UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-Q

|

| | | | | | | |

| (Mark One) |

| ☑ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | |

| For the quarterly period ended | September 30, 20192020 |

| | |

| OR |

| |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | |

For the transition period from to |

Commission file number: 001-33492

CVR ENERGY, INC.INC.

(Exact name of registrant as specified in its charter)

|

| | | | | | | | | | | | | |

| Delaware | | | | 61-1512186 |

(State or other jurisdiction of incorporation or organization) | | | (I.R.S. Employer

Identification No.) |

2277 Plaza Drive, Suite 500,, Sugar Land,, Texas77479

(Address of principal executive offices) (Zip Code)

(281) (281) 207-3200

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

| | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.01 par value per share | CVI | The New York Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

| | | | | | | | | | | | | | | | |

| Large accelerated filer | ☐☑ | Accelerated filer | ☑☐ | Non-accelerated filer | ☐ |

| Smaller reporting company | ☐ | Emerging growth company | ☐ | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined by Rule 12b-2 of the Exchange Act). Yes ☐ No ☑

There were 100,530,599 shares of the registrant’s common stock outstanding at October 22, 2019.

TABLE OF CONTENTS

CVR Energy, Inc. - Quarterly Report on Form 10-Q

September 30, 20192020

|

| | | | | | |

| PART I. Financial Information | | | PART II. Other Information | |

| | | | | | | |

| | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | |

| | | | | |

| | | |

| | | |

| | | |

| | | | | | | | | | | | | | | | | | | | |

| PART I. Financial Information | | | PART II. Other Information | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | |

| | | | |

| | | |

| | | |

| | | |

This Quarterly Report on Form 10-Q (including documents incorporated by reference herein) contains statements with respect to our expectations or beliefs as to future events. These types of statements are “forward-looking” and subject to uncertainties. See “Important Information Regarding Forward-Looking Statements” section of this filing.

September 30, 20192020 | 2

Important Information Regarding Forward-Looking Statements

This Quarterly Report on Form 10-Q (this “Report”) contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), including, but not limited to, those under Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations. These forward-looking statements are subject to a number of risks and uncertainties, many of which are beyond our control. All statements other than statements of historical fact, including without limitation, statements regarding future operations, financial position, estimated revenues and losses, growth, capital projects, stock or unit repurchases, impacts of legal proceedings, projected costs, prospects, plans and objectives are forward-looking statements. The words “could,” “believe,” “anticipate,” “intend,” “estimate,” “expect,” “may,” “continue,” “predict,” “potential,” “project,” and similar terms and phrases are intended to identify forward-looking statements.

Although we believe our assumptions concerning future events are reasonable, a number of risks, uncertainties, and other factors could cause actual results and trends to differ materially from those projected or forward-looking, includingforward looking. Forward looking statements, as well as certain risks, contingencies or uncertainties that may impact our forward looking statements, include but are not limited to:to the following:

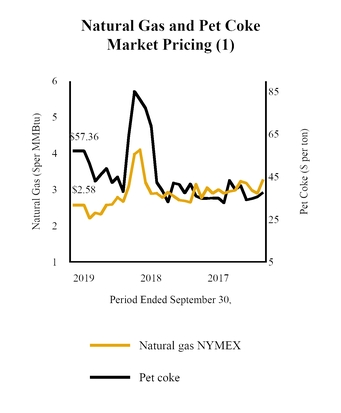

•volatile margins in the refining and nitrogen fertilizer industriesindustry and exposure to the risks associated with the pricing and availability ofvolatile crude oil, other feedstocks, pet coke, utilities, refined products, urea ammonium nitrate (“UAN”), ammonia, natural gas, Renewable Identification Numbers (“RIN”)product and environmental credits;feedstock prices;

•the availability of adequate cash credit and other sources of liquidity including volatility infor the capital needs of our businesses;

•the severity, magnitude, duration, and credit marketsimpact of the novel coronavirus 2019 (“COVID-19”) pandemic and changesof businesses’ and governments’ responses to such pandemic on our capital requirements;operations, personnel, commercial activity, and supply and demand across our and our customers’ and suppliers’ business;

•changes in market conditions and market volatility arising from the expected valueCOVID-19 pandemic, including crude oil and other commodity prices, demand for those commodities, storage and transportation capacities, and the impact of benefits derived from,such changes on our operating results and ourfinancial position;

•the ability to successfully implement, business strategies, transactions, turnarounds, maintenance,forecast our future financial condition, results of operations, revenues and capital projects;expenses;

•the effects of transactions involving forward and derivative instruments;

•changes in (and in the application of) local, state and federal laws, rules, regulations and policies including with respect to environmental matters (including climate change), health and safety, exports, transportation (including pipeline and trucking transportationthe export of crude oil, and other products), alternative energy or fuel sources, the end-use and application of fertilizers and taxes (including the tax status of CVR Partners);

changes in economic conditions impacting our business and the business of our suppliers, customers, counterparties and lenders;

interruption of or changes in the cost, availability or regulation of pipelines, vessels, trucks and other means of transporting crude oil, feedstocks, refined products pet coke, UAN, ammonia andor other products relating to our businesses;hydrocarbons;

changes•interruption in pipelines supplying feedstocks or distributing the petroleum business’ products;

•competition in the petroleum and nitrogen fertilizer businesses including topotential impacts of domestic and global supply and demand and/or domestic or international duties, tariffs, or similar costs;

•capital expenditures;

•changes in our competitive advantages;or our segments’ credit profiles;

•the cyclical and/orand seasonal nature of the petroleum and nitrogen fertilizer businesses;

•the supply, availability, and price levels of essential raw materials and feedstocks;

•our production levels, including the risk of a material decline in those levels;

•accidents or other unscheduled shutdowns or interruptions affecting our facilities, machinery, or equipment, or those of our suppliers or customers;

•existing and future laws, rulings, and regulations, including but not limited to those relating to the environment, climate change and/or the transportation of production of hazardous chemicals like ammonia, including potential liabilities or capital requirements arising from such laws, rulings or regulations;

•potential operating hazards from accidents, fire, severe weather, tornadoes, floods, or other natural disasters;

•the impact of weather on the nitrogen fertilizer business including our ability to produce, market or sell fertilizer products profitability or at all;

•rulings, judgements or settlements in litigation, tax or other legal or regulatory matters;

•the dependence of the nitrogen fertilizer business on customers and distributors including to transport goods and equipment;

•the reliance on, or the ability to procure economically or at all, pet coke our nitrogen fertilizer business purchases from CVR Refining, LP and third-party suppliers or the natural gas, electricity, oxygen, nitrogen, sulfur processing and compressed dry air and other products purchased from third parties by the nitrogen fertilizer and petroleum businesses;

weather conditions, fires, tornadoes, floods or other natural disasters affecting our operations or the areas in which our feedstocks or refined products and fertilizers are marketed or sold;

•risks associated with governmental policies affectingthird party operation of or control over important facilities necessary for operation of our refineries and nitrogen fertilizer facilities;

•risks of terrorism, cybersecurity attacks, and the agriculturalsecurity of chemical manufacturing facilities and other matters beyond our control;

•our lack of diversification of assets or operating and supply areas;

•the petroleum refining industries;

direct or indirect effects from actual or threatened terrorist incidents, security or cyber-security breaches or acts of war;

business’ and the nitrogen fertilizer business’ dependence on significant customers and suppliers and the creditworthiness and performance by counterparties;

•the potential loss of the nitrogen fertilizer business’ transportation cost advantage over its competitors;

•the potential inability to successfully implement our business strategies, including the completion of significant capital programs or projects;

•our ability to continue to license the technology used infor our operations;

•our petroleum business’ ability to purchase renewable identification numbers (“RINs”) on a timely and cost effective basis;

•our businesses’ ability to obtain, retain or securerenew environmental and other governmental permits, requiredlicenses or authorizations necessary for the petroleum businessoperation of its business;

•existing and nitrogen fertilizer business operations;proposed laws, rulings, and regulations, including but not limited to those relating to climate change, alternative energy or fuel sources, and existing and future regulations related to the end-use of our products or the application of fertilizers;

adverse rulings, judgments or settlements in litigation or other legal or tax matters, including unexpected environmental remediation costs in excess of any reserves;

•refinery and nitrogen fertilizer facilities’ operating hazards and interruptions, or production declines, including unscheduled maintenance or downtime and the availability and recoverability of adequate insurance coverage;

•risks related to services provided by or competition among our subsidiaries, including conflicts of interests and control of CVR Partners’ general partner;

•instability and volatility in the capital and credit markets;

•restrictions in our debt agreements;

•asset impairments and impacts thereof;

•the variable nature of CVR Partners’ distributions, including the ability of its general partner to modify or revoke its distribution policy, or to cease making cash distributions on its common units;

•risks associated with noncompliance by CVR Partners with continued listing standards of the New York Stock Exchange (the “NYSE”) or the effectiveness of the announced reverse unit split for regaining and maintaining compliance, including potential suspension or delisting and the impacts thereof on CVR Partners’ common unit price, valuation, access to capital, liquidity, the number of investors willing to hold or acquire CVR Partners’ common units, its ability to issue securities or obtain financing and the impact, cost, and timing of any reverse split;

•changes in CVR Partners’ treatment as a partnership for U.S. federal income or state tax purposes;

•our ability to recover under our insurance policies for damages or losses in full or at all; and

•the factors described in greater detail under “Risk Factors” in Item 1A of our Annual Report on Form 10-K for the year ended December 31, 20182019 and this Report and our other filings with the Securities and Exchange Commission.Commission (the “SEC”).

All forward-lookingforward looking statements contained in this Report only speak as of the date of this Report. Except as required by law, weWe undertake no obligation to publicly update or revise any forward-looking statements to reflect events or circumstances that occur after the date of this Report, or to reflect the occurrence of unanticipated events, except to the extent required by law.

September 30, 20192020 | 34

PART I. FINANCIAL INFORMATION

Item 1. Financial Statements

CVR ENERGY, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(unaudited)

| | | | | | | | | | | |

| (in millions) | September 30, 2020 | | December 31, 2019 |

| ASSETS |

| Current assets: | | | |

| Cash and cash equivalents (including $48 and $37, respectively, of consolidated variable interest entities (“VIEs”)) | $ | 672 | | | $ | 652 | |

| Accounts receivable (including $19 and $34, respectively, of VIEs) | 133 | | | 182 | |

| | | |

| Inventories (including $46 and $48, respectively, of VIEs) | 266 | | | 373 | |

| Prepaid expenses and other current assets (including $3 and $5, respectively, of VIEs) | 183 | | | 67 | |

| | | |

| | | |

| Total current assets | 1,254 | | | 1,274 | |

| Property, plant and equipment, net (including $913 and $952, respectively, of VIEs) | 2,267 | | | 2,336 | |

| | | |

| | | |

| | | |

| Other long-term assets (including $18 and $61, respectively, of VIEs) | 355 | | | 295 | |

| Total assets | $ | 3,876 | | | $ | 3,905 | |

| | | |

| LIABILITIES AND EQUITY |

| Current liabilities: | | | |

| | | |

| | | |

| Accounts payable (including $25 and $24, respectively, of VIEs) | $ | 242 | | | $ | 412 | |

| | | |

| | | |

| | | |

| | | |

| Other current liabilities (including $44 and $52, respectively, of VIEs) | 215 | | | 184 | |

| Total current liabilities | 457 | | | 596 | |

| | | |

| Long-term debt and finance lease obligations (including $633 and $632, respectively, of VIEs) | 1,683 | | | 1,190 | |

| | | |

| Deferred income taxes | 379 | | | 396 | |

| Other long-term liabilities (including $10 and $10, respectively, of VIEs) | 55 | | | 55 | |

| Total long-term liabilities | 2,117 | | | 1,641 | |

| | | |

| Equity: | | | |

| CVR stockholders’ equity: | | | |

| Common stock $0.01 par value per share, 350,000,000 shares authorized, 100,629,209 and 100,629,209 shares issued as of September 30, 2020 and December 31, 2019, respectively. | 1 | | | 1 | |

| Additional paid-in-capital | 1,508 | | | 1,507 | |

| Accumulated deficit | (423) | | | (113) | |

| Treasury stock, 98,610 shares at cost | (2) | | | (2) | |

| | | |

| Total CVR stockholders’ equity | 1,084 | | | 1,393 | |

| Noncontrolling interest | 218 | | | 275 | |

| Total equity | 1,302 | | | 1,668 | |

| Total liabilities and equity | $ | 3,876 | | | $ | 3,905 | |

|

| | | | | | | |

| (in millions) | September 30, 2019 | | December 31, 2018 |

| ASSETS |

| Current assets: | | | |

| Cash and cash equivalents (including $84 and $415, respectively, of consolidated variable interest entities (VIEs)) | $ | 692 |

| | $ | 668 |

|

| Accounts receivable (including $15 and $169, respectively, of VIEs) | 181 |

| | 169 |

|

| Inventories (including $57 and $380, respectively, of VIEs) | 388 |

| | 380 |

|

| Prepaid expenses and other current assets (including $5 and $56, respectively, of VIEs) | 66 |

| | 76 |

|

| Total current assets | 1,327 |

| | 1,293 |

|

| Property, plant and equipment, net (including $965 and $2,414, respectively, of VIEs) | 2,356 |

| | 2,430 |

|

| Other long-term assets (including $56 and $270, respectively, of VIEs) | 279 |

| | 277 |

|

| Total assets | $ | 3,962 |

| | $ | 4,000 |

|

| LIABILITIES AND EQUITY |

| Current liabilities: | | | |

| Accounts payable (including $32 and $317, respectively, of VIEs) | $ | 390 |

| | $ | 320 |

|

| Other current liabilities (including $53 and $154, respectively, of VIEs) | 200 |

| | 176 |

|

| Total current liabilities | 590 |

| | 496 |

|

| Long-term debt and finance lease obligations (including $632 and $1,167, respectively, of VIEs) | 1,190 |

| | 1,167 |

|

| Deferred income taxes | 405 |

| | 380 |

|

| Other long-term liabilities (including $12 and $7, respectively, of VIEs) | 52 |

| | 14 |

|

| Total long-term liabilities | 1,647 |

| | 1,561 |

|

|

| |

|

| Equity: | | | |

| CVR stockholders’ equity: | | | |

| Common stock $0.01 par value per share, 350,000,000 shares authorized, 100,629,209 shares issued | 1 |

| | 1 |

|

| Additional paid-in-capital | 1,507 |

| | 1,474 |

|

| Accumulated deficit | (77 | ) | | (187 | ) |

| Treasury stock, 98,610 shares at cost | (2 | ) | | (2 | ) |

| Total CVR stockholders’ equity | 1,429 |

| | 1,286 |

|

| Noncontrolling interest | 296 |

| | 657 |

|

| Total equity | 1,725 |

| | 1,943 |

|

| Total liabilities and equity | $ | 3,962 |

| | $ | 4,000 |

|

The accompanying notes are an integral part of these condensed consolidated financial statements.

September 30, 20192020 | 45

CVR ENERGY, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| (in millions, except share data) | 2020 | | 2019 | | 2020 | | 2019 |

| Net sales | $ | 1,005 | | | $ | 1,622 | | | $ | 2,811 | | | $ | 4,794 | |

| Operating costs and expenses: | | | | | | | |

| Cost of materials and other | 846 | | | 1,221 | | | 2,348 | | | 3,589 | |

| Direct operating expenses (exclusive of depreciation and amortization) | 116 | | | 139 | | | 353 | | | 397 | |

| Depreciation and amortization | 67 | | | 69 | | | 200 | | | 210 | |

| Cost of sales | 1,029 | | | 1,429 | | | 2,901 | | | 4,196 | |

| | | | | | | |

| Selling, general and administrative expenses (exclusive of depreciation and amortization) | 20 | | | 29 | | | 65 | | | 85 | |

| Depreciation and amortization | 2 | | | 2 | | | 8 | | | 7 | |

| Loss (gain) on asset disposals | 0 | | | 3 | | | 2 | | | (5) | |

| Goodwill impairment | 0 | | | 0 | | | 41 | | | 0 | |

| | | | | | | |

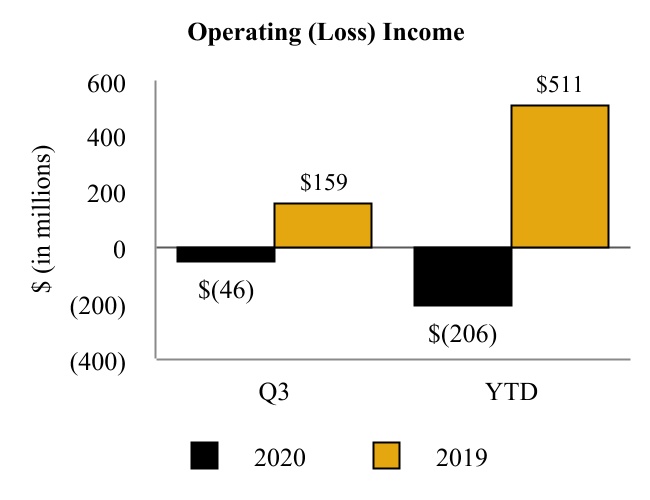

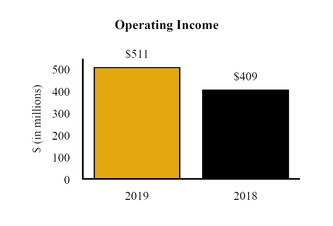

| Operating (loss) income | (46) | | | 159 | | | (206) | | | 511 | |

| Other (expense) income: | | | | | | | |

| Interest expense, net | (31) | | | (26) | | | (98) | | | (77) | |

| | | | | | | |

| | | | | | | |

| Investment loss from marketable securities | (65) | | | 0 | | | (13) | | | 0 | |

| Other income, net | 3 | | | 5 | | | 3 | | | 10 | |

| | | | | | | |

| (Loss) income before income tax expense | (139) | | | 138 | | | (314) | | | 444 | |

| Income tax (benefit) expense | (31) | | | 34 | | | (73) | | | 110 | |

| Net (loss) income | (108) | | | 104 | | | (241) | | | 334 | |

| Less: Net loss attributable to noncontrolling interest | (12) | | | (15) | | | (53) | | | (2) | |

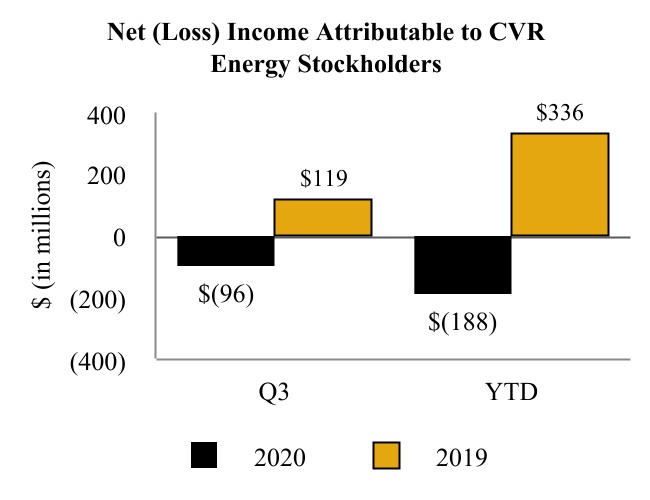

| Net (loss) income attributable to CVR Energy stockholders | $ | (96) | | | $ | 119 | | | $ | (188) | | | $ | 336 | |

| | | | | | | |

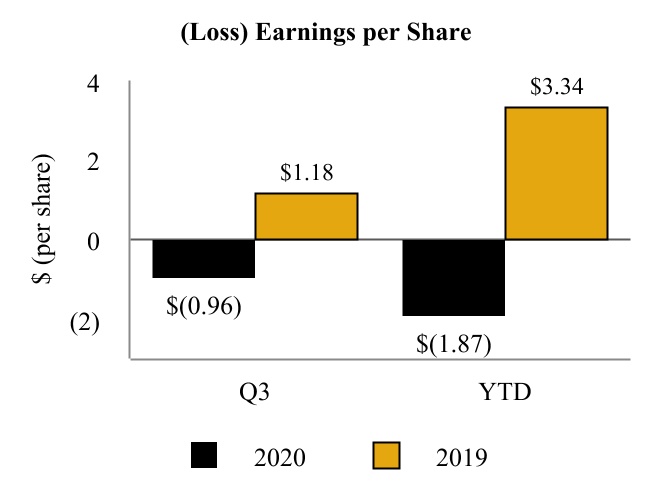

| Basic and diluted (loss) earnings per share | $ | (0.96) | | | $ | 1.18 | | | $ | (1.87) | | | $ | 3.34 | |

| | | | | | | |

| Dividends declared per share | $ | 0 | | | $ | 0.75 | | | $ | 1.20 | | | $ | 2.25 | |

| | | | | | | |

| Weighted-average common shares outstanding: | | | | | | | |

| Basic and diluted | 100.5 | | | 100.5 | | | 100.5 | | | 100.5 | |

| | | | | | | |

|

| | | | | | | | | | | | | | | |

| | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| (in millions, except share data) | 2019 | | 2018 | | 2019 | | 2018 |

| Net sales | $ | 1,622 |

| | $ | 1,935 |

| | $ | 4,794 |

| | $ | 5,386 |

|

| Operating costs and expenses: | | | | | | | |

| Cost of materials and other | 1,221 |

| | 1,556 |

| | 3,589 |

| | 4,295 |

|

| Direct operating expenses (exclusive of depreciation and amortization as reflected below) | 139 |

| | 119 |

| | 397 |

| | 390 |

|

| Depreciation and amortization | 69 |

| | 63 |

| | 210 |

| | 196 |

|

| Cost of sales | 1,429 |

| | 1,738 |

| | 4,196 |

| | 4,881 |

|

| Selling, general and administrative expenses (exclusive of depreciation and amortization as reflected below) | 29 |

| | 27 |

| | 85 |

| | 83 |

|

| Depreciation and amortization | 2 |

| | 3 |

| | 7 |

| | 8 |

|

| Loss (gain) on asset disposals | 3 |

| | 1 |

| | (5 | ) | | 5 |

|

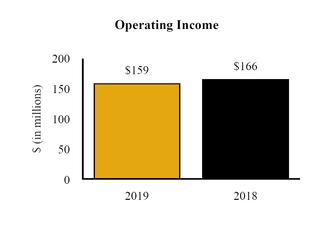

| Operating income | 159 |

| | 166 |

| | 511 |

| | 409 |

|

| Other (expense) income: | | | | | | | |

| Interest expense, net | (26 | ) | | (26 | ) | | (77 | ) | | (79 | ) |

| Other income, net | 5 |

| | 3 |

| | 10 |

| | 6 |

|

| Income before income tax expense | 138 |

| | 143 |

| | 444 |

| | 336 |

|

| Income tax expense | 34 |

| | 33 |

| | 110 |

| | 65 |

|

| Net income | 104 |

| | 110 |

| | 334 |

| | 271 |

|

| Less: Net (loss) income attributable to noncontrolling interest | (15 | ) | | 29 |

| | (2 | ) | | 86 |

|

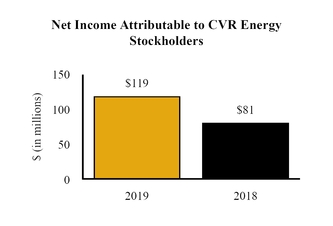

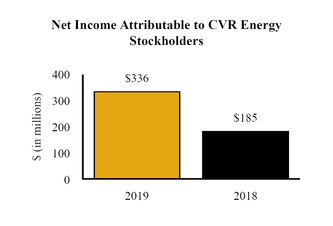

| Net income attributable to CVR Energy stockholders | $ | 119 |

| | $ | 81 |

| | $ | 336 |

| | $ | 185 |

|

| | | | | | | | |

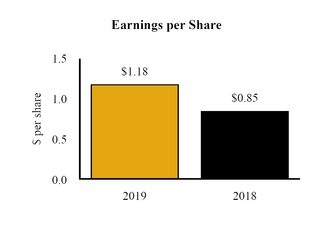

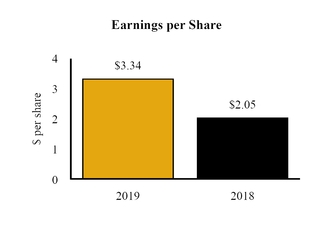

| Basic and diluted earnings per share | $ | 1.18 |

| | $ | 0.85 |

| | $ | 3.34 |

| | $ | 2.05 |

|

| Dividends declared per share | $ | 0.75 |

| | $ | 0.75 |

| | $ | 2.25 |

| | $ | 2.00 |

|

| | | | | | | | |

| Weighted-average common shares outstanding: | | | | | | | |

| Basic and diluted | 100.5 |

| | 95.8 |

| | 100.5 |

| | 89.8 |

|

The accompanying notes are an integral part of these condensed consolidated financial statements.

September 30, 20192020 | 56

CVR ENERGY, INCINC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Common Stockholders | | | | |

| (in millions, except share data) | Shares

Issued | | $0.01 Par Value Common Stock | | Additional

Paid-In

Capital | | Accumulated Deficit | | Treasury

Stock | | | | Total CVR

Stockholders’

Equity | | Noncontrolling

Interest | | Total

Equity |

| Balance at December 31, 2019 | 100,629,209 | | | $ | 1 | | | $ | 1,507 | | | $ | (113) | | | $ | (2) | | | | | $ | 1,393 | | | $ | 275 | | | $ | 1,668 | |

| Dividends paid to CVR Energy stockholders | — | | | — | | | — | | | (80) | | | — | | | | | (80) | | | — | | | (80) | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Other | — | | | — | | | — | | | (1) | | | — | | | | | (1) | | | — | | | (1) | |

| Net loss | — | | | — | | | — | | | (87) | | | — | | | | | (87) | | | (14) | | | (101) | |

| Balance at March 31, 2020 | 100,629,209 | | | $ | 1 | | | $ | 1,507 | | | $ | (281) | | | $ | (2) | | | | | $ | 1,225 | | | $ | 261 | | | $ | 1,486 | |

| Dividends paid to CVR Energy stockholders | — | | | — | | | — | | | (41) | | | — | | | | | (41) | | | — | | | (41) | |

| Changes in equity due to CVR Partners’ common unit repurchases | — | | | — | | | 1 | | | — | | | — | | | | | 1 | | | (1) | | | 0 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Net loss | — | | | — | | | — | | | (5) | | | — | | | | | (5) | | | (27) | | | (32) | |

| Balance at June 30, 2020 | 100,629,209 | | | 1 | | | $ | 1,508 | | | $ | (327) | | | $ | (2) | | | | | $ | 1,180 | | | $ | 233 | | | $ | 1,413 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Changes in equity due to CVR Partners’ common unit repurchases | — | | | — | | | 0 | | | — | | | — | | | | | 0 | | | (3) | | | (3) | |

| | | | | | | | | | | | | | | | | |

| Net loss | — | | | — | | | — | | | (96) | | | — | | | | | (96) | | | (12) | | | (108) | |

| Balance at September 30, 2020 | 100,629,209 | | | $ | 1 | | | $ | 1,508 | | | $ | (423) | | | $ | (2) | | | | | $ | 1,084 | | | $ | 218 | | | $ | 1,302 | |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Common Stockholders | | | | |

| (in millions, except share data) | Shares Issued | | $0.01 Par

Value

Common

Stock | | Additional Paid-In Capital | | Accumulated Deficit | | Treasury Stock | | Total CVR Stockholders’ Equity | | Noncontrolling Interest | | Total Equity |

| Balance at December 31, 2018 | 100,629,209 |

| | $ | 1 |

| | $ | 1,474 |

| | $ | (187 | ) | | $ | (2 | ) | | $ | 1,286 |

| | $ | 657 |

| | $ | 1,943 |

|

| Dividends paid to CVR Energy stockholders | — |

| | — |

| | — |

| | (75 | ) | | — |

| | (75 | ) | | — |

| | (75 | ) |

| Distributions from CVR Partners to its public unitholders | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | (9 | ) | | (9 | ) |

| Acquisition of CVR Refining noncontrolling interest | — |

| | | | (1 | ) | | — |

| | — |

| | (1 | ) | | (334 | ) | | (335 | ) |

| Effect of turnaround accounting change | — |

| | — |

| | 35 |

| | — |

| | — |

| | 35 |

| | — |

| | 35 |

|

| Other | — |

| | — |

| | (1 | ) | | (1 | ) | | — |

| | (2 | ) | | — |

| | (2 | ) |

| Net income | — |

| | — |

| | — |

| | 101 |

| | — |

| | 101 |

| | 1 |

| | 102 |

|

| Balance at March 31, 2019 | 100,629,209 |

| | $ | 1 |

| | $ | 1,507 |

| | $ | (162 | ) | | $ | (2 | ) | | $ | 1,344 |

| | $ | 315 |

| | $ | 1,659 |

|

| Dividends paid to CVR Energy stockholders | — |

| | — |

| | — |

| | (75 | ) | | — |

| | (75 | ) | | — |

| | (75 | ) |

| Distributions from CVR Partners to its public unitholders | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | (5 | ) | | (5 | ) |

| Net income | — |

| | — |

| | — |

| | 116 |

| | — |

| | 116 |

| | 12 |

| | 128 |

|

| Balance at June 30, 2019 | 100,629,209 |

| | 1 |

| | $ | 1,507 |

| | $ | (121 | ) | | $ | (2 | ) | | $ | 1,385 |

| | $ | 322 |

| | $ | 1,707 |

|

| Dividends paid to CVR Energy stockholders | — |

| | — |

| | — |

| | (75 | ) | | — |

| | (75 | ) | | — |

| | (75 | ) |

| Distributions from CVR Partners to its public unitholders | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | (11 | ) | | (11 | ) |

| Net income (loss) | — |

| | — |

| | — |

| | 119 |

| | — |

| | 119 |

| | (15 | ) | | 104 |

|

| Balance at September 30, 2019 | 100,629,209 |

| | $ | 1 |

| | $ | 1,507 |

| | $ | (77 | ) | | $ | (2 | ) | | $ | 1,429 |

| | $ | 296 |

| | $ | 1,725 |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Common Stockholders | | | | |

| (in millions, except share data) | Shares

Issued | | $0.01 Par Value Common Stock | | Additional

Paid-In

Capital | | Accumulated Deficit | | Treasury

Stock | | | | Total CVR

Stockholders’

Equity | | Noncontrolling

Interest | | Total

Equity |

| Balance at December 31, 2018 | 100,629,209 | | | $ | 1 | | | $ | 1,474 | | | $ | (187) | | | $ | (2) | | | | | $ | 1,286 | | | $ | 657 | | | $ | 1,943 | |

| Dividends paid to CVR Energy stockholders | — | | | — | | | — | | | (75) | | | — | | | | | (75) | | | — | | | (75) | |

| Distributions from CVR Partners to its public unitholders | — | | | — | | | — | | | — | | | — | | | | | — | | | (9) | | | (9) | |

| Acquisition of CVR Refining noncontrolling interest | — | | | — | | | (1) | | | — | | | — | | | | | (1) | | | (334) | | | (335) | |

| Effect of turnaround accounting change | — | | | — | | | 34 | | | — | | | — | | | | | 34 | | | — | | | 34 | |

| Other | — | | | — | | | (1) | | | (1) | | | — | | | | | (2) | | | — | | | (2) | |

| Net income | — | | | — | | | — | | | 101 | | | — | | | | | 101 | | | 1 | | | 102 | |

| Balance at March 31, 2019 | 100,629,209 | | | $ | 1 | | | $ | 1,506 | | | $ | (162) | | | $ | (2) | | | | | $ | 1,343 | | | $ | 315 | | | $ | 1,658 | |

| Dividends paid to CVR Energy stockholders | — | | | — | | | — | | | (75) | | | — | | | | | (75) | | | — | | | (75) | |

| Distributions from CVR Partners to its public unitholders | — | | | — | | | — | | | — | | | — | | | | | — | | | (5) | | | (5) | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Net income | — | | | — | | | — | | | 116 | | | — | | | | | 116 | | | 12 | | | 128 | |

| Balance at June 30, 2019 | 100,629,209 | | | $ | 1 | | | $ | 1,506 | | | $ | (121) | | | $ | (2) | | | | | $ | 1,384 | | | $ | 322 | | | $ | 1,706 | |

| Dividends paid to CVR Energy stockholders | — | | | — | | | — | | | (75) | | | — | | | | | (75) | | | — | | | (75) | |

| Distributions from CVR Partners to its public unitholders | — | | | — | | | — | | | — | | | — | | | | | — | | | (11) | | | (11) | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Net income (loss) | — | | | — | | | — | | | 119 | | | — | | | | | 119 | | | (15) | | | 104 | |

| Balance at September 30, 2019 | 100,629,209 | | | $ | 1 | | | $ | 1,506 | | | $ | (77) | | | $ | (2) | | | | | $ | 1,428 | | | $ | 296 | | | $ | 1,724 | |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Common Stockholders | | | | |

| (in millions, except share data) | Shares Issued | | $0.01 Par Value Common Stock | | Additional Paid-In Capital | | Accumulated Deficit | | Treasury Stock | | Total CVR Stockholders’ Equity | | Noncontrolling Interest | | Total Equity |

| Balance at December 31, 2017 | 86,929,660 |

| | $ | 1 |

| | $ | 1,197 |

| | $ | (208 | ) | | $ | (2 | ) | | $ | 988 |

| | $ | 835 |

| | $ | 1,823 |

|

| Dividends paid to CVR Energy stockholders | — |

| | — |

| | — |

| | (43 | ) | | — |

| | (43 | ) | | — |

| | (43 | ) |

| Distributions from CVR Partners to its public unitholders | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | (23 | ) | | (23 | ) |

| Other | — |

| | — |

| | — |

| | (1 | ) | | — |

| | (1 | ) | | — |

| | (1 | ) |

| Net income | — |

| | — |

| | — |

| | 60 |

| | — |

| | 60 |

| | 33 |

| | 93 |

|

| Balance at March 31, 2018 | 86,929,660 |

| | $ | 1 |

| | $ | 1,197 |

| | $ | (192 | ) | | $ | (2 | ) | | $ | 1,004 |

| | $ | 845 |

| | $ | 1,849 |

|

| Dividends paid to CVR Energy stockholders | — |

| | — |

| | — |

| | (109 | ) | | — |

| | (109 | ) | | — |

| | (109 | ) |

| Distributions from CVR Partners to its public unitholders | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | (25 | ) | | (25 | ) |

| Other | — |

| | — |

| | — |

| | 1 |

| | — |

| | 1 |

| | (1 | ) | | — |

|

| Net income | — |

| | — |

| | — |

| | 43 |

| | — |

| | 43 |

| | 25 |

| | 68 |

|

| Balance at June 30, 2018 | 86,929,660 |

| | $ | 1 |

| | $ | 1,197 |

| | $ | (257 | ) | | $ | (2 | ) | | $ | 939 |

| | $ | 844 |

| | $ | 1,783 |

|

| Dividends paid to CVR Energy stockholders | — |

| | — |

| | — |

| | (10 | ) | | — |

| | (10 | ) | | — |

| | (10 | ) |

| Distributions from CVR Partners to its public unitholders | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | (19 | ) | | (19 | ) |

| CVR Refining units exchange | 13,600,939 |

| | — |

| | 277 |

| | — |

| | — |

| | 277 |

| | (192 | ) | | 85 |

|

| Other | — |

| | — |

| | — |

| | (1 | ) | | — |

| | (1 | ) | | — |

| | (1 | ) |

| Net income | — |

| | — |

| | — |

| | 81 |

| | — |

| | 81 |

| | 29 |

| | 110 |

|

| Balance at September 30, 2018 | 100,530,599 |

| | $ | 1 |

| | $ | 1,474 |

| | $ | (187 | ) | | $ | (2 | ) | | $ | 1,286 |

| | $ | 662 |

| | $ | 1,948 |

|

The accompanying notes are an integral part of these condensed consolidated financial statements.

September 30, 20192020 | 67

CVR ENERGY, INCINC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

| | | | Nine Months Ended September 30, | | Nine Months Ended September 30, |

| (in millions) | 2019 | | 2018 | (in millions) | 2020 | | 2019 |

| Cash flows from operating activities: | | | | Cash flows from operating activities: | | | |

| Net income | $ | 334 |

| | $ | 271 |

| |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | | |

| Net (loss) income | | Net (loss) income | $ | (241) | | | $ | 334 | |

| Adjustments to reconcile net (loss) income to net cash provided by operating activities: | | Adjustments to reconcile net (loss) income to net cash provided by operating activities: | |

| Depreciation and amortization | 217 |

| | 204 |

| Depreciation and amortization | 208 | | | 217 | |

| Deferred income tax expense | 26 |

| | 39 |

| |

| (Gain) loss on disposition of assets | (5 | ) | | 5 |

| |

| | Loss on lower of cost or net realizable value adjustment | | Loss on lower of cost or net realizable value adjustment | 59 | | | 0 | |

| Goodwill impairment | | Goodwill impairment | 41 | | | 0 | |

| Unrealized loss on marketable securities | | Unrealized loss on marketable securities | 20 | | | 0 | |

| Change in deferred income tax expense | | Change in deferred income tax expense | (18) | | | 26 | |

| Loss (gain) on disposition of assets | | Loss (gain) on disposition of assets | 2 | | | (5) | |

| | Share-based compensation | 14 |

| | 17 |

| Share-based compensation | 0 | | | 14 | |

| Other non-cash items | (7 | ) | | 2 |

| |

| | Other items | | Other items | 8 | | | (7) | |

| Changes in assets and liabilities: | | | | Changes in assets and liabilities: | |

| Current assets and liabilities | 69 |

| | (27 | ) | Current assets and liabilities | (23) | | | 69 | |

| | Non-current assets and liabilities | 5 |

| | 15 |

| Non-current assets and liabilities | 6 | | | 5 | |

| | Net cash provided by operating activities | 653 |

| | 526 |

| Net cash provided by operating activities | 62 | | | 653 | |

| Cash flows from investing activities: | | | | Cash flows from investing activities: | | | |

| Capital expenditures | (85 | ) | | (68 | ) | Capital expenditures | (101) | | | (85) | |

| Capitalized turnaround expenditures | (24 | ) | | (7 | ) | |

| | Turnaround expenditures | | Turnaround expenditures | (158) | | | (24) | |

| | Proceeds from sale of assets | 36 |

| | — |

| Proceeds from sale of assets | 1 | | | 36 | |

| Investment in marketable securities | | Investment in marketable securities | (140) | | | 0 | |

| Other investing activities | — |

| | 1 |

| Other investing activities | 2 | | | 0 | |

| | Net cash used in investing activities | (73 | ) | | (74 | ) | Net cash used in investing activities | (396) | | | (73) | |

| Cash flows from financing activities: | | | | Cash flows from financing activities: | | | |

| | Proceeds from issuance of senior secured notes | | Proceeds from issuance of senior secured notes | 1,000 | | | 0 | |

| Principal payments on senior secured notes | | Principal payments on senior secured notes | (500) | | | 0 | |

| Call premium on extinguishment of debt | | Call premium on extinguishment of debt | (5) | | | 0 | |

| Repurchase of common units by CVR Partners | | Repurchase of common units by CVR Partners | (2) | | | 0 | |

| Acquisition of CVR Refining common units | (301 | ) | | — |

| Acquisition of CVR Refining common units | 0 | | | (301) | |

| | Dividends to CVR Energy’s stockholders | (225 | ) | | (162 | ) | Dividends to CVR Energy’s stockholders | (121) | | | (225) | |

| Distributions to CVR Refining or CVR Partners’ noncontrolling interest holders | (25 | ) | | (67 | ) | Distributions to CVR Refining or CVR Partners’ noncontrolling interest holders | 0 | | | (25) | |

| Other financing activities | (5 | ) | | (3 | ) | Other financing activities | (11) | | | (5) | |

| Net cash used in financing activities | (556 | ) | | (232 | ) | |

| Net increase in cash and cash equivalents | 24 |

| | 220 |

| |

| Cash and cash equivalents, beginning of period | 668 |

| | 482 |

| |

| Cash and cash equivalents, end of period | $ | 692 |

| | $ | 702 |

| |

| Net cash provided by (used in) financing activities | | Net cash provided by (used in) financing activities | 361 | | | (556) | |

| Net increase in cash, cash equivalents and restricted cash | | Net increase in cash, cash equivalents and restricted cash | 27 | | | 24 | |

| Cash, cash equivalents and restricted cash, beginning of period | | Cash, cash equivalents and restricted cash, beginning of period | 652 | | | 668 | |

| Cash, cash equivalents and restricted cash, end of period | | Cash, cash equivalents and restricted cash, end of period | $ | 679 | | | $ | 692 | |

|

The accompanying notes are an integral part of these condensed consolidated financial statements.

September 30, 20192020 | 78

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(unaudited)

(1) Organization and Nature of Business

Organization

CVR Energy, Inc. (“CVR Energy,” “CVR,” “we,” “us,” “our,” or the “Company”) is a diversified holding company primarily engaged in the petroleum refining and nitrogen fertilizer manufacturing industries through its holdings in CVR Refining, LP (the “Petroleum Segment” or “CVR Refining”) and CVR Partners, LP (the “Nitrogen Fertilizer Segment” or “CVR Partners”). CVR Refining is an independent petroleum refiner and marketer of high value transportation fuels. CVR Partners produces and markets nitrogen fertilizers in the form of urea ammonium nitrate (“UAN”) and ammonia. CVR’s common stock is listed on the New York Stock Exchange (“NYSE”(the “NYSE”) under the symbol “CVI.” Icahn Enterprises L.P. and its affiliates (“IEP”) owned approximately 71% of the Company’s outstanding common shares as of September 30, 2019.2020.

Stock Repurchase Program

On October 23, 2019, the Board of Directors of the Company authorized a stock repurchase program (the “Stock Repurchase Program”). The Stock Repurchase Program would enable the Company to repurchase up to $300 million of the Company’s common stock. Repurchases under the Stock Repurchase Program may be made from time-to-time through open market transactions, block trades, privately negotiated transactions or otherwise in accordance with applicable securities laws. The timing, price and amount of repurchases (if any) will be made at the discretion of management and are subject to market conditions as well as corporate, regulatory and other considerations. While the Stock Repurchase Program currently has a duration of four years, it does not obligate the Company to acquire any stock and may be terminated by the Company’s Board of Directors at any time.

CVR Refining, LP

On January 17, 2019, the general partner of CVR Refining assigned to the Company its right to purchase all of the issued and outstanding CVR Refining common units not already owned by CVR Refining’s general partner or its affiliates. On January 29, 2019, the Company purchased all remaining CVR Refining common units not already owned by the Company or its affiliates for a cash purchase price of $10.50 per unit (the “Call Price”), or approximately $241 million in the aggregate (the “Public Unit Purchase”). In conjunction with the exercise of its call right for all CVR Refining common units not already owned by the Company or its affiliates, the Company entered into a purchase agreement with American Entertainment Properties Corporation (“AEP”) and IEP, pursuant to which, on January 29, 2019, all of the Common Units held by AEP and IEP were purchased by the Company for a cash price per unit equal to the Call Price, or approximately $60 million in the aggregate (the “Affiliate Unit Purchase” together with the Public Unit Purchase, the “CVRR Unit Purchase”). The total purchase price of $301 million was funded with approximately $105 million in borrowings under a new credit agreement entered into by the Company on January 29, 2019, with the remaining amount being funded from the Company’s cash on hand. Amounts drawn under the new credit agreement were fully repaid in February 2019. See Note 7 (“Long-Term Debt and Finance Lease Obligations”) for further information on the credit agreement. The consolidated results of operations and financial position of CVR Refining are reflected as CVR’s Petroleum Segment. Following this transaction, CVR Refining became a wholly-owned subsidiary of the Company and therefore is no longer accounted for as a variable interest entity.

Upon the closing of the CVRR Unit Purchase, the Company, and certain of the Company’s subsidiaries, executed a full and unconditional guarantee of CVR Refining’s Senior Notes due 2022 (the “2022 Senior Notes”). Effective February 8, 2019, CVR Refining’s reporting obligations under the Exchange Act were suspended. Pursuant to SEC regulations, the Company has elected to provide condensed consolidating financial statements in lieu of providing standalone CVR Refining financial statements. See Note 15 (“Guarantor Financial Information”) for further discussion and the condensed consolidated financial statements.

CVR Partners, LP

Interest Holders - As of September 30, 2019,2020, public securitycommon unit holders held approximately 66%65% of CVR Partners’ outstanding common units and CVR Services, LLC (“CVR Services”) (formerly Coffeyville Resources, LLC (“CRLLC”)LLC), a wholly-owned subsidiary of CVR Energy, held approximately 34%35% of CVR Partners’ outstanding common units. In addition, CRLLC ownsCVR Services held 100% of CVR Partners’ general partner, CVR GP, LLC (“CVR GP”), which holdsheld a non-economic general partner interest in CVR Partners.Partners as of September 30, 2020. Following the acquisition of the noncontrolling interest in CVR Refining in January 2019, the noncontrolling interest reflected on the condensed consolidated balance sheets of CVR is only impacted by the net income of, and distributions from, CVR Partners.

NYSE Listing Requirements and Reverse Split - On April 20, 2020, the average closing price of CVR Partners’ common units over a 30 consecutive trading-day period fell below $1.00 per common unit, resulting in noncompliance with the continued listing standards in Section 802.01C of the NYSE Listed Company Manual. CVR Partners received written notification of this noncompliance from the NYSE on April 22, 2020, and currently has until January 1, 2021 to regain compliance or be subject to the NYSE’s suspension and delisting procedures. See the Form 8-K filed by CVR Partners with the SEC on April 24, 2020 for further discussion. As of September 30, 2020, the average closing price of CVR Partners’ common units over the preceding consecutive 30 trading-day period remained below $1.00 per common unit.

On November 2, 2020, CVR Partners announced that the board of directors of its general partner (the “UAN GP Board”) had approved a 1-for-10 reverse split of CVR Partners’ common units to be effective at 5:00 p.m. Eastern Time on November 23, 2020, pursuant to which each ten common units of CVR Partners would be converted into one common unit of the Partnership (the “Reverse Unit Split”). In accordance with CVR Partners’ Agreement of Limited Partnership, as amended, following the Reverse Unit Split, any fractional units of record holders will be rounded up or down, as applicable, to the nearest whole common unit, with any fraction equal to or above 0.5 common units rounding up to the next higher common unit. Following the Reverse Unit Split, the number of CVR Partners common units outstanding would decrease from approximately 111 million common units to approximately 11 million common units, with proportionate adjustments to the common units under CVR Partners’ long-term incentive plan and outstanding awards thereunder.

The UAN GP Board determined the 1-for-10 ratio to be appropriate to meet CVR Partners’ goals of improving the marketability of its common units, regaining compliance with NYSE listing requirements, and reducing the risk of future noncompliance with such listing requirements.

CVR Partners’ common units are expected to begin trading on a split-adjusted basis when markets open on November 24, 2020, under the symbol “UAN” and a new CUSIP number.

Unit Repurchase Program - On May 6, 2020, the UAN GP Board, on behalf of CVR Partners, authorized a unit repurchase program (the “Unit Repurchase Program”). The Unit Repurchase Program enables CVR Partners to repurchase up to $10 million of its common units. During the three and nine months ended September 30, 2020, CVR Partners repurchased 1,403,784 and 2,294,002 common units, respectively, on the open market in accordance with a repurchase agreement under Rules 10b5-1 and 10b-18 of the Exchange Act, which was terminated on August 6, 2020, at a cost of $1 million and $2 million, respectively, inclusive of transaction costs, or an average price of $0.94 and $0.99 per common unit, respectively. At September 30, 2020, CVR Partners had $8 million in authority remaining under the Unit Repurchase Program. This Unit Repurchase Program does not obligate CVR Partners to acquire any common units and may be cancelled or terminated by the UAN GP Board at any time.

September 30, 20192020 | 89

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(unaudited)

As a result of these repurchases, and the resulting change in CVR Energy’s ownership of CVR Partners while maintaining control, CVR Energy recognized an increase of $2.9 million to additional paid-in capital from the reduction of non-controlling interests totaling $3.9 million and the recognition of a deferred tax liability totaling $1.0 million from changes in its book versus tax basis in CVR Partners.

(2) Basis of Presentation

The accompanying condensed consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”) and in accordance with the rules and regulations of the Securities and Exchange Commission (the “SEC”). Effective January 1, 2019, the Company revised its accounting policy method for the costs of planned major maintenance activities (turnarounds) specific to the Petroleum Segment from being expensed as incurred (the direct expensing method) to the deferral method. Comparable prior period information has been recast to reflect this accounting change. The impact of adopting the new policy to account for turnaround expenses is reflected within a Current Report on Form 8-K filed by the Company with the SEC on June 12, 2019, which recast the December 31, 2018 audited information (the “Recast Form 8-K for 2018”). See Note 3 (“Recent Accounting Pronouncements and Accounting Changes”) for additional information. These condensed consolidated financial statements should be read in conjunction with the December 31, 20182019 audited consolidated financial statements and notes thereto included in CVR Energy’s Annual Report on Form 10-K for the year ended December 31, 2018, as well as the Recast2019 (the “2019 Form 8-K for 2018.10-K”).

Our condensed consolidated financial statements include the consolidated results of CVR Partners, which is defined as a variable interest entity.

In the opinion of the Company’s management, the accompanying condensed consolidated financial statements reflect all adjustments that are necessary for fair presentation of the financial position and results of operations of the Company for the periods presented. Such adjustments are of a normal recurring nature, unless otherwise disclosed.

Certain other reclassifications have been made within the condensed consolidated balance sheets as of December 31, 2019 and the condensed consolidated statements of operations for the three and nine months ended September 30, 20182019. Catalyst inventory with a value of $17 million as of December 31, 2019 was reclassified during the first quarter of 2020 to include gain (loss) on derivatives within the Cost of materials and other financial statement line itemOther long-term assets to conform withto current presentation.

The preparation of the condensed consolidated financial statements in conformity with GAAP requires management to make certain estimates and assumptions that affect the reported amounts of assets, liabilities, revenues and expenses, and the disclosure of contingent assets and liabilities. Actual results could differ from those estimates. Results of operations and cash flows for the interim periods presented are not necessarily indicative of the results that will be realized for the year ending December 31, 20192020 or any other interim or annual period.

(3) Recent Accounting Pronouncements and Accounting Changes

Recent Accounting PronouncementPronouncements - Adoption of New LeaseCredit Losses Standard

In FebruaryJune 2016, the Financial Accounting Standards Board (“FASB”) issued Accounting StandardsStandard Update (“ASU”) No. 2016-02, “Leases” (“2016-13, Financial Instruments - Credit Losses (Topic 326). The ASU 2016-02”), creatingreplaces the incurred loss model with a new topic, FASB ASC Topic 842, “Leases” (“Topic 842”), which supersedes lease requirements in FASB ASC Topic 840, “Leases.” The new standard revises accountingcurrent expected credit loss model for operating leases by a lessee, among other changes, and requires a lessee to recognize a liability related to future lease payments and a right-of-use (“ROU”) asset representing its right to usemore timely recognition of the underlying assetexpected impairment losses for the lease term on the condensed consolidated balance sheet. The ROU asset for operating leases is classified as Other long-term assets on the condensed consolidated balance sheet. The current and long-term operating lease liabilities are classified as Other current liabilities and Other long-term liabilities, respectively, on the condensed consolidated balance sheet. The ROU asset for finance leases is classified as Property, plant and equipment, net of accumulated depreciation and amortization on the condensed consolidated balance sheet. The current and long-term finance lease liabilities are classified as Other current liabilities and Long-term debt and finance lease obligations, respectively, on the condensed consolidated balance sheet.

We adopted Topic 842 as of January 1, 2019, electing the option to apply the transition provisions at the adoption date instead of the earliest comparative period presented in themost financial statements. In connection with the adoption of Topic 842, we made the following elections:

Under the short-term lease exception provided for in Topic 842, only ROU assets and related lease liabilities for leases with a term greater than one year were and will be recognized;

The accounting treatment for existing land easements was carried forward;

Lease and non-lease components were and willcertain other instruments that are not be bifurcated for all of the Company’s asset groups, respectively; and

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(unaudited)

The portfolio approach was, and will be, used in the selection of the discount rate used to calculate minimum lease payments and the related ROU asset and operating lease liability amounts.

The Company’s adoption of Topic 842 resulted in the recognition of additional ROU assets and lease liabilities of approximately $56 million as of January 1, 2019, in addition to the recognition of a finance lease asset of $26 million with an obligation of $23 million. There were no impacts to our condensed consolidated statements of operations or cash flows. See Note 6 (“Leases”) for further discussion.

Accounting Change - Turnaround Expenses

measured at fair value through net income. Effective January 1, 2019, the Company revised its accounting policy method for the costs of planned major maintenance activities (turnarounds) specific to the Petroleum Segment from being expensed as incurred (the direct expensing method) to the deferral method. Turnarounds are planned shutdowns of refinery processing units for significant overhaul and refurbishment. Under the deferral method, the costs of turnarounds are deferred and amortized on a straight-line basis generally over a four-year period of time, which represents the estimated time until the next turnaround occurs. The new method of accounting for turnarounds is considered preferable as it is more consistent2020, we adopted this ASU with the accounting policy of our peer companies and better reflects the economic substance of the benefits earned from turnaround expenditures. The condensed consolidated balance sheet as of December 31, 2018, the condensed consolidated statement of operations for the three and nine months ended September 30, 2018, and the condensed consolidated statement of cash flows for the nine months ended September 30, 2018 have been retrospectively adjusted to apply the new method. These turnaround costs, and related accumulated amortization, are included in the condensed consolidated balance sheet as Other long-term assets. The amortization expense related to turnaround costs is included in Depreciation and amortization in the condensed consolidated statement of operations. The Nitrogen Fertilizer Segment will continue to follow the direct expensing method, therefore this change had no material impact on the Nitrogen Fertilizer Segment’s current condensedCompany’s consolidated financial statements.position or results of operations.

The policy change for turnaround expenses retrospectively impacted the Company’s December 31, 2018 condensed consolidated balance sheet by increasing total assets by $93 million and total equity by $75 million. The adoption of Topic 842 on January 1, 2019 incrementally impacted the Company’s consolidated balance sheet as of that date. The following presents the financial statement line items impacted by the turnaround accounting change and the Company’s Topic 842 adoption as of the respective dates.

Effect of Topic 842 Adoption on Condensed Consolidated Balance Sheet as of January 1, 2019

|

| | | | | | | | | | | |

| (in millions) | December 31, 2018

As Stated (1) | | Effect of Adoption of Topic 842 - Leases (Unaudited) | | January 1, 2019

As Adjusted |

| Current assets: | | | | | |

| Prepaid expenses and other current assets | $ | 76 |

| | $ | (3 | ) | (2) | $ | 73 |

|

| Total currents assets | 1,293 |

| | (3 | ) | | 1,290 |

|

| Property, plant and equipment, net | 2,430 |

| | 26 |

| (3) | 2,456 |

|

| Other long-term assets | 277 |

| | 56 |

| (4) | 333 |

|

| Total assets | $ | 4,000 |

| | $ | 79 |

| | $ | 4,079 |

|

| Current liabilities: | | | | | |

| Other current liabilities | $ | 176 |

| | $ | 16 |

| (5) | $ | 192 |

|

| Total current liabilities | 496 |

| | 16 |

| | 512 |

|

| Long-term debt and finance lease obligations | 1,167 |

| | 23 |

| (3) | 1,190 |

|

| Other long-term liabilities | 14 |

| | 40 |

| (5) | 54 |

|

| Total long-term liabilities | 1,561 |

| | 63 |

| | 1,624 |

|

| Equity: | | | | | |

| Total liabilities and equity | $ | 4,000 |

| | $ | 79 |

| | $ | 4,079 |

|

| |

(1) | Represents the retrospectively adjusted balance sheet amounts upon reflection of the turnaround accounting change, for which the Recast Form 8-K for 2018 was filed on June 12, 2019, prior to the adoption of Topic 842. |

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(unaudited)

| |

(2) | Represents lease prepayments reclassified to ROU assets. |

| |

(3) | The additional $26 million right-of-use asset and $23 million in lease liability represents a lease with a third-party that met the definition of a finance lease under ASC 842 as compared to an operating lease under ASC 840. |

| |

(4) | Represents recognition of initial ROU assets for operating leases, including the reclassification of certain lease prepayments as noted above. |

| |

(5) | Represents the initial recognition of lease liabilities. |

Due to the retrospective adjustments for the turnaround accounting change, the three and nine months ended September 30, 2018 condensed consolidated statement of operations and the nine months ended September 30, 2018 condensed consolidated statement of cash flows have been recast. The impacts to previously reported amounts are shown below only for those line items impacted.

Effect of Turnaround Accounting on Condensed Consolidated Statement of Operations for the Three Months Ended September 30, 2018

|

| | | | | | | | | | | |

| (in millions) | As Previously Reported | | Effect of Turnaround Accounting Change (Unaudited) | | As Stated |

| Condensed Consolidated Statement of Operations | | | | | |

| Direct operating expenses (exclusive of depreciation and amortization as reflected below) | $ | 121 |

| | $ | (2 | ) | | $ | 119 |

|

| Depreciation and amortization | 49 |

| | 14 |

| | 63 |

|

| Income tax expense | 35 |

| | (2 | ) | | 33 |

|

| Net income | 121 |

| | (11 | ) | | 110 |

|

| Less: Net income attributable to noncontrolling interest | 31 |

| | (2 | ) | | 29 |

|

| Net income attributable to CVR Energy stockholders | $ | 90 |

| | $ | (9 | ) | | $ | 81 |

|

Effect of Turnaround Accounting on Condensed Consolidated Statement of Operations and Condensed Consolidated Statement of Cash Flows for the Nine Months Ended September 30, 2018

|

| | | | | | | | | | | |

| (in millions) | As Previously Reported | | Effect of Turnaround Accounting Change (Unaudited) | | As Stated |

| Condensed Consolidated Statement of Operations | | | | | |

| Direct operating expenses (exclusive of depreciation and amortization as reflected below) | $ | 394 |

| | $ | (4 | ) | | $ | 390 |

|

| Depreciation and amortization | 151 |

| | 45 |

| | 196 |

|

| Income tax expense | 73 |

| | (8 | ) | | 65 |

|

| Net income | 304 |

| | (33 | ) | | 271 |

|

| Less: Net income attributable to noncontrolling interest | 97 |

| | (11 | ) | | 86 |

|

| Net income attributable to CVR Energy stockholders | $ | 207 |

| | $ | (22 | ) | | $ | 185 |

|

| | | | | | |

| Condensed Consolidated Statement of Cash Flows | | | | | |

| Net cash provided by operating activities | $ | 519 |

| | $ | 7 |

| | $ | 526 |

|

| Net cash used by investing activities | $ | (67 | ) | | $ | (7 | ) | | $ | (74 | ) |

New Accounting Standards Issued But Not Yet Implemented

In August 2018, the FASB issued ASU 2018-13, Fair Value Measurement (Topic 820). The ASU eliminates such disclosures as the amount of, and reasons for, transfers between Level 1 and Level 2 of the fair value hierarchy. Certain disclosures are required to be applied on a retrospective basis and others on a prospective basis. Effective January 1, 2020, we adopted this ASU with no material impact on the Company’s disclosures.

New Accounting Standards Issued But Not Yet Implemented

In December 2019, the FASB issued ASU 2019-12, Income Taxes (Topic 740). The ASU simplifies the accounting for income taxes by removing certain exceptions to the general principles in Topic 740 and modifies other areas of the topic to clarify the application of GAAP. Certain amendments within the standard are required to be applied on a retrospective basis and others on a prospective basis. This standard is effective for the Company beginning January

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(unaudited)

1, 2020,2021, with early adoption permitted. The Company is evaluating the effect of adopting this new accounting guidance but does not currently expect adoption will have a material impact on the Company’s disclosures.

In August 2018, the FASB issued ASU 2018-15, Intangibles-Goodwill and Other-Internal-Use Software (Subtopic 350-40). This ASU addresses customer’s accounting for implementation costs incurred in a cloud computing arrangement that is a service contract and also adds certain disclosure requirements related to implementation costs incurred for internal-use software and cloud computing arrangements. The amendment aligns the requirements for capitalizing implementation costs incurred in a hosting arrangement that is a service contract with the requirements for capitalizing implementation costs incurred to develop or obtain internal-use software (and hosting arrangements that include an internal-use software license). This standard is effective for the Company beginning January 1, 2020, with early adoption permitted. The amendments in this standard can be applied either retrospectively or prospectively to all implementation costs incurred after the date of adoption. The Company is evaluating the effect of adopting this new accounting guidance on its consolidated financial

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(unaudited)

statements, but does not currently expect adoption will have a material impact on the Company’s consolidated financial position or results of operations. The Company does not intend to early adopt this ASU.

In March 2020, the FASB issued ASU 2020-04, Reference Rate Reform (Topic 848). This ASU was issued because, by the end of 2021, banks will no longer be required to report information that is used to determine London Interbank Offered Rate (“LIBOR”), which is used globally by all types of entities. As a result, LIBOR could be discontinued, as well as other interest rates used globally. ASU 2020-04 provides companies with optional expedients for contract modifications under Topics 310, 470, 842, and 815-15, excluded components of certain hedging relationships, fair value hedges, and cash flow hedges, as well as certain exceptions, which are intended to help ease the potential accounting burden associated with transitioning away from these reference rates. Companies can apply the ASU immediately. However, the guidance will only be available for a limited time (generally through December 31, 2022). The Company is currently evaluating the impact that adopting this new accounting standard will have on its consolidated financial statements and related disclosures.

(4) Inventories

Inventories consisted of the following:

| | | | | | | | | | | |

| (in millions) | September 30, 2020 | | December 31, 2019 |

| Finished goods | $ | 110 | | | $ | 177 | |

| Raw materials | 73 | | | 112 | |

| In-process inventories | 17 | | | 18 | |

| Parts, supplies and other | 66 | | | 66 | |

| Total inventories | $ | 266 | | | $ | 373 | |

|

| | | | | | | |

| (in millions) | September 30, 2019 | | December 31, 2018 |

| Raw materials | $ | 114 |

| | $ | 101 |

|

| In-process inventories | 18 |

| | 12 |

|

| Finished goods | 176 |

| | 186 |

|

| Parts, supplies and other | 80 |

| | 81 |

|

| Total inventories | $ | 388 |

| | $ | 380 |

|

As of March 31, 2020, the carrying amounts of the Petroleum Segment’s inventories exceeded their net realizable value (market value) by $58 million resulting in the recognition of a lower of cost or net realizable value adjustment. The $58 million loss represents the difference between the carrying value of the Petroleum Segment’s inventories accounted for using the first-in-first-out method and selling prices for refined products subsequent to March 31, 2020. NaN adjustment was necessary as of September 30, 2020, June 30, 2020, or December 31, 2019.

(5) Property, Plant and Equipment

Property, plant and equipment consisted of the following:

| | | | | | | | | | | |

| (in millions) | September 30, 2020 | | December 31, 2019 |

| Machinery and equipment | $ | 3,871 | | | $ | 3,805 | |

| Buildings and improvements | 88 | | | 87 | |

| ROU finance leases | 81 | | | 81 | |

| Land and improvements | 47 | | | 46 | |

| Furniture and fixtures | 37 | | | 35 | |

| Construction in progress | 91 | | | 95 | |

| Other | 15 | | | 14 | |

| | | |

| | | |

| | | |

| | | |

| 4,230 | | | 4,163 | |

| Less: Accumulated depreciation and amortization | 1,963 | | | 1,827 | |

| Total property, plant and equipment, net | $ | 2,267 | | | $ | 2,336 | |

|

| | | | | | | |

| (in millions) | September 30, 2019 | | December 31, 2018 |

| Machinery and equipment | $ | 3,830 |

| | $ | 3,785 |

|

| Buildings and improvements | 87 |

| | 87 |

|

| Land and improvements | 46 |

| | 43 |

|

| Furniture and fixtures | 33 |

| | 33 |

|

| ROU finance lease | 27 |

| | — |

|

| Construction in progress | 98 |

| | 102 |

|

| Other | 14 |

| | 17 |

|

| | 4,135 |

| | 4,067 |

|

| Less: Accumulated depreciation | 1,779 |

| | 1,637 |

|

| Total property, plant and equipment, net | $ | 2,356 |

| | $ | 2,430 |

|

As of September 30, 2020, the Company had not identified the existence of an impairment indicator for our long-lived asset groups as outlined under ASC 360.

On May 21, 2019, a subsidiary of CVR Energy sold its crude oil storage terminal located in Cushing, Oklahoma and related assets (the “Terminal”). As part of this transaction the Company received cash consideration of $43 million for the Terminal and related crude oil inventories resulting in the recognition of a gain on sale of $9 million. The carrying value(6) Goodwill

One of the inventory sold as partreporting units associated with our Nitrogen Fertilizer Segment’s Coffeyville, Kansas facility (the “Coffeyville Facility”) had a goodwill balance of this transaction has been presented on a net basis, with$41 million at December 31, 2019. During the proceeds on sale, withinsecond quarter of 2020, following the net cash used in investing sectioncompletion of the Condensed Consolidated Statements of Cash Flows.

September 30, 20192020 | 1211

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(unaudited)

(6) Leases

(7) Leases

Lease Overview

We lease certain pipelines, storage tanks, railcars, office space, land, and equipment across our refining, fertilizer and corporate operations. Most leases include one or more options to renew, with renewal terms that can extend the lease term from one to 20 years or more. The exercise of lease renewal options is at our sole discretion. Certain leases also include options to purchase the leased property. The depreciable life of assets and leasehold improvements is limited by the expected lease term, unless there is a transfer of title or purchase option reasonably certain of exercise. Certain of our lease agreements include rental payments which are adjusted periodically for factors such as inflation. Our lease agreements do not contain any material residual value guarantees or material restrictive covenants. Additionally, we do not have any material lessor or sub-leasing arrangements.

The adoption of Topic 842 impacted our January 1, 2019 condensed consolidated balance sheet as shown below only for those line items impacted.

Effect of Initial Adoption of Topic 842 - January 1, 2019

ROU Assets. Upon initial recognition, our ROU assets for operating and finance leases were comprised of the following:

|

| | | |

| (in millions) | January 1, 2019 (initial recognition) |

| Pipeline and storage agreements (1) | $ | 29 |

|

| Railcar leases (2) | 15 |

|

| Real Estate and other leases (3) | 35 |

|

| Total ROU assets | $ | 79 |

|

(1) Includes finance leased assets of $1 million as of January 1, 2019.

(2) Includes $14 million of railcar leases recognized by CVR Partners.

(3) Includes finance leased assets of $25 million as of January 1, 2019.

Lease Liabilities. Upon initial recognition, our lease liabilities for operating and finance leases were comprised of the following:

|

| | | | |

| (in millions) | | January 1, 2019 (initial recognition) |

| Current liabilities: | | |

| Operating leases | | $ | 14 |

|

| Finance leases | | 2 |

|

| Long-term liabilities: | | |

| Operating leases | | 40 |

|

| Finance leases | | 23 |

|

| Total lease liabilities | | $ | 79 |

|

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(unaudited)

Balance Sheet Summary as of September 30, 2020 and December 31, 2019

The following tables summarize the right of use asset and lease liability balances for the Company’s operating and finance leases at September 30, 2020 and December 31, 2019:

|

| | | |

| (in millions) | September 30, 2019 |

| Operating Leases: | |

| ROU assets, net | |

| Pipeline and storage | $ | 22 |

|

| Railcars | 12 |

|

| Real estate and other | 14 |

|

| Lease liability | |

| Pipelines and storage | $ | 23 |

|

| Railcars | 12 |

|

| Real estate and other | 12 |

|

|

| | | |

| (in millions) | September 30, 2019 |

| Financing Leases: | |

| ROU assets, net | |

| Pipeline and storage | $ | 30 |

|

| Real estate and other | 25 |

|

| Lease liability | |

| Pipelines and storage | $ | 41 |

|

| Real estate and other | 26 |

|

| | | | | | | | | | | |

| (in millions) | September 30, 2020 | | December 31, 2019 |

| Operating Leases: | | | |

| ROU assets, net | | | |

| Pipeline and storage | $ | 17 | | | $ | 20 | |

| Railcars | 9 | | | 12 | |

| Real estate and other | 16 | | | 16 | |

| Lease liability | | | |

| Pipelines and storage | $ | 17 | | | $ | 22 | |

| Railcars | 9 | | | 12 | |

| Real estate and other | 15 | | | 14 | |

| | | | | | | | | | | |

| (in millions) | September 30, 2020 | | December 31, 2019 |

| Finance Leases: | | | |

| ROU assets, net | | | |

| Pipeline and storage | $ | 27 | | | $ | 29 | |

| Real estate and other | 22 | | | 24 | |

| Lease liability | | | |

| Pipelines and storage | $ | 39 | | | $ | 40 | |

| Real estate and other | 23 | | | 25 | |

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(unaudited)

Lease Expense Summary for the Three and Nine Months Ended September 30, 2020 and 2019

We recognize lease expense on a straight-line basis over the lease term. For the three and nine months ended September 30, 2020 and 2019, we recognized lease expense comprised of the following components:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| (in millions) | 2020 | | 2019 | | 2020 | | 2019 |

| Operating lease expense | $ | 4 | | | $ | 4 | | | $ | 13 | | | $ | 12 | |

| Finance lease expense: | | | | | | | |

| Amortization of ROU | $ | 2 | | | $ | 2 | | | $ | 5 | | | $ | 5 | |

| Interest expense on lease liability | 1 | | | 2 | | | 4 | | | 5 | |

|

| | | | | | | |

| (in millions) | Three Months Ended

September 30, 2019 | | Nine Months Ended

September 30, 2019 |

| Operating lease expense | $ | 4 |

| | $ | 12 |

|

| Financing lease expense: | | | |

| Amortization of ROU | $ | 2 |

| | $ | 5 |

|

| Interest expense on lease liability | 2 |

| | 5 |

|

Short-term lease expense, recognized within directDirect operating expenses (exclusive of depreciation and amortization), was $2 million and $6 million for the three and nine months ended September 30, 2019.

2020, respectively, and $2 million and $6 million for the three and nine months ended September 30, 2019, | 14

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(unaudited)

Lease Terms and Discount Rates

The following outlines the remaining lease terms and discount rates used in the measurement of the Company’s ROU assets and liabilities:

| | | | | | | | | | | |

| September 30, 2020 | | December 31, 2019 |

| Weighted-average remaining lease term (years) | | | |

| Operating Leases | 3.3 | | 3.7 |

| Finance Leases | 8.4 | | 9.0 |

| Weighted-average discount rate | | | |

| Operating Leases | 5.5 | % | | 5.6 | % |

| Finance Leases | 9.0 | % | | 8.9 | % |

|

| | | | | |

| | September 30, 2019 | | January 1, 2019 (initial recognition) |

| Weighted-average remaining lease term (years) | | | |

| Operating Leases | 3.9 |

| | 4.4 |

|

| Finance Leases | 9.8 |

| | 10.3 |

|

| Weighted-average discount rate | | | |

| Operating Leases | 5.7 | % | | 5.8 | % |

| Finance Leases | 9.6 | % | | 9.8 | % |

Maturities of Lease Liabilities

The following summarizes the remaining minimum lease payments through maturity of the Company’s right-of-use assets and liabilities at September 30, 2019:2020:

| | | | | | | | | | | |

| (in millions) | Operating Leases | | Financing

Leases |

| Remainder of 2020 | $ | 4 | | | $ | 3 | |

| 2021 | 15 | | | 11 | |

| 2022 | 12 | | | 11 | |

| 2023 | 8 | | | 10 | |

| 2024 | 5 | | | 10 | |

| Thereafter | 0 | | | 43 | |

| Total lease payments | 44 | | | 88 | |

| Less: imputed interest | (3) | | | (26) | |

| Total lease liability | $ | 41 | | | $ | 62 | |

|

| | | | | | | |

| (in millions) | Operating Leases | | Financing Leases |

| Remainder of 2019 | $ | 4 |

| | $ | 3 |

|

| 2020 | 15 |

| | 11 |

|

| 2021 | 13 |

| | 11 |

|

| 2022 | 10 |