UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(MARK ONE)

x QUARTERLY REPORT PURSUANT TO SECTION 13, 15(d), OR 37 OF THE

SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended DecemberMarch 31, 20172020

OR

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _____ to _____

Commission file number 000-52313

TENNESSEE VALLEY AUTHORITY

(Exact name of registrant as specified in its charter)

|

| | | |

A corporate agency of the United States created by an act of Congress (State or other jurisdiction of incorporation or organization) | | 62-0474417 (IRS(I.R.S. Employer Identification No.) |

| |

400 W. Summit Hill Drive Knoxville, Tennessee (Address of principal executive offices) | | 37902 (Zip Code) |

(865) 632-2101

(Registrant’sRegistrant's telephone number, including area code)

None

(Former name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act |

| | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| N/A | N/A | N/A |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13, 15(d), or 37 of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large"large accelerated filer,” “accelerated" "accelerated filer,” “smaller" "smaller reporting company,”" and "emerging growth company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer o Accelerated filer o

Non-accelerated filer x (Do not check if a smaller reporting company) Smaller reporting company o

Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes o No x

|

| |

| Table of Contents |

| | |

| | Page |

GLOSSARY OF COMMON ACRONYMS...................................................................................................................................... | |

FORWARD-LOOKING INFORMATION......................................................................................................................................... | |

GENERAL INFORMATION............................................................................................................................................................ | |

| | |

|

| | |

ITEM 1. FINANCIAL STATEMENTS............................................................................................................................................. | |

| |

Consolidated Statements of Comprehensive Income (Loss) (unaudited).............................................................................(Unaudited)............................................................................ | |

Consolidated Balance Sheets (unaudited)............................................................................................................................ (Unaudited)........................................................................................................................... | |

| (Unaudited).......................................................................................................... | |

| (Unaudited)............................................................................ | |

| (Unaudited).................................................................................................... | |

| | |

| OPERATIONS... | |

Executive Overview............................................................................................................................................................... | |

Results of Operations............................................................................................................................................................ | |

Liquidity and Capital Resources............................................................................................................................................ | |

| Key Initiatives and Challenges.............................................................................................................................................. | |

| Environmental Matters.......................................................................................................................................................... | |

| Legal Proceedings................................................................................................................................................................ | |

Off-Balance Sheet Arrangements.........................................................................................................................................Arrangements.......................................................................................................................................... | |

| |

| |

Corporate Governance.......................................................................................................................................................... | |

| Legislative and Regulatory Matters....................................................................................................................................... | |

| | |

| |

| | |

ITEM 4. CONTROLS AND PROCEDURES.................................................................................................................................. | |

| Disclosure Controls and Procedures..................................................................................................................................... | |

| Changes in Internal Control over Financial Reporting.......................................................................................................... | |

| | |

|

| | |

ITEM 1. LEGAL PROCEEDINGS.................................................................................................................................................. | |

| | |

ITEM 1A. RISK FACTORS....................................................................................................................................................................................................................................................................................................................... | |

| |

| ITEM 5. OTHER INFORMATION.................................................................................................................................................. | |

| | |

ITEM 6. EXHIBITS............................................................................................................................................................................................................................................................................................................................................... | |

| | |

SIGNATURES............................................................................................................................................................................... | |

|

| | |

| GLOSSARY OF COMMON ACRONYMS |

Following are definitions of some of the terms or acronyms that may be used in this Quarterly Report on Form 10-Q for the quarter ended DecemberMarch 31, 20172020 (the "Quarterly Report"): |

| |

| Term or Acronym | | Definition |

AFUDC | | Allowance for funds used during construction |

| AOCI | | Accumulated other comprehensive income (loss) |

| ARO | | Asset retirement obligation |

| ART | | Asset Retirement Trust |

| ASLB | | Atomic Safety and Licensing Board |

BLEUBonds | | Blended low-enriched uraniumBonds, notes, or other evidences of indebtedness |

| CAA | | Clean Air Act |

CAIR | | Clean Air Interstate Rule |

| CCR | | Coal combustion residuals |

| CEL | | Chilling Effect Letter |

| CME | | Chicago Mercantile Exchange |

CO2 | | Carbon dioxide |

COL | | Combined construction and operating license |

| COLA | | Cost-of-living adjustment |

| COVID-19 | | Coronavirus Disease 2019 |

| CSAPR | | Cross-State Air Pollution Rule |

| CTs | | Combustion turbine unit(s) |

| CVA | | Credit valuation adjustment |

| CY | | Calendar year |

| DCP | | Deferred Compensation Plan |

| DER | | Distributed energy resources |

| DOE | | Department of Energy |

| EIS | | Environmental Impact Statement |

| ELGs | | Effluent Limitation Guidelines |

| EO | | Executive Order |

| EPA | | Environmental Protection Agency |

| EPRI | | Electric Power Research Institute |

| EPU | | Extended Power Uprate |

| ESPA | | Early Site Permit Application |

| FASB | | Financial Accounting Standards Board |

| FCM | | Futures Commission Merchant |

| FERC | | Federal Energy Regulatory Commission |

| FTP | | Financial Trading Program |

| GAAP | | Accounting principles generally accepted in the United States of America |

| GHG | | Greenhouse gas |

| GMDs | | Geomagnetic disturbances |

| GWh | | Gigawatt hour(s) |

| HAP | | Hazardous Air Pollutants |

| IRP | | Integrated Resource Plan |

| JSCCG | | John Sevier Combined Cycle Generation LLC |

| KOC | | Knoxville Office Complex |

| kW | | Kilowatts |

| kWh | | Kilowatt hour(s)hours |

| LPC | | Local power company customer of TVAcustomers |

| MATS | | Mercury and Air Toxics Standards |

| MD&A | | Management’sManagement's Discussion and Analysis of Financial Condition and Results of Operations |

| mmBtu | | Million British thermal unit(s) |

| MtM | | Mark-to-market |

|

| | |

| MW | | MegawattMegawatts |

| NAAQS | | National Ambient Air Quality Standards |

| NAV | | Net asset value |

| NDT | | Nuclear Decommissioning Trust |

| NEIL | | Nuclear Electric Insurance Limited |

| NEPA | | National Environmental Policy Act |

| NERC | | North American Electric Reliability Corporation |

NOx | | Nitrogen oxide |

| NPDES | | National Pollutant Discharge Elimination System |

|

| | |

| NRC | | Nuclear Regulatory Commission |

| NSR | | New Source Review |

| NWP | | Nationwide Permit |

| OCI | | Other comprehensive income (loss) |

| OCIP | | Owner Controlled Insurance Program |

| PARRS | | Putable Automatic Rate Reset Securities |

| PM | | Particulate matter |

| QER | | Quadrennial Energy Review |

| QTE | | Qualified technological equipment and software |

| RECs | | Renewable Energy Certificates |

| REIT | | Real Estate Investment Trust |

| SCCG | | Southaven Combined Cycle Generation LLC |

| SCRs | | Selective catalytic reduction systems |

| SEC | | Securities and Exchange Commission |

| SERP | | Supplemental Executive Retirement Plan |

| SHLLC | | Southaven Holdco LLC |

| SIPs | | State implementation plans |

| SMR | | Small modular reactor(s) |

SO2 | | Sulfur dioxide |

| SPC | | Summer Place Complex |

| TCWN | | Tennessee Clean Water Network |

| TDEC | | Tennessee Department of Environment &and Conservation |

TOU | | Time-of-use |

| TVA Act | | The Tennessee Valley Authority Act of 1933, as amended, 16 U.S.C. §§ 831-831ee |

| TVARS | | Tennessee Valley Authority Retirement System |

| U.S. Treasury | | United States Department of the Treasury |

| VIE | | Variable interest entity |

| XBRL | | eXtensible Business Reporting Language |

FORWARD-LOOKING INFORMATION

This Quarterly Report contains forward-looking statements relating to future events and future performance. All statements other than those that are purely historical may be forward-looking statements. In certain cases, forward-looking statements can be identified by the use of words such as "may," "will," "should," "expect," "anticipate," "believe," "intend," “project,”"project," "plan," “predict,"predict," "assume," "forecast," "estimate," "objective,”" "possible," "probably," "likely," "potential," "speculate," the negative of such words, or other similar expressions.

Although the Tennessee Valley Authority ("TVA") believes that the assumptions underlying theany forward-looking statements are reasonable, TVA does not guarantee the accuracy of these statements. Numerous factors could cause actual results to differ materially from those in theany forward-looking statements. These factors include, among other things:

The impact of the pandemic resulting from the outbreak of the Coronavirus Disease 2019 (“COVID-19”) on TVA's revenues, the demand for electricity, TVA’s workforce and operations, the availability of fuel and critical parts, supplies, and services, and the business and financial condition of TVA’s customers and counterparties;

The duration and severity of the COVID-19 pandemic, actions taken to contain its spread and mitigate its effects, and broader impacts of the COVID-19 pandemic on economic and market conditions, including impacts on interest rates, commodity prices, investment performance, and foreign currency exchange rates;

New, amended, or existing laws, regulations, or administrative orders or interpretations, including those related to environmental matters, and the costs of complying with these laws, regulations, or administrative orders;orders or interpretations;

The cost of complying with known, anticipated, or new emissions reduction requirements, some of which could render continued operation of many of TVA's aging coal-fired generation units not cost-effective andor result in their removal from service, perhaps permanently;

Significant reductions in demand for electricity produced through non-renewable or centrally located generation sources whichthat may result from, among other things, economic downturns, increased energy efficiency and conservation, increased utilization of distributed generation and microgrids, and improvements in alternative generation and energy storage technologies;

Changes in customer preferences for energy produced from cleaner generation sources;

Changes in technology;

Actions taken, or inaction, by the U.S. government relating to the national or TVA debt ceiling or automatic spending cuts in government programs;

Costs andor liabilities that are not anticipated in TVA’sTVA's financial statements for third-party claims, natural resource damages, environmental clean-upcleanup activities, or fines or penalties associated with unexpected events such as failures of a facility or infrastructure;

Addition or loss of customers by TVA or the local power company customers of TVA ("LPCs");

Significant delays, cost increases, or cost overruns associated with the construction and maintenance of generation, transmission, navigation, flood control, or related assets;

Changes inRequirements or decisions changing the amount or timing or amount of funding obligations associated with TVA's pension andplans, other post-retirement benefit plans, or health care obligations and related funding;plans;

Increases in TVA's financial liabilities for decommissioning its nuclear facilities or retiring other assets;

Risks associated with the operation of nuclear facilities or other generation and related facilities, including coal combustion residualresiduals ("CCR") facilities;

Physical attacks on TVA's assets;

Cyber attacks on TVA's assets or the assets of third parties upon which TVA relies;

The outcome of legal or administrative proceedings, including the CCR proceedings involving the Gallatin Fossil Plant as well as any other CCR proceedings that may be brought in the future;proceedings;

The failure of TVA's generation, transmission, navigation, flood control, and related assets and infrastructure, including CCR facilities, to operate as anticipated, resulting in lost revenues, damages, andor other costs that are not reflected in TVA’sTVA's financial statements or projections;

Differences between estimates of revenues and expenses and actual revenues earned and expenses incurred;

Weather conditions;

Catastrophic events such as fires, earthquakes, explosions, solar events, electromagnetic pulses ("EMP"), geomagnetic disturbances ("GMDs"), droughts, floods, hurricanes, tornadoes, or other casualty events or pandemics, wars, national emergencies, terrorist activities, andor other similar events, especially if these events occur in or near TVA's service area;

Events at a TVA facility, which, among other things, could result in loss of life, damage to the environment, damage to or loss of the facility, and damage to the property of others;

Events or changes involving transmission lines, dams, and other facilities not operated by TVA, including those that affect the reliability of the interstate transmission grid of which TVA's transmission system is a part and those that increase flows across TVA's transmission grid;

Disruption of fuel supplies, which may result from, among other things, economic conditions, weather conditions, production or transportation difficulties, labor challenges, or environmental laws or regulations affecting TVA's fuel suppliers or transporters;

Purchased power price volatility and disruption of purchased power supplies;

Events which affect the supply of water for TVA's generation facilities;

Changes in TVA's determinations of the appropriate mix of generation assets;

Ineffectiveness of TVA's efforts at adapting its organization to an evolving marketplace and remaining cost competitive;

Inability to use regulatory accounting or loss of regulatory accounting approval for certain costs;

Inability to obtain, or loss of, regulatory approval for the construction or operation of assets;

The requirement or decision to make additional contributions to TVA's pension or other post-retirement benefit plans or to TVA's Nuclear Decommissioning Trust ("NDT") or Asset Retirement Trust ("ART");

Limitations on TVA's ability to borrow money which may result from, among other things, TVA's approaching or substantially reaching the limit on bonds, notes, and other evidences of indebtedness specified in the Tennessee Valley Authority Act of 1933 as amended, 16 U.S.C. §§ 831-831ee (the “TVA Act”("TVA Act");

An increase in TVA's cost of capital whichthat may result from, among other things, changes in the market for TVA's debt securities, changes in the credit rating of TVA or the U.S. government, or, potentially, an increased reliance by TVA on alternative financing should TVA approach its debt limit;

Changes in the economy and volatility in financial markets;

Reliability andor creditworthiness of counterparties;

Changes in the market price of commodities such as coal, uranium, natural gas, fuel oil, crude oil, construction materials, reagents, electricity, andor emission allowances;

Changes in the market price of equity securities, debt securities, andor other investments;

Changes in interest rates, currency exchange rates, andor inflation rates;

Ineffectiveness of TVA's disclosure controls and procedures or its internal controlscontrol over financial reporting;

Inability to eliminate identified deficiencies in TVA's systems, standards, controls, or corporate culture;

Inability to attract or retain a skilled workforce;

Inability to respond quickly enough to current or potential customer demands or needs;

Events at a nuclear facility, whether or not operated by or licensed to TVA, which, among other things, could lead to increased regulation or restriction on the construction, ownership, operation, andor decommissioning of nuclear facilities or on the storage of spent fuel, obligate TVA to pay retrospective insurance premiums, reduce the availability and affordability of insurance, increase the costs of operating TVA's existing nuclear units, andor cause TVA to forego future construction at these or other facilities;

Loss of quorum of the TVA Board of Directors (the "TVA("TVA Board");

Changes in the membershippriorities of the TVA Board or TVA senior management; andor

Other unforeseeable events.

See also Item 1A, Risk Factors, and Item 7, Management’sManagement's Discussion and Analysis of Financial Condition and Results of Operations in TVA’sTVA's Annual Report on Form 10-K10-K/A for the year ended September 30, 20172019 (the “Annual Report”"Annual Report"), and

Part I, Item 2, Management’sManagement's Discussion and Analysis of Financial Condition and Results of Operations, and Part II, Item 1A, Risk Factors in this Quarterly Report for a discussion of factors that could cause actual results to differ materially from those in aany forward-looking statement. New factors emerge from time to time, and it is not possible for TVA to predict all such factors or to assess the extent to which any factor or combination of factors may impact TVA’sTVA's business or cause results to differ materially from those contained in any forward-looking statement. TVA undertakes no obligation to update any forward-looking statement to reflect developments that occur after the statement is made.

GENERAL INFORMATION

Fiscal Year

References to years (2018, 2017,(2020, 2019, etc.) in this Quarterly Report are to TVA’sTVA's fiscal years ending September 30. Years that are preceded by “CY”"CY" are references to calendar years.

Notes

References to “Notes”"Notes" are to the Notes to Consolidated Financial Statements contained in Part I, Item 1, Financial Statements in this Quarterly Report.

Available Information

TVA's Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K, as well asand all amendments to those reports, are available on TVA's website, free of charge, as soon as reasonably practicable after such reports are electronically filed with or furnished to the Securities and Exchange Commission ("SEC"). TVA's website is www.tva.gov. Information contained on TVA’sTVA's website shall not be deemed to be incorporated into, or to be a part of, this Quarterly Report. All TVA SEC reports are available to the public without charge from the website maintained by the SEC at www.sec.gov.

PART I - FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

TENNESSEE VALLEY AUTHORITY

CONSOLIDATED STATEMENTS OF OPERATIONS (Unaudited)

Three Months Ended December 31

(in millions)

| | | | | | | | | Three Months Ended March 31 | | Six Months Ended March 31 |

| | 2017 | | 2016 | 2020 | | 2019 | | 2020 | | 2019 |

| Operating revenues | | | | | | | | | | |

| Revenue from sales of electricity | $ | 2,509 |

| | $ | 2,508 |

| $ | 2,489 |

| | $ | 2,712 |

| | $ | 5,021 |

| | $ | 5,393 |

|

| Other revenue | 40 |

| | 38 |

| 32 |

| | 38 |

| | 78 |

| | 82 |

|

| Total operating revenues | 2,549 |

| | 2,546 |

| 2,521 |

|

| 2,750 |

|

| 5,099 |

|

| 5,475 |

|

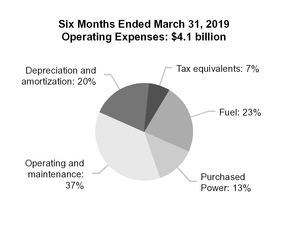

| Operating expenses | |

| | |

| |

| | |

| | |

| | |

|

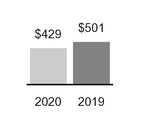

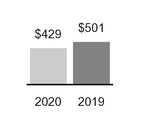

| Fuel | 475 |

| | 568 |

| 429 |

| | 501 |

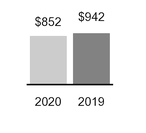

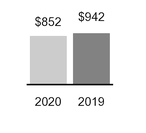

| | 852 |

| | 942 |

|

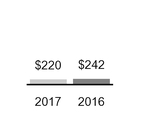

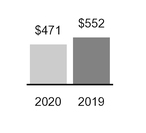

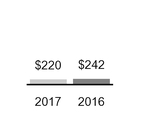

| Purchased power | 220 |

| | 242 |

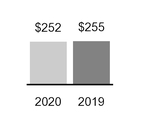

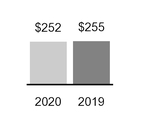

| 252 |

| | 255 |

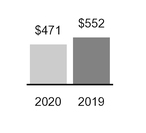

| | 471 |

| | 552 |

|

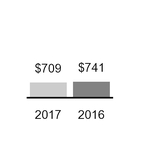

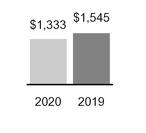

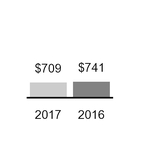

| Operating and maintenance | 709 |

| | 741 |

| 644 |

| | 800 |

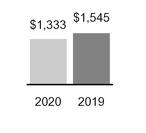

| | 1,333 |

| | 1,545 |

|

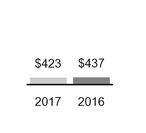

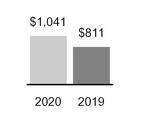

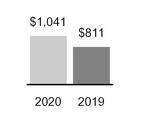

| Depreciation and amortization | 423 |

| | 437 |

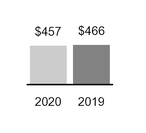

| 457 |

| | 466 |

| | 1,041 |

| | 811 |

|

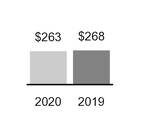

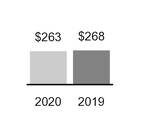

| Tax equivalents | 124 |

| | 129 |

| 132 |

| | 136 |

| | 263 |

| | 268 |

|

| Total operating expenses | 1,951 |

| | 2,117 |

| 1,914 |

| | 2,158 |

| | 3,960 |

| | 4,118 |

|

| Operating income | 598 |

| | 429 |

| 607 |

| | 592 |

| | 1,139 |

| | 1,357 |

|

| Other income (expense), net | 12 |

| | 12 |

| (1 | ) | | 14 |

| | 11 |

| | 38 |

|

| Other net periodic benefit cost | | 62 |

| | 65 |

| | 127 |

| | 129 |

|

| Interest expense | 322 |

| | 339 |

| 289 |

| | 300 |

| | 576 |

| | 602 |

|

| Net income (loss) | $ | 288 |

| | $ | 102 |

| $ | 255 |

| | $ | 241 |

| | $ | 447 |

| | $ | 664 |

|

The accompanying notes are an integral part of these consolidated financial statements. |

TENNESSEE VALLEY AUTHORITY

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS) (Unaudited)

Three Months Ended December 31(in millions)

|

| | | | | | | | | | | | | | | |

| | Three Months Ended March 31 | | Six Months Ended March 31 |

| | 2020 | | 2019 | | 2020 | | 2019 |

| Net income (loss) | $ | 255 |

| | $ | 241 |

| | $ | 447 |

| | $ | 664 |

|

| Other comprehensive income (loss) | | | | | | | |

| Net unrealized gain (loss) on cash flow hedges | (163 | ) | | 23 |

| | (87 | ) | | (29 | ) |

| Reclassification to earnings from cash flow hedges | 56 |

| | (14 | ) | | (3 | ) | | 4 |

|

| Total other comprehensive income (loss) | (107 | ) | | 9 |

| | (90 | ) | | (25 | ) |

| Total comprehensive income (loss) | $ | 148 |

| | $ | 250 |

| | $ | 357 |

| | $ | 639 |

|

| The accompanying notes are an integral part of these consolidated financial statements. |

TENNESSEE VALLEY AUTHORITY

CONSOLIDATED BALANCE SHEETS (Unaudited)

(in millions)

|

| | | | | | | |

| | 2017 | | 2016 |

| Net income (loss) | $ | 288 |

| | $ | 102 |

|

| Other comprehensive income (loss) | | | |

| Net unrealized gain (loss) on cash flow hedges | 39 |

| | (8 | ) |

| Reclassification to earnings from cash flow hedges | (3 | ) | | 38 |

|

| Total other comprehensive income (loss) | 36 |

| | 30 |

|

| Total comprehensive income (loss) | $ | 324 |

| | $ | 132 |

|

| The accompanying notes are an integral part of these consolidated financial statements. |

|

| | | | | | | |

| ASSETS |

| | March 31, 2020 |

| September 30, 2019 |

| Current assets | |

| |

| Cash and cash equivalents | $ | 835 |

| | $ | 299 |

|

| Accounts receivable, net | 1,264 |

| | 1,739 |

|

| Inventories, net | 1,071 |

| | 999 |

|

| Regulatory assets | 161 |

| | 156 |

|

| Other current assets | 93 |

| | 85 |

|

| Total current assets | 3,424 |

| | 3,278 |

|

| | | | |

| Property, plant, and equipment | |

| | |

|

| Completed plant | 63,453 |

| | 62,944 |

|

| Less accumulated depreciation | (32,237 | ) | | (31,384 | ) |

| Net completed plant | 31,216 |

| | 31,560 |

|

| Construction in progress | 2,095 |

| | 1,893 |

|

| Nuclear fuel | 1,547 |

| | 1,534 |

|

| Finance leases | 140 |

| | 146 |

|

| Total property, plant, and equipment, net | 34,998 |

| | 35,133 |

|

| | | | |

| Investment funds | 2,607 |

| | 2,968 |

|

| | | | |

| Regulatory and other long-term assets | |

| | |

|

| Regulatory assets | 9,433 |

| | 8,763 |

|

| Operating lease assets, net of amortization | 354 |

| | — |

|

| Other long-term assets | 332 |

| | 325 |

|

| Total regulatory and other long-term assets | 10,119 |

| | 9,088 |

|

| | | | |

| Total assets | $ | 51,148 |

| | $ | 50,467 |

|

| The accompanying notes are an integral part of these consolidated financial statements. |

TENNESSEE VALLEY AUTHORITY

CONSOLIDATED BALANCE SHEETS (Unaudited)

(in(in millions)

|

| | | | | | | |

| ASSETS |

| | December 31, 2017 |

| September 30, 2017 |

| Current assets | |

| |

| Cash and cash equivalents | $ | 300 |

| | $ | 300 |

|

| Restricted cash | 13 |

| | — |

|

| Accounts receivable, net | 1,500 |

| | 1,569 |

|

| Inventories, net | 1,047 |

| | 1,065 |

|

| Regulatory assets | 455 |

| | 447 |

|

| Other current assets | 95 |

| | 65 |

|

| Total current assets | 3,410 |

| | 3,446 |

|

| | | | |

| Property, plant, and equipment | |

| | |

|

| Completed plant | 59,631 |

| | 58,947 |

|

| Less accumulated depreciation | (28,587 | ) | | (28,404 | ) |

| Net completed plant | 31,044 |

| | 30,543 |

|

| Construction in progress | 2,459 |

| | 2,842 |

|

| Nuclear fuel | 1,370 |

| | 1,401 |

|

| Capital leases | 158 |

| | 161 |

|

| Total property, plant, and equipment, net | 35,031 |

| | 34,947 |

|

| | | | |

| Investment funds | 2,714 |

| | 2,603 |

|

| | | | |

| Regulatory and other long-term assets | |

| | |

|

| Regulatory assets | 8,492 |

| | 8,698 |

|

| Other long-term assets | 330 |

| | 323 |

|

| Total regulatory and other long-term assets | 8,822 |

| | 9,021 |

|

| | | | |

| Total assets | $ | 49,977 |

| | $ | 50,017 |

|

| The accompanying notes are an integral part of these consolidated financial statements. |

|

| | | | | | | |

| LIABILITIES AND PROPRIETARY CAPITAL |

| | March 31, 2020 | | September 30, 2019 |

| Current liabilities | | | |

| Accounts payable and accrued liabilities | $ | 1,764 |

| | $ | 1,812 |

|

| Accrued interest | 305 |

| | 296 |

|

| Current portion of leaseback obligations | 136 |

| | 40 |

|

| Regulatory liabilities | 207 |

| | 150 |

|

| Short-term debt, net | 1,875 |

| | 922 |

|

| Current maturities of power bonds | 1,552 |

| | 1,030 |

|

| Current maturities of long-term debt of variable interest entities | 40 |

| | 39 |

|

| Current maturities of notes payable | 22 |

| | 23 |

|

| Total current liabilities | 5,901 |

| | 4,312 |

|

| | | | |

| Other liabilities | | | |

| Post-retirement and post-employment benefit obligations | 5,984 |

| | 6,181 |

|

| Asset retirement obligations | 5,582 |

| | 5,453 |

|

| Operating lease liabilities | 262 |

| | — |

|

| Other long-term liabilities | 2,914 |

| | 2,490 |

|

| Leaseback obligations | 87 |

| | 223 |

|

| Total other liabilities | 14,829 |

| | 14,347 |

|

| | | | |

| Long-term debt, net | | | |

| Long-term power bonds, net | 17,370 |

| | 19,094 |

|

| Long-term debt of variable interest entities, net | 1,069 |

| | 1,089 |

|

| Total long-term debt, net | 18,439 |

| | 20,183 |

|

| | | | |

| Total liabilities | 39,169 |

| | 38,842 |

|

| | | | |

| Contingencies and legal proceedings (Note 19) | | | |

| | | | |

| Proprietary capital | | | |

| Power program appropriation investment | 258 |

| | 258 |

|

| Power program retained earnings | 11,271 |

| | 10,823 |

|

| Total power program proprietary capital | 11,529 |

| | 11,081 |

|

| Nonpower programs appropriation investment, net | 552 |

| | 556 |

|

| Accumulated other comprehensive income (loss) | (102 | ) | | (12 | ) |

| Total proprietary capital | 11,979 |

| | 11,625 |

|

| | | | |

| Total liabilities and proprietary capital | $ | 51,148 |

| | $ | 50,467 |

|

| The accompanying notes are an integral part of these consolidated financial statements. |

TENNESSEE VALLEY AUTHORITY

CONSOLIDATED BALANCE SHEETS (Unaudited)

(in millions)

|

| | | | | | | |

| LIABILITIES AND PROPRIETARY CAPITAL |

| | December 31, 2017 | | September 30, 2017 |

| Current liabilities | | | |

| Accounts payable and accrued liabilities | $ | 1,772 |

| | $ | 1,940 |

|

| Accrued interest | 317 |

| | 346 |

|

| Current portion of leaseback obligations | 37 |

| | 37 |

|

| Current portion of energy prepayment obligations | 85 |

| | 100 |

|

| Regulatory liabilities | 159 |

| | 163 |

|

| Short-term debt, net | 2,721 |

| | 1,998 |

|

| Current maturities of power bonds | 2,031 |

| | 1,728 |

|

| Current maturities of long-term debt of variable interest entities | 36 |

| | 36 |

|

| Current maturities of notes payable | 52 |

| | 53 |

|

| Total current liabilities | 7,210 |

| | 6,401 |

|

| | | | |

| Other liabilities | | | |

| Post-retirement and post-employment benefit obligations | 5,372 |

| | 5,477 |

|

| Asset retirement obligations | 4,206 |

| | 4,176 |

|

| Other long-term liabilities | 2,961 |

| | 3,055 |

|

| Leaseback obligations | 301 |

| | 302 |

|

| Energy prepayment obligations | — |

| | 10 |

|

| Regulatory liabilities | 25 |

| | 25 |

|

| Total other liabilities | 12,865 |

| | 13,045 |

|

| | | | |

| Long-term debt, net | | | |

| Long-term power bonds, net | 19,214 |

| | 20,205 |

|

| Long-term debt of variable interest entities, net | 1,164 |

| | 1,164 |

|

| Long-term notes payable | 68 |

| | 69 |

|

| Total long-term debt, net | 20,446 |

| | 21,438 |

|

| | | | |

| Total liabilities | 40,521 |

| | 40,884 |

|

| | | | |

| Commitments and contingencies | | | |

| | | | |

| Proprietary capital | | | |

| Power program appropriation investment | 258 |

| | 258 |

|

| Power program retained earnings | 8,571 |

| | 8,282 |

|

| Total power program proprietary capital | 8,829 |

| | 8,540 |

|

| Nonpower programs appropriation investment, net | 570 |

| | 572 |

|

| Accumulated other comprehensive income (loss) | 57 |

| | 21 |

|

| Total proprietary capital | 9,456 |

| | 9,133 |

|

| | | | |

| Total liabilities and proprietary capital | $ | 49,977 |

| | $ | 50,017 |

|

| The accompanying notes are an integral part of these consolidated financial statements. |

TENNESSEE VALLEY AUTHORITY

CONSOLIDATED STATEMENTS OF CASH FLOWS (Unaudited)

For the ThreeSix Months Ended DecemberMarch 31

(in millions)

| | | | 2017 | | 2016 | 2020 | | 2019 |

| Cash flows from operating activities | | | | | | |

| Net income (loss) | $ | 288 |

| | $ | 102 |

| $ | 447 |

| | $ | 664 |

|

| Adjustments to reconcile net income (loss) to net cash provided by operating activities | |

| | |

| |

| | |

|

| Depreciation and amortization (including amortization of debt issuance costs and premiums/discounts) | 433 |

| | 449 |

| |

Depreciation and amortization(1) | | 1,052 |

| | 821 |

|

| Amortization of nuclear fuel cost | 94 |

| | 85 |

| 194 |

| | 179 |

|

| Non-cash retirement benefit expense | 82 |

| | 84 |

| 162 |

| | 157 |

|

| Prepayment credits applied to revenue | (25 | ) | | (25 | ) | |

| Fuel cost adjustment deferral | (12 | ) | | 57 |

| |

| Fuel cost tax equivalents | (5 | ) | | 2 |

| |

| Other regulatory amortization and deferrals | | 81 |

| | 184 |

|

| Changes in current assets and liabilities | |

| | |

| |

| | |

|

| Accounts receivable, net | 70 |

| | 299 |

| 475 |

| | 269 |

|

| Inventories and other current assets, net | 7 |

| | (61 | ) | (101 | ) | | (83 | ) |

| Accounts payable and accrued liabilities | (179 | ) | | (209 | ) | (218 | ) | | (274 | ) |

| Accrued interest | (24 | ) | | (24 | ) | 13 |

| | 6 |

|

| Regulatory assets costs | (11 | ) | | (16 | ) | |

| Pension contributions | (75 | ) | | (75 | ) | (155 | ) | | (155 | ) |

| Other, net | (30 | ) | | (51 | ) | (80 | ) | | (21 | ) |

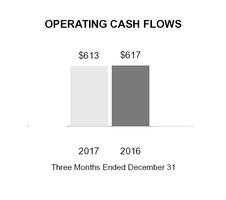

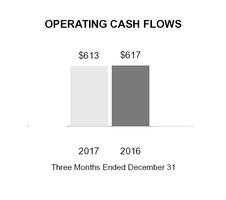

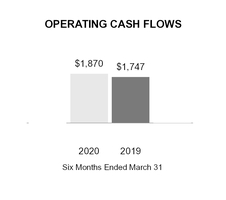

| Net cash provided by operating activities | 613 |

| | 617 |

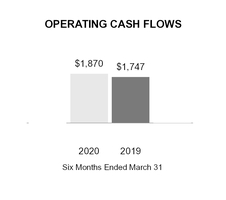

| 1,870 |

| | 1,747 |

|

| | | | | | | |

| Cash flows from investing activities | |

| | |

| |

| | |

|

| Construction expenditures | (551 | ) | | (625 | ) | (840 | ) | | (862 | ) |

| Nuclear fuel expenditures | (71 | ) | | (100 | ) | (184 | ) | | (172 | ) |

| Loans and other receivables | |

| | |

| |

| | |

|

| Advances | (6 | ) | | (3 | ) | (3 | ) | | (4 | ) |

| Repayments | 1 |

| | 1 |

| 4 |

| | 4 |

|

| Other, net | (1 | ) | | 20 |

| 13 |

| | (6 | ) |

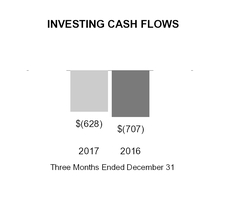

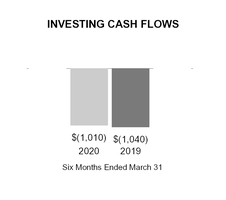

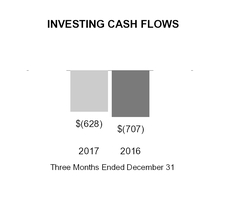

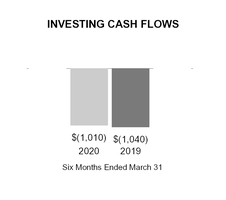

| Net cash used in investing activities | (628 | ) | | (707 | ) | (1,010 | ) | | (1,040 | ) |

| | | | | | | |

| Cash flows from financing activities | |

| | |

| |

| | |

|

| Long-term debt | |

| | |

| |

| | |

|

| Redemptions and repurchases of power bonds | (698 | ) | | (527 | ) | (1,218 | ) | | (1,003 | ) |

| Redemptions of notes payable | (2 | ) | | — |

| — |

| | (21 | ) |

| Redemptions of debt of variable interest entities | | (20 | ) | | (19 | ) |

| Short-term debt issues (redemptions), net | 717 |

| | 619 |

| 953 |

| | 378 |

|

| Payments on leases and leasebacks | (1 | ) | | (1 | ) | (43 | ) | | (40 | ) |

| Payments to U.S. Treasury | (1 | ) | | (1 | ) | |

| Other, net | | 4 |

| | (1 | ) |

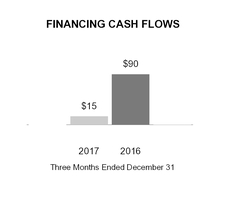

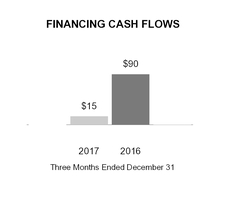

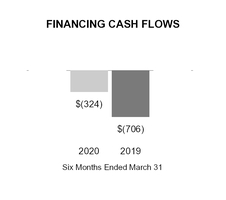

| Net cash provided by (used in) financing activities | 15 |

| | 90 |

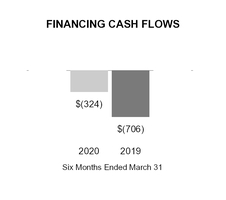

| (324 | ) | | (706 | ) |

| Net change in cash and cash equivalents | — |

| | — |

| |

| Cash and cash equivalents at beginning of period | 300 |

| | 300 |

| |

| Cash and cash equivalents at end of period | $ | 300 |

| | $ | 300 |

| |

| | | | | |

| Supplemental disclosures | | | | |

| Significant non-cash transactions | | | | |

| Accrued capital and nuclear fuel expenditures | $ | 294 |

| | $ | 336 |

| |

| Net change in cash, cash equivalents, and restricted cash | | 536 |

| | 1 |

|

| Cash, cash equivalents, and restricted cash at beginning of period | | 322 |

| | 322 |

|

| Cash, cash equivalents, and restricted cash at end of period | | $ | 858 |

| | $ | 323 |

|

Note (1) Includes amortization of debt issuance costs and premiums/discounts. | | Note (1) Includes amortization of debt issuance costs and premiums/discounts. |

The accompanying notes are an integral part of these consolidated financial statements. |

TENNESSEE VALLEY AUTHORITY

CONSOLIDATED STATEMENTS OF CHANGES IN PROPRIETARY CAPITAL (Unaudited)

For the Three Months Ended DecemberMarch 31, 20172020 and 20162019

(in millions)

| | | | Power Program Appropriation Investment | | Power Program Retained Earnings | | Nonpower Programs Appropriation Investment, Net | | Accumulated Other Comprehensive Income (Loss) from Net Gains (Losses) on Cash Flow Hedges | | Total | Power Program Appropriation Investment | | Power Program Retained Earnings | | Nonpower Programs Appropriation Investment, Net | | Accumulated Other Comprehensive Income (Loss) | | Total |

| Balance at September 30, 2016 | $ | 258 |

| | $ | 7,594 |

| | $ | 580 |

| | $ | (12 | ) | | $ | 8,420 |

| |

| Balance at December 31, 2018 | | $ | 258 |

| | $ | 9,827 |

| | $ | 562 |

| | $ | 23 |

| | $ | 10,670 |

|

| Net income (loss) | — |

| | 104 |

| | (2 | ) | | — |

| | 102 |

| — |

| | 243 |

| | (2 | ) | | — |

| | 241 |

|

| Total other comprehensive income (loss) | — |

| | — |

| | — |

| | 30 |

| | 30 |

| — |

| | — |

| | — |

| | 9 |

| | 9 |

|

| Return on power program appropriation investment | — |

| | (1 | ) | | — |

| | — |

| | (1 | ) | — |

| | (1 | ) | | — |

| | — |

| | (1 | ) |

| Balance at December 31, 2016 | $ | 258 |

| | $ | 7,697 |

| | $ | 578 |

| | $ | 18 |

| | $ | 8,551 |

| |

| Balance at March 31, 2019 | | $ | 258 |

| | $ | 10,069 |

| | $ | 560 |

| | $ | 32 |

| | $ | 10,919 |

|

| | | | | | | | | | | | | | | | | | | |

| Balance at September 30, 2017 | $ | 258 |

| | $ | 8,282 |

| | $ | 572 |

| | $ | 21 |

| | $ | 9,133 |

| |

| Balance at December 31, 2019 | | $ | 258 |

| | $ | 11,015 |

| | $ | 554 |

| | $ | 5 |

| | $ | 11,832 |

|

| Net income (loss) | — |

| | 290 |

| | (2 | ) | | — |

| | 288 |

| — |

| | 257 |

| | (2 | ) | | — |

| | 255 |

|

| Total other comprehensive income (loss) | — |

| | — |

| | — |

| | 36 |

| | 36 |

| — |

| | — |

| | — |

| | (107 | ) | | (107 | ) |

| Return on power program appropriation investment | — |

| | (1 | ) | | — |

| | — |

| | (1 | ) | — |

| | (1 | ) | | — |

| | — |

| | (1 | ) |

Balance at December 31, 2017

| $ | 258 |

| | $ | 8,571 |

| | $ | 570 |

| | $ | 57 |

| | $ | 9,456 |

| |

| Balance at March 31, 2020 | | $ | 258 |

| | $ | 11,271 |

| | $ | 552 |

| | $ | (102 | ) | | $ | 11,979 |

|

The accompanying notes are an integral part of these consolidated financial statements. |

TENNESSEE VALLEY AUTHORITY

CONSOLIDATED STATEMENTS OF CHANGES IN PROPRIETARY CAPITAL (Unaudited)

For the Six Months Ended March 31, 2020 and 2019

(in millions)

|

| | | | | | | | | | | | | | | | | | | |

| | Power Program Appropriation Investment | | Power Program Retained Earnings | | Nonpower Programs Appropriation Investment, Net | | Accumulated Other Comprehensive Income (Loss) | | Total |

| Balance at September 30, 2018 | $ | 258 |

| | $ | 9,404 |

| | $ | 564 |

| | $ | 57 |

| | $ | 10,283 |

|

| Net income (loss) | — |

| | 668 |

| | (4 | ) | | — |

| | 664 |

|

| Total other comprehensive income (loss) | — |

| | — |

| | — |

| | (25 | ) | | (25 | ) |

| Return on power program appropriation investment | — |

| | (3 | ) | | — |

| | — |

| | (3 | ) |

| Balance at March 31, 2019 | $ | 258 |

| | $ | 10,069 |

| | $ | 560 |

| | $ | 32 |

| | $ | 10,919 |

|

| | | | | | | | | | |

| Balance at September 30, 2019 | $ | 258 |

| | $ | 10,823 |

| | $ | 556 |

| | $ | (12 | ) | | $ | 11,625 |

|

| Net income (loss) | — |

| | 451 |

| | (4 | ) | | — |

| | 447 |

|

| Total other comprehensive income (loss) | — |

| | — |

| | — |

| | (90 | ) | | (90 | ) |

| Return on power program appropriation investment | — |

| | (3 | ) | | — |

| | — |

| | (3 | ) |

| Balance at March 31, 2020 | $ | 258 |

| | $ | 11,271 |

| | $ | 552 |

| | $ | (102 | ) | | $ | 11,979 |

|

| The accompanying notes are an integral part of these consolidated financial statements. |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Unaudited)

(Dollars in millions except where noted)

| | | Note | Note | Page | Note | Page |

| 1 | | Nature of Operations and Summary of Significant Accounting Policies | | | Summary of Significant Accounting Policies | |

| 2 | | Impact of New Accounting Standards and Interpretations | | | Impact of New Accounting Standards and Interpretations | |

| 3 | | Accounts Receivable, Net | | | Accounts Receivable, Net | |

| 4 | | Inventories, Net | 17 | | Inventories, Net | |

| 5 | | Other Long-Term Assets | | | Plant Closures | |

| 6 | | Regulatory Assets and Liabilities | | | Leases | |

| 7 | | Variable Interest Entities | | | Other Long-Term Assets | |

| 8 | | Gallatin Coal Combustion Residual Facilities | | | Regulatory Assets and Liabilities | |

| 9 | | Other Long-Term Liabilities | | | Variable Interest Entities | |

| 10 | | Asset Retirement Obligations | | | Other Long-Term Liabilities | |

| 11 | | Debt and Other Obligations | | | Asset Retirement Obligations | |

| 12 | | Accumulated Other Comprehensive Income (Loss) | | | Debt and Other Obligations | |

| 13 | | Risk Management Activities and Derivative Transactions | | | Accumulated Other Comprehensive Income (Loss) | |

| 14 | | Fair Value Measurements | | | Risk Management Activities and Derivative Transactions | |

| 15 | | Other Income (Expense), Net | | | Fair Value Measurements | |

| 16 | | Benefit Plans | | | Revenue | |

| 17 | | Contingencies and Legal Proceedings | | | Other Income (Expense), Net | |

| 18 | | | Supplemental Cash Flow Information | |

| 19 | | | Benefit Plans | |

| 20 | | | Contingencies and Legal Proceedings | |

| 21 | | | Subsequent Events | |

1. Nature of Operations and Summary of Significant Accounting Policies

General

The Tennessee Valley Authority ("TVA") is a corporate agency and instrumentality of the United States ("U.S.") that was created in 1933 by federal legislation enacted by the U.S. Congress in response to a requestproposal by President Franklin D. Roosevelt. TVA was created to, among other things, improve navigation on the Tennessee River, reduce the damage from destructive flood waters within the Tennessee River system and downstream on the lower Ohio and Mississippi Rivers, further the economic development of TVA's service area in the southeastern U.S., and sell the electricity generated at the facilities TVA operates.

Today, TVA operates the nation's largest public power system and supplies power in most of Tennessee, northern Alabama, northeastern Mississippi, and southwestern Kentucky and in portions of northern Georgia, western North Carolina, and southwestern Virginia to a population of over ninenearly 10 million people.

TVA also manages the Tennessee River, its tributaries, and certain shorelines to provide, among other things, year-round navigation, flood damage reduction, and affordable and reliable electricity. Consistent with these primary purposes, TVA also manages the river system and public lands to provide recreational opportunities, adequate water supply, improved water quality, cultural and natural resource protection, and economic development.

The power program has historically been separate and distinct from the stewardship programs. It is required to be self-supporting from power revenues and proceeds from power financings, such as proceeds from the issuance of bonds, notes, or other evidences of indebtedness ("Bonds"(collectively, "Bonds"). Although TVA does not currently receive congressional appropriations, it is required to make annual payments to the United StatesU.S. Department of the Treasury ("U.S. Treasury") as a return on the government's appropriation investment in TVA's power facilities (the "Power Program Appropriation Investment"). In the 1998 Energy and Water Development Appropriations Act, Congress directed TVA to fund essential stewardship activities related to its management of the Tennessee River system and nonpower or stewardship properties with power revenues in the event that there were insufficient appropriations or other available funds to pay for such activities in any fiscal year. Congress has not provided any appropriations to TVA to fund such activities since 1999. Consequently, during 2000, TVA began paying for essential stewardship activities primarily with power revenues, with the remainder funded with user fees and other forms of revenues derived in connection with those activities. The activities related to stewardship properties do not meet the criteria of

an operating segment under accounting principles generally accepted in the United States of America ("GAAP"). Accordingly, these assets and properties are included as part of the power program, TVA's only operating segment.

Power rates are established by the TVA Board of Directors (the "TVA("TVA Board") as authorized by the Tennessee Valley Authority Act of 1933, as amended 16 U.S.C. §§ 831-831ee (the “TVA Act”("TVA Act"). The TVA Act requires TVA to charge rates for power that will produce gross revenues sufficient to provide funds for operation, maintenance, and administration of its power system; payments to states and counties in lieu of taxes ("tax equivalents"); debt service on outstanding indebtedness;

payments to the U.S. Treasury in repayment of and as a return on the Power Program Appropriation Investment; and such additional margin as the TVA Board may consider desirable for investment in power system assets, retirement of outstanding Bonds in advance of maturity, additional reduction of the Power Program Appropriation Investment, and other purposes connected with TVA's power business. TVA fulfilled its requirement to repay $1.0 billion of the Power Program Appropriation Investment with the 2014 payment; therefore, this item is no longer a component of rate setting. In setting TVA's rates, the TVA Board is charged by the TVA Act to have due regard for the primary objectives of the TVA Act, including the objective that power shall be sold at rates as low as are feasible. Rates set by the TVA Board are not subject to review or approval by any state or other federal regulatory body.

Fiscal Year

TVA's fiscal year ends September 30. Years (20182020, 20172019, etc.) refer to TVA's fiscal years unless they are preceded by “CY,”"CY," in which case the references are to calendar years.

Cost-Based Regulation

Since the TVA Board is authorized by the TVA Act to set rates for power sold to its customers, TVA is self-regulated. Additionally, TVA's regulated rates are designed to recover its costs. Based on current projections, TVA believes that rates, set at levels that will recover TVA's costs, can be charged and collected. As a result of these factors, TVA records certain assets and liabilities that result from the regulated ratemaking process that would not be recorded under GAAP for non-regulated entities. Regulatory assets generally represent incurred costs that have been deferred because such costs are probable of future recovery in customer rates. Regulatory liabilities generally represent obligations to make refunds to customers for previous collections for costs that are not likely to be incurred or deferral of gains that will be credited to customers in future periods. TVA assesses whether the regulatory assets are probable of future recovery by considering factors such as applicable regulatory changes, potential legislation, and changes in technology. Based on these assessments, TVA believes the existing regulatory assets are probable of future recovery. This determination reflects the current regulatory and political environment and is subject to change in the future. If future recovery of regulatory assets ceases to be probable, or any of the other factors described above cease to be applicable, TVA would no longer be considered to be a regulated entity and would be required to write off these costs. All regulatory asset write offswrite-offs would be required to be recognized in earnings in the period in which future recovery ceases to be probable.

Basis of Presentation

TVA prepares its consolidated interim financial statements in conformity with GAAP for consolidated interim financial information. Accordingly, TVA's consolidated interim financial statements do not include all of the information and notes required by GAAP for annual financial statements. As such, they should be read in conjunction with the audited financial statements for the year ended September 30, 2017,2019, and the notes thereto, which are contained in TVA's Annual Report on Form 10-K10-K/A for the year ended September 30, 20172019 (the “Annual Report”"Annual Report"). In the opinion of management, all adjustments (consisting of items of a normal recurring nature) considered necessary for fair presentation are included inon the consolidated interim financial statements.

The accompanying consolidated interim financial statements, which have been prepared in accordance with GAAP, include the accounts of TVA, wholly-owned direct subsidiaries, and variable interest entities ("VIE") of which TVA is the primary beneficiary. See Note 7.9 — Variable Interest Entities. Intercompany balances and transactions have been eliminated in consolidation.

Use of Estimates

The preparation of financial statements requires TVA to estimate the effects of various matters that are inherently uncertain as of the date of the consolidated financial statements. Although the consolidated financial statements are prepared in conformity with GAAP, TVA is required to make estimates and assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities, and the amounts of revenues and expenses reported during the reporting period. Each of these estimates varies in regard to the level of judgment involved and its potential impact on TVA's financial results. Estimates are considered critical either when a different estimate could have reasonably been used, or where changes in the estimate are reasonably likely to occur from period to period, and such use or change would materially impact TVA's financial condition, results of operations, or cash flows.

Reclassifications

Certain historical amounts have been reclassified in the accompanying consolidated financial statements to the current presentation. In the March 31, 2019, Consolidated Statements of Cash Flows, amounts previously reported as $(10) million of Prepayment credits applied to revenue were reclassified to Other, net in cash flows from operating activities.

Cash, Cash Equivalents, and Restricted Cash

Cash includes cash on hand, non-interest bearing cash, and deposit accounts. All highly liquid investments with original maturities of three months or less are considered cash equivalents. Cash and cash equivalents that are restricted, as to withdrawal or use under the terms of certain contractual agreements, are recorded in Other long-term assets on the Consolidated Balance Sheets. Restricted cash reflects amounts to be used primarilyand cash equivalents includes cash held in trusts that are currently restricted for TVA economic development loans and for certain TVA environmental programs in accordance with agreements related to compliance with certain environmental regulations. See Note 1720 — Contingencies and Legal Proceedings — Legal Proceedings —Environmental Agreements.

|

| | | | | | | |

| Cash, Cash Equivalents, and Restricted Cash |

| | At March 31, 2020 | | At September 30, 2019 |

| Cash and cash equivalents | $ | 835 |

| | $ | 299 |

|

| Restricted cash and cash equivalents included in Other long-term assets | 23 |

| | 23 |

|

| Total cash, cash equivalents, and restricted cash | $ | 858 |

| | $ | 322 |

|

Due to recent higher volatility in the financial markets associated with the Coronavirus Disease 2019 ("COVID-19") pandemic, TVA increased its target balance of Cash and cash equivalents in March 2020 by $500 million through short-term discount note issuances.

Allowance for Uncollectible Accounts

The allowance for uncollectible accounts reflects TVA's estimate of probable losses inherent in its accounts and loans receivable balances.balances, excluding the EnergyRight® loans receivable. TVA determines the allowance based on known accounts, historical experience, and other currently available information including events such as customer bankruptcy and/or a customer failing to fulfill payment arrangements after 90 days. It also reflects TVA's corporate credit department's assessment of the financial condition of customers and the credit quality of the receivables. TVA continues to monitor the impact of the COVID-19 pandemic on accounts and loans receivable balances to evaluate the allowance for uncollectible accounts.

The allowance for uncollectible accounts was less than $1 million at both DecemberMarch 31, 2017,2020, and September 30, 2017. TVA had2019, for accounts receivable. Additionally, loans receivable of $127$137 million and $118$131 million at DecemberMarch 31, 2017,2020, and September 30, 2017,

2019, respectively, are included in Accounts receivable, net and Other long-term assets, for the current and long-term portions, respectively, and these amounts are reported net of allowances for uncollectible accounts of less than $1 million at both DecemberMarch 31, 2017,2020, and September 30, 2017.2019.

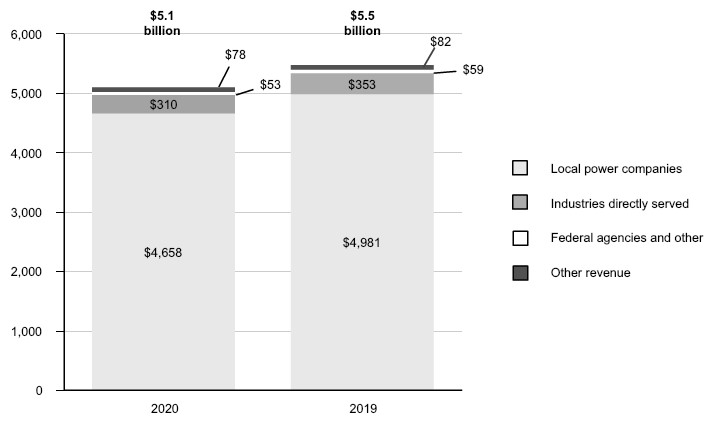

Revenues

TVA recognizes revenue from contracts with customers to depict the transfer of goods or services to customers in an amount to which the entity expects to be entitled in exchange for those goods or services. For the generation and transmission of electricity, this is generally at the time the power is delivered to a metered customer delivery point for the customer's consumption or distribution. As a result, revenues from power sales are recorded as electricity is delivered to customers. In addition to power sales invoiced and recorded during the month, TVA accrues estimated unbilled revenues for power sales provided to five customers whose billing date occurs prior to the end of the month. Exchange power sales are presented in the accompanying Consolidated Statements of Operations as a component of sales of electricity. Exchange power sales are sales of excess power after meeting TVA native load and directly served requirements. Native load refers to the customers on whose behalf a company, by statute, franchise, regulatory requirement, or contract, has undertaken an obligation to serve. TVA engages in other arrangements in addition to power sales. Certain other revenue from activities related to TVA's overall mission are recorded in Other revenue. Revenues that are not related to the overall mission are recorded in Other income (expense), net.

Leases

TVA recognizes a lease asset and lease liability for leases with terms of greater than 12 months. Lease assets represent TVA's right to use an underlying asset for the lease term, and lease liabilities represent TVA's obligation to make lease

payments arising from the lease, both of which are recognized based on the present value of the future minimum lease payments over the lease term at the commencement date. TVA has certain lease agreements that include variable lease payments that are based on energy production levels. These variable lease payments are not included in the measurement of the lease assets or lease liabilities but are recognized in the period in which the expenses are incurred.

While not specifically structured as leases, certain power purchase agreements are deemed to contain a lease of the underlying generating units when the terms convey the right to control the use of the assets. Amounts recorded for these leases are generally based on the amount of the scheduled capacity payments due over the remaining terms of the power purchase agreements, the terms of which vary. The current portion of loans receivable was $3 million at both December 31, 2017, and September 30, 2017 and istotal lease obligation included in Accounts receivable, net.payable and accrued liabilities and Operating lease liabilities related to these agreements was $296 million at March 31, 2020.

TVA has agreements with lease and non-lease components and has elected to account for the components separately. Consideration is allocated to lease and non-lease components generally based on relative standalone selling prices.

TVA has lease agreements which include options for renewal and early termination. The long-term portions of loans receivableintent to renew a lease varies depending on the lease type and asset. Renewal options that are reasonably certain to be exercised are included in Other long-term assets.the lease measurements. The decision to terminate a lease early is dependent on various economic factors. No termination options have been included in TVA's lease measurements.

Pre-Commercial Plant Operations

As partLeases with an initial term of 12 months or less, which do not include an option to extend the initial term of the process of completinglease to greater than 12 months that TVA is reasonably certain to exercise, are not recorded on the construction ofConsolidated Balance Sheets at March 31, 2020.

Operating leases are recognized on a generating unit,straight-line basis over the electricity produced is used to serve the

demandsterm of the electric system. TVA estimates revenue from such pre-commercial generation basedlease agreement. Rent expense associated with short-term leases and variable leases is recorded in Operating and maintenance expense, Fuel expense, or Purchased power expense on the guidance provided by Federal Energy Regulatory Commission ("FERC") regulations. Watts Bar Nuclear Plant ("Watts Bar") Unit 2 commenced pre-commercial plant operationsConsolidated Statements of Operations. Expenses associated with finance leases result in the separate presentation of interest expense on June 3, 2016,the lease liability and commercial operations beganamortization expense of the related lease asset on October 19, 2016. In addition, the Paradise Combined Cycle Plant commenced pre-commercial plant operations on October 10, 2016, and commercial operations began on April 7, 2017. Furthermore, the Allen Combined Cycle Plant began pre-commercial operations on September 9, 2017. Estimated revenueConsolidated Statements of $1 million and $14 million primarily related to these projects was capitalized to offset project costs for the three months ended December 31, 2017 and 2016, respectively. TVA also capitalized related fuel costs for these construction projects of approximately $2 million and $5 million during the three months ended December 31, 2017 and 2016, respectively. In addition to the projects above, Johnsonville Combustion Turbine Unit 20 commenced pre-commercial plant operations in September 2017, and was placed in service during the first quarter of 2018.Operations.

Depreciation

TVA accounts for depreciation of its properties using the composite depreciation convention of accounting. Accordingly,Under the original cost of property retired is charged to accumulated depreciation.composite method, assets with similar economic characteristics are grouped and depreciated as one asset. Depreciation is generally computed on a straight-line basis over the estimated service lives of the various classes of assets. The estimation of asset useful lives requires management judgment, supported by external depreciation studies of historical asset retirement experience. Depreciation rates are determined based on anthe external depreciation study. TVA concluded and implemented a new depreciation study effective October 1, 2016. This study will bestudies. These studies are updated at least every five years. Depreciation expense was $319$407 million and $336$424 million for the three months ended DecemberMarch 31, 20172020 and 2016,2019, respectively.

2. Impact of New Accounting Standards and Interpretations

The following are accounting standard updates issued by the Financial Accounting Standards Board ("FASB") that TVA adopted during the first quarter of 2018.

|

| | | | |

Derivatives and Hedging - Contingent Put and Call Options in Debt InstrumentsLease Accounting |

| Description | This guidance clarifieschanges the requirementsprovisions of recognition in both the lessee and lessor accounting models. The standard requires entities that lease assets ("lessees") to recognize on the balance sheet the assets and liabilities for assessing whether contingent callthe rights and obligations created by leases with terms of more than 12 months, while also refining the definition of a lease. In addition, lessees are required to disclose key information about the amount, timing, and uncertainty of cash flows arising from leasing arrangements. The recognition, measurement, and presentation of expenses and cash flows arising from a lease by a lessee primarily depend on its classification as a finance lease (formerly referred to as capital lease) or put options that can accelerateoperating lease. The standard requires both types of leases to be recognized on the paymentbalance sheet. Operating leases will result in straight-line expense, while finance leases will result in recognition of principalinterest on debt instruments are clearly and closelythe lease liability separate from amortization expense. The accounting rules for the owner of assets leased by the lessee ("lessor accounting") remain relatively unchanged.

The standard allows for certain practical expedients to be elected related to their debt hosts. An entity performing the assessment under the amendments in this update is required to assess the embedded call or put options solely in accordance with a four-step decision sequence.lease term determination, separation of lease and non-lease elements, reassessment of existing leases, and short-term leases. The standard includes interim periods within the fiscal year of adoption and requiresis to be applied using a modified retrospective transition. |

| Effective Date for TVA | October 1, 2017 |

Effect on the Financial Statements or Other Significant Matters | TVA has two issues of Putable Automatic Rate Reset Securities ("PARRS") outstanding. After a fixed-rate period of five years, the coupon rate on the PARRS may automatically be reset downward under certain market conditions on an annual basis. The coupon rate reset on the PARRS is based on a calculation. If the coupon rate is going to be reset, holders may request, for a limited period of time, redemption of the PARRS at par value, with repayment of principal on the reset date. This put option is otherwise not available. For both series of PARRS, the coupon rate will reset downward on the reset date if the rate calculated is below the then-current coupon rate on the PARRS. TVA has determined under the new guidance that contingent put options that can accelerate the payment of principal on the PARRS are clearly and closely related to their debt hosts. The adoption of this standard did not have a material impact on TVA’s financial condition, results of operations, or cash flows. |

|

Inventory Valuation |

Description | This guidance changes the model used for the subsequent measurement of inventory from the previous lower of cost or market model to the lower of cost or net realizable value. The guidance applies only to inventory valued using methods other than last-in, first out or the retail inventory method (for example, first-in, first-out or average cost). This amendment is intended to simplify the subsequent measurement of inventory. The standard includes interim periods within the fiscal year of adoption and requires a prospective transition. |

Effective Date for TVA | October 1, 20172019 |

| Effect on the Financial Statements or Other Significant Matters | TVA has elected the modified retrospective method of adoption effective October 1, 2019. Under the modified retrospective method of adoption, prior year reported results are not restated.

TVA recorded $205 million and $210 million of lease assets and lease liabilities, respectively, for operating leases in effect at the adoption date. The adoptionaccounting for finance leases remained substantially unchanged. Adoption of thisthe standard did not have a materialmaterially impact on TVA’s financial condition, results of operations or cash flows.

|

The following accounting standards have been issued but as of December 31, 2017, were not effective and had not been adopted by TVA.

|

| |

Defined Benefit Costs |

Description | This guidance changes how information about defined benefit costs for pension plans and other post-retirement benefit plans is presented in employer financial statements. The guidance requires employers that present a measure of operating income in their statement of income to include only the service cost component of net periodic pension cost and net periodic postretirement benefit cost in operating expenses (together with other employee compensation costs). The other components of net benefit cost, including amortization of prior service cost/credit and settlement and curtailment effects, are to be included in nonoperating expenses. Additionally, the guidance stipulates that only the service cost component of net benefit cost is eligible for capitalization in assets. |

Effective Date for TVA | The new standard is effective for TVA’s interim and annual reporting periods beginning October 1, 2018. While early adoption is permitted, TVA does not currently plan to adopt the standard early. |

Effect on the Financial Statements or Other Significant Matters | TVA has evaluatedelected to apply the impact of adopting this guidance, and if the guidance had been effective for TVA for the three months ended December 31, 2017 and 2016, TVA would have reclassified $63 million and $62 million, respectively, of net periodic benefit costs from Operating and maintenance expense to Other income (expense), net on the consolidated statements of operations. There will be no impact on the consolidated balance sheets because TVA has historically capitalized the service cost component which is consistent with the new guidance.following practical expedients: |

| |

Financial InstrumentsPractical Expedient |

| Description | This guidance applies to the recognition and measurement of financial assets and liabilities. The standard requires all equity investments to be measured at fair value with changes in the fair value recognized through net income (other than those accounted for under the equity method of accounting or those that result in consolidation of the investee). The standard also amends presentation requirements related to certain changes in the fair value of a liability and eliminates certain disclosure requirements of significant assumptions for financial instruments measured at amortized cost on the balance sheet. Public entities must apply the amendments by means of a cumulative-effect adjustment to the balance sheet as of the beginning of the fiscal year of adoption. |

Effective Date for TVA | The new standard is effective for TVA’s interim and annual reporting periods beginning October 1, 2018. Early adoption is not permitted unless specific early adoption guidance is applied. TVA does not currently plan to adopt the standard early. |

|

| |

Effect on the Financial Statements or Other Significant Matters | TVA currently measures all of its equity investments (other than those that result in the consolidation of the investee) at fair value, with changes in the fair value recognized through net income. The TVA Board has authorized the use of regulatory accounting for changes in fair value of certain equity investments, and as a result, those changes in fair value are deferred as regulatory assets or liabilities. TVA currently discloses significant assumptions around its estimates of fair value for financial instruments carried at amortized cost on its consolidated balance sheet. The adoption of this standard is not expected to have a material impact on TVA's financial condition, results of operations or cash flows because TVA holds no available-for-sale securities. |

| |

Revenue RecognitionPackage of transition practical expedients (for leases commenced prior to adoption date; expedients must be adopted as a package) | Do not need to (1) reassess whether any expired or existing contracts are leases or contain leases, (2) reassess the lease classification for any expired or existing leases, or (3) reassess initial direct costs for any existing leases. | |

Description | This guidance relatedShort-term lease expedient (elect by class of underlying asset) | Elect as an accounting policy to revenue from contracts with customers, including subsequent amendments, replacesnot apply the recognition requirements to short-term leases by asset class. | |

| Existing and expired land easements not previously accounted for as leases | Elect to not evaluate existing accounting standard and industry specific guidance for revenue recognition with a five-step model for recognizing and measuring revenue from contracts with customers. The underlying principle of the guidance is to recognize revenue related to the transfer of goods or services to customers at the amount expected to be collected. The objective ofexpired easements under the new standard isguidance and carry forward current accounting treatment. | |

| Comparative reporting requirements for initial adoption | Elect to provide a single, comprehensive revenue recognition model for all contracts with customers to improve comparability within and across industries. The new standard also requires enhanced disclosures regarding the nature, amount, timing, and uncertainty of revenue and the related cash flows arising from contracts with customers. Atapply transition requirements at adoption companies must also select a transition method to be applied either retrospectively to each prior reporting period presented or retrospectively with adate, recognize cumulative effect adjustment to retained earnings at the datein period of initial adoption. |

Effective Date for TVA | The new standard is effective for TVA’s interimadoption, and annual reporting periods beginning October 1, 2018. While early adoption is permitted, TVA will not adopt the standard early. |

Effect on the Financial Statements or Other Significant Matters | While TVA expects most of its revenue to be included in the scope ofapply the new guidance, it has not completed its evaluation of all contracts with customers. TVA’s effortsrequirements to date have focused on the scoping of revenue streams and evaluation of contracts with LPCs, which represent the majority of TVA's revenues. TVA is also conducting ongoing evaluations of sales to directly served industrial customers, sales to federal agencies, purchase power agreements, fuel cost adjustments, other revenue streams and the effectiveness of internal control related to revenue recognition. In addition, the power and utilities industry is currently addressing certain industry-specific issues which have not yet been finalized. As the ultimate impact of the new standard has not yet been determined, TVA has not yet elected its transition method.comparative periods, including disclosures. | |

| |

Statement of Cash Flows - Classification of Certain Cash Receipts and Cash Payments |

Description | This standard adds or clarifies guidance on the classification of certain cash receipts and payments on the statement of cash flows as follows: debt prepayment or extinguishment costs, settlement of zero-coupon bonds, contingent consideration payments made after a business combination, proceeds from the settlement of insurance claims, proceeds from the settlement of corporate-owned life insurance policies and bank-owned life insurance policies, distributions received from equity method investees, beneficial interest in securitization transactions, and the application of the predominance principle to separately identifiable cash flows. |

Effective Date for TVA | This standard is effective for TVA’s interim and annual reporting periods beginning October 1, 2018. While early adoption is permitted, TVA does not currently plan to adopt the standard early. TVA will apply the standard using a retrospective transition method to each period presented. |

Effect on the Financial Statements or Other Significant Matters | TVA’s previous treatment of the classification of certain cash receipts and cash payments is consistent

with the new standard and will have no impact on TVA’s financial condition, results of operations, or

presentation or disclosure of cash flows.

|

| |

Statement of Cash Flows - Restricted Cash |