SECURITIES AND EXCHANGE COMMISSION

[X] QUARTERLY REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended

JuneSeptember 30, 2015[ ] TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE EXCHANGE ACT

For the transition period from

__________-___________ to

_______________________

Commission File Number

000-54584Pacific Ventures Group, Inc.PACIFIC VENTURES GROUP, INC.

(Exact name of registrant as specified in its charter)

| |

Delaware | 75-2100622 |

| (State or other jurisdiction of | (IRS Employer Identification No.) |

| incorporation or organization) | |

| |

117 West 9th Street Suite 316 Los Angeles California | 90015 |

| (Address of principal executive offices) | (Zip Code) |

Delaware310-392-560675-2100622(State or other jurisdiction of (IRS Employer Identification No.)

incorporation or organization)

200 Camelia Court, Vero Beach, Florida

32963

(Address of principal executive offices)

(Zip Code)

(772) 231-1244

(Registrant’s

(Registrant's telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90

days. Yesdays.Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files)

. Yes.Yes [X] No [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of

“large"large accelerated filer,

” “accelerated" "accelerated filer,

”" and

“smaller"smaller reporting

company”company" in Rule 12b-2 of the Exchange Act.

Large Accelerated filer ¨

Accelerated filer ¨

Large Accelerated filer ◻ | Accelerated filer ◻ |

| |

Non-accelerated filer ◻ (Do not check if a smaller reporting company) | Smaller reporting company ⌧ |

Non-accelerated filer ¨

Smaller reporting company x

(Do not check if a smaller reporting company)

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes [X][] No [ X ]

Indicate the number of shares outstanding of each of the

issuer’sissuer's classes of common equity, as of the latest practicable date.

Shares of $0.001Common Stock, par value common stock$0.001, outstanding as of November 20, 2015: 25,415,000

PACIFIC VENTURES GROUP, INC.

Quarterly Report on August 14,Form 10-Q for the

Three Months Ended September 30, 2015

| PART I. – FINANCIAL INFORMATION | |

| Item 1. Financial Statements | 3 |

| Item 2. Management's Discussion and Analysis of Financial Condition and Results of Operations | 18 |

| Item 3. Quantitative and Qualitative Disclosures about Market Risk | 25 |

| Item 4. Controls and Procedures | 25 |

| PART II. – OTHER INFORMATION | |

| Item 1. Legal Proceedings | 26 |

| Item 1A. Risk Factors | 26 |

| Item 2. Unregistered Sales of Equity Securities and Use of Proceeds | 26 |

| Item 3. Defaults Upon Senior Securities | 26 |

| Item 4. Mine Safety Disclosures | 26 |

| Item 5. Other Information | 27 |

| Item 6. Exhibits | 28 |

| Exhibit 31.1 | |

| Exhibit 31.2 | |

| Exhibit 32.1 | |

| Exhibit 32.2 | |

PART I – FINANCIAL INFORMATION

Item 1. Financial Statements

Pacific Ventures Group, Inc.

FINANCIAL STATEMENTS

June 30, 2015

The unaudited financial statements included herein have been prepared by the Company pursuant to the rules and regulations of the Securities and Exchange Commission. Certain information and footnote disclosures normally included in financial statements prepared in accordance with generally accepted accounting principles have been condensed or omitted. However, in the opinion of management, all adjustments (which include only normal recurring accruals) necessary to present fairly the financial position and results of operations for the periods presented have been made. These financial statements should be read in conjunction with the accompanying notes, and with the historical financial information of the Company.

Subsidiaries

Condensed Consolidated Financial Statements

PACIFIC VENTURES GROUP, INC.

Condensed Consolidated Balance Sheets

| | | | |

| | | | |

| | June 30, | | December, 31 |

| | 2015 | | 2014 |

Assets | | (unaudited) | | |

Current Assets: | | | | |

Cash | $ | — | $ | — |

Total Current Assets | | — | | — |

| | | | |

Total assets | $ | — | $ | — |

| | | | |

Liabilities and Stockholders’ Equity (Deficit) | | | | |

Current Liabilities: | | | | |

Accounts payable | $ | 11,059 | $ | 7,471 |

Notes Payable | | 20,522 | | 14,576 |

Notes Payable due to officer | | 800 | | 400 |

Interest Payable | | 343 | | 173 |

Interest Payable due to officer | | 10 | | 6 |

| | | | |

Total current liabilities | | 32,734 | | 22,626 |

| | | | |

Stockholders’ equity (deficit): | | | | |

Preferred Stock, 10,000,000 shares authorized, $0.001 par value: | | | | |

Series E Preferred stock, 1,000,000 shares authorized, issued and outstanding | | 1,000 | | 1,000 |

Common stock, $0.001 par value; 100,000,000 shares authorized; 384,031 shares issued and outstanding | | 384 | | 384 |

Additional paid-in capital | | 47,075,200 | | 47,075,200 |

Accumulated earnings (deficit) | | (47,109,318) | | (47,099,210) |

Total stockholder’s equity (deficit) | | (32,734) | | (22,626) |

| | | | |

Total liabilities and stockholders’ equity (deficit) | $ | — | $ | — |

| | | September 30, | | | December 31, | |

| | | 2015 | | | 2014 | |

| | | (Unaudited) | | | | |

| ASSETS | | | | | | |

| Current Assets: | | | | | | |

| Cash and cash equivalents | | $ | - | | | $ | - | |

| Accounts receivable | | | - | | | | 12,721 | |

| Inventory, net | | | 120,346 | | | | 58,256 | |

| Deposits | | | 1,500 | | | | 1,500 | |

| Total Current Assets | | | 121,846 | | | | 72,477 | |

| | | | | | | | | |

| Fixed Assets | | | | | | | | |

| Fixed assets, net | | | 39,823 | | | | 106,740 | |

| Total Fixed Assets | | | 39,823 | | | | 106,740 | |

| | | | | | | | | |

| TOTAL ASSETS | | $ | 161,669 | | | $ | 179,217 | |

| | | | | | | | | |

| LIABILITIES AND STOCKHOLDERS' EQUITY | | | | | | | | |

| Bank overdraft | | $ | 1,441 | | | $ | 2,589 | |

| Accounts payable | | | 306,399 | | | | 358,867 | |

| Accrued expenses | | | 163,009 | | | | 891,532 | |

| Deferred exclusive distribution fee | | | 66,667 | | | | - | |

| Current portion, notes payable | | | 550,333 | | | | 550,333 | |

| Current portion, notes payable - related party | | | 169,838 | | | | 278,821 | |

| Current portion, leases payable | | | 42,565 | | | | 36,012 | |

| Total Current Liabilities | | | 1,300,252 | | | | 2,118,154 | |

| | | | | | | | | |

| Long-Term Liabilities: | | | | | | | | |

| Notes payable - related party | | | 386,036 | | | | 324,522 | |

| Leases payable | | | - | | | | 6,553 | |

| Total Long-Term Liabilities | | | 386,036 | | | | 331,075 | |

| | | | | | | | | |

| Total Liabilities | | | 1,6686,288 | | | | 2,449,229 | |

| | | | | | | | | |

| STOCKHOLDERS' EQUITY (DEFICIT) | | | | | | | | |

| Preferred stock, $.001 par value, 10,000,000 shares authorized, | | | | | | | | |

| 1,000,000 issued and outstanding | | | 1,000 | | | | 1,000 | |

| Common stock, $.001 par value, 30,000,000 shares | | | | | | | | |

| authorized, 25,384,031 and 22,884,031 issued and outstanding, | | | | | | | | |

| respectively | | | 25,384 | | | | 22,884 | |

| Additional paid in capital | | | 4,523,606 | | | | 3,126,535 | |

| Accumulated deficit | | | (6,074,609 | ) | | | (5,420,431 | ) |

| | | | | | | | | |

| Total Stockholders' Equity (Deficit) | | | (1,524,619 | ) | | | (2,270,012 | ) |

| | | | | | | | | |

| Total Liabilities and Stockholders' Equity (Deficit) | | $ | 161,669 | | | $ | 179,217 | |

The accompanying notes are an integral part of these

consolidated financial statements.

PACIFIC VENTURES GROUP, INC.

Condensed Consolidated Statements of Operations

(unaudited)

(unaudited)

| | | For the Three Months Ended, | | | For the Nine Months Ended, | |

| | | September 30, | | | September 30, | |

| | | 2015 | | | 2014 | | | 2015 | | | 2014 | |

| | | | | | | | | | | | | |

| Sales, net of discounts | | $ | 17,957 | | | | 22,326 | | | | 244,176 | | | | 97,436 | |

| Cost of Goods Sold | | | (2,248 | ) | | | (17,323 | ) | | | (91,500 | ) | | | (43,567 | ) |

| Gross Profit | | | 15,709 | | | | 5,003 | | | | 152,676 | | | | 53,869 | |

| | | | | | | | | | | | | | | | | |

| Operating Expenses | | | | | | | | | | | | | | | | |

| Selling, general and administrative | | | 431,052 | | | | 142,249 | | | | 513,683 | | | | 605,797 | |

| Depreciation expense | | | 22,306 | | | | 21,134 | | | | 66,917 | | | | 63,401 | |

| Salaries and wages | | | 38,721 | | | | 62,898 | | | | 178,721 | | | | 283,293 | |

| Operating Expenses/(Loss) | | | 492,079 | | | | 226,281 | | | | 759,321 | | | | 952,491 | |

| | | | | | | | | | | | | | | | | |

| Loss from Operations | | | (476,370 | ) | | | (221,278 | ) | | | (606,645 | ) | | | (898,622 | ) |

| | | | | | | | | | | | | | | | | |

| Other Non-Operating Income and Expenses | | | | | | | | | | | | | | | | |

| Interest expense | | | (13,200 | ) | | | (25,038 | ) | | | (47,533 | ) | | | (52,479 | ) |

| | | | | | | | | | | | | | | | | |

| Net Income/(Loss) before Income Taxes | | | (489,570 | ) | | | (246,316 | ) | | | (654,178 | ) | | | (951,101 | ) |

| | | | | | | | | | | | | | | | | |

| Provision for income taxes | | | - | | | | - | | | | - | | | | - | |

| | | | | | | | | | | | | | | | | |

| Net Income/(Loss) | | $ | (489,570 | ) | | $ | (246,316 | ) | | $ | (654,178 | ) | | $ | (951,101 | ) |

| | | | | | | | | | | | | | | | | |

| Basic and Diluted Loss per Share - Common Stock | | $ | (0.02 | ) | | $ | (0.01 | ) | | $ | (0.03 | ) | | $ | (0.04 | ) |

| | | | | | | | | | | | | | | | | |

| Weighted Average Number of Shares Outstanding: | | | | | | | | | | | | | | | | |

| Basic and Diluted Common Stock | | | 23,019,901 | | | | 22,884,031 | | | | 22,929,819 | | | | 22,884,031 | |

| | | | | | | | |

| | For the Three Months Ended June 30, 2015 | | For the Three Months Ended June 30, 2014 | | For the Six Months Ended June 30, 2015 | | For the Six Months Ended June 30, 2014 |

Revenue | $ | - | $ | - | $ | - | $ | - |

| | | | | | | | |

Operating expenses: | | | | | | | | |

General and administrative | | 9,534 | | 5,588 | | 9,934 | | 10,027 |

Total operating expenses | | 9,534 | | 5,588 | | 9,934 | | 10,027 |

Loss from operations | | (9,534) | | (5,588) | | (9,934) | | (10,027) |

Other Income (Expense) | | | | | | | | |

Interest income | | - | | - | | - | | - |

Interest expense | | (99) | | (46) | | (174) | | (57) |

Total other income (expense) | | (99) | | (46) | | (174) | | (57) |

Net income (loss) | $ | (9,633) | $ | (5,634) | $ | (10,108) | $ | (10,084) |

Net income (loss) per share of common stock | $ | (0.03) | $ | (0.01) | $ | (0.03) | $ | (0.03) |

Weighted average number of common shares | | 384,031 | | 384,031 | | 384,031 | | 384,031 |

The accompanying notes are an integral part of these

consolidated financial statements.

PACIFIC VENTURES GROUP, INC.

Condensed Consolidated Statements of Cash Flows

| | | | |

| | For the Six Months Ended June 30, 2015 | | For the Six Months Ended June 30, 2014 |

| | | | |

Cash flows from operating activities: | | | | |

Net income (loss) | $ | (10,108) | $ | (10,084) |

Adjustments to reconcile net loss to net cash used by operating activities | | | | |

Changes in operating assets and liabilities: | | | | |

Increase (decrease) in accounts payable | | 3,588 | | 2,748 |

Increase (decrease) in accrued interest | | 174 | | 57 |

Net cash used in operating activities | | (6,346) | | (7,279) |

| | | | |

Cash flows from financing activities: | | | | |

Proceeds - related party payable | | 400 | | 400 |

Proceeds from notes payable | | 5,946 | | 6,872 |

Net cash provided by financing activities | | 6,346 | | 7,272 |

| | | | |

Net change in cash | | - | | (7) |

Cash, beginning of period | | - | | 7 |

Cash, end of period | $ | - | $ | - |

Supplemental disclosure of cash flow information: | | | | |

Cash paid during the period for: | | | | |

Income Taxes | $ | - | $ | - |

Interest | $ | - | $ | - |

| | | For the Nine Months Ended | |

| | | September 30, | |

| | | 2015 | | | 2014 | |

| | | | | | | |

| OPERATING ACTIVITIES | | | | | | |

| Net loss | | $ | (654,178 | ) | | $ | (951,101 | ) |

| Adjustments to reconcile net loss to | | | | | | | | |

| net cash used in operating activities: | | | | | | | | |

| Shares issued for services | | | 461,903 | | | | - | |

| Depreciation | | | 66,917 | | | | 63,401 | |

| Changes in operating assets and liabilities | | | | | | | | |

| Accounts receivable | | | 12,721 | | | | 5,848 | |

| Inventory | | | (62,090 | ) | | | (57,388 | ) |

| Loans Receivable | | | - | | | | (3,566 | ) |

| Deposits | | | - | | | | 4,053 | |

| Accounts payable | | | (52,468 | ) | | | 71,947 | |

| Deferred exclusive distribution fee | | | 66,667 | | | | - | |

| Accrued expenses | | | 124,331 | | | | 125,826 | |

| Net Cash Used in Operating Activities | | | (36,197 | ) | | | (740,980 | ) |

| | | | | | | | | |

| INVESTING ACTIVITIES | | | | | | | | |

| Security Deposits | | | - | | | | 6,478 | |

| Acquisition of fixed assets | | | - | | | | 53,646 | |

| Net Cash Provided By (Used In) Investing Activities | | | - | | | | 60,124 | |

| | | | | | | | | |

| FINANCING ACTIVITIES | | | | | | | | |

| Bank overdraft | | | (1,148 | ) | | | 4,810 | |

| Proceeds from notes payable | | | - | | | | 500,000 | |

| Proceeds from notes payable – related party | | | 53,838 | | | | - | |

| Repayment of notes payable | | | (108,983 | ) | | | - | |

| Common stock issued for cash | | | 92,490 | | | | 160,107 | |

| Repayment on the leases payable | | | - | | | | (14,085 | ) |

| Net Cash Provided by Financing Activities | | | 36,197 | | | | 650,832 | |

| | | | | | | | | |

| NET INCREASE (DECREASE) IN CASH | | | - | | | | (30,024 | ) |

| CASH AT BEGINNING OF PERIOD | | | - | | | | 30,024 | |

| | | | | | | | | |

| CASH AT END OF PERIOD | | $ | - | | | $ | - | |

| | | | | | | | | |

| SUPPLEMENTAL DISCLOSURES OF CASH FLOW INFORMATION: | | | | | | | | |

| | | | | | | | | |

| CASH PAID FOR: | | | | | | | | |

| Interest | | $ | 47,533 | | | $ | 52,479 | |

| NON CASH FINANCING ACTIVITIES: | | | | | | | | |

| Issuance of shares for debt conversion | | $ | 21,675 | | | $ | 160,000 | |

| Issuance of shares for accrued wages | | $ | 225,000 | | | $ | - | |

The accompanying notes are an integral part of these

consolidated financial statements.

Pacific Ventures Group, Inc.

Notes to Unaudited

Condensed Consolidated Financial Statements

June 30, 2015

1. NATURE OF OPERATIONS

The Company and Nature of Presentation and Summary of Significant Accounting Policies

OrganizationBusiness –

Pacific Ventures Group, Inc. (the

“Company”"Company" or

“Pacific Ventures”"Pacific Ventures") was incorporated under the laws of the State of Delaware on October 3, 1986, under the name AOA Corporation. On November 12, 1991,

the the Company changed its name to American Eagle Group, Inc. On October 22, 2012, the Company changed its name to Pacific Ventures Group, Inc.

On August 14, 2015, Pacific Ventures Group, Inc. and its stockholders entered into a share exchange agreement with Snöbar Holdings, Inc. ("Snöbar Holdings"), pursuant to which Pacific Ventures acquired 100% of the issued and outstanding shares of Snöbar Holdings' Class A and Class B common stock in exchange for 22,500,000 restricted shares of Pacific Ventures' common stock while simultaneously issuing 2,500,000 shares of Pacific Ventures' restricted common stock to certain other persons.

The Company’s financial statements have been prepared using accounting principles generally acceptedShare Exchange represents a change in the United States of America applicable to a going concern, which contemplates the realization of assets and liquidation of liabilities in the normal course of business. The Company has not generated any revenue for several years and the sole officer and directorcontrol of the Company and a change in business operations. The business operations will change to that of Snöbar Holdings.

Snöbar Holdings, Inc. ("Snöbar Holdings") was formed in the State of Delaware on January 7, 2013. Snöbar Holdings is the trustor and sole beneficiary of Snobar Trust, a California trust ("Trust"), which was formed in June 1, 2013. The current trustee that holds legal title to the Trust is Clark Rutledge, who is the father of Shannon Masjedi, who controls Snöbar Holdings. The Trust owns 100% of the shares of International Production Impex Corporation, a California corporation ("IPIC"), which was formed on August 2, 2001. IPIC is in the business of selling alcohol-infused ice cream and ice-pops, and holds all of the right to the liquor licenses to sell such products and trade names "SnöBar". As such, the Trust holds all ownership interest of IPIC and its liquor licenses, permitting IPIC to sell its product to distributors, with all income, expense, gains and losses rolling up to the Trust, of which Snöbar Holdings is the sole beneficiary. Snöbar Holdings also owns 99.9% of the shares of MAS Global Distributors, Inc., a California corporation ("MGD"). MGD is in the business of selling and leasing freezers and providing marketing services. As a result of the foregoing, Snöbar Holdings is the primary beneficiary of all assets, liabilities and any income received from the business of the Trust and IPIC through the Trust and is the parent company of MGD.

The Trust and IPIC are considered variable interest entities ("VIEs") and Snöbar Holdings is identified as the primary beneficiary of the Trust and IPIC. Under ASC 810, Snöbar Holdings performs ongoing reassessments of whether it is the primary beneficiary of a VIE. As the assessment of Snöbar Holdings' management is that Snöbar Holdings has provided capitalthe power to pay priordirect the activities of a VIE that most significantly impact the VIE's activities (it is responsible for establishing and current obligations. operating IPIC), and the obligation to absorb losses of the VIE that could potentially be significant to the VIE and the right to receive benefits from the VIE that could potentially be significant to the VIE's economic performance, it was therefore concluded by management that Snöbar Holdings is the primary beneficiary of the Trust and IPIC. As such, the Trust and IPIC were consolidated in the financial statements of Snöbar Holdings since the inception of the Trust, in the case of the Trust, and since the inception of Snöbar Holdings, in the case of IPIC.

Principles of Consolidation

The consolidated financial statements include the accounts of Pacific Ventures, Inc., Snöbar Holdings and its subsidiaries, in which Snöbar Holdings has a controlling voting interest and entities consolidated under the variable interest entities ("VIE") provisions of ASC 810, "Consolidation" ("ASC 810"). Inter-company balances and transactions have been eliminated upon consolidation.

The Company applies the provisions of ASC 810 which provides a framework for identifying VIEs and determining when a company should include the assets, liabilities, non-controlling interests and results of activities of a VIE in its consolidated financial statements.

Pacific Ventures Group, Inc.

Notes to Unaudited Condensed Consolidated Financial Statements

In general, a VIE is a corporation, partnership, limited-liability corporation, trust, or any other legal structure used to conduct activities or hold assets that either (1) has an insufficient amount of equity to carry out its principal activities without additional subordinated financial support, (2) has a group of equity owners that is unable to make significant decisions about its activities, (3) has a group of equity owners that does not have the obligation to absorb losses or the right to receive returns generated by its operations or (4) the voting rights of some investors are not proportional to their obligations to absorb the expected losses of the entity, their rights to receive the expected residual returns of the entity, or both and substantially all of the entity's activities (for example, providing financing or buying assets) either involve or are conducted on behalf of an investor that has disproportionately fewer voting rights.

ASC 810 requires additional capitala VIE to continue its limited operations. Furthermore,be consolidated by the Company’s officerparty with an ownership, contractual or other financial interest in the VIE (a variable interest holder) that has both of the following characteristics: a) the power to direct the activities of a VIE that most significantly impact the VIE's economic performance and director serves without compensation. The Company assumesb) the obligation to absorb losses of the VIE that these arrangementscould potentially be significant to the VIE, or the right to receive benefits from the VIE that could potentially be significant to the VIE.

A variable interest holder that consolidates the VIE is called the primary beneficiary. If the primary beneficiaryof a variable interest entity (VIE) and the availabilityVIE are under common control, the primary beneficiary shall initially measure the assets, liabilities, and non-controlling interests of future capital sources will continue into the future, but no assurance thereof canVIE at amounts at which they are carried in the accounts of the reporting entity that controls the VIE (or would be given. A change in these circumstances would have a material adverse effect oncarried if the Company’s ability to continue as a going concern. The accompanyingreporting entity issued financial statements do not include any adjustments that might result from the outcome of this uncertainty.

Income Taxes

The Company utilizes the liability method ofprepared in conformity with generally accepted accounting for income taxes as set forth in principles).

ASC 740-20, “Accounting for Income Taxes.” Under the liability method, deferred taxes are determined based on the difference between the financial statement and tax bases of assets and liabilities using enacted tax rates in effect in the years810 also requires disclosures about VIEs in which the differences are expectedvariable interest holder is not required to reverse. An allowance against deferred tax assets is recorded whenconsolidate but in which it is more likely than not that such tax benefits will not be realized.has a significant variable interest.

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Principles of Consolidation - The consolidated financial statements include Pacific Ventures, Inc., a Delaware corporation, Snöbar Holdings, Inc. a Delaware corporation ("Snöbar Holdings"), MAS Global Distributors, Inc., a California corporation ("MGD"), International Production Impex Corporation, a California corporation ("IPIC"), and Snobar Trust, a California trust ("Trust"), which was established to hold IPIC, which in turn holds liquor licenses. All inter-company accounts have been eliminated during consolidation. See the discussion in Note 1 above for variable interest entity treatment of the Trust and IPIC.

Use of Estimates

- The preparation of financial statements in conformity with

U.S. generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and

disclosuresdisclosure of contingent assets and liabilities, at the date of the financial statements and the reported

amountsamount of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Revenue Recognition - Sales revenues are generally recognized when an agreement exists and price is determinable, the products are shipped to the customers or services are rendered, net of discounts, returns and allowance and collectability is reasonably assured.

Shipping and Handling Costs – The Company's shipping costs are all recorded as operating expenses for all periods presented.

Cash Equivalents

For purposes of reporting cash flows, the

- The Company considers

all highly-liquid debthighly liquid instruments

purchased with

an original maturity of three months or less to be cash equivalents.

Pacific Ventures Group, Inc.

Notes to Unaudited

Condensed Consolidated Financial Statements

June 30, 2015

(continued)

Accounts Receivable - Accounts receivable are stated at net realizable value. This value includes an appropriate allowance for estimated uncollectible accounts. The allowance is calculated based upon the level of past due accounts and the relationship with and financial status of our customers. The Company plans to recognize revenuedid not write off any bad debt during the nine months ended September 30, 2015 and the year ended December 31, 2014, and thus has not set an allowance for doubtful accounts.

Inventories - Inventories are stated at the lower of cost or market value. Cost has been determined using the first-in, first-out method. Inventory quantities on-hand are regularly reviewed, and where necessary, reserves for excess and unusable inventories are recorded. Inventory consists of finished goods and includes ice cream, popsicles and the related packaging materials.

Income Taxes - Deferred taxes are provided on an asset and liability method whereby deferred tax assets are recognized for deductible temporary differences and operating loss carry forwards and deferred tax liabilities are recognized for taxable temporary differences. Temporary differences are the difference between the reported amounts of assets and liabilities and their tax basis. Deferred tax assets are reduced by a valuation allowance when,

in the

following four conditionsopinion of management, it is more likely than not that some portion or all of the deferred tax assets will not be realized. Deferred tax assets and liabilities are

present: (1) persuasive evidenceadjusted for the effects of

an agreement exists, (2)changes in tax laws and rates on the

price is fixed or determinable, (3) delivery has occurred or services are rendered, and (4) collection is reasonably assured.date of enactment.

Net Income/ (Loss) Per Common Share

Income (Loss)

- Income/ (loss) per

share of common

sharestock is

computedcalculated by dividing

the net

loss available to common stockholdersincome/ (loss) by the weighted average number of

shares of common

sharesstock outstanding during the

periods presented.period. The Company has no potentially dilutive securities. Accordingly, basic and dilutive

lossincome (loss) per common share are the same.

Property and Equipment - Property and equipment are carried at cost less accumulated depreciation and includes expenditures that substantially increase the useful lives of existing property and equipment. Maintenance, repairs, and minor renovations are expensed as incurred. Upon sale or retirement of property and equipment, the cost and related accumulated depreciation are eliminated from the respective accounts and the resulting gain or loss is included in the results of operations. The Company provides for depreciation of property and equipment using the straight-line method over the estimated useful lives or the term of the lease, as appropriate. The estimated useful lives are as follows: vehicles, five years; office furniture and equipment, three to fifteen years; equipment, three years.

Fair Value

of Financial Instruments

- The carrying

valuesamounts of

Pacific Ventures' financial instruments, which include cash,

and cash equivalents, andaccounts receivable, accounts payable, and accrued

liabilities approximateexpenses are representative of their fair values

because ofdue to the short-term maturity of these

instruments.

Concentration of Credit Risk - Financial instruments that potentially subject Pacific Ventures to concentration of credit risk consist primarily of cash and accounts receivable. The Company maintains cash balances at financial

instruments.

Recently Issued Accounting Pronouncements

institutions within the United States which are insured by the Federal Deposit Insurance Corporation ("FDIC") up to limits of approximately $250,000. The Company has reviewed recently issued, but not yet adopted, accounting standards in orderexperienced any losses with regard to determine their effects, ifits bank accounts and believes it is not exposed to any risk of loss on its results of operations, financial position or cash flows. Based on that review,bank accounts.

During the

Company believes that none of these pronouncements will have a significant effect on its financial statements.

Note 2: Income Taxes

Due to losses at Junenine months ended September 30, 2015 and 2014, approximately 51% and 20% of total sales were to two distributors, respectively.

As of December 31, 2014, 99%, of accounts receivable were from one distributor. There was no accounts receivable as of September 30, 2015.

Pacific Ventures Group, Inc.

Notes to Unaudited Condensed Consolidated Financial Statements

Advertising Costs - The Company expenses advertising costs when incurred. Advertising costs incurred amounted to $35,428 and $41,509 for the Company had no income tax liability. At Junenine months ended September 30, 2015 and 2014, respectively.

Critical Accounting Policies - The Company considers revenue recognition and the Company had available unused operating loss carry forwardsvaluation of approximately $134,599accounts receivable, allowance for doubtful accounts, and $118,278, respectively, whichinventory and reserves as its significant accounting policies. Some of these policies require management to make estimates and assumptions that may affect the reported amounts in Pacific Ventures' financial statements.

Recent Accounting Pronouncements - In June 2009, the FASB established the Accounting Standards Codification ("Codification" or "ASC") as the source of authoritative accounting principles recognized by the FASB to be applied against future taxable incomeby nongovernmental entities in the preparation of financial statements in accordance with generally accepted accounting principles in the United States ("GAAP"). Rules and which expireinterpretive releases of the Securities and Exchange Commission ("SEC") issued under authority of federal securities laws are also sources of GAAP for SEC registrants. Existing GAAP was not intended to be changed as a result of the Codification, and accordingly the change did not impact our financial statements. The ASC does change the way the guidance is organized and presented.

In April 2015, FASB issued Accounting Standards Update ("ASU") No. 2015-03, "Interest – Imputation of Interest (Subtopic 835-30): Simplifying the Presentation of Debt Issuance Costs", to simplify presentation of debt issuance costs by requiring that debt issuance costs related to a recognized debt liability be presented in

various years through 2035.

Thethe balance sheet as a direct deduction from the carrying amount of that debt liability, consistent with debt discounts. The ASU does not affect the recognition and ultimate realizationmeasurement guidance for debt issuance costs. For public companies, the ASU is effective for financial statements issued for fiscal years beginning after December 15, 2015, and interim periods within those fiscal years. Early application is permitted. We are currently reviewing the provisions of this ASU to determine if there will be any impact on our results of operations, cash flows or financial condition.

In April 2015, FASB issued ASU No. 2015-04, "Compensation – Retirement Benefits (Topic 715): Practical Expedient for the Measurement Date of an Employer's Defined Benefit Obligation and Plan Assets", which permits the entity to measure defined benefit plan assets and obligations using the month-end that is closest to the entity's fiscal year-end and apply that practical expedient consistently from year to year. The ASU is effective for public business entities for financial statements issued for fiscal years beginning after December 15, 2015, and interim periods within those fiscal years. Early application is permitted. We are currently reviewing the provisions of this ASU to determine if there will be any impact on our results of operations, cash flows or financial condition.

In April 2015, FASB issued ASU No. 2015-05, "Intangibles – Goodwill and Other – Internal-Use Software (Subtopic 350-40): Customer's Accounting for Fees Paid in a Cloud Computing Arrangement", which provides guidance to customers about whether a cloud computing arrangement includes a software license. If such includes a software license, then the customer should account for the software license element of the

benefits fromarrangement consistent with the

operating loss carry forwardsacquisition of other software licenses. If the arrangement does not include a software license, the customer should account for

income tax purposesit as a service contract. For public business entities, the ASU is

dependent, in part, uponeffective for annual periods, including interim periods within those annual periods, beginning after December 15, 2015. Early application is permitted. We are currently reviewing the

tax laws in effect, the future earningsprovisions of

the Company and other future events, the effectsthis ASU to determine if there will be any impact on our results of

which cannot be determined at this time. Because of the uncertainty surrounding the realization of the loss carry forwards, the Company has established a valuation allowance equal to the tax effect of the loss carry forwards and, therefore, no deferred tax asset has been recognized for the loss carry forwards. The net deferred tax assets are approximately $50,205 and $48,118 as of June 30, 2015 and 2014, respectively, with an offsetting valuation allowance of the same amount resulting in a change in the valuation allowance of approximately $3,771 during the six months ended June 30, 2015.

operations, cash flows or financial condition. Pacific Ventures Group, Inc.

Notes to Unaudited

Condensed Consolidated Financial Statements

June 30,

In April 2015,

(continued)

Components FASB issued ASU No. 2015-06, "Earnings Per Share (Topic 260): Effects on Historical Earnings per Unit of income tax are as follows:

| | | | |

| | | | |

| | Six Months Ended June 30 |

| | 2015 | | 2014 |

Current | $ | - | $ | - |

Federal | | - | | - |

State | | - | | - |

| | - | | - |

Deferred | | - | | - |

| $ | - | $ | - |

A reconciliationMaster Limited Partnership Dropdown Transactions", which specifies that, for purposes of calculating historical earnings per unit under the two-class method, the earnings (losses) of a transferred business before the date of a drop down transaction should be allocated entirely to the general partner. In that circumstance, the previously reported earnings per unit of the provisionlimited partners (which is typically the earnings per unit measure presented in the financial statements) would not change as a result of the dropdown transaction. Qualitative disclosures about how the rights to the earnings (losses) differ before and after the dropdown transaction occurs for income tax expensepurposes of computing earnings per unit under the two-class method also are required. The ASU is effective for fiscal years beginning after December 15, 2015, and interim periods within those fiscal years. Earlier application is permitted. We are currently reviewing the provisions of this ASU to determine if there will be any impact on our results of operations, cash flows or financial condition.

In June 2014, FASB issued ASU No. 2014-10, "Development Stage Entities (Topic 915): Elimination of Certain Financial Reporting Requirements, Including an Amendment to Variable Interest Entities Guidance in Topic 810, Consolidation". The update removes all incremental financial reporting requirements from GAAP for development stage entities, including the removal of Topic 915 from the FASB Accounting Standards Codification. In addition, the update adds an example disclosure in Risks and Uncertainties (Topic 275) to illustrate one way that an entity that has not begun planned principal operations could provide information about the risks and uncertainties related to the company's current activities. Furthermore, the update removes an exception provided to development stage entities in Consolidations (Topic 810) for determining whether an entity is a variable interest entity-which may change the consolidation analysis, consolidation decision, and disclosure requirements for a company that has an interest in a company in the development stage. The update is effective for the annual reporting periods beginning after December 15, 2014, including interim periods therein. Early application is permitted with the

expected income tax computed by applying the federal statutory income tax rate to income before provision for income taxes as follows:

| | | | |

| | | | |

| | Six Months Ended June 30 |

| | 2015 | | 2014 |

Income tax computed at | | | | |

Federal statutory tax rate of 34% | $ | (3,437) | $ | (3,429) |

State taxes (net of federal benefit) of 3.3% | | (334) | | (332) |

Deferred taxes and other | | 3,771 | | 3,761 |

| $ | - | $ | - |

The Company has no tax positions at June 30, 2015 and 2014,first annual reporting period or interim period for which the ultimate deductibility is highly certain butentity's financial statements have not yet been issued (Public business entities) or made available for issuance (other entities). Our company adopted this pronouncement for year ended December 31, 2014.

In June 2014, FASB issued ASU No. 2014-12, "Compensation – Stock Compensation (Topic 718); Accounting for Share-Based Payments When the Terms of an Award Provide That a Performance Target Could Be Achieved after the Requisite Service Period". The amendments in this ASU apply to all reporting entities that grant their employees share-based payments in which

there is uncertainty about the

timing of such deductibility. The Company recognizes interest accrued related to unrecognized tax benefits in interest expense and penalties in operating expenses. During the period ended June 30, 2015 and 2014, the Company recognized no interest and penalties. The Company had no accruals for interest and penalties at June 30, 2015 and 2014. Under the rulesterms of the

Internal Revenue Service,award provide that a performance target that affects vesting could be achieved after the

Company's tax returnsrequisite service period. The amendments require that a performance target that affects vesting and that could be achieved after the requisite service period be treated as a performance condition. A reporting entity should apply existing guidance in Topic 718 as it relates to awards with performance conditions that affect vesting to account for

such awards. For all entities, the

previous three years remain openamendments in this ASU are effective for

examination.

Note 3: Capital Stock

Preferred Stockannual periods and Common Stock – The Company’s Board of Directorsinterim periods within those annual periods beginning after December 15, 2015. Earlier adoption is expresslypermitted. Entities may apply the amendments in this ASU either (a) prospectively to all awards granted or modified after the authorityeffective date or (b) retrospectively to issue, without stockholder action, the authorized sharesall awards with performance targets that are outstanding as of the Company’s preferredbeginning of the earliest annual period presented in the financial statements and common stock. The Boardto all new or modified awards thereafter. If retrospective transition is adopted, the cumulative effect of Directorsapplying this Update as of the beginning of the earliest annual period presented in the financial statements should be recognized as an adjustment to the opening retained earnings balance at that date. Additionally, if retrospective transition is adopted, an entity may issue sharesuse hindsight in measuring and recognizing the compensation cost. This updated guidance is not expected to have a material impact on our results of operations, cash flows or financial condition. We are currently reviewing the provisions of this ASU to determine the powers, preferences, limitations, and relative rightsif there will be any impact on our results of any class of shares before the issuance thereof.

operations, cash flows or financial condition. Pacific Ventures Group, Inc.

Notes to Unaudited

Condensed Consolidated Financial Statements

June 30, 2015

(continued)

In August 2014, the FASB issued ASU 2014-15 on "Presentation of Financial Statements Going Concern (Subtopic 205-40) – On October 22, 2012,Disclosure of Uncertainties about an Entity's Ability to Continue as a Going Concern". Currently, there is no guidance in U.S. GAAP about management's responsibility to evaluate whether there is substantial doubt about an entity's ability to continue as a going concern or to provide related footnote disclosures. The amendments in this Update provide that guidance. In doing so, the amendments are intended to reduce diversity in the timing and content of footnote disclosures. The amendments require management to assess an entity's ability to continue as a going concern by incorporating and expanding upon certain principles that are currently in U.S. auditing standards. Specifically, the amendments (1) provide a definition of the term substantial doubt, (2) require an evaluation every reporting period including interim periods, (3) provide principles for considering the mitigating effect of management's plans, (4) require certain disclosures when substantial doubt is alleviated as a result of consideration of management's plans, (5) require an express statement and other disclosures when substantial doubt is not alleviated, and (6) require an assessment for a period of one year after the date that the financial statements are issued (or available to be issued). We are currently reviewing the provisions of this ASU to determine if there will be any impact on our results of operations, cash flows or financial condition.

All other newly issued accounting pronouncements which are not yet effective have been deemed either immaterial or not applicable.

We reviewed all other recently issued accounting pronouncements and determined these have no current applicability to the Company filedor their effect on the financial statements would not have been significant.

3. GOING CONCERN

The accompanying unaudited consolidated financial statements have been prepared assuming the Company will continue as a Restatedgoing concern. As shown in the accompanying unaudited consolidated financial statements, the Company has incurred a net loss of $654,178 for the nine months ended September 30, 2015, and Amended Certificatehas an accumulated deficit of Incorporation increasing$6,074,609 as of September 30, 2015.

In order to continue as a going concern, the authorized PreferredCompany will need, among other things, additional capital resources. The Company is significantly dependent upon its ability, and will continue to attempt, to secure equity and/or additional debt financing. There are no assurances that the Company will be successful and without sufficient financing it would be unlikely for the Company to continue as a going concern.

The unaudited consolidated financial statements do not include any adjustments relating to the recoverability and classification of recorded assets, or the amounts of and classification of liabilities that might be necessary in the event the Company cannot continue in existence. These conditions raise substantial doubt about the Company's ability to continue as a going concern. These unaudited consolidated financial statements do not include any adjustments that might arise from this uncertainty.

Pacific Ventures Group, Inc.

Notes to Unaudited Condensed Consolidated Financial Statements

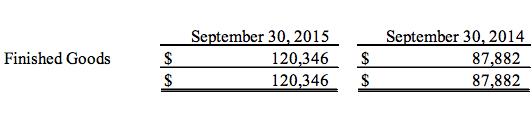

Inventories at September 30, 2015 and December 31, 2014 consisted of the following:

5. PROPERTY, PLANT AND EQUIPMENT

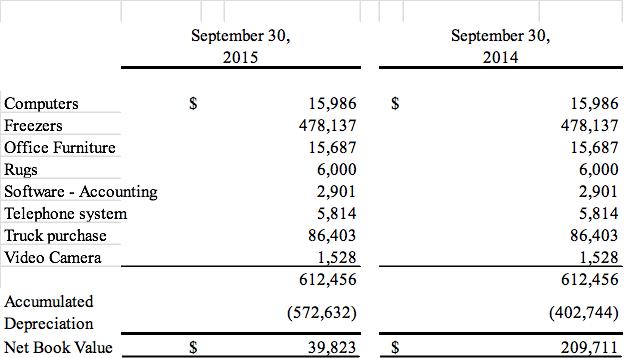

Property, plant and equipment at September 30, 2015 and December 31, 2014, consists of:

Depreciation expense for the nine months ended September 30, 2015 was $66,917 and for the nine months ended September 30, 2014 was $63,401.

6. ACCRUED EXPENSE

During the nine months ended September 30, 2015 and December 31, 2014, the Company had accrued expenses of $163,009 and $891,532, respectively. During July 2015, Snobar Holding issued 350,000 shares of class A common stock for $225,000 of accrued payroll liabilities. In September of 2015, SnoBar Holding's officers with the board of directors' approval, forgave an additional $600,000 of accrued payroll liabilities. This amount was considered forgiveness of debt by a related party and the entire $600,000 was recorded to additional paid-in capital.

Pacific Ventures Group, Inc.

Notes to Unaudited Condensed Consolidated Financial Statements

The Company accounts for income taxes under the asset and liability method, which requires the recognition of deferred tax assets and liabilities for the expected future tax consequences of events that have been included in the financial statements. Under this method, deferred tax assets and liabilities are determined on the basis of the differences between the financial statement and tax bases of assets and liabilities using enacted tax rates in effect for the year in which the differences are expected to reverse.

8. RELATED PARTY TRANSACTIONS

In January 2011, MGD entered into an unsecured promissory note with an officer and shareholder. The note had a principal balance of $150,000 with an interest rate of 3% and has a maturity date of December 31, 2017. The balance of the note at September 30, 2015 and December 31, 2014 was $142,621 and $142,621, respectively. As of September 30, 2015 and December 31, 2014 Snöbar Holdings accrued $17,621 of interest.

In February of 2012, MGD entered into an unsecured promissory note with a shareholder. The note had a principal balance of $30,000 with an interest rate of 8% and a maturity date of August 1, 2014. The note's maturity date has been extended to February 1, 2017. The note's balance is $25,000 and $25,000 as of September 30, 2015 and December 31, 2014, respectively.

Snobar Holdings entered into a promissory note agreement with a relative and former officer to purchase all shares and interests in IPIC, including liquor licenses, for $500,000. The note bears no interest and payments are due in five installments of $100,000 due each year beginning on December 31, 2013 and going through December 31, 2017. The entire purchase price of $500,000 was expensed in 2013 and the balance on the note was $190,669 and $299,522 as of September 30, 2015 and December 31, 2014, respectively.

On March 14, 2013, MGD entered into an unsecured promissory note with a shareholder. The note had a principal balance of $10,000 with an interest rate of 5% and had a maturity date of March 14, 2014 and was extended. The note is current and has an outstanding balance of $6,000 and $6,000 as of September 30, 2015 and December 31, 2014, 2014, respectively.

On March 14, 2013, MGD entered into an unsecured promissory note with a shareholder. The note had a principal balance of $87,121 with an interest rate of 5% and had a maturity date of March 14, 2014. The note's maturity date has been extended to February 1, 2017. The note is current and the entire balance is still owed and outstanding.

On July 22, 2013, Snöbar Holdings entered into an unsecured promissory note with a shareholder. The note's maturity date has been extended to February 1, 2017. The note had a principal balance of $15,000 with an interest rate of 5%.

On February 24, 2014, Snöbar Holdings entered into an unsecured promissory note with a shareholder. The note had a principal balance of $20,000 with an interest rate of 8% and a maturity date of 30 days from execution of the note. The maturity date has been extended to February 1, 2017.

During the year ended December 31, 2014, Snöbar Holdings entered into unsecured promissory notes with an entity owned by a shareholder. The notes had a total principal balance of $16,000 with an interest rate of 2% and are due on demand.

As of September 30, 2015, an officer advanced $53,838 to IPIC to pay for operating expenses.

Pacific Ventures Group, Inc.

Notes to Unaudited Condensed Consolidated Financial Statements

On December 9, 2013, Snöbar Holdings entered into an unsecured promissory note. The note had a principle balance of $100,000 with an interest rate of 6% and maturity date of February 9, 2014. During 2014, an additional $60,000 was borrowed for a total balance of $160,000. Snöbar Holdings issued 111,328 shares of its Class A Common Stock to 10,000,000pay off the entire principal balance along with accrued interest.

In February 2014, MGD entered into a secured promissory note with a principal balance of $10,000. The note was secured by interests in tangible and intangible property of MGD The Company is to make payments of $181 each business day (Monday through Friday) until the loan is paid off. The effective interest rate on the note is 137%. The note has been paid and the outstanding balance is $0 as of September 30, 2015 and December 31, 2014.

On March 10, 2014, MGD entered into a secured promissory note with a principal balance of $23,000. The note was secured by MGD future sales and accounts receivable totaling $31,970. The Company is to remit 2% of revenues and accounts receivables daily until the entire balance of $31,970 has been received. The outstanding balance on the note is $23,000 as of September 30, 2015 and December 31, 2014.

On May 19, 2014, Snöbar Holdings entered into a secured convertible promissory note with a principal balance of $500,000. The note was secured by interests in cash, accounts receivable, other receivables, inventory, supplies, other assets of Snöbar Holdings including general intangibles and rights of each liquor license owned by SnoBar Trust. The note has an interest rate of 10% and a maturity date of December 31, 2015. The Company is to make interest only payments beginning July 1, 2014.

The lender determined Snöbar Holdings to be in default and on January 29, 2015, entered into a mutually agreed loan modification. The agreement increased the principal balance of the note as of December 31, 2014 to $527,333 and all interest due and payable was deemed to have been paid and the conversion rights of the note were removed. The maturity date is December 31, 2015 and if Snöbar Holdings is not in default, the maturity date of the note will automatically be extended to December 31, 2016 ("First Extended Maturity Date"). Commencing on January 1, 2016, Snöbar Holdings will make monthly payments of $15,000 until the First Extended Maturity Date. Assuming Snöbar Holdings is not in default with respect to its obligations as of the First Extended Maturity Date, the note shall automatically be extended to December 31, 2017 ("Second Extended Maturity Date"). Commencing on January 1, 2017, the monthly payments will be increased to $25,000 for every month until the Second Extended Maturity Date. All accrued but unpaid interest, charges and the remaining principal balance of the note is fully due and payable on the Second Extended Maturity Date.

In December of 2014, the lender purchased the note entered into by IPIC on August 22, 2014.

Pacific Ventures Group, Inc.

Notes to Unaudited Condensed Consolidated Financial Statements

On August 22, 2014, IPIC entered into a secured promissory note with a principal balance of $15,000. The note was secured by interests in all accounts, cash, deposit accounts, documents, equipment, general intangibles and inventory of International Production IMPEX Corp. The Company is to make daily payments of $163 until the entire balance is paid off for an estimated total payment of $20,550. The effective interest rate on the note is 192%. This loan was purchased by the lender mentioned in the paragraph above and the outstanding balance is $0 as of September 30, 2015 and December 31, 2014.

10. STOCKHOLDERS' EQUITY

Share Exchange

On August 14, 2015, Snöbar Holdings entered into a Share Exchange Agreement ("Exchange Agreement") with Pacific Ventures Group, Inc., a Delaware corporation ("Pacific Ventures"), and Snöbar Holdings' shareholders ("Snobar Shareholders") who hold of record (i) at least 99% and up to 100% of the total issued and outstanding shares

par value $.001 per share.of Class A Common Stock and (ii) 100% of the total issued and outstanding shares of Class B Common Stock. In accordance with the terms and provisions of the Exchange Agreement, Pacific Ventures shall acquire (i) at least 99% and up to 100% of the total issued and outstanding shares of Snöbar Holdings' Class A Common Stock and (ii) 100% of the total issued and outstanding shares of Snöbar Holdings' Class B Common Stock from Snöbar Holdings' Shareholders, thus making Snöbar Holdings a majority-owned or wholly-owned subsidiary, in exchange for the issuance to the Snobar Shareholders of at least 22,285,000 and up to 22,500,000 shares of restricted common stock of Pacific Ventures for each share of common stock of Snobar while simultaneously issuing 2,500,000 shares of restricted common stock of Pacific Ventures to certain other persons.

The 2,500,000 shares of restricted common stock were issued for the following:

600,000 shares of restricted common stock were issued for services for a total of $326,900 of non-cash expenses.

A former officer of Pacific Ventures received 1,000,000 shares of restricted common stock in exchange for his 1,000,000 shares of Series E Preferred Stock.

900,000 shares of restricted common stock were issued to extinguish $21,675 of debt due to an officer and shareholder of Pacific Ventures.

Preferred Stock was authorized October 2006 for up to 1,000,00010,000,000 shares. Under the rights, preferences and privileges of the Series E Preferred Stock, the holders of the preferred stock receive a 10 to 1 voting preference over common stock. Accordingly, for every share of Series E Preferredpreferred Stock held, the holder received the voting rights equal to 10 shares of common stock. The Series E Preferred Stock is not convertible into any other class of stock of the Company and has no preferencepreferences to dividends or liquidation rights. As of JuneSeptember 30, 2015 there are 1,000,000 shares of Preferred Class E Stock issued.

Common Stock was authorized October 22, 2012 for up to 100,000,000 shares, par value $0.001 per share. Common Stock shareholders get one vote per share. As of September 30, 2015, there were 25,384,031 shares of Common Stock outstanding.

Pacific Ventures Group, Inc.

Notes to Unaudited Condensed Consolidated Financial Statements

11. COMMITMENTS, CONTINGENCIES AND UNCERTAINTIES

Capital Lease

MGD leased certain machinery and equipment in 2014 and 2013 under an agreement that is classified as a capital lease. The cost of equipment under capital leases is included in the balance sheets as property, plant and equipment and was $33,121 and $44,946 at September 30, 2015 and December 31, 2014,

there were 1,000,000 Series E Preferred shares outstanding.

Common Stock – On October 22, 2012, the Company filed a Restated and Amended Certificate of Incorporation increasing the authorized common stock to 100,000,000 shares, par value $.001 per share. Effective November 8, 2012, there was a reverse splitrespectively. Accumulated depreciation of the issued and outstanding common stock of the Company on a basis of fifty (50) to one (1). All fractional shares were rounded up to the nearest whole share, with no shareholder falling below 100 shares. There were 43,089 shares issued for rounding. The effects of which have been included in these financial statements as if the split had occurredleased equipment at the beginning of the first period presented. As of JuneSeptember 30, 2015 and December 31, 2014 there were 384,031 shares of common stock outstanding.

Note 4: Related Party Transactions

On March 31, 2014, Brett Bertolami, the sole officerwas $105,588 and director$109,908, respectively.

Operating Lease

IPIC is currently obligated under two operating leases for office spaces and associated building expenses. One of the Company converted advanced moneyleases expires in December 2015 and the other lease is on a month to month basis.

For the

Company into a promissory note for $400. On March 31, 2015, Mr. Bertolami converted an additional $400 advanced to the Company into a promissory note. All of the money was used to pay operating expenses. The notes accrue interest at 2% annually until repaid.

Fornine months ended September 30, 2015 and 2014, the sole officerInternational Production and directorMGD had rent expense of the Company has provided office space at no cost to the Company.

Note 5: Notes Payable

On March 31, 2014, Brett Bertolami, the sole officer$8,314 and director of the Company converted advanced money to the Company into a promissory note for $400. On March 31, 2015, Mr. Bertolami converted an additional $400 advanced to the Company into a promissory note. All of the money was used to pay operating expenses. The notes accrue interest at 2% annually until repaid. The balance of the notes payable, with interest, is $810.

$53,133, respectively.

12. SUBSEQUENT EVENTS

9

Pacific Ventures Group, Inc.

Notes to Unaudited Financial Statements

June 30, 2015

(continued)

From December, 2013, to June 30, 2015, the Company has borrowed funds from a private corporation to pay operating expenses. These amounts were converted into the following promissory notes. The balance of the notes payable, with interest, is $20,865 at June 30, 2015.

| | | | |

| | | | |

Date | | Principal Amount | | Interest Rate Until Paid |

June 30, 2015 | | $4,500 | | 2% |

March 31, 2015 | | $1,446 | | 2% |

September 30, 2014 | | $5,630 | | 2% |

April 1, 2014 | | $2,500 | | 2% |

March 31, 2013 | | $4,372 | | 2% |

December 31, 2013 | | $2,074 | | 2% |

Note 6: Subsequent Events

ASC 855-16-50-4 establishes accounting and disclosure requirements for subsequent events. ASC 855 details the period after the balance sheet date during which we should evaluate events or transactions that occur for potential recognition or disclosure in the financial statements, the circumstances under which we should recognize events or transactions occurring after the balance sheet date in

ourits financial statements and the required disclosures for such events.

We have evaluated all subsequent events through the date these consolidated financial statements were issued, and determined the following are material to disclose:

Share ExchangeIssuances

On August 14,

During October 2015, the Company

entered into that certain Share Exchange Agreement ("Exchange Agreement") with Snobar Holdings, Inc., a Delaware corporation ("Snobar"), and the shareholders of Snobar ("Snobar Shareholders") who hold of record (i) at least 99% and up to 100% of the total issued

and outstanding shares of Snobar’s Class A Common Stock (“Snobar Class A Common Stock”) and (ii) 100% of the total issued and outstanding shares of Snobar’s Class B Common Stock (“Snobar Class B Common Stock”). In accordance with the terms and provisions of the Exchange Agreement, the Company shall acquire (i) at least 99% and up to 100% of the total issued and outstanding shares of Snobar Class A Common Stock and (ii) 100% of the total issued and outstanding shares of Snobar Class B Common Stock from the Snobar Shareholders, thus making Snobar a majority-owned subsidiary or wholly-owned subsidiary, in exchange for the issuance to the Snobar Shareholders of at least 22,285,000 and up to 22,500,000 shares of restricted common stock of the Company (the "Exchange") for each share of common stock of Snobar while simultaneously issuing 2,500,000 shares of restricted common stock of the Company (“Other Issuance”) to certain other persons (“Other Persons”).

An initial closing date (“Initial Closing Date”) is anticipated to close by no later than August 31, 2015 but in no event before the Exchange Agreement has been signed by Snobar Shareholders holding at least 80% of the shares of SNO common stock outstanding. Subsequent to the Initial Closing Date, the Company may complete one or more additional Closings to complete the exchanges provided for in

10

the Exchange Agreement to allow the Company to complete the acquisition of at least 99% and up to 100% of the SNO common stock for a period of up to 30 days after the Initial Closing Date. Upon completion of this part of the acquisition, Snobar will become our majority-owned or wholly-owned subsidiary and the Company’s pro-forma345,000 shares of common stock outstanding giving effect tofor services.

During October 2015, the

acquisition of Snobar is expected to be approximately at least 25,172,000 and up to 25,387,000Company issued 70,000 shares of common stock

of the company outstanding with at least 22,285,000 and up to 22,500,000 shares or approximately 89% thereof owned by the Snobar Shareholders and 1,000,000 shares of the Company's Series E Preferred Stock" (with a 10 to 1 voting preference over common stock) with 100% thereof owned by a Snobar Shareholder, namely Shannon Masjedi.

Also in accordance with the terms and provisions of the Exchange Agreement: (i) Bob Smith shall be appointed as the Chief Executive Officer and a member of the Board of Directors of the Company; (ii) Shannon Masjedi shall be appointed as the President and Secretary and a member of the Board of Directors of the Company; (iii) Marc Shenkman shall be appointed as the Executive Vice President and a member of the Board of Directors of the Company; and (iv) Brett Bertolami shall resign from all of his positions as an officer of the Company, including, but not limited to, Chief Executive Officer, Chief Financial Officer, Principal Accounting Officer, President and Secretary, and as a member of the Board of Directors of the Company.

Thus, the share exchange will represent a change in control of the Company and a change in business operations. Therefore, based on the change in control of the Company, the business operations of the Company will change to that of Snobar. Snobar is the sole beneficiary of Snobar Trust, a California trust ("Trust"). The Trust owns 100% of the shares of International Production Impex Corporation, a California corporation ("IPIC"). IPIC is the owner of the licenses and trade names "Snobar" and is in the business of selling and distributing alcohol-infused ice creams and ice-pops through its distributors (the "Business"). As a result of the foregoing chain of ownership, Snobar is the beneficiary of all assets, liabilities and any income received from the Business of IPIC.

Through the operations of IPIC, Snobar produces and distributes through third party manufacturers and distributors Snobar alchohol infused popsicles, whichare original frozen beverage alcohol bars similar to popsicles on a stick, but created in a way that they are made with premium liquors, such as tequila and vodka. Margarita, Cosmopolitan and Mojito are just a few of the manufactured cocktails that currently exist in the market. The alcohol freezing technology of Snobar can be applied to almost any cocktail/alcohol type and mixture, presenting significant market potential and an almost unlimited variety of quality flavors and employment of premium brands.

In addition, through the operations of IPIC, Snobar produces and distributes through third party manufacturers and distributors Snobar alchohol infused Ice Cream products, whichare premium quality ice cream and sorbets that are also distilled spirit cocktails containing 20-30% quality liqueurs and liquors. Currently, there are 50 different Liquor Ice Cream flavors in development in classic ice cream drink flavors such as Irish Cream Ice Cream, Mojito Sorbet, Sherry Ice Cream, Brandy Alexander and Strawberry Margarita Sorbet.

11

Snobar products have been through extensive consumer testing across all age groups and sexes over 21 years of age. According to the results of the consumer testing, there is a large untapped market potential for frozen alcohol desserts.

$35,000.

The foregoing is a summary description of the terms and conditions of the Exchange Agreement and does not purport to be complete and is qualified in its entirety by reference to the Exchange Agreement, which is filed as Exhibits 10.1 to this Quarterly Report on Form 10-Q and incorporated by reference herein.

As permitted by Form 8-K, upon the initial closing occurring on August 31, 2015, the Company anticipates filing a Form 8-K on September 4, 2015 pertaining to the consummation of the Share Exchange, including Form 10 information as required by Item 2.01 of Form 8-K.

Amendment to Bylaws

Pursuant to authorization of the Board as permitted by the Delaware General Corporation Law and the provisions of the Company’s bylaws (“Bylaws”), the Bylaws were amended (the “Bylaws Amendment”) effective as of August 14, 2015 to reflect a change in the name of the Company to Pacific Ventures Group, Inc. (the “Company”). The Bylaws Amendment replaces all references in the Bylaws to American Eagle Group, Inc. with references to Pacific Ventures Group, Inc. A copy of the Bylaws Amendment is attached to this Quarterly Report on Form 10-Q as Exhibit 3 (iii).

Item 2.

Management’sManagement's Discussion and Analysis of Financial Condition and Results of Operations

Special Note Regarding Forward-Looking Statements

This

periodic reportQuarterly Report on Form 10-Q contains

certain forward-looking statements"forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of

1995 with respect1995. In addition, we may make other written and oral communications from time to

the Plan of Operations provided below, including information regarding the Company’s financial condition, results of operations, business strategies, operating efficiencies or synergies, competitive positions, growth opportunities,time that contain such statements. Forward-looking statements include statements as to industry trends, our future expectations and

the plans and objectives of management. The statements made as part of the Plan of Operationsother matters that

aredo not

relate strictly to historical facts

and are

herebybased on certain assumptions of our management (such assumptions may be identified

by "we," "our" or "us"). These statements are often identified by the use of words such as

"forward-looking"may," "strive," "will," "expect," "believe," "anticipate," "intend," "could," "estimate," or "continue," and similar expressions or variations. Further, these statements are based on the beliefs and assumptions of our management based on information currently available. Such forward-looking statements are subject to risks, uncertainties and other factors that could cause actual results to differ materially from future results expressed or implied by such forward-looking statements.

"

Critical Accounting Policies and Estimates

The preparation of financial Important factors that could cause actual results to differ materially from the forward-looking statements and related disclosures in conformity with accounting principles generally acceptedinclude, without limitation, the risks described in the United States of America requires management to make estimates and assumptions that affect the amounts reportedsection entitled "Risk Factors" under Item 1A in the unaudited Financial Statements and accompanying notes. Management bases its estimates on historical experience and on various other assumptions that are believed to be reasonable under the circumstances. Actual results could differ from these estimates under different assumptions or conditions. The Company believes there have been no significant changes during the six month period ended June 30, 2015, to the items disclosed as significant accounting policies in management's Notes to the Financial Statements in the Company's Annual Report onour Form 10-K8-K for the year ended December 31, 2014.

2014 filed on September 25, 2015.

We caution the reader to carefully consider such factors. Moreover, such forward-looking statements speak only as of the date of this report. We undertake no obligation to update any forward-looking statements to reflect events or circumstances after the date of such statements.

Pacific Ventures Group, Inc. (“("Pacific Ventures”Ventures" or the “Company”"Company") was incorporated under the laws of the State of Delaware on October 3, 1986. Pacific Ventures operated as an insurance holding company

On August 14, 2015, the Company entered into that certain Share Exchange Agreement ("Exchange Agreement") with Snobar Holdings, Inc., a Delaware corporation ("Snobar"), and the shareholders of Snobar ("Snobar Shareholders") who hold of record (i) at least 99% and up to 100% of the total issued and outstanding shares of Snobar's Class A Common Stock ("Snobar Class A Common Stock") and (ii) 100% of the total issued and outstanding shares of Snobar's Class B Common Stock ("Snobar Class B Common Stock"). In accordance with the terms and provisions of the Exchange Agreement, the Company shall acquire (i) at least 99% and up to 100% of the total issued and outstanding shares of Snobar Class A Common Stock and (ii) 100% of the total issued and outstanding shares of Snobar Class B Common Stock from the Snobar Shareholders, thus making Snobar a majority-owned subsidiary or wholly-owned subsidiary, in exchange for the issuance to the Snobar Shareholders of at least 22,285,000 and up to 22,500,000 shares of restricted common stock of the Company (the "Exchange") for each share of common stock of Snobar while simultaneously issuing 2,500,000 shares of restricted common stock of the Company ("Other Issuance") to certain other persons ("Other Persons").

The share exchange will represent a change in control of the Company and a change in business operations. Therefore, based on the change in control of the Company, the business operations of the Company will change to that of Snobar. Snobar is the sole beneficiary of Snobar Trust, a California trust ("Trust"). The Trust owns 100% of the shares of International Production Impex Corporation, a California corporation ("IPIC"). IPIC is the owner of the licenses and trade names "Snobar" and is in the business of selling and distributing alcohol-infused ice creams and ice-pops through its subsidiaries, marketeddistributors (the "Business"). As a result of the foregoing chain of ownership, Snobar is the beneficiary of all assets, liabilities and underwrote specializedany income received from the Business of IPIC.

Plan of Operations

Through the operations of IPIC, Snobar produces and distributes through third party manufacturers and distributors Snobar alchohol infused popsicles, which are original frozen beverage alcohol bars similar to popsicles on a stick, but created in a way that they are made with premium liquors, such as tequila and vodka.

IPIC is initially marketing two products: SnöBar alcohol infused ice pops, and SnöBar alcohol infused ice cream and sorbet.

SnöBar ice pops are original frozen alcohol beverage bars, similar to popsicles on a stick, but made with premium liquor such as premium tequila and vodka and are currently manufactured in three flavors, Margarita, Cosmopolitan and Mojito. The alcohol freezing technology used to produce these beverage bars can be applied to almost any alcohol type and mixture, presenting significant market potential and an almost unlimited variety of flavors and employment of premium brands. Each ice pop is the equivalent of a full cocktail.

SnöBar ice cream is an additional innovative product that the company is marketing using proprietary formulas and technology. These products are premium ice cream and sorbets that are distilled spirit cocktails containing up to 20% quality liqueurs and liquors. Currently, there are four flavors available: Brandy Alexander; Brandy Alexander with chocolate chips; Grasshopper; and Pink Squirrel. There are also numerous different liquor ice cream flavors in development in classic ice cream drink styles such as Coffee Liqueur Ice Cream, Pina Colada Sorbet, Sherry Ice Cream, and Strawberry Margarita Sorbet. The product contains ultra premium dairy and the highest quality of ingredients.

Our Technology

What makes the SnöBar products unique is the proprietary formulation and method of manufacturing. SnöBar ice pops and SnöBar ice cream use a system to stabilize the alcohol molecule, whereby the alcohol content, quality and flavor is not degraded during the production process. The technology is also applicable to other food and beverage products such as yogurt, water ice creations and alcohol based goods. IPIC has begun the process of obtaining trade secret and other intellectual property protections as to these unique technologies. The SnöBar brand is fully trademarked within the USA and casualty coverageis currently seeking worldwide trademark rights.

Our Market

SnöBar brand products have been through extensive consumer testing across all age groups and sexes over 21 years of age. According to the results of the consumer testing, there is a large untapped market potential for frozen alcohol desserts. Market research shows that there are very few alcohol infused ice-creams and ice pops available in the general aviation insurance marketplace. Historically,U.S. markets and the Company's businessfew that are out there are of lower quality ingredients and are not mass produced. IPIC holds several Federal and State granted liquor licenses. These licenses allow the SnöBar product line to be introduced and distributed in 95% of the United States. IPIC desires to be the first to mass market the SnöBar alcohol-infused products in this untapped and sizeable market segment and capitalize on these two exclusive products. IPIC only uses the finest of ingredients and dairy to produce SnöBar products and strives to achieve the highest quality of texture and taste for all of the SnöBar products. IPIC believes that the SnöBar brand has the potential to scale on a national and international level with worldwide distribution capabilities.

In 2012, the SnöBar brand was introduced in the USA in the state of Arizona. The brand was extremely well received and was immediately placed in the top chain stores and restaurants, resorts including Total Wine and the Bevmo Chains. Due to its multiple applications and uses, the SnöBar alcohol infusing technology is used to create exotic and innovative cocktails and the most unique and delicious desserts. SnöBar is one of the only few spirit brands that can offer incremental revenues and not compete with other spirits currently on the market.

In 2013, the SnöBar brand was launched in Nevada. Immediately, the SnöBar products were in demand in all the major casinos and resorts. The SnöBar brand joined forces with reputable hotels and resorts, including, but not limited to, the Bellagio, Golden Nugget, Rio, Wynn, Encore, TAO, Caesars Palace, Hilton, The M and MGM. In Nevada, IPIC's focus is to place the SnöBar brand within all the venues of the hotels including catering and banquets, room service, retail outlets and nightclubs.

Immediately following Nevada, the SnöBar brand was launched in the state of Florida, in cities including Miami, Tampa, Orlando, Jacksonville and the panhandle. This expansion resulted in SnöBar products being offered by reputable hotels and resorts, including, but not limited to, Ritz Carlton Hotel, Fountainbleau, Hilton, Waldorf Astoria and The Breakers Resort.

In 2014, the SnöBar brand was launched in California. Over 100 accounts with retailers for SnöBar products were established in the 90 day period following the launch in California. The focus in California has been organizedensuring that the accounts are reordering product and being serviced and supported properly. Currently, SnöBar products are being offered by Gelson's Markets and there has also been interest from other chains such as Ralph's (Kroger) and Costco.