UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

þ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended September 30, 2018March 31, 2019

OR

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission file number 000-54691

PHILLIPS EDISON & COMPANY, INC.

(Exact Name of Registrant as Specified in Its Charter)

|

| |

| Maryland | 27-1106076 |

(State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification No.) |

|

| |

11501 Northlake Drive Cincinnati, Ohio | 45249 |

| (Address of Principal Executive Offices) | (Zip Code) |

(513) 554-1110

(Registrant’s Telephone Number, Including Area Code)

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted, pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit such files). Yes þ No ¨

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). (Check one):Act.

|

| | | |

Large Accelerated Fileraccelerated filer | ¨ | Accelerated Filerfiler | ¨ |

| | | | |

Non-Accelerated FilerNon-accelerated filer | þ | Smaller reporting company | ¨ |

| | | | |

| | Emerging growth company | ¨ | | |

If an emerging growth company, indicate by check mark if the Registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No þ

Securities registered pursuant to Section 12(b) of the Act:

|

| | | | |

| Title of each class | | Trading Symbol | | Name of each exchange on which registered |

| None | | None | | None |

As of October 31, 2018,May 1, 2019, there were 184.0282.9 million outstanding shares of common stock of the Registrant.

INDEX TO CONSOLIDATED FINANCIAL STATEMENTSPHILLIPS EDISON & COMPANY, INC.

FORM 10-Q

TABLE OF CONTENTS

|

|

w PART I FINANCIAL INFORMATION |

ITEM 1. FINANCIAL STATEMENTS

PHILLIPS EDISON & COMPANY, INC.

CONSOLIDATED BALANCE SHEETS

AS OF SEPTEMBER 30, 2018MARCH 31, 2019 AND DECEMBER 31, 20172018

(Unaudited)

(In thousands, except per share amounts)

| | | | September 30, 2018 | | December 31, 2017 | March 31,

2019 | | December 31,

2018 |

| ASSETS | | | | | | |

| Investment in real estate: | | | | | | |

|

| Land and improvements | $ | 1,115,232 |

| | $ | 1,121,590 |

| $ | 1,592,232 |

| | $ | 1,598,063 |

|

| Building and improvements | 2,253,804 |

| | 2,263,381 |

| 3,234,798 |

| | 3,250,420 |

|

| Acquired in-place lease assets | 308,575 |

| | 313,432 |

| |

| Acquired above-market lease assets | 53,161 |

| | 53,524 |

| |

| In-place lease assets | | 461,805 |

| | 464,721 |

|

| Above-market lease assets | | 66,747 |

| | 67,140 |

|

| Total investment in real estate assets | 3,730,772 |

| | 3,751,927 |

| 5,355,582 |

| | 5,380,344 |

|

| Accumulated depreciation and amortization | (576,976 | ) | | (462,025 | ) | (619,874 | ) | | (565,507 | ) |

| Net investment in real estate assets | | 4,735,708 |

| | 4,814,837 |

|

| Investment in unconsolidated joint ventures | | 43,998 |

| | 45,651 |

|

| Total investment in real estate assets, net | 3,153,796 |

| | 3,289,902 |

| 4,779,706 |

| | 4,860,488 |

|

| Cash and cash equivalents | 6,111 |

| | 5,716 |

| 12,684 |

| | 16,791 |

|

| Restricted cash | 27,828 |

| | 21,729 |

| 74,074 |

| | 67,513 |

|

| Accounts receivable – affiliates | 6,365 |

| | 6,102 |

| 5,958 |

| | 5,125 |

|

| Corporate intangible assets, net | 46,400 |

| | 55,100 |

| 13,116 |

| | 14,054 |

|

| Goodwill | 29,066 |

| | 29,085 |

| 29,066 |

| | 29,066 |

|

| Other assets, net | 148,443 |

| | 118,448 |

| 136,680 |

| | 153,076 |

|

| Real estate investment and other assets held for sale | | 5,764 |

| | 17,364 |

|

| Total assets | $ | 3,418,009 |

| | $ | 3,526,082 |

| $ | 5,057,048 |

| | $ | 5,163,477 |

|

| | | | | | | |

| LIABILITIES AND EQUITY | |

| | |

| |

| | |

|

| Liabilities: | |

| | |

| |

| | |

|

| Debt obligations, net | $ | 1,842,947 |

| | $ | 1,806,998 |

| $ | 2,415,762 |

| | $ | 2,438,826 |

|

| Acquired below-market lease liabilities, net of accumulated amortization of $33,976 and | | | | |

| $27,388, respectively | 82,235 |

| | 90,624 |

| |

| Accounts payable – affiliates | 1,014 |

| | 1,359 |

| |

| Below-market lease liabilities, net | | 127,988 |

| | 131,559 |

|

| Earn-out liability | | 32,000 |

| | 39,500 |

|

| Deferred income | | 12,096 |

| | 14,025 |

|

| Accounts payable and other liabilities | 152,464 |

| | 148,419 |

| 119,742 |

| | 126,074 |

|

| Liabilities of real estate investment held for sale | | 275 |

| | 596 |

|

| Total liabilities | 2,078,660 |

| | 2,047,400 |

| 2,707,863 |

| | 2,750,580 |

|

| Commitments and contingencies (Note 9) | — |

| | — |

| |

| Commitments and contingencies (Note 10) | | — |

| | — |

|

| Equity: | |

| | |

| |

| | |

|

| Preferred stock, $0.01 par value per share, 10,000 shares authorized, zero shares issued | | | | | | |

| and outstanding at September 30, 2018 and December 31, 2017, respectively | — |

| | — |

| |

| Common stock, $0.01 par value per share, 1,000,000 shares authorized, 183,694 and 185,233 | | | | |

| shares issued and outstanding at September 30, 2018 and December 31, 2017, respectively | 1,837 |

| | 1,852 |

| |

| and outstanding at March 31, 2019 and December 31, 2018, respectively | | — |

| | — |

|

| Common stock, $0.01 par value per share, 1,000,000 shares authorized, 281,549 and 279,803 | | | | |

| shares issued and outstanding at March 31, 2019 and December 31, 2018, respectively | | 2,815 |

| | 2,798 |

|

| Additional paid-in capital | 1,613,375 |

| | 1,629,130 |

| 2,693,946 |

| | 2,674,871 |

|

| Accumulated other comprehensive income (“AOCI”) | 33,602 |

| | 16,496 |

| |

| Accumulated other comprehensive (loss) income (“AOCI”) | | (61 | ) | | 12,362 |

|

| Accumulated deficit | (721,017 | ) | | (601,238 | ) | (745,740 | ) | | (692,045 | ) |

| Total stockholders’ equity | 927,797 |

| | 1,046,240 |

| 1,950,960 |

| | 1,997,986 |

|

| Noncontrolling interests | 411,552 |

| | 432,442 |

| 398,225 |

| | 414,911 |

|

| Total equity | 1,339,349 |

| | 1,478,682 |

| 2,349,185 |

| | 2,412,897 |

|

| Total liabilities and equity | $ | 3,418,009 |

| | $ | 3,526,082 |

| $ | 5,057,048 |

| | $ | 5,163,477 |

|

See notes to consolidated financial statements.

PHILLIPS EDISON & COMPANY, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS(LOSS) INCOME

FOR THE THREE AND NINE MONTHS ENDED SEPTEMBER 30,MARCH 31, 2019 AND 2018 AND 2017

(Unaudited)

(In thousands, except per share amounts)

| | | | Three Months Ended September 30, | | Nine Months Ended September 30, | Three Months Ended March 31, |

| | 2018 | | 2017 | | 2018 | | 2017 | 2019 | | 2018 |

| Revenues: | | | | | | | | | | |

| Rental income | $ | 71,770 |

| | $ | 53,165 |

| | $ | 216,072 |

| | $ | 157,425 |

| $ | 128,860 |

| | $ | 93,886 |

|

| Tenant recovery income | 23,884 |

| | 17,052 |

| | 67,878 |

| | 50,442 |

| |

| Fees and management income | 8,974 |

| | — |

| | 26,823 |

| | — |

| 3,261 |

| | 8,712 |

|

| Other property income | 271 |

| | 407 |

| | 1,498 |

| | 911 |

| 648 |

| | 601 |

|

| Total revenues | 104,899 |

| | 70,624 |

| | 312,271 |

| | 208,778 |

| 132,769 |

| | 103,199 |

|

| Expenses: | |

| | |

| | | | | | | |

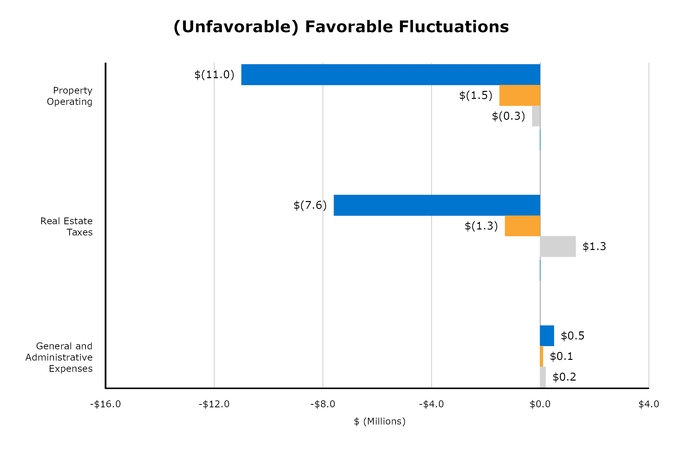

| Property operating | 19,276 |

| | 10,882 |

| | 54,292 |

| | 32,611 |

| 22,866 |

| | 18,115 |

|

| Real estate taxes | 12,873 |

| | 10,723 |

| | 39,346 |

| | 31,136 |

| 17,348 |

| | 13,147 |

|

| General and administrative | 13,579 |

| | 8,914 |

| | 37,490 |

| | 25,904 |

| 13,285 |

| | 10,461 |

|

| Termination of affiliate arrangements | — |

| | 5,454 |

| | — |

| | 5,454 |

| |

| Depreciation and amortization | 45,692 |

| | 28,650 |

| | 138,504 |

| | 84,481 |

| 60,989 |

| | 46,427 |

|

| Impairment of real estate assets | 16,757 |

|

| — |

|

| 27,696 |

|

| — |

| 13,717 |

|

| — |

|

| Total expenses | 108,177 |

| | 64,623 |

| | 297,328 |

| | 179,586 |

| 128,205 |

| | 88,150 |

|

| Other: | |

| | |

| | | | | | | |

| Interest expense, net | (17,336 | ) | | (10,646 | ) | | (51,166 | ) | | (28,537 | ) | (25,009 | ) | | (16,779 | ) |

| Transaction expenses | — |

| | (3,737 | ) | | — |

| | (9,760 | ) | |

| Gain on sale of property, net | 4,571 |

| | — |

| | 5,556 |

| | — |

| |

| Other (expense) income, net | (224 | ) | | 6 |

| | (1,513 | ) | | 642 |

| |

| Gain on disposal of property, net | | 7,121 |

| | — |

|

| Other income (expense), net | | 7,536 |

| | (107 | ) |

| Net loss | (16,267 | ) |

| (8,376 | ) |

| (32,180 | ) |

| (8,463 | ) | (5,788 | ) |

| (1,837 | ) |

| Net loss attributable to noncontrolling interests | 3,039 |

| | 144 |

| | 6,001 |

| | 144 |

| 593 |

| | 237 |

|

| Net loss attributable to stockholders | $ | (13,228 | ) |

| $ | (8,232 | ) |

| $ | (26,179 | ) |

| $ | (8,319 | ) | $ | (5,195 | ) |

| $ | (1,600 | ) |

| Earnings per common share: | |

| | |

| | | | | | | |

| Net loss per share - basic and diluted | $ | (0.07 | ) | | $ | (0.04 | ) | | $ | (0.14 | ) | | $ | (0.05 | ) | |

| Weighted-average common shares outstanding: | | | | | | | | |

| Basic | 183,699 |

| | 183,843 |

| | 184,676 |

| | 183,402 |

| |

| Diluted | 228,152 |

| | 186,492 |

| | 229,129 |

| | 186,141 |

| |

| Net loss per share attributable to stockholders - basic and diluted (See Note 13) | | $ | (0.02 | ) | | $ | (0.01 | ) |

| | | | | | | | | | | |

| Comprehensive loss: | |

| | |

| | | | | |

| Comprehensive (loss) income: | | | | |

| Net loss | $ | (16,267 | ) | | $ | (8,376 | ) | | $ | (32,180 | ) | | $ | (8,463 | ) | $ | (5,788 | ) | | $ | (1,837 | ) |

| Other comprehensive loss: | |

| | |

| | | | | |

| Change in unrealized gain (loss) on interest rate swaps | 2,869 |

| | 49 |

| | 21,212 |

| | (741 | ) | |

| Comprehensive loss | (13,398 | ) | | (8,327 | ) | | (10,968 | ) | | (9,204 | ) | |

| Other comprehensive (loss) income: | | | | |

| Change in unrealized value on interest rate swaps | | (14,361 | ) | | 13,488 |

|

| Comprehensive (loss) income | | (20,149 | ) | | 11,651 |

|

| Net loss attributable to noncontrolling interests | 3,039 |

| | 144 |

| | 6,001 |

| | 144 |

| 593 |

| | 237 |

|

| Other comprehensive loss attributable to noncontrolling interests | (517 | ) | | — |

| | (1,101 | ) | | — |

| |

| Comprehensive loss attributable to stockholders | $ | (10,876 | ) | | $ | (8,183 | ) | | $ | (6,068 | ) | | $ | (9,060 | ) | |

| Comprehensive loss (income) attributable to noncontrolling interests | | 1,938 |

| | (2,603 | ) |

| Comprehensive (loss) income attributable to stockholders | | $ | (17,618 | ) | | $ | 9,285 |

|

See notes to consolidated financial statements.

PHILLIPS EDISON & COMPANY, INC.

CONSOLIDATED STATEMENTS OF EQUITY

FOR THE NINETHREE MONTHS ENDED SEPTEMBER 30,MARCH 31, 2019 AND 2018 AND 2017

(Unaudited)

(In thousands, except per share amounts)

| | | | Common Stock | | Additional Paid-In Capital | | AOCI | | Accumulated Deficit | | Total Stockholders’ Equity | | Noncontrolling Interest | | Total Equity | Common Stock | | Additional Paid-In Capital | | AOCI | | Accumulated Deficit | | Total Stockholders’ Equity | | Noncontrolling Interest | | Total Equity |

| | Shares | | Amount | | Shares | | Amount | |

| Balance at January 1, 2017 | 185,062 |

| | $ | 1,851 |

| | $ | 1,627,098 |

| | $ | 11,916 |

| | $ | (439,484 | ) | | $ | 1,201,381 |

| | $ | 23,406 |

| | $ | 1,224,787 |

| |

| Balance at January 1, 2018 | | 185,233 |

| | $ | 1,852 |

| | $ | 1,629,130 |

| | $ | 16,496 |

| | $ | (601,238 | ) | | $ | 1,046,240 |

| | $ | 432,442 |

| | $ | 1,478,682 |

|

| Share repurchases | (4,471 | ) | | (45 | ) | | (45,557 | ) | | — |

| | — |

| | (45,602 | ) | | — |

| | (45,602 | ) | (366 | ) | | (4 | ) | | (4,011 | ) | | — |

| | — |

| | (4,015 | ) | | — |

| | (4,015 | ) |

| Dividend reinvestment plan (“DRIP”) | 3,546 |

| | 35 |

| | 36,136 |

| | — |

| | — |

| | 36,171 |

| | — |

| | 36,171 |

| 1,160 |

| | 12 |

| | 12,752 |

| | — |

| | — |

| | 12,764 |

| | — |

| | 12,764 |

|

Change in unrealized loss on interest rate swaps | — |

| | — |

| | — |

| | (741 | ) | | — |

| | (741 | ) | | — |

| | (741 | ) | |

Common distributions declared, $0.50 per share | — |

| | — |

| | — |

| | — |

| | (92,037 | ) | | (92,037 | ) | | — |

| | (92,037 | ) | |

Change in unrealized value on interest rate swaps | | — |

| | — |

| | — |

| | 10,885 |

| | — |

| | 10,885 |

| | 2,603 |

| | 13,488 |

|

Common distributions declared, $0.17 per share | | — |

| | — |

| | — |

| | — |

| | (31,326 | ) | | (31,326 | ) | | — |

| | (31,326 | ) |

| Distributions to noncontrolling interests | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | (1,384 | ) | | (1,384 | ) | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | (6,789 | ) | | (6,789 | ) |

| Share-based compensation | 3 |

| | — |

| | 40 |

| | — |

| | — |

| | 40 |

| | — |

| | 40 |

| |

| Redemption of noncontrolling interest | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | (4,179 | ) | | (4,179 | ) | |

| Share-based compensation expense | | — |

| | — |

| | 318 |

| | — |

| | — |

| | 318 |

| | — |

| | 318 |

|

| Other | | — |

| | — |

| | (13 | ) | | — |

| | — |

| | (13 | ) | | — |

| | (13 | ) |

| Net loss | — |

| | — |

| | — |

| | — |

| | (8,319 | ) | | (8,319 | ) | | (144 | ) | | (8,463 | ) | — |

| | — |

| | — |

| | — |

| | (1,600 | ) | | (1,600 | ) | | (237 | ) | | (1,837 | ) |

| Balance at September 30, 2017 | 184,140 |

| | $ | 1,841 |

| | $ | 1,617,717 |

| | $ | 11,175 |

| | $ | (539,840 | ) | | $ | 1,090,893 |

| | $ | 17,699 |

| | $ | 1,108,592 |

| |

| Balance at March 31, 2018 | | 186,027 |

| | $ | 1,860 |

| | $ | 1,638,176 |

| | $ | 27,381 |

| | $ | (634,164 | ) | | $ | 1,033,253 |

| | $ | 428,019 |

| | $ | 1,461,272 |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Balance at January 1, 2018 | 185,233 |

| | $ | 1,852 |

| | $ | 1,629,130 |

| | $ | 16,496 |

| | $ | (601,238 | ) | | $ | 1,046,240 |

| | $ | 432,442 |

| | $ | 1,478,682 |

| |

| Balance at December 31, 2018 | | 279,803 |

| | $ | 2,798 |

| | $ | 2,674,871 |

| | $ | 12,362 |

| | $ | (692,045 | ) | | $ | 1,997,986 |

| | $ | 414,911 |

| | $ | 2,412,897 |

|

Adoption of new accounting pronouncement (see Note 3) | | — |

| | — |

| | — |

| | — |

| | (528 | ) | | (528 | ) | | — |

| | (528 | ) |

| Balance at January 1, 2019 | | 279,803 |

| | $ | 2,798 |

| | $ | 2,674,871 |

| | $ | 12,362 |

| | $ | (692,573 | ) | | $ | 1,997,458 |

| | $ | 414,911 |

| | $ | 2,412,369 |

|

| Share repurchases | (4,511 | ) | | (45 | ) | | (49,589 | ) | | — |

| | — |

| | (49,634 | ) | | — |

| | (49,634 | ) | (605 | ) | | (6 | ) | | (6,674 | ) | | — |

| | — |

| | (6,680 | ) | | — |

| | (6,680 | ) |

| DRIP | 2,967 |

| | 30 |

| | 32,661 |

| | — |

| | — |

| | 32,691 |

| | — |

| | 32,691 |

| 1,603 |

| | 16 |

| | 17,702 |

| | — |

| | — |

| | 17,718 |

| | — |

| | 17,718 |

|

Change in unrealized gain on interest

rate swaps | — |

| | — |

| | — |

| | 17,106 |

| | — |

| | 17,106 |

| | 4,106 |

| | 21,212 |

| |

Common distributions declared, $0.50 per share | — |

| | — |

| | — |

| | — |

| | (93,600 | ) | | (93,600 | ) | | — |

| | (93,600 | ) | |

Change in unrealized value on interest

rate swaps | | — |

| | — |

| | — |

| | (12,423 | ) | | — |

| | (12,423 | ) | | (1,938 | ) | | (14,361 | ) |

Common distributions declared, $0.17 per share | | — |

| | — |

| | — |

| | — |

| | (47,972 | ) | | (47,972 | ) | | — |

| | (47,972 | ) |

| Distributions to noncontrolling interests | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | (21,379 | ) | | (21,379 | ) | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | (7,167 | ) | | (7,167 | ) |

| Share-based compensation | 5 |

| | — |

| | 1,329 |

| | — |

| | — |

| | 1,329 |

| | 2,384 |

| | 3,713 |

| |

| Other | — |

| | — |

| | (156 | ) | | — |

| | — |

| | (156 | ) | | — |

| | (156 | ) | |

| Share-based compensation expense | | — |

| | — |

| | 433 |

| | — |

| | — |

| | 433 |

| | 839 |

| | 1,272 |

|

| Share-based awards vesting | | 58 |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

|

| Share-based awards retained for taxes | | (18 | ) | | — |

| | (206 | ) | | — |

| | — |

| | (206 | ) | | — |

| | (206 | ) |

| Conversion of noncontrolling interests | | 708 |

| | 7 |

| | 7,820 |

| | — |

| | — |

| | 7,827 |

| | (7,827 | ) | | — |

|

| Net loss | — |

| | — |

| | — |

| | — |

| | (26,179 | ) | | (26,179 | ) | | (6,001 | ) | | (32,180 | ) | — |

| | — |

| | — |

| | — |

| | (5,195 | ) | | (5,195 | ) | | (593 | ) | | (5,788 | ) |

| Balance at September 30, 2018 | 183,694 |

| | $ | 1,837 |

| | $ | 1,613,375 |

| | $ | 33,602 |

| | $ | (721,017 | ) | | $ | 927,797 |

| | $ | 411,552 |

| | $ | 1,339,349 |

| |

| Balance at March 31, 2019 | | 281,549 |

| | $ | 2,815 |

| | $ | 2,693,946 |

| | $ | (61 | ) | | $ | (745,740 | ) | | $ | 1,950,960 |

| | $ | 398,225 |

| | $ | 2,349,185 |

|

See notes to consolidated financial statements.

PHILLIPS EDISON & COMPANY, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

FOR THE NINETHREE MONTHS ENDED SEPTEMBER 30,MARCH 31, 2019 AND 2018 AND 2017

(Unaudited)

| | | | | | | Three Months Ended March 31, |

| | 2018 | | 2017 | 2019 | | 2018 |

| CASH FLOWS FROM OPERATING ACTIVITIES: | | | | | | |

| Net loss | $ | (32,180 | ) | | $ | (8,463 | ) | $ | (5,788 | ) | | $ | (1,837 | ) |

| Adjustments to reconcile net loss to net cash provided by operating activities: | |

| | |

| |

| | |

|

| Depreciation and amortization | 125,990 |

| | 83,200 |

| |

| Depreciation and amortization of real estate assets | | 59,342 |

| | 42,040 |

|

| Impairment of real estate assets | 27,696 |

| | — |

| 13,717 |

| | — |

|

| Depreciation and amortization of corporate assets | 11,137 |

| | — |

| 1,647 |

| | 4,128 |

|

| Amortization of deferred financing expense | 3,615 |

| | 3,572 |

| |

| Amortization of deferred financing expenses | | 1,297 |

| | 1,226 |

|

| Net amortization of above- and below-market leases | (2,967 | ) | | (972 | ) | (1,133 | ) | | (1,007 | ) |

| Gain on sale of property, net | (5,556 | ) | | — |

| |

| Change in fair value of contingent liability | 1,500 |

| | — |

| |

| Gain on disposal of property, net | | (7,121 | ) | | — |

|

| Change in fair value of earn-out liability | | (7,500 | ) | | — |

|

| Straight-line rent | (3,544 | ) | | (2,913 | ) | (1,713 | ) | | (1,057 | ) |

| Share-based compensation | 3,713 |

| | — |

| |

| Share-based compensation expense | | 1,272 |

| | 318 |

|

| Equity in net loss of unconsolidated joint ventures | | 456 |

| | — |

|

| Other | 846 |

| | (927 | ) | 2,766 |

| | 1 |

|

| Changes in operating assets and liabilities: | |

| | |

| |

| | |

|

| Other assets | (10,468 | ) | | (12,193 | ) | |

| Accounts receivable and payable – affiliates | (608 | ) | | 1 |

| |

| Other assets, net | | 1,923 |

| | (4,389 | ) |

| Accounts payable and other liabilities | 2,862 |

| | 6,217 |

| (17,921 | ) | | (15,913 | ) |

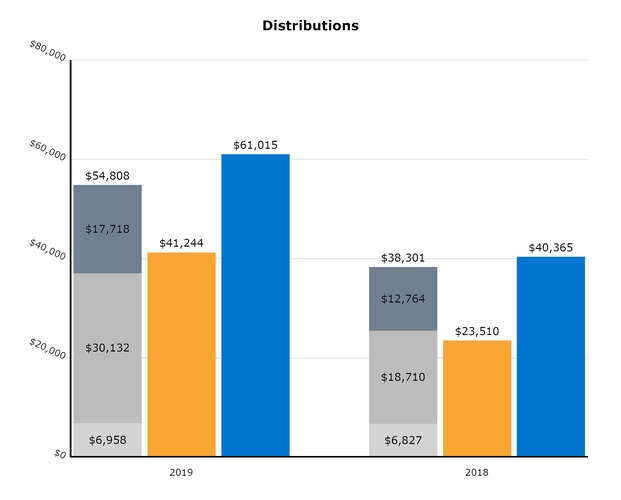

| Net cash provided by operating activities | 122,036 |

|

| 67,522 |

| 41,244 |

|

| 23,510 |

|

| CASH FLOWS FROM INVESTING ACTIVITIES: | |

| | |

| |

| | |

|

| Real estate acquisitions | (31,252 | ) | | (111,740 | ) | — |

| | (8,374 | ) |

| Capital expenditures | (29,341 | ) | | (22,505 | ) | (8,574 | ) | | (8,593 | ) |

| Proceeds from sale of real estate | 44,338 |

| | 1,137 |

| 35,755 |

| | 39 |

|

| Net cash used in investing activities | (16,255 | ) | | (133,108 | ) | |

| Return of investment in unconsolidated joint ventures | | 1,197 |

| | — |

|

| Net cash provided by (used in) investing activities | | 28,378 |

| | (16,928 | ) |

| CASH FLOWS FROM FINANCING ACTIVITIES: | |

| | |

| |

| | |

|

| Net change in credit facility | (6,000 | ) | | 202,000 |

| (22,000 | ) | | (36,000 | ) |

| Proceeds from mortgages and loans payable | 65,000 |

| | — |

| — |

| | 65,000 |

|

| Payments on mortgages and loans payable | (24,751 | ) | | (64,287 | ) | (2,428 | ) | | (2,646 | ) |

| Payments of deferred financing expenses | (782 | ) | | (2,510 | ) | |

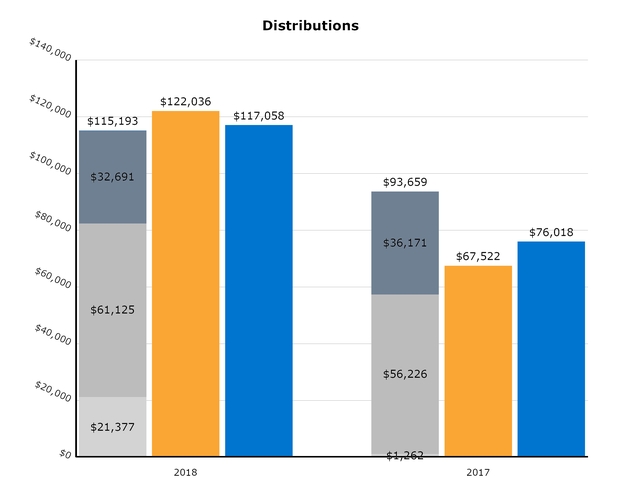

| Distributions paid, net of DRIP | (61,125 | ) | | (56,226 | ) | (30,132 | ) | | (18,710 | ) |

| Distributions to noncontrolling interests | (21,377 | ) | | (1,262 | ) | (6,958 | ) | | (6,827 | ) |

| Repurchases of common stock | (50,252 | ) | | (44,682 | ) | (5,444 | ) | | (2,875 | ) |

| Redemption of noncontrolling interests | — |

| | (4,179 | ) | |

| Net cash (used in) provided by financing activities | (99,287 | ) | | 28,854 |

| |

| NET INCREASE (DECREASE) IN CASH, CASH EQUIVALENTS, AND RESTRICTED CASH | 6,494 |

| | (36,732 | ) | |

| Other | | (206 | ) | | — |

|

| Net cash used in financing activities | | (67,168 | ) | | (2,058 | ) |

| NET INCREASE IN CASH, CASH EQUIVALENTS, AND RESTRICTED CASH | | 2,454 |

| | 4,524 |

|

| CASH, CASH EQUIVALENTS, AND RESTRICTED CASH: | |

| | |

| |

| | |

|

| Beginning of period | 27,445 |

| | 49,946 |

| 84,304 |

| | 27,445 |

|

| End of period | $ | 33,939 |

| | $ | 13,214 |

| $ | 86,758 |

| | $ | 31,969 |

|

| | | | | | | |

| RECONCILIATION TO CONSOLIDATED BALANCE SHEETS | | | | | | |

| Cash and cash equivalents | $ | 6,111 |

| | $ | 7,189 |

| $ | 12,684 |

| | $ | 14,690 |

|

| Restricted cash | 27,828 |

| | 6,025 |

| 74,074 |

| | 17,279 |

|

| Cash, cash equivalents, and restricted cash at end of period | $ | 33,939 |

| | $ | 13,214 |

| $ | 86,758 |

| | $ | 31,969 |

|

| | | | 2018 | | 2017 | 2019 | | 2018 |

| SUPPLEMENTAL CASH FLOW DISCLOSURE, INCLUDING NON-CASH INVESTING AND FINANCING ACTIVITIES: | SUPPLEMENTAL CASH FLOW DISCLOSURE, INCLUDING NON-CASH INVESTING AND FINANCING ACTIVITIES: | | | SUPPLEMENTAL CASH FLOW DISCLOSURE, INCLUDING NON-CASH INVESTING AND FINANCING ACTIVITIES: | | |

| Cash paid for interest | $ | 49,157 |

| | $ | 26,461 |

| $ | 21,679 |

| | $ | 15,792 |

|

| Fair value of assumed debt | — |

| | 30,832 |

| |

| Capital leases | 739 |

| | — |

| |

| Accrued capital expenditures | 2,881 |

| | 3,560 |

| 2,095 |

| | 2,252 |

|

| Change in distributions payable | (216 | ) | | (360 | ) | 122 |

| | — |

|

| Change in distributions payable - noncontrolling interests | | 209 |

| | — |

|

| Change in accrued share repurchase obligation | (618 | ) | | 920 |

| 1,236 |

| | 1,140 |

|

| Distributions reinvested | 32,691 |

| | 36,171 |

| 17,718 |

| | 12,764 |

|

See notes to consolidated financial statements.

Phillips Edison & Company, Inc.

Notes to Consolidated Financial Statements

(Unaudited)

Phillips Edison & Company, Inc. (“we,” the “Company,” “our,” or “us”) was formed as a Maryland corporation in October 2009. Substantially all of our business is conducted through Phillips Edison Grocery Center Operating Partnership I, L.P., (the “Operating Partnership”), a Delaware limited partnership formed in December 2009. We are a limited partner of the Operating Partnership, and our wholly owned subsidiary, Phillips Edison Grocery Center OP GP I LLC, is the sole general partner of the Operating Partnership.

We invest primarily in well-occupied, grocery-anchored, neighborhood and community shopping centers that have a mix of creditworthy national, regional, and regionallocal retailers that sell necessity-based goods and services in strong demographic markets throughout the United States. In addition to managing our own shopping centers,properties, our third-party investment management business provides comprehensive real estate and asset management services to certain(i) Phillips Edison Grocery Center REIT III, Inc. (“PECO III”), a non-traded publicly registered real estate investment trusts (“REITs”)REIT; (ii) three institutional joint ventures; and (iii) one private funds (“Managedfund (collectively, the “Managed Funds”). The Managed Funds include

In November 2018, we completed a merger (the “Merger”) with Phillips Edison Grocery Center REIT II, Inc. (“REIT II”), Phillips Edison Grocery Centera

public non-traded REIT III, Inc. (“PECO III”), Phillips Edison Limited Partnership (“PELP”),that was advised and managed by us, in a 100% stock-for-stock transaction valued at approximately

$1.9 billion. As a result of the Merger, we acquired 86 properties and a 20% equity interest in Necessity Retail Partners (“NRP” or the “NRP joint venture”).

As of September 30, 2018, we, a joint venture that owned fee simple interests in 233 real estate13 properties.

In July 2018 we entered into an Agreement and Plan of Merger (“Merger Agreement”) pursuant to which, subject to the satisfaction or waiver of certain conditions, we will merge with REIT II, and we will continue as the surviving corporation (“Merger”). To complete the proposed Merger, we will issue 2.04 shares of our common stock in exchange for each issued and outstanding share of REIT II common stock, subject to closing adjustments. For a more detailed discussion, see Note 3.4.

In November 2018, through our direct or indirect subsidiaries, we entered into a joint venture with The Northwestern

Mutual Life Insurance Company (“Northwestern Mutual”) and we contributed or sold 17 grocery-anchored shopping centers

with a fair value of approximately $359 million at formation to the new joint venture, Grocery Retail Partners I LLC (“GRP I” or the “GRP I joint venture”), in exchange for a 15% ownership interest in GRP I. For a more detailed discussion, see Note 6.

As of March 31, 2019, we wholly-owned fee simple interests in 300 real estate properties. In addition, we owned a 20% equity interest in NRP and a 15% interest in GRP I, as described previously.

|

|

| 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES |

Certain of our accounting estimates are particularly important for an understanding of our financial position and results of operations and require the application of significant judgment by management. For example, significant estimates and assumptions have been made with respect to the useful lives of assets, recoverable amounts of receivables, and other fair value measurement assessments required for the preparation of the consolidated financial statements. As a result, these estimates are subject to a degree of uncertainty.

Other than those noted below, there have been no changes to our significant accounting policies during the ninethree months ended September 30, 2018.March 31, 2019. For a full summary of our accounting policies, refer to our 20172018 Annual Report on Form 10-K filed with the SEC on March 30, 2018.13, 2019.

Basis of Presentation and Principles of Consolidation—The accompanying consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”) for interim financial information and with instructions to Form 10-Q and Article 10 of Regulation S-X. Accordingly, they do not include all of the information and footnotes required by GAAP for complete financial statements. Readers of this Quarterly Report on Form 10-Q should refer to our audited consolidated financial statements for the year ended December 31, 2017,2018, which are included in our 20172018 Annual Report on Form 10-K. In the opinion of management, all normal and recurring adjustments necessary for the fair presentation of the unaudited consolidated financial statements for the periods presented have been included in this Quarterly Report. Our results of operations for the three and nine months ended September 30, 2018,March 31, 2019, are not necessarily indicative of the operating results expected for the full year.

The accompanying consolidated financial statements include our accounts and those of our majority-owned subsidiaries. All intercompany balances and transactions are eliminated upon consolidation.

Leases—We are party to a number of lease agreements, both as a lessor as well as a lessee of various types of assets.

Lessor—The majority of our revenue is lease revenue derived from our real estate assets, which is accounted for under Accounting Standards Codification (“ASC”) Topic 842, Leases (“ASC 842”). We adopted the accounting guidance contained within ASC 842 on January 1, 2019, the effective date of the standard for public companies. We record lease and lease-related revenue as Rental Income on the consolidated statements of operations and comprehensive (loss) income, also referred to herein as our “consolidated statements of operations”, in accordance with ASC 842.

We enter into leases primarily as a lessor as part of our real estate operations, and leases represent the majority of our revenue. We lease space in our properties generally in the form of operating leases. Our leases typically provide for reimbursements from tenants for common area maintenance, insurance, and real estate tax expenses. Common area maintenance reimbursements can be fixed, with revenue earned on a straight-line basis over the term of the lease, or variable, with revenue recognized as services are performed for which we will be reimbursed.

The terms and expirations of our operating leases with our tenants are generally similar. The majority of leases for inline (non-anchor) tenants have terms that range from 2 to 10 years, and the majority of leases for anchor tenants range from 3 to 13 years. In both cases, the full term of the lease prior to our acquisition or assumption of the lease will generally be longer, however, we are measuring the commencement date for these purposes as being the date that we acquired or assumed the lease, excluding option periods.

The lease agreements frequently contain fixed-price renewal options to extend the terms of leases and other terms and conditions as negotiated. In calculating the term of our leases, we consider whether these options are reasonably certain to be exercised. Our determination involves a combination of contract-, asset-, entity-, and market-based factors and involves considerable judgment. We retain substantially all of the risks and benefits of ownership of the real estate assets leased to tenants. Currently, our tenants have no options to purchase at the end of the lease term, although in a small number of leases, a tenant, usually the anchor tenant, may have the right of first refusal to purchase one of our properties if we elect to sell the center.

Beginning January 1, 2019, we evaluate whether a lease is an operating, sales-type, or direct financing lease using the criteria established in ASC 842. Leases will be considered either sales-type or direct financing leases if any of the following criteria are met:

if the lease transfers ownership of the underlying asset to the lessee by the end of the term;

if the lease grants the lessee an option to purchase the underlying asset that is reasonably certain to be exercised;

if the lease term is for the major part of the remaining economic life of the underlying asset; or

if the present value of the sum of the lease payments and any residual value guaranteed by the lessee equals or exceeds substantially all of the fair value of the underlying asset.

We utilize substantial judgment in determining the fair value of the leased asset, the economic life of the leased asset, and the relevant borrowing rate in performing our lease classification analysis. If none of the criteria listed above are met, the lease is classified as an operating lease. Currently all of our leases are classified as operating leases, and we expect that the majority, if not all, of our leases will continue to be classified as operating leases based upon our typical lease terms.

We commence revenue recognition on our leases based on a number of factors. In most cases, revenue recognition under a lease begins when the lessee takes possession of or controls the physical use of the leased asset. The determination of when revenue recognition under a lease begins, as well as the nature of the leased asset, is dependent upon our assessment of who is the owner, for accounting purposes, of any related tenant improvements. If we are the owner, for accounting purposes, of the tenant improvements, then the leased asset is the finished space, and revenue recognition begins when the lessee takes possession of the finished space, typically when the improvements are substantially complete.

If we conclude that we are not the owner, for accounting purposes, of the tenant improvements (i.e. the lessee is the owner), then the leased asset is the unimproved space and any tenant allowances funded under the lease are treated as lease incentives, which reduce revenue recognized over the term of the lease. In these circumstances, we begin revenue recognition when the lessee takes possession of the unimproved space to construct their own improvements. We consider a number of different factors in evaluating whether the lessee or we are the owner of the tenant improvements for accounting purposes. These factors include:

whether the lease stipulates how and on what a tenant improvement allowance may be spent;

whether the tenant or landlord retains legal title to the improvements;

the uniqueness of the improvements;

the expected economic life of the tenant improvements relative to the length of the lease; and

who constructs or directs the construction of the improvements.

The majority of our leases provide for fixed rental escalations, and we recognize rental income on a straight-line basis over the term of each lease in such instances. The difference between rental income earned on a straight-line basis and the cash rent due under the provisions of the lease agreements is recorded as deferred rent receivable and is included as a component of Other Assets, Net. Due to the impact of the straight-line adjustments, rental income generally will be greater than the cash collected in the early years and will be less than the cash collected in the later years of a lease.

Reimbursements from tenants for recoverable real estate taxes and operating expenses that are fixed per the terms of the applicable lease agreements are recorded on a straight-line basis, as described above. The majority of our lease agreements with tenants, however, provide for tenant reimbursements that are variable depending upon the applicable expenses incurred. These reimbursements are accrued as revenue in the period in which the applicable expenses are incurred. We make certain assumptions and judgments in estimating the reimbursements at the end of each reporting period. We do not expect the actual results to materially differ from the estimated reimbursements. Both fixed and variable tenant reimbursements are recorded as Rental Income in the consolidated statements of operations. In certain cases, the lease agreement may stipulate that a tenant make a direct payment for real estate taxes to the relevant taxing authorities. In these cases, beginning on January 1, 2019, we no longer record any revenue or expense related to these tenant expenditures. Although we expect such cases to be rare, in the event that a direct-paying tenant failed to make their required payment to the taxing authorities, we would potentially be liable for such amounts, although they are not recorded as a liability in our consolidated balance sheets per the requirements of ASC 842. We have made a policy election to exclude amounts collected from customers for all sales tax and other similar taxes from the transaction price in our recognition of lease revenue.

Additionally, we record an immaterial amount of variable revenue in the form of percentage rental income. Our policy for percentage rental income is to defer recognition of contingent rental income until the specified target (i.e. breakpoint) that triggers the contingent rental income is achieved.

In some instances, as part of our negotiations, we may offer lease incentives to our tenants. These incentives usually take the form of payments made to or on behalf of the tenant, and such incentives will be deducted from the lease payment and recorded on a straight-line basis over the term of the new lease.

We record lease termination income if there is a signed termination agreement, all of the conditions of the agreement have been met, collectability is reasonably assured and the tenant is no longer occupying the property. Upon early lease termination, we provide for losses related to unrecovered tenant-specific intangibles and other assets. We record lease termination income as rental income in the consolidated statements of operations.

Historically, we periodically reviewed the collectability of outstanding receivables. Following the adoption of ASC 842, as of January 1, 2019, lease receivables are reviewed continually to determine whether or not it is likely that we will realize all amounts receivable for each of our tenants (i.e. whether a tenant is deemed to be a credit risk). If we determine that the tenant is not a credit risk, no reserve or reduction of revenue is recorded, except in the case of disputed charges. If we determine that the tenant is a credit risk, revenue for that tenant is recorded on a cash basis, including any amounts relating to straight-line rent receivables and/or receivables for recoverable expenses. Under ASC 842, the aforementioned adjustments as well as any reserve for disputed charges are recorded as a reduction of Rental Income rather than in Property Operating, where our reserves were previously recorded, on the consolidated statements of operations.

Lessee—We enter into leases as a lessee as part of our real estate operations in the form of ground leases of land, and as part of our corporate operations in the form of office space and office equipment leases. Ground leases typically have initial terms of 15-40 years with one or more options to renew for additional terms of 3-5 years, and may include options that grant us as the lessee the right to terminate the lease, without penalty, in advance of the full lease term. Our office space leases generally have terms of less than ten years with no renewal options. Office equipment leases typically have terms ranging from 3-5 years with options to extend the term for a year or less, but contain minimal termination rights. In calculating the term of our leases, we consider whether we are reasonably certain to exercise renewal and/or termination options. Our determination involves a combination of contract-, asset-, entity-, and market-based factors and involves considerable judgment.

Currently, neither our operating leases nor our finance leases have residual value guarantees or other restrictions or covenants, but a small number may contain nonlease components which have been deemed not material. Beginning January 1, 2019, we evaluate whether a lease is a finance or operating lease using the criteria established in ASC 842. The criteria we use to determine whether a lease is a finance lease are the same as those we use to determine whether a lease is sales-type lease as a lessor. If none of the finance lease criteria is met, we classify the lease as an operating lease.

We record right-of-use (“ROU”) assets and liabilities in the consolidated balance sheets based upon the terms and conditions of the applicable lease agreement. We use discount rates to calculate the present value of lease payments when determining lease classification and measuring our lease liability. We use the rate implicit in the lease as our discount rate unless that rate cannot be readily determined, in which case we consider various factors to select an appropriate discount rate. This requires the application of judgment, and we consider the length of the lease as well as the length and securitization of our outstanding debt agreements in selecting an appropriate rate.

Revenue Recognition—In addition to our lease-related revenue, we also earn fee revenues by providing services to the Managed Funds. These fees are accounted for within the scope of ASC Topic 606, Revenue from Contracts with Customers (“ASC 606”), and are recorded as Fees and Management Income on the consolidated statements of operations. We provide services to the Managed Funds, all of which are considered related parties. These services primarily include asset acquisition and disposition services, asset management, operating and leasing of properties, construction management, and other general and administrative responsibilities. These services are currently provided under various combinations of advisory agreements, property management agreements, and other service agreements (the “Management Agreements”). The wide variety of duties within the Management Agreements makes determining the performance obligations within the contracts a matter of judgment. We have concluded that each of the separately disclosed fee types in the below table represents a separate performance obligation within the Management Agreements.

The table below shows the most significant of these fee types in the Management Agreements: |

| | | | | | |

| Fee | | Performance Obligation Satisfied | | Timing of Payment | | Description |

| Asset Management | | Over time | | Monthly, in cash and/or ownership units | | Because each increment of service is distinct, although substantially the same, revenue is recognized at the end of each reporting period based upon asset base and the applicable rate. |

| Property Management | | Over time | | In cash, monthly | | Because each increment of service is distinct, although substantially the same, revenue is recognized at the end of each month based on a percentage of the properties’ cash receipts. |

| Leasing Commissions | | Point in time (upon close of a transaction) | | In cash, upon completion | | Revenue is recognized in an amount equal to the fees charged by unaffiliated persons rendering comparable services in the same geographic location. |

| Construction Management | | Point in time (upon close of a project) | | In cash, upon completion | | Revenue is recognized in an amount equal to the fees charged by unaffiliated persons rendering comparable services in the same geographic location. |

| Acquisition | | Point in time (upon close of a transaction) | | In cash, upon close of the transaction | | Revenue is recognized based on a percentage of the purchase price of the property acquired. |

| Disposition | | Point in time (upon close of a transaction) | | In cash, upon close of the transaction | | Revenue is recognized based on a percentage of the disposition price of the property sold. |

Due to the nature of the services being provided under our Management Agreements, each performance obligation has a variable component. Therefore, when we determine the transaction price for the contracts, we are required to constrain our estimate to an amount that is not probable of significant revenue reversal. For most of these fee types, such as acquisition fees and leasing commissions, compensation only occurs if a transaction takes place and the amount of compensation is dependent upon the terms of the transaction. For our property and asset management fees, due to the large number and broad range of possible consideration amounts, we calculate the amount earned at the end of each month.

In addition to the fees listed above, certain of our Management Agreements include the potential for additional revenues if certain market conditions are in place or certain events take place. We have not recognized revenue related to these fees, nor will we until it is no longer highly probable that there would be a material reversal of revenue.

Additionally, effective January 1, 2018, sales or transfers to non-customers of non-financial assets or in substance non-financial assets that do not meet the definition of a business are accounted for within the scope of ASC Topic 610-20, Other Income—Gains and Losses from the Derecognition of Nonfinancial Assets (“ASC 610-20”). Generally, our sales of real estate would be considered a sale of a non-financial asset as defined by ASC 610-20. Under ASC 610-20, if we determine we do not have a controlling financial interest in the entity that holds the asset and the arrangement meets the criteria to be accounted for as a contract, we would de-recognize the asset and recognize a gain or loss on the sale of the real estate when control of the underlying asset transfers to the buyer. Further, we may defer a tax gain through an Internal Revenue Code (the “Code”) Section 1031 like-kind exchange by purchasing another property within a specified time period. For additional information regarding gain on sale of assets, refer to Note 5.

Income Taxes—Our consolidated financial statements include the operations of one wholly owned subsidiarysubsidiaries that hashave jointly elected to be treated as a Taxable REIT SubsidiarySubsidiaries (“TRS”) and isare subject to U.S. federal, state, and local income taxes at regular corporate tax rates. As of September 30, 2018 and December 31, 2017, a full valuation allowance was recorded for the entire amount of the net deferred tax asset. During the three and nine months ended September 30,March 31, 2019 and 2018, no income tax expense or benefit was reported as we recorded a full valuation allowance for our net deferred tax asset.

Recently Issued and Newly Adopted and Recently Issued Accounting Pronouncements—The following table provides a brief description of newly adopted accounting pronouncements and their effect on our consolidated financial statements: |

| | | | | | |

Standard | | Description | | Date of Adoption | | Effect on the Financial Statements or Other Significant Matters |

ASU 2017-09, Compensation - Stock Compensation (Topic 718): Scope of Modification Accounting | | This update clarifies guidance about which changes to the terms or conditions of a share-based payment award require an entity to apply modification accounting. | | January 1, 2018 | | The adoption of this standard did not have a material impact on our consolidated financial statements. We will apply the guidance to any future modifications of share-based compensation awards.

|

ASU 2017-05, Other Income - Gains and Losses from the Derecognition of Nonfinancial Assets (Subtopic 610-20) | | This update amends existing guidance in order to provide consistency in accounting for the derecognition of a nonfinancial asset. | | January 1, 2018 | | We did not record any cumulative adjustment in connection with the adoption of the new pronouncement. We determined that these changes did not have any impact on our consolidated financial statements. |

ASU 2017-04, Intangibles - Goodwill and Other: Simplifying the Test for Goodwill Impairment (Topic 350) | | This update amends existing guidance in order to simplify impairment testing for goodwill. It is effective for annual reporting periods beginning after January 1, 2021, but early adoption is permitted. | | January 1, 2018 | | We elected to adopt this standard as of January 1, 2018. The adoption of this standard did not have any impact on our consolidated financial statements. |

ASU 2016-15, Statement of Cash Flows (Topic 230);

ASU 2016-18, Statement of Cash Flows (Topic 230)

| | These updates address the presentation of eight specific cash receipts and cash payments on the statement of cash flows, as well as clarify the classification and presentation of restricted cash on the statement of cash flows. | | January 1, 2018 | | We adopted these ASUs by applying a retrospective transition method which requires a restatement of our consolidated statement of cash flows for all periods presented. |

ASU 2014-09, Revenue from Contracts with Customers (Topic 606) | | This update outlines a comprehensive model for entities to use in accounting for revenue arising from contracts with customers. ASU 2014-09 states that “an entity recognizes revenue to depict the transfer of promised goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods or services.” While ASU 2014-09 specifically references contracts with customers, it also applies to certain other transactions such as the sale of real estate or equipment. Expanded quantitative and qualitative disclosures are also required for contracts subject to ASU 2014-09. | | January 1, 2018 | | Our revenue-producing contracts are primarily leases that are not within the scope of this standard. As a result, the adoption of this standard did not have a material impact on our rental or reimbursement revenue. However, the standard does apply to a majority of our fees and management income. We have evaluated the impact of this standard on our fees and management income; it did not have a material impact on our revenue recognition, but we have provided additional disclosures around fees and management revenue. We adopted this guidance on a modified retrospective basis. |

The following table provides a brief description of recent accounting pronouncements that could have a material effect on our consolidated financial statements: |

| | | | | | |

| Standard | | Description | | Date of Adoption | | Effect on the Financial Statements or Other Significant Matters |

ASU 2018-13, Fair Value Measurement (Topic 820) | | This ASU eliminates, adds and modifies certain disclosure requirements for fair value measurements as part of the FASB’s disclosure framework project. Early adoption is permitted.

| | January 1, 2020 | | We are currently evaluating the impact the adoption of these standards will have on our consolidated financial statements. |

ASU 2018-07, Compensation - Stock Compensation (Topic 718): Improvements to Non-employee Share-Based Payment Accounting | | The amendments in this update expand the scope of Topic 718: Compensation—Stock Compensation to include share-based payment transactions for acquiring goods and services from non-employees, except for specific guidance on inputs to an option pricing model and the attribution of cost (that is, the period of time over which share-based payment awards vest and the pattern of cost recognition over that period). This update is effective for public business entities for fiscal years beginning after December 15, 2018. Early adoption is permitted. | | January 1, 2019 | | We are currently evaluating the impact the adoption of this standard will have on our consolidated financial statements. |

ASU Standards Update (“ASU”) 2016-13, Financial Instruments - Credit Losses (Topic 326):Measurement of Credit Losses on Financial Instruments

ASU 2018-19, Financial Instruments - Credit Losses (Topic 326): Codification Improvements

| | The amendments in this update replace the incurred loss impairment methodology in current GAAP with a methodology that reflects expected credit losses and requires consideration of a broader range of reasonable and supportable information to inform credit loss estimates. It clarifies that receivables arising from operating leases are not within the scope of Topic 326. Instead, impairment of receivables arising from operating leases should be accounted for in accordance with Topic 842. This update is effective for public entities in fiscal years beginning after December 15, 2019, and interim periods within those fiscal years. Early adoption is permitted after December 15, 2018. | | January 1, 2020 | | We are currently evaluating the impact the adoption of this standard will have on our consolidated financial statements. |

| ASU 2018-13, Fair Value Measurement (Topic 820) | | This ASU eliminates, adds and modifies certain disclosure requirements for fair value measurements as part of the Financial Accounting Standards Board’s disclosure framework project. It is effective for annual and interim reporting beginning after December 15, 2019, but early adoption is accepted. | | January 1, 2020 | | We are currently evaluating the impact the adoption of this standard will have on our consolidated financial statements. |

| ASU 2018-17, Consolidation (Topic 810): Targeted Improvements to Related Party Guidance for Variable Interest Entities | | This Update amends two aspects of the related-party guidance in ASC 810: (1) adds an elective private-company scope exception to the variable interest entity guidance for entities under common control and (2) indirect interests held through related parties in common control arrangements should be considered on a proportional basis for determining whether fees paid to decision makers and service providers are variable interests. For entities other than private companies, the amendments in this update are effective for fiscal years beginning after December 15, 2019, and interim periods within those fiscal years. All entities are required to apply the amendments in this update retrospectively with a cumulative effect adjustment to retained earnings at the beginning of the earliest period presented. Early adoption is permitted. | | January 1, 2020 | | We are currently evaluating the impact the adoption of this standard will have on our consolidated financial statements. |

The following table provides a brief description of newly adopted accounting pronouncements and their effect on our consolidated financial statements: |

| | | | | | |

| Standard | | Description | | Date of Adoption | | Effect on the Financial Statements or Other Significant Matters |

ASU 2016-02, Leases (Topic 842);

ASU 2018-01, Leases (Topic 842): Land Easement Practical Expedient for Transition to Topic 842;

842

ASU 2018-10, Codification Improvements to Topic 842, Leases; and

Leases

ASU 2018-11, Leases (Topic 842): Targeted Improvements

ASU 2018-20, Leases (Topic 842): Narrow-Scope Improvements for Lessors

ASU 2019-01, Lease (Topic 842): Codification Improvements | | These updates amendamended existing guidance by recognizing lease assets and lease liabilities on the balance sheet and disclosing key information about leasing arrangements. Early adoption is permitted as of the original effective date.

| | January 1, 2019 | | We are currently evaluating the impactadopted this standard on January 1, 2019 and a modified retrospective transition approach was required. We determined that the adoption of these standards will havehad a material impact on our consolidated financial statements. We have identified areas within our accounting policies we believe could be impacted by the new standard. This standard impacts the lessor’s abilitystatements; please refer to capitalize certain costs related to leasing, which will result in a reduction in the amount of execution costs currently being capitalized in connection with leasing activities and an increase to our Property Operating expenses. The standard will also require new disclosures within the accompanying notes to the consolidated financial statements.Note 3 for additional details.

We expectelected to adoptutilize the following optional practical expedients available for implementation under the standard. By adopting theseupon adoption: - Package of practical expedients which permits us not to reassess our prior conclusions about lease identification, lease classification, and initial direct costs. - Practical expedient permitting us not to assess whether existing, expired, or current land easements either are or contain a lease. - Practical expedient which permits us as a lessor not to separate non-lease components, such as common area maintenance reimbursements, from the associated lease component, provided that the timing and pattern of transfer of the services are substantially the same. Because of our decision to elect this practical expedient, we will no longer present our Rental Income and Tenant Recovery Income amounts separately on our statements of income, and have reclassified Tenant Recovery Income amounts to Rental Income for all periods presented on the consolidated statements of operations and comprehensive income (loss). - Practical expedient which permits us not be required to reassess (i) whether an expiredrecord a right of use asset or existing contract meets the definitionlease liability related to leases of a lease; (ii) the lease classification at the adoption date for existing leases; and (iii) whether the costs previously capitalized as initial direct costs would continue to be amortized. Thistwelve months or fewer, but instead allows us to continuerecord expense related to accountany such leases as it is incurred.

|

ASU 2018-07, Compensation - Stock Compensation (Topic 718): Improvements to Non-employee Share-Based Payment Accounting | | The amendments in this update expanded the scope of Topic 718: Compensation - Stock Compensation to include share-base payment transactions for our leases where we areacquiring goods and services from non-employees, except for specific guidance on inputs to an option pricing model and the lessee as operating leases, however, any new or renewed leases may be classified as financing leases. We currently have fewer than 50 leasesattribution of cost (that is, the period of time over which share-based payment awards vest and the pattern of cost recognition over that period). | | January 1, 2019 | | The adoption of this type. We also expect to recognize right of use assets and lease liability on our consolidated balance sheets related to certain leases where we are the lessee.

In July 2018, the FASB issued ASU 2018-11. The update allows lessors to use a practical expedient to account for non-lease components and related lease components as a single lease component instead of accounting for them separately, if certain conditions are met. We expect to utilize this practical expedient.

We will continue to evaluate the effect the adoption of these ASUs will have on our consolidated financial statements. However, we currently believe that the adoption willstandard did not have a material impact on our consolidated financial statements.

|

ASU 2018-16, Derivatives and Hedging (Topic 815): Inclusion of the Secured Overnight Financing Rate (SOFR) Overnight Index Swap (OIS) Rate as a Benchmark Interest Rate for operating leases where we areHedge Accounting Purposes | | This update permitted use of the OIS rate based on the SOFR as a lessorUS benchmark interest rate for hedge accounting purposes under Topic 815. The purpose of this was to facilitate the LIBOR to SOFR transition and will continueprovide sufficient lead time for entities to record revenues from rental propertiesprepare for changes to interest rate risk hedging strategies for both risk management and hedge accounting purposes. | | January 1, 2019 | | The adoption of this standard did not have a material impact on our operating leases on a straight-line basis. We are still evaluating the impact for leases where we are the lessee.consolidated financial statements.

|

Reclassifications—The following line itemsitem on our consolidated statements of operations and comprehensive income (loss) for the three and nine months ended September 30, 2017, were reclassified:March 31, 2018, was reclassified to conform to current year presentation:

Unrealized (Loss) Gain on Derivatives and Reclassification of Derivative Loss to Interest Expense wereTenant Recovery was combined to Change in Unrealized Gain (Loss) on Interest Rate Swaps.

Acquisition Expenses were combined to General and Administrative.with Rental Income.

The following line items on our consolidated statements of cash flows for the ninethree months ended September 30, 2017March 31, 2018, were reclassified:reclassified to conform to current year presentation:

Net Loss (Gain) on Write-off of Unamortized Capitalized Leasing Commissions, Market Debt Adjustments, and Deferred FinancingAccounts Receivable - Affiliates was combined with Other Assets;

Share-based Compensation Expense was reclassified from Other; and

Accounts Payable - Affiliates was combined with Accounts Payable and Other Liabilities.

Standard Adoption—Effective January 1, 2019, we adopted ASU 2016-02, Leases. This standard was adopted in conjunction with the related updates, ASU 2018-01, Leases (Topic 842): Land Easement Practical Expedient for Transition to Other.Topic 842; ASU 2018-10, Codification Improvements to Topic 842, Leases; ASU 2018-11, Leases (Topic 842): Targeted Improvements; and ASU 2018-20, Leases (Topic 842): Narrow-Scope Improvements for Lessors, collectively “ASC 842,” using a modified-retrospective approach, as required. Consequently, financial information will not be updated and the disclosures required under the new standard will not be provided for dates and periods before January 1, 2019.

The adoption of ASC 842 resulted in a $0.5 million adjustment to the current year’s opening balance in Accumulated Deficit on the consolidated balance sheets as a result of recognizing ROU assets and lease liabilities as well as adjustments to our collectability reserve. Beginning in January 1, 2019, due to the new standard’s narrowed definition of initial direct costs, we now expense as incurred significant lease origination costs which were previously capitalized as initial direct costs and amortized to expense over the lease term. We capitalized $6.2 million of internal costs for the year ended December 31, 2018, some of which we will continue to capitalize in accordance with the standard. During the three months ended March 31, 2019, the amounts capitalized were $0.7 million, compared to $1.1 million during the three months ended March 31, 2018. Amounts that were capitalized prior to the adoption of ASC 842 will continue to be amortized over their remaining lives.

Additionally, ASC 842 requires that lessors exclude from variable payments all costs paid by a lessee directly to a third party. For the year ended December 31, 2018, $8.0 million in real estate tax payments made by tenants directly to third parties was recorded by us as both Tenant Recovery Income and Real Estate Taxes. This amount was approximately $1.4 million for the three months ended March 31, 2018. Beginning January 1, 2019, such amounts are no longer recognized by us. As the recorded expense was completely offset by the related payments made directly by the tenants to the taxing authorities, this has no net impact to earnings.

Beginning January 1, 2019, operating lease receivables are accounted for under ASC 842, which requires us to recognize changes in the collectability assessment for an operating lease as an adjustment to lease income. For the year ended December 31, 2018, $2.9 million of expense was recorded as Property Operating on our consolidated statements of operations, which would have been recorded as a reduction to Rental Income under the new standard. For the three months ended March 31, 2019, the total amount recorded as a reduction to Rental Income as a result of collectability reserves was $0.5 million.

Lessor—The majority of our leases are largely similar in that the leased asset is retail space within our properties, and the lease agreements generally contain similar provisions and features, without substantial variations. All of our leases are currently classified as operating leases.

Approximate future fixed contractual lease payments to be received under non-cancelable operating leases in effect as of March 31, 2019, assuming no new or renegotiated leases or option extensions on lease agreements, are as follows (in thousands): |

| | | |

| Year | Operating |

| Remaining 2019 | $ | 281,819 |

|

| 2020 | 349,800 |

|

| 2021 | 304,000 |

|

| 2022 | 259,800 |

|

| 2023 | 209,120 |

|

| 2024 and thereafter | 591,618 |

|

| Total | $ | 1,996,157 |

|

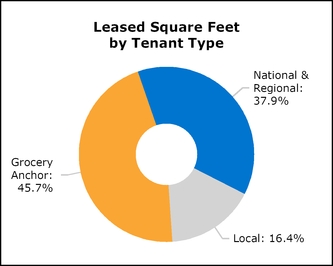

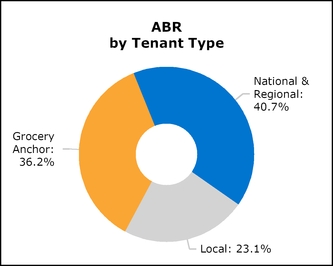

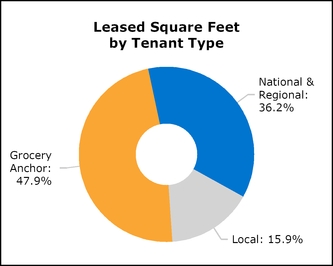

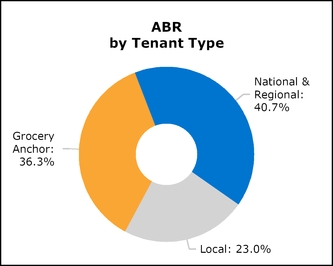

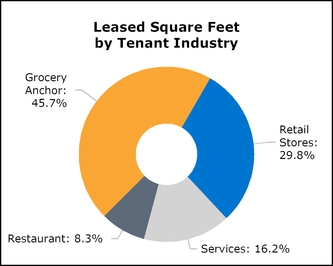

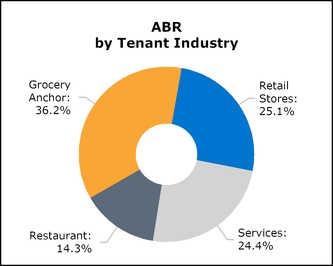

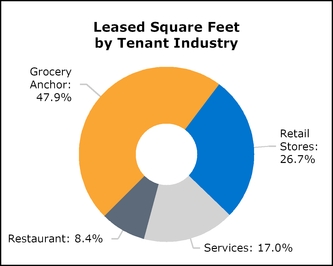

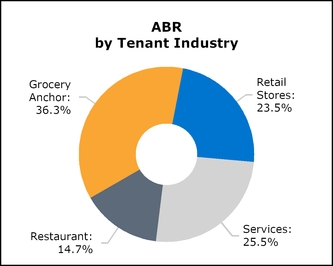

No single tenant comprised 10% or more of our aggregate annualized base rent (“ABR”) as of March 31, 2019. As of March 31, 2019, our real estate investments in Florida and California represented 12.2% and 10.2% of our ABR, respectively. As a result, the geographic concentration of our portfolio makes it particularly susceptible to adverse economic or weather developments in the Florida and California real estate markets.

Lessee—As a lessee, we recognized additional operating liabilities of $6.2 million with corresponding ROU assets of $6.0 million, and the difference between them was recorded as an adjustment to Accumulated Deficit on the consolidated balance sheets. These asset and liability amounts represent the present value of the remaining minimum rental payments under current leasing standards for existing leases, adjusted as appropriate for amounts written off in transition to the new guidance. The initial measurement of a ROU asset may differ from the initial measurement of the corresponding lease liability due to initial direct costs, prepaid lease payments, and lease incentives.

Below are the amounts recorded in our consolidated statements of operations and cash flows related to our ROU assets and lease liabilities by lease type (dollars in thousands): |

| | | |

| | Three Months Ended |

| | March 31, 2019 |

| Statements of operations information: | |

| Finance lease cost: | |

| Amortization of ROU assets | $ | 64 |

|

| Interest on lease liabilities | 5 |

|

| Operating lease costs | 348 |

|

| Short term lease expense | 391 |

|

| | |

| Statements of cash flows information: | |

| Operating cash flows used for operating leases | $ | (362 | ) |

| Financing cash flows used for finance leases | (60 | ) |

| ROU assets obtained in exchange for new lease liabilities | 36 |

|

Lease assets, grouped by balance sheet line where they are recorded, consisted of the following as of March 31, 2019 (in thousands): |

| | | |

| | March 31, 2019 |

| Assets | |

| Investment in Real Estate: | |

| ROU asset - operating leases | $ | 4,707 |

|

| Less: accumulated amortization | (85 | ) |

| Total in Investment in Real Estate | 4,622 |

|

| Other Assets: | |

| ROU asset - operating leases | 1,340 |

|

| ROU asset - finance leases | 575 |

|

| Less: accumulated amortization | (314 | ) |

| Total in Other Assets | 1,601 |

|

Total ROU lease assets(1) | $ | 6,223 |

|

| | |

| Liabilities | |

| Accounts Payable and Other Liabilities: | |

| Operating lease liability | $ | 5,886 |

|

| Debt Obligations, Net: | |

| Finance lease liability | 512 |

|

Total lease liabilities(1) | $ | 6,398 |

|

| |

(1) | As of March 31, 2019, the weighted average remaining lease term was approximately 2.0 years for finance leases and 20.5 years for operating leases. The weighted average discount rate was 3.55% for finance leases and 4.16% for operating leases. |

Future undiscounted payments for fixed lease charges by lease type as of March 31, 2019, are as follows (in thousands): |

| | | | | | | |

| | Undiscounted |

| | Operating | | Finance |

| Remaining 2019 | $ | 1,026 |

| | $ | 198 |

|

| 2020 | 927 |

| | 263 |

|

| 2021 | 446 |

| | 66 |

|

| 2022 | 392 |

| | — |

|

| 2023 | 238 |

| | — |

|

| Thereafter | 6,248 |

| | — |

|

| Total undiscounted cash flows from leases | 9,277 |

| | 527 |

|

| Total lease liabilities recorded at present value | 5,886 |

| | 512 |

|

| Difference between undiscounted cash flows and present value of lease liabilities | $ | 3,391 |

| | $ | 15 |

|

|

|

3. PROPOSED4. MERGER WITH REIT II |

In JulyDuring November 2018, we entered intoacquired 86 properties as part of the Merger Agreement, pursuant to which we will merge with REIT II. Under the terms of the Merger, at the time of closing, the following consideration was given in exchange for REIT II in a 100%common stock transaction valued at approximately $1.9 billion. This proposed Merger will create a portfolio of approximately 320 grocery-anchored shopping centers encompassing more than 36 million square feet in established trade areas across 33 states.(in thousands): |

| | | |

| | Amount |

Fair value of PECO common stock issued(1) | $ | 1,054,745 |

|

| Fair value of REIT II debt: | |

| Corporate debt | 719,181 |

|

| Mortgages and notes payable | 102,727 |

|

Derecognition of REIT II management contracts, net(2) | 30,428 |

|

| Transaction costs | 11,587 |

|

| Total consideration and debt activity | 1,918,668 |

|

| Less: debt assumed | 464,462 |

|

| Total consideration | $ | 1,454,206 |

|

| |

(1) | The total number of shares of common stock issued was 95.5 million. |

| |

(2) | Previously a component of Other Assets, Net. |

To complete the proposed Merger, we will issueissued 2.04 shares of our common stock in exchange for each issued and outstanding share of REIT II common stock, which iswas equivalent to $22.54 based on our most recent estimated net asset value per share (“EVPS”), as of the date of the transaction, of $11.05. The exchange ratio iswas based on a thorough review of the relative valuation of each entity, including factoring in our growing investment management business as well as each company’s transaction costs. REIT II’s outstanding debt of approximately $800 million is expected to be refinanced or assumed by us at closing under the terms of the Merger Agreement.

The Merger Agreement provides certain termination rights for REIT II and us. In connection with the termination of the Merger Agreement, under certain specified circumstances, REIT II may be required to pay us a termination fee of $31.7 million and we may be required to pay REIT II a termination fee of $75.6 million. The Merger Agreement provided REIT II with a 30-day go-shop period pursuant to which they could solicit, receive, evaluate, and enter into negotiations with respect to alternative proposals from third-parties. The go-shop period ended during the third quarter.

On a pro forma basis, uponUpon completion of the Merger, we estimate that our continuing stockholders will ownowned approximately 71% of the issued and outstanding shares of the combined companyCompany on a fully diluted basis (determined as if each Operating Partnership unit (“OP unit”) were exchanged for one share of our common stock), and former REIT II stockholders will ownowned approximately 29% of the issued and outstanding shares of the combined companyCompany on a fully diluted basis (determined as if each OP unit were exchanged for one share of our common stock).

Assets Acquired and Liabilities Assumed—After consideration of all applicable factors pursuant to the business combination accounting rules under ASC 805, Business Combinations(“ASC 805”), including the application of a screen test to evaluate if substantially all the fair value of the acquired properties is concentrated in a single asset or group of similar assets, we have concluded that the Merger will be treatedqualified as an asset acquisition.

Additionally, prior to the close of the Merger, all of REIT II’s real properties were managed and leased by us, under the terms of various management agreements. As we had contractual relationships with REIT II, we considered the provisions of ASC 805 regarding the settlement of pre-existing relationships. This guidance provides that a transaction that in effect settles pre-existing relationships between the acquirer and acquiree should be evaluated under the guidance set forth in ASC 805 for possible gain/loss recognition.

In applying the relevant guidance to the settlement of our contractual relationships with REIT II, we noted that the provisions of the various agreements provided both parties to each of the agreements with substantial termination rights. The agreements permitted either party to terminate without cause or penalty upon prior written notice within a specified number of days’ notice. Therefore, we determined that the termination of the agreements did not result in a settlement gain or loss under the relevant guidance, and thus no gain or loss was recorded in the consolidated financial statements.

Prior to the consummation of the Merger, we did, however, have an existing intangible asset related to our acquisition under GAAP. of certain REIT II management contracts. Because this relationship was internalized as part of the Merger, we derecognized the carrying value of these intangible assets upon completion of the Merger and have included the derecognized contract value of $30.4 million in our calculation of total consideration in the table above.

As of September 30,December 31, 2018, we have deferred for capitalization $2.8capitalized approximately $11.6 million in costs related to the merger.