UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(MARK ONE)

x QUARTERLY REPORT PURSUANT TO SECTION 13, 15(d), OR 37 OF THE

SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended June 30, 20192020

OR

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _____ to _____

Commission file number 000-52313

TENNESSEE VALLEY AUTHORITY

(Exact name of registrant as specified in its charter)

|

| | | | | | | | | | |

A corporate agency of the United States created by an act of Congress (State(State or other jurisdiction of incorporation or organization)

| | | 62-0474417 (I.R.S. Employer Identification No.) |

| | | |

400 W. Summit Hill Drive Knoxville, Tennessee (Address of principal executive offices) | | | 37902 (Zip Code) |

(865) 632-2101

(Registrant's telephone number, including area code)

None

(Former name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act |

| | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| N/A | N/A | N/A |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13, 15(d), or 37 of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer o Accelerated filer o

Non-accelerated filer x(Do not check if a smaller reporting company) Smaller reporting company o

Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes o No x

|

| | |

| Table of Contents | |

| |

| Page |

GLOSSARY OF COMMON ACRONYMS...................................................................................................................................... | |

FORWARD-LOOKING INFORMATION......................................................................................................................................... | |

GENERAL INFORMATION............................................................................................................................................................ | |

| |

| |

| |

ITEM 1. FINANCIAL STATEMENTS............................................................................................................................................. | |

| |

Consolidated Statements of Comprehensive Income (Loss) (unaudited).............................................................................(Unaudited)............................................................................ | |

Consolidated Balance Sheets (unaudited)............................................................................................................................ (Unaudited)........................................................................................................................... | |

| (Unaudited).......................................................................................................... | |

| (Unaudited)............................................................................ | |

| (Unaudited).................................................................................................... | |

| |

| ITEM 2. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS... | |

Executive Overview............................................................................................................................................................... | |

Results of Operations............................................................................................................................................................ | |

Liquidity and Capital Resources............................................................................................................................................ | |

| Key Initiatives and Challenges.............................................................................................................................................. | |

| Environmental Matters.......................................................................................................................................................... | |

| Legal Proceedings................................................................................................................................................................ | |

Off-Balance Sheet Arrangements.........................................................................................................................................Arrangements.......................................................................................................................................... | |

| |

| |

| Legislative and Regulatory Matters....................................................................................................................................... | |

| |

| |

| |

ITEM 4. CONTROLS AND PROCEDURES.................................................................................................................................. | |

| Disclosure Controls and Procedures..................................................................................................................................... | |

| Changes in Internal Control over Financial Reporting.......................................................................................................... | |

| |

| |

| |

ITEM 1. LEGAL PROCEEDINGS.................................................................................................................................................. | |

| |

ITEM 1A. RISK FACTORS....................................................................................................................................................................................................................................................................................................................... | |

| |

| ITEM 5. OTHER INFORMATION.................................................................................................................................................. | |

| |

ITEM 6. EXHIBITS............................................................................................................................................................................................................................................................................................................................................... | |

| |

SIGNATURES............................................................................................................................................................................... | |

|

| | | | | | | |

| GLOSSARY OF COMMON ACRONYMS | | |

Following are definitions of some of the terms or acronyms that may be used in this Quarterly Report on Form 10-Q for the quarter ended June 30, 20192020 (the "Quarterly Report"): |

| |

| | |

| Term or Acronym | | Definition |

AFUDC | | Allowance for funds used during construction |

AOCIACE | | Affordable Clean Energy |

| ANI | | American Nuclear Insurers |

| AOCI | | Accumulated other comprehensive income (loss) |

| ARO | | Asset retirement obligation |

| ART | | Asset Retirement Trust |

ASLBBonds | | Atomic Safety and Licensing BoardBonds, notes, or other evidences of indebtedness |

BLEUCAA | | Blended low-enriched uranium |

CAA | | Clean Air Act |

CAIRCCR | | Clean Air Interstate Rule |

CCR | | Coal combustion residuals |

CMECEL | | Chilling Effect Letter |

| CME | | Chicago Mercantile Exchange |

CO2 | | Carbon dioxide |

COLCOVID-19 | | Combined construction and operating licenseCoronavirus Disease 2019 |

COLACPP | | Cost-of-living adjustmentClean Power Plan |

| CSAPR | | Cross-State Air Pollution Rule |

| CTs | | Combustion turbine unit(s) |

| CVA | | Credit valuation adjustment |

| CY | | Calendar year |

| DCP | | Deferred Compensation Plan |

| DER | | Distributed energy resources |

| DOE | | Department of Energy |

EAEIS | | Environmental Assessments |

EIS | | Environmental Impact Statement |

EPAELGs | | Effluent Limitation Guidelines |

| EMP | | Electromagnetic pulses |

| EO | | Executive Order |

| EPA | | Environmental Protection Agency |

EPUEPRI | | Electric Power Research Institute |

| EPU | | Extended Power UpdateUprate |

| ESPA | | Early Site Permit Application |

| FASB | | Financial Accounting Standards Board |

FCMFERC | | Futures Commission Merchant |

FERC | | Federal Energy Regulatory Commission |

| FTP | | Financial Trading Program |

| GAAP | | Accounting principles generally accepted in the United States of America |

| GHG | | Greenhouse gas |

GWhGMDs | | Gigawatt hour(s)Geomagnetic disturbances |

HAPGWh | | Gigawatt hour(s) |

| HAP | | Hazardous Air Pollutants |

IRPJSCCG | | Integrated Resource Plan |

JSCCG | | John Sevier Combined Cycle Generation LLC |

| KOC | | Knoxville Office Complex |

kWhkW | | Kilowatt hour(s)Kilowatts |

LPCkWh | | TVA's localKilowatt hours |

| LPC | | Local power company customercustomers |

| MATS | | Mercury and Air Toxics Standards |

| MD&A | | Management's Discussion and Analysis of Financial Condition and Results of Operations |

| mmBtu | | Million British thermal unit(s) |

| | | | | | | | |

| MtM | | Mark-to-market |

| MW | | MegawattMegawatts |

| NAAQS | | National Ambient Air Quality Standards |

| NAV | | Net asset value |

|

| NDT | | |

NDT | | Nuclear Decommissioning Trust |

NEPANEIL | | Nuclear Electric Insurance Limited |

| NEPA | | National Environmental Policy Act |

| NERC | | North American Electric Reliability Corporation |

NOx | | Nitrogen oxide |

| NPDES | | National Pollutant Discharge Elimination System |

| NRC | | Nuclear Regulatory Commission |

NSRNWP | | New Source ReviewNationwide Permit |

| OCI | | Other comprehensive income (loss) |

OCIPPARRS | | Owner Controlled Insurance Program |

PARRS | | Putable Automatic Rate Reset Securities |

| PM | | Particulate matter |

QERQTE | | Quadrennial Energy Review |

QTE | | Qualified technological equipment and software |

REITRCRA | | Real Estate Investment TrustResource Conservation and Recovery Act |

SCCGRECs | | Renewable Energy Certificates |

| SCCG | | Southaven Combined Cycle Generation LLC |

| SCRs | | Selective catalytic reduction systems |

| SEC | | Securities and Exchange Commission |

| SERP | | Supplemental Executive Retirement Plan |

| SHLLC | | Southaven Holdco LLC |

| SIPs | | State implementation plans |

| SMR | | Small modular reactor(s) |

SO2 | | Sulfur dioxide |

TCWNSPC | | Tennessee Clean Water NetworkSummer Place Complex |

TDECSSSL | | Seven States Southaven LLC |

| TDEC | | Tennessee Department of Environment &and Conservation |

TOU | | Time-of-use |

| TVA Act | | The Tennessee Valley Authority Act of 1933, as amended, 16 U.S.C. §§ 831-831ee |

| TVARS | | Tennessee Valley Authority Retirement System |

| U.S. Treasury | | United States Department of the Treasury |

| VIE | | Variable interest entity |

| XBRL | | eXtensible Business Reporting Language |

FORWARD-LOOKING INFORMATION

This Quarterly Report contains forward-looking statements relating to future events and future performance. All statements other than those that are purely historical may be forward-looking statements. In certain cases, forward-looking statements can be identified by the use of words such as "may," "will," "should," "expect," "anticipate," "believe," "intend," "project," "plan," "predict," "assume," "forecast," "estimate," "objective," "possible," "probably," "likely," "potential," "speculate," the negative of such words, or other similar expressions.

Although the Tennessee Valley Authority ("TVA") believes that the assumptions underlying theany forward-looking statements are reasonable, TVA does not guarantee the accuracy of these statements. Numerous factors could cause actual results to differ materially from those in theany forward-looking statements. These factors include, among other things:

•The impact of the Coronavirus Disease 2019 (“COVID-19”) pandemic on TVA's operating results, financial condition, and cash flows, the demand for electricity, TVA’s workforce and operations, the availability of fuel and critical parts, supplies, and services, and the business and financial condition of TVA’s customers and counterparties;

•The duration and severity of the COVID-19 pandemic, actions taken to contain its spread and mitigate its effects, and broader impacts of the COVID-19 pandemic on economic and market conditions, including impacts on interest rates, commodity prices, investment performance, and foreign currency exchange rates;

•New, amended, or existing laws, regulations, or administrative orders or interpretations, including those related to environmental matters, and the costs of complying with these laws, regulations, or administrative orders or interpretations;

•The cost of complying with known, anticipated, or new emissions reduction requirements, some of which could render continued operation of many of TVA's aging coal-fired generation units not cost-effective or result in their removal from service, perhaps permanently;

•Significant reductions in demand for electricity produced through non-renewable or centrally located generation sources that may result from, among other things, economic downturns, increased energy efficiency and conservation, increased utilization of distributed generation and microgrids, and improvements in alternative generation and energy storage technologies;

•Changes in customer preferences for energy produced from cleaner generation sources;

•Changes in technology;

•Actions taken, or inaction, by the U.S. government relating to the national or TVA debt ceiling or automatic spending cuts in government programs;

•Costs or liabilities that are not anticipated in TVA’sTVA's financial statements for third-party claims, natural resource damages, environmental cleanup activities, or fines or penalties associated with unexpected events such as failures of a facility or infrastructure;

•Addition or loss of customers by TVA or TVA's local power company customers ("LPCs");

•Significant delays, cost increases, or cost overruns associated with the construction and maintenance of generation, transmission, navigation, flood control, or related assets;

Changes in•Requirements or decisions changing the amount or timing of funding obligations associated with TVA's pension plans, other post-retirement benefit plans, or health care plans;

•Increases in TVA's financial liabilities for decommissioning its nuclear facilities or retiring other assets;

•Risks associated with the operation of nuclear facilities or other generation and related facilities, including coal combustion residualresiduals ("CCR") facilities, or other facilities;

•Physical attacks on TVA's assets;

•Cyber attacks on TVA's assets or the assets of third parties upon which TVA relies;

•The outcome of legal or administrative proceedings, including the CCR proceedings involving the Gallatin Fossil Plant ("Gallatin") as well as any other CCR proceedings that may be brought in the future;proceedings;

•The failure of TVA's generation, transmission, navigation, flood control, and related assets and infrastructure, including CCR facilities, to operate as anticipated, resulting in lost revenues, damages, or other costs that are not reflected in TVA’sTVA's financial statements or projections;

•Differences between estimates of revenues and expenses and actual revenues earned and expenses incurred;

•Weather conditions;

•Catastrophic events such as fires, earthquakes, explosions, solar events, electromagnetic pulses ("EMP"), geomagnetic disturbances ("GMDs"), droughts, floods, hurricanes, tornadoes, or other casualty events or pandemics, wars, national emergencies, terrorist activities, or other similar events, especially if these events occur in or near TVA's service area;

•Events at a TVA facility, which, among other things, could result in loss of life, damage to the environment, damage to or loss of the facility, and damage to the property of others;

•Events or changes involving transmission lines, dams, and other facilities not operated by TVA, including those that affect the reliability of the interstate transmission grid of which TVA's transmission system is a part and those that increase flows across TVA's transmission grid;

•Disruption of fuel supplies, which may result from, among other things, economic conditions, weather conditions, production or transportation difficulties, labor challenges, or environmental laws or regulations affecting TVA's fuel suppliers or transporters;

•Purchased power price volatility and disruption of purchased power supplies;

•Events which affect the supply of water for TVA's generation facilities;

•Changes in TVA's determinations of the appropriate mix of generation assets;

•Ineffectiveness of TVA's efforts at adapting its organization to an evolving marketplace and remaining cost competitive;

•Inability to use regulatory accounting or loss of regulatory accounting approval for certain costs;

•Inability to obtain, or loss of, regulatory approval for the construction or operation of assets;

Inability to use regulatory accounting or loss of regulatory accounting approval for certain costs;

•The requirement or decision to make additional contributions to TVA's Nuclear Decommissioning Trust ("NDT"), or Asset Retirement Trust ("ART"), or pension plans;;

•Limitations on TVA's ability to borrow money which may result from, among other things, TVA's approaching or substantially reaching the limit on bonds, notes, and other evidences of indebtedness specified in the Tennessee Valley Authority Act of 1933, as amended (the “TVA Act”("TVA Act");

•An increase in TVA's cost of capital that may result from, among other things, changes in the market for TVA's debt securities, changes in the credit rating of TVA or the U.S. government, or, potentially, an increased reliance by TVA on alternative financing should TVA approach its debt limit;

•Changes in the economy and volatility in financial markets;

•Reliability or creditworthiness of counterparties;

•Changes in the market price of commodities such as coal, uranium, natural gas, fuel oil, crude oil, construction materials, reagents, electricity, or emission allowances;

•Changes in the market price of equity securities, debt securities, or other investments;

•Changes in interest rates, currency exchange rates, or inflation rates;

•Ineffectiveness of TVA's disclosure controls and procedures or its internal control over financial reporting;

•Inability to eliminate identified deficiencies in TVA's systems, standards, controls, or corporate culture;

•Inability to attract or retain a skilled workforce;

•Inability to respond quickly enough to current or potential customer demands or needs;

•Events at a nuclear facility, whether or not operated by or licensed to TVA, which, among other things, could lead to increased regulation or restriction on the construction, ownership, operation, or decommissioning of nuclear facilities or on the storage of spent fuel, obligate TVA to pay retrospective insurance premiums, reduce the availability and affordability of insurance, increase the costs of operating TVA's existing nuclear units, or cause TVA to forego future construction at these or other facilities;

•Loss of quorum of the TVA Board of Directors (the "TVA("TVA Board");

•Changes in the priorities of the TVA Board or TVA senior management; or

•Other unforeseeable events.

See also Item 1A, Risk Factors, and Item 7, Management's Discussion and Analysis of Financial Condition and Results of Operations in TVA's Annual Report on Form 10-K10-K/A for the year ended September 30, 20182019 (the "Annual Report"), and Part I, Item 2, Management's Discussion and Analysis of Financial Condition and Results of Operations, and Part II, Item 1A, Risk Factors in this Quarterly Report for a discussion of factors that could cause actual results to differ materially from those in aany forward-looking statement. New factors emerge from time to time, and it is not possible for TVA to predict all such factors or to assess the extent to which any factor or combination of factors may impact TVA's business or cause results to differ materially from those contained in any forward-looking statement. TVA undertakes no obligation to update any forward-looking statement to reflect developments that occur after the statement is made.

GENERAL INFORMATION

Fiscal Year

References to years (2019, 2018,(2020, 2019, etc.) in this Quarterly Report are to TVA's fiscal years ending September 30. Years that are preceded by "CY" are references to calendar years.

Notes

References to "Notes" are to the Notes to Consolidated Financial Statements contained in Part I, Item 1, Financial Statements in this Quarterly Report.

Available Information

TVA's Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and all amendments to those reports, are available on TVA's website, free of charge, as soon as reasonably practicable after such reports are electronically filed with or furnished to the Securities and Exchange Commission ("SEC"). TVA's website is www.tva.gov. Information contained on TVA's website shall not be deemed to be incorporated into, or to be a part of, this Quarterly Report. All TVA SEC reports are available to the public without charge from the website maintained by the SEC at www.sec.gov.

PART I - FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

TENNESSEE VALLEY AUTHORITY

CONSOLIDATED STATEMENTS OF OPERATIONS (Unaudited)

| | | | Three Months Ended June 30 | | Nine Months Ended June 30 | | Three Months Ended June 30 | | | Nine Months Ended June 30 | |

| | 2019 | | 2018 | | 2019 | | 2018 | | 2020 | | 2019 | | 2020 | | 2019 |

| Operating revenues | | | | | | | | Operating revenues | | | | | | | |

| Revenue from sales of electricity | $ | 2,565 |

| | $ | 2,669 |

| | $ | 7,958 |

| | $ | 7,931 |

| Revenue from sales of electricity | $ | 2,216 | | | $ | 2,565 | | | $ | 7,237 | | | $ | 7,958 | |

| Other revenue | 39 |

| | 38 |

| | 121 |

| | 117 |

| Other revenue | 35 | | | 39 | | | 113 | | | 121 | |

| Total operating revenues | 2,604 |

|

| 2,707 |

|

| 8,079 |

|

| 8,048 |

| Total operating revenues | 2,251 | | | 2,604 | | | 7,350 | | | 8,079 | |

| Operating expenses | |

| | |

| | |

| | |

| Operating expenses | | | | | | | |

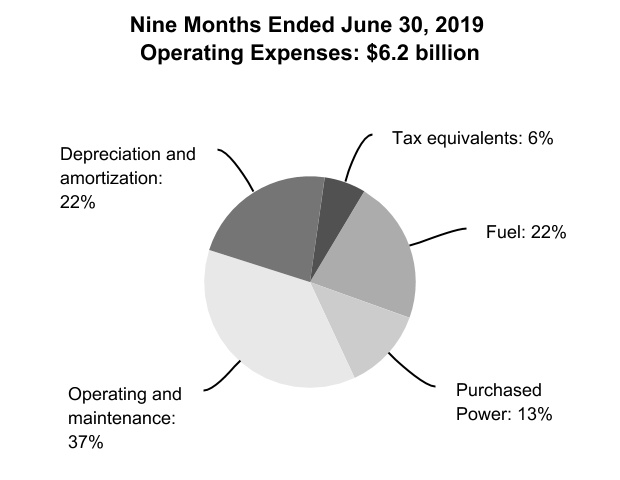

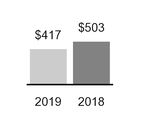

| Fuel | 417 |

| | 503 |

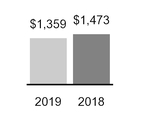

| | 1,359 |

| | 1,473 |

| Fuel | 312 | | | 417 | | | 1,164 | | | 1,359 | |

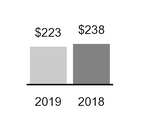

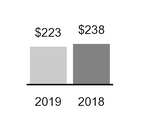

| Purchased power | 223 |

| | 238 |

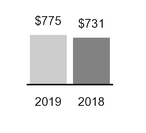

| | 775 |

| | 731 |

| Purchased power | 209 | | | 223 | | | 680 | | | 775 | |

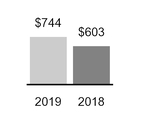

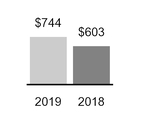

| Operating and maintenance | 744 |

| | 603 |

| | 2,289 |

| | 1,881 |

| Operating and maintenance | 681 | | | 744 | | | 2,014 | | | 2,289 | |

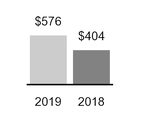

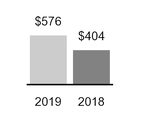

| Depreciation and amortization | 576 |

| | 404 |

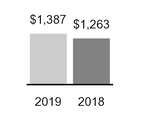

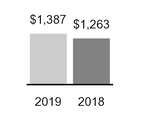

| | 1,387 |

| | 1,263 |

| Depreciation and amortization | 389 | | | 576 | | | 1,430 | | | 1,387 | |

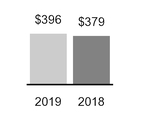

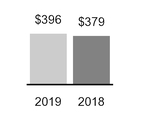

| Tax equivalents | 128 |

| | 129 |

| | 396 |

| | 379 |

| Tax equivalents | 125 | | | 128 | | | 388 | | | 396 | |

| Total operating expenses | 2,088 |

| | 1,877 |

| | 6,206 |

| | 5,727 |

| Total operating expenses | 1,716 | | | 2,088 | | | 5,676 | | | 6,206 | |

| Operating income | 516 |

| | 830 |

| | 1,873 |

| | 2,321 |

| Operating income | 535 | | | 516 | | | 1,674 | | | 1,873 | |

| Other income (expense), net | 14 |

| | 11 |

| | 52 |

| | 34 |

| Other income (expense), net | 16 | | | 14 | | | 27 | | | 52 | |

| Other net periodic benefit cost | 65 |

| | 65 |

| | 194 |

| | 193 |

| Other net periodic benefit cost | 63 | | | 65 | | | 190 | | | 194 | |

| Interest expense | 300 |

| | 306 |

| | 902 |

| | 942 |

| Interest expense | 283 | | | 300 | | | 859 | | | 902 | |

| Net income (loss) | $ | 165 |

| | $ | 470 |

| | $ | 829 |

| | $ | 1,220 |

| Net income (loss) | $ | 205 | | | $ | 165 | | | $ | 652 | | | $ | 829 | |

| The accompanying notes are an integral part of these consolidated financial statements. | The accompanying notes are an integral part of these consolidated financial statements. | The accompanying notes are an integral part of these consolidated financial statements. | |

TENNESSEE VALLEY AUTHORITY

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS) (Unaudited)

(in millions)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30 | | | | Nine Months Ended June 30 | | |

| | 2020 | | 2019 | | 2020 | | 2019 |

| Net income (loss) | $ | 205 | | | $ | 165 | | | $ | 652 | | | $ | 829 | |

| Other comprehensive income (loss) | | | | | | | |

| Net unrealized gain (loss) on cash flow hedges | 31 | | | (47) | | | (56) | | | (76) | |

| Net unrealized (gain) loss reclassified to earnings from cash flow hedges | (7) | | | 13 | | | (10) | | | 17 | |

| Total other comprehensive income (loss) | 24 | | | (34) | | | (66) | | | (59) | |

| Total comprehensive income (loss) | $ | 229 | | | $ | 131 | | | $ | 586 | | | $ | 770 | |

| The accompanying notes are an integral part of these consolidated financial statements. | | | | | | | |

|

| | | | | | | | | | | | | | | |

| | Three Months Ended June 30 | | Nine Months Ended June 30 |

| | 2019 | | 2018 | | 2019 | | 2018 |

| Net income (loss) | $ | 165 |

| | $ | 470 |

| | $ | 829 |

| | $ | 1,220 |

|

| Other comprehensive income (loss) | | | | | | | |

| Net unrealized gain (loss) on cash flow hedges | (47 | ) | | (65 | ) | | (76 | ) | | 17 |

|

| Reclassification to earnings from cash flow hedges | 13 |

| | 43 |

| | 17 |

| | 13 |

|

| Total other comprehensive income (loss) | (34 | ) | | (22 | ) | | (59 | ) | | 30 |

|

| Total comprehensive income (loss) | $ | 131 |

| | $ | 448 |

| | $ | 770 |

| | $ | 1,250 |

|

| The accompanying notes are an integral part of these consolidated financial statements. |

TENNESSEE VALLEY AUTHORITY

CONSOLIDATED BALANCE SHEETS (Unaudited)

(in millions)

| | | | | | | | | | | |

| ASSETS | | | |

| | June 30, 2020 | | September 30, 2019 |

| Current assets | | | |

| Cash and cash equivalents | $ | 800 | | | $ | 299 | |

| | | |

| | | |

| Accounts receivable, net | 1,364 | | | 1,739 | |

| Inventories, net | 1,060 | | | 999 | |

| Regulatory assets | 149 | | | 156 | |

| Other current assets | 90 | | | 85 | |

| Total current assets | 3,463 | | | 3,278 | |

| | | |

| Property, plant, and equipment | | | |

| Completed plant | 64,027 | | | 62,944 | |

| Less accumulated depreciation | (32,753) | | | (31,384) | |

| Net completed plant | 31,274 | | | 31,560 | |

| Construction in progress | 2,088 | | | 1,893 | |

| Nuclear fuel | 1,533 | | | 1,534 | |

| Finance leases | 139 | | | 146 | |

| Total property, plant, and equipment, net | 35,034 | | | 35,133 | |

| | | |

| Investment funds | 2,991 | | | 2,968 | |

| | | |

| Regulatory and other long-term assets | | | |

| Regulatory assets | 9,251 | | | 8,763 | |

| Operating lease assets, net of amortization | 332 | | | — | |

| Other long-term assets | 339 | | | 325 | |

| Total regulatory and other long-term assets | 9,922 | | | 9,088 | |

| | | |

| Total assets | $ | 51,410 | | | $ | 50,467 | |

| The accompanying notes are an integral part of these consolidated financial statements. | | | |

|

| | | | | | | |

| ASSETS |

| | June 30, 2019 |

| September 30, 2018 |

| Current assets | |

| |

| Cash and cash equivalents | $ | 300 |

| | $ | 299 |

|

| Accounts receivable, net | 1,551 |

| | 1,657 |

|

| Inventories, net | 1,051 |

| | 961 |

|

| Regulatory assets | 183 |

| | 414 |

|

| Other current assets | 87 |

| | 86 |

|

| Total current assets | 3,172 |

| | 3,417 |

|

| | | | |

| Property, plant, and equipment | |

| | |

|

| Completed plant | 62,716 |

| | 61,114 |

|

| Less accumulated depreciation | (30,928 | ) | | (29,335 | ) |

| Net completed plant | 31,788 |

| | 31,779 |

|

| Construction in progress | 1,783 |

| | 1,999 |

|

| Nuclear fuel | 1,408 |

| | 1,487 |

|

| Capital leases | 146 |

| | 149 |

|

| Total property, plant, and equipment, net | 35,125 |

| | 35,414 |

|

| | | | |

| Investment funds | 2,899 |

| | 2,862 |

|

| | | | |

| Regulatory and other long-term assets | |

| | |

|

| Regulatory assets | 6,755 |

| | 6,612 |

|

| Other long-term assets | 324 |

| | 362 |

|

| Total regulatory and other long-term assets | 7,079 |

| | 6,974 |

|

| | | | |

| Total assets | $ | 48,275 |

| | $ | 48,667 |

|

| The accompanying notes are an integral part of these consolidated financial statements. |

TENNESSEE VALLEY AUTHORITY

CONSOLIDATED BALANCE SHEETS (Unaudited)

(in millions)

| | | | | | | | | | | |

| LIABILITIES AND PROPRIETARY CAPITAL | | | |

| June 30, 2020 | | September 30, 2019 |

| Current liabilities | | | |

| Accounts payable and accrued liabilities | $ | 2,055 | | | $ | 1,812 | |

| | | |

| Accrued interest | 280 | | | 296 | |

| Current portion of leaseback obligations | 177 | | | 40 | |

| | | |

| Regulatory liabilities | 197 | | | 150 | |

| Short-term debt, net | 777 | | | 922 | |

| Current maturities of power bonds | 1,917 | | | 1,030 | |

| Current maturities of long-term debt of variable interest entities | 40 | | | 39 | |

| Current maturities of notes payable | — | | | 23 | |

| Total current liabilities | 5,443 | | | 4,312 | |

| | | |

| Other liabilities | | | |

| Post-retirement and post-employment benefit obligations | 5,912 | | | 6,181 | |

| Asset retirement obligations | 5,805 | | | 5,453 | |

| Operating lease liabilities | 244 | | | — | |

| Other long-term liabilities | 2,748 | | | 2,490 | |

| Leaseback obligations | 46 | | | 223 | |

| | | |

| | | |

| Regulatory liabilities | 5 | | | — | |

| Total other liabilities | 14,760 | | | 14,347 | |

| | | |

| Long-term debt, net | | | |

| Long-term power bonds, net | 17,932 | | | 19,094 | |

| Long-term debt of variable interest entities, net | 1,069 | | | 1,089 | |

| | | |

| Total long-term debt, net | 19,001 | | | 20,183 | |

| | | |

| Total liabilities | 39,204 | | | 38,842 | |

| | | |

| Contingencies and legal proceedings (Note 20) | | | |

| | | |

| Proprietary capital | | | |

| Power program appropriation investment | 258 | | | 258 | |

| Power program retained earnings | 11,476 | | | 10,823 | |

| Total power program proprietary capital | 11,734 | | | 11,081 | |

| Nonpower programs appropriation investment, net | 550 | | | 556 | |

| Accumulated other comprehensive income (loss) | (78) | | | (12) | |

| Total proprietary capital | 12,206 | | | 11,625 | |

| | | |

| Total liabilities and proprietary capital | $ | 51,410 | | | $ | 50,467 | |

| The accompanying notes are an integral part of these consolidated financial statements. | | | |

|

| | | | | | | |

| LIABILITIES AND PROPRIETARY CAPITAL |

| | June 30, 2019 | | September 30, 2018 |

| Current liabilities | | | |

| Accounts payable and accrued liabilities | $ | 1,739 |

| | $ | 1,982 |

|

| Accrued interest | 287 |

| | 305 |

|

| Current portion of leaseback obligations | 40 |

| | 38 |

|

| Current portion of energy prepayment obligations | — |

| | 10 |

|

| Regulatory liabilities | 161 |

| | 187 |

|

| Short-term debt, net | 1,444 |

| | 1,216 |

|

| Current maturities of power bonds | 1,030 |

| | 1,032 |

|

| Current maturities of long-term debt of variable interest entities | 39 |

| | 38 |

|

| Current maturities of notes payable | 23 |

| | 46 |

|

| Total current liabilities | 4,763 |

| | 4,854 |

|

| | | | |

| Other liabilities | | | |

| Post-retirement and post-employment benefit obligations | 4,260 |

| | 4,476 |

|

| Asset retirement obligations | 5,468 |

| | 4,665 |

|

| Other long-term liabilities | 2,226 |

| | 2,715 |

|

| Leaseback obligations | 223 |

| | 263 |

|

| Regulatory liabilities | 64 |

| | 104 |

|

| Total other liabilities | 12,241 |

| | 12,223 |

|

| | | | |

| Long-term debt, net | | | |

| Long-term power bonds, net | 19,115 |

| | 20,157 |

|

| Long-term debt of variable interest entities, net | 1,108 |

| | 1,127 |

|

| Long-term notes payable | — |

| | 23 |

|

| Total long-term debt, net | 20,223 |

| | 21,307 |

|

| | | | |

| Total liabilities | 37,227 |

| | 38,384 |

|

| | | | |

| Commitments and contingencies (Note 19) | | | |

| | | | |

| Proprietary capital | | | |

| Power program appropriation investment | 258 |

| | 258 |

|

| Power program retained earnings | 10,234 |

| | 9,404 |

|

| Total power program proprietary capital | 10,492 |

| | 9,662 |

|

| Nonpower programs appropriation investment, net | 558 |

| | 564 |

|

| Accumulated other comprehensive income (loss) | (2 | ) | | 57 |

|

| Total proprietary capital | 11,048 |

| | 10,283 |

|

| | | | |

| Total liabilities and proprietary capital | $ | 48,275 |

| | $ | 48,667 |

|

| The accompanying notes are an integral part of these consolidated financial statements. |

TENNESSEE VALLEY AUTHORITY

CONSOLIDATED STATEMENTS OF CASH FLOWS (Unaudited)

For the Nine Months Ended June 30

(in millions)

| | | | | | | | | | | |

| | 2020 | | 2019 |

| Cash flows from operating activities | | | |

| Net income (loss) | $ | 652 | | | $ | 829 | |

| Adjustments to reconcile net income (loss) to net cash provided by operating activities | | | |

Depreciation and amortization(1) | 1,447 | | | 1,402 | |

| Amortization of nuclear fuel cost | 284 | | | 277 | |

| Non-cash retirement benefit expense | 243 | | | 235 | |

| | | |

| Other regulatory amortization and deferrals | 65 | | | 240 | |

| | | |

| | | |

| | | |

| Changes in current assets and liabilities | | | |

| Accounts receivable, net | 376 | | | 149 | |

| Inventories and other current assets, net | (86) | | | (145) | |

| Accounts payable and accrued liabilities | (126) | | | (217) | |

| Accrued interest | (20) | | | (21) | |

| | | |

| Pension contributions | (230) | | | (232) | |

| | | |

| | | |

| | | |

| Other, net | (109) | | | (38) | |

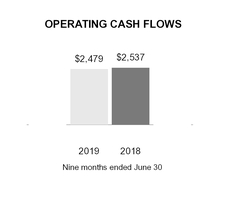

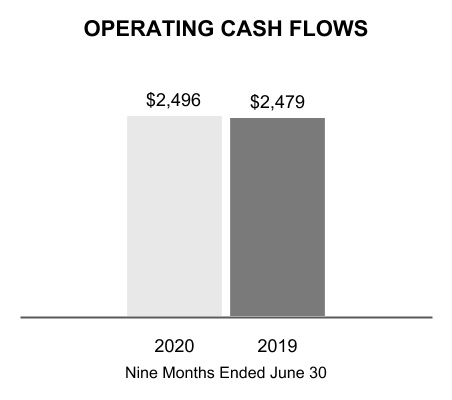

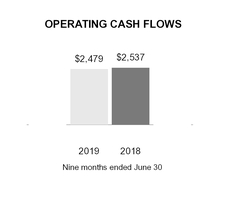

| Net cash provided by operating activities | 2,496 | | | 2,479 | |

| | | |

| Cash flows from investing activities | | | |

| Construction expenditures | (1,221) | | | (1,292) | |

| | | |

| Nuclear fuel expenditures | (251) | | | (223) | |

| | | |

| Loans and other receivables | | | |

| Advances | (6) | | | (8) | |

| Repayments | 5 | | | 6 | |

| Other, net | 6 | | | (16) | |

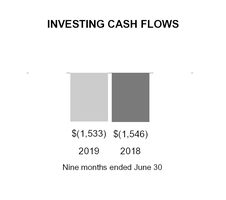

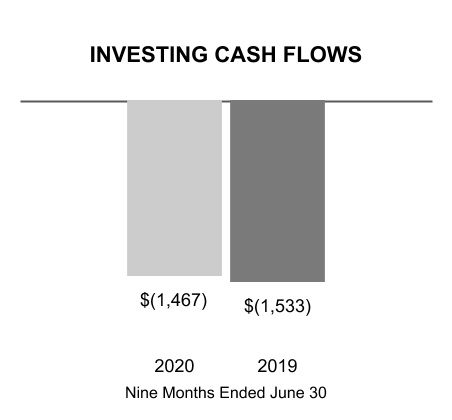

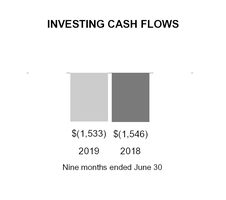

| Net cash used in investing activities | (1,467) | | | (1,533) | |

| | | |

| Cash flows from financing activities | | | |

| Long-term debt | | | |

| Issues of power bonds | 997 | | | — | |

| | | |

| Redemptions and repurchases of power bonds | (1,286) | | | (1,034) | |

| Redemptions of notes payable | (23) | | | (46) | |

| Redemptions of debt of variable interest entities | (20) | | | (19) | |

| Short-term debt issues (redemptions), net | (145) | | | 196 | |

| Payments on leases and leasebacks | (44) | | | (41) | |

| | | |

| Financing costs, net | (4) | | | — | |

| | | |

| | | |

| | | |

| Other, net | (3) | | | (1) | |

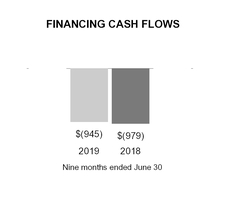

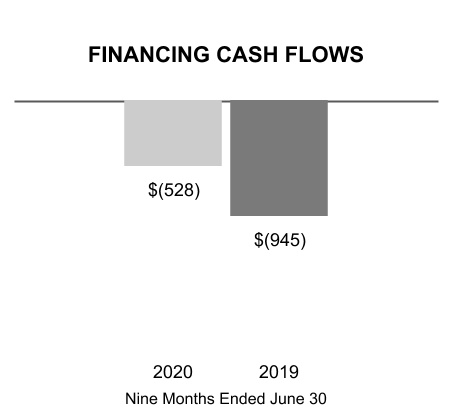

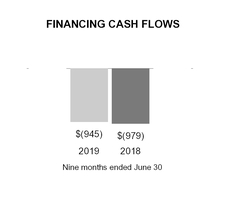

| Net cash provided by (used in) financing activities | (528) | | | (945) | |

| Net change in cash, cash equivalents, and restricted cash | 501 | | | 1 | |

| Cash, cash equivalents, and restricted cash at beginning of period | 322 | | | 322 | |

| Cash, cash equivalents, and restricted cash at end of period | $ | 823 | | | $ | 323 | |

| | | |

| | | |

| | | |

| | | |

| | | |

Note (1) Includes amortization of debt issuance costs and premiums/discounts. | | | |

| The accompanying notes are an integral part of these consolidated financial statements. | | | |

|

| | | | | | | |

| | 2019 | | 2018 |

| Cash flows from operating activities | | | |

| Net income (loss) | $ | 829 |

| | $ | 1,220 |

|

| Adjustments to reconcile net income (loss) to net cash provided by operating activities | |

| | |

|

Depreciation and amortization(1) | 1,402 |

| | 1,285 |

|

| Amortization of nuclear fuel cost | 277 |

| | 282 |

|

| Non-cash retirement benefit expense | 235 |

| | 243 |

|

| Prepayment credits applied to revenue | (10 | ) | | (75 | ) |

| Other regulatory amortization and deferrals | 240 |

| | 15 |

|

| Changes in current assets and liabilities | |

| | |

|

| Accounts receivable, net | 149 |

| | (11 | ) |

| Inventories and other current assets, net | (145 | ) | | 5 |

|

| Accounts payable and accrued liabilities | (217 | ) | | (68 | ) |

| Accrued interest | (21 | ) | | (52 | ) |

| Pension contributions | (232 | ) | | (229 | ) |

| Other, net | (28 | ) | | (78 | ) |

| Net cash provided by operating activities | 2,479 |

| | 2,537 |

|

| | | | |

| Cash flows from investing activities | |

| | |

|

| Construction expenditures | (1,292 | ) | | (1,354 | ) |

| Nuclear fuel expenditures | (223 | ) | | (181 | ) |

| Loans and other receivables | |

| | |

|

| Advances | (8 | ) | | (12 | ) |

| Repayments | 6 |

| | 3 |

|

| Other, net | (16 | ) | | (2 | ) |

| Net cash used in investing activities | (1,533 | ) | | (1,546 | ) |

| | | | |

| Cash flows from financing activities | |

| | |

|

| Long-term debt | |

| | |

|

| Issues of power bonds | — |

| | 998 |

|

| Redemptions and repurchases of power bonds | (1,034 | ) | | (1,731 | ) |

| Redemptions of notes payable | (46 | ) | | (52 | ) |

| Redemptions of debt of variable interest entities | (19 | ) | | (18 | ) |

| Short-term debt issues (redemptions), net | 196 |

| | (133 | ) |

| Payments on leases and leasebacks | (41 | ) | | (40 | ) |

| Financing costs, net | — |

| | (3 | ) |

| Other, net | (1 | ) | | — |

|

| Net cash provided by (used in) financing activities | (945 | ) | | (979 | ) |

| Net change in cash, cash equivalents, and restricted cash | 1 |

| | 12 |

|

| Cash, cash equivalents, and restricted cash at beginning of period | 322 |

| | 300 |

|

| Cash, cash equivalents, and restricted cash at end of period | $ | 323 |

| | $ | 312 |

|

| | | | |

| Supplemental disclosures | | | |

| Significant non-cash transactions | | | |

| Accrued capital and nuclear fuel expenditures | $ | 266 |

| | $ | 315 |

|

| Capital lease obligations incurred | 6 |

| | — |

|

| The accompanying notes are an integral part of these consolidated financial statements. |

Note

(1) Includes amortization of debt issuance costs and premiums/discounts.

TENNESSEE VALLEY AUTHORITY

CONSOLIDATED STATEMENTS OF CHANGES IN PROPRIETARY CAPITAL (Unaudited)

For the Three Months Ended June 30, 20192020 and 20182019

(in millions)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Power Program Appropriation Investment | |

Power Program Retained Earnings | | Nonpower Programs Appropriation Investment, Net | | Accumulated

Other

Comprehensive

Income (Loss) | |

Total |

| Balance at March 31, 2019 | $ | 258 | | | $ | 10,069 | | | $ | 560 | | | $ | 32 | | | $ | 10,919 | |

| Net income (loss) | — | | | 167 | | | (2) | | | — | | | 165 | |

| Total other comprehensive income (loss) | — | | | — | | | — | | | (34) | | | (34) | |

| Return on power program appropriation investment | — | | | (2) | | | — | | | — | | | (2) | |

| | | | | | | | | |

| Balance at June 30, 2019 | $ | 258 | | | $ | 10,234 | | | $ | 558 | | | $ | (2) | | | $ | 11,048 | |

| | | | | | | | | |

| Balance at March 31, 2020 | $ | 258 | | | $ | 11,271 | | | $ | 552 | | | $ | (102) | | | $ | 11,979 | |

| Net income (loss) | — | | | 207 | | | (2) | | | — | | | 205 | |

| Total other comprehensive income (loss) | — | | | — | | | — | | | 24 | | | 24 | |

| Return on power program appropriation investment | — | | | (2) | | | — | | | — | | | (2) | |

| | | | | | | | | |

| Balance at June 30, 2020 | $ | 258 | | | $ | 11,476 | | | $ | 550 | | | $ | (78) | | | $ | 12,206 | |

| The accompanying notes are an integral part of these consolidated financial statements. | | | | | | | | | |

|

| | | | | | | | | | | | | | | | | | | |

| | Power Program Appropriation Investment | | Power Program Retained Earnings | | Nonpower Programs Appropriation Investment, Net | | Accumulated Other Comprehensive Income (Loss) from Net Gains (Losses) on Cash Flow Hedges | | Total |

| Balance at March 31, 2018 | $ | 258 |

| | $ | 9,033 |

| | $ | 568 |

| | $ | 73 |

| | $ | 9,932 |

|

| Net income (loss) | — |

| | 472 |

| | (2 | ) | | — |

| | 470 |

|

| Total other comprehensive income (loss) | — |

| | — |

| | — |

| | (22 | ) | | (22 | ) |

| Return on power program appropriation investment | — |

| | (1 | ) | | — |

| | — |

| | (1 | ) |

| Balance at June 30, 2018 | $ | 258 |

| | $ | 9,504 |

| | $ | 566 |

| | $ | 51 |

| | $ | 10,379 |

|

| | | | | | | | | | |

| Balance at March 31, 2019 | $ | 258 |

| | $ | 10,069 |

| | $ | 560 |

| | $ | 32 |

| | $ | 10,919 |

|

| Net income (loss) | — |

| | 167 |

| | (2 | ) | | — |

| | 165 |

|

| Total other comprehensive income (loss) | — |

| | — |

| | — |

| | (34 | ) | | (34 | ) |

| Return on power program appropriation investment | — |

| | (2 | ) | | — |

| | — |

| | (2 | ) |

| Balance at June 30, 2019 | $ | 258 |

| | $ | 10,234 |

| | $ | 558 |

| | $ | (2 | ) | | $ | 11,048 |

|

| The accompanying notes are an integral part of these consolidated financial statements. |

TENNESSEE VALLEY AUTHORITY

CONSOLIDATED STATEMENTS OF CHANGES IN PROPRIETARY CAPITAL (Unaudited)

For the Nine Months Ended June 30, 20192020 and 20182019

(in millions)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Power Program Appropriation Investment | |

Power Program Retained Earnings | | Nonpower Programs Appropriation Investment, Net | | Accumulated

Other

Comprehensive

Income (Loss) | |

Total |

| Balance at September 30, 2018 | $ | 258 | | | $ | 9,404 | | | $ | 564 | | | $ | 57 | | | $ | 10,283 | |

| Net income (loss) | — | | | 835 | | | (6) | | | — | | | 829 | |

| Total other comprehensive income (loss) | — | | | — | | | — | | | (59) | | | (59) | |

| Return on power program appropriation investment | — | | | (5) | | | — | | | — | | | (5) | |

| | | | | | | | | |

| Balance at June 30, 2019 | $ | 258 | | | $ | 10,234 | | | $ | 558 | | | $ | (2) | | | $ | 11,048 | |

| | | | | | | | | |

| Balance at September 30, 2019 | $ | 258 | | | $ | 10,823 | | | $ | 556 | | | $ | (12) | | | $ | 11,625 | |

| Net income (loss) | — | | | 658 | | | (6) | | | — | | | 652 | |

| Total other comprehensive income (loss) | — | | | — | | | — | | | (66) | | | (66) | |

| Return on power program appropriation investment | — | | | (5) | | | — | | | — | | | (5) | |

| | | | | | | | | |

| Balance at June 30, 2020 | $ | 258 | | | $ | 11,476 | | | $ | 550 | | | $ | (78) | | | $ | 12,206 | |

| The accompanying notes are an integral part of these consolidated financial statements. | | | | | | | | | |

|

| | | | | | | | | | | | | | | | | | | |

| | Power Program Appropriation Investment | | Power Program Retained Earnings | | Nonpower Programs Appropriation Investment, Net | | Accumulated Other Comprehensive Income (Loss) from Net Gains (Losses) on Cash Flow Hedges | | Total |

| Balance at September 30, 2017 | $ | 258 |

| | $ | 8,282 |

| | $ | 572 |

| | $ | 21 |

| | $ | 9,133 |

|

| Net income (loss) | — |

| | 1,226 |

| | (6 | ) | | — |

| | 1,220 |

|

| Total other comprehensive income (loss) | — |

| | — |

| | — |

| | 30 |

| | 30 |

|

| Return on power program appropriation investment | — |

| | (4 | ) | | — |

| | — |

| | (4 | ) |

| Balance at June 30, 2018 | $ | 258 |

| | $ | 9,504 |

| | $ | 566 |

| | $ | 51 |

| | $ | 10,379 |

|

| | | | | | | | | | |

| Balance at September 30, 2018 | $ | 258 |

| | $ | 9,404 |

| | $ | 564 |

| | $ | 57 |

| | $ | 10,283 |

|

| Net income (loss) | — |

| | 835 |

| | (6 | ) | | — |

| | 829 |

|

| Total other comprehensive income (loss) | — |

| | — |

| | — |

| | (59 | ) | | (59 | ) |

| Return on power program appropriation investment | — |

| | (5 | ) | | — |

| | — |

| | (5 | ) |

| Balance at June 30, 2019 | $ | 258 |

| | $ | 10,234 |

| | $ | 558 |

| | $ | (2 | ) | | $ | 11,048 |

|

| The accompanying notes are an integral part of these consolidated financial statements. |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Unaudited)

(Dollars in millions except where noted)

| | | | | | | | | | | |

| Note | | | Page |

| 1 | | Summary of Significant Accounting Policies | |

| 2 | | Impact of New Accounting Standards and Interpretations | |

| 3 | | Accounts Receivable, Net | |

| 4 | | Inventories, Net | |

| 5 | | Plant Closures | |

| 6 | | Leases | |

| 7 | | Other Long-Term Assets | |

| 8 | | Regulatory Assets and Liabilities | |

| 9 | | Variable Interest Entities | |

| 10 | | Other Long-Term Liabilities | |

| 11 | | Asset Retirement Obligations | |

| 12 | | Debt and Other Obligations | |

| 13 | | Accumulated Other Comprehensive Income (Loss) | |

| 14 | | Risk Management Activities and Derivative Transactions | |

| 15 | | Fair Value Measurements | |

| 16 | | Revenue | |

| 17 | | Other Income (Expense), Net | |

| 18 | | Supplemental Cash Flow Information | |

| 19 | | Benefit Plans | |

| 20 | | Contingencies and Legal Proceedings | |

| 21 | | Subsequent Events | |

|

| | | |

| Note | Page |

| 1 | | Nature of Operations and Summary of Significant Accounting Policies | |

| 2 | | Impact of New Accounting Standards and Interpretations | |

| 3 | | Accounts Receivable, Net | |

| 4 | | Inventories, Net | |

| 5 | | Plant Closures | |

| 6 | | Other Long-Term Assets | |

| 7 | | Regulatory Assets and Liabilities | |

| 8 | | Variable Interest Entities | |

| 9 | | Gallatin Coal Combustion Residual Facilities | |

| 10 | | Other Long-Term Liabilities | |

| 11 | | Asset Retirement Obligations | |

| 12 | | Debt and Other Obligations | |

| 13 | | Accumulated Other Comprehensive Income (Loss) | |

| 14 | | Risk Management Activities and Derivative Transactions | |

| 15 | | Fair Value Measurements | |

| 16 | | Revenue | |

| 17 | | Other Income (Expense), Net | |

| 18 | | Benefit Plans | |

| 19 | | Contingencies and Legal Proceedings | |

1. Nature of Operations and Summary of Significant Accounting Policies

General

The Tennessee Valley Authority ("TVA") is a corporate agency and instrumentality of the United States ("U.S.") that was created in 1933 by federal legislation in response to a proposal by President Franklin D. Roosevelt. TVA was created to, among other things, improve navigation on the Tennessee River, reduce the damage from destructive flood waters within the Tennessee River system and downstream on the lower Ohio and Mississippi Rivers, further the economic development of TVA's service area in the southeastern U.S., and sell the electricity generated at the facilities TVA operates.

Today, TVA operates the nation's largest public power system and supplies power in most of Tennessee, northern Alabama, northeastern Mississippi, and southwestern Kentucky and in portions of northern Georgia, western North Carolina, and southwestern Virginia to a population of nearly 10 million people.

TVA also manages the Tennessee River, its tributaries, and certain shorelines to provide, among other things, year-round navigation, flood damage reduction, and affordable and reliable electricity. Consistent with these primary purposes, TVA also manages the river system and public lands to provide recreational opportunities, adequate water supply, improved water quality, cultural and natural resource protection, and economic development.

The power program has historically been separate and distinct from the stewardship programs. It is required to be self-supporting from power revenues and proceeds from power financings, such as proceeds from the issuance of bonds, notes, or other evidences of indebtedness ("Bonds"(collectively, "Bonds"). Although TVA does not currently receive congressional appropriations, it is required to make annual payments to the United StatesU.S. Department of the Treasury ("U.S. Treasury") as a return on the government's appropriation investment in TVA's power facilities (the "Power Program Appropriation Investment"). In the 1998 Energy and Water Development Appropriations Act, Congress directed TVA to fund essential stewardship activities related to its management of the Tennessee River system and nonpower or stewardship properties with power revenues in the event that there were insufficient appropriations or other available funds to pay for such activities in any fiscal year. Congress has not provided any appropriations to TVA to fund such activities since 1999. Consequently, during 2000, TVA began paying for essential stewardship activities primarily with power revenues, with the remainder funded with user fees and other forms of revenues derived in connection with those activities. The activities related to stewardship properties do not meet the criteria of an operating segment under accounting principles generally accepted in the United States of America ("GAAP"). Accordingly, these assets and properties are included as part of the power program, TVA's only operating segment.

Power rates are established by the TVA Board of Directors (the "TVA("TVA Board") as authorized by the Tennessee Valley Authority Act of 1933, as amended (the "TVA("TVA Act"). The TVA Act requires TVA to charge rates for power that will produce gross revenues sufficient to provide funds for operation, maintenance, and administration of its power system; payments to states and counties in lieu of taxes ("tax equivalents"); debt service on outstanding indebtedness; payments to the U.S. Treasury in repayment of and as a return on the Power Program Appropriation Investment; and such additional margin as the TVA Board may consider desirable for investment in power system assets, retirement of outstanding Bonds in advance of maturity, additional reduction of the Power Program Appropriation Investment, and other purposes connected with TVA's power business. TVA fulfilled its obligation under the TVA Actrequirement to repay $1.0 billion of the Power Program Appropriation Investment with the 2014 payment, andpayment; therefore, this item is no longer a component of rate setting. In setting TVA's rates, the TVA Board is charged by the TVA Act to have due regard for the primary objectives of the TVA Act, including the objective that power shall be sold at rates as low as are feasible. Rates set by the TVA Board are not subject to review or approval by any state or other federal regulatory body.

Fiscal Year

TVA's fiscal year ends September 30. Years ((2020, 2019,, 2018, etc.) refer to TVA's fiscal years unless they are preceded by "CY," in which case the references are to calendar years.

Cost-Based Regulation

Since the TVA Board is authorized by the TVA Act to set rates for power sold to its customers, TVA is self-regulated. Additionally, TVA's regulated rates are designed to recover its costs. Based on current projections, TVA believes that rates, set at levels that will recover TVA's costs, can be charged and collected. As a result of these factors, TVA records certain assets and liabilities that result from the regulated ratemaking process that would not be recorded under GAAP for non-regulated entities. Regulatory assets generally represent incurred costs that have been deferred because such costs are probable of future recovery in customer rates. Regulatory liabilities generally represent obligations to make refunds to customers for previous collections for costs that are not likely to be incurred or deferral of gains that will be credited to customers in future periods. TVA assesses whether the regulatory assets are probable of future recovery by considering factors such as applicable regulatory changes, potential legislation, and changes in technology. Based on these assessments, TVA believes the existing regulatory assets are probable of recovery. This determination reflects the current regulatory and political environment and is subject to change in the future. If future recovery of regulatory assets ceases to be probable, or any of the other factors described above cease to be applicable, TVA would no longer be considered to be a regulated entity and would be required to

write off these costs. All regulatory asset write-offs would be required to be recognized in earnings in the period in which future recovery ceases to be probable.

Basis of Presentation

TVA prepares its consolidated interim financial statements in conformity with GAAP for consolidated interim financial information. Accordingly, TVA's consolidated interim financial statements do not include all of the information and notes required by GAAP for annual financial statements. As such, they should be read in conjunction with the audited financial statements for the year ended September 30, 2018,2019, and the notes thereto, which are contained in TVA's Annual Report on Form 10-K10-K/A for the year ended September 30, 20182019 (the "Annual Report"). In the opinion of management, all adjustments (consisting of items of a normal recurring nature) considered necessary for fair presentation are included inon the consolidated interim financial statements.

The accompanying consolidated interim financial statements, which have been prepared in accordance with GAAP, include the accounts of TVA, wholly-owned direct subsidiaries, and variable interest entities ("VIE") of which TVA is the primary beneficiary. See Note 8.9 — Variable Interest Entities. Intercompany balances and transactions have been eliminated in consolidation.

Use of Estimates

The preparation of financial statements requires TVA to estimate the effects of various matters that are inherently uncertain as of the date of the consolidated financial statements. Although the consolidated financial statements are prepared in conformity with GAAP, TVA is required to make estimates and assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities, and the amounts of revenues and expenses, including impacts from the COVID-19 pandemic, reported during the reporting period. Each of these estimates varies in regard to the level of judgment involved and its potential impact on TVA's financial results. Estimates are considered critical either when a different estimate could have reasonably been used, or where changes in the estimate are reasonably likely to occur from period to period, and such use or change would materially impact TVA's financial condition, results of operations, or cash flows.

Reclassifications

Certain historical amounts have been reclassified in the accompanying consolidated financial statements to the current presentation. TVA reclassified $65 million and $193 million of net periodic benefit costs from Operating and maintenance expense to Other net periodic benefit cost in the Consolidated Statements of Operations for the three and nine months ended June 30, 2018, respectively, as a result of the retrospective presentation of financing costs due to the implementation of the new

accounting standard for defined benefit plan costs effective for TVA October 1, 2018. TVA also reclassified $13 million from Restricted cash and cash equivalents to Other long-term assets on the Consolidated Balance Sheet at September 30, 2018.

In the June 30, 20182019, Consolidated Statements of Cash Flows, amounts previously reported as $(6)$(10) million Fuel cost adjustment deferral, $(8) million Fuel cost tax equivalents, and $29 millionof Prepayment credits applied to revenue were reclassified to Other, net were consolidated and presented as $15 million Other regulatory amortization and deferrals. Additionally, $(20) million in cash flows from operating activities previously recorded as $(12) million Accounts payable and accrued liabilities and $(8) million Regulatory asset costs were reclassified to Other, net.activities.

Cash, Cash Equivalents, and Restricted Cash

Cash includes cash on hand, non-interest bearing cash, and deposit accounts. All highly liquid investments with original maturities of three months or less are considered cash equivalents. Cash and cash equivalents that are restricted, as to withdrawal or use under the terms of certain contractual agreements, are recorded in Other long-term assets inon the Consolidated Balance Sheets. Restricted cash and cash equivalents includes cash held in trusts that are currently restricted for TVA economic development loans and for certain TVA environmental programs in accordance with agreements related to compliance with certain environmental regulations. See Note 1920 — Contingencies and Legal Proceedings — Legal Proceedings — Environmental Agreements.

The following table provides a reconciliation of cash, cash equivalents, and restricted cash reported inon the Consolidated Balance Sheets and Consolidated Statements of Cash Flows:

| | | | | | | | | | | |

| Cash, Cash Equivalents, and Restricted Cash | | | |

| | At June 30, 2020 | | At September 30, 2019 |

| Cash and cash equivalents | $ | 800 | | | $ | 299 | |

| | | |

| Restricted cash and cash equivalents included in Other long-term assets | 23 | | | 23 | |

| Total cash, cash equivalents, and restricted cash | $ | 823 | | | $ | 322 | |

Due to higher volatility in the financial markets associated with the Coronavirus Disease 2019 ("COVID-19") pandemic, TVA increased its target balance of Cash and cash equivalents beginning in March 2020 by $500 million through discount note issuances.

|

| | | | | | | |

| Cash, Cash Equivalents, and Restricted Cash |

| | At June 30, 2019 | | At September 30, 2018 |

| Cash and cash equivalents | $ | 300 |

| | $ | 299 |

|

| Restricted cash and cash equivalents included in Other long-term assets | 23 |

| | 23 |

|

| Total Cash, cash equivalents, and restricted cash | $ | 323 |

| | $ | 322 |

|

The allowance for uncollectible accounts reflects TVA's estimate of probable losses inherent in its accounts and loans receivable balances, excluding the EnergyRight® loans receivable. TVA determines the allowance based on known accounts, historical experience, and other currently available information including events such as customer bankruptcy and/or a customer failing to fulfill payment arrangements after 90 days. It also reflects TVA's corporate credit department's assessment of the financial condition of customers and the credit quality of the receivables. TVA continues to monitor the impact of the COVID-19 pandemic on accounts and loans receivable balances to evaluate the allowance for uncollectible accounts.

The allowance for uncollectible accounts was less than $1 million at both June 30, 2020, and September 30, 2019, for accounts receivable. Additionally, loans receivable of $134 million and $131 million at June 30, 2020, and September 30, 2019, respectively, are included in Accounts receivable, net and Other long-term assets, for the current and long-term portions, respectively, and are reported net of allowances for uncollectible accounts of less than $1 million at both June 30, 2020, and September 30, 2019.

Revenues

TVA recognizes revenue from contracts with customers to depict the transfer of goods or services to customers in an amount to which the entity expects to be entitled in exchange for those goods or services. For the generation and transmission of electricity, this is generally at the time the power is delivered to a metered customer delivery point for the customer's consumption or distribution. As a result, revenues from power sales are recorded as electricity is delivered to customers. In addition to power sales invoiced and recorded during the month, TVA accrues estimated unbilled revenues for power sales provided to five customers whose billing date occurs prior to the end of the month. Exchange power sales are presented in the accompanying Consolidated Statements of Operations as a component of sales of electricity. Exchange power sales are sales of excess power after meeting TVA native load and directly served requirements. Native load refers to the customers on whose behalf a company, by statute, franchise, regulatory requirement, or contract, has undertaken an obligation to serve. TVA engages in other arrangements in addition to power sales. Certain other revenue from activities related to TVA’sTVA's overall mission are recorded in Other revenue. Revenues that are not related to the overall mission are recorded in Other income (expense), net.

From time to time,Leases

TVA may transfer fiber optic capacity on TVA’s network to telecommunications service carriersrecognizes a lease asset and TVA's local power company customers ("LPCs"). These transactions are structured as indefeasible rightslease liability for leases with terms of use ("IRUs"), which are the exclusivegreater than 12 months. Lease assets represent TVA's right to use an underlying asset for the lease term, and lease liabilities represent TVA's obligation to make lease payments arising from the lease, both of which are recognized based on the present value of the future minimum lease payments over the lease term at the commencement date. TVA has certain lease agreements that include variable lease payments that are based on energy production levels. These variable lease payments are not included in the measurement of the lease assets or lease liabilities but are recognized in the period in which the expenses are incurred.

While not specifically structured as leases, certain power purchase agreements are deemed to contain a specifiedlease of the underlying generating units when the terms convey the right to control the use of the assets. Amounts recorded for these leases are generally based on the amount of fiber opticthe scheduled capacity for a specified term.payments due over the remaining terms of the power purchase agreements, the terms of which vary. The total lease obligation included in Accounts payable and accrued liabilities and Operating lease liabilities related to these agreements was $285 million at June 30, 2020.

TVA accountshas agreements with lease and non-lease components and has elected to account for the consideration receivedcomponents separately. Consideration is allocated to lease and non-lease components generally based on transfersrelative standalone selling prices.

TVA has lease agreements which include options for renewal and early termination. The intent to renew a lease varies depending on the lease type and asset. Renewal options that are reasonably certain to be exercised are included in the lease measurements. The decision to terminate a lease early is dependent on various economic factors. No termination options have been included in TVA's lease measurements.

Leases with an initial term of fiber optic capacity and on all12 months or less, which do not include an option to extend the initial term of the other elements deliverable under an IRU as revenue ratablylease to greater than 12 months that TVA is reasonably certain to exercise, are not recorded on the Consolidated Balance Sheets at June 30, 2020.

Operating leases are recognized on a straight-line basis over the term of the lease agreement. TVA does not recognize revenueRent expense associated with short-term leases and variable leases is recorded in Operating and maintenance expense, Fuel expense, or Purchased power expense on any contemporaneous exchangesthe Consolidated Statements of its fiber optic capacity for an IRUOperations. Expenses associated with finance leases result in the separate presentation of fiber optic capacityinterest expense on the lease liability and amortization expense of the counterparty torelated lease asset on the exchange.Consolidated Statements of Operations.

Allowance for Uncollectible Accounts

The allowance for uncollectible accounts reflects TVA's estimate of probable losses inherent in its accounts and loans receivable balances. TVA determines the allowance based on known accounts, historical experience, and other currently available information including events such as customer bankruptcy and/or a customer failing to fulfill payment arrangements after 90 days. It also reflects TVA's corporate credit department's assessment of the financial condition of customers and the credit quality of the receivables.

The allowance for uncollectible accounts was less than $1 million at both June 30, 2019, and September 30, 2018, for accounts receivable. Additionally, loans receivable of $125 million and $138 million at June 30, 2019, and September 30, 2018, respectively, are included in Accounts receivable, net and Other long-term assets and are reported net of allowances for uncollectible accounts of less than $1 million at both June 30, 2019, and September 30, 2018.

Depreciation

Pre-Commercial Plant Operations

As part of the process of completing the construction of a generating unit, the electricity produced is used to serve the

demands of the electric system. TVA estimates revenue from such pre-commercial generation based on the guidance provided by Federal Energy Regulatory Commission ("FERC") regulations. The Allen Combined Cycle Plant ("Allen CC") began pre-commercial operations in September 2017, and began commercial operations in April 2018. Cogeneration capability at Johnsonville Combustion Turbine Unit 20 commenced pre-commercial plant operations in September 2017, and was placed in service during December 2017. Estimated revenue of less than $1 million and $11 million related to these projects was capitalized to offset project costs for the three and nine months ended June 30, 2018, respectively. TVA also capitalized related fuel costs for these construction projects of approximately $5 million and $20 million during the three and nine months ended June 30, 2018, respectively. No such amounts were capitalized during the three and nine months ended June 30, 2019.

Depreciation

TVA accounts for depreciation of its properties using the composite depreciation convention of accounting. Under the composite method, assets with similar economic characteristics are grouped and depreciated as one asset. Depreciation is generally computed on a straight-line basis over the estimated service lives of the various classes of assets. The estimation of asset useful lives requires management judgment, supported by external depreciation studies of historical asset retirement experience. Depreciation rates are determined based on the external depreciation studies. These studies are updated at least every five years. Depreciation expense was $536$344 million and $301$536 million for the three months ended June 30, 20192020 and 2018,2019, respectively. Depreciation expense was $1.3 billion and $950 million for both the nine months ended June 30, 20192020 and 2018, respectively.2019. See Note 5 — Financial Impact Plant Closures for a discussion of the impact of plant closures.

2. Impact of New Accounting Standards and Interpretations

The following are accounting standard updates issued by the Financial Accounting Standards Board ("FASB") that TVA adopted during 2019:

|

| | | | | | | | | | | | | |

Defined Benefit CostsLease Accounting | | | | |

| Description | This guidance changes howthe provisions of recognition in both the lessee and lessor accounting models. The standard requires entities that lease assets ("lessees") to recognize on the balance sheet the assets and liabilities for the rights and obligations created by leases with terms of more than 12 months, while also refining the definition of a lease. In addition, lessees are required to disclose key information about defined benefit costs for pension plansthe amount, timing, and other post-retirement benefit plans is presented in employer financial statements.uncertainty of cash flows arising from leasing arrangements. The guidancerecognition, measurement, and presentation of expenses and cash flows arising from a lease by a lessee primarily depend on its classification as a finance lease (formerly referred to as capital lease) or operating lease. The standard requires employers that present a measureboth types of operating income in their statement of income to include only the service cost component of net periodic pension cost and net periodic post-retirement benefit cost in operating expenses (together with other employee compensation costs). The other components of net benefit cost, including amortization of prior service cost/credit and settlement and curtailment effects, areleases to be includedrecognized on the balance sheet. Operating leases will result in non-operating expenses. Additionally,straight-line expense, while finance leases will result in recognition of interest on the guidance stipulates that onlylease liability separate from amortization expense. The accounting rules for the service cost componentowner of net benefit costassets leased by the lessee ("lessor accounting") remain relatively unchanged.

The standard allows for certain practical expedients to be elected related to lease term determination, separation of lease and non-lease elements, reassessment of existing leases, and short-term leases. The standard is eligible for capitalization in assets. The guidance requiresto be applied using a modified retrospective presentation of the service and non-service cost components in the Consolidated Statements of Operations. transition. | | | |

| Effective Date for TVA | October 1, 20182019 | | | |

| Effect on the Financial Statements or Other Significant Matters | TVA adopted this standard on ahas elected the modified retrospective basis formethod of adoption effective October 1, 2019. Under the modified retrospective method of adoption, prior period presented resulting in lower operating expenses and higher non-operating expenses in the Consolidated Statements of Operations of $194year reported results are not restated.

TVA recorded $205 million and $192$210 million for the nine months ended June 30, 2019 and 2018, respectively. There was no impact on the Consolidated Balance Sheets because TVA has historically capitalized only the service cost component, which is consistent with the new guidance. |

|

Financial Instruments |

Description | This guidance applies to the recognition and measurement of financiallease assets and liabilities.lease liabilities, respectively, for operating leases in effect at the adoption date. The standard requires all equity investments to be measured at fair value with changes in the fair value recognized through net income (other than those accounted for under the equity method of accounting or those that result in consolidation of the investee). The standard also amends presentation requirements related to certain changes in the fair value of a liability and eliminates certain disclosure requirements of significant assumptions for financial instruments measured at amortized cost on the balance sheet. Public entities must apply the amendments by means of a cumulative-effect adjustment to the balance sheet as of the beginning of the fiscal year of adoption. |

Effective Date for TVA | October 1, 2018 |

Effect on the Financial Statements or Other Significant Matters | TVA currently measures all of its equity investments (other than those that result in the consolidation of the investee) at fair value, with changes in the fair value recognized through net income, unless regulatory accounting is applied. The TVA Board has authorized the use of regulatory accounting for changes in fair valuefinance leases remained substantially unchanged. Adoption of certain equity investments, and as a result, those changes in fair value are deferred as regulatory assets or liabilities. TVA currently discloses significant assumptions around its estimates of fair value for financial instruments carried at amortized cost on its consolidated balance sheet. The adoption of thisthe standard did not have a materialmaterially impact on TVA's financial condition, results of operations or cash flows because changes in fair value accounting are recognized through regulatory accounting.flows.

TVA has elected to apply the following practical expedients: |

| | |

| |

Revenue from Contracts with Customers |

DescriptionPractical Expedient | This guidance, including subsequent amendments, replaces the existing accounting standard and industry specific guidance for revenue recognition with a five-step model for recognizing and measuring revenue from contracts with customers. The underlying principle of the guidance is to recognize revenue related to the transfer of goods or services to customers at the amount expected to be collected. The objective of the new standard is to provide a single, comprehensive revenue recognition model for all contracts with customers to improve comparability within and across industries. The new standard also requires enhanced disclosures regarding the nature, amount, timing, and uncertainty of revenue and the related cash flows arising from contracts with customers. Description |

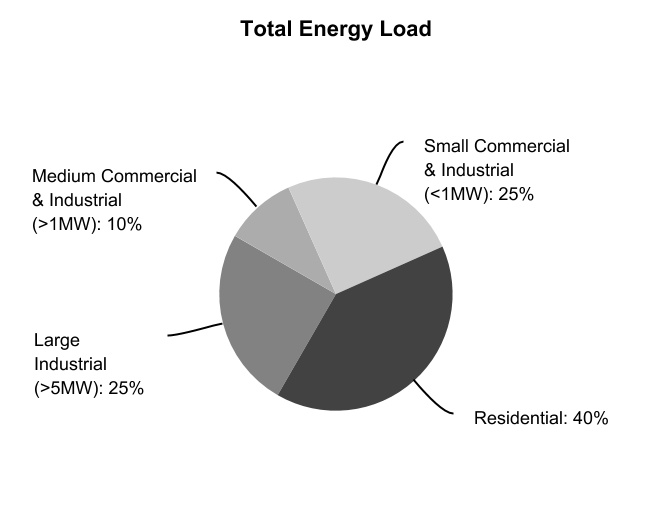

Effective Date for TVA | October 1, 2018 |