000141149412/312021Q2FALSE2,736,4931,624,15611,000,00011,000,00011,000,00011,000,00012,000,00012,000,00012,000,00012,000,0000.000010.0000190,000,000,00090,000,000,000231,366,321228,873,449231,366,321228,873,4490.000010.00001999,999,999999,999,99911110.000010.000011111111647.53.123.0105210.717.610.410.40.610.611.251.251.251.255.58.07.61.815.68.712.54.56.07.012.55.58.56.312.04.57.210.010.00.610.6135.060.48.512.51.49.64.511.52.29.11647.54.415.6852149.69.713.81.21.29.89.80.560.561.11.11.827.014.075.07.515.05.86.06.312.55.58.55.8125.57.09.89.80.560.5650.064.41.89.37.714.01.87.9P1YP3YP1Y17.528.5two years0001411494apo:PrivateEquityFundMember2020-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Form 10-Q

(Mark One)

| | | | | |

| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE QUARTERLY PERIOD ENDED JUNE 30, 2021MARCH 31, 2022 OR

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE TRANSITION PERIOD FROM TO

Commission File Number: 001-35107

APOLLO GLOBALASSET MANAGEMENT, INC.

(Exact name of Registrant as specified in its charter)

| | | | | | | | |

| Delaware | | 20-8880053 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

9 West 57th Street, 43rd42nd Floor

New York, New York 10019

(Address of principal executive offices) (Zip Code)

(212) 515-3200

(Registrant’s telephone number, including area code)

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer”, “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | | | | |

| Large accelerated filer | | ☒ | | Accelerated filer | | ☐ |

| Non-accelerated filer | | ☐ | | Smaller reporting company | | ☐ |

| | | | Emerging growth company | | ☐ |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | | |

| ☐ |

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

Class A Common Stock | | APO | | New York Stock Exchange |

| 6.375% Series A Preferred Stock | | APO.PRAAM.PR A | | New York Stock Exchange |

| 6.375% Series B Preferred Stock | | APO. PRAAM.PR B | | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

As of August 4, 2021,May 7, 2022, there were 235,527,3581,000 shares of Class A common stock, 1 share of Class B common stock and 1 share of Class C common stock of the Registrant outstanding.

As of August 4, 2021, on a fully exchanged and diluted basis, there were 432,935,490 shares of Class A common stock of the Registrant outstanding, which includes 168,253,613 Apollo Operating Group Units held by AP Professional Holdings, L.P. and 29,154,519 Apollo Operating Group Units held by Athene Holding Ltd.

| | | | | | | | |

| TABLE OF CONTENTS | |

| | | Page |

| PART I | | |

| | |

| ITEM 1. | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

ITEM 1A. | | |

| | |

| ITEM 2. | | |

| | |

| ITEM 3. | | |

| | |

| ITEM 4. | | |

| | |

| PART II | OTHER INFORMATION | |

| | |

| ITEM 1. | | |

| | |

| ITEM 1A. | | |

| | |

| ITEM 2. | | |

| | |

| ITEM 3. | | |

| | |

| ITEM 4. | | |

| | |

| ITEM 5. | | |

| | |

| ITEM 6. | | |

| |

| |

Forward-Looking Statements

This quarterly report may contain forward-looking statements that are within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These statements include, but are not limited to, discussions related to Apollo’s expectations regarding the performance of its business, its liquidity and capital resources and the other non-historical statements in the discussion and analysis. These forward-looking statements are based on management’s beliefs, as well as assumptions made by, and information currently available to, management. When used in this quarterly report, the words “believe,” “anticipate,” “estimate,” “expect,” “intend” or future or conditional verbs, such as “will,“intend,” “should,” “could,” or “may,”“target” and variations of such words or similar expressions are intended to identify forward-looking statements. Although management believes that the expectations reflected in these forward-looking statements are reasonable, it can give no assurance that these expectations will prove to behave been correct. These statements are subject to certain risks, uncertainties and assumptions, including risks relating to our dependence on certain key personnel, our ability to raise new credit, private equity, or real assets funds, the impact of COVID-19, the novel coronavirus disease 2019 (“COVID-19”),impact of energy market dislocation, market conditions, and interest rate fluctuations, generally, our ability to manage our growth, fundour ability to operate in highly competitive environments, the performance changes inof the funds we manage, our regulatory environment and tax status,ability to raise new funds, the variability of our revenues, net incomeearnings and cash flow, our dependence on certain key personnel, the accuracy of management’s assumptions and estimates, our use of leverage to finance our businesses and investments by the funds we manage, changes in our funds,regulatory environment and tax status, litigation risks and consummation ofour ability to recognize the benefits expected to be derived from the merger of Apollo with Athene Holding potential corporate governance changes and related transactions which are subject to regulatory, corporate and stockholder approvals,Ltd. (“Athene”), among others. We believe these factors include but are not limited to those described under the section entitled “Risk Factors” in the Company’s Annual Report on Form 10-K filed with the United States Securities and Exchange Commission (“SEC”) on February 19, 202125, 2022 (the “2020“2021 Annual Report”) and Quarterly Report on Form 10-Q filed with the SEC on May 10, 2021,, as such factors may be updated from time to time in our periodic filings with the SEC, which are accessible on the SEC’s website at www.sec.gov. These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included in this report and in our other filings with the SEC. We undertake no obligation to publicly update or review any forward-looking statements, whether as a result of new information, future developments or otherwise, except as required by applicable law.

Terms Used in This Report

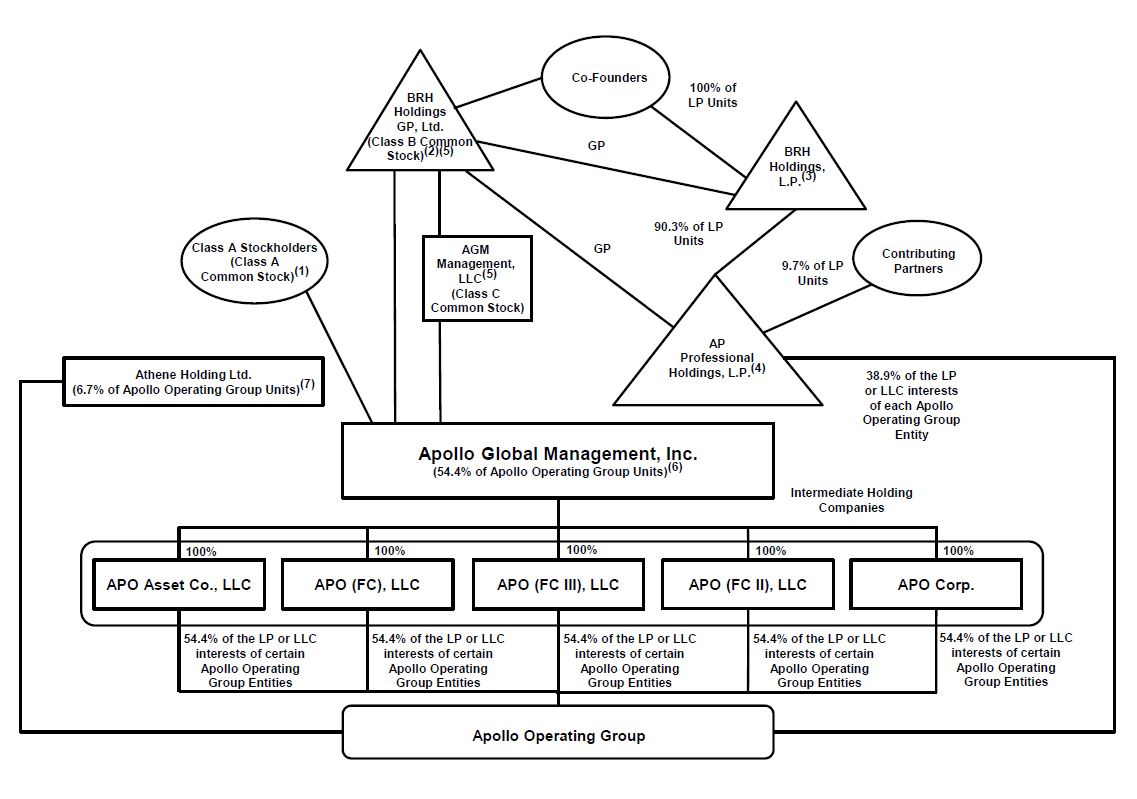

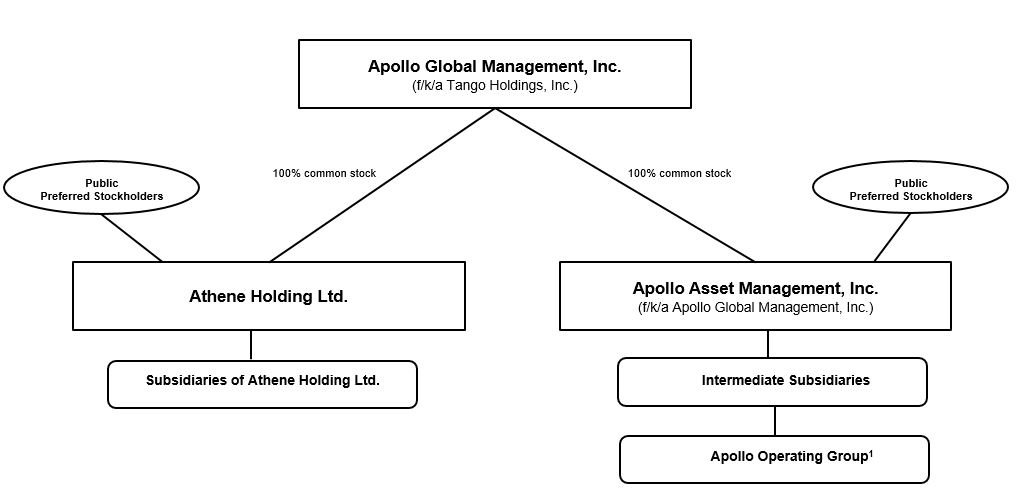

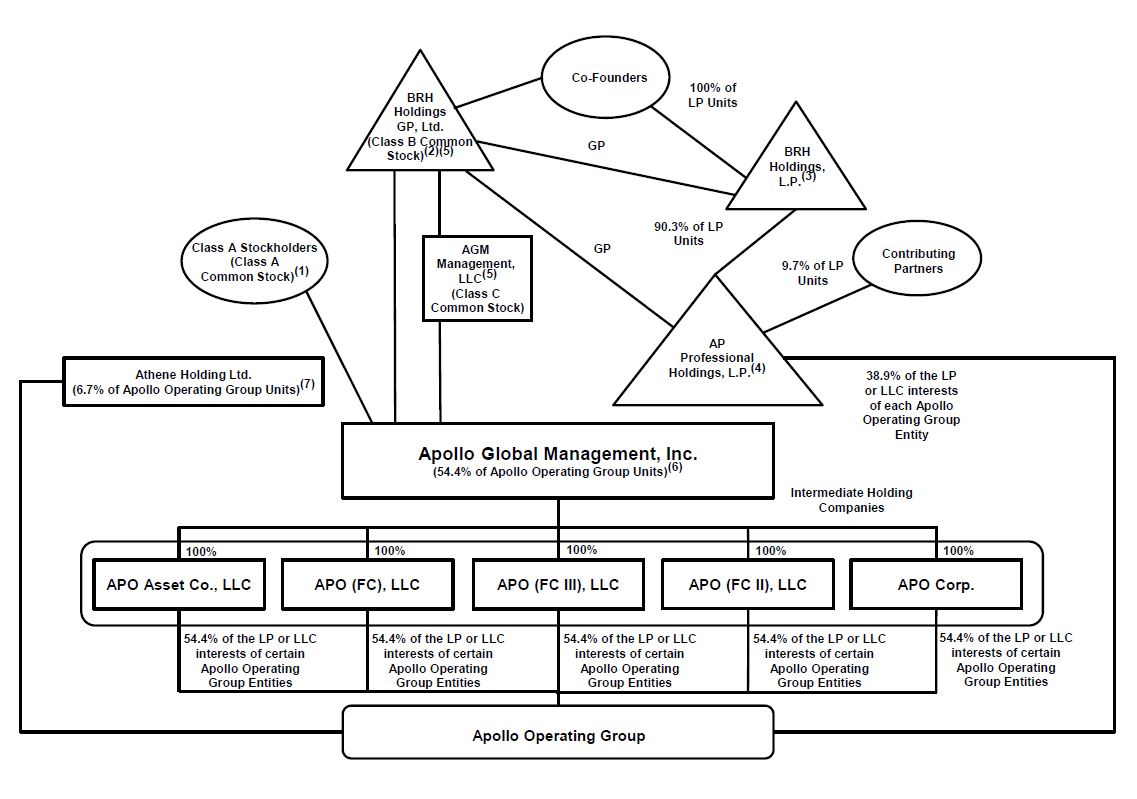

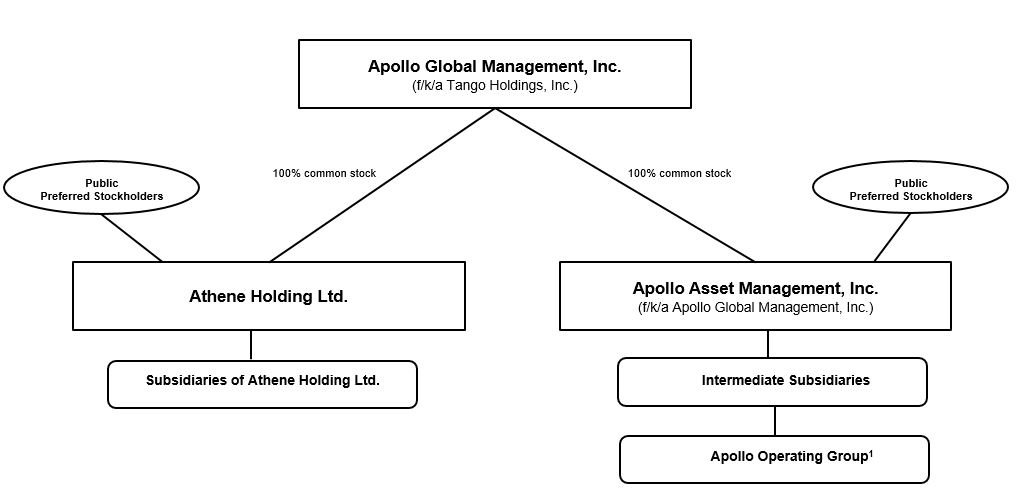

On January 1, 2022, Apollo Global Management, Inc. completed the previously announced merger transactions with Athene (the “Mergers”). Upon the closing of the Mergers, Apollo Global Management, Inc. was renamed Apollo Asset Management, Inc. (“AAM”) and became a subsidiary of Tango Holdings, Inc., and Tango Holdings, Inc. was renamed Apollo Global Management, Inc. (“AGM ”).

In this quarterly report, references to “Apollo,” “we,” “us,” “our”“our,” and the “Company” refer collectively to Apollo Global Management, Inc. (“AGM Inc.”)AAM and its subsidiaries, including the Apollo Operating Group and all of its subsidiaries, or as the context may otherwise require; "Classsubsidiaries. References to “Class A shares" refersshares” refer to the Class A common stock, $0.00001 par value per share, of AGM Inc.;AAM prior to the Mergers; “Class B share” refers to the Class B common stock, $0.00001 par value per share, of AGM Inc.; "ClassAAM prior to the Mergers; “Class C share"share” refers to the Class C common stock, $0.00001 par value per share, of AGM Inc.;AAM prior to the Mergers; “Series A Preferred shares” refers to the 6.375% Series A preferred stock of AGM Inc.;AAM; “Series B Preferred shares” refers to the 6.375% Series B preferred stock of AGM Inc.;AAM; and “Preferred shares” refers to the Series A Preferred shares and the Series B Preferred shares, collectively;collectively. In addition, references to “common stock” of the Company refer to the authorized shares of common stock, par value $0.00001 per share, of AAM following the Mergers.

The use of any defined term in this report to mean more than one entity, person, security or other item collectively is solely for convenience of reference and in no way implies that such entities, persons, securities or other items are one indistinguishable group. For example, notwithstanding the use of the defined terms "Apollo," "we", “us”, "our" and the “Company” in this report to refer to AAM and its subsidiaries, each subsidiary of AAM is a standalone legal entity that is separate and distinct from AAM and any of its other subsidiaries. Any AAM entity referenced herein is responsible for its own financial, contractual and legal obligations.

“AMH” refers to Apollo Management Holdings, L.P., a Delaware limited partnership, that is an indirect subsidiary of AGM Inc.;AAM;

“Apollo funds”, “our funds” and references to the “funds” we manage, refer to the funds (including the parallel funds and alternative investment vehicles of such funds), partnerships, accounts, including strategic investment accounts or “SIAs,” alternative asset companies and other entities for which subsidiaries of the Apollo Operating Group provide investment management or advisory services;

“Apollo Group” means (i) the Class C Stockholder and its affiliates, including their respective general partners, members and limited partners, (ii) Holdings and its affiliates, including their respective general partners, members and limited partners, (iii) with respect to each Co-Founder, such Co-Founder and such Co-Founder’s group (as defined in Section 13(d) of the Exchange Act), (iv) any former or current investment professional of or other employee of an Apollo employer (as defined below) or the Apollo Operating Group (or such other entity controlled by a member of the Apollo Operating Group) and any member of such person’s group, (v) any former or current executive officer of an Apollo employer or the Apollo Operating Group (or such other entity controlled by a member of the Apollo Operating Group) and any member of such person’s group; and (vi) any former or current director of an Apollo employer or the Apollo Operating Group (or such other entity controlled by a member of the Apollo Operating Group) and any member of such person’s group. With respect to any person, Apollo employer means AGM Inc. or such successor thereto or such other entity controlled by AGM Inc. or its successor as may be such person’s employer at such time, but does not include any portfolio companies;

“Apollo Operating Group” refers to (i) the limited partnerships and limited liability companiesentities through which we currently operate our businesses and (ii) one or more limited partnerships or limited liability companiesentities formed for the purpose of, among other activities, holding certain of our gains or losses on our principal investments in the funds, which we refer to as our “principal investments”;

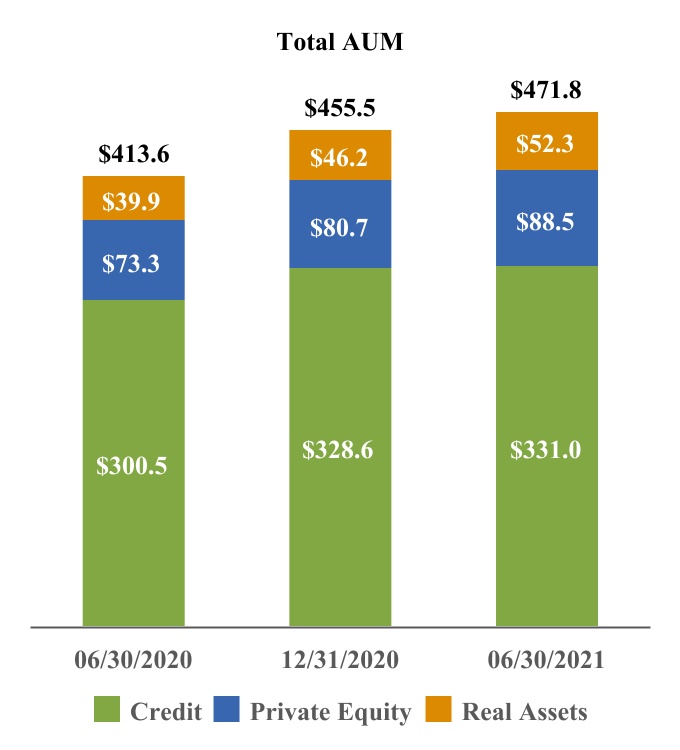

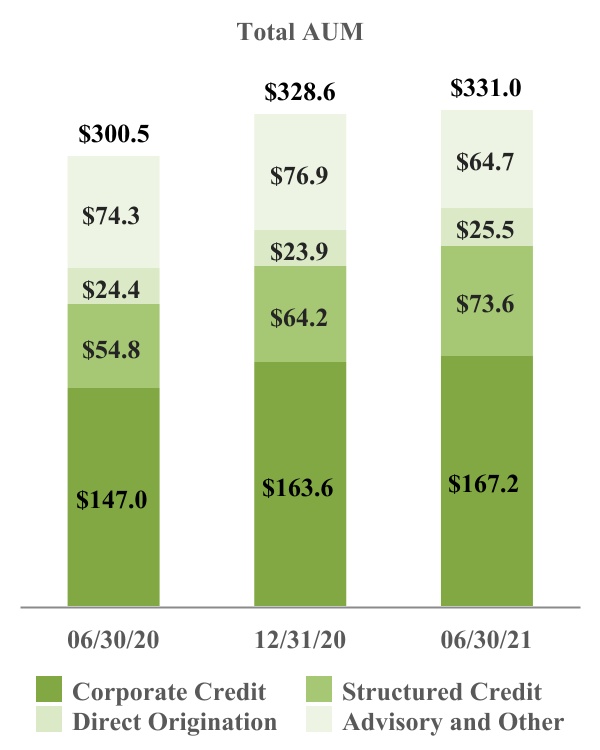

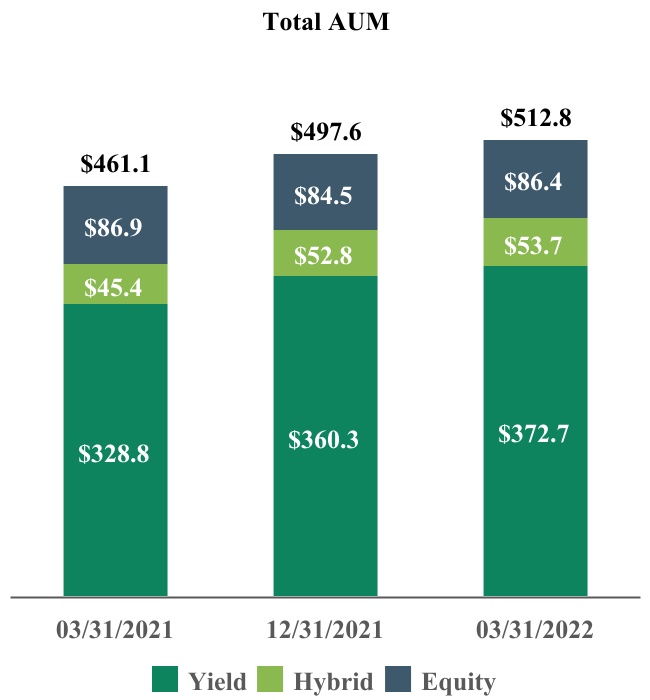

“Assets Under Management”, or “AUM”, refers to the assets of the funds, partnerships and accounts to which we provide investment management, advisory, or certain other investment-related services, including, without limitation, capital that such funds, partnerships and accounts have the right to call from investors pursuant to capital commitments. Our AUM equals the sum of:

(i)the net asset value, or “NAV,” plus used or available leverage and/or capital commitments, or gross assets plus capital commitments, of the credityield and certain hybrid funds, partnerships and accounts for which we provide investment management or advisory services, other than certain collateralized loan obligations (“CLOs”), collateralized debt obligations (“CDOs”), and certain permanentperpetual capital vehicles, which have a fee-generating basis other than the mark-to-market value of the underlying assets; for certain perpetual capital vehicles in yield, gross asset value plus available financing capacity;

(ii)the fair value of the investments of the private equity and real assetscertain hybrid funds, partnerships and accounts we manage or advise, plus the capital that such funds, partnerships and accounts are entitled to call from investors pursuant to capital commitments, plus portfolio level financings; for certain permanent capital vehicles in real assets, gross asset value plus available financing capacity;

(iii)the gross asset value associated with the reinsurance investments of the portfolio company assets we manage or advise; and

(iv)the fair value of any other assets that we manage or advise for the funds, partnerships and accounts to which we provide investment management, advisory, or certain other investment-related services, plus unused credit facilities, including capital commitments to such funds, partnerships and accounts for investments that may require pre-qualification or other conditions before investment plus any other capital commitments to such funds, partnerships and accounts available for investment that are not otherwise included in the clauses above.

Our AUM measure includes Assets Under Management for which we charge either nominal or zero fees. Our AUM measure also includes assets for which we do not have investment discretion, including certain assets for which we earn only investment-related service fees, rather than management or advisory fees. Our definition of AUM is not based on any definition of Assets Under Management contained in our governing documents or in any management agreements of our Apollo fund management agreements.the funds we manage. We consider multiple factors for determining what should be included in our definition of AUM. Such factors include but are not limited to (1) our ability to influence the investment decisions for existing and available assets; (2) our ability to generate income from the underlying assets in our funds;the funds we manage; and (3) the AUM measures that we use internally or believe are used by other investment managers. Given the differences in the investment strategies and structures among other alternative investment managers, our calculation of AUM may differ from the calculations employed by other investment managers and, as a result, this measure may not be directly comparable to similar measures presented by other investment managers. Our calculation also differs from the manner in which our affiliates registered with the SEC report “Regulatory Assets Under Management” on Form ADV and Form PF in various ways;ways.

We use AUM, Gross capital deployed and Dry powder as performance measurements of our investment activities, as well as to monitor fund size in relation to professional resource and infrastructure needs;

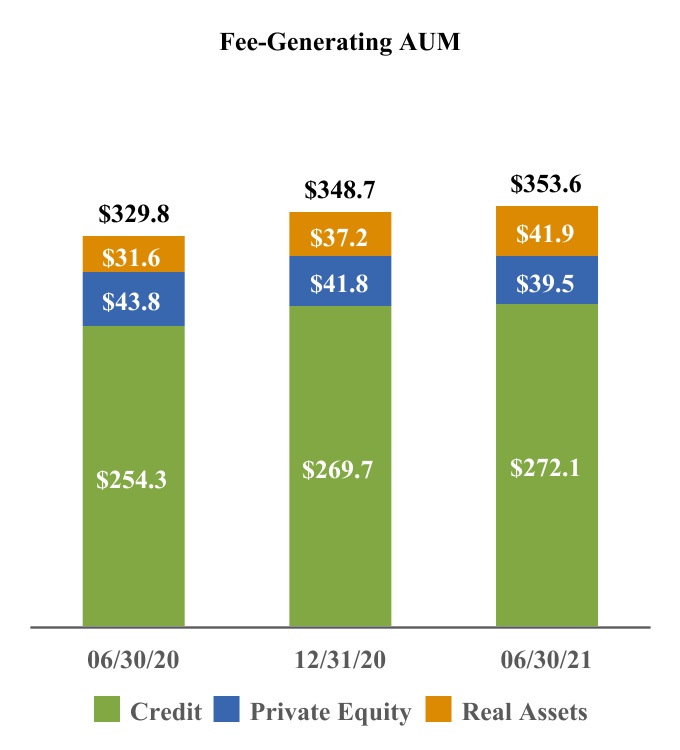

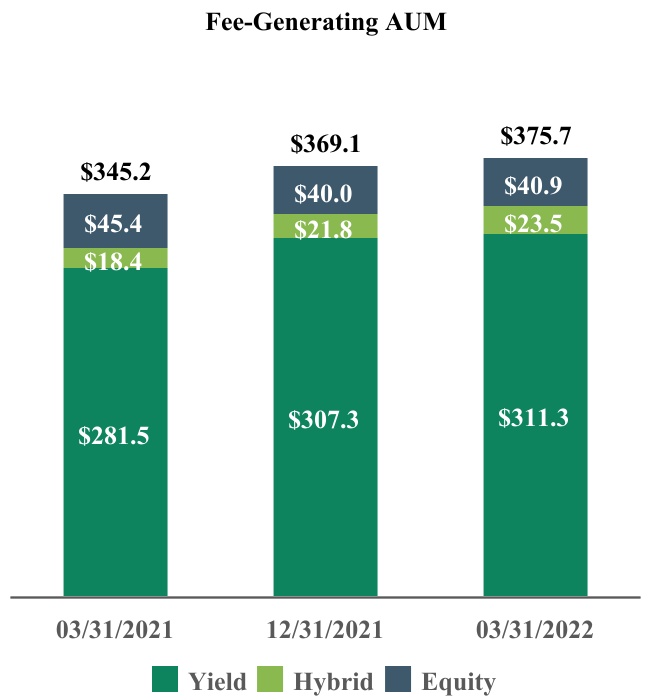

“Fee-Generating AUM” consists of assets of the funds, partnerships and accounts to which we provide investment management, advisory, or certain other investment-related services and on which we earn management fees, monitoring fees or other investment-related fees pursuant to management or other fee agreements on a basis that varies among the Apollo funds, partnerships and accounts. Management fees are normally based on “net asset value,” “gross assets,” “adjusted par asset value,” “adjusted cost of all unrealized portfolio investments,” “capital commitments,” “adjusted assets,” “stockholders’ equity,” “invested capital” or “capital contributions,” each as defined in the applicable management agreement. Monitoring fees, also referred to as advisory fees, with respect to the structured portfolio company investments of the funds, partnerships and accounts we manage or advise, are generally based on the total value of such structured portfolio company investments, which normally includes leverage, less any portion of such total value that is already considered in Fee-Generating AUM;

“Non-Fee-Generating AUM” refers to AUM that does not produce management fees or monitoring fees. This measure generally includes the following:

(i)fair value above invested capital for those funds that earn management fees based on invested capital;

(ii)net asset values related to general partner and co-investment interests;

(iii)unused credit facilities;

(iv)available commitments on those funds that generate management fees on invested capital;

(v)structured portfolio company investments that do not generate monitoring fees; and

(vi)the difference between gross asset and net asset value for those funds that earn management fees based on net asset value.

“Performance Fee-Eligible AUM” refers to the AUM that may eventually produce performance fees. All funds for which we are entitled to receive a performance fee allocation or incentive fee are included in Performance Fee-Eligible AUM, which consists of the following:

(i) “Performance Fee-Generating AUM”, which refers to invested capital of the funds, partnerships and accounts we manage, advise, or to which we provide certain other investment-related services, that is currently above its hurdle rate or preferred return, and profit of such funds, partnerships and accounts is being allocated to, or earned by, the general partner in accordance with the applicable limited partnership agreements or other governing agreements;

(ii) “AUM Not Currently Generating Performance Fees”, which refers to invested capital of the funds, partnerships and accounts we manage, advise, or to which we provide certain other investment-related services, that is currently below its hurdle rate or preferred return; and

(iii) “Uninvested Performance Fee-Eligible AUM”, which refers to capital of the funds, partnerships and accounts we manage, advise, or to which we provide certain other investment-related services, that is available for investment or reinvestment subject to the provisions of applicable limited partnership agreements or other governing agreements, which capital is not currently part of the NAV or fair value of investments that may eventually produce performance fees allocable to, or earned by, the general partner.

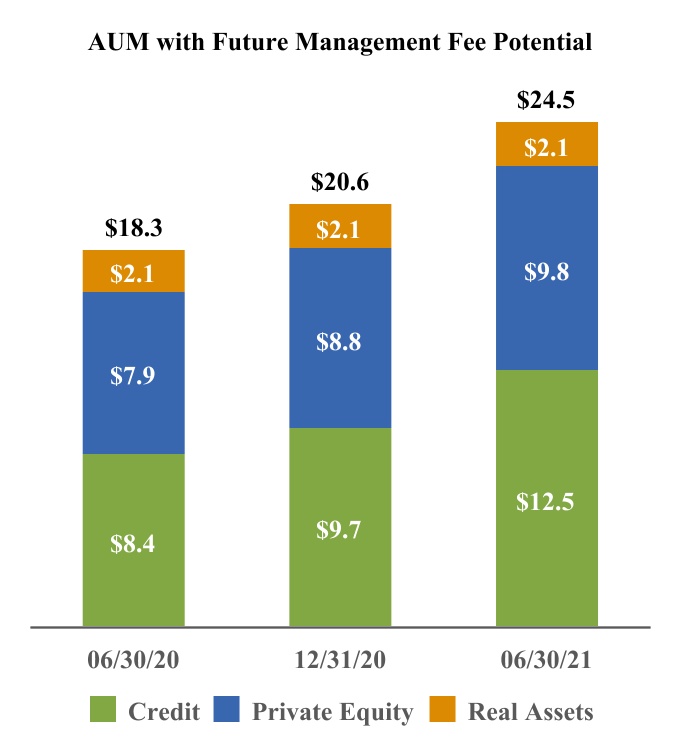

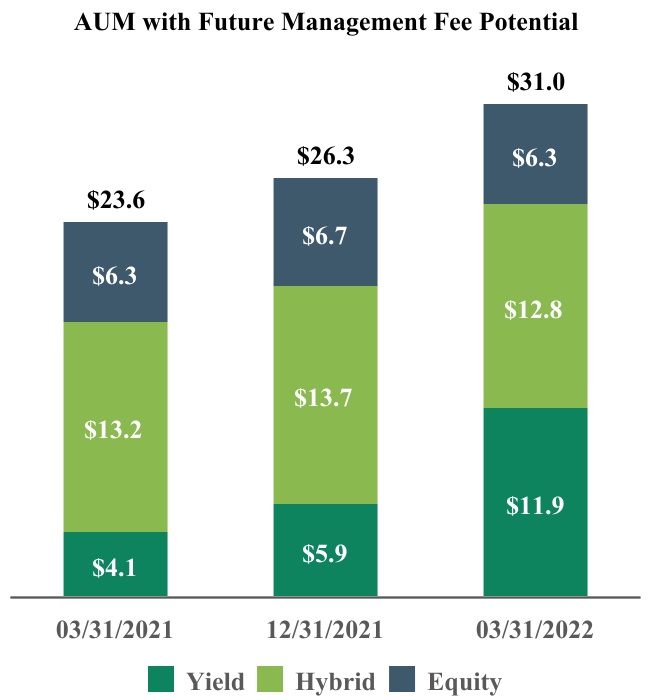

“AUM with Future Management Fee Potential” refers to the committed uninvested capital portion of total AUM not

currently earning management fees. The amount depends on the specific terms and conditions of each fund;

We use AUM as a performance measure of our funds’ investment activities of the funds we manage, as well as to monitor fund size in relation to professional resource and infrastructure needs. Non-Fee-Generating AUM includes assets on which we could earn performance fees;

“Advisory” refers to certain assets advised by Apollo Asset Management Europe PC LLP (“AAME PC”), a wholly-owned subsidiary of Apollo Asset Management Europe LLP (“AAME”). AAME PC and AAME are subsidiaries of Apollo and are collectively referred to herein as “ISGI”;

“Athene Holding” or “AHL” refers to Athene Holding Ltd. (together with its subsidiaries, “Athene”), a leading retirement services company that issues, reinsures and acquires retirement savings products designed for the increasing number of individuals and institutions seeking to fund retirement needs, and to which Apollo, through its consolidated subsidiary Apollo Insurance Solutions Group LP (formerly known as Athene Asset Management LLC) (“ISG”), provides asset management and advisory services;services. Athene Holding is a subsidiary of our parent company, Apollo Global Management, Inc.;

“Athora Holding” refers to Athora Holding, Ltd. (“Athora Holding” and together with its subsidiaries, “Athora”), a strategic platform that acquires or reinsures blocks of insurance business in the German and broader European life insurance market (collectively, the “Athora Accounts”). The Company, through ISGI, provides investment advisory services to Athora. Athora Non-Sub-Advised Assets includes the Athora assets which are managed by Apollo but not sub-advised by Apollo nor invested in Apollo funds or investment vehicles. Athora Sub-Advised includes assets which the Company explicitly sub-advises as well as those assets in the Athora Accounts which are invested directly in funds and investment vehicles Apollo manages;

“capital deployed” or “deployment”Contributing Partners” refer to those of our current and former partners and their related parties (other than Messrs. Leon Black, Joshua Harris and Marc Rowan, our co-founders) who indirectly beneficially owned (through Holdings) Apollo Operating Group units;

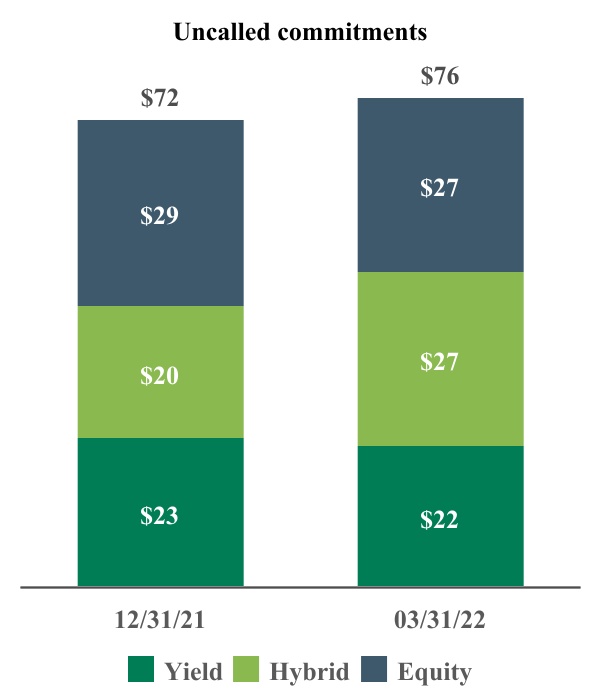

“Dry Powder” represents (i) the aggregate amount of capital that has been invested during a given period (including leverage) by our commitment basedavailable for investment or reinvestment subject to the provisions of the applicable limited partnership agreements or other governing agreements of the funds, and SIAs that have a defined maturity date, (ii) purchases of investments (net of sales) by our subscription and contribution based funds and mandates (including leverage), (iii) investments originated by certain of our platform companies, net of syndications to our other fundspartnerships and accounts but including syndicationswe manage. Dry powder excludes uncalled commitments which can only be called for fund fees and expenses and commitments from Perpetual Capital Vehicles;

“Equity Plan” refers to third parties,AGM’s 2007 Omnibus Equity Incentive Plan, which effective as of July 22, 2019, was amended, restated and (iv) third-party investment activity in opportunities sourced by our teams for which we earn a fee and in which we participate. Deployment excludes offsetting short positions, certain credit derivatives, certain short-dated government securities, and involuntary repayment of loans and bonds;

renamed the 2019 Omnibus Equity Incentive Plan; “Co-Founders”Former Managing Partners” refer to Messrs. Leon Black, Joshua Harris and Marc Rowan collectively and, when used in reference to holdings of interests in Apollo or Holdings, includes certain related parties of such individuals;

“Contributing Partners” refer to those

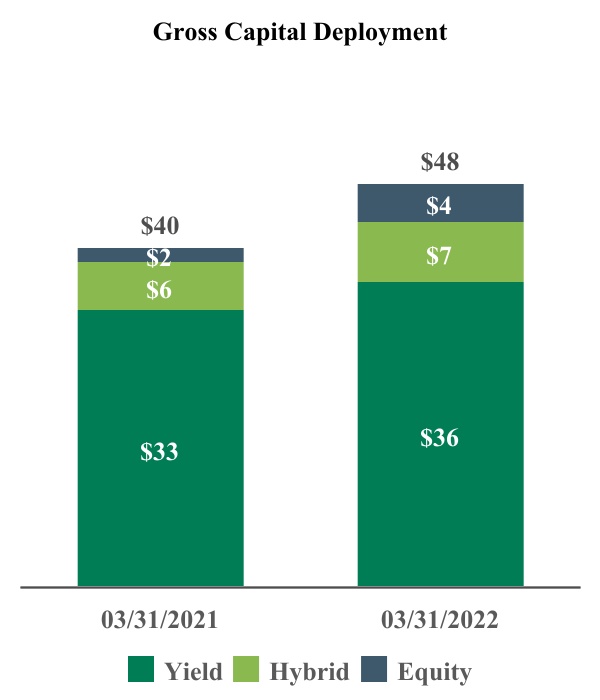

“drawdownGross capital deployed” or “drawdown deployment” isrepresents the aggregate amount ofgross capital that has been invested in investments by the funds and accounts we manage during a giventhe relevant period, (which may,but excludes certain investment activities primarily related to hedging and cash management functions at the firm. Gross capital deployment is not reduced or netted down by sales or refinancings, and takes into account leverage used by the funds and accounts we manage in certain cases, include leverage) by (i) our commitment-based funds, excluding certain funds in which permanent capital vehicles are the primary investor and (ii) SIAs that have a defined maturity date;

“Equity Plan” refersgaining exposure to the Company’s 2007 Omnibus Equity Incentive Plan, which effective as of July 22, 2019, was amended, restated and renamed the 2019 Omnibus Equity Incentive Plan;various investments that they have made;

“gross IRR” of a credit fund and the principal finance funds within the real assets segment represents the annualized return of a fund based on the actual timing of all cumulative fund cash flows before management fees, performance fees allocated to the general partner and certain other expenses. Calculations may include certain investors that do not pay fees. The terminal value is the net asset value as of the reporting date. Non-U.S. dollar denominated (“USD”) fund cash flows and residual values are converted to USD using the spot rate as of the reporting date. In addition, gross IRRs at the fund level will differ from those at the individual investor level as a result of, among other factors, timing of investor-level inflows and outflows. Gross IRR does not represent the return to any fund investor;

“gross IRR” of atraditional private equity or hybrid value fund represents the cumulative investment-related cash flows (i) for a given investment for the fund or funds which made such investment, and (ii) for a given fund, in the relevant fund itself (and not any one investor in the fund), in each case, on the basis of the actual timing of investment inflows and outflows (for unrealized investments assuming disposition on June 30, 2021March 31, 2022 or other date specified) aggregated on a gross basis quarterly, and the return is annualized and compounded before management fees, performance fees and certain other expenses (including interest incurred by the fund itself) and measures the returns on the fund’s investments as a whole without regard to whether all of the returns would, if distributed, be payable to the fund’s investors. In addition, gross IRRs at the fund level will differ from those at the individual investor level as a result of, among other factors, timing of investor-level inflows and outflows. Gross IRR does not represent the return to any fund investor;

“gross IRR”return” or “gross ROE” of a real assetstotal return yield fund excludingor the principal finance funds represents the cumulative investment-related cash flows in the fund itself (and not any one investor in the fund), on the basis of the actual timing of cash inflows and outflows (for unrealized investments assuming disposition on June 30, 2021 or other date specified) starting on the date that each investment closes, and the return is annualized and compounded before management fees, performance fees, and certain other expenses (including interest incurred by the fund itself) and measures the returns on the fund’s investments as a whole without regard to whether all of the returns would, if distributed, be payable to the fund’s investors. Non-USD fund cash flows and residual values are converted to USD using the spot rate as of the reporting date. In addition, gross IRRs at the fund level will differ from those at the individual investor level as a result of, among other factors, timing of investor-level inflows and outflows. Gross IRR does not represent the return to any fund investor;

“gross return” of ahybrid credit or real assetshedge fund is the monthly or quarterly time-weighted return that is equal to the percentage change in the value of a fund’s portfolio, adjusted for all contributions and withdrawals (cash flows) before the effects of management fees, incentive fees allocated to the general partner, or other fees and expenses. Returns for credit fundsthese categories are calculated for all funds and accounts in the respective strategies excluding assets for Athene, Athora and certain other entities where we manage or may manage a significant portion of the total company assets. Returns of CLOs represent the gross returns on assets.strategies. Returns over multiple periods are calculated by geometrically linking each period’s return over time;time. Gross return and gross ROE do not represent the return to any fund investor;

“HoldCo” refers to Tango Holdings, Inc., which was subsequently renamed Apollo Global Management, Inc. in connection with the Mergers;

“Holdings” means AP Professional Holdings, L.P., a Cayman Islands exempted limited partnership through which our Co-FoundersFormer Managing Partners and Contributing Partners indirectly beneficially ownowned their interests in the Apollo Operating Group units;

“inflows” represents (i) at the individual segment level, subscriptions, commitments, and other increases in available capital, such as acquisitions or leverage, net of inter-segment transfers, and (ii) on an aggregate basis, the sum of inflows across the credit, privateyield, hybrid and equity and real assets segments;strategies;

“net IRR” of a credit fund and the principal finance funds within the real assets segment represents the annualized return of a fund after management fees, performance fees allocated to the general partner and certain other expenses, calculated on investors that pay such fees. The terminal value is the net asset value as of the reporting date. Non-USD fund cash flows and residual values are converted to USD using the spot rate as of the reporting date. In addition, net IRR at the fund level will differ from that at the individual investor level as a result of, among other factors, timing of investor-level inflows and outflows. Net IRR does not represent the return to any fund investor;

“net IRR” of atraditional private equity or hybrid value fund means the gross IRR applicable to a fund, including returns for related parties which may not pay fees or performance fees, net of management fees, certain expenses (including interest incurred or earned by the fund itself) and realized performance fees all offset to the extent of interest income, and measures returns at the fund level on amounts that, if distributed, would be paid to investors of the fund. The timing of cash flows applicable to investments, management fees and certain expenses, may be adjusted for the usage of a fund’s subscription facility. To the extent that a fund exceeds all requirements detailed within the applicable fund agreement, the estimated unrealized value is adjusted such that a percentage of up to 20.0% of the unrealized gain is allocated to the general partner of such fund, thereby reducing the balance attributable to fund investors. In addition, net IRR at the fund level will differ from that at the individual investor level as a result of, among other factors, timing of investor-level inflows and outflows. Net IRR does not represent the return to any fund investor;

“net IRR”return” or “net ROE” of a real assetstotal return yield fund excludingor the principal finance funds represents the cumulative cash flows in the fund (and not any one investor in the fund), on the basis of the actual timing of cash inflows received from and outflows paid to investors of the fund (assuming the ending net asset value as of June 30, 2021 or other date specified is paid to investors), excluding certain non-fee and non-performance fee bearing parties, and the return is annualized and compounded after management fees, performance fees, and certain other expenses (including interest incurred by the fund itself) and measures the returns to investors of the fund as a whole. Non-USD fund cash flows and residual values are converted to USD using the spot rate as of the reporting date. In addition, net IRR at the fund level will differ from that at the individual investor level as a result of, among other factors, timing of investor-level inflows and outflows. Net IRR does not represent the return to any fund investor;

“net return” of ahybrid credit or real assetshedge fund represents the gross return after management fees, performance fees allocated to the general partner, or other fees and expenses. Returns over multiple periods are calculated by geometrically linking each period’s return over time;time. Net return and net ROE do not represent the return to any fund investor;

“other operating expenses” within the Principal Investing segment represents expenses incurred in the normal course of business and includes allocations of non-compensation expenses related to managing the business;

“performance allocations”, “performance fees”, “performance revenues”, “incentive fees” and “incentive income” refer to interests granted to Apollo by an Apollo fund that entitle Apollo to receive allocations, distributions or fees which are based on the performance of such fund or its underlying investments;

“permanentperpetual capital vehicles” refers to (a) assets that are owned by or related to Athene or Athora but only to the extent that origination or acquisitions of new liabilities exceed the run off driven by maturity or termination of existing liabilities, (b) assets that are owned by or related to MidCap FinCo Designated Activity Company (“MidCap”) and managed by Apollo, (c) assets of publicly traded vehicles managed by Apollo such as Apollo Investment Corporation (“AINV”), Apollo Commercial Real Estate Finance, Inc. (“ARI”), Apollo Tactical Income Fund Inc. (“AIF”), and Apollo Senior Floating Rate Fund Inc. (“AFT”), in each case that do not have redemption provisions or a requirement to return capital to investors upon exiting the investments made with such capital, except as required by applicable law, and (d) assets of Apollo Debt Solutions BDC ("ADS"), a non-traded business development company managed by Apollo, and (e) a publicly traded business development company from which

Apollo earns certain investment-related service fees. The investment management agreements of AINV, AIF and AFT have one year terms and the investment management agreement of ADS has an initial term of two years and then is subject to annual renewal. These investment management agreements are reviewed annually and remain in effect only if approved by the boards of directors of such companies or by the affirmative vote of the holders of a majority of the outstanding voting shares of such companies, including in either case, approval by a majority of the directors who are not “interested persons” as defined in the Investment Company Act of 1940, as amended (the “Investment Company Act”). In addition, the investment management agreements of AINV, AIF, AFT and AFTADS may be terminated in certain circumstances upon 60 days’ written notice. The investment management agreement of ARI has a one year term and is reviewed annually by ARI’s board of directors and may be terminated under certain circumstances by an affirmative vote of at least two-thirds of ARI’s independent directors. The investment management or advisory arrangements between each of MidCap and Apollo, Athene and Apollo and Athora and Apollo, may also be terminated under certain circumstances. The agreement pursuant to which Apollo earns certain investment-related service fees from a non-traded business development company may be terminated under certain limited circumstances;

“private equity fund appreciation (depreciation)” refersPrincipal investing compensation” within the Principal Investing segment represents realized performance compensation, distributions related to gain (loss)investment income and income fordividends, and includes allocations of certain compensation expenses related to managing the traditional private equity funds (as defined below), Apollo Natural Resources Partners, L.P. (together with its alternative investment vehicles, “ANRP I”), Apollo Natural Resources Partners II, L.P. (together with its alternative investment vehicles, “ANRP II”), Apollo Natural Resources Partners III, L.P. (together with its parallel vehicles and alternative investment vehicles, “ANRP III”), Apollo Special Situations Fund, L.P., AION Capital Partners Limited (“AION”) and Apollo Hybrid Value Fund, L.P. (together with its parallel funds and alternative investment vehicles, “HVF I”) for the periods presented on a total return basis before giving effect to fees and expenses. The performance percentage is determined by dividing (a) the change in the fair value of investments over the period presented, minus the change in invested capital over the period presented, plus the realized value for the period presented, by (b) the beginning unrealized value for the period presented plus the change in invested capital for the period presented. Returns over multiple periods are calculated by geometrically linking each period’s return over time;business;

“private equity investments” refer to (i) direct or indirect investments in existing and future private equity funds managed or sponsored by Apollo, (ii) direct or indirect co-investments with existing and future private equity funds managed or sponsored by Apollo, (iii) direct or indirect investments in securities which are not immediately capable of resale in a public market that

Apollo identifies but does not pursue through its private equity funds, and (iv) investments of the type described in (i) through (iii) above made by Apollo funds;

“Realized Value” refers to all cash investment proceeds received by the relevant Apollo fund, including interest and dividends, but does not give effect to management fees, expenses, incentive compensation or performance fees to be paid by such Apollo fund;

“Redding Ridge” refers to Redding Ridge Asset Management, LLC and its subsidiaries, which is a standalone, self-managed asset management business established in connection with risk retention rules that manages CLOs and retains the required risk retention interests;

“Remaining Cost” represents the initial investment of the fund in a portfolio investment, reduced for any return of capital distributed to date on such portfolio investment;

“Total Invested Capital” refers to the aggregate cash invested by the relevant Apollo fund and includes capitalized costs relating to investment activities, if any, but does not give effect to cash pending investment or available for reserves and excludes amounts, if any, invested on a financed basis with leverage facilities;

“Total Value” represents the sum of the total Realized Value and Unrealized Value of investments;

“traditional private equity funds” refers to Apollo Investment Fund I, L.P. (“Fund I”), AIF II, L.P. (“Fund II”), a mirrored investment account established to mirror Fund I and Fund II for investments in debt securities (“MIA”), Apollo Investment Fund III, L.P. (together with its parallel funds, “Fund III”), Apollo Investment Fund IV, L.P. (together with its parallel fund, “Fund IV”), Apollo Investment Fund V, L.P. (together with its parallel funds and alternative investment vehicles, “Fund V”), Apollo Investment Fund VI, L.P. (together with its parallel funds and alternative investment vehicles, “Fund VI”), Apollo Investment Fund VII, L.P. (together with its parallel funds and alternative investment vehicles, “Fund VII”), Apollo Investment Fund VIII, L.P. (together with its parallel funds and alternative investment vehicles, “Fund VIII”) and Apollo Investment Fund IX, L.P. (together with its parallel funds and alternative investment vehicles, “Fund IX”);

“Unrealized Value” refers to the fair value consistent with valuations determined in accordance with generally accepted accounting principles in the United States of America (“U.S. GAAP”), for investments not yet realized and may include payments in kind, accrued interest and dividends receivable, if any, and before the effect of certain taxes. In addition, amounts include committed and funded amounts for certain investments; and

“Vintage Year” refers to the year in which a fund’s final capital raise occurred, or, for certain funds, the year of a fund’s effective date or the year in which a fund’s investment period commences pursuant to its governing agreements..

PART I—I - FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

APOLLO GLOBALASSET MANAGEMENT, INC.

CONDENSED CONSOLIDATED STATEMENTS OF FINANCIAL CONDITION (UNAUDITED)

AS OF JUNE 30, 2021MARCH 31, 2022 AND DECEMBER 31, 20202021

(dollars in thousands, except share data)

| | | As of

June 30, 2021 | | As of

December 31, 2020 | | As of

March 31, 2022 | | As of

December 31, 2021 |

| Assets: | Assets: | | | | Assets: | | | |

| Cash and cash equivalents | Cash and cash equivalents | $ | 1,824,712 | | | $ | 1,555,517 | | Cash and cash equivalents | $ | 1,245,606 | | | $ | 917,183 | |

| Restricted cash and cash equivalents | Restricted cash and cash equivalents | 1,524,902 | | | 17,708 | | Restricted cash and cash equivalents | 1,037,673 | | | 707,885 | |

| U.S. Treasury securities, at fair value | 0 | | | 816,985 | | |

| Investments (includes performance allocations of $2,736,493 and $1,624,156 as of June 30, 2021 and December 31, 2020, respectively) | 7,910,519 | | | 4,995,411 | | |

| Investments (includes performance allocations of $3,062,672 and $2,731,733 as of March 31, 2022 and December 31, 2021, respectively) | | Investments (includes performance allocations of $3,062,672 and $2,731,733 as of March 31, 2022 and December 31, 2021, respectively) | 6,970,485 | | | 11,353,580 | |

| Assets of consolidated variable interest entities: | Assets of consolidated variable interest entities: | | Assets of consolidated variable interest entities: | |

| Cash and cash equivalents | Cash and cash equivalents | 805,736 | | | 893,306 | | Cash and cash equivalents | 19,353 | | | 463,266 | |

| Investments, at fair value | Investments, at fair value | 13,659,631 | | | 13,316,016 | | Investments, at fair value | 455,621 | | | 14,737,051 | |

| Other assets | Other assets | 167,989 | | | 290,264 | | Other assets | 11 | | | 251,581 | |

| Incentive fees receivable | 13,802 | | | 5,231 | | |

| Due from related parties | Due from related parties | 425,927 | | | 462,383 | | Due from related parties | 370,434 | | | 493,826 | |

| Deferred tax assets, net | Deferred tax assets, net | 235,118 | | | 539,244 | | Deferred tax assets, net | 673,195 | | | 424,132 | |

| Other assets | Other assets | 494,455 | | | 364,963 | | Other assets | 802,051 | | | 585,901 | |

| Lease assets | Lease assets | 361,597 | | | 295,098 | | Lease assets | 606,961 | | | 450,531 | |

| Goodwill | Goodwill | 116,958 | | | 116,958 | | Goodwill | 130,112 | | | 116,958 | |

| Total Assets | Total Assets | $ | 27,541,346 | | | $ | 23,669,084 | | Total Assets | $ | 12,311,502 | | | $ | 30,501,894 | |

| Liabilities, Redeemable non-controlling interests and Stockholders’ Equity | Liabilities, Redeemable non-controlling interests and Stockholders’ Equity | | | | Liabilities, Redeemable non-controlling interests and Stockholders’ Equity | | | |

| Liabilities: | Liabilities: | | Liabilities: | |

| Accounts payable and accrued expenses | Accounts payable and accrued expenses | $ | 141,688 | | | $ | 119,982 | | Accounts payable and accrued expenses | $ | 138,082 | | | $ | 145,054 | |

| Accrued compensation and benefits | Accrued compensation and benefits | 169,554 | | | 82,343 | | Accrued compensation and benefits | 110,537 | | | 130,107 | |

| Deferred revenue | Deferred revenue | 74,946 | | | 30,369 | | Deferred revenue | 132,079 | | | 119,688 | |

| Due to related parties | Due to related parties | 439,662 | | | 608,469 | | Due to related parties | 1,724,971 | | | 1,222,402 | |

| Profit sharing payable | Profit sharing payable | 1,521,906 | | | 842,677 | | Profit sharing payable | 1,623,854 | | | 1,444,652 | |

| Debt | Debt | 3,154,289 | | | 3,155,221 | | Debt | 2,815,348 | | | 3,134,396 | |

| Liabilities of consolidated variable interest entities: | Liabilities of consolidated variable interest entities: | | Liabilities of consolidated variable interest entities: | |

| Debt, at fair value | Debt, at fair value | 8,077,288 | | | 8,660,515 | | Debt, at fair value | 162 | | | 7,942,508 | |

| Notes payable | Notes payable | 2,498,748 | | | 2,471,971 | | Notes payable | — | | | 2,611,019 | |

| Other liabilities | Other liabilities | 912,439 | | | 773,045 | | Other liabilities | 1,755 | | | 781,482 | |

| Other liabilities | Other liabilities | 511,750 | | | 295,612 | | Other liabilities | 511,807 | | | 500,980 | |

| Lease liabilities | Lease liabilities | 409,930 | | | 332,915 | | Lease liabilities | 671,613 | | | 505,206 | |

| Total Liabilities | Total Liabilities | 17,912,200 | | | 17,373,119 | | Total Liabilities | 7,730,208 | | | 18,537,494 | |

| Commitments and Contingencies (see note 15) | Commitments and Contingencies (see note 15) | 0 | | 0 | Commitments and Contingencies (see note 15) | 0 | | 0 |

| Redeemable non-controlling interests: | Redeemable non-controlling interests: | | Redeemable non-controlling interests: | |

| Redeemable non-controlling interests | Redeemable non-controlling interests | 1,416,711 | | | 782,702 | | Redeemable non-controlling interests | 1,790,014 | | | 1,770,034 | |

| Stockholders’ Equity: | Stockholders’ Equity: | | Stockholders’ Equity: | |

| Apollo Global Management, Inc. Stockholders’ Equity: | | |

| Apollo Asset Management, Inc. Stockholders’ Equity: | | Apollo Asset Management, Inc. Stockholders’ Equity: | |

| | Series A Preferred Stock, 11,000,000 shares issued and outstanding as of June 30, 2021 and December 31, 2020 | 264,398 | | | 264,398 | | |

| Series A Preferred Stock, 11,000,000 shares issued and outstanding as of March 31, 2022 and December 31, 2021 | | Series A Preferred Stock, 11,000,000 shares issued and outstanding as of March 31, 2022 and December 31, 2021 | 264,398 | | | 264,398 | |

| | Series B Preferred Stock, 12,000,000 shares issued and outstanding as of June 30, 2021 and December 31, 2020 | 289,815 | | | 289,815 | | |

| Series B Preferred Stock, 12,000,000 shares issued and outstanding as of March 31, 2022 and December 31, 2021 | | Series B Preferred Stock, 12,000,000 shares issued and outstanding as of March 31, 2022 and December 31, 2021 | 289,815 | | | 289,815 | |

|

| | Class A Common Stock, $0.00001 par value, 90,000,000,000 shares authorized, 231,366,321 and 228,873,449 shares issued and outstanding as of June 30, 2021 and December 31, 2020, respectively | 0 | | | 0 | | |

| Common Stock, $0.00001 par value, 40,000,000 and 0 shares authorized as of March 31, 2022 and December 31, 2021, respectively, 1,000 and 0 shares issued and outstanding as of March 31, 2022 and December 31, 2021, respectively | | Common Stock, $0.00001 par value, 40,000,000 and 0 shares authorized as of March 31, 2022 and December 31, 2021, respectively, 1,000 and 0 shares issued and outstanding as of March 31, 2022 and December 31, 2021, respectively | — | | | — | |

| | Class B Common Stock, $0.00001 par value, 999,999,999 shares authorized, 1 share issued and outstanding as of June 30, 2021 and December 31, 2020 | 0 | | | 0 | | |

| Class C Common Stock, $0.00001 par value, 1 share authorized, 1 share issued and outstanding as of June 30, 2021 and December 31, 2020 | 0 | | | 0 | | |

| Class A Common Stock, $0.00001 par value, 0 and 90,000,000,000 shares authorized as of March 31, 2022 and December 31, 2021, respectively, 0 and 248,896,649 shares issued and outstanding as of March 31, 2022 and December 31, 2021, respectively | | Class A Common Stock, $0.00001 par value, 0 and 90,000,000,000 shares authorized as of March 31, 2022 and December 31, 2021, respectively, 0 and 248,896,649 shares issued and outstanding as of March 31, 2022 and December 31, 2021, respectively | — | | | — | |

| Class B Common Stock, $0.00001 par value, 0 and 999,999,999 shares authorized as of March 31, 2022 and December 31, 2021, respectively, 0 shares issued and outstanding as of March 31, 2022 and December 31, 2021 | | Class B Common Stock, $0.00001 par value, 0 and 999,999,999 shares authorized as of March 31, 2022 and December 31, 2021, respectively, 0 shares issued and outstanding as of March 31, 2022 and December 31, 2021 | — | | | — | |

| Class C Common Stock, $0.00001 par value, 0 and 1 share authorized as of March 31, 2022 and December 31, 2021, respectively, 0 shares issued and outstanding as of March 31, 2022 and December 31, 2021 | | Class C Common Stock, $0.00001 par value, 0 and 1 share authorized as of March 31, 2022 and December 31, 2021, respectively, 0 shares issued and outstanding as of March 31, 2022 and December 31, 2021 | — | | | — | |

| Additional paid in capital | Additional paid in capital | 822,612 | | | 877,173 | | Additional paid in capital | 970,498 | | | 2,096,403 | |

| Retained earnings | Retained earnings | 990,798 | | | 0 | | Retained earnings | — | | | 1,143,899 | |

| Accumulated other comprehensive loss | Accumulated other comprehensive loss | (2,542) | | | (2,071) | | Accumulated other comprehensive loss | (2,527) | | | (5,374) | |

| Total Apollo Global Management, Inc. Stockholders’ Equity | 2,365,081 | | | 1,429,315 | | |

| Total Apollo Asset Management, Inc. Stockholders’ Equity | | Total Apollo Asset Management, Inc. Stockholders’ Equity | 1,522,184 | | | 3,789,141 | |

| Non-Controlling Interests in consolidated entities | Non-Controlling Interests in consolidated entities | 2,838,121 | | | 2,275,728 | | Non-Controlling Interests in consolidated entities | 374,620 | | | 3,813,885 | |

| Non-Controlling Interests in Apollo Operating Group | Non-Controlling Interests in Apollo Operating Group | 3,009,233 | | | 1,808,220 | | Non-Controlling Interests in Apollo Operating Group | 894,476 | | | 2,591,340 | |

| Total Stockholders’ Equity | Total Stockholders’ Equity | 8,212,435 | | | 5,513,263 | | Total Stockholders’ Equity | 2,791,280 | | | 10,194,366 | |

| Total Liabilities, Redeemable non-controlling interests and Stockholders’ Equity | Total Liabilities, Redeemable non-controlling interests and Stockholders’ Equity | $ | 27,541,346 | | | $ | 23,669,084 | | Total Liabilities, Redeemable non-controlling interests and Stockholders’ Equity | $ | 12,311,502 | | | $ | 30,501,894 | |

See accompanying notes to unaudited condensed consolidated financial statements.

APOLLO ASSET MANAGEMENT, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (UNAUDITED)

FOR THE THREE MONTHS ENDED MARCH 31, 2022 AND 2021

(dollars in thousands, except share data)

| | | | | | | | | | | | |

| For the Three Months Ended

March 31, |

| | 2022 | | 2021 | |

| Revenues: | | | | |

| Management fees | $ | 522,936 | | | $ | 457,185 | | |

| Advisory and transaction fees, net | 65,786 | | | 56,348 | | |

| Investment income | 702,315 | | | 1,777,313 | | |

| Incentive fees | 5,850 | | | 3,854 | | |

| Total Revenues | $ | 1,296,887 | | | $ | 2,294,700 | | |

| Expenses: | | | | |

| Compensation and benefits | 734,105 | | | 886,558 | | |

| Interest expense | 32,993 | | | 34,799 | | |

| General, administrative and other | 140,363 | | | 100,387 | | |

| Total Expenses | $ | 907,461 | | | $ | 1,021,744 | | |

| Other Income: | | | | |

| Net gains from investment activities | 771,262 | | | 353,151 | | |

| Net gains from investment activities of consolidated variable interest entities | 279,455 | | | 112,594 | | |

| Interest income | 2,836 | | | 798 | | |

| Other income (loss), net | (25,183) | | | (17,750) | | |

| Total Other Income | 1,028,370 | | | 448,793 | | |

| Income before income tax provision | 1,417,796 | | | 1,721,749 | | |

| Income tax provision | (134,174) | | | (203,246) | | |

| Net Income | 1,283,622 | | | 1,518,503 | | |

| Net income attributable to Non-Controlling Interests | (686,654) | | | (839,613) | | |

| Net Income Attributable to Apollo Asset Management, Inc. | 596,968 | | | 678,890 | | |

| Series A Preferred share dividends | (4,383) | | | (4,383) | | |

| Series B Preferred share dividends | (4,781) | | | (4,781) | | |

| Net Income Attributable to Apollo Asset Management, Inc. Common Stockholders | $ | 587,804 | | | $ | 669,726 | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

See accompanying notes to unaudited condensed consolidated financial statements.

APOLLO GLOBALASSET MANAGEMENT, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (UNAUDITED)

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2021 AND 2020

(dollars in thousands, except share data)

| | | | | | | | | | | | | | | | | | | | | | | |

| For the Three Months Ended

June 30, | | For the Six Months Ended

June 30, |

| | 2021 | | 2020 | | 2021 | | 2020 |

| Revenues: | | | | | | | |

| Management fees | $ | 470,092 | | | $ | 409,953 | | | $ | 927,277 | | | $ | 806,557 | |

| Advisory and transaction fees, net | 86,351 | | | 61,957 | | | 142,699 | | | 98,920 | |

| Investment income (loss): | | | | | | | |

| Performance allocations | 735,139 | | | 924,599 | | | 2,130,486 | | | (809,724) | |

| Principal investment income (loss) | 76,425 | | | 111,621 | | | 458,391 | | | (76,228) | |

| Total investment income (loss) | 811,564 | | | 1,036,220 | | | 2,588,877 | | | (885,952) | |

| Incentive fees | 14,318 | | | 205 | | | 18,172 | | | 19,724 | |

| Total Revenues | 1,382,325 | | | 1,508,335 | | | 3,677,025 | | | 39,249 | |

| Expenses: | | | | | | | |

| Compensation and benefits: | | | | | | | |

| Salary, bonus and benefits | 181,299 | | | 151,019 | | | 355,929 | | | 290,288 | |

| Equity-based compensation | 52,998 | | | 59,420 | | | 109,446 | | | 111,542 | |

| Profit sharing expense | 361,247 | | | 375,959 | | | 1,016,727 | | | (260,039) | |

| Total compensation and benefits | 595,544 | | | 586,398 | | | 1,482,102 | | | 141,791 | |

| Interest expense | 34,814 | | | 32,291 | | | 69,613 | | | 63,533 | |

| General, administrative and other | 115,838 | | | 83,729 | | | 215,688 | | | 168,251 | |

| Placement fees | 591 | | | 359 | | | 1,128 | | | 768 | |

| Total Expenses | 746,787 | | | 702,777 | | | 1,768,531 | | | 374,343 | |

| Other Income (Loss): | | | | | | | |

| Net gains (losses) from investment activities | 913,394 | | | 268,667 | | | 1,266,545 | | | (995,884) | |

| Net gains (losses) from investment activities of consolidated variable interest entities | 145,403 | | | 57,862 | | | 257,997 | | | (108,058) | |

| Interest income | 645 | | | 3,994 | | | 1,443 | | | 11,928 | |

| Other income (loss), net | 4,531 | | | 3,327 | | | (13,219) | | | (13,180) | |

| Total Other Income (Loss) | 1,063,973 | | | 333,850 | | | 1,512,766 | | | (1,105,194) | |

| Income (loss) before income tax (provision) benefit | 1,699,511 | | | 1,139,408 | | | 3,421,260 | | | (1,440,288) | |

| Income tax (provision) benefit | (194,051) | | | (140,323) | | | (397,297) | | | 155,530 | |

| Net Income (Loss) | 1,505,460 | | | 999,085 | | | 3,023,963 | | | (1,284,758) | |

| Net (income) loss attributable to Non-Controlling Interests | (847,733) | | | (552,756) | | | (1,687,346) | | | 734,869 | |

Net Income (Loss) Attributable to Apollo Global

Management, Inc. | 657,727 | | | 446,329 | | | 1,336,617 | | | (549,889) | |

| Series A Preferred Stock Dividends | (4,383) | | | (4,383) | | | (8,766) | | | (8,766) | |

| Series B Preferred Stock Dividends | (4,781) | | | (4,782) | | | (9,562) | | | (9,563) | |

Net Income (Loss) Attributable to Apollo Global

Management, Inc. Class A Common Stockholders | $ | 648,563 | | | $ | 437,164 | | | $ | 1,318,289 | | | $ | (568,218) | |

| Net Income (Loss) Per Share of Class A Common Stock: | | | | | | | |

| Net Income (Loss) Available to Class A Common Stock – Basic | $ | 2.70 | | | $ | 1.84 | | | $ | 5.51 | | | $ | (2.55) | |

| Net Income (Loss) Available to Class A Common Stock – Diluted | $ | 2.70 | | | $ | 1.84 | | | $ | 5.51 | | | $ | (2.55) | |

| Weighted Average Number of Shares of Class A Common Stock Outstanding – Basic | 231,058,813 | | | 227,653,988 | | | 230,534,073 | | | 227,205,866 | |

| Weighted Average Number of Shares of Class A Common Stock Outstanding – Diluted | 231,058,813 | | | 227,653,988 | | | 230,534,073 | | | 227,205,866 | |

See accompanying notes to condensed consolidated financial statements.

APOLLO GLOBAL MANAGEMENT, INC.

CONDENSED CONSOLIDATED STATEMENTS OF

COMPREHENSIVE INCOME (LOSS) (UNAUDITED)

FOR THE THREE AND SIX MONTHS ENDED JUNE 30,MARCH 31, 2022 AND 2021 AND 2020

(dollars in thousands, except share data)

| | | | | | | | | | | | | | | | | | | | | | | |

| For the Three Months Ended

June 30, | | For the Six Months Ended

June 30, |

| 2021 | | 2020 | | 2021 | | 2020 |

| Net Income (Loss) | $ | 1,505,460 | | | $ | 999,085 | | | $ | 3,023,963 | | | $ | (1,284,758) | |

| Other Comprehensive Income (Loss), net of tax: | | | | | | | |

| Currency translation adjustments, net of tax | 3,711 | | | 6,943 | | | (11,436) | | | 1,128 | |

| Net gain from change in fair value of cash flow hedge instruments | 52 | | | 50 | | | 102 | | | 101 | |

| Net gain (loss) on available-for-sale securities | (148) | | | 3,552 | | | 670 | | | (1,348) | |

| Total Other Comprehensive Income (Loss), net of tax | 3,615 | | | 10,545 | | | (10,664) | | | (119) | |

| Comprehensive Income (Loss) | 1,509,075 | | | 1,009,630 | | | 3,013,299 | | | (1,284,877) | |

| Comprehensive (Income) Loss attributable to Non-Controlling Interests | (851,304) | | | (558,979) | | | (1,677,153) | | | 735,687 | |

| Comprehensive Income (Loss) Attributable to Apollo Global Management, Inc. | $ | 657,771 | | | $ | 450,651 | | | $ | 1,336,146 | | | $ | (549,190) | |

| | | | | | | | | | | | |

| For the Three Months Ended

March 31, |

| 2022 | | 2021 | |

| Net Income | $ | 1,283,622 | | | $ | 1,518,503 | | |

| Other Comprehensive Income (Loss), net of tax: | | | | |

| Currency translation adjustments, net of tax | (5,810) | | | (15,147) | | |

| Net gain from change in fair value of cash flow hedge instruments | 1,976 | | | 50 | | |

| Net gain (loss) on available-for-sale securities | (681) | | | 818 | | |

| Total Other Comprehensive Loss, net of tax | (4,515) | | | (14,279) | | |

| Comprehensive Income | 1,279,107 | | | 1,504,224 | | |

| Comprehensive Income attributable to Non-Controlling Interests | (679,292) | | | (825,849) | | |

| Comprehensive Income Attributable to Apollo Asset Management, Inc. | $ | 599,815 | | | $ | 678,375 | | |

See accompanying notes to unaudited condensed consolidated financial statements.

APOLLO ASSET MANAGEMENT, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES

IN STOCKHOLDERS’ EQUITY (UNAUDITED)

FOR THE THREE MONTHS ENDED MARCH 31, 2022 AND 2021

(dollars in thousands, except share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Apollo Asset Management, Inc. Stockholders | | | | | | | | |

| | Class A Common Stock | | Class B Common Stock | | Class C Common Stock | | Series A Preferred Stock | | Series B Preferred Stock | | Additional

Paid in

Capital | | Retained Earnings | | | | Accumulated

Other

Comprehensive Loss | | Total Apollo

Asset

Management,

Inc.

Stockholders’

Equity | | Non-

Controlling

Interests in

Consolidated

Entities | | Non-

Controlling

Interests in

Apollo

Operating

Group | | Total Stockholders’ Equity |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Balance at January 1, 2021 | 228,873,449 | | | 1 | | | 1 | | | $ | 264,398 | | | $ | 289,815 | | | $ | 877,173 | | | $ | — | | | | | $ | (2,071) | | | $ | 1,429,315 | | | $ | 2,275,728 | | | $ | 1,808,220 | | | $ | 5,513,263 | |

| Accretion of redeemable non-controlling interests | — | | | — | | | — | | | — | | | — | | | (26,662) | | | — | | | | | — | | | (26,662) | | | — | | | — | | | (26,662) | |

| Dilution impact of issuance of Class A Common Stock | — | | | — | | | — | | | — | | | — | | | (1,257) | | | — | | | | | — | | | (1,257) | | | — | | | — | | | (1,257) | |

| Capital increase related to equity-based compensation | — | | | — | | | — | | | — | | | — | | | 45,283 | | | — | | | | | — | | | 45,283 | | | — | | | — | | | 45,283 | |

| Capital contributions | — | | | — | | | — | | | — | | | — | | | — | | | — | | | | | — | | | — | | | 820,983 | | | — | | | 820,983 | |

| Dividends/ Distributions | — | | | — | | | — | | | (4,383) | | | (4,781) | | | — | | | (144,282) | | | | | — | | | (153,446) | | | (39,483) | | | (121,400) | | | (314,329) | |

| Payments related to issuances of Class A Common Stock for equity-based awards | 1,419,608 | | | — | | | — | | | — | | | — | | | — | | | (48,101) | | | | | — | | | (48,101) | | | — | | | — | | | (48,101) | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Exchange of AOG Units for Class A Common Stock | 1,929,515 | | | — | | | — | | | — | | | — | | | 13,658 | | | — | | | | | — | | | 13,658 | | | — | | | (8,921) | | | 4,737 | |

| Net income | — | | | — | | | — | | | 4,383 | | | 4,781 | | | — | | | 669,726 | | | | | — | | | 678,890 | | | 70,578 | | | 769,035 | | | 1,518,503 | |

| Currency translation adjustments, net of tax | — | | | — | | | — | | | — | | | — | | | — | | | — | | | | | (1,033) | | | (1,033) | | | (13,001) | | | (1,113) | | | (15,147) | |

| Net gain from change in fair value of cash flow hedge instruments | — | | | — | | | — | | | — | | | — | | | — | | | — | | | | | 27 | | | 27 | | | — | | | 23 | | | 50 | |

| Net income on available-for-sale securities | — | | | — | | | — | | | — | | | — | | | — | | | — | | | | | 491 | | | 491 | | | — | | | 327 | | | 818 | |

| Balance at March 31, 2021 | 232,222,572 | | | 1 | | | 1 | | | $ | 264,398 | | | $ | 289,815 | | | $ | 908,195 | | | $ | 477,343 | | | | | $ | (2,586) | | | $ | 1,937,165 | | | $ | 3,114,805 | | | $ | 2,446,171 | | | $ | 7,498,141 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Apollo Asset Management, Inc. Stockholders | | | | | | | | |

| | Common Stock | | | | | | Series A Preferred Stock | | Series B Preferred Stock | | Additional

Paid in

Capital | | Retained Earnings | | | | Accumulated

Other

Comprehensive Loss | | Total Apollo

Asset

Management,

Inc.

Stockholders’

Equity | | Non-

Controlling

Interests in

Consolidated

Entities | | Non-

Controlling

Interests in

Apollo

Operating

Group | | Total

Stockholders’

Equity |

| Balance at January 1, 2022 | 248,896,649 | | | | | | | $ | 264,398 | | | $ | 289,815 | | | $ | 2,096,403 | | | $ | 1,143,899 | | | | | $ | (5,374) | | | $ | 3,789,141 | | | $ | 3,813,885 | | | $ | 2,591,340 | | | $ | 10,194,366 | |

| Reverse stock split | (248,895,649) | | | | | | | — | | | — | | | — | | | — | | | | | — | | | — | | | — | | | — | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Deconsolidation of VIEs | — | | | | | | | — | | | — | | | — | | | | | | | — | | | — | | | (4,607,867) | | | — | | | (4,607,867) | |

| Accretion of redeemable non-controlling interests | — | | | | | | | — | | | — | | | (19,980) | | | — | | | | | — | | | (19,980) | | | — | | | — | | | (19,980) | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Contributions | — | | | | | | | — | | | — | | | 328,628 | | | — | | | | | — | | | 328,628 | | | 1,427,248 | | | — | | | 1,755,876 | |

| Dividends/ Distributions | — | | | | | | | (4,383) | | | (4,781) | | | (1,434,553) | | | (1,731,703) | | | | | — | | | (3,175,420) | | | (460,731) | | | (2,174,071) | | | (5,810,222) | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Net income | — | | | | | | | 4,383 | | | 4,781 | | | — | | | 587,804 | | | | | — | | | 596,968 | | | 210,109 | | | 476,545 | | | 1,283,622 | |

| Currency translation adjustments, net of tax | — | | | | | | | — | | | — | | | — | | | — | | | | | 2,646 | | | 2,646 | | | (8,024) | | | (432) | | | (5,810) | |

| Net gain from change in fair value of cash flow hedge instruments | — | | | | | | | — | | | — | | | — | | | — | | | | | 882 | | | 882 | | | — | | | 1,094 | | | 1,976 | |

| Net loss on available-for-sale securities | — | | | | | | | — | | | — | | | — | | | — | | | | | (681) | | | (681) | | | — | | | — | | | (681) | |

| Balance at March 31, 2022 | 1,000 | | | | | | | $ | 264,398 | | | $ | 289,815 | | | $ | 970,498 | | | $ | — | | | | | $ | (2,527) | | | $ | 1,522,184 | | | $ | 374,620 | | | $ | 894,476 | | | $ | 2,791,280 | |

See accompanying notes to unaudited condensed consolidated financial statements.

APOLLO GLOBALASSET MANAGEMENT, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES

IN STOCKHOLDERS’ EQUITYCASH FLOWS (UNAUDITED)

FOR THE THREE AND SIX MONTHS ENDED JUNE 30,MARCH 31, 2022 AND 2021 AND 2020

(dollars in thousands, except share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Apollo Global Management, Inc. Stockholders | | | | | | | | |

| | Class A Common Stock | | Class B Common Stock | | Class C Common Stock | | Series A Preferred Stock | | Series B Preferred Stock | | Additional

Paid in

Capital | | Accumulated Deficit | | | | Accumulated

Other

Comprehensive Loss | | Total Apollo

Global

Management,

Inc.

Shareholders’

Equity | | Non-

Controlling

Interests in

Consolidated

Entities | | Non-

Controlling

Interests in

Apollo

Operating

Group | | Total Stockholders’ Equity |

| Balance at April 1, 2020 | 228,834,099 | | | 1 | | | 1 | | | $ | 264,398 | | | $ | 289,815 | | | $ | 1,085,949 | | | $ | (1,075,323) | | | | | $ | (8,201) | | | $ | 556,638 | | | $ | 2,122,281 | | | $ | 820,115 | | | $ | 3,499,034 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Dilution impact of issuance of Class A Common Stock | — | | | — | | | — | | | — | | | — | | | 126 | | | — | | | | | — | | | 126 | | | — | | | — | | | 126 | |

| Capital increase related to equity-based compensation | — | | | — | | | — | | | — | | | — | | | 47,539 | | | — | | | | | — | | | 47,539 | | | — | | | — | | | 47,539 | |

| Capital contributions | — | | | — | | | — | | | — | | | — | | | — | | | — | | | | | — | | | — | | | 38,826 | | | — | | | 38,826 | |

| Dividends/ Distributions | — | | | — | | | — | | | (4,383) | | | (4,782) | | | (99,789) | | | 0 | | | | | — | | | (108,954) | | | (98,633) | | | (128,662) | | | (336,249) | |

| Payments related to issuances of Class A Common Stock for equity-based awards | 355,616 | | | — | | | — | | | — | | | — | | | (1,383) | | | (15,586) | | | | | — | | | (16,969) | | | — | | | — | | | (16,969) | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Net income (loss) | — | | | — | | | — | | | 4,383 | | | 4,782 | | | — | | | 437,164 | | | | | — | | | 446,329 | | | 41,068 | | | 511,688 | | | 999,085 | |

| Currency translation adjustments, net of tax | — | | | — | | | — | | | — | | | — | | | — | | | — | | | | | 2,178 | | | 2,178 | | | 4,328 | | | 437 | | | 6,943 | |

| Net gain from change in fair value of cash flow hedge instruments | — | | | — | | | — | | | — | | | — | | | — | | | — | | | | | 26 | | | 26 | | | — | | | 24 | | | 50 | |

| Net income on available-for-sale securities | — | | | — | | | — | | | — | | | — | | | — | | | — | | | | | 2,118 | | | 2,118 | | | — | | | 1,434 | | | 3,552 | |

| Balance at June 30, 2020 | 229,189,715 | | | 1 | | | 1 | | | $ | 264,398 | | | $ | 289,815 | | | $ | 1,032,442 | | | $ | (653,745) | | | | | $ | (3,879) | | | $ | 929,031 | | | $ | 2,107,870 | | | $ | 1,205,036 | | | $ | 4,241,937 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Balance at January 1, 2020 | 222,994,407 | | | 1 | | | 1 | | | $ | 264,398 | | | $ | 289,815 | | | $ | 1,302,587 | | | $ | 0 | | | | | $ | (4,578) | | | $ | 1,852,222 | | | $ | 281,904 | | | $ | 904,001 | | | $ | 3,038,127 | |

| Equity transaction with Athene Holding | — | | | — | | | — | | | — | | | — | | | (54,868) | | | — | | | | | — | | | (54,868) | | | — | | | 1,214,577 | | | 1,159,709 | |

| Consolidation of VIEs | — | | | — | | | — | | | — | | | — | | | — | | | — | | | | | — | | | — | | | 1,895,095 | | | — | | | 1,895,095 | |

| Dilution impact of issuance of Class A Common Stock | — | | | — | | | — | | | — | | | — | | | 8,329 | | | — | | | | | — | | | 8,329 | | | — | | | — | | | 8,329 | |

| Capital increase related to equity-based compensation | — | | | — | | | — | | | — | | | — | | | 93,230 | | | — | | | | | — | | | 93,230 | | | — | | | — | | | 93,230 | |

| Capital contributions | — | | | — | | | — | | | — | | | — | | | — | | | — | | | | | — | | | — | | | 181,853 | | | — | | | 181,853 | |

| Dividends/ Distributions | — | | | — | | | — | | | (8,766) | | | (9,563) | | | (312,638) | | | — | | | | | — | | | (330,967) | | | (127,570) | | | (284,300) | | | (742,837) | |

| Payments related to issuances of Class A Common Stock for equity-based awards | 3,151,903 | | | — | | | — | | | — | | | — | | | 28,991 | | | (85,527) | | | | | — | | | (56,536) | | | — | | | — | | | (56,536) | |

| Repurchase of Class A Common Stock | (2,194,095) | | | — | | | — | | | — | | | — | | | (64,205) | | | — | | | | | — | | | (64,205) | | | — | | | — | | | (64,205) | |

| Exchange of AOG Units for Class A Common Stock | 5,237,500 | | | — | | | — | | | — | | | — | | | 31,016 | | | — | | | | | — | | | 31,016 | | | — | | | (16,967) | | | 14,049 | |

| Net income (loss) | — | | | — | | | — | | | 8,766 | | | 9,563 | | | — | | | (568,218) | | | | | — | | | (549,889) | | | (123,341) | | | (611,528) | | | (1,284,758) | |

| Currency translation adjustments, net of tax | — | | | — | | | — | | | — | | | — | | | — | | | — | | | | | 1,381 | | | 1,381 | | | (71) | | | (182) | | | 1,128 | |

| Net gain from change in fair value of cash flow hedge instruments | — | | | — | | | — | | | — | | | — | | | — | | | — | | | | | 54 | | | 54 | | | — | | | 47 | | | 101 | |

| Net loss on available-for-sale securities | — | | | — | | | — | | | — | | | — | | | — | | | — | | | | | (736) | | | (736) | | | — | | | (612) | | | (1,348) | |

| Balance at June 30, 2020 | 229,189,715 | | | 1 | | | 1 | | | $ | 264,398 | | | $ | 289,815 | | | $ | 1,032,442 | | | $ | (653,745) | | | | | $ | (3,879) | | | $ | 929,031 | | | $ | 2,107,870 | | | $ | 1,205,036 | | | $ | 4,241,937 | |

| | | | | | | | | | | | | | |

| For the Three Months Ended

March 31, |

| 2022 | | 2021 | | | |

| Cash Flows from Operating Activities: | | | | | | |

| Net income | $ | 1,283,622 | | | $ | 1,518,503 | | | | |

| Adjustments to reconcile net income to net cash provided by (used in) operating activities: | | | | | | |

| Equity-based compensation | 156,288 | | | 56,448 | | | | |

| Depreciation and amortization | 7,891 | | | 6,052 | | | | |

| Unrealized (gains) losses from investment activities | 13,236 | | | (342,379) | | | | |

| Principal investment income | (158,136) | | | (381,966) | | | | |

| Performance allocations | (544,179) | | | (1,395,347) | | | | |

| Change in fair value of contingent obligations | (2,742) | | | 5,756 | | | | |

| (Gain) loss from change in tax receivable agreement liability | 14,184 | | | (1,941) | | | | |

| Deferred taxes, net | (249,068) | | | 187,293 | | | | |

| | | | | | |

| Non-cash lease expense | 9,978 | | | 8,122 | | | | |

| | | | | | |

| Other non-cash amounts included in net income (loss), net | (4,541) | | | (7,191) | | | | |

| Cash flows due to changes in operating assets and liabilities: | | | | | | |

| | | | | | |

| Due from related parties | 670,506 | | | 30,468 | | | | |

| Accounts payable and accrued expenses | (6,972) | | | 10,709 | | | | |

| Accrued compensation and benefits | (21,903) | | | 13,908 | | | | |

| Deferred revenue | 12,123 | | | 95,663 | | | | |

| Due to related parties | 476,160 | | | (888) | | | | |

| Profit sharing payable | 194,646 | | | 502,539 | | | | |

| Lease liability | — | | | (5,194) | | | | |

| Other assets and other liabilities, net | (553,130) | | | (3,518) | | | | |

| Earnings from principal investments | 234,726 | | | 25,959 | | | | |

| Earnings from performance allocations | 252,369 | | | 247,554 | | | | |

| Satisfaction of contingent obligations | (12,701) | | | (12,322) | | | | |

| Apollo Funds and VIE related: | | | | | | |

| Net realized and unrealized gains from investing activities and debt | (101,449) | | | (292,917) | | | | |

| | | | | | |

| Deconsolidation of VIEs | (743,582) | | | — | | | | |

| Purchases of investments | (2,666,619) | | | (1,617,959) | | | | |

| Proceeds from sale of investments | 1,490,289 | | | 620,345 | | | | |

| Changes in other assets and other liabilities, net | (51,466) | | | 503,552 | | | | |

| Net Cash Provided by (Used in) Operating Activities | $ | (300,470) | | | $ | (228,751) | | | | |

| Cash Flows from Investing Activities: | | | | | | |

| Purchases of fixed assets | $ | (43,542) | | | $ | (5,504) | | | | |

| | | | | | |

| Proceeds from sale of investments | 2,694 | | | — | | | | |

| Purchase of investments | (119,169) | | | — | | | | |

| Purchase of U.S. Treasury securities | (699,184) | | | — | | | | |

| Proceeds from maturities of U.S. Treasury securities | 299,763 | | | — | | | | |

| Cash contributions to principal investments | (125,201) | | | (30,646) | | | | |

| Cash distributions from principal investments | 12,454 | | | 56,006 | | | | |

| Issuance of related party loans | (1,143,756) | | | — | | | | |

| Repayment of related party loans | 580,958 | | | — | | | | |

| Other investing activities | (1,338) | | | (725) | | | | |

| Apollo Funds and VIE related: | | | | | | |

| Purchase of U.S. Treasury securities | (817,371) | | | (817,077) | | | | |

| Proceeds from maturities of U.S. Treasury | 1,162,166 | | | 816,809 | | | | |

| Net Cash Provided by (Used in) Investing Activities | $ | (891,526) | | | $ | 18,863 | | | | |

| | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Apollo Global Management, Inc. Stockholders | | | | | | | | |

| | Class A Common Stock | | Class B Common Stock | | Class C Common Stock | | Series A Preferred Stock | | Series B Preferred Stock | | Additional

Paid in

Capital | | Retained Earnings | | | | Accumulated

Other

Comprehensive Loss | | Total Apollo

Global

Management,

Inc.

Shareholders’

Equity | | Non-

Controlling

Interests in

Consolidated

Entities | | Non-

Controlling

Interests in

Apollo

Operating

Group | | Total

Stockholders’

Equity |

| Balance at April 1, 2021 | 232,222,572 | | | 1 | | | 1 | | | $ | 264,398 | | | $ | 289,815 | | | $ | 908,195 | | | $ | 477,343 | | | | | $ | (2,586) | | | $ | 1,937,165 | | | $ | 3,114,805 | | | $ | 2,446,171 | | | $ | 7,498,141 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Deconsolidation of VIEs | — | | | — | | | — | | | — | | | — | | | — | | | — | | | | | — | | | — | | | (125,215) | | | — | | | (125,215) | |

| Accretion of redeemable non-controlling interests | — | | | — | | | — | | | — | | | — | | | (15,981) | | | — | | | | | — | | | (15,981) | | | — | | | — | | | (15,981) | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Dilution impact of issuance of Class A Common Stock | — | | | — | | | — | | | — | | | — | | | (38) | | | — | | | | | — | | | (38) | | | — | | | — | | | (38) | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Capital increase related to equity-based compensation | — | | | — | | | — | | | — | | | — | | | 40,975 | | | — | | | | | — | | | 40,975 | | | — | | | — | | | 40,975 | |

| Capital contributions | — | | | — | | | — | | | — | | | — | | | — | | | — | | | | | — | | | — | | | 191,435 | | | — | | | 191,435 | |

| Dividends/ Distributions | — | | | — | | | — | | | (4,383) | | | (4,781) | | | 0 | | | (119,536) | | | | | — | | | (128,700) | | | (462,485) | | | (162,224) | | | (753,409) | |

| Payments related to issuances of Class A Common Stock for equity-based awards | 397,782 | | | — | | | — | | | — | | | — | | | 3,214 | | | (15,572) | | | | | — | | | (12,358) | | | — | | | — | | | (12,358) | |

| Repurchase of Class A Common Stock | (2,144,713) | | | — | | | — | | | — | | | — | | | (122,703) | | | — | | | | | — | | | (122,703) | | | — | | | — | | | (122,703) | |

| Exchange of AOG Units for Class A Common Stock | 890,680 | | | — | | | — | | | — | | | — | | | 8,950 | | | 0 | | | | | — | | | 8,950 | | | — | | | (6,437) | | | 2,513 | |

| Net income | — | | | — | | | — | | | 4,383 | | | 4,781 | | | — | | | 648,563 | | | | | — | | | 657,727 | | | 116,276 | | | 731,457 | | | 1,505,460 | |