UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

MARK ONE

[X] Quarterly Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

for the Quarterly Period ended March 31, 2020;2021; or

[ ] Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

for the transition period from ________ to ________

WORLD HEATHHEALTH ENERGY HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 000-30256 | |

| (State or other jurisdiction of | (I.R.S. Employer | |

| incorporation or organization) | Identification No.) |

| 1825 NW Corporate Blvd. Suite 110, Boca Raton, FL | 33431 | |

| (Address of principal executive offices) | Zip Code |

(561) 870-0440

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| N/A | N/A | N/A |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes[X]Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [X] No [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | [ ] | Accelerated filer | [ ] | |

| Non-accelerated filer | [ ] | Smaller reporting company | [X] | |

| Emerging growth company | [ ] |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes [ ] No [X]

Securities registered pursuant to Section 12(b) of the Act:

As of March 31, 2020,May 11, 2021, 89,789,407,996 shares of the registrant’s common stock, par value $0.0007 per share, were outstanding.

WORLD HEALTH ENERGY HOLDINGS, INC.

Form 10-Q

March 31, 20202021

| i |

WORLD HEALTH ENERGY HOLDINGS, INC.

CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

AS OF MARCH 31, 2021

WORLD HEALTH ENERGY HOLDINGS, INC.

Condensed Consolidated Balance SheetsINC .

| March 31, 2020 | December 31, 2019 | |||||||

| (unaudited) | ||||||||

| ASSETS | ||||||||

| CURRENT ASSETS | ||||||||

| Deposits and prepaid expenses | $ | 750 | $ | 750 | ||||

| Total current assets | 750 | 750 | ||||||

| Total Assets | $ | 750 | $ | 750 | ||||

| LIABILITIES AND STOCKHOLDERS= DEFICIT | ||||||||

| CURRENT LIABILITIES | ||||||||

| Accounts payable and accrued liabilities | $ | 132,155 | $ | 163,157 | ||||

| Due related parties | 329,063 | 283,541 | ||||||

| Total current liabilities | 461,218 | 446,698 | ||||||

| Commitments and Contingencies (note 12) | ||||||||

| STOCKHOLDERS’ DEFICIT | ||||||||

| Preferred stock, par $0.0007, 10,000,000 shares authorized, 5,000,000 shares issued and outstanding | 3,500 | 3,500 | ||||||

| Common stock, par $0.0007, 110,000,000,000 shares authorized, 89,789,407,996 shares issued and outstanding | 62,852,585 | 62,852,585 | ||||||

| Additional paid-in capital | (37,500,759 | ) | (37,500,759 | ) | ||||

| Accumulated deficit | (25,815,794 | ) | (25,801,274 | ) | ||||

| Total stockholders’ deficit | (460,468 | ) | (445,948 | ) | ||||

| Total Liabilities and Stockholders= Deficit | $ | 750 | $ | 750 | ||||

CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

AS OF MARCH 31, 2021

IN U.S. DOLLARS

TABLE OF CONTENTS

WORLD HEALTH ENERGY HOLDINGS, INC .

CONDENSED CONSOLIDATED BALANCE SHEETS

(U.S. dollars except share and per share data)

| March 31, | December 31, | |||||||

| 2021 | 2020 | |||||||

| Assets | (Unaudited) | |||||||

| Current Assets | ||||||||

| Cash and cash equivalents | 141,868 | 359,949 | ||||||

| Accounts receivable, net | 13,360 | 5,086 | ||||||

| Other current assets | 47,205 | 42,178 | ||||||

| Total Current assets | 202,433 | 407,213 | ||||||

| Right Of Use asset arising from operating lease | 230,761 | - | ||||||

| Long term prepaid expenses | 23,995 | 24,883 | ||||||

| Property and Equipment, Net | 26,270 | 26,054 | ||||||

| Total assets | 483,459 | 458,150 | ||||||

| Liabilities and Shareholders’ Deficit | ||||||||

| Current Liabilities | ||||||||

| Accounts payable | 20,860 | 26,284 | ||||||

| Right Of Use liabilities arising from operating lease | 39,610 | - | ||||||

| Other accounts liabilities | 531,580 | 496,874 | ||||||

| Total current liabilities | 592,050 | 523,158 | ||||||

| Liability for employee rights upon retirement | 133,364 | 104,850 | ||||||

| Long term loan from parent company | 1,812,704 | 1,812,704 | ||||||

| Right Of Use liabilities arising from operating lease | 193,994 | |||||||

| Total liabilities | 2,732,112 | 2,440,712 | ||||||

| Stockholders’ Deficit | ||||||||

| Preferred stock, par $0.0007, 10,000,000 shares authorized, 5,000,000 shares issued and outstanding as of March 31, 2021 and December 31, 2020. | 3,500 | 3,500 | ||||||

| Series B Convertible Preferred stock, par $0.0007, 3,870,000 shares authorized, 3,870,000 shares issued and outstanding as of March 31, 2021 and December 31, 2020. | 2,709 | 2,709 | ||||||

| Common stock, par $0.0007, 110,000,000,000 shares authorized, 89,789,407,996 shares issued and outstanding at March 31, 2021 and December 31, 2020. | 62,852,585 | 62,852,585 | ||||||

| Additional paid-in capital | (63,339,224 | ) | (63,339,224 | ) | ||||

| Foreign currency translation adjustments | (5,495 | ) | (5,495 | ) | ||||

| Accumulated deficit | (1,762,728 | ) | (1,496,637 | ) | ||||

| Total stockholders’ deficit | (2,248,653 | ) | (1,982,562 | ) | ||||

| Total liabilities and stockholders’ deficit | 483,459 | 458,150 | ||||||

The accompanying notes are an integral part of the condensed consolidated financial statements

statements.

WORLD HEALTH ENERGY HOLDINGS, INC.INC .

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE LOSS

Condensed Consolidated Statements of Operations

Three months ended March 31,

(unaudited)(U.S. dollars except share and per share data)

| 2020 | 2019 | |||||||

| OPERATING EXPENSES: | ||||||||

| General and administrative expenses | $ | 7,437 | $ | 3,719 | ||||

| Professional fees | 7,031 | 1,395 | ||||||

| Total expenses | 14,468 | 5,114 | ||||||

| Loss from operations | (14,468 | ) | (5,114 | ) | ||||

| Other income and expense | ||||||||

| Foreign exchange gain loss | 52 | - | ||||||

| Total other income | 52 | - | ||||||

| Net loss before income taxes | (14,520 | ) | (5,114 | ) | ||||

| Income taxes | - | - | ||||||

| Net loss | $ | (14,520 | ) | $ | (5,114 | ) | ||

| Loss per weighted average common share | $ | 0.00 | $ | 0.00 | ||||

| Number of weighted average common shares outstanding - Basic and Diluted | 89,789,407,996 | 89,789,407,996 | ||||||

| Three months ended | ||||||||

| March 31 | ||||||||

| 2021 | 2020 | |||||||

| (Unaudited) | ||||||||

| Revenues | 32,649 | 3,516 | ||||||

| Research and development expenses | (172,771 | ) | (99,948 | ) | ||||

| General and administrative expenses | (124,485 | ) | (57,406 | ) | ||||

| Operating loss | (264,607 | ) | (153,838 | ) | ||||

| Financing expenses, net | (1,484 | ) | (9,208 | ) | ||||

| Net loss | (266,091 | ) | (163,046 | ) | ||||

| Comprehensive loss | (266,091 | ) | (163,046 | ) | ||||

| Loss per share (basic and diluted) | (0.00 | ) | (0.00 | ) | ||||

The accompanying notes are an integral part of the condensed consolidated financial statementsstatements.

| 4 |

WORLD HEALTH ENERGY HOLDINGS, INC.INC .

Condensed Consolidated Statement of Changes in Stockholders’ DeficitCONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN SHAREHOLDERS’ DEFICIT

For the three months ended March 31, 2020

(U.S. dollars, except share and per share data)

Preferred Stock Number of Shares | Preferred Stock Par Value | Common Stock Number of Shares | Common Stock Par Value | Additional Paid-in Capital | Accumulated Deficit | Stockholders= Deficit | ||||||||||||||||||||||

| BALANCE, January 1, 2020 | 5,000,000 | $ | 3,500 | 89,789,407,996 | $ | 62,852,585 | $ | (37,500,759 | ) | $ | (25,801,274 | ) | $ | (445,949 | ) | |||||||||||||

| Net loss | - | - | - | - | - | (14,520 | ) | (14,520 | ) | |||||||||||||||||||

| BALANCE, March 31, 2020, (unaudited) | 5,000,000 | $ | 3,500 | 89,789,407,996 | $ | 62,852,585 | $ | (37,500,759 | ) | $ | (25,815,794 | ) | $ | (460,469 | ) | |||||||||||||

Preferred Stock, $0.0007, Par Value | Preferred Stock B, $0.0007, Par Value | Common Stock, $0.0007, Par Value | Additional | Foreign currency | Total Company’s | |||||||||||||||||||||||||||||||||||

| Number of Shares | Amount | Number of Shares | Amount | Number of Shares | Amount | paid-in capital | translation adjustments | Accumulated deficit | stockholders’ equity | |||||||||||||||||||||||||||||||

| BALANCE AT JANUARY 1, 2020 | - | - | 3,870,000 | 2,709 | - | - | (2,681 | ) | (5,495 | ) | (623,844 | ) | (629,311 | ) | ||||||||||||||||||||||||||

| CHANGES DURING THE PERIOD OF THREE MONTHS ENDED MARCH 31, 2020: | ||||||||||||||||||||||||||||||||||||||||

| Comprehensive loss for three month ended March 31, 2020 | - | - | - | - | - | - | - | - | (163.046 | ) | (163,046 | ) | ||||||||||||||||||||||||||||

| BALANCE AT MARCH 31, 2020 (Unaudited) | - | - | 3,870,000 | 2,709 | - | - | (2,681 | ) | (5,495 | ) | (786,890 | ) | (792,357 | ) | ||||||||||||||||||||||||||

Preferred Stock, $0.0007, Par Value | Preferred Stock B, $0.0007, Par Value | Common Stock, $0.0007, Par Value | Additional | Foreign currency | Total Company’s | |||||||||||||||||||||||||||||||||||

Number of Shares | Amount | Number of Shares | Amount | Number of Shares | Amount | paid-in capital | translation adjustments | Accumulated deficit | stockholders equity | |||||||||||||||||||||||||||||||

| BALANCE AT JANUARY 1, 2021 | 5,000,000 | 3,500 | 3,870,000 | 2,709 | 89,789,407,996 | 62,852,585 | (63,339,224 | ) | (5,495 | ) | (1,496,637 | ) | (1,982,562 | ) | ||||||||||||||||||||||||||

| CHANGES DURING THE PERIOD OF THREE MONTHS ENDED MARCH 31, 2021: | ||||||||||||||||||||||||||||||||||||||||

| Comprehensive loss for three month ended March 31, 2021 | - | - | - | - | - | - | - | - | (266,091 | ) | (266,091 | ) | ||||||||||||||||||||||||||||

| BALANCE AT MARCH 31, 2021 (Unaudited) | 5,000,000 | 3,500 | 3,870,000 | 2,709 | 89,789,407,996 | 62,852,585 | (63,339,224 | ) | (5,495 | ) | (1,762,728 | ) | (2,248,653 | ) | ||||||||||||||||||||||||||

WORLD HEALTH ENERGY HOLDINGS, INC.

Condensed Consolidated Statement of Changes in Stockholders’ Deficit

For the three months ended March 31, 2019

Preferred Stock Number of Shares | Preferred Stock Par Value | Common Stock Number of Shares | Common Stock Par Value | Additional Paid-in Capital |

Accumulated Deficit |

Stockholders= Deficit | ||||||||||||||||||||||

| BALANCE, January 1, 2019 | 2,500,000 | $ | 1,750 | 89,789,407,996 | $ | 62,852,585 | $ | (37,566,509 | ) | $ | (25,648,982 | ) | $ | (361,156 | ) | |||||||||||||

| Net loss | - | - | - | - | - | (5,114 | ) | (5,114 | ) | |||||||||||||||||||

| BALANCE, March 31, 2019, (unaudited) | 2,500,000 | $ | 1,750 | 89,789,407,996 | $ | 62,852,585 | $ | (37,566,509 | ) | $ | (25,654,096 | ) | $ | (366,270 | ) | |||||||||||||

The accompanying notes are an integral part of the condensed consolidated financial statementsstatement

WORLD HEALTH ENERGY HOLDINGS, INC.INC .

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

Condensed Consolidated Statements of Cash Flows(U.S. dollars except)

Three months ended March 31,

(unaudited)

| 2020 | 2019 | |||||||

| CASH FLOWS FROM OPERATING ACTIVITIES: | ||||||||

| Net loss | $ | (14,520 | ) | $ | (5,114 | ) | ||

| Adjustments to reconcile net loss to net cash used in operating activities: | ||||||||

| Amortization of prepaid expense | - | - | ||||||

| Changes in operating assets and liabilities | ||||||||

| (Increase) in prepaid expense and deposits | - | (1,381 | ) | |||||

| Increase (decrease) in accounts payable and accrued liabilities | (31,003 | ) | (3,802 | ) | ||||

| Increase (decrease) in due to affiliates | - | - | ||||||

| Net cash used in operating activities | (45,523 | ) | (10,297 | ) | ||||

| CASH FLOWS FROM FINANCING ACTIVITIES: | ||||||||

| Repayments of related party advances | - | - | ||||||

| Proceeds from related party advances | 45,523 | 10,297 | ||||||

| Net cash provided by financing activities | 45,523 | 10,297 | ||||||

| Net change in cash | - | - | ||||||

| Cash, beginning of year | - | - | ||||||

| Cash, end of year | $ | - | $ | - | ||||

| SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION: | ||||||||

| Interest paid in cash | $ | - | $ | - | ||||

| Income tax paid in cash | $ | - | $ | - | ||||

| Three months ended | ||||||||

| March 31, | ||||||||

| 2021 | 2020 | |||||||

| (Unaudited) | ||||||||

| CASH FLOWS FROM OPERATING ACTIVITIES: | ||||||||

| Net loss for the period | (266,091 | ) | (163,046 | ) | ||||

| Adjustments required to reconcile net loss for the period to net cash used in operating activities: | ||||||||

| Depreciation and amortization | 13,597 | 10,362 | ||||||

| Increase in liability for employee rights upon retirement | 28,514 | 2,777 | ||||||

| Decrease in accounts receivable | (8,274 | ) | (1,738 | ) | ||||

| Decrease (increase) in other current assets | (4,139 | ) | (12,719 | ) | ||||

| Increase (decrease) in accounts payable | (5,422 | ) | 7,983 | |||||

| Increase in other accounts liabilities | 37,178 | 31,606 | ||||||

| Net cash used in operating activities | (204,637 | ) | (124,775 | ) | ||||

| CASH FLOWS FROM INVESTING ACTIVITIES: | ||||||||

| Loans granted to related parties | - | (228,898 | ) | |||||

| Proceeds from related parties | 3,521 | - | ||||||

| Purchase of property and equipment | (1,668 | ) | (7,675 | ) | ||||

| Net cash used in investing activities | 1,853 | (236,573 | ) | |||||

| CASH FLOWS FROM FINANCING ACTIVITIES: | ||||||||

| Payments of lease liability | (15,297 | ) | (6,942 | ) | ||||

| Loan received from parent company | - | 91,785 | ||||||

| Net cash provided by (used in) financing activities | (15,297 | ) | 84,843 | |||||

| INCREASE (DECREASE) IN CASH AND CASH EQUIVALENTS | (218,081 | ) | (276,505 | ) | ||||

| CASH AND CASH EQUIVALENTS AT BEGINNING OF PERIOD | 359,949 | 359,461 | ||||||

| CASH AND CASH EQUIVALENTS AT END OF PERIOD | 141,868 | 82,956 | ||||||

| Supplemental disclosure of cash flow information: | ||||||||

| Non cash transactions: | ||||||||

| Initial recognition of operating lease right-of-use assets | 242,906 | - | ||||||

| Initial recognition of operating lease liability | (242,906 | ) | - | |||||

The accompanying notes are an integral part of the condensed consolidated financial statementsstatement

WORLD HEALTH ENERGY HOLDINGS, INC.INC .

Notes to Unaudited Condensed Consolidated Financial StatementsNOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (unaudited)

NOTE 1 – GENERAL

(1) NATURE OF OPERATIONS

| A. | Operations |

World Health Energy Holdings, Inc., (the “Company” or “WHEN“��WHEN”), was formed on May 21, 1986, under the laws of the State of Delaware. The Company has invested in and abandoned a variety of software programs that it strove to commercialize. It

UCG, INC. (the “UCG”) was incorporated on September 13, 2017, under the laws of the State of Florida. The Company wholly-owns the issued and outstanding shares of RNA Ltd. (Hereinafter: “RNA”).

RNA is currently seekingprimarily a research and development company that has been performing software design work for UCG in the cyber-security arena to commercialize.field of cybersecurity under the terms of development agreement between UCG and RNA. UCG is primarily engaged in the marketing and distribution of cybersecurity related products.

(2) BASIS OF PRESENTATION AND USE OF ESTIMATESIn anticipation of the transaction contemplated under the Merger Agreement, SG 77 Inc. a Delaware Corporation and a wholly-owned subsidiary of UCG (“SG”), was incorporated on April 16, 2020 and all of the cybersecurity rights and interests held by UCG, including the share ownership of RNA, were assigned to SG.

| B. | Merger Transaction |

a) BasisOn April 27, 2020, the Company completed a reverse triangular merger pursuant to the Agreement and Plan of PresentationMerger (the “Merger Agreement”) among WHEN, R2GA, Inc., a Delaware corporation and a wholly owned subsidiary of WHEN (“Sub”), UCG, SG, and RNA. Under the terms of the Merger Agreement, R2GA merged with SG, with SG remaining as the surviving corporation and a wholly-owned subsidiary of the WHEN (the “Merger”). The Merger was effective as of April 27, 2020 whereby SG became a direct and wholly owned subsidiary of WHEN and RNA indirect wholly owned subsidiary of the Company. Each of Gaya Rozensweig and George Baumeohl, directors of the Company, are also the sole shareholders and directors of the Company.

As consideration for the Merger, WHEN issued to UCG 3,870,000 Series B Convertible Preferred Stock, par value $0.0007 per share, of WHEN (the “Series B Preferred Shares”). Each share of the Series B Preferred Shares will automatically convert into 100,000 shares of WHEN’s common stock, par value $0.0007 (the “Common Stock”), for an aggregate amount of 387,000,000,000 shares of WHEN’s Common Stock, upon the filing with the Secretary of State of Delaware of an amendment to WHEN’s certificate of incorporation increasing the number of authorized shares of Common Stock that the Company is authorized to issue from time to time.

The comparative amounts presentedCompany, collectively with SG, Sub and RNA are hereunder referred to as the “Group”.

The transaction was accounted for as a reverse asset acquisition in these consolidatedaccordance with generally accepted accounting principles in the United States of America (“GAAP”). Under this method of accounting, SG was deemed to be the accounting acquirer for financial reporting purposes. This determination was primarily based on the facts that, immediately following the Merger: (i) SG’s stockholders owned a substantial majority of the voting rights in the combined company, (ii) SG designated a majority of the members of the initial board of directors of the combined company, and (iii) SG’s senior management holds all key positions in the senior management of the combined company. As a result of the Recapitalization Transaction, the shareholders of SG received the largest ownership interest in the Company, and SG was determined to be the “accounting acquirer” in the Recapitalization Transaction.

WORLD HEALTH ENERGY HOLDINGS, INC .

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (unaudited)

NOTE 1 – GENERAL (continue)

As a result, the historical financial statements areof the Company were replaced with the historical resultsfinancial statements of World Health Energy Holdings, Inc., inclusiveSG. The number of shares prior to the reverse capitalization have been retroactively adjusted based on the equivalent number of shares received by the accounting acquirer in the Recapitalization Transaction.

| C. | Going concern uncertainty |

Since inception, the Group has devoted substantially all its efforts to research and development. The Group is still in its development stage and the extent of the Group’s future operating losses and the timing of becoming profitable, if ever, are uncertain. As of March 31, 2021, the Group had $141,868 of cash and cash equivalents, net losses of $266,091, accumulated deficit of $1,762,728, and a negative working capital of $389,617.

The Group will need to secure additional capital in the future in order to meet its anticipated liquidity needs primarily through the sale of additional Common Stock or other equity securities and/or debt financing. Funds from these sources may not be available to the Group on acceptable terms, if at all, and the Group cannot give assurance that it will be successful in securing such additional capital.

These conditions raise substantial doubt about the Company’s ability to continue to operate as a “going concern.” The Company’s ability to continue operating as a going concern is dependent on several factors, among them is the ability to raise sufficient additional funding.

The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

| D. | Risk factors |

The Group face a number of risks, including uncertainties regarding finalization of the development process, demand and market acceptance of the Group’s products, the effects of technological changes, competition and the development of products by competitors. Additionally, other risk factors also exist, such as the ability to manage growth and the effect of planned expansion of operations on the Group’s future results. In addition, the Group expects to continue incurring significant operating costs and losses in connection with the development of its wholly owned subsidiaries World Health Energy, Inc. (“WHEH“)products and FSC Solutions, Inc. (“FSC“). All intercompany balancesincreased marketing efforts. As mentioned above, the Group has not yet generated significant revenues from its operations to fund its activities, and transactions have been eliminated in consolidation.therefore the continuance of its activities as a going concern depends on the receipt of additional funding from its current stockholders and investors or from third parties.

WORLD HEALTH ENERGY HOLDINGS, INC .

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (unaudited)

NOTE 2 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES AND BASIS OF PRESENTATION

Unaudited Interim Financial Statements

The accompanying unaudited condensed interimconsolidated financial statements have beeninclude the accounts of the Company and its subsidiary, prepared in accordance with Generally Accepted Accounting Principles ("GAAP")accounting principles generally accepted in the United States of America ("U.S.") as promulgated by the Financial Accounting Standards Board ("FASB") Accounting Standards Codification ("ASC"(“GAAP”) and with the rulesinstructions to Form 10-Q. In the opinion of management, the financial statements presented herein have not been audited by an independent registered public accounting firm but include all material adjustments (consisting of normal recurring adjustments) which are, in the opinion of management, necessary for a fair statement of the financial condition, results of operations and regulationscash flows for the three-months ended March 31, 2021. However, these results are not necessarily indicative of results for any other interim period or for the year ended December 31, 2021. The preparation of financial statements in conformity with GAAP requires the Company to make certain estimates and assumptions for the reporting periods covered by the financial statements. These estimates and assumptions affect the reported amounts of assets, liabilities, revenues and expenses. Actual amounts could differ from these estimates.

Certain information and footnote disclosures normally included in financial statements in accordance with generally accepted accounting principles have been omitted pursuant to the rules of the U.S. Securities and Exchange Commission ("SEC"(“SEC”). In our opinion, the accompanying unaudited interim condensedThese financial statements contain all adjustments (which are of a normal recurring nature) necessary for a fair presentation. Operating results forshould be read in conjunction with the three months ended March 31, 2020 are not necessarily indicative offinancial statements and notes thereto contained in the results that may be expectedCompany’s Annual Report on published on the OTCIQ Alternative Reporting System, for the year endingended December 31, 2020.2021.

Principles of Consolidation

The consolidated financial statements are prepared in accordance with US GAAP. The consolidated financial statements of the Company include the Company and its wholly-owned and majority-owned subsidiaries. All inter-company balances and transactions have been eliminated.

b) Use of Estimates

The preparation of unaudited condensed consolidated financial statements in conformity with accounting principles generally accepted in the United States requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, certain revenues and expenses, and disclosure of contingent assets and liabilities atas of the date of the financial statements and the reported amounts of revenues and expenses during the reporting period.statements. Actual results could differ from thesethose estimates. Significant estimates in the accompanying consolidatedAs applicable to these financial statements, involved the Going Concern.most significant estimates and assumptions relate to the going concern assumptions.

WORLD HEALTH ENERGY HOLDINGS, INC .

(3)NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (unaudited)

NOTE 2 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES AND BASIS OF PRESENTATION (continue)

a) CashRecent Accounting Pronouncements

In August 2020, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (“ASU”) 2020-06, “Debt – Debt with Conversion and Other Options (Subtopic 470-20) and Derivatives and Hedging – Contracts in Entity’s Own Equity (Subtopic 815-40): Accounting for Convertible Instruments and Contracts in an Entity’s Own Equity” (“ASU 2020-06”). The guidance in ASU 2020-06 simplifies the accounting for convertible debt and convertible preferred stock by removing the requirements to separately present certain conversion features in equity. In addition, the amendments in the ASU 2020-06 also simplify the guidance in ASC Subtopic 815-40, Derivatives and Hedging: Contracts in Entity’s Own Equity, by removing certain criteria that must be satisfied in order to classify a contract as equity, which is expected to decrease the number of freestanding instruments and embedded derivatives accounted for as assets or liabilities. Finally, the amendments revise the guidance on calculating earnings per share, requiring use of the if-converted method for all convertible instruments and rescinding an entity’s ability to rebut the presumption of share settlement for instruments that may be settled in cash equivalentsor other assets.

The amendments in ASU 2020-06 are effective for the Company considers all highly liquid securities with original maturitiesfor fiscal years beginning after December 15, 2021. Early adoption is permitted. The guidance must be adopted as of three months or less when acquired,the beginning of the fiscal year of adoption. The Company is currently evaluating the impact of this new guidance, but does not expect it to be cash equivalents. We had nohave a material impact on its financial instruments that qualified as cash equivalents at March 31, 2020 and December 31, 2019.statements.

b) Related Party NOTE 3 – RELATED PARTIES

| A. | Transactions and balances with related parties |

Three months ended March 31 | ||||||||

| 2021 | 2020 | |||||||

| General and administrative expenses: | ||||||||

| Salaries and fees to officers | 39,413 | 15,107 | ||||||

| Research and development expenses: | ||||||||

| Salaries and fees to officers | 22,653 | 8,536 | ||||||

WORLD HEALTH ENERGY HOLDINGS, INC .

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (unaudited)

NOTE 3 – RELATED PARTIES (continue)

| B. | Balances with related parties and officers: |

| As of March 31, | As of December 31, | |||||||

| 2021 | 2020 | |||||||

| Other accounts liabilities | 183,135 | 191,994 | ||||||

| Long term loan from related party | 1,812,704 | 1,812,704 | ||||||

| Liability for employee rights upon retirement | 102,516 | 95,451 | ||||||

NOTE 4 – COMMITMENTS AND CONTINGENCIES

All transactionsOn October 27, 2020 WHEN filed suit in State Court, Palm Beach County, Florida, against FSC Solutions, Inc. (“FSC”), Eli Gal Levy (“EL”) and Padem Consultants Sprl (collectively, the “Defendants”). The suit relates to the Stock Purchase Agreement entered into by WHEN with related parties areFSC and its shareholders, which included EL, pursuant to which WHEN acquired all of the issued and outstanding stock of FSC in exchange for the issuance of 70 billion shares of WHEN unregistered common stock. FSC was the putative owner of a software and trading platform which WHEN intended to use to enter into the on-line trading business. Subsequent to the completion of the acquisition, we determined that FSC did not have control over the trading platform and software we expected to acquire and operate. The Suit sought declaratory judgment to unwind the FSC transaction and cancel the shares of WHEN common stock issued in the normal course of operations andFSC transaction that are measured at the exchange amount.still outstanding.

A hearing was set for January 6, 2021 whereupon mediation was ordered. The Company has been in discussions with EL to resolve this issue.

WORLD HEALTH ENERGY HOLDINGS, INC.

Notes to Unaudited Condensed Consolidated Financial Statements

(3) SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES, continued

c) Financial instruments and Fair value measurements

FASBASC 825-10 ”Financial Instruments”, allows entities to voluntarily choose to measure certain financial assets and liabilities at fair value (fair value option). The fair value option may be elected on an instrument-by-instrument basis and is irrevocable, unless a new election date occurs. If the fair value option is elected for an instrument, unrealized gains and losses for that instrument should be reported in earnings at each subsequent reporting date. The Company did not elect to apply the fair value option to any outstanding instruments. ASC 825 also requires disclosures of the fair value of financial instruments. The carrying value of the Company’s current financial instruments, which include cash and cash equivalents, accounts payable and accrued liabilities approximates their fair values because of the short-term maturities of these instruments.

FASB ASC 820 ”Fair Value Measurement“ clarifies that fair value is an exit price, representing the amount that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants. It also requires disclosure about how fair value is determined for assets and liabilities and establishes a hierarchy for which these assets and liabilities must be grouped, based on significant levels of inputs as follows:

Level 1: Quoted prices in active markets for identical assets or liabilities.

Level 2: Quoted prices in active markets for similar assets and liabilities and inputs that are observable for the asset or liability.

Level 3: Unobservable inputs in which there is little or no market data, which require the reporting entity to develop its own assumptions.

The determination of where assets and liabilities fall within this hierarchy is based upon the lowest level of input that is significant to the fair value measurement.

d) Income Taxes

The Company uses the asset and liability method of FASB ASC 740 to account for income taxes. Under this method, deferred income taxes are determined based on the differences between the tax basis of assets and liabilities and their reported amounts in the consolidated financial statements which will result in taxable or deductible amounts in future years and are measured using the currently enacted tax rates and laws. A valuation allowance is provided to reduce net deferred tax assets to the amount that, based on available evidence, is more likely than not to be realized.

The Company follows the provisions of ASC 740-10, Accounting for Uncertain Income Tax Positions. When tax returns are filed, it is highly certain that some positions taken would be sustained upon examination by the taxing authorities, while others are subject to uncertainty about the merits of the position taken or the amount of the position that would be ultimately sustained. In accordance with the guidance of ASC 740-10, the benefit of a tax position is recognized in the financial statements in the period during which, based on all available evidence, management believes it is more likely than not that the position will be sustained upon examination including the resolution of appeals or litigation processes, if any. Tax positions taken are not offset or aggregated with other positions. Tax positions that meet the more-likely-than-not recognition threshold are measured as the largest amount of tax benefit that is more than 50 percent likely of being realized upon settlement with the applicable taxing authority. The portion of the benefits associated with tax positions taken that exceeds the amount measured as described above should be reflected as a liability for unrecognized tax benefits in the accompanying consolidated balance sheets along with any associated interest and penalties that would be payable to the taxing authorities upon examination.

WORLD HEALTH ENERGY HOLDINGS, INC.

Notes to Unaudited Condensed Consolidated Financial Statements

(3) SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES, continued

d) Income Taxes,continued

As of March 31, 2020, the tax years 2019, 2018 and 2017 for the Company remain open for IRS audit. The Company has received no notice of audit or any notifications from the IRS for any of the open tax years.,

e) Net income (loss) per share

Basic loss per share excludes dilution and is computed by dividing the loss attributable to stockholders by the weighted-average number of shares outstanding for the period. Diluted loss per share reflects the potential dilution that could occur if securities or other contracts to issue common stock were exercised or converted into common stock or resulted in the issuance of common stock that shared in the earnings of the Company. Diluted loss per share is computed by dividing the loss available to stockholders by the weighted average number of shares outstanding for the period and dilutive potential shares outstanding unless consideration of such dilutive potential shares would result in anti-dilution. There were no common stock equivalents at March 31, 2020 and December 31, 2019.

j) Lease

In February 2016, the FASB issued ASU 2016-02, “Leases” which, for operating leases, requires a lessee to recognize a right-of-use asset and a lease liability, initially measured at the present value of the lease payments, in its balance sheet. The standard also requires a lessee to recognize a single lease cost, calculated so that the cost of the lease is allocated over the lease term, on a generally straight-line basis. The Company currently leases a virtual office on a month to month basis, therefore this ASU has no effect on our financial statements.

(4) LIQUIDITY AND GOING CONCERN CONSIDERATIONS

The financial statements have been prepared on a going concern basis, which contemplates the realization of assets and the settlement of liabilities and commitments in the normal course of business. The Company sustained a net loss of approximately $14,000 for the three months ended March 31, 2020 and has an accumulated deficit of approximately $25,815,000 and a negative working capital of approximately $464,000 at March 31, 2020. These conditions raise substantial doubt about our ability to continue as a going concern.

Failure to successfully develop operations and revenues could harm our profitability and materially adversely affect the Company’s financial condition and results of operations. The Company faces all of the risks inherent in a new business, including the need for significant additional capital, management=s potential underestimation of initial and ongoing costs, and potential delays and other problems in connection with establishing the Company>s planned operations.

The Company is continuing its plan to further grow and expand restaurant operations and seek sources of capital to pay contractual obligations as they come due. Management believes that its current operating strategy will provide the opportunity for us to continue as a going concern as long as the Company is able to obtain additional financing; however, there is no assurance this will occur. The accompanying financial statements do not include any adjustments that might be necessary if the Company is unable to continue as a going concern.

WORLD HEALTH ENERGY HOLDINGS, INC.

Notes to Unaudited Condensed Consolidated Financial Statements

(5) STOCKHOLDERS‘ DEFICIT

At March 31, 2020 and December 31, 2019, the Company has 110,000,000,000 shares of par value $0.0007 common stock authorized and 89,789,407,996 shares issued and outstanding. At March 31, 2020 and December 31, 2019, the Company has 10,000,000 shares of par value $0.0007 preferred stock and 5,000,000 shares issued and outstanding.

(6) COMMITMENTS AND CONTINGENCIES

a) Legal Matters

From time to time, the Company may be involved in litigation relating to claims arising out of our operations in the normal course of business. As of March 31, 2020, there were no pending or threatened lawsuits that could reasonably be expected to have a material effect on the results of our operations.

b) COVID-19

The full extent to which the COVID-19 pandemic may directly or indirectly impact our business, results of operations and financial condition, will depend on future developments that are uncertain, including as a result of new information that may emerge concerning COVID-19 and the actions taken to contain it or treat COVID-19, as well as the economic impact on local, regional, national and international customers and markets. We have made estimates of the impact of COVID-19 within our financial statements, and although there is currently no major impact, there may be changes to those estimates in future periods.

(7) SUBSEQUENT EVENTS

a) Reverse acquisition

On April 27, 2020, WHEN completed a reverse triangular merger pursuant to the Agreement and Plan of Merger (the ”Merger Agreement“) among the Company, R2GA, Inc., a Delaware corporation and a wholly owned subsidiary of the Company (“Sub“), UCG, Inc., a Florida corporation (“Seller“), SG 77 Inc., a Delaware corporation and wholly-owned subsidiary of Seller (“SG“), and RNA Ltd., an Israeli company and a wholly owned subsidiary of SG (“RNA“). Under the terms of the Merger Agreement, R2GA merged with and into SG, with SG remaining as the surviving corporation and a wholly-owned subsidiary of the Company (the ”Merger“). The Merger was effective as of April 29, 2020 whereby SG became a direct and wholly owned subsidiary of the Company and RNA indirect wholly owned subsidiary of the Company. Each of Gaya Rozensweig and George Baumeohl, directors of the Company, are also the sole shareholders and directors of the Seller.

RNA is primarily a research and development company that has been performing software design work for the Seller in the field of cybersecurity. SG is primarily engaged in the marketing and distribution of cybersecurity related products. In anticipation of the transaction contemplated under the Merger Agreement, SG was formed and all of the cybersecurity rights and interests held by the Seller, including the share ownership of RNA, were assigned to SG. The Company intends to continue the business of SG/RNA as its principal business enterprise.

b) Stockholders’ deficit

As consideration for the Merger, the Company issued to Seller 3,870,000 shares of newly created Series B Convertible Preferred Stock, par value $0.0007 per share, of the Company (the ”Series B Preferred Shares“). Each share of the Series B Preferred Shares will automatically convert into 100,000 shares of the Company’s common stock, for an aggregate amount of 387,000,000,000 shares of the Company’s Common Stock, upon the filing with the Secretary of State of Delaware of an amendment to the Company’s certificate of incorporation increasing the number of authorized shares of Common Stock that the Company is authorized to issue from time to time.

| ITEM 2. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

THE FOLLOWING DISCUSSION SHOULD BE READ IN CONJUNCTION WITH OUR UNAUDITED INTERIM FINANCIAL STATEMENTS AND THE RELATED NOTES TO THOSE STATEMENTS INCLUDED IN THIS FORM 10-Q. SOME OF OUR DISCUSSION IS FORWARD-LOOKING AND INVOLVES RISKS AND UNCERTAINTIES. FOR INFORMATION REGARDING RISK FACTORS THAT COULD HAVE A MATERIAL ADVERSE EFFECT ON OUR BUSINESS, REFER TO THE DISCUSSION OF RISK FACTORS IN THE “DESCRIPTION OF BUSINESS” SECTION OF OUR ANNUAL REPORT ON FORM 10-K FOR THE YEAR ENDED DECEMBER 31, 2019, FILED WITH THE SECURITIES AND EXCHANGE COMMISSION ON APRIL 14, 2020 AND OUR CURRENT REPORT ON FORM 8-K FIILED WITH THE SECURITIES AND EXCHANGE COMMISSION ON APRIL 30, 2020.Forward-Looking Statements

Forward-Looking Statements

This Quarterly Report on Form 10-Q contains forward-looking statements regarding our business, financial condition, results of operations and prospects. The Securities and Exchange Commission (the “SEC”) encourages companies to disclose forward-looking information so that investors can better understand a company’s future prospects and make informed investment decisions. This Quarterly Report on Form 10-Q and other written and oral statements that we make from time to time contain such forward-looking statements that set out anticipated results based on management’s plans and assumptions regarding future events or performance. We have tried, wherever possible, to identify such statements by using words such as “anticipate,” “estimate,” “expect,” “project,” “intend,” “plan,” “believe,” “will” and similar expressions in connection with any discussion of future operating or financial performance. In particular, these include statements relating to future actions, future performance or results of current and anticipated sales efforts, expenses, the outcome of contingencies, such as legal proceedings, and financial results and the effects of the COVID-19 pandemic or any similar pandemic.

We caution that these factors could cause our actual results of operations and financial condition to differ materially from those expressed in any forward-looking statements we make and that investors should not place undue reliance on any such forward-looking statements. Further, any forward-looking statement speaks only as of the date on which such statement is made, and we undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date on which such statement is made or to reflect the occurrence of anticipated or unanticipated events or circumstances. New factors emerge from time to time, and it is not possible for us to predict all of such factors. Further, we cannot assess the impact of each such factor on our results of operations or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements.

The following discussion should be read in conjunction with our unauditedthe financial statements and the related notes that appearcontained elsewhere in this Quarterly Report on Form 10-Q, as well as our Annual Report on Form 10-K for the fiscal year ended December 31, 2020 as filed with the Securities and Exchange Commission (the “SEC”) on April 15, 2021. Certain statements made in this discussion are “forward-looking statements” within the meaning of the private securities litigation reform act of 1995,. These statements are based upon beliefs of, and information currently available to, the Company’s management as well as estimates and assumptions made by the Company’s management. Readers are cautioned not to place undue reliance on these forward-looking statements, which are only predictions and speak only as of the date hereof. When used herein, the words “anticipate,” “believe,” “estimate,” “expect,” “forecast,” “future,” “intend,” “plan,” “predict,” “project,” “target,” “potential,” “will,” “would,” “could,” “should,” “continue” or the negative of these terms and similar expressions as they relate to the Company or the Company’s management identify forward-looking statements. Such statements reflect the current view of the Company with respect to future events and are subject to risks, uncertainties, assumptions, and other SEC filings.factors, including the risks relating to the Company’s business, industry, and the Company’s operations and results of operations and the effects that the COVID-19 outbreak, or similar pandemics, could have on our business. Should one or more of these risks or uncertainties materialize, or should the underlying assumptions prove incorrect, actual results may differ significantly from those anticipated, believed, estimated, expected, intended, or planned.

The full extent to which the COVID-19 pandemic may directly or indirectly impact our business, results of operations and financial condition will depend on future developments that are uncertain, including as a result of new information that may emerge concerning COVID-19 and the actions taken to contain it or treat COVID-19, as well as the economic impact on local, regional, national and international customers and markets. We have made estimates of the impact of COVID-19 within our financial statements, and although there is currently no major impact, there may be changes to those estimates in future periods. Actual results may differ from these estimates.

Although the Company believes that the expectations reflected in the forward-looking statements are reasonable, the Company cannot guarantee future results, levels of activity, performance, or achievements. Except as required by applicable law, including the securities laws of the United States, the Company does not intend to update any of the forward-looking statements to conform these statements to actual results.

Our financial statements are prepared in accordance with accounting principles generally accepted in the United States (“GAAP”). These accounting principles require us to make certain estimates, judgments and assumptions. We believe that the estimates, judgments and assumptions upon which we rely are reasonable based upon information available to us at the time that these estimates, judgments and assumptions are made. These estimates, judgments and assumptions can affect the reported amounts of assets and liabilities as of the date of the financial statements as well as the reported amounts of revenues and expenses during the periods presented. Our financial statements would be affected to the extent there are material differences between these estimates and actual results. The following discussion should be read in conjunction with our financial statements and notes thereto appearing elsewhere in this report.

Overview

World Health Energy Holdings Inc.(“we” “us” “our” the “Company” or “WHEN” (“WHEN”) was incorporated on May 21, 1986 in the state of Delaware. WHEN is a diversified energy, health, and security technology company with corporate offices that are located in Boca Raton, Florida and Ramat Gan, Israel.

On April 27, 2020, WHEN completed a reverse triangular merger pursuant to the Agreement and Plan of Merger (the “Merger Agreement”) among the Company, R2GA, Inc., a Delaware corporation and athrough its wholly owned subsidiary of the Company (“Sub”), UCG, Inc., a Florida corporation (“Seller”),subsidiaries SG 77, Inc., a Delaware corporation and wholly-owned subsidiary of Seller (“SG”), and RNA Ltd., an Israeli company and a wholly owned subsidiary of SGLtd (“RNA”). Under the terms of the Merger Agreement, R2GA merged with and into SG, with SG remaining as the surviving corporation and a wholly-owned subsidiary of the Company (the “Merger”). The Merger was effective as of April 29, 2020, upon the filing of a copy of the Merger Agreement and certificate of merger with the Secretary of State of the State of Delaware (the “Effective Time”), whereby SG became a direct and wholly owned subsidiary of the Company and RNA indirect wholly owned subsidiary of the Company. Each of Gaya Rozensweig and George Baumeohl, directors of the Company, are also the sole shareholders and directors of UCG.

RNA is primarily a research and development company that has been performing software design work for the Seller in the field of cybersecurity. SG is primarily engaged in data security and analytics and provides intelligent security software and services to enterprises and individuals worldwide WHEN leverages artificial intelligence (“AI”) and machine learning to deliver innovative solutions in the marketing and distributionareas of cybersecurity, related products. In anticipationsafety focusing on the areas of endpoint security, endpoint management and encryption.

As the digital transformation of enterprises continues to advance, workforces are becoming more dispersed and mobile, and data and applications are increasingly migrating to the cloud. As part of this trend, the number of connected endpoints is growing rapidly, as is their complexity and the volume of data that they process and store. These endpoints, which include smartphones, laptops, desktops, servers, vehicles, industrial equipment and other connected devices in the Internet of Things (“IoT”), are increasingly a target for cyber adversaries. The COVID-19 pandemic has accelerated the decentralization of the transaction contemplated underworkplace prompting many enterprises to shift to substantially remote and mobile work models. At the Merger Agreement, SG was formedsame time, the threat environment has become increasingly hostile as the number of adversaries grows and allthe scale and sophistication of their attacks, increasingly focused on the endpoint, continue to develop.

The landscape of increasing vulnerability has created opportunities for secure communications platforms, endpoint cybersecurity rights and interests held bymanagement solutions, analytic tools and related services that help enterprises and individuals to secure their connected endpoints. Our software specializes in data protection, threat detection and response. Our product offerings enable enterprises to protect data stored on premises and in the Seller, including the share ownership of RNA, were assignedcloud, confidential data belonging to SG.customers, financial records, strategic and product plans and other intellectual property and, on a parental or guardian level, to monitor minor children’s cyber activities.

We believe that the COVID-19 pandemic, which continues to impact all of society has increased our long-term opportunity to help our customers protect their data and detect threats. Companies around the world now have employees working remotely from potentially vulnerable home networks, accessing critical on-premises data storages and infrastructure through VPNs and sharing information in cloud data stores. We believe this trend is likely to continue in the long-term and that we are striving to capitalize on the opportunity ahead.

Product Offerings & Revenue Model

Our product offerings are comprised of two principal segments, one targeting for commercial enterprises (B2B) and one for the individual users (B2C).

B2B Offerings—The B2B Cybersecurity system software development and implementation program focused on innovative solutions for the constantly evolving cyber challenges of businesses, non-governmental organizations (NGO’s) and governmental entities.

We recently launched OTOGRAPH, our comprehensive cybersecurity and information security system, to enable business enterprises to monitor, analyze and prevent suspicious or harmful behavior on corporate networks and connected devices. The OTOGRAPH is designed to analyze and prevent internal or external abuse or abnormal activity on enterprise devices, such as PCs, mobile phones, servers or any other OS-based IOT device.

The rapid transition to open and cloud-based remote workforce has exposed businesses and organizations across the world to higher risks of cyber-attacks and information security breaches. To enable businesses to better protect their data and workflow, we developed a Business Behavioral Analysis (BBA) system that enables business leaders to track all activity from any given location on a one-stop dashboard. Developed over the past two years, OTOGRAPH provides aggregated data and a wide variety of real-time analytics such as real time monitoring of online behavior, applications and system behavior, data breaches, internal and external connections analytics, productivity analysis and psycholinguistic analysis. Corporations and organizations can then use the dashboard to detect suspicious human or device activities that put their company at risk.

OTOGRAPH was developed based on a state of the art intelligence technology combined with AI technology that processes and analyzes massive amounts of behavioral and communication data and enables organizations to make real time accurate preventive assessments and decisions to protect company assets and ensure operational efficiency.OTOGRAPH deploys a unique Business Behavioral Analysis (BBA) machine learning software. Behavioral digital data is extracted from all endpoint devices that are connected to the company’s network infrastructure – whether physically, wirelessly or remotely. The data is processed and analyzed to learn and to reveal the unique digital behavioral pattern of the organization as a whole and of every endpoint or individual.

OTOGRAPH sets baselines of normal patterns for each, and constantly searches for anomalies – deviations from those expected patterns. The anomalies are detected automatically and instantly, categorized by their type and generate push alerts which are sent to the business leader’s dashboard and enabling him to respond to the threat.

B2C Cybersecurity —The B2C Cybersecurity division targets families concerned with external cyber threats and exposures in addition to monitoring a child’s behavioral patterns that may alert parents to potential tragedies caused by cyber bullying, pedophiles, other predators, and depression.

Our go-to-market strategy focuses principally on generating revenue from software, services and licensing. We intend to continue the businesssell substantially all of SG/RNAour products and services to distributors and resellers, which will sell to end-user customers, which we refer to in this report as our principal business enterprise.customers.

Other Corporate Holdings

We currently also have the following subsidiaries.

FSC Solutions, Inc. On June 26, 2015, we entered into a Stock Purchase Agreement (the “Agreement”) with FSC and its shareholders which included Uri Tadelis, our former Chief Executive Officer and Director and our former Directors Chaim J. Lieberman and Gal Levy. The Agreement was effective as of July 1, 2015 which served as the closing date for the acquisition. Pursuant to the terms of the Agreement, we acquired all of the capital stock of FSC in exchange for the issuance of 70 billion shares of our unregistered common stock with the possibility of the issuance of an additional 130 Billion common shares upon FSC meeting certain milestones as outlined in the Agreement. Upon completion of the acquisition of FSC, we intended to employ FSC’s software and trading platform to enter the on-line trading industry. Subsequent to the completion of the acquisition, we determined that FSC did not have control over the trading platform and software we expected to acquire and operate. Consequently, we never commenced operationsPlease refer to Item 1, Part II, of this business and we are in discussions with the non-management sellers of FSC to resolve this issue that arose after closing and are evaluating our alternatives.report.

World Health Energy, Inc. World Health Energy, Inc. owns an algae-tech business whose primary focus was the production of algae using their proprietary GB3000 growth system. The system quickly and efficiently grows algae for the production of biofuels and food protein. We also sought to produce and market high-quality, low-cost B100 biodiesel. Though, we believe that the Company has been successful in demonstrating the effectiveness of the GB3000 system on a small-scale the Company has not yet been able to raise the necessary capital to implement their technologies on a commercial scale.

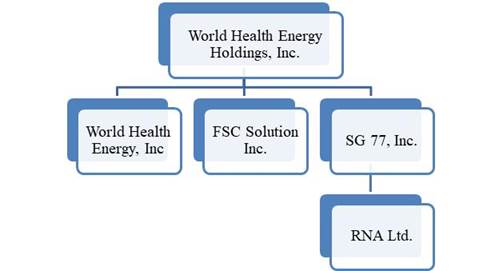

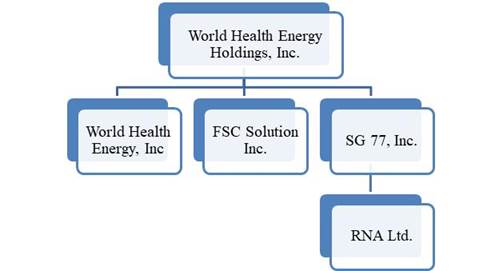

Corporate Structure (Diagram)

The corporate structure of the WHEN Group is reflected below in this diagram

Comparison of the Three Months Ended March 31, 20202021 to the Three Months Ended March 31, 20192020

RevenuesThe following table presents our results of operations for the three months ended March 31, 2021 and 2020

| Three Months Ended | ||||||||

| March 31 | ||||||||

| 2021 | 2020 | |||||||

| Revenues | 32,649 | 3,516 | ||||||

| Operating Expenses | ||||||||

| Research and development expenses | (172,771 | ) | (99,948 | ) | ||||

| General and administrative expenses | (124,485 | ) | (57,406 | ) | ||||

| Operating loss | (264,607 | ) | (153,838 | ) | ||||

| Financing expenses, net | (1,484 | ) | (9,208 | ) | ||||

| Net loss | (266,091 | ) | (163,046 | ) | ||||

Revenues. Revenues for the three month periodsmonths ended March 31, 2021 and 2020 were $32,649 and $3,516, respectively. Revenues were comprised primarily of software license fees.

Research and Development. Research and development expenses consist of salaries and related expenses, consulting fees, service providers’ costs, related materials and overhead expenses. Research and development expenses increased from $99,948 for the three months ended March 31, 2020 to $172,771 for the three months ended March 31, 2021. The increase resulted primarily from increase in salaries and 2019 were $0.related expenses associated with our development activities.

Operating Expenses

OperatingGeneral and Administrative Expenses. General and administrative expenses consist primarily of salaries and related expenses and other non-personnel related expenses such as legal expenses. General and administrative expenses increased from $57,406 for the three month periodmonths ended March 31, 2020 were $14,468 compared to $5,114$124,485 for the three month periodmonths ended March 31, 2019.2021. The reason forincrease is primarily attributable to the increase is attributable to an increase in the activities of the Company during the period, in particular relating to the consultancysalaries and related expenses, professional services other professional fees.non-personnel related expenses.

We recorded aFinancing Expenses, Net. Financing expenses, net operating lossdecreased from $9,208 for the three month periodmonths ended March 31, 2020 of $14,520 compared to $5,114$1,484 for the three month periodmonths ended March 31, 2019.2020. The decrease is mainly a result of currency exchange differences between the Dollar and the New Israeli Shekel.

Net Loss and. Net Loss Per Share

Our net loss and net loss per share was $14,520 and $0.00 for the three month period ended March 31, 2020, compared2021 was $266,091 and is primarily attributable to a $5,114research and $0.00 per share for the three month period ended March 31, 2019.development and general and administrative expenses.

Financial Condition, Liquidity and Capital Resources

Liquidity is the ability of an enterprise to generate adequate amounts of cash to meet its needs for cash requirements. At March 31, 2020,2021, we had current andassets of $202,433 compared to total current assets of $407,213 as of December 31, 2020. At March 31, 2021, we had total assets of $4,250. We$483,459 compared to total assets of $458,150 as of December 31, 2020. The increase in total assets is due to a decrease in related parties balance offset by increase in right of use asset arising from operating lease. At March 31, 2021,we had current andliabilities of $592,050 as compared to $523,158 as of December 31, 2020. At March 31, 2021, we had total liabilities of $464,718, at March$2,732,112 as compared to $2,440,712 as of December 31, 2020. The increase is mainly attributed to the increase in the balance of employees and related institutions, accrued expenses and right of use liabilities arising from operating lease.

At March 31, 2020,2021, we had a cash balance of $141,868 compared to the cash balance of $359,949 as of December 31, 2020. We have no cash equivalents.

At March 31, 2021, we had a working capital deficiency of $460,468.$389,617 as compared with a working capital deficiency of $115,945 at December 31, 2020.

We needexpect that our existing cash and cash equivalents as well as expected revenues will enable us to fund our operations and capital expenditure requirements through the fiscal year-end 2021. Our requirements for additional capital during this period will depend on many factors.

We may seek to raise any necessary additional capital to sustain operations,through a combination of private or public equity offerings, debt financings, collaborations, strategic alliances, licensing arrangements and no assurance can be givenother marketing and distribution arrangements. To the extent that we raise additional capital through marketing and distribution arrangements or other collaborations, strategic alliances or licensing arrangements with third parties, we may have to relinquish valuable rights, future revenue streams, or product candidates or to grant licenses on terms that may not be favorable to us. If we raise additional capital through private or public equity offerings, the ownership interest of our existing stockholders will be able to obtain thisdiluted, and the terms of these securities may include liquidation or other preferences that adversely affect our stockholders’ rights. If we raise additional capital on commercially acceptable terms, if at all. In such an event, this may have a materially adverse effect on our business, operating results and financial condition. If the need arises,through debt financing, we may attemptbe subject to obtain funding through the use of various types of short term funding, loanscovenants limiting or workingrestricting our ability to take specific actions, such as incurring additional debt, making capital financing arrangements from banksexpenditures or financial institutions.declaring dividends.

Going Concern

The accompanying Condensed Consolidated Financial Statementsconsolidated financial statements have been prepared assuming that we will continue as a going concern. We have an accumulateda stockholders’ deficit of $25,815,794,$2,248,653 and a working capital deficiency of $460,468$389,617 at March 31, 2020, and net loss from operations of $14,520 for the three month period ended March 31, 2020.2021 as well as negative operating cash flows. These conditions raise substantial doubt about our ability to continue as a going concern. The Condensed Consolidated Financial Statementsconsolidated financial statements do not include any adjustments that might be necessary if we are unable to continue as a going concern.

Critical Accounting Policies

Use of Estimates The Condensed Consolidated Financial Statements have been prepared in conformity with accounting principles generally accepted in the United States of America (“GAAP”). In preparing the Condensed Consolidated Financial Statements, management is required to make estimates and assumptions that affect the reported amounts on the condensed consolidated balance sheets and condensed consolidated statements of operations for the year then ended. Actual results may differ significantly from those estimates.

Net loss per shareThe Company has adopted Financial Accounting Standards Board (FASB) Accounting Standards Codification (ASC) 260-10-50,Earnings Per Share, which provides for calculation of “basic” and “diluted” earnings per share. Basic earnings per share includes no dilution and is computed by dividing net income or loss available to common shareholders by the weighted average common shares outstanding for the period. Diluted earnings per share reflect the potential dilution of securities that could share in the earnings of an entity. Basic and diluted losses per share were the same at the reporting dates as there were no common stock equivalents outstanding at March 31, 2020 or 2019.

Fair value of financial instrumentsThe carrying values of the Company’s liabilities approximate their fair values due to the short maturity of these instruments.

Off-Balance Sheet ArrangementsWe have not entered into anyno off-balance sheet arrangements during 2020 and do not anticipate entering into any off-balance sheet arrangements duringthat have or are reasonably likely to have a current or future effect on the next 12 months.Company’s financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that is material to stockholders.

| ITEM 3. | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK |

Not applicable.

| ITEM 4. | CONTROLS AND PROCEDURES |

Evaluation of Disclosure Controls and Procedures.

We maintain disclosure controls and procedures (as defined in Rule 13a-15(e) under the Exchange Act) that are designed to ensure that information required to be disclosed by us in reports that we file under the Exchange Act is recorded, processed, summarized and reported as specified in the SEC’s rules and forms and that such information required to be disclosed by us in reports that we file under the Exchange Act is accumulated and communicated to our management, including our Interim Chief Executive Officer, to allow timely decisions regarding required disclosure. Management, with the participation of our Interim Chief Executive Officer, performed an evaluation of the effectiveness of our disclosure controls and procedures as of March 31, 2020.2021. Based on that evaluation, our management, including our Interim Chief Executive Officer, concluded that our disclosure controls and procedures were not effective as of March 31, 2021.

Management recognizes that any controls and procedures, no matter how well designed and operated, can provide only reasonable assurance of achieving their objectives and management necessarily applies its judgment in evaluating the cost-benefit relationship of possible controls and procedures. As disclosed in Item 9A of our Annual Report on Form 10-K for the year ended December 31, 2020, our management concluded that our internal control over financial reporting was not effective at December 31, 2020. A material weakness is a deficiency, or a combination of deficiencies, in internal control over financial reporting, such that there is a reasonable possibility that a material misstatement of the Company’s annual or interim financial statements will not be prevented or detected on a timely basis. The limitation of the Company’s internal control over financial reporting was due to the applied risk-based approach which is indicative of many small companies with limited number of staff in corporate functions. The identified weakness were:

| ● | Material Weakness – We did not maintain effective controls over certain aspects of the financial reporting process because we (i) lacked a sufficient complement of personnel with a level of accounting expertise and an adequate supervisory review structure that is commensurate with our financial reporting requirements and (ii) we lacked controls over the disclosure of our business operations. |

| ● | lack of segregation of duties Significant Deficiencies – Inadequate segregation of duties. |

Our management believes the weaknesses identified above have not had any material effect on our financial results.

We expect to be materially dependent upon third parties to provide us with accounting consulting services for the foreseeable future which we believe mitigateswill mitigate the impact of the material weaknesses discussed above. Until such time as we have a chief financial officer with the requisite expertise in U.S. GAAP and establish an audit committee and implement internal controls and procedures, there are no assurances that the material weaknesses and significant deficiencies in our disclosure controls and procedures will not result in errors in our financial statements which could lead to a restatement of those financial statements.

Our management, including our Interim Chief Executive Officer, does not expect that our disclosure controls and procedures or our internal controls will prevent all error and all fraud. A control system, no matter how well conceived and operated, can provide only reasonable, not absolute, assurance that the objectives of the control system are met. Further, the design of a control system must reflect the fact that there are resource constraints and the benefits of controls must be considered relative to their costs. Due to the inherent limitations in all control systems, no evaluation of controls can provide absolute assurance that all control issues and instances of fraud, if any, within our company have been detected.

Changes in Internal Controls over Financial Reporting.

ThereExcept for the material weakness and associated remediation plan, , there have been no changes in our internal control over financial reporting during the fiscal quarter ended March 31, 20202021 that have materially affected, or are reasonably likely to materially affect, our internal control over financial reporting.

| ITEM 1. | LEGAL PROCEEDINGS |

We areOn October 27, 2020 WHEN filed suit in State Court, Palm Beach County, Florida, against FSC Solutions, Inc. (“FSC”), Eli Gal Levy (“EL”) and Padem Consultants Sprl (collectively, the “Defendants”). The suit relates to the Stock Purchase Agreement entered into by WHEN with FSC and its shareholders, which included EL, pursuant to which WHEN acquired all of the issued and outstanding stock of FSC in exchange for the issuance of 70 billion shares of WHEN unregistered common stock. FSC was the putative owner of a software and trading platform which WHEN intended to use to enter into the on-line trading business. Subsequent to the completion of the acquisition, we determined that FSC did not currently a partyhave control over the trading platform and software we expected to any lawsuit or proceeding which,acquire and operate. The Suit sought declaratory judgment to unwind the FSC transaction and cancel the shares of WHEN common stock issued in the opinionFSC transaction that are still outstanding.

A hearing was set for January 6, 2021 whereupon mediation was ordered. The Company has been in discussion with EL to resolve this issue.

From time to time we may become involved in various legal proceedings that arise in the ordinary course of management, is likelybusiness, including actions related to our intellectual property. Although the outcomes of these legal proceedings cannot be predicted with certainty, we are currently not aware of any such legal proceedings that arise in the ordinary course of business, including actions related to our intellectual property. Although the outcomes of these legal proceedings cannot be predicted with certainty, we are currently not aware of any such legal proceedings or claims that we believe, either individually or in the aggregate, will have a material adverse effect on usour business, financial condition, or our business.results of operations.

| ITEM 1A. | RISK FACTORS |

DuringAn investment in the quarterCompany’s Common Stock involves a number of very significant risks. You should carefully consider the risk factors included in the “Risk Factors” section of our Annual Report on Form 10-K for the year ended MarchDecember 31, 2020, there wereas filed with the SEC on April 15, 2021, in addition to other information contained in our reports and in this quarterly report in evaluating the Company and its business before purchasing shares of our Common Stock. There have been no material changes to theour risk factors previously reportedcontained in our Annual Report on Form 10-K for the year ended December 31, 2019.2020.

| ITEM 2. | UNREGISTERED SALES OF SECURITIES AND USE OF PROCEEDS |

None.

| ITEM 3. | DEFAULTS UPON SENIOR SECURITIES |

None.

| ITEM 4. | MINE SAFETY DISCLOSURES |

None.

| ITEM 5. | OTHER INFORMATION: |

None.

| ITEM 6. |

| 32.1* | ||

| 101.INS | XBRL Instance Document | |

| 101.SCH | XBRL Taxonomy Extension Schema | |

| 101.CAL | XBRL Taxonomy Extension Calculation Linkbase | |

| 101.DEF | XBRL Taxonomy Extension Definition Linkbase | |

| 101.LAB | XBRL Taxonomy Extension Label Linkbase | |

| 101.PRE | XBRL Taxonomy Extension Presentation Linkbase |

* Incorporated by reference to the Current Report on Form 10-Q filed with the Securities and Exchange Commission on April 30, 2020

** Filed herewith

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| WORLD HEALTH ENERGY HOLDINGS, INC. | ||

| (Registrant) | ||

| By: | /s/ Giora Rozensweig | |

| Giora Rozensweig | ||

| Interim Chief Executive Officer | ||

| (Principal Executive Officer and Principal Financial and Accounting Officer) | ||

| Date: | May | |