UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DCD.C. 20549

FORM 10-Q

(Mark one)

| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended:ended September 30, 20172021

OrOR

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from: toCommission File No. 000-55825

Commission File Number:0-30746TRICCAR INC.

FRONTIER OILFIELD SERVICES, INC.

(Exact name of registrant as specified in its charter)

| Nevada | 84-4250492 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification | |

220 Travis Street, Suite 501, Shreveport, Louisiana | 71101 | |

| (Address of | (Zip Code) |

(972) 243-2610318-425-5000

(Registrant’s (Registrant’s telephone number, including area code)

N/A

(Former (Former name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.0001 par value per share | TCCR | NONE |

Indicate by check mark whether the registrant:registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒ Yes ☐No☒

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☐No☒ No

| 1 |

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”filer,” “smaller reporting company,” and “smaller reporting“emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large | ||||

| Accelerated Filer ☐ | Emerging | growth company ☐ | ||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐ Yes ☐No☒ No

APPLICABLE ONLY TO CORPORATE ISSUERS:

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date.

As of October 26, 2017,November 12, 2021 there were 13,868,788 shares of Class A common stock par value $0.01 per share, outstanding.

| 2 |

FRONTIER OILFIELD SERVICES,TRICCAR, INC.

Index

PART 1 — FINANCIAL INFORMATION

FRONTIER OILFIELD SERVICES,TRICCAR, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(UNAUDITED)

| September 30, 2017 | December 31, 2016 | |||||||

| ASSETS | ||||||||

| Current Assets: | ||||||||

| Cash | $ | 4,271 | $ | 20,253 | ||||

| Accounts receivable, net | 82,817 | 73,836 | ||||||

| Advance to shareholder | 29,413 | 132,190 | ||||||

| Total current assets | 116,501 | 226,279 | ||||||

| Property and equipment, at cost | 8,481,948 | 8,481,948 | ||||||

| Less: accumulated depreciation | (4,657,122 | ) | (4,366,035 | ) | ||||

| Property and equipment, net | 3,824,826 | 4,115,913 | ||||||

| Intangibles, net | 353,659 | 408,537 | ||||||

| Deposits | 2,302 | 2,302 | ||||||

| Total other assets | 355,961 | 410,839 | ||||||

| Total Assets | $ | 4,297,288 | $ | 4,753,031 | ||||

| LIABILITIES AND STOCKHOLDERS’ DEFICIT | ||||||||

| Current Liabilities: | ||||||||

| Current maturities of long-term debt, primarily stockholders, net of deferred loan fees | $ | 7,929,660 | $ | 7,773,114 | ||||

| Accounts payable | 1,970,953 | 2,430,722 | ||||||

| Accrued liabilities | 1,171,295 | 2,171,848 | ||||||

| Total current liabilities | 11,071,908 | 12,375,684 | ||||||

| Long-term debt, less current maturities | — | — | ||||||

| Total Liabilities | 11,071,908 | 12,375,684 | ||||||

| Commitments and Contingencies (Note 7) | ||||||||

| Stockholders’ Deficit: | ||||||||

| Common stock- $.01 par value; authorized 100,000,000 shares; | ||||||||

| 13,868,788 and 11,855,276 shares issued and outstanding at September 30, 2017 and December 31, 2016, respectively | 138,689 | 118,553 | ||||||

| Additional paid-in capital | 34,918,653 | 32,925,243 | ||||||

| Accumulated deficit | (41,831,962 | ) | (40,666,449 | ) | ||||

| Total stockholders’ deficit | (6,774,620 | ) | (7,622,653 | ) | ||||

| Total Liabilities and Stockholders’ Deficit | $ | 4,297,288 | $ | 4,753,031 | ||||

| September 30, 2021 | December 31, 2020 | |||||||

| ASSETS | ||||||||

| Current Assets: | ||||||||

| Cash | $ | 9,197 | $ | 1,699 | ||||

| Total current assets | 9,197 | 1,699 | ||||||

| Total assets | $ | 9,197 | $ | 1,699 | ||||

| LIABILITIES AND STOCKHOLDERS’ DEFICIT | ||||||||

| Current Liabilities: | ||||||||

| Accounts payable | $ | 311,587 | $ | 228,411 | ||||

| Accrued liabilities, related party | — | 48,830 | ||||||

| Total current liabilities | 311,587 | 277,241 | ||||||

| Total Liabilities | 311,587 | 277,241 | ||||||

| Commitments and Contingencies (Note 5) | ||||||||

| Stockholders’ Deficit: | ||||||||

| Preferred stock $ par value; authorized shares with outstanding as June 30, 2021 and December 31, 2020 | — | — | ||||||

| Common stock- Class A $ par value; authorized shares with and shares issued and outstanding at September 30, 2021 and December 31, 2020, respectively | 2,000 | 7,250 | ||||||

| Common stock- Class B $ par value; authorized shares with and shares issued and outstanding at September 30, 2021 and December 31, 2020, respectively | 0 | 2,750 | ||||||

| Additional paid-in capital | 207,588 | 0 | ||||||

| Accumulated deficit | (511,978 | ) | (285,542 | ) | ||||

| Total stockholders’ deficit | (302,390 | ) | (275,542 | ) | ||||

| Total Liabilities and Stockholders’ Deficit | $ | 9,197 | $ | 1,699 | ||||

The accompanying notes are an integral part of these consolidated financial statements.

FRONTIER OILFIELD SERVICES,TRICCAR, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

(UNAUDITED)

| For the Three Months Ended | For the Nine Months Ended | |||||||||||||||||||||||||||||||

| September 30, 2017 | September 30, 2016 | September 30, 2017 | September 30, 2016 | For the Three Months Ended | For the Nine Months Ended | |||||||||||||||||||||||||||

| September 30, 2021 | September 30, 2020 | September 30, 2021 | September 30, 2020 | |||||||||||||||||||||||||||||

| Revenue, net of discounts | $ | 321,863 | $ | 284,345 | $ | 885,719 | $ | 1,004,162 | $ | 0 | $ | 0 | $ | 0 | $ | 0 | ||||||||||||||||

| Costs and expenses: | ||||||||||||||||||||||||||||||||

| Operating costs | 198,360 | 246,574 | 678,814 | 862,460 | ||||||||||||||||||||||||||||

| Operating costs, related party | 60,147 | — | 90,147 | 45,000 | ||||||||||||||||||||||||||||

| General and administrative | 92,117 | 71,733 | 302,875 | 431,396 | 78,451 | 7,384 | 136,289 | 9,050 | ||||||||||||||||||||||||

| Depreciation and amortization | 115,321 | 115,322 | 345,965 | 345,965 | ||||||||||||||||||||||||||||

| Total costs and expenses | 405,798 | 433,629 | 1.327,654 | 1,639,821 | 138,598 | 7,384 | 226,436 | 54,050 | ||||||||||||||||||||||||

| Operating loss | (83,935 | ) | (149,284 | ) | (441,935 | ) | (635,659 | ) | (138,598 | ) | (7,384 | ) | (226,436 | ) | (54,050 | ) | ||||||||||||||||

| Other (income) expense: | ||||||||||||||||||||||||||||||||

| Other income (Note 6) | 0 | 0 | 0 | (10,000 | ) | |||||||||||||||||||||||||||

| Interest expense | 168,516 | 272,887 | 723,578 | 842,658 | 0 | 0 | 0 | 0 | ||||||||||||||||||||||||

| (Gain) loss on disposal of property and equipment | — | (57,511 | ) | — | (102,931 | ) | ||||||||||||||||||||||||||

| Loss before provision for income taxes | (252,451 | ) | (364,660 | ) | (1,165,513 | ) | (1,375,386 | ) | (138,598 | ) | (7,384 | ) | (226,436 | ) | (44,050 | ) | ||||||||||||||||

| Provision for income taxes | — | 4,026 | — | 4,916 | 0 | 0 | 0 | 0 | ||||||||||||||||||||||||

| Net loss | $ | (252,451 | ) | $ | (368,686 | ) | $ | (1,165,513 | ) | $ | (1,380,302 | ) | $ | (138,598 | ) | $ | (7,384 | ) | $ | (226,436 | ) | (44,050 | ) | |||||||||

| Net loss per common share - basic and diluted | $ | (0.02 | ) | $ | (0.03 | ) | $ | (0.10 | ) | $ | (0.12 | ) | ||||||||||||||||||||

| Net loss per common share – basic: | $ | (0.00 | ) | $ | (0.00 | ) | $ | (0.00 | ) | $ | (0.00 | ) | ||||||||||||||||||||

| Weighted Average Common Shares Outstanding: | ||||||||||||||||||||||||||||||||

| Basic and Diluted | 12,533,742 | 11,864,962 | 12,083,917 | 11,724,327 | ||||||||||||||||||||||||||||

| Basic | 20,000,000 | 100,000,000 | 58,966,790 | 93,333,333 | ||||||||||||||||||||||||||||

The accompanying notes are an integral part of these consolidated financial statements.

FRONTIER OILFIELD SERVICES,TRICCAR, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(UNAUDITED)

| For the Nine Months Ended | ||||||||

| September 30, 2017 | September 30, 2016 | |||||||

| Cash Flows from Operating Activities: | ||||||||

| Net loss | $ | (1,165,513 | ) | $ | (1.380,302 | ) | ||

| Adjustments to reconcile net loss to net cash used in operating activities: | ||||||||

| Depreciation and amortization | 345,965 | 345,965 | ||||||

| Amortization of deferred loan fees to interest expense | 156,546 | 150,657 | ||||||

| Stock compensation | — | 29,700 | ||||||

| Changes in operating assets and liabilities: | ||||||||

| (Increase) decrease in operating assets: | ||||||||

| Accounts receivable | (8,981 | ) | 99,046 | |||||

| Inventory | — | 947 | ||||||

| Increase (decrease) in operating liabilities: | ||||||||

| Accounts payable | (27,535 | ) | (163,571 | ) | ||||

| Accrued liabilities | 580,759 | 712,403 | ||||||

| Net cash used in operating activities | (118,759 | ) | (205,155 | ) | ||||

| Cash Flows from Investing Activities: | ||||||||

| Repayment of advance to shareholder | 102,777 | 215,847 | ||||||

| Proceeds from disposition of CD | — | 77,614 | ||||||

| Net cash provided by investing activities | 102,777 | 293,461 | ||||||

| Cash Flows from Financing Activities: | ||||||||

| Payments on debt | — | (104,230 | ) | |||||

| Net cash used in financing activities | — | (104,230 | ) | |||||

| Net decrease in cash | (15,982 | ) | (15,924 | ) | ||||

| Cash at beginning of the period | 20,253 | 22,400 | ||||||

| Cash at end of the period | $ | 4,271 | $ | 6,476 | ||||

| Supplemental Cash Flow Disclosures | ||||||||

| Interest paid | $ | — | $ | 15,845 | ||||

| Taxes paid | $ | — | $ | 4,916 | ||||

| Settlement of liabilities through common stock issuance | $ | 2,013,546 | $ | 206,000 | ||||

| For the Nine Months Ended | ||||||||

September 30, 2021 | September 30, 2020 | |||||||

| Cash Flows from Operating Activities: | ||||||||

| Net loss | $ | (226,436 | ) | $ | (44,050 | ) | ||

| Adjustments to reconcile net loss to net cash used in operating activities: | ||||||||

| Changes in operating assets and liabilities: | ||||||||

| Increase (decrease) in operating liabilities: | ||||||||

| Accounts payable | 83,176 | — | ||||||

| Accrued liabilities | 0 | 16,339 | ||||||

| Net cash used in operating activities | (143,260 | ) | (27,711 | ) | ||||

| Cash Flows from Investing Activities | 0 | 0 | ||||||

| Cash Flows from Financing Activities: | ||||||||

| Contributed capital | 150,758 | 0 | ||||||

| Proceeds from equity investment | — | 2,075 | ||||||

| Net cash provided from financing activities: | 150,758 | 2,075 | ||||||

| Net increase (decrease) in cash | 7,498 | (25,636 | ) | |||||

| Cash at beginning of the period | 1,699 | 29,467 | ||||||

| Cash at end of the period | $ | 9,197 | $ | 3,831 | ||||

| Supplemental Cash Flow Disclosures | ||||||||

| Cash paid for: | ||||||||

| Interest | $ | 0 | $ | 0 | ||||

| Taxes | $ | 0 | $ | 0 | ||||

| Supplemental Disclosure of Non-Cash Investing and Financing | ||||||||

| Accrued liabilities forgiven through May 2021 Recission Agreement (See Note 7) | $ | 48,830 | $ | 0 | ||||

| Accounts payable acquired in reverse merger | $ | 0 | $ | 168,411 | ||||

The accompanying notes are an integral part of these consolidated financial statements.

FRONTIER OILFIELD SERVICES,TRICCAR, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENT OF CHANGES IN STOCKHOLDERS’ DEFICIT

FOR THE NINE MONTHS ENDED SEPTEMBER 30, 2021

(UNAUDITED)

| Additional | Total | |||||||||||||||||||||||||||

| Common Stock Class A | Common Stock Class B | Paid-In | Accumulated | Stockholders’ | ||||||||||||||||||||||||

| Shares | Par Value | Shares | Par Value | Capital | Deficit | Equity (Deficit) | ||||||||||||||||||||||

| Balance December 31, 2019 of TRICCAR Holdings, Inc. | 52,500,000 | $ | 525 | 27,500,000 | $ | 275 | $ | 101,401 | $ | (105,225 | ) | $ | (3,024 | ) | ||||||||||||||

| Contribution by shareholders | — | 0 | — | 0 | 2,075 | 0 | $ | 2,075 | ||||||||||||||||||||

| Recapitalization on reverse merger - purging previous share | (52,500,000 | ) | (525 | ) | (27,500,000 | ) | (275 | ) | (103,476 | ) | 0 | $ | (104,276 | ) | ||||||||||||||

| Recapitalization on reverse merger - issuance of new share | 72,500,000 | 7,250 | 27,500,000 | 2,750 | 0 | (74,135 | ) | $ | (64,135 | ) | ||||||||||||||||||

| Net loss | — | 0 | — | 0 | 0 | (44,050 | ) | $ | (44,050 | ) | ||||||||||||||||||

| Balance September 30, 2020 | 72,500,000 | $ | 7,250 | 27,500,000 | $ | 2,750 | $ | 0 | $ | (223,410 | ) | $ | (213,410 | ) | ||||||||||||||

| Balance December 31, 2020 of TRICCAR Holdings, Inc. | 72,500,000 | $ | 7,250 | 27,500,000 | $ | 2,750 | $ | 0 | $ | (285,542 | ) | $ | (275,542 | ) | ||||||||||||||

| Net loss | — | 0 | — | 0 | 0 | (15,609 | ) | $ | (15,609 | ) | ||||||||||||||||||

| Balance March 31, 2021 | 72,500,000 | $ | 7,250 | 27,500,000 | $ | 2,750 | $ | 0 | $ | (301,151 | ) | $ | (291,151 | ) | ||||||||||||||

| Contribution by shareholders | — | 0 | — | 0 | 150,758 | 0 | $ | 150,758 | ||||||||||||||||||||

| Accrued liabilities forgiven through May 2021 Recission Agreement (See Note 7) | — | 0 | — | 0 | 48,830 | 0 | $ | 48,830 | ||||||||||||||||||||

| Cancellation of shares related to May 2021 Recission Agreement | (52,500,000 | ) | (5,250 | ) | (27,500,000 | ) | (2,750 | ) | 8,000 | — | $ | — | ||||||||||||||||

| Net loss | — | 0 | — | 0 | 0 | (72,229 | ) | $ | (72,229 | ) | ||||||||||||||||||

| Balance June 30, 2021 | 20,000,000 | $ | 2,000 | 0 | $ | 0 | $ | 207,588 | $ | (373,380 | ) | $ | (163,792 | ) | ||||||||||||||

| Net loss | — | 0 | — | 0 | 0 | (138,598 | ) | $ | (138,598 | ) | ||||||||||||||||||

| Balance September 30, 2021 | 20,000,000 | $ | 2,000 | 0 | $ | 0 | $ | 207,588 | $ | (511,978 | ) | $ | (302,390 | ) | ||||||||||||||

The accompanying notes are an integral part of these consolidated financial statements.

TRICCAR, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

September 30, 20172021

(UNAUDITED)

1. BASIS OF PRESENTATION

Frontier Oilfield Services, Inc. (“the Company”) has prepared theThe consolidated financial statements included herein have been prepared by TRICCAR, Inc. (“the Company”), without audit, pursuant to the rules and regulations of the Securities and Exchange Commission. Certain information and footnote disclosures normally included in financial statements prepared in accordance with U.S. generally accepted accounting principles have been omitted. However, in the opinion of management, all adjustments (which include only normal recurring adjustments, unless otherwise indicated) necessary to present fairly the financial position and results of operations for the periods presented have been made. The results for interim periods are not necessarily indicative of trends or of results to be expected for the full year. These financial statements should be read in conjunction with the financial statements of the Company for the year ended December 31, 2016 (including the notes thereto) set forth in Form 10-K.

2. BUSINESS ACTIVITIES

On December 12, 2019, Frontier Oilfield Services, Inc., a Texas corporation (and collectivelyCorporation (“FOSI”) entered into a Reorganization and Stock Purchase Agreement (the “Agreement”) to change its corporate domicile from Texas to Nevada, assume the name TRICCAR, Inc. (“TRICCAR”), and to acquire 100% of the issued and outstanding equity of TRICCAR Holdings, Inc., a Nevada Corporation (“TRICCAR Holdings”).

Pursuant to the Agreement, effective on February 28, 2020, the parties closed the Agreement.

TRICCAR acquired 100% of the issued and outstanding equity of TRICCAR Holdings. TRICCAR issued 80,000,000 shares of stock to acquire all the issued and outstanding equity stock of TRICCAR Holdings while TRICCAR shareholders retained shares of stock. As a consequence, immediately subsequent to the acquisition TRICCAR will have approximately shares of common stock outstanding. The issuance of the new shares has already been reflected on TRICCAR’s book and is pending the name and symbol change with its subsidiaries, “we”, “our”, “Frontier”, “FOSI”, or the “Company”), was organized on March 24, 1995. transfer agent.

The accompanying consolidated financial statements include the accounts of the Company and Frontier Acquisition I, Inc.Company., and its subsidiary Chico Coffman Tank Trucks, Inc. (CTT) and its subsidiary Coffman Disposal, LLC, and Frontier Income and Growth, LLC (FIG) and its subsidiaries Trinity Disposal & Trucking, LLC and Trinity Disposal Wells, LLC.TRICCAR Holdings.

Frontier operates its businessThrough May 14, 2021, TRICCAR was a biomedical research, development, and marketing firm whose focus was to develop, acquire, and partner to bring bioceutical solutions (not requiring FDA approval) and pharmaceutical drugs (requiring FDA approval) to the market. The Company was in the oilfield service industrydevelopment stage of bioceutical and is primarily involved inpharmaceutical products designed to support the disposalwell-being of saltwaterhumans and other oilfield fluids in Texas. The Company currently owns and operates nine disposal wells in Texas, six within the Barnett Shale in North Texas and three in east Texas near the Louisiana state line. The Company’s customers include national, integrated, and independent oil and gas exploration companies.animals that have common diseases.

On May 14, 2021, TRICCAR and TRICCAR Holdings entered into a Mutual Rescission Agreement and General Release (“Rescission Agreement”), pursuant to which the Reorganization and Stock Purchase Agreement (“Agreement”) entered into by and between the TRICCAR and TRICCAR Holdings on December 12, 2019 was rescinded. Pursuant to the terms of the Rescission Agreement, the shares that were to be issued to the shareholders of TRICCAR Holdings will be returned by the shareholders of TRICCAR Holdings and in exchange therefor, TRICCAR will return the shares of TRICCAR Holdings it received to the shareholders of TRICCAR Holdings and the Company will disclaim any right, title and/or interest in or to any shares of capital stock of TRICCAR Holdings.

3. GOING CONCERN

The Company’s financial statements are prepared using U.S. generally accepted accounting principles (“U.S. GAAP”) applicable to a going concern which contemplates the realization of assets and liquidation of liabilities in the normal course of business. As of the date of the financial statements, the Company has generated losses from operations, has an accumulated deficit and working capital deficiency. These factors raise substantial doubt regarding the Company’s ability to continue as a going concern.

To continue as a going concern and achieve a profitable level of operations, the Company will need, among other things, to increase its business volume and grow revenues, reduce its operating expenses, raise additional capital resources and develop new and stable sources of revenue sufficient to meet its operating expenses.

The Company’s ability to continue as a going concern will be dependent upon management’s ability to successfully implement management’s plans to pursue additional business volumes from new and existing customers, reduce indebtedness through sales of non-performing assets and conversions of debt to equity, and rationalize the Company’s cost structure to achieve profitable operations. The accompanying financial statements do not include any adjustments that might be necessary if the Company is unable to continue as a going concern. The Company’s continued existence will ultimately be dependent on its ability to generate sufficient cash flows to support its operations as well as provide sufficient resources to retire existing liabilities on a timely basis. The Company faces significant risk in implementing its business plan and there can be no assurance that financing for its operations and business plan will be available or, if available, such financing will be on satisfactory terms.

In May 2014, the FASB issued ASU 2014-09,Revenue from Contracts with Customers, which provides guidance on a single comprehensive model for entities to use in accounting for revenue arising from contracts with customers. The effective date for this ASU, which was deferred by ASU 2015-14 issued in August 2015, is for fiscal years beginning after December 15, 2017. In March 2016, the FASB also issued ASU 2016-08, an amendment to the guidance in ASU 2014-09 which revises the structure of the indicators to provide indicators of when the entity is the principal or agent in a revenue transaction, and eliminated two of the indicators (“the entity’s consideration is in the form of a commission” and “the entity is not exposed to credit risk”) in making that determination. This amendment also clarifies that each indicator may be more or less relevant to the assessment depending on the terms and conditions of the contract. In April 2016, the FASB also issued ASU 2016-10, which clarifies the implementation guidance on identifying promised goods or services and on determining whether an entity’s promise to grant a license with either a right to use the entity’s intellectual property (which is satisfied at a point in time) or a right to access the entity’s intellectual property (which is satisfied over time). The amendments, collectively, should be applied retrospectively to each prior reporting period presented or as a cumulative effect adjustment as of the date of adoption. Early adoption of the guidance is not permitted. The Company is currently evaluating the impact of adopting ASU 2014-09 and the related updates to it on its financial position, results of operations and disclosures.4. SUMMARY OF SELECTED ACCOUNTING POLICIES

In January 2016, the FASB issued ASU 2016-01,Recognition and Measurement of Financial Assets and Financial Liabilities, which provides guidance for the recognition, measurement, presentation, and disclosure of financial assets and liabilities. The guidance will be effective for the fiscal year beginning after December 15, 2017, including interim periods within that year. The Company is in the process of evaluating the impacts of the adoption of this ASU.

In February 2016, the FASB issued ASU 2016-02,Leases,which will, among other impacts, change the criteria under which leases are identified and accounted for as on- or off-balance sheet. The guidance will be effective for the fiscal year beginning after December 15, 2018, including interim periods within that year. Once effective, the new guidance must be applied for all periods presented. The Company is in the process of evaluating the impacts of the adoption of this ASU.

In March 2016, the FASB issued ASU 2016-09,Improvements to Employee Share-Based Payment Accounting, which is intended to simplify several aspects of the accounting for share-based payment award transactions. The guidance will be effective for the fiscal year beginning after December 15, 2016, including interim periods within that year. The Company is in the process of evaluating the impacts of the adoption of this ASU.

Principles of Consolidation

The consolidated financial statements include the accounts of the Company and its wholly ownedwholly-owned subsidiaries. All significant inter-company transactions and balances have been eliminated in consolidation.

Fair Value of Financial Instruments

In accordance with the reporting requirements of ASC Topic 825,Financial Instruments, the Company calculates the fair value of its assets and liabilities which qualify as financial instruments under this standard and includes this

additional information in the notes to the financial statements when the fair value is different fromthan the carrying value of those financial instruments. The Company does not have any assets or liabilities measured at fair value on a recurring basisbasis. Consequently, the Company did not have any fair value adjustments for assets and liabilities measured at fair value at the balance sheet dates, nor gains or losses reported in the statements of operations that are attributable to the change in unrealized gains or losses relating to those assets and liabilities still held during the ninethree months ended September 30, 2017March 31, 2021 and 2016,2020, except as disclosed.

Basic earnings per common share are calculated by dividing net income or loss by the weighted average number of shares outstanding during the period. Diluted earnings per common share isare calculated by adjusting outstanding shares, assuming conversion of all potentially dilutive stock options and warrants. The computation of diluted EPS does not assume conversion, exercise, or contingent issuance of shares that would have an anti-dilutive effect on earnings per common share. Anti-dilution results from an increase in earnings per share or reduction in loss per share from the inclusion of potentially dilutive shares in EPS calculations. Currently there are no common stock optionsdilutive instruments in 20172021 or 2020 which have been excluded from EPS that could potentially have a dilutive effect on EPS in the future.

Use of Estimates

The preparation of the unaudited consolidated financial statements in conformity with accounting principles generally accepted in the U.S. requires management to make estimates and assumptions that affect the reported amounts of assets, liabilities, revenues, expenses, and the related disclosures at the date of the financial statements and during the reporting period. Actual results could materially differ from these estimates.

Revenue Recognition

In May 2014, the FASB issued ASU 2014-09, Revenue from Contracts with Customers (Topic 606). This update provides a comprehensive new revenue recognition model that requires a company to recognize revenue to depict the transfer of goods or services to a customer at an amount that reflects the consideration it expects to receive in exchange for those goods or services. The guidance also requires additional disclosure about the nature, amount, timing and uncertainty of revenue and cash flows arising from customer contracts.

Our salt water disposal services provide oil and gas operators that produce hydrocarbons to dispose of their by-product of salt water (produced water) in an industry approved manner. Revenue is primarily based on a per-barrel price or other throughput metrics as specified in the contract. The Company recognizes revenue as services are performed. We have adopted this update and have generated no revenues during the period of this report.

Effect of Recent Accounting Pronouncements

The Company reviews new accounting standards and updates as issued. No new standards or updates had any material effect on these financial statements. The accounting pronouncements and updates issued subsequent to the date of these financial statements that were considered significant by management were evaluated for the potential effect on these financial statements.

| 9 |

The outbreak of the coronavirus (COVID-19) resulted in increased travel restrictions, and shutdown of businesses, which may cause slower recovery of the economy. We may experience impact from quarantines, market downturns and changes in customer behavior related to pandemic fears and impact on our workforce if the virus continues to spread. In addition, one or more of our customers, partners, service providers or suppliers may experience financial distress, delayed or defaults on payment, file for bankruptcy protection, sharp diminishing of business, or suffer disruptions in their business due to the outbreak. The extent to which the coronavirus impacts our results will depend on future developments and reactions throughout the world, which are highly uncertain and will include emerging information concerning the severity of the coronavirus and the actions taken by governments and private businesses to attempt to contain the coronavirus. It is likely to result in a potential material adverse impact on our business, results of operations and financial condition. Wider-spread COVID-19 globally could prolong the deterioration in economic conditions and could cause decreases in or delays in advertising spending and reduce and/or negatively impact our short-term ability to grow our revenues. Any decreased collectability of accounts receivable, bankruptcy of small and medium businesses, or early termination of agreements due to deterioration in economic conditions could negatively impact our results of operations.

5. COMMITMENTS AND CONTINGENCIES

Litigation

From time to time, the Company may be subject to routine litigation, claims, or disputes in the ordinary course of business. In the opinion of management, no pending or known threatened claims, actions or proceedings against the Company that are expected to have a material adverse effect on its financial position, results of operations or cash flows. The Company cannot predict with certainty, however, the outcome or effect of any of the litigation or investigatory matters specifically described above or any other pending litigation or claims. There can be no assurance as to the ultimate outcome of any lawsuits and investigations.

6. OTHER INCOME

The Boardother income of Directors of$10,000 for the Company electedthree and six months ended June 30, 2020, was an Economic Injury Disaster Loan (“EIDL”) program advance provided by Small Business Administration which is designed to suspend all stock based compensation in 2015 as part ofprovide emergency economic relief to business that were impacted by COVID-10 pandemic. The advance will not have to be repaid. TRICCAR Holdings, Inc. received the Company’s cost cutting and restructuring measures.advance but were not approved for a EIDL loan.

In April 2016, the Board of Directors of the Company approved the issuance of an aggregate of 54,0007. EQUITY

The total number shares of common stock toauthorized that may be issued by the membersCompany is four hundred million () shares of common stock with a par value of one hundredth of one cent ($) per share consisting of three hundred seventy-two million five hundred thousand () shares Class A shares with 1:1 voting rights and twenty-seven million five hundred thousand () Class B shares with 20:1 voting rights, and fifty million () shares of preferred stock with a par value of one hundredth of a cent ($) per share. To the fullest extent permitted by the laws of the Boardstate of Directors. The three membersNevada (currently set forth in NRS 78.195), as the same now exists or may hereafter be amended or supplemented, the board of directors may fix and determine the designations, rights, preferences or other variations of each class or series within each class of capital stock of the Board of Directors received 18,000 shares each.corporation.

In May 2021 Recission Agreement, the Company agreed to rescind the merger transaction with TRICCAR Holdings that was effective December 12, 2019. In connection with the Recission Agreement, the Company received shares of its common stock from the previous transaction and subsequently cancelled the shares. Therefore the common stock outstanding of the company was reduced from 100,000,000 to during the period and treasury stock is outstanding. Additionally, accrued liabilities of $48,830 was forgiven in connection with TRICCAR Holdings during the period.

Borrowings8. RELATED PARTY TRANSACTIONS

For the quarter periods ending September 30, 2021 and 2020, the Company paid Elysian Fields Disposal LLC., an affiliate of our stockholder Newton Dorsett, $15,000 and $15,000, respectively, These are included as operating costs on the Statement of Operations for contract operating and management services of our SWD wells. The account payables outstanding balance with Elysian Fields Disposal was $220,000 and $175,000, as of September 30, 20172021 and December 31, 2016 were as follows:2020, respectively.

| September 30, | December 31, | |||||||

| 2017 | 2016 | |||||||

| Revolving credit facility and term loan (a) | $ | 747,757 | $ | 747,757 | ||||

| Term note (b) | 4,330,820 | 4,330,820 | ||||||

| Loans from stockholders (c) (d) | 2,870,484 | 2,870,484 | ||||||

| Installment notes (e) | 11,941 | 11,941 | ||||||

| Deferred loan fees (f) | (31,342 | ) | (187,888 | ) | ||||

| Total debt | 7,929,660 | 7,773,114 | ||||||

| Less current portion | (7,929,660 | ) | (7,773,114 | ) | ||||

| Total long-term debt | $ | — | $ | — | ||||

For the quarter period ending September 30, 2021, the Company paid Loutex Production Company LLC., an affiliate of our stockholder Newton Dorsett, $11,171, These are included as operating costs on the Statement of Operations for contract operating costs and services of our SWD wells. The account payables outstanding balance with Loutex Production Company was $11,171, as of September 30, 2021.

During 2021, $150,758 was contributed to the Company from an affiliate and stockholder.

9. SUBSEQUENT EVENTS

|

On June 30, 2017, an affiliate of an accredited investor whoOctober 13, 2021, a stockholder loaned the Company $25,000 for working capital. The note is also a principal stockholder agreed to exchange approximately $2.0 million in accounts payabledemand note that matures November 13, 2021 and accrued liabilitiesextends maturity for 2,013,546 shares of common stock of the Company. The Board approved the exchange and issuance of the shares on June 30, 2017. The liabilities exchanged for common stock included the affiliates full interest in the accrued interest payable to the stockholder associated with the Term Loan Agreement and the Senior Loan Facility. The 2,013,546 shares of common stock were issued on August 31, 2017. In connection with the exchange,thirty day intervals upon permission from the holder, of the Term Loan Agreement agreed to lower theand bears an interest rate on the Loan Agreement to 3%of 5% per annum effective July 1, 2017.annum.

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

CAUTIONARY STATEMENT

Statements in this report which are not purely historical facts, including statements regarding the Company’s anticipations, beliefs, expectations, hopes, intentions or strategies for the future, may be forward-looking statements within the meaning of Section 21E of the Securities Act of 1934, as amended. All forward-looking statements in this report are based upon information available to us on the date of the report. Any forward-looking statements involve risks and uncertainties that could cause actual results or events to differ materially from events or results described in the forward-looking statements. Important factors with respect to any such forward-looking statements, including certain risks and uncertainties that could cause actual results to differ materially from the Company’s expectations (“Cautionary Statements”), are disclosed in the Company’s annual report on Form 10-K, including, without limitation, in conjunction with the forward-looking statements under the caption “Risk Factors.” In addition, important factors that could cause actual results to differ materially from those in the forward-looking statements included herein include, but are not limited to, limited working capital, limited access to capital, changes from anticipated levels of sales and revenues changes in the oil and gas markets especially in the oil field services markets and fluids disposal business, future national or regional economic and competitive conditions, changes in relationships with customers, difficulties in developing new business, in the disposal business, difficulties integrating any new businesses or products acquired, replacing the lost customer revenue, regulatory change, the ability of the Company to meet its stated business goals, the Company’s restructuring initiatives, the Company’s ability to sustain profitability, the Company’s ability to service its debt, its ability to comply with covenants contained in its financing arrangements, the current defaults existing under the Company’s senior and subordinated credit arrangements, and general economic and business conditions. Although the Company believes the expectations reflected in such forward-looking statements are reasonable, it can give no assurance that such expectations will prove to have been correct. All subsequent written and oral forward-looking statements attributable to the Company or persons acting on its behalf are expressly qualified in their entirety by the Cautionary Statements. We do not undertake to update any forward-looking statements. Readers are cautioned not to place undue reliance on these forward-looking statements.

DESCRIPTION OF PROPERTIESThe following discussion highlights the Company’s results of operations and the principal factors that have affected its consolidated financial condition as well as its liquidity and capital resources for the periods described and provides information that management believes is relevant for an assessment and understanding of the Company’s consolidated financial condition and results of operations presented herein. The following discussion and analysis are based on the Company’s unaudited financial statements contained in this Current Report, which have been prepared in accordance with generally accepted accounting principles in the United States. You should read the discussion and analysis together with such financial statements and the related notes thereto.

Our principal executive offices areOVERVIEW

TRICCAR Inc. (or “TRICCAR” or “the Company”) focuses in the oilfield service industry and more specifically as the owner of three saltwater disposal wells (“SWDs”) located at 220 Travis St. Suite 501, Shreveport, Louisiana 71101.in Wise County Texas and the Barnett Shale region in north central Texas.

We owned 7.055 acres at 503 W. Sherman St., Chico,have an operating and management agreement with Elysian Fields Disposal LLC (“Elysian Fields”) to serve as operator, management and consultant of various field operational assets. Under the contract agreement, Elysian Fields has the authority to operate the wells and provide accounting, regulatory compliance filings, and operating services through itself or qualified sub-contractors. This agreement remains in place and the three SWD wells continue to be operated pursuant to the terms of the operating and management agreement.

The significant quantity of oil and gas wells in the Barnett Shale of Texas on which we had three buildings. These facilities servedcombined with the presence of produced water (salt water) and other fluids in the production process creates demand for disposal services such as our executivethose services provided by us.

From January 2020, through May 14, 2021, the Company was engaged in the development of bioceutical and administrative officespharmaceutical products designed to support the well-being of humans and headquarters for CTT operations including repair & maintenance facilities foranimals that have ailments and diseases, as well as the ownership and operation of its saltwater disposal services business. CTT has three operating wells near Chico, Texas. Two of these disposal well locations have small buildings for well monitoring and operations. We also own 7.49 acres in Harrison County, Texas on which three of our disposal wells are located, along with a small office and repair shop for the operation of these wells.

In September 2016,Outlook

The Company has several years of history in the holderoperations and development of saltwater disposal wells. Management currently believes the oil and gas industry outlook is positive and increasing activity levels which in turn drives more demand for our saltwater disposal services.

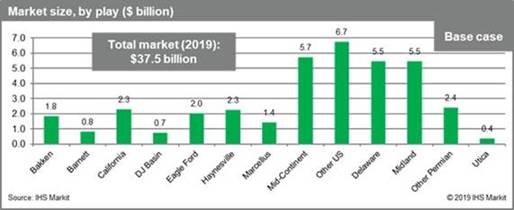

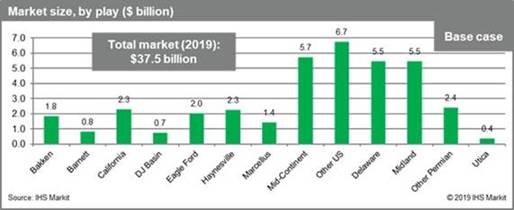

IHS Markit estimates the US oilfield water management to be valued at around $37 billion in 2019, representing a 12% year-on-year (y/y) market growth from 2018; this is mainly driven by water disposal and water logistics. The Permian Basin continues to produce and demand the largest volume of oilfield water among all US onshore regions, with water spending in the region estimated at $13.3 billion in 2019.

Figure 1: Market size, by play ($ billion)

Within the value chain of the Senior Loan Facility foreclosed on certain landwater management market, water logistics continues to be the largest segment. Indeed, logistics are expected to make up 60% of spending in 2019 with water hauling services the main driver in that category.

Right behind water logistics is water disposal. As hydrocarbon production continues to increase, mainly due to Permian Basin activities, produced water is projected to follow the same trend. As a result, the water disposal market should continue growing at a 6% compound average growth rate (CAGR) through 2024. However, this growth could be limited if the disposal challenges in the Permian Basin are not addressed by both operators and buildings owned by the Company in settlement of a portionthird-party companies.

Permian water disposal volumes contribute to more than 30% of the outstanding amounttotal disposed volumes in the onshore US, and in fact they have increased more than 40% between 2010 and 2019. In addition, disposal volumes in West Texas are expected to reach the highest level recorded in the last five years during 2019.

The industry has responded by increasing the recycle/reuse of principal onproduced water in fracking operations. Nevertheless, water recycling is not a “silver bullet” since the Senior Loan Facility. Consequently,industry produces five times more water than needed to meet frack water demand.

Looking ahead, the Company charged off the net book valuedevelopment of the landwater midstream sector will be key to the development of the market overall. The signs of consolidation in a highly fragmented market could be the first clear step the industry is taking to face the challenges associated with the water lifecycle. Consolidation continues to be a strong industry trend within the water management service sector to reduce costs generally. The active M&A market at the beginning of 2019 involved third-party companies acquiring pipeline and buildings totaling $591,705 against the outstanding principal on the Senior Loan Facility, leaving a principal balance of $747,757 remaining. The Board is considering issuing stock for the deficiency balance of this loan and the related accrued interest.

We are obligated under long-term leases forlocalized water assets to reduce the use of land where seven of ourwater haulers and to centralize the disposal wells are located. Threeprocess. IHS Markit estimates this trend will continue towards the end of the leases are for extended periods. The first lease expires on February 7, 2023 (with two optionsyear.

On May 14, 2021, Triccar, Inc. (the “Company”) and Triccar Holdings Inc. (“Holdings”) entered into a Mutual Rescission Agreement and General Release (“Rescission Agreement”), pursuant to renew for an additional 10 years each). The second lease expireswhich the Reorganization and Stock Purchase Agreement entered into by and between the Company and Holdings on December 1, 2034 with a one-year renewal option12, 2019 was rescinded. Pursuant to the terms of the Rescission Agreement, the 80,000,000 shares that were to be issued to the shareholders of Holdings will not be issued to the prior shareholders of Holdings and in exchange therefor, the prior shareholders of Holdings will own all of the capital stock of Holdings and the third lease expires on May 31, 2018 with no optionCompany will disclaim any right, title and/or interest in or to renew. The aggregate monthly lease payments for the disposal well leases are $11,080.any shares of capital stock of Holdings.

SIGNIFICANT ACCOUNTING POLICIES

A summary of significant accounting policies is included in Note 3 to the audited consolidated financial statements included on Form 10-K for the year ended December 31, 2016 as filed with the United States Securities and Exchange Commission. Management believes that the application of these policies on a consistent basis enables the Company to provide useful and reliable financial information about our operating results and financial condition.

The preparation of financial statements in conformity with US Generally Accepted Accounting Principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results may differ from those estimates. The Company has adopted ASC 842 requiring the recoding of assets and liabilities related to leases on the balance sheet. The Company records rent on straight-line basis over the terms of the underlying leases.

RESULTS OF OPERATIONS

For the nine months ended September 30, 2017,2021, we reported a net loss of $1,165,513$226,436 as compared to a net loss of $1,380,302$44,050 for the nine months ended September 30, 2016.2020. The components of these results are explained below.

Revenue - TotalNo revenue decreased by $118,443 or 11.7% from $1,004,162was generated for the ninethree months ended September 30, 2016 to $885,719 for the nine months ended September 30, 2017. The decrease was due to the termination of the provisioning of transportation services in late 2016 and lower total volumes disposed in the disposal business.2021.

Expenses -The components of our costs and expenses for the ninethree months ended September 30, 20172021 and 20162020, are as follows:

| For the Nine Months Ended | % | |||||||||||

| September 30, | September 30, | Increase | ||||||||||

| 2017 | 2016 | (Decrease) | ||||||||||

| Costs and expenses: | ||||||||||||

| Operating costs | $ | 678,814 | $ | 862,460 | -21 | % | ||||||

| General and administrative | 302,875 | 431,396 | -30 | % | ||||||||

| Depreciation and amortization | 345,965 | 345,965 | 0 | % | ||||||||

| Total cost and expenses | $ | 1,327,654 | $ | 1,639,821 | -19 | % | ||||||

The decrease in the volumes of saltwater and other fluids transported and disposed of necessitated a decrease in operating expenses for the nine months ended September 30, 2017. The decrease in operating costs is due to lower volumes disposed. This resulted in the reduction of the number of employees and the related salaries, wages and benefits as well as the elimination of costs for repairs and maintenance for the disposal wells.

The decrease in general and administrative costs for the nine months ended September 30, 2017, is the result of an overall reduction of administrative costs, especially legal fees, insurance costs and utilities resulting from lower disposal volumes.

Interest Expenses - Interest expense for the nine months ended September 30, 2017 was $723,578. Interest expense was $842,658 for the nine months ended September 30, 2016.

| For the Nine Months Ended | % | |||||||||||

| September 30, | September 30, | Increase | ||||||||||

| 2021 | 2020 | (Decrease) | ||||||||||

| Costs and expenses: | ||||||||||||

| Operating costs | $ | 90,147 | $ | 45,000 | 100 | % | ||||||

| General and administrative | 136,289 | 9,050 | 1406 | % | ||||||||

| Total cost and expenses | $ | 226,436 | $ | 54,050 | 319 | % | ||||||

Operating results for the nine months ended September 30, 20172021 and 20162020 reflect a net loss of $1,165,513$226,436 and $1,380,302a net loss of $54,050, respectively. We have not recorded any federal income taxes for the nine months ended September 30, 20172021 and 20162020 because of our accumulated losses and our substantial net operating loss carry forwards.

| 13 |

LIQUIDITY AND CAPITAL RESOURCES

Cash Flows and Liquidity

As of September 30, 2017,2021, we had total current assets of approximately $117,000.$9,197. Our total current liabilities as of September 30, 20172021 were $11.1 million, including $7.9 million of debt classified as current liabilities.approximately $311,587. We had a working capital deficit of $11.0 million and $12.1 millionapproximately $302,390 as of September 30, 2017 and December 31, 2016, respectively.2021.

Management is focused on working closely with our current lenders to fund operations through current cash flows, and pay interest costs when excess cash becomes available. Management plans to work with our current lenders and debt holders to lower our cost of borrowing by renegotiating the terms of our existing debt and potentially offering debt holders an opportunity to exchange their debt for equity in the Company. Management will seek additional financing in those instances in which we believe such additional financings will assist in accomplishing our goals. There can be no assurance that management’s plan will succeed.

On June 30, 2017, an affiliate of an accredited investor who is also a principal stockholder agreed to exchange approximately $2.0 million in accounts payable and accrued liabilities for 2,013,546 shares of common stock of the Company. The Board approved the exchange and issuance of the shares on June 30, 2017. The liabilities exchanged for common stock included the affiliates full interest in the accrued interest payable to the stockholder associated with the Term Loan Agreement and the Senior Loan Facility. The 2,013,546 shares of common stock were issued on August 31, 2017.

Our ability to obtain access to additional capital through third parties or other debt or equity financing arrangements is strictly contingent upon our ability to locate adequate financing or equity investments on commercially reasonable terms. There can be no assurance that we will be able to obtain such financing on acceptable terms.

The following table summarizes our sources and uses of cash for the nine months ended September 30, 2017 and 2016:

| For the Nine Months Ended | ||||||||

| September 30, 2017 | September 30, 2016 | |||||||

| Net cash used in operating activities | $ | (118,759 | ) | $ | (205,155 | ) | ||

| Net cash provided by investing activities | 102,777 | 293,461 | ||||||

| Net cash used in financing activities | — | (104,230 | ) | |||||

| Net decrease in cash | $ | (15,982 | ) | $ | (15,924 | ) | ||

As of September 30, 2017,2021, we had approximately $4,300$9,197 in cash, a decreasean increase of approximately $16,000$7,498 from December 31, 20162020 due to cash used in operating activities.minimal general administrative expenses and equity contributions.

Net cash used in operating activities was approximately $119,000 for the nine months ended September 30, 2017 due to the operating loss. Net cash used by operating activities was approximately $205,000 for the nine months ended September 30, 2016, due to the larger net loss.Capital Expenditures

Net cash provided by investing activities was approximately $103,000 for the nine months ended September 30, 2017 due to repayment of an advance from an entity owned by one of the principal shareholders of the Company. The cash advance is in an investment account of the entity and is due on demand to the Company at any time. Net cash provided by investing activities was approximately $293,000 for the nine months ended September 30, 2016 due to a repayment of the advance to the shareholder of approximately $216,000 and proceeds from the disposition of a certificate of deposit for $77,000.

Net cash used in financing activities was $0 for the nine months ended September 30, 2017. Net cash used in financing activities was approximately $104,000 for the nine months ended September 30, 2016, which consisted of debt repayments.

Capital Expenditures

The Company suspended capital expenditures during the ninethree months ended September 30, 20172021 due to the lower volumes disposed. The Company does not currently anticipate any majorlow working capital expenditures for the remainder of 2017. The Company made the decision to no longer provide transportation services to our customers, which led to significant disposal activities on our transportation equipment in 2015.available.

Indebtedness

On June 30, 2017, an affiliate of an accredited investor who is also a principal stockholder agreed to exchange approximately $2.0 million in accounts payable and accrued liabilities for 2,013,546 shares of common stock of the Company. The Board approved the exchange and issuance of the shares on June 30, 2017. The liabilities exchanged for common stock included the affiliates full interest in the accrued interest payable to the stockholder associated with the Term Loan Agreement and the Senior Loan Facility. The 2,013,546 shares of common stock were issued on August 31, 2017. In connection with the exchange, the holder of the Term Loan Agreement agreed to lower the interest rate on the Loan Agreement to 3% per annum effective July 1, 2017.

The Company and its subsidiaries entered a Term Loan, Guaranty and Security Agreement (the “Loan Agreement”) on July 23, 2012 with ICON for $5 million. The Loan Agreement has a senior secured position in the Company’s disposal wells and a subordinated position to the Senior Loan Facility on all other Company properties and assets. The covenants in the Loan Agreement are, in all material respects, the same as in the Senior Loan Facility. The Loan Agreement is held by an affiliate of an accredited investor who is also a stockholder. As of September 30, 2017, the Company did not comply with its debt covenants under the Loan Agreement and the lender had not exercised their rights under the Loan Agreement. The outstanding balance of the Loan Agreement note is included in current liabilities at September 30, 2017 and December 31, 2016 because the Company did not comply with its debt covenants.

In September 2016, the holder of the Senior Loan Facility foreclosed on certain land and buildings owned by the Company in settlement of a portion of the outstanding amount of principal on the Senior Loan Facility. Consequently, the Company charged off the net book value of the land and buildings totaling $591,705 against the outstanding principal on the Senior Loan Facility, leaving a principal balance of $747,757 remaining. The Board is considering issuing stock for the deficiency balance of this loan and the related accrued interest.

Outlook

Management may seek to acquire other profitable oilfield service companies to broaden the Company’s customer base and capabilities. Management believes that certain acquisitions could be achieved through the issuance of the company’s equity securities or through other financings. Management may need to incur additional financing in those instances in which we believe such additional financings will assist in accomplishing our goals. There can be no assurance that management’s plan will succeed.

ITEM 3. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

Not required for smaller reporting companies.

ITEM 4. CONTROLS AND PROCEDURES

Disclosure Controls and Procedures

Our management evaluated, with the participation of our Chief Executive Officer (CEO) and Chief AccountingFinancial Officer (CAO)(CFO), the effectiveness of the design and operation of our disclosure controls and procedures (as defined in Rules 13a-15(e) and 15d-15(e) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) as of the end of the quarter covered by this quarterly report on Form 10-Q. In making this assessment, the Company used the criteria set forth by the Committee of Sponsoring Organizations of the Treadway Commission (COSO) inInternal Control-Integrated Framework. Based on that evaluation, the Company’s management, including the CEO, concluded that the Company’s internal controls over financial reporting were not effective in that there was a material weakness as of September 30, 2016.

A material weakness is a deficiency or combination of deficiencies in internal control over financial reporting, such that there is a reasonable possibility that a material misstatement of the annual or interim financial statements will not be prevented or detected on a timely basis by the Company’s internal controls.

The Company’s management has identified a material weakness in the effectiveness of internal control over financial reporting related to a shortage of resources in the accounting department required to assure appropriate segregation of duties with employees having appropriate accounting qualifications related to the Company’s unique industry accounting and disclosure rules. Management has outsourced certain financial functions to mitigate the material weakness in internal control over financial reporting. The Company is reviewing its finance and accounting staffing requirements.

Internal Control Over Financial Reporting

There have not been any changes in the Company’s internal control over financial reporting (as such term is defined in Rules 13a-15(f) and 15d-15(f) under the Exchange Act) during the fiscal quarter to which this report relates that have materially affected, or are reasonably likely to materially affect, the Company’s internal control over financial reporting. As a result, no corrective actions were required or undertaken.

Limitations on the Effectiveness of Controls

Our management, including the CEO, does not expect that its disclosure controls or its internal controls will prevent all errors and all fraud. A control system, no matter how well conceived and operated, can provide only reasonable, not absolute, assurance that the objectives of the control system are met. Further, the design of a control system must reflect the fact that there are resource constraints, and the benefits of controls must be considered relative to their costs. Because of the inherent limitations in all control systems, no evaluation of controls can provide absolute assurance that all control issues and instances of fraud, if any, within the company have been detected. These inherent limitations include the realities that judgments in decision-making can be faulty, and that breakdowns can occur

because of simple errors or mistakes. Additionally, controls can be circumvented by the individual acts of some persons, by collusion of two or more people, or by management override of the control. The design of any system of controls also is based in part upon certain assumptions about the likelihood of future events, and there can be no assurance that any design will succeed in achieving its stated goals under all potential future conditions; over time, control may become inadequate because of changes in conditions, or the degree of compliance with the policies or procedures may deteriorate. Because of the inherent limitations in a cost-effective control system, misstatements due to error or fraud may occur and not be detected.

The Company was a named defendant along with the previously named officers in certain litigation in the 271st Judicial District Wise County, Texas wherein the Plaintiffs alleged they had been damaged by the failure of the Company to complete a disposal well in a joint venture between the parties. On April 23, 2016, the litigation was settled by agreement of the parties. Under the terms of the settlement, the plaintiffs returned to the Company 53,000 shares of restricted and unregistered stock of the Company issued to them in 2013. The Company issued 317,000 shares of restricted and unregistered shares of stock in the Company to the plaintiffs. The Company will have exclusive trading authority over the shares issued to the plaintiffs and will have the right of first refusal to purchase the shares upon any planned sale by the plaintiffs. The Company will also have a call option on the shares, which will entitle the Company to purchase the shares at $1.25 per share at any time. The settlement agreement resulted in the termination of the litigation. As of December 31, 2015, the Company recorded expense of $206,000 associated with the settlement of this litigation.None.

Item 2. UNREGISTERED SALES OF EQUITY SECURITIES AND USE OF PROCEEDS

None.

Item 3. DEFAULTS UPON SENIOR SECURITIES

The outstanding principal balance of the Senior Loan Facility, the Loan Agreement and the two stockholder loans are included in current liabilities at September 30, 2017 because the Company was not compliant with the debt covenants or payment terms on the indebtedness, including the timely payment of interest and principal in accordance with all of these loan agreements. To date, none of the holders of the Senior Loan Facility, the Loan Agreement or the two stockholder loans have declared that the Company is in default or have otherwise sought remedies under the respective terms of these loan agreements.None

In September 2016, the holder of the Senior Loan Facility foreclosed on certain land and buildings owned by the Company in settlement of a portion of the outstanding amount of principal on the Senior Loan Facility. Consequently, the Company charged off the net book value of the land and buildings totaling $591,705 against the outstanding principal on the Senior Loan Facility totaling $1,339,462, leaving a principal balance of $747,757 remaining. The Board is considering issuing stock for the deficiency balance of this loan and the related accrued interest.

Item 4. CONTROLS AND PROCEDURES

Evaluation of Disclosure Controls and Procedures: Our management carried out an evaluation of the effectiveness and design and operation of our disclosure controls and procedures as defined in Rules 13a-15(e) and 15d-15(e) under the Securities and Exchange Act of 1934, as amended (the Exchange Act). Based on that evaluation, our Chief Executive Officer and Chief Financial Officer has concluded that, at September 30, 2021, such disclosure controls and procedures were not effective.

Disclosure controls and procedures are controls and other procedures that are designed to ensure that information required to be disclosed in our reports filed or submitted under the Exchange Act is recorded, processed, summarized and reported within the time periods specified in the SEC’s rules and forms. Disclosure controls and procedures include, without limitation, controls and procedures designed to ensure that the information required to be disclosed in our reports filed or submitted under the Exchange Act is accumulated and communicated to management including our Chief Executive Officer and Chief Financial Officer, or persons performing similar functions, as appropriate, to allow timely decisions regarding required disclosure.

Limitations on the Effectiveness of Controls: Our disclosure controls and procedures are designed to provide reasonable, not absolute, assurance that the objectives of our disclosure control system are met. Because of inherent limitations in all control systems, no evaluation of controls can provide absolute assurance that all control issues, if any, within a company have been detected. Our Chief Executive Officer and Chief Financial Officer has concluded, based on his evaluation as of the end of the period covered by this Quarterly Report that our disclosure controls and procedures were not sufficiently effective to provide reasonable assurance that the objectives of our disclosure control system were met.

Changes in Internal Control over Financial Reporting: There have been no changes in our internal controls over financial reporting that occurred during the three month period ended September 30, 2021 that have materially affected, or are reasonably likely to materially affect, our internal control over financial reporting.

The BoardAs reported on the Company’s Form 8-K filed with the SEC on June 1, 2021, on May 14, 2021, Triccar, Inc. (the “Company”) and Triccar Holdings Inc. (“Holdings”) entered into a Mutual Rescission Agreement and General Release (“Rescission Agreement”), pursuant to which the Reorganization and Stock Purchase Agreement entered into by and between the Company and Holdings on December 12, 2019 was rescinded. Pursuant to the terms of Directorsthe Rescission Agreement, the 80,000,000 shares that were to be issued to the shareholders of Holdings will not be issued to the prior shareholders of Holdings and managementin exchange therefor, the prior shareholders of Holdings will own all of the capital stock of Holdings and the Company will disclaim any right, title and/or interest in or to any shares of capital stock of Holdings.

In connection with the terms of the Rescission Agreement, Bill Townsend and Katrina Yao resigned from their positions as officers and directors of the Company are currently evaluating transactions that may provideand Matthew C. Flemming was appointed to serve as the President and CEO of the Company with an opportunity to improve its current financial condition including; (i) refinancing of all oras well as a portion of our existing debt, (ii) the acquisition of profitable oilfield service companies that could increase the scale of our operations and improve cash flows and (iii) raising additional equity to pay down debt. There can be no assurance the Company will be successful in finding and closing anymember of the above options.Company’s board of directors.

| (a) | EXHIBITS: |

31.1

32.1

| 32.2 Certification of Chief Financial Officer pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002. | ||

In accordance with Section 13 or 15(d) of the Exchange Act, the registrant has caused this report to be signed on its behalf by the undersigned, thereunto duly authorized, onNovember 14, 2017.12, 2021.

FRONTIER OILFIELD SERVICES,TRICCAR, INC.

| SIGNATURE: | /s/ | |

Matthew Flemming, Chief Executive Officer, Interim Chief Financial Officer and |

EXHIBIT 31.1

CERTIFICATION

Pursuant to 18 U.S.C. Section 1350,

As adopted pursuant to Section 302 of the Sarbanes-Oxley Act of 2002

I, Matthew Flemming, certify that:

| I have reviewed this Quarterly Report on Form 10-Q of Triccar Inc. (the “registrant”); |

| 2. | Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this report; |

| 3. | Based on my knowledge, the financial statements and other financial information included in this report fairly present in all material respects the financial condition, results of operations and cash flows of the registrant as of, and for, the periods presented in this report; |

| 4. | The registrant’s other certifying officer(s) and I are responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) and internal control over financial reporting (as defined in Exchange Act Rules 13a-15(f) and 15d-15(f)) for the registrant and have: |

| (a) | Designed such disclosure controls and procedures, or caused such disclosure controls and procedures to be designed under our supervision, to ensure that material information relating to the registrant, including its consolidated subsidiaries, is made known to us by others within those entities, particularly during the period in which this report is being prepared; |

| (b) | Designed such internal control over financial reporting, or caused such internal control over financial reporting to be designed under our supervision, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles; |

| (c) | Evaluated the effectiveness of the registrant’s disclosure controls and procedures and presented in this report our conclusions about the effectiveness of the disclosure controls and procedures, as of the end of the period covered by this report based on such evaluation; and |

| (d) | Disclosed in this report any change in the registrant’s internal control over financial reporting that occurred during the registrant’s most recent fiscal quarter (the registrant’s fourth fiscal quarter in the case of an annual report) that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting. |

| 5. | The registrant’s other certifying officer(s) and I have disclosed, based on our most recent evaluation of internal control over financial reporting, to the registrant’s auditors and the audit committee of the registrant’s board of directors (or persons performing the equivalent functions): |

| (a) | All significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting, which are reasonably likely to adversely affect the registrant’s ability to record, process, summarize and report financial information; and |

| (b) | Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant’s internal control over financial reporting. |

Date: November 12, 2021

| /s/ Matthew Flemming | ||

| Name: | Matthew Flemming | |

| Title: | Chief Executive Officer (Principal Executive Officer) |

EXHIBIT 31.2

CERTIFICATION

Pursuant to 18 U.S.C. Section 1350,

As adopted pursuant to Section 302 of the Sarbanes-Oxley Act of 2002

I, Matthew Flemming, certify that:

| 1. | I have reviewed this Quarterly Report on Form 10-Q of Triccar Inc. (the “registrant”); |

| 2. | Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this report; |

| 3. | Based on my knowledge, the financial statements and other financial information included in this report fairly present in all material respects the financial condition, results of operations and cash flows of the registrant as of, and for, the periods presented in this report; |

| 4. | The registrant’s other certifying officer(s) and I are responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) and internal control over financial reporting (as defined in Exchange Act Rules 13a-15(f) and 15d-15(f)) for the registrant and have: |

| (a) | Designed such disclosure controls and procedures, or caused such disclosure controls and procedures to be designed under our supervision, to ensure that material information relating to the registrant, including its consolidated subsidiaries, is made known to us by others within those entities, particularly during the period in which this report is being prepared; |

| (b) | Designed such internal control over financial reporting, or caused such internal control over financial reporting to be designed under our supervision, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles; |

| (c) | Evaluated the effectiveness of the registrant’s disclosure controls and procedures and presented in this report our conclusions about the effectiveness of the disclosure controls and procedures, as of the end of the period covered by this report based on such evaluation; and |

| (d) | Disclosed in this report any change in the registrant’s internal control over financial reporting that occurred during the registrant’s most recent fiscal quarter (the registrant’s fourth fiscal quarter in the case of an annual report) that has materially affected, or is reasonably likely to materially affect, the Company’s internal control over financial reporting. |

| 5. | The registrant’s other certifying officer(s) and I have disclosed, based on our most recent evaluation of internal control over financial reporting, to the registrant’s auditors and the audit committee of the registrant’s board of directors (or persons performing the equivalent functions): |

| (a) | All significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting, which are reasonably likely to adversely affect the registrant’s ability to record, process, summarize and report financial information; and |

| (b) | Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant’s internal control over financial reporting. |

| Date: November 12, 2021 | ||

| /s/ Matthew Flemming | ||

| Name: | Matthew Flemming | |

| Title: | Acting Chief Financial Officer (Principal Financial and Accounting Officer) | |

EXHIBIT 32.1

CERTIFICATION PURSUANT TO

18 U.S.C. SECTION 1350,

AS ADOPTED PURSUANT TO

SECTION 906 OF THE SARBANES-OXLEY ACT OF 2002

In connection with the Quarterly Report of Triccar Inc. (the “Company”) on Form 10-Q for the period ended September 30, 2021 as filed with the Securities and Exchange Commission on the date hereof (the “Report”), Matthew Flemming, Chief Executive Officer of the Company, certifies, pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002, that, to the best of his knowledge:

(1) The Report fully complies with the requirements of Section 13(a) or Section 15(d) of the Securities Exchange Act of 1934 and

(2) The information contained in the Report fairly presents, in all material respects, the financial condition and results of operations of the Company.

| Date: November 12, 2021 | /s/ Matthew Flemming | |

| Name: | Matthew Flemming | |

| Title: | Chief Executive Officer | |

| (Principal Executive Officer) |

This certification accompanies the Report pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 and shall not, except to the extent required by the Sarbanes-Oxley Act of 2002, be deemed filed by the Company for purposes of Section 18 of the Securities Exchange Act of 1934, as amended.

EXHIBIT 32.2

CERTIFICATION PURSUANT TO

18 U.S.C. SECTION 1350,

AS ADOPTED PURSUANT TO

SECTION 906 OF THE SARBANES-OXLEY ACT OF 2002

In connection with the Quarterly Report of Triccar Inc. (the “Company”) on Form 10-Q for the period ended September 30, 2021, as filed with the Securities and Exchange Commission on the date hereof (the “Report”), Matthew Flemming, Acting Chief Financial Officer of the Company, certifies, pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002, that, to the best of his knowledge:

(1) The Report fully complies with the requirements of Section 13(a) or Section 15(d) of the Securities Exchange Act of 1934 and

(2) The information contained in the Report fairly presents, in all material respects, the financial condition and results of operations of the Company.

| Date: November 12, 2021 | /s/ Matthew Flemming | |

| Name: | Matthew Flemming | |

| Title: | Acting Chief Financial Officer | |

| (Principal Financial and Accounting Officer) |

This certification accompanies the Report pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 and shall not, except to the extent required by the Sarbanes-Oxley Act of 2002, be deemed filed by the Company for purposes of Section 18 of the Securities Exchange Act of 1934, as amended.