| (Mark One) | |||

| QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||

| For the quarterly period ended | September 30, | ||

| OR | |||

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||

| For the transition period from to | |||

Commission file number: 001-33137

EMERGENT BIOSOLUTIONS INC.

(Exact Name of Registrant as Specified in Its Charter)

| Delaware | 14-1902018 | ||

(State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification No.) | ||

| 400 Professional Drive Suite 400 | |||

| Gaithersburg, | Maryland | 20879 | |

| (Address and zip code of Principal Executive Offices) | |||

(Registrant's Telephone Number, Including Area Code)

| Securities registered pursuant to Section 12(b) of the Act | ||

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, Par Value $0.001 per share | EBS | New York Stock Exchange |

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.☒Yes☐No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). ☒Yes☐No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ☒ | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ | Smaller reporting company | ☐ |

| Emerging growth company | ☐ | ||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No

☒

As of October 27, 2017,30, 2019, the registrant had 41,395,39851,623,596 shares of common stock outstanding.

Emergent BioSolutions Inc.

Index to Form 10-Q

| Page No. | ||

EMERGENT BIOSOLUTIONS INC.

PART I. FINANCIAL INFORMATION

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This quarterly report on Form 10-Q and the documents we incorporate by reference include forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical fact, including statements regarding the future earnings and performance of Emergent BioSolutions Inc. or any of our businesses, our strategy, future operations, future financial position, future revenues, projected costs, prospects, plans and objectives of management, are forward-looking statements. We generally identify forward-looking statements by using words like "will","will," "believes," "expects," "anticipates," "intends," "plans," "forecasts," "estimates" and similar expressions in conjunction with, among other things, discussions of financial performance or financial condition, growth strategy, product sales, manufacturing capabilities, product development, regulatory approvals or expenditures. These forward-looking statements are based on our current intentions, beliefs and expectations regarding future events. We cannot guarantee that any forward-looking statement will be accurate. You should realize that if underlying assumptions prove inaccurate or unknown risks or uncertainties materialize, actual results could differ materially from our expectations. You are, therefore, cautioned not to place undue reliance on any forward-looking statement. Any forward-looking statement speaks only as of the date on which such statement is made, and, except as required by law, we do not undertake to update any forward-looking statement to reflect new information, events or circumstances.

There are a number of important factors that could cause our actual results to differ materially from those indicated by such forward-looking statements, including, among others:

appropriations for the procurement of our products addresssing public health threats (PHTs);

the continued exercise of discretion by the Biomedical Advanced Research and Development Authority (BARDA) to procure additional doses of AV7909 (anthrax vaccine adsorbed with adjuvant) in reliance on the company’s pre-Emergency Use Authorization (pre-EUA) submission to the U.S. Food and Drug Administration (FDA);

| • |

| our ability to perform under our contracts with the U.S. government (USG) related to BioThrax, our AV7909 product candidate, and our other public health threat products, including the timing of and specifications relating to deliveries; |

| • | our |

the availability of funding for our USG grants and contracts;

our ability to secure follow-on procurement contracts for our PHTs that are under procurement contracts that have expired or will be expiring;

| • |

| our ability and the ability of our |

our ability to identify and acquire companies, businesses, products or product candidates that satisfy our selection criteria;

| our ability to obtain and maintain regulatory approvals for our product candidates and the timing of any such approvals; |

EMERGENT BIOSOLUTIONS INC.

the procurement of products by USG entities under regulatory exemptions prior to approval by the FDA and corresponding procurement by government entities outside of the United States under regulatory exemptions prior to approval by the corresponding regulatory authorities in the applicable country; the success of our commercialization, marketing and manufacturing capabilities and strategy; and the accuracy of our estimates regarding future revenues, expenses, capital requirements and needs for additional financing. |

The foregoing sets forth many, but not all, of the factors that could cause actual results to differ from our expectations in any forward-looking statement. New factors emerge from time to time and it is not possible for management to predict all such factors, nor can it assess the impact of any such factor on the business or the extent to which any factor, or combination of factors, may cause results to differ materially from those contained in any forward-looking statement. You should consider this cautionary statement, the risk factors identified in the section entitled "Risk Factors" in this quarterly report on Form 10-Q and the risk factors identified in our other periodic reports filed with the Securities and Exchange Commission (SEC) when evaluating our forward-looking statements.

References in this report to “Emergent,” the “Company,” “we,” “us,” and “our” refer to Emergent BioSolutions Inc. and its consolidated subsidiaries.

NOTE REGARDING TRADENAMES

BioThrax® (Anthrax Vaccine Adsorbed), RSDL® (Reactive Skin Decontamination Lotion Kit), BAT® (Botulism Antitoxin Heptavalent (A,B,C,D,E,F,G)-(Equine)), Anthrasil® (Anthrax Immune Globulin Intravenous (Human)), VIGIV (Vaccinia Immune Globulin Intravenous (Human)), Trobigard® (atropine sulfate, obidoxime chloride), ACAM2000® (Smallpox (Vaccinia) Vaccine, Live), Vivotif® (Typhoid Vaccine Live Oral Ty21a), Vaxchora® (Cholera Vaccine, Live, Oral), NARCAN® (naloxone HCI) Nasal Spray and any and all Emergent brands, products, services and feature names, logos and slogans are trademarks or registered trademarks of Emergent or its subsidiaries in the United States or other countries. All other brands, products, services and feature names or trademarks are the property of their respective owners.

ITEM 1.FINANCIAL STATEMENTS

| Emergent BioSolutions Inc. and Subsidiaries | ||||||||

| (in thousands, except share and per share data) | ||||||||

| September 30, 2017 | December 31, 2016 | |||||||

| ASSETS | (unaudited) | |||||||

| Current assets: | ||||||||

| Cash and cash equivalents | $ | 340,991 | $ | 271,513 | ||||

| Restricted cash | 1,043 | - | ||||||

| Accounts receivable, net | 129,357 | 138,478 | ||||||

| Inventories | 68,889 | 74,002 | ||||||

| Income tax receivable, net | - | 9,996 | ||||||

| Prepaid expenses and other current assets | 15,754 | 16,229 | ||||||

| Total current assets | 556,034 | 510,218 | ||||||

| Property, plant and equipment, net | 386,457 | 376,448 | ||||||

| Intangible assets, net | 29,202 | 33,865 | ||||||

| Goodwill | 41,001 | 41,001 | ||||||

| Deferred tax assets, net | 4,864 | 6,096 | ||||||

| Other assets | 6,644 | 2,483 | ||||||

| Total assets | $ | 1,024,202 | $ | 970,111 | ||||

| LIABILITIES AND STOCKHOLDERS' EQUITY | ||||||||

| Current liabilities: | ||||||||

| Accounts payable | $ | 30,111 | $ | 34,649 | ||||

| Accrued expenses and other current liabilities | 3,918 | 6,368 | ||||||

| Accrued compensation | 32,626 | 34,537 | ||||||

| Notes payable | - | 20,000 | ||||||

| Contingent consideration, current portion | 2,393 | 3,266 | ||||||

| Income taxes payable | 1,875 | - | ||||||

| Deferred revenue, current portion | 4,509 | 7,036 | ||||||

| Total current liabilities | 75,432 | 105,856 | ||||||

| Contingent consideration, net of current portion | 9,398 | 9,919 | ||||||

| Long-term indebtedness | 248,994 | 248,094 | ||||||

| Deferred revenue, net of current portion | 24,966 | 8,433 | ||||||

| Other liabilities | 1,702 | 1,604 | ||||||

| Total liabilities | 360,492 | 373,906 | ||||||

| Stockholders' equity: | ||||||||

| Preferred stock, $0.001 par value; 15,000,000 shares authorized, 0 shares issued and outstanding at both September 30, 2017 and December 31, 2016 | - | - | ||||||

| Common stock, $0.001 par value; 200,000,000 shares authorized, 41,807,978 shares issued and 41,382,429 shares outstanding at September 30, 2017; 40,996,890 shares issued and 40,574,060 shares outstanding at December 31, 2016 | 41 | 41 | ||||||

| Treasury stock, at cost, 425,549 and 422,830 common shares at September 30, 2017 and December 31, 2016, respectively | (6,503 | ) | (6,420 | ) | ||||

| Additional paid-in capital | 370,855 | 352,435 | ||||||

| Accumulated other comprehensive loss | (3,815 | ) | (4,331 | ) | ||||

| Retained earnings | 303,132 | 254,480 | ||||||

| Total stockholders' equity | 663,710 | 596,205 | ||||||

| Total liabilities and stockholders' equity | $ | 1,024,202 | $ | 970,111 | ||||

Emergent BioSolutions Inc.

(unaudited, in millions, except per share amounts)

| (in thousands, except share and per share data) | ||||||||||||||||

| Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||

| 2017 | 2016 | 2017 | 2016 | |||||||||||||

| (Unaudited) | (Unaudited) | |||||||||||||||

| Revenues: | ||||||||||||||||

| Product sales | $ | 114,296 | $ | 96,698 | $ | 259,875 | $ | 208,785 | ||||||||

| Contract manufacturing | 18,912 | 14,712 | 52,700 | 32,455 | ||||||||||||

| Contracts and grants | 16,226 | 31,504 | 54,489 | 95,879 | ||||||||||||

| Total revenues | 149,434 | 142,914 | 367,064 | 337,119 | ||||||||||||

| Operating expenses: | ||||||||||||||||

| Cost of product sales and contract manufacturing | 44,503 | 39,560 | 125,449 | 93,025 | ||||||||||||

| Research and development | 22,659 | 27,188 | 68,886 | 81,173 | ||||||||||||

| Selling, general and administrative | 34,503 | 40,688 | 101,521 | 108,328 | ||||||||||||

| Income from operations | 47,769 | 35,478 | 71,208 | 54,593 | ||||||||||||

| Other income (expense): | ||||||||||||||||

| Interest income | 637 | 358 | 1,593 | 764 | ||||||||||||

| Interest expense | (1,991 | ) | (2,049 | ) | (5,734 | ) | (5,082 | ) | ||||||||

| Other expense, net | (101 | ) | (234 | ) | (387 | ) | (176 | ) | ||||||||

| Total other expense, net | (1,455 | ) | (1,925 | ) | (4,528 | ) | (4,494 | ) | ||||||||

| Income from continuing operations before provision for income taxes | 46,314 | 33,553 | 66,680 | 50,099 | ||||||||||||

| Provision for income taxes | 12,763 | 13,165 | 18,028 | 19,861 | ||||||||||||

| Net income from continuing operations | 33,551 | 20,388 | 48,652 | 30,238 | ||||||||||||

| Net income (loss) from discontinued operations | - | 952 | - | (15,854 | ) | |||||||||||

| Net income | $ | 33,551 | $ | 21,340 | $ | 48,652 | $ | 14,384 | ||||||||

| Net income per share from continuing operations - basic | $ | 0.81 | $ | 0.50 | $ | 1.19 | $ | 0.75 | ||||||||

| Net income (loss) per share from discontinued operations - basic | - | 0.02 | - | (0.40 | ) | |||||||||||

| Net income per share - basic | $ | 0.81 | $ | 0.52 | $ | 1.19 | $ | 0.35 | ||||||||

| Net income per share from continuing operations - diluted | $ | 0.68 | $ | 0.43 | $ | 1.03 | $ | 0.68 | ||||||||

| Net income (loss) per share from discontinued operations - diluted | - | 0.02 | - | (0.32 | ) | |||||||||||

| Net income per share - diluted (1) | $ | 0.68 | $ | 0.45 | $ | 1.03 | $ | 0.36 | ||||||||

| Weighted-average number of shares - basic | 41,222,504 | 40,465,423 | 40,989,813 | 40,071,730 | ||||||||||||

| Weighted-average number of shares - diluted | 50,467,829 | 49,440,313 | 50,090,088 | 48,826,597 | ||||||||||||

| September 30, 2019 | December 31, 2018 | ||||||

| ASSETS | |||||||

| Current assets: | |||||||

| Cash and cash equivalents | $ | 139.2 | $ | 112.2 | |||

| Restricted cash | 0.2 | 0.2 | |||||

| Accounts receivable, net | 281.2 | 262.5 | |||||

| Inventories | 230.2 | 205.8 | |||||

| Prepaid expenses and other current assets | 49.2 | 40.1 | |||||

| Total current assets | 700.0 | 620.8 | |||||

| Property, plant and equipment, net | 529.1 | 510.2 | |||||

| Intangible assets, net | 727.7 | 761.6 | |||||

| In-process research and development | 41.0 | 50.0 | |||||

| Goodwill | 268.6 | 259.7 | |||||

| Other assets | 67.4 | 27.1 | |||||

| Total assets | $ | 2,333.8 | $ | 2,229.4 | |||

| LIABILITIES AND STOCKHOLDERS' EQUITY | |||||||

| Current liabilities: | |||||||

| Accounts payable | $ | 91.3 | $ | 80.7 | |||

| Accrued expenses | 51.8 | 30.7 | |||||

| Contingent consideration, current portion | 55.7 | 5.6 | |||||

| Accrued compensation | 55.8 | 58.2 | |||||

| Debt, current portion | 10.1 | 10.1 | |||||

| Other current liabilities | 10.6 | 15.1 | |||||

| Total current liabilities | 275.3 | 200.4 | |||||

| Contingent consideration | 14.5 | 54.4 | |||||

| Debt | 813.3 | 784.5 | |||||

| Deferred tax liability | 61.1 | 67.5 | |||||

| Contract liabilities | 81.6 | 62.5 | |||||

| Other liabilities | 53.0 | 49.2 | |||||

| Total liabilities | $ | 1,298.8 | $ | 1,218.5 | |||

| Commitments and contingencies (Notes 8 & 16) | |||||||

| Stockholders' equity: | |||||||

| Preferred stock, $0.001 par value; 15.0 shares authorized, no shares issued or outstanding at both 2019 and 2018 | — | — | |||||

| Common stock, $0.001 par value; 200.0 shares authorized, 52.8 shares issued and 51.6 shares outstanding at 2019; 52.4 shares issued and 51.2 shares outstanding at 2018 | 0.1 | 0.1 | |||||

| Treasury stock, at cost, 1.2 common shares at both 2019 and 2018 | (39.7 | ) | (39.6 | ) | |||

| Additional paid-in capital | 708.8 | 688.6 | |||||

| Accumulated other comprehensive loss | (9.1 | ) | (5.5 | ) | |||

| Retained earnings | 374.9 | 367.3 | |||||

| Total stockholders' equity | 1,035.0 | 1,010.9 | |||||

| Total liabilities and stockholders' equity | $ | 2,333.8 | $ | 2,229.4 | |||

Emergent BioSolutions Inc.

Condensed Consolidated Statements of Operations

(unaudited, in millions, except per share" footnote for details on calculation.

| Emergent BioSolutions Inc. and Subsidiaries | ||||||||||||||||

| (in thousands) | ||||||||||||||||

| Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||

| 2017 | 2016 | 2017 | 2016 | |||||||||||||

| (Unaudited) | (Unaudited) | |||||||||||||||

| Net income | $ | 33,551 | $ | 21,340 | $ | 48,652 | $ | 14,384 | ||||||||

| Foreign currency translations, net of tax | (296 | ) | (492 | ) | 516 | (859 | ) | |||||||||

| Comprehensive income | $ | 33,255 | $ | 20,848 | $ | 49,168 | $ | 13,525 | ||||||||

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||

| 2019 | 2018 | 2019 | 2018 | ||||||||||||

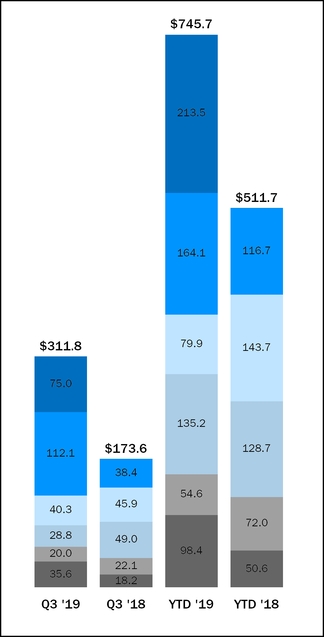

| Revenues: | |||||||||||||||

| Product sales, net | $ | 256.2 | $ | 133.3 | $ | 592.7 | $ | 389.1 | |||||||

| Contract manufacturing | 20.0 | 22.1 | 54.6 | 72.0 | |||||||||||

| Contracts and grants | 35.6 | 18.2 | 98.4 | 50.6 | |||||||||||

| Total revenues | 311.8 | 173.6 | 745.7 | 511.7 | |||||||||||

| Operating expenses: | |||||||||||||||

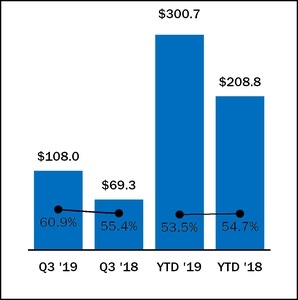

| Cost of product sales and contract manufacturing | 108.0 | 69.3 | 300.7 | 208.8 | |||||||||||

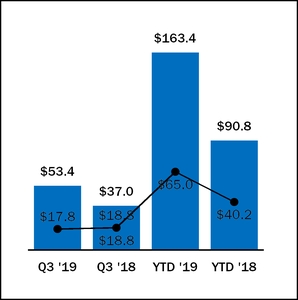

| Research and development | 53.4 | 37.0 | 163.4 | 90.8 | |||||||||||

| Selling, general and administrative | 65.0 | 42.1 | 201.3 | 121.8 | |||||||||||

| Amortization of intangible assets | 14.7 | 3.9 | 43.9 | 11.7 | |||||||||||

| Total operating expenses | 241.1 | 152.3 | 709.3 | 433.1 | |||||||||||

| Income from operations | 70.7 | 21.3 | 36.4 | 78.6 | |||||||||||

| Other income (expense): | |||||||||||||||

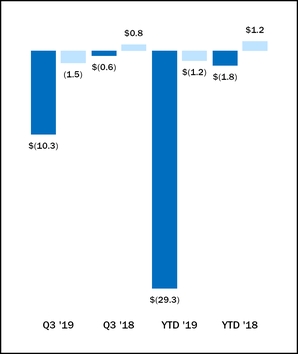

| Interest expense | (10.3 | ) | (0.6 | ) | (29.3 | ) | (1.8 | ) | |||||||

| Other (expense) income, net | (1.5 | ) | 0.8 | (1.2 | ) | 1.2 | |||||||||

| Total other income (expense), net | (11.8 | ) | 0.2 | (30.5 | ) | (0.6 | ) | ||||||||

| Income before income taxes | 58.9 | 21.5 | 5.9 | 78.0 | |||||||||||

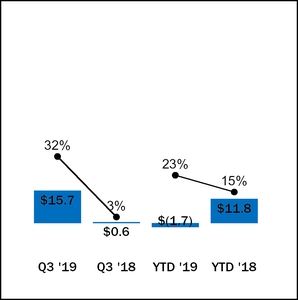

| Income tax expense (benefit) | 15.7 | 0.6 | (1.7 | ) | 11.8 | ||||||||||

| Net income | $ | 43.2 | $ | 20.9 | $ | 7.6 | $ | 66.2 | |||||||

| Net income per common share | |||||||||||||||

| Basic | $ | 0.84 | $ | 0.42 | $ | 0.15 | $ | 1.33 | |||||||

| Diluted | $ | 0.83 | $ | 0.41 | $ | 0.15 | $ | 1.29 | |||||||

| Shares used in computing income per share | |||||||||||||||

| Basic | 51.6 | 50.1 | 51.4 | 49.9 | |||||||||||

| Diluted | 52.3 | 51.5 | 52.3 | 51.2 | |||||||||||

Emergent BioSolutions Inc.

Condensed Consolidated Statements of these consolidated financial statements.Comprehensive Income

(unaudited, in millions)

| (in thousands) | ||||||||

| Nine Months Ended September 30, | ||||||||

| 2017 | 2016 | |||||||

| Cash flows from operating activities: | (Unaudited) | |||||||

| Net income | $ | 48,652 | $ | 14,384 | ||||

| Adjustments to reconcile to net cash provided by (used in) operating activities: | ||||||||

| Stock-based compensation expense | 11,805 | 14,527 | ||||||

| Depreciation and amortization | 29,899 | 28,155 | ||||||

| Income taxes | 18,618 | 4,814 | ||||||

| Change in fair value of contingent consideration | 1,350 | (1,253 | ) | |||||

| Debt issuance costs | (1,426 | ) | - | |||||

| Abandonment of long-lived assets | - | 3,749 | ||||||

| Excess tax benefits from stock-based compensation | - | (10,825 | ) | |||||

| Other | 703 | 2,467 | ||||||

| Changes in operating assets and liabilities: | ||||||||

| Accounts receivable | 9,411 | 45,035 | ||||||

| Inventories | 5,113 | (16,183 | ) | |||||

| Income taxes | (5,515 | ) | (10,072 | ) | ||||

| Prepaid expenses and other assets | (2,157 | ) | (3,146 | ) | ||||

| Accounts payable | 2,965 | (1,305 | ) | |||||

| Accrued expenses and other liabilities | (2,334 | ) | (1,699 | ) | ||||

| Accrued compensation | (1,902 | ) | (152 | ) | ||||

| Provision for chargebacks | - | 103 | ||||||

| Deferred revenue | 14,006 | (1,348 | ) | |||||

| Net cash provided by operating activities | 129,188 | 67,251 | ||||||

| Cash flows from investing activities: | ||||||||

| Purchases of property, plant and equipment and other | (42,381 | ) | (56,243 | ) | ||||

Net cash used in investing activities | (42,381 | ) | (56,243 | ) | ||||

| Cash flows from financing activities: | ||||||||

| Issuance of common stock upon exercise of stock options | 10,799 | 14,981 | ||||||

| Excess tax benefits from stock-based compensation | - | 10,825 | ||||||

| Taxes paid on behalf of employees for equity activity | (4,184 | ) | (4,590 | ) | ||||

| Payments of notes payable | (20,000 | ) | - | |||||

| Distribution of Aptevo | - | (45,000 | ) | |||||

| Contingent consideration payments | (2,744 | ) | (1,226 | ) | ||||

| Restricted cash | (1,043 | ) | - | |||||

| Purchase of treasury stock | (83 | ) | - | |||||

| Net cash used in financing activities | (17,255 | ) | (25,010 | ) | ||||

| Effect of exchange rate changes on cash and cash equivalents | (74 | ) | 139 | |||||

| Net increase (decrease) in cash and cash equivalents | 69,478 | (13,863 | ) | |||||

| Cash and cash equivalents at beginning of period | 271,513 | 312,795 | ||||||

| Cash and cash equivalents at end of period | $ | 340,991 | $ | 298,932 | ||||

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||

| 2019 | 2018 | 2019 | 2018 | ||||||||||||

| Net income | $ | 43.2 | $ | 20.9 | $ | 7.6 | $ | 66.2 | |||||||

| Other comprehensive (loss) income, net of tax: | |||||||||||||||

| Foreign currency translation | (1.1 | ) | (0.2 | ) | 0.6 | (1.0 | ) | ||||||||

| Unrealized losses on hedging activities | (3.0 | ) | — | (4.2 | ) | — | |||||||||

| Total other comprehensive loss | (4.1 | ) | (0.2 | ) | (3.6 | ) | (1.0 | ) | |||||||

| Comprehensive income | $ | 39.1 | $ | 20.7 | $ | 4.0 | $ | 65.2 | |||||||

Emergent BioSolutions Inc.

Condensed Consolidated Statements of these consolidated financial statements.Cash Flows

(unaudited, in millions)

| Nine Months Ended September 30, | |||||||

| 2019 | 2018 | ||||||

| Cash flows provided by operating activities: | |||||||

| Net income | $ | 7.6 | $ | 66.2 | |||

| Adjustments to reconcile net income to net cash provided by operating activities: | |||||||

| Share-based compensation expense | 21.0 | 16.7 | |||||

| Depreciation and amortization | 82.8 | 37.1 | |||||

| Amortization of deferred financing costs | 2.2 | — | |||||

| Deferred income taxes | (5.7 | ) | 12.8 | ||||

| Change in fair value of contingent consideration, net | 12.4 | 1.9 | |||||

| Other | 0.7 | 1.5 | |||||

| Changes in operating assets and liabilities: | |||||||

| Accounts receivable | (18.6 | ) | 66.5 | ||||

| Inventories | (24.4 | ) | 17.1 | ||||

| Prepaid expenses and other assets | (36.5 | ) | (16.1 | ) | |||

| Accounts payable | 2.5 | (5.7 | ) | ||||

| Accrued expenses | 5.2 | 2.5 | |||||

| Accrued compensation | (2.4 | ) | 3.9 | ||||

| Contract liabilities | 19.1 | 3.2 | |||||

| Net cash provided by operating activities: | 65.9 | 207.6 | |||||

| Cash flows used in investing activities: | |||||||

| Purchases of property, plant and equipment and other | (50.8 | ) | (51.3 | ) | |||

| Milestone payment from asset acquisition | (10.0 | ) | — | ||||

| Proceeds from sale of assets | — | 2.6 | |||||

| Net cash used in investing activities: | (60.8 | ) | (48.7 | ) | |||

| Cash flows provided by provided by financing activities: | |||||||

| Proceeds from revolving credit facility | 130.0 | — | |||||

| Principal payments on revolving credit facility | (95.0 | ) | — | ||||

| Principal payments on term loan facility | (8.4 | ) | — | ||||

| Issuances of stock under share-based benefit plans | 5.7 | 11.4 | |||||

| Taxes paid on behalf of employees for equity activity | (6.6 | ) | (6.3 | ) | |||

| Contingent consideration payments | (3.7 | ) | (2.2 | ) | |||

| Purchase of treasury stock | — | (0.1 | ) | ||||

| Net cash provided by financing activities: | 22.0 | 2.8 | |||||

| Effect of exchange rate changes on cash, cash equivalents and restricted cash | (0.1 | ) | (0.6 | ) | |||

| Net increase in cash, cash equivalents and restricted cash | 27.0 | 161.1 | |||||

| Cash, cash equivalents and restricted cash at beginning of period | 112.4 | 179.3 | |||||

| Cash, cash equivalents and restricted cash at end of period | $ | 139.4 | $ | 340.4 | |||

See accompanying notes.

Emergent BioSolutions Inc.

Condensed Consolidated Statements of Changes in Stockholders' Equity

(unaudited, in millions)

| $0.001 Par Value Common Stock | Additional Paid-In Capital | Treasury Stock | Accumulated Other Comprehensive Loss | Retained Earnings | Total Stockholders' Equity | |||||||||||||||||||||||||

| Shares | Amount | Shares | Amount | |||||||||||||||||||||||||||

| Balance at December 31, 2018 | 52.4 | $ | 0.1 | $ | 688.6 | (1.2 | ) | $ | (39.6 | ) | $ | (5.5 | ) | $ | 367.3 | $ | 1,010.9 | |||||||||||||

| Employee equity plans activity | 0.4 | — | 20.2 | — | (0.1 | ) | — | — | 20.1 | |||||||||||||||||||||

| Net income | — | — | — | — | — | — | 7.6 | 7.6 | ||||||||||||||||||||||

| Other comprehensive income | — | — | — | — | — | (3.6 | ) | — | (3.6 | ) | ||||||||||||||||||||

| Balance at September 30, 2019 | 52.8 | $ | 0.1 | $ | 708.8 | (1.2 | ) | $ | (39.7 | ) | $ | (9.1 | ) | $ | 374.9 | $ | 1,035.0 | |||||||||||||

| Balance at June 30, 2019 | 52.7 | $ | 0.1 | $ | 701.8 | (1.2 | ) | $ | (39.7 | ) | $ | (5.0 | ) | $ | 331.7 | $ | 988.9 | |||||||||||||

| Employee equity plans activity | 0.1 | — | 7.0 | — | — | — | 7.0 | |||||||||||||||||||||||

| Net income | — | — | — | — | — | — | 43.2 | 43.2 | ||||||||||||||||||||||

| Other comprehensive loss | — | — | — | — | — | (4.1 | ) | — | (4.1 | ) | ||||||||||||||||||||

| Balance at September 30, 2019 | 52.8 | $ | 0.1 | $ | 708.8 | (1.2 | ) | $ | (39.7 | ) | $ | (9.1 | ) | $ | 374.9 | $ | 1,035.0 | |||||||||||||

| Balance at December 31, 2017 | 50.6 | $ | 0.1 | $ | 618.3 | (1.2 | ) | $ | (39.5 | ) | $ | (3.8 | ) | $ | 337.1 | $ | 912.2 | |||||||||||||

| Adoption of new revenue accounting standard (ASC 606), net of tax | — | — | — | — | — | — | (32.5 | ) | (32.5 | ) | ||||||||||||||||||||

| Balance at January 1, 2018 | 50.6 | 0.1 | 618.3 | (1.2 | ) | (39.5 | ) | (3.8 | ) | 304.6 | 879.7 | |||||||||||||||||||

| Employee equity plans activity | 0.8 | — | 21.8 | — | (0.1 | ) | — | — | 21.7 | |||||||||||||||||||||

| Net income | — | — | — | — | — | — | 66.2 | 66.2 | ||||||||||||||||||||||

| Other comprehensive loss | — | — | — | — | — | (1.0 | ) | — | (1.0 | ) | ||||||||||||||||||||

| Balance at September 30, 2018 | 51.4 | $ | 0.1 | $ | 640.1 | (1.2 | ) | $ | (39.6 | ) | $ | (4.8 | ) | $ | 370.8 | $ | 966.6 | |||||||||||||

| Balance at June 30, 2018 | 51.2 | $ | 0.1 | $ | 632.6 | (1.2 | ) | $ | (39.6 | ) | $ | (4.6 | ) | $ | 349.9 | $ | 938.4 | |||||||||||||

| Employee equity plans activity | 0.2 | — | 7.5 | — | — | — | — | 7.5 | ||||||||||||||||||||||

| Net income | — | — | — | — | — | — | 20.9 | 20.9 | ||||||||||||||||||||||

| Other comprehensive loss | — | — | — | — | — | (0.2 | ) | — | (0.2 | ) | ||||||||||||||||||||

| Balance at September 30, 2018 | 51.4 | $ | 0.1 | $ | 640.1 | (1.2 | ) | $ | (39.6 | ) | $ | (4.8 | ) | $ | 370.8 | $ | 966.6 | |||||||||||||

See accompanying notes.

EMERGENT BIOSOLUTIONS INC. AND SUBSIDIARIES

1.Summary Business

Emergent is a global life sciences company focused on providing specialty products for civilian and military populations that address accidental, deliberate and naturally occurring PHTs.

The Company is focused on innovative preparedness and response products and solutions addressing the following four distinct PHT categories: Chemical, Biological, Radiological, Nuclear and Explosives (CBRNE); emerging infectious diseases (EID); traveler health; and opioids. The USG is the Company's largest customer and provides the Company with substantial funding for the development of significant accounting policiesa number of the Company's product candidates.

The majority of the Company's revenue comes from the following products and product candidates:

| • | Vaccines - AV7909® (Anthrax Vaccine Absorbed with Adjuvant), BioThrax® (Anthrax Vaccine Adsorbed), ACAM2000® (Smallpox (Vaccinia) Vaccine, Live), Vaxchora® (Cholera Vaccine, Live, Oral), and Vivotif® (Typhoid Vaccine, Live, Oral Ty21a). |

| • | Devices - NARCAN® (naloxone HCl) Nasal Spray for opioid overdose, and RSDL® (Reactive Skin Decontamination Lotion Kit). |

| • | Therapeutics - raxibacumab (Anthrax Monoclonal antibody therapeutic for anthrax),Anthrasil®( Anthrax Immune Globulin Intravenous (Human)), BAT®(Botulism Antitoxin Heptavalent), and VIGIV (Vaccinia Immune Globulin Intravenous (Human) therapeutic) for complications from smallpox vaccinations. |

The Company also generates revenue from contract development and manufacturing services on a clinical and commercial (small and large) scale by providing such services to the pharmaceutical and biotechnology industry. These services include process development and bulk drug substance and drug product manufacturing of biologics, fill/finish formulation and analytical development services for injectable and other sterile products, inclusive of process design, technical transfer, manufacturing validations, aseptic filling, lyophilization, final packaging and stability studies, as well as manufacturing of vial and pre-filled syringe formats across bacterial, viral and mammalian therapy technology platforms.

We operate as 1 operating segment.

2. Basis of Presentation and Principles of Consolidation

Basis of presentation and consolidation

Presentation

The accompanying unaudited condensed consolidated financial statements include the accounts of Emergent BioSolutions Inc. ("Emergent" or the "Company") and its wholly owned and majority ownedwholly-owned subsidiaries. All significant intercompany accounts and transactions have been eliminated in consolidation. The unaudited consolidated financial statements included herein have been prepared in accordance with U.S. generally accepted accounting principles (GAAP) for interim financial information and in accordance with the instructions to Form 10-Q and Article 10 of Regulation S-X issued by the Securities and Exchange Commission ("SEC").SEC. Certain information and footnote disclosures normally included in consolidated financial statements prepared in accordance with U.S. generally accepted accounting principlesGAAP have been condensed or omitted pursuant to such rules and regulations. These consolidated financial statements should be read in conjunction with the audited consolidated financial statements and notes thereto contained in the Company's Annual Report on Form 10-K for the year ended December 31, 2016,2018, as filed with the SEC.

Significant Accounting Policies

During the three and nine months ended September 30, 2017,2019, there have been no significant changes to the Company's summary of significant accounting policies contained in the Company's Annual Report on Form 10-K for the year ended December 31, 2016,2018, as filed with the SEC, except for revenue recognition associated with the Biomedical Advanced Researchrecently adopted accounting standards.

Fair Value Measurements

Separate disclosure is required for assets and Development Authority ("BARDA") procurement contract for BioThrax (the "BARDA BioThrax Contract") and the modification of the BARDA development and procurement contract for the NuThrax product candidate (the "BARDA NuThrax Contract").

EMERGENT BIOSOLUTIONS INC.

(unaudited, in millions, except share and per share amounts)

at fair value (Note 3). As of September 30, 2019 and December 31, 2018, the Company entered into a contract with BARDA, valuedhad no other significant assets or liabilities that were measured at $100 million,fair value.

Reclassifications

Certain prior year amounts have been reclassified for the delivery of BioThrax to the SNS over a two-year period of performance. In conjunctionconsistency with the signing of this contract, the Company entered into a modification to its BARDA NuThrax Contract that increases the number of doses of NuThrax to be delivered under the base period from two million to three million doses with a commensurate reduction in dose price for the initial deliveries. The modification also provides for a discountcurrent year presentation. These reclassifications had no effect on the sales price for doses to be procured duringreported results of operations. Interest income, which was previously reported as a separate line item on the option period up to $100 million. As a resultcondensed consolidated statement of the modification of the BARDA NuThrax Contract in conjunctionoperations has been combined with execution of the BARDA BioThrax Contract, the Company has determined that the two agreements are linked under the revenue recognition requirements ofother income (expense), net.

Recently Adopted Accounting Pronouncements

Leases

In February 2016, the Financial Accounting Standards Board ("FASB") Topic 605, Revenue Recognition. The Company analyzed these agreements and determined that the units of accounting under the linked agreements are:

SEC Simplification

In August 2018, the SEC issued Final Rule Release No. 33-10532, Disclosure Update and Simplification, which makes a number of changes meant to simplify interim disclosures. The new rule requires a presentation of changes in stockholders’ equity and noncontrolling interest in the form of a reconciliation, for the current and comparative year-to-date interim periods. The Company adopted the new disclosure requirements beginning in its March 31, 2019 Form 10-Q and performedincluded these disclosures in the evaluation required by the standard andcondensed consolidated statements of changes in stockholders' equity. The additional elements of this release did not identify any conditions or events that would have a material impact on the current disclosures inCompany's overall condensed consolidated financial statements.

Tax Effects from Accumulated Other Comprehensive Income

In February 2018, the financial statements. The Company has retrospectively adjustedFASB issued ASU 2018-02, Income Statement—Reporting Comprehensive Income (Topic 220): Reclassification of Certain Tax Effects from Accumulated Other Comprehensive Income. ASU 2018-02 provides the operating and financing sections within the statement of cash flows for the classification of employee taxes paid associated with equity award activities for the nine months ended September 30, 2016. In addition, the Company prospectively adopted the provisionsoption to reclassify certain income tax effects related to the excess tax benefits,Tax Cuts and as a result prior periods were not adjusted. IfJobs Act passed in December of 2017 between accumulated other comprehensive income and retained earnings and also requires additional disclosures. The Company adopted the Company had adopted this provision retrospectively, there would have beennew standard effective January 1, 2019. There was no change to the estimated effective annual tax rateimpact for the three and nine months ended September 30, 2016, but for the nine months ended September 30, 2016, there would have been a tax benefit associated with stock option activityadoption of $3.5 million recorded in the provision for income taxesASU 2018-02 on the Company's statementcondensed consolidated financial statements.

New Accounting Pronouncements

Financial Instruments - Credit Losses

In June 2016, the FASB issued ASU 2016-13, Financial Instruments - Credit Losses. ASU 2016-13 provides guidance on measurement of operations.credit losses on financial instruments that changes the impairment model for most financial assets and certain other instruments, including trade and other receivables, held-to-maturity debt securities and loans, that requires entities to use a new, forward-looking “expected loss” model that is likely to result in the earlier recognition of allowances for losses. The guidance was further amended in January 2019 to clarify or address stakeholders’ specific issues about certain aspects of the amendments in the update and in May 2019 to provide an option to irrevocably elect the fair value option for certain financial assets previously measured on an amortized cost basis. The guidance is effective for annual periods beginning after December 15, 2019, including interim periods within those years, but early adoption is permitted. The Company is currently evaluating the effect that the pronouncement will have on its consolidated financial statements.

EMERGENT BIOSOLUTIONS INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(unaudited, in millions, except share and per share amounts)

Goodwill

In January 2017, the FASB issued ASU No. 2017-01, Business Combinations (Topic 805): Clarifying the Definition of a Business ("ASU No. 2017-01"). ASU No. 2017-01 provides clarification for the definition of a business with the objective of adding guidance and providing a more robust framework to assist entities with evaluating whether transactions should be accounted for as acquisitions (or disposals) of assets or businesses. The new standard will be effective for all annual periods beginning after December 15, 2017. The Company has early adopted ASU 2017-01 and determined the acquisition of raxibacumab, acquired on October 2, 2017, is an asset acquisition. See Note 12 "Subsequent events" for further details regarding this acquisition.

Fair Value Measurements

In August 2018 the FASB issued ASU No. 2018-13, Fair Value Measurement (Topic 820): Disclosure Framework - Changes to the Disclosure Requirements for Fair Value Measurement. This new standard modifies certain disclosure requirements on fair value measurements. This new standard will be effective for the Company on January 1, 2020. The Company is currently evaluating the impact of adopting ASU 2018-13 on its disclosures.

Compensation - Retirement Benefits - Defined Benefit Plans

In August 2018, the FASB issued ASU 2018-14, Compensation - Retirement Benefits - Defined Benefit Plans - General. ASU 2018-14 modifies the disclosure requirements for defined benefit pension plans and other postretirement plans. ASU 2018-14 is effective for all entities for fiscal years ending after December 15, 2020, and earlier adoption is permitted. The Company does not believe thatis currently evaluating the new standard will have a material impact of adopting ASU 2018-14 on its consolidated financial statements.

There are no other recently issued accounting pronouncements that are expected to have a material impact on the Company's financial position, results of operations or cash flows.

Adapt

On October 15, 2018, the Company acquired Adapt, a company focused on developing new treatment options and commercializing products addressing opioid overdose and addiction. Adapt's NARCAN® (naloxone HCl) Nasal Spray marketed product is the first needle-free formulation of naloxone approved by the FDA and Health Canada for the emergency treatment of known or suspected opioid overdose as manifested by respiratory and/or central nervous system depression. This acquisition includes approximately 50 employees, located in the U.S., Canada, and Ireland, including those responsible for supply chain management, research and development, government affairs, and commercial operations. The products and product candidates within Adapt's portfolio are consistent with the Company's mission and expands the Company's core business of addressing public health threats.

Under the acquisition method of accounting, the assets and liabilities of Adapt have been recorded as of October 15, 2018, the acquisition date, at their respective fair values, and combined with those of the Company. As the Company continues to finalize the fair value of assets acquired and liabilities assumed, purchase price adjustments have been recorded and additional purchase price adjustments may be recorded during the measurement period. The Company reflects measurement period adjustments in the period in which the adjustments occur. The adjustments for the nine months ended September 30, 2019 resulted from the receipt of additional financial information associated with certain acquired contract assets and the value of associated contingent purchase consideration. These adjustments did not impact the Company's statements of operations. As of September 30, 2019, certain fair value estimates relating to income taxes could be subject to further adjustment.

The total purchase price, revised for measurement period adjustments is summarized below:

| October 15, 2018 | |||

| Cash | $ | 581.5 | |

| Equity | 37.7 | ||

| Fair value of contingent purchase consideration | 48.0 | ||

| Preliminary purchase consideration | 667.2 | ||

| Adjustments | 1.5 | ||

| Updated purchase consideration | $ | 668.7 | |

EMERGENT BIOSOLUTIONS INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(unaudited, in millions, except share and per share amounts)

The Company issued 733,309 shares of common stock at $60.44 per share, the closing price of Emergent's common stock on October 15, 2018, with a total value of $44.3 million. The $44.3 million value of the common shares issued has been adjusted to a fair value of $37.7 million considering a discount for lack of marketability due to a two-year lock-up period beginning on October 15, 2018. The remaining contingent consideration payable for the acquisition consists of up to $100 million in cash based on the achievement of certain sales milestones through 2022, which the Company has determined had a fair value of $58.6 million as of September 30, 2019 and for the payment of additional consideration based on the collectability of identified acquired contract assets. The fair value of the contingent purchase consideration is based on management’s assessment of the potential future realization of the contingent purchase consideration payments. This assessment is based on inputs that have no observable market inputs (Level 3). The obligation is measured using a discounted cash flow model.

The table below summarizes the preliminary allocation of the purchase price based upon estimated fair values of assets acquired and liabilities assumed at October 15, 2018 updated for measurement period adjustments recorded through September 30, 2019.

| October 15, 2018 | Measurement Period Adjustments | Updated October 15, 2018 | |||||||||

| Estimated fair value of tangible assets acquired and liabilities assumed: | |||||||||||

| Cash | $ | 17.7 | $ | — | $ | 17.7 | |||||

| Accounts receivable | 21.3 | — | 21.3 | ||||||||

| Inventory | 41.4 | — | 41.4 | ||||||||

| Prepaid expenses and other assets | 7.8 | 3.0 | 10.8 | ||||||||

| Accounts payable | (32.2 | ) | — | (32.2 | ) | ||||||

| Accrued expenses and other liabilities | (50.4 | ) | — | (50.4 | ) | ||||||

| Deferred tax liability, net | (62.4 | ) | (0.5 | ) | (62.9 | ) | |||||

| Total estimated fair value of tangible assets acquired and liabilities assumed | (56.8 | ) | 2.5 | (54.3 | ) | ||||||

| Acquired in-process research and development | 41.0 | — | 41.0 | ||||||||

| Acquired intangible assets | 534.0 | — | 534.0 | ||||||||

| Goodwill | 149.0 | (1.0 | ) | 148.0 | |||||||

| Total purchase price | $ | 667.2 | $ | 1.5 | $ | 668.7 | |||||

The Company determined that the estimated acquisition-date fair value of intangible assets was $534.0 million. The estimated fair value was determined using the income approach, which discounts expected future cash flows to present value. The Company has determined the useful life of the NARCAN® Nasal Spray intangible asset to be 15 years. The Company estimated the fair value using a discount rate of 10.5%; which is based on the estimated weighted-average cost of capital for companies with profiles substantially similar to that of Adapt. This is comparable to the estimated internal rate of return for the acquisition and represents the rate that market participants would use to value these intangible assets. The projected cash flows from the NARCAN® Nasal Spray intangible asset were based on key assumptions including: estimates of revenues and operating profits, and risks related to the viability of and potential alternative treatments in any future target markets. The fair value measurements are based on significant unobservable inputs that are developed by the Company using estimates and assumptions of the respective market and market penetration of the acquired company's products.

The intangible asset associated with the in-process research and development (IPR&D) acquired from Adapt is related to a product candidate. Management determined that the estimated acquisition-date fair value of intangible assets related to IPR&D was $41.0 million. The estimated fair value was determined using the income approach, which discounts expected future cash flows to present value. The Company estimated the fair value using a discount rate of 11.0%, which is based on the estimated weighted-average cost of capital for companies with profiles substantially similar to that of Adapt and IPR&D assets at a similar stage of development as the product candidate. This is comparable to the estimated internal rate of return for the acquisition and represents the rate that market participants would use to value the IPR&D. The projected cash flows for the product candidate were based on key assumptions including: estimates of revenues and operating profits, the stage of development of pipeline programs on the acquisition date; the time and resources needed

EMERGENT BIOSOLUTIONS INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(unaudited, in millions, except share and per share amounts)

to complete the development and approval of the product candidate; the life of the potential commercialized product and associated risks, including the inherent difficulties and uncertainties in developing a product candidate, such as obtaining marketing approval from the FDA and other regulatory agencies; and risks related to the viability of and potential for alternative treatments in any future target markets. IPR&D assets are considered to be indefinite-lived until the completion or abandonment of the associated research and development efforts (see Note 7).

The Company determined the fair value of inventory using the comparative sales method, which estimates the expected sales price reduced for all costs expected to be incurred to complete/dispose of the inventory with a profit on those costs.

The Company has recorded $148.0 million in goodwill related to the Adapt acquisition, which is calculated as the purchase price paid in excess of the fair value of the tangible and intangible assets acquired representing the future economic benefits the Company expects to receive as a result of the acquisition. The goodwill created from the Adapt acquisition is associated with early stage pipeline products. Substantially all of the goodwill generated from the Adapt acquisition is not expected to be deductible for tax purposes due to the legal structure of the transaction.

PaxVax

On August 1, 2016,October 4, 2018, the Company completed the spin-offacquisition of Aptevo throughPaxVax, a company focused on developing, manufacturing, and commercializing specialty vaccines that protect against existing and emerging infectious diseases. This acquisition includes Vivotif® (Typhoid Vaccine Live Oral Ty21a), the distributiononly oral vaccine licensed by the FDA for the prevention of 100%typhoid fever, Vaxchora® (Cholera Vaccine, Live, Oral), the only FDA-licensed vaccine for the prevention of cholera, and clinical-stage vaccine candidates targeting chikungunya and other emerging infectious diseases, European-based current good manufacturing practices (cGMP) biologics manufacturing facilities, and approximately 250 employees including those in research and development, manufacturing, and commercial operations with a specialty vaccines salesforce in the U.S. and in select European countries. The products and product candidates within PaxVax's portfolio are consistent with the Company’s mission and will expand the Company’s core business of addressing PHTs. In addition, the acquisition expands the Company's manufacturing infrastructure and related capabilities.

The Company paid cash consideration of $273.1 million for PaxVax. As of the outstanding sharesdate of common stock of Aptevothis filing, the accounting for the PaxVax acquisition is preliminary due to the Company's shareholders (the "Distribution").need to gather data to assess the fair value accounting for taxes. The Distribution was madetable below summarizes the preliminary allocation of the purchase price based upon estimated fair values of assets acquired and liabilities assumed at October 4, 2018 updated for measurement period adjustments recorded through September 30, 2019.

| October 4, 2018 | Measurement Period Adjustments | Updated October 4, 2018 | |||||||||

| Estimated fair value of tangible assets acquired and liabilities assumed: | |||||||||||

| Cash | $ | 9.0 | $ | — | $ | 9.0 | |||||

| Accounts receivable | 4.1 | — | 4.1 | ||||||||

| Inventory | 19.7 | — | 19.7 | ||||||||

| Prepaid expenses and other assets | 12.2 | (0.3 | ) | 11.9 | |||||||

| Property, plant and equipment | 57.8 | — | 57.8 | ||||||||

| Deferred tax assets | 3.8 | (0.2 | ) | 3.6 | |||||||

| Accounts payable | (3.5 | ) | — | (3.5 | ) | ||||||

| Accrued expenses and other liabilities | (33.6 | ) | (0.4 | ) | (34.0 | ) | |||||

| Total estimated fair value of tangible assets acquired and liabilities assumed | 69.5 | (0.9 | ) | 68.6 | |||||||

| Acquired in-process research and development | 9.0 | (9.0 | ) | — | |||||||

| Acquired intangible assets | 133.0 | — | 133.0 | ||||||||

| Goodwill | 61.6 | 9.9 | 71.5 | ||||||||

| Total purchase price | $ | 273.1 | $ | — | $ | 273.1 | |||||

EMERGENT BIOSOLUTIONS INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(unaudited, in millions, except share and per share amounts)

The estimated fair value of the intangible assets acquired for PaxVax's marketed products is a total of $133.0 million. The Company determined the estimated fair value of the intangible assets using the income approach, which is based on the present value of future cash flows. The fair value measurements are based on significant unobservable inputs that are developed by the Company using estimates and assumptions of the respective market and market penetration of the acquired products. The Company has determined that the weighted average useful lives of the intangible assets to be 19 years. The Company estimated the fair value of the Vivotif and Vaxchora intangible assets using a present value discount rate of 14.5% and 15.0%, respectively, which is based on the estimated weighted-average cost of capital for companies with profiles substantially similar to that of PaxVax. This is comparable to the Company's shareholdersestimated internal rate of recordreturn for the acquisition and represents the rate that market participants would use to value these intangible assets. The projected cash flows from these intangible assets were based on key assumptions, including: estimates of revenues and operating profits, and risks related to the viability of and potential alternative treatments in any future target markets.

The intangible asset associated with the IPR&D acquired from PaxVax is related to a product candidate. The Company has adjusted the provisional amounts recognized at the acquisition date to reflect new information obtained about facts and circumstances that existed as of the closeacquisition date that, if known, would have affected the measurement of businessthe amounts recognized as of that date. The Company estimates the fair value based on July 22, 2016 (the "Record Date"),the income approach.

The Company determined the fair value of the inventory using the comparative sales method, which estimates the expected sales price reduced for all costs expected to be incurred to complete/dispose of the inventory with a profit on those costs.

The Company determined the fair value of the property, plant and provided forequipment utilizing both the cost approach and the sales comparison approach. The cost approach is determined by establishing replacement cost of the asset and then subtracting any value that has been lost due to economic obsolescence, functional obsolescence, or physical deterioration. The sales comparison approach values an asset based on the market price of assets with comparable features such shareholdersas design, location, size, construction, materials, use, capacity, specification, operational characteristics and other features or descriptions.

The Company recorded approximately $71.5 million in goodwill related to the PaxVax acquisition, calculated as the purchase price paid in the acquisition that was in excess of the fair value of the tangible and intangible assets acquired representing the future economic benefits the Company expects to receive one share of Aptevo common stock for every two shares of Emergent common stock held as a result of the Record Date.acquisition. The Distribution was intendedgoodwill created from the PaxVax acquisition is associated with early stage pipeline products along with potential contract manufacturing services. The majority of the goodwill generated from the PaxVax acquisition is expected to qualify as a tax-free distributionbe deductible for federal income tax purposes based upon the structure used in the United States. In the aggregate, approximately 20.2 million sharesacquisition.

Impact of Aptevo common stock were distributed to the Company's shareholdersBusiness Acquisitions

The operations of record aseach of the Record Date in the Distribution. After the Distribution, the Company no longer holds shares of Aptevo's common stock. In addition, on August 1, 2016, the Company entered into a non-negotiable, unsecured promissory note with Aptevo to provide an additional $20 million in funding, which the Company paid in January 2017.

| Three months ended September 30, | Nine months ended September 30, | ||||||

| 2019 | 2019 | ||||||

| Revenue | $ | 83.7 | $ | 246.8 | |||

| Operating income | 4.9 | 9.3 | |||||

4. Inventories

The components of inventory are as follows:

| September 30, 2019 | December 31, 2018 | ||||||

| Raw materials and supplies | $ | 69.0 | $ | 51.8 | |||

| Work-in-process | 106.6 | 103.2 | |||||

| Finished goods | 54.6 | 50.8 | |||||

| Total inventories | $ | 230.2 | $ | 205.8 | |||

5. Property, Plant and Equipment

Property, plant and equipment consisted of the following:

| September 30, 2019 | December 31, 2018 | ||||||

| Land and improvements | $ | 46.3 | $ | 44.6 | |||

| Buildings, building improvements and leasehold improvements | 234.6 | 216.2 | |||||

| Furniture and equipment | 310.8 | 293.9 | |||||

| Software | 54.0 | 55.2 | |||||

| Construction-in-progress | 83.4 | 71.8 | |||||

| Property, plant and equipment, gross | 729.1 | 681.7 | |||||

| Accumulated depreciation | (200.0 | ) | (171.5 | ) | |||

| Total property, plant and equipment, net | $ | 529.1 | $ | 510.2 | |||

6. Leases

The Company has been restated. Discontinued operations include resultsoperating leases for corporate offices, research and development facilities and manufacturing facilities. We determine if an arrangement is a lease at inception. Operating leases are included in right-of-use (ROU) assets and liabilities.

ROU assets represent the Company's right to use an underlying asset for the lease term and lease liabilities represent the Company's obligation to make lease payments arising from the lease. Operating lease ROU assets and liabilities are recognized at commencement date based on the present value of Aptevo's business except for certain allocated corporate overhead costs and certain costs associated with transition services provided bylease payments over the lease term. As most of the Company's leases do not provide an implicit rate, the Company uses an incremental borrowing rate based on the information available at commencement date in determining the present value of lease payments. The Company uses an implicit rate when readily determinable. At the beginning of a lease, the operating lease ROU asset also includes any concentrated lease payments expected to Aptevo. These allocated costs remain part of continuing operations. Duebe paid and excludes lease incentives. The Company's lease ROU asset may include options to differences betweenextend or terminate the basis of presentation for discontinued operations and the basis of presentation as a stand-alone company, the financial results of Aptevo included within discontinued operations forlease when it is reasonably certain that the Company may not be indicativewill exercise those options.

Lease expense for lease payments is recognized on a straight-line basis over the lease term. The Company has lease agreements with lease and non-lease components, which are accounted for separately. The Company's leases have remaining lease terms of actual financial results1 year to 15 years, some of Aptevo.which include options to extend the leases for up to 5 years, and some of which include options to terminate the leases within 1 year.

EMERGENT BIOSOLUTIONS INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(unaudited, in millions, except share and per share amounts)

The components of lease expense were as follows:

| Three months ended September 30, | Nine months ended September 30, | ||||||

| 2019 | 2019 | ||||||

| Operating lease cost: | |||||||

| Amortization of right-of-use assets | $ | 0.8 | $ | 2.1 | |||

| Interest on lease liabilities | 0.1 | 0.4 | |||||

| Total operating lease cost | $ | 0.9 | $ | 2.5 | |||

Supplemental balance sheet information related to leases was as follows:

| (In millions, except lease term and discount rate) | Balance Sheet Location | September 30, 2019 | |||

| Operating lease right-of-use assets | Other assets | $ | 19.4 | ||

| Operating lease liabilities, current portion | Other current liabilities | 2.5 | |||

| Operating lease liabilities | Other liabilities | 17.4 | |||

| Total operating lease liabilities | $ | 19.9 | |||

| Operating leases: | |||||

| Weighted Average Remaining Lease Term (years) | 9.3 | ||||

| Weighted Average Discount Rate | 4.2 | % | |||

7. Intangible Assets

The Company's intangible assets consist of products acquired via business combinations or asset acquisitions. The following table summarizes results from discontinued operationsthe carrying amount of Aptevo includedthe Company's intangible assets and goodwill, net of accumulated amortization:

| September 30, 2019 | ||||||||||||||||||||||||

| Estimated Life (years) | Cost | Measurement Period Adjustment | Additions | Gross Total | Accumulated Amortization | Net | ||||||||||||||||||

| Intangible assets, net | 5-22 | $ | 818.4 | $ | — | $ | 10.0 | $ | 828.4 | $ | (100.7 | ) | $ | 727.7 | ||||||||||

| IPR&D | indefinite | 50.0 | (9.0 | ) | — | 41.0 | — | 41.0 | ||||||||||||||||

| Goodwill | indefinite | 259.7 | 8.9 | — | 268.6 | — | 268.6 | |||||||||||||||||

| December 31, 2018 | ||||||||||||||||||||||||

| Estimated Life (years) | Cost | Measurement Period Adjustment | Additions | Gross Total | Accumulated Amortization | Net | ||||||||||||||||||

| Intangible assets, net | 5-22 | $ | 151.4 | $ | — | $ | 667.0 | $ | 818.4 | $ | (56.8 | ) | $ | 761.6 | ||||||||||

| IPR&D | indefinite | 50.0 | — | — | 50.0 | — | 50.0 | |||||||||||||||||

| Goodwill | indefinite | 49.1 | — | 210.6 | 259.7 | — | 259.7 | |||||||||||||||||

EMERGENT BIOSOLUTIONS INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(unaudited, in millions, except share and per share amounts)

During the consolidated statements of operations for the three and nine months ended September 30, 2016:

| Three Months Ended September 30, | Nine Months Ended September 30, | |||||||

| (in thousands) | 2016 | 2016 | ||||||

| Revenues: | ||||||||

| Product sales | $ | 3,019 | $ | 21,183 | ||||

| Collaborations | 68 | 187 | ||||||

| Total revenues | 3,087 | 21,370 | ||||||

| Operating expense: | ||||||||

| Cost of product sales | 907 | 11,556 | ||||||

| Research and development | 2,509 | 18,024 | ||||||

| Selling, general and administrative | 7,499 | 23,792 | ||||||

| Loss from operations | (7,828 | ) | (32,002 | ) | ||||

| Other expense, net: | (116 | ) | (41 | ) | ||||

| Loss from discontinued operations before benefit from income taxes | (7,944 | ) | (32,043 | ) | ||||

| Benefit from income taxes | (8,896 | ) | (16,189 | ) | ||||

| Net income (loss) from discontinued operations | $ | 952 | $ | (15,854 | ) | |||

| Nine Months Ended September 30, | ||||

| (in thousands) | 2016 | |||

| Net cash used in operating activities | $ | (10,299 | ) | |

| Net cash used in investing activities | (1,926 | ) | ||

| Net cash provided by financing activities | 7,733 | |||

| Net decrease in cash and cash equivalents | $ | (4,492 | ) | |

EMERGENT BIOSOLUTIONS INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(unaudited, in millions, except share and nine months ended September 30, 2017, the contingent purchaseper share amounts)

8. Contingent Consideration

Contingent consideration obligationsliabilities associated with RSDL increased by $0.9 millionbusiness combinations are fair value measurement items. These liabilities represent an obligation of the Company to transfer additional assets to the selling shareholders and $1.4 million, respectively. For the three and nine months ended September 30, 2016, the contingent purchase consideration obligationsowners if future events occur or conditions are met. These liabilities associated with RSDL decreased by $2.3 millionbusiness combinations are measured at fair value at inception and $1.0 million, respectively.at each subsequent reporting date. The changes in the fair value of the RSDL contingent consideration obligations are primarily due to the expected amount and timing of future net sales, which are inputs that have no observable market (Level 3).

The Company also has contingent consideration associated with its asset acquisitions. These changesliabilities are classified innot recorded as level 3 fair value measurements, but rather are accrued when the Company's statement of operations as cost of product salesmilestone has been achieved and contract manufacturing.is payable.

The following table is a reconciliation of the beginning and ending balance of the liabilities, consisting only of contingent consideration, measured at fair value, usingconsiderations and is based on level 3 significant unobservable inputs, (Level 3) duringother than the milestone accrual, which is based on achievement of contractual milestones.

| Balance at December 31, 2018 | $ | 60.0 | |

| Milestone achievement - asset acquisition | 10.0 | ||

| Measurement period adjustment | 1.5 | ||

| Change in fair value | 12.4 | ||

| Settlements | (13.7 | ) | |

| Balance at September 30, 2019 | $ | 70.2 | |

During the nine months ended September 30, 2019, a contingent milestone was achieved related to the Company's acquisition of raxibacumab in October 2017. The acquisition of raxibacumab was accounted for as an asset acquisition and therefore the achievement of the $10.0 million milestone resulted in an increase to the contingent consideration liability with a corresponding increase in intangible assets.

| (in thousands) | ||||

| Balance at December 31, 2016 | $ | 13,185 | ||

| Expense included in earnings | 1,350 | |||

| Settlements | (2,744 | ) | ||

| Balance at September 30, 2017 | $ | 11,791 | ||

Risk Management Objective of Using Derivatives

The Company is required forexposed to certain risk arising from both its business operations and economic conditions. The Company principally manages its exposures to a wide variety of business and operational risks through management of its core business activities. The Company manages economic risks, including interest rate, liquidity, and credit risk primarily by managing the amount, sources, and duration of its assets and liabilities measuredand the use of derivative financial instruments. Specifically, the Company has entered into interest rate swaps to manage exposures that arise from the Company's senior secured credit agreement's payments of variable interest rate debt.

Accounting Policy for Derivative Instruments and Hedging Activities

The Company's interest rate swaps qualify for hedge accounting as cash flow hedges. All derivatives are recorded on the balance sheet at fair valuevalue. Hedge accounting provides for the matching of the timing of gain or loss recognition on these interest rate swaps with the recognition of the changes in interest expense on the Company's variable rate debt. For derivatives designated as cash flow hedges of interest rate risk, the gain or loss on the derivative is recorded in accumulated other comprehensive income and subsequently reclassified into interest expense in the same period during which the hedged transaction affects earnings. Amounts reported in accumulated other comprehensive income related to derivatives will be reclassified to interest expense as interest payments are made on the Company’s variable-rate debt. The cash flows from the designated interest rate swaps are classified as a recurring basis from those measured atcomponent of operating cash flows, similar to interest expense. If current fair value on a non-recurring basis. Asvalues of September 30, 2017 and 2016,designated interest rate swaps remained static over the next twelve months, the Company had no significant assets or liabilities that were measured at fair value on a non-recurring basis.

EMERGENT BIOSOLUTIONS INC.

(unaudited, in millions, except share and per share amounts)

| September 30, | December 31, | |||||||

| (in thousands) | 2017 | 2016 | ||||||

| Raw materials and supplies | $ | 34,075 | $ | 30,687 | ||||

| Work-in-process | 14,776 | 19,821 | ||||||

| Finished goods | 20,038 | 23,494 | ||||||

| Total inventories | $ | 68,889 | $ | 74,002 | ||||

| September 30, | December 31, | |||||||

| (in thousands) | 2017 | 2016 | ||||||

| Land and improvements | $ | 20,333 | $ | 20,340 | ||||

| Buildings, building improvements and leasehold improvements | 152,064 | 147,130 | ||||||

| Furniture and equipment | 194,385 | 190,157 | ||||||

| Software | 52,613 | 52,564 | ||||||

| Construction-in-progress | 100,328 | 77,813 | ||||||

| Property, plant and equipment, gross | 519,723 | 488,004 | ||||||

| Less: Accumulated depreciation and amortization | (133,266 | ) | (111,556 | ) | ||||

| Total property, plant and equipment, net | $ | 386,457 | $ | 376,448 | ||||

As of September 30, 2017 and December 31, 2016, construction-in-progress primarily includes costs related to2019, the build outCompany had the following outstanding interest rate derivatives that were designated as cash flow hedges of interest rate risk:

| Number of Instruments | Notional | ||||

| Interest Rate Swaps | 7 | $ | 350.0 | ||

The table below presents the fair value of the Company's CenterCompany’s derivative financial instruments designated as hedges as well as their classification on the balance sheet.

| Asset Derivatives | Liability Derivatives | ||||||||||||||

| September 30, 2019 | December 31, 2018 | September 30, 2019 | December 31, 2018 | ||||||||||||

| Balance Sheet Location | Fair Value | Balance Sheet Location | Fair Value | Balance Sheet Location | Fair Value | Balance Sheet Location | Fair Value | ||||||||

| Interest Rate Swaps | Other Assets | $ | — | Other Assets | — | Other Liabilities | $ | 4.2 | Other Liabilities | — | |||||

The valuation of the interest rate swaps is determined using widely accepted valuation techniques, including discounted cash flow analysis on the expected cash flows of each interest rate swap. This analysis reflects the contractual terms of the interest rate swaps, including the period to maturity, and uses observable market-based inputs, including interest rate curves and implied volatilities. The fair values of interest rate swaps are determined using the market standard methodology of netting the discounted future fixed cash payments (or receipts) and the discounted expected variable cash receipts (or payments). The variable cash payments (or receipts) are based on an expectation of future interest rates (forward curves) derived from observable market interest rate curves. To comply with the provisions of ASC 820, Fair Value Measurement, we incorporate credit valuation adjustments in the fair value measurements to appropriately reflect both our own nonperformance risk and the respective counterparty’s nonperformance risk. These credit valuation adjustments were concluded to not be significant inputs for Innovationthe fair value calculations for the periods presented. In adjusting the fair value of our derivative contracts for the effect of nonperformance risk, we have considered the impact of netting and any applicable credit enhancements, such as the posting of collateral, thresholds, mutual puts and guarantees. The valuation of interest rate swaps fall into Level 2 in Advanced Developmentthe fair value hierarchy.

The table below presents the effect of cash flow hedge accounting on accumulated other comprehensive income.

| Hedging derivatives | Amount of Gain/(Loss) Recognized in OCI on Derivative | Location of Gain or (Loss) Reclassified from Accumulated OCI into Income | Amount of Gain or (Loss) Reclassified from Accumulated OCI into Income | ||||||||||

| September 30, 2019 | September 30, 2018 | September 30, 2019 | September 30, 2018 | ||||||||||

| Interest Rate Swaps | $ | (4.2 | ) | — | Interest expense | $ | 0.5 | $ | — | ||||

EMERGENT BIOSOLUTIONS INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(unaudited, in millions, except share and Manufacturing ("CIADM") facility.per share amounts)

10. Debt

The Company recorded amortization expensecomponents of debt are as follows:

| Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||

| (in thousands) | 2017 | 2016 | 2017 | 2016 | ||||||||||||

| Operating expenses: | ||||||||||||||||

| Cost of product sales and contract manufacturing | $ | 1,067 | $ | 1,163 | $ | 3,199 | $ | 3,873 | ||||||||

| Research and development | 348 | 348 | 1,044 | 1,044 | ||||||||||||

| Selling, general and administrative | 140 | 140 | 420 | 420 | ||||||||||||

| Total amortization expense | $ | 1,555 | $ | 1,651 | $ | 4,663 | $ | 5,337 | ||||||||

| September 30, 2019 | December 31, 2018 | ||||||

| Senior secured credit agreement - Term loan due 2023 | $ | 438.8 | $ | 447.2 | |||

| Senior secured credit agreement - Revolver loan due 2023 | 383.0 | 348.0 | |||||

| 2.875% Convertible Senior Notes due 2021 | 10.6 | 10.6 | |||||

| Other | 3.0 | 3.0 | |||||

| Total debt | 835.4 | 808.8 | |||||

| Current portion of long-term debt, net of debt issuance costs | (10.1 | ) | (10.1 | ) | |||

| Unamortized debt issuance costs | (12.0 | ) | (14.2 | ) | |||

| Non-current portion of debt | $ | 813.3 | $ | 784.5 | |||

Senior Secured Credit Agreement

On September 29,, 2017, the Company entered into a senior secured credit agreement (the "2017 Credit Agreement") with four lending financial institutions, which replaced the Company's prior senior secured credit agreement (the "2013“2017 Credit Agreement”) with 4 lending financial institutions. On October 15, 2018, the Company entered into an Amended and Restated Credit Agreement (the "Amended Credit Agreement"). The 2017 Credit Agreement provides for a senior secured credit facility of up to $200 million through September 29, 2022. The 2017 Credit Agreement also includes a $100 million accordion feature, with multiple lending institutions, which could provide an additional $100 million in revolver or incremental term loans, at the option of the Company, resulting in a potential aggregate commitment of up to $300 million, subject to certain conditions and requirements set forth inmodified the 2017 Credit Agreement. As of September 30, 2017, no amounts were drawn under the 2017 Credit Agreement.

The Company's payment obligations under the 2017Amended Credit Agreement are secured by a lien on substantially all(i) increased the revolving credit facility (the "Revolving Credit Facility") from $200 million to $600 million, (ii) extended the maturity of the Company's assets, includingRevolving Credit Facility from September 29, 2022 to October 13, 2023, and (iii) provided for a term loan in the stockoriginal principal amount of all of$450 million (the "Term Loan Facility," and together with the Company's domestic subsidiaries, andRevolving Credit Facility, the assets of"Senior Secured Credit Facilities"). The Company may request incremental term loan facilities or increases in the subsidiary guarantors. Revolving Credit Facility (each an "Incremental Loan") as long as requirements relating to net leverage ratio will be maintained on a pro forma basis.

Borrowings under the 2017Revolving Credit AgreementFacility and the Term Loan Facility will bear interest at a rate per annum equal to (a) a eurocurrency rate plus a margin ranging from 1.50%1.25% to 2.50%2.00% per annum, depending on the Company's consolidated net leverage ratio or (b) a base rate (which is the highest of the prime rate, the federal funds rate plus 0.50%, and a eurocurrency rate for an interest period of one month plus 1%) plus a margin ranging from 0.50%0.25% to 1.50%1.00%, depending on the Company's consolidated net leverage ratio. The Company is required to make quarterly payments under the 2017Amended Credit Agreement offor accrued and unpaid interest on the outstanding principal balance, based on the above interest rates. In addition, the Company is required to pay commitment fees ranging from 0.25%0.15% to 0.40%0.30% per annum, depending on the Company's consolidated net leverage ratio, in respect of the average daily unused commitments under the 2017Revolving Credit Agreement.

Facility. The Company is to repay the outstanding principal amount of the Term Loan Facility in quarterly installments based on an annual percentage equal to 2.5% of the original principal amount of the Term Loan Facility during each of the first two years of the Term Loan Facility, 5% of the original principal amount of the Term Loan Facility during the third year of the Term Loan Facility and 7.5% of the original principal amount of the Term Loan Facility during each year of the remainder of the term of the Term Loan Facility until the maturity date of the Term Loan Facility, at which time the entire unpaid principal balance of the Term Loan Facility will be due and payable. The Company has the right to prepay the Term Loan Facility without premium or penalty. The Revolving Credit Facility and the Term Loan Facility mature (unless earlier terminated) on October 13, 2023.The 2017Amended Credit Agreement also requires mandatory prepayments of the Term Loan Facility in the event the Company or its Subsidiaries (a) incur indebtedness not otherwise permitted under the Amended Credit Agreement or (b) receive cash proceeds in excess of $100 million during the term of the Amended Credit Agreement from certain dispositions of property or from casualty events involving their property, subject to certain reinvestment rights.