We will need to obtain additional financing to fund our future operations, including completing the commercialization of our approved product and the development and commercialization of our other product candidates. Changing circumstances may cause us to increase our spending significantly faster than we currently anticipate and we may need to raise additional funds sooner than we presently anticipate. Moreover, research and development and our operating costs and fixed expenses such as rent and other contractual commitments, including those for our research collaborations, are substantial and are expected to increase in the future.

Our future funding requirements will depend on many factors, including, but not limited to:

Unless and until we can generate a sufficient amount of revenues, we may finance future cash needs through public or private equity offerings, license agreements, debt financings, collaborations, strategic alliances and marketing or distribution arrangements. However, we may be unable to raise additional funds or enter into such other arrangements when needed on favorable terms, or at all, including but not limited to the offering, issuance and sale by us of our common stock that may be issued and sold under the ATM.

To the extent that we raise additional capital through the sale of equity or equity-linked securities (including warrants), convertible debt or through the ATM, our shelf registration statement,statements, or other offerings, or if any of our current debt is converted into equity or if our existing warrants are exercised, your ownership interest will be diluted, and the terms may include liquidation or other preferences that adversely affect your rights as a stockholder. The incurrence of additional indebtedness would result in increased fixed payment obligations and could involve certain restrictive covenants, such as limitations on our ability to incur additional debt, limitations on our ability to acquire or license intellectual property rights and other operating restrictions that could adversely impact our ability to conduct our business. If we raise additional funds through strategic partnerships and alliances and licensing arrangements with third parties, we may have to relinquish valuable rights to our technologies or product candidates, or grant licenses on terms unfavorable to us. We have no committed source of additional capital and if we are unable to raise additional capital in sufficient amounts or on terms acceptable to us, we may be required to delay or reduce the scope of or eliminate one or more of our research or development programs or our commercialization efforts. Our current license and collaboration agreements may also be terminated if we are unable to meet the payment obligations under those agreements. As a result, we may seek to access the public or private capital markets whenever conditions are favorable, even if we do not have an immediate need for additional capital at that time.

We have material cash requirements to pay related-party affiliates and third parties under various contractual obligations discussed below:

In Part II, Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations” of our Annual Report on Form 10-K filed with the SEC on March 1, 2023,19, 2024, we disclose those accounting policies that we consider to be significant in determining our results of operations and financial condition. There have been no material changes to those policies that we consider to be significant as of the date of this Quarterly Report on Form 10-Q.Report.

ITEM 3. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK.

Financial market risks related to interest rates, foreign currency exchange rates, market risk on the price and volatility of our common stock, and inflation are described in Part II, Item 7A. “Quantitative and Qualitative Disclosures About Market Risk” of our Annual Report on Form 10-K filed with the SEC on March 1, 2023.19, 2024. There have been no material changes to such financial market risks as of the date of this Quarterly Report on Form 10-Q.Report. We do not currently anticipate any other near-term changes in the nature of our financial market risk exposures or in management’s objectives and strategies with respect to managing such exposures.

ITEM 4. CONTROLS AND PROCEDURES.

Our disclosure controls and procedures are designed to provide reasonable assurance of achieving their objectives of ensuring that information we are required to disclose in the reports we file or submit under the Exchange Act is accumulated and communicated to our management, including our CEO and CFO, as appropriate, to allow timely decisions regarding required disclosures, and is recorded, processed, summarized and reported, within the time periods specified in the SEC’s rules and forms. There is no assurance that our disclosure controls and procedures will operate effectively under all circumstances.

Management, with the participation of our CEO and CFO, evaluated the effectiveness of our disclosure controls and procedures as of June 30, 2023.March 31, 2024. The term “disclosure controls and procedures,” as defined in Rule 13a-15(e) of the Exchange Act means controls and other procedures of a company that are designed to provide reasonable assurance that information required to be disclosed by a company in the reports that it files or submits under the Exchange Act is recorded, processed, summarized and reported within the time periods specified in the SEC’s rules and forms. Disclosure controls and procedures include, without limitation, controls and procedures designed to provide reasonable assurance that information required to be disclosed is accumulated and communicated to our management, including our CEO and CFO, as appropriate, to allow timely decisions regarding required disclosure. Management recognizes that any controls and procedures, no matter how well designed and operated, can provide only reasonable assurance of achieving their desired control objectives, and management necessarily is required to apply its judgment in evaluating the cost-benefit relationship of possible controls and procedures. Based on the evaluation of our disclosure controls and procedures as of June 30, 2023,March 31, 2024, our CEO and CFO have concluded that, as of June 30, 2023,March 31, 2024, our disclosure controls and procedures were effective at the reasonable assurance level.

There have been no changes in our internal control over financial reporting (as defined in Rules 13a-15(f) and 15d-15(f) of the Exchange Act) during the fiscal quarter ended June 30, 2023,March 31, 2024, that have materially affected, or are reasonably likely to materially affect, our internal control over financial reporting.

Management recognizes that a control system, no matter how well conceived and operated, can provide only reasonable, not absolute, assurance that the objectives of the control system are met. Further, the design of a control system must reflect the fact that there are resource constraints, and the benefits of controls must be considered relative to their costs. Because of the inherent limitations in all control systems, no evaluation of controls can provide absolute assurance that all control issues and instances of fraud or error, if any, have been detected. These inherent limitations include the realities that judgments in decision making can be faulty, and that breakdowns can occur because of a simple error or mistake. Additionally, controls can be circumvented by the individual acts of some persons, by collusion of two or more people or by management override of the controls. The design of any system of controls also is based in part upon certain assumptions about the likelihood of future events, and there can be no assurance that any design will succeed in achieving its stated goals under all potential future conditions; over time, controls may become inadequate because of changes in conditions, or the degree of compliance with policies or procedures may deteriorate. Because of the inherent limitations in a cost-effective control system, misstatements due to error or fraud may occur and not be detected.

ITEM 1. LEGAL PROCEEDINGS.

From time to time, we may be involved in various claims and legal proceedings relating to claims arising out of our operations. We are not currently a party to any legal proceedings that, in the opinion of our management, are likely to have a material adverse effect on our business. If we are served with any such complaints, we will assess at that time any contingencies for which we may need to reserve. Regardless of the outcome, litigation can have an adverse impact on us because of defense and settlement costs, diversion of management resources, and other factors.

Shenzhen Beike Biotechnology Co. Ltd. Arbitration

In 2020, we received a Request for Arbitration before the International Chamber of Commerce, International Court of Arbitration. The arbitration relates to a license, development, and commercialization agreement that Altor entered into with Beike in 2014, which agreement was amended and restated in 2017, pursuant to which Altor granted to Beike an exclusive license to use, research, develop and commercialize products based on N-803ANKTIVA in China for human therapeutic uses. In the arbitration, Beike is asserting a claim for breach of contract under the license agreement. Among other things, Beike alleges that we failed to use commercially reasonable efforts to deliver to Beike materials and data related to N-803.ANKTIVA. Beike is seeking specific performance and declaratory relief for the alleged breaches. On September 25, 2020, the parties entered into a standstill and tolling agreement (standstill agreement) under which, among other things, the parties affirmed they will perform certain of their obligations under the license agreement by specified dates and agreed that all deadlines in the arbitration are indefinitely extended. The standstill agreement could be terminated by any party on ten calendar days’ notice, and upon termination, the parties had the right to pursue claims arising from the license agreement in any appropriate tribunal. On March 20, 2023, we terminated the standstill agreement, and on April 11, 2023, Beike served an amended Request for Arbitration. We served an Answer and Counterclaims on May 19, 2023. Beike served a Reply to our counterclaims on June 21, 2023. Beike served its Statement of Claim on March 22, 2024, and the company’s Statement of Defense and Counterclaim is due on June 21, 2024. The hearing in the arbitration is scheduled to begin on June 9, 2025. Given that no discovery has occurred, it remains too early to evaluate the likely outcome of the case or to estimate any range of potential loss. We believe the claims asserted against the company lack merit and intend to defend the case, and to pursue our counterclaims, vigorously.

Altor BioScience, LLC, and NantCell, Inc. Matters Against Dr. Hing Wong and HCW Biologics, Inc. (HCW)

On December 23, 2022, Altor and NantCell filed an arbitration demand against Dr. Hing Wong, former CEO of Altor and NantCell. The demand asserts claims for breach of Dr. Wong’s contracts with the companies, breach of the covenant of good faith and fair dealing, conversion, fraudulent concealment, unjust enrichment, breach of fiduciary duty, and replevin. The same day, Dr. Wong filed an arbitration demand seeking a declaratory judgment finding that Dr. Wong is not liable to Altor or NantCell for any of their claims. The parties have agreed to consolidate the arbitration filings in one proceeding, and on January 23, 2023, Dr. Wong filed an Answering Statement denying the claims.

Also, on December 23, 2022 Altor and NantCell filed a complaint in the United States District Court for the Southern District of Florida against HCW, Biologics, Inc. (HCW), Dr. Wong’s new company. Altor’s and NantCell’s complaint asserts claims for misappropriation of trade secrets under both Florida and federal law, inducement of breach of contract, tortious interference with contractual relations, inducement of breach of fiduciary duty, conversion, unjust enrichment, replevin, request for assignment of patents and patent applications, and establishment of a constructive trust. On January 31, 2023, HCW filed motions to compel arbitration of Altor’s and NantCell’s claims, or in the alternative to stay or dismiss them. Altor and NantCell filed an opposition to the motions on February 14, 2023, and HCW filed reply papers on February 21, 2023. At a hearing on April 18, 2023, the court heard argument and requested supplemental briefing. After the hearing, the parties reached an agreement to consolidate all claims in a single arbitration proceeding. On May 1, 2023, we filed our arbitration demand asserting the same claims against HCW that were asserted in the federal court complaint. On May 15, 2023, HCW filed an Answering Statement denying the claims.

ITEM 1A. RISK FACTORS.

Investing in our common stock involves a high degree of risk. You should carefully consider the risks described below, any of which may be relevant to decisions regarding an investment in or ownership of our stock. The occurrence of any of these risks could have a significant adverse effect on our reputation, business, financial condition, results of operations, growth, and ability to accomplish our strategic objectives. We have organized the description of these risks into groupings in an effort to enhance readability, but many of the risks interrelate or could be grouped or ordered in other ways, so no special significance should be attributed to the groupings or order below.

Risks Related to Our Limited Operating History, Financial Condition and Capital Requirements

Risks Related to Our Limited Operating History, Financial Condition and Capital Requirements

The development of biopharmaceutical products, including conducting preclinical studies and clinical trials, is a very time-consuming, expensive and uncertain process that takes years to complete. Our operations have consumed substantial amounts of cash since inception. A significant portion of our funding had been in the form of promissory notes totaling $802.5$735.0 million in indebtedness (consisting of related-party promissory notes and accrued and unpaid interest) outstanding as of June 30, 2023March 31, 2024 held by entities affiliated with Dr. Soon-Shiong.

The occurrence of any of the foregoing factors could have a material adverse effect on our business, results of operations and financial condition.

On July 20, 2023, we completed a registered direct offering of 14,569,296 shares, generating gross proceeds of approximately $40.0 million before deducting placement agent fees and other estimated offering costs. In connection with the sale of our common stock, we entered into a warrant agreement that allows the investors to purchase up to 14,569,296 shares of our common stock at an exercise price of $3.2946 per share. The warrants became immediately exercisable on July 25, 2023 and expire three years after the issuance date on July 24, 2026.

We account for the warrants as a derivative instrument,instruments, and changes in the fair value of the warrants are included in other (expense) income,expense, net, on the condensed consolidated statementstatements of operations for each reporting period. At June 30, 2023,As of March 31, 2024, the fair value of warrant liabilities included in the company’s condensed consolidated balance sheet was $27.8$110.0 million. We useduse the Black-Scholes option pricing model to determine the fair value of the warrants. As a result, the valuation of thisthese derivative instrumentinstruments is subjective, and the Black-Scholes option pricing model requires the input of highly subjective assumptions, including the expected stock price volatility and probability of a fundamental transaction (a strategic merger or sale). Changes in these assumptions can materially affect the fair value estimate. We could, at any point in time, ultimately incur amounts different than the carrying value, which could have a significant impact on our results of operations and financial position.

We account for the revenue interest liability as a liability, net of a debt discount comprised of deferred issuance costs, the fair value of a freestanding option agreement related to the SPOA, and the fair value of embedded derivatives requiring bifurcation on the consolidated balance sheet. The fluctuationscompany imputes interest expense associated with this liability using the effective interest rate method. The effective interest rate is calculated based on the rate that would enable the debt to be repaid in full over the anticipated life of the arrangement. Interest expense is recognized over the estimated term on the consolidated statement of operations. The interest rate on the liability and the underlying value of the bifurcated embedded derivative may vary during the term of the agreement depending on a number of factors, including the level of actual and forecasted net sales, and in the case of the derivative, specific probabilities associated with RIPA Put/Call events or Test Date payments underlying our Monte Carlo analysis. The company evaluates the interest rate quarterly based on actual and forecasted net sales utilizing the prospective method. A significant increase or decrease in actual or forecasted net sales will materially impact the revenue interest liability and/or the bifurcated embedded derivative, interest expense, and the time period for repayment.

Fluctuations in warrant, valuerevenue interest liability, and derivative values, and changes in the assumptions and factors used in the model may impact our operating results, making it difficult to forecast our operating results and making period-to-period comparisons less predictive of future performance. In one or more future quarters, our results of operations may fall below the expectations of securities analysts and investors. In that event, the market price of our common stock could decline. In addition, the market price of our common stock may fluctuate or decline regardless of our operating performance.performance.

The accounting method for convertible debt securities could have a material effect on our reported financial results. WeIn accordance with ASC 470-50, we recorded amendments to our related-party promissory notes entered into on September 11, 2023 under the debt modification accounting model, as the amendments were not substantially different than the terms of the promissory notes prior to the amendment. Under this model, the unamortized debt discounts from the promissory notes are amortized as an adjustment of interest expense over the remaining term of modified promissory notes using the effective interest rate method. Also, the increase in fair value of the embedded conversion feature from the debt modification was accounted for as a clinical-stage biotechnology companydebt discount to the $200.0 million convertible note that is not recorded at fair value with a limited operating history and no products approved for commercial sale. We have a history of operating losses, and we expect to continue to incur losses and may never be profitable, which together with our limited operating history, makes it difficult to assess our future viability.

We are a clinical-stage biotechnology company with a limited operating history upon which you can evaluate our business and prospects, and we have a broad portfolio of product candidates at various stages of development. None of our products have been approved for commercial sale, and we have not generated any revenue from product sales, although we have generated revenues from non-exclusive license agreements related to our cell lines, the sale of our bioreactors and related consumables and grant programs.corresponding increase in additional paid-in capital. In addition, we have limited experience and have not yet demonstrated an abilityrecorded amendments to successfully overcome many ofour related-party promissory notes entered into on December 29, 2023 under the risks and uncertainties frequently encountered by companies in new and rapidly evolving fields, particularly in the biotechnology industry, including in connection with obtaining marketing approvals, manufacturing a commercial-scale product or arranging for a third party to do so on our behalf or conducting sales and marketingactivities necessary for successful product commercialization. Because of the numerous risks and uncertainties associated with our product development efforts, we are unable to predict when we may become profitable, if at all.

Since the commencement of our operations, we have incurred significant losses each year,debt extinguishment model, and as a result recognized a total net gain on extinguishment of June 30, 2023 we had an accumulated deficit of $2.6 billion. We expect to continue to incur significant expenses as we seek to expand our business, including$36.1 million, which was recorded in connection with conducting research and development across multiple therapeutic areas, participating in clinical trial activities, continuing to acquire or in-license technologies, maintaining, protecting and expanding our intellectual property, seeking regulatory approvals, increasing our manufacturing capabilities and, upon successful receipt of FDA approval, commercializing our products. Moreover, we do not expect to have significant product sales or revenue in the near term, if ever.

If we are required by the FDA or any equivalent foreign regulatory authority to perform clinical trials or studies in addition to those we currently expect to conduct, or if there are any delays in completing the clinical trials of our product candidates, our expenses could increase substantially. We have submitted a BLA for our product candidate, Anktiva in combination with BCG for the treatment of patients with BCG-unresponsive NMIBC with CIS with or without Ta or T1 disease. On May 9, 2023, the FDA delivered a CRL to us regarding the BLA, indicating that the FDA had determined that it cannot approve the BLA in its present form, and the FDA made recommendations to address the issues raised. The company has submitted a formal meeting request and the associated briefing book to the FDA and plans to diligently address and resolve the issues identified in the CRL and seek approval as expeditiously as possible. It is unclear when the FDA will approve our BLA, if at all, for commercialization and even if approved, the resulting revenue may not enable us to achieve profitability. Even if we obtain regulatory approval to market a product candidate, our future revenues will depend upon the size of any markets in which our product candidates have received approval, and our ability to achieve sufficient market acceptance, reimbursement from third-party payors and adequate market share for our product candidates in those markets.

We expect our expenses and net losses to increase significantly as we prepare to potentially commercialize our product candidate, Anktiva in combination with BCG for the treatment of patients with BCG-unresponsive NMIBC with CIS with or without Ta or T1 disease, if approved by the FDA, continue our development of, and seek regulatory approvals for, our other product candidates, and begin to commercialize other approved products, if any, as well as hire additional personnel, protect our intellectual property and incur additional costs associated with operating as a public company. Our net losses may fluctuate significantly from quarter to quarter and year to year, depending paid-in capital, on the timingconsolidated statement of our clinical studies and trials, associated manufacturing needs, commercialization activities if our product candidates are approved and our expenditures on other research and development activities.

If our research and development efforts are successful, we may also facestockholders’ deficit, as the risks associated with the shiftdebt was acquired from development to commercialization of new products based on innovative technologies. Our ability to achieve profitability, if ever, is dependent upon, among other things, obtaining regulatory approvals for our product candidates and successfully commercializing our product candidates alone or with third parties. However, our operations may not be profitable even if one or more of our product candidatesentities under development are successfully developed and produced and thereafter commercialized. Even if we do become profitable, we may not be able to sustain or increase our profitability on a quarterly or annual basis.common control. As a result it mayof the debt amendments, we will be more difficult for yourequired to assessrecord a greater amount of non-cash interest expense in current periods presented as a result of the amortization of the discount associated with certain promissory notes. We will either report lower net income or a higher net loss in our consolidated financial results because FASB ASC Topic 470-20, Debt with Conversion and Other Options, requires interest to include both the current period’s amortization of the debt discount and the instrument’s coupon interest, which could adversely affect our reported or future viability than it could be if we had a longer operating history.

We invest our cash on hand in various financial instruments which are subject to risks that could adversely affect our business, results of operations, liquidity and financial condition.

We investhave typically invested our cash in a variety of financial instruments, principally commercial paper,including investment-grade short- to intermediate-term corporate debt securities, government-sponsored securities and governmentEuropean bonds; however, after our entry into the RIPA, we can no longer invest our excess funds in corporate or European bonds. AllCertain of theseour investments are subject to credit, liquidity, market, and interest rate risk. Such risks, including the failure or severe financial distress of the financial institutions that hold our cash, cash equivalents and investments, may result in a loss of liquidity, impairment to our investments, realization of substantial future losses, or a complete loss of the investments in the long-term, which may have a material adverse effect on our business, results of operations, liquidity and financial condition. In order toTo manage the risk to our investments, we maintain

an investment policy that, among other things, limits the amount that we may invest in any one issue or any single issuer and requires us to only invest in high credit quality securities to preserve liquidity.

Our ability to use NOLs and research and development credits to offset future taxable income may be subject to certain limitations.

In general, under Sections 382 and 383 of the Internal Revenue Code, of 1986, as amended, a corporation that undergoes an “ownership change”ownership change is subject to limitations on its ability to utilize its pre-change NOLs or credits, to offset future taxable income or taxes. For these purposes, an ownership change generally occurs where the aggregate stock ownership of one or more stockholders or groups of stockholders who owns at least 5% of a corporation’s stock increases its ownership by more than 50 percentage points over its lowest ownership percentage within a specified testing period. We have not conducted a complete study to assess whether a change of control has occurred or whether there have been multiple changes of control since inception due to the significant complexity and cost associated with such a study. If we have experienced a change of control, as defined by Section 382, at any time since inception (including as a result of the March 2021 merger which pursuant to which NantKwest and NantCell combined their businesses), utilization of the NOL carryforwards or research and development tax credit carryforwards would be subject to an annual limitation under Section 382. Any limitation may result in expiration of a portion of the NOL carryforwards or research and development tax credit carryforwards before utilization. In addition, our NOLs or credits may also be impaired under state law. Accordingly, we may not be able to utilize a material portion of our NOLs or credits.

Since we will need to raise substantial additional funding to finance our operations, we may experience further ownership changes in the future, some of which may be outside of our control. Limits on our ability to use our pre-change NOLs or credits to offset U.S. federal taxable income could potentially result in increased future tax liability to us if we earn net taxable income in the future. In addition, under the legislation commonly referred to as the Tax Cuts and Jobs Act of 2017 (TCJA),TCJA, as modified by the Coronavirus Aid, Relief, and Economic Security Act, (CARES Act), the amount of NOLs generated in taxable periods beginning after December 31, 2017, that we are permitted to deduct in any taxable year beginning after December 31, 2020 is limited to 80% of our taxable income in such year, where taxable income is determined without regard to the NOL deduction itself. The TCJA allows post-2017 unused NOLs to be carried forward indefinitely. Similar rules may apply under state tax laws.

Our transfer pricing policies may be subject to challenge by the Internal Revenue ServiceIRS or other taxing authorities.

Our intercompany relationships are subject to complex transfer pricing regulations administered by taxing authorities in various jurisdictions. The relevant taxing authorities may disagree with our determinations as to the value of assets sold or acquired or income and expenses attributable to specific jurisdictions. If such a disagreement were to occur, and our position were not sustained, we could be required to pay additional taxes, interest and penalties, which could result in one-time tax charges, higher effective tax rates, reduced cash flows, and lower overall profitability of our operations. We believe that our consolidated financial statements reflect adequate reserves to cover such a contingency, but there can be no assurances in that regard.

Unanticipated changes in effective tax rates or adverse outcomes resulting from examination of our income or other tax returns could expose us to greater than anticipated tax liabilities.

The tax laws applicable to our business, including the laws of the U.S. and other jurisdictions, are subject to interpretation and certain jurisdictions may aggressively interpret their laws in an effort to raise additional tax revenue. It is possible that tax authorities may disagree with certain positions we have taken, are currently taking or will take, and any adverse outcome of such a review or audit could have a negative effect on our financial position and results of operations. Further, the determination of our provision for income taxes and other tax liabilities requires significant judgment by management, and there are transactions where the ultimate tax determination is uncertain. Although we believe that our estimates are reasonable, the ultimate tax outcome may differ from the amounts recorded on the consolidated financial statements and may materially affect our financial results in the period or periods for which such determination is made.

In addition, tax laws are dynamic and subject to change as new laws are passed and new interpretations of the law are issued or applied. For example, in August 2022, the U.S. enacted the IRA, which imposes a 15% minimum tax on the adjusted financial statement income of certain large corporations, as well as a 1% percent excise tax on corporate stock repurchases by publicly-traded companies. Additionally, for taxable years beginning on or after January 1, 2022, the Code eliminated the right to deduct research and development expenditures currently and requires taxpayers to capitalize and amortize U.S. and foreign research and development expenditures over 5 and 15 tax years, respectively. These updates, as well as any other changes to tax laws that are enacted, could adversely affect our tax liability.

Risks Related to the Discovery, Development and Commercialization of our Approved Product and our Other Product Candidates

We will beare substantially dependent on the successsuccessful commercialization of our approved product and the success and regulatory approval of our other product candidates. If we are unable to successfully commercialize our approved product or successfully complete clinical development of, obtain regulatory approval for, or commercialize, our other product candidates, and cannot guarantee that these product candidatesor if we experience delays in doing so, our business will successfully complete development, receive regulatory approval or be successfully commercialized.materially harmed.

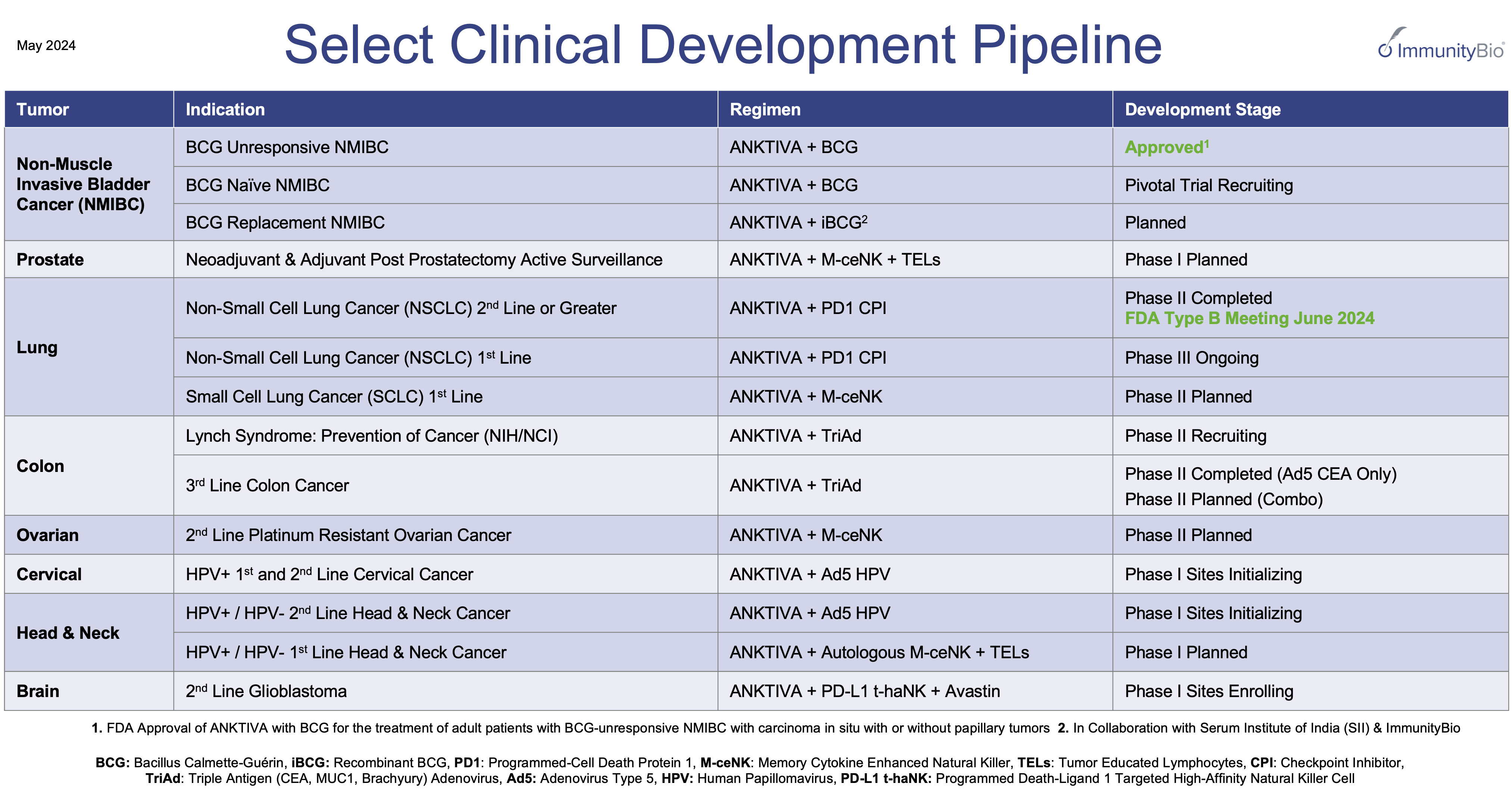

From inception through the date of this Quarterly Report, on Form 10-Q, we have generated minimal revenue from non-exclusive license agreements related to our cell lines, the sale of our bioreactors and related consumables, and grant programs. We have no clinical products approved for commercial sale and have not generated any revenue from therapeutic and vaccine product candidates that are under development. In May 2022, we announced the submission of a BLA toOn April 22, 2024, the FDA for our product candidate, Anktiva in combinationapproved ANKTIVA with BCG for the treatment of adult patients with BCG-unresponsive NMIBC with CIS, with or without Tapapillary tumors. We are required to comply with certain post-marketing commitments, including completion of our QUILT 3032 clinical trial and annual reporting for up to four years, with a final report submission to FDA by the end of 2029. Our business currently depends heavily on our ability to successfully commercialize our approved product in the U.S. and in other jurisdictions where we may obtain marketing approval. We may never be able to successfully commercialize our approved product or T1 disease. On May 9, 2023,meet our expectations with respect to revenues. We have never marketed, sold, or distributed for commercial use any pharmaceutical product other than our approved product, with respect to which we only recently began efforts to initiate commercial sales. There is no guarantee that the FDA delivered a CRLinfrastructure, systems, processes, policies, relationships, and materials we have built for the launch and commercialization of our approved product in the U.S. or elsewhere will be sufficient for us to achieve success at the levels we expect.

We may encounter issues and challenges in commercializing our approved product and generating substantial revenues. We may also encounter challenges related to reimbursement of our approved product, including potential limitations in the scope, breadth, availability, or amount of reimbursement covering our approved product. Similarly, healthcare settings or patients may determine that the financial burdens of treatment are not acceptable. We may face other limitations or issues related to the price of our approved product. Our results may also be negatively impacted if we have not adequately sized our field teams or our physician segmentation and our targeting strategy is inadequate or if we encounter deficiencies or inefficiencies in our infrastructure or processes. Other factors that may hinder our ability to successfully commercialize approved product, or any of our product candidates if or when approved and generate substantial revenues, include:

•the acceptance of our approved product by patients and the medical community;

•the ability of our third-party manufacturer(s) to manufacture commercial supplies of our approved product at acceptable costs, to remain in good standing with regulatory agencies, and to maintain commercially viable manufacturing processes that are, to the extent required, compliant with cGMP regulations;

•our ability to remain compliant with laws and regulations that apply to us and our commercial activities;

•FDA-mandated package-insert requirements and successful completion of FDA post-marketing requirements;

•the actual market size for our approved product, which may be different than expected;

•the length of time that patients who are prescribed our drug remain on treatment;

•our ability to obtain marketing approval for our approved product outside of the U.S.;

•the sufficiency of our drug supply to meet commercial and clinical demands which could be negatively impacted if our projections regarding the BLA, indicatingpotential number of patients are inaccurate, we are subject to unanticipated regulatory requirements, or our current drug supply is destroyed, or negatively impacted at our manufacturing sites, storage sites, or in transit;

•our ability to effectively compete with other therapies that may emerge for the FDA had determined that it cannot approve the BLAtreatment of bladder cancer; and

•our ability to maintain, enforce, and defend third party challenges to our intellectual property rights in its present form, and the FDA made recommendations to address theour approved product or any of our other product candidates.

Any of these issues raised. The company has submitted a formal meeting request and the associated briefing bookcould impair our ability to successfully commercialize our product or to generate substantial revenues or profits or to meet our expectations with respect to the FDAamount or timing of revenues or profits. Any issues or hurdles related to our commercialization efforts may materially adversely affect our business, results of operations, financial condition, and plansprospects. There is no guarantee that we will be successful in our launch or commercialization efforts with respect to diligently addressour approved product. We may also experience significant fluctuations in sales of our approved product from period to period and, resolve the issues identifiedultimately, we may never generate sufficient revenues from our approved product to reach or maintain profitability or sustain our anticipated levels of operations. Any inability on our part to successfully commercialize our approved product in the CRLU.S., and seek approval as expeditiously as possible. It is unclear when the FDA will approveany other international markets where it may subsequently be approved, or any significant delay, could have a material adverse impact on our BLA, if at all. ability to execute upon our business strategy.

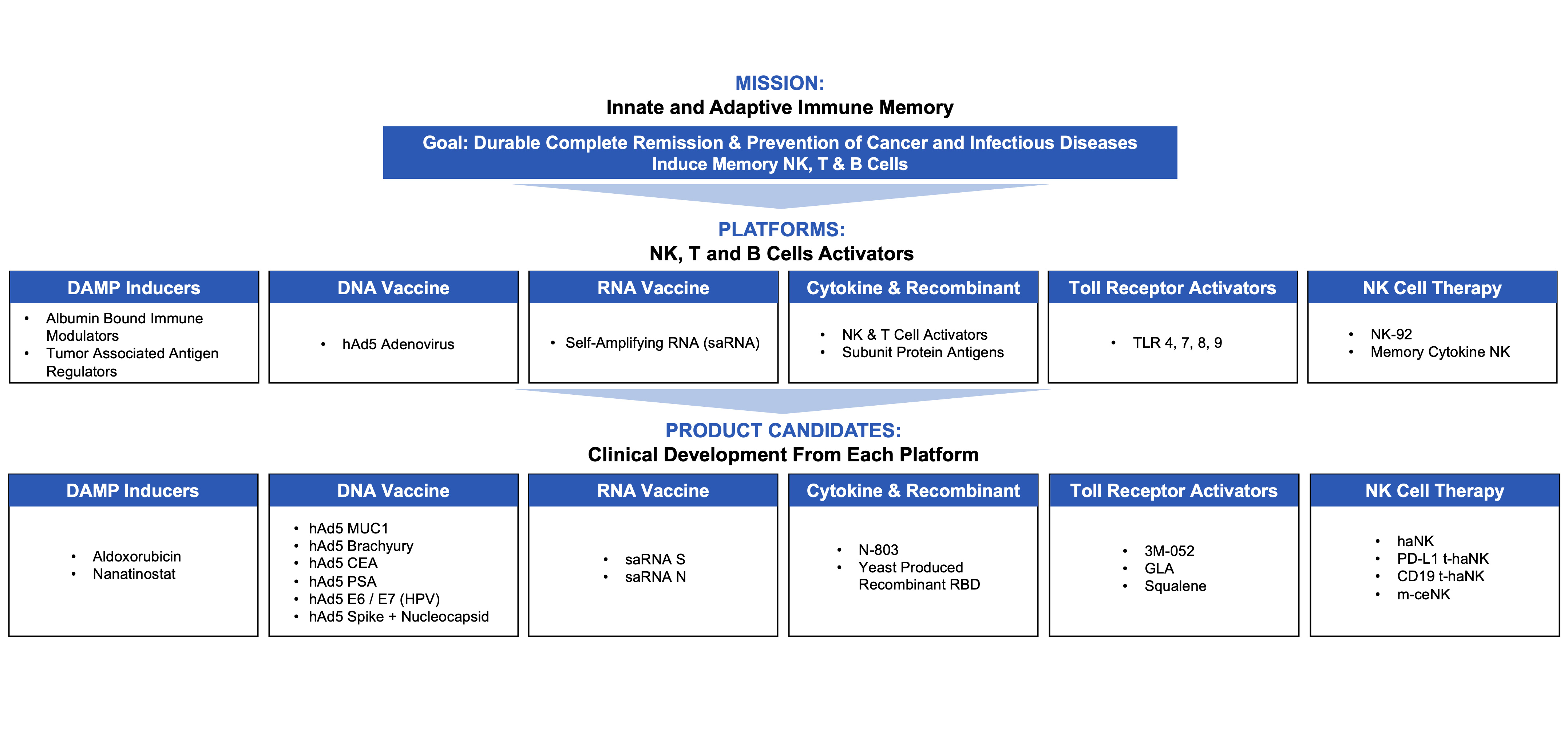

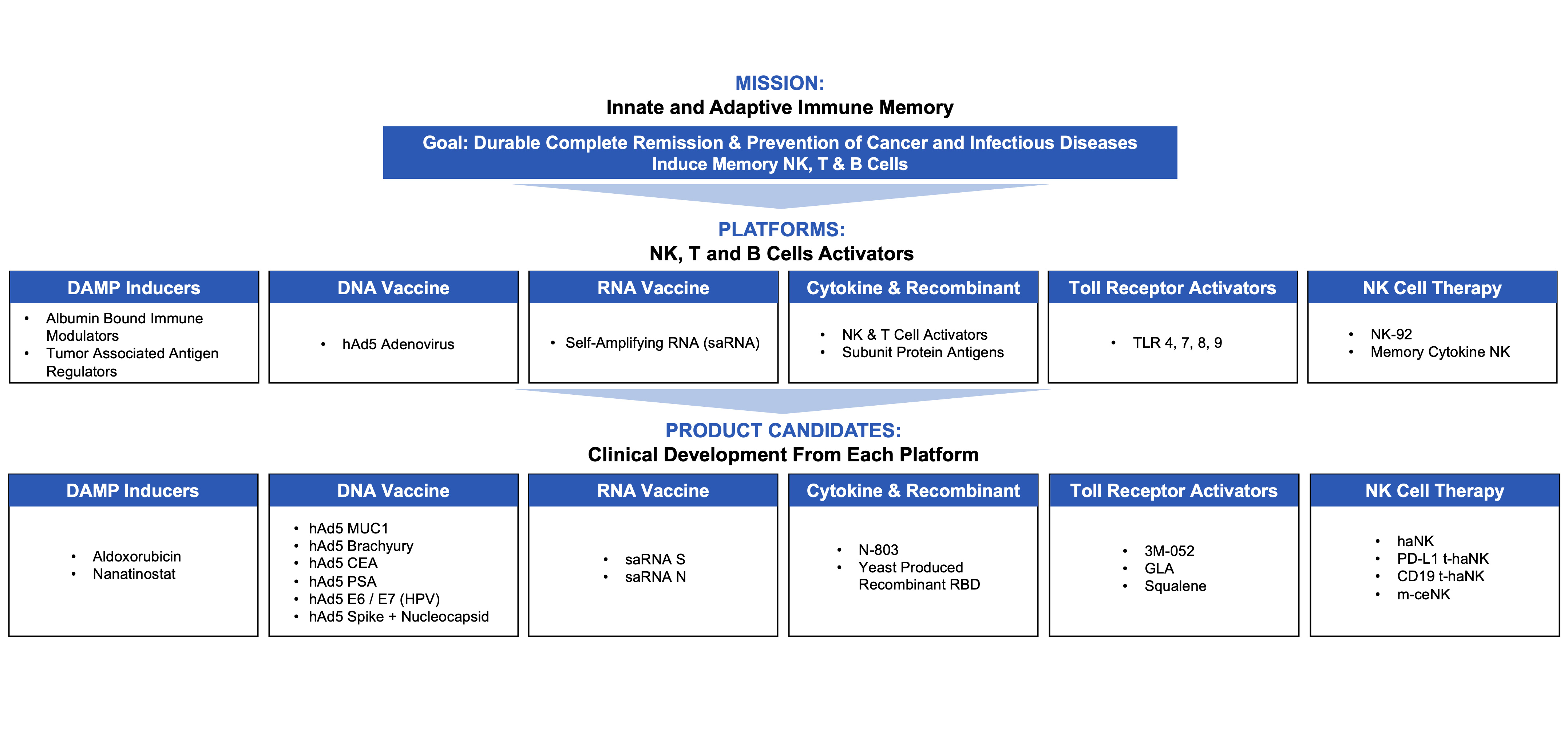

We have invested a significant portion of our efforts and financial resources in the development of our main product candidates, N-803,ANKTIVA, our novel antibody cytokineantibody-cytokine fusion protein, saRNA and our other product candidates, ssecond-generationecond-generation hAd5 and saRNA vaccine candidates, and aldoxorubicin, some of which are used in combination with our NK cell therapy candidates. Our other product candidates will require additional clinical and non-clinical development, regulatory approval, commercial manufacturing arrangements, establishmentenhancement of aour commercial organization and service providers, significant marketing efforts, and further investment before we can generate any revenues from product sales.the sale of these other potential products. We expect to invest heavily in these product candidates as well as in our other existingcurrent product candidates and in any future product candidates that we may develop. Our product candidates are susceptible to the risks of failure inherent at any stage of product development, including the appearance of unexpected adverse events or failure to achieve primary endpoints in clinical trials. Furthermore, we cannot assure you that we will meet our timelines for current or future clinical trials, including post-market study requirements for our approved product, which may be delayed or not completed for a number of reasons. Additionally, our ability to generate revenues from our approved product and any other combination therapy products will also depend on the availability of the other therapies used in combination therewith, including BCG, with which our products are intended to be used. WeIn particular, there has been a shortage of BCG in the U.S. According to the American Urological Association, Merck & Co., Inc. is the sole manufacturer and supplier of BCG in the U.S. and many other countries around the world. Although Merck has boosted its production of BCG, increasing demand for BCG has led to supply constraints for BCG, which can materially impact the demand for our approved product and our ability to commercialize our approved product. While we plan to begin shipping our approved product to customers in May 2024, we currently generate no meaningful revenues from the sale of anyour approved product or of our other product candidates, and we may never be able to develop or commercialize a product.

The CRL we received fromWe have limited experience as a commercial company and the FDA for the BLA has delayed,sales, marketing, and may decrease the likelihood of, ultimate approval and successful commercializationdistribution of our approved product candidate, Anktiva in combination with BCG for the treatment of patients with BCG-unresponsive NMIBC with CIS with or without Taany future approved products may be unsuccessful or T1 diseaseless successful than anticipated.

We recently began commercializing our approved product in the U.S. As a company, we had no prior experience commercializing a product. The success of our commercialization efforts for our approved product and potentially other markets.

In May 2022, we announced the submission of a BLAany future approved products is difficult to predict and subject to the FDA for our product candidate, Anktiva in combination with BCG for the treatment of patients with BCG-unresponsive NMIBC with CIS with or without Ta or T1 disease. In July 2022 we announced that the FDA had accepted our BLA for review and set a target PDUFA action date of May 23, 2023. On May 9, 2023, the FDA delivered a CRL to us regarding the BLA, indicating that it had determined that it cannot approve the BLA in its present form, and the FDA made recommendations to address the issues raised. The deficiencies relate to the FDA’s pre-license inspectioneffective execution of our third-party CMOs,business plan, including, among other items. Satisfactory resolutionthings, the continued development of our internal and external sales, marketing, and distribution capabilities and our ability to navigate the observations noted atsignificant expenses and risks involved with the pre-license inspection is required before the BLA may be approved. The FDA further provided recommendations specificdevelopment and management of such capabilities.

For example, we have completed hiring and contracting for service providers in areas to additional CMC issuessupport commercialization, including in sales management, sales representatives, marketing, access and assaysreimbursement, sales support, and distribution. There are significant expenses and risks involved with establishing our sales, marketing, and distribution capabilities, including our ability to be resolved. We have submitted a formal meeting requesthire, contract for, retain, and the associated briefing bookappropriately incentivize qualified individuals, provide adequate training to the FDA,sales and planmarketing personnel, and effectively manage geographically dispersed sales and marketing teams to diligently address and resolve the issues identified and seek approval as expeditiously as possible. Notwithstanding these efforts, we and/generate sufficient demand. Any failure or our third-party CMOs may be unable to adequately address and resolve the issues raised in the CRL. Further, there is uncertainty regarding the timing, contents, and outcome of the requested FDA meeting, the FDA may disagree with our proposed approach for the BLA resubmission, and the timeline of FDA review of any resubmission remains uncertain. The CRL and any subsequent resulting delay in the development and approval of such product candidate may prevent, decrease and/or delay expected revenue. Any of these riskscapabilities could delay or negatively affect the success of our commercialization efforts and our business. For example, the commercialization of our approved product may not develop as planned or anticipated, which may require us to, among others, adjust or amend our business plan and incur significant expenses.

Further, given our lack of experience commercializing products, we do not have a material impacttrack record of successfully executing on the commercialization of an approved product. If we are unsuccessful in accomplishing our objectives and executing on our business operating results,plan, or if the commercialization of our approved product or any future approved products does not develop as planned, we may require significant additional capital and financial condition.resources, we may not become profitable, and we may not be able to compete against more established companies in our industry.

There can be no assurance that we will complete a strategic partnership transaction on acceptable terms in accordance with our anticipated timeline, or at all.

As previously disclosed, weWe have been exploring partnering with a large biopharmaceutical company for commercialization of N-803 for intravesical administration with a view of completing such a transaction during 2023. While we have confirmed with the potential partner that the negotiations will continue notwithstanding the CRL that we received from the FDA, there is a risk that our ability to enter into such a strategic partnership may be impacted by the CRL. Further, theredeveloped an approved product and are developing other factors that may impact our ability, or decision, to enter into such a strategic partnership, and ultimately there can be no assurance that we will complete a transaction on acceptable terms in accordance with our anticipated timeline, or at all. If we do not execute a strategic partnership transaction in the near-term, it would eliminate a potential source of near-term funding, and may impact our ability to raise additional funds to meet our business needs. In addition, there are significant risks involved with building and managing a commercial infrastructure on a stand-alone basis, which could materialize in the event we do not execute a strategic partnership transaction.

We are developing product candidates in combination with other therapies, which exposes us to additional risks.

We have developed an approved product and are developing other product candidates in combination with one or more other therapies. We are studying N-803ANKTIVA therapy along with other products and product candidates, such as BCG, PD-L1 t-haNK, hAd5 and yeast tumor-associated antigens (TAAs),TAAs and aldoxorubicin. IfSince we have developed a product, or if we choose to develop a product candidateother products for use in combination with an approved therapy, we are subject to the risk that the FDA, EMA or comparable foreign regulatory authorities in other jurisdictions could revoke approval of, or that safety, efficacy, manufacturing or supply issues could arise with the therapy used in combination with our approved product candidate.or our other product candidates. In particular, supply chain issues or shortages of other products used in combination with our approved product or any other product candidates could impact our ability to obtain FDA regulatory approval, meet clinical trial timelines and commercialize our approved product or other product candidates. The FDA may require us to use more complex clinical trial designs in order to evaluate the contribution of each product and product candidate to any observed effects. To the extent that we do not have rights to already approved products, this may require us to work with another company to satisfy such a requirement or increase our cost of development. It is possible that the results of these trials could show that any positive results are attributable to the already approved product. Following product approval, the FDA may require that products used in conjunction with each other be cross labeled for combined use. If the therapies we use in combination with our product or our other product candidates are replaced as the standard of care for the indications we choose for our product or any of our other product candidates, the FDA or comparable foreign regulatory authorities may require us to conduct additional clinical trials. The occurrence of any of these risks could result in our own products, if approved, being removed from the market or being less successful commercially.

In addition, unapproved therapies face the same risks described with respect to our product candidates currently in development and clinical trials, including the potential for serious adverse effects, delays in clinical trials and lack of FDA approval. If the FDA or comparable foreign regulatory authorities do not approve or revoke their approval of these other therapies, or if safety, efficacy, quality, manufacturing or supply issues arise with, the therapies we choose to evaluate in combination with any of our product candidates, we may be unable to obtain approval of or market such other combination therapy.

We may choose to expend our limited resources on programs that do not yield successful product candidates as opposed to indications that may be more profitable or for which there is a greater likelihood of success.

We do not have sufficient resources to pursue development of all or even a substantial portion of the potential opportunities that we believe will be afforded to us by our product candidates. Because we have limited resources and access to capital to fund our operations, our management must make strategic decisions as to which product candidates and indications to pursue and how much of our resources to allocate to each. Our management must also evaluate the benefits of developing in‑licensed or jointly-owned technologies, which in some circumstances we may be contractually obligated to pursue, relative to developing other product candidates, indications or programs. Our management has broad discretion to suspend, scale down, or discontinue any or all of these development efforts, or to initiate new programs to treat other diseases. If we select and commit resources to opportunities that we are unable to successfully develop, or we forego more promising opportunities, our business, financial condition and results of operations will be adversely affected.

Our projections regarding the market opportunities for our product candidates may not be accurate, and the actual market for our products, if approved, may be smaller than we estimate.

Since our current product candidates and any future product candidates will represent novel approaches to treating various conditions, it may be difficult, in any event, to accurately estimate the potential revenues from these product candidates. Accordingly, we may spend significant capital trying to obtain approval for product candidates that have an uncertain commercial market. Our projections of addressable patient populations that may benefit from treatment with our product candidates are based on our beliefs and estimates. These estimates, which have been derived from a variety of sources, including scientific literature, surveys of clinics, patient foundations, or market research by third parties, may prove to be incorrect. Further, new studies or approvals of new therapeutics may change the estimated incidence or prevalence of these diseases. The number of patients may turn out to be lower than expected. Additionally, the potentially addressable patient population for our product candidates may be limited or may not be amenable to treatment with our product candidates and may also be limited by the cost of our treatments and the reimbursement of those treatment costs by third-party payors. Even if we obtain significant market share for our product candidates, because the potential target populations may be small, we may never achieve profitability without obtaining regulatory approval for additional indications.therapies.

Our clinical trials may fail to adequately demonstrate the safety and efficacy of our product candidates, which would prevent or delay regulatory approval and commercialization. If our trials are not successful, we will be unable to commercialize ourcommercialization of other product candidates.

Our research and development programs of our other non-FDA-approved product candidates are at various stages of development. The clinical trials of our product candidates as well as the manufacturing and marketing of our product candidates will be subject to extensive and rigorous review and regulation by numerous government authorities in the U.S. and in other countries where we intend to test and market our product candidates. Before obtaining regulatory approvals for the commercial sale of any of our other product candidates, we must demonstrate through lengthy, complex and expensive preclinical testing and clinical trials that our product candidates are safe, pure, and potent for use in their target indications. Each product candidate must demonstrate an adequate risk versus benefit profile in its intended patient population and for its intended use. The risk/benefit profile required for product licensure will vary depending on these factors and may include not only the ability to show tumor shrinkage, but also adequate duration of response, a delay in the progression of the disease, and/or an improvement in survival. For example, response rates from the use of our product candidates or their contribution of effect, may not be sufficient to obtain regulatory approval unless we can also show an adequate duration of response. The clinical trials for our product candidates under development may not be completed on schedule and regulatory authorities may ultimately disagree with our chosen endpoints or may find that our studies or study results do not support product approval and we cannot guarantee that the FDA or foreign regulatory authorities will interpret the results as we do or accept the therapeutic effects as valid endpoints in clinical trials necessary for market approval or they may find that our clinical trial design or conduct does not meet the applicable approval requirement and more trials could be required before we submit our product candidates for approval. Success in early clinical trials does not ensure that large-scale clinical trials will be successful, nor does it predict final results. Product candidates in later stages of clinical trials may fail to show the desired safety, tolerability and efficacy traits despite having progressed through preclinical studies and initial clinical trials and after reviewing test results, we or our collaborators may abandon projects that we might previously have believed to be promising.

In addition, we do not have data on possible harmful long-term effects of our product candidates and do not expect to have this data in the near future. As a result, our ability to generate clinical safety and effectiveness data sufficient to support submission of a marketing application or commercialization of our product candidates is uncertain and is subject to significant risk.

The ongoing shortage of BCG may adversely impact market uptake of our approved product, ANKTIVA, and it may also delay our ability to execute our clinical trials or seek new approvals.

There is an ongoing shortage of BCG, which may adversely impact market uptake of our approved product. The BCG shortage may impact the number of patients who are treated with BCG for NMIBC with CIS with or without papillary tumors, therefore limiting the pool of BCG-unresponsive patients who may be candidates for our product. In addition, the BCG shortage may also constrain the number of patients we can treat with our product since our product is administered along with BCG. In addition, ANKTIVA was awarded Fast Track designation by the FDA for the treatment of BCG-naïve NMIBC with CIS. We are currently enrolling patients in our Phase IIb blinded, randomized, two-cohort, open-label, multi-center trial of intravesical BCG with ANKTIVA versus BCG alone, in BCG-naïve patients with high-grade NMIBC with CIS (Cohort A) and NMIBC papillary (Cohort B), which is impacted by the availability of BGC. If we do not complete new trials timely, our ability to generate clinical safety and effectiveness data sufficient to support submission of a marketing application or commercialization of our product candidates in new indications could harm our business, operating results, prospects or financial condition.

We may choose to expend our limited resources on programs that do not yield successful product candidates as opposed to indications that may be more profitable or for which there is a greater likelihood of success.

We do not have sufficient resources to pursue development of all or even a substantial portion of the potential opportunities that we believe will be afforded to us by our product candidates. Because we have limited resources and access to capital to fund our operations, our management must make strategic decisions as to which product candidates and indications to pursue and how much of our resources to allocate to each. Our management must also evaluate the benefits of developing in‑licensed or jointly-owned technologies, which in some circumstances we may be contractually obligated to pursue, relative to developing other product candidates, indications or programs. Our management has broad discretion to suspend, scale down, or discontinue any or all of these development efforts, or to initiate new programs to treat other diseases. If we select and commit resources to opportunities that we are unable to successfully develop, or we forego more promising opportunities, our business, financial condition and results of operations will be adversely affected.

Our projections regarding the market opportunities for our approved product and our other product candidates may not be accurate, and the actual market for our other products, if approved, may be smaller than we estimate.

Since our approved product, current product candidates, and any future product candidates represent novel approaches to treating various conditions, it may be difficult, in any event, to accurately estimate the potential revenues from our approved product and these other product candidates. Accordingly, we may spend significant capital trying to successfully commercialize our product or obtain approval for our other product candidates that have an uncertain commercial market. Our projections of addressable patient populations that may benefit from treatment with our product or product candidates are based on our beliefs and estimates, and estimates of the therapeutic benefit and adverse event profile of our approved product and other product candidates. These estimates, which have been derived from a variety of sources, including scientific literature, preclinical and clinical studies, surveys of clinics, patient foundations, or market research by third parties, may prove to be incorrect. Further, new studies or approvals of new therapeutics may change the estimated incidence or prevalence of these diseases. The number of patients may turn out to be lower than expected. Additionally, the potentially addressable patient population for our product or product candidates may be limited or may not be amenable to treatment with our product or product candidates and may also be limited by the cost of our treatments and the reimbursement of those treatment costs by third-party payors. Even if we obtain significant market share for our product or product candidates, because the potential target populations may be small, we may never achieve profitability without obtaining regulatory approval for additional indications.

There can be no assurance that we will complete a strategic partnership transaction on acceptable terms in accordance with our anticipated timeline, or at all.

We continue to explore potential global strategic partnership transactions for commercialization of ANKTIVA for certain indications. Factors that may impact our ability, or decision, to enter into such a strategic partnership, include, without limitation, the put/call features of the RIPA that may be triggered by entry into a strategic partnership depending on its scope and terms, and ultimately there can be no assurance that we will complete a transaction on acceptable terms, or at all. If we do not execute a strategic partnership transaction in the near-term, it would eliminate a potential source of near-term funding, and may

impact our ability to raise additional funds to meet our business needs. In addition, there are significant risks involved with building and managing a commercial infrastructure on a stand-alone basis, which could materialize in the event we do not execute a strategic partnership transaction, or depending on the geographic scope of any executed transaction.

Interim, initial, “top-line”top-line and preliminary data from our clinical trials that we announce or publish from time to time may change as more patient data become available and are subject to audit and verification procedures that could result in material changes in the final data.

From time to time, we may publicly disclose preliminary, interim or top-line data from our preclinical studies and clinical trials, which are based on preliminary analyses of then-available data, and the results and related findings and conclusions are subject to change following a more comprehensive review of the data related to the particular study or trial. Interim data from clinical trials that we may complete are subject to the risk that one or more of the clinical outcomes may materially change as patient enrollment continues and more patient data become available or as patients from our clinical trials continue other treatments for their disease.disease, or as inclusion and exclusion criteria is discussed with regulators. We also may make assumptions, estimations, calculations and conclusions as part of our analyses of data, and we may not have received or had the opportunity to fully and carefully evaluate all data. As a result, the interim, top-line or preliminary results that we report may differ from future results of the same studies, or different conclusions or considerations may qualify such results, once additional data have been received and fully evaluated. Top-line data also remain subject to audit and verification procedures that may result in the final data being materially different from the preliminary data we previously published. As a result, top-line data should be viewed with caution until the final data are available. Adverse differences between preliminary or interim data and final data could significantly harm our business prospects. Further, disclosure of interim data by us or by our competitors could result in volatility in the price of our common stock.

In addition, the information we choose to publicly disclose regarding a particular study or clinical trial is typically selected from a more extensive amount of available information, and you or others may not agree with what we determine is material or otherwise appropriate information to include in our disclosure. If the interim, top-line or preliminary data that we report differ from actual results, or if others, including regulatory authorities, disagree with the conclusions reached, our ability to obtain approval for, and commercialize, our product candidates may be harmed, which could harm our business, operating results, prospects or financial condition.

Our clinical trials may not be initiated or completed when we expect, or at all, they may take longer and cost more to complete than we project, our clinical trial costs may be higher than for more conventional therapeutic technologies or drug products, and we may be required to conduct additional clinical trials or modify current or future clinical trials based on feedback we receive from the FDA.

We cannot guarantee that any current or future clinical trials will be conducted as planned or completed on schedule, if at all, or that any of our other product candidates will receive regulatory approval. A failure of one or more clinical trials can occur at any stage of the clinical trial process, other events may cause us to temporarily or permanently stop a clinical trial temporarily or permanently, and our future clinical trials may not be successful.

Because our product candidates include, and we expect our future product candidates to include, candidates based on advanced therapy technologies, we expect that they will require extensive research and development and have substantial manufacturing costs. In addition, costs to treat patients and to treat potential side effects that may result from our product candidates can be significant. Some clinical trial sites may not bill, or obtain coverage from Medicare, Medicaid, or other third-party payors for some or all of these costs for patients enrolled in our clinical trials, and clinical trial sites outside of the U.S. may not reimburse for costs typically covered by third-party payors in the U.S., and as a result we may be required by those trial sites to pay such costs. Accordingly, our clinical trial costs are likely to be significantly higher per patient than those of more conventional therapeutic technologies or drug products.

Collaborations with other entities may be subject to additional delays because of the management of the trials, contract negotiations, the need to obtain agreement from multiple parties and the necessity of obtaining additional approvals for therapeutics used in the combination trials. These combination therapies will require additional testing and clinical trials will require additional FDA regulatory approval and will increase our future costs.

Any inability to successfully complete preclinical and clinical development could result in additional costs to us, slow down our product development and approval process or impair our ability to commence product sales and generate revenues. In addition, if we make manufacturing changes to our product or product candidates, we may be required to, or we may elect to, conduct additional trials to bridge our modified product or product candidates to earlier versions. These changes may require FDA approval or notification and may not have their desired effect. The FDA may also not accept data from prior versions of the product to support an application, delaying our clinical trials or programs or necessitating additional clinical trials or preclinical studies. We may find that this change has unintended consequences that necessitates additional development and manufacturing work, additional clinical and preclinical studies, or that results in refusal to file or non-approval of a BLA and/or NDA.

Clinical trial delays could shorten any periods during which our product candidates have patent protection and may allow our competitors to bring products to market before we do, which could impair our ability to successfully commercialize our product candidates and may harm our business and results of operations. In addition, we have in the past experienced clinical holds imposed upon certain of our or investigator-led clinical trials for various reasons, and we may experience further clinical trial holds in the future. If we fail to commence or complete, or experience delays in, any of our planned clinical trials, our stock price and our ability to conduct our business as currently planned could be harmed.

Even if onemore of our product candidates isare approved and commercialized, we may not become profitable.

If approved for marketing by applicable regulatory authorities, our ability to generate revenues from our other product candidates will depend on our ability to:

•price our other product candidates competitively such that third-party and government reimbursement leads to broad product adoption;

•prepare a broad network of clinical sites for administration of our product;other product candidates;

•create market demand for our other product candidates through our own or our partner’s marketing and sales activities, and any other arrangements to promote these product candidates that we may otherwise establish;

•receive regulatory approval for the targeted patient population(s) and claims that are necessary or desirable for successful marketing;

•manufacture our other product candidates through third-party CMOs or in our own or our affiliates’, manufacturing facilities or facilities owned by entities affiliated with Dr. Soon-Shiong in sufficient quantities and at acceptable quality and manufacturing cost to meet regulatory requirements and commercial demand at launch and thereafter;

•establish and maintain agreements with wholesalers, distributors, pharmacies, and group purchasing organizations on commercially reasonable terms;

•obtain, maintain, protect and enforce patent and other intellectual property protection and regulatory exclusivity for our other product candidates;

•successfully commercialize any of our other product candidates that receive regulatory approval;

•maintain compliance with applicable laws, regulations, and guidance specific to commercialization including interactions with health care professionals, patient advocacy groups, and communication of health care economic information to payors and formularies;

•achieve market acceptance of our other product candidates by patients, the medical community, and third-party payors;

•achieve appropriate reimbursement for our product candidates;

•maintain a distribution and logistics network capable of product storage within our specifications and regulatory guidelines, and further capable of timely product delivery to commercial clinical sites;

•effectively compete with other therapies or competitors; and

•following launch, ensure that our approved product will be used as directed and that additional unexpected safety risks will not arise.

Even ifOn April 22, 2024, the FDA approves N-803approved ANKTIVA with BCG for the treatment of adult patients with BCG-unresponsive NMIBC with CIS, with or without papillary tumors. We are required to comply with certain indicationspost-marketing commitments, including completion of our QUILT 3032 clinical trial and annual reporting for up to four years, with a final report submission to FDA by the end of 2029. We can provide no assurance with respect to the profitability or in combination with other therapeutic products, and even ifthe market share that we might achieve for our approved product. The target patient population for which we obtain significant market share for it, because the potential target populationapproval may be small,narrower than we may never achieve profitability without obtaining regulatory approval for additional indications. The FDA often approves new therapies initially only for use in patients with r/r metastatic disease, which may limit our patient population.expect. Additionally, we may not be able to obtain the labeling claims necessary or desirable for the promotion of our approved product. Further, supply chain issues or shortages associates with combination products that may be used with our approved product, candidatessuch as ANKTIVA plus BCG, may limit the demand for our approved product.

In connection with our 2017 acquisition of Altor, we issued CVRs under which we agreed to pay the prior stockholders of Altor approximately $304.0 million of contingent consideration upon the successful regulatory approval of a BLA by the FDA, or foreign equivalent, for N-803 by December 31, 2022, and approximately $304.0 million of contingent consideration upon calendar-year worldwide net sales of N-803 exceeding $1.0ANKTIVA exceeding $1.0 billion prior to December 31, 2026 with amounts payable in cash or shares of our common stock or a combination thereof.

With respect to the regulatory milestone CVR agreement, in May 2022 we announced the submission As of a BLA to the FDA for our product candidate, Anktiva (N-803) in combination with BCG for the treatment of patients with BCG-unresponsive NMIBC with CIS with or without Ta or T1 disease. On May 9, 2023, the FDA delivered a CRL to us regarding the BLA, indicating that the FDA had determined that it cannot approve the BLA in its present form, and the FDA made recommendations to address the issues raised. The company has submitted a formal meeting request and the associated briefing book to the FDA and plans to diligently address and resolve the issues identified in the CRL and seek approval as expeditiously as possible. It is unclear when the FDA will approve our BLA, if at all. The FDA did not approve our BLA on or before DecemberMarch 31, 2022, and therefore the regulatory milestone was not met, and the regulatory milestone CVR agreement terminated in accordance with its terms.

With respect to the net sales milestone CVR agreement, as of December 31, 2022,2024, Dr. Soon-Shiong and his related party hold approximately $139.8 million of net sales CVRs, and they have both irrevocably agreed to receive shares of the company’s common stock in satisfaction of their CVRs. We may be required to pay the other prior Altor stockholders up to $164.2 million for their net sales CVRs should they choose to have their CVRs paid in cash instead of common stock. If this were to occur, we may need to seek additional sources of capital and any such financing activities may be restricted by the covenants included in the terms of the RIPA. As such, we may face difficulties raising additional capital and may have to accept unfavorable terms and as a result, we may not be able to achieve profitability or positive cash flow.

We planIn connection with our financing in December 2023, we entered into the RIPA with Infinity and Oberland. Oberland has the right to collaborate with governmental, academicreceive quarterly Revenue Interest Payments from us based on, among other things, our worldwide net sales, excluding those in China, which are tiered payments ranging from 4.50% to 10.00% after funding of the Second Payment, subject to increase or decrease, following the Test Date depending on whether our aggregate payments made to Oberland as of the Test Date have met or exceeded the Cumulative Purchaser Payments. In addition, if our aggregate payments made as of the Test Date to Oberland do not equal or exceed the amount of the Cumulative Purchaser Payments as of such date, then we are obligated to make a one-time payment True-Up Payment as described above. In addition to other considerations of the RIPA and corporate partners, including affiliates,the associated impact to improveour profitability and develop N-803, hAd5cash flow, if we were required to make a True-Up Payment, we may need to seek additional sources of capital, and other therapies for new indications for use in combination with other therapies and to improve and develop other product candidates, which may expose us to additional risks, or we may not realize the benefits of such collaborations.be able to achieve profitability or positive cash flow.

If we encounter delays or difficulties enrolling and/or maintaining patients in our clinical trials, our clinical development activities and receipt of necessary marketing approvals could be delayed or otherwise adversely affected.

The timely completion of clinical trials in accordance with their protocols depends, among other things, on our ability to enroll a sufficient number of patients who remain in the trial until its conclusion. We may experience difficulties or delays in patient enrollment and retention in our clinical trials for a variety of reasons.

Because the number of qualified clinical investigators is limited, we may need to conduct some of our clinical trials at the same clinical trial sites that some of our competitors use, which will reduce the number of patients who are available for our clinical trials at such clinical trial sites. In addition, in the past we have engaged, and we intend to continue to engage, in clinical trial efforts outside of the U.S., which gives rise to additional potential complexity and challenges, and further reliance upon third parties in foreign jurisdictions. Moreover, because our product candidates represent a departure from more commonly used methods for cancer and/or viral disease treatment, potential patients and their doctors may be inclined to use conventional therapies, such as chemotherapy and approved immunotherapies that have established safety and efficacy profiles, rather than enroll patients in any future clinical trial.

Delays or failures in planned patient enrollment or retention may result in increased costs or may affect the timing or outcome of the planned clinical trials, which could prevent completion of these trials and adversely affect our ability to advance the development of our product candidates or could render further development impossible.

Our other product candidates may cause undesirable side effects or have other properties that could halt their clinical development, delay or prevent their regulatory approval, limit their commercial potential or result in significant negative consequences.