UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

ý Quarterly Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the quarterly period ended September 30, 2017.2018.

o Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the Transition Period From ______________________ to _________________________

Commission file number 001-32265 (American Campus Communities, Inc.)

Commission file number 333-181102-01 (American Campus Communities Operating Partnership, L.P.)

AMERICAN CAMPUS COMMUNITIES, INC.

AMERICAN CAMPUS COMMUNITIES OPERATING PARTNERSHIP, L.P.

(Exact name of registrant as specified in its charter)

|

| | |

Maryland (American Campus Communities, Inc.) Maryland (American Campus Communities Operating Partnership, L.P.) | | 76-0753089 (American Campus Communities, Inc.) 56-2473181 (American Campus Communities Operating Partnership, L.P.) |

(State or Other Jurisdiction of Incorporation or Organization) | | (IRS Employer Identification No.) |

12700 Hill Country Blvd., Suite T-200 Austin, TX (Address of Principal Executive Offices) | | 78738 (Zip Code) |

(512) 732-1000

Registrant'sRegistrant’s telephone number, including area code

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15 (d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

|

| |

| American Campus Communities, Inc. | Yes x No o |

|

| |

| American Campus Communities Operating Partnership, L.P. | Yes x No o |

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

|

| |

| American Campus Communities, Inc. | Yes x No o |

|

| |

| American Campus Communities Operating Partnership, L.P. | Yes x No o |

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer”, “accelerated filer”, “smaller reporting company”, and “emerging growth company” in Rule 12b-2 of the Exchange Act.

American Campus Communities, Inc.

|

| |

Large accelerated filer x | Accelerated Filer o |

|

| |

Non-accelerated filer o (Do not check if a smaller reporting company) | Smaller reporting company o |

|

| |

| | Emerging growth company o |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

American Campus Communities Operating Partnership, L.P.

|

| |

Large accelerated filer o | Accelerated Filer o |

|

| |

Non-accelerated filer x (Do not check if a smaller reporting company) | Smaller reporting company o |

|

| |

| | Emerging growth company o |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

|

| |

| American Campus Communities, Inc. | Yes o No x |

|

| |

| American Campus Communities Operating Partnership, L.P | Yes o No x |

There were 136,426,506137,031,488 shares of the American Campus Communities, Inc.’s common stock with a par value of $0.01 per share outstanding as of the close of business on October 27, 2017.26, 2018.

EXPLANATORY NOTE

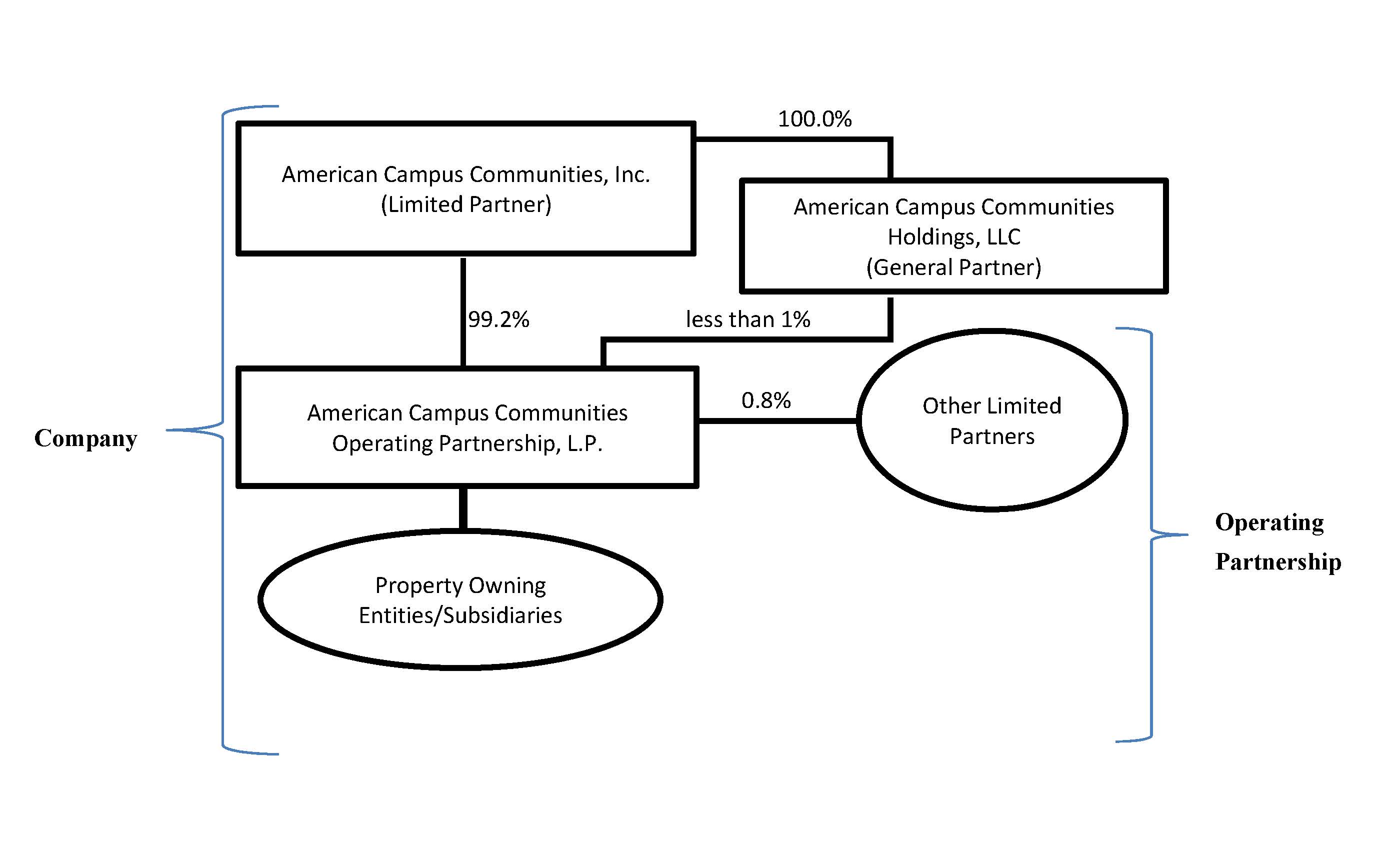

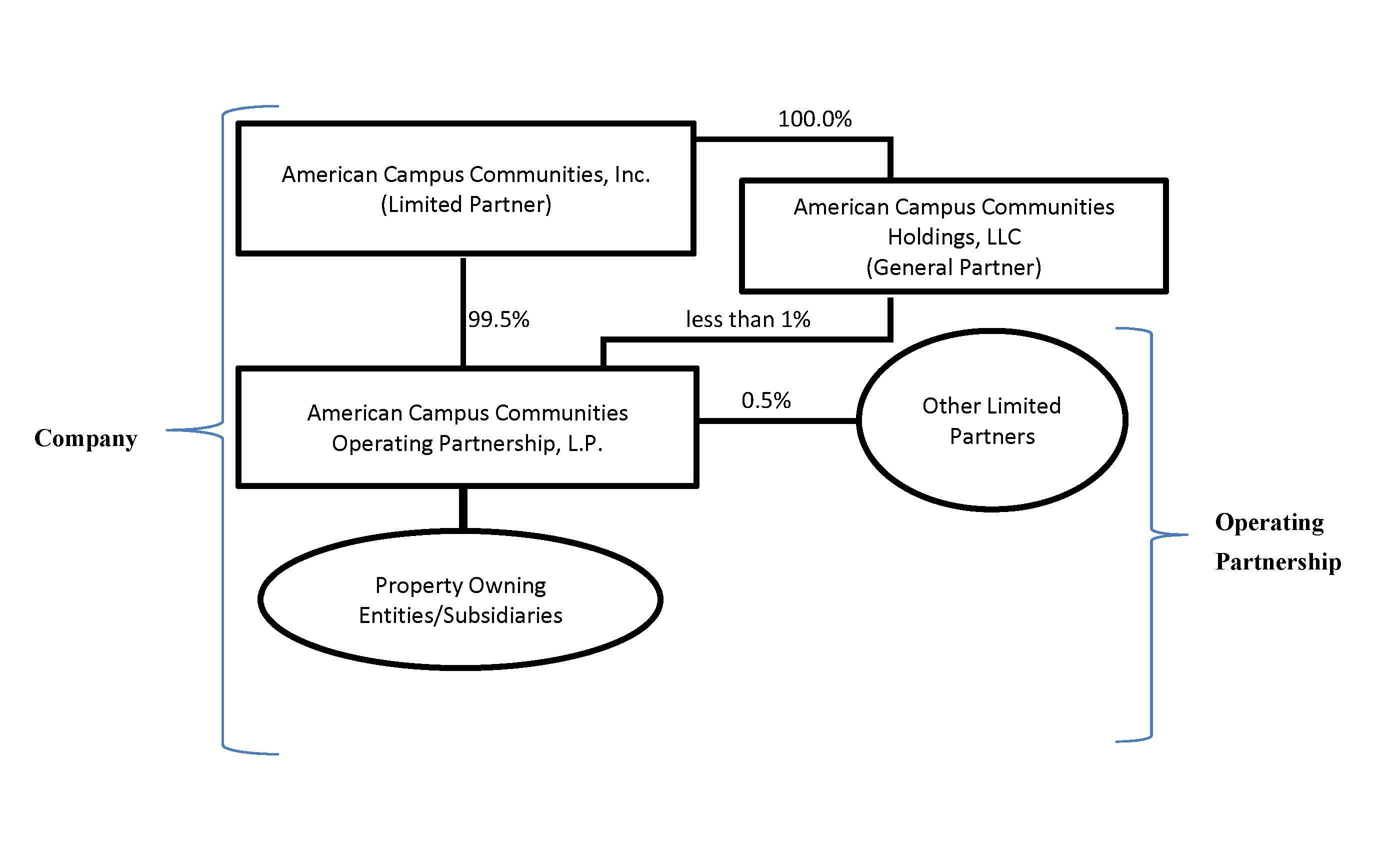

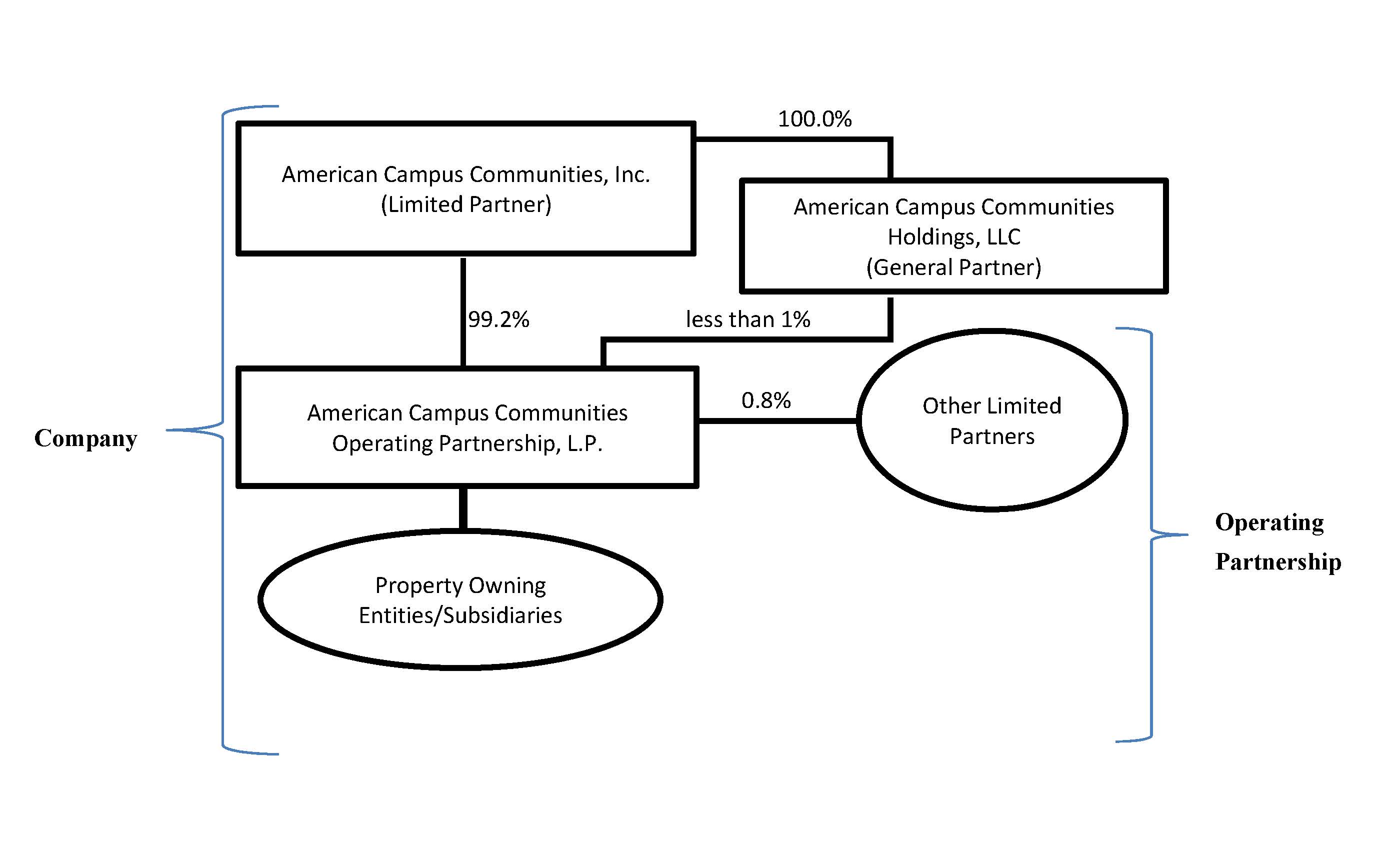

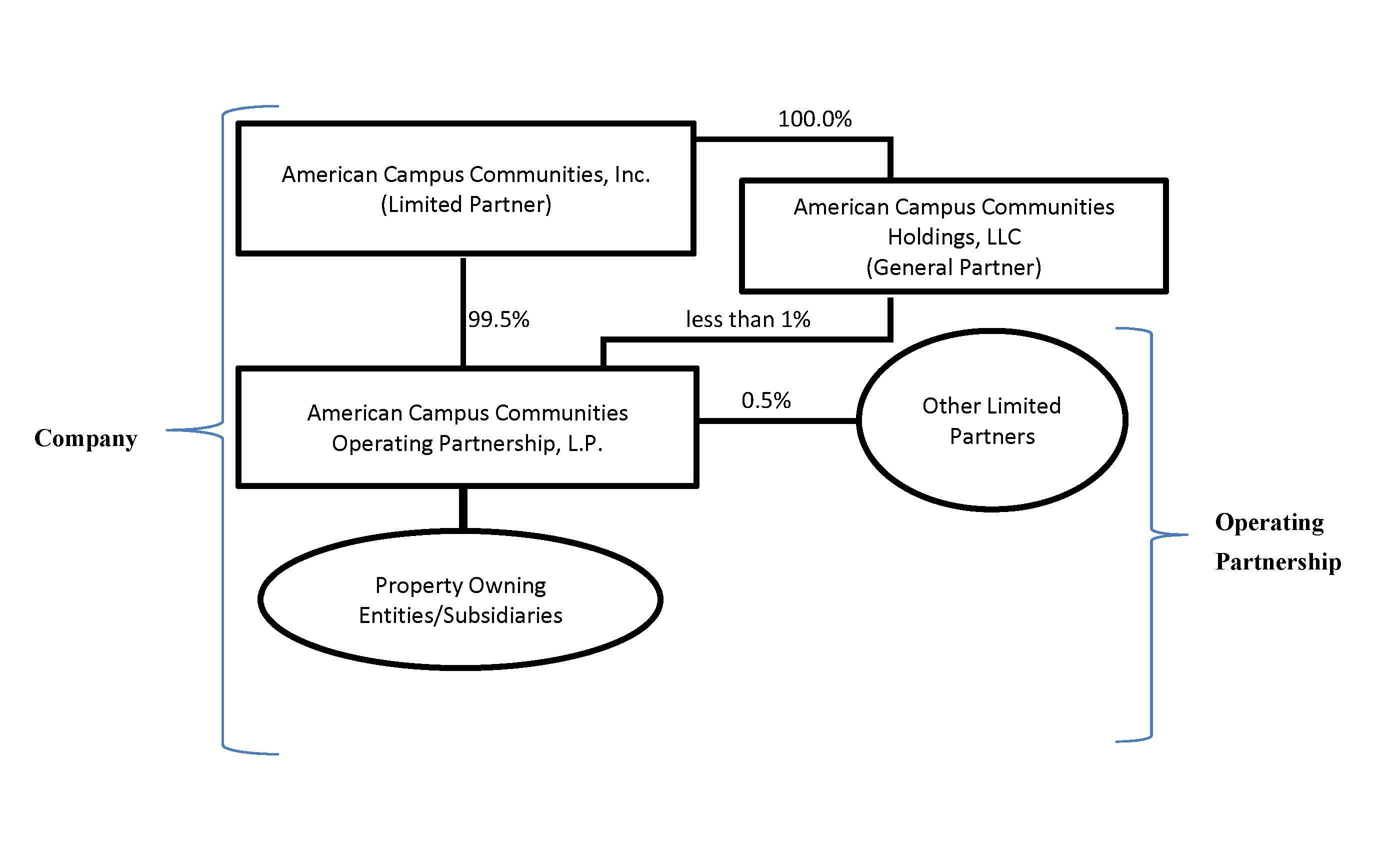

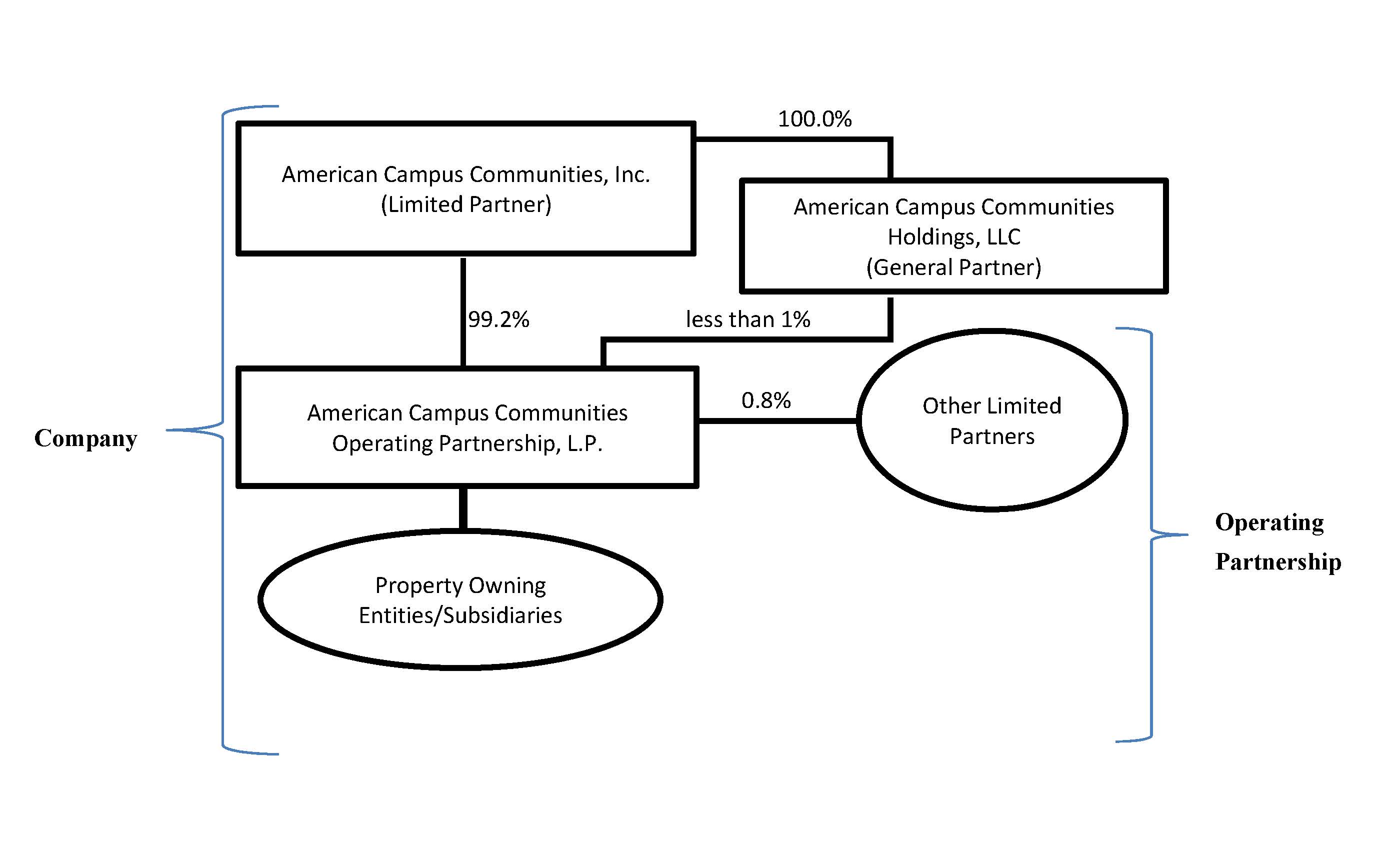

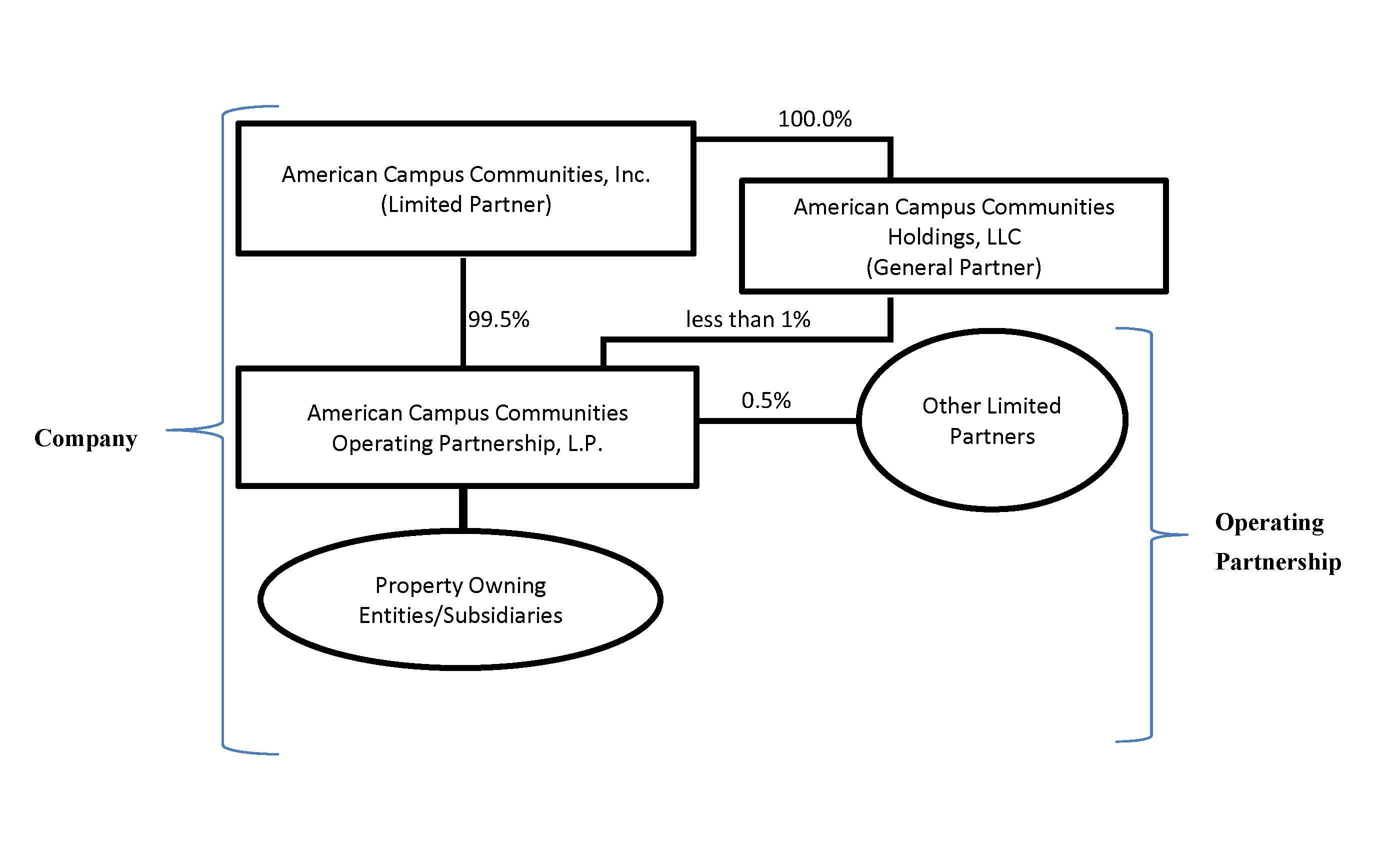

This report combines the reports on Form 10-Q for the quarterly period ended September 30, 20172018 of American Campus Communities, Inc. and American Campus Communities Operating Partnership, L.P. Unless stated otherwise or the context otherwise requires, references to “ACC” mean American Campus Communities, Inc., a Maryland corporation that has elected to be treated as a real estate investment trust (“REIT”) under the Internal Revenue Code, and references to “ACCOP” mean American Campus Communities Operating Partnership, L.P., a Maryland limited partnership. References to the “Company,” “we,” “us” or “our” mean collectively ACC, ACCOP and those entities/subsidiaries owned or controlled by ACC and/or ACCOP. References to the “Operating Partnership” mean collectively ACCOP and those entities/subsidiaries owned or controlled by ACCOP. The following chart illustrates the Company’s and the Operating Partnership’s corporate structure:

The general partner of ACCOP is American Campus Communities Holdings, LLC (“ACC Holdings”), an entity that is wholly-owned by ACC. As of September 30, 2017,2018, ACC Holdings held an ownership interest in ACCOP of less than 1%. The limited partners of ACCOP are ACC and other limited partners consisting of current and former members of management and nonaffiliated third parties. As of September 30, 2017,2018, ACC owned an approximate 99.2%99.5% limited partnership interest in ACCOP. As the sole member of the general partner of ACCOP, ACC has exclusive control of ACCOP’s day-to-day management. Management operates the Company and the Operating Partnership as one business. The management of ACC consists of the same members as the management of ACCOP. The Company is structured as an umbrella partnership REIT (“UPREIT”) and ACC contributes all net proceeds from its various equity offerings to the Operating Partnership. In return for those contributions, ACC receives a number of units of the Operating Partnership (“OP Units,” see definition below) equal to the number of common shares it has issued in the equity offering. Contributions of properties to the Company can be structured as tax-deferred transactions through the issuance of OP Units in the Operating Partnership. Based on the terms of ACCOP’s partnership agreement, OP Units can be exchanged for ACC’s common shares on a one-for-one basis. The Company maintains a one-for-one relationship between the OP Units of the Operating Partnership issued to ACC and ACC Holdings and the common shares issued to the public. The Company believes that combining the reports on Form 10-Q of ACC and ACCOP into this single report provides the following benefits:

| |

| (1) | enhances investors’ understanding of the Company and the Operating Partnership by enabling investors to view the business as a whole in the same manner as management views and operates the business; |

| |

| (2) | eliminates duplicative disclosure and provides a more streamlined and readable presentation since a substantial portion of the disclosure applies to both the Company and the Operating Partnership; and |

| |

| (3) | creates time and cost efficiencies through the preparation of one combined report instead of two separate reports. |

ACC consolidates ACCOP for financial reporting purposes, and ACC essentially has no assets or liabilities other than its investment in ACCOP. Therefore, the assets and liabilities of the Company and the Operating Partnership are the same on their respective financial statements. However, the Company believes it is important to understand the few differences between the Company and the Operating Partnership in the context of how the entities operate as a consolidated company. All of the Company’s property ownership, development and related business operations are conducted through the Operating Partnership. ACC also issues public equity from time to time and guarantees certain debt of ACCOP, as disclosed in this report. ACC does not have any indebtedness, as all debt is incurred by the Operating Partnership. The Operating Partnership holds substantially all of the assets of the Company, including the Company’s ownership interests in its joint ventures. The Operating Partnership conducts the operations of the business and is structured as a partnership with no publicly traded equity. Except for the net proceeds from ACC’s equity offerings, which are contributed to the capital of ACCOP in exchange for OP Units on a one-for-one common share per OP Unit basis, the Operating Partnership generates all remaining capital required by the Company’s business. These sources include, but are not limited to, the Operating Partnership’s working capital, net cash provided by operating activities, borrowings under its credit facility, the issuance of unsecured notes, and proceeds received from the disposition of certain properties. Noncontrolling interests, stockholders’ equity, and partners’ capital are the main areas of difference between the consolidated financial statements of the Company and those of the Operating Partnership. The noncontrolling interests in the Operating Partnership’s financial statements consist of the interests of unaffiliated partners in various consolidated joint ventures. The noncontrolling interests in the Company’s financial statements include the same noncontrolling interests at the Operating Partnership level and OP Unit holders of the Operating Partnership. The differences between stockholders’ equity and partners’ capital result from differences in the equity issued at the Company and Operating Partnership levels.

To help investors understand the significant differences between the Company and the Operating Partnership, this report provides separate consolidated financial statements for the Company and the Operating Partnership. A single set of consolidated notes to such financial statements is presented that includes separate discussions for the Company and the Operating Partnership when applicable (for example, noncontrolling interests, stockholders’ equity or partners’ capital, earnings per share or unit, etc.). A combined Management’s Discussion and Analysis of Financial Condition and Results of Operations section is also included that presents discrete information related to each entity, as applicable. This report also includes separate Part I, Item 4 Controls and Procedures sections and separate Exhibits 31 and 32 certifications for each of the Company and the Operating Partnership in order to establish that the requisite certifications have been made and that the Company and the Operating Partnership are compliant with Rule 13a-15 or Rule 15d-15 of the Securities Exchange Act of 1934 and 18 U.S.C. §1350.

In order to highlight the differences between the Company and the Operating Partnership, the separate sections in this report for the Company and the Operating Partnership specifically refer to the Company and the Operating Partnership. In the sections that combine disclosure of the Company and the Operating Partnership, this report refers to actions or holdings as being actions or holdings of the Company. Although the Operating Partnership is generally the entity that directly or indirectly enters into contracts and joint ventures and holds assets and debt, reference to the Company is appropriate because the Company operates its business through the Operating Partnership. The separate discussions of the Company and the Operating Partnership in this report should be read in conjunction with each other to understand the results of the Company on a consolidated basis and how management operates the Company.

FORM 10-Q

FOR THE QUARTER ENDED September 30, 20172018

TABLE OF CONTENTS

|

| | |

| | PAGE NO. |

| | |

| PART I. | |

| | | |

| Item 1. | Consolidated Financial Statements of American Campus Communities, Inc. and Subsidiaries: | |

| | | |

| | Consolidated Balance Sheets as of September 30, 20172018 (unaudited) and December 31, 20162017 | |

| | | |

| | Consolidated Statements of Comprehensive Income for the three and nine months ended September 30, 20172018 and 20162017 (all unaudited) | |

| | | |

| | Consolidated Statement of Changes in Equity for the nine months ended September 30, 20172018 (unaudited) | |

| | | |

| | Consolidated Statements of Cash Flows for the nine months ended September 30, 20172018 and 20162017 (all unaudited) | |

| | | |

| | Consolidated Financial Statements of American Campus Communities Operating Partnership, L.P. and Subsidiaries: | |

| | | |

| | Consolidated Balance Sheets as of September 30, 20172018 (unaudited) and December 31, 20162017 | |

| | | |

| | Consolidated Statements of Comprehensive Income for the three and nine months ended September 30, 20172018 and 20162017 (all unaudited) | |

| | | |

| | Consolidated Statement of Changes in Capital for the nine months ended September 30, 20172018 (unaudited) | |

| | | |

| | Consolidated Statements of Cash Flows for the nine months ended September 30, 20172018 and 20162017 (all unaudited) | |

| | | |

| | Notes to Consolidated Financial Statements of American Campus Communities, Inc. and Subsidiaries and American Campus Communities Operating Partnership, L.P. and Subsidiaries (unaudited) | |

| | | |

| Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | |

| | | |

| Item 3. | Quantitative and Qualitative Disclosure about Market Risk | |

| | | |

| Item 4. | Controls and Procedures | |

| | |

| PART II. | |

| | | |

| Item 1. | Legal Proceedings | |

| | | |

| Item 1A. | Risk Factors | |

| | | |

| Item 2. | Unregistered Sales of Equity Securities and Use of Proceeds | |

| | | |

| Item 3. | Defaults Upon Senior Securities | |

| | | |

| Item 4. | Mine Safety Disclosures | |

| | | |

| Item 5. | Other Information | |

| | | |

| Item 6. | Exhibits | |

| | |

| SIGNATURES | |

AMERICAN CAMPUS COMMUNITIES, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(in thousands, except share data)

| | | | | September 30, 2017 | | December 31, 2016 | | September 30, 2018 | | December 31, 2017 |

| | | (Unaudited) | | | | (Unaudited) | | |

| Assets | | | | | | | | |

| | | | | | | | | |

| Investments in real estate: | | | | | | | | |

| Wholly-owned properties, net | | $ | 6,262,077 |

| | $ | 5,427,014 |

| |

| Wholly-owned properties held for sale | | — |

| | 25,350 |

| |

| Owned properties, net | | | $ | 6,521,705 |

| | $ | 6,450,364 |

|

| On-campus participating properties, net | | 83,095 |

| | 85,797 |

| | 78,866 |

| | 81,804 |

|

| Investments in real estate, net | | 6,345,172 |

| | 5,538,161 |

| | 6,600,571 |

| | 6,532,168 |

|

| | | | | | | | | |

| Cash and cash equivalents | | 16,341 |

| | 22,140 |

| | 50,801 |

| | 41,182 |

|

| Restricted cash | | 25,824 |

| | 24,817 |

| | 39,740 |

| | 23,590 |

|

| Student contracts receivable, net | | 15,531 |

| | 8,428 |

| | 45,297 |

| | 9,170 |

|

| Other assets | | 284,023 |

| | 272,367 |

| | 309,639 |

| | 291,260 |

|

| | | | | | | | | |

| Total assets | | $ | 6,686,891 |

| | $ | 5,865,913 |

| | $ | 7,046,048 |

| | $ | 6,897,370 |

|

| | | | | | | | | |

| Liabilities and equity | | |

| | |

| | |

| | |

|

| | | | | | | | | |

| Liabilities: | | |

| | |

| | |

| | |

|

| Secured mortgage, construction and bond debt, net | | $ | 662,874 |

| | $ | 688,195 |

| | $ | 920,345 |

| | $ | 664,020 |

|

| Unsecured notes, net | | 1,190,296 |

| | 1,188,737 |

| | 1,587,796 |

| | 1,585,855 |

|

| Unsecured term loans, net | | 646,675 |

| | 149,065 |

| | 198,681 |

| | 647,044 |

|

| Unsecured revolving credit facility | | 266,440 |

| | 99,300 |

| | 266,900 |

| | 127,600 |

|

| Accounts payable and accrued expenses | | 79,612 |

| | 76,614 |

| | 86,481 |

| | 53,741 |

|

| Other liabilities | | 214,918 |

| | 158,437 |

| | 238,921 |

| | 187,983 |

|

| Total liabilities | | 3,060,815 |

| | 2,360,348 |

| | 3,299,124 |

| | 3,266,243 |

|

| | | | | | | | | |

| Commitments and contingencies (Note 13) | |

|

| |

|

| |

|

| |

|

|

| | | | | | | | | |

| Redeemable noncontrolling interests | | 112,270 |

| | 55,078 |

| | 184,654 |

| | 132,169 |

|

| | | | | | | | | |

| Equity: | | |

| | |

| | |

| | |

|

| American Campus Communities, Inc. and Subsidiaries stockholders' equity: | | |

| | |

| |

| Common stock, $0.01 par value, 800,000,000 shares authorized, 136,362,728 and 132,225,488 shares issued and outstanding at September 30, 2017 and December 31, 2016, respectively | | 1,364 |

| | 1,322 |

| |

| American Campus Communities, Inc. and Subsidiaries stockholders’ equity: | | | |

| | |

|

| Common stock, $0.01 par value, 800,000,000 shares authorized, 136,961,885 and 136,362,728 shares issued and outstanding at September 30, 2018 and December 31, 2017, respectively | | | 1,370 |

| | 1,364 |

|

| Additional paid in capital | | 4,321,228 |

| | 4,118,842 |

| | 4,456,208 |

| | 4,326,910 |

|

| Common stock held in rabbi trust, 63,778 and 20,181 shares at September 30, 2017 and December 31, 2016, respectively | | (2,944 | ) | | (975 | ) | |

| Common stock held in rabbi trust, 69,603 and 63,778 shares at September 30, 2018 and December 31, 2017, respectively | | | (3,092 | ) | | (2,944 | ) |

| Accumulated earnings and dividends | | (816,360 | ) | | (670,137 | ) | | (955,310 | ) | | (837,644 | ) |

| Accumulated other comprehensive loss | | (3,195 | ) | | (4,067 | ) | | (1,975 | ) | | (2,701 | ) |

| Total American Campus Communities, Inc. and Subsidiaries stockholders' equity | | 3,500,093 |

| | 3,444,985 |

| |

| Total American Campus Communities, Inc. and Subsidiaries stockholders’ equity | | | 3,497,201 |

| | 3,484,985 |

|

| Noncontrolling interests - partially owned properties | | 13,713 |

| | 5,502 |

| | 65,069 |

| | 13,973 |

|

| Total equity | | 3,513,806 |

| | 3,450,487 |

| | 3,562,270 |

| | 3,498,958 |

|

| | | | | | | | | |

| Total liabilities and equity | | $ | 6,686,891 |

| | $ | 5,865,913 |

| | $ | 7,046,048 |

| | $ | 6,897,370 |

|

|

| | | | | | | | |

| | | | | |

| Consolidated variable interest entities’ assets and debt included in the above balances: |

| | | | | |

| Investments in real estate, net | | $ | 954,095 |

| | $ | 438,670 |

|

| Cash, cash equivalents and restricted cash | | $ | 58,108 |

| | $ | 12,812 |

|

| Other assets | | $ | 6,968 |

| | $ | 3,134 |

|

| Secured mortgage and construction debt, net | | $ | 378,338 |

| | $ | 50,993 |

|

| Accounts payable, accrued expenses and other liabilities | | $ | 59,740 |

| | $ | 25,200 |

|

See accompanying notes to consolidated financial statements.

1

AMERICAN CAMPUS COMMUNITIES, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(unaudited, in thousands, except share and per share data)

| | | | | Three Months Ended

September 30, | | Nine Months Ended

September 30, | | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| | | 2017 | | 2016 | | 2017 |

| 2016 | | 2018 | | 2017 | | 2018 |

| 2017 |

| Revenues: | | | | | | | | | | | | | | | | |

| Wholly-owned properties | | $ | 183,569 |

| | $ | 185,694 |

| | $ | 531,556 |

| | $ | 546,078 |

| |

| Owned properties | | | $ | 202,834 |

| | $ | 183,569 |

| | $ | 597,854 |

| | $ | 531,556 |

|

| On-campus participating properties | | 6,799 |

| | 6,758 |

| | 23,128 |

| | 23,018 |

| | 6,980 |

| | 6,799 |

| | 23,605 |

| | 23,128 |

|

| Third-party development services | | 3,566 |

| | 773 |

| | 4,697 |

| | 3,929 |

| | 835 |

| | 3,566 |

| | 3,883 |

| | 4,697 |

|

| Third-party management services | | 2,291 |

| | 2,376 |

| | 7,193 |

| | 7,039 |

| | 2,128 |

| | 2,291 |

| | 7,311 |

| | 7,193 |

|

| Resident services | | 713 |

| | 810 |

| | 2,310 |

| | 2,325 |

| | 692 |

| | 713 |

| | 2,284 |

| | 2,310 |

|

| Total revenues | | 196,938 |

| | 196,411 |

| | 568,884 |

| | 582,389 |

| | 213,469 |

| | 196,938 |

| | 634,937 |

| | 568,884 |

|

| | | | | | | | | | | | | | | | | |

| Operating expenses: | | |

| | |

| | |

| | |

| |

| Wholly-owned properties | | 99,423 |

| | 100,602 |

| | 249,552 |

| | 257,175 |

| |

| Operating expenses (income): | | | |

| | |

| | |

| | |

|

| Owned properties | | | 107,997 |

| | 99,423 |

| | 282,193 |

| | 249,552 |

|

| On-campus participating properties | | 3,923 |

| | 3,784 |

| | 11,080 |

| | 10,125 |

| | 3,875 |

| | 3,923 |

| | 11,030 |

| | 11,080 |

|

| Third-party development and management services | | 3,879 |

| | 3,340 |

| | 11,789 |

| | 10,638 |

| | 3,831 |

| | 3,879 |

| | 11,573 |

| | 11,789 |

|

| General and administrative | | 8,684 |

| | 5,375 |

| | 25,200 |

| | 16,810 |

| | 7,183 |

| | 8,684 |

| | 27,055 |

| | 25,200 |

|

| Depreciation and amortization | | 61,125 |

| | 52,067 |

| | 169,391 |

| | 159,486 |

| | 66,131 |

| | 61,125 |

| | 194,447 |

| | 169,391 |

|

| Ground/facility leases | | 2,329 |

| | 1,965 |

| | 7,151 |

| | 6,736 |

| | 2,951 |

| | 2,329 |

| | 8,526 |

| | 7,151 |

|

| Provision for real estate impairment | | — |

| | — |

| | 15,317 |

| | — |

| | — |

| | — |

| | — |

| | 15,317 |

|

| Other operating income | | | — |

| | — |

| | (2,648 | ) | | — |

|

| Total operating expenses | | 179,363 |

| | 167,133 |

| | 489,480 |

| | 460,970 |

| | 191,968 |

| | 179,363 |

| | 532,176 |

| | 489,480 |

|

| | | | | | | | | | | | | | | | | |

| Operating income | | 17,575 |

| | 29,278 |

| | 79,404 |

| | 121,419 |

| | 21,501 |

| | 17,575 |

| | 102,761 |

| | 79,404 |

|

| | | | | | | | | | | | | | | | | |

| Nonoperating income and (expenses): | | |

| | |

| | |

| | |

| |

| Nonoperating income (expenses): | | | |

| | |

| | |

| | |

|

| Interest income | | 1,259 |

| | 1,272 |

| | 3,723 |

| | 4,026 |

| | 1,274 |

| | 1,259 |

| | 3,740 |

| | 3,723 |

|

| Interest expense | | (18,654 | ) | | (19,016 | ) | | (47,944 | ) | | (61,762 | ) | | (25,185 | ) | | (18,654 | ) | | (72,207 | ) | | (47,944 | ) |

| Amortization of deferred financing costs | | (1,146 | ) | | (1,344 | ) | | (3,197 | ) | | (5,238 | ) | | (1,116 | ) | | (1,146 | ) | | (4,744 | ) | | (3,197 | ) |

| (Loss) gain from disposition of real estate | | — |

| | — |

| | (632 | ) | | 17,409 |

| |

| Total nonoperating expense | | (18,541 | ) | | (19,088 | ) | | (48,050 | ) | | (45,565 | ) | |

| Gain (loss) from disposition of real estate | | | — |

| | — |

| | 42,314 |

| | (632 | ) |

| Loss from early extinguishment of debt | | | — |

| | — |

| | (784 | ) | | — |

|

| Other nonoperating income | | | 570 |

| | — |

| | 570 |

| | — |

|

| Total nonoperating expenses | | | (24,457 | ) | | (18,541 | ) | | (31,111 | ) | | (48,050 | ) |

| | | | | | | | | | | | | | | | | |

| (Loss) income before income taxes | | (966 | ) | | 10,190 |

| | 31,354 |

| | 75,854 |

| | (2,956 | ) | | (966 | ) | | 71,650 |

| | 31,354 |

|

| Income tax provision | | (267 | ) | | (345 | ) | | (791 | ) | | (1,035 | ) | | 219 |

| | (267 | ) | | (2,147 | ) | | (791 | ) |

| Net (loss) income | | (1,233 | ) | | 9,845 |

| | 30,563 |

| | 74,819 |

| | (2,737 | ) | | (1,233 | ) | | 69,503 |

| | 30,563 |

|

| Net income attributable to noncontrolling interests | | (79 | ) | | (201 | ) | | (587 | ) | | (1,150 | ) | |

| Net loss (income) attributable to noncontrolling interests | | | 392 |

| | (79 | ) | | 88 |

| | (587 | ) |

| Net (loss) income attributable to ACC, Inc. and Subsidiaries common stockholders | | $ | (1,312 | ) | | $ | 9,644 |

| | $ | 29,976 |

| | $ | 73,669 |

| | $ | (2,345 | ) | | $ | (1,312 | ) | | $ | 69,591 |

| | $ | 29,976 |

|

| | | | | | | | | | | | | | | | | |

| Other comprehensive income (loss) | | |

| | |

| | |

| | |

| |

| Other comprehensive income | | | |

| | |

| | |

| | |

|

| Change in fair value of interest rate swaps and other | | 233 |

| | 1,271 |

| | 872 |

| | (162 | ) | | 81 |

| | 233 |

| | 726 |

| | 872 |

|

| Comprehensive (loss) income | | $ | (1,079 | ) | | $ | 10,915 |

| | $ | 30,848 |

| | $ | 73,507 |

| | $ | (2,264 | ) | | $ | (1,079 | ) | | $ | 70,317 |

| | $ | 30,848 |

|

| | | | | | | | | | | | | | | | | |

| Net (loss) income per share attributable to ACC, Inc. and Subsidiaries common stockholders | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

|

| Basic | | $ | (0.01 | ) | | $ | 0.07 |

| | $ | 0.21 |

| | $ | 0.57 |

| |

| Diluted | | $ | (0.01 | ) | | $ | 0.07 |

| | $ | 0.21 |

| | $ | 0.56 |

| |

| Basic and diluted | | | $ | (0.02 | ) | | $ | (0.01 | ) | | $ | 0.50 |

| | $ | 0.21 |

|

| | | | | | | | | | | | | | | | | |

| Weighted-average common shares outstanding | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

|

| Basic | | 136,421,198 |

| | 130,786,985 |

| | 134,708,361 |

| | 128,239,294 |

| | 137,022,012 |

| | 136,421,198 |

| | 136,742,094 |

| | 134,708,361 |

|

| Diluted | | 136,421,198 |

| | 131,568,371 |

| | 135,585,850 |

| | 129,034,401 |

| | 137,022,012 |

| | 136,421,198 |

| | 137,660,802 |

| | 135,585,850 |

|

| | | | | | | | | | | | | | | | | |

| Distributions declared per common share | | $ | 0.44 |

| | $ | 0.42 |

| | $ | 1.30 |

| | $ | 1.24 |

| | $ | 0.46 |

| | $ | 0.44 |

| | $ | 1.36 |

| | $ | 1.30 |

|

See accompanying notes to consolidated financial statements.

2

AMERICAN CAMPUS COMMUNITIES, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

(unaudited, in thousands, except share data)

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Common Shares | | Par Value of Common Shares | | Additional Paid in Capital | | Common Shares Held in Rabbi Trust | | Common Shares Held in Rabbi Trust at Cost | | Accumulated Earnings and Dividends | | Accumulated Other Comprehensive Loss | | Noncontrolling Interests – Partially Owned Properties | | Total |

| Equity, December 31, 2016 | | 132,225,488 |

| | $ | 1,322 |

| | $ | 4,118,842 |

| | 20,181 |

| | $ | (975 | ) | | $ | (670,137 | ) | | $ | (4,067 | ) | | $ | 5,502 |

| | $ | 3,450,487 |

|

| Adjustments to reflect redeemable noncontrolling interests at fair value | | — |

| | — |

| | 5,943 |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 5,943 |

|

| Amortization of restricted stock awards | | — |

| | — |

| | 10,641 |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 10,641 |

|

| Vesting of restricted stock awards and restricted stock units | | 165,884 |

| | 2 |

| | (2,193 | ) | | 43,597 |

| | (1,969 | ) | | — |

| | — |

| | — |

| | (4,160 | ) |

| Distributions to common and restricted stockholders | | — |

| | — |

| | — |

| | — |

| | — |

| | (176,199 | ) | | — |

| | — |

| | (176,199 | ) |

| Distributions to noncontrolling interests - partially owned properties | | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | (212 | ) | | (212 | ) |

| Conversion of common and preferred operating partnership units to common stock | | 22,000 |

| | — |

| | 154 |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 154 |

|

| Net proceeds from sale of common stock | | 3,949,356 |

| | 40 |

| | 187,841 |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 187,881 |

|

| Change in fair value of interest rate swaps and other | | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 564 |

| | — |

| | 564 |

|

| Amortization of interest rate swap terminations | | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 308 |

| | — |

| | 308 |

|

| Contributions by noncontrolling interest | | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 8,158 |

| | 8,158 |

|

| Net income | | — |

| | — |

| | — |

| | — |

| | — |

| | 29,976 |

| | — |

| | 265 |

| | 30,241 |

|

| Equity, September 30, 2017 | | 136,362,728 |

|

| $ | 1,364 |

|

| $ | 4,321,228 |

| | 63,778 |

| | $ | (2,944 | ) |

| $ | (816,360 | ) |

| $ | (3,195 | ) |

| $ | 13,713 |

|

| $ | 3,513,806 |

|

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Common Shares | | Par Value of Common Shares | | Additional Paid in Capital | | Common Shares Held in Rabbi Trust | | Common Shares Held in Rabbi Trust at Cost | | Accumulated Earnings and Dividends | | Accumulated Other Comprehensive Loss | | Noncontrolling Interests – Partially Owned Properties | | Total |

| Equity, December 31, 2017 | | 136,362,728 |

| | $ | 1,364 |

| | $ | 4,326,910 |

| | 63,778 |

| | $ | (2,944 | ) | | $ | (837,644 | ) | | $ | (2,701 | ) | | $ | 13,973 |

| | $ | 3,498,958 |

|

| Adjustments to reflect redeemable noncontrolling interests at fair value | | — |

| | — |

| | (65,857 | ) | | — |

| | — |

| | — |

| | — |

| | — |

| | (65,857 | ) |

| Amortization of restricted stock awards and vesting of restricted stock units | | 27,376 |

| | — |

| | 9,922 |

| |

|

| | — |

| | — |

| | — |

| | — |

| | 9,922 |

|

| Vesting of restricted stock awards | | 165,263 |

| | 2 |

| | (2,758 | ) | |

|

| |

|

| | — |

| | — |

| | — |

| | (2,756 | ) |

| Distributions to common and restricted stockholders | | — |

| | — |

| | — |

| | — |

| | — |

| | (187,257 | ) | | — |

| | — |

| | (187,257 | ) |

| Contributions by noncontrolling interests - partially owned properties | | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 212,481 |

| | 212,481 |

|

| Distributions to noncontrolling interests - partially owned properties | | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | (151,271 | ) | | (151,271 | ) |

| Change in ownership of consolidated subsidiary | | — |

| | — |

| | 174,515 |

| | — |

| | — |

| | — |

| | — |

| | (9,472 | ) | | 165,043 |

|

| Conversion of common and preferred operating partnership units to common stock | | 412,343 |

| | 4 |

| | 13,328 |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 13,332 |

|

| Change in fair value of interest rate swaps and other | | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 726 |

| | — |

| | 726 |

|

| Deposits to deferred compensation plan, net of withdrawals | | (5,825 | ) | | — |

| | 148 |

| | 5,825 |

| | (148 | ) | | — |

| | — |

| | — |

| | — |

|

| Net income (loss) | | — |

| | — |

| | — |

| | — |

| | — |

| | 69,591 |

| | — |

| | (642 | ) | | 68,949 |

|

| Equity, September 30, 2018 | | 136,961,885 |

|

| $ | 1,370 |

|

| $ | 4,456,208 |

| | 69,603 |

| | $ | (3,092 | ) |

| $ | (955,310 | ) |

| $ | (1,975 | ) |

| $ | 65,069 |

|

| $ | 3,562,270 |

|

See accompanying notes to consolidated financial statements.

3

AMERICAN CAMPUS COMMUNITIES, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(unaudited, in thousands)

|

| | | | | | | | |

| | | Nine Months Ended September 30, |

| | | 2017 | | 2016 |

| Operating activities | | | | |

| Net income | | $ | 30,563 |

| | $ | 74,819 |

|

| Adjustments to reconcile net income to net cash provided by operating activities: | | |

| | |

|

| Loss (gain) from disposition of real estate | | 632 |

| | (17,409 | ) |

| Provision for real estate impairment | | 15,317 |

| | — |

|

| Depreciation and amortization | | 169,391 |

| | 159,486 |

|

| Amortization of deferred financing costs and debt premiums/discounts | | (2,691 | ) | | (4,053 | ) |

| Share-based compensation | | 11,401 |

| | 7,820 |

|

| Income tax provision | | 791 |

| | 1,035 |

|

| Amortization of interest rate swap terminations and other | | 308 |

| | 309 |

|

| Changes in operating assets and liabilities: | | |

| | |

|

| Restricted cash | | (566 | ) | | (734 | ) |

| Student contracts receivable, net | | (6,775 | ) | | 1,750 |

|

| Other assets | | (2,536 | ) | | (5,112 | ) |

| Accounts payable and accrued expenses | | (293 | ) | | 2,769 |

|

| Other liabilities | | 29,581 |

| | 22,157 |

|

| Net cash provided by operating activities | | 245,123 |

| | 242,837 |

|

| | | | | |

| Investing activities | | |

| | |

|

| Proceeds from disposition of properties | | 24,462 |

| | 72,640 |

|

| Cash paid for acquisition of operating and under development properties | | (302,318 | ) | | (96,604 | ) |

| Cash paid for land acquisitions | | (8,886 | ) | | (856 | ) |

| Capital expenditures for wholly-owned properties | | (64,464 | ) | | (45,155 | ) |

| Investments in wholly-owned properties under development | | (409,174 | ) | | (284,777 | ) |

| Capital expenditures for on-campus participating properties | | (2,909 | ) | | (2,510 | ) |

| Investment in direct financing lease | | (759 | ) | | (7,837 | ) |

| Change in escrow deposits for real estate investments | | (727 | ) | | 5,141 |

|

| Change in restricted cash related to capital reserves | | (578 | ) | | (1,099 | ) |

| Purchase of corporate furniture, fixtures and equipment | | (4,997 | ) | | (4,681 | ) |

| Net cash used in investing activities | | (770,350 | ) | | (365,738 | ) |

| | | | | |

| Financing activities | | |

| | |

|

| Proceeds from sale of common stock | | 190,912 |

| | 803,189 |

|

| Offering costs | | (2,374 | ) | | (32,912 | ) |

| Pay-off of mortgage and construction loans | | (99,185 | ) | | (152,597 | ) |

| Pay-off of unsecured term loans | | — |

| | (400,000 | ) |

| Proceeds from unsecured term loan | | 500,000 |

| | 150,000 |

|

| Proceeds from revolving credit facility | | 974,300 |

| | 123,400 |

|

| Paydowns of revolving credit facility | | (807,160 | ) | | (172,300 | ) |

| Proceeds from construction loans | | 10,812 |

| | — |

|

| Scheduled principal payments on debt | | (9,718 | ) | | (11,514 | ) |

| Debt issuance and assumption costs | | (7,335 | ) | | (744 | ) |

| Contributions by noncontrolling interests | | 11,526 |

| | — |

|

| Taxes paid on net-share settlements | | (4,920 | ) | | (2,977 | ) |

| Distributions to common and restricted stockholders | | (176,199 | ) | | (162,866 | ) |

| Distributions to noncontrolling interests | | (61,231 | ) | | (2,044 | ) |

| Net cash provided by financing activities | | 519,428 |

| | 138,635 |

|

| | | | | |

| Net change in cash and cash equivalents | | (5,799 | ) | | 15,734 |

|

| Cash and cash equivalents at beginning of period | | 22,140 |

| | 16,659 |

|

| Cash and cash equivalents at end of period | | $ | 16,341 |

| | $ | 32,393 |

|

| | | | | |

| Supplemental disclosure of non-cash investing and financing activities | | |

| | |

|

| Loans assumed in connection with property acquisitions | | $ | (80,296 | ) | | $ | (10,012 | ) |

| Conversion of common and preferred operating partnership units to common stock | | $ | 154 |

| | $ | 5,441 |

|

| Non-cash contribution from noncontrolling interest | | $ | 120,618 |

| | $ | — |

|

| Non-cash consideration exchanged in purchase of land parcel | | $ | (3,071 | ) | | $ | — |

|

| Change in accrued construction in progress | | $ | 24,753 |

| | $ | 32,941 |

|

| Change in fair value of derivative instruments, net | | $ | 564 |

| | $ | (471 | ) |

| Change in fair value of redeemable noncontrolling interests | | $ | 5,943 |

| | $ | (10,481 | ) |

| | | | | |

| Supplemental disclosure of cash flow information | | |

| | |

|

| Cash paid for interest, net of amounts capitalized | | $ | 49,562 |

| | $ | 69,884 |

|

|

| | | | | | | | |

| | | Nine Months Ended September 30, |

| | | 2018 | | 2017 |

| Operating activities | | | | |

| Net income | | $ | 69,503 |

| | $ | 30,563 |

|

| Adjustments to reconcile net income to net cash provided by operating activities: | | |

| | |

|

| (Gain) loss from disposition of real estate | | (42,314 | ) | | 632 |

|

| Loss from early extinguishment of debt | | 784 |

| | — |

|

| Provision for real estate impairment | | — |

| | 15,317 |

|

| Depreciation and amortization | | 194,447 |

| | 169,391 |

|

| Amortization of deferred financing costs and debt premiums/discounts | | 954 |

| | (2,691 | ) |

| Share-based compensation | | 9,922 |

| | 11,401 |

|

| Income tax provision | | 2,147 |

| | 791 |

|

| Amortization of interest rate swap terminations and other | | 308 |

| | 308 |

|

| Changes in operating assets and liabilities: | | |

| | |

|

| Student contracts receivable, net | | (36,584 | ) | | (6,775 | ) |

| Other assets | | (16,739 | ) | | (2,536 | ) |

| Accounts payable and accrued expenses | | 30,214 |

| | (293 | ) |

| Other liabilities | | 54,291 |

| | 29,581 |

|

| Net cash provided by operating activities | | 266,933 |

| | 245,689 |

|

| | | | | |

| Investing activities | | |

| | |

|

| Proceeds from disposition of properties | | 242,284 |

| | 24,462 |

|

| Cash paid for acquisition of operating and under development properties | | — |

| | (302,318 | ) |

| Cash paid for land acquisitions | | (26,534 | ) | | (8,886 | ) |

| Capital expenditures for owned properties | | (55,814 | ) | | (64,464 | ) |

| Investments in owned properties under development | | (372,251 | ) | | (409,174 | ) |

| Capital expenditures for on-campus participating properties | | (2,918 | ) | | (2,909 | ) |

| Investment in direct financing lease, net | | — |

| | (759 | ) |

| Proceeds from insurance settlement | | 1,649 |

| | — |

|

| Purchase of corporate furniture, fixtures and equipment | | (2,527 | ) | | (4,997 | ) |

| Net cash used in investing activities | | (216,111 | ) | | (769,045 | ) |

| | | | | |

| Financing activities | | |

| | |

|

| Proceeds from sale of common stock | | — |

| | 190,912 |

|

| Offering costs | | — |

| | (2,374 | ) |

| Pay-off of mortgage and construction loans | | (146,165 | ) | | (99,185 | ) |

| Defeasance costs related to early extinguishment of debt | | (2,726 | ) | | — |

|

| Pay-off of unsecured term loans | | (450,000 | ) | | — |

|

| Proceeds from unsecured term loans | | — |

| | 500,000 |

|

| Proceeds from revolving credit facility | | 882,800 |

| | 974,300 |

|

| Paydowns of revolving credit facility | | (743,500 | ) | | (807,160 | ) |

| Proceeds from construction loans | | 88,004 |

| | 10,812 |

|

| Proceeds from mortgage loans | | 330,000 |

| | — |

|

| Scheduled principal payments on debt | | (9,728 | ) | | (10,582 | ) |

| Debt issuance and assumption costs | | (656 | ) | | (7,335 | ) |

| Increase in ownership of consolidated subsidiary | | (10,486 | ) | | — |

|

| Contributions by noncontrolling interests | | 379,901 |

| | 11,526 |

|

| Taxes paid on net-share settlements | | (2,756 | ) | | (4,920 | ) |

| Distributions to common and restricted stockholders | | (187,257 | ) | | (176,199 | ) |

| Distributions to noncontrolling interests | | (152,484 | ) | | (61,231 | ) |

| Net cash (used in) provided by financing activities | | (25,053 | ) | | 518,564 |

|

| | | | | |

| Net change in cash, cash equivalents, and restricted cash | | 25,769 |

| | (4,792 | ) |

| Cash, cash equivalents, and restricted cash at beginning of period | | 64,772 |

| | 46,957 |

|

| Cash, cash equivalents, and restricted cash at end of period | | $ | 90,541 |

| | $ | 42,165 |

|

| | | | | |

| Reconciliation of cash, cash equivalents, and restricted cash to the consolidated balance sheets | | | | |

| Cash and cash equivalents | | $ | 50,801 |

| | $ | 16,341 |

|

| Restricted cash | | 39,740 |

| | 25,824 |

|

| Total cash, cash equivalents, and restricted cash at end of period | | $ | 90,541 |

| | $ | 42,165 |

|

| | | | | |

See accompanying notes to consolidated financial statements.

4

AMERICAN CAMPUS COMMUNITIES, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(unaudited, in thousands)

|

| | | | | | | | |

| | | Nine Months Ended September 30, |

| | | 2018 | | 2017 |

| Supplemental disclosure of non-cash investing and financing activities | | |

| | |

|

| Loans assumed in connection with property acquisitions | | $ | — |

| | $ | (80,296 | ) |

| Conversion of common and preferred operating partnership units to common stock | | $ | 13,332 |

| | $ | 154 |

|

| Non-cash contribution from noncontrolling interest | | $ | 8,729 |

| | $ | 120,618 |

|

| Non-cash consideration exchanged in purchase of land parcel | | $ | — |

| | $ | (3,071 | ) |

| Change in accrued construction in progress | | $ | (1,507 | ) | | $ | 24,753 |

|

| Change in fair value of derivative instruments, net | | $ | 418 |

| | $ | 564 |

|

| Change in fair value of redeemable noncontrolling interests | | $ | (65,857 | ) | | $ | 5,943 |

|

| Change in ownership of consolidated subsidiary | | $ | (175,529 | ) | | $ | — |

|

| | | | | |

| Supplemental disclosure of cash flow information | | |

| | |

|

| Cash paid for interest, net of amounts capitalized | | $ | 68,970 |

| | $ | 49,562 |

|

See accompanying notes to consolidated financial statements.

45

AMERICAN CAMPUS COMMUNITIES OPERATING PARTNERSHIP, L.P. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(in thousands, except unit data)

|

| | | | | | | | |

| | | September 30, 2018 | | December 31, 2017 |

| | | (Unaudited) | | |

| Assets | | | | |

| | | | | |

| Investments in real estate: | | | | |

| Owned properties, net | | $ | 6,521,705 |

| | $ | 6,450,364 |

|

| On-campus participating properties, net | | 78,866 |

| | 81,804 |

|

| Investments in real estate, net | | 6,600,571 |

| | 6,532,168 |

|

| | | | | |

| Cash and cash equivalents | | 50,801 |

| | 41,182 |

|

| Restricted cash | | 39,740 |

| | 23,590 |

|

| Student contracts receivable, net | | 45,297 |

| | 9,170 |

|

| Other assets | | 309,639 |

| | 291,260 |

|

| | | | | |

| Total assets | | $ | 7,046,048 |

| | $ | 6,897,370 |

|

| | | | | |

| Liabilities and capital | | |

| | |

|

| | | | | |

| Liabilities: | | |

| | |

|

| Secured mortgage, construction and bond debt, net | | $ | 920,345 |

| | $ | 664,020 |

|

| Unsecured notes, net | | 1,587,796 |

| | 1,585,855 |

|

| Unsecured term loans, net | | 198,681 |

| | 647,044 |

|

| Unsecured revolving credit facility | | 266,900 |

| | 127,600 |

|

| Accounts payable and accrued expenses | | 86,481 |

| | 53,741 |

|

| Other liabilities | | 238,921 |

| | 187,983 |

|

| Total liabilities | | 3,299,124 |

| | 3,266,243 |

|

| | | | | |

| Commitments and contingencies (Note 13) | |

|

| |

|

|

| | | | | |

| Redeemable limited partners | | 184,654 |

| | 132,169 |

|

| | | | | |

| Capital: | | |

| | |

|

| Partners’ capital: | | |

| | |

|

| General partner - 12,222 OP units outstanding at both September 30, 2018 and December 31, 2017 | | 56 |

| | 67 |

|

| Limited partner - 137,019,266 and 136,414,284 OP units outstanding at September 30, 2018 and December 31, 2017, respectively | | 3,499,120 |

| | 3,487,619 |

|

| Accumulated other comprehensive loss | | (1,975 | ) | | (2,701 | ) |

| Total partners’ capital | | 3,497,201 |

| | 3,484,985 |

|

| Noncontrolling interests - partially owned properties | | 65,069 |

| | 13,973 |

|

| Total capital | | 3,562,270 |

| | 3,498,958 |

|

| | | | | |

| Total liabilities and capital | | $ | 7,046,048 |

| | $ | 6,897,370 |

|

|

| | | | | | | | |

| | | September 30, 2017 | | December 31, 2016 |

| | | (Unaudited) | | |

| Assets | | | | |

| | | | | |

| Investments in real estate: | | | | |

| Wholly-owned properties, net | | $ | 6,262,077 |

| | $ | 5,427,014 |

|

| Wholly-owned properties held for sale | | — |

| | 25,350 |

|

| On-campus participating properties, net | | 83,095 |

| | 85,797 |

|

| Investments in real estate, net | | 6,345,172 |

| | 5,538,161 |

|

| | | | | |

| Cash and cash equivalents | | 16,341 |

| | 22,140 |

|

| Restricted cash | | 25,824 |

| | 24,817 |

|

| Student contracts receivable, net | | 15,531 |

| | 8,428 |

|

| Other assets | | 284,023 |

| | 272,367 |

|

| | | | | |

| Total assets | | $ | 6,686,891 |

| | $ | 5,865,913 |

|

| | | | | |

| Liabilities and capital | | |

| | |

|

| | | | | |

| Liabilities: | | |

| | |

|

| Secured mortgage, construction and bond debt, net | | $ | 662,874 |

| | $ | 688,195 |

|

| Unsecured notes, net | | 1,190,296 |

| | 1,188,737 |

|

| Unsecured term loans, net | | 646,675 |

| | 149,065 |

|

| Unsecured revolving credit facility | | 266,440 |

| | 99,300 |

|

| Accounts payable and accrued expenses | | 79,612 |

| | 76,614 |

|

| Other liabilities | | 214,918 |

| | 158,437 |

|

| Total liabilities | | 3,060,815 |

| | 2,360,348 |

|

| | | | | |

| Commitments and contingencies (Note 13) | |

|

| |

|

|

| | | | | |

| Redeemable limited partners | | 112,270 |

| | 55,078 |

|

| | | | | |

| Capital: | | |

| | |

|

| Partners' capital: | | |

| | |

|

| General partner - 12,222 OP units outstanding at both September 30, 2017 and December 31, 2016 | | 69 |

| | 82 |

|

| Limited partner - 136,414,284 and 132,233,447 OP units outstanding at September 30, 2017 and December 31, 2016, respectively | | 3,503,219 |

| | 3,448,970 |

|

| Accumulated other comprehensive loss | | (3,195 | ) | | (4,067 | ) |

| Total partners' capital | | 3,500,093 |

| | 3,444,985 |

|

| Noncontrolling interests - partially owned properties | | 13,713 |

| | 5,502 |

|

| Total capital | | 3,513,806 |

| | 3,450,487 |

|

| | | | | |

| Total liabilities and capital | | $ | 6,686,891 |

| | $ | 5,865,913 |

|

|

| | | | | | | | |

| | | | | |

| Consolidated variable interest entities’ assets and debt included in the above balances: |

| | | | | |

| Investments in real estate, net | | $ | 954,095 |

| | $ | 438,670 |

|

| Cash, cash equivalents and restricted cash | | $ | 58,108 |

| | $ | 12,812 |

|

| Other assets | | $ | 6,968 |

| | $ | 3,134 |

|

| Secured mortgage and construction debt, net | | $ | 378,338 |

| | $ | 50,993 |

|

| Accounts payable, accrued expenses and other liabilities | | $ | 59,740 |

| | $ | 25,200 |

|

See accompanying notes to consolidated financial statements.

56

AMERICAN CAMPUS COMMUNITIES OPERATING PARTNERSHIP, L.P. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(unaudited, in thousands, except unit and per unit data)

| | | | | Three Months Ended

September 30, | | Nine Months Ended

September 30, | | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| | | 2017 | | 2016 | | 2017 | | 2016 | | 2018 | | 2017 | | 2018 | | 2017 |

| Revenues: | | | | | | | | | | | | | | | | |

| Wholly-owned properties | | $ | 183,569 |

| | $ | 185,694 |

| | $ | 531,556 |

| | $ | 546,078 |

| |

| Owned properties | | | $ | 202,834 |

| | $ | 183,569 |

| | $ | 597,854 |

| | $ | 531,556 |

|

| On-campus participating properties | | 6,799 |

| | 6,758 |

| | 23,128 |

| | 23,018 |

| | 6,980 |

| | 6,799 |

| | 23,605 |

| | 23,128 |

|

| Third-party development services | | 3,566 |

| | 773 |

| | 4,697 |

| | 3,929 |

| | 835 |

| | 3,566 |

| | 3,883 |

| | 4,697 |

|

| Third-party management services | | 2,291 |

| | 2,376 |

| | 7,193 |

| | 7,039 |

| | 2,128 |

| | 2,291 |

| | 7,311 |

| | 7,193 |

|

| Resident services | | 713 |

| | 810 |

| | 2,310 |

| | 2,325 |

| | 692 |

| | 713 |

| | 2,284 |

| | 2,310 |

|

| Total revenues | | 196,938 |

| | 196,411 |

| | 568,884 |

| | 582,389 |

| | 213,469 |

| | 196,938 |

| | 634,937 |

| | 568,884 |

|

| | | | | | | | | | | | | | | | | |

| Operating expenses: | | |

| | |

| | |

| | |

| |

| Wholly-owned properties | | 99,423 |

| | 100,602 |

| | 249,552 |

| | 257,175 |

| |

| Operating expenses (income): | | | |

| | |

| | |

| | |

|

| Owned properties | | | 107,997 |

| | 99,423 |

| | 282,193 |

| | 249,552 |

|

| On-campus participating properties | | 3,923 |

| | 3,784 |

| | 11,080 |

| | 10,125 |

| | 3,875 |

| | 3,923 |

| | 11,030 |

| | 11,080 |

|

| Third-party development and management services | | 3,879 |

| | 3,340 |

| | 11,789 |

| | 10,638 |

| | 3,831 |

| | 3,879 |

| | 11,573 |

| | 11,789 |

|

| General and administrative | | 8,684 |

| | 5,375 |

| | 25,200 |

| | 16,810 |

| | 7,183 |

| | 8,684 |

| | 27,055 |

| | 25,200 |

|

| Depreciation and amortization | | 61,125 |

| | 52,067 |

| | 169,391 |

| | 159,486 |

| | 66,131 |

| | 61,125 |

| | 194,447 |

| | 169,391 |

|

| Ground/facility leases | | 2,329 |

| | 1,965 |

| | 7,151 |

| | 6,736 |

| | 2,951 |

| | 2,329 |

| | 8,526 |

| | 7,151 |

|

| Provision for real estate impairment | | — |

| | — |

| | 15,317 |

| | — |

| | — |

| | — |

| | — |

| | 15,317 |

|

| Other operating income | | | — |

| | — |

| | (2,648 | ) | | — |

|

| Total operating expenses | | 179,363 |

| | 167,133 |

| | 489,480 |

| | 460,970 |

| | 191,968 |

| | 179,363 |

| | 532,176 |

| | 489,480 |

|

| | | | | | | | | | | | | | | | | |

| Operating income | | 17,575 |

| | 29,278 |

| | 79,404 |

| | 121,419 |

| | 21,501 |

| | 17,575 |

| | 102,761 |

| | 79,404 |

|

| | | | | | | | | | | | | | | | | |

| Nonoperating income and (expenses): | | |

| | |

| | |

| | |

| |

| Nonoperating income (expenses): | | | |

| | |

| | |

| | |

|

| Interest income | | 1,259 |

| | 1,272 |

| | 3,723 |

| | 4,026 |

| | 1,274 |

| | 1,259 |

| | 3,740 |

| | 3,723 |

|

| Interest expense | | (18,654 | ) | | (19,016 | ) | | (47,944 | ) | | (61,762 | ) | | (25,185 | ) | | (18,654 | ) | | (72,207 | ) | | (47,944 | ) |

| Amortization of deferred financing costs | | (1,146 | ) | | (1,344 | ) | | (3,197 | ) | | (5,238 | ) | | (1,116 | ) | | (1,146 | ) | | (4,744 | ) | | (3,197 | ) |

| (Loss) gain from disposition of real estate | | — |

| | — |

| | (632 | ) | | 17,409 |

| |

| Total nonoperating expense | | (18,541 | ) | | (19,088 | ) | | (48,050 | ) | | (45,565 | ) | |

| Gain (loss) from disposition of real estate | | | — |

| | — |

| | 42,314 |

| | (632 | ) |

| Loss from early extinguishment of debt | | | — |

| | — |

| | (784 | ) | | — |

|

| Other nonoperating income | | | 570 |

| | — |

| | 570 |

| | — |

|

| Total nonoperating expenses | | | (24,457 | ) | | (18,541 | ) | | (31,111 | ) | | (48,050 | ) |

| (Loss) income before income taxes | | (966 | ) | | 10,190 |

| | 31,354 |

| | 75,854 |

| | (2,956 | ) | | (966 | ) | | 71,650 |

| | 31,354 |

|

| Income tax provision | | (267 | ) | | (345 | ) | | (791 | ) | | (1,035 | ) | | 219 |

| | (267 | ) | | (2,147 | ) | | (791 | ) |

| Net (loss) income | | (1,233 | ) | | 9,845 |

| | 30,563 |

| | 74,819 |

| | (2,737 | ) | | (1,233 | ) | | 69,503 |

| | 30,563 |

|

| Net income attributable to noncontrolling interests – partially owned properties | | (57 | ) | | (77 | ) | | (259 | ) | | (285 | ) | |

| Net loss (income) attributable to noncontrolling interests – partially owned properties | | | 413 |

| | (57 | ) | | 665 |

| | (259 | ) |

| Net (loss) income attributable to American Campus Communities Operating Partnership, L.P. | | (1,290 | ) | | 9,768 |

| | 30,304 |

| | 74,534 |

| | (2,324 | ) | | (1,290 | ) | | 70,168 |

| | 30,304 |

|

| Series A preferred unit distributions | | (31 | ) | | (36 | ) | | (93 | ) | | (115 | ) | | (31 | ) | | (31 | ) | | (93 | ) | | (93 | ) |

| Net (loss) income attributable to common unitholders | | $ | (1,321 | ) | | $ | 9,732 |

| | $ | 30,211 |

| | $ | 74,419 |

| | $ | (2,355 | ) | | $ | (1,321 | ) | | $ | 70,075 |

| | $ | 30,211 |

|

| | | | | | | | | | | | | | | | | |

| Other comprehensive income (loss) | | |

| | |

| | |

| | |

| |

| Other comprehensive income | | | |

| | |

| | |

| | |

|

| Change in fair value of interest rate swaps and other | | 233 |

| | 1,271 |

| | 872 |

| | (162 | ) | | 81 |

| | 233 |

| | 726 |

| | 872 |

|

| Comprehensive (loss) income | | $ | (1,088 | ) | | $ | 11,003 |

| | $ | 31,083 |

| | $ | 74,257 |

| | $ | (2,274 | ) | | $ | (1,088 | ) | | $ | 70,801 |

| | $ | 31,083 |

|

| | | | | | | | | | | | | | | | | |

| Net (loss) income per unit attributable to common unitholders | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

|

| Basic | | $ | (0.01 | ) | | $ | 0.07 |

| | $ | 0.21 |

| | $ | 0.57 |

| |

| Diluted | | $ | (0.01 | ) | | $ | 0.07 |

| | $ | 0.21 |

| | $ | 0.56 |

| |

| Basic and diluted | | | $ | (0.02 | ) | | $ | (0.01 | ) | | $ | 0.50 |

| | $ | 0.21 |

|

| | | | | | | | | | | | | | | | | |

| Weighted-average common units outstanding | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

|

| Basic | | 137,432,872 |

| | 132,008,227 |

| | 135,731,609 |

| | 129,517,442 |

| | 137,624,276 |

| | 137,432,872 |

| | 137,573,422 |

| | 135,731,609 |

|

| Diluted | | 137,432,872 |

| | 132,789,613 |

| | 136,609,098 |

| | 130,312,549 |

| | 137,624,276 |

| | 137,432,872 |

| | 138,492,130 |

| | 136,609,098 |

|

| | | | | | | | | | | | | | | | | |

| Distributions declared per Common Unit | | $ | 0.44 |

| | $ | 0.42 |

| | $ | 1.30 |

| | $ | 1.24 |

| | $ | 0.46 |

| | $ | 0.44 |

| | $ | 1.36 |

| | $ | 1.30 |

|

See accompanying notes to consolidated financial statements.

67

AMERICAN CAMPUS COMMUNITIES OPERATING PARTNERSHIP, L.P. AND SUBSIDIARIES

CONSOLIDATED STATEMENT OF CHANGES IN CAPITAL

(unaudited, in thousands, except unit data)

|

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | Accumulated | | Noncontrolling | | |

| | | | | | | Other | | Interests - | | |

|

| | | General Partner | | Limited Partner | | Comprehensive | | Partially Owned | | |

|

| | | Units | | Amount | | Units | | Amount | | Loss | | Properties | | Total |

| Capital, December 31, 2016 | | 12,222 |

| | $ | 82 |

| | 132,233,447 |

| | $ | 3,448,970 |

| | $ | (4,067 | ) | | $ | 5,502 |

| | $ | 3,450,487 |

|

| Adjustments to reflect redeemable limited partners' interest at fair value | | — |

| | — |

| | — |

| | 5,943 |

| | — |

| | — |

| | 5,943 |

|

| Amortization of restricted stock awards | | — |

| | — |

| | — |

| | 10,641 |

| | — |

| | — |

| | 10,641 |

|

| Vesting of restricted stock awards and restricted stock units | | — |

| | — |

| | 209,481 |

| | (4,160 | ) | | — |

| | — |

| | (4,160 | ) |

| Distributions | | — |

| | (16 | ) | | — |

| | (176,183 | ) | | — |

| | — |

| | (176,199 | ) |

| Distributions to noncontrolling interests - partially owned properties | | — |

| | — |

| | — |

| | — |

| | — |

| | (212 | ) | | (212 | ) |

| Conversion of common and preferred operating partnership units to common stock | | — |

| | — |

| | 22,000 |

| | 154 |

| | — |

| | — |

| | 154 |

|

| Issuance of units in exchange for contributions of equity offering proceeds | | — |

| | — |

| | 3,949,356 |

| | 187,881 |

| | — |

| | — |

| | 187,881 |

|

| Change in fair value of interest rate swaps and other | | — |

| | — |

| | — |

| | — |

| | 564 |

| | — |

| | 564 |

|

| Amortization of interest rate swap terminations | | — |

| | — |

| | — |

| | — |

| | 308 |

| | — |

| | 308 |

|

| Contributions by noncontrolling interest | | — |

| | — |

| | — |

| | — |

| | — |

| | 8,158 |

| | 8,158 |

|

| Net income | | — |

| | 3 |

| | — |

| | 29,973 |

| | — |

| | 265 |

| | 30,241 |

|

| Capital as of September 30, 2017 | | 12,222 |

| | $ | 69 |

| | 136,414,284 |

| | $ | 3,503,219 |

| | $ | (3,195 | ) | | $ | 13,713 |

| | $ | 3,513,806 |

|

|

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | Accumulated | | Noncontrolling | | |

| | | | | | | Other | | Interests - | | |

|

| | | General Partner | | Limited Partner | | Comprehensive | | Partially Owned | | |

|

| | | Units | | Amount | | Units | | Amount | | Loss | | Properties | | Total |

| Capital, December 31, 2017 | | 12,222 |

| | $ | 67 |

| | 136,414,284 |

| | $ | 3,487,619 |

| | $ | (2,701 | ) | | $ | 13,973 |

| | $ | 3,498,958 |

|

| Adjustments to reflect redeemable limited partners’ interest at fair value | | — |

| | — |

| | — |

| | (65,857 | ) | | — |

| | — |

| | (65,857 | ) |

| Amortization of restricted stock awards and vesting of restricted stock units | | — |

| | — |

| | 27,376 |

| | 9,922 |

| | — |

| | — |

| | 9,922 |

|

| Vesting of restricted stock awards | | — |

| | — |

| | 165,263 |

| | (2,756 | ) | | — |

| | — |

| | (2,756 | ) |

| Distributions | | — |

| | (17 | ) | | — |

| | (187,240 | ) | | — |

| | — |

| | (187,257 | ) |

| Contributions by noncontrolling interests - partially owned properties | | — |

| | — |

| | — |

| | — |

| | — |

| | 212,481 |

| | 212,481 |

|

| Distributions to noncontrolling interests - partially owned properties | | — |

| | — |

| | — |

| | — |

| | — |

| | (151,271 | ) | | (151,271 | ) |

| Change in ownership of consolidated subsidiary | | — |

| | — |

| | — |

| | 174,515 |

| | — |

| | (9,472 | ) | | 165,043 |

|

| Conversion of common and preferred operating partnership units to common stock | | — |

| | — |

| | 412,343 |

| | 13,332 |

| | — |

| | — |

| | 13,332 |

|

| Change in fair value of interest rate swaps and other | | — |

| | — |

| | — |

| | — |

| | 726 |

| | — |

| | 726 |

|

| Net income (loss) | | — |

| | 6 |

| | — |

| | 69,585 |

| | — |

| | (642 | ) | | 68,949 |

|

| Capital, September 30, 2018 | | 12,222 |

| | $ | 56 |

| | 137,019,266 |

| | $ | 3,499,120 |

| | $ | (1,975 | ) | | $ | 65,069 |

| | $ | 3,562,270 |

|

See accompanying notes to consolidated financial statements.

78

AMERICAN CAMPUS COMMUNITIES OPERATING PARTNERSHIP, L.P. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(unaudited, in thousands)

|

| | | | | | | | |

| | | Nine Months Ended September 30, |

| | | 2017 | | 2016 |

| Operating activities | | | | |

| Net income | | $ | 30,563 |

| | $ | 74,819 |

|

| Adjustments to reconcile net income to net cash provided by operating activities: | | |

| | |

|

| Loss (gain) from disposition of real estate | | 632 |

| | (17,409 | ) |

| Provision for real estate impairment | | 15,317 |

| | — |

|

| Depreciation and amortization | | 169,391 |

| | 159,486 |

|

| Amortization of deferred financing costs and debt premiums/discounts | | (2,691 | ) | | (4,053 | ) |

| Share-based compensation | | 11,401 |

| | 7,820 |

|

| Income tax provision | | 791 |

| | 1,035 |

|

| Amortization of interest rate swap terminations and other | | 308 |

| | 309 |

|

| Changes in operating assets and liabilities: | | |

| | |

|

| Restricted cash | | (566 | ) | | (734 | ) |

| Student contracts receivable, net | | (6,775 | ) | | 1,750 |

|

| Other assets | | (2,536 | ) | | (5,112 | ) |

| Accounts payable and accrued expenses | | (293 | ) | | 2,769 |

|

| Other liabilities | | 29,581 |

| | 22,157 |

|

| Net cash provided by operating activities | | 245,123 |

| | 242,837 |

|

| | | | | |

| Investing activities | | |

| | |

|

| Proceeds from disposition of properties | | 24,462 |

| | 72,640 |

|

| Cash paid for acquisition of operating and under development properties | | (302,318 | ) | | (96,604 | ) |

| Cash paid for land acquisitions | | (8,886 | ) | | (856 | ) |

| Capital expenditures for wholly-owned properties | | (64,464 | ) | | (45,155 | ) |

| Investments in wholly-owned properties under development | | (409,174 | ) | | (284,777 | ) |

| Capital expenditures for on-campus participating properties | | (2,909 | ) | | (2,510 | ) |

| Investment in direct financing lease | | (759 | ) | | (7,837 | ) |

| Change in escrow deposits for real estate investments | | (727 | ) | | 5,141 |

|

| Change in restricted cash related to capital reserves | | (578 | ) | | (1,099 | ) |

| Purchase of corporate furniture, fixtures and equipment | | (4,997 | ) | | (4,681 | ) |

| Net cash used in investing activities | | (770,350 | ) | | (365,738 | ) |

| | | | | |

| Financing activities | | |

| | |

|

| Proceeds from issuance of common units in exchange for contributions, net | | 188,538 |

| | 770,277 |

|

| Pay-off of mortgage and construction loans | | (99,185 | ) | | (152,597 | ) |

| Pay-off of unsecured term loan | | — |

| | (400,000 | ) |

| Proceeds from unsecured term loan | | 500,000 |

| | 150,000 |

|

| Proceeds from revolving credit facility | | 974,300 |

| | 123,400 |

|

| Paydowns of revolving credit facility | | (807,160 | ) | | (172,300 | ) |

| Proceeds from construction loans | | 10,812 |

| | — |

|

| Scheduled principal payments on debt | | (9,718 | ) | | (11,514 | ) |

| Debt issuance and assumption costs | | (7,335 | ) | | (744 | ) |

| Contributions by noncontrolling interests | | 11,526 |

| | — |

|

| Taxes paid on net-share settlements | | (4,920 | ) | | (2,977 | ) |

| Distributions paid to common and preferred unitholders | | (176,404 | ) | | (163,493 | ) |

| Distributions paid on unvested restricted stock awards | | (1,217 | ) | | (1,051 | ) |

| Distributions paid to noncontrolling interests - partially owned properties | | (59,809 | ) | | (366 | ) |

| Net cash provided by financing activities | | 519,428 |

| | 138,635 |

|

| | | | | |

| Net change in cash and cash equivalents | | (5,799 | ) | | 15,734 |

|

| Cash and cash equivalents at beginning of period | | 22,140 |

| | 16,659 |

|

| Cash and cash equivalents at end of period | | $ | 16,341 |

| | $ | 32,393 |

|

| | | | | |

| Supplemental disclosure of non-cash investing and financing activities | | |

| | |

|

| Loans assumed in connection with property acquisitions | | $ | (80,296 | ) | | $ | (10,012 | ) |

| Conversion of common and preferred operating partnership units to common stock | | $ | 154 |

| | $ | 5,441 |

|

| Non-cash contribution from noncontrolling interest | | $ | 120,618 |

| | $ | — |

|

| Non-cash consideration exchanged in purchase of land parcel | | $ | (3,071 | ) | | $ | — |

|

| Change in accrued construction in progress | | $ | 24,753 |

| | $ | 32,941 |

|

| Change in fair value of derivative instruments, net | | $ | 564 |

| | $ | (471 | ) |

| Change in fair value of redeemable noncontrolling interests | | $ | 5,943 |

| | $ | (10,481 | ) |

| | | | | |

| Supplemental disclosure of cash flow information | | |

| | |

|

| Cash paid for interest, net of amounts capitalized | | $ | 49,562 |

| | $ | 69,884 |

|

|

| | | | | | | | |

| | | Nine Months Ended September 30, |

| | | 2018 | | 2017 |

| Operating activities | | | | |

| Net income | | $ | 69,503 |

| | $ | 30,563 |

|

| Adjustments to reconcile net income to net cash provided by operating activities: | | |

| | |

|

| (Gain) loss from disposition of real estate | | (42,314 | ) | | 632 |

|

| Loss from early extinguishment of debt | | 784 |

| | — |

|

| Provision for real estate impairment | | — |

| | 15,317 |

|

| Depreciation and amortization | | 194,447 |

| | 169,391 |

|

| Amortization of deferred financing costs and debt premiums/discounts | | 954 |

| | (2,691 | ) |

| Share-based compensation | | 9,922 |

| | 11,401 |

|

| Income tax provision | | 2,147 |

| | 791 |

|

| Amortization of interest rate swap terminations and other | | 308 |

| | 308 |

|

| Changes in operating assets and liabilities: | | |

| | |

|

| Student contracts receivable, net | | (36,584 | ) | | (6,775 | ) |

| Other assets | | (16,739 | ) | | (2,536 | ) |

| Accounts payable and accrued expenses | | 30,214 |

| | (293 | ) |

| Other liabilities | | 54,291 |

| | 29,581 |

|

| Net cash provided by operating activities | | 266,933 |

| | 245,689 |

|

| | | | | |

| Investing activities | | |

| | |

|

| Proceeds from disposition of properties | | 242,284 |

| | 24,462 |

|

| Cash paid for acquisition of operating and under development properties | | — |

| | (302,318 | ) |

| Cash paid for land acquisitions | | (26,534 | ) | | (8,886 | ) |

| Capital expenditures for owned properties | | (55,814 | ) | | (64,464 | ) |

| Investments in owned properties under development | | (372,251 | ) | | (409,174 | ) |

| Capital expenditures for on-campus participating properties | | (2,918 | ) | | (2,909 | ) |

| Investment in direct financing lease | | — |

| | (759 | ) |

| Proceeds from insurance settlement | | 1,649 |

| | — |

|

| Purchase of corporate furniture, fixtures and equipment | | (2,527 | ) | | (4,997 | ) |

| Net cash used in investing activities | | (216,111 | ) | | (769,045 | ) |

| | | | | |

| Financing activities | | |

| | |

|

| Proceeds from issuance of common units in exchange for contributions, net | | — |

| | 188,538 |

|

| Pay-off of mortgage and construction loans | | (146,165 | ) | | (99,185 | ) |

| Defeasance costs related to early extinguishment of debt | | (2,726 | ) | | — |

|

| Pay-off of unsecured term loans | | (450,000 | ) | | — |

|

| Proceeds from unsecured term loans | | — |

| | 500,000 |

|

| Proceeds from revolving credit facility | | 882,800 |

| | 974,300 |

|

| Paydowns of revolving credit facility | | (743,500 | ) | | (807,160 | ) |

| Proceeds from construction loans | | 88,004 |

| | 10,812 |

|

| Proceeds from mortgage loans | | 330,000 |

| | — |

|

| Scheduled principal payments on debt | | (9,728 | ) | | (10,582 | ) |

| Debt issuance and assumption costs | | (656 | ) | | (7,335 | ) |

| Increase in ownership of consolidated subsidiary | | (10,486 | ) | | — |

|

| Contributions by noncontrolling interests | | 379,901 |

| | 11,526 |

|

| Taxes paid on net-share settlements | | (2,756 | ) | | (4,920 | ) |

| Distributions paid to common and preferred unitholders | | (187,177 | ) | | (176,404 | ) |

| Distributions paid on unvested restricted stock awards | | (1,293 | ) | | (1,217 | ) |

| Distributions paid to noncontrolling interests - partially owned properties | | (151,271 | ) | | (59,809 | ) |

| Net cash (used in) provided by financing activities | | (25,053 | ) | | 518,564 |

|

| | | | | |

| Net change in cash, cash equivalents, and restricted cash | | 25,769 |

| | (4,792 | ) |

| Cash, cash equivalents, and restricted cash at beginning of period | | 64,772 |

| | 46,957 |

|

| Cash, cash equivalents, and restricted cash at end of period | | $ | 90,541 |

| | $ | 42,165 |

|

| | | | | |

| Reconciliation of cash, cash equivalents, and restricted cash to the consolidated balance sheets | | | | |

| Cash and cash equivalents | | $ | 50,801 |

| | $ | 16,341 |

|

| Restricted cash | | 39,740 |

| | 25,824 |

|

| Total cash, cash equivalents, and restricted cash at end of period | | $ | 90,541 |

| | $ | 42,165 |

|

| | | | | |

See accompanying notes to consolidated financial statements.

9

AMERICAN CAMPUS COMMUNITIES OPERATING PARTNERSHIP, L.P. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(unaudited, in thousands)

|

| | | | | | | | |

| | | Nine Months Ended September 30, |

| | | 2018 | | 2017 |

| Supplemental disclosure of non-cash investing and financing activities | | |

| | |

|

| Loans assumed in connection with property acquisitions | | $ | — |

| | $ | (80,296 | ) |

| Conversion of common and preferred operating partnership units to common stock | | $ | 13,332 |

| | $ | 154 |

|

| Non-cash contribution from noncontrolling interest | | $ | 8,729 |

| | $ | 120,618 |

|

| Non-cash consideration exchanged in purchase of land parcel | | $ | — |

| | $ | (3,071 | ) |

| Change in accrued construction in progress | | $ | (1,507 | ) | | $ | 24,753 |

|

| Change in fair value of derivative instruments, net | | $ | 418 |

| | $ | 564 |

|

| Change in fair value of redeemable noncontrolling interests | | $ | (65,857 | ) | | $ | 5,943 |

|

| Change in ownership of consolidated subsidiary | | $ | (175,529 | ) | | $ | — |

|

| | | | | |

| Supplemental disclosure of cash flow information | | |

| | |

|

| Cash paid for interest, net of amounts capitalized | | $ | 68,970 |

| | $ | 49,562 |

|

See accompanying notes to consolidated financial statements.

810

AMERICAN CAMPUS COMMUNITIES, INC. AND SUBSIDIARIES