UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON,

United States

Securities and Exchange Commission

Washington, D.C. 20549

FORM 10-Q

(Mark One)

| ☒ | |

| |

| QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended March 31, 2024

or

| ☐ |

|

| |

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the transition period from ____ to ____

Commission File Number 333-184948001-39531

Heatwurx,Processa Pharmaceuticals, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 45-1539785 | |

|

| |

(State or other jurisdiction of incorporation or organization) | (IRS Employer Identification No.) |

530 S Lake Avenue #6157380 Coca Cola Drive, Suite 106,

Pasadena, CA 91101Hanover, Maryland21076

(Address443) 776-3133

Securities registered pursuant to Section 12(b) of principal executive offices and Zip Code)the Exchange Act:

| Title of Each Class | Trading Symbol(s) | Name of each exchange on which registered | ||

| Common Stock, $0.0001 par value per share | PCSA | The Nasdaq Stock Market LLC |

(626) 364-5342

(Registrant’s telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) YES [ ] NO [X]

Indicate by check mark whether the registrant, and (2) has been subject to such filing requirements for the past 90 days. YES [X] NO [ ]Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). YES [ ] NO [X]Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company, or emerging growth company. See the definitionsdefinition of “large accelerated filer,” “accelerated filer,” and “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ☐ | Accelerated filer | ☐ |

Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

| Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(q)13(a) of the Exchange Act. Y ES [ ] NO [X]☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

YES [ ] NO [X]

The registrant has 11,017,388number of outstanding shares of the registrant’s common stock outstanding as of September 29, 2017.at May 10, 2024 was .

HEATWURX,

PROCESSA PHARMACEUTICALS, INC.

FORM 10-Q

For the Quarter Ended June 30, 2017

TABLE OF CONTENTS

| 2 |

Part I: Financial Information

PART I. FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTSItem 1: Financial Statements

HEATWURX, INC.Processa Pharmaceuticals, Inc.

CONSOLIDATED BALANCE SHEETSCondensed Consolidated Balance Sheets

(Unaudited)

| March 31, 2024 | December 31, 2023 | |||||||

| ASSETS | ||||||||

| Current Assets | ||||||||

| Cash and cash equivalents | $ | 8,920,363 | $ | 4,706,197 | ||||

| Due from related parties | 22,295 | - | ||||||

| Prepaid expenses and other | 857,635 | 926,300 | ||||||

| Total Current Assets | 9,800,293 | 5,632,497 | ||||||

| Property and Equipment, net | 2,415 | 2,554 | ||||||

| Other Assets | ||||||||

| Lease right-of-use assets, net of accumulated amortization | 136,489 | 146,057 | ||||||

| Security deposit | 5,535 | 5,535 | ||||||

| Total Other Assets | 142,024 | 151,592 | ||||||

| Total Assets | $ | 9,944,732 | $ | 5,786,643 | ||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY | ||||||||

| Current Liabilities | ||||||||

| Current maturities of lease liabilities | $ | 89,680 | $ | 83,649 | ||||

| Accounts payable | 455,368 | 311,617 | ||||||

| Due to licensor | - | 189,000 | ||||||

| Due to related parties | - | 39 | ||||||

| Accrued expenses | 465,618 | 146,274 | ||||||

| Total Current Liabilities | 1,010,666 | 730,579 | ||||||

| Non-current Liabilities | ||||||||

| Non-current lease liabilities | 50,700 | 66,905 | ||||||

| Total Liabilities | 1,061,366 | 797,484 | ||||||

| Commitments and Contingencies | - | - | ||||||

| Stockholders’ Equity | ||||||||

| Common stock, par value $, shares authorized: issued and outstanding at March 31, 2024 and issued and outstanding at December 31, 2023 | 286 | 129 | ||||||

| Additional paid-in capital | 87,278,542 | 80,658,111 | ||||||

| Treasury stock at cost — shares at March 31, 2024 and December 31, 2023 | (300,000 | ) | (300,000 | ) | ||||

| Accumulated deficit | (78,095,462 | ) | (75,369,081 | ) | ||||

| Total Stockholders’ Equity | 8,883,366 | 4,989,159 | ||||||

| Total Liabilities and Stockholders’ Equity | $ | 9,944,732 | $ | 5,786,643 | ||||

| June 30, 2017 |

| December 31, 2016 | ||

|

|

|

| ||

ASSETS |

|

|

| ||

CURRENT ASSETS: |

|

|

| ||

Cash and cash equivalents | $ | 1,949 |

| $ | 3,237 |

Total current assets |

| 1,949 |

|

| 3,237 |

TOTAL ASSETS | $ | 1,949 |

| $ | 3,237 |

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ DEFICIT |

|

|

|

|

|

CURRENT LIABILITIES: |

|

|

|

|

|

Accounts payable | $ | 91,187 |

| $ | 166,165 |

Accrued liabilities |

| 147,619 |

|

| 134,513 |

Interest payable |

| 139,075 |

|

| 108,608 |

Interest payable, related party |

| 427,455 |

|

| 332,566 |

Income taxes payable |

| 200 |

|

| 200 |

Current portion of senior secured notes payable, related party |

| 1,037,361 |

|

| 962,361 |

Current portion of unsecured notes payable |

| 420,000 |

|

| 420,000 |

Revolving line of credit |

| 91,980 |

|

| 91,980 |

Revolving line of credit, related party |

| 138,000 |

|

| 138,000 |

Total current liabilities |

| 2,492,877 |

|

| 2,354,393 |

TOTAL LIABILITIES |

| 2,492,877 |

|

| 2,354,393 |

|

|

|

|

|

|

STOCKHOLDERS’ DEFICIT: |

|

|

|

|

|

Series D preferred stock, $0.0001 par value, 4,500,000 shares authorized; 178,924 shares issued and outstanding at June 30, 2017 and December 31, 2016; liquidation preference of $886,037 at June 30, 2017 and $875,331 at December 31, 2016, respectively |

| 18 |

|

| 18 |

Common stock, $0.0001 par value, 20,000,000 shares authorized; 11,017,388 issued and outstanding at June 30, 2017 and December 31, 2016 |

| 1,102 |

|

| 1,102 |

Additional paid-in capital |

| 14,329,057 |

|

| 14,329,057 |

Accumulated deficit |

| (15,394,689) |

|

| (15,254,917) |

Stockholder’s deficit from discontinued operations |

| (1,426,416) |

|

| (1,426,416) |

Total stockholders’ deficit |

| (2,490,928) |

|

| (2,351,156) |

TOTAL LIABILITIES AND STOCKHOLDERS’ DEFICIT | $ | 1,949 |

| $ | 3,237 |

The accompanying notes are an integral part of these unauditedcondensed consolidated financial statements.

| 3 |

HEATWURX, INC.

CONSOLIDATED STATEMENTS OF OPERATIONSProcessa Pharmaceuticals, Inc.

(Unaudited)Condensed Consolidated Statements of Operations

(Unaudited)

| Three Months Ended June 30, | Six Months Ended June 30, | ||||||

| 2017 | 2016 | 2017 | 2016 | ||||

|

|

|

|

| ||||

REVENUE: |

|

|

|

| ||||

Equipment sales | $ | - | $ | - | $ | - | $ | 5,000 |

Total revenues |

| - |

| - |

| - |

| 5,000 |

|

|

|

|

|

|

|

|

|

COST OF GOODS SOLD |

| - |

| - |

| - |

| - |

GROSS PROFIT |

| - |

| - |

| - |

| 5,000 |

|

|

|

|

|

|

|

|

|

EXPENSES: |

|

|

|

|

|

|

|

|

Selling, general and administrative |

| 10,270 |

| 3,284 |

| 23,869 |

| 83,799 |

Research and development |

| 83 |

| 5,697 |

| 166 |

| 5,697 |

Total expenses |

| 10,353 |

| 8,981 |

| 24,035 |

| 89,496 |

|

|

|

|

|

|

|

|

|

LOSS FROM OPERATIONS |

| (10,353) |

| (8,981) |

| (24,035) |

| (84,496) |

|

|

|

|

|

|

|

|

|

OTHER INCOME AND EXPENSE: |

|

|

|

|

|

|

|

|

Gain on debt forgiveness |

| 30,912 |

| 25,155 |

| 30,912 |

| 25,155 |

Interest expense |

| (63,410) |

| (62,634) |

| (125,355) |

| (118,740) |

Total other income and expense |

| (32,498) |

| (37,479) |

| (94,443) |

| (93,585) |

|

|

|

|

|

|

|

|

|

LOSS BEFORE INCOME TAXES |

| (42,851) |

| (46,460) |

| (118,478) |

| (178,081) |

Income taxes |

| - |

| - |

| - |

| - |

LOSS FROM CONTINUED OPERATIONS, net of tax |

| (42,851) |

| (46,460) |

| (118,478) |

| (178,081) |

INCOME (LOSS) FROM DISCONTINUED OPERATIONS, net of tax |

| - |

| 3,260 |

| - |

| 1,256 |

NET LOSS | $ | (42,851) | $ | (43,200) | $ | (118,478) | $ | (176,825) |

|

|

|

|

|

|

|

|

|

Preferred Stock Cumulative Dividend and Deemed Dividend |

| (10,706) |

| (10,706) |

| (21,294) |

| (21,411) |

Net loss applicable to common stockholders | $ | (53,557) | $ | (53,906) | $ | (139,772) | $ | (198,236) |

Net loss per common share basic and diluted from continuing operations |

| (0.00) |

| (0.01) |

| (0.01) |

| (0.02) |

Net loss per common share basic and diluted from discontinued operations |

| 0.00 |

| 0.00 |

| 0.00 |

| 0.00 |

Net loss per common share basic and diluted | $ | (0.00) | $ | (0.01) | $ | (0.01) | $ | (0.02) |

Weighted average shares outstanding used in calculating net loss per common share |

| 11,017,388 |

| 11,017,388 |

| 11,017,388 |

| 11,017,388 |

| 2024 | 2023 | |||||||

| Three months ended March 31, | ||||||||

| 2024 | 2023 | |||||||

| Operating Expenses | ||||||||

| Research and development expenses | $ | 1,539,070 | $ | 1,627,480 | ||||

| General and administrative expenses | 1,270,528 | 2,478,055 | ||||||

| Operating Loss | (2,809,598 | ) | (4,105,535 | ) | ||||

| Other Income (Expense), net | 83,217 | 83,462 | ||||||

| Net Loss | $ | (2,726,381 | ) | $ | (4,022,073 | ) | ||

| Net Loss Per Common Share - Basic and Diluted | $ | ) | $ | ) | ||||

| Weighted Average Common Shares Used to Compute Net Loss Per Common Shares - Basic and Diluted | ||||||||

The accompanying notes are an integral part of these unauditedcondensed consolidated financial statements.

| 4 |

HEATWURX, INC.

CONSOLIDATED STATEMENT OF CASH FLOWSProcessa Pharmaceuticals, Inc.

(Unaudited)Condensed Consolidated Statement of Changes in Stockholders’ Equity

(Unaudited)

| June 30, | ||||

| 2017 |

| 2016 | ||

|

|

|

| ||

CASH FLOWS FROM OPERATING ACTIVITIES: |

|

|

| ||

Net loss | $ | (118,478) |

| $ | (176,825) |

Less: (Income) Loss from discontinued operations, net of tax |

| - |

|

| (1,256) |

Loss from continuing operations |

| (118,478) |

|

| (178,081) |

Adjustments to reconcile net loss to cash flows used in operating activities: |

|

|

|

|

|

Depreciation expense |

| - |

|

| 159 |

Gain on debt forgiveness |

| (30,912) |

|

| (25,155) |

Amortization of discount on note payable |

| - |

|

| 967 |

Stock-based compensation |

| - |

|

| 6,691 |

Changes in current assets and liabilities: |

|

|

|

|

|

(Increase) in receivables |

| - |

|

| (25,000) |

Decrease in prepaid and other current assets |

| - |

|

| 47,722 |

(Decrease) increase in accounts payable |

| (44,066) |

|

| 17,829 |

(Decrease) in accrued liabilities |

| (8,188) |

|

| (2,840) |

Increase in interest payable |

| 30,467 |

|

| 89,889 |

Increase in interest payable, related party |

| 94,889 |

|

| 23,643 |

Net cash used in operating activities from continuing operations |

| (76,288) |

|

| (44,176) |

Net cash used in operating activities from discontinued operations |

| - |

|

| (8,766) |

|

|

|

|

|

|

CASH FLOWS FROM INVESTING ACTIVITIES: |

|

|

|

|

|

Proceeds from sale of assets held for sale |

| - |

|

| 42,000 |

Net cash provided by investing activities from continuing operations |

| - |

|

| 42,000 |

|

|

|

|

|

|

CASH FLOWS FROM FINANCING ACTIVITIES: |

|

|

|

|

|

Proceeds from issuance of senior secured notes payable |

| 75,000 |

|

| 15,000 |

Net cash provided by financing activities from continuing operations |

| 75,000 |

|

| 15,000 |

|

|

|

|

|

|

NET CHANGE IN CASH AND CASH EQUIVALENTS |

| (1,288) |

|

| 4,058 |

CASH AND CASH EQUIVALENTS, beginning of period, including discontinued operations |

| 3,237 |

|

| 14,440 |

CASH AND CASH EQUIVALENTS, Continuing Operations, end of period | $ | 1,949 |

| $ | 14,914 |

CASH AND CASH EQUIVALENTS, Discontinued Operations, end of period | $ | - |

| $ | 3,584 |

| Shares | Amount | Capital | Shares | Amount | Deficit | Total | ||||||||||||||||||||||

| Additional | ||||||||||||||||||||||||||||

| Common Stock | Paid-In | Treasury Stock | Accumulated | |||||||||||||||||||||||||

| Shares | Amount | Capital | Shares | Amount | Deficit | Total | ||||||||||||||||||||||

| Balance at January 1, 2023 | 806,774 | $ | 80 | $ | 72,018,222 | (5,000 | ) | $ | (300,000 | ) | $ | (64,247,561 | ) | $ | 7,470,741 | |||||||||||||

| Stock-based compensation | 3,195 | 1 | 341,503 | - | - | - | 341,504 | |||||||||||||||||||||

| Shares issued in connection with capital raises, net of transaction costs | 421,611 | 42 | 6,352,035 | - | - | - | 6,352,077 | |||||||||||||||||||||

| Net loss | - | - | - | - | - | (4,022,073 | ) | (4,022,073 | ) | |||||||||||||||||||

| Balance, March 31, 2023 | 1,231,580 | $ | 123 | $ | 78,711,760 | (5,000 | ) | $ | (300,000 | ) | $ | (68,269,634 | ) | $ | 10,142,249 | |||||||||||||

| Additional | ||||||||||||||||||||||||||||

| Common Stock | Paid-In | Treasury Stock | Accumulated | |||||||||||||||||||||||||

| Shares | Amount | Capital | Shares | Amount | Deficit | Total | ||||||||||||||||||||||

| Balance at January 1, 2024 | 1,291,000 | $ | 129 | $ | 80,658,111 | (5,000 | ) | $ | (300,000 | ) | $ | (75,369,081 | ) | $ | 4,989,159 | |||||||||||||

| Balance | 1,291,000 | $ | 129 | $ | 80,658,111 | (5,000 | ) | $ | (300,000 | ) | $ | (75,369,081 | ) | $ | 4,989,159 | |||||||||||||

| Stock-based compensation | 13,176 | 1 | 167,642 | - | - | - | 167,643 | |||||||||||||||||||||

| Shares issued in connection with capital raise, net of transaction costs | 1,555,555 | 156 | 6,282,274 | - | - | - | 6,282,430 | |||||||||||||||||||||

| Shares issued in connection with license agreement | 5,000 | 1 | 188,999 | - | - | - | 189,000 | |||||||||||||||||||||

| Settlement of stock award | - | - | (8,561 | ) | - | - | - | (8,561 | ) | |||||||||||||||||||

| Shares withheld to pay income taxes on stock-based compensation | (3,750 | ) | (1 | ) | (9,923 | ) | - | - | - | (9,924 | ) | |||||||||||||||||

| Net loss | - | - | - | - | - | (2,726,381 | ) | (2,726,381 | ) | |||||||||||||||||||

| Balance, March 31, 2024 | 2,860,981 | $ | 286 | $ | 87,278,542 | (5,000 | ) | $ | (300,000 | ) | $ | (78,095,462 | ) | $ | 8,883,366 | |||||||||||||

| Balance | 2,860,981 | $ | 286 | $ | 87,278,542 | (5,000 | ) | $ | (300,000 | ) | $ | (78,095,462 | ) | $ | 8,883,366 | |||||||||||||

The accompanying notes are an integral part of these unauditedcondensed consolidated financial statements.

| 5 |

HEATWURX, INC.Processa Pharmaceuticals, Inc.

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTSCondensed Consolidated Statements of Cash Flows

(Unaudited)

| 2024 | 2023 | |||||||

| Three Months Ended March 31, | ||||||||

| 2024 | 2023 | |||||||

| Cash Flows From Operating Activities | ||||||||

| Net loss | $ | (2,726,381 | ) | $ | (4,022,073 | ) | ||

| Adjustments to reconcile net loss to net cash used in operating activities: | ||||||||

| Depreciation | 139 | - | ||||||

| Non-cash lease expense for right-of-use assets | 21,372 | 19,800 | ||||||

| Stock-based compensation | 167,643 | 341,504 | ||||||

| Recording of warrant to be issued to purchase 158,007 shares of common stock in connection with a consulting agreement | - | 1,310,875 | ||||||

| Net changes in operating assets and liabilities: | ||||||||

| Prepaid expenses and other | 68,665 | 405,615 | ||||||

| Operating lease liability | (21,083 | ) | (18,926 | ) | ||||

| Accounts payable | 143,751 | (10,839 | ) | |||||

| Due (from) related parties | (22,334 | ) | (51 | ) | ||||

| Accrued expenses | 319,344 | (139,975 | ) | |||||

| Net cash used in operating activities | (2,048,884 | ) | (2,114,070 | ) | ||||

| Cash Flows From Financing Activities | ||||||||

| Net proceeds from issuance of stock | 6,282,430 | 6,352,077 | ||||||

| Shares withheld to pay taxes on stock-based compensation | (9,924 | ) | - | |||||

| Settlement of stock award | (8,561 | ) | - | |||||

| Payment of finance lease obligation | (895 | ) | - | |||||

| Net cash provided by financing activities | 6,263,050 | 6,352,077 | ||||||

| Net Increase in Cash | 4,214,166 | 4,238,007 | ||||||

| Cash and Cash Equivalents – Beginning of Period | 4,706,197 | 6,503,595 | ||||||

| Cash and Cash Equivalents – End of Period | $ | 8,920,363 | $ | 10,741,602 | ||||

| Non-Cash Financing Activities | ||||||||

| Issuance of shares of common stock in connection with a licensing agreement which had previously been recorded as a due to licensor | $ | 189,000 | $ | - | ||||

| Right-of-use asset | $ | 11,804 | $ | - | ||||

| Financing lease liability | (11,804 | ) | - | |||||

| Net | $ | - | $ | - | ||||

1.The accompanying notes are an integral part of these condensed consolidated financial statements.

PRINCIPAL BUSINESS ACTIVITIES:

| 6 |

Processa Pharmaceuticals, Inc.

Notes to Condensed Consolidated Financial Statements

(Unaudited)

Note 1 – Organization and BusinessSummary of Significant Accounting Policies

Organization - Heatwurx, Inc. (“Heatwurx,”

We are a clinical-stage biopharmaceutical company focused on incorporating our Regulatory Science Approach into the “Company”) isdevelopment of our Next Generation Chemotherapy (NGC) drugs to improve the safety and efficacy of cancer treatment. Our NGC drugs are modifications of existing FDA-approved oncology drugs resulting in an asphalt repair equipmentalteration of the metabolism and/or distribution while maintaining the well-known and technology company.established existing mechanisms of killing the cancer cells. By modifying the NGC drugs in this manner, we believe our three NGC treatments will provide improved safety-efficacy profiles when compared to their currently marketed counterparts.

2.

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES:

BasisOn January 22, 2024, we filed a Certificate of Presentation - These unaudited interimAmendment to our Certificate of Incorporation, as amended with the Secretary of State of Delaware that effected a 1-for-20 reverse stock split of our common stock, par value $ per share (the “Reverse Stock Split”). Pursuant to the Certificate of Amendment, our issued common stock decreased from shares to shares and our outstanding common stock decreased from to . The Reverse Stock Split did not affect our authorized common stock of shares or our common stock par value. All shares of common stock, including common stock underlying warrants, stock options, restricted stock awards and restricted stock units, as well as exercise prices and per share information in these condensed consolidated financial statements and related notes are presentedgive retroactive effect to the Reverse Stock Split.

Basis of Presentation

The accompanying unaudited condensed consolidated financial statements have been prepared in accordance with the accounting principles generally accepted in the United States of America (“U.S. GAAP”) for interim financial information and are expressed in U.S. dollars. with the instructions of the Securities and Exchange Commission (“SEC”) on Form 10-Q and Article 8 of Regulation S-X.

Accordingly, they do not include all the information and disclosures required in the annual financial statements by U.S. GAAP.GAAP for complete financial statements. All material intercompany accounts and transactions have been eliminated in consolidation. In the opinion of management, the accompanying unaudited interim financial statements contain all adjustments considered necessary to present fairly in all material respects the financial position as of June 30, 2017.

The Company’scondensed consolidated financial statements include Dr. Pave, LLCall adjustments necessary, which are of a normal and Dr. Pave Worldwide, LLC; both wholly-owned subsidiariesrecurring nature, for the fair presentation of our financial position and of the Company, which are represented inresults of operations and cash flows for the Company’s discontinued operations (Note 3). All intercompany balances and transactions have been eliminated in theperiods presented. These condensed consolidated financial statements.

Interim Financial Statements - These financial statements should be read in conjunction with the audited financial statements and accompanying notes for the year ended December 31, 2016, and have been prepared on a consistent basis with the accounting policies described in Note 2 - Summary of Significant Accounting Policies of the Notes to Financial Statementsthereto included in our Annual Report on Form 10-K for the year ended December 31, 2016. Our accounting policies did not change in2023, as filed with the first three or six monthsSEC. The results of 2017. Operating resultsoperations for the three and six months ended June 30, 2017interim periods shown in this report are not necessarily indicative of the results that may be expected for any other interim period or for the year ending December 31, 2017 or any future period.full year.

Use of estimatesLiquidity - The preparation of

Our condensed consolidated financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Accordingly, actual results could differ from those estimates. Such estimates include management’s assessments of the carrying value of certain assets.

Going Concern and Management’s Plan - The Company’s financial statements arehave been prepared using U.S. GAAP and are subject toon a going concern basis, which contemplates the continuity of operations, realization of assets and liquidationthe satisfaction of liabilities and commitments in the normalordinary course of business. The Company faces certain risksWe have incurred losses since inception, are currently devoting substantially all of our efforts toward research and uncertainties thatdevelopment of our NGC drug product candidates, including conducting clinical trials and providing general and administrative support for these operations, and have an accumulated deficit of $78.1million at March 31, 2024. During the three months ended March 31, 2024, we generated a net loss of $2.7 million and used $2.0 million in net cash for operating activities from continuing operations. To date, none of our drug candidates have been approved for sale, and therefore we have not generated any product revenue and do not expect positive cash flow from operations in the foreseeable future.

We have financed our operations primarily through public equity issuances, including an offering we closed on January 30, 2024 where we sold shares of our common stock, pre-funded warrants to purchase up to 1,079,555 shares of our common stock, and warrants for the purchase of up to 1,555,555 shares of our common stock for net proceeds of $6.3 million, after deducting placement agent fees and offering-related expenses. Simultaneously with the closing of the sale, the pre-funded warrants were exercised in exchange for shares of our common stock. We will continue to be dependent upon equity and/or debt financing until we are presentable to generate positive cash flows from its operations.

| 7 |

At March 31, 2024, we had cash and cash equivalents totaling $8.9 million which, based on our current business plans, we believe these funds will satisfy our capital needs into early 2025, including the beginning of our Phase 2 trial of NGC-Cap in many emerging companies regarding product development,breast cancer. Our ability to execute our longer-term operating plans, including future profitability,preclinical studies and clinical trials for our portfolio of drugs depend on our ability to obtain additional funding from the sale of equity and/or debt securities, a strategic transaction or other funding transactions.

We plan to raise additional funds in the future through a combination of public or private equity offerings, debt financings, collaborations, strategic alliances, licensing arrangements and other marketing and distribution arrangements, but will only do so if the terms are acceptable to us. If we are unable to obtain adequate financing when needed, we may have to delay, reduce the scope of, or suspend our current or planned future clinical trial plans, or research and development programs. This may also cause us to not meet obligations contained in certain of our license agreements and put these assets at risk. To the extent that we raise additional capital protectionthrough marketing and distribution arrangements or other collaborations, strategic alliances or licensing arrangements with third parties, we may have to relinquish valuable rights to our product candidates, future revenue streams, research programs or product candidates or to grant licenses on terms that may not be favorable to us. If we raise additional capital through public or private equity offerings, the ownership interest of patentsour existing stockholders will be diluted, and property rights, competition, rapid technological change, government regulations, recruitingthe terms of these securities may include liquidation or other preferences that adversely affect our stockholders’ rights. If we raise additional capital through debt financing, we may be subject to covenants limiting or restricting our ability to take specific actions, such as incurring additional debt or making capital expenditures. There can be no assurance that future funding will be available when needed.

Absent additional funding, we believe that our cash and retaining key personnel,cash equivalents will not be sufficient to fund our operations for a period of one year or more after the date that these condensed consolidated financial statements are available to be issued based on the timing and third party manufacturing organizations.

The Company has previously relied exclusively on private placements with a small groupamount of investors to finance its business and operations. The Company has had little revenue since inception. For the six months ended June 30, 2017, the Company incurred aour projected net loss from continuing operations of approximately $118,478 and cash to be used approximately $76,288 in net cash from operating activities from continuing. The Company had total cash on handduring that period of approximately $1,949 as of June 30, 2017. The Company is not able to obtain additional financing adequate to fulfill its commercialization activities, nor achievetime. As a level of revenues adequate to support the Company’s cost structure. The Company does not currently have any revenue under contract nor does it have any immediate sales prospects. The Company has significantly reduced employees and overhead. The decision to cease operations of Dr. Pave, LLC and Dr. Pave Worldwide, LLC was made on December 31, 2015. These business components are captured within discontinued operations as of June 30, 2017 (Note 3). The Company has significantly scaled back operations to maintain only a minimal level of operations necessary to support our licensee and look for potential merger candidates. It is the Company’s intention to move forward as a public entity and to seek potential merger candidates. If the Company fails to merge or be acquired by another company, we will be required to terminate all operations.

During the six months ended June 30, 2017, the Company received cash of $75,000 as part of the $2,000,000 senior secured debt offering commenced in February 2015. Based upon the Company’s current financial, the Company was not able to satisfy the mandatory principal payments in 2017 under the $2,000,000 senior secured debt. The Company will continue to work with the lenders to explore extension or conversion options, but there is no guarantee the lenders will agree to modify the repayment terms of the notes under conditions that will allow the Company to continue to repay the notes, if at all. As these notes are secured by all the assets of the Company, including intellectual property rights, the Company is in default in regard to interest payments on the notes, and the lenders may call the notes and foreclose on the Company’s assets.

The issues described above raiseresult, substantial doubt exists about the Company’sour ability to continue as a going concern.concern within one year after the date that these condensed consolidated financial statements are available to be issued. The Company has been solely reliant on raising debt and capital to maintain its operations. Previously the Company was able to raise debt and equity financing through the assistance of a small number of investors who have been substantial participants in its debt and equity offerings since the Company’s formation. These investors have chosen not to further assist the Company with its capital raising initiatives and, at this time, the Company is not able to obtain any alternative forms of financing and the Company will not be able to continue to satisfy its current or long term obligations. The Company needs to merge with or be acquired by another company. If a candidate is not identified, the Company will be forced to cease operations all together.

The accompanyingcondensed consolidated financial statements do not include any adjustments to reflect the possible future effects on the recoverability and classification of recorded assets, or the amounts and classification of liabilities that might be different should the Companywe be unable to continue as a going concern.concern based on the outcome of these uncertainties described above.

CashUse of Estimates

In preparing our condensed consolidated financial statements and related disclosures in conformity with U.S. GAAP and pursuant to the rules and regulations of the SEC, we make estimates and judgments that affect the amounts reported in the condensed consolidated financial statements and accompanying notes. Estimates are used for, but not limited to preclinical and clinical trial expenses, stock-based compensation, intangible assets, future milestone payments and income taxes. These estimates and assumptions are continuously evaluated and are based on management’s experience and knowledge of the relevant facts and circumstances. While we believe the estimates to be reasonable, actual results could differ materially from those estimates and could impact future results of operations and cash equivalentsflows.

Income Taxes

We account for income taxes in accordance with ASC Topic 740, Income Taxes. -Deferred income taxes are recorded for the expected tax consequences of temporary differences between the basis of assets and liabilities for financial reporting purposes and amounts recognized for income tax purposes. At March 31, 2024 and December 31, 2023, we recorded a valuation allowance equal to the full recorded amount of our net deferred tax assets since it is more-likely-than-not that such benefits will not be realized. The Company considers all highly liquid investments with an original maturityvaluation allowance is reviewed quarterly and is maintained until sufficient positive evidence exists to support its reversal.

Under ACS 740-270 Income Taxes – Interim Reporting, we are required to project our annual federal and state effective income tax rate and apply it to the year-to-date ordinary operating tax basis loss before income taxes. Based on the projection, no current income tax benefit or expense is expected for 2024 and the foreseeable future since we expect to generate taxable net operating losses.

| 8 |

Concentration of three months or less when purchasedCredit Risk

Financial instruments that potentially subject us to besignificant concentration of credit risk consist primarily of our cash and cash equivalents.

Net income (loss) per share - The Company computes basic We utilize only well-established banks and diluted earnings per share amounts pursuant to ASC 260-10-45. Basic earnings per share is computed by dividing net income (loss) available to common shareholders,financial institutions with high credit ratings. Balances on deposit are insured by the weighted average number of shares of common stock outstanding during the period, excluding the effects of any potentially dilutive securities. Diluted earnings per share is computedFederal Deposit Insurance Corporation (FDIC) up to specified limits. Total cash held by dividing net income (loss) available to common shareholders by the diluted weighted average number of shares of common stock during the period. The diluted weighted average number of common shares outstanding is the basic weighted number of shares adjusted as of the first day of the year for any potentially diluted debt or equity. The computation does not assume conversion, exercise or contingent exercise of securities since that would have an anti-dilutive effect on earnings during the three and six months ended June 30, 2017 and 2016, respectively.our banks at March 31, 2024, exceeded FDIC limits.

Subsequent events - The Company follows the guidance in ASC 855-10-50 for the disclosure of subsequent events. The Company will evaluate subsequent events through the date when the financial statements were issued.

Reclassification - Prior year amounts have been reclassified to conform to the current year presentation. There was no change to the total amounts for the Company’s balance sheets, income statements or statements of cash flows.

Recently IssuedRecent Accounting Pronouncements -

From time to time, the Financial Accounting Standards Board (“FASB”) or other standard setting bodies issue new accounting pronouncements. Updates to the FASB Accounting Standards Codification are communicated through issuance of an Accounting Standards Update (“ASU”). The Company hasWe have implemented all new accounting pronouncements that are in effect and that may impact itsour condensed consolidated financial statements. It hasWe have evaluated any newrecently issued accounting pronouncements that have been issued, and determined that there wasis no material impact on itsour condensed consolidated financial position or results of operations.

3.Note 2 – Stockholders’ Equity

DISCONTINUED OPERATIONS:

Preferred Stock

In

There were issued or outstanding shares of preferred stock at either March 31, 2024 or December 31, 2023.

Common Stock

During the three months ended March 31, 2024, we issued the following shares of common stock.

| ● | On January 22, 2024, we issued shares of common stock to five of our executive officers and one employee, net of shares of common stock withheld for income taxes owed upon the distribution of the shares. | |

| ● | On January 25, 2024, we issued shares of common stock to Elion Oncology, Inc. (“Elion”) in satisfaction of the third milestone event under a license agreement. | |

| ● | On January 30, 2024, we sold, pursuant to securities purchase agreements (the “Purchase Agreement”), shares of common stock, pre-funded warrants to purchase up to 1,079,555 shares of common stock in lieu of shares of common stock (the “Pre-Funded Warrants”), and warrants to purchase up to 1,555,555 shares of our common stock (the “Common Warrants’) pursuant to a public offering (the “Offering”). The Common Warrants have an exercise price of $4.50, are immediately exercisable and will remain exercisable until the date that is five yearsafter their original issuance. The Shares were offered at a combined public offering price of $4.50 per share and accompanying Common Warrant and $per Pre-Funded Warrant and accompanying Common Warrant. The Pre-Funded Warrants had an exercise price of $0.0001 and were exercised in full simultaneously with the closing of the Offering in exchange for shares of our common stock. Gross proceeds in connection with the Offering were $7.0 million. We received $6.3 millionin net proceeds from the Offering, after deducting the fees of the placement agent and other offering-related expenses. We also issued to the placement agent warrants to purchase 62,222 shares of common stock, exercisable at $5.625 per share that expire on February 1, 2027. | |

| ● | On February 5, 2024, we issued shares of common stock to a consultant in accordance with their consulting agreement. | |

| ● | On March 5, 2024, we issued shares of common stock to a former employee, net of shares of common stock withheld for income and FICA taxes owed upon the distribution of the shares. |

| 9 |

During the three months ended March 31, 2023, we issued shares of our common stock through several fundraising efforts described below:

| ● | ATM Offering – On February 5, 2023, in connection with our Registered Direct Offering discussed below, we terminated our ATM and suspended the Sales Agreement with Oppenheimer & Co. Inc., but we may reinstate it in the future. During the three months ended March 31, 2023, we sold shares at an average price of $ per share for aggregate gross proceeds of $693,000 (net proceeds of $672,000) prior to deducting sales commissions. | |

| ● | Lincoln Park Capital Fund, LLC Purchase Agreement– During the three months ended March 31, 2023, we sold shares at an average price of $ per share for aggregate gross proceeds of $54,000 under the purchase agreement with Lincoln Park. | |

| ● | Registered Direct Offering – On February 14, 2023, we closed a registered direct offering (the “Registered Direct Offering”) for the sale of shares of common stock at a purchase price of $ per share for gross proceeds of $6.3 million (net proceeds of $5.6 million). | |

| We paid the placement agent, Spartan Capital Securities, LLC, (“Spartan”) a cash fee of 8.0% of the gross proceeds from the Registered Direct Offering, excluding proceeds received from our insiders, and reimbursed Spartan for legal fees of $60,000. The engagement agreement with Spartan required us to indemnify Spartan and certain of its affiliates against certain customary liabilities. On February 14, 2023, we amended the consulting agreement with Spartan originally entered into on August 24, 2022, extending the term of the consulting agreement until February 10, 2024. As compensation for services under the agreement, on April 17, 2023, we granted Spartan warrants to purchase 158,007 shares of our common stock with an exercise price of $20.40. The warrants expire on April 17, 2026 and contain both call and cashless exercise provisions. |

On June 19, 2019, our stockholders approved, and we adopted, the Processa Pharmaceuticals Inc. 2019 Omnibus Equity Incentive Plan (the “2019 Plan”). The 2019 Plan allows us, under the direction of our Board of Directors or a committee thereof, to streamline operationsmake grants of stock options, restricted and expensesunrestricted stock and other stock-based awards to employees, including our executive officers, consultants and directors. The 2019 Plan provides for the Company elected to discontinue the Dr. Pave and Dr. Pave Worldwide entities during 2015. The financial resultsaggregate issuance of these events are represented in the discontinued operations included in the June 30, 2017 and 2016 financial statements. shares of our common stock. At March 31, 2024, we have shares available for future grants.

Stock Compensation Expense

Schedule of Stock-based Compensation Expense

| Three months ended June 30, |

| Six months ended June 30, | ||||||

| 2017 | 2016 |

| 2017 | 2016 | ||||

Revenue | $ | -- | $ | -- |

| $ | -- | $ | -- |

Expense |

| -- |

| 48 |

|

| -- |

| (1,792) |

Net Loss, before Other income and expense and taxes |

| -- |

| (48) |

|

| -- |

| (1,792) |

Other income (expense) |

| -- |

| 3,308 |

|

| -- |

| (536) |

Income tax benefit |

| -- |

| -- |

|

| -- |

| -- |

Net Income (Loss), net of tax | $ | -- | $ | 3,260 |

| $ | -- | $ | 1,256 |

| 2024 | 2023 | |||||||

| Research and development | $ | 31,121 | $ | 99,621 | ||||

| General and administrative | 136,522 | 241,883 | ||||||

| Total | $ | 167,643 | $ | 341,504 | ||||

| 10 |

The were no assets or liabilities from discontinued operations as of June 30, 2017 and December 31, 2016.

4.

NOTES PAYABLE:

Notes consisted of the following as of June 30, 2017

| Principal Balance | Interest Rate | Accrued Interest | Warrants issued | Warrant Fair Value - Discount | Unamortized Discount | ||||

Unsecured notes payable | $ | 420,000 | 12% | $ | 113,280 | 139,997 | $ | 115,159 | $ | -- |

Secured notes payable | $ | 1,037,361 | 12% - 18% | $ | 379,381 | -- | $ | -- | $ | -- |

Revolving line of credit | $ | 229,980 | 12% - 18% | $ | 73,869 | -- | $ | -- | $ | -- |

| $ | 1,687,341 |

| $ | 566,530 | 139,997 | $ | 115,159 | $ | -- |

Based upon the Company’s financial position, the Company does not believe it will be able to satisfy the mandatory principal payments in 2017. The Company will work with the lenders to explore extension or conversion options. There is no guarantee the lenders will accommodate our requests. The Company is in default in regard to interest payments on the notes, the Company’s assets may be foreclosed upon.

5.

STOCKHOLDERS’ EQUITY:

Stock Options

| Number of Options | Weighted Average Exercise Price | Weighted Average Remaining Life (Years) |

Balance, December 31, 2016 | 269,500 | $ 1.88 | 2.04 |

Granted | -- | $ -- | -- |

Exercised | -- | $ -- | -- |

Cancelled | (32,000) | $ 1.75 | -- |

Balance, June 30, 2017 | 237,500 | $ 1.89 | 1.78 |

Exercisable, June 30, 2017 | 237,500 | $ 1.89 | 1.78 |

The Company recognized no stock-based compensation expense stock options to purchase shares of common stock were forfeited or expired during the three and six months ended June 30, 2017March 31, 2024. At March 31, 2024, we had outstanding and $1,629exercisable options for the purchase of shares with a weighted average exercise price of $ and $6,691 during the three and six months ended June 30, 2016, respectively.

Asa weighted average remaining contractual life of June 30, 2017, there is no years. At March 31, 2024, we did not have any unrecognized stock-based compensation expense related to the issuance of theour granted stock options.

Restricted Stock Awards

During the three months ended March 31, 2024, we vested Restricted Stock Awards (“RSAs”) with a weighted average grant-date fair value of $ per share. We had RSAs outstanding at March 31, 2024.

8

PerformanceRestricted Stock OptionsUnits

Schedule of Restricted Stock Units (“RSUs”) Activity

| Number of shares | Weighted- average grant-date fair value per share | |||||||

| Outstanding at January 1, 2024 | 222,722 | $ | 45.82 | |||||

| Granted | - | - | ||||||

| Forfeited | (7,290 | ) | 63.91 | |||||

| Issued | (9,426 | ) | 102.68 | |||||

| Outstanding at March 31, 2024 | 206,006 | 42.58 | ||||||

| Vested and unissued | 124,529 | 59.75 | ||||||

| Unvested at March 31, 2024 | 81,477 | $ | 16.33 | |||||

On January 1, 2024, we granted RSUs for the future issuance of no more than shares of our common stock, contingent upon receiving shareholder approval to increase the number of shares available under our 2019 Omnibus Incentive Plan (“Incentive Plan”) at our annual shareholder meeting in June 30, 2017 and 2016.2024. The number of shares to be issued under the RSUs will be based on the greater of: (i) $per share or (ii) the closing price per share on the day we receive shareholder approval to increase the number of shares available under the Incentive Plan.

| Number of Options |

| Weighted Average Exercise Price |

Balance, December 31, 2016 | 40,000 |

| $ 2.00 |

Granted | -- |

| -- |

Exercised | -- |

| -- |

Cancelled | -- |

| -- |

Balance, June 30, 2017 | 40,000 |

| $ 2.00 |

Exercisable, June 30, 2017 | 40,000 |

| $ 2.00 |

WarrantsAt March 31, 2024, unrecognized stock-based compensation expense of $ for RSUs (which excludes the above grant on January 1, 2024) is expected to be fully recognized over a weighted average period of years. The unrecognized expense excludes $ of expense related to certain grants of RSUs with performance milestones that are not probable of occurring at this time.

There were no warrantsHolders of our vested RSUs will be issued during shares of our common stock upon meeting the distribution restrictions contained in their Restricted Stock Unit Award Agreement. The distribution restrictions are different (longer) than the vesting schedule, imposing an additional restriction on the holder. Unlike RSAs, while certain employees may hold fully vested RSUs, the individual does not hold any shares or have any rights of a shareholder until the distribution restrictions are met. Upon distribution to the employee, each RSU converts into one share of our common stock. The RSUs contain dividend equivalent rights.

| 11 |

Warrants

During the three and six months ended June 30, 2017.March 31, 2024, other than warrants to purchase 1,617,777 shares of common stock as part of our public offering (see Note 2), we did not grant any warrants to purchase shares of our common stock and warrants to purchase shares of common stock expired. We also repurchased a warrant issued to a consultant in 2023 for the purchase of shares of our common stock in exchange for a payment of $10,000.

| Number of Warrants | Weighted Average Exercise Price | Weighted Average Remaining Life (Years) |

Balance, December 31, 2016 | 2,000,304 | $ 2.36 | 0.63 |

Granted | -- | -- | -- |

Exercised | -- | -- | -- |

Cancelled | (523,326) | $ 3.00 | -- |

Balance, June 30, 2017 | 1,476,978 | $ 2.13 | 0.30 |

6.At March 31, 2024, we had outstanding stock purchase warrants for the purchase of 1,778,284shares with a weighted average exercise price of $6.17and a weighted average remaining contractual life of years. All the outstanding stock purchase warrants are exercisable at March 31, 2024. We did not have any unrecognized stock-based compensation expense related to our granted stock purchase warrants at March 31, 2024.

NET LOSS PER COMMON SHARE:

The Company computes

Net Loss Per Share

Basic net loss per share of common stock using the two-class method required for participating securities. The Company’s participating securities include all series of its convertible preferred stock. Undistributed earnings allocated to these participating securities are added to net loss in determining net loss applicable to common stockholders. Basic and Diluted loss per share areis computed by dividing our net loss applicableavailable to common stockholdershareholders by the weighted-averageweighted average number of shares of common stock outstanding.

Outstanding optionsoutstanding (which excludes unvested RSAs and warrants underlying 1,754,478 shares do not assume conversion, exercise or contingent exercise inincludes vested RSUs) during the computation of dilutedperiod. Diluted loss per share becauseis computed by dividing our net loss available to common shareholders by the diluted weighted average number of shares of common stock (which includes the potentially dilutive effect would be anti-dilutive.

The calculation of stock options, unvested RSAs, unvested RSUs and warrants) during the numerator and denominatorperiod. Since we experienced a net loss for both periods presented, basic and diluted net loss per common share is as follows:

| Three months ended June 30, | Six months ended June 30, | ||||||

| 2017 | 2016 | 2017 | 2016 | ||||

Net loss from continuing operations | $ | (42,851) | $ | (46,460) | $ | (118,478) | $ | (178,081) |

Net loss from discontinued operations |

| -- |

| 3,260 |

| -- |

| 1,256 |

Net Loss |

| (42,851) |

| (43,200) |

| (118,478) |

| (176,825) |

|

|

|

|

|

|

|

|

|

Basic and diluted: |

|

|

|

|

|

|

|

|

Preferred stock cumulative dividend - Series D |

| (10,706) |

| (10,706) |

| (21,294) |

| (21,411) |

Income applicable to preferred stockholders |

| (10,706) |

| (10,706) |

| (21,294) |

| (21,411) |

Net loss applicable to common stockholders | $ | (53,557) | $ | (53,906) | $ | (139,772) | $ | (198,236) |

Weighted average shares outstanding used in calculating net loss per common share |

| 11,017,388 |

| 11,017,388 |

| 11,017,388 |

| 11,017,388 |

7.

COMMITMENTS AND CONTINGENCIES:

Vendors and Debt - The Company has significant liabilities as of June 30, 2017 with limited cash flow generated byare the sale of Company assets and revenue. The Company has $238,806 in accounts payable and accrued expenses from continuing operations. In addition, the Company has $2,253,871 in debt and accrued interest from continuing operations. The Company will work with their vendors and lenders to establish payment plans, explore extensions and conversion of debt.

8.

RELATED PARTY TRANSACTIONS:

Dividend and Interest activity

Justin Yorke is the manager of the JMW Fund, LLC, the San Gabriel Fund, LLC, and the Richland Fund, LLC; and is a director of the Company. Mr. McGrain, our Interim Chief executive officer and Interim Chief financial officer is also a member of the JMW Fund, LLC, the San Gabriel Fund, LLC, and the Richland Fund, LLC. These funds own 4,725,721 shares of common stock and holds warrants to purchase 1,278,186 common shares in the aggregate.

The Company had secured notes payable with the JMW Fund, LLC, the San Gabriel Fund, LLC and the Richland Fund, LLC in the aggregate amount of $1,037,361 as of June 30, 2017 and $962,361 as of December 31, 2016. The funds had an aggregate outstanding balance of $138,000 on the revolving line of credit as of June 30, 2017 and December 31, 2016. Mr. Yorke, as the manager of these funds, earned interest from loans payablesame. As such, diluted loss per share for the three and six months ended June 30, 2017March 31, 2024 and 2023 excludes the impact of $48,093 and $94,889, respectively; andpotentially dilutive common shares since those shares would have an anti-dilutive effect on net loss per share.

Schedule of $47,316Net Loss Per Share Basic and $97,055,Diluted

| 2024 | 2023 | |||||||

Three months ended March 31, | ||||||||

| 2024 | 2023 | |||||||

| Basic and diluted net loss per share: | ||||||||

| Net loss available to common stockholders | $ | (2,726,381 | ) | $ | (4,022,073 | ) | ||

| Weighted average number of common shares-basic and diluted | ||||||||

| Basic and diluted net loss per share | $ | ) | $ | ) | ||||

| 2024 | 2023 | |||||||

| Weighted-average number of common shares outstanding – basic and diluted | ||||||||

| Weighted-average number of vested RSUs– basic and diluted | ||||||||

| Weighted-average number of common shares-basic and diluted | ||||||||

Our diluted net loss per share for the three months ended March 31, 2024 and 2023 excluded and of potentially dilutive common shares, respectively, related to outstanding stock options, warrants and unvested restricted stock since those shares would have had an anti-dilutive effect on net loss per share during the periods then ended.

| 12 |

Note 5 – Leases

We lease our office space under an operating lease agreement. This lease does not have significant rent escalation, concessions, leasehold improvement incentives, or other build-out clauses. Further, the lease does not contain contingent rent provisions. Our office space lease includes both lease (e.g., fixed payments including rent, taxes, and insurance costs) and non-lease components (e.g., common-area or other maintenance costs), which are accounted for as a single lease component as we have elected the practical expedient to group lease and non-lease components for all leases. We also lease office equipment under a financing lease. Our leases do not provide an implicit rate and, as such, we have used our incremental borrowing rate of 8% in determining the present value of the lease payments based on the information available at the lease commencement date.

Lease costs included in our condensed consolidated statements of operations totaled $22,461 for each of the three month periods ending March 31, 2024 and 2023. The weighted average remaining lease terms and discount rate for our operating leases were as follows at March 31, 2024:

Schedule of Weighted Average Remaining Lease Terms and Discount Rate for Operating and Financing Leases

| Remaining lease term (years) for our facility lease | 1.5 | |||

| Remaining lease term (years) for our equipment lease | 1.8 | |||

| Weighted average discount rate for our facility and equipment leases | 8.0 | % |

Annual lease liabilities for the operating lease were as follows at March 31, 2024:

Schedule of Annual Lease Liabilities for all Operating Leases

| 2024 | $ | 68,247 | ||

| 2025 | 70,040 | |||

| Total lease payments | 138,287 | |||

| Less: Interest | (8,816 | ) | ||

| Present value of lease liabilities | 129,471 | |||

| Less: current maturities | (84,878 | ) | ||

| Non-current lease liability | $ | 44,593 |

Annual lease liabilities for the financing lease were as follows at March 31, 2024:

Schedule of Annual Lease Liabilities for all Financing Leases

| 2024 | $ | 4,849 | ||

| 2025 | 6,820 | |||

| 2026 | 488 | |||

| Total lease payments | 12,157 | |||

| Less: Interest | (1,248 | ) | ||

| Present value of lease liabilities | 10,909 | |||

| Less: current maturities | (4,802 | ) | ||

| Non-current lease liability | $ | 6,107 |

Note 6 – Related Party Transactions

CorLyst, LLC (“CorLyst”) reimburses us for shared costs related to payroll, health insurance and rent based on actual costs incurred, which are recognized as a reduction of our general and administrative operating expenses being reimbursed in our condensed consolidated statement of operations. We recorded $23,000 and $30,000 of reimbursements during the three months ended March 31, 2024 and March 31, 2023, respectively. Total accrued interest asAt March 31, 2024, $22,295 were due from CorLyst and no amounts were due at March 31, 2023. Our President, Research and Development is the CEO of June 30, 2017CorLyst, and 2016 was $427,455CorLyst is a shareholder.

Note 7 – Commitments and $332,566, respectively.Contingencies

9.Purchase Obligations

SUPPLEMENTAL CASH FLOW INFORMATION:

| Six Months ended June 30, | ||||

| 2017 |

| 2016 | ||

Cash paid for interest | $ | -- |

| $ | 6,723 |

Cash paid for income taxes | $ | -- |

| $ | -- |

|

|

|

|

|

|

Non-cash investing and financing transactions |

|

|

|

|

|

Series D Dividend payable in accrued expenses | $ | 21,294 |

| $ | 21,411 |

10.

SUBSEQUENT EVENTS:

We have evaluated all eventsenter into contracts in the normal course of business with contract research organizations (CROs) and subcontractors to further develop our products. The contracts are cancelable, with varying provisions regarding termination. If we terminated a cancelable contract with a specific vendor, we would only be obligated for products or services that occurred afterwe received at the balance sheeteffective date throughof the date when our financial statements were issuedtermination and any applicable cancellation fees. At March 31, 2024, we are contractually obligated to determine if they must be reported. Management has determined that other than as disclosed below, there were no additional reportable subsequent eventspay up to be disclosed.

Debt offerings

The Company entered into Secured notes$984,000 of future services under the senior secured loan agreement inagreements with the aggregate amount of $15,000CROs. Our actual contractual obligations will also vary depending on July 26, 2017; $105,000 on August 7, 2017the progress and $132,000 on September 21, 2017.

Other

On July 17, 2017, the Company issued a press release entitled “Heatwurx Announces Letter of Intent with Promet Therapeutics, LLC Relating to a Reverse Merger” in which the Company disclosed that it has entered into a non-binding letter of intent to engage in a reverse merger with Promet Therapeutics, LLC.

Board of Directors

On August 24, 2017, Mr. Justin Yorke and Mr. Christopher Bragg were appointed to the Board of Directorsresults of the Company.remaining clinical trials.

| 13 |

ITEM

Item 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONSManagement’s Discussion and Analysis of Financial Condition and Results of Operation

Forward Looking Statements

This Quarterly Report on Form 10-Q contains “forward-looking statements” that reflect, when made, the Company’s expectations or beliefs concerning future events that involve risks and uncertainties. Forward-looking statements frequently are identified by the words “believe,” “anticipate,” “expect,” “estimate,” “intend,” “project,” “will be,” “will continue,” “will likely result,” or other similar words and phrases. Similarly, statements herein that describe the Company’s objectives, plans or goals also are forward-looking statements. Actual results could differ materially from those projected, implied or anticipated by the Company’s forward-looking statements. Some of the factors that could cause actual results to differ include: our limited operating history, limited cash and history of losses; our ability to achieve profitability; our ability to obtain adequate financing to fund our business operations in the future; our ability to secure required FDA or other governmental approvals for our product candidates and the breadth of the indication sought; the impact of competitive or alternative products, technologies and pricing; whether we are successful in developing and commercializing our technology, including through licensing; the adequacy of protections afforded to us and/or our licensors by the anticipated patents that we own or license and the cost to us of maintaining, enforcing and defending those patents; our and our licensors’ ability to protect non-patented intellectual property rights; our exposure to and ability to defend third-party claims and challenges to our and our licensors’ anticipated patents and other intellectual property rights; and our ability to continue as a going concern. For a discussion of these and all other known risks and uncertainties that could cause actual results to differ from those contained in the forward-looking statements, see “Risk Factors” in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023, which is available on the SEC’s website at www.sec.gov. All forward-looking statements are qualified in their entirety by this cautionary statement, and the Company undertakes no obligation to revise or update this Quarterly Report on Form 10-Q to reflect events or circumstances after the date hereof.

For purposes of this Management’s Discussion and Analysis of Financial Condition and Results of Operations, references to the “Company,” “we,” “us” or “our” refer to the operations of Processa Pharmaceuticals, Inc. and its direct and indirect subsidiaries for the periods described herein.

Overview

We are a clinical-stage biopharmaceutical company focused on utilizing our “regulatory science” approach, including the principles associated with FDA’s Project Optimus Oncology initiative and the related FDA Draft Guidance, in the development of Next Generation Chemotherapy (“NGC”) oncology drug products. Our mission is to provide better treatment options than those that presently exist by extending a patient’s survival and/or improving a patient’s quality of life. This is achieved by improving upon FDA-approved, widely used oncology drugs or the cancer-killing metabolites of these drugs by altering how they are metabolized and/or distributed in the body, including how they are distributed to the actual cancer cells.

Our regulatory science approach was conceived in the early 1990s when the founders of Processa and other faculty at the University of Maryland worked with the FDA to develop multiple FDA Guidances. Regulatory science is the science of developing new tools, standards, and approaches to assess the safety, efficacy, quality, and performance of all FDA-regulated products. Over the last 30 years, two of our founders, Dr. David Young and Dr. Sian Bigora, have expanded the original regulatory science concept by including the pre-clinical and clinical studies to justify the benefit-risk assessment required for FDA approval when designing the development programs of new drug products.

Our regulatory science approach defines the scientific information that the FDA requires to determine if the benefit outweighs the risk of a drug in a specific population of patients and at a specific dosage regimen for a specific drug product. The studies are designed to obtain the necessary scientific information to support the regulatory decision.

| 14 |

Recently, the FDA has taken steps to define some of the regulatory science required for the FDA approval of oncology products. Through the FDA’s Project Optimus Oncology Initiative and the related Draft Guidance on determining the “optimal” dosage regimen for an oncology drug, the FDA has chosen to make the development of oncology drugs more science-based than in the past. Since the principles of the FDA’s Project Optimus and the related Draft Guidance have been used by our regulatory science approach in a number of non-oncology drugs in the past, our experience with the principles of Project Optimus differentiates us from other biotechnology companies by focusing us not only on the clinical science, but also on the equally important regulatory process. We believe utilizing our regulatory science approach provides us with three distinct advantages:

| ● | greater efficiencies (e.g., the right trial design and trial readouts); | |

| ● | greater possibility of drug approval by the FDA or other regulatory authorities; and | |

| ● | greater ability to evaluate the benefit-risk of a drug compared to existing therapy, which allows prescribers to provide better treatment options for each patient. |

Our strategic prioritization is to advance our pipeline of NGC proprietary small molecule oncology drugs. The NGC products are new chemical entities, but they work by changing the metabolism, distribution and/or elimination of already FDA-approved cancer drugs or their active metabolites while maintaining the mechanism of how the drug kills cancer cells. We believe our NGC treatments will provide improved safety-efficacy profiles when compared to their currently marketed counterparts – capecitabine, gemcitabine, and irinotecan. All future studies of these drugs are subject to availability of capital to conduct the trials.

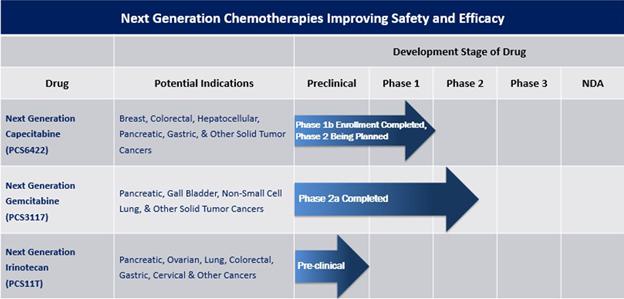

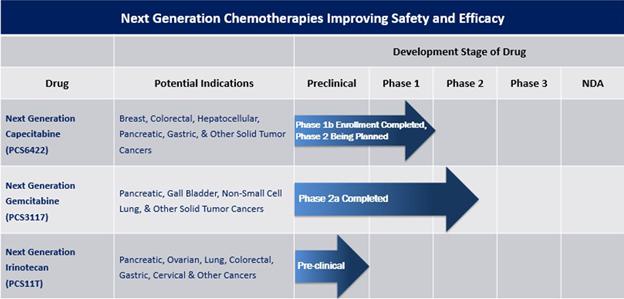

Our Drug Pipeline

Our pipeline currently consists of NGC-Cap, NGC-Gem and NGC-Iri (also identified as PCS6422, PCS3117 and PCS11T, respectively) and two non-oncology drugs (PCS12852 and PCS499). The non-oncology drugs are not included in the pipeline chart above, as we are exploring our options for those drugs, which may include out-licensing or partnership opportunities. A summary of each drug is provided below.

| 15 |

Next Generation Chemotherapy Pipeline

| ● | Next Generation Capecitabine (NGC-Cap) is a combination of PCS6422 and a lower dose of the FDA-approved cancer drug capecitabine. PCS6422 is an orally administered irreversible inhibitor of the enzyme dihydropyrimidine dehydrogenase (DPD). DPD metabolizes 5-Fluorouracil (5-FU), the major metabolite of capecitabine and widely used itself as an intravenous chemotherapeutic agent in many types of cancer, to multiple metabolites classified as catabolites. These catabolites do not have any cancer-killing properties but frequently cause dose-limiting side effects that may require dose adjustments or discontinuation of therapy. | |

| Capecitabine, as presently prescribed and FDA-approved, forms the cancer drug 5-FU which is then further metabolized to anabolites (which kill both cancer cells and normal duplicating cells) and catabolites (which cause side effects and have no cancer killing properties). When capecitabine is given in combination with PCS6422 in NGC-Cap, PCS6422 significantly changes the metabolism of 5-FU, which results in a change in the distribution of 5-FU within the body. Due to this change in metabolism and the overall metabolite profile of anabolites and catabolites, the side effect and efficacy profile of NGC-Cap has been found to be different from capecitabine given without PCS6422. Since the potency of NGC-Cap is also greater than FDA-approved capecitabine based on the 5-FU systemic exposure per mg of capecitabine administered, the amount of capecitabine anabolites formed from 1 mg of capecitabine administered in NGC-Cap will, therefore, be much greater than formed from the administration of 1 mg of existing capecitabine. | ||

| On August 2, 2021, we enrolled the first patient in our Phase 1B dose-escalation maximum tolerated dose trial in patients with advanced refractory gastrointestinal (GI) tract tumors. In this Phase 1B trial, it was demonstrated that the irreversible inhibition of DPD by PCS6422 could alter the metabolism, distribution and elimination of 5-FU, making NGC-Cap significantly (up to 50 times) more potent than capecitabine alone and potentially leading to higher levels of anabolites which can kill replicating cancer and normal cells. By administering NGC-Cap to cancer patients, the balance between anabolites and catabolites changes depending on the dosage regimens of PCS6422 and capecitabine used, making the efficacy-safety profile of NGC-Cap different than that of FDA-approved capecitabine and requiring further evaluation of the PCS6422 and capecitabine regimens to determine the optimal NGC-Cap regimens for patients. | ||

| In order for NGC-Cap to provide a safer and more efficacious profile for cancer patients compared to existing chemotherapy, understanding how the different regimens of PCS6422 and capecitabine may affect the systemic and tumor exposure to the anabolites, as well as the systemic exposure to the catabolites, is required. This can be achieved by following the timeline of DPD irreversible inhibition and the formation of new DPD using the plasma concentrations of 5-FU and its catabolites. | ||

| In an effort to better estimate the timeline of DPD inhibition and formation of new DPD, we modified the protocol for the Phase 1B trial and began enrolling patients in the amended Phase 1B trial in April 2022. On November 1, 2022, we announced that data from the Phase 1B trial identified multiple dosage regimens with potentially better safety and efficacy profiles than currently existing chemotherapy regimens. Since 5-FU exposure is dependent on both the PCS6422 regimen and the capecitabine regimen, safe regimens were identified as well as regimens that cause dose-limiting toxicities (“DLTs”). One of the early regimens in the Phase 1B trial did cause DLTs in two patients, one of whom died. No other DLTs were noted in the study. The Phase 1B trial has completed enrollment, the recommended Phase 2 dosage regimens have been determined and the Phase 2 study is being initiated. The Phase 2 trial will determine which regimens may provide an improved efficacy-safety profile over present therapy using the principles of the FDA’s Project Optimus initiative to help guide the design of the trial. This FDA initiative requires us to consider NGC regimens that are not at the maximum tolerated dose or exposure level. | ||

Discussions with the FDA in March 2023 have clarified that the major goal for the next Phase 2 trial will be to evaluate and understand the dose- and exposure-response relationship for anti-tumor activity and safety. The specific dosage regimens for the trial have been defined from our ongoing Phase 1B trial. Cohort 3 in the Phase 1B trial, which dosed patients with PCS6422 in combination with capecitabine at 150 mg BID (twice a day), completed with no dose-limiting toxicities. Enrollment in Cohort 4 was expanded to include three additional patients to further evaluate the safety at this dose. No DLTs were observed in this cohort, but the safety evaluation suggested that doing at the higher Cohort 5 (300 mg BID) would result in increased safety concerns and the Cohort 4 dose would be the maximum dose evaluated. The study is ongoing for patients who continue to receive clinical benefit from NGC-Cap. Following the FDA meeting on December 11, 2023, we have decided the next NGC-Cap trial would be a Phase 2 trial in breast cancer. This decision was supported through discussions with the FDA where we agreed with the FDA that the development of NGC-Cap in breast cancer would be a more efficient development program than metastatic colorectal cancer and improve the likelihood of FDA approval. The FDA has agreed that the data generated from past and existing studies could be used to directly support the Phase 2 trial in breast cancer. Capecitabine is already approved as both monotherapy and combination therapy in breast cancer, which contributes to the logic and efficiency of our current direction. In addition, the FDA’s agreement that our present data would support a Phase 2 trial in breast cancer makes the expansion seamless. The objective for the Phase 2 trial will be to provide safety-efficacy data to preliminarily demonstrate the benefit of NGC-Cap over capecitabine. Based on this expansion to breast cancer, we expanded our Oncology Advisory Board to include key breast cancer oncologists. We have already determined the Phase 2 study design and plan to use the funding from our January 2024 public offering to begin enrolling patients in the third quarter of 2024. | ||

| Our license agreement with Elion for NGC-Cap requires us to use commercially reasonable efforts, at our sole cost and expense, to research, develop and commercialize products in one or more countries, including meeting specific diligence milestones that include dosing a first patient with a product in a Phase 2 or 3 clinical trial on or before October 2, 2024. We are currently conducting pre-trial activities and planning to dose the first patient in our Phase 2 trial before the conclusion of the third quarter of 2024 and ahead of the required diligence milestone. |

| 16 |

| ● | NGC-Gem is a cytidine analog similar to gemcitabine (Gemzar®), but different enough in chemical structure that some patients are more likely to respond to PCS3117 than gemcitabine. In addition, we believe those patients inherently resistant or who acquire resistance to gemcitabine are likely not to be resistant to NGC-Gem. The difference in response occurs because NGC-Gem is metabolized to its active metabolite through a different enzyme system than gemcitabine. We continue to evaluate the potential use of NGC-Gem in patients with pancreatic and other potential cancers and to evaluate ways to identify patients who are more likely to respond to NGC-Gem than gemcitabine. We plan to meet with the FDA in 2024 to discuss potential trial designs including implementation of the Project Optimus initiative as part of the design. Similar to NGC-Cap, we will need to obtain additional funding before we can begin the Phase 2 trial for NGC-Gem. | |

| Our license agreement with Ocuphire Pharma, Inc. (“Ocuphire”) for NGC-Gem requires us to use commercially reasonable efforts, at our sole cost and expense to oversee such commercialization efforts, to research, develop and commercialize products in one or more countries, including meeting specific diligence milestones that consist of: (i) dosing a patient in a clinical trial prior to June 16, 2024; and (ii) dosing a patient in a pivotal clinical trial or in a clinical trial for a second indication of the drug prior to June 16, 2026. We are currently in discussions with Ocuphire to extend these deadlines. | ||

| ● | NGC-Iri is an analog of SN38 (SN38 is the active metabolite of irinotecan) and should have an improved safety/efficacy profile in every type of cancer that irinotecan is presently used. The manufacturing process and sites for drug substance and drug product are presently being evaluated and IND-enabling toxicology studies will then be initiated. In addition, we are defining the potential paths to approval, which include defining the targeted patient population and the type of cancer. We plan to conduct IND enabling and toxicology studies in 2024, subject to available funding. |

We are focused on drug products that improve the survival and/or quality of life for patients by improving the safety and/or efficacy of the drug in a targeted patient population, while providing a more efficient and probable path to FDA approval and differentiating our drugs from those on the market or are currently being developed.

Historically, much of oncology drug development has searched for novel or different ways to treat cancer. Our approach is to take three current FDA-approved cancer drugs, e.g. capecitabine, gemcitabine and irinotecan, and modify and improve how the human body metabolizes and/or distributes these NGC treatments compared to their presently approved counterpart chemotherapy drugs while maintaining the cancer-killing mechanism of action; thus, our reason for calling our drugs Next Generation Chemotherapy (or NGC) treatments. Part of the development includes determining the optimal dosage regimen based on the dose-response relationship as described in the FDA’s Project Optimus Initiative and Draft Optimal Dosage Regimen Oncology Guidance. To date, we have data that we believe suggests our NGC treatments are likely to have a better safety-efficacy profile than the current widely used marketed counterpart drugs, not only potentially making the development and approval process more efficient, but also clearly differentiating our NGC treatments from the existing treatment. We believe our NGC treatments have the potential to extend the survival and/or quality of life for more patients diagnosed with cancer while decreasing the number of patients who are required to dose-adjust or discontinue treatment because of side effects or lack of response.

Other Drugs in Our Pipeline