UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON,Washington, D.C. 20549

FORM 10-Q

[X]☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended September 30, 2017March 31, 2021

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transitional period from _____________ to ______________

Commission File Number: 333-189731

DIEGO PELLICER WORLDWIDE, INC.

(Name of registrant as specified in its charter)

| DIEGO PELLICER WORLDWIDE, INC. |

| (Exact name of registrant as specified in its charter) |

| Delaware | | 33-1223037 |

| (State or other jurisdiction of | | (I.R.S. Employer |

incorporation or organization) | | (I.R.S. Employer

Identification No.) |

9030 Seward Park Ave, S, #501, Seattle, WA 981186160 Plumas Street, Suite 100, Reno, NV 89519

(Address of principal executive offices) (Zip Code)

(516) 900-3799

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class registered: | | Trading Symbol(s): | | Name of each exchange on which registered: |

| N/A | | N/A | | N/A |

Indicate by check mark whether the registrantregistrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X]☒ No [ ]☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes [X]☒ No [ ]☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”filer,” “smaller reporting company” and “smaller reporting“emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated Filer | [ ]☐ | | Accelerated Filer | [ ]☐ | |

| Non-accelerated Filer | [ ]☒ | | Small Reporting Company | [X]☒ | |

| (Do not check if smaller reporting company) | | Emerging Growth Companygrowth company | [ ]☐ | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes [ ]☐ No [X]☒

As of November 6, 2017May 10, 2021 there were 60,737,336223,465,734 shares of common stock issued and outstanding.

TABLE OF CONTENTS

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q (this “Report”) contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Forward-looking statements discuss matters that are not historical facts. Because they discuss future events or conditions, forward-looking statements may include words such as “anticipate,” “believe,” “estimate,” “intend,” “could,” “should,” “would,” “may,” “seek,” “plan,” “might,” “will,” “expect,” “predict,” “project,” “forecast,” “potential,” “continue” negatives thereof or similar expressions. Forward-looking statements speak only as of the date they are made, are based on various underlying assumptions and current expectations about the future and are not guarantees. Such statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, level of activity, performance or achievement to be materially different from the results of operations or plans expressed or implied by such forward-looking statements.

We cannot predict all of the risks and uncertainties. Accordingly, such information should not be regarded as representations that the results or conditions described in such statements or that our objectives and plans will be achieved and we do not assume any responsibility for the accuracy or completeness of any of these forward-looking statements. These forward-looking statements are found at various places throughout this Report and include information concerning possible or assumed future results of our operations, including statements about potential acquisition or merger targets; business strategies; future cash flows; financing plans; plans and objectives of management; any other statements regarding future acquisitions, future cash needs, future operations, business plans and future financial results, and any other statements that are not historical facts.

These forward-looking statements represent our intentions, plans, expectations, assumptions and beliefs about future events and are subject to risks, uncertainties and other factors. Many of those factors are outside of our control and could cause actual results to differ materially from the results expressed or implied by those forward-looking statements. In light of these risks, uncertainties and assumptions, the events described in the forward-looking statements might not occur or might occur to a different extent or at a different time than we have described. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this Report. All subsequent written and oral forward-looking statements concerning other matters addressed in this Report and attributable to us or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this Report.

Except to the extent required by law, we undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events, a change in events, conditions, circumstances or assumptions underlying such statements, or otherwise.

PART I – FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS.

DIEGO PELLICER WORLDWIDE, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(Unaudited)

| Diego Pellicer Worldwide, Inc. |

| Condensed Consolidated Balance Sheets |

| | | September 30, 2017 | | | December 31, 2016 | |

| | | | (Unaudited) | | | | | |

| Assets | | | | | | | | |

| | | | | | | | | |

| Current assets: | | | | | | | | |

| Cash and cash equivalents | | $ | 107,462 | | | $ | 51,333 | |

| Accounts receivable | | | 25,355 | | | | - | |

| Prepaid expenses | | | 78,746 | �� | | | 482,765 | |

| Inventory | | | 29,975 | | | | 47,025 | |

| Deferred rent receivable | | | 20,867 | | | | - | |

| Total current assets | | | 262,405 | | | | 581,123 | |

| Property and equipment net | | | 517,838 | | | | 758,112 | |

| Investments at cost | | | - | | | | 43,333 | |

| Security deposits | | | 320,000 | | | | 320,000 | |

| | | | | | | | | |

| Total assets | | $ | 1,100,243 | | | $ | 1,702,568 | |

| | | | | | | | | |

| Liabilities and deficiency in stockholders’ equity | | | | | | | | |

| | | | | | | | | |

| Current liabilities: | | | | | | | | |

| Accounts payable | | $ | 495,619 | | | $ | 823,797 | |

| Accrued payable - related party | | | 743,166 | | | | 509,294 | |

| Accrued expenses | | | 186,499 | | | | 1,207,803 | |

| Notes payable - related party | | | 307,312 | | | | 307,312 | |

| Notes payable | | | 126,000 | | | | 1,310,678 | |

| Convertible notes, net of discount | | | 369,162 | | | | 334,156 | |

| Deferred rent | | | 77,182 | | | | 107,957 | |

| Deferred revenue | | | 53,000 | | | | 53,000 | |

| Derivative liabilities | | | 4,767,377 | | | | 338,282 | |

| Warrant liabilities | | | 379,084 | | | | - | |

| | | | | | | | | |

| Total current liabilities | | | 7,504,401 | | | | 4,992,279 | |

| | | | | | | | | |

| Deferred revenue | | | 275,500 | | | | 316,000 | |

| | | | | | | | | |

| Total liabilities | | | 7,779,901 | | | | 5,308,279 | |

| | | | | | | | | |

| Deficiency in stockholders’ equity: | | | | | | | | |

| | | | | | | | | |

| Preferred stock, Series A and B, par value $.0001 per share; 5,000,000 shares authorized, none issued and outstanding | | | - | | | | - | |

| Common stock, par value $.000001 per share; 95,000,000 shares authorized, 57,008,298and 49,081,878 shares outstanding as of September 30, 2017 and December 31, 2016, respectively, | | | 57 | | | | 49 | |

| Additional paid-in capital | | | 26,791,545 | | | | 24,508,365 | |

| Stock to be issued | | | 6,986,424 | | | | - | |

| Accumulated deficit | | | (40,457,684 | ) | | | (28,114,125 | ) |

| | | | | | | | | |

| Total deficiency in stockholders’ equity | | | (6,679,658 | ) | | | (3,605,711 | ) |

| | | | | | | | | |

| Total liabilities and deficiency in stockholders’ equity | | $ | 1,100,243 | | | $ | 1,702,568 | |

| | | March 31, | | December 31, |

| | | 2021 | | 2020 |

| | | (Unaudited) | | |

| Assets | | | | | | | | |

| | | | | | | | | |

| Current assets: | | | | | | | | |

| Cash | | $ | 198,101 | | | $ | 327,864 | |

| Accounts receivable | | | 520,974 | | | | 523,958 | |

| Prepaid expenses | | | 1,275 | | | | 11,275 | |

| | | | | | | | | |

| Total current assets | | | 720,350 | | | | 863,097 | |

| | | | | | | | | |

| Other receivables | | | 1,057,272 | | | | 1,030,422 | |

| Security deposits | | | 90,000 | | | | 90,000 | |

| Right of use assets | | | 951,324 | | | | 1,062,592 | |

| | | | | | | | | |

| Total assets | | $ | 2,818,946 | | | $ | 3,046,111 | |

| | | | | | | | | |

| Liabilities and deficiency in stockholders’ equity | | | | | | | | |

| | | | | | | | | |

| Current liabilities: | | | | | | | | |

| Accounts payable | | $ | 508,218 | | | $ | 526,377 | |

| Accrued payable - related parties | | | 1,333,920 | | | | 1,332,756 | |

| Accrued expenses | | | 902,788 | | | | 931,825 | |

| Notes payable - related party | | | 140,958 | | | | 140,958 | |

| Notes payable | | | 133,403 | | | | 133,403 | |

| Convertible notes, net of discount and costs | | | 2,941,274 | | | | 3,239,274 | |

| Derivative liabilities | | | 5,713,575 | | | | 5,997,865 | |

| Lease liabilities | | | 270,021 | | | | 327,685 | |

| Warrant liabilities | | | 4,918 | | | | 476 | |

| | | | | | | | | |

| Total current liabilities | | | 11,949,075 | | | | 12,630,619 | |

| | | | | | | | | |

| Notes payable - long term | | | 150,000 | | | | 206,444 | |

| Lease liabilities, net of current portion | | | 668,309 | | | | 715,488 | |

| | | | | | | | | |

| Total liabilities | | | 12,767,384 | | | | 13,552,551 | |

| | | | | | | | | |

| Redeemable convertible preferred stock, Series C, par value $.00001 per share; 1,500,000 shares authorized, 293,700 and no shares issued and outstanding, net of discount of $282,737 and $0, respectively, | | | 13,155 | | | | — | |

| | | | | | | | | |

| Deficiency in stockholders’ equity: | | | | | | | | |

| | | | | | | | | |

| Preferred stock, Series A and B, par value $.0001 per share; 5,000,000 shares authorized, none issued and outstanding | | | — | | | | — | |

| Common stock, par value $.000001 per share; 840,000,000 shares authorized, 222,327,908 and 217,271,495 shares issued and outstanding, respectively | | | 221 | | | | 216 | |

| Additional paid-in capital | | | 45,261,664 | | | | 44,554,119 | |

| Stock to be issued | | | 76,068 | | | | 49,225 | |

| Accumulated deficit | | | (55,299,546 | ) | | | (55,110,000 | ) |

| | | | | | | | | |

| Total deficiency in stockholders’ equity | | | (9,961,593 | ) | | | (10,506,440 | ) |

| | | | | | | | | |

| Total liabilities and deficiency in stockholders’ equity | | $ | 2,818,946 | | | $ | 3,046,111 | |

See Accompanying Notes to Unaudited Condensed Consolidated Financial Statements.

| Diego Pellicer Worldwide, Inc. |

4Condensed Consolidated Statements of Operations |

| (Unaudited) |

DIEGO PELLICER WORLDWIDE, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

| | | Three Months Ended | | | Three Months Ended | | | Nine Months Ended | | | Nine Months Ended | |

| | | September 30, 2017 | | | September 30, 2016 | | | September 30, 2017 | | | September 30, 2016 | |

| | | | | | | | | | | | | |

| REVENUES | | | | | | | | | | | | | | | | |

| Net Rental Revenue | | $ | 297,428 | | | $ | 90,334 | | | $ | 1,152,425 | | | $ | 313,202 | |

| Rental Expense | | | (191,556 | ) | | | (257,599 | ) | | | (828,677 | ) | | | (831,262 | ) |

| Gross Profit | | | 105,872 | | | | (167,265 | ) | | | 323,748 | | | | (518,060 | ) |

| | | | | | | | | | | | | | | | | |

| Operating expenses: | | | | | | | | | | | | | | | | |

| General and administrative expenses | | | 871,217 | | | | 738,532 | | | | 3,439,038 | | | | 4,081,460 | |

| Selling Expense | | | 37,855 | | | | 5,009 | | | | 71,744 | | | | 5,009 | |

| Depreciation Expense | | | 108,710 | | | | - | | | | 348,209 | | | | - | |

| Income (Loss) from Operations | | | (911,910 | ) | | | (910,806 | ) | | | (3,535,243 | ) | | | (4,604,529 | ) |

| | | | | | | | | | | | | | | | | |

| Other Income (Expense) | | | | | | | | | | | | | | | | |

| Licensing Revenue | | | 13,500 | | | | 13,500 | | | | 40,500 | | | | 40,500 | |

| Other Income (Expense) | | | 5,978 | | | | | | | | 51,808 | | | | | |

| Interest Expense | | | (1,230,865 | ) | | | (111,254 | ) | | | (1,965,863 | ) | | | (216,910 | ) |

| Impairment Loss | | | - | | | | (727,224 | ) | | | (82,478 | ) | | | (727,224 | ) |

| Extinguishment of Debt | | | 1,450,856 | | | | | | | | (4,156,980 | ) | | | | |

| Change in Derivative Liabilities | | | (3,310,838 | ) | | | (136,485 | ) | | | (2,316,219 | ) | | | (30,149 | ) |

| Change in Value of Warrants | | | (67,868 | ) | | | | | | | (379,084 | ) | | | | |

| Total Other Income (Loss) | | | (3,139,237 | ) | | | (961,463 | ) | | | (8,808,316 | ) | | | (933,783 | ) |

| | | | | | | | | | | | | | | | | |

| Provision for taxes | | | | | | | | | | | | | | | | |

| NET INCOME (LOSS) | | $ | (4,051,147 | ) | | $ | (1,872,269 | ) | | $ | (12,343,559 | ) | | $ | (5,538,312 | ) |

| | | | | | | | | | | | | | | | | |

| Loss per share - basic and diluted | | | (0.07 | ) | | $ | (0.04 | ) | | | (0.24 | ) | | $ | (0.14 | ) |

| | | | | | | | | | | | | | | | | |

| Weighted average common shares outstanding - basic and diluted | | | 54,208,198 | | | | 43,505,355 | | | | 51,483,444 | | | | 40,891,947 | |

| | | Three Months Ended | | Three Months Ended |

| | | March 31, 2021 | | March 31, 2020 |

| | | | | |

| Revenues | | | | | | | | |

| Net rental revenue | | $ | 191,753 | | | $ | 384,031 | |

| Rental expense | | | (159,027 | ) | | | (290,793 | ) |

| Gross profit | | | 32,726 | | | | 93,238 | |

| | | | | | | | | |

| Operating expenses: | | | | | | | | |

| General and administrative expenses | | | 198,251 | | | | 267,003 | |

| Selling expense | | | 9,881 | | | | 6,804 | |

| Loss from operations | | | (175,406 | ) | | | (180,569 | ) |

| | | | | | | | | |

| Other income (expense) | | | | | | | | |

| Interest income | | | 26,912 | | | | 32,891 | |

| Forgiveness of debt income | | | 56,908 | | | | — | |

| Interest expense | | | (209,542 | ) | | | (667,577 | ) |

| Lease termination payments | | | 33,851 | | | | — | |

| Extinguishment of debt | | | 389,550 | | | | 1,932 | |

| Change in derivative liabilities | | | 698,449 | | | | 302,004 | |

| Change in value of warrants | | | (4,442 | ) | | | 97 | |

| Total other income (loss), net | | | 991,686 | | | | (330,653 | ) |

| | | | | | | | | |

| Provision for taxes | | | — | | | | — | |

| Net income (loss) | | | 816,280 | | | | (511,222 | ) |

| Deemed dividend on preferred stock | | | (1,005,826 | ) | | | (58,456 | ) |

| Net loss attributable to common stockholders | | $ | (189,546 | ) | | $ | (569,678 | ) |

| | | | | | | | | |

| Loss per share - basic and diluted | | $ | (0.00 | ) | | $ | (0.00 | ) |

| | | | | | | | | |

| Weighted average common shares outstanding - basic and diluted | | | 219,506,975 | | | | 122,673,197 | |

See Accompanying Notes to Unaudited Condensed Consolidated Financial Statements.

| DIEGO PELLICER WORLDWIDE, INC |

5Condensed Consolidated Statements of Stockholders’ Deficit |

| For the Three Months Ended March 31, 2021 and 2020 |

| (Unaudited) |

| | | Redeemable Convertible Preferred Stock Shares | | Amount | | | Common Stock Shares | | Amount | | Preferred Stock Shares | | Amount | | Additional Paid-in Capital | | Accumulated Deficit | | Common Stock to be issued | | Total |

| Balance - December 31, 2020 | | | — | | | $ | — | | | | | 217,271,495 | | | | 216 | | | | — | | | $ | — | | | $ | 44,554,119 | | | $ | (55,110,000 | ) | | $ | 49,225 | | | $ | (10,506,440 | ) |

| Issuance of common shares for services | | | — | | | | — | | | | | 30,000 | | | | — | | | | — | | | | — | | | | 1,915 | | | | — | | | | 2,000 | | | | 3,915 | |

| Issuance of common shares for services - related parties | | | — | | | | — | | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 24,843 | | | | 24,843 | |

| Common stock issued upon conversion of notes payable and accrued interest | | | — | | | | — | | | | | 5,026,413 | | | | 5 | | | | — | | | | — | | | | 705,630 | | | | — | | | | — | | | | 705,635 | |

| Series C preferred stock issued for cash, net of costs and discounts | | | 293,700 | | | | — | | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

| Accrued dividends and accretion of conversion feature on Series C preferred stock | | | — | | | | 13,155 | | | | | — | | | | — | | | | — | | | | — | | | | — | | | | (13,155 | ) | | | — | | | | (13,155 | ) |

| Deemed dividends related to conversion feature of Series C preferred stock | | | — | | | | — | | | | | — | | | | — | | | | — | | | | — | | | | — | | | | (992,671 | ) | | | — | | | | (992,671 | ) |

| Net income | | | — | | | | — | | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 816,280 | | | | — | | | | 816,280 | |

| Balance - March 31, 2021 | | | 293,700 | | | $ | 13,155 | | | | | 222,327,908 | | | $ | 221 | | | | — | | | $ | — | | | $ | 45,261,664 | | | $ | (55,299,546 | ) | | $ | 76,068 | | | $ | (9,961,593 | ) |

DIEGO PELLICER WORLDWIDE, INC.

CONDENSED CONSOLIDATED STATEMENT OF CASH FLOW

(Unaudited)

| | | Nine Months Ended | | | Nine Months Ended | |

| | | September 30, 2017 | | | September 30, 2016 | |

| Cash flows from operating activities: | | | | | | | | |

| Net loss | | $ | (12,343,559 | ) | | $ | (5,538,312 | ) |

| Adjustments to reconcile net loss to net cash used in operating activities: | | | | | | | | |

| Depreciation | | | 348,208 | | | | - | |

| Impairment | | | 82,478 | | | | 727,224 | |

| Change in fair value of derivative liability | | | 2,316,219 | | | | 30,149 | |

| Change in value of warrants | | | 379,084 | | | | - | |

| Amortization of discount | | | 1,289,247 | | | | 58,850 | |

| Extinguishment of debt | | | 4,156,980 | | | | - | |

| Stock based compensation | | | 2,094,733 | | | | 2,662,704 | |

| Changes in operating assets and liabilities: | | | | | | | | |

| Accounts receivable | | | (25,355 | ) | | | (151,872 | ) |

| Inventory | | | 17,049 | | | | (8,096 | ) |

| Other receivable | | | - | | | | (33,302 | ) |

| Prepaid expenses | | | 404,019 | | | | 108,191 | |

| Deferred rent receivable | | | (20,867 | ) | | | - | |

| Other assets | | | - | | | | 3,000 | |

| Accounts payable | | | (350,256 | ) | | | 583,511 | |

| Accrued liability - related parties | | | 373,877 | | | | 234,078 | |

| Accrued expenses | | | 381,097 | | | | 440,835 | |

| Liabilities for equity shares to be issued | | | - | | | | 350,000 | |

| Deferred rent | | | (30,775 | ) | | | (71,018 | ) |

| Deferred revenue | | | (40,500 | ) | | | (40,500 | ) |

| | | | | | | | | |

| Cash used in operating activities | | | (968,321 | ) | | | (644,558 | ) |

| | | | | | | | | |

| Cash flows from investing activities: | | | | | | | | |

| Purchase of property and equipment | | | (125,000 | ) | | | (412,090 | ) |

| | | | | | | | | |

| Cash used in investing activities | | | (125,000 | ) | | | (412,090 | ) |

| | | | | | | | | |

| Cash flows from financing activities: | | | | | | | | |

| Proceeds from note payable | | | - | | | | 470,000 | |

| Proceeds from convertible notes payable | | | 1,278,500 | | | | 50,000 | |

| Repayments of notes payable | | | (129,050 | ) | | | - | |

| Proceeds from sale of common stock | | | - | | | | 530,491 | |

| | | | | | | | | |

| Cash provided by financing activities | | | 1,149,450 | | | | 1,050,491 | |

| | | | | | | | | |

| Net increase (decrease) in cash | | | 56,129 | | | | (6,157 | ) |

| Cash, beginning of period | | | 51,333 | | | | 36,001 | |

| Cash, end of period | | $ | 107,462 | | | $ | 29,844 | |

| | | | | | | | | |

| Cash paid for interest | | $ | - | | | $ | - | |

| Cash paid for taxes | | $ | - | | | $ | - | |

| | | | | | | | | |

| Supplemental schedule of noncash financial activities: | | | | | | | | |

| Stock issued for debt settlement | | $ | 50,000 | | | $ | - | |

| Notes converted to stock | | | 3,031,843 | | | | - | |

| Accrued interest converted to stock | | | 122,311 | | | | - | |

| Value of common stock to be issued for conversion of notes and accrued interest | | | 6,655,028 | | | | - | |

| Value of derivative liability extinguished upon conversion of notes and accrued interest | | | 5,509,516 | | | | - | |

| | | Redeemable Convertible Preferred Stock Shares | | Amount | | | Common Stock Shares | | Amount | | Preferred Stock Shares | | Amount | | Additional Paid-in Capital | | Accumulated Deficit | | Common Stock to be issued | | Total |

| Balance - December 31, 2019 | | | 140,000 | | | $ | 8,750 | | | | | 113,926,332 | | | $ | 114 | | | | — | | | $ | — | | | $ | 43,478,139 | | | $ | (51,968,902 | ) | | $ | 127,261 | | | $ | (8,363,388 | ) |

| Issuance of common shares for services | | | — | | | | — | | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 2,003 | | | | 2,003 | |

| Issuance of common shares for services - related parties | | | — | | | | — | | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 27,026 | | | | 27,026 | |

| Common stock issued upon conversion of notes payable and accrued interest | | | — | | | | — | | | | | 13,767,631 | | | | 14 | | | | — | | | | — | | | | 169,723 | | | | — | | | | — | | | | 169,737 | |

| Series C preferred stock issued for cash, net of costs and discounts | | | 55,800 | | | | — | | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

| Accrued dividends and accretion of conversion feature on Series C preferred stock | | | — | | | | 19,588 | | | | | — | | | | — | | | | — | | | | — | | | | — | | | | (19,588 | ) | | | — | | | | (19,588 | ) |

| Fair value of warrants and options granted for services | | | — | | | | — | | | | | — | | | | — | | | | — | | | | — | | | | 40,595 | | | | — | | | | — | | | | 40,595 | |

| Deemed dividends related to conversion feature of Series C preferred stock | | | — | | | | — | | | | | — | | | | — | | | | — | | | | — | | | | — | | | | (38,868 | ) | | | — | | | | (38,868 | ) |

| Net loss | | | — | | | | — | | | | | — | | | | — | | | | — | | | | — | | | | — | | | | (511,222 | ) | | | — | | | | (511,222 | ) |

| Balance - March 31, 2020 | | | 195,800 | | | $ | 28,338 | | | | | 127,693,963 | | | $ | 128 | | | | — | | | $ | — | | | $ | 43,688,457 | | | $ | (52,538,580 | ) | | $ | 156,290 | | | $ | (8,693,705 | ) |

See Accompanying Notes to Unaudited Condensed Consolidated Financial Statements.

| Diego Pellicer Worldwide, Inc. |

6Condensed Consolidated Statements of Cash Flows |

| (Unaudited) |

| | | Three Months Ended | | Three Months Ended |

| | | March 31, 2021 | | March 31, 2020 |

| | | | | |

| Cash flows from operating activities: | | | | | | | | |

| Net income (loss) | | $ | 816,280 | | | $ | (511,222 | ) |

| Adjustments to reconcile net income (loss) to net cash used in operating activities | | | | | | | | |

| Change in fair value of derivative liability | | | (698,449 | ) | | | (302,004 | ) |

| Change in value of warrants | | | 4,442 | | | | (97 | ) |

| Amortization of debt related costs | | | — | | | | 584,071 | |

| Noncash finance cost | | | 2,000 | | | | — | |

| Expense related to additional derivative liability | | | 118,027 | | | | — | |

| Extinguishment of debt | | | (389,550 | ) | | | (1,932 | ) |

| Stock-based compensation | | | 28,758 | | | | 69,624 | |

| Forgiveness of debt | | | (56,908 | ) | | | — | |

| Changes in operating assets and liabilities: | | | | | | | | |

| Accounts receivable | | | 2,984 | | | | (74,323 | ) |

| Prepaid expenses | | | 10,000 | | | | 4,000 | |

| Other receivables | | | (26,850 | ) | | | (209,258 | ) |

| Accounts payable | | | (18,159 | ) | | | (13,603 | ) |

| Accrued liability - related parties | | | 1,164 | | | | 29,300 | |

| Accrued expenses | | | 3,073 | | | | 70,638 | |

| Lease liabilities | | | 6,425 | | | | (18,915 | ) |

| | | | | | | | | |

| Cash used in operating activities | | | (196,763 | ) | | | (373,721 | ) |

| | | | | | | | | |

| Cash flows from investing activities: | | | — | | | | — | |

| | | | | | | | | |

| Cash flows from financing activities: | | | | | | | | |

| Proceeds from convertible notes payable | | | — | | | | 100,000 | |

| Repayments of convertible notes payable, net | | | (200,000 | ) | | | (2,500 | ) |

| Proceeds from sale of preferred stock, net | | | 267,000 | | | | 50,000 | |

| | | | | | | | | |

| Cash provided by financing activities | | | 67,000 | | | | 147,500 | |

| | | | | | | | | |

| Net decrease in cash | | | (129,763 | ) | | | (226,221 | ) |

| Cash, beginning of period | | | 327,864 | | | | 317,446 | |

| Cash, end of period | | $ | 198,101 | | | $ | 91,225 | |

| | | | | | | | | |

| Cash paid for interest | | $ | 70,000 | | | $ | — | |

| Cash paid for taxes | | $ | — | | | $ | — | |

| | | | | | | | | |

| | | | | | | | | |

| Supplemental schedule of noncash financial activities: | | | | | | | | |

| Notes converted to stock | | $ | 100,000 | | | $ | 89,000 | |

| Derivative liability related to convertible notes and convertible Preferred C shares | | $ | 1,377,698 | | | $ | — | |

| Accrued interest converted to stock | | $ | 6,256 | | | $ | 6,282 | |

| Value of common stock issued for conversion of notes and accrued interest | | $ | 705,635 | | | $ | — | |

| Value of derivative liability extinguished upon conversion of notes and preferred stock and payment of notes | | $ | 963,539 | | | $ | 101,764 | |

| Debt discount attributable to preferred stock | | $ | 267,000 | | | $ | — | |

| Accrued interest extinguished with note payment | | $ | 25,390 | | | $ | — | |

| Common stock payable authorized for services | | $ | 26,843 | | | $ | 29,029 | |

| Debt discount extinguished with note conversion | | $ | — | | | $ | 25,377 | |

| Accrued dividends and accretion of conversion feature on Series C preferred stock | | $ | 13,155 | | | $ | 19,588 | |

| Deemed dividends related to conversion feature of Series C preferred stock | | $ | 992,671 | | | $ | 38,868 | |

See Accompanying Notes to Unaudited Condensed Consolidated Financial Statements.

Diego Pellicer Worldwide, Inc.

September30, 2017 and 2016

Notes to the Condensed Consolidated Financial Statements

March 31, 2021 and 2020

Note 1 – Organization and Operations

History

On March 13, 2015, Diego Pellicer Worldwide, Inc. (the Company) (f/k/a Type 1 Media, Inc.) closed on a merger and share exchange agreement by and among (i) the Company, and (ii) Diego Pellicer World-wide 1, Inc., a Delaware corporation, (“Diego”), and (iii) Jonathan White, the majority shareholder of the Company. Diego was merged with and into the Company with the Company to continue as the surviving corporation in the merger.

Business Operations

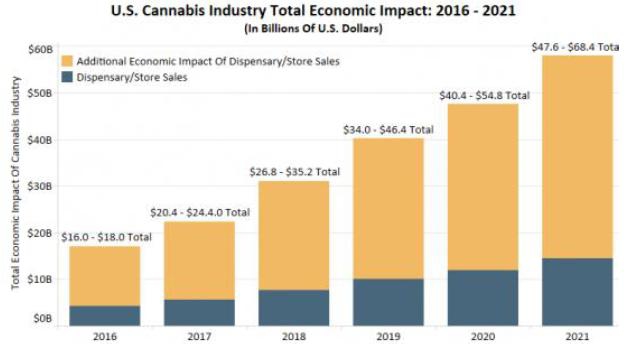

The Company leases real estate to licensed marijuana operators, providing complete turnkey growing space, processing space, recreational and medical retail sales space and related facilities to licensed marijuana growers, processors, dispensary and recreational store operators. Additionally, the Company plans to explore ancillary opportunities in the regulated marijuana industry, as well as offering for wholesale distribution branded non-marijuana clothing and accessories.

Until Federal law allows,The properties generating rents in 2021 and 2020 are as follows:

| Purpose | | Size | | City | | State |

| Retail store (recreational and medical) | | 3,300 sq. | | Denver | | CO |

| Cultivation warehouse – terminated October 2020 | | 18,600 sq. | | Denver | | CO |

| Cultivation warehouse | | 14,800 sq. | | Denver | | CO |

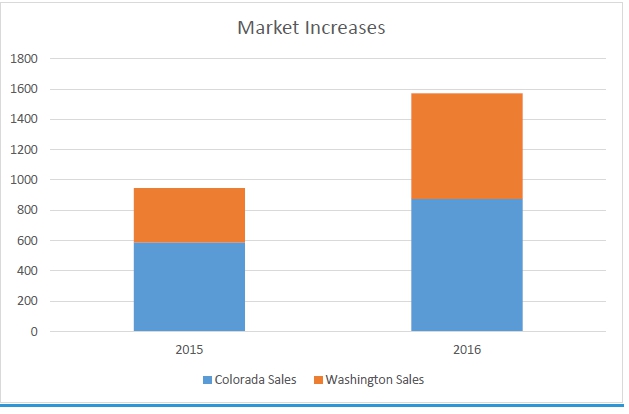

The Company’s three properties in Denver, CO (one terminated in October 2020) are leased to Royal Asset Management, LLC (“RAM”). RAM opened the Diego Denver branded flagship store in February 2017. This store is known as “Diego Colorado”. The retail facilities have shown steady growth in sales since opening. For the other two properties subleased (one terminated in October 2020), RAM uses these properties for its cultivation facilities in Denver, CO. Production at these facilities began in late 2016. The Company will not grow, harvest, process, distribute or sell marijuana or any other substances that violateis currently exploring the lawsacquisition of this entity, and the United States of America or any other country.parties are in negotiations (see Note 4).

In October 2020, the master lease and sublease associated with the 18,600 sq. cultivation warehouse in Denver were terminated (see Note 4).

Note 2 – Significant and Critical Accounting Policies and Practices

The management of the Company is responsible for the selection and use of appropriate accounting policies and for the appropriateness of accounting policies and their application. Critical accounting policies and practices are those that are both most important to the portrayal of the Company’s financial condition and results of operations and that require management’s most difficult, subjective, or complex judgments, often because of the need to make estimates about the effects of matters that are inherently uncertain. The Company’s significant and critical accounting policies and practices are disclosed below, as required by generally accepted accounting principles.

Basis of Presentation

The accompanying consolidated financial statements and related notes have been prepared pursuant to the rules and regulations of the Securities and Exchange Commission (the “SEC”) and presented in accordance with accounting principles generally accepted in the United States of America (US GAAP).

The accompanying consolidated balance sheet at December 31, 2020, has been derived from audited consolidated financial statements, but does not include all disclosures required by accounting principles generally accepted in the United States of America (“U.S. GAAP”). The accompanying unaudited condensed consolidated financial statements as of Diego Pellicer Worldwide, Inc. wereMarch 31, 2021 and for the three months ended March 31, 2021 and 2020 have been prepared in accordance with U.S. GAAP for interim financial information and with the instructions to Form 10-Q and therefore,Article 8 of Regulation S-X. Accordingly, they do not include all disclosuresof the information and footnotes required by U.S. GAAP for complete financial statements, preparedand should be read in conformityconjunction with U.S. GAAP.

This Form 10-Q relatesthe audited consolidated financial statements and related notes to the three months and nine months ended September 30, 2017 (the “Current Quarter”) andfinancial statements included in the three months and nine months ended September 30, 2016 (the “Prior Quarter”). The Company’s annual reportAnnual Report on Form 10-K for the year ended December 31, 20162020 as filed with the U.S. Securities and Exchange Commission (“2016 Form 10-K”SEC”) includes certain definitions and a summary of significant accounting policies and should be read in conjunction with this Form 10-Q. All material adjustments which, inon the opinion of management, areall material adjustments (consisting of normal recurring adjustments) considered necessary for a fair statementpresentation have been made to the condensed consolidated financial statements. The condensed consolidated financial statements include all material adjustments (consisting of normal recurring accruals) necessary to make the condensed consolidated financial statements not misleading as required by Regulation S-X Rule 10-01. Operating results for the interim periods have been reflected. The results for the current quarterthree months ended March 31, 2021 are not necessarily indicative of the results tothat may be expected for the full year.year ending December 31, 2021 or any future periods.

Principles of Consolidation

The financial statements include the accounts of Diego Pellicer Worldwide, Inc., and its wholly-owned subsidiary Diego Pellicer World-wide 1, Inc. Intercompany balances and transactions have been eliminated in consolidation.

New accounting pronouncements

In February 2016, the FASB issued guidance that requires a lessee to recognize assets and liabilities arising from leases on the balance sheet. Previous GAAP did not require lease assets and liabilities to be recognized for most leases. Additionally, companies are permitted to make an accounting policy election not to recognize lease assets and liabilities for leases with a term of 12 months or less. For both finance leases and operating leases, the lease liability should be initially measured at the present value of the remaining contractual lease payments. The recognition, measurement and presentation of expenses and cash flows arising from a lease by a lessee will not significantly change under this new guidance. This new guidance is effective for the company as of the first quarter of fiscal year 2020. The Company is evaluating the effect that this ASU will have on its financial statements and related disclosures.

In August 2016, the FASB issued ASU No. 2016-15, Classification of Certain Cash Receipts and Cash Payments. ASU 2016-15 clarifies the presentation and classification of certain cash receipts and cash payments in the statement of cash flows. This ASU is effective for public business entities for fiscal years, and interim periods within those years, beginning after December 15, 2017. Early adoption is permitted. The Company is currently assessing the potential impact of ASU 2016-15 on its financial statements and related disclosures.

In April 2016 the FASB issued ASU 2016-10, Revenue from Contracts with Customers (Topic 606). The core principle of Topic 606 is that an entity should recognize revenue to depict the transfer of promised goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods or services This ASU is effective for public business entities for fiscal years, and interim periods within those years, beginning after January 1. 2018. The Company is currently assessing the potential impact of ASU 2016-10 on its financial statements and related disclosures.

The Company believes that otherrecentlyissued accounting pronouncements and other authoritative guidance for which the effective date is in the future either will not have an impact on its accounting or reporting or that such impact will not be material to its financial position, results of operations and cash flows when implemented.

Reclassifications

Certain prior year amounts were reclassified to conform to the manner of presentation in the current period. These reclassifications had no effect on the Company’s balance sheet, net loss or stockholders’ equity.

Use of Estimates

The preparation of the financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the dates of the financial statements and the reported amounts of revenue and expenses during the reporting periods. Actual results could differ from those estimates. These estimates and assumptions include valuing equity securities and derivative financial instruments issued in financing transactions and share based payment arrangements, determining the fair value of the warrants received for the licensing agreement, the collectability of accounts receivable and other receivables (See Note 4), valuation of right of use assets and lease liabilities and deferred taxes and related valuation allowances.

Certain estimates, including evaluating the collectability of accounts receivable, could be affected by external conditions, including those unique to our industry, and general economic conditions. It is possible that these external factors could influence our estimates thatand could cause actual results to differ from our estimates. The Company intends to re-evaluate all its accounting estimates at least quarterly based on these conditions and record adjustments when necessary.

Fair Value Measurements

The Company evaluates its financial instruments to determine if such instruments are derivatives or contain features that qualify as embedded derivatives. For derivative financial instruments that are accounted for as liabilities, the derivative instrument is initially recorded at its fair value and is then re-valued at each reporting date, with changes in the fair value reported in the condensed consolidated statements of operations. The classification of derivative instruments, including whether such instruments should be recorded as liabilities or as equity, is evaluated at the end of each reporting period. Derivative instrument liabilities are classified in the balance sheet as current or non-current based on whether net-cash settlement of the derivative instrument could be required within 12 months of the balance sheet date.

Fair Value of Financial Instruments

As required by the Fair Value Measurements and Disclosures Topic of the FASB ASC, fair value is measured based on a three-tier fair value hierarchy, which prioritizes the inputs used in measuring fair value as follows:

Level 1: Unadjusted quoted prices in active markets that are accessible at the measurement date for identical, unrestricted assets or liabilities;

Level 2: Quoted prices in markets that are not active, or inputs that are observable, either directly or indirectly, for substantially the full term of the asset or liability; and

Level 3: Prices or valuation techniques that require inputs that are both significant to the fair value measurement and unobservable (supported by little or no market activity).

Fair value estimates discussed herein are based upon certain market assumptions and pertinent information available to management as of September 30, 2017March 31, 2021 and December 31, 2016.2020. The respective carrying value of certain on-balance-sheet financial instruments approximated their fair values. These financial instruments include cash, prepaid expenses and accounts payable. Fair values were assumed to approximate carrying values for cash and payables because they are short term in nature and their carrying amounts approximate fair values or they are payable on demand.

The following table reflects assets and liabilities that are measured at fair value on a recurring basis (in thousands):

| As of March 31, 2021 | | Fair Value Measurement Using | | |

| | | Level 1 | | Level 2 | | Level 3 | | Total |

| Derivative liabilities | | $ | — | | | $ | — | | | $ | 5,714 | | | $ | 5,714 | |

| Stock warrant liabilities | | | — | | | | — | | | | 5 | | | | 5 | |

| | | $ | — | | | $ | — | | | $ | 5,719 | | | $ | 5,719 | |

| As of December 31, 2020 | | Fair Value Measurement Using | | |

| | | Level 1 | | Level 2 | | Level 3 | | Total |

| Derivative liabilities | | $ | — | | | $ | — | | | $ | 5,998 | | | $ | 5,998 | |

| Stock warrant liabilities | | | — | | | | — | | | | 1 | | | | 1 | |

| | | $ | — | | | $ | — | | | $ | 5,999 | | | $ | 5,999 | |

Derivative liabilities and stock warrant liabilities were valued using the Binomial Option Pricing Model in calculating the embedded conversion features for the three months ended March 31, 2021 and the year ended December 31, 2020.

Cash

The Company maintains cash balances at various financial institutions. Accounts at each institution are insured by the Federal Deposit Insurance Corporation, and the National Credit Union Share Insurance Fund, up to $250,000. The Company’s accounts at these institutions may, at times, exceed the federal insured limits. The Company has not experienced any losses in such accounts. There were no uninsured balances at March 31, 2021. Uninsured balances were approximately $73,000 at December 31, 2020.

Revenue recognition

In accordance with ASC 842, Property and Equipment, and Depreciation PolicyLeases,

Property and equipment are stated at cost less accumulated depreciation. Depreciation is provided for the Company recognizes rent income on a straight-line basis over the useful lives oflease term to the assets. Leasehold improvements are amortized overextent that collection is considered probable. As a result the term of the lease. Expenditures for additions and improvements are capitalized; repairs and maintenance are expensedCompany been recognizing rents as incurred.they become payable.

The Company intends to take depreciation or amortization on a straight-line basis for all properties, beginning when they are put into service, using the following life expectancy:

Equipment – 5 years

Leasehold Improvements – 10 years, or the term of the lease, whichever is shorter

Buildings – 20 years

Inventory

The company conforms to the FASB issued Accounting Standards Update (“ASU”) No. 2015-11, Inventory, which requires an entity to measure inventory within the scope at the lower of cost and net realizable value. Net realizable value is the estimated selling prices in the ordinary course of business, less reasonably predictable costs of completion, disposal, and transportation. The Company’s inventory is stated at the lower of cost or estimated realizable value, with cost primarily determined on a cost basis on the first-in, first-out (“FIFO”) method.

Accounts Receivable and Allowance for Doubtful Accounts

Accounts receivable are presented at their face amount, less an allowance for doubtful accounts, on the balance sheets. Accounts receivable consist of revenue earned and currently due from sub lessee. We evaluate the collectability of accounts receivable based on a combination of factors. We recognize reserves for bad debts based on estimates developed using standard quantitative measures that incorporate historical write-offs and current economic conditions. As of September 30, 2017, the outstanding balance allowance for doubtful accounts is $9,908.

The policy for determining past due status is based on the contractual payment terms of each customer. Once collection efforts by the Company and its collection agency are exhausted, the determination for charging off uncollectible receivables is made.

Revenue recognition

The Company recognizes revenue from rent, tenant reimbursements, and other revenue sources once all the following criteria are met in accordance with SEC Staff Accounting Bulletin 104,Revenue Recognition: (a) the agreement has been fully executed and delivered; (b) services have been rendered; (c) the amount is fixed or determinable; and (d) the collectability of the amount is reasonably assured. Thus, duringDuring the initial term of the lease, management has a policy of partial rent forbearance when the tenant first opens the facility to assure that the tenant has the opportunity for success.

When the collectability is reasonably assured, Management may be required to exercise considerable judgment in accordance with ASC Topic 840 “Leases” as amended and interpreted, minimum annual rentalestimating revenue is recognized for rental revenues on a straight-line basis over the term of the related lease.to be recognized.

When management concludes that the Company is the owner of tenant improvements, managementthe Company records the cost to construct the tenant improvements as a capital asset. In addition, managementthe Company records the cost of certain tenant improvements paid for or reimbursed by tenants as capital assets when management concludes that the Company is the owner of such tenant improvements. For these tenant improvements, managementthe Company records the amount funded or reimbursed by tenants as deferred revenue, which is amortized as additional rental income over the term of the related lease. When management concludes that the tenant is the owner of tenant improvements for accounting purposes, management recordswe record the Company’s contribution towards those improvements as a lease incentive, which is amortized as a reduction to rental revenue on a straight-line basis over the term of the lease.

The Company analyzes its contracts to assess that they are within the scope and in accordance with ASC 606. In January 2014,determining the appropriate amount of revenue to be recognized as the Company entered into an agreement to license certain intellectual property to an unrelated company. In consideration,fulfills its obligations under each of its agreements, whether for goods and services or licensing, the Company received warrants to purchase sharesperforms the following steps: (i) identification of the licensee’s common stock,promised goods or services in the valuecontract; (ii) determination of whether the promised goods or services are performance obligations including whether they are distinct in the context of the warrants was recorded as an investment and the deferred revenue is being amortized over the ten year termcontract; (iii) measurement of the licensing agreement.transaction price, including the constraint on variable consideration; (iv) allocation of the transaction price to the performance obligations based on estimated selling prices; and (v) recognition of revenue when (or as) the Company satisfies each performance obligation.

Leases as LessorAdvertising

The Company currently leases properties to licensed cannabis operators for locations that meetDuring the regulatory criteria applicable by the respective regulatory jurisdiction for the sale, production,three months ended March 31, 2021 and development of cannabis products. The Company evaluates the lease to determine its appropriate classification as an operating or capital lease for financial reporting purposes. The Company leases are currently all classified as operating leases.2020, advertising expense was $9,881 and $6,804, respectively.

Minimum base rent is recorded on a straight-line basis over the lease term after an initial period during which the tenant is establishing the business and during which the Company may forbear some or all of the rent. The Company is more likely than not to forbear some or all of the rental income which it considers uncollectable during the tenant’s initial ramp-up period (seeRevenue Recognitionabove). The tenant is still liable for the full rent, although the collectability may be unlikely and the Company may not expect to collect it.

Leases as Lessee

The Company recognizes rent expense on a straight-line basis over the non-cancelable lease term and certain option renewal periods where failure to exercise such options would result in an economic penalty in such amount that renewal appears, at the inception of the lease, to be reasonably assured. Deferred rent is presented on current liabilities section on the consolidated balance sheets.

Income Taxes

Income taxes are provided for using the liability method of accounting in accordance with the Income Taxes Topic of the FASB ASC. Deferred tax assets and liabilities are determined based on differences between the financial reporting and tax basis of assets and liabilities and are measured using the enacted tax rates and laws that will be in effect when the differences are expected to reverse. A valuation allowance is established when necessary to reduce deferred tax assets to the amount expected to be realized and when, in the opinion of management, it is more likely than not that some portion or all of the deferred tax assets will not be realized. The computation of limitations relating to the amount of such tax assets, and the determination of appropriate valuation allowances relating to the realizing of such assets, are inherently complex and require the exercise of judgment. As additional information becomes available, the Company continually assesses the carrying value of their net deferred tax assets.

Preferred Stock

The Company applies the guidance enumerated in ASC Topic 480 “Distinguishing Liabilities from Equity” when determining the classification and measurement of preferred stock. Preferred shares subject to mandatory redemption are classified as liability instruments and are measured at fair value. The Company classifies conditionally redeemable preferred shares which includes preferred shares that feature redemption rights that are either within the control of the holder or subject to redemption upon the occurrence of uncertain events not solely within our control, as temporary equity. At all other times, it classifies its preferred shares in stockholders’ equity. Preferred shares do not feature any redemption rights within the holders’ control or conditional redemption features not within our control. Accordingly, all issuances of preferred stock are presented as a component of consolidated stockholders’ equity.

Common Stock Purchase Warrants and Other Derivative Financial Instruments

The Company classifies as equity any contracts that require physical settlement or net-share settlement or provide us a choice of net cash settlement or settlement in our own shares (physical settlement or net-share settlement) provided that such contracts are indexed to our own stock as defined in ASC Topic 815-40 “Contracts in Entity’s Own Equity.” The Company classifies as assets or liabilities any contracts that require net-cash settlement including a requirement to net cash settle the contract if an event occurs and if that event is outside our control or give the counterparty a choice of net-cash settlement or settlement in shares. The Company assesses classification of its common stock purchase warrants and other free-standing derivatives at each reporting date to determine whether a change in classification between assets and liabilities is required.

Stock-Based Compensation

The Company recognizes compensation expense for stock-based compensation in accordance with ASC Topic 718. The Company calculates the fair value of the award on the date of grant using the Black-Scholes method for stock options and the quoted price of our common stock for unrestrictedcommon shares; the expense is recognized over the service period for awards expected to vest. The estimation of stock-based awards that will ultimately vest requires judgment, and to the extent actual results or updated estimates differ from original estimates, such amounts are recorded as a cumulative adjustment in the period estimates are revised. The Company considers many factors when estimating expected forfeitures, including types of awards, employee class, and historical experience.

EarningsIncome (loss) per common share

Earnings (loss)The Company utilizes ASC 260, “Earnings per share is provided inShare” for calculating the basic and diluted loss per share. In accordance with ASC Subtopic 260-10. The Company presents260, the basic and diluted loss per share (“EPS”) and diluted EPS on the face of statements of operations. Basic EPS is computed by dividing reported earnings (loss)net loss available to common stockholders by the weighted average shares outstanding. Loss per common share has been computed using the weighted average number of common shares outstanding duringoutstanding. Diluted net loss per share is computed similar to basic loss per share except that the year.denominator is adjusted for the potential dilution that could occur if stock options, warrants, and other convertible securities were exercised or converted into common stock. Potentially dilutive securities are not included in the calculation of the diluted loss per share if their effect would be anti-dilutive. The Company has 132,973,796 and 926,023,386 common stock equivalents at March 31, 2021 and 2020, respectively. For the three months ended March 31, 2021 and 2020, these potential shares were excluded from the shares used to calculate diluted earnings per share as their inclusion would reduce net loss per share.

Legal and regulatory environment

The cannabis industry is subject to numerous laws and regulations of federal, state and local governments. These laws and regulations include, but are not limited to, matters such as licensure, accreditation, and different taxation between federal and state. Federal government activity may increase in the future with respect to companies involved in the cannabis industry concerning possible violations of federal statutes and regulations.

Management believes that the Company is in compliance with local, state and federal regulations and, while no regulatory inquiries have been made, compliance with such laws and regulations can be subject to future government review and interpretation, as well as regulatory actions unknown or unasserted at this time.

Recent accounting pronouncements.

The Company believes recently issued accounting pronouncements and other authoritative guidance for which the effective date is in the future either will not have an impact on its accounting or reporting or that such impact will not be material to its financial position, results of operations and cash flows when implemented.

Note 3 – Going Concern

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern. The Company has incurred losses since inception, its current liabilities exceed its current assets by $11,228,725 at March 31, 2021, and it has an accumulated deficit of $55,299,546 at March 31, 2021. These factors raise substantial doubt about its ability to continue as a going concern over the next twelve months. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

The Company believes that it has sufficient cash on hand and cash generated by real estate leases to sustain operations provided that management and board members continue to agree to be paid company stock in exchange for accrued compensation. Through September 30, 2017, management and board members have accepted stock for accrued compensation at the same discount that has been extended to the convertible noteholders of fifty percent. There are other future noncash charges in connection with financingfinancings such as a change in derivative liability that will affect income but have no effect on cash flow.

Although the Company has been successful raising additional capital, there is no assurance that the company will sell additional shares of stock or borrow additional funds. The Company’s abilityinability to raise additional cash could have a material adverse effect on its financial position, results of operations, and its ability to continue in existence. These financial statements do not include any adjustments that might result from the outcome of this uncertainty. Management believes that the Company’s future success is dependent upon its ability to achieve profitable operations, generate cash from operating activities and obtain additional financing. There is no assurance that the Company will be able to generate sufficient cash from operations, sell additional shares of stock or borrow additional funds. However, cash generated from lease revenues is currently exceeding lease costs, but is insufficient to cover operating expenses.

Note 4 – InvestmentAccounts Receivables and Other Receivables

As disclosed in Note 1, the Company subleases two properties in Colorado to Royal Asset Management at March 31, 2021. At March 31, 2021 and December 31, 2020, the Company had outstanding receivables from the subleases totaling $520,974 and $523,958, respectively, and during the three months ended March 31, 2021 and 2020 the Company’s subleases with RAM accounted for 100% of the Company’s revenues.

In January 2014,addition to the receivables from the subleases, the Company has agreed to provide RAM and affiliates of RAM up to an aggregate amount of $1,030,000 in financing. These notes accrue interest at the rates ranging from 12% to 18% per annum. As of March 31, 2021 and December 31, 2020, the outstanding balance of these notes receivable total $1,057,272 and $1,030,422, respectively, including accrued interest of $327,272 and $300,422, respectively. The notes are secured by a UCC filing and also $400,000 of the balance is personally guaranteed by the managing member of RAM. Our position is subordinate to the CEO’s note described in Note 6. We have recorded interest income of $26,850 and $32,846 during the three months ended March 31, 2021 and 2020, respectively.

If we do consummate any agreement to acquire Royal Asset Management, part of the purchase price will be paid through receivables that are owed to us (see below).

On September 9, 2020, we closed on a Membership Interest Purchase Agreement dated September 4, 2020, and obtained the right to acquire a 15.13% membership interest in Blue Bronco, LLC. The purchase of the 15.13% interest in Blue Bronco LLC is subject to the approval of the Colorado Marijuana Enforcement Division. Necessary approval by governing authorities is expected to be received in the second quarter of 2021. Accrued interest receivable of approximately $68,000 will be applied to the purchase of the membership interest upon approval of the purchase by the Colorado Marijuana Enforcement Division.

Lease Termination

On October 1, 2020, the master and sublease associated with the 18,600 sq. cultivation warehouse in Denver were terminated. In connection with that termination, we entered into a Sublease Termination Agreement (“Termination Agreement”) with RAM and an affiliate of RAM Venture Product Consulting, LLC (“VPC”). Pursuant to this agreement, with Plandai Biotechnology, Inc. (a publicly traded company)RAM acknowledged a debt of deferred rent to licensethe Company in the amount of $1,418,480 and VPC acknowledged a debt of deferred rent to them certain intellectual property rightsthe Company in exchangethe amount of $64,344. RAM and VPC executed promissory notes for warrantsthese amounts, respectively. The notes accrue interest on the unpaid balance at a rate equal to purchase 1,666,667 shares of Plandai Biotechnology, Inc. common stock. This licensing agreement carries a 10-year term with an exercise price of $0.01 per share. The Company was to obtain certain trademark rights certifiedthe Applicable Federal Rate for mid-term obligations as published by the government. The warrant has a restriction on them requiring thatInternal Revenue Service. No payment under the sale of such shares must reach a certain traded price of $0.50 per share. In 2014,promissory notes will be due to the Company useduntil the earlier of (i) the date on which RAM and the Company consummate a third-party appraisal firm to ascertainchange of control event, which is defined as: the fair valueacquisition of warrants heldRAM by the Company or an affiliated entity by means of any transaction or series of related transactions to which was determinedRAM is a party (including, without limitation, any membership interest acquisition, reorganization, merger or consolidation, (generally, a “Merger”), or, (ii) the date one (1) business day following the earlier of (x) at any time, receipt by the Company from RAM or VPC of a written notice stating such party no longer desires to be $525,567 atpursue the Merger, or (y) beginning eighteen (18) months after the date of issuance. During the year ended December 31, 2016,this Agreement, receipt by RAM or VPC from the Company of a written notice stating that the Company no longer desires to pursue the Merger (the “Maturity Date”).

We have recorded an impairment lossthe promissory notes as long term notes receivable of $73,334. The$1,482,824 at March 31, 2021. Due to the uncertainty of the collectability, we have also recorded a long term deferred credit in the same amount. We will record income under the deferred rent notes as payments are received or deemed collectible. This asset and related credit have been netted on the accompanying condensed consolidated balance sheet.

Additionally, in connection with the termination of the sublease, RAM will continue to pay the remaining future sublease premium payments due to the company on the Denver sublease (the “Future Rent Debt”) beginning on the termination date, and until the earlier of the Maturity Date or June 30, 2024, notwithstanding the termination of the Subleases. However, no payment under the Future Rent Debt agreement will be due to the Company recorded an additional impairment lossuntil the Maturity Date, at which time the entire Future Rent Debt shall be due and payable in full, except for any month in which RAM earns $725,000 of gross sales revenue, including taxes, at its Alameda location, in which case RAM shall pay the Future Rent Debt for the ninefollowing month to the Company on or before the 5th day of the following month, and such amount will not accrue as a Future Rent Debt. RAM shall continue to accrue debt to the company, assessed on the first day of each month, according to the schedule below:

| Monthly Payments Accrued | | |

| October 1, 2020 to June 30, 2021 | | $ | 11,284 | |

| July 1, 2021 to June 30, 2022 | | | 11,622 | |

| July 1, 2022 to June 30, 2023 | | | 11,971 | |

| July 1, 2023 to June 30, 2024 | | | 12,330 | |

We will record income pursuant to the Future Rent Debt as payments are received based on the Company’s analysis of collectability including, but not limited to, the potential application toward the purchase price. During 2021, we received three months ended September 30, 2017 of $43,333.payments and have recorded $33,851 as Lease Termination Payments in the Statement of Operations.

Note 5– Property and Equipment5 – Other Assets

As of September 30, 2017, and December 31, 2016, fixed assets and the estimated lives used in the computation of depreciation are as follows:

| | | Estimated | | | | | | |

| | | Useful Lives | | September 30, 2017 | | | December 31, 2016 | |

| Machinery and equipment | | 5 years | | | - | | | $ | 39,145 | |

| Leasehold improvements | | 10 years | | | 853,413 | | | | 728,413 | |

| Less: Accumulated depreciation and amortization | | | | | (335,575 | ) | | | (9,446 | ) |

| | | | | | | | | | | |

| Property and equipment, net | | | | $ | 517,838 | | | $ | 758,112 | |

Note 6 – Other Assets

Security depositsdeposits:: Security deposits reflect the deposits on various property leases, most of which require for two months’ rental expense in the form of a deposit.

Note 6 – Related Party Transactions

As of March 31, 2021 and December 31, 2020, the Company has accrued compensation to its CEO and director and to its CFO aggregating $323,997 and $289,897, respectively. As of March 31, 2021 and December 31, 2020, accrued payable due to former officers was $1,009,922 and $1,042,859, respectively. For each of the three month periods ended March 31, 2021 and 2020, total cash-based compensation to related parties was $90,000. For the three months ended March 31, 2021 and 2020, total share-based compensation to related parties was $24,843 and $67,621, respectively. These have remained unchanged,amounts are included in general and administrative expenses in the accompanying financial statements.

From 2017 to 2019, Mr. Gonfiantini, CEO, personally and through his Company, Crystal Bay Financial LLC, loaned an aggregate amount of $1,020,000 to Royal Asset Management. These notes accrue interest at 17% - 18% per annum, and require monthly payment approximately from $5,000 to $20,000. These notes are personally guaranteed by the managing member of Royal Asset Management, and are reported as $170,000 forsecured by certain equipment and other tangible properties of Royal Asset Management. Among these notes, $500,000 note was also secured by the medical marijuana licenses held by Royal Asset Management.

At March 31, 2021 and December 31, 2016, and for September 30, 2017.

Deposits – end of lease: These deposits represent an additional two months of rent on various property leases that apply to the “end-of- lease” period. These have remained unchanged, and are reported as $150,000 for December 31, 2016, and for September 30, 2017.

Note 7– Notes Payable

On April 11, 2017,2020, the Company issued two convertible notes (seeowed Mr. Throgmartin, former CEO (See Note 8). These were issued10), $140,958 pursuant to refinancea promissory note dated August 12, 2016. This note accrues interest at the following notes:

On May 20, 2015,rate of 8% per annum and was past the maturity date at March 31, 2021, however the Company issuedhas not yet received a note in total amount of $450,000 with third parties for use as operating capital. As of December 31, 2016, the outstanding principle balance ofdefault notice. Accrued interest on the note was $450,000.$52,181 and $49,401 at March 31, 2021 and December 31, 2020, respectively.

On July 8, 2015, the Company issued a note in total amount of $135,628 with third parties for use as operating capital. As of December 31, 2016, the outstanding principle balance of the note is $135,628.Note 7 – Notes Payable

On February 8, 2016, the Company issued notes in total amount of $470,000 with third parties, bearing interest at 12% per annum with a maturity date of February 7, 2017. As of December 31, 2016, the outstanding principle balance of the note is $470,000.

In accordance with in accordance with FASB Codification- Liabilities, 470-50-40-10, these liabilities were considered extinguished and the cost of the new financing of $5,607,836 was expensed in the quarter ended June 30, 2017.

On August 31, 2015, the Company issued a note in totalthe amount of $126,000 withto a third partiesparty for use as operating capital. The note was amended to include accrued interest on October 31, 2016 and extendedextend the maturity date to October 31, 2018. As of September 30, 2017,March 31, 2021 and December 31, 2020 the outstanding principal balance of the note was $126,000.$133,403, and accrued interest on the note was $71,746 and $70,101 at March 31, 2021 and December 31, 2020, respectively. As of March 31, 2021 the note was past the maturity date, however the Company has not yet received a default notice.

On April 22, 2020, the Company was granted a loan from Numerica Credit Union, in the aggregate amount of $56,444, pursuant to the Paycheck Protection Program, (the “PPP”) under Division A, Title I of the CARES Act. The loan, which was in the form of a note dated April 22, 2020 issued by the Borrower, was scheduled to mature on April 22, 2022 and bore interest at a rate of 1.0% per annum, payable monthly commencing October 22, 2020. There have not been any payments made towards this loan, as the full amount of the loan and accrued interest was forgiven in full during February 2021 and the Company recorded income of $56,908.

On June 30, 2020, the Company was granted a loan from the Small Business Association, in the aggregate amount of $150,000, pursuant to the Economic Injury Disaster Loan, (the “EIDL”) under Division A, Title I of the CARES Act. The loan, which is in the form of a note dated June 30, 2020 issued by the Borrower, matures on June 30, 2050 and bears interest at a rate of 3.75% per annum, payable monthly commencing June 30, 2021.

Note 8 – Convertible NoteNotes Payable

In addition to the two notes issued on April 11, 2017 referred to in Footnote 7, theThe Company has issued several convertible notes in the nine months ending September 30, 2017.which are outstanding. The note holder shallholders have the right to convert the amountprincipal and accrued interest outstanding into shares of common stock at a discounted price.price to the market price of our common stock. The conversion feature wasfeatures were recognized as an embedded derivativederivatives and wasare valued using a Black Scholes modelBinomial Option Pricing Model that resulted in a derivative liability of $4,767,377 for$5,326,730 and $5,997,865 at March 31, 2021 and December 31, 2020, respectively. All notes accrue interest at 10% and the quarter ended September 30, 2017.notes had all matured at March 31, 2021. In connection with the issuance of certain of these notes, the Company also issued warrants to purchase its common stock. The Company allocated the proceeds of the notes and warrants based on the relative fair value at inception for these notes.

Several convertible note holders elected to convert their notes to stock during the ninethree months ended September 30, 2017.March 31, 2021 and 2020. The tables below provide the note payable activity for the three months ended March 31, 2021 and 2020, and also a reconciliation of the beginning and ending balances for the derivative liabilities measured using Level 3 fair value inputs for the three months ended March 31, 2021 and 2020:

| | | Convertible

Notes | | Discount | | Convertible

Notes, Net of

Discount | | Derivative

Liabilities |

| Balance, December 31, 2020 | | $ | 3,239,274 | | | $ | — | | | $ | 3,239,274 | | | $ | 5,997,865 | |

| Issuance of convertible notes | | | 2,000 | | | | — | | | | 2,000 | | | | 115,160 | |

| Conversion of convertible notes | | | (100,000 | ) | | | — | | | | (100,000 | ) | | | (661,087 | ) |

| Repayment of convertible notes | | | (200,000 | ) | | | — | | | | (200,000 | ) | | | (302,452 | ) |

| Change in fair value of derivatives | | | — | | | | — | | | | — | | | | 177,244 | |

| Amortization | | | — | | | | — | | | | — | | | | — | |

| Balance March 31, 2021 | | $ | 2,941,274 | | | $ | — | | | $ | 2,941,274 | | | $ | 5,326,730 | |

| | | Convertible

Notes | | Discount | | Convertible

Notes, Net of

Discount | | Derivative

Liabilities |

| Balance, December 31, 2019 | | $ | 3,266,775 | | | $ | 914,245 | | | $ | 2,352,530 | | | $ | 4,834,190 | |

| Issuance of convertible notes | | | 103,000 | | | | 103,000 | | | | — | | | | 232,013 | |

| Conversion of convertible notes | | | (89,000 | ) | | | (25,377 | ) | | | (63,623 | ) | | | (97,838 | ) |

| Repayment of convertible notes | | | (2,500 | ) | | | — | | | | (2,500 | ) | | | (3,925 | ) |

| Change in fair value of derivatives | | | — | | | | — | | | | — | | | | (315,692 | ) |

| Amortization | | | — | | | | (452,058 | ) | | | 452,058 | | | | — | |

| Balance March 31, 2020 | | $ | 3,278,275 | | | $ | 539,810 | | | $ | 2,738,465 | | | $ | 4,648,748 | |

During the three months ended March 31, 2021, $100,000 of notes was converted into 4,444,444 shares of common stock with a value of $697,779. A gain on extinguishment of debt of $59,999 and reduction of derivative liabilities of $657,778 have been recorded related to these conversions.

During the three months ended March 31, 2021, $6,256 of accrued interest was converted into 581,969 shares of common stock with a value of $7,856. A gain on extinguishment of debt of $1,709 and reduction of derivative liabilities of $3,309 have been recorded related to these conversions.

During the three months ended March 31, 2021, we repaid an aggregate of $200,000 of note principal. A gain on extinguishment of debt of $177,116 and reduction of derivative liabilities of $177,116 have been recorded related to these payments.

During the three months ended March 31, 2021, we paid an aggregate of $70,000 in settlement of accrued interest in the amount of $95,390. A gain on extinguishment of debt of $150,726 and reduction of derivative liabilities of $125,336 have been recorded related to these payments.

During the three months ended March 31, 2021, we recorded noncash additions to convertible notes aggregating $2,000.

As of March 31, 2021, convertible notes in the aggregate principal amount of $2,941,274 were past their maturity dates; however the Company has not yet received any default notices. No default or penalty was paid or required to be paid.

The following assumptions were used in the Binomial Option Pricing Model in calculating the embedded conversion features and current liabilities for the three months ended March 31, 2021 and 2020:

| | | March 31,

2021 | | March 31,

2020 |

| Risk-free interest rates | | | 0.02 – 0.09 | % | | | 0.11 – 1.58 | % |

| Expected life (years) | | | 0.25 | | | | 0.25 – 1.0 | |

| Expected dividends | | | 0 | % | | | 0 | % |

| Expected volatility | | | 164 – 544 | % | | | 179 – 214 | % |

Note 9 – Stockholders’ Equity (Deficit)

Series C Preferred Stock

On February 24, 2021, the Company sold 179,850 of its Series C Convertible Preferred Shares, with an annual accruing dividend of 10%, to Geneva Roth Remark Holdings, Inc. (“Geneva”), for $163,500 pursuant to a Series C Preferred Purchase Agreement with Geneva. The Company may redeem the Series C Shares at various increased prices at time intervals up to the 6-month anniversary of the closing and must redeem any outstanding shares on the 24-month anniversary. Geneva may convert the Series C Shares into our common shares, commencing on the 6-month anniversary of the closing at a 30% discount to the public market price. The Company recorded a derivative liability associated with Series C Preferred Shares of $1,082,441, valued using a Binomial Option Pricing Model. On March 16, 2021, the Company sold an additional 113,850 shares for $103,500 and recorded a derivative of $177,231. The Series C Preferred Stock is classified as temporary equity due to the fact that the shares are redeemable at the option of the holder. There were 293,700 shares outstanding at March 31, 2021, with an associated derivative liability of $386.845.

The tables below provide the preferred stock activity for the three months ended March 31, 2021 and 2020, and also a reconciliation of the beginning and ending balances for the derivative liabilities measured using Level 3 fair value inputs for the three months ended March 31, 2021 and 2020:

| | | Preferred

Stock and

Accrued

Dividends | | Discount | | Preferred

Stock and

Accrued

Dividends,

Net of

Discount | | Derivative

Liabilities |

| Balance , December 31, 2020 | | $ | — | | | | — | | | | — | | | | — | |

| Issuance of Series C Preferred shares | | | 293,700 | | | | 293,700 | | | | — | | | | 1,259,672 | |

| Accretion of discount | | | — | | | | (10,963 | ) | | | 10,963 | | | | — | |

| Accretion of dividend on Series C preferred stock | | | 2,192 | | | | — | | | | 2,192 | | | | 2,866 | |

| Change in fair value of derivatives | | | — | | | | — | | | | — | | | | (875,693 | ) |

| Balance March 31, 2021 | | $ | 295,892 | | | $ | 282,737 | | | $ | 13,155 | | | $ | 386,845 | |

| | | Preferred

Stock and

Accrued

Dividends | | Discount | | Preferred

Stock and

Accrued

Dividends,

Net of

Discount | | Derivative

Liabilities |

| Balance , December 31, 2019 | | $ | 140,000 | | | $ | 131,250 | | | $ | 8,750 | | | $ | 190,131 | |

| Issuance of Series C Preferred shares | | | 55,800 | | | | 55,800 | | | | — | | | | 88,868 | |

| Accretion of discount | | | — | | | | (14,809 | ) | | | 14,809 | | | | — | |

| Accretion of dividend on Series C preferred stock | | | 4,779 | | | | — | | | | 4,779 | | | | — | |

| Change in fair value of derivatives | | | — | | | | — | | | | — | | | | 13,688 | |

| Balance March 31, 2020 | | $ | 200,579 | | | $ | 172,241 | | | $ | 28,338 | | | $ | 292,687 | |

The following assumptions were used in the Binomial Option Pricing Model in calculating the embedded conversion features and current liabilities for the three months ended March 31, 2021 and 2020:

| | | 2021 | | 2020 |

| Risk-free interest rates | | | 0.12 – 0.16 | % | | | 0.23 – 0.71 | % |

| Expected life (years) | | | 1.9 – 2.0 | | | | 1.7 – 2.0 | |

| Expected dividends | | | 0 | % | | | 0 | % |

| Expected volatility | | | 188 – 196 | % | | | 246 – 251 | % |

Common Stock

2021 Transactions