UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

| | | | | |

| x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended SeptemberJune 30, 20212022

OR

| | | | | |

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number: 001-35355

_____________________________________________________________

MANNING & NAPIER, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | |

| Delaware | | 45-2609100 |

(State or other jurisdiction of

incorporation or organization) | | (I.R.S. Employer

Identification No.) |

| |

| 290 Woodcliff Drive | | |

| Fairport, | New York | | 14450 |

| (Address of principal executive offices) | | (Zip Code) |

(585) 325-6880

(Registrant’s telephone number, including area code)

_____________________________________________________________

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Class A common stock, $0.01 par value per share | MN | New York Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act:

| | | | | | | | | | | | | | | | | | | | |

| Large accelerated filer | | ¨ | | Accelerated filerFiler | | ¨

x |

| | | |

| Non-accelerated filer | | x¨ | | Smaller reporting company | | x |

| | | | | | |

| | | | Emerging growth company | | ¨

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date.

| | | | | | | | |

| Class | | Outstanding at November 9, 2021August 4, 2022 |

| Class A common stock, $0.01 par value per share | | 18,465,55419,124,332 |

TABLE OF CONTENTS

| | | | | | | | |

| | | Page |

| Part I | | |

| Item 1. | | |

| | |

| | |

| | |

| | |

| | |

| | |

| Item 2. | | |

| Item 3. | | |

| Item 4. | | |

| | |

| Part II | | |

| Item 1A. | | |

Item 2. | | |

| Item 6. | | |

| | |

| In this Quarterly Report on Form 10-Q, “we”, “our”, “us”, the “Company”, “Manning & Napier” and the “Registrant” refers to Manning & Napier, Inc. and, unless the context otherwise requires, its consolidated direct and indirect subsidiaries and predecessors. | |

PART I—FINANCIAL INFORMATION

Item 1. Financial Statements

Manning & Napier, Inc.

Consolidated Statements of Financial Condition

(U.S. dollars in thousands, except share data)

| | | September 30, 2021 | | December 31, 2020 | | June 30, 2022 | | December 31, 2021 |

| | | | (unaudited) | | | | | (unaudited) | | |

| Assets | Assets | | Assets | |

| Cash and cash equivalents | Cash and cash equivalents | | $ | 64,567 | | | $ | 57,635 | | Cash and cash equivalents | | $ | 61,582 | | | $ | 73,489 | |

| Accounts receivable | Accounts receivable | | 11,101 | | | 11,915 | | Accounts receivable | | 9,499 | | | 13,851 | |

| Investment securities | Investment securities | | 25,091 | | | 23,497 | | Investment securities | | 34,814 | | | 24,608 | |

| Prepaid expenses and other assets | Prepaid expenses and other assets | | 14,686 | | | 15,711 | | Prepaid expenses and other assets | | 14,812 | | | 17,147 | |

| Total current assets | Total current assets | | 115,445 | | | 108,758 | | Total current assets | | 120,707 | | | 129,095 | |

| Property and equipment, net | Property and equipment, net | | 2,475 | | | 3,075 | | Property and equipment, net | | 2,107 | | | 2,109 | |

| Operating lease right-of-use assets | Operating lease right-of-use assets | | 15,017 | | | 16,405 | | Operating lease right-of-use assets | | 12,431 | | | 14,457 | |

| Net deferred tax assets, non-current | Net deferred tax assets, non-current | | 20,231 | | | 19,645 | | Net deferred tax assets, non-current | | 16,785 | | | 17,859 | |

| Goodwill | Goodwill | | 4,829 | | | 4,829 | | Goodwill | | 4,829 | | | 4,829 | |

| Other long-term assets | Other long-term assets | | 3,154 | | | 3,373 | | Other long-term assets | | 2,990 | | | 3,074 | |

| Total assets | Total assets | | $ | 161,151 | | | $ | 156,085 | | Total assets | | $ | 159,849 | | | $ | 171,423 | |

| | Liabilities | Liabilities | | Liabilities | |

| Accounts payable | Accounts payable | | $ | 2,221 | | | $ | 1,787 | | Accounts payable | | $ | 2,067 | | | $ | 1,791 | |

| Accrued expenses and other liabilities | Accrued expenses and other liabilities | | 29,157 | | | 36,439 | | Accrued expenses and other liabilities | | 26,932 | | | 36,388 | |

| Deferred revenue | Deferred revenue | | 13,152 | | | 11,476 | | Deferred revenue | | 11,795 | | | 12,963 | |

| Total current liabilities | Total current liabilities | | 44,530 | | | 49,702 | | Total current liabilities | | 40,794 | | | 51,142 | |

| Operating lease liabilities, non-current | Operating lease liabilities, non-current | | 14,931 | | | 16,646 | | Operating lease liabilities, non-current | | 11,998 | | | 14,226 | |

| Amounts payable under tax receivable agreement, non-current | Amounts payable under tax receivable agreement, non-current | | 15,598 | | | 13,759 | | Amounts payable under tax receivable agreement, non-current | | 13,503 | | | 13,499 | |

| Other long-term liabilities | Other long-term liabilities | | 182 | | | 221 | | Other long-term liabilities | | 151 | | | 155 | |

| Total liabilities | Total liabilities | | 75,241 | | | 80,328 | | Total liabilities | | 66,446 | | | 79,022 | |

| Commitments and contingencies (Note 9) | Commitments and contingencies (Note 9) | | 0 | | 0 | Commitments and contingencies (Note 9) | | 0 | | 0 |

| Shareholders’ equity | Shareholders’ equity | | Shareholders’ equity | |

| Class A common stock, $0.01 par value; 300,000,000 shares authorized; 19,214,559 and 18,465,554 shares issued and outstanding at September 30, 2021, 16,989,943 shares issued and outstanding at December 31, 2020 | | 192 | | | 170 | | |

| Treasury stock, at cost, 749,005 and zero shares at September 30, 2021 and December 31, 2020, respectively | | (5,666) | | | — | | |

| Class A common stock, $0.01 par value; 300,000,000 shares authorized; 19,873,337 and 19,124,332 shares issued and outstanding at June 30, 2022, 19,503,085 and 18,754,080 shares issued and outstanding at December 31, 2021 | | Class A common stock, $0.01 par value; 300,000,000 shares authorized; 19,873,337 and 19,124,332 shares issued and outstanding at June 30, 2022, 19,503,085 and 18,754,080 shares issued and outstanding at December 31, 2021 | | 199 | | | 195 | |

| Treasury stock, at cost, 749,005 shares at June 30, 2022 and December 31, 2021 | | Treasury stock, at cost, 749,005 shares at June 30, 2022 and December 31, 2021 | | (5,666) | | | (5,666) | |

| Additional paid-in capital | Additional paid-in capital | | 104,954 | | | 111,848 | | Additional paid-in capital | | 104,062 | | | 104,740 | |

| Retained deficit | Retained deficit | | (12,082) | | | (28,826) | | Retained deficit | | (3,951) | | | (5,569) | |

| Accumulated other comprehensive loss | Accumulated other comprehensive loss | | (315) | | | (235) | | Accumulated other comprehensive loss | | (344) | | | (337) | |

| Total shareholders’ equity | Total shareholders’ equity | | 87,083 | | | 82,957 | | Total shareholders’ equity | | 94,300 | | | 93,363 | |

| Noncontrolling interests | Noncontrolling interests | | (1,173) | | | (7,200) | | Noncontrolling interests | | (897) | | | (962) | |

| Total shareholders’ equity and noncontrolling interests | Total shareholders’ equity and noncontrolling interests | | 85,910 | | | 75,757 | | Total shareholders’ equity and noncontrolling interests | | 93,403 | | | 92,401 | |

| Total liabilities, shareholders’ equity and noncontrolling interests | Total liabilities, shareholders’ equity and noncontrolling interests | | $ | 161,151 | | | $ | 156,085 | | Total liabilities, shareholders’ equity and noncontrolling interests | | $ | 159,849 | | | $ | 171,423 | |

The accompanying notes are an integral part of these consolidated financial statements.

Manning & Napier, Inc.

Consolidated Statements of Operations

(U.S. dollars in thousands, except share data)

(Unaudited)

| | | | | Three months ended September 30, | | Nine months ended September 30, | | | Three months ended June 30, | | Six months ended June 30, |

| | 2021 | | 2020 | | 2021 | | 2020 | | 2022 | | 2021 | | 2022 | | 2021 |

| Revenues | Revenues | | | | | | | | | Revenues | | | | | | | | |

| Management Fees | | |

| Wealth Management | | $ | 16,366 | | | $ | 13,743 | | | $ | 47,825 | | | $ | 41,335 | | |

| Institutional and Intermediary | | 16,209 | | | 13,534 | | | 45,678 | | | 38,255 | | |

| Investment management fees | | Investment management fees | | $ | 29,292 | | | $ | 31,252 | | | $ | 60,119 | | | $ | 60,928 | |

| Distribution and shareholder servicing | Distribution and shareholder servicing | | 2,278 | | | 2,424 | | | 6,667 | | | 7,117 | | Distribution and shareholder servicing | | 1,945 | | | 2,236 | | | 4,027 | | | 4,389 | |

| Custodial services | Custodial services | | 1,759 | | | 1,577 | | | 5,125 | | | 4,639 | | Custodial services | | 1,588 | | | 1,721 | | | 3,265 | | | 3,366 | |

| Other revenue | Other revenue | | 925 | | | 789 | | | 2,470 | | | 2,176 | | Other revenue | | 972 | | | 868 | | | 1,935 | | | 1,545 | |

| Total revenue | Total revenue | | 37,537 | | | 32,067 | | | 107,765 | | | 93,522 | | Total revenue | | 33,797 | | | 36,077 | | | 69,346 | | | 70,228 | |

| Expenses | Expenses | | | | | | | | | Expenses | | | | | | | | |

| Compensation and related costs | Compensation and related costs | | 18,749 | | | 18,605 | | | 55,970 | | | 55,247 | | Compensation and related costs | | 14,542 | | | 18,347 | | | 35,249 | | | 37,221 | |

| Distribution, servicing and custody expenses | Distribution, servicing and custody expenses | | 2,512 | | | 2,596 | | | 7,367 | | | 7,834 | | Distribution, servicing and custody expenses | | 2,177 | | | 2,497 | | | 4,457 | | | 4,855 | |

| Other operating costs | Other operating costs | | 6,970 | | | 6,611 | | | 21,143 | | | 21,197 | | Other operating costs | | 9,973 | | | 7,463 | | | 21,450 | | | 14,173 | |

| Total operating expenses | Total operating expenses | | 28,231 | | | 27,812 | | | 84,480 | | | 84,278 | | Total operating expenses | | 26,692 | | | 28,307 | | | 61,156 | | | 56,249 | |

| Operating income | Operating income | | 9,306 | | | 4,255 | | | 23,285 | | | 9,244 | | Operating income | | 7,105 | | | 7,770 | | | 8,190 | | | 13,979 | |

| Non-operating income (loss) | Non-operating income (loss) | | | | | | | | | Non-operating income (loss) | | | | | | | | |

| Interest expense | Interest expense | | (1) | | | — | | | (4) | | | (5) | | Interest expense | | (2) | | | (1) | | | (3) | | | (3) | |

| Interest and dividend income | Interest and dividend income | | (13) | | | 115 | | | 218 | | | 835 | | Interest and dividend income | | (41) | | | 108 | | | (1) | | | 231 | |

| Change in liability under tax receivable agreement | Change in liability under tax receivable agreement | | — | | | 24 | | | (228) | | | (1,912) | | Change in liability under tax receivable agreement | | 11 | | | (228) | | | 11 | | | (228) | |

| Net gains (losses) on investments | Net gains (losses) on investments | | (59) | | | 411 | | | 655 | | | (5) | | Net gains (losses) on investments | | (2,569) | | | 377 | | | (3,215) | | | 714 | |

| Total non-operating income (loss) | Total non-operating income (loss) | | (73) | | | 550 | | | 641 | | | (1,087) | | Total non-operating income (loss) | | (2,601) | | | 256 | | | (3,208) | | | 714 | |

| Income before provision for (benefit from) income taxes | | 9,233 | | | 4,805 | | | 23,926 | | | 8,157 | | |

| Provision for (benefit from) income taxes | | 2,523 | | | 1,738 | | | 4,511 | | | (28) | | |

| Income before provision for income taxes | | Income before provision for income taxes | | 4,504 | | | 8,026 | | | 4,982 | | | 14,693 | |

| Provision for income taxes | | Provision for income taxes | | 2,064 | | | 1,285 | | | 1,318 | | | 1,988 | |

| Net income attributable to controlling and noncontrolling interests | Net income attributable to controlling and noncontrolling interests | | 6,710 | | | 3,067 | | | 19,415 | | | 8,185 | | Net income attributable to controlling and noncontrolling interests | | 2,440 | | | 6,741 | | | 3,664 | | | 12,705 | |

| Less: net income attributable to noncontrolling interests | Less: net income attributable to noncontrolling interests | | 207 | | | 560 | | | 1,747 | | | 3,274 | | Less: net income attributable to noncontrolling interests | | 96 | | | 816 | | | 134 | | | 1,540 | |

| Net income attributable to Manning & Napier, Inc. | Net income attributable to Manning & Napier, Inc. | | $ | 6,503 | | | $ | 2,507 | | | $ | 17,668 | | | $ | 4,911 | | Net income attributable to Manning & Napier, Inc. | | $ | 2,344 | | | $ | 5,925 | | | $ | 3,530 | | | $ | 11,165 | |

| | Net income per share available to Class A common stock | Net income per share available to Class A common stock | | Net income per share available to Class A common stock | |

| Basic | Basic | | $ | 0.35 | | | $ | 0.15 | | | $ | 1.01 | | | $ | 0.30 | | Basic | | $ | 0.12 | | | $ | 0.35 | | | $ | 0.19 | | | $ | 0.65 | |

| Diluted | Diluted | | $ | 0.29 | | | $ | 0.13�� | | | $ | 0.85 | | | $ | 0.15 | | Diluted | | $ | 0.11 | | | $ | 0.29 | | | $ | 0.16 | | | $ | 0.55 | |

| Weighted average shares of Class A common stock outstanding | Weighted average shares of Class A common stock outstanding | | | | | | | | | Weighted average shares of Class A common stock outstanding | | | | | | | | |

| Basic | Basic | | 18,481,147 | | | 16,176,280 | | | 17,493,299 | | | 16,041,128 | | Basic | | 19,124,332 | | | 16,956,265 | | | 19,056,827 | | | 16,991,188 | |

| Diluted | Diluted | | 22,226,455 | | | 18,928,954 | | | 20,843,170 | | | 48,339,759 | | Diluted | | 21,833,563 | | | 20,314,285 | | | 21,730,594 | | | 20,290,914 | |

The accompanying notes are an integral part of these consolidated financial statements.

Manning & Napier, Inc.

Consolidated Statements of Comprehensive Income

(U.S. dollars in thousands)

(Unaudited)

| | | | | Three months ended September 30, | | Nine months ended September 30, | | | Three months ended June 30, | | Six months ended June 30, |

| | 2021 | | 2020 | | 2021 | | 2020 | | 2022 | | 2021 | | 2022 | | 2021 |

| Net income attributable to controlling and noncontrolling interests | Net income attributable to controlling and noncontrolling interests | | $ | 6,710 | | | $ | 3,067 | | | $ | 19,415 | | | $ | 8,185 | | Net income attributable to controlling and noncontrolling interests | | $ | 2,440 | | | $ | 6,741 | | | $ | 3,664 | | | $ | 12,705 | |

| Net unrealized holding gains (losses) on investment securities, net of tax | Net unrealized holding gains (losses) on investment securities, net of tax | | (34) | | | 6 | | | (87) | | | (243) | | Net unrealized holding gains (losses) on investment securities, net of tax | | 86 | | | (60) | | | (7) | | | (52) | |

| Reclassification adjustment for net realized gains on investment securities included in net income | | (75) | | | — | | | (1) | | | (174) | | |

| Reclassification adjustment for net realized losses on investment securities included in net income | | Reclassification adjustment for net realized losses on investment securities included in net income | | 7 | | | (23) | | | 16 | | | 74 | |

| Comprehensive income | Comprehensive income | | $ | 6,601 | | | $ | 3,073 | | | $ | 19,327 | | | $ | 7,768 | | Comprehensive income | | $ | 2,533 | | | $ | 6,658 | | | $ | 3,673 | | | $ | 12,727 | |

| Less: Comprehensive income attributable to noncontrolling interests | Less: Comprehensive income attributable to noncontrolling interests | | 130 | | | 639 | | | 1,739 | | | 2,992 | | Less: Comprehensive income attributable to noncontrolling interests | | 105 | | | 789 | | | 150 | | | 1,611 | |

| Comprehensive income attributable to Manning & Napier, Inc. | Comprehensive income attributable to Manning & Napier, Inc. | | $ | 6,471 | | | $ | 2,434 | | | $ | 17,588 | | | $ | 4,776 | | Comprehensive income attributable to Manning & Napier, Inc. | | $ | 2,428 | | | $ | 5,869 | | | $ | 3,523 | | | $ | 11,116 | |

The accompanying notes are an integral part of these consolidated financial statements.

Manning & Napier, Inc.

Consolidated Statements of Shareholders’ Equity

(U.S. dollars in thousands, except share data)

(Unaudited)

| | | | | Common Stock – Class A | | Treasury Stock | | Additional

Paid in Capital | | Retained

Deficit | | Accumulated

Other

Comprehensive Income (Loss) | | Non

Controlling

Interests | | | | Common Stock – Class A | | Treasury Stock | | Additional

Paid in Capital | | Retained

Deficit | | Accumulated

Other

Comprehensive Income (Loss) | | Non

Controlling

Interests | | |

| | Shares | | Amount | | Shares | | Amount | | Total | | Shares | | Amount | | Shares | | Amount | | Total |

| Three months ended September 30, 2021 | | | | | | | | | | | | | | | | | | |

| Balance—June 30, 2021 | 18,493,570 | | | $ | 192 | | | 713,665 | | | $ | (5,337) | | | $ | 104,402 | | | $ | (17,661) | | | $ | (284) | | | $ | (1,301) | | | $ | 80,011 | | |

| Three months ended June 30, 2022 | | Three months ended June 30, 2022 | | | | | | | | | | | | | | | | | |

| Balance—March 31, 2022 | | Balance—March 31, 2022 | 19,124,332 | | | $ | 199 | | | 749,005 | | | $ | (5,666) | | | $ | 103,567 | | | $ | (5,339) | | | $ | (428) | | | $ | (962) | | | $ | 91,371 | |

| Net income | | Net income | — | | | — | | | — | | | — | | | — | | | 2,344 | | | — | | | 96 | | | 2,440 | |

| Distributions to noncontrolling interests | | Distributions to noncontrolling interests | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (45) | | | (45) | |

| Net changes in unrealized investment securities gains or losses | | Net changes in unrealized investment securities gains or losses | — | | | — | | | — | | | — | | | — | | | — | | | 84 | | | 2 | | | 86 | |

| | Equity-based compensation | | Equity-based compensation | — | | | — | | | — | | | — | | | 495 | | | — | | | — | | | 12 | | | 507 | |

| Dividends declared on Class A common stock - $0.05 per share | | Dividends declared on Class A common stock - $0.05 per share | — | | | — | | | — | | | — | | | — | | | (956) | | | — | | | — | | | (956) | |

| | Balance—June 30, 2022 | | Balance—June 30, 2022 | 19,124,332 | | | $ | 199 | | | 749,005 | | | $ | (5,666) | | | $ | 104,062 | | | $ | (3,951) | | | $ | (344) | | | $ | (897) | | | $ | 93,403 | |

| | Six months ended June 30, 2022 | | Six months ended June 30, 2022 | |

| Balance—December 31, 2021 | | Balance—December 31, 2021 | 18,754,080 | | | $ | 195 | | | 749,005 | | | $ | (5,666) | | | $ | 104,740 | | | $ | (5,569) | | | $ | (337) | | | $ | (962) | | | $ | 92,401 | |

| Net income | Net income | — | | | — | | | — | | | — | | | — | | | 6,503 | | | — | | | 207 | | | 6,710 | | Net income | — | | | — | | | — | | | — | | | — | | | 3,530 | | | — | | | 134 | | | 3,664 | |

| Distributions to noncontrolling interests | Distributions to noncontrolling interests | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (81) | | | (81) | | Distributions to noncontrolling interests | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (90) | | | (90) | |

| Net changes in unrealized investment securities gains or losses | Net changes in unrealized investment securities gains or losses | — | | | — | | | — | | | — | | | — | | | — | | | (31) | | | (3) | | | (34) | | Net changes in unrealized investment securities gains or losses | — | | | — | | | — | | | — | | | — | | | — | | | (7) | | | — | | | (7) | |

| Common stock issued under equity compensation plan, net of forfeitures | Common stock issued under equity compensation plan, net of forfeitures | 7,324 | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | Common stock issued under equity compensation plan, net of forfeitures | 370,252 | | | 4 | | | — | | | — | | | (4) | | | — | | | — | | | — | | | — | |

| Shares withheld to satisfy tax withholding requirements related to equity awards | Shares withheld to satisfy tax withholding requirements related to equity awards | — | | | — | | | — | | | — | | | 35 | | | — | | | — | | | (77) | | | (42) | | Shares withheld to satisfy tax withholding requirements related to equity awards | — | | | — | | | — | | | — | | | (1,640) | | | — | | | — | | | (38) | | | (1,678) | |

| Equity-based compensation | Equity-based compensation | — | | | — | | | — | | | — | | | 558 | | | — | | | — | | | 82 | | | 640 | | Equity-based compensation | — | | | — | | | — | | | — | | | 1,001 | | | — | | | — | | | 24 | | | 1,025 | |

| Dividends declared on Class A common stock - $0.05 per share | — | | | — | | | — | | | — | | | — | | | (924) | | | — | | | — | | | (924) | | |

| Purchases of treasury stock | (35,340) | | | — | | | 35,340 | | | (329) | | | — | | | — | | | — | | | — | | | (329) | | |

| Cost of issuing common stock | — | | | — | | | — | | | — | | | (41) | | | — | | | — | | | — | | | (41) | | |

| Dividends declared on Class A common stock - $0.10 per share | | Dividends declared on Class A common stock - $0.10 per share | — | | | — | | | — | | | — | | | — | | | (1,912) | | | — | | | — | | | (1,912) | |

| | Balance—September 30, 2021 | 18,465,554 | | | $ | 192 | | | 749,005 | | | $ | (5,666) | | | $ | 104,954 | | | $ | (12,082) | | | $ | (315) | | | $ | (1,173) | | | $ | 85,910 | | |

| Impact of changes in ownership of Manning & Napier Group, LLC (Note 4) | | Impact of changes in ownership of Manning & Napier Group, LLC (Note 4) | — | | | — | | | — | | | — | | | (35) | | | — | | | — | | | 35 | | | — | |

| | Nine months ended September 30, 2021 | | |

| Balance—December 31, 2020 | 16,989,943 | | | $ | 170 | | | — | | | $ | — | | | $ | 111,848 | | | $ | (28,826) | | | $ | (235) | | | $ | (7,200) | | | $ | 75,757 | | |

| Net income | — | | | — | | | — | | | — | | | — | | | 17,668 | | | — | | | 1,747 | | | 19,415 | | |

| Distributions to noncontrolling interests | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (652) | | | (652) | | |

| Net changes in unrealized investment securities gains or losses | — | | | — | | | — | | | — | | | — | | | — | | | (80) | | | (7) | | | (87) | | |

| Common stock issued under equity compensation plan, net of forfeitures | 631,647 | | | 6 | | | — | | | — | | | (6) | | | — | | | — | | | — | | | — | | |

| Shares withheld to satisfy tax withholding requirements related to equity awards | — | | | — | | | — | | | — | | | (4,779) | | | — | | | — | | | (419) | | | (5,198) | | |

| Equity-based compensation | — | | | — | | | — | | | — | | | 2,521 | | | — | | | — | | | 221 | | | 2,742 | | |

| Dividends declared on Class A common stock - $0.05 per share | — | | | — | | | — | | | — | | | — | | | (924) | | | — | | | — | | | (924) | | |

| Cost of issuing common stock | — | | | — | | | — | | | — | | | (97) | | | — | | | — | | | — | | | (97) | | |

| Purchases of treasury stock | (749,005) | | | — | | | 749,005 | | | (5,666) | | | — | | | — | | | — | | | — | | | (5,666) | | |

| Impact of changes in ownership of Manning & Napier Group, LLC (Note 4) | 1,592,969 | | | 16 | | | — | | | — | | | (5,153) | | | — | | | — | | | 5,137 | | | — | | |

| Deferred tax impacts from transactions with shareholders (Note 4) | — | | | — | | | — | | | — | | | 620 | | | — | | | — | | | — | | | 620 | | |

| Balance—September 30, 2021 | 18,465,554 | | | $ | 192 | | | 749,005 | | | $ | (5,666) | | | $ | 104,954 | | | $ | (12,082) | | | $ | (315) | | | $ | (1,173) | | | $ | 85,910 | | |

| Balance—June 30, 2022 | | Balance—June 30, 2022 | 19,124,332 | | | $ | 199 | | | 749,005 | | | $ | (5,666) | | | $ | 104,062 | | | $ | (3,951) | | | $ | (344) | | | $ | (897) | | | $ | 93,403 | |

| | | | Common Stock – Class A | | Treasury Stock | Additional

Paid in Capital | | Retained

Deficit | | Accumulated

Other

Comprehensive Income (Loss) | | Non

Controlling

Interests | | | | Common Stock – Class A | | Treasury Stock | Additional

Paid in Capital | | Retained

Deficit | | Accumulated

Other

Comprehensive Income (Loss) | | Non

Controlling

Interests | | |

| | Shares | | Amount | | Shares | | Amount | | Total | | Shares | | Amount | | Shares | | Amount | | Total |

| Three months ended September 30, 2020 | | | | | | | | | | | | | | | | | | |

| Balance—June 30, 2020 | 16,275,359 | | | $ | 163 | | | $ | — | | | $ | — | | | $ | 112,300 | | | $ | (36,407) | | | $ | (112) | | | $ | (6,852) | | | $ | 69,092 | | |

| Three months ended June 30, 2021 | | Three months ended June 30, 2021 | | | | | | | | | | | | | | | | | |

| Balance—March 31, 2021 | | Balance—March 31, 2021 | 17,010,797 | | | $ | 174 | | | 412,405 | | | $ | (2,987) | | | $ | 110,182 | | | $ | (23,586) | | | $ | (228) | | | $ | (6,785) | | | $ | 76,770 | |

| Net income | | Net income | — | | | — | | | — | | | — | | | — | | | 5,925 | | | — | | | 816 | | | 6,741 | |

| Distributions to noncontrolling interests | | Distributions to noncontrolling interests | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (277) | | | (277) | |

| Net changes in unrealized investment securities gains or losses | | Net changes in unrealized investment securities gains or losses | — | | | — | | | — | | | — | | | — | | | — | | | (56) | | | (4) | | | (60) | |

| Common stock issued under equity compensation plan, net of forfeitures | | Common stock issued under equity compensation plan, net of forfeitures | 191,064 | | | 2 | | | — | | | — | | | (2) | | | — | | | — | | | — | | | — | |

| Shares withheld to satisfy tax withholding requirements related to equity awards | | Shares withheld to satisfy tax withholding requirements related to equity awards | — | | | — | | | — | | | — | | | (2,233) | | | — | | | — | | | (20) | | | (2,253) | |

| Equity-based compensation | | Equity-based compensation | — | | | — | | | — | | | — | | | 872 | | | — | | | — | | | 4 | | | 876 | |

| Purchases of treasury stock | | Purchases of treasury stock | (301,260) | | | — | | | 301,260 | | | (2,350) | | | — | | | — | | | — | | | — | | | (2,350) | |

| | Cost of issuing common stock | | Cost of issuing common stock | — | | | — | | | — | | | — | | | (56) | | | — | | | — | | | — | | | (56) | |

| Impact of changes in ownership of Manning & Napier Group, LLC | | Impact of changes in ownership of Manning & Napier Group, LLC | 1,592.969 | | | 16 | | | — | | | — | | | (4,981) | | | — | | | — | | | 4,965 | | | — | |

| Deferred tax impacts from transactions with shareholders | | Deferred tax impacts from transactions with shareholders | — | | | — | | | — | | | — | | | 620 | | | — | | | — | | | — | | | 620 | |

| Balance—June 30, 2021 | | Balance—June 30, 2021 | 18,493,570 | | | $ | 192 | | | 713,665 | | | (5,337) | | | $ | 104,402 | | | $ | (17,661) | | | $ | (284) | | | $ | (1,301) | | | $ | 80,011 | |

| | Six months ended June 30, 2021 | | Six months ended June 30, 2021 | |

| Balance—December 31, 2020 | | Balance—December 31, 2020 | 16,989,943 | | | $ | 170 | | | — | | | $ | — | | | $ | 111,848 | | | $ | (28,826) | | | $ | (235) | | | $ | (7,200) | | | $ | 75,757 | |

| Net income | Net income | — | | | — | | | — | | | — | | | — | | | 2,507 | | | — | | | 560 | | | 3,067 | | Net income | — | | | — | | | — | | | — | | | — | | | 11,165 | | | — | | | 1,540 | | | 12,705 | |

| Distributions to noncontrolling interests | Distributions to noncontrolling interests | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (177) | | | (177) | | Distributions to noncontrolling interests | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (572) | | | (572) | |

| Net changes in unrealized investment securities gains or losses | Net changes in unrealized investment securities gains or losses | — | | | — | | | — | | | — | | | — | | | — | | | (73) | | | 79 | | | 6 | | Net changes in unrealized investment securities gains or losses | — | | | — | | | — | | | — | | | — | | | — | | | (49) | | | (3) | | | (52) | |

| Common stock issued under equity compensation plan, net of forfeitures | Common stock issued under equity compensation plan, net of forfeitures | 215,473 | | | 2 | | | — | | | — | | | (2) | | | — | | | — | | | — | | | — | | Common stock issued under equity compensation plan, net of forfeitures | 624,323 | | | 6 | | | — | | | — | | | (6) | | | — | | | — | | | — | | | — | |

| Shares withheld to satisfy tax withholding requirements related to equity awards | Shares withheld to satisfy tax withholding requirements related to equity awards | — | | | — | | | — | | | — | | | (565) | | | — | | | — | | | (455) | | | (1,020) | | Shares withheld to satisfy tax withholding requirements related to equity awards | — | | | — | | | — | | | — | | | (4,814) | | | — | | | — | | | (343) | | | (5,157) | |

| Equity-based compensation | Equity-based compensation | — | | | — | | | — | | | — | | | 1,108 | | | — | | | — | | | (278) | | | 830 | | Equity-based compensation | — | | | — | | | — | | | — | | | 1,963 | | | — | | | — | | | 140 | | | 2,103 | |

| | Balance—September 30, 2020 | 16,490,832 | | | $ | 165 | | | — | | | — | | | $ | 112,841 | | | $ | (33,900) | | | $ | (185) | | | $ | (7,123) | | | $ | 71,798 | | |

| | Nine months ended September 30, 2020 | | |

| Balance—December 31, 2019 | 15,956,526 | | | $ | 160 | | | $ | — | | | $ | — | | | $ | 198,516 | | | $ | (38,478) | | | $ | (50) | | | $ | (10,527) | | | $ | 149,621 | | |

| Net income | — | | | — | | | — | | | — | | | — | | | 4,911 | | | — | | | 3,274 | | | 8,185 | | |

| Distributions to noncontrolling interests | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (177) | | | (177) | | |

| Net changes in unrealized investment securities gains or losses | — | | | ��� | | | — | | | — | | | — | | | — | | | (135) | | | (108) | | | (243) | | |

| Common stock issued under equity compensation plan, net of forfeitures | 534,306 | | | 5 | | | — | | | — | | | (5) | | | — | | | — | | | — | | | — | | |

| Shares withheld to satisfy tax withholding requirements related to equity awards | — | | | — | | | — | | | — | | | (565) | | | — | | | — | | | (457) | | | (1,022) | | |

| Equity-based compensation | — | | | — | | | — | | | — | | | 1,630 | | | — | | | — | | | 1,315 | | | 2,945 | | |

| Dividends declared on Class A common stock - $0.02 per share | — | | | — | | | — | | | — | | | — | | | (333) | | | — | | | — | | | (333) | | |

| Cost of issuing common stock | | Cost of issuing common stock | — | | | — | | | — | | | — | | | (56) | | | — | | | — | | | — | | | (56) | |

| Purchases of treasury stock | | Purchases of treasury stock | (713,665) | | | — | | | 713,665 | | | (5,337) | | | — | | | — | | | — | | | — | | | (5,337) | |

| Impact of changes in ownership of Manning & Napier Group, LLC | Impact of changes in ownership of Manning & Napier Group, LLC | — | | | — | | | — | | | — | | | (90,341) | | | — | | | — | | | (443) | | | (90,784) | | Impact of changes in ownership of Manning & Napier Group, LLC | 1,592.969 | | | 16 | | | — | | | — | | | (5,153) | | | — | | | — | | | 5,137 | | | — | |

| Deferred tax impacts from transactions with shareholders | Deferred tax impacts from transactions with shareholders | | 3,606 | | | 3,606 | | Deferred tax impacts from transactions with shareholders | — | | | — | | | — | | | — | | | 620 | | | — | | | — | | | — | | | 620 | |

| Balance—September 30, 2020 | 16,490,832 | | | $ | 165 | | | — | | | $ | — | | | $ | 112,841 | | | $ | (33,900) | | | $ | (185) | | | $ | (7,123) | | | $ | 71,798 | | |

| | Balance—June 30, 2021 | | Balance—June 30, 2021 | 18,493,570 | | | $ | 192 | | | 713,665 | | | $ | (5,337) | | | $ | 104,402 | | | $ | (17,661) | | | $ | (284) | | | $ | (1,301) | | | $ | 80,011 | |

The accompanying notes are an integral part of these consolidated financial statements.

Manning & Napier, Inc.

Consolidated Statements of Cash Flows

(U.S. dollars in thousands)

(Unaudited)

| | | | | Nine months ended September 30, | | | Six months ended June 30, |

| | 2021 | | 2020 | | 2022 | | 2021 |

| Cash flows from operating activities: | Cash flows from operating activities: | | | | | Cash flows from operating activities: | | | | |

| Net income attributable to controlling and noncontrolling interests | Net income attributable to controlling and noncontrolling interests | | $ | 19,415 | | | $ | 8,185 | | Net income attributable to controlling and noncontrolling interests | | $ | 3,664 | | | $ | 12,705 | |

| Adjustment to reconcile net income to net cash provided by operating activities: | Adjustment to reconcile net income to net cash provided by operating activities: | | Adjustment to reconcile net income to net cash provided by operating activities: | |

| Equity-based compensation | Equity-based compensation | | 2,742 | | | 2,945 | | Equity-based compensation | | 1,025 | | | 2,103 | |

| Depreciation and amortization | Depreciation and amortization | | 1,472 | | | 1,147 | | Depreciation and amortization | | 3,252 | | | 909 | |

| Change in amounts payable under tax receivable agreement | Change in amounts payable under tax receivable agreement | | 228 | | | 1,912 | | Change in amounts payable under tax receivable agreement | | (11) | | | 228 | |

| Impairment of long-lived assets | Impairment of long-lived assets | | — | | | 663 | | Impairment of long-lived assets | | 430 | | | — | |

| Gain on sale of intangible assets | | — | | | (21) | | |

| | | Net losses (gains) on investment securities | Net losses (gains) on investment securities | | (655) | | | 5 | | Net losses (gains) on investment securities | | 3,215 | | | (714) | |

| Deferred income taxes | Deferred income taxes | | 1,644 | | | (789) | | Deferred income taxes | | 1,074 | | | 1,240 | |

| (Increase) decrease in operating assets and increase (decrease) in operating liabilities: | (Increase) decrease in operating assets and increase (decrease) in operating liabilities: | | (Increase) decrease in operating assets and increase (decrease) in operating liabilities: | |

| Accounts receivable | Accounts receivable | | 979 | | | (683) | | Accounts receivable | | 4,353 | | | (619) | |

| Prepaid expenses and other assets | Prepaid expenses and other assets | | 386 | | | (3,429) | | Prepaid expenses and other assets | | (441) | | | 1,215 | |

| Other long-term assets | Other long-term assets | | 1,894 | | | 2,450 | | Other long-term assets | | 1,122 | | | 1,261 | |

| Accounts payable | Accounts payable | | 434 | | | 1,112 | | Accounts payable | | 276 | | | 130 | |

| Accrued expenses and other liabilities | Accrued expenses and other liabilities | | (6,667) | | | (165) | | Accrued expenses and other liabilities | | (9,529) | | | (9,226) | |

| Deferred revenue | Deferred revenue | | 1,676 | | | 699 | | Deferred revenue | | (1,168) | | | 1,459 | |

| Other long-term liabilities | Other long-term liabilities | | (2,374) | | | (2,832) | | Other long-term liabilities | | (1,633) | | | (1,434) | |

| Net cash provided by operating activities | Net cash provided by operating activities | | 21,175 | | | 11,199 | | Net cash provided by operating activities | | 5,629 | | | 9,257 | |

| Cash flows from investing activities: | Cash flows from investing activities: | | | | | Cash flows from investing activities: | | | | |

| Purchase of property and equipment | Purchase of property and equipment | | (222) | | | (204) | | Purchase of property and equipment | | (396) | | | (53) | |

| Sale of investments | Sale of investments | | 6,190 | | | 71,310 | | Sale of investments | | 10,958 | | | 5,369 | |

| Purchase of investments | Purchase of investments | | (10,565) | | | (23,250) | | Purchase of investments | | (29,540) | | | (6,157) | |

| Sale of intangible assets | | — | | | 21 | | |

| | | Proceeds from maturity of investments | Proceeds from maturity of investments | | 3,350 | | | 18,720 | | Proceeds from maturity of investments | | 5,155 | | | 1,250 | |

| | Net cash (used in) provided by investing activities | | (1,246) | | | 66,597 | | |

| Net cash provided by (used in) investing activities | | Net cash provided by (used in) investing activities | | (13,823) | | | 409 | |

| Cash flows from financing activities: | Cash flows from financing activities: | | | | | Cash flows from financing activities: | | | | |

| Distributions to noncontrolling interests | Distributions to noncontrolling interests | | (652) | | | (177) | | Distributions to noncontrolling interests | | (90) | | | (572) | |

| Dividends paid on Class A common stock | Dividends paid on Class A common stock | | (924) | | | (645) | | Dividends paid on Class A common stock | | (1,912) | | | — | |

| Payment of shares withheld to satisfy withholding requirements | Payment of shares withheld to satisfy withholding requirements | | (5,644) | | | (1,022) | | Payment of shares withheld to satisfy withholding requirements | | (1,678) | | | (5,602) | |

| Purchases of treasury stock | Purchases of treasury stock | | (5,666) | | | — | | Purchases of treasury stock | | — | | | (5,337) | |

| Payment of capital lease obligations | Payment of capital lease obligations | | (54) | | | (81) | | Payment of capital lease obligations | | (33) | | | (18) | |

| Payment of issuing common stock costs | Payment of issuing common stock costs | | (56) | | | — | | Payment of issuing common stock costs | | — | | | (56) | |

| Purchase of Class A units of Manning & Napier Group, LLC | | — | | | (90,784) | | |

| | | Net cash used in financing activities | Net cash used in financing activities | | (12,997) | | | (92,709) | | Net cash used in financing activities | | (3,713) | | | (11,585) | |

| | Net increase (decrease) in cash and cash equivalents | | 6,932 | | | (14,913) | | |

| Net decrease in cash and cash equivalents | | Net decrease in cash and cash equivalents | | (11,907) | | | (1,919) | |

| Cash and cash equivalents: | Cash and cash equivalents: | | Cash and cash equivalents: | |

| Beginning of period | Beginning of period | | 57,635 | | | 67,088 | | Beginning of period | | 73,489 | | | 57,635 | |

| End of period | End of period | | $ | 64,567 | | | $ | 52,175 | | End of period | | $ | 61,582 | | | $ | 55,716 | |

The accompanying notes are an integral part of these consolidated financial statements.

Manning & Napier, Inc.

Notes to Consolidated Financial Statements

Note 1—Organization and Nature of the Business

Manning & Napier, Inc. ("Manning & Napier" or the "Company") is an independent investment management firm that provides our clients with a broad range of financial solutions and investment strategies. Founded in 1970 and headquartered in Fairport, NY, the Company serves a diversified client base of high-net-worth individuals and institutions, including 401(k) plans, pension plans, Taft-Hartley plans, endowments and foundations. The Company's investment strategies offer equity, fixed income and a range of blended asset portfolios, including life cycle funds.

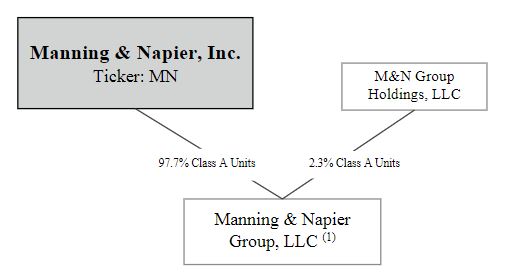

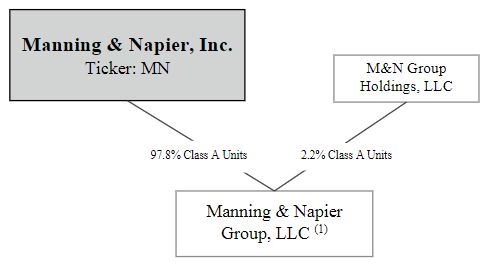

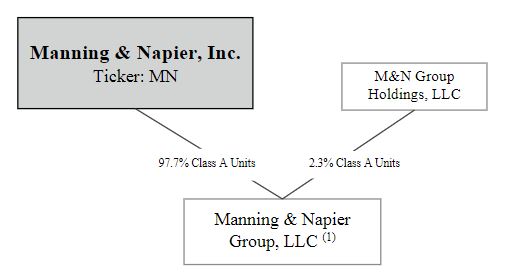

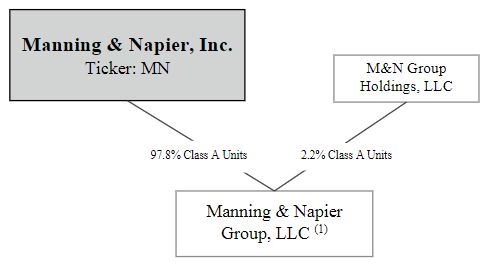

The Company was incorporated in 2011 as a Delaware corporation, and is the sole managing member of Manning & Napier Group, LLC and its subsidiaries (“Manning & Napier Group”), a holding company for the investment management businesses conducted by its operating subsidiaries. The Company completed the exchange of 1,562,959 Class A units held by M&N Group Holdings, LLC ("M&N Group Holdings") and 30,010 Class A units held by Manning & Napier Capital Company, LLC ("MNCC"), the entirety of its ownership in Manning & Napier Group, on June 30, 2021 through the issuance of 1,592,969 shares of unregistered Class A Common Stock of the Company. As a result, Manning & Napier acquired an equivalent number of Class A units of Manning & Napier Group and its ownership of Manning & Napier Group increased from approximately 89.0% to 97.7% (Refer to Note 4 for further discussion). The diagram below depicts the Company's organizational structure as of SeptemberJune 30, 2021.2022.

(1)The consolidated operating subsidiaries of Manning & Napier Group include Manning & Napier Advisors, LLC ("MNA"), Manning & Napier Investor Services, Inc., Exeter Trust Company and Rainier Investment Management, LLC ("Rainier").

Plan of Acquisition by Callodine Group, LLC.

On March 31, 2022, the Company entered into an agreement (the "Merger Agreement") under which the Company will go private and be acquired by Callodine Group, LLC ("Callodine"), with the Company continuing as the surviving corporation (the "Merger").

Pursuant to the Merger Agreement, each outstanding share of common stock of the Company and Manning & Napier Group Holdings outstanding units will be converted into the right to receive from Callodine $12.85 in cash. The Company's shareholders approved the Merger on August 3, 2022. The proposed acquisition is expected to close in the third quarter of 2022, contingent upon customary closing conditions.

Note 2—Summary of Significant Accounting Policies

Critical Accounting Policies

The Company's critical accounting policies and estimates are disclosed in its Annual Report on Form 10-K for the year ended December 31, 2020.2021. The Company believes that the disclosures herein are adequate so that the information presented is not misleading; however, these financial statements should be read in conjunction with the financial statements and the notes thereto in the Company's Annual Report on Form 10-K for the year ended December 31, 2020.2021. The financial data for the interim periods may not necessarily be indicative of results for future interim periods or for the full year.

Basis of Presentation

The accompanying unaudited consolidated financial statements were prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”) and related rules and regulations of the U.S. Securities and

Manning & Napier, Inc.

Notes to Consolidated Financial Statements (Continued)

Exchange Commission (“SEC”) for interim financial reporting and include all adjustments, consisting only of normal recurring adjustments which are, in the opinion of management, necessary for a fair statement of the results for the interim period.

The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates or assumptions that affect the reported amounts and disclosures in the consolidated financial statements. Actual results could differ from these estimates or assumptions.

Manning & Napier, Inc.

Notes to Consolidated Financial Statements (Continued)

Principles of Consolidation

The Company consolidates all majority-owned subsidiaries. As of SeptemberJune 30, 2021,2022, Manning & Napier holds an economic interest of approximately 97.7%97.8% in Manning & Napier Group and, as managing member, controls all of the business and affairs of Manning & Napier Group. As a result, the Company consolidates the financial results of Manning & Napier Group and records a noncontrolling interest on its consolidated statements of financial condition with respect to the remaining economic interest in Manning & Napier Group held by M&N Group Holdings.

All material intercompany transactions have been eliminated in consolidation.

In accordance with Accounting Standards Update ("ASU") 2015-02, Consolidation (Topic 810) – Amendments to the Consolidation Analysis, the determination of whether a company is required to consolidate an entity is based on, among other things, an entity’s purpose and design, a company’s ability to direct the activities of the entity that most significantly impact the entity’s economic performance, and whether a company is obligated to absorb losses or receive benefits that could potentially be significant to the entity. The standard also requires ongoing assessments of whether a company is the primary beneficiary of a variable interest entity (“VIE”). When utilizing the voting interest entity ("VOE") model, controlling financial interest is generally defined as majority ownership of voting interests.

The Company provides seed capital to its investment teams to develop new strategies and services for its clients. The original seed investment may be held in a separately managed account, comprised solely of the Company's investments or within a mutual fund, where the Company's investments may represent all or only a portion of the total equity investment in the mutual fund. Pursuant to U.S. GAAP, the Company evaluates its investments in mutual funds on a regular basis and consolidates such mutual funds for which it holds a controlling financial interest. When no longer deemed to hold a controlling financial interest, the Company would deconsolidate the fund and classify the remaining investment as either an equity method investment, equity investments, at fair value, or as trading securities, as applicable. As of SeptemberJune 30, 20212022 and December 31, 2020,2021, the Company did not have investments classified as an equity method investment.

The Company serves as the investment adviser for Manning & Napier Fund, Inc. series of mutual funds (the “Fund”), Exeter Trust Company Collective Investment Trusts (“CIT”) and Rainier Multiple Investment Trust. The Fund, CIT and Rainier Multiple Investment Trust are legal entities, the business and affairs of which are managed by their respective boards of directors. As a result, each of these entities is a VOE. The Company holds, in limited cases, direct investments in a mutual fund (which are made on the same terms as are available to other investors) and consolidates each of these entities where it has a controlling financial interest or a majority voting interest. The Company's investments in the Fund amounted to approximately $2.0$13.1 million as of SeptemberJune 30, 20212022 and $1.0$1.1 million as of December 31, 2020.2021. As of SeptemberJune 30, 20212022 and December 31, 2020,2021, the Company did not have a controlling financial interest in any mutual fund.

Revenue

Investment Management: Investment management fees are computed as a percentage of assets under management ("AUM"). The Company's performance obligation is a series of services that form part of a single performance obligation satisfied over time.

Separately managed accounts are paid in advance, typically for a semi-annual or quarterly period, or in arrears, typically for a monthly or quarterly period. When investment management fees are paid in advance, the Company defers the revenue as a contract liability and recognizes it over the applicable period. When investment management fees are paid in arrears, the Company estimates revenue and records a contract asset (accrued accounts receivable) based on AUM as of the most recent month end date.

Mutual funds and collective investment trust investment management revenue is calculated and earned daily based on AUM. Revenue is presented net of cash rebates and fees waived pursuant to contractual expense limitations of the funds. The Company also has agreements with third parties who provide recordkeeping and administrative services for employee benefit plans participating in the collective investment trusts. The Company is acting as an agent on behalf of the employee benefit plan sponsors, therefore, investment management revenue is recorded net of fees paid to third party service providers.

Distribution and shareholder servicing: The Company receives distribution and servicing fees for providing services to its affiliated mutual funds. Revenue is computed and earned daily based on a percentage of AUM. The performance obligation is a series of services that form part of a single performance obligation satisfied over time. The Company has agreements with third parties who provide distribution and administrative services for its mutual funds. The agreements are evaluated to determine

Manning & Napier, Inc.

Notes to Consolidated Financial Statements (Continued)

whether revenue should be reported gross or net of payments to third-party service providers. The Company controls the services provided and acts as a principal in the relationship. Therefore, distribution and shareholder servicing revenue is recorded gross of fees paid to third parties.

Custodial services: Custodial service fees are calculated as a percentage of the client’s market value with additional fees charged for certain transactions. For the safeguarding and administrative services that are subject to a percentage of market

Manning & Napier, Inc.

Notes to Consolidated Financial Statements (Continued)

value fee, the Company's performance obligation is a series of services that form part of a single performance obligation satisfied over time. Revenue for transactions assigned a stand-alone selling price is recognized in the period in which the transaction is executed. Custodial service fees are billed monthly in arrears. The Company has agreements with third parties who provide safeguarding, recordkeeping and administrative services for their clients. The Company controls the services provided and acts as a principal in the relationship. Therefore, custodial service revenue is recorded gross of fees paid to third parties.

Cash and Cash Equivalents

The Company generally considers all highly liquid investments with original maturities of three months or less to be cash equivalents. Cash and cash equivalents are primarily held in operating accounts at major financial institutions and also in money market securities. Cash equivalents are stated at cost, which approximates market value due to the short-term maturity of these investments. The fair value of cash equivalents has been classified as Level 1 in accordance with the fair value hierarchy.

Investment Securities

Investment securities are classified as either equity investments, trading, equity method investments or available-for-sale and are carried at fair value. Fair value is determined based on quoted market prices in active markets for identical or similar instruments.

Investment securities classified as equity investments, at fair value consist of equity securities and investments in mutual funds for which the Company provides advisory services. Realized and unrealized gains and losses on equity investments, at fair value or trading securities, as applicable, are recorded in net gains (losses) on investments in the consolidated statements of operations.

Investment securities classified as available-for-sale consist of U.S. Treasury notessecurities and corporate bonds. Unrealized gains and losses on available-for-sale securities are excluded from earnings and are reported, net of deferred income tax, as a separate component of accumulated other comprehensive income in shareholders’ equity until realized. The Company periodically reviews each individual security position that has an unrealized loss, or impairment, to determine if that impairment is other-than-temporary. If impairment is determined to be other-than-temporary, the carrying value of the security will be written down to fair value and the loss will be recognized in earnings. Realized gains and losses on sales of available-for-sale securities are computed on a specific identification basis and are recorded in net gains (losses) on investments in the consolidated statements of operations.

Property, Equipment, Software and Depreciation

Property and equipment is presented net of accumulated depreciation of approximately $12.0$8.9 million and $12.6$8.6 million as of SeptemberJune 30, 20212022 and December 31, 2020,2021, respectively.

Capitalized implementation costs for software hosting arrangements are included within prepaid expenses and other assets on the Company's statements of financial condition and totaled approximately $6.7$5.7 million and $5.3$7.0 million, net of accumulated amortization, as of SeptemberJune 30, 20212022 and December 31, 2020,2021, respectively.

During the six months ended June 30, 2022, the Company recognized a $1.9 million charge for the impairment of certain internal and external costs capitalized in connection with hosted software arrangements, which is reflected within other operating costs in the statements of operations. This impairment charge was recorded subsequent to the Company's determination that portions of a software license agreement with a third-party service provider would be terminated. As such, the Company concluded that capitalized costs associated with the terminated services would not ultimately be completed and placed into service. The Company does not expect to incur future cash expenditures in connection with terminating these services.

Manning & Napier, Inc.

Notes to Consolidated Financial Statements (Continued)

Goodwill and Intangible Assets

Goodwill represents the excess cost over the fair value of the identifiable net assets of acquired companies. Identifiable intangible assets generally represent the cost of client relationships and investment management agreements acquired as well as trademarks. Goodwill and indefinite-lived assets are tested for impairment annually or more frequently if events or circumstances indicate that the carrying value may not be recoverable. Intangible assets subject to amortization are tested for impairment whenever events or circumstances indicate that the carrying value may not be recoverable. Goodwill and intangible assets require significant management estimate and judgment, including the valuation and expected life determination in connection with the initial purchase price allocation and the ongoing evaluation for impairment.

Leases

The Company determines if an arrangement is a lease at inception. Operating leases are included in operating lease right-of-use ("ROU") assets, accrued expenses and other liabilities and operating lease liabilities, non-current on its consolidated statements of financial condition. Finance leases are included in other long-term assets, accrued expenses and other liabilities, and other long-term liabilities on its consolidated statements of financial condition.

ROU assets represent the Company's right to use an underlying asset for the lease term and lease liabilities represent the Company's obligation to make lease payments arising from the lease. Operating lease ROU assets and lease liabilities are recognized at commencement date based on the present value of lease payments over the lease term. As the Company's leases do not provide an implicit rate, the Company uses its incremental borrowing rate based on the information available at commencement date in determining the present value of lease payments. The incremental borrowing rate, for each identified lease, is the rate of interest that the Company would have to pay to borrow on a collateralized basis over a similar term. The

Manning & Napier, Inc.

Notes to Consolidated Financial Statements (Continued)

operating lease ROU asset is reduced for any lease incentives. The Company's lease terms may include options to extend or terminate the lease when it is reasonably certain that it will exercise that option. Lease expense for lease payments is recognized on a straight-line basis over the lease term.

The Company has lease agreements with lease and non-lease components, which are combined for all classes of underlying assets.

Treasury StockImpairment of Long-Lived Assets

On February 3, 2021,The Company reviews the Boardcarrying value of Directors approvedits long-lived assets annually or whenever events or changes in circumstances indicate that the historical cost carrying value of an asset may no longer be appropriate.

The Company entered into a share repurchase program authorizingsublease agreement in the first quarter of 2022 for a portion of the Company's currently occupied office space, triggering a change in the way the leased asset is utilized by the Company. The subleased space was determined to be a separate asset group from the remaining office space leased by the Company, and as such represents a distinct ROU asset and lease liability. The Company assessed recoverability of the asset group by comparing the undiscounted future net cash flows expected to purchase upresult from the asset group to $10.0 millionits carrying value. The carrying value exceeded the undiscounted future net cash flows of Manning & Napier Inc. Class A common shares through December 31, 2021. As of September 30, 2021, the Company had purchased 749,005 shares of Class A common stock forasset, and an aggregate priceimpairment loss of approximately $5.7 million.$0.5 million was recognized during the six months ended June 30, 2022 as the difference between the net book value and the fair value of the asset group.

Treasury Stock

Treasury stock is accounted for under the cost method and is included as a deduction from equity in the Shareholders' Equity section of the consolidated statements of financial condition. Upon any subsequent retirement or resale, the treasury stock account is reduced by the cost of such stock.

Operating Segments

The Company operates in 1 segment, the investment management industry.

Recent Accounting PronouncementsIn December 2019, the

Manning & Napier, Inc.

Notes to Consolidated Financial Accounting Standards Board ("FASB") issued ASU 2019-12, Simplifying the Accounting for Income Taxes, which is intended to simplify various aspects of the income tax accounting guidance, including interim-period accounting for enacted changes in the tax law. ASU 2019-12 is effective for public business entities for fiscal years beginning after December 15, 2020, including interim periods within those fiscal years, and early adoption is permitted. The adoption of this ASU as of January 1, 2021 did not have a material impact on the Company's consolidated financial statements.Statements (Continued)

Note 3—Revenue

Disaggregated Revenue

The following table represents the Company’s wealth management and institutional and intermediary investment management revenue by investment portfolio during the three and ninesix months ended SeptemberJune 30, 20212022 and 2020:2021:

| | | Three months ended September 30, 2021 | | Three months ended September 30, 2020 | | Three months ended June 30, 2022 | | Three months ended June 30, 2021 |

| | Wealth Management | | Institutional and Intermediary | | Total | | Wealth Management | | Institutional and Intermediary | | Total | | Wealth Management | | Institutional and Intermediary | | Total | | Wealth Management | | Institutional and Intermediary | | Total |

| | (in thousands) | | (in thousands) |

| Blended Asset | Blended Asset | | $ | 14,865 | | | $ | 8,689 | | | 23,554 | | | $ | 12,117 | | | $ | 8,261 | | | $ | 20,378 | | Blended Asset | | $ | 14,272 | | | $ | 7,849 | | | 22,121 | | | $ | 14,215 | | | $ | 8,346 | | | $ | 22,561 | |

| Equity | Equity | | 1,394 | | | 7,071 | | | 8,465 | | | 1,450 | | | 4,892 | | | 6,342 | | Equity | | 1,273 | | | 5,231 | | | 6,504 | | | 1,784 | | | 6,374 | | | 8,158 | |

| Fixed Income | Fixed Income | | 107 | | | 449 | | | 556 | | | 176 | | | 381 | | | 557 | | Fixed Income | | 115 | | | 552 | | | 667 | | | 112 | | | 421 | | | 533 | |

| Total | Total | | 16,366 | | | $ | 16,209 | | | $ | 32,575 | | | $ | 13,743 | | | $ | 13,534 | | | $ | 27,277 | | Total | | $ | 15,660 | | | $ | 13,632 | | | $ | 29,292 | | | $ | 16,111 | | | $ | 15,141 | | | $ | 31,252 | |

| | | | | Nine months ended September 30, 2021 | | Nine months ended September 30, 2020 | | | Six months ended June 30, 2022 | | Six months ended June 30, 2021 |

| | Wealth Management | | Institutional and Intermediary | | Total | | Wealth Management | | Institutional and Intermediary | | Total | | Wealth Management | | Institutional and Intermediary | | Total | | Wealth Management | | Institutional and Intermediary | | Total |

| | | | (in thousands) | | | (in thousands) |

| Blended Asset | Blended Asset | | $ | 42,714 | | | $ | 25,103 | | | $ | 67,817 | | | $ | 36,044 | | | $ | 24,096 | | | $ | 60,140 | | Blended Asset | | $ | 28,941 | | | $ | 16,146 | | | $ | 45,087 | | | $ | 27,849 | | | $ | 16,414 | | | $ | 44,263 | |

| Equity | Equity | | 4,786 | | | 19,310 | | | 24,096 | | | 4,800 | | | 13,141 | | | 17,941 | | Equity | | 2,634 | | | 11,152 | | | 13,786 | | | 3,392 | | | 12,239 | | | 15,631 | |

| Fixed Income | Fixed Income | | 325 | | | 1,265 | | | 1,590 | | | 491 | | | 1,018 | | | 1,509 | | Fixed Income | | 225 | | | 1,021 | | | 1,246 | | | 218 | | | 816 | | | 1,034 | |

| Total | Total | | $ | 47,825 | | | $ | 45,678 | | | $ | 93,503 | | | $ | 41,335 | | | $ | 38,255 | | | $ | 79,590 | | Total | | $ | 31,800 | | | $ | 28,319 | | | $ | 60,119 | | | $ | 31,459 | | | $ | 29,469 | | | $ | 60,928 | |

Manning & Napier, Inc.

Notes to Consolidated Financial Statements (Continued)

Accounts Receivable

Accounts receivable as of SeptemberJune 30, 20212022 and December 31, 20202021 consisted of the following:

| | | | | September 30, 2021 | | December 31, 2020 | | | June 30, 2022 | | December 31, 2021 |

| | | | (in thousands) | | | (in thousands) |

| Accounts receivable - third parties | Accounts receivable - third parties | | $ | 6,212 | | | $ | 7,315 | | Accounts receivable - third parties | | $ | 5,387 | | | $ | 8,119 | |

| Accounts receivable - affiliated mutual funds and collective investment trusts | Accounts receivable - affiliated mutual funds and collective investment trusts | | 4,889 | | | 4,600 | | Accounts receivable - affiliated mutual funds and collective investment trusts | | 4,112 | | | 5,732 | |

| Total accounts receivable | Total accounts receivable | | $ | 11,101 | | | $ | 11,915 | | Total accounts receivable | | $ | 9,499 | | | $ | 13,851 | |

Accounts receivable represents the Company's unconditional rights to consideration arising from its performance under separately managed account, mutual fund and collective investment trust, distribution and shareholder servicing, and custodial service contracts. Accounts receivable balances do not include an allowance for doubtful accounts nor has any significant bad debt expense attributable to accounts receivable been recorded during the three and ninesix months ended SeptemberJune 30, 20212022 or 2020.2021.

Advisory and Distribution Agreements

The Company earns investment advisory fees, distribution fees and administrative service fees under agreements with affiliated mutual funds and collective investment trusts. Fees earned for advisory and distribution services provided were approximately $11.1$9.3 million and $31.6$19.4 million for the three and ninesix months ended SeptemberJune 30, 2021,2022, respectively, and approximately $9.3$10.6 million and $26.7$20.5 million for the three and ninesix months ended SeptemberJune 30, 2020,2021, respectively, which represents greater than 25% of revenue in each period. The following provides amounts due from affiliated mutual funds and collective investment trusts reported within accounts receivable in the consolidated statements of financial condition as of SeptemberJune 30, 20212022 and December 31, 2020:2021:

| | | | | September 30, 2021 | | December 31, 2020 | | | June 30, 2022 | | December 31, 2021 |

| | | | (in thousands) | | | (in thousands) |

| Affiliated mutual funds | Affiliated mutual funds | | $ | 3,492 | | | $ | 3,275 | | Affiliated mutual funds | | $ | 3,021 | | | $ | 4,309 | |

| Affiliated collective investment trusts | Affiliated collective investment trusts | | 1,397 | | | 1,325 | | Affiliated collective investment trusts | | 1,091 | | | 1,423 | |

| Accounts receivable - affiliated mutual funds and collective investment trusts | Accounts receivable - affiliated mutual funds and collective investment trusts | | $ | 4,889 | | | $ | 4,600 | | Accounts receivable - affiliated mutual funds and collective investment trusts | | $ | 4,112 | | | $ | 5,732 | |

Manning & Napier, Inc.

Notes to Consolidated Financial Statements (Continued)

Contract assets and liabilities

Accrued accounts receivable: Accrued accounts receivable represents the Company's contract asset for revenue that has been recognized in advance of billing separately managed account contracts. Consideration for the period billed in arrears is dependent on the client’s AUM on a future billing date and therefore conditional as of the reporting period end. During the ninesix months ended SeptemberJune 30, 2021,2022, revenue was increaseddecreased by less than $0.1 million for changes in transaction price. Accrued accounts receivable of approximately $0.3 million is reported within prepaid expenses and other assets in the consolidated statements of financial condition for both SeptemberJune 30, 20212022 and December 31, 2020.2021.

Deferred revenue: Deferred revenue is recorded when consideration is received or unconditionally due in advance of providing services to the Company's customer. Revenue recognized during the ninesix months ended SeptemberJune 30, 20212022 that was included in deferred revenue at the beginning of the period was approximately $11.3$12.8 million.

Costs to obtain a contract: Under compensation plans in effect for periods prior to January 1, 2020, certain incremental first year commissions directly associated with new customer contracts were capitalized and amortized on a straight-line basis over an estimated customer contract period of 3 to 7 years. The total net asset as of SeptemberJune 30, 20212022 and December 31, 20202021 was approximately $0.4 million and $0.5 million, and $0.7 million, respectively. The related amortizationAmortization expense which is included in compensation and related costs totaled approximatelyless than $0.1 million and $0.2 million for the three and ninesix months ended SeptemberJune 30, 20212022 and approximately $0.1 million and $0.2 million for the three and ninesix months ended SeptemberJune 30, 2020.2021. An impairment loss is recorded for contract acquisition costs related to client contracts that cancel during the period. These impairment losses totaled less than $0.1 million for both the three and ninesix months ended SeptemberJune 30, 20212022 and SeptemberJune 30, 2020.2021.

Manning & Napier, Inc.

Notes to Consolidated Financial Statements (Continued)

Note 4—Noncontrolling Interests

Manning & Napier holds an economic interest of approximately 97.7%97.8% in Manning & Napier Group, and as managing member controls all of the business and affairs of Manning & Napier Group. As a result, the Company consolidates the financial results of Manning & Napier Group and records a noncontrolling interest on its consolidated statements of financial condition with respect to the remaining approximately 2.3%2.2% economic interest in Manning & Napier Group held by M&N Group Holdings. Net income attributable to noncontrolling interests on the statements of operations represents the portion of earnings attributable to the economic interest in Manning & Napier Group held by the noncontrolling interests.

The following table provides a reconciliation from “Income before provision for (benefit from) income taxes” to “Net income attributable to Manning & Napier, Inc.”:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended September 30, | | Nine months ended September 30, |

| | 2021 | | 2020 | | 2021 | | 2020 |

| | | (in thousands) |

| Income before provision for (benefit from) income taxes | | $ | 9,233 | | | $ | 4,805 | | | $ | 23,926 | | | $ | 8,157 | |

Less: income (loss) before provision for (benefit from) income taxes of Manning & Napier, Inc. (1) | | (24) | | | 14 | | | (234) | | | (1,950) | |

| Income before provision for income taxes, as adjusted | | 9,257 | | | 4,791 | | | 24,160 | | | 10,107 | |

Controlling interest percentage (2) | | 97.7 | % | | 88.2 | % | | 92.7 | % | | 64.0 | % |

| Net income attributable to controlling interest | | 9,042 | | | 4,225 | | | 22,388 | | | 6,471 | |

Plus: income (loss) before provision for (benefit from) income taxes of Manning & Napier, Inc. (1) | | (24) | | | 14 | | | (234) | | | (1,950) | |

| Income (loss) before provision for (benefit from) income taxes attributable to Manning & Napier, Inc. | | 9,018 | | | 4,239 | | | 22,154 | | | 4,521 | |

Less: provision for (benefit from) income taxes of Manning & Napier, Inc.(3) | | 2,515 | | | 1,732 | | | 4,486 | | | (390) | |

| Net income attributable to Manning & Napier, Inc. | | $ | 6,503 | | | $ | 2,507 | | | $ | 17,668 | | | $ | 4,911 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended June 30, | | Six months ended June 30, |

| | 2022 | | 2021 | | 2022 | | 2021 |

| | | (in thousands) |

| Income before provision for income taxes | | $ | 4,504 | | | $ | 8,026 | | | $ | 4,982 | | | $ | 14,693 | |

Less: income (loss) before provision for income taxes of Manning & Napier, Inc. (1) | | 182 | | | (218) | | | (1,137) | | | (211) | |

| Income before provision for income taxes, as adjusted | | 4,322 | | | 8,244 | | | 6,119 | | | 14,904 | |

Controlling interest percentage (2) | | 97.8 | % | | 90.1 | % | | 97.8 | % | | 89.6 | % |

| Income before provision for income taxes attributable to controlling interest | | 4,225 | | | 7,426 | | | 5,982 | | | 13,347 | |

Plus: income (loss) before provision for income taxes of Manning & Napier, Inc. (1) | | 182 | | | (218) | | | (1,137) | | | (211) | |

| Income before provision for income taxes attributable to Manning & Napier, Inc. | | 4,407 | | | 7,208 | | | 4,845 | | | 13,136 | |

Less: provision for income taxes of Manning & Napier, Inc.(3) | | 2,063 | | | 1,283 | | | 1,315 | | | 1,971 | |

| Net income attributable to Manning & Napier, Inc. | | $ | 2,344 | | | $ | 5,925 | | | $ | 3,530 | | | $ | 11,165 | |

_______________________________________________(1)Manning & Napier, Inc. incurs certain income or expenses that are only attributable to it and are therefore excluded from the net income attributable to noncontrolling interests.

(2)Income before provision for (benefit from) income taxes is allocated to the controlling interest based on the percentage of units of Manning & Napier Group held by Manning & Napier, Inc. The amount represents the Company's weighted ownership of Manning & Napier Group's income for the respective periods.

(3)The consolidated provision for (benefit from) income taxes is equal to the sum of (i) the provision for (benefit from) income taxes for entities other than Manning & Napier, Inc. and (ii) the provision for (benefit from) income taxes of Manning & Napier, Inc. which

Manning & Napier, Inc.

Notes to Consolidated Financial Statements (Continued)

includes all U.S. federal and state income taxes. The consolidated provision for (benefit from) income taxes was a provision of $2.5approximately $2.1 million and $1.7$1.3 million for the three months ended SeptemberJune 30, 20212022 and 2020,2021, respectively, and a provision of $4.5approximately $1.3 million and benefit of less than $0.1$2.0 million for the ninesix months ended SeptemberJune 30, 2022 and 2021, and 2020, respectively.

As of SeptemberJune 30, 2021,2022, a total of 428,812 units of Manning & Napier Group were held by the noncontrolling interests. Pursuant to the terms of the exchange agreement entered into at the time of the Company's initial public offering ("Exchange Agreement"), such units may be tendered for exchange or redemption. For any units exchanged, the Company may (i) pay an amount of cash equal to the number of tendered units multiplied by the value of one share of the Company's Class A common stock less a market discount and expected expenses, or, at the Company's election, (ii) issue shares of the Company's Class A common stock on a one-for-one basis, subject to customary adjustments. As the Company receives units of Manning & Napier Group that are exchanged, the Company's ownership of Manning & Napier Group will increase.

On March 15, 2021,During the Company received notice that 1,592,969 of Class A units of Manning & Napier Group were tendered for redemption or exchange. The independent directors, on behalf of the Company, decided that such exchange would be settled in 1,592,969 shares of unregistered Class A common stock of the Company. The Company completed the exchange onsix months ended June 30, 2021 and as a result, Manning & Napier acquired an equivalent number of Class A units of Manning & Napier Group and its ownership of Manning & Napier Group increased from 89.0% to 97.7%.

Manning & Napier, Inc.

Notes to Consolidated Financial Statements (Continued)

During the nine months ended September 30, 2021,2022, Class A common stock was issued under the Company's 2011 Equity Compensation Plan (the "Equity Plan") for which Manning & Napier, Inc. acquired an equivalent number of Class A units of Manning & Napier Group.

The following is the impact to the Company's equity ownership interest in Manning & Napier Group for the ninesix months ended SeptemberJune 30, 2021:2022:

| | | | | | | | | | | | | | | | | | | | | | | |

| Manning & Napier Group Class A Units Held | | |

| |

Manning & Napier | |

Noncontrolling Interests | | Total | | Manning & Napier Ownership % |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| As of December 31, 2020 | 15,783,638 | | | 2,021,781 | | | 17,805,419 | | | 88.6% |

| Class A Units issued | 624,323 | | | — | | | 624,323 | | | 0.4% |

| Class A Units exchanged | 1,592,969 | | | (1,592,969) | | | — | | | 8.7% |

| As of September 30, 2021 | 18,000,930 | | | 428,812 | | | 18,429,742 | | | 97.7% |

| | | | | | | | | | | | | | | | | | | | | | | |

| Manning & Napier Group Class A Units Held | | |

| |

Manning & Napier | |

Noncontrolling Interests | | Total | | Manning & Napier Ownership % |

| As of December 31, 2021 | 18,296,780 | | | 428,812 | | | 18,725,592 | | | 97.7% |

| Class A Units issued | 370,252 | | | — | | | 370,252 | | | 0.1% |

| | | | | | | |

| As of June 30, 2022 | 18,667,032 | | | 428,812 | | | 19,095,844 | | | 97.8% |

Manning & Napier Inc., as managing member, controls all of the business and affairs of Manning & Napier Group. Since the Company continues to have a controlling interest in Manning & Napier Group, the aforementioned changes in ownership of Manning & Napier Group were accounted for as equity transactions under ASC Topic 810, Consolidation. Additional paid-in capital and noncontrolling interests in the consolidated statements of financial position are adjusted to reallocate the Company's historical equity to reflect the change in ownership of Manning & Napier Group.

As a result of the completion of the exchange on June 30, 2021 and Manning & Napier Group's election under Section 754 of the Internal Revenue Code ("IRC"), the Company expects to benefit from future depreciation and amortization deductions resulting from increases in the tax basis of tangible and intangible assets of Manning & Napier Group. Those deductions allocated to the Company will be taken into account in reporting the Company's taxable income resulting in the recognition of a deferred tax asset.

Manning & Napier and the holders of Manning & Napier Group are party to a tax receivable agreement ("TRA"), pursuant to which Manning & Napier is required to pay to such holders 85% of the applicable cash savings, if any, in U.S. federal, state, local and foreign income tax that Manning & Napier actually realizes, or is deemed to realize in certain circumstances, as a result of (i) certain tax attributes of their units sold to Manning & Napier or exchanged (for shares of Class A common stock) and that are created as a result of the sales or exchanges and payments under the TRA and (ii) tax benefits related to imputed interest.