UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

| | | | | |

| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 20222023

or

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number: 000-55190

NORTHSTAR HEALTHCARE INCOME, INC.

(Exact Name of Registrant as Specified in its Charter)

| | | | | |

| Maryland | 27-3663988 |

| (State or Other Jurisdiction of | (IRS Employer |

| Incorporation or Organization) | Identification No.) |

16 East 34th Street, 18th Floor, New York, NY 10016

(Address of Principal Executive Offices, Including Zip Code)

(929) 777-3135

(Registrant’s Telephone Number, Including Area Code)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common stock, par value $0.01 per share | None | None |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ý No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | | | | | | | |

| Large accelerated filer | ¨ | Accelerated filer | ¨ | Non-accelerated filer | ý | Smaller reporting company | ☐ |

| | | | | | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ý

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date:

The Company has one class of common stock, $0.01 par value per share, 195,287,174185,712,103 shares outstanding as of November 9, 2022.13, 2023.

NORTHSTAR HEALTHCARE INCOME, INC.

FORM 10-Q

TABLE OF CONTENTS

| | | | | | | | |

| Index | | Page |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| Control and Procedures | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q contains certain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, or Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or Exchange Act. Forward-looking statements are generally identifiable by use of forward-looking terminology such as “may,” “will,” “should,” “potential,” “intend,” “expect,” “seek,” “anticipate,” “estimate,” “believe,” “could,” “project,” “predict,” “continue,” “future” or other similar words or expressions. Forward-looking statements are not guarantees of performance and are based on certain assumptions, discuss future expectations, describe plans and strategies, contain projections of results of operations or of financial condition or state other forward-looking information. Such statements include, but are not limited to, those relating to our ability to make distributions to our stockholders, successfully manage the transition to self-management andstockholders; our ability to retain our senior executives;executives and other sufficient personnel to manage our business; our ability to realize substantial efficiencies as well as anticipated strategic and financial benefits of the internalization of our management function as operating costs and business disruption may be greater than expected; the operating performance of our investments, our financing needs, the effects of our current strategies and investment activities and our ability to effectively deploy capital. Our ability to predict results or the actual effect of plans or strategies is inherently uncertain. Although we believe that the expectations reflected in such forward-looking statements are based on reasonable assumptions, our actual results and performance could differ materially from those set forth in the forward-looking statements and you should not unduly rely on these statements. These forward-looking statements involve risks, uncertainties and other factors that may cause our actual results in future periods to differ materially from those forward-looking statements.

All forward-looking statements included in this Quarterly Report on Form 10-Q are based on information available to us on the date hereof and we are under no duty to update any of the forward-looking statements after the date of this report to conform these statements to actual results.

Factors that could have a material adverse effect on our operations and future prospects are set forth in our filings with the U.S. Securities and Exchange Commission, or the SEC, including Part I, Item 1A of our Annual Report on Form 10-K for the fiscal year ended December 31, 20212022 and in Part II, Item 1A of this Quarterly Report on Form 10-Q under the heading “Risk Factors.” The risk factors set forth in our filings with the SEC could cause our actual results to differ significantly from those contained in any forward-looking statement contained in this report.

PART I—Financial Information

Item 1. Financial Statements

NORTHSTAR HEALTHCARE INCOME, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(Dollars in Thousands, Except Per Share Data)

| | | September 30, 2022 (Unaudited) | | December 31, 2021 | | September 30, 2023 (Unaudited) | | December 31, 2022 |

| Assets | Assets | | | | Assets | | | |

| Cash and cash equivalents | Cash and cash equivalents | $ | 95,145 | | | $ | 200,473 | | Cash and cash equivalents | $ | 87,581 | | | $ | 103,926 | |

| Restricted cash | Restricted cash | 12,537 | | | 10,465 | | Restricted cash | 11,386 | | | 11,734 | |

| Operating real estate, net | Operating real estate, net | 932,730 | | | 972,599 | | Operating real estate, net | 894,245 | | | 933,002 | |

| Investments in unconsolidated ventures | 205,207 | | | 212,309 | | |

| Investments in unconsolidated ventures ($3,075 held at fair value as of September 30, 2023) | | Investments in unconsolidated ventures ($3,075 held at fair value as of September 30, 2023) | 128,026 | | | 176,502 | |

| | Receivables, net | Receivables, net | 3,454 | | | 3,666 | | Receivables, net | 2,253 | | | 2,815 | |

| Intangible assets, net | Intangible assets, net | 2,337 | | | 2,590 | | Intangible assets, net | 2,000 | | | 2,253 | |

| Other assets | Other assets | 7,829 | | | 10,771 | | Other assets | 10,425 | | | 7,603 | |

Total assets(1) | Total assets(1) | $ | 1,259,239 | | | $ | 1,412,873 | | Total assets(1) | $ | 1,135,916 | | | $ | 1,237,835 | |

| | Liabilities | Liabilities | | Liabilities | |

| Mortgage and other notes payable, net | $ | 915,964 | | | $ | 929,811 | | |

| Mortgage notes payable, net | | Mortgage notes payable, net | $ | 901,610 | | | $ | 912,248 | |

| | Due to related party | Due to related party | 3,347 | | | 7,338 | | Due to related party | 292 | | | 469 | |

| Escrow deposits payable | Escrow deposits payable | 1,427 | | | 1,171 | | Escrow deposits payable | 1,023 | | | 993 | |

| Accounts payable and accrued expenses | Accounts payable and accrued expenses | 19,052 | | | 24,671 | | Accounts payable and accrued expenses | 23,967 | | | 21,034 | |

| Other liabilities | Other liabilities | 2,392 | | | 3,064 | | Other liabilities | 1,592 | | | 2,019 | |

Total liabilities(1) | Total liabilities(1) | 942,182 | | | 966,055 | | Total liabilities(1) | 928,484 | | | 936,763 | |

| Commitments and contingencies (Note 12) | Commitments and contingencies (Note 12) | | | | Commitments and contingencies (Note 12) | | | |

| Equity | Equity | | Equity | |

| NorthStar Healthcare Income, Inc. Stockholders’ Equity | NorthStar Healthcare Income, Inc. Stockholders’ Equity | | NorthStar Healthcare Income, Inc. Stockholders’ Equity | |

| Preferred stock, $0.01 par value, 50,000,000 shares authorized, no shares issued and outstanding as of September 30, 2022 and December 31, 2021 | — | | | — | | |

| Common stock, $0.01 par value, 400,000,000 shares authorized, 195,078,539 and 193,120,940 shares issued and outstanding as of September 30, 2022 and December 31, 2021, respectively | 1,951 | | | 1,930 | | |

| Preferred stock, $0.01 par value, 50,000,000 shares authorized, no shares issued and outstanding as of September 30, 2023 and December 31, 2022 | | Preferred stock, $0.01 par value, 50,000,000 shares authorized, no shares issued and outstanding as of September 30, 2023 and December 31, 2022 | — | | | — | |

| Common stock, $0.01 par value, 400,000,000 shares authorized, 185,712,103 and 195,421,656 shares issued and outstanding as of September 30, 2023 and December 31, 2022, respectively | | Common stock, $0.01 par value, 400,000,000 shares authorized, 185,712,103 and 195,421,656 shares issued and outstanding as of September 30, 2023 and December 31, 2022, respectively | 1,857 | | | 1,954 | |

| Additional paid-in capital | Additional paid-in capital | 1,728,383 | | | 1,720,719 | | Additional paid-in capital | 1,716,701 | | | 1,729,589 | |

| Retained earnings (accumulated deficit) | Retained earnings (accumulated deficit) | (1,410,309) | | | (1,277,688) | | Retained earnings (accumulated deficit) | (1,511,765) | | | (1,428,840) | |

| Accumulated other comprehensive income (loss) | Accumulated other comprehensive income (loss) | (5,088) | | | (486) | | Accumulated other comprehensive income (loss) | — | | | (3,679) | |

| Total NorthStar Healthcare Income, Inc. stockholders’ equity | Total NorthStar Healthcare Income, Inc. stockholders’ equity | 314,937 | | | 444,475 | | Total NorthStar Healthcare Income, Inc. stockholders’ equity | 206,793 | | | 299,024 | |

| Non-controlling interests | Non-controlling interests | 2,120 | | | 2,343 | | Non-controlling interests | 639 | | | 2,048 | |

| Total equity | Total equity | 317,057 | | | 446,818 | | Total equity | 207,432 | | | 301,072 | |

| Total liabilities and equity | Total liabilities and equity | $ | 1,259,239 | | | $ | 1,412,873 | | Total liabilities and equity | $ | 1,135,916 | | | $ | 1,237,835 | |

(1)Represents the consolidated assets and liabilities of NorthStar Healthcare Income Operating Partnership, LP (the “Operating Partnership”). The Operating Partnership is a consolidated variable interest entity (“VIE”), of which NorthStar Healthcare Income, Inc. (together with its consolidated subsidiaries, the “Company”) is the sole general partner and owns approximately 99.99%. As of September 30, 2022, the Operating Partnership includes $224.2Includes $174.4 million and $178.8$180.2 million of assets and liabilities, respectively, of certain VIEs that are consolidated by the Operating Partnership. Refer to Note 2, “Summary of Significant Accounting Policies.”

Refer to accompanying notes to consolidated financial statements (unaudited).

NORTHSTAR HEALTHCARE INCOME, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

(Dollars in Thousands, Except Per Share Data)

(Unaudited)

| | | Three Months Ended September 30, | | Nine Months Ended September 30, | | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2022 | | 2021 | | 2022 | | 2021 | | 2023 | | 2022 | | 2023 | | 2022 |

| Property and other revenues | Property and other revenues | | | | | | | | | Property and other revenues | | | | | | | |

| Resident fee income | Resident fee income | | $ | 11,274 | | | $ | 27,370 | | | $ | 32,987 | | | $ | 83,906 | | Resident fee income | $ | 11,966 | | | $ | 11,274 | | | $ | 35,655 | | | $ | 32,987 | |

| Rental income | Rental income | | 36,165 | | | 37,006 | | | 103,001 | | | 101,669 | | Rental income | 40,330 | | | 36,165 | | | 115,897 | | | 103,001 | |

| Other revenue | Other revenue | | 300 | | | 38 | | | 457 | | | 80 | | Other revenue | 1,078 | | | 300 | | | 2,893 | | | 457 | |

| Total property and other revenues | Total property and other revenues | | 47,739 | | | 64,414 | | | 136,445 | | | 185,655 | | Total property and other revenues | 53,374 | | | 47,739 | | | 154,445 | | | 136,445 | |

| Interest income | | |

| Interest income on debt investments | | — | | | 1,067 | | | — | | | 4,667 | | |

| | Expenses | Expenses | | Expenses | |

| Property operating expenses | Property operating expenses | | 35,134 | | | 45,784 | | | 101,258 | | | 136,503 | | Property operating expenses | 36,890 | | | 35,134 | | | 106,993 | | | 101,258 | |

| Interest expense | Interest expense | | 11,014 | | | 15,780 | | | 31,877 | | | 47,767 | | Interest expense | 14,250 | | | 11,014 | | | 37,143 | | | 31,877 | |

| Transaction costs | Transaction costs | | 857 | | | — | | | 857 | | | 54 | | Transaction costs | 358 | | | 857 | | | 455 | | | 857 | |

| Asset management fees - related party | Asset management fees - related party | | 2,428 | | | 2,769 | | | 7,532 | | | 8,307 | | Asset management fees - related party | — | | | 2,428 | | | — | | | 7,532 | |

| General and administrative expenses | General and administrative expenses | | 2,859 | | | 2,432 | | | 10,300 | | | 8,544 | | General and administrative expenses | 2,921 | | | 2,859 | | | 10,424 | | | 10,300 | |

| Depreciation and amortization | Depreciation and amortization | | 9,642 | | | 13,828 | | | 29,105 | | | 44,772 | | Depreciation and amortization | 9,848 | | | 9,642 | | | 29,305 | | | 29,105 | |

| Impairment loss | Impairment loss | | 18,500 | | | 4,600 | | | 31,502 | | | 5,386 | | Impairment loss | — | | | 18,500 | | | 43,422 | | | 31,502 | |

| Total expenses | Total expenses | | 80,434 | | | 85,193 | | | 212,431 | | | 251,333 | | Total expenses | 64,267 | | | 80,434 | | | 227,742 | | | 212,431 | |

| Other income (loss) | Other income (loss) | | Other income (loss) | |

| Other income, net | Other income, net | | — | | | — | | | 77 | | | 6,892 | | Other income, net | — | | | — | | | 202 | | | 77 | |

| Realized gain (loss) on investments and other | | 325 | | | 75 | | | 660 | | | 7,479 | | |

| Gain (loss) on investments and other | | Gain (loss) on investments and other | (347) | | | 325 | | | (4,662) | | | 660 | |

| Income (loss) before equity in earnings (losses) of unconsolidated ventures and income tax expense | Income (loss) before equity in earnings (losses) of unconsolidated ventures and income tax expense | | (32,370) | | | (19,637) | | | (75,249) | | | (46,640) | | Income (loss) before equity in earnings (losses) of unconsolidated ventures and income tax expense | (11,240) | | | (32,370) | | | (77,757) | | | (75,249) | |

| Equity in earnings (losses) of unconsolidated ventures | Equity in earnings (losses) of unconsolidated ventures | | 2,872 | | | 7,943 | | | 39,427 | | | 17,819 | | Equity in earnings (losses) of unconsolidated ventures | (127) | | | 2,872 | | | (6,595) | | | 39,427 | |

| Income tax expense | Income tax expense | | (15) | | | (59) | | | (45) | | | (85) | | Income tax expense | (17) | | | (15) | | | (43) | | | (45) | |

| Net income (loss) | Net income (loss) | | (29,513) | | | (11,753) | | | (35,867) | | | (28,906) | | Net income (loss) | (11,384) | | | (29,513) | | | (84,395) | | | (35,867) | |

| Net (income) loss attributable to non-controlling interests | Net (income) loss attributable to non-controlling interests | | 73 | | | 100 | | | 298 | | | (73) | | Net (income) loss attributable to non-controlling interests | 166 | | | 73 | | | 1,470 | | | 298 | |

| Net income (loss) attributable to NorthStar Healthcare Income, Inc. common stockholders | Net income (loss) attributable to NorthStar Healthcare Income, Inc. common stockholders | | $ | (29,440) | | | $ | (11,653) | | | $ | (35,569) | | | $ | (28,979) | | Net income (loss) attributable to NorthStar Healthcare Income, Inc. common stockholders | $ | (11,218) | | | $ | (29,440) | | | $ | (82,925) | | | $ | (35,569) | |

Net income (loss) per share of common stock, basic/diluted(1) | Net income (loss) per share of common stock, basic/diluted(1) | | $ | (0.15) | | | $ | (0.06) | | | $ | (0.18) | | | $ | (0.15) | | Net income (loss) per share of common stock, basic/diluted(1) | $ | (0.06) | | | $ | (0.15) | | | $ | (0.43) | | | $ | (0.18) | |

Weighted average number of shares of common stock outstanding, basic/diluted(1) | Weighted average number of shares of common stock outstanding, basic/diluted(1) | | 194,670,948 | | | 191,937,161 | | | 194,032,819 | | | 191,285,186 | | Weighted average number of shares of common stock outstanding, basic/diluted(1) | 185,712,103 | | | 194,670,948 | | | 191,367,117 | | | 194,032,819 | |

| Distributions declared per share of common stock | Distributions declared per share of common stock | | $ | — | | | $ | — | | | $ | 0.50 | | | $ | — | | Distributions declared per share of common stock | $ | — | | | $ | — | | | $ | — | | | $ | 0.50 | |

(1) The Company issued 49,872203,742 and 66,840116,712 restricted stock units during the nine months endedas of September 30, 2023 and September 30, 2022, and 2021, respectively. The impact of the restricted stock units onhave been excluded from the diluted earnings per share calculation as their impact is de minimis foranti-dilutive due to the net loss generated during the three and nine months ended September 30, 20222023 and 2021.

Refer to accompanying notes to consolidated financial statements (unaudited).

NORTHSTAR HEALTHCARE INCOME, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS)

(Dollars in Thousands)

(Unaudited)

| | | Three Months Ended September 30, | | Nine Months Ended September 30, | | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2022 | | 2021 | | 2022 | | 2021 | | 2023 | | 2022 | | 2023 | | 2022 |

| Net income (loss) | Net income (loss) | | $ | (29,513) | | | $ | (11,753) | | | $ | (35,867) | | | $ | (28,906) | | Net income (loss) | | $ | (11,384) | | | $ | (29,513) | | | $ | (84,395) | | | $ | (35,867) | |

| Other comprehensive income (loss) | Other comprehensive income (loss) | | Other comprehensive income (loss) | |

| Foreign currency translation adjustments related to investment in unconsolidated venture | Foreign currency translation adjustments related to investment in unconsolidated venture | | (1,664) | | | (671) | | | (4,602) | | | (1,253) | | Foreign currency translation adjustments related to investment in unconsolidated venture | | — | | | (1,664) | | | 3,679 | | | (4,602) | |

| Total other comprehensive income (loss) | Total other comprehensive income (loss) | | (1,664) | | | (671) | | | (4,602) | | | (1,253) | | Total other comprehensive income (loss) | | — | | | (1,664) | | | 3,679 | | | (4,602) | |

| Comprehensive income (loss) | Comprehensive income (loss) | | (31,177) | | | (12,424) | | | (40,469) | | | (30,159) | | Comprehensive income (loss) | | (11,384) | | | (31,177) | | | (80,716) | | | (40,469) | |

| Comprehensive (income) loss attributable to non-controlling interests | Comprehensive (income) loss attributable to non-controlling interests | | 73 | | | 100 | | | 298 | | | (73) | | Comprehensive (income) loss attributable to non-controlling interests | | 166 | | | 73 | | | 1,470 | | | 298 | |

| Comprehensive income (loss) attributable to NorthStar Healthcare Income, Inc. common stockholders | Comprehensive income (loss) attributable to NorthStar Healthcare Income, Inc. common stockholders | | $ | (31,104) | | | $ | (12,324) | | | $ | (40,171) | | | $ | (30,232) | | Comprehensive income (loss) attributable to NorthStar Healthcare Income, Inc. common stockholders | | $ | (11,218) | | | $ | (31,104) | | | $ | (79,246) | | | $ | (40,171) | |

Refer to accompanying notes to consolidated financial statements (unaudited).

NORTHSTAR HEALTHCARE INCOME, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF EQUITY

(Dollars and Shares in Thousands)

| | | Common Stock | | Additional Paid-in Capital | | Retained Earnings (Accumulated Deficit) | | Accumulated Other Comprehensive Income (Loss) | | Total Company’s Stockholders’ Equity | | Non-controlling Interests | | Total Equity | | Common Stock | | Additional Paid-in Capital | | Retained Earnings (Accumulated Deficit) | | Accumulated Other Comprehensive Income (Loss) | | Total Company’s Stockholders’ Equity | | Non-controlling Interests | | Total Equity |

| | Shares | | Amount | | | Shares | | Amount | |

| Balance as of December 31, 2020 | 190,409 | | | $ | 1,904 | | | $ | 1,710,023 | | | $ | (1,302,755) | | | $ | 467 | | | $ | 409,639 | | | $ | 2,423 | | | $ | 412,062 | | |

| Balance as of December 31, 2021 | | Balance as of December 31, 2021 | 193,121 | | | $ | 1,930 | | | $ | 1,720,719 | | | $ | (1,277,688) | | | $ | (486) | | | $ | 444,475 | | | $ | 2,343 | | | $ | 446,818 | |

| Share-based payment of advisor asset management fees | Share-based payment of advisor asset management fees | 643 | | | 6 | | | 2,494 | | | — | | | — | | | 2,500 | | | — | | | 2,500 | | Share-based payment of advisor asset management fees | 698 | | | 7 | | | 2,722 | | | — | | | — | | | 2,729 | | | — | | | 2,729 | |

| Amortization of equity-based compensation | Amortization of equity-based compensation | — | | | — | | | 46 | | | — | | | — | | | 46 | | | — | | | 46 | | Amortization of equity-based compensation | — | | | — | | | 15 | | | — | | | — | | | 15 | | | — | | | 15 | |

| Non-controlling interests - contributions | Non-controlling interests - contributions | — | | | — | | | — | | | — | | | — | | | — | | | 240 | | | 240 | | Non-controlling interests - contributions | — | | | — | | | — | | | — | | | — | | | — | | | 64 | | | 64 | |

| Non-controlling interests - distributions | Non-controlling interests - distributions | — | | | — | | | — | | | — | | | — | | | — | | | (350) | | | (350) | | Non-controlling interests - distributions | — | | | — | | | — | | | — | | | — | | | — | | | (53) | | | (53) | |

| Other comprehensive income (loss) | Other comprehensive income (loss) | — | | | — | | | — | | | — | | | (474) | | | (474) | | | — | | | (474) | | Other comprehensive income (loss) | — | | | — | | | — | | | — | | | (568) | | | (568) | | | — | | | (568) | |

| Net income (loss) | Net income (loss) | — | | | — | | | — | | | (10,463) | | | — | | | (10,463) | | | 308 | | | (10,155) | | Net income (loss) | — | | | — | | | — | | | (12,936) | | | — | | | (12,936) | | | (45) | | | (12,981) | |

| Balance as of March 31, 2021 (Unaudited) | 191,052 | | | $ | 1,910 | | | $ | 1,712,563 | | | $ | (1,313,218) | | | $ | (7) | | | $ | 401,248 | | | $ | 2,621 | | | $ | 403,869 | | |

| Balance as of March 31, 2022 (Unaudited) | | Balance as of March 31, 2022 (Unaudited) | 193,819 | | | $ | 1,937 | | | $ | 1,723,456 | | | $ | (1,290,624) | | | $ | (1,054) | | | $ | 433,715 | | | $ | 2,309 | | | $ | 436,024 | |

| Share-based payment of advisor asset management fees | Share-based payment of advisor asset management fees | 643 | | | 6 | | | 2,494 | | | — | | | — | | | 2,500 | | | — | | | 2,500 | | Share-based payment of advisor asset management fees | 637 | | | 8 | | | 2,507 | | | — | | | — | | | 2,515 | | | — | | | 2,515 | |

| Amortization of equity-based compensation | Amortization of equity-based compensation | — | | | — | | | 73 | | | — | | | — | | | 73 | | | — | | | 73 | | Amortization of equity-based compensation | — | | | — | | | 13 | | | — | | | — | | | 13 | | | — | | | 13 | |

| Non-controlling interests - contributions | Non-controlling interests - contributions | — | | | — | | | — | | | — | | | — | | | — | | | 146 | | | 146 | | Non-controlling interests - contributions | — | | | — | | | — | | | — | | | — | | | — | | | 113 | | | 113 | |

| Non-controlling interests - distributions | Non-controlling interests - distributions | — | | | — | | | — | | | — | | | — | | | — | | | (33) | | | (33) | | Non-controlling interests - distributions | — | | | — | | | — | | | — | | | — | | | — | | | (61) | | | (61) | |

| Distributions declared | | Distributions declared | — | | | — | | | — | | | (97,052) | | | — | | | (97,052) | | | — | | | (97,052) | |

| Other comprehensive income (loss) | Other comprehensive income (loss) | — | | | — | | | — | | | — | | | (108) | | | (108) | | | — | | | (108) | | Other comprehensive income (loss) | — | | | — | | | — | | | — | | | (2,370) | | | (2,370) | | | — | | | (2,370) | |

| Net income (loss) | Net income (loss) | — | | | — | | | — | | | (6,863) | | | — | | | (6,863) | | | (135) | | | (6,998) | | Net income (loss) | — | | | — | | | — | | | 6,807 | | | — | | | 6,807 | | | (180) | | | 6,627 | |

| Balance as of June 30, 2021 (Unaudited) | 191,695 | | | $ | 1,916 | | | $ | 1,715,130 | | | $ | (1,320,081) | | | $ | (115) | | | $ | 396,850 | | | $ | 2,599 | | | $ | 399,449 | | |

| Balance as of June 30, 2022 (Unaudited) | | Balance as of June 30, 2022 (Unaudited) | 194,456 | | | $ | 1,945 | | | $ | 1,725,976 | | | $ | (1,380,869) | | | $ | (3,424) | | | $ | 343,628 | | | $ | 2,181 | | | $ | 345,809 | |

| Share-based payment of advisor asset management fees | Share-based payment of advisor asset management fees | 712 | | | 7 | | | 2,762 | | | — | | | — | | | 2,769 | | | — | | | 2,769 | | Share-based payment of advisor asset management fees | 623 | | | 6 | | | 2,407 | | | — | | | — | | | 2,413 | | | — | | | 2,413 | |

| Amortization of equity-based compensation | — | | | — | | | 23 | | | — | | | — | | | 23 | | | — | | | 23 | | |

| | Non-controlling interests - contributions | Non-controlling interests - contributions | — | | | — | | | — | | | — | | | — | | | — | | | 259 | | | 259 | | Non-controlling interests - contributions | — | | | — | | | — | | | — | | | — | | | — | | | 86 | | | 86 | |

| Non-controlling interests - distributions | Non-controlling interests - distributions | — | | | — | | | — | | | — | | | — | | | — | | | (45) | | | (45) | | Non-controlling interests - distributions | — | | | — | | | — | | | — | | | — | | | — | | | (74) | | | (74) | |

| | Other comprehensive income (loss) | Other comprehensive income (loss) | — | | | — | | | — | | | — | | | (671) | | | (671) | | | — | | | (671) | | Other comprehensive income (loss) | — | | | — | | | — | | | — | | | (1,664) | | | (1,664) | | | — | | | (1,664) | |

| Net income (loss) | Net income (loss) | — | | | — | | | — | | | (11,653) | | | — | | | (11,653) | | | (100) | | | (11,753) | | Net income (loss) | — | | | — | | | — | | | (29,440) | | | — | | | (29,440) | | | (73) | | | (29,513) | |

| Balance as of September 30, 2021 (Unaudited) | 192,407 | | | $ | 1,923 | | | $ | 1,717,915 | | | $ | (1,331,734) | | | $ | (786) | | | $ | 387,318 | | | $ | 2,713 | | | $ | 390,031 | | |

| Balance as of September 30, 2022 (Unaudited) | | Balance as of September 30, 2022 (Unaudited) | 195,079 | | | $ | 1,951 | | | $ | 1,728,383 | | | $ | (1,410,309) | | | $ | (5,088) | | | $ | 314,937 | | | $ | 2,120 | | | $ | 317,057 | |

Refer to accompanying notes to consolidated financial statements (unaudited).

NORTHSTAR HEALTHCARE INCOME, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF EQUITY

(Dollars and Shares in Thousands)

| | | Common Stock | | Additional Paid-in Capital | | Retained Earnings (Accumulated Deficit) | | Accumulated Other Comprehensive Income (Loss) | | Total Company’s Stockholders’ Equity | | Non-controlling Interests | | Total Equity | | Common Stock | | Additional Paid-in Capital | | Retained Earnings (Accumulated Deficit) | | Accumulated Other Comprehensive Income (Loss) | | Total Company’s Stockholders’ Equity | | Non-controlling Interests | | Total Equity |

| | Shares | | Amount | | | Shares | | Amount | |

| Balance as of December 31, 2021 | 193,121 | | | $ | 1,930 | | | $ | 1,720,719 | | | $ | (1,277,688) | | | $ | (486) | | | $ | 444,475 | | | $ | 2,343 | | | $ | 446,818 | | |

| Share-based payment of advisor asset management fees | 698 | | | 7 | | | 2,722 | | | — | | | — | | | 2,729 | | | — | | | 2,729 | | |

| Amortization of equity-based compensation | — | | | — | | | 15 | | | — | | | — | | | 15 | | | — | | | 15 | | |

| Non-controlling interests - contributions | — | | | — | | | — | | | — | | | — | | | — | | | 64 | | | 64 | | |

| Non-controlling interests - distributions | — | | | — | | | — | | | — | | | — | | | — | | | (53) | | | (53) | | |

| Other comprehensive income (loss) | — | | | — | | | — | | | — | | | (568) | | | (568) | | | — | | | (568) | | |

| Net income (loss) | — | | | — | | | — | | | (12,936) | | | — | | | (12,936) | | | (45) | | | (12,981) | | |

| Balance as of March 31, 2022 (Unaudited) | 193,819 | | | $ | 1,937 | | | $ | 1,723,456 | | | $ | (1,290,624) | | | $ | (1,054) | | | $ | 433,715 | | | $ | 2,309 | | | $ | 436,024 | | |

| Share-based payment of advisor asset management fees | 637 | | | 8 | | | 2,507 | | | — | | | — | | | 2,515 | | | — | | | 2,515 | | |

| Amortization of equity-based compensation | — | | | — | | | 13 | | | — | | | — | | | 13 | | | — | | | 13 | | |

| Non-controlling interests - contributions | — | | | — | | | — | | | — | | | — | | | — | | | 113 | | | 113 | | |

| Non-controlling interests - distributions | — | | | — | | | — | | | — | | | — | | | — | | | (61) | | | (61) | | |

| Balance as of December 31, 2022 | | Balance as of December 31, 2022 | 195,422 | | | $ | 1,954 | | | $ | 1,729,589 | | | $ | (1,428,840) | | | $ | (3,679) | | | $ | 299,024 | | | $ | 2,048 | | | $ | 301,072 | |

| | Distributions declared | — | | | — | | | — | | | (97,052) | | | — | | | (97,052) | | | — | | | (97,052) | | |

| | Other comprehensive income (loss) | — | | | — | | | — | | | — | | | (2,370) | | | (2,370) | | | — | | | (2,370) | | |

| Net income (loss) | — | | | — | | | — | | | 6,807 | | | — | | | 6,807 | | | (180) | | | 6,627 | | |

| Balance as of June 30, 2022 (Unaudited) | 194,456 | | | $ | 1,945 | | | $ | 1,725,976 | | | $ | (1,380,869) | | | $ | (3,424) | | | $ | 343,628 | | | $ | 2,181 | | | $ | 345,809 | | |

| Share-based payment of advisor asset management fees | 623 | | | 6 | | | 2,407 | | | — | | | — | | | 2,413 | | | — | | | 2,413 | | |

| | Non-controlling interests - contributions | Non-controlling interests - contributions | — | | | — | | | — | | | — | | | — | | | — | | | 86 | | | 86 | | Non-controlling interests - contributions | — | | | — | | | — | | | — | | | — | | | — | | | 45 | | | 45 | |

| Non-controlling interests - distributions | Non-controlling interests - distributions | — | | | — | | | — | | | — | | | — | | | — | | | (74) | | | (74) | | Non-controlling interests - distributions | — | | | — | | | — | | | — | | | — | | | — | | | (22) | | | (22) | |

| | Other comprehensive income (loss) | Other comprehensive income (loss) | — | | | — | | | — | | | — | | | (1,664) | | | (1,664) | | | — | | | (1,664) | | Other comprehensive income (loss) | — | | | — | | | — | | | — | | | 1,248 | | | 1,248 | | | — | | | 1,248 | |

| Net income (loss) | Net income (loss) | — | | | — | | | — | | | (29,440) | | | — | | | (29,440) | | | (73) | | | (29,513) | | Net income (loss) | — | | | — | | | — | | | (13,926) | | | — | | | (13,926) | | | (71) | | | (13,997) | |

| Balance as of September 30, 2022 (Unaudited) | 195,079 | | | $ | 1,951 | | | $ | 1,728,383 | | | $ | (1,410,309) | | | $ | (5,088) | | | $ | 314,937 | | | $ | 2,120 | | | $ | 317,057 | | |

| Balance as of March 31, 2023 (Unaudited) | | Balance as of March 31, 2023 (Unaudited) | 195,422 | | | $ | 1,954 | | | $ | 1,729,589 | | | $ | (1,442,766) | | | $ | (2,431) | | | $ | 286,346 | | | $ | 2,000 | | | $ | 288,346 | |

| Non-controlling interests - contributions | | Non-controlling interests - contributions | — | | | — | | | — | | | — | | | — | | | — | | | 55 | | | 55 | |

| Non-controlling interests - distributions | | Non-controlling interests - distributions | — | | | — | | | — | | | — | | | — | | | — | | | (33) | | | (33) | |

| Retirement of common stock (Note 8) | | Retirement of common stock (Note 8) | (9,710) | | | (97) | | | (13,302) | | | — | | | — | | | (13,399) | | | — | | | (13,399) | |

| Other comprehensive income (loss) | | Other comprehensive income (loss) | — | | | — | | | — | | | — | | | (844) | | | (844) | | | — | | | (844) | |

Reclassification of accumulated other comprehensive loss(1) | | Reclassification of accumulated other comprehensive loss(1) | — | | | — | | | — | | | — | | | 3,275 | | | 3,275 | | | — | | | 3,275 | |

| Net income (loss) | | Net income (loss) | — | | | — | | | — | | | (57,781) | | | — | | | (57,781) | | | (1,233) | | | (59,014) | |

| Balance as of June 30, 2023 (Unaudited) | | Balance as of June 30, 2023 (Unaudited) | 185,712 | | | $ | 1,857 | | | $ | 1,716,287 | | | $ | (1,500,547) | | | $ | — | | | $ | 217,597 | | | $ | 789 | | | $ | 218,386 | |

| Amortization of equity-based compensation | | Amortization of equity-based compensation | — | | | — | | | 414 | | | — | | | — | | | 414 | | | — | | | 414 | |

| Non-controlling interests - contributions | | Non-controlling interests - contributions | — | | | — | | | — | | | — | | | — | | | — | | | 44 | | | 44 | |

| Non-controlling interests - distributions | | Non-controlling interests - distributions | — | | | — | | | — | | | — | | | — | | | — | | | (28) | | | (28) | |

| | Net income (loss) | | Net income (loss) | — | | | — | | | — | | | (11,218) | | | — | | | (11,218) | | | (166) | | | (11,384) | |

| Balance as of September 30, 2023 (Unaudited) | | Balance as of September 30, 2023 (Unaudited) | 185,712 | | | $ | 1,857 | | | $ | 1,716,701 | | | $ | (1,511,765) | | | $ | — | | | $ | 206,793 | | | $ | 639 | | | $ | 207,432 | |

Refer to accompanying notes to consolidated financial statements (unaudited).

NORTHSTAR HEALTHCARE INCOME, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Dollars in Thousands)

(Unaudited)

| | | | | | | | | | | |

| Nine Months Ended September 30, |

| 2022 | | 2021 |

| Cash flows from operating activities: | | | |

| Net income (loss) | $ | (35,867) | | | $ | (28,906) | |

| Adjustments to reconcile net income (loss) to net cash (used in) provided by operating activities: | | | |

| Equity in (earnings) losses of unconsolidated ventures | (39,427) | | | (17,819) | |

| Depreciation and amortization | 29,105 | | | 44,772 | |

| Impairment loss | 31,502 | | | 5,386 | |

| | | |

| Amortization of below market debt | 2,428 | | | 2,369 | |

| Straight-line rental (income) loss, net | — | | | 7,432 | |

| Amortization of discount/accretion of premium on investments | — | | | (697) | |

| Amortization of deferred financing costs | 475 | | | 1,354 | |

| Amortization of equity-based compensation | 150 | | | 142 | |

| Paid-in-kind interest on real estate debt investment | — | | | (194) | |

| Realized (gain) loss on investments and other | (660) | | | (7,479) | |

| Change in allowance for uncollectible accounts | 326 | | | 108 | |

| Issuance of common stock as payment for asset management fees | 7,532 | | | 7,769 | |

| Changes in assets and liabilities: | | | |

| Receivables | (114) | | | 1,191 | |

| Other assets | 3,583 | | | (7,560) | |

| Due to related party | (3,868) | | | (5,421) | |

| Escrow deposits payable | 256 | | | 1,758 | |

| Accounts payable and accrued expenses | (8,727) | | | (8,866) | |

| Other liabilities | (298) | | | 306 | |

| Net cash (used in) provided by operating activities | (13,604) | | | (4,355) | |

| Cash flows from investing activities: | | | |

| Capital expenditures for operating real estate | (17,924) | | | (17,344) | |

| Sales of operating real estate | — | | | 28,078 | |

| Repayment of real estate debt investment | — | | | 74,376 | |

| Investments in unconsolidated ventures | — | | | (400) | |

| Distributions from unconsolidated ventures | 42,173 | | | 6,971 | |

| Real estate debt investment modification fee | — | | | 686 | |

| | | |

| Net cash provided by (used in) investing activities | 24,249 | | | 92,367 | |

| Cash flows from financing activities: | | | |

| Borrowings from mortgage notes | — | | | 26,000 | |

| Repayments of mortgage notes | (16,514) | | | (61,121) | |

| | | |

| Repayment of borrowings from line of credit - related party | — | | | (35,000) | |

| Payment of deferred financing costs | (36) | | | (708) | |

| | | |

| Payments under finance leases | (408) | | | (446) | |

| | | |

| Distributions paid on common stock | (97,018) | | | — | |

| | | |

| Contributions from non-controlling interests | 263 | | | 645 | |

| Distributions to non-controlling interests | (188) | | | (428) | |

| Net cash (used in) provided by financing activities | (113,901) | | | (71,058) | |

| Net increase (decrease) in cash, cash equivalents and restricted cash | (103,256) | | | 16,954 | |

| Cash, cash equivalents and restricted cash-beginning of period | 210,938 | | | 93,570 | |

| Cash, cash equivalents and restricted cash-end of period | $ | 107,682 | | | $ | 110,524 | |

| | | | | | | | | | | |

| Nine Months Ended September 30, |

| 2023 | | 2022 |

| Cash flows from operating activities: | | | |

| Net income (loss) | $ | (84,395) | | | $ | (35,867) | |

| Adjustments to reconcile net income (loss) to net cash provided by (used in) operating activities: | | | |

| Equity in (earnings) losses of unconsolidated ventures | 6,595 | | | (39,427) | |

| Depreciation and amortization | 29,305 | | | 29,105 | |

| Impairment loss | 43,422 | | | 31,502 | |

| | | |

| Amortization of below market debt | 2,487 | | | 2,428 | |

| | | |

| | | |

| Amortization of deferred financing costs | 988 | | | 475 | |

| Amortization of equity-based compensation | 170 | | | 150 | |

| | | |

| (Gain) loss on investments and other | 4,662 | | | (660) | |

| Change in allowance for uncollectible accounts | 360 | | | 326 | |

| Issuance of common stock as payment for asset management fees | — | | | 7,532 | |

| Distributions from unconsolidated ventures | 10,640 | | | — | |

| Changes in assets and liabilities: | | | |

| Receivables | 203 | | | (114) | |

| Other assets | (3,786) | | | 3,583 | |

| Due to related party | (177) | | | (3,868) | |

| Escrow deposits payable | 30 | | | 256 | |

| Accounts payable and accrued expenses | 2,640 | | | (8,727) | |

| Other liabilities | (78) | | | (298) | |

| Net cash provided by (used in) operating activities | 13,066 | | | (13,604) | |

| Cash flows from investing activities: | | | |

| Capital expenditures for operating real estate | (28,425) | | | (17,924) | |

| Sales of real estate | 135 | | | — | |

| | | |

| | | |

| Distributions from unconsolidated ventures | 13,472 | | | 42,173 | |

| | | |

| Sales of other assets | 523 | | | — | |

| Net cash provided by (used in) investing activities | (14,295) | | | 24,249 | |

| Cash flows from financing activities: | | | |

| | | |

| Repayments of mortgage notes | (14,066) | | | (16,514) | |

| Payment of deferred financing costs | (48) | | | — | |

| | | |

| Payments under finance leases | (96) | | | (36) | |

| Acquisition and retirement of common stock | (1,315) | | | (408) | |

| Distributions paid on common stock | — | | | (97,018) | |

| | | |

| Contributions from non-controlling interests | 144 | | | 263 | |

| Distributions to non-controlling interests | (83) | | | (188) | |

| Net cash provided by (used in) financing activities | (15,464) | | | (113,901) | |

| Net increase (decrease) in cash, cash equivalents and restricted cash | (16,693) | | | (103,256) | |

| Cash, cash equivalents and restricted cash-beginning of period | 115,660 | | | 210,938 | |

| Cash, cash equivalents and restricted cash-end of period | $ | 98,967 | | | $ | 107,682 | |

Refer to accompanying notes to consolidated financial statements (unaudited).

NORTHSTAR HEALTHCARE INCOME, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS (Continued)

(Dollars in Thousands)

| | | Nine Months Ended September 30, | | Nine Months Ended September 30, |

| | 2022 | | 2021 | | 2023 | | 2022 |

| Supplemental disclosure of cash flow information: | Supplemental disclosure of cash flow information: | | | | Supplemental disclosure of cash flow information: | | | |

| Cash paid for interest | Cash paid for interest | $ | 28,625 | | | $ | 50,277 | | Cash paid for interest | $ | 29,666 | | | $ | 28,625 | |

| Cash paid for income taxes | Cash paid for income taxes | 41 | | | 45 | | Cash paid for income taxes | 61 | | | 41 | |

| Supplemental disclosure of non-cash investing and financing activities: | Supplemental disclosure of non-cash investing and financing activities: | | Supplemental disclosure of non-cash investing and financing activities: | |

| Accrued capital expenditures | Accrued capital expenditures | $ | 2,561 | | | $ | 1,391 | | Accrued capital expenditures | $ | 540 | | | $ | 2,561 | |

| Assets acquired under finance leases | — | | | 144 | | |

| Assets acquired under operating leases | — | | | 100 | | |

| Reclassification of assets held for sale | — | | | 488,241 | | |

| | Exchange of ownership interests in unconsolidated ventures for common stock | | Exchange of ownership interests in unconsolidated ventures for common stock | 13,399 | | | — | |

| Assets acquired under capital lease obligations | | Assets acquired under capital lease obligations | 25 | | | — | |

Refer to accompanying notes to consolidated financial statements (unaudited).

NORTHSTAR HEALTHCARE INCOME, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

1. Business and Organization

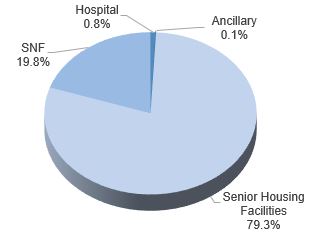

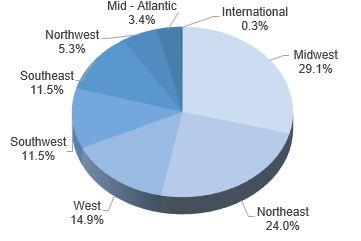

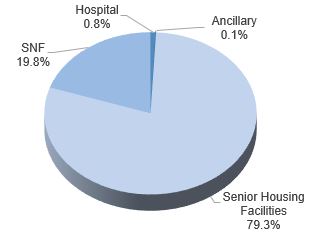

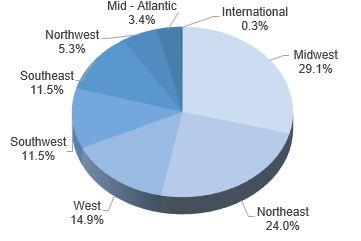

NorthStar Healthcare Income, Inc., together with its consolidated subsidiaries (the “Company”), managesowns a diversified portfolio of investments in healthcare real estate, owned directly or through joint ventures, with a focus on the seniors housing sector, which the Company defines as assisted living (“ALF”), memory care (“MCF”), skilled nursing (“SNF”),properties, including independent living facilities (“ILF”), assisted living (“ALF”) and continuingmemory care retirement communitiesfacilities (“CCRC”MCF”), which have ILF, ALF, SNF, and MCF available on one campus. The located throughout the United States. In addition, the Company is also investedhas investments through non-controlling interests in otherjoint ventures in a broader spectrum of healthcare property types,real estate, including medical office buildingsseniors housing properties, as well as skilled nursing (“MOB”SNF”), hospitals, rehabilitation facilities and ancillary healthcare services businesses. The Company’s investments are predominantly inbusinesses, located throughout the United States, but through a joint venture it also has international investments in the United Kingdom.States.

The Company was formed in October 2010 as a Maryland corporation and commenced operations in February 2013. The Company elected to be taxed as a real estate investment trust (“REIT”) under the Internal Revenue Code of 1986, as amended (the “Internal Revenue Code”), commencing with the taxable year ended December 31, 2013. The Company has conducted its operations, and intends to do so in the future, so as to continue to qualify as a REIT for U.S. federal income tax purposes.

Substantially all of the Company’s business is conducted through NorthStar Healthcare Income Operating Partnership, LP (the “Operating Partnership”). The Company is the sole general partner of the Operating Partnership. The limited partners of the Operating Partnership are NorthStar Healthcare Income Advisor, LLC and NorthStar Healthcare Income OP Holdings, LLC (the “Special Unit Holder”)., which became indirect subsidiaries of the Company on June 9, 2023. NorthStar Healthcare Income Advisor, LLC invested $1,000 in the Operating Partnership in exchange for common units and the Special Unit Holder invested $1,000 in the Operating Partnership and was issued a separate class of limited partnership units (the “Special Units”), which arewere collectively recorded as non-controlling interests on the accompanying consolidated balance sheets as of September 30, 2022 and December 31, 2021.prior to June 9, 2023. As the Company issued shares, it contributed substantially all of the proceeds from its continuous, public offerings to the Operating Partnership as a capital contribution. As of September 30, 2022,2023, the Company’s limited partnership interest in the Operating Partnership, directly or indirectly, was 99.99%100.0%.

The Company’s charter authorizes the issuance of up to 400.0 million shares of common stock with a par value of $0.01 per share and up to 50.0 million shares of preferred stock with a par value of $0.01 per share. The board of directors of the Company is authorized to amend its charter, without the approval of the stockholders, to increase the aggregate number of authorized shares of capital stock or the number of shares of any class or series that the Company has authority to issue.

SinceThe Company raised $2.0 billion in total gross proceeds from the sale of shares of common stock in its continuous, public offerings (the “Offering”), including $232.6 million pursuant to its distribution reinvestment plan (the “DRP”).

The Internalization

From inception through October 21, 2022, the Company was externally managed by CNI NSHC Advisors, LLC or its predecessor (the “Advisor”“Former Advisor”), an affiliate of NRF Holdco, LLC (the “Sponsor”“Former Sponsor”). The Former Advisor was responsible for managing the Company’s operations, subject to the supervision of the Company’s board of directors, pursuant to an advisory agreement. On October 21, 2022, the Company completed the internalization of the Company’s management function (the “Internalization”). In connection with the Internalization, the Company agreed with the Former Advisor to terminate the advisory agreement and arranged for the Former Advisor to continue to provide certain services for a transition period. Going forward, the Company will be self-managed under the leadership of Kendall Young, who was appointed by the board of directors as Chief Executive Officer and President concurrent with the Internalization. Refer to Note 13, “Subsequent Events” for further discussion.

From inception through September 30, 2022, the Company raised $2.0 billion in total gross proceeds from the sale of shares of common stock in its continuous, public offerings (the “Offering”), including $232.6 million pursuant to its distribution reinvestment plan (the “DRP”).

Impact of COVID-19

The Company's healthcare real estate business and investments have been challenged by suboptimal occupancy levels, lower labor force participation rates, which has driven increased labor costs, and inflationary pressures on other operating expenses.

These lasting effects from the response to the coronavirus 2019 (“COVID-19”) pandemic will continue to impact Company’s operational and financial performance. An extended recovery period increases the risk of a prolonged negative impact on the Company’s financial condition and results of operations. While the Company has the ability to meet its near term liquidity needs, general market concerns over credit and liquidity continue, and the effects of COVID-19 may also lead to heightened risk of litigation, with an ensuing increase in litigation and related costs.

NORTHSTAR HEALTHCARE INCOME, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Unaudited)

At this time, the progression of the global economic recovery remains difficult for the Company to assess and estimate the future impact on the Company's results of operations. Accordingly, any estimates as reflected or discussed in these financial statements are based upon the Company's best estimates using information known to the Company as of the date of this Quarterly Report on Form 10-Q, and such estimates may change, the effects of which could be material. The Company will continue to monitor the progression of the economic recovery and reassess its effects on the Company’s results of operations and recoverability of value across its assets as conditions change.

2. Summary of Significant Accounting Policies

Basis of Accounting

The accompanying unaudited consolidated financial statements and related notes of the Company have been prepared in accordance with accounting principles generally accepted in the United States (“U.S. GAAP”) for interim financial reporting and the instructions to Form 10-Q and Rule 10-01 of Regulation S-X. Accordingly, certain information and note disclosures normally included in the consolidated financial statements prepared under U.S. GAAP have been condensed or omitted. In the opinion of management, all adjustments considered necessary for a fair presentation of the Company’s financial position, results of operations and cash flows have been included and are of a normal and recurring nature. The operating results presented for interim periods are not necessarily indicative of the results that may be expected for any other interim period or for the entire year. These consolidated financial statements should be read in conjunction with the Company’s consolidated financial statements and notes thereto included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2021,2022, which was filed with the U.S. Securities and Exchange Commission on March 18, 2022.27, 2023.

NORTHSTAR HEALTHCARE INCOME, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Unaudited)

Principles of Consolidation

The consolidated financial statements include the accounts of the Company, the Operating Partnership and their consolidated subsidiaries. The Company consolidates entities in which it has a controlling financial interest by first considering if an entity meets the definition of a variable interest entity (“VIE”) for which the Company is deemed to be the primary beneficiary or if the Company has the power to control an entity through majority voting interest or other arrangements. All significant intercompany balances are eliminated in consolidation.

Variable Interest Entities

A VIE is an entity that lacks one or more of the characteristics of a voting interest entity. A VIE is defined as an entity in which equity investors do not have the characteristics of a controlling financial interest or do not have sufficient equity at risk for the entity to finance its activities without additional subordinated financial support from other parties. The determination of whether an entity is a VIE includes both a qualitative and quantitative analysis. The Company bases its qualitative analysis on its review of the design of the entity, its organizational structure including decision-making ability and relevant financial agreements and the quantitative analysis on the forecasted cash flow of the entity. The Company reassesses its initial evaluation of an entity as a VIE upon the occurrence of certain reconsideration events.

A VIE must be consolidated only by its primary beneficiary, which is defined as the party who, along with its affiliates and agents, has both the: (i) power to direct the activities that most significantly impact the VIE’s economic performance; and (ii) obligation to absorb the losses of the VIE or the right to receive the benefits from the VIE, which could be significant to the VIE. The Company determines whether it is the primary beneficiary of a VIE by considering qualitative and quantitative factors, including, but not limited to: which activities most significantly impact the VIE’s economic performance and which party controls such activities; the amount and characteristics of its investment; the obligation or likelihood for the Company or other interests to provide financial support; consideration of the VIE’s purpose and design, including the risks the VIE was designed to create and pass through to its variable interest holders and the similarity with and significance to the business activities of the Company and the other interests. The Company reassesses its determination of whether it is the primary beneficiary of a VIE each reporting period. Judgments related to these determinations include estimates about the current and future fair value and performance of investments held by these VIEs and general market conditions.

The Company evaluates its investments and financings, including investments in unconsolidated ventures and securitization financing transactions to determine whether each investment or financing is a VIE. The Company analyzes new investments and financings, as well as reconsideration events for existing investments and financings, which vary depending on type of investment or financing.

NORTHSTAR HEALTHCARE INCOME, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Unaudited)

As of September 30, 2022,2023, the Company has identified certain consolidated and unconsolidated VIEs. Assets of each of the VIEs, other than the Operating Partnership, may only be used to settle obligations of the respective VIE. Creditors of each of the VIEs have no recourse to the general credit of the Company.

Consolidated VIEs

The most significant VIEs of the Company are certain entities that are consolidated VIEs areby the Operating Partnership and certain properties that have non-controlling interests.Partnership. These entities are VIEs because theof non-controlling interests owned by third parties, which do not have substantive kick-out or participating rights. The Operating Partnership consolidates certain properties that have non-controlling interests. Included in operating real estate, net on the Company’s consolidated balance sheet as of September 30, 2022 is $214.2 million related to such consolidated VIEs. Included inand mortgage and other notes payable, net on the Company’s consolidated balance sheet as of September 30, 20222023 is $173.8$170.1 million collateralized by the real estate assets of theand $172.0 million, respectively, related to such consolidated VIEs.

Unconsolidated VIEs

As of September 30, 2022,2023, the Company identified unconsolidated VIEs related to its real estate equity investments in unconsolidated ventures with a carrying value of $205.2$128.0 million. The Company’s maximum exposure to loss as of September 30, 20222023 would not exceed the carrying value of its investment in the VIEs. Based on management’s analysis, theThe Company determined that it is not the primary beneficiary of these VIEs and, accordingly, they are not consolidated in the Company’s financial statements as of September 30, 2022.2023. The Company did not provide financial support to its unconsolidated VIEs during the nine months ended September 30, 2022.2023. As of September 30, 2022,2023, there were no explicit arrangements or implicit variable interests that could require the Company to provide financial support to its unconsolidated VIEs.

Voting Interest Entities

A voting interest entity is an entity in which the total equity investment at risk is sufficient to enable it to finance its activities independently and the equity holders have the power to direct the activities of the entity that most significantly impact its

NORTHSTAR HEALTHCARE INCOME, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Unaudited)

economic performance, the obligation to absorb the losses of the entity and the right to receive the residual returns of the entity. The usual condition for a controlling financial interest in a voting interest entity is ownership of a majority voting interest. If the Company has a majority voting interest in a voting interest entity, the entity will generally be consolidated. The Company does not consolidate a voting interest entity if there are substantive participating rights by other parties and/or kick-out rights by a single party or through a simple majority vote.

The Company performs on-going reassessments of whether entities previously evaluated under the voting interest framework have become VIEs, based on certain events, and therefore subject to the VIE consolidation framework.

Investments in Unconsolidated Ventures

A non-controlling, unconsolidated ownership interest in an entity may be accounted for using the equity method or the Company may elect the fair value option.

The Company will account for an investment under the equity method of accounting if it has the ability to exercise significant influence over the operating and financial policies of an entity, but does not have a controlling financial interest. Under the equity method, the investment is adjusted each period for capital contributions and distributions and its share of the entity’s net income (loss). Capital contributions, distributions and net income (loss) of such entities are recorded in accordance with the terms of the governing documents. An allocation of net income (loss) may differ from the stated ownership percentage interest in such entity as a result of preferred returns and allocation formulas, if any, as described in such governing documents. Equity method investments are recognized using a cost accumulation model, in which the investment is recognized based on the cost to the investor, which includes acquisition fees. The Company records as an expense certain acquisition costs and fees associated with consolidated investments deemed to be business combinations and capitalizes these costs for investments deemed to be acquisitions of an asset, including an equity method investment.

The Company may elect the fair value option of accounting for an investment that would otherwise be accounted for under the equity method. The fair value option election allows an entity to make an irrevocable election of fair value for certain financial assets and liabilities on an instrument-by-instrument basis at the initial or subsequent measurement. The decision to elect the fair value option must be applied to an entire instrument and is irrevocable once elected. Under the fair value option, the Company records its share of the changes to fair value of the investment and any unrealized gains and losses.

On June 30, 2023, the Company elected the fair value option method to account for its investment in the Espresso joint venture, which is included in investments in unconsolidated ventures on the consolidated balance sheets. The fair value election was made based on the Company’s assessment that the expected return of investment was lower than the Company’s carrying value of its investment in the Espresso joint venture, which resulted in an impairment of $4.7 million and reduced the carrying value of its investment to recoverable fair value of $3.1 million as of June 30, 2023. The Company’s assessment for the recoverability of its investment took into consideration the joint venture’s remaining assets and estimated future cash distributions, less transaction and wind down costs. The Company will record any changes to its investment’s fair value in gain (loss) on investments and other in the consolidated statements of operations. During the three months ended September 30, 2023, the Company did not record any changes to the fair value of its investment in the Espresso joint venture. Refer to Note 4 “Investment in Unconsolidated Ventures” and Note 10 “Fair Value” for further discussion.

Non-controlling Interests

A non-controlling interest in a consolidated subsidiary is defined as the portion of the equity (net assets) in a subsidiary not attributable, directly or indirectly, to the Company. A non-controlling interest is required to be presented as a separate component of equity on the consolidated balance sheets and presented separately as net income (loss) and comprehensive income (loss) attributable to controlling and non-controlling interests. An allocation to a non-controlling interest may differ from the stated ownership percentage interest in such entity as a result of a preferred return and allocation formula, if any, as described in such governing documents.

NORTHSTAR HEALTHCARE INCOME, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Unaudited)

Estimates

The preparation of consolidated financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that could affect the amounts reported in the consolidated financial statements and accompanying notes. Actual results could materially differ from those estimates and assumptions. Any estimates of the effects of the COVID-19 pandemic, inflation, rising interest rates, risk of recession and other economic conditions as reflected and/or discussed in these financial statements are based upon the Company's best estimates using information known to the Company as of the date of this Quarterly Report on Form 10-Q. Such estimates may change and the impact of which could be material.

NORTHSTAR HEALTHCARE INCOME, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Unaudited)

Cash, Cash Equivalents and Restricted Cash

The Company considers all highly-liquid investments with an original maturity date of three months or less to be cash equivalents. Cash, including amounts restricted, may at times exceed the Federal Deposit Insurance Corporation deposit insurance limit of $250,000 per institution. The Company mitigates credit risk by placing cash and cash equivalents with major financial institutions.institutions and money market funds invested in short-term U.S. government securities. To date, the Company has not experienced any losses on cash and cash equivalents.

Restricted cash consists of amounts related to operating real estate (escrows for taxes, insurance, capital expenditures, security deposits received from residents and payments required under certain lease agreements) and other escrows required by lenders of the Company’s borrowings.

The following table provides a reconciliation of cash, cash equivalents, and restricted cash as reported on the consolidated balance sheets to the total of such amounts as reported on the consolidated statements of cash flows (dollars in thousands):

| | | September 30, 2022 (Unaudited) | | December 31, 2021 | | September 30, 2023 (Unaudited) | | December 31, 2022 |

| Cash and cash equivalents | Cash and cash equivalents | | $ | 95,145 | | | $ | 200,473 | | Cash and cash equivalents | | $ | 87,581 | | | $ | 103,926 | |

| Restricted cash | Restricted cash | | 12,537 | | | 10,465 | | Restricted cash | | 11,386 | | | 11,734 | |

| Total cash, cash equivalents and restricted cash | Total cash, cash equivalents and restricted cash | | $ | 107,682 | | | $ | 210,938 | | Total cash, cash equivalents and restricted cash | | $ | 98,967 | | | $ | 115,660 | |

Operating Real Estate

Operating real estate is carried at historical cost less accumulated depreciation. Major replacements and betterments which improve or extend the life of the asset are capitalized and depreciated over their useful life. Ordinary repairs and maintenance are expensed as incurred. Operating real estate is depreciated using the straight-line method over the estimated useful life of the assets, summarized as follows:

| | | | | | | | |

| Category: | | Term: |

| Building | | 30 to 50 years |

| Building improvements | | Lesser of the useful life or remaining life of the building |

| Land improvements | | 9 to 15 years |

| Tenant improvements | | Lesser of the useful life or remaining term of the lease |

| Furniture, fixtures and equipment | | 5 to 14 years |

Construction costs incurred in connection with the Company’s investments are capitalized and included in operating real estate, net on the consolidated balance sheets. Construction in progress is not depreciated until the asset is available for its intended use.

Lessee Accounting

A leasing arrangement, a right to control the use of an identified asset for a period of time in exchange for consideration, is classified by the lessee either as a finance lease, which represents a financed purchase of the leased asset, or as an operating lease. For leases with terms greater than 12 months, a lease asset and a lease liability are recognized on the balance sheet at commencement date based on the present value of lease payments over the lease term.

Lease renewal or termination options are included in the lease asset and lease liability only if it is reasonably certain that the option to extend would be exercised or the option to terminate would not be exercised. As the implicit rate in most leases are not readily determinable, the Company’s incremental borrowing rate for each lease at commencement date is used to determine the present value of lease payments. Consideration is given to the Company’s recent debt financing transactions, as well as publicly

NORTHSTAR HEALTHCARE INCOME, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Unaudited)

available data for instruments with similar characteristics, adjusted for the respective lease term, when estimating incremental borrowing rates.

Lease expense is recognized over the lease term based on an effective interest method for finance leases and on a straight-line basis for operating leases.

NORTHSTAR HEALTHCARE INCOME, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Unaudited)

Right of Use (“ROU”) - Finance Assets

The Company has entered into finance leases for equipment which are included in operating real estate, net on the Company’s consolidated balance sheets. As of September 30, 2022,2023, furniture, fixtures and equipment under finance leases totaled $2.5$0.3 million. The leased equipment is amortized on a straight-line basis. Payments for finance leases totaled $0.4$0.1 million and $0.5$0.4 million for the nine months ended September 30, 2023 and 2022, and 2021, respectively, including assets that were disposed of through portfolio sales.respectively.

The following table presents the future minimum lease payments under finance leases and the present value of the minimum lease payments, which are included in other liabilities on the Company’s consolidated balance sheets (dollars in thousands):

| | October 1 through December 31, 2022 | | $ | 69 | | |

| October 1 through December 31, 2023 | | October 1 through December 31, 2023 | | $ | 18 | |

| Years Ending December 31: | Years Ending December 31: | | Years Ending December 31: | |

| 2023 | | 93 | | |

| 2024 | 2024 | | 60 | | 2024 | | 69 | |

| 2025 | 2025 | | 29 | | 2025 | | 38 | |

| 2026 | 2026 | | 24 | | 2026 | | 33 | |

| 2027 | | 2027 | | 18 | |

| Thereafter | Thereafter | | 28 | | Thereafter | | 10 | |

| Total minimum lease payments | Total minimum lease payments | | $ | 303 | | Total minimum lease payments | | $ | 186 | |

| Less: Amount representing interest | Less: Amount representing interest | | (29) | | Less: Amount representing interest | | (27) | |

| Present value of minimum lease payments | Present value of minimum lease payments | | $ | 274 | | Present value of minimum lease payments | | $ | 159 | |

The weighted average interest rate related to the finance lease obligations is 7.2%6.8% with a weighted average lease term of 3.4 years.

As of September 30, 2022,2023, there were no leases that had yet to commence which would create significant rights and obligations to the Company as lessee.

Intangible Assets and Deferred Costs

Deferred Costs

Deferred costs primarily includeconsist of deferred financing costs and deferred leasing costs. Deferred financing costs represent commitment fees, legal and other third-party costs associated with obtaining financing. These costs are recorded against the carrying value of such financing and are amortized to interest expense over the term of the financing using the effective interest method. Unamortized deferred financing costs are expensed to realized gain (loss) on investments and other, when the associated borrowing is repaid before maturity. Costs incurred in seeking financing transactions which do not close are expensed in the period in which it is determined that the financing will not occur. Deferred lease costs consist of fees incurred to initiate and renew operating leases, which are amortized on a straight-line basis over the remaining lease term and are recorded to depreciation and amortization in the consolidated statements of operations.

Identified Intangibles

The Company records acquired identified intangibles, such as the value of in-place leases and other intangibles, based on estimated fair value at the acquisition date. The value allocated to the identified intangibles is amortized over the remaining lease term. In-place leases are amortized into depreciation and amortization expense.

Impairment analysis for identified intangible assets is performed in connection with the impairment assessment of the related operating real estate. An impairment establishes a new basis for the identified intangible asset and any impairment loss recognized is not subject to subsequent reversal. Refer to “—Impairment on Operating Real Estate and Investments in Unconsolidated Ventures” for additional information.

NORTHSTAR HEALTHCARE INCOME, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Unaudited)

Identified intangible assets are recorded in intangible assets, net on the consolidated balance sheets. Intangible assets relate to the Company’s in-place lease values for the Company’s four net lease properties. The following table presents intangible assets, net (dollars in thousands):

| | | September 30, 2022 (Unaudited) | | December 31, 2021 | | September 30, 2023 (Unaudited) | | December 31, 2022 |

| In-place lease value | In-place lease value | | $ | 120,149 | | | $ | 120,149 | | In-place lease value | | $ | 120,149 | | | $ | 120,149 | |

| Less: Accumulated amortization | Less: Accumulated amortization | | (117,812) | | | (117,559) | | Less: Accumulated amortization | | (118,149) | | | (117,896) | |

| Intangible assets, net | Intangible assets, net | | $ | 2,337 | | | $ | 2,590 | | Intangible assets, net | | $ | 2,000 | | | $ | 2,253 | |

The Company recorded $0.1 million and $0.3 million of amortization expense for in-place leases for the three and nine months ended September 30, 2022, respectively. For the three2023 and nine months ended September 30, 2021, amortization expense for in-place leases and deferred costs was $0.3 million and $1.3 million,2022, respectively.

The following table presents future amortization of in-place lease value (dollars in thousands):

| | October 1 through December 31, 2022 | | $ | 84 | | | |

| October 1 through December 31, 2023 | | October 1 through December 31, 2023 | | $ | 84 | | |

| Years Ending December 31: | Years Ending December 31: | | | Years Ending December 31: | | |

| 2023 | | 337 | | | |

| 2024 | 2024 | | 337 | | | 2024 | | 337 | | |

| 2025 | 2025 | | 337 | | | 2025 | | 337 | | |

| 2026 | 2026 | | 337 | | | 2026 | | 337 | | |

| 2027 | | 2027 | | 337 | | |

| Thereafter | Thereafter | | 905 | | | Thereafter | | 568 | | |

| Total | Total | | $ | 2,337 | | | Total | | $ | 2,000 | | |

Derivative Instruments

The Company uses derivative instruments to manage its interest rate risk. The Company’s derivative instruments are recorded at fair value. The accounting for changes in fair value of derivatives depends upon whether or not the Company has elected to designate the derivative in a hedging relationship and the derivative qualifies for hedge accounting. Under hedge accounting, changes in fair value for derivatives are recorded through other comprehensive income. When hedge accounting is not elected, changes in fair value for derivatives are recorded through the income statement.

The Company has interest rate caps that have not been designated for hedge accounting. The fair value of the Company's interest rate caps totaled $0.8 million and $0.7 million as of September 30, 2023 and December 31, 2022, respectively, and are included in other assets on the consolidated balance sheets. Changes in fair value of derivatives have been recorded in gain (loss) on investments and other in the consolidated statements of operations. The Company recognized losses totaling $0.3 million and $0.5 million for the three and nine months ended September 30, 2023, respectively, and gains totaling $0.3 million and $0.6 million for the three and nine months ended September 30, 2022, respectively.

Revenue Recognition

Operating Real Estate

Rental income from operating real estate is derived from leasing of space to healthcare operators and residents, including rent received from the Company’s net lease properties and rent, ancillary service fees and other related revenue earned from ILF residents. Rental income recognition commences when the operator takes legal possession of the leased space and the leased space is substantially ready for its intended use. The leases are for fixed terms of varying length and generally provide for rentals and expense reimbursements to be paid in monthly installments. Rental income from leases, which includes community and move-in fees, is recognized over the term of the respective leases. ILF resident agreements are generally short-term in nature and may allow for termination with 30 days’ notice.

The Company also generates revenue from operating healthcare properties. Revenue related to operating healthcare properties includes resident room and care charges, ancillary fees and other resident service charges. Rent is charged and revenue is recognized when such services are provided, generally defined per the resident agreement as of the date upon which a resident occupies a room or uses the services. Resident agreements are generally short-term in nature and may allow for termination with 30 days’ notice. Revenue derived from our ALFs MCFs and CCRCsMCFs is recorded in resident fee income in the consolidated statements of operations.

NORTHSTAR HEALTHCARE INCOME, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Unaudited)

Revenue from operators and residents is recognized at lease commencement only to the extent collection is expected to be probable. This assessment is based on several qualitative and quantitative factors, including and as appropriate, the payment history, ability to satisfy its lease obligations, the value of the underlying collateral or deposit, if any, and current economic conditions. If collection is assessed to not be probable, thereafter lease income recognized is limited to amounts collected, with the reversal of any revenue recognized to date in excess of amounts received. If collection is subsequently reassessed to be probable, revenue is adjusted to reflect the amount that would have been recognized had collection always been assessed as probable.

The operator of the Company’s remaining four net lease properties failed to remit contractual monthly rent obligations and the Company deemed it not probable that these obligations will be satisfied in the foreseeable future. On March 27, 2023, the Company entered into a lease forbearance and modification agreement (the “Forbearance Agreement”) with the existing operator, pursuant to which, among other things, the Company will be entitled to receive all cash flow in excess of permitted expenses, and be required to fund any operating deficits, through 2025, subject to the terms and conditions thereof. For the three and nine months ended September 30, 2022,2023, the Company received excess cash flow of $0.8 million and $1.2 million, respectively, which was recorded as rental income to the extent rental payments were received.income.

For the three months ended September 30, 20222023 and 2021,2022, total property and other revenues includes variable lease revenue of $2.1$3.6 million and $3.5$2.1 million, respectively. For the nine months ended September 30, 20222023 and 2021,2022, total property and other

NORTHSTAR HEALTHCARE INCOME, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Unaudited)

revenue includes variable lease revenue of $9.2$10.7 million and $10.1$9.2 million, respectively. Variable lease revenue includes ancillary services provided to operator/residents, as well as non-recurring services and fees at the Company’s operating facilities.