U.S. SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-Q10-Q/A

Amendment No. 1

☒ Quarterly report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the period ended March 31, 2020

☐ Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the transition period from ___________ to ___________.

Commission File Number 001-34024

Sino-Global Shipping America, Ltd.

(Exact name of registrant as specified in its charter)

| Virginia | 11-3588546 | |

| (State or other jurisdiction of | (I.R.S. employer | |

| Incorporation or organization) | identification number) |

1044 Northern Boulevard, Suite 305 Roslyn, New York | 11576-1514 | |

| (Address of principal executive offices) | (Zip Code) |

+ 1 (718) 888-1814

(Registrant’s telephone number, including area code)

Securities Registered Pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| Common Stock | SINO | NASDAQ Capital Market |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ |

| Non-accelerated filer ☒ | Smaller reporting company ☒ |

| Emerging Growth Company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of July 2, 2020, the Company has 18,589,037 shares of common stock issued and outstanding.

SINO-GLOBAL SHIPPING AMERICA, LTD.

FORM 10-Q

INDEX

i

SPECIALEXPLANATORY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This document contains certain statements of a forward-looking nature. Such forward-looking statements, including but not limitedAmendment No. 1 to projected growth, trends and strategies, future operating and financial results, financial expectations and current business indicators are based upon current information and expectations and are subject to change based on factors beyond the control of the Company. Forward-looking statements typically are identified by the use of terms such as “look”, “may”, “will”, “should”, “might”, “believe”, “plan”, “expect”, “anticipate”, “estimate” and similar words, although some forward-looking statements are expressed differently. The accuracy of such statements may be impacted by a number of business risks and uncertainties that could cause actual results to differ materially from those projected or anticipated, including but not limited to the following:

Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. The Company undertakes no obligation to update this forward-looking information unless required by applicable law or regulations.

ii

SINO-GLOBAL SHIPPING AMERICA, LTD. AND AFFILIATES

CONDENSED CONSOLIDATED BALANCE SHEETS

(UNAUDITED)

| March 31, | June 30, | |||||||

| 2020 | 2019 | |||||||

| Assets | ||||||||

| Current assets | ||||||||

| Cash | $ | 143,112 | $ | 3,142,650 | ||||

| Notes receivable | - | 383,792 | ||||||

| Accounts receivable, net | 1,745,672 | 7,045,846 | ||||||

| Other receivables | 6,486,140 | 4,335,715 | ||||||

| Advances to suppliers - third parties | 112,037 | 124,140 | ||||||

| Prepaid expenses and other current assets | 239,830 | 105,054 | ||||||

| Due from related party, net | 435,898 | 807,965 | ||||||

| Total Current Assets | 9,162,689 | 15,945,162 | ||||||

| Property and equipment, net | 588,514 | 989,910 | ||||||

| Right-of-use assets | 337,899 | - | ||||||

| Intangible assets, net | 42,222 | 89,722 | ||||||

| Prepaid expenses | - | 519,503 | ||||||

| Other receivables - noncurrent | 3,549,958 | - | ||||||

| Other long-term assets - deposits | 2,956,802 | 3,054,706 | ||||||

| Total Assets | $ | 16,638,084 | $ | 20,599,003 | ||||

| Liabilities and Equity | ||||||||

| Current Liabilities | ||||||||

| Advances from customers | $ | 66,987 | $ | 68,590 | ||||

| Accounts payable | 637,489 | 567,619 | ||||||

| Lease liabilities - current | 156,190 | - | ||||||

| Taxes payable | 3,290,812 | 3,184,895 | ||||||

| Accrued expenses and other current liabilities | 1,485,743 | 1,418,129 | ||||||

| Total current liabilities | 5,637,221 | 5,239,233 | ||||||

| Lease liabilities - noncurrent | 177,495 | - | ||||||

| Total liabilities | 5,814,716 | 5,239,233 | ||||||

| Commitments and Contingencies | ||||||||

| Equity | ||||||||

| Preferred stock, 2,000,000 shares authorized, no par value, none issued | - | - | ||||||

| Common stock, 50,000,000 shares authorized, no par value; 18,139,037 and 16,054,534 shares issued as of March 31, 2020 and June 30, 2019, respectively; 18,139,037 and 15,879,037 shares outstanding as of March 31, 2020 and June 30, 2019, respectively | 28,090,992 | 26,523,830 | ||||||

| Additional paid-in capital | 2,334,962 | 2,066,906 | ||||||

| Subscription receivable | (114,054 | ) | - | |||||

| Treasury stock, at cost, 0 and 175,497 shares as of March 31, 2020 and June 30, 2019 | - | (417,538 | ) | |||||

| Accumulated deficit | (12,821,480 | ) | (6,968,700 | ) | ||||

| Accumulated other comprehensive loss | (1,142,737 | ) | (671,106 | ) | ||||

| Total Sino-Global Shipping America Ltd. Stockholders’ Equity | 16,347,683 | 20,533,392 | ||||||

| Non-controlling Interest | (5,524,315 | ) | (5,173,622 | ) | ||||

| Total Equity | 10,823,368 | 15,359,770 | ||||||

| Total Liabilities and Equity | $ | 16,638,084 | $ | 20,599,003 | ||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

SINO-GLOBAL SHIPPING AMERICA, LTD. AND AFFILIATES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

(UNAUDITED)

| For the Three Months Ended | For the Nine Months Ended | |||||||||||||||

| March 31, | March 31, | |||||||||||||||

| 2020 | 2019 | 2020 | 2019 | |||||||||||||

| Net revenues - third parties | $ | 1,353,979 | $ | 22,736,759 | $ | 5,161,329 | $ | 39,354,579 | ||||||||

| Net revenues - related party | - | 36,380 | - | 433,380 | ||||||||||||

| Total revenues | 1,353,979 | 22,773,139 | 5,161,329 | 39,787,959 | ||||||||||||

| Cost of revenues | (889,107 | ) | (21,075,195 | ) | (2,328,156 | ) | (34,715,624 | ) | ||||||||

| Gross profit | 464,872 | 1,697,944 | 2,833,173 | 5,072,335 | ||||||||||||

| Selling expenses | (79,099 | ) | (140,601 | ) | (335,253 | ) | (507,199 | ) | ||||||||

| General and administrative expenses | (952,661 | ) | (1,053,903 | ) | (2,746,180 | ) | (3,442,695 | ) | ||||||||

| Impairment loss of fixed assets and intangible asset | - | - | (327,632 | ) | - | |||||||||||

| Provision for doubtful accounts | (3,121,416 | ) | (1,583,965 | ) | (4,289,170 | ) | (2,871,752 | ) | ||||||||

| Stock-based compensation | (346,439 | ) | (148,708 | ) | (1,252,756 | ) | (2,013,292 | ) | ||||||||

| Total operating expenses | (4,499,615 | ) | (2,927,177 | ) | (8,950,991 | ) | (8,834,938 | ) | ||||||||

| Operating loss | (4,034,743 | ) | (1,229,233 | ) | (6,117,818 | ) | (3,762,603 | ) | ||||||||

| Other income, net | 21,260 | 2,499 | 7,103 | 3,993 | ||||||||||||

| Net loss before provision for income taxes | (4,013,483 | ) | (1,226,734 | ) | (6,110,715 | ) | (3,758,610 | ) | ||||||||

| Income tax expense | (189,510 | ) | (248,820 | ) | (204,257 | ) | (427,333 | ) | ||||||||

| Net loss | (4,202,993 | ) | (1,475,554 | ) | (6,314,972 | ) | (4,185,943 | ) | ||||||||

| Net loss attributable to non-controlling interest | (384,899 | ) | (86,764 | ) | (462,192 | ) | (6,419 | ) | ||||||||

| Net loss attributable to Sino-Global Shipping America, Ltd. | $ | (3,818,094 | ) | $ | (1,388,790 | ) | $ | (5,852,780 | ) | $ | (4,179,524 | ) | ||||

| Comprehensive loss | ||||||||||||||||

| Net loss | $ | (4,202,993 | ) | $ | (1,475,554 | ) | $ | (6,314,972 | ) | $ | (4,185,943 | ) | ||||

| Other comprehensive income (loss) - foreign currency | (112,671 | ) | 262,467 | (360,132 | ) | (306,457 | ) | |||||||||

| Comprehensive loss | (4,315,664 | ) | (1,213,087 | ) | (6,675,104 | ) | (4,492,400 | ) | ||||||||

| Less: Comprehensive (loss) income attributable to non-controlling interest | (322,135 | ) | (96,210 | (350,693 | ) | 37,445 | ||||||||||

| Comprehensive loss attributable to Sino-Global Shipping America, Ltd. | $ | (3,993,529 | ) | $ | (1,116,877 | ) | $ | (6,324,411 | ) | $ | (4,529,845 | ) | ||||

| Loss per share | ||||||||||||||||

| Basic and diluted | $ | (0.22 | ) | $ | (0.09 | ) | $ | (0.35 | ) | $ | (0.30 | ) | ||||

| Weighted average number of common shares used in computation | ||||||||||||||||

| Basic and diluted | 17,738,157 | 15,245,703 | 16,875,173 | 14,045,018 | ||||||||||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

SINO-GLOBAL SHIPPING AMERICA, LTD. AND AFFILIATES

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY

(UNAUDITED)

| Preferred Stock | Common Stock | Additional paid-in | Treasury Stock | Subscription | Accumulated | Accumulated other comprehensive | Noncontrolling | |||||||||||||||||||||||||||||||||||||||||

| Shares | Amount | Shares | Amount | capital | Shares | Amount | receivable | deficit | loss | interest | Total | |||||||||||||||||||||||||||||||||||||

| BALANCE, June 30, 2018 | - | $ | - | 13,271,032 | $ | 23,717,330 | $ | 1,755,573 | (175,497 | ) | $ | (417,538 | ) | $ | - | $ | (434,856 | ) | $ | (272,407 | ) | $ | (4,812,828 | ) | $ | 19,535,274 | ||||||||||||||||||||||

| Stock based compensation to employee | - | - | 430,000 | 473,000 | - | - | - | - | - | - | - | 473,000 | ||||||||||||||||||||||||||||||||||||

| Stock based compensation to consultants | - | - | 50,000 | 63,500 | - | - | - | - | - | - | - | 63,500 | ||||||||||||||||||||||||||||||||||||

| Amortization of shares to management and employees | - | - | - | - | 91,000 | - | - | - | - | - | - | 91,000 | ||||||||||||||||||||||||||||||||||||

| Amortization of shares issued to consultants | - | - | - | - | 189,708 | - | - | - | - | - | - | 189,708 | ||||||||||||||||||||||||||||||||||||

| Foreign currency translation | - | - | - | - | - | - | - | - | - | (539,656 | ) | 77,494 | (462,162 | ) | ||||||||||||||||||||||||||||||||||

| Net income (loss) | - | - | - | - | - | - | - | - | (1,316,762 | ) | - | 29,231 | (1,287,531 | ) | ||||||||||||||||||||||||||||||||||

| BALANCE, September 30, 2018 | - | - | 13,751,032 | 24,253,830 | 2,036,281 | (175,497 | ) | (417,538 | ) | - | (1,751,618 | ) | (812,063 | ) | (4,706,103 | ) | 18,602,789 | |||||||||||||||||||||||||||||||

| Stock based compensation to employee | - | - | 1,150,000 | 909,500 | - | - | - | - | - | - | - | 909,500 | ||||||||||||||||||||||||||||||||||||

| Stock based compensation to consultants | - | - | 100,000 | 128,500 | (43,333 | ) | - | - | - | - | - | - | 85,167 | |||||||||||||||||||||||||||||||||||

| Issuance of common stock to private investor | - | - | 420,168 | 500,000 | - | - | - | - | - | - | - | 500,000 | ||||||||||||||||||||||||||||||||||||

| Amortization of shares issued to consultants | - | - | - | - | 52,709 | - | - | - | - | - | - | 52,709 | ||||||||||||||||||||||||||||||||||||

| Foreign currency translation | - | - | - | - | - | - | - | - | - | (82,578 | ) | (24,184 | ) | (106,762 | ) | |||||||||||||||||||||||||||||||||

| Net income (loss) | - | - | - | - | - | - | - | - | (1,473,972 | ) | - | 51,114 | (1,422,858 | ) | ||||||||||||||||||||||||||||||||||

| BALANCE, December 31, 2018 | - | - | 15,421,200 | 25,791,830 | 2,045,657 | (175,497 | ) | (417,538 | ) | (3,225,590 | ) | (894,641 | ) | (4,679,173 | ) | 18,620,545 | ||||||||||||||||||||||||||||||||

| Stock based compensation to consultants | - | - | 50,000 | 63,500 | 32,500 | - | - | - | - | - | - | 96,000 | ||||||||||||||||||||||||||||||||||||

| Amortization of shares issued to consultants | - | - | - | - | 52,708 | - | - | - | - | - | - | 52,708 | ||||||||||||||||||||||||||||||||||||

| Foreign currency translation | - | - | - | - | - | - | - | - | - | 271,913 | (9,446 | ) | 262,467 | |||||||||||||||||||||||||||||||||||

| Net loss | - | - | - | - | - | - | - | - | (1,388,790 | ) | - | (86,764 | ) | (1,475,554 | ) | |||||||||||||||||||||||||||||||||

| BALANCE, March 31, 2019 | - | $ | - | 15,471,200 | $ | 25,855,330 | $ | 2,130,865 | (175,497 | ) | $ | (417,538 | ) | $ | - | $ | (4,614,380 | ) | $ | (622,728 | ) | $ | (4,775,383 | ) | $ | 17,556,166 | ||||||||||||||||||||||

| Preferred Stock | Common Stock | Additional paid-in | Treasury Stock | Subscription | Accumulated | Accumulated other comprehensive | Noncontrolling | |||||||||||||||||||||||||||||||||||||||||

| Shares | Amount | Shares | Amount | capital | Shares | Amount | receivable | deficit | loss | interest | Total | |||||||||||||||||||||||||||||||||||||

| BALANCE, June 30, 2019 | - | $ | - | 16,054,534 | $ | 26,523,830 | $ | 2,066,906 | (175,497 | ) | $ | (417,538 | ) | $ | - | $ | (6,968,700 | ) | $ | (671,106 | ) | $ | (5,173,622 | ) | $ | 15,359,770 | ||||||||||||||||||||||

| Stock based compensation to employees | - | - | 90,000 | 63,000 | - | - | - | - | - | - | - | 63,000 | ||||||||||||||||||||||||||||||||||||

| Stock based compensation to consultants | - | - | 240,000 | 200,300 | - | - | - | - | - | - | - | 200,300 | ||||||||||||||||||||||||||||||||||||

| Amortization of shares issued to consultants | - | - | - | - | 180,209 | - | - | - | - | - | - | 180,209 | ||||||||||||||||||||||||||||||||||||

| Foreign currency translation | - | - | - | - | - | - | - | - | - | (646,211 | ) | 142,544 | (503,667 | ) | ||||||||||||||||||||||||||||||||||

| Net loss | - | - | - | - | - | - | - | - | (1,627,353 | ) | - | (121,271 | ) | (1,748,624 | ) | |||||||||||||||||||||||||||||||||

| BALANCE, September 30, 2019 | - | - | 16,384,534 | 26,787,130 | 2,247,115 | (175,497 | ) | (417,538 | ) | - | (8,596,053 | ) | (1,317,317 | ) | (5,152,349 | ) | 13,550,988 | |||||||||||||||||||||||||||||||

| Stock based compensation to employees | - | - | 230,000 | 156,400 | - | - | - | - | - | - | - | 156,400 | ||||||||||||||||||||||||||||||||||||

| Stock based compensation to consultants | - | - | 350,000 | 282,500 | - | - | - | - | - | - | - | 282,500 | ||||||||||||||||||||||||||||||||||||

| Amortization of shares issued to consultants | - | - | - | - | 52,708 | - | - | - | - | - | - | 52,708 | ||||||||||||||||||||||||||||||||||||

| Issuance of common stock to private investor | - | - | 500,500 | 500,500 | - | - | - | - | - | - | - | 500,500 | ||||||||||||||||||||||||||||||||||||

| Cancellation of treasury stock | - | - | (175,497 | ) | (417,538 | ) | - | 175,497 | 417,538 | - | - | - | - | - | ||||||||||||||||||||||||||||||||||

| Foreign currency translation | - | - | - | - | - | - | - | - | - | 350,015 | (93,809 | ) | 256,206 | |||||||||||||||||||||||||||||||||||

| Net loss | - | - | - | - | - | - | - | - | (407,333 | ) | - | 43,978 | (363,355 | ) | ||||||||||||||||||||||||||||||||||

| BALANCE, December 31, 2019 | - | - | 17,289,537 | 27,308,992 | 2,299,823 | - | - | - | (9,003,386 | ) | (967,302 | ) | (5,202,180 | ) | 14,435,947 | |||||||||||||||||||||||||||||||||

| Stock based compensation to consultants | - | - | 350,000 | 282,500 | - | - | - | - | - | - | - | 282,500 | ||||||||||||||||||||||||||||||||||||

| Amortization of shares issued to consultants | - | - | - | - | 35,139 | - | - | - | - | - | - | 35,139 | ||||||||||||||||||||||||||||||||||||

| Issuance of common stock to private investor | - | - | 499,500 | 499,500 | - | - | - | (114,054 | ) | - | - | - | 385,446 | |||||||||||||||||||||||||||||||||||

| Foreign currency translation | - | - | - | - | - | - | - | - | - | (175,435 | ) | 62,764 | (112,671 | ) | ||||||||||||||||||||||||||||||||||

| Net loss | - | - | - | - | - | - | - | - | (3,818,094 | ) | - | (384,899 | ) | (4,202,993 | ) | |||||||||||||||||||||||||||||||||

| BALANCE, March 31, 2020 | - | $ | - | 18,139,037 | $ | 28,090,992 | $ | 2,334,962 | - | $ | - | $ | (114,054 | ) | $ | (12,821,480 | ) | $ | (1,142,737 | ) | $ | (5,524,315 | ) | $ | 10,823,368 | |||||||||||||||||||||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

4

SINO-GLOBAL SHIPPING AMERICA, LTD. AND AFFILIATES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(UNAUDITED)

| For the Nine Months Ended | ||||||||

| March 31, | ||||||||

| 2020 | 2019 | |||||||

| Operating Activities | ||||||||

| Net loss | $ | (6,314,972 | ) | $ | (4,185,943 | ) | ||

| Adjustments to reconcile net loss to net cash used in operating activities: | ||||||||

| Stock-based compensation | 1,252,756 | 2,013,292 | ||||||

| Depreciation and amortization | 320,272 | 95,313 | ||||||

| Non-cash lease expense | 113,985 | - | ||||||

| Provision for doubtful accounts | 4,289,170 | 2,871,752 | ||||||

| Impairment loss of fixed assets and intangible asset | 327,632 | - | ||||||

| Deferred tax benefit | - | (208,047 | ) | |||||

| Changes in assets and liabilities | ||||||||

| Notes receivable | 386,233 | (732,826 | ) | |||||

| Accounts receivable | 1,051,299 | (8,341,650 | ) | |||||

| Other receivables | (5,882,569 | ) | 36,014 | |||||

| Advances to suppliers - third parties | 11,820 | (410,886 | ) | |||||

| Advances to suppliers - related party | - | 3,312,375 | ||||||

| Prepaid expenses and other current assets | 165,939 | 821,662 | ||||||

| Other long-term assets - deposits | 89,274 | (2,502,946 | ) | |||||

| Due from related parties | 413,408 | 1,552,918 | ||||||

| Advances from customers | (1,496 | ) | (353,696 | ) | ||||

| Accounts payable | 72,772 | 1,336,453 | ||||||

| Taxes payable | 116,520 | 837,641 | ||||||

| Lease liabilities | (118,256 | ) | - | |||||

| Accrued expenses and other current liabilities | 65,094 | 535,921 | ||||||

| Net cash used in operating activities | (3,641,119 | ) | (3,322,653 | ) | ||||

| Investing Activities | ||||||||

| Acquisition of property and equipment | (6,979 | ) | (143,480 | ) | ||||

| Net cash used in investing activities | (6,979 | ) | (143,480 | ) | ||||

| Financing Activities | ||||||||

| Proceeds from issuance of common stock | 885,946 | 500,000 | ||||||

| Net cash provided by financing activities | 885,946 | 500,000 | ||||||

| Effect of exchange rate fluctuations on cash | (237,386 | ) | (608,219 | ) | ||||

| Net decrease in cash | (2,999,538 | ) | (3,574,352 | ) | ||||

| Cash at beginning of period | 3,142,650 | 7,098,259 | ||||||

| Cash at end of period | $ | 143,112 | $ | 3,523,907 | ||||

| Supplemental information | ||||||||

| Income taxes paid | $ | 38,557 | $ | 144,018 | ||||

| Non-cash transactions of operating and investing activities | ||||||||

| Transfer of prepayment to intangible asset | $ | 218,678 | $ | - | ||||

| Initial recognition of right-of-use assets and lease liabilities | $ | 452,119 | $ | - | ||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

SINO-GLOBAL SHIPPING AMERICA, LTD. AND AFFILIATES

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

Note 1. ORGANIZATION AND NATURE OF BUSINESS

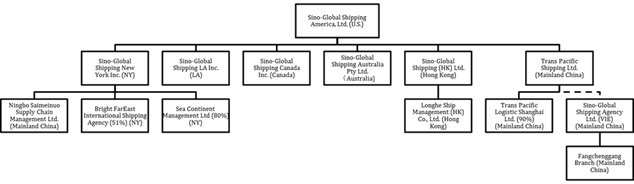

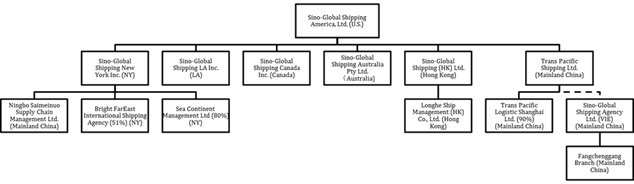

Founded in the United States (the “U.S.”) in 2001, Sino-Global Shipping America, Ltd., a Virginia corporation (“Sino-Global” or the “Company”), is a global shipping and freight logistics integrated solution provider. The Company provides tailored solutions and value-added services to its customers to drive efficiency and control in related steps throughout the entire shipping and freight logistics chain. The Company conducts its business primarily through its wholly-owned subsidiaries in the People’s Republic of China (the “PRC”) (including Hong Kong) and the U.S. where a majority of the Company’s clients are located.

The Company operates in four operating segments including (1) shipping agency and management services, which are operated by its subsidiary in Hong Kong and the U.S.; (2) inland transportation management services, which are operated by its subsidiaries in the U.S.; (3) freight logistics services, which are operated by its subsidiaries in the PRC and the U.S.; (4) container trucking services, which are operated by its subsidiaries in the PRC and the U.S.

The Company developed a mobile application which provides a full-service logistics platform for shipping operations between the U.S. and the PRC for short-haul trucking in the U.S. and in December, 2016, it signed a significant agreement with Sino-Trans Guangxi Logistics Co. Ltd. with a service period from July 1, 2017 to December 31, 2020. The Company has increased its business in the U.S. since the launch of the short haul container truck services web-based platform. The board of the directors (the “Board”) of the Company subsequently authorized the Company to upgrade its enterprise resource planning system (“ERP”) in order to manage its operations in real time throughout its multiple locations and to integrate with web applications.

On September 11, 2017, the Company set up a wholly-owned subsidiary, Ningbo Saimeinuo Supply Chain Management Ltd. (“Sino Ningbo”), via its wholly-owned entity, Sino-Global Shipping New York Inc. This subsidiary primarily engages in transportation management and freight logistics services.

Starting with fiscal year 2019, current trade dynamics make it more expensive for shipping carrier clients to cost-effectively move cargo into U.S. ports, and as a result, the Company realized lower shipping volumes and less utilization of its online platform, which has caused the Company to shift its focus back to shipping agency business. The shipping agency industry in China has improved and the number of shipping agencies in overall in the country has decreased, due to both price and the inability of competitors to embrace technology as a resource in serving client needs.

On September 3, 2018, the Company entered into a cooperation agreement with Ningbo Far-East Universal Shipping Agency Co., Ltd. to set up a joint venture in Hong Kong named Bright Far East International Shipping Agency Co., Ltd., to engage in worldwide shipping agency operations. The Company has a 51% equity interest in the joint venture. On May 23, 2019, Bright Far East International Shipping Agency Co., Ltd. incorporated in New York and terminated its registration in Hong Kong. There has been no major operation of the joint venture for the three and nine months ended March 31, 2020. Currently the Company is conducting the shipping agency business through its wholly-owned Hong Kong subsidiary.

On April 10, 2019, the Company entered into a cooperation agreement with Mr. Weijun Qin, the Chief Executive Officer of a shipping management company in China, to set up a joint venture in New York named State Priests Management Ltd. (“State Priests”), in which the Company will hold a 20% equity interest. On July 26, 2019, the Company signed a revised cooperation agreement with Mr. Weijun Qin which changed the Company’s equity interest in State Priests from 20% to 90%. The Company has not provided any cash contribution to the joint venture and there has been no operation of the joint venture pending the International Ship Safety Management Certificate from the China Classification Society (the “Certificate”). Sino-Global Shipping New York Inc. started providing shipping management related services that do not require certification which includes arranging and coordinating for ship maintenance and inspection this quarter.

On November 6, 2019, the Company signed a revised cooperation agreement with Mr. Weijun Qin to restructure their equity interest in State Priests. Given that State Priests failed to timely obtain the necessary approval from related authorities, Mr. Weijun Qin agreed to exchange 80% equity interest in Sea Continent Management Ltd. (“Sea Continent”), another New York entity Mr. Qin owns for the Company’s 90% equity interest in State Priests. The equity transfer has been consummated. Sea Continent already has the Certificate but has no operations as of March 31, 2020. There has been no capital injection nor operations of State Priests and Sea Continent as of March 31, 2020, therefore no gain or loss has been recognized in the transaction.

On January 10, 2020, the Company entered into a cooperation agreement with Mr. Shanming Liang, a shareholder of the Company, to set up a joint venture in New York named LSM Trading Ltd., in which the Company will hold a 40% equity interest. No investment has been made by the Company as of the date of this report. The new joint venture will facilitate the purchase agricultural related commodities in the U.S. for customers in China and the Company will provide comprehensive supply chain and logistics solutions.

The outbreak of the novel coronavirus (COVID-19) starting from late January 2020 in the PRC has spread rapidly to many parts of the world. In March 2020, the World Health Organization declared the COVID-19 as a pandemic and has resulted in quarantines, travel restrictions, and the temporary closure of stores and business facilities in China and the U.S. for the past few months. Given the rapidly expanding nature of the COVID-19 pandemic, and because substantially all of the Company’s business operations and its workforce are concentrated in China and the U.S., the Company’s business, results of operations, and financial condition have been adversely affected for the three and nine months ended March 31, 2020.

Note 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

(a) Basis of Presentation

The accompanying unaudited condensed consolidated financial statements have been prepared in accordance with generally accepted accounting principles in the United States of America (“US GAAP”) for interim financial information pursuant to the rules and regulations of the Securities and Exchange Commission (“SEC”). The unaudited condensed consolidated financial statements include the accounts of the Company and include the assets, liabilities, revenues and expenses of the subsidiaries and VIEs. All intercompany transactions and balances have been eliminated in consolidation. Interim results are not necessarily indicative of results to be expected for the full year. The information included in this Form 10-Q should be read in conjunction with(this “Amendment”) is being filed to amend the information included in the annualquarterly report on Form 10-K10-Q for the fiscal year ended June 30,December 31, 2019 (the “Quarterly Report”) filed on September 30, 2019.

All significant intercompany transactions and balances are eliminated in consolidation.by Sino-Global Shipping AgencyAmerica, Ltd., a PRC corporation (“Sino-China”), is considered a variable interest entity (“VIE”), with the (the “Company as the primary beneficiary. The Company, through Trans Pacific Shipping Ltd., entered into certain agreements with Sino-China, pursuant to which the Company receives 90% of Sino-China’s net income.

As a VIE, Sino-China’s revenues are included in the Company’s total revenues, and any income/loss from operations is consolidated with that of the Company. Because of contractual arrangements between the Company and Sino-China, the Company has a pecuniary interest in Sino-China that requires consolidation of the financial statements of the Company and Sino-China.

The Company has consolidated Sino-China’s operating results because the entities are under common control in accordance with Accounting Standards Codification (“ASC””) 805-10, “Business Combinations”. The agency relationship between the Company and Sino-China and its branches is governed by a series of contractual arrangements pursuant to which the Company has substantial control over Sino-China. Management makes ongoing reassessments of whether the Company remains the primary beneficiary of Sino-China.

The carrying amount and classification of Sino-China’s assets and liabilities included in the Company’s unaudited condensed consolidated balance sheets were as follows:

| March 31, | June 30, | |||||||

| 2020 | 2019 | |||||||

| Current assets: | ||||||||

| Cash | $ | 5,072 | $ | 11,691 | ||||

| Other receivables | 299 | 309 | ||||||

| Prepaid expenses and other current assets | - | 4,474 | ||||||

| Total current assets | 5,371 | 16,474 | ||||||

| Deposits | 1,605 | 1,655 | ||||||

| Property and equipment, net | 44,459 | 95,765 | ||||||

| Total assets | $ | 51,435 | $ | 113,894 | ||||

| Current liabilities: | ||||||||

| Other payables and accrued liabilities | $ | 39,835 | $ | 30,175 | ||||

| Total liabilities | $ | 39,835 | $ | 30,175 | ||||

(b) Fair Value of Financial Instruments

The Company follows the provisions of ASC 820, Fair Value Measurements and Disclosures, which clarifies the definition of fair value, prescribes methods for measuring fair value, and establishes a fair value hierarchy to classify the inputs used in measuring fair value as follows:

Level 1 — Observable inputs such as unadjusted quoted prices in active markets for identical assets or liabilities available at the measurement date.

Level 2 — Inputs other than quoted prices that are observable for the asset or liability in active markets, quoted prices for identical or similar assets and liabilities in markets that are not active, inputs other than quoted prices that are observable, and inputs derived from or corroborated by observable market data.

Level 3 — Unobservable inputs that reflect management’s assumptions based on the best available information.

The carrying value of accounts receivable, other receivables, other current assets, and current liabilities approximate their fair values because of the short-term nature of these instruments.

(c) Use of Estimates and Assumptions

The preparation of the Company’s unaudited condensed consolidated financial statements in conformity with US GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the dates of the financial statements and the reported amounts of revenues and expenses during the reporting periods. Estimates are adjusted to reflect actual experience when necessary. Significant accounting estimates reflected in the Company’s unaudited condensed consolidated financial statements include revenue recognition, fair value of stock based compensation, cost of revenues, allowance for doubtful accounts, impairment loss, deferred income taxes, income tax expense and the useful lives of property and equipment. The inputs into the Company’s judgments and estimates consider the economic implications of COVID-19 on the Company’s critical and significant accounting estimates. Since the use of estimates is an integral component of the financial reporting process, actual results could differ from those estimates.

(d) Translation of Foreign Currency

The accounts of the Company and its subsidiaries are measured using the currency of the primary economic environment in which the entity operates (the “functional currency”). The Company’s functional currency is the U.S. dollar (“USD”) while its subsidiaries in the PRC, including Sino-China, Trans Pacific Shipping Ltd. and Trans Pacific Logistic Shanghai Ltd. report their financial positions and results of operations in Renminbi (“RMB”), its subsidiary Sino-Global Shipping Australia Pty Ltd., reports its financial positions and results of operations in Australian dollar (“AUD”), its subsidiary Sino-Global Shipping Hong Kong reports its financial positions and results of operations in Hong Kong dollar (“HKD”) and its subsidiary Sino-Global Shipping Canada, Inc. reports its financial positions and results of operations in Canadian Dollar (“CAD”). The accompanying unaudited condensed consolidated financial statements are presented in USD. Foreign currency transactions are translated into USD using the fixed exchange rates in effect at the time of the transaction. Generally, foreign exchange gains and losses resulting from the settlement of such transactions are recognized in the consolidated statements of operations. The Company translates the foreign currency financial statements in accordance with ASC 830-10, “Foreign Currency Matters”. Assets and liabilities are translated at current exchange rates quoted by the People’s Bank of China at the balance sheets’ dates and revenues and expenses are translated at average exchange rates in effect during the year. The resulting translation adjustments are recorded as other comprehensive loss and accumulated other comprehensive loss as a separate component of equity of the Company, and also included in non-controlling interests.

The exchange rates as of March 31, 2020 and June 30, 2019 and for the three and nine months ended March 31, 2020 and 2019 are as follows:

| March 31, 2020 | June 30, 2019 | Three months ended March 31, | Nine months ended March 31, | |||||||||||||||||||||

| Foreign currency | Balance | Balance Sheet | 2020 Profits/Loss | 2019 Profits/Loss | 2020 Profits/Loss | 2019 Profits/Loss | ||||||||||||||||||

| RMB:1USD | 7.0799 | 6.8657 | 6.9798 | 6.7499 | 7.0130 | 6.8229 | ||||||||||||||||||

| AUD:1USD | 1.6285 | 1.4238 | 1.5209 | 1.4031 | 1.4810 | 1.3885 | ||||||||||||||||||

| HKD:1USD | 7.7509 | 7.8130 | 7.7716 | 7.8461 | 7.8091 | 7.8402 | ||||||||||||||||||

| CAD:1USD | 1.4118 | 1.3092 | 1.3417 | 1.3291 | 1.3272 | 1.3192 | ||||||||||||||||||

(e) Cash

Cash consists of cash on hand and cash in bank which are unrestricted as to withdrawal or use. The Company maintains cash with various financial institutions mainly in the PRC, Australia, Hong Kong, Canada and the U.S. As of March 31, 2020 and June 30, 2019, cash balances of $131,676 and $2,993,913, respectively, were maintained at financial institutions in the PRC. $42,189 and $2,923,972 of these balances are not covered by insurance as the deposit insurance system in China only insured each depositor at one bank for a maximum of approximately $70,000 (RMB 500,000). As of March 31, 2020 and June 30, 2019, cash balances of $4,705 and $122,017, respectively, were maintained at U.S. financial institutions, and were insured by the Federal Deposit Insurance Corporation or other programs subject to certain limitations. The Hong Kong Deposit Protection Board pays compensation up to a limit of HKD $500,000 (approximately $64,000) if the bank with which an individual/a company holds its eligible deposit fails. As of March 31, 2020 and June 30, 2019, cash balances of $865 and $4,386, respectively, were maintained at financial institutions in Hong Kong and were insured by the Hong Kong Deposit Protection Board. As of March 31, 2020 and June 30, 2019, amount of deposits the Company had covered by insurance amounted to $96,313 and $198,165, respectively.

(f) Notes receivable

Notes receivable represents trade accounts receivable due from various customers where the customers’ banks have guaranteed the payment. The notes are non-interest bearing and normally paid within three to six months. The Company has the ability to submit request for payment to the customer’s bank earlier than the scheduled payment date, but will incur an interest charge and a processing fee.

(g) Receivables and Allowance for Doubtful Accounts

Accounts receivable are presented at net realizable value. The Company maintains allowances for doubtful accounts and for estimated losses. The Company reviews the accounts receivable on a periodic basis and makes general and specific allowances when there is doubt as to the collectability of individual receivable balances. In evaluating the collectability of individual receivable balances, the Company considers many factors, including the age of the balances, customers’ historical payment history, their current credit-worthiness and current economic trends. Receivables are generally considered past due after 180 days. The Company reserves 25%-50% of the customers balance aged between 181 days to 1 year, 50%-100% of the customers balance over 1 year and 100% of the customers balance over 2 years. Accounts receivable are written off against the allowances only after exhaustive collection efforts. As the Company has focused its development in the shipping management segment, its customer base will be more from smaller privately owned companies that will pay more timely than state owned companies. The Company also considers the economic implications of COVID-19 on its estimates of the allowance and made additional $3,121,416 and $4,428,108 of allowance for doubtful accounts and wrote off $3,255,938 of accounts receivable for the three and nine months ended March 31,July 6, 2020. There was no write off for three and nine months ended March 31, 2019. The Company recovered nil and $99,366 of accounts receivable for the three and nine months ended March 31, 2020. There was no recovery for three and nine months ended March 31, 2019.

Other receivables represent mainly customer advances, prepaid employee insurance and welfare benefits, which will be subsequently deducted from the employee payroll, guarantee deposits on behalf of ship owners as well as office lease deposits. Management reviews its receivables on a regular basis to determine if the bad debt allowance is adequate, and adjusts the allowance when necessary. Delinquent account balances are written-off against allowance for doubtful accounts after management has determined that the likelihood of collection is not probable. Other receivables are written off against the allowances only after exhaustive collection efforts. For the three and nine months ended March 31, 2020, nil and $1,763 was written off against other receivables, respectively. There was no write off for the three and nine months ended March 31, 2019.

(h) Property and Equipment, net

Property and equipment are stated at historical cost less accumulated depreciation. Historical cost comprises its purchase price and any directly attributable costs of bringing the assets to its working condition and location for its intended use. Depreciation is calculated on a straight-line basis over the following estimated useful lives:

The carrying value of a long-lived asset is considered impaired by the Company when the anticipated undiscounted cash flows from such asset is less than its carrying value. If impairment is identified, a loss is recognized based on the amount by which the carrying value exceeds the fair value of the long-lived asset. Fair value is determined primarily using the anticipated cash flows discounted at a rate commensurate with the risk involved or based on independent appraisals. There was no impairment for the three months ended March 31, 2020 and 2019. For the nine months ended March 31, 2020 and 2019, an impairment of $127,177 and nil were recorded, respectively.

(i) Intangible Assets, net

Intangible assets are recorded at cost less accumulated amortization. Amortization is calculated on a straight-line basis over the following estimated useful lives:

The Company evaluates intangible assets for impairment whenever events or changes in circumstances indicate that the assets might be impaired. There was no impairment for the three months ended March 31, 2020 and 2019. For the nine months ended March 31, 2020 and 2019, an impairment of $200,455 and nil were recorded, respectively.

(j) Revenue Recognition

The Company recognizes revenue which represents the transfer of goods and services to customers in an amount that reflects the consideration to which the Company expects to be entitled in such exchange. The Company identifies contractual performance obligations and determines whether revenue should be recognized at a point in time or over time, based on when control of goods and services transfers to a customer. The Company’s revenue streams are recognized at a point in time.

The Company uses a five-step model to recognize revenue from customer contracts. The five-step model requires that the Company (i) identify the contract with the customer, (ii) identify the performance obligations in the contract, (iii) determine the transaction price, including variable consideration to the extent that it is probable that a significant future reversal will not occur, (iv) allocate the transaction price to the respective performance obligations in the contract, and (v) recognize revenue when (or as) the Company satisfies the performance obligation.

The Company continues to derive its revenues from sales contracts with its customers with revenues being recognized upon performance of services. Persuasive evidence of an arrangement is demonstrated via sales contract and invoice; and the sales price to the customer is fixed upon acceptance of the sales contract and there is no separate sales rebate, discount, or other incentive. The Company’s revenues are recognized at a point in time after all performance obligations are satisfied.

As of March 31, 2020, the Company had outstanding contracts amounting to approximately $1.4 million, all of which is expected to be completed within 3 months from March 31, 2020.

Revenues by segments:

| For the Three Months Ended | For the Nine Months Ended | |||||||||||||||

| March 31, | March 31, | March 31, | March 31, | |||||||||||||

| 2020 | 2019 | 2020 | 2019 | |||||||||||||

| Shipping and management agency services | $ | 500,000 | $ | 956,583 | $ | 1,500,000 | $ | 1,845,653 | ||||||||

| Inland transportation management services | - | 129,787 | - | 1,469,787 | ||||||||||||

| Freight logistics services | 853,979 | 21,599,675 | 3,599,620 | 36,066,151 | ||||||||||||

| Container trucking services | - | 87,094 | 61,709 | 406,368 | ||||||||||||

| Total | $ | 1,353,979 | $ | 22,773,139 | $ | 5,161,329 | $ | 39,787,959 | ||||||||

| ||

|

(k) Taxation

Because the Company and its subsidiaries and Sino-China were incorporated in different jurisdictions, they file separate income tax returns. The Company uses the asset and liability method of accounting for income taxes in accordance with U.S. GAAP. Deferred taxes, if any, are recognized for the future tax consequences of temporary differences between the tax basis of assets and liabilities and their reported amounts in the consolidated financial statements. A valuation allowance is provided against deferred tax assets if it is more likely than not that the asset will not be utilized in the future.

The Company recognizes the tax benefit from an uncertain tax position only if it is more likely than not that the tax position will be sustained on examination by the taxing authorities, based on the technical merits of the position. The Company recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense. The Company had no uncertain tax positions as of March 31, 2020 and June 30, 2019.

Income tax returns for the years prior to 2016 are no longer subject to examination by U.S. tax authorities.

PRC Enterprise Income Tax

PRC enterprise income tax is calculated based on taxable income determined under the PRC Generally Accepted Accounting Principles (“PRC GAAP”) at 25%. Sino-China and Trans Pacific are registered in PRC and governed by the Enterprise Income Tax Laws of the PRC.

PRC Value Added Taxes and Surcharges

The Company is subjectfiling this Amendment solely to value added tax (“VAT”). Revenue from services provided byadd disclosure that, in originally filing the Company’s PRC subsidiaries and affiliates, including Sino-China and Trans Pacific are subject to VAT at rates ranging from 9% to 13%. Entities that are VAT general taxpayers are allowed to offset qualified VAT paid to suppliers against their VAT liability. Net VAT liability is recorded in taxes payableQuarterly Report, the Company relied on the unaudited condensed consolidated balance sheets.

In addition, under the PRC regulations, the Company’s PRC subsidiaries and affiliates are required to pay the city construction tax (7%) and education surcharges (3%) based on the net VAT payments.

(l) Earnings (loss) per Share

Basic earnings (loss) per share is computed by dividing net income (loss) attributable to holders of common stockorder of the Company by the weighted average number of shares of common stock of the Company outstanding during the applicable period. Diluted earnings (loss) per share reflect the potential dilution that could occur if securities or other contracts to issue common stock of the Company were exercised or converted into common stock of the Company. Common stock equivalents are excluded from the computation of diluted earnings per share if their effects would be anti-dilutive.

For the three and nine months ended March 31, 2020 and 2019, there was no dilutive effect of potential shares of common stock of the Company because the Company generated a net loss.

(m) Comprehensive Income (Loss)

The Company reports comprehensive income (loss) in accordance with the authoritative guidance issued by Financial Accounting Standards Board (the “FASB”) which establishes standards for reporting comprehensive income (loss) and its component in financial statements. Other comprehensive income (loss) refers to revenue, expenses, gains and losses that under US GAAP are recorded as an element of Stockholders’ equity but are excluded from net income. Other comprehensive income (loss) consists of a foreign currency translation adjustment resulting from the Company not using the U.S. dollar as its functional currencies.

(n) Stock-based Compensation

The Company accounts for stock-based compensation awards to employees in accordance with FASB ASC Topic 718, “Compensation – Stock Compensation”, which requires that stock-based payment transactions with employees be measured based on the grant-date fair value of the equity instrument issued and recognized as compensation expense over the requisite service period. The Company records stock-based compensation expense at fair value on the grant date and recognizes the expense over the employee’s requisite service period.

The Company accounts for stock-based compensation awards to non-employees in accordance with FASB ASC Topic 718 amended by ASU 2018-07. Under FASB ASC Topic 718, stock compensation granted to non-employees has been determined as the fair value of the consideration received or the fair value of equity instrument issued, whichever is more reliably measured and is recognized as an expense as the goods or services are received.

Valuations of stock based compensation are based upon highly subjective assumptions about the future, including stock price volatility and exercise patterns. The fair value of share-based payment awards was estimated using the Black-Scholes option pricing model. Expected volatilities are based on the historical volatility of the Company’s stock. The Company uses historical data to estimate option exercise and employee terminations. The expected term of options granted represents the period of time that options granted are expected to be outstanding. The risk-free rate for periods within the expected life of the option is based on the U.S. Treasury yield curve in effect at the time of the grant.

12

(o) Risks and Uncertainties

The Company’s business, financial position and results of operations may be influenced by the political, economic, health and legal environments in the PRC, as well as by the general state of the PRC economy. The Company’s operations in the PRC are subject to special considerations and significant risks not typically associated with companies in North America and Western Europe. These include risks associated with, among others, the political, economic, health and legal environments and foreign currency exchange. The Company’s results may be adversely affected by changes in the political, regulatory and social conditions in the PRC, and by changes in governmental policies or interpretations with respect to laws and regulations, anti-inflationary measures, currency conversion, remittances abroad, and rates and methods of taxation, among other things.

In March 2020, the World Health Organization declared the COVID-19 as a pandemic. Given the rapidly expanding nature of the COVID-19 pandemic, and because substantially all of the Company’s business operations and our workforce are concentrated in China and United States, the Company’s business, results of operations, and financial condition could be adversely affected for the rest of fiscal year 2020 and beyond.

(p) Liquidity

In assessing the Company’s liquidity, the Company monitors and analyzes its cash on-hand and its operating and capital expenditure commitments. The Company’s liquidity needs are to meet its working capital requirements, operating expenses and capital expenditure obligations. As of March 31, 2020, the Company’s working capital was approximately $3.5 million and the Company had cash of approximately $0.1 million. The Company plans to fund continuing operations through identifying new prospective joint venture partners and strategic alliance opportunities for new revenue sources, and by reducing costs to improve profitability and replenish working capital. The Company’s ability to fulfill its current obligations will depend on the future realization of its current assets and the future revenues generated from its operations.

The Company expects to realize the balance of its current assets within the normal operating cycle of a twelve month period. If the Company is unable to realize its current assets within the normal operating cycle of a twelve month period, the Company may have to consider supplementing its available sources of funds through the following sources:

Based on the above considerations, the Company’s management is of the opinion that it may not have sufficient funds to meet the Company’s working capital requirements and current liabilities as they become due one year from issuance of these financial statements. There is no assurance that management will be successful in their plans. There are a number of factors that could potentially arise that could undermine the Company’s plans, such as changes in the PRC government policy, economic conditions, and competitive pricing in the industries that the Company operates in. In addition, the recent outbreak of new coronavirus pandemic posed disruption and restrictions on its operations and those of the Company’s customers which not only negatively impact the Company’s financial conditions but also slowed down the macro-economic development worldwide. If management is unable to execute this plan, there would likely be a material adverse effect on the Company’s business.

The management has considered whether there is substantial doubt about its ability to continue as a going concern due to 1) the Company’s recurring losses from operations, including approximately $5.9 million net loss attributable to the Company’s stockholders for the nine months ended March 31, 2020, 2) accumulated deficit of approximately $12.8 million as of March 31, 2020, and 3) has negative operating cash flows of approximately $3.6 million for the nine months ended March 31, 2020. All of these factors raise substantial doubt about the ability of the Company to continue as a going concern.

(q) Recent Accounting Pronouncements

Pronouncements adopted

In February 2016, the FASB issued Accounting Standards Update (“ASU”) No. 2016-02, Leases (Topic 842), to increase the transparency and comparability about leases among entities. The new guidance requires lessees to recognize a lease liability and a corresponding lease asset for virtually all lease contracts. It also requires additional disclosures about leasing arrangements. ASU 2016-02 is effective for interim and annual periods beginning after December 15, 2018, and requires a modified retrospective approach to adoption assuming the Company will remain an emerging growth company at that date. Early adoption is permitted. In September 2017, the FASB issued ASU No. 2017-13, which to clarify effective dates that public business entities and other entities were required to adopt ASC Topic 842 for annual reporting. A public business entity that otherwise would not meet the definition of a public business entity except for a requirement to include or the inclusion of its financial statements or financial information in another entity’s filing with the SEC adopting ASC Topic 842 for annual reporting periods beginning after December 15, 2019, and interim reporting periods within annual reporting periods beginning after December 15, 2020. ASU No. 2017-13 also amended that all components of a leveraged lease be recalculated from inception of the lease based on the revised after tax cash flows arising from the change in the tax law, including revised tax rates. The difference between the amounts originally recorded and the recalculated amounts must be included in income of the year in which the tax law is enacted. The Company adopted this ASU in the first quarter of fiscal year 2020 using modified retrospective transition approach at the beginning of the period of adoption. The Company recognized lease labilities of approximately $0.3 million, with corresponding right-of use (“ROU”) assets of approximately the same amount based on the present value of the future minimum rental payments of leases, using a weighted average discount rate of approximately 9.12%.

On July 1, 2019, the Company adopted ASU 2018-07 where awards to nonemployees are measured by estimating the fair value of the equity instruments to be issued. The amendments specify that Topic 718 applies to all share-based payment transactions in which a grantor acquires goods or services to be used or consumed in a grantor’s own operations by issuing share-based payment awards which superseded ASU 505-50. The ASU is required to be applied on a prospective basis to all new awards granted after the date of adoption. The Company adopted this ASU on July 1, 2019 and the adoption has no significant impact to the Company’s unaudited condensed consolidated financial statements as a whole.

On July 13, 2017, the FASB issued ASU 2017-11, Earnings Per Share (Topic 260), Distinguishing Liabilities from Equity (Topic 480), Derivatives and Hedging (Topic 815): I. Accounting for Certain Financial Instruments with Down Round Features and II. Replacement of the Indefinite Deferral for Mandatorily Redeemable Financial Instruments of Certain Nonpublic Entities and Certain Mandatorily Redeemable Noncontrolling Interests with a Scope Exception. Part I applies to entities that issue financial instruments such as warrants, convertible debt or convertible preferred stock that contain down round features. Part II does not have accounting impact. The ASU is effective for the Company for annual and interim reporting periods beginning July 1, 2019. The Company adopted this ASU on July 1, 2019 and determined the adoption of this ASU did not have a material effect on the Company’s unaudited condensed consolidated financial statements.

Pronouncements not yet adopted

In August 2018, the FASB issued ASU 2018-13, “Fair Value Measurement (Topic 820): Disclosure Framework—Changes to the Disclosure Requirements for Fair Value Measurement” (“ASU 2018-13”). ASU 2018-13 removes, modifies and adds certain disclosure requirements in Topic 820 “Fair Value Measurement”. ASU 2018-13 eliminates certain disclosures related to transfers and the valuations process, modifies disclosures for investments that are valued based on net asset value, clarifies the measurement uncertainty disclosure, and requires additional disclosures for Level 3 fair value measurements. ASU 2018-13 is effective for the Company for annual and interim reporting periods beginning July 1, 2020. The Company does not believe the adoption of this ASU will have a material effect on the Company’s unaudited condensed consolidated financial statements.

In May 2019, the FASB issued ASU 2019-05, which is an update to ASU Update No. 2016-13, Financial Instruments—Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments, which introduced the expected credit losses methodology for the measurement of credit losses on financial assets measured at amortized cost basis, replacing the previous incurred loss methodology. The amendments in Update 2016-13 added Topic 326, Financial Instruments—Credit Losses, and made several consequential amendments to the Codification. Update 2016-13 also modified the accounting for available-for-sale debt securities, which must be individually assessed for credit losses when fair value is less than the amortized cost basis, in accordance with Subtopic 326-30, Financial Instruments— Credit Losses—Available-for-Sale Debt Securities. The amendments in this ASU address those stakeholders’ concerns by providing an option to irrevocably elect the fair value option for certain financial assets previously measured at amortized cost basis. For those entities, the targeted transition relief will increase comparability of financial statement information by providing an option to align measurement methodologies for similar financial assets. Furthermore, the targeted transition relief also may reduce the costs for some entities to comply with the amendments in Update 2016-13 while still providing financial statement users with decision-useful information. In November 2019, the FASB issued ASU No. 2019-10, which to update the effective date of ASU No. 2016-13 for private companies, not-for-profit organizations and certain smaller reporting companies applying for credit losses standard. The new effective date for these preparers is for fiscal years beginning after July 1, 2023, including interim periods within those fiscal years. The Company has not early adopted this update and it will become effective on July 1, 2023 assuming the Company will remain eligible to be smaller reporting company. The Company is currently evaluating the impact of this new standard on Company's consolidated financial statements and related disclosures. The Company is currently evaluating the impact of this new standard on its unaudited condensed consolidated financial statements and related disclosures.

In December 2019, the FASB issued ASU 2019-12, “Income Taxes (Topic 740): Simplifying the Accounting for Income Taxes”. The amendments in this Update simplify the accounting for income taxes by removing certain exceptions to the general principles in Topic 740. The amendments also improve consistent application of and simplify GAAP for other areas of Topic 740 by clarifying and amending existing guidance. ASU 2019-12 is effective for the Company for annual and interim reporting periods beginning July 1, 2021. Early adoption of the amendments is permitted, including adoption in any interim period for public business entities for periods for which financial statements have not yet been issued. An entity that elects to early adopt the amendments in an interim period should reflect any adjustments as of the beginning of the annual period that includes that interim period. Additionally, an entity that elects early adoption must adopt all the amendments in the same period. The Company is currently evaluating the impact of this new standard on Company’s unaudited condensed consolidated financial statements and related disclosures.

The Company does not believe other recently issued but not yet effective accounting standards, if currently adopted, would have a material effect on the Company’s unaudited condensed consolidated financial statements.

(r) Reclassification

Certain prior year amounts have been reclassified to conform to the current year presentation mainly reclassifying advances to suppliers to other receivables (see Note 4 and 5). These reclassifications have no effect on the reported revenues, net loss or total assets.

Note 3. ACCOUNTS RECEIVABLE, NET

The Company’s net accounts receivable are as follows:

| March 31, | June 30, | |||||||

| 2020 | 2019 | |||||||

| Trade accounts receivable | $ | 8,405,601 | $ | 12,716,120 | ||||

| Less: allowances for doubtful accounts | (6,659,929 | ) | (5,670,274 | ) | ||||

| Accounts receivable, net | $ | 1,745,672 | $ | 7,045,846 | ||||

Movement of allowance for doubtful accounts are as follows:

| March 31, 2020 | June 30, 2019 | |||||||

| Beginning balance | $ | 5,670,274 | $ | 1,682,228 | ||||

| Provision for doubtful accounts | 4,428,108 | 4,091,056 | ||||||

| Less: write-off/recovery | (3,355,304 | ) | (88,882 | ) | ||||

| Exchange rate effect | (83,149 | ) | (14,128 | ) | ||||

| Ending balance | $ | 6,659,929 | $ | 5,670,274 | ||||

For the three months ended March 31, 2020 and 2019, the provision for doubtful accounts was $3,121,416 and $1,608,454, respectively. For the nine months ended March 31, 2020 and 2019, the provision for doubtful accounts was $4,428,108 and $3,005,405, respectively. The Company recovered nil and $99,366 of accounts receivable for the three and nine months ended March 31, 2020. There was no recovery for three and nine months ended March 31, 2019. The Company wrote off $3,255,938 of accounts receivable for the three and nine months ended March 31, 2020. There was no write off for three and nine months ended March 31, 2019.

Note 4. OTHER RECEIVABLES

The Company’s other receivables are as follows:

| March 31, | June 30, | |||||||

| 2020 | 2019 | |||||||

| Advances to customers* | $ | 9,983,979 | $ | 4,237,270 | ||||

| Employee business advances | 52,119 | 54,953 | ||||||

| Security deposit | - | 43,492 | ||||||

| Total | 10,036,098 | 4,335,715 | ||||||

| Less: current portion | (6,486,140 | ) | (4,335,715 | ) | ||||

| Total noncurrent portion | $ | 3,549,958 | $ | - | ||||

Note 5. ADVANCES TO SUPPLIERS

The Company’s advances to suppliers – third parties are as follows:

| March 31, | June 30, | |||||||

| 2020 | 2019 | |||||||

| Freight fees (1) | $ | 112,037 | $ | 123,767 | ||||

| Port fees | - | 373 | ||||||

| Total advances to suppliers-third parties | $ | 112,037 | $ | 124,140 | ||||

Note 6. PREPAID EXPENSES AND OTHER CURRENT ASSETS

The Company’s prepaid expenses and other assets are as follows:

| March 31, | June 30, | |||||||

| 2020 | 2019 | |||||||

| Prepaid income taxes | $ | 48,924 | $ | 35,129 | ||||

| Other (including prepaid insurance, rent, listing fees) | 115,700 | 69,925 | ||||||

| Deposit for ERP (1) | - | 218,678 | ||||||

| Prepaid leasing and service fees (2) | 75,206 | 300,825 | ||||||

| Total | 239,830 | 624,557 | ||||||

| Less: current portion | (239,830 | ) | (105,054 | ) | ||||

| Total noncurrent portion | $ | - | $ | 519,503 | ||||

Note 7. OTHER LONG-TERM ASSETS - DEPOSITS

The Company’s other long-term assets – deposits are as follows:

| March 31, | June 30, | |||||||

| 2020 | 2019 | |||||||

| Rental and utilities deposits | $ | 52,517 | $ | 60,435 | ||||

| Freight logistics deposits (1) | 2,904,285 | 2,994,271 | ||||||

| Total other long-term assets - deposits | $ | 2,956,802 | $ | 3,054,706 | ||||

17

Note 8. PROPERTY AND EQUIPMENT, NET

The Company’s net property and equipment as follows:

| March 31, | June 30, | |||||||

| 2020 | 2019 | |||||||

| Buildings | $ | 190,121 | $ | 196,050 | ||||

| Motor vehicles* | 515,870 | 700,724 | ||||||

| Computer equipment* | 96,677 | 162,865 | ||||||

| Office equipment* | 43,496 | 69,278 | ||||||

| Furniture and fixtures* | 71,548 | 167,143 | ||||||

| System software* | 107,686 | 116,339 | ||||||

| Leasehold improvements | 785,103 | 807,078 | ||||||

| Total | 1,810,501 | 2,219,477 | ||||||

| Less: Accumulated depreciation and amortization | (1,221,987 | ) | (1,229,567 | ) | ||||

| Property and equipment, net | $ | 588,514 | $ | 989,910 | ||||

Depreciation and amortization expenses for the three months ended March 31, 2020 and 2019 were $67,320 and $28,200, respectively. Depreciation and amortization expenses for the nine months ended March 31, 2020 and 2019 were $254,549 and $47,813, respectively.

Note 9. INTANGIBLE ASSETS, NET

Net intangible assets consisted of the following:

| March 31, | June 30, | |||||||

| 2020 | 2019 | |||||||

| Full service logistics platforms | $ | 190,000 | $ | 190,000 | ||||

| Less: Accumulated amortization | (147,778 | ) | (100,278 | ) | ||||

| Intangible assets, net | $ | 42,222 | $ | 89,722 | ||||

The full service logistics platform was placed in services in December 2017. The platforms are being amortized over three years. Amortization expenses amounted to $15,833 and $15,833 for the three months ended March 31, 2020 and 2019, respectively. Amortization expenses amounted to $65,723 and $47,500 for the nine months ended March 31, 2020 and 2019, respectively.

In addition, first phase of the ERP system (see more details in Note 6) was placed in use in July 2019 and is being amortized over three years. However, due to the continued decrease in revenues from the inland transportation management segment, the Company recorded an impairment of nil and $200,455 for the three and nine months ended March 31, 2020, no impairment was recorded for same period 2019.

Note 10. LEASES

The Company determines if a contract contains a lease at inception. US GAAP requires that the Company’s leases be evaluated and classified as operating or finance leases for financial reporting purposes. The classification evaluation begins at the commencement date and the lease term used in the evaluation includes the non-cancellable period for which the Company has the right to use the underlying asset, together with renewal option periods when the exercise of the renewal option is reasonably certain and failure to exercise such option which result in an economic penalty. All of the Company’s leases are classified as operating leases.

The Company has several vehicle lease agreements and office lease agreements with lease terms ranging from two to three years. Upon adoption of ASU 2016-02, the Company recognized lease labilities of approximately $0.3 million, with corresponding ROU assets of approximately the same amount based on the present value of the future minimum rental payments of leases, using a weighted average discount rate of approximately 9.12%. As of March 31, 2020, ROU assets and lease labilities amounted to $337,899 and $333,685 (including $156,190 from lease liabilities current portion and $177,495 from lease liabilities noncurrent portion), respectively.

The Company’s lease agreements do not contain any material residual value guarantees or material restrictive covenants. The leases generally do not contain options to extend at the time of expiration and the weighted average remaining lease terms are 2.17 years.

For the three months ended March 31, 2020 and 2019, rent expense amounted to approximately $65,000 and $58,000, respectively. For the nine months ended March 31, 2020 and 2019, rent expense amounted to approximately $223,000 and $171,000, respectively.

The three-year maturity of the Company’s lease obligations is presented below:

| Twelve Months Ending March 31, | Operating Lease Amount | |||

| 2021 | $ | 180,912 | ||

| 2022 | 153,185 | |||

| 2023 | 36,764 | |||

| Total lease payments | 370,861 | |||

| Less: Interest | (37,176 | ) | ||

| Present value of lease liabilities | $ | 333,685 | ||

Note 11. EQUITY

Stock issuance:

The Company’s outstanding warrants are classified as equity since they qualify for exception from derivative accounting as they are considered to be indexed to the Company’s own stock and require net share settlement. The fair value of the warrants of $881,750 is valued based on the Black-Scholes-Merton model and is recorded as additional paid-in capital from common stock based on the relative fair value of proceeds received using the following assumptions:

Following is a summary of the status of warrants outstanding and exercisable as of March 31, 2020:

| Shares | Weighted Average Exercise Price | |||||||

| Warrants outstanding, as of June 30, 2019 | 2,000,000 | $ | 1.75 | |||||

| Issued | - | - | ||||||

| Exercised | - | - | ||||||

| Expired | - | - | ||||||

| Warrants outstanding, as of March 31, 2020 | 2,000,000 | $ | 1.75 | |||||

| Warrants exercisable, as of March 31, 2020 | 2,000,000 | $ | 1.75 | |||||

| Warrants Outstanding | Warrants Exercisable | Weighted Average Exercise Price | Average Remaining Contractual Life | |||||||

| 2018 Series A, 2,000,000 | 2,000,000 | $ | 1.75 | 3.45 years | ||||||

On November 13, 2019, the Company entered into a cooperation agreement with Shanming Liang, a director of Guangxi Jinqiao Industrial Group Co., Ltd., to cooperate and expand the bulk cargo container services business. Shanming Liang agreed to purchase 1,000,000 shares of the Company’s common stock at a purchase price of $1.00 per share for aggregate proceeds of $1 million. The Company and Mr. Liang further entered into a Share Purchase Agreement on November 14, 2019 to memorialize the transaction aforementioned. Pursuant to the aforementioned agreement, the Company received proceeds of $885,946 in the second and third quarters of fiscal year 2020. On April 23, 2020, the Company received proceeds of $50,000. The rest of the payment is expected to receive by the end of the last quarter of fiscal year 2020.

On December 9, 2019, the Company authorized the cancellation of the 175,497 of the Company’s treasury shares. The shares were cancelled as of March 31, 2020. The cancellation has no effect on the Company's total shareholders' equity and earnings per share.

Stock based compensation:

In March 2017, the Company entered into a consulting and advisory services agreement with a consulting entity, which provides management consulting services that include marketing program design and implementation and cooperative partner selection and management. The service period began in March 2017 and will end in February 2020. The Company issued 250,000 shares of common stock as remuneration for the services, which were issued as restricted shares at $2.53 per share on March 22, 2017 to the consultant. These shares were valued at $632,500 and the consulting expense was $35,139 and $140,556 for the three and nine months ended March 31, 2020, respectively. $52,708 and $158,125 were recorded as compensation expense for the three and nine months ended March 31, 2019, respectively.

On October 23, 2017, the Company issued to its employees 130,000 shares of its restricted common stock valued at $2.80 per share. One quarter of the total number of common stock became vested on each of November 16, 2017, February 16, 2018, May 16, 2018 and August 16, 2018. $0 and $91,000 were recorded as compensation expense for the three and nine months ended March 31, 2019, respectively.

On October 27, 2017, the Company issued 200,000 shares of restricted common stock on the grant date with an aggregated fair value of $548,000 to a consulting company pursuant to a consulting agreement. The scope of services primarily covered advising on business development, strategic planning and compliance during the one-year service period from October 17, 2017 to October 16, 2018. $0 and $137,000 were recorded as compensation expense for the three and nine months ended March 31, 2019, respectively.

On June 7, 2018, the Company issued 400,000 shares of common stock with a fair value of $508,000 to a consulting entity pursuant to a service agreement. The scope of services primarily covers legal consultation in PRC during the two-year service period from July 2018 to June 2020. The consulting entity is entitled to be granted the common stock on a quarterly basis in eight equal instalments. The Company recorded compensation expense of $63,500 and $190,500 for the three and nine months ended March 31, 2020 and 2019, respectively. The rest of shares were subsequently issued in the last quarter of fiscal year 2020.

On September 21, 2018, the Company issued 430,000 shares of common stock valued at $1.10 per share on the grant date with an aggregated fair value of $473,000 under the 2014 Stock Incentive Plan (the “Plan”) to three employees, vesting immediately. The Company recorded compensation expense of $0 and $473,000 for the three and nine months ended March 31, 2019, respectively.

On December 11, 2018, the Company issued 200,000 shares of common stock valued at $0.89 per share on the grant date with a fair value of $178,000 under the 2014 Stock Incentive Plan to three employees, vesting immediately. The Company recorded compensation expense of $0 and $178,000 for the three and nine months ended March 31, 2019.

On November 7, 2018, the Board of the Company approved the issuance of 50,000 shares of restricted common stock to a consultant pursuant to an existing consulting agreement. The scope of services primarily covers advising on business development, strategic planning and corporate finance. The grant’s fair value of approximately $65,000 was amortized during the remaining service period from November 3, 2018 to May 2, 2019. The Company recorded compensation expense of $32,500 and $54,167 for the three and nine months ended March 31, 2019.

On December 31, 2018, the Board of the Company and the Compensation Committee of the Board (the “Committee”) approved (i) an increase in the annual salaries of Lei Cao, Chief Executive Officer, Tuo Pan, acting Chief Financial Officer, and Zhikang Huang, Chief Operating Officer (the “C-Level Executives”), effective January 1, 2019, and (ii) a one-time award of a total of 950,000 of the common stock from the shares reserved under the Company’s 2014 Stock Incentive Plan (the “Plan”) to the C-Level Executives, Chief Technology Officer, Yafei Li and the following members of the Board, effective December 31, 2018, for their valuable contributions to the Company in fiscal 2018: Jing Wang, Tieliang Liu and Bradley A. Haneberg. The Committee recommended and the Board determined to make the following stock grants under the Plan: (i) Chief Executive Officer, Lei Cao, is entitled to a one-time stock award grant of 400,000 shares, (ii) acting Chief Financial Officer, Tuo Pan, is entitled to a one-time stock award grant of 140,000 shares, (iii) Chief Operating Officer, Zhikang Huang, is entitled to a one-time stock award grant of 180,000 shares, (iv) Chief Technology Officer, Yafei Li is entitled to a one-time stock award grant of 80,000 shares, (v) Board member Jing Wang is entitled to a one-time stock award grant of 50,000 shares, (vi) Board member Tieliang Liu is entitled to a one-time stock award grant of 50,000 shares and (vii) Board member Bradley A. Haneberg is entitled to a one-time stock award grant of 50,000 shares. The Company recorded compensation expense of $0 and $731,500 for the three and nine months ended March 31, 2019.

On April 8, 2019, the Company entered into a consulting services agreement with a consulting entity, which provides management consulting and advisory services. The scope of services primarily covered advising on business development, strategic planning and compliance during the six months service period from April 8, 2019 to October 7, 2019. The Company issued 300,000 shares of common stock as remuneration for the services, which were issued as restricted shares at $0.85 per share on April 16, 2019 to the consulting entity. These shares were valued at $255,000. The Company recorded compensation expense of $0 and $127,500 for the three and nine months ended March 31, 2020, respectively.

On July 1, 2019, the Company issued 600,000 restricted shares of common stock with a fair value of $432,000 to a China-based company that specializes in the port agency business and/or its designees pursuant to a consulting service agreement. The scope of services primarily covers business consultation for one year from July 1, 2019 to June 30, 2020. The Company can terminate the agreement if they are not satisfy with the performance of the consulting firm and the consulting firm should return all the issued shares. The Company recorded compensation expense of $108,000 and $324,000 for the three and nine months ended March 31, 2020, respectively. The rest of shares were subsequently vested in the last quarter of fiscal year 2020.