UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

þ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended March 31,September 30, 2018

OR

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission file number 000-54691

PHILLIPS EDISON & COMPANY, INC.

(Exact Name of Registrant as Specified in Its Charter)

|

| |

| Maryland | 27-1106076 |

(State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification No.) |

|

| |

11501 Northlake Drive Cincinnati, Ohio | 45249 |

| (Address of Principal Executive Offices) | (Zip Code) |

(513) 554-1110

(Registrant’s Telephone Number, Including Area Code)

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the Registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit and post such files). Yes þ No ¨

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). (Check one):

|

| | | |

| Large Accelerated Filer | ¨ | Accelerated Filer | ¨ |

| | | | |

| Non-Accelerated Filer | þ(Do not check if a smaller reporting company) | Smaller reporting company | ¨ |

| | | | |

| Emerging growth company | ¨ | | |

If an emerging growth company, indicate by check mark if the Registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No þ

As of April 30,October 31, 2018, there were 183.0184.0 million outstanding shares of common stock of the Registrant.

INDEX TO CONSOLIDATED FINANCIAL STATEMENTS

|

|

w PART I FINANCIAL INFORMATION |

ITEM 1. FINANCIAL STATEMENTS

PHILLIPS EDISON & COMPANY, INC.

CONSOLIDATED BALANCE SHEETS

AS OF MARCH 31,SEPTEMBER 30, 2018 AND DECEMBER 31, 2017

(Unaudited)

(In thousands, except per share amounts)

| | | | March 31, 2018 | | December 31, 2017 | September 30, 2018 | | December 31, 2017 |

| ASSETS | | | | | | |

| Investment in real estate: | | | | | | |

| Land and improvements | $ | 1,125,816 |

| | $ | 1,121,590 |

| $ | 1,115,232 |

| | $ | 1,121,590 |

|

| Building and improvements | 2,274,876 |

| | 2,263,400 |

| 2,253,804 |

| | 2,263,381 |

|

| Acquired in-place lease assets | 314,378 |

| | 313,432 |

| 308,575 |

| | 313,432 |

|

| Acquired above-market lease assets | 53,597 |

| | 53,524 |

| 53,161 |

| | 53,524 |

|

| Total investment in real estate assets | 3,768,667 |

| | 3,751,946 |

| 3,730,772 |

| | 3,751,927 |

|

| Accumulated depreciation and amortization | (504,912 | ) | | (462,025 | ) | (576,976 | ) | | (462,025 | ) |

| Total investment in real estate assets, net | 3,263,755 |

| | 3,289,921 |

| 3,153,796 |

| | 3,289,902 |

|

| Cash and cash equivalents | 14,690 |

| | 5,716 |

| 6,111 |

| | 5,716 |

|

| Restricted cash | 17,279 |

| | 21,729 |

| 27,828 |

| | 21,729 |

|

| Account receivable – affiliates | 6,935 |

| | 6,102 |

| |

| Accounts receivable – affiliates | | 6,365 |

| | 6,102 |

|

| Corporate intangible assets, net | 52,200 |

| | 55,100 |

| 46,400 |

| | 55,100 |

|

| Goodwill | 29,066 |

| | 29,066 |

| 29,066 |

| | 29,085 |

|

| Other assets, net | 135,102 |

| | 118,448 |

| 148,443 |

| | 118,448 |

|

| Total assets | $ | 3,519,027 |

| | $ | 3,526,082 |

| $ | 3,418,009 |

| | $ | 3,526,082 |

|

| | | | | | | |

| LIABILITIES AND EQUITY | |

| | |

| |

| | |

|

| Liabilities: | |

| | |

| |

| | |

|

| Debt obligations, net | $ | 1,834,829 |

| | $ | 1,806,998 |

| $ | 1,842,947 |

| | $ | 1,806,998 |

|

| Acquired below-market lease liabilities, net of accumulated amortization | | | | |

| of $29,946 and $27,388, respectively | 88,523 |

| | 90,624 |

| |

| Acquired below-market lease liabilities, net of accumulated amortization of $33,976 and | | | | |

| $27,388, respectively | | 82,235 |

| | 90,624 |

|

| Accounts payable – affiliates | 1,733 |

| | 1,359 |

| 1,014 |

| | 1,359 |

|

| Accounts payable and other liabilities | 132,670 |

| | 148,419 |

| 152,464 |

| | 148,419 |

|

| Total liabilities | 2,057,755 |

| | 2,047,400 |

| 2,078,660 |

| | 2,047,400 |

|

| Commitments and contingencies (Note 8) | — |

| | — |

| |

| Commitments and contingencies (Note 9) | | — |

| | — |

|

| Equity: | |

| | |

| |

| | |

|

| Preferred stock, $0.01 par value per share, 10,000 shares authorized, zero shares issued and | | | | |

| outstanding at March 31, 2018 and December 31, 2017, respectively | — |

| | — |

| |

| Common stock, $0.01 par value per share, 1,000,000 shares authorized, 186,027 and 185,233 | | | | |

| shares issued and outstanding at March 31, 2018 and December 31, 2017, respectively | 1,860 |

| | 1,852 |

| |

| Preferred stock, $0.01 par value per share, 10,000 shares authorized, zero shares issued | | | | |

| and outstanding at September 30, 2018 and December 31, 2017, respectively | | — |

| | — |

|

| Common stock, $0.01 par value per share, 1,000,000 shares authorized, 183,694 and 185,233 | | | | |

| shares issued and outstanding at September 30, 2018 and December 31, 2017, respectively | | 1,837 |

| | 1,852 |

|

| Additional paid-in capital | 1,638,176 |

| | 1,629,130 |

| 1,613,375 |

| | 1,629,130 |

|

| Accumulated other comprehensive income (“AOCI”) | 27,381 |

| | 16,496 |

| 33,602 |

| | 16,496 |

|

| Accumulated deficit | (634,164 | ) | | (601,238 | ) | (721,017 | ) | | (601,238 | ) |

| Total stockholders’ equity | 1,033,253 |

| | 1,046,240 |

| 927,797 |

| | 1,046,240 |

|

| Noncontrolling interests | 428,019 |

| | 432,442 |

| 411,552 |

| | 432,442 |

|

| Total equity | 1,461,272 |

| | 1,478,682 |

| 1,339,349 |

| | 1,478,682 |

|

| Total liabilities and equity | $ | 3,519,027 |

| | $ | 3,526,082 |

| $ | 3,418,009 |

| | $ | 3,526,082 |

|

See notes to consolidated financial statements.

PHILLIPS EDISON & COMPANY, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOMELOSS

FOR THE THREE AND NINE MONTHS ENDED MARCH 31,SEPTEMBER 30, 2018 AND 2017

(Unaudited)

(In thousands, except per share amounts)

| | | | Three Months Ended March 31, | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2018 | | 2017 | 2018 | | 2017 | | 2018 | | 2017 |

| Revenues: | | | | | | | | | | |

| Rental income | $ | 71,449 |

| | $ | 51,093 |

| $ | 71,770 |

| | $ | 53,165 |

| | $ | 216,072 |

| | $ | 157,425 |

|

| Tenant recovery income | 22,437 |

| | 16,936 |

| 23,884 |

| | 17,052 |

| | 67,878 |

| | 50,442 |

|

| Fees and management income | 8,712 |

| | — |

| 8,974 |

| | — |

| | 26,823 |

| | — |

|

| Other property income | 601 |

| | 274 |

| 271 |

| | 407 |

| | 1,498 |

| | 911 |

|

| Total revenues | 103,199 |

|

| 68,303 |

| 104,899 |

| | 70,624 |

| | 312,271 |

| | 208,778 |

|

| Expenses: | | | | |

| | |

| | | | |

| Property operating | 18,115 |

| | 11,432 |

| 19,276 |

| | 10,882 |

| | 54,292 |

| | 32,611 |

|

| Real estate taxes | 13,147 |

| | 10,258 |

| 12,873 |

| | 10,723 |

| | 39,346 |

| | 31,136 |

|

| General and administrative | 10,461 |

| | 7,830 |

| 13,579 |

| | 8,914 |

| | 37,490 |

| | 25,904 |

|

| Termination of affiliate arrangements | | — |

| | 5,454 |

| | — |

| | 5,454 |

|

| Depreciation and amortization | 46,427 |

| | 27,624 |

| 45,692 |

| | 28,650 |

| | 138,504 |

| | 84,481 |

|

| Impairment of real estate assets | | 16,757 |

|

| — |

|

| 27,696 |

|

| — |

|

| Total expenses | 88,150 |

|

| 57,144 |

| 108,177 |

| | 64,623 |

| | 297,328 |

| | 179,586 |

|

| Other: | | | | |

| | |

| | | | |

| Interest expense, net | (16,779 | ) | | (8,390 | ) | (17,336 | ) | | (10,646 | ) | | (51,166 | ) | | (28,537 | ) |

| Other expense, net | (107 | ) | | (1,635 | ) | |

| Net (loss) income | (1,837 | ) |

| 1,134 |

| |

| Net loss (income) attributable to noncontrolling interests | 237 |

| | (28 | ) | |

| Net (loss) income attributable to stockholders | $ | (1,600 | ) | | $ | 1,106 |

| |

| Transaction expenses | | — |

| | (3,737 | ) | | — |

| | (9,760 | ) |

| Gain on sale of property, net | | 4,571 |

| | — |

| | 5,556 |

| | — |

|

| Other (expense) income, net | | (224 | ) | | 6 |

| | (1,513 | ) | | 642 |

|

| Net loss | | (16,267 | ) |

| (8,376 | ) |

| (32,180 | ) |

| (8,463 | ) |

| Net loss attributable to noncontrolling interests | | 3,039 |

| | 144 |

| | 6,001 |

| | 144 |

|

| Net loss attributable to stockholders | | $ | (13,228 | ) |

| $ | (8,232 | ) |

| $ | (26,179 | ) |

| $ | (8,319 | ) |

| Earnings per common share: | | | | |

| | |

| | | | |

| Net (loss) income per share attributable to stockholders - basic and diluted | $ | (0.01 | ) |

| $ | 0.01 |

| |

| Net loss per share - basic and diluted | | $ | (0.07 | ) | | $ | (0.04 | ) | | $ | (0.14 | ) | | $ | (0.05 | ) |

| Weighted-average common shares outstanding: | | | | | | | | | | |

| Basic | 185,899 |

| | 183,230 |

| 183,699 |

| | 183,843 |

| | 184,676 |

| | 183,402 |

|

| Diluted | 230,352 |

| | 186,022 |

| 228,152 |

| | 186,492 |

| | 229,129 |

| | 186,141 |

|

| | | | | | | | | | | |

| Comprehensive income: | | | | |

| Net (loss) income | $ | (1,837 | ) | | $ | 1,134 |

| |

| Other comprehensive income: | | | | |

| Change in unrealized gain on interest rate swaps | 13,488 |

| | 1,816 |

| |

| Comprehensive income | 11,651 |

| | 2,950 |

| |

| Net loss (income) attributable to noncontrolling interests | 237 |

| | (28 | ) | |

| Other comprehensive income attributable to noncontrolling interests | (2,603 | ) | | — |

| |

| Comprehensive income attributable to stockholders | $ | 9,285 |

| | $ | 2,922 |

| |

| Comprehensive loss: | | |

| | |

| | | | |

| Net loss | | $ | (16,267 | ) | | $ | (8,376 | ) | | $ | (32,180 | ) | | $ | (8,463 | ) |

| Other comprehensive loss: | | |

| | |

| | | | |

| Change in unrealized gain (loss) on interest rate swaps | | 2,869 |

| | 49 |

| | 21,212 |

| | (741 | ) |

| Comprehensive loss | | (13,398 | ) | | (8,327 | ) | | (10,968 | ) | | (9,204 | ) |

| Net loss attributable to noncontrolling interests | | 3,039 |

| | 144 |

| | 6,001 |

| | 144 |

|

| Other comprehensive loss attributable to noncontrolling interests | | (517 | ) | | — |

| | (1,101 | ) | | — |

|

| Comprehensive loss attributable to stockholders | | $ | (10,876 | ) | | $ | (8,183 | ) | | $ | (6,068 | ) | | $ | (9,060 | ) |

See notes to consolidated financial statements.

PHILLIPS EDISON & COMPANY, INC.

CONSOLIDATED STATEMENTS OF EQUITY

FOR THE THREENINE MONTHS ENDED MARCH 31,SEPTEMBER 30, 2018 AND 2017

(Unaudited)

(In thousands, except per share amounts)

| | | | Common Stock | | Additional Paid-In Capital | | AOCI | | Accumulated Deficit | | Total Stockholders’ Equity | | Noncontrolling Interest | | Total Equity | Common Stock | | Additional Paid-In Capital | | AOCI | | Accumulated Deficit | | Total Stockholders’ Equity | | Noncontrolling Interest | | Total Equity |

| | Shares | | Amount | | Shares | | Amount | |

| Balance at January 1, 2017 | 185,062 |

| | $ | 1,851 |

| | $ | 1,627,098 |

| | $ | 11,916 |

| | $ | (439,484 | ) | | $ | 1,201,381 |

| | $ | 23,406 |

| | $ | 1,224,787 |

| 185,062 |

| | $ | 1,851 |

| | $ | 1,627,098 |

| | $ | 11,916 |

| | $ | (439,484 | ) | | $ | 1,201,381 |

| | $ | 23,406 |

| | $ | 1,224,787 |

|

| Share repurchases | (3,955 | ) | | (40 | ) | | (40,300 | ) | | — |

| | — |

| | (40,340 | ) | | — |

| | (40,340 | ) | (4,471 | ) | | (45 | ) | | (45,557 | ) | | — |

| | — |

| | (45,602 | ) | | — |

| | (45,602 | ) |

| Dividend reinvestment plan (“DRIP”) | 1,345 |

| | 14 |

| | 13,702 |

| | — |

| | — |

| | 13,716 |

| | — |

| | 13,716 |

| 3,546 |

| | 35 |

| | 36,136 |

| | — |

| | — |

| | 36,171 |

| | — |

| | 36,171 |

|

Change in unrealized gain on interest rate swaps | — |

| | — |

| | — |

| | 1,816 |

| | — |

| | 1,816 |

| | — |

| | 1,816 |

| |

Common distributions declared, $0.17 per share | — |

| | — |

| | — |

| | — |

| | (30,334 | ) | | (30,334 | ) | | — |

| | (30,334 | ) | |

Change in unrealized loss on interest rate swaps | | — |

| | — |

| | — |

| | (741 | ) | | — |

| | (741 | ) | | — |

| | (741 | ) |

Common distributions declared, $0.50 per share | | — |

| | — |

| | — |

| | — |

| | (92,037 | ) | | (92,037 | ) | | — |

| | (92,037 | ) |

| Distributions to noncontrolling interests | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | (465 | ) | | (465 | ) | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | (1,384 | ) | | (1,384 | ) |

| Share-based compensation | — |

| | — |

| | 15 |

| | — |

| | — |

| | 15 |

| | — |

| | 15 |

| 3 |

| | — |

| | 40 |

| | — |

| | — |

| | 40 |

| | — |

| | 40 |

|

| Net income | — |

| | — |

| | — |

| | — |

| | 1,106 |

| | 1,106 |

| | 28 |

| | 1,134 |

| |

| Balance at March 31, 2017 | 182,452 |

| | $ | 1,825 |

| | $ | 1,600,515 |

| | $ | 13,732 |

| | $ | (468,712 | ) | | $ | 1,147,360 |

| | $ | 22,969 |

| | $ | 1,170,329 |

| |

| Redemption of noncontrolling interest | | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | (4,179 | ) | | (4,179 | ) |

| Net loss | | — |

| | — |

| | — |

| | — |

| | (8,319 | ) | | (8,319 | ) | | (144 | ) | | (8,463 | ) |

| Balance at September 30, 2017 | | 184,140 |

| | $ | 1,841 |

| | $ | 1,617,717 |

| | $ | 11,175 |

| | $ | (539,840 | ) | | $ | 1,090,893 |

| | $ | 17,699 |

| | $ | 1,108,592 |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Balance at January 1, 2018 | 185,233 |

| | $ | 1,852 |

| | $ | 1,629,130 |

| | $ | 16,496 |

| | $ | (601,238 | ) | | $ | 1,046,240 |

| | $ | 432,442 |

| | $ | 1,478,682 |

| 185,233 |

| | $ | 1,852 |

| | $ | 1,629,130 |

| | $ | 16,496 |

| | $ | (601,238 | ) | | $ | 1,046,240 |

| | $ | 432,442 |

| | $ | 1,478,682 |

|

| Share repurchases | (366 | ) | | (4 | ) | | (4,011 | ) | | — |

| | — |

| | (4,015 | ) | | — |

| | (4,015 | ) | (4,511 | ) | | (45 | ) | | (49,589 | ) | | — |

| | — |

| | (49,634 | ) | | — |

| | (49,634 | ) |

| DRIP | 1,160 |

| | 12 |

| | 12,752 |

| | — |

| | — |

| | 12,764 |

| | — |

| | 12,764 |

| 2,967 |

| | 30 |

| | 32,661 |

| | — |

| | — |

| | 32,691 |

| | — |

| | 32,691 |

|

Change in unrealized gain on interest

rate swaps | — |

| | — |

| | — |

| | 10,885 |

| | — |

| | 10,885 |

| | 2,603 |

| | 13,488 |

| — |

| | — |

| | — |

| | 17,106 |

| | — |

| | 17,106 |

| | 4,106 |

| | 21,212 |

|

Common distributions declared, $0.17 per share | — |

| | — |

| | — |

| | — |

| | (31,326 | ) | | (31,326 | ) | | — |

| | (31,326 | ) | |

Common distributions declared, $0.50 per share | | — |

| | — |

| | — |

| | — |

| | (93,600 | ) | | (93,600 | ) | | — |

| | (93,600 | ) |

| Distributions to noncontrolling interests | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | (6,789 | ) | | (6,789 | ) | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | (21,379 | ) | | (21,379 | ) |

| Share-based compensation | — |

| | — |

| | 318 |

| | — |

| | — |

| | 318 |

| | — |

| | 318 |

| 5 |

| | — |

| | 1,329 |

| | — |

| | — |

| | 1,329 |

| | 2,384 |

| | 3,713 |

|

| Other | — |

| | — |

| | (13 | ) | | — |

| | — |

| | (13 | ) | | — |

| | (13 | ) | — |

| | — |

| | (156 | ) | | — |

| | — |

| | (156 | ) | | — |

| | (156 | ) |

| Net loss | — |

| | — |

| | — |

| | — |

| | (1,600 | ) | | (1,600 | ) | | (237 | ) | | (1,837 | ) | — |

| | — |

| | — |

| | — |

| | (26,179 | ) | | (26,179 | ) | | (6,001 | ) | | (32,180 | ) |

| Balance at March 31, 2018 | 186,027 |

| | $ | 1,860 |

| | $ | 1,638,176 |

| | $ | 27,381 |

| | $ | (634,164 | ) | | $ | 1,033,253 |

| | $ | 428,019 |

| | $ | 1,461,272 |

| |

| Balance at September 30, 2018 | | 183,694 |

| | $ | 1,837 |

| | $ | 1,613,375 |

| | $ | 33,602 |

| | $ | (721,017 | ) | | $ | 927,797 |

| | $ | 411,552 |

| | $ | 1,339,349 |

|

See notes to consolidated financial statements.

PHILLIPS EDISON & COMPANY, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

FOR THE THREENINE MONTHS ENDED MARCH 31,SEPTEMBER 30, 2018 AND 2017

(Unaudited)

| | | | 2018 | | 2017 | 2018 | | 2017 |

| CASH FLOWS FROM OPERATING ACTIVITIES: | | | | | | |

| Net (loss) income | $ | (1,837 | ) | | $ | 1,134 |

| |

| Adjustments to reconcile net (loss) income to net cash provided by operating activities: | |

| | |

| |

| Net loss | | $ | (32,180 | ) | | $ | (8,463 | ) |

| Adjustments to reconcile net loss to net cash provided by operating activities: | | |

| | |

|

| Depreciation and amortization | 42,040 |

| | 27,284 |

| 125,990 |

| | 83,200 |

|

| Impairment of real estate assets | | 27,696 |

| | — |

|

| Depreciation and amortization of corporate assets | | 11,137 |

| | — |

|

| Amortization of deferred financing expense | | 3,615 |

| | 3,572 |

|

| Net amortization of above- and below-market leases | (1,007 | ) | | (331 | ) | (2,967 | ) | | (972 | ) |

| Amortization of deferred financing expense | 1,226 |

| | 1,192 |

| |

| Depreciation and amortization of corporate assets | 4,128 |

| | — |

| |

| Net gain on write-off of unamortized capitalized leasing commissions, | | | | |

| market debt adjustments, and deferred financing expense | — |

| | (477 | ) | |

| Gain on sale of property, net | | (5,556 | ) | | — |

|

| Change in fair value of contingent liability | | 1,500 |

| | — |

|

| Straight-line rent | (1,057 | ) | | (493 | ) | (3,544 | ) | | (2,913 | ) |

| Share-based compensation | | 3,713 |

| | — |

|

| Other | 319 |

| | 36 |

| 846 |

| | (927 | ) |

| Changes in operating assets and liabilities: | |

| | |

| |

| | |

|

| Accounts receivable – affiliates | (833 | ) | | — |

| |

| Other assets | (3,556 | ) | | (6,929 | ) | (10,468 | ) | | (12,193 | ) |

| Accounts payable – affiliates | 374 |

| | 234 |

| |

| Accounts receivable and payable – affiliates | | (608 | ) | | 1 |

|

| Accounts payable and other liabilities | (16,287 | ) | | (1,194 | ) | 2,862 |

| | 6,217 |

|

| Net cash provided by operating activities | 23,510 |

|

| 20,456 |

| 122,036 |

|

| 67,522 |

|

| CASH FLOWS FROM INVESTING ACTIVITIES: | |

| | |

| |

| | |

|

| Real estate acquisitions | (8,374 | ) | | (16,069 | ) | (31,252 | ) | | (111,740 | ) |

| Capital expenditures | (8,593 | ) | | (5,457 | ) | (29,341 | ) | | (22,505 | ) |

| Proceeds from sale of real estate | 39 |

| | 250 |

| 44,338 |

| | 1,137 |

|

| Net cash used in investing activities | (16,928 | ) | | (21,276 | ) | (16,255 | ) | | (133,108 | ) |

| CASH FLOWS FROM FINANCING ACTIVITIES: | |

| | |

| |

| | |

|

| Net change in credit facility | (36,000 | ) | | 57,000 |

| (6,000 | ) | | 202,000 |

|

| Proceeds from mortgages and loans payable | 65,000 |

| | — |

| 65,000 |

| | — |

|

| Payments on mortgages and loans payable | (2,646 | ) | | (37,710 | ) | (24,751 | ) | | (64,287 | ) |

| Payments of deferred financing expenses | | (782 | ) | | (2,510 | ) |

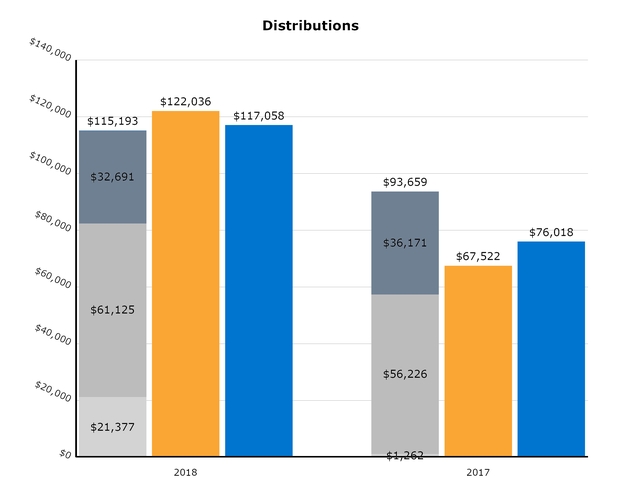

| Distributions paid, net of DRIP | (18,710 | ) | | (16,656 | ) | (61,125 | ) | | (56,226 | ) |

| Distributions to noncontrolling interests | (6,827 | ) | | (461 | ) | (21,377 | ) | | (1,262 | ) |

| Repurchases of common stock | (2,875 | ) | | (40,340 | ) | (50,252 | ) | | (44,682 | ) |

| Net cash used in financing activities | (2,058 | ) | | (38,167 | ) | |

| Redemption of noncontrolling interests | | — |

| | (4,179 | ) |

| Net cash (used in) provided by financing activities | | (99,287 | ) | | 28,854 |

|

| NET INCREASE (DECREASE) IN CASH, CASH EQUIVALENTS, AND RESTRICTED CASH | 4,524 |

| | (38,987 | ) | 6,494 |

| | (36,732 | ) |

| CASH, CASH EQUIVALENTS, AND RESTRICTED CASH: | |

| | |

| |

| | |

|

| Beginning of period | 27,445 |

| | 49,946 |

| 27,445 |

| | 49,946 |

|

| End of period | $ | 31,969 |

| | $ | 10,959 |

| $ | 33,939 |

| | $ | 13,214 |

|

| | | | | | | |

| RECONCILIATION TO CONSOLIDATED BALANCE SHEETS | | | | | | |

| Cash and cash equivalents | $ | 14,690 |

| | $ | 5,894 |

| $ | 6,111 |

| | $ | 7,189 |

|

| Restricted cash | 17,279 |

| | 5,065 |

| 27,828 |

| | 6,025 |

|

| Cash, cash equivalents, and restricted cash at end of period | $ | 31,969 |

| | $ | 10,959 |

| $ | 33,939 |

| | $ | 13,214 |

|

| | | | | |

| SUPPLEMENTAL CASH FLOW DISCLOSURE, INCLUDING NON-CASH INVESTING AND FINANCING ACTIVITIES: | | | |

| Cash paid for interest | $ | 15,792 |

| | $ | 8,178 |

| |

| Accrued capital expenditures | 2,252 |

| | 1,970 |

| |

| Change in accrued share repurchase obligation | 1,140 |

| | — |

| |

| Distributions reinvested | 12,764 |

| | 13,716 |

| |

|

| | | | | | | |

| | 2018 | | 2017 |

| SUPPLEMENTAL CASH FLOW DISCLOSURE, INCLUDING NON-CASH INVESTING AND FINANCING ACTIVITIES: | | |

| Cash paid for interest | $ | 49,157 |

| | $ | 26,461 |

|

| Fair value of assumed debt | — |

| | 30,832 |

|

| Capital leases | 739 |

| | — |

|

| Accrued capital expenditures | 2,881 |

| | 3,560 |

|

| Change in distributions payable | (216 | ) | | (360 | ) |

| Change in accrued share repurchase obligation | (618 | ) | | 920 |

|

| Distributions reinvested | 32,691 |

| | 36,171 |

|

See notes to consolidated financial statements.

Phillips Edison & Company, Inc.

Notes to Consolidated Financial Statements

(Unaudited)

Phillips Edison & Company, Inc. (“we,” the “Company,” “our,” or “us”) was formed as a Maryland corporation in October 2009. Substantially all of our business is conducted through Phillips Edison Grocery Center Operating Partnership I, L.P., (the “Operating Partnership”), a Delaware limited partnership formed in December 2009. We are a limited partner of the Operating Partnership, and our wholly owned subsidiary, Phillips Edison Grocery Center OP GP I LLC, is the sole general partner of the Operating Partnership.

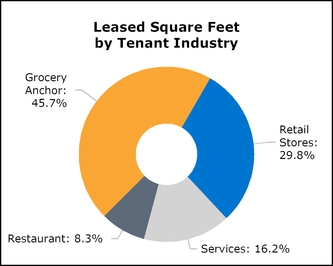

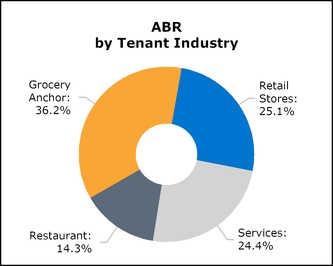

We invest primarily in well-occupied, grocery-anchored, neighborhood and community shopping centers that have a mix of creditworthy national and regional retailers that sell necessity-based goods and services in strong demographic markets throughout the United States. In addition to managing our own shopping centers, our third-party investment management business provides comprehensive real estate and asset management services to certain non-traded, publicly registered real estate investment trusts (“REITs”) and private funds (“Managed Funds”). The Managed Funds include Phillips Edison Grocery Center REIT II, Inc. (“REIT II”), Phillips Edison Grocery Center REIT III, Inc. (“REITPECO III”), Phillips Edison Limited Partnership (“PELP”), and Necessity Retail Partners (“NRP”).

As of March 31,September 30, 2018, we owned fee simple interests in 237233 real estate properties.

In July 2018 we entered into an Agreement and Plan of Merger (“Merger Agreement”) pursuant to which, subject to the satisfaction or waiver of certain conditions, we will merge with REIT II, and we will continue as the surviving corporation (“Merger”). To complete the proposed Merger, we will issue 2.04 shares of our common stock in exchange for each issued and outstanding share of REIT II common stock, subject to closing adjustments. For a more detailed discussion, see Note 3.

|

|

| 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES |

Certain of our accounting estimates are particularly important for an understanding of our financial position and results of operations and require the application of significant judgment by management. For example, significant estimates and assumptions have been made with respect to the useful lives of assets, recoverable amounts of receivables, and other fair value measurement assessments required for the preparation of the consolidated financial statements. As a result, these estimates are subject to a degree of uncertainty.

Other than those noted below, there have been no changes to our significant accounting policies during the threenine months ended March 31,September 30, 2018. For a full summary of our accounting policies, refer to our 2017 Annual Report on Form 10-K filed with the SEC on March 30, 2018.

Basis of Presentation and Principles of Consolidation—The accompanying consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”) for interim financial information and with instructions to Form 10-Q and Article 10 of Regulation S-X. Accordingly, they do not include all of the information and footnotes required by GAAP for complete financial statements. Readers of this Quarterly Report on Form 10-Q should refer to theour audited consolidated financial statements of Phillips Edison & Company, Inc. for the year ended December 31, 2017, which are included in our 2017 Annual Report on Form 10-K. In the opinion of management, all normal and recurring adjustments necessary for the fair presentation of the unaudited consolidated financial statements for the periods presented have been included in this Quarterly Report. Our results of operations for the three and nine months ended March 31,September 30, 2018, are not necessarily indicative of the operating results expected for the full year.

The accompanying consolidated financial statements include our accounts and those of our majority-owned subsidiaries. All intercompany balances and transactions are eliminated upon consolidation.

Income Taxes—Our consolidated financial statements include the operations of one wholly owned subsidiary that has jointly elected to be treated as a Taxable REIT Subsidiary (“TRS”) and is subject to U.S. federal, state, and local income taxes at regular corporate tax rates. As of March 31,September 30, 2018 and December 31, 2017, a full valuation allowance was recorded for the entire amount of the net deferred tax asset. During the three and nine months ended March 31,September 30, 2018, there was no income tax expense or benefit was reported as we recorded due to thea full valuation allowance and having afor our net operating loss. We are continuing to evaluate the impact of the 2017 Tax Cuts and Jobs Act (“2017 Tax Act”) on the organization as a whole, but we do not expect there to be a material impact on our consolidated financial statements.deferred tax asset.

Newly Adopted and Recently Issued Accounting Pronouncements—The following table provides a brief description of recent accounting pronouncements that could have a material effect on our consolidated financial statements: |

| | | | | | |

Standard | | Description | | Date of Adoption | | Effect on the Financial Statements or Other Significant Matters |

ASU 2016-02, Leases (Topic 842), ASU 2018-01, Leases (Topic 842): Land Easement Practical Expedient for

Transition to Topic 842

| | This update amends existing guidance by recognizing lease assets and lease liabilities on the balance sheet and disclosing key information about leasing arrangements.

In January 2018, the FASB issued ASU 2018-01, which includes amendments to clarify land easements are within the scope of the new leases standard (Topic 842). Early adoption is permitted as of the original effective date.

| | January 1, 2019 | | We are currently evaluating the impact the adoption of these standards will have on our consolidated financial statements. We have identified areas within our accounting policies we believe could be impacted by the new standard. This standard impacts the lessor’s ability to capitalize certain costs related to leasing, which will result in a reduction in the amount of execution costs currently being capitalized in connection with leasing activities and an increase to our Property Operating expenses.

In January 2018, the FASB issued a proposed ASU related to ASC 842. The update would allow lessors to use a practical expedient to account for non-lease components and related lease components as a single lease component instead of accounting for them separately, if certain conditions are met. This proposal is currently under consideration by regulators.

We also expect to recognize right of use assets on our consolidated balance sheets related to certain ground leases, office space, and office equipment leases where we are the lessee. We will continue to evaluate the effect the adoption of these ASUs will have on our consolidated financial statements. However, we currently believe that the adoption will not have a material impact for operating leases where we are a lessor and will continue to record revenues from rental properties for our operating leases on a straight-line basis. We are still evaluating the impact for leases where we are the lessee.

|

The following table provides a brief description of newly adopted accounting pronouncements and their effect on our consolidated financial statements: |

| | | | | | |

| Standard | | Description | | Date of Adoption | | Effect on the Financial Statements or Other Significant Matters |

| ASU 2017-09, Compensation - Stock Compensation (Topic 718): Scope of Modification Accounting | | This update clarifies guidance about which changes to the terms or conditions of a share-based payment award require an entity to apply modification accounting. | | January 1, 2018 | | The adoption of this standard did not have a material impact on our consolidated financial statements. We will apply the guidance to any future modifications of share-based compensation awards.

|

| ASU 2017-05, Other Income - Gains and Losses from the Derecognition of Nonfinancial Assets (Subtopic 610-20) | | This update amends existing guidance in order to provide consistency in accounting for the derecognition of a business or nonprofit activity.nonfinancial asset. | | January 1, 2018 | | We did not record any cumulative adjustment in connection with the adoption of the new pronouncement. We determined that these changes did not have any impact on our consolidated financial statements. |

| ASU 2017-04, Intangibles - Goodwill and Other: Simplifying the Test for Goodwill Impairment (Topic 350) | | This update amends existing guidance in order to simplify impairment testing for goodwill. It is effective for annual reporting periods beginning after January 1, 2021, but early adoption is permitted. | | January 1, 2018 | | We elected to adopt this standard as of January 1, 2018. The adoption of this standard did not have any impact on our consolidated financial statements. |

ASU 2016-15, Statement of Cash Flows (Topic 230); ASU 2016-18, Statement of Cash Flows (Topic 230) | | These updates address the presentation of eight specific cash receipts and cash payments on the statement of cash flows, as well as clarify the classification and presentation of restricted cash on the statement of cash flows. | | January 1, 2018 | | We adopted these ASUs by applying a retrospective transition method which requires a restatement of our consolidated statement of cash flows for all periods presented. |

|

| | | | | | |

| ASU 2014-09, Revenue from Contracts with Customers (Topic 606) | | This update outlines a comprehensive model for entities to use in accounting for revenue arising from contracts with customers. ASU 2014-09 states that “an entity recognizes revenue to depict the transfer of promised goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods or services.” While ASU 2014-09 specifically references contracts with customers, it also applies to certain other transactions such as the sale of real estate or equipment. Expanded quantitative and qualitative disclosures are also required for contracts subject to ASU 2014-09. | | January 1, 2018 | | Our revenue-producing contracts are primarily leases that are not within the scope of this standard. As a result, the adoption of this standard did not have a material impact on our rental or reimbursement revenue. However, the standard does apply to a majority of our fees and management income. We have evaluated the impact of this standard on our fees and management income; it did not have a material impact on our revenue recognition, but we have provided additional disclosures around fees and management revenue. We adopted this guidance on a modified retrospective basis. |

The following table provides a brief description of recent accounting pronouncements that could have a material effect on our consolidated financial statements: |

| | | | | | |

| Standard | | Description | | Date of Adoption | | Effect on the Financial Statements or Other Significant Matters |

| ASU 2018-13, Fair Value Measurement (Topic 820) | | This ASU eliminates, adds and modifies certain disclosure requirements for fair value measurements as part of the FASB’s disclosure framework project. Early adoption is permitted.

| | January 1, 2020 | | We are currently evaluating the impact the adoption of these standards will have on our consolidated financial statements. |

| ASU 2018-07, Compensation - Stock Compensation (Topic 718): Improvements to Non-employee Share-Based Payment Accounting | | The amendments in this update expand the scope of Topic 718: Compensation—Stock Compensation to include share-based payment transactions for acquiring goods and services from non-employees, except for specific guidance on inputs to an option pricing model and the attribution of cost (that is, the period of time over which share-based payment awards vest and the pattern of cost recognition over that period). This update is effective for public business entities for fiscal years beginning after December 15, 2018. Early adoption is permitted. | | January 1, 2019 | | We are currently evaluating the impact the adoption of this standard will have on our consolidated financial statements. |

| ASU 2016-13, Financial Instruments - Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments | | The amendments in this update replace the incurred loss impairment methodology in current GAAP with a methodology that reflects expected credit losses and requires consideration of a broader range of reasonable and supportable information to inform credit loss estimates. This update is effective for public entities in fiscal years beginning after December 15, 2019, and interim periods within those fiscal years. Early adoption is permitted after December 15, 2018. | | January 1, 2020 | | We are currently evaluating the impact the adoption of this standard will have on our consolidated financial statements. |

|

| | | | | | |

| Standard | | Description | | Date of Adoption | | Effect on the Financial Statements or Other Significant Matters |

ASU 2016-02, Leases (Topic 842);

ASU 2018-01, Leases (Topic 842): Land Easement Practical Expedient for Transition to Topic 842;

ASU 2018-10, Codification Improvements to Topic 842, Leases; and

ASU 2018-11, Leases (Topic 842): Targeted Improvements | | These updates amend existing guidance by recognizing lease assets and lease liabilities on the balance sheet and disclosing key information about leasing arrangements. Early adoption is permitted as of the original effective date. | | January 1, 2019 | | We are currently evaluating the impact the adoption of these standards will have on our consolidated financial statements. We have identified areas within our accounting policies we believe could be impacted by the new standard. This standard impacts the lessor’s ability to capitalize certain costs related to leasing, which will result in a reduction in the amount of execution costs currently being capitalized in connection with leasing activities and an increase to our Property Operating expenses. The standard will also require new disclosures within the accompanying notes to the consolidated financial statements.

We expect to adopt the practical expedients available for implementation under the standard. By adopting these practical expedients, we will not be required to reassess (i) whether an expired or existing contract meets the definition of a lease; (ii) the lease classification at the adoption date for existing leases; and (iii) whether the costs previously capitalized as initial direct costs would continue to be amortized. This allows us to continue to account for our leases where we are the lessee as operating leases, however, any new or renewed leases may be classified as financing leases. We currently have fewer than 50 leases of this type. We also expect to recognize right of use assets and lease liability on our consolidated balance sheets related to certain leases where we are the lessee.

In July 2018, the FASB issued ASU 2018-11. The update allows lessors to use a practical expedient to account for non-lease components and related lease components as a single lease component instead of accounting for them separately, if certain conditions are met. We expect to utilize this practical expedient.

We will continue to evaluate the effect the adoption of these ASUs will have on our consolidated financial statements. However, we currently believe that the adoption will not have a material impact for operating leases where we are a lessor and will continue to record revenues from rental properties for our operating leases on a straight-line basis. We are still evaluating the impact for leases where we are the lessee. |

Reclassifications—The following line itemitems on our consolidated statementstatements of operations and comprehensive income (loss) for the three and nine months ended March 31,September 30, 2017, waswere reclassified:

Unrealized (Loss) Gain (Loss) on Derivatives and Reclassification of Derivative Loss to Interest Expense were combined to Change in Unrealized Gain (Loss) on Interest Rate Swaps.

Acquisition Expenses were combined to General and Administrative.

The following line items on our consolidated statements of cash flows for the nine months ended September 30, 2017 were reclassified:

Net Loss (Gain) on Write-off of Unamortized Capitalized Leasing Commissions, Market Debt Adjustments, and Deferred Financing Expense was combined to Other.

|

|

| 3. PROPOSED MERGER WITH REIT II |

In July 2018, we entered into the Merger Agreement, pursuant to which we will merge with REIT II in a 100% stock transaction valued at approximately $1.9 billion. This proposed Merger will create a portfolio of approximately 320 grocery-anchored shopping centers encompassing more than 36 million square feet in established trade areas across 33 states.

To complete the proposed Merger, we will issue 2.04 shares of our common stock in exchange for each issued and outstanding share of REIT II common stock, which is equivalent to $22.54 based on our most recent estimated net asset value per share (“EVPS”) of $11.05. The exchange ratio is based on a thorough review of the relative valuation of each entity, including factoring in our growing investment management business as well as each company’s transaction costs. REIT II’s outstanding debt of approximately $800 million is expected to be refinanced or assumed by us at closing under the terms of the Merger Agreement.

The Merger Agreement provides certain termination rights for REIT II and us. In connection with the termination of the Merger Agreement, under certain specified circumstances, REIT II may be required to pay us a termination fee of $31.7 million and we may be required to pay REIT II a termination fee of $75.6 million. The Merger Agreement provided REIT II with a 30-day go-shop period pursuant to which they could solicit, receive, evaluate, and enter into negotiations with respect to alternative proposals from third-parties. The go-shop period ended during the third quarter.

On a pro forma basis, upon completion of the Merger, we estimate that our continuing stockholders will own approximately 71% of the issued and outstanding shares of the combined company on a fully diluted basis (determined as if each Operating Partnership unit (“OP unit”) were exchanged for one share of our common stock), and former REIT II stockholders will own approximately 29% of the issued and outstanding shares of the combined company on a fully diluted basis (determined as if each OP unit were exchanged for one share of our common stock).

After consideration of all applicable factors pursuant to the business combination accounting rules under ASC 805, Business Combinations, including the application of a screen test to evaluate if substantially all the fair value of the acquired properties is concentrated in a single asset or group of similar assets, we have concluded that the Merger will be treated as an asset acquisition under GAAP. As of September 30, 2018, we have deferred for capitalization $2.8 million in costs related to the merger.

On October 4, 2017, we completed a transaction to acquire certain real estate assets, the third-party investment management business, and the captive insurance company of PELP in a stock and cash transaction (“PELP transaction”). Under the terms of this transaction, the following consideration was given in exchange for the contribution of PELP’s ownership interests in 76 shopping centers, its third-party investment management business, and its captive insurance company (in thousands): | | | | Amount | Amount |

| Fair value of Operating Partnership units (“OP units”) issued | $ | 401,630 |

| |

| Fair value of OP units issued | | $ | 401,630 |

|

| Debt assumed: | | |

| Corporate debt | 432,091 |

| 432,091 |

|

| Mortgages and notes payable | 72,649 |

| 72,649 |

|

| Cash payments | 30,420 |

| 30,420 |

|

| Fair value of earn-out | 38,000 |

| 38,000 |

|

| Total consideration | 974,790 |

| 974,790 |

|

| PELP debt repaid by the Company on the transaction date | (432,091 | ) | (432,091 | ) |

| Net consideration | $ | 542,699 |

| $ | 542,699 |

|

We issued 39.4 million OP units with an estimated fair value per unit of $10.20 at the time of the transaction. Certain of our executive officers who received OP units as part of the PELP transaction entered into an agreement which provides that they will not transfer their OP units for either two or three years following the closing. The remaining holders of the OP units are subject to the terms of exchange for shares of common stock outlined in the Operating Partnership’s Third Amended and Restated Agreement of Limited Partnership (“Partnership Agreement”) (see Note 9)10). The terms of the PELP transaction includeincluded an earn-out structure with an opportunity for up to an additional 12.5 million OP units to be issued. For more detail regarding this earn-out, see Note 13.14.

Immediately following the closing of the PELP transaction, our shareholdersstockholders owned approximately 80.6% and former PELP shareholdersstockholders owned approximately 19.4% of the combined company.

Assets Acquired and Liabilities Assumed—The PELP transaction was accounted for using the acquisition method of accounting under ASC 805, Business Combinations, which requires, among other things, the assets acquired and liabilities assumed to be recognized at their fair values as of the acquisition date. The preliminary fair market value of the assets acquired and liabilities assumed was based on a valuation report prepared by a third-party valuation specialist that was subject to management’s review and approval. The following table summarizes the purchase price allocation based on that report (in thousands): |

| | | |

| | Amount |

| Assets: | |

| Land and improvements | $ | 269,140 |

|

| Building and improvements | 574,173 |

|

| Intangible lease assets | 93,506 |

|

| Cash | 5,930 |

|

| Accounts receivable and other assets | 42,426 |

|

| Management contracts | 58,000 |

|

| Goodwill | 29,066 |

|

| Total assets acquired | 1,072,241 |

|

| Liabilities: | |

| Accounts payable and other liabilities | 48,342 |

|

| Acquired below-market leases | 49,109 |

|

| Total liabilities acquired | 97,451 |

|

| Net assets acquired | $ | 974,790 |

|

The allocation of the purchase price was based on management’s assessment, which may change in the future as more information becomes available and could have an impact on the unaudited pro forma financial information presented below. Subsequent adjustments made to the purchase price allocation upon the completion of our fair value assessment process will not exceed one year from the acquisition date. The allocation of the purchase price above required a significant amount of judgment and represented management’s best estimate of the fair value as of the acquisition date.

Intangible Assets and Liabilities—The fair value and weighted-average amortization periods for the intangible assets and liabilities acquired in the PELP transaction as of the transaction date were as follows (dollars in thousands, useful life in years): |

| | | | |

| | Fair Value | Weighted-Average Useful Life |

| Management contracts | $ | 58,000 |

| 5 |

| Acquired in-place leases | 83,305 |

| 9 |

| Acquired above-market leases | 10,201 |

| 7 |

| Acquired below-market leases | (49,109 | ) | 13 |

Goodwill—In connection with the PELP transaction, we recorded goodwill of $29.1 million as a result of the consideration exceeding the fair value of the net assets acquired. Goodwill represents the estimated future benefits arising from other assets acquired that could not be individually identified and separately recognized. We do not expect that the goodwill will be deductible for tax purposes. The goodwill recorded represents our management structure and its ability to generate additional opportunities for revenue and raise additional funds, and therefore the full amount of goodwill was allocated to the Investment Management segment, which comprises one reporting unit. For more information about each of our reporting segments, see Note 14.15.

Results of Operations—The consolidated net assets and results of operations of PELP’s contributions were included in the consolidated financial statements from the transaction date going forward and resulted in the following impact to Total RevenuesRevenue and Net Loss for the three and nine months ended March 31,September 30, 2018 (in thousands): |

| | | |

| | 2018 |

| Revenues | $ | 21,470 |

|

| Net income | 1,302 |

|

|

| | | | | | | |

| | Three Months Ended September 30, 2018 | | Nine Months Ended September 30, 2018 |

| Revenue | $ | 20,943 |

| | $ | 63,894 |

|

| Net loss | (16,464 | ) | | (24,999 | ) |

Acquisition Costs—We incurred approximately $17.0 million of costs related to the PELP transaction, $1.6$9.8 million of which was incurred during the threenine months ended March 31,September 30, 2017, and was recorded in Other Expense, Netas Transaction Expenses on the consolidated statements of operations. No costs related to the PELP transaction were recorded in 2018.

Pro Forma Results (Unaudited)—The following unaudited pro forma information summarizes selected financial information from our combined results of operations, as if the PELP transaction had occurred on January 1, 2016. These results contain certain nonrecurring adjustments, such as the elimination of transaction expenses incurred related to the PELP transaction and the elimination of intercompany activity related to creating an internalized management structure. This pro forma information is presented for informational purposes only, and may not be indicative of what actual results of operations would have been had the PELP transaction occurred at the beginning of the period, nor does it purport to represent the results of future operations. | | | | For the Three Months Ended March 31, | | | | | |

| (in thousands) | 2017 | Three Months Ended September 30, 2017 | | Nine Months Ended September 30, 2017 |

| Pro forma revenues | $ | 98,679 |

| $ | 98,679 |

| | $ | 300,133 |

|

| Pro forma net income attributable to stockholders | 799 |

| 799 |

| | 2,063 |

|

|

|

4.5. REAL ESTATE ACQUISITIONSACTIVITY |

Acquisitions—During the threenine months ended March 31,September 30, 2018, we acquired onetwo grocery-anchored shopping centercenters. The first quarter acquisition closed out the Internal Revenue Code (“IRC”) Section 1031 like-kind exchange outstanding at December 31, 2017. We also acquired one land parcel adjacent to a property we currently own for $8.4$0.7 million. During the threenine months ended March 31,September 30, 2017, we acquired onesix grocery-anchored shopping center for $15.0 million. Neithercenters. All of thesethe 2017 and 2018 acquisitions were considered business combinations, but rather were classified as asset acquisitions. As such, most acquisition-related costs were capitalized and are included in the total purchase prices shown below. Our real estate assets acquired during the nine months ended September 30, 2018, acquisition closed outwere as follows (dollars in thousands): |

| | | | | | | | | | | | | |

| Property Name | | Location | | Anchor Tenant | | Acquisition Date | | Purchase Price | | Leased % of Rentable Square Feet at Acquisition |

| Shoppes of Lake Village | | Leesburg, FL | | Publix | | 2/26/2018 | | $ | 8,423 |

| | 71.3 | % |

| Sierra Vista Plaza | | Murrieta, CA | | Stater Brothers(1) | | 9/28/2018 | | 22,151 |

| | 81.0 | % |

| |

(1) | Stater Brothers is in a portion of the shopping center that we do not own. |

During the Internal Revenue Code (“IRC”) Section 1031 like-kind exchange outstanding at December 31, 2017.nine months ended September 30, 2017, we acquired the following real estate assets (dollars in thousands): |

| | | | | | | | | | | | | |

| Property Name | | Location | | Anchor Tenant | | Acquisition Date | | Purchase Price | | Leased % of Rentable Square Feet at Acquisition |

| Atwater Marketplace | | Atwater, CA | | Save Mart | | 2/10/2017 | | $ | 15,041 |

| | 94.6 | % |

| Rocky Ridge Station | | Roseville, CA | | Sprouts | | 4/18/2017 | | 37,271 |

| (1) | 96.3 | % |

| Greentree Station | | Racine, WI | | Pick ‘n Save | | 5/5/2017 | | 12,309 |

| | 90.3 | % |

| Titusville Station | | Titusville, FL | | Publix | | 6/15/2017 | | 13,817 |

| | 71.7 | % |

| Sierra Station | | Corona, CA | | Ralph’s | | 6/20/2017 | | 29,137 |

| (1) | 94.0 | % |

| Hoffman Village Station | | Hoffman Estates, IL | | Mariano’s | | 9/5/2017 | | 34,910 |

| | 93.1 | % |

| |

(1) | The purchase price includes the fair value of debt assumed as part of the acquisition. |

The fair value at acquisition and weighted-average amortization periodsuseful life for in-place, above-market, and below-market lease intangibles acquired as part of the above transactions during the threenine months ended March 31,September 30, 2018 and 2017, are as follows (dollars in thousands, weighted-average useful life in years): | | | | 2018 | | 2017 | 2018 | | 2017 |

| | Fair Value | | Weighted-Average Useful Life | | Fair Value | | Weighted-Average Useful Life | Fair Value | | Weighted-Average Useful Life | | Fair Value | | Weighted-Average Useful Life |

| Acquired in-place leases | $ | 946 |

| | 6 | | $ | 1,817 |

| | 15 | $ | 2,319 |

| | 6 | | $ | 13,647 |

| | 13 |

| Acquired above-market leases | 74 |

| | 3 | | 110 |

| | 4 | 200 |

| | 5 | | 1,012 |

| | 7 |

| Acquired below-market leases | (457 | ) | | 16 | | (593 | ) | | 24 | (1,299 | ) | | 14 | | (3,703 | ) | | 19 |

Dispositions—During the nine months ended September 30, 2018, we sold five grocery-anchored shopping centers for $45.6 million resulting in a gain of $5.6 million. We had no dispositions during the nine months ended September 30, 2017.

Impairment of Real Estate Assets—During the three and nine months ended September 30, 2018, we recognized impairment charges totaling $16.8 million and $27.7 million, respectively. The impairments were associated with certain anticipated property dispositions where the net book value exceeded the estimated fair value, as well as certain properties that we determined to be impaired following the identification of potential operational impairment indicators. Our estimated fair value was based upon the contracted price to sell, the marketed price for disposition, or comparable market assets when neither of the first two inputs were available. We have applied reasonable estimates and judgments in determining the level of impairments recognized. We did not recognize any impairments in 2017.

The following is a summary of Other Assets, Net outstanding as of March 31,September 30, 2018 and December 31, 2017 (in thousands): | | | | March 31, 2018 | | December 31, 2017 | September 30, 2018 | | December 31, 2017 |

| Other Assets, Net: | | | | |

| Other assets, net: | | | | |

| Deferred leasing commissions and costs | $ | 30,932 |

| | $ | 29,055 |

| $ | 33,491 |

| | $ | 29,055 |

|

| Deferred financing costs | 13,971 |

| | 13,971 |

| 13,971 |

| | 13,971 |

|

| Office equipment, including capital lease assets, and other | 11,512 |

| | 10,308 |

| 13,117 |

| | 10,308 |

|

| Total depreciable and amortizable assets | 56,415 |

| | 53,334 |

| 60,579 |

| | 53,334 |

|

| Accumulated depreciation and amortization | (19,677 | ) | | (17,121 | ) | (23,678 | ) | | (17,121 | ) |

| Net depreciable and amortizable assets | 36,738 |

| | 36,213 |

| 36,901 |

| | 36,213 |

|

| Accounts receivable, net | 39,732 |

| | 41,211 |

| 37,025 |

| | 41,211 |

|

| Deferred rent receivable, net | 19,281 |

| | 18,201 |

| 21,594 |

| | 18,201 |

|

| Derivative asset | 29,984 |

| | 16,496 |

| 37,708 |

| | 16,496 |

|

| Prepaid expenses | 7,455 |

| | 4,232 |

| 8,015 |

| | 4,232 |

|

| Investment in affiliates | 902 |

| | 902 |

| 903 |

| | 902 |

|

| Other | 1,010 |

| | 1,193 |

| 6,297 |

| | 1,193 |

|

| Total other assets, net | $ | 135,102 |

| | $ | 118,448 |

| $ | 148,443 |

| | $ | 118,448 |

|

The following is a summary of the outstanding principal balances and interest rates, which include the effect of derivative financial instruments, on our debt obligations as of March 31,September 30, 2018 and December 31, 2017 (in(dollars in thousands): | | | | Interest Rate | | March 31, 2018 | | December 31, 2017 | Interest Rate | | September 30, 2018 | | December 31, 2017 |

Revolving credit facility(1) | LIBOR + 1.40% | | $ | 25,569 |

| | $ | 61,569 |

| LIBOR + 1.40% | | $ | 55,568 |

| | $ | 61,569 |

|

Term loans(3)(2) | 2.51%-3.93% | | 1,205,000 |

| | 1,140,000 |

| 2.51% - 3.93% | | 1,205,000 |

| | 1,140,000 |

|

| Secured loan facility due 2026 | 3.55% | | 175,000 |

| | 175,000 |

| 3.55% | | 175,000 |

| | 175,000 |

|

| Secured loan facility due 2027 | 3.52% | | 195,000 |

| | 195,000 |

| 3.52% | | 195,000 |

| | 195,000 |

|

| Mortgages and other | 3.75%-7.91% | | 244,310 |

| | 246,217 |

| |

Mortgages and other(3) | | 3.75% - 7.91% | | 222,205 |

| | 246,217 |

|

Assumed market debt adjustments, net(4) | | 4,983 |

| | 5,254 |

| | 4,211 |

| | 5,254 |

|

Deferred financing costs(5) | | (15,033 | ) | | (16,042 | ) | | (14,037 | ) | | (16,042 | ) |

| Total | | $ | 1,834,829 |

| | $ | 1,806,998 |

| | $ | 1,842,947 |

| | $ | 1,806,998 |

|

| |

(1) | The gross borrowings and payments under our revolving credit facility were $55.0219.0 million and $91.0225.0 million, respectively, during the threenine months ended March 31,September 30, 2018. The revolving credit facility hadhas a capacity of $500 million as of March 31, 2018andDecember 31, 2017. The revolving credit facility matures in October 2021, with additional options to extend the maturity to October 2022. |

| |

(2) | We have six term loans with maturities ranging from 2019 to 2024. The $100 million term loan maturingdue in February 2019 has options to extend the maturity to 2021. We will consider options for refinancing the loan or exercising the option upon maturity. As of March 31,September 30, 2018, the availability on our revolving credit facility exceeded the balance on the loan maturing in 2019.loan. The $175 million term loan maturingdue in 2020 also has options to extend its maturity to 2021. We executed a $65 million delayed draw in January 2018 on one of our term loans that originated in October 2017. |

| |

(3) | Due to the non-recourse nature of our fixed-rate mortgages, the assets and liabilities of the properties securing such mortgages are neither available to pay the debts of the consolidated property-holding limited liability companies, nor do they constitute obligations of such consolidated limited liability companies as of March 31,September 30, 2018 and December 31, 2017. |

| |

(4) | Net of accumulated amortization of $4.0 million and $3.7 million as of March 31,September 30, 2018 and December 31, 2017, respectively. |

| |

(5) | Net of accumulated amortization of $6.37.9 million and $5.4 million as of March 31,September 30, 2018 and December 31, 2017, respectively. |

As of March 31,September 30, 2018 and December 31, 2017, the weighted-average interest rate, including the effect of derivative financial instruments, for all of our debt obligations was 3.5% and 3.4%., respectively.

The allocation of total debt between fixed- and variable-rate as well as between secured and unsecured, excluding market debt adjustments and deferred financing costs, as of March 31,September 30, 2018 and December 31, 2017, is summarized below (in thousands): | | | | March 31, 2018 | | December 31, 2017 | September 30, 2018 | | December 31, 2017 |

As to interest rate:(1) | | | | | | |

| Fixed-rate debt | $ | 1,606,311 |

| | $ | 1,608,217 |

| $ | 1,584,205 |

| | $ | 1,608,217 |

|

| Variable-rate debt | 238,568 |

| | 209,569 |

| 268,568 |

| | 209,569 |

|

| Total | $ | 1,844,879 |

| | $ | 1,817,786 |

| $ | 1,852,773 |

| | $ | 1,817,786 |

|

| As to collateralization: | | | | | | |

| Unsecured debt | $ | 1,230,569 |

| | $ | 1,202,476 |

| $ | 1,261,180 |

| | $ | 1,202,476 |

|

| Secured debt | 614,310 |

| | 615,310 |

| 591,593 |

| | 615,310 |

|

| Total | $ | 1,844,879 |

| | $ | 1,817,786 |

| $ | 1,852,773 |

| | $ | 1,817,786 |

|

| |

(1) | Includes the effects of derivative financial instruments (see Notes 78 and 1314). |

|

|

7.8. DERIVATIVES AND HEDGING ACTIVITIES |

Risk Management Objective of Using Derivatives—We are exposed to certain risks arising from both our business operations and economic conditions. We principally manage our exposure to a wide variety of business and operational risks through management of our core business activities. We manage economic risks, including interest rate, liquidity, and credit risk, primarily by managing the amount, sources, and duration of our debt funding and the use of derivative financial instruments. Specifically, we enter into interest rate swaps to manage exposures that arise from business activities that result in the receipt or payment of future known and uncertain cash amounts, the value of which are determined by interest rates. Our derivative financial instruments are used to manage differences in the amount, timing, and duration of our known or expected cash receipts and our known or expected cash payments principally related to our investments and borrowings.

Cash Flow Hedges of Interest Rate Risk—Interest rate swaps designated as cash flow hedges involve the receipt of variable amounts from a counterparty in exchange for our making fixed-rate payments over the life of the agreements without exchange of the underlying notional amount.

The change in the fair value of derivatives designated, and that qualify, as cash flow hedges is recorded in AOCI and is subsequently reclassified into earnings in the period that the hedged forecasted transaction affects earnings. During the threenine months ended March 31,September 30, 2018 and 2017, such derivatives were used to hedge the variable cash flows associated with certain variable-rate debt. The ineffectiveness previously reported in earnings for the period ended September 30, 2017, was adjusted to reflect application of the provisions of ASU 2017-12, Derivatives and Hedging (Topic 815), as of the beginning of 2017. This adjustment was not material.

Amounts reported in AOCI related to these derivatives will be reclassified to Interest Expense, Net as interest payments are made on the variable-rate debt. During the next twelve months, we estimate that an additional $4.9$8.8 million will be reclassified from Other Comprehensive Income (“OCI”) as a decrease to Interest Expense, Net.

The following is a summary of our interest rate swaps that were designated as cash flow hedges of interest rate risk as of March 31,September 30, 2018 and December 31, 2017 (notional amount in thousands): |

| | | | | | | |

| | March 31, 2018 | | December 31, 2017 |

| Count | 6 |

| | 6 |

|

| Notional amount | $ | 992,000 |

| | $ | 992,000 |

|

| Fixed LIBOR | 1.2% - 2.2% |

| | 1.2% - 2.2% |

|

| Maturity date | 2019-2024 |

| | 2019-2024 |

|

|

| | | | | |

| Count | Fixed LIBOR | Maturity Date | Notional Amount |

| 6 | 1.2% - 2.2% | 2019-2024 | $ | 992,000 |

|

The table below details the location of the gain or loss recognized on interest rate derivatives designated as cash flow hedges in the consolidated statements of operations and comprehensive income (loss) for the three and nine months ended March 31,September 30, 2018 and 2017 (in thousands): |

| | | | | | | |

| | 2018 | | 2017 |

| Amount of gain recognized in OCI on derivative | $ | 13,440 |

| | $ | 1,219 |

|

| Amount of loss reclassified from AOCI into interest expense | 48 |

| | 597 |

|

|

| | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2018 | | 2017 | | 2018 | | 2017 |

Amount of gain (loss) recognized in OCI on derivative(1) | $ | 4,061 |

| | $ | (179 | ) | | $ | 23,107 |

| | $ | (1,944 | ) |

Amount of (gain) loss reclassified from AOCI into interest expense(1) | (1,192 | ) | | 228 |

| | (1,895 | ) | | 1,203 |

|

Credit-risk-related Contingent Features—We have agreements with our derivative counterparties that contain provisions where, if we either default or are capable of being declared in default on any of our indebtedness, we could also be declared to be in default on our derivative obligations. As of March 31, 2018, the fair value, and thus the termination value if we were to breach any agreement provisions, of our derivatives in a net liability position was approximately $24,000. The fair value includes accrued interest but excludes any adjustment for nonperformance risk related to these agreements. As of March 31, 2018, we had not posted any collateral related to these agreements and were not in breach of any agreement provisions. | |

(1) | Increases in gains are solely driven from changes in LIBOR and LIBOR futures. |

|

|

8.9. COMMITMENTS AND CONTINGENCIES |

Litigation—We are involved in various claims and litigation matters arising in the ordinary course of business, some of which involve claims for damages. Many of these matters are covered by insurance, although they may nevertheless be subject to deductibles or retentions. Although the ultimate liability for these matters cannot be determined, based upon information currently available, we believe the resolution of such claims and litigation will not have a material adverse effect on our consolidated financial statements.

Environmental Matters—In connection with the ownership and operation of real estate, we may potentially be liable for costs and damages related to environmental matters. In addition, we may own or acquire certain properties that are subject to environmental remediation. Generally, the seller of the property, the tenant of the property, and/or another third party is responsible for environmental remediation costs related to a property. Additionally, in connection with the purchase of certain properties, the respective sellers and/or tenants may agree to indemnify us against future remediation costs. We also carry environmental liability insurance on our properties that provides limited coverage for any remediation liability and/or pollution liability for third-party bodily injury and/or property damage claims for which we may be liable. We are not aware of any environmental matters which we believe are reasonably likely to have a material effect on our consolidated financial statements.

On May 9, 2018, our board of directors (“Board”) increased the estimated value per shareEVPS of our common stock to $11.05 based substantially on the estimated market value of our portfolio of real estate properties and our third-party investment management business as of March 31, 2018. We engaged a third-party valuation firm to provide a calculation of the range in estimated value per shareEVPS of our common stock as of March 31, 2018, which reflected certain balance sheet assets and liabilities as of that date. Previously, on November 8, 2017, our Board increased the estimated value per shareEVPS of our common stock to $11.00 from $10.20 based substantially on the estimated market value of our portfolio of real estate properties and our third-party investment management business as of October 5, 2017, the first full business day after the closing of the PELP transaction.

Shares of our common stock are issued under the DRIPDividend Reinvestment Plan (the “DRIP”) and redeemed under the Share Repurchase Program (“SRP”), as discussed below, at the same price as the estimated value per shareEVPS in effect at the time of issuance or redemption.

Dividend Reinvestment Plan—The DRIP allows stockholders to invest distributions in additional shares of our common stock. Stockholders who elect to participate in the DRIP, and who are subject to U.S. federal income taxation laws, will incur a tax liability on an amount equal to the fair value on the relevant distribution date of the shares of our common stock purchased with reinvested distributions, even though such stockholders have elected not to receive the distributions in cash. In connection with the proposed Merger (see Note 3), the DRIP was temporarily suspended for the month of July 2018; therefore, all DRIP participants received their July 2018 distribution in cash rather than in stock. The DRIP plan resumed in August 2018, with the distribution paid in September 2018.

Share Repurchase Program—Our SRP provides an opportunity for stockholders to have shares of common stock repurchased, subject to certain restrictions and limitations. The Board reserves the right, in its sole discretion, at any time and

from time to time, to reject any request for repurchase. Further, the cash available for repurchases on any particular date will generally be limited to the proceeds from the DRIP during the preceding four fiscal quarters, less amounts already used for repurchases since the beginning of that period. In connection with the Merger, the SRP was also temporarily suspended for the month of July 2018 and resumed in August 2018.

During the threenine months ended March 31,September 30, 2018, repurchase requests surpassed the funding limits under the SRP. In April 2018, approximately 3.4Approximately 4.5 million shares of our common stock were repurchased under our SRP.the SRP during the nine months ended September 30, 2018. Repurchase requests in connection with a stockholder’s death, “qualifying disability,” or “determination of incompetence” were completed in full. The remaining repurchase requests that were in good order were fulfilled on a pro rata basis. FollowingDue to the April 2018program's funding limits, no funds will be available for the remainder of 2018. However, we will continue to fulfill repurchases sought upon a stockholder's death, “qualifying disability,” or “determination of incompetence” in accordance with the terms of the SRP.

In connection with the proposed Merger, the combined company will be required to reset its share repurchase we had 11.9 million sharesqueue. As a result, all SRP requests currently on file will be canceled on the date the Merger closes. All stockholders wishing to participate in the SRP after the Merger must submit a new SRP form to the transfer agent, DST, after the Merger to be included in the next standard repurchase of unfulfilledthe combined company. All standard repurchase requests must be on file and in good order to be included for next standard repurchase of the combined company, which is expected to be in July 2019. At that time, should the demand for standard redemptions exceed the funding available for repurchases, the combined company is expected to make pro-rata redemptions. Following that standard repurchase, standard repurchase requests that are on file with the combined company and in good order that have not been fully executed (due to pro-rata redemptions), will be treated as requestsremain on file for repurchase during future months until satisfied or withdrawn.redemptions.

Convertible Noncontrolling Interests—As part of the PELP transaction, we issued 39.4 million OP units that are classified as Noncontrolling Interests. Prior to the PELP transaction, the Operating Partnership also issued limited partnership units that were designated as Class B units for asset management services provided by our former advisor. Upon closing of the PELP transaction, all outstanding Class B units vested and were converted to OP units.

Under the terms of the Third Amended and RestatedPartnership Agreement, of Limited Partnership, OP unit holders may elect to exchange OP units. The Operating Partnership controls the form of the redemption, and may elect to exchange OP units for shares of our common stock, provided that the

OP units have been outstanding for at least one year. As the form of redemption for OP units is within our control, the OP units outstanding as of March 31,September 30, 2018 and December 31, 2017,, are classified as Noncontrolling Interests within permanent equity on our consolidated balance sheets. The cumulative distributions that have been paid on OP units are included in Distributions to Noncontrolling Interests on the consolidated statements of equity. There were 44.5 million OP units outstanding as of March 31,September 30, 2018 and December 31, 2017.

Nonconvertible Noncontrolling Interests—In addition to partnership units of the Operating Partnership, Noncontrolling Interests also includes a 25% ownership share of one of our subsidiaries who provides advisory services, which was not significant to our results.

|

|

10.11. EARNINGS PER SHARE |

We use the two-class method of computing earnings per share (“EPS”), which is an earnings allocation formula that determines EPS for common stock and any participating securities according to dividends declared (whether paid or unpaid). Under the two-class method, basic EPS is computed by dividing the income availableNet Loss Attributable to common stockholdersStockholders by the weighted-average number of shares of common stock outstanding for the period. Diluted EPS reflects the potential dilution that could occur from share equivalent activity.

OP units held by limited partners other than us are considered to be participating securities because they contain non-forfeitable rights to dividends or dividend equivalents, and have the potential to be exchanged for an equal number of shares of our common stock in accordance with the terms of the Partnership Agreement. Phantom stock units, which are restricted stock awards received by employees under our Amended and Restated 2010 Long Term Incentive Plan, are not considered participating securities, as they are not convertible into common stock.

The impact of OP units on basic and diluted EPS has been calculated using the two-class method whereby earnings are allocated to the OP units based on dividends declared and the units’ participation rights in undistributed earnings. The effects of the two-class method on basic and diluted EPS were immaterial to the consolidated financial statements as of March 31,September 30, 2018 and 2017.