RESOLUTE FOREST PRODUCTS INC.

CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY

(Unaudited, in millions of U.S. dollars)

| Three Months Ended March 31, 2021 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Resolute Forest Products Inc. Shareholders’ Equity | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Common Stock | Additional Paid-In Capital | Deficit | Accumulated Other Comprehensive Loss | Treasury Stock | Non-controlling Interest | Total Equity | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Balance as of December 31, 2020 | $ | 0 | $ | 3,804 | $ | (1,235) | $ | (1,314) | $ | (174) | $ | 1 | $ | 1,082 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Share-based compensation, net of withholding taxes | — | (2) | — | — | — | — | (2) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net income | — | — | 87 | — | — | 1 | 88 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Purchases of treasury stock (1.7 million shares) (Note 12) | — | — | — | — | (17) | — | (17) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Stock unit awards vested (0.4 million shares), net of shares forfeited for employee withholding taxes | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other comprehensive income, net of tax | — | — | — | 36 | — | 0 | 36 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Balance as of March 31, 2021 | $ | 0 | $ | 3,802 | $ | (1,148) | $ | (1,278) | $ | (191) | $ | 2 | $ | 1,187 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Three Months Ended June 30, 2020 | ||||||||||||||||||||||||||||

| Resolute Forest Products Inc. Shareholders’ Equity | ||||||||||||||||||||||||||||

Common Stock | Additional Paid-In Capital | Deficit | Accumulated Other Comprehensive Loss | Treasury Stock | Non-controlling Interest | Total Equity | ||||||||||||||||||||||

| Balance as of March 31, 2020 | $ | — | $ | 3,804 | $ | (1,246 | ) | $ | (1,181 | ) | $ | (144 | ) | $ | 1 | $ | 1,234 | |||||||||||

| Share-based compensation, net of withholding taxes | — | 1 | — | — | — | — | 1 | |||||||||||||||||||||

| Net income | — | — | 6 | — | — | — | 6 | |||||||||||||||||||||

| Purchases of treasury stock (0.3 shares) (Note 12) | — | — | — | — | (1 | ) | — | (1 | ) | |||||||||||||||||||

| Other comprehensive income, net of tax | — | — | — | 10 | — | — | 10 | |||||||||||||||||||||

| Balance as of June 30, 2020 | $ | — | $ | 3,805 | $ | (1,240 | ) | $ | (1,171 | ) | $ | (145 | ) | $ | 1 | $ | 1,250 | |||||||||||

| Six Months Ended June 30, 2020 | ||||||||||||||||||||||||||||

| Resolute Forest Products Inc. Shareholders’ Equity | ||||||||||||||||||||||||||||

Common Stock | Additional Paid-In Capital | Deficit | Accumulated Other Comprehensive Loss | Treasury Stock | Non-controlling Interest | Total Equity | ||||||||||||||||||||||

| Balance as of December 31, 2019 | $ | — | $ | 3,802 | $ | (1,245 | ) | $ | (1,179 | ) | $ | (144 | ) | $ | 1 | $ | 1,235 | |||||||||||

| Share-based compensation, net of withholding taxes | — | 3 | — | — | — | — | 3 | |||||||||||||||||||||

| Net income | — | — | 5 | — | — | — | 5 | |||||||||||||||||||||

| Purchases of treasury stock (0.3 shares) (Note 12) | — | — | — | — | (1 | ) | — | (1 | ) | |||||||||||||||||||

| Stock unit awards vested (0.7 shares), net of shares forfeited for employee withholding taxes | — | — | — | — | — | — | — | |||||||||||||||||||||

| Other comprehensive income, net of tax | — | — | — | 8 | — | — | 8 | |||||||||||||||||||||

| Balance as of June 30, 2020 | $ | — | $ | 3,805 | $ | (1,240 | ) | $ | (1,171 | ) | $ | (145 | ) | $ | 1 | $ | 1,250 | |||||||||||

| Three Months Ended June 30, 2019 | ||||||||||||||||||||||||||||

| Resolute Forest Products Inc. Shareholders’ Equity | ||||||||||||||||||||||||||||

| Common Stock | Additional Paid-In Capital | Deficit | Accumulated Other Comprehensive Loss | Treasury Stock | Non- controlling Interest | Total Equity | ||||||||||||||||||||||

| Balance as of March 31, 2019 | $ | — | $ | 3,802 | $ | (1,156 | ) | $ | (947 | ) | $ | (120 | ) | $ | 1 | $ | 1,580 | |||||||||||

| Share-based compensation, net of withholding taxes | — | 1 | — | — | — | — | 1 | |||||||||||||||||||||

| Net income | — | — | 25 | — | — | — | 25 | |||||||||||||||||||||

| Purchases of treasury stock (0.7 shares) (Note 12) | — | — | — | — | (5 | ) | — | (5 | ) | |||||||||||||||||||

| Other comprehensive loss, net of tax | — | — | — | (1 | ) | — | — | (1 | ) | |||||||||||||||||||

| Balance as of June 30, 2019 | $ | — | $ | 3,803 | $ | (1,131 | ) | $ | (948 | ) | $ | (125 | ) | $ | 1 | $ | 1,600 | |||||||||||

| Six Months Ended June 30, 2019 | ||||||||||||||||||||||||||||

| Resolute Forest Products Inc. Shareholders’ Equity | ||||||||||||||||||||||||||||

Common Stock | Additional Paid-In Capital | Deficit | Accumulated Other Comprehensive Loss | Treasury Stock | Non- controlling Interest | Total Equity | ||||||||||||||||||||||

| Balance as of December 31, 2018 | $ | — | $ | 3,802 | $ | (1,198 | ) | $ | (950 | ) | $ | (120 | ) | $ | 1 | $ | 1,535 | |||||||||||

| Share-based compensation, net of withholding taxes | — | 1 | — | — | — | — | 1 | |||||||||||||||||||||

| Net income | — | — | 67 | — | — | — | 67 | |||||||||||||||||||||

| Purchases of treasury stock (0.7 shares) (Note 12) | — | — | — | — | (5 | ) | — | (5 | ) | |||||||||||||||||||

| Stock unit awards vested (0.3 shares), net of shares forfeited for employee withholding taxes | — | — | — | — | — | — | — | |||||||||||||||||||||

| Other comprehensive income, net of tax | — | — | — | 2 | — | — | 2 | |||||||||||||||||||||

| Balance as of June 30, 2019 | $ | — | $ | 3,803 | $ | (1,131 | ) | $ | (948 | ) | $ | (125 | ) | $ | 1 | $ | 1,600 | |||||||||||

| Three Months Ended March 31, 2020 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Resolute Forest Products Inc. Shareholders’ Equity | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Common Stock | Additional Paid-In Capital | Deficit | Accumulated Other Comprehensive Loss | Treasury Stock | Non- controlling Interest | Total Equity | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Balance as of December 31, 2019 | $ | 0 | $ | 3,802 | $ | (1,245) | $ | (1,179) | $ | (144) | $ | 1 | $ | 1,235 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Share-based compensation, net of withholding taxes | — | 2 | — | — | — | — | 2 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net loss | — | — | (1) | — | — | 0 | (1) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Stock unit awards vested (0.7 million shares), net of shares forfeited for employee withholding taxes | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other comprehensive loss, net of tax | — | — | — | (2) | — | 0 | (2) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Balance as of March 31, 2020 | $ | 0 | $ | 3,804 | $ | (1,246) | $ | (1,181) | $ | (144) | $ | 1 | $ | 1,234 | |||||||||||||||||||||||||||||||||||||||||||||||||||

See accompanying notes to unaudited interim Consolidated Financial Statements.

4

RESOLUTE FOREST PRODUCTS INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited, in millions of U.S. dollars)

| Three Months Ended March 31, | ||||||||||||||||||||||||||||

| 2021 | 2020 | |||||||||||||||||||||||||||

| Cash flows from operating activities: | Cash flows from operating activities: | |||||||||||||||||||||||||||

| Net income (loss) including noncontrolling interest | Net income (loss) including noncontrolling interest | $ | 88 | $ | (1) | |||||||||||||||||||||||

| Adjustments to reconcile net income (loss) including noncontrolling interest to net cash provided by (used in) operating activities: | Adjustments to reconcile net income (loss) including noncontrolling interest to net cash provided by (used in) operating activities: | |||||||||||||||||||||||||||

| Share-based compensation | Share-based compensation | 2 | 3 | |||||||||||||||||||||||||

| Depreciation and amortization | Depreciation and amortization | 41 | 42 | |||||||||||||||||||||||||

| Deferred income taxes | Deferred income taxes | 40 | 27 | |||||||||||||||||||||||||

| Net pension contributions and other postretirement benefit payments | Net pension contributions and other postretirement benefit payments | (23) | (33) | |||||||||||||||||||||||||

| (Gain) loss on translation of foreign currency denominated deferred income taxes | (Gain) loss on translation of foreign currency denominated deferred income taxes | (12) | 69 | |||||||||||||||||||||||||

| Loss (gain) on translation of foreign currency denominated pension and other postretirement benefit obligations | Loss (gain) on translation of foreign currency denominated pension and other postretirement benefit obligations | 16 | (82) | |||||||||||||||||||||||||

| Loss on commodity contracts | Loss on commodity contracts | 14 | 0 | |||||||||||||||||||||||||

| Net planned major maintenance (payments) amortization | Net planned major maintenance (payments) amortization | (3) | 6 | |||||||||||||||||||||||||

| Changes in working capital: | Changes in working capital: | |||||||||||||||||||||||||||

| Accounts receivable | Accounts receivable | (51) | (20) | |||||||||||||||||||||||||

| Inventories | Inventories | (50) | (29) | |||||||||||||||||||||||||

| Other current assets | Other current assets | 0 | (6) | |||||||||||||||||||||||||

| Accounts payable and other | Accounts payable and other | 2 | (18) | |||||||||||||||||||||||||

| Other, net | Other, net | 10 | (7) | |||||||||||||||||||||||||

| Net cash provided by (used in) operating activities | Net cash provided by (used in) operating activities | 74 | (49) | |||||||||||||||||||||||||

| Cash flows from investing activities: | Cash flows from investing activities: | |||||||||||||||||||||||||||

| Cash invested in fixed assets | Cash invested in fixed assets | (14) | (21) | |||||||||||||||||||||||||

| Acquisition of business, net of cash acquired | Acquisition of business, net of cash acquired | 0 | (174) | |||||||||||||||||||||||||

| Increase in countervailing and anti-dumping duty cash deposits on softwood lumber | Increase in countervailing and anti-dumping duty cash deposits on softwood lumber | (32) | (15) | |||||||||||||||||||||||||

| Six Months Ended June 30, | ||||||||||||||||||||||||||||

| 2020 | 2019 | |||||||||||||||||||||||||||

| Cash flows from operating activities: | ||||||||||||||||||||||||||||

| Net income including noncontrolling interest | $ | 5 | $ | 67 | ||||||||||||||||||||||||

| Adjustments to reconcile net income including noncontrolling interest to net cash provided by operating activities: | ||||||||||||||||||||||||||||

| Share-based compensation | 4 | 3 | ||||||||||||||||||||||||||

| Depreciation and amortization | 82 | 82 | ||||||||||||||||||||||||||

| Deferred income taxes | 32 | 40 | ||||||||||||||||||||||||||

| Net pension contributions and other postretirement benefit payments | (48 | ) | (57 | ) | ||||||||||||||||||||||||

| Net gain on disposition of assets | (9 | ) | — | |||||||||||||||||||||||||

| Loss (gain) on translation of foreign currency denominated deferred income taxes | 39 | (35 | ) | |||||||||||||||||||||||||

| (Gain) loss on translation of foreign currency denominated pension and other postretirement benefit obligations | (47 | ) | 37 | |||||||||||||||||||||||||

| Net planned major maintenance (payments) amortization | (2 | ) | 7 | |||||||||||||||||||||||||

| Changes in working capital: | ||||||||||||||||||||||||||||

| Accounts receivable | 50 | 38 | ||||||||||||||||||||||||||

| Inventories | 25 | (21 | ) | |||||||||||||||||||||||||

| Other current assets | (7 | ) | (3 | ) | ||||||||||||||||||||||||

| Accounts payable and accrued liabilities | (49 | ) | (64 | ) | ||||||||||||||||||||||||

| Other, net | 1 | 1 | ||||||||||||||||||||||||||

| Net cash provided by operating activities | 76 | 95 | ||||||||||||||||||||||||||

| Cash flows from investing activities: | ||||||||||||||||||||||||||||

| Cash invested in fixed assets | (37 | ) | (45 | ) | ||||||||||||||||||||||||

| Acquisition of business, net of cash acquired | (172 | ) | — | |||||||||||||||||||||||||

| Disposition of assets | 9 | 2 | ||||||||||||||||||||||||||

| Decrease in countervailing duty cash deposits on supercalendered paper | — | 1 | ||||||||||||||||||||||||||

| Increase in countervailing and anti-dumping duty cash deposits on softwood lumber | (32 | ) | (33 | ) | ||||||||||||||||||||||||

| Decrease in countervailing duty cash deposits on uncoated groundwood paper | — | 6 | ||||||||||||||||||||||||||

| Other investing activities, net | 5 | — | Other investing activities, net | 3 | 4 | |||||||||||||||||||||||

| Net cash used in investing activities | (227 | ) | (69 | ) | Net cash used in investing activities | (43) | (206) | |||||||||||||||||||||

| Cash flows from financing activities: | Cash flows from financing activities: | |||||||||||||||||||||||||||

| Net repayments under revolving credit facilities | (2 | ) | — | |||||||||||||||||||||||||

| Net borrowings under revolving credit facilities | Net borrowings under revolving credit facilities | 0 | 189 | |||||||||||||||||||||||||

| Issuance of long-term debt | Issuance of long-term debt | 300 | 0 | |||||||||||||||||||||||||

| Proceeds from long-term debt | 180 | — | Proceeds from long-term debt | 0 | 180 | |||||||||||||||||||||||

| Repayments of debt | (1 | ) | (225 | ) | Repayments of debt | (376) | (1) | |||||||||||||||||||||

| Purchases of treasury stock | (1 | ) | (5 | ) | Purchases of treasury stock | (17) | 0 | |||||||||||||||||||||

| Payments of financing and credit facility fees | — | (2 | ) | |||||||||||||||||||||||||

| Net cash provided by (used in) financing activities | 176 | (232 | ) | |||||||||||||||||||||||||

| Payments of financing fees | Payments of financing fees | (6) | 0 | |||||||||||||||||||||||||

| Net cash (used in) provided by financing activities | Net cash (used in) provided by financing activities | (99) | 368 | |||||||||||||||||||||||||

| Effect of exchange rate changes on cash and cash equivalents, and restricted cash | (1 | ) | 1 | Effect of exchange rate changes on cash and cash equivalents, and restricted cash | 0 | (3) | ||||||||||||||||||||||

| Net increase (decrease) in cash and cash equivalents, and restricted cash | $ | 24 | $ | (205 | ) | |||||||||||||||||||||||

| Net (decrease) increase in cash and cash equivalents, and restricted cash | Net (decrease) increase in cash and cash equivalents, and restricted cash | $ | (68) | $ | 110 | |||||||||||||||||||||||

| Cash and cash equivalents, and restricted cash: | Cash and cash equivalents, and restricted cash: | |||||||||||||||||||||||||||

| Beginning of period | $ | 42 | $ | 345 | Beginning of period | $ | 159 | $ | 42 | |||||||||||||||||||

| End of period | $ | 66 | $ | 140 | End of period | $ | 91 | $ | 152 | |||||||||||||||||||

| Cash and cash equivalents, and restricted cash at end of period: | Cash and cash equivalents, and restricted cash at end of period: | |||||||||||||||||||||||||||

| Cash and cash equivalents | $ | 27 | $ | 98 | Cash and cash equivalents | $ | 33 | $ | 116 | |||||||||||||||||||

| Restricted cash (included in “Other current assets”) | Restricted cash (included in “Other current assets”) | $ | 18 | $ | 0 | |||||||||||||||||||||||

| Restricted cash (included in “Other assets”) | $ | 39 | $ | 42 | Restricted cash (included in “Other assets”) | $ | 40 | $ | 36 | |||||||||||||||||||

See accompanying notes to unaudited interim Consolidated Financial Statements.

5

RESOLUTE FOREST PRODUCTS INC.

Notes to Unaudited Interim Consolidated Financial Statements

Note 1. Organization and Basis of Presentation

Nature of operations

Resolute Forest Products Inc. (with its subsidiaries, either individually or collectively, unless otherwise indicated, referred to as “Resolute Forest Products,” “we,” “our,” “us,” “Parent,” or the “Company”) is incorporated in Delaware. We are a global leader in the forest products industry with a diverse range of products, including market pulp, tissue, wood products, and paper, which are marketed in close to 70over 50 countries. We own or operate some 40 facilities, as well as power generation assets, in the U.S. and Canada.

Financial statements

Our interim consolidated financial statements and accompanying notes (or, the “Consolidated Financial Statements”) are unaudited and have been prepared in accordance with the requirements of the U.S. Securities and Exchange Commission (or, the “SEC”) for interim reporting. Under those rules, certain footnotes and other financial information that are normally required by U.S. generally accepted accounting principles (or, “GAAP”) may be condensed or omitted. In our opinion, all adjustments (consisting of normal recurring adjustments) necessary for the fair statement of the unaudited interim Consolidated Financial Statements have been made. All amounts are expressed in U.S. dollars, unless otherwise indicated. The results for the interim period ended June 30, 2020,March 31, 2021, are not necessarily indicative of the results to be expected for the full year. These unaudited interim Consolidated Financial Statements should be read in conjunction with our Annual Report on Form 10-K for the year ended December 31, 2019,2020, filed with the SEC on March 2, 2020.1, 2021. Certain prior period amounts in the notes to our Consolidated Financial Statements have been reclassified to conform to the 20202021 presentation.

New accounting pronouncementspronouncement adopted in 20202021

ASU 2016-13 “Measurement of Credit Losses on Financial Instruments”2019-12 “Simplifying the Accounting for Income Taxes”

Effective January 1, 2020,2021, we adopted on a modified retrospective basisASU 2019-12, “Simplifying the Accounting Standards Update (or, “ASU”) 2016-13, “Measurement of Credit Losses on Financial Instruments,for Income Taxes,” issued by the Financial Accounting Standards Board (or, the “FASB”) in 20162019, which removes the specific exceptions to the general principles in ASC 740, “Income Taxes,” and amended in 2018 by ASU 2018-19, “Codification Improvements to Topic 326, Financial Instruments – Credit Losses,” which introduces the current expected credit losses model in the estimation of credit losses on financial instruments. The adoption of this new accounting guidance did not impact the opening deficit balance as of January 1, 2020. As a resultclarifies certain aspects of the adoption of ASU 2016-13, our accounts receivable accounting policy was updated as follows:

Accounting pronouncement not yet adopted as of June 30, 2020March 31, 2021

ASU 2020-04 “Reference Rate Reform”

In March 2020, the FASB issued ASU 2020-04, “Reference Rate Reform,” amended in January by ASU 2021-01, “Reference Rate Reform - Scope,” which provides optional guidance for a limited period of time to ease the potential burden in accounting for (or recognizing the effects of) reference rate reform on financial reporting. This update provides optional expedients and exceptions for applying GAAP to contracts, hedging relationships, and other transactions that reference the London Interbank Offered Rate or another reference rate expected to be discontinued because of reference rate reform. This update is effective as of March 12, 2020, through December 31, 2022. We are currently evaluating this accounting guidance and have not elected an adoption date. We do not expect this accounting guidance to materially impact our results of operations or financial position.

Note 2. Other (Expense) Income, Net

Other (expense) income, net for the three months ended March 31, 2021 and 2020, was comprised of the following:

| Three Months Ended March 31, | |||||||||||||||||||||||||||||||||||||||||

| (Unaudited, in millions) | 2021 | 2020 | |||||||||||||||||||||||||||||||||||||||

| Foreign exchange (loss) gain | $ | (5) | $ | 23 | |||||||||||||||||||||||||||||||||||||

(Loss) gain on commodity contracts (1) | (37) | 4 | |||||||||||||||||||||||||||||||||||||||

| Miscellaneous (expense) income | (3) | 1 | |||||||||||||||||||||||||||||||||||||||

| $ | (45) | $ | 28 | ||||||||||||||||||||||||||||||||||||||

(1) Principally related to lumber futures contracts, of which a $14 million loss was unrealized for the three months ended March 31, 2021.

6

RESOLUTE FOREST PRODUCTS INC.

Notes to Unaudited Interim Consolidated Financial Statements

| (Unaudited, in millions) | |||

Current assets (1) | $ | 19 | |

Fixed assets (2) | 114 | ||

Amortizable intangible assets (3) | 21 | ||

| Operating lease right-of-use assets | 2 | ||

Goodwill (4) | 31 | ||

| Total assets acquired and goodwill | $ | 187 | |

| Current liabilities | $ | 11 | |

| Long-term debt, net of current portion | 2 | ||

| Operating lease liabilities, net of current portion | 1 | ||

| Total liabilities assumed | $ | 14 | |

| Net assets acquired | $ | 173 | |

| Fair value of consideration transferred | $ | 173 | |

| Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||||

| (Unaudited, in millions) | 2020 | 2019 | 2020 | 2019 | |||||||||||||

| Sales | $ | 612 | $ | 781 | $ | 1,309 | $ | 1,597 | |||||||||

| Net income attributable to Resolute Forest Products Inc. | $ | 6 | $ | 25 | $ | 5 | $ | 67 | |||||||||

| Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||||

| (Unaudited, in millions) | 2020 | 2019 | 2020 | 2019 | |||||||||||||

| Foreign exchange (loss) gain | $ | (9 | ) | $ | (6 | ) | $ | 14 | $ | (10 | ) | ||||||

Insurance recovery (1) | 15 | — | 15 | — | |||||||||||||

| Miscellaneous income | 4 | 5 | 9 | 5 | |||||||||||||

| $ | 10 | $ | (1 | ) | $ | 38 | $ | (5 | ) | ||||||||

Note 4.3. Accumulated Other Comprehensive Loss

The change in our accumulated other comprehensive loss by component (net of tax) for the three and six months ended June 30,March 31, 2021 and 2020, and 2019, was as follows:

| (Unaudited, in millions) | Unamortized Prior Service Cost | Unamortized Actuarial Losses | Foreign Currency Translation | Total | ||||||||||||||||||||||||||||||||||

| Balance as of December 31, 2020 | $ | (1) | $ | (1,307) | $ | (6) | $ | (1,314) | ||||||||||||||||||||||||||||||

Other comprehensive income before reclassifications (1) | 0 | 22 | 0 | 22 | ||||||||||||||||||||||||||||||||||

| Amounts reclassified from accumulated other comprehensive loss | (1) | 15 | 0 | 14 | ||||||||||||||||||||||||||||||||||

| Net current period other comprehensive (loss) income | (1) | 37 | 0 | 36 | ||||||||||||||||||||||||||||||||||

| Balance as of March 31, 2021 | $ | (2) | $ | (1,270) | $ | (6) | $ | (1,278) | ||||||||||||||||||||||||||||||

| (Unaudited, in millions) | Unamortized Prior Service Credits | Unamortized Actuarial Losses | Foreign Currency Translation | Total | ||||||||||||

| Balance as of March 31, 2020 | $ | 1 | $ | (1,175 | ) | $ | (7 | ) | $ | (1,181 | ) | |||||

| Amounts reclassified from accumulated other comprehensive loss | (1 | ) | 11 | — | 10 | |||||||||||

| Balance as of June 30, 2020 | $ | — | $ | (1,164 | ) | $ | (7 | ) | $ | (1,171 | ) | |||||

| (Unaudited, in millions) | Unamortized Prior Service Credit | Unamortized Actuarial Losses | Foreign Currency Translation | Total | ||||||||||||||||||||||||||||||||||

| Balance as of December 31, 2019 | $ | 16 | $ | (1,189) | $ | (6) | $ | (1,179) | ||||||||||||||||||||||||||||||

| Other comprehensive loss before reclassifications | 0 | 0 | (1) | (1) | ||||||||||||||||||||||||||||||||||

| Amounts reclassified from accumulated other comprehensive loss | (15) | 14 | 0 | (1) | ||||||||||||||||||||||||||||||||||

| Net current period other comprehensive (loss) income | (15) | 14 | (1) | (2) | ||||||||||||||||||||||||||||||||||

| Balance as of March 31, 2020 | $ | 1 | $ | (1,175) | $ | (7) | $ | (1,181) | ||||||||||||||||||||||||||||||

| (Unaudited, in millions) | Unamortized Prior Service Credits | Unamortized Actuarial Losses | Foreign Currency Translation | Total | ||||||||||||

| Balance as of December 31, 2019 | $ | 16 | $ | (1,189 | ) | $ | (6 | ) | $ | (1,179 | ) | |||||

| Other comprehensive loss before reclassifications | — | — | (1 | ) | (1 | ) | ||||||||||

| Amounts reclassified from accumulated other comprehensive loss | (16 | ) | 25 | — | 9 | |||||||||||

| Net current period other comprehensive (loss) income | (16 | ) | 25 | (1 | ) | 8 | ||||||||||

| Balance as of June 30, 2020 | $ | — | $ | (1,164 | ) | $ | (7 | ) | $ | (1,171 | ) | |||||

| Three Months Ended March 31, | |||||||||||||||||||||||||||||||||||||||||

| (Unaudited, in millions) | 2021 | 2020 | Affected Line in the Consolidated Statements of Operations | ||||||||||||||||||||||||||||||||||||||

| Unamortized Prior Service Costs or Credits | |||||||||||||||||||||||||||||||||||||||||

| Amortization of prior service costs or credits | $ | 0 | $ | (1) | Non-operating pension and other postretirement benefit credits (1) | ||||||||||||||||||||||||||||||||||||

| Curtailment gain | (1) | (14) | Non-operating pension and other postretirement benefit credits (1) | ||||||||||||||||||||||||||||||||||||||

| 0 | 0 | Income tax provision | |||||||||||||||||||||||||||||||||||||||

| Net of tax | (1) | (15) | |||||||||||||||||||||||||||||||||||||||

| Unamortized Actuarial Losses | |||||||||||||||||||||||||||||||||||||||||

| Amortization of actuarial losses | 19 | 14 | Non-operating pension and other postretirement benefit credits (1) | ||||||||||||||||||||||||||||||||||||||

| Other items | 0 | 3 | |||||||||||||||||||||||||||||||||||||||

| (4) | (3) | Income tax provision | |||||||||||||||||||||||||||||||||||||||

| Net of tax | 15 | 14 | |||||||||||||||||||||||||||||||||||||||

| Total Reclassifications | $ | 14 | $ | (1) | |||||||||||||||||||||||||||||||||||||

7

| (Unaudited, in millions) | Unamortized Prior Service Credits | Unamortized Actuarial Losses | Foreign Currency Translation | Total | ||||||||||||

| Balance as of March 31, 2019 | $ | 25 | $ | (965 | ) | $ | (7 | ) | $ | (947 | ) | |||||

| Other comprehensive loss before reclassifications | — | (3 | ) | — | (3 | ) | ||||||||||

| Amounts reclassified from accumulated other comprehensive loss | (4 | ) | 6 | — | 2 | |||||||||||

| Net current period other comprehensive (loss) income | (4 | ) | 3 | — | (1 | ) | ||||||||||

| Balance as of June 30, 2019 | $ | 21 | $ | (962 | ) | $ | (7 | ) | $ | (948 | ) | |||||

| (Unaudited, in millions) | Unamortized Prior Service Credits | Unamortized Actuarial Losses | Foreign Currency Translation | Total | ||||||||||||

| Balance as of December 31, 2018 | $ | 28 | $ | (971 | ) | $ | (7 | ) | $ | (950 | ) | |||||

| Other comprehensive loss before reclassifications | — | (3 | ) | — | (3 | ) | ||||||||||

| Amounts reclassified from accumulated other comprehensive loss | (7 | ) | 12 | — | 5 | |||||||||||

| Net current period other comprehensive (loss) income | (7 | ) | 9 | — | 2 | |||||||||||

| Balance as of June 30, 2019 | $ | 21 | $ | (962 | ) | $ | (7 | ) | $ | (948 | ) | |||||

RESOLUTE FOREST PRODUCTS INC.

Notes to Unaudited Interim Consolidated Financial Statements

| Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||||

| (Unaudited, in millions) | 2020 | 2019 | 2020 | 2019 | Affected Line in the Consolidated Statements of Operations | ||||||||||||

| Unamortized Prior Service Credits | |||||||||||||||||

| Amortization of prior service credits | $ | (1 | ) | $ | (3 | ) | $ | (2 | ) | $ | (6 | ) | Non-operating pension and other postretirement benefit credits (1) | ||||

| Other items | — | (1 | ) | (14 | ) | (1 | ) | ||||||||||

| — | — | — | — | Income tax provision | |||||||||||||

| Net of tax | (1 | ) | (4 | ) | (16 | ) | (7 | ) | |||||||||

| Unamortized Actuarial Losses | |||||||||||||||||

| Amortization of actuarial losses | 15 | 7 | 29 | 15 | Non-operating pension and other postretirement benefit credits (1) | ||||||||||||

| Other items | — | — | 3 | — | |||||||||||||

| (4 | ) | (1 | ) | (7 | ) | (3 | ) | Income tax provision | |||||||||

| Net of tax | 11 | 6 | 25 | 12 | |||||||||||||

| Total Reclassifications | $ | 10 | $ | 2 | $ | 9 | $ | 5 | |||||||||

Note 5.4. Net Income (Loss) Per Share

The reconciliation of the basic and diluted net income (loss) per share for the three and six months ended June 30,March 31, 2021 and 2020, and 2019, was as follows:

| Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||||

| (Unaudited, in millions, except per share amounts) | 2020 | 2019 | 2020 | 2019 | |||||||||||||

| Numerator: | |||||||||||||||||

| Net income attributable to Resolute Forest Products Inc. | $ | 6 | $ | 25 | $ | 5 | $ | 67 | |||||||||

| Denominator: | |||||||||||||||||

| Weighted-average number of Resolute Forest Products Inc. common shares outstanding | 88.1 | 92.4 | 88.1 | 92.4 | |||||||||||||

| Dilutive impact of nonvested stock unit awards | 0.1 | 1.2 | 0.1 | 1.4 | |||||||||||||

| Diluted weighted-average number of Resolute Forest Products Inc. common shares outstanding | 88.2 | 93.6 | 88.2 | 93.8 | |||||||||||||

| Net income per share attributable to Resolute Forest Products Inc. common shareholders: | |||||||||||||||||

| Basic | $ | 0.07 | $ | 0.27 | $ | 0.06 | $ | 0.73 | |||||||||

| Diluted | $ | 0.07 | $ | 0.27 | $ | 0.06 | $ | 0.71 | |||||||||

| Three Months Ended March 31, | |||||||||||||||||||||||||||||||||||||||||

| (Unaudited, in millions, except per share amounts) | 2021 | 2020 | |||||||||||||||||||||||||||||||||||||||

| Numerator: | |||||||||||||||||||||||||||||||||||||||||

| Net income (loss) attributable to Resolute Forest Products Inc. | $ | 87 | $ | (1) | |||||||||||||||||||||||||||||||||||||

| Denominator: | |||||||||||||||||||||||||||||||||||||||||

| Weighted-average number of Resolute Forest Products Inc. common shares outstanding | 81.2 | 88.1 | |||||||||||||||||||||||||||||||||||||||

| Dilutive impact of nonvested stock unit awards | 0.7 | 0 | |||||||||||||||||||||||||||||||||||||||

| Diluted weighted-average number of Resolute Forest Products Inc. common shares outstanding | 81.9 | 88.1 | |||||||||||||||||||||||||||||||||||||||

Net income (loss) per share attributable to Resolute Forest Products Inc. common shareholders: | |||||||||||||||||||||||||||||||||||||||||

| Basic | $ | 1.07 | $ | (0.01) | |||||||||||||||||||||||||||||||||||||

| Diluted | $ | 1.06 | $ | (0.01) | |||||||||||||||||||||||||||||||||||||

The weighted-average number of outstanding stock options and nonvested equity-classified restricted stock units, deferred stock units and performance stock units (collectively, “stock unit awards”) that were excluded from the calculation of diluted net income (loss) per share, as their impact would have been antidilutive, for the three and six months ended June 30,March 31, 2021 and 2020, and 2019, was as follows:

| Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||

| (Unaudited, in millions) | 2020 | 2019 | 2020 | 2019 | |||||||||

| Stock options | 0.9 | 1.0 | 0.9 | 1.0 | |||||||||

| Stock unit awards | 0.9 | — | 0.9 | — | |||||||||

| Three Months Ended March 31, | |||||||||||||||||||||||||||||

| (Unaudited, in millions) | 2021 | 2020 | |||||||||||||||||||||||||||

| Stock options | 0.8 | 1.0 | |||||||||||||||||||||||||||

| Stock unit awards | 0 | 1.5 | |||||||||||||||||||||||||||

Note 6.5. Inventories, Net

Inventories, net as of June 30, 2020March 31, 2021 and December 31, 2019,2020, were comprised of the following:

| (Unaudited, in millions) | March 31, 2021 | December 31, 2020 | ||||||||||||||||||

| Raw materials | $ | 157 | $ | 132 | ||||||||||||||||

| Work in process | 53 | 46 | ||||||||||||||||||

| Finished goods | 137 | 120 | ||||||||||||||||||

| Mill stores and other supplies | 165 | 164 | ||||||||||||||||||

| $ | 512 | $ | 462 | |||||||||||||||||

Note 6. Other Assets

Other assets include countervailing and anti-dumping duty cash deposits on softwood lumber of $224 million and $51 million, respectively, as of March 31, 2021, and of $194 million and $49 million, respectively, as of December 31, 2020. See Note 11, “Commitments and Contingencies” for more information.

| (Unaudited, in millions) | June 30, 2020 | December 31, 2019 | ||||||

| Raw materials | $ | 107 | $ | 128 | ||||

| Work in process | 52 | 46 | ||||||

| Finished goods | 155 | 164 | ||||||

| Mill stores and other supplies | 192 | 184 | ||||||

| $ | 506 | $ | 522 | |||||

8

RESOLUTE FOREST PRODUCTS INC.

Notes to Unaudited Interim Consolidated Financial Statements

Note 7. Accounts Payable and Accrued LiabilitiesOther

Accounts payable and accrued liabilitiesother as of June 30, 2020March 31, 2021 and December 31, 2019,2020, were comprised of the following:

| (Unaudited, in millions) | March 31, 2021 | December 31, 2020 | ||||||||||||||||||

| Trade accounts payable | $ | 275 | $ | 251 | ||||||||||||||||

| Accrued compensation | 63 | 76 | ||||||||||||||||||

| Accrued interest | 3 | 4 | ||||||||||||||||||

| Pension and other postretirement benefit obligations | 15 | 14 | ||||||||||||||||||

| Income and other taxes payable | 3 | 5 | ||||||||||||||||||

Derivative financial instruments (1) | 14 | 0 | ||||||||||||||||||

| Other | 25 | 19 | ||||||||||||||||||

| $ | 398 | $ | 369 | |||||||||||||||||

| (Unaudited, in millions) | June 30, 2020 | December 31, 2019 | ||||||

| Trade accounts payable | $ | 226 | $ | 255 | ||||

| Accrued compensation | 42 | 52 | ||||||

| Accrued interest | 4 | 3 | ||||||

| Pension and other postretirement benefit obligations | 14 | 15 | ||||||

| Income and other taxes payable | 4 | 4 | ||||||

| Other | 10 | 13 | ||||||

| $ | 300 | $ | 342 | |||||

Note 8. Long-Term Debt

Overview

Long-term debt, including current portion, as of June 30, 2020March 31, 2021 and December 31, 2019,2020, was comprised of the following:

| (Unaudited, in millions) | March 31, 2021 | December 31, 2020 | ||||||||||||||||||

| 4.875% senior unsecured notes due 2026: | ||||||||||||||||||||

| Principal amount | $ | 300 | $ | 0 | ||||||||||||||||

| Deferred financing costs | (6) | 0 | ||||||||||||||||||

| Total 4.875% senior unsecured notes due 2026 | 294 | 0 | ||||||||||||||||||

| 5.875% senior unsecured notes due 2023: | ||||||||||||||||||||

| Principal amount | 0 | 375 | ||||||||||||||||||

| Deferred financing costs | 0 | (2) | ||||||||||||||||||

| Unamortized discount | 0 | (1) | ||||||||||||||||||

| Total 5.875% senior unsecured notes due 2023 | 0 | 372 | ||||||||||||||||||

| Senior secured credit facility - Term loans due 2030 | 180 | 180 | ||||||||||||||||||

| Finance lease obligations | 8 | 9 | ||||||||||||||||||

| Total debt | 482 | 561 | ||||||||||||||||||

| Less: Current portion of finance lease obligations | (2) | (2) | ||||||||||||||||||

| Long-term debt, net of current portion | $ | 480 | $ | 559 | ||||||||||||||||

Senior Unsecured Notes

2026 Notes

On February 2, 2021, we issued $300 million aggregate principal amount of 4.875% senior unsecured notes due 2026 (or, the “2026 Notes”) at an issue price of 100%, pursuant to an indenture as of that date (or, the “indenture”). Upon their issuance, the 2026 Notes were recorded at their fair value of $300 million. Interest on the 2026 Notes is payable semi-annually on March 1 and September 1 of each year, beginning on September 1, 2021, until their maturity date of March 1, 2026. In connection with the issuance of the 2026 Notes, we incurred financing costs of $6 million, which were deferred and recorded as a reduction of the principal. Deferred financing costs are amortized to “Interest expense” in our Consolidated Statements of Operations using the interest method over the term of the notes.

| (Unaudited, in millions) | June 30, 2020 | December 31, 2019 | ||||||

| 5.875% senior unsecured notes due 2023: | ||||||||

| Principal amount | $ | 375 | $ | 375 | ||||

| Deferred financing costs | (2 | ) | (3 | ) | ||||

| Unamortized discount | (1 | ) | (1 | ) | ||||

| Total 5.875% senior unsecured notes due 2023 | 372 | 371 | ||||||

| Term loans due 2030 | 180 | — | ||||||

| Borrowings under revolving credit facilities | 69 | 71 | ||||||

| Finance lease obligations | 9 | 7 | ||||||

| Total debt | 630 | 449 | ||||||

| Less: Current portion of finance lease obligations | (2 | ) | (1 | ) | ||||

| Long-term debt, net of current portion | $ | 628 | $ | 448 | ||||

9

RESOLUTE FOREST PRODUCTS INC.

Notes to Unaudited Interim Consolidated Financial Statements

The 2026 Notes are guaranteed by current and future wholly-owned U.S. subsidiaries that guarantee the ABL Credit Facility and the Senior Secured Credit Facility (each, as defined and discussed below). The notes are unsecured and effectively junior to indebtedness under each of the ABL Credit Facility, the Senior Secured Credit Facility, the Loan Facility and future secured indebtedness to the extent of the value of the collateral that secures such indebtedness. In addition, the notes are structurally subordinated to all existing and future indebtedness (including the Loan Facility) and other liabilities of our subsidiaries that do not guarantee the notes, including all our non-U.S. subsidiaries.

The terms of the indenture impose certain restrictions, subject to a number of exceptions and qualifications, including limits on our ability to: incur additional indebtedness or issue certain preferred shares; make dividend payments on or make other distributions in respect of our capital stock or make other restricted payments; make certain investments; sell certain assets; create liens on assets; consolidate, merge, sell or otherwise dispose of all or substantially all of our assets; and enter into certain transactions with our affiliates.

In the event of specified change of control triggering events, we shall be required to offer to repurchase the 2026 Notes at 101% of the principal amount, plus accrued and unpaid interest.

On or after March 1, 2023, we may redeem the notes at our option, in whole at any time or in part from time to time, at redemption prices equal to a percentage of the principal amount plus accrued and unpaid interest, as follows:

| Year (beginning March 1) | Redemption Price | ||||

| 2023 | 102.438 | % | |||

| 2024 | 101.219 | % | |||

| 2025 and thereafter | 100.000 | % | |||

The fair value of the 2026 Notes (Level 1) was $301 million as of March 31, 2021.

2023 Notes

We issued $600 million in aggregate principal amount of 5.875% senior unsecured notes due 2023 (or, the “2023 Notes”) on May 8, 2013. Upon their issuance, the 2023 Notes were recorded at their fair value of $594 million, which reflected a discount of $6 million that iswas being amortized to “Interest expense” in our Consolidated Statements of Operations using the interest method over the term of the 2023 Notes, resulting in an effective interest rate of 6%. Interest on the 2023 Notes iswas payable semi-annually beginning November 15, 2013, until their maturity date of May 15, 2023.2013. In connection with the issuance of the 2023 Notes, we incurred financing costs of $9 million, which were deferred and recorded as a reduction of the 2023 Notes. Deferred financing costs arewere amortized to “Interest expense” in our Consolidated Statements of Operations using the interest method over the term of the 2023 Notes.

On January 3, 2019, we repurchased $225 million in aggregate principal amount of the 2023 Notes, pursuant to a notes purchase agreement entered into on December 21, 2018, with certain noteholders, at a purchase price equal to 100% of the principal amount thereof, plus accrued and unpaid interest.

On February 2, 2021, we placed the net proceeds from the issuance of the 2026 Notes together with additional cash, into trust for the benefit of the holders of the 2023 Notes to redeem all of the $375 million aggregate principal amount of the 2023 Notes (or, the “Redemption”) at a price of 100% of the aggregate principal amount thereof, plus accrued and unpaid interest to, but not including, the redemption date. The Redemption occurred on February 18, 2021. As a result of the repurchase, we recorded a net loss on extinguishment of debt of $3 million in “Other (expense) income, (expense), net” in our Consolidated Statement of Operations for the sixthree months ended June 30, 2019.March 31, 2021.

The fair value of the 2023 Notes (Level 1) was $341 million and $380$375 million as of June 30, 2020 and December 31, 2019, respectively.

Senior Secured Credit Facility

On September 7, 2016, we entered into a senior secured credit facility for up to $185 million. This senior secured credit facility provided a term loan of $46 million with a maturity date of September 7, 2025, and a revolving credit facility of up to $139 million with a maturity date of September 7, 2022. On October 28, 2019, we entered into an amended and restated senior secured credit facility (or, the “Senior Secured Credit Facility”) for up to $360 million, replacing our existing $185 million senior secured credit facility. The Senior Secured Credit Facility providesprovided a term loan facility of up to $180 million with a delayed draw period of up to three years, and the choice of maturities of six to 10ten years from the date of drawing (or, the “Term Loan Facility”), and a six-year revolving credit facility of up to $180 million with a maturity date of October 28, 2025 (or, the

10

RESOLUTE FOREST PRODUCTS INC.

Notes to Unaudited Interim Consolidated Financial Statements

“Revolving Credit Facility”). On October 28, 2019, we repaid our $46 million term loan by borrowing under the Revolving Credit Facility. In March 2020, we borrowed $180 million in term loans under the Term Loan Facility for ten years, maturing in March 2030. There is also an uncommitted option to increase the Senior Secured Credit Facility by up to an additional $360 million, subject to certain terms and conditions. On October 28, 2019, we repaid our $46 million term loan by borrowingThe obligations under the RevolvingSenior Secured Credit Facility.Facility are guaranteed by certain of our material U.S. subsidiaries.

On April 19, 2021, we entered into a first amendment to the amended and restated Senior Secured Credit Facility. For more information, see Note 14, “Subsequent Event,” to our consolidated Financial Statements.

ABL Credit Facility

On May 14, 2019, we entered into an amended senior secured asset-based revolving credit facility (or, the “ABL Credit Facility”) with an aggregate lender commitment of up to $500 million at any time outstanding, subject to borrowing base availability based on specified advance rates, eligibility criteria and customary reserves. The amended credit agreement provides for an extension of the maturity date to May 14, 2024.

Effective January 21, 2021, we reduced the commitment under the Canadian tranche of our senior secured asset-based revolving credit facility by $50 million, to $250 million, resulting in an aggregate commitment of $450 million, subject to borrowing base limitations. The obligations under the ABL Credit Facility are guaranteed by certain of our material subsidiaries.

As of June 30, 2020,March 31, 2021, we had $241$293 million of availability under the ABL Credit Facility, net of $17 million of borrowings and $48which was undrawn except for $67 million of ordinary course letters of credit outstanding. The fair value

Loan Facility

On November 4, 2020, our Canadian subsidiary, Resolute FP Canada Inc., entered into a secured delayed draw term loan facility (or, the “Loan Facility”) with Investissement Québec as lender for up to C$220 million ($175 million as of March 31, 2021), subject to borrowing base availability based on 75% of the ABL Credit Facility (Level 2) approximatedcountervailing and anti-dumping duty deposits imposed by the U.S. Department of Commerce and collected by Customs and Border Protection Agency on U.S. imports of applicable softwood lumber products produced at sawmills of the Borrower and its carrying value asaffiliates located in the province of both June 30, 2020 andQuebec, Canada from April 28, 2017 to December 31, 2019.2022. The Loan Facility will bear interest at a floating rate equal to 1.45% above the one month Canadian banker’s acceptance rate. The principal shall be repayable in monthly installments over a period of eight years after an interest only period of two years from the date of the first draw. The Loan Facility is subject to prepayment requirements under certain conditions and may be repaid earlier without premium or penalty, but subject to prepayment of accrued and unpaid interest. The Loan Facility provides for a maximum of 10 draws and the fulfillment of certain conditions upon each draw. Borrowings are subject to certain restrictions.

11

RESOLUTE FOREST PRODUCTS INC.

Notes to Unaudited Interim Consolidated Financial Statements

Note 9. Employee Benefit Plans

Pension and other postretirement benefit plans

The components of net periodic benefit cost (credit)costs (credits) relating to our pension and OPEB plans for the three and six months ended June 30,March 31, 2021 and 2020, and 2019, were as follows:

Pension Plans:

| Three Months Ended June 30, | Six Months Ended June 30, | Three Months Ended March 31, | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (Unaudited, in millions) | 2020 | 2019 | 2020 | 2019 | (Unaudited, in millions) | 2021 | 2020 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest cost | $ | 36 | $ | 45 | $ | 74 | $ | 90 | Interest cost | $ | 33 | $ | 38 | |||||||||||||||||||||||||||||||||||||||||||||

| Expected return on plan assets | (55 | ) | (61 | ) | (111 | ) | (124 | ) | Expected return on plan assets | (54) | (56) | |||||||||||||||||||||||||||||||||||||||||||||||

| Amortization of actuarial losses | 17 | 9 | 32 | 18 | Amortization of actuarial losses | 21 | 15 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Amortization of prior service credits | — | (1 | ) | — | (1 | ) | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Non-operating pension credits | (2 | ) | (8 | ) | (5 | ) | (17 | ) | Non-operating pension credits | 0 | (3) | |||||||||||||||||||||||||||||||||||||||||||||||

| Service cost | 3 | 3 | 7 | 7 | Service cost | 4 | 4 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Net periodic benefit costs (credits) before special events | 1 | (5 | ) | 2 | (10 | ) | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other (gains) losses | — | (1 | ) | 3 | (1 | ) | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net periodic benefit costs before special events | Net periodic benefit costs before special events | 4 | 1 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other (gain) loss | Other (gain) loss | (1) | 3 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| $ | 1 | $ | (6 | ) | $ | 5 | $ | (11 | ) | $ | 3 | $ | 4 | |||||||||||||||||||||||||||||||||||||||||||||

OPEB Plans:

| Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||||

| (Unaudited, in millions) | 2020 | 2019 | 2020 | 2019 | |||||||||||||

| Interest cost | $ | 1 | $ | 1 | $ | 2 | $ | 2 | |||||||||

| Amortization of actuarial gains | (2 | ) | (2 | ) | (3 | ) | (3 | ) | |||||||||

| Amortization of prior service credits | (1 | ) | (2 | ) | (2 | ) | (5 | ) | |||||||||

| Non-operating other postretirement benefit credits | (2 | ) | (3 | ) | (3 | ) | (6 | ) | |||||||||

| Service cost | 1 | — | 1 | — | |||||||||||||

| Net periodic benefit credits before special events | (1 | ) | (3 | ) | (2 | ) | (6 | ) | |||||||||

| Curtailment gain | — | — | (14 | ) | — | ||||||||||||

| $ | (1 | ) | $ | (3 | ) | $ | (16 | ) | $ | (6 | ) | ||||||

| Three Months Ended March 31, | |||||||||||||||||||||||||||||||||||||||||

| (Unaudited, in millions) | 2021 | 2020 | |||||||||||||||||||||||||||||||||||||||

| Interest cost | $ | 1 | $ | 1 | |||||||||||||||||||||||||||||||||||||

| Amortization of actuarial gains | (2) | (1) | |||||||||||||||||||||||||||||||||||||||

| Amortization of prior service credits | 0 | (1) | |||||||||||||||||||||||||||||||||||||||

| Non-operating other postretirement benefit credits | (1) | (1) | |||||||||||||||||||||||||||||||||||||||

| Service cost | 0 | 0 | |||||||||||||||||||||||||||||||||||||||

| Net periodic benefit credits before special events | (1) | (1) | |||||||||||||||||||||||||||||||||||||||

| Curtailment gain | 0 | (14) | |||||||||||||||||||||||||||||||||||||||

| $ | (1) | $ | (15) | ||||||||||||||||||||||||||||||||||||||

Defined contribution plans

Our expense for the defined contribution plans totaled $5 million and $4 million for both the three months ended June 30,March 31, 2021 and 2020, and 2019, and $8 million and $9 millionrespectively.

U.S. pension funding

The recently passed American Rescue Plan Act of 2021 includes provisions that allow for interest rate smoothing of pension funding deficits to minimize the six months ended June 30, 2020 and 2019, respectively.

12

RESOLUTE FOREST PRODUCTS INC.

Notes to Unaudited Interim Consolidated Financial Statements

Note 10. Income Taxes

The income tax provision attributable to income before income taxes differs from the amounts computed by applying the U.S. federal statutory income tax rate of 21% for the three and six months ended June 30,March 31, 2021 and 2020, and 2019, as a result of the following:

| Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||||

| (Unaudited, in millions) | 2020 | 2019 | 2020 | 2019 | |||||||||||||

| Income before income taxes | $ | 11 | $ | 44 | $ | 37 | $ | 107 | |||||||||

| Income tax provision: | |||||||||||||||||

| Expected income tax provision | (3 | ) | (9 | ) | (8 | ) | (22 | ) | |||||||||

| Changes resulting from: | |||||||||||||||||

Valuation allowance (1) | (7 | ) | (4 | ) | (16 | ) | (11 | ) | |||||||||

| Foreign exchange | 2 | 1 | (10 | ) | 4 | ||||||||||||

U.S. tax on non-U.S. earnings (2) | — | (5 | ) | — | (5 | ) | |||||||||||

| State income taxes, net of federal income tax benefit | — | 1 | 2 | 2 | |||||||||||||

| Foreign tax rate differences | (2 | ) | (4 | ) | (5 | ) | (9 | ) | |||||||||

Other, net (3) | 5 | 1 | 5 | 1 | |||||||||||||

| $ | (5 | ) | $ | (19 | ) | $ | (32 | ) | $ | (40 | ) | ||||||

| Three Months Ended March 31, | |||||||||||||||||||||||||||||||||||||||||

| (Unaudited, in millions) | 2021 | 2020 | |||||||||||||||||||||||||||||||||||||||

| Income before income taxes | $ | 128 | $ | 26 | |||||||||||||||||||||||||||||||||||||

| Income tax provision: | |||||||||||||||||||||||||||||||||||||||||

| Expected income tax provision | (27) | (5) | |||||||||||||||||||||||||||||||||||||||

| Changes resulting from: | |||||||||||||||||||||||||||||||||||||||||

| Valuation allowance on our U.S. operations | 8 | (9) | |||||||||||||||||||||||||||||||||||||||

| Foreign exchange | 2 | (12) | |||||||||||||||||||||||||||||||||||||||

| U.S. tax on non-U.S. earnings | (18) | — | |||||||||||||||||||||||||||||||||||||||

| State income taxes, net of federal income tax benefit | 2 | 2 | |||||||||||||||||||||||||||||||||||||||

| Foreign tax rate differences | (8) | (3) | |||||||||||||||||||||||||||||||||||||||

| Other, net | 1 | 0 | |||||||||||||||||||||||||||||||||||||||

| $ | (40) | $ | (27) | ||||||||||||||||||||||||||||||||||||||

Note 11. Commitments and Contingencies

Legal matters

We become involved in various legal proceedings, claims and governmental inquiries, investigations, and other disputes in the normal course of business, including matters related to contracts, commercial and trade disputes, taxes, environmental issues, activist damages, employment and workers’ compensation claims, grievances, human rights complaints, pension and benefit plans and obligations, health and safety, product safety and liability, asbestos exposure, financial reporting and disclosure obligations, corporate governance, First NationsIndigenous peoples’ claims, antitrust, governmental regulations, and other matters. Although the final outcome is subject to many variables and cannot be predicted with any degree of certainty, we regularly assess the status of the matters and establish provisions (including legal costs expected to be incurred) when we believe an adverse outcome is probable, and the amount can be reasonably estimated. Except as described below and for claims that cannot be assessed due to their preliminary nature, we believe that the ultimate disposition of these matters outstanding or pending as of June 30, 2020,March 31, 2021, will not have a material adverse effect on our Consolidated Financial Statements.

Asbestos-related lawsuits

We are involved in a number of asbestos-related lawsuits filed primarily in U.S. state courts, including certain cases involving multiple defendants. These lawsuits principally allege direct or indirect personal injury or death resulting from exposure to asbestos-containing premises. While we dispute the plaintiffs’ allegations and intend to vigorously defend these claims, the ultimate resolution of these matters cannot be determined at this time. These lawsuits frequently involve claims for unspecified compensatory and punitive damages, and we are unable to reasonably estimate a range of possible losses. However, unfavorable rulings, judgments or settlement terms could materially impact our Consolidated Financial Statements. Hearings for certain of these matters are scheduled to occur in the next twelve months.2021.

Countervailing duty and anti-dumping investigations on softwood lumber

On November 25, 2016, countervailing duty and anti-dumping petitions were filed with the U.S. Department of Commerce (or, “Commerce”) and the U.S. International Trade Commission (or, “ITC”) by certain U.S. softwood lumber products producers and forest landowners, requesting that the U.S. government impose countervailing and anti-dumping duties on Canadian-origin softwood lumber products exported to the U.S. One of our subsidiaries was identified in the petitions as being a Canadian exporting producer of softwood lumber products to the U.S. and was selected as a mandatory respondent to be investigated by Commerce in both the countervailing duty and anti-dumping investigations.

On April 24, 2017, Commerce announced its preliminary determination in the countervailing duty investigation and, as a result, after April 28, 2017, we were required to pay cash deposits to the U.S. Customs and Border Protection agency (or, “U.S.

13

RESOLUTE FOREST PRODUCTS INC.

Notes to Unaudited Interim Consolidated Financial Statements

Customs”) at a rate of 12.82% for estimated countervailing duties on the vast majority of our U.S. imports of softwood lumber products produced at our Canadian sawmills. The preliminary rate remained in effect until August 26, 2017. Commerce changed the rate in its final affirmative determination on November 2, 2017, but the new rate did not take effect until December 28, 2017, following the ITC’s final affirmative determination and the publication by Commerce of a countervailing duty order. Since that date,Until November 30, 2020, we have been required to resume paying cash deposits to U.S. Customs at a rate of 14.70% for the vast majority of our U.S. imports of Canadian-produced softwood lumber products. On December 1, 2020, Commerce issued its final results in the countervailing duties first administrative review and established our new rate at 19.10% for countervailing duties. This rate will apply until Commerce sets a new duty rate in ansubsequent administrative review,reviews, or a new rate may be set through a remand determination by a binational panel formed pursuant to the North American Free Trade Agreement binational panelor United States-Mexico-Canada Agreement, as the case may be (or, “Panel”) on appeal. Through June 30, 2020, ourDuring the three months ended March 31, 2021, we made additional cash deposits totaled $154of $30 million, and, based on the 14.70% rate andbringing our current operating parameters, could be as high as $50 million per year. Commerce issued on January 31, 2020, its preliminary results in the countervailing duties administrative review, and on May 15, 2020, and July 10, 2020, post-preliminary results establishing our new preliminary rates at 17.57% for the period of review from April 28, 2017,total to December 31, 2017, and at 17.11% for the period of review from January 1, 2018, to December 31, 2018, which are not yet effective. The new rate to be established in the final results for the period of review from January 1, 2018, to December 31, 2018, will be used as the basis for cash deposits to U.S. Customs from the publication of the final results.$224 million.

On June 26, 2017, Commerce announced its preliminary determination in the anti-dumping investigation and, as a result, after June 30, 2017, we were required to pay cash deposits to U.S. Customs at a rate of 4.59% for estimated anti-dumping duties on the vast majority of our U.S. imports of softwood lumber products produced at our Canadian sawmills. On November 2, 2017, Commerce announced its final affirmative determination in the anti-dumping investigation and, as a result, sincefrom November 8, 2017 to November 29, 2020, we have been required to pay cash deposits to U.S. Customs, at a rate of 3.20% for the vast majority of our U.S. imports of Canadian-produced softwood lumber products. On November 30, 2020, Commerce issued its final results in the anti-dumping first administrative review and established our new rate at 1.15% for anti-dumping duties. This rate will apply until Commerce sets a duty rate in ansubsequent administrative review,reviews, or a new rate may be set through a remand determination by a Panel on appeal. Through June 30, 2020, ourDuring the three months ended March 31, 2021, we made additional cash deposits totaled $40of $2 million, and,

On April 1, 2019, Commerce published a notice initiating the administrative reviews of the countervailing duty and anti-dumping orders on softwood lumber products from Canada. WeCanada and we were selected as a mandatory respondent in these administrative reviews and we are in the process of responding to Commerce with the information requested.reviews. On March 10, 2020, Commerce published a notice initiating the second administrative review of the countervailing duty and anti-dumping orders on softwood lumber products from Canada. We were selected as a mandatory respondent for the second administrative review of the countervailing duty order and we are acting asin the process of responding to Commerce with the information required. On March 4, 2021, Commerce published a voluntary respondent fornotice initiating the secondthird administrative review of the countervailing duty and anti-dumping orders on softwood lumber products from Canada and we were selected as a mandatory respondent for the third administrative review of the countervailing duty order.

In parallel, on September 4, 2019, a Panel issued an interim decision upholding the affirmative final injury determinations of the ITC in both investigations of softwood lumber products from Canada. The Panel remanded the ITC to reconsider several findings and ordered the ITC to submit its redetermination on remand within 90 days from the date of the Panel interim decision. On December 19, 2019, the ITC issued its redetermination on remand that maintained the affirmative final injury determinations, and on May 22, 2020, the Panel issued its final decision and affirmed in its entirety the ITC’s injury determination on remand. On January 6, 2021, and January 19, 2021, we filed our complaints supporting Panel reviews of the final results in the countervailing and anti-dumping first administrative reviews.

In addition, on August 24, 2020, the World Trade Organization’s (or, “WTO”) dispute panel issued a report (or, the “Panel Report”) in the case brought by the government of Canada in “United States — Countervailing Measures on Softwood Lumber from Canada” (DS533), concluding, among other things, that Commerce acted inconsistently with the Agreement on Subsidies and Countervailing Measures on most of the matters. On September 28, 2020, the United States notified the WTO’s dispute settlement body of its decision to appeal the Panel Report.

We are not presently able to determine the ultimate resolution of these matters, but we believe it is not probable that we will ultimately be assessed with significant duties, if any, on our U.S. imports of Canadian-produced softwood lumber products. Accordingly, 0 contingent loss was recorded in respect of these petitions in our Consolidated Statements of Operations, and our cash deposits were recorded in “Other assets” in our Consolidated Balance Sheets. Cash deposits for the countervailing duty and anti-dumping investigations through December 31, 2019, totaled $128 million and $34 million, respectively.

Fibrek acquisition

Effective July 31, 2012, we completed the final step of the transaction pursuant to which we acquired the remaining 25.4%25.40% of the outstanding Fibrek Inc. (or, “Fibrek”) shares, following the approval of Fibrek’s shareholders on July 23, 2012, and the issuance of a final order by the Quebec Superior Court in Canada (or, “Quebec Superior Court”) approving the arrangement on July 27, 2012. Certain former shareholders of Fibrek exercised rights of dissent in respect of the transaction, asking for a judicial determination of the fair value of their claim under the Canada Business Corporations Act. On September 26, 2019, the Quebec

14

RESOLUTE FOREST PRODUCTS INC.

Notes to Unaudited Interim Consolidated Financial Statements

Superior Court rendered a decision fixing the fair value of the shares of the dissenting shareholders at C$1.99 per share, or C$31 million in aggregate, plus interest and an additional indemnity, for a total then estimated at C$44 million payable in cash. AsWe had previously reported, we had accrued C$14 million for the payment of the dissenting shareholders’ claims andclaims. Following the court decision, we accrued an additional C$30 million following the court decision.($23 million). Of the total amount ofC$44 million, C$19 million ($14 million) was payable immediately and paid on October 2, 2019, bringing the2019. The remaining balance toof C$25 million ($18 million and $1926 million as of June 30, 2020March 31, 2021 and December 31, 2019,2020 ($21 million and $20 million as of March 31, 2021 and December 31, 2020, respectively), which wasincludes accrued interest, is recorded in “Other liabilities” in our Consolidated Balance Sheets as of June 30, 2020 and December 31, 2019.Sheets. We are appealing the decision, therefore the payment of any additional consideration and its timing will depend on the outcome of the appeal. On November 13, 2019, a legal hypothec in the amount of C$30 million was registered on our Saint-Félicien (Quebec) immovable and movable property to secure the payment of any additional amounts following the outcome of the appeal. The hearing in this matter has not yet been scheduled but is expected to occur in 2021.

Partial wind-ups of pension plans

On June 12, 2012, we filed a motion for directives with the Quebec Superior Court, the court with jurisdiction in the creditor protection proceedings under the Companies’ Creditors Arrangement Act (Canada) (or, the “CCAA Creditor Protection Proceedings”), seeking an order to prevent pension regulators in each of Quebec, New Brunswick, and Newfoundland and Labrador from declaring partial wind-ups of pension plans relating to employees of former operations in New Brunswick, and Newfoundland and Labrador, or a declaration that any claim for accelerated reimbursements of deficits arising from a partial wind-up is a barred claim under the CCAA Creditor Protection Proceedings. We contend, among other things, that any such declaration, if issued, would be inconsistent with the Quebec Superior Court’s sanction order confirming the CCAA debtors’ CCAA Plan of Reorganization and Compromise, as amended, and the terms of our emergence from the CCAA Creditor Protection Proceedings. A partial wind-up would likely shorten the period in which any deficit within those plans, which could reach up to C$150 million ($110119 million), would have to be funded if we do not obtain the relief sought. The hearing in this matter has not yet been scheduled but could occur in the next twelve months.2021.

Environmental matters

We are subject to a number of federal or national, state, provincial, and local environmental laws, regulations, and orders in various jurisdictions. We believe our operations are in material compliance with current applicable environmental laws and regulations. Environmental regulations promulgated and orders issued in the future could require substantial additional expenditures for compliance and could have a material impact on us, in particular, and the industry in general.

We may be a “potentially responsible party” with respect to a hazardous waste site that is being addressed pursuant to the Comprehensive Environmental Response, Compensation and Liability Act of 1980 (commonly known as Superfund). We believe we will not be liable for any significant amounts at this site.

We also have asset retirement obligations of $26 million and $25 million recorded as of both June 30, 2020March 31, 2021 and December 31, 2019,2020, respectively, primarily consisting of liabilities associated with landfills, sludge basins and the dismantling of retired assets. These liabilities are included in “Accounts payable and accrued liabilities”other” and “Other liabilities” in our Consolidated Balance Sheets.

Note 12. Share Capital

On March 2, 2020, our board of directors authorized a share repurchase program of up to 15% of our common stock, for an aggregate consideration of up to $100 million. During the three and six months ended June 30, 2020,March 31, 2021, we repurchased 253,8981.7 million shares at a cost of $1$17 million. DuringNaN shares were repurchased during the three and six months ended June 30, 2019, we repurchased 720,000 shares, at a cost of $5 million under our $150 million share repurchase program, which was completed in 2019.

15

RESOLUTE FOREST PRODUCTS INC.

Notes to Unaudited Interim Consolidated Financial Statements

Note 13. Segment Information

We manage our business based on the products we manufacture. Accordingly, our reportable segments correspond to our principal product lines: market pulp, tissue, wood products, and paper. As of the second quarter of 2020, the results from our newsprint and specialty papers operations have been combined to form the paper reportable segment. This better reflects management’s internal analysis, given the diminishing percentage newsprint and specialty papers represent in our product portfolio. Comparative year information has been modified to conform to this revised segment presentation.

None of the income or loss items following “Operating income (loss)” in our Consolidated Statements of Operations are allocated to our segments, since those items are reviewed separately by management. For the same reason, closure costs, impairment and other related charges, gains and losses on disposition of assets, as well as other discretionary charges or credits are not allocated to our segments. We allocate depreciation and amortization expense to our segments, although the related fixed assets and amortizable intangible assets are not allocated to segment assets. Additionally, all selling, general and administrative expenses are allocated to our segments, with the exception of certain discretionary charges and credits, which we present under “corporate and other.”

Information about certain segment data for the three and six months ended June 30,March 31, 2021 and 2020, and 2019, was as follows:

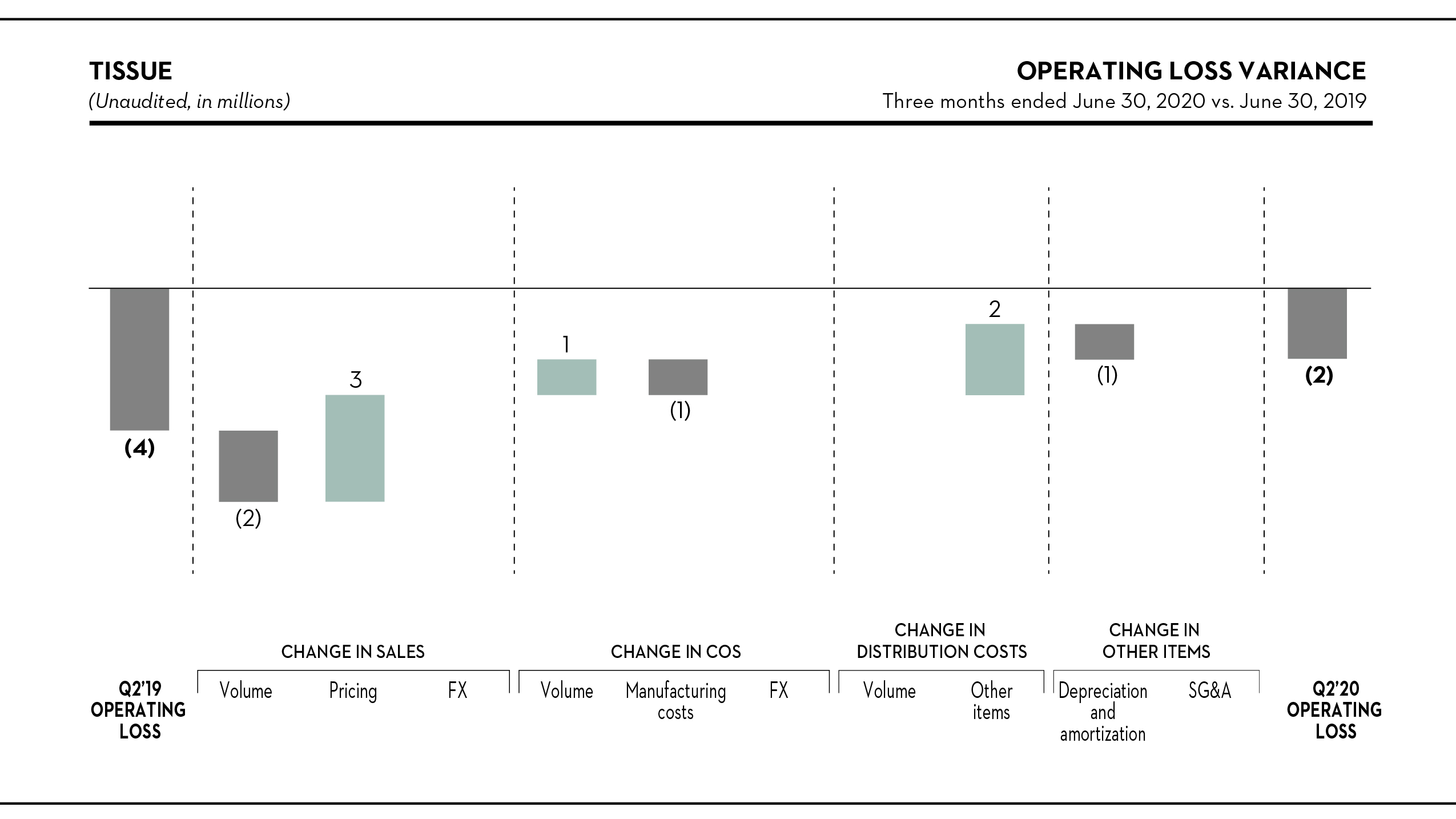

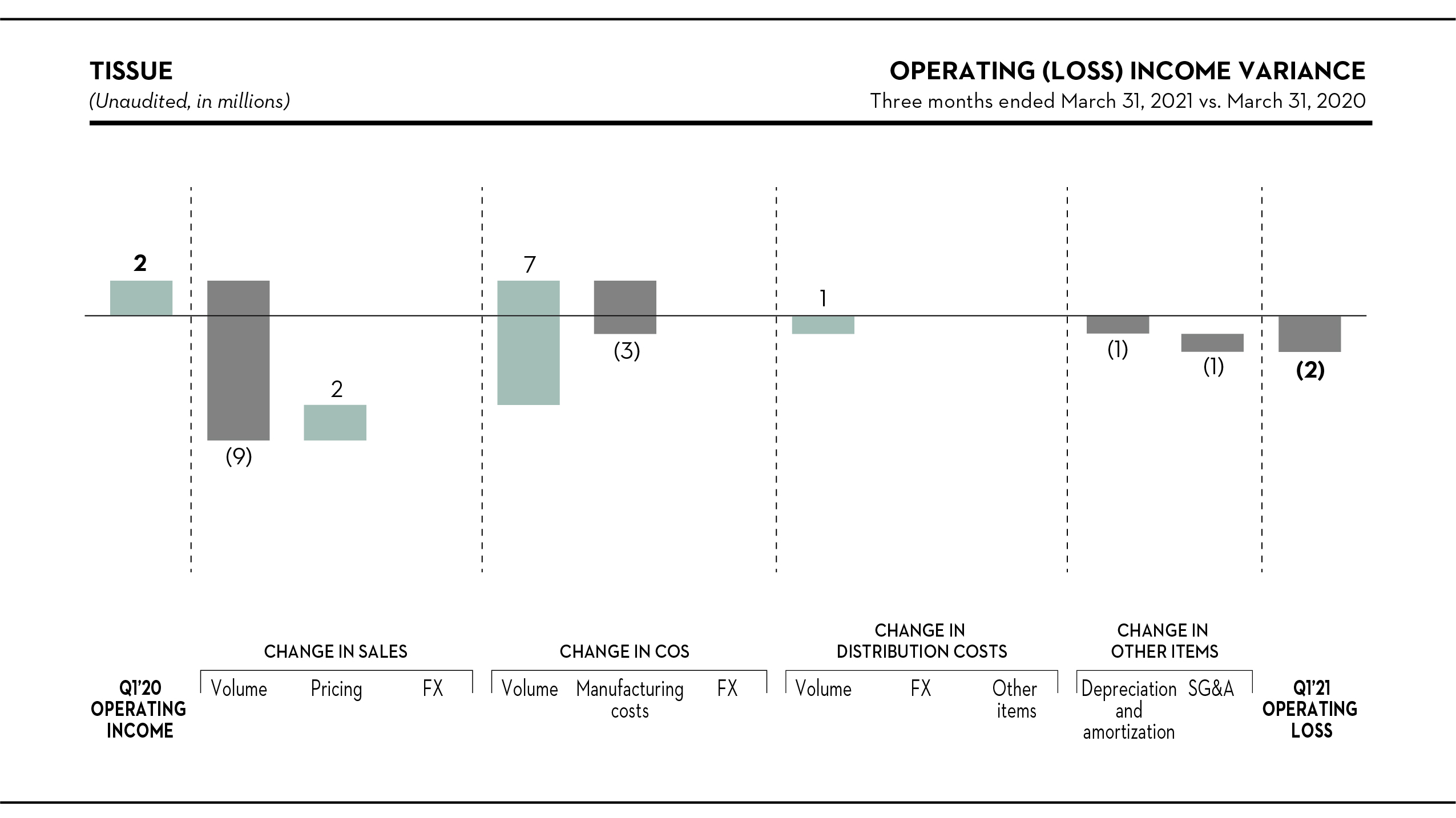

| (Unaudited, in millions) | Market Pulp (1) | Tissue | Wood Products (2) | Paper | Segment Total | Corporate and Other | Total | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Sales | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| First three months | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2021 | $ | 176 | $ | 42 | $ | 430 | $ | 225 | $ | 873 | $ | — | $ | 873 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| 2020 | $ | 177 | $ | 49 | $ | 174 | $ | 289 | $ | 689 | $ | 0 | $ | 689 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Depreciation and amortization | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| First three months | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2021 | $ | 6 | $ | 5 | $ | 11 | $ | 15 | $ | 37 | $ | 4 | $ | 41 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| 2020 | $ | 6 | $ | 4 | $ | 11 | $ | 17 | $ | 38 | $ | 4 | $ | 42 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Operating income (loss) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| First three months | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

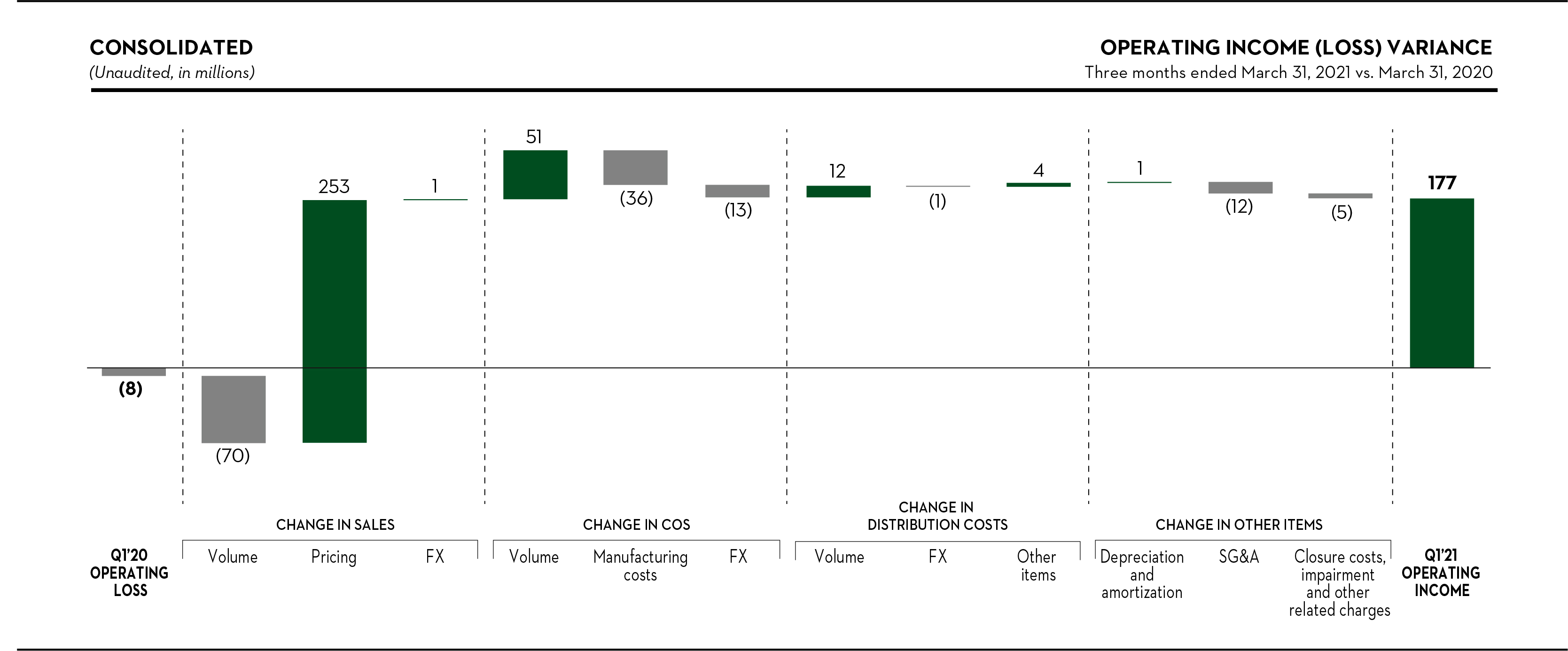

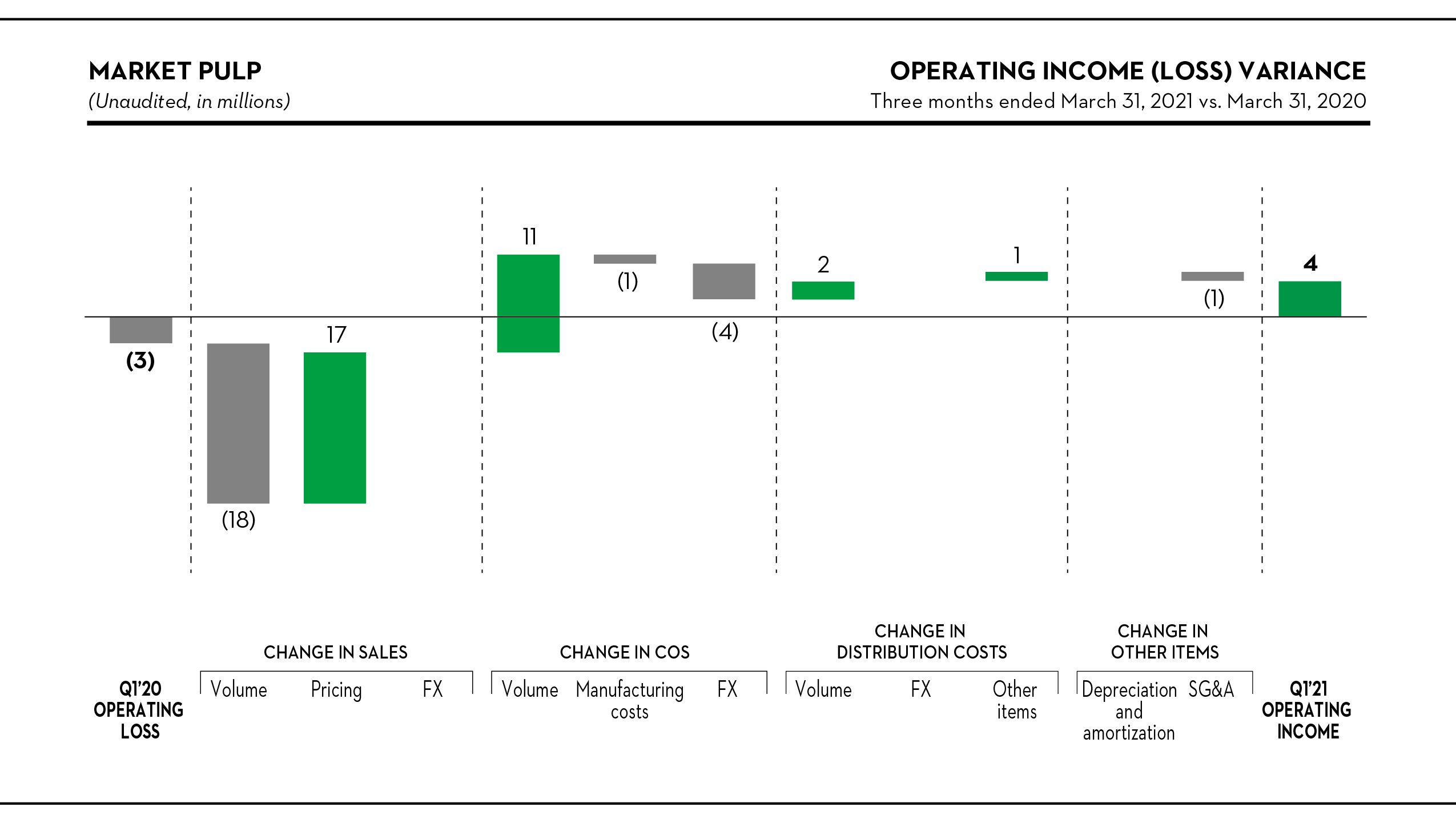

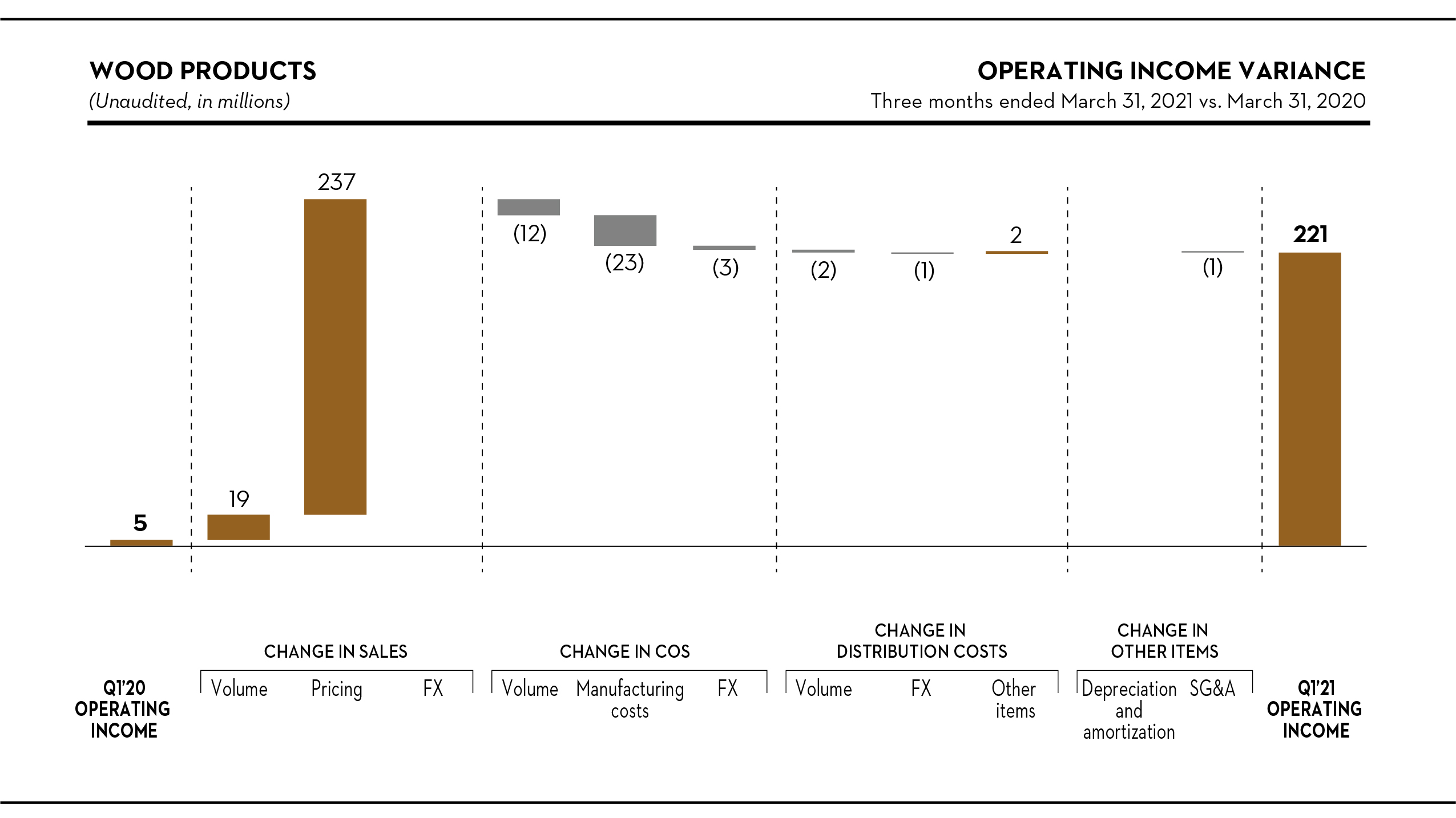

| 2021 | $ | 4 | $ | (2) | $ | 221 | $ | (24) | $ | 199 | $ | (22) | $ | 177 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| 2020 | $ | (3) | $ | 2 | $ | 5 | $ | (3) | $ | 1 | $ | (9) | $ | (8) | |||||||||||||||||||||||||||||||||||||||||||||||||||

(1)Inter-segment sales of $7 million for both the three months ended March 31, 2021 and 2020, which were transacted either at the lowest market price of the previous month or cost, were excluded from market pulp sales.

(2)Wood products sales to our joint ventures, which are transacted at arm’s length negotiated prices, were $13 million and $5 million for the three months ended March 31, 2021 and 2020, respectively.

Note 14. Subsequent Event

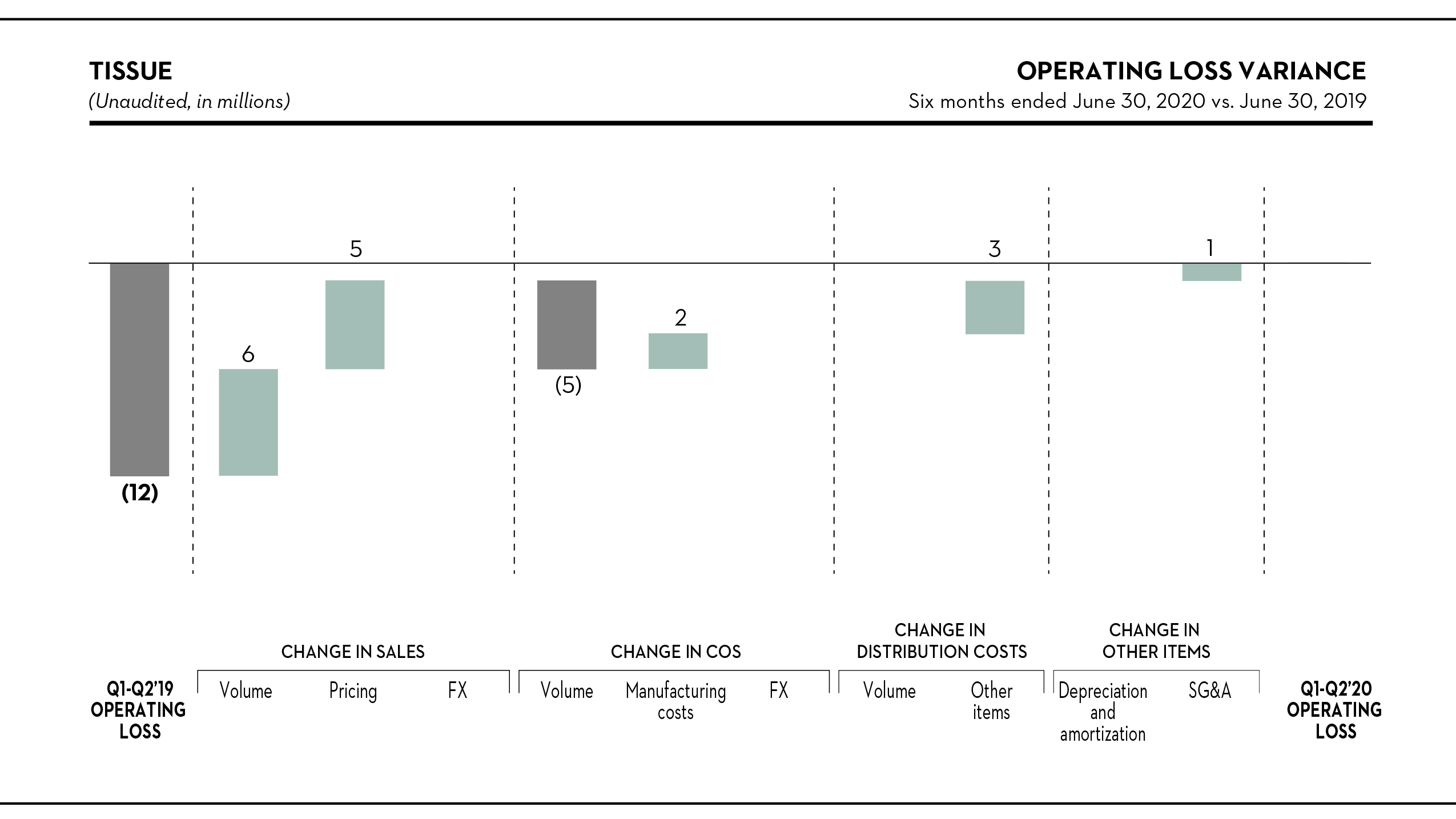

(Unaudited, in millions) | Market Pulp (1) | Tissue | Wood Products (2) | Paper | Segment Total | Corporate and Other | Total | |||||||||||||||||||||

| Sales | ||||||||||||||||||||||||||||

| Second quarter | ||||||||||||||||||||||||||||

| 2020 | $ | 161 | $ | 44 | $ | 199 | $ | 208 | $ | 612 | $ | — | $ | 612 | ||||||||||||||

| 2019 | $ | 189 | $ | 43 | $ | 168 | $ | 355 | $ | 755 | $ | — | $ | 755 | ||||||||||||||

| First six months | ||||||||||||||||||||||||||||

| 2020 | $ | 338 | $ | 93 | $ | 373 | $ | 497 | $ | 1,301 | $ | — | $ | 1,301 | ||||||||||||||

| 2019 | $ | 420 | $ | 82 | $ | 329 | $ | 719 | $ | 1,550 | $ | — | $ | 1,550 | ||||||||||||||

| Depreciation and amortization | ||||||||||||||||||||||||||||

| Second quarter | ||||||||||||||||||||||||||||

| 2020 | $ | 6 | $ | 5 | $ | 10 | $ | 16 | $ | 37 | $ | 3 | $ | 40 | ||||||||||||||

| 2019 | $ | 5 | $ | 4 | $ | 9 | $ | 19 | $ | 37 | $ | 5 | $ | 42 | ||||||||||||||

| First six months | ||||||||||||||||||||||||||||

| 2020 | $ | 12 | $ | 9 | $ | 21 | $ | 33 | $ | 75 | $ | 7 | $ | 82 | ||||||||||||||

| 2019 | $ | 10 | $ | 9 | $ | 17 | $ | 36 | $ | 72 | $ | 10 | $ | 82 | ||||||||||||||

| Operating income (loss) | ||||||||||||||||||||||||||||

| Second quarter | ||||||||||||||||||||||||||||

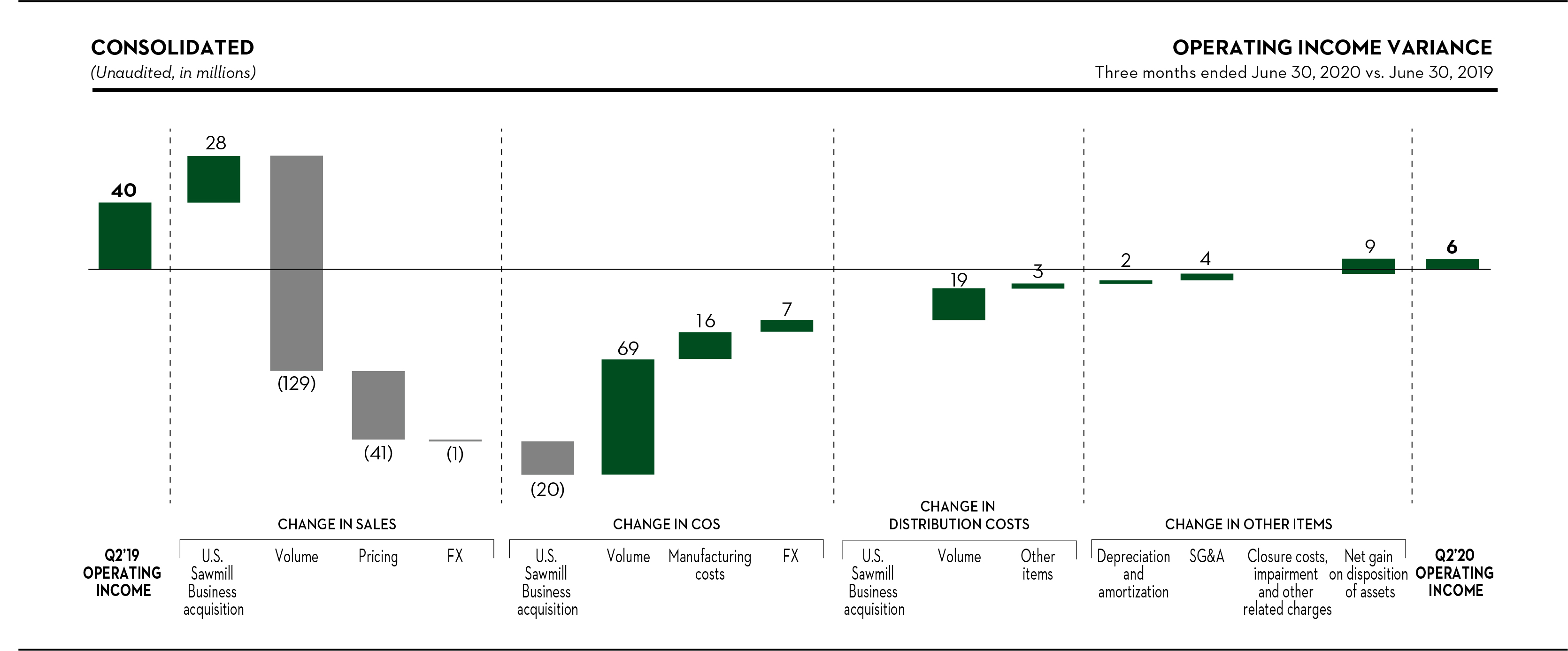

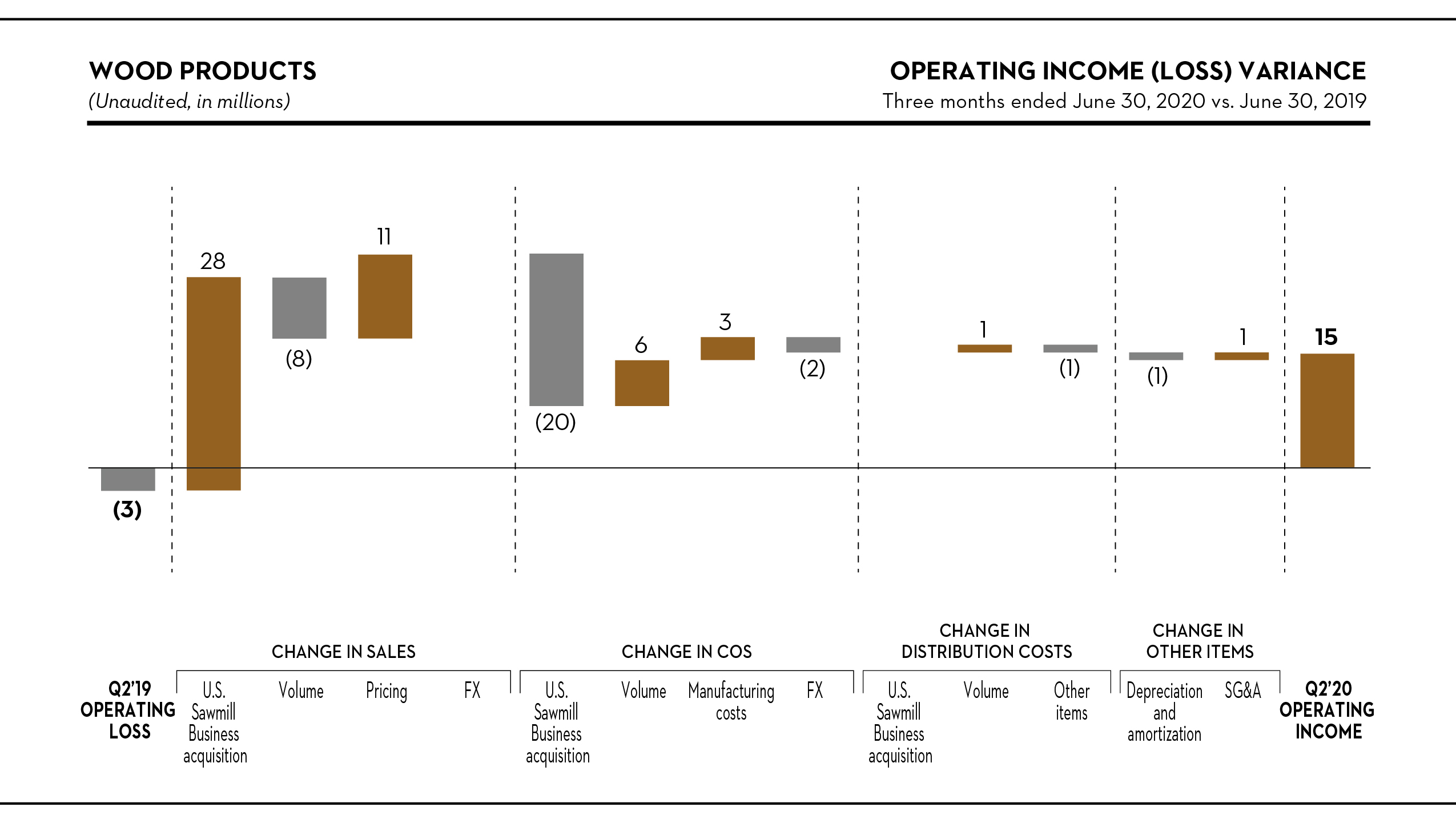

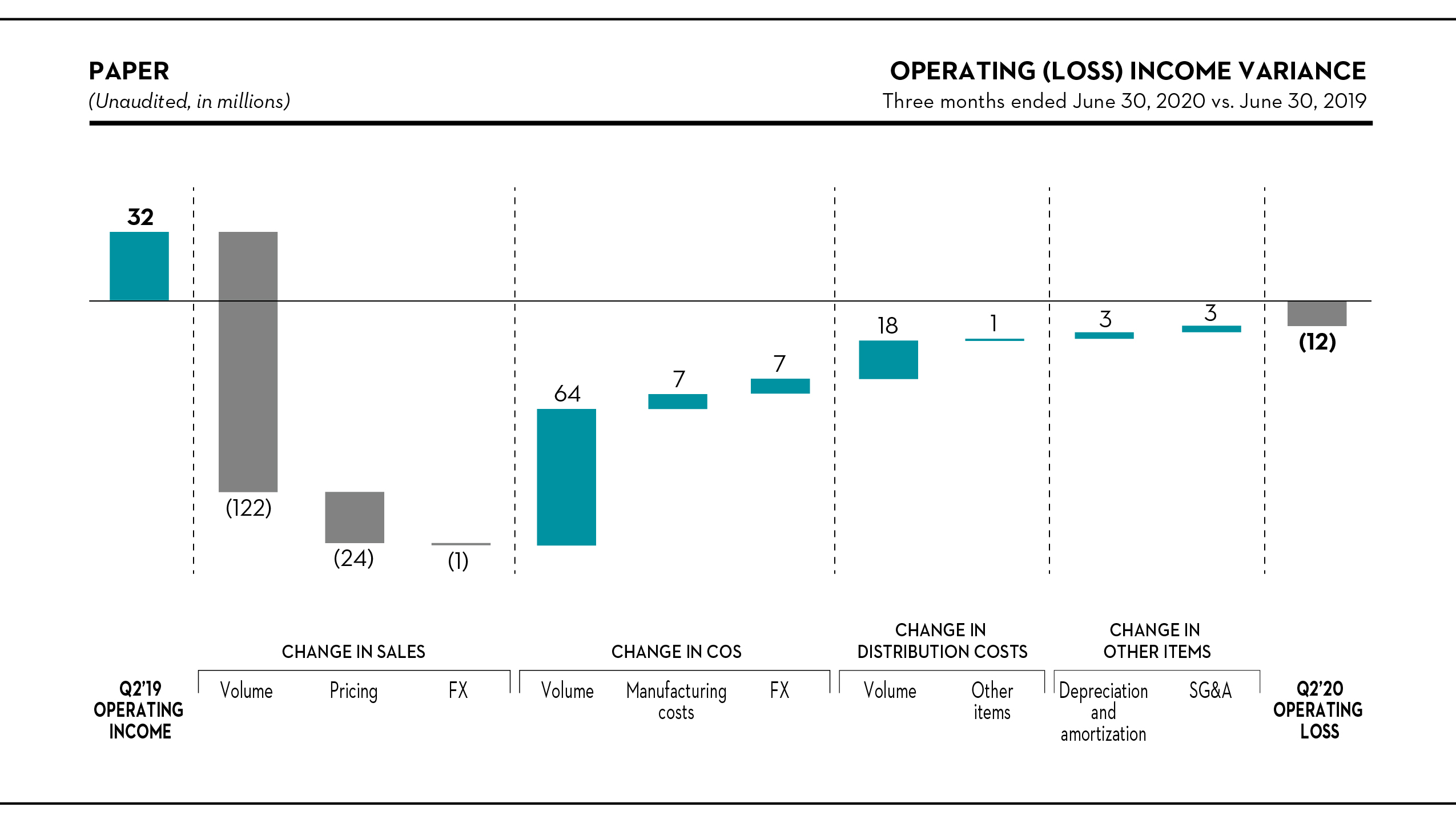

| 2020 | $ | 10 | $ | (2 | ) | $ | 15 | $ | (12 | ) | $ | 11 | $ | (5 | ) | $ | 6 | |||||||||||

| 2019 | $ | 27 | $ | (4 | ) | $ | (3 | ) | $ | 32 | $ | 52 | $ | (12 | ) | $ | 40 | |||||||||||

| First six months | ||||||||||||||||||||||||||||

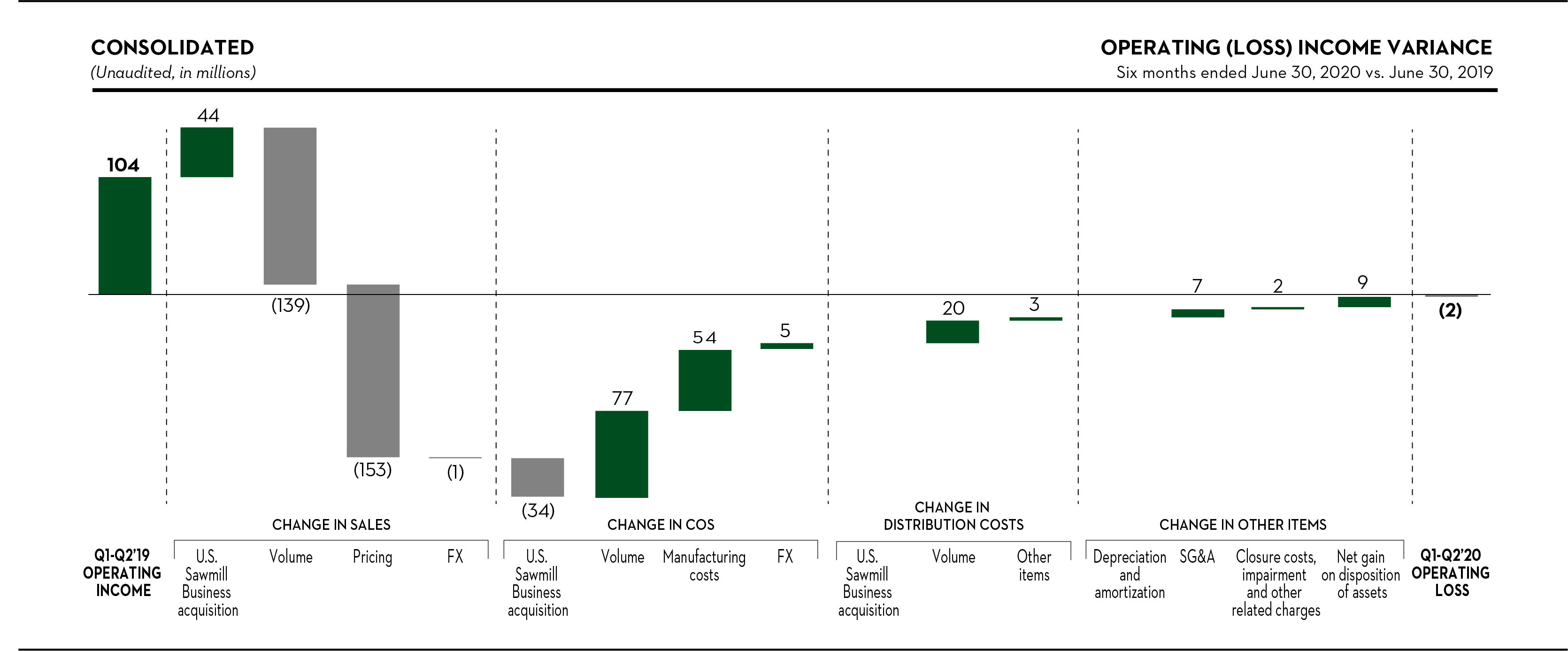

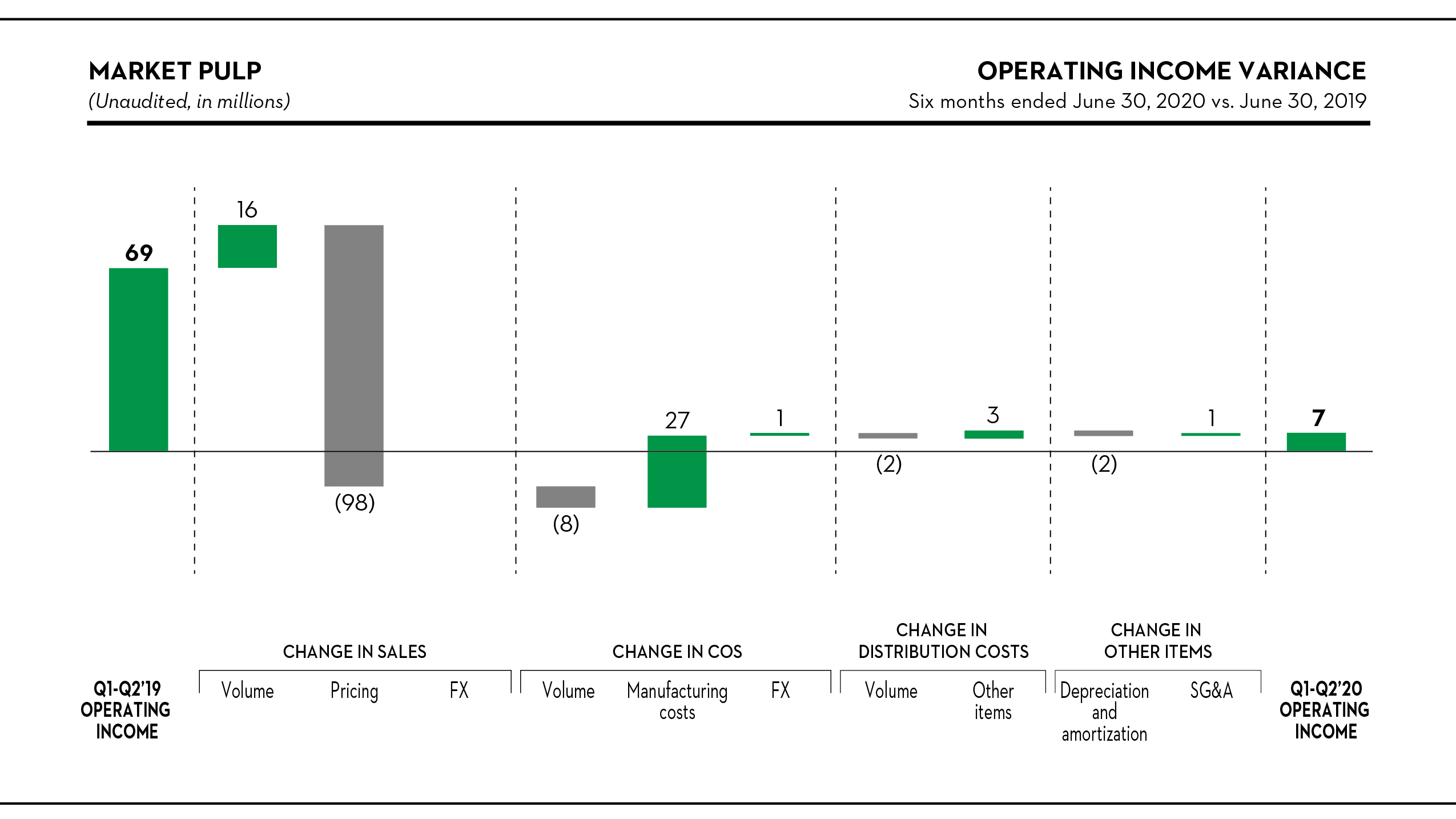

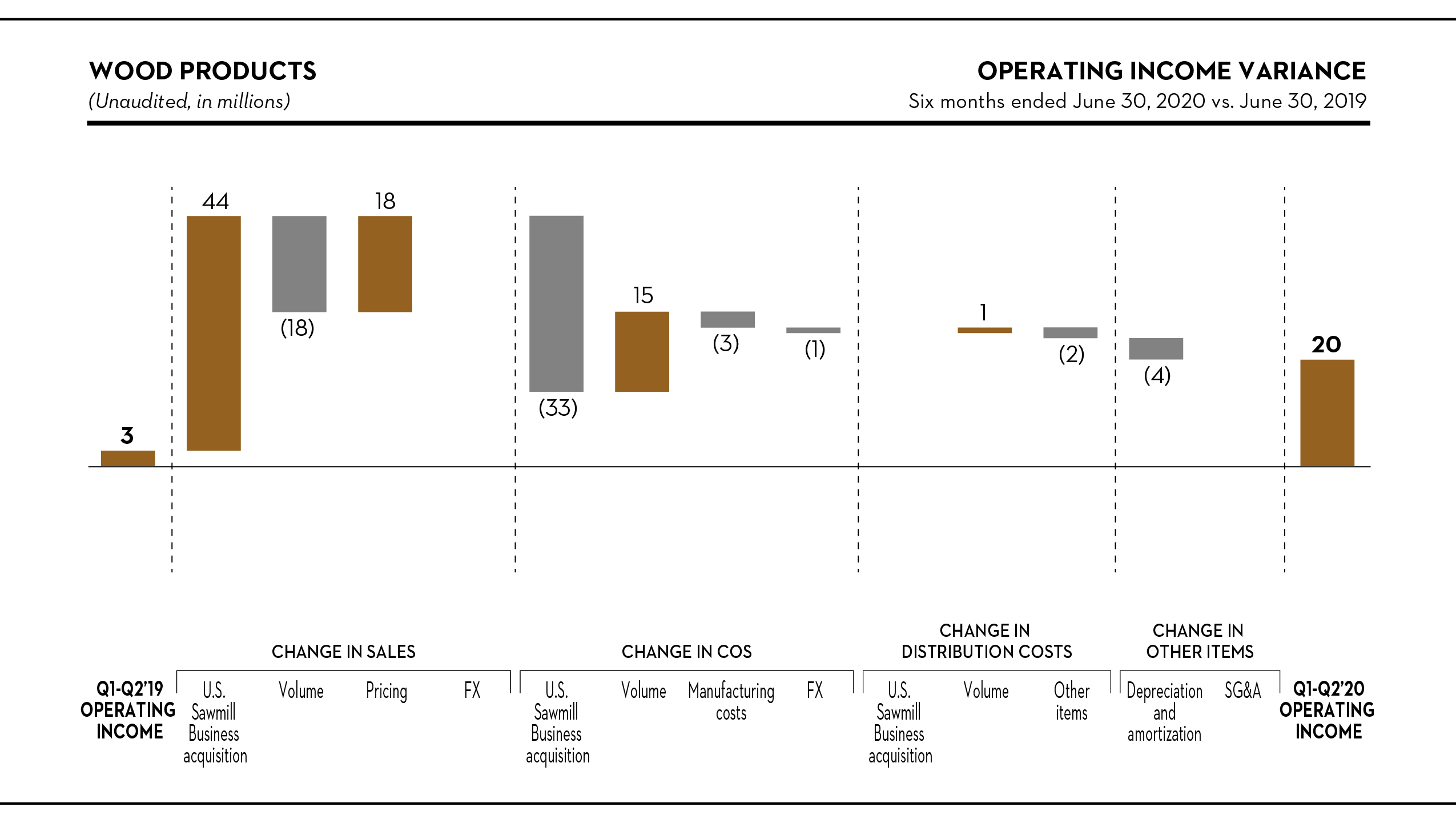

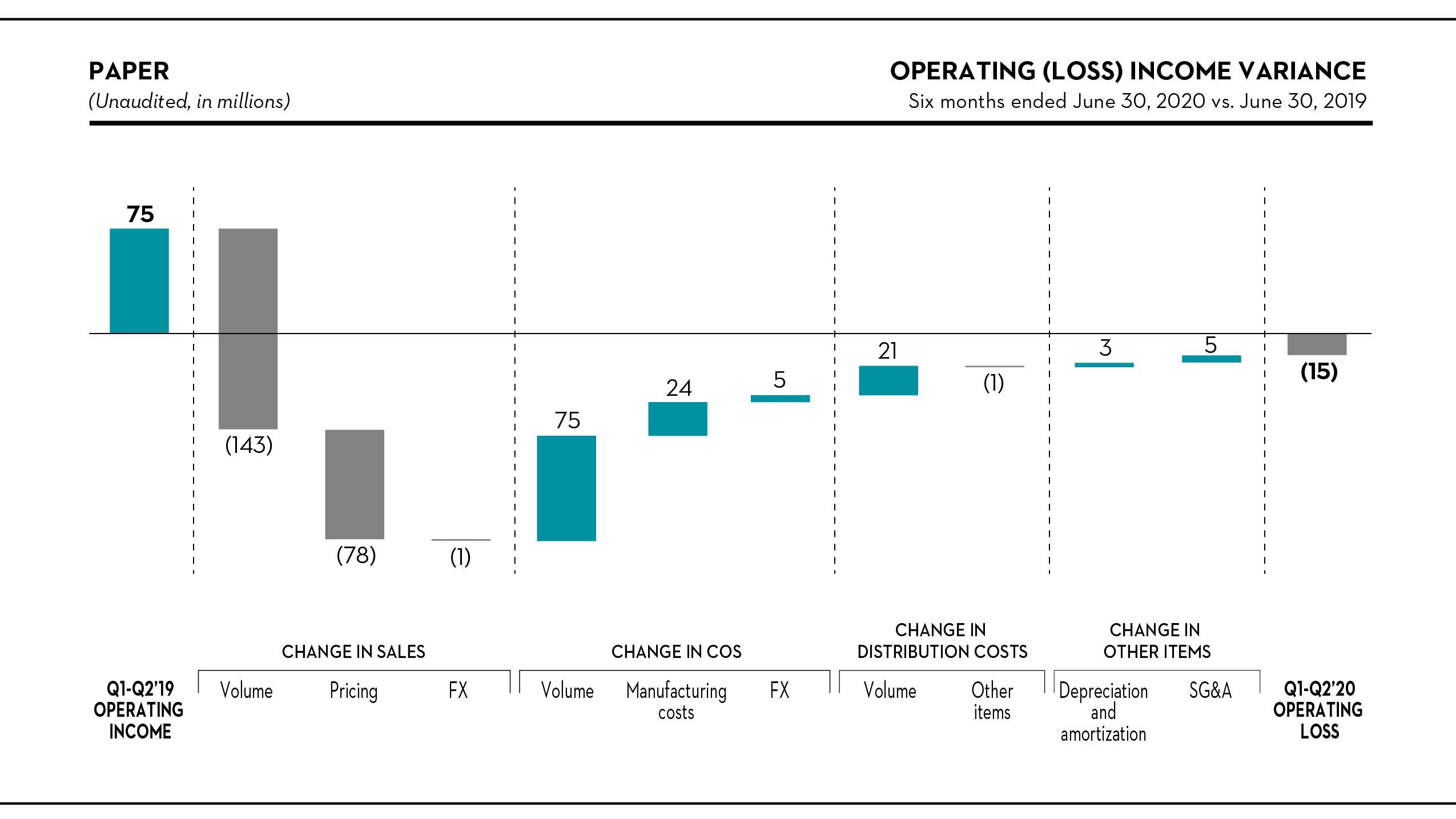

| 2020 | $ | 7 | $ | — | $ | 20 | $ | (15 | ) | $ | 12 | $ | (14 | ) | $ | (2 | ) | |||||||||||

| 2019 | $ | 69 | $ | (12 | ) | $ | 3 | $ | 75 | $ | 135 | $ | (31 | ) | $ | 104 | ||||||||||||

•On April 19, 2021 (or, the “Effective Date”), we entered into a first amendment to the amended and restated senior secured credit facility (or, the “Senior Secured Credit Facility”) entered into on October 28, 2019. The amount available under the Senior Secured Credit Facility remains unchanged for up to $360 million and is comprised of a term loan facility of up to $180 million with a delayed draw period of up to three years and the choice of maturities of six to ten years from the date of drawing (or, the “Term Loan Facility”); and a six-year revolving credit facility of up to $180 million (or, the “Revolving Credit Facility”). On the Effective Date, we repaid our $180 million of term loans under the pre-amended Senior Secured Credit Facility with a combination of proceeds of borrowings under the Revolving Credit Facility and cash on hand. The amendment then reinstated the full amount of the Term Loan Facility. There is also an uncommitted option to increase the Senior Secured Credit Facility by up to an additional $360 million, subject to certain terms and conditions. |

16

RESOLUTE FOREST PRODUCTS INC.

Notes to Unaudited Interim Consolidated Financial Statements

The obligations under the Senior Secured Credit Facility continue to be guaranteed by certain material U.S. subsidiaries of the Company and remain secured by first priority liens on assets of our Calhoun (Tennessee) facility. Interest rates under the Amended Senior Secured Credit Facility are based, at the Company’s election, on either a floating rate based on the LIBOR, or a base rate, in each case plus a spread over the index. For loans under the Term Loan Facility, the applicable spread ranges from 0.5% to 1.4% for base rate loans, from 1.5% to 2.4% for LIBOR rate loans, and from 1.7% to 2.1% for fixed rate loans. For the Revolving Credit Facility, the applicable spread ranges from 0.5% to 1.0% for base rate loans, and from 1.5% to 2.0% for LIBOR rate loans. The amended credit agreement contains customary covenants, representations and warranties, and events of default.

17

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following management’s discussion and analysis is intended to help the reader understand Resolute Forest Products, our results of operations, cash flows and financial condition. The discussion is provided as a supplement to, and should be read in conjunction with, our consolidated financial statements and the accompanying notes (or, the “Consolidated Financial Statements”) contained in Item 1, “Financial Statements,” of this Quarterly Report on Form 10-Q (or, “Form 10-Q”).

When we refer to “Resolute Forest Products,” “Resolute,” “we,” “our,” “us” or the “Company,” we mean Resolute Forest Products Inc. with its subsidiaries, either individually or collectively, unless otherwise indicated.

CAUTIONARY STATEMENTS REGARDING FORWARD-LOOKING INFORMATION AND USE OF THIRD-PARTY DATA

Statements in this Form 10-Q that are not reported financial results or other historical information of Resolute Forest Products are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. They include, for example, statements relating to the impact of the novel coronavirus (or, “COVID-19”) pandemic and resulting economic conditions on our business, results of operations and market price of our securities, and to our: efforts and initiatives to reduce costs, increase revenues, and improve profitability; business and operating outlook; future pension obligations; assessment of market conditions; growth strategies and prospects, and the growth potential of the Company and the industry in which we operate; liquidity; future cash flows, including as a result of the changes to our pension funding obligations; estimated capital expenditures; and strategies for achieving our goals generally. Forward-looking statements may be identified by the use of forward-looking terminology such as the words “should,” “would,” “could,” “will,” “may,” “expect,” “believe,” “see,” “anticipate,” “continue,” “attempt,” “project,” “progress,” “build,” “pursue,” “plan,” “grow”“grow,” “allow,” “look” and other terms with similar meaning indicating possible future events or potential impact on our business or Resolute Forest Products’ shareholders.