228 | ) | (53,044,861 | ) | (15,900,298 | ) | (19,944,076 | ) | (21,105,463 | ) | (34,876,099 | ) | ||||||||||||||||

| GROSS PROFIT | 5,276,415 | 6,242,049 | 12,615,006 | 9,646,012 | 3,536,778 | 4,202,154 | 4,704,037 | 7,338,591 | ||||||||||||||||||||||||

| OPERATING EXPENSES: | ||||||||||||||||||||||||||||||||

| OPERATING INCOME (EXPENSES): | ||||||||||||||||||||||||||||||||

| Research and development | (596,187 | ) | (5,691,649 | ) | (1,766,210 | ) | (7,091,836 | ) | (1,149,901 | ) | (632,590 | ) | (1,790,141 | ) | (1,170,023 | ) | ||||||||||||||||

| Selling and marketing | (930,810 | ) | (898,896 | ) | (2,448,291 | ) | (1,875,294 | ) | (763,666 | ) | (899,478 | ) | (1,641,972 | ) | (1,517,481 | ) | ||||||||||||||||

| General and administrative | (3,432,920 | ) | (2,070,947 | ) | (11,096,246 | ) | (5,534,039 | ) | (3,907,191 | ) | (5,623,798 | ) | (6,973,926 | ) | (7,663,326 | ) | ||||||||||||||||

| Total Operating Expenses | (4,959,917 | ) | (8,661,492 | ) | (15,310,747 | ) | (14,501,169 | ) | ||||||||||||||||||||||||

| Gain on disposal of long-live asset | 13,907,574 | - | 13,907,574 | - | ||||||||||||||||||||||||||||

| Total Operating Income (Expenses) | 8,086,816 | (7,155,866 | ) | 3,501,535 | (10,350,830 | ) | ||||||||||||||||||||||||||

| INCOME (LOSS) FROM OPERATIONS | 316,498 | (2,419,443 | ) | (2,695,741 | ) | (4,855,157 | ) | 11,623,594 | (2,953,712 | ) | 8,205,572 | (3,012,239 | ) | |||||||||||||||||||

| OTHER INCOME (EXPENSE): | �� | |||||||||||||||||||||||||||||||

| OTHER INCOME (EXPENSES): | ||||||||||||||||||||||||||||||||

| Interest income | 209,736 | 52,745 | 559,954 | 1,452,522 | 221,792 | 97,814 | 560,736 | 350,218 | ||||||||||||||||||||||||

| Interest expense | (435,524 | ) | (483,376 | ) | (1,304,062 | ) | (1,505,409 | ) | (1,123,056 | ) | (429,355 | ) | (2,105,990 | ) | (868,538 | ) | ||||||||||||||||

| Change in fair value of contingent consideration | 57,000 | (1,552,686 | ) | 694,000 | 1,814,326 | (929,000 | ) | 548,000 | 2,863,000 | 637,000 | ||||||||||||||||||||||

| Government grants | 502,146 | 607,008 | 725,189 | 717,821 | 86,799 | 175,319 | 97,898 | 223,043 | ||||||||||||||||||||||||

| Gain from equity dilution in the Affiliate Company | (49,285 | ) | - | 4,291,974 | - | - | (24,131 | ) | - | 4,341,259 | ||||||||||||||||||||||

| Gain from equity sale in the Affiliate Company | 20,574,217 | - | 20,574,217 | - | ||||||||||||||||||||||||||||

| Share of loss after tax of the Affiliate Company | (8,433,767 | ) | (3,247,343 | ) | (22,883,126 | ) | (79,592 | ) | (2,978,529 | ) | (4,500,201 | ) | (4,081,299 | ) | (14,449,359 | ) | ||||||||||||||||

| Other income , net | 57,833 | 15,735 | 357,626 | 666,294 | ||||||||||||||||||||||||||||

| Total other income (expense), net | 12,482,356 | (4,607,917 | ) | 3,015,772 | 3,065,962 | |||||||||||||||||||||||||||

| Other income (expenses), net | 1,043,335 | (174,597 | ) | 1,062,985 | 299,793 | |||||||||||||||||||||||||||

| Total other expenses, net | (3,678,659 | ) | (4,307,151 | ) | (1,602,670 | ) | (9,466,584 | ) | ||||||||||||||||||||||||

| INCOME (LOSS) BEFORE INCOME TAXES | 12,798,854 | (7,027,360 | ) | 320,031 | (1,789,195 | ) | 7,944,935 | (7,260,863 | ) | 6,602,902 | (12,478,823 | ) | ||||||||||||||||||||

| INCOME TAX (EXPENSE) BENEFIT | (709,413 | ) | 505,961 | 41,780 | 370,316 | (3,889,889 | ) | (57,295 | ) | (4,122,502 | ) | 751,193 | ||||||||||||||||||||

| NET INCOME (LOSS) | 12,089,441 | (6,521,399 | ) | 361,811 | (1,418,879 | ) | 4,055,046 | (7,318,158 | ) | 2,480,400 | (11,727,630 | ) | ||||||||||||||||||||

| OTHER COMPREHENSIVE INCOME (LOSS) | ||||||||||||||||||||||||||||||||

| Foreign currency translation | (8,531,043 | ) | (8,108,270 | ) | (8,042,604 | ) | (13,230,652 | ) | 477,734 | (4,915,589 | ) | (3,045,331 | ) | 488,439 | ||||||||||||||||||

| COMPREHENSIVE INCOME (LOSS) | $ | 3,558,398 | $ | (14,629,669 | ) | $ | (7,680,793 | ) | $ | (14,649,531 | ) | $ | 4,532,780 | $ | (12,233,747 | ) | $ | (564,931 | ) | $ | (11,239,191 | ) | ||||||||||

| WEIGHTED AVERAGE SHARES OUTSTANDING BASIC AND DILUTED | 52,613,642 | 51,474,048 | 52,332,260 | 51,089,047 | ||||||||||||||||||||||||||||

| WEIGHTED AVERAGE SHARES OUTSTANDING BASIC | 53,369,602 | 52,806,331 | 52,862,043 | 52,189,237 | ||||||||||||||||||||||||||||

| WEIGHTED AVERAGE SHARES OUTSTANDING DILUTED | 53,369,602 | 52,806,331 | 52,862,043 | 52,189,237 | ||||||||||||||||||||||||||||

| NET INCOME (LOSS) PER SHARE, BASIC AND DILUTED | $ | 0.23 | $ | (0.13 | ) | $ | 0.01 | $ | (0.03 | ) | ||||||||||||||||||||||

| NET INCOME (LOSS) PER SHARE, BASIC | $ | 0.08 | $ | (0.14 | ) | $ | 0.05 | $ | (0.22 | ) | ||||||||||||||||||||||

| NET INCOME (LOSS) PER SHARE, DILUTED | $ | 0.08 | $ | (0.14 | ) | $ | 0.05 | $ | (0.22 | ) | ||||||||||||||||||||||

See accompanying notes to condensed consolidated financial statements

2

KANDI TECHNOLOGIES GROUP, INC.

AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY

(UNAUDITED)

| Number of Outstanding Shares | Common Stock | Treasury Stock | Additional Paid-in Capital | Accumulated Deficit | Accumulated Other Comprehensive Income | Total | Number of Outstanding Shares | Common Stock | Treasury Stock | Additional Paid-in Capital | Accumulated Deficit | Accumulated Other Comprehensive Income | Total | |||||||||||||||||||||||||||||||||||||||||||

| Balance, December 31, 2018 | 51,484,444 | 51,484 | - | 254,989,657 | (9,497,009 | ) | (19,921,258 | ) | 225,622,874 | 51,484,444 | $ | 51,484 | $ | - | $ | 254,989,657 | $ | (9,497,009 | ) | $ | (19,921,258 | ) | $ | 225,622,874 | ||||||||||||||||||||||||||||||||

| Stock issuance and award | 1,096,397 | 1,097 | - | 3,387,379 | - | - | 3,388,476 | 1,096,397 | 1,097 | - | 3,387,379 | - | - | 3,388,476 | ||||||||||||||||||||||||||||||||||||||||||

| Net income (loss) | - | - | - | - | (4,409,472 | ) | - | (4,409,472 | ) | - | - | - | - | (4,409,472 | ) | - | (4,409,472 | ) | ||||||||||||||||||||||||||||||||||||||

| Foreign currency translation | - | - | - | - | - | 5,404,028 | 5,404,028 | - | - | - | - | - | 5,404,028 | 5,404,028 | ||||||||||||||||||||||||||||||||||||||||||

| Balance, March 31, 2019 | 52,580,841 | 52,581 | - | 258,377,036 | (13,906,481 | ) | (14,517,230 | ) | 230,005,906 | 52,580,841 | $ | 52,581 | $ | - | $ | 258,377,036 | $ | (13,906,481 | ) | $ | (14,517,230 | ) | $ | 230,005,906 | ||||||||||||||||||||||||||||||||

| Stock issuance and award | 238,600 | 238 | - | 1,259,569 | - | - | 1,259,807 | 238,600 | 238 | 1,259,569 | 1,259,807 | |||||||||||||||||||||||||||||||||||||||||||||

| Net income (loss) | - | - | - | - | (7,318,158 | ) | - | (7,318,158 | ) | (7,318,158 | ) | (7,318,158 | ) | |||||||||||||||||||||||||||||||||||||||||||

| Foreign currency translation | - | - | - | - | - | (4,915,589 | ) | (4,915,589 | ) | (4,915,589 | ) | (4,915,589 | ) | |||||||||||||||||||||||||||||||||||||||||||

| Balance, June 30, 2019 | 52,819,441 | 52,819 | - | 259,636,605 | (21,224,639 | ) | (19,432,819 | ) | 219,031,966 | 52,819,441 | 52,819 | - | 259,636,605 | (21,224,639 | ) | (19,432,819 | ) | 219,031,966 | ||||||||||||||||||||||||||||||||||||||

| Stock issuance and award | 20,000 | 20 | - | 69,380 | - | - | 69,400 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Stock buyback | - | - | (2,477,965 | ) | - | - | - | (2,477,965 | ) | |||||||||||||||||||||||||||||||||||||||||||||||

| Commission in stock buyback | - | - | - | (14,615 | ) | - | - | (14,615 | ) | |||||||||||||||||||||||||||||||||||||||||||||||

| Net income (loss) | - | - | - | - | 12,089,441 | - | 12,089,441 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Foreign currency translation | - | - | - | - | - | (8,531,043 | ) | (8,531,043 | ) | |||||||||||||||||||||||||||||||||||||||||||||||

| Balance, September 30, 2019 | 52,839,441 | 52,839 | (2,477,965 | ) | 259,691,370 | (9,135,198 | ) | (27,963,862 | ) | 220,167,184 | ||||||||||||||||||||||||||||||||||||||||||||||

| Number of Outstanding Shares | Common Stock | Treasury Stock | Additional Paid-in Capital | Accumulated Deficit | Accumulated Other Comprehensive Income | Total | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Balance, December 31, 2017 | 48,036,538 | 48,037 | - | 233,055,348 | (3,802,310 | ) | (6,310,763 | ) | 222,990,312 | |||||||||||||||||||||||||||||||||||||||||||||||

| Stock issuance and award | 2,972,337 | 2,972 | - | 19,099,556 | - | - | 19,102,528 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Net income (loss) | - | - | - | - | 3,727,995 | - | 3,727,995 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Foreign currency translation | - | - | - | - | - | 7,465,240 | 7,465,240 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Balance, March 31, 2018 | 51,008,875 | 51,009 | - | 252,154,904 | (74,315 | ) | 1,154,477 | 253,286,075 | ||||||||||||||||||||||||||||||||||||||||||||||||

| Stock issuance and award | 288,600 | 289 | - | 2,038,476 | - | - | 2,038,765 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Net income (loss) | - | - | - | - | 1,374,525 | - | 1,374,525 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Foreign currency translation | - | - | - | - | - | (12,587,622 | ) | (12,587,622 | ) | |||||||||||||||||||||||||||||||||||||||||||||||

| Balance, June 30, 2018 | 51,297,475 | 51,298 | - | 254,193,380 | 1,300,210 | (11,433,145 | ) | 244,111,743 | ||||||||||||||||||||||||||||||||||||||||||||||||

| Stock issuance and award | 184,469 | 184 | - | 787,529 | - | - | 787,713 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Net income (loss) | - | - | - | - | (6,521,399 | ) | - | (6,521,399 | ) | |||||||||||||||||||||||||||||||||||||||||||||||

| Foreign currency translation | - | - | - | - | - | (8,108,271 | ) | (8,108,271 | ) | |||||||||||||||||||||||||||||||||||||||||||||||

| Balance, September 30, 2018 | 51,481,944 | 51,482 | - | 254,980,909 | (5,221,189 | ) | (19,541,416 | ) | 230,269,786 | |||||||||||||||||||||||||||||||||||||||||||||||

| Number of Outstanding Shares | Common Stock | Treasury Stock | Additional Paid-in Capital | Accumulated Deficit | Accumulated Other Comprehensive Income | Total | ||||||||||||||||||||||

| Balance, December 31, 2019 | 52,839,441 | $ | 52,839 | $ | (2,477,965 | ) | $ | 259,691,370 | $ | (16,685,736 | ) | $ | (22,723,581 | ) | $ | 217,856,927 | ||||||||||||

| Stock issuance and award | 10,000 | 10 | - | 22,290 | - | - | 22,300 | |||||||||||||||||||||

| Net income (loss) | - | - | - | - | (1,574,646 | ) | - | (1,574,646 | ) | |||||||||||||||||||

| Foreign currency translation | - | - | - | - | - | (3,523,065 | ) | (3,523,065 | ) | |||||||||||||||||||

| Balance, March 31, 2020 | 52,849,441 | $ | 52,849 | $ | (2,477,965 | ) | $ | 259,713,660 | $ | (18,260,382 | ) | $ | (26,246,646 | ) | $ | 212,781,516 | ||||||||||||

| Stock issuance and award | 1,502,717 | 1,503 | - | 3,164,925 | - | - | 3,166,428 | |||||||||||||||||||||

| Net income (loss) | - | - | - | - | 4,055,043 | - | 4,055,043 | |||||||||||||||||||||

| Foreign currency translation | - | - | - | - | - | 477,734 | 477,734 | |||||||||||||||||||||

| Balance, June 30, 2020 | 54,352,158 | 54,352 | (2,477,965 | ) | 262,878,585 | (14,205,339 | ) | (25,768,912 | ) | 220,480,721 | ||||||||||||||||||

See accompanying notes to condensed consolidated financial statements.

3

KANDI TECHNOLOGIES GROUP, INC.

AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(UNAUDITED)

| Nine Months Ended | ||||||||||||||||

| September 30, 2019 | September 30, 2018 | June 30, 2020 | June 30, 2019 | |||||||||||||

| CASH FLOWS FROM OPERATING ACTIVITIES: | ||||||||||||||||

| Net income (loss) | $ | 361,811 | $ | (1,418,879 | ) | $ | 2,480,400 | $ | (11,727,630 | ) | ||||||

| Adjustments to reconcile net income to net cash provided by operating activities | ||||||||||||||||

| Depreciation and amortization | 6,443,422 | 2,271,599 | 4,022,676 | 4,376,097 | ||||||||||||

| Impairments | 44,544 | 24,854 | (148,054 | ) | 59,799 | |||||||||||

| Allowance for doubtful accounts | 15,366 | (7,093 | ) | - | 15,543 | |||||||||||

| Deferred taxes | 50,693 | - | 2,089,505 | 51,275 | ||||||||||||

| Share of loss after tax of the Affiliate Company | 22,883,126 | 79,592 | 4,081,299 | 14,449,359 | ||||||||||||

| Gain from equity dilution in the Affiliate Company | (4,291,974 | ) | - | - | (4,341,259 | ) | ||||||||||

| Gain from equity sale in the Affiliate Company | (20,574,217 | ) | - | |||||||||||||

| Gain on disposal of long-live asset | (13,907,574 | ) | - | |||||||||||||

| Change in fair value of contingent consideration | (694,000 | ) | (1,814,326 | ) | (2,863,000 | ) | (637,000 | ) | ||||||||

| Stock compensation cost | 1,337,333 | 253,934 | 847,546 | 1,314,408 | ||||||||||||

| Changes in operating assets and liabilities: | ||||||||||||||||

| (Increase) Decrease In: | ||||||||||||||||

| Accounts receivable | (36,822,184 | ) | (52,845,923 | ) | (1,431,388 | ) | (16,560,338 | ) | ||||||||

| Deferred taxes assets | - | (52,126 | ) | |||||||||||||

| Notes receivable | 174,881 | 491,272.00 | - | 250,593 | ||||||||||||

| Notes receivable from the Affiliate Company and related party | 437,203 | 3,196,340 | - | 442,223 | ||||||||||||

| Inventories | (14,813,147 | ) | 1,555,993 | (743,483 | ) | (7,093,904 | ) | |||||||||

| Other receivables and other assets | (17,275,954 | ) | 1,497,230 | (11,248,701 | ) | (6,258,341 | ) | |||||||||

| Due from employee | (25,861 | ) | 945 | |||||||||||||

| Advances to supplier and prepayments and prepaid expenses | 1,357,001 | (4,590,404 | ) | (12,586,777 | ) | 708,825 | ||||||||||

| Amount due from the Affiliate Company | 30,549,072 | (81,549,214 | ) | 4,129,516 | (4,128,506 | ) | ||||||||||

| Amount due from Affiliate Company-Long term | - | 15,907,183 | ||||||||||||||

| Due from related party | - | 161,874 | ||||||||||||||

| Increase (Decrease) In: | ||||||||||||||||

| Accounts payable | 11,383,411 | 101,684,965 | (282,560 | ) | 387,505 | |||||||||||

| Other payables and accrued liabilities | 7,791,028 | 29,845,307 | 736,715 | 7,868,402 | ||||||||||||

| Notes payable | (11,836,950 | ) | (12,434,813 | ) | (10,664,922 | ) | (10,161,233 | ) | ||||||||

| Customer deposits | (59,734 | ) | 20,350 | |||||||||||||

| Income tax payable | (1,803,574 | ) | (2,353,826 | ) | 1,161,312 | (2,134,722 | ) | |||||||||

| Deferred income | (56,448 | ) | (761,643 | ) | ||||||||||||

| Net cash used in operating activities | $ | (25,425,152 | ) | $ | (836,809 | ) | ||||||||||

| Net cash used in by operating activities | $ | (34,327,490 | ) | $ | (33,118,904 | ) | ||||||||||

| CASH FLOWS FROM INVESTING ACTIVITIES: | ||||||||||||||||

| Purchases of property, plant and equipment, net | (955,670 | ) | (304,745 | ) | (59,670 | ) | (512,707 | ) | ||||||||

| Purchases of land use rights and other intangible assets | - | (105,480 | ) | |||||||||||||

| Acquisition of Jinhua An Kao (net of cash received) | - | (3,610,846 | ) | |||||||||||||

| Acquisition of SC Autosports | - | 486,954 | ||||||||||||||

| Purchases of construction in progress | (18,491 | ) | (425,241 | ) | ||||||||||||

| Reimbursement of capitalize interests for construction in progress | - | 1,818,390 | ||||||||||||||

Proceeds from disposal of long-live asset | 34,696,547 | - | ||||||||||||||

| Cash received from equity sale in the Affiliate Company | 32,061,558 | - | 15,641,886 | - | ||||||||||||

| Long Term Investment | - | 1,458,464 | ||||||||||||||

| Net cash provided by (used in) investing activities | $ | 31,087,397 | $ | (682,504 | ) | |||||||||||

| Advance receipts of equity transfer | - | 14,740,783 | ||||||||||||||

| Net cash provided by investing activities | $ | 50,278,763 | $ | 14,228,076 | ||||||||||||

| CASH FLOWS FROM FINANCING ACTIVITIES: | ||||||||||||||||

| Proceeds from short-term bank loans | 27,864,409 | 25,515,452 | ||||||||||||||

| Repayments of short-term bank loans | (26,261,331 | ) | (26,283,065 | ) | ||||||||||||

| Repayments of long-term bank loans | (145,734 | ) | (153,523 | ) | ||||||||||||

| Proceeds from notes payable | - | 40,313,800 | ||||||||||||||

| Repayment of notes payable | - | (43,024,633 | ) | |||||||||||||

| Cash used for stock buyback | (2,492,579 | ) | - | |||||||||||||

| Net cash used in financing activities | $ | (1,035,235 | ) | $ | (3,631,969 | ) | ||||||||||

| Proceeds from short-term loans | 24,031,625 | 17,541,532 | ||||||||||||||

| Repayments of short-term loans | (49,769,638 | ) | (15,920,046 | ) | ||||||||||||

| Proceeds from long-term loans | 394,116 | - | ||||||||||||||

| Repayments of long-term loans | (284,398 | ) | (147,408 | ) | ||||||||||||

| Net cash (used in) provided by financing activities | $ | (25,628,295 | ) | $ | 1,474,078 | |||||||||||

| NET INCREASE (DECREASE) IN CASH AND CASH EQUIVALENTS AND RESTRICTED CASH | 4,627,010 | (5,151,282 | ) | |||||||||||||

| NET DECREASE IN CASH AND CASH EQUIVALENTS AND RESTRICTED CASH | (9,677,022 | ) | (17,416,750 | ) | ||||||||||||

| Effect of exchange rate changes on cash | (928,440 | ) | (512,545 | ) | (157,062 | ) | 246,604 | |||||||||

| CASH AND CASH EQUIVALENTS AND RESTRICTED CASH AT BEGINNING OF YEAR | 22,353,071 | 16,110,496 | 16,512,635 | 22,353,071 | ||||||||||||

| CASH AND CASH EQUIVALENTS AND RESTRICTED CASH AT END OF PERIOD | 26,051,641 | 10,446,669 | 6,678,551 | 5,182,925 | ||||||||||||

| -CASH AND CASH EQUIVALENTS AT END OF PERIOD | 14,338,637 | 1,342,085 | 3,457,498 | 3,608,933 | ||||||||||||

| -RESTRICTED CASH AT END OF PERIOD | 11,713,004 | 9,104,584 | 3,221,053 | 1,573,992 | ||||||||||||

| SUPPLEMENTARY CASH FLOW INFORMATION | ||||||||||||||||

| Income taxes paid | 1,711,101 | 1,981,072 | 870,082 | 1,199,807 | ||||||||||||

| Interest paid | 1,304,062 | 1,274,399 | 641,213 | 868,538 | ||||||||||||

| SUPPLEMENTAL NON-CASH DISCLOSURES: | ||||||||||||||||

| Acquisition of Jinhua An Kao by stock | - | 20,718,859 | ||||||||||||||

| Acquisition of SC Autosports by stock | - | 756,664 | ||||||||||||||

| Amount due from the Affiliate Company converted to investment in the Affiliate Company | - | 83,669,804 | ||||||||||||||

| Notes receivable from unrelated parties for equity transfer payment | 43,137,369 | - | ||||||||||||||

See accompanying notes to condensed consolidated financial statements

4

NOTE 1 - ORGANIZATION AND PRINCIPAL ACTIVITIES

Kandi Technologies Group, Inc. (“Kandi Technologies”) was incorporated under the laws of the State of Delaware on March 31, 2004. As used herein, the terms “Company” or “Kandi” refer to Kandi Technologies and its operating subsidiaries, as described below.

Headquartered in Jinhua City, Zhejiang Province, People’s Republic of China (“China” or “PRC”), the Company is one of China’s leading producers and manufacturers of electric vehicle (“EV”) products (through the Affiliate Company, formerly defined as the JV Company), EV parts, and off-road vehicles for sale in the Chinese and the global markets. The Company conducts its primary business operations through its wholly-owned subsidiaries, Zhejiang Kandi Vehicles Co., Ltd. (“Kandi Vehicles”), Kandi Vehicles’ wholly and partially-owned subsidiaries, and SC Autosports LLC (“SC Autosports”), d/b/a Kandi America).

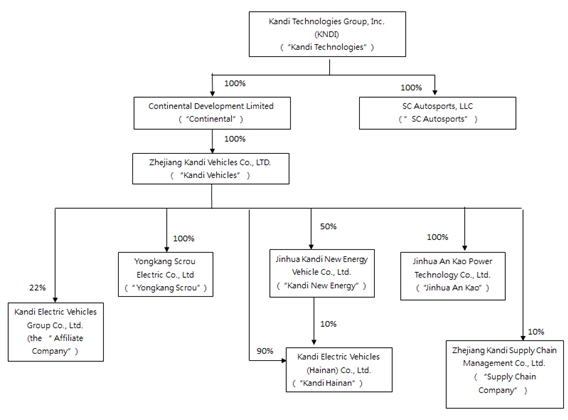

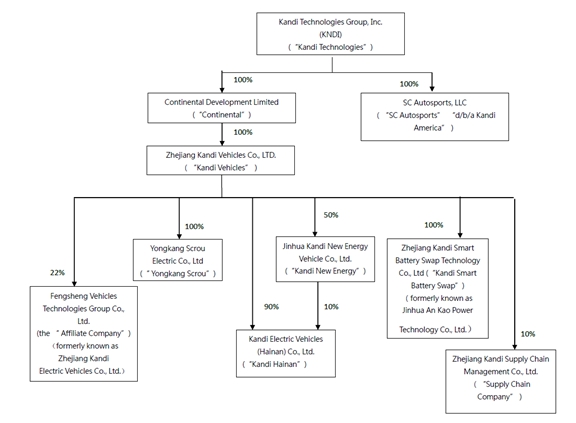

The Company’s organizational chart as of September 30, 2019the date of this report is as follows:

5

On March 21, 2019, Kandi Vehicle signed an Equity Transfer Agreement (the “Transfer Agreement”) with Geely Technologies Group

In June 2020, Jinhua An Kao Power Technology Co., Ltd. (“Geely”)changed its name to transfer certain equity interests in theZhejiang Kandi Electric Vehicles GroupSmart Battery Swap Technology Co., Ltd. (the “Affiliate Company”, formerly defined as the “JV Company”) to Geely. Pursuant to the Transfer Agreement, the Affiliate Company converted a loan of RMB 314 million (approximately $46.7 million) from Geely last year to equity in order to increase its cash flow. As a result, the registered capital of the Affiliate Company became RMB 2.40 billion (approximately $336.3 million), of which Ltd (“Kandi Vehicles then owned 43.47% and Geely owned 56.53%, respectively, upon the conversion of the loan into equity in the Affiliate Company. After that, Kandi Vehicles further agreed to sell 21.47% of its equity interests in the Affiliate Company to Geely for a total amount of RMB 516 million (approximately $72.3 million)Smart Battery Swap”). As of September 29, 2019, Kandi Vehicles has received payments in cash totaling RMB 220 million (approximately $30.9 million) and certain commercial acceptance notes of RMB 296 million (approximately $41.6 million), of which RMB 140 million (approximately $19.7 million) shall mature on January 20, 2020 and the remaining RMB 156 million (approximately $21.9 million) shall mature on March 29, 2020. As a result of the completion of the equity transfer on September 29, 2019, Kandi Vehicles now owns 22% and Geely and its affiliates own 78% of the equity interests of the Affiliate Company. As now the Company only owns 22% of the JV Company, it was redefined as the Affiliate Company.

The Company’s original primary business operations consist of designing, developing, manufacturing and commercializing EV products (through Kandi Electric Vehicles (Hainan) Co., Ltd. and the Affiliate Company), EV parts and off-road vehicles. The COVID-19 outbreak has seriously impacted the EV market in 2020. As a result, the Company plans to manufacture and sell a number of ancillary products aimed at the dynamic power train system of intelligent transportation. For example, the dynamic power train system of Electric Scooters and Electric Self-Balancing Vehicles. The Company is pursuing these opportunities by expanding production of intelligent transportation products that exploit its advantages in the Yongkang Scrou Electric Co, Ltd.’s power electric motor and Kandi Smart Battery Swap’s power battery pack. The products aimed at this market combine the Company’s motors and battery packs into a dynamic power train system. As part of its strategic objective of becoming a leading manufacturer of EV products (through the Affiliate Company) and related services, in the future, the Company has increasedwill increase its focus on pure EV-related products and intelligent transportation dynamic power train system, and is actively pursuing expansion in the Chinesedomestic and international markets, especially the U.S. market.foreign markets.

NOTE 2 - LIQUIDITY

The Company had a working capital of $80,374,159$75,587,762 as of SeptemberJune 30, 2019,2020, an increase of $77,847,248$11,889,065 from athe working capital of $2,526,911$63,698,697 as of December 31, 2018.2019. As of SeptemberJune 30, 20192020 and December 31, 2018,2019, the Company’s cash and cash equivalents was $14,338,637were $3,457,498 and $ 15,662,201, respectively, the$5,490,557, respectively. The Company’s restricted cash was $11,713,004$3,221,053 and $6,690,870,$11,022,078, respectively.

DuringAfter two years of negotiations, on March 10, 2020, a real estate repurchase agreement (the “Repurchase Agreement”) was entered into by and between Kandi Vehicles and Jinhua Economic and Technological Development Zone pursuant to which the local government shall purchase the land use right over the land of 66 acres (400 mu, 265,029 square meters) that is owned by Kandi Vehicles for RMB 525 million ($74 million). Payments to Kandi Vehicles shall be made in three installments as the Company disclosed in a Current Report on Form 8-K filed with the SEC on March 9, 2020. In addition, if Kandi Vehicles achieves certain milestones that contribute to local economic development, the Company will be eligible for tax rebates totaling up to RMB 500 million ($71 million) over the next eight years. On May 22, 2020, the Company received the first quarterpayment of 2019,RMB 244 million (approximately $35 million) under the Repurchase Agreement. On July 9, 2020, the Company signed an agreement to sell 21.47% of its equity interests inreceived the Affiliate Company to Geely for a total amountsecond payment of RMB 516119 million (approximately $72.3$17 million). As under the Repurchase Agreement. The final payment of September 29, 2019,RMB 162 million ($22.9 million) will be received when the Company has received payments in cash totaling RMB 220 million (approximately $30.9 million)vacates the land, factory buildings, and certain commercial acceptance notesother real estate and moved to the new facility. Kandi Vehicles intends to use a portion of RMB 296 million (approximately $41.6 million) from Geely, of which RMB 140 million (approximately $19.7 million) shall mature on January 20, 2020 and the remaining RMB 156 million (approximately $21.9 million) shall mature on March 29, 2020. The Company plans to apply the proceeds from the equity transferland repurchase (approximately RMB 130 million, or $18.4 million) to its ongoing operations. The cash flowfund the land use acquisition and operating capacity offactory construction in the Company will be greatly improved after receivingNew Energy Automotive Zone, and use the above payments.

rest portion to fund growth initiatives and for general corporate purposes. Although the Company expects that most of its outstanding trade receivables from customers will be collected in the next twelve months, there are uncertainties with respect to the timing in collecting these receivables, especially the receivables due from the Affiliate Company, because most of them are indirectly impacted by the progress of the receipt of government subsidies.

6

The Company’s primary need for liquidity stems from its need to fund working capital requirements of the Company’s businesses, its capital expenditures and its general operations, including debt repayment. The Company has historically financed its operations through short-term commercial bank loans from Chinese banks, as well as its ongoing operating activities by using funds from operations, external credit or financing arrangements. TheAlthough the Company routinely monitors current and expected operational requirements and financial market conditions to evaluatehas paid off all the useshort-term bank loans as of available financing sources. ConsideringJune 30, 2020, it still retains the existing working capital position andcredit line, which can be used at any time when the ability to access debt funding sources,Company has special needs. In addition, the Company received the remaining RMB186 million (approximately $26.3 million) equity transfer payment from Geely in July, 2020. The management believes that the Company’s operations and borrowing resources areCompany currently has sufficient to provide for its current and foreseeableworking capital requirements to support its ongoing operations for the next twelve months.

NOTE 3 - BASIS OF PRESENTATION

The accompanying unaudited condensed consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”) for interim information, and with the instructions to Form 10-Q and Rule 10-01 of Regulation S-X promulgated by the Securities and Exchange Commission (“SEC”). Accordingly, they do not include all of the information and notes required by U.S. GAAP for annual financial statements. In the management’s opinion, the interim financial statements reflect all normal adjustments that are necessary to provide a fair presentation of the financial results for the interim periods presented. Operating results for interim periods are not necessarily indicative of results that may be expected for an entire fiscal year. The condensed consolidated balance sheet as of December 31, 20182019 has been derived from the audited consolidated financial statements as of such date. For a more complete understanding of the Company’s business, financial position, operating results, cash flows, risk factors and other matters, please refer to its Annual Report on Form 10-K for the fiscal year ended December 31, 20182019 (the “2018“2019 Form 10-K”).

Beginning in 2020, a strain of new coronavirus (“COVID-19”) has spread globally and at this point, the extent to which the COVID-19 may impact operations of the Company is uncertain. The extent of the impact of the COVID-19 on the Company's business and operations will depend on several factors, such as the duration, severity, and geographic spread of the pandemic, development of the testing and treatment and stimulus measures of the government. The Company is monitoring and assessing the evolving situation closely and evaluating its potential exposure. The operating results for the six months ended June 30, 2020 may not be indicative of the future operating results for the fiscal year ending December 31, 2020 or other future periods, particularly in light of the uncertain impact COVID-19 could have on the Company's business.

NOTE 4 - PRINCIPLES OF CONSOLIDATION

The Company’s consolidated financial statements reflect the accounts of the Company and its ownership interests in the following subsidiaries:

| (1) | Continental Development Limited (“Continental”), a wholly-owned subsidiary of the Company, incorporated under the laws of Hong Kong; |

| (2) | Kandi Vehicles, a wholly-owned subsidiary of |

| (3) |

7

| (4) |

| (5) | Kandi Electric Vehicles (Hainan) Co., Ltd. (“Kandi Hainan”), a subsidiary, |

| (6) |

| (7) | SC Autosports, a wholly-owned subsidiary of the Company |

Equity Method Investees

The Company’s consolidated net income also includes the Company’s proportionate share of the net income or loss of its equity method investees as follows:

The Affiliate Company, a 22% owned subsidiary of Kandi Vehicles and its subsidiaries

All intra-entity profits and losses with regard to the Company’s equity method investees have been eliminated.

NOTE 5 - USE OF ESTIMATES

The preparation of financial statements in conformity with generally accepted accounting principles in the United StatesU.S. GAAP requires the Company’s management to make estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the consolidated financial statements, and the reported amounts of revenue and expenses during the reporting period. Management makes these estimates using the best information available at the time the estimates are made; however actual results when ultimately realized could differ from those estimates.

NOTE 6 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Our significant accounting policies are detailed in “Note 26 - Summary of Significant Accounting Policies” of the Company 20182019 Form 10-K.10-K, excepting the following.

(v) Reclassification

Certain reclassifications have been made to the condensed consolidated statements of cash flows for six months ended June 30, 2019 to conform to the presentation of consolidated financial statement for six months ended June 30, 2020. The Company reclassified the following 1) grouping due from employees into other receivables and other assets; 2) grouping customer deposits and deferred income into other payables and accrued liabilities.

8

NOTE 7 - NEW ACCOUNTING PRONOUNCEMENTS

In February 2016, the FASB issued ASU 2016-02, together with subsequent Accounting Standards Updates collectively known as the “leases standard” or “ASC 842”. ASC 842 requires a lessee recognize the assets and liabilities that arise from leases. All leases create an asset and a liability for the lessee in accordance with FASB Concepts Statement No. 6, Elements of Financial Statements. Effective January 1, 2019, the Company adopted the new standard using the effective date approach. The Company elected to adopt both the transition relief provided in ASU 2018-11 and the package of practical expedients which allowed us, among other things, to retain historical lease classifications and accounting for any leases that existed prior to adoption of the standard. Additionally, the management elected the practical expedients allowing the Company not to separate lease and non-lease components and not record leases with an initial term of twelve months or less (“short-term leases”) on the balance sheet across all existing asset classes.

Adoption of the new standard resulted in the recording of operating lease assets and operating lease liabilities of $140,000 as of January 1, 2019, which primarily relates to the corporate office leases for SC Autosports. The standard did not materially impact the condensed consolidated statements of operations or cash flows. Adopting the new standard did not have a material impact on the accounting for leases under which the Company is the lessee.

In January 2017, the FASB issued ASU No. 2017-04 (Topic 350) Intangibles—Goodwill and Other: Simplifying the Test for Goodwill Impairment, which removes Step 2 of the goodwill impairment test, which requires a hypothetical purchase price allocation. Under the amended guidance, a goodwill impairment charge will now be recognized for the amount by which the carrying value of a reporting unit exceeds its fair value, not to exceed the carrying amount of goodwill. This ASU will be applied on a prospective basis and is effective for interim and annual periods beginning after December 15, 2019, with early adoption permitted for any impairment tests performed after January 1, 2017. The Company plans to adopt this ASU in the fourth quarter of 2019 and does not expect the adoption to have a material impact on the Consolidated Financial Statements.

In February 2018, the FASB released ASU 2018-2, “Reclassification of Certain Tax Effects from Accumulated Other Comprehensive Income.” This standard update addresses a specific consequence of the Tax Cuts and Jobs Act (“U.S. tax reform”(the “Tax Act”) and allows a reclassification from accumulated other comprehensive income to retained earnings for the stranded tax effects resulting from U.S. tax reform.the Tax Act. Consequently, the update eliminates the stranded tax effects that were created as a result of the historical U.S. federal corporate income tax rate to the newly enacted U.S. federal corporate income tax rate. The Company is required to adopt this standard in the first quarter of fiscal year 2020, with early adoption permitted. The amendments in this update should be applied either in the period of adoption or retrospectively to each period in which the effect of the change in the U.S. federal corporate income tax rate in the Tax Cuts and Jobs Act is recognized. The Company has finishedadopted this ASU in the evaluationfirst quarter of 2020 and determined there is nothe new standard did not have a material impact of on its Condensed Consolidated Financial Statements.the consolidated financial statements.

In August 2018, the FASB issued ASU 2018-13 Disclosure Framework — Changes to the Disclosure Requirements for Fair Value Measurement, which eliminates, adds, and modifies certain disclosure requirements for fair value measurements under ASC 820. This ASU is to be applied on a prospective basis for certain modified or new disclosure requirements, and all other amendments in the standard are to be applied on a retrospective basis. The new standard is effective for interim and annual periods beginning after December 15, 2019, with early adoption permitted. The Company adopted this ASU in the first quarter of 2020 and the new standard did not have a material impact on the consolidated financial statements.

In January 2020, the FASB issued ASU 2020-01, Investments—Equity Securities, Investments—Equity Method and Joint Ventures, and Derivatives and Hedging, which clarifies the interaction of the accounting for equity securities under Topic 321, the accounting for equity method investments in Topic 323, and the accounting for certain forward contracts and purchased options in Topic 815. This guidance will be effective in the first quarter of 2021 on a prospective basis, with early adoption permitted. The Company is currently evaluating the impact of the new guidance and do not expect the adoption of this guidance will have a material impact on the Consolidated Financial Statements.consolidated financial statements.

9

NOTE 8 - CONCENTRATIONS

(a) Customers

For the three-month period ended SeptemberJune 30, 2019,2020, the Company’s major customers, each of whom accounted for more than 10% of the Company’s consolidated revenue, were as follows:

| Sales | Trade Receivable | |||||||||||||||||||||||||||||||

| Three Months | Three Months | |||||||||||||||||||||||||||||||

| Ended | Ended | |||||||||||||||||||||||||||||||

| September 30, | September 30, | September 30, | December 31, | Sales | Trade Receivable | |||||||||||||||||||||||||||

| Major Customers | 2019 | 2018 | 2019 | 2018 | | Three Months Ended June 30, 2020 | | Three Months Ended June 30, 2019 | | June 30, 2020 | | | December 31, 2019 | | ||||||||||||||||||

| Customer A | 30 | % | 24 | % | 27 | % | 22 | % | 57 | % | 36 | % | 66 | % | 55 | % | ||||||||||||||||

| Customer B | 30 | % | 4 | % | 12 | % | 2 | % | 15 | % | 27 | % | 6 | % | 5 | % | ||||||||||||||||

| Kandi Electric Vehicles Group Co., Ltd. and its subsidiaries (related party) | 15 | % | 61 | % | 30 | % | 66 | % | ||||||||||||||||||||||||

| Customer D | 10 | % | - | 8 | % | 7 | % | |||||||||||||||||||||||||

For the nine-monthsix-month period ended SeptemberJune 30, 2019,2020, the Company’s major customers, each of whom accounted for more than 10% of the Company’s consolidated revenue, were as follows:

| Sales | Trade Receivable | |||||||||||||||||||||||||||||||

| Nine Months | Nine Months | |||||||||||||||||||||||||||||||

| Ended | Ended | |||||||||||||||||||||||||||||||

| September 30, | September 30, | September 30, | December 31, | Sales | Trade Receivable | |||||||||||||||||||||||||||

| Major Customers | 2019 | 2018 | 2019 | 2018 | Six Months Ended June 30, 2020 | Six Months Ended June 30, 2019 | June 30, 2020 | December 31, 2019 | ||||||||||||||||||||||||

| Customer A | 39 | % | 24 | % | 27 | % | 22 | % | 51 | % | 47 | % | 66 | % | 55 | % | ||||||||||||||||

| Customer B | 23 | % | 6 | % | 12 | % | 2 | % | 15 | % | 18 | % | 6 | % | 5 | % | ||||||||||||||||

| Kandi Electric Vehicles Group Co., Ltd. and its subsidiaries (related party) | 14 | % | 49 | % | 30 | % | 66 | % | ||||||||||||||||||||||||

(b) Suppliers

For the three-month period ended SeptemberJune 30, 2019,2020, the Company’s material suppliers, each of whom accounted for more than 10% of the Company’s total purchases, were as follows:

| Purchases | Accounts Payable | |||||||||||||||

| Major Suppliers | Three Months Ended June 30, 2020 | Three Months Ended June 30, 2019 | June 30, 2020 | December 31, 2019 | ||||||||||||

| Zhejiang Kandi Supply Chain Management Co., Ltd. | 59 | % | 69 | % | 13 | % | 8 | % | ||||||||

| Supplier C | 24 | % | 13 | % | - | - | ||||||||||

��

10

| Purchases | Accounts Payable | |||||||||||||||

| Three Months | Three Months | |||||||||||||||

| Ended | Ended | |||||||||||||||

| September 30, | September 30, | September 30, | December 31 | |||||||||||||

| Major Suppliers | 2019 | 2018 | 2019 | 2018 | ||||||||||||

| Supplier E | 93 | % | - | 12 | % | - | ||||||||||

For the nine-monthsix-month period ended SeptemberJune 30, 2019,2020, the Company’s material suppliers, each of whom accounted for more than 10% of the Company’s total purchases, were as follows:

| Purchases | Accounts Payable | |||||||||||||||

| Nine Months | Nine Months | |||||||||||||||

| Ended | Ended | |||||||||||||||

| September 30, | September 30, | September 30, | December 31, | |||||||||||||

| Major Suppliers | 2019 | 2018 | 2019 | 2018 | ||||||||||||

| Supplier E | 67 | % | - | 12 | % | - | ||||||||||

| Supplier F | 13 | % | 3 | % | 6 | % | - | |||||||||

| Purchases | Accounts Payable | |||||||||||||||

| Major Suppliers | Six Months Ended June 30, 2020 | Six Months Ended June 30, 2019 | June 30, 2020 | December 31, 2019 | ||||||||||||

| Zhejiang Kandi Supply Chain Management Co., Ltd. | 59 | % | 48 | % | 13 | % | 8 | % | ||||||||

| Supplier C | 25 | % | 15 | % | - | - | ||||||||||

NOTE 9 - EARNINGS (LOSS) PER SHARE

The Company calculates earnings per share in accordance with ASC 260, Earnings Per Share, which requires a dual presentation of basic and diluted earnings per share. Basic earnings per share are computed using the weighted average number of shares outstanding during the reporting period. Diluted earnings per share represents basic earnings per share adjusted to include the potentially dilutive effect of outstanding stock options and warrants (using treasury stock method). Due to the average market price of the common stock during the period below the exercise price of the options approximately 3,900,000 options were excluded from the calculation of diluted net loss per share, for the three and nine months ended September 30, 2019, respectively. Duedue to the loss from operations, approximately 3,900,000 options were excluded from the calculation of diluted net loss per share, for the threethree-month and nine monthssix-month period ended SeptemberJune 30, 2018, respectively.2020.

The following is the calculation of earnings per share for the three-month and six-month periods ended SeptemberJune 30, 20192020 and 2018:2019:

| For three months ended | ||||||||

| June 30, | ||||||||

| 2020 | 2019 | |||||||

| Net income (loss) | $ | 4,055,046 | $ | (7,318,158 | ) | |||

| Weighted average shares used in basic computation | 53,369,602 | 52,806,331 | ||||||

| Dilutive shares | - | - | ||||||

| Weighted average shares used in diluted computation | 53,369,602 | 52,806,331 | ||||||

| Income (loss) per share: | ||||||||

| Basic | $ | 0.08 | $ | (0.14 | ) | |||

| Diluted | $ | 0.08 | $ | (0.14 | ) | |||

11

| For three months ended | ||||||||

| September 30, | ||||||||

| 2019 | 2018 | |||||||

| Net income (loss) | $ | 12,089,441 | $ | (6,521,399 | ) | |||

| Weighted average shares used in basic computation | 52,613,642 | 51,474,048 | ||||||

| Dilutive shares | - | - | ||||||

| Weighted average shares used in diluted computation | 52,613,642 | 51,474,048 | ||||||

| Earnings (Loss) per share: | ||||||||

| Basic and diluted | $ | 0.23 | $ | (0.13 | ) | |||

The following is the calculation of earnings per share for the nine-month periods ended September 30, 2019 and 2018:

| For nine months ended | For six months ended | |||||||||||||||

| September 30, | June 30, | |||||||||||||||

| 2019 | 2018 | 2020 | 2019 | |||||||||||||

| Net income (loss) | $ | 361,811 | $ | (1,418,879 | ) | $ | 2,480,400 | $ | (11,727,630 | ) | ||||||

| Weighted average shares used in basic computation | 52,332,260 | 51,089,047 | 52,862,043 | 52,189,237 | ||||||||||||

| Dilutive shares | - | - | - | - | ||||||||||||

| Weighted average shares used in diluted computation | 52,332,260 | 51,089,047 | 52,862,043 | 52,189,237 | ||||||||||||

| Earnings (Loss) per share: | ||||||||||||||||

| Basic and diluted | $ | 0.01 | $ | (0.03 | ) | |||||||||||

| Income (loss) per share: | ||||||||||||||||

| Basic | $ | 0.05 | $ | (0.22 | ) | |||||||||||

| Diluted | $ | 0.05 | $ | (0.22 | ) | |||||||||||

NOTE 10 - ACCOUNTS RECEIVABLE

Accounts receivable are summarized as follows:

| September 30, | December 31, | June 30, | December 31, | |||||||||||||

| 2019 | 2018 | 2020 | 2019 | |||||||||||||

| Accounts receivable | $ | 54,990,221 | $ | 34,394,738 | $ | 60,271,467 | $ | 61,436,514 | ||||||||

| Less: allowance for doubtful accounts | (130,420 | ) | (120,010 | ) | (251,012 | ) | (254,665 | ) | ||||||||

| Accounts receivable, net | $ | 54,859,801 | $ | 34,274,728 | $ | 60,020,455 | $ | 61,181,849 | ||||||||

NOTE 11 - INVENTORIES

Inventories are summarized as follows:

| September 30, | December 31, | June 30, | December 31, | |||||||||||||

| 2019 | 2018 | 2020 | 2019 | |||||||||||||

| Raw material | $ | 11,192,506 | $ | 7,040,728 | $ | 10,022,590 | $ | 12,127,957 | ||||||||

| Work-in-progress | 13,778,920 | 1,571,179 | 11,369,771 | 4,545,736 | ||||||||||||

| Finished goods | 10,475,957 | 13,385,961 | 6,852,906 | 11,062,873 | ||||||||||||

| Inventories | $ | 35,447,383 | $ | 21,997,868 | $ | 28,245,267 | $ | 27,736,566 | ||||||||

1012

NOTE 12 - NOTES RECEIVABLE

As of SeptemberJune 30, 2020, there was $0 notes receivable from unrelated parties. As of December 31, 2019, there was $41,549,888$42,487,225 notes receivable from unrelated parties, among which $70,067 were bank acceptance notes from payments for sales and $41,479,821 werewas commercial acceptance notes from payments for equity transfer of the Affiliate Company , among which $15,562,661 had been collected during first half of 2020 and the rest were considered as other receivables (refer to Note 24-summarized22-summarized information of equity method investment in the Affiliate Company). As of December 31, 2018, there was $72,712 notes receivable from unrelated parties, among which $72,712 were bank acceptance notes from payments for sales.

As of September 30, 2019, there was $0 notes receivable from the Affiliate Company and related parties. As of December 31, 2018. there was $3,861,032 notes receivable from the Affiliate Company and related parties, among which $3,861,032 were bank acceptance notes from payments for sales.

NOTE 13 - OTHER RECEIVABLES

Other receivables consist of the following:

| June 30, | December 31, | |||||||

| 2020 | 2019 | |||||||

| Amount due from unrelated party for equity transfer of the Affiliate company | $ | 26,315,045 | $ | - | ||||

| Loan to third party | 13,726,757 | 3,577,145 | ||||||

| Others | 2,619,540 | 1,442,826 | ||||||

| Total other receivables | $ | 42,661,342 | $ | 5,019,971 | ||||

Other receivable is summarized as follows:

| September 30, | December 31, | |||||||

| 2019 | 2018 | |||||||

| Loan to third party | $ | 9,187,863 | $ | - | ||||

| Others | 3,671,441 | 1,264,323 | ||||||

| Total other receivables | $ | 12,859,304 | $ | 1,264,323 | ||||

As of SeptemberJune 30, 2020, the Company’s other receivable includes $26,315,045 amount due from unrelated party for equity transfer of the Affiliate Company (refer to Note 22-summarized information of equity method investment in the Affiliate Company). As of June 30, 2020 and December 31, 2019, the Company’s other receivable includes $9.2 million$13,726,757 and $3,577,145 short-term loan lent to an unrelated party with a 6% annual interest rate to maximize the use of idled cash. This loan can be redeemed at any time.

13

NOTE 14 - PROPERTY, PLANT AND EQUIPMENT, NET

Property, plants and equipment as of SeptemberJune 30, 20192020 and December 31, 2018,2019, consisted of the following:

| September 30, | December 31, | |||||||

| 2019 | 2018 | |||||||

| At cost: | ||||||||

| Buildings | $ | 29,703,216 | $ | 30,638,417 | ||||

| Machinery and equipment | 61,376,817 | 63,398,627 | ||||||

| Office equipment | 998,625 | 852,172 | ||||||

| Motor vehicles and other transport equipment | 403,253 | 418,476 | ||||||

| Molds and others | 25,420,383 | 26,849,806 | ||||||

| 117,902,294 | 122,157,498 | |||||||

| Less : Accumulated depreciation | ||||||||

| Buildings | $ | (5,579,392 | ) | $ | (5,019,075 | ) | ||

| Machinery and equipment | (12,395,351 | ) | (8,442,940 | ) | ||||

| Office equipment | (464,806 | ) | (393,893 | ) | ||||

| Motor vehicles and other transport equipment | (344,633 | ) | (325,917 | ) | ||||

| Molds and others | (24,626,908 | ) | (25,486,100 | ) | ||||

| (43,411,090 | ) | (39,667,925 | ) | |||||

| Less: impairment | - | (443,650 | ) | |||||

| Property, plant and equipment, net | $ | 74,491,204 | $ | 82,045,923 | ||||

| June 30, | December 31, | |||||||

| 2020 | 2019 | |||||||

| At cost: | ||||||||

| Buildings | $ | 30,017,395 | $ | 30,447,480 | ||||

| Machinery and equipment | 62,128,182 | 62,973,794 | ||||||

| Office equipment | 1,041,911 | 1,048,651 | ||||||

| Motor vehicles and other transport equipment | 412,260 | 413,046 | ||||||

| Molds and others | 25,467,098 | 25,836,241 | ||||||

| 119,066,846 | 120,719,212 | |||||||

| Less : Accumulated depreciation | ||||||||

| Buildings | $ | (6,396,987 | ) | $ | (5,975,030 | ) | ||

| Machinery and equipment | (16,735,598 | ) | (14,127,506 | ) | ||||

| Office equipment | (611,384 | ) | (537,829 | ) | ||||

| Motor vehicles and other transport equipment | (369,453 | ) | (360,098 | ) | ||||

| Molds and others | (25,045,460 | ) | (25,310,891 | ) | ||||

| (49,158,882 | ) | (46,311,354 | ) | |||||

| Property, plant and equipment, net | $ | 69,907,964 | $ | 74,407,858 | ||||

As of SeptemberJune 30, 20192020 and December 31, 2018,2019, the net book value of property, plant and equipment pledged as collateral for the Company’s bank loans totaled $7,441,479$0 and $8,105,419,$6,484,497, respectively. Also see Note 18.17.

Depreciation expenses for the three months ended SeptemberJune 30, 2020 and 2019 were $1,750,013 and September 30, 2018 were $1,832,83 and $239,434,$1,876,569, respectively. Depreciation expenses for the ninesix months ended SeptemberJune 30, 2020 and 2019 were $3,530,165 and September 30, 2018 were $5,724,863 and $1,511,018, respectively$3,892,028, respectively.

NOTE 15 - INTANGIBLE ASSETS

Intangible assets include acquired other intangibles of trade name, customer relations and patent recorded at estimated fair values in accordance with purchase accounting guidelines for acquisitions.

14

The following table provides the gross carrying value and accumulated amortization for each major class of our intangible assets, other than goodwill:

| Remaining | September 30, | December 31, | Remaining | June 30, | December 31, | |||||||||||||||

| useful life | 2019 | 2018 | useful life | 2020 | 2019 | |||||||||||||||

| Gross carrying amount: | ||||||||||||||||||||

| Trade name | 2.25 years | $ | 492,235 | $ | 492,235 | 1.5 years | $ | 492,235 | $ | 492,235 | ||||||||||

| Customer relations | 2.25 years | 304,086 | 304,086 | 1.5 years | 304,086 | 304,086 | ||||||||||||||

| Patent | 5.75-7.42 years | 4,456,278 | 4,624,513 | 5-6.67 years | 4,499,024 | 4,564,506.00 | ||||||||||||||

| 5,252,599 | 5,420,834 | 5,295,345 | 5,360,827 | |||||||||||||||||

| Less : Accumulated amortization | ||||||||||||||||||||

| Trade name | $ | (376,366 | ) | $ | (338,307 | ) | $ | (414,426 | ) | $ | (389,053 | ) | ||||||||

| Customer relations | (232,505 | ) | (208,993 | ) | (256,017 | ) | (240,342 | ) | ||||||||||||

| Patent | (919,740 | ) | (545,407 | ) | (1,326,518 | ) | (1,076,660 | ) | ||||||||||||

| (1,528,611 | ) | (1,092,707 | ) | (1,996,961 | ) | (1,706,055 | ) | |||||||||||||

| Intangible assets, net | $ | 3,723,988 | $ | 4,328,127 | $ | 3,298,384 | $ | 3,654,772 | ||||||||||||

The aggregate amortization expenses for those intangible assets that continue to be amortized is reflected in amortization of intangible assets in the Consolidated Statements of Incomewere $ 152,846 and Comprehensive Income and were $154,027 and $157,817$157,967 for the three months ended SeptemberJune 30, 2020 and 2019, respectively. The aggregate amortization expenses for those intangible assets were $307,702 and 2018, respectively. And $471,497 and $493,405$317,470 for the ninesix months ended SeptemberJune 30, 2020 and 2019, and 2018, respectively.

Amortization expenses for the next five years and thereafter are as follows:

| 2019 (Three Months) | $ | 157,166 | ||||||

| 2020 | 628,663 | |||||||

| 2020 (Six months) | $ | 307,702 | ||||||

| 2021 | 628,663 | 615,403 | ||||||

| 2022 | 549,304 | 536,044 | ||||||

| 2023 | 546,568 | 533,308 | ||||||

| 2024 | 533,308 | |||||||

| Thereafter | 1,213,624 | 772,619 | ||||||

| Total | $ | 3,723,988 | $ | 3,298,384 | ||||

NOTE 16 - LAND USE RIGHTS, NET

The Company’s land use rights consist of the following:

| June 30, | December 31, | |||||||

| 2020 | 2019 | |||||||

| Cost of land use rights | $ | 11,531,218 | $ | 14,731,847 | ||||

| Less: Accumulated amortization | (2,766,022 | ) | (3,459,032 | ) | ||||

| Land use rights, net | $ | 8,765,196 | $ | 11,272,815 | ||||

During June 2020, $2.2 million of land use rights was returned to the government as the Company began to perform its obligations under the Repurchase Agreement.

15

| September 30, | December 31, | |||||||

| 2019 | 2018 | |||||||

| Cost of land use rights | $ | 14,382,544 | $ | 14,925,518 | ||||

| Less: Accumulated amortization | (3,297,827 | ) | (3,175,790 | ) | ||||

| Land use rights, net | $ | 11,084,717 | $ | 11,749,728 | ||||

As of SeptemberJune 30, 20192020 and December 31, 2018,2019, the net book value of land use rights pledged as collateral for the Company’s bank loans was $7,366,117$0 and $7,756,253,$4,937,138, respectively. Also see Note 18.17.

The amortization expenses for the three months ended SeptemberJune 30, 2020 and 2019, were $79,751 and September 30, 2018, were $80,462 and $82,586,$82,837, respectively. The amortization expenses for the ninesix months ended SeptemberJune 30, 2020 and 2019, were $160,712 and September 30, 2018, were $247,061 and $267,177,$166,599, respectively. Amortization expenses for the next five years and thereafter is as follows:

| 2019 (Three Months) | $ | 82,354 | ||||||

| 2020 | 329,415 | |||||||

| 2020 (Six months) | $ | 160,712 | ||||||

| 2021 | 329,415 | 321,424 | ||||||

| 2022 | 329,415 | 321,424 | ||||||

| 2023 | 329,415 | 321,424 | ||||||

| 2024 | 321,424 | |||||||

| Thereafter | 9,684,703 | 7,318,788 | ||||||

| Total | $ | 11,084,717 | $ | 8,765,196 | ||||

NOTE 17 - CONSTRUCTION-IN-PROGRESS

In September 2019, in order to further increase the production capacity, YongkangScrou started building a factory of efficient new energy vehicle drive motors with a space of 6,639.9 square meters on the basis of the original plant. The total contract amount was RMB 6.6 million (approximately $0.9 million). The project is expected to be completed by 2020. As of September 30, 2019 and December 31, 2018, the Company’s Construction-in-Progress (“CIP”) were $17,781 and $0, respectively. No depreciation is provided for CIP until such time as the facility is completed and placed into operation. There was no interest expense capitalized for CIP for the three and nine months ended September 30, 2019.

NOTE 18 - SHORT-TERM AND LONG-TERM BANK LOANS

Short-term loans are summarized as follows:

| June 30, | December 31, | |||||||

| 2020 | 2019 | |||||||

| Bank A | ||||||||

| Interest rate 5.66% per annum, paid off on May 22, 2020, secured by the assets of Kandi Vehicle, also guaranteed by company’s subsidiaries. Also see Note 14 and Note 16. | - | 7,004,650 | ||||||

| Interest rate 5.66% per annum, paid off on May 22, 2020,secured by the assets of Kandi Vehicle, also guaranteed by company’s subsidiaries. Also see Note 14 and Note 16. | - | 4,621,921 | ||||||

| Bank B | ||||||||

| Interest rate 5.22% per annum, paid off on April 22, 2020, secured by the assets of Kandi Vehicle. Also see Note 14 and Note 16. | - | 5,741,517 | ||||||

| Interest rate 5.22% per annum, paid off on April 24, 2020, secured by the assets of Kandi Vehicle. Also see Note 14 and Note 16. | - | 4,306,138 | ||||||

| Interest rate 5.22% per annum, paid off on April 26, 2020, secured by the assets of Kandi Vehicle. Also see Note 14 and Note 16. | - | 4,306,138 | ||||||

| $ | - | $ | 25,980,364 | |||||

16

| September 30, | December 31, | |||||||

| 2019 | 2018 | |||||||

| Loans from China Ever-bright Bank | ||||||||

| Interest rate 5.655% per annum, paid off on April 18, 2019, secured by the assets of Kandi Vehicle, guaranteed by Mr. Hu Xiaoming and his wife, also guaranteed by company’s subsidiaries. Also see Note 14 and Note 16. | - | 10,179,745 | ||||||

| Loans from Hangzhou Bank | ||||||||

| Interest rate 5.66% per annum, paid off on October 14, 2019, secured by the assets of Kandi Vehicle, also guaranteed by company’s subsidiaries. Also see Note 14 and Note 16. | 6,838,565 | 7,096,737 | ||||||

| Interest rate 5.66% per annum, due on December 31, 2019, secured by the assets of Kandi Vehicle, also guaranteed by company’s subsidiaries. Also see Note 14 and Note 16. | 5,605,381 | 5,816,997 | ||||||

| Interest rate 5.66% per annum, due on July 4, 2020, secured by the assets of Kandi Vehicle, also guaranteed by company’s subsidiaries. Also see Note 14 and Note 16. | 4,512,332 | 4,682,683 | ||||||

| Interest rate 5.66% per annum, paid off on April 24, 2019, secured by the assets of Kandi Vehicle. Also see Note 14 and Note 16. | - | 2,763,074 | ||||||

| Loans from Agricultural Bank of China | ||||||||

| Interest rate 5.22% per annum, due on April 18, 2020, secured by the assets of Kandi Vehicle. Also see Note 14 and Note 16. | 4,204,036 | - | ||||||

| Interest rate 5.22% per annum, due on April 23, 2020, secured by the assets of Kandi Vehicle. Also see Note 14 and Note 16. | 5,605,381 | - | ||||||

| Interest rate 5.22% per annum, due on May 3, 2020, secured by the assets of Kandi Vehicle. Also see Note 14 and Note 16. | 4,204,036 | - | ||||||

| $ | 30,969,731 | $ | 30,539,236 | |||||

Long-term loans are summarized as follows:

| June 30, | December 31, | |||||||

| 2020 | 2019 | |||||||

| Long term bank loans: | $ | |||||||

| Bank C | ||||||||

| Interest rate 7% per annum, due on December 12, 2021, guaranteed by the Company’s subsidiaries. | 27,446,875 | 28,133,433 | ||||||

| Other long term loans: | ||||||||

| Loan under Paycheck Protection Program① | 244,116 | - | ||||||

| Economic Injury Disaster Loan ② | 150,000 | - | ||||||

| Long term loans - current and noncurrent portion | $ | 27,840,991 | 28,133,433 | |||||

| ① | The Coronavirus Aid, Relief, and Economic Security Act, or CARES Act, was signed into law on March 27, 2020, and provides over $2.0 trillion in emergency economic relief to individuals and businesses impacted by the COVID-19 pandemic. The CARES Act authorized the Small Business Administration (“SBA”) to temporarily guarantee loans under a new 7(a) loan program called the Paycheck Protection Program (“PPP”). An eligible business can apply for a PPP loan up to the greater of: (1) 2.5 times its average monthly “payroll costs;” or (2) $10.0 million. PPP loans will have: (a) an interest rate of 1.0%, (b) a two-year loan term to maturity; and (c) principal and interest payments deferred for six months from the date of disbursement. The SBA will guarantee 100% of the PPP loans made to eligible borrowers. The entire principal amount of the borrower’s PPP loan, including any accrued interest, is eligible to be reduced by the loan forgiveness amount under the PPP so long as employee and compensation levels of the business are maintained and 75% of the loan proceeds are used for payroll expenses, with the remaining 25% of the loan proceeds used for other qualifying expenses. As of June 30, 2020, we had received $244,116 under the PPP. |

| ② | In addition, Economic Injury Disaster Loans (“EIDL”) through the SBA was also made available under the CARES Act passed by Congress in response to the COVID-19 pandemic. During June 2020, $150,000 of EIDL loan was approved with the term of a 3.75% rate over 30 years, and a 12-month deferment on the first repayment of principal with interest accrued during deferment. |

| September 30, | December 31, | |||||||

| 2019 | 2018 | |||||||

| Loans from Haikou Rural Credit Cooperative | ||||||||

| Interest rate 7% per annum, due on December 12, 2021, guaranteed by Kandi Vehicle and Kandi New Energy. | 27,606,502 | 28,794,136 | ||||||

| $ | 27,606,502 | 28,794,136 | ||||||

17

The interest expenses of short-term and long-term bank loans for the three months ended SeptemberJune 30, 2020 and 2019 were $748,269 and 2018 were $435,524 and $426,167,$429,355, respectively. The interest expenses of short-term and long-term bank loans for the ninesix months ended SeptemberJune 30, 2020 and 2019 were $1,590,317 and 2018 were $1,304,062 and $1,274,399,$868,538, respectively.

As of SeptemberJune 30, 2019,2020, the aggregate amount of short-term and long-term loans guaranteed by various third parties was $0.

NOTE 19 - NOTES PAYABLE

Notes payable is presented to certain suppliers as a payment against the outstanding trade payable. Notes payable are mainly bank acceptance notes and commercial acceptance notes which are non-interest bearing and generally mature within one year.

As of September 30, 2019, there was $11,463,004 notes payable, among which $11,463,004 was bank acceptance notes. As of December 31, 2018, there was $12,787,619 notes payable, among which $8,767,670 were bank acceptance notes, $2,763,074 were commercial acceptance notes and $1,256,875 were other notes payable. $11,463,004 and $6,440,870 were held as collateral for the notes payable as of September 30, 2019 and December 31, 2018, respectively.

NOTE 2018 - TAXES

(a) Corporation Income Tax

Pursuant to the tax laws and regulations of the PRC, the Company’s applicable corporate income tax (“CIT”) rate is 25%. However, Kandi Vehicles and Jinhua AnkaoKandi Smart Battery Swap qualify as High and New Technology Enterprise (“HNTE”) companies in the PRC, and are entitled to pay a reduced income tax rate of 15% for the years presented. A HNTE Certificate is valid for three years. An entity may re-apply for an HNTE certificate when the prior certificate expires. Historically, Kandi Vehicles has successfully re-applied for such certificates when the its prior certificates expired. Jinhua AnkaoKandi Smart Battery Swap has been qualified as HNTE since 2018. Therefore no records for renewal are available. The applicable CIT rate of each of the Company’s three other subsidiaries, Kandi New Energy, Yongkang Scrou and Kandi Hainan, the Affiliate Company and its subsidiaries is 25%.

The Company’s tax provision or benefit from income taxes for interim periods is determined using an estimate of ourits annual effective tax rate, adjusted for discrete items, if any, that are taken into account in the relevant period. Each quarter the Company updates its estimate of the annual effective tax rate, and if its estimated tax rate changes, the management makes a cumulative adjustment. For 2019, the management estimates that its effective tax rate will be favorably affected by non-taxable income such as the share of income of the Affiliate Company and the gain from the change of fair value of contingent liabilities and certain research and development super-deduction and adversely affected by non-deductible expenses such as part of entertainment expenses. The Company records valuation allowances against the deferred tax assets associated with losses for which weit may not realize a related tax benefit. After combining research and development tax credits of 25% on certain qualified research and development expenses, the Company’s effective tax ratesrate for the ninesix months ended SeptemberJune 30, 2019,2020 and 20182019 were a tax benefitexpense of 13.05%62.43% on a reported income before taxes of approximately $0.3$6.6 million, and an effective income tax rate with a tax benefit of 20.70% for the same period of last year6.02% on a reported loss before taxes of approximately $1.8$12.5 million, respectively.

The quarterly tax provision, and the quarterly estimate of ourthe Company’s annual effective tax rate, is subject to significant variation due to several factors, including variability in accurately predicting ourthe Company’s pre-tax and taxable income and loss, acquisitions (including integrations) and investments, changes in ourits stock price, changes in ourits deferred tax assets and liabilities and their valuation, return to provision true-up, foreign currency gains (losses), changes in regulations and interpretations related to tax, accounting, and other areas. Additionally, ourthe Company’s effective tax rate can be more or less volatile based on the amount of pre-tax income or loss. The income tax provision for the ninesix months ended SeptemberJune 30, 20192020 and 20182019 was tax benefitexpense of $41,780$4,122,502 and tax benefit of $370,316,$751,193, respectively.

18

Effective January 1, 2007, the Company adopted the guidance in

Under ASC 740 guidance relating to uncertain tax positions. The guidancepositions, which addresses the determination of whether tax benefits claimed or expected to be claimed on a tax return should be recorded in the financial statements. Under ASC 740,statements, the Company may recognize the tax benefit from an uncertain tax position only if it is more likely than not that the tax position will be sustained on examination by the taxing authorities, based on the technical merits of the position. The tax benefits recognized in the financial statements from such a position should be measured based on the largest benefit that has a greater than fifty percent likelihood of being realized upon ultimate settlement. ASC 740 also provides guidance on de-recognition, classification, interest and penalties on income taxes, accounting in interim periods and requires increased disclosures. As of December 31, 2018,June 30, 2020, the Company did not have any liability for unrecognized tax benefits. The Company files income tax returns with the U.S. Internal Revenue Services (“IRS”) and those states where the Company has operations. The Company is subject to U.S. federal or state income tax examinations by the IRS and relevant state tax authorities for years after 2006. During the periods open to examination, the Company has net operating loss carry forwards (“NOLs”) for U.S. federal and state tax purposes that have attributes from closed periods. Since these NOLs may be utilized in future periods, they remain subject to examination. The Company also files certain tax returns in the PRC. As of SeptemberJune 30, 2019,2020, the Company was not aware of any pending income tax examinations by U.S. or PRC tax authorities. The Company records interest and penalties on uncertain tax provisions as income tax expense. As of SeptemberJune 30, 20192020, the Company has no accrued interest or penalties related to uncertain tax positions.

The aggregate NOLs in 2019 was $9.6 million deriving from entities in the PRC and Hong Kong. The aggregate NOLs in 2018 was $28.1 million deriving from entities in the PRCand Hong Kong. The aggregate NOLs in 2017 was $22.7 million deriving from entities in the PRC, Hong Kong and U.S. The NOLs will start to expire from 2021 if they are not used. The cumulative net operating loss in the PRC can be carried forward for five years, to offset future net profits for income tax purposes. The Company has $0 cumulative net operating loss Pre-2018 in the U.S. can be carriedto carry forward for twenty years.as of June 30, 2020. The cumulative net operating loss in Hong Kong can be carried forward without an expiration date.

(b) Tax Holiday Effect