From time to time, the Company has been and may again become involved in legal proceedings arising in the ordinary course of its business, including those related to its patents and intellectual property, product liability and government investigations. Except as described below, the Company is not presently a party to any litigation whichlegal proceedings that it believes to be material, and is not aware of any pending or threatened litigation against the Company which it believes could have a material adverse effect on its business, operating results, financial condition or cash flows.

Important factors could cause our actual results to differ materially from those indicated or implied by forward-looking statements. Westatements, and as such we anticipate that subsequent events and developments will cause our views to change. Except as required by applicable law, we undertake no intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, and readers should not rely on the forward-looking statements as representing our views as of any date subsequent to the date of the filing of this Quarterly Report on Form 10-Q.

Overview

We are a specialty pharmaceutical company committed to driving innovationPacira is the therapeutic area leader in postsurgicalnon-opioid pain management with opioid-sparing strategies.a stated corporate mission of providing non-opioid pain management options to as many patients as possible and redefining the role of opioids for rescue therapy only. Our product pipeline is based onlong-acting, local analgesic EXPAREL® (bupivacaine liposome injectable suspension) utilizes our proprietary DepoFoam extended releaseunique pMVL drug delivery technology for use primarily in hospitalsthat encapsulates drugs without altering their molecular structure and ambulatory surgery centers. We are currently commercializingreleases them over a desired period of time. In the U.S., EXPAREL an amide-type local anestheticis a long-acting, non-opioid option proven to manage postsurgical pain. EXPAREL is the only product indicated for single-dose administration intolocal analgesia via infiltration in patients aged six years and older and regional analgesia via interscalene brachial plexus nerve block, sciatic nerve block in the popliteal fossa and adductor canal block in adults. In Europe, EXPAREL is approved as a brachial plexus block or femoral nerve block for treatment of post-operative pain in adults, and as a field block for treatment of somatic post-operative pain from small- to medium-sized surgical site to produce postsurgical analgesia. EXPAREL was approved by the FDAwounds in Octoberadults and children aged six years and older. Since its initial approval in 2011, and commercially launched in April 2012.more than 14 million patients have been treated with EXPAREL. We drop-ship EXPAREL directly to the end-userend-users based on orders placed to wholesalers or directly to us, and we havethere is no product held by wholesalers. Our earlier-stage pipeline includes two DepoFoam-based product candidates, DepoTranexamic AcidWith the acquisition of Flexion Therapeutics, Inc., or Flexion, in November 2021 (the “Flexion Acquisition”), we acquired ZILRETTA® (triamcinolone acetonide extended-release injectable suspension), the first and DepoMeloxicam.only extended-release, intra-articular, or IA, therapy that can provide major relief for osteoarthritis, or OA, knee pain for three months and has the potential to become an alternative to hyaluronic acid, platelet rich plasma injections or other early intervention treatments. With the acquisition of MyoScience, Inc., or MyoScience, in April 2019 (the “MyoScience Acquisition”), we acquired iovera°®, a handheld cryoanalgesia device used to deliver a precise, controlled application of cold temperature to targeted nerves, which we sell directly to end users. EXPAREL, ZILRETTA and iovera° are highly complementary products as long-acting, non-opioid therapies that alleviate pain.

We expect to continue to incur significant expenses as we pursue the expanded use of EXPAREL, ZILRETTA and iovera° in additional indications and opportunities; advanceprocedures; progress our earlier-stage product candidate pipeline; seek FDA approvalsadvance regulatory activities for EXPAREL, ZILRETTA, iovera°, PCRX-201 and our other product candidates; develop ourinvest in sales and marketing capabilities to prepareresources for their commercial launch;EXPAREL, ZILRETTA and iovera°; expand and enhance our manufacturing capacity for EXPAREL, ZILRETTA and iovera°; invest in products, businesses and technologies; and support regulatory and legal matters.

Global Economic Conditions

Direct and indirect effects of global economic conditions have in the past, and may continue to, negatively impact our business, financial condition and results of operations. Such impacts may include the effect of prolonged periods of inflation which could, among other things, result in higher costs for labor, raw materials and services; cause patients to defer or cancel medical procedures, thereby adversely impacting our revenues; and negatively impact our suppliers which could result in longer lead-times or the inability to secure a sufficient supply of materials. The current macroeconomic environment remains dynamic and subject to rapid and possibly material changes. Additional negative impacts may also arise that we are unable to foresee. The nature and extent of such impacts will depend on future developments, which are highly uncertain and cannot be predicted.

Recent Highlights

•In February 2024, the FDA approved our sNDA for a 200-liter EXPAREL manufacturing suite at our Science Center Campus in San Diego, California. We expect to start selling commercial product manufactured in this 200-liter suite later this year, which could help drive a more favorable cost of commercial product sold and Developmentsbenefit EXPAREL gross margins over time.

| |

• | In October 2017, we made an initial cash investment of $15 million in TELA Bio, Inc., or TELA Bio, a privately-held surgical reconstruction company that markets its proprietary OviTexTM portfolio of products for ventral hernia repair and abdominal wall reconstruction. OviTex Reinforced BioScaffolds (RBSs) are intended for use as a surgical mesh to reinforce and/or repair soft tissue where weakness exists. We may be required to invest up to an additional $10 million in TELA Bio under certain performance scenarios or at our own election.

|

•In October 2017,February 2024, the FDA granted a Regenerative Medicine Advanced Therapy, or RMAT, designation to PCRX-201 (enekinragene inzadenovec), our novel IA helper-dependent adenovirus (HDAd) gene therapy product candidate that codes for interleukin-1 receptor antagonist (IL-1Ra) for the treatment of OA pain of the knee. The RMAT application was supported by the preliminary safety and efficacy findings from a Phase 1 open-label, proof-of-concept, single ascending dose trial that enrolled 72 patients in two three-dose cohorts: a co-administered IA steroid cohort and a cohort that did not receive a steroid. PCRX-201 was well tolerated, with efficacy observed through at least 52 weeks at all doses and cohorts. Established under the 21st Century Cures Act, RMAT designation is a dedicated program designed to expedite the development and review processes for promising therapies—including genetic therapies—that are intended to treat, modify, reverse, or cure a serious or life-threatening disease or condition, and for which preliminary clinical evidence indicates that the drug or therapy has the potential to address an unmet medical need.

Pacira BioSciences, Inc. | Q1 2024 Form 10-Q | Page 29

•In March 2024, the United States Patent and Trademark Office issued Patent No. 11,925,706 (the ‘706 patent) claiming composition of matter, Patent No. 11,918,565 (the ‘565 patent) claiming method of use as a sciatic nerve block in the popliteal fossa and Patent No. 11,931,459 (the ‘459 patent) claiming method of use in pediatric patients. Each of these EXPAREL patents are listed in the FDA’s “Approved Drug Products with Therapeutic Equivalence Evaluations” (the “Orange Book”). The ‘706 patent has an expiration date of January 22, 2041 and the ‘459 and ‘565 patents have expiration dates of March 17, 2042 and February 2, 2043, respectively.

•In April 2024, investigators presented encouraging preliminary results from a 72-patient study of PCRX-201 data at the Osteoarthritis Research Society International, or OARSI, 2024 World Congress in Vienna, Austria. The data showed that a single IA injection of PCRX-201 demonstrated sustained clinical effect as assessed by patient-reported outcomes at all dose levels for at least one-year post-injection. Importantly, PCRX-201 was shown to be well-tolerated with a favorable safety profile. We expect to submit updated data demonstrating PCRX-201’s effectiveness through two years for presentation at a medical meeting in the second half of 2024.

•On May 7, 2024, we announced that the FDA accepted the resubmissionBoard of Directors has approved a new share repurchase program—effective immediately—which authorizes us to purchase up to an aggregate of $150.0 million of our sNDA seekingoutstanding common stock. Repurchases under this program may be made at management’s discretion on the open market or through privately negotiated transactions. The share repurchase program may be suspended or discontinued at any time by the Company and has an expiration date of December 31, 2026. We expect to fund the share repurchase program using a combination of existing cash reserves and future cash flows.

EXPAREL

In the U.S., EXPAREL is currently indicated for local analgesia via infiltration in patients aged six years and older and regional analgesia via interscalene brachial plexus nerve block, sciatic nerve block in the popliteal fossa, and adductor canal block in adults. Safety and efficacy have not been established in other nerve blocks. In Europe, EXPAREL is approved as a brachial plexus block or femoral nerve block for treatment of post-operative pain in adults, and as a field block for treatment of somatic post-operative pain from small- to medium-sized surgical wounds in adults and children aged six years and older.

EXPAREL Label Activities

•Launching EXPAREL in two new lower extremity nerve block indications. In February 2024, we launched EXPAREL in two key lower extremity nerve blocks—namely an adductor canal block and a sciatic nerve block in the popliteal fossa. We believe these two key nerve blocks provide the opportunity to significantly expand EXPAREL utilization within surgeries of the knee, lower leg, and foot and ankle procedures. The launch is supported by two successful head-to-head Phase 3 studies in which EXPAREL demonstrated four days of superiority to bupivacaine.

•Pediatrics. We are launching a Phase 1 pharmacokinetic study of EXPAREL as a single-dose post-surgical infiltration administration in patients under six years of age. If successful, we expect this study, followed by a Phase 3 registration study, will support expansion of the EXPAREL label to include administration vialabels in the U.S. and E.U. We are also discussing with the FDA, EMA and Medicines and Healthcare Products Regulatory Agency (MHRA) our regulatory strategy for EXPAREL administered as a nerve block for prolonged regional analgesia. The expected action

date byin the pediatric setting. We received notification from the FDA underin October 2023 that our pediatric studies requirement had been waived for the Prescription Drug User Fee Act, or PDUFA,indication of brachial plexus interscalene nerve block to produce postsurgical regional analgesia in pediatric patients.

•Stellate ganglion block. Planning is April 6, 2018. The sNDA is based on the positive data fromunderway for a multicenter EXPAREL Phase 3 registration program as a stellate ganglion block for preventing postoperative atrial fibrillation after cardiothoracic surgery. We worked with a steering committee of Key Opinion Leaders, or KOLs, in regional anesthesia and stellate ganglion blocks to design our program and we are awaiting FDA feedback on study design. We believe a stellate ganglion block utilizing EXPAREL will be critical in an unmet need with post-operative atrial fibrillation, or POAF. POAF is a common and costly complication after cardiothoracic surgery, occurring after up to 40% of EXPARELcardiac procedures and 20% of thoracic procedures, and often results in femoralan extended intensive care unit and/or hospital stay, as well as higher long-term risk. A stellate ganglion block is a sympathetic nerve block for total knee arthroplasty, or TKA, (lower extremity) andwhich can stabilize the heart. Since POAF typically occurs around the third day after surgery, a Phase 3 studylong-acting block with EXPAREL provided at the time of surgery may enhance current prophylactic measures.

Pacira BioSciences, Inc. | Q1 2024 Form 10-Q | Page 30

EXPAREL in brachial plexus block for shoulder surgeries (upper extremity). It also includes safety and pharmacokinetic data through 120 hours.Clinical Benefits

In September 2017, we announced a collaboration with Aetna, one of

We believe EXPAREL can replace the nation’s leading diversified health care benefits companies, with the support of the American Association of Oral and Maxillofacial Surgeons, on a national program aimed at reducing the number of opioid tablets dispensed to patients undergoing impacted third molar (wisdom tooth) extractions by at least 50 percent through the utilization of EXPAREL to provide prolonged non-opioid postsurgical pain control. Aetna will reimburse oral surgeons enrolled in the program for their use of EXPAREL in impacted third molar extraction cases performed once the surgeons have completed training on use of the product.

EXPAREL

Expanded Indication

The FDA is currently reviewing our sNDA seeking an expansion of the EXPAREL label to include administrationbupivacaine delivered via nerve block for prolonged regional analgesia. We believe that this new indication would a) present an alternative long-term method of pain control with a single injection, replacing the costly and cumbersome standard of care requiring a perineural catheter, drug reservoir and pump needed to continuously deliver bupivacaine and b) allow us to further leverage our manufacturing and commercial infrastructure. The expected action date by the FDA is April 6, 2018.

The sNDA is based on the positive data from a Phase 3 study of EXPAREL in femoral nerve block for TKA (lower extremity) and a Phase 3 study of EXPAREL in brachial plexus block for shoulder surgeries (upper extremity). It also includes safety and pharmacokinetic data through 120 hours. Eight Pacira-sponsored studies support this expanded indication. In total, 570 subjects received a dose of EXPAREL ranging from 2 mg to 310 mg. In addition, the sNDA includes data from two investigator-initiated studies that provide additional experience in smaller, peripheral nerve block settings.

Phase 4 Trials

We are investing in a series of blinded, randomized Phase 4 trials in key surgical procedures with EXPARELelastomeric pumps as the foundation of a multimodal analgesic regimen. Our Phase 4 trials are also designedregimen for long-acting postsurgical pain management. Based on our clinical data, EXPAREL:

•provides long-lasting local or regional analgesia;

•is a ready-to-use formulation;

•expands easily with saline or lactated Ringer’s solution to support clinician educationreach a desired volume;

•can be administered for local analgesia via infiltration and for regional analgesia via field block, as well as brachial plexus nerve block, sciatic nerve block in the popliteal fossa and adductor canal block; and

•facilitates treatment of a variety of surgical sites.

We believe EXPAREL is a key component of long-acting postsurgical pain management regimens that reduce the need for opioids. Based on procedure-specific best-practice care.

In July 2017, resultsthe clinical data from our Phase 3 and Phase 4 clinical studies as well as data from retrospective health outcomes studies, EXPAREL significantly reduces opioid usage while improving postsurgical pain management.

ZILRETTA

ZILRETTA is the first and only extended-release, intra-articular therapy for OA knee pain. ZILRETTA employs a proprietary microsphere technology combining triamcinolone acetonide, or TA, a commonly administered, immediate-release corticosteroid, with a poly lactic-co-glycolic acid, or PLGA, matrix to provide extended pain relief. PLGA is a proven extended-release delivery vehicle that is metabolized to carbon dioxide and water as it releases drug in the intra-articular space and is used in other approved drug products and surgical devices. The ZILRETTA microspheres slowly and continuously release triamcinolone acetonide into the knee to provide significant pain relief for 12 weeks, with some people experiencing pain relief through 16 weeks. ZILRETTA was approved by the FDA in October 2017 and launched in the U.S. shortly thereafter.

We believe ZILRETTA’s extended-release profile may also provide effective treatment for OA pain of the shoulder.

ZILRETTA Clinical Benefits

ZILRETTA combines TA, a commonly administered steroid, with a proprietary, extended-release microsphere technology to administer extended therapeutic concentrations in the joint and persistent analgesic effect.

Based on the strength of its pivotal and other clinical trials, we believe that ZILRETTA represents an important treatment option for the millions of patients in the U.S. in need of safe and effective extended relief from OA knee pain. The pivotal Phase 3 trial showed that ZILRETTA significantly reduced OA knee pain for 12 weeks, with some people experiencing pain relief through 16 weeks. We believe that ZILRETTA holds the potential to become the corticosteroid of choice given its safety and efficacy profile, and the fact that it is the first and only extended-release corticosteroid on the market. In September 2021, the American Association of Orthopaedic Surgeons, or AAOS, updated its evidence-based clinical practice guidelines, finding ZILRETTA can improve patient outcomes over traditional immediate-release corticosteroids.

In 2024, we launched a Phase 3 registration study to evaluate the safety and efficacy of ZILRETTA for the management of OA pain of the shoulder. If the study is successful, we plan to seek approval to expand the ZILRETTA label to include OA pain of the shoulder.

iovera°

The iovera° system is a non-opioid handheld cryoanalgesia device used to produce precise, controlled doses of cold temperature to targeted nerves. It is FDA 510(k) cleared in the U.S., has a CE mark in the E.U. and is cleared for marketing in Canada for the blocking of pain. We believe the iovera° system is highly complementary to EXPAREL and ZILRETTA as a non-opioid therapy that alleviates pain using a non-pharmacological nerve block to disrupt pain signals being transmitted to the brain from the site of injury or surgery. It is also indicated for the relief of pain and symptoms associated with arthritis of the knee for up to 90 days.

Pacira BioSciences, Inc. | Q1 2024 Form 10-Q | Page 31

iovera° Clinical Benefits

There is a growing body of clinical data demonstrating success with iovera° treatment for a wide range of chronic pain conditions. Some of our strongest data relates directly to the improvement of OA pain of the knee. Surgical intervention is typically a last resort for patients suffering from OA pain of the knee. In one study, the majority of the patients suffering from OA pain of the knee experienced pain relief up to 150 days after being treated with iovera°.

Preliminary findings demonstrated reductions in opioids, including:

•The daily morphine equivalent consumption in the per protocol group analysis was significantly lower at 72 hours (p<0.05), 6 weeks (p<0.05) and 12 weeks (p<0.05).

•Patients who were administered iovera° were far less likely to take opioids six weeks after surgery. The number of patients undergoingtaking opioids six weeks after total knee replacement were publishedarthroplasty, or TKA, in The Journalthe control group was three times the number of Arthroplastypatients taking opioids in the cryoanalgesia group (14 percent vs. 44 percent, p<0.01). The study compared EXPAREL admixed with bupivacaine HCl versus bupivacaine HCl alone. EXPAREL achieved statistical significance for its co-primary endpoints of opioid reduction and postsurgical pain. The EXPAREL

•Patients in the iovera° group demonstrated a 78 percent reduction in opioid consumption from zero to 48 hours after surgery and astatistically significant reduction in pain scores from their baseline pain scores at 72 hours (p<0.05) and at 12 weeks (p<0.05).

We believe these data validate iovera° as a clinically meaningful non-opioid alternative for patients undergoing TKA, and that iovera° offers the opportunity to 48 hoursprovide patients with non-opioid pain control well in advance of any necessary surgical intervention through a number of key product attributes:

•iovera° is safe and effective with immediate pain relief that can last for months as the nerve regenerates over time;

•iovera° is repeatable, with no diminishing effectiveness over time and repeat use;

•The iovera° technology does not risk damage to the surrounding tissue;

•iovera° is a convenient handheld device with a single-use procedure-specific Smart Tip; and

•iovera° can be delivered precisely using ultrasound guidance or an anatomical landmark.

A study published in 2021 that included 267 patients (169 who underwent cryoneurolysis with iovera° compared to 98 patients who did not receive iovera° treatment) showed that patients who were treated with iovera° had 51% lower daily morphine milligram equivalents during their hospital stay and a 22% lower mean pain score versus those who were not. In addition, the iovera° group had greater function at discharge, a shorter length of hospital stay and received significantly fewer opioids, including discharge prescriptions at week 2 and week 6 after surgery. EXPAREL

In September 2021, the AAOS updated its evidence-based clinical practice guidelines, reporting that denervation therapy—including cryoneurolysis—may reduce knee pain and improve function in patients with symptomatic OA of the knee.

The Osteoarthritis Market

OA is the most common form of arthritis. It is also achieved statistical significance for the study’s key secondary endpoints related to opioid reduction. Patientscalled degenerative joint disease and occurs most frequently in the EXPAREL arm required 77.6 percent fewer opioids through 72 hours than thosehands, hips and knees. With OA, the cartilage within a joint begins to break down and the underlying bone begins to change. These changes usually develop slowly and worsen over time. OA can cause pain, stiffness and swelling. In some cases, it also causes reduced function and disability—some people are no longer able to do daily tasks or work. According to the Centers for Disease Control and Prevention (CDC), OA affects over 32.5 million adults in the bupivacaine arm with 10U.S.

The lifetime risk of developing symptomatic knee OA is 45 percent remaining opioid-free through 48 and 72 hours (compared to zero patients in the bupivacaine arm; P<0.01). Time to first opioid rescue was analyzed using logistic regression and Kaplan-Meier methods, with a significant difference between the EXPAREL group versus the bupivacaine group; P=0.0230.

Product Pipeline

DepoFoam is used to extend the release of active drug substances. With this technology, we are currently developing two new DepoFoam-based product candidates—DepoTranexamic Acid, or DepoTXA, an antifibrinolytic, and DepoMeloxicam, or DepoMLX, a non-steroidal anti-inflammatory drug, or NSAID. Completion of clinical trials may take several years or more. The length of time generally varies according to the type, complexity, noveltyArthritis Foundation. The prevalence of symptomatic knee OA increases with each decade of life, with the annual incidence of knee OA being highest between age 55 and intended use64 years old. There are 14 million individuals in the U.S. who have symptomatic knee OA, and nearly two million are under the age of 45. Surgical intervention is typically a last resort for patients suffering from OA of the knee.

With ZILRETTA, we now offer clinicians the flexibility to individualize OA knee pain treatment with either ZILRETTA or a drug-free nerve block with iovera° based on patient factors and preference, physician training, site of care and reimbursement considerations.

Pacira BioSciences, Inc. | Q1 2024 Form 10-Q | Page 32

Clinical Development Programs

PCRX-201

PCRX-201 was added to our product candidate.development portfolio as part of the Flexion Acquisition. PCRX-201 is a novel, helper-dependent adenoviral vector expressing interleukin-1 receptor antagonist (IL-1Ra). After injection, the vector enters joint cells and turns them into factories to produce sustained therapeutic levels of IL-1Ra and inhibit the IL-1 pathway to manage pain and mitigate OA-related joint damage while remaining localized to the joint space. In a Phase 1 proof-of-concept study of patients with moderate to severe OA of the knee, PCRX-201 was well tolerated with improvements in knee pain observed across all doses. In February 2024, the FDA granted PCRX-201 an RMAT designation. Our RMAT application was supported by the preliminary safety and efficacy findings from a Phase 1 open-label, proof-of-concept, single ascending dose trial that enrolled 72 patients in two three-dose cohorts: a co-administered IA steroid cohort and a cohort that did not receive a steroid. PCRX-201 was well tolerated, with efficacy observed through at least 52 weeks at all doses and cohorts. The highest level of efficacy was achieved in the co-administered steroid group, which showed a greater percentage of patients with at least a 50% improvement in Western Ontario and McMaster Universities Osteoarthritis Index (WOMAC) pain and stiffness scores, as well as a meaningful improvement in (Knee Injury and Osteoarthritis Outcomes Score) KOOS functional assessment. The 52-week data were presented at the Osteoarthritis Research Society International (OARSI) 2024 World Congress in April 2024 and we expect to submit the 104-week efficacy and safety data for presentation at a medical meeting later this year.

pMVL-Based Clinical Program

Given the proven safety, flexibility and customizability of our pMVL drug delivery technology platform for acute, sub-acute and chronic pain applications, we have another pMVL-based product in clinical development. Following data readouts from preclinical and feasibility studies, we initiated a second Phase 1 study of EXPAREL for intrathecal analgesia in June 2023.

External Innovation

In parallel to our internal clinical programs, we are pursuing innovative acquisition targets that are complementary to EXPAREL, ZILRETTA and iovera° and are of great interest to the surgical and anesthesia audiences we are already calling on today. We are also evaluating other potential DepoFoam compoundsusing a combination of strategic investments, in-licensing and formulation work is underway foracquisition transactions to buildout a numberpipeline of innovation to improve patients’ journeys along the neural pain pathway. The strategic investments we have made to support promising early-stage platforms are summarized below:

| | | | | | | | | | | |

| Company | Development Stage | Description of Platform Technology | Potential Therapeutic Areas |

| CarthroniX, Inc. | Phase 1-Ready | CX-011, a small molecule modulator of gp130 formulated as an IA injection designed to slow joint degeneration by mediating IL-6 cytokines | Knee OA |

| Genascence Corporation | Phase 1b | Adeno-associated virus (AAV) based gene therapy engineered to deliver Interleukin-1 Receptor Antagonist (IL-1Ra) to target cells in joint(s) | Knee OA |

| GQ Bio Therapeutics GmbH | Preclinical | High-capacity adenovirus (HCAd) based gene therapy engineered to deliver DNA to target cells in joint(s) and intervertebral disc(s) | Knee OA and degenerative disc disease (DDD) |

| Spine BioPharma, LLC | Phase 3 | SB-01, a 7-amino acid chain peptide that binds to and induces down regulation of transforming growth factor, beta 1 (TGFβ1) | Degenerative disc disease (DDD) |

Pacira BioSciences, Inc. | Q1 2024 Form 10-Q | Page 33

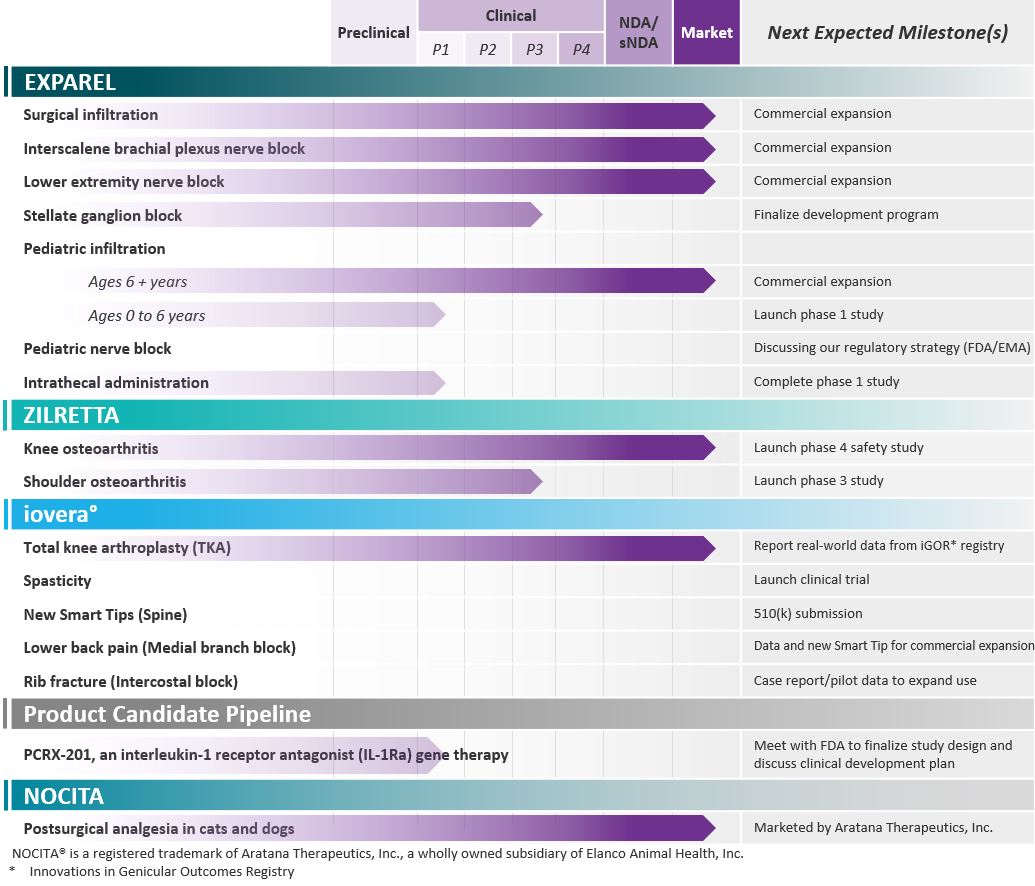

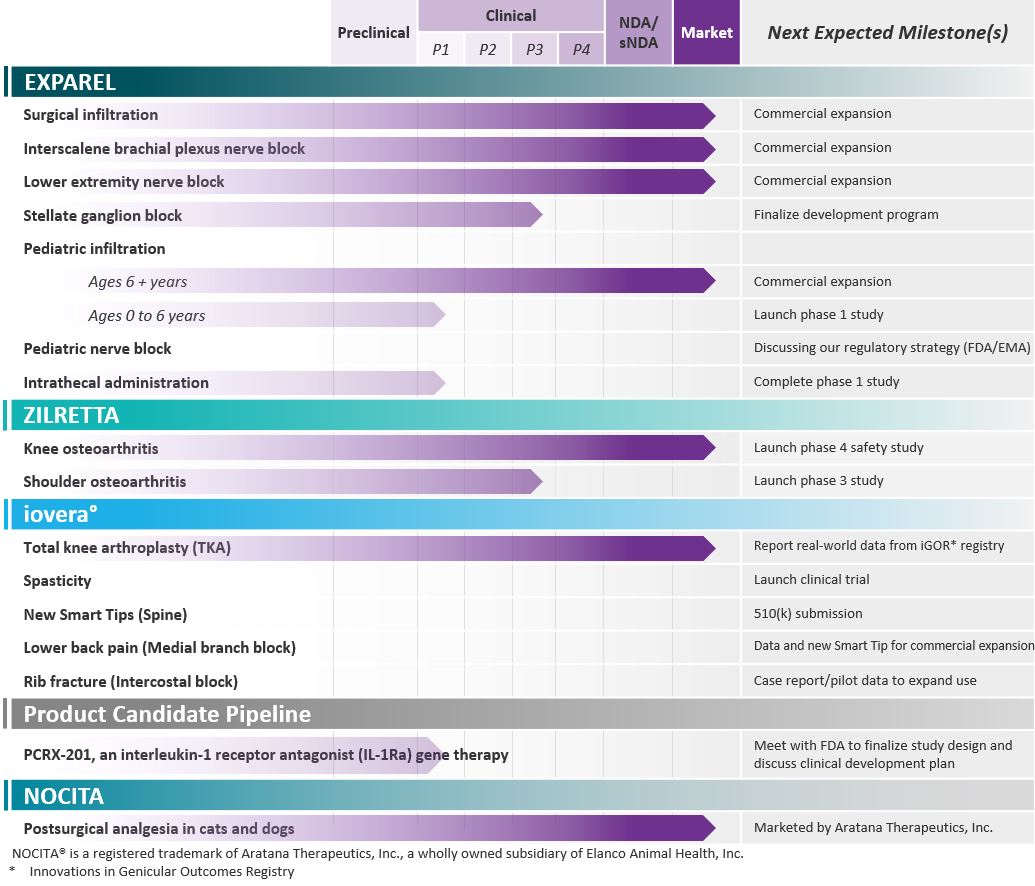

Product Portfolio and Internal Pipeline

Our current product portfolio and internal product candidate pipeline, candidates.

DepoTranexamic Acid

Tranexamic Acid, or TXA, is currently used off-label as a systemic injection or as a topical application, and is usedalong with anticipated milestones over the next 12 to treat or prevent excessive blood loss during surgery by preventing the breakdown of a clot. However, the current formulation of TXA has a short-lived effect consisting of only a few hours, while the risk of bleeding continues for two to three days after surgery. We believe DepoTXA, a long-acting local antifibrinolytic agent combining immediate and extended release TXA, could address the unmet, increasing need for rapid ambulation and discharge18 months, are summarized in the ambulatory surgery environment for jointtable below:

surgery (primarily orthopedic surgery, including spine

Pacira Training Facilities

We maintain and trauma proceduresoperate two Pacira Innovation and cardiothoracic surgery). Designed for single-dose local administration into the surgical site, DepoTXA could provide enhanced hemostabilizationTraining, or PIT, facilities—one in Tampa, Florida and improved safety and tolerability for patients over the systemic use of TXA byone in Houston, Texas. These sites were constructed with a singular goal in mind: to advance education on best practice techniques to effectively manage acute pain while reducing bleeding,or eliminating the need for blood transfusions, swelling, soft tissue hematomasopioids. These facilities provide clinicians with flexible, state-of-the-art environments for interactive, hands-on instruction on the latest and the needmost innovative local, regional and field block approaches for post-operative drains, thereby increasing vigor in patients while decreasing overall costsmanaging pain, improving patient care and enabling patient migration to the hospital system.23-hour stay environment. Each of our PIT facilities feature distinct training spaces, including simulation labs equipped with ultrasound scanning stations; lecture halls that feature liquid crystal display video walls to support live, virtual and global presentations; and green-screen broadcast studios to livestream content with single or multiple hosts. The PIT of Houston has both wet and dry lab space for cadaver and other interactive workshops. The PIT of Tampa also houses our principal executive offices and corporate headquarters.

Pacira BioSciences, Inc. | Q1 2024 Form 10-Q | Page 34

DepoTXA is currently in Phase 2 clinical development.

DepoMeloxicam

We expect to submit an Investigational New Drug application for DepoMLX in 2017 and subsequently initiate a Phase 1 clinical trial.

Results of Operations

Comparison of the Three and Nine Months Ended September 30, 2017March 31, 2024 and 2016

2023

Revenues

Our netNet product sales includeconsist of sales of (i) EXPAREL in the United StatesU.S., E.U., and DepoCyt(e)U.K.; (ii) ZILRETTA in the United StatesU.S.; (iii) iovera° in the U.S., Canada and Europe through June 2017. We also earn royalties onand (iv) sales by commercial partners of our bupivacaine liposome injectable suspension product for use in animal health indications and DepoCyt(e) and license fees and milestone paymentsveterinary use. Royalty revenues are related to a collaborative licensing agreement from third parties.

the sale of our bupivacaine liposome injectable suspension for veterinary use.

The following table provides information regarding our revenues during the periods indicated, including percent changes (dollars(dollar amounts in thousands):

| | | | | | Three Months Ended

March 31, | |

| | | | | Three Months Ended

March 31, | |

| | | | | Three Months Ended

March 31, | | | % Increase / (Decrease) |

| | | Three Months Ended

September 30, | | % Increase / (Decrease) | | Nine Months Ended

September 30, | | % Increase / (Decrease) |

| | |

| | 2017 | | 2016 | | 2017 | | 2016 | |

| | | | | | 2024 | |

| | | | | | 2024 | |

| | | | | | 2024 | |

| Net product sales: | |

| Net product sales: | |

| Net product sales: | | | | | | | | | | |

| EXPAREL | $ | 66,780 |

| | $ | 64,869 |

| | 3% | | $ | 204,254 |

| | $ | 194,374 |

| | 5% |

| DepoCyt(e) and other product sales | 171 |

| | 1,250 |

| | (86)% | | 1,261 |

| | 3,935 |

| | (68)% |

| EXPAREL | |

| EXPAREL | | | | | | | | $ | 132,430 | | | $ | 130,408 | | | 2% |

| ZILRETTA | | ZILRETTA | | | | | | | 25,839 | | | 24,334 | | | 6% |

| iovera° | | iovera° | | | | | | | 5,030 | | | 4,001 | | | 26% |

| Bupivacaine liposome injectable suspension | | Bupivacaine liposome injectable suspension | | | | | | | 2,525 | | | 688 | | | 100% + |

| Total net product sales | 66,951 |

| | 66,119 |

| | 1% | | 205,515 |

| | 198,309 |

| | 4% | Total net product sales | | | | | | | 165,824 | | | 159,431 | | 159,431 | | | 4% | | 4% |

| Collaborative licensing and milestone revenue | 26 |

| | 1,357 |

| | (98)% | | 361 |

| | 3,069 |

| | (88)% |

| Royalty revenue | 358 |

| | 879 |

| | (59)% | | 1,676 |

| | 2,091 |

| | (20)% | Royalty revenue | | | | | | | 1,293 | | | 910 | | 910 | | | 42% | | 42% |

| | Total revenues | $ | 67,335 |

| | $ | 68,355 |

| | (1)% | | $ | 207,552 |

| | $ | 203,469 |

| | 2% |

| Total revenues | |

| Total revenues | | | | | | | | $ | 167,117 | | | $ | 160,341 | | | 4% |

EXPAREL revenue grew 3% and 5%increased 2% in the three and nine months ended September 30, 2017, respectively, comparedMarch 31, 2024 versus 2023. Components of the increase included a 3% increase in gross vial volume, which was offset by a shift in product mix. EXPAREL revenue was also impacted by a 2% increase in selling price per unit related to the same periods in 2016, primarily due to respective increased sales volumes of 4% and 6%,a January 2024 price increase, which was partially offset by an increase in volume rebates and chargebacks of 1%. The demand for EXPAREL has continued to increasesales related allowances as a result of new accountsgroup purchasing organization contracting.

ZILRETTA revenue increased 6% in the three months ended March 31, 2024 versus 2023 primarily due to a 7% increase in net selling price per unit related to increases of gross selling price per unit and growth within existing accountsfavorable sales related allowances, partially offset by a 1% decrease in kit volume.

Net product sales of iovera° increased 26% in the three months ended March 31, 2024 versus 2023 primarily due to an increase of 34% in Smart Tip volume, partially offset by a 2% decrease in selling price per Smart Tip due to increased sales to clinics.

Bupivacaine liposome injectable suspension revenue increased more than 100% in the three months ended March 31, 2024 versus 2023 and its related royalties increased 42% primarily due to the continued adoptionsales mix of vial sizes and the timing of orders placed for veterinary use.

The following tables provide a summary of activity with respect to our sales related allowances and accruals related to EXPAREL in soft tissue and orthopedic procedures.ZILRETTA for the three months ended March 31, 2024 and 2023 (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| March 31, 2024 | | Returns

Allowances | | Prompt

Payment

Discounts | | Service

Fees | | Volume

Rebates and

Chargebacks | | Government

Rebates | | Total |

| Balance at December 31, 2023 | | $ | 1,868 | | | $ | 1,308 | | | $ | 3,697 | | | $ | 5,870 | | | $ | 1,175 | | | $ | 13,918 | |

| Provision | | 76 | | | 3,057 | | | 4,771 | | | 25,800 | | | 636 | | | 34,340 | |

| Payments / Adjustments | | (175) | | | (3,087) | | | (5,064) | | | (26,320) | | | (333) | | | (34,979) | |

| Balance at March 31, 2024 | | $ | 1,769 | | | $ | 1,278 | | | $ | 3,404 | | | $ | 5,350 | | | $ | 1,478 | | | $ | 13,279 | |

DepoCyt(e) and otherPacira BioSciences, Inc. | Q1 2024 Form 10-Q | Page 35

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| March 31, 2023 | | Returns

Allowances | | Prompt

Payment

Discounts | | Service

Fees | | Volume

Rebates and

Chargebacks | | Government

Rebates | | Total |

| Balance at December 31, 2022 | | $ | 1,691 | | | $ | 1,187 | | | $ | 3,193 | | | $ | 5,452 | | | $ | 786 | | | $ | 12,309 | |

| Provision | | 465 | | | 2,938 | | | 4,277 | | | 22,549 | | | 412 | | | 30,641 | |

| Payments / Adjustments | | (328) | | | (2,921) | | | (4,162) | | | (22,689) | | | (396) | | | (30,496) | |

| Balance at March 31, 2023 | | $ | 1,828 | | | $ | 1,204 | | | $ | 3,308 | | | $ | 5,312 | | | $ | 802 | | | $ | 12,454 | |

Total reductions of gross product sales decreased 86%from sales-related allowances and 68% inaccruals were $34.3 million and $30.6 million, or 17.1% and 16.2% of gross product sales, for the three and nine months ended September 30, 2017, respectively, compared to the same periodsMarch 31, 2024 and 2023, respectively. The overall 0.9% increase in 2016. The decrease in both periodssales-related allowances and accruals as a percentage of gross product sales was primarily duerelated to fewer DepoCyt(e) lots sold to our commercial partnersaccruals as a result of persistent technical issues specifically related to the DepoCyt(e) manufacturing process and the discontinuation of our DepoCyt(e) manufacturing activities in June 2017.higher chargeback-related allowances from expanded contracting efforts.

Collaborative licensing and milestone revenue decreased 98% and 88% in the three and nine months ended September 30, 2017, respectively, compared to the same periods in 2016, primarily due to milestones earned in 2016 under our agreement with Aratana Therapeutics, Inc. for the development and commercialization of our products in animal health indications in the three and nine months ended September 30, 2016.

Royalty revenue primarily reflects royalties earned on collections of end-user sales of DepoCyt(e) by our commercial partners. Royalty revenue decreased 59% and 20% in the three and nine months ended September 30, 2017, respectively, compared to the same periods in 2016, due to the discontinuation of our DepoCyt(e) manufacturing activities in June 2017.

Cost of Goods Sold

Cost of goods sold primarily relates to the costs to produce, package and deliver our products to customers. These expenses include labor, raw materials, manufacturing overhead and occupancy costs, depreciation of facilities, royalty payments, quality control and engineering.

The following table provides information regarding our cost of goods sold and gross margin during the periods indicated, including percent changes (dollar amounts in thousands):

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Three Months Ended

March 31, | | % Increase / (Decrease) |

| | | |

| | | | | | 2024 | | 2023 | |

| Cost of goods sold | | | | | | | $ | 47,416 | | $ | 49,020 | | (3)% |

| Gross margin | | | | | | | 72 | % | | 69 | % | | |

|

| | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

September 30, | | % Increase / (Decrease) | | Nine Months Ended

September 30, | | % Increase / (Decrease) |

| | | | |

| | 2017 | | 2016 | | | 2017 | | 2016 | |

| Cost of goods sold | $ | 18,228 |

| | $ | 43,152 |

| | (58)% | | $ | 66,621 |

| | $ | 86,483 |

| | (23)% |

| Gross margin | 73 | % | | 37 | % | | | | 68 | % | | 57 | % | | |

The decreases in cost of goods sold and the corresponding 36 and 11 percentage-point improvements in gross margins for theGross margin increased three and nine months ended September 30, 2017 versus 2016, respectively, were largely due to a $21.9 million charge for inventory and related reserves in the third quarter of 2016 related to a single stability batch for EXPAREL which had fallen out of specification for one of 21 acceptance criteria. The manufacturing issue that existed when this batch was made was subsequently corrected. Gross margins improved by 32 and 11 percentage-points for the three and nine months ended September 30, 2017, respectively, as a result of this 2016 event. In addition, gross margins increased by 2 and 3 percentage-points as a result of lower unplanned manufacturing shutdown and other charges in the three and nine months ended September 30, 2017, respectively. There were no scrapped lots related to DepoCyt(e) in the three months ended September 30, 2017, improving gross marginsMarch 31, 2024 versus 2023 primarily due to lower EXPAREL product cost and lower royalty expense as discussed below, partially offset by 2 percentage points versushigher inventory reserves.

On August 8, 2023, the same period in 2016. The nine months ended September 30, 2017 versus 2016U.S. District Court, District of Nevada, concluded we were no longer obligated to pay royalties to the Research and Development Foundation for EXPAREL made under the 45-liter manufacturing process. For more information, see Note 15, Commitments and Contingencies, to our condensed consolidated financial statements included scrapped lots for DepoCyt(e) in the first half of 2017 before the manufacture of the product was discontinued, decreasing gross margins by 3 percentage points.herein.

Research and Development Expenses

Research and development expenses primarily consist primarily of costs related to clinical trials and related outside services, product development and other research and development costs, including trials that we are conducting to generate new data for EXPAREL, ZILRETTA and iovera° and stock-based compensation expenses.expense. Clinical and preclinical development expenses include costs for clinical personnel, clinical trials performed by third-party contract research organizations,third-parties, toxicology studies, materials and supplies, database management and other third-party fees. Product development and other research and developmentmanufacturing capacity expansion expenses include development costs for our products, and medical information expenses, which include personnel, research equipment, materials and contractor costs for process development and product candidates, toxicology studies, expensesdevelopment costs related to a significant scale-upscale-ups of our manufacturing capacity and facility costs for our research space. Regulatory and other expenses include regulatory activities related to unapproved products and indications, medical information expenses, registry expenses and related personnel. Stock-based compensation expense relates to the costs of stock option grants, to employees and non-employees, awards of restricted stock units, or RSUs, and our employee stock purchase plan, or ESPP.

Pacira BioSciences, Inc. | Q1 2024 Form 10-Q | Page 36

The following table provides information regardinga breakout of our research and development expenses during the periods indicated, including percent changes (dollar amounts in thousands):

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Three Months Ended

March 31, | | % Increase / (Decrease) |

| | | |

| | | | | | 2024 | | 2023 | |

| Clinical and preclinical development | | | | | | | $ | 6,346 | | $ | 5,261 | | 21% |

| Product development and manufacturing capacity expansion | | | | | | | 7,395 | | 7,672 | | (4)% |

| Regulatory and other | | | | | | | 2,694 | | 2,332 | | 16% |

| Stock-based compensation | | | | | | | 1,803 | | 1,875 | | (4)% |

| Total research and development expense | | | | | | | $ | 18,238 | | $ | 17,140 | | 6% |

| % of total revenues | | | | | | | 11 | % | | 11 | % | | |

|

| | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

September 30, | | % Increase / (Decrease) | | Nine Months Ended

September 30, | | % Increase / (Decrease) |

| | | | |

| | 2017 | | 2016 | | | 2017 | | 2016 | |

| Clinical development | $ | 6,301 |

| | $ | 5,665 |

| | 11% | | $ | 29,738 |

| | $ | 14,576 |

| | 104% |

| Product development and other | 4,650 |

| | 3,399 |

| | 37% | | 15,396 |

| | 11,435 |

| | 35% |

| Stock-based compensation | 824 |

| | 690 |

| | 19% | | 2,128 |

| | 2,598 |

| | (18)% |

| Total research and development expense | $ | 11,775 |

| | $ | 9,754 |

| | 21% | | $ | 47,262 |

| | $ | 28,609 |

| | 65% |

| % of total revenues | 17 | % | | 14 | % | | | | 23 | % | | 14 | % | | |

ResearchTotal research and development expense increased 21% and 65% in the three and nine months ended September 30, 2017, respectively, compared to the same periods in 2016.

The increase in clinical development expense6% in the three months ended September 30, 2017 reflects costs for our ongoing Phase 4March 31, 2024 versus 2023.

Clinical and preclinical development expense increased 21% in the three months ended March 31, 2024 versus 2023 due to the start-up and enrollment in a ZILRETTA shoulder trial and an EXPAREL infiltration trialspediatric trial, and increased research grants.start-up activities in an iovera° spasticity trial. These increases were partially offset by the completionwinding down of our twoa PCRX-201 Phase 3 trials evaluating EXPAREL1 study for knee OA as a single-dose nerve block for prolonged regional analgesia. Enrollmentfollow-up visits of subjects were completed in these studies began in the second quarter of 2016November 2023, and concluded in June 2017.

In the nine months ended September 30, 2017, the increase in clinical development expense includes costs for our two Phase 3 EXPAREL nerve block trials which concluded in June 2017, as well as our ongoing Phase 4 EXPAREL infiltration trials and increased research grants. These increases were partially offset by the completion of our Phase 4 EXPAREL infiltration trial in TKA, which concluded enrollment in January 2017.

toxicology studies for product candidates.

Product development and other expenses increased in both the three and nine months ended September 30, 2017 versus 2016, respectively, primarily due to expenses related to a significant scale-up of our manufacturing capacity in Swindon, England, in partnership with Patheon, running test batches for DepoMLX and developing a new EXPAREL DepoFoam spray manufacturing process. These increases were partially offset by a reduction in spend for preclinical DepoFoam toxicology trials.

In the nine months ended September 30, 2017 versus 2016, stock-based compensationexpansion expense decreased 18% as expenses from new awards were more than offset by the decreased expense on mark-to-market non-employee awards that became fully vested in mid-2016. The 19% increase4% in the three months ended September 30, 2017March 31, 2024 versus 20162023, primarily attributable to the near-completion of pre-commercial scale-up activities of our EXPAREL manufacturing capacity at our Science Center Campus in San Diego, California. The FDA approved an sNDA for our 200-liter EXPAREL manufacturing suite in February 2024. This decrease is partially offset by ongoing product development costs related to PCRX-201 and an iovera° medial branch Smart Tip.

Regulatory and other expense increased 16% in the three months ended March 31, 2024 versus 2023 due to new awards grantedincreased enrollment and additional sites related to an observational registry study which tracks patients’ symptoms and experience with pain management related to OA of the knee.

Stock-based compensation decreased 4% in mid- to-late 2016the three months ended March 31, 2024 versus 2023 primarily due to the impact of a February 2024 restructuring program which resulted in accelerated stock-based compensation for those impacted being recorded in contingent consideration (gains) charges, restructuring charges and 2017.other.

Selling, General and Administrative Expenses

Sales and marketing expenses primarily consist of compensation and benefits for our sales force and personnel that support our sales, marketing, and medical and scientific affairs operations, commission payments to our commercial partners for the promotion and sale of EXPAREL, expenses related to communicating the health outcome benefits of EXPARELour products, investments in provider-level market access and patient reimbursement support and educational programs for our customers. General and administrative expenses consist of compensation and benefits for legal, finance, regulatory activities related to approved products and indications, compliance, information technology, human resources, business development, executive management and other supporting personnel. It also includes professional fees for legal, audit, tax and consulting services. Stock-based compensation expense relates to the costs of stock option grants, RSU awards and our ESPP.

Pacira BioSciences, Inc. | Q1 2024 Form 10-Q | Page 37

The following table provides information regarding our selling, general and administrative expenses during the periods indicated, including percent changes (dollar amounts in thousands):

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Three Months Ended

March 31, | | % Increase / (Decrease) |

| | | |

| | | | | | 2024 | | 2023 | |

| Sales and marketing | | | | | | | $ | 39,435 | | $ | 41,579 | | (5)% |

| General and administrative | | | | | | | 24,606 | | 20,873 | | 18% |

| Stock-based compensation | | | | | | | 7,985 | | 8,391 | | (5)% |

| Total selling, general and administrative expense | | | | | | | $ | 72,026 | | $ | 70,843 | | 2% |

| % of total revenues | | | | | | | 43 | % | | 44 | % | | |

|

| | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

September 30, | | % Increase / (Decrease) | | Nine Months Ended

September 30, | | % Increase / (Decrease) |

| | | | |

| | 2017 | | 2016 | | | 2017 | | 2016 | |

| Sales and marketing | $ | 24,557 |

| | $ | 21,490 |

| | 14% | | $ | 72,344 |

| | $ | 69,437 |

| | 4% |

| General and administrative | 9,750 |

| | 9,780 |

| | 0% | | 32,965 |

| | 32,371 |

| | 2% |

| Stock-based compensation | 6,337 |

| | 5,044 |

| | 26% | | 17,007 |

| | 16,132 |

| | 5% |

Total selling, general and administrative

expenses | $ | 40,644 |

| | $ | 36,314 |

| | 12% | | $ | 122,316 |

| | $ | 117,940 |

| | 4% |

| % of total revenues | 60 | % | | 53 | % | | | | 59 | % | | 58 | % | | |

Selling,Total selling, general and administrative expensesexpense increased 12%2% in the three months ended March 31, 2024 versus 2023.

Sales and marketing expense decreased 5% in the three months ended March 31, 2024 versus 2023, which is attributable to the impact of a February 2024 restructuring program. These measures involved reallocating resources and prioritizing investing in programs to drive awareness and education for our customers and enhance our marketing, market access and reimbursement teams and value creation for the implementation of separate Medicare reimbursement for EXPAREL at average sales price plus 6 percent in outpatient settings beginning in January 2025. We expect investments in these programs to increase in the remaining nine months of 2024.

General and administrative expense increased 18% in the three months ended March 31, 2024 versus 2023 primarily driven by legal fees primarily attributable to ongoing litigation. We also incurred compensatory costs associated with the transition to our new Chief Executive Officer effective January 2, 2024, which include compensation related to the current Chief Executive Officer and to the former Chief Executive Officer who remains employed by the Company in an advisory role, and, to a lesser extent, third-party consulting. For more information on our ongoing litigation, see Note 15, Commitments and Contingencies, to our condensed consolidated financial statements included herein.

Stock-based compensation decreased 5% for the three months ended September 30, 2017 and 4% for the nine months ended September 30, 2017, compared to the same periods in 2016.

Sales and marketing expenses increased by 14% for the three months ended September 30, 2017 and 4% in the nine months ended September 30, 2017March 31, 2024 versus the same periods in 2016. Increases in these respective periods were driven by higher costs for salaries, benefits and other personnel related costs resulting from an increase in the number of field-based medical and sales professionals to better support and educate our customers. We spent more money on marketing for EXPAREL in both the three and nine month periods ended September 30, 2017 versus 2016 on educational initiatives and programs to create product awareness within key surgical markets. This spending increase also included other selling and promotional activities to the support the growth of EXPAREL, including initiatives related to our co-promotion agreement with DePuy Synthes Sales, Inc.,

or DePuy Synthes. We also supported multiple educational programs related2023 primarily due to the impact of opioids and postsurgical pain management along with our “Choices Matter” campaign,from the February 2024 restructuring program which educates patients on non-opioid treatment options.

General and administrative expenses remained consistentresulted in the three months and increased 2% in the nine months ended September 30, 2017, respectively, versus the same periods in 2016. In the three months ended September 2017 versus 2016, legal expenditures increased, offset by a decrease in compliance related activities. In the nine months ended September 30, 2017 versus 2016, there was an increase in regulatory expenses in preparation for a European Medicines Agency Marketing Authorization Application for EXPAREL commercialization in the E.U. We also increased spending to support our investor relations and information technology functions. These increases were partially offset by lower legal and compliance expenses, primarily related to a DOJ subpoena received in April 2015.

Stock-based compensation increased $1.3 million in the three month period ended September 30, 2017, compared to the same period in 2016, primarily due to new awards granted in mid-to-late 2016 and 2017 and accelerated stock-based compensation expense. In the nine months ended September 30, 2017 versus 2016, there was a $0.9 million increase in stock-based compensation primarily due to new awards granted in mid-to-late 2016 and 2017.

Product Discontinuation Expenses

In June 2017, we discontinued all future production of DepoCyt(e) due to persistent technical issues specific to the DepoCyt(e) manufacturing process. In the three months ended September 30, 2017, we recorded a charge of $0.3 million related to the discontinuation of our DepoCyt(e) manufacturing activities, including $0.1 million for related inventory which wasthose impacted being recorded in costcontingent consideration (gains) charges, restructuring charges and other.

Amortization of goods sold. The remaining $0.2 million related to asset retirement obligations and other estimated exit costs.

In the nine months ended September 30, 2017, the total charge was $5.3 million, of which $0.6 million was for related inventory recorded in cost of goods sold, $1.9 million for lease costs less an estimate of potential sub-lease income, $1.9 million for the write-off of fixed assets and $0.9 million relating to employee severance, asset retirement obligations and other product discontinuation costs.

Other Income (Expense)Acquired Intangible Assets

The following table provides a summary of the componentsamortization of other income (expense)acquired intangible assets during the periods indicated, including percent changes (dollar amounts in thousands):

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Three Months Ended

March 31, | | % Increase / (Decrease) |

| | | |

| | | | | | 2024 | | 2023 | |

| Amortization of acquired intangible assets | | | | | | | $ | 14,322 | | | $ | 14,322 | | | —% |

|

| | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

September 30, | | % Increase / (Decrease) | | Nine Months Ended

September 30, | | % Increase / (Decrease) |

| | | | |

| | 2017 | | 2016 | | | 2017 | | 2016 | |

| Interest income | $ | 1,068 |

| | $ | 346 |

| | 209% | | $ | 2,805 |

| | $ | 923 |

| | 204% |

| Interest expense | (5,127 | ) | | (1,601 | ) | | 220% | | (12,942 | ) | | (5,203 | ) | | 149% |

| Loss on early extinguishment of debt | — |

| | — |

| | N/A | | (3,732 | ) | | — |

| | N/A |

| Other, net | 79 |

| | (8 | ) | | N/A | | 169 |

| | (8 | ) | | N/A |

| Total other expense, net | $ | (3,980 | ) | | $ | (1,263 | ) | | 215% | | $ | (13,700 | ) | | $ | (4,288 | ) | | 219% |

Total other expense, net increased by 215% and 219% inAs part of the three and nine months ended September 30, 2017, respectively, compared to the same periods in 2016, almost entirely due to the March 2017 issuance of $345.0 million of 2.375% convertible senior notes due 2022, or 2022 Notes,Flexion Acquisition and the repurchaseMyoScience Acquisition, we acquired intangible assets consisting of $118.2 milliondeveloped technology intangible assets and customer relationships, with estimated useful lives between 9 and 14 years. For more information, see Note 7, Goodwill and Intangible Assets, to our condensed consolidated financial statements included herein.

Pacira BioSciences, Inc. | Q1 2024 Form 10-Q | Page 38

Contingent Consideration Charges (Gains), Restructuring Charges and an increase in interest expense of $3.5 million and $7.7 million in the three and nine months ended September 30, 2017 versus 2016, respectively. There was also an increase in interest income of $0.7 million and $1.9 million in the same respective periods as a result of additional investments from the net proceeds of the 2022 Notes.

Income Tax Expense

Other

The following table provides information regarding our income tax expensea summary of the costs related to the contingent consideration, acquisition-related charges and restructuring charges during the periods indicated, including percent changes (dollar amounts in thousands):

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Three Months Ended

March 31, | | % Increase / (Decrease) |

| | | |

| | | | | | 2024 | | 2023 | |

| Flexion contingent consideration | | | | | | | $ | (3,806) | | | $ | 11,618 | | | N/A |

| Restructuring charges | | | | | | | 5,535 | | | — | | | N/A |

| | | | | | | | | | | |

| Acquisition-related fees | | | | | | | 174 | | | 489 | | | (64)% |

| | | | | | | | | | | |

| Total contingent consideration (gains) charges, restructuring charges and other | | | | | | | $ | 1,903 | | | $ | 12,107 | | | (84)% |

Total contingent consideration (gains) charges, restructuring charges and other decreased 84% in the three months ended March 31, 2024 versus 2023. |

| | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

September 30, | | % Increase / (Decrease) | | Nine Months Ended

September 30, | | % Increase / (Decrease) |

| | | | |

| | 2017 | | 2016 | | | 2017 | | 2016 | |

| Income tax expense | $ | 45 |

| | $ | 36 |

| | 25% | | $ | 105 |

| | $ | 126 |

| | (17)% |

| Effective tax rate | 0 | % | | 0 | % | | | | 0 | % | | 0 | % | | |

During the three months ended March 31, 2023, we recognized a contingent consideration charge of $11.6 million, which was due to a decrease to the assumed discount rate based on a significant improvement in our incremental borrowing rate resulting from the TLA Credit Agreement (as defined below) entered into in March 2023.

During the three months ended March 31, 2024, we recognized restructuring charges of $5.5 million related to employee termination benefits, such as the acceleration of share-based compensation, severance, and, to a lesser extent, other employment-related termination costs, as well as contract termination costs.

For more information, see Note 9, Financial Instruments and Note 14, Contingent Consideration Charges (Gains), Restructuring Charges and Other, to our condensed consolidated financial statements included herein.

Other Income tax expense(Expense), Net

The following table provides information regarding other income (expense), net during the periods indicated, including percent changes (dollar amounts in thousands):

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Three Months Ended

March 31, | | % Increase / (Decrease) |

| | | |

| | | | | | 2024 | | 2023 | |

| Interest income | | | | | | | $ | 3,903 | | | $ | 3,142 | | | 24% |

| Interest expense | | | | | | | (3,316) | | | (9,589) | | | (65)% |

| Loss on early extinguishment of debt | | | | | | | — | | | (16,926) | | | (100)% |

| Other, net | | | | | | | (159) | | | (10) | | | 100% + |

| Total other income (expense), net | | | | | | | $ | 428 | | | $ | (23,383) | | | N/A |

Total other income, net was less than $0.1$0.4 million in the three months ended September 30, 2017March 31, 2024. Total other expense, net was $23.4 million in the three months ended March 31, 2023.

The 24% increase in interest income in the three months ended March 31, 2024 versus 2023 was due to higher interest rates and 2016.overall investment balances.

The 65% decrease in interest expense during the three months ended March 31, 2024 versus 2023 was primarily driven by lower principal outstanding associated with the TLA Term Loan (as defined below) that was entered into on March 31, 2023 which replaced our then-outstanding TLB Term Loan (as defined below) that had a higher principal balance and interest rates.

Pacira BioSciences, Inc. | Q1 2024 Form 10-Q | Page 39

In conjunction with the entry into the TLA Credit Agreement, we incurred a $16.9 million loss on early extinguishment of debt recognized as a result of the retirement of $287.5 million aggregate principal of our TLB Term Loan (as defined below) in the three months ended March 31, 2023. For more information, see Note 8, Debt, to our condensed consolidated financial statements included herein.

Income Tax Expense (Benefit)

The following table provides information regarding our income tax expense (benefit) during the periods indicated, including percent changes (dollar amounts in thousands):

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Three Months Ended

March 31, | | % Increase / (Decrease) |

| | | |

| | | | | | 2024 | | 2023 | |

| Income tax expense (benefit) | | | | | | | $ | 4,661 | | | $ | (6,938) | | | N/A |

| Effective tax rate | | | | | | | 34 | % | | 26 | % | | |

The effective tax rates were 34% and 26% for the three months ended March 31, 2024 and 2023, respectively. Income tax expense was $0.1 million inrepresents the nineestimated annual effective tax rate applied to the year-to-date domestic operating results adjusted for certain discrete tax items.

The effective tax rate for the three months ended September 30, 2017March 31, 2024 include costs related to non-deductible stock-based compensation and 2016.non-deductible executive compensation, partially offset by tax credits and a fair value adjustment for the Flexion contingent consideration. The effective tax expense reflects current state income taxes. Duerate for the three months ended March 31, 2023 includes costs for a fair value adjustment to net losses in both periods, no current federal income tax expense was recorded. Since our deferred tax assets are fully offset byFlexion contingent consideration, and a valuation allowance incomerecorded against non-U.S. results, offset by tax expense does not reflect deferred tax expenses.credits and stock-based compensation benefits.

Liquidity and Capital Resources

Since our inception in December 2006, we have devoted most of our cash resources to manufacturing, research and development and selling, general and administrative activities related to the development and commercialization of EXPAREL. In addition, we acquired ZILRETTA as part of the Flexion Acquisition in November 2021 and iovera° as part of the MyoScience Acquisition in April 2019. We are highlyprimarily dependent on the commercial success of EXPAREL which we launched in April 2012.and ZILRETTA. We have financed our operations primarily with cash generated from product sales, the proceeds from the sale of equityconvertible senior notes and other debt, securities, borrowings under debt facilitiescommon stock, product sales and collaborative licensing and milestone revenue. As of September 30, 2017,March 31, 2024, we had an accumulated deficit of $393.7$97.8 million, cash and cash equivalents short-term investments and long-termavailable-for-sale investments of $374.9$325.9 million and working capital of $313.5$449.7 million.

We expect that our cash and cash equivalents and available-for-sale investments on hand will be adequate to cover our short-term liquidity needs, and that we would be able to access other sources of financing should the need arise.

Summary of Cash Flows

The following table summarizes our cash flows from operating, investing and financing activities for the periods indicated (in thousands): |

| | | | | | | | |

| | | Nine Months Ended

September 30, |

| Condensed Consolidated Statement of Cash Flows Data: | | 2017 | | 2016 |

| Net cash provided by (used in): | | | | |

| Operating activities | | $ | 854 |

| | $ | 16,104 |

|

| Investing activities | | (232,464 | ) | | (54,837 | ) |

| Financing activities | | 221,882 |

| | 6,191 |

|

| Net decrease in cash and cash equivalents | | $ | (9,728 | ) | | $ | (32,542 | ) |

| | | | | | | | | | | | | | |

| | Three Months Ended

March 31, |

| Condensed Consolidated Statements of Cash Flows Data: | | 2024 | | 2023 |

| Net cash provided by (used in): | | | | |

| Operating activities | | $ | 49,101 | | | $ | 19,128 | |

| Investing activities | | (15,530) | | | 66,183 | |

| Financing activities | | (2,817) | | | (153,905) | |

| Net increase (decrease) in cash and cash equivalents | | $ | 30,754 | | | $ | (68,594) | |

Operating Activities

During the ninethree months ended September 30, 2017, ourMarch 31, 2024, net cash provided by operating activities was $0.9$49.1 million, compared to $16.1$19.1 million during the ninethree months ended September 30, 2016.March 31, 2023. The decreaseincrease of $15.3$30.0 million was driven by an increaseattributable to increased revenue, lower interest paid and a $13.0 million payment made in our net loss, primarily from higher clinical trial expenses related to our two Phase 3 EXPAREL nerve block trials, our Phase 4 EXPAREL infiltration trials, payments related tothe prior year for a termination fee relatedrelating to a master distribution agreement with CrossLink BioScience, LLC and additional investments in inventory, partially offset by higher collections from EXPAREL net product sales.licensing agreement.

Pacira BioSciences, Inc. | Q1 2024 Form 10-Q | Page 40

Investing Activities

During the ninethree months ended September 30, 2017, ourMarch 31, 2024, net cash used in investing activities was $232.5$15.5 million, which reflected $212.1$12.7 million of short-term and long-termoutflows from available-for-sale investment purchases (net of maturities) primarily from the net proceedssales), as well as $2.8 million of the 2022 Notes, purchases of fixed assets of $14.2 million and contingent consideration payments of $6.2 million related to the March 2007 acquisition of Skyepharma Holding, Inc., or Skyepharma. Major fixed asset purchases included continuingcapital expenditures for expanding ourmanufacturing product fill lines and for an EXPAREL manufacturing capacity in Swindon, England in partnership with Patheon and facility upgradesexpansion project at our Science Center Campus in San Diego, California.

During the ninethree months ended September 30, 2016, ourMarch 31, 2023, net cash used inprovided by investing activities was $54.8$66.2 million, which reflected $21.2proceeds from $76.7 million of short-termavailable-for-sale investment purchasessales (net of maturities)purchases), partially offset by purchases of fixed assets of $19.8$6.6 million for fill lines for our products and contingent consideration paymentsequipment for an EXPAREL capacity expansion project at our Science Center Campus in San Diego, California and purchases of $13.8 million related to the March 2007 acquisitionequity and debt investments of Skyepharma, including an $8.0 million milestone payment in connection with achieving $250.0 million of EXPAREL net sales collected on an annual basis.

Major fixed asset purchases included continuing expenditures for expanding our manufacturing capacity in Swindon, England in partnership with Patheon.

$4.0 million.

Financing Activities

During the ninethree months ended September 30, 2017, ourMarch 31, 2024, net cash provided byused in financing activities was $221.9$2.8 million which consistedfor a voluntary prepayment of proceeds from the issuance of the 2022 Notes of $345.0 million, partially offset by $11.0 million of debt issuance and financing costs. In addition, a portion of the net proceeds from the 2022 Notes was used to retire $118.2 million in principal of the 2019 Notes and for $0.3 million in related costs. Proceeds from the exercise of stock options were $5.3 million and proceeds from the issuance of shares under our ESPP were $1.1 million.

In the nine months ended September 30, 2016, net cash provided by financing activities consisted of proceeds from the exercise of stock options of $5.2 million and $1.0 million from the issuance of shares under our ESPP.

2022 Convertible Senior Notes

On March 13, 2017, we completed a private placement of $345.0 million in aggregate principal amount of our 2022 Notes, and entered into an indenture agreement, or 2022 Indenture, with respect to the 2022 Notes. The 2022 Notes accrue interest at a fixed rate of 2.375% per annum, payable semiannually in arrears on April 1 and October 1 of each year. The 2022 Notes mature on April 1, 2022. At September 30, 2017, the outstanding principal on the 2022 Notes was $345.0 million.

On or after October 1, 2021, until the close of business on the second scheduled trading day immediately preceding April 1, 2022, holders may convert their 2022 Notes at any time. Upon conversion, holders will receive the principal amount of their 2022 Notes and any excess conversion value. For both the principal and excess conversion value, holders may receive cash, shares of our common stock or a combination of cash and shares of our common stock, at our option. The initial conversion rate for the 2022 Notes is 14.9491 shares of common stock per $1,000 principal amount, which is equivalent to an initial conversion price of approximately $66.89 per share of our common stock. The conversion rate will be subject to adjustment in some events but will not be adjusted for any accrued and unpaid interest.

Prior to the close of business on the business day immediately preceding October 1, 2021, holders may convert the 2022 Notes under certain circumstances, including if during any given calendar quarter, our stock price closes at or above 130% of the conversion price then applicable during a period of at least 20 out of the last 30 consecutive trading days of the previous quarter.

While the 2022 Notes are currently classified on our consolidated balance sheet at September 30, 2017 as long-term debt, the future convertibility and resulting balance sheet classification of this liability will be monitored at each quarterly reporting date and will be analyzed dependent upon market prices of our common stock during the prescribed measurement periods. In the event that the holders of the 2022 Notes have the election to convert the 2022 Notes at any time during the prescribed measurement period, the 2022 Notes would then be considered a current obligation and classified as such.

Prior to April 1, 2020, we may not redeem the 2022 Notes. On or after April 1, 2020, we may redeem for cash all or part of the 2022 Notes if the last reported sale price (as defined in the 2022 Indenture) of our common stock has been at least 130% of the conversion price then in effect for at least 20 trading days (whether or not consecutive) during any 30 consecutive trading-day period ending within five trading days prior to the date on which we provide notice of redemption.

TLA Term Loan principal. See Note 6, 8, Debt, to our condensed consolidated financial statements included herein for further discussion on the TLA Term Loan.

During the three months ended March 31, 2023, net cash used in financing activities was $153.9 million, which primarily consisted of a $296.9 million repayment of TLB Term Loan principal as well as a $5.8 million prepayment penalty, partially offset by the 2022 Notes.net proceeds from the TLA Term Loan of $149.6 million.

Debt

2019 Convertible Senior Notes

2028 Term Loan A Facility

On January 23, 2013,March 31, 2023, we completed a private offering of $120.0 million in aggregate principal of 3.25% convertible senior notes due 2019, or 2019 Notes, and entered into a credit agreement (the “TLA Credit Agreement”) to refinance the indebtedness outstanding under our TLB Credit Agreement (as defined and discussed below). The term loan issued under the TLA Credit Agreement (the “TLA Term Loan”) was issued at a 0.30% discount and provides for a single-advance term loan A facility in the principal amount of $150.0 million, which is secured by substantially all of our and any subsidiary guarantor’s assets and matures on March 31, 2028. We may elect to borrow either (i) alternate base rate borrowings or (ii) term benchmark borrowings or daily simple SOFR (as defined in the TLA Credit Agreement) borrowings. Each term loan borrowing which is an indenture agreement, or 2019 Indenture, with respect to the 2019 Notes. The 2019 Notes accruealternate base rate borrowing bears interest at a rate of 3.25% per annum payable semiannuallyequal to (i) the Alternate Base Rate (as defined in arrearsthe TLA Credit Agreement), plus (ii) a spread based on February 1 and August 1our Senior Secured Net Leverage Ratio ranging from 2.00% to 2.75%. Each term loan borrowing which is a term benchmark borrowing or daily simple SOFR borrowing bears interest at a rate per annum equal to (i) the Adjusted Term SOFR Rate or Adjusted Daily Simple SOFR (as each is defined in the TLA Credit Agreement), plus (ii) a spread based on our Senior Secured Net Leverage Ratio ranging from 3.00% to 3.75%. During the three months ended March 31, 2024, we made a voluntary principal prepayment of $2.8 million. Due to voluntary principal prepayments made, we are not required to make further principal payments for the year ended December 31, 2024, although we retain the option to do so. As of March 31, 2024, borrowings under the TLA Term Loan consisted entirely of term benchmark borrowings at a rate of 8.41%.

The TLA Credit Agreement requires us to, among other things, maintain (i) a Senior Secured Net Leverage Ratio (as defined in the Credit Agreement), determined as of the last day of each year,fiscal quarter, of no greater than 3.00 to 1.00 and mature(ii) a Fixed Charge Coverage Ratio (as defined in the TLA Credit Agreement), determined as of the last day of each fiscal quarter, of no less than 1.50 to 1.00. The TLA Credit Agreement requires us to maintain an unrestricted cash and cash equivalents balance of at least $500.0 million less any prepayments of the 2025 Notes (as defined below) at any time from 91 days prior to the maturity date through the earlier of (i) the latest maturity date of the 2025 Notes and (ii) the date on February 1, 2019.which there is no outstanding principal amount of the 2025 Notes, which we expect to accomplish. The TLA Credit Agreement also contains customary affirmative and negative covenants, financial covenants, representations and warranties, events of default and other provisions. As of September 30, 2017,March 31, 2024, we were in compliance with all financial covenants under the outstanding principal on the 2019 Notes was approximately $0.3 million.

TLA Credit Agreement. See Note 6, 8, Debt, to our condensed consolidated financial statements included herein for further discussiondiscussion.

2025 Convertible Senior Notes

In July 2020, we completed a private placement of $402.5 million in aggregate principal amount of our 0.750% convertible senior notes due 2025, or 2025 Notes, and entered into an indenture with respect to the 20192025 Notes. The 2025 Notes accrue interest at a fixed rate of 0.750% per annum, payable semiannually in arrears on February 1st and August 1st of each year. The 2025 Notes mature on August 1, 2025. At March 31, 2024, the outstanding principal on the 2025 Notes was $402.5 million. See Note 8, Debt, to our condensed consolidated financial statements included herein for further discussion.

Pacira BioSciences, Inc. | Q1 2024 Form 10-Q | Page 41

Future Capital Requirements