UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended June 30, 20222023

Or

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR |

For the transition period from _____________________ to _____________________

Commission File Number: 000-53500

CREATIVE MEDICAL TECHNOLOGY HOLDINGS, INC. |

(Exact name of |

Nevada |

| 87-0622284 |

(State or other jurisdiction of

|

| (I.R.S. Employer Identification No.) |

211 E Osborn Road, Phoenix, AZ |

| 85012 |

(Address of principal executive offices) |

| (Zip Code) |

(480) 399-2822

(Registrant’s telephone number, including area code)code: (480) 399-2822

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

| Trading Symbol(s) |

| Name of each exchange on which registered |

Common Stock, par value $0.001 per share |

| CELZ |

| The |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Sectionsection 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports). Yes ☒ No ☐

Indicate by check mark whether the registrant, and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically, every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ☐ | Accelerated filer | ☐ |

Non-accelerated Filer | ☒ | Smaller reporting company | ☒ |

|

| Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.Act ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The numberAs of August 11, 2023, there were 1,430,530 shares outstanding of the registrant’s common stock on August 12, 2022, was 14,070,279.outstanding.

|

| Page Number | ||

PART I – FINANCIAL INFORMATION |

|

| ||

|

|

|

| |

Item 1. | Financial Statements |

|

| |

|

|

|

|

|

|

| 3 |

| |

|

|

|

|

|

|

| 4 |

| |

|

|

|

|

|

|

| 5 |

| |

|

|

|

|

|

| Unaudited Condensed Consolidated Statements of Stockholder’ |

| 6 |

|

|

|

|

|

|

| Notes to Unaudited Condensed Consolidated Financial Statements |

|

|

|

|

|

|

|

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

|

|

| |

|

|

|

|

|

|

|

| ||

|

|

|

|

|

|

|

| ||

|

|

|

| |

|

| |||

|

|

|

| |

|

| |||

|

| |||

|

|

|

|

|

|

|

| ||

| 2 |

| Table of Contents |

CREATIVE MEDICAL TECHNOLOGY HOLDINGS, INC.

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS

|

| June 30, 2022 |

|

| December 31, 2021 |

| ||

ASSETS |

|

|

|

|

|

| ||

CURRENT ASSETS |

|

|

|

|

|

| ||

Cash |

| $ | 22,863,661 |

|

| $ | 10,723,870 |

|

Accounts receivable |

|

| 0 |

|

|

| 2,485 |

|

Inventory |

|

| 20,625 |

|

|

| 10,866 |

|

Prepaids and other current assets |

|

| 64,960 |

|

|

| 0 |

|

Total Current Assets |

|

| 22,949,246 |

|

|

| 10,737,221 |

|

|

|

|

|

|

|

|

|

|

OTHER ASSETS |

|

|

|

|

|

|

|

|

Other assets |

|

| 3,281 |

|

|

| 3,281 |

|

Licenses, net of amortization |

|

| 481,637 |

|

|

| 527,679 |

|

TOTAL ASSETS |

| $ | 23,434,164 |

|

| $ | 11,268,181 |

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY (DEFICIT) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CURRENT LIABILITIES |

|

|

|

|

|

|

|

|

Accounts payable |

| $ | 310,681 |

|

| $ | 761,862 |

|

Accrued expenses |

|

| 64,920 |

|

|

| 24,385 |

|

Management fee and patent liabilities - related parties |

|

| 0 |

|

|

| 250,000 |

|

Advances from related party |

|

| 14,194 |

|

|

| 14,194 |

|

Total Current Liabilities |

|

| 389,795 |

|

|

| 1,050,441 |

|

|

|

|

|

|

|

|

|

|

Commitments and contingencies |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

STOCKHOLDERS’ EQUITY (DEFICIT) |

|

|

|

|

|

|

|

|

Common stock, $0.001 par value, 50,000,000 authorized; 13,956,246 and 6,338,872 issued and 13,956,238 and 6,338,864 outstanding at June 30, 2022 and December 31, 2021, respectively |

|

| 13,957 |

|

|

| 6,339 |

|

Additional paid-in capital |

|

| 69,644,239 |

|

|

| 53,879,215 |

|

Accumulated deficit |

|

| (46,613,827 | ) |

|

| (43,667,814 | ) |

TOTAL STOCKHOLDERS’ EQUITY (DEFICIT) |

|

| 23,044,369 |

|

|

| 10,217,740 |

|

|

|

|

|

|

|

|

|

|

TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY (DEFICIT) |

| $ | 23,434,164 |

|

| $ | 11,268,181 |

|

The accompanying notes are an integral part of these condensed consolidated financial statements

CREATIVE MEDICAL TECHNOLOGY HOLDINGS, INC. | ||||||||

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS | ||||||||

|

| June 30, 2023 |

|

| December 31, 2022 |

| ||

ASSETS |

|

|

|

|

|

| ||

CURRENT ASSETS |

|

|

|

|

|

| ||

Cash |

| $ | 3,989,550 |

|

| $ | 8,320,519 |

|

Certificates of deposit |

|

| 9,581,207 |

|

|

| 10,078,617 |

|

Inventory |

|

| 10,194 |

|

|

| 10,194 |

|

Prepaids and other current assets |

|

| 153,692 |

|

|

| 338,120 |

|

Total Current Assets |

|

| 13,734,643 |

|

|

| 18,747,450 |

|

|

|

|

|

|

|

|

|

|

OTHER ASSETS |

|

|

|

|

|

|

|

|

Other assets |

|

| 3,281 |

|

|

| 3,281 |

|

Licenses, net of amortization |

|

| 389,553 |

|

|

| 435,595 |

|

TOTAL ASSETS |

| $ | 14,127,477 |

|

| $ | 19,186,326 |

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CURRENT LIABILITIES |

|

|

|

|

|

|

|

|

Accounts payable |

| $ | 344,413 |

|

| $ | 3,267,538 |

|

Accrued expenses |

|

| 39,920 |

|

|

| 39,920 |

|

Advances from related party |

|

| 14,194 |

|

|

| 14,194 |

|

Total Current Liabilities |

|

| 398,527 |

|

|

| 3,321,652 |

|

|

|

|

|

|

|

|

|

|

TOTAL LIABILITIES |

|

| 398,527 |

|

|

| 3,321,652 |

|

|

|

|

|

|

|

|

|

|

Commitments and contingencies |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

STOCKHOLDERS' EQUITY |

|

|

|

|

|

|

|

|

Common stock, $0.001 par value, 5,000,000 and 50,000,000 shares authorized; 1,431,127 and 1,407,625 issued and 1,431,126 and 1,407,624 outstanding at June 30, 2023 and December 31, 2022, respectively |

|

| 1,431 |

|

|

| 1,408 |

|

Additional paid-in capital |

|

| 69,693,425 |

|

|

| 69,675,124 |

|

Accumulated deficit |

|

| (55,965,906 | ) |

|

| (53,811,858 | ) |

TOTAL STOCKHOLDERS' EQUITY |

|

| 13,728,950 |

|

|

| 15,864,674 |

|

TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

|

|

|

|

|

|

| $ | 14,127,477 |

|

| $ | 19,186,326 |

|

|

|

|

|

|

|

|

|

|

The Accompanying notes are an integral part of these condensed consolidated financial statements | ||||||||

| 3 |

| Table of Contents |

CREATIVE MEDICAL TECHNOLOGY HOLDINGS, INC.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

|

| For the Three Months Ended June 30, 2022 |

|

| For the Three Months Ended June 30, 2021 |

|

| For the Six Months Ended June 30, 2022 |

|

| For the Six Months Ended June 30, 2021 |

| ||||

|

|

|

|

|

|

|

|

|

|

|

|

| ||||

Revenues |

| $ | 0 |

|

| $ | 10,000 |

|

| $ | 15,000 |

|

| $ | 10,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of revenues |

|

| 0 |

|

|

| 4,500 |

|

|

| 6,791 |

|

|

| 4,500 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit |

|

| 0 |

|

|

| 5,500 |

|

|

| 8,209 |

|

|

| 5,500 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OPERATING EXPENSES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

| 659,695 |

|

|

| 0 |

|

|

| 669,695 |

|

|

| 0 |

|

Selling, general and administrative |

|

| 1,108,428 |

|

|

| 498,321 |

|

|

| 2,238,485 |

|

|

| 779,244 |

|

Amortization of patent costs |

|

| 23,021 |

|

|

| 23,021 |

|

|

| 46,042 |

|

|

| 46,042 |

|

TOTAL EXPENSES |

|

| 1,791,144 |

|

|

| 521,342 |

|

|

| 2,954,222 |

|

|

| 825,286 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating loss |

|

| (1,791,144 | ) |

|

| (515,842 | ) |

|

| (2,946,013 | ) |

|

| (819,786 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OTHER INCOME/(EXPENSE) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense |

|

| 0 |

|

|

| (234,338 | ) |

|

| 0 |

|

|

| (570,414 | ) |

Gain on extinguishment of convertible notes |

|

| 0 |

|

|

| 96,444 |

|

|

| 0 |

|

|

| 96,444 |

|

Change in fair value of derivatives liabilities |

|

| 0 |

|

|

| (2,251,446 | ) |

|

| 0 |

|

|

| 26,224,593 |

|

Total other income (expense) |

|

| 0 |

|

|

| (2,389,340 | ) |

|

| 0 |

|

|

| 25,750,623 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

INCOME (LOSS) BEFORE PROVISION FOR INCOME TAXES |

|

| (1,791,144 | ) |

|

| (2,905,182 | ) |

|

| (2,946,013 | ) |

|

| 24,930,837 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Provision for income taxes |

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NET INCOME (LOSS) |

| $ | (1,791,144 | ) |

| $ | (2,905,182 | ) |

| $ | (2,946,013 | ) |

| $ | 24,930,837 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BASIC NET INCOME (LOSS) PER SHARE |

| $ | (0.20 | ) |

| $ | (1.25 | ) |

| $ | (0.38 | ) |

| $ | 11.12 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DILUTED NET INCOME (LOSS) PER SHARE |

| $ | (0.20 | ) |

| $ | (1.25 | ) |

| $ | (0.38 | ) |

| $ | 10.76 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

WEIGHTED AVERAGE NUMBER OF SHARES OUTSTANDING - BASIC |

|

| 9,011,248 |

|

|

| 2,320,084 |

|

|

| 7,739,696 |

|

|

| 2,242,318 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

WEIGHTED AVERAGE NUMBER OF SHARES OUTSTANDING - DILUTED |

|

| 9,011,248 |

|

|

| 2,320,084 |

|

|

| 7,739,696 |

|

|

| 2,328,927 |

|

The accompanying notes are an integral part of these condensed consolidated financial statements

CREATIVE MEDICAL TECHNOLOGY HOLDINGS, INC. | ||||||||||||||||

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS | ||||||||||||||||

| ||||||||||||||||

|

| For the Three Months Ended June 30, 2023 |

|

| For the Three Months Ended June 30, 2022 |

|

| For the Six Months Ended June 30, 2023 |

|

| For the Six Months Ended June 30, 2022 |

| ||||

|

|

|

|

|

|

|

|

|

|

|

|

| ||||

Revenues |

| $ | - |

|

| $ | - |

|

| $ | - |

|

| $ | 15,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of revenues |

|

| - |

|

|

| - |

|

|

| - |

|

|

| 6,791 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit |

|

| - |

|

|

| - |

|

|

| - |

|

|

| 8,209 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OPERATING EXPENSES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

| 309,480 |

|

|

| 659,695 |

|

|

| 628,509 |

|

|

| 669,695 |

|

Selling, general and administrative |

|

| 859,537 |

|

|

| 1,108,428 |

|

|

| 1,630,557 |

|

|

| 2,238,485 |

|

Amortization of patent costs |

|

| 23,021 |

|

|

| 23,021 |

|

|

| 46,042 |

|

|

| 46,042 |

|

TOTAL EXPENSES |

|

| 1,192,038 |

|

|

| 1,791,144 |

|

|

| 2,305,108 |

|

|

| 2,954,222 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating loss |

|

| (1,192,038 | ) |

|

| (1,791,144 | ) |

|

| (2,305,108 | ) |

|

| (2,946,013 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OTHER INCOME/(EXPENSE) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income |

|

| 89,913 |

|

|

| - |

|

|

| 151,060 |

|

|

| - |

|

Total other income (expense) |

|

| 89,913 |

|

|

| - |

|

|

| 151,060 |

|

|

| - |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LOSS BEFORE PROVISION FOR INCOME TAXES |

|

| (1,102,125 | ) |

|

| (1,791,144 | ) |

|

| (2,154,048 | ) |

|

| (2,946,013 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Provision for income taxes |

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NET LOSS |

| $ | (1,102,125 | ) |

| $ | (1,791,144 | ) |

| $ | (2,154,048 | ) |

| $ | (2,946,013 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NET LOSS PER SHARE - BASIC AND DILUTED |

| $ | (0.78 | ) |

| $ | (1.99 | ) |

| $ | (1.53 | ) |

| $ | (3.81 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

WEIGHTED AVERAGE NUMBER OF SHARES OUTSTANDING - BASIC AND DILUTED |

|

| 1,409,948 |

|

|

| 901,125 |

|

|

| 1,408,793 |

|

|

| 773,970 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The Accompanying notes are an integral part of these condensed consolidated financial statements | ||||||||||||||||

| 4 |

| Table of Contents |

CREATIVE MEDICAL TECHNOLOGY HOLDINGS, INC.

UNAUDITED CONDENSED CONSOLIDATED CASH FLOWS

CREATIVE MEDICAL TECHNOLOGY HOLDINGS, INC. | CREATIVE MEDICAL TECHNOLOGY HOLDINGS, INC. | |||||||||||||||

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS | UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS | |||||||||||||||

|

|

|

| |||||||||||||

|

| For the Six Months Ended June 30, 2022 |

|

| For the Six Months Ended June 30, 2021 |

|

| For the Six Months Ended June 30, 2023 |

|

| For the Six Months Ended June 30, 2022 |

| ||||

|

|

|

|

|

|

|

|

|

|

| ||||||

CASH FLOWS FROM OPERATING ACTIVITIES: |

|

|

|

|

|

|

|

|

|

| ||||||

Net income (loss) |

| $ | (2,946,013 | ) |

| $ | 24,930,837 |

| ||||||||

Adjustments to reconcile net income (loss) to |

|

|

|

|

| |||||||||||

net cash from operating activities: |

|

|

|

|

| |||||||||||

Net loss |

| $ | (2,154,048 | ) |

| $ | (2,946,013 | ) | ||||||||

Adjustments to reconcile net loss to |

|

|

|

|

| |||||||||||

net cash used in operating activities: |

|

|

|

|

| |||||||||||

Stock-based compensation |

| 50,422 |

| 211,768 |

|

| 18,324 |

| 50,422 |

| ||||||

Amortization |

| 46,042 |

| 46,042 |

|

| 46,042 |

| 46,042 |

| ||||||

Amortization of debt discounts |

| 0 |

| 451,614 |

| |||||||||||

Change in fair value of derivatives liabilities |

| 0 |

| (26,224,593 | ) | |||||||||||

Increase in principal and accrued interest balances due to penalty provision |

| 0 |

| 93,821 |

| |||||||||||

Gain on extinguishment of convertible notes |

| 0 |

| (96,444 | ) | |||||||||||

Changes in assets and liabilities: |

|

|

|

|

|

|

|

|

|

| ||||||

Accounts receivable |

| 2,485 |

| 0 |

|

| - |

| 2,485 |

| ||||||

Inventory |

| (9,759 | ) |

| 0 |

|

| - |

| (9,759 | ) | |||||

Prepaids and other current assets |

| (64,960 | ) |

| 0 |

|

| 184,428 |

| (64,960 | ) | |||||

Accounts payable |

| (451,181 | ) |

| 14,143 |

|

| (2,923,125 | ) |

| (451,181 | ) | ||||

Accrued expenses |

| 40,535 |

| 25,355 |

|

|

| - |

|

|

| 40,535 |

| |||

Management fee payable |

|

| 0 |

|

|

| (116,200 | ) | ||||||||

Net cash used in operating activities |

|

| (3,332,429 | ) |

|

| (663,657 | ) |

|

| (4,828,379 | ) |

|

| (3,332,429 | ) |

|

|

|

|

|

|

|

|

|

|

| ||||||

CASH FLOWS FROM INVESTING ACTIVITIES: |

|

|

|

|

|

|

|

|

|

|

|

|

| |||

Net cash used in investing activities |

|

| 0 |

|

|

| 0 |

| ||||||||

Investments in certificates of deposit |

| (4,551,049 | ) |

| - |

| ||||||||||

Redemptions of certificates of deposit |

|

| 5,048,459 |

|

|

| - |

| ||||||||

Net cash provided by investing activities |

|

| 497,410 |

|

|

| - |

| ||||||||

|

|

|

|

|

|

|

|

|

|

| ||||||

CASH FLOWS FROM FINANCING ACTIVITIES: |

|

|

|

|

|

|

|

|

|

| ||||||

Proceeds from sale of common stock and warrants, net of issuance costs |

| 15,471,775 |

| 0 |

|

| - |

| 15,471,775 |

| ||||||

Proceeds from exercise of warrants |

| 445 |

| 0 |

|

|

| - |

|

|

| 445 |

| |||

Proceeds from note payable |

| 0 |

| 100,000 |

| |||||||||||

Proceeds from convertible notes payable |

| 0 |

| 134,640 |

| |||||||||||

Proceeds from sale of preferred stock |

| 0 |

| 462,000 |

| |||||||||||

Related party advances |

| 0 |

| 226,500 |

| |||||||||||

Payments to settle convertible notes payable and warrants |

|

| 0 |

|

|

| (198,907 | ) | ||||||||

Net cash provided by financing activities |

|

| 15,472,220 |

|

|

| 724,233 |

|

|

| - |

|

|

| 15,472,220 |

|

|

|

|

|

|

|

|

|

|

|

| ||||||

NET INCREASE IN CASH |

| 12,139,791 |

| 60,576 |

| |||||||||||

NET INCREASE (DECREASE) IN CASH |

| (4,330,969 | ) |

| 12,139,791 |

| ||||||||||

BEGINNING CASH BALANCE |

|

| 10,723,870 |

|

|

| 98,012 |

|

|

| 8,320,519 |

|

|

| 10,723,870 |

|

ENDING CASH BALANCE |

| $ | 22,863,661 |

|

| $ | 158,588 |

|

| $ | 3,989,550 |

|

| $ | 22,863,661 |

|

|

|

|

|

|

|

|

|

|

|

| ||||||

SUPPLEMENTAL CASH FLOW INFORMATION: |

|

|

|

|

| |||||||||||

Cash payments for interest |

| $ | - |

|

| $ | 9,186 |

| ||||||||

Cash payments for income taxes |

| $ | - |

|

| $ | - |

| ||||||||

|

|

|

|

|

| |||||||||||

NON-CASH INVESTING AND FINANCING ACTIVITIES: |

|

|

|

|

|

|

|

|

|

| ||||||

Conversion of notes payable, accrued interest and derivative liabilities into common stock |

| $ | 0 |

|

| $ | 13,454,704 |

| ||||||||

Conversion of management fees and patent liability into common stock |

| $ | 250,000 |

|

| $ | 50,000 |

|

| $ | - |

|

| $ | 250,000 |

|

Discounts on convertible notes payable due to derivative liabilities |

| $ | 0 |

|

| $ | 134,640 |

| ||||||||

The accompanyingAccompanying notes are an integral part of these condensed consolidated financial statements.statements

| 5 |

| Table of Contents |

CREATIVE MEDICAL TECHNOLOGY HOLDINGS, INC.

UNAUDITED CONDENSED CONSOLIDATED STATEMENT OF STOCKHOLDERS’ EQUITY (DEFICIT)

CREATIVE MEDICAL TECHNOLOGY HOLDINGS, INC. | ||||||||||||||||||||||||||||||||||||||||||||

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY (DEFICIT) | ||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||

|

| Series A Preferred Stock |

|

| Series B Preferred Stock |

|

| Series C Preferred Stock |

|

| Common Stock |

|

| Additional Paid-in |

|

| Accumulated |

|

| Total Stockholders' |

| |||||||||||||||||||||||

|

| Shares |

|

| Amount |

|

| Shares |

|

| Amount |

|

| Shares |

|

| Amount |

|

| Shares |

|

| Amount |

|

| Capital |

|

| Deficit |

|

| Equity |

| |||||||||||

December 31, 2022 |

|

| - |

|

| $ | - |

|

|

| - |

|

| $ | - |

|

|

| - |

|

| $ | - |

|

|

| 1,407,624 |

|

| $ | 1,408 |

|

| $ | 69,675,124 |

|

| $ | (53,811,858 | ) |

| $ | 15,864,674 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Round-up shares issued in reverse stock split |

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| 23,502 |

|

|

| 23 |

|

|

| (23 | ) |

|

| - |

|

|

| - |

|

Stock-based compensation |

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| 18,324 |

|

|

| - |

|

|

| 18,324 |

|

Net loss |

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| (2,154,048 | ) |

|

| (2,154,048 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

June 30, 2023 |

|

| - |

|

| $ | - |

|

|

| - |

|

| $ | - |

|

|

| - |

|

| $ | - |

|

|

| 1,431,126 |

|

| $ | 1,431 |

|

| $ | 69,693,425 |

|

| $ | (55,965,906 | ) |

| $ | 13,728,950 |

|

|

| Series A Preferred Stock |

|

| Series B Preferred Stock |

|

| Series C Preferred Stock |

|

| Common Stock |

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||

|

| Shares |

|

| Amount |

|

| Shares |

|

| Amount |

|

| Shares |

|

| Amount |

|

| Shares |

|

| Amount |

|

| Additional Paid-in Capital |

|

| Accumulated Deficit |

|

| Total Stockholders’ Equity |

| |||||||||||

December 31, 2021 |

|

| - |

|

| $ | - |

|

|

| - |

|

| $ | 0 |

|

|

| - |

|

| $ | 0 |

|

|

| 6,338,864 |

|

| $ | 6,339 |

|

| $ | 53,879,215 |

|

| $ | (43,667,814 | ) |

| $ | 10,217,740 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Issuance of common stock and accompanying warrants, net of issuance costs |

|

| - |

|

|

| 0 |

|

|

| - |

|

|

| 0 |

|

|

| - |

|

|

| 0 |

|

|

| 2,991,669 |

|

|

| 2,992 |

|

|

| 15,468,783 |

|

|

| 0 |

|

|

| 15,471,775 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common stock issued for related party patent liabilities |

|

| - |

|

|

| 0 |

|

|

| - |

|

|

| 0 |

|

|

| - |

|

|

| 0 |

|

|

| 181,818 |

|

|

| 182 |

|

|

| 249,818 |

|

|

| 0 |

|

|

| 250,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common stock issued for warrant exercise |

|

| - |

|

|

| 0 |

|

|

| - |

|

|

| 0 |

|

|

| - |

|

|

| 0 |

|

|

| 4,443,887 |

|

|

| 4,444 |

|

|

| (3,999 | ) |

|

| 0 |

|

|

| 445 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stock-based compensation |

|

| - |

|

|

| 0 |

|

|

| - |

|

|

| 0 |

|

|

| - |

|

|

| 0 |

|

|

| - |

|

|

| 0 |

|

|

| 50,422 |

|

|

| 0 |

|

|

| 50,422 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss |

|

| - |

|

|

| 0 |

|

|

| - |

|

|

| 0 |

|

|

| - |

|

|

| 0 |

|

|

| - |

|

|

| 0 |

|

|

| 0 |

|

|

| (2,946,013 | ) |

|

| (2,946,013 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

June 30, 2022 |

|

| - |

|

| $ | 0 |

|

|

| - |

|

| $ | 0 |

|

|

| - |

|

| $ | 0 |

|

|

| 13,956,238 |

|

| $ | 13,957 |

|

| $ | 69,644,239 |

|

| $ | (46,613,827 | ) |

| $ | 23,044,369 |

|

|

| Series A Preferred Stock |

|

| Series B Preferred Stock |

|

| Series C Preferred Stock |

|

| Common Stock |

|

| Additional Paid-in |

|

| Accumulated |

|

| Total Stockholders' |

| |||||||||||||||||||||||

|

| Shares |

|

| Amount |

|

| Shares |

|

| Amount |

|

| Shares |

|

| Amount |

|

| Shares |

|

| Amount |

|

| Capital |

|

| Deficit |

|

| Equity |

| |||||||||||

March 31, 2023 |

|

| - |

|

| $ | - |

|

|

| - |

|

| $ | - |

|

|

| - |

|

| $ | - |

|

|

| 1,407,624 |

|

| $ | 1,408 |

|

| $ | 69,684,286 |

|

| $ | (54,863,781 | ) |

| $ | 14,821,913 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Round-up shares issued in reverse stock split |

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| 23,502 |

|

|

| 23 |

|

|

| (23 | ) |

|

| - |

|

|

| - |

|

Stock-based compensation |

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| 9,162 |

|

|

| - |

|

|

| 9,162 |

|

Net loss |

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| (1,102,125 | ) |

|

| (1,102,125 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

June 30, 2023 |

|

| - |

|

| $ | - |

|

|

| - |

|

| $ | - |

|

|

| - |

|

| $ | - |

|

|

| 1,431,126 |

|

| $ | 1,431 |

|

| $ | 69,693,425 |

|

| $ | (55,965,906 | ) |

| $ | 13,728,950 |

|

|

| Series A Preferred Stock |

|

| Series B Preferred Stock |

|

| Series C Preferred Stock |

|

| Common Stock |

|

|

|

|

|

|

|

|

|

| Series A Preferred Stock |

| Series B Preferred Stock |

| Series C Preferred Stock |

| Common Stock |

| Additional Paid-in |

| Accumulated |

| Total Stockholders' |

| |||||||||||||||||||||||||||||||||||||||||||||||||||||

|

| Shares |

|

| Amount |

|

| Shares |

|

| Amount |

|

| Shares |

|

| Amount |

|

| Shares |

|

| Amount |

|

| Additional Paid-in Capital |

| Accumulated Deficit |

| Total Stockholders’ Equity |

|

| Shares |

|

| Amount |

|

| Shares |

|

| Amount |

|

| Shares |

|

| Amount |

|

| Shares |

|

| Amount |

|

| Capital |

|

| Deficit |

|

| Equity |

| ||||||||||||||||||||||||

March 31, 2022 |

| - |

| $ | 0 |

| - |

| $ | 0 |

| - |

| $ | 0 |

| 6,520,682 |

| $ | 6,521 |

| $ | 54,170,393 |

| $ | (44,822,683 | ) |

| $ | 9,354,231 |

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

December 31, 2021 |

| - |

| $ | - |

| - |

| $ | - |

| - |

| $ | - |

| 633,886 |

| $ | 634 |

| $ | 53,884,920 |

| $ | (43,667,814 | ) |

| $ | 10,217,740 |

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||||||||||||||||||||||||||||||||||

Issuance of common stock and accompanying warrants, net of issuance costs |

| - |

| 0 |

| - |

| 0 |

| - |

| 0 |

| 2,991,669 |

| 2,992 |

| 15,468,783 |

| 0 |

| 15,471,775 |

|

| - |

| - |

| - |

| - | �� |

| - |

| - |

| 299,167 |

| 299 |

| 15,471,476 |

| - |

| 15,471,775 |

| |||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Common stock issued for related party patent liabilities |

| - |

| - |

| - |

| - |

| - |

| - |

| 18,182 |

| 18 |

| 249,982 |

| - |

| 250,000 |

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Common stock issued for warrant exercise |

| - |

| 0 |

| - |

| 0 |

| - |

| 0 |

| 4,443,887 |

| 4,444 |

| (3,999 | ) |

| 0 |

| 445 |

|

| - |

| - |

| - |

| - |

| - |

| - |

| 444,389 |

| 444 |

| 1 |

| - |

| 445 |

| |||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Stock-based compensation |

| - |

| 0 |

| - |

| 0 |

| - |

| 0 |

| - |

| 0 |

| 9,062 |

| 0 |

| 9,062 |

|

| - |

| - |

| - |

| - |

| - |

| - |

| - |

| - |

| 50,422 |

| - |

| 50,422 |

| ||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Net loss |

| - |

| 0 |

| - |

| 0 |

| - |

| 0 |

| - |

| 0 |

| 0 |

| (1,791,144 | ) |

| (1,791,144 | ) |

| - |

| - |

| - |

| - |

| - |

| - |

| - |

| - |

| - |

| (2,946,013 | ) |

| (2,946,013 | ) | ||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

June 30, 2022 |

|

| - |

|

| $ | 0 |

|

|

| - |

|

| $ | 0 |

|

|

| - |

|

| $ | 0 |

|

|

| 13,956,238 |

|

| $ | 13,957 |

|

| $ | 69,644,239 |

|

| $ | (46,613,827 | ) |

| $ | 23,044,369 |

|

|

| - |

|

| $ | - |

|

|

| - |

|

| $ | - |

|

|

| - |

|

| $ | - |

|

|

| 1,395,624 |

|

| $ | 1,395 |

|

| $ | 69,656,801 |

|

| $ | (46,613,827 | ) |

| $ | 23,044,369 |

|

|

| Series A Preferred Stock |

|

| Series B Preferred Stock |

|

| Series C Preferred Stock |

|

| Common Stock |

|

| Additional Paid-in |

|

| Accumulated |

|

| Total Stockholders' |

| |||||||||||||||||||||||

|

| Shares |

|

| Amount |

|

| Shares |

|

| Amount |

|

| Shares |

|

| Amount |

|

| Shares |

|

| Amount |

|

| Capital |

|

| Deficit |

|

| Equity |

| |||||||||||

March 31, 2022 |

|

| - |

|

| $ | - |

|

|

| - |

|

| $ | - |

|

|

| - |

|

| $ | - |

|

|

| 652,068 |

|

| $ | 652 |

|

| $ | 54,176,262 |

|

| $ | (44,822,683 | ) |

| $ | 9,354,231 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Issuance of common stock and accompanying warrants, net of issuance costs |

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| 299,167 |

|

|

| 299 |

|

|

| 15,471,476 |

|

|

| - |

|

|

| 15,471,775 |

|

Common stock issued for warrant exercise |

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| 444,389 |

|

|

| 444 |

|

|

| 1 |

|

|

| - |

|

|

| 445 |

|

Stock-based compensation |

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| 9,062 |

|

|

| - |

|

|

| 9,062 |

|

Net loss |

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| (1,791,144 | ) |

|

| (1,791,144 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

June 30, 2022 |

|

| - |

|

| $ | - |

|

|

| - |

|

| $ | - |

|

|

| - |

|

| $ | - |

|

|

| 1,395,624 |

|

| $ | 1,395 |

|

| $ | 69,656,801 |

|

| $ | (46,613,827 | ) |

| $ | 23,044,369 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The Accompanying notes are an integral part of these condensed consolidated financial statements | ||||||||||||||||||||||||||||||||||||||||||||

| 6 |

| Table of Contents |

|

| Series A Preferred Stock |

|

| Series B Preferred Stock |

|

| Series C Preferred Stock |

|

| Common Stock |

|

|

|

|

|

|

|

| |||||||||||||||||||||||||

|

| Shares |

|

| Amount |

|

| Shares |

|

| Amount |

|

| Shares |

|

| Amount |

|

| Shares |

|

| Amount |

|

| Additional Paid-in Capital |

|

| Accumulated Deficit |

|

| Total Stockholders’ Deficit |

| |||||||||||

December 31, 2020 |

|

| 3,000,000 |

|

| $ | 3,000 |

|

|

| - |

|

| $ | 0 |

|

|

| - |

|

| $ | 0 |

|

|

| 1,537,073 |

|

| $ | 1,537 |

|

| $ | 22,082,689 |

|

| $ | (61,890,236 | ) |

| $ | (39,803,010 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Proceeds from sales of preferred stock |

|

| - |

|

|

| 0 |

|

|

| 350 |

|

|

| 321,000 |

|

|

| 150 |

|

|

| 141,000 |

|

|

| 4,286 |

|

|

| 4 |

|

|

| (4 | ) |

|

| 0 |

|

|

| 462,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common stock issued for related party management liabilities |

|

| - |

|

|

| 0 |

|

|

| - |

|

|

| 0 |

|

|

| - |

|

|

| 0 |

|

|

| 89,286 |

|

|

| 89 |

|

|

| 49,911 |

|

|

| 0 |

|

|

| 50,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common stock issued for conversion of convertible notes, accrued interest and derivative liabilities |

|

| - |

|

|

| 0 |

|

|

| - |

|

|

| 0 |

|

|

| - |

|

|

| 0 |

|

|

| 772,099 |

|

|

| 772 |

|

|

| 1,228,579 |

|

|

| 0 |

|

|

| 1,229,351 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Relief of derivative liabilities |

|

| - |

|

|

| 0 |

|

|

| - |

|

|

| 0 |

|

|

| - |

|

|

| 0 |

|

|

| - |

|

|

| - |

|

|

| 12,225,353 |

|

|

| 0 |

|

|

| 12,225,353 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dividends on preferred stock |

|

| - |

|

|

| 0 |

|

|

| - |

|

|

| 0 |

|

|

| - |

|

|

| 0 |

|

|

| - |

|

|

| 0 |

|

|

| (20,752 | ) |

|

| 0 |

|

|

| (20,752 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cashless exercise of warrants |

|

| - |

|

|

| 0 |

|

|

| - |

|

|

| 0 |

|

|

| - |

|

|

| 0 |

|

|

| 37,870 |

|

|

| 38 |

|

|

| (38 | ) |

|

| 0 |

|

|

| 0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stock-based compensation |

|

| - |

|

|

| 0 |

|

|

| - |

|

|

| 0 |

|

|

| - |

|

|

| 0 |

|

|

| - |

|

|

| 0 |

|

|

| 211,768 |

|

|

| 0 |

|

|

| 211,768 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income |

|

| - |

|

|

| 0 |

|

|

| - |

|

|

| 0 |

|

|

| - |

|

|

| 0 |

|

|

| - |

|

|

| 0 |

|

|

| 0 |

|

|

| 24,930,837 |

|

|

| 24,930,837 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

June 30, 2021 |

|

| 3,000,000 |

|

| $ | 3,000 |

|

|

| 350 |

|

| $ | 321,000 |

|

|

| 150 |

|

| $ | 141,000 |

|

|

| 2,440,614 |

|

| $ | 2,440 |

|

| $ | 35,777,506 |

|

| $ | (36,959,399 | ) |

| $ | (714,453 | ) |

|

| Series A Preferred Stock |

|

| Series B Preferred Stock |

|

| Series C Preferred Stock |

|

| Common Stock |

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||

|

| Shares |

|

| Amount |

|

| Shares |

|

| Amount |

|

| Shares |

|

| Amount |

|

| Shares |

|

| Amount |

|

| Additional Paid-in Capital |

|

| Accumulated Deficit |

|

| Total Stockholders’ Deficit |

| |||||||||||

March 31, 2021 |

|

| 3,000,000 |

|

| $ | 3,000 |

|

|

| 350 |

|

| $ | 326,600 |

|

|

| 150 |

|

| $ | 141,049 |

|

|

| 2,280,160 |

|

|

| 2,280 |

|

| $ | 31,138,715 |

|

| $ | (34,054,217 | ) |

| $ | (2,442,573 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common stock issued for related party management liabilities |

|

| - |

|

|

| - |

|

|

| - |

|

|

| 0 |

|

|

| - |

|

|

| 0 |

|

|

| - |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common stock issued for conversion of convertible notes, accrued interest and derivative liabilities |

|

| - |

|

|

| 0 |

|

|

| - |

|

|

| 0 |

|

|

| - |

|

|

| 0 |

|

|

| 142,695 |

|

|

| 142 |

|

|

| 341,646 |

|

|

| 0 |

|

|

| 341,788 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Relief of derivative liabilities |

|

| - |

|

|

| 0 |

|

|

| - |

|

|

| 0 |

|

|

| - |

|

|

| 0 |

|

|

| - |

|

|

| 0 |

|

|

| 4,100,498 |

|

|

| 0 |

|

|

| 4,100,498 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dividends on preferred stock |

|

| - |

|

|

| 0 |

|

|

| - |

|

|

| (5,600 | ) |

|

| - |

|

|

| (49 | ) |

|

| - |

|

|

| 0 |

|

|

| (15,103 | ) |

|

| 0 |

|

|

| (20,752 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cashless exercise of warrants |

|

| - |

|

|

| 0 |

|

|

| - |

|

|

| 0 |

|

|

| - |

|

|

| 0 |

|

|

| 17,759 |

|

|

| 18 |

|

|

| (18 | ) |

|

| 0 |

|

|

| 0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stock-based compensation |

|

| - |

|

|

| 0 |

|

|

| - |

|

|

| 0 |

|

|

| - |

|

|

| 0 |

|

|

| - |

|

|

| 0 |

|

|

| 211,768 |

|

|

| 0 |

|

|

| 211,768 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss |

|

| - |

|

|

| 0 |

|

|

| - |

|

|

| 0 |

|

|

| - |

|

|

| 0 |

|

|

| - |

|

|

| 0 |

|

|

| 0 |

|

|

| (2,905,182 | ) |

|

| (2,905,182 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

June 30, 2021 |

|

| 3,000,000 |

|

| $ | 3,000 |

|

|

| 350 |

|

| $ | 321,000 |

|

|

| 150 |

|

| $ | 141,000 |

|

|

| 2,440,614 |

|

| $ | 2,440 |

|

| $ | 35,777,506 |

|

| $ | (36,959,399 | ) |

| $ | (714,453 | ) |

The accompanying notes are an integral part of these consolidated financial statements.

CREATIVE MEDICAL TECHNOLOGY HOLDINGS, INCINC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

JUNE 30, 20222023

NOTE 1 – ORGANIZATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Organization – - Creative Medical Technologies Holdings, Inc. (the “Company”) is a commercial stage biotechnology company focused on immunology,dedicated to the advancement of identifying and translating novel biological therapeutics in the fields of immunotherapy, endocrinology, urology, orthopedicsneurology and neurology using adult stem cell treatments.orthopedics. The Company was incorporated on December 3, 1998, in the State of Nevada under the name Jolley Marketing, Inc. On May 18, 2016, the Company closed a transaction which was accounted for as a recapitalization, reverse merger, under which Creative Medical Technologies, Inc., a Nevada corporation (“CMT”) became the Company’s wholly-ownedwholly owned subsidiary, and Creative Medical Health, Inc. (“CMH”), which was CMT’s sole stockholder prior to the merger, became the Company’s principal stockholder. In connection with this merger, the Company changed its name to Creative Medical Technologies Holdings, Inc. to reflect its current business.

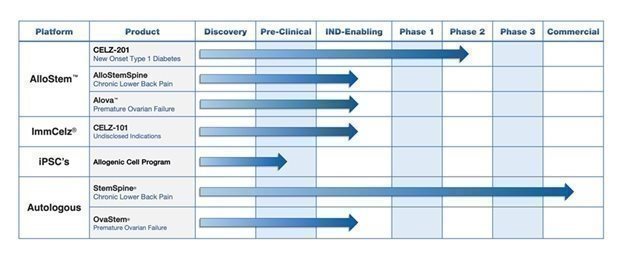

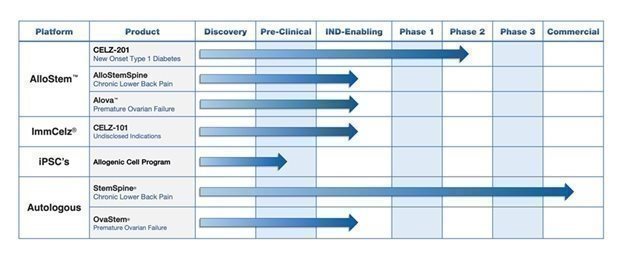

CMT was originally created on December 30, 2015 (“Inception”), as the urological arm of CMH to monetize a patent and related intellectual property related to the treatment of erectile dysfunction (“ED”), which it acquired from CMH in February 2016. Subsequently, the Company has expanded its development and acquisition of intellectual property beyond urology to include therapeutic treatments utilizing “re-programmed” stem cells, and the treatment of neurologic disorders, lower back pain, type I diabetes, and heart, liver, kidney, and other diseases using various types of stem cells through our ImmCelz, Inc., StemSpine, Inc. and AmnioStemAlloCelz LLC subsidiaries. However, neither ImmCelz Inc., StemSpine Inc. nor AmnioStemAlloCelz LLC have commenced commercial activities.

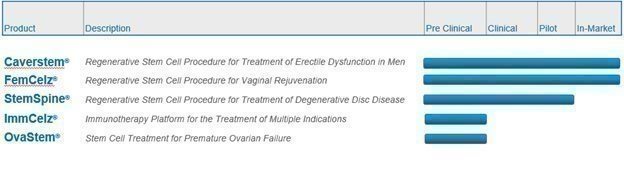

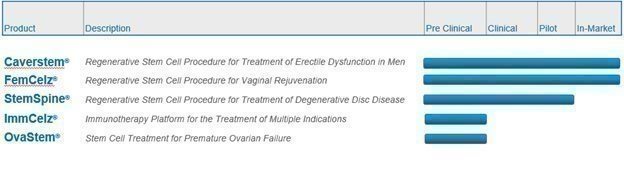

The Company currently conducts substantially all of its commercial operations through CMT, which markets and sells the Company’s CaverStem®CaverStem® and FemCelz® FemCelz® disposable kits utilized by physicians to perform autologous procedures that treat erectile dysfunction and female sexual dysfunction, respectively. In addition to its CaverStem® and FemCelz® products, the Company is currently in the process of recruiting clinical sites for its StemSpine® Regenerative Stem Cell Procedure for the Treatment of Degenerative Disc Disease, an autologous procedure that utilizes a patient’s own stem cells to treat lower back pain.

In 2020, through the Company’s ImmCelz Inc. subsidiary, the Company began exploring the development ofdeveloping treatments that utilize a patient’s own extracted immune cells that are then “reprogrammed” by culturing them outside the patient’s body with optimized stem cells. The immune cells are then re-injected into the patient from whom they were extracted. The Company believes this process endows the immune cells with regenerative properties that may be suitable for the treatment of stroke victims, among othermultiple indications. In contrast to other stem cell-based approaches, the immune cells are significantly smaller in size than stem cells and are believed to more effectively penetrate areas of the damaged tissues and induce regeneration.

Use of Estimates – – The preparation of the condensed consolidated financial statements in conformity with accounting principles generally accepted in the U.S. requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the balance sheet and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Basis of Presentation -– The consolidated financial statements and accompanying notes have been prepared in accordance with U.S. generally accepted accounting principles (“U.S. GAAP”GAAP”). The consolidated financial statements include the accounts of the Company and its wholly-ownedwholly owned subsidiaries. All intercompany balances and transactions have been eliminated in consolidation. In the opinion of the Company’s management, the consolidated financial statements include all adjustments, which include only normal recurring adjustments, necessary for the fair presentation of the Company’s financial position for the periods presented. The operations for the six-month period ended June 30, 2022, are not necessarily indicative of the operating results for the full year.

Risks and Uncertainties - The Company has a limited operating history and has only recently started to generategenerated minimal revenues from its planned principal operations.

| Table of Contents |

On January 30, 2020, the World Health Organization declared the COVID-19 outbreak a “Public Health Emergency of International Concern” and on March 10, 2020, declared it to be a pandemic. Actions taken around the world to help mitigate the spread of the COVID-19 include restrictions on travel, and quarantines in certain areas, and forced closures for certain types of public places and businesses. The COVID-19 and actions taken to mitigate it have had and are expected to continue to have an adverse impact on the economies and financial markets of many countries, including the geographical area in which the Company operates. While it is unknown how long these conditions will last and what the complete financial effect will be to the company, to-date, the Company has experienced a reduction in revenues due to the COVID-19 outbreak.

The Company’s business and operations are sensitive to general business and economic conditions in the U.S. and worldwide. These conditions include short-term and long-term interest rates, inflation, fluctuations in debt and equity capital markets and the general condition of the U.S. and world economy. A host of factors beyond the Company’s control could cause fluctuations in these conditions, including the political environment and acts or threats of war or terrorism. Adverse developments in these general business and economic conditions, including through recession, downturn or otherwise, could have a material adverse effect on the Company’s financial condition and the results of its operations.

The Company has only recently started to generate sales and we have limited marketing and/or distribution capabilities. The Company has limited experience in developing, training, or managing a sales force and will incur substantial additional expenses if it decides to market any of its current and future products and services with an internal sales organization. Developing a marketing and sales force is also time consumingtime-consuming and could delay the launch of its future products and services. In addition, the Company will compete with many companies that currently have extensive and well-funded marketing and sales operations. The Company’s marketing and sales efforts may be unable to compete successfully against these companies. In addition, the Company has limited capital to devote to sales and marketing.

The Company’s industry is characterized by rapid changes in technology and customer demands. As a result, the Company’s products and services may quickly become obsolete and unmarketable. The Company’s future success will depend on its ability to adapt to technological advances, anticipate customer demands, develop new products and services, and enhance the Company’s current products and services on a timely and cost-effective basis. Further, the Company’s products and services must remain competitive with those of other companies with substantially greater resources. The Company may experience technical or other difficulties that could delay or prevent the development, introduction or marketing of new products and services or enhanced versions of existing products and services. Also, the Company may not be able to adapt new or enhanced products and services to emerging industry standards, and the Company’s new products and services may not be favorably received. In addition, the Company may not have the capital resources to further the development of existing and/or new ones.

On July 8, 2022, the Company received a letter from The Nasdaq Stock Market LLC advising us that we were not in compliance with Nasdaq Listing Rule 5550(a)(2) because the closing bid price of our common stock was below $1.00 per share for 30 consecutive business days. Pursuant to Nasdaq’s Listing Rules, the Company hashad a 180 day180-day grace period, until January 4, 2023, during which the Company may regaincould have regained compliance if the bid price of our common stock closesclosed at $1.00 per share or more for a minimum of ten consecutive business days. In addition,Subsequent to January 4, 2023, the Company may be eligible forhas been granted an additional 180-day grace period if we meet Nasdaq’s initial listing standards (other than with respect to minimum bid price) for The Nasdaq Capital Market. The Company intends to actively monitorperiod. On June 12, 2023, the company effected a 10-to-1 reverse common stock split. Following the reverse stock split, the closing bid price forof our common stock between now and January 4, 2023, and will consider available optionswas above $1.00 per share for ten consecutive business days from June 12, 2020 to regainJune 26, 2023. Pursuant to Nasdaq’s Listing Rules, the company was in compliance with Nasdaq’sNasdaq Listing Rule 5550(a)(2). On June 27, 2023 the Company received written notice from the Nasdaq Stock Market notifying the Company that is had regained compliance with the minimum bid price requirements. However, there can be no assurance that the Company will be able to regain compliance with Nasdaq’s Listing Rules and maintain our Nasdaq listing. The delisting of our shares of common stock from Nasdaq may have a material negative impact on the liquidity of our securities, as well as a material negative impact on our ability to raise capital in the future.requirement.

Regarding the war between Russia and Ukraine, we have no direct exposure to those geographies. We cannot predict how global supply chain activities, or the economy at large may be impacted by a prolonged war in Ukraine or sanctions imposed in response to the war, or whether future conflicts, if any, may adversely affect our results of operations.