FORM 10-Q

quarterly period ended March 31, 2024

15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

______________

| Delaware | 46-4478536 | |||||||

(State or other jurisdiction of

| (

| |||||||

Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||||||||||

| Common stock: Par value $0.0001 | AZTR | NYSE American, LLC | ||||||||||||||

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐No ☒

Exchange Act:

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||||||||

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ | |||||||||

| Emerging growth company | ☒ | |||||||||||

Statements. Three Months Ended June 30, 2023 Three Months Ended June 30, 2022 Six Months Ended June 30, 2023 Six Months Ended June 30, 2022 For the Six Months Ended June 30, 2023 For the Six Months Ended June 30, 2022 NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS Deferred Offering Costs Leases are classified as either operating or financing leases based on the economic substance of the agreement. Research and Development Recent Accounting Pronouncements Management does not believe that any other recently issued, but not yet effective, accounting standards could have a material effect on the accompanying financial statements. As new accounting pronouncements are issued, the Company will adopt those that are applicable under the circumstances. 2023: Estimated Useful Life Estimated Useful Life 2023: $4,850,000. March 31, 2024. 10 years. Plan and 1,960,000 shares of common stock were available for grant under the plan. 2016 Plan. Exercise Price Number of Options at 6/30/2023 Weighted Average Exercise Price- FINANCIAL INFORMATIONItemStatements June 30, 2023 December 31, 2022 (Unaudited) ASSETS Current assets: Cash and cash equivalents $ 6,290,355 $ 3,492,656 Accounts receivable 445,120 182,820 Tax credits receivable 42,446 69,666 Income tax receivable 13,722 13,722 Deferred offering costs - 216,886 Prepaid expenses 48,523 160,133 Total current assets 6,840,166 4,135,883 Property and equipment, net 803,107 846,958 Other assets Other assets 47,744 47,507 Operating lease right-of-use asset 976,959 1,116,697 Intangible assets, net 241,580 219,567 Deferred patent costs 920,001 800,831 Total other assets 2,186,284 2,184,602 Total assets $ 9,829,557 $ 7,167,443 LIABILITIES, PREFERRED STOCK, AND STOCKHOLDERS’ EQUITY Current liabilities: Accounts payable $ 364,183 $ 784,687 Current operating lease liability 298,047 287,384 Accrued expenses 767,721 993,961 Contract liabilities 310,700 156,000 Total current liabilities 1,740,651 2,222,032 Long-term operating lease liability 693,609 840,896 Warrant liability 158,994 70,283 Convertible notes payable, net - 6,600,000 Total liabilities 2,593,254 9,733,211 Preferred stock: Series A convertible preferred stock; $ par value; shares authorized at June 30, 2023 and December 31, 2022; and shares issued and outstanding at June 30, 2023 and December 31, 2022 respectively; liquidation value of $0 and $3,337,506 at June 30, 2023 and December 31, 2022 respectively - 3,272,944 Series A-1 convertible preferred stock; $ par value; shares authorized at June 30, 2023 and December 31, 2022; and shares issued and outstanding at June 30, 2023 and December 31, 2022 respectively; liquidation value of $0 and $14,274,638 as of June 30, 2023 and December 31, 2022, respectively - 14,100,533 Series B convertible preferred stock; $ par value; shares authorized at June 30, 2023 and December 31, 2022; and shares issued and outstanding at June 30, 3023 and December 31, 2022, respectively; liquidation value of $0 and $17,000,159 as of June 30, 2023 December 31, 2022 respectively - 16,321,065 Preferred stock value Stockholders’ equity (deficit) Common stock; $ par value, shares authorized at June 30, 2023 and December 31, 2022, and shares issued and outstanding at June 30, 2023 and December 31, 2022, respectively 1,210 104 Additional paid-in capital 51,436,352 1,054,138 Accumulated deficit (44,201,259 ) (37,314,552 ) Total stockholders’ equity (deficit) 7,236,303 (36,260,310 ) Total liabilities, preferred stock and stockholders’ equity (deficit) $ 9,829,557 $ 7,167,443 March 31, 2024 December 31, 2023 ASSETS (Unaudited) Current assets: Cash and cash equivalents $ 3,001,158 $ 1,795,989 Accounts receivable 1,857 8,255 Accounts receivable - related party — 90,000 Tax credits receivable 125,516 118,383 Income tax receivable 14,235 6,836 Deferred offering costs — 67,859 Prepaid expenses 383,131 448,257 Total current assets 3,525,897 2,535,579 Property and equipment, net 676,383 710,075 Financing lease right-of-use asset 36,132 40,002 Operating lease right-of-use asset 750,363 828,960 Intangible assets, net 215,099 210,881 Deferred patent costs 816,578 742,229 Other assets 47,541 47,760 Total assets $ 6,067,993 $ 5,115,486 LIABILITIES, PREFERRED STOCK, AND STOCKHOLDERS' EQUITY Current liabilities: Accounts payable 583,055 897,272 Current financing lease liability 14,954 14,600 Current operating lease liability 310,929 307,655 Accrued expenses 348,930 383,668 Total current liabilities 1,257,868 1,603,195 Long-term financing lease liability 22,296 26,169 Long-term operating lease liability 456,315 537,523 Warrant liability 7,298 35,453 Total liabilities 1,743,777 2,202,340 Commitments and contingencies (Note 12) Preferred stock: Series A convertible preferred stock; $0.0001 par value; 205,385 shares authorized at March 31, 2024 and December 31, 2023; 0 and 0 shares issued and outstanding at March 31, 2024 and December 31, 2023 respectively; liquidation value of $0 and $0 at March 31, 2024 and December 31, 2023 respectively — — Series A-1 convertible preferred stock; $0.0001 par value; 380,657 shares authorized at March 31, 2024 and December 31, 2023; 0 and 0 shares issued and outstanding at March 31, 2024 and December 31, 2023 respectively; liquidation value of $0 and $0 as of March 31, 2024 and December 31, 2023, respectively — — Series B convertible preferred stock; $0.0001 par value; 851,108 shares authorized at March 31, 2024 and December 31, 2023; 0 and 0 shares issued and outstanding at March 31, 2024 and December 31, 2023, respectively; liquidation value of $0 and $0 as of March 31, 2024 and December 31, 2023 respectively — — Stockholders' equity Common stock; $0.0001 par value, 100,000,000 shares authorized at March 31, 2024 and December 31, 2023, 28,804,643 and 12,097,643 shares issued and outstanding at March 31, 2024 and December 31, 2023, respectively 2,880 1,210 Additional paid-in capital 55,852,544 51,510,269 Accumulated deficit (51,531,208) (48,598,333) Total stockholders' equity 4,324,216 2,913,146 Total liabilities, preferred stock, and stockholders' equity $ 6,067,993 $ 5,115,486 For the Three Months For the Three Months March 31, 2024 March 31, 2023 Service revenue - related party $ — $ 113,300 Total revenue — 113,300 Operating expenses: General and administrative 1,488,527 843,012 Research and development 1,472,970 829,035 Total operating expenses 2,961,497 1,672,047 Loss from operations (2,961,497) (1,558,747) Other income (expense): Interest income 7,609 285 Interest expense (915) (89,832) Change in fair value of convertible note — (800,000) Change in fair value of warrants 28,255 5,621 Other income (expense) (6,327) (4,792) Total other income (expense) 28,622 (888,718) Loss before income taxes (2,932,875) (2,447,465) Income tax expense — (9,715) Net loss (2,932,875) (2,457,180) Dividends on preferred stock — (712,080) Net loss attributable to common shareholders $ (2,932,875) $ (3,169,260) Net loss per share, basic and diluted $ (0.15) $ (3.00) Weighted average common stock outstanding, basic and diluted 20,182,346 1,055,455 Series A Convertible Preferred Stock Series A-1 Convertible Preferred Stock Series B Convertible Preferred Stock Common Stock Additional

Paid-in-CapitalAccumulated Deficit Total Stockholders' Equity (Deficit) Shares Amount Shares Amount Shares Amount Shares Amount Balance - December 31, 2022 205,385 $ 3,272,944 380,657 $ 14,100,533 391,303 $ 16,321,065 1,043,991 $ 104 $ 1,054,138 $ (37,314,552) $ (36,260,310) Issuance of Series B Convertible Preferred Stock — — — — 23,432 1,124,759 — — — — — Stock-based compensation — — — — — — — — 38,794 — 38,794 Exercise of stock options — — — — — — — — — — — Net loss — — — — — — — — — (2,457,180) (2,457,180) Balance, March 31, 2023 205,385 $ 3,272,944 380,657 $ 14,100,533 414,735 $ 17,445,824 1,043,991 $ 104 $ 1,092,932 $ (39,771,732) $ (38,678,696) Series A Convertible Preferred Stock Series A-1 Convertible Preferred Stock Series B Convertible Preferred Stock Common Stock Additional

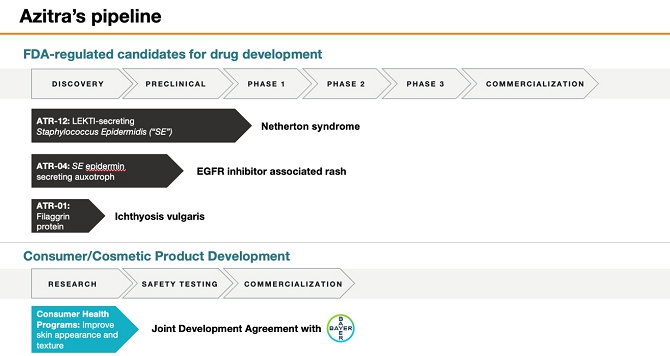

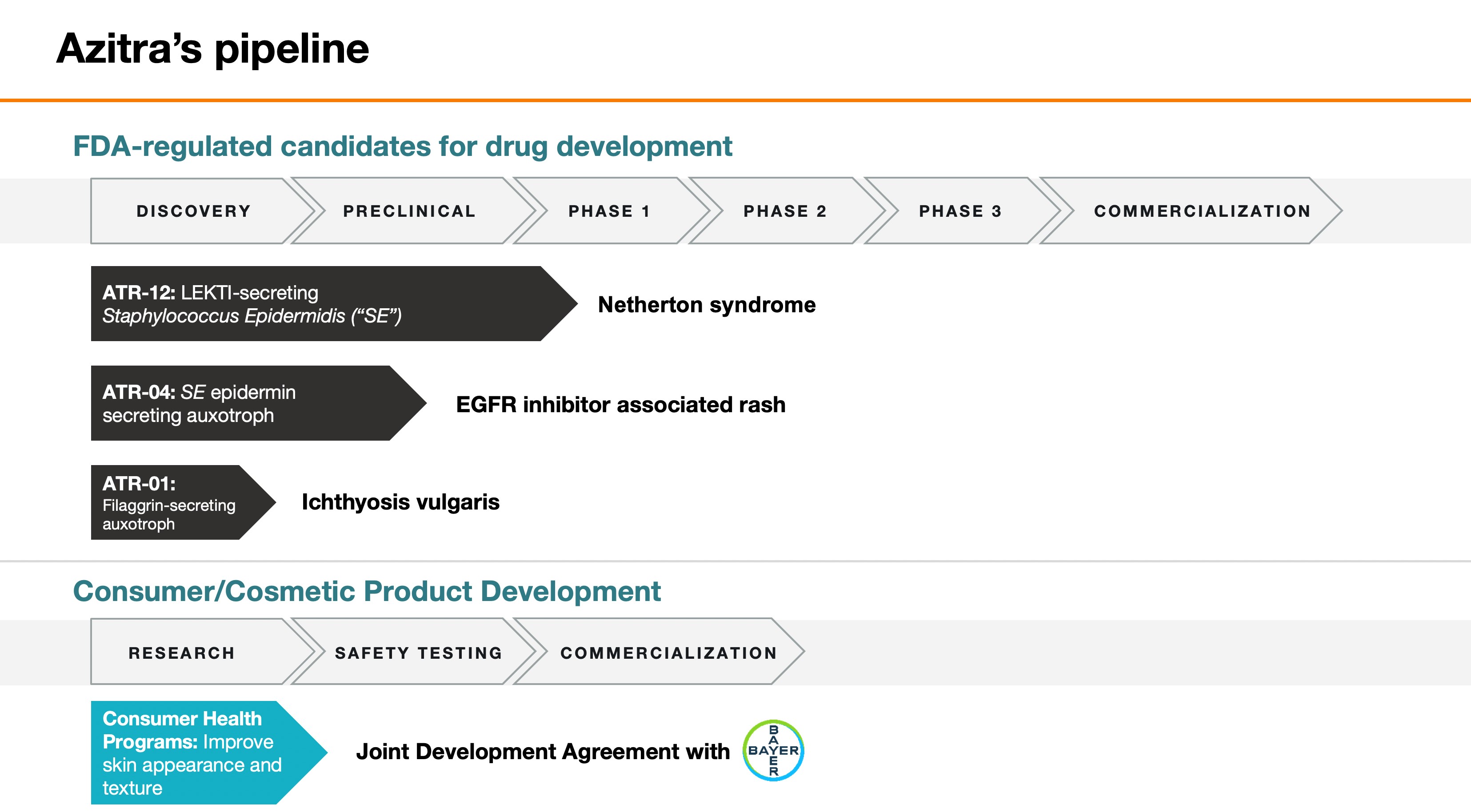

Paid-in-CapitalAccumulated Deficit Total Stockholders' Equity (Deficit) Shares Amount Shares Amount Shares Amount Shares Amount Balance - December 31, 2023 — $ — — $ — — $ — 12,097,643 $ 1,210 $ 51,510,269 $ (48,598,333) $ 2,913,146 Follow-on public offering, net of issuance costs of $709,426 — — — — — — 16,667,000 1,666 4,289,008 — 4,290,674 Stock-based compensation — — — — — — — — 34,171 — 34,171 Exercise of stock options — — — — — — 40,000 4 19,096 — 19,100 Net loss — — — — — — — — — (2,932,875) (2,932,875) Balance, March 31, 2024 — $ — — $ — — $ — 28,804,643 $ 2,880 $ 55,852,544 $ (51,531,208) $ 4,324,216 For the Three Months Ended March 31, 2024 2023 Cash flows from operating activities: Net loss $ (2,932,875) $ (2,457,180) Adjustments to reconcile net loss to net cash used in operating activities: Depreciation and amortization 31,532 32,149 Amortization of right-of-use assets 82,467 71,243 Change in foreign currency rates on remeasurement of Canadian fixed assets 3,757 — Accrued interest on convertible notes — 89,832 Stock based compensation 34,171 38,794 Change in fair value of warrant liability (28,155) (5,621) Change in fair value of convertible notes — 800,000 Changes in operating assets and liabilities: Accounts receivable 96,398 85,431 Prepaid expenses 65,126 116,497 Other assets 219 (28) Tax credits receivable (7,133) (2,690) Income tax receivable (7,399) — Accounts payable and accrued expenses (281,096) 109,610 Operating lease liability (77,934) (69,085) Contract liabilities — (113,300) Net cash used in operating activities (3,020,922) (1,304,348) Cash flows from investing activities: Purchases of property and equipment — (14,392) Capitalization of deferred patent costs (81,078) (64,584) Capitalization of licenses — (3,858) Net cash used in investing activities (81,078) (82,834) Cash flows from financing activities Payment of deferred offering costs — (272,080) Principal payments on finance leases (3,519) — Proceeds from public offering, net 4,290,674 — Proceeds from exercise of stock options 19,100 — Net cash provided by (used in) financing activities 4,306,255 (272,080) Net change in cash and cash equivalents 1,204,255 (1,659,262) Cash and cash equivalents at beginning of period 1,795,989 3,492,656 Cash and cash equivalents at end of period $ 3,000,244 $ 1,833,394 Supplemental disclosure of non-cash investing and financing information: Conversion of note to Series B Convertible Preferred Stock $ — $ 1,124,759 F-1UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSSCONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS Service revenue – related party $ 172,000 $ 85,000 $ 285,300 $ 205,000 Total revenue 172,000 85,000 285,300 205,000 Operating expenses: General and administrative 844,640 667,940 1,687,651 1,529,248 Research and development 812,836 1,505,447 1,643,017 3,060,815 Total operating expenses 1,657,476 2,173,387 3,330,668 4,590,063 Loss from operations (1,485,476 ) (2,088,387 ) (3,045,368 ) (4,385,063 ) Other income (expense): Interest income 265 335 550 855 Interest expense (76,187 ) (17,811 ) (166,019 ) (35,448 ) Employee retention credit - 229,813 - 229,813 Other income 1,600 - 2,746 - Forgiveness of accounts payable 56,285 - 56,285 - Change in fair value of convertible note (2,830,100 ) - (3,630,100 ) - Other expense (95,915 ) (14,103 ) (104,801 ) (26,327 ) Total other income (expense) (2,944,052 ) 198,234 (3,841,339 ) 168,893 Net loss before income taxes $ (4,429,528 ) $ (1,890,153 ) $ (6,886,707 ) $ (4,216,170 ) Income tax benefit (expense) - - - - Net loss (4,429,528 ) (1,890,153 ) (6,886,707 ) (4,216,170 ) Dividends on preferred stock (643,267 ) (692,246 ) (1,355,347 ) (1,384,492 ) Net loss attributable to common shareholders $ (5,072,795 ) (2,582,399 ) $ (8,242,054 ) (5,600,662 ) Net loss per share, basic and diluted $ ) $ ) $ ) $ ) Weighted average common stock outstanding, basic and diluted The accompanying notes are an integral part of these condensed consolidated financial statements.F-2Azitra, Inc. Statements of Preferred Stock and Stockholders’ Equity (Deficit)For the Three and Six Months Ended June 30, 2023 and 2022Unaudited Shares Amount Shares Amount Shares Amount Shares Amount Capital Deficit (Deficit) Series A Convertible Preferred Stock Series A-1 Convertible Preferred Stock Series B Convertible Preferred Stock Common Stock Additional Paid-In Accumulated Total Stockholders’ Equity Shares Amount Shares Amount Shares Amount Shares Amount Capital Deficit (Deficit) Balance, December 31, 2021 205,385 $ 3,272,944 380,657 $ 14,100,533 391,303 $ 16,321,065 1,043,100 $ 104 $ 868,163 $ (26,634,186 ) $ (25,765,919 ) Stock-based compensation - - - - - - - - 56,983 - 56,983 Exercise of stock options - - - - - - 888 - 1,510 - 1,510 Net loss - - - - - - - - - (2,326,017 ) (2,326,017 ) Balance, March 31, 2022 205,385 3,272,944 380,657 14,100,533 391,303 16,321,065 1,043,988 104 926,656 (28,960,203 ) (28,033,443 ) Stock-based compensation - - - - - - - - 53,826 - 53,826 Net loss - - - - - - - - - (1,890,153 ) (1,890,153 ) Balance, June 30, 2022 205,385 3,272,944 380,657 14,100,533 391,303 16,321,065 1,043,988 104 980,482 (30,850,356 ) (29,869,770 ) Balance, December 31, 2022 205,385 3,272,944 380,657 14,100,533 391,303 16,321,065 1,043,988 104 1,054,138 (37,314,552 ) (36,260,310 ) Beginning balance 205,385 3,272,944 380,657 14,100,533 391,303 16,321,065 1,043,988 104 1,054,138 (37,314,552 ) (36,260,310 ) Issuance of Series B Convertible Preferred Stock - - - - 23,432 1,124,759 - - - - 1,124,759 Stock-based compensation - - - - - - - - 38,794 - 38,794 Net loss - - - - - - - - - (2,457,179 ) (2,457,179 ) Balance, March 31, 2023 205,385 3,272,944 380,657 14,100,533 414,735 17,445,824 1,043,988 104 1,092,932 (39,771,731 ) (38,678,695 ) Conversion of convertible notes payable - - - - - - 1,846,020 185 9,494,887 - 9,495,072 Conversion of preferred stock (205,385 ) (3,272,944 ) (380,657 ) (14,100,533 ) (414,735 ) (17,445,824 ) 7,707,635 771 34,818,530 - 34,819,301 Initial public offering, net of issuance costs of $1,508,791 - - - - - - 1,500,000 150 5,991,209 - 5,991,359 Stock-based compensation - - - - - - - - 38,794 - 38,794 Net loss - - - - - - - - - (4,429,528 ) (4,429,528 ) Balance, June 30, 2023 - $ - - $ - - $ - 12,097,643 $ 1,210 $ 51,436,352 $ (44,201,259 ) $ 7,236,303 Beginning balance - $ - - $ - - $ - 12,097,643 $ 1,210 $ 51,436,352 $ (44,201,259 ) $ 7,236,303 F-3AZITRA, INC.UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS Cash flows from operating activities: Net loss $ (6,886,707 ) $ (4,216,170 ) Adjustment to reconcile net loss to net cash used in operating activities: Depreciation and amortization 64,806 61,417 Amortization of debt discount - 3,936 Amortization of right-of-use assets 139,738 140,921 Accrued interest on convertible notes 165,939 31,512 Stock based compensation 77,588 110,809 Change in fair value of warrant liability 88,711 (35 ) Change in fair value of convertible notes 3,630,100 - Forgiveness of accounts payable (56,285 ) - Loss on disposal of property and equipment - 7,923 Changes in operating assets and liabilities: Accounts Receivable (262,300 ) 134,800 Prepaid expenses 111,610 (124,465 ) Other assets (237 ) 165 Tax credits receivable 27,220 (227,955 ) Accounts payable and accrued expenses (149,781 ) 134,028 Operating lease liability (136,624 ) (133,491 ) Contract liabilities 154,700 (15,000 ) Net cash used by operating activities (3,031,522 ) (4,091,605 ) Cash flows from investing activities: Purchases of property and equipment (17,578 ) (31,453 ) Proceeds from sale of property and equipment - 4,250 Capitalization of deferred patent costs (119,170 ) (117,673 ) Capitalization of licenses (15,263 ) (57,372 ) Capitalization of patent and trademark costs (10,127 ) (585 ) Net cash used in investing activities (162,138 ) (202,833 ) Cash flows from financing activities: Proceeds from initial public offering, net 5,991,359 - Proceeds from exercise of stock options - 1,510 Net cash provided by financing activities 5,991,359 1,510 Net change in cash and cash equivalents 2,797,699 (4,292,928 ) Cash and cash equivalents at beginning of the period 3,492,656 8,044,262 Cash and cash equivalents at end of the period $ 6,290,355 $ 3,751,334 Supplemental disclosure of cash flow information: Non-cash transactions: Obtaining a right-of-use asset in exchange for lease liability - 1,418,502 Conversion of note to common stock 9,495,152 - Conversion of note to Series B Convertible Preferred Stock $ 1,124,759 $ - The accompanying notes are an integral part of these condensed consolidated financial statements.F-4AZITRA, INC.For The Three and Six Months Ended June 30, 2023 and 2022IncInc. was founded on January 2, 2014. It is a synthetic biology company focused on screening and genetically engineering microbes of the skin. The mission is to discover and develop novel therapeutics to create a new paradigm for treating skin disease. The Company’s discovery platform is screened for naturally occurring bacterial cells with beneficial effects. These microbes are then genomically sequenced and engineered to make cellular therapies, recombinant therapeutic proteins, peptides and small molecules for precision treatment of dermatology diseases. On May 17, 2023, the Company changed its name to from “Azitra Inc” to “Azitra, Inc.” This location and operations completed there remained consistent throughout 2022 and into 2023. The Company also opened a manufacturing and laboratory space in Groton, Connecticut during 2021.OfferingOfferings$$5.00 per share. The shares began trading on the NYSE American on June 16, 2023 under the symbol “AZTR”. The net proceeds received by the Company from the offering were $6.0$6.0 million, after deducting underwriting discounts, commissions and other offering expenses.$$0.01 to $.$0.0001. Accordingly, all share and per share amounts for all periods presented in the accompanying unaudited consolidated financial statements and notes thereto have been adjusted retroactively, where applicable, to reflect the effect of the Forward Stock Split. Refer to Note 87 for additional details relating to the Forward Stock Split.sixthree months ended June 30, 2023,March 31, 2024, the Company has an accumulated deficit of $44.2$51.5 million, a loss from operations of $3.0$3.0 million, and used $3.0$3.0 million to fund operations.operations and had approximately $2.3 million of working capital. These factors among others raise substantial doubt about the Company’s ability to continue as a going concern.Management plans to continue to raise funds through equity and debt financing to fund operating and working capital needs; however, thetheir pre-clinicalits pre-commercialization phase and therefore does not yet have product revenue. ThereManagement plans to continue to raise funds through equity and debt financing to fund operating and working capital needs, however, there can be no assurance that the Company will be successful in securing additional financing, if needed, to meet its operating needs.an uncertaintysubstantial doubt about the ability of the Company to continue as a going concern for twelve months from the date that the financial statements are available to be issued. The financial statements do not include any adjustments that might be necessary should the Company be unable to continue as a going concern.and six month periodsmonths are unaudited. Unaudited interim results are not necessarily indicative of the results for the full fiscal year. These unaudited interim financial statements should be read in conjunction with the financial statements of the Company for the year ended December 31, 20222023, and notes thereto that are included in the Company’s Registration StatementAnnual Report on Form 10-K, as filed with the SEC on June 5, 2023.

March 15, 2024.F-5AZITRA, INC.NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTSFor The Three and Six Months Ended June 30, 2023 and 2022Use of EstimatesThe preparation of the financial statement in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the balance sheet. While management believes the estimates and assumptions used in the preparation of the financial statement are appropriate, actual results could differ from those estimates.Cash and Cash EquivalentsFor purposes of the balance sheets and statements of cash flows, the Company considers all cash on hand, demand deposits and all highly liquid investments with original maturities of three months or less to be cash equivalents.Property and EquipmentProperty and equipment are recorded at cost. Depreciation is computed using the straight-line method over the estimated useful lives, which range from 3 to 10 years. Expenditures for maintenance and repairs, which do not extend the economic useful life of the related assets, are charged to operations as incurred. Gains or losses on disposal of property and equipment are reflected in the statements of operations in the period of disposal.Accounts ReceivableThe Company carries its accounts receivable at cost less an allowance for doubtful accounts. On a periodic basis, the Company evaluates its accounts receivable and establishes an allowance for doubtful accounts based on a history of past write-offs, collections and current conditions. There was no allowance for doubtful accounts at June 30, 2023 and December 31, 2022. Accounts receivable are written off when deemed uncollectible. Recoveries of accounts receivable previously written off are recorded when received.its IPOthese offerings within the statements of stockholders’ equity during the threeperiods ended March 31, 2024 and six months ended June 30,December 31, 2023.Right of Use Assets$1,418,502$1,418,502 as of January 1, 2022. The basis, terms and conditions of the leases are determined by the individual agreements. The Company’s option to extend certain leases ranges from 36 – 52 months. All options to extend have been included in the calculation of the ROU asset and lease liability. The leases do not contain residual value guarantees, restrictions, or covenants that could incur additional financial obligations to the Company. There are no subleases, sale-leaseback, or related party transactions.June 30, 2023,March 31, 2024, the Company had operating right-of-use assets with a net value of $976,959$750,363 and current and long-term operating lease liabilities of $298,047$310,929 and $693,609,$456,315, respectively.Intangible AssetsIntangible assets consist of trademarks and patents. All costs directly related to the filing and prosecution of patent and trademark applications are capitalized. Patents are amortized over their respective remaining useful lives upon formal approval. Trademarks have an indefinite life.The Company accounts for other indefinite life intangible assets in accordance ASC Topic 350, Goodwill and Other Intangible Assets (ASC 350). ASC 350 requires that intangible assets that have indefinite lives are required to be tested at least annually for impairment or whenever events or changes in circumstances indicate that the carrying amount may not be recoverable. Intangible assets that have finite lives will continue to be amortized over their useful lives. No impairment losses relating to intangible assets were recorded during the three and six months ended June 30, or 2022.F-6AZITRA, INC.NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTSFor The Three and Six Months Ended June 30, 2023 and 2022Deferred Patent CostsDeferred patent costs represent legal and filing expenses incurred related to the submission of patent applications for patents pending approval. These deferred costs will begin to be amortized over their estimated useful lives upon the formal approval of the patent. If the patent is not approved, the costs associated with the patent will be expensed in the year the patent was rejected. No impairment losses relating to deferred patent costs were recorded in the three and six months ended June 30, 2023 or 2022.Impairment of Long-Lived AssetsIn accordance with ASC Topic 360-10, Accounting for the Impairment or Disposal of Long-Lived Assets (ASC 360-10), the Company’s policy is to review its long-lived assets for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. In connection with this review, the Company also reevaluates the periods of depreciationentered into a lease for these assets. The Company recognizes an impairment loss when the sum of the undiscounted expected future cash flows from the use and eventual disposition of the asset is less than its carrying amount. If an asset is considered to be impaired, the impairment to be recognized is measured by the amount by which the carrying amount of the asset exceeds the fair value of the asset, which is determined using the present value of the net future operating cash flows generated by the asset.Convertible Debt and Warrant AccountingWarrantsThe Company accounts for warrants as either equity-classified or liability-classified instruments based on an assessment of the warrant’s specific terms and applicable authoritative guidance in ASC 480, Distinguishing Liabilities from Equity (“ASC 480”) and ASC 815, Derivatives and Hedging (“ASC 815”). The assessment considers whether the warrants are freestanding financial instruments pursuant to ASC 480, meet the definition of a liability pursuant to ASC 480, and whether the warrants meet all of the requirements for equity classification under ASC 815, including whether the warrants are indexed to the Company’s own common stock, among other conditions for equity classification. This assessment, which requires the use of professional judgment,certain equipment that is conducted at the time of warrant issuance and as of each subsequent quarterly period end date while the warrants are outstanding.For issued warrants that meet all of the criteria for equity classification, the warrants are required to be recordedclassified as a componentfinance lease. The finance lease has a term of additional paid-in capital at36 months. At March 31, 2024, the time of issuance. For issued warrants that do not meet all the criteria for equity classification, the warrants are required to be recorded at their initial fair value on the date of issuance, and each balance sheet date thereafter. Changes in the estimated fairCompany had financing right-of-use assets with a net value of the warrants are recognized as a non-cash gain or loss on the statements$36,132 and current and long-term operating lease liabilities of operations under Other Income/loss.Convertible debtWhen the Company issues debt with a conversion feature, it first assesses whether the debt should be accounted for in accordance with ASC 480 – Distinguishing Liabilities from Equity. If the debt does not meet the criteria of an ASC 480 liability, the note’s conversion features require bifurcation in accordance with ASC 815 – Derivatives$14,954 and Hedging. If the Company determines the embedded conversion feature requires bifurcation in accordance with ASC 815, the Company also considers if it can elect the fair value option. If the fair value option is elected, the Company records the note at its initial fair value with any subsequent changes in fair value recorded in earnings. As noted in Note 7, the Company has elected the fair value option for the 2022 Convertible Notes and will record the notes at their initial fair values with any subsequent changes in fair value recorded in earnings. The Convertible Notes were converted into the Company’s common stock on the Closing Date of the Company’s IPO.Convertible Preferred StockAs the Convertible Preferred stockholders have liquidation rights in the event of a deemed liquidation event that, in certain situations, are not solely within the control of the Company and would require the redemption of the then-outstanding Convertible Preferred Stock, the Company classifies the Convertible Preferred Stock in mezzanine equity on the balance sheet. Due to the fact that the occurrence of a deemed liquidation event is not currently probable, the carrying value of the Convertible Preferred Stock is not being accreted to its redemption value. Subsequent adjustments to the carrying value of the Convertible Preferred Stock would be made only when a deemed liquidation event becomes probable.As noted in Note 8, at the Closing Date of the Company’s IPO, the Convertible Preferred stock converted into shares of the Company’s common stock.RevenueThe Company follows the five steps to recognize revenue from contracts with customers under ASC 606, Revenue from Contracts with Customers (“ASC 606”), which are:●Step 1: Identify the contract(s) with a customer●Step 2: Identify the performance obligations in the contract●Step 3: Determine the transaction price

$22,296, respectively.F-7AZITRA, INC.NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTSFor The Three and Six Months Ended June 30, 2023 and 2022●Step 4: Allocate the transaction price to the performance obligations in the contract●Step 5: Recognize revenue when (or as) a performance obligation is satisfiedThe Company generates service revenue through a joint development agreement with a research partner. The Company recognizes revenue related to the research and development aspects of the agreement over time using the input method as work is performed on the contract.The Company also generates grant revenue, which represents monies received on contracts with various federal agencies and nonprofit research institutions for general research conducted by the Company to further their product development and are therefore considered contributions to the Company. The contracts are generally for periods of one year or more and can be cancelled by either party. The Company concluded that the grant arrangements do not meet the criteria to be treated as a collaborative arrangement under FASB ASC Topic 808 as the Company is the only active participant in the arrangement. The grant arrangements also do not meet the criteria for revenue recognition under Topic 606, as the U.S. Government would not meet the definition of a customer.Amounts earned under these grant contracts are recorded as a reduction to research and development expense when eligible expenses are incurred and the right to payment is realizable or realized and earned. The Company believes this policy is consistent with Topic 606, to ensure that recognition reflects the transfer of promised goods or services to customers in an amount that reflects the consideration that the Company expects to be entitled to in exchange for those goods or services, even though there is no exchange as defined in Topic 606. Additionally, the Company has determined that the recognition of amounts received as costs are incurred and amounts become realizable is analogous to the concept of transfer of control of a service over time under Topic 606.Receipts of grant awards in advance, which are payable back to the funding agency if not used in accordance with conditions in the grants related to allowable costs or receipt of funding from research partners related to service revenue arrangements before work is performed on the contract, are classified as contract liabilities in the accompanying balance sheets.$812,836$1,472,970 and $1,643,017$829,035 during the three months ended March 31, 2024 and six month period ended June 30,March 31, 2023, respectively. Research and development costs incurred were $1,505,447 and $3,060,815 during the three and six month period ended June 30, 2022, respectively.June 30, 2023March 31, 2024 and December 31, 2022,2023, the Company has a state tax credit receivable of $32,459$86,778 for pending refunds related to the selling of research and development tax credits back to the State of Connecticut. At June 30, 2023March 31, 2024 and December 31, 2022,2023, the$0$19,619 and $28,925,$20,040, respectively for pending refunds related to Canadian Scientific Research and Experimental Development (SRED) credits. At June 30, 2023March 31, 2024 and December 31, 2022,2023, the Company has also recorded $9,987$19,119 and $8,282,$11,565, respectively, related to refunds of Canadian Goods and Services Tax (GST) and Quebec Sales Tax (QST). Receipts of refunds are recorded in other incomeresearch and development on the statements of operations.accounts for stock-based compensation in accordance with ASC 718, Compensation-Stock Compensation (ASC 718). ASC 718 requires employee stock options and rightsis subject to purchase shares under stock participation plansrisks that are common to be accounted for at fair value. ASC 718 requires that compensation costs related to share-based payment transactions be recognized as operating expensescompanies in the financial statements. Under this method, compensation costs for all awards granted or modified are measured at estimated fair value at date of grant and are included as compensation expense over the vesting period during which an employee provides service in exchange for the award. For awards with a performance condition that affects vesting,pharmaceutical industry, including, but not limited to, development by the Company recognizes compensation expense when it is determined probable that the performance condition will be achieved.The Company uses a Black-Scholes option pricing model to determine fair valueor its competitors of its stock options. The Black-Scholes model includes various assumptions, including the valuenew technological innovations, dependence on key personnel, reliance on third party manufacturers, protection of the underlying common stock, the expected life of stock options, the expected volatilityproprietary technology, and the expected risk-free interest rate. These assumptions reflect the Company’s best estimates, but they involve inherent uncertainties based on market conditions generally outside of the control of the Company. As a result, if other assumptions had been used, stock-based compensation cost could have been materially impacted. Furthermore, if the Company uses different assumptions for future grants, stock-based compensation cost could be materially impacted in future periods.The Company accounts for equity instruments issued to non-employees in accordancecompliance with the provisions of ASC 718 as updated by Accounting Standards Update (ASU) No. 2018-07, Improvements to Nonemployee Share-Based Payment Accounting, which expands the scope of ASC 718 to include share-based payment transactions to non-employees.

regulatory requirements.F-8AZITRA, INC.NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTSFor The Three and Six Months Ended June 30, 2023 and 2022The following assumptions are used in valuing options issued using the Black-Scholes option pricing model:Expected Volatility. The expected volatility of the Company’s shares is estimated based on the Company’s external valuation.Expected Term. The expected term of options is estimated using the simplified method which is based on the vesting period and contractual term for each grant, or for each vesting-tranche for awards with graded vesting.Underlying Common Stock Value. The underlying common stock value of the Company’s shares is estimated by a third-party valuation expert.Risk-free Interest Rate. The Company bases the risk-free interest rate on the implied yield available on a U.S. Treasury note with terms equal to the expected term of the underlying grant.Dividend Yield. The Black-Scholes valuation model calls for a single expected dividend yield as an input. The Company has not paid dividends on Common stock in the past nor does it expect to pay dividends on Common stock in the near future. As such, the Company uses a dividend yield percentage of zeroIncome TaxesThe Company uses the liability method of accounting for income taxes, as set forth in ASC 740, Accounting for Income Taxes. Under this method, deferred tax assets and liabilities are recognized for the expected future tax consequence of temporary differences between the carrying amounts and the tax basis of assets and liabilities and net operating loss carry forwards, all calculated using presently enacted tax rates.Management has evaluated the effect of ASC guidance related to uncertain income tax positions and concluded that the Company has no significant financial statement exposure to uncertain income tax positions at June 30, 2023 and December 31, 2022. The Company’s income tax returns have not been examined by tax authorities through December 31, 2022.Fair Value MeasurementsThe Company carries certain liabilities at fair value on a recurring basis. A fair value hierarchy that consists of three levels is used to prioritize the inputs to fair value valuation techniques:●Level 1 – Inputs are based upon observable or quoted prices for identical instruments traded in active markets.●Level 2 – Inputs are based upon quoted prices for similar instruments in active markets, quoted prices for identical or similar instruments in markets that are not active, and model-based valuation techniques for which all significant assumptions are observable in the market or can be corroborated by observable market data for substantially the full term of the assets or liabilities.●Level 3 – Inputs are generally unobservable and typically reflect management’s estimates of assumptions that market participants would use in pricing the asset or liability. The fair values are therefore determined using model-based techniques that include option pricing models, discounted cash flow models, and similar techniques.In determining fair value, the Company utilizes valuation techniques that maximize the use of observable inputs and minimize the use of unobservable inputs to the extent possible as well as considers counterparty credit risk in its assessment of fair value.In February 2016, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) 2016-02, Leases (Topic 842). This ASU requires a lessee to recognize a right-of-use asset and a lease liability under most operating leases in its balance sheet. The ASU is effective for annual and interim periods beginning after December 15, 2021. The Company adopted ASU 2016-02 on January 1, 2022. See Note 13 – Operating Leases.In December 2019, the FASB issued ASU No. 2019-12, Income Taxes (Topic 740): Simplifying the Accounting for Income Taxes. This standard simplifies the accounting for income taxes through the removal of various exceptions previously provided, as well as providing additional reporting requirements for income taxes. The ASU is effective for the Company on January 1, 2022. The Company has adopted this standard effective January 1, 2022, which did not have a material impact to the financial statements.In August 2020, the FASB issued ASU No. 2020-06, Debt – Debt with Conversion and Other Options (Subtopic 470-20) and Derivatives and Hedging – Contracts in Entity’s Own Equity (Subtopic 815-40), which simplifies the accounting for certain financial instruments with characteristics of liabilities and equity, including convertible instruments and contracts on an entity’s own equity. This standard will be effective for the Company on January 1, 2024, with early adoption permitted (but no earlier than fiscal years beginning after December 15, 2020). The Company has adopted this standard effective January 1, 2021, which did not have a material impact to the financial statements.F-9AZITRA, INC.NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTSFor The Three and Six Months Ended June 30, 2023 and 2022Financial InstrumentsThe Company’s financial instruments are primarily comprised of accounts receivable, accounts payable, accrued liabilities, and long-term debt. For accounts receivable, accounts payable and accrued liabilities, the carrying amount approximates fair value due to the short-term maturities of such instruments. The estimated fair value of the Company’s long-term debt approximates carrying value.Employee Retention CreditThe CARES Act provides an employee retention credit (“CARES Employee Retention credit”), which is a refundable tax credit against certain employment taxes of up to $5,000 per employee for eligible employers. The tax credit is equal to 50% of qualified wages paid to employees during a quarter, capped at $10,000 of qualified wages per employee through December 31, 2020. Additional relief provisions were passed by the United States government, which extend and slightly expand the qualified wage caps on these credits through September 30, 2021. Based on these additional provisions, the tax credit is now equal to 70% of qualified wages paid to employees during a quarter, and the limit on qualified wages per employee has been increased to $10,000 of qualified wages per quarter. In April 2022, the Company determined it qualified for the tax credit under the CARES Act and recorded a receivable for $229,813 and recognized the amounts as other income on the statement of operations. The Company received full payment for the amount in September 2022.4.Property and EquipmentJune 30, 2023March 31, 2024 and December 31, 2022:Schedule of Property And Equipment June 30,2023 December 31, 2022 Lab equipment $ 1,053,710 $ 1,034,579 Computer equipment 30,825 30,825 Furniture and fixtures 24,316 24,316 Leasehold improvements 28,855 28,855 Building equipment 14,932 14,932 Property and equipment gross 1,152,638 1,133,507 Less: accumulated depreciation (349,531 ) (286,549 ) Net property and equipment $ 803,107 $ 846,958 March 31, 2024 December 31, 2023 Laboratory equipment $ 1,007,932 $ 1,013,134 Computers and office equipment 30,825 30,825 Furniture and fixtures 24,316 24,316 Leasehold improvements 28,855 28,855 Building equipment 14,932 14,932 Total property and equipment 1,106,860 1,112,062 Less accumulated depreciation & amortization (430,477) (401,987) Total property, plant, and equipment, net $ 676,383 $ 710,075 $30,877$29,935 and $61,429$30,552 for the three and six months ended June 30,March 31, 2024 and March 31, 2023, respectively. Depreciation expense was $30,148 and $59,957 for the three and six months ended June 30, 2022, respectively.5.Schedule of Intangible AssetsJune 30, 2023: Gross Amount Accumulated Amortization Net Amount Trademarks Indefinite $ 56,248 $ - $ 56,248 Patents 17 years 116,076 11,517 104,559 License agreement 17 years 80,773 - 80,773 Intangible Assets $ 253,097 $ 11,517 $ 241,580 Estimated Useful Life Gross Amount Accumulated Amortization Impairment Net Amount Trademarks Indefinite $ 57,652 $ — $ — $ 57,652 Patents 17 years 175,741 18,294 — 157,447 Intangible assets $ 233,393 $ 18,294 $ — $ 215,099 2022: Gross Amount Accumulated Amortization Net Amount Trademarks Indefinite $ 53,999 $ - $ 53,999 Patents 17 years 108,198 8,140 100,058 License agreement 17 years 65,510 - 65,510 Intangible Assets $ 227,707 $ 8,140 $ 219,567 Estimated Useful Life Gross Amount Accumulated Amortization Impairment Net Amount Trademarks Indefinite $ 57,474 $ — $ — $ 57,474 Patents 17 years 169,190 15,783 — 153,407 Intangible assets $ 226,664 $ 15,783 $ — $ 210,881 and six months ended June 30,March 31, 2024 and March 31, 2023, amortization expense related to intangible assets was $1,780$2,511 and $3,377,$1,597, respectively. During the three and six months ended June 30, 2022, amortization expense related to intangible assets was $730 and $1,460, respectively.F-10AZITRA, INC.NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTSFor The Three and Six Months Ended June 30, 2023 and 20226.Schedule of Accrued Expenses June 30, 2023 December 31, 2022 Employee payroll and bonuses $ 481,383 $ 371,010 Vacation 60,911 27,082 Research and development projects 164,036 316,389 Interest - 223,792 Professional fees 57,133 24,502 Other 4,258 31,186 Total accrued expenses $ 767,721 $ 993,961 March 31, 2024 December 31, 2023 Accrued expenses: Employee payroll and bonuses $ 131,861 $ 207,556 Vacation 44,485 31,074 Research and development projects 75,033 85,767 Professional fees 94,802 35,624 Other 2,749 23,647 Total accrued expenses $ 348,930 $ 383,668 7.$4,500,000$4,500,000 convertible promissory notes. On the same day, the Company entered into convertible promissory notes (2022 Convertible Notes) with three investors totaling $4,350,000.$4,350,000. The 2022 Convertible Notes mature on January 13, 2023 or the occurrence of an Event of Default (as defined) and bear interest at a rate of 8%8% per annum which shall accrue but is not due and payable until conversion or full repayment of outstanding principal. The principal and interest outstanding under the 2022 Convertible Notes is automatically converted a) upon the closing of a Qualified Financing resulting in gross proceeds to the Company of at least $20$20 million into securities issued in connection with the Qualified Financing, at a discount of 30%30% per share; b) upon the closing of a Change of Control event into shares of capital stock of the Company or Series B preferred stock; and c) upon the closing of a Public Company Event, into shares of capital stock being issued to investors equal to two-times (2x) the amount of the outstanding principal and accrued interest then outstanding divided by the public offering price per share. The principal and interest outstanding under the 2022 Convertible Notes is convertible, at the option of the holders, at the maturity date into a new class of Company’s Preferred Stock (Series C Preferred) equal to the quotient of the outstanding principal amount plus interest divided by the Capped Price, which is defined as the price per share equal to the Valuation Cap of $30$30 million divided by the Company Capitalization, as defined in the Agreement.$30$30 million divided by the number of shares of the Company’s common stock issued and outstanding, on a fully diluted basis, immediately prior to the close of the Qualified Financing or Change in Control event.JuneSeptember 30, 2023 and allow for the sale of additional notes of $500,000$500,000 for a total aggregate principal of $4,850,000.$9,494,887. Upon conversion,$9,494,887. During the three months ended March 31, 2023, the Company recorded a change in the fair value of $2,830,100 for the three$800,000.six months ended June 30, 2023 which was recognized as a non-cash change in fair value in Other Income (Expense) on the statement of operations.The Company accounts for the 2022 Convertible Notes under ASC 815. Under 815-15-25, the election can be at the inception of a financial instrument to account for the instrument under the fair value option under ASC 825. The Company has made such election for the 2022 Convertible Notes. Using the fair value option, the convertible promissory note is to be recorded at its initial fair value on the date of issuance, and each balance sheet date thereafter. The Company evaluates the change based on the conversion price at the current market value. When recognized, changes in the estimated fair value of the notes are recognized as a non-cash gain or loss in Other Income (Expense) on the statements of operations.Effective January 5, 2021, the Company entered into a Note Purchase Agreement to issue up to $2,000,000 of convertible promissory notes. On the same date, the Company entered into a convertible promissory note (2021 Convertible Note) with one investor for $1,000,000. The 2021 Convertible Note bears interest at a rate of 6% per annum and is due and payable in full on January 5, 2023. The 2021 Convertible Note automatically converts upon a qualified equity financing, as defined in the note agreement to the number of shares equal to all principal and accrued interest divided by the conversion price of $48.00, which is subject to adjustment as defined in the note agreement. The 2021 Convertible Note is also optionally convertible as defined in the note agreement for certain non-qualified financing, a change in control, or upon the maturity date of the 2021 Convertible Note. The Company incurred issuance costs of $15,613 related to the 2021 Convertible Note, which has been recorded as a debt discount and will be amortized over the term of the 2021 Convertible Note.F-11AZITRA, INC.NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTSFor The Three and Six Months Ended June 30, 2023 and 2022In January 2023, the Company elected to convert the 2021 Convertible Note, including interest accrued but not yet paid of $124,759 at a conversion price of $48.00 into shares of its Series B Preferred Stock in accordance with the terms outlined in the Note Purchase Agreement.The Company evaluated the terms and conditions of the Note Purchase Agreement related to the 2021 Convertible Note in order to assess the accounting considerations under ASC 480 – Distinguishing Liabilities from Equity, and ASC 815 – Derivatives and Hedging. The Company determined the Convertible Note does not meet any of the criteria to be accounted pursuant to an ASC 480 liability. The Company also assessed the embedded features pursuant to the guidance in ASC 815 and determined the embedded features do not meet any of the criteria for bifurcation.Convertible notes payable consisted of the following at:Schedule of Convertible Notes Payable June 30, 2023 December 31, 2022 2021 Convertible Note $ - $ 1,000,000 2022 Convertible Notes - 5,600,000 $ - $ 6,600,000 There was $0 amortized related to the debt issuance costs$89,832 during the three and six months ended June 30,March 31, 2024 and March 31, 2023, respectively. There was $1,968 and $3,936 amortized related to the debt issuance costs during the three and six months ended June 30, 2022, respectively. Interest accrued on the convertible notes was $0 and $223,792 at June 30, 2023 and December 31, 2022, respectively.8.$$0.01 to $$0.0001 and the authorized shares were increased to 100,000,000 shares of common stock in connection with the Forward Stock Split. Fractional shares resulting from the Forward Stock Split were rounded down to the next whole share and in lieu of any fractional shares and the Company will paypaid a cash amount to the holder of such fractional share. The accompanying financial statements and notes to the financial statements give retroactive effect to the Forward Stock Split for all periods presented. Shares of common stock underlying outstanding stock-based awards and other equity instruments were proportionately increased and the respective per share value and exercise prices, if applicable, were proportionately decreased in accordance with the terms of the agreements governing such securities.June 30, 2023March 31, 2024 and December 31, 2022,2023, per the Company’s amended and restated Certificate of Incorporation, the Company was authorized to issue shares of $$0.0001 par value common stock.The Company had and shares of common stock issued and outstanding as of June 30, 2023 and December 31, 2022, respectively.June 30, 2023.June 30, 2023March 31, 2024 and December 31, 2022,2023, per the Company’s amended and restated Certificate of Incorporation, the Company has authorized 10,000,000 shares of $$0.0001 par value preferred stock.In January 2023,Company issued sharesclose of its Series B Preferred Stock related to conversion of the 2021 Convertible Note at a conversion price of $48.00 per share (see Note 7).The Series A, Series A-1, and Series B Preferred Stock have the following rights, preferences and privileges:ConversionThe preferred stock is convertible, at the option of the holder, into common shares based upon a predefined formula. A holder of preferred stock may convert such shares into common shares at any time. For purpose of conversion, the initial conversion price is $16.25 per share (original issue price) for Series A Preferred Stock, $37.50 per share (original issue price) for Series A-1 Preferred Stock, and $43.45 per share (original issue price) for Series B Preferred Stock, and is subject to adjustment as described in the Certificate of Incorporation. Preferred stock will automatically convert into common shares upon the earlier of (a) an initial public offering with gross proceeds in excess of $100,000,000 or (b) the date and time, or the occurrence of an event, specified by vote or written consent of the required preferred stock shareholders, all outstanding Series A, Series A-1, and Series B Preferred Stock shall automatically convert into common shares, at the then effective conversion rate.F-12AZITRA, INC.NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTSFor The Three and Six Months Ended June 30, 2023 and 2022Upon the Company’s IPO in June 2023, all of the outstanding preferred stock converted to common stock, resulting in the issuance of , , and shares of common stock in exchange for outstanding Series A, Series A-1, and Series B Preferred Stock, respectively. There was no gain or loss upon conversion.Voting RightsThe holders of the Series A, Series A-1, and Series B Preferred Stock are entitled to vote on any matter presented to the stockholders of the Corporation for their action or consideration at any meeting of stockholders of the Corporation (or by written consent of stockholders in lieu of meeting), each holder of outstanding shares of preferred stock shall be entitled to cast the number of votes equal to the number of whole shares of Common Stock into which the shares of preferred stock held by such holder are convertible as of the record date for determining stockholders entitled to vote on such matter. The holders of the Series A and Series A-1 Preferred Stock are each entitled to elect one director of the Corporation. The holders of the Series B Stock are entitled to elect two members of the Board. Each class of preferred stock can remove from office such directors and to fill any vacancy caused by the resignation, death or removal of such directors under certain circumstances as described in the Certificate of Incorporation.DividendsThe holders of Series A Preferred Stock are entitled to receive dividends at a rate of 8% per annum of the Series A original issue price of $16.25 per share on each outstanding share of Series A Preferred Stock (subject to appropriate adjustment in the event of any stock dividend, stock split, combination or other similar recapitalization with respect to the Series A Preferred Stock). Dividends accumulate from the original date of issuance of the Series A Preferred Stock, are cumulative and are payable upon declaration of the Board of Directors or liquidation of the Company. At June 30, 2023, there were no cumulative dividends on Series A Preferred Stock as there was no longer any Series A Preferred Stock outstanding.The holders of Series A-1 Stock are entitled to receive dividends at a rate of 8% per annum of the Series A-1 original issue price of $37.50 per share on each outstanding share of Series A-1 (subject to appropriate adjustment in the event of any stock dividend, stock split, combination or other similar recapitalization with respect to the Series A-1 Preferred Stock). Dividends are cumulative and are payable upon declaration of the Board of Directors or liquidation of the Company. At June 30, 2023, there were no cumulative dividends on Series A-1 Preferred Stock as there was no longer any Series A-1 Preferred Stock outstanding.The holders of Series B Stock are entitled to receive dividends at a rate of 8% per annum of the Series B original issue price of $43.45 per share on each outstanding share of Series B (subject to appropriate adjustment in the event of any stock dividend, stock split, combination or other similar recapitalization with respect to the Series B Preferred Stock). Dividends are cumulative and are payable upon declaration of the Board of Directors or liquidation of the Company. At June 30, 2023, there were no cumulative dividends on Series B Preferred Stock as there was no longer any Series B Preferred Stock outstanding.LiquidationIn the event of any liquidation, dissolution or winding up of the Company, the holders of the preferred stock are entitled to receive, prior to and in preference to the holders of the common shares, an amount equal to the Series A, Series A-1, or Series B Preferred Stock original issue price, plus declared and/or accrued but unpaid dividends. In the event of any such liquidation event, after the payment of all preferential amounts required to be paid to the holders of shares of preferred stock, the remaining assets of the Corporation available for distribution to its stockholders shall be distributed among the holders of the shares of preferred stock and Common Stock, pro rata based on the number of shares held by each such holder, treating for this purpose all such securities as if they had been converted into Common Stock pursuant to the terms of the Certificate of Incorporation immediately prior to such liquidation event.9.$0.48$0.48 per share and a term of 10 years. The warrants are marked to market each reporting period. The fair value is $158,994$7,298 and $70,283$35,453 at June 30, 2023March 31, 2024 and December 31, 2022,2023, respectively. At June 30,the Company estimated the fair value of theand follow-on offering in fiscal 2024, respectively. The underwriter warrants using the Black-Scholes option pricing model with the following assumptions: Underlying common stock value of $; Expectedhave a term of 4.8 years; Expected Volatility of 82.5%; Risk Free Interest Rate of 3.01%; and Dividend Yield of 0%. At December 31, 2022, the Company estimated the fair value of the warrants using the Black-Scholes option pricing model with the following assumptions: Underlying common stock value of $; Expected term of 5 years; Expected Volatility of 86.0%; Risk Free Interest Rate of 3.01%; and Dividend Yield of 0%.20192024 which did not meet the criteria under ASC 480 to be classified as a liability, and instead meet equity classification criteria. The warrants issued in 2016 expired upon the initial public offering in June 2023.F-13AZITRA, INC.NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTSFor The Three and Six Months Ended June 30, 2023 and 2022June 30, 2023:March 31, 2024:Warrants Outstanding Warrant Exercisable Year Granted Exercise Price Number of Warrants at 03/31/2024 Weighted Average Remaining Contractual Life Weighted Average Exercise Price Number of Warrants at 03/ 31/2024 Weighted Average Remaining Contractual Life Weighted Average Exercise Price 2018 $ 0.48 47,890 4.0 years $ 0.48 47,890 4.0 years $ 0.48 2019 $ 5.28 215,846 1.9 years $ 5.28 215,846 1.9 years $ 5.28 2023 $ 6.25 60,000 4.2 years $ 6.25 60,000 4.2 years $ 6.25 2024 $ 0.38 666,680 4.9 years $ 0.38 666,680 4.9 years $ 0.38 990,416 $ 1.80 990,416 $ 1.80 Schedule of Information about Warrants Outstanding Warrants Outstanding Warrants Exercisable Year Granted Exercise Price Number of Warrants at 6/30/2023 Weighted Average Remaining Contractual Life Weighted Average Exercise Price Number of Warrants at 6/30/2023 Weighted Average Remaining Contractual Life Weighted Average Exercise Price 2018 $ 0.48 47,887 years $ 0.48 47,887 years $ 2019 $ 5.28 215,846 years $ 5.28 215,846 years $ 2023 $ 6.25 60,000 years $ 6.25 60,000 years $ 323,733 $ 4.75 323,733 $ 10..The. The 2023 Plan allows the Committee to grant up to shares of Common Stock in the form of incentive and non-statutory stock options, restricted stock awards, restricted stock units, and other stock-based awards to employees, directors, and non-employees. As of June 30, 2023, thereMarch 31, 2024, options to purchase 40,000 shares of common stock had been granted and were no awards issuedoutstanding under the 2023 Plan.(the Plan)("2016 Plan") which provides for the grantinggrant up to 1,490,595 shares of Common Stock in the form of stock options and restricted shares to the Company’s employees, officers, directors, advisors and consultants. ThereAs of March 31, 2024, options to purchase 1,208,255 shares of common stock had been granted and 223,702 shares of common stock were shares available for grantinggrant under the Plan at December 31, 2022. Options vest over varying time frames.and months ended June 30,March 31, 2024 and March 31, 2023, and 2022, the Company did not grant any stock options to acquire shares of common stock.equity awards under the 2016 or 2023 Plans. During the three and six months ended June 30,March 31, 2024 and March 31, 2023, the Company recognized stock compensation expense of $38,974$34,171 and $77,588, respectively, relating to the issuance of service-based stock options. During the three and six months ended June 30, 2022, the Company recognized stock compensation expense of $53,826 and $110,809,$38,794, respectively, relating to the issuance of service-based stock options. At June 30, 2023,March 31, 2024, there was $$292,268 of unamortized compensation expense that will be amortized over the remaining vesting period. At June 30,March 31, 2024 and 2023, and 2022, there were performance-based options outstanding with a fair value of $.$109,551. During the three and six months ended June 30,March 31, 2024 and March 31, 2023, and 2022, the Company did not recognize any compensation expense for performance-based options. The Company determined the options qualified as plain vanilla under the provisions of SAB 107 and the simplified method was used to estimate the expected option life.June 30, 2023:Schedule of Information about Options Outstanding and Exercisable Options Outstanding Options Exercisable Number of Options at 6/30/2023 Weighted Average Remaining Contractual Life Weighted Average Exercise Price Weighted Average Remaining Contractual Life Weighted Average Exercise Price $ 0.48 246,137 years $ 0.48 246,137 years $ 0.48 $ 0.93 202,040 years $ 0.93 198,290 years $ 0.93 $ 1.70 812,504 years $ 1.70 518,227 years $ 1.70 1,260,681 962,654

March 31, 2024:F-14For The Three and Six Months Ended June 30, 2023 and 2022Options Outstanding Options Exercisable Exercise Price Number of Options at March 31, 2024 Weighted Average Remaining Contractual Life Weighted Average Exercise Price Number of Options at March 31, 2024 Weighted Average Remaining Contractual Life Weighted Average Exercise Price $ 0.48 206,137 1.8 years $ 0.48 206,137 1.8 years $ 0.48 $ 0.93 202,040 1.8 years $ 0.93 202,036 1.8 years $ 0.93 $ 1.70 800,078 7.0 years $ 1.70 598,452 6.8 years $ 1.70 $ 2.07 40,000 9.4 years $ 2.07 6,667 9.4 years $ 2.07 1,248,255 1,013,292 sixthree months ended June 30, 2023March 31, 2024, is summarized as follows:Shares Weighted Average Exercise Price Outstanding at December 31, 2023 1,288,255 $ 1.37 Granted — — Exercised (40,000) 0.48 Forfeited — — Outstanding at March 31, 2024 1,248,255 $ 1.39 Schedule of Stock Option Activity Shares Outstanding at December 31, 2022 1,290,325 $ 1.27 Granted - - Exercised - - Forfeited (29,644 ) 0.93 Outstanding at June 30, 2023 1,260,681 $ 1.28 There are shares available for future grant under the Plan at June 30, 2023.11.Schedule of Fair Value Measurements for Assets and LiabilitiesJune 30, 2023 Description Level 1 Level 2 Level 3 Total Liabilities: Common stock warrants $ - $ - $ 158,698 $ 158,698 Total $ - $ - $ 158,698 $ 158,698 December 31, 2022 Description Level 1 Level 2 Level 3 Total Liabilities: Common stock warrants $ - $ - $ 70,283 $ 70,283 2022 Convertible Notes - - 5,600,000 5,600,000 Total $ - $ - $ 5,670,283 $ 5,670,283 Description Level 1 Level 2 Level 3 Total Liabilities Common stock warrants $ — $ — $ 7,298 $ 7,298 Total $ — $ — $ 7,298 $ 7,298 Description Level 1 Level 2 Level 3 Total Liabilities Common stock warrants $ — $ — $ 35,453 $ 35,453 Total $ — $ — $ 35,453 $ 35,453 June 30, 2023:ScheduleMarch 31, 2024:Balance at December 31, 2023 $ 35,453 Changes in fair value of warrants (28,155) Balance at March 31, 2024 $ 7,298 Changes in Level 3 Instruments Measured on a Recurring Basisthe warrants using the Black-Scholes option pricing model with the following assumptions:March 31, 2024 December 31, 2023 Underlying common stock value $ 0.26 $ 0.92 Expected term (years) 4.04 4.29 Expected volatility 98 % 99 % Risk free interest rate 4 % 4 % Dividend yield — % — % Balance at December 31, 2022 $ 5,670,283 Change in fair value of warrants (5,621 ) Change in fair value of 2022 Convertible Notes 800,000 Balance at March 31, 2023 $ 6,464,662 Change in fair value of warrants 94,036 Change in fair value of 2022 Convertible Notes 2,830,100 Conversion of 2022 Convertible Notes (9,230,100 ) Balance at June 30, 2023 $ 158,698 Common Stock Warrantcommon stock warrant liability valuation during each year. As the fair value of the Common stock increases the value to the holder of the instrument generally increases.FluctuationsF-15AZITRA, INC.NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTSFor The Three and Six Months Ended June 30, 2023 and 2022