UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-Q

|

| | |

| (Mark One) |

þ

☑ | QUARTERLY REPORT PURSUANT TOSECTION 13 OR 15(d)OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | |

| For the quarterly period ended | September 30, 2018 |

| 2019 |

| OR |

|

¨

☐ | TRANSITION REPORT PURSUANT TOSECTION 13 OR 15(d)OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | |

For the transition period fromto . |

Commission file number: 001-35120

CVR PARTNERS, LP

CVR Partners, LP

(Exact name of registrant as specified in its charter) |

| | | | |

| Delaware | | | | 56-2677689 |

(State or other jurisdiction of

incorporation or organization) | | | (I.R.S. Employer Identification No.) |

2277 Plaza Drive, Suite 500, Sugar Land, Texas77479

(Address of principal executive offices) (Zip Code)

(281) 207-3200

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

| |

Delaware | 56-2677689 |

(State or other jurisdictionTitle of

incorporation or organization)

each class | (I.R.S. Employer

Identification No.)

Trading Symbol(s) | Name of each exchange on which registered |

2277 Plaza Drive, Suite 500Common units representing limited partner interests | |

Sugar Land, Texas

(Address of principal executive offices)

UAN | 77479

(Zip Code)

The New York Stock Exchange |

(281) 207-3200

(Registrant’s telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yesþ☑ No o☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yesþ☑ No o☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

| | | | | |

Large accelerated filero | ☐ | Accelerated filerþ | Non-accelerated☑

| Non-Accelerated filero

| ☐ |

Smaller reporting companyo | ☐ | Emerging growth companyo | ☐ | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o☐

Indicate by check mark whether the registrant is a shell company (as defined by Rule 12b-2 of the Exchange Act). Yes o☐ No þ☑

There were 113,282,973 common units representing limited partner interests of CVR partnersPartners, LP (“common units”) outstanding at October 23, 2018.22, 2019.

TABLE OF CONTENTS

CVR PARTNERS, LP AND SUBSIDIARIES

INDEX TO QUARTERLY REPORT ON FORM- Quarterly Report on Form 10-Q

For The Quarter Ended September 30, 20182019

This Quarterly Report on Form 10-Q (including documents incorporated by reference herein) contains statements with respect to our expectations or beliefs as to future events. These types of statements are “forward-looking” and subject to uncertainties. See “Important Information Regarding Forward-Looking Statements” section of this filing.

Important Information Regarding Forward-Looking Statements

This Quarterly Report on Form 10-Q (this “Report”) contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), including, but not limited to, those under Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations. These forward-looking statements are subject to a number of risks and uncertainties, many of which are beyond our control. All statements other than statements of historical fact, including without limitation, statements regarding future operations, financial position, estimated revenues and losses, growth, capital projects, impacts of legal proceedings, projected costs, prospects, plans and objectives are forward-looking statements. The words “could,” “believe,” “anticipate,” “intend,” “estimate,” “expect,” “may,” “continue,” “predict,” “potential,” “project,” and similar terms and phrases are intended to identify forward-looking statements. Although we believe our assumptions concerning future events are reasonable, a number of risks, uncertainties and other factors could cause actual results and trends to differ materially from those projected or forward-looking, including but not limited to:

our ability to make cash distributions on our common units;

the ability of our general partner to modify or revoke our distribution policy at any time;

volatile margins in the nitrogen fertilizer industry and exposure to risks associated with the pricing and availability of feedstocks, pet coke, utilities, urea ammonium nitrate (“UAN”), ammonia, natural gas and other products;

the availability of adequate cash, credit and other sources of liquidity including volatility in the capital and credit markets and changes to our capital requirements;

changes in the expected value of, benefits derived from, and our ability to successfully implement, business strategies, transactions, turnarounds, maintenance and capital projects;

changes in (and in the application of) local, state and federal laws, rules, regulations and policies, including with respect to environmental matters (including climate change), health and safety, exports, transportation (including pipeline and trucking transportation), the end-use and application of fertilizers and taxes (including the tax status of CVR Partners);

changes in economic conditions impacting our business and the business of our suppliers, customers, counterparties and lenders;

interruption of or changes in the cost, availability or regulation of pipelines, vessels, trucks and other means of transporting feedstocks, pet coke, UAN, ammonia and other products relating to our business;

changes in competition in the nitrogen fertilizer business including to our competitive advantages;

the cyclical and/or seasonal nature of the nitrogen fertilizer business;

weather conditions, fires, tornadoes, floods or other natural disasters affecting our operations or the areas in which our feedstocks and fertilizers are marketed or sold;

risks associated with governmental policies affecting the agricultural industry;

direct or indirect effects from actual or threatened terrorist incidents, security or cyber-security breaches or acts of war;

dependence on significant customers and suppliers and the creditworthiness and performance by counterparties;

our ability to license the technology used in or secure permits required for our operations;

adverse rulings, judgments or settlements in litigation or other legal or tax matters, including unexpected environmental remediation costs in excess of any reserves;

competition with CVR Energy, Inc. and its affiliates (“CVR Energy”), control of our general partner by CVR Energy and our reliance on CVR Energy’s senior management team including conflicts of interest they face operating each of CVR Partners and CVR Energy;

operating hazards and interruptions or production declines, including unscheduled maintenance or downtime and the availability and recoverability of adequate insurance coverage; and

the factors described in greater detail under “Risk Factors” in Item 1A of our Annual Report on Form 10-K for the year ended December 31, 2018 and our other filings with the Securities and Exchange Commission.

All forward-looking statements included in this Report are based on information available to us on the date of this Report. Except as required by law, we undertake no obligation to revise or update any forward-looking statements as a result of new information, future events or otherwise.

| | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

PART I. FINANCIAL INFORMATION

Item 1. Financial Statements

CVR PARTNERS, LP AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(unaudited)

| | | (In thousands) | September 30, 2018 | | December 31, 2017 | |

| (in thousands) | | September 30, 2019 | | December 31, 2018 |

ASSETS | | Current assets: | | | | | | |

| Cash and cash equivalents | $ | 61,441 |

| | $ | 49,173 |

| $ | 83,667 |

| | $ | 61,776 |

|

| Accounts receivable, net of allowance for doubtful accounts | 20,564 |

| | 9,855 |

| |

| Accounts receivable | | 14,909 |

| | 61,662 |

|

| Inventories | 56,905 |

| | 54,097 |

| 56,864 |

| | 63,554 |

|

| Prepaid expenses and other current assets | 4,817 |

| | 5,793 |

| 4,608 |

| | 6,989 |

|

| Total current assets | 143,727 |

| | 118,918 |

| 160,048 |

| | 193,981 |

|

| Property, plant, and equipment, net of accumulated depreciation | 1,029,402 |

| | 1,069,526 |

| |

| Property, plant, and equipment, net | | 964,502 |

| | 1,015,240 |

|

| Goodwill | 40,969 |

| | 40,969 |

| 40,969 |

| | 40,969 |

|

| Other long-term assets | 4,414 |

| | 4,863 |

| 14,803 |

| | 4,198 |

|

| Total assets | $ | 1,218,512 |

| | $ | 1,234,276 |

| $ | 1,180,322 |

| | $ | 1,254,388 |

|

LIABILITIES AND PARTNERS’ CAPITAL | | Current liabilities: | | | | | | |

| Accounts payable | $ | 20,019 |

| | $ | 21,295 |

| $ | 29,389 |

| | $ | 26,789 |

|

| Accounts payable to Affiliates | 2,170 |

| | 2,223 |

| |

| Accrued expenses and other current liabilities | 64,015 |

| | 32,577 |

| |

| Accounts payable to affiliates | | 2,131 |

| | 2,976 |

|

| Deferred revenue | | 16,448 |

| | 68,804 |

|

| Other current liabilities | | 36,687 |

| | 24,066 |

|

| Total current liabilities | 86,204 |

| | 56,095 |

| 84,655 |

| | 122,635 |

|

| Long-term liabilities: | | | | |

| Long-term debt, net of current portion | 628,192 |

| | 625,904 |

| |

| Long-term debt | | 631,520 |

| | 628,989 |

|

| Other long-term liabilities | 2,919 |

| | 2,424 |

| 11,791 |

| | 2,938 |

|

| Total long-term liabilities | 631,111 |

| | 628,328 |

| 643,311 |

| | 631,927 |

|

| Commitments and contingencies (see Note 9) |

|

| |

|

| |

| Partners’ capital | 501,197 |

| | 549,853 |

| |

| |

|

| |

|

|

| Partners’ capital: | | | | |

| Common unitholders, 113,282,973 units issued and outstanding at September 30, 2019 and December 31, 2018 | | 452,355 |

| | 499,825 |

|

| General partner interest | | 1 |

| | 1 |

|

| Total partners’ capital | | 452,356 |

| | 499,826 |

|

| Total liabilities and partners’ capital | $ | 1,218,512 |

| | $ | 1,234,276 |

| $ | 1,180,322 |

| | $ | 1,254,388 |

|

The accompanying notes are an integral part of these condensed consolidated financial statements.

CVR PARTNERS, LP AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(unaudited)

| | | | Three Months Ended September 30, | | Nine Months Ended September 30, | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| (In thousands, except per unit data) | 2018 | | 2017 | | 2018 | | 2017 | |

| (in thousands, except unit data) | | 2019 | | 2018 | | 2019 | | 2018 |

| Net sales | $ | 79,909 |

| | $ | 69,393 |

| | $ | 252,965 |

| | $ | 252,610 |

| $ | 88,582 |

| | $ | 79,909 |

| | $ | 318,115 |

| | $ | 252,965 |

|

| Operating costs and expenses: | | | | | | | | | | | | | | |

| Cost of materials and other | 19,590 |

| | 19,495 |

| | 61,198 |

| | 63,373 |

| 21,617 |

| | 19,590 |

| | 71,347 |

| | 61,198 |

|

| Direct operating expenses (exclusive of depreciation and amortization) | 35,334 |

| | 40,249 |

| | 121,468 |

| | 113,941 |

| 47,554 |

| | 35,334 |

| | 128,004 |

| | 121,468 |

|

| Depreciation and amortization | 16,035 |

| | 19,483 |

| | 52,866 |

| | 54,877 |

| 18,418 |

| | 16,035 |

| | 60,032 |

| | 52,866 |

|

| Cost of sales | 70,959 |

| | 79,227 |

| | 235,532 |

| | 232,191 |

| 87,589 |

| | 70,959 |

| | 259,383 |

| | 235,532 |

|

| Selling, general and administrative expenses | 6,393 |

| | 6,083 |

| | 18,955 |

| | 18,750 |

| 6,326 |

| | 6,393 |

| | 19,637 |

| | 18,955 |

|

| Loss on asset disposals | 28 |

| | 19 |

| | 160 |

| | 58 |

| 2,184 |

| | 28 |

| | 2,629 |

| | 160 |

|

| Operating income (loss) | 2,529 |

| | (15,936 | ) | | (1,682 | ) | | 1,611 |

| |

| Operating (loss) income | | (7,517 | ) | | 2,529 |

| | 36,466 |

| | (1,682 | ) |

| Other (expense) income: | | | | | | | | |

| Interest expense, net | (15,693 | ) | | (15,723 | ) | | (47,080 | ) | | (47,111 | ) | (15,621 | ) | | (15,693 | ) | | (46,870 | ) | | (47,080 | ) |

| Other income, net | 30 |

| | 22 |

| | 100 |

| | 81 |

| 174 |

| | 30 |

| | 229 |

| | 100 |

|

| Loss before income tax | (13,134 | ) | | (31,637 | ) | | (48,662 | ) | | (45,419 | ) | |

| Net loss before income taxes | | (22,964 | ) | | (13,134 | ) | | (10,175 | ) | | (48,662 | ) |

| Income tax expense (benefit) | 12 |

| | (35 | ) | | (6 | ) | | (36 | ) | 12 |

| | 12 |

| | (88 | ) | | (6 | ) |

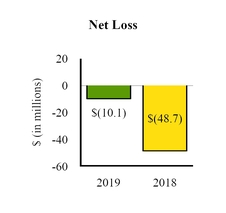

| Net loss | $ | (13,146 | ) | | $ | (31,602 | ) | | $ | (48,656 | ) | | $ | (45,383 | ) | $ | (22,976 | ) | | $ | (13,146 | ) | | $ | (10,087 | ) | | $ | (48,656 | ) |

| | | | | | | | | | | | | | | |

| Net loss per common unit — basic and diluted | $ | (0.12 | ) | | $ | (0.28 | ) | | $ | (0.43 | ) | | $ | (0.40 | ) | |

| Weighted-average common units outstanding — basic and diluted | 113,283 |

| | 113,283 |

| | 113,283 |

| | 113,283 |

| |

| Basic and diluted loss per unit data | | $ | (0.20 | ) | | $ | (0.12 | ) | | $ | (0.09 | ) | | $ | (0.43 | ) |

| Distributions declared per unit | | $ | 0.14 |

| | $ | — |

| | $ | 0.33 |

| | $ | — |

|

| | | | | | | | | |

| Weighted-average common units outstanding: | | | | | | | | |

| Basic and Diluted | | 113,283 |

| | 113,283 |

| | 113,283 |

| | 113,283 |

|

The accompanying notes are an integral part of these condensed consolidated financial statements.

CVR PARTNERS, LP AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWSPARTNERS’ CAPITAL

(unaudited)

|

| | | | | | | |

| | Nine Months Ended September 30, |

| (In thousands) | 2018 | | 2017 |

| Cash flows from operating activities: | | | |

| Net loss | $ | (48,656 | ) | | $ | (45,383 | ) |

| Adjustments to reconcile net loss to net cash provided by operating activities: | | | |

| Depreciation and amortization | 52,866 |

| | 54,877 |

|

| Share-based compensation | 2,695 |

| | 1,748 |

|

| Other non-cash items | 2,640 |

| | 2,314 |

|

| Change in assets and liabilities: | | | |

| Current assets and liabilities | 16,490 |

| | 14,272 |

|

| Non-current assets and liabilities | 1,083 |

| | 276 |

|

| Net cash provided by operating activities | 27,118 |

| | 28,104 |

|

| Cash flows from investing activities: | | | |

| Capital expenditures | (15,022 | ) | | (11,456 | ) |

| Proceeds from sale of assets | 172 |

| | — |

|

| Net cash used in investing activities | (14,850 | ) | | (11,456 | ) |

| Cash flows from financing activities: | | | |

| Cash distributions to common unitholders – Affiliates | — |

| | (778 | ) |

| Cash distributions to common unitholders – Non-affiliates | — |

| | (1,488 | ) |

| Net cash used in financing activities | — |

| | (2,266 | ) |

| Net increase in cash and cash equivalents | 12,268 |

| | 14,382 |

|

| Cash and cash equivalents, beginning of period | 49,173 |

| | 55,595 |

|

| Cash and cash equivalents, end of period | $ | 61,441 |

| | $ | 69,977 |

|

|

| | | | | | | | | | | | | | |

| | Common Units | | General Partner Interest | | Total Partners’ Capital |

| (in thousands, except unit data) | Issued | | Amount | |

| Balance at December 31, 2018 | 113,282,973 |

| | $ | 499,825 |

| | $ | 1 |

| | $ | 499,826 |

|

| Cash distributions to common unitholders - Affiliates | — |

| | (4,670 | ) | | — |

| | (4,670 | ) |

| Cash distributions to common unitholders - Non-affiliates | — |

| | (8,924 | ) | | — |

| | (8,924 | ) |

| Net loss | — |

| | (6,079 | ) | | — |

| | (6,079 | ) |

| Balance at March 31, 2019 | 113,282,973 |

| | $ | 480,152 |

| | $ | 1 |

| | $ | 480,153 |

|

| Cash distributions to common unitholders - Affiliates | — |

| | (2,724 | ) | | — |

| | (2,724 | ) |

| Cash distributions to common unitholders - Non-affiliates | — |

| | (5,205 | ) | | — |

| | (5,205 | ) |

| Net income | — |

| | 18,968 |

| | — |

| | 18,968 |

|

| Balance at June 30, 2019 | 113,282,973 |

| | $ | 491,191 |

| | $ | 1 |

| | $ | 491,192 |

|

| Cash distributions to common unitholders - Affiliates | — |

| | (5,449 | ) | | — |

| | (5,449 | ) |

| Cash distributions to common unitholders - Non-affiliates | — |

| | (10,411 | ) | | — |

| | (10,411 | ) |

| Net loss | — |

| | (22,976 | ) | | — |

| | (22,976 | ) |

| Balance at September 30, 2019 | 113,282,973 |

| | $ | 452,355 |

| | $ | 1 |

| | $ | 452,356 |

|

|

| | | | | | | | | | | | | | |

| | Common Units | | General

Partner

Interest | | Total Partners’ Capital |

| (in thousands, except unit data) | Issued | | Amount | |

| Balance at December 31, 2017 | 113,282,973 |

| | $ | 549,852 |

| | $ | 1 |

| | $ | 549,853 |

|

| Net loss | — |

| | (19,051 | ) | | — |

| | (19,051 | ) |

| Balance at March 31, 2018 | 113,282,973 |

| | $ | 530,801 |

| | $ | 1 |

| | $ | 530,802 |

|

| Net loss | — |

| | (16,459 | ) | | — |

| | (16,459 | ) |

| Balance at June 30, 2018 | 113,282,973 |

| | $ | 514,342 |

| | $ | 1 |

| | $ | 514,343 |

|

| Net loss | — |

| | (13,146 | ) | | — |

| | (13,146 | ) |

| Balance at September 30, 2018 | 113,282,973 |

| | $ | 501,196 |

| | $ | 1 |

| | $ | 501,197 |

|

The accompanying notes are an integral part of these condensed consolidated financial statements.

CVR PARTNERS, LP AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(unaudited)

|

| | | | | | | |

| | Nine Months Ended September 30, |

| (in thousands) | 2019 | | 2018 |

| Cash flows from operating activities: | | | |

| Net loss | $ | (10,087 | ) | | $ | (48,656 | ) |

| Adjustments to reconcile net loss to net cash provided by operating activities: | | | |

| Depreciation and amortization | 60,032 |

| | 52,866 |

|

| Share-based compensation | 2,970 |

| | 2,695 |

|

| Other adjustments | 5,256 |

| | 2,640 |

|

| Change in assets and liabilities: | | | |

| Current assets and liabilities | 9,283 |

| | 16,490 |

|

| Non-current assets and liabilities | 1,218 |

| | 1,083 |

|

| Net cash provided by operating activities | 68,672 |

| | 27,118 |

|

| Cash flows from investing activities: | | | |

| Capital expenditures | (9,487 | ) | | (15,022 | ) |

| Proceeds from sale of assets | 89 |

| | 172 |

|

| Net cash used in investing activities | (9,398 | ) | | (14,850 | ) |

| Cash flows from financing activities: | | | |

| Cash distributions to common unitholders - Affiliates | (12,843 | ) | | — |

|

| Cash distributions to common unitholders - Non-affiliates | (24,540 | ) | | — |

|

| Net cash used in financing activities | (37,383 | ) | | — |

|

| Net increase in cash and cash equivalents | 21,891 |

| | 12,268 |

|

| Cash and cash equivalents, beginning of period | 61,776 |

| | 49,173 |

|

| Cash and cash equivalents, end of period | $ | 83,667 |

| | $ | 61,441 |

|

The accompanying notes are an integral part of these condensed consolidated financial statements.

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(unaudited)

(1) Organization and Nature of Business

CVR Partners, LP (referred to as “CVR Partners” or the “Partnership”) is a Delaware limited partnership formed by CVR Energy, Inc. (“CVR(together with its subsidiaries, but excluding the Partnership and its subsidiaries, “CVR Energy”) to own, operate and grow its nitrogen fertilizer business. CVR Energy is a publicly traded company listedThe Partnership produces nitrogen fertilizer products at 2 manufacturing facilities, which are located in Coffeyville, Kansas (the “Coffeyville Facility”) and East Dubuque, Illinois (the “East Dubuque Facility”). The Coffeyville Facility sells and distributes products to destinations located principally on the New York Stock Exchange underUnion Pacific railroad, the ticker symbol “CVI”BNSF Railway railroad, or as direct shipments to customers, while the East Dubuque Facility primarily sells to customers located within 200 miles of the facility. As used in these financial statements, references to CVR Partners, the Partnership, “we”, which indirectly owns our general partner“us”, and “our” may refer to consolidated subsidiaries of CVR Partners or one or both of the common units owned by Coffeyville Resources, LLC (“CRLLC”). facilities, as the context may require.

As of September 30, 2018,2019, public security holders held approximately 66% of the Partnership’s outstanding limited partner interests and CRLLC,Coffeyville Resources, LLC (“CRLLC”), a wholly-owned subsidiary of CVR Energy, held approximately 34% of the Partnership’s outstanding limited partner interests and 100% of the noneconomicPartnership’s general partner interest.interest is held by CVR GP, LLC (“CVR GP” or the “general partner”), a wholly owned subsidiary of CVR Energy. As of September 30, 2018,2019, Icahn Enterprises L.P. (“IEP”) and its affiliates owned approximately 71% of the sharescommon stock of CVR Energy.

The Partnership produces nitrogen fertilizer products at two manufacturing facilities, which are located in Coffeyville, Kansas (the “Coffeyville Facility”) and East Dubuque, Illinois (the “East Dubuque Facility”). Both facilities manufacture ammonia and are able to further upgrade to other nitrogen fertilizer products, principally urea ammonium nitrate (“UAN”). Nitrogen fertilizer is used by farmers to improve the yield and quality of their crops, primarily corn and wheat. Ammonia is a direct application fertilizer and is primarily used as a building block for other nitrogen products for industrial applications and finished fertilizer products. UAN is an aqueous solution of urea and ammonium nitrate. The Partnership’s products are sold on a wholesale basis in North America.

Management and Operations

The Partnership, including CVR GP, LLC (“is party to a number of agreements with CVR GP” orEnergy and its subsidiaries to manage certain business relationships between the “general partner”)Partnership and the other parties thereto. The various rights and responsibilities of the Partnership, and its partners, are set forth in the Partnership’s limited partnership agreement and, as applicable, those agreements with CVR Energy. CVR GP manages and operates the Partnership and is a wholly-owned subsidiary of CRLLC. Common unitholders have only limited voting rights on matters affecting the Partnership. In addition, common unitholders have no right to elect the general partner’s directors on an annual or continuing basis.

The Partnership is operated byvia a combination of the general partner’s senior management team and CVR Energy’s senior management team pursuant to a services agreement among CVR Energy, CVR GP and the Partnership. The variousSee Note 13 (“Related Party Transactions”) for further discussion. Common unitholders have limited voting rights and responsibilities of the Partnership’s partners are set forth in the limited partnership agreement. The Partnership is also party to a number of agreements with CVR Energy, CVR Refining, LP (“CVR Refining”), an indirect subsidiary of CVR Energy, and CVR GP to regulate certain business relations betweenon matters affecting the Partnership and have no right to elect the other parties thereto. The Partnership also has agreements with a subsidiary of CVR Refining under which the Partnership purchases petroleum coke and hydrogen for the Coffeyville Facility. Additionally, the two parties provide feedstock and other services to one another at the Coffeyville Facility. See Note 12 ("Related Party Transactions") for further discussion.general partner’s directors on an annual or continuing basis.

(2) Basis of Presentation

The accompanying condensed consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”) and in accordance with the rules and regulations of the Securities and Exchange Commission (the “SEC”). These condensed consolidated financial statements should be read in conjunction with the December 31, 20172018 audited consolidated financial statements and notes thereto included in CVR Partners’ Annual Report on Form 10-K for the year ended December 31, 2017, which was filed with the SEC on February 23, 2018 (the “2017“2018 Form 10-K”).

In the opinion of the Partnership’s management, the accompanying condensed consolidated financial statements reflect all adjustments that are necessary to fairly presentfor fair presentation of the financial position of the Partnership as of September 30, 2018 and December 31, 2017, the results of operations of the Partnership for the three and nine month periods ended September 30, 2018 and 2017 and the cash flows of the Partnership for the nine month periods ended September 30, 2018 and 2017.presented. Such adjustments are of a normal recurring nature, unless otherwise disclosed.

Certain information hasreclassifications have been reclassifiedmade within the condensed consolidated statements of operations for the three and nine months ended September 30, 2018 to present historical information in a manner consistentconform with current presentation.

The preparation of the condensed consolidated financial statements in conformity with GAAP requires management to make certain estimates and assumptions that affect the reported amounts of assets, liabilities, revenues and expenses, and the disclosure of contingent assets and liabilities. Actual results could differ from those estimates. Results of operations and cash flows for the interim periods presented are not necessarily indicative of the results that will be realized for the year ending December 31, 20182019 or any other interim or annual period.

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(unaudited)

Planned Major Maintenance Costs

The Coffeyville Facility completed a 15-day major scheduled turnaround in the second quarter of 2018. Exclusive of the impacts due to the lost production, costs of approximately $0.0 million and $6.4 million were included in direct operating expenses (exclusive of depreciation and amortization) in the Condensed Consolidated Statements of Operations for the three and nine months ended September 30, 2018, respectively. During the third quarter of 2017, the East Dubuque Facility completed a major schedule turnaround. Exclusive of the impacts due to lost production, costs of approximately $2.5 million and $2.6 million were included in direct operating expenses (exclusive of depreciation and amortization) in the Condensed Consolidated Statements of Operations for the three and nine months ended September 30, 2017, respectively.

(3) Recent Accounting Pronouncements

Recent Accounting Pronouncement - Adoption of New RevenueLease Standard

On January 1, 2018, the Partnership adoptedIn February 2016, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards CodificationStandard Update (“ASC”ASU”) Topic 606, “Revenue from Contracts with Customers” (“ASC 606” or the “new revenue standard”) using the modified retrospective method applied to contracts which were not completed as of January 1, 2018. The new revenue standard was applied prospectively and the comparative information has not been restated and continues to be reported under the accounting standards in effect for those periods. The Partnership did not identify any material differences in its existing revenue recognition methods that require modification under the new revenue standard. However, the Partnership did identify a balance sheet presentation change discussed below. The Partnership’s Condensed Consolidated Statements of Operations and Condensed Consolidated Statements of Cash Flows were not impacted due to the adoption of ASC 606 for the nine months ended September 30, 2018.

The Partnership identified a balance sheet presentation change associated with contracts requiring customer prepayment prior to delivery. Prior to adoption of ASC 606, deferred revenue, a type of contract liability, was recorded upon customer prepayment. Under the new revenue standard, a receivable and associated deferred revenue is recorded at the point in time in which a prepaid contract is legally enforceable and the associated right to consideration is unconditional. The adoption of the new revenue standard resulted in a $21.4 million increase to deferred revenue and accounts receivable as of January 1, 2018. After the effect of adoption of the new revenue standard, deferred revenue and accounts receivable were $34.3 million and $31.2 million, respectively, as of January 1, 2018.

The following table displays the effect of the adoption of ASC 606 to the Condensed Consolidated Balance Sheet as of September 30, 2018:

|

| | | | | | | | | | | |

| | September 30, 2018 |

| (In thousands) | As Reported | | Balances without adoption of ASC 606 | | Effect of Change |

| Assets | | | | | |

| Accounts receivable | $ | 20,564 |

| | $ | 13,791 |

| | $ | 6,773 |

|

| Liabilities | | | | | |

| Deferred revenue | $ | 31,611 |

| | $ | 24,838 |

| | $ | 6,773 |

|

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(unaudited)

New Accounting Standards Issued But Not Yet Implemented

In February 2016, the FASB issued ASU No. 2016-02, “Leases” (“ASU 2016-02”), creating a new topic, FASB ASC Topic 842, “Leases” (“Topic 842”842”), which supersedes lease requirements in FASB ASC Topic 840, “Leases”.Leases.” The new standard revises accounting for operating leases by a lessee,

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(unaudited)

among other changes, and requires a lessee to recognize a liability related to future lease payments and ana right-of-use (“ROU”) asset representing its right to use of the underlying asset for the lease term on the balance sheet. QuantitativeThe ROU asset is classified as Other long-term assets on the condensed consolidated balance sheet. The current and qualitative disclosures, including disclosures regarding significant judgments made by management, will be required. In July 2018,long-term lease liabilities are classified as Other current liabilities and Other long-term liabilities, respectively, on the FASB issued updated guidance which provides entities with an additionalcondensed consolidated balance sheet.

We adopted Topic 842 as of January 1, 2019, electing the option to apply the transition method to adopt Topic 842. Under the new transition method, an entity initially applies the new leases standardprovisions at the adoption date versus at the beginninginstead of the earliest comparative period presented and recognizes a cumulative-effect adjustment to the opening balance of retained earnings in the period of adoption. The Partnership expects to elect this transition method atfinancial statements. In connection with the adoption date of January 1, 2019. The Partnership also plans to electTopic 842, we made the following elections:

Under the short-term lease exception provided for in the standard and therefore willTopic 842, only recognize right-of-useROU assets and the related lease liabilities for leases with aan initial term greater than one year. year were recognized;

The Partnership continuesaccounting treatment for existing land easements was carried forward;

Lease and non-lease components were not, and will not, be bifurcated for all of the Partnership’s asset groups; and

The portfolio approach was, and will continue to focus its implementation efforts on accounting policybe, used in the selection of the discount rate used to calculate minimum lease payments and disclosure updates along with the system implementation necessary to meet the standard’s requirements. Based on information available to date, the Partnership estimates therelated ROU asset and operating lease rightliability amounts.

The adoption of use asset and lease liability may approximate $13.0 - $17.0 million upon adoption. This preliminary estimate of the effect on the Partnership’s Consolidated Balance Sheets as a result of implementing the standardTopic 842 on January 1, 2019 could differ materially dependingincrementally impacted the Partnership’s condensed consolidated balance sheet as of that date. The following presents the financial statement line items impacted by the Partnership’s Topic 842 adoption.

Effect of Topic 842 Adoption on guidance changes fromthe Condensed Consolidated Balance Sheet as of January 1, 2019

|

| | | | | | | | | | | |

| (in thousands) | December 31, 2018 As Stated | | Effect of Adoption of Topic 842 - Leases (Unaudited) | | January 1, 2019 As Adjusted |

| Current assets: | | | | | |

| Prepaid expenses and other current assets | $ | 6,989 |

| | $ | (2,650 | ) | (1) | $ | 4,339 |

|

| Total currents assets | 193,981 |

| | (2,650 | ) | | 191,331 |

|

| Other long-term assets | 4,198 |

| | 16,923 |

| (2) | 21,121 |

|

| Total assets | $ | 1,254,388 |

| | $ | 14,273 |

| | $ | 1,268,661 |

|

| Current liabilities: | | | | | |

| Other current liabilities | $ | 24,066 |

| | $ | 3,462 |

| (3) | $ | 27,528 |

|

| Total current liabilities | 122,635 |

| | 3,462 |

| | 126,097 |

|

| Long-term liabilities: | | | | | |

| Other long-term liabilities | 2,938 |

| | 10,811 |

| (3) | 13,749 |

|

| Total long-term liabilities | 631,927 |

| | 10,811 |

| | 642,738 |

|

| Equity: | | | | | |

| Total liabilities and partners’ capital | $ | 1,254,388 |

| | $ | 14,273 |

| | $ | 1,268,661 |

|

| |

| (1) | Represents lease prepayments reclassified to ROU assets. |

| |

| (2) | Represents recognition of initial ROU assets for operating leases, including the reclassification of certain lease prepayments. |

| |

| (3) | Represents the initial recognition of lease liabilities. |

New Accounting Standards Issued But Not Yet Implemented

In August 2018, the FASB changes in outstanding leases, final verificationissued ASU 2018-13, Fair Value Measurement (Topic 820). The ASU eliminates such disclosures as the amount of, and reasons for, transfers between Level 1 and Level 2 of the Partnership’s lease accounting estimates,fair value hierarchy. Certain disclosures are required to be applied on a retrospective basis and any changes inothers on a prospective basis. This ASU is effective for the Partnership’s plans to elect certain practical expedients.Partnership beginning January 1, 2020, with early adoption permitted. The Partnership is evaluating the effect of adopting this ASU, but does not currently expect the adoption of this standard towill have a material impact on the recognition, measurement or presentation of amounts within the Condensed Consolidated Statements of Operations and the Condensed Consolidated Statements of Cash Flows.Partnership’s disclosures.

In August 2018, the FASB issued ASU 2018-15, Intangibles-Goodwill and Other-Internal-Use Software (Subtopic 350-40). This ASU addresses customer’s accounting for implementation costs incurred in a cloud computing arrangement that is a service

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(unaudited)

contract and also adds certain disclosure requirements related to implementation costs incurred for internal-use software and cloud computing arrangements. The amendment aligns the requirements for capitalizing implementation costs incurred in a hosting arrangement that is a service contract with the requirements for capitalizing implementation costs incurred to develop or obtain internal-use software (and hosting arrangements that include an internal-use software license). This standard is effective for the Partnership beginning January 1, 2020 with early adoption permitted. The amendments in this standard can be applied either retrospectively or prospectively to all implementation costs incurred after the date of adoption. The Partnership is evaluating the effect of adopting this new accounting guidance on its consolidated financial statements.

In August 2018, the FASB issued ASU 2018-13, Fair Value Measurement (Topic 820). The ASU eliminates such disclosures as the amount of and reasons for transfers between Level 1 and Level 2 of the fair value hierarchy. Certain disclosures are required to be applied on a retrospective basis and others on a prospective basis. This standard is effective for the Partnership beginning January 1, 2020, with early adoption permitted. The Partnership is evaluating the effect of adopting this new accounting guidance,statements, but does not currently expect adoption will have a material impact on the Partnership's disclosures.Partnership’s consolidated financial position or results of operations.

(4) Inventories

Inventories consisted of the following:

|

| | | | | | | |

| (in thousands) | September 30, 2019 | | December 31, 2018 |

| Finished goods | $ | 19,919 |

| | $ | 25,136 |

|

| Raw materials | 362 |

| | 439 |

|

| Parts, supplies and other | 36,583 |

| | 37,979 |

|

| Total inventories | $ | 56,864 |

| | $ | 63,554 |

|

(5) Property, Plant and Equipment

Property, plant and equipment consisted of the following:

|

| | | | | | | |

| (in thousands) | September 30, 2019 | | December 31, 2018 |

| Machinery and equipment | $ | 1,360,019 |

| | $ | 1,362,965 |

|

| Buildings and improvements | 17,116 |

| | 17,116 |

|

| Automotive equipment | 16,719 |

| | 16,773 |

|

| Land and improvements | 13,751 |

| | 13,250 |

|

| Construction in progress | 17,299 |

| | 15,126 |

|

| Other | 1,654 |

| | 2,753 |

|

| | 1,426,558 |

| | 1,427,983 |

|

| Less: Accumulated depreciation | 462,056 |

| | 412,743 |

|

| Total property, plant and equipment, net | $ | 964,502 |

| | $ | 1,015,240 |

|

On October 22, 2019, the Audit Committee of CVR Energy and the Conflicts Committee of the Board of Directors of the general partner of CVR Partners each agreed to authorize the exchange of certain parcels of property owned by subsidiaries of CVR Energy with an equal number of parcels owned by subsidiaries of CVR Partners, all located in Coffeyville, Kansas (the “Property Swap”). This Property Swap will enable each such subsidiary to create a more usable contiguous parcel of land near its own operating footprint. The Partnership will account for this transaction in accordance with the ASC 805-50 guidance on transferring assets between entities under common control.

(6) Leases

Lease Overview

We lease railcars and certain facilities to support the Partnership’s operations. Most leases include one or more options to renew, with renewal terms that can extend the lease term from one to 20 years or more. The exercise of lease renewal options is at our sole discretion. Certain leases also include options to purchase the leased property. The depreciable life of assets and leasehold improvements are limited by the expected lease term, unless there is a transfer of title or purchase option reasonably certain of exercise. Certain of our lease agreements include rental payments which are adjusted periodically for factors such as inflation. Our lease agreements do not contain any material residual value guarantees or material restrictive covenants. Additionally, we do not have any material lessor or sub-leasing arrangements.

|

| | | | | | | |

| (In thousands) | September 30, 2018 | | December 31, 2017 |

| Raw materials and precious metals | $ | 5,362 |

| | $ | 6,333 |

|

| Finished goods | 19,911 |

| | 13,594 |

|

| Parts and supplies | 31,632 |

| | 34,170 |

|

| Total inventories | $ | 56,905 |

| | $ | 54,097 |

|

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(unaudited)

(5) Property, PlantEffect of Initial Adoption of New Lease Standard - January 1, 2019

ROU Assets. Upon initial recognition, our ROU assets for operating and Equipmentfinance leases were comprised of the following:

|

| | | |

| (in thousands) | January 1, 2019 (initial recognition) |

| Railcar leases | $ | 14,255 |

|

| Real Estate and other leases | 18 |

|

| Total ROU assets | $ | 14,273 |

|

Lease Liabilities. Upon initial recognition, our lease liabilities for operating and finance leases were comprised of the following:

|

| | | |

| (in thousands) | January 1, 2019 (initial recognition) |

| Current liabilities: | |

| Operating leases | $ | 3,462 |

|

| Long-term liabilities: | |

| Operating leases | 10,811 |

|

| Total lease liabilities | $ | 14,273 |

|

Balance Sheet Summary for the Period Ended September 30, 2019

The following tables summarize the ROU asset and lease liability balances for the Partnership’s operating and finance leases at September 30, 2019:

|

| | | | | | | |

| (In thousands) | September 30, 2018 | | December 31, 2017 |

| Land and improvements | $ | 13,092 |

| | $ | 13,092 |

|

| Buildings and improvements | 16,707 |

| | 16,990 |

|

| Machinery and equipment | 1,362,014 |

| | 1,352,573 |

|

| Other | 31,411 |

| | 28,101 |

|

| | 1,423,224 |

| | 1,410,756 |

|

| Less: Accumulated depreciation | 393,822 |

| | 341,230 |

|

| Total property, plant and equipment, net | $ | 1,029,402 |

| | $ | 1,069,526 |

|

|

| | | |

| (in thousands) | September 30, 2019 |

| Operating Leases: | |

| ROU asset, net | |

| Railcars | $ | 11,454 |

|

| Real estate and other | 2,396 |

|

| Lease liability | |

| Railcars | $ | 11,666 |

|

| | |

| Financing Leases: | |

| ROU asset, net | |

| Real estate and other | $ | 226 |

|

| Lease liability | |

| Real estate and other | $ | 229 |

|

Capitalized interest recognized as a reduction in interest expense was $0.1 million and $0.0 million for the three months ended

September 30, 2018 and 2017, respectively. Capitalized interest recognized as a reduction in interest expense was $0.5 million and $0.2 million for the nine months ended September 30, 2018 and 2017, respectively.

(6) Accrued Expenses and Other Current Liabilities

Accrued expenses and other current liabilities were as follows:

|

| | | | | | | |

| (In thousands) | September 30, 2018 | | December 31, 2017 |

| Deferred revenue | $ | 31,611 |

| | $ | 12,895 |

|

| Share-based compensation | 3,077 |

| | 3,928 |

|

| Personnel accruals | 6,520 |

| | 7,533 |

|

| Accrued interest | 17,635 |

| | 2,683 |

|

| Other accrued expenses and liabilities | 5,172 |

| | 5,538 |

|

| Total accrued expenses and other current liabilities | $ | 64,015 |

| | $ | 32,577 |

|

Accrued expenses and other current liabilities include amounts owed by the Partnership to CVR Energy under the shared services agreement and affiliate balances of $3.8 million and $4.7 million at September 30, 2018 and December 31, 2017, respectively. Refer to Note 12 ("Related Party Transactions") for additional discussion.

(7) Debt

|

| | | | | | | |

| Debt Balance, Net of Current Maturities and Unamortized Discount and Issuance Costs | | | |

| (In thousands) | September 30, 2018 | | December 31, 2017 |

| 9.250% senior secured notes, due 2023 | $ | 645,000 |

| | $ | 645,000 |

|

| 6.500% notes, due 2021 | 2,240 |

| | 2,240 |

|

| Total long-term debt, before debt issuance costs and discount (a) | 647,240 |

| | 647,240 |

|

| Less: | | | |

| Unamortized discount and debt issuance costs | 19,048 |

| | 21,336 |

|

| Total long-term debt, net of current portion | $ | 628,192 |

| | $ | 625,904 |

|

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(unaudited)

Lease Expense Summary for the Three and Nine months ended September 30, 2019

We recognize lease expense on a straight-line basis over the lease term. For the three and nine months ended September 30, 2019, we recognized lease expense comprised of the following components:

|

| | | | | | | |

| (in thousands) | Three Months Ended

September 30, 2019 | | Nine Months Ended

September 30, 2019 |

| Operating lease expense | $ | 1,023 |

| | $ | 3,069 |

|

| Financing lease expense: | | | |

| Amortization of ROU asset | $ | 25 |

| | $ | 297 |

|

| Interest expense on lease liability | 2 |

| | 17 |

|

Short-term lease expense, recognized within direct operating expenses, was $0.2 million and $0.3 million for the three and nine months ended September 30, 2019, respectively.

Lease Terms and Discount Rates

The following outlines the remaining lease terms and discount rates used in the measurement of the Partnership’s ROU assets and liabilities:

|

| | | | | |

| | September 30, 2019 | | January 1, 2019 (initial recognition) |

| Weighted-average remaining lease term (years) | | | |

| Operating Leases | 3.7 |

| | 4.3 |

|

| Finance Leases | 2.5 |

| | 0.5 |

|

| Weighted-average discount rate | | | |

| Operating Leases | 5.1 | % | | 5.1 | % |

| Finance Leases | 3.9 | % | | 8.0 | % |

Maturities of Lease Liabilities

The following summarizes the remaining minimum lease payments through maturity of the Partnership’s ROU assets and liabilities at September 30, 2019:

|

| | | | | | | |

| (in thousands) | Operating Leases | | Financing Leases |

| Remainder of 2019 | $ | 1,023 |

| | $ | 27 |

|

| 2020 | 3,602 |

| | 107 |

|

| 2021 | 3,430 |

| | 107 |

|

| 2022 | 2,990 |

| | — |

|

| 2023 | 1,133 |

| | — |

|

| Thereafter | 648 |

| | — |

|

| Total lease payments | 12,826 |

| | 241 |

|

| Less: imputed interest | (1,160 | ) | | (12 | ) |

| Total lease liability | $ | 11,666 |

| | $ | 229 |

|

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(unaudited)

(7) Other Current Liabilities

Other current liabilities consisted of the following:

|

| | | | | | | |

| (in thousands) | September 30, 2019 | | December 31, 2018 |

| Accrued interest | $ | 17,470 |

| | $ | 2,516 |

|

| Personnel accruals | 7,099 |

| | 7,993 |

|

| Share-based compensation | 4,959 |

| | 2,667 |

|

| Operating lease liabilities | 3,220 |

| | — |

|

| Sales incentives | 613 |

| | 1,727 |

|

| Prepaid revenue contracts | 459 |

| | 5,863 |

|

| Other accrued expenses and liabilities | 2,867 |

| | 3,300 |

|

| Total other current liabilities | $ | 36,687 |

| | $ | 24,066 |

|

Other current liabilities include amounts accrued by the Partnership and owed to CVR Energy and its affiliates of $4.7 million and $3.5 million at September 30, 2019 and December 31, 2018, respectively. See Note 13 (“Related Party Transactions”) for additional discussion.

(8) Long-Term Debt

Long-term debt consists of the following:

|

| | | | | | | |

| (in thousands) | September 30, 2019 | | December 31, 2018 |

| 9.25% Senior Secured Notes, due 2023 (1) | $ | 645,000 |

| | $ | 645,000 |

|

| 6.50% Notes, due 2021 | 2,240 |

| | 2,240 |

|

| Unamortized discount and debt issuance costs | (15,720 | ) | | (18,251 | ) |

| Total long-term debt | $ | 631,520 |

| | $ | 628,989 |

|

| |

(a)(1) | The estimated fair value of total long-term debt outstanding was approximately $683.7$672.4 million and $694.2$670.8 million as of September 30, 20182019 and December 31, 2017,2018, respectively. |

Credit Facility

|

| | | | | | | | | | | | | | | | | |

| Credit Facilities Outstanding | | | | | | | | | |

| (In thousands) | Total Capacity | | Amount Borrowed as of September 30, 2018 | | Outstanding Letters of Credit | | Available Capacity as of September 30, 2018 | | Maturity Date |

| Asset based credit facility (b) | $ | 50,000 |

| | $ | — |

| | $ | — |

| | $ | 50,000 |

| �� | September 30, 2021 |

|

| | | | | | | | | | | | | | | | | |

| (in thousands) | Total Capacity | | Amount Borrowed as of September 30, 2019 | | Outstanding Letters of Credit | | Available Capacity as of September 30, 2019 | | Maturity Date |

| Asset Based (“AB”) Credit Facility (2) | $ | 47,517 |

| | $ | — |

| | $ | — |

| | $ | 47,517 |

| | September 30, 2021 |

| |

(b)(2) | At the option of the borrowers, loans under the asset based credit facilityAB Credit Facility initially bear interest at an annual rate equal to (i) 2.00% plus LIBOR or (ii) 1.00% plus a base rate, subject to a 0.50% step-down based on the previous quarter’s excess availability. |

Covenant Compliance

The Partnership is in compliance with all covenants of the asset based credit facilityAB Credit Facility, the 9.25% Senior Secured Notes, and the 9.250% senior secured notes and 6.500% notes6.50% Notes as of September 30, 2018.2019.

(8) Supplemental Cash Flow Information

Cash flows related to interest and construction in process were as follows:

|

| | | | | | | |

| | Nine Months Ended September 30, |

| (In thousands) | 2018 | | 2017 |

| Supplemental disclosures: | | | |

| Cash paid for interest | $ | 30,244 |

| | $ | 30,123 |

|

| Non-cash investing and financing activities: | | | |

| Construction in process additions included in accounts payable | 1,920 |

| | 608 |

|

| Change in accounts payable related to construction in process additions | 1,032 |

| | (3,263 | ) |

(9) Commitments and Contingencies

There have been no material changes in the Partnership’s commitments and contingencies disclosed in the 2017 Form 10-K. In the ordinary course of business, the Partnership may become party to lawsuits, administrative proceedings and governmental investigations, including environmental, regulatory and other matters. The outcome of these matters cannot always be predicted accurately, but the Partnership accrues liabilities for these matters if the Partnership has determined that it is probable a loss has been incurred and the loss can be reasonably estimated. While it is not possible to predict the outcome of such proceedings, if one or more of them were decided against us, the Partnership believes there would be no material impact on its consolidated financial statements.

In 2018, the Partnership submitted a business interruption claim for losses under its insurance policies, related to damage and resulting reduced equipment production rates experienced during the second half of 2017 and early 2018. At this time, the Partnership cannot estimate either the outcome of this claim or the timing of any potential recoveries.

In September 2018, the Kansas Court of Appeals upheld property tax determinations by the Kansas Board of Tax Appeals in connection with the Partnership’s dispute with Montgomery County, Kansas over prior year property tax payments as previously disclosed. The Partnership continues to monitor this matter.

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(unaudited)

(10)(9) Revenue

The following table presents the Partnership’s revenue, disaggregated by major product:

|

| | | | | | | | | | | | | | | |

| | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| (in thousands) | 2019 | | 2018 | | 2019 | | 2018 |

| Ammonia | $ | 11,110 |

| | $ | 11,391 |

| | $ | 74,416 |

| | $ | 51,361 |

|

| UAN | 61,970 |

| | 52,681 |

| | 199,576 |

| | 156,838 |

|

| Urea products | 4,575 |

| | 4,987 |

| | 14,251 |

| | 14,834 |

|

| Net sales, exclusive of freight and other | 77,655 |

| | 69,059 |

| | 288,243 |

| | 223,033 |

|

| Freight revenue | 8,752 |

| | 8,805 |

| | 23,909 |

| | 23,908 |

|

| Other revenue | 2,175 |

| | 2,045 |

| | 5,963 |

| | 6,024 |

|

| Net sales | $ | 88,582 |

| | $ | 79,909 |

| | $ | 318,115 |

| | $ | 252,965 |

|

|

| | | | | | | |

| (In thousands) | Three Months Ended September 30, 2018 | | Nine Months Ended September 30, 2018 |

| Ammonia | $ | 11,391 |

| | $ | 51,361 |

|

| UAN | 52,681 |

| | 156,838 |

|

| Urea products | 4,987 |

| | 14,834 |

|

| Fertilizer sales, exclusive of freight | 69,059 |

| | 223,033 |

|

| Freight revenue | 8,805 |

| | 23,908 |

|

| Other revenue | 2,045 |

| | 6,024 |

|

| Total net sales | $ | 79,909 |

| | $ | 252,965 |

|

The Partnership sells its products, on a wholesale basis, under a contract or by purchase order. The Partnership’s contracts with customers including purchase orders, generally contain fixed pricing and most have terms of less than one year. The Partnership recognizes revenue at the point in time at which the customer obtains control of the product, which is generally upon delivery and acceptance by the customer. The customer acceptance point is stated in the contract and may be at one of the Partnership’s manufacturing facilities, at one of the Partnership’s off-site loading facilities or at the customer’s designated facility. Freight revenue recognized by the Partnership represents the pass-through finished goods delivery costs incurred prior to customer acceptance and is reimbursed by customers. An offsetting expense for freight is included in costCost of materials and other. Qualifying taxes collected from customers and remitted to governmental authorities are not included in reported revenues.

Depending on the product sold and the type of contract, payments from customers are generally either due prior to delivery or within 15 to 30 days of product delivery.

The Partnership generally provides no warranty other than the implicit promise that goods delivered are free of liens and encumbrances and meet the agreed upon specifications. Product returns are rare, and as such, the Partnership does not record a specific warranty reserve or consider activities related to such warranty, if any, to be a separate performance obligation.

The Partnership has an immaterial amount of variable consideration for contracts with an original duration of less than a year. A small portion of the Partnership’s revenue includes contracts extending beyond one year, some of which contain variable pricing in which the majority of the variability is attributed to the market-based pricing. The Partnership’s contracts do not contain a significant financing component.

The Partnership has an immaterial amount of fee-based revenue, included in other revenue in the table above, that is recognized based on the net amount of the proceeds received.

Transaction price allocated to remaining performance obligations

As of September 30, 2018,2019, the Partnership had approximately $11.9$7.3 million of remaining performance obligations for contracts with an original expected duration of more than one year. The Partnership expects to recognize approximately 51%20% of these performance obligations as revenue by the end of 2019, an additional 25% by40% in 2020, and the remaining balance thereafter. The Partnership has elected to not disclose the amount of transaction price allocated to remaining performance obligations for contracts with an original expected duration of less than one year. The Partnership has elected to not disclose variable consideration allocated to wholly unsatisfied performance obligations that are based on market prices that have not yet been determined.

Contract balances

The Partnership’s deferred revenue is a contract liability that primarily relates to fertilizer sales contracts requiring customer prepayment prior to product delivery to guarantee a price and supply of nitrogen fertilizer. Deferred revenue is recorded at the point in time in which a prepaid contract is legally enforceable and the associated right to consideration is unconditional prior to transferring

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(unaudited)

product to the customer. An associated receivable is recorded for uncollected prepaid contract amounts. Contracts

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(unaudited)

requiring prepayment are generally short-term in nature and, as discussed above, revenue is recognized at the point in time in which the customer obtains control of the product. At September 30, 2019, $0.4 million of the deferred revenue balance pertained to prepaid contracts where the associated receivable was recognized as it had not yet been collected by the Partnership.

A summary of the deferred revenue activity duringfor the nine months ended September 30, 20182019 is presented below:

|

| | | |

| (in thousands) | |

| Balance at December 31, 2018 | $ | 68,804 |

|

| Add: | |

| New prepay contracts entered into during the period (1) | 24,121 |

|

| Less: | |

| Revenue recognized that was included in the contract liability balance at the beginning of the period | 67,823 |

|

| Revenue recognized related to contracts entered into during the period | 8,174 |

|

| Other changes | 480 |

|

| Balance at September 30, 2019 | $ | 16,448 |

|

|

| | | |

| (In thousands) | Nine Months Ended September 30, 2018 |

| Balance at January 1, 2018 | $ | 34,270 |

|

| Add: | |

| New prepay contracts entered into during the period | 35,665 |

|

| Less: | |

| Revenue recognized that was included in the contract liability balance at the beginning of the period | 33,761 |

|

| Revenue recognized related to contracts entered into during the period | 4,321 |

|

| Other changes | 242 |

|

| Balance at September 30, 2018 | $ | 31,611 |

|

(1) Includes $23.7 million where payment associated with prepaid contracts was collected.

(11)(10) Share-Based Compensation

A summary of compensation expense duringfor the three and nine months ended September 30, 20182019 and 20172018 is presented below:

|

| | | | | | | | | | | | | | | |

| | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| (in thousands) | 2019 | | 2018 | | 2019 | | 2018 |

| Phantom Units | $ | 544 |

| | $ | 710 |

| | $ | 2,089 |

| | $ | 1,663 |

|

Other Awards (1) | 208 |

| | 486 |

| | 881 |

| | 1,032 |

|

| Total share-based compensation expense | $ | 752 |

| | $ | 1,196 |

| | $ | 2,970 |

| | $ | 2,695 |

|

| |

| (1) | Other awards include the allocation of compensation expense for certain employees of CVR Energy and certain of its subsidiaries who perform services for the Partnership under the services agreement with CVR Energy and the Limited Partnership Agreement, respectively, and participate in equity compensation plans of CVR Partners’ affiliates. |

(11) Commitments and Contingencies

Except as noted below, there have been no material changes in the Partnership’s commitments and contingencies disclosed in the 2018 Form 10-K. In the ordinary course of business, the Partnership may become party to lawsuits, administrative proceedings, and governmental investigations, including environmental, regulatory, and other matters. The outcome of these matters cannot always be predicted accurately, but the Partnership accrues liabilities for these matters if the Partnership has determined that it is probable a loss has been incurred and the loss can be reasonably estimated. While it is not possible to predict the outcome of such proceedings, if one or more of them were decided against us, the Partnership believes there would be no material impact on its consolidated financial statements.

Litigation

In 2008, Coffeyville Resources Nitrogen Fertilizer LLC (“CRNF”), a subsidiary of CVR Partners LP, protested the reclassification and reassessment by Montgomery County, Kansas (the “County”) of CRNF’s nitrogen fertilizer plant following expiration of its ten year property tax abatement that expired on December 31, 2007, which reclassification and reassessment resulted in an increase in CRNF’s annual property tax expense in excess of $10 million per year for the 2008 through 2012 tax years. Despite its protest, CRNF fully accrued and paid these property taxes. In February 2013, the County and CRNF agreed to a settlement for tax years 2009 through 2012 which resulted in decreased property taxes through 2017, leaving 2008 in dispute. In 2013, the Kansas Court of Appeals overturned an adverse ruling of the Kansas Board of Tax Appeals (“BOTA”) and instructed BOTA to classify each CRNF asset on an asset-by-asset basis. In March 2015, BOTA concluded its classification and determined a substantial majority of CRNF’s assets in dispute were personal property for the 2008 tax year. In September 2018, the Kansas

|

| | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| (In thousands) | 2018 | | 2017 | | 2018 | | 2017 |

| Phantom Units | $ | 710 |

| | $ | 268 |

| | $ | 1,663 |

| | $ | 684 |

|

| Other Awards (a) | 486 |

| | 367 |

| | 1,032 |

| | 1,064 |

|

| Total Share-Based Compensation Expense | $ | 1,196 |

| | $ | 635 |

| | $ | 2,695 |

| | $ | 1,748 |

|

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(unaudited)

Court of Appeals upheld BOTA’s property tax determinations in CRNF’s favor. In October 2018, the County petitioned the Kansas Supreme Court to review the Court of Appeals determination. Subsequent briefs were filed by CRNF and the County. In April 2019, CRNF and the County executed an agreement under which the County agreed to withdraw its petition to the Kansas Supreme Court and CRNF is expected to recover $7.9 million through favorable property tax assessments from 2019 through 2028, subject to the terms of the settlement agreement.

(12) Supplemental Cash Flow Information

Cash flows related to interest, leases, and capital expenditures included in accounts payable are as follows:

|

| | | | | | | |

| | Nine Months Ended September 30, |

| (in thousands) | 2019 | | 2018 |

| Supplemental disclosures: | | | |

| Cash paid for interest | $ | 30,102 |

| | $ | 30,244 |

|

| Cash paid for amounts included in the measurement of lease liabilities (1): | | | |

| Operating cash flows from operating leases | 3,069 |

| | |

| Operating cash flows from finance leases | 17 |

| | |

| Financing cash flows from finance leases | 297 |

| | |

| Non-cash investing activities: | | | |

| Change in capital expenditures included in accounts payable | 2,087 |

| | 734 |

|

| |

(a)(1) | Other awards includeThe lease standard was adopted on January 1, 2019 on a prospective basis. Therefore only 2019 disclosures are applicable to be included within the allocation of compensation expense for certain employees of CVR Energy who perform services for the Partnership under the services agreement with CVR Energy and participate in equity compensation plans of CVR Partners’ affiliates.table above. |

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(unaudited)

(12)(13) Related Party Transactions

Activity associated with the Partnership’s related party arrangements for the three and nine month periodsmonths ended September 30, 20182019 and 20172018 is summarized below:below.

Sales to related parties

|

| | | | | | | | | | | | | | | | | |

| Expenses from related parties | | | | | | | | | |

| | | | Three Months Ended September 30, | | Nine Months Ended September 30, |

| (In thousands) | Related Party | | 2018 | | 2017 | | 2018 | | 2017 |

| Cost of materials and other | | | | | | | | | |

| Coke Supply Agreement | CRRM (a) | | $ | 1,057 |

| | $ | 586 |

| | $ | 2,133 |

| | $ | 1,566 |

|

| Hydrogen Purchase and Sale Agreement | CRRM | | 1,072 |

| | 933 |

| | 3,157 |

| | 3,042 |

|

| Railcar Lease Agreements | ARI (b) | | 361 |

| | 236 |

| | 1,082 |

| | 683 |

|

| | | | | | | | | | |

| Direct operating expenses (exclusive of depreciation and amortization) | | | | | | | | | |

| Services Agreement | CVR Energy | | $ | 761 |

| | $ | 766 |

| | $ | 2,145 |

| | $ | 2,158 |

|

| Limited Partnership Agreement | CVR GP | | 242 |

| | 127 |

| | 572 |

| | 428 |

|

| | | | | | | | | | |

| Selling, general and administrative expenses | | | | | | | | | |

| Services Agreement | CVR Energy | | $ | 3,595 |

| | $ | 3,239 |

| | $ | 10,353 |

| | $ | 9,398 |

|

| Limited Partnership Agreement | CVR GP | | 626 |

| | 677 |

| | 1,920 |

| | 2,001 |

|

|

| | | | | | | | | | | | | | | | | |

| | | | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| (in thousands) | Related Party | | 2019 | | 2018 | | 2019 | | 2018 |

| Net Sales | | | | | | | | | |

| Feedstock and Shared Services Agreement | CRRM (1) | | $ | 113 |

| | $ | — |

| | $ | 115 |

| | $ | 292 |

|

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(unaudited)

Expenses from related parties

|

| | | | | | | | | | | | | | | | | |

| | | | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| (in thousands) | Related Party | | 2019 | | 2018 | | 2019 | | 2018 |

| Cost of materials and other | | | | | | | | | |

| Coke Supply Agreement | CRRM (1) | | $ | 705 |

| | $ | 1,057 |

| | $ | 3,255 |

| | $ | 2,133 |

|

| Hydrogen Purchase and Sale Agreement | CRRM (1) | | 984 |

| | 1,072 |

| | 3,719 |

| | 3,157 |

|

| | | | | | | | | | |

| Direct operating expenses (exclusive of depreciation and amortization) | | | | | | | | | |

| Services Agreement | CVR Energy | | $ | 797 |

| | $ | 761 |

| | $ | 2,586 |

| | $ | 2,145 |

|

| Limited Partnership Agreement | CVR GP | | 219 |

| | 242 |

| | 595 |

| | 572 |

|

| | | | | | | | | | |

| Selling, general and administrative expenses | | | | | | | | | |

| Services Agreement | CVR Energy | | $ | 3,915 |

| | $ | 3,595 |

| | $ | 11,724 |

| | $ | 10,353 |

|

| Limited Partnership Agreement | CVR GP | | 651 |

| | 626 |

| | 2,191 |

| | 1,920 |

|

Amounts due to related parties

|

| | | | | | | | | |

| (in thousands) | Related Party | | September 30, 2019 | | December 31, 2018 |

| Prepaid expenses and other current assets | | | | | |

| Feedstock and Shared Services Agreement | CRRM (1) | | $ | 128 |

| | $ | — |

|

| | | | | | |

| Accounts payable to affiliates | | | | | |

| Feedstock and Shared Services Agreement | CRRM (1) | | $ | 681 |

| | $ | 1,106 |

|

| Hydrogen Purchase and Sale Agreement and other | CRRM (1) | | 348 |

| | 324 |

|

| Coke Supply Agreement | CRRM (1) | | 132 |

| | 138 |

|

| Services Agreement | CVR GP | | 970 |

| | 1,372 |

|

| | | | | | |

| Other current liabilities | | | | | |

| Limited Partnership Agreement | CVR GP | | $ | 1,697 |

| | $ | 1,179 |

|

| Services Agreement | CVR Energy | | 3,009 |

| | 2,352 |

|

| | | | | | |

| Other long-term liabilities | | | | | |

| Limited Partnership Agreement | CVR Energy | | $ | 530 |

| | $ | 503 |

|

| |

(a)(1) | Coffeyville Resources Refining & Marketing, LLC, aan indirect, wholly-owned subsidiary of CVR RefiningEnergy |

|

| | |

(b) | ARI Leasing, LLC, a company controlled by IEP | |

|

| | | | | | | | | |

| Amounts due to related parties | | | | | |

| | | | | | |

| (In thousands) | Related Party | | September 30, 2018 | | December 31, 2017 |

| Accounts payable | | | | | |

| Feedstock and Shared Services Agreement | CRRM | | $ | 747 |

| | $ | 1,020 |

|

| Hydrogen Purchase and Sale Agreement | CRRM | | 313 |

| | 324 |

|

Limited Partnership Agreement:

| CVR GP | | 955 |

| | 771 |

|

| | | | | | |

| Accrued expenses and other current liabilities | | | | | |

| Limited Partnership Agreement | CVR GP | | $ | 1,346 |

| | $ | 1,521 |

|

| Services Agreement | CVR Energy | | 2,497 |

| | 3,221 |

|

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(unaudited)

Distributions to CVR Partners’ Unitholders

The following table presents distributions paid by the Partnership to CVR Partners’ unitholders, including amounts paid to CVR Energy, as of September 30, 2019.

|

| | | | | | | | | | | | | | | | | | |

| | | | | | | Dividends Paid (in thousands) |

| Related Period | | Date Paid | | Dividend Per Common Unit | | Unitholders | | CVR Energy | | Total |

| 2018 - 4th Quarter | | March 11, 2019 | | $ | 0.12 |

| | $ | 8,924 |

| | $ | 4,670 |

| | $ | 13,594 |

|

| 2019 - 1st Quarter | | May 13, 2019 | | 0.07 |

| | 5,205 |

| | 2,724 |

| | 7,929 |

|

| 2019 - 2nd Quarter | | August 12, 2019 | | 0.14 |

| | 10,411 |

| | 5,449 |

| | 15,860 |

|

| Total | | | | $ | 0.33 |

| | $ | 24,540 |

| | $ | 12,843 |

| | $ | 37,383 |

|

For the third quarter of 2019, the Partnership, upon approval by the Board of Directors of CVR Partners’ general partner on October 22, 2019, declared a distribution of $0.07 per common unit, or $7.9 million, which is payable November 12, 2019 to unitholders of record as of November 4, 2019. Of this amount, CVR Energy will receive approximately $2.7 million, with the remaining amount payable to public unitholders.

Distributions, if any, including the payment, amount and timing thereof, are subject to change at the discretion of the Board of Directors of CVR Partners’ general partner.

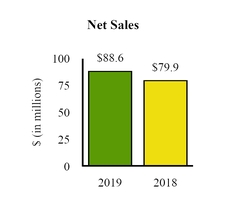

Item 2. Management’s Discussion and Analysis of Financial Condition andResults of Operations

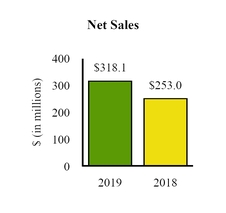

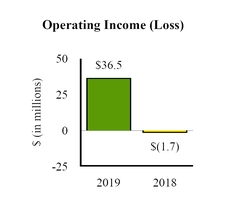

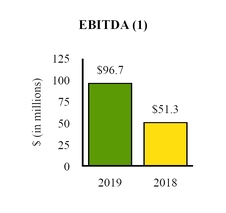

The following discussion and analysis of our financial condition, results of operations, and cash flows should be read in conjunction with the unaudited condensed consolidated financial statements and related notes and with the statistical information and financial data appearing in this Report, as well as our Annual Report on Form 10-K for the year ended December 31, 20172018 filed with the Securities and Exchange Commission (“SEC”) on February 21, 2019 (the “2017“2018 Form 10-K”). Results of operations for the three and nine months ended September 30, 20182019 and cash flows for the nine months ended September 30, 20182019 are not necessarily indicative of results to be attained for any other period. Refer to the section entitled “Forward-LookingSee “Important Information Regarding Forward Looking Statements” below..

Partnership Overview

CVR Partners, LP (“CVR Partners,”Partners” or the “Partnership,” “we,” “us” or “our”“Partnership”) is a Delaware limited partnership formed in 2011 by CVR Energy, Inc. (“CVR Energy”) to own, operate, and grow our nitrogen fertilizer business. We produce and distribute nitrogen fertilizer products, which are used by farmers to improve the yield and quality of their crops. The Partnership produces these products at two manufacturing facilities, which are located in Coffeyville, Kansas and East Dubuque, Illinois. Our principal products are ammonia and urea ammonium nitrate (“UAN”). Ammonia is a direct application fertilizer and is primarily used as a building block for other nitrogen products for industrial applications and finished fertilizer products. UAN is an aqueous solution of urea and ammonium nitrate. All of our products are sold on a wholesale basis. We produce our nitrogen fertilizer products at two manufacturing facilities, which are located in Coffeyville, Kansas (the “Coffeyville Facility”)References to CVR Partners, the Partnership, “we”, “us”, and East Dubuque, Illinois (the “East Dubuque Facility”).

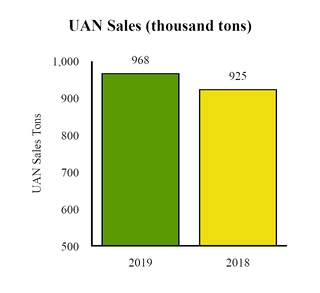

Our Coffeyville Facility includes a 1,300 ton-per-day capacity ammonia unit, a 3,000 ton-per-day capacity UAN unit, and a gasifier complex having a capacity“our” may refer to consolidated subsidiaries of 89 million standard cubic feet per day of hydrogen. Our gasifier is a dual-train facility, with each gasifier able to function independentlyCVR Partners or one or both of the other, thereby providing redundancy and improving our reliability. Strategically located adjacentfacilities, as the context may require. Additionally, as the context may require, references to a refinery owned by CVR Refining, LP (“CVR Refining”) in Coffeyville, Kansas, our Coffeyville Facility is the only operation in North America that utilizes a petroleum coke, or pet coke, gasification process to produce nitrogen fertilizer.