UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

|

| | | | |

| ☑ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended June 30, 2020March 31, 2021

or

|

| | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to .

Commission file number: 000-50600

Blackbaud, Inc.

(Exact name of registrant as specified in its charter)

| | | | | |

| |

| Delaware | 11-2617163 |

Delaware | 11-2617163 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

65 Fairchild Street

Charleston,, South Carolina29492

(Address of principal executive offices, including zip code)

(843) (843) 216-6200

(Registrant’s telephone number, including area code)

| | | | | | | | |

| | |

| | |

| Securities Registered Pursuant to Section 12(b) of the Act: |

| Title of Each Class | Trading Symbol(s) | Name of Each Exchange on which Registered |

| Common Stock, $0.001 Par Value | BLKB | Nasdaq Global Select Market |

| | |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (Section 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

|

| | | | | | | | | | | | | |

| Large accelerated filer | ☑ | | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ | | Smaller reporting company | ☐ |

| | | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ☐ No ☑

The number of shares of the registrant’s Common Stock outstanding as of July 29, 2020April 28, 2021 was 49,575,132.48,818,991.

TABLE OF CONTENTS

|

| | | | | | | |

SecondFirst Quarter 20202021 Form 10-Q | | 1 |

|

| | | | | | | |

| | CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS |

This Quarterly Report on Form 10-Q, including the documents incorporated herein by reference, contains forward-looking statements that anticipate results based on our estimates, assumptions and plans that are subject to uncertainty. These "forward-looking statements" are made subject to the safe-harbor provisions of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements consist of, among other things, specific and overall impacts of the COVID-19 global pandemic on our financial condition and results of operations and on the markets and communities in which we and our customers and partners operate, trend analyses, statements regarding future events, future financial performance, our anticipated growth, the effect of general economic and market conditions, our business strategy and our plan to build and grow our business, our operating results, our ability to successfully integrate acquired businesses and technologies, the effect of foreign currency exchange rate and interest rate fluctuations on our financial results, the impact of expensing stock-based compensation, the sufficiency of our capital resources, our ability to meet our ongoing debt and obligations as they become due, cybersecurity and data protection risks, and potential litigation involving us, all of which are based on current expectations, estimates, and forecasts, and the beliefs and assumptions of our management. Words such as “believes,” “seeks,” “expects,” “may,” “might,” “should,” “intends,” “could,” “would,” “likely,” “will,” “targets,” “plans,” “anticipates,” “aims,” “projects,” “estimates” or any variations of such words and similar expressions are also intended to identify such forward-looking statements. These forward-looking statements are subject to risks, uncertainties and assumptions that are difficult to predict. Accordingly, they should not be viewed as assurances of future performance, and actual results may differ materially and adversely from those expressed in any forward-looking statements.

Important factors that could cause actual results to differ materially from our expectations expressed in forward-looking statements include, but are not limited to, those summarized under “Part II, Item 1A. Risk factors” and elsewhere in this report, in our Annual Report on Form 10-K for the year ended December 31, 20192020 and in our other SEC filings. Forward-looking statements represent our management's beliefs and assumptions only as of the date of this Quarterly Report on Form 10-Q. We undertake no obligation to update or revise any forward-looking statements, or to update the reasons actual results could differ materially from those anticipated in any forward-looking statement, whether as a result of new information, future events or otherwise.

|

| | | | | | | |

| 2 | | SecondFirst Quarter 20202021 Form 10-Q |

|

| | | | | | | |

| | PART I. FINANCIAL INFORMATION |

ITEM 1. FINANCIAL STATEMENTS

|

| | | | | | |

Blackbaud, Inc. Condensed Consolidated Balance Sheets (Unaudited) |

| (dollars in thousands) | June 30,

2020 |

| December 31,

2019 |

|

| Assets | | |

| Current assets: | | |

| Cash and cash equivalents | $ | 30,531 |

| $ | 31,810 |

|

| Restricted cash due to customers | 421,915 |

| 545,485 |

|

| Accounts receivable, net of allowance of $9,025 and $5,529 at June 30, 2020 and December 31, 2019, respectively | 129,675 |

| 88,868 |

|

| Customer funds receivable | 1,284 |

| 524 |

|

| Prepaid expenses and other current assets | 83,699 |

| 67,852 |

|

| Total current assets | 667,104 |

| 734,539 |

|

| Property and equipment, net | 36,539 |

| 35,546 |

|

| Operating lease right-of-use assets | 95,575 |

| 104,400 |

|

| Software development costs, net | 106,044 |

| 101,302 |

|

| Goodwill | 630,687 |

| 634,088 |

|

| Intangible assets, net | 292,187 |

| 317,895 |

|

| Other assets | 68,673 |

| 65,193 |

|

| Total assets | $ | 1,896,809 |

| $ | 1,992,963 |

|

| Liabilities and stockholders’ equity | | |

| Current liabilities: | | |

| Trade accounts payable | $ | 41,029 |

| $ | 47,676 |

|

| Accrued expenses and other current liabilities | 52,893 |

| 73,317 |

|

| Due to customers | 423,199 |

| 546,009 |

|

| Debt, current portion | 9,194 |

| 7,500 |

|

| Deferred revenue, current portion | 332,570 |

| 314,335 |

|

| Total current liabilities | 858,885 |

| 988,837 |

|

| Debt, net of current portion | 478,919 |

| 459,600 |

|

| Deferred tax liability | 45,108 |

| 44,594 |

|

| Deferred revenue, net of current portion | 4,626 |

| 1,802 |

|

| Operating lease liabilities, net of current portion | 86,586 |

| 95,624 |

|

| Other liabilities | 11,883 |

| 5,742 |

|

| Total liabilities | 1,486,007 |

| 1,596,199 |

|

| Commitments and contingencies (see Note 9) |

|

|

| Stockholders’ equity: | | |

| Preferred stock; 20,000,000 shares authorized, none outstanding | — |

| — |

|

| Common stock, $0.001 par value; 180,000,000 shares authorized, 60,901,100 and 60,206,091 shares issued at June 30, 2020 and December 31, 2019, respectively | 61 |

| 60 |

|

| Additional paid-in capital | 491,450 |

| 457,804 |

|

| Treasury stock, at cost; 11,332,912 and 11,066,354 shares at June 30, 2020 and December 31, 2019, respectively | (311,661 | ) | (290,665 | ) |

| Accumulated other comprehensive loss | (14,476 | ) | (5,290 | ) |

| Retained earnings | 245,428 |

| 234,855 |

|

| Total stockholders’ equity | 410,802 |

| 396,764 |

|

| Total liabilities and stockholders’ equity | $ | 1,896,809 |

| $ | 1,992,963 |

|

| | | |

| The accompanying notes are an integral part of these condensed consolidated financial statements. |

| | | | | | | | |

Blackbaud, Inc.

Condensed Consolidated Balance Sheets

(Unaudited) |

| (dollars in thousands) | March 31,

2021 | December 31,

2020 |

| Assets | | |

| Current assets: | | |

| Cash and cash equivalents | $ | 27,753 | | $ | 35,750 | |

| Restricted cash | 255,158 | | 609,219 | |

| Accounts receivable, net of allowance of $10,361 and $10,292 at March 31, 2021 and December 31, 2020, respectively | 83,333 | | 95,404 | |

| Customer funds receivable | 945 | | 321 | |

| Prepaid expenses and other current assets | 98,095 | | 78,366 | |

| Total current assets | 465,284 | | 819,060 | |

| Property and equipment, net | 105,124 | | 105,177 | |

| Operating lease right-of-use assets | 20,055 | | 22,671 | |

| Software development costs, net | 113,624 | | 111,827 | |

| Goodwill | 637,113 | | 635,854 | |

| Intangible assets, net | 269,118 | | 277,506 | |

| Other assets | 74,022 | | 72,639 | |

| Total assets | $ | 1,684,340 | | $ | 2,044,734 | |

| Liabilities and stockholders’ equity | | |

| Current liabilities: | | |

| Trade accounts payable | $ | 35,274 | | $ | 27,836 | |

| Accrued expenses and other current liabilities | 53,013 | | 52,228 | |

| Due to customers | 254,947 | | 608,264 | |

| Debt, current portion | 12,875 | | 12,840 | |

| Deferred revenue, current portion | 290,025 | | 312,236 | |

| Total current liabilities | 646,134 | | 1,013,404 | |

| Debt, net of current portion | 537,924 | | 518,193 | |

| Deferred tax liability | 54,444 | | 54,086 | |

| Deferred revenue, net of current portion | 4,495 | | 4,678 | |

| Operating lease liabilities, net of current portion | 15,744 | | 17,357 | |

| Other liabilities | 9,439 | | 10,866 | |

| Total liabilities | 1,268,180 | | 1,618,584 | |

| Commitments and contingencies (see Note 9) | 0 | 0 |

| Stockholders’ equity: | | |

| Preferred stock; 20,000,000 shares authorized, 0ne outstanding | 0 | | 0 | |

| Common stock, $0.001 par value; 180,000,000 shares authorized, 61,595,276 and 60,904,638 shares issued at March 31, 2021 and December 31, 2020, respectively | 62 | | 61 | |

| Additional paid-in capital | 574,958 | | 544,963 | |

| Treasury stock, at cost; 12,760,956 and 12,054,268 shares at March 31, 2021 and December 31, 2020, respectively | (399,583) | | (353,091) | |

| Accumulated other comprehensive income (loss) | 4,163 | | (2,497) | |

| Retained earnings | 236,560 | | 236,714 | |

| Total stockholders’ equity | 416,160 | | 426,150 | |

| Total liabilities and stockholders’ equity | $ | 1,684,340 | | $ | 2,044,734 | |

| | |

| The accompanying notes are an integral part of these condensed consolidated financial statements. |

|

| | | | | | | |

SecondFirst Quarter 20202021 Form 10-Q | | 3 |

|

| | | | | | | | | | | | | |

Blackbaud, Inc. Condensed Consolidated Statements of Comprehensive Income (Unaudited) |

| | Three months ended

June 30, | | | Six months ended

June 30, | |

| (dollars in thousands, except per share amounts) | 2020 |

| 2019 |

| | 2020 |

| 2019 |

|

| Revenue | | | | | |

| Recurring | $ | 216,260 |

| $ | 208,468 |

| | $ | 421,127 |

| $ | 406,562 |

|

| One-time services and other | 15,731 |

| 17,166 |

| | 34,485 |

| 34,902 |

|

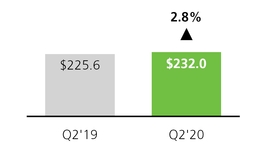

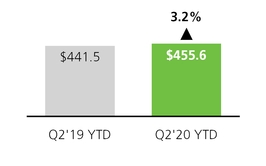

| Total revenue | 231,991 |

| 225,634 |

| | 455,612 |

| 441,464 |

|

| Cost of revenue | | | | | |

| Cost of recurring | 91,370 |

| 86,657 |

| | 180,921 |

| 171,368 |

|

| Cost of one-time services and other | 13,569 |

| 14,150 |

| | 28,883 |

| 28,722 |

|

| Total cost of revenue | 104,939 |

| 100,807 |

| | 209,804 |

| 200,090 |

|

| Gross profit | 127,052 |

| 124,827 |

| | 245,808 |

| 241,374 |

|

| Operating expenses | | | | | |

| Sales, marketing and customer success | 51,954 |

| 55,009 |

| | 110,689 |

| 110,464 |

|

| Research and development | 24,895 |

| 25,902 |

| | 49,872 |

| 54,363 |

|

| General and administrative | 29,842 |

| 28,543 |

| | 55,697 |

| 55,660 |

|

| Amortization | 729 |

| 1,152 |

| | 1,470 |

| 2,528 |

|

| Restructuring | 50 |

| 730 |

| | 74 |

| 2,683 |

|

| Total operating expenses | 107,470 |

| 111,336 |

| | 217,802 |

| 225,698 |

|

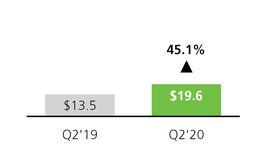

| Income from operations | 19,582 |

| 13,491 |

| | 28,006 |

| 15,676 |

|

| Interest expense | (3,893 | ) | (5,799 | ) | | (8,052 | ) | (11,122 | ) |

| Other income, net | 630 |

| 2,181 |

| | 1,700 |

| 2,363 |

|

| Income before provision for income taxes | 16,319 |

| 9,873 |

| | 21,654 |

| 6,917 |

|

| Income tax provision | 4,496 |

| 2,733 |

| | 5,192 |

| 899 |

|

| Net income | $ | 11,823 |

| $ | 7,140 |

| | $ | 16,462 |

| $ | 6,018 |

|

| Earnings per share | | | | | |

| Basic | $ | 0.25 |

| $ | 0.15 |

| | $ | 0.34 |

| $ | 0.13 |

|

| Diluted | $ | 0.24 |

| $ | 0.15 |

| | $ | 0.34 |

| $ | 0.13 |

|

| Common shares and equivalents outstanding | | | | | |

| Basic weighted average shares | 48,239,928 |

| 47,714,621 |

| | 48,138,125 |

| 47,622,740 |

|

| Diluted weighted average shares | 48,418,378 |

| 48,160,684 |

| | 48,465,077 |

| 48,101,212 |

|

| Other comprehensive loss | | | | | |

| Foreign currency translation adjustment | (887 | ) | (6,018 | ) | | (6,615 | ) | (1,428 | ) |

| Unrealized gain (loss) on derivative instruments, net of tax | 551 |

| (1,939 | ) | | (2,571 | ) | (2,871 | ) |

| Total other comprehensive loss | (336 | ) | (7,957 | ) | | (9,186 | ) | (4,299 | ) |

| Comprehensive income (loss) | $ | 11,487 |

| $ | (817 | ) | | $ | 7,276 |

| $ | 1,719 |

|

| | | | | | |

| The accompanying notes are an integral part of these condensed consolidated financial statements. |

| | | | | | | | | | | |

Blackbaud, Inc.

Condensed Consolidated Statements of Comprehensive Income

(Unaudited) |

| | | Three months ended

March 31, |

| (dollars in thousands, except per share amounts) | | | | 2021 | 2020 |

| Revenue | | | | | |

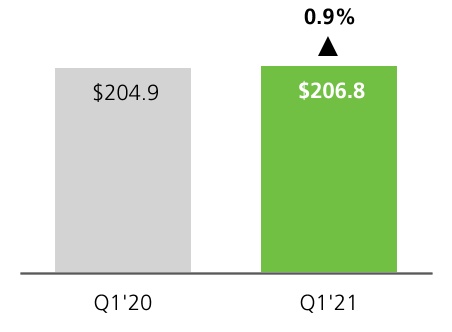

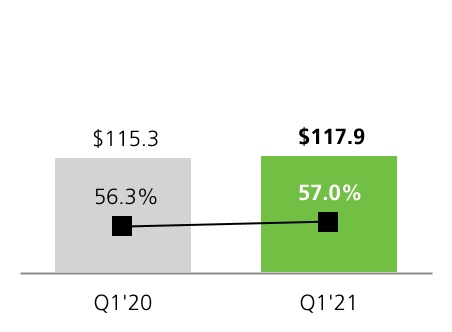

| Recurring | | | | $ | 206,750 | | $ | 204,867 | |

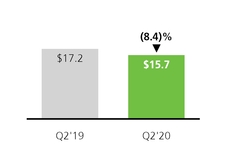

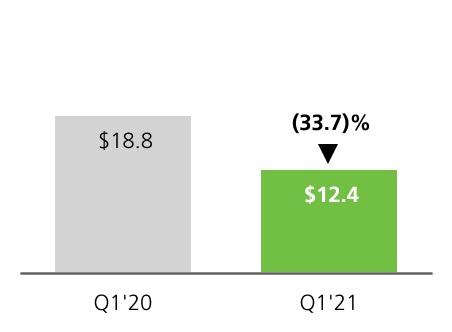

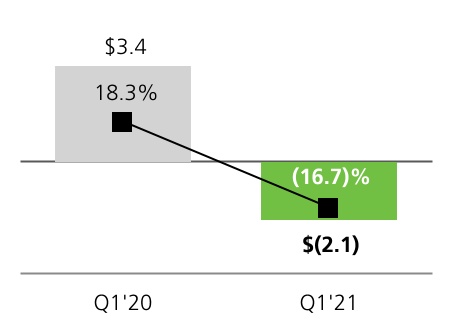

| One-time services and other | | | | 12,441 | | 18,754 | |

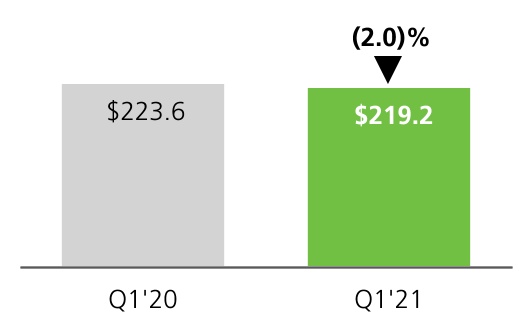

| Total revenue | | | | 219,191 | | 223,621 | |

| Cost of revenue | | | | | |

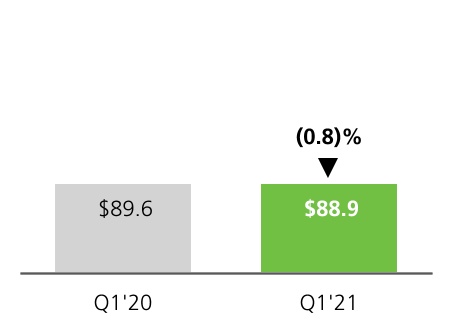

| Cost of recurring | | | | 88,865 | | 89,551 | |

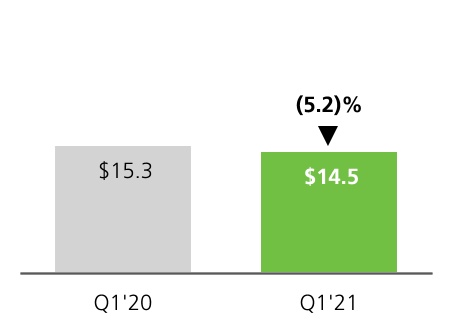

| Cost of one-time services and other | | | | 14,520 | | 15,314 | |

| Total cost of revenue | | | | 103,385 | | 104,865 | |

| Gross profit | | | | 115,806 | | 118,756 | |

| Operating expenses | | | | | |

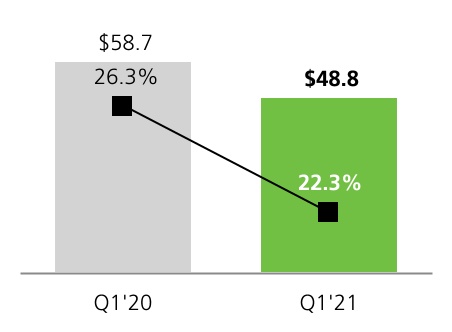

| Sales, marketing and customer success | | | | 48,793 | | 58,735 | |

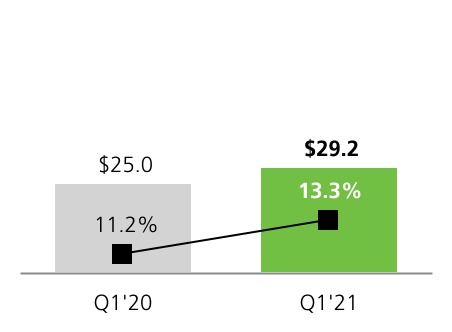

| Research and development | | | | 29,179 | | 24,977 | |

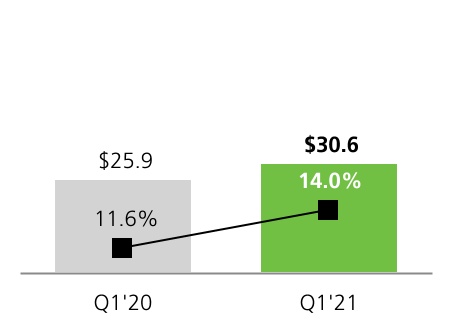

| General and administrative | | | | 30,587 | | 25,855 | |

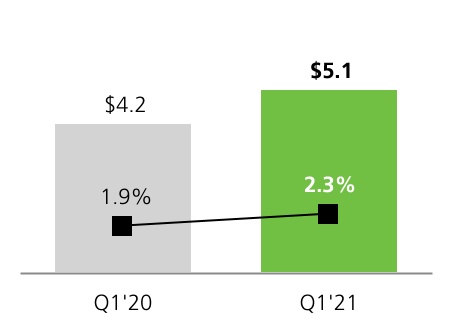

| Amortization | | | | 549 | | 741 | |

| Restructuring | | | | 54 | | 24 | |

| Total operating expenses | | | | 109,162 | | 110,332 | |

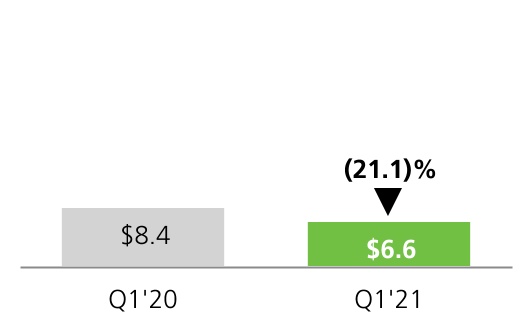

| Income from operations | | | | 6,644 | | 8,424 | |

| Interest expense | | | | (5,114) | | (4,159) | |

| Other (expense) income, net | | | | (1,010) | | 1,070 | |

| Income before provision for income taxes | | | | 520 | | 5,335 | |

| Income tax provision | | | | 684 | | 696 | |

| Net (loss) income | | | | $ | (164) | | $ | 4,639 | |

| Earnings (loss) per share | | | | | |

| Basic | | | | $ | 0 | | $ | 0.10 | |

| Diluted | | | | $ | 0 | | $ | 0.10 | |

| Common shares and equivalents outstanding | | | | | |

| Basic weighted average shares | | | | 47,363,197 | | 48,036,300 | |

| Diluted weighted average shares | | | | 47,363,197 | | 48,455,751 | |

| Other comprehensive income (loss) | | | | | |

| Foreign currency translation adjustment | | | | 2,511 | | (5,728) | |

| Unrealized gain (loss) on derivative instruments, net of tax | | | | 4,149 | | (3,122) | |

| Total other comprehensive income (loss) | | | | 6,660 | | (8,850) | |

| Comprehensive income (loss) | | | | $ | 6,496 | | $ | (4,211) | |

| | | | | |

| The accompanying notes are an integral part of these condensed consolidated financial statements. |

|

| | | | | | | |

| 4 | | SecondFirst Quarter 20202021 Form 10-Q |

| | Blackbaud, Inc. Condensed Consolidated Statements of Cash Flows (Unaudited) | Blackbaud, Inc. Condensed Consolidated Statements of Cash Flows (Unaudited) | Blackbaud, Inc.

Condensed Consolidated Statements of Cash Flows

(Unaudited) |

| | Six months ended

June 30, | | | Three months ended

March 31, |

| (dollars in thousands) | 2020 |

| 2019 |

| (dollars in thousands) | 2021 | 2020 |

| Cash flows from operating activities | | Cash flows from operating activities | |

| Net income | $ | 16,462 |

| $ | 6,018 |

| |

| Adjustments to reconcile net income to net cash provided by operating activities: | | |

| Net (loss) income | | Net (loss) income | $ | (164) | | $ | 4,639 | |

| Adjustments to reconcile net (loss) income to net cash provided by (used in) operating activities: | | Adjustments to reconcile net (loss) income to net cash provided by (used in) operating activities: | |

| Depreciation and amortization | 46,088 |

| 43,113 |

| Depreciation and amortization | 20,461 | | 21,804 | |

| Provision for credit losses and sales returns | 6,677 |

| 4,646 |

| Provision for credit losses and sales returns | 2,141 | | 2,488 | |

| Stock-based compensation expense | 33,713 |

| 28,755 |

| Stock-based compensation expense | 30,005 | | 13,580 | |

| Deferred taxes | 1,945 |

| 465 |

| Deferred taxes | (1,142) | | 954 | |

| Amortization of deferred financing costs and discount | 376 |

| 376 |

| Amortization of deferred financing costs and discount | 506 | | 188 | |

| Other non-cash adjustments | 477 |

| 1,982 |

| Other non-cash adjustments | (32) | | 102 | |

| Changes in operating assets and liabilities, net of acquisition and disposal of businesses: | | Changes in operating assets and liabilities, net of acquisition and disposal of businesses: | |

| Accounts receivable | (48,167 | ) | (45,071 | ) | Accounts receivable | 10,407 | | (3,876) | |

| Prepaid expenses and other assets | (7,068 | ) | (12,725 | ) | Prepaid expenses and other assets | (17,426) | | (5,303) | |

| Trade accounts payable | (8,984 | ) | 216 |

| Trade accounts payable | 7,550 | | (4,021) | |

| Accrued expenses and other liabilities | (26,520 | ) | (9,014 | ) | Accrued expenses and other liabilities | 549 | | (31,694) | |

| Deferred revenue | 22,489 |

| 26,328 |

| Deferred revenue | (22,752) | | (23,364) | |

| Net cash provided by operating activities | 37,488 |

| 45,089 |

| |

| Net cash provided by (used in) operating activities | | Net cash provided by (used in) operating activities | 30,103 | | (24,503) | |

| Cash flows from investing activities | | Cash flows from investing activities | |

| Purchase of property and equipment | (5,887 | ) | (6,375 | ) | Purchase of property and equipment | (3,470) | | (2,867) | |

| Capitalized software development costs | (21,679 | ) | (23,206 | ) | Capitalized software development costs | (9,302) | | (10,937) | |

| Purchase of net assets of acquired companies, net of cash and restricted cash acquired | — |

| (109,386 | ) | |

| Other investing activities | — |

| 500 |

| |

| | Net cash used in investing activities | (27,566 | ) | (138,467 | ) | Net cash used in investing activities | (12,772) | | (13,804) | |

| Cash flows from financing activities | | Cash flows from financing activities | |

| Proceeds from issuance of debt | 202,100 |

| 329,100 |

| Proceeds from issuance of debt | 80,700 | | 144,700 | |

| Payments on debt | (185,250 | ) | (155,150 | ) | Payments on debt | (59,667) | | (86,075) | |

| | Employee taxes paid for withheld shares upon equity award settlement | (20,996 | ) | (19,760 | ) | Employee taxes paid for withheld shares upon equity award settlement | (18,426) | | (19,782) | |

| Proceeds from exercise of stock options | 4 |

| 6 |

| Proceeds from exercise of stock options | 0 | | 1 | |

| Change in due to customers | (121,612 | ) | (107,808 | ) | Change in due to customers | (353,597) | | (311,095) | |

| Change in customer funds receivable | (828 | ) | (3,741 | ) | Change in customer funds receivable | (563) | | (733) | |

| Purchase of treasury stock | | Purchase of treasury stock | (28,066) | | 0 | |

| Dividend payments to stockholders | (5,960 | ) | (11,802 | ) | Dividend payments to stockholders | 0 | | (5,960) | |

| Net cash (used in) provided by financing activities | (132,542 | ) | 30,845 |

| |

| Net cash used in financing activities | | Net cash used in financing activities | (379,619) | | (278,944) | |

| Effect of exchange rate on cash, cash equivalents and restricted cash | (2,229 | ) | (526 | ) | Effect of exchange rate on cash, cash equivalents and restricted cash | 230 | | (2,822) | |

| Net decrease in cash, cash equivalents and restricted cash | (124,849 | ) | (63,059 | ) | Net decrease in cash, cash equivalents and restricted cash | (362,058) | | (320,073) | |

| Cash, cash equivalents and restricted cash, beginning of period | 577,295 |

| 449,846 |

| Cash, cash equivalents and restricted cash, beginning of period | 644,969 | | 577,295 | |

| Cash, cash equivalents and restricted cash, end of period | $ | 452,446 |

| $ | 386,787 |

| Cash, cash equivalents and restricted cash, end of period | $ | 282,911 | | $ | 257,222 | |

The following table provides a reconciliation of cash and cash equivalents and restricted cash reported within the condensed consolidated balance sheets that sum to the total of the same such amounts shown above in the condensed consolidated statements of cash flows:

| | | | | | | | |

| (dollars in thousands) | March 31,

2021 | December 31,

2020 |

| Cash and cash equivalents | $ | 27,753 | | $ | 35,750 | |

| Restricted cash | 255,158 | | 609,219 | |

| Total cash, cash equivalents and restricted cash in the statement of cash flows | $ | 282,911 | | $ | 644,969 | |

| | |

| The accompanying notes are an integral part of these condensed consolidated financial statements. |

|

| | | | | | |

| (dollars in thousands) | June 30,

2020 |

| December 31,

2019 |

|

| Cash and cash equivalents | $ | 30,531 |

| $ | 31,810 |

|

| Restricted cash due to customers | 421,915 |

| 545,485 |

|

| Total cash, cash equivalents and restricted cash in the statement of cash flows | $ | 452,446 |

| $ | 577,295 |

|

| | | |

| The accompanying notes are an integral part of these condensed consolidated financial statements. |

|

| | | | | | | |

SecondFirst Quarter 20202021 Form 10-Q | | 5 |

Blackbaud, Inc.

Condensed Consolidated Statements of Stockholders' Equity

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| (dollars in thousands) | Common stock | Additional

paid-in

capital | Treasury

stock | Accumulated

other

comprehensive

income (loss) | Retained

earnings | Total

stockholders'

equity |

| Shares | Amount |

| Balance at December 31, 2020 | 60,904,638 | | $ | 61 | | $ | 544,963 | | $ | (353,091) | | $ | (2,497) | | $ | 236,714 | | $ | 426,150 | |

| Net loss | — | | — | | — | | — | | — | | (164) | | (164) | |

| | | | | | | |

| Purchase of 465,821 treasury shares under stock repurchase program | — | | — | | — | | (28,066) | | — | | — | | (28,066) | |

| Vesting of restricted stock units | 206,418 | | — | | 0 | | — | | — | | — | | 0 | |

| Employee taxes paid for 240,867 withheld shares upon equity award settlement | — | | — | | — | | (18,426) | | — | | — | | (18,426) | |

| Stock-based compensation | — | | — | | 29,995 | | — | | — | | 10 | | 30,005 | |

| Restricted stock grants | 519,009 | | 1 | | — | | — | | — | | — | | 1 | |

| Restricted stock cancellations | (34,789) | | — | | — | | — | | — | | — | | — | |

| Other comprehensive income | — | | — | | — | | — | | 6,660 | | — | | 6,660 | |

| Balance at March 31, 2021 | 61,595,276 | | $ | 62 | | $ | 574,958 | | $ | (399,583) | | $ | 4,163 | | $ | 236,560 | | $ | 416,160 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

|

| | | (dollars in thousands) | Common stock | | Additional paid-in capital |

| Treasury stock |

| Accumulated other comprehensive income (loss) |

| Retained earnings |

| Total stockholders' equity |

| (dollars in thousands) | Common stock | Additional

paid-in

capital | Treasury

stock | Accumulated

other

comprehensive

income (loss) | Retained

earnings | Total

stockholders'

equity |

| Shares |

| Amount |

| Shares | Amount |

| Balance at December 31, 2019 | 60,206,091 |

| $ | 60 |

| $ | 457,804 |

| $ | (290,665 | ) | $ | (5,290 | ) | $ | 234,855 |

| $ | 396,764 |

| Balance at December 31, 2019 | 60,206,091 | | $ | 60 | | $ | 457,804 | | $ | (290,665) | | $ | (5,290) | | $ | 234,855 | | $ | 396,764 | |

| Net income | — |

| — |

| — |

| — |

| — |

| 4,639 |

| 4,639 |

| Net income | — | | — | | — | | — | | — | | 4,639 | | 4,639 | |

| Payment of dividends ($0.12 per share) | — |

| — |

| — |

| — |

| — |

| (5,960 | ) | (5,960 | ) | Payment of dividends ($0.12 per share) | — | | — | | — | | — | | — | | (5,960) | | (5,960) | |

| Exercise of stock options and vesting of restricted stock units | 210,057 |

| — |

| 1 |

| — |

| — |

| — |

| 1 |

| Exercise of stock options and vesting of restricted stock units | 210,057 | | — | | 1 | | — | | — | | — | | 1 | |

| Employee taxes paid for 245,358 withheld shares upon equity award settlement | — |

| — |

| — |

| (19,782 | ) | — |

| — |

| (19,782 | ) | Employee taxes paid for 245,358 withheld shares upon equity award settlement | — | | — | | — | | (19,782) | | — | | — | | (19,782) | |

| Stock-based compensation | — |

| — |

| 13,539 |

| — |

| — |

| 41 |

| 13,580 |

| Stock-based compensation | — | | — | | 13,539 | | — | | — | | 41 | | 13,580 | |

| Restricted stock grants | 563,947 |

| 1 |

| — |

| — |

| — |

| — |

| 1 |

| Restricted stock grants | 563,947 | | 1 | | — | | — | | — | | — | | 1 | |

| Restricted stock cancellations | (47,456 | ) | — |

| — |

| — |

| — |

| — |

| — |

| Restricted stock cancellations | (47,456) | | — | | — | | — | | — | | — | | — | |

| Other comprehensive loss | — |

| — |

| — |

| — |

| (8,850 | ) | — |

| (8,850 | ) | Other comprehensive loss | — | | — | | — | | — | | (8,850) | | — | | (8,850) | |

| Balance at March 31, 2020 | 60,932,639 |

| $ | 61 |

| $ | 471,344 |

| $ | (310,447 | ) | $ | (14,140 | ) | $ | 233,575 |

| $ | 380,393 |

| Balance at March 31, 2020 | 60,932,639 | | $ | 61 | | $ | 471,344 | | $ | (310,447) | | $ | (14,140) | | $ | 233,575 | | $ | 380,393 | |

| Net income | — |

| — |

| — |

| — |

| — |

| 11,823 |

| 11,823 |

| |

| Exercise of stock options and vesting of restricted stock units | 7,111 |

| — |

| 3 |

| — |

| — |

| — |

| 3 |

| |

| Employee taxes paid for 21,200 withheld shares upon equity award settlement | — |

| — |

| — |

| (1,214 | ) | — |

| — |

| (1,214 | ) | |

| Stock-based compensation | — |

| — |

| 20,103 |

| — |

| — |

| 30 |

| 20,133 |

| |

| Restricted stock grants | 20,776 |

| — |

| — |

| — |

| — |

| — |

| — |

| |

| Restricted stock cancellations | (59,426 | ) | — |

| — |

| — |

| — |

| — |

| — |

| |

| Other comprehensive loss | — |

| — |

| — |

| — |

| (336 | ) | — |

| (336 | ) | |

| Balance at June 30, 2020 | 60,901,100 |

| $ | 61 |

| $ | 491,450 |

| $ | (311,661 | ) | $ | (14,476 | ) | $ | 245,428 |

| $ | 410,802 |

| |

| | | | |

| | | |

| | | The accompanying notes are an integral part of these condensed consolidated financial statements. | | The accompanying notes are an integral part of these condensed consolidated financial statements. |

|

| | | | | | | |

| 6 | | SecondFirst Quarter 20202021 Form 10-Q |

Blackbaud, Inc.

Condensed Consolidated statements of stockholders' equity (continued)

(Unaudited)

|

| | | | | | | | | | | | | | | | | | | | |

| (dollars in thousands) | Common stock | | Additional paid-in capital |

| Treasury stock |

| Accumulated other comprehensive income (loss) |

| Retained earnings |

| Total stockholders' equity |

|

| Shares |

| Amount |

|

| Balance at December 31, 2018 | 59,327,633 |

| $ | 59 |

| $ | 399,241 |

| $ | (266,884 | ) | $ | (5,110 | ) | $ | 246,477 |

| $ | 373,783 |

|

| Net loss | — |

| — |

| — |

| — |

| — |

| (1,122 | ) | (1,122 | ) |

| Payment of dividends ($0.12 per share) | — |

| — |

| — |

| — |

| — |

| (5,901 | ) | (5,901 | ) |

| Exercise of stock options and stock appreciation rights and vesting of restricted stock units | 234,453 |

| — |

| 3 |

| — |

| — |

| — |

| 3 |

|

| Employee taxes paid for 239,311 withheld shares upon equity award settlement | — |

| — |

| — |

| (18,400 | ) | — |

| — |

| (18,400 | ) |

| Stock-based compensation | — |

| — |

| 13,693 |

| — |

| — |

| 33 |

| 13,726 |

|

| Restricted stock grants | 663,906 |

| 1 |

| — |

| — |

| — |

| — |

| 1 |

|

| Restricted stock cancellations | (43,314 | ) | — |

| — |

| — |

| — |

| — |

| — |

|

| Other comprehensive income | — |

| — |

| — |

| — |

| 3,658 |

| — |

| 3,658 |

|

| Balance at March 31, 2019 | 60,182,678 |

| $ | 60 |

| $ | 412,937 |

| $ | (285,284 | ) | $ | (1,452 | ) | $ | 239,487 |

| $ | 365,748 |

|

| Net income | — |

| — |

| — |

| — |

| — |

| 7,140 |

| 7,140 |

|

| Payment of dividends ($0.12 per share) | — |

| — |

| — |

| — |

| — |

| (5,901 | ) | (5,901 | ) |

| Exercise of stock options and stock appreciation rights and vesting of restricted stock units | 21,726 |

| — |

| 3 |

| — |

| — |

| — |

| 3 |

|

| Employee taxes paid for 17,119 withheld shares upon equity award settlement | — |

| — |

| — |

| (1,360 | ) | — |

| — |

| (1,360 | ) |

| Stock-based compensation | — |

| — |

| 15,010 |

| — |

| — |

| 19 |

| 15,029 |

|

| Restricted stock grants | 12,405 |

| — |

| — |

| — |

| — |

| — |

| — |

|

| Restricted stock cancellations | (29,746 | ) | — |

| — |

| — |

| — |

| — |

| — |

|

| Other comprehensive loss | — |

| — |

| — |

| — |

| (7,957 | ) | — |

| (7,957 | ) |

| Balance at June 30, 2019 | 60,187,063 |

| $ | 60 |

| $ | 427,950 |

| $ | (286,644 | ) | $ | (9,409 | ) | $ | 240,745 |

| $ | 372,702 |

|

| | | | | | | | |

| The accompanying notes are an integral part of these condensed consolidated financial statements. |

|

| | |

Second Quarter 2020 Form 10-Q | | 7 |

Blackbaud, Inc.

Notes to Condensed Consolidated Financial Statements

(Unaudited)

We are the world’s leading cloud software company powering social good. Serving the entire social good community—nonprofits, higher education institutions, K–12 schools, healthcare organizations, faith communities, arts and cultural organizations, foundations, companies and individual change agents—we connect and empower organizations to increase their impact through cloud software, services, expertise and data intelligence. Our portfolio is tailored to the unique needs of vertical markets, with solutions for fundraising and CRM, marketing, advocacy, peer-to-peer fundraising, corporate social responsibility, school management, ticketing, grantmaking, financial management, payment processing and analytics. Serving the industry for more than threenearly four decades, we are headquartered in Charleston, South Carolina, and have operations in the United States, Australia, Canada, Costa Rica and the United Kingdom.

Unaudited condensed consolidated interim financial statements

The accompanying condensed consolidated interim financial statements have been prepared pursuant to the rules and regulations of the United States Securities and Exchange Commission ("SEC") for interim financial reporting. These consolidated statements are unaudited and, in the opinion of management, include all adjustments (consisting of normal recurring adjustments and accruals) necessary to state fairly the consolidated balance sheets, consolidated statements of comprehensive income, consolidated statements of cash flows and consolidated statements of stockholders’ equity, for the periods presented in accordance with accounting principles generally accepted in the United States ("U.S.") ("GAAP"). The consolidated balance sheet at December 31, 20192020 has been derived from the audited consolidated financial statements at that date. Operating results and cash flows for the sixthree months ended June 30, 2020March 31, 2021 are not necessarily indicative of the results that may be expected for the fiscal year ending December 31, 2020,2021, or any other future period. Certain information and footnote disclosures normally included in annual financial statements prepared in accordance with GAAP have been omitted in accordance with the rules and regulations for interim reporting of the SEC. These condensed consolidated interim financial statements should be read in conjunction with the consolidated financial statements and notes thereto included in our Annual Report on Form 10-K for the year ended December 31, 2019,2020, and other forms filed with the SEC from time to time.

Basis of consolidation

The condensed consolidated financial statements include the accounts of Blackbaud, Inc. and its wholly owned subsidiaries. All intercompany balances and transactions have been eliminated in consolidation.

Reportable segment

We report our operating results and financial information in one operating and reportable segment. Our chief operating decision maker uses consolidated financial information to make operating decisions, assess financial performance and allocate resources. Our chief operating decision maker is our chief executive officer ("CEO").

Risks and uncertainties

Impact of related to COVID-19

We are subject to risks and uncertainties as a result of the global COVID-19 pandemic. We expectbelieve that COVID-19 willmay continue to impact all of our vertical markets across all of ourand geographies, to some degree, but the significance and duration of the impact on our business cannot be determined at this time due to numerous uncertainties, including the ultimate geographic spread of the disease, the duration of the outbreak, travel restrictions and business closures, the effectiveness of vaccination programs and other actions taken to contain the disease and other unforeseeable consequences.

|

| | | | | | | |

8First Quarter 2021 Form 10-Q | | Second Quarter 2020 Form 10-Q7 |

Blackbaud, Inc.

Notes to Condensed Consolidated Financial Statements (Continued)

(Unaudited)

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements, as well as the reported amounts of revenues and expenses during the reporting periods. On an ongoing basis, we reconsider and evaluate our estimates and assumptions, including those that impact revenue recognition, long-lived and intangible assets, income taxes, business combinations, stock-based compensation, capitalization of software development costs, our allowances for credit losses and sales returns, costs of obtaining contracts, valuation of derivative instruments and loss contingencies, among others. Changes in the facts or circumstances underlying these estimates, including due to COVID-19, could result in material changes and actual results could materially differ from these estimates.

Response to COVID-19

To better enable us to weather the extraordinary business challenges brought about by the global COVID-19 pandemic, to protect the safety and welfare of our employees, and to further effect our long-term strategy to deliver the greatest value to our stockholders, we have taken several actions. These initial measures taken are expected to provide us the financial flexibility needed to manage a wide array of outcomes that may result from the pandemic. Some of these actions include the following:

Temporarily closed our offices worldwide and transitioned our employees to work remotely;

| |

• | Rescinded our previously announced policy to pay an annual dividend at a rate of $0.48 per share of common stock and discontinued the declaration and payment of all cash dividends, beginning with the second quarter of 2020 and thereafter until such time, if any, as our Board of Directors may otherwise determine in its sole discretion;

|

| |

• | Temporarily suspended our 401(k)-match program, whereby we have historically matched 50% of qualified U.S. employees' contributions to our 401(k) plan up to 6% of their salaries, effective with the payroll period commencing April 1, 2020;

|

Temporarily froze our hiring efforts and implemented a modest and targeted headcount reduction, though we have since began backfilling sales positions;

Michael Gianoni, our President and Chief Executive Officer, elected to forego receipt of all but that portion of his base salary necessary to fund, on a pre-tax basis, his contributions to continue to participate in our health benefits plan, between April 1, 2020 and June 16, 2020;

Restricted non-essential employee travel and put in place other operating cost containment actions;

| |

• | All of our employees with a base salary equal to or less than $75 thousand received financial support in the form of a one-time bonus of $1 thousand on April 30, 2020;

|

| |

• | On May 1, 2020, we granted restricted stock units with a total grant date fair value of $8.3 million to our employees that were eligible for base salary merit increases in lieu of such increases, which will vest on May 1, 2021 subject to the recipient's continued employment with us;

|

| |

• | On May 1, 2020, we granted performance-based restricted stock units with a total grant date fair value of $34.4 million to our employees that were eligible for a 2020 cash bonus plan in lieu of such cash bonus, which may be earned and become eligible for vesting on May 1, 2021 subject to meeting certain performance conditions and the recipient's continued employment with us.

|

Recently adopted accounting pronouncements

In June 2016, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) 2016-13, Financial Instruments-Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments (“ASU 2016-13”). ASU 2016-13 requires certain types of financial instruments, including trade receivables, to be presented at the net amount expected to be collected based on historical events, current conditions and forward-looking information. We adopted ASU 2016-13 as of the January 1, 2020 effective date and the adoption did not have a material impact on our consolidated financial statements.

In August 2018, the FASB issued ASU 2018-15, Intangibles-Goodwill and Other-Internal-Use Software (Subtopic 350-40): Customer’s Accounting for Implementation Costs Incurred in a Cloud Computing Arrangement That Is a Service Contract (“ASU 2018-15”). ASU 2018-15 aligns the accounting for implementation costs related to a hosting arrangement that is a service contract with the guidance on capitalizing costs associated with developing or obtaining internal-use software. We adopted ASU 2018-15 prospectively as of the January 1, 2020 effective date and the adoption did not have a material impact on our consolidated financial statements.

|

| | |

Second Quarter 2020 Form 10-Q | | 9 |

Blackbaud, Inc.

Notes to Condensed Consolidated Financial Statements (Continued)

(Unaudited)

Recently issued accounting pronouncements

There are no recently issued accounting pronouncements that are expectedwe expect to have a material impact on our consolidated financial position or results of operationsstatements when adopted in the future.

Summary of significant accounting policies

Except for the accounting policies for allowance for credit losses and allowance for sales returns below that were updated as a result of adopting ASU 2016-13, thereThere have been no new or material changes to our significant accounting policies described in our Annual Report on Form 10-K for the year ended December 31, 2019,2020, filed with the SEC on February 20, 2020.23, 2021.

Allowance for credit losses

Our accounts receivable consist of a single portfolio segment. Accounts receivable are recorded at original invoice amounts less an allowance for credit losses, an amount we estimate to be sufficient to provide adequate protection against lifetime expected losses resulting from extending credit to our customers. In judging the adequacy of the allowance for credit losses, we consider multiple factors including historical bad debt experience, the current aging of our receivables and current economic conditions that may affect our customers' ability to pay. A considerable amount of judgment is required in assessing these factors and if any receivables were to deteriorate, an additional provision for credit losses could be required. Accounts are written off after all means of collection are exhausted and recovery is considered remote. Provisions for credit losses are recorded in general and administrative expense.

Below is a summary of the changes in our allowance for credit losses.

|

| | | | | | | | | | | | | | | |

| (in thousands) | Balance at beginning of year (1) |

| Provision/ adjustment |

| Write-off |

| Recovery |

| Balance at June 30, 2020 |

|

| 2020 | $ | 4,011 |

| $ | 3,708 |

| $ | (554 | ) | $ | 243 |

| $ | 7,408 |

|

| |

(1) | Upon adoption of ASU 2016-13 at January 1, 2020, we reclassified certain balances previously disclosed within the allowance for sales returns to the allowance for credit losses, as these amounts reflect the credit risk associated with our accounts receivable. |

The increase in our allowance for credit losses during the six months ended June 30, 2020 was primarily due to an increase in the aging of our receivables and observed changes in some of our customers' payment behavior associated with the COVID-19 pandemic. The increase in the amount of write-offs during the six months ended June 30, 2020 was insignificant.

Allowance for sales returns

We maintain a reserve for returns and credits which is estimated based on several factors including historical experience, known credits yet to be issued, the aging of customer accounts and the nature of service level commitments. A considerable amount of judgment is required in assessing these factors. Provisions for sales returns and credits are charged against the related revenue items.

Below is a summary of the changes in our allowance for sales returns.

|

| | | | | | | | | | | | |

| (in thousands) | Balance at

beginning of year (1) |

| Provision/ adjustment |

| Deduction |

| Balance at June 30, 2020 |

|

| 2020 | $ | 1,518 |

| $ | 2,969 |

| $ | (2,870 | ) | $ | 1,617 |

|

| |

(1) | As discussed above, we reclassified certain balances previously disclosed within the allowance for sales returns to the allowance for credit losses upon adoption of ASU 2016-13 at January 1, 2020. |

|

| | |

10 | | Second Quarter 2020 Form 10-Q |

Blackbaud, Inc.

Notes to Condensed Consolidated Financial Statements (Continued)

(Unaudited)

|

|

| 3. Goodwill and Other Intangible Assets |

The change in goodwill during the sixthree months ended June 30, 2020,March 31, 2021, consisted of the following:

|

| | | |

| (dollars in thousands) | Total |

| Balance at December 31, 2019 | $ | 634,088 |

|

| Effect of foreign currency translation | (3,401 | ) |

| Balance at June 30, 2020 | $ | 630,687 |

|

| | | | | |

| (dollars in thousands) | Total |

| Balance at December 31, 2020 | $ | 635,854 | |

| |

| |

| Effect of foreign currency translation | 1,259 | |

| Balance at March 31, 2021 | $ | 637,113 | |

| | |

| 4. Earnings (Loss) Per Share |

We compute basic earnings (loss) per share by dividing net income available to common stockholders by the weighted average number of common shares outstanding during the period. Diluted earnings (loss) per share is computed by dividing net income available to common stockholders by the weighted average number of common shares and dilutive potential common shares outstanding during the period. Diluted earnings (loss) per share reflect the assumed exercise, settlement and vesting of all dilutive securities using the “treasury stock method” except when the effect is anti-dilutive. Potentially dilutive securities consist of shares issuable upon the exercise of stock options, settlement of stock appreciation rights and vesting of restricted stock awards and units. Diluted loss per share for the three months ended March 31, 2021 was the same as basic loss per share as there was a net loss in the period and inclusion of potentially dilutive securities was anti-dilutive.

| | | | | | | | |

| 8 | | First Quarter 2021 Form 10-Q |

Blackbaud, Inc.

Notes to Condensed Consolidated Financial Statements (Continued)

(Unaudited)

The following table sets forth the computation of basic and diluted earnings (loss) per share:

|

| | | | | | | | | | | | | |

| | Three months ended

June 30, | | | Six months ended

June 30, | |

| (dollars in thousands, except per share amounts) | 2020 |

| 2019 |

| | 2020 |

| 2019 |

|

| Numerator: | | | | | |

| Net income | $ | 11,823 |

| $ | 7,140 |

| | $ | 16,462 |

| $ | 6,018 |

|

| Denominator: | | | | | |

| Weighted average common shares | 48,239,928 |

| 47,714,621 |

| | 48,138,125 |

| 47,622,740 |

|

| Add effect of dilutive securities: | | | | | |

| Stock-based awards | 178,450 |

| 446,063 |

| | 326,952 |

| 478,472 |

|

| Weighted average common shares assuming dilution | 48,418,378 |

| 48,160,684 |

| | 48,465,077 |

| 48,101,212 |

|

| Earnings per share: | | | | | |

| Basic | $ | 0.25 |

| $ | 0.15 |

| | $ | 0.34 |

| $ | 0.13 |

|

| Diluted | $ | 0.24 |

| $ | 0.15 |

| | $ | 0.34 |

| $ | 0.13 |

|

| | | | | | |

| Anti-dilutive shares excluded from calculations of diluted earnings per share | 1,484,976 |

| 245,060 |

| | 1,329,519 |

| 748,743 |

|

| | | | | | | | | | | |

| | | | Three months ended March 31, |

| (dollars in thousands, except per share amounts) | | | | 2021 | 2020 |

| Numerator: | | | | | |

| Net (loss) income | | | | $ | (164) | | $ | 4,639 | |

| Denominator: | | | | | |

| Weighted average common shares | | | | 47,363,197 | | 48,036,300 | |

| Add effect of dilutive securities: | | | | | |

| Stock-based awards | | | | 0 | | 419,451 | |

| Weighted average common shares assuming dilution | | | | 47,363,197 | | 48,455,751 | |

| Earnings (loss) per share: | | | | | |

| Basic | | | | $ | 0 | | $ | 0.10 | |

| Diluted | | | | $ | 0 | | $ | 0.10 | |

| | | | | |

| Anti-dilutive shares excluded from calculations of diluted earnings (loss) per share | | | | 1,360,378 | | 1,170,289 | |

|

| | |

Second Quarter 2020 Form 10-Q | | 11 |

Blackbaud, Inc.

Notes to Condensed Consolidated Financial Statements (Continued)

(Unaudited)

|

|

| 5. Fair Value Measurements |

We use a three-tier fair value hierarchy to measure fair value. This hierarchy prioritizes the inputs into three broad levels as follows:

•Level 1 - Quoted prices for identical assets or liabilities in active markets;

•Level 2 - Quoted prices for similar assets and liabilities in active markets, quoted prices for identical or similar assets in markets that are not active, and model-derived valuations in which all significant inputs and significant value drivers are observable in active markets; and

•Level 3 - Valuations derived from valuation techniques in which one or more significant inputs are unobservable.

| | | | | | | | |

| First Quarter 2021 Form 10-Q | | 9 |

Blackbaud, Inc.

Notes to Condensed Consolidated Financial Statements (Continued)

(Unaudited)

Recurring fair value measurements

Assets and liabilities that are measured at fair value on a recurring basis consisted of the following, as of the dates indicated below:

|

| | | | | | | | | | | | | | | |

| | Fair value measurement using | | |

| (dollars in thousands) | Level 1 |

| | Level 2 |

| | Level 3 |

| | Total |

|

| Fair value as of June 30, 2020 | | | | | | | |

| Financial liabilities: | | | | | | | |

| Derivative instruments | $ | — |

| | $ | 5,233 |

| | $ | — |

| | $ | 5,233 |

|

| Total financial liabilities | $ | — |

| | $ | 5,233 |

| | $ | — |

| | $ | 5,233 |

|

| | | | | | | | |

| Fair value as of December 31, 2019 | | | | | | | |

| Financial liabilities: | | | | | | | |

| Derivative instruments | $ | — |

| | $ | 1,757 |

| | $ | — |

| | $ | 1,757 |

|

| Total financial liabilities | $ | — |

| | $ | 1,757 |

| | $ | — |

| | $ | 1,757 |

|

| | | | | | | | | | | | | | | | | | | | | | | |

| Fair value measurement using | | |

| (dollars in thousands) | Level 1 | | Level 2 | | Level 3 | | Total |

| Fair value as of March 31, 2021 | | | | | | | |

| Financial assets: | | | | | | | |

| Derivative instruments | $ | 0 | | | $ | 2,851 | | | $ | 0 | | | $ | 2,851 | |

| Total financial assets | $ | 0 | | | $ | 2,851 | | | $ | 0 | | | $ | 2,851 | |

| | | | | | | |

| | | | | | | |

| Financial liabilities: | | | | | | | |

| Derivative instruments | $ | 0 | | | $ | 1,431 | | | $ | 0 | | | $ | 1,431 | |

| Total financial liabilities | $ | 0 | | | $ | 1,431 | | | $ | 0 | | | $ | 1,431 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Fair value as of December 31, 2020 | | | | | | | |

| Financial liabilities: | | | | | | | |

| Derivative instruments | $ | 0 | | | $ | 4,159 | | | $ | 0 | | | $ | 4,159 | |

| Total financial liabilities | $ | 0 | | | $ | 4,159 | | | $ | 0 | | | $ | 4,159 | |

Our derivative instruments within the scope of Accounting Standards Codification ("ASC") 815, Derivatives and Hedging, are required to be recorded at fair value. Our derivative instruments that are recorded at fair value include interest rate swaps.

The fair value of our interest rate swaps was based on model-driven valuations using LIBOR rates, which are observable at commonly quoted intervals. Accordingly, our interest rate swaps are classified within Level 2 of the fair value hierarchy. The Financial ConductConduct Authority in the U.K. has stated that it plans to phase out LIBOR by the end of calendar year 2021. We do not currently anticipate a significant impact to our financial position or results of operations as a result of this action as we expect that our financial contracts currently indexed to LIBOR will either expire or be modified without significant financial impact before the phasephase out occurs.

We believe the carrying amounts of our cash and cash equivalents, restricted cash, due to customers, accounts receivable, trade accounts payable, accrued expenses and other current liabilities and due to customers approximate their fair values at June 30,March 31, 2021 and December��31, 2020, and December 31, 2019, due to the immediate or short-term maturity of these instruments.

We believe the carrying amount of our debt approximates its fair value at June 30, 2020March 31, 2021 and December 31, 2019,2020, as the debt bears interest rates that approximate market value. As LIBOR rates are observable at commonly quoted intervals, our debt under the 2020 Credit Facility (as defined below) is classified within Level 2 of the fair value hierarchy. Our fixed rate debt is also classified within Level 2 of the fair value hierarchy.

We did not transfer any assets or liabilities among the levels within the fair value hierarchy during the sixthree months ended June 30, 2020.March 31, 2021. Additionally, we did not hold any Level 3 assets or liabilities during the sixthree months ended June 30, 2020.

|

| | | | | | | |

1210 | | SecondFirst Quarter 20202021 Form 10-Q |

Blackbaud, Inc.

Notes to Condensed Consolidated Financial Statements (Continued)

(Unaudited)

Non-recurring fair value measurements

Assets and liabilities that are measured at fair value on a non-recurring basis include long-lived assets, intangible assets, goodwill and operating lease right-of-use ("ROU") assets. These assets which are recognized at fair value during the period in which an acquisition is completed or at lease commencement, from updated estimates and assumptions during the measurement period, or when they are considered to be impaired. These non-recurring fair value measurements, primarily for long-lived assets, intangible assets acquired and operating lease ROU assets, are based on Level 3 unobservable inputs. In the event of an impairment, we determine the fair value of these assets other than goodwill using a discounted cash flow approach, which contains significant unobservable inputs and, therefore, is considered a Level 3 fair value measurement. The unobservable inputs in the analysis generally include future cash flow projections and a discount rate. For goodwill impairment testing, we estimate fair value using market-based methods including the use of market capitalization and consideration of a control premium.

During the six months ended June 30, 2020, we recorded an impairment charge of $4.3 million against certain previously capitalized software development costs that reduced the carrying value of those assets to zero. The impairment charge is reflected in cost of recurring revenue and resulted primarily from our decision to accelerate the end of customer support for certain solutions. During the six months ended June 30, 2020, we also recorded an insignificant impairment of operating lease ROU assets associated with certain leased office space we ceased using. This impairment charge is reflected in general and administrative expense.

There were no other non-recurring fair value adjustments to our long-lived assets, intangible assets, goodwill and operating lease ROU assets and goodwill during the sixthree months ended June 30, 2020.March 31, 2021.

|

| |

| 6. Consolidated Financial Statement Details |

Restricted cash

| | | | | | | | |

| (dollars in thousands) | March 31,

2021 | December 31,

2020 |

| Restricted cash due to customers | $ | 254,002 | | $ | 607,943 | |

| Real estate escrow balances | 1,156 | | 1,276 | |

| Total restricted cash | 255,158 | | 609,219 | |

Prepaid expenses and other assets

| | | | | | | | |

| (dollars in thousands) | March 31,

2021 | December 31,

2020 |

Costs of obtaining contracts(1)(2) | $ | 83,421 | | $ | 84,914 | |

Prepaid software maintenance and subscriptions(3) | 33,113 | | 24,471 | |

Receivables for probable insurance recoveries(4) | 15,723 | | 6,288 | |

Implementation costs for cloud computing arrangements, net(5)(6) | 11,451 | | 11,298 | |

| Unbilled accounts receivable | 7,660 | | 10,385 | |

| Prepaid insurance | 6,397 | | 1,426 | |

| Derivative instruments | 2,851 | | 0 | |

| Taxes, prepaid and receivable | 1,486 | | 1,891 | |

| Other assets | 10,015 | | 10,332 | |

| Total prepaid expenses and other assets | 172,117 | | 151,005 | |

| Less: Long-term portion | 74,022 | | 72,639 | |

| Prepaid expenses and other current assets | $ | 98,095 | | $ | 78,366 | |

|

| | | | | | |

| (dollars in thousands) | June 30,

2020 |

| December 31,

2019 |

|

Costs of obtaining contracts(1)(2) | $ | 89,080 |

| $ | 90,764 |

|

Prepaid software maintenance and subscriptions(3) | 28,975 |

| 17,384 |

|

Implementation costs for cloud computing arrangements, net(4)(5) | 10,563 |

| 7,294 |

|

| Unbilled accounts receivable | 8,647 |

| 6,233 |

|

| Prepaid insurance | 2,638 |

| 1,585 |

|

| Taxes, prepaid and receivable | 842 |

| 849 |

|

| Security deposits | 861 |

| 885 |

|

| Other assets | 10,766 |

| 8,051 |

|

| Total prepaid expenses and other assets | 152,372 |

| 133,045 |

|

| Less: Long-term portion | 68,673 |

| 65,193 |

|

| Prepaid expenses and other current assets | $ | 83,699 |

| $ | 67,852 |

|

| |

(1) | Amortization expense from(2)The current portion of costs of obtaining contracts as of March 31, 2021 and December 31, 2020 was $31.6 million and $31.9 million, respectively. (3)The current portion of prepaid software maintenance and subscriptions as of March 31, 2021 and December 31, 2020 was $28.0 million and $19.8 million, respectively. (4)See discussion of the Security Incident at Note 9. (5)These costs primarily relate to the multi-year implementations of our new global enterprise resource planning and customer relationship management systems. (6)Amortization expense from capitalized cloud computing implementation costs was insignificant for the three months ended March 31, 2021 and 2020, respectively. Accumulated amortization for these costs was $1.6 million as of March 31, 2021 and $1.1 million as of December 31, 2020.$9.4 million and $18.9 million for the three and six months endedJune 30, 2020, respectively, $9.8 million and $19.4 million for the three and six months endedJune 30, 2019, respectively. |

| |

(2) | The current portion of costs of obtaining contracts as of June 30, 2020 and December 31, 2019 was $32.7 million and $33.0 million, respectively.

|

| |

(3) | The current portion of prepaid software maintenance and subscriptions as of June 30, 2020 and December 31, 2019 was $24.4 million and $16.1 million, respectively.

|

| |

(4) | These costs, which were previously included in prepaid software maintenance and subscriptions, primarily relate to the multi-year implementations of our new global enterprise resource planning and customer relationship management systems. |

| |

(5) | Amortization expense from capitalized cloud computing implementation costs was insignificant for the three and six months endedJune 30, 2020 and 2019, respectively. Accumulated amortization for these costs was insignificant as of June 30, 2020 and December 31, 2019.

|

|

| | | | | | | |

SecondFirst Quarter 20202021 Form 10-Q | | 1311 |

Blackbaud, Inc.

Notes to Condensed Consolidated Financial Statements (Continued)

(Unaudited)

Accrued expenses and other liabilities

| | | | | | | | |

| (dollars in thousands) | March 31,

2021 | December 31,

2020 |

Taxes payable(1) | $ | 16,458 | | $ | 19,577 | |

| Accrued legal costs | 12,055 | | 4,808 | |

| Operating lease liabilities, current portion | 7,191 | | 9,359 | |

| Customer credit balances | 5,891 | | 5,874 | |

| Accrued commissions and salaries | 5,524 | | 5,010 | |

| Unrecognized tax benefit | 3,546 | | 3,351 | |

| Accrued health care costs | 2,389 | | 2,341 | |

| Accrued vacation costs | 2,304 | | 2,311 | |

| Derivative instruments | 1,431 | | 4,159 | |

| Other liabilities | 5,663 | | 6,304 | |

| Total accrued expenses and other liabilities | 62,452 | | 63,094 | |

| Less: Long-term portion | 9,439 | | 10,866 | |

| Accrued expenses and other current liabilities | $ | 53,013 | | $ | 52,228 | |

|

| | | | | | |

| (dollars in thousands) | June 30,

2020 |

| December 31,

2019 |

|

| Operating lease liabilities, current portion | $ | 19,316 |

| $ | 19,784 |

|

Accrued bonuses(1) | 5 |

| 24,617 |

|

| Accrued commissions and salaries | 7,601 |

| 6,980 |

|

| Taxes payable | 12,576 |

| 6,835 |

|

| Derivative instruments | 5,233 |

| 1,757 |

|

| Customer credit balances | 5,032 |

| 4,505 |

|

| Unrecognized tax benefit | 3,833 |

| 3,758 |

|

| Accrued vacation costs | 2,278 |

| 2,232 |

|

| Accrued health care costs | 2,991 |

| 2,399 |

|

| Other liabilities | 5,911 |

| 6,192 |

|

| Total accrued expenses and other liabilities | 64,776 |

| 79,059 |

|

| Less: Long-term portion | 11,883 |

| 5,742 |

|

| Accrued expenses and other current liabilities | $ | 52,893 |

| $ | 73,317 |

|

| |

(1) | In March 2020, we reduced our accrued bonuses due to the payment of bonuses from the prior year and, in response to the global COVID-19 pandemic, determined to replace our 2020 cash bonus plans with performance-based equity awards (See Note 2). |

Other (expense) income, net

|

| | | | | | | | | | | | | |

| | Three months ended

June 30, | | | Six months ended

June 30, | |

| (dollars in thousands) | 2020 |

| 2019 |

| | 2020 |

| 2019 |

|

| Interest income | $ | 110 |

| $ | 525 |

| | $ | 632 |

| $ | 1,179 |

|

| Other income, net | 520 |

| 1,656 |

| | 1,068 |

| 1,184 |

|

| Other income, net | $ | 630 |

| $ | 2,181 |

| | $ | 1,700 |

| $ | 2,363 |

|

| | | | | | | | | | | |

| | | | Three months ended March 31, |

| (dollars in thousands) | | | | 2021 | 2020 |

| Interest income | | | | $ | 152 | | $ | 522 | |

| | | | | |

| | | | | |

| Other (expense) income, net | | | | (1,162) | | 548 | |

| Other (expense) income, net | | | | $ | (1,010) | | $ | 1,070 | |

The following table summarizes our debt balances and the related weighted average effective interest rates, which includes the effect of interest rate swap agreements.

|

| | | | | | | | | | | |

| | Debt balance at | | | Weighted average effective interest rate at | |

| (dollars in thousands) | June 30,

2020 |

| December 31,

2019 |

| | June 30,

2020 |

| December 31,

2019 |

|

| Credit facility: | | | | | |

| Revolving credit loans | $ | 207,600 |

| $ | 187,000 |

| | 2.41 | % | 3.11 | % |

| Term loans | 277,500 |

| 281,250 |

| | 3.02 | % | 3.22 | % |

| Other debt | 3,926 |

| — |

| | 5.00 | % | — | % |

| Total debt | 489,026 |

| 468,250 |

| | 2.78 | % | 3.18 | % |

| Less: Unamortized discount and debt issuance costs | 913 |

| 1,150 |

| | | |

| Less: Debt, current portion | 9,194 |

| 7,500 |

| | 2.29 | % | 3.05 | % |

| Debt, net of current portion | $ | 478,919 |

| $ | 459,600 |

| | 2.78 | % | 3.18 | % |

| | | | | | | | | | | | | | | | | |

| Debt balance at | | Weighted average

effective interest rate at |

| (dollars in thousands) | March 31,

2021 | December 31,

2020 | | March 31,

2021 | December 31,

2020 |

| Credit facility: | | | | | |

| Revolving credit loans | $ | 93,425 | | $ | 69,625 | | | 1.80 | % | 1.83 | % |

| Term loans | 397,500 | | 400,000 | | | 3.13 | % | 3.12 | % |

| Real estate loans | 60,358 | | 60,626 | | | 5.22 | % | 5.22 | % |

| Other debt | 2,232 | | 3,926 | | | 5.00 | % | 5.00 | % |

| Total debt | 553,515 | | 534,177 | | | 3.14 | % | 3.21 | % |

| Less: Unamortized discount and debt issuance costs | 2,716 | | 3,144 | | | | |

| Less: Debt, current portion | 12,875 | | 12,840 | | | 2.67 | % | 2.61 | % |

| Debt, net of current portion | $ | 537,924 | | $ | 518,193 | | | 3.15 | % | 3.22 | % |

|

| | | | | | | |

1412 | | SecondFirst Quarter 20202021 Form 10-Q |

Blackbaud, Inc.

Notes to Condensed Consolidated Financial Statements (Continued)

(Unaudited)

20172020 credit facility

In June 2017,October 2020, we entered into a five-year $700.0$900.0 million senior credit facility (the "2017"2020 Credit Facility"). At June 30, 2020,March 31, 2021, we were in compliance with our debt covenants under the 20172020 Credit Facility.

Real estate loans

In August 2020, we completed the purchase of our global headquarters facility. As part of the purchase price, we assumed the Seller’s obligations under two senior secured notes with an aggregate outstanding principal amount of $61.1 million (collectively, the “Real Estate Loans”). At March 31, 2021, we were in compliance with our debt covenants under the Real Estate Loans.

Other debt

In December 2019,From time to time, we enteredenter into a 51-month $2.2 million agreement to finance our purchasethird-party financing agreements for purchases of software and related services for our internal use. The agreement is aGenerally, the agreements are non-interest-bearing notenotes requiring four equal annual payments, where the first payment was due in January 2020.payments. Interest associated with the note has beennotes is imputed at the rate we would incur for amounts borrowed under the 2017 Credit Facility.

In January 2020, we entered into an additional 39-month $3.5 million agreement to finance our purchase of software and related services for our internal use. The agreement is a non-interest-bearing note requiring three equal annual payments, where the first payment was due in March 2020. Interest associated with the note has been imputedthen-existing credit facility at the rate we would incur for amounts borrowed underinception of the 2017 Credit Facility.notes.

The following table summarizes our currently effective financing agreements as of March 31, 2021:

| | | | | | | | | | | | | | |

| (dollars in thousands) | Term

in Months | Number of

Annual Payments | First Annual Payment Due | Original Loan Value |

| Effective dates of agreements: | | | | |

| December 2019 | 51 | 4 | | January 2020 | $ | 2,150 | |

| January 2020 | 39 | 3 | | March 2020 | 3,470 | |

| | | | |

As of June 30, 2020,March 31, 2021, the required annual maturities related to the 20172020 Credit Facility, the Real Estate Loans and our other debt were as follows:

|

| | | |

Years ending December 31, (dollars in thousands) | Annual maturities |

|

| 2020 - remaining | $ | 3,750 |

|

| 2021 | 9,194 |

|

| 2022 | 475,544 |

|

| 2023 | 538 |

|

| 2024 | — |

|

| Thereafter | — |

|

| Total required maturities | $ | 489,026 |

|

| | | | | |

Years ending December 31,

(dollars in thousands) | Annual

maturities |

| 2021 - remaining | $ | 8,378 | |

| 2022 | 12,985 | |

| 2023 | 11,982 | |

| 2024 | 11,609 | |

| 2025 | 455,209 | |

| |

| Thereafter | 53,352 | |

| Total required maturities | $ | 553,515 | |

|

| |

| 8. Derivative Instruments |

Cash flow hedges

We generally use derivative instruments to manage our variable interest rate risk. We have entered into interest rate swap agreements, which effectively convert portions of our variable rate debt under the 20172020 Credit Facility to a fixed rate for the term of the swap agreements. We designated each of the interest rate swap agreements as a cash flow hedge at the inception of the contracts.

| | | | | | | | |

| First Quarter 2021 Form 10-Q | | 13 |

Blackbaud, Inc.

Notes to Condensed Consolidated Financial Statements (Continued)

(Unaudited)

The terms and notional values of our derivative instruments were as follows as of June 30, 2020:

|

| | | | |

| (dollars in thousands) | Term of derivative instrument | Notional Value |

|

| Derivative instruments designated as hedging instruments: | | |

| Interest rate swap | July 2017 - July 2021 | $ | 150,000 |

|

| Interest rate swap | February 2018 - June 2021 | 50,000 |

|

| Interest rate swap | June 2019 - June 2021 | 75,000 |

|

| | | $ | 275,000 |

|

| | | | | | | | |

| (dollars in thousands) | Term of derivative instrument | Notional

value |

| Derivative instruments designated as hedging instruments: | | |

| Interest rate swap | July 2017 - July 2021 | $ | 150,000 | |

| Interest rate swap | February 2018 - June 2021 | 50,000 | |

| Interest rate swap | June 2019 - June 2021 | 75,000 | |

| Interest rate swap | November 2020 - October 2024 | 60,000 | |

| Interest rate swap | November 2020 - October 2024 | 60,000 | |

| | $ | 395,000 | |

| | |

Second Quarter 2020 Form 10-QForward-starting interest rate swap | June 2021 - October 2024 | 15120,000 | |

| Forward-starting interest rate swap | July 2021 - October 2024 | 120,000 | |

| | $ | 240,000 | |

Blackbaud, Inc.

Notes to Condensed Consolidated Financial Statements (Continued)

(Unaudited)

The fair values of our derivative instruments were as follows as of:

|

| | | | | | | |

| | | Liability Derivatives |

| (dollars in thousands) | Balance sheet location | June 30,

2020 |

| December 31,

2019 |

|

| Derivative instruments designated as hedging instruments: | | | |

| Interest rate swaps, current portion | Accrued expenses and other current liabilities | $ | 2,515 |

| $ | — |

|

| Interest rate swaps, long-term portion | Other liabilities | 2,718 |

| 1,757 |

|

| Total derivative instruments designated as hedging instruments | | $ | 5,233 |

| $ | 1,757 |

|

| | | | | | | | | | | | | | | | | | | | | | | |

| | Asset derivatives | | | Liability derivatives |

| (dollars in thousands) | Balance sheet location | March 31,

2021 | December 31,

2020 | | Balance sheet location | March 31,

2021 | December 31,

2020 |

| Derivative instruments designated as hedging instruments: | | | | | | | |

| Interest rate swaps, current portion | Prepaid expenses

and other current assets | $ | 0 | | $ | 0 | | | Accrued expenses

and other

current liabilities | $ | 1,431 | | $ | 2,698 | |

| Interest rate swaps, long-term portion | Other assets | 2,851 | | 0 | | | Other liabilities | 0 | | 1,461 | |

| Total derivative instruments designated as hedging instruments | | $ | 2,851 | | $ | 0 | | | | $ | 1,431 | | $ | 4,159 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

The effects of derivative instruments in cash flow hedging relationships were as follows:

|

| | | | | | | | | | | |

| | Gain (loss) recognized in accumulated other comprehensive loss as of |

| Location of gain (loss) reclassified from accumulated other comprehensive loss into income | Gain (loss) reclassified from accumulated other comprehensive loss into income | |

| (dollars in thousands) | June 30,

2020 |

| Three months ended

June 30, 2020 |

| | Six months ended

June 30, 2020 |

|

| Interest rate swaps | $ | (5,233 | ) | Interest expense | $ | (1,018 | ) | | $ | (1,223 | ) |

| | | | | | |

| | June 30,

2019 |

| | Three months ended

June 30, 2019 |

| | Six months ended

June 30, 2019 |

|

| Interest rate swaps | $ | (1,826 | ) | Interest expense | $ | 244 |

| | $ | 473 |

|

| | | | | | | | | | | | | |

| Gain (loss) recognized

in accumulated other

comprehensive

loss as of | Location

of gain (loss)

reclassified from

accumulated other

comprehensive

loss into income | | | Gain (loss) reclassified from accumulated

other comprehensive loss into income |

| (dollars in thousands) | March 31,

2021 | | | Three months ended March 31, 2021 |

| Interest rate swaps | $ | 1,420 | | Interest expense | | | $ | (1,373) | |

| | | | | |

| March 31,

2020 | | | | Three months ended March 31, 2020 |

| Interest rate swaps | $ | (5,979) | | Interest expense | | | $ | (205) | |