UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

| | | | | |

| ☑ | |

þ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the quarterly period ended March 31, 2024 |

For the quarterly period ended September 30, 2017

or

| | | | | |

| ☐ | |

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the transition period from to . |

For the transition period from to .

Commission file number:000-50600

Blackbaud, Inc.

(Exact name of registrant as specified in its charter)

| | | | | |

| |

| Delaware | 11-2617163 |

| |

| |

Delaware | 11-2617163 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

2000 Daniel Island Drive65 Fairchild Street

Charleston, South Carolina 29492

(Address of principal executive offices, including zip code)

(843) 216-6200

(Registrant’s telephone number, including area code)

| | | | | | | | |

| | |

| Securities Registered Pursuant to Section 12(b) of the Act: |

| Title of Each Class | Trading Symbol(s) | Name of Each Exchange on which Registered |

| Common Stock, $0.001 Par Value | BLKB | Nasdaq Global Select Market |

| | |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

YES þ NO ¨Yes☑No☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (Section 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

YES þ NO ¨Yes☑No☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | |

| | |

Large accelerated filerþ | ☑ | | Accelerated filer | ¨☐ |

Non-accelerated filer¨ (Do not check if a smaller reporting company) | ☐ | | Smaller reporting company | ¨☐ |

| | | Emerging growth company | ¨☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.¨☐

Indicate by check mark whether registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

YES ¨ NO þYes☐No☑

The number of shares of the registrant’s Common Stock outstanding as of October 23, 2017April 29, 2024 was 48,089,595.51,626,076.

TABLE OF CONTENTS

| | | | | | | | |

| | |

ThirdFirst Quarter 20172024 Form 10-Q | | 1 |

| | | | | | | | |

| | |

| | CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS |

This Quarterly Report on Form 10-Q, including the documents incorporated herein by reference, contains forward-looking statements that anticipate results based on our estimates, assumptions and plans that are subject to uncertainty. These "forward-looking statements" are made subject to the safe-harbor provisions of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements consist of, among other things, trend analyses, statements regarding future events, future financial performance, our anticipated growth, the effect of general economic and market conditions, our business strategy and our plan to build and grow our business, our operating results, our ability to successfully integrate acquired businesses and technologies, the effect of foreign currency exchange rate and interest rate fluctuations on our financial results, the impact of expensing stock-based compensation, the sufficiency of our capital resources, our ability to meet our ongoing debt and obligations as they become due, cybersecurity and data protection risks and related liabilities, and current or potential litigationlegal proceedings involving us, all of which are based on current expectations, estimates, and forecasts, and the beliefs and assumptions of our management. Words such as “believes,” “seeks,” “expects,” “may,” “might,” “should,” “intends,” “could,” “would,” “likely,” “will,” “targets,” “plans,” “anticipates,” “aims,” “projects,” “estimates” or any variations of such words and similar expressions are also intended to identify such forward-looking statements. These forward-looking statements are subject to risks, uncertainties and assumptions that are difficult to predict. Accordingly, they should not be viewed as assurances of future performance, and actual results may differ materially and adversely from those expressed in any forward-looking statements.

Important factors that could cause actual results to differ materially from our expectations expressed in forward-looking statements include, but are not limited to, those summarized under “Item“Part II, Item 1A. Risk factors” and elsewhere in this report, in our Annual Report on Form 10-K for the year ended December 31, 20162023 and in our other SEC filings.filings made with the United States Securities & Exchange Commission ("SEC"). Forward-looking statements represent our management's beliefs and assumptions only as of the date of this Quarterly Report on Form 10-Q. We undertake no obligation to update or revise any forward-looking statements, or to update the reasons actual results could differ materially from those anticipated in any forward-looking statement, whether as a result of new information, future events or otherwise.

|

| | | | | | | |

| 2 | | ThirdFirst Quarter 20172024 Form 10-Q |

| | | | | | | | |

| | |

| | PART I. FINANCIAL INFORMATION |

ITEM 1. FINANCIAL STATEMENTS

| | Blackbaud, Inc. Consolidated balance sheets (Unaudited) | | (dollars in thousands) | September 30,

2017 |

| December 31,

2016 |

|

Blackbaud, Inc.

Condensed Consolidated Balance Sheets

(Unaudited) | | Blackbaud, Inc.

Condensed Consolidated Balance Sheets

(Unaudited) |

| (dollars in thousands, except per share amounts) | | (dollars in thousands, except per share amounts) | March 31,

2024 | December 31,

2023 |

| Assets | |

| Current assets: | |

| Current assets: | |

| Current assets: | |

| Cash and cash equivalents | $ | 17,050 |

| $ | 16,902 |

|

| Restricted cash due to customers | 139,095 |

| 353,771 |

|

| Accounts receivable, net of allowance of $4,540 and $3,291 at September 30, 2017 and December 31, 2016, respectively | 100,868 |

| 88,932 |

|

| Cash and cash equivalents | |

| Cash and cash equivalents | |

| Restricted cash | |

| Accounts receivable, net of allowance of $6,204 and $6,907 at March 31, 2024 and December 31, 2023, respectively | |

| Customer funds receivable | |

| Prepaid expenses and other current assets | 50,082 |

| 48,314 |

|

| Total current assets | 307,095 |

| 507,919 |

|

| Property and equipment, net | 43,903 |

| 50,269 |

|

| Software development costs, net | 48,618 |

| 37,582 |

|

| Operating lease right-of-use assets | |

| Software and content development costs, net | |

| Goodwill | 472,776 |

| 438,240 |

|

| Intangible assets, net | 252,713 |

| 253,676 |

|

| Other assets | 21,889 |

| 22,524 |

|

| Total assets | $ | 1,146,994 |

| $ | 1,310,210 |

|

| Liabilities and stockholders’ equity | |

| Current liabilities: | |

| Current liabilities: | |

| Current liabilities: | |

| Trade accounts payable | |

| Trade accounts payable | |

| Trade accounts payable | $ | 17,830 |

| $ | 23,274 |

|

| Accrued expenses and other current liabilities | 45,650 |

| 54,196 |

|

| Due to customers | 139,095 |

| 353,771 |

|

| Debt, current portion | 8,576 |

| 4,375 |

|

| Deferred revenue, current portion | 277,008 |

| 244,500 |

|

| Total current liabilities | 488,159 |

| 680,116 |

|

| Debt, net of current portion | 329,380 |

| 338,018 |

|

| Deferred tax liability | 39,352 |

| 29,558 |

|

| Deferred revenue, net of current portion | 5,412 |

| 6,440 |

|

| Operating lease liabilities, net of current portion | |

| Other liabilities | 7,799 |

| 8,533 |

|

| Total liabilities | 870,102 |

| 1,062,665 |

|

| Commitments and contingencies (see Note 10) |

|

| Commitments and contingencies (see Note 9) | | Commitments and contingencies (see Note 9) | |

| Stockholders’ equity: | |

| Preferred stock; 20,000,000 shares authorized, none outstanding | — |

| — |

|

| Common stock, $0.001 par value; 180,000,000 shares authorized, 58,503,687 and 57,672,401 shares issued at September 30, 2017 and December 31, 2016, respectively | 59 |

| 58 |

|

| Preferred stock; 20,000,000 shares authorized, none outstanding | |

| Preferred stock; 20,000,000 shares authorized, none outstanding | |

| Common stock, $0.001 par value; 180,000,000 shares authorized, 70,861,507 and 69,188,304 shares issued at March 31, 2024 and December 31, 2023, respectively; 51,624,243 and 53,625,440 shares outstanding at March 31, 2024 and December 31, 2023, respectively | |

| Additional paid-in capital | 341,476 |

| 310,452 |

|

| Treasury stock, at cost; 10,426,122 and 10,166,801 shares at September 30, 2017 and December 31, 2016, respectively | (234,329 | ) | (215,237 | ) |

| Accumulated other comprehensive loss | (1,013 | ) | (457 | ) |

| Treasury stock, at cost; 19,237,264 and 15,562,864 shares at March 31, 2024 and December 31, 2023, respectively | |

| Accumulated other comprehensive income (loss) | |

| Retained earnings | 170,699 |

| 152,729 |

|

| Total stockholders’ equity | 276,892 |

| 247,545 |

|

| Total liabilities and stockholders’ equity | $ | 1,146,994 |

| $ | 1,310,210 |

|

| | |

The accompanying notes are an integral part of these consolidated financial statements. | | The accompanying notes are an integral part of these condensed consolidated financial statements. | |

| The accompanying notes are an integral part of these condensed consolidated financial statements. | |

| The accompanying notes are an integral part of these condensed consolidated financial statements. | |

| | | | | | | | |

| | |

ThirdFirst Quarter 20172024 Form 10-Q | | 3 |

|

| | | | | | | | | | | | | |

Blackbaud, Inc. Consolidated statements of comprehensive income (Unaudited) |

| (dollars in thousands, except per share amounts) | Three months ended

September 30, | | | Nine months ended

September 30, | |

| 2017 |

| 2016 |

| | 2017 |

| 2016 |

|

| Revenue | | | | | |

| Subscriptions | $ | 127,492 |

| $ | 105,440 |

| | $ | 370,923 |

| $ | 306,330 |

|

| Maintenance | 31,486 |

| 36,410 |

| | 98,184 |

| 111,019 |

|

| Services and other | 36,535 |

| 41,213 |

| | 102,222 |

| 115,161 |

|

| Total revenue | 195,513 |

| 183,063 |

| | 571,329 |

| 532,510 |

|

| Cost of revenue | | | | | |

| Cost of subscriptions | 58,045 |

| 51,943 |

| | 170,336 |

| 153,772 |

|

| Cost of maintenance | 5,698 |

| 5,531 |

| | 17,551 |

| 16,547 |

|

| Cost of services and other | 23,262 |

| 25,843 |

| | 71,595 |

| 76,499 |

|

| Total cost of revenue | 87,005 |

| 83,317 |

| | 259,482 |

| 246,818 |

|

| Gross profit | 108,508 |

| 99,746 |

| | 311,847 |

| 285,692 |

|

| Operating expenses | | | | | |

| Sales, marketing and customer success | 44,193 |

| 40,690 |

| | 129,394 |

| 115,707 |

|

| Research and development | 22,071 |

| 22,510 |

| | 67,647 |

| 67,973 |

|

| General and administrative | 23,545 |

| 22,319 |

| | 67,350 |

| 62,089 |

|

| Amortization | 734 |

| 687 |

| | 2,164 |

| 2,147 |

|

| Total operating expenses | 90,543 |

| 86,206 |

| | 266,555 |

| 247,916 |

|

| Income from operations | 17,965 |

| 13,540 |

| | 45,292 |

| 37,776 |

|

| Interest expense | (3,092 | ) | (2,641 | ) | | (8,685 | ) | (8,037 | ) |

| Other income (expense), net | 468 |

| (15 | ) | | 1,581 |

| (185 | ) |

| Income before provision for income taxes | 15,341 |

| 10,884 |

| | 38,188 |

| 29,554 |

|

| Income tax provision | 2,793 |

| 1,950 |

| | 2,964 |

| 5,323 |

|

| Net income | $ | 12,548 |

| $ | 8,934 |

| | $ | 35,224 |

| $ | 24,231 |

|

| Earnings per share | | | | | |

| Basic | $ | 0.27 |

| $ | 0.19 |

| | $ | 0.76 |

| $ | 0.53 |

|

| Diluted | $ | 0.26 |

| $ | 0.19 |

| | $ | 0.74 |

| $ | 0.51 |

|

| Common shares and equivalents outstanding | | | | | |

| Basic weighted average shares | 46,711,709 |

| 46,159,956 |

| | 46,627,213 |

| 46,078,306 |

|

| Diluted weighted average shares | 47,846,997 |

| 47,394,106 |

| | 47,679,103 |

| 47,268,469 |

|

| Dividends per share | $ | 0.12 |

| $ | 0.12 |

| | $ | 0.36 |

| $ | 0.36 |

|

| Other comprehensive (loss) income | | | | | |

| Foreign currency translation adjustment | (188 | ) | 289 |

| | (467 | ) | 261 |

|

| Unrealized (loss) gain on derivative instruments, net of tax | (267 | ) | 409 |

| | (89 | ) | (378 | ) |

| Total other comprehensive (loss) income | (455 | ) | 698 |

| | (556 | ) | (117 | ) |

| Comprehensive income | $ | 12,093 |

| $ | 9,632 |

| | $ | 34,668 |

| $ | 24,114 |

|

| | | | | | |

| The accompanying notes are an integral part of these consolidated financial statements. |

| | | | | | | | | | | |

Blackbaud, Inc. Condensed Consolidated Statements of Comprehensive Income (Loss) (Unaudited) |

| | | Three months ended

March 31, |

| (dollars in thousands, except per share amounts) | | | | 2024 | 2023 |

| Revenue | | | | | |

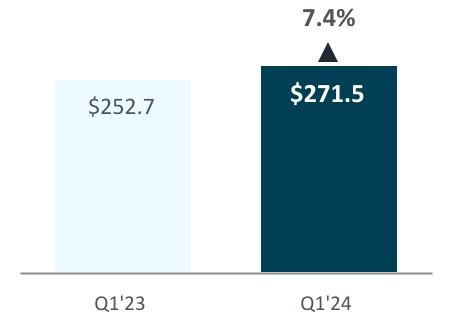

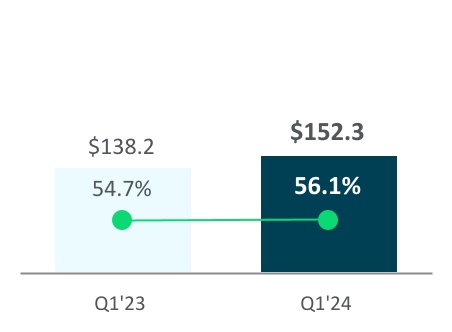

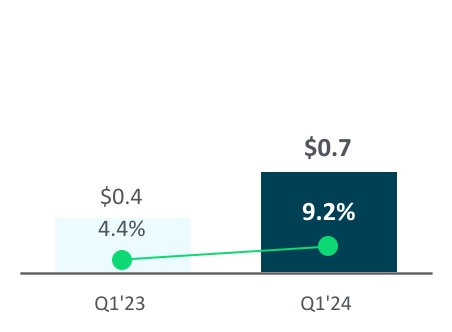

| Recurring | | | | $ | 271,518 | | $ | 252,748 | |

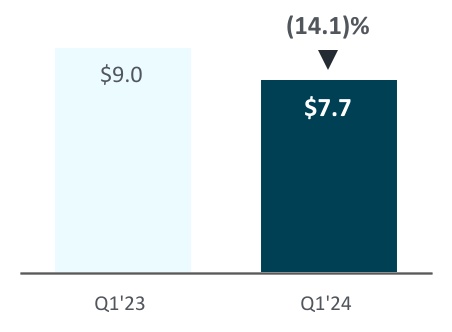

| One-time services and other | | | | 7,732 | | 9,005 | |

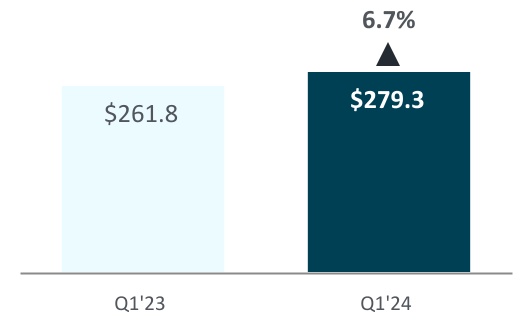

| Total revenue | | | | 279,250 | | 261,753 | |

| Cost of revenue | | | | | |

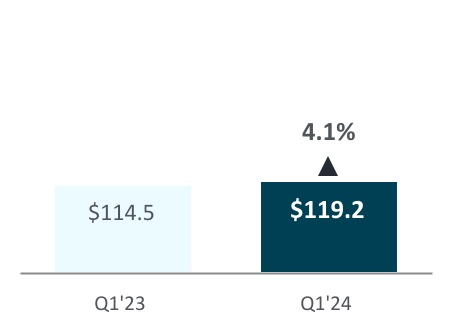

| Cost of recurring | | | | 119,188 | | 114,500 | |

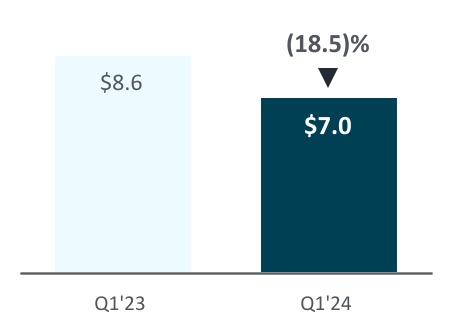

| Cost of one-time services and other | | | | 7,018 | | 8,612 | |

| Total cost of revenue | | | | 126,206 | | 123,112 | |

| Gross profit | | | | 153,044 | | 138,641 | |

| Operating expenses | | | | | |

| Sales, marketing and customer success | | | | 50,865 | | 54,385 | |

| Research and development | | | | 42,802 | | 40,591 | |

| General and administrative | | | | 47,754 | | 52,838 | |

| Amortization | | | | 904 | | 774 | |

| | | | | |

| Total operating expenses | | | | 142,325 | | 148,588 | |

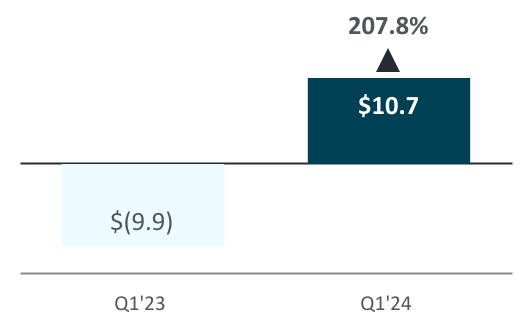

| Income (loss) from operations | | | | 10,719 | | (9,947) | |

| Interest expense | | | | (10,276) | | (10,662) | |

| Other income, net | | | | 3,347 | | 2,007 | |

| Income (loss) before benefit for income taxes | | | | 3,790 | | (18,602) | |

| Income tax benefit | | | | (1,456) | | (3,901) | |

| Net income (loss) | | | | $ | 5,246 | | $ | (14,701) | |

| Earnings (loss) per share | | | | | |

| Basic | | | | $ | 0.10 | | $ | (0.28) | |

| Diluted | | | | $ | 0.10 | | $ | (0.28) | |

| Common shares and equivalents outstanding | | | | | |

| Basic weighted average shares | | | | 52,052,370 | | 52,132,999 | |

| Diluted weighted average shares | | | | 53,414,495 | | 52,132,999 | |

| Other comprehensive income (loss) | | | | | |

| Foreign currency translation adjustment | | | | $ | (1,185) | | $ | 2,158 | |

| Unrealized gain (loss) on derivative instruments, net of tax | | | | 4,095 | | (10,692) | |

| Total other comprehensive income (loss) | | | | 2,910 | | (8,534) | |

| Comprehensive income (loss) | | | | $ | 8,156 | | $ | (23,235) | |

| | | | | |

| The accompanying notes are an integral part of these condensed consolidated financial statements. |

|

| | | | | | | |

| 4 | | ThirdFirst Quarter 20172024 Form 10-Q |

| | Blackbaud, Inc. Consolidated statements of cash flows (Unaudited) | Blackbaud, Inc.

Condensed Consolidated Statements of Cash Flows

(Unaudited) | | Blackbaud, Inc.

Condensed Consolidated Statements of Cash Flows

(Unaudited) |

| | Nine months ended

September 30, | | | Three months ended

March 31, |

| (dollars in thousands) | 2017 |

| 2016 |

| (dollars in thousands) | 2024 | 2023 |

| Cash flows from operating activities | |

| Net income | $ | 35,224 |

| $ | 24,231 |

|

| Adjustments to reconcile net income to net cash provided by operating activities: | |

| Net income (loss) | |

| Net income (loss) | |

| Net income (loss) | |

| Adjustments to reconcile net income (loss) to net cash provided by operating activities: | |

| Depreciation and amortization | 54,765 |

| 53,109 |

|

| Provision for doubtful accounts and sales returns | 7,246 |

| 3,139 |

|

| Depreciation and amortization | |

| Depreciation and amortization | |

| Provision for credit losses and sales returns | |

| Stock-based compensation expense | 31,055 |

| 25,005 |

|

| Deferred taxes | (2,511 | ) | (225 | ) |

| Amortization of deferred financing costs and discount | 650 |

| 718 |

|

| Loss on disposition of business | |

| Other non-cash adjustments | 572 |

| (634 | ) |

| Changes in operating assets and liabilities, net of acquisition and disposal of businesses: | |

| Accounts receivable | |

| Accounts receivable | |

| Accounts receivable | (17,169 | ) | (9,288 | ) |

| Prepaid expenses and other assets | 596 |

| (934 | ) |

| Trade accounts payable | (2,891 | ) | 267 |

|

| Accrued expenses and other liabilities | (9,522 | ) | (12,837 | ) |

| Restricted cash due to customers | 214,244 |

| 119,291 |

|

| Due to customers | (214,244 | ) | (119,291 | ) |

| Deferred revenue | 25,370 |

| 17,593 |

|

| Net cash provided by operating activities | 123,385 |

| 100,144 |

|

| Cash flows from investing activities | |

| Purchase of property and equipment | (8,417 | ) | (15,459 | ) |

| Capitalized software development costs | (20,605 | ) | (19,078 | ) |

| Purchase of net assets of acquired companies, net of cash acquired | (49,729 | ) | (3,377 | ) |

| Purchase of derivative instruments | (516 | ) | — |

|

| Proceeds from settlement of derivative instruments | 1,030 |

| — |

|

| Purchase of property and equipment | |

| Purchase of property and equipment | |

| Capitalized software and content development costs | |

| | Net cash used in disposition of business | |

| Net cash used in disposition of business | |

| Net cash used in disposition of business | |

| | Net cash used in investing activities | |

| Net cash used in investing activities | |

| Net cash used in investing activities | (78,237 | ) | (37,914 | ) |

| Cash flows from financing activities | |

| Proceeds from issuance of debt | 588,300 |

| 179,000 |

|

| Proceeds from issuance of debt | |

| Proceeds from issuance of debt | |

| Payments on debt | (594,144 | ) | (212,581 | ) |

| Debt issuance costs | (3,085 | ) | — |

|

| | Employee taxes paid for withheld shares upon equity award settlement | (19,092 | ) | (10,497 | ) |

| Proceeds from exercise of stock options | 14 |

| 10 |

|

| Dividend payments to stockholders | (17,299 | ) | (17,108 | ) |

| | Employee taxes paid for withheld shares upon equity award settlement | |

| | Employee taxes paid for withheld shares upon equity award settlement | |

| | Change in due to customers | |

| Change in due to customers | |

| Change in due to customers | |

| Change in customer funds receivable | |

| Purchase of treasury stock | |

| Net cash used in financing activities | (45,306 | ) | (61,176 | ) |

| Effect of exchange rate on cash and cash equivalents | 306 |

| 46 |

|

| Net increase in cash and cash equivalents | 148 |

| 1,100 |

|

| Cash and cash equivalents, beginning of period | 16,902 |

| 15,362 |

|

| Cash and cash equivalents, end of period | $ | 17,050 |

| $ | 16,462 |

|

| | |

The accompanying notes are an integral part of these consolidated financial statements. | | Effect of exchange rate on cash, cash equivalents and restricted cash | |

| Net decrease in cash, cash equivalents and restricted cash | |

| Cash, cash equivalents and restricted cash, beginning of period | |

| Cash, cash equivalents and restricted cash, end of period | |

The following table provides a reconciliation of cash and cash equivalents and restricted cash reported within the condensed consolidated balance sheets that sum to the total of the same such amounts shown above in the condensed consolidated statements of cash flows:

| | | | | | | | |

| (dollars in thousands) | March 31,

2024 | December 31,

2023 |

| Cash and cash equivalents | $ | 26,376 | | $ | 31,251 | |

| Restricted cash | 356,493 | | 697,006 | |

| Total cash, cash equivalents and restricted cash in the statement of cash flows | $ | 382,869 | | $ | 728,257 | |

| | |

| The accompanying notes are an integral part of these condensed consolidated financial statements. |

| | | | | | | | |

| | |

ThirdFirst Quarter 20172024 Form 10-Q | | 5 |

Blackbaud, Inc.

Condensed Consolidated Statements of Stockholders' Equity

(Unaudited)

|

| | | | | | | | | | | | | | | | | | | | |

Blackbaud, Inc. Consolidated statement of stockholders' equity (Unaudited) |

| (dollars in thousands) | Common stock | | Additional paid-in capital |

| Treasury stock |

| Accumulated other comprehensive loss |

| Retained earnings |

| Total stockholders' equity |

|

| Shares |

| Amount |

|

| Balance at December 31, 2016 | 57,672,401 |

| $ | 58 |

| $ | 310,452 |

| $ | (215,237 | ) | $ | (457 | ) | $ | 152,729 |

| $ | 247,545 |

|

| Net income | — |

| — |

| — |

| — |

| — |

| 35,224 |

| 35,224 |

|

| Payment of dividends | — |

| — |

| — |

| — |

| — |

| (17,299 | ) | (17,299 | ) |

| Exercise of stock options and stock appreciation rights and vesting of restricted stock units | 349,713 |

| — |

| 14 |

| — |

| — |

| — |

| 14 |

|

| Employee taxes paid for 259,321 withheld shares upon equity award settlement | — |

| — |

| — |

| (19,092 | ) | — |

| — |

| (19,092 | ) |

| Stock-based compensation | — |

| — |

| 31,010 |

| — |

| — |

| 45 |

| 31,055 |

|

| Restricted stock grants | 549,589 |

| 1 |

| — |

| — |

| — |

| — |

| 1 |

|

| Restricted stock cancellations | (68,016 | ) | — |

| — |

| — |

| — |

| — |

| — |

|

| Other comprehensive loss | — |

| — |

| — |

| — |

| (556 | ) | — |

| (556 | ) |

| Balance at September 30, 2017 | 58,503,687 |

| $ | 59 |

| $ | 341,476 |

| $ | (234,329 | ) | $ | (1,013 | ) | $ | 170,699 |

| $ | 276,892 |

|

| | | | | | | | |

| The accompanying notes are an integral part of these consolidated financial statements. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (dollars in thousands) | Common stock | | Treasury stock | | Additional

paid-in

capital | Accumulated other comprehensive income (loss) | Retained

earnings | Total

stockholders'

equity |

| Shares | Amount | | Shares | Amount | |

| Balance at December 31, 2023 | 69,188,304 | | $ | 69 | | | (15,562,864) | | $ | (591,557) | | | $ | 1,203,012 | | $ | (1,688) | | $ | 198,869 | | $ | 808,705 | |

| Net income | — | | — | | | — | | — | | | — | | — | | 5,246 | | 5,246 | |

| Purchase of treasury shares under stock repurchase program | — | | — | | | (2,954,211) | | (211,412) | | | (52,244) | | — | | — | | (263,656) | |

| Vesting of restricted stock units | 1,357,125 | | — | | | — | | — | | | — | | — | | — | | — | |

| Shares withheld to satisfy tax withholdings | — | | — | | | (720,189) | | (52,723) | | | — | | — | | — | | (52,723) | |

| Stock-based compensation | — | | — | | | — | | — | | | 33,570 | | — | | — | | 33,570 | |

| Restricted stock grants | 335,237 | | 2 | | | — | | — | | | — | | — | | — | | 2 | |

| Restricted stock cancellations | (19,159) | | — | | | — | | — | | | — | | — | | — | | — | |

| Other comprehensive income | — | | — | | | — | | — | | | — | | 2,910 | | — | | 2,910 | |

| Balance at March 31, 2024 | 70,861,507 | | $ | 71 | | | (19,237,264) | | $ | (855,692) | | | $ | 1,184,338 | | $ | 1,222 | | $ | 204,115 | | $ | 534,054 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (dollars in thousands) | Common stock | | Treasury stock | | Additional

paid-in

capital | Accumulated other comprehensive income | Retained

earnings | Total

stockholders'

equity |

| Shares | Amount | | Shares | Amount | |

| Balance at December 31, 2022 | 67,814,044 | | $ | 68 | | | (14,745,230) | | $ | (537,287) | | | $ | 1,075,264 | | $ | 8,938 | | $ | 197,049 | | $ | 744,032 | |

| Net loss | — | | — | | | — | | — | | | — | | — | | (14,701) | | (14,701) | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Vesting of restricted stock units | 954,147 | | — | | | — | | — | | | — | | — | | — | | — | |

| Shares withheld to satisfy tax withholdings | — | | — | | | (533,597) | | (30,990) | | | — | | — | | — | | (30,990) | |

| Stock-based compensation | — | | — | | | — | | — | | | 29,925 | | — | | — | | 29,925 | |

| Restricted stock grants | 427,941 | | 1 | | | — | | — | | | — | | — | | — | | 1 | |

| Restricted stock cancellations | (41,269) | | — | | | — | | — | | | — | | — | | — | | — | |

| Other comprehensive loss | — | | — | | | — | | — | | | — | | (8,534) | | — | | (8,534) | |

| Balance at March 31, 2023 | 69,154,863 | | $ | 69 | | | (15,278,827) | | $ | (568,277) | | | $ | 1,105,189 | | $ | 404 | | $ | 182,348 | | $ | 719,733 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

|

| | |

| The accompanying notes are an integral part of these condensed consolidated financial statements. |

|

| | | | | | | |

| 6 | | ThirdFirst Quarter 20172024 Form 10-Q |

Blackbaud, Inc.

Notes to consolidated financial statementsCondensed Consolidated Financial Statements

(Unaudited)

We are the world’s leading cloud software companyprovider exclusively dedicated to powering social good.impact. Serving the entirenonprofit and education sectors, companies committed to social good community—nonprofits, foundations, corporations, education institutions, healthcare institutionsresponsibility and individual change agents—we connect and empower organizationsmakers, our essential software is built to increase theiraccelerate impact through software, services, expertise and data intelligence. Our portfolio is tailored to the unique needs of vertical markets, with solutions forin fundraising, and CRM, marketing, advocacy, peer-to-peer fundraising,nonprofit financial management, digital giving, grantmaking, corporate social responsibility school management, ticketing, grantmaking, financial management, payment processing, and analytics. Serving the industry for more than three decades,education management. A remote-first company, we are headquartered in Charleston, South Carolina and have operations in the United States, Australia, Canada, Costa Rica and the United Kingdom. As of September 30, 2017, we had approximately 35,000 customers.Kingdom, supporting users in 100+ countries.

Unaudited condensed consolidated interim consolidated financial statements

The accompanying condensed consolidated interim consolidated financial statements have been prepared pursuant to the rules and regulations of the United States Securities and Exchange Commission ("SEC") for interim financial reporting. These condensed consolidated statements are unaudited and, in the opinion of management, include all adjustments (consisting of normal recurring adjustments and accruals) necessary to state fairly the consolidated balance sheets, consolidated statements of comprehensive income, consolidated statements of cash flows and consolidated statements of stockholders’ equity, for the periods presented in accordance with accounting principles generally accepted in the United States ("U.S.") ("GAAP"). The condensed consolidated balance sheet at December 31, 2016,2023 has been derived from the audited consolidated financial statements at that date. Operating results and cash flows for the ninethree months ended September 30, 2017March 31, 2024 are not necessarily indicative of the results that may be expected for the fiscal year ending December 31, 2017,2024, or any other future period. Certain information and footnote disclosures normally included in annual financial statements prepared in accordance with GAAP have been omitted in accordance with the rules and regulations for interim reporting of the SEC. These unaudited, condensed consolidated interim consolidated financial statements should be read in conjunction with the consolidated financial statements and notes thereto included in our Annual Report on Form 10-K for the year ended December 31, 2016,2023, and other forms filed with the SEC from time to time.

Reclassifications

Due to the insignificance of our revenue from "license fees and other," we have combined that revenue with our "services" revenue beginning in 2017. In order to provide comparability between periods presented, "services" and "license fees and other" have been combined within "services and other" in the previously reported consolidated statements of comprehensive income to conform to presentation of the current period. Similarly, "cost of services" and "cost of license fees and other" have been combined within "cost of services and other" in the previously reported consolidated statements of comprehensive income to conform to presentation of the current period.

Basis of consolidation

The unaudited, condensed consolidated financial statements include the accounts of Blackbaud, Inc. and its wholly-ownedwholly owned subsidiaries. All intercompany balances and transactions have been eliminated in consolidation.

Recently adopted accounting pronouncementsReportable segment

In May 2017,We report our operating results and financial information in one operating and reportable segment. Our chief operating decision maker uses consolidated financial information to make operating decisions, assess financial performance and allocate resources. Our chief operating decision maker is our chief executive officer.

Use of estimates

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the FASB issued ASU 2017-09, Compensation-Stock Compensation (Topic 718) - Scopereported amounts of Modification Accounting ("ASU 2017-09"), which provides guidance about which changes toassets and liabilities and disclosure of contingent assets and liabilities at the terms or conditions of a share-based payment award require an entity to apply modification accounting in Topic 718. Under ASU 2017-09, modification accounting is required only if the fair value, the vesting conditions, or the classificationdate of the award (as equityfinancial statements, as well as the reported amounts of revenues and expenses during the reporting periods. On an ongoing basis, we reconsider and evaluate our estimates and assumptions, including those that impact revenue recognition, long-lived and intangible assets, income taxes, business combinations, stock-based compensation, capitalization of software and content development costs, our allowances for credit losses and sales returns, costs of obtaining contracts, valuation of derivative instruments, loss contingencies and insurance recoveries, among others. Changes in the facts or liability)circumstances underlying these estimates could result in material changes as a result of the change in terms or conditions. ASU 2017-09 is effective for all companies for annual and interim periods beginning after December 15, 2017, with early adoption permitted in any interim period for reporting periods for

actual results could materially differ from these estimates.

| | | | | | | | |

| | |

ThirdFirst Quarter 20172024 Form 10-Q | | 7 |

Blackbaud, Inc.

Notes to consolidated financial statements (continued)Condensed Consolidated Financial Statements

(Unaudited)

Recently issued accounting pronouncements

which financial statements have not been issued. ASU 2017-09 should be applied prospectively to an award modified on or after the adoption date. We early adopted ASU 2017-09 as of April 1, 2017. As this standard is prospective in nature, the impact to our financial statements will depend on the nature of our future award modifications.

In January 2017, the FASBThere are no recently issued ASU 2017-01, Business Combinations (Topic 805) Clarifying the Definition of a Business ("ASU 2017-01"), which provides a screen to determine when an integrated set of assets and activities is not a business. The screen requiresaccounting pronouncements that when substantially all of the fair value of the gross assets acquired (or disposed of) is concentrated in a single identifiable asset or a group of similar identifiable assets, the set is not a business. ASU 2017-01 is effective for annual and interim periods beginning after December 15, 2017, with early adoption permitted, and applied prospectively. We early adopted ASU 2017-01 as of July 1, 2017 and do notwe expect the standard to have a material impact on our consolidated financial statements.statements when adopted in the future.

In January 2017,Summary of significant accounting policies

There have been no material changes to our significant accounting policies described in our Annual Report on Form 10-K for the FASB issued ASU 2017-04, Intangibles - Goodwill and Other (Topic 350): Simplifyingyear ended December 31, 2023, filed with the Accounting for Goodwill Impairment("ASU 2017-04"),SEC on February 21, 2024.

| | |

| 3. Business Combinations and Dispositions |

2024 Disposition

On March 2, 2024, we completed a transaction to divest our U.K.-based creative services business EVERFI Limited, formerly a wholly-owned subsidiary of EVERFI Inc, which removes the requirement to performis a hypothetical purchase price allocation to measure goodwill impairment. A goodwill impairment will now be the amount by which a reporting unit’s carrying value exceeds its fair value, not to exceed the carryingwholly-owned subsidiary of Blackbaud, Inc. EVERFI Limited's total revenue during 2023 was $8.4 million. We incurred an insignificant amount of goodwill. ASU 2017-04 is effective for annual and interim periods beginning after December 15, 2019,legal costs associated with early adoption permitted, and applied prospectively. We early adopted ASU 2017-04 as of July 1, 2017 for use in our fourth quarter annual goodwill impairment testing and do not expect the standard to have a material impact on our consolidated financial statements.

Recently issued accounting pronouncements

In November 2016, the FASB issued ASU 2016-18, Statement of Cash Flows (Topic 230) - Restricted Cash ("ASU 2016-18"), which requires entities to show the changes in the total of cash, cash equivalents, restricted cash and restricted cash equivalents in the statement of cash flows. ASU 2016-18 is effective for annual periods beginning after December 15, 2017, including interim periods within those periods. Early adoption is permitted, including adoption in an interim period, but any adjustments must be reflected as of the beginning of the fiscal year that includes that interim period. The new standard must be adopted retrospectively. We are currently evaluating the impactdisposition of this standard on our consolidated statements of cash flows.

In February 2016, the FASB issued ASU 2016-02, Leases (Topic 842) (ASU 2016-02). ASU 2016-02 will require lessees to record most leases on their balance sheets but recognize expenses in the income statement in a manner similar to current guidance. The updated guidance also eliminates certain real estate-specific provisions and changes the guidance on sale-leaseback transactions, initial direct costs and lease executory costs for all entities. For lessors, the standard modifies the classification criteria and the accounting for sales-type and direct financing leases. All entities will classify leases to determine how to recognize lease-related revenue and expense. Classification will continue to affect amounts that lessors record on the balance sheet. ASU 2016-02 is effective for annual periods beginning after December 15, 2018, and interim periods within those years. Early adoption is permitted. Upon adoption, entities will be required to use a modified retrospective approach for leases that exist or are entered into after the beginning of the earliest comparative period in the financial statements. The modified retrospective approach includes a number of optional practical expedients that entities may elect to apply. We expect ASU 2016-02 will impact our consolidated financial statements and are currently evaluating the extent of the impact that implementation of this standard will have on adoption.

In May 2014, the FASB issued ASU 2014-09, Revenue from Contracts with Customers (Topic 606) (ASU 2014-09). ASU 2014-09 outlines a single comprehensive model for entities to use in accounting for revenue arising from contracts with customers. The standard also provides guidance on the recognition of costs related to obtaining customer contracts. ASU 2014-09 will replace most existing revenue recognition guidance in GAAP when it becomes effective and permits the use of either the retrospective or cumulative effect transition method. ASU 2014-09 will be effective for us beginning in the first quarter of 2018 and we anticipate using the full retrospective transition method. We are currently evaluating the impact that the adoption of ASU 2014-09 will have on our consolidated financial statements and related disclosures. As a result of our evaluation to date, we expect that ASU 2014-09 will generally result in the deferral of more costs to obtain a contract over a longer period using the expected period of benefit as compared with our current practice of using our average initial contract term. We also anticipate incremental disclosures, including, but not limited to, the opening and closing balances of contract assets and liabilities, revenue recognized in the reporting period that was included in the contract liability balance at the beginning of the period, and the aggregate amount of the transaction price allocated to remaining performance obligations at the end of each reporting period including when we expect to recognize that amount.

|

| | |

8 | | Third Quarter 2017 Form 10-Q |

Blackbaud, Inc.

Notes to consolidated financial statements (continued)

(Unaudited)

AcademicWorks acquisition

On April 3, 2017, we acquired all of the outstanding shares of capital stock, including all voting equity interests, of AcademicWorks, Inc., a Texas corporation ("AcademicWorks"), pursuant to a stock purchase agreement. AcademicWorks is the market leader in scholarship management for higher education and K-12 institutions, foundations, and grant-making institutions. The acquisition extends our offerings for our higher education, K-12, and corporate and foundation customers. We acquired AcademicWorks for $52.1 million in cash, net of closing adjustments. We financed the acquisition through a draw down of a revolving credit loan under our then-existing credit facility.business. As a result of the acquisition, AcademicWorks has becomedisposition, we recorded a wholly-owned subsidiary of ours. The operating results of AcademicWorks have been included in our consolidated financial statements within our EMG and GMG reportable segments (as defined in Note 14 below) from the date of acquisition. During the three and nine months ended September 30, 2017, we incurred insignificant acquisition-related expenses associated with the acquisition of AcademicWorks,$1.6 million loss, which werewas recorded in general and administrative expense.

The fair values assigned to the assets acquired and liabilities assumedexpense in the table below are based on our best estimates and assumptions asunaudited, condensed consolidated statement of comprehensive income for the reporting date and are considered preliminary pending finalization. The estimates and assumptions are subject to change as we obtain additional information during the measurement period, which may be up to one year from the acquisition date. The assets and liabilities, pending finalization, include the valuation of acquired finite-lived intangible assets as well as the assumed deferred revenue and deferred income tax balances.three months ended March 31, 2024.

|

| | | |

| (in thousands) | Purchase price allocation |

|

| Net working capital, excluding deferred revenue | $ | 2,949 |

|

| Property and equipment | 290 |

|

| Finite-lived intangible assets | 30,900 |

|

| Deferred revenue | (3,950 | ) |

| Deferred tax liability | (12,350 | ) |

| Goodwill | 34,305 |

|

| Total purchase price | $ | 52,144 |

|

The estimated fair value of accounts receivable acquired approximates the contractual value of $1.0 million. The estimated goodwill recognized is attributable primarily to the opportunities for expected synergies from combining operations and the assembled workforce of AcademicWorks, with $20.6 million and $13.7 million assigned to our EMG and GMG reportable segments, respectively. None of the goodwill arising in the acquisition is deductible for income tax purposes.

The AcademicWorks acquisition resulted in the identification of the following identifiable finite-lived intangible assets: |

| | | | |

| | Intangible assets acquired |

| Weighted average amortization period |

| AcademicWorks | (in thousands) |

| (in years) |

| Acquired technology | $ | 22,500 |

| 9 |

| Customer relationships | 8,000 |

| 15 |

| Marketing assets | 320 |

| 2 |

| Non-compete agreements | 80 |

| 3 |

| Total intangible assets | $ | 30,900 |

| 10 |

The estimated fair values of the finite-lived intangible assets were based on variations of the income approach, which estimates fair value based upon the present value of cash flows that the assets are expected to generate, and which included the relief-from-royalty method, incremental cash flow method, including the comparative (with and without) method and multi-period excess earnings method, depending on the intangible asset being valued. The method of amortization of

| | |

| | |

Third Quarter 2017 Form 10-Q | | 9 |

Blackbaud, Inc.

Notes to consolidated financial statements (continued)

(Unaudited)

identifiable finite-lived intangible assets is based on the expected pattern in which the estimated economic benefits of the respective assets are consumed or otherwise used up. Customer relationships and acquired technology are being amortized on an accelerated basis. Marketing assets and non-compete agreements are being amortized on a straight-line basis.

We determined that the impact of this acquisition was not material to our consolidated financial statements; therefore, revenue and earnings since the acquisition date and pro forma information are not required or presented.

|

|

4. Goodwill and Other Intangible Assets |

The change in goodwill for each reportable segment (as defined in Note 14 below) during the nine months ended September 30, 2017, consisted of the following:

|

| | | | | | | | | | | | |

| (dollars in thousands) | EMG | GMG | IMG | Total |

| Balance at December 31, 2016 | $ | 241,334 |

| $ | 192,238 |

| $ | 4,668 |

| $ | 438,240 |

|

Additions related to current year business combination(1) | 20,583 |

| 13,722 |

| — |

| 34,305 |

|

Adjustments related to prior year business combination(2) | (29 | ) | (58 | ) | (1 | ) | (88 | ) |

| Effect of foreign currency translation | — |

| — |

| 319 |

| 319 |

|

| Balance at September 30, 2017 | $ | 261,888 |

| $ | 205,902 |

| $ | 4,986 |

| $ | 472,776 |

|

| |

(1) | See Note 3 to these consolidated financial statements for details regarding our acquisition of AcademicWorks.

|

| |

(2) | The change in goodwill was related to a post-closing working capital adjustment associated with the prior year acquisition of Good+Geek, Inc. ("Attentive.ly"), as well as an immaterial measurement period adjustment. |

|

|

5. Earnings (Loss) Per Share |

We compute basic earnings (loss) per share by dividing net income (loss) available to common stockholders by the weighted average number of common shares outstanding during the period. Diluted earnings (loss) per share is computed by dividing net income (loss) available to common stockholders by the weighted average number of common shares and dilutive potential common shares outstanding during the period. Diluted earnings (loss) per share reflectreflects the assumed exercise, settlement and vesting of all dilutive securities using the “treasury stock method” except when the effect is anti-dilutive. Potentially dilutive securities consist of shares issuable upon the exercise of stock options, settlement of stock appreciation rights and vesting of restricted stock awards and units.

|

| | |

10 | | Third Quarter 2017 Form 10-Q |

Blackbaud, Inc.

Notes to consolidated financial statements (continued)

(Unaudited)

potentially dilutive securities was anti-dilutive.

The following table sets forth the computation of basic and diluted earnings (loss) per share:

|

| | | | | | | | | | | | | |

| | Three months ended

September 30, | | | Nine months ended

September 30, | |

| (dollars in thousands, except per share amounts) | 2017 |

| 2016 |

| | 2017 |

| 2016 |

|

| Numerator: | | | | | |

| Net income | $ | 12,548 |

| $ | 8,934 |

| | $ | 35,224 |

| $ | 24,231 |

|

| Denominator: | | | | | |

| Weighted average common shares | 46,711,709 |

| 46,159,956 |

| | 46,627,213 |

| 46,078,306 |

|

| Add effect of dilutive securities: | | | | | |

| Stock-based awards | 1,135,288 |

| 1,234,150 |

| | 1,051,890 |

| 1,190,163 |

|

| Weighted average common shares assuming dilution | 47,846,997 |

| 47,394,106 |

| | 47,679,103 |

| 47,268,469 |

|

| Earnings per share: | | | | | |

| Basic | $ | 0.27 |

| $ | 0.19 |

| | $ | 0.76 |

| $ | 0.53 |

|

| Diluted | $ | 0.26 |

| $ | 0.19 |

| | $ | 0.74 |

| $ | 0.51 |

|

| | | | | | |

| Anti-dilutive shares excluded from calculations of diluted earnings per share | 1,719 |

| 1,723 |

| | 4,938 |

| 3,766 |

|

| | | | | | | | | | | |

| | | | Three months ended March 31, |

| (dollars in thousands, except per share amounts) | | | | 2024 | 2023 |

| Numerator: | | | | | |

| Net income (loss) | | | | $ | 5,246 | | $ | (14,701) | |

| Denominator: | | | | | |

| Weighted average common shares | | | | 52,052,370 | | 52,132,999 | |

| Add effect of dilutive securities: | | | | | |

| Restricted stock and units | | | | 1,362,125 | | — | |

| Weighted average common shares assuming dilution | | | | 53,414,495 | | 52,132,999 | |

| Earnings (loss) per share | | | | | |

| Basic | | | | $ | 0.10 | | $ | (0.28) | |

| Diluted | | | | $ | 0.10 | | $ | (0.28) | |

| | | | | |

| Anti-dilutive shares excluded from calculations of diluted earnings (loss) per share | | | | 622,902 | | 1,638,453 | |

| | | | | | | | |

| 8 | | First Quarter 2024 Form 10-Q |

Blackbaud, Inc.

Notes to Condensed Consolidated Financial Statements

(Unaudited)

| | |

6.5. Fair Value Measurements |

We use a three-tier fair value hierarchy to measure fair value. This hierarchy prioritizes the inputs into three broad levels as follows:

•Level 1 - Quoted prices for identical assets or liabilities in active markets;

•Level 2 - Quoted prices for similar assets and liabilities in active markets, quoted prices for identical or similar assets in markets that are not active, and model-derived valuations in which all significant inputs and significant value drivers are observable in active markets; and

•Level 3 - Valuations derived from valuation techniques in which one or more significant inputs are unobservable.

|

| | |

Third Quarter 2017 Form 10-Q | | 11 |

Blackbaud, Inc.

Notes to consolidated financial statements (continued)

(Unaudited)

Recurring fair value measurements

Financial assets and liabilities that are measured at fair value on a recurring basis consisted of the following, as of the dates indicated below:

| | | | | | | | | | | | | | | | | | | | | | | |

| Fair value measurement using | | |

| (dollars in thousands) | Quoted Prices in Active Markets for Identical Assets and Liabilities

(Level 1) | | Significant Other Observable Inputs

(Level 2) | | Significant Unobservable Inputs

(Level 3) | | Total |

| Fair value as of March 31, 2024 | | | | | | | |

| Financial assets: | | | | | | | |

| Interest rate swaps | $ | — | | | $ | 16,293 | | | $ | — | | | $ | 16,293 | |

| Foreign currency forward contracts | — | | | 260 | | | — | | | 260 | |

| Total financial assets | $ | — | | | $ | 16,553 | | | $ | — | | | $ | 16,553 | |

| | | | | | | |

| Fair value as of March 31, 2024 | | | | | | | |

| Financial liabilities: | | | | | | | |

| | | | | | | |

| Foreign currency forward contracts | $ | — | | | $ | 92 | | | $ | — | | | $ | 92 | |

| Contingent consideration obligations | — | | | — | | | 1,403 | | | 1,403 | |

| Total financial liabilities | $ | — | | | $ | 92 | | | $ | 1,403 | | | $ | 1,495 | |

| | | | | | | |

| Fair value as of December 31, 2023 | | | | | | | |

| Financial assets: | | | | | | | |

| Interest rate swaps | $ | — | | | $ | 16,198 | | | $ | — | | | $ | 16,198 | |

| Foreign currency forward contracts | — | | | — | | | — | | | — | |

| Total financial assets | $ | — | | | $ | 16,198 | | | $ | — | | | $ | 16,198 | |

| | | | | | | |

| Fair value as of December 31, 2023 | | | | | | | |

| Financial liabilities: | | | | | | | |

| Interest rate swaps | $ | — | | | $ | 5,004 | | | $ | — | | | $ | 5,004 | |

| Foreign currency forward contracts | — | | | 536 | | | — | | | 536 | |

| Contingent consideration obligations | — | | | — | | | 1,403 | | | 1,403 | |

| Total financial liabilities | $ | — | | | $ | 5,540 | | | $ | 1,403 | | | $ | 6,943 | |

|

| | | | | | | | | | | | | | | |

| | Fair value measurement using | | |

| (dollars in thousands) | Level 1 |

| | Level 2 |

| | Level 3 |

| | Total |

|

| Fair value as of September 30, 2017 | | | | | | | |

| Financial assets: | | | | | | | |

| Derivative instruments | $ | — |

| | $ | 223 |

| | $ | — |

| | $ | 223 |

|

| Total financial assets | $ | — |

| | $ | 223 |

| | $ | — |

| | $ | 223 |

|

| | | | | | | | |

| Fair value as of September 30, 2017 | | | | | | | |

| Financial liabilities: | | | | | | | |

| Derivative instruments | $ | — |

| | $ | 369 |

| | $ | — |

| | $ | 369 |

|

| Total financial liabilities | $ | — |

| | $ | 369 |

| | $ | — |

| | $ | 369 |

|

| | | | | | | | |

| Fair value as of December 31, 2016 | | | | | | | |

| Financial assets: | | | | | | | |

| Derivative instruments | $ | — |

| | $ | 206 |

| | $ | — |

| | $ | 206 |

|

| Total financial assets | $ | — |

| | $ | 206 |

| | $ | — |

| | $ | 206 |

|

| | | | | | | | |

| Fair value as of December 31, 2016 | | | | | | | |

| Financial liabilities: | | | | | | | |

| Derivative instruments | $ | — |

| | $ | 163 |

| | $ | — |

| | $ | 163 |

|

| Total financial liabilities | $ | — |

| | $ | 163 |

| | $ | — |

| | $ | 163 |

|

| | | | | | | | |

| First Quarter 2024 Form 10-Q | | 9 |

Blackbaud, Inc.

Notes to Condensed Consolidated Financial Statements

(Unaudited)

Our derivative instruments within the scope of ASCAccounting Standards Codification ("ASC") 815, Derivatives and Hedging, are required to be recorded at fair value. Our derivative instruments that are recorded at fair value include interest rate swaps as well asand foreign currency forward and option contracts. See Note 8 to these unaudited, condensed consolidated financial statements for additional information about our derivative instruments.

The fair value of our interest rate swaps wasand foreign currency forward contracts are based on model-driven valuations using LIBORSecured Overnight Financing Rate ("SOFR") rates and foreign currency forward rates, respectively, which are observable at commonly quoted intervals. Accordingly, our interest rate swaps and foreign currency forward contracts are classified within Level 2 of the fair value hierarchy.

Our foreign currency forwardContingent consideration obligations arise from business acquisitions. The fair values are based on discounted cash flow analyses reflecting a probability-weighted assessment approach derived from the likelihood of possible achievement of specified performance measures or events and option contracts are valued using standard calculations/models that use as their basis readily observable market parameters including, foreign currency exchange rates, volatilities,captures the contractual nature of the contingencies, commercial risk, and interest rates. Therefore,the time value of money. As the fair value measurements for our foreign currency forward and option contractscontingent consideration obligations contain significant unobservable inputs, they are classified within Level 23 of the fair value hierarchy.

We believe the carrying amounts of our cash and cash equivalents, restricted cash, due to customers, accounts receivable, trade accounts payable, accrued expenses and other current liabilities and due to customers approximate their fair values at September 30, 2017March 31, 2024 and December 31, 2016,2023, due to the immediate or short-term maturity of these instruments.

We believe the carrying amount of our debt approximates its fair value at September 30, 2017March 31, 2024 and December 31, 2016,2023, as the debt bears interest rates that approximate market value. As LIBORSOFR rates are observable at commonly quoted intervals, our debt under the 2020 Credit Facility (as defined below) is classified within Level 2 of the fair value hierarchy. The fair value of our fixed rate debt does not exceed the carrying amount.

We did not transfer any assets or liabilities among the levels within the fair value hierarchy during the ninethree months ended September 30, 2017. Additionally, we did not hold any Level 3 assets or liabilities during the nine months ended September 30, 2017.

|

| | |

12 | | Third Quarter 2017 Form 10-Q |

Blackbaud, Inc.

Notes to consolidated financial statements (continued)

(Unaudited)

March 31, 2024.

Non-recurring fair value measurements

Assets and liabilities that are measured at fair value on a non-recurring basis include long-lived assets, intangible assets, goodwill and goodwill, whichoperating lease right-of-use ("ROU") assets. These assets are recognized at fair value during the period in which an acquisition is completed or at lease commencement, from updated estimates and assumptions during the measurement period, or when they are considered to be impaired. These non-recurring fair value measurements, primarily for long-lived assets, intangible assets acquired and operating lease ROU assets, are based on Level 3 unobservable inputs. In the event of an impairment, we determine the fair value of thethese assets other than goodwill and intangible assets using a discounted cash flow approach, which contains significant unobservable inputs and, therefore, is considered a Level 3 fair value measurement. The unobservable inputs in the analysis generally include future cash flow projections and a discount rate. For goodwill impairment testing, we estimate fair value using market-based methods including the use of market capitalization and consideration of a control premium.

There were no significant non-recurring fair value adjustments to our long-lived assets, intangible assets, goodwill and goodwilloperating lease ROU assets during the ninethree months ended September 30, 2017, except for an insignificant business combination accounting adjustment to the initial fair value estimates of the Attentive.ly assets acquired and liabilities assumed at the acquisition date from updated information obtained during the measurement period. See Note 4 to these consolidated financial statements for additional details. The measurement period of a business combination may be up to one year from the acquisition date. We record any measurement period adjustments to the fair value of assets acquired and liabilities assumed, with the corresponding offset to goodwill.March 31, 2024.

| | |

|

7.6. Consolidated Financial Statement Details |

Restricted cash

| | | | | | | | |

| (dollars in thousands) | March 31,

2024 | December 31,

2023 |

| Restricted cash due to customers | $ | 355,307 | | $ | 695,489 | |

| | |

| Real estate escrow balances and other | 1,186 | | 1,517 | |

| Total restricted cash | $ | 356,493 | | $ | 697,006 | |

| | | | | | | | |

| 10 | | First Quarter 2024 Form 10-Q |

Blackbaud, Inc.

Notes to Condensed Consolidated Financial Statements

(Unaudited)

Prepaid expenses and other assets

| | | | | | | | |

| (dollars in thousands) | March 31,

2024 | December 31,

2023 |

Costs of obtaining contracts(1)(2) | $ | 61,313 | | $ | 62,377 | |

Prepaid software maintenance and subscriptions(3) | 34,668 | | 35,169 | |

| Derivative instruments | 16,553 | | 16,198 | |

Implementation costs for cloud computing arrangements, net(4)(5) | 9,792 | | 9,259 | |

| Prepaid insurance | 8,617 | | 3,940 | |

| Unbilled accounts receivable | 6,432 | | 5,615 | |

| Taxes, prepaid and receivable | 3,407 | | 3,418 | |

| Deferred tax assets | 617 | | 644 | |

| Other assets | 13,073 | | 13,702 | |

| Total prepaid expenses and other assets | 154,472 | | 150,322 | |

| Less: Long-term portion | 59,883 | | 51,037 | |

| Prepaid expenses and other current assets | $ | 94,589 | | $ | 99,285 | |

(1)Amortization expense from costs of obtaining contracts was $4.8 million and $8.3 million for the three months ended March 31, 2024 and 2023, respectively.

(2)The current portion of costs of obtaining contracts as of March 31, 2024 and December 31, 2023 was $18.8 million and $25.3 million, respectively.

(3)The current portion of prepaid software maintenance and subscriptions as of March 31, 2024 and December 31, 2023 was $31.6 million and $32.4 million, respectively.

(4)These costs primarily relate to the multi-year implementations of our new global enterprise resource planning and customer relationship management systems.

(5)Amortization expense from capitalized cloud computing implementation costs was insignificant for the three months ended March 31, 2024 and 2023, respectively. Accumulated amortization for these costs was $8.4 million and $7.7 million as of March 31, 2024 and December 31, 2023, respectively.

Accrued expenses and other liabilities

| | | | | | | | |

| (dollars in thousands) | March 31,

2024 | December 31,

2023 |

| Taxes payable | $ | 29,753 | | $ | 21,282 | |

Accrued legal costs(1) | 11,713 | | 3,659 | |

| Customer credit balances | 9,102 | | 10,238 | |

| Operating lease liabilities, current portion | 6,714 | | 6,701 | |

| Accrued commissions and salaries | 2,987 | | 4,413 | |

| Accrued health care costs | 2,387 | | 3,865 | |

| Accrued vacation costs | 2,349 | | 2,452 | |

| Accrued transaction-based costs related to payments services | 1,917 | | 4,323 | |

| Contingent consideration liability | 1,403 | | 1,403 | |

| Derivative instruments | 92 | | 5,540 | |

| | |

| | |

| Other liabilities | 11,017 | | 10,704 | |

| Total accrued expenses and other liabilities | 79,434 | | 74,580 | |

| Less: Long-term portion | 4,163 | | 10,258 | |

| Accrued expenses and other current liabilities | $ | 75,271 | | $ | 64,322 | |

|

| | | | | | |

| (dollars in thousands) | September 30,

2017 |

| December 31,

2016 |

|

| Accrued bonuses | $ | 14,581 |

| $ | 19,217 |

|

| Accrued commissions and salaries | 5,429 |

| 9,352 |

|

| Lease incentive obligations | 4,780 |

| 5,604 |

|

| Customer credit balances | 5,246 |

| 5,148 |

|

| Deferred rent liabilities | 4,400 |

| 4,110 |

|

| Taxes payable | 2,584 |

| 3,452 |

|

| Unrecognized tax benefit | 3,609 |

| 3,295 |

|

| Accrued subscriptions | 2,638 |

| 2,840 |

|

| Accrued vacation costs | 2,626 |

| 2,214 |

|

| Accrued health care costs | 2,479 |

| 1,495 |

|

| Other liabilities | 5,077 |

| 6,002 |

|

| Total accrued expenses and other liabilities | 53,449 |

| 62,729 |

|

| Less: Long-term portion | 7,799 |

| 8,533 |

|

| Accrued expenses and other current liabilities | $ | 45,650 |

| $ | 54,196 |

|

Other income (expense), net

|

| | | | | | | | | | | | | |

| | Three months ended

September 30, | | | Nine months ended

September 30, | |

| (dollars in thousands) | 2017 |

| 2016 |

| | 2017 |

| 2016 |

|

| Components of Other Income (Expense), Net | | | | | |

| Interest income | $ | 393 |

| $ | 224 |

| | $ | 771 |

| $ | 463 |

|

| (Loss) gain on derivative instrument | (3 | ) | — |

| | 472 |

| — |

|

| Loss on debt extinguishment | (137 | ) | — |

| | (299 | ) | — |

|

| Other income (expense), net | 215 |

| (239 | ) | | 637 |

| (648 | ) |

| Other income (expense), net | $ | 468 |

| $ | (15 | ) | | $ | 1,581 |

| $ | (185 | ) |

(1)All accrued legal costs are classified as current. See Note 9 to these unaudited, condensed consolidated financial statements for additional information about our loss contingency accruals and other legal expenses.

| | | | | | | | |

| | |

ThirdFirst Quarter 20172024 Form 10-Q | | 1311 |

Blackbaud, Inc.

Notes to consolidated financial statements (continued)Condensed Consolidated Financial Statements

(Unaudited)

Other income, net

| | | | | | | | | | | |

| | | Three months ended March 31, |

| (dollars in thousands) | | | | 2024 | 2023 |

| Interest income | | | | $ | 2,048 | | $ | 1,236 | |

| Currency revaluation gains (losses) | | | | 283 | | (245) | |

| Other income, net | | | | 1,016 | | 1,016 | |

| Other income, net | | | | $ | 3,347 | | $ | 2,007 | |

| | | | | |

| | | | | |

The following table summarizes our debt balances and the related weighted average effective interest rates, which includes the effect of interest rate swap agreements.

| | | | | | | | | | | | | | | | | |

| Debt balance at | | Weighted average

effective interest rate at |

| (dollars in thousands) | March 31,

2024 | December 31,

2023 | | March 31,

2024 | December 31,

2023 |

| Credit facility: | | | | | |

| Revolving credit loans | $ | 379,000 | | $ | 114,100 | | | 7.10 | % | 7.52 | % |

| Term loans | 603,438 | | 607,500 | | | 3.48 | % | 3.51 | % |

| Real estate loans | 56,364 | | 56,745 | | | 5.22 | % | 5.22 | % |

| Other debt | 2,231 | | 2,800 | | | 8.50 | % | 8.42 | % |

| Total debt | 1,041,033 | | 781,145 | | | 4.90 | % | 4.24 | % |

| Less: Unamortized discount and debt issuance costs | 1,211 | | 1,481 | | | | |

| Less: Debt, current portion | 19,302 | | 19,259 | | | 6.99 | % | 7.02 | % |

| Debt, net of current portion | $ | 1,020,520 | | $ | 760,405 | | | 4.86 | % | 4.17 | % |

|

| | | | | | | | | | | |

| | Debt balance at | | | Weighted average effective interest rate at | |

| (dollars in thousands) | September 30,

2017 |

| December 31,

2016 |

| | September 30,

2017 |

| December 31,

2016 |

|

| Credit facility: | | | | | |

| Revolving credit loans | $ | 39,900 |

| $ | 180,900 |

| | 3.38 | % | 2.36 | % |

| Term loans | 298,125 |

| 162,969 |

| | 2.64 | % | 2.62 | % |

| Other debt | 2,151 |

| — |

| | 4.50 | % | — | % |

| Total debt | 340,176 |

| 343,869 |

| | 2.74 | % | 2.48 | % |

| Less: Unamortized discount and debt issuance costs | 2,220 |

| 1,476 |

| | | |

| Less: Debt, current portion | 8,576 |

| 4,375 |

| | 2.74 | % | 2.50 | % |

| Debt, net of current portion | $ | 329,380 |

| $ | 338,018 |

| | 2.74 | % | 2.48 | % |

Financing for AcademicWorks acquisition

As discussed in Note 3 to these consolidated financial statements, on April 3, 2017 we acquired AcademicWorks for $52.1 million in cash, net of closing adjustments. We financed the acquisition through a draw down of a revolving credit loan under the 2014 Credit Facility (defined below).

2017 refinancing

We were previously party to a $325.0 million five-year2020 credit facility entered into during February 2014. The credit facility included: a dollar and a designated currency revolving credit facility with sublimits for letters of credit and swingline loans (the “2014 Revolving Facility”) and a term loan facility (the “2014 Term Loan”), together, (the “2014 Credit Facility”).

In June 2017,October 2020, we entered into a five-year $700.0$900.0 million senior credit facility (the “2017"2020 Credit Facility”Facility"). The 2017 Credit Facility includes a $400.0 million revolving credit facility (the “2017 Revolving Facility”) and a $300.0 million term loan facility (the “2017 Term Loan”). Upon closing we drew $300.0 million on a term loan and $110.0 million in revolving credit loans, which was used to repay all amounts outstanding under the 2014 Credit Facility, fees and expenses incurred in connection with the 2017 Credit Facility, and for other general corporate purposes.

Certain lenders of the 2014 Term Loan participated in the 2017 Term Loan and the change in the present value of our future cash flows to these lenders under the 2014 Term Loan and under the 2017 Term Loan was less than 10%. Accordingly, we accounted for the refinancing event for these lenders as a debt modification. Certain lenders of the 2014 Term Loan did not participate in the 2017 Term Loan. Accordingly, we accounted for the refinancing event for these lenders as a debt extinguishment. Certain lenders of the 2014 Revolving Facility participated in the 2017 Revolving Facility and provided increased borrowing capacities. Accordingly, we accounted for the refinancing event for these lenders as a debt modification. Certain lenders of the 2014 Revolving Facility did not participate in the 2017 Revolving Facility. Accordingly, we accounted for the refinancing event for these lenders as a debt extinguishment.

We recorded an insignificant loss on debt extinguishment related to the write-off of debt discount and deferred financing costs for the portions of the 2014 Credit Facility considered to be extinguished. This loss was recognized in the consolidated statements of comprehensive income within other income (expense), net.

In connection with our entry into the 2017 Credit Facility, we paid $3.1 million in financing costs, of which $1.0 million was capitalized in other assets and, together with a portion of the unamortized deferred financing costs from the 2014 Credit Facility and prior facilities, are being amortized into interest expense ratably over the term of the new facility. As of September 30, 2017, deferred financing costs totaling $1.3 million were included in other assets on our consolidated balance sheets. As of DecemberAt March 31, 2016, deferred financing costs included in other assets on our consolidated balance sheets were insignificant. We recorded aggregate financing costs of $1.8 million as a direct deduction from the carrying

|

| | |

14 | | Third Quarter 2017 Form 10-Q |

Blackbaud, Inc.

Notes to consolidated financial statements (continued)

(Unaudited)

amount of our debt liability, which related to debt discount (fees paid to lenders) and debt issuance costs for the 2017 Term Loan.

Summary of the 2017 Credit Facility

The 2017 Revolving Facility includes (i) a $50.0 million sublimit available for the issuance of standby letters of credit, (ii) a $50.0 million sublimit available for swingline loans, and (iii) a $100.0 million sublimit available for multicurrency borrowings.

The 2017 Credit Facility is secured by the stock and limited liability company interests of certain of our subsidiaries and any of our material domestic subsidiaries.

Amounts borrowed under the dollar tranche revolving credit loans and term loan under the 2017 Credit Facility bear interest at a rate per annum equal to, at our option, (a) a base rate equal to the highest of (i) the prime rate announced by Bank of America, N.A., (ii) the Federal Funds Rate plus 0.50% and (iii) the Eurocurrency Rate (which varies depending on the currency in which the loan is denominated) plus 1.00% (the “Base Rate”), in addition to a margin of 0.00% to 0.75%, or (b) Eurocurrency Rate plus a margin of 1.00% to 1.75%.

We also pay a quarterly commitment fee on the unused portion of the 2017 Revolving Facility from 0.15% to 0.25% per annum, depending on our net leverage ratio. At September 30, 2017, the commitment fee was 0.20%.

The term loan under the 2017 Credit Facility requires periodic principal payments. The balance of the term loan and any amounts drawn on the revolving credit loans are due upon maturity of the 2017 Credit Facility in June 2022. We evaluate the classification of our debt as current or non-current based on the required annual maturities of the 2017 Credit Facility.

The 2017 Credit Facility includes financial covenants related to the net leverage ratio and interest coverage ratio, as well as restrictions on our ability to declare and pay dividends and our ability to repurchase shares of our common stock. At September 30, 2017,2024, we were in compliance with our debt covenants under the 20172020 Credit Facility.

Real estate loans

The 2017 Credit Facility also includes an option to request increases inIn August 2020, we completed the revolving commitments and/or request additional term loans in an aggregatepurchase of our global headquarters facility. As part of the purchase price, we assumed the seller’s obligations under two senior secured notes with a then-aggregate outstanding principal amount of up to $200.0$61.1 million plus an amount, if any, such that(collectively, the Net Leverage Ratio shall be no greater than 3.00 to 1.00.

“Real Estate Loans”). At March 31, 2024, we were in compliance with our debt covenants under the Real Estate Loans.

Other debt

In September 2017,From time to time, we enteredenter into a two-year $2.2 million agreement to finance our purchasethird-party financing agreements for purchases of software licenses and related services. The agreement is a non-interest bearing noteservices for our internal use. Generally, the agreements are non-interest-bearing notes requiring annual payments, with the first payment due in November 2017.payments. Interest associated with the notenotes is imputed at the rate we would incur for amounts borrowed under our then-existing credit facility at the 2017 Credit Facility.

Asinception of September 30, 2017, the required annual maturities related to the 2017 Credit Facility and other debt were as follows: |

| | | |

Years ending December 31, (dollars in thousands) | Annual maturities |

|

| 2017 - remaining | $ | 2,950 |

|

| 2018 | 8,576 |

|

| 2019 | 7,500 |

|

| 2020 | 7,500 |

|

| 2021 | 7,500 |

|

| Thereafter | 306,150 |

|

| Total required maturities | $ | 340,176 |

|

notes.

| | | | | | | | |

| 12 | | |

ThirdFirst Quarter 20172024 Form 10-Q | | 15 |

Blackbaud, Inc.

Notes to consolidated financial statements (continued)Condensed Consolidated Financial Statements

(Unaudited)

The following table summarizes our currently effective supplier financing agreements as of March 31, 2024:

| | | | | | | | | | | | | | |

| (dollars in thousands) | Term

in Months | Number of

Annual Payments | First Annual

Payment Due | Original Loan

Value |

Effective dates of agreements (1): | | | | |

| December 2022 | 39 | 3 | | January 2023 | $ | 1,710 | |

| January 2023 | 36 | 3 | | April 2023 | $ | 2,491 | |

| | | | |

| | | | |

(1)Represent noncash investing and financing transactions during the periods indicated as we purchased software and services by assuming directly related liabilities.

The changes in supplier financing obligations during the three months ended March 31, 2024, consisted of the following:

| | | | | |

| (dollars in thousands) | Total |

| Balance at December 31, 2023 | $ | 2,800 | |

9. Derivative InstrumentsAdditions | — | |

| Settlements | (569) | |

| Balance at March 31, 2024 | $ | 2,231 | |

Cash flow hedges

| | |

| 8. Derivative Instruments |