UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | |

| For the quarterly period ended September 30, 2023March 31, 2024 |

OR |

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number:001-34743

| | |

HALLADOR ENERGY COMPANY (www.halladorenergy.com) |

Colorado (State of incorporation) | | 84-1014610 (IRS Employer Identification No.) |

| | |

1183 East Canvasback Drive, Terre Haute, Indiana (Address of principal executive offices) | | 47802 (Zip Code) |

Registrant’s telephone number, including area code: 812.299.2800

Securities registered pursuant to Section 12(b) of the Act: |

| |

Title of each class | | Trading Symbol | | Name of each exchange on which registered |

Common Shares, $.01 par value | | HNRG | | Nasdaq |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulations S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer ☐ | | Accelerated filer ☑ |

Non-accelerated filer ☐ | | Smaller reporting company ☑ |

| | Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☑

As of November 3, 2023,May 1, 2024, we had 33,142,40337,027,196 shares of common stock outstanding.

PART I - FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

Hallador Energy Company

Condensed Consolidated Balance Sheets

(in thousands, except per share data)

(unaudited)

| | | September 30, | | December 31, | | | March 31, | | December 31, | |

| | | 2023 | | | 2022 | | | 2024 | | | 2023 | |

ASSETS | | | | | | | | | | |

Current assets: | | | | | | | | | | |

Cash and cash equivalents | | $ | 2,573 | | | $ | 3,009 | | | $ | 1,635 | | | $ | 2,842 | |

Restricted cash | | 4,143 | | 3,417 | | | 4,737 | | | 4,281 | |

Accounts receivable | | 20,692 | | 29,889 | | | 14,228 | | | 19,937 | |

Inventory | | 23,749 | | 49,796 | | | 29,688 | | | 23,075 | |

Parts and supplies | | 37,012 | | 28,295 | | | 40,360 | | | 38,877 | |

Contract asset - coal purchase agreement | | — | | 19,567 | | |

Prepaid expenses | | | 4,158 | | | 4,546 | | | | 2,614 | | | | 2,262 | |

Total current assets | | | 92,327 | | | | 138,519 | | | | 93,262 | | | | 91,274 | |

Property, plant and equipment: | | | | | | | | | | |

Land and mineral rights | | 115,486 | | 115,595 | | | 115,486 | | | 115,486 | |

Buildings and equipment | | 572,885 | | 534,129 | | | 537,921 | | | 537,131 | |

Mine development | | | 153,240 | | | 140,108 | | | 161,669 | | | 158,642 | |

Finance lease right-of-use assets | | | | 16,178 | | | | 12,346 | |

Total property, plant and equipment | | 841,611 | | | 789,832 | | | 831,254 | | | 823,605 | |

Less - accumulated depreciation, depletion and amortization | | | (358,944 | ) | | | (309,370 | ) | | | (348,783 | ) | | | (334,971 | ) |

Total property, plant and equipment, net | | 482,667 | | | 480,462 | | | 482,471 | | | 488,634 | |

Investment in Sunrise Energy | | 3,038 | | 3,988 | | | 2,562 | | | 2,811 | |

Other assets | | | 7,154 | | | 7,585 | | | | 7,125 | | | | 7,061 | |

Total Assets | | $ | 585,186 | | | $ | 630,554 | | |

Total assets | | | $ | 585,420 | | | $ | 589,780 | |

| | | |

LIABILITIES AND STOCKHOLDERS' EQUITY | | | | | | | | | | |

Current liabilities: | | | | | | | | | | |

Current portion of bank debt, net | | $ | 21,188 | | $ | 33,031 | | | $ | 24,438 | | | $ | 24,438 | |

Notes payable - related party | | | 5,000 | | | — | |

Accounts payable and accrued liabilities | | 76,602 | | | 82,972 | | | 47,125 | | | 62,908 | |

Current portion of lease financing | | | 4,958 | | | 3,933 | |

Deferred revenue | | 25,712 | | 35,485 | | | 41,242 | | | 23,062 | |

Contract liability - power purchase agreement and capacity payment reduction | | | 48,087 | | | 88,114 | | | | 41,662 | | | | 43,254 | |

Total current liabilities | | | 171,589 | | | | 239,602 | | | | 164,425 | | | | 157,595 | |

Long-term liabilities: | | | | | | | | | | |

Long-term bank debt, excluding current maturities, net | | 36,482 | | 49,713 | | |

Convertible note payable | | 10,000 | | 10,000 | | |

Bank debt, net | | | 49,343 | | | 63,453 | |

Convertible notes payable | | | 10,000 | | | 10,000 | |

Convertible notes payable - related party | | 9,000 | | 9,000 | | | 1,000 | | | 9,000 | |

Long-term lease financing | | | 9,701 | | | 8,157 | |

Deferred revenue | | | 5,434 | | | — | |

Deferred income taxes | | 12,244 | | 4,606 | | | 8,625 | | | 9,235 | |

Asset retirement obligations | | 16,348 | | 17,254 | | | 14,934 | | | 14,538 | |

Contract liability - power purchase agreement | | 55,439 | | 84,096 | | | 36,229 | | | 47,425 | |

Other | | | 2,395 | | | 1,259 | | | | 1,871 | | | | 1,789 | |

Total long-term liabilities | | | 141,908 | | | | 175,928 | | | | 137,137 | | | | 163,597 | |

Total liabilities | | | 313,497 | | | | 415,530 | | | | 301,562 | | | | 321,192 | |

Commitments and contingencies | | | | | | | | | | | |

Stockholders' equity: | | | | | | | | | | |

Preferred stock, $.10 par value, 10,000 shares authorized; none issued and outstanding | | — | | — | | |

Common stock, $.01 par value, 100,000 shares authorized; 33,142 and 32,983 issued and outstanding, as of September 30, 2023 and December 31, 2022, respectively | | 332 | | 330 | | |

Preferred stock, $.10 par value, 10,000 shares authorized; none issued | | | — | | | — | |

Common stock, $.01 par value, 100,000 shares authorized; 36,534 and 34,052 issued and outstanding, as of March 31, 2024 and December 31, 2023, respectively | | | 365 | | | 341 | |

Additional paid-in capital | | 120,410 | | 118,788 | | | 144,490 | | | 127,548 | |

Retained earnings | | | 150,947 | | | 95,906 | | | | 139,003 | | | | 140,699 | |

Total stockholders’ equity | | | 271,689 | | | | 215,024 | | | | 283,858 | | | | 268,588 | |

Total liabilities and stockholders’ equity | | $ | 585,186 | | | $ | 630,554 | | | $ | 585,420 | | | $ | 589,780 | |

See accompanying notes to the condensed consolidated financial statements.

Hallador Energy Company

Condensed Consolidated Statements of Operations

(in thousands, except per share data)

(unaudited)

| | | Three Months Ended September 30, | | Nine Months Ended September 30, | | | Three Months Ended March 31, | |

| | | 2023 | | | 2022 | | | 2023 | | | 2022 | | | 2024 | | | 2023 | |

SALES AND OPERATING REVENUES: | | | | | | | | | | | | |

Electric sales | | | $ | 58,755 | | | $ | 92,392 | |

Coal sales | | $ | 97,420 | | | $ | 83,562 | | | $ | 280,596 | | | $ | 204,733 | | | | 49,630 | | | | 94,602 | |

Electric sales | | 67,403 | | | | $ | 230,812 | | — | | |

Other revenues | | | 945 | | | | 1,522 | | | | 3,888 | | | | 5,187 | | | | 1,287 | | | | 1,340 | |

Total revenue | | | 165,768 | | | | 85,084 | | | | 515,296 | | | | 209,920 | | |

Total sales and operating revenues | | | | 109,672 | | | | 188,334 | |

EXPENSES: | | | | | | | | | | | | |

Operating expenses | | 119,042 | | | 64,557 | | | 367,983 | | | 170,552 | | | 85,083 | | | 133,521 | |

Depreciation, depletion and amortization | | 16,230 | | | 11,187 | | | 51,375 | | | 31,882 | | | 15,443 | | | 17,976 | |

Asset retirement obligations accretion | | 468 | | | 255 | | | 1,380 | | | 751 | | | 399 | | | 451 | |

Exploration costs | | 171 | | | 121 | | | 682 | | | 393 | | | 70 | | | 206 | |

General and administrative | | | 6,054 | | | | 3,569 | | | | 18,596 | | | | 10,440 | | | | 5,944 | | | | 6,947 | |

Total operating expenses | | | 141,965 | | | | 79,689 | | | | 440,016 | | | | 214,018 | | | | 106,939 | | | | 159,101 | |

| | | |

INCOME (LOSS) FROM OPERATIONS | | | 23,803 | | | | 5,395 | | | | 75,280 | | | | (4,098 | ) | |

INCOME FROM OPERATIONS | | | | 2,733 | | | | 29,233 | |

| | | |

Interest expense (1) | | (3,030 | ) | | (3,355 | ) | | (10,470 | ) | | (7,476 | ) | | (3,937 | ) | | (3,899 | ) |

Loss on extinguishment of debt | | (1,491 | ) | | — | | (1,491 | ) | | — | | | (853 | ) | | — | |

Equity method investment (loss) income | | | (177 | ) | | | 168 | | | | (325 | ) | | | 506 | | | | (249 | ) | | | 69 | |

NET INCOME (LOSS) BEFORE INCOME TAXES | | | 19,105 | | | | 2,208 | | | | 62,994 | | | | (11,068 | ) | | | (2,306 | ) | | | 25,403 | |

| | | |

INCOME TAX EXPENSE (BENEFIT): | | | | | | | | | | | | |

Current | | (178 | ) | | — | | | 315 | | | — | | | — | | 432 | |

Deferred | | | 3,208 | | | | 596 | | | | 7,638 | | | | 840 | | | | (610 | ) | | | 2,920 | |

Total income tax expense | | | 3,030 | | | | 596 | | | | 7,953 | | | | 840 | | |

Total income tax expense (benefit) | | | | (610 | ) | | | 3,352 | |

| | | |

NET INCOME (LOSS) | | $ | 16,075 | | | $ | 1,612 | | | $ | 55,041 | | | $ | (11,908 | ) | | $ | (1,696 | ) | | $ | 22,051 | |

| | | |

NET INCOME (LOSS) PER SHARE: | | | | | | | | | | | | |

Basic | | $ | 0.49 | | | $ | 0.05 | | | $ | 1.66 | | | $ | (0.38 | ) | | $ | (0.05 | ) | | $ | 0.67 | |

Diluted | | $ | 0.44 | | $ | 0.05 | | $ | 1.52 | | $ | (0.38 | ) | | $ | (0.05 | ) | | $ | 0.61 | |

| | | |

WEIGHTED AVERAGE SHARES OUTSTANDING | | | | | | | | | | | | |

Basic | | 33,140 | | | 32,983 | | | 33,088 | | | 31,727 | | | 34,816 | | 32,983 | |

Diluted | | 36,848 | | | 33,268 | | | 36,748 | | | 31,727 | | | 34,816 | | 36,740 | |

| | | |

(1) Interest Expense: | | |

Interest on bank debt | | $ | 2,006 | | | $ | 2,133 | | | $ | 6,316 | | | $ | 5,555 | | | $ | 2,805 | | $ | 2,255 | |

Other interest | | 422 | | 227 | | 1,316 | | 285 | | | 728 | | 432 | |

Amortization and swap-related interest: | | |

Payments on interest rate swap, net of changes in value | | — | | | — | | | — | | | (867 | ) | |

Amortization: | | |

Amortization of debt issuance costs | | | 602 | | | | 995 | | | | 2,838 | | | | 2,503 | | | | 404 | | | | 1,212 | |

Total amortization and swap related interest | | | 602 | | | | 995 | | | | 2,838 | | | | 1,636 | | |

Total amortization | | | | 404 | | | | 1,212 | |

Total interest expense | | $ | 3,030 | | | $ | 3,355 | | | $ | 10,470 | | | $ | 7,476 | | | $ | 3,937 | | | $ | 3,899 | |

See accompanying notes to the condensed consolidated financial statements.

Hallador Energy Company

Condensed Consolidated Statements of Cash Flows

(in thousands)

(unaudited)

| | | Nine Months Ended September 30, | | | Three Months Ended March 31, | |

| | | 2023 | | | 2022 | | | 2024 | | | 2023 | |

OPERATING ACTIVITIES: | | | | | |

CASH FLOWS FROM OPERATING ACTIVITIES: | | | | | |

Net income (loss) | | $ | 55,041 | | | $ | (11,908 | ) | | $ | (1,696 | ) | | $ | 22,051 | |

Adjustments to reconcile net income to net cash provided by operating activities: | | |

Deferred income taxes | | 7,638 | | | 840 | | | (610 | ) | | 2,920 | |

Equity loss (income) – Sunrise Energy | | 325 | | | (506 | ) | | 249 | | | (69 | ) |

Cash distribution - Sunrise Energy | | 625 | | — | | | — | | | 625 | |

Depreciation, depletion, and amortization | | 51,375 | | | 31,882 | | | 15,443 | | | 17,976 | |

Loss on extinguishment of debt | | | 853 | | | — | |

Loss (gain) on sale of assets | | 78 | | (367 | ) | | (24 | ) | | 21 | |

Change in fair value of interest rate swaps | | — | | (867 | ) | |

Loss on extinguishment of debt | | 1,491 | | — | | |

Amortization of debt issuance costs | | 2,838 | | 2,503 | | | 404 | | | 1,212 | |

Asset retirement obligations accretion | | 1,380 | | 751 | | | 399 | | | 451 | |

Cash paid on asset retirement obligation reclamation | | (2,286 | ) | | (2,483 | ) | | (639 | ) | | (365 | ) |

Stock-based compensation | | 2,774 | | 230 | | | 666 | | | 1,220 | |

Provision for loss on customer contracts | | — | | 159 | | |

Amortization of contract asset and contract liabilities | | (32,444 | ) | | — | | | (12,788 | ) | | (15,569 | ) |

Other | | 914 | | 943 | | | 937 | | | 451 | |

Change in operating assets and liabilities: | | |

Accounts receivable | | 9,197 | | (3,160 | ) | | 5,709 | | | (3,269 | ) |

Inventory | | 14,874 | | (6,035 | ) | | (6,613 | ) | | (4,004 | ) |

Parts and supplies | | (8,717 | ) | | (4,975 | ) | | (1,483 | ) | | (2,926 | ) |

Prepaid expenses | | 1,116 | | (2,390 | ) | | (37 | ) | | 389 | |

Accounts payable and accrued liabilities | | (11,419 | ) | | 9,318 | | | (8,015 | ) | | 2,009 | |

Deferred revenue | | | (15,273 | ) | | | — | | | | 23,614 | | | | 2,989 | |

Cash provided by operating activities | | | 79,527 | | | | 13,935 | | |

INVESTING ACTIVITIES: | | | | | |

Net cash provided by operating activities | | | | 16,369 | | | | 26,112 | |

CASH FLOWS FROM INVESTING ACTIVITIES: | | | | | |

Capital expenditures | | (48,746 | ) | | (38,344 | ) | | (14,874 | ) | | (13,482 | ) |

Proceeds from sale of equipment | | | 62 | | | 758 | | | | 24 | | | | 15 | |

Cash used in investing activities | | | (48,684 | ) | | | (37,586 | ) | |

FINANCING ACTIVITIES: | | | | | |

Net cash used in investing activities | | | | (14,850 | ) | | | (13,467 | ) |

CASH FLOWS FROM FINANCING ACTIVITIES: | | | | | |

Payments on bank debt | | (56,463 | ) | | (35,713 | ) | | (26,500 | ) | | (27,013 | ) |

Payments on lease financing | | | (1,238 | ) | | — | |

Borrowings of bank debt | | 33,000 | | 37,700 | | | 12,000 | | | 17,000 | |

Issuance of convertible note | | — | | 11,000 | | |

Issuance of related party convertible notes payable | | — | | 18,000 | | |

Proceeds from sale and leaseback arrangement | | | 1,927 | | | — | |

Issuance of related party notes payable | | | 5,000 | | | — | |

Debt issuance costs | | (5,940 | ) | | (2,097 | ) | | (38 | ) | | (1,600 | ) |

Distributions to redeemable noncontrolling interests | | — | | (585 | ) | |

ATM offering | | | 6,580 | | | — | |

Taxes paid on vesting of RSUs | | | (1,150 | ) | | | — | | | | (1 | ) | | | (1,109 | ) |

Cash (used in) provided by financing activities | | | (30,553 | ) | | | 28,305 | | |

Increase in cash, cash equivalents, and restricted cash | | 290 | | | 4,654 | | |

Net cash used in financing activities | | | | (2,270 | ) | | | (12,722 | ) |

Decrease in cash, cash equivalents, and restricted cash | | | (751 | ) | | (77 | ) |

Cash, cash equivalents, and restricted cash, beginning of period | | | 6,426 | | | 5,829 | | | | 7,123 | | | | 6,426 | |

Cash, cash equivalents, and restricted cash, end of period | | $ | 6,716 | | | $ | 10,483 | | | $ | 6,372 | | | $ | 6,349 | |

CASH, CASH EQUIVALENTS, AND RESTRICTED CASH CONSIST OF THE FOLLOWING: | | | | | |

CASH, CASH EQUIVALENTS, AND RESTRICTED CASH: | | | | | |

Cash and cash equivalents | | $ | 2,573 | | | $ | 7,000 | | | $ | 1,635 | | | $ | 2,441 | |

Restricted cash | | | 4,143 | | | | 3,483 | | | | 4,737 | | | | 3,908 | |

| | | $ | 6,716 | | | $ | 10,483 | | |

| | | | $ | 6,372 | | | $ | 6,349 | |

SUPPLEMENTAL CASH FLOW INFORMATION: | | | | | | | | |

Cash paid for interest | | $ | 8,069 | | | $ | 4,791 | | | $ | 3,083 | | $ | 3,116 | |

SUPPLEMENTAL NON-CASH FLOW INFORMATION: | | | | | | | | |

Change in capital expenditures included in accounts payable and prepaid expense | | $ | 3,214 | | | $ | 2,396 | | | $ | (5,290 | ) | | $ | 120 | |

Convertible notes payable and related party convertible notes payable converted to common stock | | $ | — | | $ | 10,000 | | |

Stock issued on redemption of convertible notes and interest | | | $ | 9,721 | | $ | — | |

See accompanying notes to the condensed consolidated financial statements.

Hallador Energy Company

Condensed Consolidated Statements of Stockholders’ Equity

(in thousands)

(unaudited)

| | | | | | | | | Additional | | | | | Total | | | | | | | | | Additional | | | | | Total | |

| | | Common Stock Issued | | Paid-in | | Retained | | Stockholders' | | | Common Stock Issued | | Paid-in | | Retained | | Stockholders' | |

| | | Shares | | | Amount | | | Capital | | | Earnings | | | Equity | | | Shares | | | Amount | | | Capital | | | Earnings | | | Equity | |

Balance, June 30, 2023 | | 33,137 | | $ | 332 | | $ | 119,678 | | $ | 134,872 | | $ | 254,882 | | |

Balance, December 31, 2023 | | | 34,052 | | | $ | 341 | | | $ | 127,548 | | | $ | 140,699 | | | $ | 268,588 | |

Stock-based compensation | | — | | — | | 773 | | — | | 773 | | | — | | — | | 666 | | — | | 666 | |

Stock issued on vesting of RSUs | | 10 | | — | | — | | — | | — | | | 321 | | 3 | | (3 | ) | | — | | — | |

Taxes paid on vesting of RSUs | | (5 | ) | | — | | (41 | ) | | — | | (41 | ) | | (132 | ) | | (1 | ) | | — | | — | | (1 | ) |

Net income | | | — | | | — | | | — | | | 16,075 | | | 16,075 | | |

Balance, September 30, 2023 | | | 33,142 | | $ | 332 | | $ | 120,410 | | $ | 150,947 | | $ | 271,689 | | |

| | | | | | | | | | | | | |

Balance, December 31, 2022 | | 32,983 | | | $ | 330 | | | $ | 118,788 | | | $ | 95,906 | | | $ | 215,024 | | |

Stock-based compensation | | — | | — | | 2,774 | | — | | 2,774 | | |

Stock issued on vesting of RSUs | | 285 | | 3 | | (3 | ) | | — | | — | | |

Taxes paid on vesting of RSUs | | (126 | ) | | (1 | ) | | (1,149 | ) | | — | | (1,150 | ) | |

Net income | | | — | | | — | | | — | | | 55,041 | | | 55,041 | | |

Balance, September 30, 2023 | | | 33,142 | | $ | 332 | | $ | 120,410 | | $ | 150,947 | | $ | 271,689 | | |

Stock issued on redemption of convertible notes | | | 1,582 | | 15 | | 9,706 | | — | | 9,721 | |

Stock issued in ATM offering | | | 711 | | 7 | | 6,573 | | — | | 6,580 | |

Net loss | | | | — | | | | — | | | | — | | | | (1,696 | ) | | | (1,696 | ) |

Balance, March 31, 2024 | | | | 36,534 | | | $ | 365 | | | $ | 144,490 | | | $ | 139,003 | | | $ | 283,858 | |

| | | | | | | | | | | Additional | | | | | | | Total | |

| | | Common Stock Issued | | | Paid-in | | | Retained | | | Stockholders' | |

| | | Shares | | | Amount | | | Capital | | | Earnings | | | Equity | |

Balance, June 30, 2022 | | | 32,983 | | | $ | 330 | | | $ | 114,212 | | | $ | 64,281 | | | $ | 178,823 | |

Stock-based compensation | | | — | | | | — | | | | 122 | | | | — | | | | 122 | |

Cancellation of redeemable noncontrolling interests | | | — | | | | — | | | | 3,415 | | | | — | | | | 3,415 | |

Net income | | | — | | | | — | | | | — | | | | 1,612 | | | | 1,612 | |

Balance, September 30, 2022 | | | 32,983 | | | $ | 330 | | | $ | 117,749 | | | $ | 65,893 | | | $ | 183,972 | |

| | | | | | | | | | | | | | | | | | | | | |

Balance, December 31, 2021 | | | 30,785 | | | $ | 308 | | | $ | 104,126 | | | $ | 77,801 | | | $ | 182,235 | |

Stock-based compensation | | | — | | | | — | | | | 230 | | | | — | | | | 230 | |

Cancellation of redeemable noncontrolling interests | | | — | | | | — | | | | 3,415 | | | | — | | | | 3,415 | |

Stock issued on redemption of convertible note | | | 232 | | | | 2 | | | | 998 | | | | — | | | | 1,000 | |

Stock issued on redemption of related party convertible notes | | | 1,966 | | | | 20 | | | | 8,980 | | | | — | | | | 9,000 | |

Net loss | | | — | | | | — | | | | — | | | | (11,908 | ) | | | (11,908 | ) |

Balance, September 30, 2022 | | | 32,983 | | | $ | 330 | | | $ | 117,749 | | | $ | 65,893 | | | $ | 183,972 | |

| | | | | | | | | | | Additional | | | | | | | Total | |

| | | Common Stock Issued | | | Paid-in | | | Retained | | | Stockholders' | |

| | | Shares | | | Amount | | | Capital | | | Earnings | | | Equity | |

Balance, December 31, 2022 | | | 32,983 | | | $ | 330 | | | $ | 118,788 | | | $ | 95,906 | | | $ | 215,024 | |

Stock-based compensation | | | — | | | | — | | | | 1,220 | | | | — | | | | 1,220 | |

Stock issued on vesting of RSUs | | | 275 | | | | 3 | | | | (3 | ) | | | — | | | | — | |

Taxes paid on vesting of RSUs | | | (121 | ) | | | (1 | ) | | | (1,108 | ) | | | — | | | | (1,109 | ) |

Net income | | | — | | | | — | | | | — | | | | 22,051 | | | | 22,051 | |

Balance, March 31, 2023 | | | 33,137 | | | $ | 332 | | | $ | 118,897 | | | $ | 117,957 | | | $ | 237,186 | |

See accompanying notes to the condensed consolidated financial statements.

Hallador Energy Company

Notes to Condensed Consolidated Financial Statements

(unaudited)

The interim financial data is unaudited; however, in our opinion, it includes all adjustments, consisting only of normal recurring adjustments necessary for a fair statement of the results for the interim periods. The condensed consolidated financial statements included herein have been prepared pursuant to the Securities and Exchange Commission'sCommission’s (the "SEC") rules and regulations; accordingly, certain information and footnote disclosures normally included in generally accepted accounting principles ("GAAP") financial statements have been condensed or omitted.

The results of operations and cash flows for the three and ninemonths ended September 30, 2023March 31, 2024, are not necessarily indicative of the results to be expected for future quarters or for the year ending December 31, 20232024.

Our organization and business, the accounting policies we follow, and other information are contained in the notes to our consolidated financial statements filed as part of our 20222023 Annual Report on Form 10-K. This quarterly report should be read in conjunction with such Annual Report on Form 10-K.

The condensed consolidated financial statements include the accounts of Hallador Energy Company (hereinafter known as “we, us, or our”) and its wholly owned subsidiaries Sunrise Coal, LLC ("Sunrise"), Hallador Power Company, LLC ("Hallador Power"), as well as Sunrise and Hallador Power's wholly owned subsidiaries. All significant intercompany accounts and transactions have been eliminated.

As the result of Hallador Power’s acquisition of the Merom one gigawatt power plant in Sullivan County, Indiana (the “Merom Power Plant”) from Hoosier Energy Rural Electric Cooperative, Inc. (“Hoosier”) on October 21, 2022 (the “Merom Acquisition”), as further described in Note 14, beginning in the fourth quarter of 2022 we began toWe strategically view and manage our operations through two reportable segments: CoalElectric Operations and ElectricCoal Operations. The remainder of our operations, which are not significant enough on a stand-alone basis to warrant treatment as an operating segment, are presented as "Corporate and Other and Eliminations" and primarily are comprised of unallocated corporate costs and activities, the elimination of coal sales from coal operations to electric operations, a 50% interest in Sunrise Energy, LLC, a private gas exploration company with operations in Indiana, which we account for using the equity method, and our wholly-owned subsidiary Summit Terminal LLC, a logistics transport facility located on the Ohio River. Prior periods have been recast to reflect Corporate and Other and Eliminations apart from Coal

The Electric Operations which previously were aggregated into a single reportable segment.segment includes electric power generation facilities of the Merom Power Plant.

The Coal Operations reportable segment includes current operating mining complexes Oaktown 1 and 2 underground mines, Prosperity surface mine, Freelandville surface mine, and Carlisle wash plant.

The Electric On February 23, 2024, our Coal Operations reportable segment includes electric power generation facilities of the Merom Power Plant.

Segment committed to a reorganization effort designed to strengthen its financial and operational efficiency and create significant operational savings and higher margins. For further information, see “Note 16 – Organizational Restructuring” below.

(2) | RECENT ACCOUNTING PRONOUNCEMENTS NOT YET ADOPTED |

In November 2023, the Financial Accounting Standards Board ("FASB") issued Accounting Standards Update ("ASU") 2023-07, Segment Reporting (Topic 280): Improvements to Reportable Segment Disclosures ("ASU 2023-07"). ASU 2023-07 primarily requires enhanced disclosures about significant segment expenses regularly provided to the chief operating decision maker ("CODM"), the amount and composition of other segment items, and the title and position of the CODM. ASU 2023-07 is effective for fiscal years beginning after December 15, 2023, and interim periods within fiscal years beginning after December 15, 2024, with early adoption permitted. We are currently evaluating the impact of adopting ASU 2023-07, but do not expect it to have a material effect on our consolidated financial statements.

In December 2023, the FASB issued ASU 2023-09, Income Taxes (Topic 740): Improvements to Income Tax Disclosures ("ASU 2023-09"). ASU 2023-09 primarily requires enhanced disclosures to (1) disclose specific categories in the rate reconciliation, (2) disclose the amount of income taxes paid and expensed disaggregated by federal, state, and foreign taxes, with further disaggregation by individual jurisdictions if certain criteria are met, and (3) disclose income (loss) from continuing operations before income tax (benefit) disaggregated between domestic and foreign. ASU 2023-09 is effective for fiscal years beginning after December 15, 2024, with early adoption permitted. We are currently evaluating the impact of adopting ASU 2023-09, but do not expect it to have a material effect on our consolidated financial statements.

(3) | LONG-LIVED ASSET IMPAIRMENTS |

Long-lived assets are reviewed for impairment whenever events or changes in circumstance indicate that the carrying amount of the assets may not be recoverable. For the three and nine-month periods ended September 30, 2023 and for the threeMarch 31, 2024 and nineMarch 31, 2023, -month periods ended September 30, 2022, there were no impairment charges were recorded for long-lived assets.

Inventory is valued at a lower of average cost or net realizable value (NRV). As of September 30, 2023March 31, 2024, and December 31, 20222023, coal inventory includes NRV adjustments of $1.1$1.3 million and $4.9$2.0 million, respectively.

On March 13, 2023, we executed an amendment to our credit agreement with PNC Bank, National Association (in its capacity as administrative agent, "PNC"), administrative agent for our lenders under our credit agreement, which was accounted for as a debt modification. The primary purpose of the amendment was to convert $35$35.0 million of the outstanding balance on the revolver into a new term loan with a maturity of March 31, 2024, and extend the maturity date of the revolver to May 31, 2024. The amendment reduced the total capacity under the revolver to $85$85.0 million from $120$120.0 million, waived the maximum annual capital expenditure covenant for 2022, and increased the covenant for 2023 to $75$75.0 million.

On August 2, 2023, we executed an additional amendment to our credit agreement with PNC, which was accounted for as a debt extinguishment. The primary purpose of the amendment was to convert $65$65.0 million of the outstanding funded debt into a new term loan with a maturity of March 31, 2026, and enter into a revolver of $75$75.0 million with a maturity of July 31, 2026. The amendment increased the maximum annual capital expenditure limit to $100$100.0 million.

Bank debt was reduced by $23.5$14.5 million during the ninethree months ended September 30, 2023.March 31, 2024. Under the terms of the August 2, 2023 amendment, bank debt is comprised of term debt ($61.858.5 million as of September 30,March 31, 2024) 2023) and a $75$75.0 million revolver ($0.018.5 million borrowed as of September 30, 2023)March 31, 2024). The term debt requires quarterly payments of $3.3 million each quarter, which commenced in September 2023, increasing to $6.5 million in MarchApril 2024 through maturity. Our debt is recorded at amortized cost, which approximates fair value due to the variable interest rates in the agreement and is collateralized primarily by our assets.

Liquidity

As of September 30, 2023March 31, 2024, we had an additional borrowing capacity of $63.8$37.9 million and total liquidity of $66.4$39.5 million. Our additional borrowing capacity is net of $11.2$18.6 million in outstanding letters of credit as of September 30, 2023March 31, 2024, that were required to maintain surety bonds. Liquidity consists of our additional borrowing capacity and cash and cash equivalents.

Fees

Unamortized bank fees and other costs incurred in connection with the initial facility and subsequent amendments totaled $2.5 million as of December 31, 2022. Additional costs incurred with the March 13,During 2023, and August 2, 2023 amendments totaled $1.6 million and $4.3 million, respectively. During the three and nine months ended September 30, 2022, we recognized a loss on extinguishment of debt of $1.5 million for the write-off of unamortized loan fees related to the August 2, 2023 amendment to our credit agreement, which was accounted for as a debt extinguishment. Unamortized bank fees incurred with the March 13,2023 and August 2, 2023 amendments totaled $1.6 million and $4.3 million, respectively. The remaining costs were deferred and are being amortized over the term of the loan. Unamortized costs as of September 30, 2023March 31, 2024, and December 31, 20222023, were $4.1$3.2 million and $2.5$3.6 million, respectively.

Bank debt, less debt issuance costs, is presented below (in thousands):

| | | September 30, | | | December 31, | |

| | | 2023 | | | 2022 | |

Current bank debt | | $ | 22,750 | | | $ | 35,500 | |

Less unamortized debt issuance cost | | | (1,562 | ) | | | (2,469 | ) |

Net current portion | | $ | 21,188 | | | $ | 33,031 | |

| | | | | | | | | |

Long-term bank debt | | $ | 39,000 | | | $ | 49,713 | |

Less unamortized debt issuance cost | | | (2,518 | ) | | | — | |

Net long-term portion | | $ | 36,482 | | | $ | 49,713 | |

| | | | | | | | | |

Total bank debt | | $ | 61,750 | | | $ | 85,213 | |

Less total unamortized debt issuance cost | | | (4,080 | ) | | | (2,469 | ) |

Net bank debt | | $ | 57,670 | | | $ | 82,744 | |

Bank debt, less debt issuance costs, is presented below (in thousands):

| | | March 31, | | | December 31, | |

| | | 2024 | | | 2023 | |

Current bank debt | | $ | 26,000 | | | $ | 26,000 | |

Less unamortized debt issuance cost | | | (1,562 | ) | | | (1,562 | ) |

Net current portion | | $ | 24,438 | | | $ | 24,438 | |

| | | | | | | | | |

Long-term bank debt | | $ | 51,000 | | | $ | 65,500 | |

Less unamortized debt issuance cost | | | (1,657 | ) | | | (2,047 | ) |

Net long-term portion | | $ | 49,343 | | | $ | 63,453 | |

| | | | | | | | | |

Total bank debt | | $ | 77,000 | | | $ | 91,500 | |

Less total unamortized debt issuance cost | | | (3,219 | ) | | | (3,609 | ) |

Net bank debt | | $ | 73,781 | | | $ | 87,891 | |

Covenants

The credit facility includes a Maximum Leverage Ratio (consolidated funded debt/trailing twelve months adjusted EBITDA), calculated as of the end of each fiscal quarter for the trailing twelve months, not to exceed the amounts below:2.25 to 1.00.

Fiscal Periods Ending

| | Ratio

| |

September 30, 2023, and each fiscal quarter thereafter

| | 2.25 to 1.00 | |

As of September 30, 2023March 31, 2024, our Leverage Ratio of 0.711.58 was in compliance with the 2.25 covenant defined inrequirements of the credit agreement.

The credit facility requires a Minimum Debt Service Coverage Ratio (consolidated adjusted EBITDA/annual debt service) calculated as of the end of each fiscal quarter for the trailing twelve months of 1.25 to 1.00 through the credit facility's maturity.

As of September 30, 2023,March 31, 2024, our Debt Service Coverage Ratio of 3.752.88 was in compliance with the requirements of the credit agreement.

As of September 30, 2023,March 31, 2024, we were in compliance with all other covenants defined in the credit agreement.

Interest Rate

The interest rate on the facility ranges from SOFR plus 4.00% to SOFR plus 5.00%, depending on our Leverage Ratio. As of September 30, 2023March 31, 2024, we arewere paying SOFR plus 4.25%4.50% on the outstanding bank debt.debt which equates to an all in rate of 10.0%.

(56) | ACCOUNTS PAYABLE AND ACCRUED LIABILITIES (in thousands)(IN THOUSANDS) |

| | | March 31, | | | December 31, | |

| | | 2024 | | | 2023 | |

Accounts payable | | $ | 28,947 | | | $ | 43,636 | |

Accrued property taxes | | | 3,458 | | | | 2,987 | |

Accrued payroll | | | 4,620 | | | | 6,575 | |

Workers' compensation reserve | | | 4,306 | | | | 3,629 | |

Group health insurance | | | 2,200 | | | | 2,300 | |

Asset retirement obligation - current portion | | | 1,514 | | | | 2,150 | |

Other | | | 2,080 | | | | 1,631 | |

Total accounts payable and accrued liabilities | | $ | 47,125 | | | $ | 62,908 | |

| | | September 30, | | | December 31, | |

| | | 2023 | | | 2022 | |

Accounts payable | | $ | 52,491 | | | $ | 62,306 | |

Accrued property taxes | | | 3,008 | | | | 1,917 | |

Accrued payroll | | | 7,373 | | | | 5,933 | |

Workers' compensation reserve | | | 4,130 | | | | 3,440 | |

Group health insurance | | | 2,300 | | | | 2,250 | |

Asset retirement obligation - current portion | | | 3,580 | | | | 3,580 | |

Other | | | 3,720 | | | | 3,546 | |

Total accounts payable and accrued liabilities | | $ | 76,602 | | | $ | 82,972 | |

Revenue from Contracts with Customers

We account for a contract with a customer when the parties have approved the contract and are committed to performing their respective obligations, the rights of each party are identified, payment terms are identified, the contract has commercial substance, and it is probable substantially all the consideration will be collected. We recognize revenue when we satisfy a performance obligation by transferring control of a good or service to a customer.

Electric operations

We concluded that for a Power Purchase Agreement (“PPA”) that is not determined to be a lease or derivative, the definition of a contract and the criteria in ASC 606, Revenue from Contracts with Customers ("ASC 606"), is met at the time a PPA is executed by the parties, as this is the point at which enforceable rights and obligations are established. Accordingly, we concluded that a PPA that is not determined to be a lease or derivative constitutes a valid contract under ASC 606.

We recognize revenue daily, based on an output method of capacity made available as part of any stand-ready obligations for contract capacity performance obligations and daily, based on an output method of MWh of electricity delivered.

For the delivered energy performance obligation in the PPA with Hoosier, we recognize revenue daily for actual delivered electricity plus the amortization of the contract liability as a result of the Asset Purchase Agreement with Hoosier. For delivered energy to all other customers, we recognize revenue daily for the actual delivered electricity.

Coal operations

Our coal revenue is derived from sales to customers of coal produced at our facilities. Our customers typically purchase coal directly from our mine sites or our rail facility in Princeton, Indiana, where the sale occurs and where title, risk of loss, and control pass to the customer at that point. Our customers arrange for and bear the costs of transporting their coal from our mines to their plants or other specified discharge points. Our customers are typically domestic utility companies. Our coal sales agreements with our customers are fixed-priced, fixed-volume supply contracts, or include a pre-determined escalation in price for each year. Price re-opener and index provisions may allow either party to commence a renegotiation of the contract price at a pre-determined time. Price re-opener provisions may automatically set a new price based on the prevailing market price or, in some instances, require us to negotiate a new price, sometimes within specified ranges of prices. The terms of our coal sales agreements result from competitive bidding and extensive negotiations with customers. Consequently, the terms of these contracts vary by customer.

Coal sales agreements will typically contain coal quality specifications. With coal quality specifications in place, the raw coal sold by us to the customer at the delivery point must be substantially free of magnetic material and other foreign material impurities and crushed to a maximum size as set forth in the respective coal sales agreement. Price adjustments are made and billed in the month the coal sale was recognized based on quality standards that are specified in the coal sales agreement, such as Btu factor, moisture, ash, and sulfur content, and can result in either increases or decreases in the value of the coal shipped.

Electric operations

The Company concluded that for a Power Purchase Agreement (“PPA”) that is not determined to be a lease or derivative, the definition of a contract and the criteria in ASC 606, Revenue from Contracts with Customers ("ASC 606"), is met at the time a PPA is executed by the parties, as this is the point at which enforceable rights and obligations are established. Accordingly, the Company concluded that a PPA that is not determined to be a lease or derivative constitutes a valid contract under ASC 606.

The Company will recognize revenue daily, based on an output method of capacity made available as part of any stand-ready obligations for contract capacity performance obligations and daily, based on an output method of MWh of electricity delivered.

For the delivered energy performance obligation in the PPA with Hoosier, the Company will recognize revenue daily for actual delivered electricity plus the amortization of the contract liability as a result of the Asset Purchase Agreement with Hoosier.

Disaggregation of Revenue

Revenue is disaggregated by revenue source for our electric operations and by primary geographic markets for our coal operations and by revenue source for our electric operations, as we believe this best depicts how the nature, amount, timing, and uncertainty of our revenue and cash flows are affected by economic factors.

For the three months ended March 31, 2024, electric sales revenue from delivered energy generation and capacity sales revenue was $47.0 million and $11.8 million, respectively. For the three months ended March 31, 2023, electric sales revenue from delivered energy generation and capacity sales revenue was $76.4 million and $16.0 million, respectively.

Coal operations

51% For the three months ended March 31, 2024 and 2023, 36% and 52%, respectively, of our coal revenue for the three and nine months ended September 30,2023,was sold to outside third-party customers in the State of Indiana with the remainder sold to customers in Florida, North Carolina, Georgia, and Alabama. 70% and 79%

Performance Obligations

Electric operations

We concluded that each megawatt-hour ("MWh") of delivered energy is capable of being distinct as a customer could benefit from each on its own by using/consuming it as a part of its operations. We also concluded that the stand-ready obligation to be available to provide electricity is capable of being distinct as each unit of capacity provides an economic benefit to the holder and could be sold by the customer.

During 100%2022, we entered into an Asset Purchase Agreement (“APA”) with Hoosier (“Hoosier APA”) in which Hallador Power shall sell, and Hoosier shall buy, at least 70% of our electric revenuethe delivered energy quantities through 2025 at the contract price, which is $34.00 per MWh. We have remaining delivered energy obligations to Hoosier totaling $99.3 million through 2025 as of March 31, 2024. The agreement was amended August 31, 2023 to extend through 2028 with additional obligations to Hoosier of $186.6 million as of March 31, 2024.

In addition to delivered energy, under the Hoosier APA, Hallador Power shall provide a stand-ready obligation to provide electricity, also known as contract capacity. The contract capacity that Hallador Power shall provide to Hoosier is 917 megawatts (“MW”) for contract year one, and on average 300 MW for contract years two to four. Hoosier shall pay Hallador Power the capacity price of $5.80 per kilowatt month for the three and nine months ended September 30, 2023, was soldcontract capacity. We have remaining capacity obligations to Hoosier or the Midcontinent Independent System Operator ("MISO") wholesale market. MISO is the independent system operator managing the flowthrough 2025 totaling $35.2 million as of high-voltage electricity across 15March 31, 2024 U.S. states and the Canadian province of Manitoba. 100% of our electric revenue through. The agreement was amended MayAugust 31, 2023 was soldto extend through 2028 with additional capacity obligations to Hoosier inof $60.9 million as of March 31, 2024.

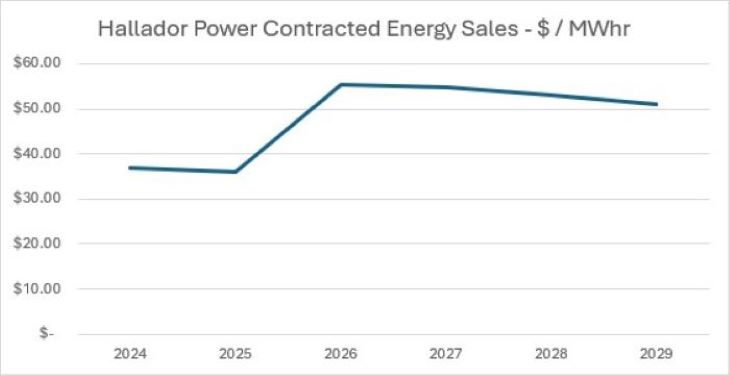

We also have energy and capacity obligations outside of the state of Indiana. 32% of our electric revenue for the months of June 2023 Hoosier APA to September 2023 was sold to Hoosier. For the three and nine months ended September 30, 2023, revenue from delivered energy was $54.4customers through 2029 totaling $111.97 million and $184.7$163.51 million, respectively. For therespectively, as of threeMarch 31, 2024 and nine months ended September 30, 2023, . We have $46.7 million of deferred revenue from capacity payments was $13.0 million and $46.1 million, respectively.

Performance Obligationsas of March 31, 2024, related to these obligations.

Coal operations

A performance obligation is a promise in a contract with a customer to provide distinct goods or services. Performance obligations are the unit of account for purposes of applying the revenue recognition standard and therefore determine when and how revenue is recognized. In most of our coal contracts, the customer contracts with us to provide coal that meets certain quality criteria. We consider each ton of coal a separate performance obligation and allocate the transaction price based on the base price per the contract, increased or decreased for quality adjustments.

We recognize revenue at a point in time as the customer does not have control over the asset at any point during the contract's fulfillment.fulfillment of the contract. For substantially all of our customers, this is supported by the fact that title and risk of loss transfer to the customer upon loading of the truck or railcar at the mine. This is also the point at which physical possession of the coal transfers to the customer, as well as the right to receive substantially all benefits and the risk of loss in ownership of the coal.

We have remaining coal sales performance obligations relating to fixed-pricedfixed priced contracts to third-party customers of approximately $426.1$270.2 million, which representrepresents the average fixed prices on our committed contracts as of September 30, 2023.March 31, 2024. Approximately 31%We expect to recognize approximately 47% of this relates to committed obligationscoal sales revenue in 2023,2024, with the remainder committed in 2024recognized through 2027.2027.

We have remaining performance obligations relating to 3.0 million tons of unpriced coal sales contracts with price reopeners of approximately $155$155.0 million, which represents our estimate of the expected reopener price on committed contracts as of September 30, 2023.March 31, 2024. We expect to recognize all of this coal sales revenue beginning in 2025.2025 through 2027.

The coal tons used to determine the remaining performance obligations are subject to adjustment in instances of force majeure and exercise of customer options to either take additional tons or reduce tonnage if such an option exists in the customer contract.

Electric operations

The Company concluded that each megawatt-hour ("MWh") of delivered energy is capable of being distinct as a customer could benefit from each on its own by using/consuming it as a part of its operations. The Company also concluded that the stand-ready obligation to be available to provide electricity to Hoosier is capable of being distinct as each unit of capacity provides an economic benefit to the holder and could be sold by the customer.

We have remaining delivered energy obligations through 2028 totaling $312 million as of September 30, 2023.

In addition to delivered energy, Hallador provides stand-ready obligations to provide electricity, also known as contract capacity. We have remaining capacity obligations through 2028 totaling $204 million as of September 30, 2023.

Contract Balances

Under ASC 606, the timing of when a performance obligation is satisfied can affect the presentation of accounts receivable, contract assets, and contract liabilities. The main distinction between accounts receivable and contract assets is whether consideration is conditional on something other than the passage of time. A receivable is an entity’s right to consideration that is unconditional.

Under the typical payment terms of our contracts with customers, the customer pays us a base price for the coal, increased or decreased for any quality adjustments, electricity, or capacity. Amounts billed and due are recorded as trade accounts receivable and included in accounts receivable in our condensed consolidated balance sheets. As of January 1, 2022,2023, accounts receivable for coal sales billed to customers was $12.8$16.3 million. We do

not9 currently have any contracts in place where we would transfer coal, electricity, or capacity in advance

Table of knowing the final price, and thus do not have any contract assets recorded. Contract liabilities also arise when consideration is received in advance of performance. As of January 1, 2023, deferred revenue for payments related to coal operations in advance of performance was $8.9 million, and deferred revenue for payments related to electric operations in advance of performance was $26.6 million. Additional payments for electric operations in advance of performance for the three and nine months ended September 30, 2023 were $0.0 million and $43.8 million, respectively. For the three and nine months ended September 30, 2023, we recognized revenue from coal operations of $2.5 million and $7.5 million, respectively, as tons of outstanding coal delivery obligations were fulfilled, and we recognized revenue from electric operations of $12.9 million and $46.0 million, respectively, as outstanding capacity obligations were fulfilled. Pursuant to the terms of the underlying contracts, performance obligations representing $1.3 million and $8.3 million will be satisfied and recognized as revenue related to our coal operations and electric operations, respectively, during the three-month period ending December 31, 2023.Contents

For the ninethree months ended September 30, 2023,March 31, 2024 and 2022,2023, we recorded income taxes using an estimated annual effective tax rate based upon projected annual income, forecasted permanent tax differences, discrete items, and statutory rates in states in which we operate. The effective tax rate for the ninethree months ended September 30, 2023,March 31. 2024 and 20222023, was ~13%26% and ~ (8%)13%, respectively. Historically, our actual effective tax rates have differed from the statutory effective rate primarily due to the benefit received from statutory percentage depletion in excess of tax basis. The deduction for statutory percentage depletion does not necessarily change proportionately to changes in income (loss) before income taxes.

(89) | STOCK COMPENSATION PLANS |

Non-vested grants as of December 31, 20222023 | | | 1,056,937858,363 | |

Awarded - weighted average share price on award date was $9.388.41 | | | 267,0001,500 | |

Vested - weighted average share price on vested date was $9.185.33 | | | (285,221321,419 | ) |

Forfeited | | | (10,00028,000 | ) |

Non-vested grants as of September 30, 2023March 31, 2024 | | | 1,028,716510,444 | |

For the three and ninemonths ended September 30, March 31, 2024 and 2023,, our stock compensation was $0.8$0.7 million and $2.8 million, respectively. For the three and nine months ended September 30, 2022, our stock compensation was $0.1 million and $0.2$1.2 million, respectively.

Non-vested RSU grants will vest as follows:

Vesting Year | | RSUs Vesting | | | RSUs Vesting | |

2023 | | 189,000 | | |

2024 | | 300,608 | | | 1,000 | |

2025 | | | 539,108 | | | | 509,444 | |

| | | | 1,028,716 | | | | 510,444 | |

The outstanding RSUs have a value of $14.8$2.7 million based on the September 30, 2023March 28, 2024 closing stock price of $14.42.$5.33.

As of September 30, 2023,March 31, 2024, unrecognized stock compensation expense is $4.7$3.3 million, and we had 395,657611,035 RSUs available for future issuance. RSUs are not allocated earnings and losses as they are considered non-participating securities.

We have operating leases for office space and processing facilities with remaining lease terms ranging from 104 months to 96 months.8 years. As most of the leases do not provide an implicit rate, we calculated the right-of-use assets and lease liabilities using ourits secured incremental borrowing rate at the lease commencement date. We currently do

During the notfourth have anyquarter of 2023, we entered into three finance leases outstanding.

The following table (in thousands) relates to our operating leases:

| | | Three Months Ended September 30, | | | Nine Months Ended September 30, | |

| | | 2023 | | | 2022 | | | 2023 | | | 2022 | |

Operating lease information: | | | | | | | | | | | | | | | | |

Operating cash outflows from operating leases | | $ | 52 | | | $ | 54 | | | $ | 156 | | | $ | 164 | |

Weighted average remaining lease term in years | | | 8.75 | | | | 1.51 | | | | 8.75 | | | | 1.51 | |

Weighted average discount rate | | | 6.0 | % | | | 6.0 | % | | | 6.0 | % | | | 6.0 | % |

Future minimum lease payments under non-cancellablewhich were accounted for as failed sale-leaseback transactions. During the three months ended March 31, 2024, we entered into two finance leases with the same terms that were also accounted for as of September 30, 2023, were as follows:

| | Amount | |

| | (In thousands) | |

2023 | $ | 85 | |

2024 | | 89 | |

2025 | | 121 | |

2026 | | 124 | |

2027 | | 128 | |

After 2027 | | 516 | |

Total minimum lease payments | $ | 1,063 | |

Less imputed interest | | (323 | ) |

| | | | |

Total operating lease liability | $ | 740 | |

| | | | |

As reflected within the following balance sheet line items: | | | |

Accounts payable and accrued liabilities | $ | 85 | |

Other long-term liabilities | | 655 | |

| | | | |

Total operating lease liability | $ | 740 | |

As of September 30, 2023 and December 31, 2022, we had approximately $0.7 million and $0.2 million, respectively, of right-of-use operatingfailed sale-leaseback transactions. Finance lease assets recorded within “buildings and equipment”are included in finance lease right-of-use assets on the condensed consolidated balance sheets.sheets and the associated finance lease liabilities are reflected within current portion of lease financing and long-term lease financing on the condensed consolidated balance sheets as applicable. Depreciation on our finance lease assets was $1.1 million for the three months ended March 31, 2024. Imputed interest expense on our lease liabilities was $0.3 million for the three months ended March 31, 2024. We deferred financing fees of $0.1 million at March 31, 2024 and December 31, 2023, respectively, in connection with entry into the finance leases. These deferred financing fees will be amortized on a straight-line basis over the term of the finance leases. We did not have finance leases during the three months ended March 31, 2023.

The following table (in thousands) relates to our leases:

| | | Three Months Ended March 31, | |

| | | 2024 | | | 2023 | |

Operating lease information: | | | | | | | | |

Operating cash outflows from operating leases | | $ | 52 | | | $ | 52 | |

Weighted average remaining lease term in years | | | 7.80 | | | | 1.10 | |

Weighted average discount rate | | | 10.0 | % | | | 6.0 | % |

Finance lease information: | | | | | | | | |

Financing cash outflows from finance leases | | $ | 1,238 | | | | — | |

Proceeds from sale and leaseback arrangement | | $ | 1,927 | | | | — | |

Weighted average remaining lease term in years | | | 2.82 | | | | — | |

Weighted average discount rate | | | 8.5 | % | | | — | % |

Future minimum lease payments under non-cancellable leases as of March 31, 2024, were as follows:

| | | Operating | | | Finance | |

| | | Leases | | | Leases | |

| | | (In thousands) | |

2024 | | $ | 33 | | | $ | 4,569 | |

2025 | | | 88 | | | | 6,092 | |

2026 | | | 121 | | | | 5,780 | |

2027 | | | 124 | | | | 241 | |

2028 | | | 128 | | | | — | |

Thereafter | | | 516 | | | | — | |

Total minimum lease payments | | $ | 1,010 | | | $ | 16,682 | |

Less imputed interest and deferred finance fees | | | (335 | ) | | | (2,023 | ) |

| | | | | | | | | |

Total lease liability | | $ | 675 | | | $ | 14,659 | |

As reflected within the following balance sheet line items:

| | | | Three Months Ended March 31, | | | For the Year Ended December 31, | |

| | | | 2024 | | | 2023 | |

| | | | (In thousands) | |

| | | | | | | | | | |

Operating lease assets | Buildings and equipment | | $ | 675 | | | $ | 712 | |

Operating lease liabilities: | | | | | | | | | |

Current operating lease liabilities | Accounts payable and accrued liabilities | | $ | 52 | | | $ | 58 | |

Non-current operating lease liabilities | Other long-term liabilities | | | 623 | | | | 654 | |

Total operating lease liability | | $ | 675 | | | $ | 712 | |

| | | | | | | | | | |

Finance lease assets | Finance lease right-of-use assets | | $ | 16,178 | | | $ | 12,346 | |

Finance lease liabilities: | | | | | | | | | |

Current finance lease liabilities | Current portion of lease financing | | $ | 4,958 | | | $ | 3,933 | |

Non-current finance lease liabilities | Long-term lease financing | | | 9,701 | | | | 8,157 | |

Total finance lease liabilities | | $ | 14,659 | | | $ | 12,090 | |

As of March 31, 2024 and December 31, 2023, we had approximately $0.7 million, respectively, of right-of-use operating lease assets recorded within “buildings and equipment” on the condensed consolidated balance sheets.

We self-insure our non-leased underground mining equipment. Such equipment is allocated among seven mining units dispersed over teneleven miles. The historical cost of such equipment was approximately $299 million and $280$262.0 million as of September 30, 2023March 31, 2024, and December 31, 20222023, respectively..

Restricted cash of $4.1$4.7 million and $3.4$4.3 million as of September 30, 2023March 31, 2024, and December 31, 20222023, respectively, represents cash held and controlled by a third party and is restricted for future workers’ compensation claim payments and cash collateral to provide power in the MISO grid.payments.

(1112) | FAIR VALUE MEASUREMENTS |

We account for certain assets and liabilities at fair value. The hierarchy below lists three levels of fair value based on the extent to which inputs used in measuring fair value are observable in the market. We categorize each of our fair value measurements in one of these three levels based on the lowest level input that is significant to the fair value measurement in its entirety. These levels are:

Level 1: Unadjusted quoted prices in active markets that are accessible at the measurement date for identical, unrestricted assets or liabilities. We consider active markets as those in which transactions for the assets or liabilities occur in sufficient frequency and volume to provide pricing information on an ongoing basis. We have no Level 1 instruments.

Level 2: Quoted prices in markets that are not active, or inputs that are observable, either directly or indirectly, for substantially the full term of the asset or liability. We have no Level 2 instruments.

Level 3: Measured based on prices or valuation models that require inputs that are both significant to the fair value measurement and less observable from objective sources (i.e., supported by little or no market activity). We have noARO liabilities use Level 3 instruments. non-recurring fair value measures.

(1213) | EQUITY METHOD INVESTMENTS |

We own a 50% interest in Sunrise Energy, LLC, which owns gas reserves and gathering equipment with plans to develop and generates revenue from gas sales.operate such reserves. Sunrise Energy, LLC, also plans to continue developingdevelop and exploringexplore for oil, natural gas, and coal-bed methane gas reserves on or near our underground coal reserves. The carrying value of the investment included in our condensed consolidated balance sheets as of September 30, 2023March 31, 2024, and December 31, 20222023, was $3.0$2.6 million and $4.0$2.8 million, respectively.

On May 2, 2022, and May 20, 2022, we issued senior unsecured convertible notes (the "Notes") to five parties, in the aggregate principal amount of $10 million, with $9 million going to related parties affiliated with independent members of our board of directors and the remainder to a non-affiliated party. The Notes were scheduled to mature on December 29, 2028, and accrue interest at 8% per annum, with interest payable on the date of maturity. Pursuant to the terms of the Notes, the holders of the Notes were entitled to convert the entire principal balance and all accrued and unpaid interest then outstanding during the period beginning June 1,2022, and ending on May 31, 2027, into shares of the Company Common Stock at a conversion price the greater of (i)$3.33 and (ii) the 30-day trailing volume-weighted average sales price for the Common Stock on the Nasdaq Capital Market ending on and including the date on which the Note was converted.

In June 2022, the four holders of the $9 million related party Notes converted them into 1,965,841 shares of common stock of the Company, and the one holder of the $1 million Note converted it into 231,697 shares of common stock pursuant to the terms of the Notes and their related agreements.

On July 29, 2022, we issued $5$5.0 million of a senior unsecured convertible notenotes (collectively, with the subsequent 2022 issuances, the ("Notes”)) to a related party affiliated with an independent member of our board of directors. The noteNote carries an interest rate of 8% per annum with a maturity date of December 29, 2028. For the period August 18, 2022, through August 17, 2024, the holder has the option to convert the Note into shares of the Company's common stock at a conversion price of $6.254. During the three months ended March 31, 2024, the holders of the $5.0 million senior unsecured convertible notes converted them into 799,488 shares of common stock of the Company and, in connection with such early conversion, we elected to pay interest through August 2025 with 112,570 shares of common stock on the conversion date. We recorded a loss on extinguishment of debt in the condensed consolidated statements of operations in the amount of $0.55 million during the three months ended March 31, 2024.

On August 8, 2022, we issued an additional $4.0 million of senior unsecured convertible notes to related parties affiliated with independent members of our board of directors. The Notes carry an interest rate of 8% per annum with a maturity date of December 29, 2028. For the period August 18, 2022, through August 17, 2024, the holder has the option to convert the Notes into shares of the Company's common stock at a conversion price of $6.254. Beginning August 18,8, 2025, the Companywe may elect to redeem the note,Note and the holder shall be obligated to surrender the noteNote at 100% of the outstanding principal balance together with any accrued unpaid interest. Upon receipt of the redemption notice from the Company, the holder may elect to convert the principal balance and accrued interest into the Company's common stock. During the three months ended March 31, 2024, the holders converted $3.0 million senior unsecured convertible notes into 479,693 shares of common stock of the Company and, in connection with such early conversion, we elected to pay interest through August 2025 with 67,542 shares of common stock on the conversion date. During the same period, the holders also converted accrued interest into 57,564 shares of the Company's common stock. We recorded a loss on extinguishment of debt in the condensed consolidated statements of operations in the amount of $0.30 million during the three months ended March 31, 2024.

On August 8,12, 2022, we issued $4an additional $10.0 million of senior unsecured convertible notesnote to related parties affiliated with independent members of our board of directors.an unrelated party. The notes carryNote carries an interest rate of 8% per annum with a maturity date of December 29, 2028.31, 2026. For the period August 18, 2022, through August 17, 2024, the maturity date, the holder has the option to convert the notesNote into shares of the Company's common stock at a conversion price of $6.254.$6.15. Beginning August 8,12, 2025, the Companywe may elect to redeem the note,Note and the holder shall be obligated to surrender the noteNote at 100% of the outstanding principal balance together with any accrued unpaid interest. Upon receipt of the redemption notice from the Company, the holder may elect to convert the principal balance and accrued interest into the Company's common stock.

On During the August 12, 2022, threewe issued a $10 million senior unsecured convertible note to an unrelated party. The note carries an interest rate of 8% per annum with a maturity date of months ended DecemberMarch 31, 2026.2024, For the period August 18, 2022, through the maturity date, the holder has the option to convert the notes into shares of the Company's common stock at a conversion price of $6.15. Beginning August 12, 2025, the Company may elect to redeem the note, and the holder shall be obligated to surrender the note at 100% of the outstanding principal balance together with any accrued unpaid interest. Upon receipt of the redemption notice from the Company, the holder may elect to convert the principal balance andconverted accrued interest into 65,041 shares of the Company's common stock.

The funds received from the notesissuance of the various Notes described above were used to provide additional working capital to the Company. Each Conversion Share will consist of one share of our common stock. The conversion price and number of shares of the Company’s Common StockCompany's common stock issuable upon conversion of the above notes are subject to adjustment from time to time for any subdivision or consolidation of the Company’sour shares of common stock and other standard dilutive events.

(1415) | NOTES PAYABLE - RELATED PARTIES |

In March 2024, we issued unsecured promissory notes, having a 12-month maturity date and 12% per annum interest rate, to (i) Charles R. Wesley IV Revocable Trust (in which our director Charles R. Wesley IV has a pecuniary interest) in the principal amount of $2,000,000, (ii) Lubar Opportunities Fund I, LLC (in which are our director David J. Lubar has a pecuniary interest) in the principal amount of $2,500,000, and (iii) Hallador Alternative Investment Advisors LLC (in which our director David C. Hardie has a pecuniary interest) in the principal amount of $500,000.

At March 31, 2024, accrued interest associated with the notes payable – related party on the condensed consolidated balance sheets was $0.1 million.

MEROM ACQUISITION(16)

| ORGANIZATIONAL RESTRUCTURING |

On February 23, 2024, (the "Effective Date"), we committed to a reorganization effort in the Coal Operations Segment (the "Reorganization Plan") that included a workforce reduction of approximately 110 employees, or approximately 12% of the workforce. The reduction in workforce was communicated to employees on the Effective Date and implemented immediately, subject to certain administrative procedures. The Reorganization Plan is designed to strengthen our financial and operational efficiency and create significant operational savings and higher margins in our coal segment. This step will help to advance our transition from a company primarily focused on coal production to a more resilient and diversified integrated independent power producer ("IPP"). As part of this initiative, we substantially idled production at our higher cost surface mines, Prosperity Mine, and Freelandville Mine, with minimal production. We also focused our seven units of underground equipment on four units of our lowest cost production at our Oaktown Mine. In connection with the Reorganization Plan, we incurred an aggregate of $1.9 million one-time charges, of which $0.8 million were included in accounts payable and accrued liabilities in the condensed consolidated balance sheets and $1.1 million were included in operating expenses in the condensed consolidated statements of operations. The one-time charges were related to compensation, tax, professional, and insurance related expenses.

On February 14, 2022,December Hallador Power signed18,2023, we entered into an Asset PurchaseAt Market Issuance Sales Agreement (“APA”(the “Sales Agreement”) with Hoosier, a rural electric membership corporation organizedB. Riley Securities, Inc. (the “Agent”), pursuant to which we may issue and existingsell, from time to time, shares (the “Shares”) of our common stock, par value $0.01 per share (the “Common Stock”), with aggregate gross proceeds of up to $50.0 million through an “at-the-market” equity offering program under which the lawsAgent will act as sales agent (the “ATM Program”). Under the Sales Agreement, each of us have the stateright, by giving five (5) days’ notice, to terminate the Sales Agreement in its sole discretion. The Agent may also terminate the Agreement, by notice to us, upon the occurrence of Indiana.certain events described in the Sales Agreement.

UnderDuring December 2023, we issued 794,000 shares of Common Stock under the APA, Hallador acquired the Merom power plant, along with equipment and machinery in the power plant; materials inventory; a coal purchase agreement; a coal combustion certified coal ash landfill, certain Generation Interconnection Agreements, and coal inventory (collectively, the “Acquired Assets”). Additionally, contemporaneous with entering into the APA, Hallador entered into three other agreements with Hoosier comprisedATM Program for net proceeds of (1) a Power Purchase Agreement (the "PPA”), (2) a Coal Supply Purchase Agreement (the "Coal Purchase Agreement"), and (3) a Closing Side Letter agreeing to a reduction in future capacity payments of $15.0 million (“Capacity Payment Reduction”). The purchase price for the Acquired Assets also consists of the assumption of the power plant’s closure and post-closure remediation, valued at approximately $7.2 million; no cash will be paid by Hallador to Hoosier to effectuate the APA other than payments totaling approximately $17.0 million for coal inventory on hand, with an initial payment of $5.4 million and subsequent periodic payments over time, subject to post-close adjustments based on actual on-site inventories. The acquisition closed on October 21, 2022.

The acquisition was accounted for as an asset acquisition under ASC 805-50 as substantially all of the fair value of the gross assets acquired are concentrated in a group of similar identifiable assets. As such, the total purchase consideration (which includes $2.9 million of transaction costs) was allocated to the assets acquired on a relative fair value basis.

Consideration: | | (in thousands) | |

Direct transaction costs | | $ | 2,855 | |

Contract liability - PPA | | | 184,500 | |

Contract liability - Capacity payment reduction | | | 11,000 | |

Contract asset - Coal purchase agreement | | | (34,300 | ) |

Coal inventory purchased | | | 5,400 | |

Deferred coal inventory payment | | | 11,600 | |

Total consideration | | $ | 181,055 | |

Relative fair value of assets acquired: | | | | |

Plant | | $ | 165,816 | |

Materials and supplies | | | 12,009 | |

Coal inventory | | | 10,460 | |

Amount attributable to assets acquired | | $ | 188,285 | |

Fair value of liabilities assumed: | | | | |

Asset retirement obligations | | $ | 7,230 | |

Amount attributable to liabilities assumed | | $ | 7,230 | |

Operating revenue for the Electric Operations segment includes revenue derived from a power purchase agreement signed with Hoosier in conjunction with the Merom Acquisition at fixed prices below market prices on the date we closed the transaction. The power purchase agreement expires in 2025 and requires us to provide a fixed amount of power over the term of the agreement. As a result of the below-market contract, we recorded a contract liability at the close of the acquisition totaling $184.5 million that will be amortized over the term of the agreement as the contract is fulfilled. For$7.3 million. During the three and ninemonths ended September 30, 2023, March 31, 2024,we recorded $10.3 million and $63.2 million, respectively,issued 710,623 shares of revenue as a resultCommon Stock under the ATM Program for net proceeds of amortizing the contract liability, resulting in an ending balance as of September 30, 2023, of $98.0 million that is recorded within current and long-term contract liabilities in our condensed consolidated balance sheets.$6.6 million.

Operating expenses for the Electric Operations segment include coal purchased under an agreement signed with Hoosier in conjunction with the Merom Acquisition at fixed prices which were below market prices at the date we entered into the agreement. The coal purchase agreement expired in May 2023 that required us to purchase a fixed amount of coal over the term of the agreement. As a result of the below-market contract, we recorded a contract asset at the close of the acquisition totaling $34.3 million that was amortized over the term of the agreement as the contract was fulfilled. For the three and six months ended June 30,2023, we recorded $13.0 million and $30.7 million in additional operating expenses for coal purchased and used and a reduction of $6.8 million and $11.2 million, respectively, to inventory for coal purchased and unused as a result of amortizing the contract asset, thereby eliminating the remaining balance of the contract asset as of June 30,2023.

(1518) | SEGMENTS OF BUSINESS |

As of September 30, 2023,March 31, 2024, our operations are divided into two primary reportable segments, the CoalElectric Operations and ElectricCoal Operations segments. The remainder of our operations, which are not significant enough on a stand-alone basis to warrant treatment as an operating segment, are presented as "Corporate and Other and Eliminations" and primarily are comprised of unallocated corporate costs and activities, the elimination of coal sales from coal operations to electric operations,including a 50% interest in Sunrise Energy, LLC, a private gas exploration company with operations in Indiana, which we accountthe Company accounts for using the equity method and our wholly-owned subsidiary Summit Terminal LLC, a logistics transport facility located on the Ohio River.

| | | Three Months Ended September 30, | | | Nine Months Ended September 30, | |

| | | 2023 | | | 2022 | | | 2023 | | | 2022 | |

| | | (in thousands) | | | (in thousands) | |

Operating Revenues | | | | | | | | | | | | | | | | |

Coal Operations | | $ | 134,896 | | | $ | 84,530 | | | $ | 343,267 | | | $ | 208,190 | |

Electric Operations | | | 67,544 | | | | - | | | | 231,141 | | | | - | |

Corporate and Other and Eliminations | | | (36,672 | ) | | | 554 | | | | (59,112 | ) | | | 1,730 | |

Consolidated Operating Revenues | | $ | 165,768 | | | $ | 85,084 | | | $ | 515,296 | | | $ | 209,920 | |

| | | | | | | | | | | | | | | | | |

Income (Loss) from Operations | | | | | | | | | | | | | | | | |

Coal Operations | | $ | 24,764 | | | $ | 6,098 | | | $ | 64,215 | | | $ | 580 | |

Electric Operations | | | (2,676 | ) | | | (991 | ) | | | 25,285 | | | | (991 | ) |

Corporate and Other and Eliminations | | | 1,715 | | | | 288 | | | | (14,220 | ) | | | (3,687 | ) |

Consolidated Income (Loss) from Operations | | $ | 23,803 | | | $ | 5,395 | | | $ | 75,280 | | | $ | (4,098 | ) |

| | | | | | | | | | | | | | | | | |

Depreciation, Depletion and Amortization | | | | | | | | | | | | | | | | |

Coal Operations | | $ | 11,508 | | | $ | 11,149 | | | $ | 37,249 | | | $ | 31,772 | |

Electric Operations | | | 4,695 | | | | - | | | | 14,045 | | | | - | |

Corporate and Other and Eliminations | | | 27 | | | | 38 | | | | 81 | | | | 110 | |

Consolidated Depreciation, Depletion and Amortization | | $ | 16,230 | | | $ | 11,187 | | | $ | 51,375 | | | $ | 31,882 | |

| | | | | | | | | | | | | | | | | |

Assets | | | | | | | | | | | | | | | | |

Coal Operations | | $ | 375,682 | | | $ | 374,223 | | | $ | 375,682 | | | $ | 374,223 | |

Electric Operations | | | 209,455 | | | | 351 | | | | 209,455 | | | | 351 | |

Corporate and Other and Eliminations | | | 49 | | | | 8,787 | | | | 49 | | | | 8,787 | |

Consolidated Assets | | $ | 585,186 | | | $ | 383,361 | | | $ | 585,186 | | | $ | 383,361 | |

| | | | | | | | | | | | | | | | | |

Capital Expenditures | | | | | | | | | | | | | | | | |

Coal Operations | | $ | 11,570 | | | $ | 15,097 | | | $ | 38,654 | | | $ | 38,000 | |

Electric Operations | | | 6,566 | | | | 344 | | | | 10,092 | | | | 344 | |

Corporate and Other and Eliminations | | | - | | | | - | | | | - | | | | - | |

Consolidated Capital Expenditures | | $ | 18,136 | | | $ | 15,441 | | | $ | 48,746 | | | $ | 38,344 | |

| | | Three Months Ended March 31, | |

| | | 2024 | | | 2023 | |

| | | (in thousands) | |

Operating revenues | | | | | | | | |

Electric operations | | $ | 58,912 | | | $ | 92,494 | |

Coal operations | | | 66,870 | | | | 95,273 | |

Corporate and other and eliminations | | | (16,110 | ) | | | 567 | |

Consolidated operating revenues | | $ | 109,672 | | | $ | 188,334 | |

| | | | | | | | | |

Income (loss) from operations | | | | | | | | |

Electric operations | | $ | 15,247 | | | $ | 18,705 | |

Coal operations | | | (11,457 | ) | | | 13,088 | |

Corporate and other and eliminations | | | (1,057 | ) | | | (2,560 | ) |

Consolidated income (loss) from operations | | $ | 2,733 | | | $ | 29,233 | |

| | | | | | | | | |

Depreciation, depletion and amortization | | | | | | | | |

Electric operations | | $ | 4,697 | | | $ | 4,675 | |

Coal operations | | | 10,728 | | | | 13,275 | |

Corporate and other and eliminations | | | 18 | | | | 26 | |

Consolidated depreciation, depletion and amortization | | $ | 15,443 | | | $ | 17,976 | |

| | | | | | | | | |

Assets | | | | | | | | |

Electric operations | | $ | 211,116 | | | $ | 218,132 | |

Coal operations | | | 370,292 | | | | 391,248 | |

Corporate and other and eliminations | | | 4,012 | | | | 7,247 | |

Consolidated assets | | $ | 585,420 | | | $ | 616,627 | |

| | | | | | | | | |

Capital expenditures | | | | | | | | |

Electric operations | | $ | 6,242 | | | $ | 843 | |

Coal operations | | | 8,632 | | | | 12,639 | |

Corporate and other and eliminations | | | — | | | | — | |

Consolidated capital expenditures | | $ | 14,874 | | | $ | 13,482 | |

(1619) | NET INCOME (LOSS) PER SHARE |

The following table (in thousands, except per share amounts) sets forth the computation of basic net income (loss)earnings per share:share for the periods presented:

| | | Three Months Ended September 30, | | | Nine Months Ended September 30, | |

| | | 2023 | | | 2022 | | | 2023 | | | 2022 | |

Basic earnings per common share: | | | | | | | | | | | | | | | | |

Net income (loss) - basic | | $ | 16,075 | | | $ | 1,612 | | | $ | 55,041 | | | $ | (11,908 | ) |

Weighted average shares outstanding - basic | | | 33,140 | | | | 32,983 | | | | 33,088 | | | | 31,727 | |