UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-Q

|

| | | | |

þ☑ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 2017

|

| | | | |

o☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ___ to ___

Commission File Number 001-31792

CNO Financial Group, Inc.

| | | | | | | | | | | | | | | | | |

| Delaware | | 75-3108137 |

| State of Incorporation | | IRS Employer Identification No. |

| | | | | | |

| 11825 N. Pennsylvania Street | | | |

| Carmel, | Indiana | 46032 | | (317) | 817-6100 |

| Address of principal executive offices | | Telephone |

Securities registered pursuant to Section 12(b) of the Act: |

| | | | | | | | | | | | | |

DelawareTitle of each class | | 75-3108137Trading Symbol | | Name of each exchange on which registered |

State of IncorporationCommon Stock, par value $0.01 per share | | IRS Employer Identification No.CNO | | New York Stock Exchange |

| Rights to purchase Series D Junior Participating Preferred Stock | | |

11825 N. Pennsylvania Street | | |

Carmel, Indiana 46032 | | (317) 817-6100 |

Address of principal executive offices | | TelephoneNew York Stock Exchange |

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days: Yes [ X ]☒ No [ ]☐

Indicate by check mark whether the Registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [ X ]☒ No [ ]☐

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer", "accelerated filer", "smaller reporting company", and "emerging growth company" in Rule 12b-2 of the Exchange Act. Large accelerated filer [ X ]☒ Accelerated filer [ ]☐ Non-accelerated filer [ ]☐ Smaller reporting company [ ]☐ Emerging growth company [ ]☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]☐

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act): Yes [ ]☐ No [ X ]☒

Shares of common stock outstanding as of October 19, 2017: 167,762,323

TABLE OF CONTENTS

TABLE OF CONTENTS

| | | | | | | | |

| PART I - FINANCIAL INFORMATION | Page |

| | |

| Item 1. | Financial Statements (unaudited) | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| Item 2. | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| Item 3. | | |

| | |

| Item 4. | | |

| | |

| | |

| PART II - OTHER INFORMATION | |

| | |

| Item 1. | | |

| | |

| Item 1A. | | |

| | |

| Item 2. | | |

| | |

Item 5.6. | | |

| | |

Item 6. | | |

PART I - FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS.

CNO FINANCIAL GROUP, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEET

(Dollars in millions)

(unaudited)

ASSETS

| | | | | | | | | | | |

| September 30,

2020 | | December 31,

2019 |

| | | | |

| Investments: | | | |

| Fixed maturities, available for sale, at fair value (net of allowance for credit losses of $7.6 at September 30, 2020; amortized cost: September 30, 2020 - $19,783.3; December 31, 2019 - $19,179.5) | $ | 22,702.9 | | | $ | 21,295.2 | |

| Equity securities at fair value | 62.1 | | | 44.1 | |

| Mortgage loans (net of allowance for credit losses of $12.2 at September 30, 2020) | 1,444.9 | | | 1,566.1 | |

| Policy loans | 123.6 | | | 124.5 | |

| Trading securities | 240.3 | | | 243.9 | |

| Investments held by variable interest entities (net of allowance for credit losses of $22.2 at September 30, 2020; amortized cost: September 30, 2020 - $1,223.7; December 31, 2019 - $1,206.3) | 1,172.6 | | | 1,188.6 | |

| Other invested assets | 1,070.6 | | | 1,118.5 | |

| Total investments | 26,817.0 | | | 25,580.9 | |

| Cash and cash equivalents - unrestricted | 735.6 | | | 580.0 | |

| Cash and cash equivalents held by variable interest entities | 51.0 | | | 74.7 | |

| Accrued investment income | 214.4 | | | 205.9 | |

| Present value of future profits | 255.9 | | | 275.4 | |

| Deferred acquisition costs | 1,084.0 | | | 1,215.5 | |

| Reinsurance receivables (net of allowance for credit losses of $4.0 at September 30, 2020) | 4,613.1 | | | 4,785.7 | |

| Income tax assets, net | 322.0 | | | 432.6 | |

| Assets held in separate accounts | 3.9 | | | 4.2 | |

| Other assets | 472.3 | | | 476.0 | |

| Total assets | $ | 34,569.2 | | | $ | 33,630.9 | |

|

| | | | | | | |

| | September 30,

2017 | | December 31,

2016 |

| | | | |

| Investments: | | | |

| Fixed maturities, available for sale, at fair value (amortized cost: September 30, 2017 - $20,092.5; December 31, 2016 - $19,803.1) | $ | 22,129.9 |

| | $ | 21,096.2 |

|

| Equity securities at fair value (cost: September 30, 2017 - $688.7; December 31, 2016 - $580.7) | 713.3 |

| | 584.2 |

|

| Mortgage loans | 1,667.8 |

| | 1,768.0 |

|

| Policy loans | 114.6 |

| | 112.0 |

|

| Trading securities | 294.4 |

| | 363.4 |

|

| Investments held by variable interest entities | 1,382.5 |

| | 1,724.3 |

|

| Other invested assets | 752.1 |

| | 589.5 |

|

| Total investments | 27,054.6 |

| | 26,237.6 |

|

| Cash and cash equivalents - unrestricted | 765.9 |

| | 478.9 |

|

| Cash and cash equivalents held by variable interest entities | 105.9 |

| | 189.3 |

|

| Accrued investment income | 268.0 |

| | 239.6 |

|

| Present value of future profits | 368.5 |

| | 401.8 |

|

| Deferred acquisition costs | 1,023.8 |

| | 1,044.7 |

|

| Reinsurance receivables | 2,195.5 |

| | 2,260.4 |

|

| Income tax assets, net | 567.4 |

| | 789.7 |

|

| Assets held in separate accounts | 4.8 |

| | 4.7 |

|

| Other assets | 350.2 |

| | 328.5 |

|

| Total assets | $ | 32,704.6 |

| | $ | 31,975.2 |

|

(continued on next page)

The accompanying notes are an integral part

of the consolidated financial statements.

CNO FINANCIAL GROUP, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEET, continued

(Dollars in millions)

(unaudited)

LIABILITIES AND SHAREHOLDERS' EQUITY

| | | | | | | | | | | |

| September 30,

2020 | | December 31,

2019 |

| | | | |

| Liabilities: | | | |

| Liabilities for insurance products: | | | |

| Policyholder account liabilities | $ | 12,357.5 | | | $ | 12,132.3 | |

| Future policy benefits | 11,753.1 | | | 11,498.5 | |

| Liability for policy and contract claims | 473.2 | | | 522.3 | |

| Unearned and advanced premiums | 256.8 | | | 260.5 | |

| Liabilities related to separate accounts | 3.9 | | | 4.2 | |

| Other liabilities | 855.8 | | | 750.2 | |

| Investment borrowings | 1,642.9 | | | 1,644.3 | |

| Borrowings related to variable interest entities | 1,152.0 | | | 1,152.5 | |

| Notes payable – direct corporate obligations | 990.1 | | | 989.1 | |

| Total liabilities | 29,485.3 | | | 28,953.9 | |

| Commitments and Contingencies | | | |

| Shareholders' equity: | | | |

| Common stock ($0.01 par value, 8,000,000,000 shares authorized, shares issued and outstanding: September 30, 2020 – 138,931,352; December 31, 2019 – 148,084,178) | 1.4 | | | 1.5 | |

| Additional paid-in capital | 2,623.4 | | | 2,767.3 | |

| Accumulated other comprehensive income | 1,801.6 | | | 1,372.5 | |

| Retained earnings | 657.5 | | | 535.7 | |

| Total shareholders' equity | 5,083.9 | | | 4,677.0 | |

| Total liabilities and shareholders' equity | $ | 34,569.2 | | | $ | 33,630.9 | |

|

| | | | | | | |

| | September 30,

2017 | | December 31,

2016 |

| | | | |

| Liabilities: | | | |

| Liabilities for insurance products: | | | |

| Policyholder account balances | $ | 11,113.5 |

| | $ | 10,912.7 |

|

| Future policy benefits | 11,374.1 |

| | 10,953.3 |

|

| Liability for policy and contract claims | 519.5 |

| | 500.6 |

|

| Unearned and advanced premiums | 262.4 |

| | 282.5 |

|

| Liabilities related to separate accounts | 4.8 |

| | 4.7 |

|

| Other liabilities | 789.1 |

| | 611.4 |

|

| Investment borrowings | 1,646.9 |

| | 1,647.4 |

|

| Borrowings related to variable interest entities | 1,198.2 |

| | 1,662.8 |

|

| Notes payable – direct corporate obligations | 914.4 |

| | 912.9 |

|

| Total liabilities | 27,822.9 |

| | 27,488.3 |

|

| Commitments and Contingencies |

|

| |

|

|

| Shareholders' equity: | |

| | |

|

| Common stock ($0.01 par value, 8,000,000,000 shares authorized, shares issued and outstanding: September 30, 2017 – 167,762,323; December 31, 2016 – 173,753,614) | 1.7 |

| | 1.7 |

|

| Additional paid-in capital | 3,094.5 |

| | 3,212.1 |

|

| Accumulated other comprehensive income | 933.6 |

| | 622.4 |

|

| Retained earnings | 851.9 |

| | 650.7 |

|

| Total shareholders' equity | 4,881.7 |

| | 4,486.9 |

|

| Total liabilities and shareholders' equity | $ | 32,704.6 |

| | $ | 31,975.2 |

|

The accompanying notes are an integral part

of the consolidated financial statements.

CNO FINANCIAL GROUP, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENT OF OPERATIONS

(Dollars in millions, except per share data)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended | | Nine months ended |

| | September 30, | | September 30, |

| | | 2020 | | 2019 | | 2020 | | 2019 |

| Revenues: | | | | | | | | |

| Insurance policy income | | $ | 628.3 | | | $ | 620.0 | | | $ | 1,882.3 | | | $ | 1,857.6 | |

| Net investment income: | | | | | | | | |

| General account assets | | 276.9 | | | 274.1 | | | 788.9 | | | 827.8 | |

| Policyholder and other special-purpose portfolios | | 66.6 | | | 25.4 | | | 43.0 | | | 162.0 | |

| Realized investment gains (losses): | | | | | | | | |

| Net realized investment gains (losses) | | 8.2 | | | 5.7 | | | (24.0) | | | 29.3 | |

| Change in allowance for credit losses and other-than-temporary impairment losses (a) | | 8.1 | | | (3.4) | | | (31.4) | | | (5.6) | |

| | | | | | | | |

| Total realized gains (losses) | | 16.3 | | | 2.3 | | | (55.4) | | | 23.7 | |

| Fee revenue and other income | | 25.4 | | | 22.2 | | | 86.1 | | | 75.7 | |

| Total revenues | | 1,013.5 | | | 944.0 | | | 2,744.9 | | | 2,946.8 | |

| Benefits and expenses: | | | | | | | | |

| Insurance policy benefits | | 560.7 | | | 582.8 | | | 1,591.8 | | | 1,816.7 | |

| Interest expense | | 23.7 | | | 37.5 | | | 85.5 | | | 117.1 | |

| Amortization | | 53.5 | | | 51.6 | | | 192.2 | | | 156.0 | |

| Loss on extinguishment of debt | | 0 | | | 0 | | | 0 | | | 7.3 | |

| | | | | | | | |

| Other operating costs and expenses | | 209.2 | | | 218.6 | | | 674.6 | | | 682.9 | |

| Total benefits and expenses | | 847.1 | | | 890.5 | | | 2,544.1 | | | 2,780.0 | |

| Income before income taxes | | 166.4 | | | 53.5 | | | 200.8 | | | 166.8 | |

| Income tax expense (benefit): | | | | | | | | |

| Tax expense on period income | | 37.2 | | | 11.5 | | | 44.8 | | | 35.4 | |

| Valuation allowance for deferred tax assets and other tax items | | 0 | | | 0 | | | (34.0) | | | 0 | |

| Net income | | $ | 129.2 | | | $ | 42.0 | | | $ | 190.0 | | | $ | 131.4 | |

| Earnings per common share: | | | | | | | | |

| Basic: | | | | | | | | |

| Weighted average shares outstanding | | 140,900,000 | | | 154,257,000 | | | 143,384,000 | | | 158,007,000 | |

| Net income | | $ | .92 | | | $ | .27 | | | $ | 1.33 | | | $ | .83 | |

| Diluted: | | | | | | | | |

| Weighted average shares outstanding | | 141,730,000 | | | 155,260,000 | | | 144,090,000 | | | 159,061,000 | |

| Net income | | $ | .91 | | | $ | .27 | | | $ | 1.32 | | | $ | .83 | |

|

| | | | | | | | | | | | | | | | |

| | | Three months ended | | Nine months ended |

| | | September 30, | | September 30, |

| | | 2017 | | 2016 | | 2017 | | 2016 |

| Revenues: | | | | | | | | |

| Insurance policy income | | $ | 659.3 |

| | $ | 649.0 |

| | $ | 1,987.2 |

| | $ | 1,947.0 |

|

| Net investment income: | | | | | | |

| | |

|

| General account assets | | 325.9 |

| | 301.7 |

| | 960.3 |

| | 888.5 |

|

| Policyholder and other special-purpose portfolios | | 52.7 |

| | 43.1 |

| | 171.8 |

| | 82.7 |

|

| Realized investment gains (losses): | | | | | | |

| | |

|

| Net realized investment gains (losses), excluding impairment losses | | 34.5 |

| | 12.8 |

| | 74.8 |

| | 55.4 |

|

| Other-than-temporary impairments: | | | | | | | | |

| Total other-than-temporary impairment losses | | (4.7 | ) | | (1.2 | ) | | (17.3 | ) | | (24.8 | ) |

| Portion of other-than-temporary impairment losses recognized in accumulated other comprehensive income | | — |

| | — |

| | (.9 | ) | | — |

|

| Net impairment losses recognized | | (4.7 | ) | | (1.2 | ) | | (18.2 | ) | | (24.8 | ) |

| Loss on dissolution of variable interest entities | | (.6 | ) | | — |

| | (4.3 | ) | | (7.3 | ) |

| Total realized gains | | 29.2 |

| | 11.6 |

| | 52.3 |

| | 23.3 |

|

| Fee revenue and other income | | 12.2 |

| | 10.5 |

| | 35.5 |

| | 38.7 |

|

| Total revenues | | 1,079.3 |

| | 1,015.9 |

| | 3,207.1 |

| | 2,980.2 |

|

| Benefits and expenses: | | | | | | | | |

| Insurance policy benefits | | 638.1 |

| | 609.8 |

| | 1,941.6 |

| | 1,861.2 |

|

| Loss on reinsurance transaction | | — |

| | 75.4 |

| | — |

| | 75.4 |

|

| Interest expense | | 30.1 |

| | 29.4 |

| | 92.3 |

| | 86.0 |

|

| Amortization | | 58.2 |

| | 64.7 |

| | 181.3 |

| | 181.6 |

|

| Loss on extinguishment of borrowings related to a variable interest entity | | 5.5 |

| | — |

| | 5.5 |

| | — |

|

| Other operating costs and expenses | | 217.5 |

| | 187.3 |

| | 631.3 |

| | 603.5 |

|

| Total benefits and expenses | | 949.4 |

| | 966.6 |

| | 2,852.0 |

| | 2,807.7 |

|

| Income before income taxes | | 129.9 |

| | 49.3 |

| | 355.1 |

| | 172.5 |

|

| Income tax expense (benefit): | | | | | | | | |

| Tax expense on period income | | 44.1 |

| | 16.9 |

| | 123.6 |

| | 61.7 |

|

| Valuation allowance for deferred tax assets and other tax items | | (15.0 | ) | | 13.8 |

| | (15.0 | ) | | (13.2 | ) |

| Net income | | $ | 100.8 |

| | $ | 18.6 |

| | $ | 246.5 |

| | $ | 124.0 |

|

| Earnings per common share: | | | | | | | | |

| Basic: | | | | | | | | |

| Weighted average shares outstanding | | 168,684,000 |

| | 174,247,000 |

| | 170,890,000 |

| | 177,640,000 |

|

| Net income | | $ | .60 |

| | $ | .11 |

| | $ | 1.44 |

| | $ | .70 |

|

| Diluted: | | | | | | | | |

|

| Weighted average shares outstanding | | 170,982,000 |

| | 175,723,000 |

| | 172,800,000 |

| | 179,373,000 |

|

| Net income | | $ | .59 |

| | $ | .11 |

| | $ | 1.43 |

| | $ | .69 |

|

______________

(a) No portion of the other-than-temporary impairments recognized in the 2019 periods was included in accumulated other comprehensive income.

The accompanying notes are an integral part

of the consolidated financial statements.

CNO FINANCIAL GROUP, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

(Dollars in millions)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended | | Nine months ended |

| September 30, | | September 30, |

| 2020 | | 2019 | | 2020 | | 2019 |

| Net income | $ | 129.2 | | | $ | 42.0 | | | $ | 190.0 | | | $ | 131.4 | |

| Other comprehensive income, before tax: | | | | | | | |

| Unrealized gains on investments | 428.4 | | | 619.5 | | | 759.2 | | | 1,991.0 | |

| | | | | | | |

| | | | | | | |

| Adjustment to present value of future profits and deferred acquisition costs | (59.9) | | | (58.3) | | | (54.6) | | | (175.0) | |

| Amount related to premium deficiencies assuming the net unrealized gains had been realized | (1.0) | | | (124.0) | | | (196.0) | | | (200.5) | |

| Reclassification adjustments: | | | | | | | |

| For net realized investment (gains) losses included in net income | (8.5) | | | 2.6 | | | 41.2 | | | (.3) | |

| For amortization of the present value of future profits and deferred acquisition costs related to net realized investment (gains) losses included in net income | .1 | | | .2 | | | (3.0) | | | .6 | |

| Other comprehensive income before tax | 359.1 | | | 440.0 | | | 546.8 | | | 1,615.8 | |

| Income tax expense related to items of accumulated other comprehensive income | (77.7) | | | (95.3) | | | (117.7) | | | (350.6) | |

| Other comprehensive income, net of tax | 281.4 | | | 344.7 | | | 429.1 | | | 1,265.2 | |

| Comprehensive income | $ | 410.6 | | | $ | 386.7 | | | $ | 619.1 | | | $ | 1,396.6 | |

|

| | | | | | | | | | | | | | | |

| | Three months ended | | Nine months ended |

| | September 30, | | September 30, |

| | 2017 | | 2016 | | 2017 | | 2016 |

| Net income | $ | 100.8 |

| | $ | 18.6 |

| | $ | 246.5 |

| | $ | 124.0 |

|

| Other comprehensive income, before tax: | | | | | | | |

| Unrealized gains for the period | 120.9 |

| | 228.3 |

| | 794.5 |

| | 1,329.2 |

|

| Adjustment to present value of future profits and deferred acquisition costs | (1.8 | ) | | (11.3 | ) | | (25.3 | ) | | (119.6 | ) |

| Amount related to premium deficiencies assuming the net unrealized gains (losses) had been realized | (31.0 | ) | | (82.8 | ) | | (243.0 | ) | | (493.4 | ) |

| Reclassification adjustments: | | | | | | | |

| For net realized investment (gains) losses included in net income | (27.7 | ) | | (14.6 | ) | | (44.0 | ) | | (24.2 | ) |

| For amortization of the present value of future profits and deferred acquisition costs related to net realized investment gains (losses) included in net income | .7 |

| | .2 |

| | 1.0 |

| | .9 |

|

| Unrealized gains on investments | 61.1 |

| | 119.8 |

| | 483.2 |

| | 692.9 |

|

| Change related to deferred compensation plan | — |

| | — |

| | — |

| | 8.6 |

|

| Other comprehensive income before tax | 61.1 |

| | 119.8 |

| | 483.2 |

| | 701.5 |

|

| Income tax expense related to items of accumulated other comprehensive income | (22.0 | ) | | (42.1 | ) | | (172.0 | ) | | (248.8 | ) |

| Other comprehensive income, net of tax | 39.1 |

| | 77.7 |

| | 311.2 |

| | 452.7 |

|

| Comprehensive income | $ | 139.9 |

| | $ | 96.3 |

| | $ | 557.7 |

| | $ | 576.7 |

|

The accompanying notes are an integral part

of the consolidated financial statements.

CNO FINANCIAL GROUP, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENT OF SHAREHOLDERS' EQUITY

(Dollars in millions)millions, shares in thousands)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Common stock | |

Additional

paid-in | | Accumulated other comprehensive | | Retained | | |

| | Shares | | Amount | | capital | | income | | earnings | | Total |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Balance, June 30, 2019 | 156,768 | | | $ | 1.6 | | | $ | 2,903.2 | | | $ | 1,098.2 | | | $ | 249.2 | | | $ | 4,252.2 | |

| Net income | — | | | — | | | — | | | — | | | 42.0 | | | 42.0 | |

| Change in unrealized appreciation (depreciation) of investments (net of applicable income tax expense of $93.8) | — | | | — | | | — | | | 339.2 | | | — | | | 339.2 | |

| Change in noncredit component of impairment losses on fixed maturities, available for sale (net of applicable income tax expense of $1.5) | — | | | — | | | — | | | 5.5 | | | — | | | 5.5 | |

| Common stock repurchased | (4,798) | | | (.1) | | | (75.2) | | | — | | | — | | | (75.3) | |

| Dividends on common stock | — | | | — | | | — | | | — | | | (16.9) | | | (16.9) | |

| Employee benefit plans, net of shares used to pay tax withholdings | 213 | | | — | | | 6.6 | | | — | | | — | | | 6.6 | |

| Balance, September 30, 2019 | 152,183 | | | $ | 1.5 | | | $ | 2,834.6 | | | $ | 1,442.9 | | | $ | 274.3 | | | $ | 4,553.3 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Balance, June 30, 2020 | 141,719 | | | $ | 1.4 | | | $ | 2,664.3 | | | $ | 1,520.2 | | | $ | 545.3 | | | $ | 4,731.2 | |

| Net income | — | | | — | | | — | | | — | | | 129.2 | | | 129.2 | |

| Change in unrealized appreciation (depreciation) of investments (net of applicable income tax expense of $77.7) | — | | | — | | | — | | | 281.4 | | | — | | | 281.4 | |

| Common stock repurchased | (2,997) | | | — | | | (50.0) | | | — | | | — | | | (50.0) | |

| Dividends on common stock | — | | | — | | | — | | | — | | | (17.0) | | | (17.0) | |

| Employee benefit plans, net of shares used to pay tax withholdings | 209 | | | — | | | 9.1 | | | — | | | — | | | 9.1 | |

| Balance, September 30, 2020 | 138,931 | | | $ | 1.4 | | | $ | 2,623.4 | | | $ | 1,801.6 | | | $ | 657.5 | | | $ | 5,083.9 | |

|

| | | | | | | | | | | | | | | |

| | Common stock and additional paid-in capital | | Accumulated other comprehensive income | | Retained earnings | | Total |

| Balance, December 31, 2015 | $ | 3,388.6 |

| | $ | 402.8 |

| | $ | 347.1 |

| | $ | 4,138.5 |

|

| Net income | — |

| | — |

| | 124.0 |

| | 124.0 |

|

| Change in unrealized appreciation (depreciation) of investments and other (net of applicable income tax expense of $248.1) | — |

| | 451.5 |

| | — |

| | 451.5 |

|

| Change in noncredit component of impairment losses on fixed maturities, available for sale (net of applicable income tax expense of $.7) | — |

| | 1.2 |

| | — |

| | 1.2 |

|

| Cost of common stock repurchased | (203.0 | ) | | — |

| | — |

| | (203.0 | ) |

| Dividends on common stock | — |

| | — |

| | (40.8 | ) | | (40.8 | ) |

| Stock options, restricted stock and performance units | 22.4 |

| | — |

| | — |

| | 22.4 |

|

| Balance, September 30, 2016 | $ | 3,208.0 |

| | $ | 855.5 |

| | $ | 430.3 |

| | $ | 4,493.8 |

|

| | | | | | | | |

| Balance, December 31, 2016 | $ | 3,213.8 |

| | $ | 622.4 |

| | $ | 650.7 |

| | $ | 4,486.9 |

|

| Cumulative effect of accounting change | .9 |

| | — |

| | (.6 | ) | | .3 |

|

| Net income | — |

| | — |

| | 246.5 |

| | 246.5 |

|

| Change in unrealized appreciation (depreciation) of investments (net of applicable income tax expense of $170.9) | — |

| | 309.1 |

| | — |

| | 309.1 |

|

| Change in noncredit component of impairment losses on fixed maturities, available for sale (net of applicable income tax expense of $1.1) | — |

| | 2.1 |

| | — |

| | 2.1 |

|

| Cost of common stock repurchased | (140.1 | ) | | — |

| | — |

| | (140.1 | ) |

| Dividends on common stock | — |

| | — |

| | (44.7 | ) | | (44.7 | ) |

| Stock options, restricted stock and performance units | 21.6 |

| | — |

| | — |

| | 21.6 |

|

| Balance, September 30, 2017 | $ | 3,096.2 |

| | $ | 933.6 |

| | $ | 851.9 |

| | $ | 4,881.7 |

|

The accompanying notes are an integral part

of the consolidated financial statements.

CNO FINANCIAL GROUP, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENT OF SHAREHOLDERS' EQUITY, continued

(Dollars in millions, shares in thousands)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Common stock | |

Additional

paid-in | | Accumulated other comprehensive | | Retained | | |

| | Shares | | Amount | | capital | | income | | earnings | | Total |

| Balance, December 31, 2018 | 162,202 | | | $ | 1.6 | | | $ | 2,995.0 | | | $ | 177.7 | | | $ | 196.6 | | | $ | 3,370.9 | |

| Cumulative effect of accounting change | — | | | — | | | — | | | — | | | (3.1) | | | (3.1) | |

| Balance, January 1, 2019 | 162,202 | | | 1.6 | | | 2,995.0 | | | 177.7 | | | 193.5 | | | 3,367.8 | |

| Net income | — | | | — | | | — | | | — | | | 131.4 | | | 131.4 | |

| Change in unrealized appreciation (depreciation) of investments (net of applicable income tax expense of $349.1) | — | | | — | | | — | | | 1,259.6 | | | — | | | 1,259.6 | |

| Change in noncredit component of impairment losses on fixed maturities, available for sale (net of applicable income tax expense of $1.5) | — | | | — | | | — | | | 5.6 | | | — | | | 5.6 | |

| Common stock repurchased | (11,033) | | | (.1) | | | (177.2) | | | — | | | — | | | (177.3) | |

| Dividends on common stock | — | | | — | | | — | | | — | | | (50.6) | | | (50.6) | |

| Employee benefit plans, net of shares used to pay tax withholdings | 1,014 | | | — | | | 16.8 | | | — | | | — | | | 16.8 | |

| Balance, September 30, 2019 | 152,183 | | | $ | 1.5 | | | $ | 2,834.6 | | | $ | 1,442.9 | | | $ | 274.3 | | | $ | 4,553.3 | |

| | | | | | | | | | | |

| Balance, December 31, 2019 | 148,084 | | | $ | 1.5 | | | $ | 2,767.3 | | | $ | 1,372.5 | | | $ | 535.7 | | | $ | 4,677.0 | |

| Cumulative effect of accounting change | — | | | — | | | — | | | — | | | (17.8) | | | (17.8) | |

| Balance, January 1, 2020 | 148,084 | | | 1.5 | | | 2,767.3 | | | 1,372.5 | | | 517.9 | | | 4,659.2 | |

| Net income | — | | | — | | | — | | | — | | | 190.0 | | | 190.0 | |

| Change in unrealized appreciation (depreciation) of investments (net of applicable income tax expense of $117.7) | — | | | — | | | — | | | 429.1 | | | — | | | 429.1 | |

| Common stock repurchased | (10,048) | | | (.1) | | | (162.9) | | | — | | | — | | | (163.0) | |

| Dividends on common stock | — | | | — | | | — | | | — | | | (50.4) | | | (50.4) | |

| Employee benefit plans, net of shares used to pay tax withholdings | 895 | | | — | | | 19.0 | | | — | | | — | | | 19.0 | |

| Balance, September 30, 2020 | 138,931 | | | $ | 1.4 | | | $ | 2,623.4 | | | $ | 1,801.6 | | | $ | 657.5 | | | $ | 5,083.9 | |

The accompanying notes are an integral part

of the consolidated financial statements.

CNO FINANCIAL GROUP, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENT OF CASH FLOWS

(Dollars in millions)

(unaudited)

| | | | | | | | | | | |

| Nine months ended |

| September 30, |

| | 2020 | | 2019 |

| Cash flows from operating activities: | | | |

| Insurance policy income | $ | 1,747.8 | | | $ | 1,726.2 | |

| Net investment income | 805.9 | | | 839.7 | |

| Fee revenue and other income | 86.1 | | | 75.7 | |

| Insurance policy benefits | (1,195.0) | | | (1,224.0) | |

| Interest expense | (76.1) | | | (103.9) | |

| Deferrable policy acquisition costs | (201.5) | | | (217.5) | |

| Other operating costs | (612.4) | | | (588.7) | |

| Income taxes | (13.0) | | | 3.4 | |

| Net cash from operating activities | 541.8 | | | 510.9 | |

| Cash flows from investing activities: | | | |

| Sales of investments | 1,163.2 | | | 2,659.3 | |

| Maturities and redemptions of investments | 1,502.7 | | | 1,625.6 | |

| Purchases of investments | (3,086.7) | | | (4,387.7) | |

| Net sales (purchases) of trading securities | 16.2 | | | (6.6) | |

| Other | (25.2) | | | (92.1) | |

| Net cash used by investing activities | (429.8) | | | (201.5) | |

| Cash flows from financing activities: | | | |

| Issuance of notes payable, net | 0 | | | 494.2 | |

| Payments on notes payable | 0 | | | (425.0) | |

| Expenses related to extinguishment of debt | 0 | | | (6.1) | |

| Issuance of common stock | 5.0 | | | 6.0 | |

| Payments to repurchase common stock | (168.2) | | | (181.2) | |

| Common stock dividends paid | (50.4) | | | (50.6) | |

| Amounts received for deposit products | 1,160.1 | | | 1,307.4 | |

| Withdrawals from deposit products | (923.6) | | | (1,017.2) | |

| Issuance of investment borrowings: | | | |

| Federal Home Loan Bank | 190.3 | | | 536.8 | |

| | | |

| Payments on investment borrowings: | | | |

| Federal Home Loan Bank | (191.7) | | | (537.7) | |

| Related to variable interest entities | (1.6) | | | (270.6) | |

| | | |

| Net cash provided (used) by financing activities | 19.9 | | | (144.0) | |

| Net increase in cash and cash equivalents | 131.9 | | | 165.4 | |

| Cash and cash equivalents - unrestricted and held by variable interest entities, beginning of period | 654.7 | | | 656.6 | |

| Cash and cash equivalents - unrestricted and held by variable interest entities, end of period | $ | 786.6 | | | $ | 822.0 | |

|

| | | | | | | |

| | Nine months ended |

| | September 30, |

| | 2017 | | 2016 |

| Cash flows from operating activities: | | | |

| Insurance policy income | $ | 1,859.4 |

| | $ | 1,837.9 |

|

| Net investment income | 898.9 |

| | 877.7 |

|

| Fee revenue and other income | 35.5 |

| | 38.7 |

|

| Cash and cash equivalents received upon recapture of reinsurance | — |

| | 73.6 |

|

| Insurance policy benefits | (1,491.7 | ) | | (1,439.6 | ) |

| Interest expense | (81.0 | ) | | (66.5 | ) |

| Deferrable policy acquisition costs | (183.4 | ) | | (179.4 | ) |

| Other operating costs | (546.0 | ) | | (552.1 | ) |

| Income taxes | (58.0 | ) | | (5.5 | ) |

| Net cash from operating activities | 433.7 |

| | 584.8 |

|

| Cash flows from investing activities: | |

| | |

|

| Sales of investments | 1,742.5 |

| | 2,225.7 |

|

| Maturities and redemptions of investments | 2,543.0 |

| | 1,529.5 |

|

| Purchases of investments | (4,076.8 | ) | | (4,196.7 | ) |

| Net sales (purchases) of trading securities | 94.8 |

| | (31.0 | ) |

| Change in cash and cash equivalents held by variable interest entities | 83.4 |

| | 216.7 |

|

| Other | (23.6 | ) | | (17.8 | ) |

| Net cash provided (used) by investing activities | 363.3 |

| | (273.6 | ) |

| Cash flows from financing activities: | |

| | |

|

| Issuance of common stock | 6.0 |

| | 6.9 |

|

| Payments to repurchase common stock | (142.3 | ) | | (210.0 | ) |

| Common stock dividends paid | (44.5 | ) | | (40.9 | ) |

| Amounts received for deposit products | 1,067.2 |

| | 992.1 |

|

| Withdrawals from deposit products | (920.8 | ) | | (891.5 | ) |

| Issuance of investment borrowings: | | | |

| Federal Home Loan Bank | 332.0 |

| | 432.7 |

|

| Related to variable interest entities | 387.3 |

| | 477.1 |

|

| Payments on investment borrowings: | | | |

| Federal Home Loan Bank | (332.6 | ) | | (333.3 | ) |

| Related to variable interest entities | (862.3 | ) | | (470.6 | ) |

| Net cash used by financing activities | (510.0 | ) | | (37.5 | ) |

| Net increase in cash and cash equivalents | 287.0 |

| | 273.7 |

|

| Cash and cash equivalents, beginning of period | 478.9 |

| | 432.3 |

|

| Cash and cash equivalents, end of period | $ | 765.9 |

| | $ | 706.0 |

|

The accompanying notes are an integral part

of the consolidated financial statements.

CNO FINANCIAL GROUP, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

(unaudited)

___________________

BUSINESS AND BASIS OF PRESENTATION

The following notes should be read together with the notes to the consolidated financial statements included in our 20162019 Annual Report on Form 10-K.

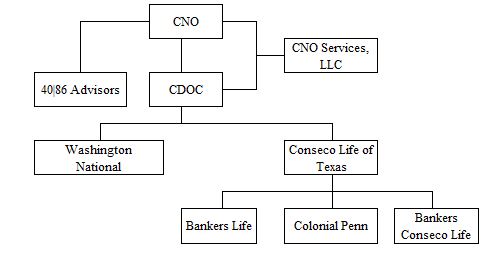

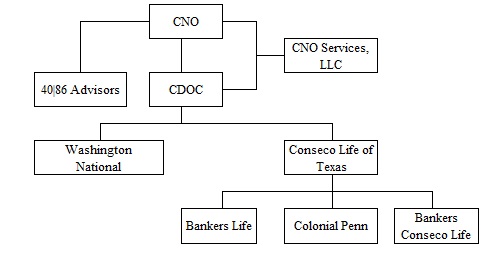

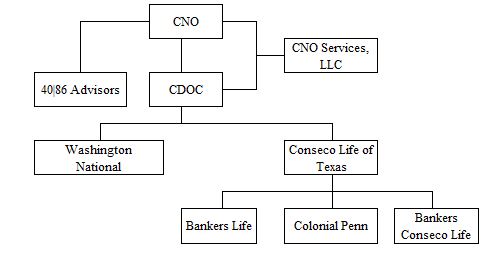

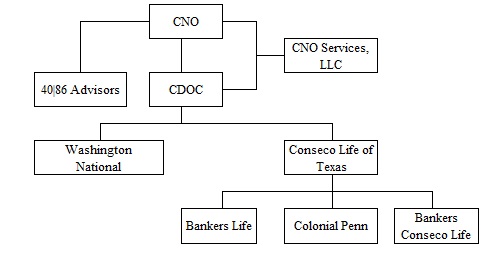

CNO Financial Group, Inc., a Delaware corporation ("CNO"), is a holding company for a group of insurance companies operating throughout the United States that develop, market and administer health insurance, annuity, individual life insurance and other insurance products. The terms "CNO Financial Group, Inc.", "CNO", the "Company", "we", "us", and "our" as used in these financial statements refer to CNO and its subsidiaries. Such terms, when used to describe insurance business and products, refer to the insurance business and products of CNO's insurance subsidiaries.

We focus on serving middle-income pre-retiree and retired Americans, which we believe are attractive, underserved, high growth markets. We sell our products through three3 distribution channels: career agents, independent producers (some of whom sell one or more of our product lines exclusively) and direct marketing.

Our unaudited consolidated financial statements reflect normal recurring adjustments that, in the opinion of management, are necessary for a fair statement of our financial position, results of operations and cash flows for the periods presented. As permitted by rules and regulations of the Securities and Exchange Commission (the "SEC") applicable to quarterly reports on Form 10-Q, we have condensed or omitted certain information and disclosures normally included in financial statements prepared in accordance with accounting principles generally accepted in the United States of America ("GAAP"). We have reclassified certain amounts from the prior periods to conform to the 20172020 presentation. These reclassifications have no effect on net income or shareholders' equity. Results for interim periods are not necessarily indicative of the results that may be expected for a full year.year, especially when considering the risks and uncertainties associated with the novel coronavirus ("COVID-19") and the impact it may have on our business, results of operations and financial condition. The COVID-19 pandemic has negatively impacted the U.S. and global economies, created significant volatility and disruption in the capital markets, dramatically increased unemployment levels and has fueled concerns that it will lead to a global recession. Depending on the duration and severity of the pandemic, we foresee the potential for adverse impacts related to, among other things: (i) sales results; (ii) insurance product margin; (iii) net investment income; (iv) invested assets; (v) regulatory capital; (vi) liabilities for insurance products; (vii) deferred acquisition costs; (viii) the present value of future profits; and (ix) income tax assets. The full extent to which COVID-19 will impact our business, results of operations and financial condition remains uncertain.

The balance sheet at December 31, 2016,2019, presented herein, has been derived from the audited financial statements at that date but does not include all of the information and footnotes required by GAAP for complete financial statements.

When we prepare financial statements in conformity with GAAP, we are required to make estimates and assumptions that significantly affect reported amounts of various assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements and revenues and expenses during the reporting periods. For example, we use significant estimates and assumptions to calculate values for deferred acquisition costs, the present value of future profits, fair value measurements of certain investments (including derivatives), other-than-temporary impairments of investments, assets and liabilities related to income taxes, liabilities for insurance products, liabilities related to litigation and guaranty fund assessment accruals. If our future experience differs from these estimates and assumptions, our financial statements wouldcould be materially affected.

The accompanying financial statements include the accounts of the Company and its subsidiaries. Our consolidated financial statements exclude transactions between us and our consolidated affiliates, or among our consolidated affiliates.

INVESTMENTS

We classify our fixed maturity securities into one of two categories: (i) "available for sale" (which we carry at estimated fair value with any unrealized gain or loss, net of tax and related adjustments, recorded as a component of shareholders' equity); or (ii) "trading" (which we carry at estimated fair value with changes in such value recognized as either net investment income (classified as investment income from policyholder and other special-purpose portfolios) or realized investment gains (losses)).

CNO FINANCIAL GROUP, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

(unaudited)

___________________

Trading securities include: (i) investments purchased with the intent of selling in the near term to generate income; (ii) investments supporting certain insurance liabilities (including investments backing the market strategies of our multibucket annuity products);liabilities; and (iii) certain fixed maturity securities containing embedded derivatives for which we have elected the fair value option. The change in fair value of the income generating investments and investments supporting insurance liabilities and reinsurance agreements is recognized in income from policyholder and other special-purpose portfolios (a component of net investment income). The change in fair value of securities with embedded derivatives is recognized in realized investment gains (losses). Investment income related to investments supporting certain insurance liabilities is substantially offset by the change in insurance policy benefits related to certain products.

CNO FINANCIAL GROUP, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

(unaudited)

___________________

Accumulated other comprehensive incomeWhen an available for sale fixed maturity security's fair value is primarily comprised of the net effect of unrealized appreciation (depreciation) on our investments. These amounts, included in shareholders' equity as of September 30, 2017 and December 31, 2016, were as follows (dollars in millions):

|

| | | | | | | |

| | September 30,

2017 | | December 31,

2016 |

| Net unrealized appreciation (depreciation) on fixed maturity securities, available for sale, on which an other-than-temporary impairment loss has been recognized | $ | 2.4 |

| | $ | (1.1 | ) |

| Net unrealized gains on all other investments | 2,058.9 |

| | 1,311.9 |

|

| Adjustment to present value of future profits (a) | (98.1 | ) | | (106.2 | ) |

| Adjustment to deferred acquisition costs | (287.9 | ) | | (223.5 | ) |

| Adjustment to insurance liabilities | (224.5 | ) | | (13.5 | ) |

| Deferred income tax liabilities | (517.2 | ) | | (345.2 | ) |

| Accumulated other comprehensive income | $ | 933.6 |

| | $ | 622.4 |

|

________

| |

(a) | The present value of future profits is the value assigned to the right to receive future cash flows from contracts existing at September 10, 2003, the date Conseco, Inc., an Indiana corporation, emerged from bankruptcy. |

At September 30, 2017, adjustments to the present value of future profits, deferred acquisition costs, insurance liabilities and deferred tax assets included $(86.7) million, $(135.8) million, $(224.5) million and $159.1 million, respectively, for premium deficiencies that would exist on certain blocks of business (primarily long-term care products) if unrealized gains on the assets backing such products had been realized and the proceeds from the sales of such assets were invested at then current yields.

At September 30, 2017,below the amortized cost, gross unrealizedthe security is considered impaired. If a portion of the decline is due to credit-related factors, we separate the credit loss component of the impairment from the amount related to all other factors and report the credit loss component in net realized investment gains and losses,(losses) limited to the difference between estimated fair value other-than-temporary impairmentsand amortized cost. The impairment related to all other factors (non-credit factors) is reported in accumulated other comprehensive income ofalong with unrealized gains related to fixed maturities,maturity investments, available for sale, net of tax and equity securities were as follows (dollars in millions):

|

| | | | | | | | | | | | | | | | | | | |

| | Amortized cost | | Gross unrealized gains | | Gross unrealized losses | | Estimated fair value | | Other-than-temporary impairments included in accumulated other comprehensive income |

| Corporate securities | $ | 13,145.4 |

| | $ | 1,537.6 |

| | $ | (33.0 | ) | | $ | 14,650.0 |

| | $ | (3.6 | ) |

| United States Treasury securities and obligations of United States government corporations and agencies | 145.4 |

| | 26.9 |

| | — |

| | 172.3 |

| | — |

|

| States and political subdivisions | 1,857.2 |

| | 220.7 |

| | (.9 | ) | | 2,077.0 |

| | — |

|

| Debt securities issued by foreign governments | 58.1 |

| | 3.1 |

| | (.1 | ) | | 61.1 |

| | — |

|

| Asset-backed securities | 2,608.6 |

| | 180.6 |

| | (3.1 | ) | | 2,786.1 |

| | — |

|

| Collateralized debt obligations | 236.5 |

| | 1.4 |

| | — |

| | 237.9 |

| | — |

|

| Commercial mortgage-backed securities | 1,311.6 |

| | 37.4 |

| | (10.1 | ) | | 1,338.9 |

| | — |

|

| Mortgage pass-through securities | 2.0 |

| | .2 |

| | — |

| | 2.2 |

| | — |

|

| Collateralized mortgage obligations | 727.7 |

| | 77.3 |

| | (.6 | ) | | 804.4 |

| | (1.1 | ) |

| Total fixed maturities, available for sale | $ | 20,092.5 |

| | $ | 2,085.2 |

| | $ | (47.8 | ) | | $ | 22,129.9 |

| | $ | (4.7 | ) |

| Equity securities | $ | 688.7 |

| | $ | 27.2 |

| | $ | (2.6 | ) | | $ | 713.3 |

| | |

CNO FINANCIAL GROUP, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

(unaudited)

___________________

At December 31, 2016, the amortized cost, gross unrealized gainsrelated adjustments. The allowance is adjusted for any additional credit losses and losses, estimated fair value, other-than-temporary impairments in accumulated other comprehensive income of fixed maturities, available for sale, and equity securities were as follows (dollars in millions):

|

| | | | | | | | | | | | | | | | | | | |

| | Amortized cost | | Gross unrealized gains | | Gross unrealized losses | | Estimated fair value | | Other-than-temporary impairments included in accumulated other comprehensive income |

| Corporate securities | $ | 12,549.9 |

| | $ | 1,100.0 |

| | $ | (139.0 | ) | | $ | 13,510.9 |

| | $ | (3.6 | ) |

| United States Treasury securities and obligations of United States government corporations and agencies | 143.8 |

| | 20.5 |

| | — |

| | 164.3 |

| | — |

|

| States and political subdivisions | 1,811.8 |

| | 186.7 |

| | (9.6 | ) | | 1,988.9 |

| | (3.0 | ) |

| Debt securities issued by foreign governments | 37.1 |

| | .2 |

| | (.4 | ) | | 36.9 |

| | — |

|

| Asset-backed securities | 2,641.5 |

| | 84.3 |

| | (15.5 | ) | | 2,710.3 |

| | — |

|

| Collateralized debt obligations | 230.0 |

| | 1.0 |

| | (.3 | ) | | 230.7 |

| | — |

|

| Commercial mortgage-backed securities | 1,531.0 |

| | 33.1 |

| | (27.9 | ) | | 1,536.2 |

| | — |

|

| Mortgage pass-through securities | 2.3 |

| | .2 |

| | — |

| | 2.5 |

| | — |

|

| Collateralized mortgage obligations | 855.7 |

| | 61.4 |

| | (1.6 | ) | | 915.5 |

| | (1.4 | ) |

| Total fixed maturities, available for sale | $ | 19,803.1 |

| | $ | 1,487.4 |

| | $ | (194.3 | ) | | $ | 21,096.2 |

| | $ | (8.0 | ) |

| Equity securities | $ | 580.7 |

| | $ | 11.5 |

| | $ | (8.0 | ) | | $ | 584.2 |

| | |

The following table sets forth the amortized cost and estimated fair value of fixed maturities, available for sale, at September 30, 2017, by contractual maturity. Actual maturities will differ from contractual maturities because certain borrowers may have the right to call or prepay obligationssubsequent recoveries. When recognizing an allowance associated with or without penalties. Structured securities (such as asset-backed securities, collateralized debt obligations, commercial mortgage-backed securities, mortgage pass-through securities and collateralized mortgage obligations, collectively referred to as "structured securities") frequently include provisions for periodic principal payments and permit periodic unscheduled payments.

|

| | | | | | | |

| | Amortized cost | | Estimated fair value |

| | (Dollars in millions) |

| Due in one year or less | $ | 398.1 |

| | $ | 406.1 |

|

| Due after one year through five years | 2,004.8 |

| | 2,131.7 |

|

| Due after five years through ten years | 1,562.8 |

| | 1,671.1 |

|

| Due after ten years | 11,240.4 |

| | 12,751.5 |

|

| Subtotal | 15,206.1 |

| | 16,960.4 |

|

| Structured securities | 4,886.4 |

| | 5,169.5 |

|

| Total fixed maturities, available for sale | $ | 20,092.5 |

| | $ | 22,129.9 |

|

CNO FINANCIAL GROUP, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

(unaudited)

___________________

The following table sets forth the amortized cost and estimated fair value of fixed maturities, available for sale, at December 31, 2016, by contractual maturity.

|

| | | | | | | |

| | Amortized cost | | Estimated fair value |

| | (Dollars in millions) |

| Due in one year or less | $ | 354.7 |

| | $ | 359.8 |

|

| Due after one year through five years | 2,243.8 |

| | 2,399.5 |

|

| Due after five years through ten years | 1,549.1 |

| | 1,620.8 |

|

| Due after ten years | 10,395.0 |

| | 11,320.9 |

|

| Subtotal | 14,542.6 |

| | 15,701.0 |

|

| Structured securities | 5,260.5 |

| | 5,395.2 |

|

| Total fixed maturities, available for sale | $ | 19,803.1 |

| | $ | 21,096.2 |

|

Net Realized Investment Gains (Losses)

The following table sets forth the net realized investment gains (losses) for the periods indicated (dollars in millions):

|

| | | | | | | | | | | | | | | |

| | Three months ended | | Nine months ended |

| | September 30, | | September 30, |

| | 2017 | | 2016 | | 2017 | | 2016 |

| Fixed maturity securities, available for sale: | | | | | | | |

| Gross realized gains on sale | $ | 32.3 |

| | $ | 7.3 |

| | $ | 60.4 |

| | $ | 127.1 |

|

| Gross realized losses on sale | (8.5 | ) | | (2.8 | ) | | (16.4 | ) | | (84.4 | ) |

| Impairments: | | | | | | | |

| Total other-than-temporary impairment losses | (3.2 | ) | | — |

| | (10.0 | ) | | (6.3 | ) |

| Other-than-temporary impairment losses recognized in accumulated other comprehensive income | — |

| | — |

| | (.9 | ) | | — |

|

| Net impairment losses recognized | (3.2 | ) | | — |

| | (10.9 | ) | | (6.3 | ) |

| Net realized investment gains from fixed maturities | 20.6 |

| | 4.5 |

| | 33.1 |

| | 36.4 |

|

| Equity securities | 7.7 |

| | 17.2 |

| | 9.6 |

| | 21.3 |

|

| Commercial mortgage loans | — |

| | — |

| | 1.0 |

| | — |

|

| Impairments of other investments | (1.5 | ) | | (1.2 | ) | | (7.3 | ) | | (18.5 | ) |

| Loss on dissolution of variable interest entities | (.6 | ) | | — |

| | (4.3 | ) | | (7.3 | ) |

| Other (a) | 3.0 |

| | (8.9 | ) | | 20.2 |

| | (8.6 | ) |

| Net realized investment gains | $ | 29.2 |

| | $ | 11.6 |

| | $ | 52.3 |

| | $ | 23.3 |

|

_________________

| |

(a) | Changes in the estimated fair value of trading securities that we have elected the fair value option (and are still held as of the end of the respective periods) were $13.0 million and $.8 million for the nine months ended September 30, 2017 and 2016, respectively. |

During the first nine months of 2017, we recognized net realized investment gains of $52.3 million, which were comprised of: (i) $60.1 million of net gains from the sales of investments; (ii) $4.3 million of losses on the dissolution of variable interest entities ("VIEs"); (iii) the increase in fair value of certain fixed maturity investments with embedded derivatives of $12.3 million; (iv) the increase in fair value of embedded derivatives related to a modified coinsurance agreement of $2.4 million; and (v) $18.2 million of writedowns of investments for other than temporary declines in fair value recognized through net income.

CNO FINANCIAL GROUP, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

(unaudited)

___________________

During the first nine months of 2016, we recognized net realized investment gains of $23.3 million, which were comprised of: (i) $48.1 million of net gains from the sales of investments; (ii) a $7.3 million loss on the dissolution of a VIE; (iii) the increase in fair value of certain fixed maturity investments with embedded derivatives of $.6 million; (iv) the increase in fair value of embedded derivatives related to a modified coinsurance agreement of $6.7 million; and (v) $24.8 million of writedowns of investments for other than temporary declines in fair value recognized through net income.

During the first nine months of 2017 and 2016, certain VIEs that were required to be consolidated were dissolved. We recognized a loss of $4.3 million and $7.3 million during the first nine months of 2017 and 2016, respectively, representing the difference between the carrying value of the investment borrowings of such VIEs and the contractual distributions required following the liquidation of the underlying assets.

Our fixed maturity investments are generally purchased in the context of various long-term strategies, including funding insurance liabilities, so we do not generally seek to generate short-term realized gains through the purchase and sale of such securities. In certain circumstances, including those in which securities are selling at prices which exceed our view of their underlying economic value, or when it is possible to reinvest the proceeds to better meet our long-term asset-liability objectives, we may sell certain securities.

During the first nine months of 2017, the $16.4 million of gross realized losses on sales of $290.8 million of fixed maturity securities, available for sale included: (i) $9.7 million related to various corporate securities; (ii) $3.1 million related to commercial mortgage-backed securities; and (iii) $3.6 million related to various other investments. Securities are generally sold at a loss following unforeseen issue-specific events or conditions or shifts in perceived relative values. These reasons include but are not limited to: (i) changes in the investment environment; (ii) expectation that the market value could deteriorate; (iii) our desire to reduce our exposure to an asset class, an issuer or an industry; (iv) prospective or actual changes in credit quality; or (v) changes in expected portfolio cash flows.

During the first nine months of 2017, we recognized $18.2 million of impairment losses recorded in earnings which included: (i) $5.7 million of writedowns on fixed maturities in the energy sector; (ii) $5.2 million of writedowns related to a mortgage loan; and (iii) $7.3 million of writedowns on other investments. Factors considered in determining the writedowns of investments in the first nine months of 2017 included changes in the estimated recoverable value of the assets related to each investment and the timing of and complexities related to the recovery process.

During the first nine months of 2016, we recognized $24.8 million of impairment losses recorded in earnings which included: (i) $6.3 million of writedowns on fixed maturities of a single issuer in the energy sector; (ii) $3.7 million of writedowns on a direct loan due to borrower specific events; (iii) $12.7 million of writedowns on a privately placed preferred stock of an entity formed to construct and operate a chemical plant; (iv) $.9 million of writedowns related to a real estate investment; and (v) $1.2 million of writedowns of investments held by VIEs due to other-than-temporary declines in value.

We regularly evaluate all of our investments with unrealized losses for possible impairment. Our assessment of whether unrealized losses are "other than temporary" requires significant judgment. Factors considered include: (i) the extent to which fair value is less than the cost basis; (ii) the length of time that the fair value has been less than cost; (iii) whether the unrealized loss is event driven, credit-driven or a result of changes in market interest rates or risk premium; (iv) the near-term prospects for specific events, developments or circumstances likely to affect the value of the investment; (v) the investment's rating and whether the investment is investment-grade and/or has been downgraded since its purchase; (vi) whether the issuer is current on all payments in accordance with the contractual terms of the investment and is expected to meet all of its obligations under the terms of the investment; (vii) whether we intend to sell the investment or it is more likely than not that circumstances will require us to sell the investment before recovery occurs; (viii) the underlying current and prospective asset and enterprise values of the issuer and the extent to which the recoverability of the carrying value of our investment may be affected by changes in such values; (ix) projections of, and unfavorable changes in, cash flows on structured securities including mortgage-backed and asset-backed securities; (x) our best estimate of the value of any collateral; and (xi) other objective and subjective factors.

Future events may occur, or additional information may become available, which may necessitate future realized losses in our portfolio. Significant losses could have a material adverse effect on our consolidated financial statements in future periods.

CNO FINANCIAL GROUP, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

(unaudited)

___________________

Impairment losses on equity securities are recognized in net income. The manner in which impairment losses on fixed maturity securities, available for sale, are recognized in the financial statements is dependent on the facts and circumstances related to the specific security. If we intend to sell a security or it is more likely than not that we would be required to sell a security before the recovery of its amortized cost, the security is other-than-temporarily impaired and the full amount of the impairment is recognized as a loss through earnings. If we do not expect to recover the amortized cost basis, we do not plan to sell the security, and if it is not more likely than not that we would be required to sell a security before the recovery of its amortized cost, less any current period credit loss, the recognition ofcost basis is not adjusted. When we determine a security is uncollectable, the other-than-temporary impairment is bifurcated. We recognize the credit loss portion in net income and the noncredit loss portion in accumulated other comprehensive income.remaining amortized cost will be written off.

We estimate the amount ofIn determining the credit loss component, of a fixed maturity security impairment aswe discount the difference between amortized cost and the present value of the expectedestimated cash flows on a security by security basis. We consider the impact of macroeconomic conditions on inputs used to measure the security. The present value is determined using the best estimateamount of future cash flows discounted at the effective interest rate implicit to the security at the date of purchase or the current yield to accrete an asset-backed or floating-rate security. The methodology and assumptions for establishing the best estimate of future cash flows vary depending on the type of security.

credit loss. For most structured securities, cash flow estimates are based on bond-specific facts and circumstances that may include collateral characteristics, expectations of delinquency and default rates, loss severity, prepayment speeds and structural support, including overcollateralization, excess spread, subordination and guarantees. For corporate bonds, cash flow estimates are derived from scenario-based outcomes ofby considering asset type, rating, time to maturity, and applying an expected corporate restructuringsloss rate.

If we intend to sell an impaired fixed maturity security, available for sale, or identify an impaired fixed maturity security, available for sale, for which is it more likely than not we will be required to sell before anticipated recovery, the disposition of assets using bond specific factsdifference between the fair value and circumstances. The previousthe amortized cost basis less the impairment recognizedis included in net incomerealized investment gains (losses) and the fair value becomes the security's new cost basis. We accrete theamortized cost. The new cost basis is not adjusted for any subsequent recoveries in fair value.

The Company reports accrued investment income separately from fixed maturities, available for sale, and has elected not to measure an allowance for credit losses for accrued investment income. Accrued investment income is written off through net investment income at the estimated future cash flows overtime the expected remaining lifeissuer of the security, except when the securitybond defaults or is inexpected to default or considered nonperforming.on payments.

The remaining noncredit impairment, which is recorded in accumulatedAccumulated other comprehensive income is primarily comprised of the difference betweennet effect of unrealized appreciation (depreciation) on our investments. These amounts, included in shareholders' equity as of September 30, 2020 and December 31, 2019, were as follows (dollars in millions):

| | | | | | | | | | | |

| September 30,

2020 | | December 31,

2019 |

| Net unrealized appreciation (depreciation) on fixed maturity securities, available for sale, on which an other-than-temporary impairment loss has been recognized | $ | 0 | | | $ | 1.1 | |

| Net unrealized gains on all other fixed maturity securities, available for sale | 0 | | | 2,095.3 | |

| Net unrealized gains on investments having no allowance for credit losses | 2,926.3 | | | 0 | |

| Unrealized losses on investments with an allowance for credit losses | (29.5) | | | 0 | |

| Adjustment to present value of future profits (a) | (11.2) | | | (18.9) | |

| Adjustment to deferred acquisition costs | (395.9) | | | (227.9) | |

| Adjustment to insurance liabilities | (189.8) | | | (96.5) | |

| Deferred income tax liabilities | (498.3) | | | (380.6) | |

| Accumulated other comprehensive income | $ | 1,801.6 | | | $ | 1,372.5 | |

________

(a)The present value of future profits is the security's estimated fair value and our best estimate ofassigned to the right to receive future cash flows discountedfrom contracts existing at September 10, 2003, the effective interest rate prior to impairment. The remaining noncredit impairment typically represents changes in the market interest rates, current market liquidity and risk premiums. As of September 30, 2017date Conseco, Inc., other-than-temporary impairments included in accumulated other comprehensive income totaled $4.7 million (before taxes and related amortization).

The following table summarizes the amount of credit losses recognized in earnings on fixed maturity securities, available for sale, held at the beginning of the period, for which a portion of the other-than-temporary impairment was also recognized in accumulated other comprehensive income for the three and nine months ended September 30, 2017 and 2016 (dollars in millions):

an Indiana corporation, emerged from bankruptcy.

|

| | | | | | | | | | | | | | | |

| | Three months ended | | Nine months ended |

| | September 30, | | September 30, |

| | 2017 | | 2016 | | 2017 | | 2016 |

| Credit losses on fixed maturity securities, available for sale, beginning of period | $ | (4.9 | ) | | $ | (2.6 | ) | | $ | (5.5 | ) | | $ | (2.6 | ) |

| Add: credit losses on other-than-temporary impairments not previously recognized | — |

| | — |

| | — |

| | — |

|

| Less: credit losses on securities sold | — |

| | .1 |

| | 1.6 |

| | .1 |

|

| Less: credit losses on securities impaired due to intent to sell (a) | — |

| | — |

| | — |

| | — |

|

| Add: credit losses on previously impaired securities | — |

| | — |

| | (1.0 | ) | | — |

|

| Less: increases in cash flows expected on previously impaired securities | — |

| | — |

| | — |

| | — |

|

| Credit losses on fixed maturity securities, available for sale, end of period | $ | (4.9 | ) | | $ | (2.5 | ) | | $ | (4.9 | ) | | $ | (2.5 | ) |

CNO FINANCIAL GROUP, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

(unaudited)

___________________

At September 30, 2020, adjustments to the present value of future profits, deferred acquisition costs, insurance liabilities and deferred tax assets included $(8.9) million, $(132.8) million, $(189.8) million and $72.0 million, respectively, for premium deficiencies that would exist on certain blocks of business if unrealized gains on the assets backing such products had been realized and the proceeds from the sales of such assets were invested at then current yields.

__________

| |

(a) | Represents securities for which the amount previously recognized in accumulated other comprehensive income was recognized in earnings because we intend to sell the security or we more likely than not will be required to sell the security before recovery of its amortized cost basis. |

At December 31, 2019, adjustments to the present value of future profits, deferred acquisition costs, insurance liabilities and deferred tax assets included $(12.2) million, $(26.8) million, $(96.5) million and $29.4 million, respectively, for premium deficiencies that would exist on certain blocks of business if unrealized gains on the assets backing such products had been realized and the proceeds from the sales of such assets were invested at then current yields.

At September 30, 2020, the amortized cost, gross unrealized gains, gross unrealized losses, allowance for credit losses and estimated fair value of fixed maturities, available for sale, were as follows (dollars in millions):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Amortized cost | | Gross unrealized gains | | Gross unrealized losses | | Allowance for credit losses | | Estimated fair value |

| Corporate securities | $ | 11,769.3 | | | $ | 2,239.8 | | | $ | (31.3) | | | $ | (7.2) | | | $ | 13,970.6 | |

| United States Treasury securities and obligations of United States government corporations and agencies | 162.3 | | | 79.5 | | | 0 | | | 0 | | | 241.8 | |

| States and political subdivisions | 2,282.7 | | | 352.7 | | | (6.3) | | | (.4) | | | 2,628.7 | |

| Foreign governments | 85.6 | | | 18.7 | | | 0 | | | 0 | | | 104.3 | |

| Asset-backed securities | 1,093.0 | | | 39.1 | | | (14.7) | | | 0 | | | 1,117.4 | |

| Agency residential mortgage-backed securities | 60.9 | | | 6.7 | | | 0 | | | 0 | | | 67.6 | |

| Non-agency residential mortgage-backed securities | 1,988.9 | | | 177.7 | | | (5.6) | | | 0 | | | 2,161.0 | |

| Commercial mortgage-backed securities | 1,870.7 | | | 96.8 | | | (16.1) | | | 0 | | | 1,951.4 | |

| Collateralized loan obligations | 469.9 | | | .1 | | | (9.9) | | | 0 | | | 460.1 | |

| Total fixed maturities, available for sale | $ | 19,783.3 | | | $ | 3,011.1 | | | $ | (83.9) | | | $ | (7.6) | | | $ | 22,702.9 | |

At December 31, 2019, the amortized cost, gross unrealized gains and losses, estimated fair value and other-than-temporary impairments in accumulated other comprehensive income of fixed maturities, available for sale, were as follows (dollars in millions):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Amortized cost | | Gross unrealized gains | | Gross unrealized losses | | Estimated fair value | | Other-than-temporary impairments included in accumulated other comprehensive income |

| Corporate securities | $ | 11,403.5 | | | $ | 1,544.1 | | | $ | (12.3) | | | $ | 12,935.3 | | | $ | 0 | |

| United States Treasury securities and obligations of United States government corporations and agencies | 161.4 | | | 43.3 | | | (.1) | | | 204.6 | | | 0 | |

| States and political subdivisions | 2,002.1 | | | 246.1 | | | (1.5) | | | 2,246.7 | | | 0 | |

| Foreign governments | 82.6 | | | 13.0 | | | 0 | | | 95.6 | | | 0 | |

| Asset-backed securities | 1,352.9 | | | 36.8 | | | (1.8) | | | 1,387.9 | | | 0 | |

| Agency residential mortgage-backed securities | 89.2 | | | 5.8 | | | 0 | | | 95.0 | | | 0 | |

| Non-agency residential mortgage-backed securities | 1,871.0 | | | 172.3 | | | (1.0) | | | 2,042.3 | | | (.3) | |

| Commercial mortgage-backed securities | 1,812.7 | | | 75.3 | | | (1.0) | | | 1,887.0 | | | 0 | |

| Collateralized loan obligations | 404.1 | | | .1 | | | (3.4) | | | 400.8 | | | 0 | |

| Total fixed maturities, available for sale | $ | 19,179.5 | | | $ | 2,136.8 | | | $ | (21.1) | | | $ | 21,295.2 | | | $ | (.3) | |

CNO FINANCIAL GROUP, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

(unaudited)

___________________

The following table sets forth the amortized cost and estimated fair value of fixed maturities, available for sale, at September 30, 2020, by contractual maturity. Actual maturities will differ from contractual maturities because borrowers may have the right to call or prepay obligations with or without penalties. Structured securities (such as asset-backed securities, collateralized loan obligations, commercial mortgage-backed securities, agency residential mortgage-backed securities and non-agency residential mortgage-backed securities, collectively referred to as "structured securities") frequently include provisions for periodic principal payments and permit periodic unscheduled payments.

| | | | | | | | | | | |

| Amortized

cost | | Estimated

fair

value |

| | (Dollars in millions) |

| Due in one year or less | $ | 289.2 | | | $ | 293.1 | |

| Due after one year through five years | 1,104.1 | | | 1,164.6 | |

| Due after five years through ten years | 1,516.1 | | | 1,659.4 | |

| Due after ten years | 11,390.5 | | | 13,828.3 | |

| Subtotal | 14,299.9 | | | 16,945.4 | |

| Structured securities | 5,483.4 | | | 5,757.5 | |

| Total fixed maturities, available for sale | $ | 19,783.3 | | | $ | 22,702.9 | |

The following table sets forth the amortized cost and estimated fair value of fixed maturities, available for sale, at December 31, 2019, by contractual maturity.

| | | | | | | | | | | |

| Amortized

cost | | Estimated

fair

value |

| | (Dollars in millions) |

| Due in one year or less | $ | 282.2 | | | $ | 286.0 | |

| Due after one year through five years | 1,082.2 | | | 1,130.8 | |

| Due after five years through ten years | 1,376.6 | | | 1,481.7 | |

| Due after ten years | 10,908.6 | | | 12,583.7 | |

| Subtotal | 13,649.6 | | | 15,482.2 | |

| Structured securities | 5,529.9 | | | 5,813.0 | |

| Total fixed maturities, available for sale | $ | 19,179.5 | | | $ | 21,295.2 | |

Gross Unrealized Investment Losses

Our investment strategy is to maximize, over a sustained period and within acceptable parameters of quality and risk, investment income and total investment return through active strategic asset allocation and investment management. Accordingly, we may sell securities at a gain or a loss to enhance the projected total return of the portfolio as market opportunities change, to reflect changing perceptions of risk, or to better match certain characteristics of our investment portfolio with the corresponding characteristics of our insurance liabilities.

CNO FINANCIAL GROUP, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

(unaudited)

___________________

The following table summarizes the gross unrealized losses and fair values of our investments with unrealized losses that arefor which an allowance for credit losses has not deemed to be other-than-temporarily impaired,been recorded, aggregated by investment category and length of time that such securities have been in a continuous unrealized loss position, at September 30, 20172020 (dollars in millions):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Less than 12 months | | 12 months or greater | | Total |

| Description of securities | | Fair

value | | Unrealized

losses | | Fair

value | | Unrealized

losses | | Fair

value | | Unrealized

losses |

| Corporate securities | | $ | 364.4 | | | $ | (16.3) | | | $ | 5.0 | | | $ | (.8) | | | $ | 369.4 | | | $ | (17.1) | |

| United States Treasury securities and obligations of United States government corporations and agencies | | 8.1 | | | 0 | | | 0 | | | 0 | | | 8.1 | | | 0 | |

| States and political subdivisions | | 30.5 | | | (.3) | | | 0 | | | 0 | | | 30.5 | | | (.3) | |

| | | | | | | | | | | | |

| Asset-backed securities | | 154.1 | | | (11.8) | | | 31.2 | | | (2.6) | | | 185.3 | | | (14.4) | |

| | | | | | | | | | | | |

| Non-agency residential mortgage-backed securities | | 275.6 | | | (5.1) | | | 28.2 | | | (.5) | | | 303.8 | | | (5.6) | |

| Collateralized loan obligations | | 254.2 | | | (5.5) | | | 200.8 | | | (4.4) | | | 455.0 | | | (9.9) | |

| Commercial mortgage-backed securities | | 486.1 | | | (15.9) | | | 29.5 | | | (.2) | | | 515.6 | | | (16.1) | |

| | | | | | | | | | | | |

| Total fixed maturities, available for sale | | $ | 1,573.0 | | | $ | (54.9) | | | $ | 294.7 | | | $ | (8.5) | | | $ | 1,867.7 | | | $ | (63.4) | |

|

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Less than 12 months | | 12 months or greater | | Total |

| Description of securities | | Fair value | | Unrealized losses | | Fair value | | Unrealized losses | | Fair value | | Unrealized losses |

| United States Treasury securities and obligations of United States government corporations and agencies | | $ | 20.3 |

| | $ | — |

| | $ | .6 |

| | $ | — |

| | $ | 20.9 |

| | $ | — |

|

| States and political subdivisions | | 35.1 |

| | (.6 | ) | | 19.3 |

| | (.3 | ) | | 54.4 |

| | (.9 | ) |

| Debt securities issued by foreign governments | | 10.5 |

| | (.1 | ) | | — |

| | — |

| | 10.5 |

| | (.1 | ) |

| Corporate securities | | 666.9 |

| | (7.8 | ) | | 400.4 |

| | (25.2 | ) | | 1,067.3 |

| | (33.0 | ) |

| Asset-backed securities | | 276.7 |

| | (1.3 | ) | | 79.6 |

| | (1.8 | ) | | 356.3 |

| | (3.1 | ) |

| Collateralized debt obligations | | 24.0 |

| | — |

| | — |

| | — |

| | 24.0 |

| | — |

|

| Commercial mortgage-backed securities | | 226.2 |

| | (1.3 | ) | | 221.9 |

| | (8.8 | ) | | 448.1 |

| | (10.1 | ) |

| Collateralized mortgage obligations | | 72.8 |

| | (.5 | ) | | 11.6 |

| | (.1 | ) | | 84.4 |

| | (.6 | ) |

| Total fixed maturities, available for sale | | $ | 1,332.5 |

| | $ | (11.6 | ) | | $ | 733.4 |

| | $ | (36.2 | ) | | $ | 2,065.9 |

| | $ | (47.8 | ) |

| Equity securities | | $ | 37.4 |

| | $ | (.8 | ) | | $ | 89.7 |

| | $ | (1.8 | ) | | $ | 127.1 |

| | $ | (2.6 | ) |

CNO FINANCIAL GROUP, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

(unaudited)

___________________

The following table summarizes the gross unrealized losses and fair values of our investments with unrealized losses that are not deemed to be other-than-temporarily impaired, aggregated by investment category and length of time that such securities have been in a continuous unrealized loss position, at December 31, 20162019 (dollars in millions):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Less than 12 months | | 12 months or greater | | Total |

| Description of securities | | Fair

value | | Unrealized

losses | | Fair

value | | Unrealized

losses | | Fair

value | | Unrealized

losses |

| Corporate securities | | $ | 305.5 | | | $ | (6.6) | | | $ | 96.8 | | | $ | (5.7) | | | $ | 402.3 | | | $ | (12.3) | |

| United States Treasury securities and obligations of United States government corporations and agencies | | 7.0 | | | (.1) | | | 3.5 | | | 0 | | | 10.5 | | | (.1) | |

| States and political subdivisions | | 110.1 | | | (1.5) | | | 0 | | | 0 | | | 110.1 | | | (1.5) | |

| Foreign governments | | 3.4 | | | 0 | | | 0 | | | 0 | | | 3.4 | | | 0 | |

| Asset-backed securities | | 75.7 | | | (.4) | | | 45.5 | | | (1.4) | | | 121.2 | | | (1.8) | |

| Agency residential mortgage-backed securities | | 8.8 | | | 0 | | | 0 | | | 0 | | | 8.8 | | | 0 | |

| Non-agency residential mortgage-backed securities | | 137.4 | | | (.7) | | | 67.2 | | | (.3) | | | 204.6 | | | (1.0) | |

| Collateralized loan obligations | | 220.7 | | | (1.1) | | | 115.4 | | | (2.3) | | | 336.1 | | | (3.4) | |

| Commercial mortgage-backed securities | | 394.2 | | | (1.0) | | | 12.8 | | | 0 | | | 407.0 | | | (1.0) | |

| | | | | | | | | | | | |

| Total fixed maturities, available for sale | | $ | 1,262.8 | | | $ | (11.4) | | | $ | 341.2 | | | $ | (9.7) | | | $ | 1,604.0 | | | $ | (21.1) | |

|

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Less than 12 months | | 12 months or greater | | Total |

| Description of securities | | Fair value | | Unrealized losses | | Fair value | | Unrealized losses | | Fair value | | Unrealized losses |

| United States Treasury securities and obligations of United States government corporations and agencies | | $ | 8.0 |

| | $ | — |

| | $ | — |

| | $ | — |

| | $ | 8.0 |

| | $ | — |

|

| States and political subdivisions | | 176.3 |

| | (7.8 | ) | | 18.3 |

| | (1.8 | ) | | 194.6 |

| | (9.6 | ) |

| Debt securities issued by foreign governments | | 18.9 |

| | (.4 | ) | | — |

| | — |

| | 18.9 |

| | (.4 | ) |

| Corporate securities | | 1,907.6 |

| | (75.5 | ) | | 559.6 |

| | (63.5 | ) | | 2,467.2 |

| | (139.0 | ) |

| Asset-backed securities | | 692.9 |

| | (8.5 | ) | | 262.5 |