UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

|

| |

| x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended March 31, 20152016

or

|

| |

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

| | | | | | |

Exact name of registrant as specified in its charter | | State or other jurisdiction of incorporation or organization | | Commission File Number | | I.R.S. Employer Identification No. |

| | | |

| Windstream Holdings, Inc. | | Delaware | | 001-32422 | | 46-2847717 |

| Windstream Services, LLC | | Delaware | | 001-36093 | | 20-0792300 |

|

| | | | |

| | | | | |

| 4001 Rodney Parham Road | | | |

| Little Rock, Arkansas | | 72212 |

| (Address of principal executive offices) | | (Zip Code) |

| | | | | |

| | | (501) 748-7000 | | |

| | (Registrants’ telephone number, including area code) | |

| | | | | |

| | | | | |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

|

| | | | |

| Windstream Holdings, Inc. | ý YES ¨ NO | | | |

| Windstream Services, LLC | ý YES ¨ NO | | | |

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

|

| | | | |

| Windstream Holdings, Inc. | ý YES ¨ NO | | | |

| Windstream Services, LLC | ý YES ¨ NO | | | |

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

| | | | |

| Windstream Holdings, Inc. | | | Large accelerated filer ý | Accelerated filer ¨ |

| | | | Non-accelerated filer ¨ | Smaller reporting company ¨ |

| Windstream Services, LLC | | | Large accelerated filer ý¨ | Accelerated filer ¨ |

| | | | Non-accelerated filer ¨ý | Smaller reporting company ¨ |

Indicate by check mark whether the registrant is a shell company (as defined by Rule 12b-2 of the Exchange Act). |

| | | | |

| Windstream Holdings, Inc. | ¨ YES ý NO | | | |

| Windstream Services, LLC | ¨ YES ý NO | | | |

As of April 30, 2015, 100,825,00929, 2016, 96,310,037 shares of common stock of Windstream Holdings, Inc.were outstanding. Windstream Holdings, Inc. holds a 100 percent interest in Windstream Services, LLC.

This Form 10-Q is a combined quarterly report being filed separately by two registrants: Windstream Holdings, Inc. and Windstream Services, LLC. Windstream Services, LLC is a direct, wholly-owned subsidiary of Windstream Holdings, Inc. Accordingly, Windstream Services, LLC meets the conditions set forth in general instruction H(1)(a) and (b) of Form 10-Q and is therefore filing this form with the reduced disclosure format. Unless the context indicates otherwise, the use of the terms “Windstream,” “we,” “us” or “our” shall refer to Windstream Holdings, Inc. and its subsidiaries, including Windstream Services, LLC, and the term “Windstream Services” shall refer to Windstream Services, LLC and its subsidiaries.

|

| | |

The Exhibit Index is located on page 7068. | | |

WINDSTREAM HOLDINGS, INC.

WINDSTREAM SERVICES, LLC

FORM 10-Q

TABLE OF CONTENTS

|

| | |

| | | |

| | | Page No. |

|

| | | |

| Item 1. | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Item 2. | | |

| Item 3. | | |

| Item 4. | | |

| |

|

| | | |

| Item 1. | | |

| Item 1A. | | |

| Item 2. | | * |

| Item 3. | Defaults Upon Senior Securities | * |

| Item 4. | Mine Safety Disclosures | * |

| Item 5. | Other Information | * |

| Item 6. | | |

_____________

| |

| * | No reportable information under this item. |

WINDSTREAM HOLDINGS, INC.

WINDSTREAM SERVICES, LLC

FORM 10-Q

PART I - FINANCIAL INFORMATION

Item 1. Financial Statements

WINDSTREAM HOLDINGS, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS (UNAUDITED)

|

| | | | | | | | | | | | |

| | | | | Three Months Ended

March 31, |

| (Millions, except per share amounts) | | | | | | 2015 |

| | 2014 |

|

| Revenues and sales: | | | | | | | | |

| Service revenues: | | | | | | | | |

| Enterprise and small business | | | | | | $ | 740.9 |

| | $ | 748.1 |

|

| Consumer | | | | | | 312.2 |

| | 313.0 |

|

| Carrier | | | | | | 176.5 |

| | 189.8 |

|

| Wholesale | | | | | | 98.3 |

| | 113.8 |

|

| Other | | | | | | 53.9 |

| | 55.0 |

|

| Total service revenues | | | | | | 1,381.8 |

| | 1,419.7 |

|

| Product sales | | | | | | 36.8 |

| | 45.2 |

|

| Total revenues and sales | | | | | | 1,418.6 |

| | 1,464.9 |

|

| Costs and expenses: | | | | | | | | |

Cost of services (exclusive of depreciation and amortization included below) | | | | | | 680.0 |

| | 657.9 |

|

| Cost of products sold | | | | | | 31.9 |

| | 41.1 |

|

| Selling, general and administrative | | | | | | 225.0 |

| | 238.9 |

|

| Depreciation and amortization | | | | | | 340.7 |

| | 338.9 |

|

| Merger and integration costs | | | | | | 14.1 |

| | 7.9 |

|

| Restructuring charges | | | | | | 7.0 |

| | 12.4 |

|

| Total costs and expenses | | | | | | 1,298.7 |

| | 1,297.1 |

|

| Operating income | | | | | | 119.9 |

| | 167.8 |

|

| Other (expense) income, net | | | | | | (1.2 | ) | | 0.9 |

|

| Interest expense | | | | | | (141.1 | ) | | (141.9 | ) |

| (Loss) income before income taxes | | | | | | (22.4 | ) | | 26.8 |

|

| Income tax (benefit) expense | | | | | | (27.7 | ) | | 10.8 |

|

| Net income | | | | | | $ | 5.3 |

| | $ | 16.0 |

|

| Basic and diluted earnings per share: | | | | | | | | |

| Net income | | | | | |

| $.05 |

| |

| $.15 |

|

|

| | | | | | | | | | | | |

| | | | | Three Months Ended

March 31, |

| (Millions, except per share amounts) | | | | | | 2016 |

| | 2015 |

|

| Revenues and sales: | | | | | | | | |

| Service revenues | | | | | | $ | 1,340.6 |

| | $ | 1,381.8 |

|

| Product sales | | | | | | 32.8 |

| | 36.8 |

|

| Total revenues and sales | | | | | | 1,373.4 |

| | 1,418.6 |

|

| Costs and expenses: | | | | | | | | |

Cost of services (exclusive of depreciation and amortization included below) | | | | | | 668.8 |

| | 680.0 |

|

| Cost of products sold | | | | | | 28.9 |

| | 31.9 |

|

| Selling, general and administrative | | | | | | 203.8 |

| | 225.0 |

|

| Depreciation and amortization | | | | | | 304.8 |

| | 340.7 |

|

| Merger and integration costs | | | | | | 5.0 |

| | 14.1 |

|

| Restructuring charges | | | | | | 4.4 |

| | 7.0 |

|

| Total costs and expenses | | | | | | 1,215.7 |

| | 1,298.7 |

|

| Operating income | | | | | | 157.7 |

| | 119.9 |

|

| Dividend income on CS&L common stock | | | | | | 17.6 |

| | — |

|

| Other expense, net | | | | | | (1.2 | ) | | (1.2 | ) |

| Net loss on early extinguishment of debt | | | | | | (35.4 | ) | | — |

|

Other-than-temporary impairment loss on investment in CS&L common stock | | | | | | (181.9 | ) | | — |

|

| Interest expense | | | | | | (219.7 | ) | | (141.1 | ) |

| Loss before income taxes | | | | | | (262.9 | ) | | (22.4 | ) |

| Income tax benefit | | | | | | (31.0 | ) | | (27.7 | ) |

| Net (loss) income | | | | | | $ | (231.9 | ) | | $ | 5.3 |

|

| Basic and diluted (loss) earnings per share: | | | | | | | | |

| Net (loss) income | | | | | |

| ($2.52 | ) | |

| $.05 |

|

See the accompanying notes to the unaudited interim consolidated financial statements.

WINDSTREAM HOLDINGS, INC.

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (UNAUDITED)

| | | | | | | Three Months Ended

March 31, | | | | Three Months Ended

March 31, |

| (Millions) | | 2015 |

| | 2014 |

| | 2016 |

| | 2015 |

|

| Net income | | $ | 5.3 |

| | $ | 16.0 |

| |

| Other comprehensive (loss) income: | | | | | |

| Net (loss) income | | | $ | (231.9 | ) | | $ | 5.3 |

|

| Other comprehensive income (loss): | | | | | |

| Available-for-sale securities: | | | | | |

| Unrealized holding gain arising during the period | | | 104.6 |

| | — |

|

Other-than-temporary impairment loss recognized in the period | | | 181.9 |

| | — |

|

| Change in available-for-sale securities | | | 286.5 |

| | — |

|

| Interest rate swaps: | | | | | | | | |

| Changes in designated interest rate swaps | | (8.6 | ) | | (6.9 | ) | |

| Unrealized loss on designated interest rate swaps | | | (8.3 | ) | | (8.6 | ) |

Amortization of unrealized losses on de-designated interest rate swaps | | 3.4 |

| | 4.2 |

| | 1.2 |

| | 3.4 |

|

| Income tax benefit | | 2.0 |

| | 1.0 |

| | 2.7 |

| | 2.0 |

|

| Unrealized holding loss on interest rate swaps | | (3.2 | ) | | (1.7 | ) | |

| Change in interest rate swaps | | | (4.4 | ) | | (3.2 | ) |

| Postretirement and pension plans: | | | | | | | | |

| Change in net actuarial gain for postretirement plan | | — |

| | (0.8 | ) | |

| Plan curtailment | | — |

| | (9.5 | ) | | (5.5 | ) | | — |

|

| Amounts included in net periodic benefit cost: | | | | | | | | |

| Amortization of net actuarial loss | | 0.2 |

| | — |

| | 0.1 |

| | 0.2 |

|

| Amortization of prior service credits | | (1.3 | ) | | (1.7 | ) | | (0.5 | ) | | (1.3 | ) |

| Income tax benefit | | 0.2 |

| | 4.5 |

| | 2.3 |

| | 0.2 |

|

| Change in postretirement and pension plans | | (0.9 | ) | | (7.5 | ) | | (3.6 | ) | | (0.9 | ) |

| Other comprehensive loss | | (4.1 | ) | | (9.2 | ) | |

| Other comprehensive income (loss) | | | 278.5 |

| | (4.1 | ) |

| Comprehensive income | | $ | 1.2 |

| | $ | 6.8 |

| | $ | 46.6 |

| | $ | 1.2 |

|

See the accompanying notes to the unaudited interim consolidated financial statements.

WINDSTREAM HOLDINGS, INC.

CONSOLIDATED BALANCE SHEETS (UNAUDITED)

|

| | | | | | | | |

| (Millions, except par value) | | March 31,

2016 |

| | December 31,

2015 |

|

| Assets | | | | |

| Current Assets: | | | | |

| Cash and cash equivalents | | $ | 74.6 |

| | $ | 31.3 |

|

| Accounts receivable (less allowance for doubtful | | | | |

| accounts of $30.6 and $33.1, respectively) | | 636.1 |

| | 643.9 |

|

| Inventories | | 79.4 |

| | 79.5 |

|

| Prepaid expenses and other | | 149.9 |

| | 120.6 |

|

| Total current assets | | 940.0 |

| | 875.3 |

|

| Goodwill | | 4,213.6 |

| | 4,213.6 |

|

| Other intangibles, net | | 1,457.2 |

| | 1,504.7 |

|

| Net property, plant and equipment | | 5,255.7 |

| | 5,279.8 |

|

| Investment in CS&L common stock | | 653.8 |

| | 549.2 |

|

| Other assets | | 90.9 |

| | 95.5 |

|

| Total Assets | | $ | 12,611.2 |

| | $ | 12,518.1 |

|

| Liabilities and Shareholders’ Equity | | | | |

| Current Liabilities: | | | | |

| Current maturities of long-term debt | | $ | 11.9 |

| | $ | 5.9 |

|

| Current portion of long-term lease obligations | | 156.6 |

| | 152.7 |

|

| Accounts payable | | 323.6 |

| | 430.1 |

|

| Advance payments and customer deposits | | 193.9 |

| | 193.9 |

|

| Accrued taxes | | 71.6 |

| | 84.1 |

|

| Accrued interest | | 118.1 |

| | 78.4 |

|

| Other current liabilities | | 273.9 |

| | 322.0 |

|

| Total current liabilities | | 1,149.6 |

| | 1,267.1 |

|

| Long-term debt | | 5,433.1 |

| | 5,164.6 |

|

| Long-term lease obligations | | 4,959.8 |

| | 5,000.4 |

|

| Deferred income taxes | | 254.9 |

| | 287.4 |

|

| Other liabilities | | 476.1 |

| | 492.2 |

|

| Total liabilities | | 12,273.5 |

| | 12,211.7 |

|

| Commitments and Contingencies (See Note 13) | |

|

| |

|

|

| Shareholders’ Equity: | | | | |

| Common stock, $.0001 par value, 166.7 shares authorized, | | | | |

| 96.3 and 96.7 shares issued and outstanding, respectively | | — |

| | — |

|

| Additional paid-in capital | | 587.6 |

| | 602.9 |

|

| Accumulated other comprehensive loss | | (5.9 | ) | | (284.4 | ) |

| Accumulated deficit | | (244.0 | ) | | (12.1 | ) |

| Total shareholders’ equity | | 337.7 |

| | 306.4 |

|

| Total Liabilities and Shareholders’ Equity | | $ | 12,611.2 |

| | $ | 12,518.1 |

|

See the accompanying notes to the unaudited interim consolidated financial statements.

WINDSTREAM HOLDINGS, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED)

|

| | | | | | | | |

| | | Three Months Ended

March 31, |

| (Millions) | | 2016 |

| | 2015 |

|

| Cash Flows from Operating Activities: | | | | |

| Net (loss) income | | $ | (231.9 | ) | | $ | 5.3 |

|

| Adjustments to reconcile net (loss) income to net cash provided from operations: | | | | |

| Depreciation and amortization | | 304.8 |

| | 340.7 |

|

| Provision for doubtful accounts | | 9.7 |

| | 10.3 |

|

| Share-based compensation expense | | 13.7 |

| | 14.8 |

|

| Deferred income taxes | | (27.5 | ) | | (33.8 | ) |

Other-than-temporary impairment loss on investment in CS&L common stock | | 181.9 |

| | — |

|

| Noncash portion of net loss on early extinguishment of debt | | (7.4 | ) | | — |

|

| Amortization of unrealized losses on de-designated interest rate swaps | | 1.2 |

| | 3.4 |

|

| Plan curtailment | | (5.5 | ) | | — |

|

| Other, net | | (15.3 | ) | | 6.9 |

|

| Changes in operating assets and liabilities, net | | | | |

| Accounts receivable | | (2.0 | ) | | (33.3 | ) |

| Prepaid income taxes | | (5.8 | ) | | 7.8 |

|

| Prepaid expenses and other | | (6.0 | ) | | (24.8 | ) |

| Accounts payable | | (100.2 | ) | | (64.2 | ) |

| Accrued interest | | 39.8 |

| | 67.4 |

|

| Accrued taxes | | (12.5 | ) | | (10.9 | ) |

| Other current liabilities | | 4.2 |

| | (43.2 | ) |

| Other liabilities | | (10.0 | ) | | (2.6 | ) |

| Other, net | | (4.0 | ) | | — |

|

| Net cash provided from operating activities | | 127.2 |

| | 243.8 |

|

| Cash Flows from Investing Activities: | | | | |

| Additions to property, plant and equipment | | (263.8 | ) | | (189.3 | ) |

| Proceeds from the sale of property | | 6.2 |

| | — |

|

| Grant funds received for broadband stimulus projects | | — |

| | 7.4 |

|

| Network expansion funded by Connect America Fund - Phase I | | — |

| | (8.3 | ) |

| Change in restricted cash | | — |

| | (0.4 | ) |

| Other, net | | — |

| | (2.1 | ) |

| Net cash used in investing activities | | (257.6 | ) | | (192.7 | ) |

| Cash Flows from Financing Activities: | | | | |

| Dividends paid to shareholders | | (14.9 | ) | | (151.5 | ) |

| Repayments of debt and swaps | | (985.3 | ) | | (325.4 | ) |

| Proceeds of debt issuance | | 1,278.0 |

| | 490.0 |

|

| Debt issuance costs | | (10.7 | ) | | — |

|

| Stock repurchases | | (28.9 | ) | | — |

|

| Payments under long-term lease obligations | | (36.8 | ) | | — |

|

| Payments under capital lease obligations | | (19.8 | ) | | (11.2 | ) |

| Other, net | | (7.9 | ) | | (6.8 | ) |

| Net cash provided from (used in) financing activities | | 173.7 |

| | (4.9 | ) |

| Increase in cash and cash equivalents | | 43.3 |

| | 46.2 |

|

| Cash and Cash Equivalents: | | | | |

| Beginning of period | | 31.3 |

| | 27.8 |

|

| End of period | | $ | 74.6 |

| | $ | 74.0 |

|

| Supplemental Cash Flow Disclosures: | | | | |

| Interest paid | | $ | 178.6 |

| | $ | 74.7 |

|

| Income taxes paid (refunded), net | | $ | 6.5 |

| | $ | (1.2 | ) |

See the accompanying notes to the unaudited interim consolidated financial statements.

WINDSTREAM HOLDINGS, INC.

CONSOLIDATED STATEMENT OF SHAREHOLDERS’ EQUITY (UNAUDITED)

|

| | | | | | | | | | | | | | | | |

| (Millions, except per share amounts) | | Common Stock and Additional Paid-In Capital | | Accumulated Other Comprehensive Loss | | Accumulated Deficit | | Total |

| Balance at December 31, 2015 | | $ | 602.9 |

| | $ | (284.4 | ) | | $ | (12.1 | ) | | $ | 306.4 |

|

| Net loss | | — |

| | — |

| | (231.9 | ) | | (231.9 | ) |

| Other comprehensive income (loss), net of tax: | | | | | | | | |

| Change in available-for-sale securities | | — |

| | 286.5 |

| | — |

| | 286.5 |

|

| Change in postretirement and pension plans | | — |

| | (3.6 | ) | | — |

| | (3.6 | ) |

Amortization of unrealized losses on de-designated interest rate swaps | | — |

| | 0.7 |

| | — |

| | 0.7 |

|

| Change in designated interest rate swaps | | — |

| | (5.1 | ) | | — |

| | (5.1 | ) |

| Comprehensive income (loss) | | — |

| | 278.5 |

| | (231.9 | ) | | 46.6 |

|

| Share-based compensation expense (See Note 6) | | 6.6 |

| | — |

| | — |

| | 6.6 |

|

| Stock options exercised | | 0.4 |

| | — |

| | — |

| | 0.4 |

|

Stock issued for management incentive compensation plans (See Note 6) | | 5.5 |

| | — |

| | — |

| | 5.5 |

|

| Stock issued to employee savings plan (See Note 5) | | 24.0 |

| | — |

| | — |

| | 24.0 |

|

| Stock repurchases | | (28.9 | ) | | — |

| | — |

| | (28.9 | ) |

| Taxes withheld on vested restricted stock and other | | (8.3 | ) | | — |

| | — |

| | (8.3 | ) |

| Dividends of $.15 per share declared to shareholders | | (14.6 | ) | | — |

| | — |

| | (14.6 | ) |

| Balance at March 31, 2016 | | $ | 587.6 |

| | $ | (5.9 | ) | | $ | (244.0 | ) | | $ | 337.7 |

|

See the accompanying notes to the unaudited interim consolidated financial statements.

WINDSTREAM HOLDINGS, INC.SERVICES, LLC

CONSOLIDATED BALANCE SHEETSSTATEMENTS OF OPERATIONS (UNAUDITED)

|

| | | | | | | | |

| (Millions, except par value) | | March 31,

2015 |

| | December 31,

2014 |

|

| Assets | | | | |

| Current Assets: | | | | |

| Cash and cash equivalents | | $ | 74.0 |

| | $ | 27.8 |

|

| Restricted cash | | 7.1 |

| | 6.7 |

|

| Accounts receivable (less allowance for doubtful | | | | |

| accounts of $42.3 and $43.4, respectively) | | 658.5 |

| | 635.5 |

|

| Inventories | | 63.0 |

| | 63.7 |

|

| Deferred income taxes | | 91.7 |

| | 105.4 |

|

| Prepaid expenses and other | | 171.6 |

| | 164.6 |

|

| Total current assets | | 1,065.9 |

| | 1,003.7 |

|

| Goodwill | | 4,352.8 |

| | 4,352.8 |

|

| Other intangibles, net | | 1,710.5 |

| | 1,764.0 |

|

| Net property, plant and equipment | | 5,315.0 |

| | 5,412.3 |

|

| Other assets | | 174.9 |

| | 180.6 |

|

| Total Assets | | $ | 12,619.1 |

| | $ | 12,713.4 |

|

| Liabilities and Shareholders’ Equity | | | | |

| Current Liabilities: | | | | |

| Current maturities of long-term debt | | $ | 92.5 |

| | $ | 717.5 |

|

| Current portion of interest rate swaps | | 28.5 |

| | 28.5 |

|

| Accounts payable | | 332.0 |

| | 403.3 |

|

| Advance payments and customer deposits | | 214.5 |

| | 214.7 |

|

| Accrued dividends | | 151.7 |

| | 152.4 |

|

| Accrued taxes | | 84.3 |

| | 95.2 |

|

| Accrued interest | | 170.4 |

| | 102.5 |

|

| Other current liabilities | | 282.4 |

| | 328.9 |

|

| Total current liabilities | | 1,356.3 |

| | 2,043.0 |

|

| Long-term debt | | 8,728.1 |

| | 7,934.2 |

|

| Deferred income taxes | | 1,828.8 |

| | 1,878.6 |

|

| Other liabilities | | 610.9 |

| | 632.8 |

|

| Total liabilities | | 12,524.1 |

| | 12,488.6 |

|

| Commitments and Contingencies (See Note 6) | |

|

| |

|

|

| Shareholders’ Equity: | | | | |

| Common stock, $.0001 par value, 166.7 shares authorized, | | | | |

| 100.8 and 100.5 shares issued and outstanding, respectively | | 0.1 |

| | 0.1 |

|

| Additional paid-in capital | | 86.9 |

| | 212.6 |

|

| Accumulated other comprehensive income | | 8.0 |

| | 12.1 |

|

| Retained earnings | | — |

| | — |

|

| Total shareholders’ equity | | 95.0 |

| | 224.8 |

|

| Total Liabilities and Shareholders’ Equity | | $ | 12,619.1 |

| | $ | 12,713.4 |

|

|

| | | | | | | | | | | | |

| | | | | Three Months Ended

March 31, |

| (Millions) | | | | | | 2016 |

| | 2015 |

|

| Revenues and sales: | | | | | | | | |

| Service revenues | | | | | | $ | 1,340.6 |

| | $ | 1,381.8 |

|

| Product sales | | | | | | 32.8 |

| | 36.8 |

|

| Total revenues and sales | | | | | | 1,373.4 |

| | 1,418.6 |

|

| Costs and expenses: | | | | | | | | |

Cost of services (exclusive of depreciation and amortization included below) | | | | | | 668.8 |

| | 680.0 |

|

| Cost of products sold | | | | | | 28.9 |

| | 31.9 |

|

| Selling, general and administrative | | | | | | 203.3 |

| | 224.4 |

|

| Depreciation and amortization | | | | | | 304.8 |

| | 340.7 |

|

| Merger and integration costs | | | | | | 5.0 |

| | 14.1 |

|

| Restructuring charges | | | | | | 4.4 |

| | 7.0 |

|

| Total costs and expenses | | | | | | 1,215.2 |

| | 1,298.1 |

|

| Operating income | | | | | | 158.2 |

| | 120.5 |

|

| Dividend income on CS&L common stock | | | | | | 17.6 |

| | — |

|

| Other expense, net | | | | | | (1.2 | ) | | (1.2 | ) |

| Net loss on early extinguishment of debt | | | | | | (35.4 | ) | | — |

|

Other-than-temporary impairment loss on investment in CS&L common stock | | | | | | (181.9 | ) | | — |

|

| Interest expense | | | | | | (219.7 | ) | | (141.1 | ) |

| Loss before income taxes | | | | | | (262.4 | ) | | (21.8 | ) |

| Income tax benefit | | | | | | (30.8 | ) | | (27.4 | ) |

| Net (loss) income | | | | | | $ | (231.6 | ) | | $ | 5.6 |

|

See the accompanying notes to the unaudited interim consolidated financial statements.

WINDSTREAM HOLDINGS, INC.SERVICES, LLC

CONSOLIDATED STATEMENTS OF CASH FLOWSCOMPREHENSIVE INCOME (UNAUDITED)

|

| | | | | | | | |

| | | Three Months Ended

March 31, |

| (Millions) | | 2015 |

| | 2014 |

|

| Cash Provided from Operations: | | | | |

| Net income | | $ | 5.3 |

| | $ | 16.0 |

|

| Adjustments to reconcile net income to net cash provided from operations: | | | | |

| Depreciation and amortization | | 340.7 |

| | 338.9 |

|

| Provision for doubtful accounts | | 10.3 |

| | 12.3 |

|

| Share-based compensation expense | | 14.8 |

| | 13.7 |

|

| Deferred income taxes | | (33.8 | ) | | 9.3 |

|

| Amortization of unrealized losses on de-designated interest rate swaps | | 3.4 |

| | 4.2 |

|

| Plan curtailment and other, net | | 6.9 |

| | (4.9 | ) |

| Changes in operating assets and liabilities, net | | | | |

| Accounts receivable | | (33.3 | ) | | (9.7 | ) |

| Prepaid income taxes | | 7.8 |

| | 5.6 |

|

| Prepaid expenses and other | | (24.8 | ) | | (20.1 | ) |

| Accounts payable | | (64.2 | ) | | (46.1 | ) |

| Accrued interest | | 67.4 |

| | 66.0 |

|

| Accrued taxes | | (10.9 | ) | | (15.2 | ) |

| Other current liabilities | | (43.2 | ) | | (32.4 | ) |

| Other liabilities | | (2.6 | ) | | (3.3 | ) |

| Other, net | | — |

| | (14.5 | ) |

| Net cash provided from operations | | 243.8 |

| | 319.8 |

|

| Cash Flows from Investing Activities: | | | | |

| Additions to property, plant and equipment | | (189.3 | ) | | (153.0 | ) |

| Broadband network expansion funded by stimulus grants | | — |

| | (7.1 | ) |

| Changes in restricted cash | | (0.4 | ) | | (0.9 | ) |

| Grant funds received for broadband stimulus projects | | 7.4 |

| | 11.4 |

|

| Grant funds received from Connect America Fund - Phase I | | — |

| | 26.0 |

|

| Network expansion funded by Connect America Fund - Phase I | | (8.3 | ) | | — |

|

| Other, net | | (2.1 | ) | | — |

|

| Net cash used in investing activities | | (192.7 | ) | | (123.6 | ) |

| Cash Flows from Financing Activities: | | | | |

| Dividends paid to shareholders | | (151.5 | ) | | (150.2 | ) |

| Repayments of debt and swaps | | (325.4 | ) | | (331.6 | ) |

| Proceeds of debt issuance | | 490.0 |

| | 325.0 |

|

| Payments under capital lease obligations | | (11.2 | ) | | (7.8 | ) |

| Other, net | | (6.8 | ) | | (9.8 | ) |

| Net cash used in financing activities | | (4.9 | ) | | (174.4 | ) |

| Increase in cash and cash equivalents | | 46.2 |

| | 21.8 |

|

| Cash and Cash Equivalents: | | | | |

| Beginning of period | | 27.8 |

| | 48.2 |

|

| End of period | | $ | 74.0 |

| | $ | 70.0 |

|

| Supplemental Cash Flow Disclosures: | | | | |

| Interest paid | | $ | 74.7 |

| | $ | 74.7 |

|

| Income taxes refunded, net | | $ | (1.2 | ) | | $ | (1.0 | ) |

|

| | | | | | | | | | | | |

| | | | | Three Months Ended

March 31, |

| (Millions) | | | | | | 2016 |

| | 2015 |

|

| Net (loss) income | | | | | | $ | (231.6 | ) | | $ | 5.6 |

|

| Other comprehensive income (loss): | | | | | | | | |

| Available-for-sale securities: | | | | | | | | |

| Unrealized holding gain arising during the period | | | | | | 104.6 |

| | — |

|

Other-than-temporary impairment loss recognized in the period | | | | | | 181.9 |

| | — |

|

| Change in available-for-sale securities | | | | | | 286.5 |

| | — |

|

| Interest rate swaps: | | | | | | | | |

| Unrealized loss on designated interest rate swaps | | | | | | (8.3 | ) | | (8.6 | ) |

Amortization of unrealized losses on de-designated interest rate swaps | | | | | | 1.2 |

| | 3.4 |

|

| Income tax benefit | | | | | | 2.7 |

| | 2.0 |

|

| Change in interest rate swaps | | | | | | (4.4 | ) | | (3.2 | ) |

| Postretirement and pension plans: | | | | | | | | |

| Plan curtailment | | | | | | (5.5 | ) | | — |

|

| Amounts included in net periodic benefit cost: | | | | | | | | |

| Amortization of net actuarial loss | | | | | | 0.1 |

| | 0.2 |

|

| Amortization of prior service credits | | | | | | (0.5 | ) | | (1.3 | ) |

| Income tax benefit | | | | | | 2.3 |

| | 0.2 |

|

| Change in postretirement and pension plans | | | | | | (3.6 | ) | | (0.9 | ) |

| Other comprehensive income (loss) | | | | | | 278.5 |

| | (4.1 | ) |

| Comprehensive income | | | | | | $ | 46.9 |

| | $ | 1.5 |

|

See the accompanying notes to the unaudited interim consolidated financial statements.

WINDSTREAM HOLDINGS, INC.SERVICES, LLC

CONSOLIDATED STATEMENTS OF SHAREHOLDERS’ EQUITYBALANCE SHEETS (UNAUDITED)

|

| | | | | | | | | | | | | | | | |

| (Millions, except per share amounts) | | Common Stock and Additional Paid-In Capital | | Accumulated Other Comprehensive Income | | Retained Earnings | | Total |

| Balance at December 31, 2014 | | $ | 212.7 |

| | $ | 12.1 |

| | $ | — |

| | $ | 224.8 |

|

| Net income | | — |

| | — |

| | 5.3 |

| | 5.3 |

|

| Other comprehensive (loss) income, net of tax: | | | | | | | | |

| Change in postretirement and pension plans | | — |

| | (0.9 | ) | | — |

| | (0.9 | ) |

Amortization of unrealized losses on de-designated interest rate swaps | | — |

| | 2.0 |

| | — |

| | 2.0 |

|

| Changes in designated interest rate swaps | | — |

| | (5.2 | ) | | — |

| | (5.2 | ) |

| Comprehensive (loss) income | | — |

| | (4.1 | ) | | 5.3 |

| | 1.2 |

|

| Share-based compensation expense (See Note 8) | | 5.0 |

| | — |

| | — |

| | 5.0 |

|

| Stock issued to employee savings plan (See Note 7) | | 21.6 |

| | — |

| | — |

| | 21.6 |

|

| Taxes withheld on vested restricted stock and other | | (7.1 | ) | | — |

| | — |

| | (7.1 | ) |

| Dividends of $1.50 per share declared to shareholders | | (145.2 | ) | | — |

| | (5.3 | ) | | (150.5 | ) |

| Balance at March 31, 2015 | | $ | 87.0 |

| | $ | 8.0 |

| | $ | — |

| | $ | 95.0 |

|

|

| | | | | | | | |

| (Millions, except number of shares) | | March 31,

2016 |

| | December 31,

2015 |

|

| Assets | | | | |

| Current Assets: | | | | |

| Cash and cash equivalents | | $ | 74.6 |

| | $ | 31.3 |

|

| Accounts receivable (less allowance for doubtful | | | | |

| accounts of $30.6 and $33.1, respectively) | | 636.1 |

| | 643.9 |

|

| Inventories | | 79.4 |

| | 79.5 |

|

| Prepaid expenses and other | | 149.9 |

| | 120.6 |

|

| Total current assets | | 940.0 |

| | 875.3 |

|

| Goodwill | | 4,213.6 |

| | 4,213.6 |

|

| Other intangibles, net | | 1,457.2 |

| | 1,504.7 |

|

| Net property, plant and equipment | | 5,255.7 |

| | 5,279.8 |

|

| Investment in CS&L common stock | | 653.8 |

| | 549.2 |

|

| Other assets | | 90.9 |

| | 95.5 |

|

| Total Assets | | $ | 12,611.2 |

| | $ | 12,518.1 |

|

| Liabilities and Member Equity | | | | |

| Current Liabilities: | | | | |

| Current maturities of long-term debt | | $ | 11.9 |

| | $ | 5.9 |

|

| Current portion of long-term lease obligations | | 156.6 |

| | 152.7 |

|

| Accounts payable | | 323.6 |

| | 430.1 |

|

| Advance payments and customer deposits | | 193.9 |

| | 193.9 |

|

| Payable to Windstream Holdings, Inc. | | 14.9 |

| | 15.1 |

|

| Accrued taxes | | 71.6 |

| | 84.1 |

|

| Accrued interest | | 118.1 |

| | 78.4 |

|

| Other current liabilities | | 259.0 |

| | 306.9 |

|

| Total current liabilities | | 1,149.6 |

| | 1,267.1 |

|

| Long-term debt | | 5,433.1 |

| | 5,164.6 |

|

| Long-term lease obligations | | 4,959.8 |

| | 5,000.4 |

|

| Deferred income taxes | | 254.9 |

| | 287.4 |

|

| Other liabilities | | 476.1 |

| | 492.2 |

|

| Total liabilities | | 12,273.5 |

| | 12,211.7 |

|

| Commitments and Contingencies (See Note 13) | |

| |

|

|

| Member Equity: | | | | |

| Additional paid-in capital | | 584.7 |

| | 600.3 |

|

| Accumulated other comprehensive loss | | (5.9 | ) | | (284.4 | ) |

| Accumulated deficit | | (241.1 | ) | | (9.5 | ) |

| Total member equity | | 337.7 |

| | 306.4 |

|

| Total Liabilities and Member Equity | | $ | 12,611.2 |

| | $ | 12,518.1 |

|

See the accompanying notes to the unaudited interim consolidated financial statements.

WINDSTREAM SERVICES, LLC

CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED)

|

| | | | | | | | |

| | | Three Months Ended

March 31, |

| (Millions) | | 2016 |

| | 2015 |

|

| Cash Flows from Operating Activities: | | | | |

| Net (loss) income | | $ | (231.6 | ) | | $ | 5.6 |

|

| Adjustments to reconcile net (loss) income to net cash provided from operations: | | | | |

| Depreciation and amortization | | 304.8 |

| | 340.7 |

|

| Provision for doubtful accounts | | 9.7 |

| | 10.3 |

|

| Share-based compensation expense | | 13.7 |

| | 14.8 |

|

| Deferred income taxes | | (27.5 | ) | | (33.8 | ) |

Other-than-temporary impairment loss on investment in CS&L common stock | | 181.9 |

| | — |

|

| Noncash portion of net loss on early extinguishment of debt | | (7.4 | ) | | — |

|

| Amortization of unrealized losses on de-designated interest rate swaps | | 1.2 |

| | 3.4 |

|

| Plan curtailment | | (5.5 | ) | | — |

|

| Other, net | | (15.3 | ) | | 6.9 |

|

| Changes in operating assets and liabilities, net | | | | |

| Accounts receivable | | (2.0 | ) | | (33.3 | ) |

| Prepaid income taxes | | (5.8 | ) | | 7.8 |

|

| Prepaid expenses and other | | (6.0 | ) | | (24.8 | ) |

| Accounts payable | | (100.2 | ) | | (64.2 | ) |

| Accrued interest | | 39.8 |

| | 67.4 |

|

| Accrued taxes | | (12.5 | ) | | (10.9 | ) |

| Other current liabilities | | 4.2 |

| | (43.2 | ) |

| Other liabilities | | (10.0 | ) | | (2.6 | ) |

| Other, net | | (4.0 | ) | | — |

|

| Net cash provided from operating activities | | 127.5 |

| | 244.1 |

|

| Cash Flows from Investing Activities: | | | | |

| Additions to property, plant and equipment | | (263.8 | ) | | (189.3 | ) |

| Proceeds from the sale of property | | 6.2 |

| | — |

|

| Grant funds received for broadband stimulus projects | | — |

| | 7.4 |

|

| Network expansion funded by Connect America Fund - Phase I | | — |

| | (8.3 | ) |

| Change in restricted cash | | — |

| | (0.4 | ) |

| Other, net | | — |

| | (2.1 | ) |

| Net cash used in investing activities | | (257.6 | ) | | (192.7 | ) |

| Cash Flows from Financing Activities: | | | | |

| Distributions to Windstream Holdings, Inc. | | (44.1 | ) | | (151.8 | ) |

| Repayments of debt and swaps | | (985.3 | ) | | (325.4 | ) |

| Proceeds of debt issuance | | 1,278.0 |

| | 490.0 |

|

| Debt issuance costs | | (10.7 | ) | | — |

|

| Payments under long-term lease obligations | | (36.8 | ) | | — |

|

| Payments under capital lease obligations | | (19.8 | ) | | (11.2 | ) |

| Other, net | | (7.9 | ) | | (6.8 | ) |

| Net cash provided from (used in) financing activities | | 173.4 |

| | (5.2 | ) |

| Increase in cash and cash equivalents | | 43.3 |

| | 46.2 |

|

| Cash and Cash Equivalents: | | | | |

| Beginning of period | | 31.3 |

| | 27.8 |

|

| End of period | | $ | 74.6 |

| | $ | 74.0 |

|

| Supplemental Cash Flow Disclosures: | | | | |

| Interest paid | | $ | 178.6 |

| | $ | 74.7 |

|

| Income taxes paid (refunded), net | | $ | 6.5 |

| | $ | (1.2 | ) |

See the accompanying notes to the unaudited interim consolidated financial statements.

WINDSTREAM SERVICES, LLC

CONSOLIDATED STATEMENT OF MEMBER EQUITY (UNAUDITED)

|

| | | | | | | | | | | | | | | | |

| (Millions) | | Additional Paid-In Capital | | Accumulated Other Comprehensive Loss | | Accumulated Deficit | | Total |

| Balance at December 31, 2015 | | $ | 600.3 |

| | $ | (284.4 | ) | | $ | (9.5 | ) | | $ | 306.4 |

|

| Net loss | | — |

| | — |

| | (231.6 | ) | | (231.6 | ) |

| Other comprehensive income (loss), net of tax: | | | | | | | | |

| Change in available-for-sale securities | | — |

| | 286.5 |

| | — |

| | 286.5 |

|

| Change in postretirement and pension plans | | — |

| | (3.6 | ) | | — |

| | (3.6 | ) |

Amortization of unrealized losses on de-designated interest rate swaps | | — |

| | 0.7 |

| | — |

| | 0.7 |

|

| Change in designated interest rate swaps | | — |

| | (5.1 | ) | | — |

| | (5.1 | ) |

| Comprehensive income (loss) | | — |

| | 278.5 |

| | (231.6 | ) | | 46.9 |

|

| Share-based compensation expense (See Note 6) | | 6.6 |

| | — |

| | — |

| | 6.6 |

|

| Stock options exercised | | 0.4 |

| | — |

| | — |

| | 0.4 |

|

Stock issued for management incentive compensation plans (See Note 6) | | 5.5 |

| | — |

| | — |

| | 5.5 |

|

| Stock issued to employee savings plan (See Note 5) | | 24.0 |

| | — |

| | — |

| | 24.0 |

|

| Taxes withheld on vested restricted stock and other | | (8.3 | ) | | — |

| | — |

| | (8.3 | ) |

| Distributions payable to Windstream Holdings, Inc. | | (43.8 | ) | | — |

| | — |

| | (43.8 | ) |

| Balance at March 31, 2016 | | $ | 584.7 |

| | $ | (5.9 | ) | | $ | (241.1 | ) | | $ | 337.7 |

|

See the accompanying notes to the unaudited interim consolidated financial statements.

WINDSTREAM SERVICES, LLC

CONSOLIDATED STATEMENTS OF OPERATIONS (UNAUDITED)

|

| | | | | | | | | | | | |

| | | | | Three Months Ended

March 31, |

| (Millions) | | | | | | 2015 |

| | 2014 |

|

| Revenues and sales: | | | | | | | | |

| Service revenues: | | | | | | | | |

| Enterprise and small business | | | | | | $ | 740.9 |

| | $ | 748.1 |

|

| Consumer | | | | | | 312.2 |

| | 313.0 |

|

| Carrier | | | | | | 176.5 |

| | 189.8 |

|

| Wholesale | | | | | | 98.3 |

| | 113.8 |

|

| Other | | | | | | 53.9 |

| | 55.0 |

|

| Total service revenues | | | | | | 1,381.8 |

| | 1,419.7 |

|

| Product sales | | | | | | 36.8 |

| | 45.2 |

|

| Total revenues and sales | | | | | | 1,418.6 |

| | 1,464.9 |

|

| Costs and expenses: | | | | | | | | |

Cost of services (exclusive of depreciation and amortization included below) | | | | | | 680.0 |

| | 657.9 |

|

| Cost of products sold | | | | | | 31.9 |

| | 41.1 |

|

| Selling, general and administrative | | | | | | 224.4 |

| | 238.4 |

|

| Depreciation and amortization | | | | | | 340.7 |

| | 338.9 |

|

| Merger and integration costs | | | | | | 14.1 |

| | 7.4 |

|

| Restructuring charges | | | | | | 7.0 |

| | 12.9 |

|

| Total costs and expenses | | | | | | 1,298.1 |

| | 1,296.6 |

|

| Operating income | | | | | | 120.5 |

| | 168.3 |

|

| Other (expense) income, net | | | | | | (1.2 | ) | | 0.9 |

|

| Interest expense | | | | | | (141.1 | ) | | (141.9 | ) |

| (Loss) income before income taxes | | | | | | (21.8 | ) | | 27.3 |

|

| Income tax (benefit) expense | | | | | | (27.4 | ) | | 11.0 |

|

| Net income | | | | | | $ | 5.6 |

| | $ | 16.3 |

|

See the accompanying notes to the unaudited interim consolidated financial statements.

WINDSTREAM SERVICES, LLC

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (UNAUDITED)

|

| | | | | | | | | | | | |

| | | | | Three Months Ended

March 31, |

| (Millions) | | | | | | 2015 |

| | 2014 |

|

| Net income | | | | | | $ | 5.6 |

| | $ | 16.3 |

|

| Other comprehensive (loss) income: | | | | | | | | |

| Interest rate swaps: | | | | | | | | |

| Changes in designated interest rate swaps | | | | | | (8.6 | ) | | (6.9 | ) |

| Amortization of unrealized losses on de-designated interest rate swaps | | 3.4 |

| | 4.2 |

|

| Income tax benefit | | | | | | 2.0 |

| | 1.0 |

|

| Unrealized holding loss on interest rate swaps | | | | | | (3.2 | ) | | (1.7 | ) |

| Postretirement and pension plans: | | | | | | | | |

| Change in net actuarial gain for postretirement plan | | | | | | — |

| | (0.8 | ) |

| Plan curtailment | | | | | | — |

| | (9.5 | ) |

| Amounts included in net periodic benefit cost: | | | | | | | | |

| Amortization of net actuarial loss | | | | | | 0.2 |

| | — |

|

| Amortization of prior service credits | | | | | | (1.3 | ) | | (1.7 | ) |

| Income tax benefit | | | | | | 0.2 |

| | 4.5 |

|

| Change in postretirement and pension plans | | | | | | (0.9 | ) | | (7.5 | ) |

| Other comprehensive loss | | | | | | (4.1 | ) | | (9.2 | ) |

| Comprehensive income | | | | | | $ | 1.5 |

| | $ | 7.1 |

|

See the accompanying notes to the unaudited interim consolidated financial statements.

WINDSTREAM SERVICES, LLC

CONSOLIDATED BALANCE SHEETS (UNAUDITED)

|

| | | | | | | | |

| (Millions, except number of shares) | | March 31,

2015 |

| | December 31,

2014 |

|

| Assets | | | | |

| Current Assets: | | | | |

| Cash and cash equivalents | | $ | 74.0 |

| | $ | 27.8 |

|

| Restricted cash | | 7.1 |

| | 6.7 |

|

| Accounts receivable (less allowance for doubtful | | | | |

| accounts of $42.3 and $43.4, respectively) | | 658.5 |

| | 635.5 |

|

| Inventories | | 63.0 |

| | 63.7 |

|

| Deferred income taxes | | 91.7 |

| | 105.4 |

|

| Prepaid expenses and other | | 171.6 |

| | 164.6 |

|

| Total current assets | | 1,065.9 |

| | 1,003.7 |

|

| Goodwill | | 4,352.8 |

| | 4,352.8 |

|

| Other intangibles, net | | 1,710.5 |

| | 1,764.0 |

|

| Net property, plant and equipment | | 5,315.0 |

| | 5,412.3 |

|

| Other assets | | 174.9 |

| | 180.6 |

|

| Total Assets | | $ | 12,619.1 |

| | $ | 12,713.4 |

|

| Liabilities and Member Equity | | | | |

| Current Liabilities: | | | | |

| Current maturities of long-term debt | | $ | 92.5 |

| | $ | 717.5 |

|

| Current portion of interest rate swaps | | 28.5 |

| | 28.5 |

|

| Accounts payable | | 332.0 |

| | 403.3 |

|

| Advance payments and customer deposits | | 214.5 |

| | 214.7 |

|

| Payable to Windstream Holdings, Inc. | | 151.7 |

| | 152.4 |

|

| Accrued taxes | | 84.3 |

| | 95.2 |

|

| Accrued interest | | 170.4 |

| | 102.5 |

|

| Other current liabilities | | 282.4 |

| | 328.9 |

|

| Total current liabilities | | 1,356.3 |

| | 2,043.0 |

|

| Long-term debt | | 8,728.1 |

| | 7,934.2 |

|

| Deferred income taxes | | 1,828.8 |

| | 1,878.6 |

|

| Other liabilities | | 610.9 |

| | 632.8 |

|

| Total liabilities | | 12,524.1 |

| | 12,488.6 |

|

| Commitments and Contingencies (See Note 6) | | | | |

| Member Equity: | | | | |

| Additional paid-in capital | | 87.0 |

| | 212.7 |

|

| Accumulated other comprehensive income | | 8.0 |

| | 12.1 |

|

| Retained earnings | | — |

| | — |

|

| Total member equity | | 95.0 |

| | 224.8 |

|

| Total Liabilities and Member Equity | | $ | 12,619.1 |

| | $ | 12,713.4 |

|

See the accompanying notes to the unaudited interim consolidated financial statements.

WINDSTREAM SERVICES, LLC

CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED)

|

| | | | | | | | |

| | | Three Months Ended

March 31, |

| (Millions) | | 2015 |

| | 2014 |

|

| Cash Provided from Operations: | | | | |

| Net income | | $ | 5.6 |

| | $ | 16.3 |

|

| Adjustments to reconcile net income to net cash provided from operations: | | | | |

| Depreciation and amortization | | 340.7 |

| | 338.9 |

|

| Provision for doubtful accounts | | 10.3 |

| | 12.3 |

|

| Share-based compensation expense | | 14.8 |

| | 13.7 |

|

| Deferred income taxes | | (33.8 | ) | | 9.3 |

|

| Amortization of unrealized losses on de-designated interest rate swaps | | 3.4 |

| | 4.2 |

|

| Plan curtailment and other, net | | 6.9 |

| | (4.9 | ) |

| Changes in operating assets and liabilities, net | | | | |

| Accounts receivable | | (33.3 | ) | | (9.7 | ) |

| Prepaid income taxes | | 7.8 |

| | 5.6 |

|

| Prepaid expenses and other | | (24.8 | ) | | (20.1 | ) |

| Accounts payable | | (64.2 | ) | | (46.1 | ) |

| Accrued interest | | 67.4 |

| | 66.0 |

|

| Accrued taxes | | (10.9 | ) | | (15.0 | ) |

| Other current liabilities | | (43.2 | ) | | (32.4 | ) |

| Other liabilities | | (2.6 | ) | | (3.3 | ) |

| Other, net | | — |

| | (14.5 | ) |

| Net cash provided from operations | | 244.1 |

| | 320.3 |

|

| Cash Flows from Investing Activities: | | | | |

| Additions to property, plant and equipment | | (189.3 | ) | | (153.0 | ) |

| Broadband network expansion funded by stimulus grants | | — |

| | (7.1 | ) |

| Changes in restricted cash | | (0.4 | ) | | (0.9 | ) |

| Grant funds received for broadband stimulus projects | | 7.4 |

| | 11.4 |

|

| Grant funds received from Connect America Fund - Phase I | | — |

| | 26.0 |

|

| Network expansion funded by Connect America Fund - Phase I | | (8.3 | ) | | — |

|

| Other, net | | (2.1 | ) | | — |

|

| Net cash used in investing activities | | (192.7 | ) | | (123.6 | ) |

| Cash Flows from Financing Activities: | | | | |

| Distributions to Windstream Holdings, Inc. | | (151.8 | ) | | (150.7 | ) |

| Repayments of debt and swaps | | (325.4 | ) | | (331.6 | ) |

| Proceeds of debt issuance | | 490.0 |

| | 325.0 |

|

| Payments under capital lease obligations | | (11.2 | ) | | (7.8 | ) |

| Other, net | | (6.8 | ) | | (9.8 | ) |

| Net cash used in financing activities | | (5.2 | ) | | (174.9 | ) |

| Increase in cash and cash equivalents | | 46.2 |

| | 21.8 |

|

| Cash and Cash Equivalents: | | | | |

| Beginning of period | | 27.8 |

| | 48.2 |

|

| End of period | | $ | 74.0 |

| | $ | 70.0 |

|

| Supplemental Cash Flow Disclosures: | | | | |

| Interest paid | | $ | 74.7 |

| | $ | 74.7 |

|

| Income taxes refunded, net | | $ | (1.2 | ) | | $ | (1.0 | ) |

See the accompanying notes to the unaudited interim consolidated financial statements.

WINDSTREAM SERVICES, LLC

CONSOLIDATED STATEMENTS OF MEMBER EQUITY (UNAUDITED)

|

| | | | | | | | | | | | | | | | |

| (Millions, except per share amounts) | | Additional Paid-In Capital | | Accumulated Other Comprehensive Income | | Retained Earnings | | Total |

| Balance at December 31, 2014 | | $ | 212.7 |

| | $ | 12.1 |

| | $ | — |

| | $ | 224.8 |

|

| Net income | | — |

| | — |

| | 5.6 |

| | 5.6 |

|

| Other comprehensive (loss) income, net of tax: | | | | | | | | |

| Change in postretirement and pension plans | | — |

| | (0.9 | ) | | — |

| | (0.9 | ) |

Amortization of unrealized losses on de-designated interest rate swaps | | — |

| | 2.0 |

| | — |

| | 2.0 |

|

| Changes in designated interest rate swaps | | — |

| | (5.2 | ) | | — |

| | (5.2 | ) |

| Comprehensive (loss) income | | — |

| | (4.1 | ) | | 5.6 |

| | 1.5 |

|

| Share-based compensation expense (See Note 8) | | 5.0 |

| | — |

| | — |

| | 5.0 |

|

| Stock issued to employee savings plan (See Note 7) | | 21.6 |

| | — |

| | — |

| | 21.6 |

|

| Taxes withheld on vested restricted stock and other | | (7.1 | ) | | — |

| | — |

| | (7.1 | ) |

| Distributions payable to Windstream Holdings, Inc. | | (145.2 | ) | | — |

| | (5.6 | ) | | (150.8 | ) |

| Balance at March 31, 2015 | | $ | 87.0 |

| | $ | 8.0 |

| | $ | — |

| | $ | 95.0 |

|

See the accompanying notes to the unaudited interim consolidated financial statements.

NOTES TO UNAUDITED INTERIM CONSOLIDATED FINANCIAL STATEMENTS

1. Preparation of Interim Financial Statements:

In these consolidated financial statements, unless the context requires otherwise, the use of the terms “Windstream,” “we,” “us” or “our” shall refer to Windstream Holdings, Inc. and its subsidiaries, including Windstream Services, LLC, and the term “Windstream Services” shall refer to Windstream Services, LLC and its subsidiaries.

Organizational Structure–Windstream –Windstream Holdings, Inc. (“Windstream Holdings”) is a publicly traded holding company and the parent of Windstream Services, LLC (“Windstream Services”), formerly Windstream Corporation.. Windstream Holdings common stock trades on the NasdaqNASDAQ Global Select Market (“NASDAQ”) under the ticker symbol “WIN”. Effective February 28, 2015, Windstream Corporation was converted to a limited liability company (“LLC”). As a result, all issued and outstanding common stock of Windstream Corporation held by Windstream Holdings was converted intoowns a 100 percent interest in Windstream Services. The conversion of Windstream Services to a LLC has been accounted for as a change in reporting entity and accordingly, the historical equity presentation of Windstream Services reflect the effect of the LLC conversion for all periods presented. Windstream Services and its guarantor subsidiaries are the sole obligors of all outstanding debt obligations and, as a result also file periodic reports with the Securities and Exchange Commission (“SEC”). Windstream Holdings is not a guarantor of nor subject to the restrictive covenants included in any of Windstream Services’ debt agreements. The Windstream Holdings board of directors and officers oversee both companies.

As further discussed in Note 13, on April 24, 2015, we completed the spin-off certain telecommunications network assets, including our fiber and copper networks and other real estate into an independent, publicly traded real estate investment trust (“REIT”). Upon completion of the spin-off, we amended our certificate of incorporation to decrease the number of authorized shares of common stock from 1.0 billion to 166.7 million and enacted a one-for-six reverse stock split with respect to all of our outstanding shares of common stock which became effective on April 26, 2015. All share data of Windstream Holdings presented has been retrospectively adjusted to reflect the effects of the decrease in its authorized shares and the reverse stock split, as appropriate.

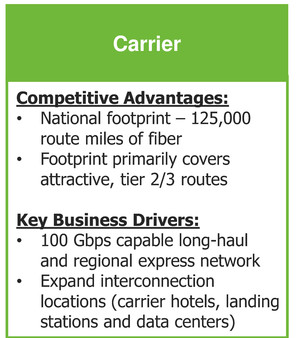

Description of Business – We are a leading provider of advanced network communications and technology solutions for consumers, businesses, enterprise organizations and carrier partners across the United States. We offer bundled services, including broadband, security solutions, voice and digital television to consumers. We also provide data, cloud solutions, unified communications and managed services and cloud computing, to businesses nationwide. In addition to business services, we offer broadband, voice and video services to consumers primarily in rural markets.enterprise clients. We have operations in 48 states and the District of Columbia,supply core transport solutions on a local and long-haul fiberfiber-optic network spanning approximately 121,000 miles, a robust business sales division and 27 data centers offering managed services and cloud computing.125,000 miles.

Enterprise and small business service revenues include revenues from integrated voice and data services, advanced data, traditional voice and long-distance services provided to enterprise customers. Consumer service revenues are generated from the provisioning of high-speed Internet, voice and video services to consumers. Small business service revenues include revenues from integrated voice and data services, advanced data and traditional voice and long-distance services provided to small business customers. Carrier revenues include revenues from other carriers for special access circuits and fiber connections as well as voice and data services sold on a wholesale basis. Consumer service revenues are generated from the provision of high-speed Internet, voice and video services to consumers. Wholesale serviceRegulatory revenues include switched access revenues, federal and state Universal Service Fund (“USF”) revenues.revenues and amounts received from Connect America Fund - Phase II. Other service revenues include USF surcharge revenues, other miscellaneous services and consumer revenues generated in markets where we lease the connection to the customer premise. We no longer offer new consumer service in those areas.

Basis of Presentation – The accompanying unaudited consolidated financial statements have been prepared based upon SEC rules that permit reduced disclosure for interim periods. Certain information and footnote disclosures have been condensed or omitted in accordance with those rules and regulations. The accompanying consolidated balance sheet as of December 31, 2014,2015, was derived from audited financial statements, but does not include all disclosures required by accounting principles generally accepted in the United States. In our opinion, these financial statements reflect all adjustments that are necessary for a fair presentation of results of operations and financial condition for the interim periods shown including normal recurring accruals and other items. The results for the interim periods are not necessarily indicative of results for the full year. For a more complete discussion of significant accounting policies and certain other information, this report should be read in conjunction with the consolidated financial statements and accompanying notes included in our Annual Report on Form 10-K for the year ended December 31, 2014,2015, which was filed with the SEC on February 24, 201525, 2016..

NOTES TO UNAUDITED INTERIM CONSOLIDATED FINANCIAL STATEMENTS

____

1. Preparation of Interim Financial Statements, Continued:

Windstream Holdings and its domestic subsidiaries, including Windstream Services, file a consolidated federal income tax return. As such, Windstream Services and its subsidiaries are not separate taxable entities for federal and certain state income tax purposes. In instances when Windstream Services does not file a separate return, income taxes as presented within the accompanying consolidated financial statements attribute current and deferred income taxes of Windstream Holdings to Windstream Services and its subsidiaries in a manner that is systematic, rational and consistent with the asset and liability method. Income tax provisions presented for Windstream Services and its subsidiaries are prepared under the “separate return method.” The separate return method represents a hypothetical computation assuming that the reported revenue and expenses of Windstream Services and its subsidiaries were incurred by separate taxable entities.

The preparation of financial statements, in accordance with accounting principles generally accepted in the United States (“U.S. GAAP”), requires management to make estimates and assumptions that affect the reported amounts of assets, liabilities, revenues and expenses and disclosure of contingent assets and liabilities. The estimates and assumptions used in the accompanying consolidated financial statements are based upon management’s evaluation of the relevant facts and circumstances as of the date of the consolidated financial statements. Actual results may differ from the estimates and assumptions used in preparing the accompanying consolidated financial statements, and such differences could be material.

NOTES TO UNAUDITED INTERIM CONSOLIDATED FINANCIAL STATEMENTS

____

1. Preparation of Interim Financial Statements, Continued:

There are no significant differences between the consolidated results of operations, financial condition, and cash flows of Windstream Holdings and those of Windstream Services other than for certain expenses incurred directly by Windstream Holdings principally consisting of audit, legal and board of director fees, NasdaqNASDAQ listing fees, other shareholder-related costs, income taxes, common stock activity, and payables from Windstream Services to Windstream Holdings. Earnings per share data has not been presented for Windstream Services, because that entity has not issued publicly held common stock as defined in accordance with U.S. GAAP. Unless otherwise indicated, the note disclosures included herein pertain to both Windstream Holdings and Windstream Services.

Revision to Prior Period Financial Statements

During the first quarter of 2015, as a result of the recent change in our executive management team, we have begun to reorganize the way in which we will manage our business for purposes of operating decisions and assessing profitability. In undertaking this reorganizational effort, which has yet to be completed, management became aware of and corrected for the immaterial misclassification of certain operating expenses. The previously reportedCertain prior year amounts included certain costs related to customer service delivery, customer care and field operations that had been classified as selling, general and administrative expense and should have been reported as cost of services.reclassified to conform to the current year financial statement presentation. These revisionschanges and reclassifications did not impact previously reported operating income, net (loss) income or comprehensive income.

The following tables present the effect of the revisions to Windstream Holdings’ consolidated statements of operations for the three months ended March 31, 2014 and the annual periods ended December 31, 2014, 2013 and 2012.

|

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended March 31, 2014 | | Year Ended December 31, 2014 |

| (Millions) | | As Previously Reported | | Effect of Revision | | As Revised | | As Previously Reported | | Effect of Revision | | As Revised |

| Cost of services | | $ | 644.6 |

| | $ | 13.3 |

| | $ | 657.9 |

| | $ | 2,719.3 |

| | $ | 54.0 |

| | $ | 2,773.3 |

|

| Selling, general and administrative | 252.2 |

| | (13.3 | ) | | 238.9 |

| | 983.8 |

| | (54.0 | ) | | 929.8 |

|

|

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Year Ended December 31, 2013 | | Year Ended December 31, 2012 |

| (Millions) | | As Previously Reported | | Effect of Revision | | As Revised | | As Previously Reported | | Effect of Revision | | As Revised |

| Cost of services | | $ | 2,492.1 |

| | $ | 49.1 |

| | $ | 2,541.2 |

| | $ | 2,692.2 |

| | $ | 43.5 |

| | $ | 2,735.7 |

|

| Selling, general and administrative | 923.4 |

| | (49.1 | ) | | 874.3 |

| | 967.3 |

| | (43.5 | ) | | 923.8 |

|

The effect of the revisions to Windstream Services’ consolidated statements of operations would be the same for all periods presented. We evaluated the materiality of these revisions and have determined they were not material to any prior period. Upon completion of our reorganizational efforts, we will reassess our segment reporting during the second quarter of 2015.

NOTES TO UNAUDITED INTERIM CONSOLIDATED FINANCIAL STATEMENTS

____

1. Preparation of Interim Financial Statements, Continued:

Recently Issued Authoritative Guidance

Presentation of Debt Issuance CostsRevenue Recognition – In April 2015,May 2014, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update No. 2015-03, Interest – Imputation of Interest: Simplifying the Presentation of Debt Issuance Costs (“ASU 2015-03”ASU”). The standard outlines a simplified presentation of debt issuance costs and requires that debt issuance costs related to a recognized debt liability be presented in the balance sheet as a direct deduction from the carrying amount of that debt liability, consistent with debt discounts. ASU 2015-03 does not affect the recognition and measurement guidance for debt issuance costs. ASU 2015-03 is effective for annual periods beginning after December 15, 2015, and interim periods within fiscal years beginning after December 15, 2016. Debt issuance costs totaling $84.0 million and $87.7 million were included in other assets in our accompanying consolidated balance sheets as of March 31, 2015 and December 31, 2014, respectively. In connection with the debt-for-debt exchange and redemption of long-term debt further discussed in Note 13, we expect to write off approximately $13.0 million of unamortized debt issuance costs. Upon adoption of ASU 2015-03, the remaining unamortized debt issuance costs will be reflected as a reduction of long-term debt.

Revenue Recognition – In May 2014, the FASB issued Accounting Standards Update No. 2014-09, Revenue from Contracts with Customers (“ASU 2014-09”).Customers. The standard outlines a single comprehensive revenue recognition model for entities to follow in accounting for revenue from contracts with customers and supersedes most current revenue recognition guidance, including industry-specific guidance. The core principle of the revenue model is that an entity should recognize revenue for the transfer of promised goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled to receive for those goods or services. ASU 2014-09 also includes new accounting principles related to the deferral and amortization of contract acquisition and fulfillment costs. ASU 2014-09 is effective for annual periods beginning after December 15, 2016 and interim periods within those annual periods. Early adoption is not permitted. ASU 2014-09 may be adopted by applying the provisions of the new standard on a retrospective basis to all periods presented in the financial statements or on a modified retrospective basis which would result in the recognition of a cumulative effect adjustment in the year of adoption. On April 29,When issued, ASU 2014-09 was to be effective for annual periods beginning after December 15, 2016 and interim periods within those annual periods. Early adoption was not permitted.

In July 2015, the FASB proposed deferringdeferred the effective date of ASU 2014-09 by one year to December 15, 2017 for annual reporting periods beginning after that date. The FASB also proposed permittingdate, or January 1, 2018, for calendar companies like Windstream. Entities are permitted to early adoption ofadopt the standard, but not before the original effective date of December 15, 2016. We are in the process of determining the method of adoption and assessing the impact the new standard will have on our consolidated financial statements. We expect to adopt this standard effective January 1, 2018.

In March 2016, FASB issued ASU 2016-08, Revenue from Contracts with Customers (Topic 606): Principal versus Agent Considerations (Reporting Revenue Gross versus Net). The amendments are intended to improve the operability and understandability of the implementation guidance on principal versus agent considerations. The effective date for this ASU is the same as the effective date for ASU 2014-09. In conjunction with our assessment of ASU 2014-09, we are currently evaluating the impacts of this new guidance.

Fair Value Measurement Disclosures – In May 2015, the FASB issued ASU No. 2015-07, Disclosures for Investments in Certain Entities That Calculate Net Asset Value Per Share (or Its Equivalent), which amends certain fair value measurement disclosures. The standard removes the requirement to categorize within the fair value hierarchy investments for which fair value is measured using the net asset value per share practical expedient and also removes certain related disclosure requirements. ASU 2015-07 is effective retrospectively for fiscal years, and interim periods within those years, beginning after December 31, 2015, with early adoption permitted.

2. GoodwillPension Plan Investment Disclosures – In July 2015, the FASB issued ASU No. 2015-12, Plan Accounting: Defined Benefit Pension Plans (Topic 960), Defined Contribution Plans (Topic 962), Health and Other Intangible Assets:

Goodwill representsWelfare Benefit Plans (Topic 965). This standard eliminates the excess of cost overrequirement to measure the fair value of net identifiable tangiblefully benefit-responsive investment contracts and intangible assets acquired through various business combinations. The cost of acquired entities atprovide the date of the acquisition is allocated to identifiable assets, and the excess of the total purchase price over the amounts assigned to identifiable assets has been recorded as goodwill. In accordance with authoritative guidance, goodwill is to be assigned to a company’s reporting units and tested for impairment at least annually using a consistent measurement date, which for us is January 1st of each year. Goodwill is tested at the reporting unit level. A reporting unit is an operating segment or one level below an operating segment, referred to as a component. A component of an operating segment is a reporting unit for which discrete financial information is available and our executive management team regularly reviews the operating results of that component. Additionally, components of an operating segment can be combined as a single reporting unit if the components have similar economic characteristics. If therelated fair value disclosures. Under the new guidance, fully benefit-responsive investment contracts will be measured and disclosed only at contract value. The standard also eliminates certain disclosure requirements related to an employee benefit plan’s investments presented in the plan’s standalone financial statements. ASU 2015-12 is effective retrospectively for fiscal years beginning after December 31, 2015, with early adoption permitted. Adoption of the reporting unit exceeds its carrying value, goodwillASU 2015-07 and 2015-12 will impact certain annual disclosures related to our qualified pension plan assets, but otherwise is not impaired and no further testing is performed. If the carrying value of the reporting unit exceeds its fair value, thenexpected to have a second step must be performed, and the implied fair value of the reporting unit’s goodwill must be determined and compared to the carrying value of the reporting unit’s goodwill. If the carrying value of a reporting unit’s goodwill exceeds its implied fair value, then an impairment loss equal to the difference will be recorded. Prior to performing the two step evaluation, an entity has the option to perform a qualitative assessment to determine whether it is more likely than not that the fair value of a reporting unit exceeds the carrying value. Under the qualitative assessment, if an entity determines that it is more likely than not that a reporting unit’s fair value exceeds its carrying value, then the entity is not required to complete the two step goodwill impairment evaluation.material impact on our consolidated financial statements.

As of January 1, 2015, we have three reporting units, excluding corporate level activities. In performing our annual goodwill impairment assessment, we estimated the fair value of each of our three reporting units utilizing both an income approach and a market approach. The income approach is based on the present value of projected cash flows and a terminal value, which represents the expected normalized cash flows of the reporting unit beyond the cash flows from the discrete projection period of five years. We discounted the estimated cash flows for each of the reporting units using a rate that represents a market participant’s weighted average cost of capital commensurate with the reporting unit’s underlying business operations. The market approach included the use of comparable multiples of publicly traded companies operating in businesses similar to ours. We also reconciled the estimated fair value of our reporting units to our total market capitalization.

NOTES TO UNAUDITED INTERIM CONSOLIDATED FINANCIAL STATEMENTS

____

2. Goodwill and Other Intangible Assets,1. Preparation of Interim Financial Statements, Continued:

AsValuation of January 1,Inventory – In July 2015, basedthe FASB issued ASU No. 2015-11, Simplifying the Measurement of Inventory. The updated guidance requires that an entity should measure inventory valued using a first-in, first-out or average cost method at the lower of cost and net realizable value. Net realizable value is defined as the estimated selling price in the ordinary course of business, less reasonably predictable costs of completion, disposal, and transportation. ASU 2015-11 should be applied on our assessment performeda prospective basis and is effective for fiscal years, and interim periods within those years, beginning after December 15, 2016, with respectearly adoption permitted. We are currently assessing the timing of adoption of ASU 2015-11, however, we do not expect it to have a material impact to our three reporting units as described above, we concluded that goodwill for allconsolidated results of our reporting units was not impaired as of that date, and accordingly, no further analysis was required.

As previously discussed, as a result of recent changes in our executive management team, we have begun to reorganize the way in which we manage our business and will reassess our reporting unit structure during the second quarter of 2015.

Other intangible assets arising from business combinations are initially recorded at estimated fair value and amortized over the estimated useful lives.

Other intangible assets were as follows at:

|

| | | | | | | | | | | | | | | | | | | | | | | | |

| | March 31, 2015 | | December 31, 2014 |

| (Millions) | | Gross Cost | | Accumulated Amortization | | Net Carrying Value | | Gross Cost | | Accumulated Amortization | | Net Carrying Value |

| Franchise rights | | $ | 1,285.1 |

| | $ | (254.0 | ) | | $ | 1,031.1 |

| | $ | 1,285.1 |

| | $ | (243.3 | ) | | $ | 1,041.8 |

|

| Customer lists | | 1,914.0 |

| | (1,249.8 | ) | | 664.2 |

| | 1,914.0 |

| | (1,203.4 | ) | | 710.6 |

|

| Cable franchise rights | | 39.8 |

| | (28.5 | ) | | 11.3 |

| | 39.8 |

| | (28.2 | ) | | 11.6 |

|

| Other (a) | | 42.0 |

| | (38.1 | ) | | 3.9 |

| | 37.9 |

| | (37.9 | ) | | — |

|

| Balance | | $ | 3,280.9 |

| | $ | (1,570.4 | ) | | $ | 1,710.5 |

| | $ | 3,276.8 |

| | $ | (1,512.8 | ) | | $ | 1,764.0 |

|

| |

(a) | During the first quarter of 2015, we acquired for cash non-exclusive licenses to various patents, which are being amortized on a straight-line basis over the estimated useful life of 3 years. |

Intangible asset amortization methodology and useful lives were as follows as of operations, financial position or cash flows.March 31, 2015:

|

| | | | |

Intangible Assets | | Amortization Methodology | | Estimated Useful Life |

Franchise rights | | straight-line | | 30 years |

Customer lists | | sum-of-years-digits | | 9 - 15 years |

Cable franchise rights | | straight-line | | 15 years |

Other | | straight-line | | 1 - 3 years |

Amortization expenseLeases – In February 2016, the FASB issued ASU 2016-02, Leases, which will require that virtually all lease arrangements that do not meet the criteria of a short-term lease be presented on the lessee’s balance sheet by recording a right-of-use asset and a lease liability equal to the present value of the related future lease payments. The income statement impacts of the leases will depend on the nature of the leasing arrangement and will be similar to existing accounting for intangible assets subject to amortization was $57.6 millionoperating and capital leases. The new standard does not substantially change the accounting for lessors. The new standard will also require additional disclosures regarding an entity’s leasing arrangements and will be effective for the three monthfirst interim reporting period ended March 31, 2015, as comparedwithin annual periods beginning after December 15, 2018, although early adoption is permitted. Lessees and lessors will be required to apply the new standard at the beginning of the earliest period presented in the financial statements in which they first apply the new guidance, using a modified retrospective transition method. We are currently assessing the timing of adoption and the impact the new standard will have on our consolidated financial statements.

$65.6 millionDerivatives and Hedging – In March 2016, the FASB issued ASU 2016-05, Derivatives and Hedging (Topic 815): Effect of Derivative Contract Novations on Existing Hedge Accounting Relationships (a consensus of the Emerging Issues Task Force). ASU 2016-05 clarifies that a change in the counterparty to a derivative instrument that has been designated as the hedging instrument does not, in and of itself, require de-designation of that hedging relationship provided that all other hedge accounting criteria continue to be met. ASU 2016-05 is effective for fiscal years beginning after December 15, 2016, and interim periods within those fiscal years. Early adoption is permitted. We do not expect that the sameadoption of ASU 2016-05 will have a material impact on our consolidated financial statements.