United States

Securities and Exchange Commission

Washington, D.C. 20549

FORM 10-Q

(Mark One)

| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended March 31, 20232024

or

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ____ to ____

Commission File Number 001-39531

Processa Pharmaceuticals, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 45-1539785 | |

(State or other jurisdiction of incorporation or organization) | (IRS Employer Identification No.) |

7380 Coca Cola Drive, Suite 106,

Hanover, Maryland 21076

((443)443) 776-3133

Securities registered pursuant to Section 12(b) of the Exchange Act:

| Title of Each Class | Trading Symbol(s) | Name of each exchange on which registered | ||

| Common Stock, $0.0001 par value per share | PCSA | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

| Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No No☒ ☒

The number of outstanding shares of the registrant’s common stock at May 9, 202310, 2024 was .

PROCESSA PHARMACEUTICALS, INC.

TABLE OF CONTENTS

| 2 |

Part I: Financial Information

Item 1: Financial Statements

Processa Pharmaceuticals, Inc.

Condensed Consolidated Balance Sheets

(Unaudited)

March 31, 2023 | December 31, 2022 | March 31, 2024 | December 31, 2023 | |||||||||||||

| ASSETS | ||||||||||||||||

| Current Assets | ||||||||||||||||

| Cash and cash equivalents | $ | 10,741,602 | $ | 6,503,595 | $ | 8,920,363 | $ | 4,706,197 | ||||||||

| Due from related parties | 22,295 | - | ||||||||||||||

| Prepaid expenses and other | 1,477,519 | 1,883,134 | 857,635 | 926,300 | ||||||||||||

| Total Current Assets | 12,219,121 | 8,386,729 | 9,800,293 | 5,632,497 | ||||||||||||

| Property and Equipment, net | - | - | 2,415 | 2,554 | ||||||||||||

| Other Assets | ||||||||||||||||

| Operating lease right-of-use assets, net of accumulated amortization | 207,787 | 227,587 | ||||||||||||||

| Lease right-of-use assets, net of accumulated amortization | 136,489 | 146,057 | ||||||||||||||

| Security deposit | 5,535 | 5,535 | 5,535 | 5,535 | ||||||||||||

| Total Other Assets | 213,322 | 233,122 | 142,024 | 151,592 | ||||||||||||

| Total Assets | $ | 12,432,443 | $ | 8,619,851 | $ | 9,944,732 | $ | 5,786,643 | ||||||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY | ||||||||||||||||

| Current Liabilities | ||||||||||||||||

| Current maturities of operating lease liability | $ | 81,166 | $ | 78,896 | ||||||||||||

| Current maturities of lease liabilities | $ | 89,680 | $ | 83,649 | ||||||||||||

| Accounts payable | 316,709 | 327,548 | 455,368 | 311,617 | ||||||||||||

| Due to licensor | 189,000 | 189,000 | - | 189,000 | ||||||||||||

| - | 51 | - | 39 | |||||||||||||

| Accrued expenses | 1,573,961 | 403,061 | 465,618 | 146,274 | ||||||||||||

| Total Current Liabilities | 2,160,836 | 998,556 | 1,010,666 | 730,579 | ||||||||||||

| Non-current Liabilities | ||||||||||||||||

| Non-current operating lease liability | 129,358 | 150,554 | ||||||||||||||

| Non-current lease liabilities | 50,700 | 66,905 | ||||||||||||||

| Total Liabilities | 2,290,194 | 1,149,110 | 1,061,366 | 797,484 | ||||||||||||

| Commitments and Contingencies | - | - | - | - | ||||||||||||

| Stockholders’ Equity | ||||||||||||||||

| Common stock, par value $, shares authorized: issued and outstanding at March 31, 2023 and issued and outstanding at December 31, 2022 | 2,463 | 1,614 | ||||||||||||||

| Common stock, par value $, shares authorized: issued and outstanding at March 31, 2024 and issued and outstanding at December 31, 2023 | 286 | 129 | ||||||||||||||

| Additional paid-in capital | 78,709,420 | 72,016,688 | 87,278,542 | 80,658,111 | ||||||||||||

| Treasury stock at cost — shares at March 31, 2023 and December 31, 2022 | (300,000 | ) | (300,000 | ) | ||||||||||||

| Treasury stock at cost — shares at March 31, 2024 and December 31, 2023 | (300,000 | ) | (300,000 | ) | ||||||||||||

| Accumulated deficit | (68,269,634 | ) | (64,247,561 | ) | (78,095,462 | ) | (75,369,081 | ) | ||||||||

| Total Stockholders’ Equity | 10,142,249 | 7,470,741 | 8,883,366 | 4,989,159 | ||||||||||||

| Total Liabilities and Stockholders’ Equity | $ | 12,432,443 | $ | 8,619,851 | $ | 9,944,732 | $ | 5,786,643 | ||||||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

| 3 |

Processa Pharmaceuticals, Inc.

Condensed Consolidated Statements of Operations

(Unaudited)

| 2023 | 2022 | 2024 | 2023 | |||||||||||||

| Three months ended March 31, | Three months ended March 31, | |||||||||||||||

| 2023 | 2022 | 2024 | 2023 | |||||||||||||

| Operating Expenses | ||||||||||||||||

| Research and development expenses | $ | 1,627,480 | $ | 2,043,984 | $ | 1,539,070 | $ | 1,627,480 | ||||||||

| General and administrative expenses | 2,478,055 | 1,184,730 | 1,270,528 | 2,478,055 | ||||||||||||

| Operating Loss | (4,105,535 | ) | (3,228,714 | ) | (2,809,598 | ) | (4,105,535 | ) | ||||||||

| Other Income (Expense), net | 83,462 | 1,583 | 83,217 | 83,462 | ||||||||||||

| Net Operating Loss Before Income Tax Benefit | (4,022,073 | ) | (3,227,131 | ) | ||||||||||||

| Income Tax Benefit | - | - | ||||||||||||||

| Net Loss | $ | (4,022,073 | ) | $ | (3,227,131 | ) | $ | (2,726,381 | ) | $ | (4,022,073 | ) | ||||

| Net Loss Per Common Share - Basic and Diluted | $ | (0.18 | ) | $ | (0.20 | ) | $ | ) | $ | ) | ||||||

| Weighted Average Common Shares Used to Compute Net Loss Per Common Shares - Basic and Diluted | 22,770,789 | 15,831,118 | ||||||||||||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

| 4 |

Processa Pharmaceuticals, Inc.

Condensed Consolidated Statement of Changes in Stockholders’ Equity

(Unaudited)

| Shares | Amount | Capital | Shares | Amount | Deficit | Total | ||||||||||||||||||||||

| Additional | ||||||||||||||||||||||||||||

| Common Stock | Paid-In | Treasury Stock | Accumulated | |||||||||||||||||||||||||

| Shares | Amount | Capital | Shares | Amount | Deficit | Total | ||||||||||||||||||||||

| Balance at January 1, 2022 | 15,710,246 | $ | 1,571 | $ | 62,306,861 | - | $ | - | $ | (36,823,332 | ) | $ | 25,485,100 | |||||||||||||||

| Stock-based compensation | 103,670 | 10 | 828,887 | - | - | - | 828,897 | |||||||||||||||||||||

| Acquisition of treasury stock | - | - | - | (100,000 | ) | (300,000 | ) | - | (300,000 | ) | ||||||||||||||||||

| Shares issued in connection with purchase agreement | 123,609 | 12 | 449,988 | - | - | - | 450,000 | |||||||||||||||||||||

| Net loss | - | - | - | - | - | (3,227,131 | ) | (3,227,131 | ) | |||||||||||||||||||

| Balance, March 31, 2022 | 15,937,525 | $ | 1,593 | $ | 63,585,736 | (100,000 | ) | $ | (300,000 | ) | $ | (40,050,463 | ) | $ | 23,236,866 | |||||||||||||

| Balance | 15,937,525 | $ | 1,593 | $ | 63,585,736 | (100,000 | ) | $ | (300,000 | ) | $ | (40,050,463 | ) | $ | 23,236,866 | |||||||||||||

| Shares | Amount | Capital | Shares | Amount | Deficit | Total | ||||||||||||||||||||||

| Additional | ||||||||||||||||||||||||||||

| Common Stock | Paid-In | Treasury Stock | Accumulated | |||||||||||||||||||||||||

| Shares | Amount | Capital | Shares | Amount | Deficit | Total | ||||||||||||||||||||||

| Balance at January 1, 2023 | 806,774 | $ | 80 | $ | 72,018,222 | (5,000 | ) | $ | (300,000 | ) | $ | (64,247,561 | ) | $ | 7,470,741 | |||||||||||||

| Stock-based compensation | 3,195 | 1 | 341,503 | - | - | - | 341,504 | |||||||||||||||||||||

| Shares issued in connection with capital raises, net of transaction costs | 421,611 | 42 | 6,352,035 | - | - | - | 6,352,077 | |||||||||||||||||||||

| Net loss | - | - | - | - | - | (4,022,073 | ) | (4,022,073 | ) | |||||||||||||||||||

| Balance, March 31, 2023 | 1,231,580 | $ | 123 | $ | 78,711,760 | (5,000 | ) | $ | (300,000 | ) | $ | (68,269,634 | ) | $ | 10,142,249 | |||||||||||||

| Additional | Additional | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Common Stock | Paid-In | Treasury Stock | Accumulated | Common Stock | Paid-In | Treasury Stock | Accumulated | |||||||||||||||||||||||||||||||||||||||||||||||||

| Shares | Amount | Capital | Shares | Amount | Deficit | Total | Shares | Amount | Capital | Shares | Amount | Deficit | Total | |||||||||||||||||||||||||||||||||||||||||||

| Balance at January 1, 2023 | 16,135,400 | $ | 1,614 | $ | 72,016,688 | (100,000 | ) | $ | (300,000 | ) | $ | (64,247,561 | ) | $ | 7,470,741 | |||||||||||||||||||||||||||||||||||||||||

| Balance at January 1, 2024 | 1,291,000 | $ | 129 | $ | 80,658,111 | (5,000 | ) | $ | (300,000 | ) | $ | (75,369,081 | ) | $ | 4,989,159 | |||||||||||||||||||||||||||||||||||||||||

| Balance | 1,291,000 | $ | 129 | $ | 80,658,111 | (5,000 | ) | $ | (300,000 | ) | $ | (75,369,081 | ) | $ | 4,989,159 | |||||||||||||||||||||||||||||||||||||||||

| Stock-based compensation | 63,882 | 6 | 341,498 | - | - | - | 341,504 | 13,176 | 1 | 167,642 | - | - | - | 167,643 | ||||||||||||||||||||||||||||||||||||||||||

| Shares issued in connection with capital raises, net of transaction costs | 8,432,192 | 843 | 6,351,234 | - | - | - | 6,352,077 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Shares issued in connection with capital raise, net of transaction costs | 1,555,555 | 156 | 6,282,274 | - | - | - | 6,282,430 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Shares issued in connection with license agreement | 5,000 | 1 | 188,999 | - | - | - | 189,000 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Settlement of stock award | - | - | (8,561 | ) | - | - | - | (8,561 | ) | |||||||||||||||||||||||||||||||||||||||||||||||

| Shares withheld to pay income taxes on stock-based compensation | (3,750 | ) | (1 | ) | (9,923 | ) | - | - | - | (9,924 | ) | |||||||||||||||||||||||||||||||||||||||||||||

| Net loss | - | - | - | - | - | (4,022,073 | ) | (4,022,073 | ) | - | - | - | - | - | (2,726,381 | ) | (2,726,381 | ) | ||||||||||||||||||||||||||||||||||||||

| Balance, March 31, 2023 | 24,631,474 | $ | 2,463 | $ | 78,709,420 | (100,000 | ) | $ | (300,000 | ) | $ | (68,269,634 | ) | $ | 10,142,249 | |||||||||||||||||||||||||||||||||||||||||

| Balance, March 31, 2024 | 2,860,981 | $ | 286 | $ | 87,278,542 | (5,000 | ) | $ | (300,000 | ) | $ | (78,095,462 | ) | $ | 8,883,366 | |||||||||||||||||||||||||||||||||||||||||

| Balance | 24,631,474 | $ | 2,463 | $ | 78,709,420 | (100,000 | ) | $ | (300,000 | ) | $ | (68,269,634 | ) | $ | 10,142,249 | 2,860,981 | $ | 286 | $ | 87,278,542 | (5,000 | ) | $ | (300,000 | ) | $ | (78,095,462 | ) | $ | 8,883,366 | ||||||||||||||||||||||||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

| 5 |

Processa Pharmaceuticals, Inc.

Condensed Consolidated Statements of Cash Flows

(Unaudited)

| 2023 | 2022 | 2024 | 2023 | |||||||||||||

| Three Months Ended March 31, | Three Months Ended March 31, | |||||||||||||||

| 2023 | 2022 | 2024 | 2023 | |||||||||||||

| Cash Flows From Operating Activities | ||||||||||||||||

| Net loss | $ | (4,022,073 | ) | $ | (3,227,131 | ) | $ | (2,726,381 | ) | $ | (4,022,073 | ) | ||||

| Adjustments to reconcile net loss to net cash used in operating activities: | ||||||||||||||||

| Depreciation | 139 | - | ||||||||||||||

| Non-cash lease expense for right-of-use assets | 19,800 | 22,559 | 21,372 | 19,800 | ||||||||||||

| Amortization of issuance costs | - | 3,113 | ||||||||||||||

| Amortization of intangible asset | - | 197,124 | ||||||||||||||

| Stock-based compensation | 341,504 | 828,897 | 167,643 | 341,504 | ||||||||||||

| Recording of warrant to be issued to purchase 3,160,130 shares of common stock in connection with a consulting agreement | 1,310,875 | - | ||||||||||||||

| Recording of warrant to be issued to purchase 158,007 shares of common stock in connection with a consulting agreement | - | 1,310,875 | ||||||||||||||

| Net changes in operating assets and liabilities: | ||||||||||||||||

| Prepaid expenses and other | 405,615 | 216,717 | 68,665 | 405,615 | ||||||||||||

| Operating lease liability | (18,926 | ) | (23,195 | ) | (21,083 | ) | (18,926 | ) | ||||||||

| Accounts payable | (10,839 | ) | 97,187 | 143,751 | (10,839 | ) | ||||||||||

| Due (from) to related parties | (51 | ) | (1,772 | ) | ||||||||||||

| Other receivables | - | 70,274 | ||||||||||||||

| Due (from) related parties | (22,334 | ) | (51 | ) | ||||||||||||

| Accrued expenses | (139,975 | ) | 13,301 | 319,344 | (139,975 | ) | ||||||||||

| Net cash used in operating activities | (2,114,070 | ) | (1,802,926 | ) | (2,048,884 | ) | (2,114,070 | ) | ||||||||

| Cash Flows From Financing Activities | ||||||||||||||||

| Net proceeds from common stock issued | 6,352,077 | - | ||||||||||||||

| Acquisition of treasury stock | - | (300,000 | ) | |||||||||||||

| Net cash provided by (used in) financing activities | 6,352,077 | (300,000 | ) | |||||||||||||

| Net proceeds from issuance of stock | 6,282,430 | 6,352,077 | ||||||||||||||

| Shares withheld to pay taxes on stock-based compensation | (9,924 | ) | - | |||||||||||||

| Settlement of stock award | (8,561 | ) | - | |||||||||||||

| Payment of finance lease obligation | (895 | ) | - | |||||||||||||

| Net cash provided by financing activities | 6,263,050 | 6,352,077 | ||||||||||||||

| Net Increase (Decrease) in Cash | 4,238,007 | (2,102,926 | ) | |||||||||||||

| Net Increase in Cash | 4,214,166 | 4,238,007 | ||||||||||||||

| Cash and Cash Equivalents – Beginning of Period | 6,503,595 | 16,497,581 | 4,706,197 | 6,503,595 | ||||||||||||

| Cash and Cash Equivalents – End of Period | $ | 10,741,602 | $ | 14,394,655 | $ | 8,920,363 | $ | 10,741,602 | ||||||||

| Non-Cash Financing Activities | ||||||||||||||||

| Issuance of shares of common stock in connection with the Purchase Agreement with Lincoln Park | $ | - | $ | 450,000 | ||||||||||||

| Issuance of shares of common stock in connection with a licensing agreement which had previously been recorded as a due to licensor | $ | 189,000 | $ | - | ||||||||||||

| Right-of-use asset | $ | 11,804 | $ | - | ||||||||||||

| Financing lease liability | (11,804 | ) | - | |||||||||||||

| Net | $ | - | $ | - | ||||||||||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

| 6 |

Processa Pharmaceuticals, Inc.

Notes to Condensed Consolidated Financial Statements

(Unaudited)

Note 1 – Organization and Summary of Significant Accounting Policies

Organization

We are a clinical-stage biopharmaceutical company focused on incorporating our Regulatory Science Approach into the development of our Next Generation Chemotherapy (NGC) drugs to improve the safety and efficacy of cancer treatment. Our NGC drugs are modifications of existing FDA-approved oncology drugs resulting in an alteration of the metabolism and/or distribution while maintaining the well-known and established existing mechanisms of killing the cancer cells. By modifying the NGC drugs in this manner, we believe our three NGC treatments will provide improved safety-efficacy profiles when compared to their currently marketed counterparts.

On January 22, 2024, we filed a Certificate of Amendment to our Certificate of Incorporation, as amended with the Secretary of State of Delaware that effected a 1-for-20 reverse stock split of our common stock, par value $ per share (the “Reverse Stock Split”). Pursuant to the Certificate of Amendment, our issued common stock decreased from shares to shares and our outstanding common stock decreased from to . The Reverse Stock Split did not affect our authorized common stock of shares or our common stock par value. All shares of common stock, including common stock underlying warrants, stock options, restricted stock awards and restricted stock units, as well as exercise prices and per share information in these condensed consolidated financial statements give retroactive effect to the Reverse Stock Split.

Basis of Presentation

The accompanying unaudited condensed consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”) for interim financial information and with the instructions of the Securities and Exchange Commission (“SEC”) on Form 10-Q and Article 8 of Regulation S-X.

Accordingly, they do not include all the information and disclosures required by U.S. GAAP for complete financial statements. All material intercompany accounts and transactions have been eliminated in consolidation. In the opinion of management, the accompanying unaudited condensed consolidated financial statements include all adjustments necessary, which are of a normal and recurring nature, for the fair presentation of our financial position and of the results of operations and cash flows for the periods presented. These condensed consolidated financial statements should be read in conjunction with the audited financial statements and notes thereto included in our Annual Report on Form 10-K for the year ended December 31, 2022,2023, as filed with the SEC. The results of operations for the interim periods shown in this report are not necessarily indicative of the results that may be expected for any other interim period or for the full year.

Liquidity

Our condensed consolidated financial statements have been prepared on a going concern basis, which contemplates the continuity of operations, realization of assets and the satisfaction of liabilities and commitments in the ordinary course of business. We have incurred losses since inception, are currently devoting substantially all of our efforts toward research and development of our NGC drug product candidates, including conducting clinical trials and providing general and administrative support for these operations, and have an accumulated deficit of $68.3 78.1million at March 31, 2023.2024. During the three months ended March 31, 2023,2024, we generated a net loss of $4.0 2.7 million and used $2.0 million in net cash for operating activities from continuing operations. To date, none of our drug candidates have been approved for sale, and therefore we have not generated any product revenue and do not expect to continue to generate operating losses and negativepositive cash flow from operations forin the foreseeable future. Based

We have financed our operations primarily through public equity issuances, including an offering we closed on January 30, 2024 where we sold shares of our common stock, pre-funded warrants to purchase up to 1,079,555 shares of our common stock, and warrants for the purchase of up to 1,555,555 shares of our common stock for net proceeds of $6.3 million, after deducting placement agent fees and offering-related expenses. Simultaneously with the closing of the sale, the pre-funded warrants were exercised in exchange for shares of our common stock. We will continue to be dependent upon equity and/or debt financing until we are able to generate positive cash flows from its operations.

| 7 |

At March 31, 2024, we had cash and cash equivalents totaling $8.9 million which, based on our current business plans, we believe these funds will satisfy our current cash balances are adequate for at least capital needs into early 2025, including the next twelve months.beginning of our Phase 2 trial of NGC-Cap in breast cancer. Our ability to execute our longer-term operating plans, including future preclinical studies and clinical trials for our portfolio of drugs depend on our ability to obtain additional funding from the sale of equity and/or debt securities, a strategic transaction or other funding transactions.

We plan to continueraise additional funds in the future through a combination of public or private equity offerings, debt financings, collaborations, strategic alliances, licensing arrangements and other marketing and distribution arrangements, but will only do so if the terms are acceptable to actively pursueus. If we are unable to obtain adequate financing alternatives, but therewhen needed, we may have to delay, reduce the scope of, or suspend our current or planned future clinical trial plans, or research and development programs. This may also cause us to not meet obligations contained in certain of our license agreements and put these assets at risk. To the extent that we raise additional capital through marketing and distribution arrangements or other collaborations, strategic alliances or licensing arrangements with third parties, we may have to relinquish valuable rights to our product candidates, future revenue streams, research programs or product candidates or to grant licenses on terms that may not be favorable to us. If we raise additional capital through public or private equity offerings, the ownership interest of our existing stockholders will be diluted, and the terms of these securities may include liquidation or other preferences that adversely affect our stockholders’ rights. If we raise additional capital through debt financing, we may be subject to covenants limiting or restricting our ability to take specific actions, such as incurring additional debt or making capital expenditures. There can be no assurance that wefuture funding will obtain the necessary funding in the futurebe available when necessary.needed.

We had no revenue during the three months ended March 31, 2023Absent additional funding, we believe that our cash and docash equivalents will not have any revenue under contract or any immediate sales prospects. Our primary uses of cash arebe sufficient to fund our planned clinical trials, research and development expenditures and other operating expenses. Cash usedoperations for a period of one year or more after the date that these condensed consolidated financial statements are available to fund operating expenses is impacted bybe issued based on the timing and amount of whenour projected net loss from continuing operations and cash to be used in operating activities during that period of time. As a result, substantial doubt exists about our ability to continue as a going concern within one year after the date that these condensed consolidated financial statements are available to be issued. The accompanying condensed consolidated financial statements do not include any adjustments to reflect the possible future effects on the recoverability and classification of recorded assets, or the amounts and classification of liabilities that might be different should we incur and paybe unable to continue as a going concern based on the outcome of these expenses.uncertainties described above.

During the three months ended March 31, 2023, we raised gross proceeds of $7.0 million (net proceeds of $6.4 million) from the sale of shares of our common stock, as described in Note 2. We plan to use the net proceeds from these financings to prepare for future clinical trials; and on research and development expenses, working capital and other general corporate purposes.

Use of Estimates

In preparing our condensed consolidated financial statements and related disclosures in conformity with U.S. GAAP and pursuant to the rules and regulations of the SEC, we make estimates and judgments that affect the amounts reported in the condensed consolidated financial statements and accompanying notes. Estimates are used for, but not limited to preclinical and clinical trial expenses, stock-based compensation, intangible assets, future milestone payments and income taxes. These estimates and assumptions are continuously evaluated and are based on management’s experience and knowledge of the relevant facts and circumstances. While we believe the estimates to be reasonable, actual results could differ materially from those estimates and could impact future results of operations and cash flows.

Income Taxes

We account for income taxes in accordance with ASC Topic 740, Income Taxes. Deferred income taxes are recorded for the expected tax consequences of temporary differences between the basis of assets and liabilities for financial reporting purposes and amounts recognized for income tax purposes. At March 31, 20232024 and December 31, 2022,2023, we recorded a valuation allowance equal to the full recorded amount of our net deferred tax assets since it is more-likely-than-not that such benefits will not be realized. The valuation allowance is reviewed quarterly and is maintained until sufficient positive evidence exists to support its reversal.

Under ACS 740-270 Income Taxes – Interim Reporting, we are required to project our annual federal and state effective income tax rate and apply it to the year-to-date ordinary operating tax basis loss before income taxes. Based on the projection, no current income tax benefit or expense is expected for 20232024 and the foreseeable future since the deferred tax liability has been offset completely at December 31, 2021 and we expect to generate taxable net operating losses.

| 8 |

Concentration of Credit Risk

Financial instruments that potentially subject us to significant concentration of credit risk consist primarily of our cash and cash equivalents. We utilize only well-established banks and financial institutions with high credit ratings. Balances on deposit are insured by the Federal Deposit Insurance Corporation (FDIC) up to specified limits. Total cash held by our banks at March 31, 2023,2024, exceeded FDIC limits.

Recent Accounting Pronouncements

From time to time, the Financial Accounting Standards Board (“FASB”) or other standard setting bodies issue new accounting pronouncements. Updates to the FASB Accounting Standards Codification are communicated through issuance of an Accounting Standards Update (“ASU”). We have implemented all new accounting pronouncements that are in effect and that may impact our condensed consolidated financial statements. We have evaluated recently issued accounting pronouncements and determined that there is no material impact on our condensed consolidated financial position or results of operations.

Note 2 – Stockholders’ Equity

Preferred Stock

There were issued or outstanding shares of preferred stock at either March 31, 20232024 or December 31, 2022.2023.

Common Stock

During the three months ended March 31, 2024, we issued the following shares of common stock.

| ● | On January 22, 2024, we issued shares of common stock to five of our executive officers and one employee, net of shares of common stock withheld for income taxes owed upon the distribution of the shares. | |

| ● | On January 25, 2024, we issued shares of common stock to Elion Oncology, Inc. (“Elion”) in satisfaction of the third milestone event under a license agreement. | |

| ● | On January 30, 2024, we sold, pursuant to securities purchase agreements (the “Purchase Agreement”), shares of common stock, pre-funded warrants to purchase up to 1,079,555 shares of common stock in lieu of shares of common stock (the “Pre-Funded Warrants”), and warrants to purchase up to 1,555,555 shares of our common stock (the “Common Warrants’) pursuant to a public offering (the “Offering”). The Common Warrants have an exercise price of $4.50, are immediately exercisable and will remain exercisable until the date that is five yearsafter their original issuance. The Shares were offered at a combined public offering price of $4.50 per share and accompanying Common Warrant and $per Pre-Funded Warrant and accompanying Common Warrant. The Pre-Funded Warrants had an exercise price of $0.0001 and were exercised in full simultaneously with the closing of the Offering in exchange for shares of our common stock. Gross proceeds in connection with the Offering were $7.0 million. We received $6.3 millionin net proceeds from the Offering, after deducting the fees of the placement agent and other offering-related expenses. We also issued to the placement agent warrants to purchase 62,222 shares of common stock, exercisable at $5.625 per share that expire on February 1, 2027. | |

| ● | On February 5, 2024, we issued shares of common stock to a consultant in accordance with their consulting agreement. | |

| ● | On March 5, 2024, we issued shares of common stock to a former employee, net of shares of common stock withheld for income and FICA taxes owed upon the distribution of the shares. |

| 9 |

During the three months ended March 31, 2023, we issued shares of our common stock through several fundraising efforts.efforts described below:

ATM Offering

On August 20, 2021, we entered into the Sales Agreement with Oppenheimer & Co. Inc. (the “Sales Agent”) under which we may issue and sell up to $30.0 million from time to time under the ATM Offering. We expect to use net proceeds from the ATM Offering over time as a source for working capital and general corporate purposes. During the three months ended March 31, 2023, we sold shares at an average price of $ per share for aggregate gross proceeds of $693,000 (net proceeds of $672,000) prior to deducting sales commissions. On February 5, 2023, in connection with our Registered Direct Offering, we suspended the Sales Agreement with the Sales Agent, but we expect to reinstate it during 2023.

Lincoln Park Capital Fund, LLC Purchase Agreement

On March 23, 2022, we entered into the Purchase Agreement with Lincoln Park, pursuant to which Lincoln Park has committed to purchase up to $15.0 million of shares (the “Purchase Shares”) of our common stock, subject to the terms and conditions in the Purchase Agreement with Lincoln Park, including that the closing sale price of the common stock on the purchase date is not below a threshold price of $1.00. Any proceeds that we receive under the Purchase Agreement are expected to be used for working capital and general corporate purposes. During the three months ended March 31, 2023, we sold shares at an average price of $ per share for aggregate gross proceeds of $54,000 under the Purchase Agreement with Lincoln Park.

Registered Direct Offering

On February 14, 2023, we closed a registered direct offering (the “Offering”) for the sale of shares of common stock at a purchase price of $per share for gross proceeds of $6.3 million (net proceeds of $5.6 million). The Purchase Agreement provides that, subject to certain exceptions, until the earlier of (i) 90 days after the closing of the Offering or (ii) the trading day following the date that our common stock’s closing price exceeds $2.00 for a period of 10 consecutive trading days, neither we nor our subsidiary will issue or enter into any agreement to issue or announce the issuance or proposed issuance of any shares of common stock or common stock equivalents.

We paid the Placement Agent a cash fee of 8.0% of the gross proceeds from the Offering, excluding proceeds received from our insiders, and reimbursed the Placement Agent for legal fees of $60,000. The engagement agreement with the Placement Agent requires us to indemnify the Placement Agent and certain of its affiliates against certain customary liabilities. On February 14, 2023, we amended our consulting agreement with Spartan originally entered into on August 24, 2022, extending the term of the consulting agreement until February 10, 2024. As compensation for services under the agreement, on April 17, 2023, we granted Spartan a warrant to purchase 3,160,130 shares of our common stock with an exercise price of $1.02. The warrant will expire three yearsfrom the date of issuance and contains both call and cashless exercise provisions.

| ● | ATM Offering – On February 5, 2023, in connection with our Registered Direct Offering discussed below, we terminated our ATM and suspended the Sales Agreement with Oppenheimer & Co. Inc., but we may reinstate it in the future. During the three months ended March 31, 2023, we sold shares at an average price of $ per share for aggregate gross proceeds of $693,000 (net proceeds of $672,000) prior to deducting sales commissions. |

| ● | Lincoln Park Capital Fund, LLC Purchase Agreement– During the three months ended March 31, 2023, we sold shares at an average price of $ per share for aggregate gross proceeds of $54,000 under the purchase agreement with Lincoln Park. | |

| ● | Registered Direct Offering – On February 14, 2023, we closed a registered direct offering (the “Registered Direct Offering”) for the sale of shares of common stock at a purchase price of $ per share for gross proceeds of $6.3 million (net proceeds of $5.6 million). | |

| We paid the placement agent, Spartan Capital Securities, LLC, (“Spartan”) a cash fee of 8.0% of the gross proceeds from the Registered Direct Offering, excluding proceeds received from our insiders, and reimbursed Spartan for legal fees of $60,000. The engagement agreement with Spartan required us to indemnify Spartan and certain of its affiliates against certain customary liabilities. On February 14, 2023, we amended the consulting agreement with Spartan originally entered into on August 24, 2022, extending the term of the consulting agreement until February 10, 2024. As compensation for services under the agreement, on April 17, 2023, we granted Spartan warrants to purchase 158,007 shares of our common stock with an exercise price of $20.40. The warrants expire on April 17, 2026 and contain both call and cashless exercise provisions. |

On June 19, 2019, our stockholders approved, and we adopted, the Processa Pharmaceuticals Inc. 2019 Omnibus Equity Incentive Plan (the “2019 Plan”). The 2019 Plan allows us, under the direction of our Board of Directors or a committee thereof, to make grants of stock options, restricted and unrestricted stock and other stock-based awards to employees, including our executive officers, consultants and directors. The 2019 Plan provides for the aggregate issuance of shares of our common stock. At March 31, 2023,2024, we have shares available for future grants.

Stock Compensation Expense

Schedule of Stock-based Compensation Expense

| 2024 | 2023 | |||||||

| Research and development | $ | 31,121 | $ | 99,621 | ||||

| General and administrative | 136,522 | 241,883 | ||||||

| Total | $ | 167,643 | $ | 341,504 | ||||

| 2023 | 2022 | |||||||

| Research and development | $ | 99,621 | $ | 191,875 | ||||

| General and administrative | 241,883 | 637,022 | ||||||

| Total | $ | 341,504 | $ | 828,897 | ||||

| 10 |

At March 31, 2023, we recorded an expense and related accrued liability of $1.3 million related to the warrant we issued to Spartan, which is not included in the table above. No tax benefits were attributed to the stock-based compensation expense because a valuation allowance was maintained for all net deferred tax assets relating to this expense.

Stock Options

stock options to purchase shares of common stock were forfeited or expired during the three months ended March 31, 2023, stock options to purchase shares of common stock expired and there were no exercises or grants of stock options.2024. At March 31, 2023,2024, we had outstanding and exercisable options for the purchase of shares with a weighted average exercise price of $, and a weighted average remaining contractual life of years. At March 31, 2023,2024, we did not have any unrecognized stock-based compensation expense related to our granted stock options.

Restricted Stock Awards

Activity with respect to our Restricted Stock Awards (RSAs) duringDuring the three months ended March 31, 2023 was as follows:2024, we vested

RSchedule of Restrictedestricted Stock Awards (“RSAs”RSAs”) Activity

Number of shares | Weighted- average grant-date fair value per share | |||||||

| Outstanding at January 1, 2023 | 61,888 | $ | 4.72 | |||||

| Granted | 90,000 | 1.10 | ||||||

| Cancelled | (26,118 | ) | 1.72 | |||||

| Outstanding and unvested at March 31, 2023 | 125,770 | $ | 2.75 | |||||

On January 1, 2023, we granted RSAs totaling shares of common stock to three directors for their service for the six month period ending June 30, 2023 in order to align their compensation plan with their service period and change the annual service period to begin and end on the date of respective Annual Meetings rather than the calendar year. Our directors are compensated through a combination of cash and equity. On March 8, 2023, the directors increased the cash component and decreased the equity component of their compensation by equal amounts on a retroactive basis, to the beginning of their respective service periods. Accordingly, we cancelled RSAs representing shares of common stock.

At March 31, 2023, the total unrecognized stock-based compensation expense related to the outstanding and unvested RSAs was $, which is expected to be recognized over a weighted average periodgrant-date fair value of $ per share. We had years. RSAs outstanding at March 31, 2024.

Restricted Stock Units

Schedule of Restricted Stock Units (“RSUs”) Activity

| Number of shares | Weighted- average grant-date fair value per share | |||||||

| Outstanding at January 1, 2024 | 222,722 | $ | 45.82 | |||||

| Granted | - | - | ||||||

| Forfeited | (7,290 | ) | 63.91 | |||||

| Issued | (9,426 | ) | 102.68 | |||||

| Outstanding at March 31, 2024 | 206,006 | 42.58 | ||||||

| Vested and unissued | 124,529 | 59.75 | ||||||

| Unvested at March 31, 2024 | 81,477 | $ | 16.33 | |||||

Number of shares | Weighted- average grant-date fair value per share | |||||||

| Outstanding at January 1, 2023 | 2,713,977 | $ | 3.69 | |||||

| Granted | 966,503 | 1.10 | ||||||

| Outstanding at March 31, 2023 | 3,680,480 | 3.01 | ||||||

| Vested and unissued | 2,585,247 | 3.50 | ||||||

| Unvested at March 31, 2023 | 1,095,233 | $ | 1.86 | |||||

On January 1, 2024, we granted RSUs for the future issuance of no more than shares of our common stock, contingent upon receiving shareholder approval to increase the number of shares available under our 2019 Omnibus Incentive Plan (“Incentive Plan”) at our annual shareholder meeting in June 2024. The number of shares to be issued under the RSUs will be based on the greater of: (i) $per share or (ii) the closing price per share on the day we receive shareholder approval to increase the number of shares available under the Incentive Plan.

At March 31, 2023,2024, unrecognized stock-based compensation expense of $ for RSUs (which excludes the above grant on January 1, 2024) is expected to be fully recognized over a weighted average period of years. The unrecognized expense excludes $ of expense related to certain grants of RSUs with a performance milestonemilestones that isare not probable of occurring at this time.

Holders of our vested RSUs have our promise to issuewill be issued shares of our common stock upon meeting the distribution restrictions contained in their Restricted Stock Unit Award Agreement. The distribution restrictions are different (longer) than the vesting schedule, imposing an additional restriction on the holder. Unlike RSAs, while certain employees may hold fully vested RSUs, the individual does not hold any shares or have any rights of a shareholder until the distribution restrictions are met. Upon distribution to the employee, each RSU converts into one share of our common stock. The RSUs contain dividend equivalent rights.

| 11 |

Warrants

During the three months ended March 31, 2023, we agreed to grant a warrant2024, other than warrants to purchase a total1,617,777 shares of common stock as part of our public offering (see Note 2), we did not grant any warrants to purchase shares of our common stock as compensation for services provided under an amended consulting agreement with Spartan, the placement agentand warrants to purchase shares of common stock expired. We also repurchased a warrant issued to a consultant in 2023 for the Offeringpurchase of . The warrant was issued and exercisable on April 17, 2023 with an exercise priceshares of our common stock in exchange for a payment of $1.0210,000 and expiration date of April 17, 2026. The warrant contains both call and cashless exercise provisions. We recorded $1,310,875 as a general and administrative expense and related accrued liability representing the fair value of this warrant on February 14, 2023, the date we amended the consulting agreement, since there were no contingent conditions on that date through April 17, 2023..

At March 31, 2023,2024, we had outstanding stock purchase warrants including the warrant issued on April 17, 2023, for the purchase of 3,366,4801,778,284 shares with a weighted average exercise price of $1.616.17 and a weighted average remaining contractual life of years. Stock purchase warrants forAll the purchase of shares were exercisable at March 31, 2023 and the remaining outstanding stock purchase warrants will beare exercisable in the second quarter of 2023.

Atat March 31, 2023, we2024. We did not have any unrecognized stock-based compensation expense related to our granted stock purchase warrants.warrants at March 31, 2024.

Net Loss Per Share

Basic net loss per share is computed by dividing our net loss available to common shareholders by the weighted average number of shares of common stock outstanding (which excludes unvested RSAs and includes vested RSUs) during the period. Diluted loss per share is computed by dividing our net loss available to common shareholders by the diluted weighted average number of shares of common stock (which includes the potentially dilutive effect of stock options, unvested RSAs, unvested RSUs and warrants) during the period. Since we experienced a net loss for both periods presented, basic and diluted net loss per share are the same. As such, diluted loss per share for the three months ended March 31, 20232024 and 20222023 excludes the impact of potentially dilutive common shares since those shares would have an anti-dilutive effect on net loss per share.

Schedule of Net Loss Per Share Basic and DiluteDiluted

| 2023 | 2022 | 2024 | 2023 | |||||||||||||

Three months ended March 31, | Three months ended March 31, | |||||||||||||||

| 2023 | 2022 | 2024 | 2023 | |||||||||||||

| Basic and diluted net loss per share: | ||||||||||||||||

| Net loss available to common stockholders | $ | (4,022,073 | ) | $ | (3,227,131 | ) | $ | (2,726,381 | ) | $ | (4,022,073 | ) | ||||

| Weighted average number of common shares-basic and diluted | 22,770,789 | 15,831,118 | ||||||||||||||

| Basic and diluted net loss per share | $ | (0.18 | ) | $ | (0.20 | ) | $ | ) | $ | ) | ||||||

| 2024 | 2023 | |||||||

| Weighted-average number of common shares outstanding – basic and diluted | ||||||||

| Weighted-average number of vested RSUs– basic and diluted | ||||||||

| Weighted-average number of common shares-basic and diluted | ||||||||

Our diluted net loss per share for the three months ended March 31, 20232024 and 20222023 excluded (including the committed warrant to purchase 3,160,130 shares of common stock) and of potentially dilutive common shares, respectively, related to outstanding stock options, warrants and unvested restricted stock since those shares would have had an anti-dilutive effect on net loss per share during the periods then ended.

| 12 |

Note 5 – Operating Leases

We lease our office space under an operating lease agreement. This lease does not have significant rent escalation, concessions, leasehold improvement incentives, or other build-out clauses. Further, the lease does not contain contingent rent provisions. Our office space lease includes both lease (e.g., fixed payments including rent, taxes, and insurance costs) and non-lease components (e.g., common-area or other maintenance costs), which are accounted for as a single lease component as we have elected the practical expedient to group lease and non-lease components for all leases. We also lease office equipment under an operatinga financing lease. Our leases do not provide an implicit rate and, as such, we have used our incremental borrowing rate of 8% in determining the present value of the lease payments based on the information available at the lease commencement date.

Lease costs included in our condensed consolidated statements of operations totaled $22,461 and $21,918 for each of the three months endedmonth periods ending March 31, 20232024 and 2022, respectively.2023. The weighted average remaining lease terms and discount rate for our operating leases were as follows at March 31, 2023:2024:

Schedule of Weighted Average Remaining Lease Terms and Discount Rate for Operating and Financing Leases

| Remaining lease term (years) for our facility lease | ||||

| Remaining lease term (years) for our equipment lease | ||||

| Weighted average discount rate for our facility and equipment leases | 8.0 | % |

Annual lease liabilities for allthe operating leaseslease were as follows at March 31, 2023:2024:

Schedule of Annual Lease Liabilities for all Operating Leases

| 2023 | $ | 70,600 | ||||||

| 2024 | 92,356 | $ | 68,247 | |||||

| 2025 | 70,040 | 70,040 | ||||||

| Total lease payments | 232,996 | 138,287 | ||||||

| Less: Interest | (22,472 | ) | (8,816 | ) | ||||

| Present value of lease liabilities | 210,524 | 129,471 | ||||||

| Less: current maturities | (81,166 | ) | (84,878 | ) | ||||

| Non-current lease liability | $ | 129,358 | $ | 44,593 | ||||

Annual lease liabilities for the financing lease were as follows at March 31, 2024:

Schedule of Annual Lease Liabilities for all Financing Leases

| 2024 | $ | 4,849 | ||

| 2025 | 6,820 | |||

| 2026 | 488 | |||

| Total lease payments | 12,157 | |||

| Less: Interest | (1,248 | ) | ||

| Present value of lease liabilities | 10,909 | |||

| Less: current maturities | (4,802 | ) | ||

| Non-current lease liability | $ | 6,107 |

Note 6 – Related Party Transactions

CorLyst, LLC (“CorLyst”) reimburses us for shared costs related to payroll, health insurance and rent based on actual costs incurred, which are recognized as a reduction of our general and administrative operating expenses being reimbursed in our condensed consolidated statement of operations. We recorded $30,20523,000 and $31,26230,000 of reimbursements during the three months ended March 31, 20232024 and March 31, 2022,2023, respectively. At March 31, 2024, $22,295 were due from CorLyst and Nono amounts were due from CorLyst at March 31, 2023 or 2022.2023. Our CEOPresident, Research and Development is also the CEO of CorLyst, and CorLyst is a shareholder.

Note 7 – Commitments and Contingencies

Purchase Obligations

We enter into contracts in the normal course of business with contract research organizations (CROs) and subcontractors to further develop our products. The contracts are cancelable, with varying provisions regarding termination. If we terminated a cancelable contract with a specific vendor, we would only be obligated for products or services that we received at the effective date of the termination and any applicable cancellation fees. At March 31, 2023,2024, we are contractually obligated to pay up to $3.0984,000 million of future services under the agreements with the CROs. Our actual contractual obligations will also vary depending on the progress and results of the remaining clinical trials.

| 13 |

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operation

Forward Looking Statements

This Quarterly Report on Form 10-Q contains “forward-looking statements” that reflect, when made, the Company’s expectations or beliefs concerning future events that involve risks and uncertainties. Forward-looking statements frequently are identified by the words “believe,” “anticipate,” “expect,” “estimate,” “intend,” “project,” “will be,” “will continue,” “will likely result,” or other similar words and phrases. Similarly, statements herein that describe the Company’s objectives, plans or goals also are forward-looking statements. Actual results could differ materially from those projected, implied or anticipated by the Company’s forward-looking statements. Some of the factors that could cause actual results to differ include: our limited operating history, limited cash and history of losses; our ability to achieve profitability; our ability to obtain adequate financing to fund our business operations in the future; the impact of COVID-19, including its impact on our ability to obtain financing or complete clinical trials; our ability to secure required FDA or other governmental approvals for our product candidates and the breadth of the indication sought; the impact of competitive or alternative products, technologies and pricing; whether we are successful in developing and commercializing our technology, including through licensing; the adequacy of protections afforded to us and/or our licensors by the anticipated patents that we own or license and the cost to us of maintaining, enforcing and defending those patents; our and our licensors’ ability to protect non-patented intellectual property rights; our exposure to and ability to defend third-party claims and challenges to our and our licensors’ anticipated patents and other intellectual property rights; and our ability to continue as a going concern. For a discussion of these and all other known risks and uncertainties that could cause actual results to differ from those contained in the forward-looking statements, see “Risk Factors” in the Company’s Annual Report on Form 10-K for the year ended December 31, 2022,2023, which is available on the SEC’s website at www.sec.gov. All forward-looking statements are qualified in their entirety by this cautionary statement, and the Company undertakes no obligation to revise or update this Quarterly Report on Form 10-Q to reflect events or circumstances after the date hereof.

For purposes of this Management’s Discussion and Analysis of Financial Condition and Results of Operations, references to the “Company,” “we,” “us” or “our” refer to the operations of Processa Pharmaceuticals, Inc. and its direct and indirect subsidiaries for the periods described herein.

Overview

We are a clinical-stage biopharmaceutical company focused on utilizing our Regulatory Science Approach,“regulatory science” approach, including the principles associated with FDA’s Project Optimus Oncology initiative and the related FDA Draft Guidance, in the development of Next Generation Chemotherapy (NGC)(“NGC”) oncology drug products. Our mission is to provide better treatment options than those that presently exist by extending a patient’s survival and/or improving a patient’s quality of life. This is achieved by improving upon FDA-approved, widely used oncology drugs or the cancer-killing metabolites of these drugs by altering how they are metabolized and/or distributed in the body, including how they are distributed to the actual cancer cells.

RegulatoryOur regulatory science approach was conceived in the early 1990s when the founders of Processa and other faculty at the University of Maryland worked with the FDA to develop multiple FDA Guidance documents.Guidances. Regulatory science is the science of developing new tools, standards, and approaches to assess the safety, efficacy, quality, and performance of all FDA-regulated products. Over the last 30 years, two of our founders, Dr. David Young and Dr. Sian Bigora, have expanded the original regulatory science concept by including the pre-clinical and clinical studies to include other factors, such asjustify the benefit-risk assessment required for FDA approval when designing the development programs of new drug products.

Our regulatory science approach defines the scientific information that the FDA requires to determine if the benefit outweighs the risk of a drug in a specific population of patients and at a specific dosage regimen for a specific drug product. The studies are designed to obtain the necessary scientific information to support the regulatory decision.

| 14 |

Recently, the FDA has taken steps to define some of the regulatory science required for the FDA approval of oncology products. Through the FDA’s Project Optimus Oncology Initiative and the related Draft Guidance on determining the “optimal” dosage regimen for an oncology drug, the FDA has chosen to make the development of oncology drugs more science-based than in the past. Since the principles of Project Optimus, which can affect the risk-benefit analyses that FDA conducts for every FDA drug approval. In fact, the principles of FDA’s Project Optimus and the related Draft Guidance have been used by Drs. Young and Bigora to identify and justify an “optimal” dosage regimen forour regulatory science approach in a number of non-oncology FDA-approved drugs. Our Regulatory Science Approach anddrugs in the past, our past experience with the principles of Project Optimus differentiates us from other biotechnology companies by focusing us not only on the clinical science, but also on the equally important regulatory process. We believe utilizing our Regulatory Science Approachregulatory science approach provides us with three distinct advantages:

| ● | greater efficiencies (e.g., the right trial design and trial readouts); | |

| ● | greater possibility of drug approval by the FDA or other regulatory authorities; and | |

| ● |

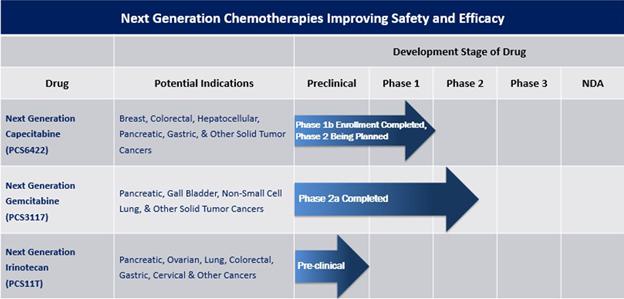

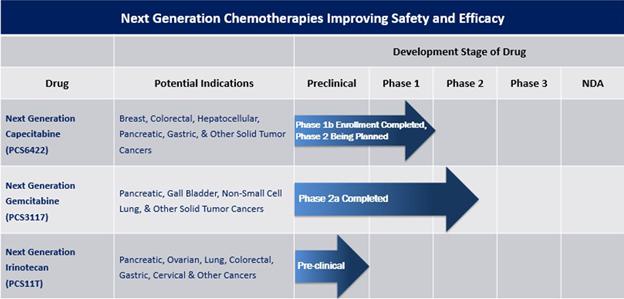

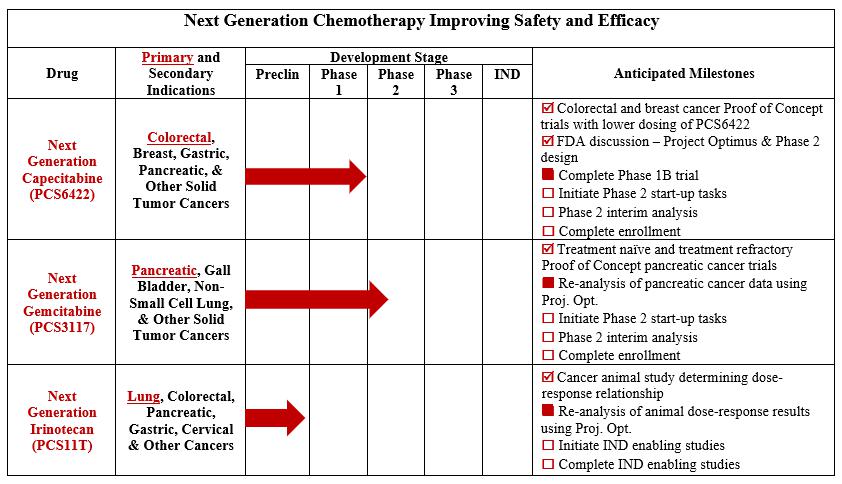

In January 2023, we announced ourOur strategic prioritization is to advance our pipeline of Next Generation ChemotherapyNGC proprietary small molecule oncology drugs. ByThe NGC products are new chemical entities, but they work by changing either the metabolism, distribution and/or elimination of already FDA-approved cancer drugs or their active metabolites while maintaining the mechanism of how the drug kills cancer cells, wecells. We believe our NGC treatments will provide improved safety-efficacy profiles when compared to their currently marketed counterparts -– capecitabine, gemcitabine, and irinotecan. All future studies of these drugs are subject to availability of capital to conduct the trials.

The three NGC treatments in our pipeline are as follows:

Due primarily to the inability to identify and enroll patients since the beginning of our rare disease Phase 2 trial for PCS499 in ulcerative Necrobiosis Lipoidica (uNL), we decided to cease further enrollment in the PCS499 trial in February 2023. In addition, we have completed our Phase 2A trial for PCS12852 in gastroparesis patients with positive results. We did not experience any safety concerns during the conduct of either the PCS12852 or PCS499 trial. We are currently evaluating options to monetize PCS12852 and PCS499.

Our shift in prioritization to NGC oncology drugs does not change our mission. We continue to be focused on drug products that improve the survival and/or quality of life for patients by improving the safety and/or efficacy of the drug in a targeted patient population, while providing a more efficient and probable path to FDA approval, and differentiating our drugs from those on the market or are currently being developed.

Historically, much of oncology drug development has searched for novel or different ways to treat cancer. Our de-risked approach is to modify and improve three different and well-known, currently approved, and successfully used chemotherapy treatments so that the human body metabolizes and/or distributes these NGC treatments differently than their presently approved counterpart drugs while maintaining the cancer-killing mechanism of action. FDA’s newly issued Project Optimus Oncology initiative and draft guidance on determining the optimal dose for oncology drugs recommends that the dose-response (both safety and efficacy) relationships be evaluated for all oncology drugs. Our Regulatory Science Approach, developed over the last 30 years, is very well aligned with the principles of Project Optimus and draft guidance where the objective is to identify the optimal dosage regimen, rather than the old approach of identifying the maximum tolerated dose (MTD) and adjust dosing accordingly. To date, we have data that suggests our NGC treatments are likely to have a better safety-efficacy profile than the current widely used marketed counterpart drugs, not only potentially making the development and approval process more efficient, but also clearly differentiating our NGC treatments from the existing treatment. We believe our NGC treatments have the potential to extend the survival and/or quality of life for more patients diagnosed with cancer while decreasing the number of patients who are required to dose-adjust or discontinue treatment because of side effects or lack of response.

Our StrategyDrug Pipeline

Our strategy is to develop our pipeline of Next Generation Chemotherapy (NGC) proprietary small molecule oncology drugs using our Regulatory Science approach, encompassing the principles of the FDA’s recent Project Optimus initiative and draft guidance on determining the optimal dosage regimen of oncology drugs.

By changing either the metabolism, distribution, and/or elimination of already FDA-approved cancer drugs or their active metabolites while maintaining the mechanism of how the drug kills cancer cells, we believe our three NGC treatments will provide improved safety-efficacy profiles when compared to their currently marketed counterparts - capecitabine, gemcitabine, and irinotecan. By combining these modified approved cancer treatments with our Regulatory Science Approach and our experience using the principles of FDA’s Project Optimus initiative, we will be able to increase the probability of FDA approval, improve the safety-efficacy profile over their existing counterparts which is important to patients and prescribers, and more efficiently develop each drug.

Our pipeline of NGCs (i) already has data demonstrating the desired pharmacological activity in humans or appropriate animal models and is able to provide improved safety and/or efficacy by some modification in the formation and/or distribution of the active moieties associated with the drug and (ii) targets cancers for which a single positive pivotal trial demonstrating efficacy might provide enough evidence that the clinical benefits of the drug and its approval outweighs the risks associated with the drug.

Our Drug Pipeline

Our pipeline currently consists of NGC-Capecitabine, NGC-GemcitabineNGC-Cap, NGC-Gem and NGC-IrinotecanNGC-Iri (also identified as PCS6422, PCS3117 and PCS11T, respectively) and two non-oncology drugs (PCS12852 and PCS499). The non-oncology drugs are not included in the pipeline chart above, as we are exploring our options for those drugs, which may include out-licensing or partnership opportunities. A timeline and summary of each drug is provided below.

Key:

Next Generation Chemotherapy Pipeline

| ● | Next Generation Capecitabine | |

| Capecitabine, as presently prescribed and FDA-approved, forms the | ||

| On August 2, 2021, we enrolled the first patient in our Phase 1B dose-escalation maximum tolerated dose trial in patients with advanced refractory gastrointestinal (GI) tract tumors. | ||

| In order for |

| In an effort to better estimate the timeline of DPD inhibition and formation of new DPD, we modified the protocol for the Phase 1B trial and began enrolling patients in the amended Phase 1B trial in April 2022. On November 1, 2022, we announced that data from the Phase 1B trial identified multiple dosage regimens with potentially better safety and efficacy profiles than currently existing chemotherapy regimens. Since 5-FU exposure is dependent on both the PCS6422 regimen and the capecitabine regimen, safe regimens were identified as well as regimens that cause | ||

Discussions with the FDA in Following the FDA meeting on December 11, 2023, we have | ||

| Our license agreement with Elion for NGC-Cap requires us to use commercially reasonable efforts, at our sole cost and expense, to research, develop and commercialize products in one or more countries, including meeting specific diligence milestones that include dosing a first patient with a product in a Phase 2 or 3 clinical trial on or before |

| ● | ||

| Our license agreement with Ocuphire Pharma, Inc. (“Ocuphire”) for NGC-Gem requires us to use commercially reasonable efforts, at our sole cost and expense to oversee such commercialization efforts, to research, develop and commercialize products in one or more countries, including meeting specific diligence milestones that consist of: (i) dosing a patient in a clinical trial prior to June 16, 2024; and (ii) dosing a patient in a pivotal clinical trial or in a clinical trial for a second indication of the | ||

| ● |

Non-Oncology PipelineWe are focused on drug products that improve the survival and/or quality of life for Out-licensing patients by improving the safety and/or Partnershipefficacy of the drug in a targeted patient population, while providing a more efficient and probable path to FDA approval and differentiating our drugs from those on the market or are currently being developed.

Historically, much of oncology drug development has searched for novel or different ways to treat cancer. Our approach is to take three current FDA-approved cancer drugs, e.g. capecitabine, gemcitabine and irinotecan, and modify and improve how the human body metabolizes and/or distributes these NGC treatments compared to their presently approved counterpart chemotherapy drugs while maintaining the cancer-killing mechanism of action; thus, our reason for calling our drugs Next Generation Chemotherapy (or NGC) treatments. Part of the development includes determining the optimal dosage regimen based on the dose-response relationship as described in the FDA’s Project Optimus Initiative and Draft Optimal Dosage Regimen Oncology Guidance. To date, we have data that we believe suggests our NGC treatments are likely to have a better safety-efficacy profile than the current widely used marketed counterpart drugs, not only potentially making the development and approval process more efficient, but also clearly differentiating our NGC treatments from the existing treatment. We believe our NGC treatments have the potential to extend the survival and/or quality of life for more patients diagnosed with cancer while decreasing the number of patients who are required to dose-adjust or discontinue treatment because of side effects or lack of response.

Other Drugs in Our Pipeline

In 2023, we completed our Phase 2A trial for PCS12852 in gastroparesis patients with positive results. Additionally, in February 2023, due primarily to the inability to identify and enroll patients in our rare disease Phase 2 trial for PCS499 in ulcerative Necrobiosis Lipoidica (uNL), we decided to cease further enrollment in the PCS499 trial and terminated the trial. We did not experience any safety concerns during the conduct of either the PCS12852 or PCS499 trial. We continue to evaluate options to monetize these non-core drug assets, which may include out-licensing or partnering these assets with one or more third parties.

Recent Developments

DuringReverse Stock Split

On January 22, 2024, we effected a 1-for-20 reverse stock split, reducing the three months ended March 31, 2023,number of our common shares issued on that date from 24,706,474 shares to 1,291,000 shares. There is no corresponding reduction in the number of authorized shares of common stock and no change in the par value per share. All share and per share amounts and conversion and exercise prices presented herein have been adjusted retroactively to reflect this change.

Public Offering

On January 30, 2024, we raised gross proceeds of $7.0 million (net proceeds of $6.4$6.3 million) from the sale of 8,432,192476,000 shares of our common stock, throughpre-funded warrants to purchase up to 1,079,555 shares of our common stock and warrants to purchase 1,555,555 shares of our common stock in a public offering, as described in Note 2. Simultaneously with the following transactions:closing of the sale, the pre-funded warrants were exercised in exchange for 1,079,555 shares of our common stock. We plan to use the net proceeds from this financing for continued research and development for NCG-Cap, and working capital and general corporate purposes.

Termination of PCS499 Trial

Due to enrollment difficulties that we have experienced since the beginning of our rare disease trial for PCS499 in uNL, we decided to cease further enrollment in the PCS499 trial in February 2023. There were no safety concerns noted during the trial.

Results of Operations

Comparison of the three months ended March 31, 20232024 and 20222023

The following table summarizes our net loss during the periods indicated:

| Three months ended | Three months ended | |||||||||||||||||||||||

| March 31, | March 31, | |||||||||||||||||||||||

| 2023 | 2022 | Change | 2024 | 2023 | Change | |||||||||||||||||||

| Operating Expenses | ||||||||||||||||||||||||

| Research and development expenses | $ | 1,627,480 | $ | 2,043,984 | $ | (416,504 | ) | $ | 1,539,070 | $ | 1,627,480 | $ | (88,410 | ) | ||||||||||

| General and administrative expenses | 2,478,055 | 1,184,730 | 1,293,325 | 1,270,528 | 2,478,055 | (1,207,527 | ) | |||||||||||||||||

| Operating Loss | (4,105,535 | ) | (3,228,714 | ) | (2,809,598 | ) | (4,105,535 | ) | ||||||||||||||||

| Other Income (Expense), net | 83,462 | 1,583 | 81,879 | 83,217 | 83,462 | (245 | ) | |||||||||||||||||

| Net Operating Loss Before Income Tax Benefit | (4,022,073 | ) | (3,227,131 | ) | (794,942 | ) | ||||||||||||||||||

| Income Tax Benefit | - | - | - | |||||||||||||||||||||

| Net Loss | $ | (4,022,073 | ) | $ | (3,227,131 | ) | $ | (2,726,381 | ) | $ | (4,022,073 | ) | ||||||||||||

Revenues

We do not currently have any revenue under contract or any immediate sales prospects.

Research and Development Expenses

Our research and development costs are expensed as incurred. Research and development expenses include (i) program and testing related expenses including external consulting and professional fees related to the product testing and our development activities and (ii) internal research and development staff salaries and other payroll costs including stock-based compensation, payroll taxes and employee benefits.

During the three months ended March 31, 2023, our research and development expenses decreased by $416,504 to $1,627,480 from $2,043,984 for the three months ended March 31, 2022. Costs for the three months ended March 31, 2023 and 2022 were as follows:

| Three months ended March 31, | ||||||||

| 2023 | 2022 | |||||||

| Amortization of intangible assets | $ | - | $ | 197,124 | ||||

| Research and development salaries and benefits | 518,803 | 526,616 | ||||||

| Preclinical, clinical trial and other costs | 1,108,677 | 1,320,244 | ||||||

| Total | $ | 1,627,480 | $ | 2,043,984 | ||||

During the three months ended March 31, 2024, our research and development expenses decreased by $88,410 to $1,539,070 from $1,627,480 for the three months ended March 31, 2023. Costs for the three months ended March 31, 2024 and 2023 were as follows:

| Three months ended March 31, | ||||||||

| 2024 | 2023 | |||||||

| Research and development salaries and benefits | $ | 507,790 | $ | 518,803 | ||||

| Preclinical, clinical trial and other costs | 1,031,280 | 1,108,677 | ||||||

| Total | $ | 1,539,070 | $ | 1,627,480 | ||||

The decrease in research and development expenses excluding amortization, was primarily due to a decrease in preclinical, clinical trial and other costs during the three months ended March 31, 20232024 when compared to the same period in 2022.2023. This decrease was attributable to having only one open clinical trial for NGC-Cap in 2024. During the completion ofsame period in 2023, in addition to clinical trial costs for NGC-Cap, we also were incurring closing costs in our clinical trial for PCS12852 and the early termination of our clinical trial for PCS499. We also did not have any amortization expense, as we fully impaired our intangible asset at December 31, 2022. During the same period in 2022, we had three active clinical trials and amortization expense for our intangible asset.

UntilAs we continue our Phase 1B clinical trial for NGC-Cap and begin our next clinicalPhase 2 trial for NGC-Cap, we anticipate our research and development costs to remain consistentwill increase. We will also continue incurring nominal costs for NGC-Gem as we close outprepare to meet with the FDA to discuss potential study designs and receive final reports relatedfor NGC-Iri should we decide to our clinical trials for PCS499conduct IND-enabling and PCS12852. We will, however, continue incurring costs in our clinical trial for NGC-Capecitabine, including the cost of having drug product manufactured and other tasks necessary for the Phase 2 clinical trial, as well as costs necessary to submit the Phase 2B protocol for NGC-Gemcitabine.toxicology studies.

The funding necessary to bring a drug candidate to market is subject to numerous uncertainties. Once a drug candidate is identified, the further development of that drug candidate may be halted or abandoned at any time due to a number of factors. These factors include, but are not limited to, funding constraints, safety or a change in market demand. For each of our drug candidate programs, we periodically assess the scientific progress and merits of the programs to determine if continued research and development is economically viable. Some programs may be terminated due to the lack of scientific progress and lack of prospects for ultimate commercialization.

Our clinical trial cost accruals are based on estimates of patient enrollment and related costs at clinical investigator sites, as well as estimates for the services received and efforts expended pursuant to contracts with multiple research institutions and CROs that conduct and manage clinical trials on our behalf.

We estimate preclinical and clinical trial expenses based on the services performed, pursuant to contracts with research institutions and clinical research organizations that conduct and manage preclinical studies and clinical trials on our behalf. In accruing service fees, we estimate the time period over which services will be performed and the level of patient enrollment and activity expended in each period. If the actual timing of the performance of services or the level of effort varies from the estimate, we will adjust the accrual accordingly. Payments made to third parties under these arrangements in advance of the receipt of the related services are recorded as prepaid expenses and expensed when the services are rendered.

General and Administrative Expenses

Our general and administrative expenses for the three months ended March 31, 2023 increased2024 decreased by $1,293,325$1,207,527 to $2,478,055$1,270,528 from $1,184,730$2,478,055 for the three months ended March 31, 2022.2023. This increase isdecrease was due primarily attributable to the fair valueas a result of $1,310,875 related toa non-recurring expense that was incurred during 2023 in connection with the stock purchase warrant granted to Spartan, which had a fair value of $1,310,875, under the amended consulting agreement (see Note 2 to the condensed consolidated financial statements), which was primarily offset by; and a decrease in taxes.

employee stock-based compensation of $132,000 since our 2024 stock grant is contingent on receiving shareholder approval to increase the number of shares available for issuance under our Incentive Plan. The decreases were offset by an increase in professional fees by $48,000; a net $19,000 increase in various office expenses; and $162,000 increase in salaries and other payroll-related costs from increased salary rates, primarily paid to our executive officers. We also received $7,000 less in reimbursements from CorLyst during the three months ended March 31, 2024 when compared to the same period in 2023.

| 19 |

Other Income

Other income represents interest income of $83,462$83,217 and $1,583$83,462 for the three months ended March 31, 2024 and 2023, and 2022, respectively.

Income Tax Benefit

We did not recognize any income tax benefit for the three months ended March 31, 20232024 or 2022.2023.

Cash Flows

The following table sets forth our sources and uses of cash and cash equivalents for the three months ended March 31, 20232024 and 2022:2023:

| Three months ended | Three months ended | |||||||||||||||

| March 31, | March 31, | |||||||||||||||

| 2023 | 2022 | 2024 | 2023 | |||||||||||||

| Net cash (used in) provided by: | ||||||||||||||||

| Operating activities | $ | (2,114,070 | ) | $ | (1,802,926 | ) | $ | (2,048,884 | ) | $ | (2,114,070 | ) | ||||

| Financing activities | 6,352,077 | (300,000 | ) | 6,263,050 | 6,352,077 | |||||||||||

| Net increase (decrease) in cash | $ | 4,238,077 | $ | (2,102,926 | ) | |||||||||||

| Net increase in cash | $ | 4,214,166 | $ | 4,238,077 | ||||||||||||

Net cash used in operating activities

We used net cash in our operating activities of $2,144,070$2,048,884 and $1,802,926$2,144,070 during the three months ended March 31, 20232024 and 2022,2023, respectively. The increasedecrease in cash used in operating activities during the first quarter of 20232024 compared to the same period in 20222023 of $65,184 was primarily related to increased cash compensation to our executive team and directors.decreased operating costs in the first quarter of 2024.

As we continue our clinical trial for NGC-Capecitabinedevelopment of NGC-Cap and evaluate the other NGC drugs in our portfolio, we anticipate our research and development efforts and ongoing general and administrative costs will continue to generate negative cash flows from operating activities for the foreseeable future. These amountsAs we begin our Phase 2 clinical trial for NGC-Cap in 2024, we anticipate our clinical trial costs will begin to decreaseincrease when compared to prior periods due tosince our current cash balances unless we raise enough fundsactivities are related primarily to conduct future clinical trials.the completion of our Phase 1b trial for NGC-Cap.

Net cash (used in) provided by financing activities

During the three months ended March 31, 2024, we sold 476,000 shares of common stock, pre-funded warrants to purchase up to 1,079,555 shares of common stock in lieu of shares of common stock, all of which were exercised into shares of our common stock, and warrants to purchase up to 1,555,555 shares of our common stock pursuant to a public offering for net proceeds of $6.3 million.We also used cash classified as financing activities of $9,924 to pay income taxes owed on stock-based compensation, $8,561 for the settlement of a stock award and $895 for payments owed under a financing lease obligation.

During the three months ended March 31, 2023, we raised net proceeds of $6.4 million from the sale of 8,432,192421,611 shares of our common stock. We used net cash in financing activities during the three months ended March 31, 2022 of $300,000 to purchase 100,000 shares of our common stock from a licensee.

Liquidity

At March 31, 20232024 we had $10.7 million in cash and cash equivalents.