UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

|

| | | | |

| ☑ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended June 30, 20192020

or

|

| | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ___________ to ___________

Commission File Number: 001-36257

RETROPHIN, INC.

(Exact name of registrant as specified in its charter)

|

| | | | | | | | | | | | | |

| Delaware | | 27-4842691 | |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) | |

3721 Valley Centre Drive,, Suite 200

San Diego,, CA92130

(Address of Principal Executive Offices)

(888) (888) 969-7879

(Registrant's Telephone number including area code)

|

| | | | | | | |

| N/A | |

| Former name, former address and former fiscal year, if changed since last report | |

Securities registered pursuant to Section 12(b) of the Act:

|

| | | | | | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | |

| Common Stock, par value $0.0001 per share | RTRX | The Nasdaq Global Market | |

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

|

| | | | | | | | | | |

| Large accelerated filer | ☑ | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ | Smaller reporting company | ☐ |

| | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☑

The number of shares of outstanding common stock, par value $0.0001 per share, of the Registrant as of August 5, 2019July 29, 2020 was 42,954,151.

RETROPHIN, INC.

Form 10-Q

For the Fiscal Quarter Ended June 30, 20192020

TABLE OF CONTENTS

FORWARD-LOOKING STATEMENTS

This report contains forward-looking statements regarding our business, financial condition, results of operations and prospects. Words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates” and similar expressions or variations of such words are intended to identify forward-looking statements, but are not deemed to represent an all-inclusive means of identifying forward-looking statements as denoted in this report. Additionally, statements concerning future matters are forward-looking statements.

Although forward-looking statements in this report reflect the good faith judgment of our management, such statements can only be based on facts and factors currently known by us. Consequently, forward-looking statements are inherently subject to risks and uncertainties and actual results and outcomes may differ materially from the results and outcomes discussed in or anticipated by the forward-looking statements. Factors that could cause or contribute to such differences in results and outcomes include, without limitation, those specifically addressed under the headings “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our annual reportAnnual Report on Form 10-K for the fiscal year ended December 31, 20182019 (the "2018"2019 10-K"), and in this quarterly reportQuarterly Report on Form 10-Q and information contained in other reports that we file with the Securities and Exchange Commission (the “SEC”).10-Q. You are urged not to place undue reliance on these forward-looking statements, which speak only as of the date of this report.

In addition, statements that "we believe" and similar statements reflect our beliefs and opinions on the relevant subject. These statements are based upon information available to us as of the date of this quarterly reportQuarterly Report on Form 10-Q, and while we believe such information forms a reasonable basis for such statements, such information may be limited or incomplete, and our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all potentially available relevant information. These statements are inherently uncertain and you are cautioned to not unduly rely upon these statements.

We file reports with the SEC.Securities and Exchange Commission ("SEC"). The SEC maintains a website (www.sec.gov) that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC, including us.

We undertake no obligation to revise or update any forward-looking statements in order to reflect any event or circumstance that may arise after the date of this report, except as required by law. Readers are urged to carefully review and consider the various disclosures made throughout the entirety of this quarterly report, which are designed to advise interested parties of the risks and factors that may affect our business, financial condition, results of operations and prospects.

PART I - FINANCIAL INFORMATION

Item 1. Financial Statements

RETROPHIN, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands, except par value and share amounts)

| | | | June 30, 2019 | | December 31, 2018 | | June 30, 2020 | | December 31, 2019 |

| Assets | (unaudited) | | |

| Assets | (unaudited) | | |

| Current assets: | |

| | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 75,657 |

| | $ | 102,873 |

| Cash and cash equivalents | $ | 237,170 | | | $ | 62,436 | |

| Marketable securities | 350,243 |

| | 368,668 |

| |

| Available-for-sale debt securities, at fair value (amortized cost $218,596, allowance for credit losses of $0 as of June 30, 2020; amortized cost $335,206, allowance for credit losses of $0 as of December 31, 2019) | | Available-for-sale debt securities, at fair value (amortized cost $218,596, allowance for credit losses of $0 as of June 30, 2020; amortized cost $335,206, allowance for credit losses of $0 as of December 31, 2019) | 220,206 | | | 336,088 | |

| Accounts receivable, net | 15,451 |

| | 12,662 |

| Accounts receivable, net | 14,077 | | | 18,048 | |

| Inventory, net | 5,050 |

| | 5,619 |

| Inventory, net | 6,286 | | | 6,082 | |

| Prepaid expenses and other current assets | 9,164 |

| | 4,140 |

| Prepaid expenses and other current assets | 7,714 | | | 5,015 | |

| Prepaid taxes | 1,450 |

| | 1,716 |

| |

| Tax receivable | | Tax receivable | 20,109 | | | 1,395 | |

| | Total current assets | 457,015 |

| | 495,678 |

| Total current assets | 505,562 | | | 429,064 | |

| Property and equipment, net | 3,015 |

| | 3,146 |

| Property and equipment, net | 2,930 | | | 2,891 | |

| Other non-current assets | 12,702 |

| | 7,709 |

| Other non-current assets | 13,895 | | | 14,709 | |

| Investment-equity | 15,000 |

| | 15,000 |

| |

| | Intangible assets, net | 158,906 |

| | 186,691 |

| Intangible assets, net | 155,371 | | | 157,200 | |

| Goodwill | 936 |

| | 936 |

| Goodwill | 936 | | | 936 | |

| | Total assets | $ | 647,574 |

| | $ | 709,160 |

| Total assets | $ | 678,694 | | | $ | 604,800 | |

| Liabilities and Stockholders' Equity | |

| | |

| Liabilities and Stockholders' Equity | | | |

| Current liabilities: | |

| | |

| Current liabilities: | | | |

| Accounts payable | $ | 12,519 |

| | $ | 6,954 |

| Accounts payable | $ | 10,198 | | | $ | 26,614 | |

| Accrued expenses | 50,557 |

| | 49,695 |

| Accrued expenses | 44,379 | | | 51,745 | |

| | Other current liabilities | 8,417 |

| | 6,165 |

| Other current liabilities | 7,356 | | | 8,590 | |

| Business combination-related contingent consideration | 19,094 |

| | 19,350 |

| Business combination-related contingent consideration | 8,000 | | | 8,500 | |

| 2019 Convertible debt | — |

| | 22,457 |

| |

| | Total current liabilities | 90,587 |

| | 104,621 |

| Total current liabilities | 69,933 | | | 95,449 | |

| 2025 Convertible debt | 199,891 |

| | 195,091 |

| |

| Convertible debt | | Convertible debt | 210,009 | | | 204,861 | |

| Other non-current liabilities | 22,102 |

| | 17,545 |

| Other non-current liabilities | 19,507 | | | 20,894 | |

| | Business combination-related contingent consideration, less current portion | 57,905 |

| | 73,650 |

| Business combination-related contingent consideration, less current portion | 60,600 | | | 62,400 | |

| | Total liabilities | 370,485 |

| | 390,907 |

| Total liabilities | 360,049 | | | 383,604 | |

| Stockholders' Equity: | |

| | |

| Stockholders' Equity: | | | |

| Preferred stock $0.0001 par value; 20,000,000 shares authorized; 0 issued and outstanding as of June 30, 2019 and December 31, 2018 | — |

| | — |

| |

| Common stock $0.0001 par value; 100,000,000 shares authorized; 42,899,318 and 41,389,524 issued and outstanding as of June 30, 2019 and December 31, 2018, respectively | 4 |

| | 4 |

| |

| Preferred stock $0.0001 par value; 20,000,000 shares authorized; 0 issued and outstanding as of June 30, 2020 and December 31, 2019 | | Preferred stock $0.0001 par value; 20,000,000 shares authorized; 0 issued and outstanding as of June 30, 2020 and December 31, 2019 | — | | | — | |

| Common stock $0.0001 par value; 100,000,000 shares authorized; 50,902,874 and 43,088,921 issued and outstanding as of June 30, 2020 and December 31, 2019, respectively | | Common stock $0.0001 par value; 100,000,000 shares authorized; 50,902,874 and 43,088,921 issued and outstanding as of June 30, 2020 and December 31, 2019, respectively | 5 | | | 4 | |

| Additional paid-in capital | 625,999 |

| | 589,795 |

| Additional paid-in capital | 758,945 | | | 636,910 | |

| Accumulated deficit | (349,695 | ) | | (270,017 | ) | Accumulated deficit | (441,704) | | | (416,444) | |

| Accumulated other comprehensive income (loss) | 781 |

| | (1,529 | ) | |

| Accumulated other comprehensive income | | Accumulated other comprehensive income | 1,399 | | | 726 | |

| Total stockholders' equity | 277,089 |

| | 318,253 |

| Total stockholders' equity | 318,645 | | | 221,196 | |

| Total liabilities and stockholders' equity | $ | 647,574 |

| | $ | 709,160 |

| Total liabilities and stockholders' equity | $ | 678,694 | | | $ | 604,800 | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

RETROPHIN, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

(in thousands, except share and per share amounts)

(unaudited)

| | | | Three Months Ended June 30, | | Six Months Ended June 30, | | Three Months Ended June 30, | | | Six Months Ended June 30, | |

| | 2019 | | 2018 | | 2019 | | 2018 | | 2020 | | 2019 | | 2020 | | 2019 |

| Net product sales | $ | 44,707 |

| | $ | 41,337 |

| | $ | 84,277 |

| | $ | 79,769 |

| Net product sales | $ | 48,430 | | | $ | 44,707 | | | $ | 96,199 | | | $ | 84,277 | |

| Operating expenses: | |

| | |

| | | | | Operating expenses: | | | | |

| Cost of goods sold | 979 |

| | 1,178 |

| | 1,996 |

| | 2,791 |

| Cost of goods sold | 1,494 | | | 979 | | | 2,864 | | | 1,996 | |

| Research and development | 37,934 |

|

| 34,460 |

|

| 71,377 |

|

| 59,096 |

| Research and development | 30,790 | | | 37,934 | | | 61,038 | | | 71,377 | |

| Selling, general and administrative | 38,970 |

|

| 25,100 |

|

| 71,639 |

|

| 51,568 |

| Selling, general and administrative | 34,971 | | | 38,970 | | | 68,110 | | | 71,639 | |

| Change in fair value of contingent consideration | 3,353 |

| | 2,159 |

| | 6,522 |

| | 5,786 |

| Change in fair value of contingent consideration | 4,286 | | | 3,353 | | | 2,363 | | | 6,522 | |

| Impairment of L-UDCA IPR&D intangible asset | — |

| | — |

| | 25,500 |

| | — |

| |

| Write off of L-UDCA IPR&D intangible asset | | Write off of L-UDCA IPR&D intangible asset | — | | | — | | | — | | | 25,500 | |

| Write off of L-UDCA contingent consideration | — |

| | — |

| | (18,000 | ) | | — |

| Write off of L-UDCA contingent consideration | — | | | — | | | — | | | (18,000) | |

| | Total operating expenses | 81,236 |

| | 62,897 |

| | 159,034 |

| | 119,241 |

| Total operating expenses | 71,541 | | | 81,236 | | | 134,375 | | | 159,034 | |

| Operating loss | (36,529 | ) |

| (21,560 | ) |

| (74,757 | ) |

| (39,472 | ) | Operating loss | (23,111) | | | (36,529) | | | (38,176) | | | (74,757) | |

| Other income (expenses), net: | |

| | |

| | | | | Other income (expenses), net: | | | | | | | |

| Other income (expense), net | 125 |

|

| (403 | ) |

| (177 | ) |

| (282 | ) | Other income (expense), net | 426 | | | 125 | | | 235 | | | (177) | |

| Interest income | 2,589 |

|

| 858 |

|

| 5,408 |

|

| 1,655 |

| Interest income | 1,316 | | | 2,589 | | | 3,291 | | | 5,408 | |

| Interest expense | (4,817 | ) |

| (1,057 | ) |

| (9,682 | ) |

| (2,212 | ) | Interest expense | (4,634) | | | (4,817) | | | (9,521) | | | (9,682) | |

| | Total other expense, net | (2,103 | ) | | (602 | ) | | (4,451 | ) | | (839 | ) | Total other expense, net | (2,892) | | | (2,103) | | | (5,995) | | | (4,451) | |

| Loss before income taxes | (38,632 | ) | | (22,162 | ) | | (79,208 | ) | | (40,311 | ) | Loss before income taxes | (26,003) | | | (38,632) | | | (44,171) | | | (79,208) | |

| Income tax expense | (69 | ) |

| (167 | ) |

| (470 | ) |

| (396 | ) | |

| Income tax (expense) benefit | | Income tax (expense) benefit | (65) | | | (69) | | | 18,911 | | | (470) | |

| Net loss | $ | (38,701 | ) | | $ | (22,329 | ) | | $ | (79,678 | ) | | $ | (40,707 | ) | Net loss | $ | (26,068) | | | $ | (38,701) | | | $ | (25,260) | | | $ | (79,678) | |

| | | |

|

|

|

|

|

| | | | | | | | |

| Basic and diluted net loss per common share: | $ | (0.92 | ) |

| $ | (0.56 | ) |

| $ | (1.91 | ) |

| $ | (1.03 | ) | |

| Basic and diluted weighted average common shares outstanding: | 41,957,860 |

|

| 40,061,045 |

|

| 41,685,599 |

|

| 39,641,334 |

| |

| Basic and diluted net loss per common share | | Basic and diluted net loss per common share | $ | (0.58) | | | $ | (0.92) | | | $ | (0.57) | | | $ | (1.91) | |

| | Basic and diluted weighted average common shares outstanding | | Basic and diluted weighted average common shares outstanding | 44,763,843 | | | 41,957,860 | | | 43,943,370 | | | 41,685,599 | |

| | Comprehensive loss: | |

| | |

| | | | | Comprehensive loss: | | | | |

| Net loss | $ | (38,701 | ) | | $ | (22,329 | ) | | $ | (79,678 | ) | | $ | (40,707 | ) | Net loss | $ | (26,068) | | | $ | (38,701) | | | $ | (25,260) | | | $ | (79,678) | |

| Foreign currency translation | (91 | ) | | 2 |

| | 27 |

| | 24 |

| Foreign currency translation | (247) | | | (91) | | | (56) | | | 27 | |

| Unrealized gain (loss) on marketable securities | 815 |

| | 375 |

| | 2,284 |

| | (161 | ) | |

| Unrealized gain on debt securities | | Unrealized gain on debt securities | 3,146 | | | 815 | | | 729 | | | 2,284 | |

| Comprehensive loss | $ | (37,977 | ) | | $ | (21,952 | ) | | $ | (77,367 | ) | | $ | (40,844 | ) | Comprehensive loss | $ | (23,169) | | | $ | (37,977) | | | $ | (24,587) | | | $ | (77,367) | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

RETROPHIN, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(unaudited, in thousands) | | | | For the Six Months Ended June 30, | | For the Six Months Ended June 30, | |

| | 2019 | | 2018 | | 2020 | | 2019 |

| Cash Flows From Operating Activities: | | | | Cash Flows From Operating Activities: | | | |

| Net loss | $ | (79,678 | ) | | $ | (40,707 | ) | Net loss | $ | (25,260) | | | $ | (79,678) | |

| Adjustments to reconcile net loss to net cash used in operating activities: | |

| | |

| Adjustments to reconcile net loss to net cash used in operating activities: | | | |

| Depreciation and amortization | 9,742 |

| | 8,991 |

| Depreciation and amortization | 11,507 | | | 9,742 | |

| | Non-cash interest expense | 798 |

| | 767 |

| Non-cash interest expense | 893 | | | 798 | |

| (Accretion) amortization of discounts/premiums on investments, net | (580 | ) | | 647 |

| |

| Amortization (accretion) of discounts/premiums on investments, net | | Amortization (accretion) of discounts/premiums on investments, net | 337 | | | (580) | |

| Amortization of debt discount and issuance costs | 4,933 |

| | 325 |

| Amortization of debt discount and issuance costs | 5,147 | | | 4,933 | |

| | Provision for Inventory | (358 | ) | | 378 |

| Provision for Inventory | 662 | | | (358) | |

| Share based compensation | 11,947 |

| | 10,160 |

| |

| ESPP Expense | 345 |

| | — |

| |

| | Share-based compensation | | Share-based compensation | 11,474 | | | 11,947 | |

| ESPP expense | | ESPP expense | 390 | | | 345 | |

| Change in fair value of contingent consideration | (11,478 | ) | | 5,786 |

| Change in fair value of contingent consideration | 2,363 | | | (11,478) | |

| Payments related to change in fair value of contingent consideration | (2,767 | ) | | (5,563 | ) | Payments related to change in fair value of contingent consideration | (8,674) | | | (2,767) | |

| Impairment of IPR&D intangible assets | 25,500 |

| | — |

| |

| | Write off of IPR&D intangible assets | | Write off of IPR&D intangible assets | — | | | 25,500 | |

| | Unrealized foreign currency transaction gain (loss) | 14 |

| | 214 |

| Unrealized foreign currency transaction gain (loss) | (222) | | | 14 | |

| Other | 60 |

| | 199 |

| Other | 496 | | | 60 | |

| Changes in operating assets and liabilities, net of business acquisitions: | |

| | |

| |

| Changes in operating assets and liabilities: | | Changes in operating assets and liabilities: | | | |

| Accounts receivable | (2,396 | ) | | 1,431 |

| Accounts receivable | 3,979 | | | (2,396) | |

| Inventory | 918 |

| | (433 | ) | Inventory | (875) | | | 918 | |

| Tax receivable | | Tax receivable | (18,714) | | | — | |

| Other current and non-current operating assets | (10,101 | ) | | 637 |

| Other current and non-current operating assets | (2,508) | | | (10,101) | |

| Accounts payable and accrued expenses | 6,305 |

| | (2,811 | ) | Accounts payable and accrued expenses | (16,407) | | | 6,305 | |

| Other current and non-current operating liabilities | 7,195 |

| | 2,485 |

| Other current and non-current operating liabilities | (196) | | | 7,195 | |

| Net cash used in operating activities | (39,601 | ) | | (17,494 | ) | Net cash used in operating activities | (35,608) | | | (39,601) | |

| Cash Flows From Investing Activities: | |

| | |

| Cash Flows From Investing Activities: | | | |

| Purchase of fixed assets | (21 | ) | | (601 | ) | Purchase of fixed assets | (518) | | | (21) | |

| Cash paid for intangible assets | (7,347 | ) | | (11,389 | ) | Cash paid for intangible assets | (8,532) | | | (7,347) | |

| Proceeds from the sale/maturity of marketable securities | 115,998 |

| | 63,565 |

| |

| Purchase of marketable securities | (94,812 | ) | | (29,519 | ) | |

| Cash paid for investments - equity | — |

| | (15,000 | ) | |

| Proceeds from the sale/maturity of debt securities | | Proceeds from the sale/maturity of debt securities | 153,146 | | | 115,998 | |

| Purchase of debt securities | | Purchase of debt securities | (36,743) | | | (94,812) | |

| | Net cash provided by investing activities | 13,818 |

| | 7,056 |

| Net cash provided by investing activities | 107,353 | | | 13,818 | |

| Cash Flows From Financing Activities: | |

| | |

| Cash Flows From Financing Activities: | | | |

| Payment of acquisition-related contingent consideration | (1,722 | ) | | (7,947 | ) | Payment of acquisition-related contingent consideration | (6,101) | | | (1,722) | |

| Payment of guaranteed minimum royalty | (1,034 | ) | | (1,000 | ) | Payment of guaranteed minimum royalty | (1,050) | | | (1,034) | |

| Payment of other liability | — |

| | (500 | ) | |

| Proceeds from exercise of warrants | — |

| | 2,140 |

| |

| | Proceeds from exercise of stock options | 317 |

| | 6,890 |

| Proceeds from exercise of stock options | 431 | | | 317 | |

| Other financing activities | 1,005 |

| | 800 |

| |

| Net cash (used in) provided by financing activities | (1,434 | ) | | 383 |

| |

| | Proceeds from issuance of common stock, net of issuance costs | | Proceeds from issuance of common stock, net of issuance costs | 108,644 | | | — | |

| | Proceeds from issuances under employee stock purchase plan | | Proceeds from issuances under employee stock purchase plan | 1,098 | | | 1,005 | |

| Net cash provided by (used in) financing activities | | Net cash provided by (used in) financing activities | 103,022 | | | (1,434) | |

| Effect of exchange rate changes on cash | 1 |

| | (34 | ) | Effect of exchange rate changes on cash | (33) | | | 1 | |

| Net change in cash and cash equivalents | (27,216 | ) | | (10,089 | ) | Net change in cash and cash equivalents | 174,734 | | | (27,216) | |

| Cash and cash equivalents, beginning of year | 102,873 |

| | 99,394 |

| Cash and cash equivalents, beginning of year | 62,436 | | | 102,873 | |

| Cash and cash equivalents, end of period | $ | 75,657 |

| | $ | 89,305 |

| Cash and cash equivalents, end of period | $ | 237,170 | | | $ | 75,657 | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

RETROPHIN, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY

(unaudited, in thousands, except share amounts)

| | | | Three Months Ended June 30, 2019 | | Three Months Ended June 30, 2018 | | Three Months Ended June 30, 2020 | | | Three Months Ended June 30, 2019 | |

| | Common Stock | | Additional Paid in Capital | | Accumulated Other Comprehensive Income (Loss) | | Accumulated

Deficit | | Total

Stockholders'

Equity | | Common Stock | | Additional Paid in Capital | | Accumulated Other Comprehensive Income (Loss) | | Accumulated

Deficit | | Total

Stockholders'

Equity | | Common Stock | | | Additional Paid in Capital | | Accumulated Other Comprehensive Income (Loss) | | Accumulated

Deficit | | Total

Stockholders'

Equity | | Common Stock | | | Additional Paid in Capital | | Accumulated Other Comprehensive Income (Loss) | | Accumulated

Deficit | | Total

Stockholders'

Equity |

| | Shares | Amount | | Shares | Amount | | | Shares | Amount | | | | | | | | | | Shares | Amount | | | | | | | | |

| Balance - March 31 | 41,438,020 |

| $ | 4 |

| | $ | 596,644 |

| | $ | 57 |

| | $ | (310,994 | ) | | $ | 285,712 |

| | 39,873,285 |

| $ | 4 |

| | $486,717 | | $ | (1,529 | ) | | $ | (185,717 | ) | | $ | 299,475 |

| Balance - March 31 | 43,153,215 | | $ | 4 | | | $ | 642,880 | | | $ | (1,500) | | | $ | (415,636) | | | $ | 225,748 | | | 41,438,020 | | $ | 4 | | | $ | 596,644 | | | $ | 57 | | | $ | (310,994) | | | $ | 285,712 | |

| Share based compensation | | | | 5,577 |

| | | | | | 5,577 |

| | | | | 5,372 |

| | | | | | 5,372 |

| Share based compensation | | | 5,760 | | | | | | | 5,760 | | | | | 5,577 | | | | | | | 5,577 | |

| Issuance of common shares under the equity incentive plan and proceeds from exercise | 100,151 |

| | | 12 |

| | | | | | 12 |

| | 198,630 |

| — |

| | 2,633 |

| | | | | | 2,633 |

| |

| Exercise of warrants | | | | | | | | | | — |

| | 255,445 |

| — |

| | 1,533 |

| | | | | | 1,533 |

| |

| Unrealized gain on marketable securities | | | | | | 815 |

| | | | 815 |

| | | | | | | 375 |

| | | | 375 |

| |

| Issuance of common stock under the equity incentive plan and proceeds from exercise | | Issuance of common stock under the equity incentive plan and proceeds from exercise | 177,115 | | | 371 | | | 371 | | | 100,151 | | | 12 | | | 12 | |

| Equity offering | | Equity offering | 7,475,000 | | 1 | | 108,643 | | | 108,644 | | |

| Unrealized gain on debt securities | | Unrealized gain on debt securities | | 3,146 | | | 3,146 | | | | 815 | | | 815 | |

| Foreign currency translation adjustments | | | | | | (91 | ) | | | | (91 | ) | | | | | | | 2 |

| | | | 2 |

| Foreign currency translation adjustments | | (247) | | | (247) | | | (91) | | | (91) | |

| Issuance of common stock from maturity of the 2019 Convertible debt outstanding | 1,297,343 |

| | | 22,590 |

| | | | | | 22,590 |

| | | | | | | | | | | — |

| Issuance of common stock from maturity of the 2019 Convertible debt outstanding | | 1,297,343 | | | 22,590 | | | 22,590 | |

| ESPP stock purchase and expense | 63,804 |

| — |

| | 1,176 |

| | | | | | 1,176 |

| | 43,161 |

| — |

| | 928 |

| | | | | | 928 |

| ESPP stock purchase and expense | 97,544 | | | 1,291 | | | 1,291 | | | 63,804 | | | 1,176 | | | 1,176 | |

| Net loss | | | | | | | | (38,701 | ) | | (38,701 | ) | | | | | | | | | (22,329 | ) | | (22,329 | ) | Net loss | | (26,068) | | | (26,068) | | | (38,701) | | | (38,701) | |

| Balance - June 30 | 42,899,318 |

| $ | 4 |

| | $ | 625,999 |

| | $ | 781 |

| | $ | (349,695 | ) | | $ | 277,089 |

| | 40,370,521 |

| $ | 4 |

| | $ | 497,183 |

| | $ | (1,152 | ) | | $ | (208,046 | ) | | $ | 287,989 |

| Balance - June 30 | 50,902,874 | | $ | 5 | | | $ | 758,945 | | | $ | 1,399 | | | $ | (441,704) | | | $ | 318,645 | | | 42,899,318 | | $ | 4 | | | $ | 625,999 | | | $ | 781 | | | $ | (349,695) | | | $ | 277,089 | |

| | Six Months Ended June 30, 2019 | | Six Months Ended June 30, 2018 | | | | | | | | | | | | | | | | | | | | |

| | | Six Months Ended June 30, 2020 | | | Six Months Ended June 30, 2019 | |

| | | Common Stock | | | Additional Paid in Capital | | Accumulated Other Comprehensive Income (Loss) | | Accumulated

Deficit | | Total

Stockholders'

Equity | | Common Stock | | | Additional Paid in Capital | | Accumulated Other Comprehensive Income (Loss) | | Accumulated

Deficit | | Total

Stockholders'

Equity |

| | | Shares | Amount | | | | | | | | | | Shares | Amount | | | | | | | | |

| Balance - December 31 | 41,389,524 |

| $ | 4 |

| | $ | 589,795 |

| | $ | (1,529 | ) | | $ | (270,017 | ) | | $ | 318,253 |

| | 39,373,745 |

| $ | 4 |

| | $ | 471,800 |

| | $ | (1,015 | ) | | $ | (177,655 | ) | | $ | 293,134 |

| Balance - December 31 | 43,088,921 | | $ | 4 | | | $ | 636,910 | | | $ | 726 | | | $ | (416,444) | | | $ | 221,196 | | | 41,389,524 | | $ | 4 | | | $ | 589,795 | | | $ | (1,529) | | | $ | (270,017) | | | $ | 318,253 | |

| Adoption of ASU 2017-11 - reclassification of derivative liability of warrants with down round provisions | | | | | | | | | | — |

| | | | | 5,394 |

| | | | 10,316 |

| | 15,710 |

| |

| Share based compensation | | | | 11,947 |

| | | | | | 11,947 |

| | | | | 9,915 |

| | | | | | 9,915 |

| Share based compensation | | | | 11,474 | | | | | | | 11,474 | | | | | 11,947 | | | | | | | 11,947 | |

| Issuance of common shares under the equity incentive plan and proceeds from exercise | 148,647 |

| | | 317 |

| | | | | | 317 |

| | 529,558 |

| — |

| | 6,890 |

| | | | | | 6,890 |

| |

| Exercise of warrants | | | | | | | | | | — |

| | 424,057 |

| — |

| | 2,140 |

| | | | | | 2,140 |

| |

| Unrealized gain (loss) on marketable securities | | | | | | 2,284 |

| | | | 2,284 |

| | | | | | | (161 | ) | | | | (161 | ) | |

| Issuance of common stock under the equity incentive plan and proceeds from exercise | | Issuance of common stock under the equity incentive plan and proceeds from exercise | 241,409 | | | 431 | | | 431 | | | 148,647 | | | 317 | | | 317 | |

| Equity offering | | Equity offering | 7,475,000 | | 1 | | 108,643 | | | 108,644 | | |

| Unrealized gain on debt securities | | Unrealized gain on debt securities | | | 729 | | | 729 | | | 2,284 | | | 2,284 | |

| Foreign currency translation adjustments | | | | | | 26 |

| | | | 26 |

| | | | | | | 24 |

| | | | 24 |

| Foreign currency translation adjustments | | | (56) | | | (56) | | | 26 | | | 26 | |

| Issuance of common stock from maturity of the 2019 Convertible debt outstanding | 1,297,343 |

| — |

| | 22,590 |

| | | | | | 22,590 |

| | | | | | | | | | | — |

| Issuance of common stock from maturity of the 2019 Convertible debt outstanding | | | | 1,297,343 | | | 22,590 | | | | | 22,590 | |

| ESPP stock purchase and expense | 63,804 |

| — |

| | 1,350 |

| | | | | | 1,350 |

| | 43,161 |

| | | 1,044 |

| | | | | | 1,044 |

| ESPP stock purchase and expense | 97,544 | | | 1,487 | | | 1,487 | | | 63,804 | | | 1,350 | | | 1,350 | |

| Net loss | | | | | | | | (79,678 | ) | | (79,678 | ) | | | | | | | | | (40,707 | ) | | (40,707 | ) | Net loss | | | (25,260) | | | (25,260) | | | (79,678) | | | (79,678) | |

| Balance - June 30 | 42,899,318 |

| $ | 4 |

| | $ | 625,999 |

| | $ | 781 |

| | $ | (349,695 | ) | | $ | 277,089 |

| | 40,370,521 |

| $ | 4 |

| | $ | 497,183 |

| | $ | (1,152 | ) | | $ | (208,046 | ) | | $ | 287,989 |

| Balance - June 30 | 50,902,874 | | $ | 5 | | | $ | 758,945 | | | $ | 1,399 | | | $ | (441,704) | | | $ | 318,645 | | | 42,899,318 | | $ | 4 | | | $ | 625,999 | | | $ | 781 | | | $ | (349,695) | | | $ | 277,089 | |

|

The accompanying notes are an integral part of these condensed consolidated financial statements.

RETROPHIN, INC. AND SUBSIDIARIES

NOTES TO THE UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

NOTE 1. DESCRIPTION OF BUSINESS

Organization and Description of Business

Retrophin, Inc. (“we”, “our”, “us”, “Retrophin” and the “Company”) refers to Retrophin, Inc., a Delaware corporation, as well as our direct and indirect subsidiaries. Retrophin is a fully integrated biopharmaceutical company headquartered in San Diego, California, focused on identifying, developing and delivering life-changing therapies to people living with rare diseases. We regularly evaluate and, where appropriate, act on opportunities to expand our product pipeline through licenses and acquisitions of products in areas that will serve patients with serious or rare diseases and that we believe offer attractive growth characteristics.

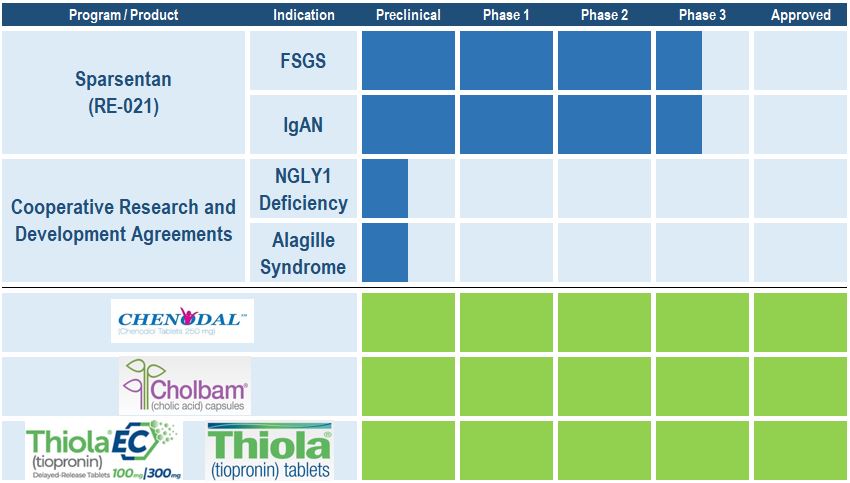

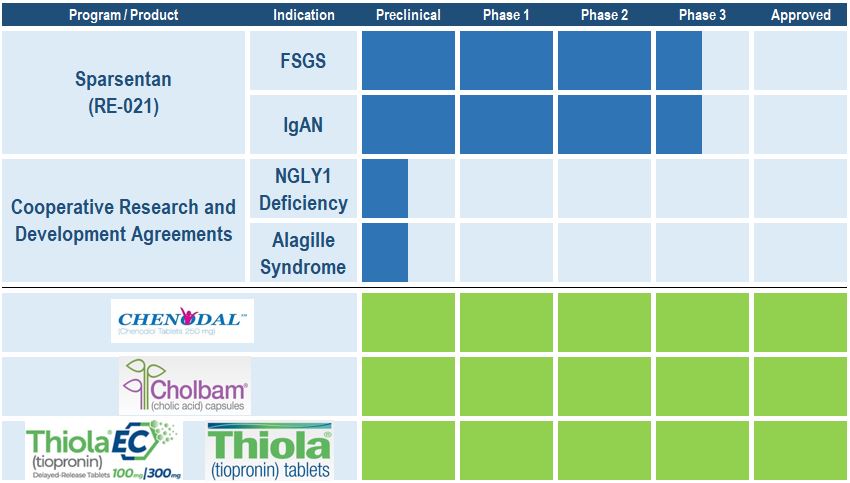

On January 30, 2020, the World Health Organization (“WHO”) declared that the recent novel coronavirus (COVID-19) outbreak was a global health emergency, which prompted national governments to begin putting actions in place to slow the spread of COVID-19. In March 2020, the WHO classified the COVID-19 outbreak as a pandemic. The outbreak of COVID-19 has resulted in travel restrictions, quarantines, “stay-at-home” and “shelter-in-place” orders and extended shutdown of certain businesses around the world. While the impact of the COVID-19 pandemic did not have a material adverse effect on our financial position or results of operations for the three and six months ended June 30, 2020, these governmental actions and the widespread economic disruption arising from the pandemic have the potential to materially impact our business and influence our business decisions. The extent and duration of the pandemic is unknown, and the future effects on our business are uncertain and difficult to predict. The Company is developingcontinuing to monitor the following pipeline products:

The Company is developing fosmetpantotenate (RE-024), a novel small molecule, as a potential treatment for pantothenate kinase-associated neurodegeneration (“PKAN”). PKAN is a genetic neurodegenerative disorder that is typically diagnosedevents and circumstances surrounding the COVID-19 pandemic, which may require adjustments to the Company’s estimates and assumptions in the first decade of life.future.

Clinical Programs:

Sparsentan, also known as RE-021, is an investigational product candidate with a dual mechanism of action, a potent angiotensin receptor blocker (“ARB”) and selective endothelin receptor antagonist (“ERA”), with in vitro selectivity toward endothelin receptor type A.A, and a potent angiotensin receptor blocker (“ARB”). Sparsentan is currently being evaluated in two pivotal Phase 3 clinical studies in the following indications:

•Focal segmental glomerulosclerosis ("FSGS") is a rare kidney disease characterized by proteinuria where the glomeruli become progressively scarred. FSGS is a leading cause of end-stage renal disease.

•Immunoglobulin A nephropathy ("IgAN") is an immune-complex-mediated glomerulonephritis characterized by hematuria, proteinuria, and variable rates of progressive renal failure. IgAN is the most common primary glomerular disease.

Chenodal® has been recognized as the standard of care for cerebrotendinous xanthomatosis (“CTX”) patients for more than three decades but is not currently labeled for this indication. In September 2017,January 2020, we randomized the Company entered intofirst patients in a three-way Phase 3 clinical trial to evaluate the effects of Chenodal in adult and pediatric patients with CTX. The pivotal study, known as the RESTORE study, is intended to support a new drug application (“NDA”) submission for marketing authorization of Chenodal for CTX in the United States.

Cooperative Research and Development AgreementAgreements ("CRADA"CRADAs"):

The Company is a participant in two CRADAs, which form a multi-stakeholder approach to pool resources with leading experts, and incorporates the patient perspective early in the identification and development process. Retrophin has partnered with the National Institutes of Health’s National Center for Advancing Translational Sciences ("NCATS") and leading patient advocacy foundationorganizations, NGLY1.org to collaborate on research effortsand Alagille Syndrome Alliance ("ALGSA"), aimed at the identification of potential small molecule therapeutics for NGLY1 deficiency.

In June 2019, the Company announced that it has entered into a three-way CRADA with NCATSdeficiency and patient advocacy foundation Alagille Syndrome Alliance ("ALGSA") to collaborate on research efforts aimed at the identification and development of potentially novel therapeutics for Alagille syndrome, ("ALGS").respectively. There are no treatment options currently approved for these diseases.

The Company sells the following threeApproved products:

•Chenodal (chenodiol tablets) is approved in the United States for the treatment of patients suffering from gallstones in whom surgery poses an unacceptable health risk due to disease or advanced age. Chenodal has been the standard of care for cerebrotendinous xanthomatosis ("CTX")CTX patients for more than three decades and the Company is currently pursuing adding this indication to the label.decades.

Cholbam•Cholbam® (cholic acid capsules) is approved in the United States for the treatment of bile acid synthesis disorders due to single enzyme defects and is further indicated for adjunctive treatment of patients with peroxisomal disorders.

•Thiola® and Thiola EC® (tiopronin tablets) isare approved in the United States for the prevention of cystine (kidney) stone formation in patients with severe homozygous cystinuria. On June 28, 2019, the Company announced that the U.S. Food and Drug Administration ("FDA") approved 100 mg and 300 mg tablets

NOTE 2. BASIS OF PRESENTATION AND SIGNIFICANT ACCOUNTING POLICIES

The accompanying unaudited condensed consolidated financial statements should be read in conjunction with the audited consolidated financial statements and notes thereto included in the 20182019 10-K filed with the SEC on February 26, 2019.24, 2020. The accompanying condensed consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States (“GAAP”) for interim financial information, the instructions for Form 10-Q and the rules and regulations of the SEC. Accordingly, since they are interim statements, the accompanying condensed consolidated financial statements do not include all of the information and notes required by GAAP for annual financial statements, but reflect all adjustments consisting of normal, recurring adjustments, that are necessary for a fair presentation of the financial position, results of operations and cash flows for the interim periods presented. Interim results are not necessarily indicative of the results that may be expected for any future periods. The December 31, 20182019 balance sheet information was derived from the audited financial statements as of that date. Certain reclassifications have been made to the prior period consolidated financial statements to conform to the current period presentation.

A summary of the significant accounting policies applied in the preparation of the accompanying condensed consolidated financial statements follows:

Principles of Consolidation

The unaudited condensed consolidated financial statements represent the consolidation of the accounts of the Company and its subsidiaries in conformity with GAAP. All intercompany accounts and transactions have been eliminated in consolidation.

Revenue Recognition

The Company recognizes revenue when its customer obtains control of promised goods or services, in an amount that reflects the consideration which the entity expects to receive in exchange for those goods or services. To determine revenue recognition for arrangements that an entity determines are within the scope of Topic 606, the entity performs the following five steps: (i) identify the contract(s) with a customer; (ii) identify the performance obligations in the contract; (iii) determine the transaction price; (iv) allocate the transaction price to the performance obligations in the contract; and (v) recognize revenue when (or as) the entity satisfies a performance obligation. The Company only applies the five-step model to contracts when it is probable that the entity will collect substantially all the consideration it is entitled to in exchange for the goods or services it transfers to the customer. See Note 3 for further discussion.

Research and Development Expenses

Research and development expenses are comprised of salaries and bonuses, benefits, non-cash share-based compensation, license fees, costs paid to third-party contractors to perform research, conduct clinical trials and pre/non-clinical trials, develop drug materials, and associated overhead expenses and facilities. We also incur indirect costs that are not allocated to specific programs because such costs benefit multiple development programs and allow us to increase our pharmaceutical development capabilities. These consist of internal shared resources related to the development and maintenance of systems and processes applicable to all of our programs.

Clinical Trial Expenses

Our clinical trials are conducted pursuant to contracts with contract research organizations ("CROs") that support conducting and managing clinical trials. The financial terms and activities of these agreements vary from contract to contract and may result in uneven expense levels. Generally, these agreements set forth activities that drive the recording of expenses such as start-up, initiation activities, enrollment, treatment of patients, or the completion of other clinical trial activities.

Expenses related to clinical trials are accrued based on our estimates and/or representations from service providers regarding work performed, including actual level of patient enrollment, completion of patient studies and progress of the clinical trials, and completion of patient studies.trials. Other incidental costs related to patient enrollment or treatment are accrued when reasonably certain. If the amounts we are obligated to pay under our clinical trial agreements are modified (for instance, as a result of changes in the clinical trial protocol or scope of work to be performed), we adjust our accruals accordingly on a prospective basis. Revisions to our contractual payment obligations are charged to expense in the period in which the facts that give rise to the revision become reasonably certain.

We currently have three Phase 3 clinical trials in process that are in varying stages of activity, with ongoing non-clinical support trials. As such, clinical trial expenses will vary depending on all the factors set forth above and may fluctuate significantly from quarter to quarter.

Adoption of New Accounting Standards

In February 2016, the FASB issued ASU No. 2016-02, Leases. The new standard establishes a right-of-use ("ROU") model that requires a lessee to record a ROU asset and a lease liability on the balance sheet for all leases with terms longer than 12 months. Leases will be classified as either finance or operating, with classification affecting the pattern of expense recognition in the income statement. The new standard is effective for fiscal years beginning after December 15, 2018, including interim periods within those fiscal years. See Note 6 for further discussion.

Recently Issued Accounting Pronouncements

From time to time, new accounting pronouncements are issued by the FASB or other standard setting bodies. Unless otherwise noted, the Company believes that the impact of recently issued standards that are not yet effective will not have a material impact on its consolidated financial position or results of operations upon adoption.

In June 2016, the FASB issued ASU No. 2016-13, Financial Instruments - Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments. Topic 326 amends guidance on reporting credit losses for assets held at amortized cost basis and available-for-sale debt securities. For assets held at amortized cost basis, Topic 326 eliminates the probable initial recognition threshold in current GAAP and, instead, requires an entity to reflect its current estimate of all expected credit losses. The allowance for credit losses is a valuation account that is deducted from the amortized cost basis of the financial assets to present the net amount expected to be collected. For available-for-sale debt securities, credit losses should be measured in a manner similar to current GAAP, however Topic 326 will require that credit losses be presented as an allowance rather than as a write-down. This ASU update affects entities holding financial assets and net investment in leases that are not accounted for at fair value through net income. The amendments affect loans, debt securities, trade receivables, net investments in leases, off balance sheet credit exposures, reinsurance receivables, and any other financial assets not excluded from the scope that have the contractual right to receive cash. This update is effective for fiscal years beginning after December 15, 2019, including interim periods within those fiscal years. The Company's adoption of this standard has had an immaterial impact on our condensed consolidated financial statements, and there was no recorded impact to our opening accumulated deficit balance for the cumulative-effect adjustment. As of June 30, 2019,2020, the Company held $350.2$14.1 million in trade receivables and $220.2 million in available-for-sale debt securities. If adoptedExpected credit losses on our trade receivables are estimated to be immaterial and the Company has 0 recorded allowances for expected credit losses on the available-for-sale debt securities held as of June 30, 2019, this ASU update would not have a material impact on the Company's financial statements.2020. See Note 16 and Note 4 for further discussion.

NOTE 3. REVENUE RECOGNITION

Product Revenue, Net

The Company sells ChenodalProduct sales consist of Bile Acid products (Chenodal and Cholbam (Kolbam), which are aggregated as bile acidCholbam) and Tiopronin products (Thiola and Thiola through direct-to-patient distributors.EC). The Company sells its products through direct-to-patient distributors worldwide, with more than 95% of the revenue generated in North America.

Revenues from product sales are recognized when the customer obtains control of the Company’s product, which occurs upon delivery to the customer. The Company receives payments from its product sales based on terms that generally are within 30 days of delivery of product to the patient.

Deductions from Revenue

Revenues from product sales are recorded at the net sales price, which includes provisions resulting from discounts, rebates and co-pay assistance that are offered to customers, health care providers, payors and other indirect customers relating to the Company’s sales of its products. These provisions are based on the amounts earned or to be claimed on the related sales and are classified as a reduction of accounts receivable (if the amount is payable to a customer) or as a current liability (if the amount is payable to a party other than a customer). Where appropriate, these reserves take into consideration the Company’s historical experience, current contractual and statutory requirements and specific known market events and trends, industry data and forecasted customer buying and payment patterns.trends. Overall, these reserves reflect the Company’s best estimates of the amount of consideration to which it is entitled based on the terms of the contract. If actual results in the future vary from the Company’s provisions, the Company will adjust the provision, which would affect net product revenue and earnings in the period such variances become known. Our historical experience is that such adjustments have been immaterial.

Government Rebates: We calculate the rebates that we will be obligated to provide to government programs and deduct these estimated amounts from our gross product sales at the time the revenues are recognized. Allowances for government rebates and discounts are established based on actual payer information, which is reasonably estimated at the time of delivery, and the government-mandated discounts applicable to government-funded programs. Rebate discounts are included in other current liabilities in the accompanying consolidated balance sheets.

Commercial Rebates: We calculate the rebates that we incur due to contracts with certain commercial payors and deduct these amounts from our gross product sales at the time the revenues are recognized. Allowances for commercial rebates are established based on actual payer information, which is reasonably estimated at the time of delivery. Rebate discounts are included in other current liabilities in the accompanying consolidated balance sheets.

Prompt Pay Discounts: We offer discounts to certain customers for prompt payments. We accrue for the calculated prompt pay discount based on the gross amount of each invoice for those customers at the time of sale.

Product Returns: Consistent with industry practice, we offer our customers a limited right to return product purchased directly from the Company, which is principally based upon the product’s expiration date. Generally, shipments are only made upon a patient prescription thus returns are minimal.

Co-pay Assistance: We offer a co-pay assistance program, which is intended to provide financial assistance to qualified commercially insured patients with prescription drug co-payments required by payors. The calculation of the accrual for co-pay assistance is based on an identification of claims and the cost per claim associated with product that has been recognized as revenue.

The following table summarizes net product revenues for the three and six months ended June 30, 20192020 and 20182019 (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | | | Six Months Ended June 30, | | |

| 2020 | | 2019 | | 2020 | | 2019 |

| Bile acid products | $ | 21,573 | | | $ | 20,929 | | | $ | 43,854 | | | $ | 39,319 | |

| Tiopronin products | 26,857 | | | 23,778 | | | 52,345 | | | 44,958 | |

| Total net product revenue | $ | 48,430 | | | $ | 44,707 | | | $ | 96,199 | | | $ | 84,277 | |

|

| | | | | | | | | | | | | | | |

| | Three Months Ended June 30, | | Six Months Ended June 30, |

| | 2019 | | 2018 | | 2019 | | 2018 |

| Bile acid products | $ | 20,929 |

| | $ | 18,594 |

| | $ | 39,319 |

|

| $ | 37,102 |

|

| Thiola | 23,778 |

| | 22,743 |

| | 44,958 |

|

| 42,667 |

|

| Total net product revenue | $ | 44,707 |

| | $ | 41,337 |

| | $ | 84,277 |

| | $ | 79,769 |

|

NOTE 4. MARKETABLEDEBT SECURITIES

The Company's marketabledebt securities as of June 30, 20192020 and December 31, 20182019 were comprised of available-for-sale marketablecorporate and govenrment debt securities. These securities which are carried at fair value, with the unrealized gains and losses reported in accumulated other comprehensive income (loss). Realized gains and losses and declines in value judged, unless an impairment is determined to be other-than-temporary, if any, on available-for-sale securities are included in other incomethe result of credit-related factors or expense. Interest and dividends on securities classified as available-for-sale are included in interest income.the Company intends to sell the security or it is more likely than not that the Company will be required to sell the security before recovery. The amortized cost of debt securities is adjusted for amortization of premiums and accretion of discounts to maturity. Such amortization and accretion is included in interest income. Realized gains and losses and declines in value that are determined to be the result of credit losses, if any, on available-for-sale securities are included in other income or expense. Unrealized losses that are determined to be credit-related are also recorded as an allowance against the amortized cost basis. The cost of securities sold is based on the specific identification method. Interest and dividends on securities classified as available-for-sale are included in interest income. All available-for-sale securities are classified as current assets, even if the maturity when acquired by the Company is greater than one year due to the ability to liquidate within the next 12 months.

During the six months ended June 30, 2019,2020, investment activity for the Company included $116.0$153.3 million in maturities and $94.8$36.7 million in purchases, all relating to debt based marketable securities.

MarketableDebt securities consisted of the following (in thousands):

| | | | June 30, 2019 | | December 31, 2018 | | June 30, 2020 | | December 31, 2019 |

| Commercial paper | $ | 43,675 |

| | $ | 59,255 |

| Commercial paper | $ | — | | | $ | 17,152 | |

| Corporate debt securities | 306,568 |

| | 299,413 |

| Corporate debt securities | 210,205 | | | 306,436 | |

| Securities of government sponsored entities | — |

| | 10,000 |

| Securities of government sponsored entities | 10,001 | | | 12,500 | |

| Total marketable securities: | $ | 350,243 |

| | $ | 368,668 |

| |

| Total debt securities: | | Total debt securities: | $ | 220,206 | | | $ | 336,088 | |

The following is a summary of short-term debt securities classified as available-for-sale as of June 30, 2020 (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Remaining Contractual Maturity

(in years) | | Amortized Cost | | Unrealized Gains | | Unrealized Losses | | Aggregate Estimated Fair Value |

| Commercial paper | Less than 1 | | $ | — | | | $ | — | | | $ | — | | | $ | — | |

| Corporate debt securities | Less than 1 | | 132,352 | | | 770 | | | — | | | 133,122 | |

| | | | | | | | | |

| Total maturity less than 1 year | | | 132,352 | | | 770 | | | — | | | 133,122 | |

| Corporate debt securities | 1 to 2 | | 76,244 | | | 848 | | | (9) | | | 77,083 | |

| Securities of government-sponsored entities | 1 to 2 | | 10,000 | | | 1 | | | — | | | 10,001 | |

| Total maturity 1 to 2 years | | | 86,244 | | | 849 | | | (9) | | | 87,084 | |

| Total available-for-sale securities | | | $ | 218,596 | | | $ | 1,619 | | | $ | (9) | | | $ | 220,206 | |

The following is a summary of short-term marketable securities classified as available-for-sale as of June 30, 2019 (in thousands): |

| | | | | | | | | | | | | | | | | |

| | Remaining Contractual Maturity

(in years) | | Amortized Cost | | Unrealized Gains | | Unrealized Losses | | Aggregate Estimated Fair Value |

| Commercial paper | Less than 1 | | $ | 43,632 |

| | $ | 43 |

| | $ | — |

| | $ | 43,675 |

|

| Corporate debt securities | Less than 1 | | 178,776 |

| | 315 |

| | (49 | ) | | 179,042 |

|

| Total maturity less than 1 year | | | 222,408 |

| | 358 |

| | (49 | ) | | 222,717 |

|

| Corporate debt securities | 1 to 2 | | 126,833 |

| | 700 |

| | (7 | ) | | 127,526 |

|

| Total maturity 1 to 2 years | | | 126,833 |

| | 700 |

| | (7 | ) | | 127,526 |

|

| Total available-for-sale securities | | | $ | 349,241 |

| | $ | 1,058 |

| | $ | (56 | ) | | $ | 350,243 |

|

The following is a summary of short-term marketabledebt securities classified as available-for-sale as of December 31, 20182019 (in thousands):

|

| | | | | | | | | | | | | | | | | |

| | Remaining Contractual Maturity (in years) | | Amortized Cost | | Unrealized Gains | | Unrealized Losses | | Aggregate Estimated Fair Value |

| Commercial paper | Less than 1 | | $ | 59,313 |

| | $ | — |

| | $ | (58 | ) | | $ | 59,255 |

|

| Corporate debt securities | Less than 1 | | 149,824 |

| | — |

| | (604 | ) | | 149,220 |

|

| Total maturity less than 1 year | | | 209,137 |

| | — |

| | (662 | ) | | 208,475 |

|

| Corporate debt securities | 1 to 2 | | 150,813 |

| | 18 |

| | (638 | ) | | 150,193 |

|

| Securities of government-sponsored entities | 1 to 2 | | 9,997 |

| | 4 |

| | (1 | ) | | 10,000 |

|

| Total maturity 1 to 2 years | | | 160,810 |

| | 22 |

| | (639 | ) | | 160,193 |

|

| Total available-for-sale securities | | | $ | 369,947 |

| | $ | 22 |

| | $ | (1,301 | ) | | $ | 368,668 |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Remaining Contractual Maturity

(in years) | | Amortized Cost | | Unrealized Gains | | Unrealized Losses | | Aggregate Estimated Fair Value |

| Commercial paper | Less than 1 | | $ | 17,136 | | | $ | 16 | | | $ | — | | | $ | 17,152 | |

| Corporate debt securities | Less than 1 | | 191,770 | | | 582 | | | (10) | | | 192,342 | |

| | | | | | | | | |

| Total maturity less than 1 year | | | 208,906 | | | 598 | | | (10) | | | 209,494 | |

| Corporate debt securities | 1 to 2 | | 113,799 | | | 351 | | | (56) | | | 114,094 | |

| Securities of government-sponsored entities | 1 to 2 | | 12,501 | | | — | | | (1) | | | 12,500 | |

| Total maturity 1 to 2 years | | | 126,300 | | | 351 | | | (57) | | | 126,594 | |

| Total available-for-sale securities | | | $ | 335,206 | | | $ | 949 | | | $ | (67) | | | $ | 336,088 | |

The primary objective of the Company’s investment portfolio is to enhance overall returns while preserving capital and liquidity. The Company’s investment policy limits interest-bearing security investments to certain types of instruments issued by institutions with primarily investment grade credit ratings and places restrictions on maturities and concentration by asset class and issuer. All available-for-sale securities are held in current assets regardless of contractual maturities exceeding one year, as the Company has the ability to sell them within the next twelve months.

The Company reviews the available-for-sale investmentsdebt securities for other-than-temporary declines in fair value below the cost basis each quarter and whenever events or changes in circumstances indicate that thequarter. For any security whose fair value is below its amortized cost basis, of an asset may not be recoverable. This evaluation is based on a number of factors, including the length of time and the extent to which the fair value has been below the cost basis and adverse conditions related specifically to the security, including any changes to the credit rating of the security, and the intentCompany first evaluates whether it intends to sell the impaired security, or whether the Company will otherwise be more likely than not be required to sell the security before recovery. If either are true, the amortized cost basis of the security is written down to its fair value at the reporting date. If neither circumstance holds true, the Company assesses whether any portion of the unrealized loss is a result of a credit loss. Any amount deemed to be attributable to credit loss is recognized in the income statement, with the amount of the loss limited to the difference between fair value and amortized cost and recorded as an allowance for credit losses. The portion of the unrealized loss related to factors other than credit losses is recognized in other comprehensive income (loss).

The following is a summary of available-for-sale debt securities in an unrealized loss position with no credit losses reported as of June 30, 2020 (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Less Than 12 Months | | | | 12 Months or Greater | | | | Total | | |

| Description of Securities | | Fair Value | | Unrealized Losses | | Fair Value | | Unrealized Losses | | Fair Value | | Unrealized Losses |

| Commercial paper | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | |

| Corporate debt securities | | 5,015 | | | 9 | | | — | | | — | | | 5,015 | | | 9 | |

| Securities of government-sponsored entities | | — | | | — | | | — | | | — | | | — | | | — | |

| Total | | $ | 5,015 | | | $ | 9 | | | $ | — | | | $ | — | | | $ | 5,015 | | | $ | 9 | |

The following is a summary of available-for-sale debt securities in an unrealized loss position with no credit losses reported as of December 31, 2019 (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Less Than 12 Months | | | | 12 Months or Greater | | | | Total | | |

| Description of Securities | | Fair Value | | Unrealized Losses | | Fair Value | | Unrealized Losses | | Fair Value | | Unrealized Losses |

| Commercial paper | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | |

| Corporate debt securities | | 74,151 | | | 64 | | | 7,509 | | | 2 | | | 81,660 | | | 66 | |

| Securities of government-sponsored entities | | 5,000 | | | 1 | | | — | | | — | | | 5,000 | | | 1 | |

| Total | | $ | 79,151 | | | $ | 65 | | | $ | 7,509 | | | $ | 2 | | | $ | 86,660 | | | $ | 67 | |

As of June 30, 2020 and December 31, 2019, the Company does not intend to sell these investments and it is not more likely than not that the Company will be required to sell the investments before recovery of itstheir amortized cost basis. The assessment of whether a security is other-than-temporarily impaired could changeCompany does not believe the unrealized losses incurred during the period are due to credit-related factors. Liquidity issues that arose from economic circumstances surrounding the COVID-19 pandemic have begun to ease and unrealized losses observed in the future duefirst quarter 2020 have been substantially recovered. The credit ratings of the securities held remain of the highest quality, and while certain securities in the portfolio may be downgraded momentarily, the Federal Reserve has allowed institutions to new developments or changes in assumptions relatedcontinue to any particular security. As of June 30, 2019 and December 31, 2018,issue debt where there is need, with the government itself purchasing such securities. Moreover, the Company believedcontinues to receive payments of interest and principal as they become due, and our expectation is that those payments will continue to be received timely. Uncertainty surrounding the cost basis for available-for-sale investments was recoverableCOVID-19 pandemic, as well as other factors unknown to us at this time, may cause actual results to differ and require adjustments to the Company’s estimates and assumptions in all material respects.the future.

NOTE 5. FUTURE ACQUISITION RIGHT AND JOINT DEVELOPMENT AGREEMENT

Censa Pharmaceuticals Inc.

In December 2017, the Company entered into a Future Acquisition Right and Joint Development Agreement (the “Option Agreement”) with Censa, which became effective in January 2018. The Company made an upfront payment of $10.0 million, agreed to fund certain development activities of Censa’s CNSA-001 program which were expected to be approximately $19.9 million through proof of concept, and paid $5.0 million related to a development milestone for the right, but not the obligation, to acquire Censa (the “Option”) on the terms and subject to the conditions set forth in a separate Agreement and Plan of Merger. The Company capitalized the upfront and milestone payments and expensed the development funding as incurred. The Company treated the upfront payment and milestone payment, both of which were consideration for the Option, as a cost-method investment with a carrying value of $15.0 million as of June 30, 2019.

Ifand expensed the Company had exercised the Option, the Company would have acquired Censa for an additional $65.0 million, which would have been reduced by up to $2.8 million of development funding ("creditable"), paid as a combination of 20% in cash and 80% in shares of the Company’s common stock, valued at a fixed price of $21.40 per share; provided, however, that Censa could have elected on behalf of its equity holders to receive the

upfront consideration in 100% cash if the average price per share of the Company’s common stock for the ten trading days ending on the date the Company provided notice of interest to exercise the Option was less than $19.26. In addition, if the Company had exercised the Option and acquired Censa, the Company would have been required to make further cash payments to Censa’s equity holders of up to an aggregate of $25.0 million if the CNSA-001 program had achieved specified development and commercial milestones.

The Company determined that Censa was a variable interest entity ("VIE"), and concluded that the Company was not the primary beneficiary of the VIE. As such, the Company did not consolidate Censa’s results into its consolidated financial statements.

The following table presents the Company’s development funding roll-forward through June 30, 2019 and its effect on the upfront consideration if the Company exercised the Option (in thousands):

|

| | | |

| | June 30, 2019 |

| Non-creditable development funding commitment | $ | 17,091 |

|

| Development funding creditable against purchase option | 2,831 |

|

| Total development funding | 19,922 |

|

| Development funding paid through June 30, 2019 | 19,308 |

|

| Development funding payable | $ | 614 |

|

In August 2019, following a strategic review of the CNSA-001 program in patients with phenylketonuria (PKU), the Company made the decision to decline to exercise its option to acquire Censa Pharmaceuticals and accordingly discontinue its joint development program for CNSA-001. The Company expects to impairwrote off the $15$15.0 million long term investment on the balance sheet during the third quarter of 2019.investment.

NOTE 6. LEASES

As of January 1, 2019 the Company adopted ASU No. 2016-02, Leases, using a modified retrospective basis method under which prior comparative periods are not restated.

The new standard establishes an ROU model that requires a lessee to record a ROU asset and a lease liability on the balance sheet for all leases with terms longer than 12 months. Leases will be classified as either finance or operating, with classification affecting the pattern of expense recognition in the income statement. In addition, the FASB issued ASU No. 2018-10, Codification Improvements to Topic 842, ASU No. 2018-11, Targeted Improvements, and ASU No. 2018-20, Narrow-Scope Improvements for Lessors, to clarify and amend the guidance in ASU No. 2016-02. The Company has elected the following as practical expedients from within these ASUs: 1) an entity need not reassess whether any expired or existing contractsare or contain leases, 2) an entity need not reassess the lease classification for any expired or existing leases, and 3) an entity need not reassess initial direct costsfor any existing leases.

As of January 1, 2019June 30, 2020, the Company had a singletwo operating leaseleases with Kilroy Realty, L.P. (the "Landlord") for its office space located in San Diego, California. The Company currently occupies the office space subject to the first lease, was originally signed in July 2016 wasand later amended in July 2017 and isMarch 2019. In April 2019, the Company entered into a second office lease with the Landlord, which was subsequently amended in May 2020, for approximately 45,000 square feet of office space in an adjacent buildings.building located in San Diego, California. The termCompany plans to consolidate its corporate headquarters into the new lease space beginning in late 2020 and into early 2021.

As a condition of the originalnew lease, isthe Company has been granted an existing premises continuation option to continue leasing all or a portion of the currently occupied office space, in addition to the new lease space. On February 7, years, 7 months, and is coterminous for all2020, the Company elected to forgo this continuation option by notifying the Landlord of its intention to vacate the premises of its existing lease. The abandonment of this leased office space, occurringwhich was originally scheduled to expire in July 2024. Under2024, coincides with the termsCompany’s expected occupancy of the new office lease space in the adjacent building per the office lease effective April 2019. The Company estimates that it will fully vacate the existing leases in the first quarter of 2021, through which time the Company is obligated to pay all base rent, operating expenses and other obligations due under the existing lease.

Coinciding with the notice delivered to the Landlord, the Company recorded an adjustment to the ROU asset and lease liability in February 2020 to reflect the impending expiration of the existing lease. The remeasurement of the lease liability resulted in a $7.0 million adjustment to the lease liability and ROU asset. A revised timing estimate resulted in the Company will pay base annual rent (subjectrecording an additional adjustment, resulting in a reduction of $0.5 million to an annual fixed percentage increase), plus property taxesthe related lease liability and other normal and necessary expenses, such as utilities, repairs, security and maintenance. Certain incentives were includedROU asset in the current quarter. The remeasured straight-line expense will be amortized over the revised lease including approximately $2.3 million in tenant improvement allowancesterm along with acceleration of related lease incentives.

The ROU asset and seven months of rent abatement. Thelease liability related to the new office lease will be established when the Company is granted access to the premises and has the rightability to extenddirect its use, which is expected to occur in phases over the remainder of 2020 as certain spaces become available, the timing of which may be impacted due to circumstances surrounding the COVID-19 pandemic. As such, the ROU asset for the new lease will be established prior to the extinguishment of the ROU asset and lease liability for five years.the existing lease, resulting in an overlap of ROU assets during the interim period between inception of the new lease and

the Company's remaining minimumexpiration of the old lease. In June 2020, the Landlord delivered possession of a portion of the new lease paymentsspace for the purpose of construction of leasehold improvements. Coinciding with our ability to direct the use of that space, and unamortized lease incentives were approximately $14.0 million and $1.8 million, respectively. Usingutilizing a discount rate equal to our borrowing rate of 7.7%6.7%, the Company has established a ROU asset totaling $8.9 million and a remaining termlease liability totaling $8.8 million. The ROU asset and lease liability are offset by lease incentives associated with tenant improvement allowances totaling $2.0 million. Establishment of 5 years, 7 months, the Company determined the ROU asset and lease liability as of adoption were $7.9 million and $11.3 million, respectively. There was no cumulative adjustment to our beginning accumulated deficit balance.

In March 2019, the company amended the existing office lease to add approximately 16,000 square feet of office space in adjacent buildings; 5,700 square feet has been occupied as of June 30, 2019. The total additional space is expected to be utilized through August 2020 and has future minimum lease payments of approximately $1.0 million. The Company determined the ROU asset and lease liability were each $0.4 million for the remaining spaces under the new lease space that has commenced and is occupied as of June 30, 2019.

On April 23, 2019, the Company entered into an office lease with an effective date of April 12, 2019 with Kilroy Realty, L.P. (the "Landlord") for the lease of 77,242 square feetwill occur upon delivery of the building located at 3611 Valley Centre Drive, San Diego, California. The Company expects to use the premises as its new principal corporate offices and plans to consolidate its corporate headquarters into the premises from the current location of multiple suites in adjacent buildings at 3721 and 3661 Valley Centre Drive, San Diego, California. Under the terms of the lease, the Company will have the one time right of first offer on the suites it currently occupies and a general right of first offer to lease additional space from the Landlord in the development. The commencement date of the lease is expected to be October 1, 2020. respective spaces.

The initial term of the new lease is 7 years, 7 months, and the Landlord has granted the Company an option to extend the term of the lease by a period of 5 years. The measurement of the lease term occurs from the planned occupancy date of the primary spaces estimated to be delivered in the latter part of 2020. The aggregate base rent due over the initial term under the terms of the lease is approximately $49.5 million, which consists of $13.0 million for the space delivered in June 2020, and $36.5 million.million for the primary spaces yet to be delivered.

Following is a schedule of the future minimum rental commitments for our operating lease, excluding commitments related to rental spaces not yet delivered, reconciled to the lease liability and ROU assets as of June 30, 20192020 (in thousands):

| | | | | |

| June 30, 2020 |

| 2020 | $ | 1,207 | |

| 2021 | 960 | |

| 2022 | 1,543 | |

| 2023 | 1,590 | |

| 2024 | 1,637 | |

| Thereafter | 6,435 | |

| Total undiscounted future minimum payments | 13,372 | |

| Lease incentives payable by lessor | (1,983) | |

| Present value discount | (3,121) | |

| Total lease liability | 8,268 | |

| Unamortized lease incentives, less incentives payable by lessor | (404) | |

| Cash payments in excess of straight-line lease expense | (952) | |

| Total ROU asset | $ | 6,912 | |

|

| | | |

| | June 30, 2019 |

|

| 2019 | $ | 1,318 |

|

| 2020 | 2,613 |

|

| 2021 | 2,486 |

|

| 2022 | 2,560 |

|

| 2023 | 2,637 |

|

| Thereafter | 1,585 |

|

| Total undiscounted future minimum payments | 13,199 |

|

| Present value discount | (2,278 | ) |

| Total lease liability | 10,921 |

|

| Lease incentives | (1,703 | ) |

| Straight line lease expense in excess of cash payments | (1,622 | ) |

| Total ROU asset | $ | 7,596 |

|

As of June 30, 2019, the current and non-current portions of2020, the ROU asset wereof $6.9 million was recorded to the Condensed Consolidated Balance Sheets as non-current Other Assets as follows (in thousands):.

|

| | | |

| | June 30, 2019 |

| Prepaid expenses and other current assets | $ | 2,170 |

|

| Other non-current assets | 5,426 |

|

| Total ROU asset | $ | 7,596 |

|

As of June 30, 2019,2020, the current and non-current portions of the lease liability were recorded to the Condensed Consolidated Balance Sheets as follows (in thousands):

| | | | | |

| June 30, 2020 |

| Other current liabilities | $ | 1,379 | |

| Other non-current liabilities | 6,889 | |

| Total lease liabilities | $ | 8,268 | |

|

| | | |

| | June 30, 2019 |

| Other current liabilities | $ | 2,674 |

|

| Other non-current liabilities | 8,247 |

|

| Total lease liabilities | $ | 10,921 |

|

For the three and six months ended June 30, 2020 and 2019, the Company recorded a $0.2 million credit to expense and 0, respectively, and $0.6 million and $1.3 million, respectively, in expense related to operating leases, respectively.leases.

NOTE 7. FAIR VALUE MEASUREMENTS

Financial Instruments and Fair Value

The Company accounts for financial instruments in accordance with ASC 820, Fair Value Measurements and Disclosures (“ASC 820”). ASC 820 establishes a fair value hierarchy that prioritizes the inputs to valuation techniques used to measure fair value. The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements). The three levels of the fair value hierarchy under ASC 820 are described below:

Level 1 – Unadjusted quoted prices in active markets that are accessible at the measurement date for identical, unrestricted assets or liabilities;

Level 2 – Quoted prices in markets that are not active or financial instruments for which all significant inputs are observable, either directly or indirectly; and

Level 3 – Prices or valuations that require inputs that are both significant to the fair value measurement and unobservable.

The valuation techniques used to measure the fair value of the Company’s marketabledebt securities and all other financial instruments, all of which have counter-parties with high credit ratings, were valued based on quoted market prices or model driven valuations using significant inputs derived from or corroborated by observable market data. Based on the fair value hierarchy, the Company classified marketabledebt securities within Level 2.