13. Fair Value

The following tables present the Company’s financial assets and liabilities that are measured at fair value on a recurring basis. There

| As of June 30, 2021 | As of December 31, 2020 | ||||||||||||||||||||||||||||||||||||||||||||||

| Level 1 | Level 2 | Total | Level 1 | Level 2 | Total | ||||||||||||||||||||||||||||||||||||||||||

| Assets: | |||||||||||||||||||||||||||||||||||||||||||||||

| Investments: | |||||||||||||||||||||||||||||||||||||||||||||||

| FFELP loan asset-backed debt securities - available-for-sale | $ | 0 | 371,433 | 371,433 | 0 | 346,502 | 346,502 | ||||||||||||||||||||||||||||||||||||||||

| Private education loan asset-backed debt securities - available-for-sale | 0 | 307,293 | 307,293 | 0 | 0 | 0 | |||||||||||||||||||||||||||||||||||||||||

| Other debt securities - available-for-sale | 100 | 2,001 | 2,101 | 103 | 2,002 | 2,105 | |||||||||||||||||||||||||||||||||||||||||

| Equity securities (a) | 34,550 | 0 | 34,550 | 10,114 | 0 | 10,114 | |||||||||||||||||||||||||||||||||||||||||

| Equity securities measured at net asset value (b) | 34,573 | 31,927 | |||||||||||||||||||||||||||||||||||||||||||||

| Total investments | 34,650 | 680,727 | 749,950 | 10,217 | 348,504 | 390,648 | |||||||||||||||||||||||||||||||||||||||||

| Total assets | $ | 34,650 | 680,727 | 749,950 | 10,217 | 348,504 | 390,648 | ||||||||||||||||||||||||||||||||||||||||

(a) As of June 30, 2021, $14.8 million and $19.8 million of equity securities were no transfers into or outclassified as trading and available-for-sale, respectively. All equity securities as of level 1, level 2, or level 3 forDecember 31, 2020 were classified as available-for-sale.

(b) In accordance with the nine months ended September 30, 2017.

| As of September 30, 2017 | As of December 31, 2016 | |||||||||||||||||

| Level 1 | Level 2 | Total | Level 1 | Level 2 | Total | |||||||||||||

| Assets: | ||||||||||||||||||

| Investments (available-for-sale and trading): | ||||||||||||||||||

| Student loan and other asset-backed securities | $ | — | 72,427 | 72,427 | — | 103,780 | 103,780 | |||||||||||

| Equity securities | 2,875 | — | 2,875 | 2,694 | — | 2,694 | ||||||||||||

| Debt securities | 111 | — | 111 | 119 | — | 119 | ||||||||||||

| Total investments (available-for-sale and trading) | 2,986 | 72,427 | 75,413 | 2,813 | 103,780 | 106,593 | ||||||||||||

| Derivative instruments | — | 996 | 996 | — | 87,531 | 87,531 | ||||||||||||

| Total assets | $ | 2,986 | 73,423 | 76,409 | 2,813 | 191,311 | 194,124 | |||||||||||

| Liabilities: | ||||||||||||||||||

| Derivative instruments | $ | — | 30,105 | 30,105 | — | 77,826 | 77,826 | |||||||||||

| Total liabilities | $ | — | 30,105 | 30,105 | — | 77,826 | 77,826 | |||||||||||

Fair Value Measurements Topic of the FASB Accounting Standards Codification, certain investments that are measured at fair value using the net asset value per share (or its equivalent) practical expedient have not been classified in the fair value hierarchy.

The following table summarizes the fair values of all of the Company’s financial instruments on the consolidated balance sheets:

| As of June 30, 2021 | |||||||||||||||||||||||||||||

| Fair value | Carrying value | Level 1 | Level 2 | Level 3 | |||||||||||||||||||||||||

| Financial assets: | |||||||||||||||||||||||||||||

| Loans receivable | $ | 20,712,564 | 19,352,681 | 0 | 0 | 20,712,564 | |||||||||||||||||||||||

| Accrued loan interest receivable | 834,989 | 834,989 | 0 | 834,989 | 0 | ||||||||||||||||||||||||

| Cash and cash equivalents | 212,989 | 212,989 | 212,989 | 0 | 0 | ||||||||||||||||||||||||

| Investments (at fair value) | 749,950 | 749,950 | 34,650 | 680,727 | 0 | ||||||||||||||||||||||||

| Beneficial interest in loan securitizations | 123,329 | 105,017 | 0 | 0 | 123,329 | ||||||||||||||||||||||||

| Restricted cash | 616,711 | 616,711 | 616,711 | 0 | 0 | ||||||||||||||||||||||||

| Restricted cash – due to customers | 247,673 | 247,673 | 247,673 | 0 | 0 | ||||||||||||||||||||||||

| Financial liabilities: | |||||||||||||||||||||||||||||

| Bonds and notes payable | 19,639,727 | 19,381,835 | 0 | 19,639,727 | 0 | ||||||||||||||||||||||||

| Accrued interest payable | 4,922 | 4,922 | 0 | 4,922 | 0 | ||||||||||||||||||||||||

| Bank deposits | 201,957 | 202,841 | 44,632 | 157,325 | 0 | ||||||||||||||||||||||||

| Due to customers | 303,173 | 303,173 | 303,173 | 0 | 0 | ||||||||||||||||||||||||

| As of September 30, 2017 | |||||||||||||||

| Fair value | Carrying value | Level 1 | Level 2 | Level 3 | |||||||||||

| Financial assets: | |||||||||||||||

| Student loans receivable | $ | 23,635,887 | 22,528,845 | — | — | 23,635,887 | |||||||||

| Cash and cash equivalents | 254,391 | 254,391 | 254,391 | — | — | ||||||||||

| Investments (available-for-sale) | 75,413 | 75,413 | 2,986 | 72,427 | — | ||||||||||

| Notes receivable | 16,393 | 16,393 | — | 16,393 | — | ||||||||||

| Loans receivable | 42,006 | 40,339 | — | — | 42,006 | ||||||||||

| Restricted cash | 725,463 | 725,463 | 725,463 | — | — | ||||||||||

| Restricted cash – due to customers | 105,299 | 105,299 | 105,299 | — | — | ||||||||||

| Accrued interest receivable | 396,827 | 396,827 | — | 396,827 | — | ||||||||||

| Derivative instruments | 996 | 996 | — | 996 | — | ||||||||||

| Financial liabilities: | |||||||||||||||

| Bonds and notes payable | 22,319,439 | 22,240,279 | — | 22,319,439 | — | ||||||||||

| Accrued interest payable | 47,824 | 47,824 | — | 47,824 | — | ||||||||||

| Due to customers | 105,299 | 105,299 | 105,299 | — | — | ||||||||||

| Derivative instruments | 30,105 | 30,105 | — | 30,105 | — | ||||||||||

| As of December 31, 2016 | As of December 31, 2020 | |||||||||||||||||||||||||||||||||||||||||||

| Fair value | Carrying value | Level 1 | Level 2 | Level 3 | Fair value | Carrying value | Level 1 | Level 2 | Level 3 | |||||||||||||||||||||||||||||||||||

| Financial assets: | Financial assets: | |||||||||||||||||||||||||||||||||||||||||||

| Student loans receivable | $ | 25,653,581 | 24,903,724 | — | — | 25,653,581 | ||||||||||||||||||||||||||||||||||||||

| Loans receivable | Loans receivable | $ | 20,454,132 | 19,391,045 | 0 | 0 | 20,454,132 | |||||||||||||||||||||||||||||||||||||

| Accrued loan interest receivable | Accrued loan interest receivable | 794,611 | 794,611 | 0 | 794,611 | 0 | ||||||||||||||||||||||||||||||||||||||

| Cash and cash equivalents | 69,654 | 69,654 | 69,654 | — | — | Cash and cash equivalents | 121,249 | 121,249 | 121,249 | 0 | 0 | |||||||||||||||||||||||||||||||||

| Investments (available-for-sale and trading) | 106,593 | 106,593 | 2,813 | 103,780 | — | |||||||||||||||||||||||||||||||||||||||

| Notes receivable | 17,031 | 17,031 | — | 17,031 | — | |||||||||||||||||||||||||||||||||||||||

| Investments (at fair value) | Investments (at fair value) | 390,648 | 390,648 | 10,217 | 348,504 | 0 | ||||||||||||||||||||||||||||||||||||||

| Beneficial interest in loan securitizations | Beneficial interest in loan securitizations | 58,709 | 58,331 | 0 | 0 | 58,709 | ||||||||||||||||||||||||||||||||||||||

| Restricted cash | 980,961 | 980,961 | 980,961 | — | — | Restricted cash | 553,175 | 553,175 | 553,175 | 0 | 0 | |||||||||||||||||||||||||||||||||

| Restricted cash – due to customers | 119,702 | 119,702 | 119,702 | — | — | Restricted cash – due to customers | 283,971 | 283,971 | 283,971 | 0 | 0 | |||||||||||||||||||||||||||||||||

| Accrued interest receivable | 391,264 | 391,264 | — | 391,264 | — | |||||||||||||||||||||||||||||||||||||||

| Derivative instruments | 87,531 | 87,531 | — | 87,531 | — | |||||||||||||||||||||||||||||||||||||||

| Financial liabilities: | Financial liabilities: | |||||||||||||||||||||||||||||||||||||||||||

| Bonds and notes payable | 24,220,996 | 24,668,490 | — | 24,220,996 | — | Bonds and notes payable | 19,270,810 | 19,320,726 | 0 | 19,270,810 | 0 | |||||||||||||||||||||||||||||||||

| Accrued interest payable | 45,677 | 45,677 | — | 45,677 | — | Accrued interest payable | 28,701 | 28,701 | 0 | 28,701 | 0 | |||||||||||||||||||||||||||||||||

| Bank deposits | Bank deposits | 54,599 | 54,633 | 48,422 | 6,177 | 0 | ||||||||||||||||||||||||||||||||||||||

| Due to customers | 119,702 | 119,702 | 119,702 | — | — | Due to customers | 301,471 | 301,471 | 301,471 | 0 | 0 | |||||||||||||||||||||||||||||||||

| Derivative instruments | 77,826 | 77,826 | — | 77,826 | — | |||||||||||||||||||||||||||||||||||||||

The methodologies for estimating the fair value of financial assets and liabilities are described in note 2022 of the notes to consolidated financial statements included in the 20162020 Annual Report.

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

(Management’s Discussion and Analysis of Financial Condition and Results of Operations is for the three and ninesix months ended SeptemberJune 30, 20172021 and 2016.2020. All dollars are in thousands, except per share amounts, unless otherwise noted.)

The following discussion and analysis provides information that the Company’s management believes is relevant to an assessment and understanding of the consolidated results of operations and financial condition of the Company. The discussion should be read in conjunction with the Company’s consolidated financial statements included in the 20162020 Annual Report.

Forward-looking and cautionary statements

This report contains forward-looking statements and information that are based on management's current expectations as of the date of this document. Statements that are not historical facts, including statements about the Company's plans and expectations for future financial condition, results of operations or economic performance, or that address management's plans and objectives for future operations, and statements that assume or are dependent upon future events, are forward-looking statements. The words “may,“anticipate,” “should,“assume,” “believe,” “continue,” “could,” “would,” “predict,” “potential,” “continue,“estimate,” “expect,” “anticipate,“forecast,” “future,” “intend,” “scheduled,“may,” “plan,” “believe,“potential,” “estimate,“predict,” “assume,“scheduled,” “forecast,“should,” “will,” “would,” and similar expressions, as well as statements in future tense, are intended to identify forward-looking statements.

The forward-looking statements are based on assumptions and analyses made by management in light of management's experience and its perception of historical trends, current conditions, expected future developments, and other factors that management believes are appropriate under the circumstances. These statements are subject to known and unknown risks, uncertainties, assumptions, and other factors that may cause the actual results and performance to be materially different from any future results or performance expressed or implied by such forward-looking statements. These factors include, among others, the risks and uncertainties set forth in the “Risk Factors” section of the 20162020 Annual Report and elsewhere in this report, and include such risks and uncertainties as:

•risks and uncertainties related to the severity, magnitude, and duration of the coronavirus disease 2019 (“COVID-19”) pandemic, including changes in the macroeconomic environment and consumer behavior, restrictions on business, educational, individual, or travel activities intended to slow the spread of the pandemic, and volatility in market conditions resulting from the pandemic, including interest rates, the value of equities, and other financial assets;

•risks related to the ability to successfully maintain and increase allocated volumes of student loans serviced by the Company under existing and any future servicing contracts with the U.S. Department of Education (the "Department"), which current contracts accounted for 27 percent of the Company's revenue in 2020, risks to the Company related to the Department's initiatives to procure new contracts for federal student loan servicing, including the pending and uncertain nature of the Department's procurement process (under which awards of new contracts have been made to other service providers), risks that the Company may not be successful in obtaining any of such potential new contracts, and risks related to the Company's ability to comply with agreements with third-party customers for the servicing of Federal Direct Loan Program, Federal Family Education Loan Program (the "FFEL Program" or "FFELP"), private education, and consumer loans;

•loan portfolio risks such as interest rate basis and repricing risk resulting from the fact that the interest rate characteristics of the student loan assets do not match the interest rate characteristics of the funding for those assets, the risk of loss of floor income on certain student loans originated under the Federal Family Education LoanFFEL Program, (the "FFEL Program" or "FFELP"), risks related to the use of derivatives to manage exposure to interest rate fluctuations, uncertainties regarding the expected benefits from purchased securitized and unsecuritized FFELP, private education, and consumer loans, or investment interests therein, and initiatives to purchase additional FFELP, private education, and consumer loans, and risks from changes in levels of student loan prepayment or default rates;

•financing and liquidity risks, including risks of changes in the general interest rate environment, including the availability of any relevant money market index rate such as LIBOR or the relationship between the relevant money market index rate and the rate at which the Company's assets and liabilities are priced, and changes in the securitization and other financing markets for student loans, including adverse changes resulting from slower than expected paymentsunanticipated repayment trends on student loans in FFELPthe Company's securitization trusts that could accelerate or delay repayment of the associated bonds, which may increase the costs or limit the availability of financings necessary to purchase, refinance, or continue to hold student loans;

•risks from changes in the terms of education loans and in the educational credit and services markets resulting from changes in applicable laws, regulations, and government programs and budgets, such as changes resulting from the Coronavirus Aid, Relief, and Economic Security Act (the "CARES Act") and the expected decline over time in FFELP

30

loan interest income and fee-based revenues due to the discontinuation of new FFELP loan originations in 2010 and potential government initiatives or legislative proposals to consolidate existing FFELP loans to the Federal Direct Loan Program, or otherwise allow FFELP loans to be refinanced with Federal Direct Loan Program loans;loans, or create additional loan forgiveness or broad debt cancellation programs;

•risks related to a breach of or failure in the Company's operational or information systems or infrastructure, or those of third-party vendors, including cybersecurity risks related to the potential disclosure of confidential student loan borrower and other customer information;information, the potential disruption of the Company's systems or those of third-party vendors or customers, and/or the potential damage to the Company's reputation resulting from cyber-breaches;

•uncertainties inherent in forecasting future cash flows from student loan assets and related asset-backed securitizations;

•risks related to the expected benefits to the Company and to ALLO Communications LLC (“ALLO”) from the recapitalization and additional communitiesfunding for ALLO and managethe Company’s continuing investment in ALLO, and risks related construction risks;to investments in solar projects, including risks of not being able to realize tax credits which remain subject to recapture by taxing authorities;

•risks and uncertainties related to other initiatives to pursue additional strategic investments, acquisitions, and other activities, such as the completed and additional planned transactions associated with the sale by Wells Fargo of its private education loan portfolio for which the Company was selected as the new servicer (including risks associated with errors that occasionally occur in converting loan servicing portfolio acquisitions to a new servicing platform), including investments and acquisitionsactivities that are intended to diversify the Company both within and outside of its historical core education-related businesses; and

•risks and uncertainties associated with litigation matters and with maintaining compliance with the extensive regulatory requirements applicable to the Company's businesses, reputational and other risks, including the risk of increased regulatory costs resulting from the recent politicization of student loan servicing, and uncertainties inherent in the estimates and assumptions about future events that management is required to make in the preparation of the Company's consolidated financial statements.

All forward-looking statements contained in this report are qualified by these cautionary statements and are made only as of the date of this document. Although the Company may from time to time voluntarily update or revise its prior forward-looking statements to reflect actual results or changes in the Company's expectations, the Company disclaims any commitment to do so except as required by securities laws.law.

31

OVERVIEW

The Company is a diverse company with a focus onpurpose to serve others and a vision to make customers' dreams possible by delivering education-relatedcustomer focused products and services and student loan asset management.services. The largest operating businesses engage in student loan servicing tuitionand education technology, services, and payment processing, and school information systems, andthe Company also has a significant investment in communications. A significant portion of the Company's revenue is net interest income earned on a portfolio of federally insured student loans. The Company also makes investments to further diversify the Company both within and outside of its historical core education-related businesses, including, but not limited to, investments in real estate, early-stage and start-up ventures.

emerging growth companies, and renewable energy.

GAAP Net Income and Non-GAAP Net Income, Excluding Adjustments

The Company prepares its financial statements and presents its financial results in accordance with U.S. GAAP. However, it also provides additional non-GAAP financial information related to specific items management believes to be important in the evaluation of its operating results and performance. A reconciliation of the Company's GAAP net income to net income, excluding derivative market value and foreign currency transaction adjustments, and a discussion of why the Company believes providing this additional information is useful to investors, is provided below.

| Three months ended June 30, | Six months ended June 30, | ||||||||||||||||||||||

| 2021 | 2020 | 2021 | 2020 | ||||||||||||||||||||

| GAAP net income attributable to Nelnet, Inc. | $ | 83,867 | 86,482 | 207,465 | 45,950 | ||||||||||||||||||

| Realized and unrealized derivative market value adjustments | 1,615 | 3,911 | (37,194) | 24,513 | |||||||||||||||||||

| Tax effect (a) | (388) | (939) | 8,927 | (5,883) | |||||||||||||||||||

| Net income attributable to Nelnet, Inc., excluding derivative market value adjustments (b) | $ | 85,094 | 89,454 | 179,198 | 64,580 | ||||||||||||||||||

| Earnings per share: | |||||||||||||||||||||||

| GAAP net income attributable to Nelnet, Inc. | $ | 2.16 | 2.21 | 5.36 | 1.16 | ||||||||||||||||||

| Realized and unrealized derivative market value adjustments | 0.04 | 0.10 | (0.96) | 0.62 | |||||||||||||||||||

| Tax effect (a) | — | (0.03) | 0.23 | (0.15) | |||||||||||||||||||

| Net income attributable to Nelnet, Inc., excluding derivative market value adjustments (b) | $ | 2.20 | 2.28 | 4.63 | 1.63 | ||||||||||||||||||

| Three months ended September 30, | Nine months ended September 30, | |||||||||||

| 2017 | 2016 | 2017 | 2016 | |||||||||

| GAAP net income attributable to Nelnet, Inc. | $ | 46,303 | 84,294 | 125,065 | 158,405 | |||||||

| Realized and unrealized derivative market value adjustments | (21,429 | ) | (47,093 | ) | (22,381 | ) | 1,556 | |||||

| Unrealized foreign currency transaction adjustments | 13,683 | 4,831 | 45,635 | 13,543 | ||||||||

| Net tax effect (a) | 2,943 | 16,060 | (8,837 | ) | (5,737 | ) | ||||||

| Net income, excluding derivative market value and foreign currency transaction adjustments (b) | $ | 41,500 | 58,092 | 139,482 | 167,767 | |||||||

| Earnings per share: | ||||||||||||

| GAAP net income attributable to Nelnet, Inc. | $ | 1.11 | 1.98 | 2.97 | 3.70 | |||||||

| Realized and unrealized derivative market value adjustments | (0.51 | ) | (1.10 | ) | (0.53 | ) | 0.03 | |||||

| Unrealized foreign currency transaction adjustments | 0.33 | 0.11 | 1.09 | 0.32 | ||||||||

| Net tax effect (a) | 0.07 | 0.37 | (0.21 | ) | (0.13 | ) | ||||||

| Net income, excluding derivative market value and foreign currency transaction adjustments (b) | $ | 1.00 | 1.36 | 3.32 | 3.92 | |||||||

The accounting for derivatives requires that changes in the fair value of derivative instruments be recognized currently in earnings, with no fair value adjustment of the hedged item, unless specific hedge accounting criteria is met. Management has structured all of the Company’s derivative transactions with the intent that each is economically effective; however, the Company’s derivative instruments do not qualify for hedge accounting. As a result, the change in fair value of derivative instruments is reported in current period earnings with no consideration for the corresponding change in fair value of the hedged item. Under GAAP, the cumulative net realized and unrealized gain or loss caused by changes in fair values of derivatives in which the Company plans to hold to maturity will equal zero over the life of the contract. However, the net realized and unrealized gain or loss during any given reporting period fluctuates significantly from period to period. In addition, the Company has incurred unrealized foreign currency transaction adjustments for periodic fluctuations in currency exchange rates between the U.S. dollar and Euro in connection with its student loan asset-backed Euro-denominated bonds with an interest rate based on a spread to the EURIBOR index.

The principal and accrued interest on these bonds were remeasured at each reporting period and recorded in the Company's consolidated balance sheet in U.S. dollars based on the foreign currency exchange rate on that date.

32

This factor was partially offset by the following items:

•The recognition of net investment gains and income of $15.6 million ($11.8 million after tax) on certain venture capital and real estate investments during the three months ended June 30, 2021;

•The recognition of a gain of $15.3 million ($11.6 million after tax) from the sale of a portfolio of consumer loans during the second quarter of 2021;

•The recognition of a net loss by ALLO of $7.1 million ($5.4 million after tax) during the three months ended June 30, 2020, prior to the deconsolidation of ALLO in December 2020;

•An increase of $6.2 million ($4.7 million after tax) in interest income from the Company's consumer loan beneficial interest investments; and

•An increase in net gainsincome in the second quarter of 2021 as compared to 2020 of $5.5 million ($4.2 million after tax) from the Education Technology, Services, and Payment Processing operating segment.

GAAP net income increased for the six months ended June 30, 2021 compared to the same period in 2020 primarily due to the following factors:

•The recognition of $97.1 million ($73.8 million after tax) of certain expenses during the first quarter of 2020 as a result of the COVID-19 pandemic, consisting of the recognition of an incremental provision for loan losses of $63.0 million ($47.9 million after tax), provision expense of $26.3 million ($20.0 million after tax) related to the Company's investment in certain consumer loan beneficial interest securitizations, and $7.8 million ($5.9 million after tax) impairment expense on certain venture capital investments;

•Net income of $37.2 million ($28.3 million after tax) related to changes in the fair values of derivative instruments and anthat do not qualify for hedge accounting in the six months ended June 30, 2021 as compared to a net loss of $24.5 million ($18.6 million after tax) in 2020;

•An increase of $26.7 million ($20.3 million after tax) in losses relatednet interest income due to foreign currency transaction adjustments caused by the re-measurement ofimproved loan spread (including derivative settlements) on the Company's Euro-denominated bonds to U.S. dollars.

•A decrease of $23.8 million ($18.1 million after tax) in interest expense during the first quarter of 2021 as a result of the Company reversing a historical accrued interest liability on certain bonds (initially recorded when certain asset-backed securitizations were acquired in 2011 and 2013), which liability the Company determined is no longer probable of being required to be paid;

•The recognition of net investment gains of $24.1 million ($18.3 million after tax) on certain venture capital and real estate investments during the six months ended June 30, 2021;

•The recognition of $16.7 million ($12.7 million after tax) negative provision for loan losses on the Company's loan portfolio during the six months ended June 30, 2021 as a result of management's estimate of certain continued improved economic conditions as compared to a provision expense (excluding the incremental provision for loan losses related to foreign currency transaction adjustments causedCOVID-19) of $16.3 million ($12.4 million after tax) during 2020;

•The recognition of a $15.3 million ($11.6 million after tax) gain from the sale of consumer loans in the second quarter of 2020;

•The recognition of a net loss by ALLO of $14.3 million ($10.9 million after tax) during the six months ended June 30, 2020. ALLO was deconsolidated in December 2020;

•An increase in net income during the six months ended June 30, 2021 as compared to 2020 of $9.2 million ($7.0 million after tax) from the Education Technology, Services, and Payment Processing operating segment;

•An increase of $5.9 million ($4.5 million after tax) in interest income from the Company's consumer loan beneficial interest investments; and

•An increase in net income during the six months ended June 30, 2021 as compared to 2020 of $3.4 million ($2.6 million after tax) from the Loan Servicing and Systems operating segment.

These factors were partially offset by the re-measurementfollowing items:

•The recognition of a $51.0 million ($38.8 million after tax) gain in the second quarter of 2020 to adjust the carrying value of the Company's Euro-denominated bondsinvestment in Hudl to U.S. dollars, partially offset by an increasereflect Hudl's May 2020 equity raise transaction value;

•The recognition of a $18.2 million ($13.8 million after tax) gain from the sale of consumer loans in the first quarter of 2020;

•The recognition of a net gainsloss of $16.8 million ($12.8 million after tax) during the six months of 2021 related to changesthe Company's investment in the fair valuesALLO; and

33

•A decrease of derivative instruments.

Operating Results

The Company earns net interest income on its FFELP student loan portfolio, consisting primarily of FFELP loans, in its Asset Generation and Management ("AGM") operating segment. This segment is expected to generate a stable net interest margin and significant amounts of cash as the FFELP portfolio amortizes. As of SeptemberJune 30, 2017, the Company2021, AGM had a $22.5$19.3 billion student loan portfolio that management anticipates will amortize over the next approximately 2520 years and has a weighted average remaining life of 9.5 years. The Company actively works to maximize the amount and timing of cash flows generated by its FFELP portfolio and seeks to acquire additional FFELP loan portfoliosassets to leverage its servicing scale and expertise to generate incremental earnings and cash flow.

In addition, the Company earns fee-based revenue through the following reportable operating segments:

•Loan SystemsServicing and ServicingSystems ("LSS") - referred to as Nelnet Diversified SolutionsServices ("NDS")

On November 2, 2020, the Company obtained final approval for federal deposit insurance from the Federal Deposit Insurance Corporation ("Allo"FDIC")

and for a bank charter from the Utah Department of Financial Institutions ("UDFI") in connection with the establishment of Nelnet Bank, and Nelnet Bank launched operations. Nelnet Bank operates as an internet Utah-chartered industrial bank franchise focused on the private education loan marketplace, with a home office in Salt Lake City, Utah. Nelnet Bank’s operations are presented by the Company as a reportable operating segment.

Other business activities and operating segments that are not reportable are combined and included in Corporate and Other Activities ("Corporate"). Corporate and Other Activities also includes income earned on certain investments and interest expense incurred on unsecured and other corporate related debt transactions. In addition, the Corporate segment includes direct incremental costs associated with Nelnet Bank prior to the UDFI’s approval for its bank charter and certain shared service and support costs incurred by the Company that will not be reflected in Nelnet Bank’s operating results through 2023 (the bank’s de novo period). Such Nelnet Bank-related costs included in the Corporate segment totaled $1.0 million (pre-tax) and $1.3 million (pre-tax) for the three months ended June 30, 2021 and 2020, respectively, and $1.7 million (pre-tax) and $2.5 million (pre-tax) for the six months ended June 30, 2021 and 2020, respectively.

34

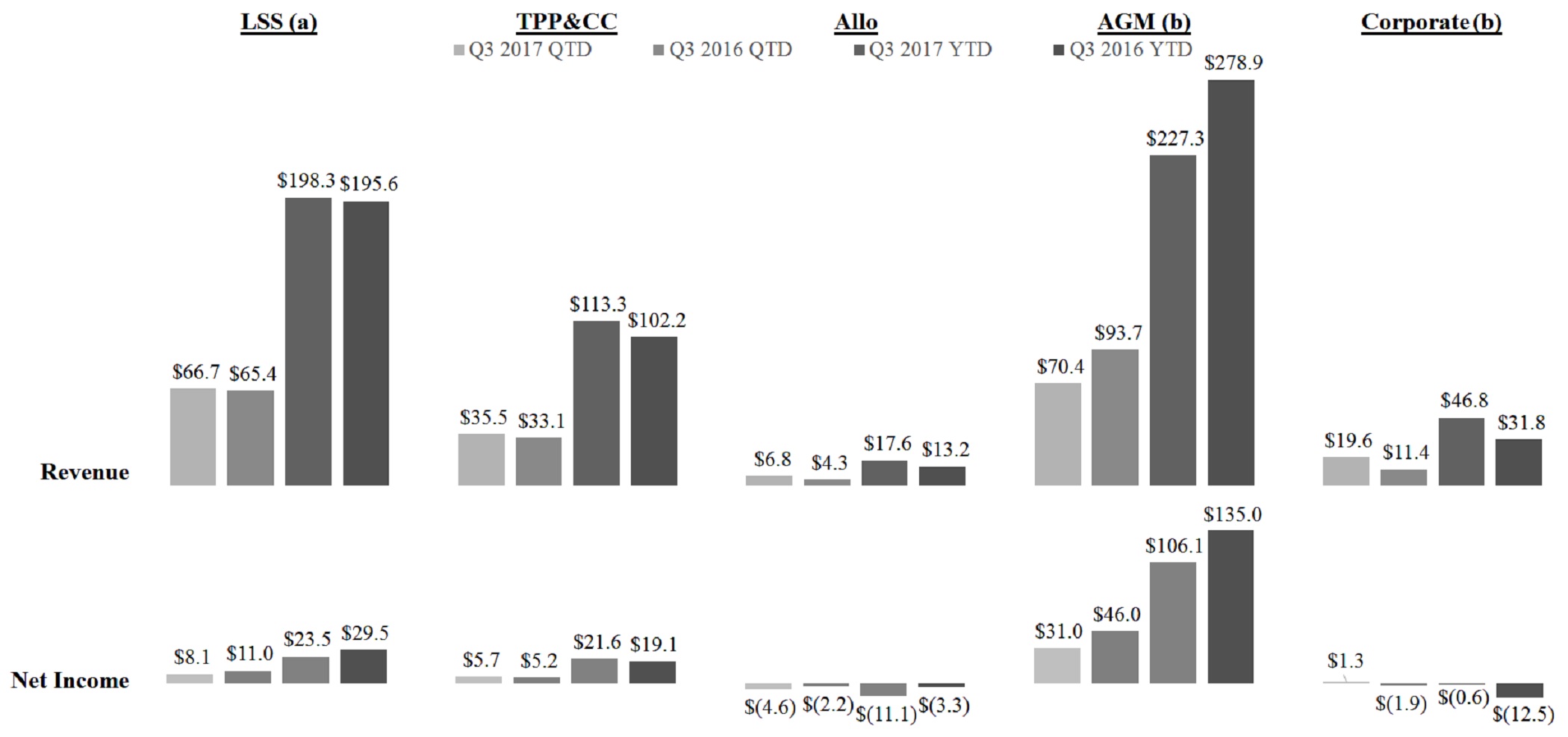

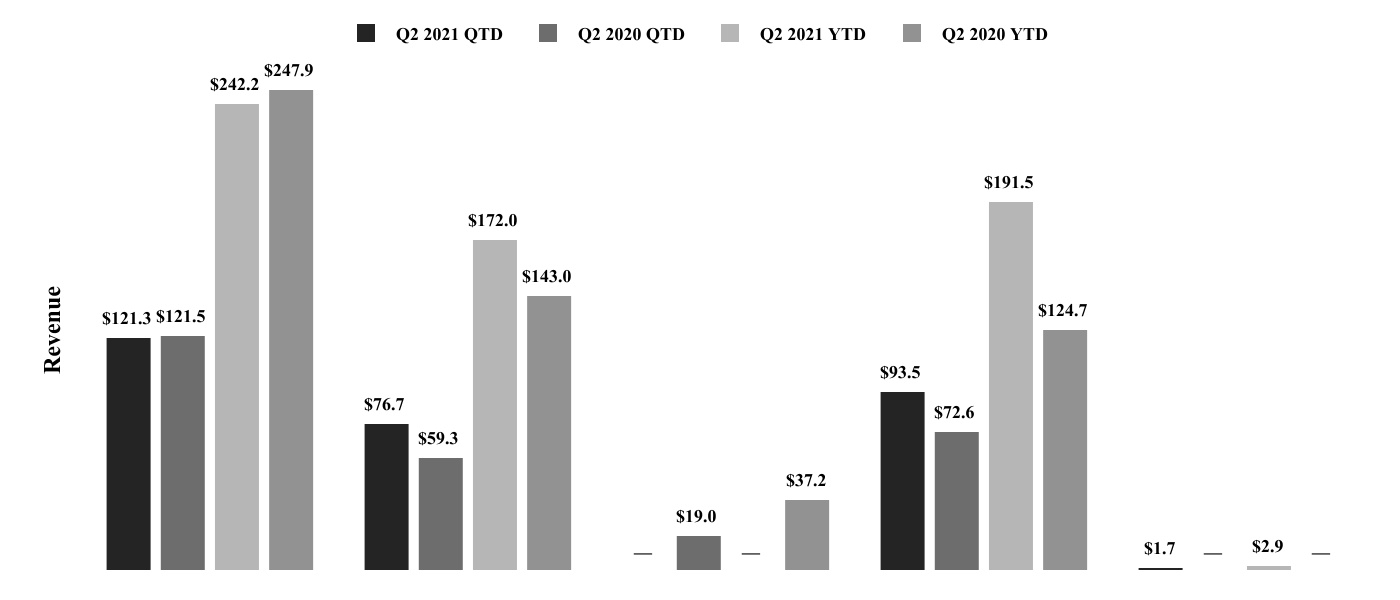

The information below provides the operating results for each reportable operating segment and Corporate and Other Activities for the three and ninesix months ended SeptemberJune 30, 20172021 and 20162020 (dollars in millions).

| LSS (a) | ETS&PP | ALLO (b) | AGM (c) | Bank (c) | |||||||||||||||||||||||||||||||

(b) On December 21, 2020, the Company was servicing $207.8 billion in FFELP, government owned, and private education and consumer loans, as compared with $193.2 billiondeconsolidated ALLO from the Company’s consolidated financial statements. See note 2 of loans as of September 30, 2016.

(c) Total revenue includes "net interest income" and "total other income/expense" from the Company's segment statements of income, excluding from AGM the impact from changes in fair values of derivatives. Net income (loss) excludes from AGM changes in fair values of derivatives, net of tax. For information regarding the exclusion of the impact from changes in fair values of derivatives, see "GAAP Net Income and Non-GAAP Net Income, Excluding Adjustments" above.

35

COVID-19

Beginning in March 2020, the COVID-19 pandemic resulted in many businesses and schools closing or reducing hours throughout the U.S. to combat the spread of COVID-19, and states and local jurisdictions implementing various containment efforts, including lockdowns on non-essential business and other business restrictions, stay-at-home orders, and shelter-in-place orders. The COVID-19 pandemic caused significant disruption to the same periodsU.S. and world economies, including significantly higher unemployment and underemployment, significantly lower interest rates, and extreme volatility in 2016 duethe U.S. and world markets. While certain COVID-19 vaccines have been approved and have become widely available for use in the U.S., the Company is unable to growthpredict how widely utilized the vaccines will be or how effective they will be in private educationpreventing the spread of COVID-19 (including variant strains of the virus which have emerged or may emerge). As a result, although the economy has improved since the pandemic began, it is still uncertain when or if economic activity and consumer loan servicing volume from existing and new clients. In addition, revenue increased for the nine months ended September 30, 2017 compared to the same period in 2016 due to an increase in revenue on the government servicing contract. The increase in revenue for the nine months ended September 30, 2017 compared to the same period in 2016 was partially offset by the loss of guaranty servicing and collection revenue on June 30, 2016.

amount of time they work in recently re-opened offices. The Company's government servicing contract is currently set to expire on June 16, 2019. In April 2016, the Department announced a new contract procurement process for the Department to acquire a single servicing platform to manage all student loans owned by the Department.

COVID-19 Pandemic.”

36

CONSOLIDATED RESULTS OF OPERATIONS

An analysis of the Company's operating results for the three and ninesix months ended SeptemberJune 30, 20172021 compared to the same periods in 20162020 is provided below.

The Company’s operating results are primarily driven by the performance of its existing loan portfolio and the revenues generated by its fee-based businesses and the costs to provide such services. The performance of the Company’s portfolio is driven by net interest income (which includes financing costs) and losses related to credit quality of the assets, along with the cost to administer and service the assets and related debt.

The Company operates as distinct reportable operating segments as described above. For a reconciliation of the reportable segment operating results to the consolidated results of operations, see note 10 of the notes to consolidated financial statements included under Part I, Item 1 of this report. Since the Company monitors and assesses its operations and results based on these segments, the discussion following the consolidated results of operations is presented on a reportable segment basis.basis (except for ALLO, which was deconsolidated from the Company's consolidated financial statements in December 2020).

| Three months ended | Six months ended | ||||||||||||||||||||||||||||

| June 30, | June 30, | ||||||||||||||||||||||||||||

| 2021 | 2020 | 2021 | 2020 | Additional information | |||||||||||||||||||||||||

| Loan interest | $ | 122,005 | 146,140 | 246,123 | 327,933 | Decrease was due primarily to decreases in the gross yield earned on loans and the average balance of loans, partially offset by an increase in gross fixed rate floor income due to lower interest rates in 2021 as compared to 2020. | |||||||||||||||||||||||

| Investment interest | 11,578 | 5,743 | 16,563 | 13,141 | Includes income from unrestricted interest-earning deposits and investments and funds in asset-backed securitizations. Increase was due to interest income earned on consumer loan beneficial interest investments, partially offset by a decrease in interest rates in 2021 as compared to 2020. | ||||||||||||||||||||||||

| Total interest income | 133,583 | 151,883 | 262,686 | 341,074 | |||||||||||||||||||||||||

| Interest expense | 49,991 | 85,248 | 77,764 | 219,366 | Decrease was due primarily to a decrease in cost of funds and a decrease in the average balance of debt outstanding. In addition, during the first quarter of 2021, the Company reduced interest expense by $23.8 million as a result of reversing a historical accrued interest liability on certain bonds, which liability the Company determined is no longer probable of being required to be paid. The liability was initially recorded when certain asset-backed securitizations were acquired in 2011 and 2013. | ||||||||||||||||||||||||

| Net interest income | 83,592 | 66,635 | 184,922 | 121,708 | |||||||||||||||||||||||||

| Less provision (negative provision) for loan losses | 374 | 2,999 | (16,674) | 79,297 | The Company recognized negative provision in the first quarter of 2021 due to management's estimate of improved economic conditions as of March 31, 2021 in comparison to management's estimate of economic conditions used to determine the allowance for loan losses as of December 31, 2020. During the first quarter of 2020, the Company recognized an incremental provision of $63.0 million as a result of an increase in expected defaults due to the COVID-19 pandemic. | ||||||||||||||||||||||||

| Net interest income after provision for loan losses | 83,218 | 63,636 | 201,596 | 42,411 | |||||||||||||||||||||||||

| Other income/expense: | |||||||||||||||||||||||||||||

| LSS revenue | 112,094 | 111,042 | 223,611 | 223,778 | See LSS operating segment - results of operations. | ||||||||||||||||||||||||

| ETS&PP revenue | 76,702 | 59,304 | 171,960 | 142,979 | See ETS&PP operating segment - results of operations. | ||||||||||||||||||||||||

| Communications revenue | — | 18,998 | — | 37,179 | As discussed above, on December 21, 2020, the Company deconsolidated ALLO from the Company’s consolidated financial statements. | ||||||||||||||||||||||||

| Other | 22,921 | 60,127 | 18,317 | 68,408 | See table below for the components of "other." | ||||||||||||||||||||||||

| Gain on sale of loans | 15,271 | — | 15,271 | 18,206 | The Company sold a portfolio of consumer loans in each of May 2021 and January 2020 and recognized gains of $15.3 million and $18.2 million, respectively. | ||||||||||||||||||||||||

| Impairment expense and provision for beneficial interests, net | (500) | (332) | 1,936 | (34,419) | During the first quarter of 2020, the Company recognized impairments of $26.3 million and $7.8 million related to beneficial interest in consumer loan securitization investments and several venture capital investments, respectively. Such impairments were the result of impacts from the COVID-19 pandemic. During the first quarter of 2021, the Company reversed the remaining allowance of $2.4 million related to the beneficial interest in consumer loan securitizations due to continued improved economic conditions. | ||||||||||||||||||||||||

| Derivative settlements, net | (5,374) | 5,821 | (9,678) | 10,058 | The Company maintains an overall risk management strategy that incorporates the use of derivative instruments to reduce the economic effect of interest rate volatility. Derivative settlements for each applicable period should be evaluated with the Company's net interest income. See AGM operating segment - results of operations. | ||||||||||||||||||||||||

| Derivative market value adjustments, net | (1,615) | (3,911) | 37,194 | (24,513) | Includes the realized and unrealized gains and losses that are caused by changes in fair values of derivatives which do not qualify for "hedge treatment" under GAAP. The majority of the derivative market value adjustments during the six months ended June 30, 2021 and 2020 related to the changes in fair value of the Company's floor income interest rate swaps. Such changes reflect that a decrease in the forward yield curve during a reporting period results in a decrease in the fair value of the Company's floor income interest rate swaps, and an increase in the forward yield curve during a reporting period results in an increase in the fair value of such swaps. | ||||||||||||||||||||||||

| Total other income/expense | 219,499 | 251,049 | 458,611 | 441,676 | |||||||||||||||||||||||||

37

| Three months | Nine months | |||||||||||||

| ended September 30, | ended September 30, | Additional information | ||||||||||||

| 2017 | 2016 | 2017 | 2016 | |||||||||||

| Loan interest | $ | 191,755 | 193,721 | 562,451 | 567,775 | Decrease due to a decrease in the average balance of student loans, a decrease in gross fixed rate floor income, and an adjustment recorded during the third quarter of 2016 to reflect the net impact on prior periods for a correction of an error regarding the Company's method of applying the interest method to amortize premiums and accrete discounts on its student loan portfolio, partially offset by an increase in the gross yield earned on the student loan portfolio. | ||||||||

| Investment interest | 5,129 | 2,460 | 11,335 | 6,674 | Includes income from unrestricted interest-earning deposits and investments and funds in asset-backed securitizations. The increase in 2017 compared to 2016 is due to an increase in interest-earning investments and an increase in interest rates. | |||||||||

| Total interest income | 196,884 | 196,181 | 573,786 | 574,449 | ||||||||||

| Interest expense | 121,650 | 96,386 | 341,787 | 280,847 | Increase due primarily to an increase in the Company's cost of funds, partially offset by a decrease in the average balance of debt outstanding. | |||||||||

| Net interest income | 75,234 | 99,795 | 231,999 | 293,602 | See table below for additional analysis. | |||||||||

| Less provision for loan losses | 6,000 | 6,000 | 9,000 | 10,500 | Represents the periodic expense of maintaining an allowance appropriate to absorb losses inherent in the portfolio of student loans. See AGM operating segment - results of operations. | |||||||||

| Net interest income after provision for loan losses | 69,234 | 93,795 | 222,999 | 283,102 | ||||||||||

| Other income: | ||||||||||||||

| LSS revenue | 55,950 | 54,350 | 167,079 | 161,082 | See LSS operating segment - results of operations. | |||||||||

| TPP&CC revenue | 35,450 | 33,071 | 113,293 | 102,211 | See TPP&CC operating segment - results of operations. | |||||||||

| Communications revenue | 6,751 | 4,343 | 17,577 | 13,167 | See Communications operating segment - results of operations. | |||||||||

| Enrollment services revenue | — | — | — | 4,326 | On February 1, 2016, the Company sold Sparkroom LLC. After this sale, the Company no longer earns enrollment services revenue. | |||||||||

| Other income | 19,756 | 15,150 | 44,874 | 38,711 | See table below for the components of "other income." | |||||||||

| Gain from debt repurchases | 116 | 2,160 | 5,537 | 2,260 | Gains are from the Company repurchasing its own debt. During the first quarter of 2017, the Company initiated a cash tender offer to purchase any and all of its outstanding Hybrid Securities. The Company paid $25.3 million to redeem $29.7 million of these notes and recognized a gain of $4.4 million. Other gains are from the repurchase of the Company's asset-backed debt securities. | |||||||||

| Derivative settlements, net | (573 | ) | (6,261 | ) | (2,314 | ) | (18,292 | ) | The Company maintains an overall risk management strategy that incorporates the use of derivative instruments to reduce the economic effect of interest rate volatility. Derivative settlements for each applicable period should be evaluated with the Company's net interest income. See table below for additional analysis. | |||||

| Derivative market value and foreign currency transaction adjustments, net | 7,746 | 42,262 | (23,254 | ) | (15,099 | ) | Includes (i) the realized and unrealized gains and losses that are caused by changes in fair values of derivatives which do not qualify for "hedge treatment" under GAAP; and (ii) the foreign currency transaction gains or losses caused by the re-measurement of the Company's Euro-denominated bonds to U.S. dollars. | |||||||

| Total other income | 125,196 | 145,075 | 322,792 | 288,366 | ||||||||||

| Operating expenses: | ||||||||||||||

| Salaries and benefits | 74,193 | 63,743 | 220,684 | 187,907 | Increase was due to an (i) increase in contract programming related to the GreatNet joint venture and an increase in personnel to support the increase in volume of loans serviced for the government entering repayment status and the increase in private education and consumer loan servicing volume in the LSS operating segment; (ii) increase in personnel to support the growth in revenue in the TPP&CC operating segment; and (iii) increase in personnel at Allo to support the Lincoln, Nebraska network expansion. See each individual operating segment results of operations discussion for additional information. | |||||||||

| Depreciation and amortization | 10,051 | 8,994 | 27,687 | 24,817 | Increase was due to additional depreciation expense at Allo. Since the acquisition of Allo on December 31, 2015, there has been a significant amount of property and equipment purchases to support the Lincoln, Nebraska network expansion. | |||||||||

| Loan servicing fees | 7,939 | 5,880 | 19,584 | 20,024 | Increase for the three months ended September 30, 2017 compared to the same period in 2016 due to a payment of $2.8 million in conversion fees related to a transfer of loans in August 2017 from a third-party servicer to the LSS operating segment's servicing platform. Excluding the $2.8 million conversion fee paid in the third quarter of 2017, loan servicing fees paid to third-parties decreased $0.7 million and $3.2 million for the three and nine months ended September 30, 2017 compared to the same periods in 2016 due to runoff of the Company's student loan portfolio and transfers of loans in August 2017 and June 2016 from third-party servicers to the LSS's servicing platform. | |||||||||

| Cost to provide communication services | 2,632 | 1,784 | 6,789 | 5,169 | Represents costs of services and products primarily associated with television programming costs in the Communications operating segment. | |||||||||

| Cost to provide enrollment services | — | — | — | 3,623 | On February 1, 2016, the Company sold Sparkroom LLC. After this sale, the Company no longer provides enrollment services. | |||||||||

| Other expenses | 30,518 | 26,391 | 84,593 | 84,174 | Increase was a result of an increase in operating expenses due to GreatNet, additional costs to support the increase in payment plans and campus commerce activity, and an increase in operating expenses at Allo to support the Lincoln, Nebraska network expansion, partially offset by the elimination of FFELP guaranty collection costs. The Company's remaining guaranty collection client exited the FFELP guaranty business at the end of their contract term on June 30, 2016, and after this date the Company has no remaining guaranty collection revenue. Accordingly, there were no collection costs for the three and nine months ended September 30, 2017, compared to no collection costs and $3.5 million for the three months and nine months ended September 30, 2016, respectively. | |||||||||

| Total operating expenses | 125,333 | 106,792 | 359,337 | 325,714 | ||||||||||

| Cost of services: | |||||||||||||||||||||||||||||

| Cost to provide education technology, services, and payment processing services | 21,676 | 15,376 | 48,728 | 38,181 | Represents primarily direct costs to provide payment processing and instructional services in the ETS&PP operating segment. Increase in 2021 compared to 2020 was primarily due to additional instructional services costs. | ||||||||||||||||||||||||

| Cost to provide communications services | — | 5,743 | — | 11,325 | As discussed above, on December 21, 2020, the Company deconsolidated ALLO from the Company’s consolidated financial statements. | ||||||||||||||||||||||||

| Total cost of services | 21,676 | 21,119 | 48,728 | 49,506 | |||||||||||||||||||||||||

| Operating expenses: | |||||||||||||||||||||||||||||

| Salaries and benefits | 118,968 | 119,247 | 234,759 | 239,125 | Decrease was due to a decrease in contact center operations and support in the LSS operating segment as a result of federal student loan payments being suspended under the CARES Act, and the deconsolidation of ALLO from the Company's consolidated financial statements. These decreases were partially offset by an increase in expenses in the ETS&PP operating segment due to an increase in headcount to support the growth of its customer base, the investment in the development of new technologies, and businesses it acquired in December 2020. | ||||||||||||||||||||||||

| Depreciation and amortization | 20,236 | 29,393 | 40,419 | 57,041 | Decrease was primarily due to the deconsolidation of ALLO from the Company's consolidated financial statements on December 21, 2020, resulting in no depreciation expense being recorded in 2021 for ALLO. | ||||||||||||||||||||||||

| Other expenses | 32,587 | 37,052 | 69,286 | 80,439 | Other expenses includes expenses necessary for operations, such as postage and distribution, consulting and professional fees, occupancy, communications, and certain information technology-related costs. Decrease was due to cost savings in the LSS segment from an increase in the adoption of electronic borrower statements and correspondence and a decrease in printing and postage while loan payments are suspended as a result of COVID-19 borrower relief efforts, and the deconsolidation of ALLO in December 2020. | ||||||||||||||||||||||||

| Total operating expenses | 171,791 | 185,692 | 344,464 | 376,605 | |||||||||||||||||||||||||

| Income before income taxes | 109,250 | 107,874 | 267,015 | 57,976 | |||||||||||||||||||||||||

| Income tax expense | 26,237 | 21,264 | 61,098 | 11,131 | The effective tax rate was 23.83% and 19.74% for the three months ended June 30, 2021 and 2020, respectively, and 22.75% and 19.50% for the six months ended June 30, 2021 and 2020, respectively. The Company currently expects its effective tax rate for 2021 will range between 22 and 24 percent. | ||||||||||||||||||||||||

| Net income | 83,013 | 86,610 | 205,917 | 46,845 | |||||||||||||||||||||||||

| Net loss (income) attributable to noncontrolling interests | 854 | (128) | 1,548 | (895) | |||||||||||||||||||||||||

| Net income attributable to Nelnet, Inc. | $ | 83,867 | 86,482 | 207,465 | 45,950 | ||||||||||||||||||||||||

38

| Income before income taxes | 69,097 | 132,078 | 186,454 | 245,754 | ||||||||||

| Income tax expense | 25,562 | 47,715 | 70,349 | 87,184 | The effective tax rate was 35.60% and 36.15% for the three months ended September 30, 2017 and 2016, respectively, and 36.00% and 35.50% for the nine months ended September 30, 2017 and 2016, respectively. The lower effective tax rate for the nine months ended September 30, 2016 was due to the resolution of certain tax positions during the first quarter of 2016. | |||||||||

| Net income | 43,535 | 84,363 | 116,105 | 158,570 | ||||||||||

| Net loss (income) attributable to noncontrolling interest | 2,768 | (69 | ) | 8,960 | (165 | ) | In 2017, represents primarily the net loss of GreatNet attributable to Great Lakes. See "Noncontrolling Interest" in note 1 of the notes to consolidated financial statements included under Part I, Item 1 of this report. | |||||||

| Net income attributable to Nelnet, Inc. | $ | 46,303 | 84,294 | 125,065 | 158,405 | |||||||||

| Additional information: | ||||||||||||||

| Net income attributable to Nelnet, Inc. | $ | 46,303 | 84,294 | 125,065 | 158,405 | See "Overview - GAAP Net Income and Non-GAAP Net Income, Excluding Adjustments" above for additional information about non-GAAP net income, excluding derivative market value and foreign currency transaction adjustments. | ||||||||

| Derivative market value and foreign currency transaction adjustments, net | (7,746 | ) | (42,262 | ) | 23,254 | 15,099 | ||||||||

| Net tax effect | 2,943 | 16,060 | (8,837 | ) | (5,737 | ) | ||||||||

| Net income attributable to Nelnet, Inc., excluding derivative market value and foreign currency transaction adjustments | $ | 41,500 | 58,092 | 139,482 | 167,767 | |||||||||

The following table summarizes the components of “net interest income”"other" in "other income/expense" on the consolidated statements of income.

| Three months ended June 30, | Six months ended June 30, | ||||||||||||||||||||||

| 2021 | 2020 | 2021 | 2020 | ||||||||||||||||||||

| Income/gains from investments, net (a) | $ | 15,591 | 51,111 | 24,089 | 50,085 | ||||||||||||||||||

| ALLO preferred return (b) | 2,020 | — | 4,342 | — | |||||||||||||||||||

| Investment advisory services (c) | 1,145 | 922 | 3,842 | 3,724 | |||||||||||||||||||

| Income (loss) from ALLO voting membership interest investment (d) | 1,094 | — | (21,125) | — | |||||||||||||||||||

| Borrower late fee income (e) | 744 | 319 | 1,184 | 3,506 | |||||||||||||||||||

| Management fee revenue (f) | 701 | 1,914 | 1,814 | 4,544 | |||||||||||||||||||

| (Loss) income from solar investments (g) | (2,302) | 2,040 | (3,982) | (799) | |||||||||||||||||||

| Other | 3,928 | 3,821 | 8,153 | 7,348 | |||||||||||||||||||

| Other income | $ | 22,921 | 60,127 | 18,317 | 68,408 | ||||||||||||||||||

(a) During the second quarter of 2020, the Company recognized a $51.0 million (pre-tax) gain to adjust the carrying value of its investment in Hudl to reflect Hudl’s May 2020 equity raise transaction value. During the three and “derivative settlements, net.”six months ended June 30, 2021, the Company recognized (pre-tax) realized and unrealized gains from certain real estate and venture capital investments, including realized gains from the sale of certain real estate investments of $6.0 million and $11.1 million, respectively.

(b) Represents the Company's income on its preferred membership interests in a holding company for ALLO, which was deconsolidated from the Company's financial statements in December 2020. As of June 30, 2021, the amount of preferred membership interests held by the Company was $129.7 million that earns a preferred annual return of 6.25 percent.

(d) Represents the Company's derivative instruments basedshare of income or loss on their contractual terms. Derivative accounting requires that net settlements with respect to derivatives that do not qualify for "hedge treatment" under GAAP be recordedits voting membership interests in a separate income statement line item below net interest income. The Company maintains an overall risk management strategy that incorporates the use of derivative instruments to reduce the economic effect of interest rate volatility. As such, management believes derivative settlementsholding company for each applicable period should be evaluated with the Company’s net interest income as presented in the table below. Net interest income (net of settlements on derivatives) is a non-GAAP financial measure, and the Company reports this non-GAAP information because the Company believes that it provides additional information regarding operational and performance indicators that are closely assessed by management. There is no comprehensive, authoritative guidance for the presentation of such non-GAAP information, which is only meant to supplement GAAP results by providing additional information that management utilizes to assess performance.ALLO. See note 45 of the notes to consolidated financial statements included under Part I, Item 1 of this report for additional information onregarding the accounting for and income statement impact of this investment during 2021.

(e) Represents borrower late fees earned by the AGM operating segment. The decrease in borrower late fees for the six months ended June 30, 2021 as compared to the same period in 2020 was due to the Company suspending borrower late fees effective March 13, 2020 to provide borrowers relief as a result of the COVID-19 pandemic.

(f) Represents revenue earned from providing administrative support and marketing services primarily to Great Lakes’ former parent company under a contract that expired in January 2021.

(g) Represents the Company's derivative instruments, includingshare of income or loss from solar investments accounted for using the net settlement activity recognized byHLBV method of accounting. For the Company for each typemajority of derivative for the periods presentedCompany's solar investments, the HLBV method of accounting results in accelerated losses in the table under the caption "Income Statement Impact" in note 4 and in the table below. initial years of investment.

39

| Three months ended September 30, | Nine months ended September 30, | Additional information | ||||||||||||

| 2017 | 2016 | 2017 | 2016 | |||||||||||

| Variable student loan interest margin | $ | 46,683 | 57,442 | 139,082 | 159,932 | Represents the yield the Company receives on its student loan portfolio less the cost of funding these loans. Variable student loan spread is also impacted by the amortization/accretion of loan premiums and discounts and the 1.05% per year consolidation loan rebate fee paid to the Department. In the third quarter of 2016, the Company revised its policy to correct for an error in its method of applying the interest method used to amortize premiums and accrete discounts on its student loan portfolio. During the third quarter of 2016, the Company recorded an adjustment to reflect the net impact on prior periods for the correction of this error that resulted in an $8.2 million reduction to the Company's net loan discount balance and a corresponding increase in interest income. See AGM operating segment - results of operations. | ||||||||

| Settlements on associated derivatives | (4,265 | ) | (871 | ) | (7,598 | ) | (2,355 | ) | Includes the net settlements paid/received related to the Company’s 1:3 basis swaps and cross-currency interest rate swap. | |||||

| Variable student loan interest margin, net of settlements on derivatives | 42,418 | 56,571 | 131,484 | 157,577 | ||||||||||

| Fixed rate floor income | 24,586 | 41,509 | 84,382 | 131,720 | The Company has a portfolio of student loans that are earning interest at a fixed borrower rate which exceeds the statutorily defined variable lender rates, generating fixed rate floor income. See Item 3, "Quantitative and Qualitative Disclosures About Market Risk - Interest Rate Risk" for additional information. | |||||||||

| Settlements on associated derivatives | 3,883 | (5,157 | ) | 5,877 | (15,241 | ) | Includes the net settlements paid/received related to the Company’s floor income interest rate swaps. | |||||||

| Fixed rate floor income, net of settlements on derivatives | 28,469 | 36,352 | 90,259 | 116,479 | ||||||||||

| Investment interest | 5,129 | 2,460 | 11,335 | 6,674 | ||||||||||

| Corporate debt interest expense | (1,164 | ) | (1,616 | ) | (2,800 | ) | (4,724 | ) | Includes interest expense on the Junior Subordinated Hybrid Securities and unsecured line of credit. During the first quarter of 2017, the Company repurchased $29.7 million of its Hybrid Securities. In addition, the weighted average balance outstanding under the Company's unsecured line of credit was lower during 2017 as compared to 2016. These factors resulted in less corporate debt interest expense in 2017 as compared to 2016. | |||||

| Non-portfolio related derivative settlements | (191 | ) | (233 | ) | (593 | ) | (696 | ) | Includes the net settlements paid/received related to the Company’s hybrid debt hedges. | |||||

| Net interest income (net of settlements on derivatives) | $ | 74,661 | 93,534 | 229,685 | 275,310 | |||||||||

| Three months ended September 30, | Nine months ended September 30, | |||||||||||

| 2017 | 2016 | 2017 | 2016 | |||||||||

| Investment advisory fees | $ | 5,852 | 1,535 | 11,661 | 3,367 | |||||||

| Peterson's revenue | 3,402 | 4,128 | 9,282 | 10,655 | ||||||||

| Borrower late fee income | 2,731 | 3,158 | 9,098 | 9,910 | ||||||||

| Realized and unrealized gains on investments classified as available-for-sale and trading, net | 2,468 | 506 | 3,185 | 1,444 | ||||||||

| Other | 5,303 | 5,823 | 11,648 | 13,335 | ||||||||

| Other income | $ | 19,756 | 15,150 | 44,874 | 38,711 | |||||||

LOAN SYSTEMSSERVICING AND SERVICINGSYSTEMS OPERATING SEGMENT – RESULTS OF OPERATIONS

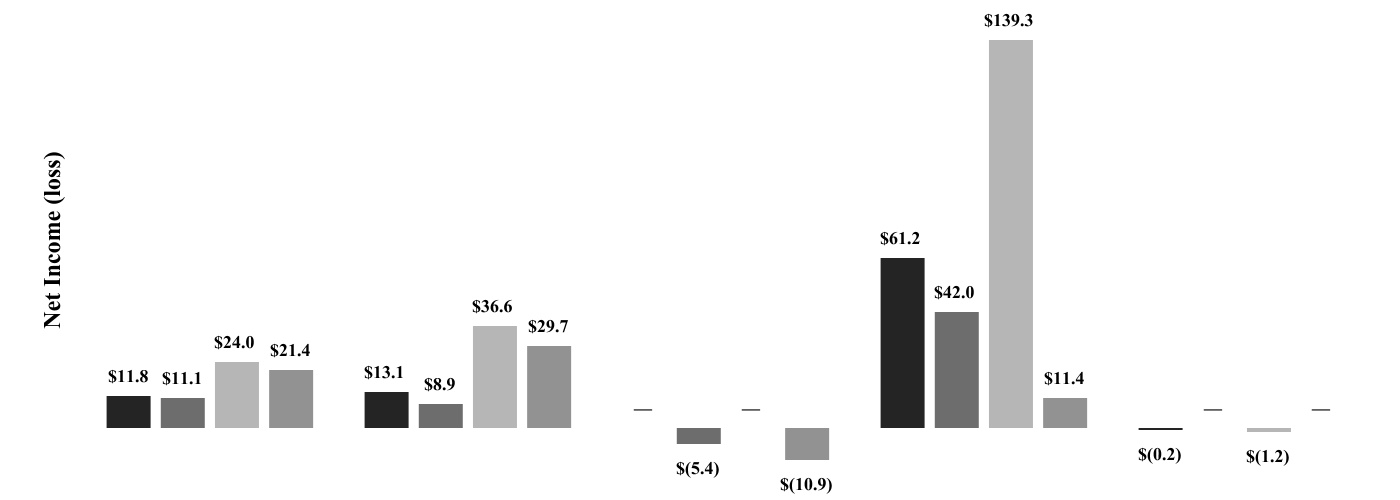

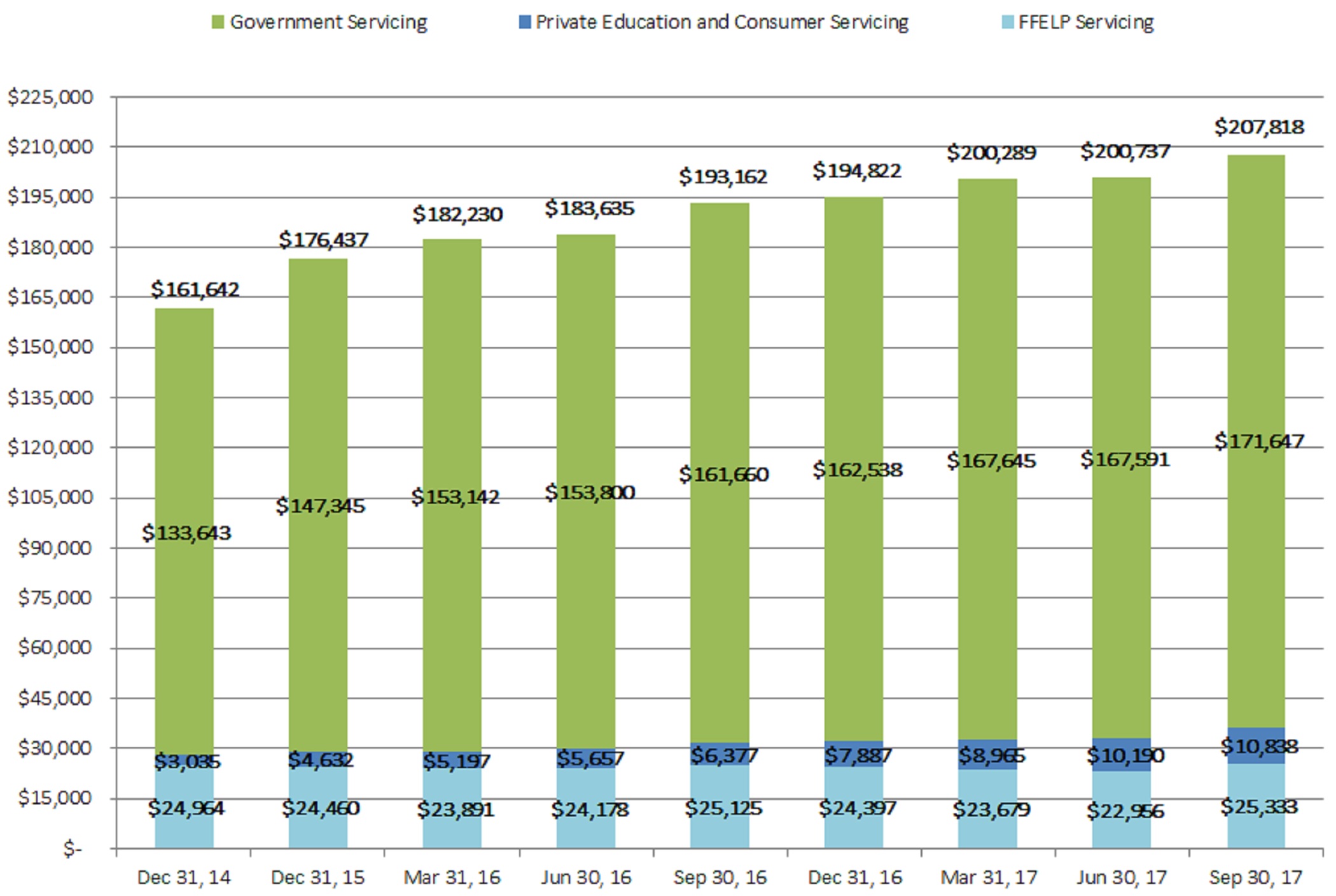

Loan Servicing Volumes (dollars

| As of | |||||||||||||||||||||||||||||||||||||||||||||||

| December 31, 2019 | March 31, 2020 | June 30, 2020 | September 30, 2020 | December 31, 2020 | March 31, 2021 | June 30, 2021 | |||||||||||||||||||||||||||||||||||||||||

| Servicing volume (dollars in millions): | |||||||||||||||||||||||||||||||||||||||||||||||

| Nelnet Servicing: | |||||||||||||||||||||||||||||||||||||||||||||||

| Government | $ | 183,790 | 185,477 | 185,315 | 189,932 | 191,678 | 195,875 | 195,030 | |||||||||||||||||||||||||||||||||||||||

| FFELP | 33,185 | 32,326 | 31,392 | 31,122 | 30,763 | 30,084 | 29,361 | ||||||||||||||||||||||||||||||||||||||||

| Private and consumer | 16,033 | 16,364 | 16,223 | 16,267 | 16,226 | 21,397 | 24,758 | ||||||||||||||||||||||||||||||||||||||||

| Great Lakes: | |||||||||||||||||||||||||||||||||||||||||||||||

| Government | 239,980 | 243,205 | 243,609 | 249,723 | 251,570 | 257,806 | 257,420 | ||||||||||||||||||||||||||||||||||||||||

| Total | $ | 472,988 | 477,372 | 476,539 | 487,044 | 490,237 | 505,162 | 506,569 | |||||||||||||||||||||||||||||||||||||||

| Number of servicing borrowers: | |||||||||||||||||||||||||||||||||||||||||||||||

| Nelnet Servicing: | |||||||||||||||||||||||||||||||||||||||||||||||

| Government | 5,574,001 | 5,498,872 | 5,496,662 | 5,604,685 | 5,645,946 | 5,664,094 | 5,636,781 | ||||||||||||||||||||||||||||||||||||||||

| FFELP | 1,478,703 | 1,423,286 | 1,370,007 | 1,332,908 | 1,300,677 | 1,233,461 | 1,198,863 | ||||||||||||||||||||||||||||||||||||||||

| Private and consumer | 682,836 | 670,702 | 653,281 | 649,258 | 636,136 | 882,477 | 1,039,537 | ||||||||||||||||||||||||||||||||||||||||

| Great Lakes: | |||||||||||||||||||||||||||||||||||||||||||||||

| Government | 7,396,657 | 7,344,509 | 7,346,691 | 7,542,679 | 7,605,984 | 7,637,270 | 7,616,270 | ||||||||||||||||||||||||||||||||||||||||

| Total | 15,132,197 | 14,937,369 | 14,866,641 | 15,129,530 | 15,188,743 | 15,417,302 | 15,491,451 | ||||||||||||||||||||||||||||||||||||||||

| Number of remote hosted borrowers: | 6,433,324 | 6,354,158 | 6,264,559 | 6,251,598 | 6,555,841 | 4,307,342 | 4,338,570 | ||||||||||||||||||||||||||||||||||||||||

Government Loan Servicing

Nelnet Servicing's and Great Lakes' current student loan servicing contracts with the Department are currently scheduled to expire on December 14, 2021. The Consolidated Appropriations Act, 2021, signed into law on December 27, 2020, provides that the Department may extend the period of performance for the servicing contracts for up to two additional years to December 14, 2023. The Department is conducting a contract procurement process for a new framework for the servicing of all student loans owned by the Department. See note 12 of the notes to consolidated financial statements included under Part I, Item 1 of this report for additional information.

Nelnet Servicing and Great Lakes are two of the four large private sector companies (referred to as Title IV Additional Servicers, or "TIVAS") that have student loan servicing contracts with the Department. In addition, the Department has contracts with four not-for-profit ("NFP") entities to service loans owned by the Department. The Department currently allocates new loan volume among its servicers based on certain performance metrics that measure the satisfaction among separate customer groups, including borrowers and Department personnel who work with the servicers, and that measure the success of keeping borrowers in millions)an on-time repayment status and helping borrowers avoid default. Under the most recent publicly announced performance metrics measurements used by the Department for the quarterly periods July 1, 2020 through December 31, 2020, Great Lakes’ and Nelnet Servicing’s overall rankings among the eight current servicers for the Department were second and tied for third, respectively. Based on these results, Great Lakes’ and Nelnet Servicing’s allocation of new student loan servicing volumes for the period March 1, 2021 through August 31, 2021 are 15% and 14%, respectively. On July 8, 2021 and July 19, 2021, the Pennsylvania Higher Education Assistance Agency ("PHEAA"), one of the TIVAS, and the New Hampshire Higher Education Association Foundation Network ("Granite State"), one of the NFP servicers that utilizes Nelnet Servicing's platform to service its loans for the Department, announced that they will exit the federal student loan servicing business after their current contracts with the Department expire in December 2021. PHEAA and Granite State service approximately 8.5 million and 1.3 million borrowers, respectively, under their contracts. As of the filing of this report, the Department has not yet indicated how or when the PHEAA and Granite State servicing volume will be transitioned to other servicers for the Department.

In December of 2020, Wells Fargo announced the sale of its approximately $10.0 billion portfolio of private education student loans representing approximately 445,000 borrowers. In conjunction with the sale, the Company was selected as servicer of the portfolio. During March 2021, approximately 261,000 borrowers were converted to the Company's servicing platform, with the remaining borrowers converted in the second quarter of 2021.

40

| Company owned | $19,742 | $18,886 | $18,433 | $18,079 | $17,429 | $16,962 | $16,352 | $15,789 | $18,403 | ||||||||||||||||||

| % of total | 12.2% | 10.7% | 10.1% | 9.8% | 9.0% | 8.7% | 8.2% | 7.9% | 8.9% | ||||||||||||||||||

| Number of servicing borrowers: | |||||||||||||||||||||||||||

| Government servicing: | 5,915,449 | 5,842,163 | 5,786,545 | 5,726,828 | 6,009,433 | 5,972,619 | 5,924,099 | 5,849,283 | 5,906,404 | ||||||||||||||||||

| FFELP servicing: | 1,397,295 | 1,335,538 | 1,298,407 | 1,296,198 | 1,357,412 | 1,312,192 | 1,263,785 | 1,218,706 | 1,317,552 | ||||||||||||||||||

| Private education and consumer loan servicing: | 202,529 | 245,737 | 250,666 | 267,073 | 292,989 | 355,096 | 389,010 | 454,182 | 478,150 | ||||||||||||||||||

| Total: | 7,515,273 | 7,423,438 | 7,335,618 | 7,290,099 | 7,659,834 | 7,639,907 | 7,576,894 | 7,522,171 | 7,702,106 | ||||||||||||||||||

| Number of remote hosted borrowers: | 1,611,654 | 1,755,341 | 1,796,783 | 1,842,961 | 2,103,989 | 2,230,019 | 2,305,991 | 2,317,151 | 2,714,588 | ||||||||||||||||||

Summary and Comparison of Operating Results

| Three months ended June 30, | Six months ended June 30, | ||||||||||||||||||||||||||||

| 2021 | 2020 | 2021 | 2020 | Additional information | |||||||||||||||||||||||||

| Net interest income | $ | 7 | 24 | 16 | 296 | Decrease was due to lower interest rates in 2021 as compared to 2020. | |||||||||||||||||||||||

| Loan servicing and systems revenue | 112,094 | 111,042 | 223,611 | 223,778 | See table below for additional information. | ||||||||||||||||||||||||

| Intersegment servicing revenue | 8,480 | 8,537 | 16,748 | 19,591 | Represents revenue earned by the LSS operating segment as a result of servicing loans for the AGM and Nelnet Bank operating segments. Decrease in the six months ended June 30, 2021 compared to the same period in 2020 was due to the impact of borrower relief policies implemented in March 2020 in response to the COVID-19 pandemic and the expected amortization of AGM's FFELP portfolio. FFELP intersegment servicing revenue will continue to decrease as AGM's FFELP portfolio pays off. | ||||||||||||||||||||||||

| Other income | 701 | 1,914 | 1,814 | 4,544 | Represents revenue earned from providing administrative support and marketing services primarily to Great Lakes’ former parent company under a contract that expired in January 2021. | ||||||||||||||||||||||||

| Total other income | 121,275 | 121,493 | 242,173 | 247,913 | |||||||||||||||||||||||||

| Salaries and benefits | 68,388 | 68,401 | 134,846 | 138,894 | Decrease in the six months ended June 30, 2021 compared to the same period in 2020 was due to a decrease in contact center operations and support as a result of federal student loan payments being suspended in March 2020 under the CARES Act, which suspension has been extended through at least September 30, 2021. The Company currently expects salaries and benefits will increase as it prepares for the provisions of the CARES Act to expire. | ||||||||||||||||||||||||

| Depreciation and amortization | 7,974 | 9,142 | 16,166 | 17,990 | Includes depreciation on property and equipment and amortization of intangibles from the Great Lakes acquisition in February 2018. Amortization of intangible assets for the three months ended June 30, 2021 and 2020 was $5.5 million and $5.0 million, respectively, and for the six months ended June 30, 2021 and 2020 was $11.0 million and $9.8 million, respectively. The majority of the Great Lakes' intangible assets became fully amortized at June 30, 2021. The Company expects amortization expense for the second half of 2021 to be approximately $1.4 million. Excluding amortization of intangible assets, the decrease in 2021 compared to 2020 was due to certain purchases to integrate Great Lakes and expand servicing capacity becoming fully depreciated. | ||||||||||||||||||||||||

| Other expenses | 13,273 | 13,380 | 26,557 | 30,870 | Decrease in the six months ended June 30, 2021 compared to same period in 2020 was due to cost savings as a result of the impact of the COVID-19 pandemic and the resulting CARES Act (which became effective March 13, 2020), primarily associated with the fact that while student loan payments are suspended there is a significant reduction of borrower statement printing and postage costs. The Company currently expects these costs will increase when the provisions of the CARES Act expire, currently scheduled for September 30, 2021 but subject to possible further extension. Decrease was also due to cost savings from an increase in the adoption of electronic borrower statements and correspondence. | ||||||||||||||||||||||||

| Intersegment expenses | 16,134 | 15,996 | 33,024 | 32,235 | Intersegment expenses represent costs for certain corporate activities and services that are allocated to each operating segment based on estimated use of such activities and services. | ||||||||||||||||||||||||

| Total operating expenses | 105,769 | 106,919 | 210,593 | 219,989 | |||||||||||||||||||||||||

| Income before income taxes | 15,513 | 14,598 | 31,596 | 28,220 | |||||||||||||||||||||||||

| Income tax expense | (3,723) | (3,504) | (7,583) | (6,773) | Represents income tax expense at an effective tax rate of 24%. | ||||||||||||||||||||||||

| Net income | $ | 11,790 | 11,094 | 24,013 | 21,447 | ||||||||||||||||||||||||

| Before tax operating margin | 12.8 | % | 12.0 | % | 13.0 | % | 11.4 | % | Before tax operating margin is a measure of before tax operating profitability as a percentage of revenue, and for the LSS segment is calculated as income before income taxes divided by the total of loan servicing and systems revenue, intersegment servicing revenue, and other income revenue. The Company uses this metric to monitor and assess the segment’s performance, manage operating costs, identify and evaluate business trends affecting the segment, and make strategic decisions, and believes that it facilitates an understanding of the operating performance of the segment and provides a meaningful comparison of the results of operations between periods. Before tax operating margin increased in 2021 as compared to 2020 primarily due to operating expenses decreasing as a result of federal student loan payments being suspended under the CARES Act as discussed above. The Company currently expects these costs will increase and operating margin to decrease from recent historical levels as it prepares for the provisions of the CARES Act to expire. | ||||||||||||||||||||

41

| Three months ended September 30, | Nine months ended September 30, | Additional information | ||||||||||||

| 2017 | 2016 | 2017 | 2016 | |||||||||||

| Net interest income | $ | 147 | 37 | 361 | 80 | |||||||||

| Loan systems and servicing revenue | 55,950 | 54,350 | 167,079 | 161,082 | See table below for additional analysis. | |||||||||

| Intersegment servicing revenue | 10,563 | 11,021 | 30,839 | 34,436 | Represents revenue earned by the LSS operating segment as a result of servicing loans for the AGM operating segment. Decrease was due to a decrease in loans serviced for the AGM segment during the comparable periods due to portfolio run-off. In August 2017, the AGM operating segment converted $3.1 billion of loans from a third-party servicer to the LSS operating segment's servicing platform. | |||||||||

| Total other income | 66,513 | 65,371 | 197,918 | 195,518 | ||||||||||

| Salaries and benefits | 38,435 | 32,505 | 116,932 | 96,851 | Increase due to contract programming related to GreatNet and an increase in personnel to support the increase in volume of loans serviced for the government entering repayment status and the increase in private education and consumer loan servicing volume. | |||||||||

| Depreciation and amortization | 549 | 557 | 1,644 | 1,440 | ||||||||||

| Other expenses | 10,317 | 8,784 | 28,333 | 31,635 | Increase in the three months ended September 30, 2017 compared to the same period in 2016 due to increase in operating expenses related to GreatNet. Decrease in the nine months ended September 30, 2017 compared to the same period in 2016 due primarily to the elimination of FFELP guaranty collection costs directly related to the loss of FFELP guaranty collection revenue. There were no collection costs for the three and nine months ended September 30, 2017 and three months ended September 30, 2016, and $3.5 million for the nine months ended September 30, 2016. Excluding collection costs, other expenses were $28.1 million for the nine months ended September 30, 2016. See additional information below regarding the loss of FFELP guaranty collection revenue. | |||||||||

| Intersegment expenses, net | 7,774 | 5,825 | 23,496 | 18,168 | Intersegment expenses represent costs for certain corporate activities and services that are allocated to each operating segment based on estimated use of such activities and services. | |||||||||

| Total operating expenses | 57,075 | 47,671 | 170,405 | 148,094 | ||||||||||

| Income before income taxes | 9,585 | 17,737 | 27,874 | 47,504 | ||||||||||

| Income tax expense | (4,937 | ) | (6,740 | ) | (14,410 | ) | (18,052 | ) | Reflects income tax expense based on 38% of income before taxes and the net loss attributable to noncontrolling interest. | |||||

| Net income | 4,648 | 10,997 | 13,464 | 29,452 | ||||||||||

| Net loss attributable to noncontrolling interest | 3,408 | — | 10,050 | — | Represents the net loss of GreatNet attributable to Great Lakes. See "Noncontrolling Interest" in note 1 of the notes to consolidated financial statements included under Part I, Item 1 of this report. | |||||||||

Net income attributable to Nelnet, Inc. | $ | 8,056 | 10,997 | 23,514 | 29,452 | |||||||||

| Before tax operating margin | 14.4 | % | 27.1 | % | 14.1 | % | 24.3 | % | Decrease in margin due to increases in salaries and benefits and other operating expenses as described above (including costs incurred related to GreatNet) and the loss of the guaranty business which had higher margin than the remaining businesses. Before tax operating margin, excluding the net loss attributable to noncontrolling interest (Great Lakes) for the three and nine months ended September 30, 2017 was 18.5% and 18.2%, respectively. | |||||

Loan systemsservicing and servicingsystems revenue

| Three months ended June 30, | Six months ended June 30, | ||||||||||||||||||||||||||||

| 2021 | 2020 | 2021 | 2020 | Additional information | |||||||||||||||||||||||||

| Government servicing - Nelnet | $ | 35,376 | 37,360 | 70,248 | 76,010 | Represents revenue from Nelnet Servicing's Department servicing contract. Decrease in the six months ended June 30, 2021 compared to the same period in 2020 was due to a decrease in revenue from the administration of the Total and Permanent Disability (TPD) Discharge program, decrease in fees earned from the Department for originating consolidation loans, and decrease in revenue earned per borrower as a result of certain provisions included in the CARES Act suspending federal student loan payments through at least September 30, 2021. Decrease in revenue for the three months ended June 30, 2021 compared to the same period in 2020 was due to a further decrease in revenue earned per borrower (from the monthly rate of $2.19 per borrower to $2.05 per borrower) as a result of the Department issuing a change request effective October 1, 2020. The decrease in revenue in 2021 as compared to 2020 was partially offset as a result of an increase in the number of borrowers serviced. The Company expects future revenue per borrower to continue to be lower while the loan payment suspension provisions of the CARES Act remain in effect. | |||||||||||||||||||||||

| Government servicing - Great Lakes | 43,863 | 45,213 | 87,165 | 91,660 | Represents revenue from Great Lakes' Department servicing contract. Decrease in the six months ended June 30, 2021 compared to the same period in 2020 was due to a decrease in fees earned from the Department for originating consolidation loans and decrease in revenue earned per borrower as a result of certain provisions included in the CARES Act suspending federal student loan payments through at least September 30, 2021. Decrease in revenue for the three months ended June 30, 2021 compared to the same period in 2020 was due to a further decrease in revenue earned per borrower (from the monthly rate of $2.19 per borrower to $2.05 per borrower) as a result of the Department issuing a change request effective October 1, 2020. The decrease in revenue in 2021 as compared to 2020 was partially offset as a result of an increase in the number of borrowers serviced. The Company expects future revenue per borrower to continue to be lower while the loan payment suspension provisions of the CARES Act remain in effect. | ||||||||||||||||||||||||