UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-Q

(Mark One)

| | | | | |

| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended March 31,June 30, 2020

OR

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 001-35518

SUPERNUS PHARMACEUTICALS, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | |

| Delaware | | | | 20-2590184 |

(State or other jurisdiction of

incorporation or organization) | | | | (I.R.S. Employer

Identification No.) |

| | | | |

| 9715 Key West Avenue | Rockville | MD | | 20850 |

| (Address of principal executive offices) | | | | (Zip Code) |

(301) 838-2500

(Registrant’s telephone number, including area code)

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

☒ Yes No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | |

| Large accelerated filer | ☒

| | Accelerated filer | ☐ |

| | | | |

| Non-accelerated filer | ☐ | | Smaller reporting company | ☐ |

| | | | |

| | | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐ Yes ☒ No

Securities registered pursuant to Section 12(b) of the Exchange Act

| | | | | | | | | | | | | | | | | | | | |

| Title of each class | | Outstanding at April 29,July 31, 2020 | | Trading Symbol | | Name of each exchange on which registered |

| Common Stock, $0.001 par value per share | | 52,538,65952,664,084 | | SUPN | | The Nasdaq Global Market |

SUPERNUS PHARMACEUTICALS, INC.

FORM 10-Q — QUARTERLY REPORT

FOR THE QUARTERLY PERIOD ENDED March 31,June 30, 2020

PART I — FINANCIAL INFORMATION

Supernus Pharmaceuticals, Inc.

Condensed Consolidated Balance Sheets

(in thousands, except share data)

| | | | | | | | | | | |

| March 31, | | December 31, |

| 2020 | | 2019 |

| (unaudited) | | |

| Assets | | | |

| Current assets | | | |

| Cash and cash equivalents | $ | 225,767 | | | $ | 181,381 | |

| Marketable securities | 175,104 | | | 165,692 | |

| Accounts receivable, net | 119,195 | | | 87,332 | |

| Inventories, net | 24,418 | | | 26,628 | |

| Prepaid expenses and other current assets | 12,564 | | | 11,611 | |

| Total current assets | 557,048 | | | 472,644 | |

| Long term marketable securities | 534,712 | | | 591,773 | |

| Property and equipment, net | 18,011 | | | 17,068 | |

| Intangible assets, net | 23,579 | | | 24,840 | |

| Lease assets | 21,911 | | | 21,279 | |

| Deferred income taxes | 34,067 | | | 32,063 | |

| Other assets | 538 | | | 615 | |

| | | |

| Total assets | $ | 1,189,866 | | | $ | 1,160,282 | |

| | | |

| Liabilities and stockholders’ equity | | | |

| Current liabilities | | | |

| Accounts payable | $ | 3,124 | | | $ | 10,141 | |

| Accrued product returns and rebates | 119,453 | | | 107,629 | |

| Accrued expenses and other current liabilities | 33,003 | | | 37,130 | |

| Income taxes payable | 9,097 | | | 2,443 | |

| Nonrecourse liability related to sale of future royalties, current portion | 3,658 | | | 3,244 | |

| Total current liabilities | 168,335 | | | 160,587 | |

| Convertible notes, net | 349,232 | | | 345,170 | |

| Nonrecourse liability related to sale of future royalties, long term | 18,369 | | | 19,248 | |

| Lease liabilities, long term | 30,804 | | | 30,440 | |

| Other liabilities | 9,743 | | | 9,409 | |

| Total liabilities | 576,483 | | | 564,854 | |

| | | |

| Stockholders’ equity | | | |

| Common stock, $0.001 par value; 130,000,000 shares authorized; 52,537,159 and 52,533,348 shares issued and outstanding as of March 31, 2020 and December 31, 2019, respectively | 53 | | | 53 | |

| Additional paid-in capital | 392,430 | | | 388,410 | |

| Accumulated other comprehensive earnings (loss), net of tax | (166) | | | 7,417 | |

| Retained earnings | 221,066 | | | 199,548 | |

| Total stockholders’ equity | 613,383 | | | 595,428 | |

| | | |

| Total liabilities and stockholders’ equity | $ | 1,189,866 | | | $ | 1,160,282 | |

| | | | | | | | | | | |

| June 30, | | December 31, |

| 2020 | | 2019 |

| (unaudited) | | |

| Assets | | | |

| Current assets | | | |

| Cash and cash equivalents | $ | 210,975 | | | $ | 181,381 | |

| Marketable securities | 163,839 | | | 165,692 | |

| Accounts receivable, net | 126,559 | | | 87,332 | |

| Inventories, net | 35,338 | | | 26,628 | |

| Prepaid expenses and other current assets | 20,442 | | | 11,611 | |

| Total current assets | 557,153 | | | 472,644 | |

| Long term marketable securities | 358,673 | | | 591,773 | |

| Property and equipment, net | 17,941 | | | 17,068 | |

| Operating lease assets | 21,289 | | | 21,279 | |

| Finance lease asset | 22,479 | | | — | |

| Intangible assets, net | 408,272 | | | 24,840 | |

| Goodwill | 88,095 | | | — | |

| Deferred income tax assets | — | | | 32,063 | |

| Other assets | 17,118 | | | 615 | |

| Total assets | $ | 1,491,020 | | | $ | 1,160,282 | |

| | | |

| Liabilities and stockholders’ equity | | | |

| Current liabilities | | | |

| Accounts payable | $ | 5,515 | | | $ | 10,141 | |

| Accrued product returns and rebates | 144,105 | | | 107,629 | |

| Accrued expenses and other current liabilities | 58,818 | | | 34,305 | |

| Contingent consideration, current portion | 23,500 | | | — | |

| Income taxes payable | 25,052 | | | 2,443 | |

| Operating lease liabilities, current portion | 3,560 | | | 2,825 | |

| Finance lease liability, current portion | 4,201 | | | — | |

| Nonrecourse liability related to sale of future royalties, current portion | 4,525 | | | 3,244 | |

| Total current liabilities | 269,276 | | | 160,587 | |

| Convertible notes, net | 353,349 | | | 345,170 | |

| Contingent consideration, long term | 92,200 | | | — | |

| Nonrecourse liability related to sale of future royalties, long term | 16,455 | | | 19,248 | |

| Operating lease liabilities, long term | 30,108 | | | 30,440 | |

| Finance lease liability, long term | 18,382 | | | — | |

| Deferred income tax liabilities | 35,716 | | | — | |

| Other liabilities | 9,560 | | | 9,409 | |

| Total liabilities | 825,046 | | | 564,854 | |

| | | |

| Stockholders’ equity | | | |

| Common stock, $0.001 par value; 130,000,000 shares authorized; 52,624,084 and 52,533,348 shares issued and outstanding as of June 30, 2020 and December 31, 2019, respectively | 53 | | | 53 | |

| Additional paid-in capital | 398,829 | | | 388,410 | |

| Accumulated other comprehensive earnings, net of tax | 11,359 | | | 7,417 | |

| Retained earnings | 255,733 | | | 199,548 | |

| Total stockholders’ equity | 665,974 | | | 595,428 | |

| | | |

| Total liabilities and stockholders’ equity | $ | 1,491,020 | | | $ | 1,160,282 | |

See accompanying notes.

Supernus Pharmaceuticals, Inc.

Condensed Consolidated Statements of Earnings

(in thousands, except share and per share data)

| | | | | | | | | | | | | | | |

| Three Months ended March 31, | | | | | | |

| 2020 | | 2019 | | | | |

| (unaudited) | | | | | | |

| Revenues | | | | | | | |

| Net product sales | $ | 92,490 | | | $ | 83,099 | | | | | |

| Royalty revenues | 2,486 | | | 2,375 | | | | | |

| Total revenues | 94,976 | | | 85,474 | | | | | |

| | | | | | | |

| Costs and expenses | | | | | | | |

| Cost of goods sold | 4,152 | | | 3,684 | | | | | |

| Research and development | 18,937 | | | 15,394 | | | | | |

| Selling, general and administrative | 42,875 | | | 40,968 | | | | | |

| | | | | | | |

| Total costs and expenses | 65,964 | | | 60,046 | | | | | |

| | | | | | | |

| Operating earnings | 29,012 | | | 25,428 | | | | | |

| | | | | | | |

| Other income (expense) | | | | | | | |

| Interest expense | (5,755) | | | (5,870) | | | | | |

| Interest income, net | 5,777 | | | 4,681 | | | | | |

| Total other income (expense) | 22 | | | (1,189) | | | | | |

| | | | | | | |

| Earnings before income taxes | 29,034 | | | 24,239 | | | | | |

| | | | | | | |

| Income tax expense | 7,516 | | | 5,899 | | | | | |

| Net earnings | $ | 21,518 | | | $ | 18,340 | | | | | |

| | | | | | | |

| Earnings per share | | | | | | | |

| Basic | $ | 0.41 | | | $ | 0.35 | | | | | |

| Diluted | $ | 0.40 | | | $ | 0.34 | | | | | |

| | | | | | | |

| Weighted-average shares outstanding | | | | | | | |

| Basic | 52,534,787 | | | 52,336,443 | | | | | |

| Diluted | 53,581,051 | | | 53,985,385 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months ended June 30, | | | | Six Months ended

June 30, | | |

| 2020 | | 2019 | | 2020 | | 2019 |

| (unaudited) | | | | (unaudited) | | |

| Revenues | | | | | | | |

| Net product sales | $ | 123,984 | | | $ | 102,358 | | | $ | 216,474 | | | $ | 185,457 | |

| Royalty revenues | 2,745 | | | 2,337 | | | 5,231 | | | 4,712 | |

| Total revenues | 126,729 | | | 104,695 | | | 221,705 | | | 190,169 | |

| | | | | | | |

| Costs and expenses | | | | | | | |

Cost of goods sold(a) | 8,386 | | | 4,044 | | | 12,538 | | | 7,728 | |

| Research and development | 22,247 | | | 16,970 | | | 41,184 | | | 32,364 | |

| Selling, general and administrative | 48,103 | | | 39,777 | | | 89,717 | | | 79,439 | |

| Amortization of intangible assets | 2,445 | | | 1,306 | | | 3,706 | | | 2,612 | |

| | | | | | | |

| Total costs and expenses | 81,181 | | | 62,097 | | | 147,145 | | | 122,143 | |

| | | | | | | |

| Operating earnings | 45,548 | | | 42,598 | | | 74,560 | | | 68,026 | |

| | | | | | | |

| Other income (expense) | | | | | | | |

| Interest income | 4,151 | | | 5,448 | | | 9,726 | | | 10,137 | |

| Interest expense | (5,815) | | | (5,389) | | | (11,570) | | | (11,268) | |

| Other income, net | 3,326 | | | 89 | | | 3,528 | | | 90 | |

| Total other income (expense) | 1,662 | | | 148 | | | 1,684 | | | (1,041) | |

| | | | | | | |

| Earnings before income taxes | 47,210 | | | 42,746 | | | 76,244 | | | 66,985 | |

| | | | | | | |

| Income tax expense | 12,543 | | | 10,019 | | | 20,059 | | | 15,918 | |

| Net earnings | $ | 34,667 | | | $ | 32,727 | | | $ | 56,185 | | | $ | 51,067 | |

| | | | | | | |

| Earnings per share | | | | | | | |

| Basic | $ | 0.66 | | | $ | 0.62 | | | $ | 1.07 | | | $ | 0.98 | |

| Diluted | $ | 0.65 | | | $ | 0.61 | | | $ | 1.05 | | | $ | 0.95 | |

| | | | | | | |

| Weighted-average shares outstanding | | | | | | | |

| Basic | 52,557,035 | | | 52,385,590 | | | 52,545,910 | | | 52,361,149 | |

| Diluted | 53,645,828 | | | 53,912,977 | | | 53,611,418 | | | 53,947,834 | |

(a)

See accompanying notes.

Supernus Pharmaceuticals, Inc.

Condensed Consolidated Statements of Comprehensive Earnings

(in thousands)

| | | | | | | | | | | | | | | |

| Three Months ended March 31, | | | | | | |

| 2020 | | 2019 | | | | |

| (unaudited) | | | | | | |

| Net earnings | $ | 21,518 | | | $ | 18,340 | | | | | |

| Other comprehensive (loss) earnings | | | | | | | |

| Unrealized (loss) gain on marketable securities, net of tax | (7,583) | | | 4,585 | | | | | |

| Other comprehensive (loss) earnings | (7,583) | | | 4,585 | | | | | |

| | | | | | | |

| Comprehensive earnings | $ | 13,935 | | | $ | 22,925 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months ended June 30, | | | | Six Months ended

June 30, | | |

| 2020 | | 2019 | | 2020 | | 2019 |

| (unaudited) | | | | (unaudited) | | |

| Net earnings | $ | 34,667 | | | $ | 32,727 | | | $ | 56,185 | | | $ | 51,067 | |

| Other comprehensive earnings | | | | | | | |

| Unrealized gain on marketable securities, net of tax | 11,525 | | | 4,497 | | | 3,942 | | | 9,082 | |

| Other comprehensive earnings | 11,525 | | | 4,497 | | | 3,942 | | | 9,082 | |

| | | | | | | |

| Comprehensive earnings | $ | 46,192 | | | $ | 37,224 | | | $ | 60,127 | | | $ | 60,149 | |

See accompanying notes.

Supernus Pharmaceuticals, Inc.

Condensed Consolidated Statements of Changes in Stockholders’ Equity

ThreeSix Months ended March 31,June 30, 2020 and 2019

(unaudited, in thousands, except share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| j | Common Stock | | | | Additional

Paid-in Capital | | Accumulated Other

Comprehensive

Earnings (Loss) | | Retained

Earnings | | Total

Stockholders’

Equity |

| Shares | | Amount | | | | | | | | |

| Balance, December 31, 2019 | 52,533,348 | | | $ | 53 | | | $ | 388,410 | | | $ | 7,417 | | | $ | 199,548 | | | $ | 595,428 | |

| Share-based compensation | — | | | — | | | 3,988 | | | — | | | — | | | 3,988 | |

| Exercise of stock options | 3,811 | | | — | | | 32 | | | — | | | — | | | 32 | |

| Net earnings | — | | | — | | | — | | | — | | | 21,518 | | | 21,518 | |

| Unrealized loss on marketable securities, net of tax | — | | | — | | | — | | | (7,583) | | | — | | | (7,583) | |

| Balance, March 31, 2020 | 52,537,159 | | | $ | 53 | | | $ | 392,430 | | | $ | (166) | | | $ | 221,066 | | | $ | 613,383 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| j | Common Stock | | | | Additional

Paid-in Capital | | Accumulated Other

Comprehensive

Earnings (Loss) | | Retained

Earnings | | Total

Stockholders’

Equity |

| Shares | | Amount | | | | | | | | |

| Balance, December 31, 2019 | 52,533,348 | | | $ | 53 | | | $ | 388,410 | | | $ | 7,417 | | | $ | 199,548 | | | $ | 595,428 | |

| Share-based compensation | — | | | — | | | 3,988 | | | — | | | — | | | 3,988 | |

| Exercise of stock options | 3,811 | | | — | | | 32 | | | — | | | — | | | 32 | |

| Net earnings | — | | | — | | | — | | | — | | | 21,518 | | | 21,518 | |

| Unrealized loss on marketable securities, net of tax | — | | | — | | | — | | | (7,583) | | | — | | | (7,583) | |

| Balance, March 31, 2020 | 52,537,159 | | | $ | 53 | | | $ | 392,430 | | | $ | (166) | | | $ | 221,066 | | | $ | 613,383 | |

| Share-based compensation | — | | | — | | | 4,962 | | | — | | | — | | | 4,962 | |

| Issuance of ESPP shares | 48,650 | | | — | | | 981 | | | — | | | — | | | 981 | |

| Exercise of stock options | 38,275 | | | — | | | 456 | | | — | | | — | | | 456 | |

| Net earnings | — | | | — | | | — | | | — | | | 34,667 | | | 34,667 | |

| Unrealized gain on marketable securities, net of tax | — | | | — | | | — | | | 11,525 | | | — | | | 11,525 | |

| Balance, June 30, 2020 | 52,624,084 | | | $ | 53 | | | $ | 398,829 | | | $ | 11,359 | | | $ | 255,733 | | | $ | 665,974 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | Common Stock | | | Additional

Paid-in Capital | | Accumulated Other

Comprehensive

Earnings (Loss) | | Retained

Earnings | | Total

Stockholders’

Equity | | Common Stock | | | Additional

Paid-in Capital | | Accumulated Other

Comprehensive

Earnings (Loss) | | Retained

Earnings | | Total

Stockholders’

Equity |

| | Shares | | Amount | | | | | | | | | | Shares | | Amount | | | | | Total

Stockholders’

Equity | | |

| Balance, December 31, 2018 | Balance, December 31, 2018 | 52,316,583 | | | $ | 52 | | | $ | 369,637 | | | $ | (3,158) | | | $ | 86,492 | | | $ | 453,023 | | Balance, December 31, 2018 | 52,316,583 | | | $ | 52 | | | $ | 369,637 | | | $ | (3,158) | | | $ | 86,492 | | | $ | 453,023 | |

| Share-based compensation | Share-based compensation | — | | | — | | | 3,287 | | | — | | | — | | | 3,287 | | Share-based compensation | — | | | — | | | 3,287 | | | — | | | — | | | 3,287 | |

| Exercise of stock options | Exercise of stock options | 57,665 | | | — | | | 783 | | | — | | | — | | | 783 | | Exercise of stock options | 57,665 | | | — | | | 783 | | | — | | | — | | | 783 | |

| Net earnings | Net earnings | — | | | — | | | — | | | — | | | 18,340 | | | 18,340 | | Net earnings | — | | | — | | | — | | | — | | | 18,340 | | | 18,340 | |

| Unrealized gain on marketable securities, net of tax | Unrealized gain on marketable securities, net of tax | | — | | | — | | | — | | | 4,585 | | | — | | | 4,585 | | Unrealized gain on marketable securities, net of tax | — | | | — | | | — | | | 4,585 | | | — | | | 4,585 | |

| Balance, March 31, 2019 | Balance, March 31, 2019 | 52,374,248 | | | $ | 52 | | | $ | 373,707 | | | $ | 1,427 | | | $ | 104,832 | | | $ | 480,018 | | Balance, March 31, 2019 | 52,374,248 | | | $ | 52 | | | $ | 373,707 | | | $ | 1,427 | | | $ | 104,832 | | | $ | 480,018 | |

| Share-based compensation | | Share-based compensation | — | | | — | | | 4,022 | | | — | | | — | | | 4,022 | |

| Issuance of ESPP shares | | Issuance of ESPP shares | 48,950 | | | — | | | 1,377 | | | — | | | — | | | 1,377 | |

| Exercise of stock options | | Exercise of stock options | 25,838 | | | — | | | 263 | | | — | | | — | | | 263 | |

| Net earnings | | Net earnings | — | | | — | | | — | | | — | | | 32,727 | | | 32,727 | |

| Unrealized gain on marketable securities, net of tax | | Unrealized gain on marketable securities, net of tax | — | | | — | | | — | | | 4,497 | | | — | | | 4,497 | |

| Balance, June 30, 2019 | | Balance, June 30, 2019 | 52,449,036 | | | $ | 52 | | | $ | 379,369 | | | $ | 5,924 | | | $ | 137,559 | | | $ | 522,904 | |

|

See accompanying notes.

Supernus Pharmaceuticals, Inc.

Condensed Consolidated Statements of Cash Flows

(in thousands)

| | | | | | | | | | | |

| Three Months ended March 31, | | |

| 2020 | | 2019 |

| (unaudited) | | |

| Cash flows from operating activities | | | |

| Net earnings | $ | 21,518 | | | $ | 18,340 | |

| | | |

| Adjustments to reconcile net earnings to net cash provided by operating activities: | | | |

| Share-based compensation expense | 3,988 | | | 3,287 | |

| Depreciation and amortization | 1,732 | | | 1,679 | |

| Amortization of premium/discount on marketable securities | (451) | | | (1,102) | |

| Amortization of deferred financing costs and debt discount | 4,061 | | | 3,848 | |

| Noncash interest expense | 1,366 | | | 1,437 | |

| Noncash royalty revenue | (1,567) | | | (1,576) | |

| Noncash operating lease cost | 991 | | | 879 | |

| Deferred income tax benefit | 538 | | | 279 | |

| Changes in operating assets and liabilities: | | | |

| Accounts receivable | (31,823) | | | 23,013 | |

| Inventories | 2,210 | | | (859) | |

| Prepaid expenses and other current assets | (454) | | | (1,799) | |

| Other noncurrent assets | — | | | (196) | |

| Accounts payable | (7,017) | | | 4,045 | |

| Accrued product returns and rebates | 11,824 | | | (18,863) | |

| Accrued expenses and other current liabilities | (3,634) | | | (3,177) | |

| Income taxes payable | 6,654 | | | 4,856 | |

| Other liabilities | (1,020) | | | (1,098) | |

| Net cash provided by operating activities | 8,916 | | | 32,993 | |

| | | |

| Cash flows from investing activities | | | |

| Purchases of marketable securities | (15,382) | | | (150,167) | |

| Sales and maturities of marketable securities | 53,357 | | | 47,143 | |

| Purchases of property and equipment | (2,537) | | | (221) | |

| Deferred legal fees | — | | | (1) | |

| Net cash provided by (used in) investing activities | 35,438 | | | (103,246) | |

| | | |

| Cash flows from financing activities | | | |

| | | |

| | | |

| | | |

| | | |

| Proceeds from issuance of common stock | 32 | | | 783 | |

| Net cash provided by financing activities | 32 | | | 783 | |

| | | |

| Net change in cash and cash equivalents | 44,386 | | | (69,470) | |

| Cash and cash equivalents at beginning of year | 181,381 | | | 192,248 | |

| Cash and cash equivalents at end of period | $ | 225,767 | | | $ | 122,778 | |

| | | |

| Supplemental cash flow information | | | |

| Cash paid for interest on convertible notes | $ | 1,258 | | | $ | 1,258 | |

| Income taxes paid | $ | 324 | | | $ | 800 | |

| | | |

| Noncash investing and financing activities | | | |

| Deferred legal fees and fixed assets included in accounts payable and accrued expenses | $ | 708 | | | $ | 250 | |

| Property and equipment additions from utilization of tenant improvement allowance | $ | — | | | $ | 282 | |

| | | | | | | | | | | |

| Six Months ended June 30, | | |

| 2020 | | 2019 |

| (unaudited) | | |

| Cash flows from operating activities | | | |

| Net earnings | $ | 56,185 | | | $ | 51,067 | |

| Adjustments to reconcile net earnings to net cash provided by operating activities: | | | |

| Share-based compensation expense | 8,950 | | | 7,309 | |

| Depreciation and amortization | 5,044 | | | 3,355 | |

| Amortization of premium/discount on marketable securities | 984 | | | (1,625) | |

| Amortization of deferred financing costs and debt discount | 8,179 | | | 7,748 | |

| Realized gains from sales of marketable securities | (3,316) | | | (93) | |

| Noncash interest expense | 2,870 | | | 2,851 | |

| Noncash royalty revenue | (3,918) | | | (3,368) | |

| Noncash operating lease cost | 1,842 | | | 1,230 | |

| Deferred income tax benefit | (3,062) | | | 861 | |

| Changes in operating assets and liabilities: | | | |

| Accounts receivable | (20,431) | | | 18,439 | |

| Inventories | 1,689 | | | (365) | |

| Prepaid expenses and other current assets | (4,767) | | | (3,581) | |

| Other noncurrent assets | (1,176) | | | (140) | |

| Accounts payable | (7,199) | | | 886 | |

| Accrued product returns and rebates | 28,298 | | | (11,129) | |

| Accrued expenses and other current liabilities | 10,913 | | | (1,307) | |

| Income taxes payable | 22,513 | | | (9,703) | |

| Other liabilities | (2,731) | | | (755) | |

| Net cash provided by operating activities | 100,867 | | | 61,680 | |

| | | |

| Cash flows from investing activities | | | |

| Acquisition of USWM, net of cash acquired | (297,200) | | | — | |

| Investment in Navitor Pharmaceuticals, Inc. | (15,000) | | | — | |

| Purchases of marketable securities | (15,382) | | | (264,926) | |

| Sales and maturities of marketable securities | 257,936 | | | 96,165 | |

| Purchases of property and equipment | (3,072) | | | (245) | |

| Deferred legal fees | (24) | | | (1) | |

| Net cash used in investing activities | (72,742) | | | (169,007) | |

| | | |

| Cash flows from financing activities | | | |

| Proceeds from issuance of common stock | 1,469 | | | 2,423 | |

| Net cash provided by financing activities | 1,469 | | | 2,423 | |

| | | |

| Net change in cash and cash equivalents | 29,594 | | | (104,904) | |

| Cash and cash equivalents at beginning of year | 181,381 | | | 192,248 | |

| Cash and cash equivalents at end of period | $ | 210,975 | | | $ | 87,344 | |

| | | |

| Supplemental cash flow information | | | |

| Cash paid for interest on convertible notes | $ | 1,258 | | | $ | 1,258 | |

| Income taxes paid | 607 | | | 24,795 | |

| | | |

| Noncash investing and financing activities | | | |

| Contingent consideration liability accrued in USWM Acquisition | $ | 115,700 | | | $ | — | |

| Deferred legal fees and fixed assets included in accounts payable and accrued expenses | 365 | | | 280 | |

| Property and equipment additions from utilization of tenant improvement allowance | — | | | 431 | |

| Lease assets and tenant receivable obtained for new leases | 24,738 | | | 31,727 | |

See accompanying notes.

Supernus Pharmaceuticals, Inc.

Notes to Condensed Consolidated Financial Statements (unaudited)

1. Organization and Business

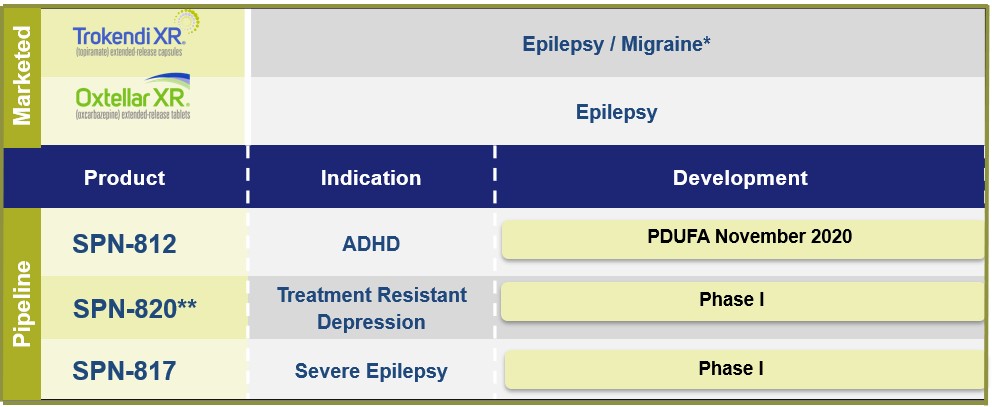

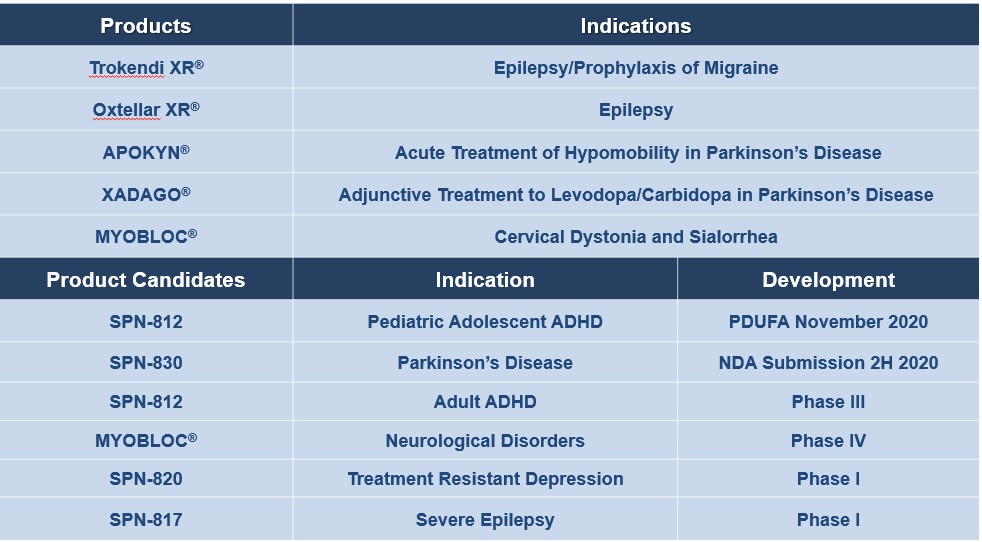

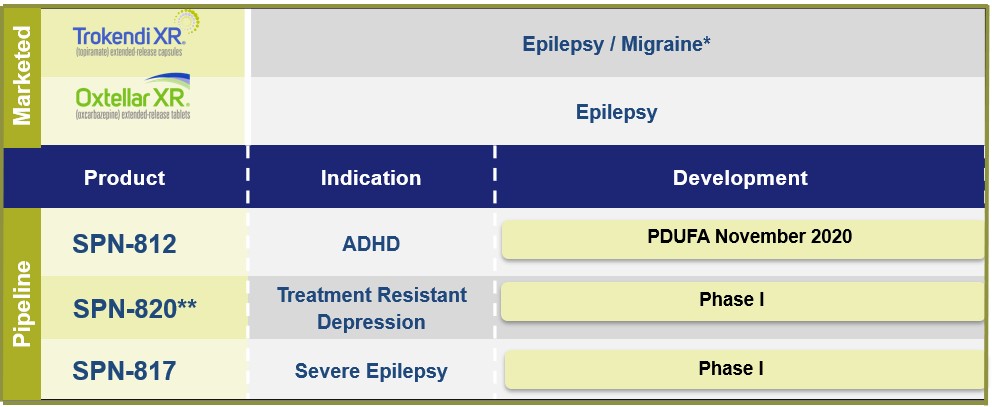

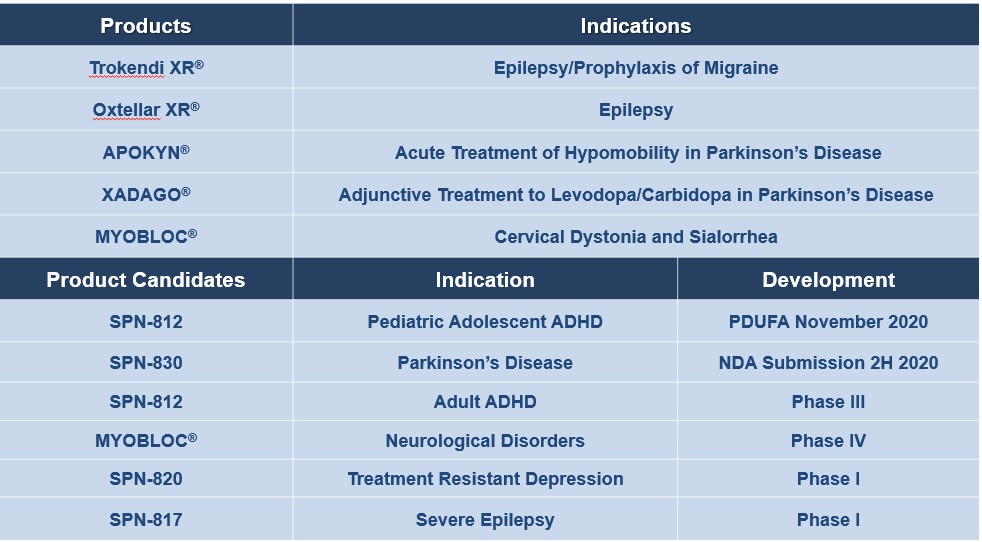

Supernus Pharmaceuticals, Inc. (the Company) was incorporated in Delaware, and commencedcommencing operations in 2005. The Company is a pharmaceutical company focused on developing and commercializing products for the treatment of central nervous system (CNS) diseases. The Company markets 2diseases, marketing 5 products: Oxtellar XR for the treatment of epilepsy andepilepsy; Trokendi XR for the prophylaxis of migraine headache and the treatment of epilepsy.epilepsy; APOKYN and XADAGO for the treatment of Parkinson's disease and MYOBLOC for the treatment of cervical dystonia and sialorrhea. The Company is also developing multiple proprietary CNS product candidates to address significant unmet medical needs and market opportunities.

The Company launched Oxtellar XR and Trokendi XR for the treatment of epilepsy in 2013, followed by the launch of Trokendi XR for the prophylaxis of migraine headache in adolescents and adults in 2017. The Company launched Oxtellar XR with an expanded indication to include monotherapy for partial seizures in January 2019. On June 9, 2020, the Company completed the previously announced acquisition of the CNS portfolio of US WorldMeds Partners, LLC (USWM Acquisition). With the acquisition, the Company acquired the right to further develop and commercialize 3 marketed products and a product candidate in late-stage development. Refer to Note 3 for further discussion on the USWM Acquisition.

COVID-19 Impact

The Company is closely monitoring the impact of the COVID-19 pandemic on all aspects of its business operations, and has assessed the impact of the COVID-19 pandemic on its condensed consolidated financial statements as of March 31,June 30, 2020. Through the first six months of 2020, the impact of the pandemic has had limited effect on the Company's business operations, and no material impact on its condensed consolidated financial statements.

Since the situation surrounding the COVID-19 pandemic remains fluid and the long term duration is uncertain, the long-term nature and extent of the effectsimpacts of the pandemic on the Company's business operations and financial position cannot be reasonably estimated at this time.

2. Summary of Significant Accounting Policies

Basis of Presentation

The Company’s condensed consolidated financial statements include the accounts of: Supernus Pharmaceuticals, Inc.; Supernus Europe Ltd.; Biscayne Neurotherapeutics, Inc.; and Biscayne Neurotherapeutics Australia Pty Ltd. These are collectively referred to herein as “Supernus” or “the Company.” All significant intercompany transactions and balances have been eliminated in consolidation.

The Company’s unaudited condensed consolidated financial statements have been prepared in accordance with the requirements of the U.S. Securities and Exchange Commission (SEC) for interim financial information. As permitted under Generally Accepted Accounting Principles in the United States (U.S. GAAP), certain notes and other information have been omitted from the interim unaudited condensed consolidated financial statements presented in this Quarterly Report on Form 10-Q. Therefore, these financial statements should be read in conjunction with the Company’s most recent Annual Report on Form 10-K, for the year ended December 31, 2019, filed with the SEC.

In management’s opinion, the condensed consolidated financial statements include all normal and recurring adjustments necessary for a fair presentation of the Company’s financial position, results of operations and cash flows. The results of operations for any interim period are not necessarily indicative of the Company’s future quarterly or annual results.

The Company, which is primarily located in the United States (U.S.), operates in 1 operating segment.

Reclassifications

Certain prior year amounts on the condensed consolidated statements of earnings have been reclassified to conform to the current year presentation, including a reclassification made to separately present amortization of intangible assets, previously included in Selling, general and administrative expenses, to the Amortization of intangible assets on the condensed consolidated statements of earnings. These reclassifications had no effect on operating earnings or our other condensed consolidated financial statements for the three and six months ended June 30, 2020 and 2019.

Consolidation

The Company’s condensed consolidated financial statements include the accounts of: Supernus Pharmaceuticals, Inc.; Supernus Europe Ltd.; Biscayne Neurotherapeutics, Inc.; Biscayne Neurotherapeutics Australia Pty Ltd; MDD US Enterprises,

LLC (formerly USWM Enterprises, LLC) and MDD US Enterprises, LLC's wholly owned subsidiaries. These are collectively referred to herein as “Supernus” or “the Company.” All significant intercompany transactions and balances have been eliminated in consolidation.

The condensed consolidated financial statements reflect the consolidation of entities in which the Company has a controlling financial interest. In determining whether there is a controlling financial interest, the Company considers if it has a majority of the voting interests of the entity, or if the entity is a variable interest entity (VIE) and whether the Company is the primary beneficiary. In determining the primary beneficiary of a VIE, the Company evaluates whether it has both (1) the power to direct the activities of the VIE that most significantly impact the VIE’s economic performance and (2) the obligation to absorb losses of, or the right to receive benefits from, the VIE that could potentially be significant to that VIE. The Company's judgment with respect to its level of influence or control of an entity involves the consideration of various factors including the form of ownership interest, representation in the entity’s governance, the size of the investment, estimates of future cash flows, the ability to participate in policy making decisions and the rights of the other investors to participate in the decision making process and to liquidate the entity, if applicable. If the Company is not the primary beneficiary and an ownership interest is held in the entity, the interest is accounted for under the equity or cost methods of accounting, as appropriate. The Company continuously assesses whether it is the primary beneficiary of a VIE as changes to existing relationships or future transactions may result in changing conclusions.

Use of Estimates

The Company bases its estimates on: historical experience; various forecasts; information received from its service providers; information from other sources; and other assumptions that the Company believes are reasonable under the circumstances. Actual results could differ materially from the Company’s estimates. The Company evaluates the methodologies employed in making its estimates on an ongoing basis.

Business Combinations and Contingent Considerations

To determine whether acquisitions should be accounted for as a business combination or as an asset acquisition, the Company makes certain judgments as to determine whether the acquired set of activities and assets meets the definition of a business. Significant judgment is required in making the assessment as to whether the acquired processes or activities along with their inputs would be substantive so as to constitute a business, as defined by U.S. GAAP.

If the acquired set of activities and assets meets the definition of a business, the Company applies the acquisition method of accounting to that transaction. Otherwise, the transaction is recorded as an asset acquisition and not a business combination. In an asset acquisition, any acquired in-process research and development (IPR&D) that does not have an alternative future use is charged to expense at the acquisition date, and no goodwill is recorded.

Under the acquisition method of accounting, assets acquired and liabilities assumed are required to be recorded at their respective fair values as of the acquisition date. The excess of the purchase price over the fair value of the acquired net assets, where applicable, is recorded as goodwill. The operating results of the acquired business is included in the Company’s condensed consolidated statement of earnings beginning on the effective acquisition date. Acquisition-related expenses are recognized separately from the business combination, and are expensed as incurred.

Significant judgment is involved in determining the fair values assigned to assets acquired and liabilities assumed in a business combination, as well as the estimated asset lives. These can materially affect our consolidated results of operations. The fair values of intangible assets, including acquired IPR&D, are determined using information available near the acquisition date, based on estimates and assumptions that are deemed reasonable by management. Significant estimates and assumptions include, but are not limited to, probability of technical success, revenue growth and discount rate. Depending on the facts and circumstances, the Company may deem it necessary to engage an independent valuation expert to assist in valuing significant assets and liabilities.

While the Company uses its best estimates and assumptions to accurately value assets acquired and liabilities assumed at the acquisition date, estimates are inherently uncertain and subject to refinement. As a result, during the measurement period, which may be up to one year from the acquisition date, the Company may record adjustments to the assets acquired and liabilities assumed, with the corresponding offset to goodwill. In addition, uncertain tax positions and tax-related valuation allowances are initially recorded in connection with a business combination as of the acquisition date. The Company continues to collect information and re-evaluate these estimates and assumptions on a quarterly basis. The Company records any adjustments to the Company’s preliminary estimates to goodwill, provided these adjustments are within the one year measurement period from the

acquisition date. Upon the conclusion of the measurement period or subsequent to the final determination of the values of assets acquired or liabilities assumed, whichever comes first, any subsequent adjustments are recorded to our condensed consolidated statements of earnings in the period that these adjustments are identified.

Contingent Considerations

Certain of the Company’s business combinations involve the potential for future payment of consideration that is contingent upon the achievement of certain milestones related to the development and sale of its products; for example, product development milestones and royalty payments on future product sales. The fair value of contingent consideration liabilities is determined at the acquisition date using unobservable inputs. These inputs include the estimated amount and timing of projected cash flows, volatility, the probability of milestone achievement (i.e., achievement of the contingent event) and the estimated discount rates and risk-free rate used to present value the probability-weighted cash flows. Subsequent to the acquisition date, at each reporting period until the contingency is resolved, the contingent consideration liability is remeasured at current fair value, with changes recorded in earnings in the period of remeasurement.

Similarly, the determination of initial and subsequent fair value of the contingent consideration liability requires significant judgment by management. Changes in any of the inputs may result in a significantly different fair value adjustment and can impact the results of operations.

Additional information regarding the Company's recent business combination and contingent consideration arrangement is included in Note 3, USWM Acquisition.

Revenuefrom Product Sales

The Company’s customers are primarily pharmaceutical wholesalers, specialty pharmacies, and distributors. Customers purchase product to fulfill orders from retail pharmacy chains and independent pharmacies of varying size and purchasing power. The Company recognizes gross revenue when its products are physically received by its customers, upon shipment from a third party fulfillment center. The Company's customers take control of its products, including title and ownership, upon physical receipt of its products at their facilities. Customer orders are generally fulfilled within a few days of receipt, resulting in minimal order backlog. The Company does not adjust revenue for any financing effects, for those transactions where the Company expects the period between the transfer of the goods or services and collection to be less than one year. There are no minimum product purchase requirements with our customers.

The Company recognizes revenue from product sales in an amount that reflects the consideration the Company expects to receive in exchange for those goods. Product sales are recorded net of various forms of variable consideration, including: provision for estimated rebates; provision for estimated future product returns; and an estimated allowance for discounts. These are collectively considered "sales deductions."

As described below, variability in the net transaction price for the Company’s products arises primarily from the aforementioned sales deductions. Significant judgment is required in estimating certain sales deductions. In making these estimates, the Company considers: historical experience; product price increases; current contractual arrangements under applicable payor programs; unbilled claims; processing time lags; inventory levels in the wholesale, specialty pharmacy, and retail distribution channel and product life cycle. The Company adjusts its estimates of revenue either when the most likely amount of consideration it expects to receive changes, or when the consideration becomes fixed. Variable consideration on product sales is only recognized when it is probable that a significant reversal will not occur.

If actual results in the future vary from our estimates, the Company adjusts its estimates in that calendar period. These adjustments could materially affect net product sales and earnings in the period that such adjustments are recorded.

Sales Deductions

The Company records product sales net of the following sales deductions:

•Rebates: Rebates are discounts which the Company pays under either public sector or private sector health care programs. Public sector rebate programs encompass: various Medicaid drug rebate programs; Medicare gap coverage programs; programs covering public health service institutions; and programs covering government entities. All federal employees and agencies purchase drugs under the Federal Supply Schedule. Private sector rebate programs include: contractual agreements with managed care providers, under which the Company pays fees to gain access to that provider’s patient drug formulary; and Company sponsored programs, under which the Company defrays or eliminates

patient co-payment charges that the patient would otherwise be obligated to pay to their managed care provider in order to fill their prescription.

Rebates paid under public sector programs are generally mandated under law, whereas private sector rebates are generally contractually negotiated by the Company with managed care providers. Both types of rebates vary over time.

Rebates are owed upon dispensing our product to a patient; i.e., filling a prescription. The accrual balance for rebates consists of the following three components. First, because rebates are generally invoiced and paid quarterly in arrears, the accrual balance consists of an estimate of the amount expected to be incurred for prescriptions dispensed in the current quarter. Second, the accrual balance also includes an estimate for known or estimated prior quarters’ unpaid rebates, covering those prescriptions dispensed in past quarters but for which no invoice has yet been received. Third, the accrual balance includes an estimate for rebates that will be prospectively owed, for prescriptions filled in future quarters. This estimate pertains to product that has been sold by the Company to wholesalers or distributors, and which resides either as wholesaler/distributor inventory or as inventory held at pharmacies. As of the end of the reporting period, this product has not been dispensed to a patient.

The Company’s estimates of expected rebate claims vary by program and by type of customer, because the period from the date at which the prescription is filled and the date at which the Company receives and pays the invoice varies substantially. For each of its products, the Company bases its estimates of expected rebate claims on multiple factors, including: historical levels of deductions; contractual terms with managed care providers; actual and anticipated changes in product price; prospective changes in managed care fee for service contracts; prospective changes in co-pay assistance programs; and anticipated changes in program utilization rates; i.e., patient participation rates under each specific program.

The Company records an estimated liability for rebates at the time the customer takes title to the product (i.e., at the time of sale to wholesalers/distributors), and records this liability as a reduction to gross product sales. This liability is recorded as an increase in Accrued product returns and rebates, and is reflected in current liabilities on our condensed consolidated balance sheets.

The sensitivity of the Company’s estimates varies by program and by type of customer. If actual rebates vary from estimated amounts, the Company will adjust the balances of such accrued rebates to reflect actual experience. These adjustments could materially affect the estimated liability balance, net product sales and earnings in the period in which the adjustment(s) is made.

•Returns: Sales of the Company’s products are not subject to a general right of return. Product that has been used to fill patient prescriptions is no longer subject to any right of return. However, the Company will accept return of product that is damaged or defective when shipped from its third party fulfillment center.

The Company will accept return of expired product six months prior to and up to 12 months subsequent to the product’s expiry date. Expired or defective returned product cannot be re-sold and is therefore destroyed.

The Company records an estimated liability for product returns at the time the customer takes title to the product (i.e., at time of sale). The liability is reflected as a reduction to gross product sales. This liability is recorded as an increase in Accrued product returns and rebates, in current liabilities on our condensed consolidated balance sheets. The Company estimates the liability for returns based primarily on the actual returns experience for its 5 commercial products.

Because the Company’s products have a shelf life up to 60 months from date of manufacture, and because the Company accepts return of product up to 12 months post expiry, there is a significant time lag of several years between the time when the product is sold and the time when the Company issues credit on expired product. The Company’s returns policy generally permits product returns to be processed at current wholesaler price rather than at historical acquisition price. Hence, the Company’s estimated liability for product returns is affected by price increases taken subsequent to the date of sale.

When the Company adjusts its estimates for product returns, the adjustment affects the estimated liability, product sales and earnings in the period of adjustment. Those adjustments may be material to our financial results.

•Sales discounts: Distributors and wholesalers of the Company's pharmaceutical products are generally offered various forms of consideration, including allowances, service fees and prompt payment discounts, for distributing our

products. Distributor and wholesaler allowances and service fees arise from contractual agreements, and are estimated as a percentage of the price at which the Company sells product to them. In addition, distributors and wholesalers are offered a prompt pay discount for payment within a specified period.

The Company accounts for these discounts at the time of sale, as a reduction to gross product sales, recording these discounts as a valuation allowance against Accounts receivable on the condensed consolidated balance sheets.

Royalty Revenues

The Company recognizes noncash royalty revenue for amounts earned pursuant to its royalty agreement with United Therapeutics Corporation (United Therapeutics), based on estimated product sales by United Therapeutics (see Note 4). This agreement includes the right to use the Company’s intellectual property as a functional license. In 2014, the Company sold certain of these royalty rights to Healthcare Royalty Partners III, L.P. (HC Royalty) (see Note 19). Sales of Orenitram by United Therapeutics result in payments made by United Therapeutics to HC Royalty, in accordance with these agreements. Consequent to this agreement, the Company recorded a nonrecourse liability related to this transaction, and amortizes this liability as noncash royalty revenue.

The Company also recognizes noncash interest expense related to this liability, and accrues interest expense at an effective interest rate (see Note 18). This interest rate is determined based on projections of HC Royalty’s rate of return.

Royalty revenue also includes cash royalty amounts received from other collaboration partners, including from Shire Plc (Shire, a subsidiary of Takeda Pharmaceutical Company Ltd), based on net product sales of Shire's product, Mydayis, in the current period. Royalty revenue is only recognized when the underlying product sale by Shire occurs. The Shire arrangement also includes Shire's right to use the Company’s intellectual property as a functional license.

There are 0 guaranteed minimum amounts owed to the Company related to any of these royalty revenue agreements.

Research and Development Expenses and Related Accrued Research and Development Expenses

Research and development expenditures are expensed as incurred. These expenses include: employee salaries, benefits and share-based compensation; cost of contract research and development services provided by third parties; costs for conducting preclinical and clinical studies; cost of acquiring or manufacturing clinical trial materials; regulatory costs; facilities costs; depreciation expense and allocated expenses; and license fees and milestone payments related to in-licensed products and technologies. Assets acquired that are used for research and development and that have no future alternative use are expensed as in-process research and development as incurred.

The Company estimates preclinical and clinical trial expenses based on services performed pursuant to contracts with research institutions, clinical investigators, clinical research organizations (CROs) and other service providers that provide services on the Company’s behalf. In recording service fees, the Company estimates the cost of those services which have been performed on behalf of the Company during the current period, and compares those costs with the cumulative expenses recorded and cumulative payments made for such services. As appropriate, the Company accrues additional service fees for services that have been delivered, or defers nonrefundable advance payments until the related services are performed. If the actual timing of the performance of services or the level of effort varies from the estimate, the Company adjusts its accrued expenses or its deferred advance payments, accordingly. If the Company subsequently determines that it no longer expects the services associated with a nonrefundable advance payment to be rendered, the remaining portion of that advance payment is charged to expense in the period in which such a determination is made.

Marketable Securities

Marketable securities consist of investments in: U.S. Treasury bills and notes; bank certificates of deposit; various U.S. governmental agency debt securities; corporate and municipal bonds; and other fixed income securities. The Company places all investments with governmental, industrial or financial institutions whose debt is rated as investment grade.

The Company's investments are classified as available-for-sale and are carried at fair value. The Company classifies all available-for-sale marketable securities with maturities greater than one year from the balance sheet date as non-current assets.

Any unrealized holding gains or losses on debt securities are reported, net of any tax effects, as a component of other comprehensive earnings (loss) in the condensed consolidated statement of comprehensive earnings. Realized gains and losses,

included in Other income (expense), net in the condensed consolidated statement of earnings, are determined using the specific identification method for determining the cost of securities sold.

The Company adopted Accounting Standards Update (ASU) No. 2016-13, Financial Instruments - Credit Losses (Topic 326) on January 1, 2020, using the allowance approach. Declines in fair value below amortized cost related to credit losses (i.e., impairment due to credit losses), if any, are included in the condensed consolidated statement of earnings, with a corresponding allowance established. If the estimate of expected credit losses decreases in subsequent periods, the Company will reverse the credit losses through current period earnings, and accordingly adjust the allowance (see Recently Issued Accounting Pronouncements).

Inventories

Inventories, which are recorded at the lower of cost or net realizable value, include materials, labor, direct costs and indirect costs. These are valued using the first-in, first-out method. The Company writes down inventory that has become obsolete, or has a cost basis in excess of its expected net realizable value. Expired inventory is disposed of, and the related costs are recognized as Cost of goods sold in the condensed consolidated statement of earnings.

Inventories Produced in Preparation of Product Launches

The Company capitalizes inventories produced in preparation for product launches when future commercialization of a product is probable and when future economic benefit is expected to be realized. The determination to capitalize is based on the particular facts and circumstances relating to the product. Capitalization of such inventory begins when the Company determines that (i) positive results have been obtained for the clinical trials that are necessary to support regulatory approval; (ii) uncertainties regarding regulatory approval have been significantly reduced; and (iii) it is probable that these capitalized costs will provide future economic benefit in excess of capitalized costs.

In evaluating whether these conditions are met, the Company considers the following factors: the product candidate’s current status in the regulatory approval process; results from the related pivotal clinical trials; results from meetings with relevant regulatory agencies prior to the filing of regulatory applications; compilation of the regulatory applications; consequent acceptance by the regulatory body; potential impediments to the approval process, such as product safety or efficacy concerns, potential labeling restrictions, and other impediments; historical experience with manufacturing and commercializing similar products as well as the relevant product candidate; and the resilience of the Company’s manufacturing environment, including its supply chain, in determining logistical constraints that could hamper approval or commercialization. In assessing the economic benefit that the Company is likely to realize, the Company considers: the shelf life of the product in relation to the expected timeline for approval; patent related or contract issues that may prevent or delay commercialization; product stability data of all pre-approval production to determine whether there is adequate expected shelf life; viability of commercialization, taking into account competitive dynamics in the marketplace and market acceptance; anticipated future sales; and anticipated reimbursement strategies that may prevail with respect to the product, if approved.

In applying the lower of cost or net realizable value to pre-launch inventory, the Company estimates a range of likely commercial prices based on comparable commercial products and pre-launch discussions with managed care providers.

The Company could be required to write down previously capitalized costs related to pre-launch inventories upon a change in such judgment(s), due to, among other potential factors, a denial or significant delay of approval by regulatory bodies, a delay in commercialization, or other adverse factors.

Revenuefrom Product SalesIntangible Assets

The Company’s customers, who are primarily pharmaceutical wholesalersIntangible assets consist of definite-lived intangible assets, including: acquired developed technology and distributors, purchase product to fulfill orders from retail pharmacy chainsrights intangible, and independent pharmaciespatent defense costs. They also consist of varying sizeindefinite-lived intangible assets, such as acquired IPR&D and purchasing power. The Company recognizes gross revenue when its products are physically received by its customers, upon shipment from a third party fulfillment center. Customers take control of our products, including title and ownership, upon physical receipt of our products at the customers' facilities. Customer orders are generally fulfilled within a few days of receipt, resulting in minimal order backlog. The Company does not adjust revenue for any financing effects, in transactions where the Company expects the period between the transfer of the goods or services and collection to be less than one year. There are no minimum product purchase requirements with customers.goodwill.

The Company recognizes revenue from product salesPatent defense costs are deferred legal fees that have been incurred in connection with legal proceedings related to the defense of patents for Oxtellar XR and Trokendi XR. Patent defense costs are charged to expense in the event of an amount that reflectsunsuccessful outcome of the consideration the Company expects to receive in exchange for those goods or services. Product sales are recorded net of various forms of variable consideration, including: provision for estimated rebates; provision for estimated future product returns; and an estimated allowance for discounts. These are collectively considered "sales deductions."litigation.

As described below, variability inDefinite-lived intangible assets are carried at cost less accumulated amortization, with amortization calculated on a straight line basis over the net transaction price for the Company’s products arises primarily from the aforementioned sales deductions. Variable consideration on product sales is only recognized when it is probable that a significant reversal will not occur. Significant judgment is required in estimating certain sales deductions. In making these estimates, the Company considers: historical experience; product price increases; current contractual arrangements under applicable payor programs; unbilled claims; processing time lags; and inventory levels in the wholesale and retail distribution channel.estimated useful lives. The Company adjustsevaluates the estimated remaining useful lives of its estimates of revenue either when the most likely amount of consideration it expects to receive changes,intangible assets annually or when events or changes in circumstances warrant a revision to the consideration becomes fixed.

If actual results in the future vary from our estimates, the Company adjusts these estimates. These adjustments could materially affect net product sales and earnings in the period that such adjustments are recorded.

Sales Deductions

The Company records product sales netremaining periods of the following sales deductions:

•Rebates: Rebates are discounts which the Company pays under either public sector or private sector health care programs. Public sector rebate programs encompass: various Medicaid drug rebate programs; Medicare gap coverageamortization.

programs; programs covering public health service institutions; and government entities. All federal employees and agencies purchase drugs under the Federal Supply Schedule. Private sector rebate programs include: contractual agreements with managed care providers, under which the Company pays fees to gain access to that provider’s patient drug formulary; and Company sponsored programs, under which the Company defrays or eliminates patient co-payment charges that the patient would otherwise be obligated to pay to their managed care provider in order to fill their prescription.

Rebates paid under public sector programs are generally mandated under law, whereas private sector rebates are generally contractually negotiated by the Company with managed care providers. Both types of rebates vary over time.

Rebates are owed upon dispensing our product to a patient; i.e., filling a prescription. The accrual balance for rebates consists of the following three components. First, because rebates are generally invoiced and paid quarterly in arrears, the accrual balance consists of an estimate of the amount expected to be incurred for prescriptions dispensed in the current quarter. Second, the accrual balance also includes an estimate for known or estimated prior quarters’ unpaid rebates, to cover prescriptions dispensed in past quarters, but for which no invoice has yet been received. Third, the accrual balance includes an estimate for rebates that will be prospectively owed, for prescriptions filled in future quarters. This pertains to product that has been sold by the Company to wholesalers or distributors, and which resides either as wholesaler/distributor inventory or as inventory held at pharmacies, but as of the end of the reporting period, this product has not been dispensed to a patient.

The Company’s estimates of expected rebate claims vary by program and by type of customer, because the period from the date at which the prescription is filled and the date at which the Company receives and pays the invoice varies substantially. For each of its products, the Company bases its estimates of expected rebate claims on multiple factors, including: historical levels of deductions; contractual terms with managed care providers; actual and anticipated changes in product price; prospective changes in managed care fee for service contracts; prospective changes in co-pay assistance programs; and anticipated changes in program utilization rates i.e., patient participation rates under each specific program. The Company records an estimated liability for rebates at the time the customer takes title to the product (i.e., at the time of sale to wholesalers/distributors), and records this liability as a reduction to gross product sales. This liability is recorded as an increase in Accrued product returns and rebates, in current liabilities on our condensed consolidated balance sheets.

The sensitivity of the Company’s estimates varies by program and by type of customer. If actual rebates vary from estimated amounts, the Company will adjust the balances of such accrued rebates to reflect actual experience with respect to these programs. These adjustments could materially affect the estimated liability balance, net product sales and earnings in the period in which the adjustment(s) is made.

•Returns: Sales of the Company’s products are not subject to a general right of return. Product that has been used to fill patient prescriptions is no longer subject to any right of return. However, the Company will accept return of product that is damaged or defective when shipped from its third party fulfillment center.

The Company will accept return of expired product six months prior to and up to 12 months subsequent to the product’s expiry date. Expired or defective returned product cannot be re-sold and is therefore destroyed.

The Company records an estimated liability for product returns at the time the customer takes title to the product (i.e., at time of sale) as a reduction to gross product sales. This liability is recorded as an increase in Accrued product returns and rebates, in current liabilities on our condensed consolidated balance sheets. The Company estimates the liability for returns based primarily on the actual returns experience for its 2 commercial products.

Because the Company’s products have a shelf life of 48 months from date of manufacture, and because the Company accepts return of product up to 12 months post expiry, there is a significant time lag of several years between the time when the product is sold and the time when the Company issues credit on expired product. The Company’s returns policy generally permits product returns to be processed at current wholesaler price rather than at historical acquisition price. Hence, the Company’s estimated liability for product returns is affected by price increases taken subsequent to the date of sale.

When the Company adjusts its estimates for product returns, the adjustment affects the estimated liability, product sales and earnings in the period of adjustment. Those adjustments may be material to our financial results.

•

Sales discounts: Distributors and wholesalers

Indefinite-lived intangible assets are not amortized but tested for impairment annually. Acquired IPR&D in a business combination is considered to be indefinite-lived until the completion or abandonment of the Company's pharmaceutical products are generally offered various forms of consideration, including allowances, service feesassociated research and prompt payment discounts for distributing our products. Distributor and wholesaler allowances and service fees arise from contractual agreements, and are estimated as a percentagedevelopment efforts. Upon successful completion of the price atproject, the Company will make a determination as to the then-useful life of the intangible asset, generally determined by the period in which the Company sells productsubstantial majority of the cash flows are expected to them. In addition, distributors and wholesalersbe generated. The capitalized amount is then amortized over its estimated useful life. If a project is abandoned, all remaining capitalized amounts are offered a prompt pay discountwritten off immediately. During the period prior to completion or abandonment, the IPR&D asset will not be amortized but will be tested for payment within a specified period. The Company accounts for these discounts at the time of sale, as a reduction to gross product sales, and records these discounts as a valuation allowance against Accounts receivable impairment on the condensed consolidated balance sheets.an annual basis.

License Revenues

License and Collaboration AgreementsGoodwill Impairment Assessment

The Company has entered into collaboration agreementsevaluates goodwill for possible impairment at least annually during the fourth quarter of each fiscal year, or more often, if and when circumstances indicate that goodwill may be impaired. This includes but is not limited to facilitate commercialization of both Oxtellar XR and Trokendi XR outsidesignificant adverse changes in the business climate, market conditions, or other events that indicate that it is more likely than not that the fair value of the U.S. Those agreements include the right to use the Company’s intellectual property as a functional license, and generally include an up-front license fee and ongoing milestone payments upon the achievement of certain specific events. These agreements may also require minimum royalty payments based on sales of products which use the applicable intellectual property.

Up-front license fees are recognized once the license has been executed betweenreporting unit is less than its carrying value. In performing its annual goodwill assessment, the Company andfirst performs a qualitative test. If necessary, the Company then performs a quantitative test. To conduct the quantitative impairment test of goodwill, the Company compares the fair value of a reporting unit to its licensee.

Milestones are a form of variable consideration that are recognized when either the underlying events have transpired (i.e., event-based milestone) or when the sales-based targets have been met by the collaborative partner (i.e., sales-based milestone). Both types of milestone payments are nonrefundable.carrying value. Evaluating for impairment requires judgment, including estimating future cashflows. The Company estimates the amountfair values of its reporting unit using discounted cash flow models or other valuation models, such as comparative transactions and market multiples. If the milestone to be included inreporting unit’s carrying value exceeds its fair value, the transaction price by using the most likely amount method. The Company includes in the transaction price some or all of the amount of variable consideration (i.e., the value of the associated milestone), but includes this onlyrecords an impairment loss to the extent that it is probable that a significant revenue reversal will not occur when the uncertainty associated with the variable consideration is subsequently resolved. Assessing whether it is probable that a significant revenue reversal will not occur once the uncertainty related to the variable consideration is subsequently resolved requires management judgment, and may require assessing factors that are outsidecarrying value of the Company’s influence, such as: likelihood of regulatory success; availability of third party information; and expected time period until achievement of the event. These factors are evaluated based on the specific facts and circumstances.

Event-based milestones are recognized in the period that the related event, such as regulatory approval, occurs. Sales-based milestones are recognized as revenue only when the sales-based target is achieved.

There are 0 guaranteed minimum amounts owed to the Company related to license and collaboration agreements.

Royalty Revenues

The Company recognizes noncash royalty revenue for amounts earned pursuant togoodwill exceeds its royalty agreement with United Therapeutics Corporation (United Therapeutics), based on estimated product sales by United Therapeutics (see Note 3). This agreement includes the right to use the Company’s intellectual property as a functional license. In 2014, the Company sold certain of these royalty rights to Healthcare Royalty Partners III, L.P. (HC Royalty) (see Note 17, Commitments and Contingencies). Sales of Orenitram by United Therapeutics result in payments made by United Therapeutics to HC Royalty, in accordance with these agreements. Consequent to this agreement, the Company recorded a nonrecourse liability related to this transaction, and amortizes this amount as noncash royalty revenue.

The Company also recognizes noncash interest expense related to this liability, and accrues interest expense at an effective interest rate (see Note 16). The interest rate is determined based on projections of HC Royalty’s rate of return.

Royalty revenue also includes cash royalty amounts received from collaboration partners, including from Shire Plc (Shire, a subsidiary of Takeda Pharmaceutical Company Ltd), based on net product sales in the current period of Shire’s product, Mydayis. Royalty revenue is only recognized when the underlying product sale by Shire occurs. The Shire arrangement also includes Shire's right to use the Company’s intellectual property as a functional license.

There are 0 guaranteed minimum amounts owed to the Company related to any of these royalty revenue agreements.

Research and Development Expense and Related Accrued Research and Development Expenses

Research and development expenditures are expensed as incurred. These expenses include: salaries, benefits and share-based compensation; contract research and development services provided by third parties; costs for conducting preclinical and clinical studies; cost of acquiring or manufacturing clinical trial materials; regulatory costs; facilities costs; depreciation expense and other allocated expenses; and license fees and milestone payments related to in-licensed products and technologies. Assets acquired that are used for research and development and that have no future alternative use are expensed as in-process research and development.

The Company estimates preclinical and clinical trial expenses based on services performed pursuant to contracts with research institutions, clinical investigators, clinical research organizations (CROs) and other service providers that provide services on the Company’s behalf. In recording service fees, the Company estimates the cost of those services which have been performed on behalf of the Company during the current period, and compares those costs with the cumulative expenses recorded and cumulative payments made for such services. As appropriate, the Company accrues additional service fees, or defers nonrefundable advance payments, until the related services are performed. If the actual timing of the performance of services or the level of effort varies from the estimate, the Company adjusts its accrued expenses, or its deferred advance payments, accordingly. If the Company subsequently determines that it no longer expects the services associated with a nonrefundable advance payment to be rendered, the remaining portion of that advance payment is charged to expense in the period in which such a determination is made.

Marketable Securities

Marketable securities consist of investments in: U.S. Treasury bills and notes; certificates of deposit; various U.S. governmental agency debt securities; corporate and municipal bonds; and other fixed income securities. The Company places all investments with governmental, industrial or financial institutions whose debt is rated as investment grade.

The Company classifies all available-for-sale marketable securities with maturities greater than one year from the balance sheet date as non-current assets. The Company's investments are classified as available-for-sale and are carried atimplied fair value.

Any unrealized holding gains or losses on debt securities are reported, netImpairment of any tax effects, as a component of other comprehensive earnings (loss) in the condensed consolidated statement of comprehensive earnings. Realized gains and losses are included in interest income, and are determined using the specific identification method for determining the cost of securities sold.Long Lived Assets

Long-lived assets consist primarily of property and equipment, operating lease assets and intangible assets. The carrying value of intangible assets is assessed for impairment annually during the fourth quarter of each year, or more frequently if impairment indicators exist. Impairment indicators include but are not limited to adverse changes in circumstances or other events that indicate the carrying amount of an asset may not be recoverable. Evaluating for impairment requires judgment, including estimating future cash flows, future growth rates and profitability, and the expected life over which cash flows will occur.

For IPR&D assets, the Company adopted Accounting Standards Update (ASU) No. 2016-13, Financial Instruments - Credit Losses (Topic 326) on January 1, 2020, usingalso considers various factors and risks for potential impairment, including the allowance approach. Declinescurrent legal and regulatory environment and the competitive landscape. Adverse clinical trial results, significant delays, or inability to obtain governmental approval, inability to commercialize the product candidate, and the introduction or advancement of competitor products and product candidates could result in partial or full impairment of the related intangible asset. Consequently, the eventual realized value of the IPR&D asset may vary from its fair value below amortized cost related to credit losses (i.e.,at the date of acquisition, and impairment due to credit losses), if any, are includedcharges may occur in future periods. Changes in the condensed consolidated statementCompany's business strategy or adverse changes in market conditions could adversely affect impairment analyses. If indications of earnings. A corresponding allowanceimpairment exist, projected future undiscounted cash flows associated with the asset are compared to the carrying value of the asset, to determine whether the asset's value is established.recoverable. If the estimate of expected credit losses decreases in subsequent periods,impairment is determined, the Company will reversewrites down the credit losses through current period earnings, and adjust accordinglyasset to its estimated fair value; i.e., the allowance (see Note 2 - Recently Issued Accounting Pronouncements).Company recognizes an impairment charge equal to the excess of the carrying value of the long-lived asset over its estimated fair value at the time at which a determination is made.

Share-Based Compensation

Stock Options

The Company recognizes share-based compensation expense over the service period, using the straight-line method. Employee share-based compensation for stock options is measured based on estimated fair value as of the grant date, using the Black-Scholes option-pricing model, in calculatingto compute the fair value of option grants as of the grant date. Forfeitures are accounted for as they occur. The Company uses the following assumptions for estimating the fair value of option grants:

Fair Value of Common Stock—The fair value of common stock underlying the option grants is determined based on observable market prices of the Company’s common stock.

Expected Volatility—Volatility is a measure of the amount by which the Company’s share price has historically fluctuated orand is expected to fluctuate (i.e., expected volatility) during a period. Beginning in the first quarter of 2019, the Company began using the historical volatility of its common stock to measure expected volatility. Prior to the first quarter of 2019, volatility was estimated using the observed volatility of the common stock of several public entities of similar size, complexity, and stage of development, as well as taking into consideration the Company’s actual volatility since the Company’s IPO in 2012.future.

Dividend Yield—The Company has never declared or paid dividends, and has no plans to do so in the foreseeable future. Dividend yield is therefore 0.

Expected Term—This is the period of time during which options are expected to remain unexercised. Options have a maximum contractual term of ten years. Beginning in the first quarter of 2019, the Company began estimating the average expected life of stock options using its historical experience. Prior to the first quarter of 2019, the Company determined the average expected life of stock options according to the “simplified method”, as described in Staff Accounting Bulletin 110, which is the mid-point between the vesting date and the end of the contractual term.

Risk-Free Interest Rate—This is the observed U.S. Treasury Note rate, as of the week each option grant is issued, with a term that most closely resembles the expected term of the option.

Expected Forfeiture Rate—Forfeitures are accounted for as they occur.

Restricted Stock Units (RSUs)

Compensation expense is recorded based on amortizing the fair market value as of the date of the grant over the implied service period. RSUs generally vest one year from the date of the grant and are subject to continued service requirements.

Performance Stock Units (PSUs)

Performance-Based Awards